CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Notes to the Condensed Consolidated Financial Statements

1. Significant Accounting Policies

Basis of Presentation

Our condensed consolidated financial statements comply with the Standard on Quarterly Financial Reports for Crown Corporations issued by the Treasury Board of Canada.

Except as indicated below, these condensed interim consolidated financial statements follow the same accounting policies and methods of computation as our audited consolidated financial statements for the year ended December 31, 2017. They should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2017 and the accompanying notes as set out on pages 88-141 of our 2017 Annual Report.

Basis of Consolidation

Our consolidated financial statements include the assets, liabilities, results of operations and cash flows of our wholly owned subsidiaries and those structured entities consolidated under IFRS 10 – Consolidated Financial Statements. Intercompany transactions and balances have been eliminated.

Application of New and Revised International Financial Reporting Standards

| (a) | New standards, amendments and interpretations adopted during the year |

The following standards issued by the IASB were adopted during the year:

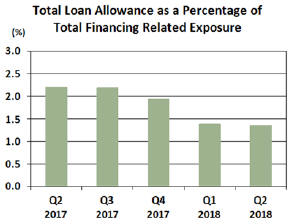

IFRS 9 – Financial Instruments – In July 2014, the IASB issued the final version of IFRS 9—Financial Instruments (IFRS 9), which is applicable for reporting periods beginning on or after January 1, 2018 and replaces the guidance in IAS 39 Financial Instruments: Recognition and Measurement (IAS 39). As we early adopted the classification and measurement requirements of IFRS 9 upon transition to IFRS in 2011 and do not apply hedge accounting to our derivatives, we only implemented the impairment requirements on January 1, 2018.

IFRS 9 does not require restatement of comparative period financial statements except in limited circumstances relating to the hedge accounting provisions of the standard. We chose not to restate comparative figures on transition and recognized the measurement difference of $400 million through an adjustment to opening retained earnings.

The impairment requirements under IFRS 9 are calculated using an expected credit loss (ECL) model as opposed to the incurred loss model under IAS 39 and impacts the allowance on our loans receivable, loan commitments and loan guarantees. Our updated accounting policy is as follows:

Allowance for Losses on Loans Receivable, Loan Commitments and Loan Guarantees

The allowance for losses on loans receivable, loan commitments and loan guarantees represents management’s best estimate of probable credit losses and is based on the expected credit loss model.

Financial assets subject to an impairment assessment include loans held at amortized cost. The allowance for credit losses related to loans receivable are presented in the allowance for losses on loans receivable in the condensed consolidated statement of financial position.

Off-balance sheet items subject to an impairment assessment include loan commitments and loan guarantees. The allowance for credit losses related to loan commitments are presented in allowance for losses on loan commitments and allowances for credit losses related to loan guarantees are included in the liability for loan guarantees in the condensed consolidated statement of financial position.

16 EXPORT DEVELOPMENT CANADA