UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to _______

Commission file number 1-5684

W.W. Grainger, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Illinois | | | 36-1150280 |

| (State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

| 100 Grainger Parkway | | | |

| Lake Forest, | Illinois | | | 60045-5201 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (847) 535-1000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock | GWW | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☒ Accelerated Filer ☐ Non-accelerated Filer ☐ Smaller Reporting Company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The aggregate market value of the voting common equity held by non-affiliates of the registrant was $20,483,168,550 as of the close of trading as reported on the New York Stock Exchange on June 30, 2021. The Company does not have nonvoting common equity.

The registrant had 51,107,898 shares of the Company’s Common Stock outstanding as of February 11, 2022.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement to be filed in connection with the annual meeting of shareholders to be held on April 27, 2022, are incorporated by reference into Part III of this Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (Form 10-K) where indicated. The registrant's definitive 2021 proxy statement will be filed on or about March 17, 2022.

| | | | | | | | | | | | | | | | | | | | |

| TABLE OF CONTENTS | Page |

|

| PART I | |

| Item 1: | BUSINESS | |

| Item 1A: | RISK FACTORS | |

| Item 1B: | UNRESOLVED STAFF COMMENTS | |

| Item 2: | PROPERTIES | |

| Item 3: | LEGAL PROCEEDINGS | |

| Item 4: | MINE SAFETY DISCLOSURES | |

| PART II | |

| Item 5: | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER | |

| | MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

| Item 6: | RESERVED | |

| Item 7: | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL | |

| | CONDITION AND RESULTS OF OPERATIONS | |

| Item 7A: | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| Item 8: | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

| Item 9: | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS | |

| | ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| Item 9A: | CONTROLS AND PROCEDURES | |

| Item 9B: | OTHER INFORMATION | |

| Item 9C: | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | |

| PART III | |

| Item 10: | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

| Item 11: | EXECUTIVE COMPENSATION | |

| Item 12: | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND | |

| | RELATED STOCKHOLDER MATTERS | |

| Item 13: | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR | |

| | INDEPENDENCE | |

| Item 14: | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| PART IV | |

| Item 15: | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |

| Item 16: | FORM 10-K SUMMARY | |

| Signatures | | | | | |

PART I

Item 1: Business

W.W. Grainger, Inc., incorporated in the State of Illinois in 1928, is a broad line, business-to-business distributor of maintenance, repair and operating (MRO) products and services with operations primarily in North America (N.A.), Japan and the United Kingdom (U.K.). In this report, the words “Grainger” or “Company” mean W.W. Grainger, Inc. and its subsidiaries, except where the context makes it clear that the reference is only to W.W. Grainger, Inc. itself and not its subsidiaries.

For financial information regarding the Company, see the Consolidated Financial Statements and Notes included in Part II, Item 8: Financial Statements and Supplementary Data of this Form 10-K.

The Grainger Edge

Grainger's framework, “The Grainger Edge,” uniquely defines the Company by asserting why it exists, how it serves customers and how team members work together to achieve its objectives. Grainger’s purpose is to keep the world working, which in turn allows customers to focus on the core of their businesses and do what they do best.

This framework also outlines a set of principles that define the behaviors expected from Grainger’s team members in working with each other and the Company's customers, suppliers and communities as Grainger executes its strategy and creates value for shareholders. For further information on the Company's principles, see below "Workplace Practices and Policies."

General

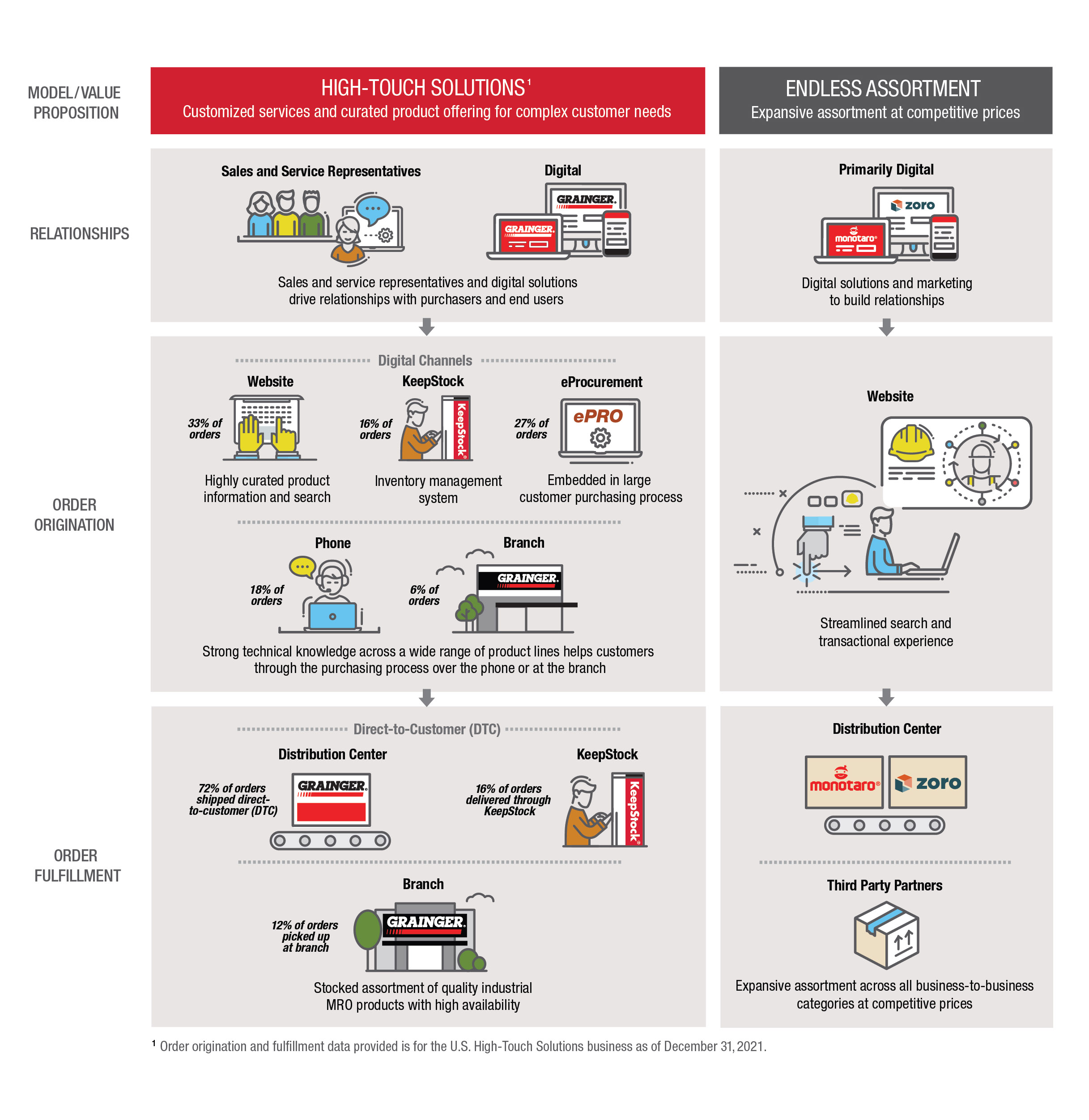

Effective January 1, 2021, Grainger's two reportable segments are High-Touch Solutions N.A. and Endless Assortment. These reportable segments align with Grainger's go-to-market strategies and bifurcated business models of high-touch solutions and endless assortment. For further segment information, see Part II, Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) and Note 14 of the Notes to Consolidated Financial Statements in Part II, Item 8: Financial Statements and Supplementary Data of this Form 10-K.

Below is a description of Grainger’s reportable segments and other businesses.

High-Touch Solutions N.A.

The Company's High-Touch Solutions N.A. segment provides value-added MRO solutions that are rooted in deep product knowledge and customer expertise. The high-touch solutions model serves customers with complex buying needs. This segment includes the Grainger-branded businesses in the United States (U.S.), Canada, Mexico and Puerto Rico.

Endless Assortment

The Company’s Endless Assortment segment provides a streamlined and transparent online platform with one-stop shopping for millions of products. The Endless Assortment segment includes the Company’s Zoro Tools, Inc. (Zoro) and MonotaRO Co., Ltd. (MonotaRO) online channels which operate predominately in the U.S., U.K. and Japan.

Other

Other businesses is comprised of smaller international high-touch solutions businesses primarily in the U.K., as well as the Fabory and China businesses in the periods prior to their divestitures in the second and third quarter of 2020, respectively. These businesses individually and in the aggregate do not meet the criteria of a reportable segment. For further business divestitures and liquidation information, see Note 2 of the Notes to Consolidated Financial Statements in Part II, Item 8: Financial Statements and Supplementary Data of this Form 10-K.

Business Models

Competing with both high-touch solutions and endless assortment business models allows Grainger to leverage its scale and advantaged supply chain to meet the changing needs of its customers. The following provides a high-level view of the Company's business models:

Customers

The Company uses a combination of its two business models to serve its more than 4.5 million customers worldwide which rely on Grainger for products and services that enable them to run safe, sustainable and productive operations. Grainger’s customers range from smaller businesses to large corporations, government entities and other institutions, representing a broad collection of industries, including, but not limited to commercial, healthcare, and manufacturing. No single end customer accounted for more than 3% of total sales for the year ended December 31, 2021.

In the High-Touch Solutions N.A. segment, customers are typically large enterprises with multi-faceted purchasing and processing complexities. Customers served in this segment expect product and service depth and are focused on total cost of procurement. For customers with sophisticated electronic purchasing platforms, the segment utilizes eProcurement technology that allows these systems to communicate directly with Grainger.com. Sales and service representatives drive relationships with customers by helping select the right products and reducing costs by utilizing Grainger as a consistent source of supply. KeepStock®, Grainger's inventory management solution, serves customers on site, offering valuable insights to drive efficiencies and cost savings. The North American Customer Service Centers handle customer interactions for the region via phone, email, eCommerce portals and online chat.

In the Endless Assortment segment, customers are typically smaller businesses with straight-forward product and service needs. Additionally, MonotaRO continues to attract and retain large enterprise customers. Customers purchasing through the endless assortment platforms are focused on transparent pricing and an easy-to-navigate procurement process. MonotaRO and Zoro offer an innovative customer experience by allowing customers to quickly find competitively priced products through intuitive business-focused eCommerce platforms with intelligent analytic capabilities.

Products

Grainger’s product offering is grouped under several broad categories, including safety and security, material handling and storage, pumps and plumbing equipment, cleaning and maintenance, metalworking and hand tools. Products are regularly added and removed from Grainger's product lines based on customer demand, market research, suppliers' recommendations and other factors. No single product category comprised more than 18% of the Company's sales for the year ended December 31, 2021.

In the High-Touch Solutions N.A. segment, Grainger.com provides real-time price and product availability, detailed product information and features, such as product search and compare capabilities. Collectively, this segment offers more than 2 million products.

In the Endless Assortment segment, Grainger offers an expansive product assortment and a broad, extensive product range that contains millions of products including those outside of traditional industrial MRO categories. Collectively in the U.S. and U.K., Zoro offers approximately 10 million products and MonotaRO provides access to more than 20 million products, primarily through its websites and catalogs. The endless assortment businesses continue to enhance assortment by strategically adding products and expanding the offer of third party held products.

Distribution and Sources of Supply

In the large and fragmented MRO industry, Grainger holds an advantaged position with its supply chain infrastructure and broad in-stock product offering. Approximately 5,000 suppliers worldwide provide Grainger businesses with more than 1.5 million products stocked in Distribution Centers (DCs) and branches globally. No single supplier comprised more than 5% of Grainger's total purchases for the year ended December 31, 2021.

In the High-Touch Solutions N.A. segment, DCs are the primary order fulfillment channel, mainly through direct shipments to customers. Automation in the DCs allows most orders to ship complete with next-day delivery and replenish branches that provide same-day availability to customers. Grainger’s North American distribution network supplies inventory planning and management, transportation and distribution services to all Grainger businesses in the North American region. Branches serve the immediate needs of customers by allowing them to directly pick up items and leverage branch staff for their technical product expertise and search-and-select support. Additionally, Grainger offers comprehensive inventory management through its KeepStock® program that includes vendor-managed inventory, customer-managed inventory and onsite vending machines.

In the Endless Assortment segment, orders are placed primarily through online channels. Zoro leverages the High-Touch Solution N.A.'s DCs and third-party drop shipments to deliver products to customers. MonotaRO fulfills customer orders through local DCs and third-party drop shipments.

For further information on the Company’s properties, see Part I, Item 2: Properties of this Form 10-K.

Trademarks and Service Marks

Grainger conducts business under various trademarks and service marks. Approximately 19% of 2021 sales were private label MRO items bearing Grainger’s registered trademarks, including DAYTON®, SPEEDAIRE®, AIR HANDLER®, TOUGH GUY®, WESTWARD®, CONDOR® and LUMAPRO®. Grainger also provides a suite of inventory services to its customers under the KEEPSTOCK® brand, which is a registered service mark. Grainger has taken steps to protect these service marks and trademarks against infringement and believes they will remain available for future use in its business.

Seasonality

Grainger sells products that may have seasonal demand fluctuations during the winter or summer seasons or during periods of natural disasters. However, historical seasonality impacts have not been material to Grainger’s operating results.

Competition

Grainger faces competition from a variety of competitors, including manufacturers (including some of its own suppliers) that sell directly to certain segments of the market, wholesale distributors, retailers and internet-based businesses. Also, competitors vary by size, from large broad line distributors and eCommerce retailers to small local and regional competitors. Grainger differentiates itself by providing local product availability, a broad product line, sales and service representatives and advanced electronic and eCommerce technology. Grainger also offers other services, such as inventory management and technical support.

Government Regulations

Grainger’s business is subject to a wide array of laws, regulations and standards in each domestic and foreign jurisdiction where Grainger operates. In addition to Grainger’s U.S.-based operations, which in 2021 generated approximately 79% of its consolidated net sales, Grainger operates its business principally through wholly owned subsidiaries in Canada, Mexico and the U.K., and through its majority-owned subsidiary in Japan. Compliance with these laws, regulations and standards requires the dedication of time and effort of team members as well as financial resources. In 2021, compliance with the applicable laws, regulations and standards did not have a material effect on capital expenditures, earnings or competitive position. See Part I, Item 1A: Risk Factors of this Form 10-K for a discussion of the risks associated with government regulations that may materially impact Grainger.

Human Capital

The Company strongly believes that its corporate culture must be aligned with its business strategy and aspiration to create value. To that end, Grainger's Board of Directors and senior management are actively involved in cultivating Grainger’s culture. The Compensation Committee of the Board, which is comprised of independent directors, oversees the Company's human capital management programs and policies and routinely provides updates to the Board.

Grainger believes that a purpose-driven culture is an asset that creates a sustainable, competitive advantage for the Company. Building on its strong foundation while evolving a framework to address future challenges is critical to Grainger’s continued success. Grainger has been consistently recognized for its commitment to its culture, diversity, equity and inclusion efforts and employee engagement.

Team Member Profile

As of December 31, 2021, Grainger had approximately 24,200 team members worldwide, of whom approximately 22,700 were full-time and 1,500 were part-time or temporary. Approximately 86% of these team members resided in North America, 8% in Asia and 6% in Europe. Grainger has not experienced any major work stoppages and considers team member relations to be good.

Workplace Practices and Policies

The Company has in place a strategic framework, The Grainger Edge, which outlines a set of principles that define the behaviors expected from Grainger’s team members in working with each other and the Company's customers, suppliers and communities. This framework helps the Company execute its strategy and create value for shareholders.

The Grainger Edge principles also guide the Company’s actions supporting health and safety, diversity, equity and inclusion, and team member experience, including talent acquisition and team member retention, development and compensation and benefits. The Grainger Edge principles are:

| | | | | |

•Start with the Customer | •Win as One Team |

•Embrace Curiosity | •Invest in our Success |

•Act with Intent | •Do the Right Thing |

•Compete with Urgency | |

Grainger’s culture and principles help the Company attract, retain, motivate and develop its workforce and help drive team member engagement. The Company believes an engaged workforce leads to a more innovative, productive and profitable company and measures team member engagement on an ongoing basis. The results from engagement surveys are used to identify and then implement programs and processes designed to enhance the inclusive culture Grainger aspires to achieve.

Health and Safety

Grainger strives to provide a safe work environment and ensuring team members are properly prepared to perform the many tasks required to support customers. The Company’s Environmental, Health and Safety (EHS) program is designed to integrate EHS into Grainger’s business operations and comply with applicable regulations. To that end, the Company requires each of its locations to perform regular safety audits to confirm proper safety policies, programs, procedures and training are in place.

The Company is focused on promoting a culture of safety and education. Operational team members must complete routine training to fully understand the expectation of behaviors defined by the Company’s global EHS policy. Managing and reducing risks at DCs and other facilities remain a core objective and injury rates continue to be low. In 2021, the Company’s Occupational Safety and Health Administration (OSHA) Total Recordable Incident Rate in the U.S. was 1.2 and the Company’s Lost Time Incident Rate in the U.S. was 0.3 based upon the number of incidents per 100 team members (or per 200,000 work hours).

The Company has a proactive response to the coronavirus (COVID-19) pandemic via a task force that helps to ensure the Company’s actions around team members and facilities meet the rigorous guidelines from the Center for Disease Control and World Health Organization, as well as maintaining compliance with state and local health guidelines.

To further support team members' well-being, the Company enhanced its benefit offerings to provide greater access to mental, financial and physical health resources.

Diversity, Equity and Inclusion

Grainger believes a diverse talent pipeline is essential to live its principles, foster innovation, build high-performing teams and drive business results. The Company understands that future business success requires a mix of current and new skill sets, multiple experiences, and a diversity of backgrounds and perspectives, and strives to reflect this priority in its hiring, retention and promotion practices. The Company aspires to increasingly promote a welcoming, inclusive culture that values all people – regardless of sex, gender, race, color, religion, national origin, age, disability, veteran status, sexual orientation, gender expression or experiences – through recruiting outreach, internal networking, business resource groups and mentoring programs.

Grainger's commitment to diversity, equity and inclusion starts at the top. The Company’s Board of Directors is comprised of approximately 31% female and 31% racially and ethnically diverse directors. Grainger also maintains this strong commitment with the CEO's leadership team and throughout the organization. The CEO's leadership team is comprised of approximately 43% women and approximately 29% racially and ethnically diverse leaders. As of December 31, 2021, within Grainger’s U.S. workforce, approximately 39% of team members were women and approximately 37% of team members were racially and ethnically diverse.

Talent Acquisition, Retention and Development

Grainger believes that a great customer experience starts with a great team member experience. The Company is committed to providing team members with resources designed to help them succeed. Grainger focuses on creating opportunities for team member growth, development and training, including offering a comprehensive talent program that continues throughout a team member’s career. This talent program is comprised of performance management, career management, professional development learning opportunities and milestone leadership development programs.

Compensation and Benefits

Grainger believes that its future success is highly dependent upon the Company’s continued ability to attract, retain and motivate team members. As part of its efforts in these areas, the Company offers competitive compensation and benefits to meet the diverse needs of team members and support their health and well-being, financial future and work-life balance. Team members are given access to health plan resources which include 24-hour virtual health services, disease management, tobacco cessation, parental support, stress management and weight loss programs with access to online support communities. In addition, Grainger provides retirement savings, paid holidays and time off, educational assistance and income protection benefits as well as a variety of other programs.

Available Information

Grainger makes available free of charge, through its website, http://www.invest.grainger.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after these materials are electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC). The content of Grainger’s website is not incorporated by reference into this Form 10-K or in any other report or document filed with the SEC, and any references to Grainger’s website are intended to be inactive textual references only. The SEC also maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Information about Executive Officers

Following is information about the Executive Officers of Grainger, including age, as of January 31, 2022. Executive officers of Grainger generally serve until the next annual appointment of officers, or until earlier resignation or removal.

| | | | | |

| Name and Age | Positions and Offices Held and Principal Occupation and Employment |

| Kathleen S. Carroll (53) | Senior Vice President and Chief Human Resources Officer, a position assumed in December 2018. Previously, Ms. Carroll served as Executive Vice President, Chief Human Resources Officer of First Midwest Bancorp, Inc., a diversified financial services company, from 2017 to 2018. Prior to that role, Ms. Carroll was employed at Aon Corporation, a global insurance brokerage and consulting company, between 2006 and 2017 in various human resources roles, culminating in her position as Vice President, Global Head of Talent Acquisition. |

| John L. Howard (64) | Senior Vice President and General Counsel, a position assumed in January 2000. Previously, Mr. Howard served in several roles of increasing responsibility at Tenneco, Inc., a global conglomerate. Prior to those roles, Mr. Howard held a variety of legal positions in the federal government, including Associate Deputy Attorney General in the U.S. Department of Justice and in The White House as Counsel to the Vice President. |

| D.G. Macpherson (54) | Chairman of the Board, a position assumed in October 2017, and Chief Executive Officer, a position assumed in October 2016 at which time he was also appointed to the Board of Directors. Previously, Mr. Macpherson served as Chief Operating Officer, a position assumed in 2015, Senior Vice President and Group President, Global Supply Chain and International, a position assumed in 2013, Senior Vice President and President, Global Supply Chain and Corporate Strategy, a position assumed in 2012, and Senior Vice President, Global Supply Chain, a position assumed in 2008. Prior to Grainger, Mr. Macpherson served as Partner and Managing Director at Boston Consulting Group, a global management consulting firm. |

| Deidra C. Merriwether (53) | Senior Vice President and Chief Financial Officer, a position assumed in January 2021. Previously, Ms. Merriwether served as Senior Vice President, and President, North American Sales & Services, a position assumed in November 2019, Senior Vice President, U.S. Direct Sales and Strategic Initiatives, a position assumed in September 2017, Vice President, Pricing and Indirect Procurement, a position assumed in 2016 and as a Vice President in Finance from 2013 to 2016. Prior to Grainger, Ms. Merriwether held various positions as a Vice President, including positions of increasing responsibility at Sears Holdings Corporation, a broadline retailer, PriceWaterhouseCoopers, a global professional services firm, and Eli Lilly & Company, a global pharmaceutical company. |

| Paige K. Robbins (53) | Senior Vice President and President, Grainger Business Unit, a position assumed in January 2021. Previously, Ms. Robbins served as Senior Vice President and Chief Technology, Merchandising, Marketing, and Strategy Officer, a position assumed in November 2019, as Senior Vice President and Chief Merchandising, Marketing, Digital, Strategy Officer, a position assumed in May 2019, as Senior Vice President and Chief Digital Officer, a position assumed in September 2017, and as Senior Vice President, Global Supply Chain, Branch Network, Contact Centers and Corporate Strategy, a position assumed in 2016. Since joining Grainger in September 2010, Ms. Robbins has held various positions as a Vice President, including in the areas of Global Supply Chain and Logistics. Prior to Grainger, Ms. Robbins served as Partner and Managing Director at Boston Consulting Group, a global management consulting firm. |

Laurie R. Thomson (48)

| Vice President, Controller and principal accounting officer, a position assumed in May 2021. Previously, Ms. Thomson served as Vice President, Internal Audit and Finance Continuous Improvement of the Company, a position assumed in November 2019, Vice President, Internal Audit from October 2016 to November 2019, Senior Director, Finance from June 2011 to September 2016, and Director, Internal Audit from February 2008 to June 2011. Ms. Thomson is a certified public accountant and prior to Grainger served as Director, Internal Audit at CVS Health Corporation, a pharmacy healthcare provider, and Audit Manager at Arthur Andersen LLP, a professional services firm. |

Item 1A: Risk Factors

The following is a discussion of significant risk factors relevant to Grainger’s business that could adversely affect its financial condition, results of operations and cash flows. The risk factors discussed in this section should be considered together with information included elsewhere in this Annual Report on Form 10-K and should not be considered the only risks to which the Company is exposed.

Industry and Market Risks

Grainger’s business and operations have been and may continue to be adversely affected by the global outbreak of the Coronavirus and its variants, including the Delta variant, the Omicron variant and any other variants that may emerge (COVID-19 pandemic) and may be adversely affected by other global outbreaks of pandemic disease.

Any global outbreaks of pandemic disease, such as the COVID-19 pandemic, could have a material adverse effect on Grainger’s business, results of operations and financial condition, including liquidity, capital and financing resources.

The COVID-19 pandemic has disrupted and adversely affected Grainger’s business, including its business with customers and suppliers. Among other things, Grainger experienced customer disruptions, including their ability or willingness to purchase products, delays in making purchasing decisions, and shifts in the types and quantities of products purchased. These may recur during and beyond the COVID-19 pandemic. Grainger has also experienced and may continue to experience supply chain disruptions, supplier inability to manufacture or deliver products to Grainger or meet the unprecedented demand for pandemic-related products, rapid shifts in the type, quantity or quality of products sold, and higher product costs as a result of inflation.

Additional effects from the COVID-19 pandemic on Grainger's business include adverse impacts on transportation, including shipping delays and port disruptions, increased shipping costs, constraints on the availability of products, and labor shortages, which have impacted Grainger’s ability to hire employees to fill all open positions. The potential for further disruptions from the COVID-19 pandemic, including closures of customer and supplier facilities remains. Furthermore, Grainger's ability to collect its accounts receivable or receive product ordered from suppliers, as customers and suppliers face higher liquidity and solvency risks and seek terms that are less favorable to Grainger, may adversely affect the Company’s business. These developments, alone or in combination, could materially adversely affect Grainger’s future sales and results of operations.

The effects of the COVID-19 pandemic on Grainger also include restrictions on Grainger’s employees’ ability to visit customers and many of Grainger’s employees’ ability to work in offices or at facilities, as well as disruptions or temporary closures of the Company’s facilities, including distribution centers, branches, and support buildings. Some actions that Grainger has taken in response to the COVID-19 pandemic, including enabling remote working arrangements, may increase Grainger’s vulnerability to cybersecurity incidents including breaches of information systems security, which could damage Grainger’s reputation and commercial relationships, disrupt operations, increase costs and/or decrease revenues, and expose Grainger to claims from customers, suppliers, financial institutions, regulators, payment card association, employees and others. In addition, Grainger’s remote working arrangements have required the Company to make adaptions to its controls and procedures that could impact their design or operating effectiveness. The COVID-19 pandemic has also resulted in increased variable compensation, wage rates and employee healthcare costs, which adversely affect net earnings, and Grainger expects these trends to continue.

Furthermore, as a result of surges in demand and disruptions in supply chains, including in Asia and other locations, from time to time, the COVID-19 pandemic has resulted in shortages of certain PPE, cleaning supplies and other products. These shortages have impacted and in the future may continue to impact Grainger's ability to obtain or deliver inventory to customers on a timely basis or at all. While Grainger attempts to maintain sufficient inventory levels to meet quickly shifting customer demand patterns and supplier lead time requirements, which may become extended due to the pandemic demand increase, the Company cannot be certain it will be able to accurately predict demand or lead times, which might cause it to be unable to service customer demand or expose it to risks of product shortages. This uncertainty caused Grainger to acquire excess inventory, which led to additional inventory carrying costs and inventory obsolescence, and similar results may occur in the future. For example, in each of its first two fiscal quarters of 2021 as discussed in its corresponding Quarterly Reports on Form 10-Q, the Company had pandemic-related inventory adjustments in the U.S. business (part of High-Touch Solutions N.A.) on certain non-core SKUs, which were selling below cost based on then current market-relevant pricing.

From time to time, product shortages have also required the Company to procure products from new suppliers or through brokers with whom it has a limited or no prior relationship. Despite due diligence and product compliance protocols, the products from these sources may not be delivered on a timely basis or at all, or their quality may not be as represented, all of which could cause Grainger to incur costs, including the expense of procuring alternate products or recalling or replacing products in addition to reputational and other adverse impacts to Grainger’s business.

Moreover, global outbreaks such as the COVID-19 pandemic have resulted in a widespread health crisis that has adversely affected and could continue to adversely affect the economies of many countries, resulting in a global or regional economic downturn or recession and supply chain challenges. Any such recession could result in a significant decline in access to products, demand for the Company’s products or limit Grainger’s ability to access capital markets, any of which could materially adversely affect the Company’s business, results of operations and financial condition.

The duration and ultimate impact of the COVID-19 pandemic on the Company’s business, results of operations and financial condition will depend on numerous evolving factors and future developments, which are highly uncertain and cannot be predicted at this time. Such factors and developments may include the geographic spread, severity and duration of the COVID-19 pandemic, including whether there are periods of increased COVID-19 cases, the further spread of the Delta variant, Omicron variant or the emergence of other new or more contagious variants that may render vaccines ineffective or less effective, disruption to Grainger’s operations resulting from employee illnesses or any inability to attract, retain or motivate employees, the development, availability and administration of effective treatment or vaccines and the willingness of individuals to receive a vaccine or otherwise comply with various mandates, the extent and duration of the impact on the U.S. or global economy, including the pace and extent of recovery when the pandemic subsides, and the actions that have been or may be taken by various governmental authorities in response to the outbreak.

The Company is a federal contractor and part of its workforce is covered by vaccine mandates imposed under President Biden's September 9, 2021 executive order. Complying with these requirements or other potential government mandates could disrupt the workforce and operations and impose additional compliance and other costs. Other requirements, including health and safety measures such as social distancing and mask mandates and/or travel bans, import and export restrictions, pricing mandates, including disaster or emergency declaration pricing statutes, and mandatory directives that certain products be allocated or provided to certain customers, could also disrupt the Company’s business and impose costs. If the Company is unable to respond to and manage the impact of these mandates, requirement or events, the Company’s business and results of operations may continue to be adversely affected.

Inflation could cause Grainger's operating and administrative expenses to grow more rapidly than net sales, which could result in lower gross margins and lower net earnings.

Market variables, such as inflation of product costs, labor rates and fuel, freight and energy costs, could increase potentially causing the Company to be unable to manage its operating and administrative expenses in a way that would enable it to leverage its revenue growth into higher net earnings. In addition, Grainger's inability to pass on such increases in costs to customers in a timely manner, or at all, could cause Grainger's operating and administrative expenses to grow, which could result in lower gross profit margins and lower net earnings.

Disruptions in Grainger’s supply chain could result in an adverse impact on results of operations.

The occurrence of one or more natural or human induced disasters, including earthquakes, storms, hurricanes, floods, fires, droughts, tornados and other extreme weather; pandemic diseases or viral contagions such as the COVID-19 pandemic; geopolitical events, such as war, civil unrest or terrorist attacks in a country in which Grainger operates or in which its suppliers are located; and the imposition of measures that create barriers to or increase the costs associated with international trade could result in disruption of Grainger’s logistics or supply chain network. For example, the outbreak of the COVID-19 pandemic has disrupted and may continue to disrupt the operations of the Company and its suppliers and customers. Customer demand for certain products has also fluctuated as the pandemic has progressed, which has challenged Grainger's ability to anticipate and/or procure product to maintain inventory levels to meet that demand. These factors have resulted in higher out-of-stock inventory positions in certain products as well as delays in delivering those products to the Company's distribution centers, branches or customers, and similar results may occur in the future. Even when Grainger is able to find alternate sources for certain products, they may cost more or require the Company to incur higher transportation costs, which could adversely impact the Company's profitability and financial condition. Any of these circumstances could impair Grainger's ability to meet customer demand for products and result in lost sales, increased supply chain costs, penalties or damage to Grainger's reputation. Grainger’s ability to provide same-day shipping and next-day delivery is an integral component of Grainger’s business strategy and any such disruption could adversely impact results of operations and financial performance.

Weakness in the economy, market trends and other conditions affecting the profitability and financial stability of Grainger’s customers could negatively impact Grainger’s sales growth and results of operations.

Economic, political and industry trends affect Grainger’s business environments. Grainger serves several industries and markets in which the demand for its products and services is sensitive to the production activity, capital spending and demand for products and services of Grainger’s customers. Many of these customers operate in markets that are subject to cyclical fluctuations resulting from market uncertainty, trade and tariff policies, costs of goods sold, currency exchange rates, central bank interest rate fluctuations, economic downturns, recessions, foreign competition, offshoring of production, oil and natural gas prices, geopolitical developments, labor shortages, inflation, natural or human induced disasters, extreme weather, outbreaks of pandemic disease such as the COVID-19 pandemic, inflation, deflation, and a variety of other factors beyond Grainger’s control. Any of these factors could cause customers to idle or close facilities, delay purchases, reduce production levels, or experience reductions in the demand for their own products or services.

Any of these events could also reduce the volume of products and services these customers purchase from Grainger or impair the ability of Grainger’s customers to make full and timely payments and could cause increased pressure on Grainger’s selling prices and terms of sale. Accordingly, a significant or prolonged slowdown in economic activity in Canada, China, Japan, Mexico, the U.K., the U.S. or any other major world economy, or a segment of any such economy, could negatively impact Grainger’s sales growth and results of operations.

Unexpected product shortages, tariffs, product cost increases and risks associated with Grainger’s suppliers could negatively impact customer relationships or result in an adverse impact on results of operations.

Grainger’s competitive strengths include product selection and availability. Products are purchased from more than 4,900 suppliers located in various countries around the world, not one of which accounted for more than 5% of total purchases.

Disruptions in procuring sources of supply could occur due to factors beyond Grainger’s control. These factors could include economic downturns, recessions, outbreaks of pandemic disease such as the COVID-19 pandemic (which from time to time has resulted in some shortages of PPE, cleaning supplies and other products), natural or human induced disasters, extreme weather, geopolitical unrest, tariffs, new tariffs or tariff increases, trade issues and policies, detention orders or withhold release orders on imported products, labor problems or shortages experienced by Grainger’s suppliers or others in the supply chain, transportation availability, staffing and cost, shortage of raw materials, unilateral product cost increases by suppliers of products in short supply, inflation and other factors, any of which could adversely affect a supplier’s ability to manufacture or deliver products or could result in an increase in Grainger’s product costs.

Further, Grainger sources products from Asia and other areas of the world. This increases the risk of supply disruption due to the additional lead time required and distances involved.

If Grainger was unable to promptly replace sources of supply that become disrupted, there could be adverse effects on inventory levels, results of operations, customer relationships and Grainger’s reputation. In addition, Grainger has strategic relationships with a number of vendors. In the event Grainger was unable to maintain those relations, there might be a loss of competitive pricing advantages which could, in turn, adversely affect results of operations.

Volatility in commodity prices may adversely affect gross margins.

Some of Grainger’s products contain significant amounts of commodity-priced materials, such as steel, copper, petroleum derivatives, rare earth minerals, or other materials or inputs required to manufacture PPE and other pandemic-related products and are subject to price changes based on fluctuations in the commodities market. The recent global geopolitical and trade environment has resulted in raw material inflation and potential for increased escalation of domestic and international tariffs and retaliatory trade policies. Further changes in U.S. trade policy (including new or additional increases in duties or tariffs) and retaliatory actions by U.S. trade partners could result in a worsening of economic conditions. The level of demand for Grainger's products and services is influenced in multiple ways by the price and availability of raw materials and commodities, including fuel. Fluctuations in the price of fuel or increased demand for freight services, including as a result of outbreaks of pandemic disease such as the COVID-19 pandemic, could affect transportation costs. Grainger’s ability to pass on such increases in costs in a timely manner depends on market conditions. The inability to pass along cost increases could result in lower gross margins. In addition, higher prices could reduce demand for these products, resulting in lower sales volumes.

Fluctuations in foreign currency could have an effect on reported results of operations.

Grainger’s exposure to fluctuations in foreign currency rates results primarily from the translation exposure associated with the preparation of the Consolidated Financial Statements (Financial Statements), as well as from transaction exposure associated with transactions in currencies other than an entity’s functional currency. While the Financial Statements are reported in U.S. dollars, the Financial Statements of Grainger’s subsidiaries outside the U.S. are prepared using the local currency as the functional currency and translated into U.S. dollars. In addition, Grainger is exposed to foreign currency exchange rate risk with respect to the U.S. dollar relative to the local currencies of Grainger’s international subsidiaries, primarily the Canadian dollar, euro, pound sterling, Mexican peso, renminbi and yen, arising from transactions in the normal course of business, such as sales and loans to wholly owned subsidiaries, sales to customers, purchases from suppliers, and bank loans and lines of credit denominated in foreign currencies. Grainger also has foreign currency exposure to the extent receipts and expenditures are not denominated in a subsidiary’s functional currency and that could have an impact on sales, costs and cash flows. These fluctuations in foreign currency exchange rates could affect Grainger’s results of operations and impact reported net sales and net earnings.

The facilities maintenance industry is highly competitive, and changes in competition could result in decreased demand for Grainger’s products and services.

Grainger competes in a variety of ways, including product assortment and availability, services offered to customers, pricing, purchasing convenience, and the overall experience Grainger offers. This includes the ease of use of Grainger’s high-touch operations and delivery of products.

There are several large competitors in the industry, although most of the market is served by small local and regional competitors. Grainger faces competition in all markets it serves from manufacturers (including some of its own suppliers) that sell directly to certain segments of the market, wholesale distributors, catalog houses, retail enterprises and online businesses that compete with price transparency.

To remain competitive, the Company must be willing and able to respond to market pressures. Downward pressure on sales prices, changes in the volume of orders, and an inability to pass higher product costs on to customers could cause Grainger’s gross profit percentage to fluctuate or decline. Grainger may not be able to pass rising product costs to customers if those customers have ready product or supplier alternatives in the marketplace. These pressures could have a material effect on Grainger’s sales and profitability. If the Company is unable to grow sales or reduce costs, among other actions, the Company’s results of operations and financial condition may be adversely affected.

Moreover, Grainger expects technological advancements and the increased use of eCommerce solutions within the industry to continue to evolve at a rapid pace. As a result, Grainger’s ability to effectively compete requires Grainger to respond and adapt to new industry trends and developments. Grainger has increased, and expects to continue to increase, its investments in developing, managing and implementing technology information systems, software development and other capabilities to provide high-quality service to its customers and simplify customer interactions. Developing, managing or implementing new technology and innovations may result in unexpected costs and disruptions to operations, may take longer than expected, may increase the Company’s vulnerability to cyber breaches, attacks or intrusions, and may not provide all anticipated benefits.

Changes in customer base or product mix could cause changes in Grainger’s revenue or gross margin, or affect Grainger’s competitive position.

From time to time, Grainger experiences changes in customer base and product mix that affect gross margin. Changes in customer base and product mix result primarily from business acquisitions, changes in customer demand, customer acquisitions, selling and marketing activities, competition and the increased use of eCommerce by Grainger and its competitors. For example, as a result of the COVID-19 pandemic, the Company has sold higher volumes of lower-margin pandemic-related products to larger, lower-margin customers, while non-pandemic sales have decreased.

In addition, Grainger has entered, and may in the future continue to enter, into contracts with group purchasing organizations (GPOs) that aggregate the buying power of their member customers in negotiating selling prices. If the Company is unable to enter into, or sustain, contractual arrangements on a satisfactory commercial basis with GPOs, Grainger's results of operations could be adversely affected.

As customer base and product mix change over time, Grainger must identify new products, product lines and services that respond to industry trends and customer needs. The inability to introduce new products and services and effectively integrate them into Grainger’s existing mix could have a negative impact on future sales growth and Grainger’s competitive position.

Grainger’s common stock may be subject to volatility or price declines.

The trading prices and volumes of Grainger’s common stock may be subject to broad and unpredictable fluctuations due to changes in economic, political and market conditions, the financial results and business strategies of Grainger and its competitors, changes in expectations as to Grainger’s future financial or operating performance, including estimates by securities analysts and investors, the Company’s failure to meet the financial performance guidance or other forward-looking statements provided to the public, speculation, coverage or sentiment in the media or investment community or by groups of individual investors, changes in capital structure, share repurchase programs or dividend policies, outbreak of pandemic disease such as the COVID-19 pandemic, and a number of other factors, including those discussed in this Item 1A. These factors, many of which are outside of Grainger’s control, could cause stock price and trading volume volatility or Grainger’s stock price to decline. Volatility in the price of Grainger's securities could result in the filing of securities class action litigation, which could result in substantial costs and the diversion of management time and resources.

Operational Risks

Interruptions in the proper functioning of information systems could disrupt operations and cause unanticipated increases in costs and/or decreases in revenues.

The proper functioning of Grainger’s information systems is critical to the successful operation of its business. Grainger continues to invest in software, hardware and network infrastructures in order to effectively manage its information systems. Although Grainger’s information systems are protected with robust backup and security systems, including physical and software safeguards and remote processing capabilities, information systems are still vulnerable to damage or interruption from natural or human induced disasters, extreme weather, power losses, telecommunication failures, user error, third party actions such as malicious computer programs, denial-of-service attacks and cybersecurity breaches, and other problems. In addition, from time to time Grainger relies on the information technology (IT) systems of third parties to assist in conducting its business.

If Grainger’s systems or those of third parties on which Grainger depends are damaged, breached, cease to function properly or are otherwise disrupted, Grainger may have to make a significant investment to repair or replace them and may suffer interruptions in its business operations in the interim. If critical information systems fail or otherwise become unavailable, Grainger’s ability to operate its eCommerce platforms, process orders, maintain proper levels of inventories, collect accounts receivable, disburse funds, manage its supply chain, monitor results of operations, and process and store employee or customer data, among other functions, could be adversely affected. Any such interruption of Grainger’s information systems could have a material adverse effect on its business or results of operations. Grainger has experienced these incidents in the past, which it deemed immaterial to its business and operations individually and in the aggregate and may be subject to other incidents in the future. There can be no assurance that any future incidents will not be material to Grainger’s business, operations or financial condition.

Cybersecurity incidents, including breaches of information systems security, could damage Grainger’s reputation, disrupt operations, increase costs and/or decrease revenues.

Through Grainger’s sales and eCommerce channels, the Company collects and stores personally identifiable, confidential, proprietary and other information from customers so that they may, among other things, purchase products or services, enroll in promotional programs, register on Grainger’s websites or otherwise communicate or interact with the Company. Moreover, Grainger’s operations routinely involve receiving, storing, processing and transmitting sensitive information pertaining to its business, customers, suppliers and employees, and other sensitive matters.

Cyber threats are rapidly evolving and those threats and the means for obtaining access to information in digital and other storage media are becoming increasingly sophisticated. Each year, cyber-attackers make numerous attempts to access the information stored in the Company’s information systems. If successful, these attacks may expose Grainger to risk of loss or misuse of proprietary or confidential information or disruptions of business operations. Some actions that Grainger has taken in response to the COVID-19 pandemic, including enabling remote working arrangements, may increase Grainger’s vulnerability to cybersecurity incidents, including breaches of information systems security, which could damage Grainger’s reputation and commercial relationships, disrupt operations, increase costs and/or decrease revenues, and expose Grainger to claims from customers, suppliers, financial institutions, regulators, payment card association, employees and others.

Grainger's IT infrastructure also includes products and services provided by suppliers, vendors and other third parties, and these providers can experience breaches of their systems and products that impact the security of systems and proprietary or confidential information. Moreover, from time to time, Grainger may share information with these third parties in connection with the products and services they provide to the business. While Grainger requires assurances that these third parties will protect confidential information, there is a risk that the confidentiality of data held or accessed by them may be compromised. If successful, those attempting to penetrate Grainger’s or its vendors’ information systems may misappropriate intellectual property or personally identifiable, credit card, confidential, proprietary or other sensitive customer, supplier, employee or business information, or cause systems disruption. While many of Grainger's agreements with these third parties include indemnification provisions, the Company may not be able to recover sufficiently, or at all, under such provisions to adequately offset any losses it may incur.

Moreover, the Company may face the threat to its computer systems of unauthorized access, computer hackers, computer viruses, malicious code, ransomware, phishing, organized cyber-attacks and other security problems and system disruptions. Such tactics may also seek to cause payments due to or from the Company to be misdirected to fraudulent accounts, which may not be recoverable by the Company.

In addition, a Grainger employee, contractor or other third party with whom Grainger does business may attempt to circumvent security measures or otherwise access Grainger’s information systems in order to obtain such information or inadvertently cause a breach involving such information. Further, Grainger’s systems are integrated with customer systems in certain cases, and a breach of the Company’s information systems could be used to gain illicit access to a customer’s systems and information.

Grainger has been subject to unauthorized accesses of certain supplier and customer information in the past, which it deemed immaterial to its business and operations individually and in the aggregate, and may be subject to other unauthorized accesses of its systems in the future. There can be no assurance that any future unauthorized access to or breach of Grainger’s information systems will not be material to Grainger’s business, operations or financial condition.

Grainger maintains information security staff, policies and procedures for managing risk to its information security systems, conducts annual employee awareness training of cybersecurity threats and routinely utilizes consultants to assist in evaluating the effectiveness of the security of its IT systems. While Grainger has instituted these and other safeguards for the protection of information, because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until they are launched against a target, Grainger may be unable to anticipate these techniques or implement adequate preventative measures. Any breach of Grainger’s security measures or any breach, error or malfeasance of those of its third-party service providers could cause Grainger to incur significant costs to protect any customers, suppliers, employees, and other parties whose personal data is compromised and to make changes to its information systems and administrative processes to address security issues. In addition, although Grainger maintains insurance coverage that may, subject to policy terms and conditions, cover certain aspects of cyber and information security risks, such insurance coverage may be insufficient to cover all losses.

Grainger continuously evaluates the need to upgrade and/or replace its systems and network infrastructure to protect its computing environment, to stay current on vendor supported products and to improve the efficiency of its systems and for other business reasons. The implementation of new systems and IT could adversely impact its operations by imposing substantial capital expenditures, demands on management time and risks of delays or difficulties in transitioning to new systems. In addition, the Company's systems implementations may not result in productivity improvements at the levels anticipated. Systems implementation disruption and any other IT disruption, if not anticipated and appropriately mitigated, could have an adverse effect on its business.

Loss of customer, supplier, employee or intellectual property or other business information or failure to comply with data privacy and security laws could disrupt operations, damage Grainger’s reputation and expose Grainger to claims from customers, suppliers, financial institutions, regulators, payment card associations, employees and others, any of which could have a material adverse effect on Grainger, its financial condition and results of operations. In the past, Grainger has experienced certain cybersecurity incidents. In each instance, Grainger provided notifications and adopted remedial measures. While these incidents have not been deemed to be material to Grainger, there can be no assurance that a future breach or incident would not be material to Grainger’s operations and financial condition.

Grainger’s ability to adequately protect its intellectual property or successfully defend against infringement claims by others may have an adverse impact on operations.

Grainger’s business relies on the use, validity and continued protection of certain proprietary information and intellectual property, which includes current and future patents, trade secrets, trademarks, service marks, copyrights and confidentiality agreements as well as license and sublicense agreements to use intellectual property owned by affiliated entities or third parties. Unauthorized use of Grainger’s intellectual property by others could result in harm to various aspects of the business and may result in costly and protracted litigation in order to protect Grainger’s rights. In addition, Grainger may be subject to claims that it has infringed on the intellectual property rights of others, which could subject Grainger to liability, require Grainger to obtain licenses to use those rights at significant cost or otherwise cause Grainger to modify its operations.

In order to compete, Grainger must attract, retain, train, motivate and develop key employees, and the failure to do so could have an adverse effect on results of operations.

In order to compete and have continued growth, Grainger must attract, retain, train, motivate and develop executives and other key employees, including those in managerial, technical, sales, marketing and IT support positions. Grainger competes to hire employees at increasingly competitive wage rates and then must train them and develop their skills and competencies. Qualified individuals needed to fill open positions may be in short supply in some areas. Further, changes in market compensation rates may adversely affect the Company's labor costs. Competition for qualified employees could require the Company to pay higher wages to attract a sufficient number of employees. The Company's employee hiring and retention also depends on the Company's ability to build and maintain a diverse and inclusive workplace culture that enables its employees to thrive.

Grainger’s results of operations could be adversely affected by increased costs due to increased competition for diverse talent, higher employee turnover, increased employee benefit costs, failure to successfully hire executives and key employees or the loss of executives and key employees. Further, changes in the Company's management team may be disruptive to its business, and any failure to successfully transition and assimilate key new hires or promoted employees could adversely affect its business and results of operations.

Grainger’s continued success is substantially dependent on positive perceptions of Grainger’s reputation.

One of the reasons customers choose to do business with Grainger and employees choose Grainger as a place of employment is the reputation that Grainger has built over many years. Grainger devotes time and resources to environmental, social and governance (ESG) efforts that are consistent with its corporate values and are designed to strengthen its business and protect and preserve its reputation, including programs driving ethics and corporate responsibility, strong communities, diversity, equity and inclusion, gender equality and environmental sustainability. Grainger’s failure to execute its ESG programs as planned could adversely affect the Company’s reputation, business and financial performance. To be successful in the future, Grainger must continue to preserve, grow and leverage the value of Grainger’s brand. Reputational value is based in large part on perceptions of subjective qualities. Even an isolated incident, or the aggregate effect of individually insignificant incidents, can erode trust and confidence, particularly if they result in adverse publicity, governmental investigations or litigation, and as a result, could tarnish Grainger’s brand and lead to adverse effects on Grainger’s business.

Regulatory, Legal and Tax Risks

Grainger is subject to various domestic and foreign laws, regulations and standards. Failure to comply or unforeseen developments in related contingencies such as litigation could adversely affect Grainger’s financial condition, profitability and cash flows.

Grainger’s business is subject to legislative, legal, and regulatory risks and conditions specific to the countries in which it operates. In addition to Grainger’s U.S. operations, which in 2021 generated approximately 79% of its consolidated net sales, Grainger operates its business principally through wholly owned subsidiaries in Canada, China, Mexico, and the U.K., and its majority-owned subsidiary in Japan.

The wide array of laws, regulations and standards in each domestic and foreign jurisdiction where Grainger operates, include, but are not limited to: advertising and marketing regulations, anti-bribery and corruption laws, anti-competition regulations, data protection (including, because Grainger accepts credit cards, the Payment Card Industry Data Security Standard), data privacy (including in the U.S., the California Consumer Privacy Act, and in the European Union, the General Data Protection Regulation 2016) and cybersecurity requirements (including protection of information and incident responses), environmental protection laws, foreign exchange controls and cash repatriation restrictions, health and safety laws, import and export requirements, intellectual property laws, labor laws (including federal and state wage and hour laws), product compliance or safety laws, supplier regulations regarding the sources of supplies or products, tax laws (including as to U.S. taxes on foreign subsidiaries), unclaimed property laws and laws, regulations and standards applicable to other commercial matters. Moreover, Grainger is also subject to audits and inquiries in the normal course of business.

Failure to comply with any of these laws, regulations and standards could result in civil, criminal, monetary and non-monetary fines, penalties and/or, remediation costs as well as potential damage to the Company’s reputation. Changes in these laws, regulations and standards, or in their interpretation, could increase the cost of doing business, including, among other factors, as a result of increased investments in technology and the development of new operational processes. Furthermore, while Grainger has implemented policies and procedures designed to facilitate compliance with these laws, regulations and standards, there can be no assurance that employees, contractors, suppliers, vendors, or other third parties will not violate such laws, regulations and standards or Grainger’s policies. Any such failure to comply or violation could individually or in the aggregate materially adversely affect Grainger’s financial condition, results of operations and cash flows.

In addition, Grainger’s business and results of operations in the U.K. may be negatively affected by changes in trade policies, or changes in labor, immigration, tax or other laws, resulting from the U.K.’s exit from the European Union.

Grainger is subject to a number of rules and regulations related to its government contracts, which may result in increased compliance costs and potential liabilities.

Grainger’s contracts with U.S. federal, state and local government entities are subject to various and changing regulations related to procurement, formation and performance. In addition, the Company’s government contracts may provide for termination, reduction or modification by the government at any time, with or without cause. From time to time, Grainger is subject to governmental or regulatory investigations or audits related to its compliance with these rules and regulations. Violations of these regulations could result in fines, criminal sanctions, the inability to participate in existing or future government contracting and other administrative sanctions. Any such penalties could result in damage to the Company’s reputation, increased costs of compliance and/or remediation and could adversely affect the Company’s financial condition and results of operations.

In conducting its business, Grainger may become subject to legal proceedings or governmental investigations, including in connection with product liability or product compliance claims if people, property or the environment are harmed by Grainger’s products or services.

Grainger is, and from time to time may become, party to a number of legal proceedings or governmental investigations for alleged violations of laws, rules or regulations. Grainger also may be subject to disputes and proceedings incidental to its business, including product-related claims for personal injury or illness, death, environmental or property damage or other commercial disputes, including the proceedings discussed in Part I, Item 3: Legal Proceedings. The defense of these proceedings may require significant expenses and divert management’s time and attention, and Grainger may be required to pay damages that could individually or in the aggregate materially adversely affect its financial condition, results of operations and cash flows. In addition, any insurance or indemnification rights that Grainger may have with respect to such matters may be insufficient or unavailable to protect the Company against potential loss exposures. Grainger also may be requested or required to recall products or take other actions. The Company’s reputation could also be adversely affected by any resulting negative publicity.

Tax changes could affect Grainger’s effective tax rate and future profitability.

Grainger’s future results could be adversely affected by changes in the effective tax rate as a result of Grainger’s relative overall profitability and the mix of earnings in countries with differing statutory tax rates, changes in tax legislation, the results of the examination of previously filed tax returns, and continuing assessment of the Company’s tax exposures.

Grainger may be adversely impacted by the effects of climate change and may incur increased costs and experience other impacts due to new or more stringent environmental laws and regulations designed to address climate change.

The potential impacts of climate change on the Company’s suppliers, product offerings, operations, facilities and customers are accelerating and uncertain. Increased public awareness and concern regarding global climate change may result in more international, federal, and/or state or other stakeholder requirements or expectations that could result in more restrictive or expansive standards, such as stricter limits on greenhouse gas emissions or more prescriptive reporting of environmental, social, and governance metrics. There continues to be a lack of consistent climate change legislation and standards, which creates economic and regulatory uncertainty. New laws, regulations and enforcement could strain the Company’s suppliers and result in increased compliance-related costs, which could result in higher product costs that are passed to the Company. New or changing environmental laws and regulations could also increase the Company’s operating costs, including through higher utility and transportation costs, and Grainger is unable to predict the potential impact such laws and regulations could have on its financial condition and results of operations. In addition, the potential physical risks of climate change may impact the availability and cost of materials and natural resources, sources and supply of energy and product demand, and could increase the Company’s operating costs. Natural disasters as a result of climate change at locations where the Company, its suppliers or customers operate could cause disruptions to the Company’s operations, which could adversely affect sales and could negatively impact Grainger’s business, financial condition, results of operations and cash flows. If environmental laws and regulations are either changed or adopted that impose significant operational restrictions or compliance requirements upon the Company or its suppliers, products, or customers, or the Company's operations are disrupted due to physical impacts of climate change, the Company's business, capital expenditures, financial condition, results of operations and competitive position could be negatively impacted.

Credit and Liquidity Risks

Changes in Grainger’s credit ratings and outlook may reduce access to capital and increase borrowing costs.

Grainger’s credit ratings are based on a number of factors, including the Company’s financial strength and factors outside of Grainger’s control, such as conditions affecting Grainger’s industry generally or the introduction of new rating practices and methodologies. Grainger cannot provide assurances that its current credit ratings will remain in effect or that the ratings will not be lowered, suspended or withdrawn entirely by the rating agencies. If rating agencies lower, suspend or withdraw the ratings, the market price or marketability of Grainger’s securities may be adversely affected. In addition, any change in ratings could make it more difficult for the Company to raise capital on favorable terms, impact the Company’s ability to obtain adequate financing, and result in higher interest costs for the Company’s existing credit facilities or on future financings.

Grainger has incurred substantial indebtedness and may incur substantial additional indebtedness, which could adversely affect cash flow, decrease business flexibility, or prevent Grainger from fulfilling its obligations.

As of December 31, 2021, Grainger’s consolidated indebtedness was approximately $2.4 billion. The Company’s indebtedness could, among other things, limit Grainger’s ability to respond to rapidly changing business and economic conditions, require the Company to dedicate a substantial portion of its cash flows to the payment of principal and interest on its indebtedness, reducing the funds available for other business purposes, and make it more difficult to satisfy the Company’s financial obligations as they come due during periods of adverse economic and industry conditions.

The agreements governing Grainger’s debt agreements and instruments contain representations, warranties, affirmative, negative and financial covenants, and default provisions. Grainger’s failure to comply with these restrictions and obligations could result in a default under such agreements, which may allow Grainger’s creditors to accelerate the related indebtedness. Any such acceleration could have a material adverse effect on Grainger’s business, financial condition, results of operations, cash flows, and its ability to obtain financing on favorable terms in the future.

In addition, Grainger may in the future seek to raise additional financing for working capital, capital expenditures, refinancing of indebtedness, share repurchases or other general corporate purposes. Grainger’s ability to obtain additional financing will be dependent on, among other things, the Company’s financial condition, prevailing market conditions and numerous other factors beyond the Company’s control. Such additional financing may not be available on commercially reasonable terms or at all. Any inability to obtain financing when needed could materially adversely affect the Company’s business, financial condition or results of operations.

Item 1B: Unresolved Staff Comments

None.

Item 2: Properties

As of December 31, 2021, Grainger’s owned and leased facilities totaled approximately 29.2 million square feet. Grainger owns and leases facilities primarily in the U.S., Japan, Canada (5), Mexico (6), Puerto Rico (7) and the U.K. (8) The Company's corporate headquarters is located in Lake Forest, Illinois and other general offices are located in the Chicago Metropolitan area. Grainger believes that its properties are generally in excellent condition, well maintained and suitable for the conduct of business.

The following table includes Grainger's material facilities:

| | | | | | | | | | | | | | | | | | | | |

| Location | | Facility and Use (9) | | Size in Square Feet (in thousands) | | Segment |

U.S. (1) | | DCs | | 9,132 | | High-Touch Solutions N.A. |

U.S. (2) | | Branch Locations | | 6,407 | | High-Touch Solutions N.A. |

U.S. (3) | | Other Facilities | | 4,805 | | High-Touch Solutions N.A. |

Japan (4) | | DCs | | 3,718 | | Endless Assortment |

(1) Consists of 16 DCs that range in size from approximately 55,000 to 1.5 million square feet. These facilities are primarily owned.

(2) Consists of 246 branches, 45 onsite and three will-call express locations. These branches range in size from approximately 500 to 109,000 square feet. These facilities are primarily owned.

(3) Primarily consists of storage facilities, office space and customer service centers. These facilities are both owned and leased. These facilities range in size from approximately 200 to 633,000 square feet.