Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[GRAPHIC]

clearly

better connections

[LOGO]

[GRAPHIC]

Optelecom, Inc.

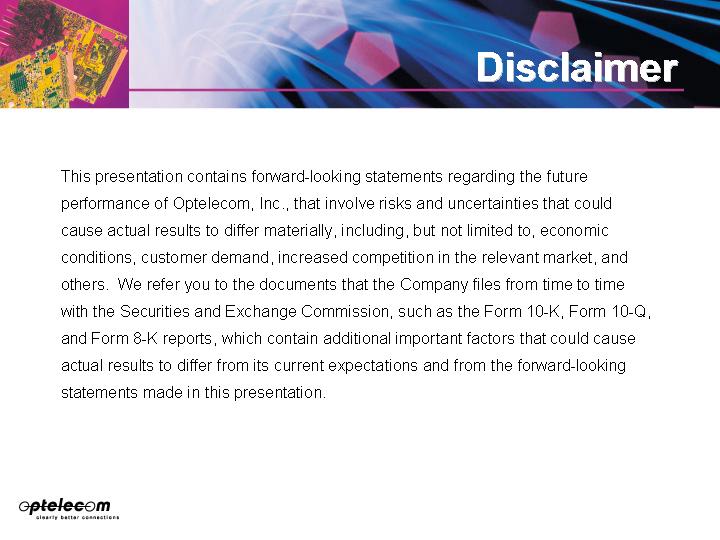

Disclaimer

This presentation contains forward-looking statements regarding the future performance of Optelecom, Inc., that involve risks and uncertainties that could cause actual results to differ materially, including, but not limited to, economic conditions, customer demand, increased competition in the relevant market, and others. We refer you to the documents that the Company files from time to time with the Securities and Exchange Commission, such as the Form 10-K, Form 10-Q, and Form 8-K reports, which contain additional important factors that could cause actual results to differ from its current expectations and from the forward-looking statements made in this presentation.

[LOGO]

CURRENT BUSINESS

PROFILE

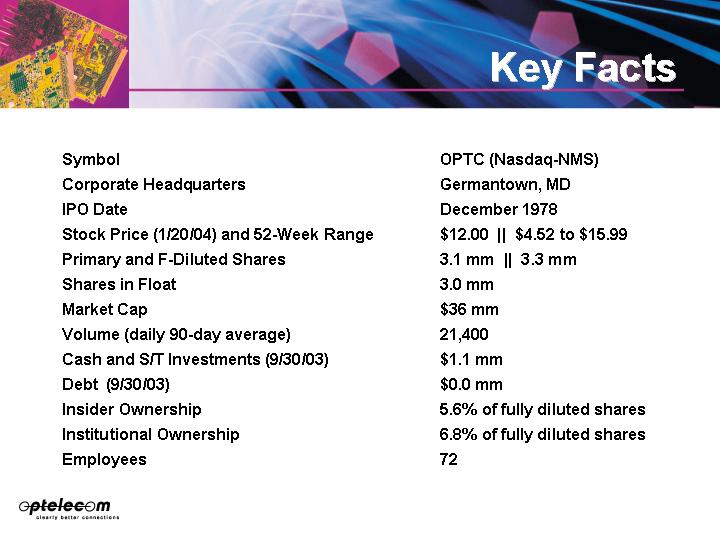

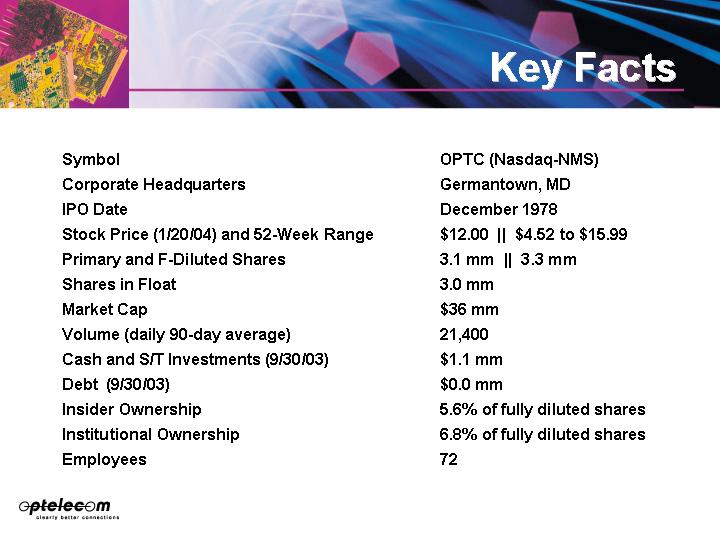

Key Facts

Symbol | | OPTC (Nasdaq-NMS) |

| | |

Corporate Headquarters | | Germantown, MD |

| | |

IPO Date | | December 1978 |

| | |

Stock Price (1/20/04) and 52-Week Range | | $12.00 || $4.52 to $15.99 |

| | |

Primary and F-Diluted Shares | | 3.1 mm || 3.3 mm |

| | |

Shares in Float | | 3.0 mm |

| | |

Market Cap | | $36 mm |

| | |

Volume (daily 90-day average) | | 21,400 |

| | |

Cash and S/T Investments (9/30/03) | | $1.1 mm |

| | |

Debt (9/30/03) | | $0.0 mm |

| | |

Insider Ownership | | 5.6% of fully diluted shares |

| | |

Institutional Ownership | | 6.8% of fully diluted shares |

| | |

Employees | | 72 |

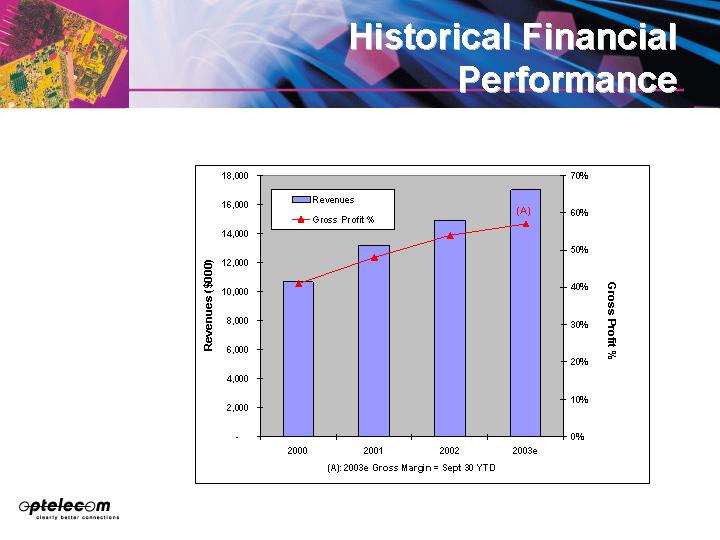

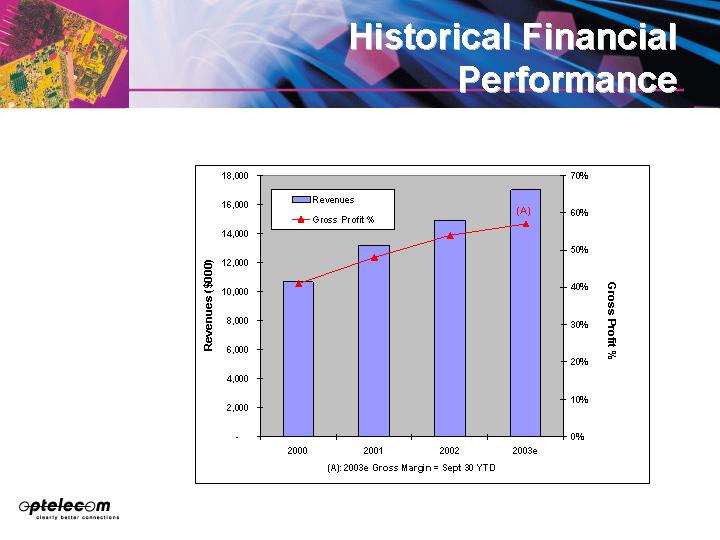

Historical Financial

Performance

[CHART]

Business Structure

• Communications Products Division (CPD)

• Produces and markets fiber optic transmission equipment

• Markets served: Security and Surveillance, ITS, Government/Military

[GRAPHIC]

• Integrated Systems (IS)

• New business activity started in 2003

• Provides solutions that allow customers the ability to store, retrieve, analyze and distribute rich media and real-time video streams.

[GRAPHIC]

• Electro-Optics Technology (E/O Tech)

• Manufactures fiber optic gyro coils

• Contract R&D on fiber optic avionics systems

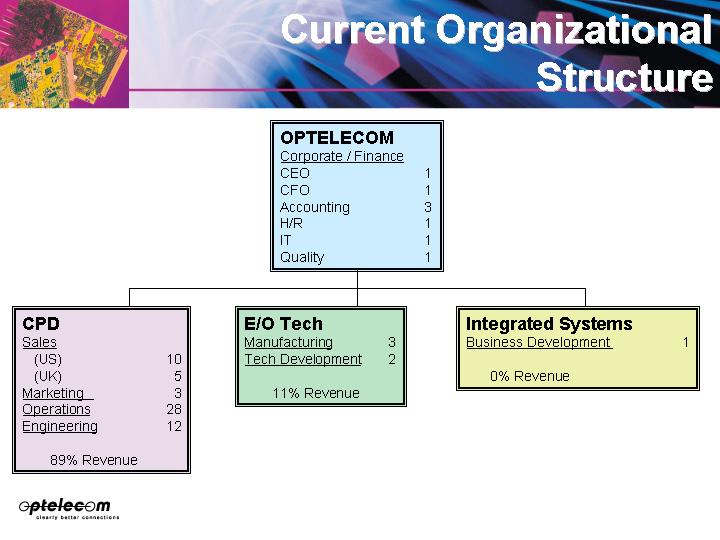

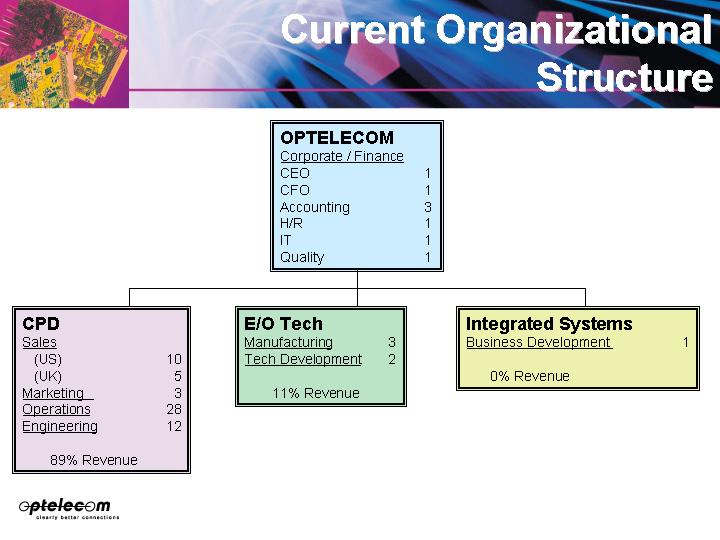

Current Organizational

Structure

[CHART]

Optelecom Organization

[CHART]

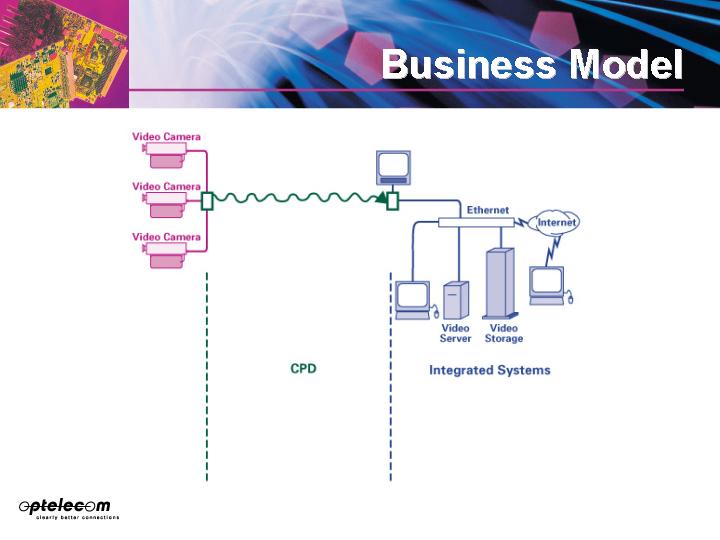

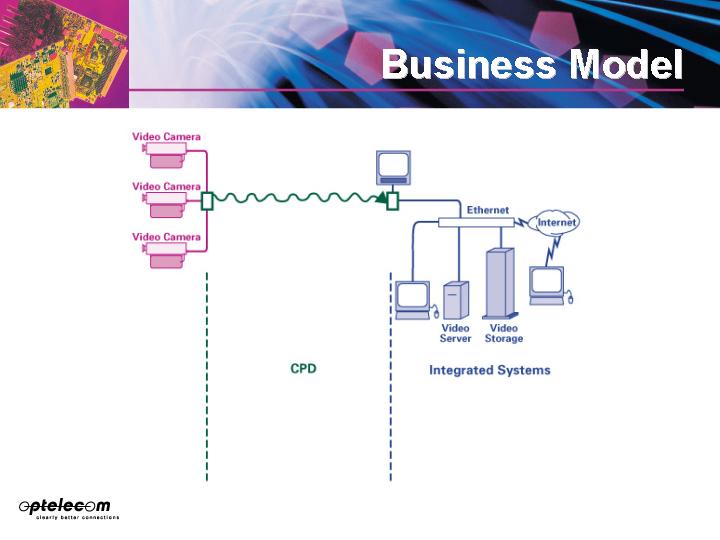

Business Model

[GRAPHIC]

CPD

[GRAPHIC]

• Video Transmission for Surveillance and Display

• Point-to-Point

• CWDM

• Ethernet/IP

• Applications

• Transportation: Air, Rail, Seaport, Highways

• Security: Borders, Stadiums, Factories, Buildings, Campuses, Theme Parks

Target Markets (CPD)

[GRAPHIC]

Transportation

[GRAPHIC]

Security

[GRAPHIC]

Government

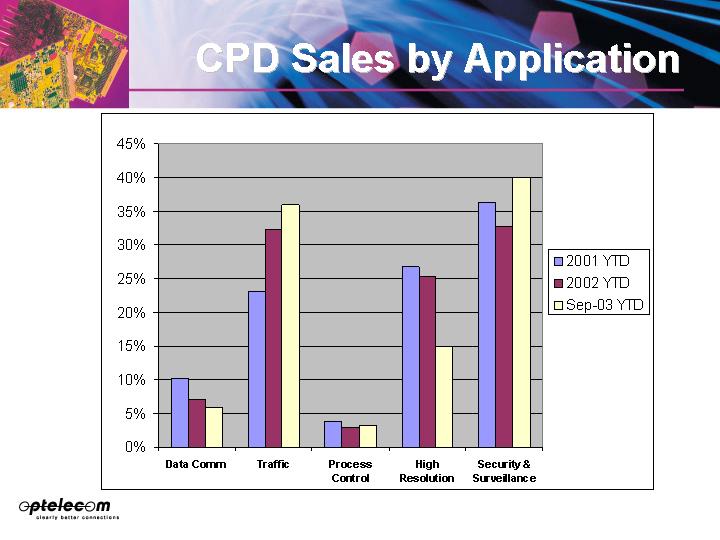

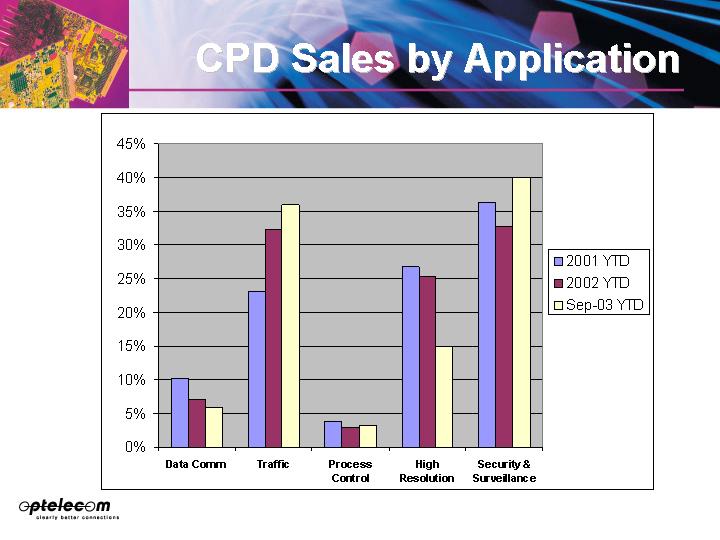

CPD Sales by Application

[CHART]

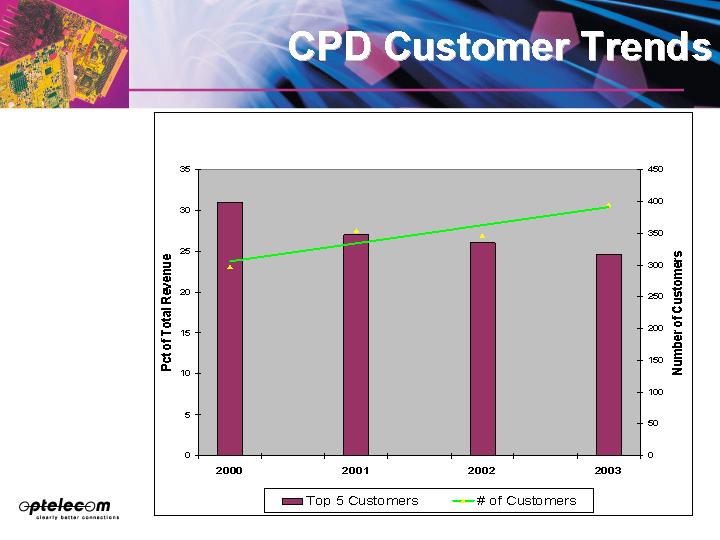

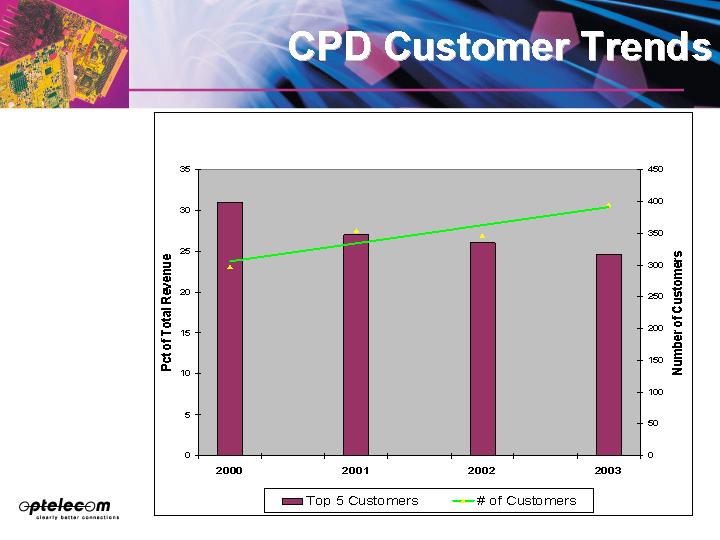

CPD Customer Trends

[CHART]

Examples of Significant

Market Potential (CPD)

[GRAPHIC]

• Homeland Security

• National emphasis on improving infrastructure will create demand

• Transportation

• Leverage existing highway system through improved traffic management

• Air Traffic Control

• Premier system installation in Vienna and all of Spanish airports can be replicated in other countries. US programs slated to ramp up beginning in 2004

• International Markets

• 26% of revenue from 6 countries

• Aggressive program to expand (14 international trade shows in 2004)

Differentiators

[GRAPHIC]

32 YEARS OF EXCELLENCE

• Longevity

• Ability to continuously adapt to market trends

• Reputation for high quality products and services

• ISO 9001 certification

• Breadth of product line

• International sales channels

• Market-leading technology

• Digital video and CWDM products superior to competitor offerings

Barriers to Entry

• Product development — time to market

• Products must be matched to specific requirements of customers

• Reputation

• Optelecom enjoys a long history of successful product deployment and customer service. Customers prefer proven suppliers

• Proprietary technologies

• Optelecom’s digital products are designed with unique, industry leading features

• Access to independent sales reps

• Reps prefer established companies with good product line

CPD Product Direction

[GRAPHIC]

• Digital Video

• Unique 9-Bit product for security industry provides high resolution at low price points

• Ethernet/Internet

• Products in development will offer Gigabit network capability for severe environments

• Enhanced CWDM

• New modules will add greatly increased range and connectivity to our existing system

Integrated Systems

[GRAPHIC]

• Video Capture, Storage, Analysis, and Distribution

• Applications

• Security

• Healthcare

• Distance Learning

• Corporate Communications

• Sell Through Partners

Products/Markets (IS)

• Rich Media Communications

• Corporate Communications

• E-Learning and Education

• Health Care Communications

[GRAPHIC]

• Networked Security Systems

• Enterprise Level Security Software

• Video Servers

• Network Storage

• Encoder and Decoders

[GRAPHIC]

Rich-Media

Market Potential (IS)

• By 2006, 80% of Global 2000 enterprises will be supporting business-critical applications that require live streaming and streaming on demand to the desktop. (Gartner Group)

• Digital Marketing spending is expected to reach $19.3B in 2006 (Jupiter Media Metrix)

• Global eLearning market will reach $33B by 2005 from an estimated $4.2B in 2002 (Gartner Group)

Target Markets (E/O Tech)

[GRAPHIC]

• Contract Coil Winding Services

• Standard and Custom Winding Configurations

• Quadrapole Precision Wound Fiber Gyro Coils

[GRAPHIC]

• Contract Engineering Development

• Fiber-optic sensors development

• WDM bus technology development

• WDM fiber network replacement of actuator control cables

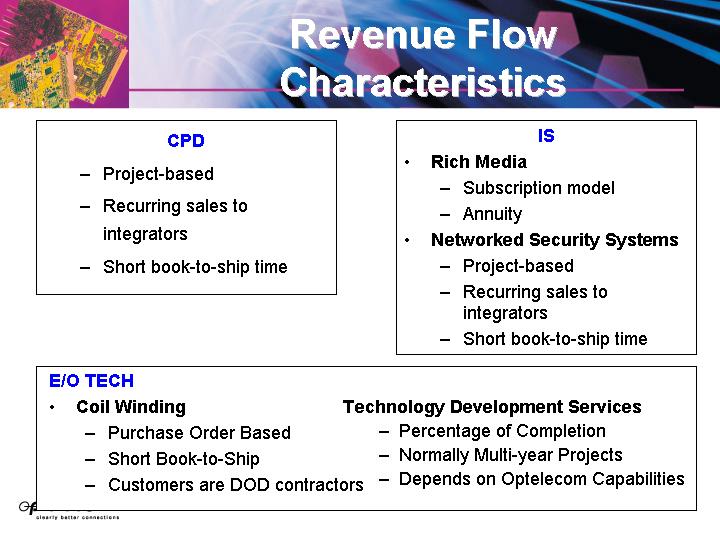

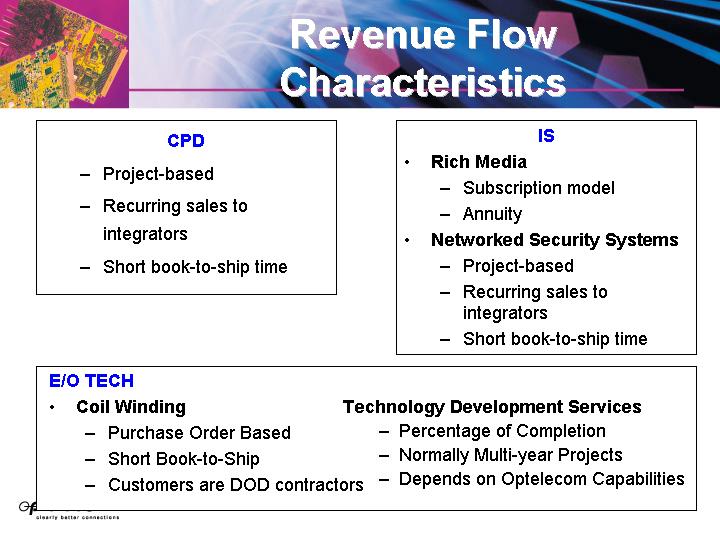

Revenue Flow

Characteristics

CPD

• Project-based

• Recurring sales to integrators

• Short book-to-ship time

IS

• Rich Media

• Subscription model

• Annuity

• Networked Security Systems

• Project-based

• Recurring sales to integrators

• Short book-to-ship time

E/O TECH

• Coil Winding

• Purchase Order Based

• Short Book-to-Ship

• Customers are DOD contractors

Technology Development Services

• Percentage of Completion

• Normally Multi-year Projects

• Depends on Optelecom Capabilities

BUSINESS DIRECTION

• Marketing

• Acquisitions

• Product Development

Future Growth: Marketing

• Improved financial condition allows increased marketing investment

• Goal: Strengthen existing sales channels

• Goal: New channels in new markets

• Sales and Marketing investment increasing from 15% to 20% of sales

• CPD market penetration doubling by 2006

Future Growth: Acquisitions

• Industry is highly fragmented

• Acquisition Targets:

• Numerous small/private players

• Very small divisions of much larger companies

• Continuous pipeline of potential acquisition targets

• No specific acquisitions are presently contemplated

Future Growth: New

Directions

• Integrated Systems is our first example of new product initiatives

• Other opportunities for vertical integration

• Audio/Video manipulation/analysis software

• Front-end compression/manipulation techniques

• Video File Management

Growth Objectives

• 2003 Revenues: $17 million (estimated)

• Potential to grow to $50 million in 2006:

• CPD growth of 15%-20% | | $25-$27 | mm |

• E/O Tech | | $3-$4 | mm |

• Integrated Systems | | $5-$7 | mm |

• Possible Future Acquisitions | | $10-$15 | mm |

| | | |

Total | | $43-$53 | mm |

Optelecom

• History of innovation

• Understands the market

• Proven ability to execute

• Team is in place

• Extensive experience in the business

• Ready for significant growth