UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-02857 and 811-21434

Name of Fund: BlackRock Total Return Fund of BlackRock Bond Fund, Inc. and Master Total Return Portfolio of Master Bond LLC

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Total Return Fund of BlackRock Bond Fund, Inc. and Master Total Return Portfolio of Master Bond LLC, 55 East 52nd Street, New York, NY 10055

Registrants’ telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2018

Date of reporting period: 09/30/2018

Item 1 – Report to Stockholders

SEPTEMBER 30, 2018

ANNUAL REPORT |  |

BlackRock Bond Fund, Inc.

| ▶ | BlackRock Total Return Fund |

| Not FDIC Insured § May Lose Value § No Bank Guarantee |

Dear Shareholder,

In the 12 months ended September 30, 2018, the strongest corporate profits in seven years drove the equity market higher, while rising interest rates constrained bond returns. Though the market’s appetite for risk remained healthy, risk-taking was tempered somewhat, as shorter-term, higher-quality securities led the bond market, and U.S. equities outperformed most international stock markets.

Volatility in emerging market stocks rose as U.S.-China trade relations and debt concerns adversely affected the Chinese stock market, while Turkey and Argentina became embroiled in currency crises, largely due to hyperinflation in both countries. An economic slowdown in Europe led to modest performance for European equities.

Short-term U.S. Treasury interest rates rose the fastest, while longer-term rates slightly increased, leading to a negative return for long-term U.S. Treasuries and a substantial flattening of the yield curve. Many investors are concerned with the flattening yield curve as a harbinger of recession, but given the extraordinary monetary measures in the last decade, we believe a more accurate barometer for the economy is the returns along the risk spectrums in stock and bond markets. Although the fundamentals in credit markets remained relatively solid, investment-grade bonds declined slightly, and high-yield bonds posted modest returns.

In response to rising growth and inflation, the U.S. Federal Reserve (the “Fed”) increased short-term interest rates four times during the reporting period. The Fed also continued to reduce its balance sheet during the reporting period, gradually reversing the unprecedented stimulus measures it enacted after the financial crisis. Meanwhile, the European Central Bank announced that its bond-purchasing program would conclude at the end of the year, while also expressing its commitment to low interest rates. In contrast, the Bank of Japan continued to expand its balance sheet through bond purchasing while lowering its expectations for inflation.

The U.S. economy continued to gain momentum despite the Fed’s modest reduction of economic stimulus; unemployment declined to 3.7%, the lowest rate of unemployment in almost 50 years. The number of job openings reached a record high of more than 7 million, which exceeded the total number of unemployed workers. Strong economic performance has justified the Fed’s somewhat faster pace of rate hikes, as the headline inflation rate and investors’ expectations for inflation have already surpassed the Fed’s target of 2.0%.

While markets have recently focused on the risk of rising long-term interest rates, we continue to believe the primary risk to economic expansion is trade protectionism that could lead to slower global trade and unintended consequences for the globalized supply chain. So far, U.S. tariffs have only had a modest negative impact on economic growth, but the fear of an escalating trade war has stifled market optimism somewhat, leading to higher volatility in risk assets. The outcome of trade negotiations between the United States and China is likely to influence the global growth trajectory and set the tone for free trade in many other nations. Any easing of tensions could lead to greater upside for markets, while additional tariffs could adversely affect investor sentiment.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of September 30, 2018 | ||||

| 6-month | 12-month | |||

U.S. large cap equities | 11.41% | 17.91% | ||

U.S. small cap equities | 11.61 | 15.24 | ||

International equities | 0.10 | 2.74 | ||

Emerging market equities (MSCI Emerging Markets Index) | (8.97) | (0.81) | ||

3-month Treasury bills | 0.95 | 1.59 | ||

U.S. Treasury securities | (1.40) | (4.02) | ||

U.S. investment grade bonds (Bloomberg Barclays U.S. Aggregate Bond Index) | (0.14) | (1.22) | ||

Tax-exempt municipal bonds (S&P Municipal Bond Index) | 0.77 | 0.48 | ||

U.S. high yield bonds | 3.46 | 3.05 | ||

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

| 2 | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

| Page | ||||

| 2 | ||||

Annual Report: | ||||

| 4 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

Fund Financial Statements: | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 21 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

Master Portfolio Consolidated Financial Statements: | ||||

| 29 | ||||

| 104 | ||||

| 105 | ||||

| 106 | ||||

| 107 | ||||

| 108 | ||||

Master Portfolio Report of Independent Registered Public Accounting Firm | 122 | |||

Disclosure of Investment Advisory Agreements and Sub-Advisory Agreements | 123 | |||

| 127 | ||||

| 130 | ||||

| 132 | ||||

| 3 |

| Fund Summary as of September 30, 2018 | BlackRock Total Return Fund |

Investment Objective

BlackRock Total Return Fund’s (the “Fund”) investment objective is to realize a total return that exceeds that of the Bloomberg Barclays U.S. Aggregate Bond Index.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended September 30, 2018, the Fund, through its investment in Master Total Return Portfolio (the “Master Portfolio”), underperformed its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

What factors influenced performance?

During the period, the Master Portfolio’s overweight to emerging markets detracted from performance. The Master Portfolio’s stance with respect to duration (sensitivity to interest rate changes), investment-grade credit positioning and U.S. relative-value strategies also detracted.

The Master Portfolio’s allocations to non-agency mortgage-backed securities (“MBS”) and collateralized loan obligations (“CLOs”), overweight to municipal bonds, security selection within commercial mortgage-backed securities (“CMBS”), and high yield credit allocation were the principal contributors to performance.

Describe recent portfolio activity.

In late 2017, the Master Portfolio maintained an underweight to duration as accelerating global growth, the prospect of tax reform and low market volatility drove risk assets and interest rates higher. In anticipation of strengthening inflation in 2018, inflation protection was added at the front end of the yield curve. The Master Portfolio was positioned with a focus on generating income through allocations to securitized assets including MBS, CMBS and CLOs, emerging market bonds, and select investment grade and high yield corporate bonds with a focus on idiosyncratic credit stories given high valuations. The Master Portfolio ended 2017 with an overweight in emerging markets on the view that synchronized developed market growth supported the sector.

In 2018, after increasing the Master Portfolio’s duration underweight in January, the underweight was tactically narrowed, with a preference for the front end of the yield curve. A spike in market volatility on concerns surrounding inflation and trade tensions led the Master Portfolio to become more tactical within corporate credit. Risk within the sector was reduced, while the investment adviser looked for more carry-oriented opportunities in higher quality assets including shorter-term Treasuries, securitized assets and select emerging markets.

The Master Portfolio maintained its defensive posture during the summer of 2018 as rolling bouts of market volatility maintained downward pressure on riskier assets and interest rates despite elevated Treasury issuance. The Master Portfolio’s duration underweight was maintained, with a continued preference for the front end of the yield curve given an attractive risk/reward profile relative to longer-dated Treasuries. The investment adviser sought to maintain a cautious stance regarding corporate credit, preferring to diversify into sectors such as agency MBS and municipals. The Master Portfolio also continued to favor carry-oriented opportunities within high quality assets with less interest rate risk such as front-end Treasuries, commercial paper and securitized assets in view of continued geopolitical uncertainty.

The Master Portfolio held derivatives through the use of options, futures contracts, swaps and foreign currency contracts for risk management purposes as well as to manage exposures with the goal of generating alpha. The overall use of derivatives detracted from the Fund’s performance as the investment adviser sought to tactically manage the portfolio’s duration and sector exposure throughout the reporting period.

Describe portfolio positioning at period end.

Toward the end of the period, the Master Portfolio moved to an overweight duration position versus the benchmark index as rising interest rates provided an attractive entry point. In addition, the Master Portfolio’s overweight to the front end of the curve was increased with a steepening bias given an attractive risk/reward profile relative to longer-dated Treasuries. A slightly cautious stance was maintained regarding corporate credit given elevated valuations, with a neutral weight in investment grade and modestly increased high yield exposure for income. The Master Portfolio held a reduced weight in emerging markets, while balancing less liquid opportunities in securitized assets with exposure to front-end Treasuries and other shorter-dated assets.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | 2 0 1 8 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| Fund Summary (continued) | BlackRock Total Return Fund |

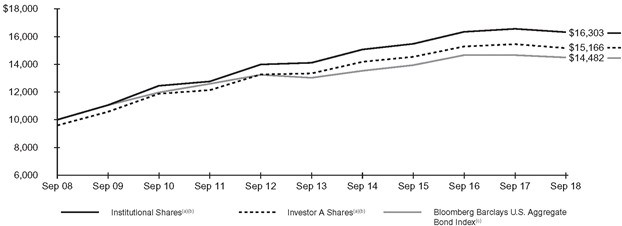

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, transaction costs and other operating expenses, including investment advisory and administration fees. Institutional Shares do not have a sales charge. |

| (b) | The Fund invests all of its assets in the Master Portfolio. The Master Portfolio typically invests more than 90% of its assets in a diversified portfolio of fixed-income securities such as corporate bonds and notes, mortgage-backed securities, asset-backed securities, convertible securities, preferred securities and government obligations. Under normal circumstances, the Master Portfolio invests at least 80% of its assets in bonds and invests primarily in investment grade fixed-income securities. |

| (c) | A widely recognized unmanaged market-weighted index, comprised of investment-grade corporate bonds rated BBB or better, mortgages and U.S. Treasury and U.S. Government agency issues with at least one year to maturity. |

Performance Summary for the Period Ended September 30, 2018

| Average Annual Total Returns(a)(b) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||||||||||||||||||

Institutional | 3.05 | % | 3.02 | % | (0.41 | )% | (1.55 | )% | N/A | 2.95 | % | N/A | 5.01 | % | N/A | |||||||||||||||||||||||||||||||||||||

Service | 2.73 | 2.72 | (0.47 | ) | (1.76 | ) | N/A | 2.67 | N/A | 4.75 | N/A | |||||||||||||||||||||||||||||||||||||||||

Investor A | 2.58 | 2.57 | (0.58 | ) | (1.88 | ) | (5.80 | )% | 2.62 | 1.78 | % | 4.68 | 4.25 | % | ||||||||||||||||||||||||||||||||||||||

Investor A1 | 2.89 | 2.84 | (0.48 | ) | (1.69 | ) | N/A | 2.81 | N/A | 4.87 | N/A | |||||||||||||||||||||||||||||||||||||||||

Investor C | 2.01 | 1.95 | (0.90 | ) | (2.53 | ) | (3.48 | ) | 1.94 | 1.94 | 4.02 | 4.02 | ||||||||||||||||||||||||||||||||||||||||

Investor C1 | 2.11 | 2.10 | (0.78 | ) | (2.36 | ) | N/A | 2.04 | N/A | 4.08 | N/A | |||||||||||||||||||||||||||||||||||||||||

Investor C2 | 2.44 | 2.18 | (0.62 | ) | (2.05 | ) | N/A | 2.36 | N/A | 4.35 | N/A | |||||||||||||||||||||||||||||||||||||||||

Class K | 3.10 | 3.10 | (0.38 | ) | (1.49 | ) | N/A | 3.02 | N/A | 5.10 | N/A | |||||||||||||||||||||||||||||||||||||||||

Class R | 2.43 | 2.35 | (0.70 | ) | (2.12 | ) | N/A | 2.35 | N/A | 4.42 | N/A | |||||||||||||||||||||||||||||||||||||||||

Bloomberg Barclays U.S. Aggregate Bond Index | — | — | (0.14 | ) | (1.22 | ) | N/A | 2.16 | N/A | 3.77 | N/A | |||||||||||||||||||||||||||||||||||||||||

| (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. |

| (b) | The Fund invests all of its assets in the Master Portfolio. The Master Portfolio typically invests more than 90% of its assets in a diversified portfolio of fixed-income securities such as corporate bonds and notes, mortgage-backed securities, asset-backed securities, convertible securities, preferred securities and government obligations. Under normal circumstances, the Master Portfolio invests at least 80% of its assets in bonds and invests primarily in investment grade fixed-income securities. |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| FUND SUMMARY | 5 |

| Disclosure of Expenses | BlackRock Total Return Fund |

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense examples shown below (which are based on a hypothetical investment of $1,000 invested on April 1, 2018 and held through September 30, 2018) are intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Expense Example

| Actual | Hypothetical(c) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Including Interest Expense and Fees | Excluding Interest Expense and Fees | Including Interest Expense and Fees | Excluding Interest Expense and Fees | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Beginning Account Value (04/01/18) | Ending Account Value (09/30/18) | Expenses Paid During the Period(a) | Expenses Paid During the Period(b) | Beginning Account Value (04/01/18) | Ending Account Value (09/30/18) | Expenses Paid During the Period(a) | Ending Account Value (09/30/18) | Expenses Paid During the Period(b) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 995.90 | $ | 2.69 | $ | 2.22 | $ | 1,000.00 | $ | 1,022.24 | $ | 2.72 | $ | 1,022.71 | $ | 2.25 | ||||||||||||||||||||||||||||||||||||||||||||

Service | 1,000.00 | 995.30 | 4.24 | 3.76 | 1,000.00 | 1,020.68 | 4.30 | 1,021.17 | 3.81 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Investor A | 1,000.00 | 994.20 | 4.40 | 3.91 | 1,000.00 | 1,020.51 | 4.46 | 1,021.01 | 3.96 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Investor A1 | 1,000.00 | 995.20 | 3.47 | 2.96 | 1,000.00 | 1,021.46 | 3.51 | 1,021.96 | 3.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Investor C | 1,000.00 | 991.00 | 7.68 | 7.17 | 1,000.00 | 1,017.21 | 7.78 | 1,017.72 | 7.27 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Investor C1 | 1,000.00 | 992.20 | 7.28 | 6.77 | 1,000.00 | 1,017.62 | 7.37 | 1,018.13 | 6.86 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Investor C2 | 1,000.00 | 993.80 | 5.63 | 5.15 | 1,000.00 | 1,019.28 | 5.70 | 1,019.76 | 5.22 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Class K | 1,000.00 | 996.20 | 2.40 | 1.93 | 1,000.00 | 1,022.53 | 2.43 | 1,023.00 | 1.95 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Class R | 1,000.00 | 993.00 | 5.64 | 5.15 | 1,000.00 | 1,019.28 | 5.71 | 1,019.77 | 5.22 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.54% for Institutional, 0.85% for Service, 0.89% for Investor A, 0.70% for Investor A1, 1.55% for Investor C, 1.47% for Investor C1, 1.13% for Investor C2, 0.48% for Class K and 1.13% for Class R), multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period shown). |

| (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.45% for Institutional, 0.76% for Service, 0.79% for Investor A, 0.60% for Investor A1, 1.45% for Investor C, 1.36% for Investor C1, 1.04% for Investor C2, 0.39% for Class K and 1.04% for Class R), multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period shown). |

| (c) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| 6 | 2 0 1 8 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| The Benefits and Risks of Leveraging | BlackRock Total Return Fund |

The Master Portfolio may utilize leverage to seek to enhance returns and net asset value (“NAV”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

The Master Portfolio may utilize leverage through a credit facility. In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by the Master Portfolio on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of the Master Portfolio (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Master Portfolio’s investors benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to the Master Portfolio’s investors, and the value of these portfolio holdings is reflected in the Master Portfolio’s NAV. However, in order to benefit investors, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed the Master Portfolio’s return on assets purchased with leverage proceeds, income to investors is lower than if the Master Portfolio had not used leverage.

Furthermore, the value of the Master Portfolio’s investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence the Master Portfolio’s NAV positively or negatively in addition to the impact on the Master Portfolio’s performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that the Master Portfolio’s leveraging strategy will be successful.

The use of leverage also generally causes greater changes in the Master Portfolio’s NAV and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV of the Master Portfolio’s shares than if the Master Portfolio were not leveraged. In addition, the Master Portfolio may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of the leverage instruments, which may cause the Master Portfolio to incur losses. The use of leverage may limit the Master Portfolio’s ability to invest in certain types of securities or use certain types of hedging strategies. The Master Portfolio incurs expenses in connection with the use of leverage, all of which are borne by the Master Portfolio’s investors and may reduce income.

Derivative Financial Instruments

The Master Portfolio may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Master Portfolio’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Master Portfolio can realize on an investment and/or may result in lower distributions paid to shareholders. The Master Portfolio’s investments in these instruments, if any, are discussed in detail in the Master Portfolio’s Notes to Consolidated Financial Statements.

| THE BENEFITS AND RISKS OF LEVERAGING / DERIVATIVE FINANCIAL INSTRUMENTS | 7 |

| About Fund Performance | BlackRock Total Return Fund |

Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors.

Service Shares are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are available only to certain eligible investors.

Investor A Shares are subject to a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. On December 27, 2017, the Fund’s issued and outstanding Investor B Shares were converted into Investor A Shares with the same relative aggregate NAV.

Investor A1 Shares are subject to a maximum initial sales charge (front-end load) of 1.00% and a service fee of 0.10% per year (but no distribution fee). The maximum initial sales charge does not apply to current eligible shareholders of Investor A1 Shares of the Fund. Certain redemptions of these shares may be subject to a CDSC where no initial sales charge was paid at time of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans or to redemptions of shares acquired through reinvestment of dividends and capital gains by existing shareholders.

Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. Effective November 8, 2018, the Fund will adopt an automatic conversion feature whereby Investor C Shares will be automatically converted into Investor A Shares after a conversion period of approximately ten years, and, thereafter, investors will be subject to lower ongoing fees.

Investor C1 Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans or to redemptions of shares acquired through reinvestment of dividends and capital gains by existing shareholders. In addition, these shares are subject to a distribution fee of 0.55% per year and a service fee of 0.25% per year. Effective November 8, 2018, the Fund will adopt an automatic conversion feature whereby Investor C1 Shares will be automatically converted into Investor A Shares after a conversion period of approximately ten years, and, thereafter, investors will be subject to lower ongoing fees.

Investor C2 Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans or to redemptions of shares acquired through reinvestment of dividends and capital gains by existing shareholders. In addition, these shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. Effective November 8, 2018, the Fund will adopt an automatic conversion feature whereby Investor C2 Shares will be automatically converted into Investor A Shares after a conversion period of approximately ten years, and, thereafter, investors will be subject to lower ongoing fees.

Class R Shares are not subject to any sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans.

Investor A1, Investor C1 and Investor C2 Shares are only available for dividend and capital gain reinvestment by existing shareholders, and for purchase by certain employer-sponsored retirement plans.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous page assume reinvestment of all distributions, if any, at NAV on the ex-dividend/payable date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Fund’s investment adviser, has contractually agreed to waive and/or reimburse a portion of the Fund’s expenses. Without such waiver and/or reimbursement, the Fund’s performance would have been lower. The Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See Note 4 of the Notes to Financial Statements for additional information on waivers and/or reimbursements. The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements.

| 8 | 2 0 1 8 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Statement of Assets and Liabilities

September 30, 2018

| BlackRock Total Return Fund | ||||

ASSETS | ||||

Investments at value — Master Portfolio | $ | 12,420,121,249 | ||

Receivables: | ||||

Capital shares sold | 34,822,135 | |||

From the Manager | 165,838 | |||

Withdrawals from the Master Portfolio | 14,782,189 | |||

Prepaid expenses | 330,345 | |||

|

| |||

Total assets | 12,470,221,756 | |||

|

| |||

LIABILITIES | ||||

Payables: | ||||

Board realignment and consolidation | 348,273 | |||

Capital shares redeemed | 49,604,324 | |||

Income dividend distributions | 6,712,839 | |||

Investment advisory fees | 2,965,969 | |||

Officer’s fees | 2,012 | |||

Other accrued expenses | 745,378 | |||

Other affiliates | 357,049 | |||

Service and distribution fees | 650,065 | |||

Transfer agent fees | 2,163,377 | |||

|

| |||

Total liabilities | 63,549,286 | |||

|

| |||

NET ASSETS | $ | 12,406,672,470 | ||

|

| |||

NET ASSETS CONSIST OF | ||||

Paid-in capital | $ | 12,973,685,574 | ||

Distributions in excess of net investment income | (8,290,155 | ) | ||

Accumulated net realized loss allocated from the Master Portfolio | (304,139,400 | ) | ||

Net unrealized appreciation (depreciation) allocated from the Master Portfolio | (254,583,549 | ) | ||

|

| |||

NET ASSETS | $ | 12,406,672,470 | ||

|

| |||

NET ASSET VALUE | ||||

Institutional — Based on net assets of $5,402,121,418 and 481,715,117 shares outstanding, 1 billion shares authorized, $0.10 par value | $ | 11.21 | ||

|

| |||

Service — Based on net assets of $117,278,264 and 10,455,965 shares outstanding, 50 million shares authorized, $0.10 par value | $ | 11.22 | ||

|

| |||

Investor A — Based on net assets of $1,729,459,400 and 154,156,282 shares outstanding, 450 million shares authorized, $0.10 par value | $ | 11.22 | ||

|

| |||

Investor A1 — Based on net assets of $28,071,943 and 2,504,072 shares outstanding, 50 million shares authorized, $0.10 par value | $ | 11.21 | ||

|

| |||

Investor C — Based on net assets of $235,681,945 and 21,023,985 shares outstanding, 100 million shares authorized, $0.10 par value | $ | 11.21 | ||

|

| |||

Investor C1 — Based on net assets of $10,788,744 and 961,967 shares outstanding, 100 million shares authorized, $0.10 par value | $ | 11.22 | ||

|

| |||

Investor C2 — Based on net assets of $1,021,452 and 91,135 shares outstanding, 50 million shares authorized, $0.10 par value | $ | 11.21 | ||

|

| |||

Class K — Based on net assets of $4,726,240,194 and 421,505,586 shares outstanding, 1 billion shares authorized, $0.10 par value | $ | 11.21 | ||

|

| |||

Class R — Based on net assets of $156,009,110 and 13,904,591 shares outstanding, 250 million shares authorized, $0.10 par value | $ | 11.22 | ||

|

| |||

See notes to financial statements.

| FUND FINANCIAL STATEMENTS | 9 |

Year Ended September 30, 2018

| BlackRock Total Return Fund | ||||

INVESTMENT INCOME | ||||

Net investment income allocated from the Master Portfolio: | ||||

Interest — unaffiliated | $ | 473,294,537 | ||

Dividends — affiliated | 7,593,060 | |||

Dividends — unaffiliated | 2,153,627 | |||

Securities lending income — affiliated — net | 775,780 | |||

Foreign taxes withheld | (230,653 | ) | ||

Total expenses excluding interest expense | (8,927,356 | ) | ||

Interest expense | (32,197,504 | ) | ||

Fees waived | 126,057 | |||

|

| |||

Total investment income | 442,587,548 | |||

|

| |||

FUND EXPENSES | ||||

Investment advisory | 35,046,579 | |||

Transfer agent — class specific | 9,867,400 | |||

Service and distribution — class specific | 8,857,413 | |||

Registration | 1,089,166 | |||

Board realignment and consolidation | 348,273 | |||

Professional | 174,024 | |||

Printing | 64,866 | |||

Officer | 9,210 | |||

Accounting services | 1,939 | |||

Miscellaneous | 5,189 | |||

|

| |||

Total expenses | 55,464,059 | |||

Less: | ||||

Fees waived by the Manager | (3,398 | ) | ||

Transfer agent fees waived and/or reimbursed — class specific | (2,517,115 | ) | ||

|

| |||

Total expenses after fees waived and/or reimbursed | 52,943,546 | |||

|

| |||

Net investment income | 389,644,002 | |||

|

| |||

REALIZED AND UNREALIZED GAIN (LOSS) ALLOCATED FROM THE MASTER PORTFOLIO | ||||

Net realized loss from investments, borrowed bonds, foreign currency transactions, forward foreign currency exchange contracts, futures contracts, options written, payments by affiliate and swaps | (202,759,976 | ) | ||

Net change in unrealized appreciation (depreciation) on investments, borrowed bonds, foreign currency translations, forward foreign currency exchange contracts, futures contracts, options written, short sales and swaps | (375,574,324 | ) | ||

|

| |||

Net realized and unrealized loss | (578,334,300 | ) | ||

|

| |||

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (188,690,298 | ) | |

|

| |||

See notes to financial statements.

| 10 | 2 0 1 8 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Statements of Changes in Net Assets

| BlackRock Total Return Fund | ||||||||

| Year Ended September 30, | ||||||||

| 2018 | 2017 | |||||||

INCREASE (DECREASE) IN NET ASSETS | ||||||||

OPERATIONS | ||||||||

Net investment income | $ | 389,644,002 | $ | 272,202,897 | ||||

Net realized loss | (202,759,976 | ) | (76,361,557 | ) | ||||

Net change in unrealized appreciation (depreciation) | (375,574,324 | ) | (31,191,786 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in net assets resulting from operations | (188,690,298 | ) | 164,649,554 | |||||

|

|

|

| |||||

DISTRIBUTIONS TO SHAREHOLDERS(a) | ||||||||

From net investment income: | ||||||||

Institutional | (171,990,481 | ) | (111,606,780 | ) | ||||

Service | (3,638,411 | ) | (3,080,098 | ) | ||||

Investor A | (57,025,339 | ) | (54,286,738 | ) | ||||

Investor A1 | (983,351 | ) | (929,500 | ) | ||||

Investor B | (8,143 | ) | (41,724 | ) | ||||

Investor C | (6,532,847 | ) | (8,547,231 | ) | ||||

Investor C1 | (306,956 | ) | (945,729 | ) | ||||

Investor C2 | (29,093 | ) | (66,506 | ) | ||||

Class K | (145,324,812 | ) | (100,328,440 | ) | ||||

Class R | (4,454,410 | ) | (3,202,667 | ) | ||||

|

|

|

| |||||

Decrease in net assets resulting from distributions to shareholders | (390,293,843 | ) | (283,035,413 | ) | ||||

|

|

|

| |||||

CAPITAL SHARE TRANSACTIONS | ||||||||

Net increase in net assets derived from capital share transactions | 1,903,361,114 | 2,443,130,115 | ||||||

|

|

|

| |||||

NET ASSETS | ||||||||

Total increase in net assets | 1,324,376,973 | 2,324,744,256 | ||||||

Beginning of year | 11,082,295,497 | 8,757,551,241 | ||||||

|

|

|

| |||||

End of year | $ | 12,406,672,470 | $ | 11,082,295,497 | ||||

|

|

|

| |||||

Distributions in excess of net investment income, end of period | $ | (8,290,155 | ) | $ | (4,825,343 | ) | ||

|

|

|

| |||||

| (a) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

See notes to financial statements.

| FUND FINANCIAL STATEMENTS | 11 |

(For a share outstanding throughout each period)

| BlackRock Total Return Fund | ||||||||||||||||||||||||

| Institutional | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.77 | $ | 11.96 | $ | 11.71 | $ | 11.76 | $ | 11.43 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(a) | 0.38 | 0.34 | 0.31 | 0.32 | 0.42 | |||||||||||||||||||

Net realized and unrealized gain | (0.56 | ) | (0.18 | ) | 0.32 | 0.01 | 0.34 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net increase (decrease) from investment operations | (0.18 | ) | 0.16 | 0.63 | 0.33 | 0.76 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Distributions from net investment income(b) | (0.38 | ) | (0.35 | ) | (0.38 | ) | (0.38 | ) | (0.43 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net asset value, end of year | $ | 11.21 | $ | 11.77 | $ | 11.96 | $ | 11.71 | $ | 11.76 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Return(c) | ||||||||||||||||||||||||

Based on net asset value | (1.55 | )%(d) | 1.43 | % | 5.47 | % | 2.77 | % | 6.72 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ratios to Average Net Assets(e)(f) | ||||||||||||||||||||||||

Total expenses(g) | 0.75 | % | 0.74 | % | 0.61 | % | 0.56 | % | 0.77 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed(g) | 0.71 | % | 0.69 | % | 0.58 | % | 0.50 | % | 0.67 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed excluding interest expense(g) | 0.45 | % | 0.45 | % | 0.45 | % | 0.45 | % | 0.53 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(g) | 3.31 | % | 2.93 | % | 2.63 | % | 2.72 | % | 3.62 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Supplemental Data | ||||||||||||||||||||||||

Net assets, end of year (000) | $ | 5,402,121 | $ | 4,621,641 | $ | 3,126,440 | $ | 1,547,791 | $ | 859,415 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Portfolio turnover rate of the Master Portfolio(h) | 734 | % | 806 | % | 841 | % | 1,015 | % | 750 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, assumes the reinvestment of distributions. |

| (d) | Includes a payment received from an affiliate, which had no impact on the Fund’s total return. |

| (e) | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. |

| (f) | Includes the Fund’s share of the Master Portfolio’s allocated expenses and/or net investment income. |

| (g) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Investments in underlying funds | 0.01 | % | 0.01 | % | 0.01 | % | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

| (h) | Includes mortgage dollar roll transactions. Additional information regarding portfolio turnover rate is as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Portfolio turnover rate (excluding mortgage dollar roll transactions) | 350 | % | 540 | % | 598 | % | 725 | % | 529 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

See notes to financial statements.

| 12 | 2 0 1 8 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||||

| Service | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.77 | $ | 11.96 | $ | 11.71 | $ | 11.76 | $ | 11.43 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(a) | 0.34 | 0.31 | 0.28 | 0.29 | 0.39 | |||||||||||||||||||

Net realized and unrealized gain | (0.54 | ) | (0.18 | ) | 0.31 | 0.01 | 0.34 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net increase (decrease) from investment operations | (0.20 | ) | 0.13 | 0.59 | 0.30 | 0.73 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Distributions from net investment income(b) | (0.35 | ) | (0.32 | ) | (0.34 | ) | (0.35 | ) | (0.40 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net asset value, end of year | $ | 11.22 | $ | 11.77 | $ | 11.96 | $ | 11.71 | $ | 11.76 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Return(c) | ||||||||||||||||||||||||

Based on net asset value | (1.76 | )%(d) | 1.13 | % | 5.15 | % | 2.55 | % | 6.48 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ratios to Average Net Assets(e)(f) | ||||||||||||||||||||||||

Total expenses(g) | 1.03 | % | 1.02 | % | 0.93 | % | 0.80 | % | 1.07 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed(g) | 1.03 | % | 1.00 | % | 0.88 | % | 0.74 | % | 0.89 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed excluding interest expense(g) | 0.75 | % | 0.75 | % | 0.75 | % | 0.67 | % | 0.76 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(g) | 3.01 | % | 2.62 | % | 2.35 | % | 2.46 | % | 3.37 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Supplemental Data | ||||||||||||||||||||||||

Net assets, end of year (000) | $ | 117,278 | $ | 125,903 | $ | 74,723 | $ | 45,616 | $ | 720 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Portfolio turnover rate of the Master Portfolio(h) | 734 | % | 806 | % | 841 | % | 1,015 | % | 750 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, assumes the reinvestment of distributions. |

| (d) | Includes a payment received from an affiliate, which had no impact on the Fund’s total return. |

| (e) | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. |

| (f) | Includes the Fund’s share of the Master Portfolio’s allocated expenses and/or net investment income. |

| (g) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Investments in underlying funds | 0.01 | % | 0.01 | % | 0.01 | % | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

| (h) | Includes mortgage dollar roll transactions. Additional information regarding portfolio turnover rate is as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Portfolio turnover rate (excluding mortgage dollar roll transactions) | 350 | % | 540 | % | 598 | % | 725 | % | 529 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

See notes to financial statements.

| FUND FINANCIAL HIGHLIGHTS | 13 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||||

| Investor A | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.78 | $ | 11.96 | $ | 11.71 | $ | 11.76 | $ | 11.43 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(a) | 0.34 | 0.30 | 0.28 | 0.28 | 0.39 | |||||||||||||||||||

Net realized and unrealized gain | (0.56 | ) | (0.16 | ) | 0.31 | 0.01 | 0.33 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net increase (decrease) from investment operations | (0.22 | ) | 0.14 | 0.59 | 0.29 | 0.72 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Distributions from net investment income(b) | (0.34 | ) | (0.32 | ) | (0.34 | ) | (0.34 | ) | (0.39 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net asset value, end of year | $ | 11.22 | $ | 11.78 | $ | 11.96 | $ | 11.71 | $ | 11.76 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Return(c) | ||||||||||||||||||||||||

Based on net asset value | (1.88 | )%(d) | 1.18 | % | 5.12 | % | 2.44 | % | 6.42 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ratios to Average Net Assets(e)(f) | ||||||||||||||||||||||||

Total expenses(g) | 1.08 | % | 1.04 | % | 0.91 | % | 0.87 | % | 1.05 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed(g) | 1.07 | % | 1.03 | % | 0.91 | % | 0.84 | % | 0.95 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed excluding interest expense(g) | 0.79 | % | 0.79 | % | 0.78 | % | 0.78 | % | 0.82 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(g) | 2.97 | % | 2.58 | % | 2.34 | % | 2.40 | % | 3.33 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Supplemental Data | ||||||||||||||||||||||||

Net assets, end of year (000) | $ | 1,729,459 | $ | 2,033,975 | $ | 2,087,043 | $ | 2,267,386 | $ | 1,084,239 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Portfolio turnover rate of the Master Portfolio(h) | 734 | % | 806 | % | 841 | % | 1,015 | % | 750 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| (d) | Includes a payment received from an affiliate, which had no impact on the Fund’s total return. |

| (e) | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. |

| (f) | Includes the Fund’s share of the Master Portfolio’s allocated expenses and/or net investment income. |

| (g) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Investments in underlying funds | 0.01 | % | 0.01 | % | 0.01 | % | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

| (h) | Includes mortgage dollar roll transactions. Additional information regarding portfolio turnover rate is as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Portfolio turnover rate (excluding mortgage dollar roll transactions) | 350 | % | 540 | % | 598 | % | 725 | % | 529 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

See notes to financial statements.

| 14 | 2 0 1 8 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||||

| Investor A1 | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.77 | $ | 11.95 | $ | 11.70 | $ | 11.75 | $ | 11.42 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(a) | 0.36 | 0.32 | 0.30 | 0.31 | 0.41 | |||||||||||||||||||

Net realized and unrealized gain (loss) | (0.56 | ) | (0.16 | ) | 0.31 | 0.00 | (b) | 0.34 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net increase (decrease) from investment operations | (0.20 | ) | 0.16 | 0.61 | 0.31 | 0.75 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Distributions from net investment income(c) | (0.36 | ) | (0.34 | ) | (0.36 | ) | (0.36 | ) | (0.42 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net asset value, end of year | $ | 11.21 | $ | 11.77 | $ | 11.95 | $ | 11.70 | $ | 11.75 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Return(d) | ||||||||||||||||||||||||

Based on net asset value | (1.69 | )%(e) | 1.37 | % | 5.32 | % | 2.63 | % | 6.63 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ratios to Average Net Assets(f)(g) | ||||||||||||||||||||||||

Total expenses(h) | 0.92 | % | 0.86 | % | 0.74 | % | 0.67 | % | 0.86 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed(h) | 0.88 | % | 0.84 | % | 0.72 | % | 0.64 | % | 0.76 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed excluding interest expense(h) | 0.60 | % | 0.60 | % | 0.60 | % | 0.60 | % | 0.62 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(h) | 3.17 | % | 2.77 | % | 2.54 | % | 2.59 | % | 3.53 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Supplemental Data | ||||||||||||||||||||||||

Net assets, end of year (000) | $ | 28,072 | $ | 31,705 | $ | 34,722 | $ | 38,412 | $ | 40,402 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Portfolio turnover rate of the Master Portfolio(i) | 734 | % | 806 | % | 841 | % | 1,015 | % | 750 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Amount is less than $0.005 per share. |

| (c) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (d) | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| (e) | Includes a payment received from an affiliate, which had no impact on the Fund’s total return. |

| (f) | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. |

| (g) | Includes the Fund’s share of the Master Portfolio’s allocated expenses and/or net investment income. |

| (h) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Investments in underlying funds | 0.01 | % | 0.01 | % | 0.01 | % | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

| (i) | Includes mortgage dollar roll transactions. Additional information regarding portfolio turnover rate is as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Portfolio turnover rate (excluding mortgage dollar roll transactions) | 350 | % | 540 | % | 598 | % | 725 | % | 529 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

See notes to financial statements.

| FUND FINANCIAL HIGHLIGHTS | 15 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||||

| Investor C | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.77 | $ | 11.95 | $ | 11.70 | $ | 11.75 | $ | 11.42 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(a) | 0.27 | 0.22 | 0.20 | 0.20 | 0.31 | |||||||||||||||||||

Net realized and unrealized gain | (0.56 | ) | (0.16 | ) | 0.31 | 0.01 | 0.34 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net increase from investment operations | (0.29 | ) | 0.06 | 0.51 | 0.21 | 0.65 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Distributions from net investment income(b) | (0.27 | ) | (0.24 | ) | (0.26 | ) | (0.26 | ) | (0.32 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net asset value, end of year | $ | 11.21 | $ | 11.77 | $ | 11.95 | $ | 11.70 | $ | 11.75 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Return(c) | ||||||||||||||||||||||||

Based on net asset value | (2.53 | )%(d) | 0.52 | % | 4.42 | % | 1.76 | % | 5.75 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ratios to Average Net Assets(e)(f) | ||||||||||||||||||||||||

Total expenses(g) | 1.82 | % | 1.76 | % | 1.66 | % | 1.60 | % | 1.80 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed(g) | 1.74 | % | 1.68 | % | 1.58 | % | 1.50 | % | 1.58 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed excluding interest expense(g) | 1.45 | % | 1.45 | % | 1.45 | % | 1.45 | % | 1.45 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(g) | 2.32 | % | 1.90 | % | 1.67 | % | 1.73 | % | 2.70 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Supplemental Data | ||||||||||||||||||||||||

Net assets, end of year (000) | $ | 235,682 | $ | 339,329 | $ | 498,254 | $ | 421,097 | $ | 316,553 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Portfolio turnover rate of the Master Portfolio(h) | 734 | % | 806 | % | 841 | % | 1,015 | % | 750 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| (d) | Includes a payment received from an affiliate, which had no impact on the Fund’s total return. |

| (e) | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. |

| (f) | Includes the Fund’s share of the Master Portfolio’s allocated expenses and/or net investment income. |

| (g) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Investments in underlying funds | 0.01 | % | 0.01 | % | 0.01 | % | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

| (h) | Includes mortgage dollar roll transactions. Additional information regarding portfolio turnover rate is as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Portfolio turnover rate (excluding mortgage dollar roll transactions) | 350 | % | 540 | % | 598 | % | 725 | % | 529 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

See notes to financial statements.

| 16 | 2 0 1 8 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||||

| Investor C1 | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.77 | $ | 11.96 | $ | 11.71 | $ | 11.76 | $ | 11.43 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(a) | 0.28 | 0.23 | 0.21 | 0.22 | 0.32 | |||||||||||||||||||

Net realized and unrealized gain (loss) | (0.55 | ) | (0.17 | ) | 0.31 | 0.00 | (b) | 0.34 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net increase (decrease) from investment operations | (0.27 | ) | 0.06 | 0.52 | 0.22 | 0.66 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Distributions from net investment income(c) | (0.28 | ) | (0.25 | ) | (0.27 | ) | (0.27 | ) | (0.33 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net asset value, end of year | $ | 11.22 | $ | 11.77 | $ | 11.96 | $ | 11.71 | $ | 11.76 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Return(d) | ||||||||||||||||||||||||

Based on net asset value | (2.36 | )%(e) | 0.52 | % | 4.52 | % | 1.85 | % | 5.82 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ratios to Average Net Assets(f)(g) | ||||||||||||||||||||||||

Total expenses(h) | 1.69 | % | 1.58 | % | 1.49 | % | 1.44 | % | 1.63 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed(h) | 1.66 | % | 1.57 | % | 1.48 | % | 1.41 | % | 1.53 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed excluding interest expense(h) | 1.36 | % | 1.37 | % | 1.36 | % | 1.37 | % | 1.39 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(h) | 2.40 | % | 1.93 | % | 1.79 | % | 1.83 | % | 2.76 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Supplemental Data | ||||||||||||||||||||||||

Net assets, end of year (000) | $ | 10,789 | $ | 15,744 | $ | 69,583 | $ | 88,551 | $ | 105,604 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Portfolio turnover rate of the Master Portfolio(i) | 734 | % | 806 | % | 841 | % | 1,015 | % | 750 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Amount is less than $0.005 per share. |

| (c) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (d) | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| (e) | Includes a payment received from an affiliate, which had no impact on the Fund’s total return. |

| (f) | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. |

| (g) | Includes the Fund’s share of the Master Portfolio’s allocated expenses and/or net investment income. |

| (h) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Investments in underlying funds | 0.01 | % | 0.01 | % | 0.01 | % | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

| (i) | Includes mortgage dollar roll transactions. Additional information regarding portfolio turnover rate is as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Portfolio turnover rate (excluding mortgage dollar roll transactions) | 350 | % | 540 | % | 598 | % | 725 | % | 529 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

See notes to financial statements.

| FUND FINANCIAL HIGHLIGHTS | 17 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||||

| Investor C2 | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.76 | $ | 11.95 | $ | 11.70 | $ | 11.75 | $ | 11.42 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(a) | 0.31 | 0.26 | 0.25 | 0.25 | 0.35 | |||||||||||||||||||

Net realized and unrealized gain | (0.55 | ) | (0.16 | ) | 0.31 | 0.01 | 0.34 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net increase (decrease) from investment operations | (0.24 | ) | 0.10 | 0.56 | 0.26 | 0.69 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Distributions from net investment income(b) | (0.31 | ) | (0.29 | ) | (0.31 | ) | (0.31 | ) | (0.36 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net asset value, end of year | $ | 11.21 | $ | 11.76 | $ | 11.95 | $ | 11.70 | $ | 11.75 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Return(c) | ||||||||||||||||||||||||

Based on net asset value | (2.05 | )%(d) | 0.84 | % | 4.86 | % | 2.17 | % | 6.09 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ratios to Average Net Assets(e)(f) | ||||||||||||||||||||||||

Total expenses(g) | 1.52 | % | 1.30 | % | 1.20 | % | 1.16 | % | 1.37 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed(g) | 1.32 | % | 1.25 | % | 1.16 | % | 1.09 | % | 1.27 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed excluding interest expense(g) | 1.04 | % | 1.04 | % | 1.04 | % | 1.05 | % | 1.13 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(g) | 2.72 | % | 2.27 | % | 2.11 | % | 2.15 | % | 3.01 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Supplemental Data | ||||||||||||||||||||||||

Net assets, end of year (000) | $ | 1,021 | $ | 1,259 | $ | 3,878 | $ | 4,729 | $ | 5,530 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Portfolio turnover rate of the Master Portfolio(h) | 734 | % | 806 | % | 841 | % | 1,015 | % | 750 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, excludes the effects of any sales charges and assumes the reinvestment of distributions. |

| (d) | Includes a payment received from an affiliate, which had no impact on the Fund’s total return. |

| (e) | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%. |

| (f) | Includes the Fund’s share of the Master Portfolio’s allocated expenses and/or net investment income. |

| (g) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Investments in underlying funds | 0.01 | % | 0.01 | % | 0.01 | % | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

| (h) | Includes mortgage dollar roll transactions. Additional information regarding portfolio turnover rate is as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Portfolio turnover rate (excluding mortgage dollar roll transactions) | 350 | % | 540 | % | 598 | % | 725 | % | 529 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

See notes to financial statements.

| 18 | 2 0 1 8 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||||

| Class K | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.77 | $ | 11.95 | $ | 11.71 | $ | 11.76 | $ | 11.43 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(a) | 0.39 | 0.35 | 0.32 | 0.33 | 0.44 | |||||||||||||||||||

Net realized and unrealized gain (loss) | (0.56 | ) | (0.17 | ) | 0.30 | 0.00 | (b) | 0.33 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net increase (decrease) from investment operations | (0.17 | ) | 0.18 | 0.62 | 0.33 | 0.77 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Distributions from net investment income(c) | (0.39 | ) | (0.36 | ) | (0.38 | ) | (0.38 | ) | (0.44 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net asset value, end of year | $ | 11.21 | $ | 11.77 | $ | 11.95 | $ | 11.71 | $ | 11.76 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Return(d) | ||||||||||||||||||||||||

Based on net asset value | (1.49 | )%(e) | 1.59 | % | 5.44 | % | 2.84 | % | 6.86 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ratios to Average Net Assets(f)(g) | ||||||||||||||||||||||||

Total expenses(h) | 0.64 | % | 0.64 | % | 0.52 | % | 0.46 | % | 0.64 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed(h) | 0.64 | % | 0.63 | % | 0.52 | % | 0.44 | % | 0.54 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses after fees waived and/or reimbursed excluding interest expense(h) | 0.38 | % | 0.39 | % | 0.39 | % | 0.39 | % | 0.40 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net investment income(h) | 3.36 | % | 3.00 | % | 2.73 | % | 2.76 | % | 3.75 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Supplemental Data | ||||||||||||||||||||||||

Net assets, end of year (000) | $ | 4,726,240 | $ | 3,751,146 | $ | 2,770,095 | $ | 2,500,152 | $ | 521,495 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Portfolio turnover rate of the Master Portfolio(i) | 734 | % | 806 | % | 841 | % | 1,015 | % | 750 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Amount is less than $0.005 per share. |

| (c) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (d) | Where applicable, assumes the reinvestment of distributions. |

(e) Includes a payment received from an affiliate, which had no impact on the Fund’s total return.

(f) Includes the Fund’s share of the Master Portfolio’s allocated fees waived of less than 0.01%.

| (g) | Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. |

| (h) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Investments in underlying funds | 0.01 | % | 0.01 | % | 0.01 | % | — | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

| (i) | Includes mortgage dollar roll transactions. Additional information regarding portfolio turnover rate is as follows: |

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||||

Portfolio turnover rate (excluding mortgage dollar roll transactions) | 350 | % | 540 | % | 598 | % | 725 | % | 529 | % | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

See notes to financial statements.

| FUND FINANCIAL HIGHLIGHTS | 19 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Total Return Fund (continued) | ||||||||||||||||||||||||

| Class R | ||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||

Net asset value, beginning of year | $ | 11.78 | $ | 11.96 | $ | 11.71 | $ | 11.76 | $ | 11.43 | ||||||||||||||