peers; and (3) and the management fees for the Janus Henderson Funds, on average, were 7% under the average management fees for their Expense Groups. The Trustees also considered the total expenses for each share class of each Janus Henderson Fund compared to the average total expenses for its Broadridge Expense Group peers and to average total expenses for its Broadridge Expense Universe.

For certain Janus Henderson Funds, the independent fee consultant also performed a systematic “focus list” analysis of expenses which assessed fund fees in the context of fund performance being delivered. Based on this analysis, the independent fee consultant found that the combination of service quality/performance and expenses on these individual Janus Henderson Funds was reasonable in light of performance trends, performance histories, and existence of performance fees, breakpoints, and/or expense waivers on such Janus Henderson Funds.

The Trustees considered the methodology used by Janus Capital and each subadviser in determining compensation payable to portfolio managers, the competitive environment for investment management talent, and the competitive market for mutual funds in different distribution channels.

The Trustees also reviewed management fees charged by Janus Capital and each subadviser to comparable separate account clients and to comparable non-affiliated funds subadvised by Janus Capital or by a subadviser (for which Janus Capital or the subadviser provides only or primarily portfolio management services). Although in most instances subadvisory and separate account fee rates for various investment strategies were lower than management fee rates for Janus Henderson Funds having a similar strategy, the Trustees considered that Janus Capital noted that, under the terms of the management agreements with the Janus Henderson Funds, Janus Capital performs significant additional services for the Janus Henderson Funds that it does not provide to those other clients, including administration services, oversight of the Janus Henderson Funds’ other service providers, trustee support, regulatory compliance and numerous other services, and that, in serving the Janus Henderson Funds, Janus Capital assumes many legal risks and other costs that it does not assume in servicing its other clients. Moreover, they noted that the independent fee consultant found that: (1) the management fees Janus Capital charges to the Janus Henderson Funds are reasonable in relation to the management fees Janus Capital charges to funds subadvised by Janus Capital and to the fees Janus Capital charges to its institutional separate account clients; (2) these subadvised and institutional separate accounts have different service and infrastructure needs; and (3) Janus Henderson mutual fund investors enjoy reasonable fees relative to the fees charged to Janus Henderson subadvised fund and separate account investors; (4) 11 of 12 Janus Henderson Funds have lower management fees than similar funds subadvised by Janus Capital; and (5) six of nine Janus Henderson Funds have lower management fees than similar separate accounts managed by Janus Capital.

The Trustees considered the fees for each Fund for its fiscal year ended in 2018, and noted the following with regard to each Fund’s total expenses, net of applicable fee waivers (the Fund’s “total expenses”):

Janus Henderson Absolute Return Income Opportunities Fund

Additional Information (unaudited)

Fixed-Income Funds

· For Janus Henderson Absolute Return Income Opportunities Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

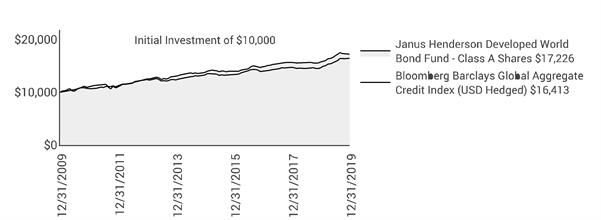

· For Janus Henderson Developed World Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Flexible Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson High-Yield Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Multi-Sector Income Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Short-Term Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for all share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

Global and International Equity Funds

· For Janus Henderson Asia Equity Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Emerging Markets Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson European Focus Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Equity Income Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Life Sciences Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Real Estate Fund, the Trustees noted although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Research Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Select Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Technology Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Janus Henderson Absolute Return Income Opportunities Fund

Additional Information (unaudited)

· For Janus Henderson Global Value Fund, the Trustees noted that although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable.

· For Janus Henderson International Opportunities Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson International Small Cap Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson International Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Overseas Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Money Market Funds

· For Janus Henderson Government Money Market Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

· For Janus Henderson Money Market Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable.

Multi-Asset Funds

· For Janus Henderson Adaptive Global Allocation Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Dividend & Income Builder Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Value Plus Income Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Multi-Asset U.S. Equity Funds

· For Janus Henderson Balanced Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Contrarian Fund, the Trustees noted that the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Enterprise Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Forty Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Growth and Income Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Research Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Janus Henderson Absolute Return Income Opportunities Fund

Additional Information (unaudited)

· For Janus Henderson Triton Fund, the Trustees noted that, although the Fund’s expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson U.S. Growth Opportunities Fund, that Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Venture Fund, the Trustees noted that, although the Fund’s expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

Quantitative Equity Funds

· For Janus Henderson Emerging Markets Managed Volatility Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Income Managed Volatility Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson International Managed Volatility Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson U.S. Managed Volatility Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

U.S. Equity Funds

· For Janus Henderson Large Cap Value Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Mid Cap Value Fund, the Trustees noted that, although the Fund’s expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Small Cap Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Small-Mid Cap Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

The Trustees reviewed information on the overall profitability to Janus Capital and its affiliates of their relationship with the Janus Henderson Funds, and considered profitability data of other publicly traded mutual fund advisers. The Trustees recognized that profitability comparisons among fund managers are difficult because of the variation in the type of comparative information that is publicly available, and the profitability of any fund manager is affected by numerous factors, including the organizational structure of the particular fund manager, differences in complex size, difference in product mix, difference in types of business (mutual fund, institutional and other), differences in the types of funds and other accounts it manages, possible other lines of business, the methodology for allocating expenses, and the fund manager’s capital structure and cost of capital.

Additionally, the Trustees considered the estimated profitability to Janus Capital from the investment management services it provided to each Janus Henderson Fund. In their review, the Trustees considered whether Janus Capital and each subadviser receive adequate incentives and resources to manage the Janus Henderson Funds effectively. In reviewing profitability, the Trustees noted that the estimated profitability for an individual Janus Henderson Fund is

Janus Henderson Absolute Return Income Opportunities Fund

Additional Information (unaudited)

necessarily a product of the allocation methodology utilized by Janus Capital to allocate its expenses as part of the estimated profitability calculation. In this regard, the Trustees noted that the independent fee consultant found that (1) the expense allocation methodology and rationales utilized by Janus Capital were reasonable and (2) no clear correlation between expense allocations and operating margins. The Trustees also considered that the estimated profitability for an individual Janus Henderson Fund was influenced by a number of factors, including not only the allocation methodology selected, but also the presence of fee waivers and expense caps, and whether the Janus Henderson Fund’s investment management agreement contained breakpoints or a performance fee component. The Trustees determined, after taking into account these factors, among others, that Janus Capital’s estimated profitability with respect to each Janus Henderson Fund was not unreasonable in relation to the services provided, and that the variation in the range of such estimated profitability among the Janus Henderson Funds was not a material factor in the Board’s approval of the reasonableness of any Janus Henderson Fund’s investment management fees.

The Trustees concluded that the management fees payable by each Janus Henderson Fund to Janus Capital and its affiliates, as well as the fees paid by Janus Capital to the subadvisers of subadvised Janus Henderson Funds, were reasonable in relation to the nature, extent, and quality of the services provided, taking into account the fees charged by other advisers for managing comparable mutual funds with similar strategies, the fees Janus Capital and the subadvisers charge to other clients, and, as applicable, the impact of fund performance on management fees payable by the Janus Henderson Funds. The Trustees also concluded that each Janus Henderson Fund’s total expenses were reasonable, taking into account the size of the Janus Henderson Fund, the quality of services provided by Janus Capital and any subadviser, the investment performance of the Janus Henderson Fund, and any expense limitations agreed to or provided by Janus Capital.

Economies of Scale

The Trustees considered information about the potential for Janus Capital to realize economies of scale as the assets of the Janus Henderson Funds increase. They noted that their independent fee consultant published a report to the Trustees in November 2019 which provided its research and analysis into economies of scale. They also noted that, although many Janus Henderson Funds pay advisory fees at a base fixed rate as a percentage of net assets, without any breakpoints or performance fees, their independent fee consultant concluded that 64% of these Janus Henderson Funds’ share classes have contractual management fees (gross of waivers) below their Broadridge expense group averages. They also noted the following: (1) that for those Janus Henderson Funds whose expenses are being reduced by the contractual expense limitations of Janus Capital, Janus Capital is subsidizing certain of these Janus Henderson Funds because they have not reached adequate scale; (2) as the assets of some of the Janus Henderson Funds have declined in the past few years, certain Janus Henderson Funds have benefited from having advisory fee rates that have remained constant rather than increasing as assets declined; (3) performance fee structures have been implemented for various Janus Henderson Funds that have caused the effective rate of advisory fees payable by such a Janus Henderson Fund to vary depending on the investment performance of the Janus Henderson Fund relative to its benchmark index over the measurement period; and (4) a few Janus Henderson Funds have fee schedules with breakpoints and reduced fee rates above certain asset levels. The Trustees also noted that the Janus Henderson Funds share directly in economies of scale through the lower charges of third-party service providers that are based in part on the combined scale of all of the Janus Henderson Funds.

The Trustees also considered the independent fee consultant’s conclusion that, given the limitations of various analytical approaches to economies of scale and their conflicting results, it is difficult to analytically confirm or deny the existence of economies of scale in the Janus Henderson complex. In this regard, the independent consultant concluded that (1) to the extent there were economies of scale at Janus Capital, Janus Capital’s general strategy of setting fixed management fees below peers appeared to share any such economies with investors even on smaller Janus Henderson Funds which have not yet achieved those economies and (2) by setting lower fixed fees from the start on these Janus Henderson Funds, Janus Capital appeared to be investing to increase the likelihood that these Janus Henderson Funds will grow to a level to achieve any scale economies that may exist. Further, the independent fee consultant provided its belief that Janus Henderson Fund investors are well-served by the fee levels and performance fee structures in place on the Janus Henderson Funds in light of any economies of scale that may be present at Janus Capital.

Based on all of the information reviewed, including the recent and past research and analysis conducted by the Trustees’ independent fee consultant, the Trustees concluded that the current fee structure of each Janus Henderson Fund was reasonable and that the current rates of fees do reflect a sharing between Janus Capital and the Janus

Janus Henderson Absolute Return Income Opportunities Fund

Additional Information (unaudited)

Henderson Fund of any economies of scale that may be present at the current asset level of the Janus Henderson Fund.

Other Benefits to Janus Capital

The Trustees also considered benefits that accrue to Janus Capital and its affiliates and subadvisers to the Janus Henderson Funds from their relationships with the Janus Henderson Funds. They recognized that two affiliates of Janus Capital separately serve the Janus Henderson Funds as transfer agent and distributor, respectively, and the transfer agent receives compensation directly from the non-money market funds for services provided, and that such compensation contributes to the overall profitability of Janus Capital and its affiliates that results from their relationship with the Janus Henderson Funds. The Trustees also considered Janus Capital’s past and proposed use of commissions paid by the Janus Henderson Funds on portfolio brokerage transactions to obtain proprietary and third-party research products and services benefiting the Janus Henderson Fund and/or other clients of Janus Capital and/or Janus Capital, and/or a subadviser to a Janus Henderson Fund. The Trustees concluded that Janus Capital’s and the subadvisers’ use of these types of client commission arrangements to obtain proprietary and third-party research products and services was consistent with regulatory requirements and guidelines and was likely to benefit each Janus Henderson Fund. The Trustees also concluded that, other than the services provided by Janus Capital and its affiliates and subadvisers pursuant to the agreements and the fees to be paid by each Janus Henderson Fund therefor, the Janus Henderson Funds and Janus Capital and the subadvisers may potentially benefit from their relationship with each other in other ways. They concluded that Janus Capital and its affiliates share directly in economies of scale through the lower charges of third-party service providers that are based in part on the combined scale of the Janus Henderson Funds and other clients serviced by Janus Capital and its affiliates. They also concluded that Janus Capital and/or the subadvisers benefit from the receipt of research products and services acquired through commissions paid on portfolio transactions of the Janus Henderson Funds and that the Janus Henderson Funds benefit from Janus Capital’s and/or the subadvisers’ receipt of those products and services as well as research products and services acquired through commissions paid by other clients of Janus Capital and/or other clients of the subadvisers. They further concluded that the success of any Janus Henderson Fund could attract other business to Janus Capital, the subadvisers or other Janus Henderson funds, and that the success of Janus Capital and the subadvisers could enhance Janus Capital’s and the subadvisers’ ability to serve the Janus Henderson Funds.

Approval of an Amended and Restated Investment Advisory Agreement for Janus Henderson Small-Mid Cap Value Fund (formerly, Janus Henderson Select Value Fund)

Janus Capital Management LLC (“Janus Capital”) met with the Trustees, each of whom serves as an “independent” Trustee (the “Trustees”), on December 5, 2018 and March 14, 2019, to discuss the Amended and Restated Investment Advisory Agreement (the “Amended Advisory Agreement”) for Janus Henderson Small-Mid Cap Value Fund (formerly, Janus Henderson Select Value Fund) (“Small-Mid Cap Value Fund”) and other matters related to investment strategy changes to shift the market capitalization focus of Small-Mid Cap Value Fund (the “Strategy Change”). At these meetings, the Trustees discussed the Amended Advisory Agreement and the Strategy Change with their independent counsel, separately from management. During the course of the meetings, the Trustees requested and considered such information as they deemed relevant to their deliberations. At the meeting held on March 14, 2019, the Trustees, upon the recommendation of Janus Capital, voted unanimously to approve the Amended Advisory Agreement for Small-Mid Cap Value Fund, and recommended that the Amended Advisory Agreement be submitted to shareholders for approval. The Trustees also approved matters related to the Strategy Change, effective upon approval of the Amended Advisory Agreement by the Fund’s shareholders.

In determining whether to approve the Amended Advisory Agreement, the Trustees noted their most recent consideration of Small-Mid Cap Value Fund’s current advisory agreement (the “Current Advisory Agreement”) as part of the Trustees’ annual review and consideration of whether to continue the investment advisory agreement and sub-advisory agreement, as applicable, for each Janus Henderson fund, including Small-Mid Cap Value Fund (the “Annual Review”). The Trustees noted that in connection with the Annual Review: (i) the Trustees received and reviewed information provided by Janus Capital and each sub-adviser, including Perkins Investment Management LLC (“Perkins”), in response to requests of the Trustees and their independent legal counsel, and also received and reviewed information and analysis provided by, and in response to requests of, their independent fee consultant; and (ii) throughout the Annual Review, the Trustees were advised by their independent legal counsel. The Trustees also noted that based on the Trustees’ evaluation of the information provided by Janus Capital, Perkins, and the independent fee consultant, as well as other information, the Trustees determined that the overall arrangements between Small-Mid Cap

Janus Henderson Absolute Return Income Opportunities Fund

Additional Information (unaudited)

Value Fund and Janus Capital and Perkins were fair and reasonable in light of the nature, extent and quality of the services provided by Janus Capital, its affiliates and Perkins, the fees charged for those services, and other matters that the Trustees considered relevant in the exercise of their business judgment, and the Trustees unanimously approved the continuation of the Current Advisory Agreement for another year.

In considering the Amended Advisory Agreement, the Trustees reviewed and analyzed various factors that they determined were relevant, including the factors described below, none of which by itself was considered dispositive. However, the material factors and conclusions that formed the basis for the Trustees’ determination to approve the Amended Advisory Agreement are discussed separately below.

· The Trustees determined that the terms of the Amended Advisory Agreement are substantially similar to those of the Current Advisory Agreement, which the Trustees recently reviewed as part of the Annual Review, and the material changes made to the Amended Advisory Agreement address the proposed change to the benchmark index and the description of the period used for calculating the performance fee in order to allow for continuity of the fee based on Small-Mid Cap Value Fund’s historical performance over a 36-month measurement period.

· As part of the Strategy Change, Small-Mid Cap Value Fund will focus its investments on common stocks of companies that are small- and mid-capitalization stocks. The Trustees determined that the proposed benchmark index, the Russell 2500TM Value Index, is more closely aligned with a small- and mid-cap stock focus than Small-Mid Cap Value Fund’s current benchmark index, the Russell 3000® Value Index.

· Under the Amended Advisory Agreement, the structure of the performance fee was not changing, other than to utilize a different benchmark and performance calculation period to implement the new benchmark over time, and that this structure had been implemented initially for Small-Mid Cap Value Fund based on analysis provided by the independent fee consultant. The Trustees considered the information provided by Janus Capital in this regard, and noted Janus Capital’s belief that this performance fee structure remained reasonable and appropriate for Small-Mid Cap Value Fund. The Trustees concluded that this performance fee structure was reasonable for Small-Mid Cap Value Fund as proposed, and also determined to seek further analysis from their independent fee consultant with respect to this matter. In this regard, Janus Capital agreed to consider further revisions to the proposed performance fee structure should that be needed based on the additional analysis provided.

· As part of the Strategy Change, Perkins will continue to provide sub-advisory services to Small-Mid Cap Value Fund, but will utilize new portfolio managers to implement Small-Mid Cap Value Fund’s focus on common stocks of companies that are small- and mid-capitalization stocks. In this regard, the Trustees noted the information provided by Janus Capital with respect to the qualifications and experience of the new portfolio managers implementing investment strategies similar to the one to be utilized by Small-Mid Cap Value Fund, and also noted that Perkins and the new portfolio managers provide sub-advisory services to other Janus Henderson funds the Trustees oversee.

· The information provided by Janus Capital with respect to (i) the impact of the Amended Advisory Agreement on the potential advisory fees to be paid by Small-Mid Cap Value Fund going forward; and (ii) the potential transaction costs and capital gains to be incurred by Small-Mid Cap Value Fund as part of the efforts to reposition Small-Mid Cap Value Fund’s portfolio to focus its investments on common stocks of companies that are small- and mid-capitalization stocks. In this regard, the Trustees noted that Small-Mid Cap Value Fund’s operating costs were not expected otherwise to materially change under the Amended Advisory Agreement.

· Janus Capital’s reasons for seeking to implement the Strategy Change, including Janus Capital’s belief that current marketplace demands for a small and mid-cap strategy, combined with Perkins’ experience in managing small- and mid-cap stocks, will provide greater opportunity for Small-Mid Cap Value Fund to grow over the long-term, and that the Strategy Change is designed to create asset growth through increased sales for Small-Mid Cap Value Fund, potentially resulting in increased operational efficiencies for Small-Mid Cap Value Fund.

· Janus Capital will pay the fees and expenses related to seeking shareholder approval of the Amended Advisory Agreement, including the costs related to the preparation and distribution of proxy materials, and all other costs incurred in connection with the solicitation of proxies.

After discussion, the Trustees determined that the overall arrangements between Small-Mid Cap Value Fund, Janus Capital, and Perkins under the Amended Advisory Agreement would continue to be fair and reasonable in light of the

Janus Henderson Absolute Return Income Opportunities Fund

Additional Information (unaudited)

nature, extent, and quality of the services expected to be provided by Janus Capital, its affiliates, and Perkins following the Strategy Change.

Janus Henderson Absolute Return Income Opportunities Fund

Useful Information About Your Fund Report (unaudited)

Management Commentary

The Management Commentary in this report includes valuable insight as well as statistical information to help you understand how your Fund’s performance and characteristics stack up against those of comparable indices.

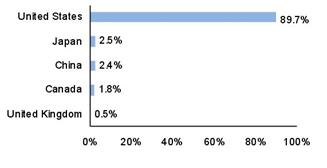

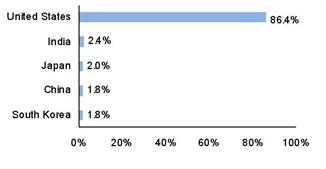

If the Fund invests in foreign securities, this report may include information about country exposure. Country exposure is based primarily on the country of risk. A company may be allocated to a country based on other factors such as location of the company’s principal office, the location of the principal trading market for the company’s securities, or the country where a majority of the company’s revenues are derived.

Please keep in mind that the opinions expressed in the Management Commentary are just that: opinions. They are a reflection based on best judgment at the time this report was compiled, which was December 31, 2019. As the investing environment changes, so could opinions. These views are unique and are not necessarily shared by fellow employees or by Janus Henderson in general.

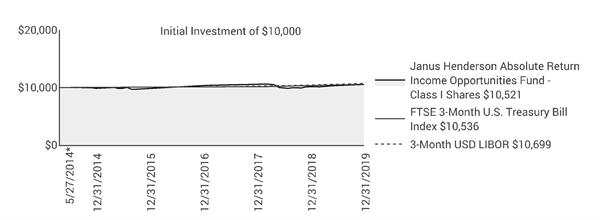

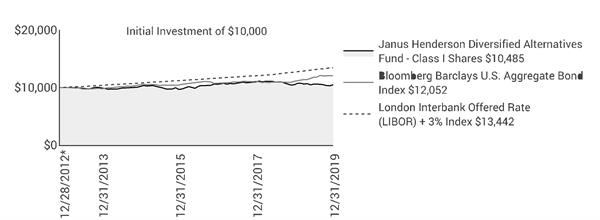

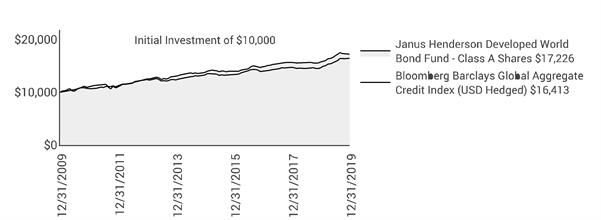

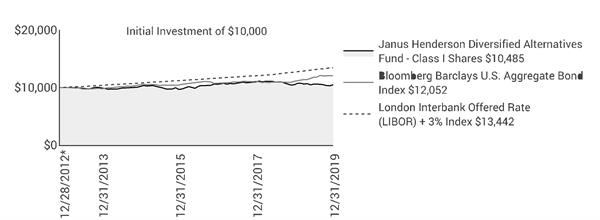

Performance Overviews

Performance overview graphs compare the performance of a hypothetical $10,000 investment in the Fund with one or more widely used market indices. When comparing the performance of the Fund with an index, keep in mind that market indices are not available for investment and do not reflect deduction of expenses.

Average annual total returns are quoted for a Fund with more than one year of performance history. Average annual total return is calculated by taking the growth or decline in value of an investment over a period of time, including reinvestment of dividends and distributions, then calculating the annual compounded percentage rate that would have produced the same result had the rate of growth been constant throughout the period. Average annual total return does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Cumulative total returns are quoted for a Fund with less than one year of performance history. Cumulative total return is the growth or decline in value of an investment over time, independent of the period of time involved. Cumulative total return does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Pursuant to federal securities rules, expense ratios shown in the performance chart reflect subsidized (if applicable) and unsubsidized ratios. The total annual fund operating expenses ratio is gross of any fee waivers, reflecting the Fund’s unsubsidized expense ratio. The net annual fund operating expenses ratio (if applicable) includes contractual waivers of Janus Capital and reflects the Fund’s subsidized expense ratio. Ratios may be higher or lower than those shown in the “Financial Highlights” in this report.

Schedule of Investments

Following the performance overview section is the Fund’s Schedule of Investments. This schedule reports the types of securities held in the Fund on the last day of the reporting period. Securities are usually listed by type (common stock, corporate bonds, U.S. Government obligations, etc.) and by industry classification (banking, communications, insurance, etc.). Holdings are subject to change without notice.

The value of each security is quoted as of the last day of the reporting period. The value of securities denominated in foreign currencies is converted into U.S. dollars.

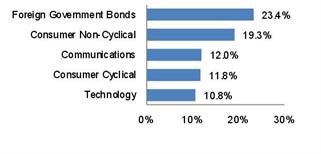

If the Fund invests in foreign securities, it will also provide a summary of investments by country. This summary reports the Fund exposure to different countries by providing the percentage of securities invested in each country. The country of each security represents the country of risk. The Fund’s Schedule of Investments relies upon the industry group and country classifications published by Barclays and/or MSCI Inc.

Tables listing details of individual forward currency contracts, futures, written options, swaptions, and swaps follow the Fund’s Schedule of Investments (if applicable).

Statement of Assets and Liabilities

This statement is often referred to as the “balance sheet.” It lists the assets and liabilities of the Fund on the last day of the reporting period.

Janus Henderson Absolute Return Income Opportunities Fund

Useful Information About Your Fund Report (unaudited)

The Fund’s assets are calculated by adding the value of the securities owned, the receivable for securities sold but not yet settled, the receivable for dividends declared but not yet received on securities owned, and the receivable for Fund shares sold to investors but not yet settled. The Fund’s liabilities include payables for securities purchased but not yet settled, Fund shares redeemed but not yet paid, and expenses owed but not yet paid. Additionally, there may be other assets and liabilities such as unrealized gain or loss on forward currency contracts.

The section entitled “Net Assets Consist of” breaks down the components of the Fund’s net assets. Because the Fund must distribute substantially all earnings, you will notice that a significant portion of net assets is shareholder capital.

The last section of this statement reports the net asset value (“NAV”) per share on the last day of the reporting period. The NAV is calculated by dividing the Fund’s net assets for each share class (assets minus liabilities) by the number of shares outstanding.

Statement of Operations

This statement details the Fund’s income, expenses, realized gains and losses on securities and currency transactions, and changes in unrealized appreciation or depreciation of Fund holdings.

The first section in this statement, entitled “Investment Income,” reports the dividends earned from securities and interest earned from interest-bearing securities in the Fund.

The next section reports the expenses incurred by the Fund, including the advisory fee paid to the investment adviser, transfer agent fees and expenses, and printing and postage for mailing statements, financial reports and prospectuses. Expense offsets and expense reimbursements, if any, are also shown.

The last section lists the amounts of realized gains or losses from investment and foreign currency transactions, and changes in unrealized appreciation or depreciation of investments and foreign currency-denominated assets and liabilities. The Fund will realize a gain (or loss) when it sells its position in a particular security. A change in unrealized gain (or loss) refers to the change in net appreciation or depreciation of the Fund during the reporting period. “Net Realized and Unrealized Gain/(Loss) on Investments” is affected both by changes in the market value of Fund holdings and by gains (or losses) realized during the reporting period.

Statements of Changes in Net Assets

These statements report the increase or decrease in the Fund’s net assets during the reporting period. Changes in the Fund’s net assets are attributable to investment operations, dividends and distributions to investors, and capital share transactions. This is important to investors because it shows exactly what caused the Fund’s net asset size to change during the period.

The first section summarizes the information from the Statement of Operations regarding changes in net assets due to the Fund’s investment operations. The Fund’s net assets may also change as a result of dividend and capital gains distributions to investors. If investors receive their dividends and/or distributions in cash, money is taken out of the Fund to pay the dividend and/or distribution. If investors reinvest their dividends and/or distributions, the Fund’s net assets will not be affected. If you compare the Fund’s “Net Decrease from Dividends and Distributions” to “Reinvested Dividends and Distributions,” you will notice that dividends and distributions have little effect on the Fund’s net assets. This is because the majority of the Fund’s investors reinvest their dividends and/or distributions.

The reinvestment of dividends and distributions is included under “Capital Share Transactions.” “Capital Shares” refers to the money investors contribute to the Fund through purchases or withdrawals via redemptions. The Fund’s net assets will increase and decrease in value as investors purchase and redeem shares from the Fund.

Financial Highlights

This schedule provides a per-share breakdown of the components that affect the Fund’s NAV for current and past reporting periods as well as total return, asset size, ratios, and portfolio turnover rate.

The first line in the table reflects the NAV per share at the beginning of the reporting period. The next line reports the net investment income/(loss) per share. Following is the per share total of net gains/(losses), realized and unrealized. Per share dividends and distributions to investors are then subtracted to arrive at the NAV per share at the end of the period. The next line reflects the total return for the period. The total return may include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes. As a result, the

Janus Henderson Absolute Return Income Opportunities Fund

Useful Information About Your Fund Report (unaudited)

total return may differ from the total return reflected for individual shareholder transactions. Also included are ratios of expenses and net investment income to average net assets.

The Fund’s expenses may be reduced through expense offsets and expense reimbursements. The ratios shown reflect expenses before and after any such offsets and reimbursements.

The ratio of net investment income/(loss) summarizes the income earned less expenses, divided by the average net assets of the Fund during the reporting period. Do not confuse this ratio with the Fund’s yield. The net investment income ratio is not a true measure of the Fund’s yield because it does not take into account the dividends distributed to the Fund’s investors.

The next figure is the portfolio turnover rate, which measures the buying and selling activity in the Fund. Portfolio turnover is affected by market conditions, changes in the asset size of the Fund, fluctuating volume of shareholder purchase and redemption orders, the nature of the Fund’s investments, and the investment style and/or outlook of the portfolio manager(s) and/or investment personnel. A 100% rate implies that an amount equal to the value of the entire portfolio was replaced once during the fiscal year; a 50% rate means that an amount equal to the value of half the portfolio is traded in a year; and a 200% rate means that an amount equal to the value of the entire portfolio is traded every six months.

Janus Henderson Absolute Return Income Opportunities Fund

Notes

NotesPage1

Knowledge. Shared

At Janus Henderson, we believe in the sharing of expert insight for better investment and business decisions. We call this ethos Knowledge. Shared.

Learn more by visiting janushenderson.com.

| | | | | | | | | |

| | | | | |

| | | | |

This report is submitted for the general information of shareholders of the Fund. It is not an offer or solicitation for the Fund and is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. |

Janus Henderson, Janus, Henderson, Perkins, Intech and Knowledge. Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc. Janus Henderson Distributors |

| | | | | 125-24-93024 02-20 |

| | | |

| | | |

| | | SEMIANNUAL REPORT December 31, 2019 |

| | |

| | Janus Henderson Adaptive Global Allocation Fund |

| | |

| | Janus Investment Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or your plan sponsor, broker-dealer, or financial intermediary, or if you invest directly with the Fund, by contacting a Janus Henderson representative. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your plan sponsor, broker-dealer, or financial intermediary, or if you invest directly with the Fund, by visiting janushenderson.com/edelivery. You may elect to receive all future reports in paper free of charge. If you do not invest directly with the Fund, you should contact your plan sponsor, broker-dealer, or financial intermediary, to request to continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-525-3713 to let the Fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Janus Henderson mutual funds where held (i.e., all Janus Henderson mutual funds held in your account if you invest through your financial intermediary or all Janus Henderson mutual funds held with the fund complex if you invest directly with a fund). |

| | | |

| | | HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund performance, characteristics

and holdings |

| | | |

| | |

|

Table of Contents

Janus Henderson Adaptive Global Allocation Fund

Janus Henderson Adaptive Global Allocation Fund (unaudited)

| | | | | | |

FUND SNAPSHOT This global allocation fund seeks to provide investors total return by dynamically allocating its assets across a portfolio of global equity and fixed income investments, which may involve the use of derivatives. The Fund is designed to actively adapt based on forward-looking views on extreme market movements, both positive and negative, with the goal of minimizing the risk of significant loss in a major downturn while participating in the growth potential of capital markets. | | | |

Ashwin Alankar co-portfolio manager |

Enrique Chang co-portfolio manager |

| | | |

PERFORMANCE OVERVIEW

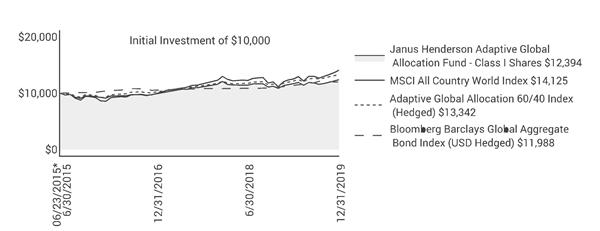

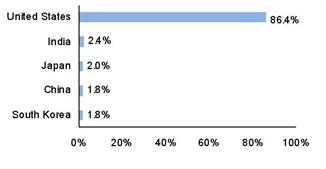

Janus Henderson Adaptive Global Allocation Fund Class I Shares returned 3.94% for the six-month period ended December 31, 2019. This compares with a return of 8.92% for its primary benchmark, the MSCI All Country World IndexSM. The Fund’s secondary benchmark, the Adaptive Global Allocation 60-40 Index, an internally calculated index that comprises the MSCI All Country World IndexSM (60%) and the Bloomberg Barclays Global Aggregate Bond Index (40%), returned 6.21%. Its tertiary benchmark, the Bloomberg Barclays Global Aggregate Bond Index, returned 2.09%.

MARKET ENVIRONMENT

Global financial markets generated positive returns during the period, with riskier assets outperforming safer government bonds as optimism brewed that heretofore slowing global growth may reaccelerate. Two developments fueling investor optimism were stabilizing global purchasing managers’ indices and headway in U.S.-China trade negotiations. Although yields across the U.S. Treasuries curve were down for the period, the curve between 2-year and 10-year maturities steepened as the former was anchored to a succession of rate cuts by the Federal Reserve (Fed) and the latter proved more susceptible to a potential uptick in global growth. Investment-grade credit marginally outperformed high-yield issuers due in part to falling interest rates. Yet for both categories, spreads between their yields and those of their risk-free benchmarks narrowed considerably. Equities rallied, with some U.S. benchmarks achieving new record closes by the end of the period, but international stocks also moved upward on improving growth prospects. This occurred after an extended period of underperformance by international stocks.

PERFORMANCE DISCUSSION

For the six-month period, the Fund underperformed its primary and tertiary benchmarks. Underperformance relative to its secondary benchmark, comprising a 60/40 allocation to equities and bonds, was largely due to an underweighting to stocks during the last four months of 2019, a period that was characterized by strong equity performance.

Underperformance relative to its primary, equities-focused benchmark was due to an underweighting in a concentrated group of stocks that drove a considerable portion of the index’s returns for the period. After beginning the period at 82% exposure to equities, the Fund de-risked to 62% by the end of August as its proprietary options-market signals indicated decreased attractiveness of? equities. Subsequently, the Fund’s proprietary signals indicated increased attractiveness of? equities during October, November and December, and the Fund consequently increased its equity exposure significantly from 69% at the end of September to 87% by the end of December.

That said, it should be noted that a key characteristic of market behavior in 2019 was multiple periods of rapid mean reversion. Under such environments, our options-sourced signals can suffer from being exposed to “whipsawed” conditions, thereby leading to underperformance.

In executing the strategy, during the period the Fund utilized derivatives, including futures and forward exchange contracts. For the period covered by this letter, the impact of derivatives on the Fund was negative. Please see the Derivative Instruments section in the “Notes to Financial Statements” for a discussion of derivatives used by the Fund.

OUTLOOK

Our signals of forward-looking inflation continue to point to the upside. The robustness of this view is reflected in its consistency over the past several months. As we start the new year, we believe that inflation is the greatest risk

Janus Henderson Adaptive Global Allocation Fund (unaudited)

faced by markets, particularly because most have written it off, citing structural headwinds. Often, an ignored risk turns out to be the most painful kind.

The central bank-manufactured “cheap” money environment that financial assets have ridden to new highs could quickly disappear in the face of unexpected inflation and a likely shift toward a tightening regime. We have seen time and again how the market responds when fears of tightening unfold, and it is not pretty.

And one must not forget that despite these structural headwinds, the year-over-over U.S. core inflation, as measured by the consumer price index, sits at 2.3%, far from any notion of disinflation. Consistent with a possible pick-up in inflation, we see nominal bonds as challenged, according to our signals.

In response to potential structural headwinds and inflation data showing restraint, the Fed and other global central banks have made it very clear that not only will accommodation last, but they are comfortable with inflation climbing above their targets. This is potentially a dangerous game to play, because inflation is rarely tame. During hibernation, a bear appears tame, but when it wakes up, it is anything but docile. History suggests that the same holds true for inflation. The good news is our signals are not currently pointing to “stagflation.” But beware that inflation could compromise today’s stimulative financial conditions as well as economic growth, as the Fed would inevitably respond by increasing interest rates, leading to higher real rates and costs of capital.

Thank you for investing in Janus Henderson Adaptive Global Allocation Fund

Janus Henderson Adaptive Global Allocation Fund (unaudited)

Fund At A Glance

December 31, 2019

| | |

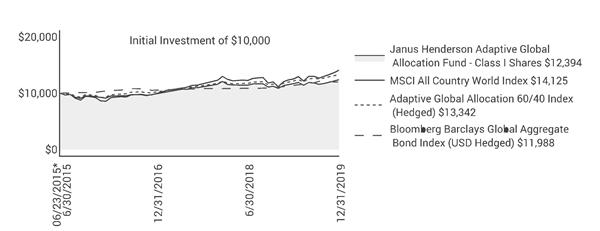

5 Largest Equity Holdings - (% of Net Assets) |

Vanguard FTSE All-World ex-US | |

Exchange-Traded Funds (ETFs) | 13.9% |

Vanguard FTSE Europe | |

Exchange-Traded Funds (ETFs) | 7.2% |

Vanguard S&P 500 | |

Exchange-Traded Funds (ETFs) | 6.7% |

Vanguard FTSE Pacific | |

Exchange-Traded Funds (ETFs) | 6.4% |

Vanguard FTSE Emerging Markets | |

Exchange-Traded Funds (ETFs) | 6.2% |

| | 40.4% |

| | | | | | |

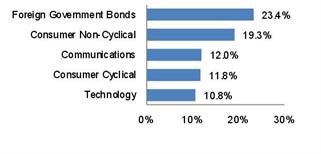

Asset Allocation - (% of Net Assets) |

Investment Companies | | 74.9% |

Common Stocks | | 21.8% |

U.S. Government Agency Notes | | 2.8% |

Investments Purchased with Cash Collateral from Securities Lending | | 0.4% |

OTC Purchased Options – Calls | | 0.1% |

Preferred Stocks | | 0.0% |

OTC Purchased Options – Puts | | 0.0% |

Other | | 0.0% |

| | | 100.0% |

| | |

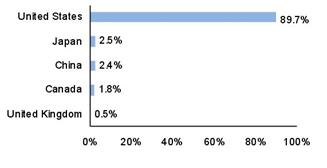

Top Country Allocations - Long Positions - (% of Investment Securities) |

As of December 31, 2019

| As of June 30, 2019

|

Janus Henderson Adaptive Global Allocation Fund (unaudited)

Performance

| |

See important disclosures on the next page. |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Average Annual Total Return - for the periods ended December 31, 2019 | | | Expense Ratios |

| | Fiscal

Year-to-Date | One

Year | Since

Inception* | | | Total Annual Fund

Operating Expenses‡ | Net Annual Fund

Operating Expenses‡ |

Class A Shares at NAV | | 3.79% | 13.71% | 4.61% | | | 1.84% | 1.12% |

Class A Shares at MOP | | -2.18% | 7.22% | 3.25% | | | | |

Class C Shares at NAV | | 3.83% | 13.90% | 4.06% | | | 2.58% | 1.84% |

Class C Shares at CDSC | | 2.83% | 12.90% | 4.06% | | | | |

Class D Shares(1) | | 3.93% | 13.97% | 4.71% | | | 1.53% | 0.96% |

Class I Shares | | 3.94% | 13.96% | 4.86% | | | 1.45% | 0.87% |

Class N Shares | | 3.98% | 14.11% | 4.91% | | | 1.36% | 0.81% |

Class S Shares | | 3.86% | 13.99% | 4.57% | | | 2.10% | 1.31% |

Class T Shares | | 3.83% | 13.85% | 4.71% | | | 1.72% | 1.06% |

MSCI All Country World Index | | 8.92% | 26.60% | 7.93% | | | | |

Adaptive Global Allocation 60/40 Index (Hedged) | | 6.21% | 19.18% | 6.58% | | | | |

Bloomberg Barclays Global Aggregate Bond Index (USD Hedged) | | 2.09% | 8.22% | 4.09% | | | | |

Morningstar Quartile - Class I Shares | | - | 3rd | 2nd | | | | |

Morningstar Ranking - based on total returns for World Allocation Funds | | - | 386/480 | 171/401 | | | | |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 800.668.0434 (or 800.525.3713 if you hold shares directly with Janus Henderson) or visit janushenderson.com/performance (or janushenderson.com/allfunds if you hold shares directly with Janus Henderson).

Maximum Offering Price (MOP) returns include the maximum sales charge of 5.75%. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

CDSC returns include a 1% contingent deferred sales charge (CDSC) on Shares redeemed within 12 months of purchase. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

Janus Henderson Adaptive Global Allocation Fund (unaudited)

Performance

Net expense ratios reflect the expense waiver, if any, contractually agreed to through October 28, 2020.

Performance may be affected by risks that include those associated with non-diversification, portfolio turnover, short sales, potential conflicts of interest, foreign and emerging markets, initial public offerings (IPOs), high-yield and high-risk securities, undervalued, overlooked and smaller capitalization companies, real estate related securities including Real Estate Investment Trusts (REITs), derivatives, and commodity-linked investments. Each product has different risks. Please see the prospectus for more information about risks, holdings and other details.

There is a risk that the Fund’s investments will correlate with stocks and bonds to a greater degree than anticipated, and the investment process may not achieve the desired results. The Fund may underperform during up markets and be negatively affected in down markets. Diversification does not assure a profit or eliminate the risk of loss.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

Ranking is for the share class shown only; other classes may have different performance characteristics. When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2019 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

See “Useful Information About Your Fund Report.”

*The Fund’s inception date – June 23, 2015

‡ As stated in the prospectus. See Financial Highlights for actual expense ratios during the reporting period.

(1) Closed to certain new investors.

Janus Henderson Adaptive Global Allocation Fund (unaudited)

Expense Examples

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as sales charges (loads) on purchase payments (applicable to Class A Shares only); and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in any share class or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. These fees are fully described in the Fund’s prospectuses. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | |

| | | | | | | | | |

| | | | Actual | | Hypothetical

(5% return before expenses) | |

| Beginning

Account

Value

(7/1/19) | Ending

Account

Value

(12/31/19) | Expenses

Paid During

Period

(7/1/19 - 12/31/19)† | | Beginning

Account

Value

(7/1/19) | Ending

Account

Value

(12/31/19) | Expenses

Paid During

Period

(7/1/19 - 12/31/19)† | Net Annualized

Expense Ratio

(7/1/19 - 12/31/19) |

Class A Shares | $1,000.00 | $1,037.90 | $5.23 | | $1,000.00 | $1,020.01 | $5.18 | 1.02% |

Class C Shares | $1,000.00 | $1,038.30 | $5.07 | | $1,000.00 | $1,020.16 | $5.03 | 0.99% |

Class D Shares | $1,000.00 | $1,039.30 | $4.31 | | $1,000.00 | $1,020.91 | $4.27 | 0.84% |

Class I Shares | $1,000.00 | $1,039.40 | $3.95 | | $1,000.00 | $1,021.27 | $3.91 | 0.77% |

Class N Shares | $1,000.00 | $1,039.80 | $3.64 | | $1,000.00 | $1,021.57 | $3.61 | 0.71% |

Class S Shares | $1,000.00 | $1,038.60 | $4.30 | | $1,000.00 | $1,020.91 | $4.27 | 0.84% |

Class T Shares | $1,000.00 | $1,038.30 | $4.56 | | $1,000.00 | $1,020.66 | $4.52 | 0.89% |

† | Expenses Paid During Period are equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Fund’s prospectuses for more information regarding waivers and/or reimbursements. |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments (unaudited)

December 31, 2019

| | | | | | | | |

Shares/Principal/

Contract Amounts | | | Value | |

Common Stocks – 21.8% | | | |

Aerospace & Defense – 0.1% | | | |

| | Airbus SE | | 22 | | | $3,220 | |

| | Arconic Inc | | 151 | | | 4,646 | |

| | BAE Systems PLC | | 503 | | | 3,763 | |

| | CAE Inc | | 221 | | | 5,852 | |

| | General Dynamics Corp | | 42 | | | 7,407 | |

| | Huntington Ingalls Industries Inc | | 13 | | | 3,261 | |

| | L3Harris Technologies Inc | | 22 | | | 4,353 | |

| | Leonardo SpA | | 58 | | | 680 | |

| | Meggitt PLC | | 721 | | | 6,272 | |

| | Raytheon Co | | 36 | | | 7,911 | |

| | Thales SA | | 18 | | | 1,868 | |

| | | 49,233 | |

Air Freight & Logistics – 0% | | | |

| | Bollore SA | | 483 | | | 2,107 | |

| | Deutsche Post AG | | 13 | | | 496 | |

| | Expeditors International of Washington Inc | | 86 | | | 6,710 | |

| | FedEx Corp | | 151 | | | 22,833 | |

| | | 32,146 | |

Airlines – 0.1% | | | |

| | Alaska Air Group Inc | | 11 | | | 745 | |

| | American Airlines Group Inc | | 222 | | | 6,367 | |

| | ANA Holdings Inc | | 100 | | | 3,352 | |

| | Delta Air Lines Inc | | 21 | | | 1,228 | |

| | easyJet PLC | | 21 | | | 396 | |

| | Southwest Airlines Co | | 306 | | | 16,518 | |

| | United Airlines Holdings Inc* | | 118 | | | 10,395 | |

| | | 39,001 | |

Auto Components – 0% | | | |

| | Aptiv PLC | | 113 | | | 10,732 | |

| | Bridgestone Corp | | 100 | | | 3,746 | |

| | Cie Generale des Etablissements Michelin SCA | | 28 | | | 3,426 | |

| | NGK Spark Plug Co Ltd | | 100 | | | 1,964 | |

| | Nokian Renkaat Oyj | | 254 | | | 7,302 | |

| | Valeo SA | | 28 | | | 986 | |

| | Yokohama Rubber Co Ltd | | 100 | | | 1,962 | |

| | | 30,118 | |

Automobiles – 0.1% | | | |

| | Daimler AG | | 28 | | | 1,550 | |

| | Ferrari NV | | 24 | | | 3,981 | |

| | Fiat Chrysler Automobiles NV | | 283 | | | 4,188 | |

| | Ford Motor Co | | 3,871 | | | 36,000 | |

| | Mitsubishi Motors Corp | | 400 | | | 1,686 | |

| | Peugeot SA | | 153 | | | 3,655 | |

| | Renault SA | | 216 | | | 10,219 | |

| | Toyota Motor Corp | | 100 | | | 7,101 | |

| | | 68,380 | |

Banks – 0.5% | | | |

| | Aozora Bank Ltd | | 200 | | | 5,322 | |

| | Banco de Sabadell SA | | 11,520 | | | 13,438 | |

| | Bank of East Asia Ltd | | 3,800 | | | 8,486 | |

| | Bankia SA | | 2,001 | | | 4,270 | |

| | Bankinter SA | | 654 | | | 4,791 | |

| | Barclays PLC | | 787 | | | 1,872 | |

| | Bendigo & Adelaide Bank Ltd | | 894 | | | 6,134 | |

| | BOC Hong Kong Holdings Ltd | | 3,000 | | | 10,415 | |

| | Chiba Bank Ltd | | 400 | | | 2,331 | |

| | Citizens Financial Group Inc | | 481 | | | 19,533 | |

| | Commerzbank AG | | 140 | | | 866 | |

| | Commonwealth Bank of Australia | | 28 | | | 1,570 | |

| | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. |

| |

Janus Investment Fund | 7 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments (unaudited)

December 31, 2019

| | | | | | | | | |

Shares/Principal/

Contract Amounts | | | Value | |

Common Stocks – (continued) | | | |

Banks – (continued) | | | |

| | Concordia Financial Group Ltd | | 700 | | | $2,912 | |

| | DNB ASA | | 318 | | | 5,942 | |

| | Hang Seng Bank Ltd | | 1,700 | | | 35,127 | |

| | Intesa Sanpaolo SpA | | 3,314 | | | 8,729 | |

| | Japan Post Bank Co Ltd | | 2,900 | | | 28,028 | |

| | KeyCorp | | 1,355 | | | 27,425 | |

| | National Australia Bank Ltd | | 3,153 | | | 54,485 | |

| | Oversea-Chinese Banking Corp Ltd | | 1,700 | | | 13,882 | |

| | People's United Financial Inc | | 91 | | | 1,538 | |

| | Raiffeisen Bank International AG | | 228 | | | 5,726 | |

| | Regions Financial Corp | | 462 | | | 7,928 | |

| | Seven Bank Ltd | | 2,300 | | | 7,579 | |

| | Shizuoka Bank Ltd | | 600 | | | 4,518 | |

| | Standard Chartered PLC | | 117 | | | 1,104 | |

| | Sumitomo Mitsui Financial Group Inc | | 200 | | | 7,434 | |

| | Svenska Handelsbanken AB | | 127 | | | 1,369 | |

| | United Overseas Bank Ltd | | 500 | | | 9,821 | |

| | Westpac Banking Corp | | 217 | | | 3,689 | |

| | | 306,264 | |

Beverages – 0.1% | | | |

| | Brown-Forman Corp | | 335 | | | 22,646 | |

| | Coca-Cola Amatil Ltd | | 454 | | | 3,523 | |

| | Coca-Cola Bottlers Japan Holdings Inc | | 100 | | | 2,569 | |

| | Coca-Cola Co | | 578 | | | 31,992 | |

| | Coca-Cola HBC AG* | | 241 | | | 8,187 | |

| | Davide Campari-Milano SpA | | 817 | | | 7,459 | |

| | Heineken NV | | 100 | | | 10,646 | |

| | Suntory Beverage & Food Ltd | | 100 | | | 4,184 | |

| | Treasury Wine Estates Ltd | | 312 | | | 3,555 | |

| | | 94,761 | |

Biotechnology – 0.2% | | | |

| | AbbVie Inc | | 38 | | | 3,365 | |

| | Alexion Pharmaceuticals Inc* | | 176 | | | 19,034 | |

| | Amgen Inc | | 9 | | | 2,170 | |

| | BeiGene Ltd (ADR)* | | 10 | | | 1,658 | |

| | Biogen Inc* | | 46 | | | 13,650 | |

| | CSL Ltd | | 46 | | | 8,900 | |

| | Gilead Sciences Inc | | 869 | | | 56,468 | |

| | Grifols SA | | 652 | | | 22,984 | |

| | Incyte Corp* | | 168 | | | 14,670 | |

| | Vertex Pharmaceuticals Inc* | | 62 | | | 13,575 | |

| | | 156,474 | |

Building Products – 0% | | | |

| | Allegion PLC | | 154 | | | 19,179 | |

| | AO Smith Corp | | 155 | | | 7,384 | |

| | Cie de Saint-Gobain | | 7 | | | 287 | |

| | Masco Corp | | 58 | | | 2,783 | |

| | | 29,633 | |

Capital Markets – 0.3% | | | |

| | 3i Group PLC | | 152 | | | 2,210 | |

| | ASX Ltd | | 112 | | | 6,161 | |

| | BlackRock Inc | | 4 | | | 2,011 | |

| | CI Financial Corp | | 138 | | | 2,307 | |

| | CME Group Inc | | 54 | | | 10,839 | |

| | Deutsche Boerse AG | | 22 | | | 3,458 | |

| | E*TRADE Financial Corp | | 366 | | | 16,605 | |

| | Franklin Resources Inc | | 126 | | | 3,273 | |

| | Hong Kong Exchanges & Clearing Ltd | | 600 | | | 19,482 | |

| | Invesco Ltd | | 224 | | | 4,028 | |

| | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. |

| |

8 | DECEMBER 31, 2019 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments (unaudited)

December 31, 2019

| | | | | | | | | |

Shares/Principal/

Contract Amounts | | | Value | |

Common Stocks – (continued) | | | |

Capital Markets – (continued) | | | |

| | Japan Exchange Group Inc | | 500 | | | $8,883 | |

| | London Stock Exchange Group PLC | | 103 | | | 10,572 | |

| | MSCI Inc | | 21 | | | 5,422 | |

| | Nasdaq Inc | | 351 | | | 37,592 | |

| | Partners Group Holding AG | | 20 | | | 18,342 | |

| | S&P Global Inc | | 70 | | | 19,113 | |

| | Schroders PLC | | 128 | | | 5,652 | |

| | Singapore Exchange Ltd | | 2,300 | | | 15,155 | |

| | State Street Corp | | 58 | | | 4,588 | |

| | | 195,693 | |

Chemicals – 0.4% | | | |

| | Air Liquide SA | | 116 | | | 16,419 | |

| | Air Products & Chemicals Inc | | 6 | | | 1,410 | |

| | Air Water Inc | | 100 | | | 1,473 | |

| | Albemarle Corp | | 62 | | | 4,528 | |

| | BASF SE | | 148 | | | 11,180 | |

| | Celanese Corp | | 143 | | | 17,606 | |

| | CF Industries Holdings Inc | | 136 | | | 6,493 | |

| | Clariant AG* | | 847 | | | 18,908 | |

| | Covestro AG (144A) | | 86 | | | 3,998 | |

| | Daicel Corp | | 300 | | | 2,897 | |

| | DuPont de Nemours Inc | | 49 | | | 3,146 | |

| | Eastman Chemical Co | | 83 | | | 6,579 | |

| | Ecolab Inc | | 65 | | | 12,544 | |

| | Evonik Industries AG | | 144 | | | 4,395 | |

| | FMC Corp | | 153 | | | 15,272 | |

| | Givaudan SA | | 7 | | | 21,927 | |

| | Incitec Pivot Ltd | | 2,035 | | | 4,540 | |

| | International Flavors & Fragrances Inc | | 45 | | | 5,806 | |

| | JSR Corp | | 100 | | | 1,852 | |

| | Kaneka Corp | | 100 | | | 3,240 | |

| | Kansai Paint Co Ltd | | 100 | | | 2,464 | |

| | LANXESS AG | | 34 | | | 2,281 | |

| | Mitsubishi Gas Chemical Co Inc | | 200 | | | 3,082 | |

| | Mosaic Co | | 311 | | | 6,730 | |

| | Nissan Chemical Corp | | 100 | | | 4,230 | |

| | Orica Ltd | | 218 | | | 3,362 | |

| | Sherwin-Williams Co | | 10 | | | 5,835 | |

| | Showa Denko KK | | 100 | | | 2,668 | |

| | Sumitomo Chemical Co Ltd | | 800 | | | 3,667 | |

| | Symrise AG | | 48 | | | 5,050 | |

| | Teijin Ltd | | 200 | | | 3,765 | |

| | Tosoh Corp | | 300 | | | 4,681 | |

| | Umicore SA | | 120 | | | 5,836 | |

| | Yara International ASA | | 487 | | | 20,265 | |

| | | 238,129 | |

Commercial Services & Supplies – 0.1% | | | |

| | Brambles Ltd | | 275 | | | 2,261 | |

| | Cintas Corp | | 28 | | | 7,534 | |

| | Copart Inc* | | 31 | | | 2,819 | |

| | Edenred | | 129 | | | 6,670 | |

| | G4S PLC | | 1,932 | | | 5,578 | |

| | Rollins Inc | | 62 | | | 2,056 | |

| | Toppan Printing Co Ltd | | 100 | | | 2,081 | |

| | Waste Management Inc | | 78 | | | 8,889 | |

| | | 37,888 | |

Communications Equipment – 0.1% | | | |

| | Arista Networks Inc* | | 35 | | | 7,119 | |

| | Cisco Systems Inc | | 369 | | | 17,697 | |

| | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. |

| |

Janus Investment Fund | 9 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments (unaudited)

December 31, 2019

| | | | | | | | | |

Shares/Principal/

Contract Amounts | | | Value | |

Common Stocks – (continued) | | | |

Communications Equipment – (continued) | | | |

| | Nokia OYJ | | 7,042 | | | $26,033 | |

| | Telefonaktiebolaget LM Ericsson | | 644 | | | 5,610 | |

| | | 56,459 | |

Construction & Engineering – 0% | | | |

| | Bouygues SA | | 143 | | | 6,076 | |

| | CIMIC Group Ltd | | 101 | | | 2,348 | |

| | Ferrovial SA | | 515 | | | 15,579 | |

| | Jacobs Engineering Group Inc | | 20 | | | 1,797 | |

| | Skanska AB | | 46 | | | 1,040 | |

| | | 26,840 | |

Construction Materials – 0.1% | | | |

| | Boral Ltd | | 1,695 | | | 5,328 | |

| | HeidelbergCement AG | | 261 | | | 19,016 | |

| | Imerys SA | | 92 | | | 3,888 | |

| | James Hardie Industries PLC (CDI) | | 217 | | | 4,243 | |

| | LafargeHolcim Ltd* | | 129 | | | 7,159 | |

| | Martin Marietta Materials Inc | | 43 | | | 12,025 | |

| | Taiheiyo Cement Corp | | 200 | | | 5,919 | |

| | Vulcan Materials Co | | 66 | | | 9,503 | |

| | | 67,081 | |

Consumer Finance – 0% | | | |

| | Acom Co Ltd | | 1,600 | | | 7,320 | |

| | Synchrony Financial | | 77 | | | 2,773 | |

| | | 10,093 | |

Containers & Packaging – 0.1% | | | |

| | Avery Dennison Corp | | 206 | | | 26,949 | |

| | Ball Corp | | 57 | | | 3,686 | |

| | CCL Industries Inc | | 309 | | | 13,165 | |

| | International Paper Co | | 174 | | | 8,013 | |

| | Packaging Corp of America | | 131 | | | 14,671 | |

| | Sealed Air Corp | | 124 | | | 4,939 | |

| | Westrock Co | | 44 | | | 1,888 | |

| | | 73,311 | |

Distributors – 0.1% | | | |

| | LKQ Corp* | | 912 | | | 32,558 | |

Diversified Consumer Services – 0% | | | |

| | Benesse Holdings Inc | | 100 | | | 2,645 | |

| | H&R Block Inc | | 598 | | | 14,041 | |

| | | 16,686 | |

Diversified Financial Services – 0% | | | |

| | AMP Ltd | | 3,663 | | | 4,921 | |

| | Berkshire Hathaway Inc* | | 11 | | | 2,492 | |

| | Eurazeo SA | | 49 | | | 3,352 | |

| | Groupe Bruxelles Lambert SA | | 10 | | | 1,054 | |

| | Industrivarden AB | | 348 | | | 8,396 | |

| | Wendel SA | | 43 | | | 5,715 | |

| | | 25,930 | |

Diversified Telecommunication Services – 0.3% | | | |

| | AT&T Inc | | 2,767 | | | 108,134 | |

| | BCE Inc | | 33 | | | 1,529 | |

| | BT Group PLC | | 1,990 | | | 5,072 | |

| | CenturyLink Inc | | 232 | | | 3,065 | |

| | Deutsche Telekom AG | | 38 | | | 621 | |

| | Elisa OYJ | | 192 | | | 10,606 | |

| | HKT Trust & HKT Ltd | | 2,000 | | | 2,818 | |

| | Iliad SA | | 11 | | | 1,426 | |

| | Koninklijke KPN NV | | 4,127 | | | 12,179 | |

| | Orange SA | | 129 | | | 1,898 | |

| | PCCW Ltd | | 9,000 | | | 5,325 | |

| | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. |

| |

10 | DECEMBER 31, 2019 |

Janus Henderson Adaptive Global Allocation Fund

Schedule of Investments (unaudited)

December 31, 2019

| | | | | | | | | |

Shares/Principal/

Contract Amounts | | | Value | |

Common Stocks – (continued) | | | |

Diversified Telecommunication Services – (continued) | | | |

| | Singapore Telecommunications Ltd | | 2,300 | | | $5,765 | |

| | Swisscom AG (REG) | | 7 | | | 3,708 | |

| | Telefonica Deutschland Holding AG | | 3,053 | | | 8,848 | |

| | Telefonica SA | | 3,084 | | | 21,539 | |

| | Telenor ASA | | 184 | | | 3,301 | |

| | Telia Co AB | | 1,017 | | | 4,372 | |

| | Telstra Corp Ltd | | 901 | | | 2,238 | |

| | TELUS Corp | | 234 | | | 9,062 | |

| | | 211,506 | |

Electric Utilities – 0.2% | | | |

| | American Electric Power Co Inc | | 188 | | | 17,768 | |

| | AusNet Services | | 1,385 | | | 1,652 | |

| | Chugoku Electric Power Co Inc | | 300 | | | 3,949 | |

| | CLP Holdings Ltd | | 500 | | | 5,256 | |

| | Duke Energy Corp | | 141 | | | 12,861 | |

| | Electricite de France SA | | 309 | | | 3,441 | |

| | Emera Inc | | 20 | | | 859 | |

| | Endesa SA | | 156 | | | 4,163 | |

| | Enel SpA | | 689 | | | 5,465 | |

| | Eversource Energy | | 8 | | | 681 | |

| | Exelon Corp | | 173 | | | 7,887 | |

| | FirstEnergy Corp | | 63 | | | 3,062 | |

| | Fortum Oyj | | 88 | | | 2,171 | |

| | Iberdrola SA | | 1,305 | | | 13,437 | |

| | Kyushu Electric Power Co Inc | | 100 | | | 870 | |