Connecticut Water Service, Inc. 2015 Annual Meeting of Shareholders May 7, 2015

Connecticut Water Service, Inc. Carol P. Wallace Lead Director

CTWS Shareholders 3 • Registered shares held in all 50 states, except Nebraska. Top Ten States with CTWS Shareholders New York Pennsylvania Connecticut New Jersey Massachusetts California Maine North Carolina Florida Virginia Information provided by Broadridge Corporate Solutions, Inc.

CTWS Shareholders 4 • Range of Registered Share Holdings – 34% own fewer than 49 shares – 44% own 50 to 500 shares – 22% own more than 500 shares Information provided by Broadridge Corporate Solutions, Inc.

Brad Hunter • Chief Financial Officer of Dead River Company, the largest residential distributor of heating oil and propane in northern New England, from 2007 until his retirement in 2013. • Spent 26 years in commercial banking where he last served as Chairman and CEO of Bank of America, Maine and its predecessor, Fleet Bank of Maine. 5

Ellen Wolf • Senior Vice President and Chief Financial Officer of American Water Works Company, Inc., the largest investor owned U.S. water and wastewater company, from 2006 until her retirement in May 2013. • Senior Vice President and Chief Financial Officer of Centrus Energy (formerly USEC, Inc.) from 2003 until 2006. 6

Board Focus • Growth • Risk Management – Cyber Security Audit Committee • Executive Compensation Welcome Shareholder Contact and Feedback 7

Connecticut Water Service, Inc. Eric W. Thornburg President & CEO

Forward Looking Statements Except for the historical statements and discussions, some statements contained in this presentation constitute “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward looking statements are based on current expectations and rely on a number of assumptions concerning future events, and are subject to a number of uncertainties and other factors, many of which are outside our control, that could cause actual results to differ materially from such statements. These forward-looking statements speak only as of the date of this presentation. Connecticut Water does not assume any obligation to update or revise any forward-looking statement made in this presentation or that may, from time to time, be made by or on behalf of the Company. Neither this presentation nor any verbal communication shall constitute an invitation or inducement to any person to subscribe for or otherwise acquire any Connecticut Water securities. For further information regarding risks and uncertainties associated with Connecticut Water’s business, please refer to Connecticut Water’s annual, quarterly and periodic SEC filings which can be found on the investor relations page of the company’s website www.ctwater.com and at www.sec.gov.

Water, the basic ingredient of Life…

Our Mission … • Passionate employees delivering life sustaining, high quality water service to families and communities while providing a fair return to our shareholders 11

Our Values… • Honesty • Trust • Respect • Service • Teamwork • Positive Attitude • Straight Talk

Who We Are • Serving families and communities since 1849 • Founded in 1956 • Serving 400,000 people • 77 cities/towns • 265 Employees

Company Strategy Shareholders/Growth Environment Customers Employees

Delivering Growth • Industry leading acquisitions since 2012 – 32,000 customers, 35% growth through acquisitions of Aqua Maine and the Biddeford & Saco Water Company • UConn/Mansfield water supply – Acquiring 150+ off-campus customers served by University • Linebacker expansion • WISC & WICA 15

Delivering for Customers • First of its kind customer protection program • Rate Settlements in Connecticut and Maine • Maine Water and Biddeford & Saco corporate office consolidated • Customer Satisfaction > 92.3% 16

Delivering for Employees • Employee Satisfaction • Serving the Community! 17

Delivering for Shareholders • Record Earnings • Total Shareholder Value Added • Water Revenue Adjustment (WRA) • Maine Rate Cases • Repair Tax Adoption • Continuous Operations Savings Team (COST) 18

Connecticut Water Service, Inc. David C. Benoit Senior Vice President, CFO & Treasurer

CTWS Creates Shareholder Value Strong Core Business plus Best In Class Tools for Success Strong Predictable Revenue (WRA) Minimal Regulatory Lag (WICA, WISC) Effective Expense Management

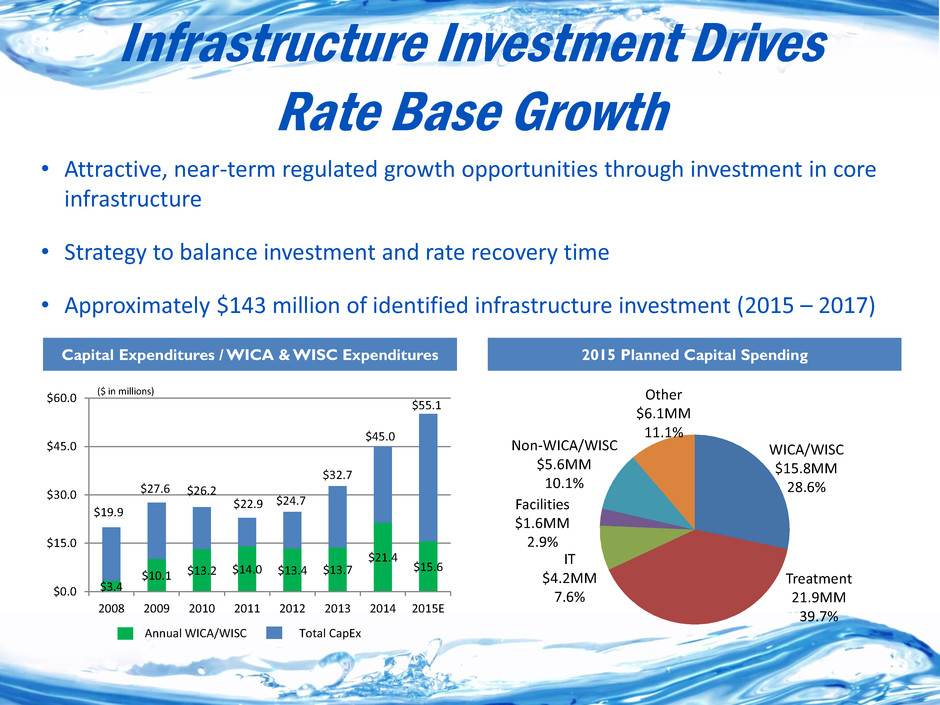

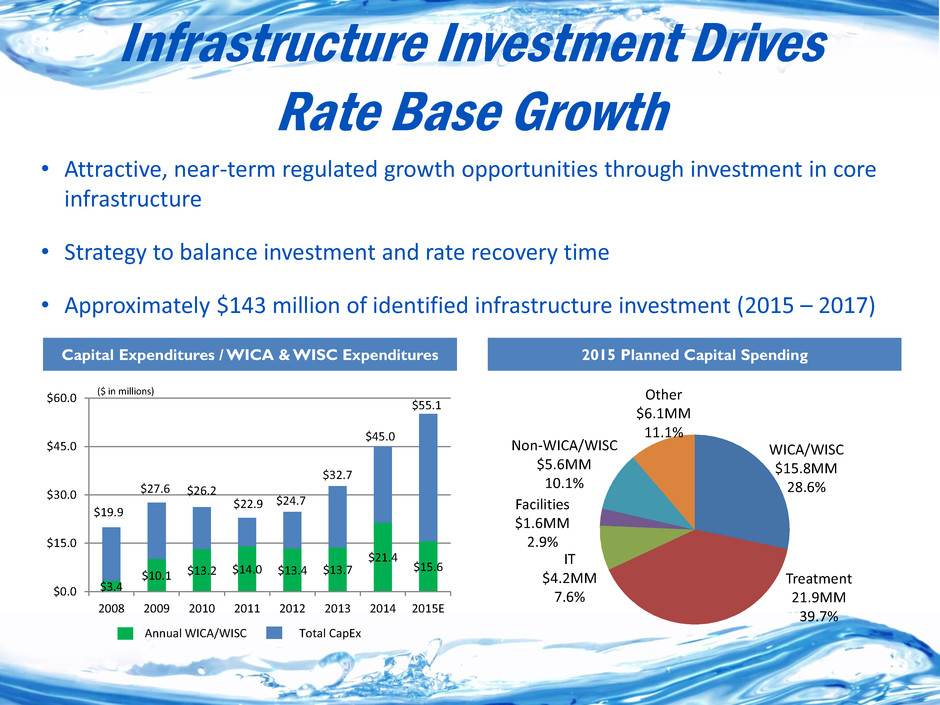

Infrastructure Investment Drives Rate Base Growth • Attractive, near-term regulated growth opportunities through investment in core infrastructure • Strategy to balance investment and rate recovery time • Approximately $143 million of identified infrastructure investment (2015 – 2017) 2015 Planned Capital Spending Capital Expenditures / WICA & WISC Expenditures ($ in millions) Annual WICA/WISC $3.4 $10.1 $13.2 $14.0 $13.4 $13.7 $21.4 $15.6 $19.9 $27.6 $26.2 $22.9 $24.7 $32.7 $45.0 $55.1 $0.0 $15.0 $30.0 $45.0 $60.0 2008 2009 2010 2011 2012 2013 2014 2015E WICA/WISC $15.8MM 28.6% Treatment 21.9MM 39.7% Non-WICA/WISC $5.6MM 10.1% IT $4.2MM 7.6% Other $6.1MM 11.1% Facilities $1.6MM 2.9% Total CapEx

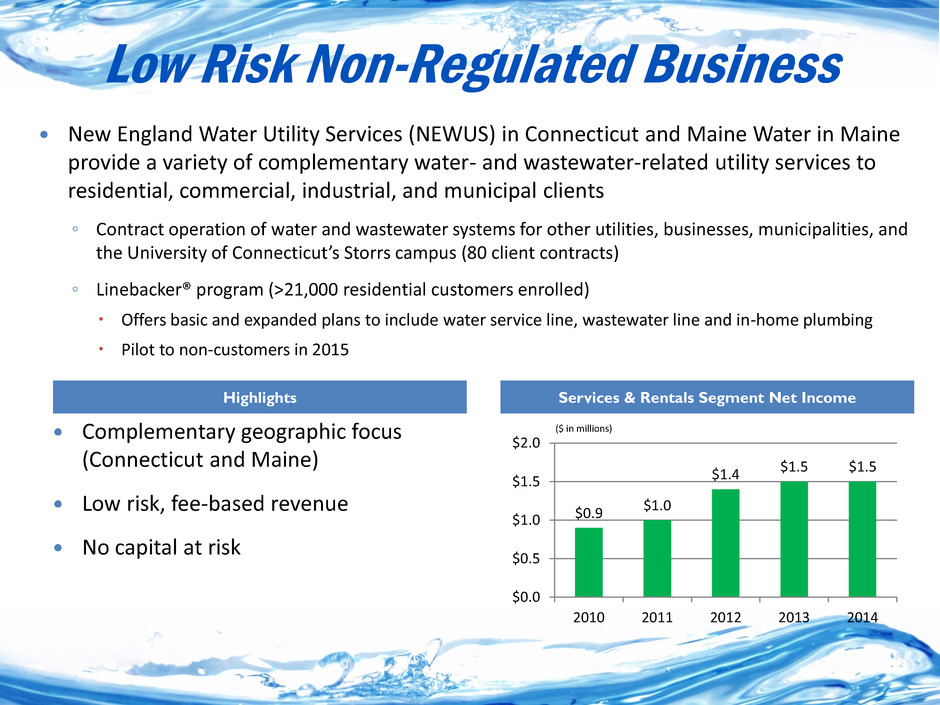

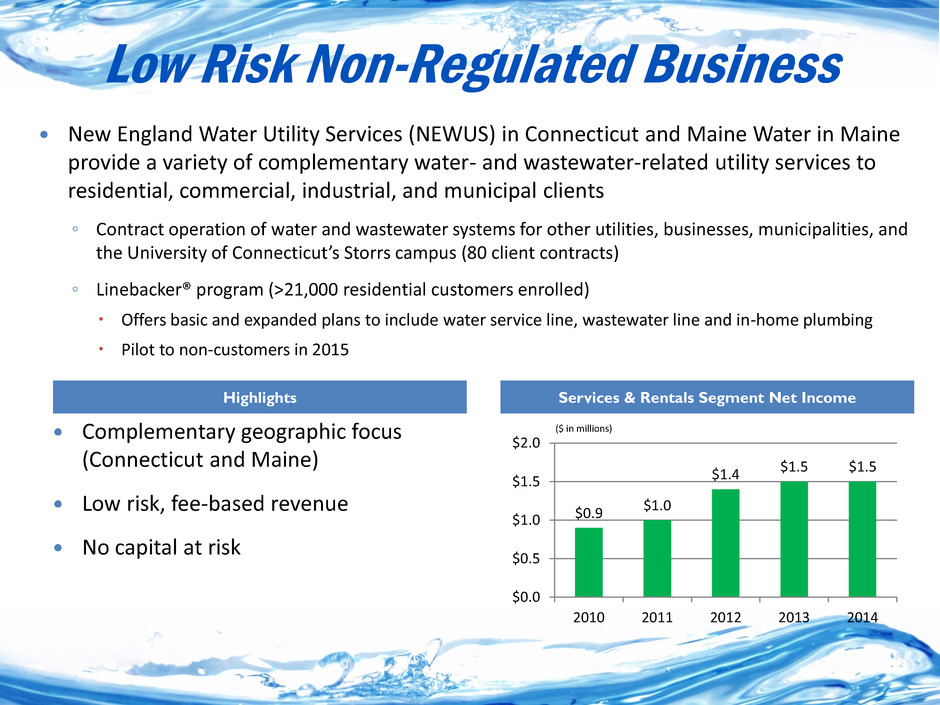

New England Water Utility Services (NEWUS) in Connecticut and Maine Water in Maine provide a variety of complementary water- and wastewater-related utility services to residential, commercial, industrial, and municipal clients ◦ Contract operation of water and wastewater systems for other utilities, businesses, municipalities, and the University of Connecticut’s Storrs campus (80 client contracts) ◦ Linebacker® program (>21,000 residential customers enrolled) Offers basic and expanded plans to include water service line, wastewater line and in-home plumbing Pilot to non-customers in 2015 Low Risk Non-Regulated Business Services & Rentals Segment Net Income ($ in millions) Highlights Complementary geographic focus (Connecticut and Maine) Low risk, fee-based revenue No capital at risk $0.9 $1.0 $1.4 $1.5 $1.5 $0.0 $0.5 $1.0 $1.5 $2.0 2010 2011 2012 2013 2014

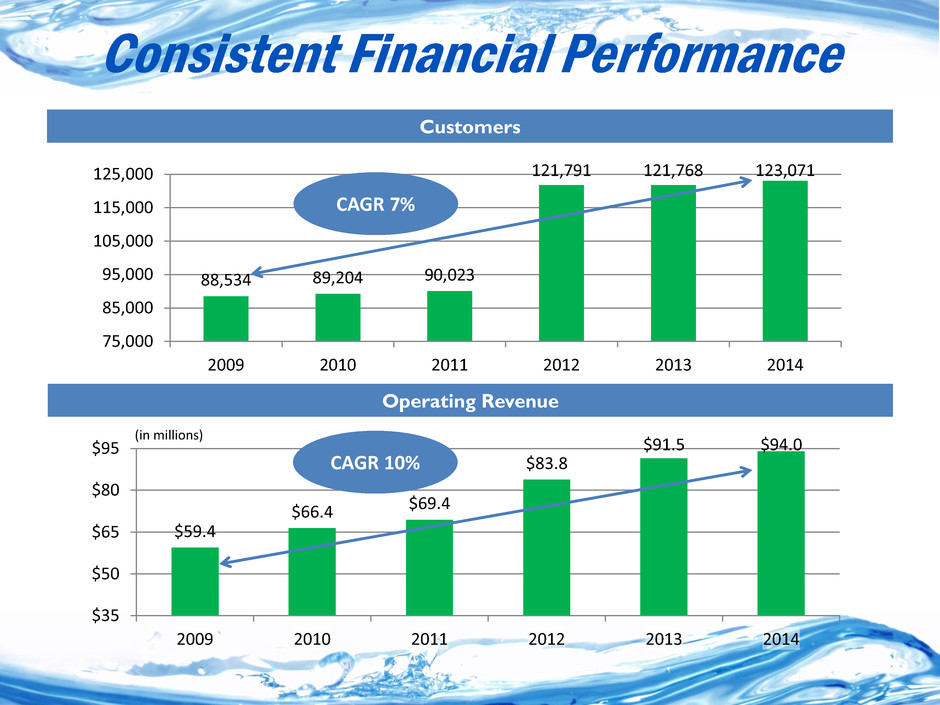

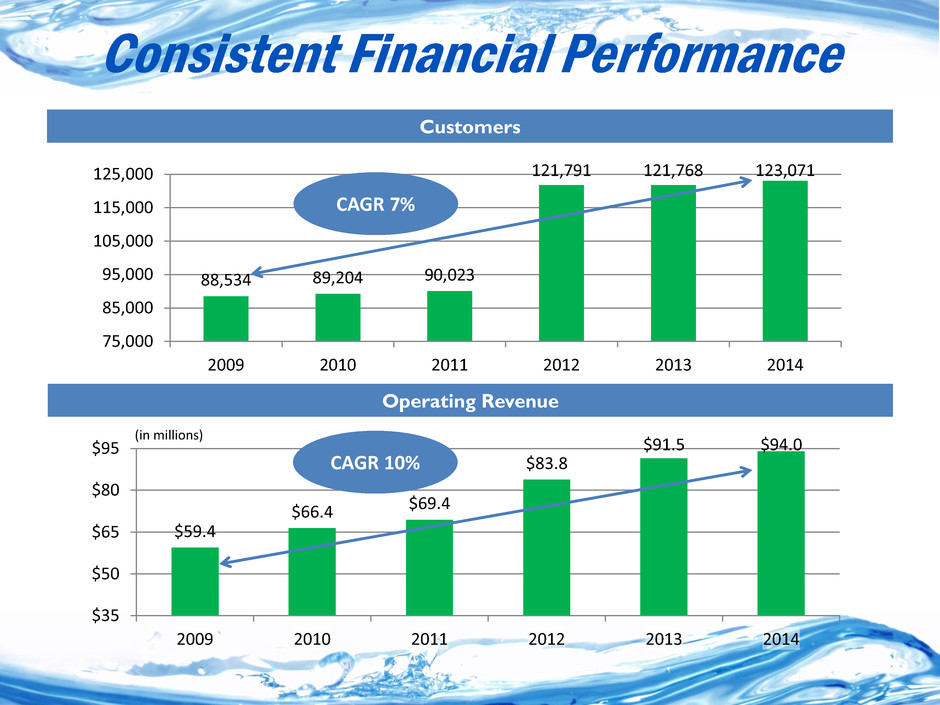

$59.4 $66.4 $69.4 $83.8 $91.5 $94.0 $35 $50 $65 $80 $95 2009 2010 2011 2012 2013 2014 88,534 89,204 90,023 121,791 121,768 123,071 75,000 85,000 95,000 105,000 115,000 125,000 2009 2010 2011 2012 2013 2014 Consistent Financial Performance Customers Operating Revenue (in millions) CAGR 7% CAGR 10%

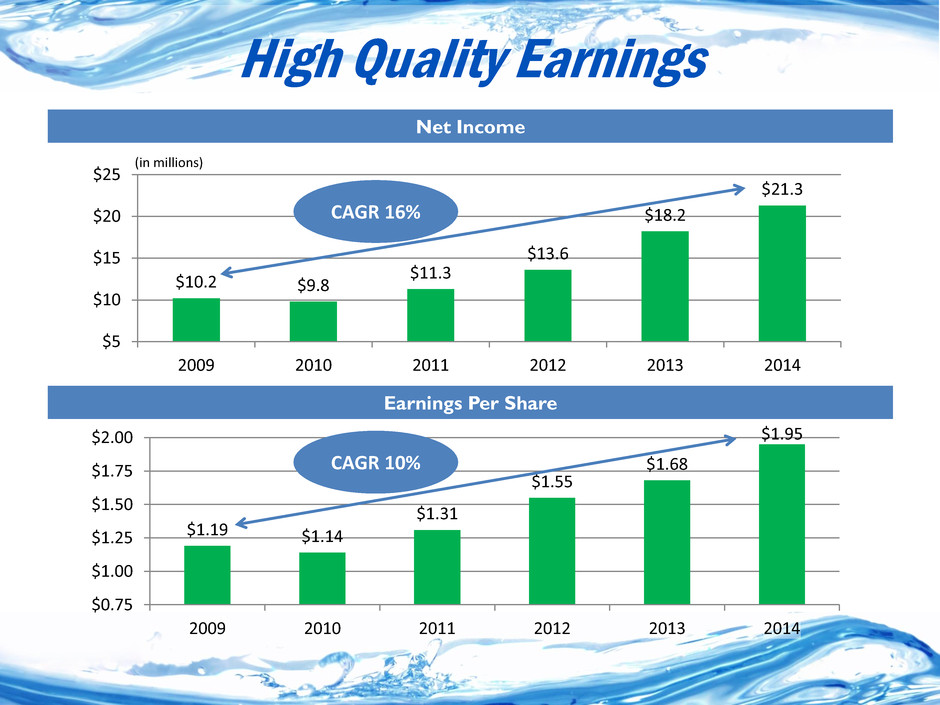

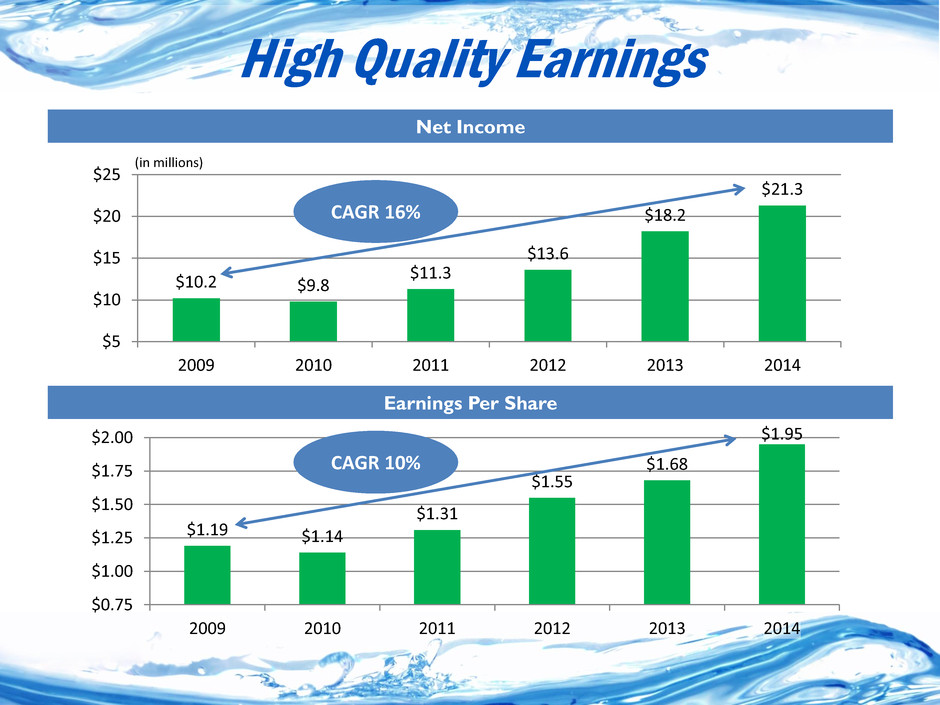

High Quality Earnings $10.2 $9.8 $11.3 $13.6 $18.2 $21.3 $5 $10 $15 $20 $25 2009 2010 2011 2012 2013 2014 Net Income $1.19 $1.14 $1.31 $1.55 $1.68 $1.95 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 2009 2010 2011 2012 2013 2014 Earnings Per Share (in millions) CAGR 16% CAGR 10%

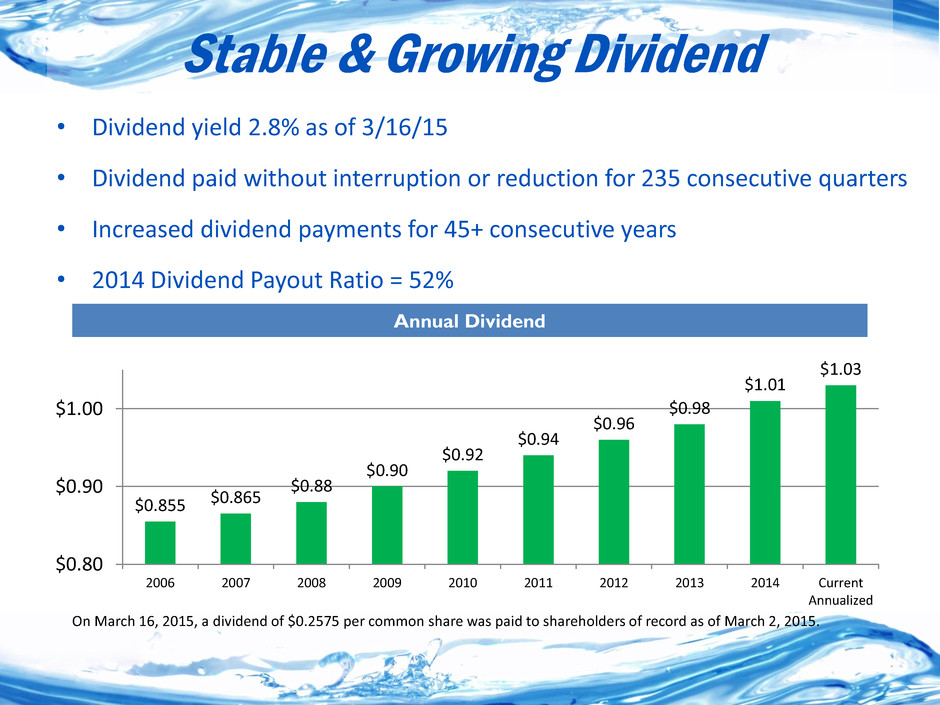

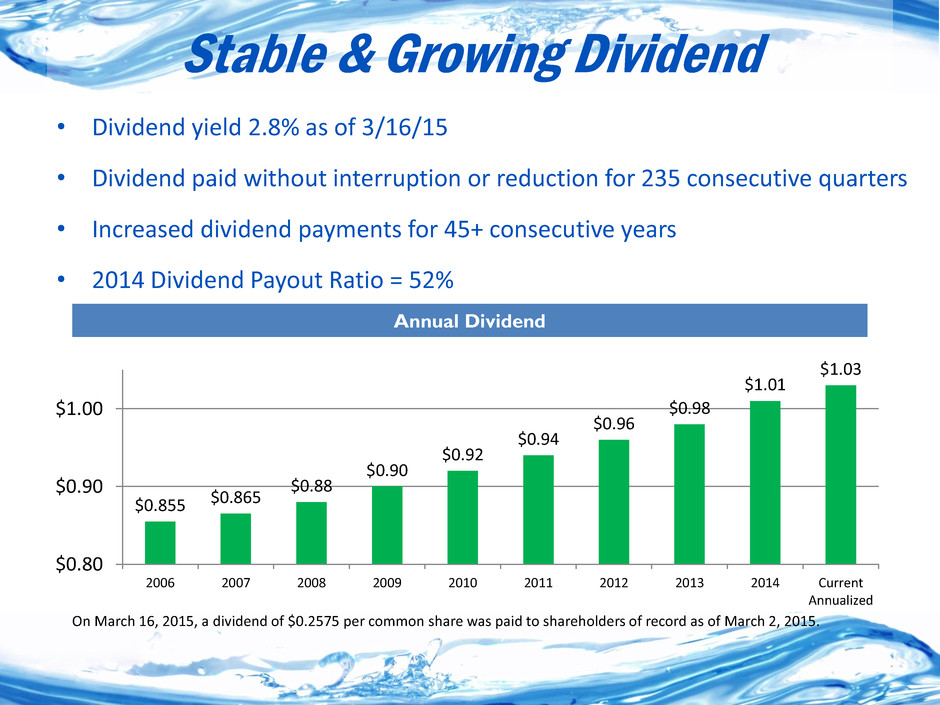

Stable & Growing Dividend • Dividend yield 2.8% as of 3/16/15 • Dividend paid without interruption or reduction for 235 consecutive quarters • Increased dividend payments for 45+ consecutive years • 2014 Dividend Payout Ratio = 52% Annual Dividend $0.855 $0.865 $0.88 $0.90 $0.92 $0.94 $0.96 $0.98 $1.01 $1.03 $0.80 $0.90 $1.00 2006 2007 2008 2009 2010 2011 2012 2013 2014 Current Annualized On March 16, 2015, a dividend of $0.2575 per common share was paid to shareholders of record as of March 2, 2015.

Performance 11.1% 12.6% 9.8% 0% 2% 4% 6% 8% 10% 12% 14% CTWS S&P Utility Sector Peer Average Average Annual 5 Year Total Shareholder Return @ 12/31/14 1 Connecticut Water delivered an average annual 5 year total return to shareholders (assuming reinvestment of dividends) of 11.1% for the five-year period 2010–2014 according to Standard & Poor’s. 1 Small Cap peers (ARTNA, MSEX, SJW, YORW)

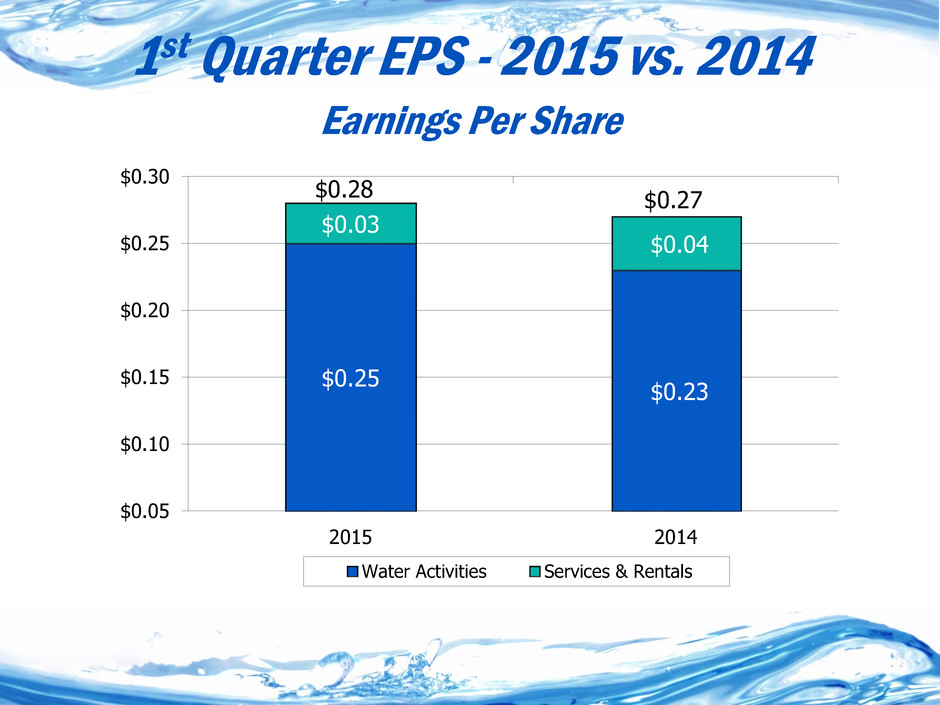

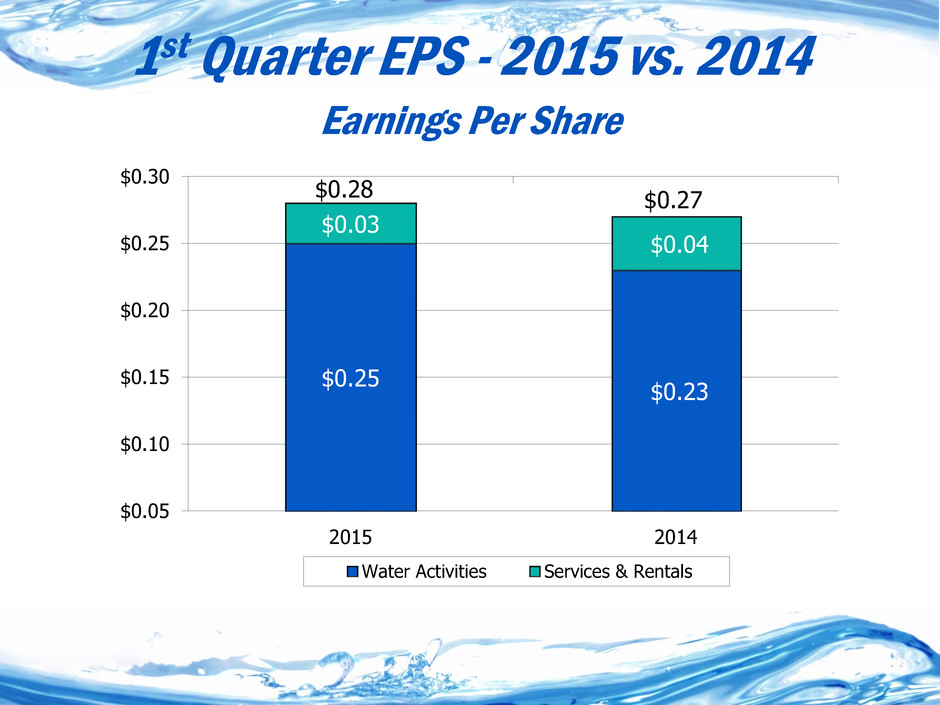

1st Quarter EPS - 2015 vs. 2014 $0.25 $0.23 $0.03 $0.04 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 2015 2014 Water Activities Services & Rentals Earnings Per Share $0.28 $0.27

Thank you for your support Your Questions & Feedback…