KEY RISK MANAGEMENT GROUPS

Global Risk Management Group

The Global Risk Management Group provides independent oversight of and effective challenge to the management of risks inherent in our activities, including the establishment of our Enterprise Risk Management policies and framework to manage risk in alignment with our risk appetite and business strategies. The GRM Group is responsible for identifying, measuring, monitoring, assessing, and reporting on risk factors facing EDC, and ensuring that risk considerations are taken into account and align with our risk tolerance in all areas and processes at EDC. The GRM Group is headed by the SVP, Global Risk Management and Chief Risk Officer, who works closely with the President and Chief Executive Officer, the Chief Business Officer, the Board of Directors and other members of Senior Management to set the ‘tone at the top’ and establish a risk aware culture across EDC.

Finance

Responsible for financial planning, accounting, financial reporting and cash management, Finance ensures that appropriate controls exist to ensure effective cash management and delivery of complete and accurate financial reporting.

Internal Audit

As the third line of defence, Internal Audit (IA) is responsible to provide independent and objective assurance and advisory services designed to add value and help us achieve our business objectives pertaining to operations, reporting, and compliance with laws and regulations. IA does this by bringing a systematic and disciplined approach to evaluating and improving internal controls, risk management, and governance processes. Although IA’s mandate includes the provision of advisory services to management, these services will be ancillary to the assurance services it provides to the Audit Committee of the Board of Directors. Our Chief Internal Auditor reports to the Chair of the Audit Committee of the Board of Directors and has a dotted line reporting relationship with our President & CEO.

IA governs itself by adhering to The Institute of Internal Auditors’ (IIA) mandatory guidance, including the Core Principles for the Professional Practice of Internal Auditing, the Definition of Internal Auditing, the IIA Code of Ethics and the International Standards for the Professional Practice of Internal Auditing. This guidance constitutes principles of the fundamental requirements for the professional practice of internal auditing and for evaluating the effectiveness of internal audit’s performance.

Front Line Units

Front Line Units includes business units and other functions within the first line of defence who take, own and manage risk on a day-to-day basis. These functions are responsible for identifying, assessing, mitigating, assuming, controlling and reporting on risk in accordance with established enterprise risk appetite, policies, culture and strategic goals.

Risk Taxonomy

Our Enterprise Risk Management taxonomy breaks risk down into three broad risk areas, expressing our risk appetite and tolerance in terms of financial risk, operational risk, and strategic risk. As a financial institution, financial risk is naturally front and centre and, as a result, the majority of this report covers this area.

FINANCIAL RISK MANAGEMENT

Portfolio Risk Profile

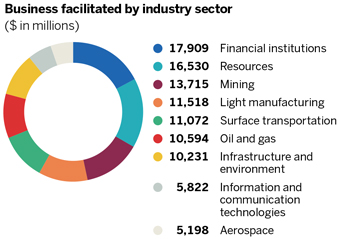

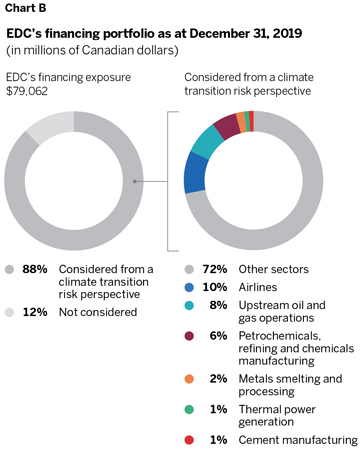

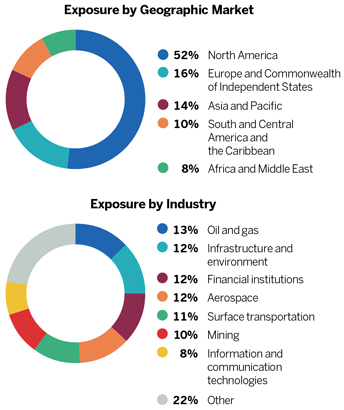

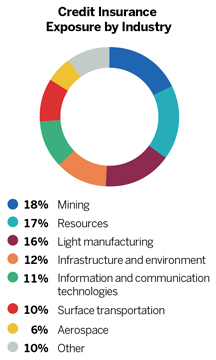

While EDC follows leading risk management practices, we generally assume more risk than a typical financial institution due to our mandate. We take on larger single counterparty exposures and larger concentration exposures by sector than other financial institutions, most notably in the transportation and extractive sectors which lead Canadian exports.

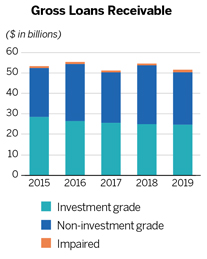

Despite a portfolio distribution that is almost equally segmented between investment grade and non-investment grade borrowers in 2019, the vast majority of EDC’s risk profile, as determined by capital demand for credit risk, emanates from the non-investment grade space. Although only 52% of EDC’s loan portfolio is non-investment grade, 80% of capital demand is attributable to this category of obligor.

| | | | |

| | | | 68 MANAGEMENT’S DISCUSSION AND ANALYSIS | EDC 2019 ANNUAL REPORT |