Disciplined Growth Investor Presentation November 2016

Safe Harbor Statement This presentation contains unaudited financial information and forward-looking statements. Statements that are not historical are forward-looking statements and may contain words such as “may,” “will,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “project,” “estimate,” and “objective” or similar terminology, concerning the Company’s future financial performance, business strategy, plans, goals and objectives. These expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning the Company’s possible or assumed future performance or results of operations and are not guarantees. While these statements are based on assumptions and judgments that management has made in light of industry experience as well as perceptions of historical trends, current conditions, expected future developments and other factors believed to be appropriate under the circumstances, they are subject to risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different. Such risks and uncertainties include, but are not limited to, economic conditions, product and price competition, supplier and raw material prices, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation, legal and regulatory developments and other risks and uncertainties described under Item 1A, Risk Factors, in the Company’s Annual Report on Form 10-K and in other filings with the Securities and Exchange Commission (“SEC”). Such forward-looking statements are made as of the date hereof and we undertake no obligation to update these forward-looking statements regardless of new developments or otherwise. This presentation also contains certain measures that are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations, and to provide an additional measure of performance which management considers in operating the business. A reconciliation of these items to the most comparable GAAP measures is provided in our filings with the SEC and in the Appendix to this presentation. 2

Our Mission Providing products and services to protect people and our planet Our Values We operate with the highest principles and deliver results through - Customer focus - Innovation - Continuous improvement - Teamwork and investing in our people Our Numbers $718 M revenue, $68 M operating income (TTM as of 9/30/16) ~$733 M market capitalization (11/2/16) Diversified manufacturing from 10 facilities in 5 countries Employees: ~2,200 worldwide 3

Experienced Management Team Dennis Martin Executive Chairman President and Chief Executive Officer October 2010 – December 2015 Previously served as Chairman, President and CEO of General Binding Corporation 35+ years operational and leadership experience, primarily at Illinois Tool Works and Ingersoll-Rand Transitioning to non-executive Chairman January 1, 2017 Brian Cooper Chief Financial Officer Appointed May, 2013 Chief Financial Officer of Westell Technologies, Inc. from 2009 – 2013 Previously with Fellowes, Inc. (CFO), United Stationers, Borg-Warner Security and Amoco Strong treasury, financial, M&A and strategy background Jennifer Sherman President and Chief Executive Officer Appointed January, 2016 Previously Chief Operating Officer, Chief Administrative Officer, Secretary and General Counsel, with operating responsibilities for the Company’s Safety and Security Systems Group Joined Federal Signal in 1994 as Corporate Counsel 4 Ian Hudson Vice President, Corporate Controller Appointed August, 2013 Previously served as Director of Accounting – Latin America and Asia Pacific at Groupon, Inc. 13+ years public accounting experience with Ernst & Young, LLP

Federal Signal Businesses Environmental Solutions (ESG) Vactor sewer cleaners and hydro-excavators, and Guzzler vacuum trucks Elgin street sweepers Jetstream waterblasters Safety and Security Systems (SSG) Vehicle lights and sirens (U.S. PSS and Vama) Indoor and outdoor mass warning and notification systems (Industrial Systems ) Signaling products Victor mining and electrical safety equipment SmartMsg Enabled Systems Enterprise Integrated Command Solution Sensors/ Detectors Cameras Networked PAGASYS Rack $493 M Westech rugged vacuum trucks $225 M Note: Data represents Q3 2016 TTM FS Solutions rental centers, parts and service 5

Environmental Solutions (ESG) Market Share: ≈30-50% U.S. 78% 22% Sales by Geography U.S. Non-U.S. Federal Signal Business Groups Note: Sales-by-Geography data represents Q3 2016 TTM End Markets by Users* 63% 37% Sales by Geography U.S. Non-U.S. Safety and Security Systems (SSG) Market Share: ≈30% U.S. End Markets by Users* Users by Industry Municipal/Government Industrial Cleaning Construction & Industrial Utility Oil and Gas Other * Based on management estimates for 2016 6

Positioning for Profitable Growth Dennis Martin named Executive Chairman; Jennifer Sherman Appointed President and CEO Completion of acquisition of Westech Vac Systems Ltd. Close of transaction to acquire substantially all of the assets and operations of Joe Johnson Equipment Execution of new $325 million credit facility Completion of the sale of the Bronto Skylift business to Morita Group $ January 1, 2016 January 5, 2016 January 27, 2016 January 29, 2016 June 3, 2016 7

Strengthened Growth Platform Federal Signal is well positioned to take advantage of business cycles and grow long term Succession planning and talent development Flexible manufacturing model New product development Portfolio realignment, Bronto divestiture Reinstated dividend Disciplined M&A process Strong balance sheet 8

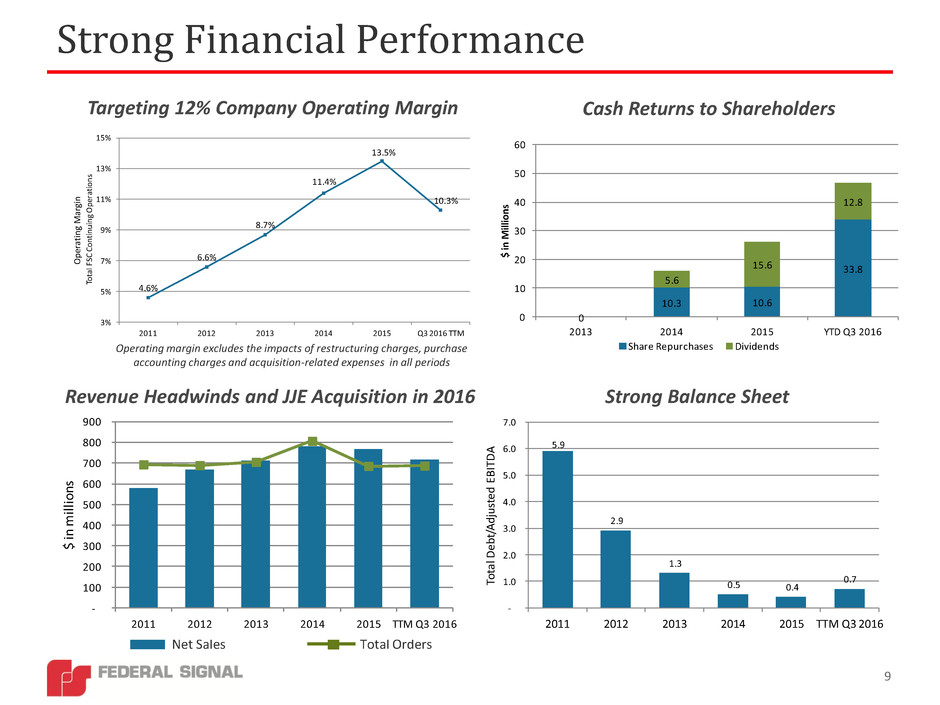

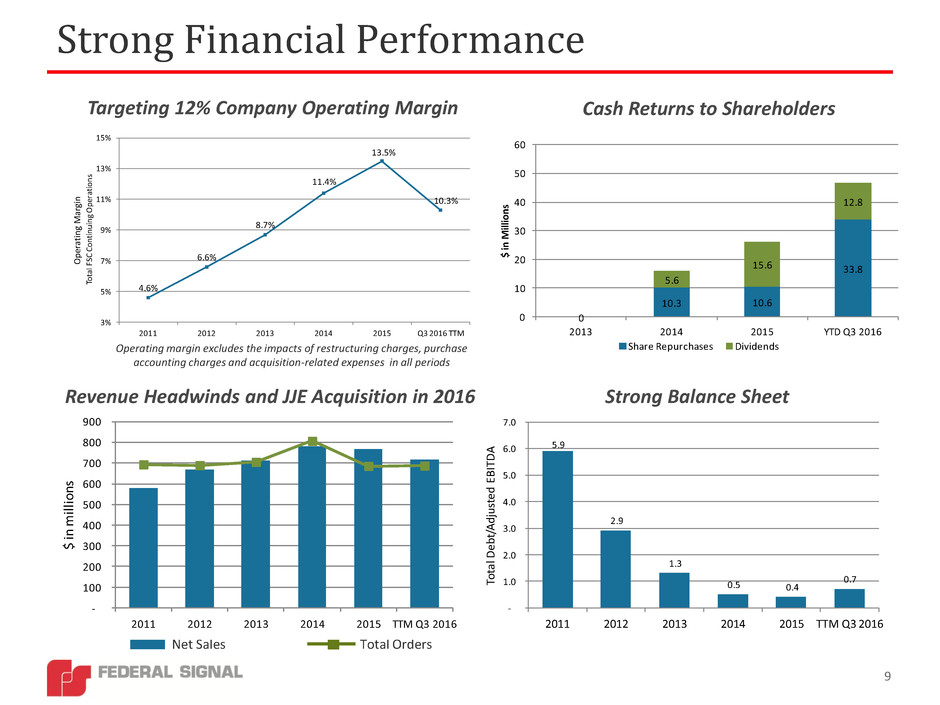

Strong Financial Performance 9 Targeting 12% Company Operating Margin Cash Returns to Shareholders Revenue Headwinds and JJE Acquisition in 2016 Strong Balance Sheet Net Sales Total Orders Operating margin excludes the impacts of restructuring charges, purchase accounting charges and acquisition-related expenses in all periods 0 10.3 10.6 33.8 5.6 15.6 12.8 0 10 20 30 40 50 60 2013 2014 2015 YTD Q3 2016 $ i n M illi on s Share Repurchases Dividends - 100 200 300 400 500 600 700 800 900 2011 2012 2013 2014 2015 TTM Q3 2016 $ i n m illi on s 5.9 2.9 1.3 0.5 0.4 0.7 - 1.0 2.0 3.0 4. 5.0 6.0 7.0 2011 2012 2013 2014 2015 TTM Q3 2016 To tal De bt/ Ad jus ted EB ITD A 4.6% 6.6% 8.7% 11.4% 13.5% 10.3% 3% 5% 7% 9% 11% 13% 15% 2011 2012 2013 2014 2015 Q3 2016 TTM Op erat ing M arg in Tot al F SC Con tin uin g O pe rat ion s

• Add $250 M in revenues through strategic acquisitions • Successfully integrate acquired businesses • Deliver on strategic value of JJE and Westech • Innovate to develop new product applications for adjacent end-markets • Build new sources of profitability, including service, recurring and after-market revenue streams • Invest to grow revenue faster than GDP • Continue to improve manufacturing efficiencies and costs • Leverage our existing plants and invested capital Federal Signal Strategic Focus Execute on Acquisition Objectives Grow in New End-Markets Optimize Existing End-Markets 10

• Continue our focus on refreshing products and developing new product opportunities • Continue investing in sales resources to capture new market opportunities and offset soft markets • Closely monitor our costs and performance metrics against our targets • Smoothly integrate the Joe Johnson Equipment acquisition to capture its value and incremental opportunities • Maintain our disciplined development of additional acquisition opportunities • Continue developing our people and building a solid bench to support our growth 2016 Priorities 11

Innovating for Growth – New Product Development ParaDIGm (ESG) G-Series (SSG) Targeted global expansion in higher- margin industrial markets Developed the Global Signaling (“G-Series”) line of internationally certified (ATEX or IECEx) products for rugged, hazardous industrial applications Product design and development in under 12 months Vacuum excavation outside of oil & gas continues to grow, with adoption rising in municipal, utility and construction Targeted a new ParaDIGm truck design purpose-built for utility market Designed and built prototypes in less than 5 months; entered full-scale production in June 2016 Winner at the Chicago Innovation Awards in October, 2016 12

Innovating for Growth – New Product Development Water Recycler (ESG) Introduced in February 2016 Saves water, re-using sewer water instead of clean water Increases productivity up to 100% – uninterrupted cleaning of more lines in less time Appears superior to existing competitive products Trailer-Mounted Jetter (ESG) Trailer and skid-mounted jetters being introduced in Q1 2016 Complements Vactor’s suite of products, filling need for smaller sewer-cleaning jetters Capitalizes on ESG’s expansive dealer network, support and service Cost-competitive and retrofits to many existing Vactor sewer cleaners 13

Acquisition Strategy – Stay Close To The Core Geographies Products Desire to add $250 M of revenue from acquisitions within three years • Channel access for FSC products to new or extended markets • Complementary offerings for new or underserved geographies Geographies Products Channels and end markets • New offerings that can capitalize on existing FSC channels • Products utilizing FSC core production capabilities • Customer/channel expansion to new or underserved geographies Ideal Candidates: Business Attributes • Aligned with strategies • Leadership in a market segment • Products to expand FSC core • Industrial focus, strong distribution • Similar manufacturing capabilities or opportunities to leverage 80/20 principles • Strong management Financial Attributes • Modest-sized “tuck-in” acquisitions with potential for larger transformative transactions • Identifiable synergies • Healthy recurring revenue • Solid operating margin opportunities • Earn more than the Company’s risk-adjusted cost of capital 14

JJE Acquisition Significantly expands our industrial footprint from 13 to 25 service centers throughout Canada and US Expands our share of after-market activity Allows capture of additional customer base Attractive margin profile Product offering to capture more market and respond to competition Solid rental platform that we can leverage across North America, complementing existing Jetstream rentals Strong municipal equipment distributor Leverage existing channel to increase industrial sales and service coverage for our Jetstream, Guzzler and Westech products JJE should benefit from new Canadian focus on infrastructure spend * Estimated % of JJE 2015 revenues based on unaudited financial statements prepared in accordance with ASPE. 15

JJE Update • Acquisition closed on June 3, 2016 • Initial integration efforts largely complete • Post-acquisition results (standalone basis, through end of Q3) Net sales of ~$50 M Adjusted operating income of ~$4 M • Excludes purchase accounting effects of $3 M • Excludes acquisition costs of $0.3 M • Acquisition increases our product offerings and expands footprint across North America • Expect EPS contribution of $0.10 to $0.15 by 2018 Intercompany profit deferrals affect initial years 16

Priority Driven Capital Allocation Organic projects leverage existing assets, generally require limited cash investment Innovation R&D efforts target new and updated products Generally, already funded within operating results, cash flow and normal capital expenditures Desire to add $250 M from acquisitions to our revenue run-rate by 2018 Focused primarily on acquisitions that fit closely within our existing products and services, manufacturing competencies, channels and customers Opportunistic share buybacks as a return of cash to our shareholders Spent $33.8 M through YTD 2016, compared to $10.6 M in full year 2015 Remaining repurchase authorization is $35 M Reinvest in the Business Dividend Policy Share Repurchase Acquisitions Provide a competitive dividend yield while funding business growth At $0.07 per share, dividend yield is ~2% Paid dividends of $12.8 M through YTD 2016 and $15.6 M in full year 2015 17

2016 Outlook Adjusted EPS ranging from $0.65 to $0.70 18 Narrowed from previous outlook range of $0.65 to $0.75 Range reflects: Solid performance in municipal-based businesses (> 60% of company revenues) Negative volume/operating leverage in manufacturing activities versus prior year Backlog entering Q4 carries a lower gross-margin than prior year Continued softness and uncertainty in industrial demand Higher percentage of orders for products manufactured by other companies Full-year income tax rate of ~35% Adjustments for: Purchase accounting impacts from acquired JJE inventory and fleet Acquisition-related expenses Restructuring charges Debt settlement charges Certain special tax items

Protecting People And Our Planet 19

Appendix • Company Products (Pictured) • Group and Corporate Results • Consolidated Historical Financial Performance • Adjusted EPS • Total Debt to Adjusted EBITDA • Operating Margins • Estimated Global Sales • Joe Johnson Equipment (JJE) Background • Investor Information 20

Environmental Solutions Group Products 21

Safety and Security Systems Group Products 22

Safety and Security Integrated Systems Products SmartMsg Enabled Systems Enterprise Integrated Command Solution Sensors/Detectors Cameras Networked PAGASYS Rack Control Modules/Nodes Control Modules/Nodes Control Modules/Nodes 23

Appendix 2: Group and Corporate Results $ millions, except % Q3 2016 Q3 2015 % Chg ESG Orders 136.0 108.5 25% Sales 134.3 123.0 9% Operating income 12.5 21.5 -42% Operating margin 9.3% 17.5% SSG Orders 50.1 59.7 -16% Sales 52.4 56.7 -8% Operating income 6.5 9.3 -30% Operating margin 12.4% 16.4% Corporate expenses 5.5 5.6 -2% Consolidated Orders 186.1 168.2 11% Sales 186.7 179.7 4% Operating income 13.5 25.2 -46% Operating margin 7.2% 14.0% Presented on a GAAP basis, before adjustments made to determine adjusted EPS. 24

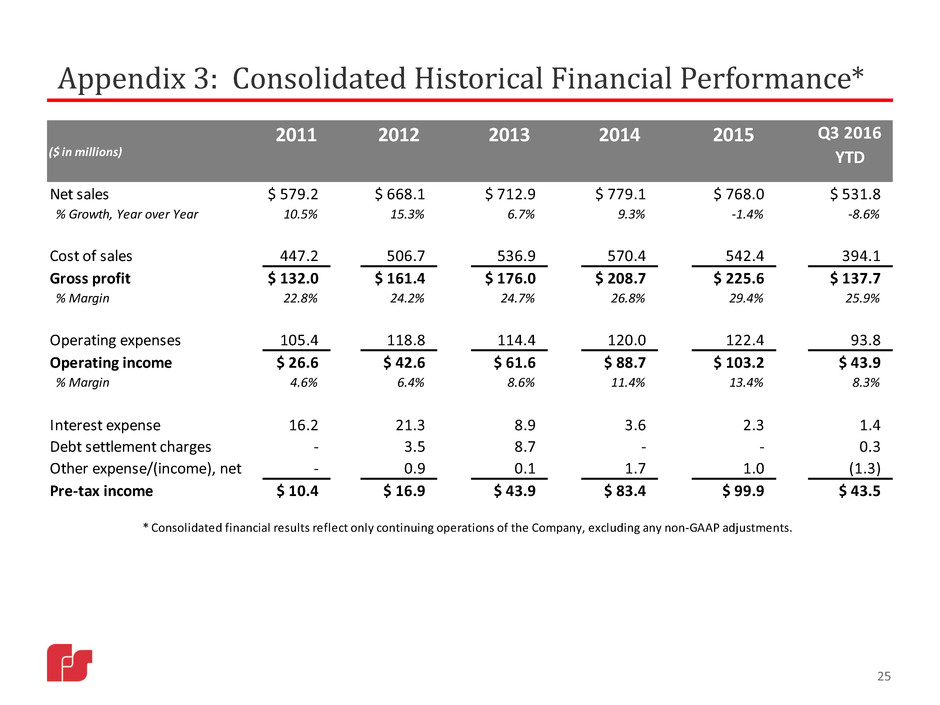

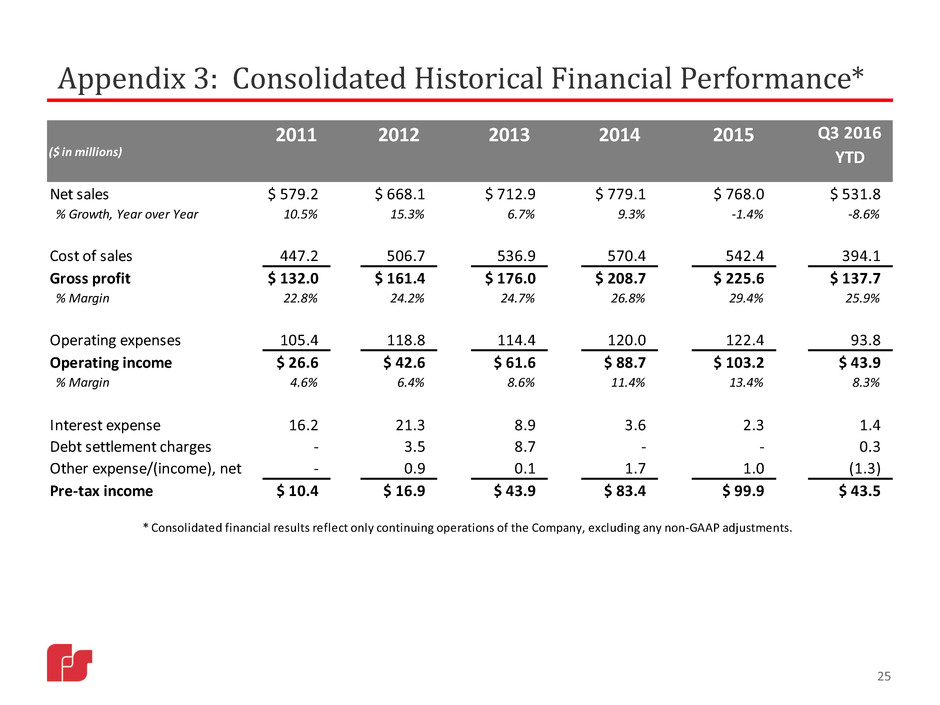

Appendix 3: Consolidated Historical Financial Performance* ($ in millions) 2011 2012 2013 2014 2015 Q3 2016 YTD Net sales $ 579.2 $ 668.1 $ 712.9 $ 779.1 $ 768.0 $ 531.8 % Growth, Year over Year 10.5% 15.3% 6.7% 9.3% -1.4% -8.6% Cost of sales 447.2 506.7 536.9 570.4 542.4 394.1 Gross profit $ 132.0 $ 161.4 $ 176.0 $ 208.7 $ 225.6 $ 137.7 % Margin 22.8% 24.2% 24.7% 26.8% 29.4% 25.9% Operating expenses 105.4 118.8 114.4 120.0 122.4 93.8 Operating income $ 26.6 $ 42.6 $ 61.6 $ 88.7 $ 103.2 $ 43.9 % Margin 4.6% 6.4% 8.6% 11.4% 13.4% 8.3% Interest expense 16.2 21.3 8.9 3.6 2.3 1.4 Debt settlement charges - 3.5 8.7 - - 0.3 Other expense/(income), net - 0.9 0.1 1.7 1.0 (1.3) Pre-tax income $ 10.4 $ 16.9 $ 43.9 $ 83.4 $ 99.9 $ 43.5 * Consolidated financial results reflect only continuing operations of the Company, excluding any non-GAAP adjustments. 25

Appendix 4: Adjusted Earnings per Share (“EPS”)* * The adjusted financial measures presented above are unaudited and are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations below, and to provide an additional measure of performance which management considers in operating the business. ($ in millions) 2016 2015 2016 2015 Income from continuing operations 7.5$ 15.8$ 27.3$ 48.4$ Add: Income tax expense 5.7 8.5 16.2 27.2 Income before income taxes 13.2 24.3 43.5 75.6 Add: Restructuring 0.4 - 1.6 0.4 Acquisition and integration related expenses 0.3 - 1.2 - Purchase accounting effects (1) 2.5 - 3.0 - Debt settlement charges - - 0.3 - Adjusted income before income taxes 16.4 24.3 49.6 76.0 Adjusted income tax expense (2) (3) (5.9) (8.5) (17.3) (27.4) Adjusted net income from continuing operations 10.5$ 15.8$ 32.3$ 48.6$ Diluted EPS from continuing operations 0.12$ 0.25$ 0.45$ 0.76$ Adjusted diluted EPS from continuing operations 0.17$ 0.25$ 0.53$ 0.77$ Three Months Ended September 30, Nine Months Ended September 30, (3) Adjusted income tax expense for the nine months ended September 30, 2015 w as recomputed after excluding the impact of restructuring activity. (1) Purchase accounting effects relate to adjustments to exclude the step-up in the valuation of JJE inventory that w as sold subsequent to the acquisition in the three and nine months ended September 30, 2016, as w ell as to exclude the depreciation of the step-up in the valuation of the rental fleet acquired. (2) Adjusted income tax expense for the three and nine months ended September 30, 2016 w as recomputed after excluding the impact of restructuring activity, acquisition and integration related expenses and purchase accounting effects. Adjusted income tax expense for the three and nine months ended September 30, 2016 also excludes $0.7 M of expense associated w ith an increase in Canadian valuation allow ance and $0.1 M of expense associated w ith a change in the enacted tax rate in the U.K. 26

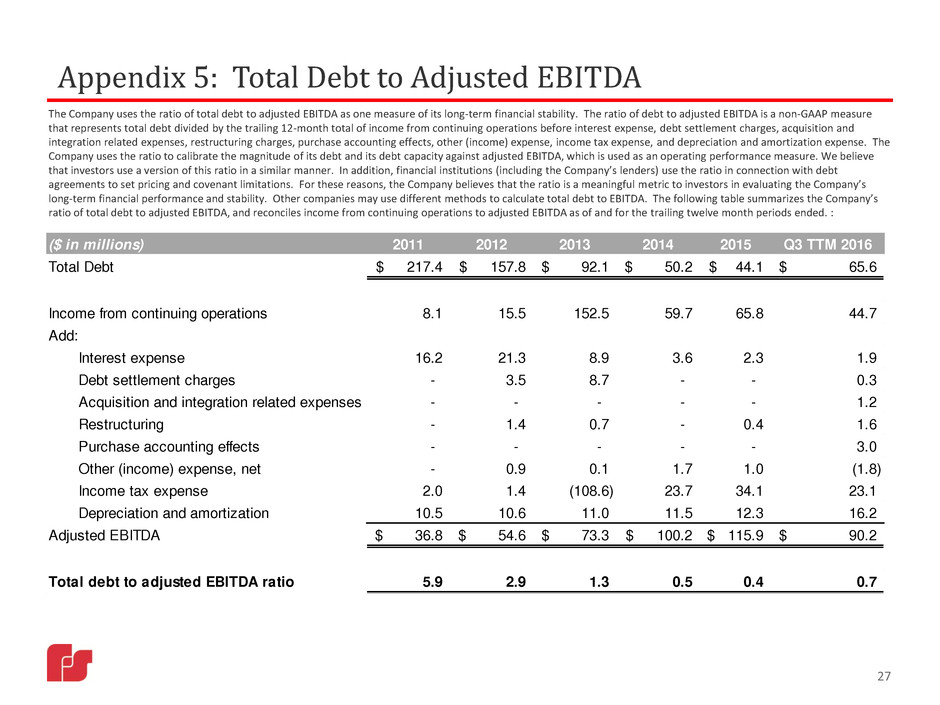

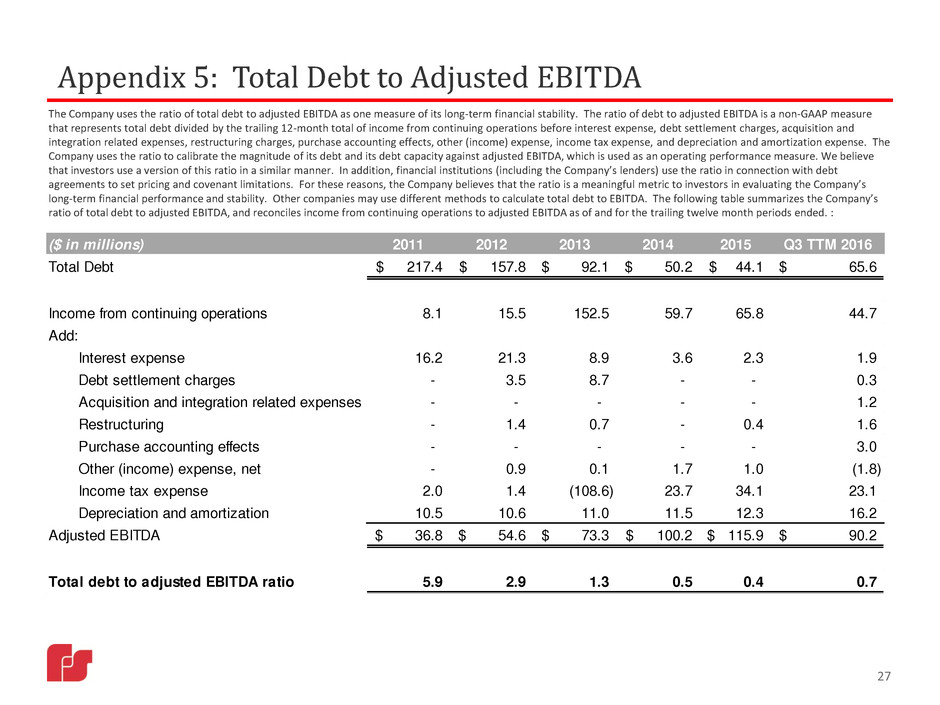

Appendix 5: Total Debt to Adjusted EBITDA The Company uses the ratio of total debt to adjusted EBITDA as one measure of its long-term financial stability. The ratio of debt to adjusted EBITDA is a non-GAAP measure that represents total debt divided by the trailing 12-month total of income from continuing operations before interest expense, debt settlement charges, acquisition and integration related expenses, restructuring charges, purchase accounting effects, other (income) expense, income tax expense, and depreciation and amortization expense. The Company uses the ratio to calibrate the magnitude of its debt and its debt capacity against adjusted EBITDA, which is used as an operating performance measure. We believe that investors use a version of this ratio in a similar manner. In addition, financial institutions (including the Company’s lenders) use the ratio in connection with debt agreements to set pricing and covenant limitations. For these reasons, the Company believes that the ratio is a meaningful metric to investors in evaluating the Company’s long-term financial performance and stability. Other companies may use different methods to calculate total debt to EBITDA. The following table summarizes the Company’s ratio of total debt to adjusted EBITDA, and reconciles income from continuing operations to adjusted EBITDA as of and for the trailing twelve month periods ended. : ($ in millions) 2011 2012 2013 2014 2015 Q3 TTM 2016 Total Debt 217.4$ 157.8$ 92.1$ 50.2$ 44.1$ 65.6$ Income from continuing operations 8.1 15.5 152.5 59.7 65.8 44.7 Add: Interest expense 16.2 21.3 8.9 3.6 2.3 1.9 Debt settlement charges - 3.5 8.7 - - 0.3 Acquisition and integration related expenses - - - - - 1.2 Restructuring - 1.4 0.7 - 0.4 1.6 P rchas accounting effects - - - - - 3.0 Oth r ( ome) expense, net - 0.9 0.1 1.7 1.0 (1.8) Income tax expense 2.0 1.4 (108.6) 23.7 34.1 23.1 Depreciation and amortization 10.5 10.6 11.0 11.5 12.3 16.2 Adjusted EBITDA 36.8$ 54.6$ 73.3$ 100.2$ 115.9$ 90.2$ Total debt to adjusted EBITDA ratio 5.9 2.9 1.3 0.5 0.4 0.7 27

Appendix 6: Operating Margins Operating margin excludes the impact of purchase accounting, acquisition- related expenses and restructuring charges in all periods Busi e s Segment FY 2011 Operating Margin FY 2012 Operating Margin FY 2013 Operating Margin FY 2014 Operating Margin FY 2015 Operating Margin Q3 YTD 2016 Operating Margin Long-term Margin Targets ESG 6.8% 9.8% 12.3% 15.3% 18.1% 12.8% 14% - 16% SSG 9.7% 12.0% 11.3% 13.2% 14.0% 12.0% 14% - 16% Consolidated 4.6% 6.6% 8.7% 11.4% 13.5% 9.3% 12% 28

74% 9% 17% Sales by domestic subsidiaries within U.S. Sales by domestic subsidiaries outside of U.S. * Sales by non-U.S. subsidiaries outside of U.S. ** Estimated trailing 12 month sales allocations as of September 30, 2016 * Sales from the U.S. are predominantly denominated in U.S. dollars. ** Sales from and within other currency zones are predominantly in the source-location currencies. Appendix 7: Estimated Global Sales (in $US) 29

Rental of Equipment Sewer & Street Maintenance Hydro Excavation, DOT & Industrial Vacuum Snow & Ice Control Refuse & Recycling Indoor Recreational Ice Products Industrial Service Sale of New Equipment Sale of Used Equipment Parts Full Maintenance Lease Programs Premier Infrastructure Maintenance Equipment Product Portfolio Infrastructure Efficiency Environment Safety Joe Johnson Equipment (JJE) Full Product and Service Offering Industry Segments 30

JJE – Expanding ESG Industrial Reach North American Industrial Market Coverage 31 Expands our after- market reach Increases service center locations from 13 to 25 Serves majority of our end-customer concentrations

Investor Information Stock Ticker NYSE: FSS Website www.federalsignal.com/investors Headquarters 1415 W. 22nd Street, Suite 1100 Oak Brook, IL 60523 Investor Relations Contacts: Telephone: 630-954-2000 Brian Cooper BCooper@federalsignal.com SVP, Chief Financial Officer Svetlana Vinokur SVinokur@federalsignal.com VP, Treasurer and Corporate Development 32