UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

BAYLAKE CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Notes:

Reg. (S) 240.14a-101.

SEC 1913 (3-99)

BAYLAKE CORP.

217 North Fourth Avenue

Sturgeon Bay, Wisconsin 54235

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 7, 2004

April 23, 2004

To Shareholders of Baylake Corp.

NOTICE IS HEREBY GIVEN that theAnnual Meeting of the shareholders of Baylake Corp. (“Baylake”), a Wisconsin corporation and registered bank holding company, will be held atBaylake Bank Conference Center, 222 North Third Avenue, Sturgeon Bay, Wisconsin on Monday, June 7, 2004, at 7:00 p.m., for the purpose of considering and voting upon the following matters:

| | 1. | The election of four (4) directors of Class I whose terms will expire in 2007. The Board of Directors’ nominees are named in the accompanying Proxy Statement. |

| | 2. | Such other business relating to the foregoing as may properly be brought before the meeting or any adjournment thereof. |

The Baylake Corp. Board of Directors has fixed the close of business on March 19, 2004 as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting, and only holders of Common Stock of Baylake of record at the close of business on such date will be entitled to notice of and to vote at such meeting and all adjournments thereof.

WE URGE YOU TO MARK, SIGN, DATE, AND RETURN THE ENCLOSED PROXY PROMPTLY IN THE ENCLOSED ENVELOPE SO THAT YOUR SHARES CAN BE VOTED IN ACCORDANCE WITH YOUR WISHES. RETURN THE ENCLOSED PROXY PROMPTLY REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. IF FOR ANY REASON YOU SHOULD DESIRE TO REVOKE YOUR PROXY, YOU MAY DO SO AT ANY TIME BEFORE IT IS VOTED.

PROXY STATEMENT

for

ANNUAL MEETING OF SHAREHOLDERS

of

BAYLAKE CORP.

General

This Proxy Statement is being furnished to the shareholders of Baylake Corp. (“Baylake”) in connection with the solicitation of proxies on behalf of Baylake’s Board of Directors to be voted at the Annual Meeting of Shareholders to be held at 7:00 p.m., local time, on Monday, June 7, 2004, at the Baylake Bank Conference Center, 222 North Third Avenue, Sturgeon Bay, Wisconsin, and at any adjournment or postponement thereof (the “Annual Meeting”). Proxies are solicited to give all shareholders of record at the close of business on March 19, 2004 (the “Record Date”), an opportunity to vote on matters that come before the Annual Meeting. This Proxy Statement and the enclosed proxy card are being mailed to the shareholders on or about April 23, 2004.

At the Annual Meeting, Baylake shareholders will be asked to elect four (4) directors to serve as Class I directors, whose terms as directors will expire in 2007. This matter is described in detail herein. Baylake does not know of any matters, other than as described in the Notice of Annual Meeting and this Proxy Statement, that are to come before the Annual Meeting.

THE BOARD OF DIRECTORS OF BAYLAKE UNANIMOUSLY RECOMMENDS:

| | • | a vote FOR each of the four nominees for Class I director, |

AS THE BOARD OF DIRECTORS BELIEVES SUCH ACTIONS TO BE IN THE BEST INTERESTS OF BAYLAKE AND ITS SHAREHOLDERS.

Quorum

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Baylake Common entitled to vote shall constitute a quorum for all matters to be considered at the Annual Meeting. Abstentions and withholding of votes as to any proposal will not be counted as votes cast in favor of or against the proposal. In addition, shares held in street name which have been designated by brokers on proxy cards as not voted as to any proposal (so-called broker non-votes) will not be counted as votes cast with respect to the proposal. Proxies marked as abstentions, withhold or as broker non-votes, however, will be treated as shares present for purposes of determining the presence or absence of a quorum. The Inspector of Election appointed by the Board of Directors will determine the shares represented at the Annual Meeting and the validity of proxies and ballots, and will count all votes and ballots.

Voting

The Baylake Common Stock (“Baylake Common”) is the only class of voting security of Baylake. As of the Record Date, 7,627,477 shares of Baylake Common were issued and outstanding. Each share of Baylake Common outstanding on the Record Date is entitled to one vote with respect to each matter properly brought before the Annual Meeting.

The voting requirements and procedures described below are based upon the provisions of the Wisconsin Business Corporation Law, Baylake’s charter documents and other requirements applicable to the matters to be voted upon at the Annual Meeting. All shares of Baylake Common represented at the Annual Meeting by properly executed proxies received prior to or at the Annual Meeting, and not revoked in the manner described below, will be voted in accordance with the instructions made on the proxy card. If no instructions are indicated, properly executed proxies will be votedFOR the election of the four director nominees named herein. If any of the nominees would decline or be unable to act, which management does not anticipate, proxies will be voted with discretionary authority for a substitute nominee selected by the Board of Directors. In addition, if any other matters are properly presented at the Annual Meeting for action, the persons named in the enclosed proxy card will have the discretion to vote on such matters in accordance with their best judgment.

Directors will be elected by a plurality of the votes of the shares of Baylake Common present in person or represented by proxy at the Annual Meeting. The four nominees receiving the most votes will be elected as Directors of Baylake, each to serve a three-year term. Only shares that are voted in favor of a particular nominee, including those voted for “all” nominees, will be counted toward that nominee’s achievement of a plurality. Shares present at the Annual Meeting that are not voted for a particular nominee or shares present by proxy as to which the shareholder properly withheld authority to vote for the nominee (including broker non-votes) will not be counted toward the nominee’s achievement of a plurality.

Revocability of Proxies and Proxy Information

Any shareholder submitting a proxy has the right to revoke the proxy at any time before it is voted at the Annual Meeting by (i) giving written notice of revocation (bearing a date later than the proxy) to the Secretary of Baylake, (ii) giving oral notice to the presiding officer during the Annual Meeting that the shareholder intends to vote in person, or (iii) submitting a later dated proxy. Attendance by a shareholder at the Annual Meeting will not in and of itself constitute revocation of a proxy. Any written notice revoking a proxy should be delivered to Daniel F. Maggle, Secretary, Baylake Corp., 217 N. Fourth Avenue, P.O. Box 9, Sturgeon Bay, WI 54235.

The expense of preparing, printing and mailing this Proxy Statement and the solicitation of proxies at the Annual Meeting will be borne by Baylake. Baylake will reimburse brokers and others who are record holders of Baylake Common for the reasonable expenses incurred in obtaining voting instructions from beneficial owners of such shares. In addition to solicitation by mail, directors, officers and employees of Baylake may solicit proxies by telephone, facsimile transmission or personal contact, but will receive no compensation for such services other than their regular compensation.

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

Proposal 1: Election of Directors

The only item to be acted upon at the Annual Meeting is the election of four directors to serve until the 2007 Annual Meeting of Shareholders. The Bylaws of Baylake provide for classification of the Board of Directors into three classes as nearly equal in number as practicable, each to serve staggered three-year terms, with the term of one class expiring each year. The Bylaws also provide that the Board may consist of not less than five (5) or more than seventeen (17) directors as shall be determined from year to year by the shareholders. The Board of Directors currently consists of eleven (11) directors, including four (4) Class I directors, whose terms expire in 2004, four (4) Class II directors whose terms expire in 2005, and three (3) Class III directors whose terms expire in 2006. The Board of Directors has nominated four (4) individuals

2

named below for election as directors of Class I, to serve for terms expiring at the 2007 Annual Meeting of Shareholders and upon the election of their successors. All four of the nominees are currently directors of Baylake. There are no arrangements or understandings between any director or nominee and any other person pursuant to which such director or nominee was selected, and no director, nominee or executive officer is related to any other director, nominee or executive officer by blood, marriage or adoption.

Unless otherwise directed, proxies will be votedFOR the election of the four Class I director nominees. If any of the nominees would decline or be unable to act, which management does not anticipate, proxies will be voted with discretionary authority for a substitute nominee to be designated by the Board of Directors.

The following also sets forth information as to current directors of Baylake who will serve as directors for the indicated terms. Except as otherwise indicated, each of the directors has been employed in such director’s current occupation for at least five years. All of the directors of Baylake also serve as directors of Baylake Bank, Baylake’s principal operating subsidiary.

Nominees for Election as Class I Directors for Term Expiring in 2007:

| | | | |

Name and Age

| | Principal Occupation and Business Experience

| | Director

Since

|

John W. Bunda (69) | | Retired Retailer | | 1972 |

(3) | | | | |

| | |

Roger G. Ferris (61) | | Managing Director; Aon Risk Services | | 2001 |

(2) | | Of Wisconsin (insurance brokerage operation) | | |

| | |

Thomas L. Herlache (61) | | President, Chief Executive Officer and | | 1970 |

(1)(2)(4) | | Chairman of Baylake; President, CEO, | | |

Ex officio:(5) | | Chairman and Trust Officer of Baylake Bank | | |

| | |

Paul Jay Sturm (52) | | Attorney with Omholt & Forsythe, SC. | | 1998 |

(2)(4)(5) | | (attorney at law) | | |

Continuing Class II Directors Whose Term Expires in 2005:

| | | | |

Name and Age

| | Principal Occupation and Business Experience

| | Director

Since

|

Robert W. Agnew (62) | | President & CEO, Peterson Industries, | | 2001 |

(2)(3) | | LLC | | |

| | |

George Delveaux, Jr. (61) | | Dairy Farmer | | 1981 |

(5) | | | | |

| | |

Dee Geurts-Bengtson (51) | | Executive of Special Events, Green Bay | | 2003 |

(5) | | Packers | | |

| | |

Joseph Morgan (61) | | President of Mary Morgan, Inc. (printing), | | 1995 |

(4)(5) | | a Gannett Company | | |

3

Continuing Class III Directors Whose Term Expires in 2006:

| | | | |

Name and Age

| | Principal Occupation and Business Experience

| | Director

Since

|

Ronald D. Berg (69) | | Retired; formerly, Senior Vice President of | | 1979 |

(1)(3) | | Baylake Bank, retired more than 3 years. | | |

| | |

Richard A. Braun (61) | | Executive Vice President and Vice Chairman | | 1994 |

(1)(2)(4)(5) | | of Baylake | | |

| | |

William C. Parsons (67) | | President of Palmer Johnson Enterprises | | 1979 |

(1)(3)(4) | | (heavy equipment transmission distributor) | | |

| (1) | Member of theExecutive Committee, which reviews the financial, administrative and regulatory activities of Baylake and Baylake Bank. This committee is authorized by the Board of Directors to act on its behalf on any matter permitted by law. This committee generally meets on a regular basis throughout the year and held 14 meetings during 2003. Mr. Herlache serves as the Chairman of this Committee. |

| (2) | Member of theDirector Loan Committee, which reviews certain loan transactions of Baylake Bank. This committee meets on a weekly basis and held 50 meetings during 2003. Mr. Braun serves as the Chairman of this Committee. |

| (3) | Member of theAudit and Legal Committee, which reviews financial and legal matters of Baylake. This committee held 12 meetings in 2003. Mr. Berg serves as the Chairman of this Committee. All members of the Committee are independent directors and have no relationship other than customary banking arrangements. |

| (4) | Member of thePersonnel and Compensation Committee, which reviews the personnel policies and annual compensation levels of Baylake Bank. This committee held 2 meetings during 2003. |

| (5) | Member of theAsset Management Committee, which reviews the function and administration of the trust and financial services departments of Baylake Bank and Baylake’s non-bank subsidiaries. This committee meets on a monthly basis and held 12 meetings during 2003. Mr. Sturm serves as the Chairman of this Committee. |

Each member of the Board of Directors attended at least 75% of the meetings of the Board of Directors and of all committees on which such directors served during 2003.Although not required to do so, all of the Directors attended the annual meeting of shareholders.

Ownership of Baylake Common

The table below sets forth information regarding the beneficial ownership of Baylake Common as of March 16, 2004 by (a) each director and nominee for director (including the named executive officers in the Summary Compensation Table below), (b) each of the named executive officers not listed as a director, (c) all executive officers and directors of Baylake and its subsidiaries as a group, and (d) all shareholders, including addresses, who are known to Baylake to beneficially own more than 5% of the outstanding shares of Baylake Common as of such date.

4

| | | | | | |

| | | Name(1)

| | Number

of Shares

| | Percent

|

| (a) | | Thomas L. Herlache | | 129,716(2) | | 1.70% |

| | | Robert A. Agnew | | 3,225 | | * |

| | | Dee Guerts-Bengtson | | 200 | | * |

| | | Ronald D. Berg | | 13,291 | | * |

| | | Richard A. Braun | | 102,000(3) | | 1.33% |

| | | John W. Bunda | | 2,384 | | * |

| | | George Delveaux, Jr. | | 2,029 | | * |

| | | Roger G. Ferris | | 4,793 | | * |

| | | Joseph Morgan | | 14,580 | | * |

| | | William C. Parsons | | 83,372 | | 1.09% |

| | | Paul Jay Sturm | | 20,000 | | * |

| | | |

| (b) | | Michael J. Gilson | | 83,455(4) | | 1.08% |

| | | Daniel M. Hanson | | 63,571(5) | | * |

| | | Steven D. Jennerjohn | | 68,292(6) | | * |

| | | Robert M. Zubella | | 84,563(7) | | 1.10% |

| | | |

| (c) | | All executive officers and directors as a group (23 persons) | | 964,854(8) | | 11.81% |

| | | |

| (d) | | Ellsworth L. Peterson | | 762,917 | | 10.00% |

| | | 55 Utopia Circle | | | | |

| | | Sturgeon Bay, WI 54235 | | | | |

| | | |

| | | Oliver Ulvilden | | 403,676 | | 5.28% |

| | | P.O. Box 189 | | | | |

| | | Ephraim, WI 54211 | | | | |

| * | Constitutes less than 1% of the outstanding shares |

| (1) | For all listed persons, the number includes shares held by, jointly with, or in trust for the benefit of, spouse and dependent children. Shares are reported in such cases on the presumption that the individual may share voting and/or investment power because of the family relationship. |

| (2) | Includes beneficial ownership of 20,395 shares which may be acquired upon the exercise of stock options (of which 1,855 are in the money) exercisable currently or within 60 days of the date hereof. |

| (3) | Includes beneficial ownership of 16,900 shares which may be acquired upon the exercise of stock options (of which 10,900 are in the money) exercisable currently or within 60 days of the date hereof. |

| (4) | Includes beneficial ownership of 65,895 shares which may be acquired upon the exercise of stock options (of which 47,355 are in the money) exercisable currently or within 60 days of the date hereof. |

| (5) | Includes beneficial ownership of 63,395 shares which may be acquired upon the exercise of stock options (of which 44,855 are in the money) exercisable currently or within 60 days of the date hereof. |

| (6) | Includes beneficial ownership of 56,395 shares which may be acquired upon the exercise of stock options (of which 37,855 are in the money) exercisable currently or within 60 days of the date hereof. |

5

| (7) | Includes beneficial ownership of 68,395 shares which may be acquired upon the exercise of stock options (of which 49,855 are in the money) exercisable currently or within 60 days of the date hereof. |

| (8) | Includes beneficial ownership of 543,183 shares which may be acquired upon the exercise of stock options (of which 350,913 are in the money) exercisable currently or within 60 days of the date hereof. |

Directors’ Fees and Benefits

Directors of Baylake or Baylake Bank were paid $450 for each general board meeting attended, and $200 for each board meeting which not attended. Members of any of the identified committees also received $250 for each committee meeting attended.

Baylake also has deferred compensation agreements with certain of its directors, including John W. Bunda, George Delveaux, Jr., and William Parsons. Under these agreements, participating directors may elect to defer a portion of their annual directors’ fees until retirement, termination, death or disability, at which time the deferred amount, including any income or gains thereon, are payable in a lump sum or in annual installments. At death, all sums held in the account of a participating director are payable to designated beneficiaries. Although Baylake maintains policies of insurance to support payments under these agreements, participating directors have no interest in such policies or any benefits accruing under such policies.

Director Nominations

The Baylake Board of Directors does not have a separate nominating committee, but chooses nominees as a full-board function because they are better able to make recommendations and evaluate proposed nominees from across the Bank’s entire geographic market. The process includes the participation of both management and the Board. Baylake’s Bylaws require that notice of shareholder nominations for directors must be made by notice in writing, delivered or mailed by first class United States mail, postage prepaid, to the Secretary of Baylake not less than 14 days nor more than 70 days prior to the Annual Meeting in order to be considered. Each notice of nomination must contain the name and address, the principal occupation or employment, and number of shares of Baylake Common beneficially owned by each nominee and the class for which nominated. The Chairman of the Annual Meeting shall determine whether any nomination was not made in accordance with the Bylaws and, if so determined, he shall indicate such at the Annual Meeting and the defective nomination will be disregarded.

Executive Officers who are not Directors

Set forth below is information with respect to the principal occupations during the last five years for the executive officers of Baylake and Baylake Bank who do not serve as directors of Baylake. All executive officers are elected annually by the Board of Directors and serve until their successors are elected and qualified. As of the date hereof, no executive officer set forth below is related to any director or other executive officer of Baylake or Baylake Bank by blood, marriage or adoption, and there are no arrangements or understandings between a director of Baylake and any other person pursuant to which such person was elected an executive officer.

Susan F. Anschutz. Age 40. Ms. Anschutz currently serves as Senior Vice President of Marketing of Baylake Bank and has held that position since 1996. Ms. Anschutz joined Baylake Bank in 1992.

Marcia M. Cryderman. Age 51. Ms. Cryderman currently serves as Executive Vice President – Sales and has held that position since 2001. Ms. Cryderman joined Baylake Bank in 1995.

6

Michael J. Gilson. Age 56. Mr. Gilson currently serves as Executive Vice President - Commercial Division of Baylake Bank and has held that position since 1985. Mr. Gilson joined Baylake Bank in 1971.

Sharon A. Haines. Age 56. Ms. Haines currently serves as Senior Vice President of Human Resources of Baylake Bank and has held that position since 1998. Ms. Haines joined Baylake Bank in 1989.

Daniel M. Hanson. Age 47. Mr. Hanson currently serves as Executive Vice President – Operations Division and has held that position since 1991. Mr. Hanson joined Baylake Bank in 1980.

John A. Hauser. Age 45. Mr. Hauser currently serves as Executive Vice President and Chief Investment Officer of Baylake Bank and has held those positions since 1992. Mr. Hauser joined Baylake Bank in 1984.

Judith A. Heidner. Age 62. Ms. Heidner currently serves as Senior Vice President – Compliance and New Product Development of Baylake Bank and has held that position since 2000. Ms. Heidner joined Baylake Bank in 1996 and has previously served as Compliance Officer since 1996.

Steven D. Jennerjohn. Age 50. Mr. Jennerjohn currently serves as Treasurer and Chief Financial Officer of Baylake and Senior Vice President - Accounting Division of Baylake Bank and has held those positions since 1992. Mr. Jennerjohn joined Baylake Bank in 1977.

Daniel F. Maggle. Age 49. Mr. Maggle currently serves as Secretary of Baylake and Senior Vice President - Administration Division of Baylake Bank and has held those positions since 1992. Mr. Maggle joined Baylake Bank in 1972.

Robert W. Swank. Age 48. Mr. Swank currently serves as Senior Vice President – Trust Division of Baylake Bank and has held that position since 2003. Mr. Swank joined Baylake Bank in 2003. He has held executive trust management positions for the past 5 years prior to this statement.

Paul C. Wickmann. Age 52. Mr. Wickmann currently serves as Vice President of Baylake and Senior Vice President – Asset Management Division of Baylake Bank and has held those positions since 1981. Mr. Wickmann joined Baylake Bank in 1973.

Robert M. Zubella. Age 51. Mr. Zubella currently serves as Vice President of Baylake and Executive Vice President – Retail Division of Baylake Bank and has held those positions since 1992. Mr. Zubella joined Baylake Bank in 1986.

Code of Ethics

Baylake Bank has a formal code of ethics which applies to its senior officers. You may review a copy of the code of ethics by requesting a copy from Stephen A. Kase, General Counsel, Baylake Corp., 217 N. Fourth Avenue, P.O. Box 9, Sturgeon Bay, WI 54235.

Executive Compensation

Compensation Summary. The following table summarizes certain information for each of the last three years concerning all compensation awarded or paid to or earned by the Chief Executive Officer and the four other most highly compensated officers of Baylake Bank whose salary and bonus exceeded $100,000 during 2003.

7

Summary Compensation Table

Annual Compensation(5)

| | | | | | | | | | | |

Name and Principal Position

| | Year

| | Salary

($)(1)

| | | Bonus

($)(2)

| | Options

(#)

| | All other

Compensation

($)(3)

|

Thomas L. Herlache President and Chief Executive Officer | | 2003

2002

2001 | | 332,887

331,015

326,813 | (4)

(4)

(4) | | 87,500

100,000

90,000 | | 3,240

2,944

2,950 | | 78,251

81,021

74,722 |

| | | | | |

Michael J. Gilson Executive Vice President Commercial Division | | 2003

2002

2001 | | 125,000

119,480

116,000 |

| | 7,500

14,848

4,814 | | 3,240

2,944

2,950 | | 14,045

12,761

12,409 |

| | | | | |

Daniel M. Hanson Executive Vice President Operations Division | | 2003

2002

2001 | | 113,000

108,150

99,580 |

| | 11,865

20,395

— | | 3,240

2,944

2,950 | | 12,812

11,279

10,266 |

| | | | | |

Steven D. Jennerjohn Senior Vice President Accounting Division | | 2003

2002

2001 | | 113,000

108,150

99,580 |

| | 6,780

13,981

— | | 3,240

2,944

2,950 | | 11,804

11,244

10,372 |

| | | | | |

Robert M. Zubella Executive Vice President Retail Division | | 2003

2002

2001 | | 113,000

108,150

105,000 |

| | 7,345

12,884

4,357 | | 3,240

2,944

2,950 | | 12,092

11,525

9,500 |

| (1) | The salary amount set forth include base salaries, directors’ fees and employee contributions made to the account of the named executive officer pursuant to the Baylake Bank’s 401(k) Plan. |

| (2) | Consists of bonuses earned during the years indicated pursuant to Baylake Bank’s Pay-for-Performance Program and prior bonus plans, which amounts were paid as soon as practicable in the following year. See “Personnel and Compensation Committee Report on Management Compensation — Year-end Bonuses” below for more detailed information. |

| (3) | Consists of employer matching and other contributions made to the account of the named executive officer under Baylake Bank’s 401(k) Plan and group term life insurance premiums. |

| (4) | Includes annual compensation deferred at Mr. Herlache’s election pursuant to the Thomas L. Herlache Deferred Compensation Plan, under which Mr. Herlache may defer a portion of his annual compensation in an amount equal to the greater of $20,500 or 15.6% of his base salary. Amounts deferred are held in a rabbi trust for the benefit of Mr. Herlache. |

| (5) | Although the named individuals received perquisites or other personal benefits in the years shown, in accordance with SEC regulations the value of these benefits is not shown because they did not in the aggregate exceed 10% of the individual’s salary and bonus in any year. |

Mr. Herlache has a Preferred Compensation Agreement with Baylake Bank under which Mr. Herlache is entitled to receive a minimum cash benefit of $20,000 per year (payable in monthly installments) upon his

8

death, disability or retirement at age 65. Such payment will be made for a period of ten years. If Mr. Herlache decides to retire before age 65, he will be entitled to reduced annual benefits (with the reduction equal to 6.5% multiplied by the difference between his age at early retirement and age 65). Mr. Herlache also has an “Executive Employee Salary Continuation Agreement” with Baylake Bank under which Mr. Herlache is entitled to receive a maximum cash benefit of $67,500 per year (payable in monthly installments) upon his death, disability, or retirement at age 65. Such payment will be made for a period of at least fifteen years.

Stock Options. The following tables set forth certain information concerning grants of options to purchase Baylake Common made to the named executive officers during 2003 and the number and value of options outstanding at the end of 2003 for the named executive officers.

Options/SAR Grants in Last Fiscal Year

Individual Grants(1)

| | | | | | | | | | | | | | | | | |

Name

| | Options/

SARs Granted(#)

| | Percent of

Total Options/

SARs Granted

to Employees in Fiscal Year

| | | Exercise

or Base Price($/sh)

| | Market Price

at Date of Grant

| | Expiration Date

| | Potential Realizable

Value at Assumed

Annual Rates of

Stock Price

Appreciation for

Option Term(2)

|

| | | | | | | 5%($)

| | 10%($)

|

Thomas L. Herlache | | 3,240 | | 8.79 | % | | $ | 13.30 | | $ | 13.30 | | 4/29/13 | | 27,100 | | 68,678 |

Michael J. Gilson | | 3,240 | | 8.79 | % | | $ | 13.30 | | $ | 13.30 | | 4/29/13 | | 27,100 | | 68,678 |

Daniel H. Hanson | | 3,240 | | 8.79 | % | | $ | 13.30 | | $ | 13.30 | | 4/29/13 | | 27,100 | | 68,678 |

Steven D. Jennerjohn | | 3,240 | | 8.79 | % | | $ | 13.30 | | $ | 13.30 | | 4/29/13 | | 27,100 | | 68,678 |

Robert M. Zubella | | 3,240 | | 8.79 | % | | $ | 13.30 | | $ | 13.30 | | 4/29/13 | | 27,100 | | 68,678 |

| (1) | Consists entirely of non-qualified stock options granted pursuant to Baylake’s 1993 Stock Option Plan. All options granted after April 30, 1993 have and will have exercise prices equal to 100% of Baylake Common fair market value on the date of grant. The options granted to date become exercisable 20% per year, commencing one year from date of grant. |

| (2) | Pre-tax gain. The dollar amounts under these columns result from calculations at the 5% and 10% rates set by the Securities and Exchange Commission in the proxy disclosure rules and, therefore, are not intended to forecast possible future appreciation, if any, in Baylake’s stock price. The per share price of Baylake Common would be $21.66 and $34.50 if the increase was 5% and 10%, respectively, compounded annually over the option term. |

Aggregated Option/SAR Exercises in Last Fiscal Year

And Fiscal Year-End Option/SAR Values(1)

| | | | | | | | | | | | | | | |

| | | | | | | Number of Securities

Underlying Unexercised Options/SARs at Fiscal Year-End (#)

| | Value of Unexercised In-the-Money Options/SARs At Fiscal Year-End ($)(3)

|

Name

| | Shares Acquired

on Exercise (#)

| | Value Realized ($)(2)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Thomas L. Herlache | | 18,000 | | $ | 85,912 | | 608 | | 5,626 | | $ | 912 | | $ | 7,467 |

| | | | | | |

Michael J. Gilson | | 12,000 | | $ | 48,200 | | 48,608 | | 5,626 | | $ | 227,472 | | $ | 7,467 |

| | | | | | |

Daniel M. Hanson | | 17,000 | | $ | 57,700 | | 43,608 | | 5,626 | | $ | 212,472 | | $ | 7,467 |

| | | | | | |

Steven D. Jennerjohn | | 15,000 | | $ | 48,730 | | 43,608 | | 5,626 | | $ | 209,472 | | $ | 7,467 |

| | | | | | |

Robert M. Zubella | | 12,000 | | $ | 49,100 | | 48,608 | | 5,626 | | $ | 227,472 | | $ | 7,467 |

| (1) | Consists entirely of non-qualified stock options; no SARs have been granted or exercised. |

9

| (2) | Pre-tax gain. Market price at date of exercise of options, less option exercise price, times number of shares, equals value realized. |

| (3) | Pre-tax gain. Calculated assuming market price of Baylake Common at fiscal year-end of $14.50 per share. |

Personnel and Compensation Committee Report on Management Compensation

The Board of Directors determines the compensation of Baylake Bank’s executive officers, based on the recommendations of the Personnel and Compensation Committee (the “Committee”). However, with respect to the compensation of Thomas L. Herlache, Baylake Bank’s President and Chief Executive Officer, the Board of Directors determines his compensation based upon various factors, including: (i) the financial performance of Baylake Bank; (ii) his length of service and an evaluation of his overall job performance; (iii) the compensation levels of executive officers in similar positions with similar companies; and (iv) other information and subjective factors which the Committee deems appropriate. The Committee subjectively analyzes these factors, and certain factors may weigh more heavily than others. Directors and Committee members who are also executive officers of Baylake Bank do not participate in discussions concerning his compensation. The Board of Directors unanimously adopted the recommendations of the Committee without modifications.

The Committee is comprised of six persons, including four outside directors, Thomas L. Herlache, and Sharon Haines, Director of Human Resources. Ms. Haines is substantially responsible for initially formulating the recommended compensation levels of the salaried employees and executive officers. The Committee generally meets two times during the year to consider compensation levels and make recommendations to the Board. It works with the human resources department which gathers and provides useful information for the Committee’s review.

The general philosophy of the Committee is to offer employees fair and competitive compensation, based on the employee’s individual contribution, experience and performance and on Baylake Bank’s overall growth and performance. Baylake Bank’s executive compensation policies are intended to attract and retain competent management with a balance of short- and long-term considerations and to provide incentives to individuals based upon the Bank’s growth and earnings and the attainment of certain goals. The Board of Directors believes that this policy is critical to the long-term success and competitiveness of Baylake.

In making its executive compensation recommendations for 2004, the Committee considered various factors, including the following: (i) the financial performance of Baylake Bank as a whole on both a short-term and long-term basis (including net income, an increase in deposits and loans, return on average shareholder equity, and return on average assets); (ii) with respect to each individual executive officer, the financial performance of that area of Baylake Bank, if any, for which such executive is responsible, including whether or not that area of the Bank achieved its goals for 2003; (iii) the length of service of the executive and an evaluation of the executive’s overall job performance; (iv) the compensation levels of executive officers in similar positions with similar companies; and (v) other information (such as cost of living increases) and subjective factors which the Committee deems appropriate for a particular executive. The Committee subjectively analyzes these factors, and certain factors may weigh more heavily than others with regard to any individual executive officer.

10

The main components of Baylake Bank’s executive compensation program consist of base salary, a year-end bonus, and stock options, in addition to standard medical, life and disability benefits and a 401(k) profit sharing plan made available to all employees.

Base Salary. The principal component of executive compensation is base salary. The Committee believes that base salary is most important in retaining highly qualified officers. Accordingly, it reviews compensation surveys and comparisons collected by the Human Resources Department and seeks to recommend salaries at levels above those applicable to other financial institutions and businesses similarly situated on the basis of type, size and community, although the Committee and Human Resources Department do not perform any mathematical calculations or statistical analyses to arrive at any percentile comparison. Salary surveys include both informal surveys conducted by the Human Resources Department with the cooperation of nearby community financial institutions and businesses, and formal financial surveys conducted by independent banking consultants and banking associations.

In recommending base salary levels for 2004, the Committee (and the Board, as to the salary of Mr. Herlache) considered such factors as growth in net income and earnings per share and return on average assets and average stockholders’ equity. With respect to Mr. Herlache’s salary in particular, the Board took into account the sustained top performance of Baylake under his leadership as well as Baylake’s most recent annual performance. In view of these considerations, the Board and Committee determined that a salary increase for the executive officers ranging from 2.4% to 25.0% including a salary increase for Mr. Herlache of 3.0% would be appropriate. The highest percentage increases related to persons whose duties and responsibilities significantly increased in 2003. As part of Mr. Herlache’s compensation, a $87,500 bonus was paid in 2003, or 30.0% of base salary, compared to $100,000, or 34.3% of base salary, in 2002 (See “Summary Compensation Table”).

Year-End Bonuses. The Board of Directors, in conjunction with the Committee, implemented a year-end bonus program, called the “Pay-for-Performance Program,” which commenced in 1993. The Pay-for-Performance Program offers incentives to executive officers and other eligible employees, except for Mr. Herlache, to earn bonuses directly dependent on the Bank’s performance in numerous select areas and in various divisions. The bonus plans reflect the philosophy of the Board that a significant portion of executive compensation should be related to the financial performance of the Bank.

The Pay-for-Performance Program is intended to motivate and reward management and other employees by linking bonuses to critical financial performance components of the Bank. Under the Program, key indicators have been identified which are considered by the Board to have an impact on the earnings of Baylake Bank. These indicators include the following: growth in net income, asset quality measurements, and productivity measurements. Certain quantitative goals were assigned to each of these indicators (ranging from goal 1 to goal 10), and each indicator was assigned a weighted value based on its perceived influence on earnings. The Board determined that achievement of the maximum goals (goal 10) across all indicators in 2003 should generate at least $2,106,000 in additional pre-tax income, and that the bonus pool should constitute 50% of additional net income attributable to the performance indicators (resulting in a maximum potential bonus pool of approximately $1,000,000 for 2003). In addition, management receives additional bonuses based on criteria related to overall divisional performance. However, it was agreed that no bonuses would be awarded unless Baylake’s return on average stockholders’ equity for 2003 was at least 13.5%. Although this goal was not achieved, some bonuses were awarded to management on the basis of other performance indicators.

After determining the bonus pool, a calculation is made as to the size of the bonus pool set forth as a percentage of total salary expense, and each employee is eligible to receive a bonus equal to such percentage multiplied by their base salary. Based on actual results for 2003 among the various indicators which achieved

11

prescribed goals, no bonus pool was established. Executive officers of Baylake Bank received bonuses ranging from 3.5% to 12.5%. Individual goals were set for executive officers and other personnel during the year, independent of the “Pay for Performance” program.

Stock Options. In April 1993, the Board of Directors approved Baylake’s 1993 Stock Option Plan (the “Option Plan”), which was later approved by the shareholders in June 1993. The Option Plan was established to provide a long-term incentive to the Bank’s executive officers and other key employees, to increase the overall value of Baylake in future years. The Board seeks to further motivate management by granting them options to purchase shares of Baylake Common and thus offering them a greater stake in Baylake’s future. The Board also views the Option Plan as a significant component of the Bank’s overall compensation package and is a complement to base salary and bonus. The Option Plan also enables the Bank to compensate its officers without having to make any cash payments.

A total of 1,200,000 shares of Baylake Common have been reserved for issuance upon exercise of options granted and to be granted under the Option Plan. Options to purchase an additional 25,000 shares were granted in January, 2004 at an exercise price of $14.15 per share, which approximates the then current market value of the Baylake Common. To date, options to purchase up to 983,619 in aggregate have been granted to a total of thirteen executive officers of the Bank. All options granted will have an exercise price equal to the market value of the Baylake Common at the date of grant. Option grants have been and will be made at or near the current market value so that any value is dependent upon an increase in the market value of the Baylake Common. The options vest over five years (20% per year), commencing one year after date of grants, and expire after 10 years if not exercised.

The total number of options earned by Baylake Bank’s executive officers in 2003 was generally based on the Bank’s continued performance in 2003 as compared to 2002, and the number of options granted on an individual basis took into account the executive officer’s relative cash compensation, experience, responsibilities and attribution to the Bank’s past and future performance. In 2003, Mr. Herlache was granted options to purchase 3,240 shares of Baylake Common, while other divisional vice presidents were granted options to purchase 3,240 shares, except that Marcia Cryderman was granted options to purchase 1,620 shares.

Submitted by the Personnel and Compensation Committee:

Richard A. Braun

Sharon Haines (non-director)

Thomas L. Herlache

Joseph Morgan

William C. Parsons

Paul Jay Sturm

Compensation Committee Interlocks and Insider Participation

As indicated above, Thomas L. Herlache, President and Chief Executive Officer of Baylake and Baylake Bank, and Sharon Haines, Director of Human Resources, serve as members of the Personnel and Compensation Committee. However, Mr. Herlache does not participate on decisions affecting his own compensation. During 2003, no executive officer of Baylake (a) served as a member of the compensation committee of another entity, one of whose executive officers served on the Personnel and Compensation Committee of Baylake, (b) served as a director of another entity, one of whose executive officers served on the Personnel and Compensation Committee of Baylake, or (c) was a member of the compensation committee of another entity, one of whose executive officers served as a Director of Baylake.

12

Certain Transactions with Management

Baylake Bank has, and expects to continue to have, regular dealings with officers and directors of Baylake as well as their associates. Since January 1, 2003, several such persons have been indebted to Baylake Bank for loans made in the ordinary course of business. Loans to all such persons remain on substantially the same terms, including interest rates and collateral, on those prevailing at the time for comparable transactions with unaffiliated persons, are current with respect to payments, and do not involve more than the normal risk of collectability or present other unfavorable features.

Compliance with Section 16(a) of the Exchange Act

Under Section 16(a) of the Exchange Act, Baylake’s directors and executive officers, and any persons holding more than 10% of the outstanding Baylake Common, are required to report their initial ownership of the Baylake Common and any subsequent changes to such ownership to the Securities and Exchange Commission and to furnish Baylake with copies of all such reports they file. Baylake knows of no person who owns 10% or more of the Baylake Common.

Specific due dates for these reports have been established, and Baylake is required to disclose in this Proxy Statement any failure to file such reports by these dates during 2003. Based solely on review of the copies of these reports furnished to Baylake and written representations that no other reports were required to be filed, Baylake believes that all reporting requirements under Section 16(a) for the fiscal year ended December 31, 2003 were met in a timely manner by its directors and officers.

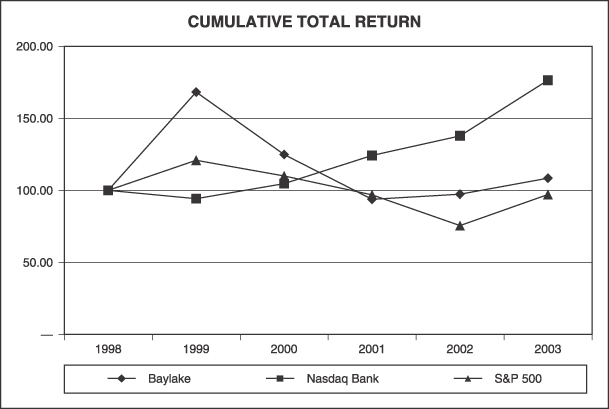

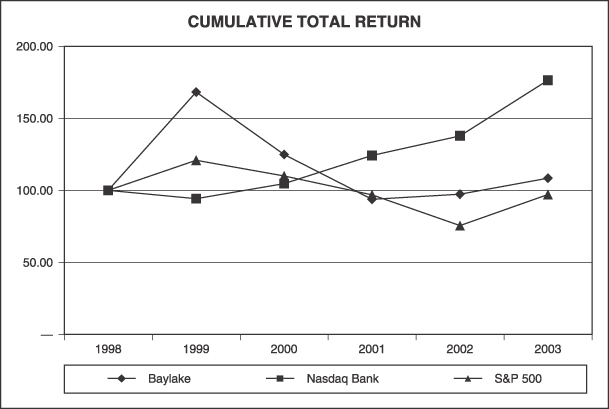

Performance Graph

The following graph shows the cumulative stockholder return on the Baylake Common over the last five fiscal years compared to the returns of Standard & Poors 500 Stock Index and the Nasdaq Bank Index, prepared for Nasdaq by the Center for Research in Securities Prices at the University of Chicago.

| | | | | | |

| | | Baylake

| | NASDAQ

| | S&P 500 Stock Index

|

1998 | | 100.00 | | 100.00 | | 100.00 |

1999 | | 168.32 | | 94.30 | | 120.90 |

2000 | | 124.96 | | 104.70 | | 110.00 |

2001 | | 93.77 | | 124.30 | | 96.90 |

2002 | | 97.33 | | 137.90 | | 75.60 |

2003 | | 108.47 | | 176.40 | | 97.10 |

| (1) | Assumes $100 invested on December 31, 1998 in each of Baylake Corp. common stock, the Standard & Poors 500 Stock Index and the Nasdaq Bank Index. Dividends are assumed to be reinvested. |

13

Audit & Legal Committee Report on Audit Activities

The Board of Directors evaluates the requirements for audit activities by independent auditors on a regular basis. The Audit & Legal Committee, which reviews Baylake’s financial reporting process on behalf of the Board of Directors, consists solely of qualified independent directors, but does not include any single member who has substantial independent experience in finance and accounting. Under SEC rules, the Board is required to review the qualifications of the members of the Committee to determine if any members are “audit committee financial experts”. The Committee does not include a financial expert at the present time because the Board does not believe that any of the members meet the requirements within the meaning of the SEC rules, but believes that all members of the Committee have the requisite knowledge and skill to meaningfully interpret financial statements and perform their duties. The Board of Directors has adopted a written Audit Committee Charter, effective November 18, 2003. Additional responsibilities of the Audit & Legal Committee are set forth in the Audit Committee Charter, appended as Exhibit A. In addition, it has reported its activities and findings under the Report of the Audit & Legal Committee dated March 16, 2004.

Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In this context, and in accordance with its Charter, the Audit & Legal Committee has reviewed and discussed Baylake’s audited financial statements for fiscal 2003 with management of Baylake. During these discussions, management represented to the Audit & Legal Committee that Baylake’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. In addition, the Audit & Legal Committee has discussed with Smith & Gesteland, LLP, Baylake’s independent accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee also has received the written disclosures and the letter from Smith & Gesteland, LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and has discussed with Smith & Gesteland, LLP its independence from Baylake and its management. The Audit & Legal Committee has, on a continuing basis, considered the possibility of a conflict of interest arising as a result of Smith & Gesteland, LLP performing independent audit services and other non-audit services. The Committee approves all engagement of independent auditors in advance, including approval of related fees and an annual budget for projects and fees. Items that are not covered under the budget or fees that exceed the budget are approved by the Committee. Prior authorization was granted by the Committee in each case before any services were performed in 2003. The Board is satisfied that the audit services have been provided in compliance with adequate standards for independence.

Based on its review and discussions with management and the auditors, the Audit & Legal Committee has recommended to the Board of Directors, and the Board of Directors subsequently approved the recommendation, that the audited financial statements of the Company be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2003 for filing with the Securities and Exchange Commission, a copy of which report is attached to this Proxy Statement.

Submitted by the Audit & Legal Committee:

Ronald D. Berg (Chairman)

Robert W. Agnew

John W. Bunda

William C. Parsons

14

Fees of Independent Public Accountants

For services rendered in 2003 by Smith & Gesteland, LLP, Baylake’s independent auditors, the following fees were incurred for audit of Baylake’s annual consolidated financial statements for years ended December 31, 2002 and December 31, 2003 and fees billed for other services:

| | | | | | |

| | | Fiscal 2003

| | Fiscal 2002

|

Audit fees(1) | | $ | 53,407 | | $ | 50,465 |

Audit-related fees(2) | | | 10,997 | | | 10,200 |

Tax fees(3) | | | 35,239 | | | 24,734 |

All other fees(4) | | | 2,382 | | | 3,535 |

| | |

|

| |

|

|

Total fees | | $ | 102,025 | | $ | 88,934 |

| (1) | The Audit fees consist of fees billed for professional services rendered for the audit of Baylake’s consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports, and services that are normally provided by Smith & Gesteland, LLP in connection with statutory and regulatory filings or engagements. |

| (2) | The Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of Baylake’s consolidated financial statements and are not reported under “Audit fees”. This category includes fees related to employee benefit plan and pooled fund audits. |

| (3) | Tax fees consist of fees for professional services rendered for federal and state tax compliance, tax advice, and tax planning. |

| (4) | All other fees consist of fees for services other than the services reported above. In fiscal 2003, this category included fees for advisory services related to accounting for derivatives, cash surrender value of insurance, branch purchase issues, and trust preferred securities. |

The Audit & Legal Committee of the Board of Directors intends to continue to use the accounting firm of Smith & Gesteland, LLP as independent auditors to audit the financial statements of Baylake for 2004. Representatives of Smith & Gesteland, LLP are expected to be present at the Baylake Annual Meeting to respond to appropriate questions and to make a statement if they desire to do so.

Other Matters

The Board of Directors is not aware of any other matters to be presented at the Annual Meeting. If any other matter proper for action at the Annual Meeting should be presented, the persons named as proxies will vote the shares represented by the proxy on such matter in accordance with their best judgment pursuant to discretionary authority granted in the proxy. If any matter not proper for action at the Annual Meeting should be presented, the named proxies will vote against consideration thereof or action thereon. The Committee’s bylaws do not permit consideration at a shareholders’ meeting of a nominee or proposal by a shareholder which has not been provided to the Board of Directors in advance.

15

Submission of Shareholder Proposals

Proposals intended for inclusion in the proxy statement for next year’s annual meeting of shareholders must be in writing and must be received by the Secretary of the Company at 217 N. Fourth Avenue, Sturgeon Bay, WI 54235 not later than January 3, 2005. To be considered for inclusion in the Company’s proxy statement and proxy card for an annual meeting, the shareholder proposal must be submitted on a timely basis and the proposal and proponent thereof must meet the requirements established by the Securities and Exchange Commission for shareholder proposals.

In addition, Baylake’s bylaws provide that any proposal for action or nomination to the Board of Directors which is proposed by persons other than the Board of Directors must be received by the Board in writing together with specified accompanying information at least 14 days, but not more than 70 days prior to an annual meeting in order to be considered at the meeting. The 2005 annual meeting is tentatively scheduled for June 6, 2005 and any notice of intent to consider other questions and/or nominees and related information must be received between March 28, 2005 and May 23, 2005. The purpose of this bylaw is to assure adequate notice of and information regarding any such matter as to which shareholder action may be sought. No notices have been received to date relating to the 2004 annual meeting.

Other Information

Consolidated financial statements of Baylake and its subsidiaries are included in the Annual Report to Shareholders for the year ended December 31, 2003. Additional copies of the Annual Report to Shareholders and Baylake’s Annual Report on Form 10-K (without exhibits) as filed with the Securities and Exchange Commission, which accompanies this Proxy Statement, may be obtained, without charge, upon written request to Steven Jennerjohn, Chief Financial Officer, Baylake Corp., 217 N. Fourth Avenue, P.O. Box 9, Sturgeon Bay, WI 54235.

|

By Order of the Board of Directors |

|

| /S/ DANIEL F. MAGGLE |

|

| Daniel F. Maggle |

| Secretary |

16

BAYLAKE CORP.

AUDIT, LEGAL & COMPLIANCE COMMITTEE CHARTER

Adopted by Resolution of the Board of Directors

November 18, 2003

General

There shall be a committee of the Board of Directors of Baylake Bank (the “Company”) to be known as the Audit, Legal & Compliance Committee (the “Committee”).

The role of the Committee is to provide assistance to the Company’s Board of Directors in fulfilling its responsibilities to the Company’s shareholders and the investment community relating to corporate accounting, reporting practices of the Company and the quality and integrity of the financial reports of the Company. The Committee will provide such assistance by overseeing:

| | • | the integrity of the Company’s financial statements, |

| | • | the Company’s compliance with legal and regulatory requirements, |

| | • | the independent auditor’s qualifications and independence, |

| | • | the performance of the Company’s internal audit function and independent auditor, and |

| | • | the Company’s system of disclosure controls and system of internal controls regarding finance, accounting, legal compliance, and ethics that management and the Board have established |

The Committee has the authority to obtain advice and assistance from outside legal, accounting, or other advisors as deemed appropriate to perform its duties and responsibilities and the Company shall provide appropriate funding, as determined by the Committee, for compensation to such outside advisers that the Committee chooses to engage.

Composition and Organization

The Committee shall consist of three or more directors as determined by the Board of Directors, each of whom shall be independent of the management of the Company, and free from any relationship that, in the opinion of the Board of Directors, would interfere with the exercise of his or her independent judgment as a member of the Committee. The members of the Committee are to be elected by the Board of Directors and shall serve until their successors are duly elected and qualified. Unless a Chairman is elected by the full Board of Directors, the members of the Committee may designate a Chairman by majority vote of the full Committee membership. A Vice Chairman shall also be appointed to act in the absence of the Chairman.

In determining whether any director is independent, the Board of Directors shall take into consideration the requirements of the principal exchange or system, if any, on which any class of the Company’s stock is traded. By way of example, and not limitation, Directors who are affiliates of the Company, or officers or employees of the Company and/or any of its subsidiaries, will not be considered independent.

All members of the Committee must be able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. The board shall determine whether at least one member of the Committee qualifies as an “audit committee financial expert” in compliance with the criteria established by the SEC and other relevant regulations, reflecting other comparable experience or background, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities which results in the member’s financial sophistication. The existence of such member, including his or her name and whether or not he or she is independent, shall be disclosed in periodic filings as required by the SEC.

Page 1

Meetings

The Committee shall hold regular meetings as may be necessary, generally on a monthly basis, and special meetings as may be called by the Chairman of the Committee. Each regularly scheduled meeting shall conclude with an executive session of the Committee absent members of management and on such terms and conditions as the Committee may elect. As part of its job to foster open communication, the Committee should meet periodically with management, the director of the internal auditing function and the independent auditors in separate executive sessions to discuss any matters that the Committee or each of these groups believe should be discussed privately. In addition, the Committee or its Chairman should meet, either in person or via conference call, with the independent auditors and management on a quarterly basis to review the Company’s financial statements.

Relationship with Internal and Independent Auditors

The Company’s internal auditors and independent auditors are to be ultimately accountable to the Board of Directors and the Committee through regular reporting to and review by the Committee and the Board. The Committee and the Board shall be directly responsible for the performance of the independent auditors, including the authority and responsibility to select, evaluate and, where appropriate, replace the internal auditors or independent auditors (or nominate the independent auditors to be proposed for shareholder approval in any proxy statement.)

Responsibilities and Duties

To fulfill its responsibilities and duties, the Committee shall:

Document/Reports/Information Review

| • | Review the Company’s annual financial statements and any reports or other financial information submitted to the Securities and Exchange Commission or the public, including any certification, report, opinion, or review rendered by the independent auditors. |

| • | Review with financial management and the independent auditors the Company’s filings with the Securities and Exchange Commission on Forms 10-K and 10-Q prior to their filing or prior to the release of earnings to the public, including management certifications as required by the Sarbanes-Oxley Act of 2002. Recommend to the Board whether the financial statements should be included in the Annual Report on Form 10-K. |

Internal Auditors

| • | Review the regular internal reports (or summaries thereof) to management prepared by the internal auditing department and management’s response. The internal auditors shall report directly to the Committee and the Committee shall oversee the resolution of disagreements between management and the auditors in the event that they arise. |

| • | Review with the Company’s internal auditors and the financial and accounting personnel, the adequacy and effectiveness of the accounting and financial controls of the Company, and elicit recommendations for the improvement of such internal control procedures or particular areas where new or more detailed controls or procedures are desirable. Particular emphasis should be given to the adequacy of such internal controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper. |

Page 2

| • | Review the internal audit function of the Company including the independence and authority of its reporting obligations, the proposed audit schedule for the coming year, and the coordination of such schedule with independent auditors. |

Independent Auditors

| • | Review and approve the selection and compensation of the independent auditors to audit the consolidated financial statements of the Company, considering independence and effectiveness, and approve the fees and other compensation to be paid to the independent auditors. Consider whether the auditors’ performance of permissible non-audit services is compatible with the auditors’ independence. |

| • | On an annual basis, obtain from the independent auditors, and review and discuss with the independent auditors, a formal written statement delineating all relationships the auditors have with the Company, consistent with the Sarbanes-Oxley Act, and actively engage in a dialogue with the independent auditors with respect to any disclosed relationships or services that may impact the objectivity and independence of the independent auditors. Review the performance of the independent auditors and approve any proposed discharge of the independent auditors when circumstances warrant. |

| • | Periodically consult with the independent auditors out of the presence of management and review the independent auditor’s attestation and report on management’s internal control report, the completeness and accuracy of the Company’s financial statements, and the following: |

| | • | all critical accounting policies and practices; |

| | • | all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor; |

| | • | material written communications between the independent auditor and management including, but not limited to, the management letter and schedule of unadjusted differences;and |

| • | Review and preapprove both audit and non-audit services to be provided by the independent auditor (other than with respect tode minimis exceptions permitted by the Sarbanes-Oxley Act of 2002). |

Financial Reporting Processes and Accounting Policies

| • | In consultation with the independent auditors, review the integrity of the organization’s financial reporting processes, both internal and external. Meet with representatives of the Corporate Governance committee on a periodic basis to discuss any matters of concern arising from the Committee’s quarterly process to assist the CEO and CFO in their Sarbanes-Oxley Act of 2002 Section 302 certifications. |

| • | Establish regular and separate reporting to the Committee by management and the independent auditors regarding any significant judgments made in management’s preparation of the financial statements and the view of each as to the appropriateness of such judgments. Consider the independent auditors’ judgments about the quality and appropriateness of the Company’s accounting principles as applied in its financial reporting, setting forth significant reporting issues and judgments made in connection with the preparation of the financial statements. |

| • | Review analyses prepared by management and approve, if appropriate, major changes to the Company’s auditing and accounting principles and practices as suggested by the independent auditors or management. Review with the independent auditors and management the extent to which changes or improvements in financial or accounting practices, as approved by the Committee, have been implemented. |

Page 3

| • | Following completion of the annual audit, review separately with each of management and the independent auditors any significant difficulties encountered during the course of the audit, including any restrictions on the scope of work or access to required information. Review any significant disagreement among management and the independent auditors in connection with the preparation of the financial statements. |

| • | Establish and maintain procedures for the receipt, retention, and treatment of complaints regarding accounting, internal accounting, or auditing matters.Establish and maintain procedures for the confidential, anonymous submission by Company employees regarding questionable accounting or auditing. |

Ethical and Legal Compliance

| • | Review, with the Company’s counsel, any legal matter that could have a significant impact on the Company’s financial statements. |

| • | Perform any other activities consistent with this Charter, the Company’s bylaws and governing law, as the Committee or the Company Board’s of Directors deems necessary or appropriate. |

| • | Discuss policies with respect to risk assessment and risk management. Such discussions should include the Company’s major financial and accounting risk exposures and the steps management has undertaken to control them. |

| • | Review and update periodically a Code of Ethical Conduct and ensure that the code is in compliance with all applicable rules and regulations. Review management’s monitoring of compliance with the organization’s Code of Ethical Conduct, and ensure that management has the proper review system in place to ensure that the Company’s financial statements, reports and other financial information disseminated to governmental organizations, and the public satisfy ethical and legal requirements. |

Page 4

BAYLAKE CORP.

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS - JUNE 7, 2004

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned appoints Thomas L. Herlache and/or William C. Parsons as Proxies, each with the power to appoint his substitute, and hereby authorizes either of them to represent and to vote, as designated below, all the shares of common stock of Baylake Corp. held of record by the undersigned on March 19, 2004 at the Annual Meeting of Shareholders to be held on June 7, 2004, or any adjournment thereof.

PROPOSAL 1: ELECTION OF DIRECTORS - Nominees for Class I of the Board of Directors :

John W. Bunda Roger G. Ferris Thomas L. Herlache Paul Jay Sturm

Instruction: To withhold authority to vote for any individual nominee, strike a line through the name of the nominee in the list stated above.

| | |

| Vote for all nominees named above | | ________ |

| Withhold vote for all nominees named above | | ________ |

| Vote for all nominees named, except those crossed out | | ________ |

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED ABOVE BY THE UNDERSIGNED SHAREHOLDER(S). IF PROPERLY SIGNED, BUT NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED IN FAVOR OF THE NOMINEES NAMED IN PROPOSAL NUMBER ONE.

Please sign exactly as your name appears on this Proxy. When shares are held by joint tenants, both should sign. When signing as attorney, personal representative, administrator, trustee, or guardian, please give full title as such. If a corporation or partnership, please sign in full corporate name, by the President, other authorized officer, or by an authorized person.

Dated: , 2004.

| | | | |

| | |

| | | | | |

| | | |

|

| Signature | | | | Signature, if jointly held |

PLEASE MARK YOUR SELECTION FOR THE ELECTION OF DIRECTORS. THEN SIGN AND DATE THIS FORM. PLEASE RETURN THIS PROXY FORM PROMPTLY, USING THE ENCLOSED ENVELOPE FOR YOUR CONVENIENCE.

April 23, 2004

Dear Baylake Shareholder:

You are invited to attend the Annual Meeting of Shareholders of Baylake Corp, scheduled to be held at 7:00 p.m. on Monday, June 7, 2004 at the Baylake Bank Conference Center, 222 North Third Avenue, Sturgeon Bay, Wisconsin.

The matters expected to be acted upon at the meeting are described in detail in the Notice of Annual Meeting and Proxy Statement which are enclosed. These matters include the election of four (4) directors in Class I, who are nominated by the Board of Directors for a term of three years. In addition, we will take up consideration of any other matters which may properly come before the meeting.

Please complete and return the accompanying Proxy card promptly in the enclosed envelope to assure that your shares are represented in voting on these very important matters, whether or not you plan to attend the Annual Meeting. Instructions about your Proxy are included with the Proxy card. If you do attend the meeting, you may still vote your shares in person at the Annual Meeting by revoking your proxy when you arrive, even if you have already submitted your Proxy to us as requested in the enclosed information.

You should complete the attached Request Form ONLY if you plan to attend the meeting. Upon receipt of the attached form, we will send you an Entrance Card to be presented when you attend the meeting. Please return the form by May 25th to allow us to make proper accommodations for those attending the meeting.

If you have any questions or require assistance, please contact Stephen A. Kase, General Counsel, at Baylake Bank at either 920-743-5551 or 800-267-3610.

|

Sincerely, |

|

| |

|

| Thomas L. Herlache |

| President and Chief Executive Officer |

REQUEST FOR ENTRANCE CARD

If you plan to attend the Annual Meeting, please complete and return in the enclosed Proxy envelope.