UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02841

Fidelity Capital Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | April 30, 2022 |

Item 1.

Reports to Stockholders

Fidelity® Value Fund

Semi-Annual Report

April 30, 2022

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2022 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

Top Ten Stocks as of April 30, 2022

| | % of fund's net assets |

| Antero Resources Corp. | 1.5 |

| Hess Corp. | 1.4 |

| Edison International | 1.1 |

| Dollar Tree, Inc. | 1.1 |

| Cenovus Energy, Inc. (Canada) | 1.0 |

| PG&E Corp. | 1.0 |

| Fluor Corp. | 1.0 |

| Ventas, Inc. | 1.0 |

| Canadian Natural Resources Ltd. | 0.9 |

| Sempra Energy | 0.9 |

| | 10.9 |

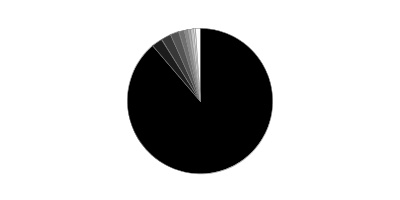

Market Sectors as of April 30, 2022

| | % of fund's net assets |

| Industrials | 20.6 |

| Consumer Discretionary | 13.9 |

| Energy | 13.0 |

| Materials | 11.1 |

| Financials | 10.8 |

| Information Technology | 6.4 |

| Utilities | 6.1 |

| Health Care | 5.8 |

| Real Estate | 5.8 |

| Consumer Staples | 3.1 |

| Communication Services | 2.5 |

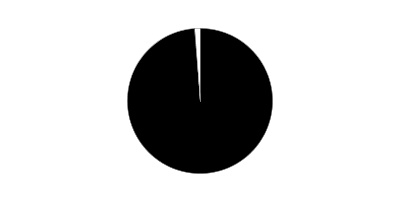

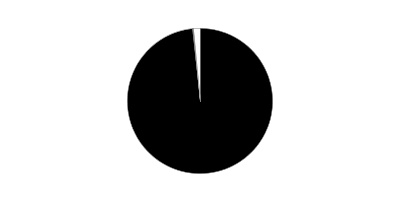

Asset Allocation (% of fund's net assets)

| As of April 30, 2022* |

| | Stocks and Equity Futures | 99.4% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 0.6% |

* Foreign investments - 15.7%

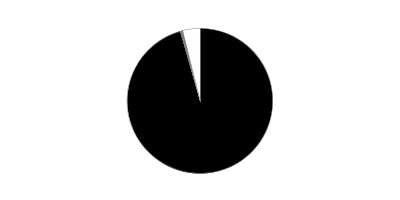

Geographic Diversification (% of fund's net assets)

| As of April 30, 2022 |

| | United States of America* | 84.3% |

| | Canada | 4.2% |

| | United Kingdom | 3.0% |

| | Bermuda | 2.8% |

| | Ireland | 2.3% |

| | Singapore | 0.7% |

| | British Virgin Islands | 0.6% |

| | France | 0.5% |

| | Luxembourg | 0.5% |

| | Other | 1.1% |

* Includes Short-Term investments and Net Other Assets (Liabilities)

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

Schedule of Investments April 30, 2022 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 99.1% | | | |

| | | Shares | Value (000s) |

| COMMUNICATION SERVICES - 2.5% | | | |

| Diversified Telecommunication Services - 0.3% | | | |

| Liberty Global PLC Class C (a) | | 979,100 | $23,205 |

| Interactive Media & Services - 0.2% | | | |

| Ziff Davis, Inc. (a) | | 241,600 | 21,348 |

| Media - 2.0% | | | |

| Advantage Solutions, Inc. Class A (a) | | 4,174,700 | 20,999 |

| DISH Network Corp. Class A (a) | | 585,400 | 16,690 |

| Interpublic Group of Companies, Inc. | | 1,465,900 | 47,818 |

| News Corp. Class A | | 1,036,100 | 20,577 |

| Nexstar Broadcasting Group, Inc. Class A | | 225,700 | 35,755 |

| Scholastic Corp. | | 503,900 | 18,569 |

| Thryv Holdings, Inc. (a) | | 1,022,200 | 26,403 |

| | | | 186,811 |

|

| TOTAL COMMUNICATION SERVICES | | | 231,364 |

|

| CONSUMER DISCRETIONARY - 13.9% | | | |

| Auto Components - 0.6% | | | |

| Adient PLC (a) | | 1,306,500 | 44,604 |

| Autoliv, Inc. | | 208,900 | 15,392 |

| | | | 59,996 |

| Automobiles - 0.4% | | | |

| Harley-Davidson, Inc. | | 928,000 | 33,826 |

| Diversified Consumer Services - 0.9% | | | |

| Adtalem Global Education, Inc. (a) | | 2,014,456 | 59,044 |

| Frontdoor, Inc. (a) | | 456,500 | 14,110 |

| H&R Block, Inc. | | 602,500 | 15,707 |

| | | | 88,861 |

| Hotels, Restaurants & Leisure - 1.9% | | | |

| ARAMARK Holdings Corp. | | 722,400 | 26,187 |

| Brinker International, Inc. (a) | | 1,305,100 | 47,414 |

| Caesars Entertainment, Inc. (a) | | 916,804 | 60,766 |

| Hilton Grand Vacations, Inc. (a) | | 519,000 | 24,305 |

| Hyatt Hotels Corp. Class A (a) | | 169,900 | 16,134 |

| | | | 174,806 |

| Household Durables - 2.2% | | | |

| KB Home | | 1,084,100 | 35,157 |

| Mohawk Industries, Inc. (a) | | 417,000 | 58,822 |

| Newell Brands, Inc. | | 1,386,300 | 32,093 |

| Tempur Sealy International, Inc. | | 1,283,700 | 34,801 |

| Tupperware Brands Corp. (a) | | 2,008,248 | 35,305 |

| Whirlpool Corp. | | 40,200 | 7,297 |

| | | | 203,475 |

| Internet & Direct Marketing Retail - 0.7% | | | |

| eBay, Inc. | | 862,364 | 44,774 |

| Qurate Retail, Inc. Series A | | 4,306,000 | 18,128 |

| | | | 62,902 |

| Leisure Products - 0.7% | | | |

| Mattel, Inc. (a) | | 2,644,800 | 64,295 |

| Multiline Retail - 1.7% | | | |

| Dollar Tree, Inc. (a) | | 614,900 | 99,891 |

| Franchise Group, Inc. | | 352,050 | 13,128 |

| Nordstrom, Inc. (b) | | 1,786,500 | 45,913 |

| | | | 158,932 |

| Specialty Retail - 4.2% | | | |

| Academy Sports & Outdoors, Inc. | | 929,479 | 34,725 |

| American Eagle Outfitters, Inc. (b) | | 1,423,400 | 21,508 |

| Bath & Body Works, Inc. | | 617,500 | 32,660 |

| Camping World Holdings, Inc. (b) | | 808,800 | 20,770 |

| Gap, Inc. | | 2,828,700 | 35,132 |

| Lithia Motors, Inc. Class A (sub. vtg.) | | 180,600 | 51,133 |

| Rent-A-Center, Inc. | | 1,403,500 | 33,852 |

| Sally Beauty Holdings, Inc. (a) | | 2,218,771 | 33,548 |

| Signet Jewelers Ltd. (b) | | 662,400 | 46,500 |

| Victoria's Secret & Co. (a) | | 895,733 | 42,207 |

| Warby Parker, Inc. (a) | | 82,200 | 1,914 |

| Williams-Sonoma, Inc.(b) | | 290,500 | 37,904 |

| | | | 391,853 |

| Textiles, Apparel & Luxury Goods - 0.6% | | | |

| Capri Holdings Ltd. (a) | | 1,101,066 | 52,521 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 1,291,467 |

|

| CONSUMER STAPLES - 3.1% | | | |

| Beverages - 0.5% | | | |

| Primo Water Corp. | | 3,159,800 | 46,259 |

| Food & Staples Retailing - 1.0% | | | |

| Albertsons Companies, Inc. | | 933,200 | 29,190 |

| U.S. Foods Holding Corp. (a) | | 1,682,700 | 63,303 |

| | | | 92,493 |

| Food Products - 1.2% | | | |

| Bunge Ltd. | | 380,600 | 43,053 |

| Darling Ingredients, Inc. (a) | | 869,800 | 63,835 |

| | | | 106,888 |

| Household Products - 0.2% | | | |

| Spectrum Brands Holdings, Inc. | | 231,180 | 19,666 |

| Personal Products - 0.2% | | | |

| Herbalife Nutrition Ltd. (a) | | 760,300 | 20,209 |

|

| TOTAL CONSUMER STAPLES | | | 285,515 |

|

| ENERGY - 13.0% | | | |

| Energy Equipment & Services - 2.1% | | | |

| Halliburton Co. | | 1,029,400 | 36,667 |

| John Wood Group PLC (a) | | 7,561,826 | 21,026 |

| Liberty Oilfield Services, Inc. Class A (a) | | 2,948,233 | 47,584 |

| Technip Energies NV | | 1,491,760 | 18,128 |

| TechnipFMC PLC (a) | | 6,704,900 | 46,398 |

| Tenaris SA | | 1,439,200 | 21,994 |

| | | | 191,797 |

| Oil, Gas & Consumable Fuels - 10.9% | | | |

| Antero Resources Corp. (a) | | 3,886,200 | 136,793 |

| APA Corp. | | 693,981 | 28,405 |

| Canadian Natural Resources Ltd. | | 1,360,100 | 84,180 |

| Cenovus Energy, Inc. (Canada) | | 5,279,581 | 97,606 |

| Cheniere Energy, Inc. | | 388,700 | 52,789 |

| Denbury, Inc. (a) | | 885,279 | 56,640 |

| Devon Energy Corp. | | 622,163 | 36,191 |

| DHT Holdings, Inc. | | 1,349,100 | 7,582 |

| Diamondback Energy, Inc. | | 153,574 | 19,386 |

| Energy Transfer LP | | 4,050,900 | 44,884 |

| Enviva, Inc. | | 554,621 | 46,777 |

| Euronav NV | | 666,400 | 7,705 |

| Genesis Energy LP | | 2,709,739 | 29,753 |

| Hess Corp. | | 1,220,877 | 125,836 |

| HF Sinclair Corp. (a) | | 1,008,300 | 38,336 |

| Imperial Oil Ltd. | | 429,900 | 21,645 |

| Kosmos Energy Ltd. (a) | | 2,689,600 | 18,182 |

| Targa Resources Corp. | | 764,300 | 56,107 |

| The Williams Companies, Inc. | | 796,372 | 27,308 |

| Tourmaline Oil Corp. | | 947,000 | 48,771 |

| Valero Energy Corp. | | 284,100 | 31,671 |

| | | | 1,016,547 |

|

| TOTAL ENERGY | | | 1,208,344 |

|

| FINANCIALS - 10.8% | | | |

| Banks - 2.6% | | | |

| Bank of Kyoto Ltd. | | 405,300 | 17,658 |

| East West Bancorp, Inc. | | 368,100 | 26,246 |

| First Citizens Bancshares, Inc. | | 60,792 | 38,869 |

| First Citizens Bancshares, Inc. Class B | | 5,400 | 3,402 |

| M&T Bank Corp. | | 458,100 | 76,338 |

| PacWest Bancorp | | 1,064,400 | 35,008 |

| Signature Bank | | 161,300 | 39,075 |

| | | | 236,596 |

| Capital Markets - 1.5% | | | |

| Ameriprise Financial, Inc. | | 182,100 | 48,346 |

| Lazard Ltd. Class A | | 856,400 | 28,064 |

| LPL Financial | | 325,700 | 61,189 |

| | | | 137,599 |

| Consumer Finance - 1.0% | | | |

| OneMain Holdings, Inc. | | 1,057,480 | 48,570 |

| SLM Corp. | | 2,704,996 | 45,255 |

| | | | 93,825 |

| Diversified Financial Services - 1.2% | | | |

| Apollo Global Management, Inc. | | 1,249,900 | 62,195 |

| ECN Capital Corp. | | 3,133,300 | 14,195 |

| Equitable Holdings, Inc. | | 1,316,100 | 37,943 |

| | | | 114,333 |

| Insurance - 3.5% | | | |

| AMBAC Financial Group, Inc. (a) | | 2,040,459 | 15,773 |

| American Financial Group, Inc. | | 314,000 | 43,483 |

| Arch Capital Group Ltd. (a) | | 877,000 | 40,053 |

| Assurant, Inc. | | 343,100 | 62,403 |

| Fairfax Financial Holdings Ltd. (sub. vtg.) | | 70,900 | 38,957 |

| Reinsurance Group of America, Inc. | | 429,249 | 46,067 |

| The Travelers Companies, Inc. | | 466,300 | 79,765 |

| | | | 326,501 |

| Thrifts & Mortgage Finance - 1.0% | | | |

| Axos Financial, Inc. (a) | | 880,500 | 33,353 |

| Essent Group Ltd. | | 842,100 | 34,130 |

| Walker & Dunlop, Inc. | | 187,400 | 22,443 |

| | | | 89,926 |

|

| TOTAL FINANCIALS | | | 998,780 |

|

| HEALTH CARE - 5.8% | | | |

| Biotechnology - 0.5% | | | |

| Ascendis Pharma A/S sponsored ADR (a) | | 32,743 | 2,988 |

| Horizon Therapeutics PLC (a) | | 79,854 | 7,870 |

| United Therapeutics Corp. (a) | | 215,600 | 38,282 |

| | | | 49,140 |

| Health Care Equipment & Supplies - 0.5% | | | |

| Dentsply Sirona, Inc. | | 132,162 | 5,285 |

| Hologic, Inc. (a) | | 145,654 | 10,486 |

| STERIS PLC | | 15,700 | 3,518 |

| Teleflex, Inc. | | 30,215 | 8,630 |

| The Cooper Companies, Inc. | | 35,577 | 12,845 |

| Zimmer Biomet Holdings, Inc. | | 65,004 | 7,849 |

| Zimvie, Inc. (a) | | 6,500 | 146 |

| | | | 48,759 |

| Health Care Providers & Services - 3.1% | | | |

| Accolade, Inc. (a)(b) | | 191,900 | 1,067 |

| AdaptHealth Corp. (a)(b)(c) | | 3,132,300 | 39,655 |

| agilon health, Inc. (a) | | 237,600 | 4,222 |

| AmerisourceBergen Corp. | | 48,300 | 7,307 |

| Cano Health, Inc. (a) | | 19,600 | 104 |

| Cardinal Health, Inc. | | 49,577 | 2,878 |

| Centene Corp. (a) | | 727,500 | 58,600 |

| Cigna Corp. | | 257,500 | 63,546 |

| DaVita HealthCare Partners, Inc. (a) | | 10,600 | 1,149 |

| Laboratory Corp. of America Holdings | | 199,276 | 47,882 |

| McKesson Corp. | | 68,243 | 21,129 |

| Molina Healthcare, Inc. (a) | | 51,607 | 16,176 |

| Tenet Healthcare Corp. (a) | | 327,700 | 23,762 |

| | | | 287,477 |

| Health Care Technology - 0.0% | | | |

| Evolent Health, Inc. (a) | | 81,900 | 2,254 |

| Teladoc Health, Inc. (a)(b) | | 35,200 | 1,188 |

| | | | 3,442 |

| Life Sciences Tools & Services - 0.7% | | | |

| Agilent Technologies, Inc. | | 60,715 | 7,241 |

| Avantor, Inc. (a) | | 71,200 | 2,270 |

| Bio-Rad Laboratories, Inc. Class A (a) | | 26,106 | 13,368 |

| IQVIA Holdings, Inc. (a) | | 69,006 | 15,043 |

| Maravai LifeSciences Holdings, Inc. (a) | | 79,400 | 2,440 |

| PerkinElmer, Inc. | | 77,547 | 11,369 |

| Syneos Health, Inc. (a) | | 104,810 | 7,661 |

| | | | 59,392 |

| Pharmaceuticals - 1.0% | | | |

| Catalent, Inc. (a) | | 81,771 | 7,405 |

| Jazz Pharmaceuticals PLC (a) | | 490,767 | 78,631 |

| Perrigo Co. PLC | | 32,300 | 1,108 |

| Royalty Pharma PLC | | 53,300 | 2,270 |

| Viatris, Inc. | | 189,400 | 1,957 |

| | | | 91,371 |

|

| TOTAL HEALTH CARE | | | 539,581 |

|

| INDUSTRIALS - 20.6% | | | |

| Aerospace & Defense - 1.5% | | | |

| Curtiss-Wright Corp. | | 397,300 | 56,778 |

| Northrop Grumman Corp. | | 79,300 | 34,844 |

| The Boeing Co. (a) | | 196,400 | 29,232 |

| Triumph Group, Inc. (a) | | 900,500 | 20,297 |

| | | | 141,151 |

| Air Freight & Logistics - 0.7% | | | |

| FedEx Corp. | | 318,500 | 63,299 |

| Building Products - 1.7% | | | |

| Builders FirstSource, Inc. (a) | | 1,067,450 | 65,723 |

| Jeld-Wen Holding, Inc. (a) | | 3,156,827 | 65,630 |

| UFP Industries, Inc. | | 322,600 | 24,960 |

| | | | 156,313 |

| Commercial Services & Supplies - 1.3% | | | |

| CoreCivic, Inc. (a) | | 1,596,360 | 19,843 |

| HNI Corp. (b) | | 857,600 | 30,565 |

| The Brink's Co. | | 871,300 | 51,363 |

| The GEO Group, Inc. (a) | | 2,501,300 | 16,333 |

| | | | 118,104 |

| Construction & Engineering - 3.6% | | | |

| AECOM | | 198,019 | 13,972 |

| API Group Corp. (a) | | 1,718,363 | 31,893 |

| Fluor Corp. (a) | | 3,635,000 | 89,966 |

| Granite Construction, Inc. | | 2,153,900 | 63,863 |

| MDU Resources Group, Inc. | | 2,069,400 | 53,308 |

| Quanta Services, Inc. | | 17,500 | 2,030 |

| Valmont Industries, Inc. | | 112,400 | 27,966 |

| Willscot Mobile Mini Holdings (a) | | 1,394,500 | 48,947 |

| | | | 331,945 |

| Electrical Equipment - 1.6% | | | |

| Array Technologies, Inc. (a)(b) | | 3,297,600 | 21,533 |

| GrafTech International Ltd. | | 2,360,300 | 21,432 |

| Regal Rexnord Corp. | | 399,056 | 50,776 |

| Sensata Technologies, Inc. PLC | | 887,606 | 40,306 |

| Vertiv Holdings Co. | | 1,251,700 | 15,684 |

| | | | 149,731 |

| Machinery - 3.9% | | | |

| Allison Transmission Holdings, Inc. | | 1,882,929 | 70,497 |

| CNH Industrial NV (b) | | 24,400 | 346 |

| Crane Co. | | 621,200 | 59,778 |

| Daimler Truck Holding AG (a) | | 16,300 | 438 |

| EnPro Industries, Inc. | | 114,271 | 10,651 |

| Flowserve Corp. | | 944,409 | 30,892 |

| Kennametal, Inc. | | 1,810,500 | 46,584 |

| Korea Shipbuilding & Offshore Engineering Co. Ltd. (a) | | 4,040 | 289 |

| Mueller Industries, Inc. | | 432,837 | 23,438 |

| Oshkosh Corp. | | 468,500 | 43,308 |

| Stanley Black & Decker, Inc. | | 306,100 | 36,778 |

| Timken Co. | | 748,700 | 43,155 |

| | | | 366,154 |

| Marine - 0.5% | | | |

| Genco Shipping & Trading Ltd. | | 399,480 | 8,801 |

| Kirby Corp. (a) | | 501,800 | 32,717 |

| Navios Maritime Partners LP | | 30,742 | 904 |

| Star Bulk Carriers Corp. (b) | | 137,351 | 3,860 |

| | | | 46,282 |

| Professional Services - 1.2% | | | |

| CACI International, Inc. Class A (a) | | 125,100 | 33,189 |

| Manpower, Inc. | | 618,300 | 55,771 |

| Nielsen Holdings PLC | | 937,800 | 25,142 |

| | | | 114,102 |

| Road & Rail - 1.5% | | | |

| Knight-Swift Transportation Holdings, Inc. Class A | | 332,900 | 15,943 |

| Ryder System, Inc. | | 682,800 | 47,728 |

| TFI International, Inc. (Canada) | | 359,700 | 28,935 |

| XPO Logistics, Inc. (a) | | 803,800 | 43,236 |

| | | | 135,842 |

| Trading Companies & Distributors - 3.1% | | | |

| Beacon Roofing Supply, Inc. (a) | | 1,113,000 | 66,368 |

| Custom Truck One Source, Inc. Class A (a) | | 2,466,400 | 16,204 |

| Fortress Transportation & Infrastructure Investors LLC | | 1,443,438 | 31,019 |

| GMS, Inc. (a) | | 844,000 | 40,470 |

| Herc Holdings, Inc. | | 309,600 | 39,573 |

| MRC Global, Inc. (a) | | 2,325,958 | 27,888 |

| NOW, Inc. (a) | | 998,852 | 10,887 |

| Univar Solutions, Inc. (a) | | 1,749,727 | 50,952 |

| | | | 283,361 |

|

| TOTAL INDUSTRIALS | | | 1,906,284 |

|

| INFORMATION TECHNOLOGY - 6.4% | | | |

| Communications Equipment - 0.3% | | | |

| Lumentum Holdings, Inc. (a) | | 279,000 | 22,658 |

| Electronic Equipment & Components - 1.6% | | | |

| Flex Ltd. (a) | | 4,231,000 | 69,769 |

| Insight Enterprises, Inc. (a) | | 336,800 | 33,468 |

| Vontier Corp. | | 1,902,900 | 48,752 |

| | | | 151,989 |

| IT Services - 2.3% | | | |

| Concentrix Corp. | | 274,700 | 43,260 |

| Cyxtera Technologies, Inc. Class A (a) | | 3,555,992 | 42,779 |

| Fidelity National Information Services, Inc. | | 417,500 | 41,395 |

| Unisys Corp. (a) | | 3,342,272 | 47,494 |

| Verra Mobility Corp. (a) | | 2,421,900 | 33,979 |

| | | | 208,907 |

| Software - 1.7% | | | |

| Micro Focus International PLC | | 4,733,800 | 22,354 |

| NCR Corp. (a) | | 1,569,500 | 54,980 |

| NortonLifeLock, Inc. | | 1,229,500 | 30,787 |

| SS&C Technologies Holdings, Inc. | | 811,100 | 52,446 |

| | | | 160,567 |

| Technology Hardware, Storage & Peripherals - 0.5% | | | |

| Seagate Technology Holdings PLC | | 340,000 | 27,894 |

| Xerox Holdings Corp. | | 1,297,600 | 22,578 |

| | | | 50,472 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 594,593 |

|

| MATERIALS - 11.1% | | | |

| Chemicals - 4.7% | | | |

| Axalta Coating Systems Ltd. (a)(b) | | 2,450,437 | 62,168 |

| Cabot Corp. | | 346,300 | 22,804 |

| Celanese Corp. Class A | | 271,767 | 39,933 |

| Corteva, Inc. | | 479,319 | 27,652 |

| Eastman Chemical Co. | | 515,200 | 52,896 |

| Huntsman Corp. | | 1,793,983 | 60,762 |

| Methanex Corp. | | 49,800 | 2,498 |

| Olin Corp. | | 755,700 | 43,377 |

| The Chemours Co. LLC | | 1,150,700 | 38,054 |

| Trinseo PLC | | 1,075,790 | 51,046 |

| Tronox Holdings PLC | | 1,678,174 | 28,865 |

| Westlake Corp. | | 38,700 | 4,897 |

| | | | 434,952 |

| Construction Materials - 1.2% | | | |

| Eagle Materials, Inc. | | 288,000 | 35,516 |

| GCC S.A.B. de CV | | 2,585,400 | 17,100 |

| Martin Marietta Materials, Inc. | | 58,702 | 20,793 |

| Summit Materials, Inc. (a) | | 1,256,900 | 34,942 |

| | | | 108,351 |

| Containers & Packaging - 1.9% | | | |

| Berry Global Group, Inc. (a) | | 1,104,324 | 62,229 |

| Crown Holdings, Inc. | | 473,600 | 52,115 |

| O-I Glass, Inc. (a) | | 3,572,084 | 48,152 |

| WestRock Co. | | 358,994 | 17,781 |

| | | | 180,277 |

| Metals & Mining - 3.3% | | | |

| Alcoa Corp. | | 575,200 | 38,999 |

| Allegheny Technologies, Inc. (a) | | 1,000,900 | 27,204 |

| ArcelorMittal SA Class A unit GDR | | 709,100 | 20,734 |

| Arconic Corp. (a) | | 1,842,030 | 46,345 |

| Carpenter Technology Corp. | | 1,001,100 | 38,222 |

| Constellium NV (a) | | 2,925,499 | 48,827 |

| First Quantum Minerals Ltd. | | 779,400 | 22,345 |

| Freeport-McMoRan, Inc. | | 759,800 | 30,810 |

| Steel Dynamics, Inc. | | 345,548 | 29,631 |

| | | | 303,117 |

|

| TOTAL MATERIALS | | | 1,026,697 |

|

| REAL ESTATE - 5.8% | | | |

| Equity Real Estate Investment Trusts (REITs) - 3.9% | | | |

| CubeSmart | | 1,476,537 | 70,150 |

| Equinix, Inc. | | 50,100 | 36,026 |

| Equity Lifestyle Properties, Inc. | | 749,322 | 57,908 |

| Lamar Advertising Co. Class A | | 258,700 | 28,563 |

| Ventas, Inc. | | 1,571,486 | 87,296 |

| VICI Properties, Inc. | | 1,365,500 | 40,706 |

| Welltower, Inc. | | 428,500 | 38,912 |

| | | | 359,561 |

| Real Estate Management & Development - 1.9% | | | |

| Cushman & Wakefield PLC (a) | | 4,068,398 | 72,824 |

| Jones Lang LaSalle, Inc. (a) | | 191,900 | 41,974 |

| Realogy Holdings Corp. (a) | | 2,697,500 | 29,565 |

| WeWork, Inc. (a)(b) | | 4,704,577 | 32,979 |

| | | | 177,342 |

|

| TOTAL REAL ESTATE | | | 536,903 |

|

| UTILITIES - 6.1% | | | |

| Electric Utilities - 3.9% | | | |

| Constellation Energy Corp. | | 1,034,569 | 61,257 |

| Edison International | | 1,528,800 | 105,166 |

| Entergy Corp. | | 500,700 | 59,508 |

| FirstEnergy Corp. | | 1,105,300 | 47,871 |

| PG&E Corp. (a) | | 7,204,100 | 91,132 |

| | | | 364,934 |

| Independent Power and Renewable Electricity Producers - 1.3% | | | |

| The AES Corp. | | 3,707,200 | 75,701 |

| Vistra Corp. | | 1,841,700 | 46,079 |

| | | | 121,780 |

| Multi-Utilities - 0.9% | | | |

| Sempra Energy | | 510,600 | 82,390 |

|

| TOTAL UTILITIES | | | 569,104 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $7,679,577) | | | 9,188,632 |

| | | Principal Amount (000s) | Value (000s) |

|

| U.S. Treasury Obligations - 0.0% | | | |

| U.S. Treasury Bills, yield at date of purchase 0.66% to 0.75% 7/7/22 to 7/14/22 (d) | | | |

| (Cost $2,956) | | 2,960 | 2,955 |

| | | Shares | Value (000s) |

|

| Money Market Funds - 2.3% | | | |

| Fidelity Cash Central Fund 0.32% (e) | | 66,867,254 | $66,881 |

| Fidelity Securities Lending Cash Central Fund 0.32% (e)(f) | | 145,568,166 | 145,583 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $212,463) | | | 212,464 |

| TOTAL INVESTMENT IN SECURITIES - 101.4% | | | |

| (Cost $7,894,996) | | | 9,404,051 |

| NET OTHER ASSETS (LIABILITIES) - (1.4)% | | | (129,166) |

| NET ASSETS - 100% | | | $9,274,885 |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional Amount (000s) | Value (000s) | Unrealized Appreciation/(Depreciation) (000s) |

| Purchased | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini S&P MidCap 400 Index Contracts (United States) | 126 | June 2022 | $31,438 | $(2,552) | $(2,552) |

The notional amount of futures purchased as a percentage of Net Assets is 0.3%

For the period, the average monthly notional amount at value for futures contracts in the aggregate was $35,306,000.

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated company

(d) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $1,795,000.

(e) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(f) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.32% | $44,445 | $1,588,106 | $1,565,670 | $68 | $-- | $-- | $66,881 | 0.1% |

| Fidelity Securities Lending Cash Central Fund 0.32% | 192,078 | 805,308 | 851,803 | 293 | -- | -- | 145,583 | 0.4% |

| Total | $236,523 | $2,393,414 | $2,417,473 | $361 | $-- | $-- | $212,464 | |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are presented in the table below. Certain corporate actions, such as mergers, are excluded from the amounts in this table if applicable.

| Affiliate (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| AdaptHealth Corp. | $-- | $55,883 | $823 | $-- | $(653) | $(14,752) | $39,655 |

| Total | $-- | $55,883 | $823 | $-- | $(653) | $(14,752) | $39,655 |

Investment Valuation

The following is a summary of the inputs used, as of April 30, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $231,364 | $231,364 | $-- | $-- |

| Consumer Discretionary | 1,291,467 | 1,291,467 | -- | -- |

| Consumer Staples | 285,515 | 285,515 | -- | -- |

| Energy | 1,208,344 | 1,139,491 | 68,853 | -- |

| Financials | 998,780 | 981,122 | 17,658 | -- |

| Health Care | 539,581 | 539,581 | -- | -- |

| Industrials | 1,906,284 | 1,905,557 | 727 | -- |

| Information Technology | 594,593 | 572,239 | 22,354 | -- |

| Materials | 1,026,697 | 1,026,697 | -- | -- |

| Real Estate | 536,903 | 536,903 | -- | -- |

| Utilities | 569,104 | 569,104 | -- | -- |

| U.S. Government and Government Agency Obligations | 2,955 | -- | 2,955 | -- |

| Money Market Funds | 212,464 | 212,464 | -- | -- |

| Total Investments in Securities: | $9,404,051 | $9,291,504 | $112,547 | $-- |

| Derivative Instruments: | | | | |

| Liabilities | | | | |

| Futures Contracts | $(2,552) | $(2,552) | $-- | $-- |

| Total Liabilities | $(2,552) | $(2,552) | $-- | $-- |

| Total Derivative Instruments: | $(2,552) | $(2,552) | $-- | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of April 30, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| (Amounts in thousands) | | |

| Equity Risk | | |

| Futures Contracts(a) | $0 | $(2,552) |

| Total Equity Risk | 0 | (2,552) |

| Total Value of Derivatives | $0 | $(2,552) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | April 30, 2022 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $135,996) — See accompanying schedule:

Unaffiliated issuers (cost $7,628,126) | $9,151,932 | |

| Fidelity Central Funds (cost $212,463) | 212,464 | |

| Other affiliated issuers (cost $54,407) | 39,655 | |

| Total Investment in Securities (cost $7,894,996) | | $9,404,051 |

| Foreign currency held at value (cost $714) | | 716 |

| Receivable for investments sold | | 79,845 |

| Receivable for fund shares sold | | 7,261 |

| Dividends receivable | | 4,560 |

| Interest receivable | | 1 |

| Distributions receivable from Fidelity Central Funds | | 81 |

| Prepaid expenses | | 3 |

| Other receivables | | 454 |

| Total assets | | 9,496,972 |

| Liabilities | | |

| Payable to custodian bank | $121 | |

| Payable for investments purchased | 64,659 | |

| Payable for fund shares redeemed | 3,874 | |

| Accrued management fee | 5,474 | |

| Payable for daily variation margin on futures contracts | 879 | |

| Other affiliated payables | 1,015 | |

| Other payables and accrued expenses | 500 | |

| Collateral on securities loaned | 145,565 | |

| Total liabilities | | 222,087 |

| Net Assets | | $9,274,885 |

| Net Assets consist of: | | |

| Paid in capital | | $7,290,849 |

| Total accumulated earnings (loss) | | 1,984,036 |

| Net Assets | | $9,274,885 |

| Net Asset Value and Maximum Offering Price | | |

| Value: | | |

| Net Asset Value, offering price and redemption price per share ($8,017,219 ÷ 576,846 shares) | | $13.90 |

| Class K: | | |

| Net Asset Value, offering price and redemption price per share ($1,257,666 ÷ 90,359 shares) | | $13.92 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Six months ended April 30, 2022 (Unaudited) |

| Investment Income | | |

| Dividends | | $85,947 |

| Interest | | 4 |

| Income from Fidelity Central Funds (including $293 from security lending) | | 361 |

| Total income | | 86,312 |

| Expenses | | |

| Management fee | | |

| Basic fee | $25,203 | |

| Performance adjustment | 7,167 | |

| Transfer agent fees | 5,326 | |

| Accounting fees | 635 | |

| Custodian fees and expenses | 32 | |

| Independent trustees' fees and expenses | 16 | |

| Registration fees | 138 | |

| Audit | 30 | |

| Legal | 10 | |

| Interest | 1 | |

| Miscellaneous | 18 | |

| Total expenses before reductions | 38,576 | |

| Expense reductions | (140) | |

| Total expenses after reductions | | 38,436 |

| Net investment income (loss) | | 47,876 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 562,449 | |

| Affiliated issuers | (653) | |

| Foreign currency transactions | 42 | |

| Futures contracts | (15,299) | |

| Total net realized gain (loss) | | 546,539 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (808,977) | |

| Affiliated issuers | (14,752) | |

| Assets and liabilities in foreign currencies | (63) | |

| Futures contracts | (2,975) | |

| Total change in net unrealized appreciation (depreciation) | | (826,767) |

| Net gain (loss) | | (280,228) |

| Net increase (decrease) in net assets resulting from operations | | $(232,352) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended April 30, 2022 (Unaudited) | Year ended October 31, 2021 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $47,876 | $68,102 |

| Net realized gain (loss) | 546,539 | 1,487,674 |

| Change in net unrealized appreciation (depreciation) | (826,767) | 1,892,801 |

| Net increase (decrease) in net assets resulting from operations | (232,352) | 3,448,577 |

| Distributions to shareholders | (871,432) | (64,718) |

| Share transactions - net increase (decrease) | 849,476 | 892,433 |

| Total increase (decrease) in net assets | (254,308) | 4,276,292 |

| Net Assets | | |

| Beginning of period | 9,529,193 | 5,252,901 |

| End of period | $9,274,885 | $9,529,193 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Value Fund

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2022 | 2021 | 2020 | 2019 | 2018 A | 2017 A |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $15.72 | $9.57 | $10.59 | $11.15 | $12.19 | $10.30 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)B,C | .07 | .12 | .12 | .14 | .15 | .18D |

| Net realized and unrealized gain (loss) | (.45) | 6.15 | (.77) | .71 | (.62) | 1.85 |

| Total from investment operations | (.38) | 6.27 | (.65) | .85 | (.47) | 2.03 |

| Distributions from net investment income | (.20) | (.12) | (.14)E | (.12) | (.17) | (.14) |

| Distributions from net realized gain | (1.24) | – | (.23)E | (1.29) | (.41) | –F |

| Total distributions | (1.44) | (.12) | (.37) | (1.41) | (.57)G | (.14) |

| Net asset value, end of period | $13.90 | $15.72 | $9.57 | $10.59 | $11.15 | $12.19 |

| Total ReturnH,I | (2.38)% | 65.91% | (6.52)% | 9.31% | (4.14)% | 19.86% |

| Ratios to Average Net AssetsC,J,K | | | | | | |

| Expenses before reductions | .81%L | .79% | .57% | .58% | .58% | .58% |

| Expenses net of fee waivers, if any | .81%L | .79% | .57% | .58% | .58% | .58% |

| Expenses net of all reductions | .81%L | .79% | .55% | .58% | .56% | .57% |

| Net investment income (loss) | .99%L | .82% | 1.30% | 1.38% | 1.25% | 1.51%D |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $8,017 | $8,361 | $4,760 | $6,112 | $6,181 | $7,344 |

| Portfolio turnover rateM | 71%L | 77% | 90% | 75% | 100% | 73% |

A Per share amounts have been adjusted to reflect the impact of the 10 for 1 share split that occurred on May 11, 2018.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

D Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.03 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been 1.23%.

E The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

F Amount represents less than $.005 per share.

G Total distributions per share do not sum due to rounding.

H Total returns for periods of less than one year are not annualized.

I Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

J Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

K Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

L Annualized

M Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Value Fund Class K

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2022 | 2021 | 2020 | 2019 | 2018 A | 2017 A |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $15.74 | $9.59 | $10.60 | $11.16 | $12.21 | $10.32 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)B,C | .08 | .13 | .13 | .15 | .16 | .19D |

| Net realized and unrealized gain (loss) | (.45) | 6.15 | (.76) | .72 | (.62) | 1.85 |

| Total from investment operations | (.37) | 6.28 | (.63) | .87 | (.46) | 2.04 |

| Distributions from net investment income | (.21) | (.13) | (.15)E | (.13) | (.18) | (.15) |

| Distributions from net realized gain | (1.24) | – | (.23)E | (1.29) | (.41) | –F |

| Total distributions | (1.45) | (.13) | (.38) | (1.43)G | (.59) | (.15) |

| Net asset value, end of period | $13.92 | $15.74 | $9.59 | $10.60 | $11.16 | $12.21 |

| Total ReturnH,I | (2.28)% | 65.90% | (6.33)% | 9.43% | (4.11)% | 19.98% |

| Ratios to Average Net AssetsC,J,K | | | | | | |

| Expenses before reductions | .73%L | .71% | .47% | .49% | .48% | .48% |

| Expenses net of fee waivers, if any | .73%L | .71% | .47% | .49% | .48% | .48% |

| Expenses net of all reductions | .73%L | .71% | .45% | .48% | .46% | .48% |

| Net investment income (loss) | 1.07%L | .91% | 1.40% | 1.48% | 1.34% | 1.61%D |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $1,258 | $1,168 | $493 | $740 | $844 | $1,073 |

| Portfolio turnover rateM | 71%L | 77% | 90% | 75% | 100% | 73% |

A Per share amounts have been adjusted to reflect the impact of the 10 for 1 share split that occurred on May 11, 2018.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

D Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.03 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been 1.33%.

E The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

F Amount represents less than $.005 per share.

G Total distributions per share do not sum due to rounding.

H Total returns for periods of less than one year are not annualized.

I Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

J Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

K Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

L Annualized

M Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended April 30, 2022

(Amounts in thousands except percentages)

1. Organization.

Fidelity Value Fund (the Fund) is a fund of Fidelity Capital Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Value and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio(a) |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

(a) Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – unadjusted quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, ETFs and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of April 30, 2022 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Certain Funds may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Funds may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any withholding tax reclaims income is included in the Statement of Operations in dividends. Any receivables for withholding tax reclaims are included in the Statement of Assets and Liabilities in dividends receivable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of a fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of a fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred, as applicable. Certain expense reductions may also differ by class, if applicable. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for certain Funds, certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in affiliated mutual funds, are marked-to-market and remain in a fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees presented below are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, as applicable.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, foreign currency transactions, passive foreign investment companies (PFIC), deferred trustees compensation, capital loss carryforwards, partnerships and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $2,089,483 |

| Gross unrealized depreciation | (617,574) |

| Net unrealized appreciation (depreciation) | $1,471,909 |

| Tax cost | $7,929,590 |

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment.

|

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, U.S. government securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| Fidelity Value Fund | 3,389,107 | 3,355,968 |

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .22% during the period. The group fee rate is based upon the monthly average net assets of a group of registered investment companies with which the investment adviser has management contracts. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Value as compared to its benchmark index, the Russell Midcap Value Index, over the same 36 month performance period. For the reporting period, the total annualized management fee rate, including the performance adjustment, was .67% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of Value except for Class K. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets(a) |

| Value | $5,078 | .12 |

| Class K | 248 | .04 |

| | $5,326 | |

(a) Annualized

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. For the period, the fees were equivalent to the following annualized rates:

| | % of Average Net Assets |

| Fidelity Value Fund | .01 |

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| | Amount |

| Fidelity Value Fund | $108 |

Interfund Lending Program. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the Fund, along with other registered investment companies having management contracts with Fidelity Management & Research Company LLC (FMR), or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. Activity in this program during the period for which loans were outstanding was as follows:

| | Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense |

| Fidelity Value Fund | Borrower | $48,821 | .32% | $1 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. Interfund trades during the period are noted in the table below.

| | Purchases ($) | Sales ($) | Realized Gain (Loss) ($) |

| Fidelity Value Fund | 294,060 | 200,487 | 26,300 |

Other. During the period, the investment adviser reimbursed the Fund for certain losses as follows:

| | Amount ($) |

| Fidelity Value Fund | 5 |

7. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Statement of Operations, and are listed below. During the period, there were no borrowings on this line of credit.

| | Amount |

| Fidelity Value Fund | $8 |

8. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End |

| Fidelity Value Fund | $31 | $1 | $– |

9. Expense Reductions.

During the period the investment adviser or an affiliate reimbursed and/or waived a portion of fund-level operating expenses in the amount of $140.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended

April 30, 2022 | Year ended

October 31, 2021 |

| Fidelity Value Fund | | |

| Distributions to shareholders | | |

| Value | $764,386 | $58,303 |

| Class K | 107,046 | 6,415 |

| Total | $871,432 | $64,718 |

11. Share Transactions.

Share transactions for each class were as follows and may contain in-kind transactions, automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended April 30, 2022 | Year ended October 31, 2021 | Six months ended April 30, 2022 | Year ended October 31, 2021 |

| Fidelity Value Fund | | | | |

| Value | | | | |

| Shares sold | 48,226 | 108,639 | $707,224 | $1,570,378 |

| Reinvestment of distributions | 50,898 | 4,594 | 704,841 | 54,026 |

| Shares redeemed | (54,266) | (78,502) | (788,122) | (1,105,911) |

| Net increase (decrease) | 44,858 | 34,731 | $623,943 | $518,493 |

| Class K | | | | |

| Shares sold | 19,174 | 45,765 | $277,239 | $690,373 |

| Reinvestment of distributions | 7,724 | 545 | 107,046 | 6,415 |

| Shares redeemed | (10,737) | (23,501) | (158,752) | (322,848) |

| Net increase (decrease) | 16,161 | 22,809 | $225,533 | $373,940 |

12. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

13. Coronavirus (COVID-19) Pandemic.

An outbreak of COVID-19 first detected in China during December 2019 has since spread globally and was declared a pandemic by the World Health Organization during March 2020. Developments that disrupt global economies and financial markets, such as the COVID-19 pandemic, may magnify factors that affect the Fund's performance.

Shareholder Expense Example

As a shareholder, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or redemption proceeds, as applicable and (2) ongoing costs, which generally include management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2021 to April 30, 2022).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class/Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. If any fund is a shareholder of any underlying mutual funds or exchange-traded funds (ETFs) (the Underlying Funds), such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses incurred presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. If any fund is a shareholder of any Underlying Funds, such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses as presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Annualized Expense Ratio-A | Beginning

Account Value

November 1, 2021 | Ending

Account Value

April 30, 2022 | Expenses Paid

During Period-B

November 1, 2021

to April 30, 2022 |

| Fidelity Value Fund | | | | |

| Value | .81% | | | |

| Actual | | $1,000.00 | $976.20 | $3.97 |

| Hypothetical-C | | $1,000.00 | $1,020.78 | $4.06 |

| Class K | .73% | | | |

| Actual | | $1,000.00 | $977.20 | $3.58 |

| Hypothetical-C | | $1,000.00 | $1,021.17 | $3.66 |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/ 365 (to reflect the one-half year period). The fees and expenses of any Underlying Funds are not included in each annualized expense ratio.