TABLEOF CONTENTS

An investor should consider each Fund’s investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information about each Fund can be found in the Funds’ prospectus. To obtain a prospectus, call toll-free 877-757-7424. Please read the prospectus carefully before investing.

| | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

i

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

We are pleased to present the enclosed annual report for Regions Morgan Keegan Select Mid Cap Growth Fund, Regions Morgan Keegan Select Growth Fund, Regions Morgan Keegan Select Core Equity Fund, Regions Morgan Keegan Select Mid Cap Value Fund, Regions Morgan Keegan Select Value Fund, Regions Morgan Keegan Select Balanced Fund, Regions Morgan Keegan Select Fixed Income Fund, Regions Morgan Keegan Select Limited Maturity Fixed Income Fund, Regions Morgan Keegan Select Intermediate Tax Exempt Bond Fund, Regions Morgan Keegan Select Treasury Money Market Fund and Regions Morgan Keegan Select Money Market Fund (each a “Fund” and, collectively, the “Funds”). In this report, you will find information on each Fund’s investment objective and strategy and learn how your investment performed during the fiscal year ended November 30, 2008. The portfolio managers will also provide an overview of the market conditions and discuss some of the factors that affected investment performance during the reporting period. In addition, this report includes each Fund’s audited financial statements and portfolio of investments as of November 30, 2008.

As I write, the markets continue to operate under substantial stresses. Although, the worst appears to have passed, the current situation is far from normal. World economic worries compound our own domestic economic issues. Market places for stocks, bonds and other financial instruments continue to operate, but only marginally. Investors and lenders continue to be skeptical and unwilling to venture far from “home”. World governments are loosening credit and supporting institutions in an effort to avoid further declines. As managers of your Funds, our duty is to appraise the economic and market environment and do our best to select prudent and valuable investments. We continue in the belief that capitalism is still an outstanding economic system; that economic downturns are followed by recoveries; and that severely shaken financial markets will once again find their footings and operate normally. With these thoughts, we strive to provide you with worthwhile results.

As always, we appreciate your continued support of the Regions Morgan Keegan Select family of funds. It is important to stay focused on your long-term investment strategy. Your financial adviser can help you evaluate your portfolio’s performance to ensure that your diversified mix of investments is designed to help generate the long-term performance your goals demand. We remain committed to helping you pursue your financial goals through investments in our fund family. You have our commitment to bring you the highest level of disciplined decision-making and personal service to meet your financial needs. If you have any questions about the Funds, please call us toll-free at 877-757-7424.

Sincerely,

Brian B. Sullivan, CFA

President

Regions Morgan Keegan Select Funds

January 26, 2009

1

ABOUT SHAREHOLDERAND FUND EXPENSES (UNAUDITED)

All mutual funds have operating expenses and it is important for our shareholders to understand the impact of expenses on their investments. As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and on redemptions; and (2) operating costs, including management fees; to the extent applicable, distribution (12b-1) fees and/or shareholder services fees; and other Fund expenses. Operating costs, which are deducted from a Fund’s gross income, reduce the investment return of the Fund.

A Fund’s operating expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following example is intended to help you to understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning June 1, 2008 and ending November 30, 2008.

The following table illustrates your Fund’s costs in two ways:

Based on actual fund return. This section helps you estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading entitled “Expenses Paid During Period.”

Based on hypothetical 5% return. This section is intended to help you compare your Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on the 5% return. You can assess your Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any sales charges (loads) on purchases or on redemptions which may be incurred by some of the Fund’s share classes. Therefore, the hypothetical account values and expenses in the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different Funds. In addition, if these sales charges (loads) were included, your overall costs would have been higher.

You can find more information about a Fund’s expenses, including annual expense ratios for the past five years, in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the Funds’ prospectus.

2

ABOUT SHAREHOLDERAND FUND EXPENSES (UNAUDITED)

| | | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account Value

June 1, 2008 | | Ending

Account Value

November 30,

2008 | | Expenses

Paid During

Period(1) |

| | | | | |

| MID CAP GROWTH FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.29 | % | | $ | 1,000 | | $ | 557.20 | | $ | 5.02 |

Class C Shares | | 2.04 | % | | | 1,000 | | | 554.90 | | | 7.93 |

Class I Shares | | 1.04 | % | | | 1,000 | | | 557.80 | | | 4.05 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.29 | % | | $ | 1,000 | | $ | 1,018.55 | | $ | 6.51 |

Class C Shares | | 2.04 | % | | | 1,000 | | | 1,014.80 | | | 10.28 |

Class I Shares | | 1.04 | % | | | 1,000 | | | 1,019.80 | | | 5.25 |

| | | | | |

| GROWTH FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.30 | % | | $ | 1,000 | | $ | 648.30 | | $ | 5.36 |

Class C Shares | | 2.05 | % | | | 1,000 | | | 645.70 | | | 8.43 |

Class I Shares | | 1.05 | % | | | 1,000 | | | 648.90 | | | 4.33 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.30 | % | | $ | 1,000 | | $ | 1,018.50 | | $ | 6.56 |

Class C Shares | | 2.05 | % | | | 1,000 | | | 1,014.75 | | | 10.33 |

Class I Shares | | 1.05 | % | | | 1,000 | | | 1,019.75 | | | 5.30 |

| | | | | |

| CORE EQUITY FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.86 | % | | $ | 1,000 | | $ | 611.40 | | $ | 7.49 |

Class C Shares | | 2.61 | % | | | 1,000 | | | 611.20 | | | 10.51 |

Class I Shares | | 1.61 | % | | | 1,000 | | | 612.10 | | | 6.49 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.86 | % | | $ | 1,000 | | $ | 1,015.70 | | $ | 9.37 |

Class C Shares | | 2.61 | % | | | 1,000 | | | 1,011.95 | | | 13.13 |

Class I Shares | | 1.61 | % | | | 1,000 | | | 1,016.95 | | | 8.12 |

| | | | | |

| MID CAP VALUE FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.53 | % | | $ | 1,000 | | $ | 643.10 | | $ | 6.28 |

Class C Shares | | 2.28 | % | | | 1,000 | | | 640.80 | | | 9.35 |

Class I Shares | | 1.28 | % | | | 1,000 | | | 643.80 | | | 5.26 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.53 | % | | $ | 1,000 | | $ | 1,017.35 | | $ | 7.72 |

Class C Shares | | 2.28 | % | | | 1,000 | | | 1,013.60 | | | 11.48 |

Class I Shares | | 1.28 | % | | | 1,000 | | | 1,018.60 | | | 6.46 |

(1) | | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

3

ABOUT SHAREHOLDERAND FUND EXPENSES (UNAUDITED)

| | | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account Value

June 1, 2008 | | Ending

Account Value

November 30,

2008 | | Expenses

Paid During

Period(1) |

| | | | | |

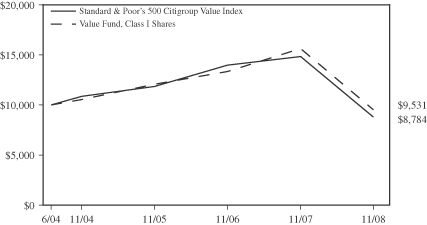

| VALUE FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.31 | % | | $ | 1,000 | | $ | 636.50 | | $ | 5.36 |

Class C Shares | | 2.06 | % | | | 1,000 | | | 634.10 | | | 8.42 |

Class I Shares | | 1.06 | % | | | 1,000 | | | 637.30 | | | 4.34 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.31 | % | | $ | 1,000 | | $ | 1,018.45 | | $ | 6.61 |

Class C Shares | | 2.06 | % | | | 1,000 | | | 1,014.70 | | | 10.38 |

Class I Shares | | 1.06 | % | | | 1,000 | | | 1,019.70 | | | 5.35 |

| | | | | |

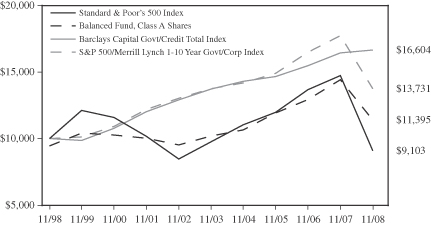

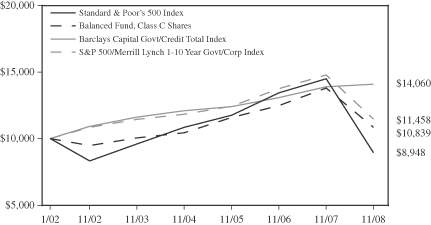

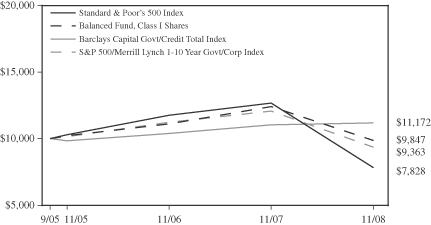

| BALANCED FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.41 | % | | $ | 1,000 | | $ | 780.80 | | $ | 6.28 |

Class C Shares | | 2.16 | % | | | 1,000 | | | 778.30 | | | 9.60 |

Class I Shares | | 1.16 | % | | | 1,000 | | | 781.80 | | | 5.17 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.41 | % | | $ | 1,000 | | $ | 1,017.95 | | $ | 7.11 |

Class C Shares | | 2.16 | % | | | 1,000 | | | 1,014.20 | | | 10.88 |

Class I Shares | | 1.16 | % | | | 1,000 | | | 1,019.20 | | | 5.86 |

| | | | | |

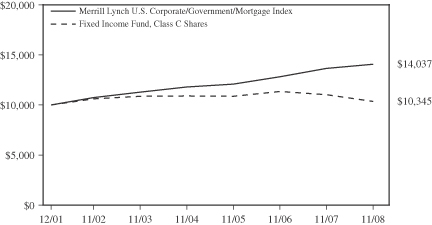

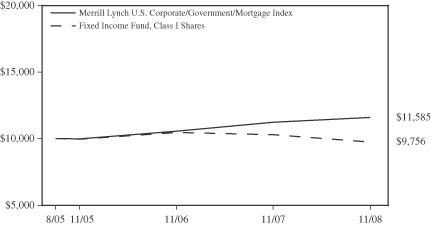

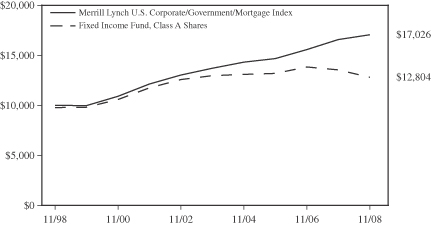

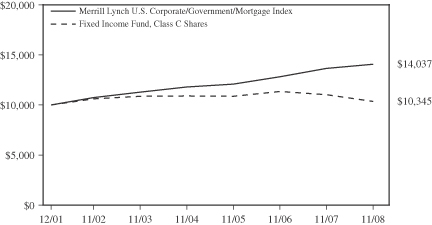

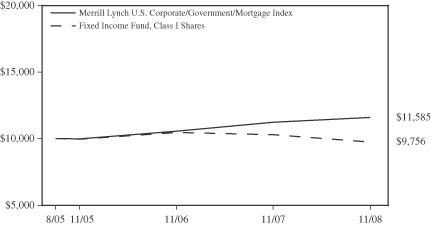

| FIXED INCOME FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.03 | % | | $ | 1,000 | | $ | 943.40 | | $ | 5.00 |

Class C Shares | | 1.78 | % | | | 1,000 | | | 939.90 | | | 8.63 |

Class I Shares | | 0.78 | % | | | 1,000 | | | 944.60 | | | 3.79 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.03 | % | | $ | 1,000 | | $ | 1,019.85 | | $ | 5.20 |

Class C Shares | | 1.78 | % | | | 1,000 | | | 1,016.10 | | | 8.97 |

Class I Shares | | 0.78 | % | | | 1,000 | | | 1,021.10 | | | 3.94 |

| | | | |

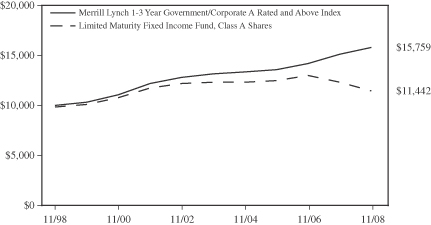

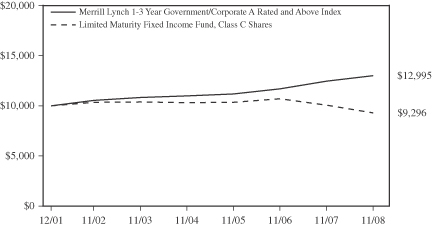

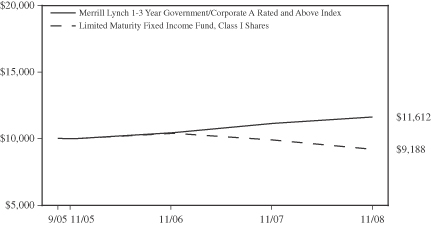

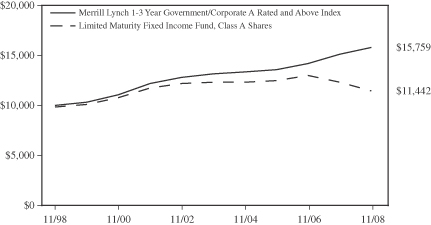

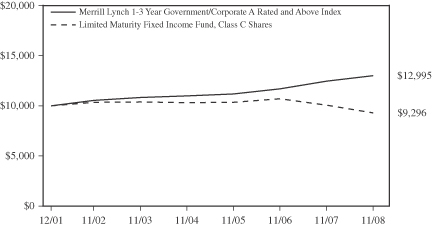

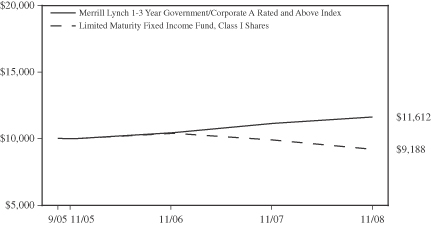

| LIMITED MATURITY FIXED INCOME FUND | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.00 | % | | $ | 1,000 | | $ | 968.50 | | $ | 4.92 |

Class C Shares | | 1.75 | % | | | 1,000 | | | 964.90 | | | 8.60 |

Class I Shares | | 0.75 | % | | | 1,000 | | | 969.10 | | | 3.69 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.00 | % | | $ | 1,000 | | $ | 1,020.00 | | $ | 5.05 |

Class C Shares | | 1.75 | % | | | 1,000 | | | 1,016.25 | | | 8.82 |

Class I Shares | | 0.75 | % | | | 1,000 | | | 1,021.25 | | | 3.79 |

(1) | | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

4

ABOUT SHAREHOLDERAND FUND EXPENSES (UNAUDITED)

| | | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account Value

June 1, 2008 | | Ending

Account Value

November 30,

2008 | | Expenses

Paid During

Period(1) |

| | | | |

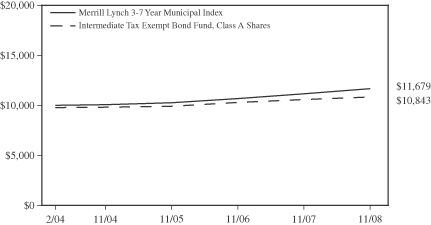

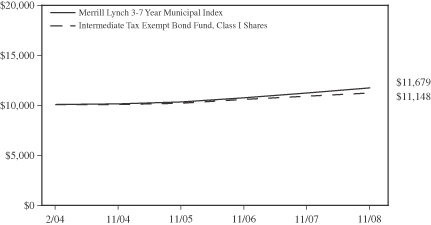

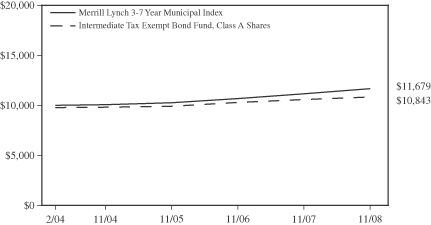

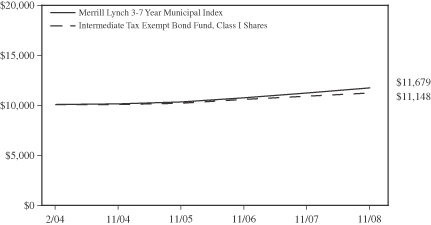

| INTERMEDIATE TAX EXEMPT BOND FUND | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 1.00 | % | | $ | 1,000 | | $ | 1,005.90 | | $ | 5.01 |

Class C Shares | | 1.75 | % | | | 1,000 | | | 1,002.20 | | | 8.76 |

Class I Shares | | 0.75 | % | | | 1,000 | | | 1,008.20 | | | 3.77 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 1.00 | % | | $ | 1,000 | | $ | 1,020.00 | | $ | 5.05 |

Class C Shares | | 1.75 | % | | | 1,000 | | | 1,016.25 | | | 8.82 |

Class I Shares | | 0.75 | % | | | 1,000 | | | 1,021.25 | | | 3.79 |

| | | | | |

| TREASURY MONEY MARKET FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 0.65 | % | | $ | 1,000 | | $ | 1,004.00 | | $ | 3.26 |

Class I Shares | | 0.40 | % | | | 1,000 | | | 1,005.30 | | | 2.01 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 0.65 | % | | $ | 1,000 | | $ | 1,021.75 | | $ | 3.29 |

Class I Shares | | 0.40 | % | | | 1,000 | | | 1,023.00 | | | 2.02 |

| | | | | |

| MONEY MARKET FUND | | | | | | | | | | | | |

| Actual | | | | | | | | | | | | |

Class A Shares | | 0.72 | % | | $ | 1,000 | | $ | 1,008.10 | | $ | 3.61 |

Class I Shares | | 0.47 | % | | | 1,000 | | | 1,009.40 | | | 2.36 |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | |

Class A Shares | | 0.72 | % | | $ | 1,000 | | $ | 1,021.40 | | $ | 3.64 |

Class I Shares | | 0.47 | % | | | 1,000 | | | 1,022.65 | | | 2.38 |

(1) | | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

5

REGIONS MORGAN KEEGAN SELECT MID CAP GROWTH FUND

OBJECTIVE & STRATEGY

Regions Morgan Keegan Select Mid Cap Growth Fund seeks long-term capital appreciation. The Fund invests primarily in equity securities of mid-capitalization companies (i.e., companies whose market capitalization falls within the range tracked by the Russell Mid Cap Growth Index at the time of purchase).

INVESTMENT RISKS: Equity securities (stocks) can be more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. Mid-capitalization and growth stocks typically carry additional risk, since smaller companies generally have higher risk of failure and growth stocks generally have been more susceptible to market, economic and individual company developments and, in each case historically, these stocks have experienced a greater degree of volatility. The net asset value per share of the Fund will fluctuate as the value of the securities in the portfolio changes.

MANAGEMENT DISCUSSIONOF FUND PERFORMANCE

What started out as a modest gain during the first half of the Fund’s fiscal year turned into an absolute rout in the second half of the fiscal year ended November 30, 2008. In our years of investment management experience, we have never seen stocks cascade down in price as they have over the last few months. The last few months will certainly be remembered well into the future.

For the fiscal year ended November 30, 2008, Regions Morgan Keegan Select Mid Cap Growth Fund’s Class A Shares had a total return of –41.79%, based on net asset value. The Russell Mid Cap Growth Index(1), the Fund’s benchmark, had a total return of –46.15% and the Lipper Mid Cap Growth Index(2) showed an average return of –45.29% during the same period. While the numbers were certainly not what we had envisioned at the beginning of the year, the Fund was able to outperform its index and peer group.

In what started as a long row of dominos falling over, the year began with poor performance from high-yield/structured debt funds, then on to bank stocks collapsing, a frozen financial system, and now potential major industrial problems (e.g., GM, Ford and Chrysler). We all are looking for what’s next, but perhaps all the dominos (or enough of them) have fallen over. The stock market has certainly declined enough to discount any (or most) unforeseen events.

While there were no sectors that provided positive returns, the Energy, Industrial and Consumer Discretionary sectors declined less than the market. Information Technology, Materials, and Financials were the weaker performing sectors. Individual stocks that added to performance were: Dollar Tree Stores, +47%; Southwestern Energy, +38%; Church & Dwight, +6%; and Ross Stores, +1%. While we try to avoid large price declines in stocks we hold, it was almost impossible to avoid large percentage losses in the Fund due to the overall decline of the market. The weaker performing holdings in the Fund were: Sirius XM Radio, –95%; Boyd Gaming, –88%; Health Net, –81%; CB Richard Ellis –81%; and Coventry Health, –78%.

There are any number of variables that could happen to the economy, but positive actions by the Federal Reserve and Treasury Department should lessen the economic pain and lead to eventual recovery of the economy. Unfortunately, there are no guarantees as it’s been over seventy years since the economy has suffered such financial shocks as we have over the last year.

| | |

| |  |

Charles A. Murray, CFA Senior Portfolio Manager Morgan Asset Management, Inc. | | David P. McGrath, CFA Senior Portfolio Manager Morgan Asset Management, Inc. |

(Unaudited)

6

REGIONS MORGAN KEEGAN SELECT MID CAP GROWTH FUND

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objectives. These views are subject to change at any time based upon market or other conditions, and Morgan Asset Management, Inc. disclaims any responsibility to update such views. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and, therefore, the value of the Fund’s shares may be less than what you paid for them. Accordingly, you can lose money investing in the Fund.

TOP TEN EQUITY HOLDINGS†

AS OF NOVEMBER 30, 2008

| | | | | | | | | | | | | | |

| TICKER | | DESCRIPTION | | % OF TOTAL NET ASSETS | | TICKER | | DESCRIPTION | | % OF TOTAL NET ASSETS |

SWN | | Southwestern Energy Company | | 5.4% | | DNB | | The Dun & Bradstreet Corporation | | 2.2% |

MDY | | Midcap Standard & Poors Trust Series 1 | | 4.3% | | NEM | | Newmont Mining Corporation | | 2.2% |

NBL | | Noble Energy, Inc. | | 3.6% | | HRS | | Harris Corporation | | 1.9% |

ABX | | Barrick Gold Corporation | | 3.3% | | SUN | | Sunoco, Inc. | | 1.8% |

JEC | | Jacobs Engineering Group Inc. | | 2.5% | | NRG | | NRG Energy, Inc. | | 1.7% |

| † | | The Fund’s composition is subject to change. |

EQUITY SECTOR DIVERSIFICATION†

AS OF NOVEMBER 30, 2008

| | | | | | |

% OF TOTAL INVESTMENTS

EXCLUDINGCOLLATERALFORSECURITIESLENDING | | % OF TOTAL INVESTMENTS

EXCLUDINGCOLLATERALFORSECURITIESLENDING |

Consumer Products | | 28.6% | | Technology | | 7.0% |

Energy | | 25.8% | | Financials | | 4.8% |

Industrials | | 8.8% | | Communications | | 4.7% |

Exchange Traded Funds | | 8.0% | | Utilities | | 2.3% |

Basic Materials | | 8.2% | | Short Term Investments | | 1.8% |

| | | | | | |

|

| | | | | Total | | 100.0% |

| † | | The Fund’s composition is subject to change. |

INDEX DESCRIPTIONS

(1) | | The Russell Mid Cap Growth Index tracks equity securities of medium-sized companies whose market capitalization falls within the $17 million to $15.4 billion range. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. |

(2) | | The Lipper Mid Cap Growth Index is the average return of the 30 largest mid-cap growth funds. Funds in the index are rebalanced quarterly. It is not possible to invest directly in an index. |

(Unaudited)

7

REGIONS MORGAN KEEGAN SELECT MID CAP GROWTH FUND

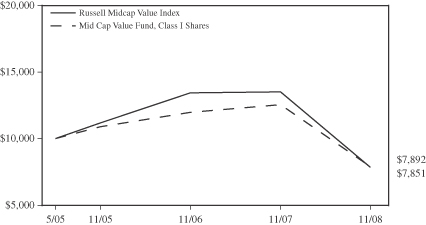

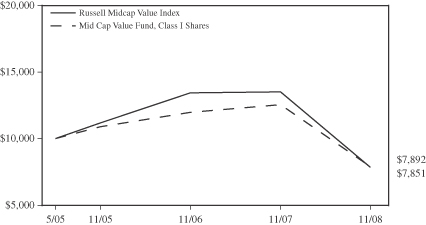

GROWTHOFA $10,000 INVESTMENT

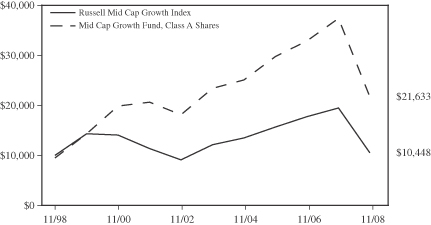

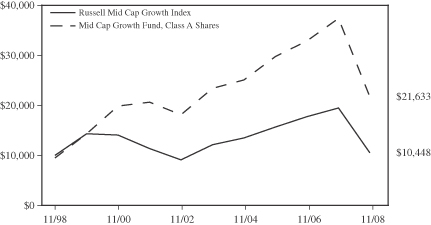

CLASS A SHARES

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Mid Cap Growth Fund—Class A Shares(1) from Novemeber 30, 1998 to November 30, 2008 compared to the Russell Mid Cap Growth Index(2).

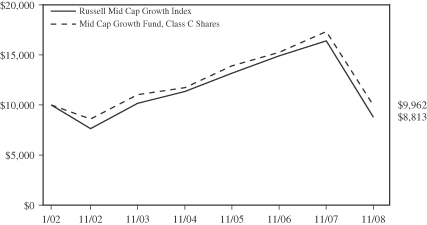

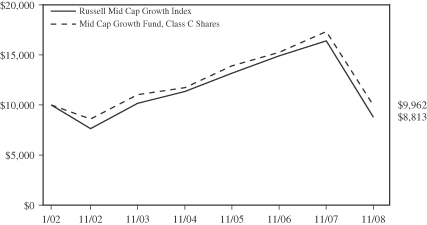

GROWTHOFA $10,000 INVESTMENT

CLASS C SHARES

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Mid Cap Growth Fund—Class C Shares from the commencement of investment operations on January 7, 2002 to November 30, 2008 compared to the Russell Mid Cap Growth Index (2).

(Unaudited)

8

REGIONS MORGAN KEEGAN SELECT MID CAP GROWTH FUND

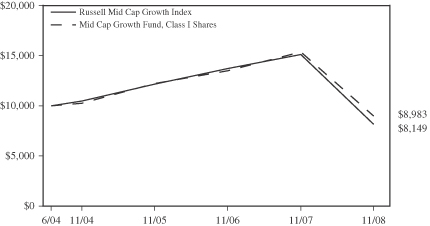

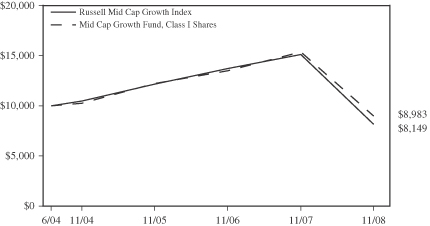

GROWTHOFA $10,000 INVESTMENT

CLASS I SHARES

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Mid Cap Growth Fund—Class I Shares from the commencement of investment operations on June 23, 2004 to November 30, 2008 compared to the Russell Mid Cap Growth Index (2).

PERFORMANCE INFORMATION

| | | | | | | | | | | | | | | |

| | | AVERAGE ANNUAL TOTAL RETURNS | |

| AS OF NOVEMBER 30, 2008 | | SIX

MONTHS* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | | | COMMENCEMENT

OF INVESTMENT

OPERATIONS(3) | |

| CLASS A SHARES**(1) | | -47.34 | % | | -44.99 | % | | -2.58 | % | | 8.02 | % | | 9.61 | % |

(EXCLUDINGSALESLOAD)(1) | | -44.28 | % | | -41.79 | % | | -1.47 | % | | 8.63 | % | | 10.01 | % |

| CLASS C SHARES*** | | -45.06 | % | | -42.95 | % | | -2.01 | % | | N/A | | | -0.06 | % |

(EXCLUDINGCDSC) | | -44.51 | % | | -42.37 | % | | -2.01 | % | | N/A | | | -0.06 | % |

| CLASS I SHARES | | -44.22 | % | | -41.62 | % | | N/A | | | N/A | | | -2.39 | % |

| RUSSELL MID CAP GROWTH INDEX(2) | | -46.59 | % | | -46.15 | % | | -2.83 | % | | 0.44 | % | | — | |

| * | | Not annualized for periods less than one year. |

| ** | | Reflects the maximum sales load of 5.50%. |

| *** | | Reflects the maximum contingent deferred sales charge (CDSC) of 1.00% for shares redeemed within one year of purchase. |

(1) | | Effective June 4, 2004, all Class B Shares of the Fund converted to Class A Shares. Historical total return information for any period or portion thereof prior to the commencement of investment operations of Class A Shares on May 20, 1998 is that of Class B Shares and reflects all charges, expenses and fees incurred by Class B Shares, which were generally higher than the expenses of Class A Shares, during such periods. |

(2) | | The Russell Mid Cap Growth Index tracks equity securities of medium-sized companies whose market capitalization falls within the $17 million to $15.4 billion range. Total returns for the index shown are not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. |

(3) | | The Fund’s Class A Shares (including predecessor Class B Shares), Class C Shares and Class I Shares commenced investment operations on June 30, 1993, January 7, 2002 and June 23, 2004, respectively. |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent performance, call toll-free 877-757-7424. The Fund’s performance results are shown on a total return basis and include the reinvestment of all dividends and capital gain distributions in the Fund. Returns shown in the chart and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not bank deposits or obligations, are not guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. Investment in mutual funds involves investment risk, including possible loss of principal.

(Unaudited)

9

REGIONS MORGAN KEEGAN SELECT MID CAP GROWTH FUND

PORTFOLIOOF INVESTMENTS

NOVEMBER 30, 2008

| | | | | | | |

| Shares | | | | | | Value |

| Common Stocks–89.9% | | | |

| | | |

| | | | | Basic Materials–8.2% | | | |

| | | | | Iron/ Steel–2.5% | | | |

| 140,000 | | | | Carpenter Technology Corporation | | $ | 2,332,400 |

| 160,000 | | | | Steel Dynamics, Inc. | | | 1,321,600 |

| 60,000 | | | | United States Steel Corporation | | | 1,824,000 |

| | | | | | |

|

|

| | | | | Total | | | 5,478,000 |

| | | | | | |

|

|

| | | | | Mining–5.7% | | | |

| 15,000 | | (2) | | Agnico-Eagle Mines Limited | | | 564,900 |

| 240,000 | | | | Barrick Gold Corporation | | | 7,070,400 |

| 140,000 | | | | Newmont Mining Corporation | | | 4,711,000 |

| | | | | | |

|

|

| | | | | Total | | | 12,346,300 |

| | | | | | |

|

|

| | | | | Total Basic Materials | | | 17,824,300 |

| | | | | | |

|

|

| | | |

| | | | | Communications–4.7% | | | |

| | | | | Media–1.9% | | | |

| 120,000 | | (1) | | DISH Network Corporation | | | 1,329,600 |

| 80,000 | | | | John Wiley & Sons, Inc. | | | 2,876,800 |

| | | | | | |

|

|

| | | | | Total | | | 4,206,400 |

| | | | | | |

|

|

| | | | | Radio–0.1% | | | |

| 700,000 | | (1)(2) | | SIRIUS XM Radio Inc. | | | 142,100 |

| | | | | Telecommunications–2.7% | | | |

| 140,000 | | (1)(2) | | Ciena Corporation | | | 1,036,000 |

| 50,000 | | (1) | | CommScope, Inc. | | | 564,500 |

| 120,000 | | | | Harris Corporation | | | 4,185,600 |

| | | | | | |

|

|

| | | | | Total | | | 5,786,100 |

| | | | | | |

|

|

| | | | | Total Communications | | | 10,134,600 |

| | | | | | |

|

|

| | | |

| | | | | Consumer Products–28.5% | | | |

| | | | | Agriculture–1.6% | | | |

| 80,000 | | (2) | | Bunge Limited | | | 3,396,800 |

| | | | | Airlines–1.1% | | | |

| 200,000 | | (1)(2) | | AirTran Holdings, Inc. | | | 682,000 |

| 200,000 | | (1)(2) | | AMR Corporation | | | 1,756,000 |

| | | | | | |

|

|

| | | | | Total | | | 2,438,000 |

| | | | | | |

|

|

| | | | | Apparel–1.3% | | | |

| 120,000 | | (1) | | Coach, Inc. | | | 2,148,000 |

| 70,000 | | (1)(2) | | The Timberland Company | | | 710,500 |

| | | | | | |

|

|

| | | | | Total | | | 2,858,500 |

| | | | | | |

|

|

| | | | | Beverages–1.0% | | | |

| 120,000 | | | | The Pepsi Bottling Group, Inc. | | | 2,170,800 |

| | | | | Biotechnology–2.7% | | | |

| 40,000 | | (1) | | Celgene Corporation | | | 2,084,000 |

| 150,000 | | (1)(2) | | Vertex Pharmaceuticals Incorporated | | | 3,688,500 |

| | | | | | |

|

|

| | | | | Total | | | 5,772,500 |

| | | | | | |

|

|

| | | | | Commercial Services–1.0% | | | |

| 50,000 | | | | Lender Processing Services, Inc. | | | 1,103,000 |

| 90,000 | | (1)(2) | | Monster Worldwide, Inc. | | | 1,032,300 |

| | | | | | |

|

|

| | | | | Total | | | 2,135,300 |

| | | | | | |

|

|

| | | | | Cosmetics/Personal Care–0.7% | | | |

| 70,000 | | | | Avon Products, Inc. | | | 1,477,000 |

| | | | | Distribution/Wholesale–1.4% | | | |

| 80,000 | | (2) | | Fastenal Company | | | 3,080,800 |

| | | | | | | |

| Shares | | | | | | Value |

| Common Stocks (continued) | | | |

| | | | | Healthcare Products–3.2% | | | |

| 60,000 | | (2) | | DENTSPLY International, Inc. | | $ | 1,564,800 |

| 50,000 | | (1) | | Henry Schein, Inc. | | | 1,786,500 |

| 140,000 | | (1)(2) | | Hologic, Inc. | | | 1,968,400 |

| 60,000 | | (1) | | St. Jude Medical, Inc. | | | 1,681,800 |

| | | | | | |

|

|

| | | | | Total | | | 7,001,500 |

| | | | | | |

|

|

| | | | | Healthcare Services–1.1% | | | |

| 50,000 | | (1) | | Coventry Health Care, Inc. | | | 623,500 |

| 60,000 | | (1) | | Pediatrix Medical Group, Inc. | | | 1,867,200 |

| | | | | | |

|

|

| | | | | Total | | | 2,490,700 |

| | | | | | |

|

|

| | | | | Home Furnishings–0.4% | | | |

| 50,000 | | | | Harman International Industries, Incorporated | | | 752,500 |

| | | | | Household Products–2.2% | | | |

| 40,000 | | | | Church & Dwight Co., Inc. | | | 2,377,600 |

| 200,000 | | (1)(2) | | Jarden Corporation | | | 2,496,000 |

| | | | | | |

|

|

| | | | | Total | | | 4,873,600 |

| | | | | | |

|

|

| | | | | Lodging–0.2% | | | |

| 100,000 | | (2) | | Boyd Gaming Corporation | | | 440,000 |

| | | | | Pharmaceuticals–2.4% | | | |

| 50,000 | | | | Allergan, Inc. | | | 1,884,000 |

| 40,000 | | (1) | | Express Scripts, Inc. | | | 2,300,400 |

| 50,000 | | (1)(2) | | VCA Anatech, Inc. | | | 952,500 |

| | | | | | |

|

|

| | | | | Total | | | 5,136,900 |

| | | | | | |

|

|

| | | | | Retail–8.2% | | | |

| 70,000 | | | | Advance Auto Parts, Inc. | | | 2,125,200 |

| 130,000 | | (2) | | American Eagle Outfitters, Inc. | | | 1,248,000 |

| 100,000 | | | | Brinker International, Inc. | | | 664,000 |

| 180,000 | | (2) | | CBRL Group, Inc. | | | 3,479,400 |

| 300,000 | | (1)(2) | | Chico’s FAS, Inc. | | | 765,000 |

| 56,000 | | (1) | | Dollar Tree Stores, Inc. | | | 2,368,240 |

| 140,000 | | | | Guess?, Inc. | | | 1,852,200 |

| 120,000 | | | | Ross Stores, Inc. | | | 3,180,000 |

| 80,000 | | (1)(2) | | Urban Outfitters, Inc. | | | 1,453,600 |

| 100,000 | | (2) | | Williams-Sonoma, Inc. | | | 701,000 |

| | | | | | |

|

|

| | | | | Total | | | 17,836,640 |

| | | | | | |

|

|

| | | | | Total Consumer Products | | | 61,861,540 |

| | | | | | |

|

|

| | | |

| | | | | Energy–25.7% | | | |

| | | | | Coal–3.2% | | | |

| 230,000 | | | | Arch Coal, Inc. | | | 3,537,400 |

| 150,000 | | (2) | | Peabody Energy Corporation | | | 3,514,500 |

| | | | | | |

|

|

| | | | | Total | | | 7,051,900 |

| | | | | | |

|

|

| | | | | Energy Alternate Sources–0.1% | | | |

| 1,000 | | (1) | | First Solar, Inc. | | | 124,840 |

| | | | | Oil & Gas–13.9% | | | |

| 80,000 | | (1) | | Cameron International Corporation | | | 1,688,000 |

| 60,000 | | | | ENSCO International Incorporated | | | 1,944,600 |

| 80,000 | | (1) | | Newfield Exploration Company | | | 1,806,400 |

| 150,000 | | | | Noble Energy, Inc. | | | 7,842,000 |

| 30,000 | | | | Range Resources Corporation | | | 1,244,100 |

| 340,000 | | (1) | | Southwestern Energy Company | | | 11,685,800 |

| 100,000 | | (2) | | Sunoco, Inc. | | | 3,974,000 |

| | | | | | |

|

|

| | | | | Total | | | 30,184,900 |

| | | | | | |

|

|

The Notes to the Financial Statements are an integral part of, and should be read in conjunction with, the Financial Statements.

10

REGIONS MORGAN KEEGAN SELECT MID CAP GROWTH FUND

PORTFOLIOOF INVESTMENTS

NOVEMBER 30, 2008

| | | | | | | |

| Shares | | | | | | Value |

| Common Stocks (continued) | | | |

| | | | | Oil & Gas Services–5.9% | | | |

| 80,000 | | (2) | | Cimarex Energy Co. | | $ | 2,269,600 |

| 100,000 | | (1) | | Denbury Resources Inc. | | | 953,000 |

| 80,000 | | (1) | | FMC Technologies, Inc. | | | 2,197,600 |

| 80,000 | | | | Frontier Oil Corporation | | | 955,200 |

| 70,000 | | (1) | | National Oilwell Varco, Inc. | | | 1,980,300 |

| 50,000 | | (1) | | Oceaneering International, Inc. | | | 1,291,000 |

| 70,000 | | | | Smith International, Inc. | | | 2,046,800 |

| 100,000 | | (1) | | Weatherford International Ltd. | | | 1,277,000 |

| | | | | | |

|

|

| | | | | Total | | | 12,970,500 |

| | | | | | |

|

|

| | | | | Pipelines–2.6% | | | |

| 56,000 | | | | Equitable Resources, Inc. | | | 1,868,720 |

| 80,000 | | | | Questar Corporation | | | 2,575,200 |

| 70,000 | | | | The Williams Companies, Inc. | | | 1,135,400 |

| | | | | | |

|

|

| | | | | Total | | | 5,579,320 |

| | | | | | |

|

|

| | | | | Total Energy | | | 55,911,460 |

| | | | | | |

|

|

| | | |

| | | | | Financials–4.8% | | | |

| | | | | Diversified Financial Services–4.6% | | | |

| 80,000 | | | | Ameriprise Financial, Inc. | | | 1,476,800 |

| 24,000 | | (1)(2) | | IntercontinentalExchange, Inc. | | | 1,766,400 |

| 220,000 | | (2) | | Janus Capital Group, Inc. | | | 1,793,000 |

| 60,000 | | | | NYSE Euronext, Inc. | | | 1,428,600 |

| 160,000 | | (1)(2) | | The Nasdaq Stock Market, Inc. | | | 3,440,000 |

| | | | | | |

|

|

| | | | | Total | | | 9,904,800 |

| | | | | | |

|

|

| | | | | Real Estate Investment Trusts–0.2% | | | |

| 100,000 | | (1) | | CB Richard Ellis Group, Inc. | | | 456,000 |

| | | | | | |

|

|

| | | | | Total Financials | | | 10,360,800 |

| | | | | | |

|

|

| | | |

| | | | | Industrials–8.8% | | | |

| | | | | Diversified Machinery–1.2% | | | |

| 50,000 | | | | Flowserve Corporation | | | 2,516,500 |

| | | | | Electrical Components & Equipment–1.8% | | | |

| 80,000 | | (1)(2) | | Energizer Holdings, Inc. | | | 3,473,600 |

| 13,386 | | (1) | | SunPower Corporation | | | 348,304 |

| | | | | | |

|

|

| | | | | Total | | | 3,821,904 |

| | | | | | |

|

|

| | | | | Electronics–0.4% | | | |

| 40,000 | | | | Amphenol Corporation | | | 928,800 |

| | | | | Engineering & Construction–3.4% | | | |

| 44,000 | | | | Fluor Corporation | | | 2,003,760 |

| 120,000 | | (1) | | Jacobs Engineering Group Inc. | | | 5,372,400 |

| | | | | | |

|

|

| | | | | Total | | | 7,376,160 |

| | | | | | |

|

|

| | | | | Manufacturing–0.6% | | | |

| 17,280 | | | | John Bean Technologies Corporation | | | 150,855 |

| 80,000 | | | | Textron Inc. | | | 1,218,400 |

| | | | | | |

|

|

| | | | | Total | | | 1,369,255 |

| | | | | | |

|

|

| | | | | Metal Fabricate/Hardware–1.4% | | | |

| 50,000 | | | | Precision Castparts Corp. | | | 3,135,000 |

| | | | | | |

|

|

| | | | | Total Industrials | | | 19,147,619 |

| | | | | | |

|

|

| | | |

| | | | | Technology–7.0% | | | |

| | | | | Computers–2.7% | | | |

| 40,000 | | (1) | | Cognizant Technology Solutions Corporation | | | 768,000 |

| | | | | | | | |

| Shares | | | | | | Value |

| | Common Stocks (continued) | | | |

| | 70,000 | | (1)(2) | | DST Systems, Inc. | | $ | 2,646,700 |

| | 40,000 | | (1) | | Synopsys, Inc. | | | 641,200 |

| | 140,000 | | (1) | | Western Digital Corporation | | | 1,708,000 |

| | | | | | | |

|

|

| | | | | | Total | | | 5,763,900 |

| | | | | | | |

|

|

| | | | | | Semiconductors–1.3% | | | |

| | 100,000 | | | | Applied Materials, Inc. | | | 958,000 |

| | 100,000 | | (1)(2) | | Cypress Semiconductor Corporation | | | 373,000 |

| | 200,000 | | (1)(2) | | NVIDIA Corporation | | | 1,494,000 |

| | | | | | | |

|

|

| | | | | | Total | | | 2,825,000 |

| | | | | | | |

|

|

| | | | | | Software–3.0% | | | |

| | 100,000 | | | | Fidelity National Information Services, Inc. | | | 1,718,000 |

| | 60,000 | | | | The Dun & Bradstreet Corporation | | | 4,800,000 |

| | | | | | | |

|

|

| | | | | | Total | | | 6,518,000 |

| | | | | | | |

|

|

| | | | | | Total Technology | | | 15,106,900 |

| | | | | | | |

|

|

| | | |

| | | | | | Utilities–2.2% | | | |

| | | | | | Electric–2.2% | | | |

| | 160,000 | | (1)(2) | | NRG Energy, Inc. | | | 3,790,400 |

| | 140,000 | | (1) | | The AES Corporation | | | 1,076,600 |

| | | | | | | |

|

|

| | | | | | Total Utilities | | | 4,867,000 |

| | | | | | | |

|

|

| | | | | | Total Common Stocks

(identified cost $277,834,590) | | | 195,214,219 |

| | | | | | | |

|

|

| | Exchange Traded Funds–8.0% | | | |

| | 200,000 | | (2) | | Financial Select Sector SPDR | | | 2,522,000 |

| | 140,000 | | (2) | | Market Vectors Gold Miners | | | 3,729,600 |

| | 100,000 | | (2) | | Midcap Standard & Poors Trust Series 1 | | | 9,359,000 |

| | 100,000 | | (2) | | Semiconductor HOLDRs | | | 1,664,000 |

| | | | | | | |

|

|

| | | | | | Total | | | 17,274,600 |

| | | | | | | |

|

|

| | | | | | Total Exchange Traded Funds

(identified cost $24,641,737) | | | 17,274,600 |

| | | | | | | |

|

|

| | Short-Term Investments–17.7% | | | |

| | 34,703,387 | | | | Bank of New York Institutional Cash Reserves Fund (held as collateral for securities lending) | | | 34,546,558 |

| | 1,986,818 | | | | Fidelity Institutional Money Market Fund | | | 1,986,818 |

| | 1,986,818 | | | | Lehman Brothers Institutional Prime Money Market Fund | | | 1,986,818 |

| | | | | | | |

|

|

| | | | | | Total Short-Term Investments (identified cost $38,677,023) | | | 38,520,194 |

| | | | | | | |

|

|

Principal

Amount | | | | | | Value |

| | Certificates of Deposit–6.4% | | | |

| $ | 1,993,653 | | | | Bank of Ireland, 1.539%, 2/12/2009 (held as collateral for securities lending) | | | 1,993,653 |

The Notes to the Financial Statements are an integral part of, and should be read in conjunction with, the Financial Statements.

11

REGIONS MORGAN KEEGAN SELECT MID CAP GROWTH FUND

PORTFOLIOOF INVESTMENTS

NOVEMBER 30, 2008

| | | | | | | | | |

Principal

Amount | | | | | | Value | |

| | Certificates of Deposit (continued) | | | | |

| $ | 2,962,950 | | | | Calyon New York, 1.463%, 2/13/2009 (held as collateral for securities lending) | | $ | 2,962,950 | |

| | 2,958,596 | | | | Deutsche Bank AG Yankee, 4.035%, 1/25/2010 (held as collateral for securities lending) | | | 2,958,596 | |

| | 2,992,174 | | | | Nordea Bank Finland New York, 2.178%, 2/6/2009 (held as collateral securities lending) | | | 2,992,174 | |

| | 1,956,114 | | | | Suntrust Bank, 1.415%, 6/25/2009 (held as collateral for securities lending) | | | 1,956,114 | |

| | 957,426 | | | | Suntrust Bank, 1.471%, 1/29/2010 (held as collateral for securities lending) | | | 957,426 | |

| | | | | | | |

|

|

|

| | | | | | Total Certificates of Deposit (identified cost $13,820,913) | | | 13,820,913 | |

| | | | | | | |

|

|

|

| | | | | | Total Investments–122.0% (identified cost $354,974,263) | | | 264,829,926 | |

| | | | | | | |

|

|

|

| | | | | | Other Assets and Liabilities–net–(22.0)% | | | (47,685,651 | ) |

| | | | | | | |

|

|

|

| | | | | | Total Net Assets–100.0% | | $ | 217,144,275 | |

| | | | | | | |

|

|

|

|

| Call Options Written November 30, 2008 |

| | | | |

| | |

Number of

Contracts

| | Common Stocks/Expiration

Date/Exercise Price

| | |

| 200 | | Church & Dwight Co., Inc. /

January 2009 / 65.000 | | (14,000) |

| 1,000 | | Southwestern Energy Company /

January 2009 / 47.500 | | (105,000) |

| | | |

|

| 1,200 | | Total Call Options Written

(Premiums Received $250,025) | | (119,000) |

| | | |

|

| (1) | | Non-income producing security. |

| (2) | | Certain shares are temporarily on loan to unaffiliated broker-dealers. See Notes 2 and 5 of the Financial Statements for additional information about securities lending. |

Note: The categories of investments are shown as a percentage of total net assets at November 30, 2008.

The Notes to the Financial Statements are an integral part of, and should be read in conjunction with, the Financial Statements.

12

[THIS PAGE INTENTIONALLY LEFT BLANK]

13

REGIONS MORGAN KEEGAN SELECT GROWTH FUND

OBJECTIVE & STRATEGY

Regions Morgan Keegan Select Growth Fund seeks growth of capital and income. The Fund invests in common stocks of companies that are expected to achieve above-average growth in earnings.

INVESTMENT RISKS: Equity securities (stocks) can be more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. Growth style stocks are considered to be more susceptible to developments affecting the market/economy and the individual company than common stocks in general. The net asset value per share of the Fund will fluctuate as the value of the securities in the portfolio changes.

MANAGEMENT DISCUSSIONOF FUND PERFORMANCE

For the fiscal year ended November 30, 2008, Regions Morgan Keegan Select Growth Fund’s Class A Shares had a total return of –35.65%, based on net asset value. During the same period, the Standard & Poor’s 500 Index(1), the Fund’s benchmark, had a total return of –38.09% and the Lipper Large Cap Growth Index(2) had a total return of –42.88%. The miserable performance of the equity markets reflected a convergence of declining housing prices, an institutional credit crisis, skyrocketing unemployment, plunging consumer confidence (and spending), and massive government intervention. While we are not pleased with the Fund’s performance, we did avoid many major disasters in the financial sector. Also, we were underweighted in the “high expectations” stocks with high valuations that performed poorly during the year.

Only three stocks held in the Fund showed a positive return. They were Southwest Energy (+38%), Wal-Mart (+19%) and Genentech (+0.4%). The list of stocks that showed poor performance for the year is extensive, but some of the worst include Coventry Health (–78%), NYSE Euronext (–72%) and Research in Motion (–63%).

The last few months left no place for investors to hide. Only three economic sectors in the Standard & Poor’s 500 Index showed a better performance than –38% for the twelve months ended November 30, 2008. They were Consumer Staples (–13%), Energy (–26%) and Health Care (–27%). We continue to hold a slight overweight in the Energy and Material sectors as compared to the Fund’s benchmark index.

| | |

| |  |

Charles A. Murray, CFA Senior Portfolio Manager Morgan Asset Management, Inc. | | David P. McGrath, CFA Senior Portfolio Manager Morgan Asset Management, Inc. |

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objectives. These views are subject to change at any time based upon market or other conditions, and Morgan Asset Management, Inc. disclaims any responsibility to update such views. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and, therefore, the value of the Fund’s shares may be less than what you paid for them. Accordingly, you can lose money investing in the Fund.

(Unaudited)

14

REGIONS MORGAN KEEGAN SELECT GROWTH FUND

TOP TEN EQUITY HOLDINGS†

AS OF NOVEMBER 30, 2008

| | | | | | | | | | | | | | |

| TICKER | | DESCRIPTION | | % OF TOTAL NET ASSETS | | TICKER | | DESCRIPTION | | % OF TOTAL NET ASSETS |

XOM | | Exxon Mobil Corp. | | 6.4% | | MSFT | | Microsoft Corp. | | 3.4% |

CSCO | | Cisco Systems, Inc. | | 4.0% | | PG | | The Procter & Gamble Co. | | 3.4% |

ORCL | | Oracle Corp. | | 3.9% | | IBM | | International Business Machines Corp. | | 3.3% |

JNJ | | Johnson & Johnson | | 3.8% | | CVX | | Chevron Corp. | | 3.2% |

OIH | | Oil Services HOLDRs | | 3.5% | | ABX | | Barrick Gold Corp. | | 3.1% |

| † | | The Fund’s composition is subject to change. |

EQUITY SECTOR DIVERSIFICATION†

AS OF NOVEMBER 30, 2008

| | | | | | | | |

%OFTOTALINVESTMENTS EXCLUDINGCOLLATERALFORSECURITIESLENDING | | %OFTOTALINVESTMENTS EXCLUDINGCOLLATERALFORSECURITIESLENDING |

Consumer Products | | 33.1% | | Industrials | | 5.9% |

Energy | | 21.3% | | Exchange Traded Fund | | 5.4% |

Technology | | 15.8% | | Financials | | 0.8% |

Communications | | 6.4% | | Short Term Investments | | 5.3% |

| | | | | | |

|

Basic Materials | | 6.0% | | Total | | 100.0% |

| † | | The Fund’s composition is subject to change. |

INDEX DESCRIPTIONS

(1) | | The Standard & Poor’s 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregated market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. |

(2) | | The Lipper Large Cap Growth Index is the average return of the 30 largest large-cap growth funds. Funds in the index are rebalanced quarterly. It is not possible to invest directly in an index. |

(Unaudited)

15

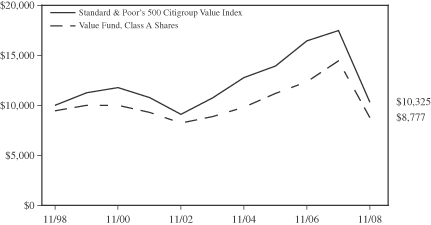

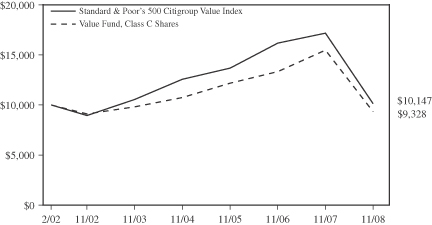

REGIONS MORGAN KEEGAN SELECT GROWTH FUND

GROWTHOFA $10,000 INVESTMENT

CLASS A SHARES

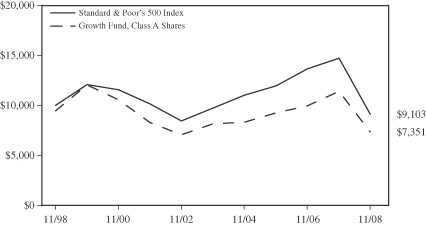

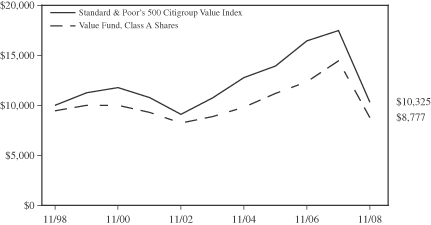

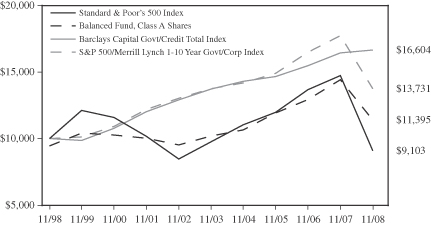

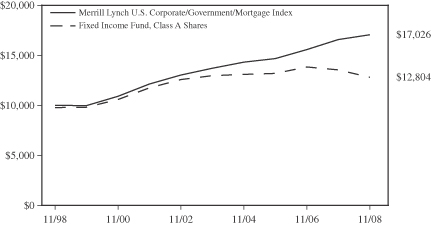

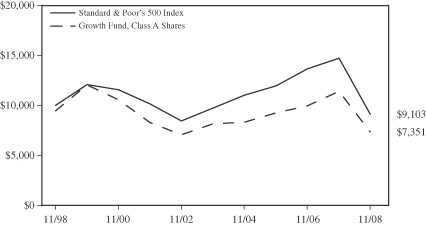

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Growth Fund—Class A Shares(1) from November 30, 1998 to November 30, 2008 compared to the Standard & Poor’s 500 Index(2), a broad-based market index.

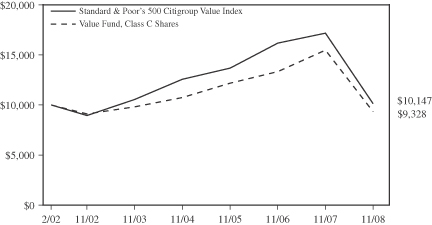

GROWTHOFA $10,000 INVESTMENT

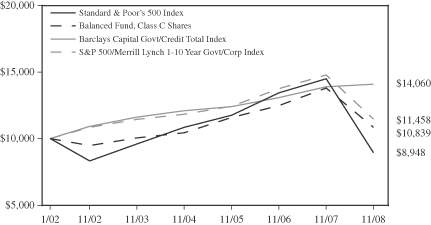

CLASS C SHARES

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Growth Fund—Class C Shares from the commencement of investment operations on January 7, 2002 to November 30, 2008 compared to the Standard & Poor’s 500 Index(2), a broad-based market index.

(Unaudited)

16

REGIONS MORGAN KEEGAN SELECT GROWTH FUND

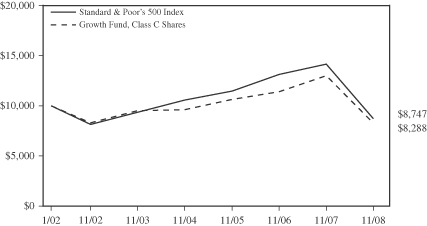

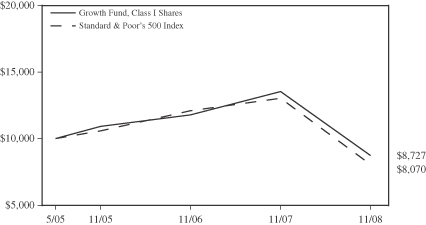

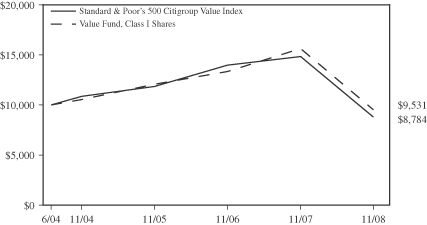

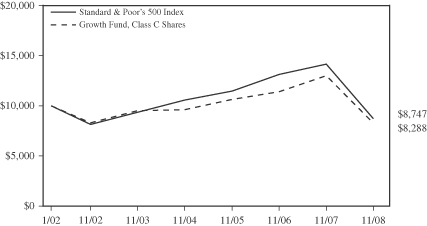

GROWTHOFA $10,000 INVESTMENT

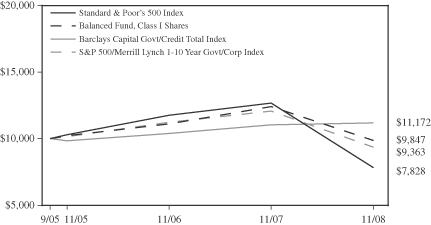

CLASS I SHARES

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Growth Fund—Class I Shares from the commencement of investment operations on May 19, 2005 to November 30, 2008 compared to the Standard & Poor’s 500 Index(2), a broad-based market index.

PERFORMANCE INFORMATION

| | | | | | | | | | | | | | | |

| | | AVERAGE ANNUAL TOTAL RETURNS | |

| AS OF NOVEMBER 30, 2008 | | SIX

MONTHS* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | | | COMMENCEMENT

OF INVESTMENT

OPERATIONS(3) | |

| CLASS A SHARES**(1) | | -38.73 | % | | -39.19 | % | | -3.24 | % | | -3.03 | % | | 4.62 | % |

(EXCLUDINGSALESLOAD)(1) | | -35.17 | % | | -35.65 | % | | -2.13 | % | | -2.48 | % | | 4.98 | % |

| CLASS C SHARES*** | | -36.07 | % | | -36.93 | % | | -2.74 | % | | N/A | | | -2.68 | % |

(EXCLUDINGCDSC) | | -35.43 | % | | -36.30 | % | | -2.74 | % | | N/A | | | -2.68 | % |

| CLASS I SHARES | | -35.11 | % | | -35.53 | % | | N/A | | | N/A | | | -3.77 | % |

| STANDARD & POOR’S 500 INDEX(2) | | -35.20 | % | | -38.09 | % | | -1.39 | % | | -0.93 | % | | — | |

| * | | Not annualized for periods less than one year. |

| ** | | Reflects the maximum sales load of 5.50%. |

| *** | | Reflects the maximum contingent deferred sales charge (CDSC) of 1.00% for shares redeemed within one year of purchase. |

(1) | | Effective June 4, 2004, all Class B Shares of the Fund converted to Class A Shares. Historical total return information for any period or portion thereof prior to the commencement of investment operations of Class A Shares on May 20, 1998 is that of Class B Shares and reflects all charges, expenses and fees incurred by Class B Shares, which were generally higher than the expenses of Class A Shares, during such periods. |

(2) | | The Standard & Poor’s 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregated market value of 500 stocks representing all major industries. Total returns for the index shown are not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. |

(3) | | The Fund’s Class A Shares (including predecessor Class B Shares), Class C Shares and Class I Shares commenced investment operations on April 20, 1992, January 7, 2002 and May 19, 2005, respectively. |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent performance, call toll-free 877-757-7424. The Fund’s performance results are shown on a total return basis and include the reinvestment of all dividends and capital gain distributions in the Fund. Returns shown in the chart and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not bank deposits or obligations, are not guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. Investment in mutual funds involves investment risk, including possible loss of principal.

(Unaudited)

17

REGIONS MORGAN KEEGAN SELECT GROWTH FUND

PORTFOLIOOF INVESTMENTS

NOVEMBER 30, 2008

| | | | | | | |

| Shares | | | | | | Value |

| Common Stocks–89.5% | | | |

| | | |

| | | | | Basic Materials–6.0% | | | |

| | | | | Iron/Steel–1.3% | | | |

| 70,000 | | | | Nucor Corporation | | $ | 2,497,600 |

| 24,000 | | | | United States Steel Corporation | | | 729,600 |

| | | | | | |

|

|

| | | | | Total | | | 3,227,200 |

| | | | | | |

|

|

| | | | | Mining–4.7% | | | |

| 260,000 | | | | Barrick Gold Corporation | | | 7,659,600 |

| 120,000 | | | | Newmont Mining Corporation | | | 4,038,000 |

| | | | | | |

|

|

| | | | | Total | | | 11,697,600 |

| | | | | | |

|

|

| | | | | Total Basic Materials | | | 14,924,800 |

| | | | | | |

|

|

| | | |

| | | | | Communications–6.4% | | | |

| | | | | Internet–0.9% | | | |

| 8,000 | | (1) | | Google Inc. | | | 2,343,680 |

| | | | | Telecommunications–5.5% | | | |

| 600,000 | | (1) | | Cisco Systems, Inc. | | | 9,924,000 |

| 110,000 | | | | QUALCOMM Incorporated | | | 3,692,700 |

| | | | | | |

|

|

| | | | | Total | | | 13,616,700 |

| | | | | | |

|

|

| | | | | Total Communications | | | 15,960,380 |

| | | | | | |

|

|

| | | |

| | | | | Consumer Products–33.2% | | | |

| | | | | Agriculture–0.8% | | | |

| 50,000 | | (2) | | Bunge Limited | | | 2,123,000 |

| | | | | Apparel–1.1% | | | |

| 60,000 | | (1) | | Coach, Inc. | | | 1,074,000 |

| 30,000 | | | | NIKE, Inc. | | | 1,597,500 |

| | | | | | |

|

|

| | | | | Total | | | 2,671,500 |

| | | | | | |

|

|

| | | | | Beverages–4.2% | | | |

| 120,000 | | | | PepsiCo, Inc. | | | 6,804,000 |

| 70,000 | | | | The Coca-Cola Company | | | 3,280,900 |

| 20,000 | | | | The Pepsi Bottling Group, Inc. | | | 361,800 |

| | | | | | |

|

|

| | | | | Total | | | 10,446,700 |

| | | | | | |

|

|

| | | | | Biotechnology–6.6% | | | |

| 80,000 | | (1) | | Celgene Corporation | | | 4,168,000 |

| 40,000 | | (1) | | Genentech, Inc. | | | 3,064,000 |

| 90,000 | | (1) | | Genzyme Corporation | | | 5,761,800 |

| 80,000 | | (1) | | Gilead Sciences, Inc. | | | 3,583,200 |

| | | | | | |

|

|

| | | | | Total | | | 16,577,000 |

| | | | | | |

|

|

| | | | | Commercial Services–1.2% | | | |

| 20,000 | | (2) | | MasterCard Incorporated | | | 2,906,000 |

| | | | | Cosmetics/Personal Care–3.3% | | | |

| 130,000 | | | | The Procter & Gamble Company | | | 8,365,500 |

| | | | | Healthcare Products–4.5% | | | |

| 160,000 | | | | Johnson & Johnson | | | 9,372,800 |

| 60,000 | | | | Medtronic, Inc. | | | 1,831,200 |

| | | | | | |

|

|

| | | | | Total | | | 11,204,000 |

| | | | | | |

|

|

| | | | | Healthcare Services–2.4% | | | |

| 160,000 | | | | UnitedHealth Group Incorporated | | | 3,361,600 |

| 70,000 | | (1) | | WellPoint, Inc. | | | 2,492,000 |

| | | | | | |

|

|

| | | | | Total | | | 5,853,600 |

| | | | | | |

|

|

| | | | | | | |

| Shares | | | | | | Value |

| Common Stocks (continued) | | | |

| | | | | Pharmaceuticals–3.8% | | | |

| 140,000 | | | | Abbott Laboratories | | $ | 7,334,600 |

| 60,000 | | | | Wyeth | | | 2,160,600 |

| | | | | | |

|

|

| | | | | Total | | | 9,495,200 |

| | | | | | |

|

|

| | | | | Retail–5.3% | | | |

| 40,000 | | (2) | | CVS Corporation | | | 1,157,200 |

| 30,000 | | (1) | | Kohl’s Corporation | | | 979,800 |

| 80,000 | | | | Lowe’s Companies, Inc. | | | 1,652,800 |

| 120,000 | | (1)(2) | | Starbucks Corporation | | | 1,071,600 |

| 40,000 | | | | Target Corporation | | | 1,350,400 |

| 100,000 | | | | Walgreen Co. | | | 2,474,000 |

| 80,000 | | | | Wal-Mart Stores, Inc. | | | 4,470,400 |

| | | | | | |

|

|

| | | | | Total | | | 13,156,200 |

| | | | | | |

|

|

| | | | | Total Consumer Products | | | 82,798,700 |

| | | | | | |

|

|

| | | |

| | | | | Energy–21.4% | | | |

| | | | | Coal–0.8% | | | |

| 80,000 | | (2) | | Peabody Energy Corporation | | | 1,874,400 |

| | | | | Oil & Gas–18.8% | | | |

| 18,000 | | | | Apache Corporation | | | 1,391,400 |

| 100,000 | | | | Chevron Corporation | | | 7,901,000 |

| 10,000 | | | | Devon Energy Corporation | | | 723,400 |

| 200,000 | | | | Exxon Mobil Corporation | | | 16,030,000 |

| 10,000 | | | | Murphy Oil Corporation | | | 440,500 |

| 90,000 | | (2) | | Noble Corporation | | | 2,411,100 |

| 100,000 | | | | Noble Energy, Inc. | | | 5,228,000 |

| 80,000 | | (1) | | Southwestern Energy Company | | | 2,749,600 |

| 60,000 | | (2) | | Sunoco, Inc. | | | 2,384,400 |

| 200,000 | | | | XTO Energy Inc. | | | 7,648,000 |

| | | | | | |

|

|

| | | | | Total | | | 46,907,400 |

| | | | | | |

|

|

| | | | | Oil & Gas Services–1.8% | | | |

| 40,000 | | | | Schlumberger Limited | | | 2,029,600 |

| 80,000 | | | | Smith International, Inc. | | | 2,339,200 |

| 20,000 | | (1) | | Weatherford International Ltd. | | | 255,400 |

| | | | | | |

|

|

| | | | | Total | | | 4,624,200 |

| | | | | | |

|

|

| | | | | Total Energy | | | 53,406,000 |

| | | | | | |

|

|

| | | |

| | | | | Financials–0.8% | | | |

| | | | | Diversified Financial Services–0.8% | | | |

| 60,000 | | (2) | | American Express Company | | | 1,398,600 |

| 30,000 | | | | NYSE Euronext, Inc. | | | 714,300 |

| | | | | | |

|

|

| | | | | Total | | | 2,112,900 |

| | | | | | |

|

|

| | | | | Total Financials | | | 2,112,900 |

| | | | | | |

|

|

| | | |

| | | | | Industrials–5.9% | | | |

| | | | | Aerospace/Defense–1.2% | | | |

| 60,000 | | | | United Technologies Corporation | | | 2,911,800 |

| | | | | Electrical Components & Equipment–0.7% |

| 50,000 | | | | Emerson Electric Co. | | | 1,794,500 |

| | | | | Machinery–2.3% | | | |

| 100,000 | | | | Caterpillar Inc. | | | 4,099,000 |

| 50,000 | | | | Deere & Company | | | 1,740,500 |

| | | | | | |

|

|

| | | | | Total | | | 5,839,500 |

| | | | | | |

|

|

The Notes to the Financial Statements are an integral part of, and should be read in conjunction with, the Financial Statements.

18

REGIONS MORGAN KEEGAN SELECT GROWTH FUND

PORTFOLIOOF INVESTMENTS

NOVEMBER 30, 2008

| | | | | | | |

Shares | | | | | | Value |

| Common Stocks (continued) | | | |

| | | | | Transportation–1.7% | | | |

| 40,000 | | | | Burlington Northern Santa Fe Corporation | | $ | 3,064,400 |

| 20,000 | | (2) | | United Parcel Service, Inc. | | | 1,152,000 |

| | | | | | |

|

|

| | | | | Total | | | 4,216,400 |

| | | | | | |

|

|

| | | | | Total Industrials | | | 14,762,200 |

| | | | | | |

|

|

| | | |

| | | | | Technology–15.8% | | | |

| | | | | Computers–5.3% | | | |

| 10,000 | | (1) | | Apple Computer, Inc. | | | 926,700 |

| 100,000 | | (1) | | Dell Inc. | | | 1,117,000 |

| 180,000 | | (1) | | EMC Corporation | | | 1,902,600 |

| 100,000 | | | | International Business Machines Corporation | | | 8,160,000 |

| 80,000 | | (1)(2) | | NetApp, Inc. | | | 1,080,000 |

| | | | | | |

|

|

| | | | | Total | | | 13,186,300 |

| | | | | | |

|

|

| | | | | Semiconductors–2.3% | | | |

| 200,000 | | (2) | | Applied Materials, Inc. | | | 1,916,000 |

| 140,000 | | | | Intel Corporation | | | 1,932,000 |

| 120,000 | | | | Texas Instruments Incorporated | | | 1,868,400 |

| | | | | | |

|

|

| | | | | Total | | | 5,716,400 |

| | | | | | |

|

|

| | | | | Software–8.2% | | | |

| 90,000 | | (1)(2) | | Citrix Systems, Inc. | | | 2,399,400 |

| 420,000 | | | | Microsoft Corporation | | | 8,492,400 |

| 600,000 | | (1) | | Oracle Corporation | | | 9,654,000 |

| | | | | | |

|

|

| | | | | Total | | | 20,545,800 |

| | | | | | |

|

|

| | | | | Total Technology | | | 39,448,500 |

| | | | | | |

|

|

| | | | | Total Common Stocks

(identified cost $240,352,772) | | | 223,413,480 |

| | | | | | |

|

|

| Exchange Traded Funds–5.4% | | | |

| 180,000 | | (2) | | Market Vectors Gold Miners ETF | | | 4,795,200 |

| 100,000 | | | | Oil Services HOLDRs | | | 8,666,000 |

| | | | | | |

|

|

| | | | | Total Exchange Traded Funds

(identified cost $14,039,999) | | | 13,461,200 |

| | | | | | |

|

|

| Short-Term Investments–11.2% | | | |

| 14,923,696 | | | | Bank of New York Institutional Cash Reserves Fund (held as collateral for securities lending) | | | 14,879,068 |

| 6,586,042 | | | | Fidelity Institutional Money Market Fund | | | 6,586,042 |

| 6,586,043 | | | | Lehman Brothers Prime Money Market Fund | | | 6,586,043 |

| | | | | | |

|

|

| | | | | Total Short-Term Investments (identified cost $28,095,781) | | | 28,051,153 |

| | | | | | |

|

|

| | | | | | | | | |

Principal

Amount | | | | Value | |

| | Certificates of Deposit–2.6% | | | | |

| $ | 1,993,653 | | | | Bank of Ireland, 1.539%, 2/12/2009 (held as collateral for securities lending) | | $ | 1,993,653 | |

| | 1,975,300 | | | | Calyon New York, 1.463%, 2/13/2009 (held as collateral for securities lending) | | | 1,975,300 | |

| | 2,493,478 | | | | Nordea Bank Finland New York, 2.178%, 2/6/2009 (held as collateral for securities lending) | | | 2,493,478 | |

| | | | | | | |

|

|

|

| | | | | | Total Certificates of Deposit (identified cost $6,462,431) | | | 6,462,431 | |

| | | | | | | |

|

|

|

| | | | | | Total Investments–108.7%

(identified cost $288,950,983) | | | 271,388,264 | |

| | | | | | | |

|

|

|

| | | | | | Other Assets and Liabilities–

net–(8.7)% | | | (21,772,926 | ) |

| | | | | | | |

|

|

|

| | | | | | Total Net Assets–100.0% | | $ | 249,615,338 | |

| | | | | | | |

|

|

|

| | Call Options Written November 30, 2008 | | | | |

| | | | |

| | |

Number of

Contracts

| | Common Stocks/Expiration

Date/Exercise Price

| | |

| 1,000 | | Exxon Mobil Corporation / December 2008 / 85.00 | | (160,000) |

| 1,000 | | Exxon Mobil Corporation / January 2009 / 80.00 | | (593,000) |

| | | |

|

| 2,000 | | Total Call Options Written

(Premiums Received $542,727) | | (753,000) |

| | | |

|

| (1) | | Non-income producing security. |

| (2) | | Certain shares are temporarily on loan to unaffiliated broker- dealers. See Notes 2 and 5 of the financial statements for additional information about securities lending. |

Note: The categories of investments are shown as a percentage of total net assets at November 30, 2008.

The Notes to the Financial Statements are an integral part of, and should be read in conjunction with, the Financial Statements.

19

REGIONS MORGAN KEEGAN SELECT CORE EQUITY FUND

OBJECTIVE & STRATEGY

Regions Morgan Keegan Select Core Equity Fund seeks long-term growth of capital, current income and growth of income. The Fund typically invests in a combination of growth stocks and value stocks. By investing in a blend of stocks that demonstrate strong long-term earnings potential and undervalued stocks, the Fund seeks to achieve strong returns with less volatility.

INVESTMENT RISKS: Equity securities (stocks) can be more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. Growth style stocks are considered to be more susceptible to developments affecting the market/economy and the individual company than common stocks in general. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value. The net asset value per share of the Fund will fluctuate as the value of the securities in the portfolio changes.

MANAGEMENT DISCUSSIONOF FUND PERFORMANCE

In the past year, we have witnessed events not seen since and reminiscent of the 1930s: the dramatic slowing economic growth; the freeze-up of the financial system; and the decline in the stock market. However, unlike the 1930s, the significant fiscal and monetary responses, although slow in coming, are unprecedented.

The stresses in the financial markets and the economy are evidenced in the negative reaction of stocks such as the decline seen in the Fund’s benchmark, the Standard & Poor’s 500 Index(1), which fell 38.09 percent for the twelve months ended November 30, 2008. Regions Morgan Keegan Select Core Equity Fund’s Class A Shares performed in line with the Fund’s benchmark with a decline of 39.36 percent, based on net asset value (1.26 percent underperformance). The Lipper Large-Cap Core Funds Index(2) fell 38.52 percent during the same period.

All sectors in the benchmark index produced negative returns. For the Fund, the best performing sector was the Financial sector because of selection. Energy was the poorest performing sector for the Fund because of underweight and selection. Much of the outperformance resulted from not owning such stocks as Lehman Brothers, Merrill Lynch, Fannie Mae, Freddie Mac and Washington Mutual. In the Energy sector, holdings of Smith International, National Oilwell Varco and Bank of America negatively affected performance. In the Healthcare sector, holdings of Gilead Sciences, Express Scripts, and Medco Health were additive to performance.

It is with trepidation that we look to 2009. Uncertainty exists concerning the recovery of the domestic economy, and fears abound that the global economy will continue to slow. Increased unemployment and a cautious consumer are strong headwinds for any improvement in economic growth here in the U.S.; and, as the U.S. slows, so does the rest of the world.

As things now stand, serious damage has been done to home prices, bond prices, and stock prices. Cash and U.S. Treasury securities seem to be the safe havens of choice. As of this writing, 90-day Treasury bills yield zero percent. The ten-year Treasury yields slightly more than two percent.

As a result of the dismal outlook and price depreciation, attractive valuations unseen for over fifty years have appeared in the stock market. For example, the dividend yield on the Standard & Poor’s 500 Index is now 3.30 percent. Compared to the Treasury yields cited previously, the yield is quite attractive and we have not seen such a spread since the 1950s.

Although the outlook for earnings is dismal, even at reduced levels, the earnings yield on stocks is significantly higher than aforementioned Treasury yields. Thus, at some point normal relative valuations could return. Money would move out of the safety of Treasury securities, and into other bonds and stocks. Cash on the sidelines has grown significantly. When money comes out of Treasury bills and cash, stocks have the potential to dramatically outperform other asset classes.

(Unaudited)

20

REGIONS MORGAN KEEGAN SELECT CORE EQUITY FUND

In the meantime, building or adding to a portfolio of quality stocks presents an attractive, forward-looking strategy. The Fund provides a portfolio of domestic stocks that should participate in the ultimate stock market recovery.

| | |

| |  |

Walter A. Hellwig Senior Portfolio Manager Morgan Asset Management, Inc. | | John B. Russell, CFA Assistant Portfolio Manager Morgan Asset Management, Inc. |

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objectives. These views are subject to change at any time based upon market or other conditions, and Morgan Asset Management, Inc. disclaims any responsibility to update such views. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and, therefore, the value of the Fund’s shares may be less than what you paid for them. Accordingly, you can lose money investing in the Fund.

TOP TEN EQUITY HOLDINGS†

AS OF NOVEMBER 30, 2008

| | | | | | | | | | | | | | |

| TICKER | | DESCRIPTION | | % OF TOTAL NET ASSETS | | TICKER | | DESCRIPTION | | % OF TOTAL NET ASSETS |

GILD | | Gilead Sciences, Inc. | | 4.1% | | PG | | The Procter & Gamble Company | | 2.9% |

XOM | | Exxon Mobil Corp. | | 3.7% | | MON | | Monsanto Company | | 2.7% |

T | | AT&T, Inc. | | 3.3% | | WFC | | Wells Fargo & Company | | 2.6% |

MCD | | McDonald’s Corporation | | 3.0% | | ESRX | | Express Scripts, Inc. | | 2.6% |

JNJ | | Johnson & Johnson | | 3.0% | | MO | | Altria Group, Inc. | | 2.6% |

| † | | The Fund’s composition is subject to change. |

EQUITY SECTOR DIVERSIFICATION†

AS OF NOVEMBER 30, 2008

| | | | | | | | |

%OFTOTALINVESTMENTS | | | | %OFTOTALINVESTMENTS |

Consumer Products | | 23.5% | | | | Energy | | 7.9% |

Healthcare | | 18.4% | | | | Communications | | 5.8% |

Financials | | 13.0% | | | | Basic Materials | | 2.7% |

Technology | | 10.3% | | | | Utilities | | 1.0% |

Industrials | | 8.8% | | | | Short Term Investments | | 8.6% |

| | | | | | | | |

|

| | | | | | | Total | | 100.0% |

| † | | The Fund’s composition is subject to change. |

INDEX DESCRIPTIONS

(1) | | The Standard & Poor’s 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregated market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. |

(2) | | The Lipper Large-Cap Core Funds Index consists of managed mutual funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the Standard & Poor’s SuperComposite 1500 Index. Large-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio, price-to-book ratio and three-year sales-per-share growth value compared to the Standard & Poor’s 500 Index. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. |

(Unaudited)

21

REGIONS MORGAN KEEGAN SELECT CORE EQUITY FUND

GROWTHOFA $10,000 INVESTMENT

CLASS A SHARES

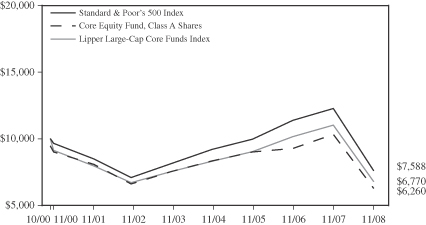

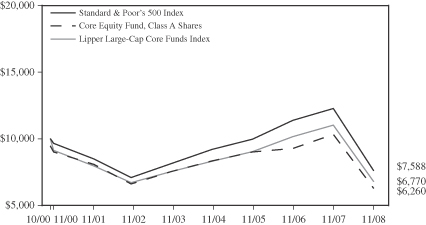

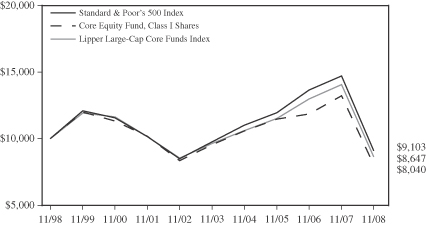

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Core Equity Fund—Class A Shares from the commencement of investment operations on October 26, 2000 to November 30, 2008 compared to the Standard & Poor’s 500 Index(1), a broad-based market index, and the Lipper Large-Cap Core Funds Index(2).

GROWTHOFA $10,000 INVESTMENT

CLASS C SHARES

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Core Equity Fund—Class C Shares from the commencement of investment operations on April 3, 2006 to November 30, 2008 compared to the Standard & Poor’s 500 Index(1), a broad-based market index, and the Lipper Large-Cap Core Funds Index(2).

(Unaudited)

22

REGIONS MORGAN KEEGAN SELECT CORE EQUITY FUND

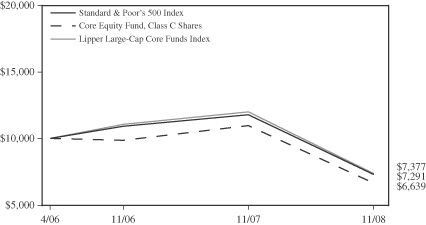

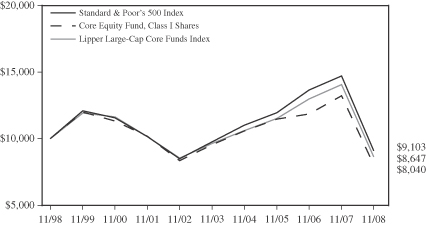

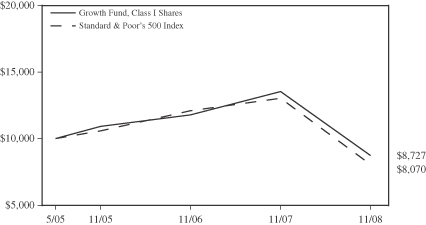

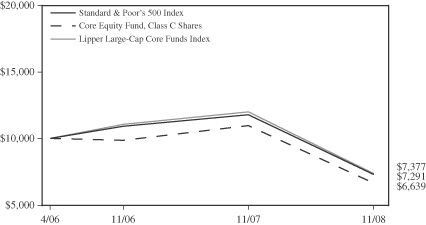

GROWTHOFA $10,000 INVESTMENT

CLASS I SHARES

The graph below illustrates a hypothetical investment of $10,000 in Regions Morgan Keegan Select Core Equity Fund—Class I Shares from November 30, 1998 to November 30, 2008 compared to the Standard & Poor’s 500 Index(1), a broad-based market index, and the Lipper Large-Cap Core Funds Index(2).

PERFORMANCE INFORMATION

| | | | | | | | | | | | | | | |

| | | AVERAGE ANNUAL TOTAL RETURNS | |

| AS OF NOVEMBER 30, 2008 | | SIX

MONTHS* | | | 1 YEAR | | | 5 YEAR | | | 10

YEAR | | | COMMENCEMENT

OF INVESTMENT

OPERATIONS(3) | |

| CLASS A SHARES**(3) | | -42.23 | % | | -42.69 | % | | -4.73 | % | | N/A | | | -5.62 | % |

(EXCLUDINGSALESLOAD) | | -38.86 | % | | -39.36 | % | | -3.64 | % | | N/A | | | -4.96 | % |

| CLASS C SHARES*** | | -39.49 | % | | -40.06 | % | | N/A | | | N/A | | | -14.24 | % |

(EXCLUDINGSALESLOAD) | | -38.88 | % | | -39.46 | % | | N/A | | | N/A | | | -14.24 | % |

| CLASS I SHARES(3) | | -38.79 | % | | -39.22 | % | | -3.39 | % | | -2.16 | % | | 4.86 | % |

| STANDARD & POOR’S 500 INDEX(1) | | -35.20 | % | | -38.09 | % | | -1.39 | % | | -0.93 | % | | — | |

| LIPPER LARGE-CAP CORE FUNDS INDEX(2) | | -36.05 | % | | -38.52 | % | | -2.15 | % | | -1.45 | % | | — | |

| * | | Not annualized for periods less than one year. |

| ** | | Reflects the maximum sales load of 5.50%. |

| *** | | Reflects the maximum contingent deferred sales charge (CDSC) of 1.00% for shares redeemed within one year of purchase. |

(1) | | The Standard & Poor’s 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregated market value of 500 stocks representing all major industries. Total returns for the index shown are not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. |

(2) | | The Lipper Large-Cap Core Funds Index consists of managed mutual funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the Standard & Poor’s SuperComposite 1500 Index. Large-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio, price-to-book ratio and three-year sales-per-share growth value compared to the Standard & Poor’s 500 Index. It is not possible to invest directly in an index. |

(3) | | The Fund began operations on February 18, 2005 as the successor to a substantially similar fund. On that date, the Fund merged with LEADER Growth & Income Fund, a series of LEADER Mutual Funds, and assumed that portfolio’s operating history and performance record. The Fund’s performance prior to February 18, 2005 is that of the Fund’s predecessor, the inception date of which was October 26, 2000 (Class A Shares) and September 1, 1994 (Class I Shares) and reflects fees and expenses paid by the predecessor fund’s Class A Shares and Class I Shares. Effective April 1, 2006, Regions Morgan Keegan Select LEADER Growth & Income Fund changed its name to Regions Morgan Keegan Select Core Equity Fund. The Fund’s Class C Shares commenced investment operations on April 3, 2006. |

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent performance, call toll-free 877-757-7424. The Fund’s performance results are shown on a total return basis and include the reinvestment of all dividends and capital gain distributions in the Fund. Returns shown in the chart and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not bank deposits or obligations, are not guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. Investment in mutual funds involves investment risk, including possible loss of principal.

(Unaudited)

23

REGIONS MORGAN KEEGAN SELECT CORE EQUITY FUND

PORTFOLIOOF INVESTMENTS

NOVEMBER 30, 2008

| | | | | | | |

| Shares | | | | | | Value |

| Common Stocks–92.0% | | | |

| | | |

| | | | | Basic Materials–2.7% | | | |

| | | | | Chemicals–2.7% | | | |

| 3,000 | | | | Monsanto Company | | $ | 237,600 |

| | | | | | |

|

|

| | | | | Total Basic Materials | | | 237,600 |

| | | | | | |

|

|

| | | |

| | | | | Communications–5.9% | | | |

| | | | | Internet–0.7% | | | |

| 200 | | (1) | | Google Inc. | | | 58,592 |

| | | | | | |

|

|

| | | | | Telecommunications–5.2% | | | |

| 10,000 | | | | AT&T Inc. | | | 285,600 |

| 5,000 | | | | QUALCOMM Inc. | | | 167,850 |

| | | | | | |

|

|

| | | | | Total | | | 453,450 |

| | | | | | |

|

|

| | | | | Total Communications | | | 512,042 |

| | | | | | |

|

|

| | | |

| | | | | Consumer Products–23.7% | | | |

| | | | | Agriculture–5.0% | | | |