Federal Signal to Acquire Mark Rite Lines Equipment Company, Inc. May 14, 2019 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer

Safe Harbor This presentation contains unaudited financial information and various forward-looking statements as of the date hereof and we undertake no obligation to update these forward-looking statements regardless of new developments or otherwise. Statements in this presentation that are not historical are forward-looking statements. Such statements are subject to various risks and uncertainties that could cause actual results to vary materially from those stated. Such risks and uncertainties include but are not limited to: economic conditions in various regions, product and price competition, supplier and raw material prices, risks associated with acquisitions such as integration of operations and achieving anticipated revenue and cost benefits, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation results, legal and regulatory developments and other risks and uncertainties described in filings with the Securities and Exchange Commission. 2

Federal Signal to Expand its Specialty Vehicle Platform Signs a definitive agreement to acquire Mark Rite Lines Equipment Company, Inc. (“MRL”) • MRL is a leading U.S. manufacturer of truck-mounted and ride-on road- marking equipment . MRL’s wholly-owned subsidiary, HighMark Traffic Services (“HighMark”), provides road-marking services, primarily in the state of Montana . Headquartered in Billings, Montana; ~250 employees • Generated $67 M of revenues during year ended December 31, 2018, with an EBITDA margin of 13% • Strategic addition to Federal Signal’s portfolio of niche, market-leading specialty vehicle manufacturing companies serving maintenance and infrastructure markets • Proprietary deal sourced through internal M&A pipeline 3

MRL’s Broad Product Portfolio and Service Offering Road-Marking Equipment Thermoplastic Marking Trucks Paint Marking Trucks Line Removal Trucks Plural Component Marking Self-Propelled / Ride-on Trucks Marking Equipment Road-Marking Services Parts and Repair Services • HighMark provides road-marking services, primarily in • MRL offers replacement parts and repair services to the state of Montana customers 4

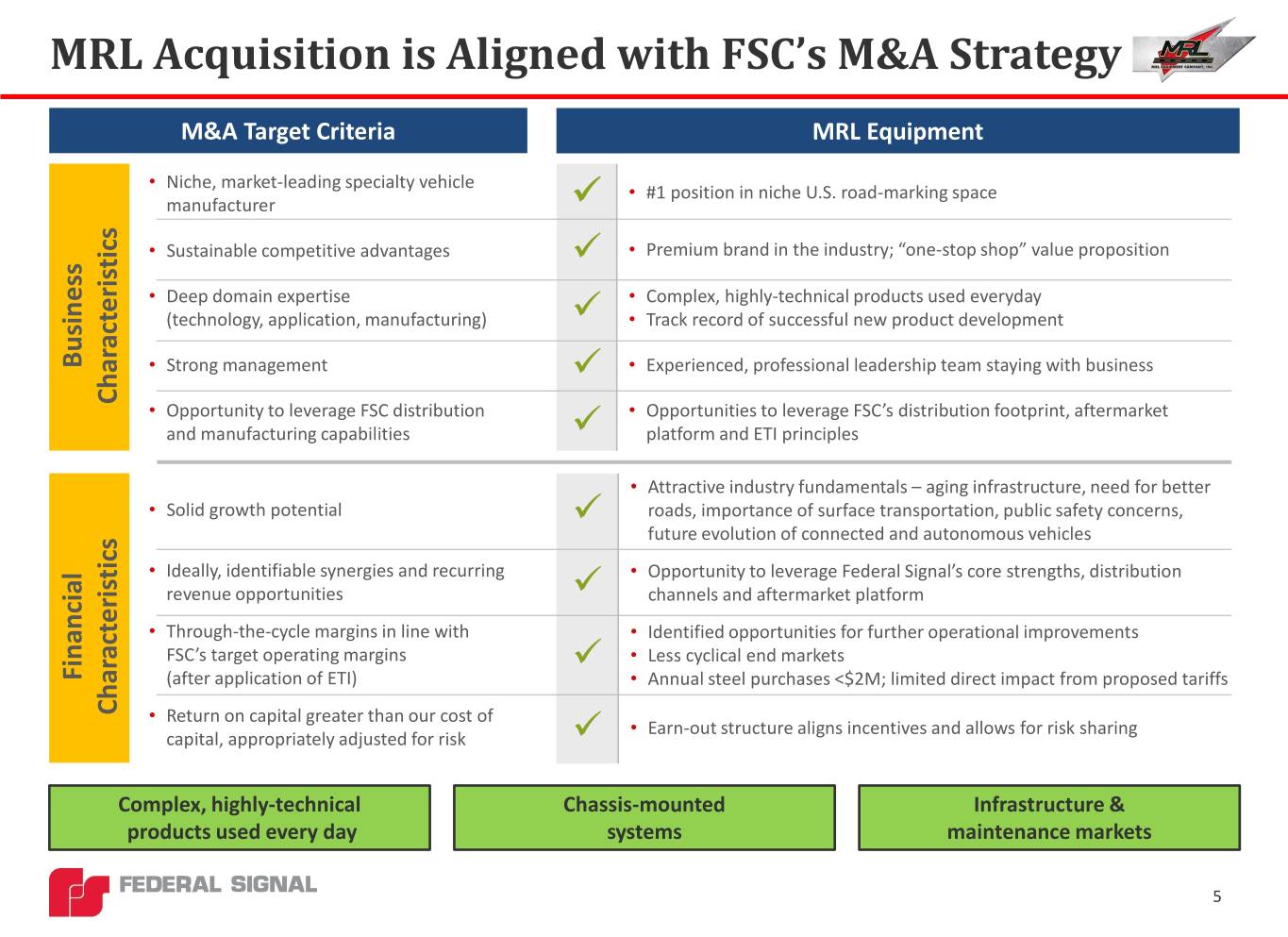

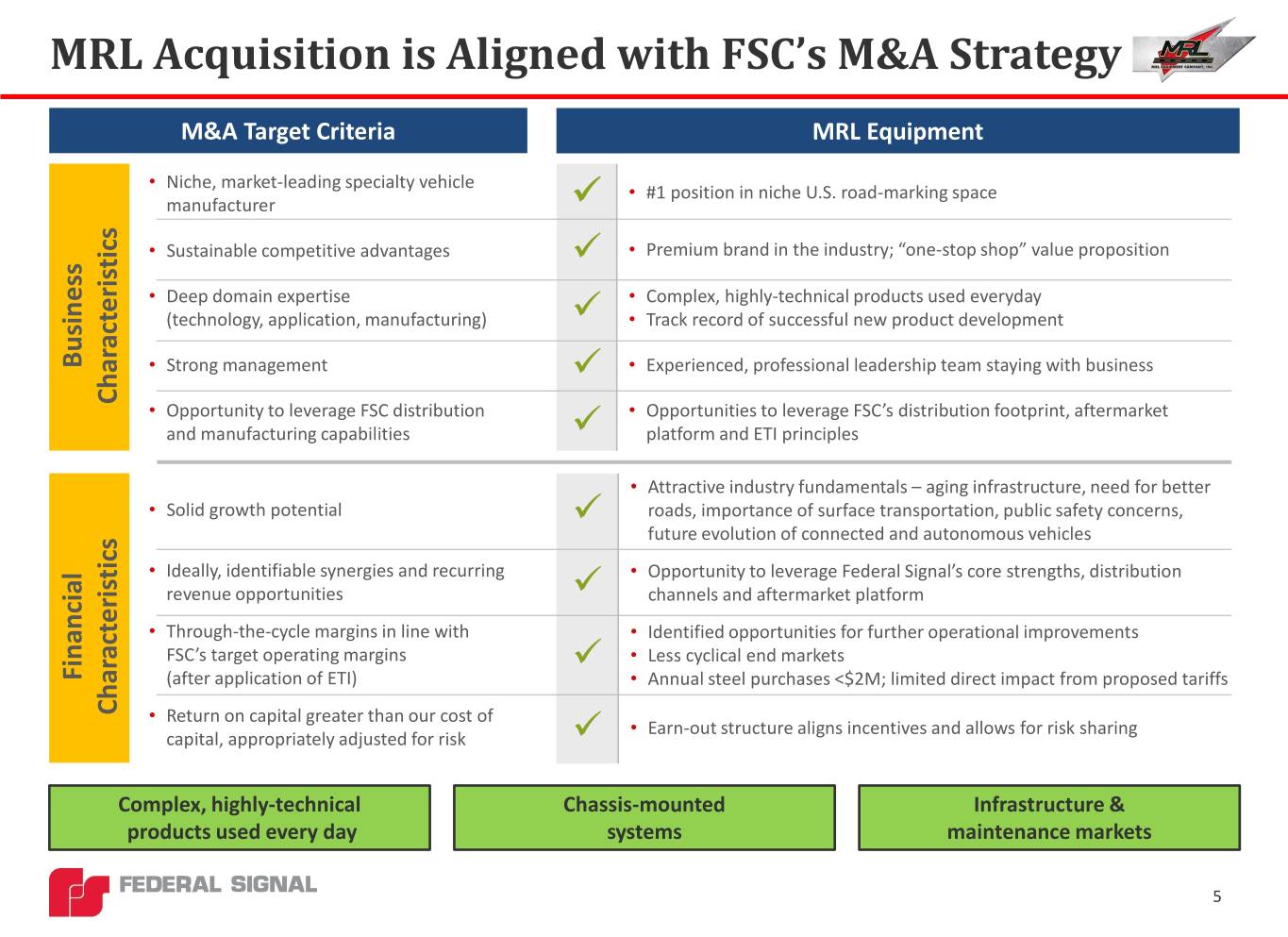

MRL Acquisition is Aligned with FSC’s M&A Strategy M&A Target Criteria MRL Equipment • Niche, market-leading specialty vehicle • #1 position in niche U.S. road-marking space manufacturer • Sustainable competitive advantages • Premium brand in the industry; “one-stop shop” value proposition • Deep domain expertise • Complex, highly-technical products used everyday (technology, application, manufacturing) • Track record of successful new product development Business Business • Strong management • Experienced, professional leadership team staying with business Characteristics • Opportunity to leverage FSC distribution • Opportunities to leverage FSC’s distribution footprint, aftermarket and manufacturing capabilities platform and ETI principles • Attractive industry fundamentals – aging infrastructure, need for better • Solid growth potential roads, importance of surface transportation, public safety concerns, future evolution of connected and autonomous vehicles • Ideally, identifiable synergies and recurring • Opportunity to leverage Federal Signal’s core strengths, distribution revenue opportunities channels and aftermarket platform • Through-the-cycle margins in line with • Identified opportunities for further operational improvements FSC’s target operating margins • Less cyclical end markets Financial Financial (after application of ETI) • Annual steel purchases <$2M; limited direct impact from proposed tariffs Characteristics • Return on capital greater than our cost of • Earn-out structure aligns incentives and allows for risk sharing capital, appropriately adjusted for risk Complex, highly-technical Chassis-mounted Infrastructure & products used every day systems maintenance markets 5

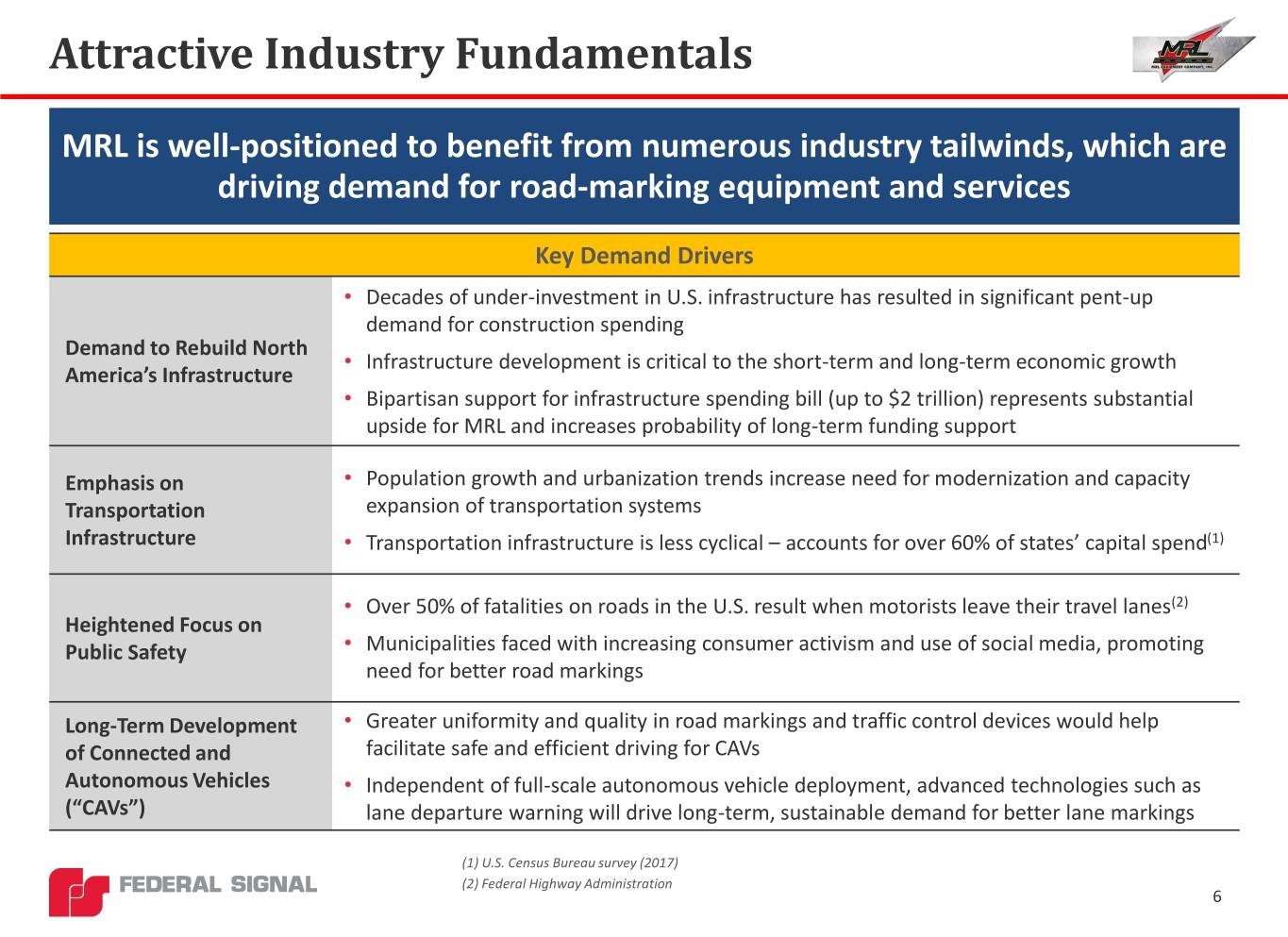

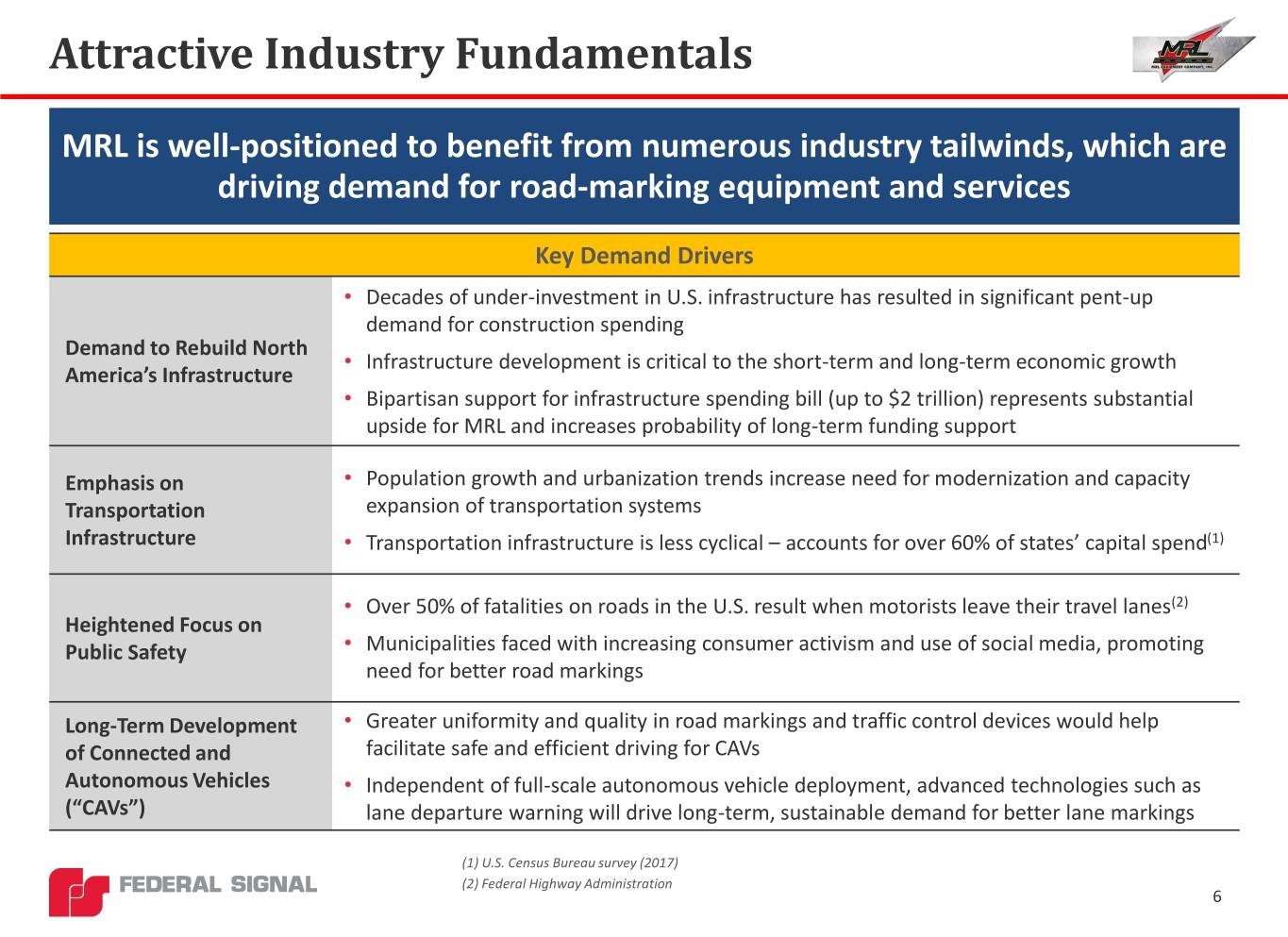

Attractive Industry Fundamentals MRL is well-positioned to benefit from numerous industry tailwinds, which are driving demand for road-marking equipment and services Key Demand Drivers • Decades of under-investment in U.S. infrastructure has resulted in significant pent-up demand for construction spending Demand to Rebuild North • Infrastructure development is critical to the short-term and long-term economic growth America’s Infrastructure • Bipartisan support for infrastructure spending bill (up to $2 trillion) represents substantial upside for MRL and increases probability of long-term funding support Emphasis on • Population growth and urbanization trends increase need for modernization and capacity Transportation expansion of transportation systems Infrastructure • Transportation infrastructure is less cyclical – accounts for over 60% of states’ capital spend(1) • Over 50% of fatalities on roads in the U.S. result when motorists leave their travel lanes(2) Heightened Focus on Public Safety • Municipalities faced with increasing consumer activism and use of social media, promoting need for better road markings Long-Term Development • Greater uniformity and quality in road markings and traffic control devices would help of Connected and facilitate safe and efficient driving for CAVs Autonomous Vehicles • Independent of full-scale autonomous vehicle deployment, advanced technologies such as (“CAVs”) lane departure warning will drive long-term, sustainable demand for better lane markings (1) U.S. Census Bureau survey (2017) (2) Federal Highway Administration 6

Transaction Summary • Initial purchase price of $55.5 M, subject to post closing adjustments • In addition, there is a contingent earnout payment of up to $15.5 M . Earnout is tied to MRL’s financial performance in the 3 years post closing • Intend to finance the acquisition with cash on hand and borrowings available under our existing credit facility • Expect acquisition to be modestly accretive to non-GAAP adjusted earnings per share (“EPS”) in 2019 and add up to $0.10 of adjusted EPS accretion by year 3 • Transaction expected to close in the third quarter of 2019, subject to customary closing conditions 7

Federal Signal’s Growing Specialty Vehicle Platform Acquisition of MRL will further solidify FSC’s presence in the maintenance and infrastructure space Markets Served Application Street Sewer Safe Industrial Material Road Sweeping Cleaning Digging Cleaning Hauling Marking Brands Products End Markets Municipal Municipal Industrial, Utility, Industrial Construction, Industrial, Transportation, Oil & Gas Landscaping, Municipal Infrastructure, Municipal Dealer Channel Dealer Dealer Dealer Direct Direct Direct Direct Routes to Market Rental/Aftermarket Dealer Network Distribution U.S. U.S. Dealer Largest Canadian Provide parts / service / Distribution For ESG products and Network distributor of refurbishment / rental offering Network other OEM’s products maintenance equipment through the network of 20+ to municipalities 8 locations in U.S. and Canada

Federal Signal Conference Call Q&A May 14, 2019 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer 9

Investor Information Stock Ticker - NYSE:FSS Company website: federalsignal.com/investors HEADQUARTERS 1415 West 22nd Street, Suite 1100 Oak Brook, IL 60523 INVESTOR RELATIONS CONTACTS 630-954-2000 Ian Hudson Svetlana Vinokur SVP, Chief Financial Officer VP, Treasurer and Corporate Development IHudson@federalsignal.com SVinokur@federalsignal.com 10