Investor Presentation: November 2023 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer Felix Boeschen, VP, Corporate Strategy & Investor Relations Moves. Cleans. Protects.

2 This presentation contains unaudited financial information and forward-looking statements. Statements that are not historical are forward-looking statements and may contain words such as “may”, “will” ,“believe”, “expect”, “anticipate”, “intend”, “plan”, “project”, “estimate”, and “objective” or similar terminology, concerning the company’s future financial performance, business strategy, plans, goals and objectives. These expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning the Company’s possible or assumed future performance or results of operations and are not guarantees. While these statements are based on assumptions and judgments that management has made in light of industry experience as well as perceptions of historical trends, current conditions, expected future developments and other factors believed to be appropriate under the circumstances, they are subject to risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different. Such risks and uncertainties include, but are not limited to: direct and indirect impacts of the coronavirus pandemic and the associated government response, risks and adverse economic effects associated with emerging geopolitical conflicts, product and price competition, supply chain disruptions, work stoppages, availability and pricing of raw materials, cybersecurity risks, risks associated with acquisitions such as integration of operations and achieving anticipated revenue and cost benefits, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation results, legal and regulatory developments and other risks and uncertainties described in filings with the Securities and Exchange Commission (“SEC”). Such forward-looking statements are made as of the date hereof and we undertake no obligation to update these forward-looking statements regardless of new developments or otherwise. This presentation also contains certain measures that are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations, and to provide an additional measure of performance which management considers in operating the business. A reconciliation of these items to the most comparable GAAP measures is provided in our filings with the SEC and/or in the Appendix to this presentation. All financial figures in the presentation refer to FY2022 annual results unless otherwise noted. Safe Harbor Statement

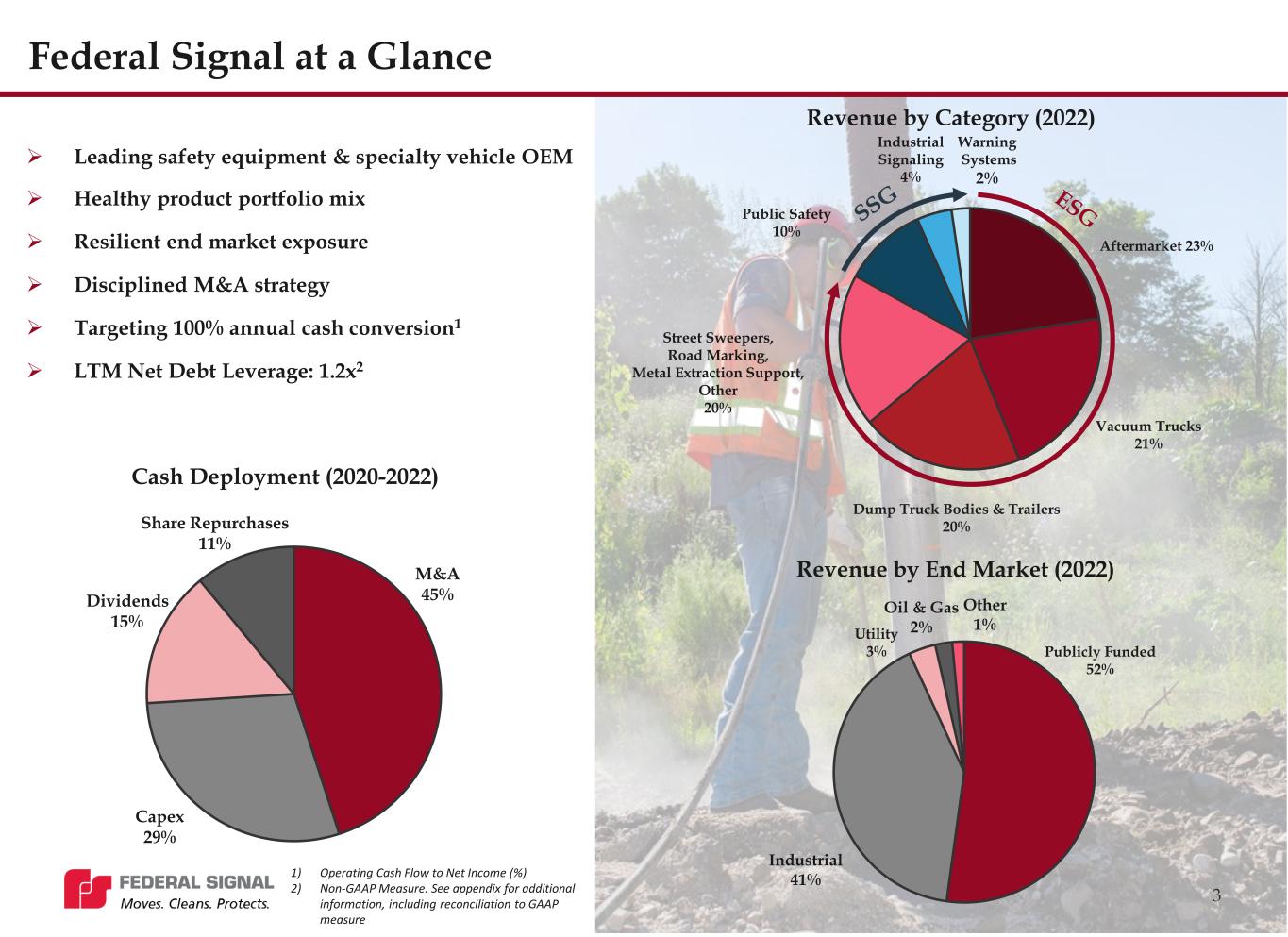

Federal Signal at a Glance Leading safety equipment & specialty vehicle OEM Healthy product portfolio mix Resilient end market exposure Disciplined M&A strategy Targeting 100% annual cash conversion1 LTM Net Debt Leverage: 1.2x2 M&A 45% Capex 29% Dividends 15% Share Repurchases 11% Cash Deployment (2020-2022) Publicly Funded 52% Industrial 41% Utility 3% Oil & Gas 2% Other 1% 3 Aftermarket 23% Vacuum Trucks 21% Dump Truck Bodies & Trailers 20% Public Safety 10% Street Sweepers, Road Marking, Metal Extraction Support, Other 20% Industrial Signaling 4% Warning Systems 2% 1) Operating Cash Flow to Net Income (%) 2) Non-GAAP Measure. See appendix for additional information, including reconciliation to GAAP measure Revenue by Category (2022) Revenue by End Market (2022)

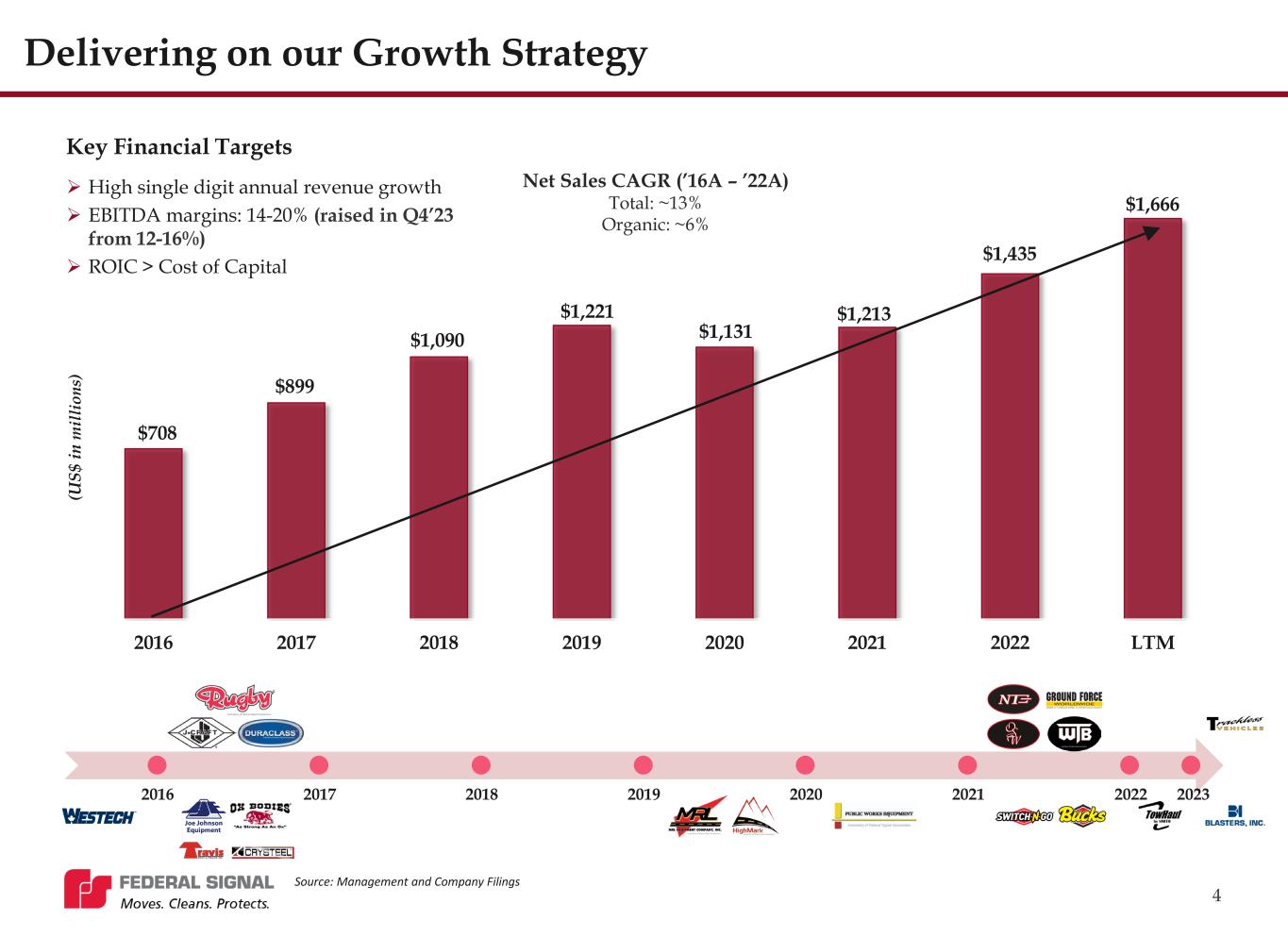

4 $708 $899 $1,090 $1,221 $1,131 $1,213 $1,435 $1,666 2016 2017 2018 2019 2020 2021 2022 LTM Net Sales CAGR (’16A – ’22A) Total: ~13% Organic: ~6% 2016 2017 2018 2019 2020 2021 2022 2023 Delivering on our Growth Strategy High single digit annual revenue growth EBITDA margins: 14-20% (raised in Q4’23 from 12-16%) ROIC > Cost of Capital (U S$ in m ill io ns ) Key Financial Targets Source: Management and Company Filings

5 Vehicle Product Market Share Rank2 Vacuum Trucks #1 Street Sweepers #1-2 Industrial Cleaning #2 Dump Truck Bodies & Trailers #1 Multi-Purpose Maintenance Vehicle #1 Road-Marking and Line-Removal #1 Metal & Mineral Extraction Support #1 Manufacturing Facility (19) Headquarters Aftermarket Site (29) ESG1: Growing A Best-In-Class Specialty Vehicle Platform Recent Highlights Q4’23: Raised ESG EBITDA margin targets to 17-22% (from 15-18%) 2021: Purchased Elgin, IL manufacturing facility (Street Sweepers) 2020: Expanded capacity at Lake Crystal, Rugby, and Billings manufacturing facilities (Dump Truck Bodies/Road-Marking) 2019: Expanded capacity at largest manufacturing facility (Streator, IL) by ~40% (Vacuum Trucks) 1. ESG = Environmental Solutions Group 2. Management estimates of North America market share

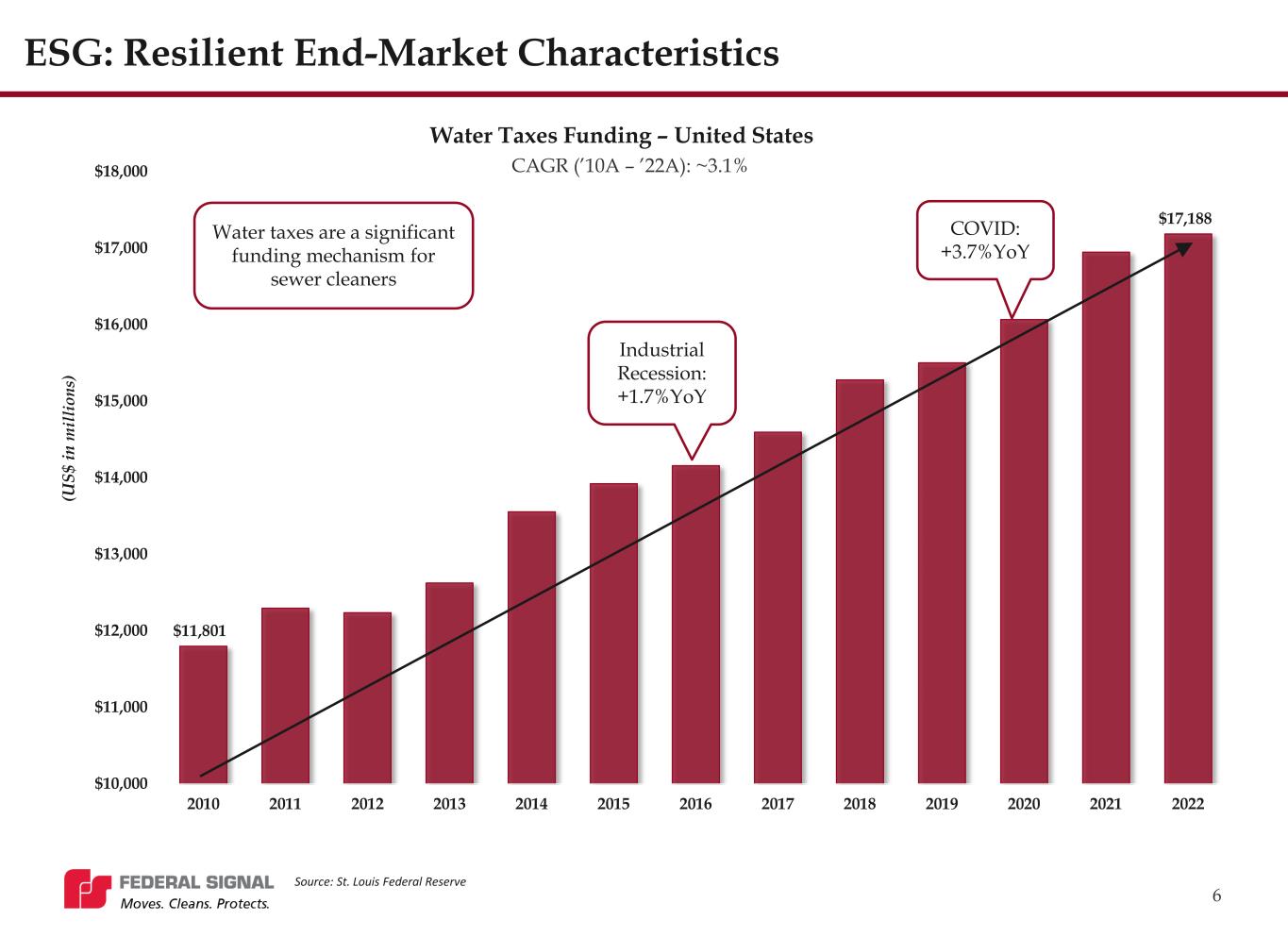

$10,000 $11,000 $12,000 $13,000 $14,000 $15,000 $16,000 $17,000 $18,000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 6 ESG: Resilient End-Market Characteristics Water Taxes Funding – United States CAGR (’10A – ’22A): ~3.1% Industrial Recession: +1.7%YoY COVID: +3.7%YoY $11,801 $17,188 Source: St. Louis Federal Reserve Water taxes are a significant funding mechanism for sewer cleaners (U S$ in m ill io ns )

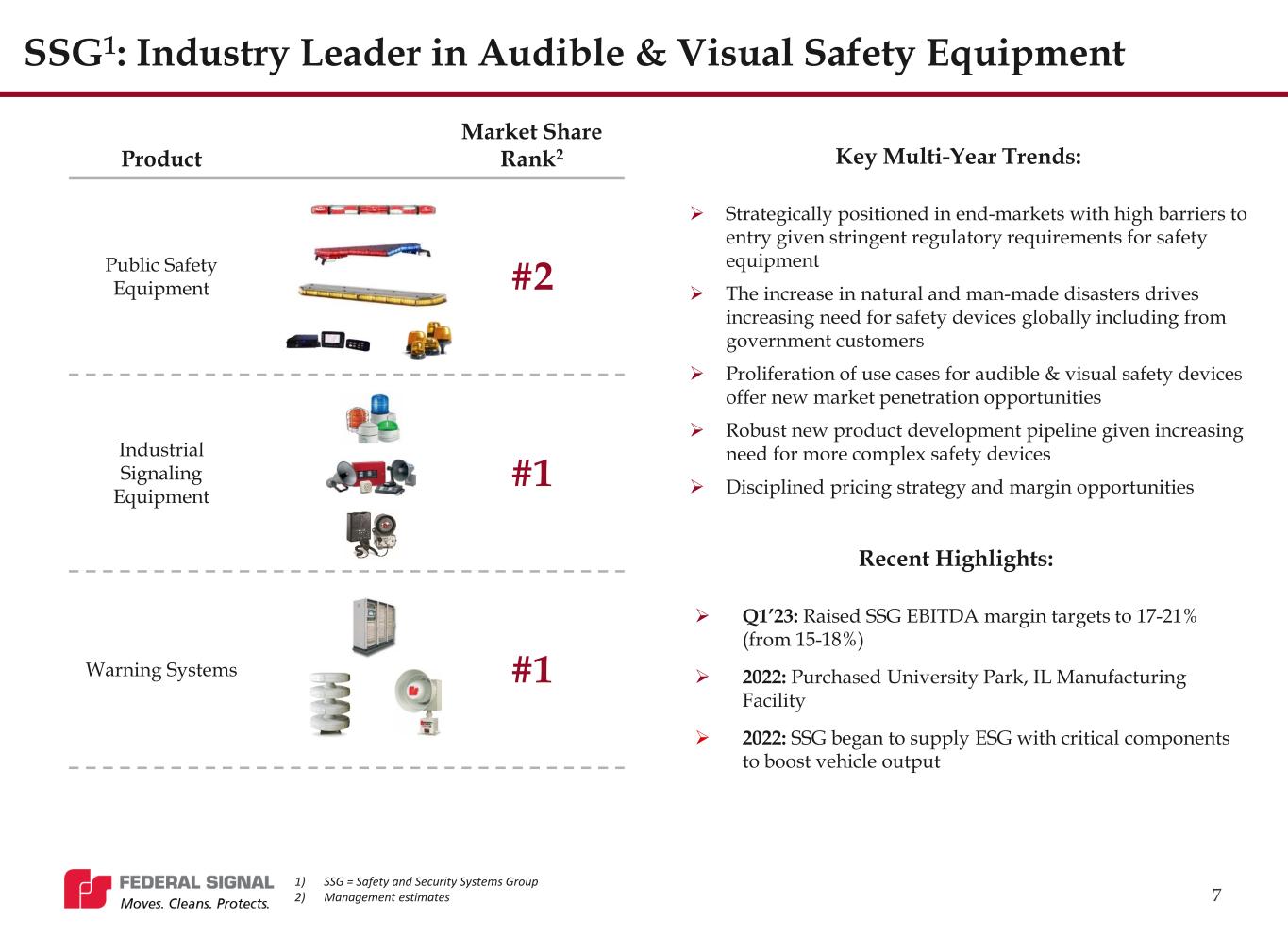

7 Product Market Share Rank2 Public Safety Equipment #2 Industrial Signaling Equipment #1 Warning Systems #1 Strategically positioned in end-markets with high barriers to entry given stringent regulatory requirements for safety equipment The increase in natural and man-made disasters drives increasing need for safety devices globally including from government customers Proliferation of use cases for audible & visual safety devices offer new market penetration opportunities Robust new product development pipeline given increasing need for more complex safety devices Disciplined pricing strategy and margin opportunities SSG1: Industry Leader in Audible & Visual Safety Equipment Recent Highlights: Q1’23: Raised SSG EBITDA margin targets to 17-21% (from 15-18%) 2022: Purchased University Park, IL Manufacturing Facility 2022: SSG began to supply ESG with critical components to boost vehicle output Key Multi-Year Trends: 1) SSG = Safety and Security Systems Group 2) Management estimates

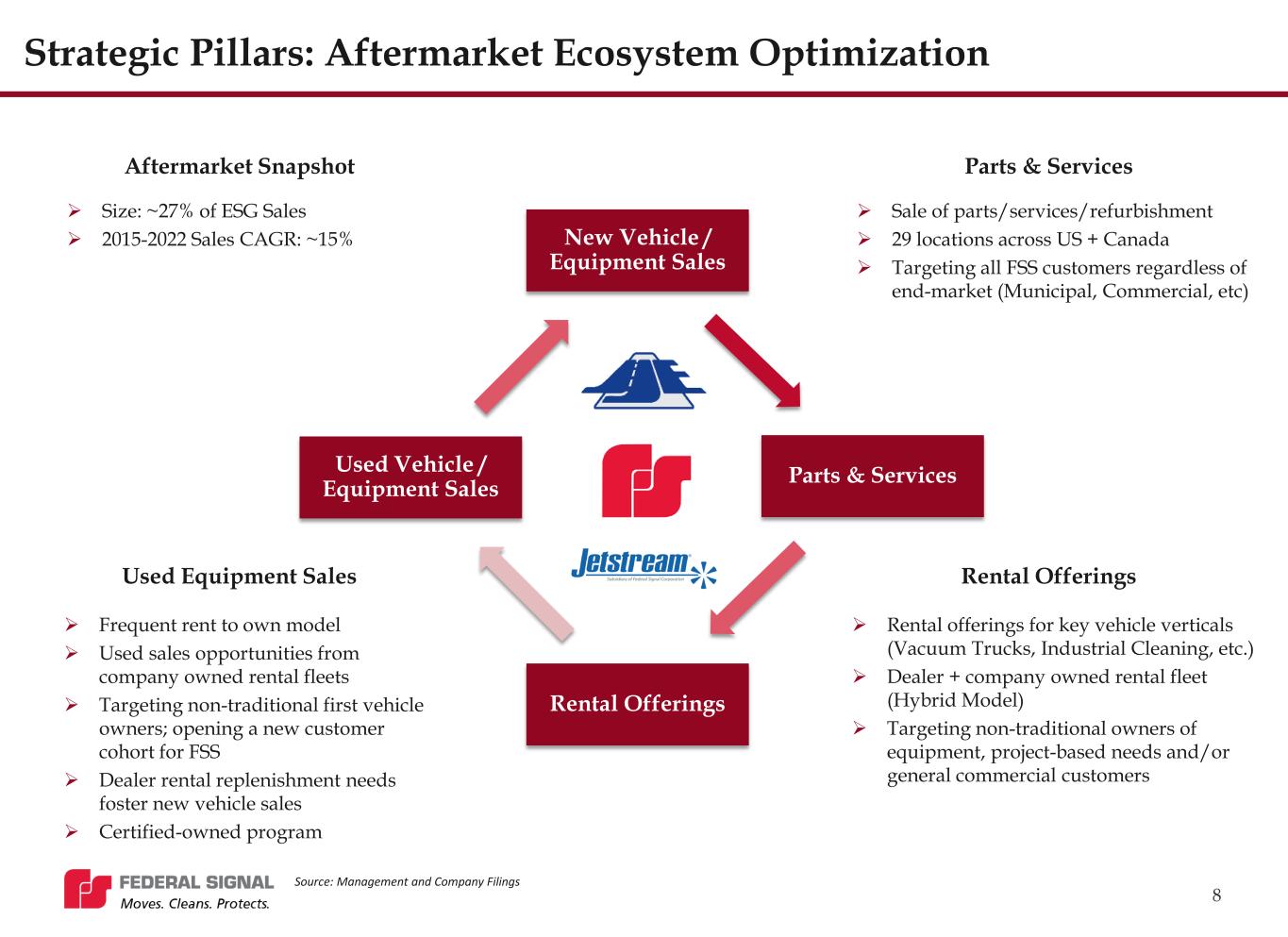

8 Strategic Pillars: Aftermarket Ecosystem Optimization New Vehicle / Equipment Sales Parts & Services Rental Offerings Used Vehicle / Equipment Sales Parts & ServicesAftermarket Snapshot Used Equipment Sales Rental Offerings Size: ~27% of ESG Sales 2015-2022 Sales CAGR: ~15% Sale of parts/services/refurbishment 29 locations across US + Canada Targeting all FSS customers regardless of end-market (Municipal, Commercial, etc) Frequent rent to own model Used sales opportunities from company owned rental fleets Targeting non-traditional first vehicle owners; opening a new customer cohort for FSS Dealer rental replenishment needs foster new vehicle sales Certified-owned program Rental offerings for key vehicle verticals (Vacuum Trucks, Industrial Cleaning, etc.) Dealer + company owned rental fleet (Hybrid Model) Targeting non-traditional owners of equipment, project-based needs and/or general commercial customers Source: Management and Company Filings

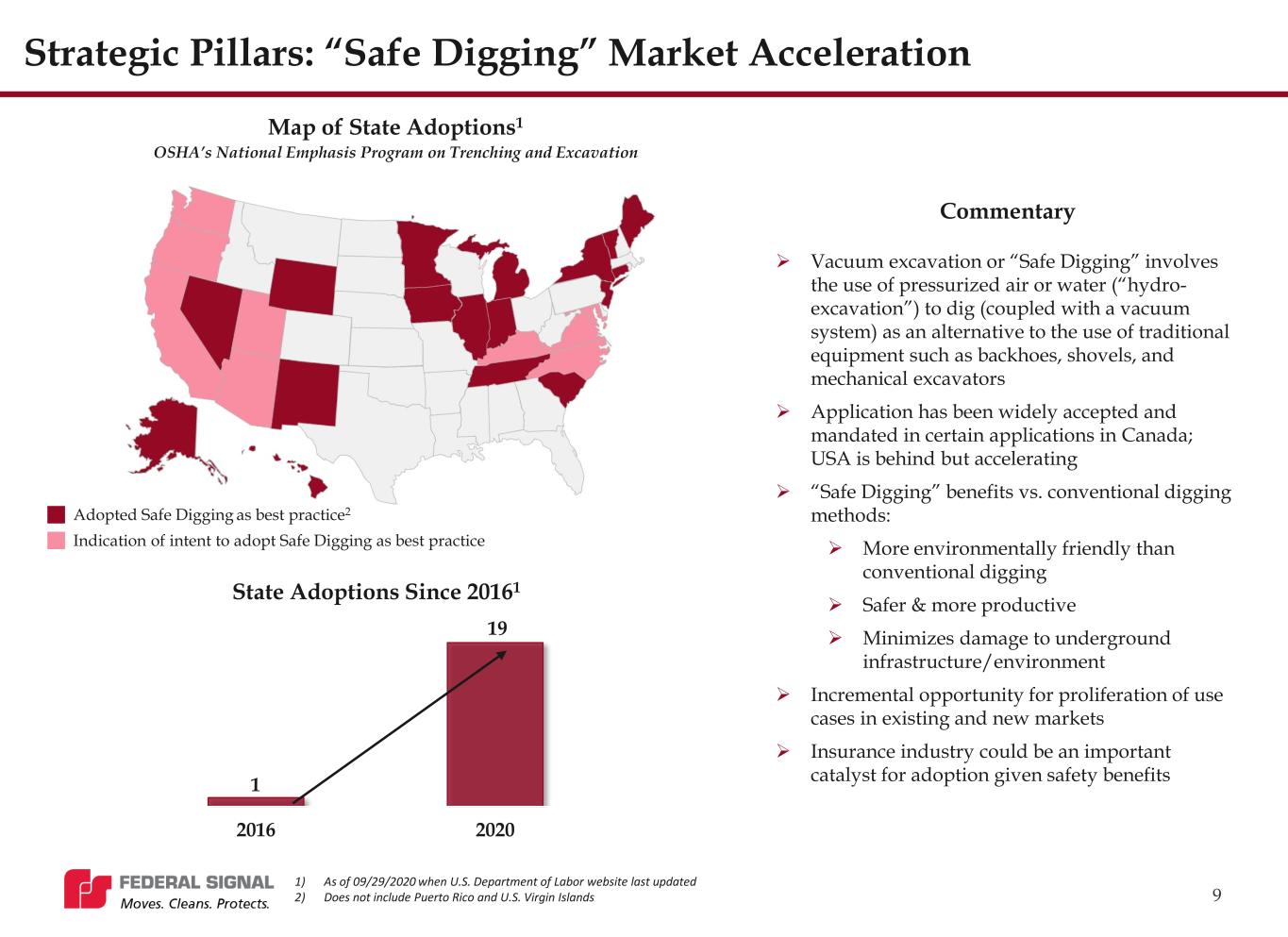

9 Vacuum excavation or “Safe Digging” involves the use of pressurized air or water (“hydro- excavation”) to dig (coupled with a vacuum system) as an alternative to the use of traditional equipment such as backhoes, shovels, and mechanical excavators Application has been widely accepted and mandated in certain applications in Canada; USA is behind but accelerating “Safe Digging” benefits vs. conventional digging methods: More environmentally friendly than conventional digging Safer & more productive Minimizes damage to underground infrastructure/environment Incremental opportunity for proliferation of use cases in existing and new markets Insurance industry could be an important catalyst for adoption given safety benefits Map of State Adoptions1 Indication of intent to adopt Safe Digging as best practice Adopted Safe Digging as best practice2 Strategic Pillars: “Safe Digging” Market Acceleration State Adoptions Since 20161 1 19 2016 2020 OSHA’s National Emphasis Program on Trenching and Excavation Commentary 1) As of 09/29/2020 when U.S. Department of Labor website last updated 2) Does not include Puerto Rico and U.S. Virgin Islands

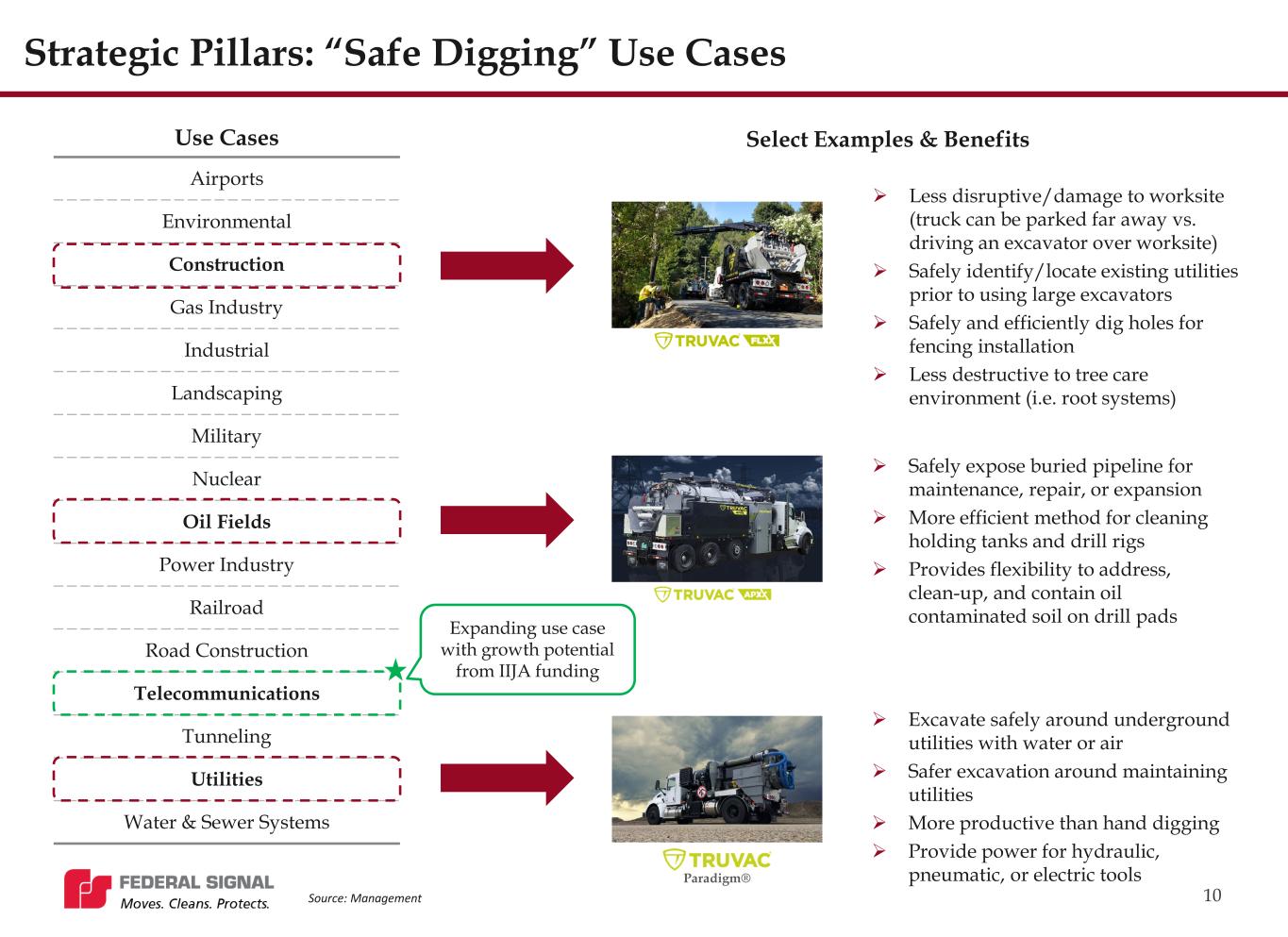

10 Strategic Pillars: “Safe Digging” Use Cases Use Cases Airports Environmental Construction Gas Industry Industrial Landscaping Military Nuclear Oil Fields Power Industry Railroad Road Construction Telecommunications Tunneling Utilities Water & Sewer Systems Select Examples & Benefits Less disruptive/damage to worksite (truck can be parked far away vs. driving an excavator over worksite) Safely identify/locate existing utilities prior to using large excavators Safely and efficiently dig holes for fencing installation Less destructive to tree care environment (i.e. root systems) Safely expose buried pipeline for maintenance, repair, or expansion More efficient method for cleaning holding tanks and drill rigs Provides flexibility to address, clean-up, and contain oil contaminated soil on drill pads Paradigm® Excavate safely around underground utilities with water or air Safer excavation around maintaining utilities More productive than hand digging Provide power for hydraulic, pneumatic, or electric tools Source: Management Expanding use case with growth potential from IIJA funding

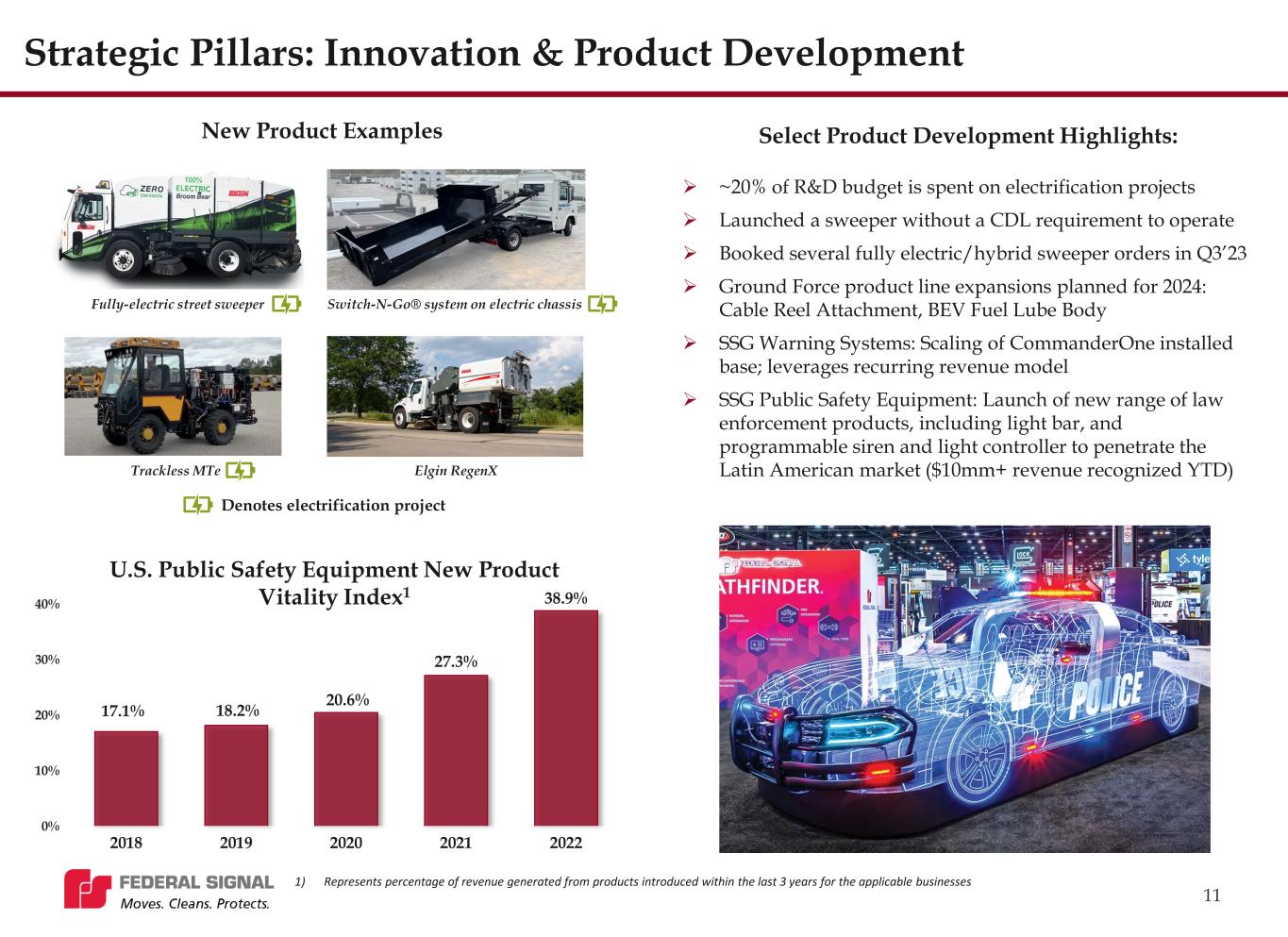

11 Strategic Pillars: Innovation & Product Development Fully-electric street sweeper Select Product Development Highlights: ~20% of R&D budget is spent on electrification projects Launched a sweeper without a CDL requirement to operate Booked several fully electric/hybrid sweeper orders in Q3’23 Ground Force product line expansions planned for 2024: Cable Reel Attachment, BEV Fuel Lube Body SSG Warning Systems: Scaling of CommanderOne installed base; leverages recurring revenue model SSG Public Safety Equipment: Launch of new range of law enforcement products, including light bar, and programmable siren and light controller to penetrate the Latin American market ($10mm+ revenue recognized YTD) U.S. Public Safety Equipment New Product Vitality Index1 17.1% 18.2% 20.6% 27.3% 38.9% 0% 10% 20% 30% 40% 2018 2019 2020 2021 2022 Trackless MTe New Product Examples Switch-N-Go® system on electric chassis Denotes electrification project 1) Represents percentage of revenue generated from products introduced within the last 3 years for the applicable businesses Elgin RegenX

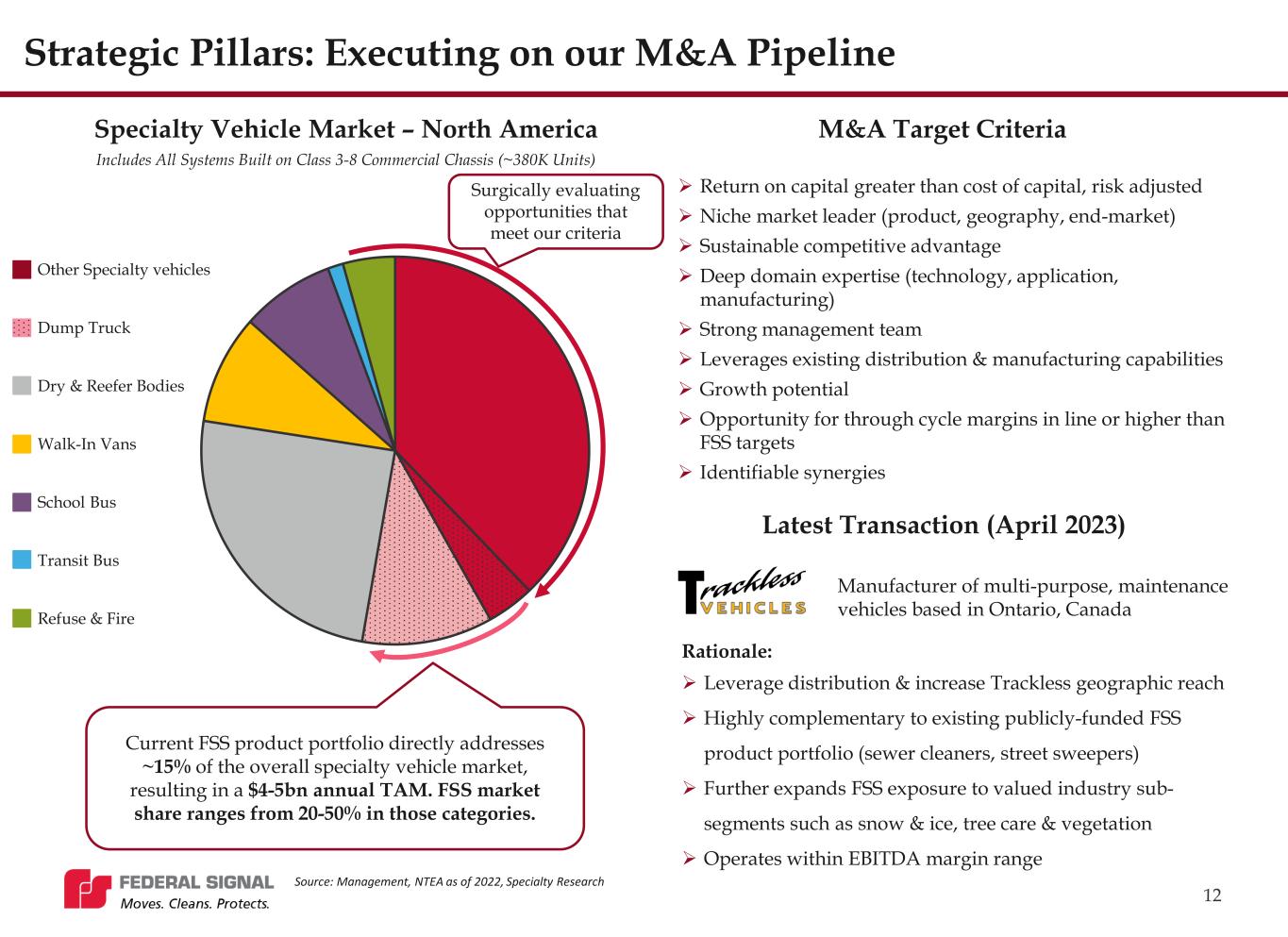

12 Strategic Pillars: Executing on our M&A Pipeline M&A Target Criteria Return on capital greater than cost of capital, risk adjusted Niche market leader (product, geography, end-market) Sustainable competitive advantage Deep domain expertise (technology, application, manufacturing) Strong management team Leverages existing distribution & manufacturing capabilities Growth potential Opportunity for through cycle margins in line or higher than FSS targets Identifiable synergies Latest Transaction (April 2023) Rationale: Leverage distribution & increase Trackless geographic reach Highly complementary to existing publicly-funded FSS product portfolio (sewer cleaners, street sweepers) Further expands FSS exposure to valued industry sub- segments such as snow & ice, tree care & vegetation Operates within EBITDA margin range Manufacturer of multi-purpose, maintenance vehicles based in Ontario, Canada Specialty Vehicle Market – North America Includes All Systems Built on Class 3-8 Commercial Chassis (~380K Units) Current FSS product portfolio directly addresses ~15% of the overall specialty vehicle market, resulting in a $4-5bn annual TAM. FSS market share ranges from 20-50% in those categories. Source: Management, NTEA as of 2022, Specialty Research Surgically evaluating opportunities that meet our criteria Other Specialty vehicles Dump Truck Dry & Reefer Bodies Walk-In Vans School Bus Transit Bus Refuse & Fire

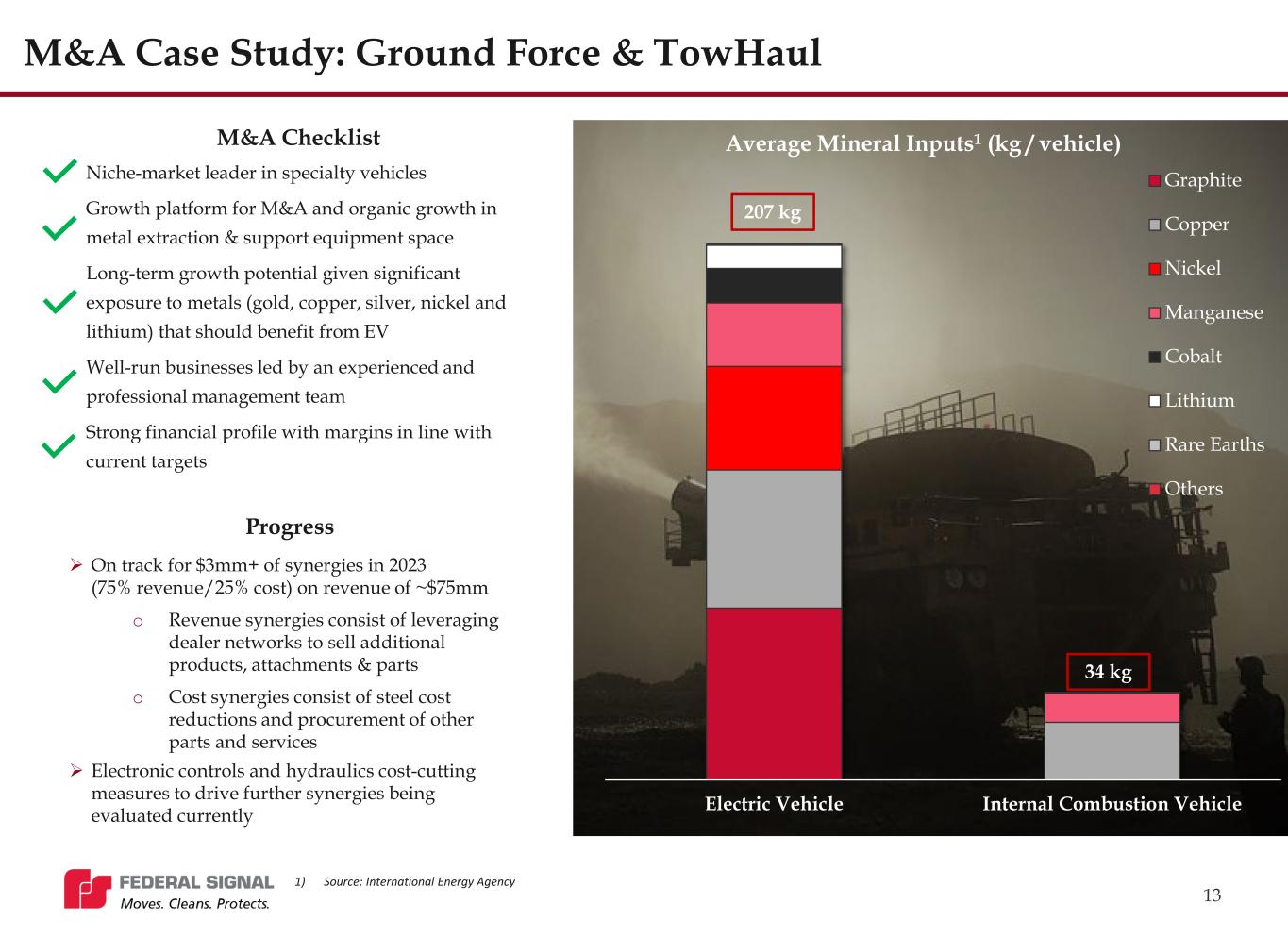

13 M&A Case Study: Ground Force & TowHaul Progress M&A Checklist Niche-market leader in specialty vehicles Growth platform for M&A and organic growth in metal extraction & support equipment space Long-term growth potential given significant exposure to metals (gold, copper, silver, nickel and lithium) that should benefit from EV Well-run businesses led by an experienced and professional management team Strong financial profile with margins in line with current targets On track for $3mm+ of synergies in 2023 (75% revenue/25% cost) on revenue of ~$75mm o Revenue synergies consist of leveraging dealer networks to sell additional products, attachments & parts o Cost synergies consist of steel cost reductions and procurement of other parts and services Electronic controls and hydraulics cost-cutting measures to drive further synergies being evaluated currently 1) Source: International Energy Agency Electric Vehicle Internal Combustion Vehicle Graphite Copper Nickel Manganese Cobalt Lithium Rare Earths Others 207 kg 34 kg Average Mineral Inputs1 (kg / vehicle)

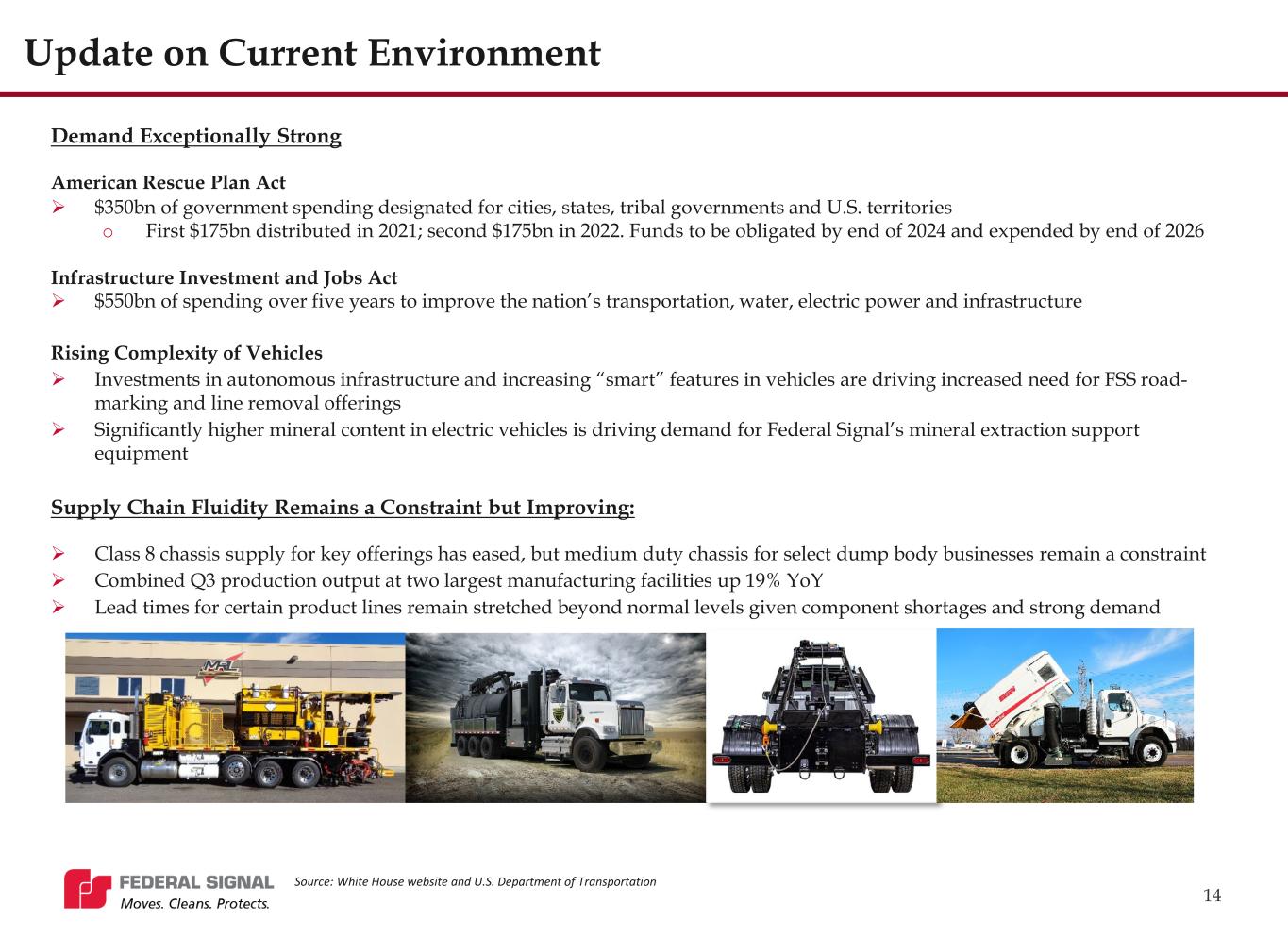

14 Update on Current Environment Demand Exceptionally Strong American Rescue Plan Act $350bn of government spending designated for cities, states, tribal governments and U.S. territories o First $175bn distributed in 2021; second $175bn in 2022. Funds to be obligated by end of 2024 and expended by end of 2026 Infrastructure Investment and Jobs Act $550bn of spending over five years to improve the nation’s transportation, water, electric power and infrastructure Rising Complexity of Vehicles Investments in autonomous infrastructure and increasing “smart” features in vehicles are driving increased need for FSS road- marking and line removal offerings Significantly higher mineral content in electric vehicles is driving demand for Federal Signal’s mineral extraction support equipment Supply Chain Fluidity Remains a Constraint but Improving: Class 8 chassis supply for key offerings has eased, but medium duty chassis for select dump body businesses remain a constraint Combined Q3 production output at two largest manufacturing facilities up 19% YoY Lead times for certain product lines remain stretched beyond normal levels given component shortages and strong demand Source: White House website and U.S. Department of Transportation

15 Infrastructure Bill Impacts in Early Innings of Multiyear Opportunities Source: White House website and U.S. Department of Transportation 1) Infrastructure Investment and Jobs Act Select IIJA1 Awards FY 2022 WA-1 Segment: Ogden Junction Rockport Bridge Rehabilitation Freight Rail Project Otay Mesa East Port of Entry Project North Baton Rouge Mobility Projects Presque Isle Corridor Project Downeast Coastal US 1 Rehabilitation Project I-90 Austin Bridges Improvement Project US 212 Freight Mobility & Safety Project I-70 Floyd Hill to Veterans Memorial Tunnels Improvements I-4 West Central Florida Truck Parking Facility US-395 & Virginia Street North Valleys I-85 FUTURES Hunts Point Terminal Produce Market Intermodal Facility Border Highway Connector Project I-375 Community Reconnection Project Western Hills Viaduct Replacement Potential Market Opportunities: Description: Constructs a new toll road and Port of Entry facility at Otay Mesa Duration: 2023 – 2026 (3 years) Potential Equipment: Road Marking, Street Sweeping, Industrial Cleaning and Materials Hauling Description: Adds a travel lane, constructs a frontage road connection, and adds a new ramp Duration: 2023 – 2028 (5 years) Potential Equipment: Road Marking, Street Sweeping, Industrial Cleaning, Materials Hauling, and Safe Digging Description: The project removes fifteen old bridges & two stormwater runoff pump stations, rehabilitates one stormwater runoff pump station, and constructs wider sidewalks Duration: 2025 – 2028 (3 years) Potential Equipment: Road Marking, Street Sweeping, Industrial Cleaning, Materials Hauling, and Safe Digging

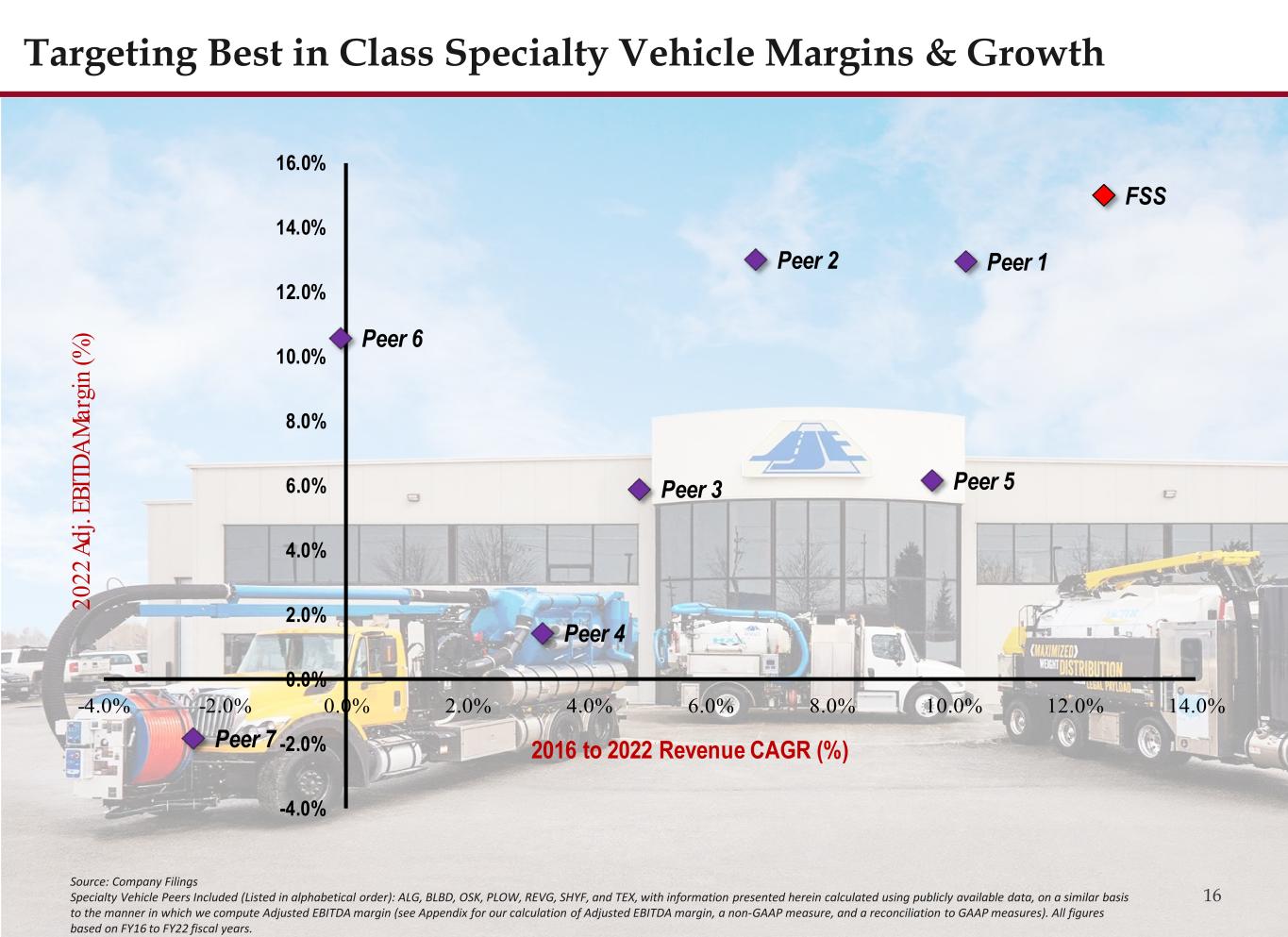

16 FSS Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 20 22 Ad j. E BI TD A M ar gi n (% ) 2016 to 2022 Revenue CAGR (%) Targeting Best in Class Specialty Vehicle Margins & Growth Source: Company Filings Specialty Vehicle Peers Included (Listed in alphabetical order): ALG, BLBD, OSK, PLOW, REVG, SHYF, and TEX, with information presented herein calculated using publicly available data, on a similar basis to the manner in which we compute Adjusted EBITDA margin (see Appendix for our calculation of Adjusted EBITDA margin, a non-GAAP measure, and a reconciliation to GAAP measures). All figures based on FY16 to FY22 fiscal years.

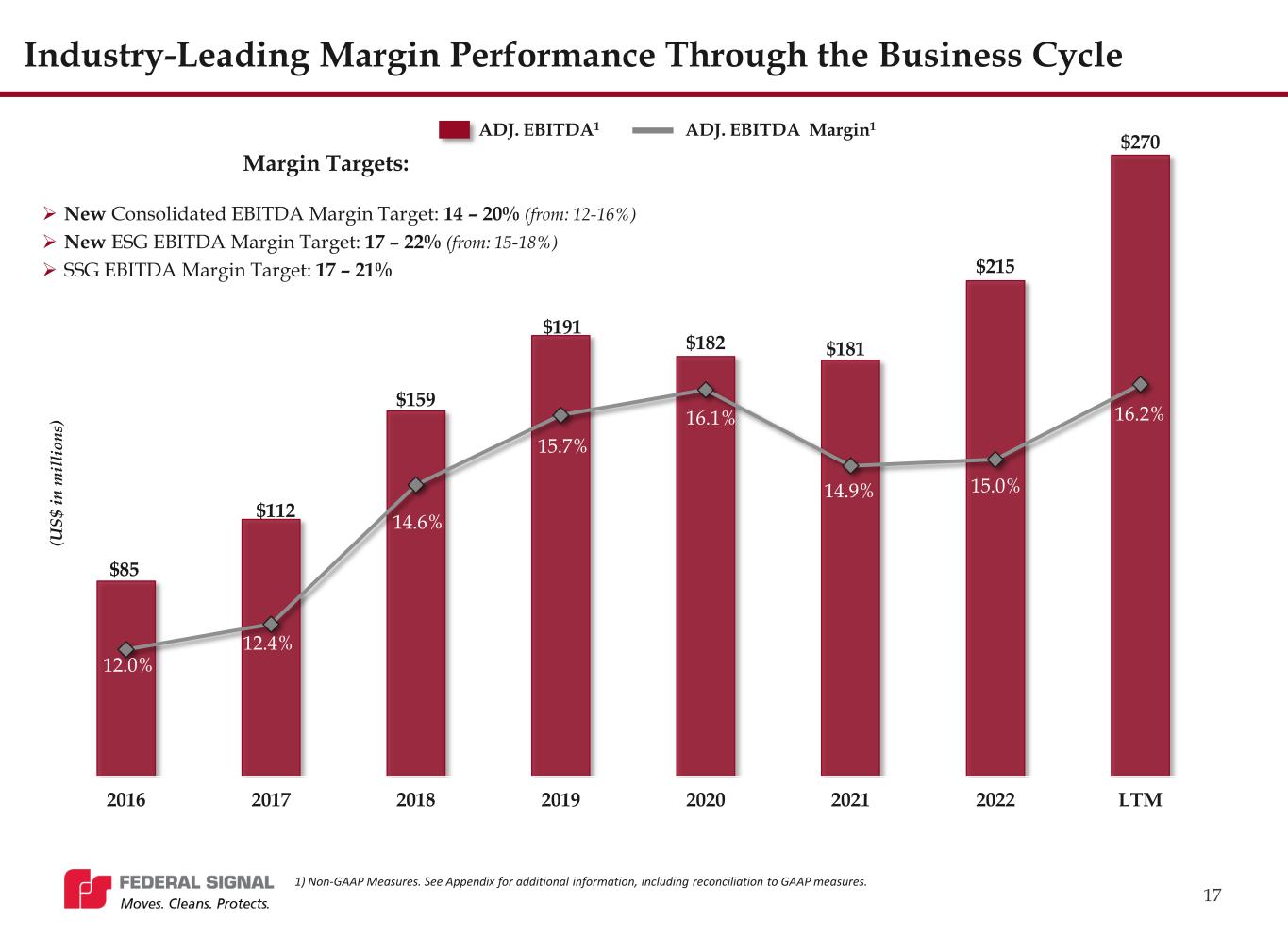

$85 $112 $159 $191 $182 $181 $215 $270 12.0% 12.4% 14.6% 15.7% 16.1% 14.9% 15.0% 16.2% 2016 2017 2018 2019 2020 2021 2022 LTM 17 Industry-Leading Margin Performance Through the Business Cycle (U S$ in m ill io ns ) ADJ. EBITDA1 ADJ. EBITDA Margin1 New Consolidated EBITDA Margin Target: 14 – 20% (from: 12-16%) New ESG EBITDA Margin Target: 17 – 22% (from: 15-18%) SSG EBITDA Margin Target: 17 – 21% Margin Targets: 1) Non-GAAP Measures. See Appendix for additional information, including reconciliation to GAAP measures.

$708 $899 $1,090 $1,221 $1,131 $1,213 $1,435 $1,666 $674 $1,018 $1,173 $1,269 $1,047 $1,539 $1,692 $1,849 2016 2017 2018 2019 2020 2021 2022 LTM $21 $66 $79 $68 $107 $64 $19 $102 2016 2017 2018 2019 2020 2021 2022 LTM 18 Financial Performance Net Sales & Orders Free Cash Flow Generation1 Net Sales Orders Facility investments & working capital headwinds Source: Company Filings 1) Non-GAAP measure, calculated as: Net cash provided by operating activities – Purchases of Properties and Equipment (Capital Expenditures). See Appendix for additional information, including reconciliation to GAAP measure. (U S$ in m ill io ns ) (U S$ in m ill io ns )

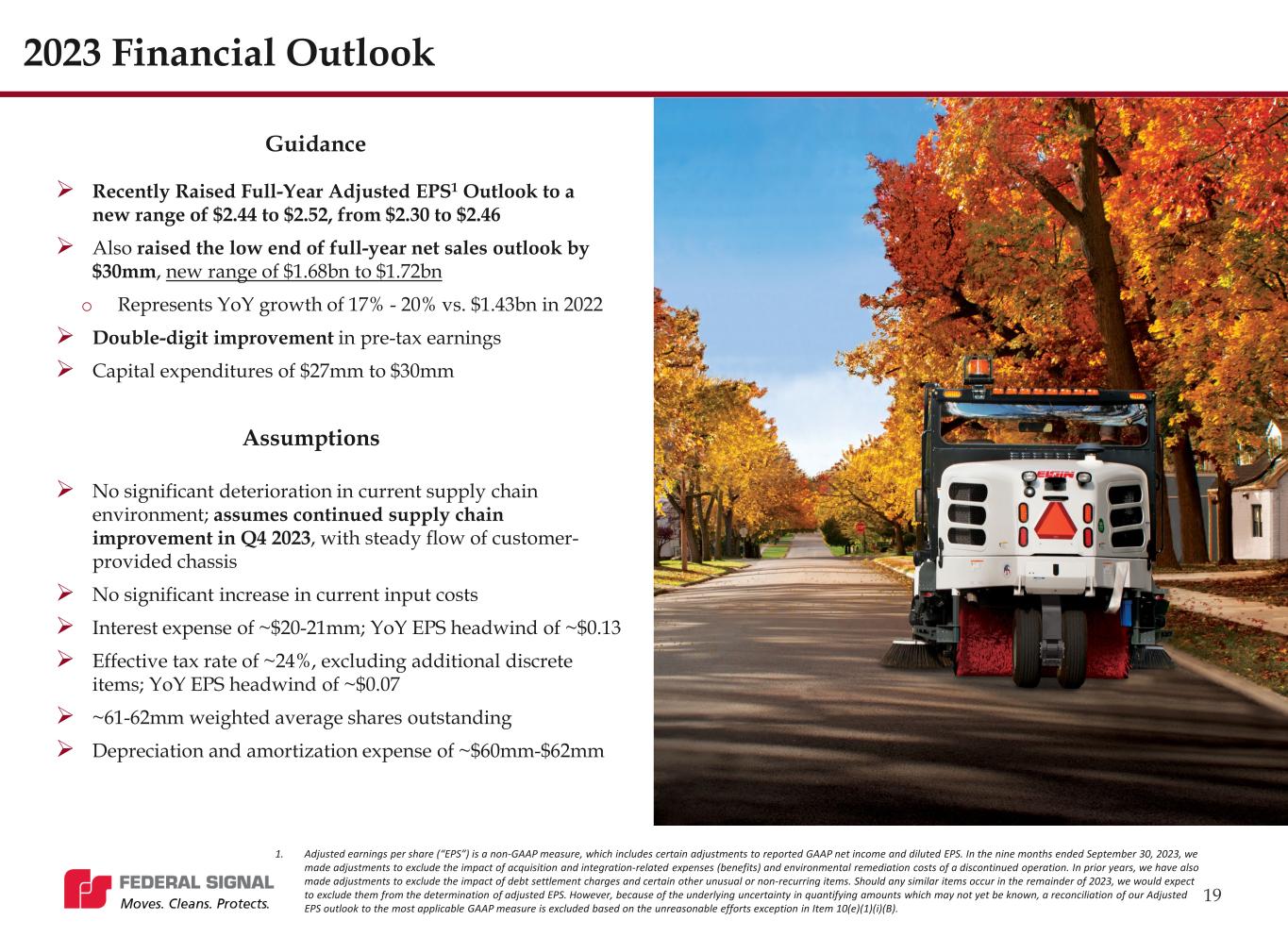

19 2023 Financial Outlook Recently Raised Full-Year Adjusted EPS1 Outlook to a new range of $2.44 to $2.52, from $2.30 to $2.46 Also raised the low end of full-year net sales outlook by $30mm, new range of $1.68bn to $1.72bn o Represents YoY growth of 17% - 20% vs. $1.43bn in 2022 Double-digit improvement in pre-tax earnings Capital expenditures of $27mm to $30mm Guidance Assumptions No significant deterioration in current supply chain environment; assumes continued supply chain improvement in Q4 2023, with steady flow of customer- provided chassis No significant increase in current input costs Interest expense of ~$20-21mm; YoY EPS headwind of ~$0.13 Effective tax rate of ~24%, excluding additional discrete items; YoY EPS headwind of ~$0.07 ~61-62mm weighted average shares outstanding Depreciation and amortization expense of ~$60mm-$62mm 1. Adjusted earnings per share (“EPS”) is a non-GAAP measure, which includes certain adjustments to reported GAAP net income and diluted EPS. In the nine months ended September 30, 2023, we made adjustments to exclude the impact of acquisition and integration-related expenses (benefits) and environmental remediation costs of a discontinued operation. In prior years, we have also made adjustments to exclude the impact of debt settlement charges and certain other unusual or non-recurring items. Should any similar items occur in the remainder of 2023, we would expect to exclude them from the determination of adjusted EPS. However, because of the underlying uncertainty in quantifying amounts which may not yet be known, a reconciliation of our Adjusted EPS outlook to the most applicable GAAP measure is excluded based on the unreasonable efforts exception in Item 10(e)(1)(i)(B).

20 Appendix I. Our Portfolio of Brands & Products II. Federal Signal Operating System III. Environmental, Social and Governance Initiatives IV. Non-GAAP Measures V. Executive Compensation VI. Investor Information

21 Appendix I: Our Portfolio of Brands & Products ESG SSG Source: Management

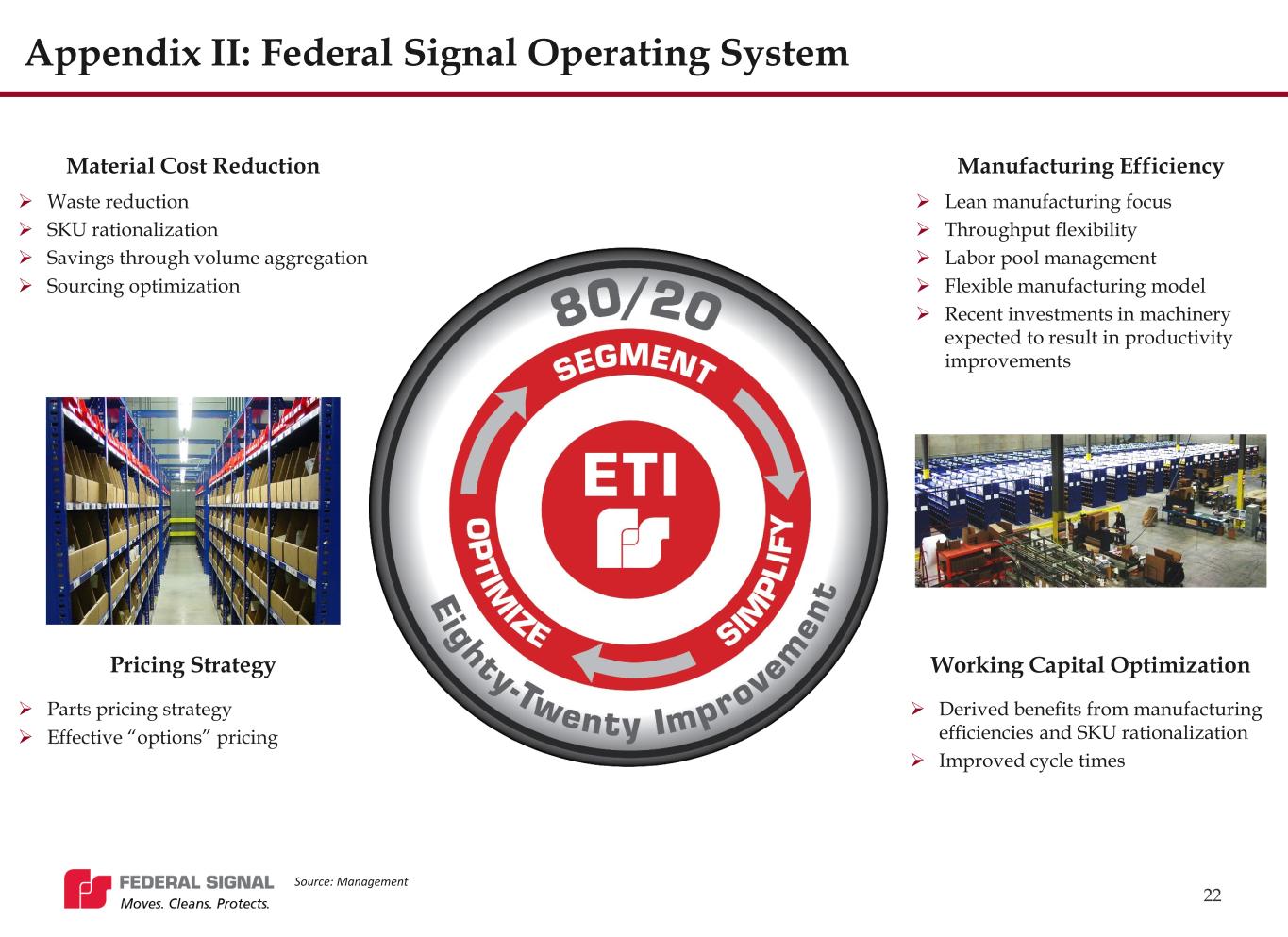

22 Appendix II: Federal Signal Operating System Material Cost Reduction Waste reduction SKU rationalization Savings through volume aggregation Sourcing optimization Manufacturing Efficiency Lean manufacturing focus Throughput flexibility Labor pool management Flexible manufacturing model Recent investments in machinery expected to result in productivity improvements Working Capital Optimization Derived benefits from manufacturing efficiencies and SKU rationalization Improved cycle times Pricing Strategy Parts pricing strategy Effective “options” pricing Source: Management

23 Appendix III: Environmental, Social and Governance Initiatives Environmental Products o Continue to search for ways to integrate electrification into our suite of products, with a focus on improved air quality and a reduced carbon footprint o Fully electric sweeper introduced in Q1 2023 at ConExpo trade show o Fully electric Switch-N-Go product introduced in Q1 2023 at NTEA work truck show Resource Consumption o Ongoing energy consumption assessments and adopting energy efficient measures to reduce CO2 emissions and energy intensity o During 2022, our electricity and water consumption intensity were both more than 10% lower than our 2018 baseline, achieving our stated goal early o Launched environmental education and awareness programs to implement best practices o Enhanced measuring and reporting practices and energy consumption audits Social Diversity, Equity, & Inclusion (DEI) o Ongoing DEI training at executive and employee level o Workforce data analysis and various programs promoting diverse cultures and viewpoints found at Federal Signal o 50% of current executive officers are gender diverse Community Engagement o Active participation with local charities, promoting and participating in educational and wellness programs o Volunteering in local communities o Federal Signal and our employees are committed to giving back and improving our surrounding areas at a national and local level Corporate Governance Board Composition o 29% of directors are gender diverse o 43% of directors are considered diverse o Lead independent director is gender diverse ESG Governance o Published 2023 Sustainability Report in Q2 o Completed annual Materiality Assessment o Held Environmental Compliance Oversight Committee review Source: Management and Company Filings

24 Appendix IV: Non-GAAP Measures (Adjusted EBITDA) Source: Company Filings LTM ($ in mil l ions) 2016 2017 2018 2019 2020 2021 2022 Q3 2023 Net income 39.4 60.5$ 93.7$ 108.4$ 96.1$ 100.6$ 120.4$ 145.6$ Add (less): Interest expense 1.9 7.3 9.3 7.9 5.7 4.5 10.3 19.8 Pension settlement charges - 6.1 - - - 10.3 - - Hearing loss settlement charges - 1.5 0.4 - - - - - Acquisition and integration-related expenses (benefits) 1.4 2.7 1.5 2.5 2.1 (2.1) (0.5) 2.5 Coronavirus-related expenses - - - - 2.3 1.2 - - Restructuring 1.7 0.6 - - 1.3 - - - Executive severance costs - 0.7 - - - - - - Debt settlement charges - - - - - 0.1 0.1 Purchase accounting effects (a) 3.6 4.4 0.7 0.2 0.3 0.3 - - Other (income) expense, net 1.8 (0.8) 0.6 0.6 1.1 (1.7) (0.5) 1.6 Income tax expense 17.4 0.5 17.9 30.2 28.5 17.0 30.5 40.9 Depreciation and amortization 19.1 30.0 36.4 41.5 44.8 50.4 54.7 59.1 Deferred gain recognition (b) (1.9) (2.0) (1.9) - - - - - Adjusted EBITDA 84.7$ 111 .5$ 158 .6$ 191 .3$ 182 .2$ 180 .5$ 215 .0$ 269 .6$ Net Sales 707.9$ 898 .5$ 1 ,089.5$ 1 ,221.3$ 1 ,130.8$ 1 ,213.2$ 1 ,434.8$ 1 ,665.8$ Adjusted EBITDA Margin 12.0% 12.4% 14.6% 15.7% 16.1% 14.9% 15.0% 16.2% (a) Excludes purchase accounting effects reflected in depreciation and amortization of $0.3 M, $0.4 M, $0.5 M, $0.6 M, $0.4 M and $0.4 M for 2016, 2017, 2018, 2019, 2020 and 2021, respectively. (b) Adjustment to exclude recognition of deferred gain associated with historical sale lease-back transactions. Effective 2019, the Company no longer recognizes the gain due to the adoption of new lease accounting standard. Adjusted EBITDA and Adjusted EBITDA Margin The Company uses adjusted EBITDA and the ratio of adjusted EBITDA to net sales (“adjusted EBITDA margin”), as additional measures which are representative of its underlying performance and to improve the comparability of results across reporting periods. We believe that investors use versions of these metrics in a similar manner. For these reasons, the Company believes that adjusted EBITDA and adjusted EBITDA margin are meaningful metrics to investors in evaluating the Company’s underlying financial performance. Other companies may use different methods to calculate adjusted EBITDA and adjusted EBITDA margin. Adjusted EBITDA is a non-GAAP measure that represents the total of net income, interest expense, pension settlement charges, hearing loss settlement charges, acquisition and integration-related expenses (benefits), coronavirus-related expenses, restructuring activity, executive severance costs, debt settlement charges, purchase accounting effects, other income/expense, income tax expense, depreciation and amortization expense, and the impact of adoption of a new lease accounting standard, where applicable. Consolidated adjusted EBITDA margin is a non-GAAP measure that represents the total of net income, interest expense, pension settlement charges, hearing loss settlement charges, acquisition and integration-related expenses (benefits), coronavirus-related expenses, restructuring activity, executive severance costs, debt settlement charges, purchase accounting effects, other income/expense, income tax expense, depreciation and amortization expense, and the impact of adoption of a new lease accounting standard, where applicable, divided by net sales for the applicable period(s).

25 Appendix IV: Non-GAAP Measures (Net Debt Leverage and Free Cash Flow) Net Debt Leverage Net debt leverage is a non-GAAP measure that is computed as total borrowings and finance lease obligations less cash and cash equivalents, divided by Adjusted EBITDA (as separately defined within). The Company believes that net debt leverage provides investors with a view of the Company’s ability to generate earnings sufficient to service its debt. Other companies may use different methods to calculate net debt leverage. LTM Q3 ($ in millions) 2023 Total Borrowings and Finance Lease Obligations 365.9$ Less: Cash and Cash Equivalents (41.0) Net Debt as of Q3 2023 324.9$ Adjusted EBITDA (LTM Q3 2023) 269.6$ Net Debt Leverage 1.2x ($ in millions) 2016 2017 2018 2019 2020 2021 2022 LTM Q3 2023 Net Cash Provided by Continuing Operating Activities 26.7$ 73.5$ 92.8$ 103.4$ 136.3$ 101.8$ 71.8$ 130.4$ Less: Purchases of Property and Equipment (6.1) (8.0) (14.1) (35.4) (29.7) (37.4) (53.0) (28.8) Free Cash Flow 20.6$ 65.5$ 78.7$ 68.0$ 106.6$ 64.4$ 18.8$ 101.6$ Free Cash Flow Free cash flow is a non-GAAP measure that is computed as net cash provided by continuing operating activities less purchases of property and equipment. Management believes that free cash flow provides investors with a relevant measure of liquidity and is a useful basis for assessing the Company’s ability to fund its activities and obligations. Other companies may use different methods to calculate free cash flow. Source: Company Filings

26 Appendix V: Executive Compensation Aligned with Long-term Objectives The Company continues to focus on executing against a number of key long-term objectives, which include (i) creating disciplined growth; (ii) improving manufacturing efficiencies and costs; (iii) leveraging invested capital; and (iv) diversifying our customer base Cash Bonus (STIP) Earnings (60%) EBITDA Margin (20%) Individual Objectives (20%) Short-Term Annual Goals 1. Profitability and growth 2. Market share Performance Share Units EPS (75%) Return on Invested Capital (25%) Relative TSR (modifier) Long-Term 3-year Performance and Vesting Periods 1. Profitability and growth 2. Shareholder value creation 3. Efficient use of capital 4. Facilitates stock ownership 5. Executive retention 6. TSR component introduced in 2022 to measure performance vs. peers Restricted Stock Awards Long-Term 3-year Cliff Vesting 1. Executive recruitment 2. Executive retention Share Price Appreciation Stock Options Longer-Term 3-year Ratable Vesting Period and 10-year Exercise Period 1. Shareholder value creation 2. Facilitates stock ownership 3. Executive retention One Year Three Years Ten Years Source: Management and Company Filings

27 Appendix VI: Investor Information Stock Ticker: NYSE:FSS Company website: federalsignal.com/investors HEADQUARTERS 1415 West 22nd Street, Suite 1100 Oak Brook, IL 60523 Felix Boeschen VP Corporate Strategy & Investor Relations fboeschen@federalsignal.com