The following table sets forth information regarding the fees paid to Baylake’s non-employee directors during 2013:

CORPORATE GOVERNANCE MATTERS

Independence and Meetings

The Board of Directors has affirmatively determined that all of Baylake’s directors (other than Mr. Cera) are qualified as “independent” as defined under NASDAQ Rule 4200. Mr. Cera is not independent due to his employment as President and Chief Executive Officer of Baylake and Baylake Bank.

The Board of Directors held 13 meetings during 2013. Each member of the Board of Directors attended at least 75% of the aggregate number of meetings of the Board of Directors and of all committees on which such director served during 2013, with the exception of Mr. Fulwiler who attended 65.5%. While no formal policy is currently in place, it is Baylake’s preference that its directors should attend the Annual Meeting of Shareholders if possible. All of the directors attended the 2013 Annual Meeting of Shareholders.

Board Committees

Members of Baylake’s Board of Directors have been appointed to serve on various committees. The Boards of Directors of Baylake and Baylake Bank currently have six standing committees: (1) the Executive Committee; (2) the Director Loan Committee; (3) the Audit and Risk Committee; (4) the Personnel and Compensation Committee; (5) the Director Wealth Services Committee; and (6) the Nominating Committee. Each of Baylake’s standing committees has a charter which is available on Baylake’s website, atwww.baylake.com.

Executive Committee. The Executive Committee reviews the financial, administrative, and regulatory activities of Baylake and Baylake Bank. This committee is authorized by the Board of Directors to act on its behalf on any matter permitted by law. This committee generally meets on an as-needed basis throughout the year. Ten meetings were held during 2013. The current members of the Executive Committee are Messrs. Agnew, Braun, Cera, Ferris, Herlache, Jeanquart, and Parsons. Mr. Braun currently serves as the Chairman of the Committee.

Director Loan Committee.The Director Loan Committee reviews certain loan transactions of Baylake Bank. This committee held 14 meetings during 2013. The current members of the Director Loan Committee are Messrs. Agnew, Braun, Cera, Ferris, Herlache, Jeanquart, and Sturm. Mr. Braun currently serves as the Chairman of the Committee.

Audit and Risk Committee.The Audit and Risk Committee reviews the financial and legal matters of Baylake. The Committee is responsible for supervising Baylake’s accounting, reporting, and financial control practices. Generally, this committee reviews the quality and integrity of Baylake’s financial information and reporting functions, the adequacy and effectiveness of Baylake’s system of internal accounting and financial controls, and the independent audit process, and annually reviews the qualifications of the independent registered public accountants. The independent registered public accountants are responsible for auditing Baylake’s financial statements and expressing an opinion as to their conformity with generally accepted accounting principles. The current members of the Audit and Risk Committee are Messrs. Agnew, Braun, Fulwiler, Herlache, Nolden, Parsons, and Ms. Stackhouse. In addition to being “independent” directors as defined under NASDAQ Rule 4200, as currently in effect, all members of the Audit and Risk Committee satisfy the heightened independence standards under the Securities and Exchange Commission (“SEC”) rules, as currently in effect. The Board of Directors has determined that Mr. Parsons, Mr. Herlache, and Mr. Nolden are “audit committee financial experts” as that term is defined in SEC rules. This committee held 10 meetings during 2013. Mr. Nolden currently serves as Chairman of the Committee.

Personnel and Compensation Committee.The Personnel and Compensation Committee reviews the personnel policies and annual compensation levels of Baylake. The Personnel and Compensation Committee also advises and assists management in formulating policies regarding compensation and in preparing its Compensation Discussion and Analysis included elsewhere in this Proxy Statement, and submits its Compensation Committee Report, which is also included herein. This committee held three meetings during 2013. The Committee currently comprises six directors who are “independent” as defined in NASDAQ Rule 4200 (Messrs. Morgan, Parsons, Sturm, Herlache, Ms. Geurts-Bengtson, and Ms. Stackhouse). In addition, a representative from the Human Resources Department of Baylake Bank meets regularly with the Committee. Mr. Parsons currently serves as Chairman of the Committee.

8

Director Wealth Services Committee.The Director Wealth Services Committee reviews the function and administration of the trust and financial services departments of Baylake Bank and Baylake’s non-bank subsidiaries. This committee meets on a bi-monthly basis and held six meetings during 2013. The current members of this committee are Messrs. Ferris, Fulwiler, Morgan, Sturm, and Ms. Geurts-Bengtson. Mr. Sturm currently serves as Chairman of the Committee.

Nominating Committee.The Nominating Committee meets to review candidates for membership on the Baylake and Baylake Bank Boards of Directors and recommends individuals for nomination to the Boards. The Nominating Committee also prepares and periodically reviews with the entire Board of Directors a list of general criteria for Board nominees. It is also the responsibility of this committee to recommend a successor to the Chief Executive Officer when that position becomes or is expected to become vacant. The Nominating Committee held two meetings during 2013. The current members of the Nominating Committee are Messrs. Agnew, Braun, Ferris, Jeanquart, Parsons, and Herlache, each of whom are qualified as “independent” as defined under NASDAQ Rule 4200. Mr. Agnew currently serves as Chairman of the Nominating Committee.

Board Leadership Structure and Role in Risk Oversight

Baylake is committed to a strong, independent Board and believes that objective oversight of the performance of its management is a critical aspect of effective governance. Accordingly, the roles of Chairman of the Board of Directors and Chief Executive Officer are held by different individuals. Baylake’s Co-Chairmen are independent directors and have the following duties:

| | |

| • | Chair and preside at Board meetings; |

| • | Coordinate with Baylake’s CEO in establishing the agendas and topic items for Board meetings; |

| • | Advise on the quality, quantity, and timeliness of the flow of information from management to the Board; |

| • | Act as principal liaisons between management and the Board on sensitive issues; |

| • | Retain independent advisors on behalf of the Board as the Board may determine is necessary or appropriate; and |

| • | Provide an important communication link between the Board and shareholders, as appropriate. |

Baylake’s Board of Directors, together with the various Board committees, coordinate with each other to provide enterprise-wide oversight of its management and handling of risk. These committees report regularly to the entire Board of Directors on risk-related matters and provide the Board of Directors with integrated insight about Baylake’s management of strategic, credit, interest rate, financial reporting, technology, liquidity, compliance, operational, market, fiduciary, and reputational risks. Baylake’s Board also monitors whether material new initiatives have been appropriately analyzed and approved, and reviews all regulatory findings directed to the attention of the Board and the adequacy of management’s response.

Director Nomination Procedures

The Baylake Board of Directors Nominating Committee will consider nominations for directors submitted by shareholders in accordance with Baylake’s Bylaws. Pursuant to Baylake’s Bylaws, notice of shareholder nominations for directors must be made in writing, delivered or mailed by first class United States mail, postage prepaid, to the Secretary of Baylake not less than fourteen (14) days nor more than seventy (70) days prior to the annual meeting in order to be considered. Each notice of nomination must contain the name and address, the principal occupation or employment, and number of shares of Baylake common stock beneficially owned by each nominee. The Nominating Committee shall determine whether nominations were made in accordance with the Bylaws and, if not, any defective nomination will be disregarded.

The Board of Directors considers various factors to be important when evaluating potential members of the Board, regardless of whether the candidate is proposed by the Nominating Committee or by a shareholder, including the individual’s integrity, general business background and experience, experience in the banking industry, and his or her ability to serve on the Board of Directors. The Board does not attempt to assign any relative weights to the factors, but considers them as a whole.

9

Although Baylake has no formal policy on Board diversity, the Board believes that a diverse board of directors is desirable to expand its collective knowledge and expertise relating to Baylake’s business, as well as to evaluate management and positively influence its performance. Accordingly, in carrying out its responsibilities for locating, recruiting, and nominating candidates for election to the Board, Baylake takes into account a number of factors and considerations, including diversity. Such considerations of diversity include geographic regions, professional or business experience, gender, race, national origin, specialized education or work experience, and viewpoints.

If any shareholder wishes to recommend a potential nominee for consideration by the Board, that nominee’s name and related information should be sent to the Board in care of Teresa A. Rosengarten, Secretary, Baylake Corp., 217 North Fourth Avenue, Sturgeon Bay, Wisconsin 54235. While the Nominating Committee does not have any formal procedures for consideration of such recommendations, shareholder nominees are analyzed by the Nominating Committee in the same manner as nominees that are identified by the committee.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was or is an officer or employee of Baylake or any of its subsidiaries and all members are considered “independent” as defined in NASDAQ Rule 4200.

Code of Ethics

Baylake has made its Code of Ethics available on its website atwww.baylake.com.Changes to the Code of Ethics and any written waivers from the Code of Ethics that may be granted to any director or executive officer will also be posted on that website.

Communications With Board of Directors

Although Baylake has not to date developed formal processes by which shareholders may communicate directly to directors, it believes that the informal process in which any communication sent to the Board in care of the Secretary is forwarded to the Board, has historically served the Board’s and its shareholders’ needs. The Board of Directors periodically considers whether changes to this procedure are appropriate. However, unless and until a new means of communication is promulgated, communications to the Board should be sent in care of Teresa A. Rosengarten, Secretary, Baylake Corp., 217 North Fourth Avenue, Sturgeon Bay, Wisconsin 54235. Ms. Rosengarten will pass along all such communications (except for complaints of a personal nature that are not relevant to Baylake or Baylake Bank as a whole).

EXECUTIVE OFFICERS

All executive officers are elected annually by the Board of Directors and serve until their successors are elected and qualified. As of the date hereof, no executive officer set forth below is related to any director or other executive officer of Baylake or Baylake Bank by blood, marriage or adoption, and there are no arrangements or understandings between a director of Baylake and any other person pursuant to which such person was elected an executive officer. Set forth below is information as of March 31, 2014 with respect to the principal occupations during the last five years for the executive officers of Baylake and Baylake Bank who do not serve as directors of Baylake.

| | |

Name and Age | | Position |

| | |

Jamie D. Alberts, 41 | | Market President – Bay Region of Baylake Bank since December 2013. Prior to his current position, Mr. Alberts was Vice President, Commercial Banking Manager of Baylake Bank. Mr. Alberts joined Baylake Bank in 1995. |

| | |

Michael J. Gilson, 66 | | Market President – Lakeshore Region of Baylake Bank since January 2007. Prior to his current position, Mr. Gilson was Executive Vice President – Business Services / Lending Division of Baylake Bank. Mr. Gilson joined Baylake Bank in 1971. |

10

| | |

Daniel M. Hanson, 57 | | Senior Vice President – Operations/IT of Baylake Bank since September 1991. Prior to his current position, Mr. Hanson held various positions with Baylake Bank since he joined the bank in 1980. |

| | |

John A. Hauser, 55 | | Senior Vice President – Wealth Services of Baylake Bank since March 2014. Mr. Hauser originally joined Baylake Bank in 1984 and left the bank to join an investment advisory firm as a financial advisor in February 2008. Prior to leaving Baylake Bank, Mr. Hauser was Senior Vice President of Administration. In August 2009 Mr. Hauser returned to Baylake Bank and assumed the position of Senior Vice President and Treasurer of Baylake Bank. In August of 2012 he was appointed Senior Vice President - Asset Management and Trust. |

| | |

Kevin L. LaLuzerne, 52 | | Treasurer and Chief Financial Officer of Baylake since July 2007, Senior Vice President – Finance of Baylake Bank since March 2006 and Chief Financial Officer of Baylake Bank since December 2006. Prior to his current position, Mr. LaLuzerne held various positions with Baylake Bank since he joined the bank in 1980. |

| | |

Kenneth R. Lammersfeld, 48 | | Chief Strategy and Development Officer of Baylake Bank since March 2014. Mr. Lammersfeld joined Baylake Bank in June 2008 as Senior Vice President of Retail / Brokerage / Training and Development. Prior to joining Baylake Bank, Mr. Lammersfeld was Consumer Banking Sales Coordinator at Associated Bank. Prior to that he served as Vice President - District Manager at Associated Bank. |

| | |

David J. Miller, 50 | | Chief Credit Officer of Baylake Bank since January 2007. Prior to 2007, Mr. Miller was Vice President – Agricultural/Commercial Loan Officer of Baylake Bank. Mr. Miller joined Baylake Bank in 1987. |

| | |

Richard J. Schabo, 46 | | Market President –Fox Valley Region of Baylake Bank since February 2014. Prior to joining Baylake Bank, Mr. Schabo was Senior Vice President – Commercial Banking at Associated Bank. Prior to that he served as Vice President Commercial Banking at M&I Marshall & Ilsley Bank. |

| | |

Teresa A. Rosengarten, 53 | | Secretary of Baylake since January 2008 and Chief Risk Officer of Baylake Bank since March 2014. Ms. Rosengarten joined Baylake Bank in December 2007 as an Executive Vice President. Prior to joining Baylake Bank, Ms. Rosengarten was Executive Vice President – Consumer Banking at Associated Bank. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 2, 2014, the number of shares of common stock beneficially owned by (i) each director, nominee for director and Named Executive Officer of Baylake, (ii) all directors and executive officers of Baylake as a group, and (iii) each person known to or believed by Baylake to be the beneficial owner of more than 5% of the outstanding shares of Baylake common stock. Except as otherwise indicated and as set forth in footnote (1) on the following page, persons listed have sole voting and investment power over shares beneficially owned. Indicated options are all exercisable within 60 days of April 2, 2014.

11

| | | | | |

Name of Beneficial Owner(1) | | Common Stock

Beneficially

Owned | | Percent of Class (2) |

| | | | | |

Directors: | | | | | |

Robert W. Agnew | | 86,563 | (3) | | 1.09% |

Dee Geurts-Bengtson | | 3,122 | | | * |

Richard A. Braun | | 140,000 | (4) | | 1.76% |

Robert J. Cera | | 98,839 | (5) | | 1.24% |

Roger G. Ferris | | 77,503 | (3) | | * |

Terrence R. Fulwiler | | 36,298 | (6) | | * |

Thomas L. Herlache | | 123,492 | (7) | | 1.55% |

Louis J. “Rick” Jeanquart | | 328,059 | (8) | | 4.13% |

Joseph J. Morgan | | 23,789 | | | * |

Dean J. Nolden | | 805 | | | * |

William C. Parsons | | 177,044 | (9) | | 2.23% |

Elyse Mollner Stackhouse | | 16,489 | | | * |

Paul J. Sturm | | 96,811 | (10) | | 1.22% |

| | | | | |

Non-director Named Executive Officers: | | | | | |

| | | | | |

Teresa A. Rosengarten | | 35,023 | (11) | | * |

Kevin L. LaLuzerne | | 37,530 | (12) | | * |

All directors and executive officers

as a group (23 persons) | | 1,412,904 | (13) | | 17.77% |

| | | | | |

5 Percent Beneficial Owner: | | | | | |

None | | | | | |

* Less than one percent.

| |

(1) | For all listed persons, the number includes shares held by, jointly with, or in trust for the benefit of, the person’s spouse and dependent children. Shares are reported in such cases on the presumption that the individual may share voting and/or investment power because of the family relationship. |

(2) | Options to purchase shares of Baylake common stock held by directors and executive officers that would be exercisable within 60 days after April 2, 2014 (“currently exercisable”) are treated as outstanding for the purpose of computing the number and percentage of outstanding securities of the class owned by each such person and for all directors and executive officers as a group, but not for the purpose of computing the percentage of class owned by any other person. |

(3) | Includes 40,000 shares represented by convertible debentures. |

(4) | Includes 30,000 shares represented by convertible debentures. |

(5) | Includes 25,000 shares represented by convertible debentures and options to purchase 20,454 shares. |

(6) | Includes 20,000 shares represented by convertible debentures. |

(7) | Includes 10,000 shares represented by convertible debentures. |

(8) | Includes 3,000 shares held by JIT Corp, of which Mr. Jeanquart, as Chairman of the Board, has pecuniary interest and 80,000 shares represented by convertible debentures. |

(9) | Includes 30,000 shares represented by convertible debentures and 45,186 shares held in a trust of which Mr. Parsons’ wife is a beneficiary and for which Mr. Parsons serves as trustee. |

(10) | Includes 20,000 shares represented by convertible debentures and 17,462 shares owned by adult children of Mr. Sturm for whom he serves as agent under a power of attorney. |

(11) | Includes 10,000 shares represented by convertible debentures and options to purchase 10,536 shares. |

(12) | Includes 10,000 shares represented by convertible debentures and options to purchase 9,507 shares. |

(13) | Includes 340,000 shares represented by convertible debentures and options to purchase 67,930 shares. |

12

COMPENSATION COMMITTEE REPORT

The Personnel and Compensation Committee of the Board of Directors of Baylake oversees Baylake’s compensation program on behalf of the Board. In fulfilling its oversight responsibilities, the Personnel and Compensation Committee reviewed and discussed with management the Compensation Discussion and Analysis set forth in this proxy statement.

In reliance on the review and discussion referred to above, the Personnel and Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in Baylake’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and Baylake’s proxy statement in connection with Baylake’s 2014 Annual Meeting of Shareholders, to be filed with the Securities and Exchange Commission.

This report is submitted on behalf of the current members of the Personnel and Compensation Committee:

Dee Geurts-Bengtson

Thomas L. Herlache

Joseph J. Morgan

William C. Parsons, Chairman

Elyse Mollner Stackhouse

Paul J. Sturm

COMPENSATION DISCUSSION AND ANALYSIS

The following Compensation Discussion and Analysis, or CD&A, describes Baylake’s 2013 executive compensation program. This CD&A is intended to be read in conjunction with the tables beginning on page 21, which provide detailed compensation information for Baylake’s named executive officers, or NEOs. For 2013, Baylake’s NEOs are:

| |

Name | Title |

Robert J. Cera | President and Chief Executive Officer (“CEO”) |

Teresa A. Rosengarten | Secretary and Chief Risk Officer |

Kevin L. LaLuzerne | Chief Financial Officer (“CFO”) |

Executive Summary

2013 Financial Highlights.2013 was a year of continued improvement in Baylake’s performance, as illustrated by the following key results:

| | |

| • | Baylake’s stock price increased from $7.60 per share at December 31, 2012 to $13.02 per share at December 31, 2013, an increase of 71%. |

| • | Shareholders received dividends of $0.22 per share in 2013 compared to $0.08 per share in 2012. |

| • | Non-performing assets decreased from $24.9 million at December 31, 2012 to $13.0 million at December 31, 2013. |

| • | Non-performing loans decreased from $14.4 million at December 31, 2012 to $6.7 million at December 31 2013. |

| • | Net loan charge-offs decreased from $6.9 million during 2012 to $2.9 million during 2013. |

| • | Noninterest expense decreased from $31.7 million for 2012 to $27.3 million for 2013. |

Key Executive Compensation Actions. The Personnel and Compensation Committee (“Compensation Committee”) took the following key actions in 2013, which are explained in greater detail throughout this CD&A.

| | |

| • | Salaries: Mr. Cera’s salary was increased from $300,000 to $340,000 as a reflection of competitive market salary survey data and improvement in Baylake’s performance, both from an earnings and asset quality standpoint. Base salaries for Ms. Rosengarten and Mr. LaLuzerne increased approximately 3% over their 2012 levels. |

13

| | |

| • | Annual Incentive Awards: Annual incentives were awarded in 2014 in recognition of Baylake’s corporate performance in 2013, as well as Baylake’s NEOs’ contributions to its success in 2013. The Board of Directors approved awards of 48% of salary for Mr. Cera, 22% of salary for Ms. Rosengarten, and 34% of salary for Mr. LaLuzerne. |

| | |

| • | Long-Term Incentive Compensation: Baylake granted restricted stock units and stock options to each of its NEOs in 2013. Equity was awarded in recognition of Baylake’s performance, as well as the need to retain its executives and align their interests with the interests of shareholders. |

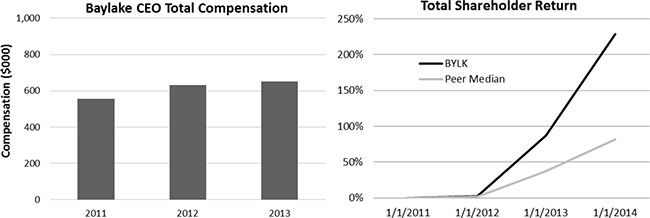

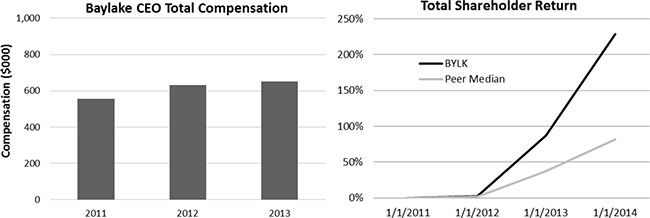

Pay for Performance Analysis. The Compensation Committee believes that Baylake’s policies support a pay-for-performance culture, where executives are rewarded for their contributions to Baylake’s corporate success as well as the success of Baylake’s shareholders. The following charts illustrate the change in CEO total compensation from 2011 to 2013, as well as Baylake’s total shareholder return compared to the median of its peer group over that same period.

Compensation Philosophy, Objectives and Policies

Baylake’s executive compensation policies are intended to attract, retain, and motivate top quality management through a balance of short-term and long-term compensation as well as fixed and at-risk compensation. As part of the at-risk portion of its compensation program, Baylake seeks to provide incentives to individuals commensurate with Baylake’s growth and earnings as well as the attainment of certain goals that it believes are drivers of its long-term shareholder value. The Compensation Committee is responsible for reviewing Baylake’s compensation policies and programs and make recommendations to the Board in accordance with the general compensation philosophy of Baylake, which is to offer employees fair and competitive compensation based on each employee’s individual contribution, experience, and performance as well as Baylake’s overall growth and performance. While the Compensation Committee may take into account the recommendations of certain executives, the Human Resources Department, and various consultants, it does not delegate any of its duties to these parties. Baylake’s compensation philosophy is to target base salaries for NEOs in the range of the 50th to 60th percentiles of the market for fully-acclimated officers. Baylake also strives to provide meaningful incentives through pay-for-performance programs that result in compensation between the 50th and 75th percentiles for expected performance and at the 75th percentile or higher when maximum results are achieved. The Compensation Committee and Baylake’s Board of Directors believe that attracting, retaining, and motivating top quality management is critical to the long-term success of Baylake.

Administration and Process

Overview.In making its executive compensation recommendations for 2013, the Compensation Committee considered various factors, including (i) the financial performance of Baylake as a whole on both a short-term and long-term basis (including net income, increase in deposits and loans, return on average shareholder equity, and return on average assets); (ii) with respect to each individual executive officer, the financial performance of those

14

areas of Baylake and Baylake Bank, if any, for which such executive is responsible, including whether such areas achieved their specific goals for the year; (iii) an evaluation of the executive’s overall job performance; (iv) the compensation levels of executive officers in similar positions with similar companies; and (v) other information (such as cost of living increases) and subjective factors which the Compensation Committee deems appropriate for a particular executive. The Compensation Committee subjectively analyzes these factors, and certain factors may weigh more heavily than others with regard to any individual executive officer.

Role of Executives.Mr. Cera, as CEO of Baylake, annually reviews the performance of each executive officer, excluding himself, with respect to their specific performance goals established for the year. Mr. Cera also reviews each executive’s performance in relation to the overall performance of Baylake and Baylake Bank for the year. Based upon these reviews, Mr. Cera makes recommendations to the Compensation Committee with respect to the compensation of each executive, other than himself. The Compensation Committee considers Mr. Cera’s recommendations, but uses its own discretion in making final compensation recommendations with respect to the NEOs, which may differ from the recommendations of Mr. Cera. The Human Resources Department also provides support to the Compensation Committee, including the collection of compensation data and plans, administrative duties, and other special projects as needed.

Use of Consultants.From time to time, the Compensation Committee has engaged the services of McLagan, a subsidiary of Aon Hewitt, to assist in proxy preparation, analyzing Baylake’s executive compensation program, reviewing the annual and long-term management incentive plans, and other projects on an as-needed basis. In 2013, Baylake considered the independence of McLagan in light of new SEC and NASDAQ rules. The Compensation Committee requested and received a report from McLagan addressing the independence of McLagan and the senior advisors involved in the engagement, including the following factors: (1) other services provided to Baylake by McLagan; (2) fees paid by Baylake as a percentage of McLagan’s total revenue; (3) policies or procedures maintained by McLagan that are designed to prevent a conflict of interest; (4) any business or personal relationships between the senior advisors and a member of the Compensation Committee; (5) any company stock owned by the senior advisors; and (6) any business or personal relationships between Baylake’s executive officers and the senior advisors. The Compensation Committee discussed these considerations and concluded that the work performed by McLagan and McLagan’s senior advisors involved in the engagements did not raise any conflict of interest.

Peer Group & Benchmarking. Market benchmarking is one of the tools that the Compensation Committee uses to assess the competitiveness of Baylake’s executive compensation programs. Benchmarking is an important tool in the compensation decision-making process; however, it is only one of the factors considered in establishing compensation amounts and overall program design. While no formal benchmarking was completed for the executive officers during 2013, in 2012 McLagan reviewed Baylake’s executive compensation program for the purpose of comparing its compensation levels and pay practices to those of a peer group of similar financial services organizations. Peers were selected based on the following criteria as of March 31, 2012:

| | |

| • | Assets between $600 million and $2.1 billion |

| | |

| • | Located in Minnesota, Iowa, Wisconsin, Illinois, Indiana, Michigan, or Ohio |

| | |

| • | Positive Return on Average Equity |

| | |

| • | Non-Performing Assets/Total Assets less than 7% |

| | |

| • | Consumer loans less than 45% of total loan portfolio |

15

The following peers were selected based on the criteria shown above:

| | | | |

| | | | |

| Company Name | Ticker | State | Total

Assets

3/31/12

($000) |

1 | QCR Holdings Inc. | QCRH | IL | 1,992,998 |

2 | Peoples Bancorp Inc. | PEBO | OH | 1,805,923 |

3 | MidWestOne Financial Grp Inc. | MOFG | IA | 1,725,844 |

4 | First Mid-Illinois Bancshares | FMBH | IL | 1,534,423 |

5 | Firstbank Corp. | FBMI | MI | 1,533,551 |

6 | Mercantile Bank Corp. | MBWM | MI | 1,401,596 |

7 | Isabella Bank Corporation | ISBA | MI | 1,369,220 |

8 | West Bancorp. | WTBA | IA | 1,321,204 |

9 | Tri City Bankshares Corp. | TRCY | WI | 1,205,126 |

10 | First Business Finl. Svcs. Inc | FBIZ | WI | 1,162,045 |

11 | First Citizens Banc Corp | FCZA | OH | 1,133,434 |

12 | Ames National Corp. | ATLO | IA | 1,094,656 |

13 | Farmers & Merchants Bancorp | FMAO | OH | 944,783 |

14 | United Bancorp Inc. | UBMI | MI | 914,450 |

15 | LCNB Corp. | LCNB | OH | 791,905 |

16 | Community Bank Shares of IN | CBIN | IN | 790,902 |

17 | Rurban Financial Corp. | RBNF | OH | 644,976 |

18 | PSB Holdings Inc. | PSBQ | WI | 606,788 |

| Average | | | 1,220,768 |

| 25th Percentile | | | 922,033 |

| 50th Percentile | | | 1,183,586 |

| 75th Percentile | | | 1,500,562 |

| Baylake Corp. | BYLK | WI | 1,067,705 |

| Percent Rank | | | 34% |

In addition to data from peer institutions, Baylake used compensation data from proprietary industry surveys, including the McLagan and American Bankers Association surveys, to assess compensation for its CEO and NEOs.

16

Elements of Executive Compensation

The three primary components of executive compensation currently employed by Baylake are base salary, annual incentive compensation paid in cash, and long-term incentives using stock options and restricted stock units. These, along with the other components of executive compensation (benefits and perquisites) are described below.

| | | | |

| Elements | | Description |

| | | | |

Short-Term Compensation | | | • | Fixed annual amount |

Base Salary | | • | Provides a level of income security |

| | • | Used to determine pay-based benefits and establish incentive awards |

| | | |

Annual Cash Incentive

|

| •

| Annual cash award based on achievement of performance objectives

|

| | | | |

Long-Term Compensation | | | • | Equity grants that vest over a period of several years |

Stock Options and | | • | Links a portion of executive pay to stock performance |

Restricted Stock Units | | • | Effective retention tool |

| | • | Encourages long-term focus |

Base Salary.The Compensation Committee believes that base salary for NEOs should be targeted in the range of the market median (50th percentile) to the 60th percentile based on peer group and industry survey data. Base salaries are reviewed annually and adjusted from time to time, based on the Compensation Committee’s review of market data; an assessment of company, business unit, and individual performance; experience; internal pay equity; and, except in the case of his own salary, the recommendations of Baylake’s CEO. In 2013, Mr. Cera received a 13% salary increase, as a reflection of competitive market salary survey data as well as the improvement in Baylake’s performance, both from an earnings and asset quality standpoint, while Ms. Rosengarten and Mr. LaLuzerne received increases of approximately 3%. These increases were determined based on individual performance and comparison to peers. The table below summarizes these base salary increases for each NEO:

| | | |

Executive Name | Title | 2012 Salary | 2013 Salary |

Robert J. Cera | President & CEO | $300,000 | $340,000 |

Teresa A. Rosengarten | Secretary & Chief Risk Officer | $180,000 | $186,000 |

Kevin L. LaLuzerne | CFO | $185,000 | $190,000 |

Annual Incentive Compensation.Baylake attempts to balance the security provided by base salary with the “at-risk” feature of annual incentive compensation in its efforts to attract and retain top quality executive management and provide proper incentive to enhance the value of Baylake common stock for its shareholders. The purpose of the Management Incentive Plan (“MIP”) is to incent and reward the Baylake Bank management team for performance that meets the goals of Baylake’s operating plan and budget. The MIP for 2013 was based on overall bank goals linked to the long-term viability of the organization, and individual or department goals that are linked to each officer’s functional responsibility. In addition, the plan included performance qualifiers that must be met before any payments are made to each executive officer. For 2013, the qualifiers consisted of a company Return on Average Assets (“ROAA”) of at least 0.5% and satisfactory performance reviews for each of the participants.

The MIP used corporate, department, and individual goals to determine the incentive payout level for each NEO, with performance goals weighted for the CEO and CFO so that company performance represented 80% of the target awards and department and individual performance represented 20% of the target awards. Performance goals for Ms. Rosengarten were weighted 25% corporate and 75% department and individual goals, consisting of

17

Mortgage Gain on Sale, Mortgage Net Income, and Enterprise Risk Management Internal Audit results. In addition, while the 2013 MIP utilized structured goals and weightings, final incentive awards are determined by the Compensation Committee. The Compensation Committee maintains the authority to adjust or eliminate awards as necessary based on their evaluation of Baylake and individual performance as a whole.

For each of the NEOs, 75% of the corporate performance portion of the award was predicated on Baylake’s net income in 2013, while the remaining 25% of the corporate performance portion was based on the level of Baylake’s non-performing assets. No awards would have been granted if Baylake’s 2013 net income fell below $5.95 million, and no awards would have been granted if Baylake failed to maintain a satisfactory risk rating as determined by the Board of Directors.

2013 Corporate Performance Goals

| | | | |

| Threshold | Target | Maximum | 2013 Performance

Result |

Net Income | $5.95 million | $7.00 million | $8.05 million | $8.01 million |

Non-Performing Assets | $17.25 million | $15.0 million | $12.75 million | $12.96 million |

In 2013, Baylake’s corporate net income and non-performing assets both neared the “Maximum” performance level under the 2013 MIP. Ms. Rosengarten’s incentive compensation is weighted more heavily toward individual goals, some of which were not fully achieved in 2013. The cash incentive opportunities available to Baylake’s NEOs in 2013, as well as the actual incentive awards paid, are expressed in the table below as a percentage of each NEO’s 2013 base salary.

2013 NEO Incentive Payout Opportunity Levels as a Percentage of Base Salary

| | | | |

| Threshold | Target | Maximum | Actual Payout as %

of Salary |

| | | | |

Robert J. Cera | 0% | 35% | 52.5% | 48% |

Teresa A. Rosengarten | 0% | 25% | 37.5% | 22% |

Kevin L. LaLuzerne | 0% | 25% | 37.5% | 34% |

Long-term Incentive Compensation.In 1993, the Board of Directors and shareholders approved Baylake’s 1993 Stock Option Plan (the “Option Plan”), which had a ten-year life and expired in April 2003. As of December 31, 2013, the remaining options granted in prior years for 10,000 shares remained outstanding, all of which were vested. However, those options expired unexercised on January 6, 2014.

In 2010, Baylake obtained approval from its shareholders for the 2010 Equity Incentive Plan (the “Equity Plan”). Under the Equity Plan, Baylake has the ability to grant up to 750,000 shares of its common stock in the form of stock options, restricted stock, restricted stock units, and stock appreciation rights. Within this plan, all 750,000 shares may be granted as incentive stock options, but only 375,000 of the 750,000 shares may be granted in the form of restricted stock, or restricted stock units. The number of shares granted to officers or directors is determined by the Compensation Committee on an annual basis based on performance and market research to ensure a reasonable and competitive total compensation package. The Equity Plan also uses vesting provisions that will require the officer to remain employed by Baylake Bank for a defined period of time or risk losing all or a portion of each equity grant. Refer to Note 18 under Part II, Item 8, “Financial Statements and Supplementary Data” of Baylake’s Form 10-K for the year ended December 31, 2013 for information regarding stock options and restricted stock units granted to date under the Equity Plan.

18

On March 19, 2013, the Board granted equity awards to Baylake’s NEOs in recognition of its strong performance in 2012, the NEOs’ contributions to 2012 corporate performance, and the need to provide a retention incentive for key executives. The grant date fair value of the award was divided into 75% restricted stock units and 25% options. Awards vest in equal installments on each of the first five anniversaries of the grant date, a schedule that the Compensation Committee believes is an appropriate and effective retention tool for Baylake’s key employees.

The table below details the equity grants made to NEOs in 2013:

| | | |

Executive Name | Number of Shares

Underlying Stock Unit

Awards | Number of Shares

Underlying Stock

Options | Total Grant Date

Fair Value |

Robert J. Cera | 10,658 | 13,081 | $135,000 |

Teresa A. Rosengarten | 4,263 | 5,233 | $54,000 |

Kevin L. LaLuzerne | 3,938 | 4,833 | $49,875 |

Stock Ownership Requirement: In February of 2014, Baylake approved an Executive Ownership Plan (“EOP”), which identifies the minimum level of stock ownership it expects from its executives. Pursuant to the EOP, Baylake’s CEO is required to own at least 25,000 shares of Baylake’s common stock, plus 50% of the restricted stock units granted to the CEO that become vested. The other NEOs are required to own at least 10,000 shares of Baylake common stock, plus 50% of the restricted stock units granted to them that become vested. Executives will be expected to meet these requirements within three years of joining the executive team.

Supplemental Executive Retirement Plan (“SERP”).In 2005, Baylake Bank implemented a SERP for certain management and highly compensated employees. The SERP was structured so both the individual and Baylake Bank can make contributions to the plan on an annual basis. Baylake Bank has not made any contributions to the plan since 2007, although some participants have made contributions since 2007. In 2010, Baylake Bank decided to replace the SERP with a similar non-qualified deferred compensation plan that was designed by Charles Schwab. The plan design for the new non-qualified deferred compensation plan is similar to the previous SERP in that both Baylake Bank and the participant can make contributions to the plan. In 2013, Baylake Bank did not make any contributions to this non-qualified deferred compensation plan.

Other Benefits and Perquisites. Executive officers are eligible for all of the benefits made available to full-time employees of Baylake Bank (such as the 401(k) plan, employee stock purchase plan, health insurance, group term life insurance, and disability insurance) on the same basis as other full-time employees and are subject to the same sick leave and other employee policies.

Baylake provides its executive officers with certain additional benefits and perquisites, which it believes are appropriate in order to attract and retain the proper quality of talent for these positions and to recognize that similar executive benefits and perquisites are commonly offered by comparable financial institutions. While no formal perquisite program is currently in place, Baylake generally provides the following benefits and perquisites to its executive officers:

| |

• | In 2013, Baylake paid or reimbursed 50% of club dues for certain executive officers, including Mr. Cera and Ms. Rosengarten; |

• | In 2013, Baylake provided a company automobile to Mr. Cera; |

• | In 2013, Baylake provided a tax reimbursement to Mr. Cera for personal use of a company automobile; |

• | All of Baylake’s executive officers received two days of vacation in addition to the maximum allotment for other officers and employees. |

19

The cost to Baylake of certain of these perquisites is included in the table appearing on page 21 under “Details of Amounts Included in ‘All Other Compensation’ Column of Summary Compensation Table.”

Baylake believes that benefits and perquisites provided to its executive officers in 2013 represented a reasonable percentage of each executive’s total compensation package and were not inconsistent, in the aggregate, with perquisites provided to executive officers of comparable competing financial institutions.

Employment Agreements and Post-Termination Payments

In 2008, Baylake entered into employment agreements with Mr. Cera and Ms. Rosengarten and Change of Control Agreements with Mr. Cera, Ms. Rosengarten and Mr. LaLuzerne that provide for severance benefits under certain circumstances following termination of their individual employment (see “Other Agreements With Named Executive Officers” starting on page 24). Baylake believes that the severance payments called for by the agreements are appropriate because the officers are bound by confidentiality, nonsolicitation, and non-compete provisions. This provides Baylake with more flexibility to make changes in those positions if such changes are in the best interest of Baylake and its shareholders. In December 2010, Baylake made amendments to the employment agreements to comply with the requirements of Section 409A of the Internal Revenue Code.

Incentive Compensation Risk Assessment

The Compensation Committee has reviewed Baylake’s compensation policies and practices and believes that they do not encourage excessive and unnecessary risk-taking, and that the level of risk that they do encourage is not reasonably likely to have a material adverse effect on Baylake. Several features of Baylake’s compensation programs reflect sound risk-management practices. Specifically, Baylake allocates compensation among salary and short and long-term compensation opportunities in such a way as to encourage its employees to make decisions that are in the best long-term interest of Baylake. Further, payments under Baylake’s various cash incentive plans measure performance across a variety of corporate, department, and individual factors and contain appropriate hurdles that must be met before incentives are paid. Finally, the Compensation Committee believes that the compensation programs are subject to appropriate oversight by the Board of Directors and management and compatible with Baylake’s internal control functions.

Adjustment or Recovery of Awards

The 2013 Annual Incentive Compensation Plan includes a formal clawback provision. If the Committee determines that a participant received a payout that was based on materially inaccurate financial statements, reviews, gains, or any other materially inaccurate criteria used in determining or setting such an award, then the Committee will determine the amount of any such payout that was paid as a result of such materially inaccurate financial statements, reviews, gains, or other materially inaccurate criteria (the “Overpayment Amount”). The Committee will send the participant a notice of recovery specifying the Overpayment Amount and the terms for prompt repayment.

Impact of Accounting and Tax Treatments

Section 162(m) of the Internal Revenue Code (the “Code”) prohibits publicly held companies, such as Baylake, from deducting compensation to any one executive officer in excess of $1.0 million during the tax year, unless it is performance-based within the meaning of the statute. It is likely that none of the compensation of the NEOs, other than gains from the exercise of stock options, will qualify as performance-based compensation within the meaning of Section 162(m) of the Code. Therefore, taxable income in excess of $1.0 million for any person considered a NEO on the last day of the taxable year will not be deductible for federal income tax purposes by Baylake, except for any income attributable to the exercise of stock options. The Board of Directors, however, does not believe that it is likely that any individual’s compensation will exceed $1.0 million in any year, except as a result of the exercise of stock options.

20

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table shows cash and non-cash compensation for the years ended December 31 of 2012 and 2013 for the person serving as Baylake’s “principal executive officer” during 2013 and for the next two most highly-compensated executive officers who were serving in such capacity at December 31, 2013.

| | | | | | | | | | | | | | | |

Name and

Principal Position | | Year | | Salary(1)

($) | | Stock

Awards(2)

($) | | Option

Awards(2)

($) | | Non-Equity

Incentive Plan

Compensation ($) | | All Other

Compensation(3)

($) | | Total

($) | |

| | | | | | | | | | | | | | | |

Robert J. Cera, | | 2013 | | 330,769 | | 101,251 | | 33,749 | | 164,120 | | 21,231 | | 651,120 | |

President and CEO | | 2012 | | 298,154 | | 138,235 | | 55,963 | | 120,000 | | 18,586 | | 630,938 | |

| | | | | | | | | | | | | | | |

Teresa A. Rosengarten, | | 2013 | | 184,615 | | 40,499 | | 13,501 | | 41,547 | | 9,013 | | 289,175 | |

Secretary and Chief | | 2012 | | 178,846 | | 58,826 | | 23,815 | | 49,950 | | 8,741 | | 320,178 | |

Risk Officer | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Kevin L. LaLuzerne, | | 2013 | | 188,846 | | 37,411 | | 12,469 | | 65,510 | | 5,665 | | 309,901 | |

CFO | | 2012 | | 164,272 | | 52,942 | | 21,433 | | 46,550 | | 5,121 | | 290,318 | |

| |

(1) | For a discussion of the relationship between salary and bonus, please see “Compensation Discussion and Analysis – Base Salary” and “Compensation Discussion and Analysis – Annual Incentive Compensation” on page 17. |

|

(2) | Amounts in these columns reflect the aggregate grant date fair value of restricted stock units and stock option awards granted during the applicable fiscal year, computed in accordance with FASB ASC Topic 718. Refer to Note 18 under Part II, Item 8, “Financial Statements and Supplementary Data” of Baylake’s Form 10-K for the year ended December 31, 2013 for the relevant assumptions used to determine the valuation of equity awards. |

|

(3) | A detailed breakdown of “All Other Compensation” is provided below. |

Details of Amounts Included in “All Other Compensation” Column of Summary Compensation Table

The table below provides the details of amounts included in the 2013 “All Other Compensation” column of the Summary Compensation Table for each NEO:

| | | | | | | | | | |

| | Mr. Cera | | Ms.

Rosengarten | | Mr.

LaLuzerne | |

| | | | | | | | | | |

Baylake Contribution to Officers’ 401(k) Plan Accounts | | | $7,650 | | | $5,539 | | | $5,665 | |

| | | | | | | | | | |

10% Employer Match to Stock Purchase Plan | | | 195 | | | 65 | | | - | |

| | | | | | | | | | |

Club Dues | | | 4,413 | | | 3,409 | | | - | |

| | | | | | | | | | |

Personal use of company automobile | | | 5,268 | | | - | | | - | |

| | | | | | | | | | |

Tax reimbursements(1) | | | 3,705 | | | - | | | - | |

| | | | | | | | | | |

Totals

| | | $21,231

| | | $9,013

| | | $5,665

| |

| |

(1) | Reimbursement of income taxes payable on personal use of company automobile for Mr. Cera. |

21

Grants of Plan-Based Awards

The following table sets forth the grants of plan-based awards to the NEO’s during fiscal year 2013:

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | All Other

Stock

Awards:

Number of

Shares of

Stock or

Units(2)

# | | All Other

Option

Awards:

Number of

Securities

Underlying

Options(2)

# | | Exercise

or Base

Price of

Awards

$ | | Grant

Date

Fair

Value of

Stock

and

Option

Awards

$ | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | Estimated Future Payouts Under Non-Equity

Incentive Plan Awards(1) | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| | Grant Date | | Threshold

$ | | Target

$ | | Maximum

$ | | | | | |

Name | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Robert J. Cera | | 3/19/13 | | 0 | | 119,000 | | 178,500 | | 10,658 | | 13,081 | | 9.50 | | 135,000 | |

| | | | | | | | | | | | | | | | | |

Teresa A. Rosengarten | | 3/19/13 | | 0 | | 46,500 | | 69,750 | | 4,263 | | 5,233 | | 9.50 | | 54,000 | |

| | | | | | | | | | | | | | | | | |

Kevin L. LaLuzerne | | 3/19/13 | | 0 | | 47,500 | | 71,250 | | 3,938 | | 4,833 | | 9.50 | | 49,875 | |

| |

(1) | See page 17 for a detailed discussion of the 2013 Management Incentive Plan. |

|

(2) | Stock options and restricted stock units granted pursuant to the Equity Plan vest over five years at a rate of 20% per year, commencing one year from the date of grant. |

Outstanding Equity Awards at Fiscal Year End

| | | | | | | | | | | | | | |

| | Option Awards | | | Stock Awards | |

| | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable(1) | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable(1) | | Option Exercise

Price ($) | | Option Expiration

Date | | | Number

of Unvested

Shares or

Units (#)(1) | | Market Value of

Shares or Units

Not Vested ($)(2) | |

Robert J. Cera | | 4,459 | | 13,377 | | 4.15 | | 3/15/2021 | | | 13,377 | | 174,169 | |

| | 4,460 | | 17,836 | | 6.20 | | 4/1/2022 | | | 17,836 | | 232,225 | |

| | - | | 13,081 | | 9.50 | | 3/19/2023 | | | 10,658 | | 138,767 | |

| | | | | | | | | | | | | | |

Teresa A. Rosengarten | | 3,796 | | 5,692 | | 4.15 | | 3/15/2021 | | | 5,692 | | 74,110 | |

| | 1,898 | | 7,590 | | 6.20 | | 4/1/2022 | | | 7,590 | | 98,822 | |

| | - | | 5,233 | | 9.50 | | 3/19/2023 | | | 4,263 | | 55,504 | |

| | | | | | | | | | | | | | |

Kevin L. LaLuzerne | | 3,416 | | 5,123 | | 4.15 | | 3/15/2021 | | | 5,123 | | 66,701 | |

| | 1,708 | | 6,831 | | 6.20 | | 4/1/2022 | | | 6,831 | | 88,940 | |

| | - | | 4,833 | | 9.50 | | 3/19/2023 | | | 3,938 | | 51,273 | |

| |

(1) | Stock options and restricted stock units granted pursuant to the Equity Plan vest over five years at a rate of 20% per year, commencing one year from the date of grant. |

|

(2) | Market value based on the closing price of Baylake common stock of $13.02 on December 31, 2013. |

22

2013 Option Exercises and Stock Vested

The following table sets forth information about stock options exercised and stock awards vested during the year ended December 31, 2013 for each NEO.

| | | | | | | | | | | | | |

| | Option Awards | | Stock Awards | |

Name | | Number of

Shares Acquired

on Exercise

(#) | | Value

Realized

on

Exercise

($)1 | | Number of

Shares

Acquired

on

Vesting

(#) | | Value

Realized

on

Vesting

($)2 | |

Robert J. Cera | | | 4,460 | | | 23,270 | | | 8,919 | | | 82,724 | |

Teresa A. Rosengarten | | | - | | | - | | | 3,796 | | | 35,208 | |

Kevin L. LaLuzerne | | | - | | | - | | | 3,416 | | | 31,683 | |

| |

(1) | The dollar value reflects the stock price at exercise minus the option’s exercise price. |

|

(2) | Represents the value realized upon vesting of restricted stock units based on the market value of the awards on the vesting date. |

Pension Benefits

Baylake does not maintain any pension benefit plans for its officers or directors that would otherwise be subject to disclosure in these proxy materials.

Nonqualified Deferred Compensation in 2013

Effective March 1, 2005, Baylake Bank adopted the SERP, which was intended to reward certain management and highly compensated employees of Baylake Bank who have contributed and are expected to continue to contribute to Baylake Bank’s success, by providing for deferred compensation in addition to that available under Baylake Bank’s other retirement programs. Participants in the SERP were chosen by Baylake Bank’s Executive Committee. There are nine participants in the SERP, one of which is Ms. Rosengarten; however neither Mr. Cera nor Mr. LaLuzerne is a participant in the SERP.

Both the participant and Baylake Bank may make contributions to the SERP.

Each participant has a Deferral Account, which consists of voluntary participant deferrals of up to 100% of salary (but reduced to satisfy employee tax obligations or elections made as part of Baylake Bank’s other benefit plans) and up to 100% of bonus. Each participant is fully vested in his or her Deferral Account at all times. The Board approved the Compensation Committee’s recommendation to not allow participant deferrals in 2013.

Each participant also has a SERP Account which consists of discretionary employer contributions. In 2013, Baylake Bank did not make any contributions to the SERP. A participant becomes 100% vested in his or her SERP Account upon completion of ten years of service (measured from when the participant first commenced employment with Baylake Bank or a predecessor entity) and attaining age 55.

Benefits are generally payable under the SERP upon termination of employment, to the extent vested. Accounts are payable in a lump sum or in installments, as elected by each participant.

Each participant has the right to designate how amounts in the Deferral Account and SERP Account will be deemed to be invested from among a menu of mutual funds. Baylake purchased life insurance in connection with adopting the SERP, however the participants or their beneficiaries had no rights in such policies, and are unsecured creditors of Baylake Bank in connection with the SERP. In February 2011, Baylake surrendered the life insurance policies and no replacement policies were purchased. Instead, a nonqualified deferred compensation trust, commonly known as a Rabbi Trust, was established with Charles Schwab Trust Company serving as trustee. Assets held in the Rabbi Trust are invested in a parallel manner to the elections that participants make for the deemed investment of their balances in the SERP Account and Deferral Account.

23

The following table shows the contributions made in 2013 by Baylake and participants, earnings and account balances for Baylake’s 2013 NEOs.

| | | | | | | | | | | | | | | | | | | |

Name | | Executive

Contributions

in Last FY

($) | | Registrant

Contributions

in Last FY

($) | | Aggregate

Earnings

in Last FY

($) | | Aggregate

Withdrawals/

Distributions

($) | | Aggregate

Balance

at Last FYE

($) | | 12/31/2013

Percent

Vested

(%) | |

Robert J. Cera | | | - | | | - | | | - | | | - | | | - | | | - | |

Teresa A. Rosengarten | | | - | | | - | | | 5,058 | | | - | | | 43,221 | | | 100 | |

Kevin L. LaLuzerne | | | - | | | - | | | - | | | - | | | - | | | - | |

Potential Payments Upon Termination of Employment (without Change in Control)

Baylake does not have any formal severance policy in connection with terminations of employment of its executive officers absent a change in control, which is described in more detail below. However, Mr. Cera’s and Ms. Rosengarten’s employment agreements do provide severance benefits to them in connection with the termination of their employment by Baylake under certain circumstances.See “Other Agreements With Named Executive Officers” below.

Potential Payments Upon Change In Control

Baylake entered into a Change in Control Severance Agreement (“CIC Agreement”) with each executive officer in April 2008 and amended them in 2010, as approved by the Compensation Committee. Under the terms of the CIC Agreements:

| |

• | Under certain termination events within twelve months following a change in control, each of Baylake’s NEOs is entitled to severance in the form of a lump-sum payment in cash equal to a multiple of an amount equal to the sum of: (i) the greater of his or her salary at the time of the change in control or termination of employment; (ii) the greater of (a) the executive’s target bonus in the year the change in control occurs, (b) the executive’s target bonus in the year in which termination of employment occurs, or (c) the annual incentive bonus the executive received which was attributable to the year prior to the year in which termination of employment occurs; and (iii) the amount contributed by Baylake to the executive’s 401(k) account in the year prior to the year in which termination of employment occurs. The severance multiple is 2.0X this sum for Mr. Cera, 1.5X for Ms. Rosengarten, and 1.0X for Mr. LaLuzerne. In addition, Baylake will continue to provide the executive with health and dental insurance for a period of 12 months following his or her termination of employment. Such payments and benefits are triggered if the executive’s employment is terminated following a “Change of Control” either by Baylake or its successor without “Cause” or by the executive for “Good Reason” (each as defined in the CIC Agreement). If a change in control had occurred at December 31, 2013, the NEOs would have been eligible to receive the following payments in the case of qualifying termination under the CIC Agreements: Mr. Cera - $934,700; Ms. Rosengarten - $361,748; and Mr. LaLuzerne - $241,938. |

| |

• | The amount of the severance payment is subject to customary “cutback” provisions designed to avoid the imposition of parachute tax under the Internal Revenue Code. |

| |

• | The executive is bound by confidentiality provisions that would generally prohibit him or her from disclosing or using for his or her personal benefit any “Confidential Information” (as defined in the CIC Agreement) obtained by him or her during the course of his or her employment and for a two-year period after termination. |

Other Agreements With Named Executive Officers

2008 Employment Agreement with Mr.Cera.In April 2008, Baylake and Mr. Cera entered into an employment agreement (in this discussion, the “2008 Cera Agreement”) that replaced the employment agreement between Mr. Cera and Baylake dated August 2006. The 2008 Cera Agreement is similar to the August 2006 employment agreement in many respects. The 2008 Cera Agreement contemplates an “at will” employment relationship and does not have a stated term; rather, under the 2008 Cera Agreement, Mr. Cera’s employment can be

24

terminated by Baylake or Mr. Cera at any time and for any reason. In December 2010, the 2008 Cera Agreement was amended to comply with the requirements of Section 409A of the Internal Revenue Code.

| |

| Compensation and Benefits. The 2008 Cera Agreement established Mr. Cera’s 2008 annual base salary of $285,000 subject to annual increase (but not decrease) based on a performance review by the Board of Directors. He is also eligible to earn an annual (calendar year) performance-based bonus in an amount to be determined by the Board of Directors in its sole discretion for each full calendar year during which he is employed. Effective April 1, 2009, Mr. Cera consented to a 2% reduction in his base salary. On January 28, 2010 the Board of Directors approved the Compensation Committee’s recommendation to reinstate the 2% to Mr. Cera’s base salary retroactive to January 1, 2010. The 2008 Cera Agreement provides that Mr. Cera is eligible to participate in Baylake Bank’s welfare benefit plans generally applicable to all employees, is entitled to reimbursement of business expenses, and vacation and other benefits in accordance with company policy for executive officers. Further, Baylake is required to provide Mr. Cera with life insurance equal to three times his base salary (subject to a $500,000 maximum). Other elements of compensation under the 2008 Cera Agreement include use of a company automobile, tax reimbursement for certain benefits that may be taxable to Mr. Cera, and reimbursement of country club dues. |

| |

| Severance Benefits. The 2008 Cera Agreement provides for severance benefits provided that Mr. Cera signs and does not revoke a mutual release of claims between himself and Baylake. If Mr. Cera’s employment is terminated by Baylake (other than for “Cause” as defined in the 2008 Cera Agreement) or is terminated by Mr. Cera for “Good Reason” (as defined in the 2008 Cera Agreement), Mr. Cera is entitled to a severance payment equal to one year’s base salary plus the annual bonus he would have received for the year of termination had his employment not been terminated, and Baylake would also subsidize his health insurance premiums for that one-year period. However, if Mr. Cera’s employment is terminated by Baylake for “Cause” or if he terminates his employment voluntarily other than for “Good Reason,” he would not be entitled to any severance payments. If Mr. Cera’s employment is terminated due to his death or disability, he or his beneficiary would receive salary continuation payments and a health insurance premium subsidy for one year after termination and, in addition, the vesting of certain other benefits could be accelerated. |

| |

| Confidentiality. The 2008 Cera Agreement contains confidentiality provisions that are typical in agreements of this kind, which generally prohibit him from disclosing or using for his personal benefit any “Confidential Information” (as defined in the 2008 Cera Agreement) obtained by him during the course of his employment and for a two-year period after termination. |

| |

| Non-Compete. Under the non-compete provisions of the 2008 Cera Agreement, Mr. Cera has agreed that during the term of his employment and for one year following termination of his employment for whatever reason (i) he will not provide services similar to the services he provides to Baylake Bank to any “Competitor” (defined, generally, as any financial institution located within 30 miles of any Baylake Bank office); (ii) he will not solicit the business of certain “Restricted Customers” of Baylake Bank (defined, generally, as customers with which Mr. Cera had contact or about which he obtained confidential information during the two-year period prior to termination); and (iii) he will not solicit for employment any employee of Baylake or Baylake Bank or encourage any such employee to terminate his or her employment. Mr. Cera would be denied any of the severance benefits due him under the 2008 Cera Agreement as a consequence of any breach by him of the confidentiality and non-compete provisions thereof. |

Employment Agreement with Ms. Rosengarten.In April 2008, Baylake and Ms. Rosengarten entered into an employment agreement (in this discussion, the “Rosengarten Agreement”). The Rosengarten Agreement contemplates an “at will” employment relationship and does not have a stated term; rather, under the Rosengarten Agreement, Ms. Rosengarten’s employment can be terminated by Baylake or Ms. Rosengarten at any time and for any reason. In December 2010, the Rosengarten Agreement was amended to comply with the requirements of Section 409A of the Internal Revenue Code.

| |

| Compensation and Benefits. The Rosengarten Agreement established Ms. Rosengarten’s 2008 annual base salary of $170,000 subject to annual increase (but not decrease) based on a review by the Compensation Committee and the CEO. She is also eligible to earn an annual (calendar year) performance-based bonus in an amount to be determined by the Board of Directors in its sole discretion for each full calendar year during which she is employed. Effective April 1, 2009, Ms. Rosengarten consented to a 2% reduction in her base salary. On January 28, 2010 the Board of Directors approved the Compensation Committee’s recommendation to reinstate the 2% to Ms. Rosengarten’s base salary retroactive to January 1, 2010. The Rosengarten |

25

| |

| Agreement provides that Ms. Rosengarten is eligible to participate in Baylake Bank’s welfare benefit plans generally applicable to all employees, is entitled to reimbursement of business expenses and vacation and other benefits in accordance with company policy for executive officers. Further, Baylake is required to provide Ms. Rosengarten with life insurance equal to three times her base salary (subject to a $500,000 maximum). Other elements of compensation under the Rosengarten Agreement include reimbursement of country club dues. |

| |

| Severance Benefits. The Rosengarten Agreement provides for severance benefits provided that Ms. Rosengarten signs and does not revoke a mutual release of claims between herself and Baylake. If Ms. Rosengarten’s employment is terminated by Baylake (other than for “Cause” as defined in the Rosengarten Agreement) or is terminated by Ms. Rosengarten for “Good Reason” (as defined in the Rosengarten Agreement), Ms. Rosengarten is entitled to a severance payment equal to one year’s base salary plus the annual bonus she would have received for the year of termination had her employment not been terminated, and Baylake would also subsidize her health insurance premiums for the one-year period. However, if Ms. Rosengarten’s employment is terminated by Baylake for “Cause” or if she terminates her employment voluntarily other than for “Good Reason,” she would not be entitled to any severance payments. If Ms. Rosengarten’s employment is terminated due to her disability, she would receive salary continuation payments and a health insurance premium subsidy for one year after termination and, in addition, the vesting of certain other benefits could be accelerated. In the event of Ms. Rosengarten’s employment terminating due to her death, her beneficiary would receive a health insurance premium subsidy for one year after termination. |

| |

| Confidentiality. The Agreement contains confidentiality provisions that are typical in agreements of this kind, which generally prohibit her from disclosing or using for her personal benefit any “Confidential Information” (as defined in the Rosengarten Agreement) obtained by her during the course of her employment and for a two-year period after termination. |

| |

| Non-Compete. Under the non-compete provisions of the Rosengarten Agreement, Ms. Rosengarten has agreed that during the term of her employment and for one year following termination of her employment for whatever reason (i) she will not provide services similar to the services she provides to Baylake Bank to any “Competitor” (defined, generally, as any financial institution located within 30 miles of any Baylake Bank office); (ii) she will not solicit the business of certain “Restricted Customers” of Baylake Bank (defined, generally, as customers with which Ms. Rosengarten had contact or about which she obtained confidential information during the two-year period prior to termination); or (iii) she will not solicit for employment any employee of Baylake or Baylake Bank or encourage any such employee to terminate his or her employment. Ms. Rosengarten would be denied any of the severance benefits due her under the Rosengarten Agreement as a consequence of any breach by her of the confidentiality and non-compete provisions thereof. |

PROPOSAL 2

ADVISORY (NON-BINDING) VOTE ON EXECUTIVE COMPENSATION

Shareholders are urged to read the “Executive Compensation” section of this proxy statement above, which discusses Baylake’s compensation policies and procedures with respect to its NEOs, as well as compensation paid to its NEOs for fiscal years 2013 and 2012.

In accordance with recently adopted changes to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), shareholders are being asked at the 2014 annual meeting to provide their support with respect to the compensation of Baylake’s NEOs by voting on the following advisory (non-binding) resolution:

“RESOLVED, that the shareholders of Baylake Corp. approve, on an advisory basis, the compensation of Baylake’s named executive officers as described in the “Executive Compensation section of the proxy statement for the 2014 annual meeting of shareholders.”

This advisory vote, commonly known as a “say-on-pay” advisory vote, gives shareholders the opportunity to endorse or not endorse Baylake’s executive pay program. Although non-binding, the Board of Directors and the Compensation Committee value constructive dialogue with Baylake’s shareholders on executive compensation and other important governance topics and encourages all shareholders to vote their shares on this matter. The Board of

26

Directors and the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding the executive compensation program.

The Board of Directors recommends a vote FOR the approval of the advisory (non-binding)

resolution.

PROPOSAL 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Baylake’s independent registered public accounting firm for the fiscal year ended December 31, 2013 was Baker Tilly Virchow Krause, LLP (“Baker Tilly”). Baylake’s Audit Committee has also selected Baker Tilly as its independent registered public accounting firm for the fiscal year ending December 31, 2014. Although Baylake’s shareholders are not required to vote on the appointment of Baylake’s independent registered public accounting firm, it is presenting this selection to its shareholders for ratification. Proxies solicited by the Board of Directors will, unless otherwise directed, be voted to ratify the Board of Directors’ appointment of Baker Tilly as Baylake’s independent registered public accounting firm for the fiscal year ending December 31, 2014. Even if the appointment of Baker Tilly is ratified by the shareholders, the Audit Committee, in its discretion, could decide to terminate the engagement of Baker Tilly and to engage another firm if the Audit Committee determines such action is necessary or desirable. If the appointment of Baker Tilly is not ratified, the Audit Committee will reconsider the appointment (but may decide to maintain the appointment). Baylake has been advised by Baker Tilly that they are independent certified public accountants with respect to Baylake within the meaning of the Exchange Act and the rules and regulations promulgated thereunder.

Representatives of Baker Tilly are expected to attend the 2014 Annual Meeting. They will be given an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders present at the meeting.

The Board of Directors recommends a vote FOR the ratification of Baker Tilly as Baylake’s independent registered public accounting firm for the fiscal year ending December 31, 2014.

For services rendered in 2013 and 2012 by Baker Tilly, the following fees were billed for the audit of Baylake’s annual consolidated financial statements for the years ended December 31, 2013 and 2012, respectively and for other services:

| | | | | | | |

Fees | | 2013 | | 2012 | |

Audit Fees(1) | | $ | 272,400 | | $ | 328,800 | |

Audit-related Fees(2) | | | 28,187 | | | 22,399 | |

Tax Fees(3) | | | 62,018 | | | 69,360 | |

All Other Fees | | | - | | | - | |

Total | | $ | 362,605 | | $ | 420,559 | |

| |

(1) | The Audit Fees consist of fees billed for professional services rendered for the audit of Baylake’s consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports, and services that are normally provided by Baker Tilly in connection with statutory and regulatory filings or engagements. |

| |

(2) | The Audit-related Fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of Baylake’s consolidated financial statements and are not reported under “Audit Fees.” |

| |

(3) | Tax Fees consist of fees for professional services rendered for federal and state tax compliance, assistance with the IRS audit, tax advice and tax planning. |

The Audit Committee approves all engagements of independent auditors in advance, including approval of related fees and an annual budget for projects and fees. Items that are not covered under the budget or fees that exceed the budget require approval by the Audit Committee prior to payment.

27

AUDIT AND RISK COMMITTEE REPORT

The Board of Directors evaluates the requirements for audit activities by independent auditors on a regular basis. The Audit and Risk Committee (the “Audit Committee”), which reviews Baylake’s financial reporting process on behalf of the Board of Directors, consists solely of qualified independent directors as defined under NASDAQ Rule 4200. Under SEC rules, the Board of Directors is required to review the qualifications of the members of the Audit Committee to determine if any members are “audit committee financial experts.” The Board of Directors named William Parsons as an “audit committee financial expert” on November 16, 2004. The Board of Directors believes Mr. Parsons qualified as an “audit committee financial expert” based on his professional training as a certified public accountant, years of involvement with financial reporting and long experience on the Board of Directors. On March 20, 2012, the Board of Directors also named Thomas Herlache as an “audit committee financial expert.” The Board of Directors believes Mr. Herlache qualified as an “audit committee financial expert” based on his years of banking experience, involvement with financial reporting oversight and long experience on the Board of Directors. On January 15, 2013, the Board of Directors also named Dean J. Nolden as an “audit committee financial expert.” The Board of Directors believes Mr. Nolden qualified as an “audit committee financial expert” based on his professional training as a certified public accountant and his years of involvement with financial reporting as both a public accountant, and as the controller and as vice president finance of a public company. The Audit Committee’s functions and responsibilities are described in a written charter.

Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In this context, and in accordance with its charter, the Audit Committee has reviewed and discussed Baylake’s audited financial statements for fiscal 2013 with management of Baylake. During these discussions, management represented to the Audit Committee that Baylake’s consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles. In addition, the Audit Committee has discussed with Baker Tilly, Baylake’s independent registered public accounting firm, the matters required to be discussed by Auditing Standard No. 61, as amended (Communications with Audit Committees), as adopted by the Public Company Accounting Oversight Board. The Audit Committee also has received the written disclosures from Baker Tilly required by applicable requirements of the Public Company Accounting Oversight Board regarding independent accountants communications with the audit committee concerning independence, and has discussed with Baker Tilly the firm’s independence from Baylake and its management. The Audit Committee has, on a continuing basis, considered the possibility of a conflict of interest arising as a result of Baker Tilly performing independent audit services and other non-audit services. The Board of Directors is satisfied that the audit services have been provided in compliance with adequate standards for independence.