UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2841

Fidelity Capital Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | April 30, 2006 |

Item 1. Reports to Stockholders

| | Fidelity®

Capital Appreciation

Fund

|

| | Semiannual Report

April 30, 2006

|

| Contents | | | | |

| |

| Chairman’s Message | | 3 | | Ned Johnson’s message to shareholders. |

| Shareholder Expense | | 4 | | An example of shareholder expenses. |

| Example | | | | |

| Investment Changes | | 6 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 7 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 18 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 22 | | Notes to the financial statements. |

| Board Approval of | | 28 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended

June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commis

sion’s (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of

the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies,

Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks

of FMR Corp. or an affiliated company.

|

| | This report and the financial statements contained herein are submitted for the general information

of the shareholders of the fund. This report is not authorized for distribution to prospective investors in

the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of

each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at http://www.sec.gov.

A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference Room in

Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be

obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view the most

recent quarterly holdings report, semiannual report, or annual report on Fidelity’s web site at

http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

|

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

Although many securities markets made gains in early 2006, there is only one certainty when it comes to investing: There is no sure thing. There are, however, a number of time tested, fundamental investment principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets’ inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets’ best days can significantly diminish investor returns. Patience also affords the benefits of compounding of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn’t eliminate risk, it can considerably lessen the effect of short term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio’s long term success. The right mix of stocks, bonds and cash aligned to your particular risk tolerance and investment objective is very important. Age appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities which historically have been the best performing asset class over time is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more stable fixed investments (bonds or savings plans).

A third investment principle investing regularly can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won’t pay for all your shares at market highs. This strategy known as dollar cost averaging also reduces unconstructive “emotion” from investing, helping shareholders avoid selling weak per formers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

3 Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2005 to April 30, 2006).

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the share holder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During Period* |

| | | Account Value | | Account Value | | November 1, 2005 |

| | | November 1, 2005 | | April 30, 2006 | | to April 30, 2006 |

| Actual | | | | $ 1,000.00 | | | | $ 1,163.70 | | | | $ 5.04 |

| Hypothetical (5% return per year | | | | | | | | | | | | |

| before expenses) | | | | $ 1,000.00 | | | | $ 1,020.13 | | | | $ 4.71 |

* Expenses are equal to the Fund’s annualized expense ratio of .94%; multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one half year period).

5 Semiannual Report

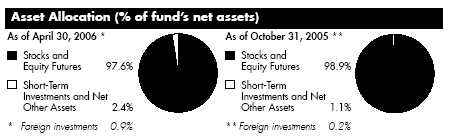

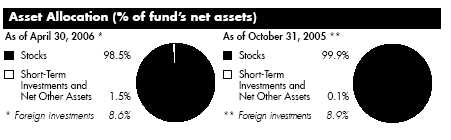

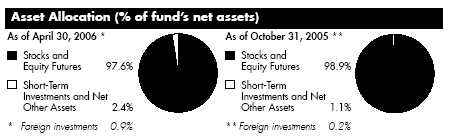

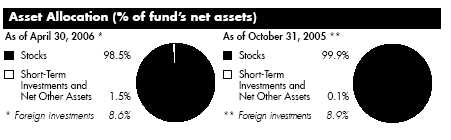

| Investment Changes | | | | |

| |

| Top Ten Stocks as of April 30, 2006 | | | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| The Walt Disney Co. | | 3.3 | | 1.1 |

| QUALCOMM, Inc. | | 2.9 | | 1.4 |

| Motorola, Inc. | | 2.9 | | 1.3 |

| Morgan Stanley | | 2.9 | | 0.0 |

| Abercrombie & Fitch Co. Class A | | 2.3 | | 0.2 |

| Qwest Communications International, Inc. | | 2.1 | | 0.1 |

| Broadcom Corp. Class A | | 2.0 | | 0.0 |

| Advanced Micro Devices, Inc. | | 2.0 | | 0.4 |

| Schlumberger Ltd. (NY Shares) | | 2.0 | | 0.1 |

| American Tower Corp. Class A | | 1.8 | | 0.8 |

| | | 24.2 | | |

Top Five Market Sectors as of April 30, 2006 | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Information Technology | | 20.7 | | 26.5 |

| Industrials | | 18.7 | | 7.5 |

| Consumer Discretionary | | 17.6 | | 20.1 |

| Energy | | 9.2 | | 8.9 |

| Health Care | | 8.6 | | 8.3 |

Semiannual Report 6

| Investments April 30, 2006 (Unaudited) |

| Showing Percentage of Net Assets | | | | | | |

| |

| Common Stocks 95.5% | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | (000s) |

| |

| CONSUMER DISCRETIONARY – 17.6% | | | | | | |

| Auto Components 1.3% | | | | | | |

| Goodyear Tire & Rubber Co. (a)(d) | | 2,208,400 | | | | $ 30,918 |

| Johnson Controls, Inc. | | 953,400 | | | | 77,750 |

| | | | | | | 108,668 |

| Diversified Consumer Services – 1.2% | | | | | | |

| Apollo Group, Inc. Class A (a) | | 757,200 | | | | 41,373 |

| Career Education Corp. (a) | | 1,064,600 | | | | 39,252 |

| Corinthian Colleges, Inc. (a) | | 1,164,200 | | | | 17,335 |

| ITT Educational Services, Inc. (a) | | 47,300 | | | | 3,006 |

| | | | | | | 100,966 |

| Hotels, Restaurants & Leisure 2.8% | | | | | | |

| Ambassadors Group, Inc. | | 574,501 | | | | 15,339 |

| P.F. Chang’s China Bistro, Inc. (a)(d) | | 331,300 | | | | 14,117 |

| Starbucks Corp. (a)(d) | | 3,500,000 | | | | 130,445 |

| The Cheesecake Factory, Inc. (a) | | 126,300 | | | | 3,986 |

| Vail Resorts, Inc. (a) | | 195,000 | | | | 7,332 |

| Wynn Resorts Ltd. (a)(d) | | 793,500 | | | | 60,393 |

| | | | | | | 231,612 |

| Household Durables – 1.2% | | | | | | |

| Ethan Allen Interiors, Inc. | | 94,800 | | | | 4,256 |

| Garmin Ltd. | | 236,600 | | | | 20,433 |

| Koninklijke Philips Electronics NV (NY Shares) | | 402,300 | | | | 13,871 |

| Whirlpool Corp. | | 652,400 | | | | 58,553 |

| | | | | | | 97,113 |

| Leisure Equipment & Products – 0.2% | | | | | | |

| SCP Pool Corp. | | 380,631 | | | | 17,783 |

| Media – 5.2% | | | | | | |

| Carmike Cinemas, Inc. | | 229,700 | | | | 5,676 |

| Grupo Televisa SA de CV (CPO) sponsored ADR | | 1,615,600 | | | | 34,251 |

| Interpublic Group of Companies, Inc. (a) | | 94,700 | | | | 907 |

| Lamar Advertising Co. Class A (a) | | 652,500 | | | | 35,881 |

| McGraw Hill Companies, Inc. | | 674,700 | | | | 37,554 |

| Meredith Corp. | | 225,700 | | | | 11,195 |

| Regal Entertainment Group Class A | | 284,700 | | | | 5,984 |

| The McClatchy Co. Class A | | 94,600 | | | | 4,276 |

| The New York Times Co. Class A (d) | | 673,765 | | | | 16,703 |

| The Walt Disney Co. (d) | | 9,674,893 | | | | 270,504 |

| | | | | | | 422,931 |

| |

| |

| See accompanying notes which are an integral part of the financial statements. | | | | |

| |

| 7 | | Semiannual Report |

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | | | |

| | | | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| CONSUMER DISCRETIONARY – continued | | | | | | | | |

| Multiline Retail – 0.2% | | | | | | | | |

| Family Dollar Stores, Inc. | | | | 592,000 | | | | $ 14,800 |

| Specialty Retail – 4.4% | | | | | | | | |

| Abercrombie & Fitch Co. Class A | | | | 3,112,200 | | | | 189,004 |

| American Eagle Outfitters, Inc. | | | | 1,332,500 | | | | 43,173 |

| CarMax, Inc. (a) | | | | 112,100 | | | | 3,958 |

| Chico’s FAS, Inc. (a) | | | | 241,500 | | | | 8,950 |

| Cost Plus, Inc. (a)(e) | | | | 1,323,472 | | | | 23,293 |

| Guitar Center, Inc. (a) | | | | 127,800 | | | | 6,871 |

| Gymboree Corp. (a) | | | | 1,631,082 | | | | 49,063 |

| Urban Outfitters, Inc. (a) | | | | 1,154,700 | | | | 26,789 |

| Wet Seal, Inc. Class A (a) | | | | 943,900 | | | | 5,427 |

| | | | | | | | | 356,528 |

| Textiles, Apparel & Luxury Goods – 1.1% | | | | | | | | |

| Carter’s, Inc. (a) | | | | 226,600 | | | | 15,264 |

| Crocs, Inc. (d) | | | | 901,700 | | | | 26,961 |

| Deckers Outdoor Corp. (a)(d)(e) | | | | 791,600 | | | | 33,793 |

| Wolverine World Wide, Inc. | | | | 485,800 | | | | 12,067 |

| | | | | | | | | 88,085 |

| |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | | 1,438,486 |

| |

| CONSUMER STAPLES 1.3% | | | | | | | | |

| Beverages – 0.3% | | | | | | | | |

| Hansen Natural Corp. (a) | | | | 179,096 | | | | 23,186 |

| Food Products 0.6% | | | | | | | | |

| Archer-Daniels Midland Co. | | | | 1,318,700 | | | | 47,922 |

| Household Products – 0.0% | | | | | | | | |

| Colgate-Palmolive Co. | | | | 94,600 | | | | 5,593 |

| Tobacco 0.4% | | | | | | | | |

| Reynolds American, Inc. | | | | 275,100 | | | | 30,165 |

| |

| TOTAL CONSUMER STAPLES | | | | | | | | 106,866 |

| |

| ENERGY 9.2% | | | | | | | | |

| Energy Equipment & Services – 4.3% | | | | | | | | |

| BJ Services Co. | | | | 2,473,200 | | | | 94,105 |

| Grant Prideco, Inc. (a) | | | | 755,000 | | | | 38,656 |

| National Oilwell Varco, Inc. (a) | | | | 320,870 | | | | 22,130 |

| Pride International, Inc. (a) | | | | 755,500 | | | | 26,359 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | (000s) |

| |

| ENERGY – continued | | | | | | |

| Energy Equipment & Services – continued | | | | | | |

| Schlumberger Ltd. (NY Shares) | | 2,351,400 | | | | $ 162,576 |

| Weatherford International Ltd. (a) | | 94,600 | | | | 5,007 |

| | | | | | | 348,833 |

| Oil, Gas & Consumable Fuels – 4.9% | | | | | | |

| Arch Coal, Inc. | | 960,800 | | | | 91,266 |

| Cameco Corp. | | 3,348,800 | | | | 136,258 |

| Occidental Petroleum Corp. | | 283,900 | | | | 29,168 |

| Peabody Energy Corp. | | 1,445,500 | | | | 92,310 |

| Valero Energy Corp. | | 828,100 | | | | 53,611 |

| | | | | | | 402,613 |

| |

| TOTAL ENERGY | | | | | | 751,446 |

| |

| FINANCIALS – 8.3% | | | | | | |

| Capital Markets 6.5% | | | | | | |

| E*TRADE Financial Corp. (a) | | 2,077,300 | | | | 51,683 |

| Janus Capital Group, Inc. | | 1,195,150 | | | | 23,258 |

| Jefferies Group, Inc. | | 227,700 | | | | 15,131 |

| Lehman Brothers Holdings, Inc. (d) | | 333,100 | | | | 50,348 |

| Merrill Lynch & Co., Inc. | | 1,718,800 | | | | 131,076 |

| Morgan Stanley | | 3,612,000 | | | | 232,252 |

| TD Ameritrade Holding Corp. | | 1,242,817 | | | | 23,067 |

| | | | | | | 526,815 |

| Commercial Banks – 0.1% | | | | | | |

| Bank of America Corp. | | 189,300 | | | | 9,450 |

| Consumer Finance – 0.1% | | | | | | |

| Capital One Financial Corp. | | 142,000 | | | | 12,303 |

| Diversified Financial Services – 0.7% | | | | | | |

| Chicago Mercantile Exchange Holdings, Inc. Class A | | 94,800 | | | | 43,418 |

| Moody’s Corp. | | 236,700 | | | | 14,678 |

| | | | | | | 58,096 |

| Insurance – 0.6% | | | | | | |

| Brown & Brown, Inc. | | 94,900 | | | | 2,964 |

| Prudential Financial, Inc. | | 124,800 | | | | 9,751 |

| RLI Corp. | | 160,800 | | | | 7,976 |

| The Chubb Corp. | | 189,300 | | | | 9,757 |

| Willis Group Holdings Ltd. | | 429,200 | | | | 15,086 |

| | | | | | | 45,534 |

See accompanying notes which are an integral part of the financial statements.

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | (000s) |

| |

| FINANCIALS – continued | | | | | | |

| Real Estate 0.2% | | | | | | |

| CB Richard Ellis Group, Inc. Class A (a) | | 179,400 | | | | $ 15,767 |

| Thrifts & Mortgage Finance – 0.1% | | | | | | |

| Clayton Holdings, Inc. | | 244,700 | | | | 5,278 |

| |

| TOTAL FINANCIALS | | | | | | 673,243 |

| |

| HEALTH CARE – 8.6% | | | | | | |

| Biotechnology – 2.2% | | | | | | |

| Biogen Idec, Inc. (a) | | 2,687,500 | | | | 120,534 |

| Charles River Laboratories International, Inc. (a) | | 533,400 | | | | 25,203 |

| Cytogen Corp. (a) | | 248,400 | | | | 805 |

| Diversa Corp. (a) | | 28,400 | | | | 299 |

| Gilead Sciences, Inc. (a) | | 331,300 | | | | 19,050 |

| Origin Agritech Ltd. (a) | | 131,300 | | | | 2,282 |

| Pharmion Corp. (a)(d) | | 355,628 | | | | 6,885 |

| | | | | | | 175,058 |

| Health Care Equipment & Supplies – 2.0% | | | | | | |

| Alcon, Inc. | | 379,000 | | | | 38,548 |

| Aspect Medical Systems, Inc. (a) | | 209,060 | | | | 5,950 |

| Cytyc Corp. (a) | | 1,586,310 | | | | 41,006 |

| Intuitive Surgical, Inc. (a) | | 284,300 | | | | 36,106 |

| Thermo Electron Corp. (a) | | 1,126,300 | | | | 43,408 |

| | | | | | | 165,018 |

| Health Care Providers & Services – 2.6% | | | | | | |

| American Retirement Corp. (a) | | 926,800 | | | | 23,541 |

| Brookdale Senior Living, Inc. | | 551,400 | | | | 20,975 |

| Healthways, Inc. (a) | | 398,000 | | | | 19,526 |

| Omnicare, Inc. | | 378,900 | | | | 21,487 |

| UnitedHealth Group, Inc. | | 1,726,300 | | | | 85,866 |

| VCA Antech, Inc. (a) | | 1,103,500 | | | | 34,308 |

| Visicu, Inc. | | 131,100 | | | | 3,120 |

| Vital Images, Inc. (a) | | 157,769 | | | | 5,274 |

| | | | | | | 214,097 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | (000s) |

| |

| HEALTH CARE – continued | | | | | | |

| Pharmaceuticals – 1.8% | | | | | | |

| Allergan, Inc. | | 682,000 | | | | $ 70,055 |

| Elan Corp. PLC sponsored ADR (a)(d) | | 5,414,600 | | | | 79,649 |

| | | | | | | 149,704 |

| |

| TOTAL HEALTH CARE | | | | | | 703,877 |

| |

| INDUSTRIALS – 18.7% | | | | | | |

| Aerospace & Defense – 0.1% | | | | | | |

| Rockwell Collins, Inc. | | 189,300 | | | | 10,828 |

| Airlines – 2.6% | | | | | | |

| AMR Corp. (a)(d) | | 3,405,500 | | | | 83,912 |

| Continental Airlines, Inc. Class B (a)(d) | | 1,812,900 | | | | 47,208 |

| Ryanair Holdings PLC sponsored ADR (a) | | 886,100 | | | | 41,718 |

| UAL Corp. (a) | | 724,000 | | | | 26,071 |

| US Airways Group, Inc. (a) | | 285,000 | | | | 12,329 |

| | | | | | | 211,238 |

| Building Products 0.2% | | | | | | |

| Goodman Global, Inc. | | 669,700 | | | | 13,260 |

| Kingspan Group PLC (Ireland) | | 303,200 | | | | 5,011 |

| | | | | | | 18,271 |

| Commercial Services & Supplies – 2.3% | | | | | | |

| Advisory Board Co. (a) | | 143,900 | | | | 8,076 |

| Allied Waste Industries, Inc. (a) | | 2,803,201 | | | | 39,693 |

| Corporate Executive Board Co. | | 236,900 | | | | 25,379 |

| Covanta Holding Corp. (a) | | 875,400 | | | | 14,602 |

| RPS Group PLC | | 851,900 | | | | 3,076 |

| Synagro Technologies, Inc. | | 181,425 | | | | 871 |

| Tetra Tech, Inc. (a) | | 420,690 | | | | 8,174 |

| Waste Management, Inc. | | 2,336,300 | | | | 87,518 |

| | | | | | | 187,389 |

| Construction & Engineering – 2.0% | | | | | | |

| Empresas ICA Sociedad Controladora SA de CV sponsored | | | | | | |

| ADR (a) | | 490,425 | | | | 18,342 |

| Granite Construction, Inc. | | 572,493 | | | | 26,541 |

| McDermott International, Inc. (a) | | 1,319,900 | | | | 80,250 |

| Quanta Services, Inc. (a) | | 1,708,000 | | | | 27,704 |

| Shaw Group, Inc. (a) | | 276,000 | | | | 8,446 |

| | | | | | | 161,283 |

See accompanying notes which are an integral part of the financial statements.

11 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | | | |

| | | | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| INDUSTRIALS – continued | | | | | | | | |

| Electrical Equipment – 2.8% | | | | | | | | |

| ABB Ltd. sponsored ADR | | | | 5,987,700 | | | | $ 85,145 |

| Rockwell Automation, Inc. | | | | 1,988,000 | | | | 144,050 |

| | | | | | | | | 229,195 |

| Machinery – 3.8% | | | | | | | | |

| Caterpillar, Inc. | | | | 776,760 | | | | 58,832 |

| Deere & Co. (d) | | | | 1,201,900 | | | | 105,503 |

| Flow International Corp. (a)(d) | | | | 1,450,872 | | | | 19,616 |

| Flowserve Corp. (a) | | | | 712,100 | | | | 40,960 |

| Pentair, Inc. | | | | 2,196,800 | | | | 84,094 |

| | | | | | | | | 309,005 |

| Road & Rail 3.5% | | | | | | | | |

| Burlington Northern Santa Fe Corp. | | | | 1,016,000 | | | | 80,802 |

| Canadian National Railway Co. | | | | 749,000 | | | | 33,584 |

| Norfolk Southern Corp. | | | | 2,283,650 | | | | 123,317 |

| Union Pacific Corp. | | | | 568,300 | | | | 51,835 |

| | | | | | | | | 289,538 |

| Trading Companies & Distributors – 1.4% | | | | | | | | |

| Fastenal Co. | | | | 475,200 | | | | 22,244 |

| Finning International, Inc. | | | | 845,200 | | | | 30,467 |

| Interline Brands, Inc. (a) | | | | 553,200 | | | | 14,826 |

| MSC Industrial Direct Co., Inc. Class A | | | | 284,200 | | | | 14,739 |

| WESCO International, Inc. (a) | | | | 393,302 | | | | 29,498 |

| | | | | | | | | 111,774 |

| |

| TOTAL INDUSTRIALS | | | | | | | | 1,528,521 |

| |

| INFORMATION TECHNOLOGY – 20.7% | | | | | | | | |

| Communications Equipment – 9.2% | | | | | | | | |

| Alcatel SA sponsored ADR (a) | | | | 4,765,000 | | | | 68,711 |

| CIENA Corp. (a) | | | | 3,338,700 | | | | 13,655 |

| CommScope, Inc. (a)(d) | | | | 2,023,900 | | | | 66,890 |

| Corning, Inc. (a) | | | | 2,084,000 | | | | 57,581 |

| Finisar Corp. (a) | | | | 4,171,100 | | | | 19,604 |

| JDS Uniphase Corp. (a) | | | | 3,992,700 | | | | 13,935 |

| Motorola, Inc. | | | | 10,935,300 | | | | 233,469 |

| Nortel Networks Corp. (a) | | | | 1,895,400 | | | | 5,041 |

| Oplink Communications, Inc. (a) | | | | 594,447 | | | | 11,461 |

| QUALCOMM, Inc. | | | | 4,651,100 | | | | 238,787 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | (000s) |

| |

| INFORMATION TECHNOLOGY – continued | | | | | | |

| Communications Equipment – continued | | | | | | |

| Sycamore Networks, Inc. (a) | | 4,646,000 | | | | $ 21,836 |

| Tellabs, Inc. (a) | | 283,900 | | | | 4,500 |

| | | | | | | 755,470 |

| Computers & Peripherals – 1.8% | | | | | | |

| Apple Computer, Inc. (a) | | 1,918,400 | | | | 135,036 |

| Diebold, Inc. | | 247,500 | | | | 10,531 |

| | | | | | | 145,567 |

| Electronic Equipment & Instruments – 0.5% | | | | | | |

| Aeroflex, Inc. (a) | | 1,893,900 | | | | 23,882 |

| Vishay Intertechnology, Inc. (a) | | 972,800 | | | | 15,195 |

| | | | | | | 39,077 |

| Internet Software & Services – 2.3% | | | | | | |

| Akamai Technologies, Inc. (a) | | 667,700 | | | | 22,495 |

| DealerTrack Holdings, Inc. | | 273,200 | | | | 6,092 |

| Equinix, Inc. (a) | | 369,000 | | | | 24,317 |

| Google, Inc. Class A (sub. vtg.) (a) | | 182,838 | | | | 76,415 |

| Homestore, Inc. (a) | | 4,606,099 | | | | 28,281 |

| iPass, Inc. (a) | | 872,400 | | | | 7,258 |

| RealNetworks, Inc. (a) | | 2,414,584 | | | | 24,194 |

| | | | | | | 189,052 |

| IT Services – 1.1% | | | | | | |

| Electronic Data Systems Corp. | | 1,447,100 | | | | 39,187 |

| Paychex, Inc. | | 1,251,300 | | | | 50,540 |

| | | | | | | 89,727 |

| Semiconductors & Semiconductor Equipment – 5.7% | | | | | | |

| Advanced Micro Devices, Inc. (a) | | 5,066,200 | | | | 163,892 |

| ATI Technologies, Inc. (a) | | 2,970,700 | | | | 46,097 |

| Atmel Corp. (a) | | 2,222,600 | | | | 11,646 |

| Broadcom Corp. Class A (a) | | 4,049,248 | | | | 166,465 |

| Ikanos Communications, Inc. | | 615,946 | | | | 11,407 |

| Integrated Device Technology, Inc. (a) | | 1,078,300 | | | | 16,412 |

| Marvell Technology Group Ltd. (a) | | 275,700 | | | | 15,740 |

| Omnivision Technologies, Inc. (a) | | 178,800 | | | | 5,200 |

| RF Micro Devices, Inc. (a) | | 94,600 | | | | 880 |

| Texas Instruments, Inc. | | 888,000 | | | | 30,822 |

| | | | | | | 468,561 |

See accompanying notes which are an integral part of the financial statements.

13 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | (000s) |

| |

| INFORMATION TECHNOLOGY – continued | | | | | | |

| Software 0.1% | | | | | | |

| Aspen Technology, Inc. (a) | | 391,600 | | | | $ 5,036 |

| |

| TOTAL INFORMATION TECHNOLOGY | | | | | | 1,692,490 |

| |

| MATERIALS 5.2% | | | | | | |

| Chemicals – 3.1% | | | | | | |

| Airgas, Inc. | | 1,160,700 | | | | 46,950 |

| Arch Chemicals, Inc. | | 182,000 | | | | 5,362 |

| Material Sciences Corp. (a) | | 2,400 | | | | 25 |

| Monsanto Co. | | 1,736,100 | | | | 144,791 |

| Syngenta AG sponsored ADR | | 2,066,300 | | | | 57,402 |

| | | | | | | 254,530 |

| Metals & Mining – 2.0% | | | | | | |

| Allegheny Technologies, Inc. | | 1,800,100 | | | | 124,819 |

| Carpenter Technology Corp. | | 88,400 | | | | 10,515 |

| United States Steel Corp. | | 426,500 | | | | 29,215 |

| | | | | | | 164,549 |

| Paper & Forest Products 0.1% | | | | | | |

| P.H. Glatfelter Co. | | 255,500 | | | | 4,783 |

| |

| TOTAL MATERIALS | | | | | | 423,862 |

| |

| TELECOMMUNICATION SERVICES – 5.6% | | | | | | |

| Diversified Telecommunication Services – 2.2% | | | | | | |

| Cbeyond Communications, Inc. | | 212,548 | | | | 4,198 |

| Qwest Communications International, Inc. (a) | | 26,176,500 | | | | 175,644 |

| | | | | | | 179,842 |

| Wireless Telecommunication Services – 3.4% | | | | | | |

| America Movil SA de CV Series L sponsored ADR | | 1,042,200 | | | | 38,468 |

| American Tower Corp. Class A (a) | | 4,373,400 | | | | 149,308 |

| Centennial Communications Corp. Class A | | 1,111,821 | | | | 7,583 |

| Dobson Communications Corp. Class A (a) | | 4,683,000 | | | | 42,147 |

| NII Holdings, Inc. (a) | | 700,400 | | | | 41,954 |

| | | | | | | 279,460 |

| |

| TOTAL TELECOMMUNICATION SERVICES | | | | | | 459,302 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | (000s) |

| |

| UTILITIES – 0.3% | | | | | | |

| Independent Power Producers & Energy Traders – 0.3% | | | | | | |

| Mirant Corp. (a) | | 758,500 | | | | $ 18,629 |

| TOTAL COMMON STOCKS | | | | | | |

| (Cost $6,546,278) | | | | | | 7,796,722 |

| Convertible Preferred Stocks 0.0% | | | | | | |

| |

| INFORMATION TECHNOLOGY – 0.0% | | | | | | |

| Communications Equipment – 0.0% | | | | | | |

| Chorum Technologies, Inc. Series E (a)(f) | | 15,100 | | | | 0 |

| TOTAL CONVERTIBLE PREFERRED STOCKS | | | | | | |

| (Cost $227) | | | | | | 0 |

| Money Market Funds 10.0% | | | | | | |

| Fidelity Cash Central Fund, 4.8% (b) | | 574,506,639 | | | | 574,507 |

| Fidelity Securities Lending Cash Central Fund, 4.83% (b)(c) | | 241,375,865 | | | | 241,376 |

| TOTAL MONEY MARKET FUNDS | | | | | | |

| (Cost $815,883) | | | | | | 815,883 |

| |

| TOTAL INVESTMENT PORTFOLIO – 105.5% | | | | | | |

| (Cost $7,362,388) | | | | | | 8,612,605 |

| |

| NET OTHER ASSETS – (5.5)% | | | | | | (446,476) |

| NET ASSETS 100% | | | | | | $ 8,166,129 |

Legend

(a) Non-income producing

(b) Affiliated fund that is available only to

investment companies and other

accounts managed by Fidelity

Investments. The rate quoted is the

annualized seven-day yield of the fund

at period end. A complete unaudited

listing of the fund’s holdings as of its

most recent quarter end is available

upon request.

|

(c) Investment made with cash collateral

received from securities on loan.

(d) Security or a portion of the security is on

loan at period end.

(e) Affiliated company

|

See accompanying notes which are an integral part of the financial statements.

15 Semiannual Report

Investments (Unaudited) continued

(f) Restricted securities – Investment in

securities not registered under the

Securities Act of 1933 (excluding 144A

issues). At the end of the period, the

value of restricted securities (excluding

144A issues) amounted to $0 or 0.0% of

net assets.

|

Additional information on each holding is as follows:

| | | Acquisition | | Acquisition |

| Security | | Date | | Cost (000s) |

| Chorum | | | | | | |

| Technologies, Inc. | | | | | | |

| Series E | | 9/19/00 | | | | $ 227 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the fund from the affiliated Central funds is as follows:

| Fund | | Income earned |

| | | (Amounts in thousands) |

| Fidelity Cash Central Fund | | | | $ 11,206 |

| Fidelity Securities Lending Cash Central Fund | | | | 1,094 |

| Total | | | | $ 12,300 |

Other Affiliated Issuers

An affiliated company is a company in which the fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| | | Value, | | Purchases | | | | Sales | | | | Dividend | | Value, end of |

| Affiliate | | beginning of | | | | | | | | Proceeds | | | | Income | | period |

| (Amounts in thousands) | | period | | | | | | | | | | | | | | | | |

| Cost Plus, Inc. | | $ — | | | | $ 23,662 | | | | $ — | | | | $ — | | | | $ 23,293 |

| Deckers Outdoor Corp. | | — | | | | 28,935 | | | | | | | | | | | | 33,793 |

| Gymboree Corp. | | 5,260 | | | | 29,020 | | | | 1,016 | | | | — | | | | — |

| Monster Worldwide, | | | | | | | | | | | | | | | | | | |

| Inc. | | 218,042 | | | | — | | | | 225,153 | | | | — | | | | — |

| New York Mortgage | | | | | | | | | | | | | | | | | | |

| Trust, Inc. | | 7,975 | | | | — | | | | 7,471 | | | | 196 | | | | — |

| Total | | $ 231,277 | | | | $ 81,617 | | | | $ 233,640 | | | | $ 196 | | | | $ 57,086 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 16

Other Information

Distribution of investments by country of issue, as a percentage of total net assets, is as follows:

| United States of America | | 87.4% |

| Canada | | 3.2% |

| Switzerland | | 2.2% |

| Netherlands Antilles | | 2.0% |

| Ireland | | 1.5% |

| Mexico | | 1.1% |

| Panama | | 1.0% |

| Others (individually less than 1%) . | | 1.6% |

| | | 100.0% |

See accompanying notes which are an integral part of the financial statements.

17 Semiannual Report

| Financial Statements | | | | | | |

| |

| Statement of Assets and Liabilities | | | | | | |

| Amounts in thousands (except per share amount) | | | | April 30, 2006 (Unaudited) |

| |

| Assets | | | | | | |

| Investment in securities, at value (including securities | | | | | | |

| loaned of $235,809) See accompanying schedule: | | | | | | |

| Unaffiliated issuers (cost $6,493,908) | | | | $ 7,739,636 | | |

| Affiliated Central Funds (cost $815,883) | | | | 815,883 | | |

| Other affiliated issuers (cost $52,597) | | | | 57,086 | | |

| Total Investments (cost $7,362,388) | | | | | | $ 8,612,605 |

| Receivable for investments sold | | | | | | 25,908 |

| Receivable for fund shares sold | | | | | | 12,795 |

| Dividends receivable | | | | | | 1,232 |

| Interest receivable | | | | | | 2,086 |

| Prepaid expenses | | | | | | 20 |

| Other affiliated receivables | | | | | | 35 |

| Other receivables | | | | | | 576 |

| Total assets | | | | | | 8,655,257 |

| |

| Liabilities | | | | | | |

| Payable for investments purchased | | | | $ 234,612 | | |

| Payable for fund shares redeemed | | | | 6,665 | | |

| Accrued management fee | | | | 4,756 | | |

| Other affiliated payables | | | | 1,564 | | |

| Other payables and accrued expenses | | | | 155 | | |

| Collateral on securities loaned, at value | | | | 241,376 | | |

| Total liabilities | | | | | | 489,128 |

| |

| Net Assets | | | | | | $ 8,166,129 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | | $ 6,550,824 |

| Undistributed net investment income | | | | | | 10,656 |

| Accumulated undistributed net realized gain (loss) on | | | | | | |

| investments and foreign currency transactions | | | | | | 354,423 |

| Net unrealized appreciation (depreciation) on | | | | | | |

| investments and assets and liabilities in foreign | | | | | | |

| currencies | | | | | | 1,250,226 |

| Net Assets, for 293,652 shares outstanding | | | | | | $ 8,166,129 |

| Net Asset Value, offering price and redemption price per | | | | | | |

| share ($8,166,129 ÷ 293,652 shares) | | | | | | $ 27.81 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 18

| Statement of Operations | | | | | | |

| Amounts in thousands | | Six months ended April 30, 2006 (Unaudited) |

| |

| Investment Income | | | | | | |

| Dividends (including $196 received from other | | | | | | |

| affiliated issuers) | | | | | | $ 31,263 |

| Interest | | | | | | 578 |

| Income from affiliated Central Funds | | | | | | 12,300 |

| Total income | | | | | | 44,141 |

| |

| Expenses | | | | | | |

| Management fee | | | | | | |

| Basic fee | | | | $ 21,551 | | |

| Performance adjustment | | | | 5,239 | | |

| Transfer agent fees | | | | 7,965 | | |

| Accounting and security lending fees | | | | 587 | | |

| Independent trustees’ compensation | | | | 15 | | |

| Appreciation in deferred trustee compensation account | | | | 7 | | |

| Custodian fees and expenses | | | | 122 | | |

| Registration fees | | | | 155 | | |

| Audit | | | | 52 | | |

| Legal | | | | 31 | | |

| Miscellaneous | | | | 33 | | |

| Total expenses before reductions | | | | 35,757 | | |

| Expense reductions | | | | (2,361) | | 33,396 |

| |

| Net investment income (loss) | | | | | | 10,745 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | 328,039 | | |

| Other affiliated issuers | | | | 29,981 | | |

| Foreign currency transactions | | | | (284) | | |

| Futures contracts | | | | 7,164 | | |

| Total net realized gain (loss) | | | | | | 364,900 |

| Change in net unrealized appreciation (depreciation) on: | | | | | | |

| Investment securities | | | | 760,624 | | |

| Assets and liabilities in foreign currencies | | | | (3) | | |

| Futures contracts | | | | 1,508 | | |

| Total change in net unrealized appreciation | | | | | | |

| (depreciation) | | | | | | 762,129 |

| Net gain (loss) | | | | | | 1,127,029 |

| Net increase (decrease) in net assets resulting from | | | | | | |

| operations | | | | | | $ 1,137,774 |

See accompanying notes which are an integral part of the financial statements.

19 Semiannual Report

| Financial Statements continued | | | | | | | | |

| |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | Six months ended | | | | Year ended |

| | | April 30, 2006 | | | | October 31, |

| Amounts in thousands | | (Unaudited) | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | | | $ 10,745 | | | | $ (3,320) |

| Net realized gain (loss) | | | | 364,900 | | | | 682,010 |

| Change in net unrealized appreciation (depreciation) . | | | | 762,129 | | | | (103,351) |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | | | 1,137,774 | | | | 575,339 |

| Distributions to shareholders from net investment income . | | | | — | | | | (2,359) |

| Distributions to shareholders from net realized gain | | | | (656,523) | | | | (285,485) |

| Total distributions | | | | (656,523) | | | | (287,844) |

| Share transactions | | | | | | | | |

| Proceeds from sales of shares | | | | 1,100,035 | | | | 2,301,286 |

| Reinvestment of distributions | | | | 631,915 | | | | 276,903 |

| Cost of shares redeemed | | | | (1,016,663) | | | | (1,757,319) |

| Net increase (decrease) in net assets resulting from | | | | | | | | |

| share transactions | | | | 715,287 | | | | 820,870 |

| Total increase (decrease) in net assets | | | | 1,196,538 | | | | 1,108,365 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 6,969,591 | | | | 5,861,226 |

| End of period (including undistributed net investment | | | | | | | | |

| income of $10,656 and accumulated net investment | | | | | | | | |

| loss of $89, respectively) | | | | $ 8,166,129 | | | | $ 6,969,591 |

| |

| Other Information | | | | | | | | |

| Shares | | | | | | | | |

| Sold | | | | 41,241 | | | | 89,960 |

| Issued in reinvestment of distributions | | | | 24,967 | | | | 10,812 |

| Redeemed | | | | (38,380) | | | | (68,970) |

| Net increase (decrease) | | | | 27,828 | | | | 31,802 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights | | | | | | | | | | | | |

| | | Six months ended | | | | | | | | | | |

| | | April 30, 2006 | | Years ended October 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | |

| beginning of period | | | | $ 26.22 | | $ 25.05 | | $ 23.53 | | $ 16.28 | | $ 18.57 | | $ 25.82 |

| Income from Investment | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | | | |

| income (loss)E | | | | .04 | | (.01)F | | (.03) | | (.06) | | (.07) | | .04 |

| Net realized and un | | | | | | | | | | | | | | |

| realized gain (loss) | | | | 4.01 | | 2.40 | | 1.58 | | 7.31 | | (2.22) | | (5.01) |

| Total from investment | | | | | | | | | | | | | | |

| operations | | | | 4.05 | | 2.39 | | 1.55 | | 7.25 | | (2.29) | | (4.97) |

| Distributions from net | | | | | | | | | | | | | | |

| investment income | | | | — | | (.01) | | (.01) | | — | | — | | (.15) |

| Distributions from net | | | | | | | | | | | | | | |

| realized gain | | | | (2.46) | | (1.21) | | (.02) | | — | | — | | (2.13) |

| Total distributions | | | | (2.46) | | (1.22) | | (.03) | | — | | — | | (2.28) |

| Net asset value, | | | | | | | | | | | | | | |

| end of period | | | | $ 27.81 | | $ 26.22 | | $ 25.05 | | $ 23.53 | | $ 16.28 | | $ 18.57 |

| Total ReturnB,C,D | | | | 16.37% | | 9.66% | | 6.60% | | 44.53% | | (12.33)% | | (20.86)% |

| Ratios to Average Net AssetsG | | | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | | | |

| reductions | | | | .94%A | | .94% | | .94% | | .91% | | 1.07% | | .94% |

| Expenses net of fee | | | | | | | | | | | | | | |

| waivers, if any | | | | .94%A | | .94% | | .94% | | .91% | | 1.07% | | .94% |

| Expenses net of all | | | | | | | | | | | | | | |

| reductions | | | | .88%A | | .90% | | .91% | | .88% | | 1.03% | | .91% |

| Net investment in | | | | | | | | | | | | | | |

| come (loss) | | | | .28%A | | (.05)%F | | (.12)% | | (.31)% | | (.35)% | | .17% |

| Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | |

| period (in millions) | | | | $ 8,166 | | $ 6,970 | | $ 5,861 | | $ 3,943 | | $ 1,705 | | $ 2,118 |

| Portfolio turnover | | | | | | | | | | | | | | |

| rate | | | | 198%A | | 109% | | 72% | | 54% | | 80% | | 120% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the former contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Investment income per share reflects a special dividend which amounted to $.03 per share. Excluding the special dividend, the ratio of net investment

income (loss) to average net assets would have been (.19)%.

G Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reduc

tions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when

reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions

from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund.

|

See accompanying notes which are an integral part of the financial statements.

21 Semiannual Report

Notes to Financial Statements

For the period ended April 30, 2006 (Unaudited)

(Amounts in thousands except ratios)

1. Significant Accounting Policies.

Fidelity Capital Appreciation Fund (the fund) is a fund of Fidelity Capital Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open end management investment company organized as a Massachusetts business trust. The fund may invest in affiliated money market central funds (Money Market Central Funds), which are open end investment companies available to investment companies and other accounts managed by Fidelity Management & Research Company (FMR) and its affili ates. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require manage ment to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Debt securities, including restricted securities, for which quotations are readily available, are valued by independent pricing services or by dealers who make markets in such securities. Pricing services consider yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices. Investments in open end mutual funds, are valued at their closing net asset value each business day. Short term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securi ties markets, reviewing developments in foreign markets and evaluating the performance of ADRs, futures contracts and exchange traded funds. Because the fund’s utilization of

| 1. Significant Accounting Policies continued |

Security Valuation continued | | |

fair value pricing depends on market activity, the frequency with which fair value pricing is used can not be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts’ terms.

Foreign denominated assets, including investment securities, and liabilities are trans lated into U.S. dollars at the exchange rate at period end. Purchases and sales of invest ment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex dividend date, except for certain dividends from foreign securities where the ex dividend date may have passed, which are recorded as soon as the fund is informed of the ex dividend date. Non cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securi ties. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

23 Semiannual Report

| Notes to Financial Statements (Unaudited) continued |

| (Amounts in thousands except ratios) |

| |

| 1. Significant Accounting Policies continued |

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees must defer receipt of a portion of, and may elect to defer receipt of an additional portion of, their annual compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of the fund or are invested in a cross section of other Fidelity funds, and are marked to market. Deferred amounts remain in the fund until distributed in accordance with the Plan.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex dividend date. Income and capital gain distribu tions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book tax differences will reverse in a subsequent period.

Book tax differences are primarily due to futures transactions, foreign currency transac tions, passive foreign investment companies (PFIC), deferred trustees compensation and losses deferred due to wash sales.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows:

| Unrealized appreciation | | | | $ 1,349,471 |

| Unrealized depreciation | | | | (102,696) |

| Net unrealized appreciation (depreciation) | | | | $ 1,246,775 |

| Cost for federal income tax purposes | | | | $ 7,365,830 |

| |

| 2. Operating Policies. | | | | |

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by

2. Operating Policies continued

Repurchase Agreements continued

government or non government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Futures Contracts. The fund may use futures contracts to manage its exposure to the stock market. Buying futures tends to increase a fund’s exposure to the underlying instrument, while selling futures tends to decrease a fund’s exposure to the underlying instrument or hedge other fund investments. Upon entering into a futures contract, a fund is required to deposit with a clearing broker, no later than the following business day, an amount (“initial margin”) equal to a certain percentage of the face value of the contract. The initial margin may be in the form of cash or securities and is transferred to a segregated account on settlement date. Subsequent payments (“variation margin”) are made or received by a fund depending on the daily fluctuations in the value of the futures contract and are accounted for as unrealized gains or losses. Realized gains (losses) are recorded upon the expiration or closing of the futures contract. Securities deposited to meet margin requirements are identified in the Schedule of Investments. Losses may arise from changes in the value of the underlying instruments or if the counterparties do not perform under the contract’s terms. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded.

Restricted Securities. The fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transac tions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the fund’s Schedule of Investments.

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short term securities and U.S. government securities, aggregated $7,655,012 and $6,945,207, respectively.

25 Semiannual Report

| Notes to Financial Statements (Unaudited) continued |

| (Amounts in thousands except ratios) |

| |

| 4. Fees and Other Transactions with Affiliates. |

Management Fee. FMR and its affiliates provide the fund with investment manage ment related services for which the fund pays a monthly management fee. The manage ment fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the fund’s average net assets and a group fee rate that averaged .27% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of .20% of the fund’s average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the fund’s relative investment performance as compared to an appropriate benchmark index. For the period, the total annualized management fee rate, including the performance adjustment, was .71% of the fund’s average net assets.

Transfer Agent Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the fund’s transfer, dividend disbursing and shareholder servicing agent. FSC receives account fees and asset based fees that vary according to account size and type of account. FSC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annualized rate of .21% of average net assets.

Accounting and Security Lending Fees. FSC maintains the fund’s accounting re cords. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Affiliated Central Funds. The fund may invest in Money Market Central Funds which seek preservation of capital and current income and are managed by Fidelity Invest ments Money Management, Inc. (FIMM), an affiliate of FMR.

The Money Market Central Funds do not pay a management fee.

Brokerage Commissions. The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $78 for the period.

5. Committed Line of Credit.

|

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the “line of credit”) to be utilized for temporary or emergency purposes to fund share holder redemptions or for other short term liquidity purposes. The fund has agreed to pay commitment fees on its pro rata portion of the line of credit, which amounts to $11 and is reflected in Miscellaneous Expense on the Statement of Operations. During the period, there were no borrowings on this line of credit.

The fund lends portfolio securities from time to time in order to earn additional income. On the settlement date of the loan, the fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the fund’s Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less fees and expenses associated with the loan, plus any premium payments that may be received on the loan of certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from affiliated central funds. Net income from lending portfolio securities during the period amounted to $1,094.

Many of the brokers with whom FMR places trades on behalf of the fund provided services to the fund in addition to trade execution. These services included payments of certain expenses on behalf of the fund totaling $2,216 for the period. In addition, through arrangements with the fund’s custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce the fund’s expenses. During the period, these credits reduced the fund’s custody and transfer agent expenses by $3 and $142 respectively.

The fund’s organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

27 Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees

Fidelity Capital Appreciation Fund

On January 19, 2006, the Board of Trustees, including the Independent Trustees (together, the Board), voted to approve a general research services agreement (the Agreement) between FMR, FMR Co., Inc. (FMRC), Fidelity Investments Money Manage ment, Inc. (FIMM), and Fidelity Research & Analysis Company (FRAC) (together, the Investment Advisers) for the fund, effective January 20, 2006, pursuant to which FRAC may provide general research and investment advisory support services to FMRC and FIMM. The Board considered that it has approved previously various sub advisory agreements for the fund with affiliates of FMR that allow FMR to obtain research, non discretionary advice, or discretionary portfolio management at no additional expense to the fund. The Board, assisted by the advice of fund counsel and independent Trustees’ counsel, considered a broad range of information and determined that it would be beneficial for the fund to access the research and investment advisory support services supplied by FRAC at no additional expense to the fund.

The Board reached this determination in part because the new arrangement will involve no changes in (i) the contractual terms of and fees payable under the fund’s manage ment contract or sub advisory agreements; (ii) the investment process or strategies employed in the management of the fund’s assets; (iii) the nature or level of services provided under the fund’s management contract or sub advisory agreements; (iv) the day to day management of the fund or the persons primarily responsible for such man agement; or (v) the ultimate control or beneficial ownership of FMR, FMRC, or FIMM. The Board also considered that the establishment of the Agreement would not necessi tate prior shareholder approval of the Agreement or result in an assignment and termination of the fund’s management contract or sub advisory agreements under the Investment Company Act of 1940.

Because the Board was approving an arrangement with FRAC under which the fund will not bear any additional management fees or expenses and under which the fund’s portfolio manager would not change, it did not consider the fund’s investment perfor mance, competitiveness of management fee and total expenses, costs of services and profitability, or economies of scale to be significant factors in its decision.

In connection with its future renewal of the fund’s management contract and sub advisory agreements, the Board will consider: (i) the nature, extent, and quality of services provided to the fund, including shareholder and administrative services and investment performance; (ii) the competitiveness of the fund’s management fee and total expenses; (iii) the costs of the services and profitability, including the revenues earned and the expenses incurred by Fidelity in conducting the business of developing, marketing, distributing, managing, administering, and servicing the fund and its shareholders; and (iv) whether there have been economies of scale in respect of the management of the Fidelity funds, whether the Fidelity funds (including the fund) have

appropriately benefited from any such economies of scale, and whether there is potential for realization of any further economies.

Based on its evaluation of all of the conclusions noted above, and after considering all material factors, the Board ultimately concluded that the fund’s Agreement is fair and reasonable, and that the fund’s Agreement should be approved.

29 Semiannual Report

Managing Your Investments

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

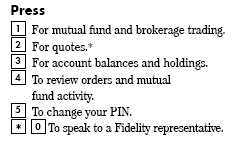

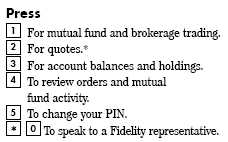

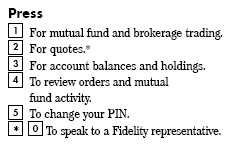

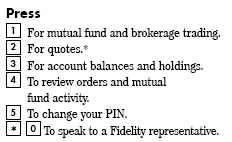

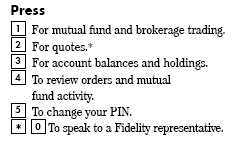

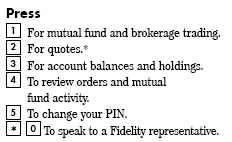

By Phone

Fidelity Automated Service Telephone provides a single toll free number to access account balances, positions, quotes and trading. It’s easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

By PC

Fidelity’s web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

* When you call the quotes line, please remember that a fund’s yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guar anteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains, and the effects of any sales charges.

Semiannual Report 30

To Write Fidelity

We’ll give your correspondence immediate attention and send you written confirmation upon completion of your request.

(such as changing name, address, bank, etc.)

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0002

|

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Overnight Express

Fidelity Investments

Attn: Distribution Services

100 Crosby Parkway KC1H

Covington, KY 41015

Selling shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0035

Overnight Express

Fidelity Investments

Attn: Distribution Services

100 Crosby Parkway KC1H

Covington, KY 41015

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

|

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Selling shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0035

Overnight Express

Fidelity Investments

Attn: Distribution Services

100 Crosby Parkway KC1H

Covington, KY 41015

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

|

31 Semiannual Report

| | Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub Advisers

FMR Co., Inc.

Fidelity Management & Research

(U.K.) Inc.

Fidelity Research & Analysis Company

(formerly Fidelity Management &

Research (Far East) Inc.)

Fidelity Investments Japan Limited

Fidelity International Investment

Advisors

Fidelity International Investment

Advisors (U.K.) Limited

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Service Agent

Fidelity Service Company, Inc.

Boston, MA

Custodian

Brown Brothers Harriman & Co.

Boston, MA

|

| The Fidelity Telephone Connection |

| Mutual Fund 24-Hour Service |

| Exchanges/Redemptions | | |

| and Account Assistance | | 1-800-544-6666 |

| Product Information | | 1-800-544-6666 |

| Retirement Accounts | | 1-800-544-4774 |

| (8 a.m. - 9 p.m.) | | |

| TDD Service | | 1-800-544-0118 |

| for the deaf and hearing impaired | | |

| (9 a.m. - 9 p.m. Eastern time) | | |

| Fidelity Automated Service | | |

| Telephone (FAST®) (automated phone logo) | | 1-800-544-5555 |

| (automated phone logo) Automated line for quickest service |

CAF USAN-0606

1.784911.103

|

| | Fidelity®

Disciplined Equity

Fund

|

| | Semiannual Report

April 30, 2006

|

| Contents | | | | |

| |

| Chairman’s Message | | 3 | | Ned Johnson’s message to shareholders. |

| Shareholder Expense | | 4 | | An example of shareholder expenses. |

| Example | | | | |

| Investment Changes | | 5 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 6 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 15 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, as |

| | | | | well as financial highlights. |

| Notes | | 19 | | Notes to the financial statements. |

| Board Approval of | | 25 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended

June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commis

sion’s (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of

the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies, Inc.

and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks

of FMR Corp. or an affiliated company.

|

| | This report and the financial statements contained herein are submitted for the general information

of the shareholders of the fund. This report is not authorized for distribution to prospective investors

in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third

quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at

http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Refer

ence Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference

Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio

holdings, view the most recent quarterly holdings report, semiannual report, or annual report

on Fidelity’s web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

|

Chairman’s Message

(photograph of Edward C. Johnson)

Dear Shareholder:

Although many securities markets made gains in early 2006, there is only one certainty when it comes to investing: There is no sure thing. There are, however, a number of time tested, funda mental investment principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets’ inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets’ best days can significantly diminish investor returns. Patience also affords the benefits of compounding of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn’t eliminate risk, it can considerably lessen the effect of short term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio’s long term success. The right mix of stocks, bonds and cash aligned to your particular risk tolerance and investment objective is very important. Age appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities which historically have been the best performing asset class over time is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more stable fixed investments (bonds or savings plans).

A third investment principle investing regularly can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won’t pay for all your shares at market highs. This strategy known as dollar cost averaging also reduces unconstructive “emotion” from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

3 Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2005 to April 30, 2006).

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the share holder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During Period* |

| | | Account Value | | Account Value | | November 1, 2005 |

| | | November 1, 2005 | | April 30, 2006 | | to April 30, 2006 |

| Actual | | | | $ 1,000.00 | | | | $ 1,108.10 | | | | $ 4.81 |

| Hypothetical (5% return per year | | | | | | | | | | | | |

| before expenses) | | | | $ 1,000.00 | | | | $ 1,020.23 | | | | $ 4.61 |

* Expenses are equal to the Fund’s annualized expense ratio of .92%; multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one half year period).

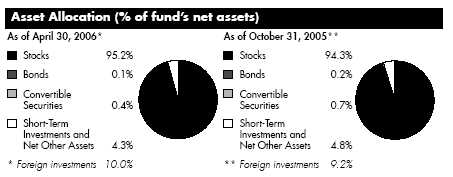

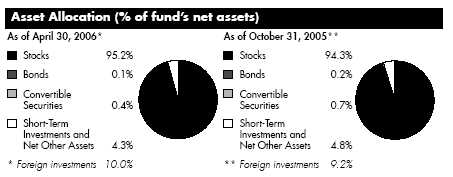

| Investment Changes | | | | |

| |

| |

| Top Ten Stocks as of April 30, 2006 | | | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Exxon Mobil Corp. | | 4.5 | | 3.3 |

| Hewlett Packard Co. | | 2.5 | | 1.2 |

| JCPenney Co., Inc. | | 2.4 | | 0.3 |

| Citigroup, Inc. | | 2.4 | | 0.4 |

| Prudential Financial, Inc. | | 2.2 | | 2.4 |

| International Business Machines Corp. | | 2.1 | | 2.0 |

| MetLife, Inc. | | 2.1 | | 2.4 |