* Total liabilities include deferred taxes on unrealized gains.

** Return on equity is calculated by dividing the Company’s net income or loss for the period by the average stockholders’ equity for the period.

In 2008 revenue from operations was $1,761,055.vs. 2007 revenue from operations of $ 1,869,779 for a decrease of 6%. In 2006, operating revenues were $1,486,449.

Equipment sales and kit sales decreased from $1,453,201 in 2007 to $1,381,105 in 2008. In 2008 the Company sold four blood volume analyzers for a total of $260,000 versus six in 2007 for $390,500. Kit sales increased by 4% in 2008 over 2007 and by 15% in 2007 over 2006. Kit sales increased by 35% in 2006 over 2005 and by 53% in 2005 over 2004. 3,113 patients, utilizing the BVA-100, had blood volume measurements in 2008 vs. 3,015 in 2007, 2,886 in 2006 and 2,132 in 2005. For the year ended December 31, 2008 the Company provided 472 Volumex doses free of charge to facilities utilizing the BVA-100 for research versus 328 in 2007, 194 in 2006,95 in 2005 and 83 in 2004.

The major reasons for the current year increase in kit sales are an increase in utilization of existing instruments along with 53 Blood Volume Analyzers placed in service at December 31, 2008 versus 50 placed in service at December 31, 2007. Effective February 1, 2007, the Company raised prices by approximately 5% on Blood Volume Kits which was the first price increase in two years. The Company did not raise prices on Blood Volume Kits in 2008.

The decrease in Gross Profit Percentage on Kit Sales for the year ended December 31, 2008 is mainly due to the aforementioned increase in Volumex doses provided free of charge to facilities using the BVA-100 for research. The main reason for the decrease in Gross Profit Percentage for Equipment Sales and Related Services from 56.3% for the year ended December 31, 2007 to 51.2% for the year ended December 31, 2008 is that six blood volume analyzers were sold in 2007 versus four in 2008. The gross margin on the blood volume analyzer is substantially higher than the gross margin on Volumex Kits.

The following table provides gross margin information on Equipment Sales & Related Services for the years ended December 31, 2008 and December 31, 2007:

| | | | | | | | | | |

Equipment Sales and

Related Services: | | Kit Sales Year Ended

December 31,

2008 | | Equipment Sales and Other Year Ended

December 31,

2008 | | Total Year Ended December 31,

2008 | |

| | | | | | | | | | | |

Revenue | | $ | 1,005,981 | | $ | 375,124 | | $ | 1,381,105 | |

Cost of Goods Sold | | | 516,054 | | | 158,522 | | | 674,576 | |

Gross Profit | | | 489,927 | | | 216,602 | | | 706,529 | |

Gross Profit Percentage | | | 48.7 | % | | 57.7 | % | | 51.2 | % |

| | | | | | | | | | |

Equipment Sales and

Related Services: | | Kit Sales Year Ended

December 31,

2007 | | Equipment Sales and Other Year Ended

December 31,

2007 | | Total Year Ended December 31,

2007 | |

| | | | | | | | | | | |

Revenue | | $ | 963,318 | | $ | 489,883 | | $ | 1,453,201 | |

Cost of Goods Sold | | | 475,811 | | | 159,127 | | | 634,938 | |

Gross Profit | | | 487,507 | | | 330,756 | | | 818,263 | |

Gross Profit Percentage | | | 50.6 | % | | 67.5 | % | | 56.3 | % |

Operating revenues from Cryobanking and related services decreased in 2008 by $36,628 or 8.8% from 2007. This was due mainly to revenue from semen storage decreasing by $19,392 or 6.9% to $262,675 versus $282,067 in the year ended December 31, 2007. There was also a decrease of $14,743 in semen analysis and other lab services. The Company’s Idant Laboratories subsidiary contributed 21.6%, 22.3%, and 29.0% of operating revenues in 2008, 2007 and 2006 respectively.

Operating Expenses

For 2008, consolidated expenses from operations including cost of sales totaled $6,968,207 and the loss from operations was $5,207,152. In 2007, expenses from operations including cost of sales totaled $7,300,649; the loss from operations was $ 5,430,870. In 2006, expenses from operations including cost of sales totaled $6,911,370; the loss from operations totaled $5,424,921.

Total Operating costs including cost of sales for Daxor and the BVA segment were $6,017,752 for the year ended December 31, 2008 versus $6,351,501 for the year ended December 31, 2007 for a decrease of $ 333,749 or 5.2%. The main reason for this decrease is a reduction of $278,489 in payroll and related expenses.

Research and Development expenses for Daxor and the BVA segment decreased in 2008 by $132,751 or 5.5% to $2,257,601 from $2,390,352 in 2007. However, Daxor remains committed to making Blood Volume Analysis a standard of care in at least three disease states. In order to achieve this goal, we are continuing to spend time and money in research and development in order to get the best product to market. We are still working on the following three projects: 1) GFR: Glomeril Filtration Rate, 2) Total Body Albumin Analysis, and 3) Wipe Tests for radiation contamination and detection. We are also progressing on the next version of the delivery device for the radioactive dose Volumex. The current version is the “Max-100” which has a patent. The next version, the “Max-200” will be without a needle and should give the company extended protection with a second patent when it is completed.

Total Operating Costs including cost of sales for the Cryobanking segment were $950,455 for the year ended December 31, 2008 versus $949,148 for the year ended December 31, 2007 for an increase of $1,307 or 0.1%.

Dividend Income

Dividend income earned in 2008 was $2,509,966 vs. $2,419,476 in 2007, for an increase of $90,490, or 3.7%. In 2006, dividend income was $2,273,737.

Investment Gains

Gains on the sale of investments were $17,249,716 in 2008 vs. $14,853,934 in 2007, and $3,316,710 in 2006. A major reason for the increase in Gains on the sale of investments in 2008 is that the Company realized $1,173,622 in gains on a security that was sold as the result of a merger. This stock would not have otherwise been sold but would have been held by the Company as of December 31, 2008.

22

The sum of dividend income plus investment gain from sale of securities was $19,759,682 in 2008, $17,273,410 in 2007, and $5,590,447 in 2006.

LIQUIDITY AND CAPITAL RESOURCES

The Company’s management has pursued a policy of maintaining sufficient liquidity and capital resources in order to assure continued availability of necessary funds for the viability and projected growth of all ongoing projects.

At December 31, 2008, the Company had $32,973,248 in short-term debt versus $47,214,047 at December 31, 2007. The following amounts are included in short-term debt at December 31, 2008 and December 31, 2007: Income Taxes Payable of $2,643,958 and $1,295,668 respectively, Deferred Tax Liability of $8,066,823 and $15,726,213 respectively, and Securities borrowed at fair market value of $107,871 and $20,362,259. The Deferred Tax Liability represents taxes due on the unrealized gain of the investment portfolio and Securities borrowed at fair market value represent short positions in common stock.

At December 31, 2008, stockholders’ equity was $43,460,641 vs. $54,915,885 at December 31, 2007. At December 31, 2008 the Company’s security portfolio had a market value of $68,339,143 versus $74,919,193 at December 31, 2007. At December 31, 2008, the Company’s total liabilities and stockholders’ equity were $76,824,181 versus $102,560,500 at December 31, 2007.

Income from the Company’s security portfolio is a major asset for the Company as it conintues its efforts in research and marketing staff. At December 31, 2008, the Company is in a satisfactory financial position with adequate funds available for its immediate and anticipated needs. The Company plans its budgetary outlays on the assumption that the raising of additional financial capital may be difficult in the next 2 to 4 years. The Company believes that its present liquidity and assets are adequate to sustain the expenses associated with its sales and marketing program.

The following table shows the Cost, Market Value, Net Unrealized Gain, Unrealized Gain and Loss at December 31st from 2004 through 2008.

| | | | | | | | | | | | | | | | |

Valuation Date: | | Cost | | Fair Market

Value | | Net Unrealized

Gain | | Unrealized Gains | | Unrealized

Losses | |

| | | | �� | | | | | | | | |

December 31, 2008 | | $ | 50,709,601 | | $ | 68,339,143 | | $ | 17,629,542 | | $ | 28,469,540 | | $ | (10,839,998 | ) |

December 31, 2007 | | | 29,987,157 | | | 74,919,193 | | | 44,932,036 | | | 47,386,399 | | | (2,454,363 | ) |

December 31, 2006 | | | 23,307,390 | | | 66,968,446 | | | 43,661,056 | | | 43,927,770 | | | (266,714 | ) |

December 31, 2005 | | | 25,649,467 | | | 57,246,006 | | | 31,596,539 | | | 32,440,131 | | | (843,592 | ) |

December 31, 2004 | | | 22,907,780 | | | 54,806,400 | | | 31,898,620 | | | 32,133,292 | | | (234,672 | ) |

The Company’s invested capital has increased over the past 5 years, going from $22,907,780 in 2004 to $50,709,601 in 2008. The value of the Company’s investments increased from $54,806,400 in 2004 to $68,339,143 during this 5 year period. The Company has been able to partially offset the continuing operating losses which in 2007 were the highest in the Company’s history. The increase in value of the Company’s assets provides an underpinning for the Company’s expanding activities. While there can be no assurance that these assets will not decrease in value, it is unlikely, at the present time, that they will go back to historical cost. The Company feels, however, that with respect to the Blood Volume Analyzer and the Blood Optimization Program, it is undercapitalized. Recent inquiries have indicated that additional capital is not available on reasonable terms without great dilution to existing shareholders. The Company believes that if the blood volume analyzer becomes a standard of care in any one of the areas described in this 10-K filing, it will then have much easier access to additional capital.

CRITICAL ACCOUNTING POLICIES

Available for Sale Securities

Available-for-sale securities represent investments in debt and equity securities (primarily common and preferred stock of utility companies)that management has determined meet the definition of available-for-sale under SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities. Accordingly, these investments are stated at fair market value and all unrealized holding gains or losses are recorded in the Stockholders’ Equity section as Accumulated Other Comprehensive Income (Loss). Conversely, all realized gains, losses and earnings are recorded in the Statement of Operations under Other Income (Expense).

The company will also engage in the short selling of stock. When this occurs, the short position is marked to the market and this adjustment is recorded in the Statement of Operations. Any gain or loss is recorded for the period presented

23

Historical cost is used by the Company to determine all gains and losses, and fair market value is obtained by readily available market quotes on all securities.

The Company’s investment goals, strategies and policies are as follows:

| | |

1. | The Company’s investment goals are capital preservation and maintaining returns on this capital with a high degree of safety. |

| | |

2. | The Company maintains a diversified securities portfolio comprised primarily of electric utility preferred and common stocks. The Company also sells covered calls on portions of its portfolio and also sells puts on stocks it is willing to own. It also sells uncovered calls and will engage in short positions up to 15% of the value of its portfolio. The Company’s short position may temporarily rise to 20% of the Company’s portfolio without any specific action because of changes in valuation, but should not exceed this amount. The Company’s investment policy is to maintain approximately of 80% of its portfolio in electric utilities. Investments in utilities are primarily in electric companies. Investments in non-utility stocks will not exceed 15% of the portfolio. |

| | |

3. | Investment in speculative issues, including short sales, maximum of 15%. |

| | |

4. | Limited use of options to increase yearly investment income. |

| | |

| a. | The use of “Call” Options. Covered options can be sold up to a maximum of 20% of the value of the portfolio. This provides extra income in addition to dividends received from the company’s investments. The risk of this strategy is that investments the company may have preferred to retain can be called away. Therefore, a limitation of 20% is placed on the amount of stock on which options which can be written. The amount of the portfolio on which options are actually written is usually between 3-10% of the portfolio. The actual turnover of the portfolio is such that the average holding period is in excess of 5 years for available for sale securities. |

| | |

| b. | The use of “Put” options. Put options are written on stocks which the company is willing to purchase. While the company does not have a high rate of turnover in its portfolio, there is some turnover; for example, due to preferred stocks being called back by the issuing company, or stocks being called away because call options have been written. If the stock does not go below the put exercise price, the company records the proceeds from the sale as income. If the put is exercised, the cost basis is reduced by the proceeds received from the sale of the put option. There may be occasions where the cost basis of the stock is lower than the market price at the time the option is exercised. |

| | |

| c. | Speculative Short Sales/Short Options. The company limits its speculative transactions to no more than 15% of the value of the portfolio. The company may sell uncovered calls on certain stocks. If the stock price does not rise to the price of the calls, the option is not exercised, and the company records the proceeds from the sale of the call as income. If the call is exercised, the company will have a short position in the related stock. The company then has the choice of covering the short position or selling a put against it. If the put is exercised, the short position is covered. The company’s current accounting policy is to mark to the market at the end of each quarter any short positions, and include it in the income statement. While the company may have so-called speculative positions equal to 15% of its accounts, in actual practice the average short stock positions usually account for less than 10% of the assets of the company. |

| | |

5. | In the event of a merger, the Company will elect to receive shares in the new company. In the event of a cash only offer, the Company will receive cash and be forced to sell its stock. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations discuss the Company’s condensed consolidated financial statements, which have been prepared in accordance with US GAAP. The Company considers the following accounting policies to be critical accounting policies.

Revenue Recognition

The Company recognizes operational revenues from several sources. The first source is the outright sale of equipment, the Blood Volume Analyzer, to customers. The second source is the sale and associated shipping revenues of single-use radioisotope doses (Volumex) that are injected into the patient and measured by the Blood Volume Analyzer. The third source of revenue is service contracts on the Blood Volume Analyzer, after it has been sold to a customer. The fourth source of revenue is the storage fees associated with cryobanked blood and semen specimens. The fifth is lab revenues from laboratory services, and the sixth is revenue from semen sales.

The Company currently offers three different methods of purchasing the Blood Volume Analyzer equipment. A customer may purchase the equipment directly, lease the equipment, or rent the equipment on a month-to-month basis. The revenues generated by a direct sale or a monthly rental are recognized as revenue in the period in which the sale or rental occurred. If a customer is to select the “lease” option, the Company refers its customer to a third party finance company with which it has established a relationship, and if the lease is approved, the Company receives 100% of the sales proceeds from the finance company and recognizes 100% of the revenue. The finance company then deals directly with the customer with regard to lease payments and related collections. Daxor Corporation does not guarantee payments to the leasing company.

24

The sales of the single-use radioisotope doses (Volumex) that are used in conjunction with the Blood Volume Analyzer are recognized as revenue in the period in which the sale occurred.

When Blood Volume Analyzer equipment has been sold to a customer, the Company offers a one year warranty on the product, which covers all mechanical failures. This one year warranty is effective on the date of sale of the equipment. After the one year period expires, customers may purchase a service contract through the Company. Historically, service contracts were recorded by the Company as deferred revenue and were amortized into income in the period in which they were earned. Effective January 1, 2006, the Company began offering service contracts priced on an annual basis which are billed annually or quarterly depending upon the contractual arrangement with the customer. There were four hospitals that the Company billed during the year ended December 31, 2008 for the entire amount of their annual service contract. At December 31, 2008 and December 31, 2007, deferred revenue pertaining to the historical service contracts was $17,042 and $7,417 respectively.

The storage fees associated with the cryobanked blood and semen samples are recognized as income in the period for which the fee applies. The Company invoices customers for storage fees for various time periods. These time periods range from one month up to one, two or three years. The Company will only recognize revenue for those storage fees that are earned in the current reporting period, and will defer the remaining revenues to the period in which they are earned. Effective October, 2005, the Company has altered our billing procedure as such that clients will only be billed on a quarterly basis. Therefore, future revenue recognition will not include deferred revenue on the storage fees, but rather will be earned in the same period in which the invoices are generated.

Comprehensive Income (Loss)

The Company reports components of comprehensive income under the requirements of SFAS No. 130, Reporting Comprehensive Income. This statement establishes rules for the reporting of comprehensive income and requires certain transactions to be presented as separate components of stockholders’ equity. The Company currently reports the unrealized holding gains and losses on available-for-sale securities, net of deferred taxes, as accumulated other comprehensive income (loss).

Product Warrantees and Related Liabilities

The Company offers a one year warranty on the Blood Volume Analyzer equipment. This warranty is effective on the date of sale and covers all mechanical failures of the equipment. All major components of the equipment are purchased and warranted by the original third party manufacturers.

Once the initial one year warranty period has expired, customers may purchase annual service contracts for the equipment. These service contracts warranty the mechanical failures of the equipment that are not associated with normal wear-and-tear of the components.

To date, the Company has not experienced any major mechanical failures on any equipment sold. In addition, the majority of the potential liability would revert to the original manufacturer. Due to this history, a liability has not been recorded with respect to product / warranty liability.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the dates of the financial statements and the results of operations during the reporting periods.. Although these estimates are based upon management’s best knowledge of current events and actions, actual results could differ from those estimates

Income Taxes

The Company accounts for income taxes under the provisions of SFAS No. 109, Accounting for Income Taxes. This pronouncement requires recognition of deferred tax assets and liabilities for the estimated future tax consequences of event attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which the differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of changes in tax rates is recognized in the statement of operations in the period in which the enactment rate changes. Deferred tax assets and liabilities are reduced through the establishment of a valuation allowance at such time as, based on available evidence, it is more likely than not that the deferred tax assets will not be realized.

25

Contractual Obligations

In December 2002, the Company signed a lease which commenced on January 1, 2003, for its existing facility at the Empire State Building. The lease expires on December 31, 2015. The Company has occupied this space since January 1992. The company currently occupies approximately 7,200 square feet. There are options for an additional 18,000 square feet of space. The Company has acquired a 20,000 square foot manufacturing facility in Oak Ridge, Tennessee which is currently manufacturing the BVA-100 Blood Volume Analyzers, and where R&D activities are performed. The Company’s Volumex syringes are filled by an FDA approved radio pharmaceutical manufacturer. The manufacturer has worked with Daxor since 1987. The manufacturer’s prices are reviewed annually.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

| | | | | | | | | | | | | | | | |

| | | | Payments Due By Period | |

Contractual

Obligations | | Total | | Less Than

1 Year | | 1 – 3

Years | | 3 – 5 Years | | More Than

5 years | |

| | | | | | | | | | | | | | | | | |

(Long-Term Debt Obligations)1 | | $ | 515,542 | | $ | 71,190 | | $ | 142,380 | | $ | 301,972 | | | 0 | |

| | | | | | | | | | | | | | | | |

(Capital Lease Obligations) | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | |

(Operating Lease Obligations)2 | | $ | 2,205,588 | | $ | 315,084 | | $ | 630,168 | | $ | 630,168 | | $ | 630,168 | |

| | | | | | | | | | | | | | | | |

(Purchase Obligations) | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | |

(Other Long-Term Liabilities Reflected on the Registrant’s Balance Sheet under GAAP) | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 2,721,130 | | $ | 386,274 | | $ | 772,548 | | $ | 932,140 | | $ | 630,168 | |

| | | | | | | | | | | | | | | | |

1This amount represents the total monthly mortgage payment of $5,932 which includes principal and interest for the property purchased at 107 and 109 Meco Lane in Oak Ridge, Tennessee. There is a monthly payment of $5,932 through December of 2011. The Company has the option of making a balloon payment of $301,972 in January of 2012 or refinancing the remaining amount of the mortgage.

2This amount represents a total monthly rental payment of $26,257 which consists of base rent of $25,535 and $722 for two separate spaces at 350 5th Avenue.

Summary of Actual Portfolio Investments

The company’s portfolio value is exposed to fluctuations in the general value of utilities. An increase of interest rates could affect the company in two ways: one would be to put downward pressure on the valuation of utility stocks as well as increase the company’s cost of borrowing.

Because of the size of the unrealized gains in the company’s portfolio, the company does not anticipate any changes which could reduce the value of the company’s utility portfolio below historical cost. Utilities operate in an environment of federal, state and local regulations, and they may disproportionately affect an individual utility. The company’s exposure to regulatory risk is mitigated due to it’s diversity of holdings. At December 31, 2008 and 2007, the company held 104 and 63 separate stocks, respectively.

Puts and calls are marked to market for each reporting period and any gain or loss is recognized through the Statement of Operations and labeled as “Mark to market of short positions”.

26

December 31, 2008

The following is summary information on the actual Securities Portfolio held by Daxor Corporation during the year ended and as at December 31, 2008:

| | | | | | | | | | | | | | | | | | | |

Description | | Percent of

Portfolio Cost | | Cost | | Market Value | | Unrealized

Gains | | Unrealized

Losses | | Dividends and

Interest | |

| | | | | | | | | | | | | | |

Utilities-Common Stock | | | 63.25 | % | $ | 32,074,124 | | $ | 53,875,289 | | $ | 27,660,548 | | $ | (5,859,383 | ) | $ | 2,096,733 | |

Non-Utilities Common | | | 30.95 | % | | 15,692,238 | | | 12,035,699 | | | 610,069 | | | (4,266,608 | ) | | 124,453 | |

Total Common Stock | | | 94.20 | % | | 47,766,362 | | | 65,910,988 | | | 28,270,617 | | | (10,125,991 | ) | | 2,221,186 | |

Mutual Funds-Non-Utilities | | | 0.34 | % | | 172,710 | | | 165,500 | | | 0 | | | (7,210 | ) | | | |

Utilities-Preferred Stock | | | 0.53 | % | | 270,498 | | | 438,884 | | | 173,317 | | | (4,931 | ) | | 26,523 | |

Non-Utilities- Preferred | | | 4.87 | % | | 2,467,026 | | | 1,823,771 | | | 25,606 | | | (668,861 | ) | | 123,134 | |

Total Preferred Stock | | | 5.40 | % | | 2,737,524 | | | 2,262,655 | | | 198,923 | | | (673,792 | ) | | 149,657 | |

Total Equities | | | 99.94 | % | | 50,676,596 | | | 68,339,143 | | | 28,469,540 | | | (10,806,993 | ) | | 2,370,843 | |

Utilities-Bonds | | | .06 | % | | 33,005 | | | 0 | | | 0 | | | (33,005 | ) | | 0 | |

Total Portfolio | | | 100.00 | % | $ | 50,709,601 | | $ | 68,339,143 | | $ | 28,469,540 | | $ | (10,839,998 | ) | $ | 2,370,843 | |

| | | | | | | | | | | | | | | | | | | |

During the year ended December 31, 2008, the Company received $ 87,465 of dividends on stocks that were not in the Securities Portfolio at December 31, 2008 and was charged $32,483 for dividends on short positions. The Company also received $84,141 in money market dividends.

Summary of Put and Call Options at December 31, 2008

| | | | | | | | | | | | | |

Description | | Proceeds Received | | Market Value | | Unrealized Gains | | Unrealized Losses | |

| | | | | | | | | | |

Puts | | $ | 7,125,645 | | $ | 7,118,277 | | $ | 2,364,802 | | $ | (2,357,434 | ) |

Calls | | $ | 6,686,330 | | $ | 1,306,082 | | $ | 5,575,222 | | $ | (194,974 | ) |

| | | | | | | | | | | | | |

Total Puts and Calls | | $ | 13,811,975 | | $ | 8,424,359 | | $ | 7,940,024 | | $ | (2,552,408 | ) |

| | | | | | | | | | | | | |

December 31, 2007

The following is summary information on the actual Securities Portfolio held by Daxor Corporation during the year ended and as at December 31, 2007:

| | | | | | | | | | | | | | | | | | | |

Description | | Percent of

Portfolio Cost | | Cost | | Market Value | | Unrealized

Gains | | Unrealized

Losses | | Dividends and

Interest | |

| | | | | | | | | | | | | | |

Utilities-Common Stock | | | 86.51 | % | $ | 25,941,264 | | $ | 70,550,992 | | $ | 46,696,888 | | | (2,087,160 | ) | $ | 1,957,012 | |

| | | | | | | | | | | | | | | | | | | |

Non-Utilities Common | | | 9.68 | % | | 2,903,548 | | | 2,770,677 | | | 226,645 | | | (359,516 | ) | | 4,640 | |

Total Common Stock | | | 96.19 | % | | 28,844,812 | | | 73,321,669 | | | 46,923,533 | | | (2,446,676 | ) | | 1,961,652 | |

Utilities-Preferred Stock | | | 2.25 | % | | 673,367 | | | 968,869 | | | 295,502 | | | 0 | | | 47,594 | |

Non-Utilities- Preferred | | | .95 | % | | 284,332 | | | 282,105 | | | 5,460 | | | (7,687 | ) | | 9,444 | |

Total Preferred Stock | | | 3.20 | % | | 957,699 | | | 1,250,974 | | | 300,962 | | | (7,687 | ) | | 57,038 | |

Total Equities | | | 99.39 | % | | 29,802,511 | | | 74,572,643 | | | 47,224,495 | | | (2,454,363 | ) | | 2,018,690 | |

Utilities-Bonds | | | .51 | % | | 151,881 | | | 289,550 | | | 137,669 | | | 0 | | | 0 | |

Non-Utilities- Bonds | | | .10 | % | | 32,765 | | | 57,000 | | | 24,235 | | | 0 | | | 3,687 | |

Total Bonds | | | .61 | % | | 184,646 | | | 346,550 | | | 161,904 | | | 0 | | | 3,687 | |

| | | | | | | | | | | | | | | | | | | |

Total Portfolio | | | 100.00 | % | $ | 29,987,157 | | $ | 74,919,193 | | $ | 47,386,399 | | $ | (2,454,363 | ) | $ | 2,022,377 | |

| | | | | | | | | | | | | | | | | | | |

27

During the year ended December 31, 2007, the Company received $381,578 of dividends on stocks that were not in the Securities Portfolio at December 31, 2007 and was charged $74,427 for dividends on short positions. The Company also received $93,635 in money market dividends.

Summary of Put and Call Options at December 31, 2007

| | | | | | | | | | | | | |

Description | | Proceeds Received | | Market Value | | Unrealized Gains | | Unrealized Losses | |

| | | | | | | | | | |

Puts | | $ | 1,545,102 | | $ | 2,172,670 | | $ | 360,565 | | $ | (988,133 | ) |

Calls | | $ | 6,100,731 | | $ | 3,799,962 | | $ | 3,602,061 | | $ | (1,301,292 | ) |

| | | | | | | | | | | | | |

Total Puts and Calls | | $ | 7,645,833 | | $ | 5,972,632 | | $ | 3,962,626 | | $ | (2,289,425 | ) |

| | | | | | | | | | | | | |

Item 7A: Quantitative and Qualitative Disclosures about Market Risk.

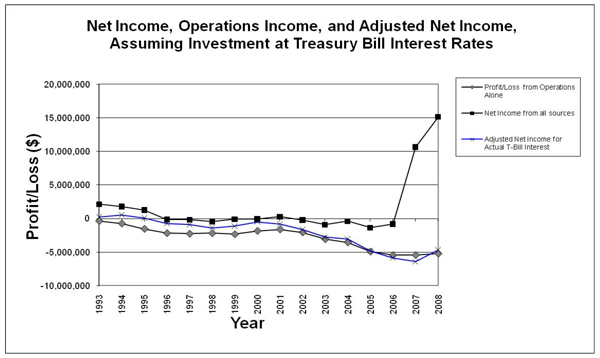

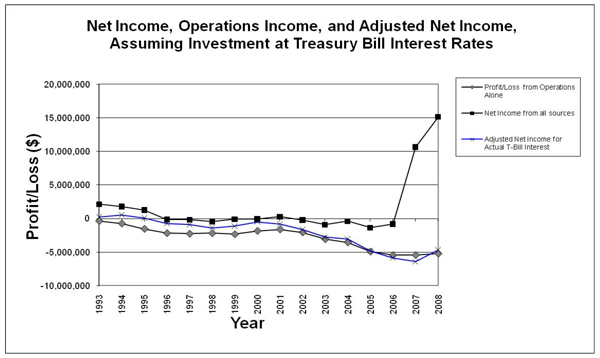

In light of the Safe Harbor provisions so that a company could not be considered an investment company, we have done an analysis of what would have occurred if the company had elected to use a Safe Harbor provision instead of the cash management program that it developed which utilizes dividend paying utilities combined with option sales. It should be noted that it is not mandatory to utilize T-bills, only that it is a Safe Harbor provision, where one is not required to explain or justify that one is an operating company rather than in investment company. We elected to augment the company’s revenue rather than accept the Safe Harbor T-bill scenario. We understood that there were risks, and the concept was approved by the Board of Directors of Daxor before this policy was inaugurated.

The Board of Directors reviews and approves the investment policy at least once a year. The current policy is: 1) the primary investments are in electric utilities; no more than 20% of the company’s assets can be in “shorts” at any one time; 2)the company can continue to sell covered call options; sell naked put options on securities it is willing to own; 3) concentration of no more than 10% of any one stock in the portfolio; 4) if a stock were to grow to more than 10% due to natural increase in value, it is exempt from the 10% concentration rule. The Company has always had on its Board of Directors, for the last twenty years, at least one person who could be considered an expert on investing accounting policy with Wall Street experience.

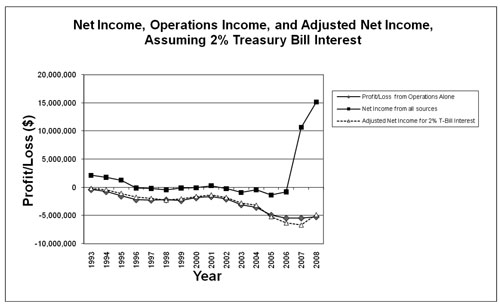

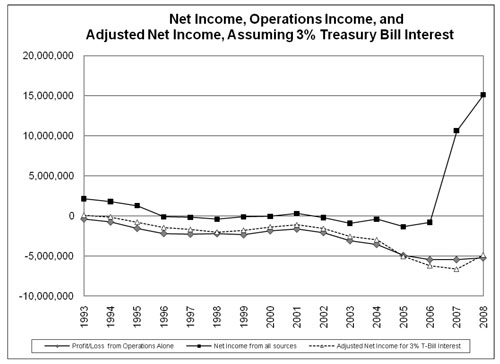

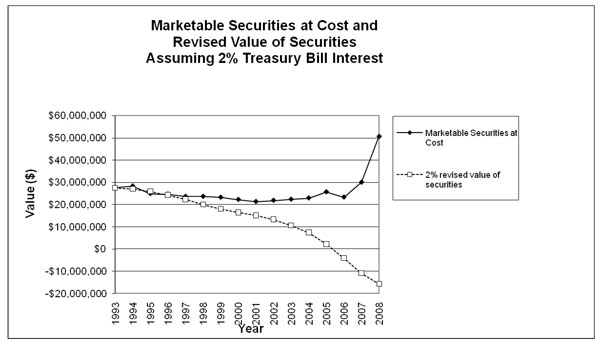

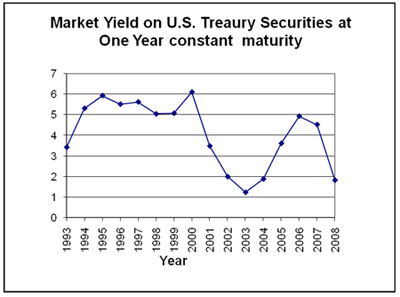

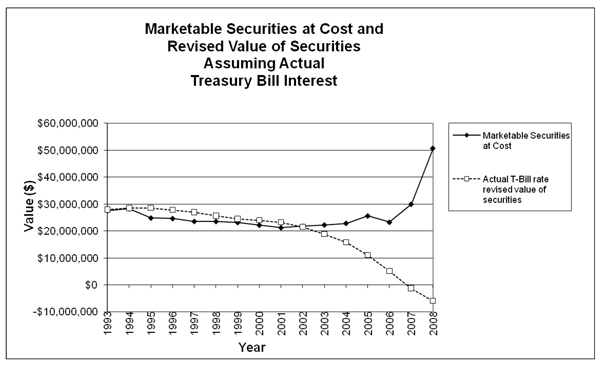

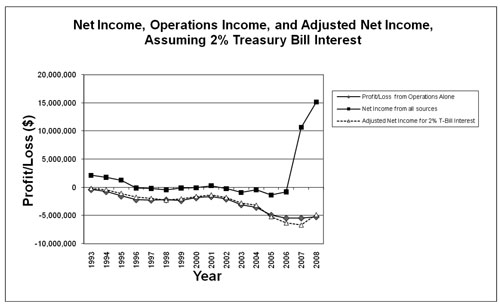

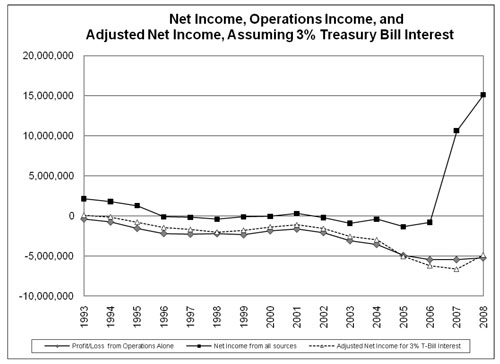

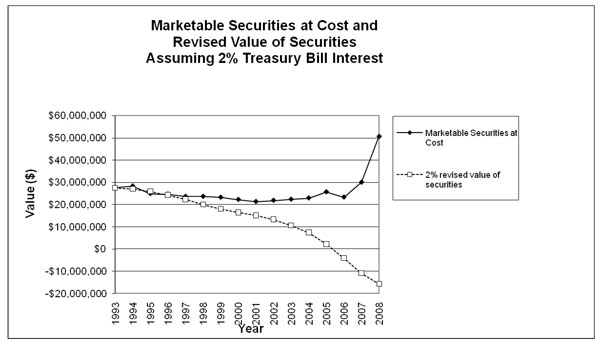

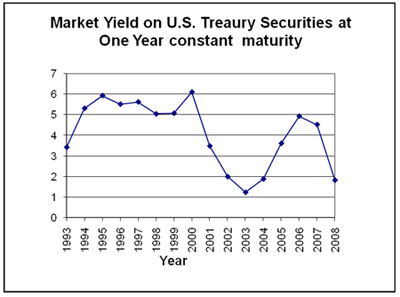

In 1985, the Company had a secondary offering which raised approximately $7.1 million. In 1984, prior to clearance by the SEC of the underwriting, the Company had its cash management policy of investing in electric utilities reviewed by the SEC. The SEC reviewed the policy and the Company’s operations, and permitted the secondary offering to proceed without any alterations. In 1992, the Company had its cash management investment policies questioned by the SEC and no action was taken against the Company. The following graphs illustrate what would have happened to the company if the Company had chosen at that time, beginning in 1993, to undertake a so-called Safe Harbor policy. Two separate T-bill rates were used for this analysis; one for an average rate of approximately 2%, and one for an average rate of approximately 3%. The 2% and 3% scenarios are reasonable approximations of which the Company might have encountered during this time. During the 16 year period of 1993-2008 which is covered in this analysis, the annual yield on U.S. Treasuries at a one year constant maturity varied from 1.24% to 6.11%.

In November 2005, the Company’s cash policy was again questioned by the SEC and a formal response was provided by the Company on January 13, 2006. The following additional information is provided to illustrate what the Company’s current financial position would have been had it followed a simple policy of investing its cash in treasury securities. The Company also is providing a graph adapted from information provided on the Federal Reserve website atwww.federalreserve.gov. The company provided similar information in an amended 10-K filed on November 9, 2006. The current graphs include the year ended December 31, 2008.

Graph 1 illustrates three sets of data from 1993 to 2008: 1) the company’s reported net income from all sources, 2) the company’s operation income minus operating expenses, and 3) a hypothetical net income calculated assuming that, rather than following its existing investment policy, the Company had invested in Treasury Bills and received an interest rate of 2%.

28

Graph 1: Comparison of Net Earnings with Hypothetical Earnings That Would Have Resulted Had the Company Invested in Treasury Bills from 1993 to 2008 and Received a 2% Interest Rate

For the years ended December 31, 2008 and 2007, the Company had net income of $15,123,269 and $10,647,216 respectively. However, for the years ended December 31, 2006, 2005 and 2004, the company recorded losses of $785,531, $1,335,981 and $389,622 despite supplemental revenue from investments. For the years ended December 31, 1996 through December 31,2002, the company sustained heavy operating losses but was close to breaking even due to supplemental income. From 1993 to 1995, the company reported a net profit despite increasing losses from operations. As can be seen, from 1993 through 1995, the company also sustained operating losses.

Had the company invested in Treasury Bills and received a 2% interest rate, the annual losses for 2005 through 2008 would have been approximately $5 million. In 2004, the loss would have been over $3 million and in 2003 close to $3 million. From 1996-2002, the company would have lost approximately $2 million each year.

29

Graph 2: Comparison of Net Earnings with Hypothetical Earnings That Would Have Resulted Had the Company Invested in Treasury Bills from 1993 to 2008 and Received a 3% Interest Rate

Graph 2 shows the same basic scenario as Graph 1, except that the hypothetical net income was calculated assuming a 3% interest rate from Treasury Bills. The results are similar to those from Graph 1, but the loss is slightly lower because of the 1% higher interest rate.

30

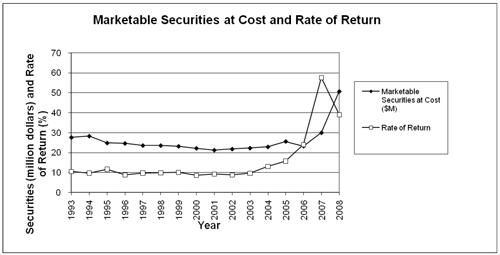

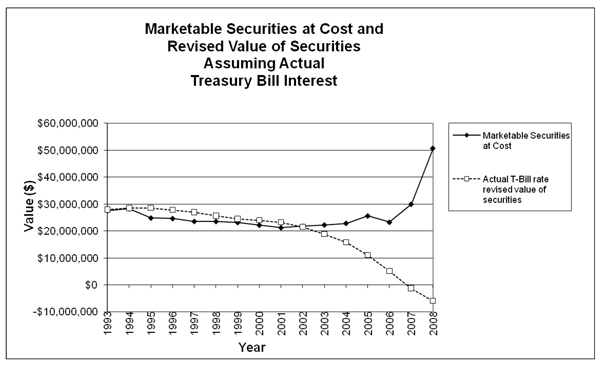

Graph 3: Hypothetical Change in Company Assets that Would Have Occurred Had Persistent Losses from Investment in Treasury Bills with a 2% Rate of Interest Forced the Company to Cover Losses by Liquidating Sections of its Portfolio

Graph 3 compares the Company’s marketable securities at cost with a hypothetical value of securities. This hypothetical value was calculated assuming that the Company had begun investing in Treasury Bills in 1993 and received a 2% interest rate. The marketable securities at cost approximately represent the amount of money the Company has available, or its approximate assets. Using our existing investment policy, the cost of the Company’s marketable securities has gradually increased from approximately $28 million at December 31, 1993 to approximately $50 million at December 31, 2008.

Had the company invested in Treasury Bills, because of the continuing net loss (as demonstrated in Graph 1), the Company would have been forced to steadily sell investment capital to cover those losses. The calculations take this dwindling supply of capital into account. Lost capital would only have been partially replaced by interest on the Treasury Bills, and the amount of investment income would have declined as the amount of capital decreased. By year end 2004, the value of the Company’s securities would have dwindled to approximately $7 million, from a starting point of over $27 million. By year end 2005, the estimated value of the securities would have fallen to approximately $2 million and the Company would likely have faced likely bankruptcy by the end of 2006.

31

Graph 4: Hypothetical Change in Company Assets that Would Have Occurred Had Persistent Losses from Investment in Treasury Bills a 3% Rate of Interest Forced the Company to Cover Losses by Liquidating Sections of its Portfolio

Graph 4 illustrates the same scenario as Graph 3, but assuming a 3% interest rate from Treasury Bills. The loss is somewhat less in this scenario, but by year end 2004, securities would have fallen to approximately $10 million, and the estimated value of the securities by 2005 would have been approximately $5 million by the end of 2005. Under this scenario, the Company would have been facing bankruptcy by the end of 2007.

32

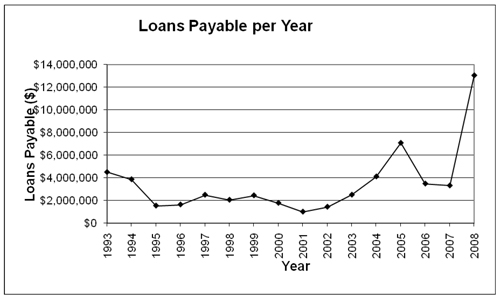

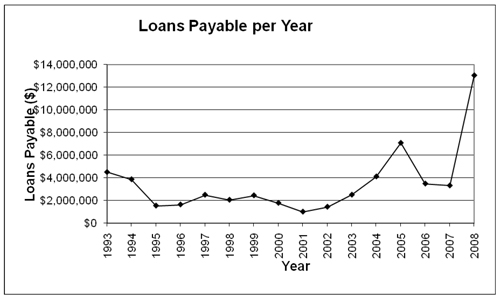

Graph 5: Loans Payable per Year

Graph 5 illustrates the Company’s loans payable at December 31 from 1993 to 2008. From 1993 to 1995, the amount of loans payable decreased sharply, and then stayed in a narrow range from 1995 to 2001, remaining below $3 million and reaching a low of $1 million at December 31, 2001. After 2001, because of the company’s expanded research and development, the amount of loans began to increase steadily until December 31, 2005, when they exceeded the 1993 amount. By December 31, 2007, the amount of loans returned somewhat to 2004 levels. The increase in the loan balance at December 31, 2008 is mainly a result of the increased cost of the investment portfolio.

33

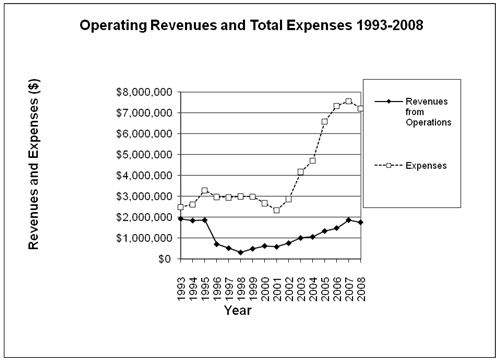

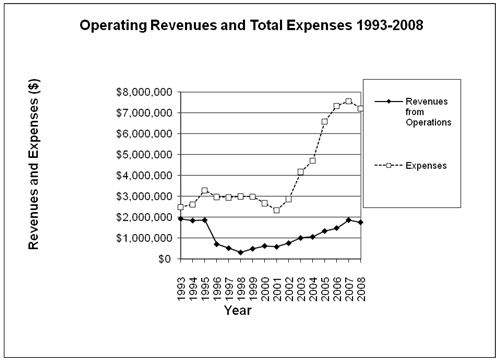

Graph 6: Operating Revenues and Total Expenses from 1993 to 2008

Graph 6 illustrates operational revenues and total expenses from 1993 to 2008. Operational revenues dropped sharply between 1995 and 1996. Between 1998 and 1999, operational revenues began to recover, and reached pre-1995 levels in 2007. Expenses were fairly constant between 1993 and 2001, but they have increased since 2001 because of the expansion in research, development, and marketing. Throughout the entire sixteen year period of 1993-2008, operating expenses have exceeded operating revenues each year.

34

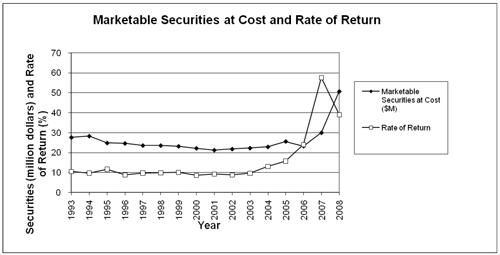

Graph 7: Marketable Securities at Cost Compared to the Rate of Return

Graph 7 shows the cost of securities compared with rate of return (investment income/cost of securities) from 1993 to 2008. The rate of return includes dividends and net profits from security sales, but it does not include unrealized profits. If unrealized profits had been included, the rate of return would have been higher.

The actual rate of return is more than three times the rate of return that the company would have received if the Company had invested exclusively in Treasury Bills. The Company, therefore, has benefited from the cash management policy of the past 16 years.

Graph 8: Portfolio of Treasury Securities at One Year constant maturity from 1993 -2008 from Federal Reserve Bank Data.

35

Graph 8 shows the market yield for the past 15 years on U.S Government Treasury securities at a one year constant maturity. The yields have ranged from a high of 6.11% in 2000 down to a low of 1.24% in 2003. The average yield for the past sixteen years is 4.10%, and the average interest rate for the past five years is 3.36%.

Graph 9: Comparison of Net Earnings with Hypothetical Earnings That Would Have Resulted Had the Company Invested in Treasury Bills with Yields reported by the Federal Reserve Bank from 1993-2008.

Graph 9 illustrates the same three sets of data as graphs 1 and 2, utilizing interest rates from Graph 8. The results are similar to those from the previous two graphs, validating the accuracy of those hypothetical predictions. Had the company invested in these or similar Treasury Bills, the company would have faced persistent losses over this 16 year period.

36

Graph 10: Hypothetical Change in Company Assets that Would Have Occurred Had Persistent Losses from Investment in Treasury Bills with Yields Reported by the Federal Reserve Bank Forced the Company to Cover Losses by Liquidating Sections of its Portfolio

Graph 10 illustrates the same scenario as Graphs 3 and 4, utilizing the interest rates from Graph 8. Again, the results are very similar to those from graphs 4 and 5, providing validation for the hypothetical predictions. By year end 2004, securities would have fallen to approximately $15 million, and securities by year end 2005 to been approximately $10 million. Had the company invested in these or similar Treasury Bills, by year end 2006, the value of the securities would have fallen to $5 million and the Company would likely have faced bankruptcy in 2007.

37

Item 8: Financial Statements and Supplementary Data.

Index to Consolidated Financial Statements

38

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of Daxor Corporation

We have audited the accompanying consolidated balance sheets of Daxor Corporation and subsidiary (the “Company”) as of December 31, 2008 and 2007, and the related consolidated statements of operations, stockholders’ equity and comprehensive income (loss), and cash flows for each of the three years in the period ended December 31, 2008. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Daxor Corporation and subsidiary as of December 31, 2008 and 2007, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2008, in conformity with U.S. generally accepted accounting principles.

/s/ Rotenberg Meril Solomon Bertiger & Guttilla, P.C.

Saddle Brook, NJ

March 20, 2009

39

DAXOR CORPORATION AND SUBSIDIARY

CONSOLIDATED FINANCIAL STATEMENTS

DAXOR CORPORATION AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

| | | | | | | |

| | December 31,

2008 | | December 31,

2007 | |

| | | | | |

|

| | | | | | |

ASSETS | | | | | | | |

| | | | | | | | |

| | | | | | | |

CURRENT ASSETS | | | | | | | |

| | | | | | | |

Cash and cash equivalents, including $1,994,558 of Treasury Bills in 2008 and $1,970,872 at 2007 | | $ | 2,545,040 | | $ | 2,029,834 | |

Receivable from broker(held in money market accounts) | | | 2,829,979 | | | 10,495,417 | |

Available-for-sale securities, at fair value | | | 68,339,143 | | | 74,919,193 | |

Securities sold, not received, at fair value | | | — | | | 12,404,409 | |

Accounts receivable, net of reserve of $88,645 in 2007 and $57,655 in 2007 | | | 205,568 | | | 214,334 | |

Inventory | | | 426,826 | | | 255,834 | |

Prepaid expenses and other current assets | | | 131,912 | | | 145,827 | |

| | | | | | | |

| | | | | | | |

Total Current Assets | | | 74,478,468 | | | 100,464,848 | |

| | | | | | | |

Property and equipment, net | | | 2,308,555 | | | 2,058,494 | |

Other assets | | | 37,158 | | | 37,158 | |

| | | | | | | |

| | | | | | | |

Total Assets | | $ | 76,824,181 | | $ | 102,560,500 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

| | | | | | | | |

| | | | | | | |

CURRENT LIABILITIES | | | | | | | |

| | | | | | | |

Accounts payable and accrued liabilities | | $ | 604,420 | | $ | 498,212 | |

Loans payable | | | 13,052,162 | | | 3,314,303 | |

Income taxes payable | | | 2,643,958 | | | 1,295,668 | |

Mortgage payable, current portion | | | 40,306 | | | 37,313 | |

Puts and calls, at fair value | | | 8,424,359 | | | 5,972,632 | |

Securities borrowed, at fair value | | | 107,871 | | | 20,362,259 | |

Deferred revenue | | | 33,349 | | | 7,417 | |

Deferred income taxes | | | 8,066,823 | | | 15,726,213 | |

| | | | | | | |

| | | | | | | |

Total Current Liabilities | | | 32,973,248 | | | 47,214,017 | |

| | | | | | | |

LONG TERM LIABILITIES | | | | | | | |

| | | | | | | |

Mortgage payable, less current portion | | | 390,292 | | | 430,598 | |

| | | | | | | |

Total Liabilities | | | 33,363,540 | | | 47,644,615 | |

| | | | | | | |

COMMITMENTS AND CONTINGENCIES | | | | | | | |

| | | | | | | |

STOCKHOLDERS’ EQUITY | | | | | | | |

Common stock, $.01 par value | | | | | | | |

Authorized - 10,000,000 shares | | | | | | | |

Issued - 5,316,550 shares | | | | | | | |

Outstanding – 4,289,118 and 4,468,618 shares, respectively | | | 53,165 | | | 53,165 | |

Additional paid in capital | | | 10,660,547 | | | 10,594,161 | |

Accumulated other comprehensive income | | | 11,459,203 | | | 29,205,823 | |

Retained earnings | | | 32,158,138 | | | 23,487,371 | |

Less: cost of common stock held in treasury, at cost, 1,027,432 shares in 2008 and 847,932 in 2007 | | | (10,870,412 | ) | | (8,424,635 | ) |

| | | | | | | |

Total Stockholders’ Equity | | | 43,460,641 | | | 54,915,885 | |

| | | | | | | |

Total Liabilities and Stockholders’ Equity | | $ | 76,824,181 | | $ | 102,560,500 | |

| | | | | | | |

See accompanying notes to consolidated financial statements

40

DAXOR CORPORATION AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31

| | | | | | | | | | |

REVENUES: | | 2008 | | 2007 | | 2006 | |

| | | | | | | |

| | | | | | | | | | |

Operating revenues - equipment sales and related services | | $ | 1,381,105 | | $ | 1,453,201 | | $ | 1,055,706 | |

Operating revenues - cryobanking and related services | | | 379,950 | | | 416,578 | | | 430,743 | |

| | | | | | | | | | |

|

Total Revenues | | | 1,761,055 | | | 1,869,779 | | | 1,486,449 | |

| | | | | | | | | | |

|

Costs of Sales: | | | | | | | | | | |

Costs of equipment sales and related services | | | 674,576 | | | 634,938 | | | 585,742 | |

Costs of cryobanking and related services | | | 42,702 | | | 47,848 | | | 45,825 | |

| | | | | | | | | | |

|

Total Costs of Sales | | | 717,278 | | | 682,786 | | | 631,567 | |

| | | | | | | | | | |

|

Gross Profit | | | 1,043,777 | | | 1,186,993 | | | 854,882 | |

| | | | | | | | | | |

| | | | | | | | | | |

OPERATING EXPENSES: | | | | | | | | | | |

| | | | | | | | | | |

Research and development expenses: | | | | | | | | | | |

Research and development-equipment sales and related services | | | 2,257,601 | | | 2,390,352 | | | 2,195,371 | |

Research and development-cryobanking and related services | | | 180,822 | | | 186,356 | | | 137,028 | |

| | | | | | | | | | |

|

Total Research and Development Expenses | | | 2,438,423 | | | 2,576,708 | | | 2,332,399 | |

| | | | | | | | | | |

|

Selling, General & Administrative Expenses: | | | | | | | | | | |

Selling, general, and administrative; equipment sales and related services | | | 3,085,575 | | | 3,326,211 | | | 3,645,655 | |

Selling, general & administrative; cryobanking and related services | | | 726,931 | | | 714,944 | | | 301,749 | |

| | | | | | | | | | |

|

Total Selling, General & Administrative Expenses | | | 3,812,506 | | | 4,041,155 | | | 3,947,404 | |

| | | | | | | | | | |

|

Total Operating Expenses | | | 6,250,929 | | | 6,617,863 | | | 6,279,803 | |

| | | | | | | | | | |

|

Loss from Operations | | | (5,207,152 | ) | | (5,430,870 | ) | | (5,424,921 | ) |

| | | | | | | | | | |

|

Other income (expenses): | | | | | | | | | | |

Dividend income-investment portfolio | | | 2,509,966 | | | 2,419,476 | | | 2,273,737 | |

Realized gains on sale of securities, net | | | 17,249,716 | | | 14,853,934 | | | 3,316,710 | |

Mark to market of short positions | | | 5,364,215 | | | 357,337 | | | (544,629 | ) |

Other revenues | | | 11,924 | | | 11,112 | | | 13,838 | |

Interest expense, net of interest income of $37,408,$12,838 and $3,699 | | | (147,501 | ) | | (197,211 | ) | | (363,952 | ) |

Administrative expenses relating to portfolio investments | | | (99,935 | ) | | (55,538 | ) | | (44,564 | ) |

| | | | | | | | | | |

|

Total Other income, net | | | 24,888,385 | | | 17,389,110 | | | 4,651,140 | |

|

Income (Loss) before income taxes | | $ | 19,681,233 | | $ | 11,958,240 | | $ | (773,781 | ) |

|

Provision for income taxes | | | 4,557,964 | | | 1,311,024 | | | 11,750 | |

| | | | | | | | | | |

|

Net Income (Loss) | | $ | 15,123,269 | | $ | 10,647,216 | | $ | (785,531 | ) |

| | | | | | | | | | |

|

Weighted average number of shares outstanding - basic | | | 4,350,951 | | | 4,572,119 | | | 4,625,168 | |

Net income (loss) per common equivalent share - basic | | $ | 3.48 | | $ | 2.33 | | $ | (0.17 | ) |

|

Weighted average number of shares outstanding - diluted | | | 4,375,623 | | | 4,572,119 | | | 4,625,168 | |

Net income (loss) per common equivalent share - diluted | | $ | 3.46 | | $ | 2.33 | | $ | (0.17 | ) |

41

DAXOR CORPORATION AND SUBSIDIARY

STATEMENTS OF STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME (LOSS)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Number of

Shares

Outstanding | | Amount | | Additional

Paid in Capital | | Accumulated

Other

Comprehensive

Income | | Retained

Earnings | | Treasury

Stock | | Total | | Comprehensive

Income (Loss) | |

| | | | | | | | | | | | | | | | | |

|

Balances, December 31, 2005 | | | 4,630,426 | | $ | 53,165 | | $ | 10,303,902 | | $ | 20,537,750 | | $ | 13,625,686 | | $ | (5,775,702 | ) | $ | 38,744,801 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Change in unrealized gain on securities, net of$4,222,581deferred taxes | | | | | | | | | | | | 7,841,937 | | | | | | | | | 7,841,937 | | $ | 7,841,937 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Option based compensation expense | | | | | | | | | 77,980 | | | | | | | | | | | | 77,980 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss | | | | | | | | | | | | | | | (785,531 | ) | | | | | (785,531 | ) | | (785,531 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Purchase of treasury stock | | | (15,100 | ) | | | | | | | | | | | | | | (241,395 | ) | | (241,395 | ) | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Comprehensive Income | | | | | | | | | | | | | | | | | | | | | | | $ | 7,056,406 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, December 31, 2006 | | | 4,615,326 | | $ | 53,165 | | $ | 10,381,882 | | $ | 28,379,687 | | $ | 12,840,155 | | $ | (6,017,097 | ) | $ | 45,637,792 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | �� | | | | | | | | | | | |

Change in unrealized gain on securities, net of$444,843 deferred taxes | | | | | | | | | | | | 826,136 | | | | | | | | | 826,136 | | $ | 826,136 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Option based compensation expense | | | | | | | | | 43,937 | | | | | | | | | | | | 43,937 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | | | | | | | 10,647,216 | | | | | | 10,647,216 | | | 10,647,216 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Treasury stock issued upon exercise of stock options | | | 17,100 | | | | | | 168,342 | | | | | | | | | 91,578 | | | 259,920 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Purchase of treasury stock | | | (163,808 | ) | | | | | | | | | | | | | | (2,499,116 | ) | | (2,499,116 | ) | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Comprehensive Income | | | | | | | | | | | | | | | | | | | | | | | $ | 11,473,352 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, December 31, 2007 | | | 4,468,618 | | $ | 53,165 | | $ | 10,594,161 | | $ | 29,205,823 | | $ | 23,487,371 | | $ | (8,424,635 | ) | $ | 54,915,885 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Change in unrealized gain on securities, net of $9,555,873 deferred taxes | | | | | | | | | | | | (17,746,620 | ) | | | | | | | | (17,746,620 | ) | $ | (17,746,620 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Option based compensation expense | | | | | | | | | 66,386 | | | | | | | | | | | | 66,386 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | | | | | | | 15,123,269 | | | | | | 15,123,269 | | | 15,123,269 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Common Stock Dividends | | | | | | | | | | | | | | | (6,452,502 | ) | | | | | (6,452,502 | ) | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Purchase of treasury stock | | | (179,500 | ) | | | | | | | | | | | | | | (2,445,777 | ) | | (2,445,777 | ) | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Comprehensive Loss | | | | | | | | | | | | | | | | | | | | | | | $ | (2,623,351 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Balances, December 31, 2008 | | | 4,289,118 | | $ | 53,165 | | $ | 10,660,547 | | $ | 11,459,203 | | $ | 32,158,138 | | $ | (10,870,412 | ) | $ | 43,460,641 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

42

DAXOR CORPORATION AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31

| | | | | | | | | | |

| | 2008 | | 2007 | | 2006 | |

| | | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | | |

Net income (loss) | | $ | 15,123,269 | | $ | 10,647,216 | | $ | (785,531 | ) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | | | | | | |

Depreciation & amortization | | | 288,748 | | | 229,929 | | | 166,399 | |

Deferred Income Taxes | | | 1,896,483 | | | — | | | — | |

Provision for bad debts | | | 30,990 | | | 23,492 | | | (7,137 | ) |

Gain on sale of fixed assets | | | (213,814 | ) | | (151,016 | ) | | (29,802 | ) |

Loss on disposal of fixed assets | | | 81,315 | | | 73,384 | | | — | |

Non-cash consideration received on instrument sale (1) | | | — | | | (65,000 | ) | | — | |

Stock dividend income received on investments | | | — | | | — | | | (4,326 | ) |

Stock based compensation associated with employee stock option plans | | | 66,386 | | | 43,937 | | | 77,980 | |

Non-cash research and development Expense (1) | | | — | | | 65,000 | | | — | |

Gains on sale of investments, net | | | (17,249,716 | ) | | (14,853,934 | ) | | (3,316,710 | ) |

Marked to market adjustments on options and shorts | | | (5,364,215 | ) | | (357,337 | ) | | 544,629 | |

Change in operating assets and operating liabilities: | | | | | | | | | | |

Increase in accounts receivable | | | (22,224 | ) | | (63,717 | ) | | (35,380 | ) |

(Increase) decrease in prepaid expenses & other current assets | | | 13,915 | | | (30,716 | ) | | 115,521 | |

(Increase) decrease in inventory | | | (170,992 | ) | | (84,838 | ) | | 20,865 | |

Increase in other assets | | | — | | | (5,000 | ) | | — | |

Increase (decrease) in accounts payable and accrued liabilities | | | 106,208 | | | 99,071 | | | (99,057 | ) |

Increase in Income Taxes Payable | | | 1,348,290 | | | 1,281,842 | | | — | |

Increase(decrease) in deferred income | | | 25,932 | | | 4,662 | | | (87,713 | ) |

| | | | | | | | | | |

Net cash used in operating activities | | | (4,039,425 | ) | | (3,143,025 | ) | | (3,440,262 | ) |

| | | | | | | | | | |

| | | | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | | |

Purchase of property and equipment | | | (666,310 | ) | | (1,642,489 | ) | | (344,534 | ) |

Proceeds from sale of fixed assets | | | 260,000 | | | 195,500 | | | 65,000 | |

| | | | | | | | | | |

(Decrease) increase in securities sold, not received | | | 12,404,409 | | | (5,301,646 | ) | | (6,083,827 | ) |

(Decrease) increase in securities borrowed | | | (20,254,388 | ) | | 9,696,537 | | | 9,362,925 | |

Purchases of put and call options | | | (430,233 | ) | | (772,799 | ) | | (224,165 | ) |

Sale of put and call options | | | 34,377,992 | | | 18,662,703 | | | 6,710,808 | |

Purchase of investments | | | (72,322,528 | ) | | (31,263,920 | ) | | (13,697,234 | ) |

| | | | | | | | | | |

Sales of investments | | | 42,717,984 | | | 25,195,606 | | | 14,238,819 | |

| | | | | | | | | | |

Net cash provided by (used in)investing activities | | | (3,913,074 | ) | | 14,769,492 | | | 10,027,792 | |

| | | | | | | | | | |

| | | | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | |

Proceeds from bank loan | | | 1,225,000 | | | 1,400,000 | | | — | |

Repayment of bank loan | | | (1,690,000 | ) | | (1,400,000 | ) | | — | |

Proceeds from margin loans | | | 94,420,864 | | | 40,045,820 | | | 23,902,822 | |

Repayment of margin loans | | | (76,552,567 | ) | | (50,710,095 | ) | | (27,503,033 | ) |

Proceeds from mortgage | | | — | | | 500,000 | | | — | |

Dividends paid | | | (6,452,502 | ) | | | | | | |

Repayment of mortgage | | | (37,313 | ) | | (32,089 | ) | | — | |

Purchase of treasury stock | | | (2,445,777 | ) | | (2,499,116 | ) | | (241,395 | ) |

Proceeds from sale of treasury Stock | | | — | | | 259,920 | | | — | |

| | | | | | | | | | |

Net cash provided by (used in) financing activities | | | 8,467,705 | | | (12,435,560 | ) | | (3,841,606 | ) |

| | | | | | | | | | |

| | | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 515,206 | | | (809,093 | ) | | 2,745,924 | |

Cash and cash equivalents at beginning of period | | | 2,029,834 | | | 2,838,927 | | | 93,003 | |

| | | | | | | | | | |

Cash and cash equivalents at end of period | | $ | 2,545,040 | | $ | 2,029,834 | | $ | 2,838,927 | |

| | | | | | | | | | |

1. The Company owed a hospital $65,000 of credits for Volumex Kits that were paid for and used in a research study.

See accompanying notes to consolidated financial statements

43

DAXOR CORPORATION AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(1) BUSINESS AND SIGNIFICANT ACCOUNTING POLICIES

Business

Daxor Corporation is a medical device manufacturing company that offers additional biotech services, such as cryobanking, through its wholly owned subsidiary Scientific Medical Systems Corp. The main focus of Daxor Corporation has been the development and marketing of an instrument that rapidly and accurately measures human blood volume. This instrument is used in conjunction with a single use diagnostic injection and collection kit that the Company also sells to its customers.

Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts of Daxor Corporation and Scientific Medical Systems Corp, a wholly-owned subsidiary. All significant intercompany transactions and balances have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Reclassifications

Reclassifications occurred to certain prior year amounts in order to conform to the current year classifications. The reclassifications have no effect on the reported net loss.

Segment Information

The Company has two operating segments: Equipment Sales and Related Services, and Cryobanking and Related Services.

The Equipment Sales and Related Services segment comprises the Blood Volume Analyzer equipment and related activity. This includes equipment sales, equipment rentals, equipment delivery fees, BVA-100 kit sales and service contract revenues.

The Cryobanking and Related Services segment is comprised of activity relating to the storage of blood and semen, and related laboratory services and handling fees.

Although not deemed an operating segment, the Company reports a third business segment; Investment activity. This segment reports the activity of the Company’s Investment Portfolio. This includes all earnings, gains and losses, and expenses relating to these investments.

Cash and Cash Equivalents

The Company considers cash equivalents to be all highly liquid investments purchased with an original maturity of 90 days or less. Normally, these consist of U.S. Treasury Bills. At December 31, 2008 and 2007 there were $1,994,558 and $1,970,872 of U.S. Treasury Bills included in Cash and Cash Equivalents.

Fair Value of Financial Instruments

The carrying amounts of financial instruments, including cash and cash equivalents, accounts receivable and payable, accrued liabilities, deferred option premiums and loans payable approximate fair value because of their short maturities. The carrying amount of the mortgage payable is estimated to approximate fair value as the mortgage was closed in 2007 at a current interest rate.

44

Fair Value Measurements

Effective January 1, 2008, we adopted SFAS No. 157, “Fair Value Measurements” (SFAS 157). SFAS 157 defines fair value, establishes a framework for measuring fair value under GAAP and enhances disclosures about fair value measurements. Fair value is defined under SFAS 157 as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. SFAS 157 establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair values which are discussed below. The adoption of SFAS 157 had no impact on our financial statements other than the disclosures presented herein.

Level 1- Quoted prices in active markets for identical assets or liabilities.

Level 2 - Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 2 assets include corporate-owned key person life insurance policies.

Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation. This category includes auction rate securities where independent pricing information was not able to be obtained.

The Company’s marketable securities are valued using Level 1 observable inputs utilizing quoted market prices in active markets. These marketable securities are summarized in footnote 2, Fair Value Measurements.

Puts and Calls at Fair Value

As part of the company’s investment strategy, put and call options are sold on various stocks the company is willing to buy or sell. The premiums received are deferred until such time as they are exercised or expire. In accordance with SFAS No. 133 -Accounting for Derivative Instruments and Hedging Activities,these options are marked to market for each reporting period using readily available market quotes, and this fair value adjustment is recorded as a gain or loss in the Statement of Operations.

Upon exercise, the value of the premium will adjust the basis of the underlying security bought or sold. Options that expire are recorded as income in the period they expire.

Receivable from Broker

The Receivable from Broker represents cash proceeds from sales of securities and dividends. These proceeds are kept in interest bearing money market accounts.

Available for Sale Securities

Available-for-sale securities represent investments in debt and equity securities (primarily common and preferred stock of utility companies)that management has determined meet the definition of available-for-sale under SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities. Accordingly, these investments are stated at fair market value and all unrealized holding gains or losses are recorded in the Stockholders’ Equity section as Accumulated Other Comprehensive Income (Loss). Conversely, all realized gains, losses and earnings are recorded in the Statement of Operations under Other Income (Expense).

The company will also engage in the short selling of stock. When this occurs, the short position is marked to the market and this adjustment is recorded in the Statement of Operations. Any gain or loss is recorded for the period presented

The Company’s investment goals, strategies and policies are as follows:

| | |

1. | The Company’s investment goals are capital preservation and maintaining returns on this capital with a high degree of safety. |

| |

2. | The Company maintains a diversified securities portfolio comprised primarily of electric utility preferred and common stocks. The Company also sells covered calls on portions of its portfolio and also sells puts on stocks it is willing to own. It also sells uncovered calls and will engage in short positions up to 15% of the value of its portfolio. The Company’s short position may temporarily rise to 20% of the Company’s portfolio without any specific action because of changes in valuation, but should not exceed this amount. The Company’s investment policy is to maintain approximately of 80% of its portfolio in electric utilities. Investments in utilities are primarily in electric companies. Investments in non-utility stocks will not exceed 15% of the portfolio. |

| |

3. | Investment in speculative issues, including short sales, maximum of 15%. |

| |

4. | Limited use of options to increase yearly investment income. |

45

| | |

| a. | The use of “Call” Options. Covered options can be sold up to a maximum of 20% of the value of the portfolio. This provides extra income in addition to dividends received from the company’s investments. The risk of this strategy is that investments the company may have preferred to retain can be called away. Therefore, a limitation of 20% is placed on the amount of stock on which options which can be written. The amount of the portfolio on which options are actually written is usually between 3-10% of the portfolio. The actual turnover of the portfolio is such that the average holding period is in excess of 5 years for available for sale securities. |

| | |

| d. | The use of “Put” options. Put options are written on stocks which the company is willing to purchase. While the company does not have a high rate of turnover in its portfolio, there is some turnover; for example, due to preferred stocks being called back by the issuing company, or stocks being called away because call options have been written. If the stock does not go below the put exercise price, the company records the proceeds from the sale as income. If the put is exercised, the cost basis is reduced by the proceeds received from the sale of the put option. There may be occasions where the cost basis of the stock is lower than the market price at the time the option is exercised. |

| | |

| e. | Speculative Short Sales/Short Options. The company limits its speculative transactions to no more than 15% of the value of the portfolio. The company may sell uncovered calls on certain stocks. If the stock price does not rise to the price of the calls, the option is not exercised, and the company records the proceeds from the sale of the call as income. If the call is exercised, the company will have a short position in the related stock. The company then has the choice of covering the short position or selling a put against it. If the put is exercised, the short position is covered. The company’s current accounting policy is to mark to the market at the end of each quarter any short positions, and include it in the income statement. While the company may have so-called speculative positions equal to 15% of its accounts, in actual practice the average short stock positions usually account for less than 10% of the assets of the company. |

| | |

5. | In the event of a merger, the Company will elect to receive shares in the new company. In the event of a cash only offer, the Company will receive cash and be forced to sell its stock. |

Securities borrowed at fair value

When a call option that has been sold short is exercised, a short position is created in the related common stock. The recorded cost of these short positions is the amount received on the sale of the stock plus the proceeds received from the underlying call option. These positions are shown on the Balance Sheet as “Securities borrowed at fair value” and the carrying value is reduced or increased at the end of each quarter by the mark to market adjustment which is recorded in accordance with SFAS No. 115 –Accounting for Certain Investments in Debt and Equity Securities.

Securities sold, not received at fair value

As of December 31, 2007, some of the financial institutions who held our securities did not increase our account with the cash proceeds on a short sale of stock. In lieu of cash, some of our accounts received a credit for the proceeds of the short sale. Cash was added or subtracted to these accounts weekly based on the market value of these short positions. These securities were recorded by the Company as received but not delivered and were valued at their quoted market price.

The short positions where the Company did not receive cash proceeds were closed out during 2008.

Accounts Receivable

Accounts receivable are reviewed by the Company at the end of each reporting period to determine the collectability based upon the aging of the balances and the history of the customer.

Inventory

Inventory is stated at the lower of cost or market, using the first-in, first-out method (FIFO), and consists primarily of finished goods.

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets generally consist of prepayments for future services and corporate capital base/personal holding taxes. Prepayments are expensed when the services are received or as the prepaid capital base/personal holding taxes are offset by the related tax liability. All prepaid expenses and taxes are expensed within one year of the Balance Sheet date and are thus classified as Current Assets.

Property and Equipment

Property and Equipment is stated at cost and consists of BVA equipment loaned on a trial basis, laboratory and office equipment, furniture and fixtures, and leasehold improvements. These assets are depreciated under the straight-line method, over their estimated useful lives, which range from 5 to 39 years.

Amounts spent to repair or maintain these assets arising out of the normal course of business are expensed in the period incurred. The cost of betterments and additions are capitalized and depreciated over the life of the asset. The cost of assets disposed of or determined to be non-revenue producing, together with the related accumulated depreciation applicable thereto, are eliminated from the accounts, and any gain or loss is recognized.

In accordance with SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, management reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Currently, management does not believe there is any impairment of any long-lived assets.

46

Revenue Recognition

The Company recognizes operational revenues from several sources. The first source is the sale of equipment, the Blood Volume Analyzer, to customers. The second source is the sale of single use tracer doses supplied as Volumex kits that are injected into the patient and measured by the Blood Volume Analyzer. The third source of revenue is service contracts on the Blood Volume Analyzer, after it has been sold to a customer. The fourth source of revenue is the storage fees associated with cryobanked blood and semen specimens, and associated laboratory tests.

The Company currently offers three different methods of purchasing the Blood Volume Analyzer equipment. A customer may purchase the equipment directly, lease the equipment, or rent the equipment on a month-to-month basis. The revenues generated by a direct sale or a monthly rental are recognized as revenue in the period in which the sale or rental occurred. If a customer is to select the “lease” option, the Company refers its customer to a third party finance company with which it has established a relationship, and if the lease is approved, the Company receives 100% of the sales proceeds from the finance company and recognizes 100% of the revenue. The finance company then deals directly with the customer with regard to lease payments and related collections.

The sales of the single-use radioisotope doses (Volumex) that are used in conjunction with the Blood Volume Analyzer are recognized as revenue in the period in which the doses are shipped.

When Blood Volume Analyzer equipment has been sold to a customer, the Company offers a one year warranty on the product, which covers all mechanical failures. This one year warranty is effective on the date of sale of the equipment. After the one year period expires, customers may purchase a service contract through the Company, which is usually offered in one-year increments. These service contracts are recorded by the Company as deferred revenue and are amortized into income in the period in which they apply.

As at December 31, 2008 and December 31, 2007, deferred revenue pertaining to the kit sales and historical service contracts was $31,706 and $7,417 respectively. Deferred revenue related to the storage fees was $1,643 and $0, respectively. The total deferred revenues were $33,349 and $7,417 respectively.

The storage fees associated with the cryobanked blood and semen samples are recognized as income in the period for which the fee applies. Although the Company historically offered annual storage fee contracts, effective October 1, 2005, the Company only offers three month storage terms.

Income Taxes