United States Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

Investment Company Act file number 811-01879

Janus Investment Fund

(Exact name of registrant as specified in charter)

151 Detroit Street, Denver, Colorado 80206

(Address of principal executive offices) (Zip code)

Kathryn Santoro, 151 Detroit Street, Denver, Colorado 80206

(Name and address of agent for service)

Registrant's telephone number, including area code: 303-333-3863

Date of fiscal year end: 6/30

Date of reporting period: 6/30/17

Item 1 - Reports to Shareholders

ANNUAL REPORT June 30, 2017 | |||

Janus Henderson Adaptive Global Allocation Fund (formerly named Janus Adaptive Global Allocation Fund) | |||

Janus Investment Fund | |||

| |||

HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund performance, characteristics | |||

| |||

Table of Contents

Janus Henderson Adaptive Global Allocation Fund

Janus Henderson Adaptive Global Allocation Fund (unaudited)

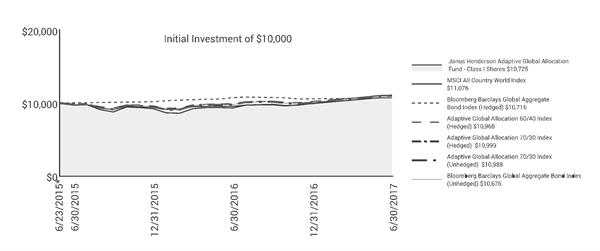

PERFORMANCE OVERVIEW

Janus Henderson Adaptive Global Allocation Fund Class I Shares returned 12.42% for the 12-month period ended June 30, 2017. This compares with a return of 18.78% for its primary benchmark, the MSCI All Country World Index. The Fund’s secondary benchmark, the Adaptive Global Allocation 60-40 Index, an internally calculated index comprised of the MSCI All Country World Index (60%) and the Bloomberg Barclays Global Aggregate Bond Index (40%), returned 10.75%. Its tertiary benchmark, the Bloomberg Barclays Global Aggregate Bond Index, returned -0.41%.

MARKET ENVIRONMENT

Risk assets rallied over the period, driven by improving optimism on the potential for synchronized global growth, a scenario that had proven elusive in the years since the Global Financial Crisis. Most global stock indices traded in a narrow range for the first part of the period. An inflection point was reached after the election of Donald Trump to the U.S. presidency, as investors priced in a pro-growth agenda. The exception was emerging markets, which sold off in the election’s aftermath. Once immediate concerns about rising protectionism subsided, however, shares in those markets experienced their own rally and finished up for the period. European stocks rose as well, although investors exercised caution during France’s election cycle. The ascendency of Emmanuel Macron to the country’s presidency appeared to quell the tide of populism roiling the continent, which, in turn sent regional indices higher. In the aftermath, Germany’s blue chip benchmark hit a record high, as did many U.S. indices in the period’s closing weeks.

Segments of global fixed income markets diverged at first as a pro-growth bias and the expectation of interest rate hikes by the Federal Reserve (Fed) sent yields on safe-haven U.S. Treasurys higher. After cresting above 2.6% in March, the yield on the 10-year note slid over much of the remainder of the period as investors lowered their expectation for regulatory and tax reforms. The yield on the 2-year note rose over the entirety of the period as that segment of the curve tends to be more sensitive to rate hikes, which occurred three times during the period. Investment-grade corporate credits initially generated negative returns but later rallied as spreads on U.S. credits tightened to 109 basis points (bps) by period end. The higher risk high-yield segment of corporates performed well over the whole period, with spreads dipping 230 bps, finishing June at 364 bps. Benchmark crude oil rose to as high as $56 per barrel but fell by roughly 20% over the period’s final months. After rising early on, the value of the U.S. dollar as measured by a widely followed index based on six currencies finished slightly in the red.

PERFORMANCE DISCUSSION

For the period, the Fund underperformed its primary benchmark, the MSCI All Country World Index, due, in part, to its equity underweighting over the full period. However, it outperformed its secondary and tertiary benchmarks: the Adaptive Global Allocation 60-40 Index and the Bloomberg Barclays Global Aggregate Bond Index. During the period, riskier assets, including global equities, generated strong returns as both economic drivers and corporate performance proved favorable.

We believe that compound returns are most affected by tail risks, not average returns. For that key reason, the Fund’s focus is on mitigating drawdowns while capturing upside opportunities. Our proprietary technology garners information constantly from the options markets, and we view their implied estimates of tail risk as robust and reliable indicators of future risk. The strategy sees these indicators as extremely useful in dynamically managing the risk of an investment in order to enhance compound returns. While the Fund dynamically allocates to equities, at any time, equity weightings could vary. The typical average equity weight is less than 100% .Thus, the Fund

Janus Investment Fund | 1 |

Janus Henderson Adaptive Global Allocation Fund (unaudited)

may underperform during a period of consistently strong equity performance.

We view investment risk as having two components: drawdown risk and upside risk. Of course, while compound returns are most affected by drawdowns (left tail risk), we believe that not participating in upside opportunities (right tail risk) is also risky. During the full year, investors wrestled with both types of risks. Globally – although the balance sheets of central banks have exploded from a “mere” $3 trillion in 2000 to $19 trillion currently – global growth remains subdued. In the case of the European Central Bank (ECB), it remains the largest single buyer of debt issued by major eurozone countries (e.g., Germany 17%, France 14% and Italy 12%). The question is: when the ECB slows or – stops – buying, where will the demand for sovereign debt come from?

On the other side of the Atlantic, the Federal Reserve (Fed) increased its benchmark rate three times in the last eight months and announced that it will begin to reduce its $4.0 trillion balance sheet later this year. Whether the unwinding can be accomplished in a smooth way is an open question. As important, against tightening monetary conditions, the potential for sudden, intensifying instability in the fixed income markets (and spillover effect on the equity markets) during the second half of 2017 and beyond can’t be ignored.

With regard to equities, the appetite for this higher-risk asset class remained strong during the full year. Indeed, equities surprised to the upside.

That said, the earlier market confidence in the Trump administration to quickly pass promised reforms seems to be diminishing. In addition, stretched equity valuations, as well as the fact that a small number of stocks explain much of the equity returns year to date, could restrain investors’ appetite in equities in the coming year.

During the period, with the aim of hedging certain exposures, the Fund used a series of derivative instruments including options, futures, swaps and forward exchange contracts. Since many of the derivatives we use, namely futures and certain options, are liquid, the Fund utilizes them as low-cost instruments to dynamically adjust exposures to desired targets. Other derivatives, including swaps and forward contracts, are also used to adjust portfolio exposures as conditions merit in a timely and/or cost-effective manner. This may lead to short positions in futures when exposures need to be adjusted downward. For the period, the Fund’s derivative exposure contributed to performance.

Please see the Derivative Instruments section in the “Notes to Financial Statements” for a discussion of derivatives used by the Fund

OUTLOOK

The Fund is designed to operate at a level of risk consistent with the long-term average downside risk of a 60/40 portfolio. If the risk in markets today is much higher than average, then the Fund allocations will be adjusted away from 60/40 to an allocation that seeks to provide the targeted risk level.

While our signals over the past year consistently pointed to equities as being attractive, in the period’s closing weeks, our proprietary options-based tail risk model signals no compelling opportunities across asset classes with none offering large upside potential. The trade-off between the level of expected upside risk versus the level of expected downside risk is not particularly attractive for equities or any other asset class. However, on the bright side, we also do not see significant downside risk to stocks, suggesting that we aren’t near a left-tail tipping point just yet.

Thank you for investing in Janus Henderson Adaptive Global Allocation Fund.

2 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund (unaudited)

Fund At A Glance

June 30, 2017

5 Largest Equity Holdings - (% of Net Assets) | |

Vanguard FTSE Emerging Markets | |

Exchange-Traded Funds (ETFs) | 7.2% |

Vanguard Small-Cap | |

Exchange-Traded Funds (ETFs) | 4.4% |

iShares Core FTSE 100 UCITS GBP Dist | |

Exchange-Traded Funds (ETFs) | 4.0% |

Vanguard FTSE All World ex-US Small-Cap | |

Exchange-Traded Funds (ETFs) | 3.5% |

Vanguard Value | |

Exchange-Traded Funds (ETFs) | 3.4% |

22.5% | |

Asset Allocation - (% of Net Assets) | |||||

Investment Companies | 69.5% | ||||

Common Stocks | 29.9% | ||||

U.S. Government Agency Notes | 2.3% | ||||

Preferred Stocks | 0.1% | ||||

Other | (1.8)% | ||||

100.0% | |||||

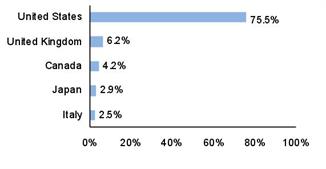

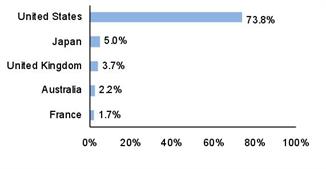

Top Country Allocations - Long Positions - (% of Investment Securities) | |

As of June 30, 2017

| As of June 30, 2016

|

Janus Investment Fund | 3 |

Janus Henderson Adaptive Global Allocation Fund (unaudited)

Performance

See important disclosures on the next page. |

| Expense Ratios - | |||||||

Average Annual Total Return - for the periods ended June 30, 2017 |

|

| per the October 28, 2016 prospectuses | |||||

|

| One | Since |

|

| Total Annual Fund | Net Annual Fund | |

Class A Shares at NAV |

| 12.17% | 3.26% |

|

| 1.65% | 1.17% | |

Class A Shares at MOP |

| 5.71% | 0.27% |

|

|

|

| |

Class C Shares at NAV | 11.21% | 2.46% |

|

| 2.40% | 1.92% | ||

Class C Shares at CDSC |

| 10.21% | 2.46% |

|

|

|

| |

Class D Shares(1) |

| 12.13% | 3.25% |

|

| 2.70% | 1.19% | |

Class I Shares |

| 12.42% | 3.53% |

|

| 1.39% | 0.92% | |

Class N Shares |

| 12.43% | 3.53% |

|

| 1.38% | 0.92% | |

Class S Shares |

| 11.95% | 3.08% |

|

| 1.89% | 1.42% | |

Class T Shares |

| 12.17% | 3.33% |

|

| 1.64% | 1.17% | |

MSCI All Country World Index(2) |

| 18.78% | 5.19% |

|

|

|

| |

Bloomberg Barclays Global Aggregate Bond Index (Hedged) |

| -0.41% | 3.48% |

|

|

|

| |

Adaptive Global Allocation 60/40 Index (Hedged) |

| 10.75% | 4.68% |

|

|

|

| |

Adaptive Global Allocation 70/30 Index (Hedged) |

| 12.71% | 4.83% |

|

|

|

| |

Adaptive Global Allocation 70/30 Index (Unhedged)(3) |

| 12.13% | 4.77% |

|

|

|

| |

Bloomberg Barclays Global Aggregate Bond Index (Unhedged)(3) |

| -2.18% | 3.29% |

|

|

|

| |

Morningstar Quartile - Class I Shares |

| 2nd | 2nd |

|

|

|

| |

Morningstar Ranking - based on total returns for World Allocation Funds |

| 128/493 | 170/473 |

|

|

|

| |

4 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund (unaudited)

Performance

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 800.668.0434 (or 800.525.3713 if you hold shares directly with Janus Henderson) or visit janushenderson.com/performance (or janushenderson.com/allfunds if you hold shares directly with Janus Henderson).

Maximum Offering Price (MOP) returns include the maximum sales charge of 5.75%. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

CDSC returns include a 1% contingent deferred sales charge (CDSC) on Shares redeemed within 12 months of purchase. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

The expense ratios shown are estimated.

Performance may be affected by risks that include those associated with non-diversification, portfolio turnover, short sales, potential conflicts of interest, foreign and emerging markets, initial public offerings (IPOs), high-yield and high-risk securities, undervalued, overlooked and smaller capitalization companies, real estate related securities including Real Estate Investment Trusts (REITs), derivatives, and commodity-linked investments. Each product has different risks. Please see the prospectus for more information about risks, holdings and other details.

Janus Capital Management does not have prior experience managing an adaptive global allocation investment strategy. There is a risk that the Fund’s investments will correlate with stocks and bonds to a greater degree than anticipated, and that the proprietary options implied information model used to implement the Fund's investment strategy may not achieve the desired results. The Fund may underperform during up markets and be negatively affected in down markets. Diversification does not assure a profit or eliminate the risk of loss.

See Financial Highlights for actual expense ratios during the reporting period.

Until the earlier of three years from inception or the Fund’s assets meeting the first fee breakpoint, expenses previously waived or reimbursed may be recovered if the expense ratio falls below certain limits.

Ranking is for the share class shown only; other classes may have different performance characteristics. When an expense waiver is in effect, it may have a material effect on the total return or yield, and therefore the ranking for the period.

© 2017 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

See “Useful Information About Your Fund Report.”

*The Fund’s inception date – June 23, 2015

(1) Closed to certain new investors.

(2) Effective on or about January 1, 2017, the Fund’s investment strategies and benchmark indices changed. These changes are intended to provide the Fund with more flexibility to invest across global equity investments and global fixed-income investments and at times, invest in commodity-linked investments, without having to allocate its investments across these asset classes in any fixed proportion. In addition, these changes limit the Fund’s use of derivatives. The changes to the Fund's benchmark indices are summarized below:

· The Fund’s primary benchmark changed from the Adaptive Global Allocation 70/30 Index to the MSCI All Country World Index.

· The Adaptive Global Allocation 60/40 Index was added as a secondary benchmark for the Fund.

· The Fund will continue to retain the Bloomberg Barclays Global Aggregate Bond Index as an additional secondary benchmark.

(3) The Fund’s primary and secondary benchmarks changed to reflect the hedged, rather than unhedged, version of the Bloomberg Barclays Global Aggregate Bond Index. This change was intended to provide a more appropriate comparison for the Fund.

Janus Investment Fund | 5 |

Janus Henderson Adaptive Global Allocation Fund (unaudited)

Expense Examples

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as sales charges (loads) on purchase payments (applicable to Class A Shares only); and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in any share class or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. These fees are fully described in the Fund’s prospectuses. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Actual | Hypothetical | |||||||||

| Beginning | Ending | Expenses |

| Beginning | Ending | Expenses | Net Annualized | ||

Class A Shares | $1,000.00 | $1,082.10 | $5.42 |

| $1,000.00 | $1,019.59 | $5.26 | 1.05% | ||

Class C Shares | $1,000.00 | $1,077.10 | $9.27 |

| $1,000.00 | $1,015.87 | $9.00 | 1.80% | ||

Class D Shares | $1,000.00 | $1,081.00 | $4.75 |

| $1,000.00 | $1,020.23 | $4.61 | 0.92% | ||

Class I Shares | $1,000.00 | $1,083.00 | $4.08 |

| $1,000.00 | $1,020.88 | $3.96 | 0.79% | ||

Class N Shares | $1,000.00 | $1,083.00 | $4.08 |

| $1,000.00 | $1,020.88 | $3.96 | 0.79% | ||

Class S Shares | $1,000.00 | $1,080.00 | $5.98 |

| $1,000.00 | $1,019.04 | $5.81 | 1.16% | ||

Class T Shares | $1,000.00 | $1,082.10 | $4.75 |

| $1,000.00 | $1,020.23 | $4.61 | 0.92% | ||

† | Expenses Paid During Period are equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Fund’s prospectuses for more information regarding waivers and/or reimbursements. | |||||||||

6 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – 29.9% | |||||||

Aerospace & Defense – 0.3% | |||||||

Arconic Inc | .281 | $6,365 | |||||

Meggitt PLC | 2,631 | 16,339 | |||||

Northrop Grumman Corp | 38 | 9,755 | |||||

Raytheon Co | 247 | 39,886 | |||||

Rockwell Collins Inc | 140 | 14,711 | |||||

Textron Inc | 946 | 44,557 | |||||

Thales SA | 38 | 4,090 | |||||

Zodiac Aerospace | 2,545 | 69,027 | |||||

204,730 | |||||||

Air Freight & Logistics – 0.1% | |||||||

Bollore SA | 492 | 2,237 | |||||

Deutsche Post AG | 237 | 8,883 | |||||

Expeditors International of Washington Inc | 585 | 33,041 | |||||

FedEx Corp | 48 | 10,432 | |||||

Yamato Holdings Co Ltd | 300 | 6,078 | |||||

60,671 | |||||||

Airlines – 0.1% | |||||||

Alaska Air Group Inc | 151 | 13,554 | |||||

American Airlines Group Inc | 191 | 9,611 | |||||

Delta Air Lines Inc | 196 | 10,533 | |||||

Deutsche Lufthansa AG | 272 | 6,189 | |||||

International Consolidated Airlines Group SA | 211 | 1,674 | |||||

Japan Airlines Co Ltd | 300 | 9,267 | |||||

Southwest Airlines Co | 281 | 17,461 | |||||

United Continental Holdings Inc* | 199 | 14,975 | |||||

83,264 | |||||||

Auto Components – 0.2% | |||||||

Aisin Seiki Co Ltd | 200 | 10,226 | |||||

Bridgestone Corp | 100 | 4,304 | |||||

Continental AG | 81 | 17,478 | |||||

Denso Corp | 100 | 4,217 | |||||

GKN PLC | 11,651 | 49,461 | |||||

NGK Spark Plug Co Ltd | 300 | 6,373 | |||||

NOK Corp | 200 | 4,222 | |||||

Sumitomo Electric Industries Ltd | 200 | 3,077 | |||||

Yokohama Rubber Co Ltd | 100 | 2,005 | |||||

101,363 | |||||||

Automobiles – 0.1% | |||||||

Fiat Chrysler Automobiles NV* | 59 | 622 | |||||

General Motors Co | 507 | 17,710 | |||||

Isuzu Motors Ltd | 200 | 2,465 | |||||

Mitsubishi Motors Corp | 700 | 4,606 | |||||

Renault SA | 181 | 16,381 | |||||

Subaru Corp | 100 | 3,367 | |||||

Toyota Motor Corp | 500 | 26,200 | |||||

Yamaha Motor Co Ltd | 200 | 5,154 | |||||

76,505 | |||||||

Banks – 0.6% | |||||||

ABN AMRO Group NV | 26 | 689 | |||||

Aozora Bank Ltd | 1,000 | 3,806 | |||||

Banco de Sabadell SA | 12,887 | 26,181 | |||||

Bank of America Corp | 1,242 | 30,131 | |||||

Bank of East Asia Ltd | 2,000 | 8,595 | |||||

Bankinter SA | 3,860 | 35,551 | |||||

CaixaBank SA | 1,427 | 6,812 | |||||

Comerica Inc | 150 | 10,986 | |||||

Concordia Financial Group Ltd | 100 | 504 | |||||

DBS Group Holdings Ltd | 600 | 9,041 | |||||

Erste Group Bank AG* | 31 | 1,187 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 7 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Banks – (continued) | |||||||

Fukuoka Financial Group Inc | .1,000 | $4,748 | |||||

Hachijuni Bank Ltd | 300 | 1,902 | |||||

Hang Seng Bank Ltd | 500 | 10,458 | |||||

Intesa Sanpaolo SpA | 5,001 | 14,826 | |||||

KeyCorp | 1,750 | 32,795 | |||||

Kyushu Financial Group Inc | 200 | 1,261 | |||||

Lloyds Banking Group PLC | 30,828 | 26,555 | |||||

Mebuki Financial Group Inc | 500 | 1,858 | |||||

Mediobanca SpA | 806 | 7,953 | |||||

Mitsubishi UFJ Financial Group Inc | 2,000 | 13,423 | |||||

Mizuho Financial Group Inc | 6,100 | 11,141 | |||||

Nordea Bank AB | 97 | 1,235 | |||||

Oversea-Chinese Banking Corp Ltd | 1,100 | 8,623 | |||||

People's United Financial Inc | 496 | 8,759 | |||||

Raiffeisen Bank International AG* | 700 | 17,667 | |||||

Resona Holdings Inc | 2,200 | 12,099 | |||||

Seven Bank Ltd | 1,100 | 3,932 | |||||

Sumitomo Mitsui Financial Group Inc | 400 | 15,575 | |||||

Sumitomo Mitsui Trust Holdings Inc | 300 | 10,721 | |||||

Wells Fargo & Co | 65 | 3,602 | |||||

Zions Bancorporation | 140 | 6,147 | |||||

348,763 | |||||||

Beverages – 0.7% | |||||||

Anheuser-Busch InBev SA/NV | 94 | 10,382 | |||||

Asahi Group Holdings Ltd | 300 | 11,279 | |||||

Brown-Forman Corp | 1,619 | 78,683 | |||||

Coca-Cola Co | 1,821 | 81,672 | |||||

Dr Pepper Snapple Group Inc | 492 | 44,826 | |||||

Kirin Holdings Co Ltd | 400 | 8,142 | |||||

PepsiCo Inc | 1,469 | 169,655 | |||||

Pernod Ricard SA | 40 | 5,356 | |||||

409,995 | |||||||

Biotechnology – 0.5% | |||||||

AbbVie Inc | 111 | 8,049 | |||||

Alexion Pharmaceuticals Inc* | 88 | 10,707 | |||||

Biogen Inc* | 116 | 31,478 | |||||

Celgene Corp* | 75 | 9,740 | |||||

Gilead Sciences Inc | 1,253 | 88,687 | |||||

Grifols SA | 3,583 | 99,778 | |||||

Incyte Corp* | 66 | 8,310 | |||||

Regeneron Pharmaceuticals Inc* | 8 | 3,929 | |||||

Shire PLC | 776 | 42,825 | |||||

303,503 | |||||||

Building Products – 0.2% | |||||||

Allegion PLC | 201 | 16,305 | |||||

Asahi Glass Co Ltd | 800 | 33,648 | |||||

Daikin Industries Ltd | 300 | 30,598 | |||||

Fortune Brands Home & Security Inc | 213 | 13,896 | |||||

LIXIL Group Corp | 300 | 7,493 | |||||

Masco Corp | 34 | 1,299 | |||||

103,239 | |||||||

Capital Markets – 0.8% | |||||||

3i Group PLC | 3,497 | 41,098 | |||||

Affiliated Managers Group Inc | 112 | 18,576 | |||||

Bank of New York Mellon Corp | 1,831 | 93,418 | |||||

CBOE Holdings Inc | 103 | 9,414 | |||||

Daiwa Securities Group Inc | 1,000 | 5,920 | |||||

Deutsche Boerse AG | 86 | 9,077 | |||||

E*TRADE Financial Corp* | 452 | 17,190 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

8 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Capital Markets – (continued) | |||||||

Goldman Sachs Group Inc | .126 | $27,959 | |||||

Hong Kong Exchanges & Clearing Ltd | 1,500 | 38,772 | |||||

Investec PLC | 1,964 | 14,667 | |||||

London Stock Exchange Group PLC | 1,777 | 84,369 | |||||

Nasdaq Inc | 480 | 34,315 | |||||

Nomura Holdings Inc | 600 | 3,593 | |||||

Northern Trust Corp | 48 | 4,666 | |||||

Partners Group Holding AG | 15 | 9,303 | |||||

S&P Global Inc | 109 | 15,913 | |||||

SBI Holdings Inc/Japan | 800 | 10,827 | |||||

Schroders PLC | 356 | 14,390 | |||||

Singapore Exchange Ltd | 3,700 | 19,731 | |||||

Thomson Reuters Corp | 666 | 30,840 | |||||

504,038 | |||||||

Chemicals – 1.1% | |||||||

Air Products & Chemicals Inc | 123 | 17,596 | |||||

Air Water Inc | 100 | 1,835 | |||||

Akzo Nobel NV | 969 | 84,201 | |||||

Albemarle Corp | 145 | 15,303 | |||||

Arkema SA | 99 | 10,563 | |||||

Asahi Kasei Corp | 1,000 | 10,737 | |||||

CF Industries Holdings Inc | 160 | 4,474 | |||||

Covestro AG | 133 | 9,601 | |||||

Eastman Chemical Co | 270 | 22,677 | |||||

Ecolab Inc | 170 | 22,568 | |||||

EMS-Chemie Holding AG | 21 | 15,488 | |||||

Evonik Industries AG | 988 | 31,575 | |||||

FMC Corp | 177 | 12,930 | |||||

Givaudan SA | 7 | 14,006 | |||||

International Flavors & Fragrances Inc | 235 | 31,725 | |||||

Johnson Matthey PLC | 1,381 | 51,630 | |||||

JSR Corp | 100 | 1,722 | |||||

K+S AG | 2,064 | 52,846 | |||||

Kansai Paint Co Ltd | 100 | 2,299 | |||||

Koninklijke DSM NV | 736 | 53,490 | |||||

Kuraray Co Ltd | 400 | 7,249 | |||||

LANXESS AG | 303 | 22,938 | |||||

LyondellBasell Industries NV | 85 | 7,173 | |||||

Mitsubishi Chemical Holdings Corp | 800 | 6,616 | |||||

Mitsubishi Gas Chemical Co Inc | 100 | 2,112 | |||||

Mitsui Chemicals Inc | 2,000 | 10,582 | |||||

Mosaic Co | 324 | 7,397 | |||||

Nissan Chemical Industries Ltd | 100 | 3,299 | |||||

Nitto Denko Corp | 100 | 8,216 | |||||

Potash Corp of Saskatchewan Inc | 1,169 | 19,069 | |||||

Praxair Inc | 290 | 38,440 | |||||

Sherwin-Williams Co | 65 | 22,812 | |||||

Shin-Etsu Chemical Co Ltd | 100 | 9,057 | |||||

Sika AG | 3 | 19,278 | |||||

Sumitomo Chemical Co Ltd | 1,000 | 5,744 | |||||

Symrise AG | 205 | 14,519 | |||||

Toray Industries Inc | 1,700 | 14,214 | |||||

685,981 | |||||||

Commercial Services & Supplies – 0.3% | |||||||

Babcock International Group PLC | 342 | 3,921 | |||||

Cintas Corp | 102 | 12,856 | |||||

Dai Nippon Printing Co Ltd | 1,000 | 11,097 | |||||

Edenred | 200 | 5,214 | |||||

G4S PLC | 1,987 | 8,446 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 9 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Commercial Services & Supplies – (continued) | |||||||

Republic Services Inc | .1,305 | $83,168 | |||||

Secom Co Ltd | 200 | 15,161 | |||||

Securitas AB | 368 | 6,205 | |||||

Sohgo Security Services Co Ltd | 100 | 4,499 | |||||

Stericycle Inc* | 265 | 20,225 | |||||

Toppan Printing Co Ltd | 1,000 | 10,955 | |||||

Waste Management Inc | 164 | 12,029 | |||||

193,776 | |||||||

Communications Equipment – 0.2% | |||||||

Harris Corp | 278 | 30,324 | |||||

Juniper Networks Inc | 2,181 | 60,806 | |||||

Motorola Solutions Inc | 16 | 1,388 | |||||

Nokia OYJ | 3,112 | 19,031 | |||||

Telefonaktiebolaget LM Ericsson | 3,995 | 28,582 | |||||

140,131 | |||||||

Construction & Engineering – 0.1% | |||||||

Boskalis Westminster | 322 | 10,456 | |||||

Bouygues SA | 217 | 9,149 | |||||

Ferrovial SA | 390 | 8,656 | |||||

HOCHTIEF AG | 59 | 10,807 | |||||

JGC Corp | 400 | 6,481 | |||||

Obayashi Corp | 1,000 | 11,746 | |||||

Quanta Services Inc* | 213 | 7,012 | |||||

Shimizu Corp | 1,000 | 10,590 | |||||

Taisei Corp | 1,000 | 9,123 | |||||

84,020 | |||||||

Construction Materials – 0% | |||||||

James Hardie Industries PLC (CDI) | 170 | 2,678 | |||||

Martin Marietta Materials Inc | 32 | 7,123 | |||||

Vulcan Materials Co | 79 | 10,008 | |||||

19,809 | |||||||

Consumer Finance – 0.2% | |||||||

AEON Financial Service Co Ltd | 100 | 2,115 | |||||

American Express Co | 842 | 70,930 | |||||

Credit Saison Co Ltd | 600 | 11,706 | |||||

Synchrony Financial | 1,208 | 36,023 | |||||

120,774 | |||||||

Containers & Packaging – 0.3% | |||||||

Avery Dennison Corp | 654 | 57,794 | |||||

Ball Corp | 1,018 | 42,970 | |||||

CCL Industries Inc | 449 | 22,720 | |||||

International Paper Co | 475 | 26,890 | |||||

Sealed Air Corp | 489 | 21,888 | |||||

Toyo Seikan Group Holdings Ltd | 800 | 13,487 | |||||

WestRock Co | 339 | 19,208 | |||||

204,957 | |||||||

Distributors – 0.1% | |||||||

Jardine Cycle & Carriage Ltd | 100 | 3,222 | |||||

LKQ Corp* | 1,033 | 34,037 | |||||

37,259 | |||||||

Diversified Consumer Services – 0% | |||||||

H&R Block Inc | 288 | 8,902 | |||||

Diversified Financial Services – 0.1% | |||||||

Challenger Ltd/Australia | 896 | 9,184 | |||||

First Pacific Co Ltd/Hong Kong | 6,000 | 4,427 | |||||

Mitsubishi UFJ Lease & Finance Co Ltd | 100 | 546 | |||||

Onex Corp | 464 | 37,149 | |||||

ORIX Corp | 700 | 10,831 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

10 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Diversified Financial Services – (continued) | |||||||

Wendel SA | .67 | $9,916 | |||||

72,053 | |||||||

Diversified Telecommunication Services – 0.7% | |||||||

AT&T Inc | 938 | 35,391 | |||||

BCE Inc | 65 | 2,928 | |||||

BT Group PLC | 8,422 | 32,326 | |||||

CenturyLink Inc | 1,274 | 30,423 | |||||

Deutsche Telekom AG | 1,581 | 28,382 | |||||

Elisa OYJ | 137 | 5,308 | |||||

HKT Trust & HKT Ltd | 13,000 | 17,051 | |||||

Koninklijke KPN NV | 6,787 | 21,710 | |||||

Nippon Telegraph & Telephone Corp | 900 | 42,495 | |||||

PCCW Ltd | 30,000 | 17,061 | |||||

Singapore Telecommunications Ltd | 14,700 | 41,545 | |||||

Swisscom AG | 45 | 21,721 | |||||

Telefonica Deutschland Holding AG | 2,144 | 10,707 | |||||

Telia Co AB | 7,592 | 34,971 | |||||

TELUS Corp | 347 | 11,981 | |||||

TPG Telecom Ltd | 1,348 | 5,904 | |||||

Verizon Communications Inc | 1,230 | 54,932 | |||||

414,836 | |||||||

Electric Utilities – 0.7% | |||||||

AusNet Services | 3,084 | 4,111 | |||||

Chubu Electric Power Co Inc | 300 | 3,981 | |||||

Chugoku Electric Power Co Inc | 300 | 3,305 | |||||

CLP Holdings Ltd | 3,000 | 31,740 | |||||

Duke Energy Corp | 188 | 15,715 | |||||

Electricite de France SA | 545 | 5,901 | |||||

Emera Inc | 24 | 892 | |||||

Eversource Energy | 253 | 15,360 | |||||

FirstEnergy Corp | 332 | 9,681 | |||||

Fortum OYJ | 302 | 4,735 | |||||

Hydro One Ltd | 6,505 | 116,544 | |||||

Iberdrola SA | 2,464 | 19,509 | |||||

Kansai Electric Power Co Inc | 400 | 5,502 | |||||

Pinnacle West Capital Corp | 59 | 5,024 | |||||

Power Assets Holdings Ltd | 2,000 | 17,663 | |||||

PPL Corp | 1,093 | 42,255 | |||||

Red Electrica Corp SA | 2,089 | 43,645 | |||||

Southern Co | 205 | 9,815 | |||||

SSE PLC | 858 | 16,234 | |||||

Tohoku Electric Power Co Inc | 1,400 | 19,358 | |||||

Tokyo Electric Power Co Holdings Inc* | 300 | 1,235 | |||||

Xcel Energy Inc | 73 | 3,349 | |||||

395,554 | |||||||

Electrical Equipment – 0.1% | |||||||

AMETEK Inc | 364 | 22,047 | |||||

Fuji Electric Co Ltd | 1,000 | 5,264 | |||||

Nidec Corp | 100 | 10,235 | |||||

OSRAM Licht AG | 188 | 14,975 | |||||

Rockwell Automation Inc | 41 | 6,640 | |||||

59,161 | |||||||

Electronic Equipment, Instruments & Components – 0.6% | |||||||

Alps Electric Co Ltd | 100 | 2,881 | |||||

Amphenol Corp | 1,827 | 134,869 | |||||

FLIR Systems Inc | 2,181 | 75,593 | |||||

Hexagon AB | 1,048 | 49,841 | |||||

Hirose Electric Co Ltd | 100 | 14,245 | |||||

Hitachi High-Technologies Corp | 300 | 11,631 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 11 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Electronic Equipment, Instruments & Components – (continued) | |||||||

Hitachi Ltd | .1,000 | $6,130 | |||||

Kyocera Corp | 200 | 11,570 | |||||

Omron Corp | 200 | 8,670 | |||||

Shimadzu Corp | 200 | 3,802 | |||||

TDK Corp | 100 | 6,571 | |||||

TE Connectivity Ltd | 413 | 32,495 | |||||

Yaskawa Electric Corp | 200 | 4,234 | |||||

Yokogawa Electric Corp | 400 | 6,406 | |||||

368,938 | |||||||

Energy Equipment & Services – 0.4% | |||||||

Baker Hughes Inc | 977 | 53,256 | |||||

Halliburton Co | 1,465 | 62,570 | |||||

Helmerich & Payne Inc | 211 | 11,466 | |||||

National Oilwell Varco Inc | 876 | 28,855 | |||||

Petrofac Ltd | 1,341 | 7,718 | |||||

Saipem SpA* | 3,231 | 11,933 | |||||

Schlumberger Ltd | 1,335 | 87,896 | |||||

Tenaris SA | 403 | 6,282 | |||||

269,976 | |||||||

Equity Real Estate Investment Trusts (REITs) – 0.5% | |||||||

Alexandria Real Estate Equities Inc | 112 | 13,493 | |||||

Apartment Investment & Management Co | 147 | 6,317 | |||||

Ascendas Real Estate Investment Trust | 600 | 1,138 | |||||

Boston Properties Inc | 9 | 1,107 | |||||

British Land Co PLC | 202 | 1,593 | |||||

CapitaLand Mall Trust | 4,400 | 6,314 | |||||

Crown Castle International Corp | 234 | 23,442 | |||||

Daiwa House REIT Investment Corp | 4 | 9,493 | |||||

Dexus | 1,227 | 8,938 | |||||

Digital Realty Trust Inc | 68 | 7,681 | |||||

Equity Residential | 209 | 13,758 | |||||

Essex Property Trust Inc | 39 | 10,034 | |||||

Federal Realty Investment Trust | 53 | 6,699 | |||||

Fonciere Des Regions | 46 | 4,267 | |||||

H&R Real Estate Investment Trust | 897 | 15,234 | |||||

Hammerson PLC | 224 | 1,676 | |||||

Host Hotels & Resorts Inc | 83 | 1,516 | |||||

Iron Mountain Inc | 425 | 14,603 | |||||

Japan Prime Realty Investment Corp | 4 | 13,854 | |||||

Japan Real Estate Investment Corp | 2 | 9,941 | |||||

Klepierre | 74 | 3,033 | |||||

Land Securities Group PLC | 243 | 3,205 | |||||

Macerich Co | 149 | 8,651 | |||||

Mid-America Apartment Communities Inc | 104 | 10,960 | |||||

Nippon Building Fund Inc | 2 | 10,208 | |||||

Nippon Prologis REIT Inc | 1 | 2,129 | |||||

Prologis Inc | 207 | 12,138 | |||||

Regency Centers Corp | 143 | 8,958 | |||||

Simon Property Group Inc | 19 | 3,073 | |||||

Suntec Real Estate Investment Trust | 2,500 | 3,397 | |||||

UDR Inc | 424 | 16,523 | |||||

Unibail-Rodamco SE | 4 | 1,008 | |||||

Ventas Inc | 20 | 1,390 | |||||

Vicinity Centres | 3,682 | 7,271 | |||||

Welltower Inc | 28 | 2,096 | |||||

Weyerhaeuser Co | 480 | 16,080 | |||||

281,218 | |||||||

Food & Staples Retailing – 0.5% | |||||||

Aeon Co Ltd | 300 | 4,554 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

12 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Food & Staples Retailing – (continued) | |||||||

Alimentation Couche-Tard Inc | .140 | $6,712 | |||||

Carrefour SA | 508 | 12,850 | |||||

Colruyt SA | 569 | 29,972 | |||||

Costco Wholesale Corp | 315 | 50,378 | |||||

CVS Health Corp | 155 | 12,471 | |||||

FamilyMart UNY Holdings Co Ltd | 100 | 5,718 | |||||

George Weston Ltd | 201 | 18,198 | |||||

ICA Gruppen AB | 129 | 4,804 | |||||

Kroger Co | 1,264 | 29,476 | |||||

Lawson Inc | 100 | 6,989 | |||||

Loblaw Cos Ltd | 581 | 32,326 | |||||

METRO AG | 184 | 6,210 | |||||

Metro Inc | 1,032 | 33,970 | |||||

Seven & i Holdings Co Ltd | 200 | 8,230 | |||||

Tesco PLC* | 3,085 | 6,781 | |||||

Wal-Mart Stores Inc | 32 | 2,422 | |||||

Wesfarmers Ltd | 36 | 1,110 | |||||

Wm Morrison Supermarkets PLC | 5,259 | 16,518 | |||||

289,689 | |||||||

Food Products – 1.4% | |||||||

Ajinomoto Co Inc | 200 | 4,315 | |||||

Barry Callebaut AG* | 2 | 2,750 | |||||

Campbell Soup Co | 2,783 | 145,133 | |||||

Danone SA | 300 | 22,546 | |||||

General Mills Inc | 2,621 | 145,203 | |||||

Hershey Co | 709 | 76,125 | |||||

Hormel Foods Corp | 2,496 | 85,139 | |||||

JM Smucker Co | 661 | 78,216 | |||||

Kellogg Co | 1,694 | 117,665 | |||||

Kraft Heinz Co | 429 | 36,740 | |||||

McCormick & Co Inc/MD | 733 | 71,475 | |||||

Mondelez International Inc | 265 | 11,445 | |||||

Nisshin Seifun Group Inc | 700 | 11,484 | |||||

Tate & Lyle PLC | 2,241 | 19,319 | |||||

Tyson Foods Inc | 75 | 4,697 | |||||

WH Group Ltd | 6,000 | 6,056 | |||||

Wilmar International Ltd | 1,500 | 3,651 | |||||

841,959 | |||||||

Gas Utilities – 0.1% | |||||||

APA Group | 971 | 6,842 | |||||

Hong Kong & China Gas Co Ltd | 5,000 | 9,402 | |||||

Osaka Gas Co Ltd | 2,000 | 8,172 | |||||

Toho Gas Co Ltd | 1,000 | 7,274 | |||||

Tokyo Gas Co Ltd | 2,000 | 10,391 | |||||

42,081 | |||||||

Health Care Equipment & Supplies – 1.1% | |||||||

Abbott Laboratories | 681 | 33,103 | |||||

Align Technology Inc* | 58 | 8,707 | |||||

Becton Dickinson and Co | 102 | 19,901 | |||||

Boston Scientific Corp* | 768 | 21,289 | |||||

Cochlear Ltd | 37 | 4,420 | |||||

Cooper Cos Inc | 17 | 4,070 | |||||

CYBERDYNE Inc* | 500 | 6,647 | |||||

DENTSPLY SIRONA Inc | 1,237 | 80,207 | |||||

Edwards Lifesciences Corp* | 40 | 4,730 | |||||

Getinge AB | 3,122 | 61,134 | |||||

Hologic Inc* | 136 | 6,172 | |||||

Hoya Corp | 100 | 5,187 | |||||

Intuitive Surgical Inc* | 32 | 29,932 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 13 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Health Care Equipment & Supplies – (continued) | |||||||

Smith & Nephew PLC | .14,791 | $255,207 | |||||

Sonova Holding AG | 279 | 45,316 | |||||

Straumann Holding AG | 34 | 19,348 | |||||

Sysmex Corp | 200 | 11,933 | |||||

Terumo Corp | 600 | 23,608 | |||||

Varian Medical Systems Inc* | 134 | 13,827 | |||||

Zimmer Biomet Holdings Inc | 53 | 6,805 | |||||

661,543 | |||||||

Health Care Providers & Services – 0.8% | |||||||

Aetna Inc | 126 | 19,131 | |||||

Alfresa Holdings Corp | 100 | 1,927 | |||||

Cigna Corp | 19 | 3,180 | |||||

Fresenius Medical Care AG & Co KGaA | 1,012 | 97,275 | |||||

Fresenius SE & Co KGaA | 282 | 24,173 | |||||

Healthscope Ltd | 8,371 | 14,215 | |||||

Henry Schein Inc* | 225 | 41,180 | |||||

Humana Inc | 205 | 49,327 | |||||

Laboratory Corp of America Holdings* | 226 | 34,836 | |||||

Medipal Holdings Corp | 200 | 3,696 | |||||

Miraca Holdings Inc | 100 | 4,490 | |||||

| �� | Patterson Cos Inc | 1,316 | 61,786 | ||||

Quest Diagnostics Inc | 851 | 94,597 | |||||

Ramsay Health Care Ltd | 79 | 4,468 | |||||

Suzuken Co Ltd/Aichi Japan | 200 | 6,633 | |||||

Universal Health Services Inc | 81 | 9,888 | |||||

470,802 | |||||||

Health Care Technology – 0% | |||||||

M3 Inc | 300 | 8,256 | |||||

Hotels, Restaurants & Leisure – 0.5% | |||||||

Accor SA | 67 | 3,141 | |||||

Aristocrat Leisure Ltd | 150 | 2,600 | |||||

Carnival PLC | 167 | 11,047 | |||||

Chipotle Mexican Grill Inc* | 191 | 79,475 | |||||

Darden Restaurants Inc | 65 | 5,879 | |||||

Domino's Pizza Enterprises Ltd | 176 | 7,043 | |||||

Genting Singapore PLC | 6,500 | 5,124 | |||||

Hilton Worldwide Holdings Inc | 547 | 33,832 | |||||

InterContinental Hotels Group PLC | 461 | 25,615 | |||||

Marriott International Inc/MD | 63 | 6,320 | |||||

Merlin Entertainments PLC | 3,302 | 20,661 | |||||

MGM China Holdings Ltd | 2,800 | 6,226 | |||||

Oriental Land Co Ltd/Japan | 300 | 20,295 | |||||

Sands China Ltd | 3,600 | 16,485 | |||||

SJM Holdings Ltd | 2,000 | 2,108 | |||||

Wyndham Worldwide Corp | 245 | 24,600 | |||||

Wynn Macau Ltd | 1,600 | 3,738 | |||||

274,189 | |||||||

Household Durables – 0.7% | |||||||

Barratt Developments PLC | 2,202 | 16,158 | |||||

Leggett & Platt Inc | 3,144 | 165,154 | |||||

Mohawk Industries Inc* | 357 | 86,283 | |||||

Nikon Corp | 800 | 12,776 | |||||

Panasonic Corp | 700 | 9,486 | |||||

PulteGroup Inc | 524 | 12,854 | |||||

SEB SA | 47 | 8,440 | |||||

Sekisui House Ltd | 3,700 | 65,127 | |||||

Sony Corp | 300 | 11,433 | |||||

Whirlpool Corp | 117 | 22,420 | |||||

410,131 | |||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

14 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Household Products – 1.0% | |||||||

Church & Dwight Co Inc | .1,469 | $76,212 | |||||

Clorox Co | 603 | 80,344 | |||||

Colgate-Palmolive Co | 3,503 | 259,677 | |||||

Kimberly-Clark Corp | 1,074 | 138,664 | |||||

Procter & Gamble Co | 373 | 32,507 | |||||

Reckitt Benckiser Group PLC | 215 | 21,793 | |||||

Unicharm Corp | 200 | 5,019 | |||||

614,216 | |||||||

Independent Power and Renewable Electricity Producers – 0% | |||||||

AES Corp/VA | 973 | 10,810 | |||||

Electric Power Development Co Ltd | 400 | 9,881 | |||||

20,691 | |||||||

Industrial Conglomerates – 0.2% | |||||||

CK Hutchison Holdings Ltd | 6,000 | 75,315 | |||||

General Electric Co | 254 | 6,861 | |||||

Koninklijke Philips NV | 321 | 11,399 | |||||

93,575 | |||||||

Information Technology Services – 1.1% | |||||||

Accenture PLC | 746 | 92,265 | |||||

Alliance Data Systems Corp | 75 | 19,252 | |||||

Amadeus IT Group SA | 413 | 24,691 | |||||

Atos SE | 110 | 15,439 | |||||

Capgemini SE | 19 | 1,963 | |||||

CGI Group Inc* | 880 | 44,971 | |||||

Cognizant Technology Solutions Corp | 91 | 6,042 | |||||

CSRA Inc | 709 | 22,511 | |||||

Fidelity National Information Services Inc | 320 | 27,328 | |||||

Fujitsu Ltd | 1,000 | 7,361 | |||||

Gartner Inc* | 402 | 49,651 | |||||

Global Payments Inc | 482 | 43,534 | |||||

Nomura Research Institute Ltd | 300 | 11,804 | |||||

NTT Data Corp | 1,500 | 16,673 | |||||

Paychex Inc | 253 | 14,406 | |||||

PayPal Holdings Inc* | 975 | 52,328 | |||||

Total System Services Inc | 1,189 | 69,259 | |||||

Visa Inc | 1,209 | 113,380 | |||||

Xerox Corp | 1,078 | 30,971 | |||||

663,829 | |||||||

Insurance – 1.3% | |||||||

AIA Group Ltd | 1,000 | 7,307 | |||||

Aon PLC | 134 | 17,815 | |||||

Arthur J Gallagher & Co | 1,154 | 66,067 | |||||

Chubb Ltd | 252 | 36,636 | |||||

Cincinnati Financial Corp | 317 | 22,967 | |||||

Dai-ichi Life Holdings Inc | 300 | 5,406 | |||||

Everest Re Group Ltd | 167 | 42,517 | |||||

Gjensidige Forsikring ASA | 568 | 9,698 | |||||

Great-West Lifeco Inc | 137 | 3,714 | |||||

Hartford Financial Services Group Inc | 952 | 50,047 | |||||

Intact Financial Corp | 857 | 64,748 | |||||

Japan Post Holdings Co Ltd | 300 | 3,719 | |||||

Lincoln National Corp | 43 | 2,906 | |||||

Loews Corp | 1,224 | 57,295 | |||||

Mapfre SA | 14,076 | 49,157 | |||||

Medibank Pvt Ltd | 1,975 | 4,249 | |||||

MS&AD Insurance Group Holdings Inc | 100 | 3,356 | |||||

Old Mutual PLC | 3,007 | 7,573 | |||||

Poste Italiane SpA (144A) | 1,108 | 7,586 | |||||

Power Corp of Canada | 637 | 14,532 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 15 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Insurance – (continued) | |||||||

Progressive Corp | .478 | $21,075 | |||||

Prudential Financial Inc | 148 | 16,005 | |||||

QBE Insurance Group Ltd | 1,125 | 10,209 | |||||

RSA Insurance Group PLC | 5,126 | 41,085 | |||||

Sampo Oyj | 419 | 21,470 | |||||

Sompo Holdings Inc | 300 | 11,575 | |||||

Standard Life PLC | 6,449 | 33,516 | |||||

Swiss Life Holding AG* | 12 | 4,051 | |||||

T&D Holdings Inc | 400 | 6,080 | |||||

Tokio Marine Holdings Inc | 200 | 8,271 | |||||

Torchmark Corp | 913 | 69,845 | |||||

Travelers Cos Inc | 223 | 28,216 | |||||

UnipolSai Assicurazioni SpA | 10,463 | 22,834 | |||||

Willis Towers Watson PLC | 41 | 5,964 | |||||

777,491 | |||||||

Internet & Direct Marketing Retail – 0.4% | |||||||

Amazon.com Inc* | 104 | 100,672 | |||||

Expedia Inc | 122 | 18,172 | |||||

Netflix Inc* | 168 | 25,101 | |||||

Priceline Group Inc* | 27 | 50,504 | |||||

Rakuten Inc | 300 | 3,527 | |||||

Start Today Co Ltd | 200 | 4,917 | |||||

TripAdvisor Inc* | 330 | 12,606 | |||||

215,499 | |||||||

Internet Software & Services – 0.4% | |||||||

Alphabet Inc - Class A* | 66 | 61,359 | |||||

DeNA Co Ltd | 200 | 4,474 | |||||

eBay Inc* | 1,948 | 68,024 | |||||

Facebook Inc | 468 | 70,659 | |||||

Kakaku.com Inc | 600 | 8,606 | |||||

Mixi Inc | 100 | 5,558 | |||||

Shopify Inc* | 59 | 5,124 | |||||

United Internet AG | 321 | 17,649 | |||||

Yahoo Japan Corp | 2,800 | 12,175 | |||||

253,628 | |||||||

Leisure Products – 0.2% | |||||||

Hasbro Inc | 335 | 37,356 | |||||

Mattel Inc | 2,382 | 51,284 | |||||

Sega Sammy Holdings Inc | 100 | 1,344 | |||||

Yamaha Corp | 100 | 3,450 | |||||

93,434 | |||||||

Life Sciences Tools & Services – 0.3% | |||||||

Agilent Technologies Inc | 220 | 13,048 | |||||

Illumina Inc* | 54 | 9,370 | |||||

Lonza Group AG* | 135 | 29,194 | |||||

Mettler-Toledo International Inc* | 70 | 41,198 | |||||

PerkinElmer Inc | 760 | 51,786 | |||||

Waters Corp* | 134 | 24,635 | |||||

169,231 | |||||||

Machinery – 0.4% | |||||||

Alstom SA | 311 | 10,871 | |||||

ANDRITZ AG | 160 | 9,637 | |||||

Caterpillar Inc | 103 | 11,068 | |||||

Deere & Co | 95 | 11,741 | |||||

FANUC Corp | 100 | 19,256 | |||||

Fortive Corp | 408 | 25,847 | |||||

GEA Group AG | 335 | 13,707 | |||||

Hino Motors Ltd | 200 | 2,218 | |||||

IMI PLC | 287 | 4,466 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

16 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Machinery – (continued) | |||||||

JTEKT Corp | .400 | $5,840 | |||||

Komatsu Ltd | 100 | 2,538 | |||||

Kone OYJ | 178 | 9,054 | |||||

MAN SE | 358 | 38,377 | |||||

Metso OYJ | 243 | 8,425 | |||||

Mitsubishi Heavy Industries Ltd | 1,000 | 4,089 | |||||

NGK Insulators Ltd | 200 | 3,982 | |||||

THK Co Ltd | 200 | 5,655 | |||||

Wartsila OYJ Abp | 26 | 1,537 | |||||

Weir Group PLC | 337 | 7,596 | |||||

Xylem Inc/NY | 228 | 12,638 | |||||

Yangzijiang Shipbuilding Holdings Ltd | 6,700 | 5,793 | |||||

214,335 | |||||||

Media – 1.4% | |||||||

Axel Springer SE | 282 | 16,939 | |||||

CBS Corp | 393 | 25,066 | |||||

Charter Communications Inc* | 165 | 55,580 | |||||

Dentsu Inc | 100 | 4,775 | |||||

Discovery Communications Inc* | 3,722 | 96,139 | |||||

DISH Network Corp* | 533 | 33,451 | |||||

Eutelsat Communications SA | 667 | 17,032 | |||||

Hakuhodo DY Holdings Inc | 100 | 1,326 | |||||

Interpublic Group of Cos Inc | 2,995 | 73,677 | |||||

ITV PLC | 10,378 | 24,515 | |||||

News Corp | 4,938 | 67,651 | |||||

REA Group Ltd | 12 | 612 | |||||

Scripps Networks Interactive Inc | 1,320 | 90,169 | |||||

SES SA | 162 | 3,797 | |||||

Shaw Communications Inc | 3,727 | 81,318 | |||||

Telenet Group Holding NV* | 199 | 12,533 | |||||

Twenty-First Century Fox Inc - Class A | 344 | 9,749 | |||||

Vivendi SA | 1,463 | 32,563 | |||||

Walt Disney Co | 1,842 | 195,712 | |||||

WPP PLC | 189 | 3,972 | |||||

846,576 | |||||||

Metals & Mining – 0.6% | |||||||

Agnico Eagle Mines Ltd | 121 | 5,457 | |||||

Alumina Ltd | 1,892 | 2,791 | |||||

Anglo American PLC* | 324 | 4,320 | |||||

ArcelorMittal* | 756 | 17,146 | |||||

Barrick Gold Corp | 59 | 939 | |||||

BHP Billiton Ltd | 149 | 2,665 | |||||

BHP Billiton PLC | 2,069 | 31,684 | |||||

Boliden AB | 642 | 17,527 | |||||

Franco-Nevada Corp | 483 | 34,856 | |||||

Freeport-McMoRan Inc* | 514 | 6,173 | |||||

Glencore PLC* | 6,389 | 23,894 | |||||

Goldcorp Inc | 3,413 | 44,012 | |||||

JFE Holdings Inc | 300 | 5,203 | |||||

Kobe Steel Ltd* | 100 | 1,026 | |||||

Maruichi Steel Tube Ltd | 200 | 5,807 | |||||

Mitsubishi Materials Corp | 200 | 6,047 | |||||

Newmont Mining Corp | 1,638 | 53,055 | |||||

Nippon Steel & Sumitomo Metal Corp | 200 | 4,514 | |||||

Nucor Corp | 154 | 8,912 | |||||

Rio Tinto PLC | 432 | 18,238 | |||||

South32 Ltd | 2,362 | 4,864 | |||||

Sumitomo Metal Mining Co Ltd | 1,000 | 13,343 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 17 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Metals & Mining – (continued) | |||||||

thyssenkrupp AG | .1,075 | $30,538 | |||||

343,011 | |||||||

Multiline Retail – 0.4% | |||||||

Dollar General Corp | 307 | 22,132 | |||||

Dollar Tree Inc* | 209 | 14,613 | |||||

Dollarama Inc | 491 | 46,923 | |||||

Isetan Mitsukoshi Holdings Ltd | 300 | 3,004 | |||||

J Front Retailing Co Ltd | 300 | 4,599 | |||||

Kohl's Corp | 80 | 3,094 | |||||

Macy's Inc | 2,703 | 62,818 | |||||

Marks & Spencer Group PLC | 5,232 | 22,708 | |||||

Marui Group Co Ltd | 100 | 1,473 | |||||

Nordstrom Inc | 28 | 1,339 | |||||

Target Corp | 744 | 38,904 | |||||

221,607 | |||||||

Multi-Utilities – 0.3% | |||||||

Ameren Corp | 346 | 18,916 | |||||

Canadian Utilities Ltd | 609 | 19,572 | |||||

CenterPoint Energy Inc | 135 | 3,696 | |||||

Centrica PLC | 11,557 | 30,129 | |||||

CMS Energy Corp | 371 | 17,159 | |||||

Dominion Energy Inc | 232 | 17,778 | |||||

DTE Energy Co | 165 | 17,455 | |||||

E.ON SE | 973 | 9,165 | |||||

Engie SA | 505 | 7,621 | |||||

Innogy SE (144A) | 111 | 4,369 | |||||

RWE AG | 321 | 6,395 | |||||

Suez | 568 | 10,518 | |||||

Veolia Environnement SA | 394 | 8,324 | |||||

171,097 | |||||||

Oil, Gas & Consumable Fuels – 1.9% | |||||||

AltaGas Ltd | 2,797 | 64,025 | |||||

Anadarko Petroleum Corp | 619 | 28,065 | |||||

Apache Corp | 472 | 22,623 | |||||

ARC Resources Ltd | 597 | 7,809 | |||||

BP PLC | 5,869 | 33,842 | |||||

Cabot Oil & Gas Corp | 2,714 | 68,067 | |||||

Caltex Australia Ltd | 115 | 2,793 | |||||

Cameco Corp | 1,478 | 13,462 | |||||

Cenovus Energy Inc | 889 | 6,555 | |||||

Chevron Corp | 77 | 8,033 | |||||

Cimarex Energy Co | 339 | 31,869 | |||||

Concho Resources Inc* | 185 | 22,483 | |||||

ConocoPhillips | 2,175 | 95,613 | |||||

Crescent Point Energy Corp | 196 | 1,500 | |||||

Devon Energy Corp | 743 | 23,754 | |||||

Enagas SA | 37 | 1,037 | |||||

Enbridge Inc | 59 | 2,351 | |||||

Encana Corp | 208 | 1,830 | |||||

EOG Resources Inc | 738 | 66,804 | |||||

EQT Corp | 822 | 48,161 | |||||

Hess Corp | 354 | 15,530 | |||||

Husky Energy Inc* | 158 | 1,794 | |||||

Inpex Corp | 500 | 4,806 | |||||

Inter Pipeline Ltd | 509 | 9,971 | |||||

JXTG Holdings Inc | 1,000 | 4,363 | |||||

Kinder Morgan Inc/DE | 2,478 | 47,478 | |||||

Koninklijke Vopak NV | 38 | 1,762 | |||||

Lundin Petroleum AB* | 747 | 14,379 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

18 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Oil, Gas & Consumable Fuels – (continued) | |||||||

Marathon Oil Corp | .1,143 | $13,545 | |||||

Marathon Petroleum Corp | 646 | 33,805 | |||||

Murphy Oil Corp | 299 | 7,663 | |||||

Neste Oyj | 214 | 8,429 | |||||

Noble Energy Inc | 978 | 27,677 | |||||

Occidental Petroleum Corp | 1,617 | 96,810 | |||||

Oil Search Ltd | 282 | 1,478 | |||||

OMV AG | 168 | 8,717 | |||||

ONEOK Inc | 225 | 11,736 | |||||

Origin Energy Ltd* | 197 | 1,038 | |||||

Phillips 66 | 602 | 49,779 | |||||

Pioneer Natural Resources Co | 137 | 21,862 | |||||

PrairieSky Royalty Ltd | 145 | 3,302 | |||||

Range Resources Corp | 2,530 | 58,620 | |||||

Repsol SA | 187 | 2,862 | |||||

Santos Ltd* | 778 | 1,811 | |||||

Snam SpA | 4,749 | 20,695 | |||||

Statoil ASA | 378 | 6,269 | |||||

Tesoro Corp | 714 | 66,830 | |||||

TOTAL SA | 127 | 6,278 | |||||

TransCanada Corp | 145 | 6,913 | |||||

Valero Energy Corp | 749 | 50,528 | |||||

Woodside Petroleum Ltd | 84 | 1,928 | |||||

1,159,334 | |||||||

Paper & Forest Products – 0% | |||||||

Oji Holdings Corp | 1,000 | 5,157 | |||||

Personal Products – 0.1% | |||||||

Estee Lauder Cos Inc | 195 | 18,716 | |||||

Kao Corp | 100 | 5,933 | |||||

Shiseido Co Ltd | 100 | 3,551 | |||||

Unilever PLC | 226 | 12,228 | |||||

40,428 | |||||||

Pharmaceuticals – 1.1% | |||||||

Allergan PLC | 76 | 18,475 | |||||

Astellas Pharma Inc | 2,400 | 29,333 | |||||

AstraZeneca PLC* | 110 | 7,355 | |||||

Bayer AG | 122 | 15,771 | |||||

Bristol-Myers Squibb Co | 902 | 50,259 | |||||

Daiichi Sankyo Co Ltd | 1,000 | 23,537 | |||||

Eisai Co Ltd | 100 | 5,518 | |||||

Hisamitsu Pharmaceutical Co Inc | 200 | 9,568 | |||||

Johnson & Johnson | 287 | 37,967 | |||||

Kyowa Hakko Kirin Co Ltd | 400 | 7,423 | |||||

Merck & Co Inc | 677 | 43,389 | |||||

Merck KGaA | 735 | 88,763 | |||||

Mylan NV* | 180 | 6,988 | |||||

Novartis AG | 1,155 | 96,150 | |||||

Ono Pharmaceutical Co Ltd | 300 | 6,538 | |||||

Roche Holding AG | 60 | 15,285 | |||||

Sanofi | 268 | 25,635 | |||||

Santen Pharmaceutical Co Ltd | 500 | 6,776 | |||||

Sumitomo Dainippon Pharma Co Ltd | 400 | 5,453 | |||||

Takeda Pharmaceutical Co Ltd | 800 | 40,612 | |||||

UCB SA | 1,158 | 79,650 | |||||

Valeant Pharmaceuticals International Inc* | 376 | 6,536 | |||||

Vifor Pharma AG | 305 | 33,631 | |||||

Zoetis Inc | 129 | 8,047 | |||||

668,659 | |||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 19 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Professional Services – 0.3% | |||||||

Bureau Veritas SA | .170 | $3,761 | |||||

Equifax Inc | 169 | 23,224 | |||||

IHS Markit Ltd* | 2,498 | 110,012 | |||||

Robert Half International Inc | 620 | 29,717 | |||||

Verisk Analytics Inc* | 473 | 39,907 | |||||

206,621 | |||||||

Real Estate Management & Development – 0.1% | |||||||

Cheung Kong Property Holdings Ltd | 1,500 | 11,749 | |||||

City Developments Ltd | 200 | 1,559 | |||||

Daiwa House Industry Co Ltd | 300 | 10,238 | |||||

Henderson Land Development Co Ltd | 1,200 | 6,694 | |||||

Mitsubishi Estate Co Ltd | 300 | 5,585 | |||||

Mitsui Fudosan Co Ltd | 200 | 4,767 | |||||

New World Development Co Ltd | 7,000 | 8,885 | |||||

Swire Pacific Ltd | 3,000 | 29,300 | |||||

Swiss Prime Site AG* | 32 | 2,908 | |||||

UOL Group Ltd | 600 | 3,330 | |||||

Vonovia SE | 71 | 2,819 | |||||

87,834 | |||||||

Road & Rail – 0.2% | |||||||

Central Japan Railway Co | 100 | 16,281 | |||||

East Japan Railway Co | 300 | 28,664 | |||||

Kansas City Southern | 179 | 18,732 | |||||

MTR Corp Ltd | 500 | 2,815 | |||||

Norfolk Southern Corp | 119 | 14,482 | |||||

Union Pacific Corp | 179 | 19,495 | |||||

West Japan Railway Co | 300 | 21,170 | |||||

121,639 | |||||||

Semiconductor & Semiconductor Equipment – 0.5% | |||||||

Analog Devices Inc | 550 | 42,790 | |||||

ASM Pacific Technology Ltd | 400 | 5,405 | |||||

ASML Holding NV | 99 | 12,900 | |||||

Broadcom Ltd | 20 | 4,661 | |||||

Infineon Technologies AG | 1,290 | 27,232 | |||||

Lam Research Corp | 53 | 7,496 | |||||

Micron Technology Inc* | 446 | 13,318 | |||||

NVIDIA Corp | 389 | 56,234 | |||||

Qorvo Inc* | 76 | 4,812 | |||||

QUALCOMM Inc | 1,110 | 61,294 | |||||

Rohm Co Ltd | 100 | 7,674 | |||||

Skyworks Solutions Inc | 99 | 9,499 | |||||

STMicroelectronics NV | 298 | 4,278 | |||||

Texas Instruments Inc | 21 | 1,616 | |||||

Xilinx Inc | 498 | 32,031 | |||||

291,240 | |||||||

Software – 0.9% | |||||||

ANSYS Inc* | 1,179 | 143,461 | |||||

Autodesk Inc* | 56 | 5,646 | |||||

Dassault Systemes SE | 160 | 14,342 | |||||

Gemalto NV | 460 | 27,605 | |||||

Intuit Inc | 126 | 16,734 | |||||

Konami Holdings Corp | 100 | 5,549 | |||||

Microsoft Corp | 132 | 9,099 | |||||

Nexon Co Ltd* | 500 | 9,870 | |||||

Open Text Corp | 565 | 17,835 | |||||

Oracle Corp Japan | 300 | 19,447 | |||||

Red Hat Inc* | 984 | 94,218 | |||||

Sage Group PLC | 6,055 | 54,248 | |||||

salesforce.com Inc* | 1,321 | 114,399 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

20 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Software – (continued) | |||||||

Synopsys Inc* | .425 | $30,995 | |||||

Trend Micro Inc/Japan | 100 | 5,149 | |||||

568,597 | |||||||

Specialty Retail – 0.8% | |||||||

Advance Auto Parts Inc | 199 | 23,201 | |||||

AutoZone Inc* | 81 | 46,207 | |||||

Bed Bath & Beyond Inc | 2,301 | 69,950 | |||||

CarMax Inc* | 195 | 12,297 | |||||

Dixons Carphone PLC | 5,421 | 20,020 | |||||

Dufry AG* | 285 | 46,707 | |||||

Foot Locker Inc | 309 | 15,228 | |||||

Gap Inc | 165 | 3,628 | |||||

Hennes & Mauritz AB | 338 | 8,425 | |||||

Home Depot Inc | 415 | 63,661 | |||||

Kingfisher PLC | 9,917 | 38,832 | |||||

Lowe's Cos Inc | 305 | 23,647 | |||||

O'Reilly Automotive Inc* | 35 | 7,656 | |||||

Signet Jewelers Ltd | 32 | 2,024 | |||||

Tiffany & Co | 164 | 15,395 | |||||

TJX Cos Inc | 213 | 15,372 | |||||

Tractor Supply Co | 443 | 24,015 | |||||

Yamada Denki Co Ltd | 3,800 | 18,855 | |||||

455,120 | |||||||

Technology Hardware, Storage & Peripherals – 0.5% | |||||||

Apple Inc | 595 | 85,692 | |||||

BlackBerry Ltd* | 1,403 | 14,024 | |||||

Brother Industries Ltd | 500 | 11,529 | |||||

Canon Inc | 2,500 | 84,830 | |||||

FUJIFILM Holdings Corp | 600 | 21,554 | |||||

Hewlett Packard Enterprise Co | 2,223 | 36,880 | |||||

HP Inc | 857 | 14,980 | |||||

Konica Minolta Inc | 100 | 829 | |||||

Ricoh Co Ltd | 100 | 882 | |||||

Seagate Technology PLC | 301 | 11,664 | |||||

Seiko Epson Corp | 300 | 6,666 | |||||

Western Digital Corp | 230 | 20,378 | |||||

309,908 | |||||||

Textiles, Apparel & Luxury Goods – 0.6% | |||||||

adidas AG | 47 | 9,004 | |||||

Asics Corp | 200 | 3,703 | |||||

Burberry Group PLC | 100 | 2,163 | |||||

Hanesbrands Inc | 1,028 | 23,808 | |||||

Hermes International | 30 | 14,823 | |||||

Kering | 23 | 7,832 | |||||

Li & Fung Ltd | 90,000 | 32,739 | |||||

Luxottica Group SpA | 14 | 810 | |||||

Michael Kors Holdings Ltd* | 773 | 28,021 | |||||

NIKE Inc | 2,697 | 159,123 | |||||

PVH Corp | 263 | 30,114 | |||||

Ralph Lauren Corp | 562 | 41,476 | |||||

Under Armour Inc* | 978 | 21,281 | |||||

Yue Yuen Industrial Holdings Ltd | 500 | 2,075 | |||||

376,972 | |||||||

Tobacco – 0.2% | |||||||

Altria Group Inc | 712 | 53,023 | |||||

Imperial Brands PLC* | 1,558 | 69,964 | |||||

Japan Tobacco Inc | 300 | 10,529 | |||||

Philip Morris International Inc | 22 | 2,584 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 21 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Common Stocks – (continued) | |||||||

Tobacco – (continued) | |||||||

Swedish Match AB | .221 | $7,786 | |||||

143,886 | |||||||

Trading Companies & Distributors – 0.2% | |||||||

Bunzl PLC | 780 | 23,240 | |||||

Fastenal Co | 130 | 5,659 | |||||

ITOCHU Corp | 1,000 | 14,841 | |||||

Marubeni Corp | 400 | 2,582 | |||||

MISUMI Group Inc | 100 | 2,282 | |||||

Mitsubishi Corp | 200 | 4,190 | |||||

Mitsui & Co Ltd | 800 | 11,421 | |||||

Rexel SA | 99 | 1,620 | |||||

Sumitomo Corp | 1,300 | 16,900 | |||||

Travis Perkins PLC | 356 | 6,745 | |||||

United Rentals Inc* | 86 | 9,693 | |||||

WW Grainger Inc | 55 | 9,929 | |||||

109,102 | |||||||

Transportation Infrastructure – 0% | |||||||

Aena SA | 12 | 2,341 | |||||

Fraport AG Frankfurt Airport Services Worldwide | 231 | 20,392 | |||||

Japan Airport Terminal Co Ltd | 200 | 7,638 | |||||

30,371 | |||||||

Water Utilities – 0% | |||||||

Severn Trent PLC | 321 | 9,121 | |||||

United Utilities Group PLC | 1,324 | 14,957 | |||||

24,078 | |||||||

Wireless Telecommunication Services – 0.4% | |||||||

KDDI Corp | 700 | 18,518 | |||||

NTT DOCOMO Inc | 2,000 | 47,163 | |||||

Rogers Communications Inc | 914 | 43,176 | |||||

StarHub Ltd | 12,300 | 24,307 | |||||

Tele2 AB | 3,318 | 34,751 | |||||

Vodafone Group PLC | 16,084 | 45,607 | |||||

213,522 | |||||||

Total Common Stocks (cost $17,681,952) | 18,062,754 | ||||||

Preferred Stocks – 0.1% | |||||||

Auto Components – 0% | |||||||

Schaeffler AG | 682 | 9,767 | |||||

Automobiles – 0% | |||||||

Porsche Automobil Holding SE | 180 | 10,111 | |||||

Chemicals – 0.1% | |||||||

FUCHS PETROLUB SE | 556 | 30,271 | |||||

Media – 0% | |||||||

ProSiebenSat.1 Media SE | 225 | 9,415 | |||||

Total Preferred Stocks (cost $54,296) | 59,564 | ||||||

Investment Companies – 69.5% | |||||||

Exchange-Traded Funds (ETFs) – 69.5% | |||||||

Deutsche X-trackers Harvest CSI 300 China A-Shares | 7,574 | 206,467 | |||||

iShares 20+ Year Treasury Bond | 10,270 | 1,284,982 | |||||

iShares 7-10 Year Treasury Bond | 2,129 | 226,973 | |||||

iShares Core FTSE 100 UCITS GBP Dist | 257,222 | 2,421,725 | |||||

iShares Edge MSCI Min Vol Global | 17,044 | 1,348,180 | |||||

iShares iBoxx $ High Yield Corporate Bond | 9,327 | 824,414 | |||||

iShares iBoxx $ Investment Grade Corporate Bond | 3,673 | 442,633 | |||||

iShares International Select Dividend† | 47,091 | 1,540,818 | |||||

iShares MSCI Canada | 61,570 | 1,647,613 | |||||

iShares MSCI EAFE Growth† | 27,176 | 2,009,937 | |||||

iShares MSCI EAFE Value | 35,563 | 1,838,607 | |||||

iShares MSCI Europe Financials | 8,060 | 176,836 | |||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

22 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Shares or | Value | ||||||

Investment Companies – (continued) | |||||||

Exchange-Traded Funds (ETFs) – (continued) | |||||||

iShares MSCI Hong Kong | .7,890 | $184,863 | |||||

iShares MSCI South Korea Capped | 17,317 | 1,174,266 | |||||

LYXOR CAC 40 DR UCITS | 13,983 | 823,976 | |||||

LYXOR FTSE MIB UCITS | 61,378 | 1,437,826 | |||||

PowerShares QQQ Trust Series 1 | 12,688 | 1,746,376 | |||||

Vanguard FTSE All World ex-US Small-Cap† | 19,601 | 2,119,260 | |||||

Vanguard FTSE Emerging Markets | 105,744 | 4,317,604 | |||||

Vanguard FTSE Europe | 33,681 | 1,857,170 | |||||

Vanguard FTSE Pacific† | 30,783 | 2,025,521 | |||||

Vanguard Growth | 15,593 | 1,980,935 | |||||

Vanguard High Dividend Yield | 9,777 | 764,170 | |||||

Vanguard International High Dividend Yield | 10,868 | 679,902 | |||||

Vanguard Mid-Cap† | 13,926 | 1,984,734 | |||||

Vanguard S&P 500 | 8,969 | 1,991,656 | |||||

Vanguard Small-Cap | 19,409 | 2,630,696 | |||||

Vanguard Total International Bond | 5,163 | 280,661 | |||||

Vanguard Value† | 21,152 | 2,042,437 | |||||

Total Investment Companies (cost $39,906,881) | 42,011,238 | ||||||

U.S. Government Agency Notes – 2.3% | |||||||

Federal Home Loan Bank Discount Notes: | |||||||

0%, 7/3/17◊ (cost $1,399,924) | $1,400,000 | 1,400,000 | |||||

Total Investments (total cost $59,043,053) – 101.8% | 61,533,556 | ||||||

Liabilities, net of Cash, Receivables and Other Assets – (1.8)% | (1,070,125) | ||||||

Net Assets – 100% | $60,463,431 | ||||||

Summary of Investments by Country - (Long Positions) (unaudited) | |||||

% of | |||||

Investment | |||||

Country | Value | Securities | |||

United States | $46,447,257 | 75.5 | % | ||

United Kingdom | 3,823,295 | 6.2 | |||

Canada | 2,563,425 | 4.2 | |||

Japan | 1,763,576 | 2.9 | |||

Italy | 1,531,367 | 2.5 | |||

France | 1,220,938 | 2.0 | |||

South Korea | 1,174,266 | 1.9 | |||

Germany | 726,319 | 1.2 | |||

Switzerland | 375,136 | 0.6 | |||

Hong Kong | 372,066 | 0.6 | |||

Spain | 321,894 | 0.5 | |||

Sweden | 269,640 | 0.4 | |||

Netherlands | 224,212 | 0.4 | |||

China | 206,467 | 0.3 | |||

Singapore | 136,775 | 0.2 | |||

Belgium | 132,537 | 0.2 | |||

Australia | 113,222 | 0.2 | |||

Finland | 77,989 | 0.1 | |||

Austria | 37,208 | 0.1 | |||

Norway | 15,967 | 0.0 | |||

Total | $61,533,556 | 100.0 | % |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Janus Investment Fund | 23 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments

June 30, 2017

Schedule of Foreign Currency Contracts, Open |

Counterparty/ Currency | Settlement Date | Currency Units Sold | Currency Value | Unrealized Appreciation/ (Depreciation) | ||||

Bank of America: | ||||||||

British Pound | 7/13/17 | 607,000 | $ | 790,687 | $ | (4,726) | ||

Canadian Dollar | 7/13/17 | 945,000 | 728,960 | (28,455) | ||||

Euro | 7/13/17 | 3,177,375 | 3,630,426 | (59,979) | ||||

Japanese Yen | 7/13/17 | 118,305,000 | 1,052,430 | 24,362 | ||||

6,202,503 | (68,798) | |||||||

RBC Capital Markets Corp.: | ||||||||

Japanese Yen | 7/13/17 | 25,495,000 | 226,801 | 5,041 | ||||

Swiss Franc | 7/13/17 | 271,000 | 282,887 | (2,483) | ||||

509,688 | 2,558 | |||||||

Total | $ | 6,712,191 | $ | (66,240) | ||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

24 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Notes to Schedule of Investments and Other Information

Adaptive Global Allocation 60/40 Index | An internally-calculated, hypothetical combination of total returns from the MSCI All Country World IndexSM (60%) and the Bloomberg Barclays Global Aggregate Bond Index (Hedged) (40%). |

Adaptive Global Allocation 70/30 Index (Hedged) | An internally-calculated, hypothetical combination of total returns from the MSCI All Country World IndexSM (70%) and the Bloomberg Barclays Global Aggregate Bond Index (Hedged) (30%). |

Adaptive Global Allocation 70/30 Index (Unhedged) | An internally-calculated, hypothetical combination of total returns from the MSCI All Country World IndexSM (70%) and the Bloomberg Barclays Global Aggregate Bond Index (Unhedged) (30%). |

Bloomberg Barclays Global Aggregate Bond Index | A broad-based measure of the global investment grade fixed-rate debt markets. |

MSCI All Country World IndexSM | An unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes. |

CDI | Clearing House Electronic Subregister System Depositary Interest |

LLC | Limited Liability Company |

PLC | Public Limited Company |

144A | Securities sold under Rule 144A of the Securities Act of 1933, as amended, are subject to legal and/or contractual restrictions on resale and may not be publicly sold without registration under the 1933 Act. Unless otherwise noted, these securities have been determined to be liquid under guidelines established by the Board of Trustees. The total value of 144A securities as of the year ended June 30, 2017 is $11,955, which represents 0.0% of net assets. |

* | Non-income producing security. |

† | A portion of this security has been segregated to cover margin or segregation requirements on open futures contracts, forward currency contracts, options contracts, short sales, swap agreements, and/or securities with extended settlement dates, the value of which, as of June 30, 2017, is $9,132,800. |

◊ | Zero coupon bond. |

Share | Share | |||||||||||||

Balance | Balance | Realized | Dividend | Value | ||||||||||

at 6/30/16 | Purchases | Sales | at 6/30/17 | Gain/(Loss) | Income | at 6/30/17 | ||||||||

Janus Cash Liquidity Fund LLC | 1,192,000 | 29,846,203 | (31,038,203) | — | $— | $29,287 | $— |

Janus Investment Fund | 25 |

Janus Henderson Adaptive Global Allocation Fund

Notes to Schedule of Investments and Other Information

The following is a summary of the inputs that were used to value the Fund’s investments in securities and other financial instruments as of June 30, 2017. See Notes to Financial Statements for more information. | |||||||||||||

Valuation Inputs Summary | |||||||||||||

Level 2 - | Level 3 - | ||||||||||||

Level 1 - | Other Significant | Significant | |||||||||||

Quotes Prices | Observable Inputs | Unobservable Inputs | |||||||||||

Assets | |||||||||||||

Investments in Securities: | |||||||||||||

Common Stocks | $ | 18,062,754 | $ | - | $ | - | |||||||

Preferred Stocks | - | 59,564 | - | ||||||||||

Investment Companies | 42,011,238 | - | - | ||||||||||

U.S. Government Agency Notes | - | 1,400,000 | - | ||||||||||

Total Investments in Securities | $ | 60,073,992 | $ | 1,459,564 | $ | - | |||||||

Other Financial Instruments(a): | |||||||||||||

Forward Currency Contracts | - | 29,403 | - | ||||||||||

Total Assets | $ | 60,073,992 | $ | 1,488,967 | $ | - | |||||||

Liabilities | |||||||||||||

Other Financial Instruments(a): | |||||||||||||

Forward Currency Contracts | $ | - | $ | 95,643 | $ | - | |||||||

(a) | Other financial instruments include forward currency, futures, written options, written swaptions, and swap contracts. Forward currency contracts are reported at their unrealized appreciation/(depreciation) at measurement date, which represents the change in the contract's value from trade date. Futures, certain written options on futures, and centrally cleared swap contracts are reported at their variation margin at measurement date, which represents the amount due to/from the Fund at that date. Written options, written swaptions, and other swap contracts are reported at their market value at measurement date. | ||||||||||||

26 | JUNE 30, 2017 |

Janus Henderson Adaptive Global Allocation Fund

Statement of Assets and Liabilities

June 30, 2017

See footnotes at the end of the Statement. |

|

|

|

|

|

|

|

Assets: | ||||||

Investments, at cost | $ | 59,043,053 | ||||

Investments, at value | 61,533,556 | |||||

Cash | 2,293 | |||||

Forward currency contracts | 29,403 | |||||

Cash denominated in foreign currency(1) | 36,616 | |||||

Non-interested Trustees' deferred compensation | 1,076 | |||||

Receivables: | ||||||

Investments sold | 8,366,170 | |||||

Due from adviser | 49,203 | |||||

Dividends | 37,501 | |||||

Foreign tax reclaims | 5,905 | |||||