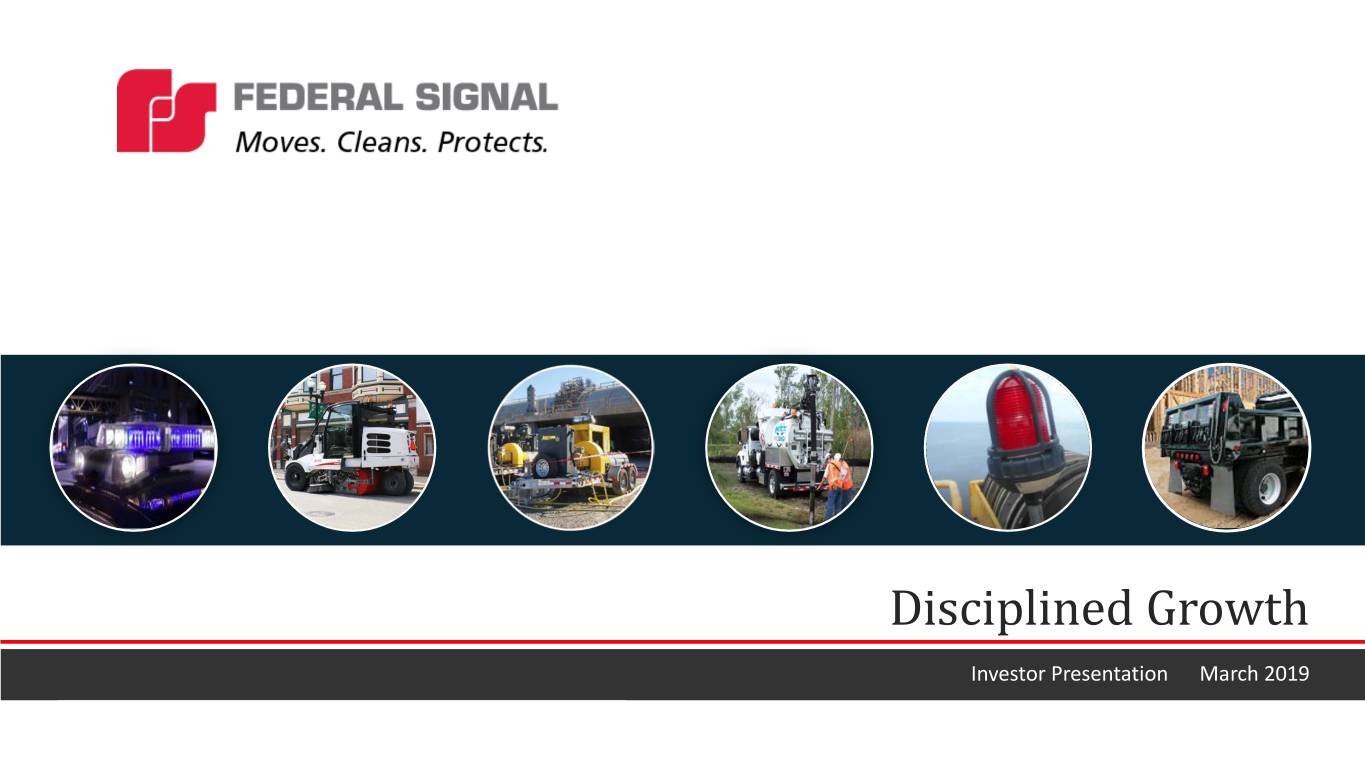

Disciplined Growth Investor Presentation March 2019

Safe Harbor Statement This presentation contains unaudited financial information and forward-looking statements. Statements that are not historical are forward-looking statements and may contain words such as “may”, “will” ,“believe”, “expect”, “anticipate”, “intend”, “plan”, “project”, “estimate”, and “objective” or similar terminology, concerning the company’s future financial performance, business strategy, plans, goals and objectives. These expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning the Company’s possible or assumed future performance or results of operations and are not guarantees. While these statements are based on assumptions and judgments that management has made in light of industry experience as well as perceptions of historical trends, current conditions, expected future developments and other factors believed to be appropriate under the circumstances, they are subject to risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different. Such risks and uncertainties include, but are not limited to, economic conditions, product and price competition, supplier and raw material prices, risks associated with acquisitions such as integration of operations and achieving anticipated revenue and cost benefits, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation results, legal and regulatory developments and other risks and uncertainties described under Item 1A, Risk Factors, in the Company’s Annual Report on Form 10-K and in other filings with the Securities and Exchange Commission. Such forward-looking statements are made as of the date hereof and we undertake no obligation to update these forward-looking statements regardless of new developments or otherwise. This presentation also contains certain measures that are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations, and to provide an additional measure of performance which management considers in operating the business. A reconciliation of these items to the most comparable GAAP measures is provided in our filings with the SEC and in the Appendix to this presentation. 2

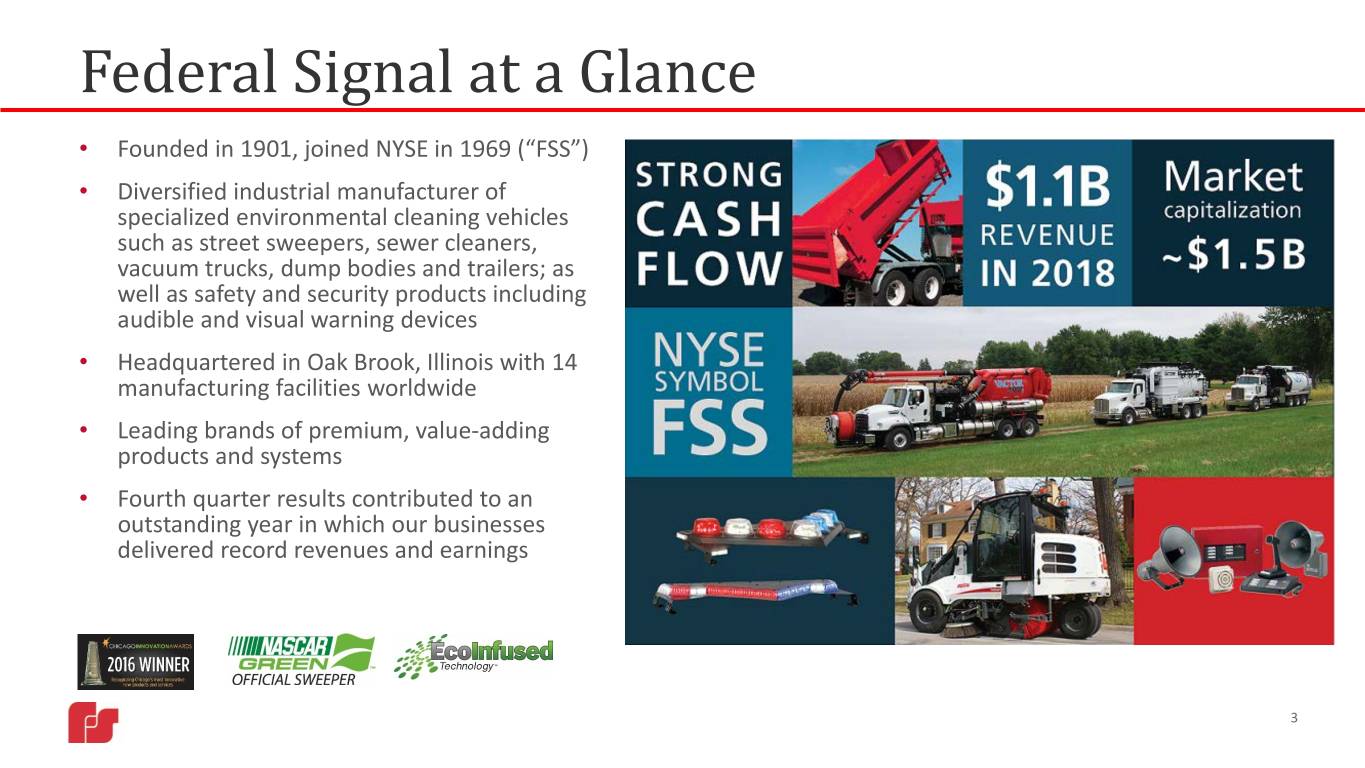

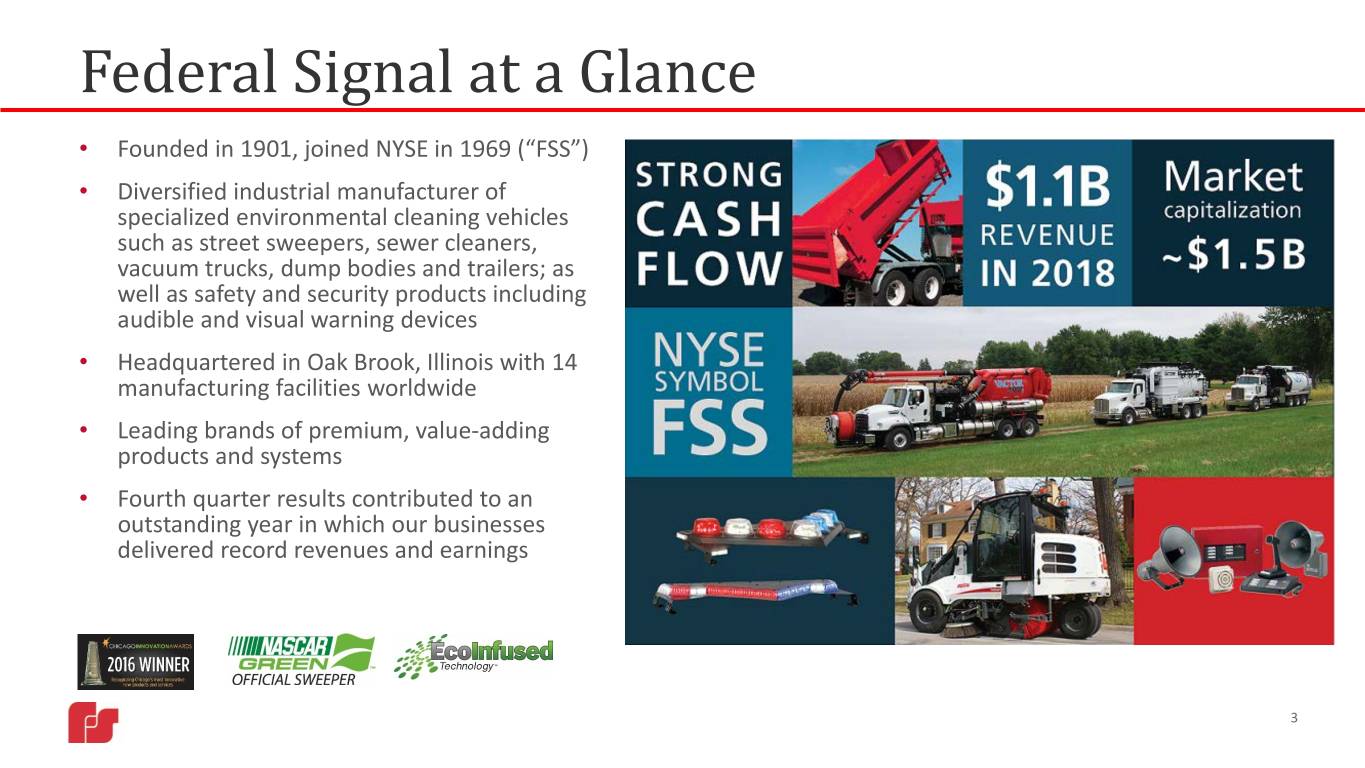

Federal Signal at a Glance • Founded in 1901, joined NYSE in 1969 (“FSS”) • Diversified industrial manufacturer of specialized environmental cleaning vehicles such as street sweepers, sewer cleaners, vacuum trucks, dump bodies and trailers; as well as safety and security products including audible and visual warning devices • Headquartered in Oak Brook, Illinois with 14 manufacturing facilities worldwide • Leading brands of premium, value-adding products and systems • Fourth quarter results contributed to an outstanding year in which our businesses delivered record revenues and earnings 3

An Experienced Leadership Team Jennifer Sherman Mark D. Weber President and Chief Executive Officer Senior Vice President and Chief Operating Officer . Appointed January, 2016 . Appointed January, 2018 . Previously Chief Operating Officer, Chief Administrative . Previously served as President and Chief Executive Officer Officer, Secretary and General Counsel, with operating of Supreme Industries, Inc. responsibilities for the Company’s Safety and Security . Prior to joining Supreme, Mr. Weber spent 17 years at Systems Group Federal Signal, initially as Vice President of Operations, . Joined Federal Signal in 1994 as Corporate Counsel Elgin Sweeper, before progressing through multiple roles of increasing responsibility, serving as President of the Environmental Solutions Group for over a decade Ian Hudson Svetlana Vinokur Senior Vice President and Chief Financial Officer Vice President, Treasurer and Corporate Development . Appointed October, 2017 . Appointed April, 2015 . Joined Federal Signal in August 2013 as Vice President and . Previously served as Assistant Treasurer for Illinois Tool Corporate Controller Works Inc., Finance Head of M&A Strategy at Mead Johnson . Previously served as Director of Accounting – Latin America Nutrition Company, and Senior Associate for Robert W. Baird and Asia Pacific at Groupon, Inc. & Company’s Consumer and Industrial Investment Banking . 13+ years public accounting experience with Ernst & Young, group LLP 4

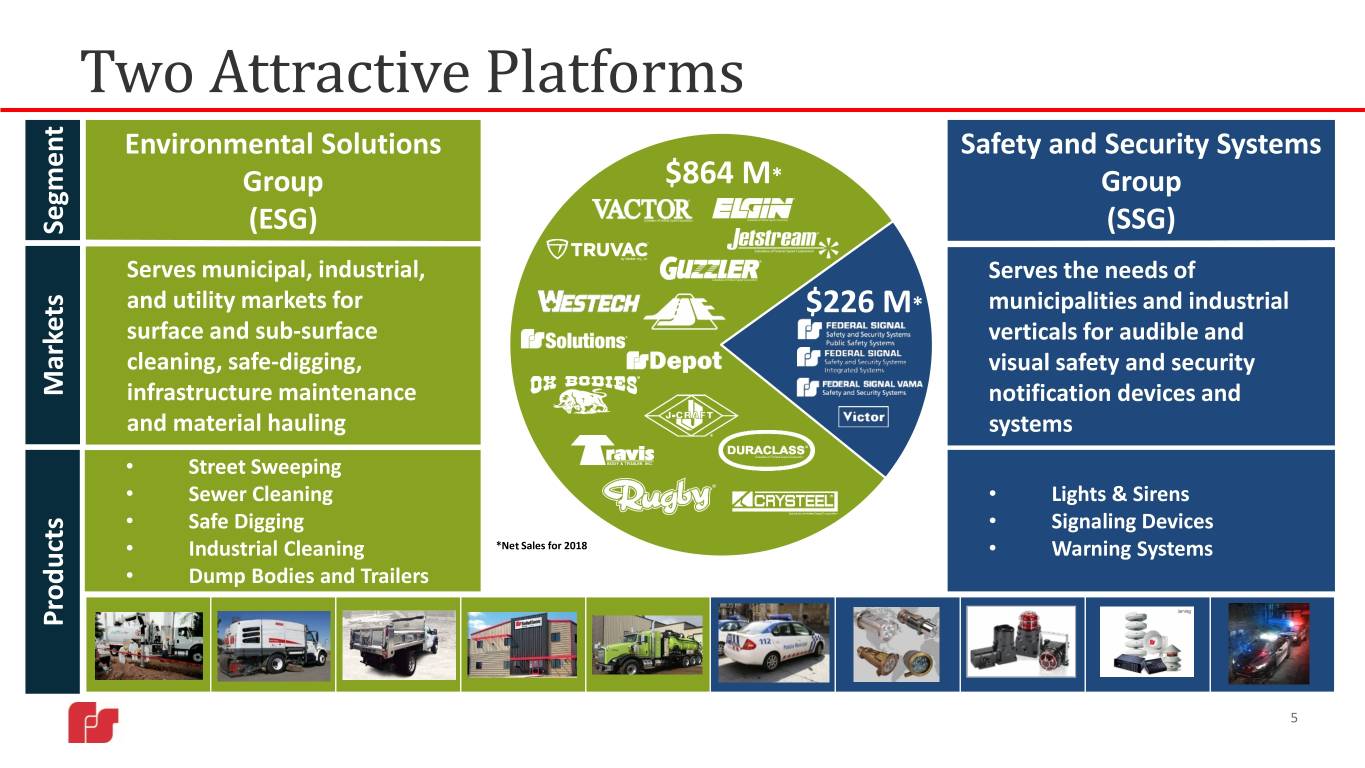

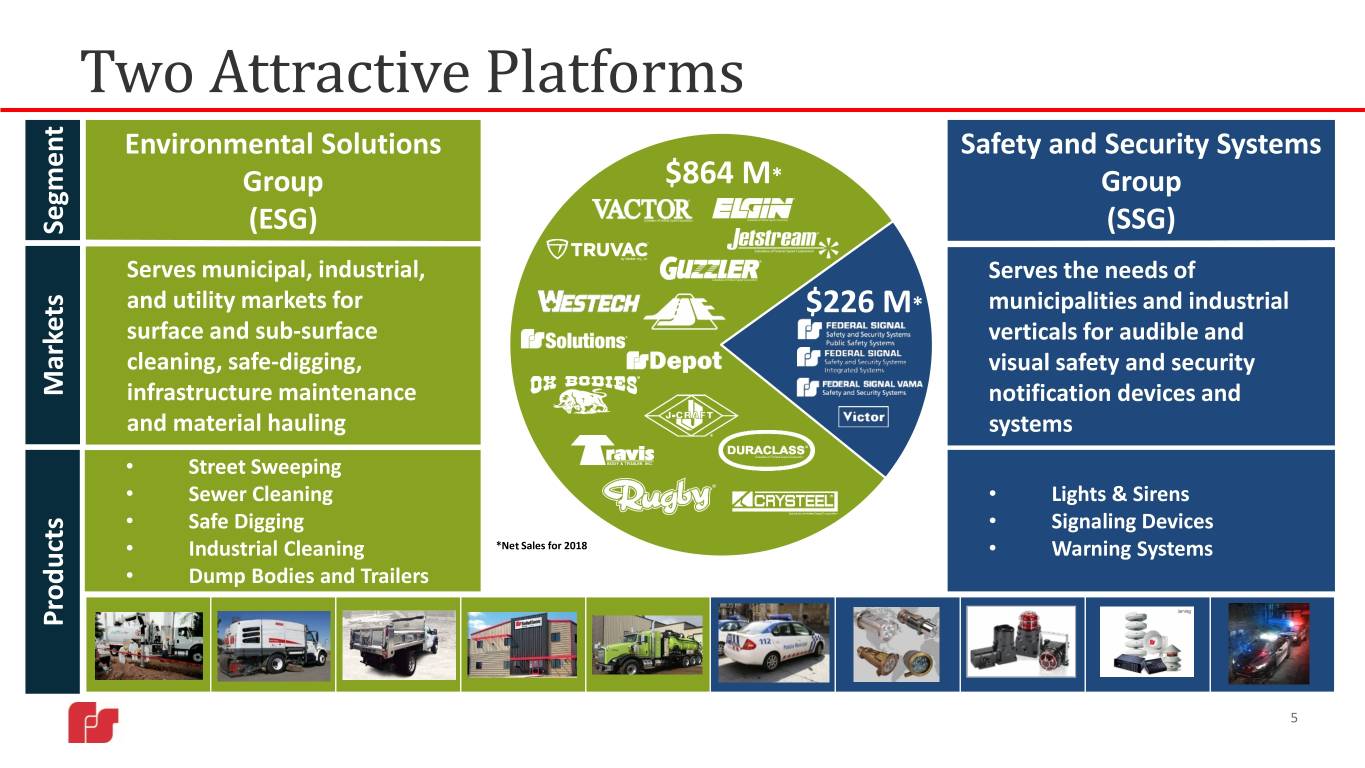

Two Attractive Platforms Environmental Solutions Safety and Security Systems Group $864 M* Group Segment (ESG) (SSG) Serves municipal, industrial, Serves the needs of and utility markets for $226 M* municipalities and industrial surface and sub-surface verticals for audible and cleaning, safe-digging, visual safety and security Markets infrastructure maintenance notification devices and and material hauling 5 systems • Street Sweeping • Sewer Cleaning • Lights & Sirens • Safe Digging • Signaling Devices • Industrial Cleaning *Net Sales for 2018 • Warning Systems • Dump Bodies and Trailers Products 5

Environmental Solutions Group (ESG) Have successfully established a platform serving maintenance and infrastructure markets to provide customers with a comprehensive suite of products and services Street Sewer Safe Industrial Materials Hauling Application sweeping cleaning digging cleaning Brands Products Industrial End Markets and Municipal Municipal Industrial Municipal, Construction, Industrial, Utility Channels Dealer Dealer Direct Landscaping, Waste / Rendering Oil & Gas Dealer / Direct Dealer / Direct Addressable Market ~$3.6B Routes to Market Rental/Aftermarket Dealer Network Distribution US US Dealer Largest Canadian Provide parts / service / refurbishment / rental Distribution For ESG products and Network distributor of offering through the network of 20+ locations in US Network other OEM’s products 6 maintenance equipment and Canada such as snow equipment to municipalities and garbage trucks

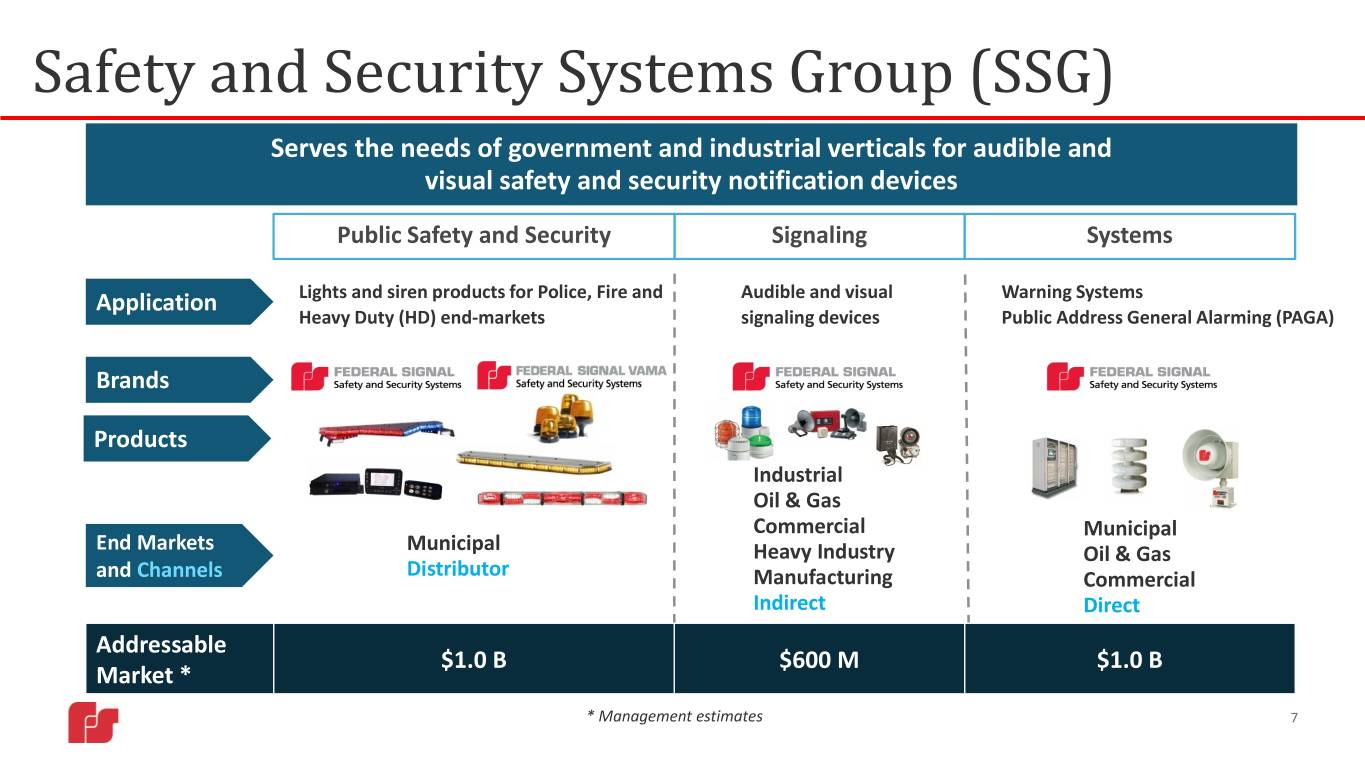

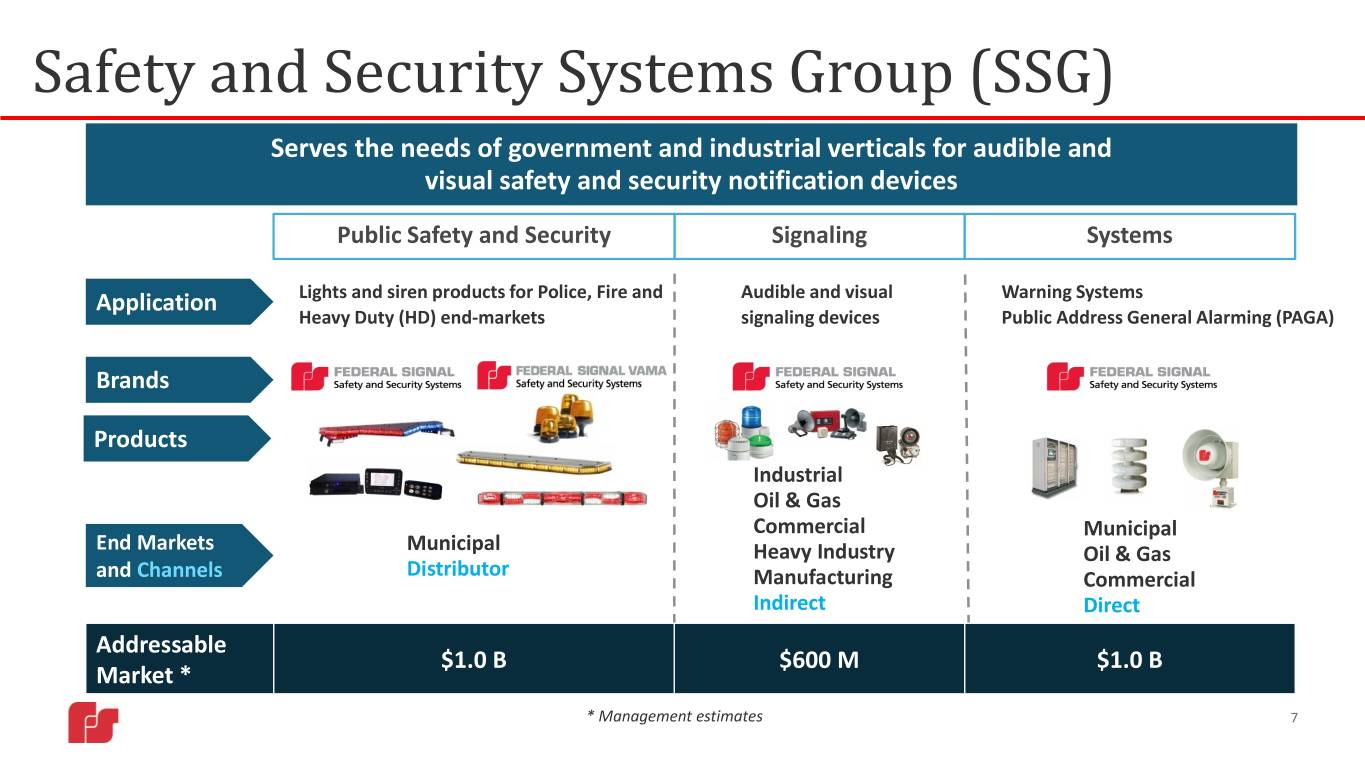

Safety and Security Systems Group (SSG) Serves the needs of government and industrial verticals for audible and visual safety and security notification devices Public Safety and Security Signaling Systems Application Lights and siren products for Police, Fire and Audible and visual Warning Systems Heavy Duty (HD) end-markets signaling devices Public Address General Alarming (PAGA) Brands Products Industrial Oil & Gas Commercial Municipal End Markets Municipal Heavy Industry Oil & Gas and Channels Distributor Manufacturing Commercial Indirect Direct Addressable $1.0 B $600 M $1.0 B Market * * Management estimates 7

Key Strategic Initiatives Specialty Vehicles for Aftermarket Parts and Audible and Visual Safe Digging Diverse Focus Services Warning Devices Areas of End-Markets Supported By Flexible New Product Technology as an Manufacturing & “ETI” Disciplined M&A Development Enabler Culture 8

Strategic Initiative – Safe Digging Federal Signal is well positioned to establish a leading position in an emerging application for vacuum-excavation technology; increased regulation expected to accelerate growth What is it? Why is it Attractive? Why Federal Signal? • Vacuum excavation or “Safe Digging” involves the • In many circumstances, vacuum excavation is a safer • Sole manufacturer of complete range of truck- use of pressurized air or water (“hydro-excavation”) and more productive means for digging (in mounted safe-digging equipment, with applications to dig (coupled with a vacuum system) as an comparison to traditional excavation) across a number of end-markets alternative to the use of traditional equipment such • Significantly minimizes chances of damage to • 30 year track record of manufacturing leading as backhoes and mechanical excavators underground infrastructure during the digging vacuum-excavation products • Acceptance of safe-digging applications continues process • Widest service and support network for vacuum- to improve significantly over the last decade • Less intrusive to the surrounding site at point of excavation products • Application has been widely accepted in Canada; US digging • Best-in-class payload for Ontario market is behind but great early indicators – 16 states now • Provides opportunity for the use of our broad range • Dedicated and experienced sales organization in include vacuum excavation as part of “safe of offerings in new and emerging end markets place to support initiative excavation practices” beyond oil and gas • ~$60M of incremental vacuum truck orders in 2018 Recently announced plans to invest up to $25 M to expand Streator, IL manufacturing facility; expected to increase production capacity by ~40%, with completion targeted by end of 2019 9

Strategic Initiative – Aftermarket Parts & Services Optimizing platform to transform Federal Signal’s aftermarket business into an industry leader of parts and services to the infrastructure maintenance and material hauling markets • Unified platform to serve municipal and industrial Rentals ObjectivesStrategic customers across all ESG businesses JJE acquisition • Undivided focus on growing and optimizing Federal Signal’s non-whole goods capabilities Used Equipment • Areas of focus: Sales . E-commerce capability development . Joint procurement initiatives to optimize input Parts & Service costs . Pricing harmonization across customers . Alternative ownership structures – rental and New Equipment Sales used equipment • ESG’s rental income in 2018 increased by over 30% from 2017, while total aftermarket revenues increased by $20 M, or 10% 10

Strategic Initiative – Audible & Visual Warning Devices SSG businesses focused on optimizing their existing channels and expanding product offerings Optimize Channel Product Portfolio Expansion Smart Products • Pricing / Promotion Strategy • “Allegiant” – low cost lightbar to • CommanderOne – monetization of • E-commerce platform development expand addressable market existing installed base for outdoor • Comprehensive customer service • “Pathfinder” siren – superior warning products solution product features at a lower price • Smart peripheral lights for police point and fire markets • Automatic License Plate Recognition • Multifunction, intelligent and (“ALPR”) product introduction connected industrial signaling products 11

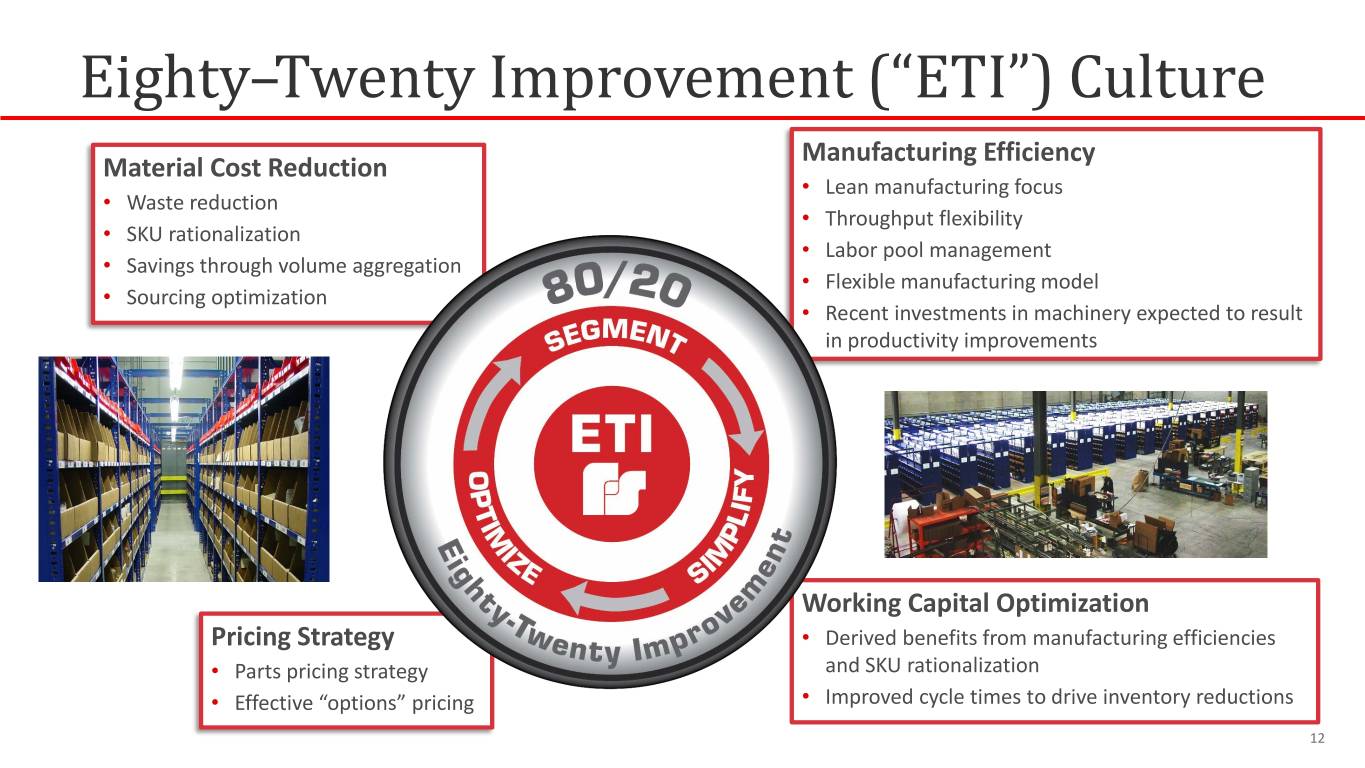

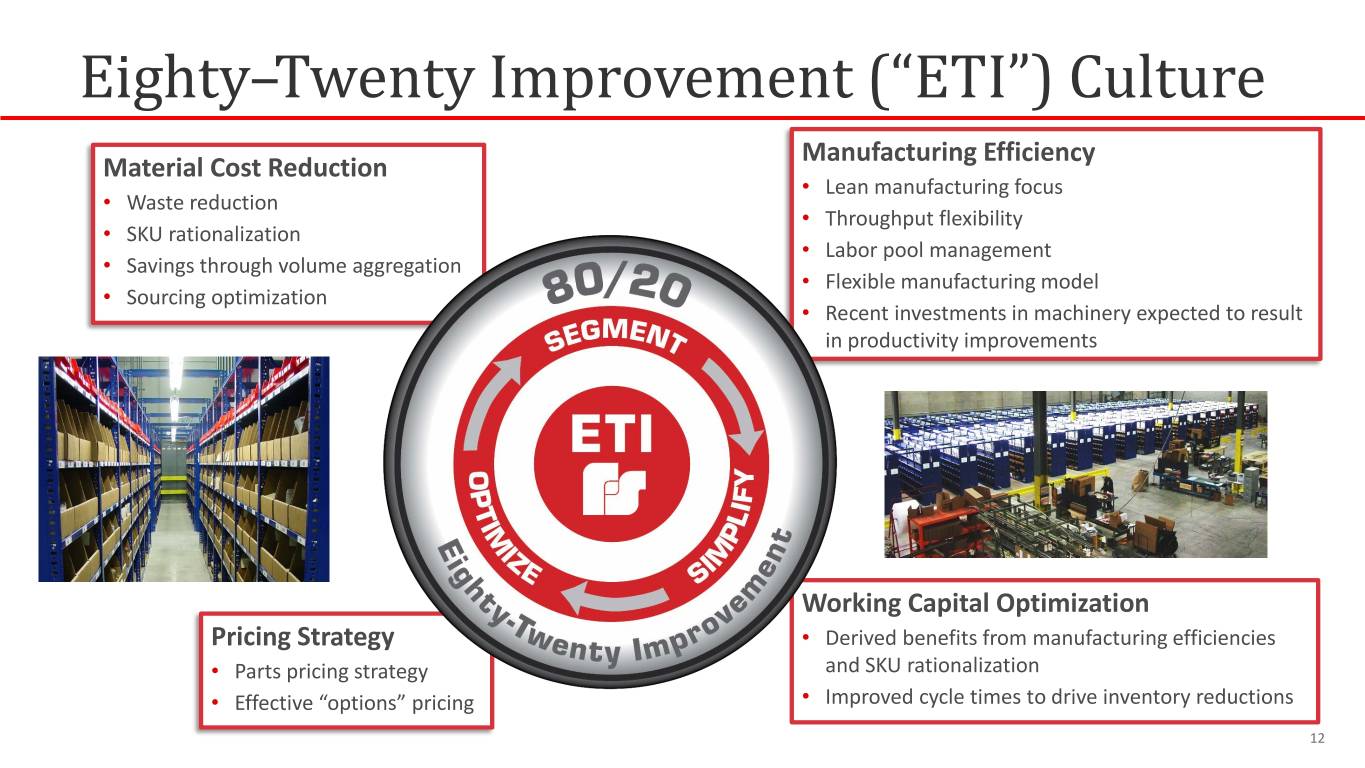

Eighty–Twenty Improvement (“ETI”) Culture Manufacturing Efficiency Material Cost Reduction • Lean manufacturing focus • Waste reduction • Throughput flexibility • SKU rationalization • Labor pool management • Savings through volume aggregation • Flexible manufacturing model • Sourcing optimization • Recent investments in machinery expected to result in productivity improvements Working Capital Optimization Pricing Strategy • Derived benefits from manufacturing efficiencies • Parts pricing strategy and SKU rationalization • Effective “options” pricing • Improved cycle times to drive inventory reductions 12

New Product Development (“NPD”) Customer Focused Process • Complete change in approach to innovation, starting in 2013 • Current innovation organization has had a number of successes, including the record- breaking launch of the ParaDIGm vacuum excavator • Most successful new product launch in over a decade • Initial market demand exceeding expectations • Named a 2016 Chicago Innovation Awards Winner • In 2018, announced acceleration of innovation initiatives to drive long-term organic growth; targeting long-term organic revenue growth of a couple percentage points above GDP Environmental Solutions Group (ESG) Safety and Security Systems Group (SSG) • Vehicle-based monitoring and reporting solutions • Automatic License Plate Recognition (ALPR) Systems • Sewer Cleaner productivity improvements such as • CommanderOne Direct Messaging (SMS/Phone) new boom design and upgraded control panel • IP-Enabled Warning Devices • Enhanced Street Sweeper Models • Next-Generation PAGA • All-New HXX Hydro-Excavator with • Optimized Light Bar Production improved weight distribution • Global Series Signaling Devices • Jetstream portfolio of attachments • Allegiant Police Light Bar 13

Profitable Growth Execution and Strong Financial Position Net Sales Adjusted EBITDA Margin** 2018 Highlights: (Consolidated) • Record year in revenues and earnings • Net sales of $1.1B, up $191M, or 21%, from 2017 • Adjusted EBITDA* of $160.5M, up 41%, from $113.5M in 2017 • Improved Adjusted EBITDA margin* of 14.7%, up from 12.6% in 2017, towards high end of target range • Adjusted EPS* of $1.43, up 68% Target EBITDA Margin ranges1 from $0.85 in 2017 Orders • Cash from operations of $93M, • ESG: 15% - 18% up 26% from 2017; facilitated • SSG: 15% - 17% debt pay down of $62M, cash dividends of $18.7M and share • Consolidated: 12% - 16% repurchases of $1.2M . Historical EBITDA margins • Total orders exceeded $1.1B, up and targets place Federal $155M or 15%, compared to 2017 • Year-end backlog of $338M, up Signal in the top tier of its $80M, or 31%, from last year peer group of specialty • Credit line availability of $179M vehicle manufacturers at end of year, with ability to increase by additional $75M for (1) Underlying assumptions: Absence of extraordinary factors affecting demand from acquisitions end-markets; No unusual hearing loss litigation expenses *Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EPS are non-GAAP measures. See Appendix II for additional information, including reconciliation to GAAP measures. 14 **Revised to exclude deferred gain recognition resulting from adoption of new accounting standard. See Appendix II for additional information, including reconciliation to GAAP measures.

Disciplined M&A Target companies that accelerate our current strategic initiatives or provide a platform for growth in adjacent markets or new geographies • Niche market leader (product, geography, end-market) • Sustainable competitive advantage • Deep domain expertise (technology, application, manufacturing) Business • Strong management team Characteristics • Leverages our distribution and manufacturing capabilities • Solid growth potential • Through-the-cycle margins comparable to or higher than our target margins • Ideally, identifiable synergies and recurring revenue opportunities Financial Financial Characteristics • Return on capital greater than our cost of capital, appropriately adjusted for risk 15

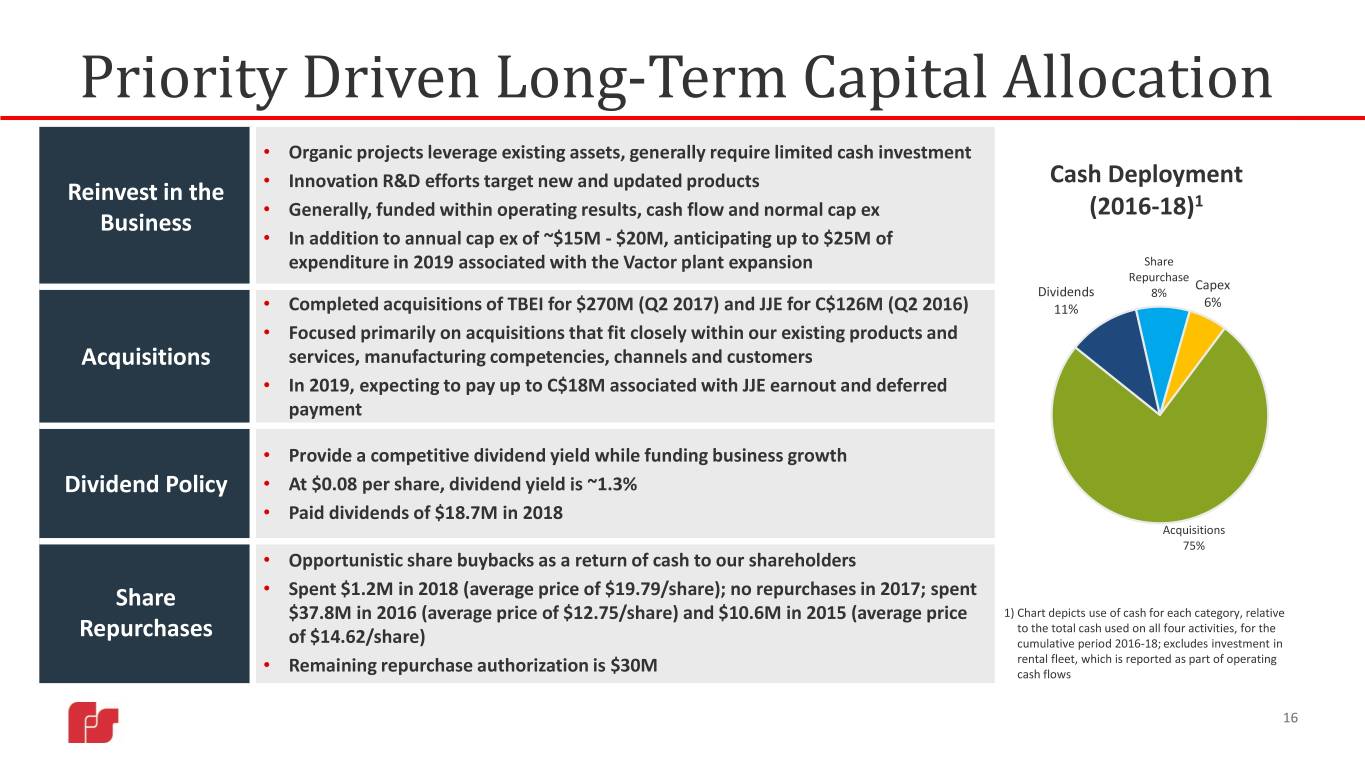

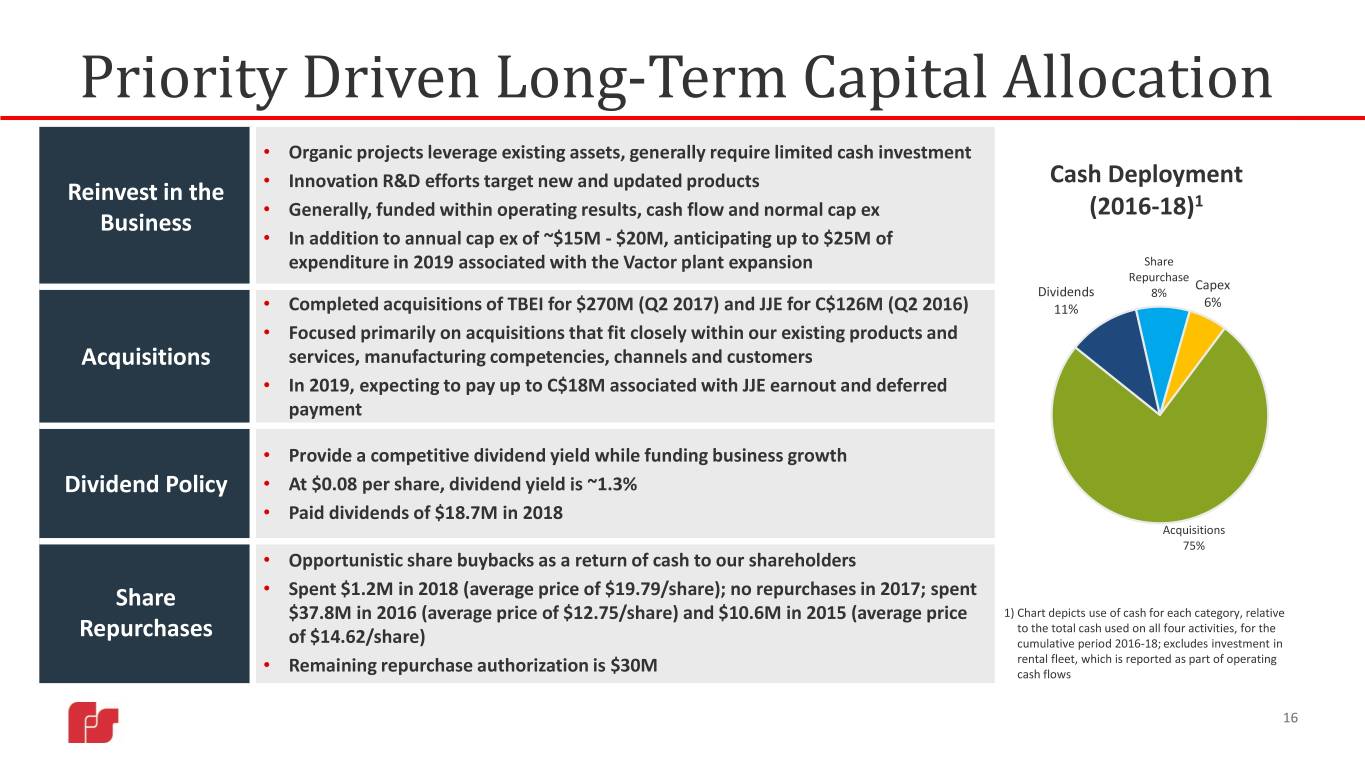

Priority Driven Long-Term Capital Allocation • Organic projects leverage existing assets, generally require limited cash investment Cash Deployment Reinvest in the • Innovation R&D efforts target new and updated products • Generally, funded within operating results, cash flow and normal cap ex (2016-18)1 Business • In addition to annual cap ex of ~$15M - $20M, anticipating up to $25M of expenditure in 2019 associated with the Vactor plant expansion Share Repurchase Capex Dividends 8% • Completed acquisitions of TBEI for $270M (Q2 2017) and JJE for C$126M (Q2 2016) 11% 6% • Focused primarily on acquisitions that fit closely within our existing products and Acquisitions services, manufacturing competencies, channels and customers • In 2019, expecting to pay up to C$18M associated with JJE earnout and deferred payment • Provide a competitive dividend yield while funding business growth Dividend Policy • At $0.08 per share, dividend yield is ~1.3% • Paid dividends of $18.7M in 2018 Acquisitions 75% • Opportunistic share buybacks as a return of cash to our shareholders Share • Spent $1.2M in 2018 (average price of $19.79/share); no repurchases in 2017; spent $37.8M in 2016 (average price of $12.75/share) and $10.6M in 2015 (average price 1) Chart depicts use of cash for each category, relative Repurchases to the total cash used on all four activities, for the of $14.62/share) cumulative period 2016-18; excludes investment in rental fleet, which is reported as part of operating • Remaining repurchase authorization is $30M cash flows 16

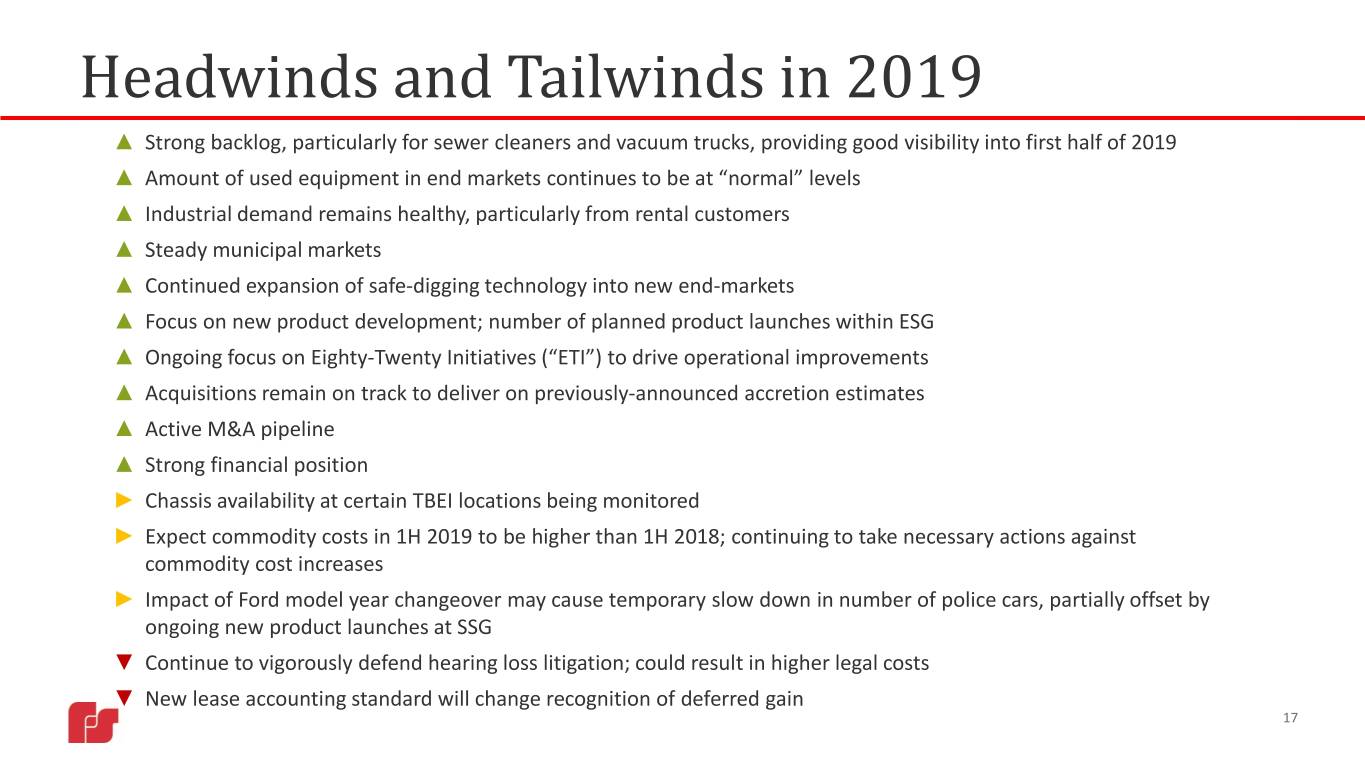

Headwinds and Tailwinds in 2019 ▲ Strong backlog, particularly for sewer cleaners and vacuum trucks, providing good visibility into first half of 2019 ▲ Amount of used equipment in end markets continues to be at “normal” levels ▲ Industrial demand remains healthy, particularly from rental customers ▲ Steady municipal markets ▲ Continued expansion of safe-digging technology into new end-markets ▲ Focus on new product development; number of planned product launches within ESG ▲ Ongoing focus on Eighty-Twenty Initiatives (“ETI”) to drive operational improvements ▲ Acquisitions remain on track to deliver on previously-announced accretion estimates ▲ Active M&A pipeline ▲ Strong financial position ► Chassis availability at certain TBEI locations being monitored ► Expect commodity costs in 1H 2019 to be higher than 1H 2018; continuing to take necessary actions against commodity cost increases ► Impact of Ford model year changeover may cause temporary slow down in number of police cars, partially offset by ongoing new product launches at SSG ▼ Continue to vigorously defend hearing loss litigation; could result in higher legal costs ▼ New lease accounting standard will change recognition of deferred gain 17

2019 Outlook Adjusted EPS* ranging from $1.48 to $1.60 At the midpoint, represents increase of ~9% over record 2018* Key Assumptions . Adjustments to include acquisition-related items . Interest expense of ~4% . Depreciation and amortization expense to increase . Increase in pension expense (non-operating) of $0.5M by ~$5M to $6M . Effective income tax rate of ~25%-26% . Not expecting to maintain same level of debt repayment as in 2018: . Expect Q1 earnings to represent ~16% to 17% of full- . Vactor plant expansion of up to $25M year earnings . Other capital expenditures of between $15M and $20M . JJE earnout payment due in Q2 2019 * Adjusted earnings per share (“EPS”) is a non-GAAP measure, which includes certain adjustments to reported GAAP net income and diluted EPS. In 2018, we made adjustments to exclude the impact of acquisition and integration-related expenses, purchase accounting effects, hearing loss settlement charges and special tax items, where applicable. Should any similar items occur in 2019, we would expect to exclude them from the determination of adjusted EPS. However, because of the underlying uncertainty in quantifying amounts which may not yet be known, a reconciliation of our Adjusted EPS outlook to the most applicable GAAP measure is excluded based on the unreasonable efforts exception in Item 10(e)(1)(i)(B). In addition, to facilitate comparisons with prior periods, when reporting our interim and annual results in 2019, we will be adjusting our previously issued non-GAAP results for 2018 to exclude the recognition of a deferred gain, which will no longer occur in 2019 following the adoption of the new lease accounting standards. On this basis, Adjusted EPS for 2018 would have been $1.41. See Appendix for reconciliation of GAAP EPS for 2018 to Adjusted EPS for 2018, as initially presented, and to the revised Adjusted EPS for 2018 (excluding the deferred gain recognition). 18

Positioned for Long-Term Growth With continued focus on organic growth and M&A, and margin performance above that of many of our peers, our financial framework aims to create long-term shareholder value Adjusted Earnings per Share* Long-Term Organic Value-Added (US$/share) Revenue Growth Acquisitions (Couple of % points > GDP) CAGR: 44% High Single Digit Revenue Growth ESG: 15-18% EBITDA Margin SSG: 15-17% Targets: Consolidated: 12-16% Cash Conversion: ROIC > Cost of ~100% of net income Capital 19 * Adjusted earnings per share (“EPS”) is a non-GAAP measure. See footnote on page 18.

Appendix I. Segments Overview II. Non-GAAP Reconciliations III. Executive Compensation IV. Investor Information 20

Appendix I: ESG Products 21

Appendix I: ESG Products (continued) 22

Appendix I: ESG - Market Influencers & Where We Play Market Dynamics . Economic recovery supports state and local funding for 2018 Sales by Geography sweepers and sewer cleaners . Funding for sewer cleaners through water tax 18% revenues adds further stability 82% . Continued recovery in oil & gas markets benefiting hydro- excavation and industrial cleaning business U.S. Non-U.S. . Aging infrastructure, pipeline expansion, and increasing urbanization support long-term demand for safe digging 2018 End Markets by Users products, dump bodies and trailers Municipal/Government . Healthy housing market and improving industrial activity Industrial supports growth opportunities for dump bodies and trailers Utility . Upsides from prospective infrastructure spending, if any Oil and Gas approved . Tracking new housing starts, Class 8 truck chassis, municipal spending, oil rig counts, and overall industrial activity Source: Management Estimates 23

Appendix I: SSG Products 24

Appendix I: SSG - Market Influencers & Where We Play Market Dynamics 2018 Sales by Geography . Increased national focus on issues of public safety and law enforcement, and rising public expectations for transparency and accountability driving demand for 37% safety and security products 63% . Recovery in oil & gas will benefit signaling products and U.S. systems applications for hazardous areas Non-U.S. . Rising occurrence of natural and man-made disasters . Shift in customer preference towards inter-connected 2018 End Markets by Users platforms expected to drive demand for security Municipal/Government systems integration Industrial Utility . Tracking police data that indicates the number of new police vehicle registrations; 2019 demand expected to Oil and Gas be temporarily impacted by Ford’s model year Other changeover Source: Management Estimates 25

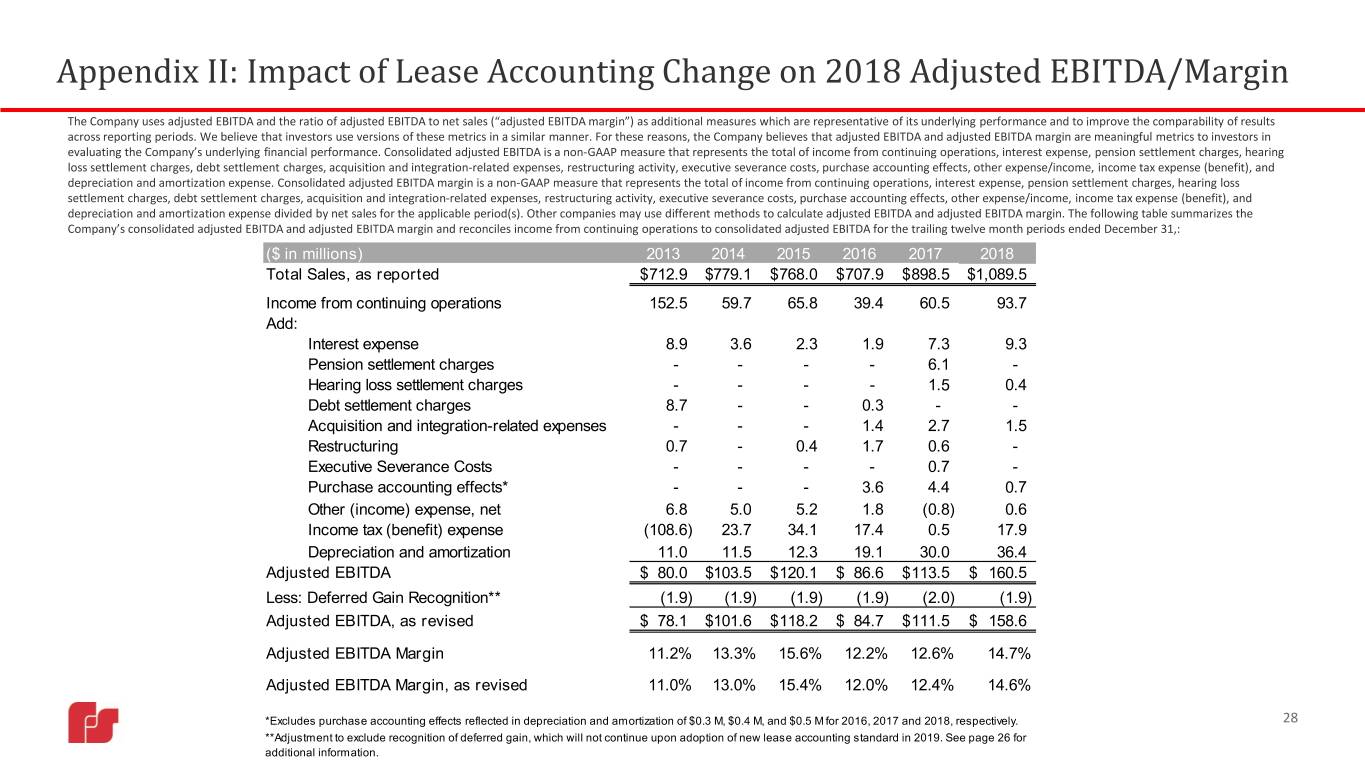

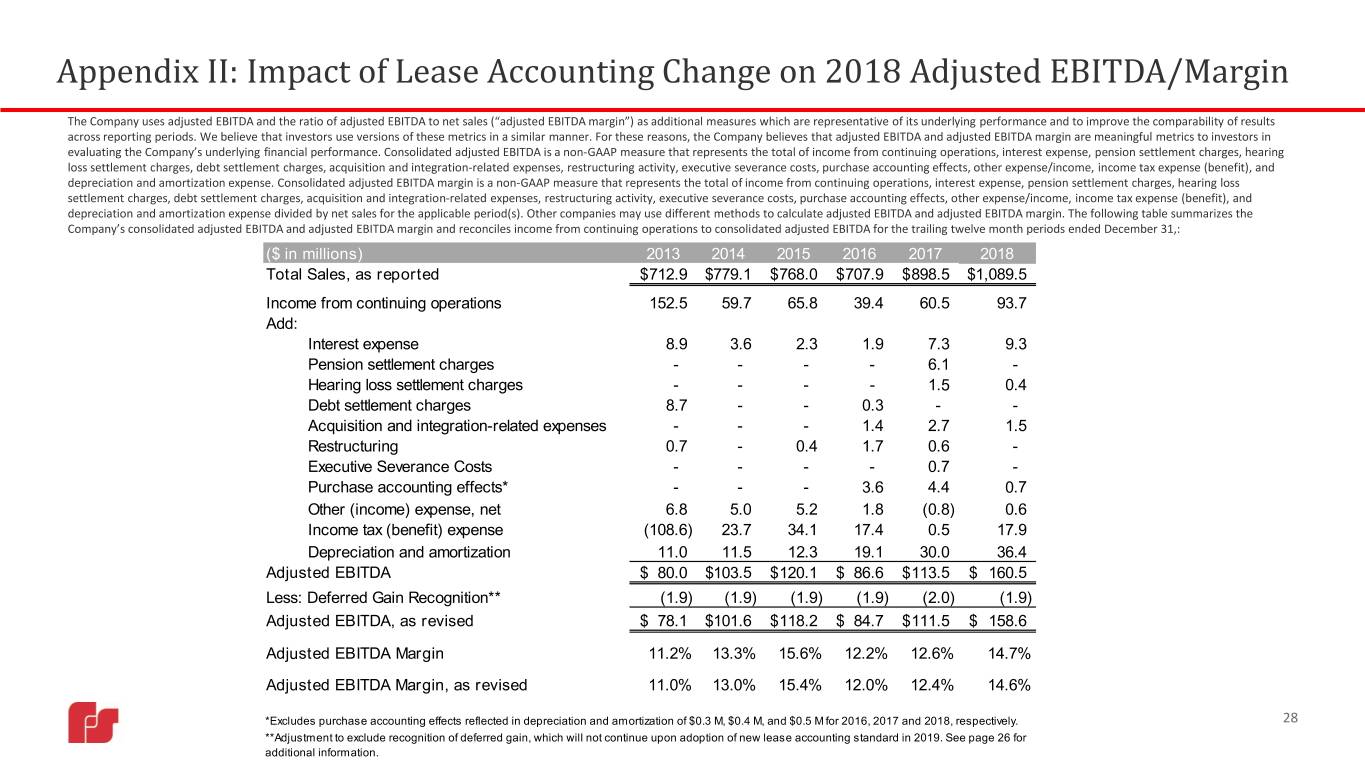

Appendix II: Impact of Lease Accounting Change on Non-GAAP Measures . Effective January 1, 2019, the Company will adopt the new lease accounting standard, which will result in the recognition of right-of-use assets and lease liabilities on the Company’s Consolidated Balance Sheet and will result in a change to the Company’s recognition of the deferred gain associated with historical sale lease-back transactions. The deferred gain, which initially totaled $29.0 M, has been recognized through the Company’s Consolidated Statement of Operations on a straight-line basis over the 15-year life of the respective leases. As a result, approximately $1.9 M of the deferred gain has been recognized each year since 2008, of which approximately $1.1 M and $0.8 M has been recognized within the ESG and SSG, respectively . Effective in 2019, the Company will no longer recognize any portion of the gain through the Consolidated Statement of Operations, and will recognize the remaining deferred gain balance, net of the related deferred tax asset, as a cumulative effect adjustment to opening retained earnings. To facilitate comparisons with prior periods, when reporting our interim and annual non-GAAP results in 2019, we will be adjusting our previously issued non-GAAP results for 2018 and earlier years to exclude the recognition of this deferred gain, which will no longer occur following the adoption of the new lease accounting standards . We have included a reconciliation of our GAAP EPS for 2018 to Adjusted EPS for 2018, as initially presented, and to the revised Adjusted EPS for 2018 (excluding the deferred gain recognition) on page 27 . In addition, we have included a reconciliation of our GAAP income from continuing operations for the years ended December 31, 2013 through 2018 to Adjusted EBITDA, as initially presented, and to the revised Adjusted EBITDA (excluding the deferred gain recognition) on page 28 26

Appendix II: Impact of Lease Accounting Change on 2018 Adjusted EPS 27

Appendix II: Impact of Lease Accounting Change on 2018 Adjusted EBITDA/Margin The Company uses adjusted EBITDA and the ratio of adjusted EBITDA to net sales (“adjusted EBITDA margin”) as additional measures which are representative of its underlying performance and to improve the comparability of results across reporting periods. We believe that investors use versions of these metrics in a similar manner. For these reasons, the Company believes that adjusted EBITDA and adjusted EBITDA margin are meaningful metrics to investors in evaluating the Company’s underlying financial performance. Consolidated adjusted EBITDA is a non-GAAP measure that represents the total of income from continuing operations, interest expense, pension settlement charges, hearing loss settlement charges, debt settlement charges, acquisition and integration-related expenses, restructuring activity, executive severance costs, purchase accounting effects, other expense/income, income tax expense (benefit), and depreciation and amortization expense. Consolidated adjusted EBITDA margin is a non-GAAP measure that represents the total of income from continuing operations, interest expense, pension settlement charges, hearing loss settlement charges, debt settlement charges, acquisition and integration-related expenses, restructuring activity, executive severance costs, purchase accounting effects, other expense/income, income tax expense (benefit), and depreciation and amortization expense divided by net sales for the applicable period(s). Other companies may use different methods to calculate adjusted EBITDA and adjusted EBITDA margin. The following table summarizes the Company’s consolidated adjusted EBITDA and adjusted EBITDA margin and reconciles income from continuing operations to consolidated adjusted EBITDA for the trailing twelve month periods ended December 31,: ($ in millions) 2013 2014 2015 2016 2017 2018 Total Sales, as reported $ 712.9 $779.1 $ 768.0 $ 707.9 $ 898.5 $1,089.5 Income from continuing operations 152.5 59.7 65.8 39.4 60.5 93.7 Add: Interest expense 8.9 3.6 2.3 1.9 7.3 9.3 Pension settlement charges - - - - 6.1 - Hearing loss settlement charges - - - - 1.5 0.4 Debt settlement charges 8.7 - - 0.3 - - Acquisition and integration-related expenses - - - 1.4 2.7 1.5 Restructuring 0.7 - 0.4 1.7 0.6 - Executive Severance Costs - - - - 0.7 - Purchase accounting effects* - - - 3.6 4.4 0.7 Other (income) expense, net 6.8 5.0 5.2 1.8 (0.8) 0.6 Income tax (benefit) expense (108.6) 23.7 34.1 17.4 0.5 17.9 Depreciation and amortization 11.0 11.5 12.3 19.1 30.0 36.4 Adjusted EBITDA $ 80.0 $103.5 $ 120.1 $ 86.6 $ 113.5 $ 160.5 Less: Deferred Gain Recognition** (1.9) (1.9) (1.9) (1.9) (2.0) (1.9) Adjusted EBITDA, as revised $ 78.1 $101.6 $ 118.2 $ 84.7 $ 111.5 $ 158.6 Adjusted EBITDA Margin 11.2% 13.3% 15.6% 12.2% 12.6% 14.7% Adjusted EBITDA Margin, as revised 11.0% 13.0% 15.4% 12.0% 12.4% 14.6% *Excludes purchase accounting effects reflected in depreciation and amortization of $0.3 M, $0.4 M, and $0.5 M for 2016, 2017 and 2018, respectively. 28 **Adjustment to exclude recognition of deferred gain, which will not continue upon adoption of new lease accounting standard in 2019. See page 26 for additional information.

Appendix III: Executive Compensation Aligned with Long-term Objectives • The Company continues to focus on executing against a number of key long-term objectives, which include the following: . Creating disciplined growth . Improving manufacturing efficiencies and costs . Leveraging invested capital . Diversifying our customer base One Year Three Years Ten Years Cash Bonus (STIP) Short-Term • Earnings (55%) Annual Goals EBITDA Margin (15%) 1. Profitability and growth • 2. Market share • Individual Objectives (30%) Performance Share Units Long-Term • EPS (75%) 3-year Performance and Vesting Periods 1. Profitability and growth • Return on Invested Capital (25%) 2. Shareholder value creation 3. Facilitates stock ownership 4. Executive retention Long-Term Restricted Stock Awards 3-year Cliff Vesting 1. Executive recruitment 2. Executive retention 3. Facilitates stock ownership Share Price Appreciation Longer-Term • Stock Options 3-year Ratable Vesting Period and 10 Year Exercise Period 1. Shareholder value creation 2. Facilitates stock ownership 3. Executive retention 29

Appendix IV: Investor Information Stock Ticker: NYSE:FSS Company website: federalsignal.com/investors HEADQUARTERS 1415 West 22nd Street, Suite 1100 Oak Brook, IL 60523 INVESTOR RELATIONS CONTACTS 630-954-2000 Ian Hudson Svetlana Vinokur SVP & Chief Financial Officer VP, Treasurer and Corporate Development IHudson@federalsignal.com SVinokur@federalsignal.com 30