UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a‑101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| þ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule 14a‑12 |

THE DAVEY TREE EXPERT COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| | | |

| þ | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | | |

| | | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | | |

| | | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | |

| | | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | | |

| | | | |

| | (5) | Total fee paid: | |

| | | | |

| | | | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| | | | |

| | (1) | Amount Previously Paid: | |

| | | | |

| | | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | | |

| | | | |

| | (3) | Filing Party: | |

| | | | |

| | | | |

| | (4) | Date Filed: | |

| | | | |

THE DAVEY TREE EXPERT COMPANY

2018 Proxy Statement and

Notice of Annual Meeting of Shareholders

Annual Meeting

Tuesday, May 15, 2018

5:00 p.m., Eastern Daylight Time

The Davey Tree Expert Company

Corporate Headquarters, Davey Institute Building

1500 North Mantua Street, Kent, Ohio 44240

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders to be held at the Company's corporate headquarters in the Davey Institute building, 1500 North Mantua Street, Kent, Ohio, at 5:00 p.m. EDT on Tuesday, May 15, 2018. We hope you will be able to attend.

We will report on our operations at the Annual Meeting of Shareholders, entertain any discussion, vote on the matters identified in this Proxy Statement, and consider other business matters properly brought before the meeting.

The Notice of Annual Meeting of Shareholders and the Proxy Statement describe the matters to be acted upon at the meeting. Regardless of the number of shares you own, your vote on these matters is important. Whether or not you plan to attend the meeting, we urge you to vote, sign and return your proxy card. If you later decide to vote in person at the meeting, you will have an opportunity to revoke your proxy and vote by ballot.

We look forward to seeing you at the meeting.

|

| | |

| | | Sincerely, |

| | | |

| | | /s/ Karl J. Warnke |

| | | Karl J. Warnke Chairman |

|

| | |

| | | |

| | | /s/ Patrick M. Covey |

| | | Patrick M. Covey President and Chief Executive Officer |

|

| | | | |

| | | | | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 15, 2018 |

| | | | | |

The Proxy Statement, proxy cards, Notice letter, 2017 Annual Report and Annual Report on Form 10-K for the fiscal year ended December 31, 2017 are available on our website at www.davey.com. |

| | | | | |

|

| | | | |

| | | | | |

| Notice of 2018 Annual Meeting |

| of Shareholders |

| | | | | |

Tuesday, May 15, 2018

5:00 p.m., EDT

The Davey Tree Expert Company

Corporate Headquarters, Davey Institute Building

1500 North Mantua Street, Kent, Ohio 44240

The Annual Meeting of Shareholders of The Davey Tree Expert Company will be held at The Davey Tree Expert Company, Davey Institute building, 1500 North Mantua Street, Kent, Ohio, at 5:00 p.m. EDT on Tuesday, May 15, 2018. The purpose of the meeting is:

| |

| 1. | To elect as directors the nominees named in this Proxy Statement and recommended by the Board of Directors to the class whose terms expire in 2021. |

| |

| 2. | To hear reports and to transact any other business that may properly come before the meeting. |

Shareholders of record at the close of business on March 16, 2018 are entitled to notice of and to vote at the meeting and any postponement or adjournment thereof.

For 2018, we will use the "notice and access" option for the delivery of proxy materials. The Notice of Internet Availability of Proxy Materials will be mailed to our shareholders on or about April 5, 2018. Our Proxy Statement, proxy cards, 2017 Annual Report and Annual Report on Form 10-K for the fiscal year ended December 31, 2017 will be made available to our shareholders on the same date as the Notice is mailed and may be accessed on our Internet website at www.davey.com under the tab "Corporate Information" at the bottom of the page and then under "SEC Filings." On or about that date, we will begin mailing paper copies of our proxy materials to shareholders who request them.

All shareholders are invited to attend the meeting. However, seating will be on a first-come, first-served basis, and we cannot guarantee seating for all shareholders.

|

| | |

| | | For the Board of Directors, |

| | | |

| | | /s/ Joseph R. Paul |

| | | Joseph R. Paul Secretary |

|

| | | | |

| | |

| VISION | | MISSION |

| Provide solutions that promote balance among people, progress and the environment. | | Deliver unmatched excellence in client experience, employee strength, safety and financial sustainability as we advance the green industry. |

| |

| | | | | |

| | | | | |

| | | |

| | | VALUES | | |

| | Integrity | Improvement | Safety | |

| | Leadership | Expertise | Resolve | |

| | | | | |

| | | | | |

| | |

| STRATEGIES | | PRIORITIES |

| Smart Growth | | Maintain Focus |

| Excellent Service Experience | | Mission Progress |

| Differentiate Davey | | Align and Adjust |

| Employee Strength | | Diversity |

| Financial Sustainability | | | |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- i -

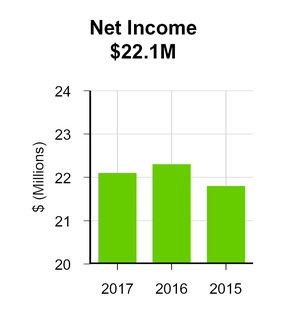

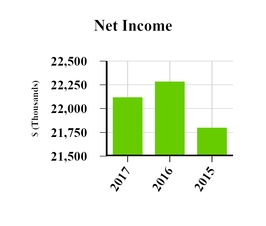

This summary highlights information contained in this Proxy Statement. This summary does not contain all of the information that you should consider, and we encourage you to read the Proxy Statement and our Annual Report on Form 10-K before voting. In this Proxy Statement, the terms "Davey," "Company," "we," and "our" refer to The Davey Tree Expert Company and its consolidated subsidiaries. The charts below are based on Davey's fiscal year ended December 31, 2017, as well as information for the 2016 and 2015 fiscal years.

2017 Financial Highlights

* Prior periods have been adjusted for the two-for-one stock split, effective June 1, 2017

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- ii -

Elements of 2017 Named Executive Officer ("NEO") Compensation

|

| |

| Realized Pay - Amounts actually paid to or on behalf of NEOs |

| | |

| Title | Description |

| Base Salary | NEO base salaries |

| | |

| Annual Incentive Compensation Plan | Calculated based on 2017 results and paid in 2018 |

| | |

| Supplemental Bonus Plan | Bonuses paid in 2017 |

| | |

| Perquisites | Paid in 2017 on behalf of the NEOs |

| | |

| Realizable Pay - The value of benefits that may be payable over specific periods of time in the future, as calculated pursuant to the SEC's rules |

| |

| Title | Description |

| Stock Options and Stock Appreciation Rights | Awarded in 2017 and exercisable over time in future years |

| | |

| Long-Term Equity Incentives | Awarded in 2017 and payable after retirement |

| | |

| Retirement Plans | Allocated in 2017 and payable after retirement |

Other Key Features of NEO Compensation

| |

| • | No individual severance / employment agreements |

| |

| • | No tax related gross-ups |

| |

| • | Stock redemption time limits / insider trading policy |

2017 Named Executive Officer Target Pay Mix

The chart below shows composite percentage values for the element of our NEOs' 2017 compensation. For more information, please see the Summary Compensation Table on page 32 of this Proxy Statement.

|

| | | | | | |

| Realized Compensation | | Realizable (Contingent) Compensation |

| Salary | Bonuses / Incentives | Perquisites | | Stock Awards | Option Awards | Retirement Plans |

| 41.5% | 37.4% | 3.4% | | 7.6% | 6.7% | 3.4% |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- iii -

|

| | | | |

| | | | | |

| PROXY STATEMENT |

| FOR THE ANNUAL MEETING OF SHAREHOLDERS |

| TO BE HELD ON MAY 15, 2018 |

| | | | | |

The Board of Directors of The Davey Tree Expert Company (the "Board" or "Board of Directors") requests your proxy for use at the Annual Meeting of Shareholders and at any postponements or adjournments of that meeting. The Annual Meeting of Shareholders of the Company will be held at the Company's corporate headquarters in the Davey Institute building, 1500 North Mantua Street, Kent, Ohio, at 5:00 p.m. EDT on Tuesday, May 15, 2018. This proxy statement is to inform you about the matters to be acted upon at the meeting.

If you attend the annual meeting, you can vote your shares in person or by ballot. If you do not attend the meeting, your shares will still be voted at the meeting if you sign and return your proxy card. Shares represented by a properly signed proxy card will be voted in accordance with the choices marked on the card. If you return a properly signed proxy card, but do not indicate how to vote your shares, the persons identified on your proxy card as proxies will vote in accordance with the Board of Directors' recommendations, as set forth below:

|

| | |

| Proposal | Vote to be cast | See page number below for a detailed explanation of the proposal |

Proposal 1 - Election of nominees for director | FOR THE NOMINEES | 3 |

You may revoke your previously submitted proxy before it is voted by submitting another properly signed proxy card with a later date, or by giving notice to us in writing or orally at the annual meeting. Attending the annual meeting will not by itself revoke your proxy.

For 2018, we will use the "notice and access" option for the delivery of proxy materials. The Notice of Internet Availability of Proxy Materials will be mailed to our shareholders on or about April 5, 2018. Our Proxy Statement, proxy cards, 2017 Annual Report and Annual Report on Form 10-K for the fiscal year ended December 31, 2017 will be made available to our shareholders on the same date as the Notice is mailed and may be accessed on our Internet website at www.davey.com under the tab "Corporate Information" at the bottom of the page and then under "SEC Filings." On or about that date, we will begin mailing paper copies of our proxy materials to shareholders who request them. The information on our Internet website is not incorporated by reference into, and is not a part of, this Proxy Statement, and our Internet address is included in this Proxy Statement as an inactive textual reference only.

Our 2017 Annual Report, a copy of the Notice letter, and individual proxy cards will be mailed to our shareholders on or about April 16, 2018. Our corporate headquarters are located at 1500 North Mantua Street, Kent, Ohio 44240. Our telephone number is 330.673.9511.

Questions and Answers about the Annual Meeting and Voting

What is a proxy?

It is your legal designation of another person to vote your shares of stock in accordance with the choices marked on your proxy card. That other person is called a proxy. We have designated the persons identified on your proxy card as proxies for the 2018 Annual Meeting of Shareholders.

What is a proxy statement?

It is a document that the Securities and Exchange Commission's ("SEC") regulations require us to make available to you when we ask you to sign a proxy card. The proxy statement contains information about the matters to be voted upon at the meeting, information about our directors and executive officers and other important information, including how to change your vote after you vote your shares.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 1 -

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered in your name, i.e., you have stock certificates with your name on them, you are a shareholder of record. If your shares are held in the 401KSOP and ESOP Plan in your name, you are a beneficial owner.

What shares are included on the proxy card?

The shares registered in your name as of the record date are included on the white proxy card. The shares held beneficially in your name in the 401KSOP and ESOP Plan as of the record date are included on the green proxy card.

What constitutes a quorum for the Annual Meeting?

A majority of the voting power of the Company present in person or by proxy constitutes a quorum for the Annual Meeting.

Who can vote at the Annual Meeting?

Each share of Davey's common stock, whether held as a shareholder of record or as a beneficial owner, has one vote on each matter.

What is the vote required for each proposal?

|

| |

| Proposal to Elect Directors |

| Proposal | Vote Required |

Proposal 1 - Election of nominees for director | Plurality vote: the nominees receiving the greatest number of "for" votes cast at the Annual Meeting by proxy or by ballot will be elected. A properly executed proxy card marked "withhold" with respect to election of any nominee will not be voted with respect to that nominee. |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 2 -

PROPOSAL ONE - ELECTION OF DIRECTORS

Our Regulations provide for the annual election by the shareholders of those directors in the class whose terms in office expire at the Annual Meeting of Shareholders that year. Our Regulations also provide that the Board of Directors will be divided into three classes consisting of not less than three directors (including vacancies), each whose terms in office will expire in consecutive years. Further, the number of directors may be fixed or changed by the shareholders at any meeting of shareholders called to elect directors at which a quorum is present.

Our Board of Directors is now composed of eight directors and one vacancy, with two directors and one vacancy in the class whose terms expire in 2018, three directors in the class whose terms expire in 2019 and three directors in the class whose terms expire in 2020. Each of our directors serves for a term of three years and until a successor is elected. If the shareholders vote to elect the nominees listed, we expect one vacancy will exist after the Annual Meeting due to the May 15, 2018 retirement of J. Dawson Cunningham, a director in the class whose term expires in 2020.

In anticipation of Mr. Cunningham’s retirement after thirteen years of service on the Board, the Corporate Governance Committee has recommended to the full Board of Directors, and the Board of Directors has approved, that Ms. Catherine M. Kilbane be nominated for election to the Board at the Annual Meeting.

The Corporate Governance Committee, consisting of John E. Warfel, Committee chair, Donald C. Brown, Patrick M. Covey, President and Chief Executive Officer, Sandra W. Harbrecht, and Karl J. Warnke, Chairman of the Board, maintains the ongoing practice of identifying, evaluating and recommending future director prospects who will bring interpersonal skills, integrity and the specific business experience needed to effectively serve as a director for The Davey Tree Expert Company and its shareholders.

The Corporate Governance Committee facilitated a director search process, which was accelerated over the past twenty-four months. Multiple candidates with excellent qualifications were identified and interviewed in a formal evaluation process. Candidates were known business leaders in Northeast Ohio or other large, geographic markets where Davey operates. The Corporate Governance Committee members, Davey business associates and other respected professionals in the business community were involved in the initial identification phase. Final candidates were interviewed multiple times by both the Board chairman and the Corporate Governance Committee chairman. Personal interviews with Committee members and select executive management, including the Chief Executive Officer, were also conducted.

Ms. Catherine M. Kilbane will be in the class of directors that includes Messrs. Warnke and Brown, with terms expiring in 2018, and will stand for election at the Annual Meeting for a three-year term.

Proxies cannot be voted for a greater number of persons than the number of nominees named. The Company believes the current directors and the director nominees represent a diverse group of leaders in their respective field who have the skills and dedication necessary to guide the Company's overall strategic objectives and policies. Although we will not recommend a candidate simply because a vacancy exists, the Corporate Governance Committee will continue to search for a qualified candidate to fill the vacancy that we expect to be created by Mr. Cunningham’s retirement from the Board.

Directors are responsible for overseeing our business strategy and objectives consistent with their fiduciary duties to shareholders. The Board believes that each director and nominee for director has unique and valuable individual skills and experience that, when taken as a whole, promote the overall management of the Company for the benefit of our shareholders. Moreover, the individual qualifications, accomplishments and characteristics of each of our directors and nominees for director provide us with the variety and depth of knowledge, diversity, judgment and vision necessary to provide effective oversight in guiding our affairs and direction.

We believe that each director and nominee for director has the requisite experience in a variety of fields, including services delivery, industry, transportation, governmental, regulatory, nonprofit, education, and environmental protection, each of which, we believe, provides a diverse range of perspectives, and valuable knowledge and insight concerning various elements of our business.

All directors play an active role in overseeing our business, both at the Board and Committee level. The directors and nominees for director have demonstrated leadership skills in managing business risk and in various aspects of business, government, education and philanthropy, which contributes significantly to fulfilling their responsibility to us and to our shareholders.

The nominees for election as directors for the term expiring in 2021, as well as present directors whose terms will continue after the meeting, appear below.

The Board of Directors recommends you vote for the nominees listed.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 3 -

PROPOSAL ONE - Election of Directors

Directors and Nominees for Election at the Annual Meeting

|

| |

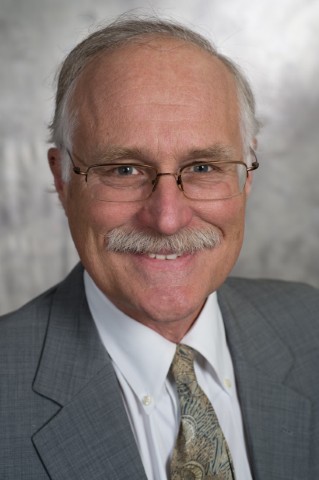

| KARL J. WARNKE (Chairman) Age: 66 Director since: 2000 Committees: Governance Committee Business Experience: Mr. Warnke retired in July 2017 as Chief Executive Officer of the Company, a position he held since January 2007. He has been the Chairman of the Board since May 2009. He had been an officer of the Company since 1988. He was President and Chief Operating Officer from 1999 through December 31, 2006, and prior to that, he was Vice President and General Manager of Utility Services from 1988 and was named Executive Vice President of the Company from 1993 to 1999. Mr. Warnke has served as a member of the Conference Board's Executive Council for Mid-Cap Companies, a member of the executive committee of the Greater Akron Chamber Board of Directors, and a vice chair of the Board of Trustees for the Ohio Chapter of The Nature Conservancy. He is a director and compensation committee member of the Wikoff Color Corporation, which provides specialty inks throughout the U.S. and select foreign countries. Key Qualifications, Attributes and Skills: Mr. Warnke has over forty years of experience in the horticulture, arboriculture, landscape and environmental science industry, and has been a board member for nonprofit, for profit and professional organizations for over twenty years. He has extensive experience in business management, strategic plan development, sales, production and management of multiple services and subsidiary companies in the United States and Canada, has thirty years of experience as a corporate officer with executive-level leadership of Davey and its subsidiaries, and serves as a director for a multinational employee-owned ink manufacturing company. |

|

| |

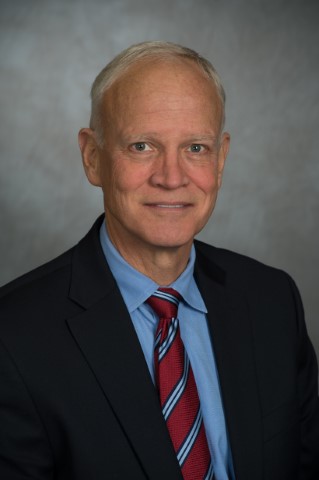

| DONALD C. BROWN Age: 62 Director since: 2016 Committees: Audit Committee; Governance Committee Business Experience: Mr. Brown retired in 2017 as Executive Vice President of FedEx Freight, a North American freight shipping company, having served as Executive Vice President, Finance and Administration, and Chief Financial Officer from 2008 to November 2016. Before joining FedEx Freight as Senior Vice President and Chief Financial Officer in 2001, he held financial management positions at FedEx Corporation, FedEx Corporate Services and FedEx Logistics. His prior affiliations include Caliber System, Inc., Roadway Services, Inc. and Ernst & Young. He is a member of the Board of Advisors for Miller Transfer & Rigging, and is a past member of the Board of Directors of the Memphis Development Foundation. Mr. Brown is a graduate of Kent State University where he serves on the College of Business Administration National Advisory Board and National Athletic Development Council, and was recognized in 2014 as a Distinguished Athletic Alumnus. Key Qualifications, Attributes and Skills: Mr. Brown has over twenty-five years of executive experience with transportation companies involved in freight and parcel delivery services, extensive experience with internal and external financial reporting, including filings with the SEC, interactions with audit committees, as well as executive level responsibility for risk management and human resources, and has thirteen years of experience as a CPA with a large international accounting firm concentrating on financial audit services and acquisitions. |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 4 -

PROPOSAL ONE - Election of Directors

Directors and Nominees for Election at the Annual Meeting (continued)

|

| |

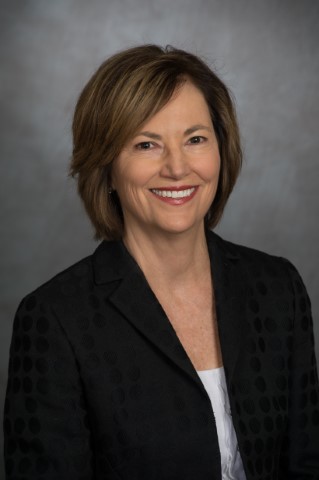

| CATHERINE M. KILBANE Age: 54 Nominee for Director Business Experience: Ms. Kilbane retired in 2017 as Senior Vice President of The Sherwin-Williams Company, a Fortune 500 global leader in paints and coatings. She joined Sherwin-Williams in 2013 as Senior Vice President, General Counsel and Secretary. Prior to that, Ms. Kilbane was Senior Vice President and General Counsel from 2003 to 2012 at American Greetings Corporation, one of the world’s largest manufacturers of social expression products. From 1987 to 2003, she was a partner in the general business group at Baker & Hostetler LLP in Cleveland, Ohio. Ms. Kilbane is currently Lead Director of The Andersons, Inc., a Fortune 500 diversified agribusiness company in the grain, ethanol, plant nutrient, and rail sectors. She is a member of the board of trustees of the Cleveland Clinic Foundation and a past member of the board of trustees for University Hospitals Health System and United Way of Greater Cleveland. Key Qualifications, Attributes and Skills: Ms. Kilbane has over thirty years of experience in corporate law, extensive experience in mergers and acquisitions, including large, multinational transactions, a solid understanding of ensuring shareholder value through her fourteen years of experience with two publicly traded companies and board member experience with for-profit and nonprofit organizations. |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 5 -

PROPOSAL ONE - Election of Directors

Directors Whose Terms Expire in 2019

|

| |

| WILLIAM J. GINN Age: 65 Director since: 2007 Committees: Audit Committee; Compensation Committee Business Experience: Mr. Ginn was named Executive Vice President of The Nature Conservancy, an international nonprofit conservation organization, in 2014, and prior to that was the Chief Conservation Officer. He has also served that organization as its Director of the Global Forest Partnership, Manager of Division Conservation Programs-NEC, and as Senior Advisor to the Asia Pacific Region. Before joining The Nature Conservancy, Mr. Ginn developed one of the first major U.S. companies in the organic recycling area, which was later sold to a Fortune 500 solid-waste management company. He has also taught courses in economics and environment as a visiting faculty member at the College of the Atlantic. Key Qualifications, Attributes and Skills: Mr. Ginn has extensive experience in environmental conservation, most notably in sustainability, recycling and forest conservation, completed undergraduate and graduate work in human ecology and landscape architecture, is well-versed in various aspects of starting, managing, and selling a successful recycling business, and has executive-level management experience. |

|

| |

| DOUGLAS K. HALL Age: 66 Director since: 1998 Committees: Audit Committee (Chair); Compensation Committee Business Experience: Mr. Hall retired in February 2008 after serving since 1999 as President and Chief Executive Officer of MDA Federal, Inc. ("MDA Federal") (formerly Earth Satellite Corporation), a subsidiary of MDA Corporation, a provider of remote sensing systems and data utilizing geographic information systems. Prior to joining MDA Federal, he was Vice President and Chief Operations Officer of The Nature Conservancy, an international nonprofit conservation organization, from 1996 to 1999. From 1993 to 1996, he served as Assistant Secretary for Oceans and Atmosphere and Deputy Administrator of the National Oceanic and Atmospheric Administration in the U.S. Department of Commerce. He formerly served as a senior fellow for the World Wildlife Fund in Washington, D.C. Key Qualifications, Attributes and Skills: Mr. Hall has extensive experience in business leadership, financial management and financial audit, is well-versed and experienced in environmental policy, has had significant involvement in human resources and corporate management, and is experienced in mergers and acquisitions and strategic planning. |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 6 -

PROPOSAL ONE - Election of Directors

Directors Whose Terms Expire in 2019 (continued)

|

| |

| JOHN E. WARFEL Age: 69 Director since: 2008 Committees: Compensation Committee; Governance Committee (Chair) Business Experience: Mr. Warfel is owner of Warfel Group, Inc., dba Action Coach, a business coaching franchise founded in 2010 and helping business owners with achieving their goals and strategies, and is also currently President of Warfel Enterprises, LLC, a consulting company. He has served on various boards of private companies. He was President of Westfield Financial Corporation, a diverse group of financial services and related companies operating in the United States and Canada and a member of Westfield Group, from 2002 through 2008. He previously served as Chairman of Westfield Bancorp and Chairman of Southern Title Corporation. Prior to joining Westfield Financial Corporation, he was Vice Chairman and President of Oswald Companies, a large regional insurance firm, from 1975 to 2002. He is past President of the Insurance Board of Greater Cleveland, a member of national and local chapters of Property and Casualty Underwriters, past Vice President of the Ohio ESOP Association, past member of the Board of Trustees of Assurex Global, past Chairman of Employer's Resource Council, and past board member and Secretary/Treasurer of the National American Heart Association. Key Qualifications. Attributes and Skills: Mr. Warfel has over forty years of executive experience in sales, marketing and growing companies, including significant experience with acquisitions and their integration, and has extensive experience in property and casualty insurance and risk management. He is a business owner, including current ownership of consulting entities, with expertise in succession planning and leadership transitions in small and large companies and has financial acumen and experience with Employee Stock Ownership Plans (ESOPs). |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 7 -

PROPOSAL ONE - Election of Directors

Directors Whose Terms Expire in 2020

|

| |

| PATRICK M. COVEY Age: 54 Director since: 2014 Committees: Governance Committee Business Experience: Mr. Covey has been with the Company since 1991. He was elected Chief Executive Officer effective July 2017, having served as President since March 2016. He was Chief Operating Officer from February 2012 to July 2017 and was previously appointed as Executive Vice President, Operations in 2007. Prior to that, Mr. Covey served as Vice President and General Manager of the Davey Resource Group, Operations Vice President, Southern Utility Operations, and in various managerial positions within the Company, including Manager of Systems and Process Management and Administrative Manager, Utility Services. He is a board member of Environmental Design, Inc., a tree and landscape company headquartered in Texas, a member of the Board of Trustees for the Arbor Day Foundation and a recently appointed board member of Akron Children's Hospital. Key Qualifications, Attributes and Skills: Mr. Covey has over twenty-five years of experience with the Company with involvement in all areas of operations and administrative groups. Mr. Covey is a CPA with financial and auditing experience with a large national accounting firm and the Company. He has board member experience with nonprofit and professional organizations, and has extensive experience in all aspects of mergers, acquisitions and strategic partnerships. |

|

| |

| J. DAWSON CUNNINGHAM Age: 71 Director since: 2005 Committees: Audit Committee; Compensation Committee (Chair) Business Experience: Mr. Cunningham was Executive Vice President and Chief Financial Officer of Roadway Corporation ("Roadway"), an over-the-road truck transport operation, from 1998 until his retirement in 2003. Prior to that, he held various positions as an officer of Roadway beginning in 1986. Mr. Cunningham previously served as Co-Chairman of the Board of Trustees, New York State Teamsters Council Health and Hospital Fund and Conference Pension and Retirement Fund, having served as a trustee since 1992, and was a trustee of the New England Teamsters and Trucking Industry Pension Fund from 1996 until January 2007. He served as a member of the Board of Trustees of Akron General Health System, serving as Chairman from 1998 to 2003. He is also a past member of the board of directors of the American Red Cross and Junior Achievement. Key Qualifications, Attributes and Skills: Mr. Cunningham has executive-level experience with a service-based over-the-road transportation public company, experience as chief financial officer with responsibility for internal and external financial reporting, including filings with the SEC, executive-level responsibility for corporate-wide human resources, including compensation, benefits and policy, fifteen years of experience as a CPA with a large international accounting firm, and is experienced in mergers and acquisitions. Retirement: On March 28, 2018, Mr. Cunningham provided notice to the Board of his intention to resign as a director of the Company at the conclusion of the Annual Meeting. |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 8 -

PROPOSAL ONE - Election of Directors

Directors Whose Terms Expire in 2020 (continued)

|

| |

| SANDRA W. HARBRECHT Age: 68 Director since: 2008 Committees: Audit Committee; Governance Committee Business Experience: Ms. Harbrecht has been President and Chief Executive Officer of Paul Werth Associates, a public relations firm, since 2008 and President since 1985. Prior to that, she was a Credit Analyst for Bank One, Columbus NA and also an educator for ten years in the Worthington City School system. She is past Chair of the Board of Trustees for Kent State University and serves on the Dean's Advisory Councils for the Fisher College of Business and the College of Engineering at The Ohio State University. She is also the past Chair of Experience Columbus and a former board member of the Columbus Chamber of Commerce, an accredited member of the Public Relations Society of America, a past chair of the Society's Counselors Academy and a founding member of the PR Council. Ms. Harbrecht also serves as a director on the board of the Motorists Mutual Insurance Company, a regional insurance firm. Key Qualifications, Attributes and Skills: Ms. Harbrecht has extensive experience in business marketing, advertising, promotion, public relations and communications, has experience as an educator guiding and facilitating student learning, is significantly involved with college advisory boards and councils, and has over twenty-five years of executive-level experience. |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 9 -

CORPORATE GOVERNANCE

Director Selection Process

We believe the Board should represent a broad and diverse spectrum of experienced and qualified individuals who are able to contribute value to our business. The Corporate Governance Committee is responsible for the review of and recommendation to the Board of Directors of nominees for election as directors. The Committee works with the full Board to develop criteria for open Board positions, taking into account the factors that it deems appropriate. These factors may include identifying a nominee whose array and diversity of talents, experiences, qualifications, personal attributes, and skills would complement those already represented on the Board; the level of independence from us; our current needs, business priorities, objectives and goals; and the need for a certain specialized expertise. In applying these criteria, the Committee considers a candidate's general understanding of elements relevant to the success of a service company in the current business environment, the understanding of our business and our risk factors, senior operating experience with a service company, public company, or other organizations, a broad understanding of and direct experience in corporate business and service delivery, as well as the candidate's educational and professional background. The Board believes that diversity of professional experience, professional training and personal accomplishments are important factors in determining the composition of the Board. The Committee considers candidates suggested by other Board members, management and shareholders. The Committee may also retain a qualified independent third-party search firm to identify and review candidates.

The minimum qualifications a director nominee should possess include depth of knowledge in the nominee's field, diversity of experience and background, demonstrated judgment and vision to oversee and guide our business.

Once a prospective nominee has been identified, the Committee will make an initial determination as to whether to continue with a full review and evaluation. In making this determination, the Committee will take into account all information provided to the Committee, as well as the Committee's own expertise and experience. The Committee will then consider the potential candidate to ensure he or she has exhibited the criteria that the Committee has established for the position, as well as the time and desire to effectively carry out their duties and responsibilities.

If the prospective nominee passes the preliminary review, members of the Committee, as well as other Board members as deemed appropriate, will interview the nominee. Upon completion of this process, the Committee will confer and make a recommendation to the Board. The Board, after reviewing the Committee's report, will make the final determination whether to nominate the candidate. Selection for persons identified to be appointed to a Board position will be conducted in the manner described above. Any shareholder who desires to recommend a prospective nominee for the Board should notify our Corporate Secretary in the manner described below in "Shareholder Nominations for Director."

Shareholder Nominations for Director

Shareholders may nominate candidates for election as directors by following the procedures and complying with the deadlines specified in our Regulations. Under those procedures, any shareholder who proposes to nominate one or more candidates for election as director must, not less than 30 days prior to the meeting at which the directors are elected, notify the Corporate Secretary of the shareholder's intention to make the nomination and provide the Company with all of the information about each of the candidates as would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of the candidate, including (i) name, age, and business and residence address, (ii) principal occupations or employment during the last five years, (iii) the number of shares of the Company beneficially owned by the candidate, (iv) transactions between the candidate and the Company, and (v) all other information required under the rules of the SEC. A copy of the Regulations is available to any shareholder who makes a written request to the Corporate Secretary, and shareholders may submit nominations in writing by sending the submission to the Corporate Secretary, at The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

Board Independence

The Board reviews, at least annually, director independence. As part of that review, the Board considers transactions and relationships between each director and any member of his or her family, and the Company and its subsidiaries and affiliates. Any such relationships are reported under the heading "Transactions with Related-Persons, Promoters and Certain Control Persons" in this Proxy Statement. The purpose of this review is to determine whether any relationships or transactions existed or exist that could be considered inconsistent with a determination that the director is independent. Although our common shares are not listed on the New York Stock Exchange ("NYSE") or on any other exchange, with respect to determining if a director or a director nominee is independent, we utilize the SEC approved standards as developed by the NYSE.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 10 -

As a result of their most recent review, the Board determined that the following Directors and nominees are independent: Mr. Brown, Mr. Cunningham, Mr. Ginn, Mr. Hall, Ms. Harbrecht, Ms. Kilbane and Mr. Warfel. No director has been identified as a lead independent director. Mr. Warnke, a former employee of the Company, and Mr. Covey, our President and Chief Executive Officer, a current employee of the Company, are not considered independent directors.

The Company also determined by due inquiry that no director has a relationship with our principal independent auditor, Ernst & Young LLP.

Committees of the Board of Directors; Attendance

The Members of each Committee of the Board of Directors are listed in the following table:

|

| | | |

| Director | Compensation Committee | Audit Committee | Corporate Governance Committee |

Karl J. Warnke, Chairman | | | X |

| Donald C. Brown | | X | X |

| Patrick M. Covey | | | X |

J. Dawson Cunningham(1) | (Chair) | X | |

| William J. Ginn | X | X | |

| Douglas K. Hall | X | (Chair) | |

| Sandra W. Harbrecht | | X | X |

| John E. Warfel | X | | (Chair) |

|

| |

| (1) | Mr. Cunningham has notified the Board of his intention to resign as a director of the Company at the conclusion of the Annual Meeting. Upon Mr. Cunningham's retirement, a new Chair of the Compensation Committee will be appointed. |

Compensation Committee

The Compensation Committee is composed entirely of independent directors who meet the NYSE's independence standards, which we follow. The Compensation Committee recommends to the Board of Directors the salaries and other compensation of our executive officers and supervises the administration of our benefit programs. As more fully set out in the "Compensation Discussion and Analysis" in this Proxy Statement, the Compensation Committee does not delegate its authority to set compensation; however, the Board does review recommendations from our Chief Executive Officer regarding the compensation of other officers. Furthermore, the Committee periodically retains outside consultants to review and discuss compensation and benefit plans. The Compensation Committee met two times in 2017.

When utilized, outside consultants are provided with specific instructions relating to the research to be performed. Once engaged to conduct a salary and bonus-level review, the consultants are directed to compare our plans with those of companies of similar size and in similar industries. Similarly, the consultants are directed to compare and contrast benefit plans that are applicable to private and public companies of similar size and with similar governance structures. Findings by the consultants are reviewed by the Committee and with the full Board, which then makes the final decisions regarding compensation. The Committee directed the executive officers to engage Pay Governance LLC ("Pay Governance") to review the compensation structure in 2017, which had been previously reviewed and updated in 2015. The next compensation structure review is scheduled to occur in 2019.

Pay Governance has not provided other professional services to date, including advice related to our insurance and employee benefit programs. In order to perform the services that are required of them, Pay Governance does have access to certain confidential information about us; however, they do not participate in the final strategic decision-making process. Further, Pay Governance is compensated on a fee-based structure and no portion of any payment made to them is dependent upon achieving a certain result or is otherwise commission-based.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 11 -

Audit Committee

The Audit Committee is composed entirely of independent directors who meet the independence requirements under the NYSE's listing standards and SEC rules. The Board has determined that Messrs. Brown and Cunningham qualify as audit committee financial experts pursuant to the SEC's rules. The Audit Committee met seven times in 2017.

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to: the integrity of the Company's financial statements and financial reporting process; the Company's systems of internal accounting and financial controls; the performance of the Company's internal and independent auditors; the independent auditors' qualifications and independence; and the Company's compliance with ethics policies and legal and regulatory requirements. Specifically, the Audit Committee oversees the appointment, engagement, compensation, termination and oversight of the Company's independent auditors, including conducting a review of their independence, reviewing and approving the planned scope of the Company's annual audit, overseeing the independent auditors' audit work, reviewing and preapproving any audit and nonaudit services that may be performed by the Company's independent auditors, reviewing with management and the Company's independent auditors the adequacy of the Company's internal control over financial reporting and disclosure controls, and reviewing the Company's critical accounting policies and the application of accounting principles.

In addition, the Audit Committee establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting control over financial reporting or auditing matters and the confidential anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Audit Committee's role also includes meeting to review the Company's annual audited financial statements and quarterly financial statements with management and the Company's independent auditors. The Audit Committee annually reviews the independence and performance of the independent auditor in connection with any determination of whether to retain the independent auditor or engage another firm as our independent auditor. In the course of these reviews, the Committee considers, among other things, the historical and recent performance, and an analysis of known legal risks and significant proceedings.

Corporate Governance Committee

Messrs. Brown and Warfel and Ms. Harbrecht are independent directors who meet the NYSE's independence standards; the other two Committee members, Messrs. Warnke and Covey, are not. The Corporate Governance Committee screens and recommends candidates for election as directors and recommends committee members and committee chairpersons for appointment by the Board of Directors. The Committee will consider nominees for the Board of Directors recommended by our shareholders. The Committee also conducts annual performance evaluations of the committees of the Board. The Corporate Governance Committee met two times in 2017.

Compensation Committee Interlocks and Insider Participation

No director has been identified as having a relationship that requires disclosure as a compensation committee interlock.

General

Non-independent directors may not serve on the Compensation or Audit Committee. Independent directors generally serve on at least two committees.

The Board met five times in 2017. All incumbent directors attended at least 75% of the meetings of the Board of Directors and of the committees on which they served during the period that they served. We encourage our directors to attend the Annual Meeting of Shareholders. In 2017, all directors with the exception of Messrs. Cunningham and Ginn attended the Annual Meeting of Shareholders.

The charters of the Compensation, Audit and Corporate Governance committees, as well as the Corporate Governance Guidelines, are available on the Company's website at www.davey.com under the tab "Corporate Information," at the bottom of the page then under "Board Committee Charters," or by contacting the Corporate Secretary at The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

Role of the Board in Risk Oversight

The Board recognizes that it is neither possible nor reasonable to eliminate all risk, and that in order to remain competitive, certain risk-taking is an essential element of every business decision and part of our business strategy. However, the Board also understands

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 12 -

that within any business framework, steps must be taken to properly safeguard the assets of the Company, implement and maintain appropriate financial and other controls, and ensure that business is conducted prudently and in compliance with applicable laws and regulations and proper governance.

Assessing and managing risk is the responsibility of management. It is the responsibility of the Board of Directors to oversee risk management. As part of this responsibility, the Board oversees and reviews certain aspects of our risk management efforts. For example, the Board requires that an annual overall assessment of risk be performed and has delegated this oversight of the process to the Audit Committee. This enterprise-wide risk management assessment is designed to review and identify potential events that may affect us, including cybersecurity risks, manage risks within our risk profile and provide reasonable assurance regarding the achievement of our objectives. The Audit Committee reviews and discusses with management our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our financial risk assessment and risk management policies.

We are aware that cybersecurity is an integral part of our risk analysis and discussions. While all entities are at some risk of a cybersecurity attack, the Company has taken steps deemed appropriate by the Company to detect and limit the severity of a cybersecurity attack. These measures include, among other things, robust password requirements, firewalls, and limiting access to sensitive information. To date, the Company is not aware of any successful system-wide cybersecurity attack. The Company maintains employee and customer information and has developed contingency plans, but has not developed a system-wide cybersecurity attack cost matrix.

Company representatives meet annually in executive session with the Audit Committee. The Manager of Internal Audit and the Chief Financial Officer review with the Audit Committee each year's annual internal audit plan, which focuses on significant areas of financial, operating and compliance risk. The Audit Committee also receives regular reports from management on the results of internal audits.

In addition, each year, our management team conducts an assessment of potential risks facing us and reports its findings to the Audit Committee. Risks are rated as to severity and the likelihood of threat, and management outlines the mitigation efforts associated with each risk. To the extent management identifies mitigation efforts that were not in place, management identifies the initiative to address the particular situation. The Audit Committee then reports these findings to the full Board to assist in its oversight of risk.

As further described under "Compensation Risk Analysis," the Compensation Committee is responsible for the oversight of risks relating to employment policies and our compensation and benefits arrangements. To assist in satisfying these oversight responsibilities, the Committee may retain a compensation consultant and meets regularly with management to understand the financial, human resource and shareholder implications of compensation decisions that are made by the Board. The philosophy, process and rationale the Compensation Committee utilized as part of its responsibilities is discussed in detail in the "Compensation Discussion and Analysis" included in this Proxy Statement beginning on page 20.

Board Leadership

Mr. Warnke is the Chairman of our Board of Directors, and Mr. Covey is our President and Chief Executive Officer. In anticipation of Mr. Warnke’s retirement on July 21, 2017, our Board undertook a detailed review and assessment of our current leadership structure. As part of this assessment, given his long history of leadership within the Company and close working relationship with Mr. Covey, who succeeded Mr. Warnke as Chief Executive Officer, the Board decided it was in the best interests of the Company and our shareholders to have Mr. Warnke continue serving as Chairman of the Board following his retirement as Chief Executive Officer. While this results in a separation of the roles of Chief Executive Officer and Chairman of the Board, the Board believes it is appropriate to separate the positions at this time in order to facilitate a smooth transition to a new Chief Executive Officer and to provide Mr. Covey with the opportunity to focus on the day-to-day leadership of the Company in his new role as Chief Executive Officer. Further, the new structure also provides both the Board and Mr. Covey with the opportunity to draw upon the skills and experience of Mr. Warnke who, as Chairman, continues to provide strategic oversight. Although the Board has not and does not intend to appoint a lead independent director, the Board believes that it is able to effectively provide independent oversight of our business and affairs, including risks facing the Company, through the composition of our Board of Directors and the strong leadership of our independent directors.

Our Board continues to believe that no single leadership structure is most effective in all circumstances and will continue to retain the authority to evaluate and modify the Company’s leadership structure at such times as it deems appropriate. The Board’s role in risk oversight has not impacted our leadership structure.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 13 -

Communicating Concerns to Directors

We have established procedures to permit communications with the Board of Directors regarding the Company. Interested parties may communicate with the Board of Directors by contacting the Chairman, the chairs of the Audit, Compensation and Corporate Governance Committees of the Board, or any independent Director by sending a letter to the following address: The Davey Tree Expert Company, Corporate Secretary, 1500 North Mantua Street, Kent, Ohio 44240.

An interested party may also communicate concerns through other mediums as set forth in our Whistleblower Reporting Policy. A copy of our Whistleblower Reporting Policy is available on our Company's website at www.davey.com under the tab "Corporate Information" at the bottom of the page and then under "Corporate Policies," or by contacting the Corporate Secretary at The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

All communications directed to our Board of Directors or Board Committees are reviewed and communicated with the appropriate Board member or members.

Transactions with Related Persons, Promoters and Certain Control Persons

Our Board of Directors has adopted a written policy regarding related party transactions. Under that policy, all transactions with or involving a related person must be disclosed to and approved in advance by the Corporate Governance Committee. Further, each officer and director is requested, on an annual basis, to confirm the existence of any related person transaction. Each such transaction must have a legitimate business purpose and be on terms no less favorable than that which could be obtained from unrelated third parties. Related party transactions are considered when determining if a director is deemed to be an independent director.

In 2017, no executive officer, director or director nominee was indebted to us or was a party to any transaction in which any related person would have a direct or indirect material interest. Further, no related person has proposed such a transaction. For purposes of this discussion, a related person is a director, a nominee for director, an executive officer, an immediate family member (including nonrelated persons sharing the same household) of any of these persons, or any entity controlled by any of these persons.

Environmental Stewardship

We understand our corporate responsibility is to maintain shareholder value through continued economic sustainability. In fulfilling this responsibility to our shareholders, most of whom are current or past employees or immediate family members or trusts of current or former employees, we are cognizant that economic sustainability is multifaceted. We understand that one facet relates to our environmental stewardship. As outlined in our 2016 Corporate Responsibility Report, which was published in 2017, we respect the connection between our services and our impacts on employees, clients, the natural environment and communities. We also have an Environmental Policy, which is available on our website at www.davey.com under the tab "Corporate Information" at the bottom of the page, then under "Corporate Policies." We will continue to monitor our activities as a responsible corporate citizen and review our business practices in light of our corporate responsibility.

Employee Ownership

In 1979, the Company was sold to its employees by the family and descendants of the Company's founder. At that time, in addition to the employees purchasing common shares of the Company, the Company formed an Employee Stock Ownership Trust ("ESOP"), which was later converted to the 401KSOP and ESOP Plan. The Company has remained largely employee-owned since the sale in 1979, and employee ownership remains a hallmark of the Company. Currently, the Company is one of the largest and oldest ESOP service firms in the United States.

In addition to offering employees a means to earn a paycheck and obtain employee benefits, employees have the opportunity to become shareholders of the Company. This has allowed the Company to grow and become a stable yet progressive institution. Our decisions regarding our business, our growth, and our compensation plans are directly influenced by our employee ownership nature.

Shareholder Proposals

The Company provides its shareholders with a process to submit shareholder proposals for consideration at the annual shareholder's meeting. Any shareholder who wishes to submit a proposal to be considered for a vote must follow the requirements set out in SEC Rule 14a-8, which include a shareholder owning at least $2,000 or 1% of Company common stock for at least one year by the date the proposal is submitted. Further, the proposal must be limited to 500 words.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 14 -

Any shareholder who wishes to submit a proposal to be considered for inclusion in next year's Proxy Statement should send the proposal to us on or before December 6, 2018. Additionally, a shareholder may submit a proposal for consideration at next year's Annual Meeting of Shareholders, but not for inclusion in next year's Proxy Statement, if that proposal is submitted on or before February 19, 2019.

Business Conduct Policies

We have a Code of Ethics that applies to all of our employees and directors and we have a Code of Ethics for Financial Matters that applies to all employees and directors, but particularly those who oversee the preparation of our financial statements. We also have a Harassment Policy, an Equal Employment Opportunity Policy, an Environmental Policy and a Privacy Policy. These policies are available at our website, www.davey.com under the tab "Corporate Information" at the bottom of the page, then under "Corporate Policies," or by contacting the Corporate Secretary at The Davey Tree Expert Company, 1500 North Mantua Street, Kent, Ohio 44240.

2017 DIRECTOR COMPENSATION(1)

|

| | | | | | | | | |

| Director | Fees Earned or

Paid in Cash(3) | Stock Awards | Total |

Karl J. Warnke, Chairman(2) | $ | — |

| $ | — |

| $ | — |

|

| Donald C. Brown | 54,000 |

| 35,974 |

| 89,974 |

|

| J. Dawson Cunningham | 60,000 |

| 35,974 |

| 95,974 |

|

| William J. Ginn | 53,000 |

| 35,974 |

| 88,974 |

|

| Douglas K. Hall | 62,000 |

| 35,974 |

| 97,974 |

|

| Sandra W. Harbrecht | 53,500 |

| 35,974 |

| 89,474 |

|

| John E. Warfel | 53,000 |

| 35,974 |

| 88,974 |

|

|

| |

| (1) | Prior periods have been adjusted for the two-for-one stock split, effective June 1, 2017. |

| (2) | Mr. Warnke retired on July 21, 2017 and did not receive compensation as a director until after that date. Mr. Warnke's compensation for services as a director is reported in the 2017 Summary Compensation Table. Mr. Covey is an employee and does not receive any compensation for services as director. |

| (3) | Directors may elect to defer all or part of their director fees in stock equivalent units (SEUs). Ms. Harbrecht and Messrs. Brown and Ginn have made such an election. SEUs are calculated by dividing the fee earned by the then current market price. SEUs will subsequently be valued for payment purposes at the market price in effect on the date of payment. |

Effective as of July 22, 2017, we entered into an agreement with Mr. Warnke, Chairman of the Board of Directors, pursuant to which Mr. Warnke agreed to serve as non-executive Chairman through the conclusion of the 2018 Annual Meeting, to stand for re-election to the Board for a three-year term at the 2018 Annual Meeting, and to serve as Chairman for one additional year, until the 2019 Annual Meeting of Shareholders, subject to re-election by shareholders at the 2018 Annual Meeting. Consistent with the recommendations of Pay Governance, the Company agreed to pay to Mr. Warnke a one-time fee of $25,000 for transition-related services (including $7,500 for the then-regular Chairman of the Board retainer), which was paid in October. Otherwise, Mr. Warnke would receive regular director compensation as a non-employee director and reimbursement of all reasonable expenses incurred by him in the performance of his services. If Mr. Warnke died or became disabled at any time before the conclusion of the 2019 Annual Meeting of Shareholders (if re-elected by shareholders at the 2018 Annual Meeting) and, at the time of his death or the onset of his disability, he retained the position of Chairman of the Board, the Company would continue to make all payments described above to Mr. Warnke or his estate or beneficiary. It was also agreed that 50% of Mr. Warnke’s SARs awarded as of January 1, 2017 would be deemed to have vested as of July 21, 2017 and would be exercisable by Mr. Warnke in accordance with their other terms at any time before October 21, 2017. With regard to Mr. Warnke’s PRSUs awarded as of January 1, 2017, it was agreed that Mr. Warnke’s final award reflecting the determination of the Company’s “return on average invested capital” for 2017 would be determined on the basis of a target award of 1,700 PRSUs. The Company and Mr. Warnke also agreed that Mr. Warnke’s final award for fiscal 2017 under the MICP would be calculated with reference to a target MICP award amount of $290,900, and Mr. Warnke’s discretionary annual bonus for 2017 (payable in 2018) would be $55,000 (calculated at 50% of Mr. Warnke’s actual discretionary bonus for 2016, paid in 2017). Mr. Warnke exercised his SARs referenced above in October 2017.

The aggregate number of all vested and unvested (exercisable and unexercisable) Stock Appreciation Rights, or SARs, awards and unvested DRSU awards for each director, outstanding as of December 31, 2017, is set forth in the following table.

|

| | | | |

Director(1) | SARs (Exercisable

and Unexercisable) | DRSU |

| Donald C. Brown | — |

| 3,511 |

|

| J. Dawson Cunningham | 13,332 |

| 4,308 |

|

| William J. Ginn | 18,666 |

| 4,308 |

|

| Douglas K. Hall | 18,666 |

| 4,308 |

|

| Sandra W. Harbrecht | 14,220 |

| 4,308 |

|

| John E. Warfel | 18,666 |

| 4,308 |

|

|

| |

| (1) | Mr. Warnke had no outstanding awards as of December 31, 2017. |

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 16 -

2017 DIRECTOR COMPENSATION

Compensation of Directors

The current compensation structure for nonemployee directors is designed to fairly pay directors for work required based on our size, scope and industry. The primary goal of the directors is to enhance the long-term interests of our shareholders by establishing company-wide general goals and objectives and identifying executive officers capable of carrying out those goals and objectives. In order to align director compensation with these objectives, the Compensation Committee reviews director compensation and recommends changes to the Board. To assist with this review, the Board periodically directs the Company to engage Pay Governance, an independent compensation consulting firm, to review and evaluate director compensation. Pay Governance assists us in fostering a framework for director compensation based on market conditions, our compensation philosophy, and comparisons to companies of similar size and complexity. A review by Pay Governance was completed in 2017 and another review is scheduled to occur in 2019.

2017 Director Compensation

In 2017, we paid nonemployee directors a fee of $40,000 per year, plus $1,000 for the first and $500 for each additional board or committee meeting attended on the same day, plus reasonably incurred travel and lodging expenses. Committee Chairs received an additional retainer as follows: Audit Committee Chair - $8,000/year; Compensation Committee Chair - $6,000/year; and Governance Committee Chair - $5,000/year. Mr. Warnke, as non-employee Chairman of the Board, received a one-time fee of $25,000 for transition-related services through the 2018 Annual Meeting (including $7,500 for the then-regular Chairman of the Board retainer), which was paid in October 2017.

Each nonemployee Director receives an annual stock award grant of Director Restricted Stock Units ("DRSU") equal to a fixed amount of $36,000. In 2017, the annual grant, at the then-fair value price of $17.60, equaled 2,045 units awarded to each Director. The number of DRSUs associated with the award will fluctuate based on the fair value price of the Company's common shares; however, the value of $36,000 will remain constant. The award will vest over three years and vesting will accelerate upon retirement. Beginning with the 2017 award, an award may be paid in one-to-five-year installments, but must be paid in full by age 75.

Directors may defer all or part of their fees in cash or stock equivalent units until their retirement as directors.

2018 Director Compensation

Effective January 1, 2018, in accordance with Pay Governance’s recommendations, board and committee meeting fees were eliminated, unless there are more than 20 meetings per year, in which case the fee would be $1,000 per meeting. The meeting fees have been replaced with an increased retainer of $55,000 for a non employee director’s service on our board, and the Audit Committee Chair’s retainer was increased to $10,000 per year. The retainers for the Compensation Committee Chair, Governance Committee Chair and Chairman of the Board remained unchanged. Directors will continue to be reimbursed for their reasonable business expenses such as travel and lodging in connection with their attendance of our board meetings.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 17 -

OWNERSHIP OF COMMON SHARES(1)

The following table shows, as of March 16, 2018, the number and percent of our common shares beneficially owned by each nominee, director, and officer listed in the "2017 Summary Compensation Table," and all directors and officers as a group.

|

| | | | |

| Name | Number of Shares (3)(4)(5)(6) | Percent(4)(7) |

Karl J. Warnke, Chairman(2) | 971,839 |

| 3.98 | % |

Patrick M. Covey(2) | 272,851 |

| 1.11 | % |

| Donald C. Brown | 10,733 |

| .04 | % |

| J. Dawson Cunningham | 60,260 |

| .25 | % |

| William J. Ginn | 40,866 |

| .17 | % |

| Douglas K. Hall | 119,891 |

| .49 | % |

| Sandra W. Harbrecht | 82,526 |

| .34 | % |

| Catherine M. Kilbane | — |

| — | % |

| John E. Warfel | 47,753 |

| .20 | % |

| Joseph R. Paul | 179,465 |

| .73 | % |

| James F. Stief | 453,491 |

| 1.85 | % |

| Dan A. Joy | 180,292 |

| .74 | % |

| Brent R. Repenning | 83,269 |

| .34 | % |

| 19 directors, director nominee and officers as a group, including those listed above | 3,492,644 |

| 14.28 | % |

|

| |

| (1) | Prior periods have been adjusted for the two-for-one stock split, effective June 1, 2017. |

| (2) | Mr. Warnke retired as Chief Executive Officer, and Mr. Covey became Chief Executive Officer, both effective July 21, 2017. |

| (3) | Other than as described below, individuals who have beneficial ownership of the common shares listed in the table have sole voting and investment power over these shares. |

| (4) | The following persons share voting and investment power with a spouse with respect to the following number of shares: Mr. Warnke, 289,930; Mr. Hall, 80,774; Mr. Stief, 115,298; and Mr. Repenning, 9,652. Mr. Warfel shares voting and investment power with his spouse and daughter with respect to 11,038 shares. |

| (5) | Includes shares allocated to individual accounts under our 401KSOP and ESOP Plan for which the following executive officers have sole voting power as follows: Mr. Covey, 11,565 shares; Mr. Paul, 7,150 shares; Mr. Stief, 52,304 shares; Mr. Joy, 87,567 shares; Mr. Repenning 4,907 shares; and 559,296 shares by all officers as a group. |

| (6) | These numbers include the right to purchase common shares on or before May 15, 2018 upon the exercise of outstanding stock options: Mr. Covey, 38,000 shares; Mr. Paul, 20,600 shares; Mr. Stief, 20,500 shares; Mr. Joy, 15,800 shares; Mr. Repenning, 15,200 shares; and 199,190 common shares by all directors and officers as a group. These numbers also include the right to purchase common shares on or before May 15, 2018 upon the exercise of outstanding stock appreciation rights: Mr. Covey, 119,220 shares; Mr. Paul, 73,560 shares; Mr. Stief, 59,800 shares; Mr. Joy, 22,300 shares; Mr. Repenning, 26,000 shares; and 509,950 common shares by all directors and officers as a group, and the right to purchase common shares on or before May 15, 2018 upon the exercise of Stock Rights under the Stock Subscription program: Mr. Covey, 1,258 shares; Mr. Paul, 2,508 shares; Mr. Repenning 2,757 shares; and 26,628 common shares by all directors and officers as a group. |

| (7) | Percentage calculation based on total shares outstanding plus the options and rights exercisable by the respective individual on or before May 15, 2018, in accordance with Rule 13d-3(d) of the Securities Exchange Act of 1934, as amended. |

To our knowledge, as of March 16, 2018, no person or entity was an owner, beneficial or otherwise, of more than five percent of our outstanding common shares. Argent Trust Company, trustee of the 401KSOP and ESOP Plan, 1100 Abernathy Road, 500 Northpark, Suite 550, Atlanta, GA 30328, had, as of March 16, 2018, certain trustee-imposed rights and duties with respect to common shares held by it. The number of common shares held in the 401KSOP and ESOP Plan as of March 16, 2018, was 6,470,524 or 26.49% of our outstanding common shares.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 18 -

OWNERSHIP OF COMMON SHARES

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers and persons who own more than ten percent of our common shares to file reports of ownership and changes in ownership of our common shares held by them with the SEC. Currently, we file these reports on behalf of our directors and executive officers. Based on our review of these reports, we believe during the year ended December 31, 2017, all reports were timely filed, other than Form 4 filings for each of Lawrence S. Abernathy, Christopher J. Bast, Marjorie L. Conner, Patrick M. Covey, James Edgar Doyle, Gregory M. Ina, Dan A. Joy, Steven A. Marshall, Brent R. Repenning, Joseph R. Paul, Thea R. Sears, James F. Stief, Nicholas R. Sucic, Mark J. Vaughn and Karl J. Warnke, which incorrectly reported the grant date of certain PRSUs and SARs (and in the case of Mr. Sucic, the grant of shares pursuant to the Management Incentive Plan) to our executive officers as March 14, 2017, rather than March 3, 2017.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 19 -

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

The Compensation Discussion and Analysis section of the Proxy Statement discusses the compensation of the NEOs and includes an overview of 2017's business environment and company performance, as well as a description of the major elements of the Company's executive officer compensation plans and programs, and the factors that are considered in making compensation decisions.

The Compensation Committee of the Board of Directors, which is composed entirely of independent, nonemployee directors, assists the Board of Directors in carrying out its responsibilities for management succession matters, for developing, approving and administering the Company's executive officer incentive and benefits programs, for establishing the base salary for the Chief Executive Officer, and for recommending director compensation. In this role, the Compensation Committee's objective is to align executive officer compensation with the interests of the Company's shareholders.

Financial Performance Overview

2017 Financial and Operating Highlights

We delivered impressive results in 2017. We finished the year with record revenue and strong growth while preserving profitability. Revenues increased $70,280,000 or 8.3%, and income from operations was $47,005,000, an increase of 3.6% from 2016. Although the Company faced unique challenges in 2017 dealing with environmental issues arising from wildfires, floods and hurricanes, the majority of our divisions provided strong performances. We continued to implement the Company’s Vision 2020 growth and value strategy, and we are poised to achieve $1 billion in revenue by 2020. We also completed several business acquisitions in strategic geographic regions and markets in 2017.

We consistently return significant value to our shareholders in the form of dividends and repurchases of our stock. Dividends paid in 2017 totaled $2,513,000 and repurchases of stock totaled $32,194,000.

The following graphs shows our company’s performance for key financial measures over the past three-year period.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 20 -

COMPENSATION DISCUSSION AND ANALYSIS

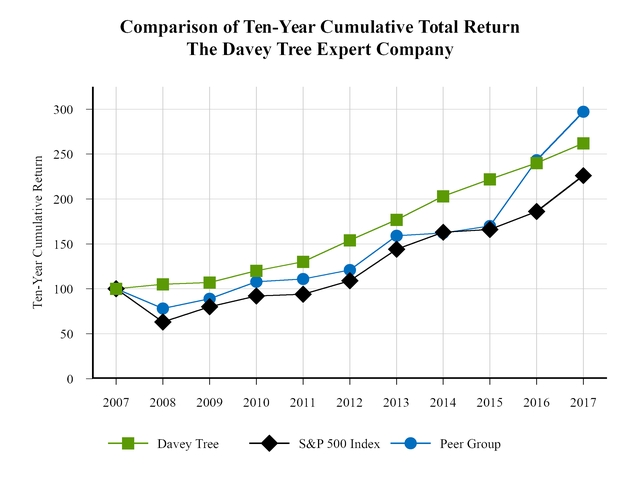

The following performance graph compares cumulative total shareholder returns for our common shares during the last ten years to the Standard & Poor's 500 Stock Index (the "S&P 500") and to an index of selected peer group companies. Our Peer Group, which is the same group used by our independent stock valuation firm, consists of: ABM Industries Incorporated; Comfort Systems USA, Inc.; Dycom Industries, Inc.; MYR Group Inc.; Quanta Services, Inc.; Rollins, Inc.; and The Scotts Miracle-Gro Company. Each of the three measures of cumulative total return assumes reinvestment of dividends.

The Company continues to achieve its objective of providing increased shareholder returns for our common stock that is historically better or comparable to those achieved by our peer group or the S&P 500.

|

| | | | | | | | | | | |

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Davey | 100 | 105 | 107 | 120 | 130 | 154 | 177 | 203 | 222 | 240 | 262 |

| S&P 500 Index | 100 | 63 | 80 | 92 | 94 | 109 | 144 | 163 | 166 | 186 | 226 |

| Peer Group | 100 | 78 | 89 | 108 | 111 | 121 | 159 | 162 | 170 | 243 | 297 |

Changes in Executive Compensation

In 2017, the Compensation Committee amended the Management Incentive Compensation Plan (the "MICP") to remove the stock component of the plan award. Under the previous plan, 10% of a participant’s award greater than $25,000 was paid in shares of the Company’s common stock and the participants could elect to receive up to 100% of their award in shares of Company’s common stock. Awards paid in 2018 for 2017 operating performance instead are paid 100% in cash.

|

| | |

| The Davey Tree Expert Company - 2018 Proxy Statement | | |

- 21 -

COMPENSATION DISCUSSION AND ANALYSIS

Philosophy and Elements of Executive Compensation Structure and Components

Aligning Compensation to Company Performance and Shareholder Value

Our compensation philosophy is to drive and support the Company's business goals by recognizing the attainment of measurable performance and the achievement of approved goals and objectives. In addition, we regularly assess whether the Company's compensation structure establishes appropriate incentives for management and employees, and validate that awards are made with due consideration of balancing risks and rewards.