Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer Federal Signal Q3 2021 Earnings Call November 9, 2021

Safe Harbor This presentation contains unaudited financial information and various forward‐looking statements as of the date hereof and we undertake no obligation to update these forward‐ looking statements regardless of new developments or otherwise. Statements in this presentation that are not historical are forward‐looking statements. Such statements are subject to various risks and uncertainties that could cause actual results to vary materially from those stated. Such risks and uncertainties include but are not limited to: direct and indirect impacts of the coronavirus pandemic and the associated government response, economic conditions in various regions, product and price competition, supply chain disruptions, work stoppages, availability and pricing of raw materials, risks associated with acquisitions such as integration of operations and achieving anticipated revenue and cost benefits, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation results, legal and regulatory developments and other risks and uncertainties described in filings with the Securities and Exchange Commission. This presentation also contains references to certain non‐GAAP financial information. Such items are reconciled herein and in our earnings news release provided as of the date of this presentation. 2

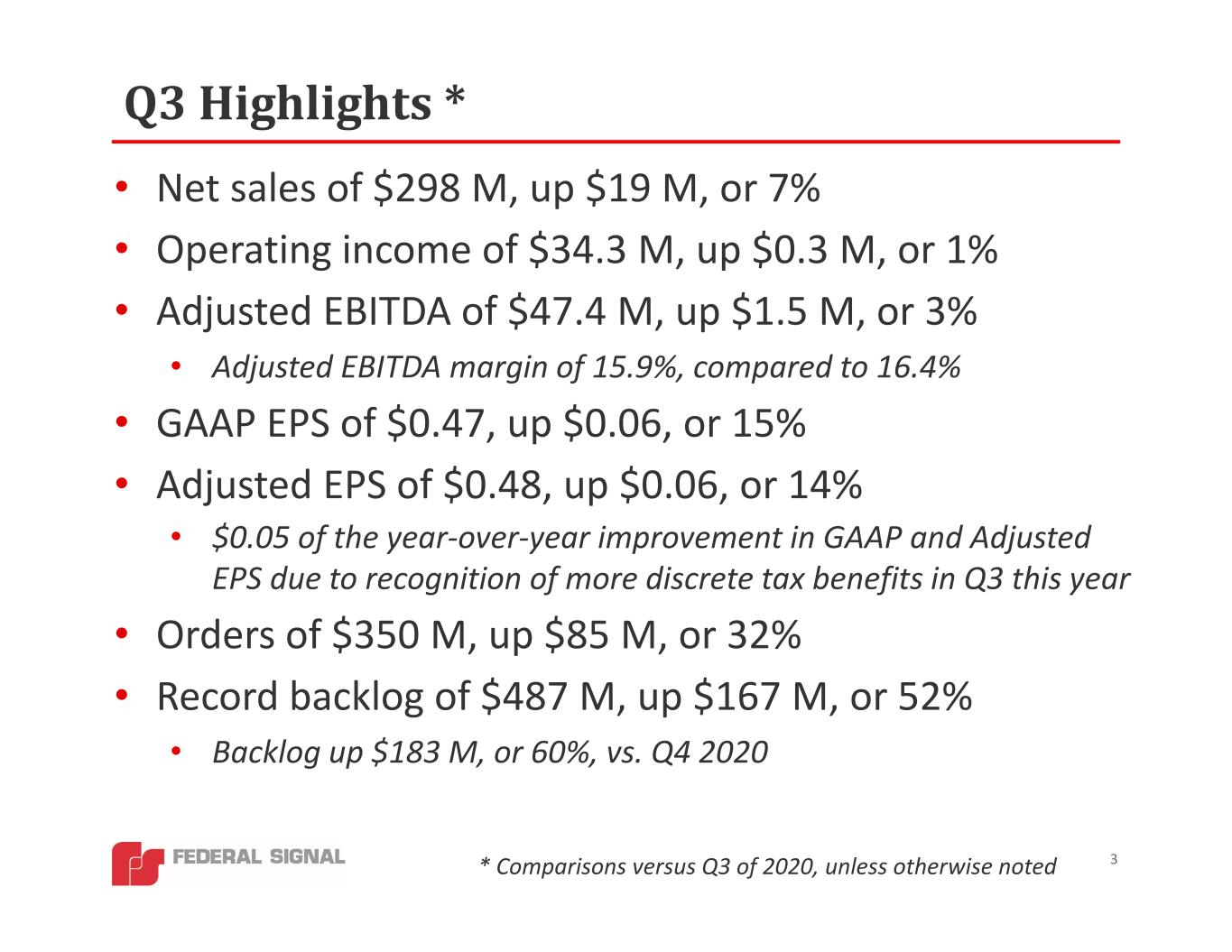

Q3 Highlights * 3* Comparisons versus Q3 of 2020, unless otherwise noted • Net sales of $298 M, up $19 M, or 7% • Operating income of $34.3 M, up $0.3 M, or 1% • Adjusted EBITDA of $47.4 M, up $1.5 M, or 3% • Adjusted EBITDA margin of 15.9%, compared to 16.4% • GAAP EPS of $0.47, up $0.06, or 15% • Adjusted EPS of $0.48, up $0.06, or 14% • $0.05 of the year‐over‐year improvement in GAAP and Adjusted EPS due to recognition of more discrete tax benefits in Q3 this year • Orders of $350 M, up $85 M, or 32% • Record backlog of $487 M, up $167 M, or 52% • Backlog up $183 M, or 60%, vs. Q4 2020

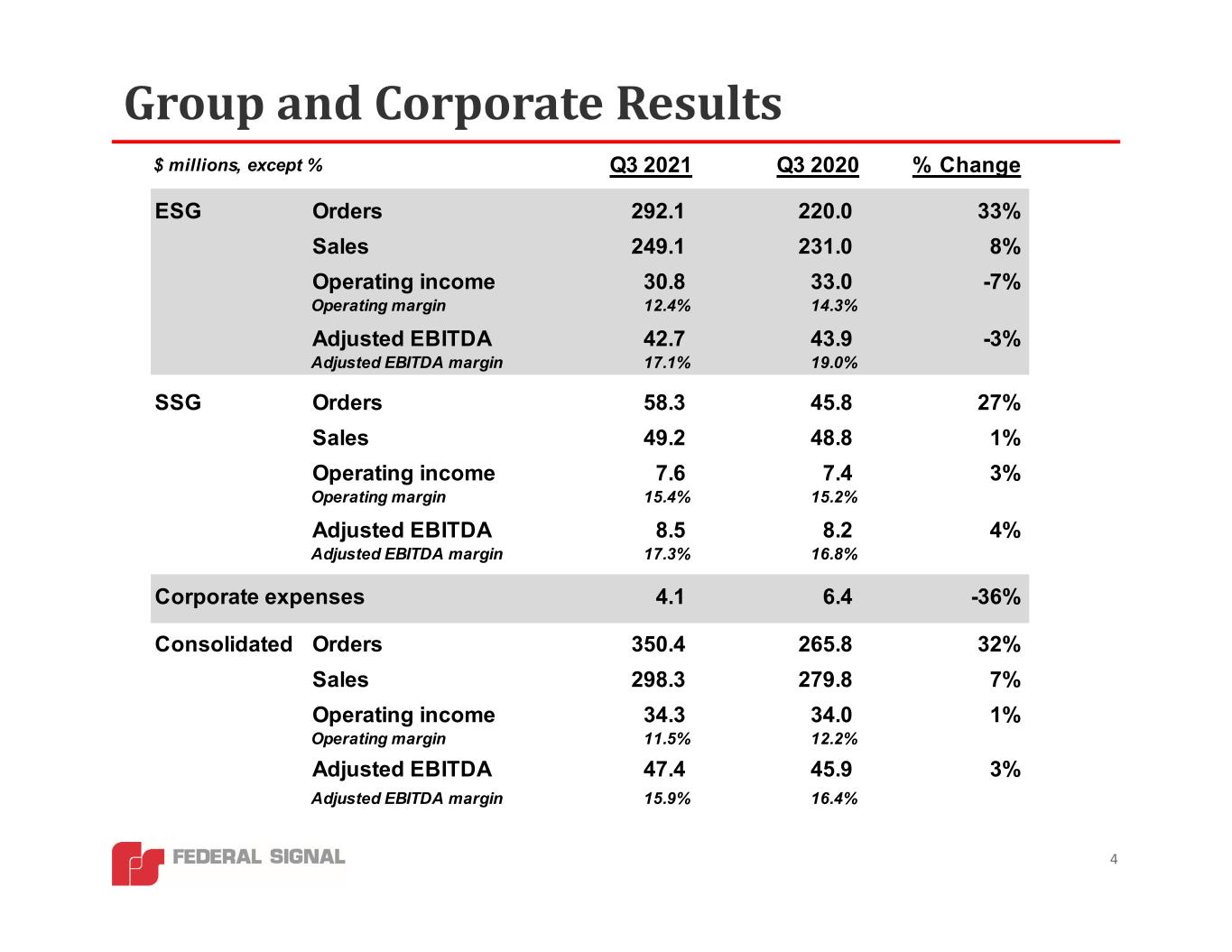

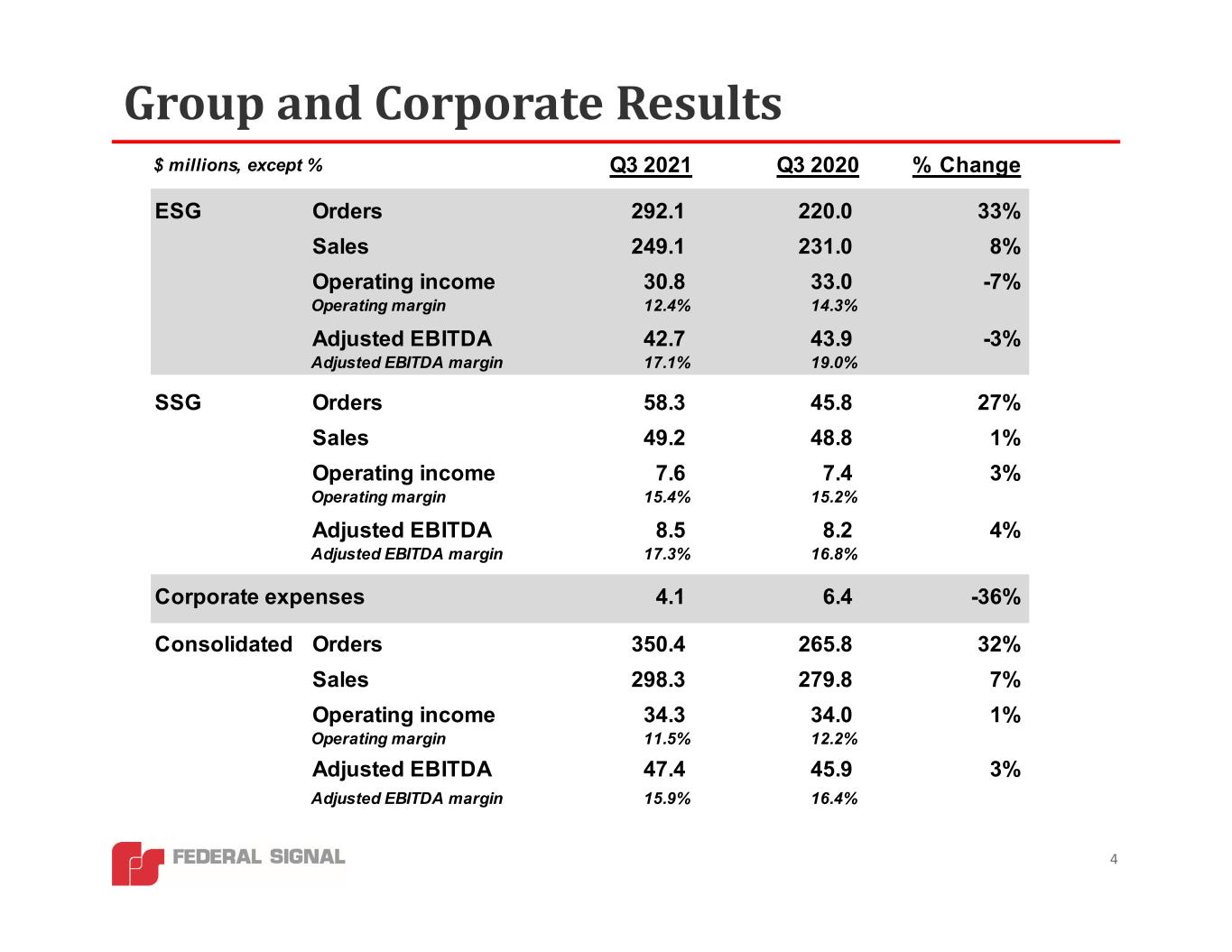

4 Group and Corporate Results $ millions, except % Q3 2021 Q3 2020 % Change ESG Orders 292.1 220.0 33% Sales 249.1 231.0 8% Operating income 30.8 33.0 -7% Operating margin 12.4% 14.3% Adjusted EBITDA 42.7 43.9 -3% Adjusted EBITDA margin 17.1% 19.0% SSG Orders 58.3 45.8 27% Sales 49.2 48.8 1% Operating income 7.6 7.4 3% Operating margin 15.4% 15.2% Adjusted EBITDA 8.5 8.2 4% Adjusted EBITDA margin 17.3% 16.8% Corporate expenses 4.1 6.4 -36% Consolidated Orders 350.4 265.8 32% Sales 298.3 279.8 7% Operating income 34.3 34.0 1% Operating margin 11.5% 12.2% Adjusted EBITDA 47.4 45.9 3% Adjusted EBITDA margin 15.9% 16.4%

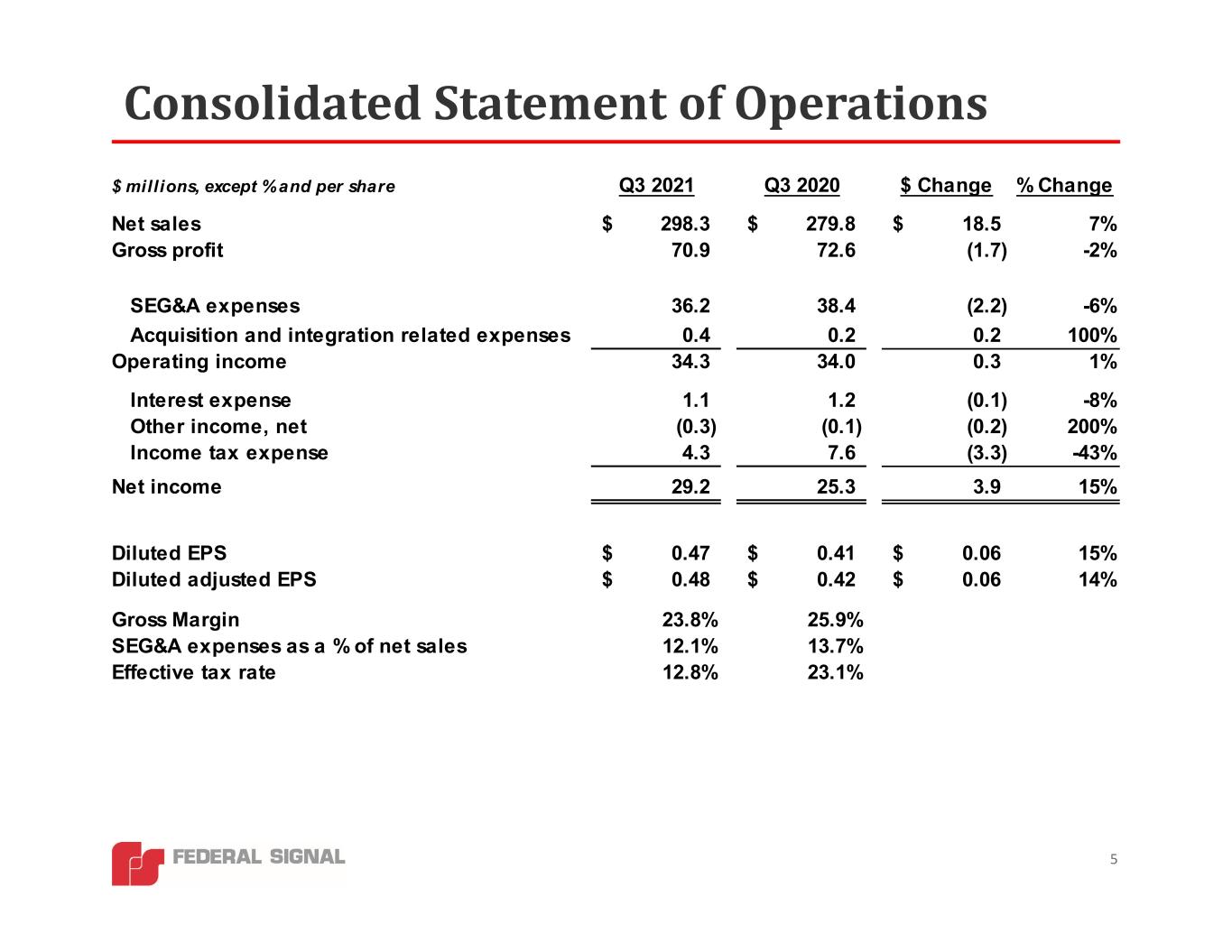

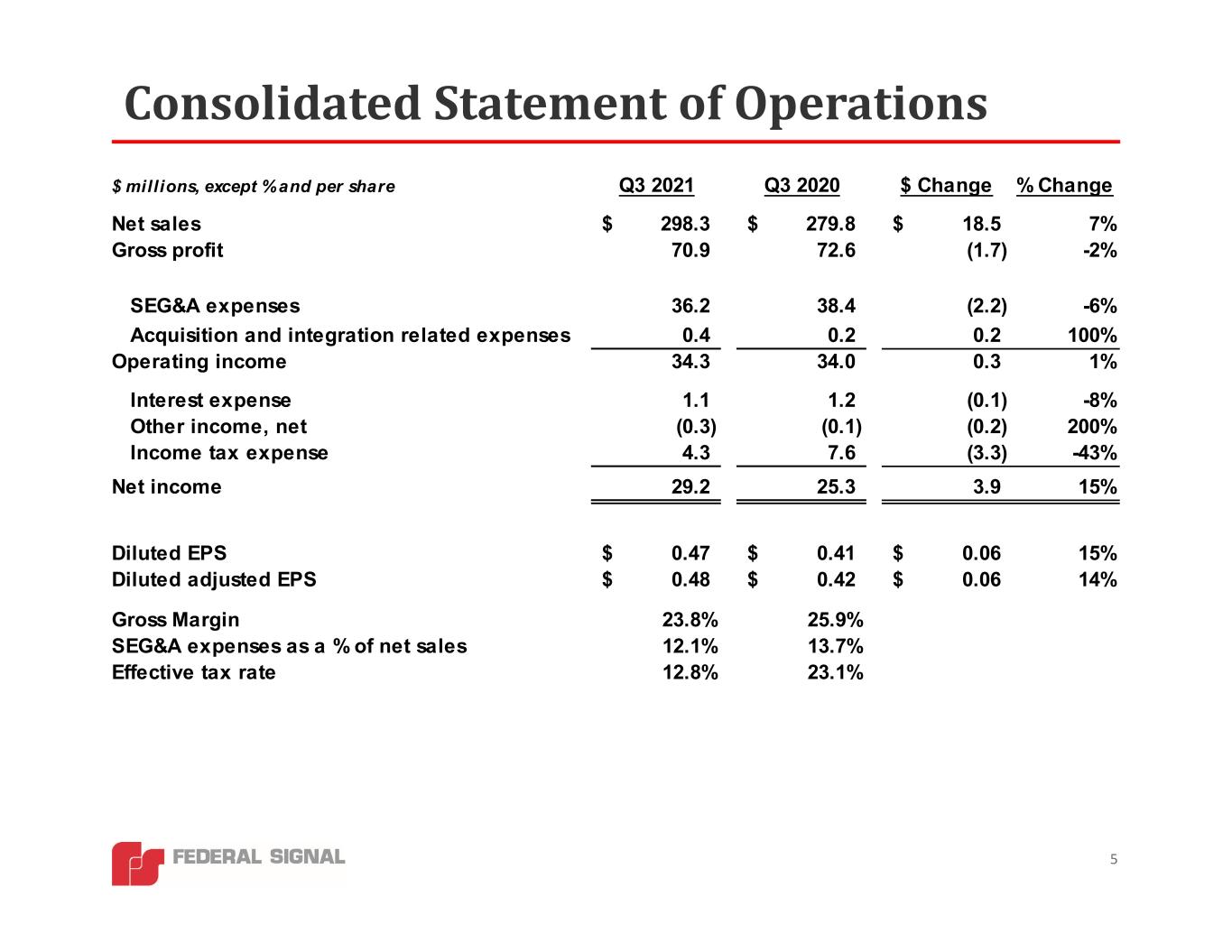

Consolidated Statement of Operations 5 $ millions, except % and per share Q3 2021 Q3 2020 $ Change % Change Net sales 298.3$ 279.8$ 18.5$ 7% Gross profit 70.9 72.6 (1.7) -2% SEG&A expenses 36.2 38.4 (2.2) -6% Acquisition and integration related expenses 0.4 0.2 0.2 100% Operating income 34.3 34.0 0.3 1% Interest expense 1.1 1.2 (0.1) -8% Other income, net (0.3) (0.1) (0.2) 200% Income tax expense 4.3 7.6 (3.3) -43% Net income 29.2 25.3 3.9 15% Diluted EPS 0.47$ 0.41$ 0.06$ 15% Diluted adjusted EPS 0.48$ 0.42$ 0.06$ 14% Gross Margin 23.8% 25.9% SEG&A expenses as a % of net sales 12.1% 13.7% Effective tax rate 12.8% 23.1%

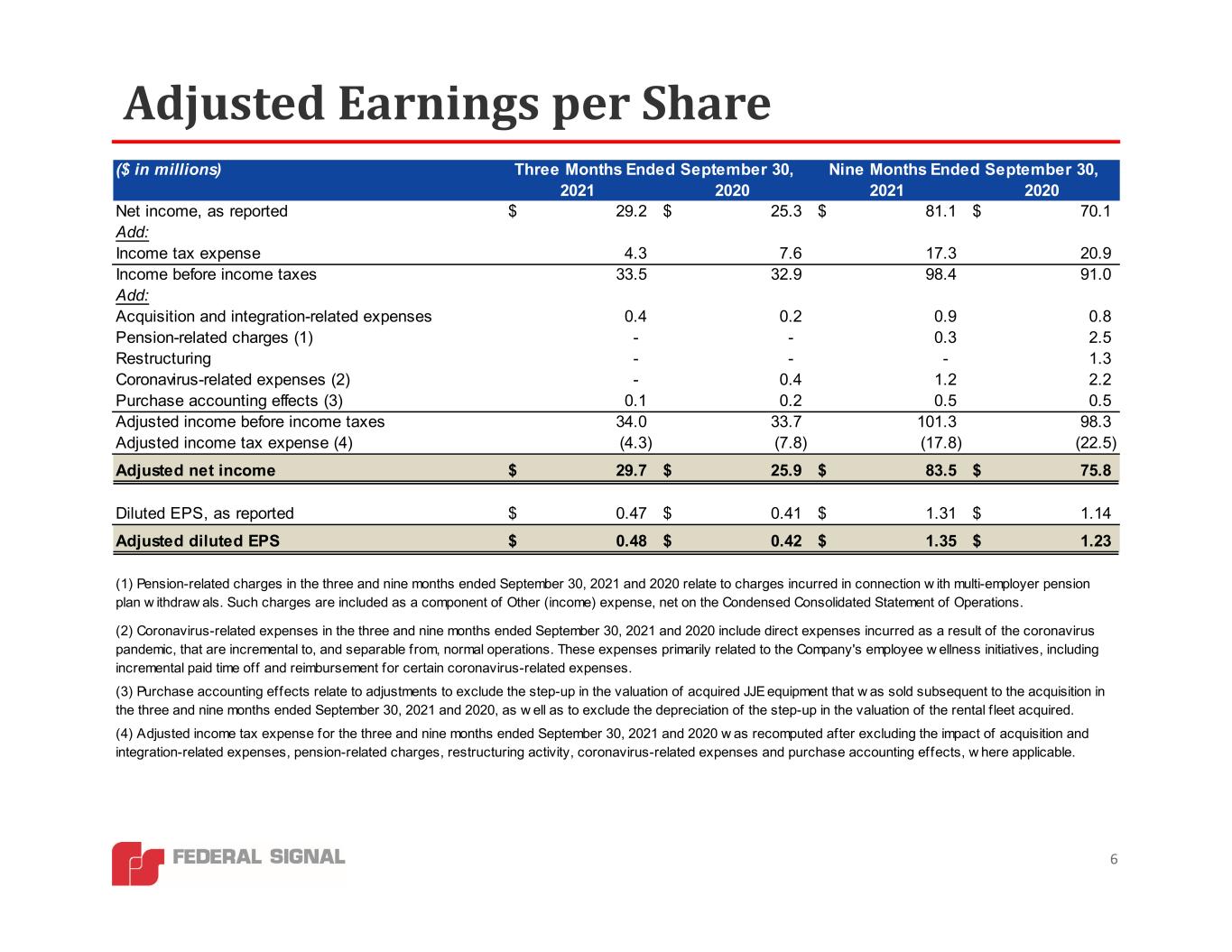

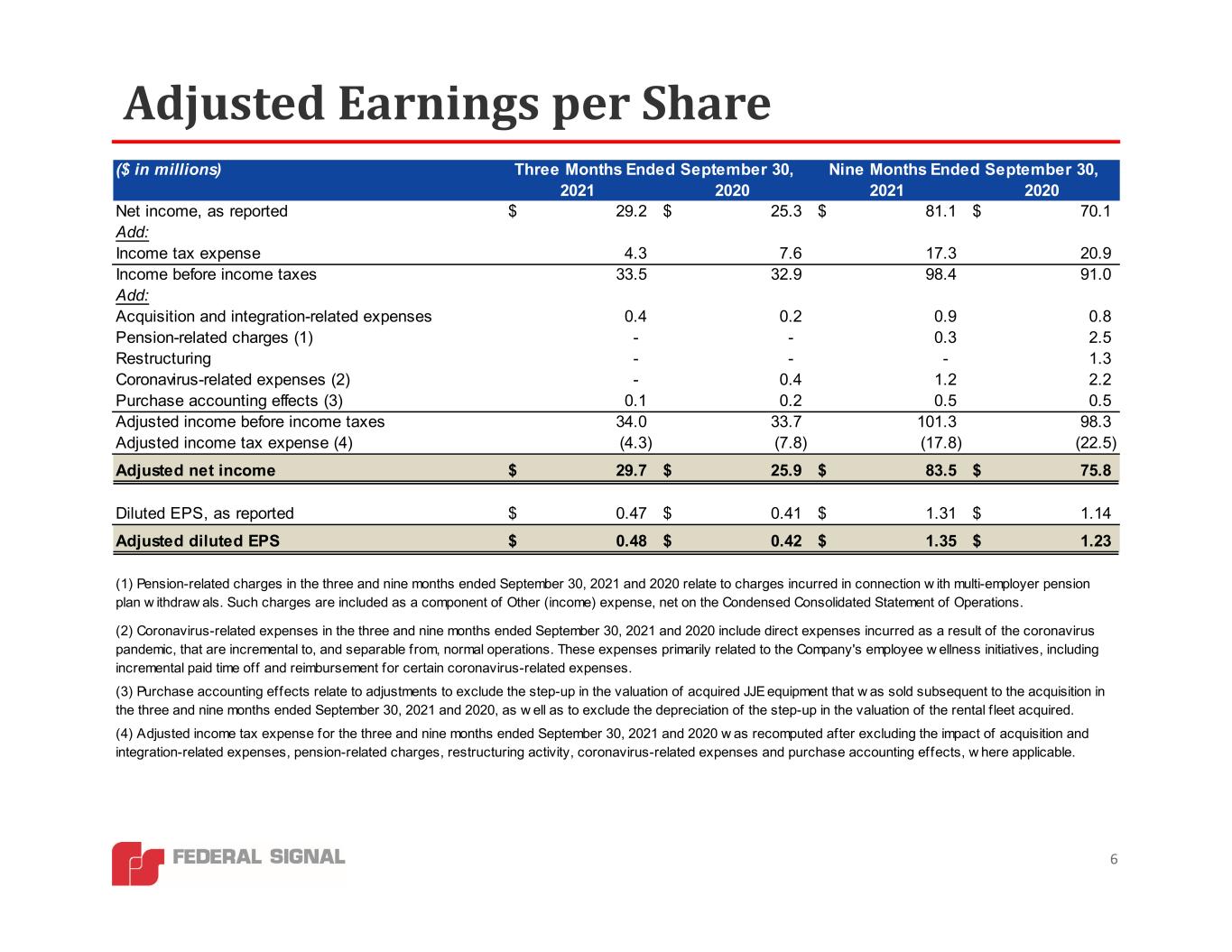

6 Adjusted Earnings per Share ($ in millions) 2021 2020 2021 2020 Net income, as reported 29.2$ 25.3$ 81.1$ 70.1$ Add: Income tax expense 4.3 7.6 17.3 20.9 Income before income taxes 33.5 32.9 98.4 91.0 Add: Acquisition and integration-related expenses 0.4 0.2 0.9 0.8 Pension-related charges (1) - - 0.3 2.5 Restructuring - - - 1.3 Coronavirus-related expenses (2) - 0.4 1.2 2.2 Purchase accounting effects (3) 0.1 0.2 0.5 0.5 Adjusted income before income taxes 34.0 33.7 101.3 98.3 Adjusted income tax expense (4) (4.3) (7.8) (17.8) (22.5) Adjusted net income 29.7$ 25.9$ 83.5$ 75.8$ Diluted EPS, as reported 0.47$ 0.41$ 1.31$ 1.14$ Adjusted diluted EPS 0.48$ 0.42$ 1.35$ 1.23$ Three Months Ended September 30, Nine Months Ended September 30, (3) Purchase accounting effects relate to adjustments to exclude the step-up in the valuation of acquired JJE equipment that w as sold subsequent to the acquisition in the three and nine months ended September 30, 2021 and 2020, as w ell as to exclude the depreciation of the step-up in the valuation of the rental f leet acquired. (4) Adjusted income tax expense for the three and nine months ended September 30, 2021 and 2020 w as recomputed after excluding the impact of acquisition and integration-related expenses, pension-related charges, restructuring activity, coronavirus-related expenses and purchase accounting effects, w here applicable. (2) Coronavirus-related expenses in the three and nine months ended September 30, 2021 and 2020 include direct expenses incurred as a result of the coronavirus pandemic, that are incremental to, and separable from, normal operations. These expenses primarily related to the Company's employee w ellness initiatives, including incremental paid time off and reimbursement for certain coronavirus-related expenses. (1) Pension-related charges in the three and nine months ended September 30, 2021 and 2020 relate to charges incurred in connection w ith multi-employer pension plan w ithdraw als. Such charges are included as a component of Other (income) expense, net on the Condensed Consolidated Statement of Operations.

7 Financial Strength and Flexibility * * Dollar amounts as of, or for the quarter ending 9/30/2021 ** Net debt is a non‐GAAP measure and is computed as total debt of $252.4 M, less total cash and cash equivalents of $88.0 M Strong capital structure • Cash and cash equivalents of ~$88 M • Net debt of ~$164 M ** • In July 2019, we executed a five‐year, $500 M revolving credit facility, with flexibility to increase by additional $250 M for acquisitions • No debt maturities until July 2024 • Net debt leverage remains low • Compliant with all covenants with significant headroom Healthy cash flow and access to cash facilitate organic growth investment, M&A and cash returns to stockholders • Generated ~$16 M of cash from operations in Q3 this year, up 8% vs. Q3 last year; brings year‐to‐date operating cash generation to ~$55 M • ~$240 M of availability under revolving credit facility • Anticipating full year cap ex of $20 M ‐ $25 M, including investments in our plants to add capacity and gain efficiencies through automation • Completed acquisition of Ground Force Worldwide on October 4, 2021 for initial purchase price of $43 M • Executed agreement to acquire substantially all assets and operations of Deist Industries, Inc. on November 9, 2021 • Paid $5.5 M for dividends, reflecting dividend of $0.09 per share; recently declared similar dividend for Q4 2021 • $3.2 M of share repurchases in Q3 2021; ~$87 M of repurchase authorization remaining under current programs (~3% of market cap)

CEO Remarks – Q3 Performance 8 • Meaningful improvement in net sales and earnings during Q3 • However, delays in chassis deliveries and other parts shortages estimated to have adversely impacted Q3 sales by ~$30 M • Despite this impact, Q3 adjusted EBITDA margin towards high end of target range • Continuing to realize benefits from diversification of revenue streams and end markets in recent years Q3 aftermarket revenues up $11 M, or 18%, year‐over‐ year, representing ~30% of ESG’s revenues • Higher rental utilization and improved used equipment/stock unit sales helped to partially mitigate impact of increases in commodity costs and freight charges in Q3

CEO Remarks – Market Conditions 9 • Outstanding Q3 orders of $350 M, up $85 M, or 32% vs. last year; contributing to another record backlog • Seeing signs that first tranche of stimulus money is flowing to municipal customers • U.S. municipal orders up 50% in both Q3 and YTD 2021 YTD street sweeper orders up $46 M, or 84% vs. last year YTD sewer cleaner orders up $45 M, or 64% vs. last year • U.S. industrial orders also up 50% vs. last year YTD orders for safe digging trucks and industrial vacuum loaders collectively up $45 M, or 87%, vs. last year

10 Acquisition of Ground Force Worldwide

Parts Interchangeable Truck Bodies 11 Agreement to Acquire Deist Industries, Inc. Mini Roll‐Off Containers (Drop Boxes) Front/Rear Loading ContainersRoll‐Off Containers Cable Hoist Systems

2021 Outlook Adjusted EPS* outlook range of $1.68 to $1.78 12 Revenue growth Depreciation and amortization expense of ~$50 M Capital expenditures of $20 M to $25 M Interest rate of 2‐3% Key Full‐Year Assumptions Effective income tax rate of ~18%, including estimated discrete tax benefits ~62 M weighted average shares outstanding Assumes no significant delays in our receipt of chassis or COVID‐related disruption *Adjusted earnings per share (“EPS”) is a non-GAAP measure, which includes certain adjustments to reported GAAP net income and diluted EPS. When reporting adjusted EPS in 2021, we have made, and would expect to continue to make, certain adjustments to exclude the impact of acquisition and integration-related expenses, pension-related charges, coronavirus-related expenses and purchase accounting effects, where applicable. However, because of the underlying uncertainty in quantifying amounts which may not yet be known, a reconciliation of our Adjusted EPS outlook to the most applicable GAAP measure is excluded based on the unreasonable efforts exception in Item 10(e)(1)(i)(B).

Looking Ahead 13 • Economic stimulus and infrastructure legislation expected to be catalysts for growth, benefiting most of our product offerings • Recent capacity expansions position us well to respond once supply chains improve • Diversification of revenue streams and end markets over last several years has enabled us to adjust as needed to changing/challenging market conditions • Consistent EBITDA margin performance within our target ranges highlight resiliency of our businesses • Strong financial position, with low leverage, supporting additional M&A; current pipeline remains active • Continued investment in new product development, with momentum on electrification initiatives • Ongoing commitment to Environmental, Social and Governance provides differentiation in hiring and retaining skilled employees at most locations Recently‐issued Sustainability Report highlights many of our accomplishments ~20 hourly job openings out of ~1,000 at our 3 largest U.S. facilities Improving vaccination rates across organization, but still experiencing some COVID‐related disruption at certain facilities

Federal Signal Q3 2021 Earnings Call 14 Q&A November 9, 2021 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer

Investor Information Stock Ticker ‐ NYSE:FSS Company website: federalsignal.com/investors HEADQUARTERS 1415 West 22nd Street, Suite 1100 Oak Brook, IL 60523 INVESTOR RELATIONS 630‐954‐2000 Ian Hudson SVP, Chief Financial Officer IHudson@federalsignal.com 15

Federal Signal Q3 2021 Earnings Call 16 Appendix

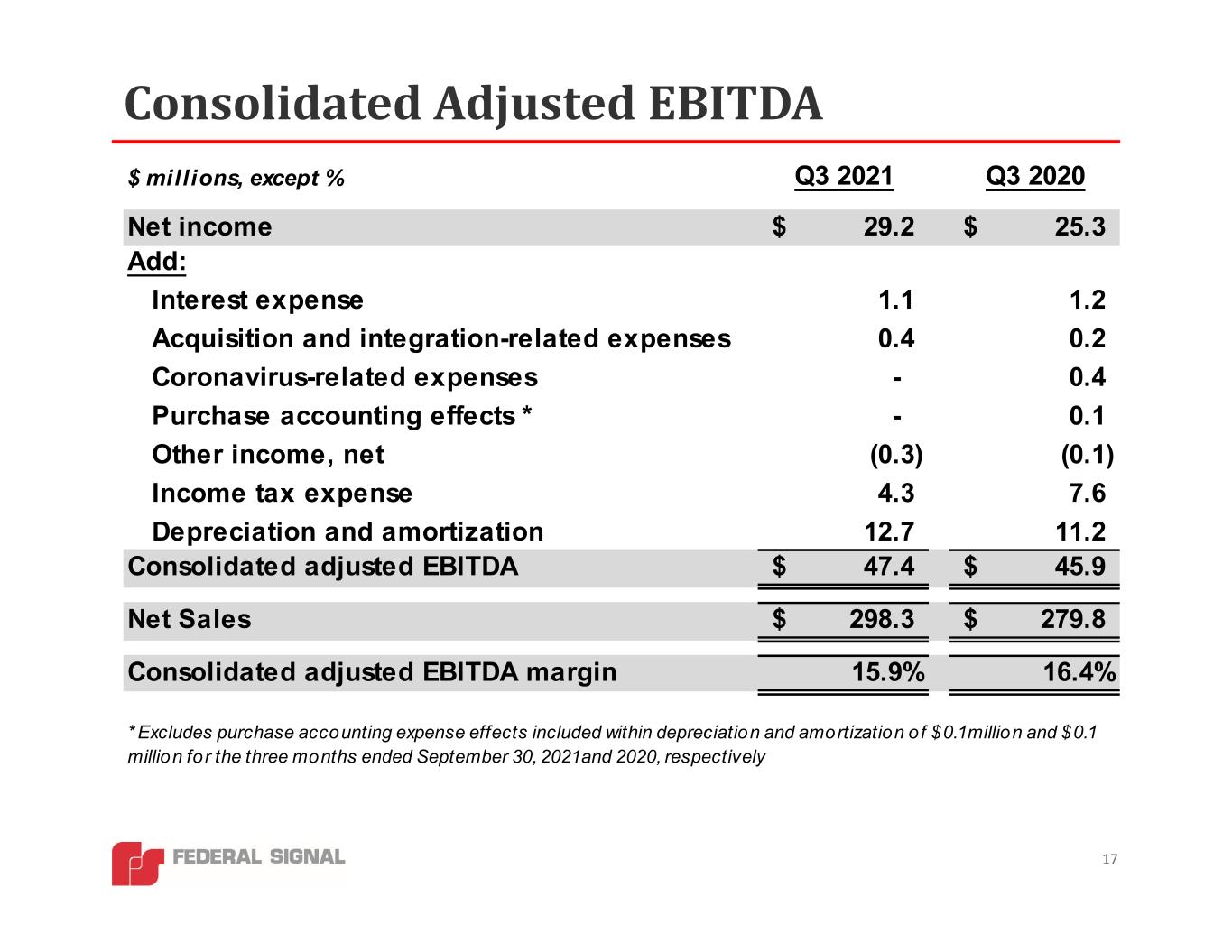

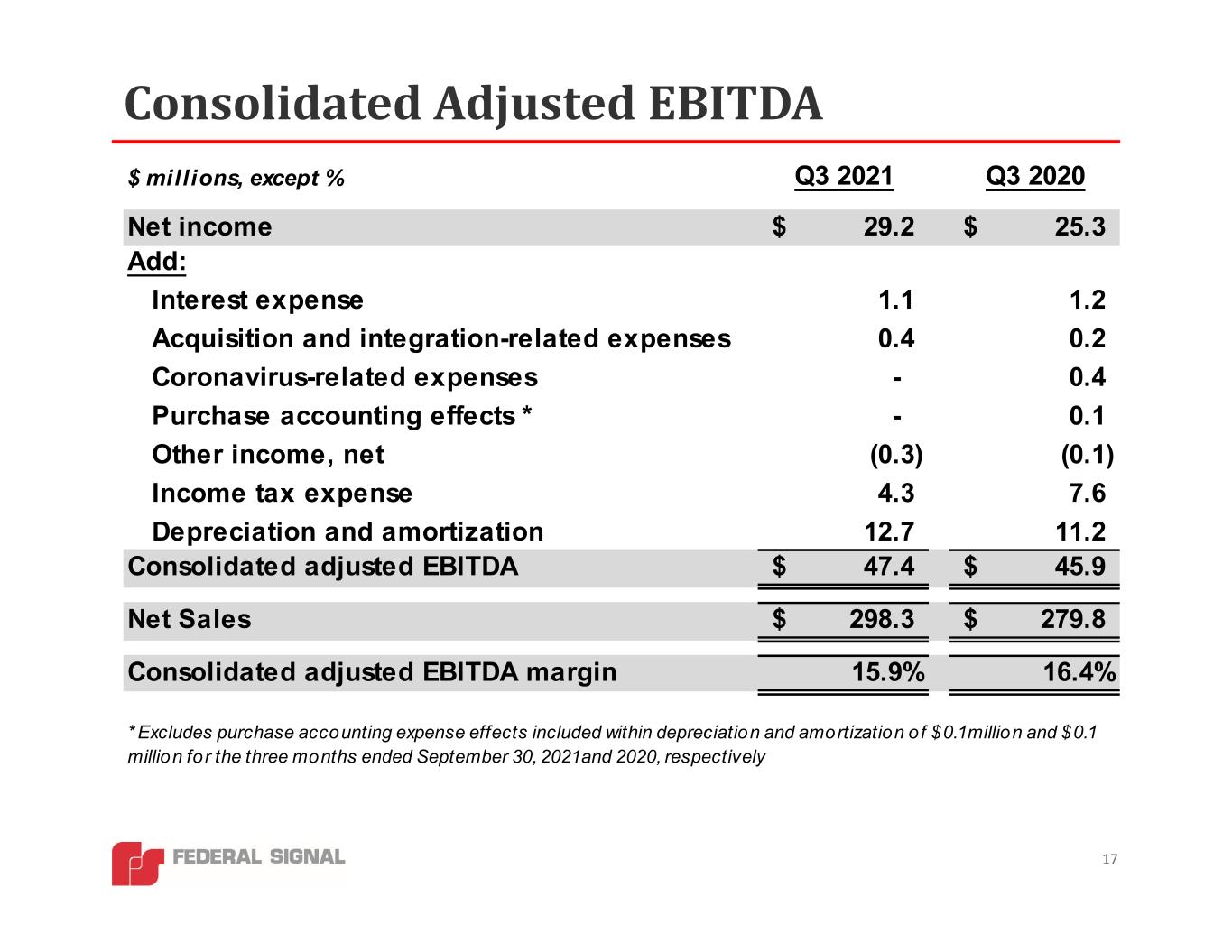

Consolidated Adjusted EBITDA 17 $ millions, except % Q3 2021 Q3 2020 Net income 29.2$ 25.3$ Add: Interest expense 1.1 1.2 Acquisition and integration-related expenses 0.4 0.2 Coronavirus-related expenses - 0.4 Purchase accounting effects * - 0.1 Other income, net (0.3) (0.1) Income tax expense 4.3 7.6 Depreciation and amortization 12.7 11.2 Consolidated adjusted EBITDA 47.4$ 45.9$ Net Sales 298.3$ 279.8$ Consolidated adjusted EBITDA margin 15.9% 16.4% * Excludes purchase accounting expense effects included within depreciation and amortization of $0.1 million and $0.1 million for the three months ended September 30, 2021 and 2020, respectively

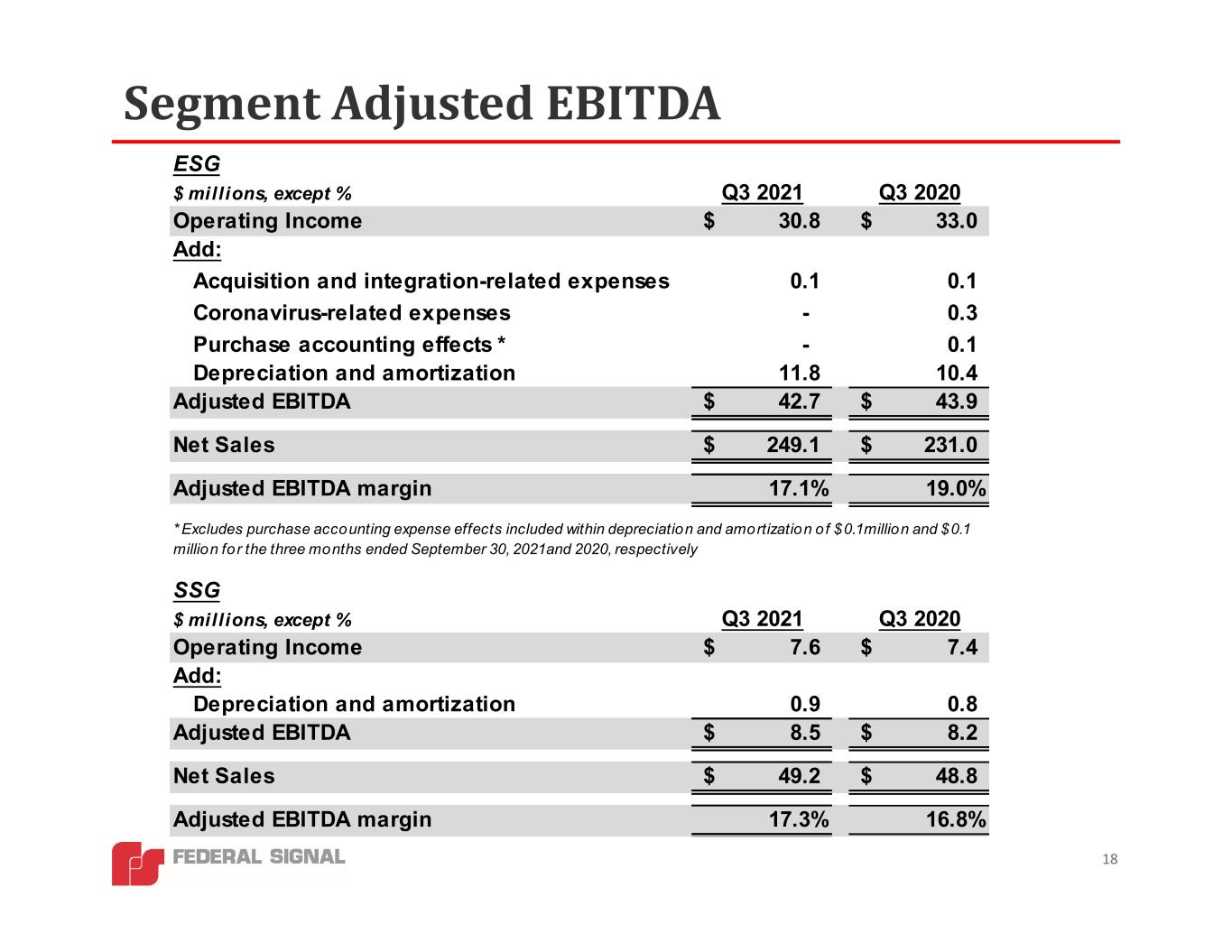

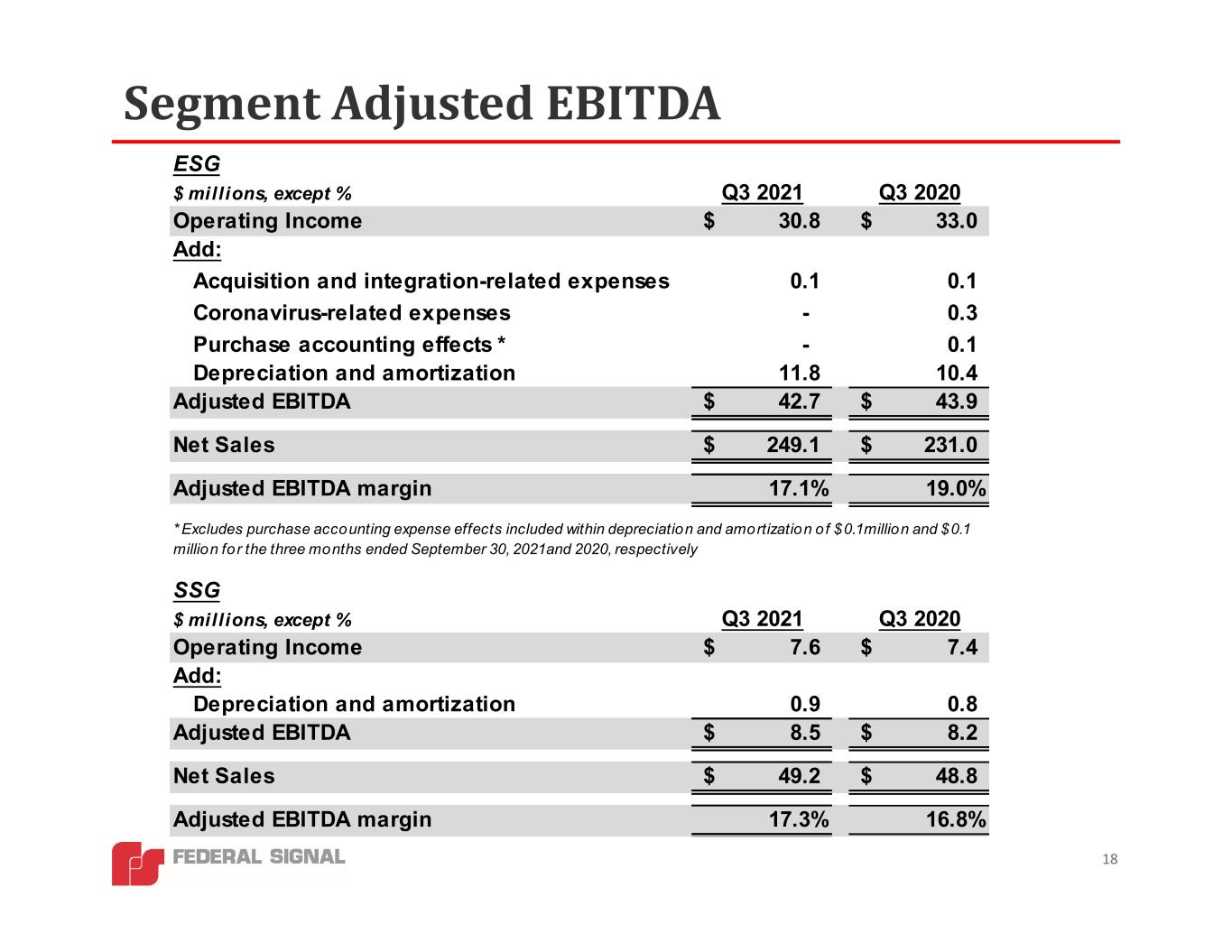

Segment Adjusted EBITDA 18 ESG $ millions, except % Q3 2021 Q3 2020 Operating Income 30.8$ 33.0$ Add: Acquisition and integration-related expenses 0.1 0.1 Coronavirus-related expenses - 0.3 Purchase accounting effects * - 0.1 Depreciation and amortization 11.8 10.4 Adjusted EBITDA 42.7$ 43.9$ Net Sales 249.1$ 231.0$ Adjusted EBITDA margin 17.1% 19.0% SSG $ millions, except % Q3 2021 Q3 2020 Operating Income 7.6$ 7.4$ Add: Depreciation and amortization 0.9 0.8 Adjusted EBITDA 8.5$ 8.2$ Net Sales 49.2$ 48.8$ Adjusted EBITDA margin 17.3% 16.8% * Excludes purchase accounting expense effects included within depreciation and amortization o f $0.1 million and $0.1 million for the three months ended September 30, 2021 and 2020, respectively

Non‐GAAP Measures • Adjusted net income and earnings per share (“EPS”) ‐ The Company believes that modifying its 2021 and 2020 net income and diluted EPS provides additional measures which are representative of the Company’s underlying performance and improves the comparability of results between reporting periods. During the three and nine months ended September 30, 2021 and 2020, adjustments were made to reported GAAP net income and diluted EPS to exclude the impact of acquisition and integration‐related expenses, pension‐related charges, restructuring activity, coronavirus‐related expenses and purchase accounting effects, where applicable. • Adjusted EBITDA and adjusted EBITDA margin ‐ The Company uses adjusted EBITDA and the ratio of adjusted EBITDA to net sales (“adjusted EBITDA margin”), at both the consolidated and segment level, as additional measures which are representative of its underlying performance and to improve the comparability of results across reporting periods. We believe that investors use versions of these metrics in a similar manner. For these reasons, the Company believes that adjusted EBITDA and adjusted EBITDA margin, at both the consolidated and segment level, are meaningful metrics to investors in evaluating the Company’s underlying financial performance. Other companies may use different methods to calculate adjusted EBITDA and adjusted EBITDA margin. • Consolidated adjusted EBITDA is a non‐GAAP measure that represents the total of net income, interest expense, acquisition and integration‐related expenses, restructuring activity, coronavirus‐related expenses, purchase accounting effects, other income/expense, income tax expense, and depreciation and amortization expense. Consolidated adjusted EBITDA margin is a non‐GAAP measure that represents the total of net income, interest expense, acquisition and integration‐related expenses, restructuring activity, coronavirus‐related expenses, purchase accounting effects, other income/expense, income tax expense, and depreciation and amortization expense divided by net sales for the applicable period(s). • Segment adjusted EBITDA is a non‐GAAP measure that represents the total of segment operating income, acquisition and integration‐related expenses, restructuring activity, coronavirus‐related expenses, purchase accounting effects and depreciation and amortization expense, as applicable. Segment adjusted EBITDA margin is a non‐GAAP measure that represents the total of segment operating income, acquisition and integration‐related expenses, restructuring activity, coronavirus‐related expenses, purchase accounting effects and depreciation and amortization expense, as applicable, divided by net sales for the applicable period(s). Segment operating income includes all revenues, costs and expenses directly related to the segment involved. In determining segment income, neither corporate nor interest expenses are included. Segment depreciation and amortization expense relates to those assets, both tangible and intangible, that are utilized by the respective segment. 19