QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | |

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 3, 2007 |

OR |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number1-6049

TARGET CORPORATION

(Exact name of registrant as specified in its charter)

Minnesota

(State or other jurisdiction of

incorporation or organization) | | 41-0215170

(I.R.S. Employer

Identification No.) |

1000 Nicollet Mall, Minneapolis, Minnesota

(Address of principal executive offices) |

|

55403

(Zip Code) |

Registrant's telephone number, including area code: 612/304-6073

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

| | Name of Each Exchange on Which Registered

|

|---|

| Common Stock, par value $.0833 per share | | New York Stock Exchange |

| Preferred Share Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Act).

Large accelerated filerý Accelerated filero Non-accelerated filero

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

Aggregate market value of the voting stock held by non-affiliates of the registrant on July 29, 2006 was $39,796,702,943.82, based on the closing price of $46.46 per share of Common Stock as reported on the New York Stock Exchange-Composite Index.

Indicate the number of shares outstanding of each of registrant's classes of Common Stock, as of the latest practicable date. Total shares of Common Stock, par value $.0833, outstanding at March 14, 2007 were 858,580,232.

DOCUMENTS INCORPORATED BY REFERENCE

1. Portions of Target's Proxy Statement to be filed on or about April 9, 2007 are incorporated into Part III.

(This page has been left blank intentionally.)

TARGET FISCAL 2007 FORM 10-K

TABLE OF CONTENTS

| PART I | | |

| | Item 1. | | Business. | | 4 |

| | Item 1A. | | Risk Factors. | | 6 |

| | Item 1B. | | Unresolved Staff Comments. | | 6 |

| | Item 2. | | Properties. | | 6 |

| | Item 3. | | Legal Proceedings. | | 7 |

| | Item 4. | | Submission of Matters to a Vote of Security Holders. | | 7 |

| | Item 4A. | | Executive Officers. | | 8 |

PART II |

|

|

| | Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | | 9 |

| | Item 6. | | Selected Financial Data. | | 11 |

| | Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations. | | 11 |

| | Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk. | | 21 |

| | Item 8. | | Financial Statements and Supplementary Data. | | 22 |

| | Item 9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | | 48 |

| | Item 9A. | | Controls and Procedures. | | 48 |

| | Item 9B. | | Other Information. | | 48 |

PART III |

|

|

| | Item 10. | | Directors, Executive Officers and Corporate Governance. | | 49 |

| | Item 11. | | Executive Compensation. | | 49 |

| | Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | | 49 |

| | Item 13. | | Certain Relationships and Related Transactions, and Director Independence. | | 49 |

| | Item 14. | | Principal Accountant Fees and Services. | | 49 |

PART IV |

|

|

| | Item 15. | | Exhibits and Financial Statement Schedules. | | 50 |

Signatures |

|

52 |

| Schedule II – Valuation and Qualifying Accounts | | 53 |

| Exhibit Index | | 54 |

| Exhibit 12 – Computations of Ratios of Earnings to Fixed Charges for each of the Five Years in the Period Ended February 3, 2007 | | 55 |

| Shareholder Information | | 55 |

PART I

Item 1. Business.

General

Target Corporation (the Corporation or Target) was incorporated in Minnesota in 1902. We operate large-format general merchandise and food discount stores in the United States, which include Target and SuperTarget stores. We offer both everyday essentials and fashionable, differentiated merchandise at exceptional prices. Our ability to deliver a shopping experience that is preferred by our guests is supported by our strong supply chain and technology network, a devotion to innovation that is ingrained in our organization and culture, and our disciplined approach to managing our current business and investing in future growth. We operate as a single business segment.

Our credit card operations represent an integral component of our core retail business. Through our branded proprietary credit card products (REDcard), we strengthen the bond with our guests, drive incremental sales and contribute meaningfully to earnings. We also operate a fully integrated on-line business, Target.com. Although Target.com is small relative to our overall size, its sales are growing at a much more rapid annual pace than our other sales, and it provides important benefits to our stores and credit card operations.

We are committed to consistently delighting our guests, providing a workplace that is preferred by our team members and investing in the communities where we do business to improve the quality of life. We believe that this unwavering focus, combined with disciplined execution of the fundamentals of our strategy, will enable us to continue generating profitable market share growth and delivering superior shareholder value for many years to come.

Financial Highlights

Our fiscal year ends on the Saturday nearest January 31. Unless otherwise stated, references to years in this report relate to fiscal years, rather than to calendar years. Fiscal year 2006 (2006) ended February 3, 2007 and consisted of 53 weeks. Fiscal year 2005 (2005) ended January 28, 2006 and fiscal year 2004 (2004) ended January 29, 2005, and both consisted of 52 weeks.

For information on key financial highlights for 2006 (along with other years), see the items referenced in Item 6, Selected Financial Data, and Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, of this Form 10-K.

Seasonality

Due to the seasonal nature of our business, a substantially larger share of total annual revenues and earnings occur in the fourth quarter because it includes the peak sales period from Thanksgiving to the end of December.

Merchandise

We operate Target general merchandise stores with a wide assortment of general merchandise and a more limited assortment of food items, as well as SuperTarget stores with a full line of food and general merchandise items. Target.com offers a wide assortment of general merchandise including many items found in our stores and a complementary assortment, such as extended sizes and colors, sold only on-line. A significant portion of our sales is from national brand merchandise. In addition, we sell merchandise under private-label brands including, but not limited to, Archer Farms®, Choxie™, Circo®, Embark®, Gilligan & O'Malley®, Kool Toyz®, Market Pantry®, Merona®, ProSpirit®, Room Essentials™, Target Limited Edition, Trutech® and Xhilaration®. We also sell merchandise through unique programs such as ClearRxSM, Global Bazaar and Go International. In addition, we also sell merchandise under licensed brands including, but not limited to, C9 by Champion, ChefMate, Cherokee, Eddie Bauer, Fieldcrest, Isaac Mizrahi for Target, Kitchen Essentials by Calphalon, Liz Lange for Target, Michael Graves Design, Mossimo, Nick and Nora, Genuine Kids by Osh Kosh, Sean Conway, Smith & Hawken, Simply Shabby Chic, Sonia Kashuk, Thomas O'Brien, Waverly, and Woolrich. We also generate revenue from in-store amenities such as Food Avenue®, Target ClinicSM, Target PharmacySM, and Target PhotoSM, and from leased or licensed departments such as Optical, Pizza Hut, Portrait Studio and Starbucks.

For 2006 and 2005, percentage of sales by product category were as follows:

|

| | Percentage of Sales

|

|---|

Category

| | 2006

| | 2005

|

|---|

|

| Consumables and commodities | | 32% | | 30% |

| Electronics, entertainment, sporting goods and toys | | 23% | | 23% |

| Apparel and accessories | | 22% | | 22% |

| Home furnishings and décor | | 19% | | 20% |

| Other | | 4% | | 5% |

|

| Total | | 100% | | 100% |

|

Distribution

The vast majority of our merchandise is distributed through a network of 25 regional distribution centers and four import warehouses. General merchandise is shipped to and from our distribution centers by common carriers. Certain food items are distributed by third parties. Merchandise sold through Target.com is either distributed through our own distribution network, through third parties, or shipped directly from vendors.

Employees

At February 3, 2007, we employed approximately 352,000 full-time, part-time and seasonal employees, referred to as "team members." We consider our team member relations to be good. We offer a broad range of company-paid benefits to our team members, including a pension plan, 401(k) plan, medical and dental plans, a retiree medical plan, short-term and long-term disability insurance, paid vacation, tuition reimbursement, various team member assistance programs, life insurance and merchandise discounts. Eligibility for and the level of these benefits varies depending on team members' full-time or part-time status and/or length of service.

Working Capital

Because of the seasonal nature of our business, our working capital needs are greater in the months leading up to our peak sales period from Thanksgiving to the end of December each year. The increase in working capital during this time is typically financed with cash flow from operations and short-term borrowings. See further description in the Liquidity and Capital Resources section in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations.

Competition

Our business is conducted under highly-competitive conditions. Our stores compete with national and local department, specialty, off-price, discount, supermarket and drug store chains, independent retail stores and Internet businesses that sell similar lines of merchandise. We also compete with other companies for new store sites.

We believe the principal methods of competing in this industry include brand recognition, customer service, store location, differentiated offerings, value, quality, fashion, price, advertising, depth of selection and credit availability. We believe that we have a competitive advantage with regard to these factors. Additionally, we are a leader in supporting the communities where we do business.

Intellectual Property

Our brand image is a critical element of our business strategy. Our principal trademarks, including Target, SuperTarget and our "bullseye" design, have been registered with the U.S. Patent and Trademark Office.

Geographic Information

Substantially all of our revenues are generated in, and long-lived assets are located in, the United States.

Available Information

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge at www.Target.com (click on "Investors" and "SEC Filings") as soon as reasonably practicable after we file such material with, or furnish it to, the Securities and Exchange Commission (SEC). Our Corporate Governance Guidelines, Business Conduct Guide, Corporate Responsibility Report and the position descriptions for our Board of Directors and Board committees are also available free of charge in print upon request or at www.Target.com (click on "Investors" and "Corporate Governance").

Item 1A. Risk Factors.

A description of risk factors and cautionary statements relating to forward-looking information is included in Exhibit (99)A to this Form 10-K, which is incorporated herein by reference.

Item 1B. Unresolved Staff Comments.

Not Applicable.

Item 2. Properties.

The following table lists our retail stores as of February 3, 2007:

| |

|

State

| Number of Stores

| | Retail Sq. Ft.

(in thousands)

| | State

| Number of Stores

| | Retail Sq. Ft.

(in thousands)

|

|---|

| |

|

| Alabama | 13 | | 1,919 | | Montana | 7 | | 767 |

| Alaska | — | | — | | Nebraska | 12 | | 1,581 |

| Arizona | 41 | | 5,081 | | Nevada | 15 | | 1,863 |

| Arkansas | 6 | | 745 | | New Hampshire | 8 | | 1,023 |

| California | 209 | | 26,391 | | New Jersey | 36 | | 4,666 |

| Colorado | 36 | | 5,265 | | New Mexico | 9 | | 1,011 |

| Connecticut | 14 | | 1,834 | | New York | 55 | | 7,323 |

| Delaware | 2 | | 268 | | North Carolina | 44 | | 5,716 |

| Florida | 102 | | 13,532 | | North Dakota | 4 | | 554 |

| Georgia | 47 | | 6,222 | | Ohio | 56 | | 6,836 |

| Hawaii | — | | — | | Oklahoma | 11 | | 1,536 |

| Idaho | 6 | | 664 | | Oregon | 18 | | 2,166 |

| Illinois | 79 | | 10,589 | | Pennsylvania | 41 | | 5,220 |

| Indiana | 32 | | 4,207 | | Rhode Island | 3 | | 378 |

| Iowa | 21 | | 2,855 | | South Carolina | 17 | | 2,097 |

| Kansas | 18 | | 2,450 | | South Dakota | 4 | | 417 |

| Kentucky | 12 | | 1,383 | | Tennessee | 26 | | 3,210 |

| Louisiana | 12 | | 1,726 | | Texas | 130 | | 17,392 |

| Maine | 4 | | 503 | | Utah | 11 | | 1,679 |

| Maryland | 31 | | 3,935 | | Vermont | — | | — |

| Massachusetts | 26 | | 3,284 | | Virginia | 42 | | 5,498 |

| Michigan | 56 | | 6,466 | | Washington | 32 | | 3,714 |

| Minnesota | 66 | | 8,997 | | West Virginia | 5 | | 626 |

| Mississippi | 4 | | 489 | | Wisconsin | 32 | | 3,731 |

| Missouri | 31 | | 4,068 | | Wyoming | 2 | | 187 |

| |

|

| | | | | | Total | 1,488 | | 192,064 |

| | | | | |

|

The following table summarizes the number of owned or leased stores and distribution centers at February 3, 2007:

| |

| | Stores

| | Distribution

Centers

| |

|---|

| |

| Owned | | 1,260 | | 25 | |

| Leased | | 71 | | 1 | |

| Combined(a) | | 157 | | 3 | |

| |

| Total | | 1,488 | | 29 | (b) |

| |

- (a)

- Properties within the "combined" category are primarily owned buildings on leased land.

- (b)

- The 29 distribution centers have a total of 41,460 thousand square feet.

We own our corporate headquarters buildings located in Minneapolis, Minnesota, and we lease and own additional office space elsewhere in the United States. Our international merchandise sourcing operations headquartered in New York, New York, have 39 office locations in 27 countries, all of which are leased. We also lease office space in Bangalore, India, where we operate various support functions.

For additional information on our properties see also: Capital Expenditures section in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations; Note 13 and Note 22 of the Notes to Consolidated Financial Statements in Item 8, Financial Statements and Supplementary Data.

Item 3. Legal Proceedings.

SEC Rule S-K Item 103 requires that companies disclose environmental legal proceedings involving a governmental authority when such proceedings involve potential monetary sanctions of $100,000 or more. We are a party to two administrative actions by governmental authorities involving environmental matters, each of which may involve potential monetary sanctions in excess of $100,000. The allegations, both made by the California Environmental Protection Agency Air Resources Board, each involve a non-food product we formerly sold that contained levels of a volatile organic compound in excess of permissible levels. The first allegation was made in March 2006, and we expect the sanctions for this matter will not exceed $200,000. The second allegation was made in April 2006, and we expect the sanctions for this matter will not exceed $500,000, for which the vendor is indemnifying Target. We previously reported an allegation made by the United States Environmental Protection Agency in September 2005 that a product we formerly sold contained a prohibited substance. This matter was settled in January 2007 with a payment of $120,000. For description of other legal proceedings see Note 18.

The American Jobs Creation Act of 2004 requires SEC registrants to disclose if they have been required to pay certain penalties for failing to disclose to the Internal Revenue Service their participation in listed transactions. We have not been required to pay any of the penalties set forth in Section 6707A(e)(2) of the Internal Revenue Code.

Item 4. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 4A. Executive Officers.

The executive officers of Target as of March 14, 2007 and their positions and ages, are as follows:

|

Name

| | Title

| | Age

|

|---|

|

| Timothy R. Baer | | Executive Vice President, General Counsel and Corporate Secretary | | 46 |

| Michael R. Francis | | Executive Vice President, Marketing | | 44 |

| John D. Griffith | | Executive Vice President, Property Development | | 45 |

| Jodeen A. Kozlak | | Executive Vice President, Human Resources | | 43 |

| Troy H. Risch | | Executive Vice President, Stores | | 39 |

| Janet M. Schalk | | Executive Vice President and Chief Information Officer | | 48 |

| Douglas A. Scovanner | | Executive Vice President and Chief Financial Officer | | 51 |

| Terrence J. Scully | | President, Target Financial Services | | 54 |

| Gregg W. Steinhafel | | President and Director | | 52 |

| Robert J. Ulrich | | Chairman of the Board, Chief Executive Officer, Chairman of the Executive Committee and Director | | 63 |

|

Each officer is elected by and serves at the pleasure of the Board of Directors. There is neither a family relationship between any of the officers named and any other executive officer or member of the Board of Directors, nor is there any arrangement or understanding pursuant to which any person was selected as an officer. The period of service of each officer in the positions listed and other business experience for the past five years is listed below.

| Timothy R. Baer | | Executive Vice President, General Counsel and Corporate Secretary since March 2007. Senior Vice President, General Counsel and Corporate Secretary from June 2004 to March 2007. Senior Vice President from April 2004 to May 2004. Vice President from February 2002 to March 2004. |

Michael R. Francis |

|

Executive Vice President, Marketing since February 2003. Senior Vice President, Marketing from January 2001 to February 2003. |

John D. Griffith |

|

Executive Vice President, Property Development since February 2005. Senior Vice President, Property Development from February 2000 to January 2005. |

Jodeen A. Kozlak |

|

Executive Vice President, Human Resources since March 2007. Senior Vice President, Human Resources from February 2006 to March 2007. Vice President, Human Resources and Employee Relations General Counsel from November 2005 to February 2006. From June 2001 to November 2005 Ms. Kozlak held several positions in Employee Relations at Target. |

Troy H. Risch |

|

Executive Vice President, Stores since September 2006. Group Vice President from September 2005 to September 2006. Group Director from February 2002 to September 2005. |

Janet M. Schalk |

|

Executive Vice President and Chief Information Officer since March 2007. Senior Vice President and Chief Information Officer from September 2005 to March 2007. Vice President, Application Development from November 2004 to September 2005. Director, Target Technology Services from July 1997 to November 2004. |

Douglas A. Scovanner |

|

Executive Vice President and Chief Financial Officer since February 2000. |

Terrence J. Scully |

|

President, Target Financial Services since March 2003. Vice President, Target Financial Services, from April 1998 to February 2003. |

Gregg W. Steinhafel |

|

Director since January 2007. President since August 1999. |

Robert J. Ulrich |

|

Chairman of the Board, Chief Executive Officer, Chairman of the Executive Committee and Director of Target since 1994. |

PART II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is listed on The New York Stock Exchange under the symbol "TGT." We are authorized to issue up to 6,000,000,000 shares of common stock, par value $.0833, and up to 5,000,000 shares of preferred stock, par value $.01. At March 14, 2007, there were 18,139 shareholders of record. Dividends declared per share and the high and low closing common stock price for each fiscal quarter during 2006 and 2005 are disclosed in Note 29.

The following table presents information with respect to purchases of Target common stock made during the fourteen weeks ended February 3, 2007, by Target or any "affiliated purchaser" of Target, as defined in Rule 10b-18(a)(3) under the Exchange Act.

|

Period

| | Total Number

of Shares

Purchased(b)(c)

| | Average

Price Paid

per Share(b)

| | Total Number of

Shares Purchased

as Part of

Publicly Announced

Program(a)(b)(c)

| | Approximate

Dollar Value of

Shares that May

Yet Be Purchased

Under the Program(a)

|

|---|

|

| October 29, 2006 through November 25, 2006 | | 140,000 | | $41.75 | | 70,813,275 | | $1,562,564,371 |

| November 26, 2006 through December 30, 2006 | | — | | — | | 70,813,275 | | 1,562,564,371 |

| December 31, 2006 through February 3, 2007 | | 231,569 | | 53.02 | | 71,044,844 | | 1,550,285,850 |

|

| Total | | 371,569 | | $48.77 | | 71,044,844 | | $1,550,285,850 |

|

- (a)

- In June 2004, our Board of Directors authorized the repurchase of $3 billion of our common stock. In November 2005, our Board increased the aggregate authorization by $2 billion, for a total authorization of $5 billion. We expect to continue to execute this share repurchase program primarily in open market transactions, subject to market conditions. We expect to complete the total program by fiscal year-end 2008 or sooner. Since the inception of this share repurchase program, we have repurchased a total of 71.0 million shares of our common stock for a total cash investment of $3,450 million ($48.56 per share).

- (b)

- In addition to shares purchased under our share repurchase program, we acquire shares of common stock held by team members who wish to tender owned shares to satisfy the exercise price on stock option exercises or tax withholding on equity awards as part of our long-term incentive plans. From October 29, 2006 through February 3, 2007, 1,683 shares were acquired at an average price of $59.41 pursuant to our long-term incentive plans.

- (c)

- Includes shares reacquired upon settlement of prepaid forward contracts. In 2006, 1.6 million shares were reacquired through these contracts. The details of our long positions in prepaid forward contracts is provided in Note 27.

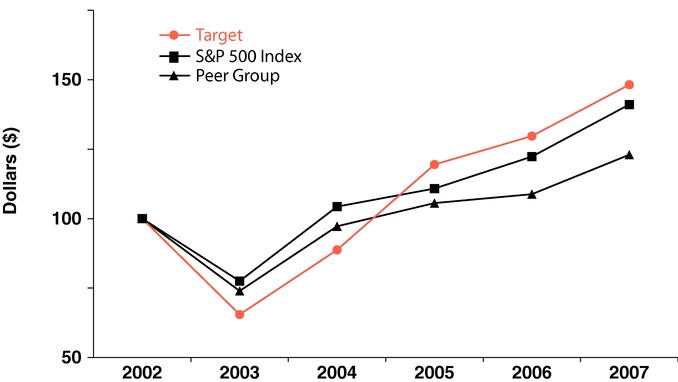

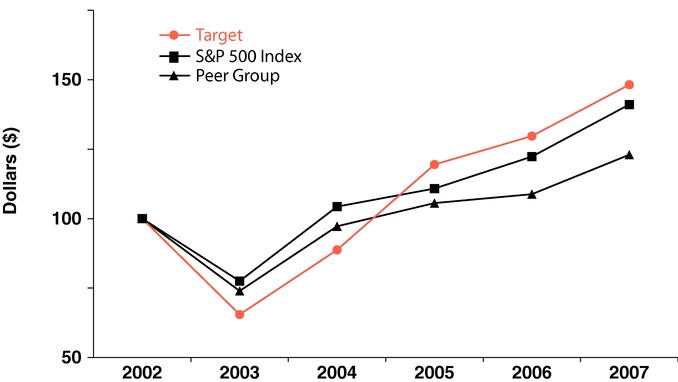

Comparision of Cumulative Five Year Total Return

|

| | Fiscal Years Ended

|

|---|

| | February 2,

2002

| | February 1,

2003

| | January 31,

2004

| | January 29,

2005

| | January 28,

2006

| | February 3,

2007

|

|---|

|

| Target | | $100.00 | | $65.49 | | $88.76 | | $119.49 | | $129.74 | | $148.22 |

| S&P 500 Index | | 100.00 | | 77.54 | | 104.34 | | 110.84 | | 122.35 | | 141.09 |

| Peer Group | | 100.00 | | 73.98 | | 97.26 | | 105.61 | | 108.82 | | 123.01 |

|

The graph above compares the cumulative total shareholder return on our common stock for the last five fiscal years with the cumulative total return on the S&P 500 Index and a peer group consisting of the companies comprising the S&P 500 Retailing Index and the S&P 500 Food and Staples Retailing Index (Peer Group) over the same period. The Peer Group index consists of 38 general merchandise, food and drug retailers and is weighted by the market capitalization of each component company. The graph assumes the investment of $100 in Target common stock, the S&P 500 Index and the Peer Group on February 2, 2002 and reinvestment of all dividends.

Item 6. Selected Financial Data.

|

| | 2006(a)

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

|

|---|

|

| Financial Results:(in millions) | | | | | | | | | | | | |

| Total revenues | | $59,490 | | $52,620 | | $46,839 | | $42,025 | | $37,410 | | $33,021 |

| Earnings from continuing operations | | $2,787 | | $2,408 | | $1,885 | | $1,619 | | $1,376 | | $1,101 |

Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share | | $3.23 | | $2.73 | | $2.09 | | $1.78 | | $1.52 | | $1.22 |

| Diluted earnings per share | | $3.21 | | $2.71 | | $2.07 | | $1.76 | | $1.51 | | $1.21 |

| Cash dividends declared | | $.460 | | $.380 | | $.310 | | $.270 | | $.240 | | $.225 |

Financial Position:(in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets | | $37,349 | | $34,995 | | $32,293 | | $27,390 | | $24,506 | | $19,808 |

| Long-term debt, including current portion | | $10,037 | | $9,872 | | $9,538 | | $11,018 | | $11,090 | | $8,957 |

|

- (a)

- Consisted of 53 weeks.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Executive Summary

Fiscal 2006, a 53 week period, was a year of substantial sales and earnings growth for Target. Earnings from continuing operations increased 15.8 percent to $2,787 million, and on this same basis, diluted earnings per share rose 18.5 percent to $3.21. Sales increased 12.9 percent, including comparable-store sales (as defined below) growth of 4.8 percent. The combination of strong performance in both our retail and credit card operations produced earnings from continuing operations before interest expense and income taxes of $5,069 million, an increase of more than 17 percent from 2005.

Net cash provided by operating activities was $4,862 million for 2006. During 2006 we repurchased 19.5 million shares of our common stock under our share repurchase program for a total investment of $977 million and paid dividends of $380 million. In addition, we opened 91 net new stores in 2006.

Management's Discussion and Analysis is based on our Consolidated Financial Statements in Item 8, Financial Statements and Supplementary Data.

Analysis of Continuing Operations

Revenues and Comparable-Store Sales

Sales include merchandise sales, net of expected returns, from our stores and our on-line business, as well as gift card breakage. Refer to Note 2 for a definition of gift card breakage. Total revenues include sales and net credit card revenues. Total revenues do not include sales tax as we consider ourselves a pass-through conduit for collecting and remitting sales taxes. Comparable-store sales are sales from general merchandise and SuperTarget stores open longer than one year, including:

- •

- sales from stores that have been remodeled or expanded while remaining open

- •

- sales from stores that have been relocated to new buildings of the same format within the same trade area, in which the new store opens at about the same time as the old store closes

Comparable-store sales do not include:

- •

- sales from our on-line business

- •

- sales from general merchandise stores that have been converted, or relocated within the same trade area, to a SuperTarget store format

- •

- sales from stores that were intentionally closed to be remodeled, expanded or reconstructed

Comparable-store sales increases or decreases are calculated by comparing sales in current year periods to comparable, prior fiscal-year periods of equivalent length. The method of calculating comparable-store sales varies across the retail industry.

|

Revenue Growth

| | 2006

| | 2005

| | 2004

|

|---|

|

| Comparable-store sales | | 4.8% | | 5.6% | | 5.3% |

| Sales | | 12.9% | (a) | 12.2% | | 11.6% |

| Net credit card revenues | | 19.5% | (a) | 16.5% | | 5.5% |

| Total revenues | | 13.1% | (a) | 12.3% | | 11.5% |

|

- (a)

- Consisted of 53 weeks.

In 2006, total revenues were $59,490 million compared to $52,620 in 2005, an increase of 13.1 percent. Total revenue growth was attributable to the opening of new stores, a comparable-store sales increase of 4.8 percent, the addition of the 53rd week and the 19.5 percent increase in net credit card revenues.

Comparable-store sales growth in 2006 and 2005 was attributable to growth in average transaction amount and the number of transactions in comparable stores. In each of the past several years, our comparable-store sales growth has experienced a modest negative impact due to the transfer of sales to new stores. In 2006, there was a deflationary impact of approximately 1 percent on sales growth compared to essentially no impact of inflation/deflation in 2005 and a deflationary impact of approximately 1 percent in 2004. In 2007, a 52-week year following a 53-week year, we expect to generate a high single-digit percent increase in revenues, reflecting contribution from new store expansion, continued growth in comparable-store sales due to increases in average transaction amount and the number of transactions in comparable stores and growth in net credit card revenues. We do not expect inflation/deflation to have a significant effect on sales growth in 2007.

Subsequent to year end, we changed our definition of comparable-store sales to include sales from our on-line business because we believe this combined measure represents a more useful disclosure in light of our fully-integrated, multi-channel approach to our business.

Gross Margin Rate

Gross margin rate represents gross margin (sales less cost of sales) as a percentage of sales. See Note 3 for a description of expenses included in cost of sales.

In 2006, our consolidated gross margin rate was 31.9 percent compared to 31.9 percent in 2005. Within our gross margin rate for the year, we experienced an increase in markup, which was offset by an increase in markdowns. Markup is the difference between an item's cost and its retail price (expressed as a percentage of its retail price). Factors that affect markup include vendor offerings and negotiations, vendor income, sourcing strategies, market forces like the cost of raw materials and freight, and competitive influences. Markdowns are the reduction in the original or previous price of retail merchandise. Factors that affect markdowns include inventory management and competitive influences. The definition and method of calculating markup, markdowns and gross margin varies across the retail industry.

In 2005, our consolidated gross margin rate was 31.9 percent compared to 31.2 percent in 2004. This change in gross margin rate primarily reflected an improvement in markup, including an increase in direct import penetration, as well as favorable inventory shrink performance.

We expect our consolidated gross margin rate in 2007 to be approximately equal to our 2006 gross margin rate. The factors affecting our outlook include: our introduction of new merchandising strategies, our growth in direct imports and our ability to leverage our increasing scale, offset by the more rapid pace of growth of lower margin categories like consumables and commodities.

Selling, General and Administrative Expense Rate

Our selling, general and administrative (SG&A) expense rate represents SG&A expenses as a percentage of sales. See Note 3 for a description of expenses included in SG&A expenses. SG&A expenses exclude depreciation and amortization, and SG&A expenses also exclude expenses associated with our credit card operations, which are reflected separately in our Consolidated Statements of Operations.

In 2006, our SG&A expense rate was 22.2 percent compared to 21.8 percent in 2005. This increase was primarily due to higher store payroll costs, the year-over-year impact of reduced transition services income related to our 2004 divestiture of Mervyn's and the $27 million Visa/MasterCard settlement that reduced SG&A expense in 2005.

In 2005, our consolidated SG&A expense rate was 21.8 percent compared to 21.4 percent in 2004. The expense rate increase was due to several factors including the year-over-year impact of reduced transition services income related to our 2004 divestitures of Marshall Field's and Mervyn's, higher utilities expense and the effects of stronger year-over-year performance on incentive and share-based compensation expense. Some of the expense rate increase was also attributable to growth in marketing expenses for which the corresponding vendor income is recorded as a reduction of inventory costs because it did not meet the criteria required for recording it as an element of SG&A expenses. The combination of all unfavorable expense items more than offset the year-over-year favorability from the $65 million lease accounting adjustment during 2004.

In 2007, we expect our SG&A expense rate to be approximately equal to our 2006 rate.

Credit Card Contribution

We offer credit to qualified guests through our REDcard products, the Target Visa and the Target Card. Our credit card program strategically supports our core retail operations and remains an important contributor to our overall profitability. Our credit card revenues are comprised of finance charges, late fees and other revenues. In addition, we receive fees from merchants who accept the Target Visa credit card. In 2006, our net credit card revenues primarily increased due to an 11.1 percent increase in average receivables.

Our credit card operations are allocated a portion of consolidated interest expense based on estimated funding costs for average net accounts receivable and other financial services assets. Our allocation methodology assumes that 90 percent of the sum of average net receivables and other financial services assets are debt-financed with a mix of fixed rate and variable rate debt in proportion to the mix of fixed and variable rate financial services assets. Beginning in 2005, the majority of our credit card portfolio began to earn interest at variable rates; thus, the majority of the interest allocation to the credit card business in 2006 and 2005 is at rates that are determined based upon our approximate marginal variable rate cost of borrowed funds.

Credit card expenses include a bad debt provision, as well as operations and marketing expenses supporting our credit card portfolio. In 2006 versus 2005, our bad debt provision decreased relative to our average receivables balance due to the favorable write-off experience and continued strength of the overall credit quality of the portfolio. Our 2006 year-end reserve balance as a percentage of average receivables increased as we reserved for the expected increase in future write-offs. Our delinquency rates increased in the last quarter of 2006 as compared to 2005 as we cycled the effects of the October 2005 federal bankruptcy legislation and experience the effects of the mandated increases in minimum payments for certain guests. Operations and marketing expenses increased primarily due to the growth of the Target Visa portfolio.

In 2005 versus 2004, our bad debt provision grew at a slower pace than our average receivables balance due to the aging of the portfolio and the favorable macro-economic credit card environment. However, our total reserve balance as a percentage of average receivables increased in 2005 as we reserved for the expected effects of the mandated increases in minimum payments for certain guests. Our net write-offs as a percentage of average receivables and our delinquency rates continued to improve, despite a significant increase in bankruptcy filings in advance of the October 2005 effective date of the related federal bankruptcy legislation. Operations and marketing expenses increased primarily due to the growth of the Target Visa portfolio.

In 2006, our credit card operations' contribution to earnings from continuing operations before income taxes (EBT) was $693 million, a 53.3 percent increase from 2005. The favorability in credit card contribution was attributable to strong growth in net interest income and the year-over-year reduction in bad debt expense.

In 2005, our credit card operations' contribution to EBT was $452 million, a 77.4 percent increase from 2004. The favorability in credit card contribution was attributable to strong growth in net interest income. Average receivables rose 12.5 percent from 2004, which was approximately equal to our sales growth.

We expect our 2007 credit card receivables to increase in line with 2007 sales growth, and we expect our overall credit card performance to remain strong. In 2007, our delinquency rate is expected to remain stable in the range of our recent experience, approximately 3.5 percent to 4.0 percent of average receivables, and we expect our net write-off experience to be closer to our 2004 and 2005 rates than our 2006 rate.

| |

Credit Card Contribution to EBT

(millions)

| | 2006

| | 2005

| | 2004

| |

|---|

| |

| Revenues | | | | | | | |

| Finance charges | | $1,117 | | $915 | | $772 | |

| Interest expense | | (286 | ) | (193 | ) | (230 | ) |

| |

| Net interest income | | 831 | | 722 | | 542 | |

| |

| Late fees and other revenues | | 356 | | 310 | | 287 | |

| Merchant fees | | | | | | | |

| | Intracompany | | 74 | | 72 | | 65 | |

| | Third-party | | 139 | | 124 | | 98 | |

| |

| Non-interest income | | 569 | | 506 | | 450 | |

| |

| Expenses | | | | | | | |

| Bad debt | | 380 | | 466 | | 451 | |

| Operations and marketing | | 327 | | 310 | | 286 | |

| |

| Total expenses | | 707 | | 776 | | 737 | |

| |

| Credit card contribution to EBT | | $693 | | $452 | | $255 | |

| |

| As a percentage of average receivables | | 11.0% | | 8.2% | | 5.2% | |

| Net interest margin(a) | | 13.2% | | 13.0% | | 11.0% | |

| |

- (a)

- Net interest income divided by average accounts receivable.

|

Receivables

(millions)

| | 2006

| | 2005

| | 2004

|

|---|

|

| Year-end receivables | | $6,711 | | $6,117 | | $5,456 |

| Average receivables | | $6,161 | | $5,544 | | $4,927 |

| Accounts with three or more payments past due as a percentage of year-end receivables | | 3.5% | | 2.8% | | 3.5% |

|

| |

Allowance for Doubtful Accounts

(millions)

| | 2006

| | 2005

| | 2004

| |

|---|

| |

| Allowance at beginning of year | | $451 | | $387 | | $352 | |

| Bad debt provision | | 380 | | 466 | | 451 | |

| Net write-offs | | (314 | ) | (402 | ) | (416 | ) |

| |

| Allowance at end of year | | $517 | | $451 | | $387 | |

| |

| As a percentage of year-end receivables | | 7.7% | | 7.4% | | 7.1% | |

| |

| Net write-offs as a percentage of average receivables | | 5.1% | | 7.2% | | 8.4% | |

| |

We offer new account discounts and rewards programs on our REDcard products. These discounts and rewards are redeemable only on purchases made at Target. The discounts associated with our REDcard products are included as reductions in sales in our Consolidated Statements of Operations and were $104 million, $97 million and $80 million in 2006, 2005 and 2004, respectively.

Depreciation and Amortization

During 2006, we adjusted the period over which we amortize leasehold acquisition costs to match the expected terms for individual leases, resulting in a cumulative benefit to depreciation and amortization expense of approximately $28 million. This change reduced depreciation and amortization expense during 2006, when depreciation and amortization expense totaled $1,496 million, compared to $1,409 million in 2005, an increase of 6.1 percent. In 2005, depreciation and amortization expense increased 11.9 percent, in line with our sales growth for the year, to $1,409 million. We expect 2007 depreciation and amortization expense to be approximately $1.7 billion.

Net Interest Expense

In 2006, net interest expense was $572 million compared to $463 million in 2005, an increase of 23.4 percent. This increase related primarily to growth in the cost of funding our credit card operations and was also unfavorably impacted by the 53rd week in the current fiscal year. The average portfolio interest rate was 6.2 percent in 2006 and 5.9 percent in 2005.

In 2005, net interest expense was $463 million, compared to $570 million in 2004. This decrease was primarily due to a significantly smaller loss on debt repurchase in 2005 (less than $1 million in 2005 compared to $89 million in 2004). The decrease in 2005 net interest expense also reflected the benefit of lower average net debt in the first half of the year due to the application of proceeds from the mid-2004 Marshall Field's and Mervyn's sale transactions. This benefit was partially offset by higher average net debt balances in the second half of the year and a higher annual average portfolio interest rate. For the full year, the average portfolio interest rate was 5.9 percent in 2005 and 5.5 percent in 2004.

Our 2007 net interest expense is expected to increase due to modestly higher average net debt. To preserve our net interest margin on our receivables, we intend to maintain a sufficient level of floating-rate debt to generate parallel changes in net interest expense and finance charge revenue.

Provision for Income Taxes

Our effective income tax rate from continuing operations was 38.0 percent in 2006, 37.6 percent in 2005 and 37.8 percent in 2004. Our lower 2005 effective rate was due to the favorable resolution of various tax matters in 2005. We expect our effective income tax rate in 2007 to rise modestly from 2006.

Analysis of Financial Condition

Liquidity and Capital Resources

Our financial condition remains strong. In assessing our financial condition, we consider factors such as cash flow provided by operations, capital expenditures and debt service obligations. Cash flow provided by operations was $4,862 million in 2006 compared to $4,451 million in 2005, primarily due to higher earnings from continuing operations.

We continue to fund our growth and execute our share repurchase program through a combination of internally-generated funds and debt financing.

Our year-end gross receivables were $6,711 million compared to $6,117 million in 2005, an increase of 9.7 percent. This growth was driven by increased issuance and usage of the Target Visa credit card by our guests during 2006. Average receivables in 2006 increased 11.1 percent. In 2007 we expect our credit card receivables to grow in line with our 2007 sales.

Year-end inventory levels increased $416 million, or 7.1 percent, reflecting the natural increase required to support additional square footage and comparable-store sales growth. This growth was largely funded by an increase in accounts payable over the same period.

In June 2004, our Board of Directors authorized the repurchase of $3 billion of our common stock. In November 2005, our Board increased the aggregate authorization by $2 billion for a total authorization of $5 billion. In 2006, we repurchased 19.5 million shares of our common stock for a total investment of $977 million ($50.16 per share), primarily through open market transactions. Since the inception of this share repurchase program, we have repurchased a total of 71.0 million shares of our common stock for a total investment of $3,450 million ($48.56 per share). Of the shares reacquired in 2006, a portion was delivered upon settlement of prepaid forward contracts. The details of prepaid forward contract settlements and our long positions in prepaid forward contracts have been provided in Note 25 and Note 27. In 2005 we reacquired 23.1 million shares for a total investment of $1,197 million ($51.88 per share). We expect to continue to execute our share repurchase program primarily in open market transactions, subject to market conditions, and to complete the total program by year-end 2008 or sooner.

Our financing strategy is to ensure liquidity and access to capital markets, to manage our net exposure to floating interest rate volatility and to maintain a balanced spectrum of debt maturities. Within these parameters, we seek to minimize our cost of borrowing.

In 2006 we declared dividends of $.46 per share totaling approximately $396 million, an increase of 18.6 percent over 2005. In 2005 we declared dividends of $.38 per share totaling approximately $334 million, an increase of 19.3 percent over 2004. We have paid dividends every quarter since our first dividend was declared following our 1967 initial public offering, and it is our intent to continue to do so in the future.

Management believes that cash flows from operations, together with current levels of cash and cash equivalents, proceeds from long-term financing activities and issuance of short-term debt will be sufficient in 2007 to fund planned capital expenditures, share repurchases, growth in receivables, maturities of long-term debt, and other cash requirements, including our seasonal inventory buildup.

Maintaining strong investment-grade debt ratings is a key part of our strategy. Our debt ratings as of February 3, 2007 were:

|

Debt Ratings

| |

| | Standard and

Poor's

| |

|

|---|

| | Moody's

| | Fitch

|

|---|

|

| Long-term debt | | A1 | | A+ | | A+ |

| Commercial paper | | P-1 | | A-1 | | F1 |

| Securitized receivables | | Aaa | | AAA | | n/a |

|

As described in Note 19, during 2006 we issued $750 million of long-term debt and issued $500 million of Variable Funding Certificates backed by credit card receivables through the Target Credit Card Master Trust. As of February 3, 2007, $100 million of the Variable Funding Certificates were outstanding. Further liquidity is provided by a committed $1.6 billion unsecured revolving credit facility obtained through a group of banks in June 2005, which is scheduled to expire in June 2010. No balances were outstanding at any time during 2006 or 2005 under this or previously existing revolving credit facilities. Most of our long-term debt obligations contain covenants related to secured debt levels. In addition, our credit facility contains a debt leverage covenant. We are, and expect to remain, in compliance with these covenants. At February 3, 2007, no notes or debentures contained provisions requiring acceleration of payment upon a debt rating downgrade.

Our interest coverage ratio represents the ratio of pre-tax earnings before fixed charges (interest expense and the interest portion of rent expense) to fixed charges. Our interest coverage ratio calculated as prescribed by Securities and Exchange Commission (SEC) rules was 7.1x, 7.2x, and 5.4x in 2006, 2005 and 2004, respectively. The ratio in 2004 was adversely affected by losses from discretionary debt repurchase transactions and excludes historical income from discontinued operations. Management believes adjustments for these items are necessary to make the coverage ratio a more useful and consistent indicator of creditworthiness.

Capital Expenditures

Capital expenditures were $3,928 million in 2006 compared to $3,388 million in 2005 and $3,068 million in 2004. This increase was primarily attributable to continued new store expansion, an increase in remodel program expenditures and growth in distribution center capital investment. Net property and equipment increased $2,393 in 2006 following an increase of $2,178 million in 2005.

Spending for new stores, store expansions and remodels, and information systems hardware and software, distribution capacity and other infrastructure to support store growth as a percentage of total capital expenditures are shown below for each of the last three fiscal years.

|

| | Percentage of Capital Expenditures

|

|---|

Capital Expenditures

|

|---|

| | 2006

| | 2005

| | 2004

|

|---|

|

| New stores | | 61% | | 60% | | 64% |

| Remodels and expansions | | 12% | | 12% | | 12% |

| Information technology, distribution and other | | 27% | | 28% | | 24% |

|

| Total | | 100% | | 100% | | 100% |

|

In 2007, we expect to invest $4.2 billion to $4.4 billion primarily in new stores, store expansions and remodels, as well as information systems hardware and software, distribution capacity and other infrastructure to support our planned growth. Our estimated 2007 store opening program reflects net square footage growth of approximately 8 percent, including 115 to 120 new stores partially offset by closings and relocations. We also expect to remodel approximately 40 to 45 stores, most of which will be expanded. In addition, we expect to open two distribution centers in 2007.

|

Number of Stores

| | February 3,

2007

| |

| |

| | January 28,

2006

|

|---|

| | Opened

| | Closed (a)

|

|---|

|

| Target general merchandise stores | | 1,311 | | 94 | | 22 | | 1,239 |

| SuperTarget stores | | 177 | | 19 | | — | | 158 |

|

| Total | | 1,488 | | 113 | | 22 | | 1,397 |

|

| Retail Square Feet(b) | | | | | | | | |

|

| Target general merchandise stores | | 160,806 | | 12,860 | | 2,372 | | 150,318 |

| SuperTarget stores | | 31,258 | | 3,316 | | — | | 27,942 |

|

| Total | | 192,064 | | 16,176 | | 2,372 | | 178,260 |

|

- (a)

- Includes 18 store relocations in the same trade area and four stores closed without replacement.

- (b)

- Reflects total square feet, less office, distribution center and vacant space.

Commitments and Contingencies

At February 3, 2007, our contractual obligations were as follows:

|

Contractual Obligations

| |

| |

| |

| |

| |

|

|---|

| | Payments Due by Period

|

|---|

(millions)

| | Total

| | Less than

1 Year

| | 1-3

Years

| | 3-5

Years

| | After 5

Years

|

|---|

|

| Long-term debt(a) | | $9,897 | | $1,355 | | $2,268 | | $2,343 | | $3,931 |

| Interest payments – long-term debt (b) | | 4,165 | | 547 | | 899 | | 625 | | 2,094 |

| Capital lease obligations | | 249 | | 15 | | 30 | | 32 | | 172 |

| Operating leases (c) | | 3,325 | | 142 | | 266 | | 235 | | 2,682 |

| Deferred compensation | | 691 | | 46 | | 205 | | 98 | | 342 |

| Real estate obligations | | 1,106 | | 1,106 | | — | | — | | — |

| Purchase obligations | | 1,613 | | 483 | | 605 | | 290 | | 235 |

|

| Contractual cash obligations | | $21,046 | | $3,694 | | $4,273 | | $3,623 | | $9,456 |

|

- (a)

- Required principal payments only. Excludes Statement of Financial Accounting Standards No. 133, "Accounting for Derivative Instruments and Hedging Activities," fair market value adjustments recorded in long-term debt.

- (b)

- Includes payments on $1,750 million of floating rate long-term debt secured by credit card receivables, $750 million of which matures in 2007, $900 million of which matures in 2010, and $100 million of which matures in 12 monthly installments beginning in October 2007. These payments are calculated assuming rates of approximately 5.5 percent, based on a spread over presumed LIBOR of 5.35%, for each year outstanding. Excludes payments received or made related to interest rate swaps. The fair value of outstanding interest rate swaps has been provided in Note 21.

- (c)

- Total contractual lease payments include $1,631 million related to certain options to extend the lease term that are reasonably assured of being exercised and also includes $188 million of legally binding minimum lease payments for stores opening in 2007 or later. Refer to Note 22 for further description of leases.

Real estate obligations include commitments for the purchase, construction or remodeling of real estate and facilities. Purchase obligations include all legally binding contracts such as firm minimum commitments for inventory purchases, merchandise royalties, purchases of equipment, marketing-related contracts, software acquisition/license commitments and service contracts.

We issue inventory purchase orders in the normal course of business, which represent authorizations to purchase that are cancelable by their terms. We do not consider purchase orders to be firm inventory commitments; therefore, they are excluded from the table above. We also issue trade letters of credit in the ordinary course of business, which are excluded from this table as these obligations are conditional on the purchase order not being cancelled. If we choose to cancel a purchase order, we may be obligated to reimburse the vendor for unrecoverable outlays incurred prior to cancellation, under certain circumstances.

We have not included obligations under our pension and postretirement health care benefit plans in the contractual obligations table above. Our historical practice regarding these plans has been to contribute amounts necessary to satisfy minimum pension funding requirements plus periodic discretionary amounts determined to be appropriate. Further information on these plans, including our expected contributions for 2007, is included in Note 28.

We have not provided any material financial guarantees as of February 3, 2007. We have not created and are not party to any off-balance sheet entities for the purpose of raising capital, incurring debt or operating our business. We do not have any arrangements or relationships with entities that are not consolidated into the financial statements that are reasonably likely to materially affect our liquidity or the availability of capital resources.

Analysis of Discontinued Operations

Marshall Field's and Mervyn's were divested in 2004; no financial results of discontinued operations are included for 2006 or 2005. In 2004, revenues and earnings from discontinued operations reflected only a partial year of results and excluded the holiday season. For 2004, total revenues included in discontinued operations were $3,095 million, and earnings from discontinued operations were $75 million, net of taxes of $46 million. In addition, we recorded a gain on the sale of discontinued operations of $1,238 million, net of taxes of $761 million, during 2004.

Critical Accounting Estimates

Our analysis of operations and financial condition is based on our consolidated financial statements, prepared in accordance with U.S. generally accepted accounting principles (GAAP). Preparation of these consolidated financial statements requires us to make estimates and assumptions affecting the reported amounts of assets and liabilities at the date of the financial statements, reported amounts of revenues and expenses during the reporting period and related disclosures of contingent assets and liabilities. In the Notes to Consolidated Financial Statements, we describe our significant accounting policies used in preparing the consolidated financial statements. Our estimates are evaluated on an ongoing basis and are drawn from historical experience and other assumptions that we believe to be reasonable under the circumstances. Actual results could differ under different assumptions or conditions. Our senior management has discussed the development and selection of our critical accounting estimates with the Audit Committee of our Board of Directors. The following items in our consolidated financial statements require significant estimation or judgment:

Inventory and cost of sales We use the retail inventory method to account for substantially all of our inventory and the related cost of sales. Under this method, inventory is stated at cost using the last-in, first-out (LIFO) method as determined by applying a cost-to-retail ratio to each merchandise grouping's ending retail value. Cost includes the purchase price as adjusted for vendor income. Since inventory value is adjusted regularly to reflect market conditions, our inventory methodology reflects the lower of cost or market. We reduce inventory for estimated losses related to shrink and markdowns. Our shrink estimate is based on historical losses verified by ongoing physical inventory counts. Markdowns designated for clearance activity are recorded when the salability of the merchandise has diminished. Inventory is at risk of obsolescence if economic conditions change. Examples of relevant economic conditions include shifting consumer demand, changing consumer credit markets or increasing competition. We believe these risks are largely mitigated because substantially all of our inventory turns in less than six months. Inventory is further described in Note 11.

Vendor income receivable Cost of sales and SG&A expenses are partially offset by various forms of consideration received from our vendors. This "vendor income" is earned for a variety of vendor-sponsored programs, such as volume rebates, markdown allowances, promotions and advertising, as well as for our compliance programs. We establish a receivable for the vendor income that is earned but not yet received. Based on provisions of the agreements in place, this receivable is computed by estimating the point at which we have completed our performance and the amount earned. We perform detailed analyses to determine the appropriate level of the receivable in aggregate. The majority of all year-end receivables associated with these activities are collected within the following fiscal quarter. See further description in Note 4.

Allowance for doubtful accounts When receivables are recorded, we recognize an allowance for doubtful accounts in an amount equal to anticipated future write-offs. This allowance includes provisions for uncollectible finance charges and other credit fees. We estimate future write-offs based on delinquencies, risk scores, aging trends, industry risk trends and our historical experience. Substantially all accounts continue to accrue finance charges until they are written off. Accounts are automatically written off when they become 180 days past due. Management believes the allowance for doubtful accounts is adequate to cover anticipated losses in our credit card accounts receivable under current conditions; however, significant deterioration in any of the factors mentioned above or in general economic conditions could materially change these expectations. Accounts receivable is described in Note 10.

Analysis of long-lived and intangible assets for impairment We review assets at the lowest level for which there are identifiable cash flows, usually at the store level. The carrying amount of assets is compared to the expected undiscounted future cash flows to be generated by those assets over their estimated remaining economic lives. Impairment testing of intangibles requires a comparison between the carrying value and the fair value. Discounted cash flow models are used in determining fair value for the purposes of the required annual impairment analysis. No material impairments were recorded in 2006, 2005 or 2004 as a result of the tests performed.

Insurance/self-insurance We retain a substantial portion of the risk related to certain general liability, workers' compensation, property loss and team member medical and dental claims. Liabilities associated with these losses include estimates of both claims filed and losses incurred but not yet reported. We estimate our ultimate cost based on an analysis of historical data and actuarial estimates. General liability and workers' compensation liabilities are recorded at our estimate of their net present value; other liabilities are not discounted. We believe that the amounts accrued are adequate, although actual losses may differ from the amounts provided. We maintain stop-loss coverage to limit the exposure related to certain risks.

Income taxes We pay income taxes based on the tax statutes, regulations and case law of the various jurisdictions in which we operate. Significant judgment is required in determining income tax provisions and in evaluating the ultimate resolution of tax matters in dispute with tax authorities. Historically, our assessments of the ultimate resolution of tax issues have been materially accurate. The current open tax issues are not dissimilar in size or substance from historical items. Management believes the resolution of the foregoing matters will not have a material impact on our consolidated financial statements. Income taxes are further described in Note 23.

Pension and postretirement health care accounting We fund and maintain a qualified defined benefit pension plan. We also maintain several smaller nonqualified plans and a postretirement health care plan for certain retired team members. The costs for these plans are calculated based on actuarial calculations using the assumptions described in the following paragraphs.

Our expected long-term rate of return on plan assets is determined by the composition of our asset portfolio, our historical long-term investment performance and current market conditions.

The discount rate used to determine benefit obligations is adjusted annually based on the interest rate for long-term high-quality corporate bonds as of the measurement date (October 31) using yields for maturities that are in line with the duration of our pension liabilities. Historically, this same discount rate has also been used to determine pension and postretirement health care expense for the following plan year. We are currently evaluating whether we will early adopt the measurement date provisions of SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R)" (SFAS 158), as discussed below in the 2006 Adoptions section. In 2006, we increased our discount rate by 0.05 percentage points from the previous year for the purpose of calculating the October 31, 2006 benefit obligation.

Based on our experience, we use a graduated compensation growth schedule that assumes higher compensation growth for younger, shorter-service pension-eligible team members than it does for older, longer-service pension-eligible team members. In 2006, we increased the assumed rate of compensation increase by 0.50 percentage points for the purpose of calculating the October 31, 2006 benefit obligation. In 2005, we made a 0.75 percentage point increase in the assumed compensation rate increase, which impacted the net periodic benefit cost for 2006.

Pension and postretirement health care benefits are further described in Note 28.

New Accounting Pronouncements

2006 Adoptions

We adopted the recognition and disclosure provisions of SFAS 158 during 2006. Please refer to Note 28 (Pension and Postretirement Health Care Benefits) for further description of this adoption. We are currently evaluating whether we will adopt the SFAS 158 measurement date provisions in 2007 or 2008, including the potential impact on our results of operations and financial position.

In September 2006, the SEC staff published Staff Accounting Bulletin No. 108, "Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements" (SAB 108). SAB 108 addresses quantifying the financial statement effects of misstatements, specifically, how the effects of prior year uncorrected errors must be considered in quantifying misstatements in the current year financial statements. We adopted SAB 108 during the fourth quarter of 2006. The adoption of this statement did not have any impact on our consolidated net earnings, cash flows or financial position.

2007 and Future Adoptions

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109" (FIN 48). FIN 48 prescribes the financial statement recognition and measurement criteria for tax positions taken in a tax return, clarifies when tax benefits should be recorded and how they should be classified in financial statements, and requires certain disclosures of uncertain tax matters. FIN 48 is effective at the beginning of fiscal 2007. We are presently evaluating the impact of the adoption of FIN 48 on our results of operations and financial position.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, "Fair Value Measurement" (SFAS 157). SFAS 157 provides a definition of fair value, provides guidance for measuring fair value in U.S. GAAP and expands disclosures about fair value measurements. SFAS 157 will be effective at the beginning of fiscal 2008. We are presently evaluating the impact of the adoption of SFAS 157 on our results of operations and financial position.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, "The Fair Value Option for Financial Assets and Financial Liabilities" (SFAS 159). SFAS 159 permits entities to choose to measure many financial instruments and certain other items at fair value. SFAS 159 will be effective at the beginning of fiscal 2008. We are presently evaluating the impact of the adoption of SFAS 159 on our results of operations and financial position.

Forward-Looking Statements

This report, including the preceding Management's Discussion and Analysis, contains forward-looking statements regarding our performance, financial position, liquidity and adequacy of capital resources. Forward-looking statements are typically accompanied by the words "expect," "may," "could," "believe," "would," "might," "anticipates," or words of similar import. The forward-looking statements in this report include the anticipated impact of new and proposed accounting pronouncements, the expected outcome of pending and threatened litigation, our expectations with respect to our share repurchase program and our outlook in fiscal 2007. Forward-looking statements are based on our current assumptions and expectations and are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. We caution that the forward-looking statements are qualified by the risks and challenges posed by increased competition (including the effects of competitor liquidation activities), shifting consumer demand, changing consumer credit markets, changing wages, health care and other benefit costs, shifting capital markets and general economic conditions, hiring and retaining effective team members, sourcing merchandise from domestic and international vendors, investing in new business strategies, the outbreak of war or pandemics and other significant national and international events, and other risks and uncertainties. As a result, although we believe there is a reasonable basis for the forward- looking statements, you should not place undue reliance on those statements. You are encouraged to review Exhibit (99)A to this Form 10-K, which contains additional important factors that may cause actual results to differ materially from those predicted in the forward-looking statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Our exposure to market risk results primarily from interest rate changes on our debt obligations and on our credit card receivables, the majority of which are now assessed finance charges at a prime-based floating rate. To preserve our net interest margin, we intend to maintain sufficient levels of floating-rate debt to generate parallel changes in net interest expense as finance charge revenues fluctuate. At February 3, 2007, our level of floating-rate debt obligations exceeded our level of floating-rate credit card assets by approximately $1 billion. As a result, based on our balance sheet position at February 3, 2007, the annualized effect of a one percentage point increase in floating interest rates on our interest rate swap agreements and other floating rate debt obligations, net of our floating rate credit card assets, would be to decrease earnings from continuing operations before income taxes by approximately $10 million. See further description in Note 21.

We record our general liability and workers' compensation liabilities at net present value; therefore, these liabilities fluctuate with changes in interest rates. We economically hedge a portion of our exposure to these interest rate changes by entering into interest rate forward contracts that partially mitigate the effects of interest rate changes. As a result, we do not have significant net exposure to interest rate changes for these liabilities.

In addition, we are exposed to fluctuations of market returns on our qualified defined benefit pension and nonqualified defined contribution plans. The annualized effect of a one percentage point decrease in the return on pension plan assets would decrease plan assets by $21 million at February 3, 2007. The resulting impact on net pension expense would be calculated consistent with the provisions of SFAS No. 87, "Employers' Accounting for Pensions." See further description in Note 28.

As more fully described in Note 14 and Note 27, we are exposed to market returns on accumulated team member balances in our nonqualified, unfunded deferred compensation plans. We control our risk of offering the nonqualified plans by making investments in life insurance contracts and prepaid forward contracts on our own common stock that offset a substantial portion of our economic exposure to the returns on these plans. The annualized effect of a one percentage point change in market returns on our nonqualified defined contribution plans (inclusive of the effect of the investment vehicles used to manage our economic exposure) would not be significant.

We do not have significant direct exposure to foreign currency rates as all of our stores are located in the United States and the vast majority of imported merchandise is purchased in U.S. dollars.

Overall, there have been no material changes in our primary risk exposures or management of market risks since the prior year.

Item 8. Financial Statements and Supplementary Data.

Report of Management on the Consolidated Financial Statements

Management is responsible for the consistency, integrity and presentation of the information in the Annual Report. The consolidated financial statements and other information presented in this Annual Report have been prepared in accordance with accounting principles generally accepted in the United States and include necessary judgments and estimates by management.

To fulfill our responsibility, we maintain comprehensive systems of internal control designed to provide reasonable assurance that assets are safeguarded and transactions are executed in accordance with established procedures. The concept of reasonable assurance is based upon recognition that the cost of the controls should not exceed the benefit derived. We believe our systems of internal control provide this reasonable assurance.

The Board of Directors exercised its oversight role with respect to the Corporation's systems of internal control primarily through its Audit Committee, which is comprised of four independent directors. The Committee oversees the Corporation's systems of internal control, accounting practices, financial reporting and audits to assess whether their quality, integrity and objectivity are sufficient to protect shareholders' investments.

In addition, our consolidated financial statements have been audited by Ernst & Young LLP, independent registered public accounting firm, whose report also appears on this page.

| |  |

Robert J. Ulrich

Chairman of the Board and

Chief Executive Officer

March 14, 2007 |

|

Douglas A. Scovanner

Executive Vice President and

Chief Financial Officer |

Report of Independent Registered Public Accounting Firm on Consolidated Financial Statements

The Board of Directors and Shareholders

Target Corporation

We have audited the accompanying consolidated statements of financial position of Target Corporation and subsidiaries (the Corporation) as of February 3, 2007 and January 28, 2006, and the related consolidated statements of operations, cash flows, and shareholders' investment for each of the three years in the period ended February 3, 2007. Our audits also included the financial statement schedule listed in Item 15(a). These financial statements and schedule are the responsibility of the Corporation's management. Our responsibility is to express an opinion on these financial statements and schedule based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Target Corporation and subsidiaries at February 3, 2007 and January 28, 2006, and the consolidated results of their operations and their cash flows for each of the three years in the period ended February 3, 2007, in conformity with U.S. generally accepted accounting principles. Also, in our opinion, the related financial statement schedule, when considered in relation to the basic financial statements taken as a whole, presents fairly, in all material respects, the information set forth therein.

As discussed in Note 28, Pension and Postretirement Health Care Benefits, to the consolidated financial statements, effective February 3, 2007, the Corporation adopted the recognition and disclosure provisions of SFAS 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R)."

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of the Corporation's internal control over financial reporting as of February 3, 2007, based on criteria established inInternal Control – Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated March 14, 2007, expressed an unqualified opinion thereon.

Minneapolis, Minnesota

March 14, 2007

Report of Management on Internal Control

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f). Under the supervision and with the participation of our management, including our chief executive officer and chief financial officer, we assessed the effectiveness of our internal control over financial reporting as of February 3, 2007, based on the framework inInternal Control – Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on our assessment, we conclude that the Corporation's internal control over financial reporting is effective based on those criteria.