UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02841

Fidelity Capital Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | April 30, 2024 |

Item 1.

Reports to Stockholders

Fidelity® Value Fund

Semi-Annual Report

April 30, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you're an individual investing directly with Fidelity, call 1-800-835-5092 if you're a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you're an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Top Holdings (% of Fund's net assets) |

| |

| Constellation Energy Corp. | 1.6 | |

| Antero Resources Corp. | 1.1 | |

| PG&E Corp. | 1.0 | |

| Global Payments, Inc. | 1.0 | |

| The AES Corp. | 0.9 | |

| WestRock Co. | 0.9 | |

| Expro Group Holdings NV | 0.9 | |

| Cenovus Energy, Inc. (Canada) | 0.9 | |

| Flex Ltd. | 0.8 | |

| Apollo Global Management, Inc. | 0.8 | |

| | 9.9 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Financials | 18.6 | |

| Industrials | 18.5 | |

| Consumer Discretionary | 11.8 | |

| Materials | 11.0 | |

| Energy | 10.4 | |

| Utilities | 8.4 | |

| Health Care | 6.3 | |

| Real Estate | 4.6 | |

| Consumer Staples | 3.2 | |

| Communication Services | 3.1 | |

| Information Technology | 2.9 | |

| |

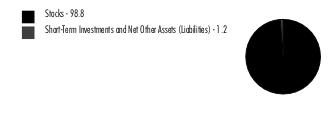

Asset Allocation (% of Fund's net assets) |

|

Futures - 0.9% |

|

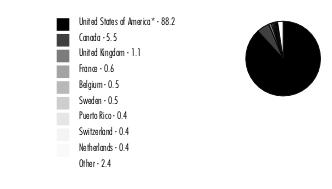

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| |

Showing Percentage of Net Assets

| Common Stocks - 98.8% |

| | | Shares | Value ($) (000s) |

| COMMUNICATION SERVICES - 3.1% | | | |

| Diversified Telecommunication Services - 0.3% | | | |

| Cellnex Telecom SA (a) | | 836,400 | 27,647 |

| Entertainment - 0.2% | | | |

| Ubisoft Entertainment SA (b) | | 804,600 | 19,037 |

| Interactive Media & Services - 0.4% | | | |

| Zoominfo Technologies, Inc. (b) | | 2,437,400 | 38,657 |

| Media - 2.2% | | | |

| Grupo Televisa SA de CV (CPO) sponsored ADR (c) | | 10,854,671 | 31,696 |

| Interpublic Group of Companies, Inc. | | 1,859,900 | 56,615 |

| Nexstar Media Group, Inc. Class A | | 237,200 | 37,966 |

| Thryv Holdings, Inc. (b) | | 1,572,263 | 36,178 |

| WPP PLC | | 3,634,600 | 36,430 |

| | | | 198,885 |

TOTAL COMMUNICATION SERVICES | | | 284,226 |

| CONSUMER DISCRETIONARY - 11.8% | | | |

| Automobile Components - 1.2% | | | |

| Aptiv PLC (b) | | 893,900 | 63,467 |

| Autoliv, Inc. | | 372,600 | 44,634 |

| Cie Automotive SA | | 66,805 | 1,775 |

| | | | 109,876 |

| Automobiles - 0.6% | | | |

| Harley-Davidson, Inc. | | 1,589,400 | 54,659 |

| Broadline Retail - 0.4% | | | |

| Kohl's Corp. (c) | | 1,349,900 | 32,317 |

| Distributors - 0.3% | | | |

| LKQ Corp. | | 621,900 | 26,823 |

| Diversified Consumer Services - 0.2% | | | |

| H&R Block, Inc. | | 472,822 | 22,331 |

| Hotels, Restaurants & Leisure - 1.5% | | | |

| Brinker International, Inc. (b) | | 916,657 | 49,133 |

| Everi Holdings, Inc. (b) | | 1,943,400 | 15,878 |

| Hilton Grand Vacations, Inc. (b) | | 851,200 | 35,444 |

| Marriott Vacations Worldwide Corp. | | 249,100 | 23,941 |

| Red Rock Resorts, Inc. | | 240,893 | 12,796 |

| | | | 137,192 |

| Household Durables - 1.3% | | | |

| Mohawk Industries, Inc. (b) | | 333,800 | 38,494 |

| Newell Brands, Inc. (c) | | 3,306,900 | 26,257 |

| Tempur Sealy International, Inc. | | 1,020,300 | 51,076 |

| | | | 115,827 |

| Leisure Products - 1.3% | | | |

| BRP, Inc. | | 692,000 | 46,557 |

| Brunswick Corp. | | 365,900 | 29,506 |

| Topgolf Callaway Brands Corp. (b) | | 2,809,700 | 45,011 |

| | | | 121,074 |

| Specialty Retail - 2.9% | | | |

| Academy Sports & Outdoors, Inc. | | 457,679 | 26,683 |

| Camping World Holdings, Inc. (c) | | 1,577,400 | 31,974 |

| Gap, Inc. | | 375,200 | 7,699 |

| Lithia Motors, Inc. Class A (sub. vtg.) (c) | | 207,800 | 52,860 |

| Sally Beauty Holdings, Inc. (b) | | 2,393,290 | 25,967 |

| Signet Jewelers Ltd. (c) | | 499,677 | 48,983 |

| Upbound Group, Inc. | | 1,533,274 | 47,547 |

| Victoria's Secret & Co. (b) | | 1,598,733 | 28,170 |

| | | | 269,883 |

| Textiles, Apparel & Luxury Goods - 2.1% | | | |

| Dr. Martens Ltd. (c) | | 14,428,400 | 13,702 |

| Gildan Activewear, Inc. | | 1,383,200 | 47,947 |

| PVH Corp. | | 492,000 | 53,530 |

| Samsonite International SA (a) | | 13,397,400 | 47,101 |

| Tapestry, Inc. | | 688,700 | 27,493 |

| | | | 189,773 |

TOTAL CONSUMER DISCRETIONARY | | | 1,079,755 |

| CONSUMER STAPLES - 3.2% | | | |

| Beverages - 0.3% | | | |

| Keurig Dr. Pepper, Inc. | | 812,200 | 27,371 |

| Consumer Staples Distribution & Retail - 0.6% | | | |

| U.S. Foods Holding Corp. (b) | | 1,038,100 | 52,165 |

| Food Products - 1.6% | | | |

| Archer Daniels Midland Co. | | 637,800 | 37,413 |

| Bunge Global SA | | 545,200 | 55,480 |

| Darling Ingredients, Inc. (b) | | 1,144,294 | 48,484 |

| Lamb Weston Holdings, Inc. | | 31,100 | 2,592 |

| | | | 143,969 |

| Personal Care Products - 0.4% | | | |

| Kenvue, Inc. | | 2,078,900 | 39,125 |

| Tobacco - 0.3% | | | |

| Philip Morris International, Inc. | | 328,300 | 31,169 |

TOTAL CONSUMER STAPLES | | | 293,799 |

| ENERGY - 10.4% | | | |

| Energy Equipment & Services - 3.8% | | | |

| Baker Hughes Co. Class A | | 1,705,800 | 55,643 |

| Expro Group Holdings NV (b) | | 4,206,000 | 78,905 |

| John Wood Group PLC (b) | | 2,440,021 | 4,525 |

| Liberty Oilfield Services, Inc. Class A | | 673,485 | 14,817 |

| Secure Energy Services, Inc. | | 3,208,100 | 27,172 |

| Tenaris SA | | 1,738,600 | 29,084 |

| Tidewater, Inc. (b) | | 505,900 | 46,467 |

| Valaris Ltd. (b) | | 813,500 | 52,926 |

| Vallourec SA (b) | | 2,309,700 | 40,092 |

| | | | 349,631 |

| Oil, Gas & Consumable Fuels - 6.6% | | | |

| Antero Resources Corp. (b) | | 2,866,100 | 97,476 |

| Canadian Natural Resources Ltd. | | 605,500 | 45,884 |

| Cenovus Energy, Inc. (Canada) | | 3,819,581 | 78,464 |

| Delek U.S. Holdings, Inc. (c) | | 974,400 | 26,630 |

| Diamondback Energy, Inc. | | 143,631 | 28,889 |

| Energy Transfer LP | | 2,351,097 | 36,983 |

| Imperial Oil Ltd. | | 699,900 | 48,121 |

| Imperial Oil Ltd. (U.S.) (c) | | 130,200 | 8,977 |

| Kosmos Energy Ltd. (b) | | 4,059,158 | 23,015 |

| MEG Energy Corp. (b) | | 762,100 | 17,333 |

| Phillips 66 Co. | | 423,900 | 60,707 |

| Range Resources Corp. | | 494,700 | 17,765 |

| Targa Resources Corp. | | 580,780 | 66,244 |

| Tourmaline Oil Corp. | | 892,600 | 43,623 |

| | | | 600,111 |

TOTAL ENERGY | | | 949,742 |

| FINANCIALS - 18.6% | | | |

| Banks - 3.5% | | | |

| Axos Financial, Inc. (b) | | 396,869 | 20,086 |

| Barclays PLC | | 4,118,700 | 10,384 |

| East West Bancorp, Inc. | | 634,566 | 47,269 |

| First Citizens Bancshares, Inc. | | 35,792 | 60,373 |

| First Citizens Bancshares, Inc. Class B | | 6,100 | 9,242 |

| KeyCorp | | 3,452,000 | 50,019 |

| M&T Bank Corp. | | 70,800 | 10,223 |

| Popular, Inc. | | 468,800 | 39,843 |

| U.S. Bancorp | | 1,175,600 | 47,765 |

| Webster Financial Corp. | | 713,800 | 31,286 |

| | | | 326,490 |

| Capital Markets - 3.5% | | | |

| Ameriprise Financial, Inc. | | 109,500 | 45,091 |

| BGC Group, Inc. Class A | | 5,558,930 | 43,526 |

| Carlyle Group LP | | 1,094,800 | 49,047 |

| LPL Financial | | 190,700 | 51,323 |

| Onex Corp. (sub. vtg.) | | 264,200 | 18,744 |

| Petershill Partners PLC (a) | | 8,282,600 | 21,579 |

| Raymond James Financial, Inc. | | 408,700 | 49,861 |

| UBS Group AG | | 1,508,810 | 39,836 |

| | | | 319,007 |

| Consumer Finance - 2.3% | | | |

| Ally Financial, Inc. | | 1,290,000 | 49,472 |

| Navient Corp. | | 1,394,200 | 20,941 |

| OneMain Holdings, Inc. | | 1,031,380 | 53,745 |

| PROG Holdings, Inc. | | 1,190,482 | 39,572 |

| SLM Corp. | | 2,236,679 | 47,395 |

| | | | 211,125 |

| Financial Services - 4.4% | | | |

| Apollo Global Management, Inc. | | 714,502 | 77,438 |

| Corebridge Financial, Inc. (c) | | 1,349,700 | 35,848 |

| ECN Capital Corp. | | 8,921,393 | 11,406 |

| Essent Group Ltd. | | 941,800 | 49,887 |

| Global Payments, Inc. | | 737,200 | 90,506 |

| NCR Atleos Corp. | | 2,204,150 | 43,929 |

| Voya Financial, Inc. | | 653,100 | 44,515 |

| WEX, Inc. (b) | | 227,700 | 48,104 |

| | | | 401,633 |

| Insurance - 4.9% | | | |

| AMBAC Financial Group, Inc. (b) | | 1,921,502 | 27,766 |

| American Financial Group, Inc. | | 467,500 | 59,723 |

| Assurant, Inc. | | 216,179 | 37,702 |

| First American Financial Corp. | | 787,300 | 42,176 |

| Globe Life, Inc. | | 424,824 | 32,359 |

| Hartford Financial Services Group, Inc. | | 651,000 | 63,075 |

| Primerica, Inc. | | 111,523 | 23,627 |

| Prudential PLC | | 1,918,500 | 16,686 |

| Reinsurance Group of America, Inc. | | 288,649 | 53,974 |

| Stewart Information Services Corp. | | 329,908 | 20,458 |

| The Travelers Companies, Inc. | | 254,400 | 53,974 |

| Unum Group | | 314,300 | 15,935 |

| | | | 447,455 |

TOTAL FINANCIALS | | | 1,705,710 |

| HEALTH CARE - 6.3% | | | |

| Biotechnology - 0.5% | | | |

| Alnylam Pharmaceuticals, Inc. (b) | | 11,400 | 1,641 |

| Biogen, Inc. (b) | | 50,965 | 10,948 |

| BioMarin Pharmaceutical, Inc. (b) | | 47,465 | 3,833 |

| Exact Sciences Corp. (b) | | 52,898 | 3,139 |

| Galapagos NV (b) | | 711,900 | 20,136 |

| United Therapeutics Corp. (b) | | 13,677 | 3,205 |

| | | | 42,902 |

| Health Care Equipment & Supplies - 0.8% | | | |

| Baxter International, Inc. | | 491,198 | 19,830 |

| Dentsply Sirona, Inc. | | 73,803 | 2,215 |

| Globus Medical, Inc. (b)(c) | | 34,800 | 1,733 |

| Hologic, Inc. (b) | | 98,232 | 7,443 |

| QuidelOrtho Corp. (b) | | 486,000 | 19,707 |

| STERIS PLC | | 26,775 | 5,477 |

| Teleflex, Inc. | | 15,110 | 3,154 |

| The Cooper Companies, Inc. | | 97,040 | 8,642 |

| Zimmer Biomet Holdings, Inc. | | 74,113 | 8,914 |

| | | | 77,115 |

| Health Care Providers & Services - 3.1% | | | |

| Acadia Healthcare Co., Inc. (b) | | 65,554 | 4,847 |

| AdaptHealth Corp. (b) | | 2,722,896 | 26,821 |

| BrightSpring Health Services, Inc. | | 1,748,400 | 18,690 |

| Cencora, Inc. | | 53,041 | 12,679 |

| Centene Corp. (b) | | 691,400 | 50,514 |

| Chemed Corp. | | 6,600 | 3,749 |

| Cigna Group | | 144,949 | 51,753 |

| CVS Health Corp. | | 610,500 | 41,337 |

| Encompass Health Corp. | | 57,752 | 4,815 |

| Henry Schein, Inc. (b) | | 47,342 | 3,280 |

| Humana, Inc. | | 92,700 | 28,004 |

| Molina Healthcare, Inc. (b) | | 26,468 | 9,055 |

| PACS Group, Inc. | | 815,400 | 20,361 |

| Quest Diagnostics, Inc. | | 71,414 | 9,868 |

| R1 RCM, Inc. (b) | | 46,200 | 568 |

| Tenet Healthcare Corp. (b) | | 31,100 | 3,492 |

| | | | 289,833 |

| Health Care Technology - 0.0% | | | |

| Doximity, Inc. (b) | | 19,700 | 479 |

| Life Sciences Tools & Services - 0.8% | | | |

| Agilent Technologies, Inc. | | 55,311 | 7,580 |

| Avantor, Inc. (b) | | 216,000 | 5,234 |

| Bio-Rad Laboratories, Inc. Class A (b) | | 10,906 | 2,942 |

| Charles River Laboratories International, Inc. (b) | | 27,726 | 6,349 |

| Fortrea Holdings, Inc. | | 822,500 | 30,095 |

| ICON PLC (b) | | 37,503 | 11,171 |

| Illumina, Inc. (b) | | 28,510 | 3,508 |

| Revvity, Inc. | | 19,700 | 2,019 |

| West Pharmaceutical Services, Inc. | | 4,700 | 1,680 |

| | | | 70,578 |

| Pharmaceuticals - 1.1% | | | |

| Bausch Health Cos., Inc. (United States) (b)(c) | | 76,800 | 673 |

| Catalent, Inc. (b) | | 44,176 | 2,467 |

| Elanco Animal Health, Inc. (b) | | 152,600 | 2,008 |

| Jazz Pharmaceuticals PLC (b) | | 276,867 | 30,663 |

| Organon & Co. | | 51,300 | 955 |

| Perrigo Co. PLC | | 60,100 | 1,963 |

| Royalty Pharma PLC | | 281,124 | 7,787 |

| Teva Pharmaceutical Industries Ltd. sponsored ADR (b) | | 2,500,600 | 35,133 |

| Viatris, Inc. | | 1,746,200 | 20,204 |

| | | | 101,853 |

TOTAL HEALTH CARE | | | 582,760 |

| INDUSTRIALS - 18.5% | | | |

| Air Freight & Logistics - 0.6% | | | |

| DHL Group | | 272,500 | 11,410 |

| FedEx Corp. | | 179,700 | 47,042 |

| | | | 58,452 |

| Building Products - 2.4% | | | |

| AZZ, Inc. | | 383,600 | 27,477 |

| Builders FirstSource, Inc. (b) | | 272,350 | 49,791 |

| Johnson Controls International PLC | | 785,700 | 51,125 |

| Tecnoglass, Inc. (c) | | 893,400 | 49,628 |

| UFP Industries, Inc. | | 338,400 | 38,138 |

| | | | 216,159 |

| Commercial Services & Supplies - 2.0% | | | |

| Driven Brands Holdings, Inc. (b) | | 2,532,600 | 36,292 |

| HNI Corp. | | 394,261 | 16,539 |

| The Brink's Co. | | 567,800 | 49,660 |

| The GEO Group, Inc. (b)(c) | | 1,960,958 | 29,140 |

| Vestis Corp. | | 2,729,137 | 50,271 |

| | | | 181,902 |

| Construction & Engineering - 1.6% | | | |

| Fluor Corp. (b) | | 1,027,000 | 41,419 |

| Granite Construction, Inc. | | 277,800 | 15,418 |

| MDU Resources Group, Inc. | | 1,922,400 | 47,483 |

| Willscot Mobile Mini Holdings (b) | | 1,216,400 | 44,958 |

| | | | 149,278 |

| Electrical Equipment - 1.4% | | | |

| Acuity Brands, Inc. | | 170,200 | 42,261 |

| GrafTech International Ltd. | | 4,838,609 | 8,322 |

| Regal Rexnord Corp. | | 339,156 | 54,730 |

| Siemens Energy AG (b) | | 935,800 | 19,275 |

| | | | 124,588 |

| Ground Transportation - 2.3% | | | |

| ArcBest Corp. | | 297,700 | 33,018 |

| Ryder System, Inc. | | 367,870 | 44,825 |

| TFI International, Inc. (Canada) | | 274,600 | 35,761 |

| U-Haul Holding Co. (non-vtg.) | | 757,625 | 46,458 |

| XPO, Inc. (b) | | 434,400 | 46,681 |

| | | | 206,743 |

| Machinery - 4.2% | | | |

| Allison Transmission Holdings, Inc. | | 706,429 | 51,958 |

| Atmus Filtration Technologies, Inc. | | 1,500,700 | 45,456 |

| Barnes Group, Inc. | | 1,215,600 | 42,206 |

| Chart Industries, Inc. (b)(c) | | 272,500 | 39,256 |

| CNH Industrial NV | | 3,236,400 | 36,895 |

| Gates Industrial Corp. PLC (b) | | 2,665,200 | 46,961 |

| Oshkosh Corp. | | 346,500 | 38,902 |

| Terex Corp. | | 489,600 | 27,442 |

| Timken Co. | | 676,996 | 60,402 |

| | | | 389,478 |

| Professional Services - 1.9% | | | |

| Clarivate PLC (b)(c) | | 4,777,773 | 32,298 |

| Concentrix Corp. | | 652,000 | 35,645 |

| First Advantage Corp. (c) | | 1,414,700 | 23,060 |

| Genpact Ltd. | | 698,700 | 21,478 |

| ManpowerGroup, Inc. | | 435,692 | 32,873 |

| WNS Holdings Ltd. | | 774,996 | 32,480 |

| | | | 177,834 |

| Trading Companies & Distributors - 2.1% | | | |

| Beacon Roofing Supply, Inc. (b) | | 255,600 | 25,184 |

| GMS, Inc. (b) | | 470,600 | 43,540 |

| Herc Holdings, Inc. | | 334,700 | 47,872 |

| Rush Enterprises, Inc. Class A | | 225,620 | 9,909 |

| WESCO International, Inc. | | 419,000 | 64,002 |

| | | | 190,507 |

TOTAL INDUSTRIALS | | | 1,694,941 |

| INFORMATION TECHNOLOGY - 2.9% | | | |

| Communications Equipment - 0.8% | | | |

| Ciena Corp. (b) | | 612,000 | 28,293 |

| Lumentum Holdings, Inc. (b) | | 1,070,694 | 46,854 |

| | | | 75,147 |

| Electronic Equipment, Instruments & Components - 0.8% | | | |

| Flex Ltd. (b) | | 2,717,311 | 77,851 |

| IT Services - 0.3% | | | |

| GoDaddy, Inc. (b) | | 202,700 | 24,806 |

| Semiconductors & Semiconductor Equipment - 0.6% | | | |

| First Solar, Inc. (b) | | 201,900 | 35,595 |

| ON Semiconductor Corp. (b) | | 244,600 | 17,161 |

| | | | 52,756 |

| Software - 0.4% | | | |

| NCR Voyix Corp. (b) | | 3,249,207 | 39,803 |

TOTAL INFORMATION TECHNOLOGY | | | 270,363 |

| MATERIALS - 11.0% | | | |

| Chemicals - 5.0% | | | |

| Axalta Coating Systems Ltd. (b) | | 885,737 | 27,848 |

| Cabot Corp. | | 443,100 | 40,424 |

| Celanese Corp. Class A | | 147,288 | 22,625 |

| Corteva, Inc. | | 763,312 | 41,318 |

| Methanex Corp. | | 1,030,419 | 49,367 |

| OCI NV | | 1,440,500 | 38,894 |

| Olin Corp. | | 890,400 | 46,550 |

| Syensqo SA | | 332,400 | 30,930 |

| The Chemours Co. LLC | | 2,334,645 | 62,452 |

| Tronox Holdings PLC | | 1,825,055 | 31,008 |

| Westlake Corp. | | 485,449 | 71,536 |

| | | | 462,952 |

| Construction Materials - 1.1% | | | |

| Eagle Materials, Inc. | | 139,900 | 35,074 |

| GCC S.A.B. de CV | | 2,994,900 | 34,088 |

| Martin Marietta Materials, Inc. | | 48,868 | 28,689 |

| | | | 97,851 |

| Containers & Packaging - 1.8% | | | |

| Berry Global Group, Inc. | | 249,000 | 14,103 |

| Graphic Packaging Holding Co. | | 1,431,300 | 36,999 |

| International Paper Co. | | 337,900 | 11,806 |

| O-I Glass, Inc. (b) | | 1,753,084 | 26,226 |

| WestRock Co. | | 1,688,800 | 80,995 |

| | | | 170,129 |

| Metals & Mining - 2.0% | | | |

| ATI, Inc. (b) | | 602,600 | 35,975 |

| Compass Minerals International, Inc. (c) | | 1,035,400 | 12,891 |

| Constellium NV (b) | | 3,774,614 | 74,322 |

| First Quantum Minerals Ltd. | | 1,286,563 | 16,336 |

| Perseus Mining Ltd. (Australia) | | 1,719,345 | 2,515 |

| Radius Recycling, Inc. Class A | | 685,000 | 11,933 |

| Steel Dynamics, Inc. | | 198,811 | 25,869 |

| | | | 179,841 |

| Paper & Forest Products - 1.1% | | | |

| Interfor Corp. (b)(d) | | 3,277,326 | 41,590 |

| Louisiana-Pacific Corp. | | 755,097 | 55,266 |

| | | | 96,856 |

TOTAL MATERIALS | | | 1,007,629 |

| REAL ESTATE - 4.6% | | | |

| Equity Real Estate Investment Trusts (REITs) - 4.0% | | | |

| Camden Property Trust (SBI) | | 515,800 | 51,415 |

| Extra Space Storage, Inc. | | 283,600 | 38,082 |

| Lamar Advertising Co. Class A | | 261,900 | 30,341 |

| Outfront Media, Inc. | | 2,924,137 | 46,377 |

| Prologis, Inc. | | 420,602 | 42,922 |

| Sun Communities, Inc. | | 196,100 | 21,830 |

| Ventas, Inc. | | 1,559,000 | 69,033 |

| Welltower, Inc. | | 710,800 | 67,725 |

| | | | 367,725 |

| Real Estate Management & Development - 0.6% | | | |

| Compass, Inc. (b) | | 11,235,676 | 35,392 |

| Newmark Group, Inc. | | 1,792,700 | 17,156 |

| | | | 52,548 |

TOTAL REAL ESTATE | | | 420,273 |

| UTILITIES - 8.4% | | | |

| Electric Utilities - 5.4% | | | |

| Constellation Energy Corp. | | 775,169 | 144,125 |

| Edison International | | 881,384 | 62,631 |

| Entergy Corp. | | 439,200 | 46,849 |

| FirstEnergy Corp. | | 1,741,000 | 66,750 |

| NextEra Energy, Inc. | | 635,300 | 42,546 |

| NRG Energy, Inc. | | 209,400 | 15,217 |

| PG&E Corp. | | 5,576,200 | 95,409 |

| SSE PLC | | 1,044,800 | 21,718 |

| | | | 495,245 |

| Gas Utilities - 0.8% | | | |

| Southwest Gas Holdings, Inc. | | 432,100 | 32,243 |

| UGI Corp. | | 1,617,100 | 41,333 |

| | | | 73,576 |

| Independent Power and Renewable Electricity Producers - 1.4% | | | |

| The AES Corp. | | 4,723,300 | 84,547 |

| Vistra Corp. | | 575,500 | 43,646 |

| | | | 128,193 |

| Multi-Utilities - 0.8% | | | |

| Algonquin Power & Utilities Corp. | | 5,219,600 | 31,887 |

| Sempra | | 639,800 | 45,829 |

| | | | 77,716 |

TOTAL UTILITIES | | | 774,730 |

| TOTAL COMMON STOCKS (Cost $7,182,200) | | | 9,063,928 |

| | | | |

| U.S. Treasury Obligations - 0.1% |

| | | Principal Amount (e) (000s) | Value ($) (000s) |

U.S. Treasury Bills, yield at date of purchase 5.29% to 5.29% 5/16/24 to 5/30/24 (Cost $4,803) | | 4,820 | 4,803 |

| | | | |

| Money Market Funds - 1.9% |

| | | Shares | Value ($) (000s) |

| Fidelity Cash Central Fund 5.39% (f) | | 977 | 1 |

| Fidelity Securities Lending Cash Central Fund 5.39% (f)(g) | | 176,882,852 | 176,901 |

| TOTAL MONEY MARKET FUNDS (Cost $176,902) | | | 176,902 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 100.8% (Cost $7,363,905) | 9,245,633 |

NET OTHER ASSETS (LIABILITIES) - (0.8)% | (75,877) |

| NET ASSETS - 100.0% | 9,169,756 |

| | |

| Futures Contracts |

| | Number of contracts | Expiration Date | Notional Amount ($) (000s) | Value ($) (000s) | Unrealized Appreciation/ (Depreciation) ($) (000s) |

| Purchased | | | | | |

| | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini S&P MidCap 400 Index Contracts (United States) | 296 | Jun 2024 | 85,165 | (747) | (747) |

| | | | | | |

| The notional amount of futures purchased as a percentage of Net Assets is 0.9% |

Any values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $96,327,000 or 1.1% of net assets. |

| (c) | Security or a portion of the security is on loan at period end. |

| (e) | Amount is stated in United States dollars unless otherwise noted. |

| (f) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (g) | Investment made with cash collateral received from securities on loan. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate (Amounts in thousands) | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 32,997 | 2,188,587 | 2,221,584 | 2,317 | 1 | - | 1 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 174,301 | 894,447 | 891,847 | 2,041 | - | - | 176,901 | 0.6% |

| Total | 207,298 | 3,083,034 | 3,113,431 | 4,358 | 1 | - | 176,902 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are presented in the table below. Certain corporate actions, such as mergers, are excluded from the amounts in this table if applicable. A dash in the Value end of period ($) column means either the issuer is no longer held at period end, or the issuer is held at period end but is no longer an affiliate.

| Affiliate (Amounts in thousands) | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Interfor Corp. | 15,768 | 35,424 | 5,564 | - | (274) | (3,764) | 41,590 |

| Total | 15,768 | 35,424 | 5,564 | - | (274) | (3,764) | 41,590 |

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of April 30, 2024, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

Description (Amounts in thousands) | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Communication Services | 284,226 | 220,149 | 64,077 | - |

Consumer Discretionary | 1,079,755 | 1,032,654 | 47,101 | - |

Consumer Staples | 293,799 | 293,799 | - | - |

Energy | 949,742 | 949,742 | - | - |

Financials | 1,705,710 | 1,678,640 | 27,070 | - |

Health Care | 582,760 | 562,624 | 20,136 | - |

Industrials | 1,694,941 | 1,683,531 | 11,410 | - |

Information Technology | 270,363 | 270,363 | - | - |

Materials | 1,007,629 | 1,005,114 | 2,515 | - |

Real Estate | 420,273 | 420,273 | - | - |

Utilities | 774,730 | 753,012 | 21,718 | - |

|

| U.S. Government and Government Agency Obligations | 4,803 | - | 4,803 | - |

|

| Money Market Funds | 176,902 | 176,902 | - | - |

| Total Investments in Securities: | 9,245,633 | 9,046,803 | 198,830 | - |

Derivative Instruments: Liabilities | | | | |

Futures Contracts | (747) | (747) | - | - |

| Total Liabilities | (747) | (747) | - | - |

| Total Derivative Instruments: | (747) | (747) | - | - |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of April 30, 2024. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

Primary Risk Exposure / Derivative Type | Value |

| (Amounts in thousands) | Asset ($) | Liability ($) |

| Equity Risk | | |

Futures Contracts (a) | 0 | (747) |

| Total Equity Risk | 0 | (747) |

| Total Value of Derivatives | 0 | (747) |

(a)Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

| Statement of Assets and Liabilities |

| Amounts in thousands (except per-share amounts) | | | | April 30, 2024 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $167,428) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $7,138,011) | $ | 9,027,141 | | |

Fidelity Central Funds (cost $176,902) | | 176,902 | | |

Other affiliated issuers (cost $48,992) | | 41,590 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $7,363,905) | | | $ | 9,245,633 |

| Cash | | | | 333 |

| Foreign currency held at value (cost $693) | | | | 689 |

| Receivable for investments sold | | | | 186,929 |

| Receivable for fund shares sold | | | | 1,476 |

| Dividends receivable | | | | 9,423 |

| Distributions receivable from Fidelity Central Funds | | | | 165 |

| Prepaid expenses | | | | 3 |

| Other receivables | | | | 433 |

Total assets | | | | 9,445,084 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 80,057 | | |

| Payable for fund shares redeemed | | 3,003 | | |

| Accrued management fee | | 6,288 | | |

| Notes payable to affiliates | | 7,684 | | |

| Payable for daily variation margin on futures contracts | | 747 | | |

| Other payables and accrued expenses | | 667 | | |

| Collateral on securities loaned | | 176,882 | | |

| Total liabilities | | | | 275,328 |

| Net Assets | | | $ | 9,169,756 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 6,753,732 |

| Total accumulated earnings (loss) | | | | 2,416,024 |

| Net Assets | | | $ | 9,169,756 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Value : | | | | |

Net Asset Value, offering price and redemption price per share ($7,981,130 ÷ 538,465 shares) | | | $ | 14.82 |

| Class K : | | | | |

Net Asset Value, offering price and redemption price per share ($1,188,626 ÷ 80,121 shares) | | | $ | 14.84 |

| Statement of Operations |

| Amounts in thousands | | | | Six months ended April 30, 2024 (Unaudited) |

| Investment Income | | | | |

| Dividends | | | $ | 80,501 |

| Interest | | | | 376 |

| Income from Fidelity Central Funds (including $2,041 from security lending) | | | | 4,358 |

| Total income | | | | 85,235 |

| Expenses | | | | |

| Management fee | | | | |

| Basic fee | $ | 24,606 | | |

| Performance adjustment | | 8,628 | | |

| Transfer agent fees | | 3,316 | | |

| Accounting fees | | 386 | | |

| Custodian fees and expenses | | 49 | | |

| Independent trustees' fees and expenses | | 21 | | |

| Registration fees | | 123 | | |

| Audit | | 33 | | |

| Legal | | 12 | | |

| Interest | | 6 | | |

| Miscellaneous | | 16 | | |

| Total expenses before reductions | | 37,196 | | |

| Expense reductions | | (395) | | |

| Total expenses after reductions | | | | 36,801 |

| Net Investment income (loss) | | | | 48,434 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 538,816 | | |

| Fidelity Central Funds | | 1 | | |

| Other affiliated issuers | | (274) | | |

| Foreign currency transactions | | 68 | | |

| Futures contracts | | 21,006 | | |

| Total net realized gain (loss) | | | | 559,617 |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 1,114,448 | | |

| Affiliated issuers | | (3,764) | | |

| Assets and liabilities in foreign currencies | | 4 | | |

| Futures contracts | | (747) | | |

| Total change in net unrealized appreciation (depreciation) | | | | 1,109,941 |

| Net gain (loss) | | | | 1,669,558 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 1,717,992 |

| Statement of Changes in Net Assets |

| |

| Amount in thousands | | Six months ended April 30, 2024 (Unaudited) | | Year ended October 31, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 48,434 | $ | 80,170 |

| Net realized gain (loss) | | 559,617 | | 269,308 |

| Change in net unrealized appreciation (depreciation) | | 1,109,941 | | (258,943) |

| Net increase (decrease) in net assets resulting from operations | | 1,717,992 | | 90,535 |

| Distributions to shareholders | | (317,212) | | (550,862) |

| | | | | |

| Share transactions - net increase (decrease) | | 600,330 | | (720,277) |

| Total increase (decrease) in net assets | | 2,001,110 | | (1,180,604) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 7,168,646 | | 8,349,250 |

| End of period | $ | 9,169,756 | $ | 7,168,646 |

| | | | | |

| | | | | |

Financial Highlights

| | Six months ended (Unaudited) April 30, 2024 | | Years ended October 31, 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.52 | $ | 13.27 | $ | 15.72 | $ | 9.57 | $ | 10.59 | $ | 11.15 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .08 | | .13 | | .17 | | .12 | | .12 | | .14 |

| Net realized and unrealized gain (loss) | | 2.75 | | - C | | (1.18) | | 6.15 | | (.77) | | .71 |

| Total from investment operations | | 2.83 | | .13 | | (1.01) | | 6.27 | | (.65) | | .85 |

| Distributions from net investment income | | (.15) | | (.09) | | (.20) | | (.12) | | (.14) D | | (.12) |

| Distributions from net realized gain | | (.38) | | (.80) | | (1.24) | | - | | (.23) D | | (1.29) |

| Total distributions | | (.53) | | (.88) E | | (1.44) | | (.12) | | (.37) | | (1.41) |

| Net asset value, end of period | $ | 14.82 | $ | 12.52 | $ | 13.27 | $ | 15.72 | $ | 9.57 | $ | 10.59 |

Total Return F,G | | | | .97% | | (6.80)% | | 65.91% | | (6.52)% | | 9.31% |

Ratios to Average Net Assets A,H,I | | | | | | | | | | | | |

| Expenses before reductions | | .85% J | | .87% | | .83% | | .79% | | .57% | | .58% |

| Expenses net of fee waivers, if any | | | | .87% | | .83% | | .79% | | .57% | | .58% |

| Expenses net of all reductions | | .84% J | | .87% | | .83% | | .79% | | .55% | | .58% |

| Net investment income (loss) | | 1.08% J | | .99% | | 1.18% | | .82% | | 1.30% | | 1.38% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (in millions) | $ | 7,981 | $ | 6,539 | $ | 7,190 | $ | 8,361 | $ | 4,760 | $ | 6,112 |

Portfolio turnover rate K | | | | 69% | | 74% | | 77% | | 90% | | 75% |

ANet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

BCalculated based on average shares outstanding during the period.

CAmount represents less than $.005 per share.

DThe amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

ETotal distributions per share do not sum due to rounding.

FTotal returns for periods of less than one year are not annualized.

GTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

HFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

IExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

JAnnualized.

KAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

Fidelity® Value Fund Class K |

| |

| | Six months ended (Unaudited) April 30, 2024 | | Years ended October 31, 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.54 | $ | 13.30 | $ | 15.74 | $ | 9.59 | $ | 10.60 | $ | 11.16 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .08 | | .14 | | .18 | | .13 | | .13 | | .15 |

| Net realized and unrealized gain (loss) | | 2.77 | | - C | | (1.17) | | 6.15 | | (.76) | | .72 |

| Total from investment operations | | 2.85 | | .14 | | (.99) | | 6.28 | | (.63) | | .87 |

| Distributions from net investment income | | (.16) | | (.10) | | (.21) | | (.13) | | (.15) D | | (.13) |

| Distributions from net realized gain | | (.38) | | (.80) | | (1.24) | | - | | (.23) D | | (1.29) |

| Total distributions | | (.55) E | | (.90) | | (1.45) | | (.13) | | (.38) | | (1.43) E |

| Net asset value, end of period | $ | 14.84 | $ | 12.54 | $ | 13.30 | $ | 15.74 | $ | 9.59 | $ | 10.60 |

Total Return F,G | | | | .99% | | (6.63)% | | 65.90% | | (6.33)% | | 9.43% |

Ratios to Average Net Assets B,H,I | | | | | | | | | | | | |

| Expenses before reductions | | .77% J | | .79% | | .75% | | .71% | | .47% | | .49% |

| Expenses net of fee waivers, if any | | | | .78% | | .74% | | .71% | | .47% | | .49% |

| Expenses net of all reductions | | .76% J | | .78% | | .74% | | .71% | | .45% | | .48% |

| Net investment income (loss) | | 1.16% J | | 1.07% | | 1.27% | | .91% | | 1.40% | | 1.48% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (in millions) | $ | 1,189 | $ | 630 | $ | 1,160 | $ | 1,168 | $ | 493 | $ | 740 |

Portfolio turnover rate K | | | | 69% | | 74% | | 77% | | 90% | | 75% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CAmount represents less than $.005 per share.

DThe amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

ETotal distributions per share do not sum due to rounding.

FTotal returns for periods of less than one year are not annualized.

GTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

HFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

IExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

JAnnualized.

KAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

For the period ended April 30, 2024

(Amounts in thousands except percentages)

1. Organization.

Fidelity Value Fund (the Fund) is a fund of Fidelity Capital Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Value and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing services or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing services who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing services. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price or official closing price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of April 30, 2024 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Certain Funds may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Funds may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any withholding tax reclaims income is included in the Statement of Operations in dividends. Any receivables for withholding tax reclaims are included in the Statement of Assets and Liabilities in dividends receivable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of a fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of a fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred, as applicable. Certain expense reductions may also differ by class, if applicable. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds (ETFs). Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund (ETF). Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for certain Funds, certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in affiliated mutual funds, are marked-to-market and remain in a fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees presented below are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, as applicable.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), future transactions, partnerships and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $2,223,747 |

| Gross unrealized depreciation | (382,064) |

| Net unrealized appreciation (depreciation) | $1,841,683 |

| Tax cost | $7,403,950 |

Restricted Securities (including Private Placements). Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities held at period end is included at the end of the Schedule of Investments, if applicable.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objectives allow for various types of derivative instruments, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

Derivatives were used to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the objectives may not be achieved.

Derivatives were used to increase or decrease exposure to the following risk(s):

| | |

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

Funds are also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that a fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to a fund. Counterparty credit risk related to exchange-traded contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. Futures contracts were used to manage exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end, and is representative of volume of activity during the period unless an average notional amount is presented. Any securities deposited to meet initial margin requirements are identified in the Schedule of Investments. Any cash deposited to meet initial margin requirements is presented as segregated cash with brokers for derivative instruments in the Statement of Assets and Liabilities.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, U.S. government securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| Fidelity Value Fund | 3,754,990 | 3,479,301 |

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee.

Effective March 1, 2024, the Fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (Transfer Agent and Accounting agreements). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The investment adviser or an affiliate pays certain expenses of managing and operating the Fund out of each class's management fee. Each class of the Fund pays a management fee to the investment adviser. The management fee is calculated and paid to the investment adviser every month. The management fee is determined by calculating a basic fee and then applying a performance adjustment. When determining a class's basic fee, a mandate rate is calculated based on the monthly average net assets of a group of funds advised by FMR within a designated asset class. A discount rate is subtracted from the mandate rate once the Fund's monthly average net assets reach a certain level. The mandate rate and discount rate may vary by class. The annual basic fee rate for a class of shares of the Fund is the lesser of (1) the class's mandate rate reduced by the class's discount rate (if applicable) or (2) the amount set forth in the following table.

| | Maximum Management Fee Rate % |

| Value | .63 |

| Class K | .55 |

One-twelfth of the basic fee rate for a class is applied to the average net assets of the class for the month, giving a dollar amount which is the basic fee for the class for that month. A different management fee rate may be applicable to each class of the Fund. The difference between classes is the result of separate arrangements for class-level services and/or waivers of certain expenses. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the Fund's assets, which do not vary by class. For the portion of the reporting period on or after March 1, 2024, the total annualized management fee rates were as follows:

| | Total Management Fee Rate % |

| Value | .63 |

| Class K | .55 |

Prior to March 1, 2024, the management fee was the sum of an individual fund fee rate that was based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .22% during the period. The group fee rate was based upon the monthly average net assets of a group of registered investment companies with which the investment adviser has management contracts. The group fee rate decreased as assets under management increased and increased as assets under management decreased. For the portion of the reporting period prior to March 1, 2024, the total annualized management fee rate was .52%.

The performance adjustment rate is calculated monthly by comparing over the performance period the Fund's performance to that of the performance adjustment index listed below.

| | Performance Adjustment Index |

| Fidelity Value Fund | Russell Midcap Value Index |

For the purposes of calculating the performance adjustment for the Fund, the Fund's investment performance is based on the performance of Value. To the extent that other classes of the Fund have higher expenses, this could result in those classes bearing a larger positive performance adjustment and smaller negative performance adjustment than would be the case if each class's own performance were considered. The performance period is the most recent 36 month period. The maximum annualized performance adjustment rate is ±.20% of the Fund's average net assets over the performance period. The performance adjustment rate is divided by twelve and multiplied by the Fund's average net assets over the performance period, and the resulting dollar amount is proportionately added to or subtracted from a class's basic fee. For the entire reporting period, the total annualized performance adjustment was .19%.

Effective March 1, 2024, the Fund's sub-advisory agreements with FMR Investment Management (UK) Limited, Fidelity Management & Research (Hong Kong) Limited, and Fidelity Management & Research (Japan) Limited were amended to provide that the investment adviser pays each sub-adviser monthly fees equal to 110% of the sub-adviser's costs for providing sub-advisory services.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. Effective March 1, 2024, the Fund's management contract was amended to incorporate transfer agent services and associated fees previously covered under a separate services agreement. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

During November 2023, the Board approved a change in the transfer agent fees effective December 1, 2023 to a fixed annual rate of class-level average net assets as follows:

| | % of Class-Level Average Net Assets |

| Value | .1269 |

Prior to December 1, 2023, FIIOC received account fees and asset-based fees that varied according to the account size and type of account of the shareholders of Value, except for Class K. FIIOC received an asset-based fee of Class K's average net assets. For the portion of the reporting period prior to March 1, 2024, the fees were equivalent to the following annualized rates:

| | Amount ($) | % of Class-Level Average Net AssetsA |

| Value | 3,167 | .13 |

| Class K | 149 | .04 |

| | 3,316 | |

A Annualized

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. Effective March 1, 2024, the Fund's management contract was amended to incorporate accounting services and associated fees previously covered under a separate services agreement.

During November 2023, the Board approved a change in the accounting fees effective December 1, 2023 to a fixed annual rate of average net assets as follows:

| | % of Average Net Assets |

| Fidelity Value Fund | .0134 |

Prior to December 1, 2023, the accounting fee was based on the level of average net assets for each month. For the portion of the reporting period prior to March 1, 2024, the fees were equivalent to the following annualized rates:

| | % of Average Net Assets |

| Fidelity Value Fund | .01 |

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| | Amount ($) |

| Fidelity Value Fund | 108 |

Interfund Lending Program. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the Fund, along with other registered investment companies having management contracts with Fidelity Management & Research Company LLC (FMR), or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. Any open loans, including accrued interest, at period end are presented as Notes payable to affiliates in the Statement of Assets and Liabilities. Activity in this program during the period for which loans were outstanding was as follows:

| | Borrower or Lender | Average Loan Balance ($) | Weighted Average Interest Rate | Interest Expense ($) |

| Fidelity Value Fund | Borrower | 9,064 | 5.57% | 6 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. Interfund trades during the period are noted in the table below.

| | Purchases ($) | Sales ($) | Realized Gain (Loss)($) |

| Fidelity Value Fund | 151,825 | 299,435 | 46,227 |

7. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Statement of Operations, and are listed below. During the period, there were no borrowings on this line of credit.

| | Amount ($) |

| Fidelity Value Fund | 8 |

8. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS ($) | Security Lending Income From Securities Loaned to NFS ($) | Value of Securities Loaned to NFS at Period End ($) |

| Fidelity Value Fund | 217 | -A | - |

A In the amount of less than five hundred dollars.

9. Expense Reductions.

During the period the investment adviser or an affiliate reimbursed and/or waived a portion of fund-level operating expenses in the amount of $395.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended April 30, 2024 | Year ended October 31, 2023 |

| Fidelity Value Fund | | |

| Distributions to shareholders | | |

| Value | $275,443 | $473,295 |

| Class K | 41,769 | 77,567 |

Total | $317,212 | $550,862 |

11. Share Transactions.

Share transactions for each class were as follows and may contain in-kind transactions, automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended April 30, 2024 | Year ended October 31, 2023 | Six months ended April 30, 2024 | Year ended October 31, 2023 |

| Fidelity Value Fund | | | | |

| Value | | | | |

| Shares sold | 34,803 | 25,663 | $493,834 | $340,386 |

| Reinvestment of distributions | 18,648 | 34,449 | 250,634 | 434,054 |

| Shares redeemed | (37,422) | (79,290) | (533,543) | (1,032,323) |

| Net increase (decrease) | 16,029 | (19,178) | $210,925 | $(257,883) |

| Class K | | | | |

| Shares sold | 34,657 | 11,753 | $460,535 | $155,225 |

| Reinvestment of distributions | 3,103 | 6,151 | 41,769 | 77,567 |

| Shares redeemed | (7,842) | (54,898) | (112,899) | (695,186) |

| Net increase (decrease) | 29,918 | (36,994) | $389,405 | $(462,394) |

12. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

13. Risk and Uncertainties.

Many factors affect a fund's performance. Developments that disrupt global economies and financial markets, such as pandemics, epidemics, outbreaks of infectious diseases, war, terrorism, and environmental disasters, may significantly affect a fund's investment performance. The effects of these developments to a fund will be impacted by the types of securities in which a fund invests, the financial condition, industry, economic sector, and geographic location of an issuer, and a fund's level of investment in the securities of that issuer. Significant concentrations in security types, issuers, industries, sectors, and geographic locations may magnify the factors that affect a fund's performance.

As a shareholder, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or redemption proceeds, as applicable and (2) ongoing costs, which generally include management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2023 to April 30, 2024). |

Actual Expenses