Filed by: Connecticut Water Service, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Connecticut Water Service, Inc. (Commission File No.: 0-8084)

This filing relates to the proposed transaction between SJW Group (“SJW Group”) and Connecticut Water Service, Inc. (“CTWS”) pursuant to the Agreement and Plan of Merger, dated as of March 14, 2018, among SJW Group, Hydro Sub, Inc. and CTWS.

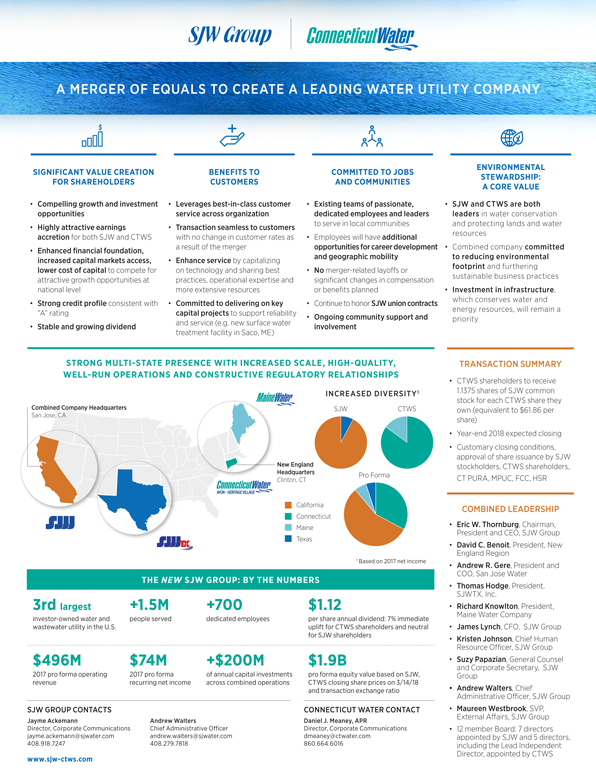

The following is an infographic that was published in conjunction with an analyst/investor conference call and webcast, held on March 15, 2018, to discuss the proposed transaction.

A MERGER OF EQUALS TO CREATE A LEADING WATER UTILITY COMPANY ENVIRONMENTAL SIGNIFICANT VALUE CREATION BENEFITS TO COMMITTED TO JOBS STEWARDSHIP: FOR SHAREHOLDERS CUSTOMERS AND COMMUNITIES A CORE VALUE • Compelling growth and investment • Leveragesbest-in-class customer • Existing teams of passionate, • SJW and CTWS are both opportunities service across organization dedicated employees and leaders leaders in water conservation Highly to serve in local communities and protecting lands and water • attractive earnings • Transaction seamless to customers resources accretion for both SJW and CTWS with no change in customer rates as • Employees will have additional financial foundation, a result of the merger opportunities for career development • Combined company committed • Enhanced and geographic mobility to reducing environmental increased capital markets access, • Enhance service by capitalizing footprint and furthering lower cost of capital to compete for on technology and sharing best • No merger-related layoffs or sustainable business practices attractive growth opportunities at practices, operational expertise and significant changes in compensation national level more extensive resources or benefits planned • Investment in infrastructure, which conserves water and • Strong credit profile consistent with • Committed to delivering on key • Continue to honor SJW union contracts energy resources, will remain a “A” rating capital projects to support reliability • Ongoing community support and priority and growing dividend and service (e.g. new surface water • Stable involvement treatment facility in Saco, ME) STRONG MULTI-STATE PRESENCE WITH INCREASED SCALE, HIGH-QUALITY, TRANSACTION SUMMARYWELL-RUN OPERATIONS AND CONSTRUCTIVE REGULATORY RELATIONSHIPS • CTWS shareholders to receive INCREASED DIVERSITY1 1.1375 shares of SJW common stock for each CTWS share they Combined Company Headquarters SJW CTWS own (equivalent to $61.86 per San Jose, CA share) •Year-end 2018 expected closing • Customary closing conditions, approval of share issuance by SJW New England stockholders, CTWS shareholders, Headquarters Pro Forma Clinton, CT CT PURA, MPUC, FCC, HSR • California COMBINED LEADERSHIP Connecticut Maine • Eric W. Thornburg, Chairman, President and CEO, SJW Group Texas TX _ • David C. Benoit, President, New England Region 1 Based on 2017 net income • Andrew R. Gere, President and COO, San Jose Water THE NEW SJW GROUP: BY THE NUMBERS • Thomas Hodge, President, SJWTX, Inc. 3rd largest +1.5M +700 $1.12 • Richard Knowlton, President, Maine Water Company investor-owned water and people served dedicated employees per share annual dividend: 7% immediate wastewater utility in the U.S. uplift for CTWS shareholders and neutral • James Lynch, CFO, SJW Group for SJW shareholders • Kristen Johnson, Chief Human Resource Officer, SJW Group $496M $74M +$200M $1.9B • Suzy Papazian, General Counsel 2017 pro forma operating 2017 pro forma of annual capital investments pro forma equity value based on SJW, and Corporate Secretary, SJW revenue recurring net income across combined operations CTWS closing share prices on 3/14/18 Group and transaction exchange ratio • Andrew Walters, Chief Administrative Officer, SJW Group SJW GROUP CONTACTS CONNECTICUT WATER CONTACT • Maureen Westbrook, SVP, External Affairs, SJW Group Jayme Ackemann Andrew Walters Daniel J. Meaney, APR Director, Corporate Communications Chief Administrative Officer Director, Corporate Communications • 12 member Board: 7 directors jayme.ackemann@sjwater.com andrew.walters@sjwater.com dmeaney@ctwater.com appointed by SJW and 5 directors, 408.918.7247 408.279.7818 860.664.6016 including the Lead Independent Director, appointed by CTWSwww.sjw-ctws.com

A MERGER OF EQUALS TO CREATE A LEADING WATER UTILITY COMPANY Forward Looking Statements This document contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Connecticut Water or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water or SJW Group; (8) the ability of Connecticut Water and SJW Group to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on FormS-4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. In addition, actual results are subject to other risks and uncertainties that relate more broadly to SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017, and Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017 (which will be filed today). Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither SJW Group or its management nor Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements. Additional Information and Where to Find It In connection with the proposed transaction between SJW Group and Connecticut Water, SJW Group will file with the SEC a Registration Statement on FormS-4 that will include a joint proxy statement of SJW Group and Connecticut Water that also constitutes a prospectus of SJW Group. SJW Group and Connecticut Water may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, FormS-4 or any other document which SJW Group or Connecticut Water may file with the SEC. INVESTORS AND SECURITY HOLDERS OF SJW GROUP AND CONNECTICUT WATER ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website at https://sjwgroup.com/investor_relations. Copies of documents filed with the SEC by Connecticut Water will be made available free of charge on Connecticut Water’s investor relations website at https://ir.ctwater.com/. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Participants in the Solicitation SJW Group, Connecticut Water and certain of their respective directors and officers, and other members of management and employees, may be deemed to be participants in the solicitation of proxies from the holders of SJW Group and Connecticut Water securities in respect of the proposed transaction. Information regarding SJW Group’s directors and officers is available in SJW Group’s annual report on Form10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated March 6, 2018, which are filed with the SEC. Information regarding Connecticut Water’s directors and officers is available in Connecticut Water’s annual report on Form10-K for the fiscal year ended December 31, 2017, which will be filed today, and its proxy statement for its 2017 annual meeting dated March 30, 2017, which is filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water. These documents will be available free of charge from the sources indicated above. SJW GROUP CONTACTS CONNECTICUT WATER CONTACT Jayme Ackemann Andrew Walters Daniel J. Meaney, APR Director, Corporate Communications Chief Administrative Officer Director, Corporate Communications jayme.ackemann@sjwater.com andrew.walters@sjwater.com dmeaney@ctwater.com 408.918.7247 408.279.7818 860.664.6016www.sjw-ctws.com