UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 2, 2005

OPTELECOM, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

0-8828 | | 52-1010850 |

(Commission File Number) | | (IRS Employer Identification No.) |

12920 Cloverleaf Center Drive,

Germantown, Maryland 20874

(Address of Principal Executive Offices) (Zip Code)

(301) 444-2200

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events

Attached is Optelecom, Inc.’s (Roadshow) slide presentation Corporate Fact Sheet

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 2, 2005

| OPTELECOM, INC. |

| |

| |

| By: | /s/ James Armstrong | |

| | James Armstrong |

| | Chief Financial Officer |

3

Searchable text section of graphics shown above

[GRAPHIC]

Experts in Networked Video

[LOGO]

Optelecom-NKF

16th Annual NYC

Analyst

Conference

June 3, 2005

DISCLAIMER

This presentation contains forward-looking statements regarding the future performance of Optelecom-NKF, Inc., that involve risks and uncertainties that could cause actual results to differ materially, including, but not limited to, economic conditions, customer demand, increased competition in the relevant market, and others. We refer you to the documents that the Company files from time to time with the Securities and Exchange Commission, such as the Form 10-K, Form 10-Q, and Form 8-K reports, which contain additional important factors that could cause actual results to differ from its current expectations and from the forward-looking statements made in this presentation.

3

Agenda

• Company Overview

• Industry Overview

• Company Strategy

• Financial Highlights

• Investment Highlights

4

Business Description

• Experts in networked video transmission for applications dealing with:

• Security and Surveillance

• Highway traffic management

6

Company History

• Optelecom (OPTC) founded in 1972

• NKF Electronics founded in 1981

• OPTC Acquired NKF Electronics, B.V. in March 2005

• Doubled the size of Optelecom

• Acquired at discount to industry norm

• Positions company as the leading independent provider of networked video systems

• Integrated product suites: Fiber, Ethernet/IP, Copper

• Broadened management team

7

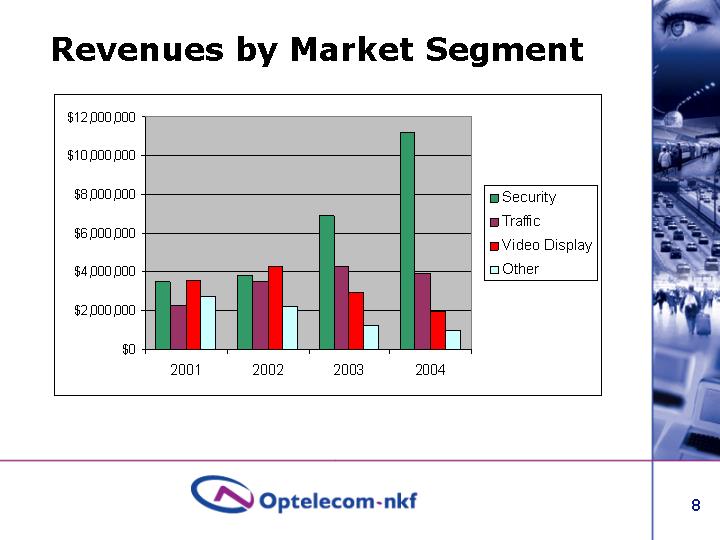

Revenues by Market Segment

[CHART]

8

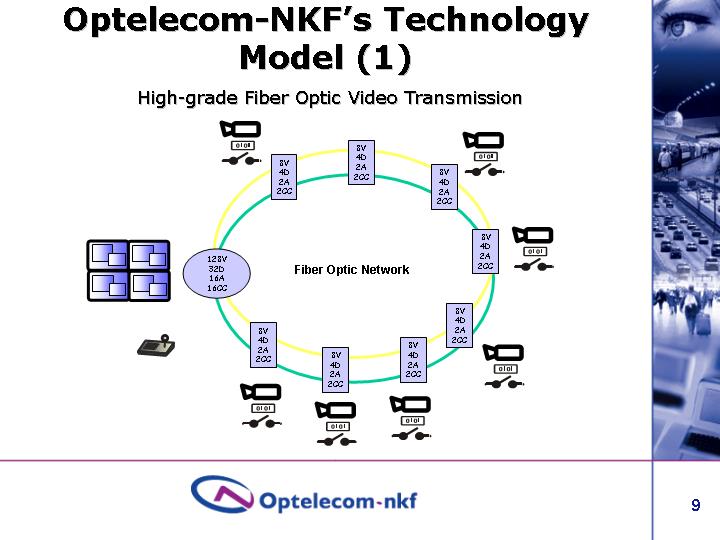

Optelecom-NKF’s Technology Model (1)

High-grade Fiber Optic Video Transmission

[GRAPHIC]

9

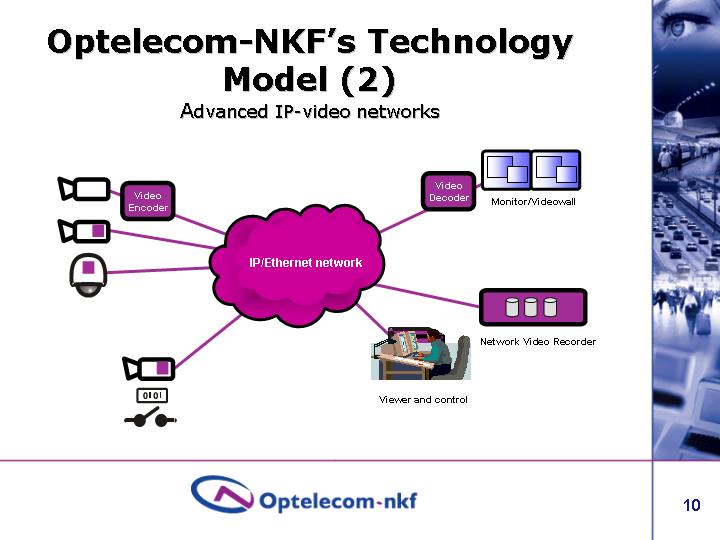

Optelecom-NKF’s Technology Model (2)

Advanced IP-video networks

[GRAPHIC]

10

Security/Surveillance

• Applications:

• City centers

• Airports

• Public Transport

• Federal Facilities

• Stadiums

• Object monitoring

• Drivers:

• Trend of increasing violence

• Protection against terrorism

• Advantages:

• Storage & retrieval of accurate, real time information

• Wide area coverage

• Instant dissemination of images

[GRAPHIC]

12

Highway Traffic Management

• Applications:

• Incident management

• Intelligent Transportation Systems

• Drivers:

• Trend of increasing mobility

• Law Enforcement

• Advantages:

• Optimize infrastructure

• Reduce environmental issues

• Minimize financial drain

• Enforcement enhancement

• Security enhancement

[GRAPHIC]

13

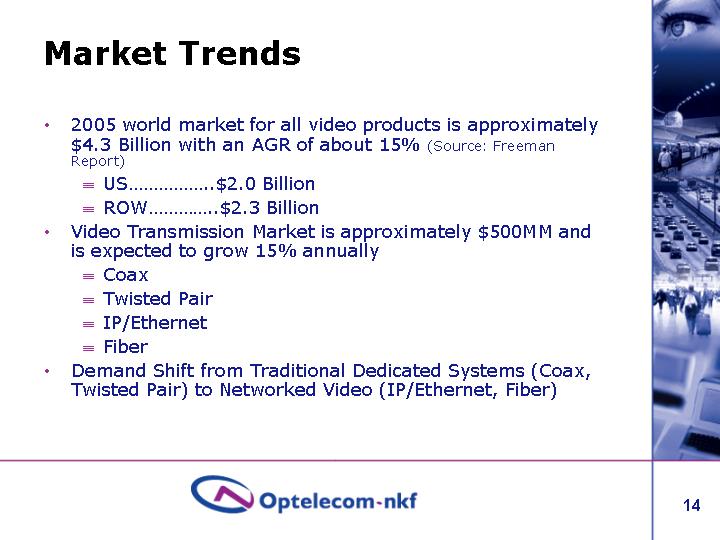

Market Trends

• 2005 world market for all video products is approximately $4.3 Billion with an AGR of about 15% (Source: Freeman Report)

• US $2.0 Billion

• ROW $2.3 Billion

• Video Transmission Market is approximately $500MM and is expected to grow 15% annually

• Coax

• Twisted Pair

• IP/Ethernet

• Fiber

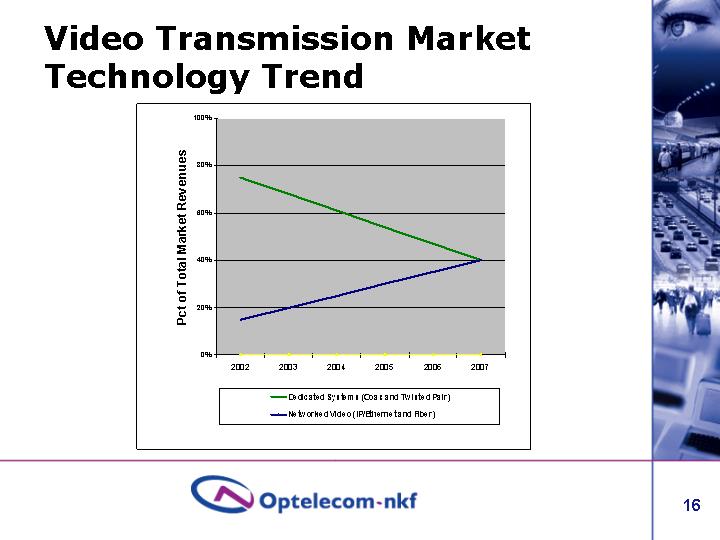

• Demand Shift from Traditional Dedicated Systems (Coax, Twisted Pair) to Networked Video (IP/Ethernet, Fiber)

14

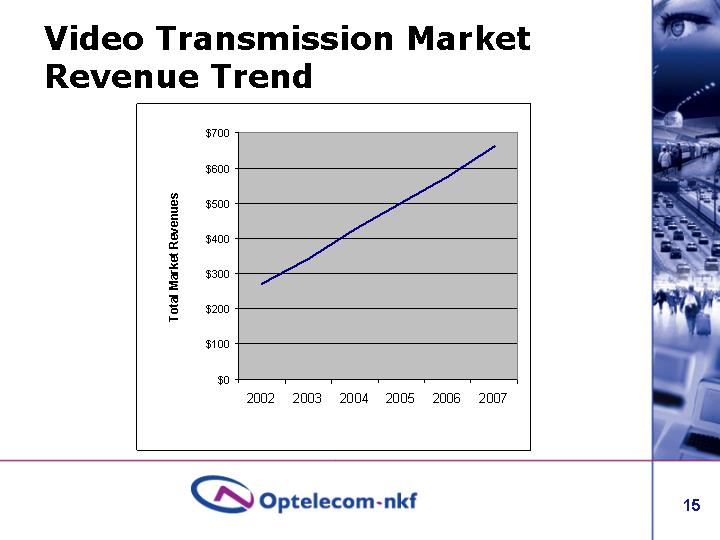

Video Transmission Market Revenue Trend

[CHART]

15

Video Transmission Market Technology Trend

[CHART]

16

Who Serves End Users?

• Large System Integrators

• Honeywell

• Tyco

• GE-Security

• Raytheon

• Bosch

• Siemens

• Small System Integrators

• No product branding

• Hundreds in the U.S. and Europe

• Optelecom-NKF sells to each Large System Integrator and many of the small ones

17

Competitive Environment

• Large Security Conglomerates

• GE-Security

• Honeywell

• Tyco Fire and Security

• Communication Equipment Manufacturers

• Camera Manufacturers

• DVR Manufacturers

18

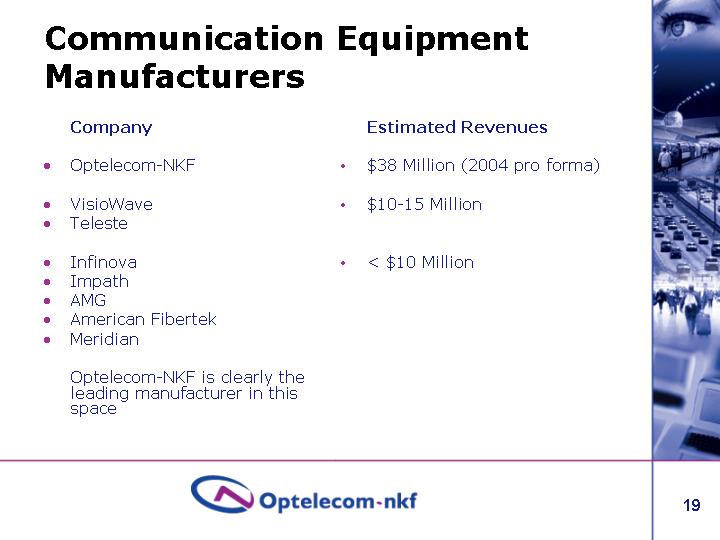

Communication Equipment Manufacturers

Company | | Estimated Revenues |

| | |

• Optelecom-NKF | | • $38 Million (2004 pro forma) |

| | |

• VisioWave | | • $10-15 Million |

• Teleste | | |

| | |

• Infinova | | • < $10 Million |

• Impath | | |

• AMG | | |

• American Fibertek | | |

• Meridian | | |

|

Optelecom-NKF is clearly the leading manufacturer in this space |

19

Why Optelecom-NKF?

• Strong distribution network in the USA and Europe

• Strong and wide product range

• Reputation of high quality and reliable products at a competitive price

• Market driven

• In-depth market knowledge

• Perfect timing of new products and/or new concepts

• Innovative

• Ability to adjust to new technologies

• Outstanding delivery performance

• Flexible and lean organization

20

Why Optelecom-NKF?

• Focused

• Fast

• Decisive

21

Overview

• Core Activity: Video Networking

• Strengths: Market Position

• Growth Strategy:

• Horizontal Integration with Image Storage, Video Switching, and Image Analysis Software

• Geographical

• Other vertical markets

23

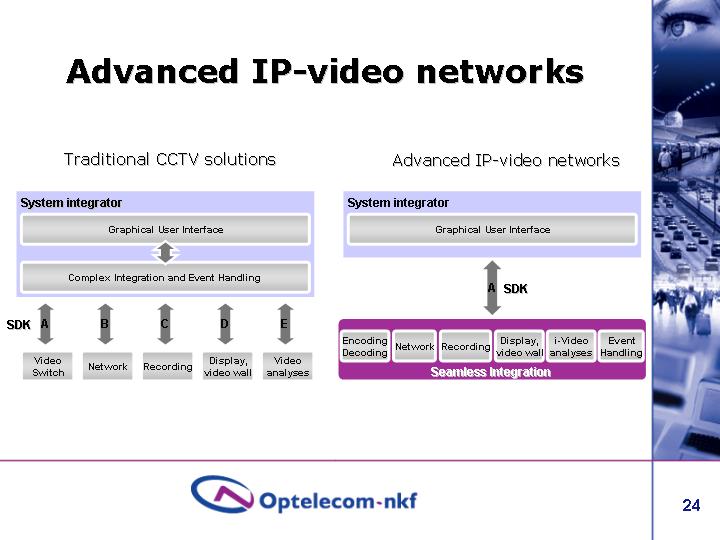

Advanced IP-video networks

Traditional CCTV solutions

System integrator | | | | | | | | | | |

| | | | | | | | | | |

Graphical User Interface |

|

Complex Integration and Event Handling |

| | | | | | | | | | | |

SDK | | A | | B | | C | | D | | E | |

| | Video Switch | | Network | | Recording | | Display, video wall | | Video analyses | |

| | | | | | | | | | | | | | | | | | | | | |

Advanced IP-video networks

System integrator |

|

Graphical User Interface |

|

| | | | | A | SDK | | | | |

| | | | | | | | | | |

Encoding

Decoding | | Network | | Recording | | Display,

video wall | | i-Video

analyses | | Event

Handling |

|

Seamless Seamless Integration |

24

Objective

• $ 80 Million Run Rate by 2008

• Maintain organic growth rate of 15%

• Rationalize Sales Force and Channels

• Assign Product Development Projects according to Center of Excellence

• Achieve significant new cross-selling revenues

• Launch common product package

• Achieve horizontal market integration capability

• Image Storage

• Video Switching

• Image Analysis Software

• Continue acquisition strategy

• Accretive

• Complimentary Technology

• Supports Vertical Market Strategy

25

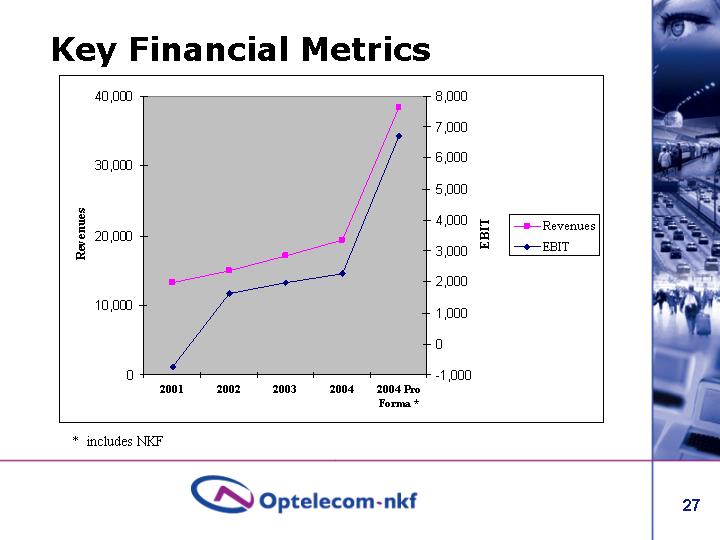

Key Financial Metrics

[CHART]

* includes NKF

27

Gross Margin Performance

[CHART]

* includes NKF

Improvement due to:

• Shift to digital video products

• Manufacturing efficiencies

• Modular product design

• Favorable pricing structure

28

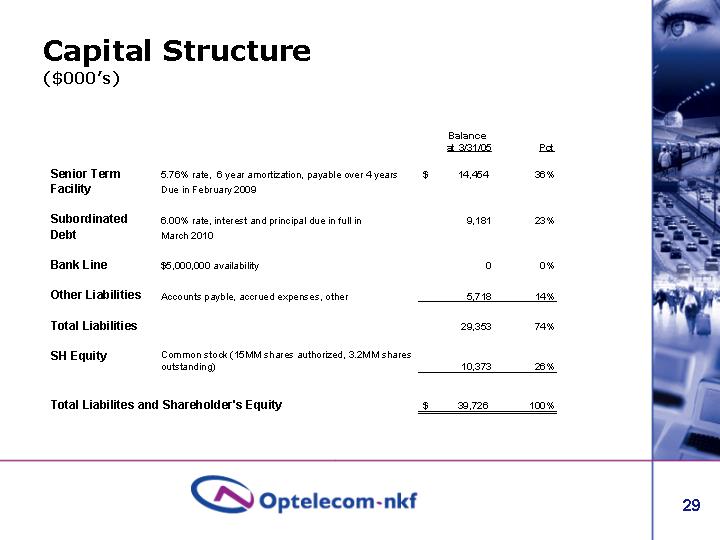

Capital Structure

($000’s)

| | | | Balance

at 3/31/05 | | Pct | |

Senior Term Facility | | 5.76% rate, 6 year amortization, payable over 4 years Due in February 2009 | | $ | 14,454 | | 36 | % |

| | | | | | | |

Subordinated Debt | | 6.00% rate, interest and principal due in full in March 2010 | | 9,181 | | 23 | % |

| | | | | | | |

Bank Line | | $5,000,000 availability | | 0 | | 0 | % |

| | | | | | | |

Other Liabilities | | Accounts payble, accrued expenses, other | | 5,718 | | 14 | % |

| | | | | | | |

Total Liabilities | | | | 29,353 | | 74 | % |

| | | | | | | |

SH Equity | | Common stock (15MM shares authorized, 3.2MM shares outstanding) | | 10,373 | | 26 | % |

| | | | | | | |

Total Liabilites and Shareholder’s Equity | | $ | 39,726 | | 100 | % |

29

Key Financial Management Objectives

• Realize cost savings from:

• Trade shows / advertising

• Headcount reduction (e.g. UK sales office)

• Materials purchasing

• Optimize engineering resources

• Eliminate interest rate variability

• Implement global tax strategy

• Potentially replace debt with equity

30

Investment Highlights

• Leading independent manufacturer of Networked Video Systems

• Markets in which we currently participate are experiencing substantial growth

• Significant organic growth Opportunities

• Opportunities for growth by acquisition

• Current stock price represents significant discount to intrinsic value

32