Connecticut Water Service, Inc. 2019 Annual Meeting of Shareholders May 9, 2019 Exhibit 99.2

Connecticut Water Service, Inc. David C. Benoit President & CEO

Forward Looking Statements Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the SJW Group transaction are not satisfied; (2) the risk that the regulatory approvals required for the proposed transaction are not obtained at all, or if obtained, on the terms expected or on the anticipated schedule; (3) the risk that the California Public Utilities Commission’s (CPUC) investigation may cause delays in or otherwise adversely affect the proposed transaction and that SJW Group may be required to consummate the proposed transaction prior to the CPUC’s issuance of an order with respect to its investigation; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the proposed transaction; (6) the ability of each party to meet expectations regarding timing, completion and accounting and tax treatments of the proposed transaction; (7) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement between the parties to the proposed transaction; (8) changes in demand for water and other products and services; (9) unanticipated weather conditions; (10) catastrophic events such as fires, earthquakes, explosions, floods, ice storms, tornadoes, terrorist acts, physical attacks, cyber-attacks, or other similar occurrences that could adversely affect the facilities, operations, financial condition, results of operations and reputation of CTWS; (11) risks that the proposed transaction disrupts the current plans and operations of CTWS; (12) potential difficulties in employee retention as a result of the proposed transaction; (13) unexpected costs, charges or expenses resulting from the proposed transaction; (14) the effect of the announcement or pendency of the proposed transaction on business relationships, operating results, and business generally, including, without limitation, competitive responses to the proposed transaction; (15) risks related to diverting management’s attention from ongoing business operations of CTWS; and (16) legislative and economic developments. In addition, actual results are subject to other risks and uncertainties that relate more broadly to CTWS’s overall business and financial condition, including those more fully described in its filings with the U.S. Securities and Exchange Commission , including, without limitation, its Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2019. Forward-looking statements are not guarantees of performance, and speak only as of the date made, and neither CTWS nor its management undertakes any obligation to update or revise any forward-looking statements except as required by law.

Water, the basic ingredient of Life…

Who we are… Our Mission… Passionate employees delivering life sustaining, high quality water service to families and communities while providing a fair return to our shareholders Our Vision… To serve our customers, shareholders and employees at world class levels

Our Values… Honesty Trust Respect Service Teamwork Positive Attitude Straight Talk

Company Strategy Shareholders Environment Customers Employees

Delivering for Customers World-Class customer satisfaction Composite Satisfaction Index – 92.4% Settlement Agreement on Rates in CT Targeted recovery of generational investment Passing along benefits of Tax Act Supporting municipalities

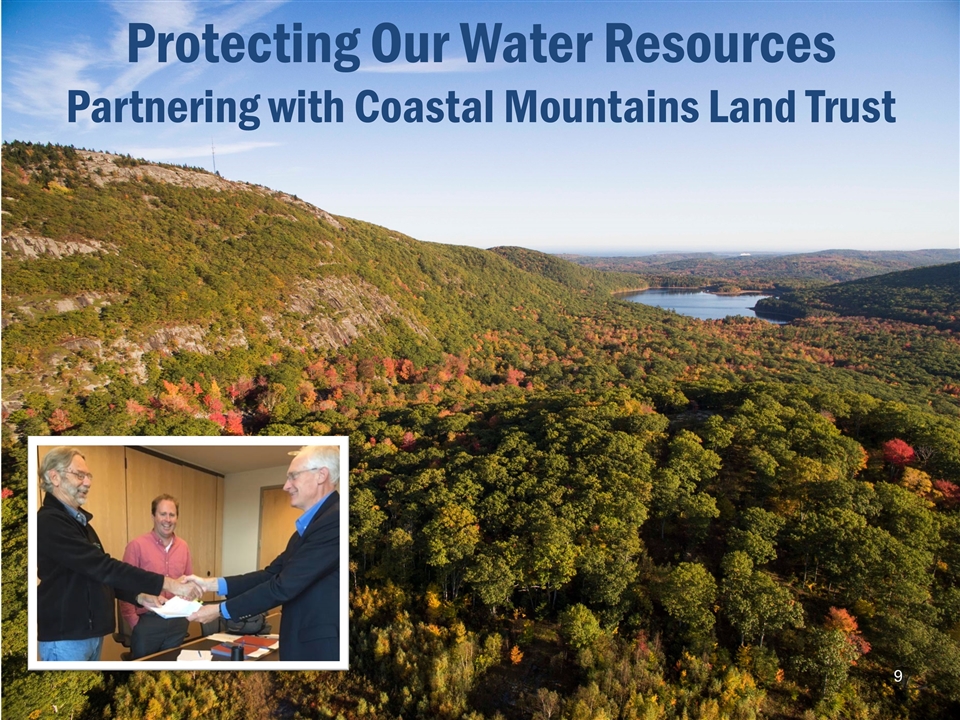

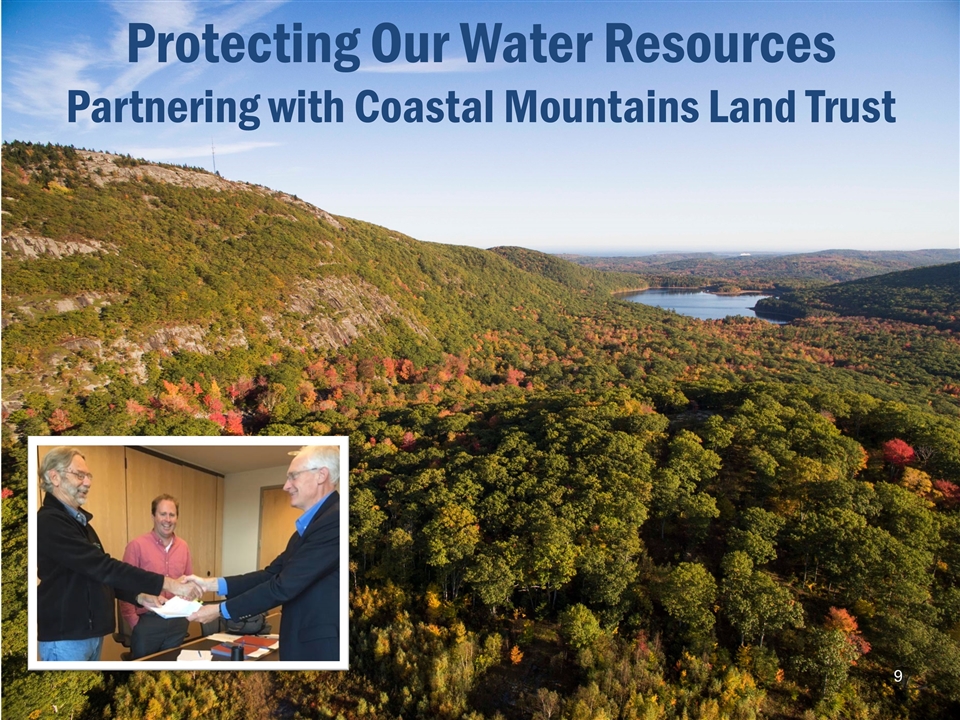

Protecting Our Water Resources Partnering with Coastal Mountains Land Trust

Protecting the Resource Cleanups, Plantings, Hikes & Paddles

Delivering for Employees Employee 2020 Safety & Security Succession Planning & Development Construction Safety Award (15th year)

Every employee is a leader when they deliver on the mission, demonstrate our core values Training delivered in 90 minute segments Highly Interactive Minimum class size is 6 3 or more people in 1 Location in ME or CT, can attend a class in other state via video Leadership Development For Everyone Giving Feedback Building Trust Leveraging Personality Differences Essential Elements Interviewing 101 Active Listening Skills Peer Coaching When to Coach, Counsel and Discipline Advanced Interviewing and Bias Training

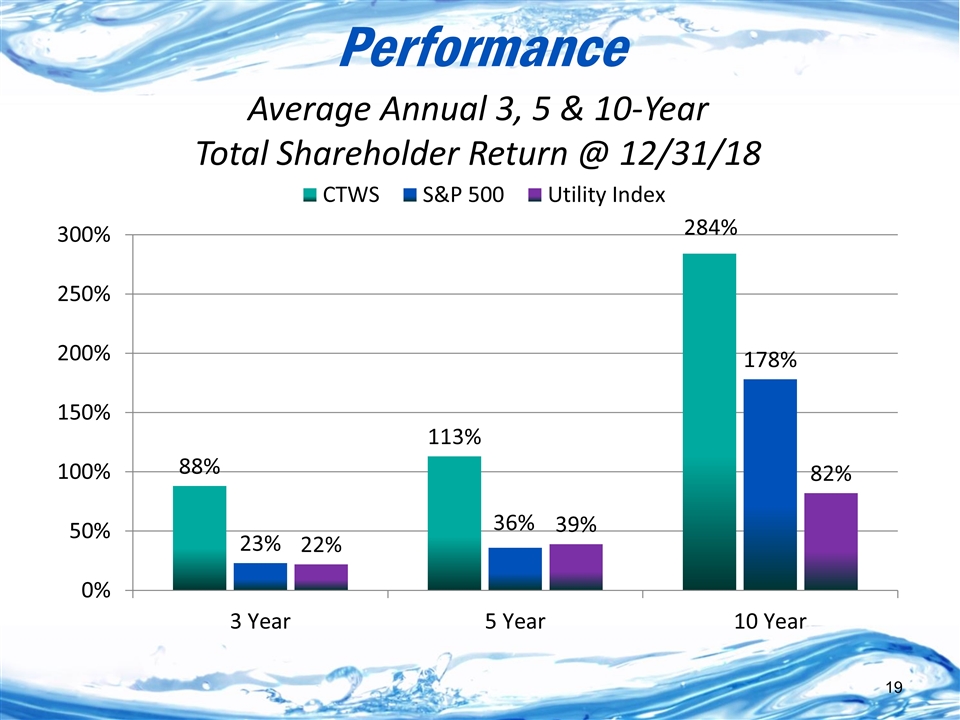

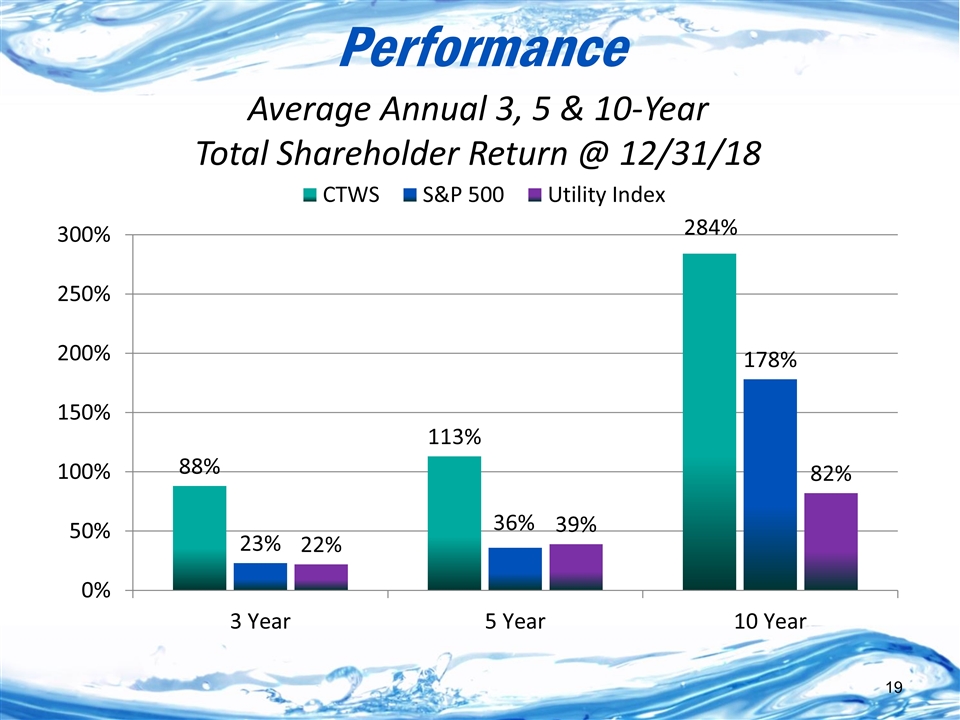

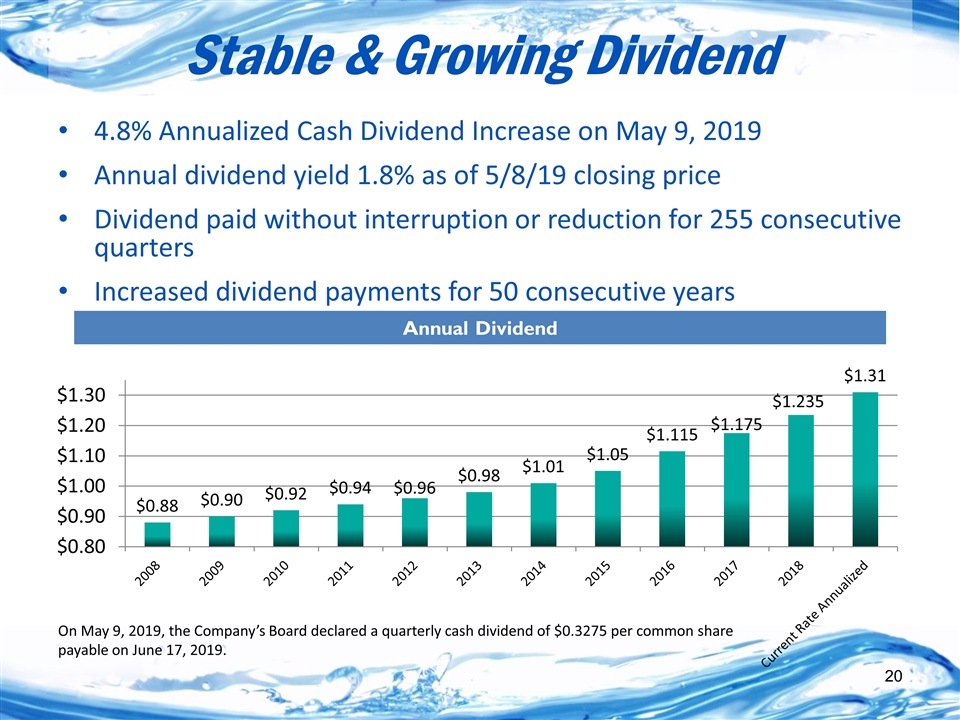

Delivering for Shareholders TSR top quartile of utility indices 50 consecutive years of dividend increases True to our mission and our investments

Merger Update Merger agreement remains in effect and companies remain committed to closing the transaction and realizing its many benefits New applications filed in Connecticut (April) and Maine (May) that are responsive to concerns communicated by regulators in connection with the prior applications

Merger Update New applications offer comprehensive commitments and additional evidence that merger is in public interest and will deliver benefits to all stakeholders

Connecticut Water Service, Inc. Robert J. Doffek CFO, Treasurer and Controller

2018 Financial Highlights Net Income of $16.7 million including $11 million of costs related to the SJW Group combination $27.7 Million Adjusted Net Income* – 5 Year CAGR 8.6% Dividend Increase of 5.0% Successful Rate Activity in Connecticut allowing recovery of the $36.3 million investment in the new Rockville Drinking Water Treatment Facility Invested more than $54.5 million to improve our distribution system, treatment facilities and related infrastructure * Adjusted Net Income is a non-GAAP financial measure which excludes the impacts of costs related to the SJW Group combination.

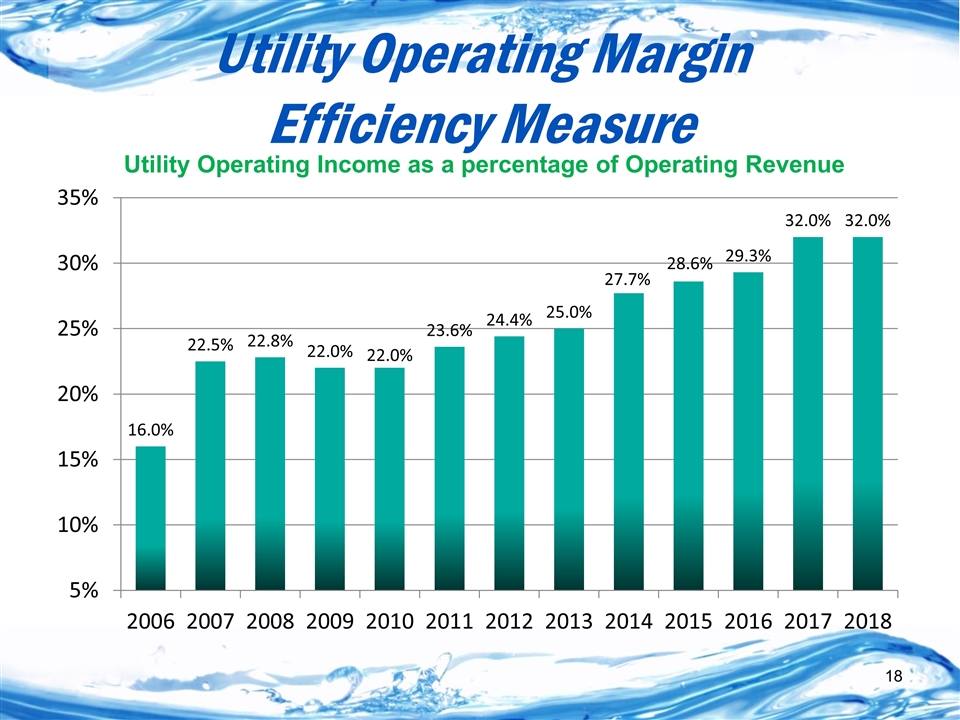

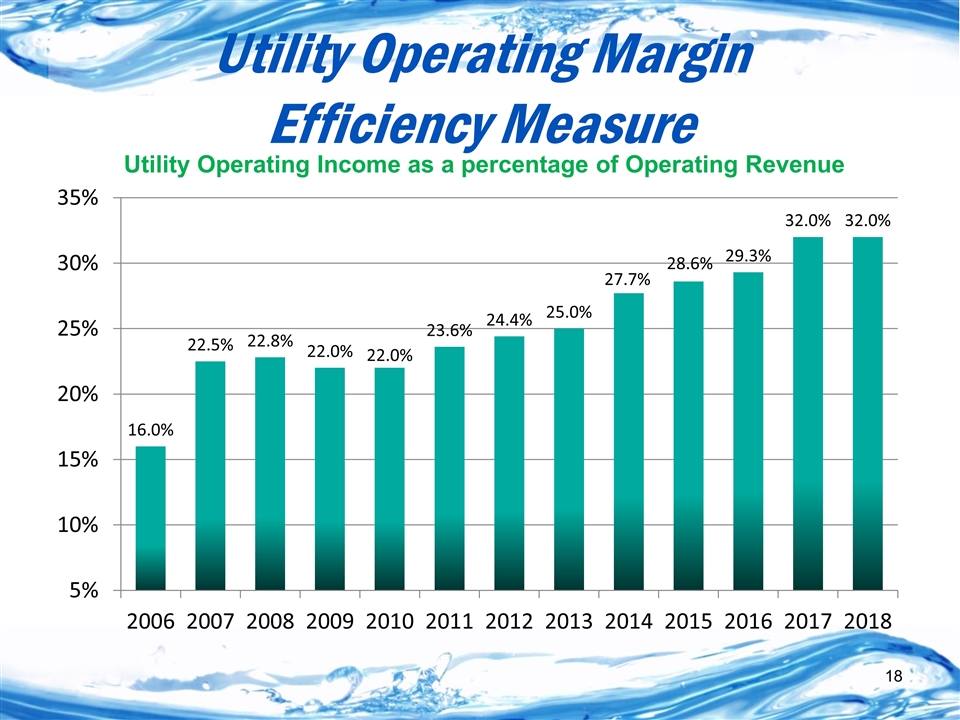

Utility Operating Margin Efficiency Measure Utility Operating Income as a percentage of Operating Revenue

Performance Average Annual 3, 5 & 10-Year Total Shareholder Return @ 12/31/18

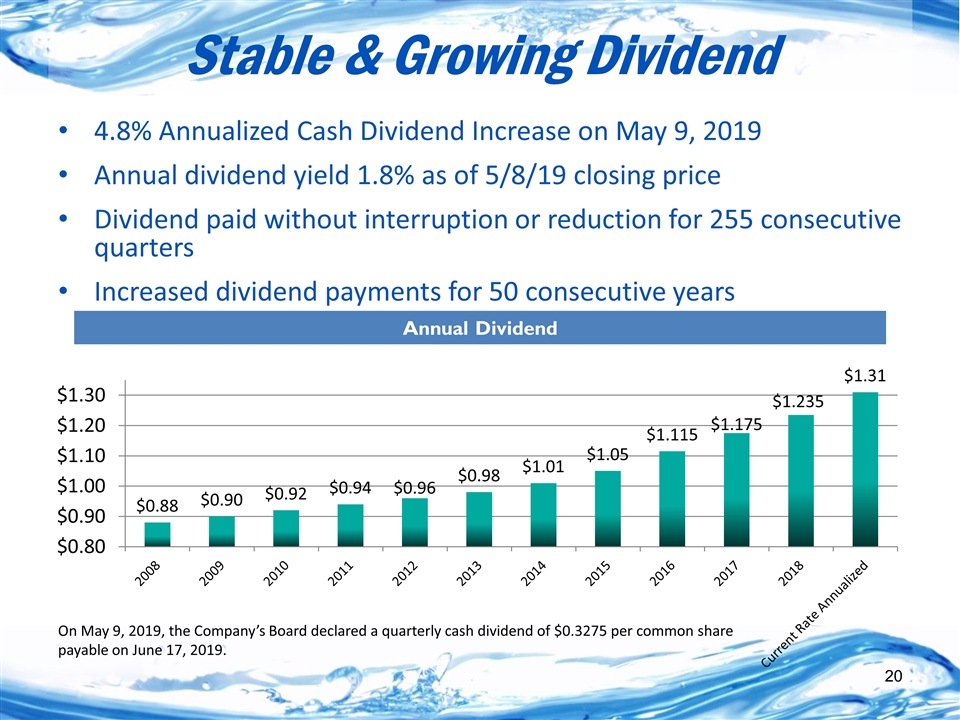

Stable & Growing Dividend 4.8% Annualized Cash Dividend Increase on May 9, 2019 Annual dividend yield 1.8% as of 5/8/19 closing price Dividend paid without interruption or reduction for 255 consecutive quarters Increased dividend payments for 50 consecutive years Annual Dividend On May 9, 2019, the Company’s Board declared a quarterly cash dividend of $0.3275 per common share payable on June 17, 2019.

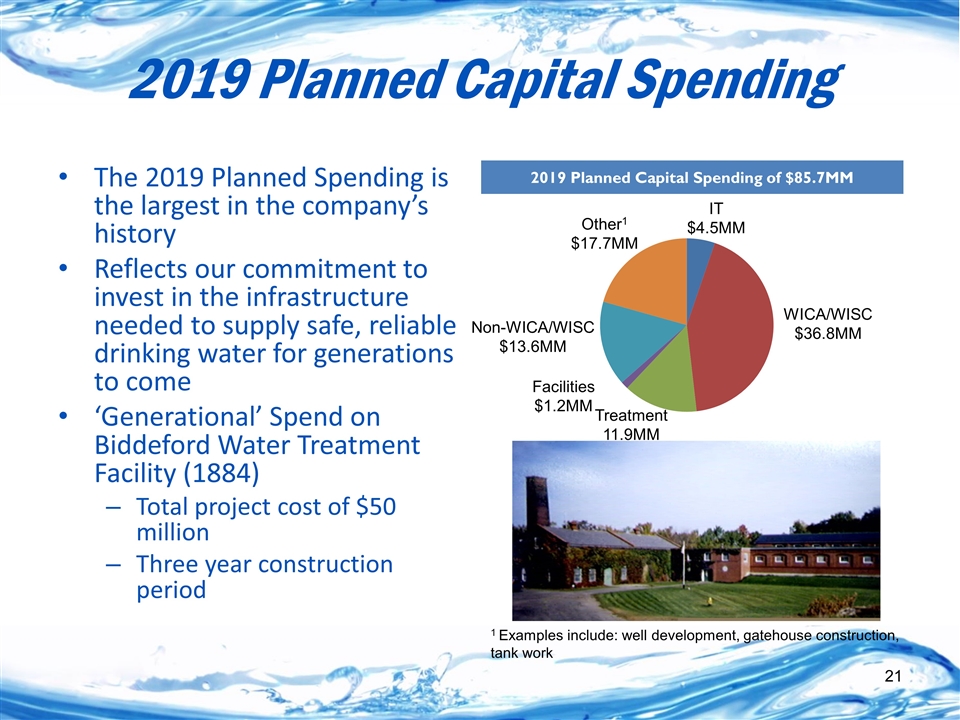

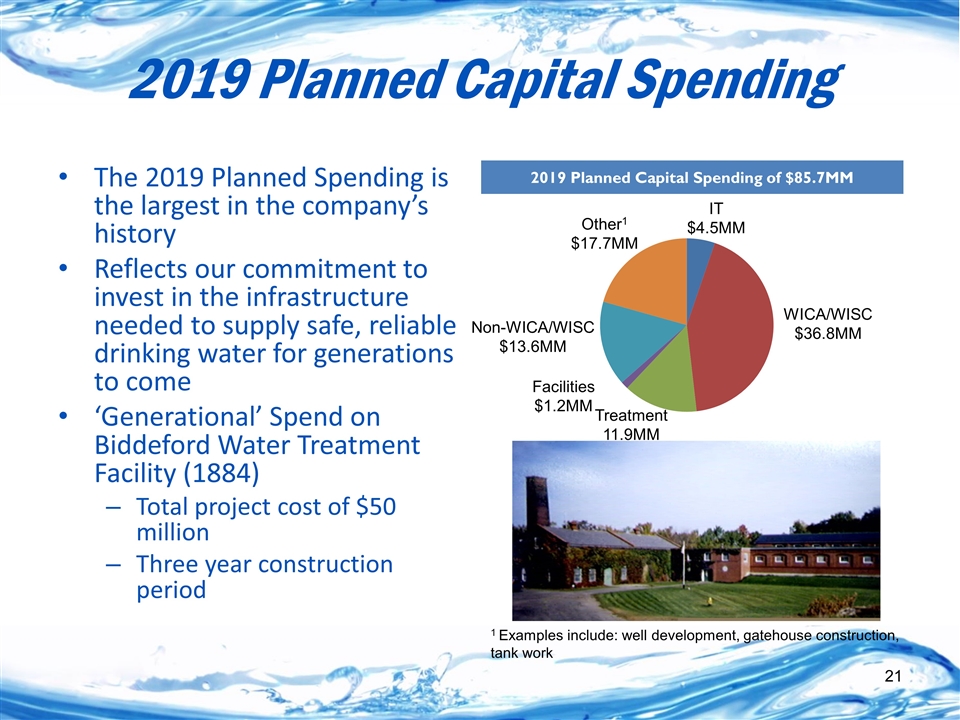

2019 Planned Capital Spending 2019 Planned Capital Spending of $85.7MM WICA/WISC $36.8MM Treatment 11.9MM Non-WICA/WISC $13.6MM IT $4.5MM Other1 $17.7MM Facilities $1.2MM 1 Examples include: well development, gatehouse construction, tank work The 2019 Planned Spending is the largest in the company’s history Reflects our commitment to invest in the infrastructure needed to supply safe, reliable drinking water for generations to come ‘Generational’ Spend on Biddeford Water Treatment Facility (1884) Total project cost of $50 million Three year construction period

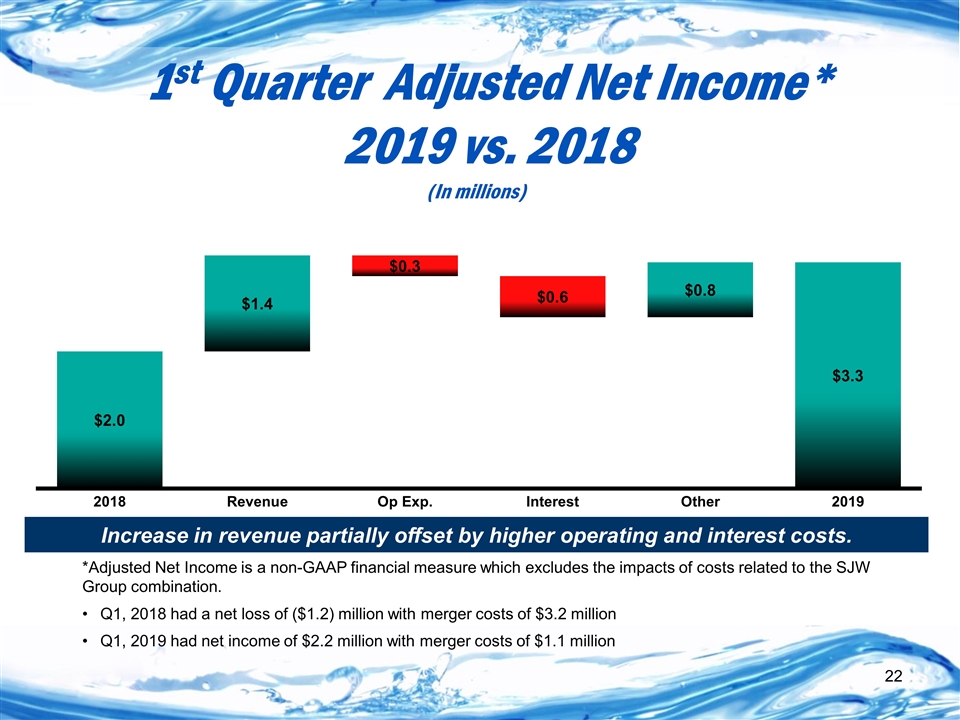

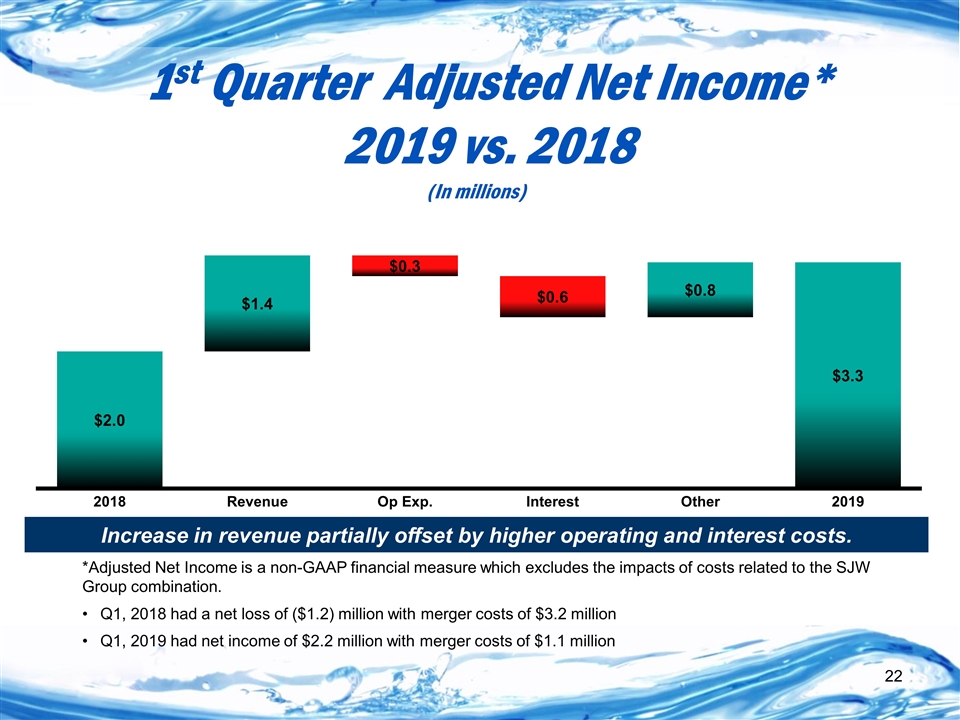

1st Quarter Adjusted Net Income* 2019 vs. 2018 Increase in revenue partially offset by higher operating and interest costs. *Adjusted Net Income is a non-GAAP financial measure which excludes the impacts of costs related to the SJW Group combination. Q1, 2018 had a net loss of ($1.2) million with merger costs of $3.2 million Q1, 2019 had net income of $2.2 million with merger costs of $1.1 million (In millions)

Thank you for your support Your Questions & Feedback…

Appendix

Use and Definition of Non-GAAP Financial Measures We consider Adjusted Net Income as a key business metric, which is a Non-GAAP financial measure. We define Adjusted Net Income as Net Income excluding certain material items outside of normal business operations. For this Non-GAAP financial measure, we consider these items to be expenses related to mergers and acquisitions. This includes costs incurred in 2019 and 2018 for the proposed merger with SJW. Adjusted Net Income is a supplemental financial measure used by us and by external users of our financial statements and is considered to be an indicator of the operational strength and performance of our business. Adjusted Net Income allows us to assess our performance without regard to the impact of matters that we do not consider indicative of the operating performance of our business. We use Adjusted Net Income to facilitate a comparison of our operating performance on a consistent basis from period to period that, when viewed in combination with our results prepared in accordance with GAAP, provides a more complete understanding of factors and trends affecting our business. We believe Adjusted Net Income assists our Board of Directors, management and investors in comparing our operating performance on a consistent basis from period to period because they remove the impact of certain material items outside of normal business operations (such as the costs incurred for the proposed merger with SJW) from our operating results. Despite the importance of this Non-GAAP financial measure in analyzing our business, measuring and determining incentive compensation and otherwise evaluating our operating performance, Adjusted Net Income is not a measurement of financial performance under GAAP, may have limitations as an analytical tool and should not be considered in isolation from, or as an alternative to, Net Income or any other measure of our performance derived in accordance with GAAP. Adjusted Net Income is not a measure of profitability under GAAP. We also urge you to review the reconciliation of this Non-GAAP financial measure included in the Results of Operations section of the Quarterly Report on Form 10-Q for three months ended March 31, 2019 and the Annual Report on Form 10-K for the year ended December 31, 2018. To properly and prudently evaluate our business, we encourage you to review the Condensed Consolidated Financial Statements and related notes included elsewhere in our Form 10-Q and to not rely on any single financial measure to evaluate our business. In addition, because the Adjusted Net Income measure is susceptible to varying calculations, such Non-GAAP financial measures may differ from, and may therefore not be comparable to, similarly titled measures used by other companies.

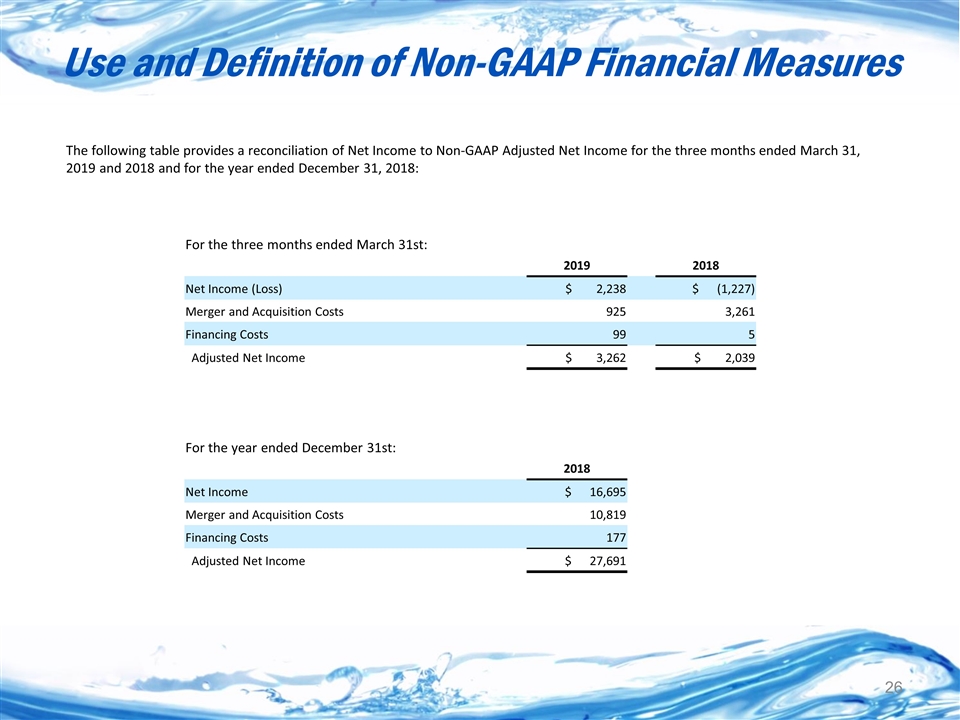

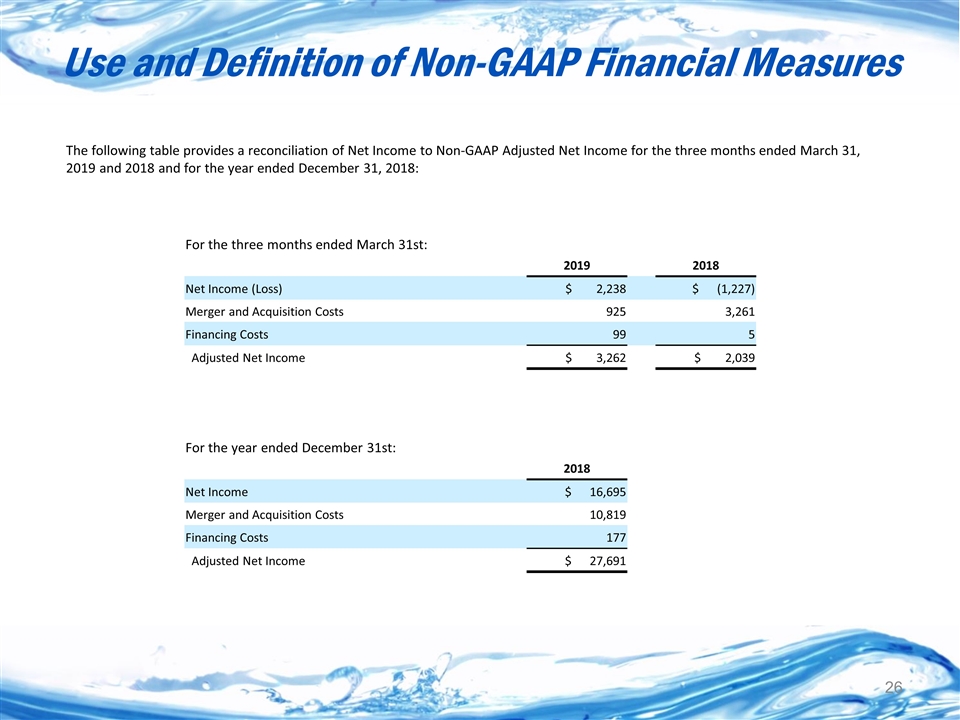

Use and Definition of Non-GAAP Financial Measures The following table provides a reconciliation of Net Income to Non-GAAP Adjusted Net Income for the three months ended March 31, 2019 and 2018 and for the year ended December 31, 2018: For the three months ended March 31st: 2019 2018 Net Income (Loss) $ 2,238 $ (1,227) Merger and Acquisition Costs 925 3,261 Financing Costs 99 5 Adjusted Net Income $ 3,262 $ 2,039 For the year ended December 31st: 2018 Net Income $ 16,695 Merger and Acquisition Costs 10,819 Financing Costs 177 Adjusted Net Income $ 27,691