SCHEDULE 14(A) INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] Preliminary Proxy Statement | | [ ] Confidential, For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2) |

[X ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Under Rule 14a-12

| |

AMCAST INDUSTRIAL CORPORATION (Name of Registrant as Specified In Its Charter) |

| |

|

(Name of Person(s) Filing Proxy Statement, if other than Registrant) |

Payment of Filing Fee (Check the appropriate box):

[X ] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and O-11.

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule O-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

INDUSTRIAL CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD DECEMBER 18, 2002

To the Shareholders of Amcast Industrial Corporation:

The Annual Meeting of Shareholders of Amcast Industrial Corporation will be held at the Hilton O’Hare, O’Hare International Airport, Chicago, Illinois 60666, on Wednesday, December 18, 2002, at 10:00 a.m., C.S.T., for the purpose of considering and voting upon:

| | 1. | | Election of three directors to serve for a term of three years; |

| | 2. | | Ratification of the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending August 31, 2003; and |

| | 3. | | Transaction of such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The Board of Directors of the Company has fixed the close of business on October 21, 2002, as the record date for determination of shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

It is important that your shares be represented at the meeting. For that reason we ask that you please mark, date, sign, and return the enclosed proxy in the envelope provided or provide your broker with voting instructions. Giving the proxy will not affect your right to vote in person if you attend the meeting.

By Order of the Board of Directors

Samuel T. Rees, Secretary

Washington Park I

7887 Washington Village Drive

Dayton, Ohio 45459

November 13, 2002

INDUSTRIAL CORPORATION

PROXY STATEMENT FOR 2002 ANNUAL MEETING

GENERAL INFORMATION

This proxy statement is furnished to shareholders of Amcast Industrial Corporation, an Ohio corporation (hereinafter the “Company”), in connection with the solicitation by its Board of Directors of proxies to be used at the Annual Meeting of Shareholders to be held on December 18, 2002, and any adjournment thereof. The Company has one class of shares outstanding, namely Common Shares, of which there were 8,710,553 outstanding at the close of business on October 21, 2002. The close of business on October 21, 2002 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting, and each such shareholder is entitled to one vote per share.

All Common Shares represented by properly executed proxies received by the Board of Directors pursuant to this solicitation will be voted in accordance with the shareholder’s directions specified on the proxy. If no directions have been specified by marking the appropriate squares on the accompanying proxy card, the shares will be voted in accordance with the Board of Directors’ recommendations. A shareholder signing and returning the accompanying proxy has the power to revoke it at any time prior to its exercise by voting in person at the meeting, by delivering to the Company a later dated proxy, or by giving notice to the Secretary of the Company in writing or in open meeting but without affecting any vote previously taken.

The presence, in person or by properly executed proxy, of the holders of a majority of the Company’s outstanding shares is necessary to constitute a quorum at the Annual Meeting. Shares represented by proxies received by the Company will be counted as present at the Annual Meeting for the purpose of determining the existence of a quorum, regardless of how or whether such shares are voted on a specific proposal. Abstentions will be treated as votes cast on a particular matter as well as shares present at the Annual Meeting. Where nominee shareholders do not vote on specific issues because they did not receive specific instructions on such issues from the beneficial owners of such shares (“Broker Nonvotes”), such Broker Nonvotes will not be treated as either votes cast or shares present.

This proxy statement and the accompanying form of proxy were first mailed to shareholders on or about November 13, 2002.

ELECTION OF DIRECTORS

The Company’s Board of Directors is divided into three classes. Each class is comprised of three directors, and one class is elected at each Annual Meeting of Shareholders for a term of three years.

At the 2002 Annual Meeting, shareholders will elect three directors who will hold office until the Annual Meeting of Shareholders in 2005. The Board has nominated Don R. Graber, Joseph R. Grewe and R. William Van Sant for election as directors at the 2002 Annual Meeting.

It is the intention of the proxy agents named in the accompanying proxy to vote such proxy for the election of Messrs. Graber, Grewe and Van Sant. Should any of them be unable to accept the office of director, an eventuality that is not anticipated, proxies may be voted with discretionary authority for a substitute nominee or nominees designated by the Board of Directors. Messrs. Graber, Grewe and Van Sant are presently directors and are nominated to succeed themselves.

Set forth below is information about the three nominees for election as a director and the directors whose terms of office will continue after the 2002 Annual Meeting.

Nominees for a Term of Office Expiring in 2005

DON R. GRABER, age 58, has been a director of the Company since July 2001. Mr. Graber has been Chairman, President and Chief Executive Officer of Huffy Corporation (a manufacturer of sporting goods and provider of retail services) since December 1997; from 1996 to 1997, he was President and Chief Operating Officer of Huffy Corporation. Previously, Mr. Graber was President of Worldwide Household Products Group of The Black & Decker Corporation. Mr. Graber is also a director of Precision Castparts Corp. and MTC Technologies.

JOSEPH R. GREWE, age 54, has been a director of the Company since April 8, 2002. Mr. Grewe has been President and Chief Operating Officer of the Company since April 2002. Mr. Grewe was Group President, Film & Fabrics from 2001 to 2002 and Divisional Vice President, Fluid Systems from 1999 to 2001, of Saint-Gobain (a diversified, multi-national group of manufacturing companies headquartered in France, active in glass, high-performance materials and construction products). From 1998 to 1999, Mr. Grewe was Executive Vice President, Commercial Business and from 1996 to 1998 Vice President, Operations of Furon Company (a designer, developer and manufacturer of engineered polymer products).

R. WILLIAM VAN SANT, age 64, has been a director of the Company since October 1993. Mr. Van Sant is an Operating Partner with Norwest Equity Partners. Mr. Van Sant was Chairman and Chief Executive Officer of Nortrax, Inc. (a national retail distributor of John Deere construction and allied equipment) from December 1999 to February 2001. From December 1991 to May 1998, Mr. Van Sant was Chairman and Chief Executive Officer of Lukens Inc. and from October 1991 to December 1991, he was President and Chief Operating Officer of Lukens Inc. Mr. Van Sant is also a director of H.B. Fuller Company.

2

Directors Continuing in Office Until 2004

WALTER E. BLANKLEY, age 67, has been a director of the Company since February 1994. Mr. Blankley, retired, was Chairman from April 1993 to December 2000 and was Chief Executive Officer from April 1990 to September 1999 of Ametek, Inc. (a manufacturer of electrical motor blowers and precision electronic instruments). Mr. Blankley is also a director of CDI Corporation.

BYRON O. POND, age 66, has been a director of the Company since February 2001. Mr. Pond has been Chairman of the Board and Chief Executive Officer of the Company since April 2002. From February 2001 to April 2002, Mr. Pond was President and Chief Executive Officer of the Company. From 1996 to 1998, Mr. Pond served as Chairman and Chief Executive Officer of Arvin Industries, Inc. (a leading manufacturer of automotive emission and ride control systems) and from 1993 to 1996 as President and Chief Executive Officer of Arvin. He became Arvin’s President and Chief Operating Officer in 1991. Mr. Pond is also a director of Cooper Tire & Rubber Company, Precision Castparts Corp. and GSI Lumonics.

WILLIAM G. ROTH, age 64, has been a director of the Company since December 1989. Mr. Roth, retired, was Chairman of Dravo Corporation (a natural resource company producing lime and construction aggregates) from June 1987 to April 1994; and from June 1987 to January 1990, he was its Chairman and Chief Executive Officer. Mr. Roth is also a director of Lennox International, Inc.

Directors Continuing in Office Until 2003

PETER H. FORSTER, age 60, has been a director of the Company since May 1988. Mr. Forster has been Chairman of DPL Inc. (a diversified regional merchant energy company) and The Dayton Power and Light Company (its principal subsidiary) since April 1988. He had been President and Chief Executive Officer of DPL Inc. until April 1992 and its Chairman and Chief Executive Officer until the end of 1996. He continues to serve as Chairman and as a consultant to DPL Inc. on strategic matters.

LEO W. LADEHOFF, age 70, has been a director of the Company since 1978. Mr. Ladehoff was Chairman of the Board of the Company from February 2001 to April 2002 and from December 1980 to December 1997. He served as Chief Executive Officer of the Company from May 1979 to March 1995.

BERNARD G. RETHORE, age 61, has been a director of the Company since October 1999. Mr. Rethore has been Chairman Emeritus of Flowserve Corporation (a global manufacturer of advanced technology fluid transfer and control equipment, systems and services) since his retirement as an executive officer and director in April 2000. He had been Chairman and Chief Executive Officer of Flowserve since July 1997 and held the additional title of President from November 1998 until July 1999. Mr. Rethore was Chairman of the Board of BW/IP, Inc. in 1997 and served as its President, Chief Executive Officer and a director from 1995 to 1997. He was Senior Vice President of Phelps Dodge Corporation and President of Phelps Dodge Industries from 1989 to 1995. Mr. Rethore is also a director of Maytag Corporation, Dover Corporation, Belden, Inc. and Walter Industries, Inc.

Certain Information Concerning the Board of Directors

There were eight meetings of the Board of Directors during fiscal 2002. The Board of Directors had five standing committees in fiscal 2002 (the number of meetings of each of these committee is shown in parentheses): Executive Committee (1), Audit Committee (4), Compensation Committee (3), Pension Review Committee (4) and the Committee on the Board (2). During fiscal 2002, the Audit Committee and Pension Review Committee were combined and renamed the Audit, Finance and Pension Committee; the Committee on the Board was renamed the Governance and Nominating Committee; and the Compensation

3

Committee was renamed the Compensation and Benefits Committee. Each committee has adopted a new charter which has been approved by the Board.

The Executive Committee (Messrs. Pond (Chairman), Ladehoff, Forster and Roth) is authorized, in intervals between meetings of the Board of Directors, to exercise all the powers of the Board with the exception of filling vacancies on the Board or any board committee.

The Audit, Finance and Pension Committee (Messrs. Rethore (Chairman), Graber and Roth), now appoints the independent auditors, reviews the independence of such auditors, approves the scope of the annual audit activities of the independent auditors, reviews the audit activities of the Company’s internal auditors, reviews audit results and reviews the administration of retirement plans, investment manager and trustee performance, and the results of independent audits of plan financial statements. The Audit, Finance and Pension Committee Charter, adopted by the Board and included as Appendix A to this Proxy Statement, more specifically sets forth the duties and responsibilities of the Audit, Finance and Pension Committee.

The Compensation and Benefits Committee (Messrs. Van Sant (Chairman), Blankley, Forster and Graber) now oversees the Company’s compensation and benefit plans for directors, officers and key employees and acts in an advisory capacity to the Board of Directors in all matters relating to the compensation of directors and officers, among other duties.

The Governance and Nominating Committee (Messrs. Blankley (Chairman), Rethore and Van Sant) now recommends the criteria and qualifications for board membership, recommends to the Board candidates for election as directors, recommends to the Chairman and the Board the composition of committees of the Board, provides annually to the Board an assessment of Board and individual director performance, reports annually to the Board on director compensation in relation to comparable companies and current best practices of public companies, among other duties. If a shareholder desires to recommend to this Committee a person to consider for nomination as a director of the Company, the shareholder should give written notice to the Secretary of the Company, at the Company’s principal executive office, Washington Park I, 7887 Washington Village Drive, Dayton, Ohio, 45459, at least 120 days before the date of the meeting of shareholders at which directors are to be elected. Such notice should state the name, age, business and residence address of the proposed candidate, and the principal occupation or employment of the proposed candidate.

Each current director attended 75% percent or more of the meetings of the Board of Directors and committees on which he served held during his term as a director in fiscal 2002.

Each non-employee director receives a yearly stipend of $16,000, which is payable in cash or Company shares at the option of the director, a grant of 200 restricted shares of the Company and $1,000 for each Board or committee meeting that he attends. For 2003, non-employee directors who chair a standing committee will receive an additional $3,000 yearly stipend. A director may elect to defer receipt of fees payable to him into a cash account upon which the Company pays interest or, at the director’s option, into Company shares. Payment of deferred amounts commence after the director ceases to be a director or on an earlier date as specified by him.

The Company’s 1999 Director Stock Incentive Plan provides that options to purchase up to a maximum of 250,000 shares may be granted to directors who are not employed by the Company. Under the

4

plan, each nonemployee director, who is a director of the Company on the first business day of January of each year, is automatically granted an option to purchase 1,500 shares at an option price per share equal to the fair market value of a share on the date of grant. Options become exercisable one year after grant.

The Company believes that it is important for directors to have a meaningful ownership position in the Company. Stock ownership guidelines are therefore established for directors. Directors are expected to achieve ownership levels of Company stock equal in value to three times their yearly stipend and restricted stock grant.

AUDIT, FINANCE AND PENSION COMMITTEE REPORT TO SHAREHOLDERS

The Audit, Finance and Pension Committee is comprised of three members of the Company’s Board of Directors. Each member of the Audit, Finance and Pension Committee is independent as “independence” is defined at Sections 303.01(B)(2)(a) and B(3) of the New York Stock Exchange’s listing standards. The duties and responsibilities of the Audit, Finance and Pension Committee are set forth in the Audit, Finance and Pension Committee Charter, which the Board of Directors adopted on August 21, 2002. A copy of Charter is included as Appendix A to this Proxy Statement. The Audit, Finance and Pension Committee, among other things, (i) recommends to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K and (ii) selects the independent auditors to audit the books and records of the Company.

The Audit, Finance and Pension Committee has (i) reviewed and discussed the Company’s audited financial statements for the fiscal year ended August 31, 2002 with the Company’s management and with the Company’s independent auditors; (ii) discussed with the Company’s independent auditors the matters required to be discussed by SAS 61 (Codification for Statements on Auditing Standards); and (iii) received and discussed the written disclosures and the letter from the Company’s independent auditors required by Independence Standards Board Statement No. 1 (Independence discussions with Audit Committees). Based on such review and discussions with management and the independent auditors, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 2002 for filing with the U.S. Securities and Exchange Commission.

Respectfully submitted,

AUDIT, FINANCEAND PENSION COMMITTEE

Bernard G. Rethore, Chairman

Don R. Graber

William G. Roth

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires directors and executive officers of the Company and owners of more than 10 percent of the Company’s common shares to file an initial ownership report with the Securities and Exchange Commission and additional reports listing subsequent changes in their ownership of common shares. The Company believes, based on information provided to the Company by the persons required to file such reports, that all filing requirements applicable to such persons during the period from September 1, 2001 through August 31, 2002 have been met.

5

SECURITY OWNERSHIP OF DIRECTORS, NOMINEES AND EXECUTIVE OFFICERS

Set forth in the table below is information as of October 21, 2002, with respect to the number of Common Shares of the Company beneficially owned by each director, nominee for director and certain executive officers of the Company and by all directors, nominees and executive officers as a group. For purposes of this table, an individual is considered to “beneficially own” any Common Shares (i) over which he exercises sole or shared voting or investment power or (ii) which he has the right to acquire at any time within 60 days after October 21, 2002.

Individuals or Group

| | (A) Number of Shares, Including Option Shares Shown in Column (B), Beneficially Owned as of 10/21/02(1)(2)

| | (B) Option Shares Which May be Acquired Within 60 Days of 10/21/02

|

| Walter E. Blankley | | 17,787 | | 6,000 |

| Peter H. Forster | | 22,149 | | 6,000 |

| Don R. Graber | | 700 | | 0 |

| Joseph R. Grewe | | 75,000 | | 75,000 |

| Leo W. Ladehoff | | 299,839 | | 144,813 |

| Byron O. Pond | | 167,500 | | 167,500 |

| Bernard G. Rethore | | 10,949 | | 3,000 |

| William G. Roth | | 49,149 | | 6,000 |

| R. William Van Sant | | 28,342 | | 16,000 |

| Francis J. Drew | | 70,781 | | 70,000 |

| Luciano Lenotti | | 15,000 | | 15,000 |

| Dean Meridew | | 46,696 | | 41,871 |

|

Directors, nominees and executive officers as a group

(19 persons) | | 1,003,104 | | 728,314 |

| (1) | | Unless otherwise indicated, voting power and investment power are exercised solely by the named individual or are shared by such individual and his immediate family members. |

| (2) | | Mr. Ladehoff beneficially owns 3.39% of the outstanding Common Shares. Mr. Pond beneficially owns 1.89%. No other director or officer owns in excess of 1% of the Common Shares. Directors, nominees and executive officers as a group own 10.63% of the Common Shares. Percentages are calculated on the basis of the number of shares outstanding at October 21, 2002, plus the number of shares subject to outstanding options held by the individual or group which are exercisable within 60 days thereafter. |

6

REPORT OF THE COMPENSATION AND BENEFITS COMMITTEE

ON EXECUTIVE COMPENSATION

Philosophy. The Company’s executive compensation program is based on two objectives: provide market-competitive compensation opportunities and create a strong link among the interests of the shareholders, the Company’s financial performance and the total compensation of the Company’s executive officers.

The Compensation and Benefits Committee of the Board of Directors (the “Committee”) consists of four directors, none of whom is a past or present employee of the Company. The Committee meets periodically and reviews executive compensation and makes recommendations to the Board.

There are three components to the Company’s executive compensation program: annual salary, annual incentive compensation and long-term incentive compensation. Base salary and all forms of incentive compensation opportunities are set by periodic comparison to external rates of pay for comparable positions within the industry.

Salaries. Base salaries are targeted at the midpoint of competitive data as measured by Towers, Perrin, Forster & Crosby and other similar services. Individual variability is based on performance with regard to business acumen, management competencies and personal competencies, determined by individual achievement in a number of areas, including earnings adequacy, business planning, asset management, leadership, staffing and development, customer satisfaction and quality commitment. Adjustments are considered periodically, based upon general movement in external salary levels, individual performance and potential and changes in the position’s duties and responsibilities. Mr. Pond has been Chief Executive Officer since February of 2001. His fiscal 2002 salary is within the competitive range for chief executive officers in similar circumstances. For other Named Executive Officers, the Company paid salaries at or near the competitive data midpoint during fiscal 2002.

Annual Incentives. Annual incentives for Named Executive Officers (other than Mr. Pond) are a function of plan profit, net operating asset targets and the achievement of personal goals. These are paid on the basis of preset performance measures for the Company and for the operating divisions or subsidiaries which are established by the Board. Payments on individual achievement of personal goals by such officers during the fiscal year are also determined by the Board. Performance by the Company or a specific division or subsidiary at below preset levels results in the elimination of annual incentive awards for the responsible officers for payments based on profit or on net operating assets. Mr. Pond declined an annual incentive payment for fiscal 2002.

Long-Term Incentives. Long-term incentives have been provided in the past under the Long-Term Incentive Plan (“LTIP”). The LTIP provides for grants of two types of awards: stock options and cash awards. No awards were granted under the LTIP after the grants on the first day of fiscal 2001 and the program is currently suspended. In fiscal 2002, the grants issued in fiscal 1999 matured but no payments were made since the Company’s average annual ROE during the period was less than the targeted threshold for payment.

1999 Stock Incentive Plan. Stock option grants are awarded to the Named Executive Officers and other employees under the 1999 Stock Incentive Plan. The grant of stock options to senior executives provides

7

additional compensation and more strongly aligns their interests with those of the shareholders.None of the Named Executive Officers will realize a benefit from the options unless and until the market price of the Company’s common shares increases.

No employee of the Company received remuneration from the Company in excess of $1,000,000 in fiscal 2002.

The Committee believes that its compensation plans compensate executives appropriately and competitively.

Respectfully submitted,

COMPENSATIONAND BENEFITS COMMITTEE

R. William Van Sant, Chairman

Walter E. Blankley

Peter H. Forster

Don R. Graber

8

EXECUTIVE COMPENSATION

The following table presents for fiscal years ended August 31, 2002, 2001 and 2000 the compensation earned by the Chief Executive Officer and the four other most highly compensated executive officers of the Company in fiscal 2002 (the “Named Executive Officers”) for services they performed in all capacities to the Company and its subsidiaries during such years.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | Long Term Compensation

| | |

| | | | | | | | | | Awards

| | Payouts

| | |

| | | | | Annual Compensation

| | | Shares Underlying Options Granted(1)

| | | | |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | | | LTIP Payouts

| | All Other Compensation(2)

|

| Byron O. Pond | | 2002 | | $ | 430,000 | | | 0 | (4) | | 0 | | 0 | | | 0 |

| Chairman and Chief Executive Officer(3) | | 2001 | | $ | 237,113 | | | 0 | (4) | | 250,000 | | 0 | | | 0 |

|

| Joseph R. Grewe | | 2002 | | $ | 134,616 | | $ | 116,667 | | | 150,000 | | 0 | | | 0 |

| President and Chief Operating Officer(3) | | | | | | | | | | | | | | | | |

|

| Francis J. Drew | | 2002 | | $ | 256,000 | | $ | 92,000 | | | 30,000 | | 0 | | $ | 3,020 |

| Vice President, Finance and Chief Financial Officer(3) | | 2001 | | $ | 91,115 | | $ | 30,000 | | | 70,000 | | 0 | | | 0 |

|

| Luciano Lenotti | | 2002 | | $ | 229,989 | | $ | 40,299 | | | 22,500 | | 0 | | | 0 |

Managing Director, Speedline(3) | | 2001 | | $ | 177,930 | | $ | 32,158 | | | 0 | | 0 | | | 0 |

|

| Dean Meridew | | 2002 | | $ | 170,962 | | $ | 96,448 | | | 20,000 | | 0 | | $ | 1,755 |

| Vice President and General Manager, North American Wheel Division | | 2001 2000 | | $ $ | 160,000 159,462 | | $ $ | 43,906 21,447 | | | 18,719 4,663 | | 0 0 | | $ $ | 2,028 3,301 |

| | | | | | | | | | | | | | | | | |

| (1) | | Reflects number of shares subject to options granted under the 1999 Stock Incentive Plan and inducement options granted to Messrs. Pond, Grewe and Drew. |

| (2) | | Reflects the dollar value of Company shares contributed to officer accounts in defined contribution plans which are available to all salaried employees of the Company. |

| (3) | | Mr. Pond joined the Company on February 14, 2001, Mr. Grewe on April 8, 2002, Mr. Drew on April 4, 2001 and Mr. Lenotti on October 30, 2000. |

| (4) | | Mr. Pond declined an incentive payment for fiscal 2002 and fiscal 2001. |

9

STOCK OPTIONS

The following table contains information concerning the grant of stock options under the Company’s 1999 Stock Incentive Plan to the Named Executive Officers and inducement options to Mr. Grewe during fiscal 2002.

OPTION GRANTS IN FISCAL 2002

| | | Individual Grants

| | |

| | | Number of Shares Underlying Options Granted

| | % of Total Options Granted to Employees in Fiscal 2002

| | | Exercise Price

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (1)

|

Name

| | | | | | 5%

| | 10%

|

| Byron O. Pond | | 0 | | 0 | | | | | | | | | 0 | | | 0 |

|

| Joseph R. Grewe | | 150,000 | | 42.86 | % | | $ | 5.48 | | 3/31/2007 | | $ | 227,103 | | $ | 501,839 |

|

| Francis J. Drew | | 30,000 | | 8.57 | % | | $ | 3.525 | | 8/19/2007 | | $ | 29,217 | | $ | 64,561 |

|

| Luciano Lenotti | | 15,000 7,500 | | 4.29 2.14 | % % | | $ $ | 6.695 3.525 | | 10/1/2006 8/19/2007 | | $ $ | 27,746 7,304 | | $ $ | 61,310 16,140 |

|

| Dean Meridew | | 20,000 | | 5.71 | % | | $ | 3.525 | | 8/19/2007 | | $ | 19,478 | | $ | 43,041 |

| (1) | | All incentive options first become exercisable one year after the date of grant and have a 5 or 10-year term. Mr. Grewe’s inducement options vest as follows: 75,000 on date of grant and 75,000 on his anniversary date of employment. The dollar amounts in these columns are the hypothetical gains that would exist for the options at the end of their terms, assuming annual compound rates of stock appreciation of 5% and 10%. Such appreciation rates are prescribed by the Securities and Exchange Commission and are not intended to forecast possible appreciation, if any, of the Company’s share price. |

10

OPTION EXERCISES

The following table sets forth information, with respect to the Named Executive Officers, concerning their exercise of options during the Company’s fiscal year ended August 31, 2002 and the unexercised options held by such executives at August 31, 2002.

AGGREGATED OPTION EXERCISES IN FISCAL YEAR 2002

AND FISCAL YEAR-END OPTION VALUES

Name

| | Shares Acquired on Exercise

| | Value Realized(1)

| | Number of Shares Underlying Unexercised Options at Fiscal Year-End Exercisable(E) Unexercisable(U)

| | | Value of Unexercised In-The-Money Options at Fiscal Year-End Exercisable(E) Unexercisable(U)

| |

| Byron O. Pond | | 0 | | $ | 0 | | 167,500 82,500 | (E) (U) | | $ $ | 0 0 | (E) (U) |

|

| Joseph R. Grewe | | 0 | | $ | 0 | | 75,000 75,000 | (E) (U) | | $ $ | 0 0 | (E) (U) |

|

| Francis J. Drew | | 0 | | $ | 0 | | 70,000 30,000 | (E) (U) | | $ $ | 0 0 | (E) (U) |

|

| Luciano Lenotti | | 0 | | $ | 0 | | 0 22,500 | (E) (U) | | $ $ | 0 0 | (E) (U) |

|

| Dean Meridew | | 0 | | $ | 0 | | 41,871 20,000 | (E) (U) | | $ $ | 0 0 | (E) (U) |

| (1) | | At August 31, 2002 all option exercise prices were higher than the market price of a common share of the Company. |

11

LONG-TERM INCENTIVE PLAN

The following table sets forth certain information as to awards under the Company’s Long-Term Incentive Plan (“LTIP”) granted in fiscal 2002.

LONG-TERM INCENTIVE PLAN—AWARDS IN FISCAL 2002

| | | Percentage of Salary(1)

| | Performance or Other Period Until Maturation or Payout(2)

| | Estimated Future Payouts

|

Name

| | | | Threshold

| | Target

| | Maximum

|

| Byron O. Pond | | 0 | | 0 | | 0 | | 0 | | 0 |

| Joseph R. Grewe | | 0 | | 0 | | 0 | | 0 | | 0 |

| Francis J. Drew | | 0 | | 0 | | 0 | | 0 | | 0 |

| Luciano Lenotti | | 0 | | 0 | | 0 | | 0 | | 0 |

| Dean Meridew | | 0 | | 0 | | 0 | | 0 | | 0 |

| (1) | | Awards consist of the designation of target percentages of annual salary to be paid at the end of the performance period if the Company achieves certain performance objectives. No payout occurs unless the Company achieves certain threshold performance objectives. Above the threshold, payouts may be greater or less than the target percentage to the extent that the Company’s performance exceeds or fails to meet the target objectives specified in the plan. Payouts under the LTIP are based on the Company achieving designated percentages of Return on Equity (ROE). |

| (2) | | Grants are typically made the first day of the fiscal year. The performance period includes fiscal year 2002, 2003 and 2004. The future payouts, if any, are based upon fiscal year 2002 salaries. No awards were made on the first day of fiscal 2003. The plan is currently suspended except for possible pay-outs from awards made in prior fiscal years. |

12

RETIREMENT PLANS

The Company has a noncontributory, defined benefit pension plan for officers and other salaried employees of the Company and its subsidiaries, which is a qualified plan under applicable provisions of the Internal Revenue Code (the “Pension Plan”). Retirement benefits under the Pension Plan are calculated on the basis of the number of credited years of service the employee has with the Company, as well as the employee’s average annual earnings for the three highest consecutive years during the employee’s last ten years of employment. The maximum annual retirement benefit that may be paid under the Pension Plan to any participant under present law is $160,000.

The Company also has a Nonqualified Supplementary Benefit Plan (the “Supplemental Plan”), which provides supplemental retirement benefits for Messrs. Pond, Grewe, Drew and Meridew, and other persons as they become eligible for participation in the plan under criteria established by the Board. This benefit is equal to the excess of (a) the benefit that would have been payable to the participant under the Pension Plan without regard to certain annual retirement income and benefit limitations imposed by federal law, over (b) the benefit payable to the participant under the Pension Plan. Mr. Lenotti, an Italian citizen, does not participate in the U.S. pension plans.

Earnings for the purpose of calculating retirement benefits include salary and bonuses as shown in the Summary Compensation Table. The actual years of service at October 21, 2002, for executive officers named in the Summary Compensation Table, were as follows: Mr. Pond–1.7, Mr. Grewe–.5, Mr. Drew–1.5, and Mr. Meridew–17.75.

The following table shows the estimated maximum annual retirement benefits payable under the Pension Plan and Supplemental Plan at selected earnings levels after various years of service. Amounts shown are straight-life annuity amounts and are not subject to any deduction for social security.

PENSION PLAN TABLE

Final Average Annual Earnings

| | 10 Years

| | 15 Years

| | 20 Years

| | 25 Years

|

| $200,000 | | $ 47,732 | | $ 71,598 | | $ 95,464 | | $119,330 |

| 250,000 | | 60,232 | | 90,348 | | 120,464 | | 150,580 |

| 300,000 | | 72,732 | | 109,098 | | 145,464 | | 181,830 |

| 350,000 | | 85,232 | | 127,848 | | 170,464 | | 213,080 |

| 400,000 | | 97,732 | | 146,598 | | 195,464 | | 244,330 |

| 450,000 | | 110,232 | | 165,348 | | 220,464 | | 275,580 |

| 500,000 | | 122,732 | | 184,098 | | 245,464 | | 306,830 |

| 550,000 | | 135,232 | | 202,848 | | 270,464 | | 338,080 |

| 600,000 | | 147,732 | | 221,598 | | 295,464 | | 369,330 |

| 650,000 | | 160,232 | | 240,348 | | 320,464 | | 400,580 |

| 700,000 | | 172,732 | | 259,098 | | 345,464 | | 431,830 |

13

CERTAIN AGREEMENTS

The employment agreement between the Company and Mr. Pond provides that he will serve as Chief Executive Officer for a period ending February 15, 2004 subject to his right to resign upon notice to the Company. Mr. Pond is entitled to receive an annual salary of a minimum of $430,000 and annual discretionary incentive payments targeted at 65% of his salary based on achievement of goals established by the Board. Mr. Pond has requested that Amcast pay $80,000 of his salary for its fiscal year ending August 31, 2003 in Amcast common shares payable in four quarterly installments of shares having a fair market value of $20,000 on the date of payment. Mr. Pond’s employment may be terminated because of his death, disability, breach or at the will of the Company. If Mr. Pond’s employment is terminated for any reason other than death, disability or breach of the agreement by Mr. Pond, Mr. Pond would be entitled to receive his remaining salary and pro-rata bonus to the date of his termination plus his base salary for the twelve months following his termination. If Mr. Pond’s employment is terminated by the Company or by Mr. Pond for good reason (as defined in the agreement) within one year after a change in control of the Company (as defined in the agreement), Mr. Pond would be entitled to receive his base salary for 36 months following the termination plus the greater of three times his average annual bonus for the last three years or three times 32 1/2% of his then current annual base salary and continuation of health benefits for up to eighteen months. In addition, he would be entitled to certain payments to offset any additional taxes which may be payable by him in the event any of the payments made to him by the Company as a result of a change of control are “parachute payments” as defined under Section 280G of the Internal Revenue Code.

The Company has entered into an employment agreement with Mr. Grewe, dated April 1, 2002, under which Mr. Grewe agrees to serve as President and Chief Operating Officer. Mr. Grewe is entitled to receive an annual salary of $350,000; annual incentive payments targeted at 50% of his salary retroactive to January 1, 2002, based on achievement of goals established by the Board; $28,000 in February 2003 and 2004 to replace the bonus he would have received from his prior employer; supplemental pension benefits should a change of control occur before he becomes vested in the Merged Pension Plan; additional supplemental pension benefits increases by three years his years of service with the Company once he becomes vested in the Merged Pension Plan; and a grant of an option to purchase an aggregate of 150,000 common shares of the Company at market price on the date of the grant. The Company also agreed to provide certain enhanced relocation benefits and to reimburse Mr. Grewe partially on an after-tax basis for interest he pays on a real estate loan arranged by Mr. Grewe’s prior employer until the earlier of the sale of the residence securing the loan or April 8, 2004. If Mr. Grewe’s employment is terminated by the Company other than for death or cause, Mr. Grewe would be entitled to receive his base salary for 12 months following the termination and a continuation of health benefits for up to twelve months.

The Company has entered into severance agreements with Messrs. Drew, Grewe, Lenotti and Meridew. Under these agreements, each employee is entitled to severance benefits if his employment with the Company is terminated within two years of a change of control of the Company (as defined in the agreement) either by the employee for good reason or by the Company for any reason other than cause, disability, normal retirement, or death. In the event of a covered termination, severance benefits include a payment equal to one or two times the employee’s salary and recent incentive award, depending on the employee’s position and length of service with the Company. The agreements also provide for the payment of the cash value of the outstanding options in cancellation of the options and the continuance of life and health insurance coverage until the earlier of the employee becoming eligible for coverage by a subsequent employer or the expiration of one, two or three years. The agreements also protect the Company against the

14

disclosure of confidential information and, in certain circumstances, require the employee to pay the Company 20% of the compensation received from a subsequent employer. Mr. Grewe’s non-disclosure provisions are set forth in his employment agreement with the Company.

Mr. Ladehoff has entered into an amended consulting agreement with the Company under the terms of which Mr. Ladehoff’s services as an independent consultant to the Company were extended through August 31, 2004. Mr. Ladehoff is entitled to a monthly consulting fee at an annualized rate of $200,000 per year through February 28, 2003 and a reduced annualized rate of $100,000 per year after February 28, 2003 through August 31, 2004. The Company may terminate the consulting agreement on two weeks written notice. In the event of termination by the Company, Mr. Ladehoff is entitled to receive his remaining unpaid consulting fees.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Leo W. Ladehoff’s son, Lance A. Ladehoff, is Vice President, Sales and Marketing, of Elkhart Products Corporation, a subsidiary of the Company. In such capacity, Lance Ladehoff was paid an annual salary and bonus of $145,021 in fiscal 2002.

15

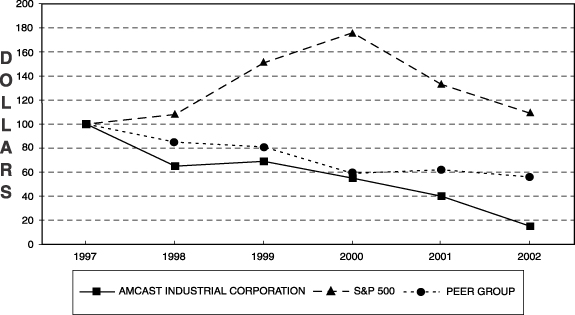

COMPANY’S STOCK PERFORMANCE GRAPH

The following chart compares the cumulative total return to shareholders on the Company’s Common Shares for its last five fiscal years with the cumulative total return of the (a) Standard and Poor’s 500 Index (a broad equity market index) and (b) a Peer Group for the same periods. The Company is not a component of the S&P 500 or the Peer Group. The graph depicts the value on August 31, 2002, of a $100 investment made on August 31, 1997, in Company shares, the S&P 500 and the Peer Group, with all dividends reinvested.

| | | 1998

| | 1999

| | 2000

| | 2001

| | 2002

|

| Amcast | | $ | 65 | | $ | 69 | | $ | 55 | | $ | 40 | | $ | 15 |

| Peer Group | | $ | 85 | | $ | 81 | | $ | 59 | | $ | 62 | | $ | 56 |

| S&P 500 | | $ | 108 | | $ | 151 | | $ | 176 | | $ | 133 | | $ | 109 |

The Peer Group is comprised of the following companies: Ampco-Pittsburgh Corp., Federal Mogul Corp., Harsco Corp., Hayes Lemmerz International, Inc., Intermet Corp., Kennametal Inc., Lawson Products Inc., Modine Mfg. Co., Mueller Industries, Inc., SPS Technologies Inc., Superior Industries International Inc., Timken Co., Trinity Industries Inc., Tyler Technologies, Inc. and Wolverine Tube Inc. Allied Products Corporation and Fansteel, Inc. have been deleted from the Peer Group this year since their stock is no longer publicly traded.

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Set forth below is certain information about the only persons known by the Board of Directors of the Company to be a beneficial owner of more than five percent of the outstanding Common Shares of the Company as of October 21, 2002:

Name and Address

| | Number of Common Shares Beneficially Owned as of 10/21/02(1)

| | Percent of Class

| |

First Carolina Investors, Inc.(2) 1350 One M&T Plaza Buffalo, NY 14203 | | 1,088,000 | | 12.5 | % |

|

Dimensional Fund Advisors Inc.(2) 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 | | 710,000 | | 8.2 | % |

|

Sligo Partners, LLC 191 Peachtree Street, 16th Floor Atlanta, GA 30303 | | 667,900 | | 7.7 | % |

|

JB Capital Partners Alan Weber 23 Berkley Lane Rye Brook, NY 10573 | | 555,000 | | 6.4 | % |

|

Robotti & Company, Incorporated 52 Vanderbilt Avenue, Suite 503 New York, NY 10017 | | 516,810 | | 5.9 | % |

| (1) | | For purposes of this table, an individual is considered to “beneficially own” any Common Shares (a) over which he has the right to acquire beneficial ownership at any time within 60 days after October 21, 2002, or (b) over which he exercises sole or shared voting or investment power. |

| (2) | | Dimensional Fund Advisors Inc. and First Carolina Investors, Inc. are investment advisors registered under the Investment Advisors Act of 1940. |

17

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Ernst & Young LLP served as the Company’s independent auditors for the year ended August 31, 2002. Subject to ratification by shareholders, the Audit, Finance and Pension Committee, has appointed Ernst & Young LLP as independent auditors of the Company for the fiscal year ending August 31, 2003 and recommends a vote “FOR” the proposal to ratify such appointment.

In addition to rendering audit services during fiscal 2002, Ernst & Young performed certain non-audit services for the Company and its consolidated subsidiaries. The Company paid the following fees to Ernst & Young for services relating to fiscal 2002:

| Audit Fees | | $ | 436,000 |

| Financial Information Systems | | | |

| Design and Implementation Fees | | $ | 0 |

| All Other Fees | | $ | 58,000 |

During the process of selecting the independent auditors for fiscal 2003, the Audit, Finance and Pension Committee reviewed past audit results and non-audit services performed during fiscal 2002 and proposed to be performed during fiscal 2003. In selecting Ernst & Young, the Committee carefully considered the impact of such services on Ernst & Young’s independence. The Committee has determined that the performance of such non-audit services did not affect the independence of Ernst & Young. Ernst & Young has advised the Company that Ernst & Young is in compliance with all rules, standards and policies of the Independence Standards Board and the Securities and Exchange Commission governing auditor independence.

A representative of Ernst & Young LLP is expected to be present at the Annual Meeting with the opportunity to make a statement if he desires to do so and to respond to appropriate questions from shareholders.

18

OTHER MATTERS

The Board of Directors does not intend to present, and has no knowledge that others will present, any other business at the meeting. However, if any other matters are properly brought before the meeting, it is intended that the holders of proxies in the enclosed form will vote thereon in their discretion.

The cost of solicitation of proxies will be borne by the Company. In addition to the use of the mail, proxy solicitations may be made by directors, officers and employees of the Company, personally or by telephone and telegram, without receiving additional compensation. Banks, brokerage houses and other custodians, nominees and fiduciaries will be requested to forward soliciting material to their principals and to obtain authorization for the execution of proxies. The Company will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their out-of-pocket expenses.

FUTURE SHAREHOLDER PROPOSALS

The 2003 Annual Meeting of Shareholders is presently scheduled for December 17, 2003. A proposal by a shareholder intended for inclusion in the Company’s proxy statement and form of proxy for the 2003 Annual Meeting of Shareholders must, in accordance with applicable regulations of the Securities and Exchange Commission, be received by the Company Secretary on or before July 16, 2003, in order to be eligible for such inclusion.

For any proposal that is not submitted for inclusion in next year’s proxy statement, but is instead sought to be presented directly by a shareholder at the 2003 Annual Meeting, management will be able to vote proxies in its discretion if the Company: (1) receives notice of the proposal before the close of business on September 29, 2003 and advises shareholders in the 2003 proxy statement about the nature of the matter and how management intends to vote on such matter or (2) does not receive notice of the proposal before the close of business on September 29, 2003.

The Company’s Code of Regulations, which is available upon request to the Corporate Secretary, provides that nomination for director may only be made by the Board of Directors (or an authorized board committee) or a shareholder entitled to vote who sends notice of the nomination to the Corporate Secretary not fewer than 50 days nor more than 75 days prior to the meeting date. Such notice is required to contain certain information specified in the Company’s Code of Regulations. For a nominee of a shareholder to be eligible for election at the 2003 Annual Meeting, the shareholder’s notice of nomination must be received by the Corporate Secretary between October 3, 2003 and October 28, 2003. This advance notice period is intended to allow all shareholders to have an opportunity to consider nominees expected to be considered at the meeting.

All submissions to, or requests from, the Corporate Secretary should be made to Amcast Industrial Corporation, Washington Park I, 7887 Washington Village Drive, Dayton, Ohio 45459.

By Order of the Board of Directors

Samuel T. Rees, Secretary

19

APPENDIX A

AUDIT, FINANCE AND PENSION COMMITTEE CHARTER

I. Committee Role and Purpose.

The Committee’s role is to act on behalf of the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of all material aspects of the Company’s financial reporting, control and audit functions, except those specifically related to the responsibilities of another standing committee of the Board, and to select, retain, compensate, oversee and terminate the Company’s external auditors subject to ratification by the shareholders. The Committee’s role also includes coordination with other Board committees and the maintenance of strong, positive working relationships with management, external auditors, internal auditors, counsel and other Committee advisors. The Committee is further responsible for overseeing the Company’s Code of Business Conduct and reviewing and approving any waivers thereto for directors or senior management. As to the Company’s pension plans, the Committee is responsible for overseeing all such plans, including regulatory compliance; investment manager and trustee selection, retention and performance; and audits but excluding administration and oversight of pension plan benefits and amendments.

The Committee is expected to have open communications, including regular, private executive sessions, as appropriate, with the independent auditors, internal auditors and management and to report regularly to the Board.

II. Committee Membership and Qualification.

The Committee shall be appointed by the Board of Directors and shall consist of at least three directors, each of whom shall be independent of management and not own directly or indirectly in excess of five percent of the Company’s outstanding shares. The members shall be financially literate (or shall become financially literate within a reasonable period after appointment to the Committee), as required by the New York Stock Exchange (NYSE). The Chair shall be literate in business and financial reporting and control, including knowledge of applicable regulatory requirements and have past employment experience in finance or accounting or other comparable experience or background.

The Committee shall have access to its own counsel and other advisors at the Committee’s sole discretion.

III. Meeting Frequency.

The Committee shall meet at least quarterly to review and assess quarterly and/or annual financial results, public releases and guidance to analysts and rating services. It shall also meet in conjunction with at least two meetings of the full Board to carry out an annual plan of reviews and discussions with the independent and internal auditors and management, which covers the areas of primary Committee responsibility, next discussed.

20

IV. Primary Committee Responsibilities

The Committee shall review and assess:

| | Risk | | Management—In reliance on management’s representations and the independent auditors’ review, the Company’s business risk and management process, including insurance coverage and the scope thereof, and the adequacy of the Company’s overall control environment and controls in selected areas representing significant financial and business risk. |

| | Internal | | Controls and Regulatory Compliance—In reliance on management’s representations and the independent auditors’ review, the Company’s system of internal controls for detecting and reporting financial errors, fraud and defalcations, legal violations, noncompliance with the Company’ Code of Business Conduct and significant conflicts of interest and related-party transactions. |

| | Financial | | Reporting and Controls—Financial statement issues and risks that may have a material impact or effect on reported financial information, the processes used by management to address such matters, related auditor views and the basis for audit conclusions. Material conclusions on audit work in advance of the public release of financials. |

| | Auditor | | Recommendations—Important external and internal auditor recommendations on financial reporting, controls, other matters and management’s response. The views of management and auditors on the overall quality of annual financial reporting. |

| | External | | Audit Responsibilities—Auditor independence and the overall scope and focus of the annual audit, including the scope and level of involvement with unaudited quarterly or other period information. |

| | Internal | | Audit Responsibilities—The annual internal audit plan and the process used to develop the plan. Status of activities, significant findings, recommendations and management’s response. Internal audit performance and changes in internal audit leadership and/or financial management. |

| | Regulatory | | Examinations—SEC inquiries and the results of examinations by other regulatory authorities in terms of important findings, recommendations and management’s response. |

| | Annual | | Reports and Other Major and Quarterly Regulatory Filings—Annual and quarterly financial information and such other information that the Committee deems necessary in advance of filings and/or distribution. |

| | Corporate | | Officer and Director Transactions—Management and Board member transactions with the Company to include reimbursement of expenses, personal use of Company assets, loans, stock transactions and/or paid advisory or other services performed for the Company. In addition, the Committee will be responsible for reviewing and overseeing the Company’s Code of Business Conduct and shall review and be responsible for approving any waivers thereof by directors or senior management. |

While the Committee has the responsibilities and powers noted above, it is not the duty of the Committee to plan or conduct audits or to independently determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles and/or regulatory requirements. Management remains responsible for preparing the Company’s financial

21

statements and the independent auditors remain responsible for auditing them. Further, it is not the duty of the Committee to conduct investigations or to assure compliance with laws and regulations and the Company’s Code of Business Conduct. These are also responsibilities of management.

V. Committee’s Relationship with External Auditors.

The Committee shall:

Select the firm of public accountants to audit the Company’s financial statements, determine and approve their compensation, evaluate their performance and, where appropriate, terminate their services to the Company, subject to shareholder ratification. The Committee shall also verify the independence of such firm, discussing with the Board any relationships that may adversely affect the independence of the auditor.

Have a clear understanding with management and the independent auditors that the independent auditors are ultimately accountable to the Board and the Committee as representatives of the Company’s shareholders.

Discuss with the independent auditors their qualifications and independence from management and the Company and the matters included in the written disclosures required by the Independent Standards Board. The Committee recognizes that it is the policy of the Company that employees of the independent auditors may not be employed by the Company as associates for at least five years following their departure from the firm.

Secure and review annually from the independent auditors their report describing the firm’s internal quality control procedures, material issues raised in any recent internal quality control or peer reviews, and any inquiry or investigation by governmental or professional authorities issued or commenced within the proceeding five years and the resolution thereof.

Discuss with the independent auditors the overall scope and plans for its external audits and the fit with those being done internally, including the adequacy of staffing and compensation. Also, the Committee shall discuss with management and the independent auditors the adequacy and effectiveness of the accounting and financial controls, including the Company’s system to monitor business risk and legal and ethical compliance programs. Further, the Committee shall meet separately with the independent auditors, with and without management present, to discuss the results of their examinations.

Review the financial statements contained in the Company’s annual report to shareholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and content of the financial statements presented to shareholders. The Committee shall also review with the independent auditors their assessment of the quality, not just the acceptability, of the Company’s significant accounting principles and underlying estimates as applied in its financial reporting and any important changes in accounting principles and the application thereof in both interim and annual financial reports.

Review the quarterly financial statements and earnings releases and selected financial data with management and the independent auditors prior to public release. Particular attention should be given to the quality and integrity of the results, including discussion of the adequacy and propriety of

22

reserves and accruals, income and expense recognition practices and off-balance sheet transactions, if any. The Committee also shall determine that the independent auditors are satisfied with the quarterly results and the disclosure and content of the proposed press release.

Review management’s discussion and analysis of financial condition and results of operations contained in annual and quarterly financial statements with both management and the independent auditors.

Review and assess any non-audit service to be provided by the independent auditors. As part of such review, the Committee will assess, among other things, whether the role of those performing the non-audit service would be inconsistent with the auditor’s role, whether the audit firm personnel would be assuming a management role or creating a conflicting interest with management, whether the project must be completed very quickly and whether the size of the fees for the non-audit services are appropriate.

Discuss periodically with the independent auditors their evaluation of the quality and effectiveness of the financial organization and its principal personnel in carrying out their duties on the Company’s behalf.

Discuss with the independent auditors their evaluation of the impact of opinions of the Financial Accounting Standards Board (FASB), releases of the Securities and Exchange Commission (SEC), rules of the NYSE, and changes in tax laws and any other pertinent laws or regulations that could have a material impact on the Company’s financial condition and statements.

Review with the independent auditors any audit problems or difficulties encountered in performing their services and the response of management.

VI. Committee’s Relationship with Internal Auditor.

The Committee shall:

Meet, at least annually, with the Company’s Director, Internal Audits, to review the internal audit program of the Company and its annual plan.

Receive periodic reports on such program, including information on audits completed and in progress and audits added to or deleted from the program. Such reports shall include a discussion of any major findings disclosed during the course of such audits, their implications and management’s response and plan of corrective action, as appropriate.

Meet periodically, but at least annually, with the internal auditors in executive session to discuss any matters which the Committee seeks to raise or which the internal auditors judge they should identify to the Committee.

VII. Committee’s Pension Review Duties.

The Committee shall:

Oversee the Company’s defined benefit and defined contribution plans and review any recommended changes thereto.

Oversee the selection, retention, compensation and performance of all investment managers and trustees for such plans.

23

Meet periodically with plan investment managers and actuaries.

Select and retain consultants and advisors as deemed necessary.

Review and approve investment manager objectives and guidelines.

Oversee the Company’s Pension Committee.

Select the independent auditors for such plans and review the results of their examination.

VIII. Committee’s Code of Business Conduct Duties.

The Committee shall:

Annually review with management and report to the Board on the implementation of the Company’s Code of Business Conduct and the periodic certification by associates of the Company.

Discuss and secure annual certifications from all directors as to their compliance with the Code.

Review and approve or reject any request for waiver of material deviations or exceptions from the provisions of the Code by any director or senior management associate and provide for such disclosure thereof as is required.

IX. Charter Review and Audit Committee Report.

In accordance with the NYSE listing standards, the Committee will review and reevaluate annually the adequacy of its Charter and, where review requires amending the Charter, request that the Board of Directors approve such amendments. The Committee will also include a report in the annual proxy statement provided to shareholders in connection with the Company’s annual meeting and shall recommend that the Board provide such written affirmation as is required by the NYSE listing standards.

24

INDUSTRIAL CORPORATION

Dear Shareholder:

You are cordially invited to attend the 2002 Annual Meeting of Shareholders of Amcast Industrial Corporation, which will be held at the Hilton O'Hare, O'Hare International Airport, Chicago, Illinois 60666, at 10:00 a.m. C.S.T., on Wednesday, December 18, 2002.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement describe the items to be considered and acted upon by the shareholders.

Whether or not you plan to attend this meeting, please sign, date, and return your proxy form below as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. If you attend the meeting, you may revoke your proxy, if you wish, and vote personally. It is very important that your stock be represented.

Sincerely,

Byron O. Pond

Chairman and Chief Executive Officer

Ú PLEASE VOTE, SIGN, AND RETURN THE PROXY BELOW Ú

(please sign on reverse side)

PROXY

AMCAST INDUSTRIAL CORPORATION

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS DECEMBER 18, 2002

Solicited on Behalf of the Board of Directors of the Company

The undersigned holder(s) of common shares of AMCAST INDUSTRIAL CORPORATION, an Ohio corporation (the “Company”), hereby appoints Byron O. Pond and Joseph R. Grewe, and each of them, attorneys of the undersigned, with power of substitution, to vote all of the common shares that the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Company to be held on Wednesday, December 18, 2002, at 10:00 a.m. C.S.T., and at any adjournment thereof, as follows:

| 1. | | Election of Directors. Nominees for directors are: Don R. Graber, Joseph R. Grewe and R. William Van Sant; |

| 2. | | Ratification of the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending August 31, 2003; and |

| 3. | | In their discretion, upon such other business as may properly come before the meeting, or at any adjournment thereof. |

INDUSTRIAL CORPORATION

Annual Meeting of Shareholders

DATE: December 18, 2002

TIME: 10:00 a.m. C.S.T.

PLACE: the Hilton O'Hare

O'Hare International Airport

Chicago, Illinois 60666

Ú PLEASE VOTE, SIGN, AND RETURN THE PROXY BELOW Ú

| | | | | | | |

|

| | |

| | | | | | | | | x | | Please mark your votes as in this example. |

| | | | | | | |

|

| | |

| | | | | | | | | | | When properly executed, this proxy will be voted in the manner directed by the undersigned shareholder. If no direction is specified, this proxy will be voted for Proposals 1 and 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Directors recommend a vote FOR all Nominees. | | Directors recommend a vote FOR Item 2. | | |

|

|

|

|

|

1. Election of All

| | FOR | | | | WITHHELD | | | | 2. Ratification of the

| | FOR | | | | AGAINST | | | | ABSTAIN | | | | 3. In their discretion, upon such other business as may properly come before the meeting, or at any adjournment thereof. |

| |

|

| | |

|

| | | | |

|

| | |

|

| | |

|

| | | |

Directors (see reverse) | | | | | | | | | | appointment of Ernst & Young LLP as independent | | | | | | | | | | | | | |

| |

|

| | |

|

| | | | |

|

| | |

|

| | |

|

| | | | |

For all except the following nominee: | | | | auditor of the Company for the fiscal year ending August 31, 2003. | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders should date this proxy and sign here exactly

as name appears hereon. If stock is held jointly, both owners should sign this proxy. Executors, administrators, trustees, guardians, and other signing in a representative capacity should indicate the capacity in which they sign. Receipt is acknowledged of Notice of the above meeting, the Proxy Statement relating thereto, and the Annual Report to Shareholders for the fiscal year ended August 31, 2002.

SIGNATURES(S) DATE