OMB APPROVAL

OMB Number: 3235-0570

Expires: January 31, 2017

Estimated average burden

hours per response: 20.6

The sole purpose of this Form N-CSRS filing is to submit the Registrant's Form N-CSRS for the reporting period ended December 31, 2015. This filing was inadvertently submitted on March 4, 2016 (Accession No. 0000277751-16-000035) under the incorrect filing type of Form N-CSR instead of Form N-CSRS.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-1879

Janus Investment Fund

(Exact name of registrant as specified in charter)

151 Detroit Street, Denver, Colorado 80206

(Address of principal executive offices) (Zip code)

Stephanie Grauerholz, 151 Detroit Street, Denver, Colorado 80206

(Name and address of agent for service)

Registrant's telephone number, including area code: 303-333-3863

Date of fiscal year end: 6/30

Date of reporting period: 12/31/15

Item 1 - Reports to Shareholders

SEMIANNUAL REPORT December 31, 2015 | |||

INTECH Emerging Markets Managed Volatility Fund | |||

Janus Investment Fund | |||

| |||

HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund performance, characteristics | |||

| |||

Table of Contents

INTECH Emerging Markets Managed Volatility Fund

INTECH Emerging Markets Managed Volatility Fund (unaudited)

PERFORMANCE OVERVIEW

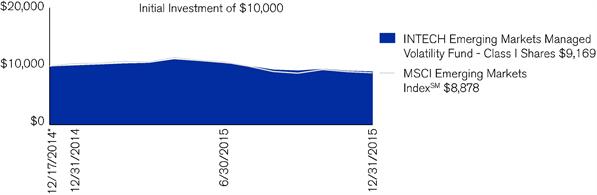

For the six-month period ended December 31, 2015, INTECH Emerging Markets Managed Volatility Fund returned -13.42% for its Class I Shares. This compares to the -17.36% return posted by the MSCI Emerging Markets Index, the Fund’s benchmark.

INVESTMENT STRATEGY

INTECH’s mathematical investment process is designed to determine potentially more efficient equity weightings of the securities in the benchmark index, utilizing a specific mathematical optimization and disciplined rebalancing routine. Rather than trying to predict the future direction of stock prices, the process seeks to use the volatility and correlation characteristics of stocks to construct portfolios.

The investment process begins with the stocks in the MSCI Emerging Markets Index. INTECH’s investment process aims to capture stocks’ natural volatility through a rebalancing mechanism based on estimates of relative volatility and correlation in order to outperform the benchmark index over the long term. Within specific risk constraints, the investment process will tend to favor stocks with higher relative volatility and lower correlation as they offer more potential to capture volatility through periodic rebalancing. Once the target proportions are determined and the portfolio is constructed, it is then rebalanced to those target proportions and re-optimized on a periodic basis. The INTECH Emerging Markets Managed Volatility Fund focuses on seeking an excess return above the benchmark, while also reducing or managing the standard deviation of the portfolio depending on the market conditions, a strategy designed to manage the absolute risk of the portfolio.

PERFORMANCE REVIEW

The MSCI Emerging Markets Index posted a return of -17.36% for the six-month period ending December 31, 2015. INTECH Emerging Markets Managed Volatility Fund outperformed the MSCI Emerging Markets Index over the period and generated a return of -13.42%.

The Fund’s defensive positioning acted as tailwind to relative performance as volatility picked up in the emerging equity markets. On average, the Fund was overweight lower beta stocks or stocks with lower sensitivity to market movements which tend to be less volatile. During the period, lower beta stocks outperformed higher beta stocks and the overall market, on average. Consequently, the Fund’s overweight to lower beta stocks contributed to the Fund’s relative return for the period.

An overall decrease in market diversity over the period reflected a change in the distribution of capital, in which larger cap stocks outperformed smaller cap stocks on average within the MSCI Emerging Markets Index. INTECH Emerging Markets Managed Volatility Fund, which tends to overweight smaller cap stocks as they provide more relative volatility capture potential, was negatively impacted by the overall decrease in market diversity over the period.

The Fund’s active sector positioning tends to vary over time and is a function of the volatility and correlation characteristics of the underlying stocks. The Fund’s overall active sector positioning detracted from relative performance during the period. Specifically, an average underweight to the information technology sector, as well as an average overweight allocation to the telecommunication services sector, detracted from relative performance. However, an overall positive selection effect offset adverse sector positioning and contributed to the Fund’s relative performance during the period, especially within the financials and telecommunication services sectors.

OUTLOOK

Because INTECH does not conduct traditional economic or fundamental analysis, INTECH has no view on individual stocks, sectors, economic, or market conditions.

Janus Investment Fund | 1 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Going forward, we will continue building portfolios in a disciplined and deliberate manner, with risk management remaining the hallmark of our investment process. As INTECH’s ongoing research efforts yield modest improvements, we will continue implementing changes that we believe are likely to improve the long-term results for our Fund shareholders.

Thank you for your investment in INTECH Emerging Markets Managed Volatility Fund.

2 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Fund At A Glance

December 31, 2015

5 Largest Equity Holdings - (% of Net Assets) | |

iShares India 50 | |

Exchange-Traded Funds (ETFs) | 11.2% |

Chunghwa Telecom Co., Ltd. | |

Diversified Telecommunication Services | 5.1% |

Public Bank Bhd | |

Commercial Banks | 1.8% |

Komercni Banka A/S | |

Commercial Banks | 1.8% |

Far EasTone Telecommunications Co., Ltd. | |

Wireless Telecommunication Services | 1.7% |

21.6% | |

Asset Allocation - (% of Net Assets) | |||||

Common Stocks | 86.5% | ||||

Investment Companies | 11.8% | ||||

Preferred Stocks | 1.8% | ||||

Other | (0.1)% | ||||

100.0% | |||||

Emerging markets comprised 97.3% of total net assets.

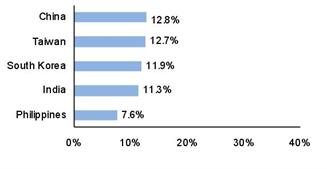

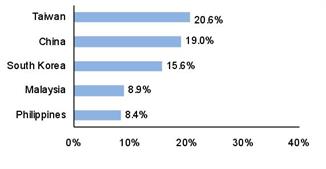

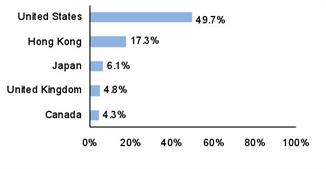

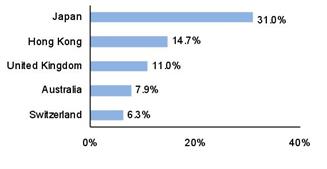

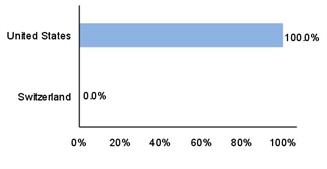

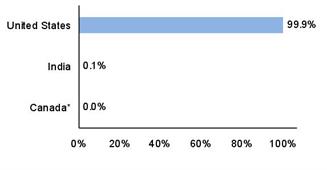

Top Country Allocations - Long Positions - (% of Investment Securities) | |

As of December 31, 2015

| As of June 30, 2015

|

Janus Investment Fund | 3 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Performance

See important disclosures on the next page. |

Expense Ratios - per the October 28, 2015 | ||||||||

Average Annual Total Return - for the periods ended December 31, 2015 |

| prospectuses | ||||||

|

| Fiscal | One | Since |

| Total Annual Fund | Net Annual Fund | |

Class A Shares at NAV | -13.47% | -10.16% | -8.24% |

| 36.32% | 1.36% | ||

Class A Shares at MOP |

| -18.41% | -15.32% | -13.33% |

|

|

| |

Class C Shares at NAV | -13.86% | -10.90% | -8.96% |

| 37.13% | 2.14% | ||

Class C Shares at CDSC |

| -14.71% | -11.78% | -8.96% |

|

|

| |

Class D Shares(1) |

| -13.40% | -10.08% | -8.16% |

| 27.21% | 1.28% | |

Class I Shares |

| -13.42% | -9.93% | -8.02% |

| 27.42% | 1.10% | |

Class S Shares |

| -13.47% | -10.32% | -8.40% |

| 36.59% | 1.63% | |

Class T Shares |

| -13.40% | -10.08% | -8.16% |

| 35.60% | 1.37% | |

MSCI Emerging Markets IndexSM |

| -17.36% | -14.92% | -10.83% |

|

|

| |

Morningstar Quartile - Class I Shares |

| - | 1st | 2nd |

|

|

| |

Morningstar Ranking - based on total returns for Diversified Emerging Markets Funds |

| - | 201/870 | 254/870 |

|

|

| |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 877.33JANUS(52687) (or 800.525.3713 if you hold shares directly with Janus Capital) or visit janus.com/advisor/mutual-funds (or janus.com/allfunds if you hold shares directly with Janus Capital).

Maximum Offering Price (MOP) returns include the maximum sales charge of 5.75%. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

CDSC returns include a 1% contingent deferred sales charge (CDSC) on Shares redeemed within 12 months of purchase. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

INTECH's focus on managed volatility may keep the Fund from achieving excess returns over its index. The strategy may underperform during certain periods of up markets, and may not achieve the desired level of protection in down markets.

A Fund’s performance may be affected by risks that include those associated with nondiversification, non-investment grade debt securities, high-yield/high-risk securities, undervalued or overlooked companies, investments in specific industries or countries and potential conflicts of interest. Additional risks to a Fund may also include, but are not limited to, those associated with investing in foreign securities, emerging markets, initial public offerings, real estate investment trusts (REITs), derivatives, short sales, commodity-linked investments and companies with relatively small market

4 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Performance

capitalizations. Each Fund has different risks. Please see a Janus prospectus for more information about risks, Fund holdings and other details.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

The Fund will normally invest at least 80% of its net assets, measured at the time of purchase, in the type of securities described by its name.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

Standard deviation measures historical volatility. Higher standard deviation implies greater volatility. Beta is a measure of the volatility of a portfolio in comparison to a benchmark index.

Ranking is for the share class shown only; other classes may have different performance characteristics. When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2015 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

The weighting of securities within the Fund's portfolio may differ significantly from the weightings within the index. The index is unmanaged and not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

See “Useful Information About Your Fund Report.”

* The Fund’s inception date – December 17, 2014

(1) Closed to certain new investors.

Janus Investment Fund | 5 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Expense Examples

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as sales charges (loads) on purchase payments (applicable to Class A Shares only); and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in any share class or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. These fees are fully described in the Fund’s prospectuses. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Actual | Hypothetical | |||||||||

| Beginning | Ending | Expenses | Beginning | Ending | Expenses | Net Annualized | |||

Class A Shares | $1,000.00 | $865.30 | $6.10 |

| $1,000.00 | $1,018.60 | $6.60 | 1.30% | ||

Class C Shares | $1,000.00 | $861.40 | $9.36 |

| $1,000.00 | $1,015.08 | $10.13 | 2.00% | ||

Class D Shares | $1,000.00 | $866.00 | $5.82 |

| $1,000.00 | $1,018.90 | $6.29 | 1.24% | ||

Class I Shares | $1,000.00 | $865.80 | $5.11 |

| $1,000.00 | $1,019.66 | $5.53 | 1.09% | ||

Class S Shares | $1,000.00 | $865.30 | $6.33 |

| $1,000.00 | $1,018.35 | $6.85 | 1.35% | ||

Class T Shares | $1,000.00 | $866.00 | $5.30 |

| $1,000.00 | $1,019.46 | $5.74 | 1.13% | ||

† | Expenses Paid During Period are equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Fund’s prospectuses for more information regarding waivers and/or reimbursements. | |||||||||

6 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2015

| Value | ||||||

Common Stocks – 86.5% | |||||||

Air Freight & Logistics – 0.9% | |||||||

Hyundai Glovis Co., Ltd.* | 91 | $14,982 | |||||

Auto Components – 0.7% | |||||||

Cheng Shin Rubber Industry Co., Ltd. | 2,000 | 3,246 | |||||

Hyundai Mobis Co., Ltd.* | 44 | 9,252 | |||||

12,498 | |||||||

Automobiles – 1.5% | |||||||

Hyundai Motor Co. | 30 | 3,813 | |||||

Kia Motors Corp.* | 472 | 21,178 | |||||

24,991 | |||||||

Beverages – 0.7% | |||||||

Cia Cervecerias Unidas SA | 179 | 1,983 | |||||

Coca-Cola Femsa SAB de CV | 200 | 1,438 | |||||

Tsingtao Brewery Co., Ltd. | 2,000 | 9,058 | |||||

12,479 | |||||||

Chemicals – 0.1% | |||||||

Hyosung Corp.* | 16 | 1,604 | |||||

Commercial Banks – 18.5% | |||||||

Agricultural Bank of China, Ltd. - Class H | 11,000 | 4,499 | |||||

Alior Bank SA* | 167 | 2,836 | |||||

Banco de Chile | 74,011 | 7,547 | |||||

Banco de Credito e Inversiones | 78 | 2,946 | |||||

Banco Santander Chile | 28,564 | 1,283 | |||||

Bangkok Bank PCL | 700 | 3,007 | |||||

Bank of Communications Co., Ltd - Class H | 9,000 | 6,341 | |||||

Bank of the Philippine Islands | 5,660 | 10,089 | |||||

Bank Pekao SA | 272 | 9,968 | |||||

BDO Unibank, Inc. | 4,140 | 9,241 | |||||

Chang Hwa Commercial Bank, Ltd. | 1,680 | 803 | |||||

China CITIC Bank Corp., Ltd. - Class H* | 2,000 | 1,296 | |||||

China Construction Bank Corp. - Class H | 9,000 | 6,167 | |||||

China Everbright Bank Co., Ltd. - Class H | 1,000 | 486 | |||||

Commercial Bank QSC | 550 | 6,932 | |||||

Commercial International Bank Egypt SAE | 4,786 | 23,282 | |||||

Doha Bank QSC | 825 | 10,081 | |||||

Dubai Islamic Bank PJSC | 834 | 1,403 | |||||

First Financial Holding Co., Ltd. | 18,105 | 8,435 | |||||

First Gulf Bank PJSC | 3,765 | 12,967 | |||||

Grupo Financiero Banorte SAB de CV | 300 | 1,654 | |||||

Hong Leong Bank Bhd | 3,100 | 9,712 | |||||

Industrial & Commercial Bank of China, Ltd. - Class H | 3,000 | 1,812 | |||||

Kasikornbank PCL | 500 | 2,078 | |||||

KB Financial Group, Inc.* | 49 | 1,386 | |||||

Komercni Banka A/S | 152 | 30,282 | |||||

Krung Thai Bank PCL | 10,000 | 4,643 | |||||

Masraf Al Rayan QSC | 148 | 1,528 | |||||

Mega Financial Holding Co., Ltd. | 7,000 | 4,529 | |||||

National Bank of Abu Dhabi PJSC | 6,026 | 13,060 | |||||

OTP Bank PLC | 722 | 14,969 | |||||

Powszechna Kasa Oszczednosci Bank Polski SA* | 516 | 3,602 | |||||

Public Bank Bhd | 7,100 | 30,651 | |||||

Qatar Islamic Bank SAQ | 495 | 14,503 | |||||

Qatar National Bank SAQ | 523 | 25,132 | |||||

Shinhan Financial Group Co., Ltd.* | 28 | 945 | |||||

Taiwan Cooperative Financial Holding Co., Ltd. | 50,521 | 21,152 | |||||

VTB Bank PJSC (GDR) | 2,983 | 6,291 | |||||

317,538 | |||||||

Commercial Services & Supplies – 1.5% | |||||||

KEPCO Plant Service & Engineering Co., Ltd.* | 160 | 12,147 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 7 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2015

| Value | ||||||

Common Stocks – (continued) | |||||||

Commercial Services & Supplies – (continued) | |||||||

S-1 Corp.* | 161 | $13,692 | |||||

25,839 | |||||||

Construction Materials – 0.3% | |||||||

Siam Cement PCL | 400 | 5,071 | |||||

Consumer Finance – 0.1% | |||||||

Gentera SAB de CV | 500 | 968 | |||||

Containers & Packaging – 0.3% | |||||||

Klabin SA | 900 | 5,336 | |||||

Diversified Consumer Services – 0.4% | |||||||

New Oriental Education & Technology Group, Inc. (ADR) | 200 | 6,274 | |||||

Diversified Financial Services – 0.6% | |||||||

Ayala Corp. | 670 | 10,768 | |||||

Diversified Telecommunication Services – 7.1% | |||||||

China Telecom Corp., Ltd. - Class H | 18,000 | 8,454 | |||||

China Unicom Hong Kong, Ltd. | 4,000 | 4,878 | |||||

Chunghwa Telecom Co., Ltd. | 29,000 | 87,508 | |||||

Emirates Telecommunications Group Co. PJSC | 845 | 3,704 | |||||

Hellenic Telecommunications Organization SA | 73 | 733 | |||||

Telekom Malaysia Bhd | 2,000 | 3,161 | |||||

Telekomunikasi Indonesia Persero Tbk PT | 57,100 | 12,866 | |||||

121,304 | |||||||

Electric Utilities – 1.6% | |||||||

CEZ A/S | 1,283 | 22,942 | |||||

Equatorial Energia SA | 500 | 4,329 | |||||

PGE Polska Grupa Energetyczna SA | 228 | 745 | |||||

28,016 | |||||||

Electronic Equipment, Instruments & Components – 0.4% | |||||||

AAC Technologies Holdings, Inc. | 500 | 3,261 | |||||

Delta Electronics Thailand PCL | 1,700 | 3,615 | |||||

6,876 | |||||||

Food & Staples Retailing – 4.3% | |||||||

China Resources Beer Holdings Co., Ltd. | 4,000 | 8,568 | |||||

Controladora Comercial Mexicana SAB de CV | 4,100 | 11,259 | |||||

CP ALL PCL | 10,200 | 11,130 | |||||

Pick n Pay Stores, Ltd. | 632 | 2,659 | |||||

President Chain Store Corp. | 1,000 | 6,257 | |||||

Spar Group, Ltd. | 139 | 1,656 | |||||

Sun Art Retail Group, Ltd. | 17,500 | 13,210 | |||||

Wal-Mart de Mexico SAB de CV | 7,800 | 19,690 | |||||

74,429 | |||||||

Food Products – 3.7% | |||||||

BRF SA | 100 | 1,401 | |||||

China Huishan Dairy Holdings Co., Ltd. | 16,000 | 6,132 | |||||

China Mengniu Dairy Co., Ltd. | 2,000 | 3,262 | |||||

Gruma SAB de CV - Class B | 1,100 | 15,436 | |||||

Grupo Lala SAB de CV | 1,300 | 3,024 | |||||

JBS SA | 700 | 2,186 | |||||

Lotte Confectionery Co., Ltd.* | 2 | 3,888 | |||||

PPB Group Bhd | 200 | 741 | |||||

Uni-President Enterprises Corp. | 2,000 | 3,343 | |||||

Universal Robina Corp. | 3,030 | 11,981 | |||||

Want Want China Holdings, Ltd. | 15,000 | 11,168 | |||||

62,562 | |||||||

Gas Utilities – 0.1% | |||||||

Petronas Gas Bhd | 200 | 1,058 | |||||

Health Care Providers & Services – 2.4% | |||||||

Bangkok Dusit Medical Services PCL | 26,600 | 16,491 | |||||

Bumrungrad Hospital PCL | 3,200 | 18,771 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

8 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2015

| Value | |||||||

Common Stocks – (continued) | ||||||||

Health Care Providers & Services – (continued) | ||||||||

IHH Healthcare Bhd | 4,300 | $6,595 | ||||||

41,857 | ||||||||

Hotels, Restaurants & Leisure – 1.6% | ||||||||

Jollibee Foods Corp. | 2,010 | 9,358 | ||||||

Kangwon Land, Inc.* | 390 | 12,775 | ||||||

Minor International PCL | 4,180 | 4,213 | ||||||

OPAP SA | 183 | 1,611 | ||||||

27,957 | ||||||||

Household Durables – 0.7% | ||||||||

Coway Co., Ltd.* | 9 | 646 | ||||||

Hanssem Co., Ltd.* | 61 | 12,046 | ||||||

12,692 | ||||||||

Household Products – 1.1% | ||||||||

Kimberly-Clark de Mexico SAB de CV - Class A | 6,400 | 14,997 | ||||||

Unilever Indonesia Tbk PT | 1,300 | 3,491 | ||||||

18,488 | ||||||||

Independent Power and Renewable Electricity Producers – 1.1% | ||||||||

Aboitiz Power Corp. | 14,100 | 12,499 | ||||||

AES Gener SA | 7,603 | 3,378 | ||||||

Colbun SA | 4,530 | 1,083 | ||||||

Glow Energy PCL | 900 | 1,852 | ||||||

18,812 | ||||||||

Industrial Conglomerates – 3.1% | ||||||||

Aboitiz Equity Ventures, Inc. | 14,020 | 17,272 | ||||||

CITIC, Ltd. | 5,000 | 8,852 | ||||||

Industries Qatar QSC | 19 | 580 | ||||||

JG Summit Holdings, Inc. | 8,460 | 13,183 | ||||||

SM Investments Corp. | 710 | 13,041 | ||||||

52,928 | ||||||||

Insurance – 2.4% | ||||||||

Hanwha Life Insurance Co., Ltd.* | 641 | 4,041 | ||||||

Hyundai Marine & Fire Insurance Co., Ltd.* | 366 | 11,255 | ||||||

Powszechny Zaklad Ubezpieczen SA | 950 | 8,254 | ||||||

Qatar Insurance Co. SAQ | 240 | 5,404 | ||||||

Samsung Fire & Marine Insurance Co., Ltd.* | 44 | 11,541 | ||||||

40,495 | ||||||||

Internet Software & Services – 0.3% | ||||||||

Kakao Corp.* | 40 | 3,951 | ||||||

NAVER Corp.* | 3 | 1,684 | ||||||

5,635 | ||||||||

Machinery – 0.1% | ||||||||

CRRC Corp., Ltd. - Class H | 2,000 | 2,472 | ||||||

Media – 0.4% | ||||||||

Cyfrowy Polsat SA* | 1,194 | 6,367 | ||||||

Metals & Mining – 1.5% | ||||||||

AngloGold Ashanti, Ltd.* | 610 | 4,195 | ||||||

China Steel Corp. | 6,000 | 3,279 | ||||||

Gold Fields, Ltd. | 3,123 | 8,530 | ||||||

Korea Zinc Co., Ltd.* | 5 | 2,000 | ||||||

Severstal PAO (GDR) | 856 | 7,160 | ||||||

25,164 | ||||||||

Multiline Retail – 0.3% | ||||||||

El Puerto de Liverpool SAB de CV | 400 | 4,878 | ||||||

Multi-Utilities – 0.7% | ||||||||

Qatar Electricity & Water Co QSC | 188 | 11,171 | ||||||

Oil, Gas & Consumable Fuels – 3.9% | ||||||||

China Coal Energy Co., Ltd. - Class H | 4,000 | 1,533 | ||||||

MOL Hungarian Oil & Gas PLC | 329 | 16,205 | ||||||

Petronas Dagangan Bhd | 500 | 2,897 | ||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 9 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2015

| Value | ||||||

Common Stocks – (continued) | |||||||

Oil, Gas & Consumable Fuels – (continued) | |||||||

Polski Koncern Naftowy Orlen SA | 1,155 | $20,014 | |||||

Polskie Gornictwo Naftowe i Gazownictwo SA | 14,656 | 19,239 | |||||

Qatar Gas Transport Co., Ltd. | 944 | 6,053 | |||||

Surgutneftegas OAO (ADR) | 100 | 595 | |||||

66,536 | |||||||

Paper & Forest Products – 0.6% | |||||||

Empresas CMPC SA | 173 | 374 | |||||

Fibria Celulose SA | 800 | 10,496 | |||||

10,870 | |||||||

Personal Products – 0.3% | |||||||

Hengan International Group Co., Ltd. | 500 | 4,723 | |||||

Pharmaceuticals – 2.4% | |||||||

CSPC Pharmaceutical Group, Ltd. | 2,000 | 2,044 | |||||

Hanmi Pharm Co., Ltd. | 22 | 13,662 | |||||

Hanmi Science Co., Ltd. | 36 | 3,961 | |||||

Richter Gedeon Nyrt | 417 | 7,922 | |||||

Sihuan Pharmaceutical Holdings Group, Ltd.ß | 24,000 | 13,555 | |||||

41,144 | |||||||

Real Estate Investment Trusts (REITs) – 0.1% | |||||||

Resilient REIT, Ltd. | 168 | 1,256 | |||||

Real Estate Management & Development – 1.5% | |||||||

Ayala Land, Inc. | 13,200 | 9,667 | |||||

Barwa Real Estate Co. | 464 | 5,096 | |||||

Central Pattana PCL | 800 | 1,045 | |||||

China Vanke Co., Ltd. - Class Hß | 2,300 | 6,796 | |||||

Longfor Properties Co., Ltd. | 500 | 746 | |||||

New Europe Property Investments PLC | 190 | 2,187 | |||||

25,537 | |||||||

Road & Rail – 0.6% | |||||||

BTS Group Holdings PCL | 43,100 | 10,904 | |||||

Semiconductor & Semiconductor Equipment – 0.2% | |||||||

Hanergy Thin Film Power Group, Ltd.*,ß | 52,000 | 1,441 | |||||

Powertech Technology, Inc. | 1,000 | 1,985 | |||||

3,426 | |||||||

Software – 0% | |||||||

NCSoft Corp. | 2 | 363 | |||||

Textiles, Apparel & Luxury Goods – 3.5% | |||||||

ANTA Sports Products, Ltd. | 5,000 | 13,742 | |||||

Belle International Holdings, Ltd. | 3,000 | 2,253 | |||||

Eclat Textile Co., Ltd. | 1,000 | 13,809 | |||||

Feng TAY Enterprise Co., Ltd. | 1,030 | 5,269 | |||||

LPP SA | 4 | 5,675 | |||||

Pou Chen Corp. | 2,000 | 2,625 | |||||

Shenzhou International Group Holdings, Ltd. | 3,000 | 17,246 | |||||

60,619 | |||||||

Tobacco – 1.6% | |||||||

KT&G Corp.* | 302 | 26,921 | |||||

Transportation Infrastructure – 3.6% | |||||||

Airports of Thailand PCL | 2,300 | 22,124 | |||||

Beijing Capital International Airport Co., Ltd. - Class H | 4,000 | 4,320 | |||||

COSCO Pacific, Ltd. | 14,000 | 15,427 | |||||

Grupo Aeroportuario del Pacifico SAB de CV - Class B | 700 | 6,178 | |||||

Grupo Aeroportuario del Sureste SAB de CV - Class B | 55 | 779 | |||||

Jiangsu Expressway Co., Ltd. - Class H | 10,000 | 13,497 | |||||

62,325 | |||||||

Water Utilities – 0.9% | |||||||

Aguas Andinas SA - Class A | 7,286 | 3,743 | |||||

Guangdong Investment, Ltd. | 8,000 | 11,334 | |||||

15,077 | |||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

10 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2015

| Value | |||||||

Common Stocks – (continued) | ||||||||

Wireless Telecommunication Services – 8.8% | ||||||||

Advanced Info Service PCL | 6,000 | $25,354 | ||||||

Axiata Group Bhd | 7,300 | 10,907 | ||||||

China Mobile, Ltd. | 500 | 5,645 | ||||||

DiGi.Com Bhd | 18,600 | 23,413 | ||||||

Far EasTone Telecommunications Co., Ltd. | 14,000 | 28,818 | ||||||

Globe Telecom, Inc. | 120 | 4,724 | ||||||

Maxis Bhd | 10,200 | 16,168 | ||||||

Philippine Long Distance Telephone Co. | 195 | 8,540 | ||||||

Taiwan Mobile Co., Ltd. | 9,000 | 27,405 | ||||||

Vodacom Group, Ltd. | 62 | 612 | ||||||

151,586 | ||||||||

Total Common Stocks (cost $1,612,634) | 1,482,796 | |||||||

Preferred Stocks – 1.8% | ||||||||

Automobiles – 1.0% | ||||||||

Hyundai Motor Co. | 102 | 8,962 | ||||||

Hyundai Motor Co. - 2nd Preference | 87 | 7,792 | ||||||

16,754 | ||||||||

Paper & Forest Products – 0.8% | ||||||||

Suzano Papel e Celulose SA | 3,100 | 14,650 | ||||||

Total Preferred Stocks (cost $33,388) | 31,404 | |||||||

Investment Companies – 11.8% | ||||||||

Exchange-Traded Funds (ETFs) – 11.2% | ||||||||

iShares India 50 | 7,100 | 193,049 | ||||||

Money Markets – 0.6% | ||||||||

Janus Cash Liquidity Fund LLC, 0.3105%ºº,£ | 10,000 | 10,000 | ||||||

Total Investment Companies (cost $216,379) | 203,049 | |||||||

Total Investments (total cost $1,862,401) – 100.1% | 1,717,249 | |||||||

Liabilities, net of Cash, Receivables and Other Assets – (0.1)% | (2,150) | |||||||

Net Assets – 100% | $1,715,099 | |||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 11 |

INTECH Emerging Markets Managed Volatility Fund

Schedule of Investments (unaudited)

December 31, 2015

Summary of Investments by Country - (Long Positions) (unaudited) | |||||

Country | Value | % of Investment Securities | |||

China | $220,492 | 12.8 | % | ||

Taiwan | 218,464 | 12.7 | |||

South Korea | 204,487 | 11.9 | |||

India | 193,049 | 11.3 | |||

Philippines | 130,363 | 7.6 | |||

Thailand | 130,298 | 7.6 | |||

Malaysia | 105,303 | 6.1 | |||

Qatar | 86,480 | 5.0 | |||

Mexico | 80,301 | 4.7 | |||

Poland | 76,700 | 4.5 | |||

Czech Republic | 53,224 | 3.1 | |||

Hungary | 39,096 | 2.3 | |||

Brazil | 38,398 | 2.2 | |||

United Arab Emirates | 31,134 | 1.8 | |||

Egypt | 23,282 | 1.4 | |||

Chile | 22,337 | 1.3 | |||

South Africa | 21,095 | 1.2 | |||

Indonesia | 16,357 | 1.0 | |||

Russia | 14,046 | 0.8 | |||

United States | 10,000 | 0.6 | |||

Greece | 2,344 | 0.1 | |||

Total | $1,717,250 | 100.0 | % | ||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

12 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund

Notes to Schedule of Investments and Other Information (unaudited)

MSCI Emerging Markets IndexSM | A free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. |

ADR | American Depositary Receipt |

GDR | Global Depositary Receipt |

LLC | Limited Liability Company |

PCL | Public Company Limited |

PJSC | Private Joint Stock Company |

PLC | Public Limited Company |

* | Non-income producing security. |

ß | Security is illiquid. |

ºº | Rate shown is the 7-day yield as of December 31, 2015. |

£ | The Fund may invest in certain securities that are considered affiliated companies. As defined by the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the outstanding voting securities, or a company which is under common ownership or control. The following securities were considered affiliated companies for all or some portion of the period ended December 31, 2015. Unless otherwise indicated, all information in the table is for the period ended December 31, 2015. |

| Share | Purchases | Sales | Share | Dividend | Value |

Janus Cash Collateral Fund LLC | 3,025 | 180,350 | (183,375) | - | $ -(1) | $ - |

Janus Cash Liquidity Fund LLC | 35,000 | 459,010 | (484,010) | 10,000 | $ 18 | $ 10,000 |

Total | $ 18 | $ 10,000 |

(1)Net of income paid to the securities lending agent and rebates paid to the borrowing counterparties.

The following is a summary of the inputs that were used to value the Fund's investments in securities and other financial instruments as of December 31, 2015. See Notes to Financial Statements for more information. | |||

Valuation Inputs Summary | |||

| Level 1 - | Level 2 - | Level 3 - |

Assets | |||

Investments in Securities: | |||

Common Stocks | |||

Pharmaceuticals | $ 27,589 | $ - | $ 13,555 |

Real Estate Management & Development | 18,741 | 6,796 | - |

Semiconductor & Semiconductor Equipment | 1,985 | - | 1,441 |

All Other | 1,412,689 | - | - |

Preferred Stocks | - | 31,404 | - |

Investment Companies | 193,049 | 10,000 | - |

Total Assets | $ 1,654,053 | $ 48,200 | $ 14,996 |

Janus Investment Fund | 13 |

INTECH Emerging Markets Managed Volatility Fund

Statement of Assets and Liabilities (unaudited)

December 31, 2015

Assets: |

|

|

|

| ||

Investments, at cost | $ | 1,862,401 | ||||

Unaffiliated investments, at value | $ | 1,707,249 | ||||

Affiliated investments, at value | 10,000 | |||||

Cash | 631 | |||||

Cash denominated in foreign currency(1) | 5 | |||||

Non-interested Trustees' deferred compensation | 35 | |||||

Receivables: | ||||||

Due from adviser | 28,874 | |||||

Dividends | 2,957 | |||||

Fund shares sold | 863 | |||||

Foreign tax reclaims | 188 | |||||

Dividends from affiliates | 3 | |||||

Other assets | 19 | |||||

Total Assets |

|

| 1,750,824 |

| ||

Liabilities: | ||||||

Payables: | — | |||||

Professional fees | 23,658 | |||||

Custodian fees | 5,665 | |||||

Accounting systems fees | 1,551 | |||||

Advisory fees | 1,512 | |||||

Registration fees | 1,141 | |||||

Transfer agent fees and expenses | 373 | |||||

12b-1 Distribution and shareholder servicing fees | 86 | |||||

Non-interested Trustees' deferred compensation fees | 35 | |||||

Fund administration fees | 15 | |||||

Non-interested Trustees' fees and expenses | 12 | |||||

Accrued expenses and other payables | 1,677 | |||||

Total Liabilities |

|

| 35,725 |

| ||

Net Assets |

| $ | 1,715,099 |

| ||

See Notes to Financial Statements. | |

14 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund

Statement of Assets and Liabilities (unaudited)

December 31, 2015

Net Assets Consist of: |

|

|

|

| ||

Capital (par value and paid-in surplus) | $ | 1,982,817 | ||||

Undistributed net investment income/(loss) | 15,760 | |||||

Undistributed net realized gain/(loss) from investments and foreign currency transactions | (138,307) | |||||

Unrealized net appreciation/(depreciation) of investments, foreign currency translations and non-interested Trustees’ deferred compensation | (145,171) | |||||

Total Net Assets |

| $ | 1,715,099 |

| ||

Net Assets - Class A Shares | $ | 137,195 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 15,260 | |||||

Net Asset Value Per Share(2) |

| $ | 8.99 |

| ||

Maximum Offering Price Per Share(3) |

| $ | 9.54 |

| ||

Net Assets - Class C Shares | $ | 45,377 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 5,045 | |||||

Net Asset Value Per Share(2) |

| $ | 8.99 |

| ||

Net Assets - Class D Shares | $ | 1,029,646 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 114,540 | |||||

Net Asset Value Per Share |

| $ | 8.99 |

| ||

Net Assets - Class I Shares | $ | 307,339 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 34,185 | |||||

Net Asset Value Per Share |

| $ | 8.99 |

| ||

Net Assets - Class S Shares | $ | 45,654 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 5,077 | |||||

Net Asset Value Per Share |

| $ | 8.99 |

| ||

Net Assets - Class T Shares | $ | 149,888 | ||||

Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | 16,673 | |||||

Net Asset Value Per Share |

| $ | 8.99 |

| ||

(1) Includes cost of foreign cash of $4.56. (2) Redemption price per share may be reduced for any applicable contingent deferred sales charge. (3) Maximum offering price is computed at 100/94.26 of net asset value. |

See Notes to Financial Statements. | |

Janus Investment Fund | 15 |

INTECH Emerging Markets Managed Volatility Fund

Statement of Operations (unaudited)

For the period ended December 31, 2015

Investment Income: |

|

|

| ||

| Dividends | $ | 34,920 | ||

Affiliated securities lending income, net | 72 | ||||

Dividends from affiliates | 18 | ||||

Other income | 101 | ||||

Foreign tax withheld | (4,349) | ||||

Total Investment Income |

| 30,762 |

| ||

Expenses: | |||||

Advisory fees | 9,049 | ||||

12b-1Distribution and shareholder servicing fees: | |||||

Class A Shares | 168 | ||||

Class C Shares | 223 | ||||

Class S Shares | 56 | ||||

Transfer agent administrative fees and expenses: | |||||

Class D Shares | 720 | ||||

Class S Shares | 61 | ||||

Class T Shares | 198 | ||||

Transfer agent networking and omnibus fees: | |||||

Class I Shares | 9 | ||||

Other transfer agent fees and expenses: | |||||

Class A Shares | 24 | ||||

Class C Shares | 9 | ||||

Class D Shares | 503 | ||||

Class I Shares | 74 | ||||

Class S Shares | 6 | ||||

Class T Shares | 19 | ||||

Registration fees | 57,429 | ||||

Professional fees | 21,908 | ||||

Custodian fees | 20,433 | ||||

Shareholder reports expense | 5,420 | ||||

Fund administration fees | 91 | ||||

Non-interested Trustees’ fees and expenses | 26 | ||||

Other expenses | 3,306 | ||||

Total Expenses |

| 119,732 |

| ||

Less: Excess Expense Reimbursement |

| (108,169) |

| ||

Net Expenses |

| 11,563 |

| ||

Net Investment Income/(Loss) |

| 19,199 |

| ||

Net Realized Gain/(Loss) on Investments: | |||||

Investments and foreign currency transactions | (137,695) | ||||

Total Net Realized Gain/(Loss) on Investments |

| (137,695) |

| ||

Change in Unrealized Net Appreciation/Depreciation: | |||||

Investments, foreign currency translations and non-interested Trustees’ deferred compensation | (131,313) | ||||

Total Change in Unrealized Net Appreciation/Depreciation |

| (131,313) |

| ||

Net Increase/(Decrease) in Net Assets Resulting from Operations | $ | (249,809) |

| ||

See Notes to Financial Statements. | |

16 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund

Statements of Changes in Net Assets (unaudited)

|

|

| Period ended |

| Period ended | |||

Operations: | ||||||||

Net investment income/(loss) | $ | 19,199 | $ | 11,591 | ||||

Net realized gain/(loss) on investments | (137,695) | 14,600 | ||||||

Change in unrealized net appreciation/depreciation | (131,313) | (13,858) | ||||||

Net Increase/(Decrease) in Net Assets Resulting from Operations |

| (249,809) |

|

| 12,333 | |||

Dividends and Distributions to Shareholders: | ||||||||

Class A Shares | (1,178) | — | ||||||

Class C Shares | (20) | — | ||||||

Class D Shares | (9,709) | — | ||||||

Class I Shares | (3,366) | — | ||||||

Class S Shares | (309) | — | ||||||

Class T Shares | (1,423) | — | ||||||

| Total Dividends from Net Investment Income |

| (16,005) |

|

| — | ||

Distributions from Net Realized Gain from Investment Transactions | ||||||||

Class A Shares | (1,145) | — | ||||||

Class C Shares | (382) | — | ||||||

Class D Shares | (8,596) | — | ||||||

Class I Shares | (2,530) | — | ||||||

Class S Shares | (382) | — | ||||||

Class T Shares | (1,258) | — | ||||||

| Total Distributions from Net Realized Gain from Investment Transactions | (14,293) |

|

| — | |||

Net Decrease from Dividends and Distributions to Shareholders |

| (30,298) |

|

| — | |||

Capital Share Transactions: | ||||||||

Class A Shares | 2,323 | 150,000 | ||||||

Class C Shares | 402 | 50,000 | ||||||

Class D Shares | (132,762) | 1,339,896 | ||||||

Class I Shares | 48,307 | 306,508 | ||||||

Class S Shares | 690 | 50,000 | ||||||

Class T Shares | 4,876 | 162,633 | ||||||

Net Increase/(Decrease) from Capital Share Transactions |

| (76,164) |

|

| 2,059,037 | |||

Net Increase/(Decrease) in Net Assets |

| (356,271) |

|

| 2,071,370 | |||

Net Assets: | ||||||||

Beginning of period | 2,071,370 | — | ||||||

| End of period | $ | 1,715,099 |

| $ | 2,071,370 | ||

Undistributed Net Investment Income/(Loss) | $ | 15,760 |

| $ | 12,566 | |||

(1) Period from December 17, 2014 (inception date) through June 30, 2015. |

See Notes to Financial Statements. | |

Janus Investment Fund | 17 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Financial Highlights

Class A Shares | |||||||||

For a share outstanding during the period ended December 31, 2015 (unaudited) and the period ended June 30, 2015 | 2015 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $10.49 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | |||||||||

Net investment income/(loss)(2) | 0.10 | 0.06 | |||||||

Net realized and unrealized gain/(loss) | (1.44) | 0.43 | |||||||

Total from Investment Operations |

| (1.34) |

|

| 0.49 |

| |||

Less Dividends and Distributions: | |||||||||

Dividends (from net investment income) | (0.08) | — | |||||||

Distributions (from capital gains) | (0.08) | — | |||||||

Total Dividends and Distributions |

| (0.16) |

|

| — |

| |||

Net Asset Value, End of Period | $8.99 | $10.49 | |||||||

Total Return* |

| (13.47)% |

|

| 4.90% |

| |||

Net Assets, End of Period (in thousands) | $137 | $157 | |||||||

Average Net Assets for the Period (in thousands) | $144 | $159 | |||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

| |||

Ratio of Gross Expenses | 12.81% | 36.27% | |||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.30% | 1.31% | |||||||

Ratio of Net Investment Income/(Loss) | 1.97% | 1.05% | |||||||

Portfolio Turnover Rate | 52% | 43% | |||||||

Class C Shares | |||||||||

For a share outstanding during the period ended December 31, 2015 (unaudited) and the period ended June 30, 2015 | 2015 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $10.44 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | |||||||||

Net investment income/(loss)(2) | 0.06 | 0.02 | |||||||

Net realized and unrealized gain/(loss) | (1.43) | 0.42 | |||||||

Total from Investment Operations |

| (1.37) |

|

| 0.44 |

| |||

Less Dividends and Distributions: | |||||||||

Dividends (from net investment income) | —(3) | — | |||||||

Distributions (from capital gains) | (0.08) | — | |||||||

Total Dividends and Distributions |

| (0.08) |

|

| — |

| |||

Net Asset Value, End of Period | $8.99 | $10.44 | |||||||

Total Return* |

| (13.86)% |

|

| 4.40% |

| |||

Net Assets, End of Period (in thousands) | $45 | $52 | |||||||

Average Net Assets for the Period (in thousands) | $48 | $53 | |||||||

Ratios to Average Net Assets**: |

|

| �� |

|

|

| |||

Ratio of Gross Expenses | 13.50% | 37.08% | |||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 2.00% | 2.09% | |||||||

Ratio of Net Investment Income/(Loss) | 1.27% | 0.27% | |||||||

Portfolio Turnover Rate | 52% | 43% | |||||||

* Total return not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Period from December 17, 2014 (inception date) through June 30, 2015. (2) Per share amounts are calculated based on average shares outstanding during the year or period. (3) Less than $0.005 on a per share basis. |

See Notes to Financial Statements. | |

18 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Financial Highlights

Class D Shares | |||||||||

For a share outstanding during the period ended December 31, 2015 (unaudited) and the period ended June 30, 2015 | 2015 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $10.49 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | |||||||||

Net investment income/(loss)(2) | 0.10 | 0.08 | |||||||

Net realized and unrealized gain/(loss) | (1.43) | 0.41 | |||||||

Total from Investment Operations |

| (1.33) |

|

| 0.49 |

| |||

Less Dividends and Distributions: | |||||||||

Dividends (from net investment income) | (0.09) | — | |||||||

Distributions (from capital gains) | (0.08) | — | |||||||

Total Dividends and Distributions |

| (0.17) |

|

| — |

| |||

Net Asset Value, End of Period | $8.99 | $10.49 | |||||||

Total Return* |

| (13.40)% |

|

| 4.90% |

| |||

Net Assets, End of Period (in thousands) | $1,030 | $1,335 | |||||||

Average Net Assets for the Period (in thousands) | $1,176 | $1,037 | |||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

| |||

Ratio of Gross Expenses | 12.71% | 27.16% | |||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.24% | 1.23% | |||||||

Ratio of Net Investment Income/(Loss) | 2.06% | 1.38% | |||||||

Portfolio Turnover Rate | 52% | 43% | |||||||

Class I Shares | |||||||||

For a share outstanding during the period ended December 31, 2015 (unaudited) and the period ended June 30, 2015 | 2015 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $10.50 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | |||||||||

Net investment income/(loss)(2) | 0.10 | 0.10 | |||||||

Net realized and unrealized gain/(loss) | (1.43) | 0.40 | |||||||

Total from Investment Operations |

| (1.33) |

|

| 0.50 |

| |||

Less Dividends and Distributions: | |||||||||

Dividends (from net investment income) | (0.10) | — | |||||||

Distributions (from capital gains) | (0.08) | — | |||||||

Total Dividends and Distributions |

| (0.18) |

|

| — |

| |||

Net Asset Value, End of Period | $8.99 | $10.50 | |||||||

Total Return* |

| (13.42)% |

|

| 5.00% |

| |||

Net Assets, End of Period (in thousands) | $307 | $305 | |||||||

Average Net Assets for the Period (in thousands) | $296 | $181 | |||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

| |||

Ratio of Gross Expenses | 12.71% | 27.37% | |||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.09% | 1.05% | |||||||

Ratio of Net Investment Income/(Loss) | 2.14% | 1.79% | |||||||

Portfolio Turnover Rate | 52% | 43% | |||||||

* Total return not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Period from December 17, 2014 (inception date) through June 30, 2015. (2) Per share amounts are calculated based on average shares outstanding during the year or period. |

See Notes to Financial Statements. | |

Janus Investment Fund | 19 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Financial Highlights

Class S Shares | |||||||||

For a share outstanding during the period ended December 31, 2015 (unaudited) and the period ended June 30, 2015 | 2015 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $10.47 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | |||||||||

Net investment income/(loss)(2) | 0.09 | 0.04 | |||||||

Net realized and unrealized gain/(loss) | (1.43) | 0.43 | |||||||

Total from Investment Operations |

| (1.34) |

|

| 0.47 |

| |||

Less Dividends and Distributions: | |||||||||

Dividends (from net investment income) | (0.06) | — | |||||||

Distributions (from capital gains) | (0.08) | — | |||||||

Total Dividends and Distributions |

| (0.14) |

|

| — |

| |||

Net Asset Value, End of Period | $8.99 | $10.47 | |||||||

Total Return* |

| (13.47)% |

|

| 4.70% |

| |||

Net Assets, End of Period (in thousands) | $46 | $52 | |||||||

Average Net Assets for the Period (in thousands) | $48 | $53 | |||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

| |||

Ratio of Gross Expenses | 13.05% | 36.54% | |||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.35% | 1.58% | |||||||

Ratio of Net Investment Income/(Loss) | 1.92% | 0.78% | |||||||

Portfolio Turnover Rate | 52% | 43% | |||||||

Class T Shares | |||||||||

For a share outstanding during the period ended December 31, 2015 (unaudited) and the period ended June 30, 2015 | 2015 |

|

| 2015(1) |

| ||||

Net Asset Value, Beginning of Period |

| $10.00 |

|

| $10.00 |

| |||

Income/(Loss) from Investment Operations: | |||||||||

Net investment income/(loss)(2) | 0.10 | 0.06 | |||||||

Net realized and unrealized gain/(loss) | (0.94) | 0.43 | |||||||

Total from Investment Operations |

| (0.84) |

|

| 0.49 |

| |||

Less Dividends and Distributions: | |||||||||

Dividends (from net investment income) | (0.09) | — | |||||||

Distributions (from capital gains) | (0.08) | — | |||||||

Total Dividends and Distributions |

| (0.17) |

|

| — |

| |||

Net Asset Value, End of Period | $8.99 | $10.49 | |||||||

Total Return* |

| (13.40)% |

|

| 4.90% |

| |||

Net Assets, End of Period (in thousands) | $150 | $169 | |||||||

Average Net Assets for the Period (in thousands) | $155 | $165 | |||||||

Ratios to Average Net Assets**: |

|

|

|

|

|

| |||

Ratio of Gross Expenses | 12.86% | 35.55% | |||||||

Ratio of Net Expenses (After Waivers and Expense Offsets) | 1.13% | 1.32% | |||||||

Ratio of Net Investment Income/(Loss) | 2.13% | 1.07% | |||||||

Portfolio Turnover Rate | 52% | 43% | |||||||

* Total return not annualized for periods of less than one full year. ** Annualized for periods of less than one full year. (1) Period from December 17, 2014 (inception date) through June 30, 2015. (2) Per share amounts are calculated based on average shares outstanding during the year or period. |

See Notes to Financial Statements. | |

20 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Notes to Financial Statements

1. Organization and Significant Accounting Policies

INTECH Emerging Markets Managed Volatility Fund (the “Fund”) is a series fund. The Fund is part of Janus Investment Fund (the “Trust”), which is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The Trust offers forty-five Funds which include multiple series of shares, with differing investment objectives and policies. The Fund invests primarily in common stocks. The Fund is classified as diversified, as defined in the 1940 Act.

The Fund offers multiple classes of shares in order to meet the needs of various types of investors. Each class represents an interest in the same portfolio of investments. Certain financial intermediaries may not offer all classes of shares.

Class A Shares and Class C Shares are generally offered through financial intermediary platforms including, but not limited to, traditional brokerage platforms, mutual fund wrap fee programs, bank trust platforms, and retirement platforms.

Class D Shares are generally no longer being made available to new investors who do not already have a direct account with the Janus funds. Class D Shares are available only to investors who hold accounts directly with the Janus funds, to immediate family members or members of the same household of an eligible individual investor, and to existing beneficial owners of sole proprietorships or partnerships that hold accounts directly with the Janus funds.

Class I Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. Class I Shares are also available to certain direct institutional investors including, but not limited to, corporations, certain retirement plans, public plans, and foundations/endowments.

Class S Shares are offered through financial intermediary platforms including, but not limited to, retirement platforms and asset allocation, mutual fund wrap, or other discretionary or nondiscretionary fee-based investment advisory programs. In addition, Class S Shares may be available through certain financial intermediaries who have an agreement with Janus Capital Management LLC (“Janus Capital”) or its affiliates to offer Class S Shares on their supermarket platforms.

Class T Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. In addition, Class T Shares may be available through certain financial intermediaries who have an agreement with Janus Capital or its affiliates to offer Class T Shares on their supermarket platforms.

The following accounting policies have been followed by the Fund and are in conformity with accounting principles generally accepted in the United States of America.

Investment Valuation

Securities held by the Fund are valued in accordance with policies and procedures established by and under the supervision of the Trustees (the “Valuation Procedures”). Equity securities traded on a domestic securities exchange are generally valued at the closing prices on the primary market or exchange on which they trade. If such price is lacking for the trading period immediately preceding the time of determination, such securities are valued at their current bid price. Equity securities that are traded on a foreign exchange are generally valued at the closing prices on such markets. In the event that there is no current trading volume on a particular security in such foreign exchange, the bid price from the primary exchange is generally used to value the security. Securities that are traded on the over-the-counter (“OTC”) markets are generally valued at their closing or latest bid prices as available. Foreign securities and currencies are converted to U.S. dollars using the applicable exchange rate in effect at the close of the New York Stock Exchange (“NYSE”). The Fund will determine the market value of individual securities held by it by using prices provided by one or more approved professional pricing services or, as needed, by obtaining market quotations from independent broker-dealers. Most debt securities are valued in accordance with the evaluated bid price supplied by the pricing service that is intended to reflect market value. The evaluated bid price supplied by the pricing service is an evaluation that may consider factors such as security prices, yields, maturities and ratings. Certain short-term securities maturing within 60 days or less may be evaluated and valued on an amortized cost basis provided that the amortized cost determined

Janus Investment Fund | 21 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Notes to Financial Statements

approximates market value. Securities for which market quotations or evaluated prices are not readily available or deemed unreliable are valued at fair value determined in good faith under the Valuation Procedures. Circumstances in which fair value pricing may be utilized include, but are not limited to: (i) a significant event that may affect the securities of a single issuer, such as a merger, bankruptcy, or significant issuer-specific development; (ii) an event that may affect an entire market, such as a natural disaster or significant governmental action; (iii) a nonsignificant event such as a market closing early or not opening, or a security trading halt; and (iv) pricing of a nonvalued security and a restricted or nonpublic security. Special valuation considerations may apply with respect to “odd-lot” fixed-income transactions which, due to their small size, may receive evaluated prices by pricing services which reflect a large block trade and not what actually could be obtained for the odd-lot position. The Fund uses systematic fair valuation models provided by independent third parties to value international equity securities in order to adjust for stale pricing, which may occur between the close of certain foreign exchanges and the close of the NYSE.

Valuation Inputs Summary

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements regarding fair value measurements. This standard emphasizes that fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability and establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. These inputs are summarized into three broad levels:

Level 1 – Unadjusted quoted prices in active markets the Fund has the ability to access for identical assets or liabilities.

Level 2 – Observable inputs other than unadjusted quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Assets or liabilities categorized as Level 2 in the hierarchy generally include: debt securities fair valued in accordance with the evaluated bid or ask prices supplied by a pricing service; securities traded on OTC markets and listed securities for which no sales are reported that are fair valued at the latest bid price (or yield equivalent thereof) obtained from one or more dealers transacting in a market for such securities or by a pricing service approved by the Fund’s Trustees; certain short-term debt securities with maturities of 60 days or less that are fair valued at amortized cost; and equity securities of foreign issuers whose fair value is determined by using systematic fair valuation models provided by independent third parties in order to adjust for stale pricing which may occur between the close of certain foreign exchanges and the close of the NYSE. Other securities that may be categorized as Level 2 in the hierarchy include, but are not limited to, preferred stocks, bank loans, swaps, investments in unregistered investment companies, options, and forward contracts.

Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

There have been no significant changes in valuation techniques used in valuing any such positions held by the Fund since the beginning of the fiscal year.

The inputs or methodology used for fair valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used as of December 31, 2015 to fair value the Fund’s investments in securities and other financial instruments is included in the “Valuation Inputs Summary” in the Notes to Schedule of Investments and Other Information.

The Fund did not hold a significant amount of Level 3 securities as of December 31, 2015.

There were no transfers between Level 1, Level 2 and Level 3 of the fair value hierarchy during the period. The Fund recognizes transfers between the levels as of the beginning of the fiscal year.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend, if such information is obtained subsequent to the ex-dividend date. Dividends from foreign securities may

22 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Notes to Financial Statements

be subject to withholding taxes in foreign jurisdictions. Interest income is recorded on the accrual basis and includes amortization of premiums and accretion of discounts. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes. Income, as well as gains and losses, both realized and unrealized, are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of total net assets.

Expenses

The Fund bears expenses incurred specifically on its behalf, as well as a portion of general expenses, which may be allocated pro rata to the Fund. Each class of shares bears a portion of general expenses, which are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of total net assets. Expenses directly attributable to a specific class of shares are charged against the operations of such class.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications

In the normal course of business, the Fund may enter into contracts that contain provisions for indemnification of other parties against certain potential liabilities. The Fund’s maximum exposure under these arrangements is unknown, and would involve future claims that may be made against the Fund that have not yet occurred. Currently, the risk of material loss from such claims is considered remote.

Foreign Currency Translations

The Fund does not isolate that portion of the results of operations resulting from the effect of changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held at the date of the financial statements. Net unrealized appreciation or depreciation of investments and foreign currency translations arise from changes in the value of assets and liabilities, including investments in securities held at the date of the financial statements, resulting from changes in the exchange rates and changes in market prices of securities held.

Currency gains and losses are also calculated on payables and receivables that are denominated in foreign currencies. The payables and receivables are generally related to foreign security transactions and income translations.

Foreign currency-denominated assets and forward currency contracts may involve more risks than domestic transactions, including currency risk, counterparty risk, political and economic risk, regulatory risk and equity risk. Risks may arise from unanticipated movements in the value of foreign currencies relative to the U.S. dollar.

Dividends and Distributions

The Fund generally declares and distributes dividends of net investment income and realized capital gains (if any) annually. The Fund may treat a portion of the amount paid to redeem shares as a distribution of investment company taxable income and realized capital gains that are reflected in the net asset value. This practice, commonly referred to as “equalization,” has no effect on the redeeming shareholder or a Fund’s total return, but may reduce the amounts that would otherwise be required to be paid as taxable dividends to the remaining shareholders. It is possible that the Internal Revenue Service (IRS) could challenge the Funds’ equalization methodology or calculations, and any such challenge could result in additional tax, interest, or penalties to be paid by the Fund.

The Fund may make certain investments in real estate investment trusts (“REITs”) which pay dividends to their shareholders based upon funds available from operations. It is quite common for these dividends to exceed the REITs’ taxable earnings and profits, resulting in the excess portion of such dividends being designated as a return of capital. If the Fund distributes such amounts, such distributions could constitute a return of capital to shareholders for federal income tax purposes.

Federal Income Taxes

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income in accordance with the requirements of Subchapter M of the Internal Revenue Code. Management has analyzed the Fund’s tax positions taken for all open federal income tax years, generally a three-year period, and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund is not aware of any tax

Janus Investment Fund | 23 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Notes to Financial Statements

positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

2. Other Investments and Strategies

Additional Investment Risk

The financial crisis in both the U.S. and global economies over the past several years has resulted, and may continue to result, in a significant decline in the value and liquidity of many securities of issuers worldwide in the equity and fixed-income/credit markets. In response to the crisis, the United States and certain foreign governments, along with the U.S. Federal Reserve and certain foreign central banks, took steps to support the financial markets. The withdrawal of this support, a failure of measures put in place to respond to the crisis, or investor perception that such efforts were not sufficient could each negatively affect financial markets generally, and the value and liquidity of specific securities. In addition, policy and legislative changes in the United States and in other countries continue to impact many aspects of financial regulation. The effect of these changes on the markets, and the practical implications for market participants, including the Fund, may not be fully known for some time. As a result, it may also be unusually difficult to identify both investment risks and opportunities, which could limit or preclude the Fund’s ability to achieve its investment objective. Therefore, it is important to understand that the value of your investment may fall, sometimes sharply, and you could lose money.

The enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) provided for widespread regulation of financial institutions, consumer financial products and services, broker-dealers, OTC derivatives, investment advisers, credit rating agencies, and mortgage lending, which expanded federal oversight in the financial sector, including the investment management industry. Many provisions of the Dodd-Frank Act remain pending and will be implemented through future rulemaking. Therefore, the ultimate impact of the Dodd-Frank Act and the regulations under the Dodd-Frank Act on the Fund and the investment management industry as a whole, is not yet certain.

A number of countries in the European Union (“EU”) have experienced, and may continue to experience, severe economic and financial difficulties. In particular, many EU nations are susceptible to economic risks associated with high levels of debt, notably due to investments in sovereign debt of countries such as Greece, Italy, Spain, Portugal, and Ireland. Many non-governmental issuers, and even certain governments, have defaulted on, or been forced to restructure, their debts. Many other issuers have faced difficulties obtaining credit or refinancing existing obligations. Financial institutions have in many cases required government or central bank support, have needed to raise capital, and/or have been impaired in their ability to extend credit. As a result, financial markets in the EU experienced extreme volatility and declines in asset values and liquidity. Responses to these financial problems by European governments, central banks, and others, including austerity measures and reforms, may not work, may result in social unrest, and may limit future growth and economic recovery or have other unintended consequences. Further defaults or restructurings by governments and others of their debt could have additional adverse effects on economies, financial markets, and asset valuations around the world. Greece, Ireland, and Portugal have already received one or more "bailouts" from other Eurozone member states, and it is unclear how much additional funding they will require or if additional Eurozone member states will require bailouts in the future. One or more countries may abandon the euro and/or withdraw from the EU, placing its currency and banking system in jeopardy.

Certain areas of the world have historically been prone to and economically sensitive to environmental events such as, but not limited to, hurricanes, earthquakes, typhoons, flooding, tidal waves, tsunamis, erupting volcanoes, wildfires or droughts, tornadoes, mudslides, or other weather-related phenomena. Such disasters, and the resulting physical or economic damage, could have a severe and negative impact on the Fund’s investment portfolio and, in the longer term, could impair the ability of issuers in which the Fund invests to conduct their businesses as they would under normal conditions. Adverse weather conditions may also have a particularly significant negative effect on issuers in the agricultural sector and on insurance companies that insure against the impact of natural disasters.

Counterparties

Fund transactions involving a counterparty are subject to the risk that the counterparty or a third party will not fulfill its obligation to the Fund (“counterparty risk”). Counterparty risk may arise because of the counterparty’s financial condition (i.e., financial difficulties, bankruptcy, or insolvency), market activities and developments, or other reasons, whether foreseen or not. A counterparty’s inability to fulfill its obligation may result in significant financial loss to the Fund. The Fund may be unable to recover its investment from the counterparty or may obtain a limited recovery, and/or recovery

24 | DECEMBER 31, 2015 |

INTECH Emerging Markets Managed Volatility Fund (unaudited)

Notes to Financial Statements

may be delayed. The extent of the Fund’s exposure to counterparty risk with respect to financial assets and liabilities approximates its carrying value. See the "Offsetting Assets and Liabilities" section of this Note for further details.

The Fund may be exposed to counterparty risk through participation in various programs, including, but not limited to, lending its securities to third parties, cash sweep arrangements whereby the Fund’s cash balance is invested in one or more types of cash management vehicles, as well as investments in, but not limited to, repurchase agreements, debt securities, and derivatives, including various types of swaps, futures and options. The Fund intends to enter into financial transactions with counterparties that Janus Capital believes to be creditworthy at the time of the transaction. There is always the risk that Janus Capital’s analysis of a counterparty’s creditworthiness is incorrect or may change due to market conditions. To the extent that the Fund focuses its transactions with a limited number of counterparties, it will have greater exposure to the risks associated with one or more counterparties.

Emerging Market Investing

To the extent that emerging markets may be included in its benchmark index, the Fund may invest in securities of issuers or companies from or with exposure to one or more “developing countries” or “emerging market countries.” To the extent that the Fund invests a significant amount of its assets in one or more of these countries, its returns and net asset value may be affected to a large degree by events and economic conditions in such countries. The risks of foreign investing are heightened when investing in emerging markets, which may result in the price of investments in emerging markets experiencing sudden and sharp price swings. In many developing markets, there is less government supervision and regulation of business and industry practices (including the potential lack of strict finance and accounting controls and standards), stock exchanges, brokers, and listed companies, making these investments potentially more volatile in price and less liquid than investments in developed securities markets, resulting in greater risk to investors. There is a risk in developing countries that a future economic or political crisis could lead to price controls, forced mergers of companies, expropriation or confiscatory taxation, imposition or enforcement of foreign ownership limits, seizure, nationalization, sanctions or imposition of restrictions by various governmental entities on investment and trading, or creation of government monopolies, any of which may have a detrimental effect on the Fund’s investments. In addition, the Fund’s investments may be denominated in foreign currencies and therefore, changes in the value of a country’s currency compared to the U.S. dollar may affect the value of the Fund’s investments. To the extent that the Fund invests a significant portion of its assets in the securities of issuers in or companies of a single country or region, it is more likely to be impacted by events or conditions affecting that country or region, which could have a negative impact on the Fund’s performance. Additionally, foreign and emerging market risks, including, but not limited to, price controls, expropriation or confiscatory taxation, imposition or enforcement of foreign ownership limits, nationalization, and restrictions on repatriation of assets may be heightened to the extent the Fund invests in Chinese local market securities.

Exchange-Traded Funds