Filed pursuant to Rule 425 under the

Securities Act of 1933, as amended, and

deemed filed under Rule14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: SJW Group

Commission File No.:1-08966

Subject Company: Connecticut Water Service, Inc.

Commission File No.:0-08084

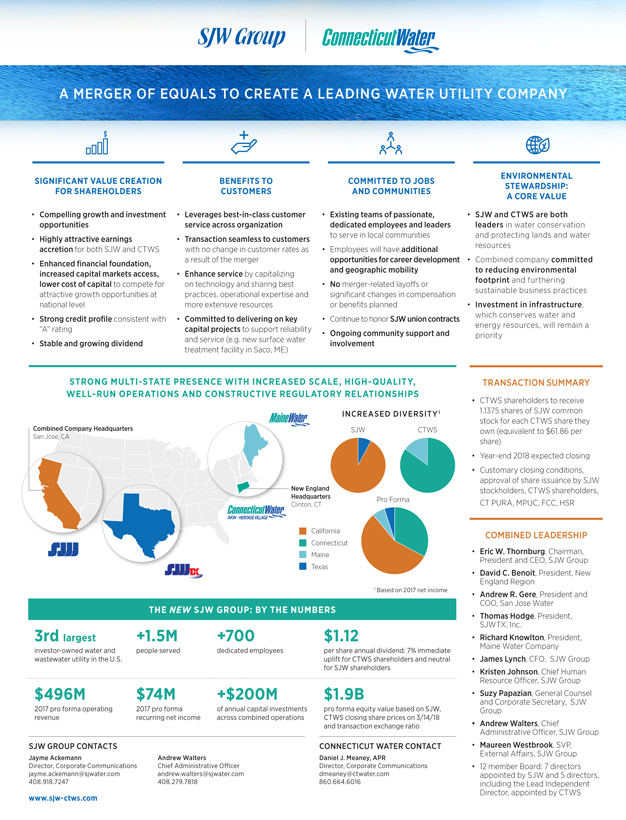

Infographic

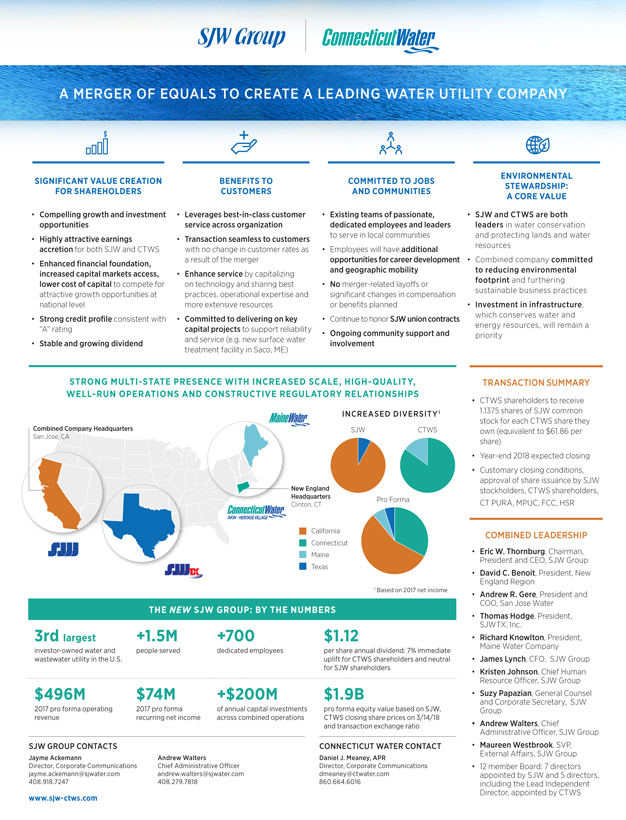

A MERGER OF EQUALS TO CREATE A LEADING WATER UTILITY COMPANY SIGNIFICANT VALUE CREATION FOR SHAREHOLDERS BENEFITS TO CUSTOMERS COMMITTED TO JOBS AND COMMUNITIES ENVIRONMENTAL STEWARDSHIP: A CORE VALUE INCREASED DIVERSITY1 Compelling growth and investment opportunities Highly attractive earnings accretion for both SJW and CTWS Enhanced finnancial foundation, increased capital markets access, lower cost of capital to compete for attractive growth opportunities at national level Strong credit profile consistent with “A” rating Stable and growing dividend Leverages best-in-class customer service across organization Transaction seamless to customers with no change in customer rates as a result of the merger Enhance service by capitalizing on technology and sharing best practices, operational expertise and more extensive resources Committed to delivering on key capital projects to support reliability and service (e.g. new surface water treatment facility in Saco, ME) Existing teams of passionate, dedicated employees and leaders to serve in local communities Employees will have additional opportunities for career development and geographic mobility No merger-related layoffs or significant changes in compensation or benefits planned Continue to honor SJW union contracts Ongoing community support and involvement SJW and CTWS are both leaders in water conservation and protecting lands and water resources Combined company committed to reducing environmental footprint and furthering sustainable business practices Investment in infrastructure, which conserves water and energy resources, will remain a priority STRONG MULTI-STATE PRESENCE WITH INCREASED SCALE, HIGH-QUALITY, WELL-RUN OPERATIONS AND CONSTRUCTIVE REGULATORY RELATIONSHIPS Combined Company Headquarters San Jose, CA New England Headquarters Clinton, CT TRANSACTION SUMMARY CTWS shareholders to receive 1.1375 shares of SJW common stock for each CTWS share they own (equivalent to $61.86 per share) Year-end 2018 expected closing Customary closing conditions, approval of share issuance by SJW stockholders, CTWS shareholders, CT PURA, MPUC, FCC, HSR COMBINED LEADERSHIP Eric W. Thornburg, Chairman, President and CEO, SJW Group David C. Benoit, President, New England Region Andrew R. Gere, President and COO, San Jose Water Thomas Hodge, President, SJWTX, Inc. Richard Knowlton, President, Maine Water Company James Lynch, CFO, SJW Group Kristen Johnson, Chief Human Resource Officer, SJW Group Suzy Papazian, General Counsel and Corporate Secretary, SJW Group Andrew Walters, Chief Administrative Officer, SJW Group Maureen Westbrook, SVP, External Affairs, SJW Group 12 member Board: 7 directors appointed by SJW and 5 directors, including the Lead Independent Director, appointed by CTWS investor-owned water and wastewater utility in the U.S. people served dedicated employees per share annual dividend: 7% immediate uplift for CTWS shareholders and neutral for SJW shareholders 2017 pro forma operating revenue 2017 pro forma recurring net income of annual capital investments across combined operations pro forma equity value based on SJW, CTWS closing share prices on 3/14/18 andtransaction exchange ratio SJW GROUP CONTACTS Jayme Ackemann Director, Corporate Communications jayme.ackemann@sjwater.com 408.918.7247 Andrew Walters Chief Administrative Officer andrew.walters@sjwater.com 408.279.7818 CONNECTICUT WATER CONTACT Daniel J. Meaney, APR Director, Corporate Communications dmeaney@ctwater.com 860.664.6016 www.sjw-ctws.com Texas Maine Connecticut California Connecticutwater 3rd largest +1.5M people served +700 dedicated employees $1.12 $496M $74M +$200M $1.9B SIGNIFICANT VALUE CREATION FOR SHAREHOLDERS BENEFITS TO CUSTOMERS COMMITTED TO JOBS AND COMMUNITIES ENVIRONMENTAL STEWARDSHIP: A CORE VALUE

A MERGER OF EQUALS TO CREATE A LEADING WATER UTILITY COMPANY Forward Looking Statements This document contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Connecticut Water or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water or SJW Group; (8) the ability of Connecticut Water and SJW Group to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. In addition, actual results are subject to other risks and uncertainties that relate more broadly to SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2017, and Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2017 (which will be filed today). Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither SJW Group or its management nor Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements. Additional Information and Where to Find It In connection with the proposed transaction between SJW Group and Connecticut Water, SJW Group will file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement of SJW Group and Connecticut Water that also constitutes a prospectus of SJW Group. SJW Group and Connecticut Water may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, Form S-4 or any other document which SJW Group or Connecticut Water may file with the SEC. INVESTORS AND SECURITY HOLDERS OF SJW GROUP AND CONNECTICUT WATER ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Form S-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website at https://sjwgroup.com/investor_relations. Copies of documents filed with the SEC by Connecticut Water will be made available free of charge on Connecticut Water’s investor relations website at https://ir.ctwater.com/. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Participants in the Solicitation SJW Group, Connecticut Water and certain of their respective directors and officers, and other members of management and employees, may be deemed to be participants in the solicitation of proxies from the holders of SJW Group and Connecticut Water securities in respect of the proposed transaction. Information regarding SJW Group’s directors and officers is available in SJW Group’s annual report on Form 10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated March 6, 2018, which are filed with the SEC. Information regarding Connecticut Water’s directors and officers is available in Connecticut Water’s annual report on Form 10-K for the fiscal year ended December 31, 2017, which will be filed today, and its proxy statement for its 2017 annual meeting dated March 30, 2017, which is filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the Form S-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water. These documents will beavailable free of charge from the sources indicated above. SJW GROUP CONTACTS Jayme Ackemann Director, Corporate Communications jayme.ackemann@sjwater.com 408.918.7247 Andrew Walters Chief Administrative Officer andrew.walters@sjwater.com 408.279.7818 CONNECTICUT WATER CONTACT Daniel J. Meaney, APR Director, Corporate Communications dmeaney@ctwater.com 860.664.6016 www.sjw-ctws.com ConnecticutWater SJW Group Pro Forma 1 Based on 2017 net income

SJW-CTWS JointAll-Employee Video Transcript

Eric Thornburg:

| | • | | This is an historic moment! |

| | • | | This morning, we announced an agreement to merge two great companies – SJW Group and Connecticut Water. |

| | • | | I am delighted to be here with Dave, my former colleague from Connecticut Water, to discuss this news and the exciting opportunities this creates. |

| | • | | The merger will be one of equals! |

| | • | | It combines our talents, expertise and shared vision to create a premier organization with significant long-term benefits for you, our employees, as well as for customers, shareholders and the communities we serve. It will truly transform us! |

| | • | | We wanted to deliver this news to all of you in person, but circumstances required that we be on hand to meet with shareholders as we make this announcement. |

| | • | | You have your local leaders with you today to answer any questions you may have, and I assure you that Dave and I will be available in the coming days and weeks to talk directly with you all. |

| | • | | I’ll be back in San Jose tomorrow to meet with San Jose Water employees and share my thoughts in person and answer your questions. I’ll be in Texas in the very near future as well to talk with you all in person. |

| | • | | Having spent more than 11 years at Connecticut Water and since joining SJW Group last year, I have a deep appreciation for each company and their teams, and I am confident that we can achieve great things together. |

| | • | | We will be the 3rd largest investor-owned water and wastewater utility in the United States! |

David Benoit:

| | • | | I share Eric’s excitement about this merger and look forward to working with him once again, and continuing to build on the shared leadership model and the culture of service that we are both so proud to be a part of. |

| | • | | Our organizations are located across the country from each other, creating a geographically diverse partnership that is positioned for growth. |

| | • | | The combined company will have a strong multi-state presence in California, Connecticut, Maine and Texas. |

| | • | | We will rely on our dedicated teams of employees locally who consistently deliver high-quality,well-run operations, and the world-class customer service that defines us. |

| | • | | Together, our team of 700+ water professionals will serve more than 1.5 million people with safe, high-quality and reliable water service. |

| | • | | Our cultural fit is strong. We are closely aligned in our focus on service to customers, communities, employees, shareholders and environmental stewardship. |

| | • | | Together, we are a larger, stronger organization with even more opportunities for growth and success. |

SJW-CTWS JointAll-Employee Video Transcript

Eric Thornburg:

| | • | | Dave and I both understand what makes our organizations successful – it is our people and the culture we build together! |

| | • | | This merger will reinforce that commitment – by bringing together the values, talents and capabilities that all of you bring to your job every day. |

| | • | | Our Board of Directors and executive leadership team will be made up of individuals from both companies. |

| | • | | I will serve as Chairman, President and CEO of the newly combined company, and Dave will serve as President of the New England Region, overseeing our New England operations, including Connecticut Water. |

| | • | | Our operations will remain locally based and locally managed, and we will maintain our teams and a strong presence across our multi-state operations. |

| | • | | Each of the combined company’s utilities will operate under their current brand names – San Jose Water, SJWTX, Maine Water, Connecticut Water, Heritage Village and Avon Water. |

| | • | | Their customers will continue to be supported locally by a team of passionate, dedicated employees and leaders. |

| | • | | And our current presidents and local teams will continue to serve, including: |

| | • | | As mentioned, Dave will be the President of New England and lead Connecticut Water Company; |

| | • | | Andy Gere will serve as President and Chief Operating Officer of San Jose Water; |

| | • | | Tom Hodge will serve as President of SJWTX; and |

| | • | | Rick Knowlton will serve as President of Maine Water. |

| | • | | Additionally, we will establish ‘centers of excellence’ with leaders from both organizations who will blend the strengths and talents of our teams in key functional areas. For the combined company: |

| | • | | Jim Lynch will serve as Chief Financial Officer; |

| | • | | Kristen Johnson will serve as Chief Human Resource Officer; |

| | • | | Suzy Papazian will serve as General Counsel and Corporate Secretary; |

| | • | | Andrew Walters will serve as Chief Administrative Officer; and |

| | • | | Maureen Westbrook will serve as Senior Vice President of External Affairs. |

| | • | | You, our employees, are critical to our success and you can be assured that there are no merger-related layoffs or significant changes in compensation or benefit packages planned as a result of this transaction. |

| | • | | For SJW Group, I also want to be clear that we value our trusted partnership with our union represented employees and of course all union contracts will continue to be honored. |

| | • | | Once the merger is closed, there will be greater opportunities for employees, including career development and geographic mobility as part of a larger, stronger, more diverse company. |

David Benoit:

| | • | | The benefits for our customers and communities are compelling. |

| | • | | Connecticut Water and SJW Group both have records of world-class customer service and strong community support. |

SJW-CTWS JointAll-Employee Video Transcript

| | • | | As our individual companies have grown through the years, our commitment to our customers and communities has been unwavering – and we expect that to continue to be the case as we join together. |

| | • | | The new organization will maintain outstanding customer service, which will be enhanced by sharing of best practices, operational expertise and more extensive resources. |

| | • | | Indeed, this transaction should be virtually seamless to the customers we serve. |

| | • | | There will be no change in customer rates as a result of the merger. |

| | • | | We will also honor commitments for approximately $200 million of annual capital investments in the communities we serve across our combined operations. This includes moving forward with Maine Water’s construction of a new surface water treatment facility in Saco, Maine. |

| | • | | For our communities, we will remain a committed partner with employees active in local organizations and a focus on water conservation and environmental stewardship. |

| | • | | We will continue to focus on supporting economic development with investments that provide for growth, safety and reliability in the communities where we live, work and serve. |

Eric Thornburg:

| | • | | While we have highlighted some of the many benefits we expect to achieve as we come together, we know that today’s announcement is just the first step in this journey. |

| | • | | The transaction is expected to close byyear-end 2018, subject to customary closing conditions and approvals. |

| | • | | Until the closing, our companies will remain separate organizations, and business will continue as usual. |

| | • | | As we move forward, you have our commitment to keep you informed. |

| | • | | I want to thank you now for your dedication and hard work. |

| | • | | I couldn’t be more excited about our new team and the opportunities this transaction creates. |

| | • | | Dave and I are bothcounting on everyone to remain focused on serving! Serve your customers! Serve our communities! And serve each other! |

David Benoit:

| | • | | I echo Eric’s gratitude and his excitement. |

| | • | | I am proud to be part of this newly combined team and I’m here if you have any questions. |

| | • | | I ask for your trust as we move forward together. |

SJW-CTWS JointAll-Employee Video Transcript

Forward Looking Statements

This document contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology.

The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Connecticut Water or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water or SJW Group; (8) the ability of Connecticut Water and SJW Group to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on FormS-4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017, and Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017 (which will be filed today). Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither SJW Group or its management nor Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed transaction between SJW Group and Connecticut Water, SJW Group will file with the SEC a Registration Statement on FormS-4 that will include a joint proxy statement of SJW Group and Connecticut Water that also constitutes a prospectus of SJW Group. SJW Group and Connecticut Water may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, FormS-4 or any other document which SJW Group or Connecticut Water may file with the SEC. INVESTORS AND SECURITY HOLDERS OF SJW GROUP AND CONNECTICUT WATER ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website at https://sjwgroup.com/investor_relations. Copies of documents filed with the SEC by Connecticut Water will be made available free of charge on Connecticut Water’s investor relations website at https://ir.ctwater.com/.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Participants in the Solicitation

SJW Group, Connecticut Water and certain of their respective directors and officers, and other members of management and employees, may be deemed to be participants in the solicitation of proxies from the holders of SJW Group and Connecticut Water securities in respect of the proposed transaction. Information regarding SJW Group’s directors and officers is available in SJW Group’s annual report on Form10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated March 6, 2018, which are filed with the SEC. Information regarding Connecticut Water’s directors and officers is available in Connecticut Water’s annual report on Form10-K for the fiscal year ended December 31, 2017, which will be filed today, and its proxy statement for its 2017 annual meeting dated March 30, 2017, which is filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water. These documents will be available free of charge from the sources indicated above.

Employee Letter for Email Distribution

Dear Team,

I am pleased to share exciting news about our company. Today, we announced that SJW Group and Connecticut Water have signed a definitive agreement to combine in a merger of equals to create the 3rd largest investor-owned water and wastewater utility in the United States.

Connecticut Water is New England’s largest publicly traded water and wastewater utility and through its regulated utility subsidiaries, it serves more than 450,000 people in 80 communities across Connecticut and Maine, and provide wastewater service to more than 10,000 people in Connecticut. Together, we will serve more than 1.5 million people with over 700 employees across California, Connecticut, Maine and Texas. The combined company will be led by an experienced leadership team that leverages the strengths and capabilities of its subsidiaries. All utility and operating subsidiaries will continue under existing local leaders and brand names.

This transformational merger creates a premier organization with substantial opportunities for new investment across a diverse set of geographies and an improved ability to serve our customers. Indeed, our combination with Connecticut Water joins two leading and complementary water utility companies to create significant long-term benefits for employees, customers, shareholders and the communities we serve. You can read the full press release atwww.sjw-ctws.com.

As you may know, I led Connecticut Water for over 11 years until joining SJW Group last fall. As a result of my time at both companies, I know that SJW Group and Connecticut Water are a strong cultural match with many shared values. Like SJW Group, Connecticut Water has a passion for delivering life-sustaining water service to families and communities, serving their colleagues, being good stewards of the natural resources entrusted to them and creating shareholder value. Each of our companies also has talented and engaged employees. By bringing our teams together and capitalizing on the strengths and best practices of both SJW Group and Connecticut Water, we believe we will be well positioned to realize the substantial benefits inherent in our combination. For example:

| | • | | Employees will have additional opportunities for career development and geographic mobility as part of a larger, stronger, more diverse organization committed to fostering a workplace that supports professional employee growth. Existing leadership and the valued employees at our local utility companies will remain in place across the combined company’s multi-state operations. Our employees are critical to our success, and can be assured that there are no merger-related layoffs or significant changes in compensation or benefit packages planned as a result of the transaction. We value our trusted union partnerships, and all union contracts will continue to be honored; |

| | • | | Customers will benefit from outstanding customer service that will be enhanced by sharing of best practices, operational expertise and more extensive resources. There will be no change in customer rates as a result of the merger; |

| | • | | Communitieswill continue to have a committed partner in our company. We will continue our record of environmental stewardship and maintain a commitment to community involvement. We will continue to focus on supporting economic development with investments in growth, safety and reliability in the communities where we live, work and serve; and |

| | • | | Shareholders of both SJW Group and Connecticut Water will have the opportunity to participate in the combined company’s growth and value creation. |

Upon closing of the transaction, I will serve as Chairman, President and Chief Executive Officer of the newly merged company, and Connecticut Water’s President and Chief Executive Officer, David Benoit, will serve as President, New England Region, overseeing the New England operations, including Connecticut Water. Additional members of our combined leadership team are reviewed in the release we issued today. The combined company’s headquarters will be located in San Jose, CA, with the New England headquarters located in Clinton, CT.

While I’ve highlighted some of the many benefits we expect to achieve as a result of our merger, today’s announcement is just the first step toward bringing our companies together. The transaction is expected to close byyear-end 2018, subject to customary closing conditions and various approvals. Until the closing, SJW Group and Connecticut Water remain separate organizations, and we will operate as usual. It is important that we all remain focused on ourday-to-day responsibilities and serving our customers with world-class water service and reliability, as we always have.

Dave Benoit and I have recorded a video discussing our merger and its benefits, which you can access at [WEBSITE], please use the password: [PASSWORD]. Team leaders will also be available throughout the day to address questions you may have, and I look forward to seeing many of you personally over the coming days and weeks. In addition, an FAQ and other materials can be found on our intranet at this link: [WEBSITE]

While I wanted to be there with youin-person to make today’s announcement, circumstances prevented it. But I will be back in San Jose on Friday and I have scheduled meetings at both Bascom and Taylor offices. Please plan to attend the meeting that work’s best for you, if you have questions about today’s announcement or if you would like to talk with me about the news. These meetings are informal, I won’t have a prepared agenda. But I would like to listen to any thoughts you might have. I hope you’ll join me.

One reminder: today’s announcement is likely to generate increased interest in SJW Group. Consistent with usual policies, media inquiries should be forwarded to Jayme Ackemann at [CONTACT INFORMATION]. Investor-related inquiries should be referred to Andrew Walters at [CONTACT INFORMATION].

On behalf of our board of directors and management team, thank you for your hard work and commitment to SJW Group. I look forward to the opportunities ahead.

In service,

Forward Looking Statements

This document contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology.

The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Connecticut Water or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water or SJW Group; (8) the ability of Connecticut Water and SJW Group to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or

expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on

FormS-4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017, and Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017 (which will be filed today). Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither SJW Group or its management nor Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed transaction between SJW Group and Connecticut Water, SJW Group will file with the SEC a Registration Statement on FormS-4 that will include a joint proxy statement of SJW Group and Connecticut Water that also constitutes a prospectus of SJW Group. SJW Group and Connecticut Water may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, FormS-4 or any other document which SJW Group or Connecticut Water may file with the SEC. INVESTORS AND SECURITY HOLDERS OF SJW GROUP AND CONNECTICUT WATER ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THEPROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website athttps://sjwgroup.com/investor_relations. Copies of documents filed with the SEC by Connecticut Water will be made available free of charge on Connecticut Water’s investor relations website athttps://ir.ctwater.com/.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Participants in the Solicitation

SJW Group, Connecticut Water and certain of their respective directors and officers, and other members of management and employees, may be deemed to be participants in the solicitation of proxies from the holders of SJW Group and Connecticut Water securities in respect of the proposed transaction. Information regarding SJW Group’s directors and officers is available in SJW Group’s annual report on Form10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated March 6, 2018, which are filed with the SEC. Information regarding Connecticut Water’s directors and officers is available in Connecticut Water’s annual report on Form10-K for the fiscal year ended December 31, 2017, which will be filed today, and its proxy statement for its 2017 annual meeting dated March 30, 2017, which is filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water. These documents will be available free of charge from the sources indicated above.

SJW GROUP Announcement Supplier Business Partner Letter

March 15, 2018

Subject: SJW Group Announces Definitive Agreement to Initiate a Merger of Equals with Connecticut Water

Dear [INSERT PARTNER HERE],

I am pleased to share that SJW Group, the parent company of INSERT RELEVANT SUBSIDIARY, has announced a definitive agreement to combine with Connecticut Water Service in a merger of equals to create the 3rd largest investor-owned water and wastewater utility in the United States. Connecticut Water is New England’s largest publicly traded water and wastewater utility and through its regulated water utility subsidiaries, it serves more than 450,000 people in 80 communities across Connecticut and Maine, and more than 3,000 wastewater customers in Connecticut. Together, we will serve more than 1.5 million people with over 700 employees across California, Connecticut, Maine and Texas.

As a result of this transformational merger, we will have an attractive range of new investment opportunities across a diverse set of geographies and be even better positioned to create significant long-term benefits for all of our stakeholders.

For example, the outstanding service we offer our customers today will be enhanced by the sharing of best practices, operational expertise and more extensive resources of the combined company. We also believe the employees of the new organization will benefit from additional opportunities for career development and geographic mobility as part of a larger, stronger, more diverse organization. For the communities we serve, the new company will continue our record of environmental stewardship and community support with our utility operations remaining locally based and locally managed.

As we become a more vital and valued partner to our customers and communities, we expect our combination will lead to growth opportunities for our suppliers and business partners as well.

While we believe there are many reasons to be excited about this transaction, the announcement of our agreement is just the first step. We expect the transaction to close byyear-end 2018, subject to customary closing conditions and various approvals. Until the closing, SJW Group and Connecticut Water remain separate organizations, and we will operate as usual.

Please know that all operations at SJW Group are unchanged. Your SJW Group contact remains the same, and all contracts are continuing in the normal course.

We value the relationship we have with you and thank you for your partnership.

If you have any questions, please feel free to contact your regular SJW Group representative.

[Sincerely,

USUAL CLOSING]

Forward Looking Statements

This document contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology.

The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Connecticut Water or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water or SJW Group; (8) the ability of Connecticut Water and SJW Group to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on FormS-4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017, and Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017 (which will be filed today). Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither SJW Group or its management nor Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed transaction between SJW Group and Connecticut Water, SJW Group will file with the SEC a Registration Statement on FormS-4 that will include a joint proxy statement of SJW Group and Connecticut Water that also constitutes a prospectus of SJW Group. SJW Group and Connecticut Water may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, FormS-4 or any other document which SJW Group or Connecticut Water may file with the SEC. INVESTORS AND SECURITY HOLDERS OF SJW GROUP AND CONNECTICUT WATER ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website at https://sjwgroup.com/investor_relations. Copies of documents filed with the SEC by Connecticut Water will be made available free of charge on Connecticut Water’s investor relations website at https://ir.ctwater.com/.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Participants in the Solicitation

SJW Group, Connecticut Water and certain of their respective directors and officers, and other members of management and employees, may be deemed to be participants in the solicitation of proxies from the holders of SJW Group and Connecticut Water securities in respect of the proposed transaction. Information regarding SJW Group’s directors and officers is available in SJW Group’s annual report on Form10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated March 6, 2018, which are filed with the SEC. Information regarding Connecticut Water’s directors and officers is available in Connecticut Water’s annual report on Form10-K for the fiscal year ended December 31, 2017, which will be filed today, and its proxy statement for its 2017 annual meeting dated March 30, 2017, which is filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water. These documents will be available free of charge from the sources indicated above.

| | |

| SJW Group Employee FAQ | | 03.13.18 |

| Page 1 of 5 | | 10:00 PM ET |

| 1. | What was announced? What are the benefits of this transaction? |

| | • | | We announced that SJW Group and Connecticut Water have signed a definitive agreement to combine in a merger of equals to create the 3rd largest investor-owned water and wastewater utility in the United States. |

| | • | | The new company will serve more than 1.5 million people with over 700 employees across California, Connecticut, Maine and Texas. |

| | • | | The combined company will be led by an experienced Board of Directors and leadership team that leverages the strengths and capabilities of both companies. All utility and operating subsidiaries will continue under existing local leaders and brand names. |

| | • | | This is a transformational merger that positions the new company to drive growth, serve customers and create opportunities for employees as a result of increased scale and geographic diversity, combined operating expertise and enhanced financial strength. |

| | • | | Together, we create a new larger, stronger company capable of delivering greater value and benefits than either company could deliver on its own. |

| | • | | For more information on the merger, please visitwww.sjw-ctws.com. |

| 2. | Who is Connecticut Water? |

| | • | | Connecticut Water is the largest publicly traded water utility based in New England. |

| | • | | Through its regulated utility subsidiaries and with the support of more than 290 employees, Connecticut Water serves more than 135,000 water customers, or more than 450,000 people in 80 communities across Connecticut and Maine, and more than 3,000 wastewater customers in Connecticut. |

| | • | | Connecticut Water shares similar values with SJW Group and is committed to conducting its business operations in a manner that respects the natural environment and with a focus on service to customers, communities, employees and shareholders. |

| | • | | As you know, our President and Chief Executive Officer, Eric W. Thornburg, previously served as President and Chief Executive Officer of Connecticut Water. |

| | • | | Given the strong cultural fit between our organizations, we are very confident in our ability to successfully bring the two companies together and create a new industry leader with world class service, reliability and growth. |

| | • | | For more information on Connecticut Water, please visit www.ctwater.com. |

| 3. | What does the transaction mean for employees? |

| | • | | This transaction is about growth – for our combined company and our combined employees. |

| | • | | SJW Group and Connecticut Water both recognize the valuable contributions that employees make to our success, and our intent is to capitalize on the capabilities and talent of both organizations. |

| | • | | The combined company will maintain a strong workforce across its multi-state operations. Employees will have a role in our newly combined organization and can be assured that there are no merger-related layoffs or significant changes in compensation or benefit packages planned as a result of the transaction. We value our trusted union partnerships, and all union contracts will continue to be honored. |

| | • | | Following the close of the transaction, we expect employees to benefit from new career development opportunities and geographic mobility that result from being part of a larger, stronger, more diverse organization. |

| | • | | While we are excited about this merger, our announcement is just the first step toward bringing our companies together. |

| | • | | Until the transaction’s closing, SJW Group and Connecticut Water remain separate organizations, and we will operate as usual. |

| | |

| SJW Group Employee FAQ | | 03.13.18 |

| Page 2 of 5 | | 10:00 PM ET |

| 4. | Are any layoffs planned as a result of the transaction? |

| | • | | Our employees will have a role in our newly combined organization and can be assured that there are no merger-related layoffs or significant changes in compensation or benefit packages planned as a result of the transaction. We value our trusted union partnerships, and all union contracts will continue to be honored. |

| | • | | Each of the combined company’s operating utilities and their customers will continue to be supported locally by a team of passionate, dedicated employees and existing leaders. Employees will bring their extensive certifications, operating experience and local knowledge to the communities they serve. |

| 5. | Will there be any changes to compensation or benefits plans? |

| | • | | Our employees will have a role in our newly combined organization and can be assured that there are no merger-related layoffs or significant changes in compensation or benefit packages planned as a result of the transaction. |

| | • | | We value our trusted union partnerships, and all union contracts will continue to be honored. |

| | • | | As we always have, we will continue to offer a salary and benefits package that is competitive within individual markets and the industry as a whole. |

| 6. | Will employees be able to transfer, or be asked to transfer, to Connecticut Water facilities or locations? |

| | • | | Until the closing, SJW Group and Connecticut Water remain separate organizations, and we will operate as usual. |

| | • | | Following the close, the combined company’s operating utilities will continue to be supported locally by existing teams and leaders. |

| | • | | However, geographic mobility is one of the employee benefits resulting from this transaction and we will explore related opportunities after the transaction closes. |

| 7. | Will any offices or facilities be closed as a result of the merger? |

| | • | | SJW Group and Connecticut Water market footprints are highly complementary with no overlap. |

| | • | | Given the complementary nature of our operations and the growth opportunity we see resulting from this transaction, we do not expect any changes to our offices or facilities as a result of the merger. |

| 8. | When will the merger be completed? What can employees expect between now and the close of the transaction? |

| | • | | We expect the transaction to close byyear-end 2018. |

| | • | | The transaction is subject to customary closing conditions and approvals, including the approval of the issuance of shares in the transaction by SJW Group shareholders, the approval of Connecticut Water shareholders, the approvals of the Connecticut Public Utilities Regulatory Authority and the Maine Public Utilities Commission, the approval of the Federal Communications Commission and the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act. |

| | • | | Until the closing, SJW Group and Connecticut Water remain separate organizations, and we will operate as usual. |

| | • | | We ask that you remain focused on yourday-to-day responsibilities and serving our customers with world-class water service and reliability, as we always have. |

| | • | | Over the coming months, SJW Group and Connecticut Water leadership will have more detailed discussions about how best to bring the companies together. |

| | • | | As we move toward the closing of the transaction, we will continue to keep you informed of additional information as it becomes available. |

| | |

| SJW Group Employee FAQ | | 03.13.18 |

| Page 3 of 5 | | 10:00 PM ET |

| 9. | Who will lead the combined company? |

| | • | | The combined company will be led by an experienced Board of Directors and leadership team that leverages the strengths and capabilities of its subsidiaries. All utility and operating subsidiaries will continue under existing local leaders and brand names. |

| | • | | Upon closing of the transaction: |

| | - | The Board of Directors of the combined company will consist of 12 directors, with seven directors appointed by SJW Group and five directors, including the Lead Independent Director, appointed by Connecticut Water. |

| | - | Eric Thornburg will serve as Chairman, President and Chief Executive Officer of the newly merged company. |

| | - | David Benoit will serve as President, New England Region, overseeing the New England operations, including Connecticut Water. |

| | - | Andrew Gere will continue serving as President and Chief Operating Officer of San Jose Water. |

| | - | Thomas Hodge will continue serving as President of SJWTX. |

| | - | Richard Knowlton will continue serving as President of Maine Water Company. James Lynch will serve as Chief Financial Officer of the combined company, Kristen Johnson will serve as Chief Human Resource Officer, Suzy Papazian will serve as General Counsel and Corporate Secretary, Andrew Walters will serve as Chief Administration Officer and Maureen Westbrook will serve as Senior Vice President of External Affairs. |

| 10. | Where will the combined company be headquartered? |

| | • | | The combined company’s headquarters will be located in San Jose, CA, with the New England headquarters located in Clinton, CT. |

| | • | | All utility and operating subsidiaries will continue from their existing locations. |

| 11. | How will this merger benefit customers? |

| | • | | We believe this transaction is awin-win for all of our stakeholders, including our customers. |

| | • | | There will be no change in customer rates as a result of the merger, and the operating subsidiaries of the combined company will each continue to be subject to oversight by their respective state regulatory commissions for rates and quality of service. |

| | • | | The new organization will maintain the longstanding commitments of SJW Group and Connecticut Water to outstanding customer service, which will be enhanced by sharing of best practices, operational expertise and more extensive resources. |

| | • | | Further, the combined company can cost effectively implement updated customer service tools across Connecticut and Maine utility operations by leveraging leading Information Services and Technology systems that have been established at SJW Group. |

| | • | | The new company will honor commitments for approximately $200 million of annual capital investments across its combined operations. |

| 12. | How can employees learn more about this transaction? |

| | • | | For additional information on the transaction and its benefits, please visit the website we have created for the transaction,www.sjw-ctws.com. |

| | • | | We will also continue to keep employees updated through usual communications channels as we have additional information to share. |

| | • | | As always, you may also contact your supervisor or HR representative. |

| | |

| SJW Group Employee FAQ | | 03.13.18 |

| Page 4 of 5 | | 10:00 PM ET |

| 13. | What should employees say if contacted by customers or other third parties about the transaction? |

| | • | | If customers ask about the transaction, we ask that you emphasize that it is business as usual at SJW Group and that we remain focused on serving them with world-class water service and reliability, as we always have. |

| | • | | With respect to questions you may get from others outside the Company, please note that only certain company executives are authorized to officially comment about this announcement on the Company’s behalf. |

| | • | | Consistent with usual policies, media inquiries should be forwarded to Jayme Ackemann at jayme.ackemann@sjwater.com or408-918-7247. Investor and analyst-related inquiries should be referred to Andrew Walters at andrew.walters@sjwater.com or408-279-7818. |

Forward Looking Statements

This document contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology.

The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Connecticut Water or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water or SJW Group; (8) the ability of Connecticut Water and SJW Group to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on FormS-4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017, and Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017 (which will be filed today). Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither SJW Group or its management nor Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed transaction between SJW Group and Connecticut Water, SJW Group will file with the SEC a Registration Statement on FormS-4 that will include a joint proxy statement of SJW Group and Connecticut Water that also constitutes a prospectus of SJW Group. SJW Group and Connecticut Water may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, FormS-4 or any other document which SJW Group or Connecticut Water may file with the SEC. INVESTORS AND SECURITY HOLDERS OF SJW GROUP AND CONNECTICUT WATER ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website at https://sjwgroup.com/investor_relations. Copies of documents filed with the SEC by Connecticut Water will be made available free of charge on Connecticut Water’s investor relations website at https://ir.ctwater.com/.

| | |

| SJW Group Employee FAQ | | 03.13.18 |

| Page 5 of 5 | | 10:00 PM ET |

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Participants in the Solicitation

SJW Group, Connecticut Water and certain of their respective directors and officers, and other members of management and employees, may be deemed to be participants in the solicitation of proxies from the holders of SJW Group and Connecticut Water securities in respect of the proposed transaction. Information regarding SJW Group’s directors and officers is available in SJW Group’s annual report on Form10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated March 6, 2018, which are filed with the SEC. Information regarding Connecticut Water’s directors and officers is available in Connecticut Water’s annual report on Form10-K for the fiscal year ended December 31, 2017, which will be filed today, and its proxy statement for its 2017 annual meeting dated March 30, 2017, which is filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water. These documents will be available free of charge from the sources indicated above.

SJW Group Stakeholder Letter for Email Outreach

Email:

Dear Elected Official, Staff, and Community Leaders,

For more than 150 years, SJW Group, through San Jose Water and our subsidiaries, has proudly served our customers and communities with high quality, life sustaining water, and an emphasis on exceptional customer service. I am excited to share some news that will enable us to be an even stronger partner to you and to all of the communities where we live, work and serve.

Today, we announced that SJW Group and Connecticut Water Service have signed a definitive agreement to combine through a merger of equals to create the 3rd largest investor-owned water and wastewater utility in the United States. By way of background, Connecticut Water is New England’s largest publicly traded water and wastewater utility and through its regulated water utility subsidiaries, it serves more than 450,000 people in 80 communities across Connecticut and Maine, and more than 10,000 wastewater customers in Connecticut.

Together, we will serve more than 1.5 million people with over 700 employees across California, Connecticut, Maine and Texas. The combined company will be led by an experienced Board of Directors and leadership team that leverages the strengths and capabilities of its subsidiaries. Each of the combined company’s operating utilities and their customers will continue to be supported locally by a team of dedicated employees and existing leaders. They will bring their extensive certifications, operating experience and local knowledge to the communities they serve.

Both SJW Group and Connecticut Water are a strong cultural match with many shared values. Like SJW Group, Connecticut Water has a passion for delivering life-sustaining water service to families and communities, serving their colleagues, being good stewards of the natural resources entrusted to them and creating shareholder value. By bringing our teams together and capitalizing on the strengths and best practices of both SJW Group and Connecticut Water, we believe we will be well positioned to realize the substantial benefits inherent in our combination.

Upon closing the transaction, Eric Thornburg will serve as Chairman, President and Chief Executive Officer of the newly merged company. Connecticut Water’s President and CEO, David Benoit, will serve as President, New England Region, overseeing the New England operations, including Connecticut Water. Additional members of our combined leadership team are reviewed in the release we issued today. We do not anticipate any merger-related layoffs or any significant changes in employee compensation or benefits packages as a result of the transaction. We value our trusted union partnerships, and all union contracts will continue to be honored.

For the communities we serve, the new company will maintain strong community ties and participation in community events and organizations. The combined company will continue to focus on supporting economic development with investments in growth, safety and reliability. The combined company’s headquarters will be located in San Jose, CA, with the New England headquarters in Clinton, CT.

Environmental stewardship is a core value for both organizations given the local nature of the water business. That focus will continue as the newly-merged organization seeks to further reduce its environmental footprint and look for opportunities to improve the sustainability of its business practices.

All of this means that the way that we operate in your community will largely stay the same.

Looking ahead, while today’s announcement is significant, it is just the first step toward bringing our companies together. The transaction is expected to close byyear-end 2018, subject to customary closing conditions and various approvals. Until the closing, SJW Group and Connecticut Water remain separate organizations, and we will operate as usual.

All of us at San Jose Water are deeply grateful for the support that you have extended to our company. We will continue to keep you posted on our progress. For additional information, please don’t hesitate to contact me or visithttp://www.sjw-ctws.com/.

Best,

Forward Looking Statements

This document contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology.

The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Connecticut Water or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of Connecticut Water or SJW Group; (8) the ability of Connecticut Water and SJW Group to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on FormS-4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017, and Connecticut Water’s overall business and financial condition, including those more fully described in Connecticut Water’s filings with the SEC including its annual report on Form10-K for the fiscal year ended December 31, 2017 (which will be filed today). Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither SJW Group or its management nor Connecticut Water or its management undertakes any obligation to update or revise any forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed transaction between SJW Group and Connecticut Water, SJW Group will file with the SEC a Registration Statement on FormS-4 that will include a joint proxy statement of SJW Group and Connecticut Water that also constitutes a prospectus of SJW Group. SJW Group and Connecticut Water may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, FormS-4 or any other document which SJW Group or Connecticut Water may file with the SEC. INVESTORS AND SECURITY HOLDERS OF SJW GROUP AND CONNECTICUT WATER ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and

security holders may obtain free copies of the FormS-4 and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by SJW Group and Connecticut Water through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website at https://sjwgroup.com/investor_relations. Copies of documents filed with the SEC by Connecticut Water will be made available free of charge on Connecticut Water’s investor relations website at https://ir.ctwater.com/.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Participants in the Solicitation