UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2841

Fidelity Capital Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | October 31, 2010 |

Item 1. Reports to Stockholders

Fidelity®

Capital Appreciation

Fund

Annual Report

October 31, 2010

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | The Chairman's message to shareholders. |

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion of Fund Performance | <Click Here> | The Portfolio Manager's review of fundperformance and strategy. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

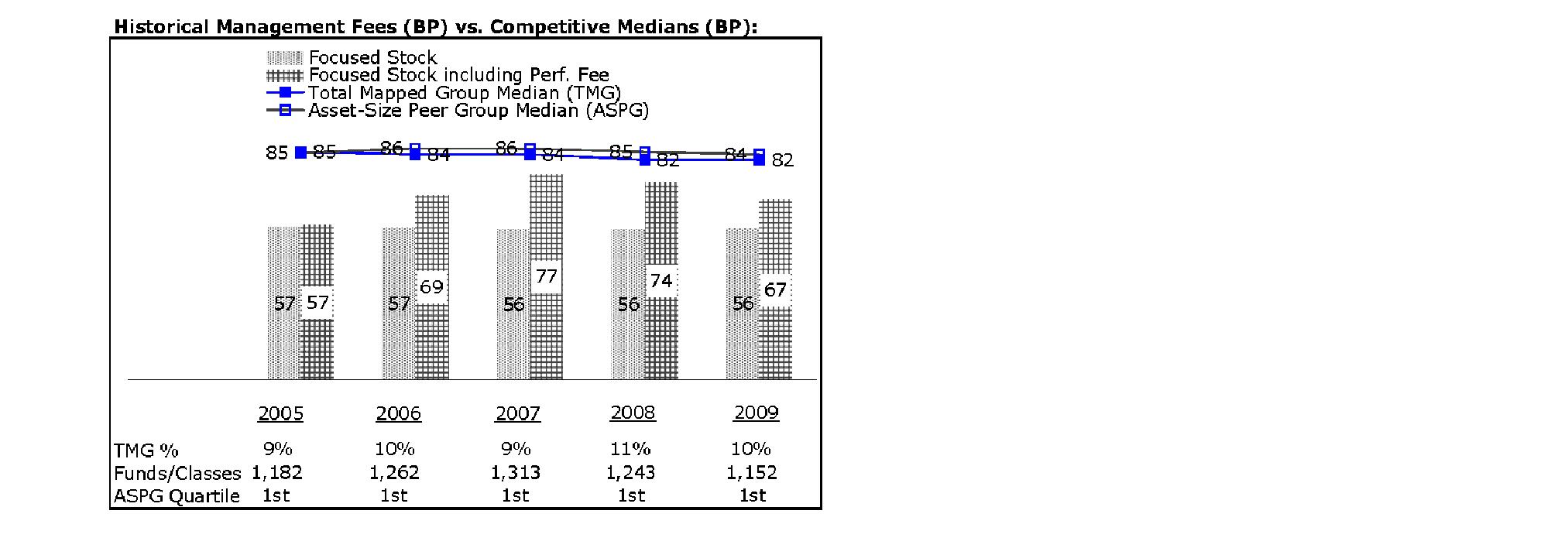

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Equities have staged a rally in the second half of 2010, shaking off concerns about the European debt crisis and the possibility of a double-dip recession in the U.S. Although the short-term surge pushed major equity indexes back into positive territory for the year, several questions remain about the longer-term outlook, including lackluster economic growth and persistently high unemployment. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The chairman's signature appears here.)

Edward C. Johnson 3d

Annual Report

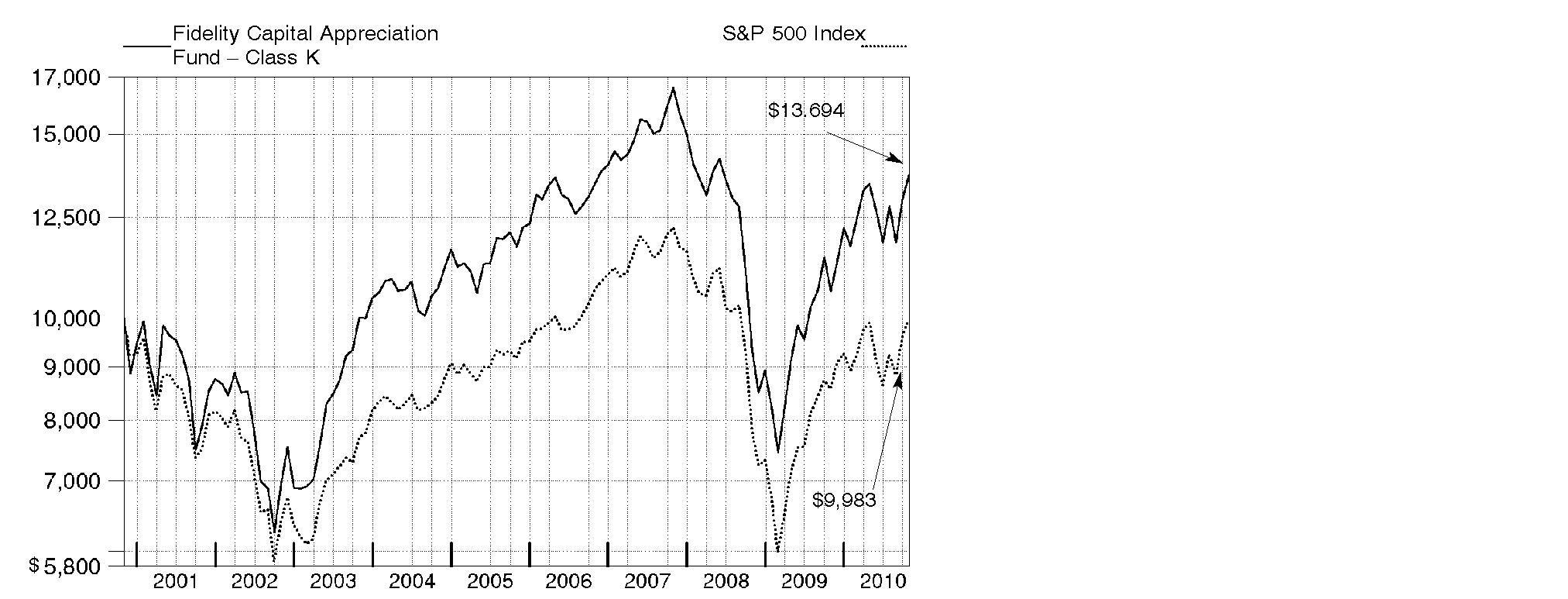

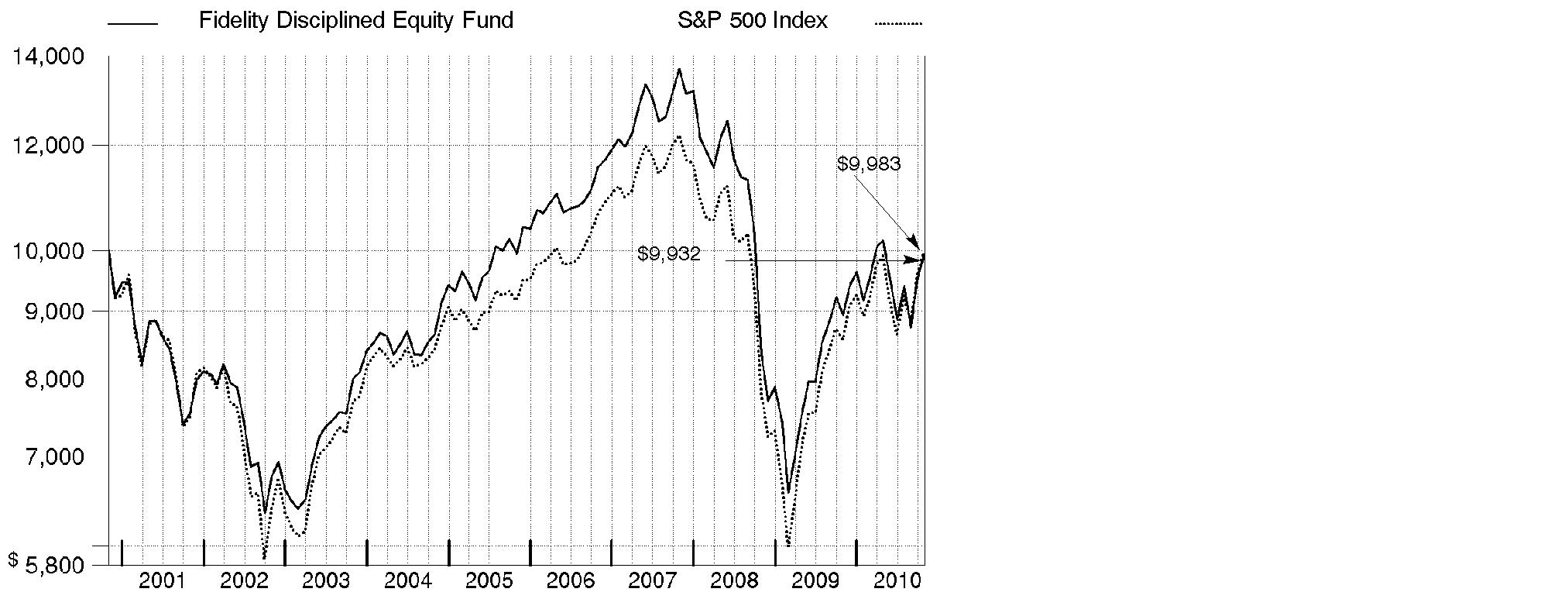

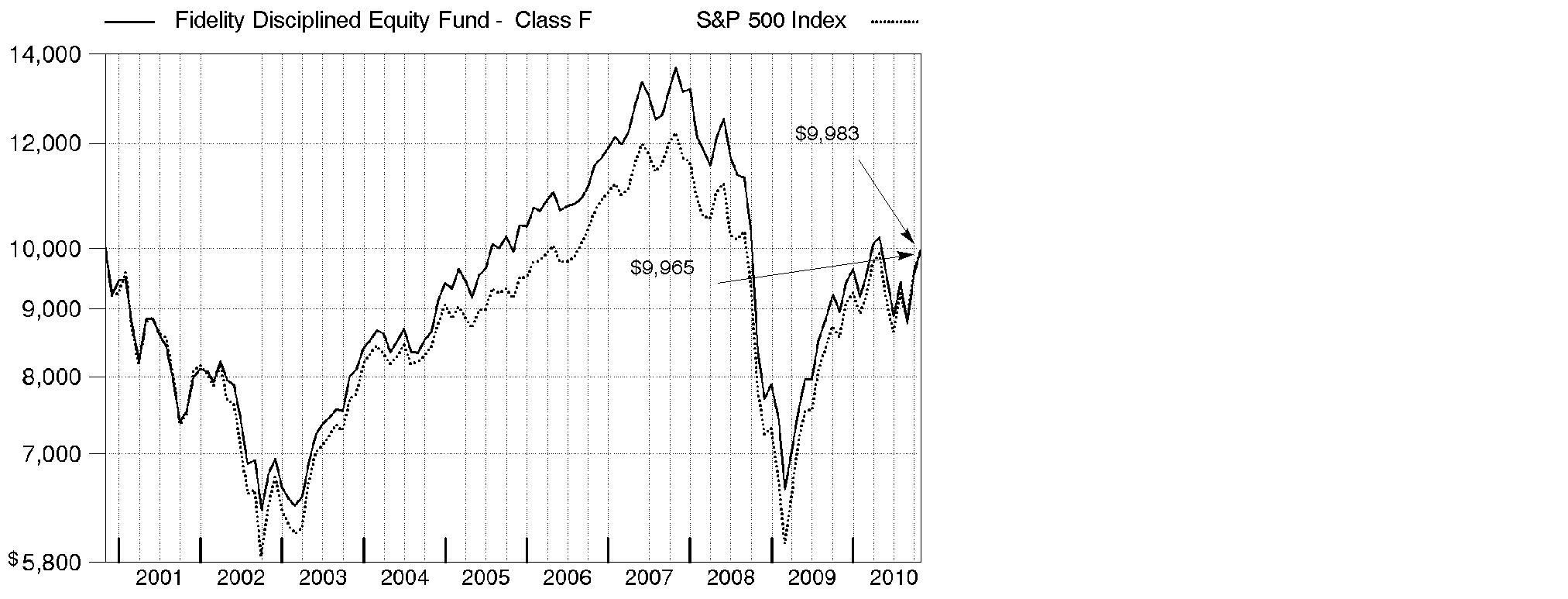

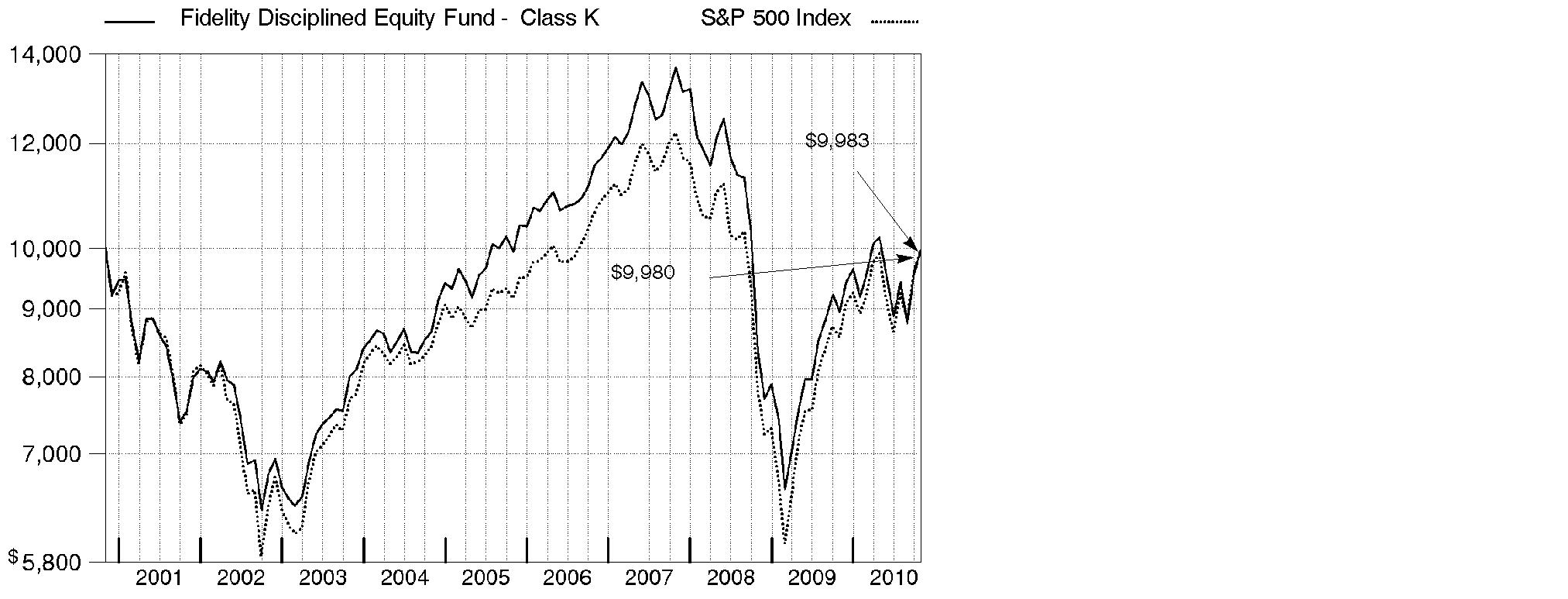

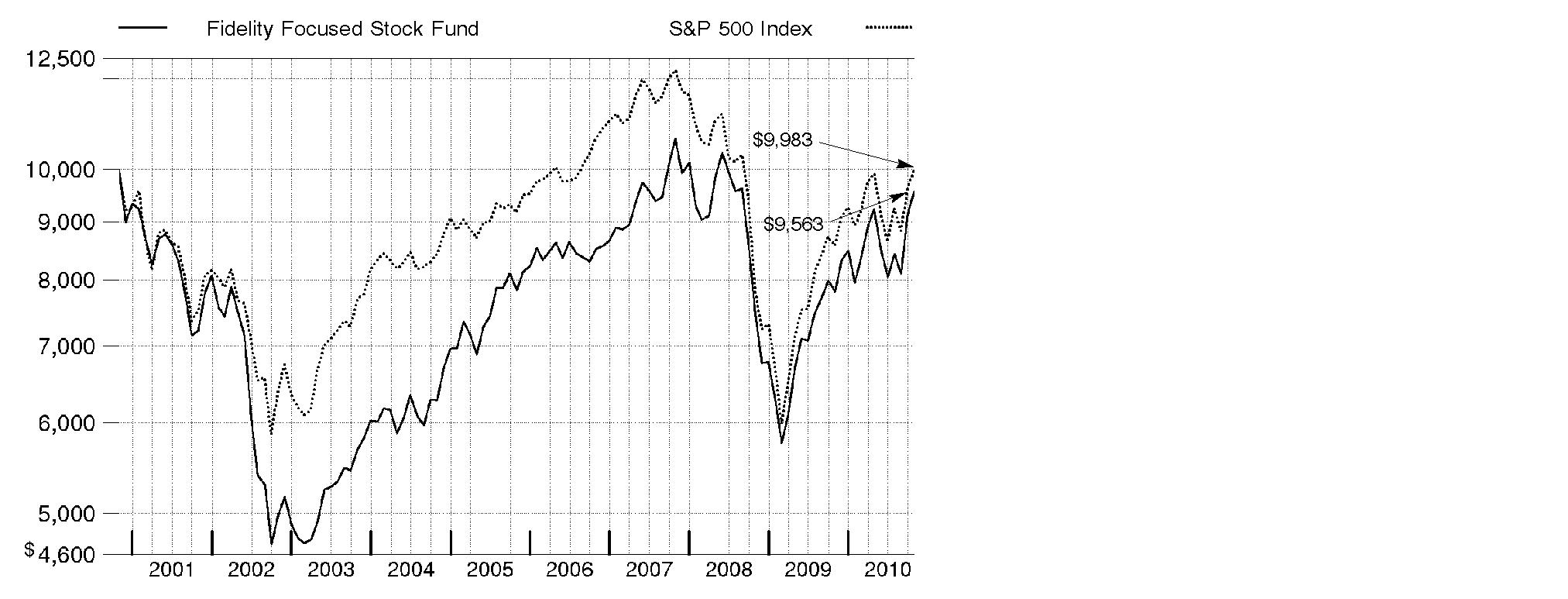

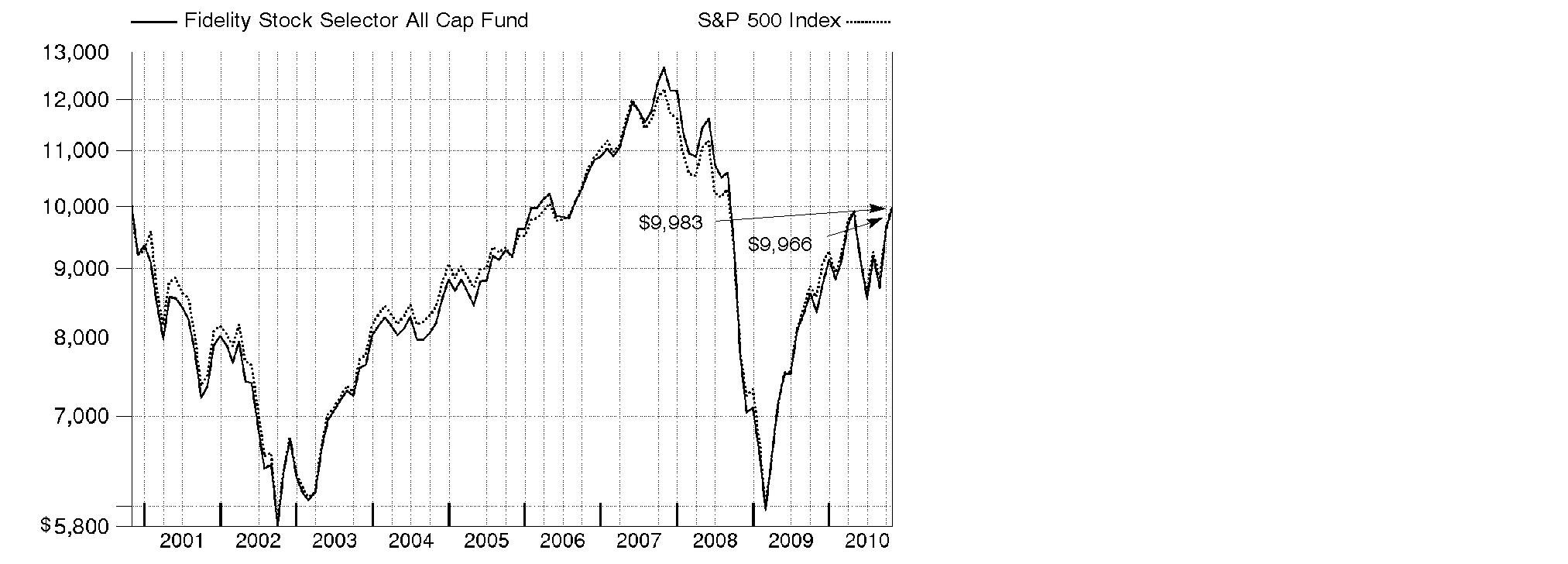

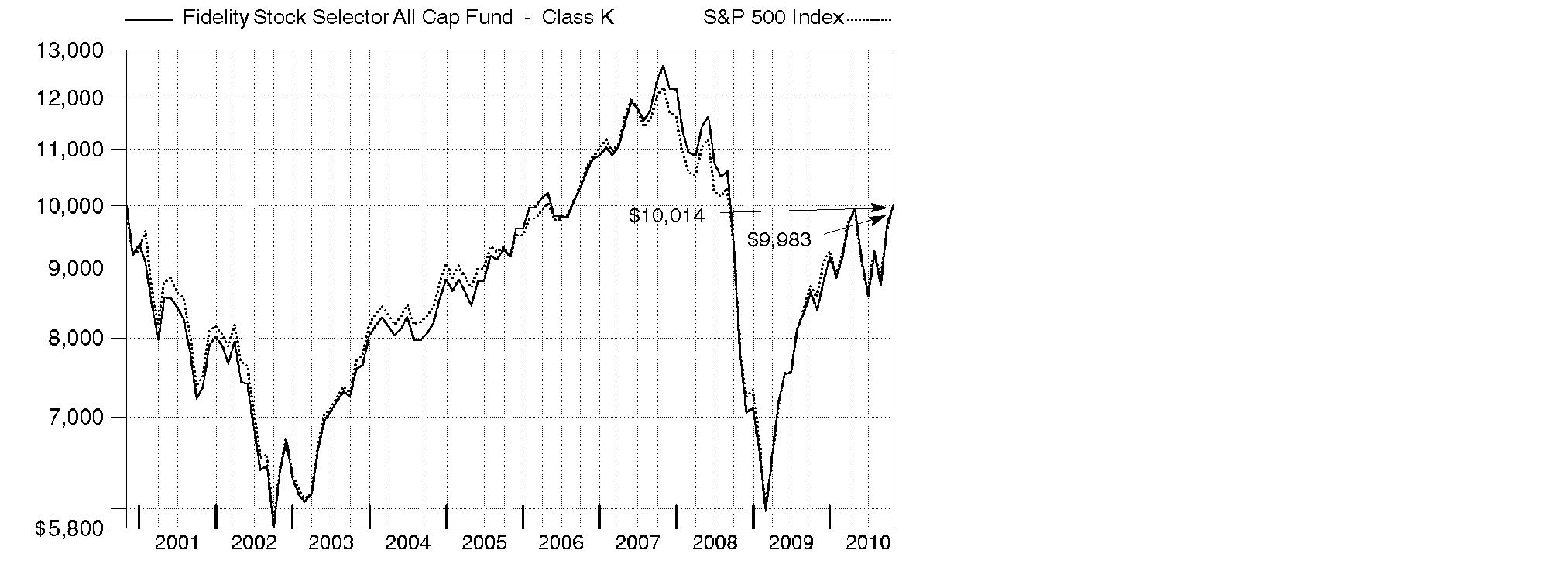

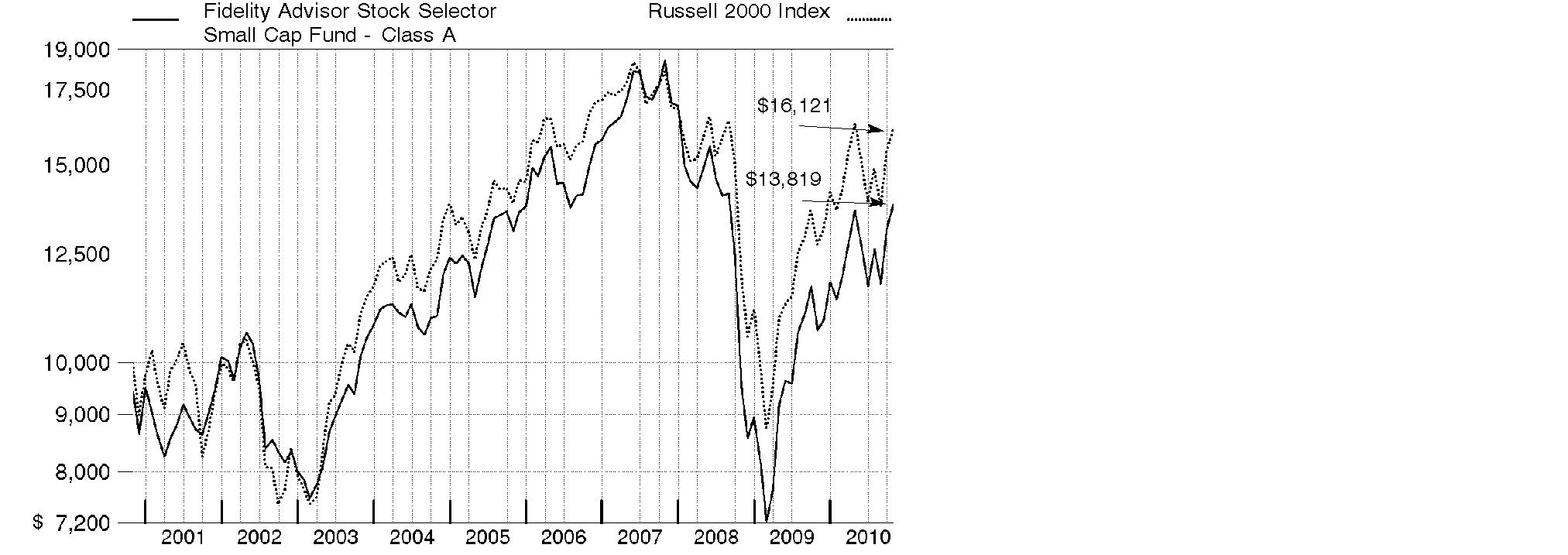

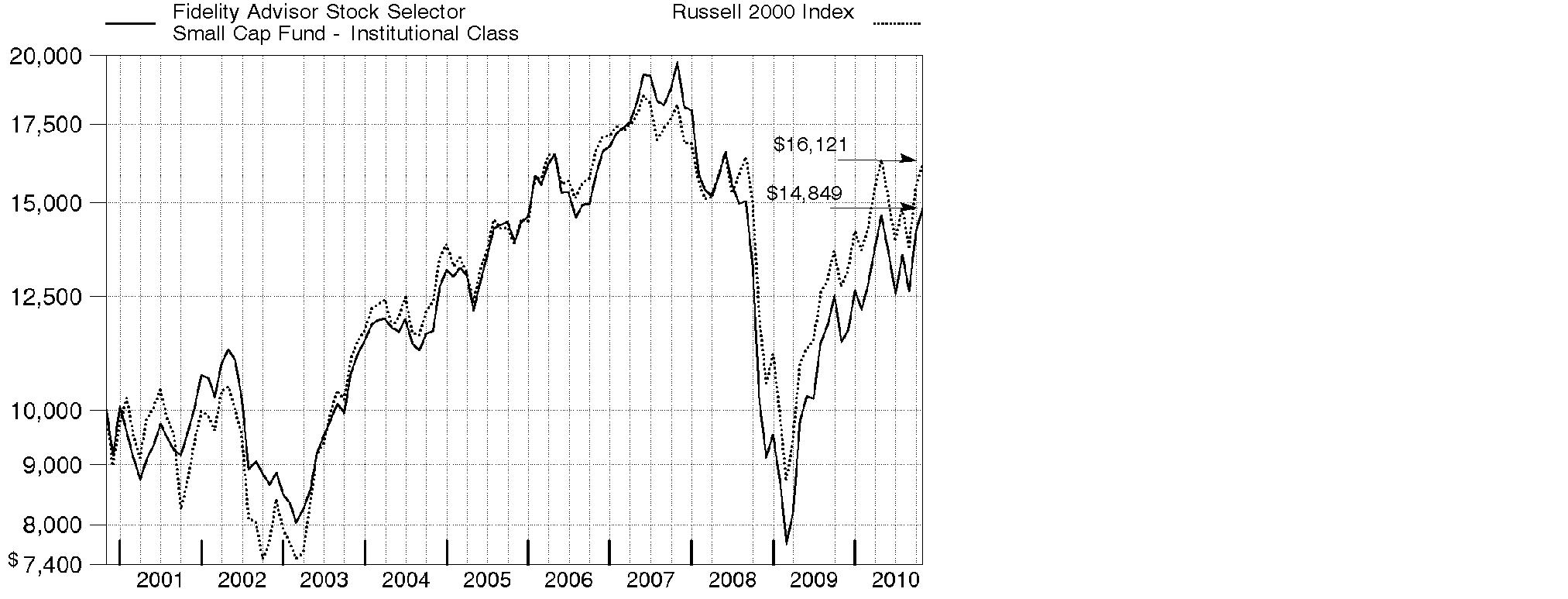

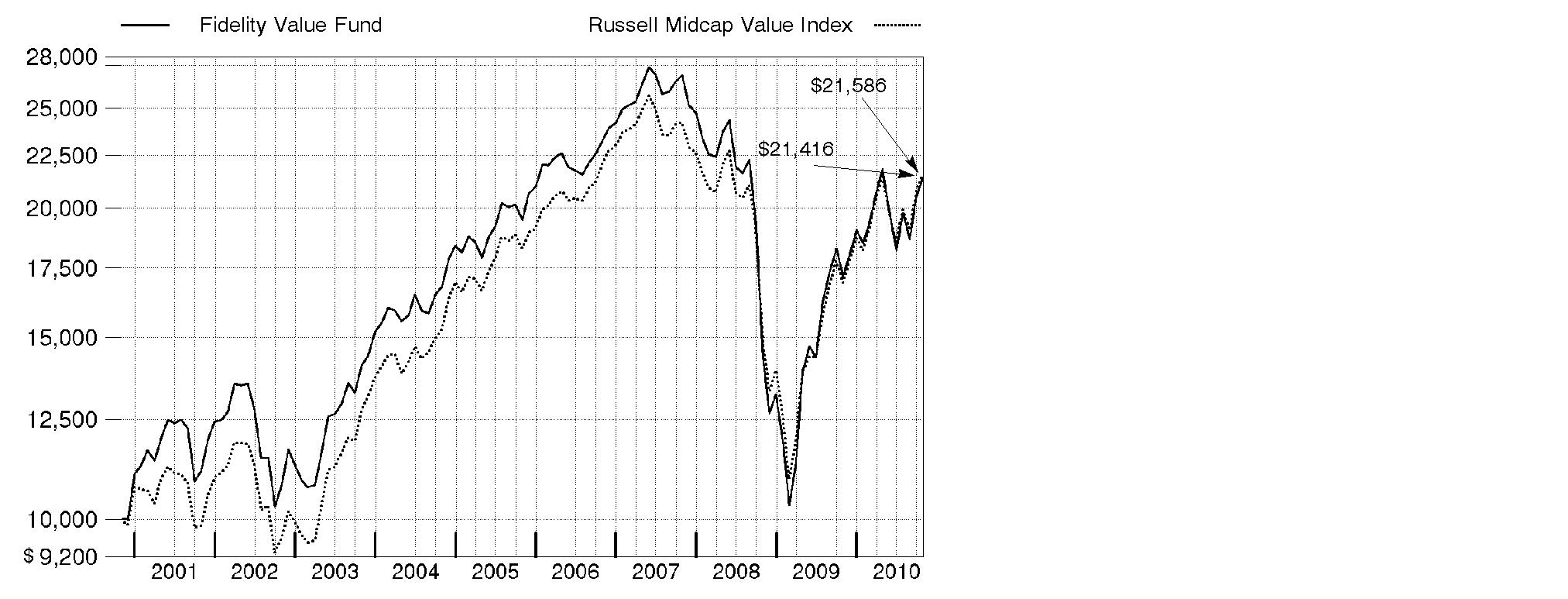

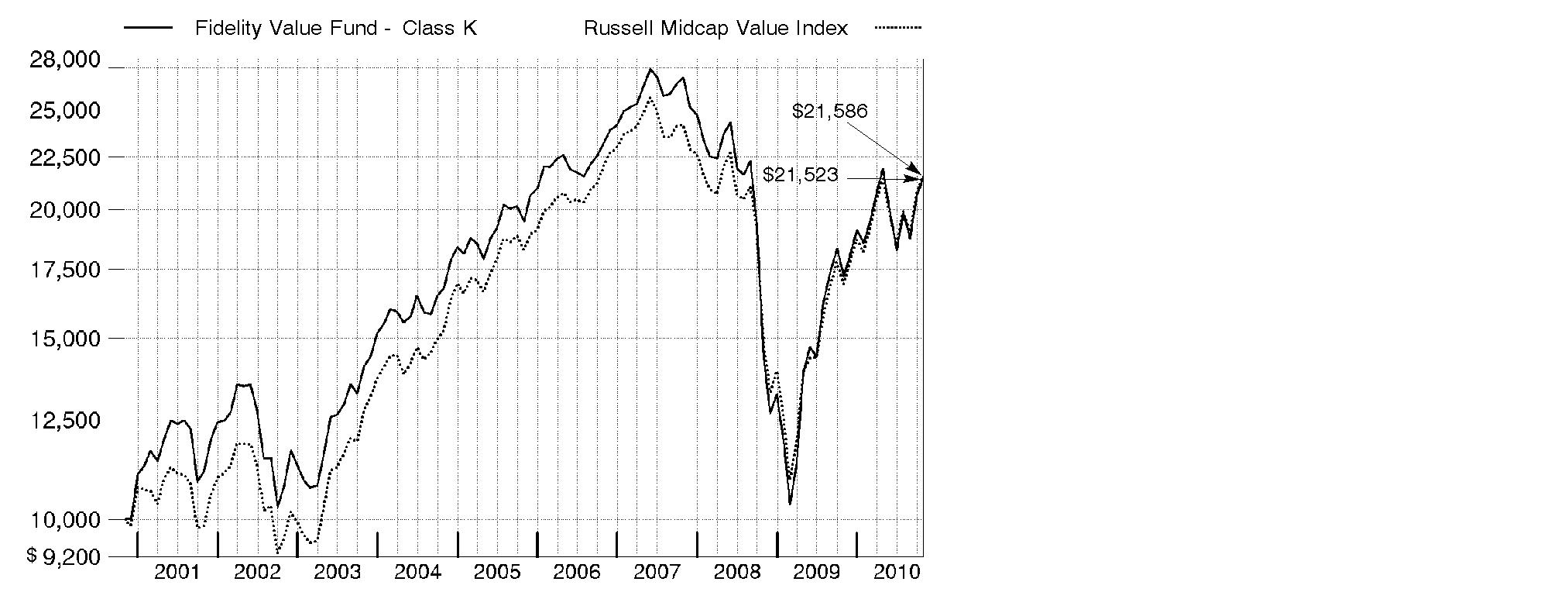

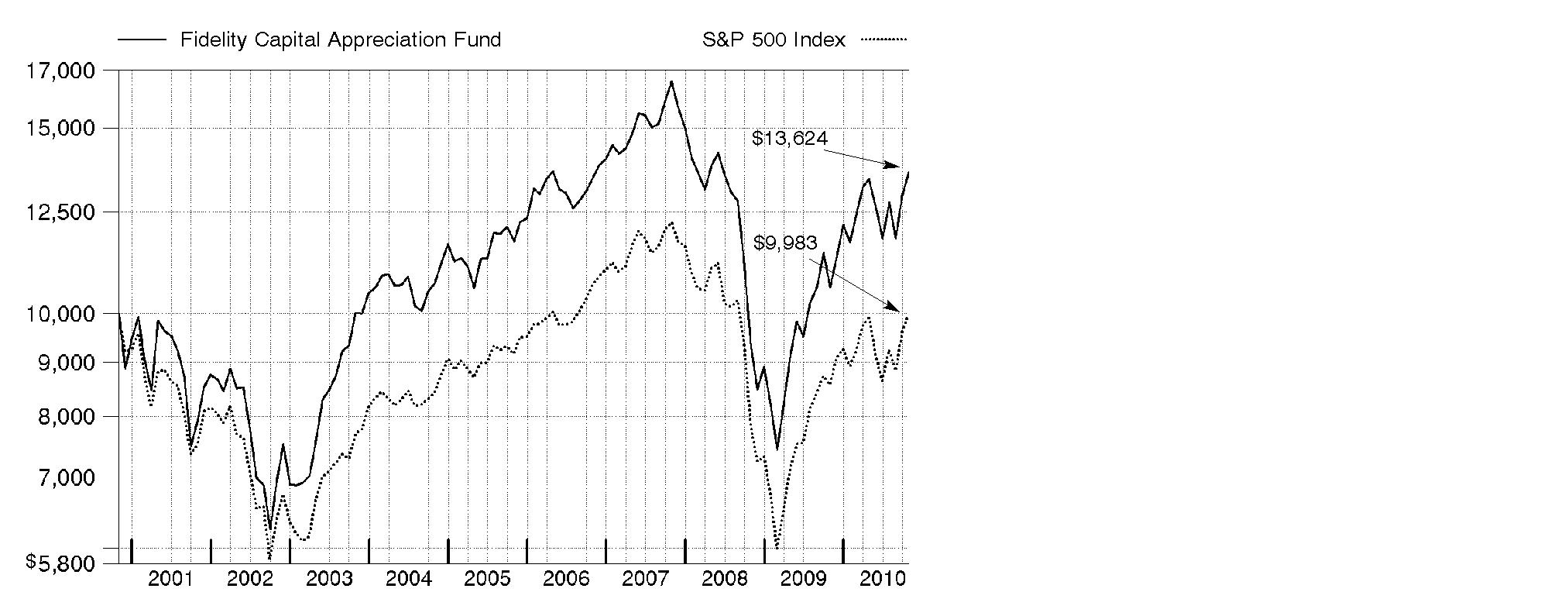

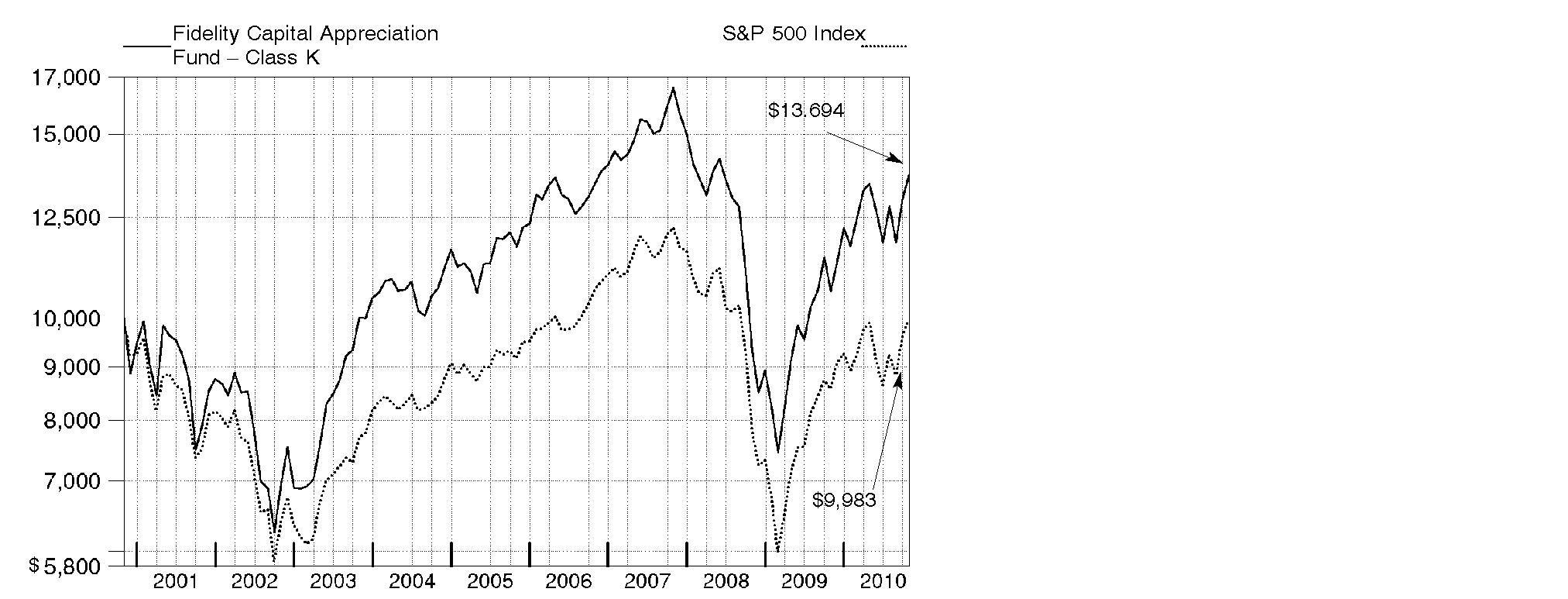

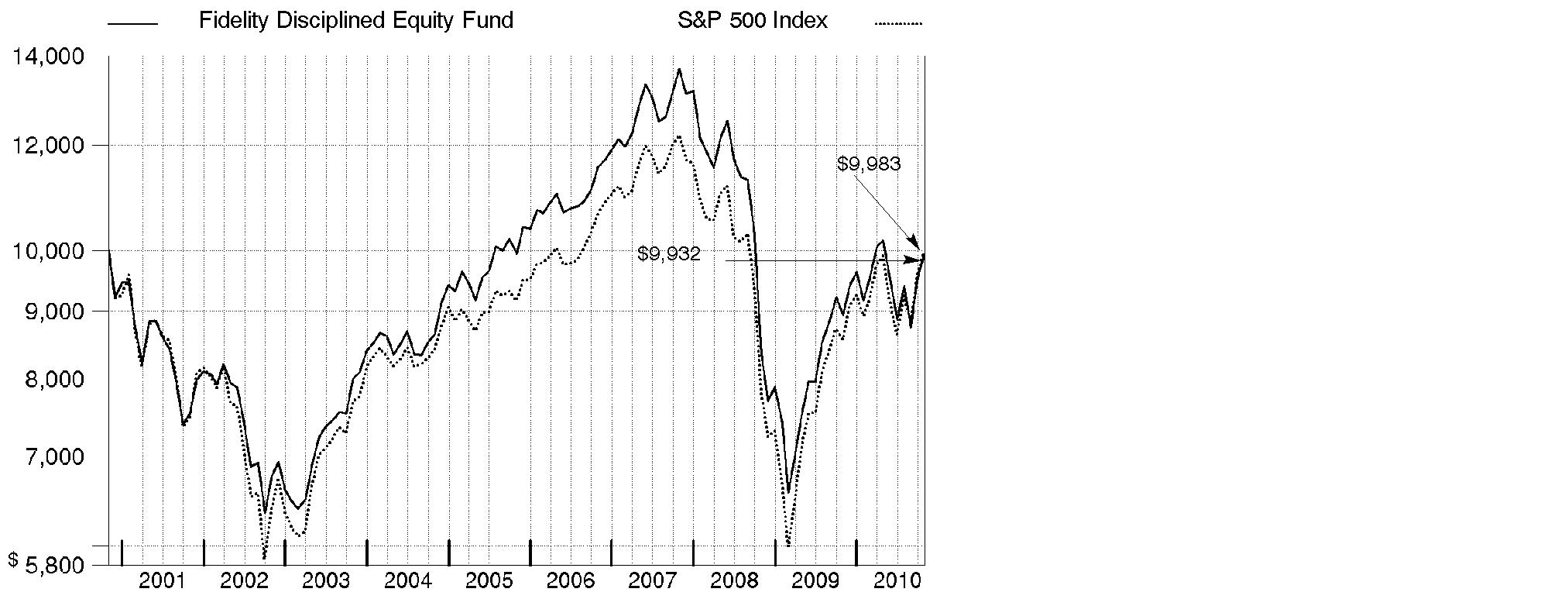

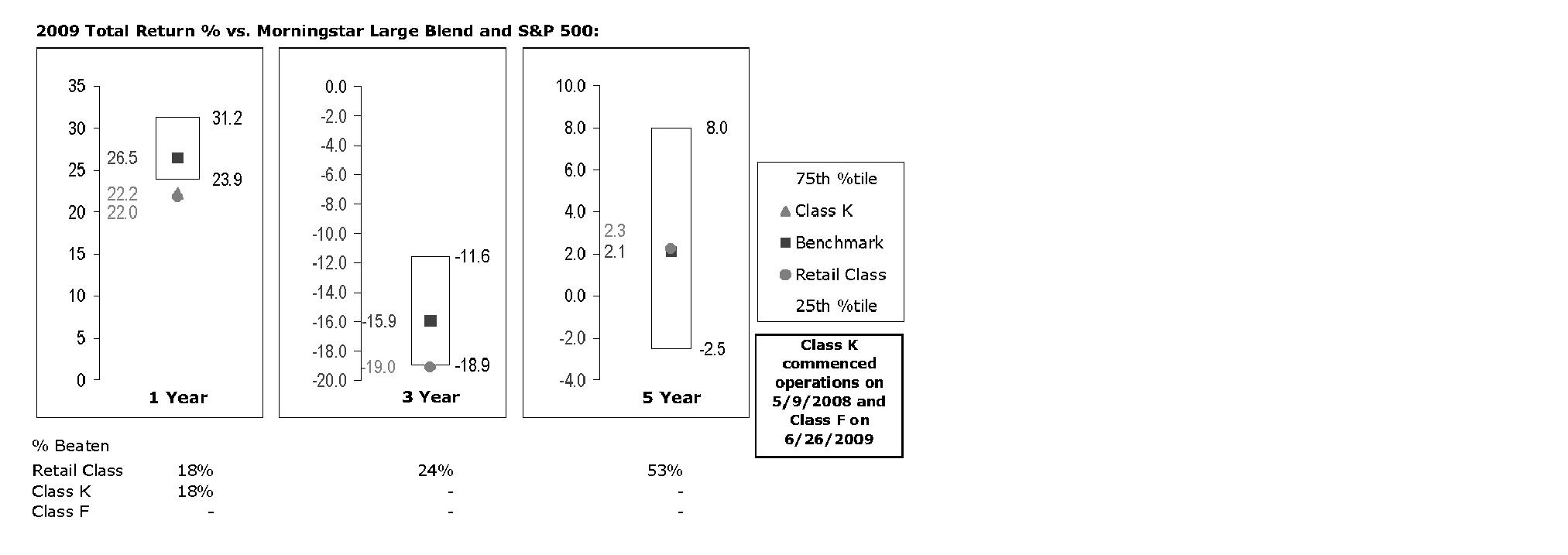

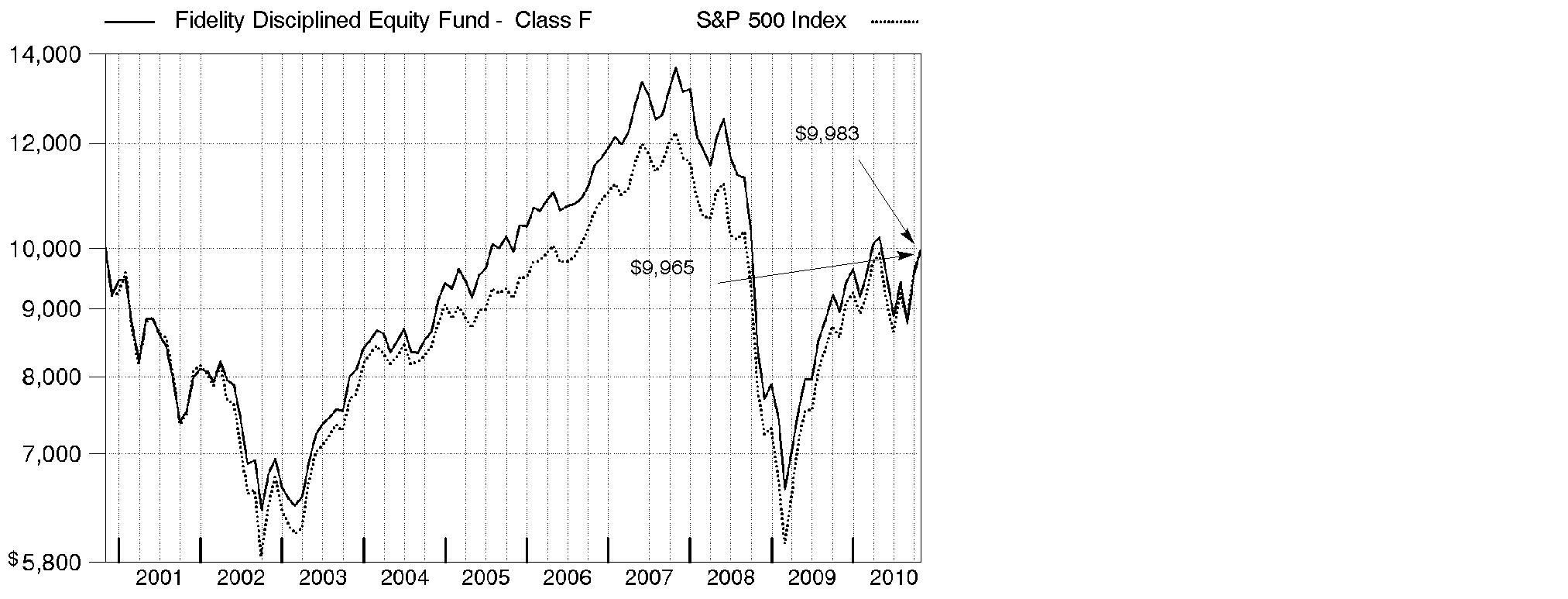

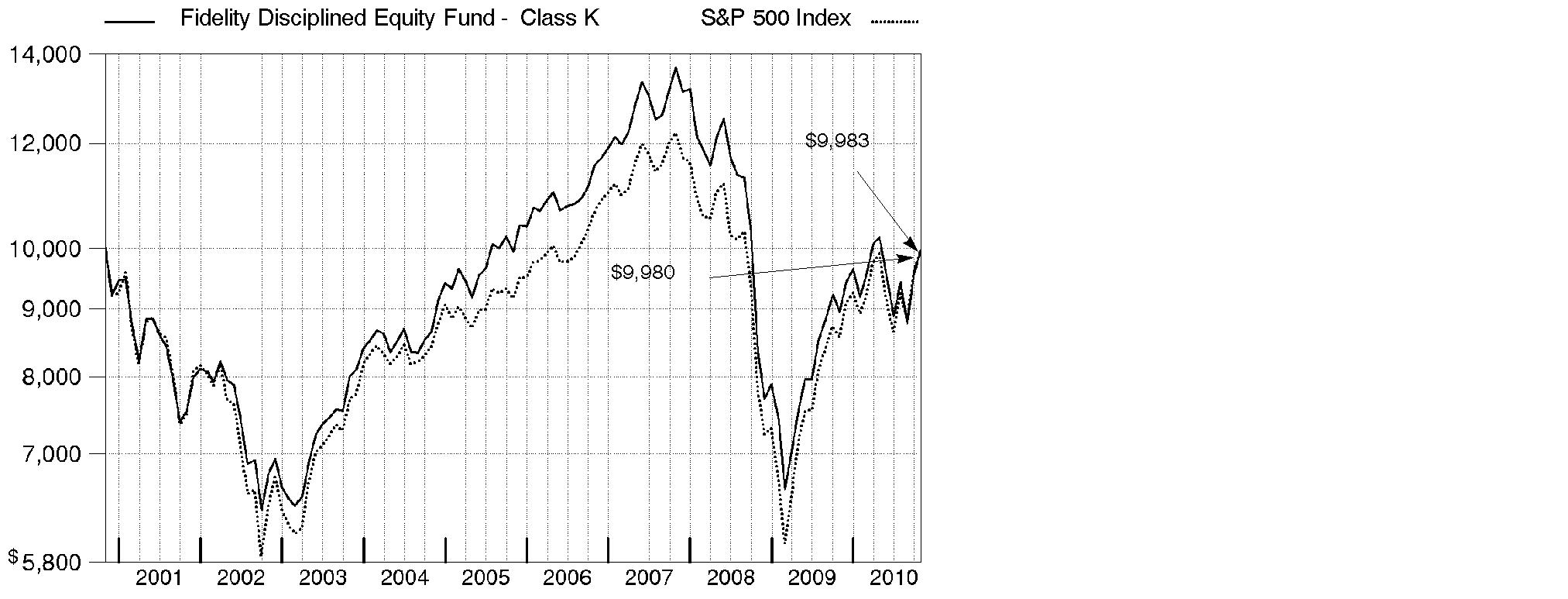

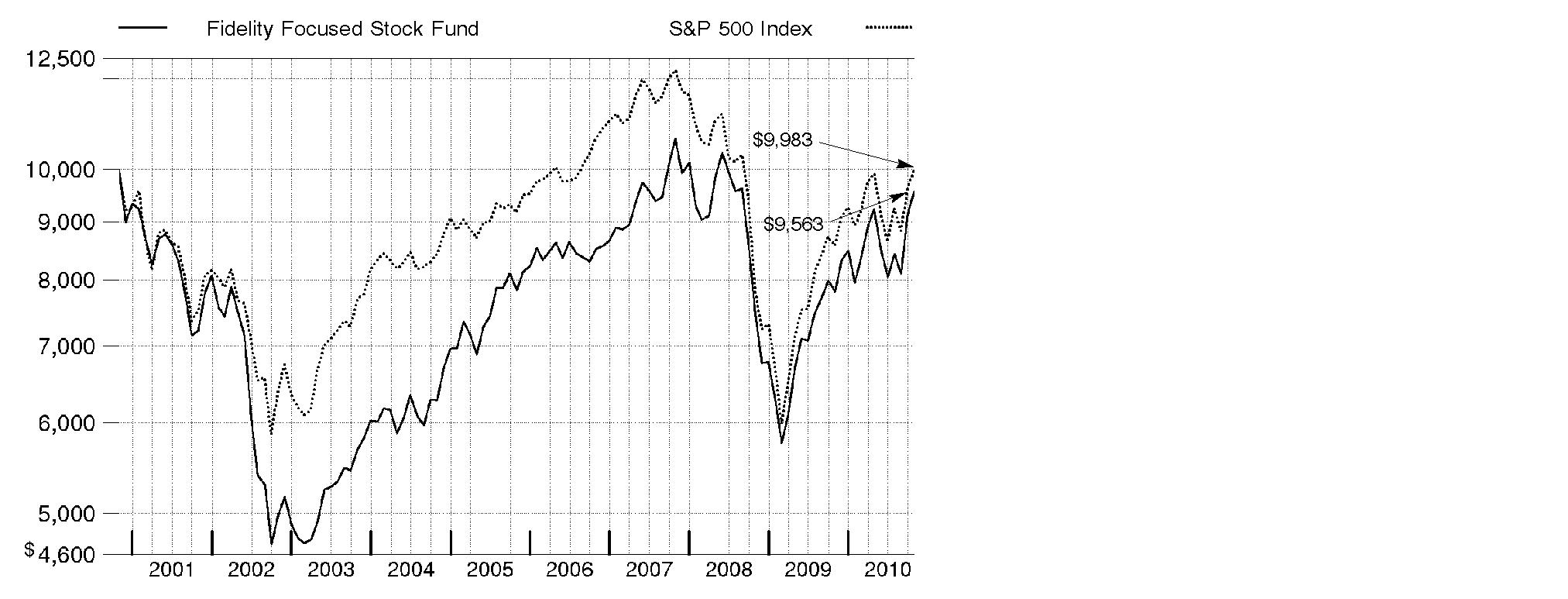

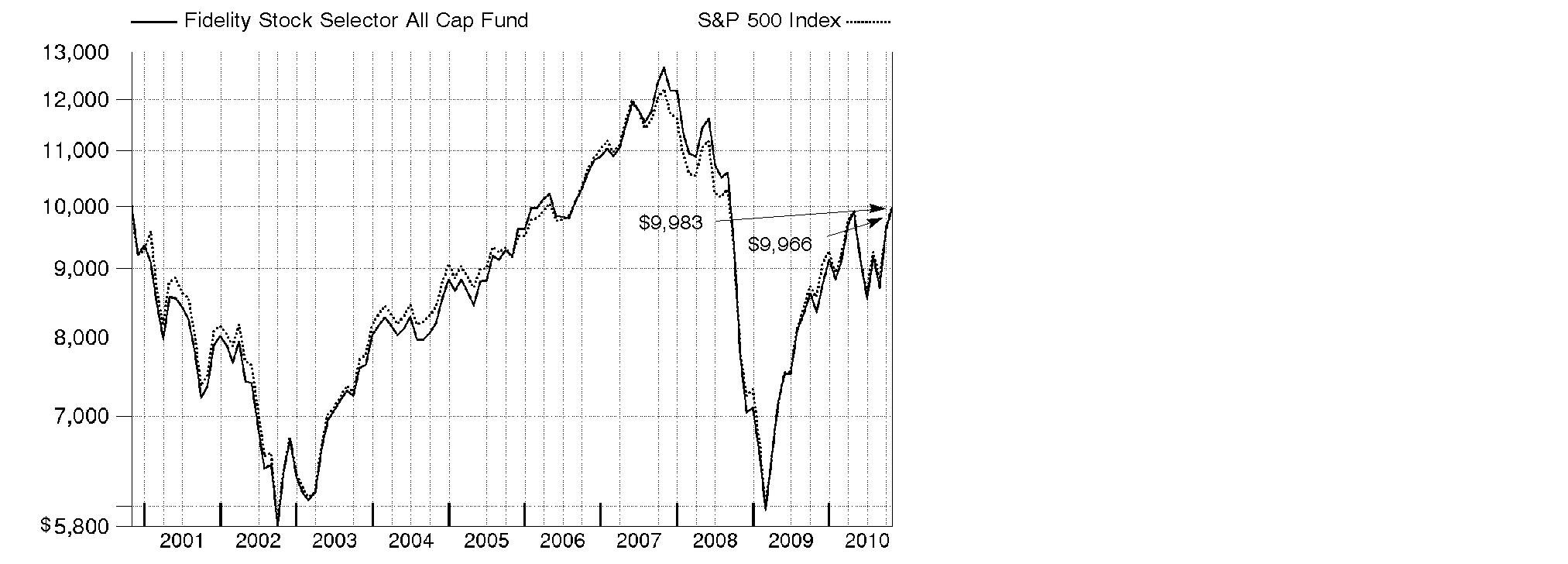

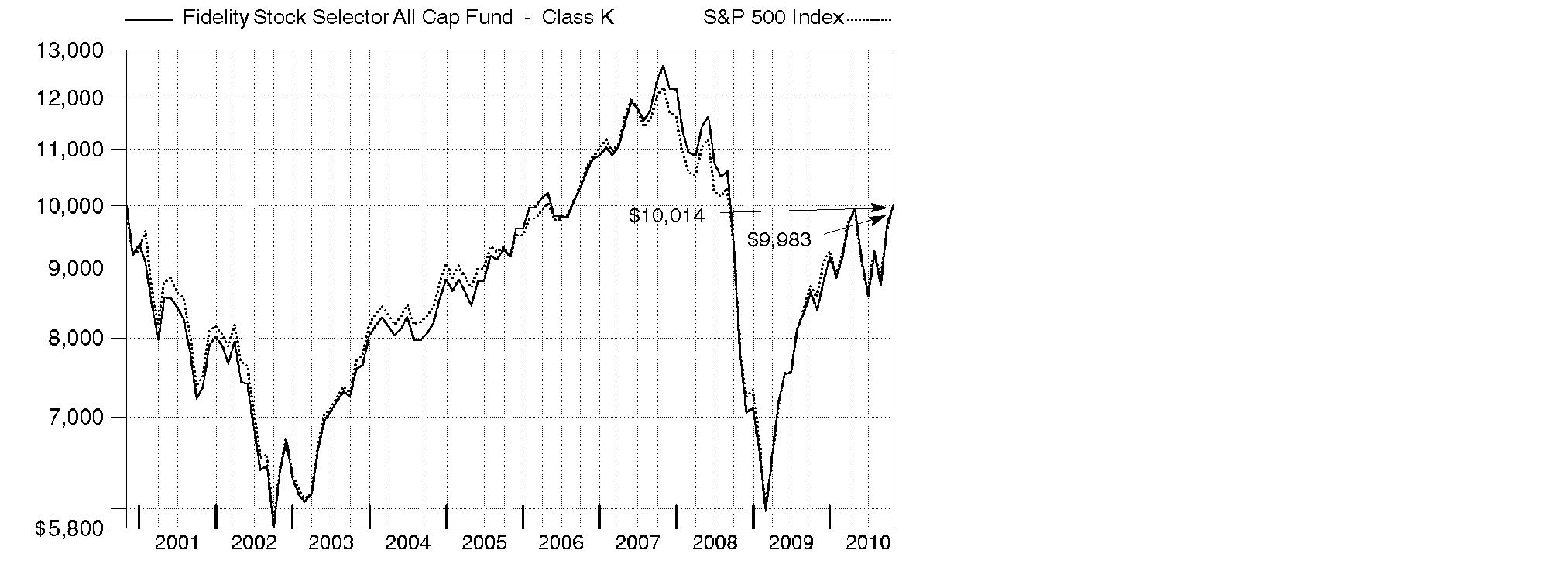

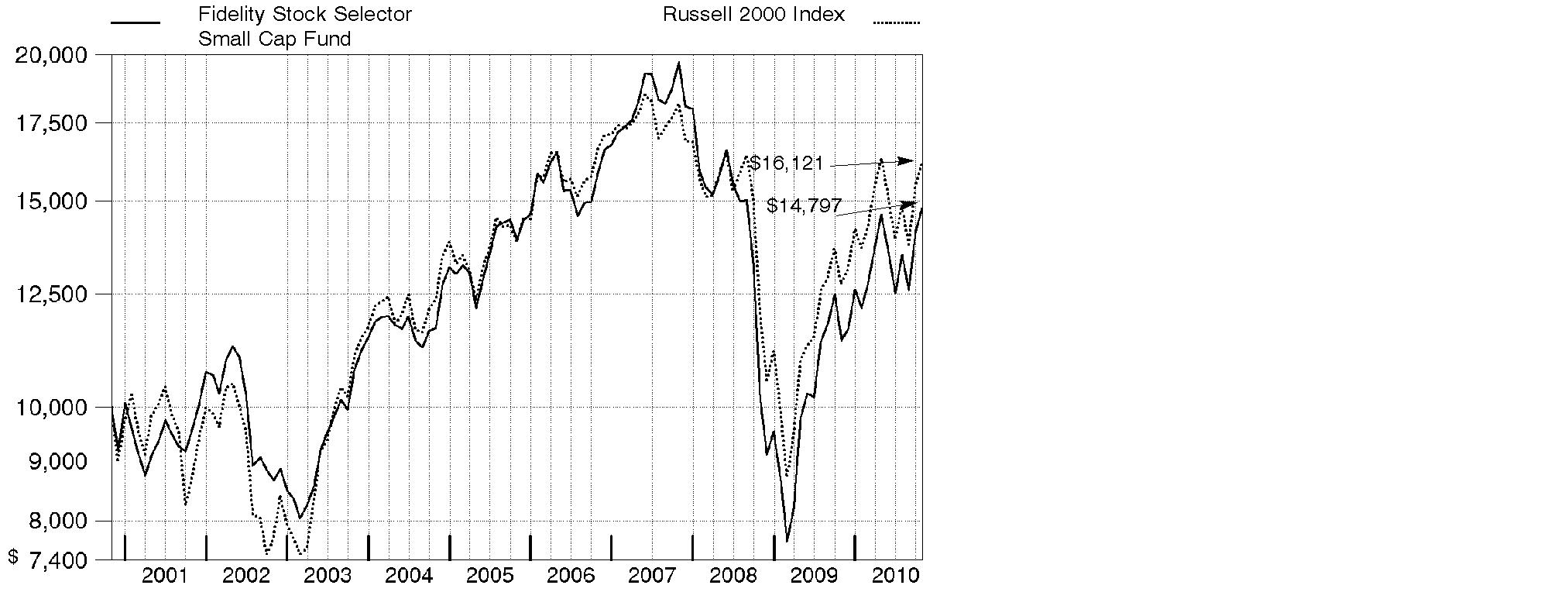

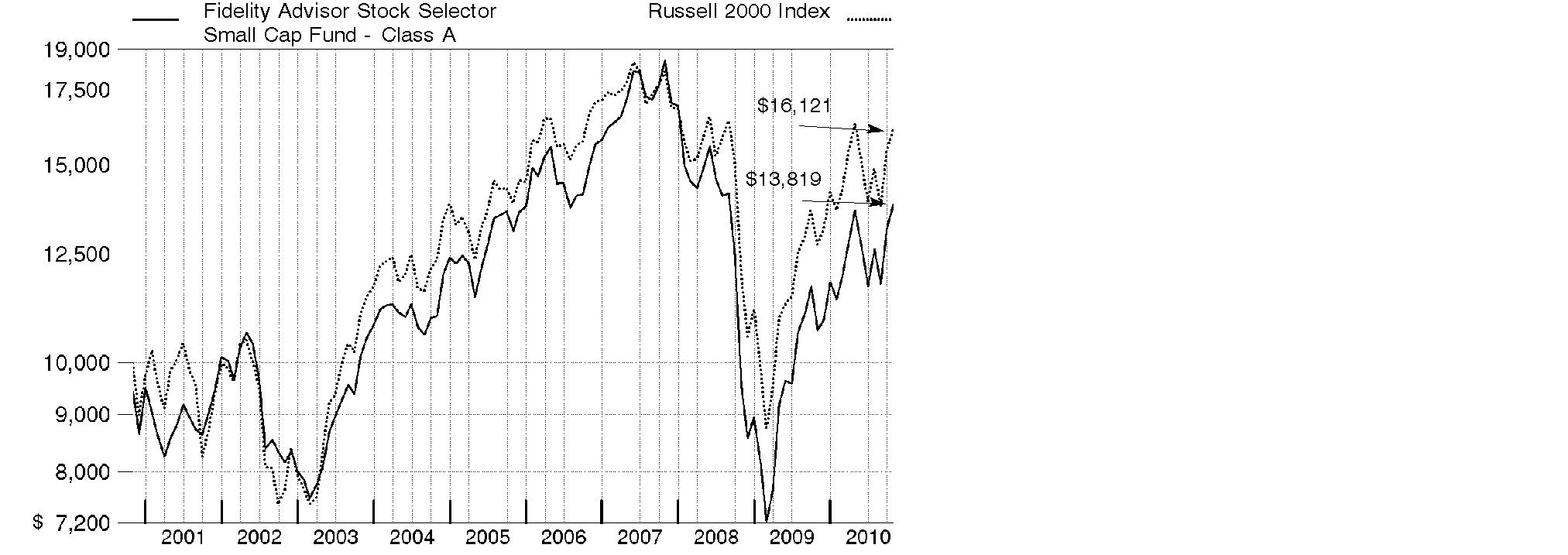

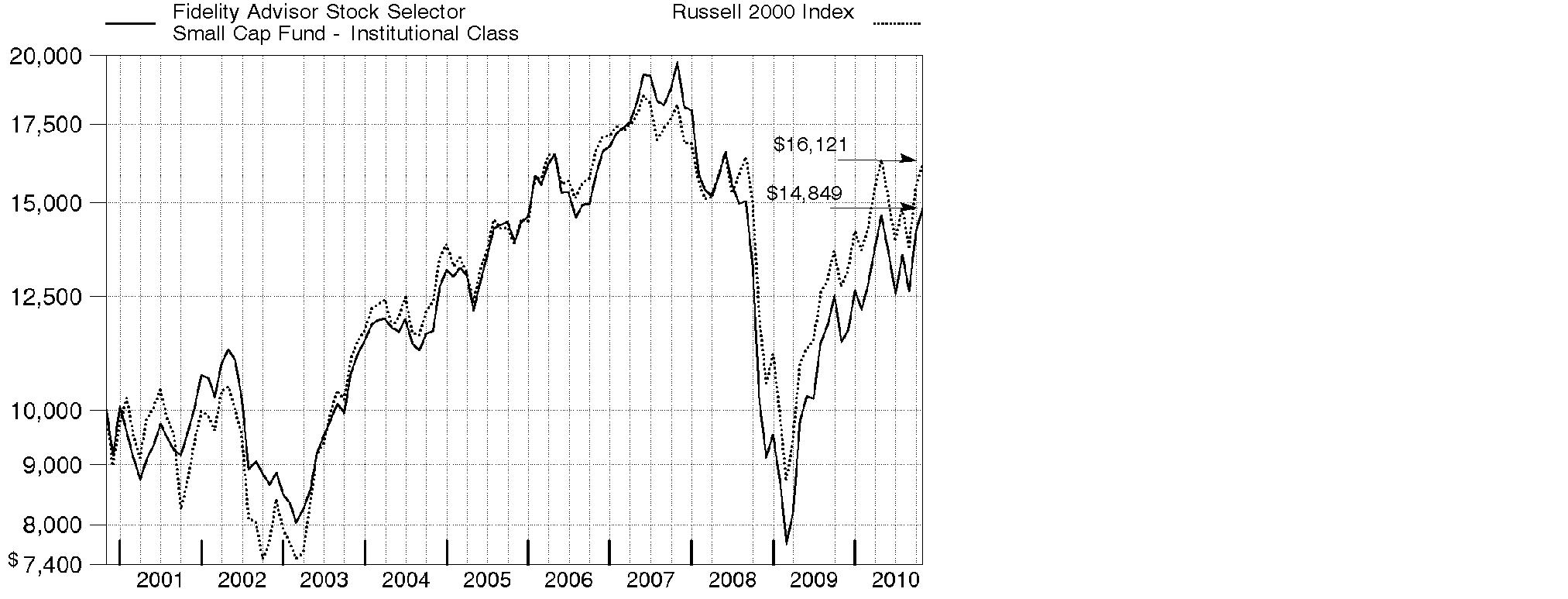

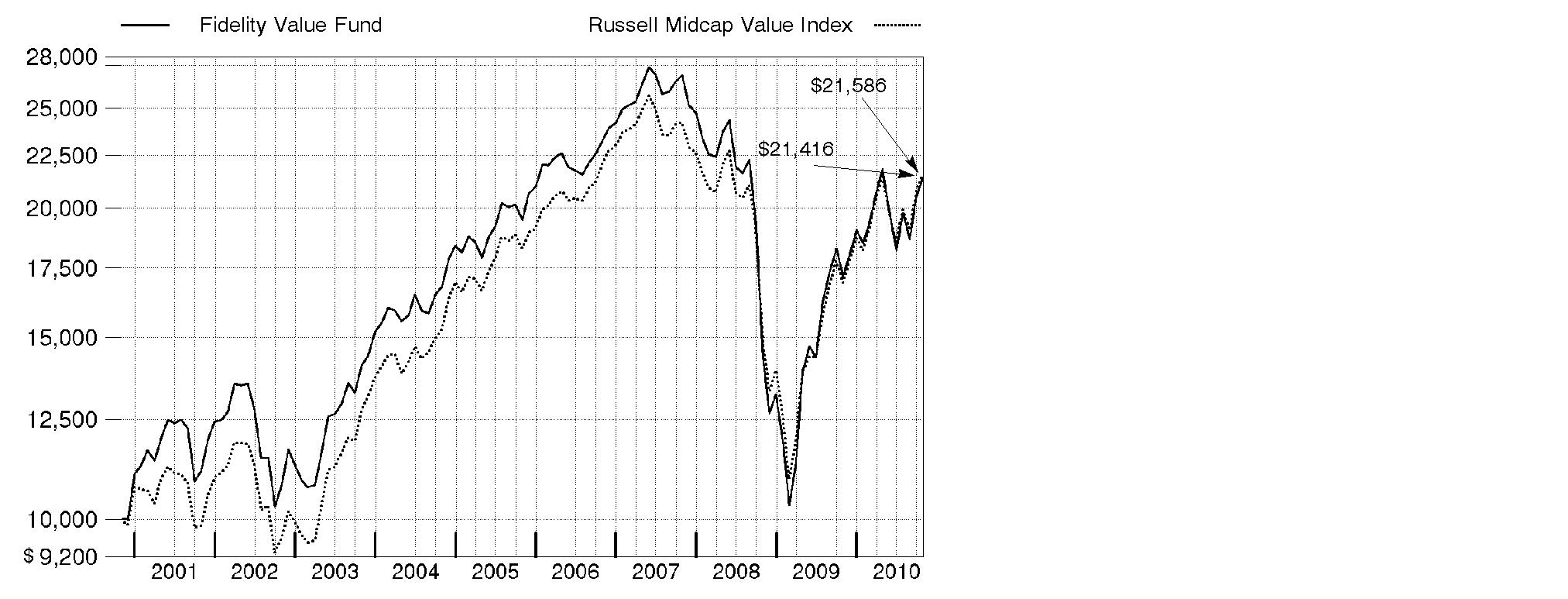

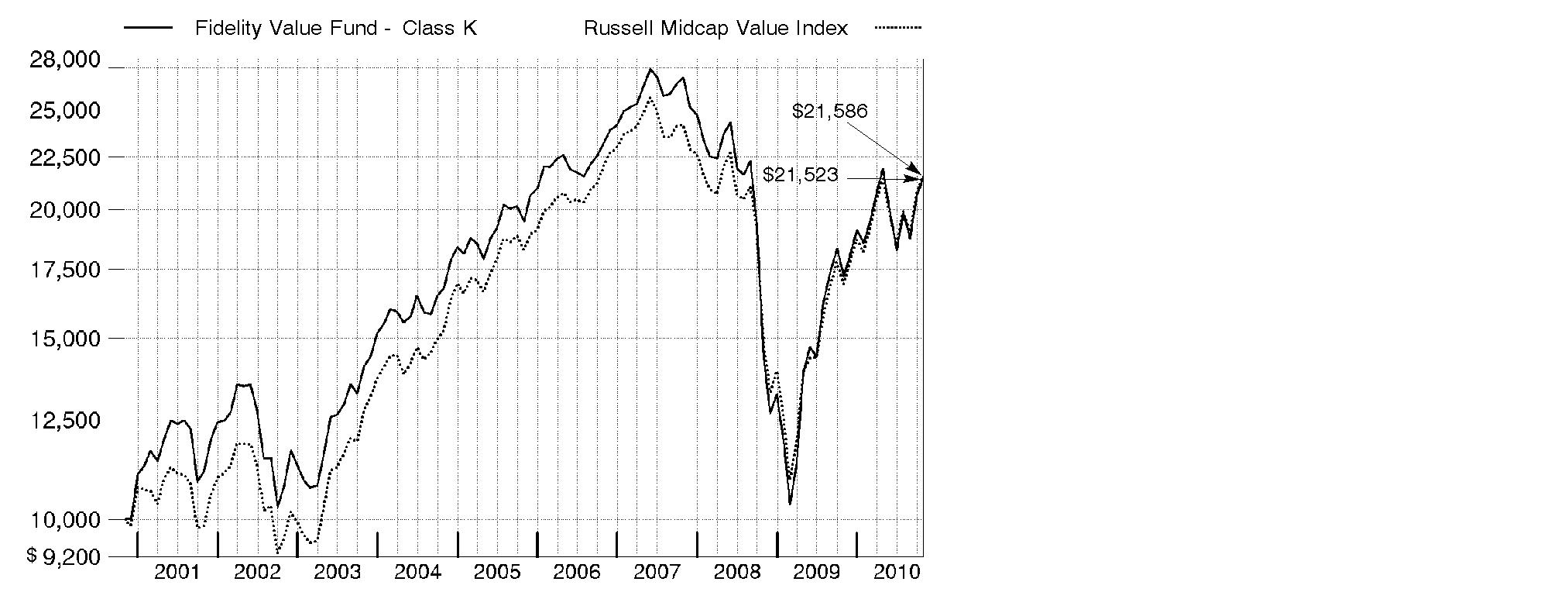

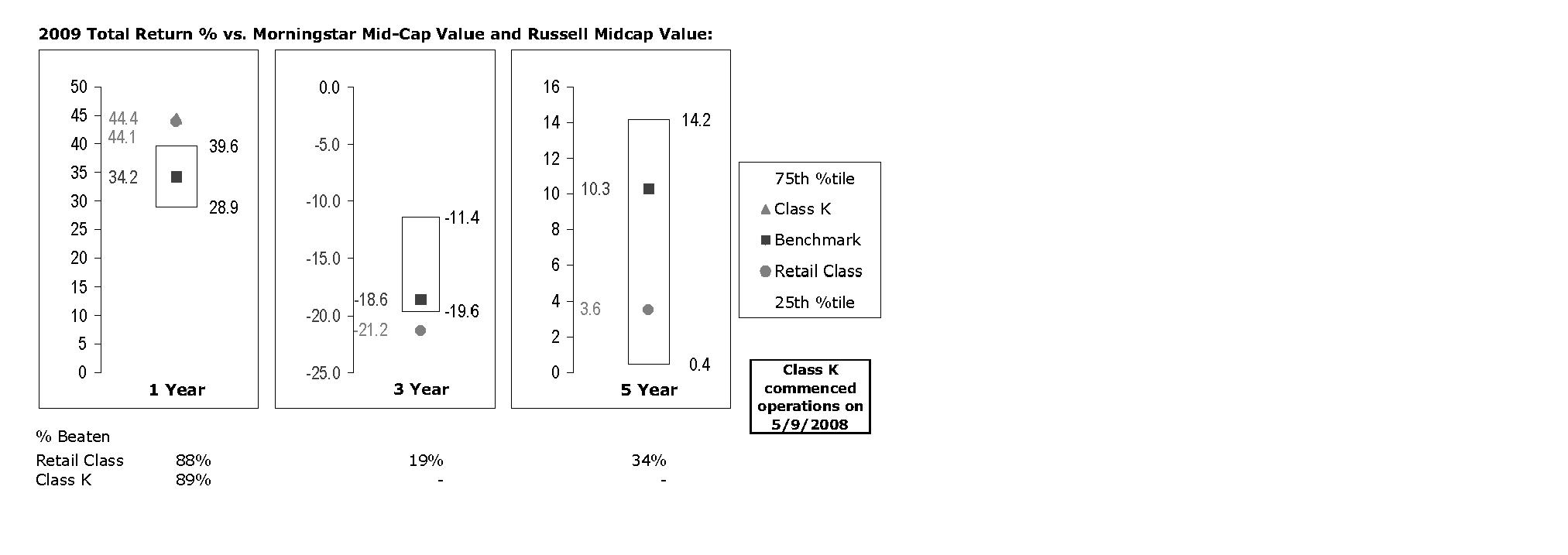

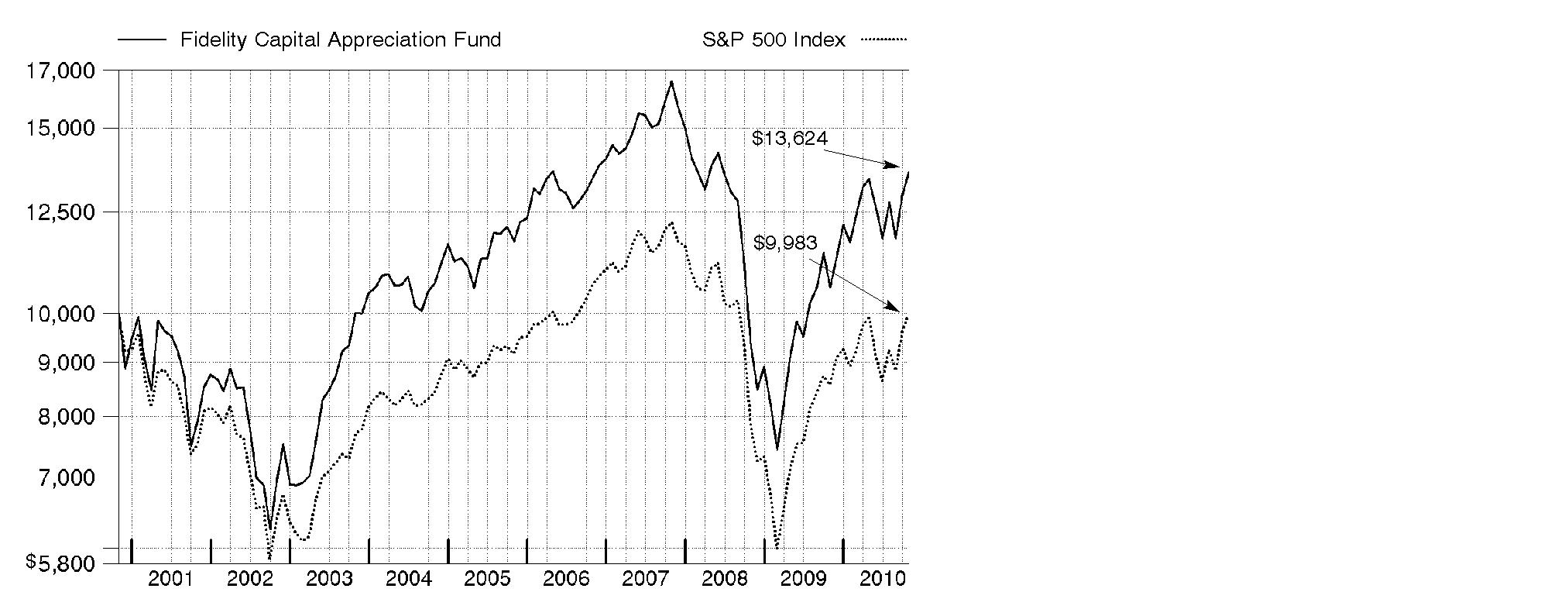

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

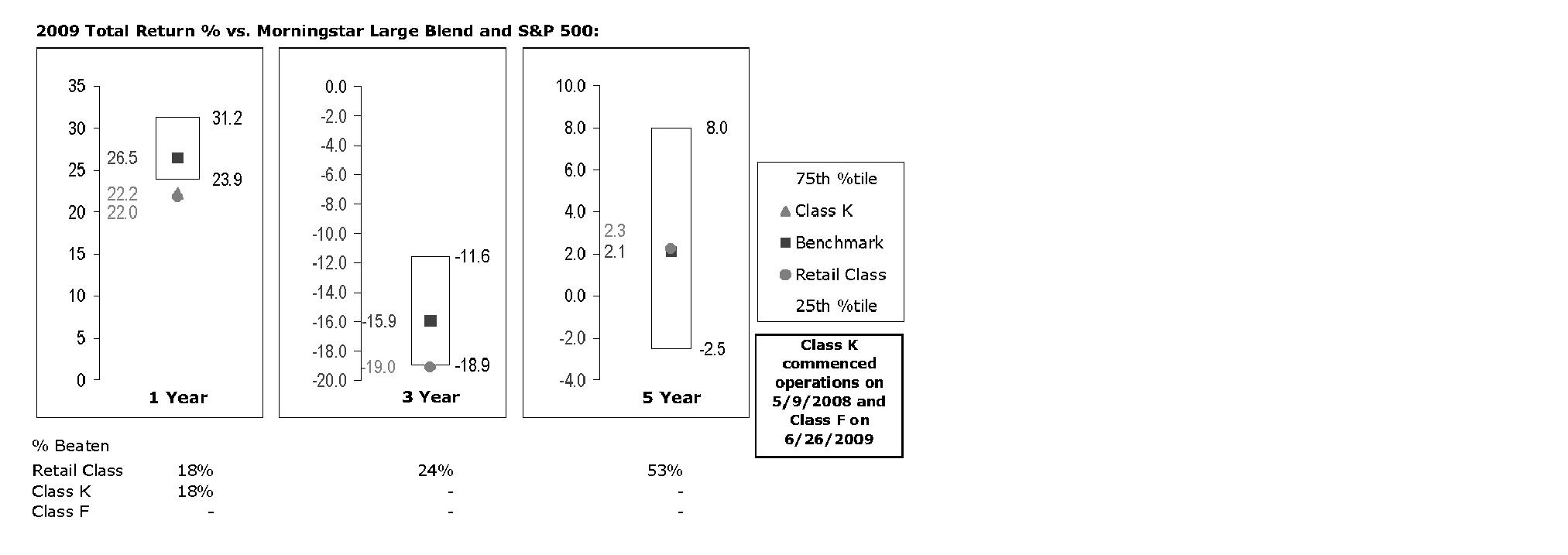

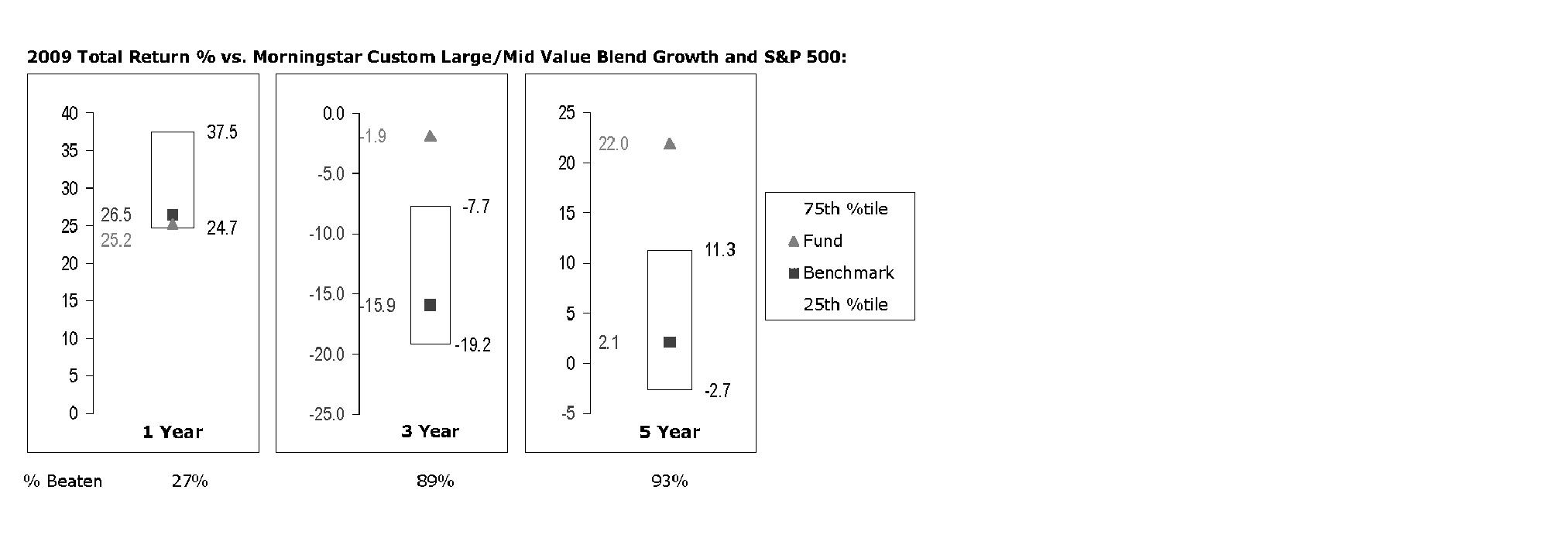

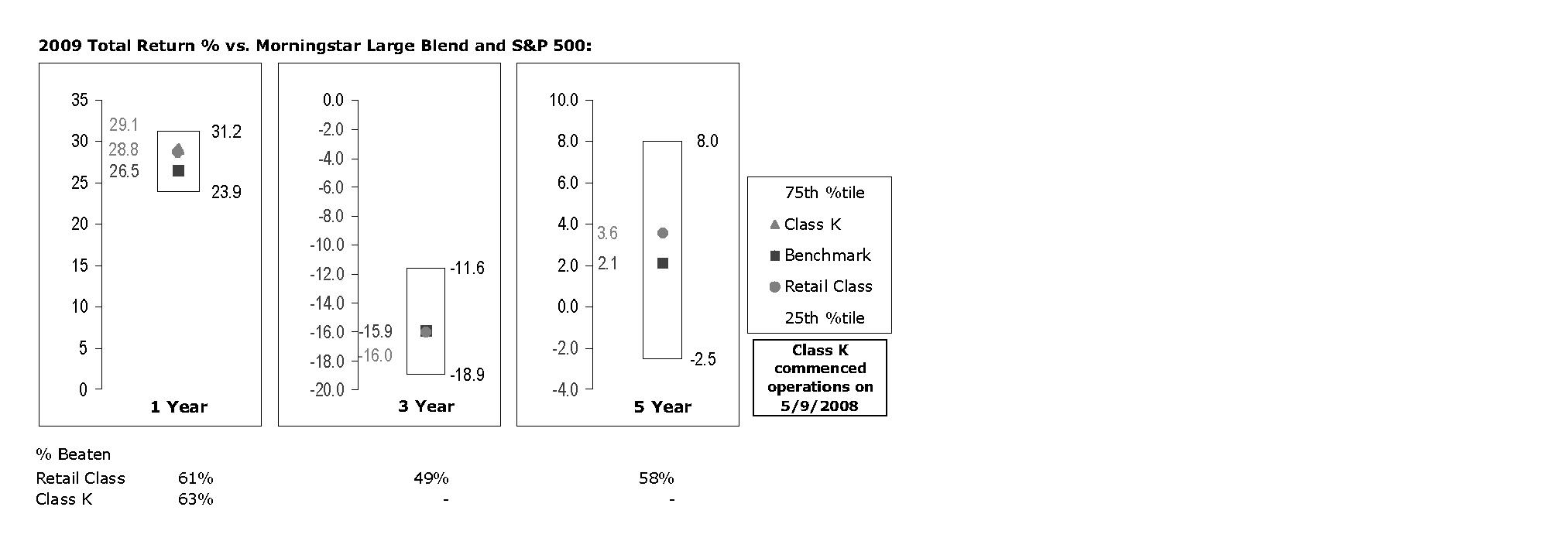

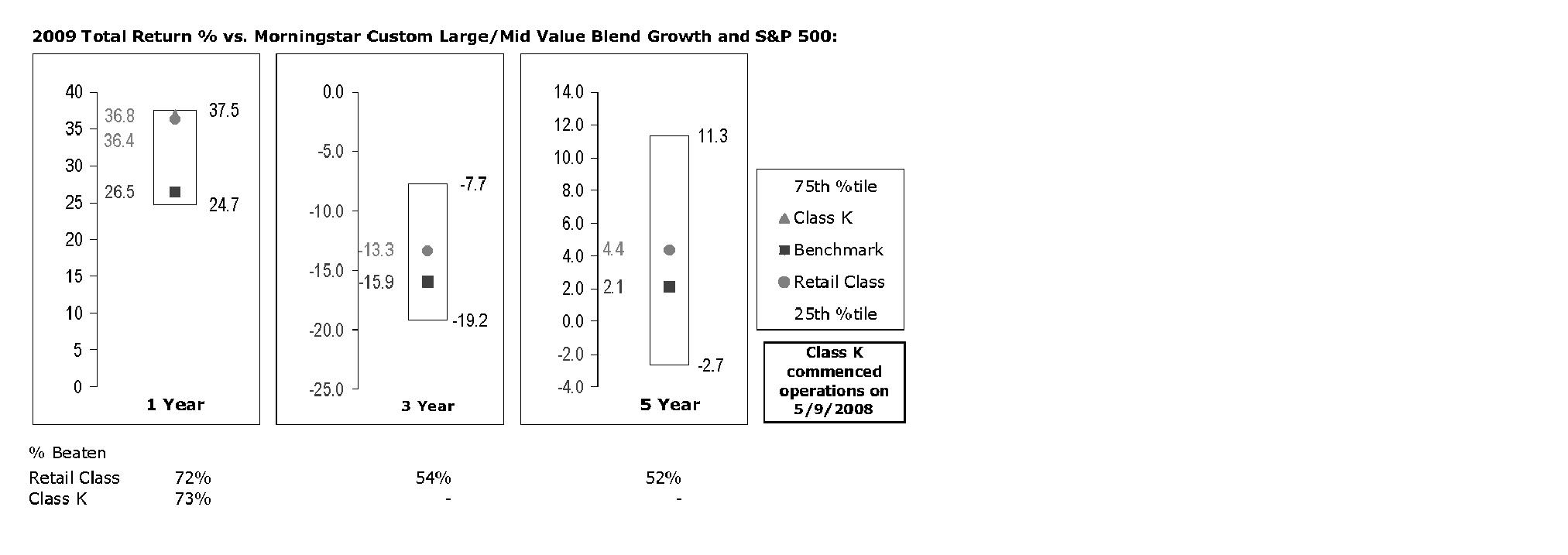

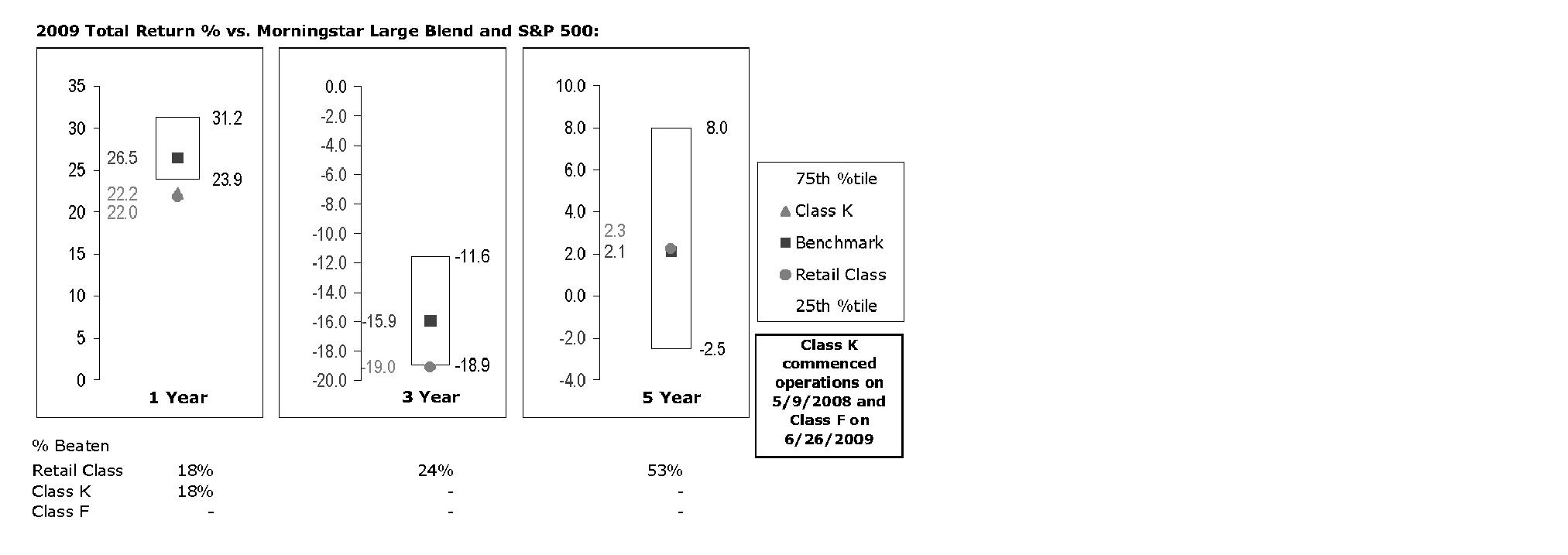

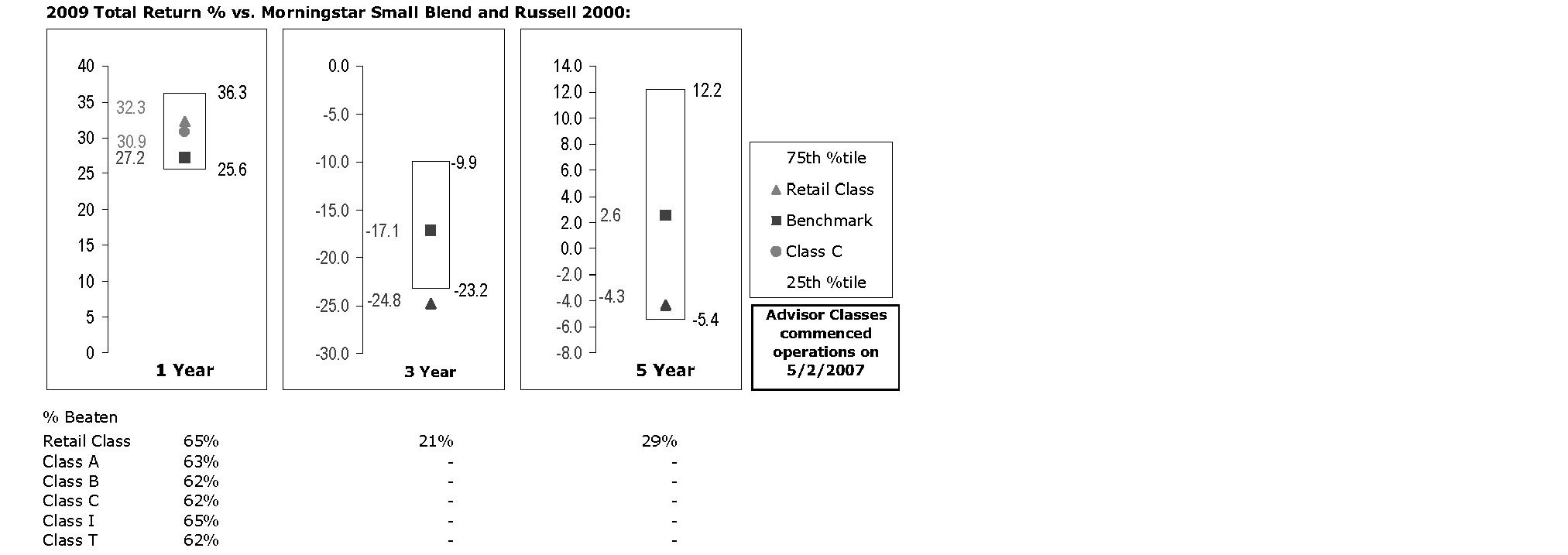

Average Annual Total Returns

Periods ended October 31, 2010 | Past 1

year | Past 5

years | Past 10

years |

Fidelity® Capital Appreciation Fund | 28.57% | 3.05% | 3.14% |

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Capital Appreciation Fund, a class of the fund, on October 31, 2000. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

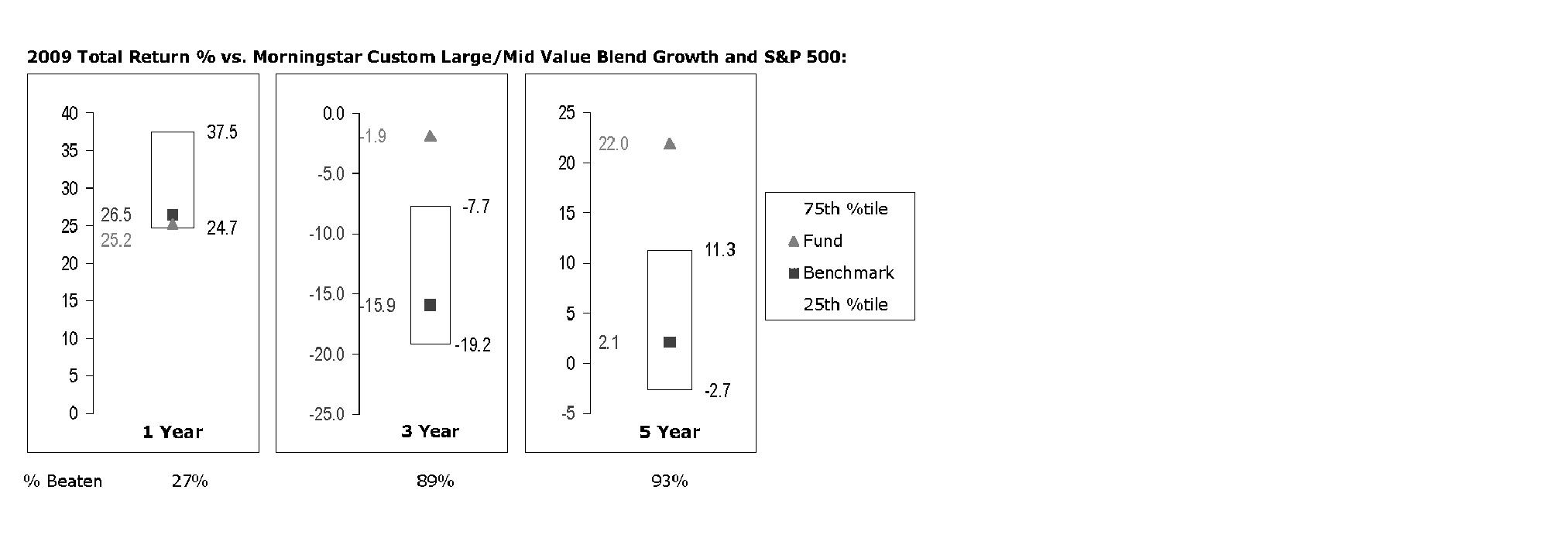

Market Recap: Amid bouts of volatility, major U.S. stock market indexes recorded double-digit gains for the year ending October 31, 2010, lifted by economic optimism, encouraging earnings reports and a wave of corporate mergers. Aside from a January dip, stocks trended upward for the first half of the period amid indications the Great Recession was over. However, in April, lingering high unemployment and heightened concern over European debt sent equities falling. Markets regrouped in July, but fell again in August on mixed economic data. The final two months of the period brought renewed optimism, with the large-cap S&P 500® Index posting its best September/October performance since 1998. For the full 12 months, the S&P 500® rose 16.52%, while the blue-chip-laden Dow Jones Industrial AverageSM added 17.62% and the technology-heavy Nasdaq Composite® Index rose 23.72%. Among market segments, all 10 sectors in the S&P 500 posted gains, with more than half outperforming the broad-market index. Stocks of mid- and small-sized companies surged, with the Russell Midcap® Index adding 27.71% and Russell 2000® Index climbing 26.58%. Looking abroad, debt problems in several European countries cooled gains in developed markets, and yet the MSCI® EAFE® (Europe, Australasia, Far East) Index still rose 8.49%.

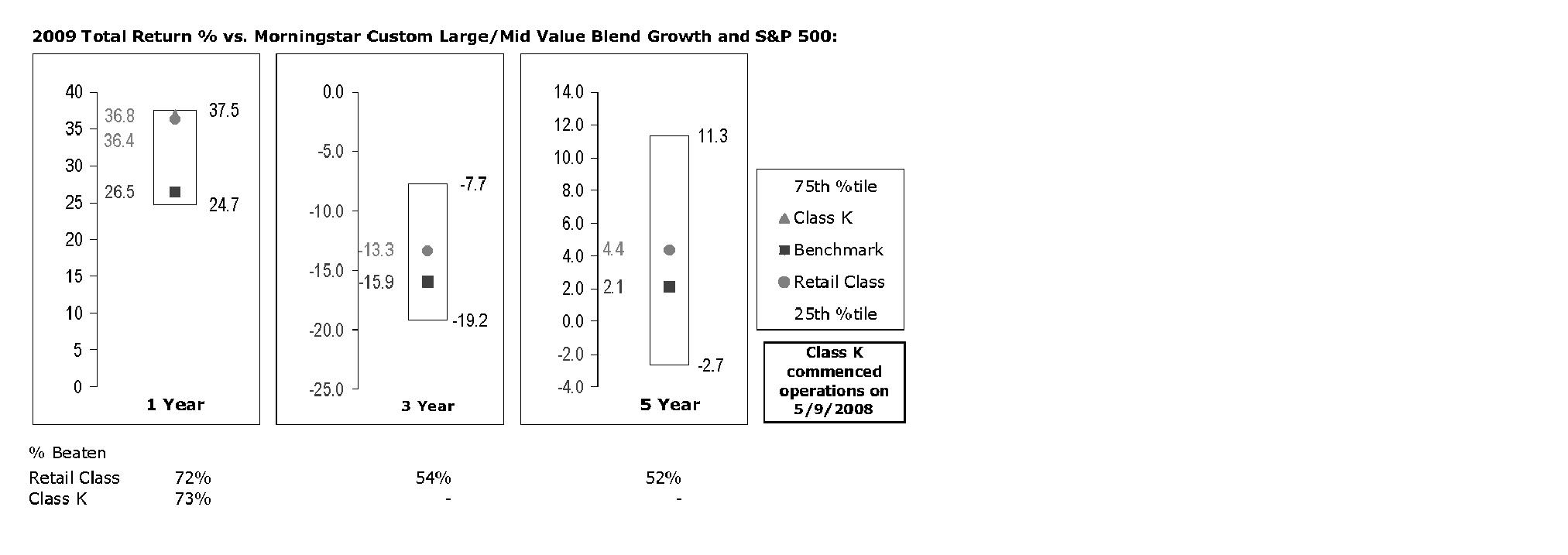

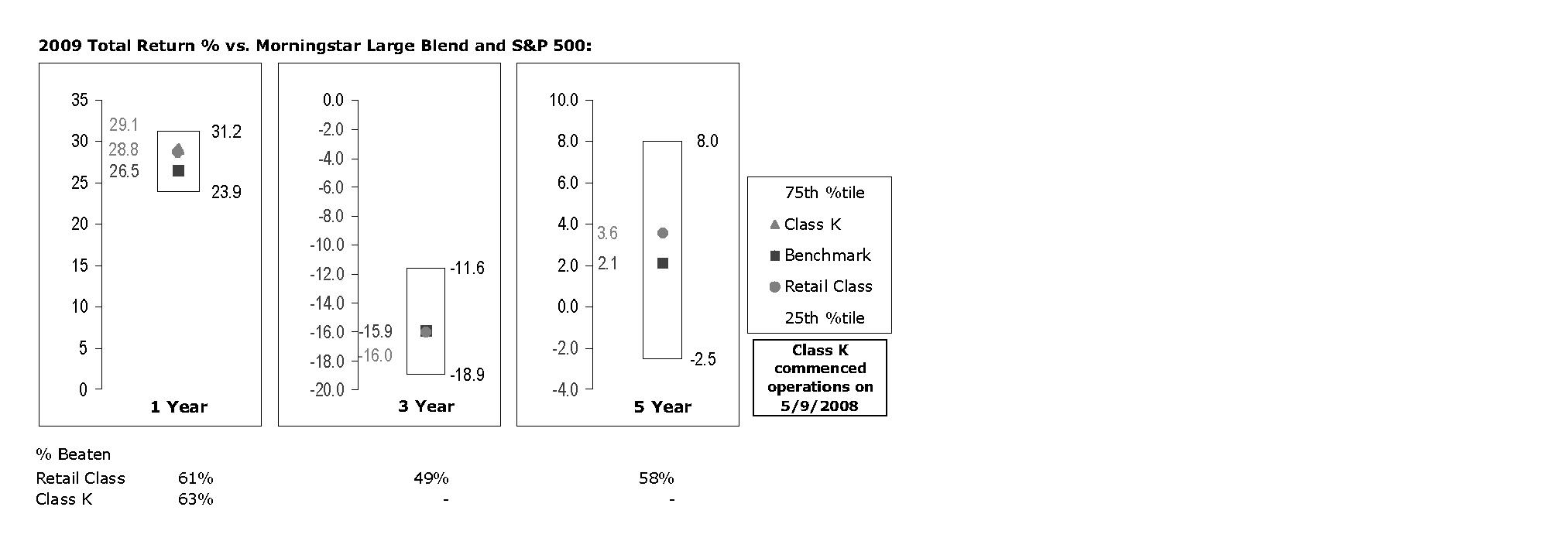

Comments from Fergus Shiel, Portfolio Manager of Fidelity® Capital Appreciation Fund: During the year, the fund's Retail Class shares returned 28.57%, handily beating the S&P 500. Versus the index, superior security selection and a large overweighting in the transportation industry helped performance the most, followed by an overweighting and solid picks in media, and security selection in financials. A bias toward mid- and small-caps also was beneficial. Individual contributors included Continental Airlines; UAL, parent company of United Airlines; Delta Air Lines; and US Airways Group. Continental and UAL merged during the period to form United Continental Holdings, the fund's largest holding at period end. Other contributors included U.K.-based cable television provider Virgin Media and a large underweighting in energy giant Exxon Mobil, which I sold. Conversely, weak security selection and an underweighting in information technology hurt, as did an overweighting in banks and stock picking in retailing. For-profit educator ITT Educational Services was the fund's largest individual detractor. Performance also was hampered by personal computer/consumer electronics maker Apple - mainly due to untimely ownership - drilling rig owner/operator Pride International, network equipment maker Cisco Systems and Bank of Ireland. All of the holdings I mentioned, except for Exxon Mobil, Apple and Cisco Systems, were out of index. Pride International and Bank of Ireland were sold from the fund.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2010 to October 31, 2010).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Annual Report

| Annualized

Expense Ratio | Beginning

Account Value

May 1, 2010 | Ending

Account Value

October 31, 2010 | Expenses Paid

During Period*

May 1, 2010 to

October 31, 2010 |

Capital Appreciation | .88% | | | |

Actual | | $ 1,000.00 | $ 1,016.50 | $ 4.47 |

HypotheticalA | | $ 1,000.00 | $ 1,020.77 | $ 4.48 |

Class K | .71% | | | |

Actual | | $ 1,000.00 | $ 1,017.70 | $ 3.61 |

HypotheticalA | | $ 1,000.00 | $ 1,021.63 | $ 3.62 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Annual Report

Investment Changes (Unaudited)

Top Ten Stocks as of October 31, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

United Continental Holdings, Inc. | 8.1 | 0.0 |

Apple, Inc. | 4.0 | 0.9 |

Virgin Media, Inc. | 3.9 | 1.4 |

Sprint Nextel Corp. | 3.5 | 2.1 |

Delta Air Lines, Inc. | 3.1 | 3.9 |

The Walt Disney Co. | 2.8 | 3.7 |

US Airways Group, Inc. | 2.2 | 1.0 |

Union Pacific Corp. | 2.1 | 0.0 |

Juniper Networks, Inc. | 2.0 | 0.7 |

Cisco Systems, Inc. | 1.8 | 3.8 |

| 33.5 | |

Top Five Market Sectors as of October 31, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Consumer Discretionary | 27.6 | 17.1 |

Industrials | 26.1 | 18.6 |

Information Technology | 11.4 | 12.3 |

Financials | 7.9 | 16.2 |

Energy | 6.8 | 9.3 |

Asset Allocation (% of fund's net assets) |

As of October 31, 2010 * | As of April 30, 2010 ** |

| Stocks 96.1% | |  | Stocks 91.6% | |

| Short-Term

Investments and

Net Other Assets 3.9% | |  | Short-Term

Investments and

Net Other Assets 8.4% | |

* Foreign investments | 7.5% | | ** Foreign investments | 8.9% | |

Annual Report

Investments October 31, 2010

Showing Percentage of Net Assets

Common Stocks - 96.1% |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - 27.6% |

Diversified Consumer Services - 1.5% |

ITT Educational Services, Inc. (a)(d) | 932,006 | | $ 60,142 |

Strayer Education, Inc. (d) | 146,121 | | 20,432 |

| | 80,574 |

Hotels, Restaurants & Leisure - 5.4% |

Accor SA | 643,336 | | 26,376 |

Marriott International, Inc. Class A | 904,404 | | 33,508 |

McDonald's Corp. | 1,088,682 | | 84,667 |

MGM Mirage, Inc. (a)(d) | 1,484,500 | | 16,226 |

Paddy Power PLC (Ireland) | 1,188,758 | | 47,969 |

Starwood Hotels & Resorts Worldwide, Inc. | 1,486,120 | | 80,459 |

| | 289,205 |

Internet & Catalog Retail - 1.1% |

Amazon.com, Inc. (a) | 287,061 | | 47,405 |

Blue Nile, Inc. (a) | 285,000 | | 12,141 |

| | 59,546 |

Media - 10.9% |

CBS Corp. Class B | 2,573,281 | | 43,566 |

Interpublic Group of Companies, Inc. (a) | 6,621,473 | | 68,532 |

Kabel Deutschland Holding AG | 1,115,800 | | 50,234 |

The Walt Disney Co. | 4,125,262 | | 148,963 |

Valassis Communications, Inc. (a) | 1,895,434 | | 62,549 |

Virgin Media, Inc. (d) | 8,355,135 | | 212,471 |

| | 586,315 |

Multiline Retail - 0.3% |

Retail Ventures, Inc. (a) | 1,035,657 | | 14,075 |

Specialty Retail - 5.5% |

Bed Bath & Beyond, Inc. (a) | 1,336,069 | | 58,653 |

Chico's FAS, Inc. | 5,047,714 | | 49,064 |

DSW, Inc. Class A (a)(d) | 662,321 | | 22,035 |

J. Crew Group, Inc. (a)(d) | 841,400 | | 26,916 |

Staples, Inc. | 2,276,346 | | 46,597 |

Tiffany & Co., Inc. | 395,905 | | 20,983 |

TJX Companies, Inc. | 1,583,486 | | 72,666 |

| | 296,914 |

Textiles, Apparel & Luxury Goods - 2.9% |

Coach, Inc. | 940,164 | | 47,008 |

NIKE, Inc. Class B | 197,940 | | 16,120 |

Phillips-Van Heusen Corp. | 859,100 | | 52,697 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Textiles, Apparel & Luxury Goods - continued |

Polo Ralph Lauren Corp. Class A | 247,500 | | $ 23,978 |

VF Corp. | 227,330 | | 18,923 |

| | 158,726 |

TOTAL CONSUMER DISCRETIONARY | | 1,485,355 |

CONSUMER STAPLES - 4.5% |

Beverages - 2.8% |

Anheuser-Busch InBev SA NV | 593,922 | | 37,217 |

Grupo Modelo SAB de CV Series C | 3,100,300 | | 17,361 |

The Coca-Cola Co. | 1,583,546 | | 97,103 |

| | 151,681 |

Food Products - 0.5% |

Kraft Foods, Inc. Class A | 791,841 | | 25,553 |

Tobacco - 1.2% |

Reynolds American, Inc. | 996,640 | | 64,682 |

TOTAL CONSUMER STAPLES | | 241,916 |

ENERGY - 6.8% |

Energy Equipment & Services - 0.4% |

National Oilwell Varco, Inc. | 395,923 | | 21,285 |

Oil, Gas & Consumable Fuels - 6.4% |

Alpha Natural Resources, Inc. (a) | 791,800 | | 35,766 |

Chevron Corp. | 1,039,184 | | 85,847 |

Massey Energy Co. | 643,340 | | 27,065 |

Occidental Petroleum Corp. | 1,020,708 | | 80,258 |

Patriot Coal Corp. (a)(d) | 1,187,700 | | 16,022 |

Peabody Energy Corp. | 395,800 | | 20,938 |

Royal Dutch Shell PLC Class A sponsored ADR | 1,237,141 | | 80,328 |

| | 346,224 |

TOTAL ENERGY | | 367,509 |

FINANCIALS - 7.9% |

Capital Markets - 1.3% |

Franklin Resources, Inc. | 198,035 | | 22,715 |

Janus Capital Group, Inc. | 1,977,543 | | 20,883 |

Lazard Ltd. Class A | 679,700 | | 25,081 |

| | 68,679 |

Common Stocks - continued |

| Shares | | Value (000s) |

FINANCIALS - continued |

Commercial Banks - 3.8% |

Comerica, Inc. | 1,375,188 | | $ 49,204 |

PNC Financial Services Group, Inc. | 1,285,702 | | 69,299 |

Regions Financial Corp. | 3,661,900 | | 23,070 |

SunTrust Banks, Inc. | 1,336,138 | | 33,430 |

SVB Financial Group (a) | 640,394 | | 27,755 |

| | 202,758 |

Diversified Financial Services - 1.5% |

CME Group, Inc. | 218,333 | | 63,240 |

Moody's Corp. | 593,805 | | 16,068 |

| | 79,308 |

Real Estate Management & Development - 1.3% |

CB Richard Ellis Group, Inc. Class A (a) | 3,982,147 | | 73,072 |

TOTAL FINANCIALS | | 423,817 |

HEALTH CARE - 2.6% |

Biotechnology - 1.3% |

Biogen Idec, Inc. (a) | 1,076,960 | | 67,536 |

Health Care Equipment & Supplies - 1.1% |

Edwards Lifesciences Corp. (a) | 712,600 | | 45,542 |

Symmetry Medical, Inc. (a) | 399,897 | | 3,539 |

Wright Medical Group, Inc. (a) | 891,987 | | 11,899 |

| | 60,980 |

Health Care Technology - 0.2% |

Transcend Services, Inc. (a)(e) | 625,383 | | 10,894 |

TOTAL HEALTH CARE | | 139,410 |

INDUSTRIALS - 26.1% |

Aerospace & Defense - 0.4% |

GeoEye, Inc. (a) | 526,888 | | 23,325 |

Air Freight & Logistics - 0.2% |

Air Transport Services Group, Inc. (a) | 1,976,893 | | 13,285 |

Airlines - 13.4% |

Delta Air Lines, Inc. (a) | 12,106,033 | | 168,153 |

United Continental Holdings, Inc. (a)(d) | 15,071,989 | | 437,693 |

US Airways Group, Inc. (a)(d)(e) | 9,983,845 | | 117,710 |

| | 723,556 |

Common Stocks - continued |

| Shares | | Value (000s) |

INDUSTRIALS - continued |

Commercial Services & Supplies - 1.2% |

Pitney Bowes, Inc. | 2,845,282 | | $ 62,425 |

Construction & Engineering - 0.5% |

Fluor Corp. | 544,323 | | 26,231 |

Electrical Equipment - 0.5% |

Emerson Electric Co. | 494,863 | | 27,168 |

Industrial Conglomerates - 0.7% |

Textron, Inc. | 1,710,667 | | 35,616 |

Machinery - 6.1% |

Bucyrus International, Inc. Class A | 742,245 | | 50,591 |

Caterpillar, Inc. | 494,888 | | 38,898 |

Cummins, Inc. | 791,801 | | 69,758 |

Deere & Co. | 692,820 | | 53,209 |

Joy Global, Inc. | 494,900 | | 35,113 |

Trinity Industries, Inc. | 834,449 | | 18,967 |

Vallourec SA | 211,593 | | 21,955 |

WABCO Holdings, Inc. (a) | 858,319 | | 39,843 |

| | 328,334 |

Road & Rail - 3.1% |

Norfolk Southern Corp. | 890,794 | | 54,775 |

Union Pacific Corp. | 1,286,630 | | 112,812 |

| | 167,587 |

TOTAL INDUSTRIALS | | 1,407,527 |

INFORMATION TECHNOLOGY - 11.4% |

Communications Equipment - 3.8% |

Cisco Systems, Inc. (a) | 4,275,013 | | 97,599 |

Juniper Networks, Inc. (a) | 3,265,938 | | 105,784 |

| | 203,383 |

Computers & Peripherals - 4.0% |

Apple, Inc. (a) | 712,568 | | 214,390 |

Internet Software & Services - 1.6% |

Equinix, Inc. (a) | 296,900 | | 25,011 |

Google, Inc. Class A (a) | 99,000 | | 60,686 |

| | 85,697 |

IT Services - 0.7% |

Paychex, Inc. | 1,385,530 | | 38,379 |

Semiconductors & Semiconductor Equipment - 0.8% |

Altera Corp. | 1,435,060 | | 44,788 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

Software - 0.5% |

Citrix Systems, Inc. (a) | 395,902 | | $ 25,365 |

TOTAL INFORMATION TECHNOLOGY | | 612,002 |

MATERIALS - 2.5% |

Metals & Mining - 2.5% |

Alcoa, Inc. | 1,632,959 | | 21,441 |

Newmont Mining Corp. | 346,470 | | 21,090 |

Nucor Corp. | 494,900 | | 18,915 |

Steel Dynamics, Inc. | 1,484,600 | | 21,556 |

United States Steel Corp. (d) | 1,187,693 | | 50,821 |

| | 133,823 |

TELECOMMUNICATION SERVICES - 6.7% |

Diversified Telecommunication Services - 0.4% |

Iliad Group SA | 191,005 | | 21,501 |

Wireless Telecommunication Services - 6.3% |

American Tower Corp. Class A (a) | 791,722 | | 40,861 |

Clearwire Corp. Class A (a)(d) | 4,783,479 | | 33,915 |

SOFTBANK CORP. | 692,800 | | 22,249 |

Sprint Nextel Corp. (a) | 46,397,699 | | 191,159 |

Vodafone Group PLC sponsored ADR | 1,979,292 | | 54,450 |

| | 342,634 |

TOTAL TELECOMMUNICATION SERVICES | | 364,135 |

TOTAL COMMON STOCKS (Cost $4,728,892) | 5,175,494 |

Money Market Funds - 8.5% |

| Shares | | Value (000s) |

Fidelity Cash Central Fund, 0.23% (b) | 136,327,358 | | $ 136,327 |

Fidelity Securities Lending Cash Central Fund, 0.24% (b)(c) | 319,496,836 | | 319,497 |

TOTAL MONEY MARKET FUNDS (Cost $455,824) | 455,824 |

TOTAL INVESTMENT PORTFOLIO - 104.6% (Cost $5,184,716) | | 5,631,318 |

NET OTHER ASSETS (LIABILITIES) - (4.6)% | | (248,244) |

NET ASSETS - 100% | $ 5,383,074 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Affiliated company |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 1,053 |

Fidelity Securities Lending Cash Central Fund | 1,276 |

Total | $ 2,329 |

Other Affiliated Issuers |

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliate

(Amounts in thousands) | Value,

beginning of

period | Purchases | Sales

Proceeds | Dividend

Income | Value,

end of

period |

AMR Corp. | $ 106,576 | $ 6,566 | $ 143,714 | $ - | $ - |

Cbeyond, Inc. | 25,670 | - | 24,980 | - | - |

Continental Airlines, Inc. Class B | 105,889 | 35,858 | 23,236 | - | - |

James River Coal Co. | 34,883 | - | 34,548 | - | - |

Transcend Services, Inc. | - | 9,787 | - | - | 10,894 |

US Airways Group, Inc. | 23,575 | 22,909 | 2,688 | - | 117,710 |

Total | $ 296,593 | $ 75,120 | $ 229,166 | $ - | $ 128,604 |

Other Information |

The following is a summary of the inputs used, as of October 31, 2010, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description

(Amounts in thousands) | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 1,485,355 | $ 1,485,355 | $ - | $ - |

Consumer Staples | 241,916 | 241,916 | - | - |

Energy | 367,509 | 367,509 | - | - |

Financials | 423,817 | 423,817 | - | - |

Health Care | 139,410 | 139,410 | - | - |

Industrials | 1,407,527 | 1,407,527 | - | - |

Information Technology | 612,002 | 612,002 | - | - |

Materials | 133,823 | 133,823 | - | - |

Telecommunication Services | 364,135 | 341,886 | 22,249 | - |

Money Market Funds | 455,824 | 455,824 | - | - |

Total Investments in Securities: | $ 5,631,318 | $ 5,609,069 | $ 22,249 | $ - |

Income Tax Information |

At October 31, 2010, the Fund had a capital loss carryforward of approximately $642,471,000 all of which will expire on October 31, 2016. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | October 31, 2010 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $315,935) - See accompanying schedule: Unaffiliated issuers (cost $4,548,236) | $ 5,046,890 | |

Fidelity Central Funds (cost $455,824) | 455,824 | |

Other affiliated issuers (cost $180,656) | 128,604 | |

Total Investments (cost $5,184,716) | | $ 5,631,318 |

Receivable for investments sold | | 149,061 |

Receivable for fund shares sold | | 4,359 |

Dividends receivable | | 1,071 |

Distributions receivable from Fidelity Central Funds | | 219 |

Other receivables | | 349 |

Total assets | | 5,786,377 |

| | |

Liabilities | | |

Payable for investments purchased | $ 75,660 | |

Payable for fund shares redeemed | 4,505 | |

Accrued management fee | 2,496 | |

Other affiliated payables | 974 | |

Other payables and accrued expenses | 171 | |

Collateral on securities loaned, at value | 319,497 | |

Total liabilities | | 403,303 |

| | |

Net Assets | | $ 5,383,074 |

Net Assets consist of: | | |

Paid in capital | | $ 5,593,078 |

Distributions in excess of net investment income | | (93) |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (656,498) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 446,587 |

Net Assets | | $ 5,383,074 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities - continued

Amounts in thousands (except per-share amounts) | October 31, 2010 |

| | |

Capital Appreciation:

Net Asset Value, offering price and redemption price per share ($4,671,565 ÷ 194,442 shares) | | $ 24.03 |

| | |

Class K:

Net Asset Value, offering price and redemption price per share ($711,509 ÷ 29,540 shares) | | $ 24.09 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Year ended October 31, 2010 |

| | |

Investment Income | | |

Dividends | | $ 51,959 |

Interest | | 1 |

Income from Fidelity Central Funds | | 2,329 |

Total income | | 54,289 |

| | |

Expenses | | |

Management fee

Basic fee | $ 29,605 | |

Performance adjustment | 3,175 | |

Transfer agent fees | 11,352 | |

Accounting and security lending fees | 1,193 | |

Custodian fees and expenses | 144 | |

Independent trustees' compensation | 31 | |

Registration fees | 86 | |

Audit | 66 | |

Legal | 28 | |

Miscellaneous | 72 | |

Total expenses before reductions | 45,752 | |

Expense reductions | (1,042) | 44,710 |

Net investment income (loss) | | 9,579 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 290,585 | |

Other affiliated issuers | (245,010) | |

Foreign currency transactions | (843) | |

Capital gain distribution from Fidelity Central Funds | 11 | |

Total net realized gain (loss) | | 44,743 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 1,258,916 | |

Assets and liabilities in foreign currencies | (33) | |

Total change in net unrealized appreciation (depreciation) | | 1,258,883 |

Net gain (loss) | | 1,303,626 |

Net increase (decrease) in net assets resulting from operations | | $ 1,313,205 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Amounts in thousands | Year ended

October 31,

2010 | Year ended

October 31,

2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 9,579 | $ 12,057 |

Net realized gain (loss) | 44,743 | 183,369 |

Change in net unrealized appreciation (depreciation) | 1,258,883 | 368,356 |

Net increase (decrease) in net assets resulting

from operations | 1,313,205 | 563,782 |

Distributions to shareholders from net investment income | (5,772) | (53,246) |

Share transactions - net increase (decrease) | (834,386) | (487,277) |

Total increase (decrease) in net assets | 473,047 | 23,259 |

| | |

Net Assets | | |

Beginning of period | 4,910,027 | 4,886,768 |

End of period (including distributions in excess of net investment income of $93 and distributions in excess of net investment income of $90, respectively) | $ 5,383,074 | $ 4,910,027 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Capital Appreciation

Years ended October 31, | 2010 | 2009 | 2008 | 2007 | 2006 |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 18.71 | $ 16.68 | $ 32.13 | $ 27.41 | $ 26.22 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .04 | .04 | .16 | .11 | .10 |

Net realized and unrealized gain (loss) | 5.30 | 2.17 | (13.27) | 6.06 | 3.55 |

Total from investment operations | 5.34 | 2.21 | (13.11) | 6.17 | 3.65 |

Distributions from net investment income | (.02) | (.18) | (.12) | (.11) | - |

Distributions from net realized gain | - | - | (2.22) | (1.34) | (2.46) |

Total distributions | (.02) | (.18) | (2.34) | (1.45) | (2.46) |

Net asset value, end of period | $ 24.03 | $ 18.71 | $ 16.68 | $ 32.13 | $ 27.41 |

Total Return A | 28.57% | 13.54% | (43.80)% | 23.51% | 14.70% |

Ratios to Average Net Assets C, E | | | | |

Expenses before reductions | .88% | .79% | .82% | .83% | .91% |

Expenses net of fee waivers, if any | .88% | .79% | .82% | .83% | .91% |

Expenses net of all reductions | .86% | .78% | .82% | .82% | .87% |

Net investment income (loss) | .16% | .25% | .67% | .36% | .36% |

Supplemental Data | | | | |

Net assets, end of period (in millions) | $ 4,672 | $ 4,627 | $ 4,794 | $ 10,139 | $ 8,353 |

Portfolio turnover rate D | 186% | 243% | 157% | 135% | 198% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class K

Years ended October 31, | 2010 | 2009 | 2008 G |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 18.73 | $ 16.69 | $ 25.11 |

Income from Investment Operations | | | |

Net investment income (loss) D | .08 | .08 | .03 |

Net realized and unrealized gain (loss) | 5.31 | 2.18 | (8.45) |

Total from investment operations | 5.39 | 2.26 | (8.42) |

Distributions from net investment income | (.03) | (.22) | - |

Net asset value, end of period | $ 24.09 | $ 18.73 | $ 16.69 |

Total Return B, C | 28.80% | 13.85% | (33.53)% |

Ratios to Average Net Assets E, H | | |

Expenses before reductions | .70% | .55% | .66% A |

Expenses net of fee waivers, if any | .70% | .55% | .66% A |

Expenses net of all reductions | .68% | .54% | .65% A |

Net investment income (loss) | .34% | .49% | .41% A |

Supplemental Data | | |

Net assets, end of period (in millions) | $ 712 | $ 283 | $ 93 |

Portfolio turnover rate F | 186% | 243% | 157% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period May 9, 2008 (commencement of sale of shares) to October 31, 2008.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended October 31, 2010

(Amounts in thousands except ratios)

1. Organization.

Fidelity Capital Appreciation Fund (the Fund) is a fund of Fidelity Capital Trust (the Trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Capital Appreciation and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions also differ by class.

2. Investments in Fidelity Central Funds.

The Fund may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Fund uses independent pricing services approved by the

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

3. Significant Accounting Policies - continued

Security Valuation - continued

Board of Trustees to value its investments. When current market prices or quotations are not readily available or reliable, valuations may be determined in good faith in accordance with procedures adopted by the Board of Trustees. Factors used in determining value may include market or security specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The value used for net asset value (NAV) calculation under these procedures may differ from published prices for the same securities.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below.

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the fund's own assumptions based on the best information available)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of October 31, 2010, is included at the end of the Fund's Schedule of Investments. Valuation techniques used to value the Fund's investments by major category are as follows.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when significant market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-traded funds (ETFs) and certain indexes as well as quoted prices for similar securities are used and are categorized as Level 2 in the hierarchy in these circumstances. Utilizing these techniques may result in transfers between Level 1 and Level 2. For restricted equity securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day and are categorized as Level 1 in the hierarchy. Short-term securities with remaining maturities of sixty days or less for which

Annual Report

3. Significant Accounting Policies - continued

Security Valuation - continued

quotations are not readily available are valued at amortized cost, which approximates fair value and are categorized as Level 2 in the hierarchy.

Foreign Currency. The Fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. As a result of a change in the estimate of the return of capital component of dividend income realized in the year ended October 31, 2009, dividend income has been increased $7,146, with a corresponding decrease to net unrealized appreciation (depreciation). The change in estimate has no impact on total net assets or total return of the Fund. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

3. Significant Accounting Policies - continued

Expenses. Most expenses of the Trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned amongst each fund in the Trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year the Fund intends to qualify as a regulated investment company, including distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. As of October 31, 2010, the Fund did not have any unrecognized tax benefits in the accompanying financial statements. A fund's federal tax return is subject to examination by the Internal Revenue Service (IRS) for a period of three years. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to the short-term gain distributions from the Fidelity Central Funds, foreign currency transactions, deferred trustees compensation, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 741,080 |

Gross unrealized depreciation | (308,505) |

Net unrealized appreciation (depreciation) | $ 432,575 |

| |

Tax Cost | $ 5,198,743 |

Annual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax-based components of distributable earnings as of period end were as follows:

Capital loss carryforward | $ (642,471) |

Net unrealized appreciation (depreciation) | $ 432,560 |

The tax character of distributions paid was as follows:

| October 31, 2010 | October 31, 2009 |

Ordinary Income | $ 5,772 | $ 53,246 |

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $8,845,563 and $9,503,135, respectively.

5. Fees and Other Transactions with Affiliates.

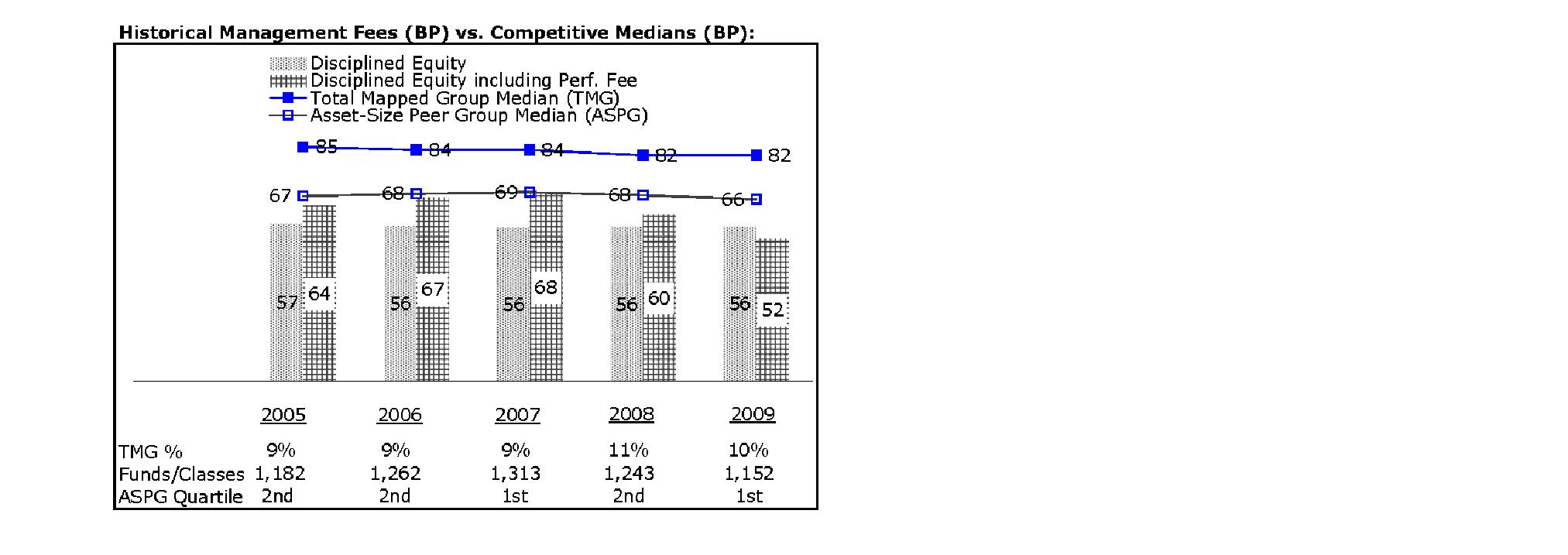

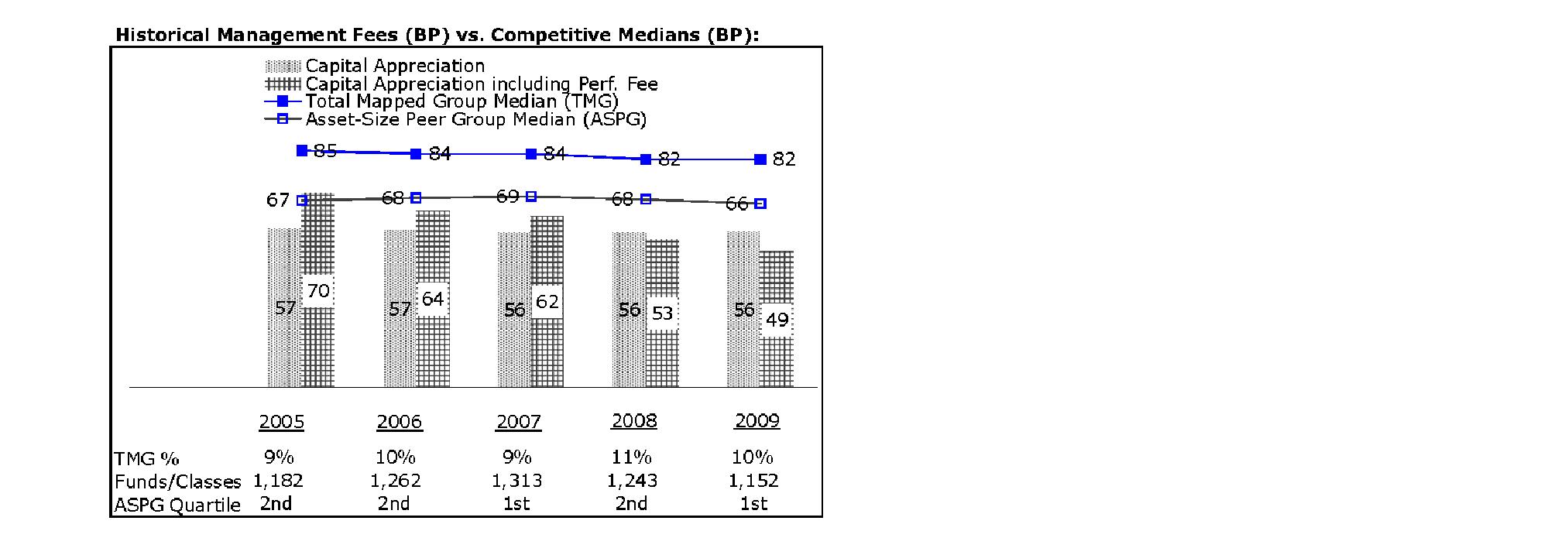

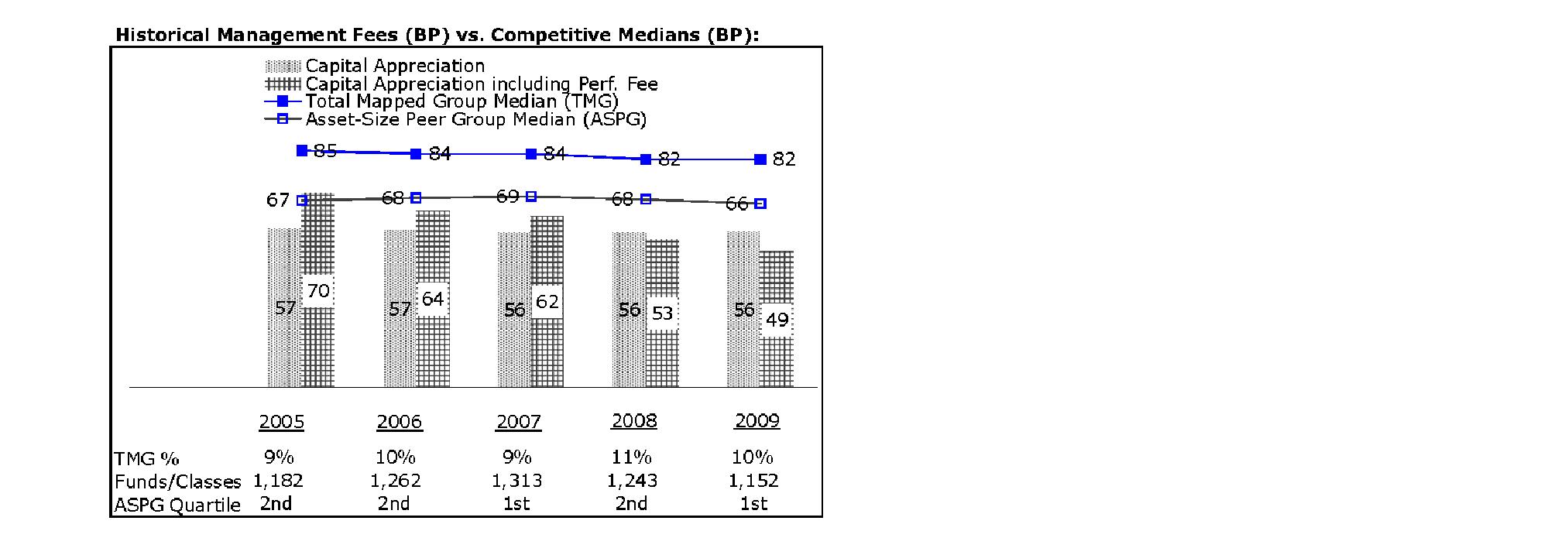

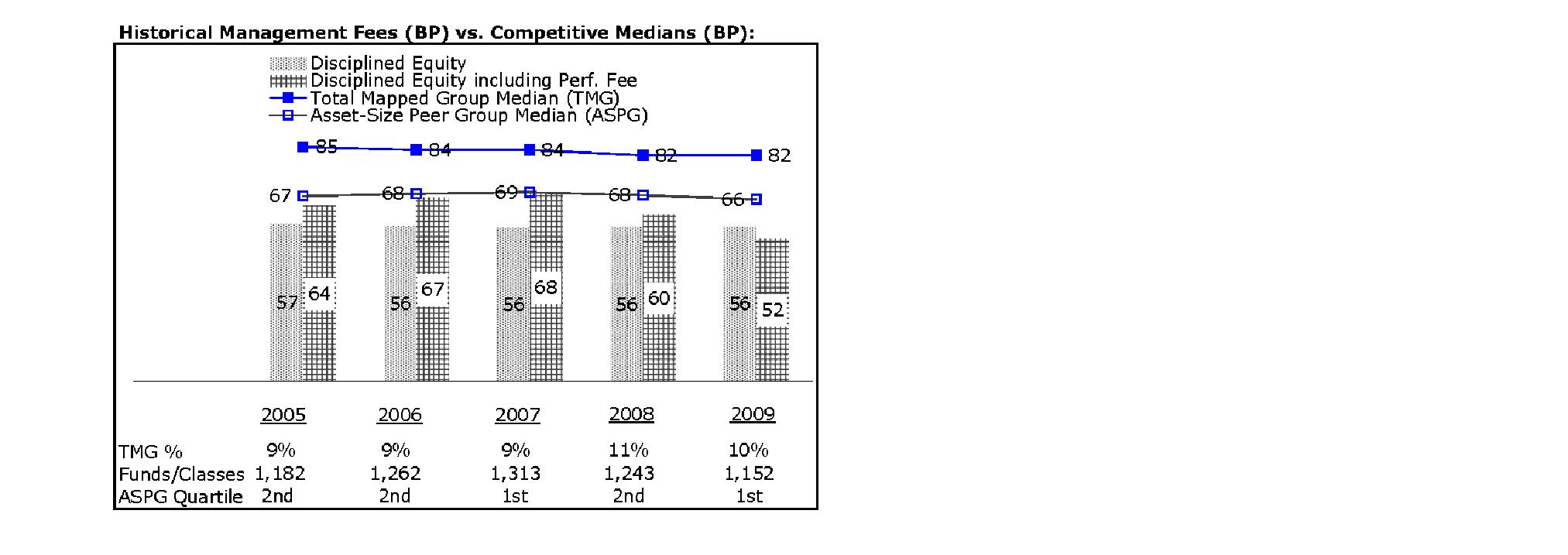

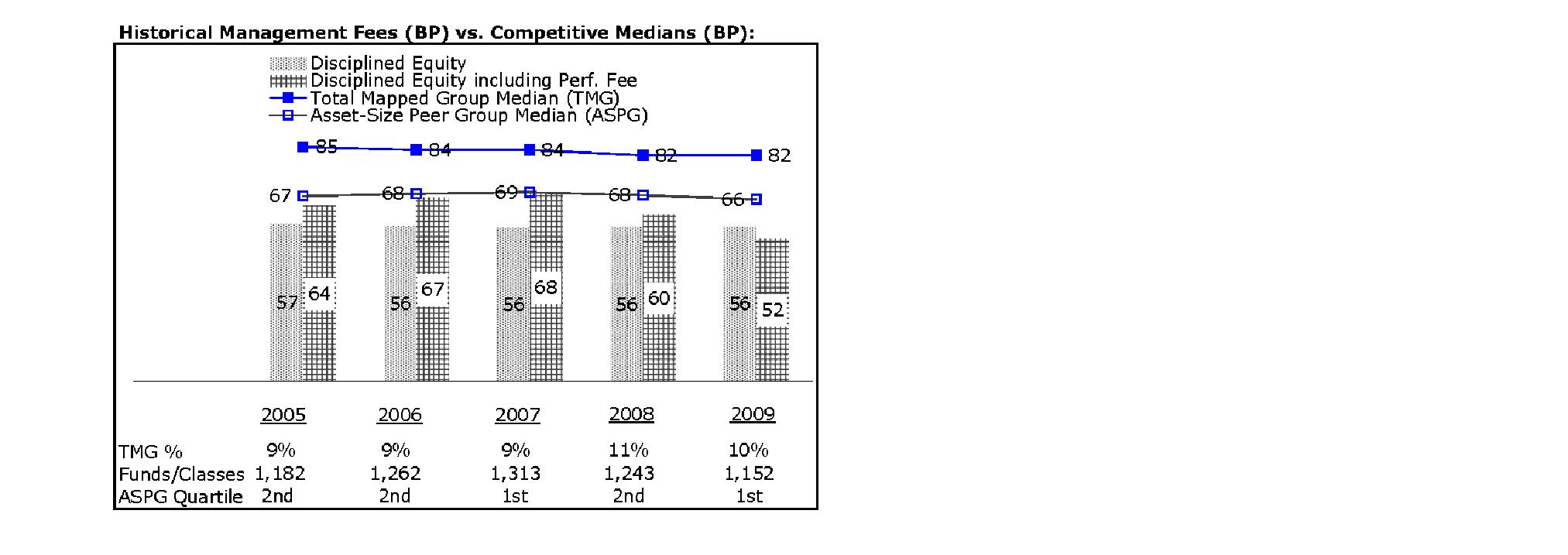

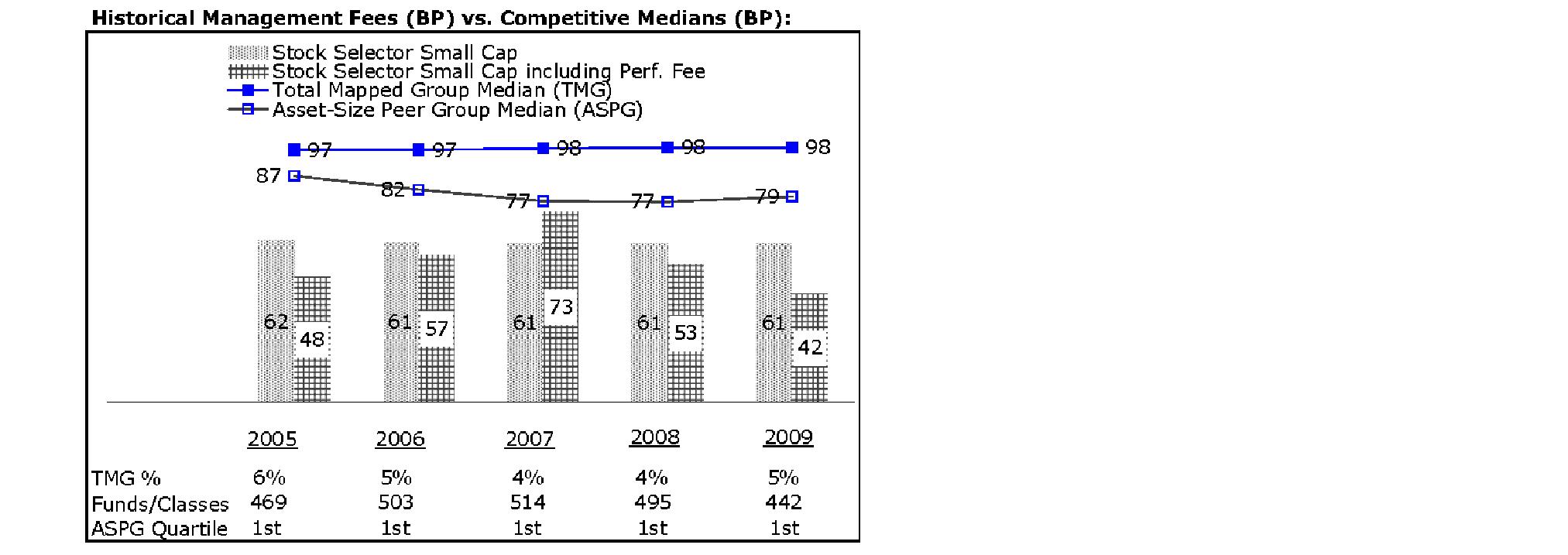

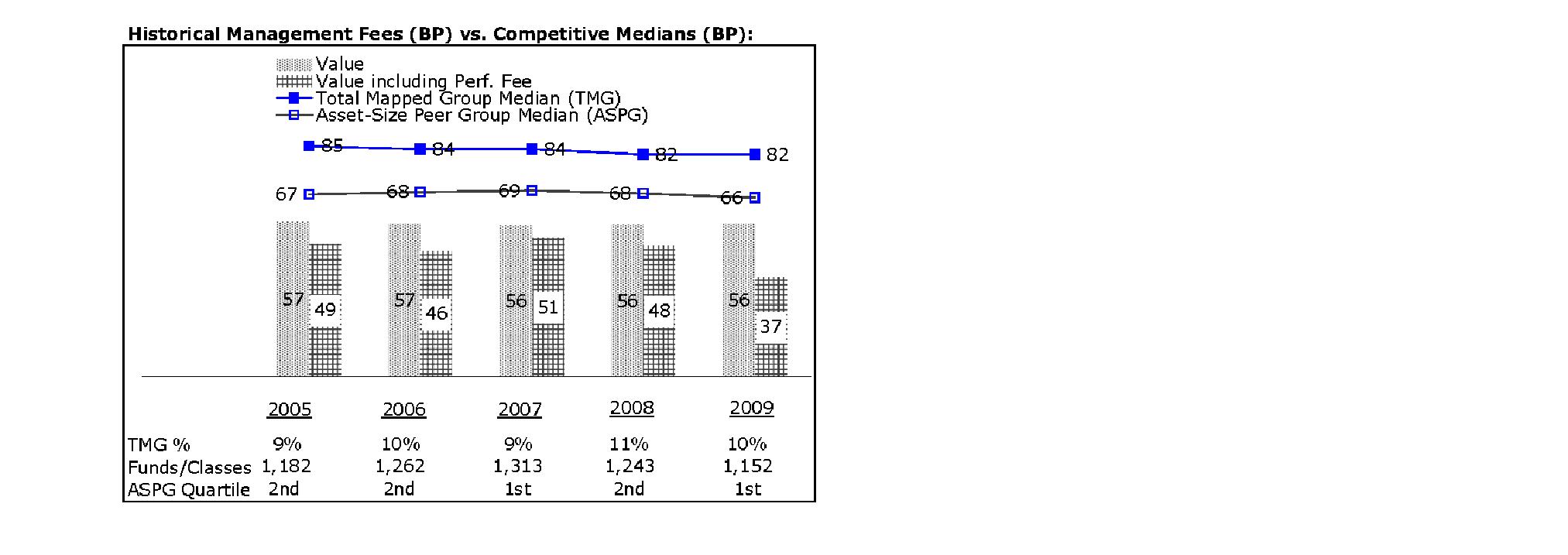

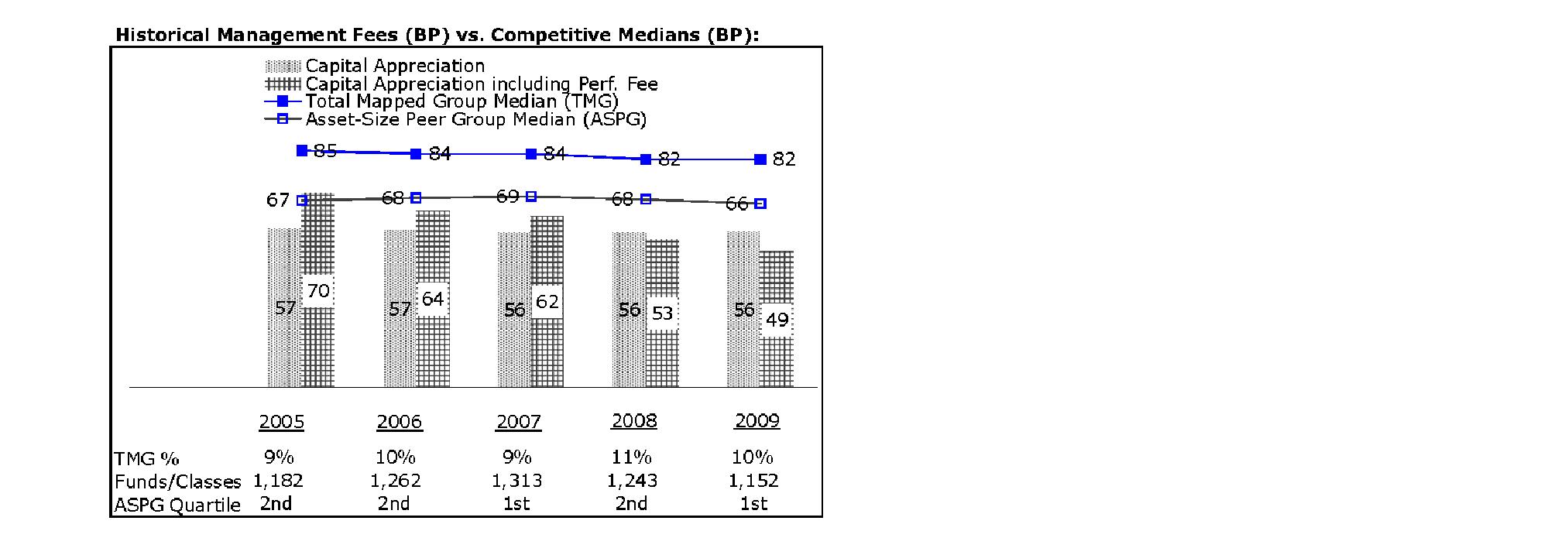

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and a group fee rate that averaged .26% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of ± .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of the retail class of the Fund, Capital Appreciation as compared to an appropriate benchmark index. For the period, the total annual management fee rate, including the performance adjustment, was .62% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of Capital Appreciation. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

5. Fees and Other Transactions with Affiliates - continued

Transfer Agent Fees - continued

pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, transfer agent fees for each class were as follows:

| Amount | % of

Average

Net Assets |

Capital Appreciation | $ 11,046 | .23 |

Class K | 306 | .05 |

| $ 11,352 | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $351 for the period.

6. Committed Line of Credit.

The Fund participates with other funds managed by FMR or an affiliate in a $3.75 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $21 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, there were no borrowings on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. The lending agent may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could

Annual Report

7. Security Lending - continued

experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. The value of securities loaned to FCM at period end was $420. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $1,276, including $5 from securities loaned to FCM.

8. Expense Reductions.

Many of the brokers with whom FMR places trades on behalf of the Fund provided services to the Fund in addition to trade execution. These services included payments of certain expenses on behalf of the Fund totaling $1,042 for the period.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

Years ended October 31, | 2010 | 2009 |

From net investment income | | |

Capital Appreciation | $ 5,336 | $ 51,796 |

Class K | 436 | 1,450 |

Total | $ 5,772 | $ 53,246 |

10. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

Years ended October 31, | 2010 | 2009A | 2010 | 2009A |

Capital Appreciation | | | | |

Shares sold | 24,608 | 32,746 | $ 544,840 | $ 532,909 |

Conversion to Class K | - | (9,081) | - | (137,950) |

Reinvestment of distributions | 250 | 3,319 | 5,154 | 49,955 |

Shares redeemed | (77,678) | (67,177) | (1,707,314) | (1,079,034) |

Net increase (decrease) | (52,820) | (40,193) | $ (1,157,320) | $ (634,120) |

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

10. Share Transactions - continued

| Shares | Dollars |

Years ended October 31, | 2010 | 2009A | 2010 | 2009A |

Class K | | | | |

Shares sold | 22,592 | 3,750 | $ 500,526 | $ 63,798 |

Conversion from Capital Appreciation | - | 9,086 | - | 137,950 |

Reinvestment of distributions | 21 | 96 | 436 | 1,450 |

Shares redeemed | (8,191) | (3,358) | (178,028) | (56,355) |

Net increase (decrease) | 14,422 | 9,574 | $ 322,934 | $ 146,843 |

A Conversion transactions for Class K and Capital Appreciation are presented for the period November 1, 2008, through August 31, 2009.

11. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Annual Report

To the Trustees of Fidelity Capital Trust and the Shareholders of Fidelity Capital Appreciation Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Capital Appreciation Fund (a fund of Fidelity Capital Trust) at October 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fidelity Capital Appreciation Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

December 10, 2010

Annual Report

The Trustees, Member of the Advisory Board, and executive officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for James C. Curvey, each of the Trustees oversees 221 funds advised by FMR or an affiliate. Mr. Curvey oversees 410 funds advised by FMR or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 72nd birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. The executive officers and Advisory Board Member hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

Experience, Skills, Attributes, and Qualifications of the Fund's Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Annual Report

Trustees and Officers - continued

Board Structure and Oversight Function. Edward C. Johnson 3d is an interested person (as defined in the 1940 Act) and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Ned C. Lautenbach serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's equity and high income funds and another Board oversees Fidelity's investment-grade bond, money market, and asset allocation funds. The asset allocation funds may invest in Fidelity funds overseen by the fund's Board. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through FMR, its affiliates and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the fund's activities, oversight is exercised primarily through the Operations, Audit, and Compliance Committees. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate. The responsibilities of each committee, including their oversight responsibilities, are described further under "Standing Committees of the Fund's Trustees."

Annual Report

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-8544.

Interested Trustees*:

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupations and Other Relevant Experience+ |

Edward C. Johnson 3d (80) |

| Year of Election or Appointment: 1978 Mr. Johnson is Trustee and Chairman of the Board of Trustees of certain Trusts. Mr. Johnson serves as Chief Executive Officer, Chairman, and a Director of FMR LLC; Chairman and a Director of FMR; Chairman and a Director of Fidelity Research & Analysis Company (FRAC); Chairman and a Director of Fidelity Investments Money Management, Inc.; and Chairman and a Director of FMR Co., Inc. In addition, Mr. Johnson serves as Chairman and Director of FIL Limited. Previously, Mr. Johnson served as President of FMR LLC (2006-2007). |

James C. Curvey (75) |

| Year of Election or Appointment: 2007 Mr. Curvey also serves as Trustee (2007-present) of other investment companies advised by FMR. Mr. Curvey is a Director of Fidelity Investments Money Management, Inc. (2009-present), Director of Fidelity Research & Analysis Co. (2009-present) and Director of FMR and FMR Co., Inc. (2007-present). Mr. Curvey is also Vice Chairman (2007-present) and Director of FMR LLC. In addition, Mr. Curvey serves as an Overseer for the Boston Symphony Orchestra and a member of the Trustees of Villanova University. Previously, Mr. Curvey was the Vice Chairman (2006-2007) and Director (2000-2007) of FMR Corp. |

* Trustees have been determined to be "Interested Trustees" by virtue of, among other things, their affiliation with the trust or various entities under common control with FMR.

Annual Report

Trustees and Officers - continued

+ The information above includes each Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each Trustee's qualifications to serve as a Trustee, which led to the conclusion that each Trustee should serve as a Trustee for the fund.

Independent Trustees:

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustees) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Age; Principal Occupations and Other Relevant Experience+ |

Dennis J. Dirks (62) |

| Year of Election or Appointment: 2005 Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Company (DTC) and President and Board member of the National Securities Clearing Corporation (NSCC). In addition, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation, Chief Executive Officer and Board member of the Mortgage-Backed Securities Clearing Corporation, as a Trustee and a member of the Finance Committee of Manhattan College (2005-2008), and as a Trustee and a member of the Finance Committee of AHRC of Nassau County (2006-2008). Mr. Dirks is a member of the Independent Directors Council (IDC) Governing Council (2010-Present) and Board of Directors for The Brookville Center for Children's Services, Inc. (2009-present). |

Alan J. Lacy (57) |

| Year of Election or Appointment: 2008 Mr. Lacy serves as Senior Adviser (2007-present) of Oak Hill Capital Partners, L.P. (private equity). Mr. Lacy also served as Chief Executive Officer (2000-2005) and Vice Chairman (2005-2006) of Sears Holdings Corporation and Sears, Roebuck and Co. (retail). In addition, Mr. Lacy serves as a member of the Board of Directors of The Western Union Company (global money transfer, 2006-present) and Bristol-Myers Squibb Company (global pharmaceuticals, 2007-present). Mr. Lacy is Chairman (2008-present) and a member (2006-present) of the Board of Trustees of The National Parks Conservation Association. |

Ned C. Lautenbach (66) |

| Year of Election or Appointment: 2000 Mr. Lautenbach is Chairman of the Independent Trustees of the Equity and High Income Funds (2006-present). Mr. Lautenbach currently serves as the Lead Director of the Eaton Corporation Board of Directors (diversified industrial, 1997-present). Mr. Lautenbach is also a member of the Board of Directors of the Philharmonic Center for the Arts in Naples, Florida (1999-present); a member of the Board of Trustees of Fairfield University (2005-present); and a member of the Council on Foreign Relations (1994-present). Previously, Mr. Lautenbach was a Partner/Advisory Partner at Clayton, Dubilier & Rice, Inc. (private equity investment, 1998-2010), as well as a Director of Sony Corporation (2006-2007). |

Joseph Mauriello (66) |

| Year of Election or Appointment: 2008 Prior to his retirement in January 2006, Mr. Mauriello served in numerous senior management positions including Deputy Chairman and Chief Operating Officer (2004-2005), and Vice Chairman of Financial Services (2002-2004) of KPMG LLP US (professional services, 1965-2005). Mr. Mauriello currently serves as a member of the Board of Directors of XL Group plc. (global insurance and re-insurance, 2006-present) and of Arcadia Resources Inc. (health care services and products, 2007-present). Previously, Mr. Mauriello served as a Director of the Hamilton Funds of the Bank of New York (2006-2007). |

Cornelia M. Small (66) |

| Year of Election or Appointment: 2005 Ms. Small is a member of the Board of Directors of the Teagle Foundation (2009-present). Ms. Small is also a member of the Investment Committee, and Chair (2008-present) and a member of the Board of Trustees of Smith College. In addition, Ms. Small serves on the Investment Committee of the Berkshire Taconic Community Foundation (2008-present). Previously, Ms. Small served as Chairperson of the Investment Committee (2002-2008) of Smith College. In addition, Ms. Small served as Chief Investment Officer, Director of Global Equity Investments, and a member of the Board of Directors of Scudder, Stevens & Clark and Scudder Kemper Investments. |

William S. Stavropoulos (71) |

| Year of Election or Appointment: 2002 Mr. Stavropoulos is Vice Chairman of the Independent Trustees of the Equity and High Income Funds (2006-present). Mr. Stavropoulos serves as President and Founder of the Michigan Baseball Foundation, the Great Lakes Loons (2007-present). Mr. Stavropoulos is Chairman Emeritus of the Board of Directors of The Dow Chemical Company, where he previously served in numerous senior management positions, including President, CEO (1995-2000; 2002-2004), Chairman of the Executive Committee (2000-2006), and as a member of the Board of Directors (1990-2006). Currently, Mr. Stavropoulos is Chairman of Univar (global distributor of commodity and specialty chemicals, 2010-present), a Director of Teradata Corporation (data warehousing and technology solutions, 2008-present), Chemical Financial Corporation, Maersk Inc. (industrial conglomerate), Tyco International, Inc. (multinational manufacturing and services, 2007-present), and a member of the Advisory Board for Metalmark Capital (private equity investment, 2005-

present). Mr. Stavropoulos is a special advisor to Clayton, Dubilier & Rice, Inc. (private equity investment). In addition, Mr. Stavropoulos is a member of the University of Notre Dame Advisory Council for the College of Science. |

David M. Thomas (61) |

| Year of Election or Appointment: 2008 Previously, Mr. Thomas served as Executive Chairman (2005-2006) and Chairman and Chief Executive Officer (2000-2005) of IMS Health, Inc. (pharmaceutical and healthcare information solutions). In addition, Mr. Thomas serves as a member of the Board of Directors of Fortune Brands, Inc. (consumer products), and Interpublic Group of Companies, Inc. (marketing communication, 2004-present). |

Michael E. Wiley (60) |

| Year of Election or Appointment: 2008 Mr. Wiley also serves as a Director of Asia Pacific Exploration Consolidated (international oil and gas exploration and production, 2008-present). Mr. Wiley serves as a Director of Tesoro Corporation (independent oil refiner and marketer, 2005-present), and a Director of Bill Barrett Corporation (exploration and production, 2005-present). In addition, Mr. Wiley also serves as a Director of Post Oak Bank (privately-held bank, 2004-present). Previously, Mr. Wiley served as a member of the Board of Trustees of the University of Tulsa (2000-2006; 2007-2010), as a Senior Energy Advisor of Katzenbach Partners, LLC (consulting, 2006-2007), as an Advisory Director of Riverstone Holdings (private investment), Chairman, President, and CEO of Baker Hughes, Inc. (oilfield services, 2000-2004), and as Director of Spinnaker Exploration Company (exploration and production, 2001-2005). |

Annual Report

+ The information above includes each Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each Trustee's qualifications to serve as a Trustee, which led to the conclusion that each Trustee should serve as a Trustee for the fund.

Advisory Board Member and Executive Officers:

Correspondence intended for each executive officer and Peter S. Lynch may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Peter S. Lynch (66) |

| Year of Election or Appointment: 2003 Member of the Advisory Board of Fidelity's Equity and High Income Funds. Mr. Lynch is Vice Chairman and a Director of FMR and FMR Co., Inc. In addition, Mr. Lynch serves as a Trustee of Boston College and as the Chairman of the Inner-City Scholarship Fund. Previously, Mr. Lynch served on the Special Olympics International Board of Directors (1997-2006). |