EXHIBIT 3

Canada’s Bridge

to Global Trade and Investment

ANNUAL REPORT 2002

TABLE OF CONTENTS

Overview

For almost six decades, EDC has served Canadian exporters and investors of all sizes, from all sectors of the economy, doing business in up to 200 markets around the world. We offer a full range of financial products and services, tailored to meet customers’ needs.

Canada’s Bridge to Global Trade and Investment

During 2002, revelations of corporate malfeasance, just on the heels of September 11 (2001), heightened uncertainty associated with international trade. EDC fulfilled a critical role, helping customers expand their financial capacity, access relevant knowledge, identify opportunities and venture into global markets with confidence.

The following statistics represent a few highlights of EDC’s performance in 2002:

| • | | $51.2 billion in exports and international investments using EDC solutions |

| |

| • | | 7,223 customers served |

| | • | | 648 large customers |

| |

| | • | | 6,575 small and medium-sized customers |

| • | | $122 million net income |

| |

| • | | $24.6 billion total assets |

| |

| • | | $0 Parliamentary appropriation |

| |

| • | | $95 million dividend to shareholder |

| |

| • | | 992 average employee strength |

i

2002 Corporate Account Highlights

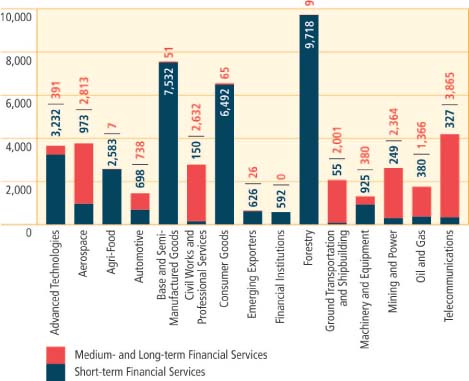

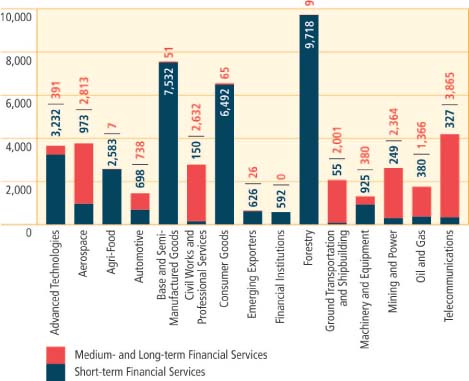

Business Volume by

Industry Sector

($ in millions) |

|

| | | |

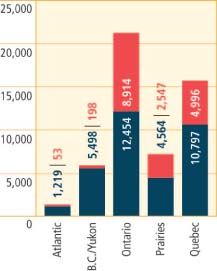

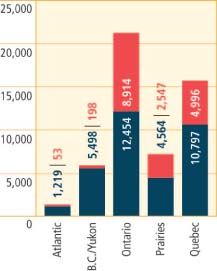

Business Volume by

Geographic Market

($ in millions) | | Business Volume by

Canadian Region

($ in millions) |

| |  |

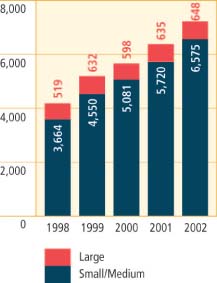

Five-Year Review

ii

| | | | | |

Business Volume

($ in millions) | | Shareholder’s Equity

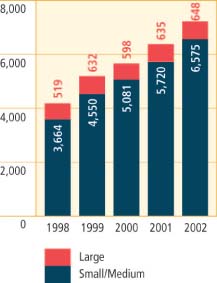

($ in millions) | | Customers Served |

| |  | |

|

SME Scorecard

| | | | | | | | | | | | | | | | | |

| | | 2002 | | Target | | % Achieved | | 2001 |

| | |

| |

| |

| |

|

| SME – Customers served count (direct and indirect) | | | 6,575 | | | | 6,050 | | | | 109 | % | | | 5,720 | |

| SME – Business volume ($ millions) | | | 9,698 | | | | 7,800 | | | | 124 | % | | | 7,670 | |

| Emerging Exporters (EE) – number of new customers | | | 818 | | | | 800 | | | | 102 | % | | | 743 | |

| EE – average credit approval turnaround time | | 2 days | | | — | | | | — | | | 2 days |

| | | | | |

| SMEs as a Percentage | | SME Volume by | | SME Product Usage |

| of EDC’s Customer Base | | Geographic Market | |

|

| |  | |  |

| | | | | |

| Number of SME | | Volume Support | | SME Service |

| Customers | | for SMEs

($ in billions) | | Attribute Ratings

(%) |

| |  | |  |

Helping small and medium-sized enterprises (SMEs) expand and grow their business in international markets is a top priority for EDC. No company is too small to export, and no exporter is too small for EDC. The Emerging Exporters (EE) Team, which signed 818 new accounts receivable insurance customers in 2002, specializes in serving businesses with up to $1 million in annual export sales. In total, the EE Team now accounts for more than 50 per cent of EDC’s direct customer base.

iii

Contents

| | | |

| i | | Canada’s Bridge to Global Trade and Investment |

| | | |

| ii | | 2002 Corporate Account Highlights and Five-Year Review |

| | | |

| iii | | SME Scorecard |

| | | |

| | | 2002 Corporate Review |

| | | |

| 2 | | Message to the Shareholder |

| 9 | | Message from the Chairperson |

| 10 | | Performance Against Objectives |

| 14 | | Capacity |

| 16 | | Knowledge |

| 18 | | Opportunity |

| 20 | | Confidence |

| 22 | | Milestones 2002 |

Investor Relations

| | | |

| 23 | | Message to Investors |

| 24 | | Investor Relations |

| 25 | | Secure |

| 25 | | Experienced |

| 26 | | Debt Products |

| 26 | | Performance |

| 27 | | Liquidity |

| 27 | | Funding Program |

| | | |

| 28 | | Executive Management Team/Management Representatives |

| | | |

| 29 | | 2002 Financial Review |

| | | |

| 30 | | Management’s Discussion and Analysis |

| 54 | | Financial Reporting Responsibility |

| 55 | | Auditor’s Report |

| 56 | | Consolidated Financial Statements |

| 78 | | Five-Year Review |

| | | |

| 81 | | Board of Directors |

| | | |

| 82 | | Corporate Governance Practices |

| 85 | | Committees of the Board of Directors |

| | | |

| 88 | | Code of Business Ethics |

| | | |

| 90 | | Glossary of Financial Terms |

| | | |

| 91 | | Corporate Offices |

| | | |

| 92 | | Vision and Values |

Message to the Shareholder

| | | |

A. Ian Gillespie

President and Chief Executive Officer | |  |

Against a backdrop of continued economic and financial market uncertainty and geo-political tensions, EDC’s role as a steadfast bridge to international success and competitiveness proved to be more important than ever in 2002.

2

Canada’s Bridge to Global Trade and Investment

The risks associated with international trade increased significantly post-September 11, 2001. In 2002, a series of new concerns — particularly revelations of corporate malfeasance — pushed uncertainty to a whole new level. For Canadian exporters, the fallout included border delays, higher insurance rates and renewed signs of trade protectionism, all of which translated into higher risks and costs.

Overall, Canadian companies experienced lower export sales in 2002. Despite this decline, EDC carried out $51.2 billion in business volumes on behalf of Canadian companies during 2002, an increase of 16 per cent over the 2001 level of $44.3 billion. This is not entirely surprising, since Canadian companies engaged in international trade had an increased stake in managing their trade risk in 2002, and they faced a greater need for financial intermediation.

EDC business volumes in 2002 were equivalent to 11 per cent of total Canadian exports of goods and services — up from 9.4 per cent in 2001. The increase comes from the fact that while overall Canadian exports were down in 2002, EDC volumes continued to grow.

In keeping with our mandate to facilitate Canada’s trade and investment agenda, EDC continued to serve Canadian exporters and investors of all sizes and from all sectors of the economy by helping to expand financial capacity, access relevant knowledge, identify opportunities and venture into global markets with confidence.

We served 7,223 customers in 2002, doing business in 182 countries and territories. A majority of the Canadian companies using our services were small and medium-sized companies (SMEs). We worked with 6,575 SMEs, an increase of 855 new SME customers over the previous year. The total volume of SME transactions amounted to $9.7 billion, an increase of $2 billion over SME business volumes in 2001.

3

Building Capacity

While exporter needs vary depending on their size and industry sector, EDC remains focused on finding ways to build capacity for Canadian companies across the board.

Today, global competitiveness increasingly hinges on being able to participate in global supply chains. For larger customers, this often means having the capacity to establish manufacturing facilities abroad, and to merge, create alliances, enter partnerships or participate in joint ventures. In some cases, the majority of content of a particular export may be produced outside of Canada, but we will facilitate a transaction as long as there are sufficient Canadian benefits associated with it.

Over the years, EDC’s Canadian benefits policy has evolved to keep pace with the way international trade is conducted in an increasingly globalized environment. Canadian benefits are not defined exclusively in terms of Canadian content. Today, other benefits such as future trade creation, R&D investment, higher-quality jobs in Canada, sub-supply for smaller Canadian firms and the maintenance of international market share are more important than ever.

In 2002, we better positioned ourselves to address the evolving needs of exporters by launching our first web-based products, EXPORT Check and EXPORT Protect. Both products enhance the accessibility and timeliness of our short-term insurance services. In 2003 we will launch GLOBEX, a new application that will automate short-term underwriting processes and will give us a solid foundation for further “webifying” delivery of our insurance services. Across all our teams, we are continually updating and adding new risk management tools.

To further enhance our ability to serve exporters, we continued to leverage our private and our public sector partnerships. In 2002, EDC developed and executed a strategy to expand our working capital solutions through the banking network, geared primarily to serving SMEs. Through Canadian risk-sharing partnerships, we continued to make working capital solutions available to smaller businesses and increase our partners’ involvement in international transactions. For example, we expanded our two-year partnership with i-Trade Inc., a Canadian private trade finance provider, resulting in increased access to working capital and cash flow for EDC policyholders.

By pursuing reinsurance treaties with both public and private international partners, we continued to extend the global reach of Canadian companies and minimize their risk in third countries. Reinsurance agreements were finalized with our counterparts in Italy (SACE) and the Netherlands (Gerling-NCM), making it easier and less costly for exporters in all three countries to access the support they need to close their deals.

We also continued to develop our public sector partnerships, to enhance our ability to provide Canadian business with seamless and practical access to a full range of international business development services offered by the Government of Canada. In addition to maintaining our close relationships with the Department of

| | | |

| EDC’s new web-based products, EXPORT Check and EXPORT Protect, enhance the accessibility and timeliness of our short-term insurance services. | |  |

4

Foreign Affairs and International Trade, Department of Finance, Industry Canada, other financial Crown corporations and provincial and municipal governments engaged in trade advisory or business development activities, we became an Executive Member of Team Canada Inc.

Knowledge sharing

In today’s increasingly integrated global economy, rapidly changing economic, market and political conditions generate an endless stream of data and opinion that can challenge the knowledge resources of even the largest of corporations. EDC is a recognized centre of international trade finance expertise, offering the knowledge capacity that our customers need to manage uncertainty and risk in global markets.

From a geographic standpoint, our economists continued to offer customized political risk and investment assessment services that gave our customers real and meaningful insight on specific countries and sectors. Our semi-annual Let’s Talk Risk Workshops and Executive Roundtables were delivered in 16 major cities across Canada, complemented by national distribution of our Global Export Forecast and Trade Confidence Index. These, plus our new EXPORT Market Insight service, were central to our efforts to package our information in formats that are relevant, useful and timely for our customers.

In addition, EDC’s sector-based approach to serving customers helps us continue to build in-depth knowledge. This enables us to anticipate emerging customer needs, so that we are better able to provide customized solutions and facilitate their efforts to do more business in more markets. Furthermore, it provides us with the insight we need to identify potential opportunities and bridge gaps in the current export landscape.

For example, EDC identified the environmental sector as having growth potential, and responded by launching its EnviroExport Initiative about four years ago. Today, we play a key role in expanding exports of Canadian environmental goods, technologies and services for some 200 customers. Last year alone, EDC’s trade finance and risk management services facilitated about $500 million in environmental industry exports and investments.

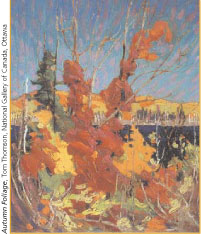

In other non-traditional export sectors, such as culture, we also expanded our support. The added dimension to EDC’s promotion of culture is the opportunity to showcase a key national strength. Canada’s culture helps define us as a nation and, in the face of today’s often homogenizing forces of globalization, we must use every opportunity to demonstrate our nation’s unique attributes. In fact, EDC took a hands-on approach to promoting Canadian culture in 2002, becoming the presenting sponsor of the Tom Thomson Exhibition at the National Gallery of Canada. In 2003, we will further enhance our support for Canadian culture by becoming the presenting sponsor for the National Arts Centre Orchestra’s fall tour of 10 cities in the United States and Mexico, which coincides with the tenth anniversary of the North American Free Trade Agreement (NAFTA).

| | | |

| | Ian Gillespie in conversation with Alexandre Dubé, one of EDC’s 21 Education and Youth Employment (EYE) scholarship winners. |

5

In addition to seeking new ways to serve current exporters in 2002, EDC continued to foster the development of an export culture in Canada through education. This entailed a wide range of sponsorship and outreach activities, with special emphasis on providing learning and employment opportunities for youth. Last year, we expanded our university partnership program, increasing the number of partners to 25 (up from 18) and offering 21 international studies scholarships.

Seeking Opportunities

A central component of EDC’s public policy mandate is our commitment to better assist Canadian companies doing business in higher risk developing markets, where financial intermediation is less prevalent but where significant export growth potential exists.

In 2002, we strengthened EDC’s foreign market expertise by establishing permanent representation in Warsaw (Poland), and placing a second representative in Mexico — this time in Monterrey. EDC’s business volumes for Canadian firms selling to or investing in the Mexican market have almost doubled (from $1.2 billion in 1999 to $2.3 billion in 2002) since we established our first representation in Mexico City in 1999 to build on opportunities created by NAFTA.

These two new additions enhance our existing complement of representatives in Beijing (China), Sâo Paulo (Brazil) and Mexico City (Mexico). All are strategically placed to access several economies rich in opportunities for Canadians. In-market presence helps us develop firsthand, competitive intelligence, and identify opportunities for Canadian business. Plans are underway to place representatives in additional markets in 2003.

An important aspect of our developing market strategy lies in working directly with Canadian companies to back their international marketing activities. In 2002, we took part in five federal trade missions including two Team Canada excursions to Germany and Russia, and missions with the Minister for International Trade to Africa, India and Mexico. EDC also sponsored and participated in many market development activities that included additional trade missions and exporter outreach roundtables.

In 2002, EDC facilitated more than $9.9 billion of business in 152 developing markets. This represents a downward turn in EDC business volumes in higher risk markets compared to 2001 figures, which was consistent with the downturn in global demand. However, the number of customers using EDC services to expand their business in developing markets has risen steadily, reaching 1,370 last year (up from 1,278 in 2001). In 2003, we will continue our efforts to find new opportunities and partnerships in these markets.

All of these activities rely on the strength of our balance sheet, which in turn requires that we manage portfolio risk. We must diversify our exposures geographically and across industry sectors, while at the same time responding to specific needs within the Canadian economy. In 2002, two key sectors faced highly unusual economic conditions: aerospace and telecommunications. EDC has an established record of providing services to Canadian exporters in both the aerospace and telecommunications sectors, and last year we continued to

| | | |

| In 2002, EDC established permanent representation in Warsaw (Poland) and placed a second representative in Mexico, for a total of five international representatives. | |  |

6

deliver the trade finance services exporters needed, while managing the associated risks. Consistent with other financial institutions, EDC provisions against possible future loan losses and insurance claims by setting aside both specific and general allowances from its net income.

EDC’s net income in 2002 was $122 million, an increase from $58 million the previous year. The increase reflected income of $96 million as a result of the federal government reimbursing EDC for an amount equal to debt relief granted by the Government of Canada to poor countries for debts incurred with EDC in prior years. Lower cost of funds also contributed to the increase in net income. The impact of these factors was partially offset by increased provisions for credit losses required due to credit deterioration. Also during 2002, at the request of the federal government, EDC paid a dividend of $95 million.

Maintaining a healthy balance sheet in 2002 has positioned us to live up to our commitment of ensuring there is substantial and growing capacity in Canada’s financial system to meet the trade and investment finance needs of Canadian businesses.

Confidence

EDC takes great pride in our reputation for sustainability and integrity, particularly in today’s increasingly challenging global trade environment. An area that has always been an important priority, and is increasingly brought under scrutiny in this post-Enron environment, is business ethics. EDC has implemented a series of fundamental practices designed to ensure that we conduct our business based on a high standard of business ethics. Anti-corruption declarations, and the review of environmental and social impacts, have become integral to our processes when analyzing finance and insurance transactions.

Since its establishment in the fall of 2001, EDC’s Advisory Council on Corporate Social Responsibility has provided a regular forum for the review of emerging national and international standards for both the public and private sector and our own business practices. The Advisory Council meets semi-annually and is an important pillar of EDC’s overall stakeholder engagement strategy. EDC has taken significant steps to ensure that it obtains views from other stakeholders, including non-government organizations.

In 2002, EDC appointed its first Compliance Officer, to provide additional public accountability. The Compliance Officer’s role included establishing a compliance program for matters related to EDC’s disclosure policy, environmental review directive, and anti-corruption practices.

From a policy perspective, in 2002 we updated EDC’s environmental review procedures to ensure that the transactions we facilitate will comply with the requirements of the Environmental Review Directive, which was made part of the Export Development Act when it was amended in 2001. As part of this initiative, we strengthened our team of environmental specialists who review transactions being considered for EDC support and work with international organizations to advance the environmental and social requirements of projects in which Canadian suppliers may have an interest.

| | | |

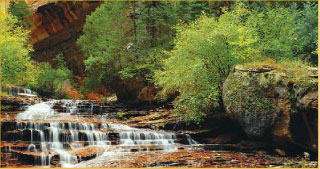

| | The review of environmental and social impacts has become integral to EDC processes when analyzing finance and insurance transactions. |

7

Since our introduction of a new disclosure policy in October 2001, as a means of providing greater public transparency on our operations, our web site has become a rich source of information about our aggregate business as well as about specific transactions. I am pleased that our customers have fully endorsed this approach, enabling us to achieve 100 per cent compliance from customers asked to consent to the public release of this information.

In addition to continuing to evolve and strengthen our own environmental review and disclosure procedures, we actively engage in discussions with export credit agencies in other countries. We seek to encourage greater transparency on project-related environmental information around the globe, and to ensure Canadian exporters, as leaders in these areas, are not put at a competitive disadvantage by Canada’s heightened requirements.

We provide clear direction with regard to the ethical standards applied to EDC business activities — to employees, customers and stakeholders — via our own Code of Conduct and Code of Business Ethics. EDC has also adhered to international anti-corruption initiatives such as the 1997 Action Statement by OECD export credit agencies, and to Canada’s anti-corruption legislation, The Corruption of Foreign Public Officials Act. To ensure effective implementation of these new obligations, we have trained staff, updated documentation and enhanced monitoring systems. We have informed our customers of requirements related to anti-corruption and have held workshops across Canada to encourage our customers to develop best practices in this area. In 2002, we also took steps to ensure our business practices conform with Canada’s obligations under the United Nations Security Council Resolution against terrorism.

Bridge to Global Markets

The people of EDC are dedicated to helping Canadian companies build bridges to global markets — working with them to find financial solutions, access relevant knowledge and access global opportunities. The demands we have placed on our employees have never been greater, the circumstances never more challenging, yet our employees have passed the test with flying colours once again. One measure of this is that they achieved a customer satisfaction survey score of 81.8 in 2002, up from 81.5 in 2001. My sincere thanks to each of you for your accomplishments last year, and for the enthusiasm you have shown in taking on even larger performance goals for 2003. I would also like to thank the Advisory Council on Corporate Social Responsibility for being an indispensable sounding board, and the Board of Directors for its unfailing and ongoing support.

A. Ian Gillespie

President and Chief Executive Officer

| | | |

| EDC is dedicated to helping Canadian companies build bridges to global markets. | |  |

8

Message from the Chairperson

When I joined the EDC Board of Directors on January 1, 2002, the corporation was heading into a challenging year. The Export Development Act, by which EDC is governed, had been recently amended in December 2001, following an extensive legislative review process. The resulting message was essentially: we like what you are doing EDC — do more of it. In 2002, during a slow and uncertain economic recovery, EDC continued to expand its ability to serve Canadian businesses of all sizes and across all sectors of the Canadian economy.

In talking with Canadian business people — and specifically EDC customers — it is evident that EDC has a unique and critical role to play within Canada’s export credit system. As Chairperson of EDC’s Board of Directors, I have a personal interest in helping EDC optimize this role. The Board has always helped to shape EDC’s strategic direction, and played an integral role during the legislative review process concluded in 2001.

In October 2002, the Board created a committee to conduct a strategic review. While the legislative review process studied EDC and its evolving role, the current strategic review will examine Canada’s export credit system and EDC’s place and function within that system. It will help determine how EDC can partner with others within Canada’s export credit system to ensure that optimal support from both the public and the private sectors is available to Canadian companies pursuing international business, for years to come.

In 2002, the corporation proved yet again that it is a dedicated and reliable partner for Canadian exporters and investors, as evidenced by the results in this report. Furthermore, EDC effectively managed its own portfolios and finances to maintain a solid financial base, enabling it to meet the current and future needs of its customers, and to fulfill the expectations of the shareholder and other stakeholders.

In closing, on behalf of the Board, I would like to congratulate the management team on EDC’s impressive ranking among the top 100 employers in Canada for the second year running. I would also like to thank the employees of EDC for their ongoing efforts to help Canadian businesses succeed in the increasingly competitive global marketplace. EDC has our commitment and support, as together we strive to enhance the availability and competitiveness of financial services for Canadian exporters and investors.

Paul Gobeil, FCA

Chairperson of the Board of Directors

9

Performance Against Objectives

Strategic Objectives 2002

Expand on EDC’s reputation for Corporate Social Responsibility (CSR)

| | Respond to the findings of the Legislative Review. |

| |

| | • | Strengthen EDC’s environmental review procedures. |

| |

| | • | Be mindful of Canadian international commitments. |

| |

| | • | Implement the disclosure policy. |

| |

| | • | Strengthen communication between EDC and the Department of Foreign Affairs and International Trade (DFAIT) with respect to human rights in countries where EDC conducts business. |

| |

| | • | Continue stakeholder engagement. |

| |

| | • | Build awareness of EDC’s new name and logo. |

Results

| | • | In 2002, EDC updated its environmental review procedures and its systems to ensure that supported transactions meet the legal requirements of the Environmental Review Directive (ERD). |

| |

| | • | EDC has taken steps to ensure that its customers are aware of Canada’s anti-corruption legislation, the Corruption of Foreign Public Officials Act and the OECD efforts in that regard, and that its business practices conform with Canada’s obligations under the United Nations Security Council Resolution against terrorism. |

| |

| | • | Enhanced aggregate and individual transaction reporting have been successfully implemented at EDC. Provisions for the disclosure of environmental and social impact information on projects took effect on May 1, 2002. |

| |

| | • | In 2002, EDC and DFAIT took steps to strengthen their channels of communications with respect to human rights developments in relevant countries. |

| |

| | • | EDC maintains a regular dialogue with a variety of stakeholders ranging from government and customers to non-governmental organizations, to seek their feedback on an array of issues. Significant progress was made in 2002, including: improvements to the CSR area of our web site; the addition of a compliance program; and sponsorship of a series of cross-Canada briefings on matters related to CSR. |

| |

| | • | Various communication tools were utilized to promote EDC’s new name, which instantly identifies the organization as a Canadian entity. |

10

Capture Opportunities for Canadian Companies

| | Enhance EDC’s products and service delivery to serve more Canadian companies operating internationally. |

| |

| | • | Increase the number of customers served to 6,800. Increase the number of SMEs served to 6,050. |

| |

| | • | Introduce expanded e-services, in particular for SMEs. |

| |

| | • | Enhance EDC’s distribution channel strategy to reach more companies and optimize service to customers (EDC sales force; its brokers and bank partners; e-business channels). |

| |

| | • | Achieve a Customer Satisfaction Index (CSI) rating of 80.0. |

Results

| | • | A total of 7,223 customers were served, an increase of 14 per cent over 2001. Of these customers, 6,575 were SMEs, a 15 per cent growth over 2001. |

| |

| | • | EDC introduced two new on-line products in 2002, EXPORT Check and EXPORT Protect, our first fully automated trade finance products. |

| |

| | • | Several financial institutions signed master facility agreements relating to EDC’s pre-shipment financing program for small business. As for e-business channels, seven new portals to EDC were built from association web sites to provide easy links to EDC for association members. |

| |

| | • | EDC’s customers once again expressed high levels of satisfaction with EDC. The 2002 CSI came in at a record 81.8, up from 81.5 last year. |

| | Leverage EDC’s reputation for leadership and excellence and provide value-added support to Canadian companies selling or investing abroad. |

| |

| | • | Support $40 billion or more in volume of exports and investments. |

| |

| | • | Develop and implement an integrated country sectors strategy to build a platform for increased support to developing markets. In 2002, support $9.5 billion or more business in developing markets. |

| |

| | • | Expand presence abroad. |

Results

| | • | EDC continued its partnerships with Canadian companies by facilitating $51.2 billion of their export and investment business, representing a 16 per cent increase over 2001 volume. |

| |

| | • | EDC expanded its developing markets tool kit and initiated new partnership approaches with exporters in support of its integrated country sectors strategy. Business concluded in 2002 exceeded the target, $9.9 billion versus $9.5 billion, but represents a decrease of 10 per cent compared to 2001 results. The decrease was primarily due to financial crises in key markets which saw a reduced level of export activity in 2002. |

| |

| | • | EDC increased its foreign representation from three to five in 2002, adding permanent resources in both Warsaw, Poland and Monterrey, Mexico. |

| | Add financial and/or service capacity by expanding the network of partners. |

| |

| | • | Implement the broker and banker strategies. |

Results

| | • | In 2002, a strategy was developed and executed to expand EDC’s working capital support through the banking network. |

11

Strategic Objectives 2002

Financial Health

| | Carefully manage financial risks to ensure that EDC remains financially sound, to support future business. |

| |

| | • | Net loss of $159 million. |

| |

| | • | Financial Sustainability Ratio (FSR) of 12.3 per cent. |

| |

| | • | Internal Efficiency Ratio (IER) of 20.7 per cent. The IERs reported in EDC’s 2002 and 2003 Corporate Plans were 20.0% for 2002 and 17.0% for 2003. Subsequent to the publication of the 2003 Corporate Plan, the calculation basis for the IER was modified as explained on page 35 of this Annual Report. The strategic objectives have been revised to reflect the change in calculation basis. |

| |

| | • | Return On Equity (ROE) of -9.2 per cent. |

Results

| | • | EDC achieved a net income of $122 million. All our financial results in 2002 were better than forecast under the Corporate Plan. The Plan was developed soon after the events of September 11 when it was nearly impossible to predict how 2002 would unfold. |

| |

| | • | An FSR of 13.9 per cent was achieved. |

| |

| | • | The IER came in at 17.4 per cent. |

| |

| | • | An ROE of 5.9 per cent was attained. |

12

Internal Readiness

| | Ensure adequate resources and efficient internal processes to deliver results. |

| |

| | • | Maintain voluntary turnover rate of less than 10 per cent. |

| |

| | • | Invest an average of five training days per employee. |

| |

| | • | Broaden awareness of EDC as an employer of choice. |

| |

| | • | Introduce flexibility in the employee benefits program. |

| |

| | • | Target an improvement in key areas with respect to the employee survey. |

Results

| | • | The turnover rate came in at a record low of four per cent. |

| |

| | • | On average, employees received five days of training. |

| |

| | • | For the second year in a row, EDC was recognized as one of the “Top 100 Employers” in Canada. This public recognition enhances EDC’s employment brand and helps attract the best people. |

| |

| | • | A review of EDC’s benefits programs was completed and a new design was proposed. |

| |

| | • | A Climate Pulse Check was administered to all EDC employees to measure progress against key areas. The results will be available in the first quarter of 2003. |

Improve productivity and service with technology.

| | • | Continue to capitalize on high growth opportunities in E-Business including more “self-service” to our short-term insurance customers. |

| |

| | • | Expand on our capabilities within our Treasury function. |

| |

| | • | Continue automation of the Medium- and Long-Term Financial Services areas. |

| |

| Results |

| |

| | • | In October, EDC launched its new Receivable Insurance Centre, where our customers can perform a variety of insurance-related functions online. |

| |

| | • | With Treasury’s enhanced pricing capabilities coupled with its aggressive investor relations initiative, EDC executed in excess of 100 transactions worldwide to fund Canadian exports. |

| |

| | • | EDC enhanced the automated authorization process for its financing products from time of enquiry to time of signing, and continued to upgrade the existing automated underwriting processes for its insurance products. |

Strategic Objectives 2003

Operate in a Socially Responsible Manner

| • | | Engage Non-governmental Organizations stakeholders on a quarterly basis on CSR issues. |

| |

| • | | Host an international workshop on “Reputation Risk Management” for members of the Berne Union. |

| |

| • | | Raise the profile of the compliance program. |

| |

| • | | Continue to actively promote the disclosure of information on projects for which EDC is considering providing support. |

| |

| • | | Continue to strengthen EDC’s environmental review procedures in preparation for a special audit of the implementation of the ERD. |

Grow EDC’s Customer Base and Enhance our Customer Service Proposition

| • | | Implement a brand positioning campaign with our new advertising agency. |

| |

| • | | Create a proactive Small Business brand image and improve prospecting and service process efficiencies. |

| |

| • | | Develop a proactive relationship management strategy for key customers. |

| |

| • | | Expand geographic representation in both domestic and international markets. |

| |

| • | | Enhance EDC’s tool kit. |

| |

| • | | Increase the number of customers served to 8,000. |

| |

| • | | Increase the number of SMEs served to 7,200. |

| |

| • | | Achieve a Customer Satisfaction Index (CSI) rating of 80.0. |

Expand our support of Canada’s trade and investments abroad.

| • | | Raise awareness of EDC’s activities and promote EDC’s interest and capabilities in developing markets in order to proactively pursue more business in these markets. |

| |

| • | | Expand the use of partnerships with both the private and public sector in order to create capacity to support more business. |

| |

| • | | Enhance risk-sharing products with financial institutions. |

| |

| • | | Support $54.5 billion or more in volume of exports and investments. |

| |

| • | | Support $11.75 billion or more business in developing markets. |

Manage in a Financially Prudent Manner

| • | | Net income of $190 million. |

| |

| • | | FSR of 13.0 per cent. |

| |

| • | | Internal Efficiency Ratio of 19.8 per cent. The IERs reported in EDC’s 2002 and 2003 Corporate Plans were 20.0% for 2002 and 17.0% for 2003. Subsequent to the publication of the 2003 Corporate Plan, the calculation basis for the IER was modified as explained on page 35 of this Annual Report. The strategic objectives have been revised to reflect the change in calculation basis. |

| |

| • | | ROE of 8.4 per cent. |

Resource to Deliver Results

| • | | Maintain voluntary turnover rate of less than 10 per cent. |

| |

| • | | Invest an average of five training days per employee. |

| |

| • | | Rank above high-quality organizations for the majority of elements measured on EDC’s employee opinion survey. |

| |

| • | | Create a compelling career choice. |

| |

| • | | Continue to develop outstanding leaders. |

Improve productivity and service with technology.

| • | | Continue to focus on E-Business: make the internet an effective information channel; enhance customer service by “webifying” all parts of our short-term insurance value chain; and sell credit and financial services online. |

13

| | | |

| EDC’s Regional Vice-President for western Canada, Lewis Megaw (left),with Robert Ohlson, President, Niko Resources Ltd. | |  |

“EDC frees up cash and working capital for Niko by providing performance guarantees to our banks. This in turn gives us the capacity to undertake more contracts, and expand our use of Canadian supplies and services.’’

| | Robert Ohlson, President,

Niko Resources Ltd.

Calgary, Alberta |

14

Capacity

For many Canadian businesses, international trade offers far greater potential to expand and succeed than focusing on the more limited domestic market. To compete in global markets, these businesses need the capacity to establish operations abroad and to enter into partnerships.

More than almost any other industrialized country in the world, Canada’s economic prosperity depends on its ability to maintain and expand its trade capacity. Canada’s economy relies heavily on international trade, with exports representing 43 per cent of Canadian GDP. About 30 cents of every dollar earned by Canadians, and one out of every five jobs, is associated with the export of goods and services.

EDC remains committed to its vision: to be the recognized leader in providing ground-breaking commercial financial solutions to companies of all sizes, helping them succeed in the global marketplace and create enduring prosperity for Canada.

To encourage more companies to compete in global markets, EDC offers a range of products and services, including trade finance and risk management solutions. Its export insurance provides protection against non-payment, and is used extensively by the small and medium-sized companies that make up 91 per cent of EDC’s customer base.

For larger, more long-term projects, foreign buyers are increasingly looking to their suppliers for alternative sources of financing. EDC’s financing solutions can give Canadian exporters a competitive edge in these situations. To provide Canadian exporters with the broadest possible access to capital, EDC works together with Canadian banks to help finance opportunities for Canadian companies in global markets.

EDC was able to provide this type of financing advantage to Niko Resources Ltd., a Calgary-based oil and gas company. Niko operates oil and gas fields located in India, and its Indian operations account for 99 per cent of the company’s total revenue. The company typically begins by drilling low-risk development wells and reworking existing wells, then expands into exploration and development operations — and all of these stages employ Canadians.

During the exploration phase, Niko requires a financial guarantee to meet its contractual obligations with the government of India. EDC provides Niko’s bank with an annual Performance Security Guarantee, rather than the bank putting a lien on the company’s own funds for security. This frees more of Niko’s cash and working capital to enable it to pursue other opportunities — a very real advantage, given its foothold in India, the world’s sixth largest energy consumer.

| | | |

| | Bridge to China

“While a revival in world markets for agriculture, telecom and transportation should help restore Canadian exports to China back to their previous levels, it will take a stronger commitment of Canadian capital and technology to enhance capacity and ensure we enjoy a sustained and expanding share of China’s import market.”

Alison Nankivell,

EDC’s Regional Director for China (Beijing, China) |

15

| | | |

| | EDC’s Regional Vice-President for Quebec, Françoise Faverjon-Fortin, with Jean-Pierre Dion, Financial and Corporate Events Manager, Cirque Éloize |

“EDC has proven to us that they are not just ‘money’ people — they are creative and they are able to provide creative solutions. This opened up new opportunities to partner with us.’’

| | Jean-Pierre Dion, Financial and Corporate Events Manager,

Cirque Éloize

Montreal, Quebec |

16

Knowledge

EDC’s sector-based approach to serving customers enables it to build in-depth knowledge of individual sectors and enhances the corporation’s ability to provide customized solutions. In some cases, sector knowledge helps EDC to identify other potential growth sectors, and to bridge gaps in the current export landscape.

In recent years, EDC has expanded its customer base and facilitated a range of non-traditional exports, such as film and television, multimedia and the performing arts. Typically, these companies come to EDC for insurance to protect them against non-payment or contract frustration, on a specific contract or transaction. EDC can also provide bonding, which protects the customer’s bank.

Initially, insurance and bonding were the types of services that EDC offered to Cirque Éloize. This circus company approached EDC to insure Excentricus, a show encompassing circus arts, theatre and music. However, working closely with Cirque Éloize gave EDC further insight into how it could customize more of its services to meet additional needs.

While it was producing its latest creation, Nomade, Cirque Éloize became the first company in the entertainment industry to take advantage of EDC’s pre-shipment financing, an EDC product designed to finance work in progress. Financing is required during the development stage of each new production to cover costs such as salaries, props, lighting, special effects, costumes, choreography, music and travel.

Through pre-shipment financing, EDC can guarantee up to 75 per cent of a loan needed to finance a product — whether its something that comes in a box or something less tangible like the productions of Cirque Éloize. EDC can also partner with other financial institutions to enhance support for an exporter. In the case of Cirque Éloize, a partnership between La Caisse d’économie Desjardins de la culture and EDC’s Small Business Financial Solutions Team, helped guarantee part of Cirque Éloize’s line of credit, so they could obtain needed working capital.

Other non-traditional export sectors offer significant growth opportunities as well. In 2002, EDC identified tourism as one such sector. In-bound tourism is valued at more than $16 billion annually, and accounts for almost 30 per cent of Canada’s total services exports. EDC is promoting its insurance services to tourism operators, as a means of facilitating in-bound tourism business to Canada. Tourism is a departure from the traditional definition of exporting, expanding it to encompass Canadian services purchased by foreign buyers — in transactions that take place on Canadian soil.

| | | |

| | Bridge to Mexico

“To develop an effective market expansion strategy, you need three key types of intelligence: market intelligence, customer intelligence and competitor intelligence. The constant turmoil of today’s markets makes accurately gathering this kind of knowledge challenging, but even more essential to understanding the forces at play.”

Marvin Hough (left), EDC’s Regional Director for Mexico

and Central America (Mexico City, Mexico)

Noé Elizondo, EDC’s Regional Manager for Monterrey (Monterrey, Mexico) |

17

| | | |

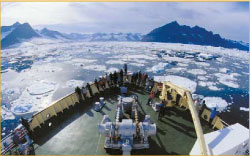

| EDC’s Regional Vice-President for Atlantic Canada, David Surrette (right), with Martin Karlsen, President and Owner, Karlsen Shipping Company Limited and Polar Star Expeditions | |  |

“Without EDC financing, this project would not have happened in Canada. The conversion of the Polar Star would have been done elsewhere, likely in Poland, and Canadian shipyard workers would not have had the job opportunities.”

| | Martin Karlsen, President and Owner,

Karlsen Shipping Company Limited and Polar Star Expeditions

Halifax, Nova Scotia |

18

Opportunity

In today’s global marketplace, export and investment opportunities are as diverse as the companies pursuing them. Increasingly, EDC has found ways to facilitate transactions that help create new and innovative possibilities for Canadian companies.

Helping Canadian companies engage in international trade extends well beyond facilitating the export of goods or services to other countries. While that is the traditional concept of trade, it represents a gradually shrinking proportion of it.

Among the many Canadian companies which have adapted and evolved accordingly are Halifax-based Karlsen Shipping Company and its spin-off, Polar Star Expeditions. Founded more than 100 years ago, Karlsen Shipping traditionally operated fishing, offshore support and other vessels. In 2001, it expanded operations to include the adventure travel industry, with the launch of Polar Star Expeditions.

Karlsen Shipping had previous experience in Arctic tour operations, having chartered a vessel to a tour operator in Spitzbergen, north of Norway. It took about five years of searching before the company found the ‘Njord’ (now called the ‘Polar Star’) to purchase and convert into a tour boat. Since its commissioning in 1969, the ship had served as an icebreaker and training ship with the Swedish Navy and Coast Guard.

In addition to shopping around for a vessel to purchase, Karlsen Shipping researched financing options and came across EDC. The corporation financed the transaction through Karlsen’s foreign affiliate, and the ship conversion was done at the Verreault Navigation shipyard of Les Mechins, Quebec. Benefits to Canada included the labour and a portion of the supplies required to modify the former icebreaker, converting it into a passenger ship with a capacity of 100. Today, the Polar Star provides expedition cruises to the Arctic, Antarctic and other destinations.

The Canadian benefits associated with the financing for conversion of the Polar Star are among the types of less traditional Canadian benefits now being taken into consideration in the evaluation of transactions. Recognizing that Canadian benefits can no longer be defined exclusively in terms of Canadian content, the economic impact of other benefits such as future trade creation, R&D investment, higher-quality jobs in Canada, sub-supply from smaller Canadian firms and the maintenance of international market share are increasingly being taken into account in EDC’s decisions.

| | | |

| | Bridge to Central and Eastern Europe

“In general, prospects for economies throughout Central and Eastern Europe have brightened considerably during the past two years. With a combined population of more than 300 million, comprised of people well aware that goods and services can make life more enjoyable, these countries are ripe with opportunity.”

Dennis Goresky,

EDC’s Regional Director for Central and Eastern Europe

(Warsaw, Poland) |

19

| | | |

| |  |

| | | EDC’s Regional Vice-President for Ontario, Ruth Fothergill,

with Douglas Langley, Vice-President, Delcan Corporation’s

Environmental Division |

“For financing, we depend on EDC to supplement our private sources of capital. In Venezuela alone, EDC has already financed a half a dozen of our projects in the environmental sector, including design/build, equipment procurement and management of municipal wastewater treatment plants.”

| | Douglas Langley, Vice-President,

Delcan Corporation’s Environmental Division

Toronto, Ontario |

20

Confidence

Business ethics have always been an important priority for EDC. The corporation has implemented a series of fundamental business practices designed to ensure that it maintains its high ethical standards. This in turn helps build confidence among Canadian exporters and investors, as well as their foreign buyers and partners.

Sustainable trade is top-of-mind in today’s global arena, brought to the forefront by the United Nations’ Kyoto Protocol and events such as the World Summit on Sustainable Development held in 2002. At EDC, the review of environmental and social impacts, and anti-corruption declarations, have become integral to its analysis of finance and insurance transactions. Last year, EDC appointed a Compliance Officer to address these issues, provide advice to EDC, and to oversee compliance audits.

EDC’s compliance program serves as a bridge between all stakeholders and certain public policy initiatives of EDC. All stakeholders, including customers, may avail themselves of EDC’s compliance program to satisfy themselves as to the integrity of EDC’s initiatives. During 2002, the inaugural year of the program, two complaints were received.

The environmental industry presents a wealth of opportunities to Canadian firms that supply innovative environmental products or services. In recognition of the growth potential within this sector, EDC launched its EnviroExport Initiative about four years ago. Today, EDC plays a key role in expanding exports of Canadian environmental goods, technologies and services for some 200 customers. Last year alone, EDC’s trade finance and risk management services facilitated about $500 million in environmental industry exports and investments.

Canadian firms are achieving recognition for their expertise in developing water and wastewater treatment technologies, handling liquid and solid wastes, and manufacturing environmental equipment. For example, Delcan Corporation — a key player in rehabilitating lakes and giving people access to potable water in many parts of Latin America — was named winner of the Industry Award for Export Performance at GLOBE 2002. Canadian expertise in environmental engineering and environmental consulting is also in high demand.

Many environmental exporters use EDC’s short-term credit insurance, which protects them against non-payment by foreign buyers, covering up to 90 per cent of the loss. However, EDC can also provide insurance of service contracts and coverage of bid and performance bonds, political risk insurance, and some types of financing.

| | | |

| | Bridge to Brazil and Southern Cone

“Shortly after Brazil’s new government assumed power last year, the country’s currency improved, as did investor confidence. With the renewed focus on fostering change in the macroeconomic condition of Brazil, a Canadian proposal that complements goods and services with partnerships, transfer of technology and investment is clearly a winning combination.”

J. Claudio Escobar,

EDC’s Regional Director for Brazil and Southern Cone Countries

(Sâo Paulo, Brazil) |

21

Milestones 2002

| | | |

| | EDC was the presenting sponsor of an exhibit of Canadian artist Tom Thomson’s work, at the National Gallery of Canada in Ottawa. We believe that support of our Canadian identity, including our cultural identity, contributes significantly to the success of Canadian exporters and investors. The exhibit drew more than 105,000 visitors, a quarter of whom were from outside of Canada. |

Community Milestones

| • | | EDC’s annual United Way/Healthpartners Campaign raised over $135,000. In addition, this year more than 60 EDC employees donated their time, participating in the Day of Caring hosted by the United Way and Volunteer Ottawa in October. |

| |

| • | | 85 per cent of EDC employees participated in the 2002 Commuter Challenge, using environmentally friendly alternatives to get to work, and earning EDC first place in our category (government company with 100-1,000 employees). This resulted in the selection of EDC’s Fitness Centre as the launch site for the City of Ottawa’s second annual Gottawalk campaign. |

| |

| • | | As part of its Education and Youth Employment strategy, EDC: |

| | • | | sponsored the Junior Team Canada program, which enabled 1,600 students to attend training centres across Canada; sent 60 delegates on Economic Missions to Mexico, China and the Philippines; and sent three delegates on the Prime Minister’s Trade Mission to Russia. |

| |

| | • | | expanded its University Partnership program from 18 to 25 partners across Canada, and offered 21 International Studies Scholarships. |

| |

| | • | | launched its Go Global: Youth Trade Challenge, an essay contest enabling Canadian youth 18-25 to share their ideas on international trade, offering a total of $11,000 in prizes. Some 350 youth took part in the discussions and essay contest and more than 6,000 visitors logged onto the web site. |

Corporate Milestones

| • | | EDC established permanent representatives in Warsaw, Poland and Monterrey, Mexico, to better serve Canadian companies and their buyers in those markets. These two new additions enhance our existing complement of representatives in Beijing (China), Sao Paulo (Brazil) and Mexico City (Mexico). |

| |

| • | | EDC appointed a fourth Regional Vice-President in Canada, this one to serve the Atlantic region. |

| |

| • | | EDC’s Compliance Officer established a compliance program for matters related to EDC’s disclosure policy, environmental review directive, and business ethics program. |

| |

| • | | EDC was ranked by Macleans’ magazine among the top 100 employers in Canada for the second year in a row, with its employee newsletter making the top 10 for a second time. |

| |

| • | | EDC implemented its revised Environmental Review Directive (ERD), establishing objective and systematic practices for conducting environmental reviews of projects being considered for financing or political risk insurance services. |

| |

| • | | EDC launched its first web-based products, EXPORT Check and EXPORT Protect. |

| |

| • | | EDC became an Executive Member of Team Canada Inc. |

| |

| • | | EDC’s 2001 Annual Report received the Auditor General of Canada’s Award for Excellence in Annual Reporting — this is the fifth time in nine years that EDC has received the award. |

22

Message to Investors

| | | |

Marie MacDougall

Vice-President and Treasurer | |  |

For more than 50 years, Export Development Canada (EDC) has facilitated steady growth in Canadian exports. Such strong performance is the result of a business strategy that seeks to balance growth in three areas — customers, capacity and people.

We continue to look for opportunities to develop new products and services to meet customer needs. Recently, EDC added internet-based services, delivery partners and knowledge products, responding to customer needs in competitive markets around the world. As a result, our customer base continues to expand.

Our financial capacity is a critical element of our growth strategy. As Canada’s export volumes continue to expand, EDC must ensure that the strength of its balance sheet keeps up with the increasing demand for its services. Shareholder’s equity has grown steadily and in 2002 reached CAD 2.1 billion. Our total assets were CAD 24.6 billion in 2002, and we continue to prudently manage portfolio risk by diversifying our exposures both geographically and across industry sectors.

The third element of our strategy is our people. We have the largest pool of trade finance talent in Canada. The bottom line is that EDC is a well established financial institution, with more than five decades of solid growth and strong financial performance.

Two years ago, EDC launched a global investor relations initiative and since that time EDC executives have met with 200 investors in Asia, Europe and Canada. Our web site contains information of interest to current and prospective investors. In 2002, EDC conducted a direct mail campaign to more than 1,000 professional bond managers to inform them of EDC’s funding activities in the domestic market. Our aim is to better understand their requirements and structure our funding program to incorporate their feedback.

EDC’s credit rating was upgraded to Aaa/AAA, contributing to increased demand for our debt securities. Our total funding programs were targeted to reach USD 8 billion in 2002. We focused our efforts on selected markets, including Canada, Asia, Europe and the United States and raised USD 7 billion. Given international demand we launched USD 1 billion of long-term debt into the global capital market.

In 2003, EDC will raise USD 5.5 billion in long-term debt and will operate a USD 2.5 billion commercial paper program, targeting Canada, the United States, Asia and Europe. We will continue with our enhanced global investor relations program in 2003, ensuring investors have access to the information they need to make informed investment decisions.

As you weigh the various investment choices for your portfolio, please consider the comparative advantages of EDC bonds. EDC is a leading provider of risk-free debt securities and provides a broad range of products through financial institutions or private placements directly with investors. EDC not only provides vital services to Canadian exporters — it makes an excellent choice for your portfolio.

Marie MacDougall

Vice-President and Treasurer

23

Investor Relations

EDC debt securities offer many comparative advantages for investors

Innovative

EDC continues to strengthen its relationships with investors around the world through direct contact and dialogue.

Relationships with the investment community are essential to EDC. Ensuring investors are well-informed of EDC’s investment products and services further strengthens those relationships. To that end, EDC executives met with over 100 investment dealers and bankers in London last year, enhancing EDC’s name recognition in a key market. Relationship building efforts continued in Toronto where EDC met with partners from financial institutions and the investment community to acknowledge their key role in the success of EDC’s borrowing program.

In September, EDC executives held inaugural meetings with institutional investors in Beijing presenting EDC’s borrowing program. In Tokyo, EDC conducted a road show with more than 50 investors and 30 representatives from Japanese security houses. To further enhance its investor relations efforts, meetings took place with regional financial institutions in the Nagoya region.

Executives also met with banks, insurance companies and fund managers from across Canada to better understand their investment needs. Feedback from these investors has been invaluable in guiding the development of a responsive borrowing strategy.

Keeping our investors informed of EDC’s role in supporting Canadian exporters and the benefits of EDC debt securities remains a key priority. Our web site provides information for current and prospective investors in multiple languages, and is located at www.edc.ca/invest. Our longstanding commitment to transparency and reporting excellence guides the development of our web site content. In 2002, EDC introduced enhanced functionality to our web site such as:

| • | | Capital Markets Activity Report — an updated list of recent trades |

| |

| • | | Credit Spread History — to demonstrate spread performance of selected issues |

| |

| • | | Bond Report — indicative rates for structured products |

In 2003, EDC will expand the web site content to include:

| • | | Call monitor — an updated list of bonds to be called |

| |

| • | | Order book distribution on recent issues |

| |

| • | | Complete list of EDC’s Treasury team members with contact information |

www.edc.ca/invest

24

Secure

Aaa/AAA Rating

The ratings for the debt of EDC reflect its status as an agent of Her Majesty in right of Canada; as such, EDC’s debt is an irrevocable full faith and credit obligation of the Canadian government.

In 2002, Moody’s Investor Service and Standard & Poor’s upgraded Canada’s ratings to Aaa/AAA. The ratings upgrades were based on:

| • | | Canada’s track record of improving public-sector finance levels; |

| |

| • | | the shift of Canada’s current account balance into a surplus allowing its net liability position to improve; and |

| |

| • | | diminishment of contentious constitutional issues. |

In conjunction with the Government of Canada upgrade, the ratings of Export Development Canada debt securities were also upgraded to Aaa/AAA.

In 2002, the Japan Credit Rating Agency conducted an assessment and re-confirmed its AAA rating of EDC’s debt securities.

| | | | | | | | | | | | | | | | | |

| | | Domestic | | Foreign Currency |

| | |

| |

|

| | | Long-term | | Short-term | | Long-term | | Short-term |

| | |

| |

| |

| |

|

| Moody’s | | Aaa | | | P1 | | | Aaa | | | P1 | |

| Standard & Poor’s | | AAA | | | A-1+ | | | AAA | | | A-1+ | |

| DBRS | | AAA | | R-1 (high) | | AA (high) | | R-1 (high) |

| JCR | | AAA | | | — | | | AAA | | | — | |

0% BIS Risk Weighted

EDC debt obligations incur favourable capital treatment as they constitute a direct claim on a central government within the OECD. This is in accordance with the International Convergence of Capital Measurement and Capital Standards set forth by the Basel Committee on Banking Regulations and Supervisory practices. As such, EDC carries a zero risk weighting for regulatory capital applications.

Experienced

EDC has been a recognized leader in the capital markets for more than three decades. In a world where the pace of change continues to accelerate, this kind of knowledge is a valuable commodity. For our investors, it is experience they value and trust.

EDC partners with financial institutions who continuously demonstrate their commitment to market making. EDC’s knowledge and experience ensures high execution standards and allows us to reach a broad range of investors. Our expectation is to receive solid primary placement with institutional and retail investors around the world.

In 2002, we developed new structures and extended terms on our debt securities to enhance our ability to do more business with investors.

Partnering with underwriters enables EDC to achieve key objectives, a broader investor base and spread performance in the secondary market.

25

Debt Products

As a frequent international issuer, EDC customizes debt offerings to respond to investors’ portfolio requirements by providing a spectrum of products in a wide variety of structures and currencies. Timing of issuance and structuring of debt products can be executed quickly to allow investors to respond to opportunities.

Debt products issued by EDC:

| | | | | | | |

| • | | Eurobonds, Global Bonds and Domestic Issues | | • | | Callable Structured Notes |

| • | | Zero Coupon | | • | | Dual Currency Issues |

| • | | Floating Rate Notes | | • | | Private Placements |

| • | | Step Up | | • | | Commercial Paper |

In 2002, EDC executed more than 100 transactions through a combination of strategic and opportunistic issues complemented by structured products.

Performance

In 2002, EDC re-entered the global bond market, executing two successful transactions in the three and five-year maturities. Investor participation and geographical distribution met our expectations.

USD 500 million 2.750% Global Bond due December 12, 2005

Export Development Canada (Aaa/AAA)

| | | | |

| Issue Details | | | |

Launch Date:

Issue Price:

Co-Lead Managers:

Syndicate Group: | | December 9, 2002

99.829

RBC Capital Markets/Salomon Smith Barney

DB/CIBC/BMO/Scotia/BNP Paribas/Mizuho/NBF/TD | |

| |

| Investor Participation | | Geographical Distribution | |

| |

| |

| |

USD 500 million 4.00% Global Bond due August 1, 2007

Export Development Canada (Aaa/AAA)

|

| Issue Details | | | |

Launch Date:

Issue Price:

Co-Lead Managers:

Syndicate Group: | | July 24, 2002

99.874

BNP Paribas/Salomon Smith Barney

CSFB/Deutsche/Dresdner/Mizuho/RBC/TD | |

| |

26

| | | | |

| Investor Participation | | Geographical Distribution | |

| |

| |

Liquidity

EDC debt securities are a component of major bond indices.

| • | | Scotia Capital Universe Index |

| |

| • | | Lehman Global Aggregate Index |

Investors who are benchmarked against these indices understand the importance of including EDC debt in their portfolios in order to match or exceed their return targets.

EDC bonds are a component of the Scotia Capital Universe Index. Major fixed-income indices are used by investors to determine asset allocation and for performance measurement. Entry into the Scotia Capital Universe Index is determined by minimum issue size of CAD 100 million, liquidity and pricing.

EDC debt obligations are also included in the Lehman Global Aggregate Index. The weight of EDC bonds is expected to increase in 2003 due to the addition of Canadian provincial, agency and investment grade corporate bonds. For inclusion in the Lehman Global Aggregate Index, Canadian bonds must have the equivalent of USD 300 million par amount outstanding and a BBB rating or higher by Moody’s Investor Service.

EDC will continue to monitor the indices which are most relevant to our investors, in order to demonstrate liquidity in capital markets.

Funding Program

The funding program supports EDC’s lending activities in order to support Canadian exporters. As EDC’s business continues to grow its funding program must keep pace.

2002 Highlights

Due to continued volatility in the capital markets, securities of high-quality borrowers were in demand in 2002. EDC creates value for global investors by managing its funding program to meet their requirements within approved asset-liability policies.

Long-term Funding Program

| • | | Aggregate volume of USD 4 billion |

| |

| • | | In excess of 100 transactions |

| |

| • | | Core markets: Asia, Canada, Europe and the United States |

| |

| • | | Maturities of one year and longer |

Short-term Funding Program

| • | | Aggregate volume of USD 3 billion |

| |

| • | | Core markets: Asia, Canada, Europe and the United States |

| |

| • | | Maturities up to 365 days |

2003 Borrowing Strategy

EDC expects to issue USD 8 billion in debt securities.

| • | | Short-term funding target of USD 2.5 billion |

| |

| • | | Long-term funding target of USD 5.5 billion |

Core markets will be targeted

| • | | Canada |

| |

| • | | United States |

| |

| • | | Europe |

| |

| • | | Asia |

27

Management Representatives

| | | |

| |  |

| Left to right: Rolfe Cooke, Eric Siegel and Ron Dahms | | Left to right: Susanne Laperle, Peter Allen and Gilles Ross. |

| | | | | | | |

Executive

Management Team

As at December 31, 2002

| | Management

Representatives

As at December 31, 2002

| | | | |

| |

A. Ian Gillespie

President and Chief

Executive Officer

Peter Allen

Senior Vice-President and

Chief Financial Officer

Rolfe Cooke

Senior Vice-President,

Short-term

Financial Services

Ron Dahms

Senior Vice-President,

Business Development

Susanne Laperle

Senior Vice-President,

Human Resources

Gilles Ross

Senior Vice-President,

Legal Services and

Secretary

Eric Siegel

Executive Vice-President,

Medium- and Long-term

Financial Services | | Rosemarie Boyle

Corporate Communications

and External Relations

Jim Brockbank

Risk Management Office

Jim Christie

National Sales

Don Curtis

Industrial Equipment

June Domokos

International Markets — Asia

Françoise Faverjon-Fortin

Quebec Region

Robert Forbes

Energy, Infrastructure

and Services

Ruth Fothergill

Ontario Region

John Gagan

Corporate Finance

and Control

Pierre Gignac

Insurance and Loan Services | | Glen Hodgson

Economics

Harry Kaunisviita

Corporate Business Systems

Louise Landry

Strategic Planning and

Corporate Performance

Derek Layne

Project Finance

Norman Low

Information Technologies

Marie MacDougall

Treasury

Jim McArdle

Legal Services

Mike McLean

International Markets —

Americas

Lewis Megaw

Western Region

Keith Milloy

Short-term Insurance | | Gilles Morin

E-Business

Suzanne Morris

SME Services

Mike Neals

Marketing

Sherry Noble

Structured Finance

Kevin O’Brien

Transportation, Equity and CIB

Brian Pearce

Internal Audit and Evaluation

Stephen Poloz

Economics

Sandy Reid

Asset Management

Ed Simac

Information Systems

Henri Souquières

International Markets

David Surrette

Atlantic Region |

28

2002 Financial Review

| | | | |

| | | Management’s Discussion and Analysis |

| 30 | | | Operating Highlights |

| 37 | | | Risk Management |

| | | | |

| 54 | | Financial Reporting Responsibility |

| | | | |

| 55 | | Auditor’s Report |

| | | | |

| | | Consolidated Financial Statements |

| 56 | | | Consolidated Balance Sheet |

| 57 | | | Consolidated Statement of Income and Retained Earnings |

| 58 | | | Consolidated Statement of Cash Flows |

| 59 | | | Notes to the Consolidated Financial Statements |

| | | | |

| 78 | | Five-Year Review |

29

Management’s Discussion and Analysis

Operating Highlights

Income Statement Discussion

Net Income

Net income reported for 2002 was $122 million, up $64 million from the 2001 level of $58 million primarily due to increased net interest income. Net interest income increased by $175 million, or 21% from the 2001 level of $814 million principally as a result of two factors. Firstly, receipt of debt relief resulted in the recognition of income associated with non-accrued capitalized interest (debt relief income) and secondly, lower funding costs were achieved in a low interest rate environment. This increased income was partially offset by increased provisions and administrative expenses. EDC’s provision for credit losses increased by a net amount of $99 million from the level of $741 million in 2001. Additional provisions required due to credit deterioration and impairment were partially offset by provisions released as a result of prepayments and debt relief. Administrative expenses were 17% higher than 2001 mainly as a result of the increased human resources, occupancy and technology costs required to manage higher business volumes.

The following table outlines net income and return on shareholder’s equity over the last five years:

| | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 |

| |

| |

| |

| |

| |

|

| Net income | | | 122 | | | | 58 | | | | 194 | | | | 118 | | | | 135 | |

| Shareholder’s equity | | | 2,077 | | | | 2,050 | | | | 1,992 | | | | 1,798 | | | | 1,680 | |

| | |

| |

| |

| |

| |

|

| Return (%) on shareholder’s equity | | | 5.9 | % | | | 2.8 | % | | | 9.7 | % | | | 6.6 | % | | | 8.0 | % |

| | |

| |

| |

| |

| |

|

Net Interest Income

The net margin of 3.86%, which represents net interest income expressed as a percentage of average performing assets employed, increased by 50 basis points from the 2001 level of 3.36%.

The following items contributed to this increase:

| | | | | |

| | | bp |

| | |

|

| Increase in debt relief income | | | 37 | |

| Increased spread due to lower debt funding costs | | | 13 | |

| Decreased interest reversals on impaired loans | | | 4 | |

| Decreased amortization of non-accrued capitalized interest | | | (3 | ) |

| Impact of decreased prepayment fees | | | (2 | ) |

| Increased gains on sale of shares/loan assets | | | 1 | |

| | | |

| |

| Net increase in net interest margin | | | 50 | bp |

| | | |

| |

Net Margin

The net interest margin increased in 2002 primarily due to increased debt relief income and reduced funding costs. Debt relief income was $96 million in 2002 compared to $1 million in 2001 and pertained to amounts received for Yugoslavia ($61 million) and Ivory Coast ($35 million). The interest rate environment in 2002 was such that it was beneficial to increase short-term funding to take advantage of the low interest rates in the short-term. This funding strategy reduced interest expense and thereby increased the spread between the yield on assets and the cost to borrow.

Decreased amortization of non-accrued capitalized interest and decreased prepayment fees reduced the margin by 5 basis points, but this was offset by the positive effect of reduced interest reversals on impaired loans and increased gains on sale of loan assets.

30

| | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 |

| |

| |

| |

| |

| |

|

| Average gross loans receivable | | | 24,790 | | | | 22,982 | | | | 19,744 | | | | 17,331 | | | | 14,286 | |

| Average investment portfolio balance | | | 2,759 | | | | 2,840 | | | | 3,215 | | | | 2,758 | | | | 1,908 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Less: average impaired loans | | | 1,914 | | | | 1,596 | | | | 1,311 | | | | 1,468 | | | | 1,861 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Total average assets employed | | | 25,635 | | | | 24,226 | | | | 21,648 | | | | 18,621 | | | | 14,333 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Interest income: | | | | | | | | | | | | | | | | | | | | |

| | Loans | | | 1,404 | | | | 1,620 | | | | 1,585 | | | | 1,256 | | | | 1,055 | |

| | Debt relief | | | 96 | | | | 1 | | | | — | | | | 2 | | | | — | |

| | Investment portfolio | | | 69 | | | | 127 | | | | 197 | | | | 146 | | | | 126 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Total interest income | | | 1,569 | | | | 1,748 | | | | 1,782 | | | | 1,404 | | | | 1,181 | |

| Interest expense | | | 580 | | | | 934 | | | | 1,066 | | | | 796 | | | | 642 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net interest income | | $ | 989 | | | $ | 814 | | | $ | 716 | | | $ | 608 | | | $ | 539 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net margin | | | 3.86 | % | | | 3.36 | % | | | 3.31 | % | | | 3.27 | % | | | 3.76 | % |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Interest Income — Loans

For 2002, loan interest income was $1,404 million, a decrease of $216 million, or 13%, from the level of $1,620 million in 2001. The performing gross loans receivable averaged $22,876 million in 2002 (2001 — $21,386 million) with an average yield of 6.56% (2001 — 7.58%). In 2002, disbursements exceeded repayments by $871 million, which, when combined with increased average foreign exchange rates, had the impact of increasing the average performing loans by $1,490 million, or 7%, over 2001.

Components of change in interest income — loans from prior year

| | | | | | |

| ($ in millions) |

| | | | | | |

| Volume increases | | | 88 | |

| Yield decreases | | | (290 | ) |

| Foreign exchange impact | | | 17 | |

| Decrease in other loan interest | | | (31 | ) |

| | | | |

| |

| Net change in interest income — loans | | $ | (216 | ) |

| | | | |

| |

| | | |

| Interest Income — Loans* | | Loan Interest Yield |

| ($ in millions) Yield (%) | | Yield (%) |

| |  |

Performing fixed rate loans receivable averaged $11,969 million in 2002 (2001 — $10,235 million) with an average coupon yield of 6.99% (2001 — 7.19%), earning interest of $837 million (2001 — $736 million). The increase in average fixed rate loans receivable was principally the result of increases in the aerospace and mining and power industry sectors. The coupon on performing fixed rate loans receivable decreased over last year. This was due to the changes in the portfolio as older loans earning higher interest rates were repaid. Meanwhile, current loan disbursements carry lower interest rates. Disbursements during the year yielded 6.38% while existing loans repaid carried a yield of 7.37%. New fixed rate loans signed in 2002 yielded 5.96% compared with 6.68% in 2001.