EXHIBIT 99.3

At Export Development Canada (EDC), we measure success one way: our impact in helping Canadian companies compete and win in an increasingly complex trade environment.

Did we help companies find success in international markets? Did we manage our resources – our knowledge, our capital, our products – to maximum effect? Did we bring creativity to the solutions Canadian exporters need?

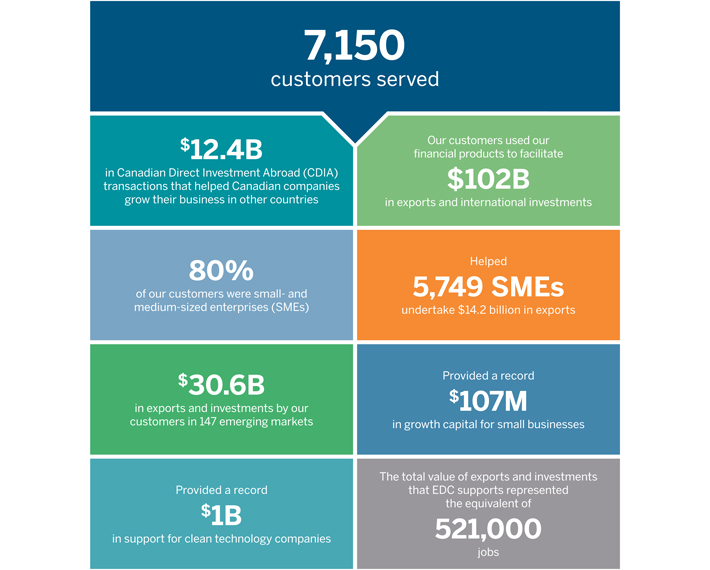

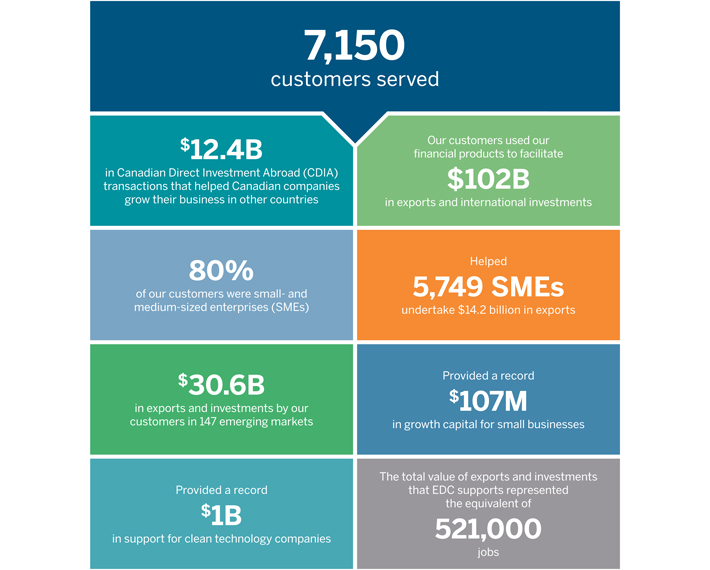

Broadly speaking, this annual report is intended to answer those questions. And for 2016, the answer to each was a solid yes. By most measures, last year was very successful for EDC: we set corporate records for supporting cleantech companies, providing growth capital for small businesses, and financing for small and medium enterprises. Our products and programs helped Canadian companies gain access to global supply chains, connect with foreign buyers, manage risk, access capital, and explore new markets.

But even against that backdrop, 2016 was a success for another reason. It was the year we determined that we could do better, and where we asked ourselves if we could create even more impact than we already have. The answer we arrived at (again) was yes.

In 2016, we challenged ourselves by asking the most fundamental questions: What does success really look like? What would make EDC more relevant to our customers? Where are we falling short and what can we do about it? Can we help more companies find new markets, and in this way contribute to building a bigger, stronger, and more sustainable Canadian economy?

The answer to these questions begins, in part, with our new corporate vision: EDC is the leader in helping every Canadian company go, grow, and succeed internationally.

It’s a big, ambitious vision for our organization’s future. We hope that as you read this annual report you’ll get a clear sense of the impact EDC had last year, and also the potential impact we can bring to exporters in the years ahead.

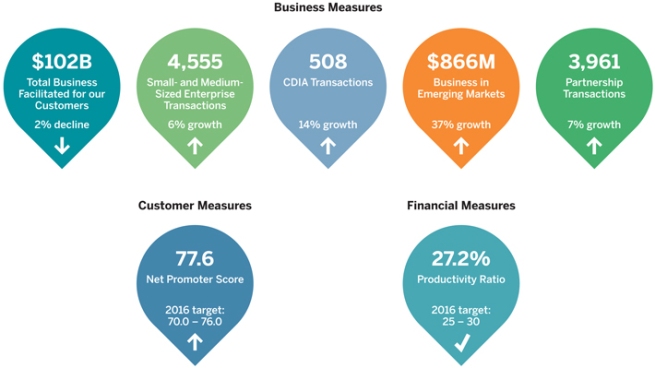

Key Performance Indicators

Performance Measures

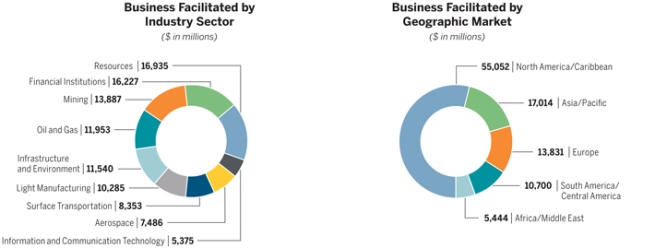

Highlights by Sector and Market

2016 Highlights

Message from the Chair

Over the past year, the global economy continued to experience volatility and Canadian companies endured uncertainty as they contemplated pursuing opportunities abroad. With a downturn in commodities that has yet to fully rebound and seemingly louder voices opposed to trade and globalization, it’s easy to conceive of a new trade paradigm riddled with complex challenges and barriers. And yet, Canada is a nation that has historically relied on trade to drive economic growth.

What does this all mean? While the Canadian economy faces challenges ahead and trade is ever-evolving, there are still business opportunities for Canadian companies that can adapt to these realities. There are many paths to export success, but businesses – particularly small- and medium-sized enterprises (SMEs) – will need more help than ever to navigate their export journey and find their way to foreign buyers and global supply chains.

In 2016, EDC continued to help ensure that Canadian businesses were aware of the benefits of exporting, that they could access the products and services they needed to succeed internationally, and that they had new opportunities to expand beyond their traditional markets. However, as Canadian companies must adapt to be successful traders in today’s world, so must we as Canada’s export credit agency. EDC has a significant role to play in ensuring that all Canadian companies remain well positioned to compete globally. We need to focus on the evolving needs of our customers, particularly SMEs.

The Board has been involved in, and supportive of, EDC’s new business strategy that will focus on serving more Canadian exporters by exploring new ways to

respond to their broad spectrum of needs. In addition to our financing, insurance, and bonding solutions that mitigate the risk associated with exporting, we will be doing more to build awareness and provide our knowledge, expertise, and connections to help more Canadians find success in exporting. This means we must engage companies much earlier in their exporting journey, whether they are getting ready to export or are just considering it for the future of their business.

Now is a good time for change and to strive for new goals. EDC’s shareholder is pursuing a progressive and inclusive trade agenda. We will be actively supporting its commitment to free trade and will help raise Canada’s profile globally. In addition to the free trade agreements already in place, Canadian companies stand to benefit significantly from new agreements on the horizon, such as the Comprehensive Economic and Trade Agreement (CETA). These can help to further reduce barriers and offer greater access to international markets. Helping to grow Canada’s export potential is a collaborative effort that will require cooperation among all government players, as well as stronger relationships with a broader set of stakeholders.

This effort will also require the continuance of strong management and performance by EDC. As Chair, I would like to thank my colleagues on the Board for their commitment and guidance to help ensure EDC’s strong corporate governance. More specifically, their support of EDC’s transformation in enterprise risk management (ERM) will help ensure that the risks we take in pursuit of our business objectives are effectively managed and governed.

| | |

In 2017, we will be implementing a major component of our ERM program – the Three Lines of Defence (3LD) model, which bolsters our risk management capacity across the organization. This new model will help ensure that we have the appropriate checks and balances in place and conduct our business in a manner similar to leading financial institutions. With better clarity on our risk appetite, we will have more flexibility to serve even more Canadian exporters and investors. On behalf of the Board, I would also like to express my gratitude to our executive management team for their continued leadership and vision. Despite another year of economic and geopolitical volatility, the team led EDC to strong results in 2016, especially in terms of supporting more SMEs, business in emerging markets, and supporting | | foreign investment. This success should also be attributed to EDC’s 1,400 employees around the world, who pushed through 2016 with great skill and tireless efforts to help stretch our capacity as a leader in exports and trade. As Chair of EDC’s Board for the past three-and-a-half years, I am confident in our ability to help grow Canada’s export potential over the long-term. The importance of international trade for Canada’s economy only grows, and so do the opportunities for Canadian companies to expand their business and find success in new markets. Now is also the time to focus on how EDC will grow to ensure we fulfil the various export needs of Canadian companies so that they are ready to respond to calls for Canadian capabilities and expertise around the world. |

Message from

the President and CEO

EDC’s customers continued to engage in trade and make investments outside Canada in 2016 despite headlines that suggested a global slowdown in trade-related activity. Leveraging EDC’s unique financial, risk, and trade expertise allowed these companies to boldly pursue new opportunities in a volatile world and generate successful outcomes for their international business.

Our small business customers used a record $107 million of EDC’s growth capital products. For those companies requiring working capital solutions, we provided more than $550 million in direct financing for small- and medium-sized companies – a 166 per cent increase over the previous year. In addition, EDC provided more than $1 billion though our export guarantee program, which helps smaller companies to develop new markets, increase their productivity, or to make international investments.

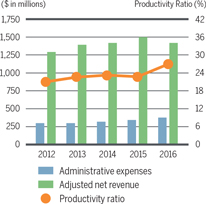

While helping our customers in 2016, EDC also took care of the fundamentals – the business essentials that protect our sustainability as a commercial operation. We generated a net income of $1.07 billion, reflecting a well-managed and profitable portfolio supported by a strong capital position of $9.8 billion. Our productivity ratio ensured that just 27 cents of every dollar we earned went to pay our expenses, while the remaining 73 cents was available for reinvestment in what is most important to us – doing more to help Canadian companies take advantage of trade opportunities. EDC’s prudential business model also provides a financial benefit for our Shareholder, the Government of Canada, through the payment of a $786 million dividend for the 2016 calendar year.

This was also a year in which EDC helped to expand Canada’s global brand, opening new representations in London and Jakarta. We also added our first standalone, wholly-owned branch in Singapore, which is capable of underwriting financial transactions in market to better support the growing business of Canadian companies in one of the world’s most vibrant economic regions.

The achievements of 2016 tell a story about the kind of impact that EDC had helping Canadian exporters find international success, and I hope you’ll take the time to explore all of it in this annual report. But not everything that EDC accomplished last year can be captured on a map or spreadsheet.

In 2016, we devoted significant time and resources to building a better understanding of the marketplace. We studied the journey Canadian companies go through as they evolve from playing exclusively in a domestic market to becoming trade-ready businesses. Our objective was to get a clearer picture of what companies really need, unrelated to the solutions that EDC currently offers. What are the non-financial hurdles that companies face and what information do exporters need? What type of connections help companies take their products or services to international markets?

That, naturally, led to an analysis of our own organization – areas of focus, operational model, and definition of success. In truth, this kind of continuous improvement is an approach that EDC has been practicing for years. But what defined 2016 were the steps taken to reshape EDC’s business, including a corporate-wide reorganization currently underway that responds directly to what we have learned about the exporter journey. It’s a reshaping of our business that we

| | |

believe will grow EDC’s ability to have a greater impact on more Canadian companies, which is captured in our new corporate vision statement: EDC is the leader in helping every Canadian company go, grow, and succeed internationally. It’s a bold aspiration, rooted in and inspired by the many success stories captured in this report. Canada needs more of them, and EDC will play a leading role in helping Canadian companies generate more trade business. EDC’s success is built on the dedication of its employees who, every day, bring skill, creativity, and energy to our mandate of expanding the | | impact of Canadian businesses around the world. They are the people who made such a difference for so many Canadian companies in 2016, and will continue to make a difference in the years to come. I’m also proud of how they help those companies, bringing the highest ethical standards and a culture of corporate social responsibility to every transaction. Ultimately, the achievements you will read about in this annual report are their achievements, the women and men of EDC. It is a privilege to work with them all. Together, we’ll continue our work of bringing more of the benefits of international trade home to Canada ... and bringing more of Canada to the world. |

EDC Annual Report 2016 11

How to gain

knowledge to inform

business strategy

|

LED Roadway Lighting According to Peter Conlon, CEO of Halifax-based LED Roadway Lighting, there are two essential qualities a business needs to succeed internationally – courage and patience. His innovative company, which designs and manufactures LED-based roadway and infrastructure lighting products, has demonstrated both qualities and today they’re illuminating streets, buildings, and bridges in 60 countries around the world. When Conlon talks about the courage needed to export, he doesn’t mean it in the sense of taking a blind leap beyond our borders and hoping for the best. He insists that knowledge is essential because the more informed you are, the more confidence you have to make a bold move. He also says that when the going gets tough, understanding of global economic trends and awareness of market forces can help a new exporter make patient, measured choices that keep their export journey on track. Conlon credits EDC’s Global Export Forecast with providing that knowledge piece that is so crucial to success. Not only does it provide important numbers like forecasts for the CAD/USD exchange rate, or expected GDP growth in key emerging markets, it puts those numbers into context, making them tangible and relevant for Canadian businesses in all sectors. |

EDC Annual Report 2016 13

How to make

connections with

new foreign buyers

|

Vizimax People all over the world rely on energy – a lot – and that demand is growing by the day. Recognizing this undeniable trend, Longeuil, Quebec’s Vizimax came up with innovative solutions to optimize how energy companies generate, move, and consume energy. Vizimax products can be used in different industries, from electric utilities to railway infrastructure. Since the desire for energy efficiency is global, they’ve been able to sell their technology all over the world. EDC supported a number of those sales and recognized the expertise that Vizimax had to offer. When EDC was planning a trade mission to Chile in 2015 along with the TCS (focused on smart electric grid technology), Vizimax was invited along. While in Chile, they sat down with Conecta, a large Chilean energy company that deals in power systems and smart grids. Eighteen months later, that introduction translated into new business for Vizimax, as Conecta chose the Canadian company’s patented technology for two major projects it was working on. EDC recognizes that connections drive business, which is why we’re making our business more about connections. |

EDC Annual Report 2016 15

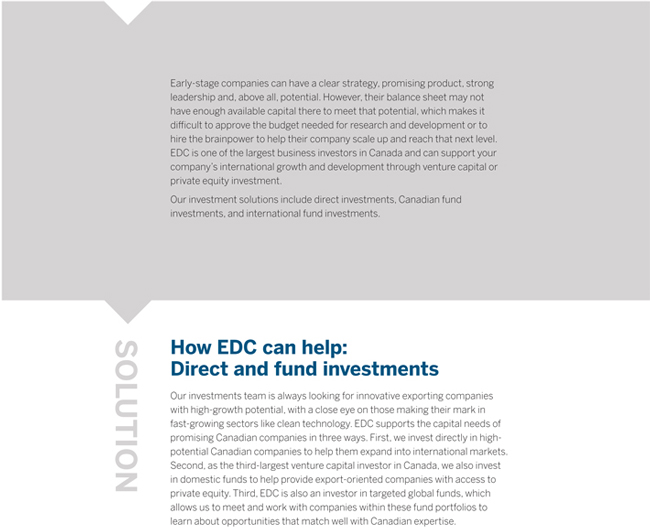

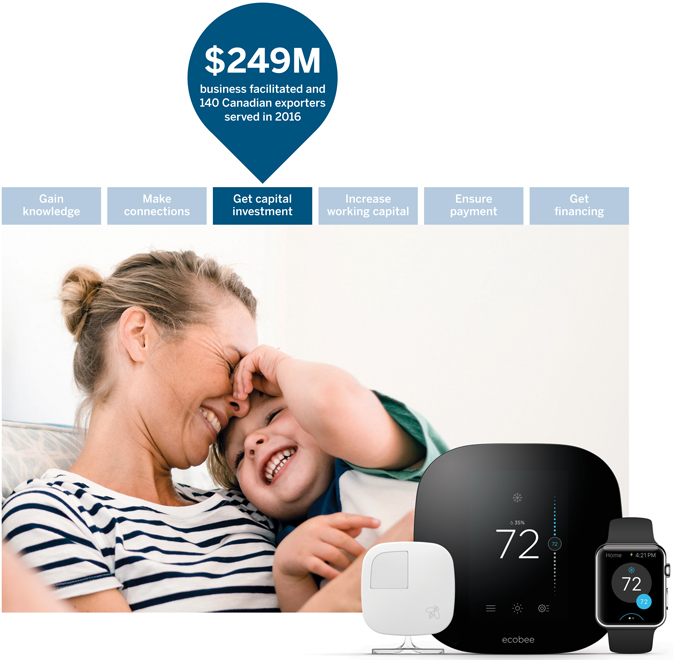

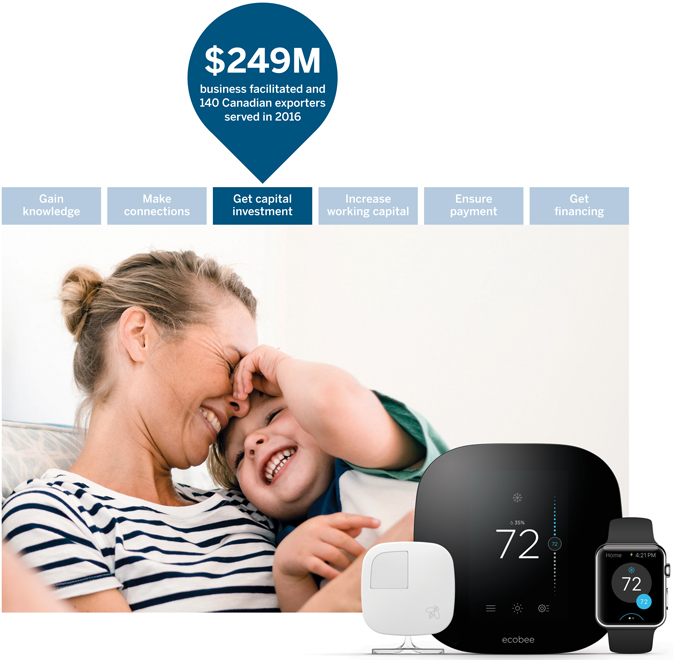

How to access

capital to grow

your business

|

ecobee Inspired by ideas to reduce his family’s energy use, engineer Stuart Lombard formed ecobee – a clean technology company that launched the first WiFi-connected thermostat in 2009. Since then, the company has experienced rapid growth, with its customers across North America saving on energy bills and experiencing unparalleled comfort with ecobee’s innovative product. With sales more than doubling each year, the Toronto-based company has become a global leader in the emerging thermostat market, second only to Nest – a company acquired by Google in 2014. Stirred by increasing competition from much larger companies, ecobee’s growth strategy continues to focus on innovation, while also improving the customer experience and building its brand. This past year, EDC played an important role in helping ecobee execute on its plans. Our commitment to ecobee, working with other co-investors like Amazon, is designed to help boost the company’s international sales. |

EDC Annual Report 2016 17

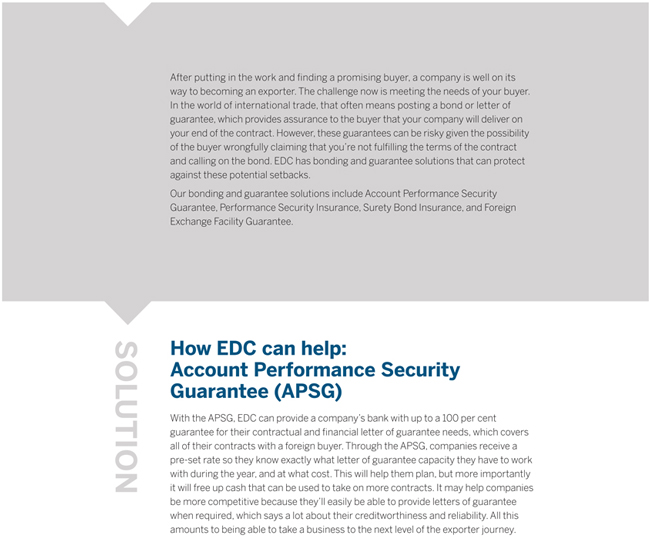

How to increase

your working capital

|

International Frontier Resources Corporation Calgary-based International Frontier Resources Corporation (IFR), a Canadian oil and gas exploration and production company, took a big export step in 2014 – they decided to look beyond Canada and the U.S. to pursue opportunities in Mexico. They did so following an announcement by the Mexican government in 2013 that the country would start undergoing significant energy reforms, including partially opening the country’s untapped oil reserves to foreign investment. As part of IFR’s Mexico focus, a new team of energy professionals from Calgary with experience in the latest oilfield drilling and completion technologies joined the company. IFR also formed a strategic joint-venture with a Mexican petrochemical leader. With that partnership in place, IFR was able to secure a contract to explore one of the oil fields made available by the reforms. One requirement for the contract, however, was a U.S. $1.76 million performance bond to guarantee a minimum amount of work would be done on the newly acquired oil field. EDC was able to guarantee this bond by providing IFR with an APSG. The APSG unlocked capital for IFR that would have otherwise been tied up in the bond, which they can now leverage to seek out more business and accelerate their growth in the promising new market. |

EDC Annual Report 2016 19

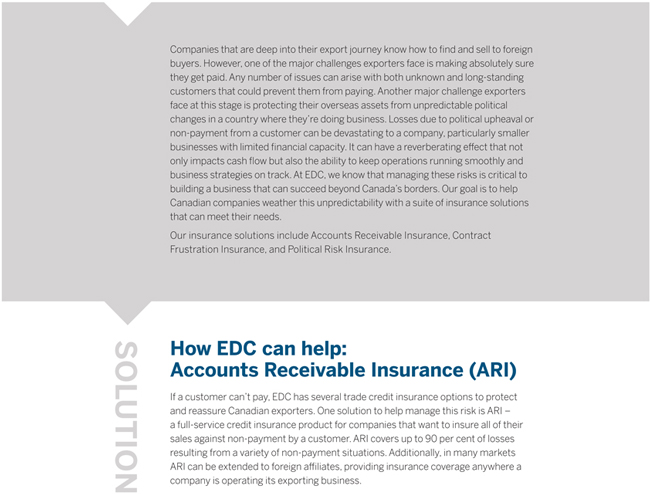

How to make sure

you get paid by a

new foreign buyer

|

AGT Many people don’t know that Canada is the second biggest producer of pulse crops in the world. High-quality superfoods like lentils, peas, and beans leave our borders in heaps, and there’s one company that’s supplying the world with a ton of them – Regina, Saskatchewan’s AGT Food and Ingredients (AGT). Founded in 2007, AGT has undergone rapid growth through acquisitions and international investment. In 2010, the company had nine facilities in two countries. Today, it has 41 across five continents. EDC became involved with what is now AGT in 2002, when it was still a small company named Saskcan Pulse Trading. One of the tools that helped the company along its export journey was EDC’s ARI. By insuring its sales, other financial institutions were more willing to lend AGT money because they knew it would be getting paid, regardless of whether customers defaulted. AGT then used this extra capital to grow its business in size and global reach. The proof, as they say, is in the pulses: in 2003, EDC insured U.S. $11-million worth of AGT’s exports. In 2015, that number was just under U.S. $1 billion. |

EDC Annual Report 2016 21

How to get reliable

financing for your

international business

|

LCI Education Network The export journey is unique for all companies, and that’s especially true for LCI Education Network. Since it was founded in 1959, the Montreal-based organization has developed a vast network of post-secondary institutions focused on creative and management fields, but it was only after 30 years in business that it opened its first international campus in Casablanca, Morocco. After finding success there, it began expanding to new campuses all over the world. Today, LCI is exporting its top-tier education to thousands of students spread out over 22 campuses in 12 countries. Part of its expansion plan was to purchase campuses in order to avoid the complications of renting properties in different markets. The trade-off, however, was significant upfront expenses. EDC was able to support LCI’s strategy, providing it with direct financing for its investments abroad. EDC’s loans helped LCI purchase a campus in Bogota, Colombia, and another in Melbourne, Australia, which officially opened its doors in 2016. With this international expansion, LCI has become one of the most widespread academic networks in the world. |

EDC Annual Report 2016 23

EDC Annual Report 2016 25

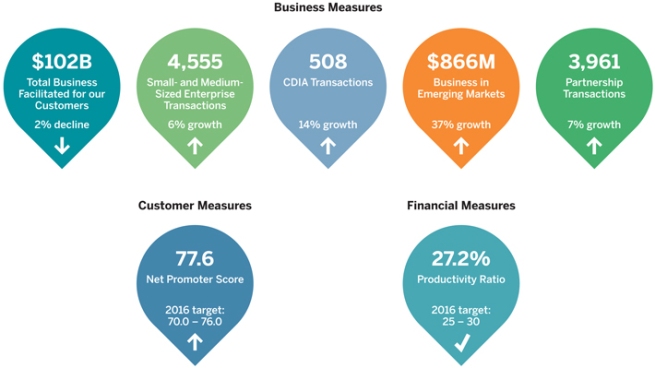

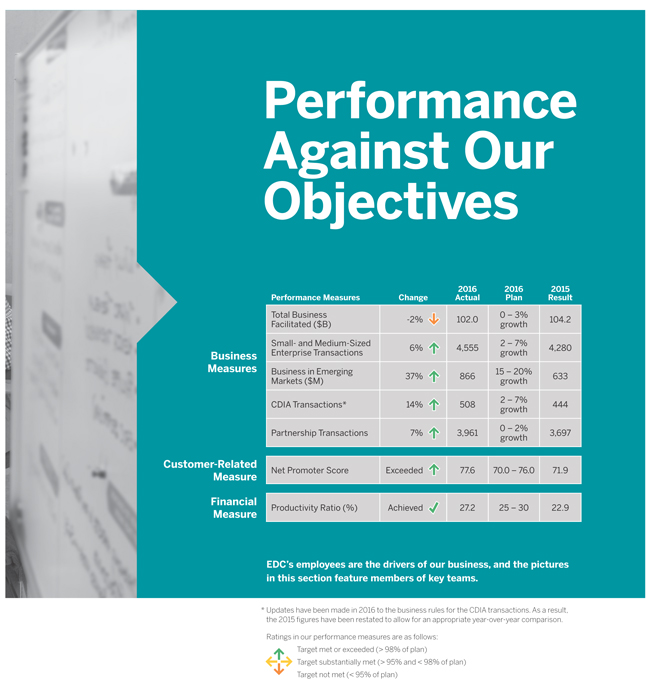

Business Measures

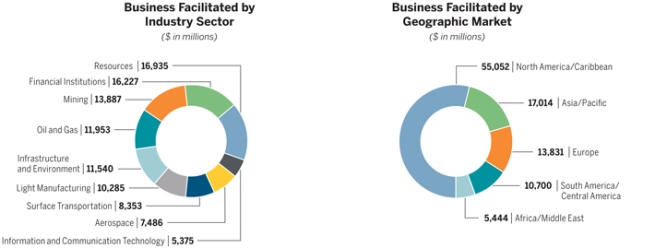

Total Business Facilitated

$102B  -2%

-2%

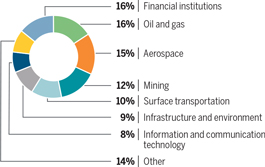

Through our financial solutions, our customers’ exports and investments totalled $102 billion, slightly down from $104 billion in 2015, mainly as a result of decreases across our insurance products.

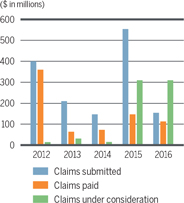

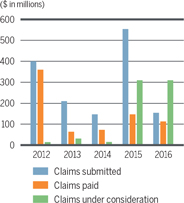

Through all of our insurance products, we helped 5,400 clients undertake more than $73 billion in export sales with about 87,000 buyers in almost every country in the world. EDC’s insurance products help companies mitigate credit risk and leverage their receivables with financial institutions to unlock more short term financing. EDC earned $192 million in premiums for coverage under all our insurance products and paid out $110 million in claims, compared to the $143 million paid out in 2015.

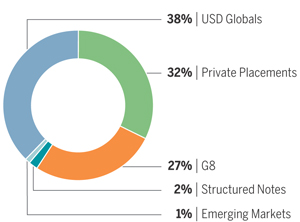

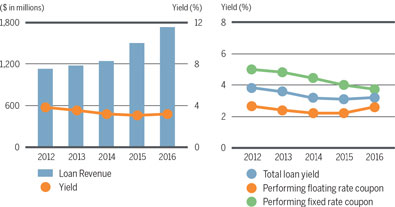

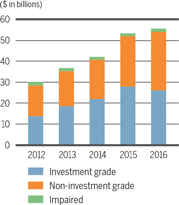

In addition, our financing activities delivered a record of $28 billion in loans to Canadian clients and their foreign trading partners. We earned more than $1.8 billion in loan revenue and guarantee fees, which was aided by higher interest rates and growth in our loan portfolio in 2016.

Small- and Medium-Sized Enterprise Transactions

4,555  6%

6%

SMEs are important contributors to Canada’s economy. A key measure of our corporate success is our ability to help SMEs (companies with sales under $50 million) export and expand to new markets. We accomplish this through our financing and insurance solutions, as well as leveraging our relationships with foreign buyers to encourage the purchase of Canadian goods and services and to introduce SMEs into their supply chains.

To track our efforts, we look at the number of insurance and financing transactions that occur in a calendar year. In 2016, we facilitated 4,555 transactions, up from 4,280 the previous year. Our customers expect fast, simple, and predictable services, as well as the ability to access from anywhere at any time. With these expectations in mind, we embarked on several initiatives tailored to SMEs. This includes the nationwide launch of Select Credit Insurance in 2015. This online, self-service product is geared toward small businesses, providing them with selective sales coverage in minutes. By the end of 2016, this insurance product covered 346 transactions, which is a 55 per cent increase from 2015. This is a good sign our SME customers value this type of coverage. Similarly, more SMEs used our Export Guarantee Program, which hit a record of $1 billion in 2016.

Business in Emerging Markets

$866M  37%

37%

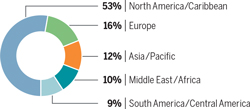

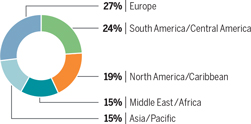

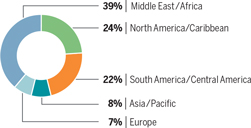

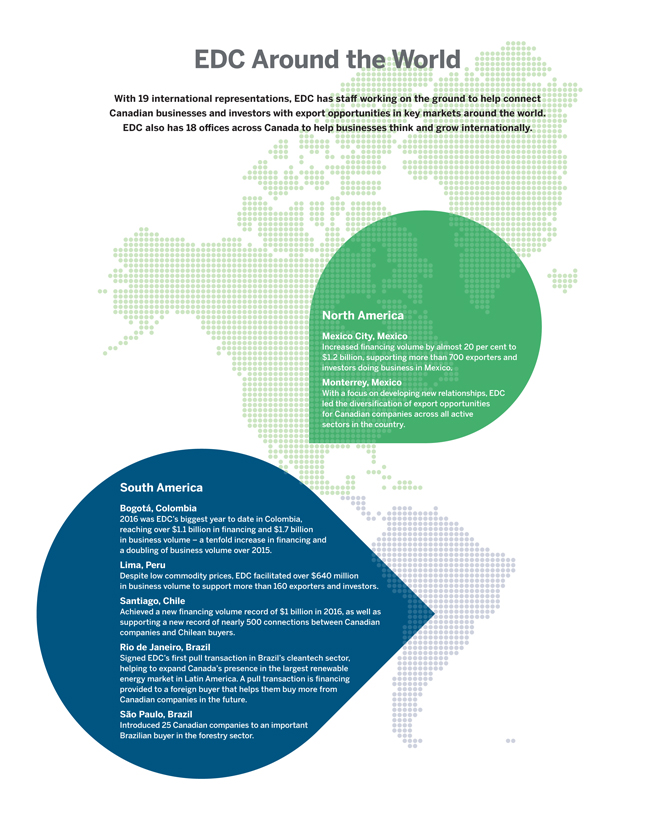

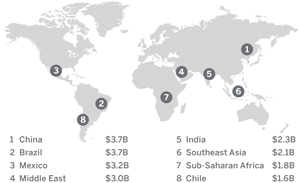

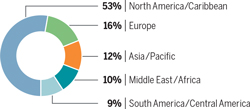

In 2016, EDC saw significant growth in emerging markets, which represented 30 per cent of the business EDC supports – up from 28 per cent in 2015.

Our customers used EDC’s products and services to support $30.6 billion of their emerging market business, a five per cent increase over 2015. That business generated $866 million in revenue for EDC, up 37 per cent from the previous year. Our financing activities in emerging markets reached $8.7 billion in 2016, up 23 per cent from 2015.

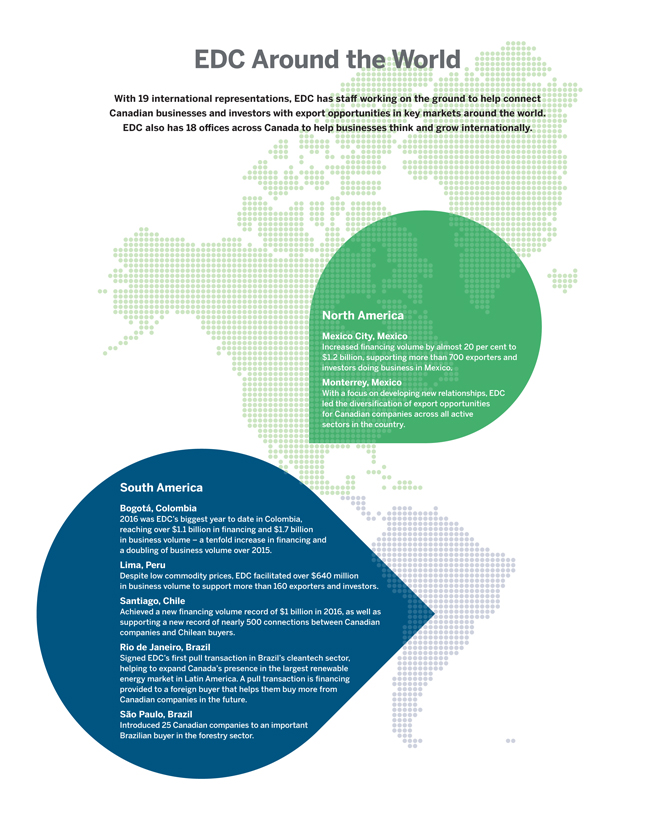

To help grow Canada’s footprint in key markets, EDC opened permanent representations in London, U.K., and Jakarta, Indonesia, bringing our total to 19 locations in 14 countries. EDC also opened our first full service foreign office in Singapore, where we can complement our business development efforts with onsite underwriting of financing products. This will help EDC be more competitive and provide faster turnaround times in supporting Canadian companies and their Asian buyers throughout the region.

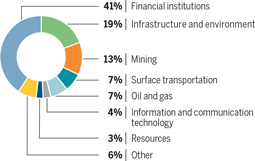

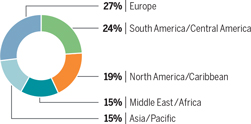

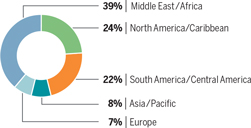

Business Facilitated in Emerging Markets in 2016

Canadian Direct Investment

Abroad (CDIA) Transactions

508  14%

14%

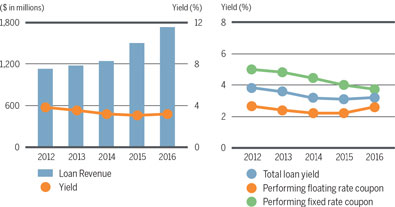

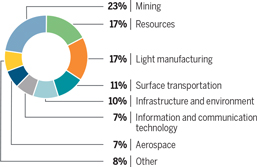

In an integrated global economy, having a local presence in foreign markets is key to achieving the business goals of Canadian companies. That’s why we offer a range of solutions to assist Canadian companies with their foreign investment activities. These include loans to help companies open facilities in new markets or participate in joint ventures. These also include insurance products to mitigate risks, such as a customer’s refusal to pay a foreign affiliate or a government taking possession of a Canadian company’s overseas equipment or facility.

CDIA continues to contribute to the strength of Canadian companies at home, and supporting CDIA transactions has become an integral part of our core business. In fact, Canadian companies now generate almost as many sales via their affiliates every year as they do directly from their Canadian exporting operations.

In 2016, we facilitated 508 transactions for our customers’ investment activities abroad, up from 444 last year. This growth was primarily due to increased demand for our financing solutions like the Export Guarantee Program (EGP). We continue to grow the EGP through nationwide awareness campaigns with banks. Additionally, an improved U.S. economy led to more demand for EGPs from EDC’s customers in the light manufacturing sector.

EDC Annual Report 2016 27

Partnership Transactions

3,961  7%

7%

EDC is committed to working with the private sector to ensure Canadian companies have access to the financial services they need to go, grow, and succeed internationally. We believe that combining our expertise with financial institution partners is an effective way to expand our reach and serve more Canadian exporters. This involves complementing the activities of financial institutions such as banks, insurance companies, sureties, and brokers, depending on the level of private sector capacity.

In 2016, the number of transactions we undertook with financial partners reached 3,961 – a 7 per cent increase compared to 2015. This growth was primarily due to increased demand for products within our guarantee solutions. Through these solutions, EDC shares the risk and security with our financial partners to encourage them to increase their lending, particularly to SMEs.

Customer Measures

Net Promoter Score

Exceeded target  77.6

77.6

The Net Promoter Score (NPS) is the measure EDC uses to determine customer satisfaction and improve the customer experience. It is a way of understanding and delivering on what our customers want.

This metric is based on a single question we ask our customers in a survey: “On a scale of 0 – 10, with 0 being not at all likely and 10 being extremely likely, how likely is it that you would recommend EDC to a colleague who is also an exporter?” The NPS is calculated by subtracting the percentage of customers who are “Detractors” (0s to 6s) from the percentage of customers who are “Promoters” (9s and 10s).

EDC is an industry leader – historically our NPS is among the top 10 per cent of North American B2B companies. This year is no exception with a NPS of 77.6 – our highest score since we started using this metric. This strong result refiects our maturity in understanding communications as a key driver of our NPS. Our sales force increased its communication efforts this year with the goal of acting more effectively on customer feedback, which resulted in an improved customer experience.

Financial Measures

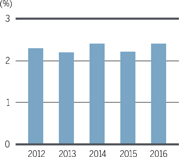

Productivity Ratio

Achieved  27.2%

27.2%

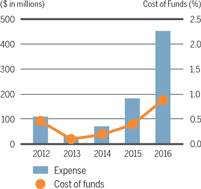

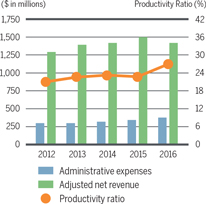

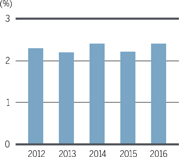

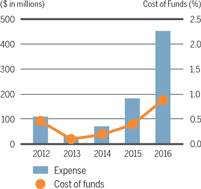

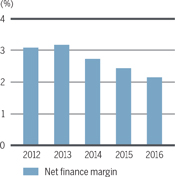

The Productivity Ratio (PR), the ratio of administrative expenses to net revenue, captures how well we use our resources and ultimately manage our costs. In 2016, our PR was 27.2 per cent and was within our targeted range for the year of 25 to 30 per cent. This PR means that 27.2 cents of every dollar we earn goes to pay our expenses, and the other 72.8 cents is available to grow our capital base and support our loan and insurance portfolios. While our PR was less favourable than the 2015 PR of 22.9 per cent, 2016 saw significant investments in our business. These initiatives are necessary to fulfill our mandate of supporting Canadian exporters, including a large-scale transformation effort to modernize our systems and the build out of our enterprise risk management (ERM) framework. As a result of these investments, we experienced an increase in administrative expenses in 2016.

EDC Annual Report 2016 29

EDC Annual Report 2016 31

|

Innovating for Canadian Companies |

We are developing solutions that fit the nature of trade today. As we adjust to the changing needs of our customers, sometimes we adapt or stretch the parameters of our existing solutions to support them in new ways. In some cases we try new and different approaches that have never been done before. Our support for Shopify and IL&FS are just two examples of the creative, novel thinking we provide to help more Canadian companies export.

Shopify

As a leading Canadian e-commerce company, Shopify knows what it takes to support small business growth. With its headquarters based in Ottawa, the technology company’s innovative software helps businesses manage sales across multiple channels, including web, social media, marketplaces, and brick-and-mortar locations. Shopify’s platform has helped businesses of all sizes scale up, serving customers in approximately 150 countries worldwide.

In 2016, EDC worked with Shopify to insure merchant cash advances offered by Shopify Capital – a new division the company launched to address the cash-flow needs of their small-business customers. With Shopify Capital, businesses can complete a few simple steps to secure tailored financing options that can help spur their growth. By supporting this new division of Shopify, EDC is not only helping one of Canada’s corporate champions grow, but also contributing to a broader shared goal: to help more SMEs get the financing they need to go global.

IL&FS

This past year, EDC completed a landmark financial transaction in India, which remains a strategic market and one of the bright spots in the still-volatile global economy. In November 2016, EDC disbursed the first-ever Indian rupee-denominated loan (also referred to as a Masala loan) by a foreign financial institution, providing Infrastructure Leasing & Financial Services (IL&FS) with INR 3.2 billion in financing. As one of the leading infrastructure and development companies in India, IL&FS is able to use this financing to develop critical infrastructure improvement projects across the country using Canadian suppliers. This also marked the company’s first financing from a Canadian institution.

With its unique structure, the Masala loan eliminates currency risk entirely and allows IL&FS to deploy the funding as it sees fit, without needing to convert dollars into rupees. Building on more than 30 years of experience in India, EDC is committed to supporting more Indian companies in their currency of choice, with the goal of facilitating more business with Canada.

A shared priority

As one of the fastest-growing sectors, cleantech offers significant economic opportunities for Canada. Companies in this sector use proprietary technology in innovative ways to directly reduce negative environmental impacts, or create net positive ones. Cleantech as a whole generated $11.7 billion in annual revenues and directly employed more than 55,000 Canadians in 2014. If properly supported, companies in this sector can help contribute to Canada’s key priorities on many fronts.

While 87 per cent of Canadian cleantech companies are currently exporting, there is an opportunity for Canada to have a much larger share of the massive global market, which was estimated at close to U.S. $1 trillion in 2014. However, access to financing can often be a significant limiting factor, especially for high-growth companies in this space.

We have been actively supporting Canadian cleantech companies since 2012, when we began a focused effort to help catalyze the cleantech space. As a result of this experience, we are more acutely aware of the international opportunities for Canadian companies and the challenges they may face along their export journey. Since then, we’ve continued to grow our portfolio of customers in this sector year after year. In 2016, we supported more than 120 Canadian cleantech companies – a 36 per cent increase over 2015 – and facilitated a record of $1 billion of their business.

Doing more where it matters

Over the years, we’ve focused on responding to the needs of cleantech companies, which has led us to work with companies in earlier commercialization stages. Reflecting on our experience and success, this past year we updated our cleantech strategy to ensure that we continue to advance the Canadian cleantech ecosystem.

As part of Canada’s Cleantech Working Group, we have been collaborating with our partners at the Business Development Bank of Canada (BDC), Sustainable Development Technology Canada (SDTC), and Global Affairs Canada to focus on how we can work together to provide enhanced support to the sector.

At EDC, we will play a leading role in providing financial services to the Canadian cleantech sector. Moving forward, we will also be taking the necessary steps to ensure that the most relevant solutions are in place to serve more cleantech companies and increase the volume of business we support.

Canadian success stories

There is a wide range of industries in the cleantech sector. Many innovative, export-oriented companies draw on Canada’s strengths in power generation, energy infrastructure, energy efficiency, and water and wastewater. The following three success stories are good examples of how EDC can support this sector.

EDC Annual Report 2016 33

| | | | |

| | | | Temporal Power Mississauga-based Temporal Power uses its leading-edge technology to deliver a highly efficient, renewable energy storage solution. The company is helping to improve power quality, maintain grid stability, and balance energy on power systems. After signing a contract with the Aruba government, Temporal Power sought support from EDC to help navigate the unfamiliar banking, legal, and construction regulations. EDC provided bonding solutions that allowed the company to take advance payments from customers, freeing up its capital to help fund the project and pay suppliers. |

| | | |

| | | | |

| | | | Green Power Labs Based in Dartmouth, Nova Scotia, Green Power Labs is a leading developer and service provider for predictive energy management solutions. With over 13 years of operational experience, the company uses predictive analytics and controls to provide critical weather and energy data for building and grid operations in real time. It then uses this data to optimize building energy performance, as well as improve energy consumption, generation, and storage. These innovations also help reduce energy use, costs, and carbon footprint. This past year, Green Power Labs relied on EDC’s knowledge for insight on the German and Indian markets, as well as products to reduce the risk of managing foreign accounts receivable. |

| | | |

| | | | |

| | | | Electrovaya As a leading developer and manufacturer of lithium-ion battery power solutions, Electrovaya has been an export- focused company since its founding in 1996. With its advanced technology, Electrovaya supplies solutions for clean transportation and renewable energy applications in the automotive, aerospace, and personal electronics sectors. As more countries look to mitigate the effects of climate change, the competitive global market for lithium-ion batteries will continue to grow. Electrovaya’s purchase of a large manufacturing plant in Germany helped boost the company’s exports. To help provide Electrovaya with access to working capital, EDC partnered with the company’s bank through the Export Guarantee Program (EGP). Additionally, EDC insured contracts for the company with Accounts Receivable Insurance (ARI), which provided increased margining and, in turn, additional access to working capital. |

| | | |

London

With the official opening of a new representation in London in September 2016, EDC has further bolstered its position to support Canadian companies in one of the largest markets for trade and investment. Even with the uncertainty emerging in the wake of Brexit, the U.K. remains one of the most accommodating business environments, and the largest destination for Canadian direct investment in Europe. With CETA moving forward, Canadian companies will benefit even more from our London representation as a gateway to the rest of Europe.

In 2016, EDC supported approximately $3.1 billion in total business volume and just over $1 billion in financing in the U.K., serving 584 Canadian customers. For Western Europe, these volumes extend to $10.8 billion in total business, $4.5 billion in financing and 1,283 total customers served.

Connected by strong historic and cultural ties with the U.K., Canada will have strong opportunities in the future, especially for export-minded companies from a diversity of sectors, such as cleantech and renewable energy, metals and mining, infrastructure, and transportation. As a global financial centre that is home to many multinationals, London also offers a gateway to opportunities in different markets across Europe. More broadly, London can provide access to the supply chains in emerging markets and is often the place of choice for raising capital for companies operating in these regions.

|

EDC in the United Kingdom › 584 Canadian companies assisted › $3.1 billion in business volume |

Opening the door for Canada’s oil and gas sector

In 2016, EDC committed $50 million in a credit facility for Lundin Petroleum – a Swedish oil and gas exploration and production company – to support upstream projects that could provide international opportunities for Canadian suppliers. This deal represents the first agreement of its kind in Scandinavia, which is an increasingly promising region for Canadian businesses. Our new office in London was instrumental in originating and completing this deal, as it ensured a direct and close relationship with Lundin Petroleum out of Geneva, Switzerland and Oslo, Norway. This proximity will be integral for introducing unique Canadian capabilities to the company going forward.

EDC Annual Report 2016 35

Singapore

As both a financial and transport hub for Southeast Asia, Singapore is a vital entry and distribution point for the broader region, where the total stock of Canadian direct investment now exceeds that in China and India combined. As a result, Singapore is an attractive market that offers plenty of export opportunities for Canadian companies. With a robust rule of law regime, business-friendly government policies, forward-looking and visionary leadership, first-class infrastructure, low tax rate, highly skilled labour force, and an anti-corruption culture, Singapore is one of the easiest places in the world to set up businesses.

This year, EDC reached $2.1 billion in terms of business facilitated, including $438 million financing to support 493 Canadian customers in the ASEAN region. In December, we opened our first international branch in Singapore, which allows EDC to conduct financial transactions directly in the market and react to customer demands in real time.

The costs of operating in Singapore, a sophisticated and competitive market, can be relatively high for Canadian companies. However, demand for exports in the aerospace, ICT, transportation, and infrastructure sectors, among many others, remains strong. Additionally, Canada’s resource wealth presents emerging opportunities in the agri-food and forestry sectors. For many exporters, the key to success here is developing tailored approaches given the diversity of markets within the region.

|

EDC in Singapore › 232 Canadian companies assisted › $795 million in business volume |

Supporting a Canadian exporter’s sales

Headquartered in Montreal, CAE is a global leader in training for the civil aviation, defence and security, and healthcare markets. With its innovative virtual-to-live training solutions, the company has a long history of business success in the Asia Pacific region. CAE continues to export to this region’s fast-growing civil aviation industry, as many airlines seek to recruit and train more pilots in response to increasing passenger traffic – a trend that is expected to continue. EDC has provided a combination of financing and insurance solutions to CAE in pursuit of its export growth.

In 2016, we provided financing to support the sale of CAE’s training solutions, including flight simulators, to airlines expanding throughout the region. These opportunities are further bolstered by CAE’s training network, which includes centres in key growth markets such as Singapore, in addition to new centres recently opened in Japan and Korea.

|

Corporate Social Responsibility |

At EDC, we see Corporate Social Responsibility (CSR) as a critical component to helping Canadian businesses operate internationally. Over the past few years, more consumers have come to expect robust CSR practices, creating greater demands on companies to conduct their business ethically and to keep a close eye on their social and environmental impacts.

In today’s trading environment, not only do companies need a smart export strategy to grow and succeed, they also need to recognize the increasing role of CSR in underscoring their competitiveness internationally. Fortunately, many Canadian businesses have taken a progressive, proactive approach to CSR, which can often be a differentiator in international markets.

To help Canadian companies succeed internationally, we’ve enhanced our focus on CSR with our customers. Increasingly, a key part of our business is providing guidance to companies to help them identify CSR risks in certain markets and sectors, and to help them work through challenging situations when they arise abroad. We want to help all Canadian companies raise the bar and take CSR seriously. Being ranked among the Corporate Knights Future 40 Responsible Corporate Leaders in Canada tells us we’re on the right track, but there’s still more to achieve.

As we continue to adapt and build our capacity to meet our customers’ evolving needs, our understanding of CSR will also broaden. Moving forward, CSR will remain a critical component of the transactions we support and will also be more deeply ingrained in our culture.

For more information, EDC’s 2015 CSR Report can be accessed online at www.edc.ca.

2016 Highlights

Environmental Leadership

This year, EDC has begun officially reporting its contribution to climate finance. In 2016, EDC provided $273 million in support of transactions in developing countries that contributed to climate change mitigation by reducing or avoiding greenhouse gas emissions. These transactions are evaluated using the International Finance Corporation’s Definitions and Metrics for Climate-Related Activities, the benchmark international standard, and are part of EDC’s commitment to developing meaningful initiatives that support the Government of Canada’s contributions to a low-carbon and climate-resilient future.

EDC Annual Report 2016 37

|

Corporate Social Responsibility |

CSR Scorecard

| | |

Priority | | 2016 Activities |

| |

| Combatting corruption | | Launched a multi-year project to advance our Financial Crimes and Know Your Customer (KYC) program, including hiring an external consultant to conduct a current state and gap analysis. |

| |

| Focusing on climate change | | Adopted and implemented the Organisation for Economic Co-operation and Development (OECD) Sector Understanding limiting support for coal-fired power plants. Began evaluating the carbon exposure of our business portfolio. |

| |

| Protecting human rights | | Continued to evolve our approach for screening transactions for human rights risks, including establishing a committee to monitor emerging issues and provide recommendations on how to support and manage customer exposure in high-risk circumstances. |

| |

Honouring international commitments | | Continued role as an Equator Principles Association Steering Committee member. Actively engaged within the OECD Environmental and Social Practitioners to share experiences and advance environmental and social risk management practices among export credit agencies. |

| |

| Investing in our community | | Held first-ever Community Investment Day, with almost 800 employees across Canada and around the world volunteering to support 26 organizations. |

Community Investment

Small enterprise development: Through our ongoing partnership with CARE Canada, four EDC employees were posted at CARE offices in Ottawa, Morocco, and Zambia in 2016, applying their knowledge and skills to economic empowerment initiatives in emerging markets. Since 2009, 29 EDC advisors have volunteered in seven CARE locations around the world, where we are proud partners in programs contributing to financial inclusion, microfinance, small enterprise development, and women’s economic empowerment initiatives.

Charitable giving: In 2016, EDC donated $56,750 to 28 Canadian charitable organizations through our Charitable Donations Program. This program includes the contributions of more than 50 employees who volunteered a total of more than 4,000 hours in 2016. EDC employees and Board members also donated an initial $20,660 to assist the people of Fort McMurray, Alberta in response to the wildfires. This amount grew to $61,980 after being matched twice – once by the Government of Canada and once by EDC – effectively tripling our impact. Additionally, EDC employees gave $202,985 to this year’s corporate Charitable Campaign, supporting the United Way/Centraide, HealthPartners, and many other registered charities across Canada.

Educating youth: To help foster the next generation of Canadian business leaders, EDC awarded 30 scholarships to post-secondary students at 16 colleges and universities in seven provinces as part of its International Business Scholarships Program. Our employees also conducted trade simulations with almost 500 high school and university students across Canada, helping them better understand the opportunities and challenges of doing business abroad. Additionally, our employees volunteered their time as judges and speakers at five university-level international business case competitions.

Supporting entrepreneurs: To honour our late colleague and friend, Dr. Adam Chowaniec, EDC continued to fund the Adam Chowaniec Memorial Fund for Global Entrepreneurship in partnership with StartUp Canada. The fund has helped more than 400 entrepreneurs access the resources and opportunities to help them scale up.

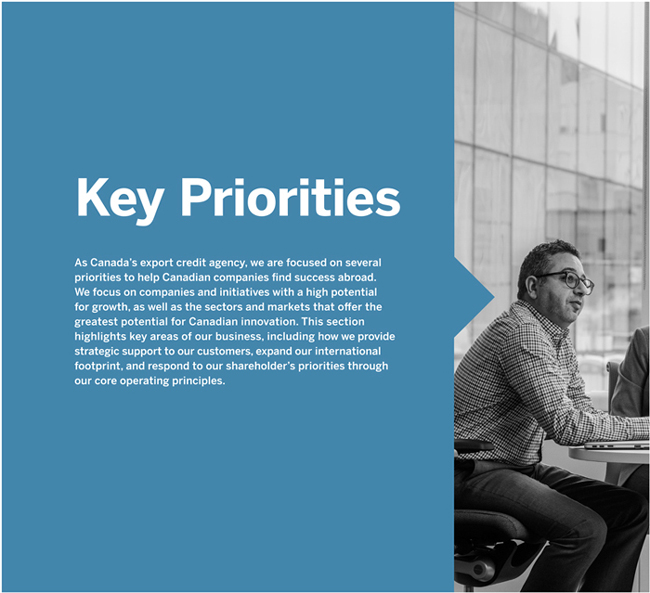

EDC’s Treasury team issues debt securities, manages the Corporation’s liquidity, and mitigates operational and financial risks. We aim to establish a presence in capital markets and borrow in currencies that are important to Canadian exporters. Our capital market activities can support the future potential of Canadian companies as they strive to go, grow, and succeed internationally.

Funding

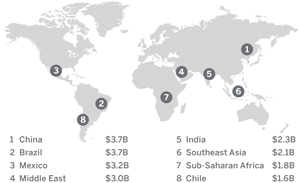

By the end of 2016, EDC had borrowed USD 10.4 billion and was active with benchmark bond issuances. American Dollar Global benchmarks are a large part of our funding program, and we issued four USD 1 billion Global benchmarks (two five-year and two three-year bonds).

Floating rate notes were also in demand in 2016, and EDC issued two USD 500 million four-year bonds; one in March and a second in November.

EDC was equally active in the Sterling market and reopened an existing three-year benchmark bond, increasing it twice by GBP 125 million and GBP 75 million, respectively, to bring the total to GBP 500 million. We also issued a new GBP 350 million four-year benchmark transaction that was subsequently reopened, increasing it by GBP 150 million to bring the total to GBP 500 million.

EDC also issued a 300 million Australian Dollar five-year benchmark bond. We maintained our presence in the New Zealand Dollar market by reopening an existing four-year benchmark bond, increasing it by NZD 125 million to bring the total to NZD 425 million.

Fiscal Year 2016

Total Funding YTD USD 10.4 billion

EDC Annual Report 2016 39

EDC continues to focus on supporting the internationalization of the Chinese Renminbi and presented two Chinese Yuan-denominated bonds: a one-year 400 million Yuan bond through the sale of 3.36 per cent notes due in May 2017 and a one-year 170 million Yuan bond through the sale of 2.90 per cent notes due in June 2017. These two bonds were the only emerging currency bonds issued this year.

EDC also responded to investor needs for private placement transactions denominated in a variety of currencies.

Looking Ahead

The 2017 plan is to borrow USD 11 billion – USD 12 billion. We will continue to monitor our positions to determine the appropriate mix of fixed- and floating-rate liabilities. We will look for opportunities to issue public transactions in U.S. Dollars, Australian Dollars, New Zealand Dollars, and Great Britain Pounds. We anticipate the remaining funding will come from private placements in U.S. Dollars and emerging market currencies.

The volatility in the current market environment, the potential for the U.S. Federal Reserve to continue to increase interest rates, and an evolving regulatory landscape could impact liquidity and swap spreads in 2017. We have seen U.S. dollar interest rates increase and anticipate a widening of credit spreads. These movements could impact our overall floating rate borrowing costs, which may increase in 2017 as we continue to fund in line with the market.

Based on the projected cash requirements for 2017, we expect the range for commercial paper outstanding to be between USD 6 billion and USD 8 billion.

Sovereign, Supranational and Agency (SSA) issuers, including EDC, may face the potential of rising interest rates. This will affect the tenor that investors demand and could constrict issuers’ funding options. EDC believes it can meet its funding requirements as it remains one of the most sought-after names in the SSA market.

Credit Credentials

While we service our debt from our own resources, our bonds carry the full faith and credit obligations of the Government of Canada. The ratings reflect our status as an agent of her Majesty in right of Canada and EDC’s 100 per cent ownership by the Government of Canada. EDC’s debt is a charge on and payable out of the Consolidated Revenue Fund (the government’s primary account).

| | | | | | | | |

Risk | | Domestic | | Foreign Currency |

Rating | | Long-term | | Short-term | | Long-term | | Short-term |

Moody’s | | Aaa | | P-1 | | Aaa | | P-1 |

S & P | | AAA | | A-1+ | | AAA | | A-1+ |

DBRS | | AAA | | R-1 (high) | | AAA | | R-1 (high) |

JCR | | AAA | | – | | AAA | | – |

Zero per cent BIS risk weighted according to Basel II guidelines

The following is an overview of the business strategy and performance measures of the 2017-2021 Corporate Plan. A summary of the Plan is available on www.edc.ca.

The Planning Environment

The global economy continues to experience volatility, giving rise to an unpredictable international landscape. While uncertainty has emerged around a shift in U.S. trade policy, the U.S. will likely remain a key driver of global growth over the planning period, and we expect positive growth in emerging markets, such as China and India. The Canadian economy faces challenges ahead, resulting from the downturn in commodities. As such, globalization remains an important contributor to Canada’s growth. Furthermore, Canada continues to enter into and ratify new free trade agreements that will make it easier for Canadian companies to engage in international trade.

Within this context, EDC is forecasting Canada’s export growth to be approximately 6.0 per cent in 2017. Trade and investment will be key drivers for the Canadian economy over the planning period, in part driven by a lower Canadian dollar. Canadian businesses have articulated a comprehensive set of challenges they face when looking to develop and grow their international footprint. Our job is to help them respond and compete successfully.

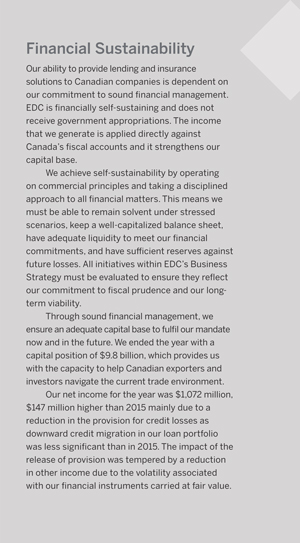

The Business Strategy

EDC’s business strategy for the 2017-2021 period is focused on doing more to increase the number of Canadian companies exporting and to support their diversification to new markets. We will also play a key role in supporting the Government of Canada as it advances its progressive trade agenda and works to raise Canada’s profile globally.

We will explore new ways to address the broad spectrum of challenges that Canadian companies and exporters face. Our solutions include early-stage services, such as knowledge and advice on exporting, and solutions for later-stage needs, including a range of financing, insurance, and bonding solutions to help Canadian exporters. We will work through our network of representatives in Canada and abroad, as well as through our partners, such as the Trade Commissioner Service.

The 2017 – 2021 Business Strategy outlines three main objectives:

1. Build awareness of the benefits of exporting and provide knowledge and advice to help Canadian companies go international: We will connect with more Canadian companies to share information and build awareness of the solutions EDC and its partners can provide to help Canadian companies become exporters and encourage trade growth.

2. Anticipate and respond to the needs of Canadian companies to support and accelerate their international growth: We will ensure that current and potential exporters have access to a range of solutions that address and evolve with their needs as they grow their business internationally.

3. Create new trade opportunities and promote trade diversification in order to help Canadian companies succeed internationally: We will facilitate connections and find new opportunities for Canadian companies to help them expand beyond traditional markets.

Objective 1: Build awareness and share our knowledge

We will continue to increase awareness about the benefits of exporting, and the knowledge and services that EDC can offer to exporters of all sizes and stages. The goal is to encourage more Canadian companies to start exporting and to encourage those that already are to export more. This is particularly important for SMEs, as we look to help them grow their small firms into big businesses by selling internationally. We will help give businesses the confidence they need to go global by promoting free trade agreements, responding to the need for knowledge, and connecting companies with information, tools, and partners required to begin selling overseas.

EDC Annual Report 2016 41

Objective 2: Anticipate and respond to needs

As Canadian businesses progress along their journey to globalization, the support they need evolves and becomes more specific to their respective global strategies. By listening to what Canadian exporters are telling us they require to conduct business internationally, we will ensure that Canadian businesses have access to a comprehensive suite of products to help them achieve growth at any stage in their exporter life cycle. Over the planning period, we will work to anticipate and respond to exporter needs and enhance our existing service offerings to address these needs. We will do so by continuing to invest in online services for our customers, taking more risk for Canadian SMEs and supporting Canadian direct investment abroad (CDIA). We will also continue supporting companies in key Canadian industries, such as cleantech, manufacturing, mining, and oil and gas.

Objective 3: Create new trade opportunities

We will help create new opportunities for Canadian businesses and promote trade diversification among exporters and investors. In order to do so, we will leverage our deep knowledge of Canadian capabilities and industries, in-depth market knowledge, and our connections with foreign buyers for the benefit of Canadian companies seeking new trade opportunities. EDC’s international footprint is core to our trade diversification strategy, as we will leverage recently opened offices and continue to look to expand our global presence. We will focus on helping more Canadian exporters enter lucrative emerging markets like China and India, and to do so faster. We will also build awareness and increase trade to developed markets that remain critically important to Canadian companies as a gateway to these emerging markets.

Corporate Social Responsibility

Today’s broader global market has enhanced expectations regarding responsible business practices. As we assist customers in pursuit of international opportunities, we also support them in responding to these expectations by informing them about conducting business in a socially responsible manner. By educating and promoting strong CSR practices with current and future exporters, we help them manage risks and give them the confidence they need to enter new markets.

Our CSR practices balance the interests of our many stakeholders and are foundational to what we do, guiding our actions as we conduct business both in Canada and abroad. We review transactions to ensure that international standards will be met. We work with customers and borrowers to help increase their knowledge and understanding of these standards and how they can enhance their own business practices. CSR will remain a corporate priority for EDC throughout the planning period.

EDC was ranked in the top 10 among the Corporate Knights Future 40 Responsible Corporate Leaders in Canada in both 2015 and 2016. We are continually exploring ways to actively engage in CSR discussions, both at customer and international standard levels. Over the planning period, we will explore new ways to add value to our customers in this regard and, in so doing, we will help Canadian companies increase their awareness and practice of international CSR standards when conducting business internationally.

Delivering on our Objectives

To meet the needs of more customers than ever before and to contribute significantly to the Government of Canada’s trade agenda over the long term, we have in place robust practices for risk management, operational management, financial sustainability, and human resources that are in alignment with private sector best practices. We continuously look for ways to create capacity, efficiency, and value for our customers.

Measuring Success

Our scorecard tracks our performance against the strategic objectives outlined in the Business Strategy through the measures outlined below. As the trade environment and our priorities evolve, so do the benchmarks against which we measure our success.

| | |

Performance Measures | | 2017 Plan |

Customer-related Measures |

Net Promoter Score | | 70.0 – 76.0 |

Business Measures |

Total Business Facilitated | | 4 – 7% growth |

Business in Emerging Markets | | 2 – 6% growth |

CDIA Transactions | | 2 – 7% growth |

Small Business and Commercial Transactions (new measure) | | 4 – 10% growth |

| | |

Financial Measures |

Productivity Ratio | | 28 – 32% |

Net Promoter Score

The Net Promoter Score (NPS) is the measure against which we evaluate our customers’ satisfaction and loyalty. NPS measures the likelihood that our customers would recommend EDC to business colleagues. EDC continues to be a leader in customer loyalty. Our score, relative to other organizations, is strong and remains in the top 10 per cent of North American B2B companies. For 2017, our target NPS range is 70.0 – 76.0.

Total Business Facilitated

This measure provides an order of magnitude of the business Canadian companies carry out with the help of our solutions. Looking forward to 2017, we are projecting growth in the range of 4 to 7 per cent. This growth is expected to stem from targeted initiatives in our ARI product, increases in signings due to new foreign office openings, and new pull transactions with international buyers.

Business in Emerging Markets (BEM)

This measure uses revenue to demonstrate the value we deliver to Canadian companies in emerging markets. Revenue is a comparable measure of value across our insurance and financing programs, therefore providing a balanced view of our business. Revenue derived from all programs counts towards BEM and is defined as the accounting revenue reported on the income statement earned during the calendar year through premiums, fees, and interest on transactions in emerging markets. In 2017, we expect growth in BEM to be in the 2 to 6 per cent range, due in part to growth in our loan portfolio.

Canadian Direct Investment Abroad (CDIA) Transactions

CDIA continues to be critical to the health of the Canadian economy, and supporting CDIA transactions has become an integral part of our core business. We expect the 2016 trend to continue, resulting in a growth range for CDIA of 2 to 7 per cent in 2017. This will be attributable to our focus on expanding partnerships with financial institutions and making improvements to our programs to add more value for our partners.

Small Business and Commercial Transactions

Over the past number of years, we have placed a strong emphasis on supporting SMEs in both developed and emerging markets. In 2017, we are replacing the Small- and Medium-Sized Business Transactions measure with a new, modified measure called Small Business and Commercial Transactions. This updated measure reflects a more comprehensive range of businesses that export to ensure that we have an eye on companies of all sizes and at all stages. We anticipate growth in this measure to be in the 4 to 10 per cent range due to our continued efforts to increase EDC’s awareness and to strengthen partnerships with financial institutions.

Productivity Ratio

Our Productivity Ratio captures, in aggregate form, how well we use our resources. It is the ratio of administrative expenses to net revenue. In 2017, our targeted range will be 28 to 32 per cent, which reflects critical investments we are making in key areas, including transformation projects and our effort to serve more Canadian exporters than before.

|

| EDC Annual Report 2016 43 |

Board Stewardship and Governance

EDC’s stewardship rests with its Board of Directors, which is composed of seasoned professionals in the fields of business, finance, investment, policy, and risk management. Members possess deep knowledge and understanding of various sectors including agriculture, fishing, mining, energy, manufacturing and transportation. Their collective experience is leveraged to help inform EDC’s business direction.

Each year the Board provides input to, and approves, EDC’s Corporate Plan. In 2016, Board discussions focused around how the plan would flow directly from EDC’s long-term Corporate Strategy. Three strategic objectives were identified as the guiding focus for the corporate plan.

These were:

| | 1. | Building awareness of the benefits of exporting and provide knowledge and advice to help Canadian companies go international; |

| | 2. | Anticipating and responding to the needs of Canadian companies to support and accelerate their international growth; and |

| | 3. | Creating new trade opportunities and promoting diversification in order to help Canadian companies succeed internationally. |

All three goals stem from EDC’s determination to stay relevant to the needs of existing and future customers.

EDC’s Board also plays the important role, along with the Executive Management Team, of ensuring that the Corporate Plan is aligned with the Government of Canada’s priorities.

Board Governance

2016 marked the first year of the Board’s enhanced governance framework, which was the result of last year’s Board Governance review. The new framework helped ensure continued strong corporate governance for EDC through a variety of measures. Of note, the Terms of Reference for certain board committees were revised and improved, as was the Director Profile, which outlines the ideal skills and capabilities for Directors and helps determine if the Board as a whole possesses all of the required skills.

The Board also welcomed the introduction of a new digital platform to allow EDC to continue to share key information with the Board in a timely and secure manner, thereby facilitating meeting effectiveness and supporting informed decision-making during Board and Committee meetings.

Finally, the Government of Canada announced a new approach for Governor in Council appointments, including Crown directors in February 2016. With several board member terms having expired and others coming to an end in 2017, EDC worked closely with the government to ensure that new Director appointments will be undertaken in accordance with these new guidelines.

Enterprise Risk Management

Enterprise risk management (ERM) continues to be a priority for EDC’s Board. As EDC undertakes a multi-year ERM transformation program, the Board continued to play a significant role in supporting the ongoing planning and implementation of EDC’s ERM practice. This included in-depth discussions during the Board’s annual strategy session in June, as well as regular engagement during all Board meetings. In particular, the Board approved an updated Risk Appetite Statement for the Corporation, as well as a “Policy of Policies” (POP), an ERM Policy, an ERM Framework, and a Model Risk Management Policy. In addition, the Board approved a Compliance and Ethics Charter that outlines the mandate of the Compliance and Ethics function.

To help support the ERM transformation program, a sub-Committee of the Risk Management Committee was also created. The Board, as well as the Executive Management Team, will continue to be actively engaged in building an ERM practice that reflects strong, effective governance and risk management.

The Board’s Risk Management Committee, the Senior Vice-President and Chief Risk Officer, and the Vice President and Chief Compliance & Ethics Officer, will all play central roles in delivering on the critical priority of building a culture of risk awareness.

New Corporate Strategy

This past year, the Executive Management Team began its work to implement EDC’s new long term Corporate Strategy. The Board and the Business Development and Strategy Committee have been engaged on this initiative throughout the year.

Public Policy Objective and Legislated Mandate

The mandate and powers of EDC are established by statute, which remained unchanged in 2016. The Board reviewed the 2016 Statement of Priorities and Accountabilities (SPA) received from the Minister responsible for EDC, which provides guidance for the Corporation’s strategic orientation. The Board also reviewed the Minister of International Trade’s Mandate Letter and received an update on the recently announced Government of Canada’s Trade and Investment Strategy to ensure that EDC’s activities reflect the Government’s specific goals and objectives.

Corporate Social Responsibility (CSR) and Culture of Ethical Conduct

EDC’s CSR activities are a critical component of enhancing Canada’s trade performance. The Board engaged on CSR issues throughout the year, received regular quarterly updates on Environmental Review Directive (ERD) transactions and significant CSR group undertakings, and held periodic discussions on specific CSR matters of interest or concern. In addition, one Board member attended EDC’s CSR Advisory Council as a participant to bring the Board’s perspective to the discussions.

The Board promotes an ethical business culture, and leads by example in this regard. EDC Directors file standing declarations of interest and refrain from discussions or voting where a real or potential conflict of interest exists. Board documents are screened to flag companies listed in the standing declarations of Directors so that transaction documents are withheld from a Director who has declared an interest in a party related to that transaction.

Each year, the Board receives a report on employee confirmation with EDC’s Code of Conduct, including the Values and Ethics Code for the Public Sector that became part of EDC’s own Code of Conduct in 2012. Board members also receive annual “refresher” training to confirm their own understanding and compliance with the requirements of the EDC Code of Conduct that apply to Directors, and with the board-specific procedures that regulate conflicts of interest and insider trading. In 2016, this training was given by EDC’s Vice President and Chief Compliance & Ethics Officer.

Accountability and Operations

The Board has an effective working relationship with EDC’s management and regularly reviews the allocation of responsibilities. The EDC by-law regulates the proceedings of the Board, and establishes matters for which the Board has reserved authority. The Board Charter elaborates on roles and responsibilities, in terms of board stewardship, and provides additional detail on board proceedings.

EDC’s Board functions independently of management. At each Board and Committee meeting, time is reserved for Directors to meet in camera with the CEO and separately without the CEO. The Audit Committee meets in camera in three sessions: with the federal Auditor General’s representatives; with EDC’s Senior Vice-President and Chief Internal Auditor (newly appointed in 2016); and, the full Audit Committee without the CEO. The Risk Management Committee holds regular in camera sessions with the Chief Risk Officer and Vice President and Chief Compliance Officer & Ethics Officer.

The roles of EDC’s Chair and President are separate. All board members, other than the President, are independent of EDC management. Directors receive agendas and materials for, and are welcome to attend, any committees of which they are not members.

|

| EDC Annual Report 2016 45 |

Communication with Stakeholders

In 2016, the Board continued to monitor and facilitate effective communication between EDC and its key stakeholders, including its shareholder, the Government of Canada.

The Board was kept informed of outreach activities that help EDC obtain stakeholder input and feedback, including the meeting of the Industry Stakeholder Panel. At formal and informal board events, experts from various fields were invited to provide their insight and have discussions with the Board. Additionally, the Board conducts regular outreach during its out-of-town meetings in order to interact with local EDC customers, government officials, and other key stakeholders in these communities. In 2016, for example, four CEOs of companies in the oil and gas sector participated in a session with the Board during the June meetings in Calgary.

With encouragement from the Board, EDC continued to prioritize partnerships in 2016. The Corporation undertook initiatives to enhance relationships with the Trade Commissioner Services, Canadian financial institutions, and sister Crown corporations such as the Canadian Commercial Corporation (CCC) and the Business Development Bank of Canada (BDC).

The Business Development and Strategy Committee played a key role in reviewing programs to increase public awareness of EDC and the services it can provide to Canadian businesses.

Senior Management Evaluation and Succession

The Board evaluates the performance of the President and Senior Vice-Presidents on an annual basis. The President’s annual performance objectives are set by the Human Resources Committee and are directly related to EDC achieving objectives set out in the Corporate Plan. The Human Resources Committee reviews the President’s performance based on these objectives, and makes recommendations to the Board. The Board in turn provides the government with recommendations for ratings related to the President’s salary and variable pay. The Human Resources Committee also reviews performance and compensation of senior management and certain other positions on an annual basis.

In addition, the Board oversees senior management succession. The succession plan, as developed by management and approved by the Human Resources Committee, is used for senior appointments.

Travel and Hospitality Directive

In response to the Government of Canada’s Directive to Crown corporations to align with the Treasury Board procedures and guidelines on Travel, Hospitality, Conference and Event Expenditures, the Board worked closely with the Executive Management Team to ensure that both EDC’s corporate and Board travel-related policies were compliant with the Directive.

Audit Activities

The Board received regular reports from the Audit Committee in 2016. A sub-Committee of the Audit Committee continued to provide additional oversight of the Credit Insurance Transformation (CIT) project, the goal of which is to make it easier and more cost-effective for companies to obtain receivables insurance from EDC.

In December 2016, the Board also approved the Office of the Auditor General of Canada’s (OAG) Special Examination plan, which is undertaken at least every ten years. The examination enables the OAG to provide the Board with reasonable assurance that there are no significant deficiencies in the Corporation’s financial and management control, information systems, and management practices.

Committee Mandates

The Audit Committee ensures the Board fulfills its mandate in financial matters, as well as with respect to reporting of any investigations by the Vice President and Chief Compliance & Ethics Officer, and internal and external auditor terms of engagement. The Audit Committee approves and monitors important capital and administrative expenditures, reviews the implications of new accounting policies, and reviews internal and external audit results. The Committee approves quarterly financial statements for public release. All Audit Committee members are financially literate and are independent of EDC management. The Committee, chaired by Herbert Clarke, held six regular meetings and one special meeting.

The Business Development and Strategy Committee provides direction that strengthens EDC’s ability to meet the ongoing needs of Canadian exporters and investors. The Committee monitors the development and approval of the Corporate Plan, recommends the Plan to the Board, oversees management activities in analyzing market conditions and developing responses, and monitors corporate performance against business development plans and related frameworks. The Committee reviews sector strategies and new product initiatives, and annually reviews the impact of EDC’s business on Canada’s economy. The Committee, chaired by Jeffrey Steiner, held six regular meetings and one special meeting.

The Executive Committee has the authority to exercise certain board powers, and meets only if necessary to deal with urgent matters that arise between board meetings. A meeting of the Executive Committee was not required in 2016. Kevin Warn-Schindel, as Chair of the Board, chairs the Committee.

The Human Resources Committee supports the Board’s oversight of human resources strategic planning and approves the management succession plan, employee and executive compensation, and the measures and targets for the corporate incentive program. It sets objectives and advises the Board on the assessment of the President’s performance and oversees the design, investment strategy, and performance of pension plans for employees. The Committee, chaired by Jeff Burghardt, held six regular meetings and one special meeting.

The Nominating and Corporate Governance Committee deals with matters relating to EDC’s governance regime. It has input into the ethics program for Directors, selection criteria for appointments of the President and the chair, profiles of the desirable skills and experience required of Directors, consideration of board candidates, and orientation and education programs. It oversees the board governance survey, monitors relations with management, and reviews the membership and mandates of committees. In 2016, governance matters were elevated for discussion or decision to the full Board. The Board Chair acts as chair of this committee, which had one special meeting in 2016.

The Risk Management Committee supports the Board’s oversight of the prudent management of EDC’s capital structure, including the management of credit, market, and other enterprise risks. The Committee oversees and recommends updates to the internal policy framework governing authorization of EDC’s business activities, and oversees the authorizations that EDC requires in order to undertake specific transactions. It reviews and recommends transactions requiring Board approval, and monitors compliance with the Environmental Review Directive. It also oversees EDC’s compliance and ethics programs and receives updates on portfolio management activities. The Committee, chaired by Darlene Thibault, held six regular meetings.

Director Remuneration

Compensation paid to Directors is set by Order in Council. The Chair and other independent Directors receive an annual retainer for their services, plus a fixed per diem for travel time, and for attending committee and board meetings. The following compensation schedule has been in place since 2000, in accordance with Treasury Board Guidelines.

| | › | Chair of the Board: annual retainer of $12,400; $485 per diem |

| | › | Other Directors: annual retainer of $6,200; $485 per diem |

| | › | Chairs of committees (other than Executive Committee) and Vice-Chair of the Board: base retainer plus $2,000 |

Directors are reimbursed for their reasonable out-of-pocket expenses while performing their duties, including travel, accommodations and meals. Most Board members serve on three committees. There were 13 Board meetings in 2016 (6 regular, 7 special) and 28 committee meetings. Meetings convened between regularly scheduled Board sessions are usually held by teleconference. The total remuneration paid to independent Directors including the Chair (annual retainers plus per diems) was $271,202.50 in 2016 compared to $258,368 in 2015. The total for business travel, promotion and meeting expenses paid to members of the Board plus meeting expenses for the Board and Committees was $169,511 in 2016 compared to $179,084 in 2015 (both figures exclusive of the expenses of the President). The total for the President’s business travel and hospitality expenses in 2016 was $79,390 compared to $69,279 in 2015.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Membership and attendance at meetings of the EDC Board and Board Committees in 2016 | |

| | | Total

Compensation

(retainer plus per

diem payments) | | | Audit Committee Meeting

(6 regular, 1 special) | | | Business

Development

and Strategy

Committee Meeting

(6 regular, 1 special) | | | Human Resources

Committee Meeting

(6 regular, 1 special) | | | Nominating

& Corporate

Governance

Committee Meeting

(1 special) | | | Risk Management

Committee Meeting

(6 regular) | | | Board of Directors Meeting

(6 regular, 7 special) | |

Boivin, Jacques | | | $20,628.75 | | | | 6/7 | | | | 7/7 | | | | | | | | | | | | | | | | 12/13 | |

Burghardt, Jeff | | | $29,540.00 | | | | 7/7 | | | | 7/7 | | | | 7/7 | | | | 1/1 | | | | | | | | 13/13 | |