UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

☐ | | Preliminary Proxy Statement |

| |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ | | Definitive Proxy Statement |

| |

☐ | | Definitive Additional Materials |

| |

☒ | | Soliciting Material Pursuant to §240.14a-12 |

Janus Investment Fund

(Exact Name of Registrant as Specified in Charter)

151 Detroit Street, Denver, Colorado 80206-4805

(Address of Principal Executive Offices)

303-333-3863

(Registrant’s Telephone No., including Area Code)

Michelle Rosenberg — 151 Detroit Street, Denver, Colorado 80206-4805

(Name and Address of Agent for Service)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | Fee not required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

HENDERSON GLOBAL FUNDS

MERGER GUIDE

Information relating to the Janus Henderson merger in the US

As of December 2016

CONTENTS

Overview 1

US Mutual Fund range 2

Integration timetable 3

Questions & answers 4-5

This publication is not intended to, and shall not, constitute an offer to purchase or sell shares of any of the funds; nor is this press release intended to solicit a proxy from any shareholder of any of the funds. The solicitation of the purchase or sale of securities or of proxies to effect the reorganization may only be made by a final, effective Registration Statement, which will include a definitive Combined Proxy Statement/Prospectus, after the Registration Statement is declared effective by the SEC.

Overview

Chuck Thompson

Head of North America Distribution

To our clients and shareholders,

On October 3, 2016, we announced the planned merger of Henderson Global Investors and Janus Capital Group, which is expected to close in the second quarter of 2017. We believe this merger will benefit our clients and shareholders as it creates a truly global active management firm with $320B in assets under management (as of 9/30/16). The new firm will offer a broader range of investment options, potentially lower fees on certain funds, and the combined resources of Henderson and Janus.

The following merger guide provides information about the upcoming planned merger. We have laid out a mapping of the Henderson Global Funds family on the following page, followed by an integration timeline and Q&A section covering key points on both the corporate and fund mergers. In addition, we want to make you aware that there will be no changes on your account servicing relationships with Henderson key contacts or investment management of the Henderson Funds until the closing of the merger in Q2 2017. Further details will be available on the Janus Henderson combined product line at that time.

We hope this information gives you a sense of what to expect in the coming months as we approach the merger close date. For more information please do not hesitate to contact your Henderson Relationship Manager or our sales desk at 1.866.443.6337.

Best,

Chuck Thompson

Head of North America Distribution

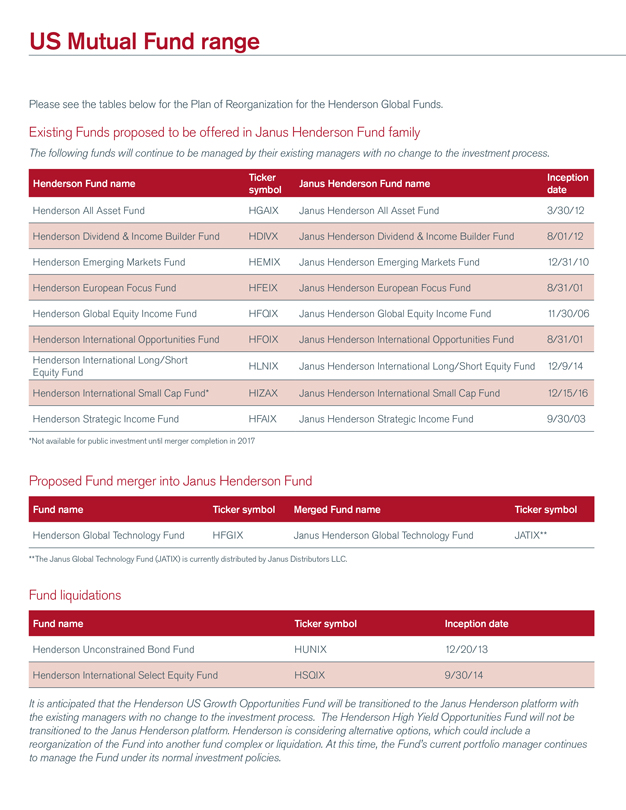

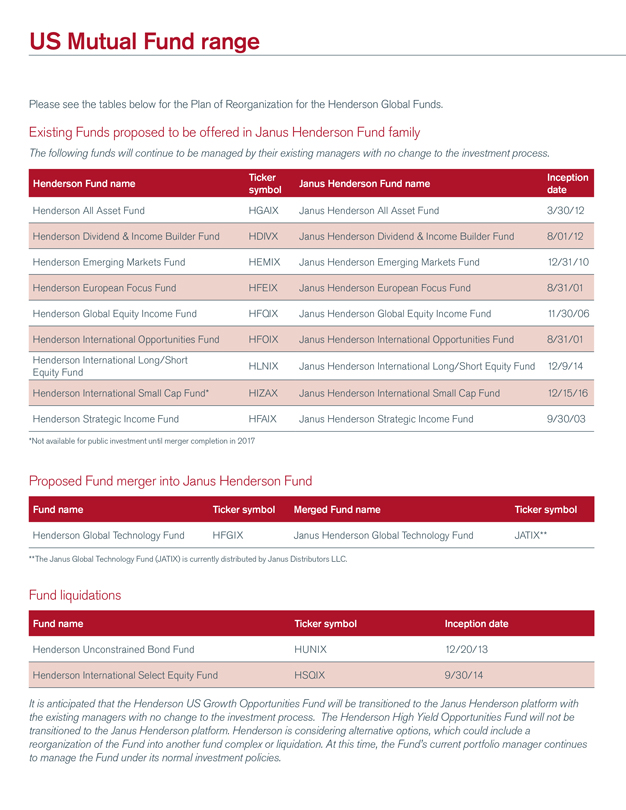

US Mutual Fund range

Please see the tables below for the Plan of Reorganization for the Henderson Global Funds.

Existing Funds proposed to be offered in Janus Henderson Fund family

The following funds will continue to be managed by their existing managers with no change to the investment process.

Henderson Fund name

Ticker

Inception

Henderson Fund name

Janus Henderson Fund name

symbol

date

Henderson All Asset Fund

HGAIX

Janus Henderson All Asset Fund

3/30/12

Henderson Dividend & Income Builder Fund

HDIVX

Janus Henderson Dividend & Income Builder Fund

8/01/12

Henderson Emerging Markets Fund

HEMIX

Janus Henderson Emerging Markets Fund

12/31/10

Henderson European Focus Fund

HFEIX

Janus Henderson European Focus Fund

8/31/01

Henderson Global Equity Income Fund

HFQIX

Janus Henderson Global Equity Income Fund

11/30/06

Henderson International Opportunities Fund

HFOIX

Janus Henderson International Opportunities Fund

8/31/01

Henderson International Long/Short

HLNIX

Janus Henderson International Long/Short Equity Fund

12/9/14

Equity Fund

Henderson International Small Cap Fund*

HIZAX

Janus Henderson International Small Cap Fund

12/15/16

Henderson Strategic Income Fund

HFAIX

Janus Henderson Strategic Income Fund

9/30/03

*Not available for public investment until merger completion in 2017

Proposed Fund merger into Janus Henderson Fund

Fund name

Ticker symbol

Merged Fund name

Ticker symbol

Henderson Global Technology Fund

HFGIX

Janus Henderson Global Technology Fund

JATIX**

**The Janus Global Technology Fund (JATIX) is currently distributed by Janus Distributors LLC.

Fund liquidations

Fund name

Ticker symbol

Inception date

Henderson Unconstrained Bond Fund

HUNIX

12/20/13

Henderson International Select Equity Fund

HSQIX

9/30/14

It is anticipated that the Henderson US Growth Opportunities Fund will be transitioned to the Janus Henderson platform with the existing managers with no change to the investment process. The Henderson High Yield Opportunities Fund will not be transitioned to the Janus Henderson platform. Henderson is considering alternative options, which could include a reorganization of the Fund into another fund complex or liquidation. At this time, the Fund’s current portfolio manager continues to manage the Fund under its normal investment policies.

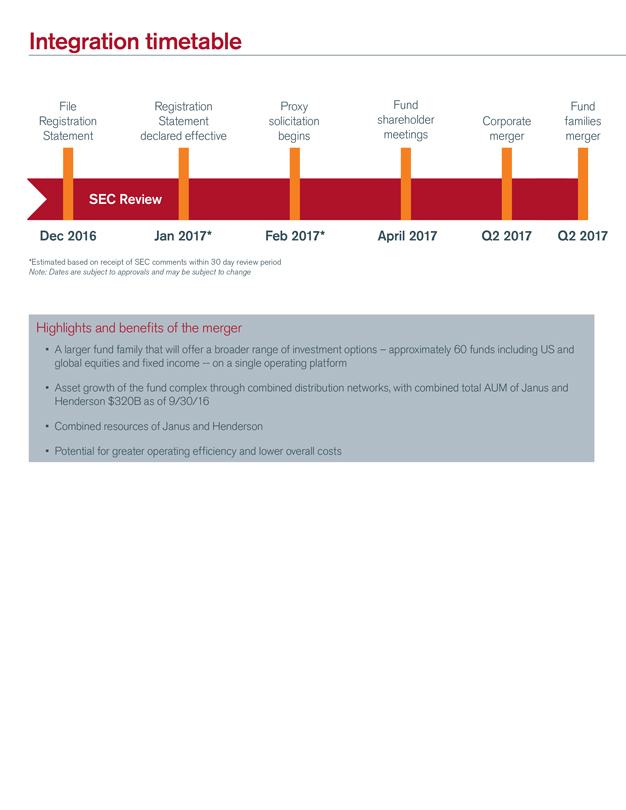

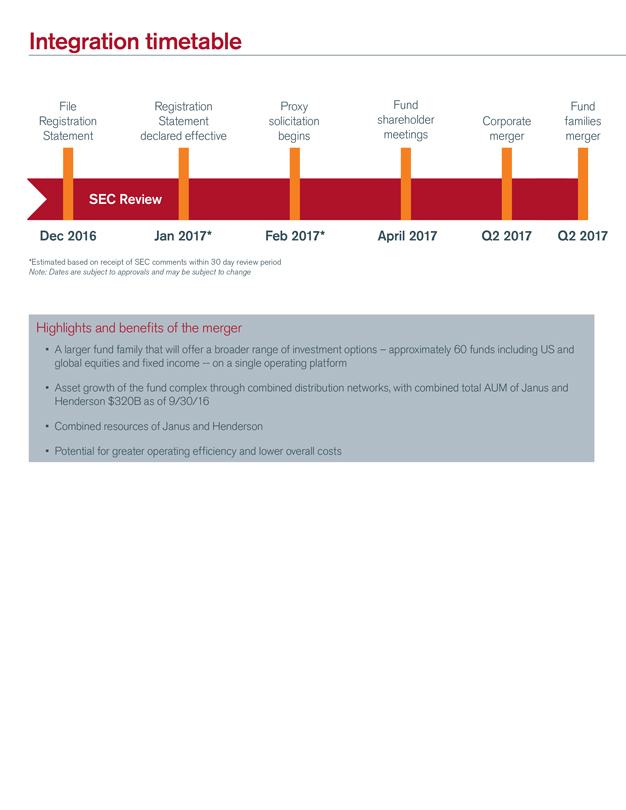

Integration timetable

Fund name

Ticker symbol

Inception date

Henderson Unconstrained Bond Fund

HUNIX

12/20/13

Henderson International Select Equity Fund

HSQIX

9/30/14

Dec 2016 Jan 2017* Feb 2017* April 2017 Q2 2017 Q2 2017

*Estimated based on receipt of SEC comments within 30 day review period

Note: Dates are subject to approvals and may be subject to change

Highlights and bene?ts of the merger

A larger fund family that will offer a broader range of investment options – approximately 60 funds including US and global equities and ?xed income — on a single operating platform

Asset growth of the fund complex through combined distribution networks, with combined total AUM of Janus and Henderson $320B as of 9/30/16

Combined resources of Janus and Henderson

Potential for greater operating efficiency and lower overall costs

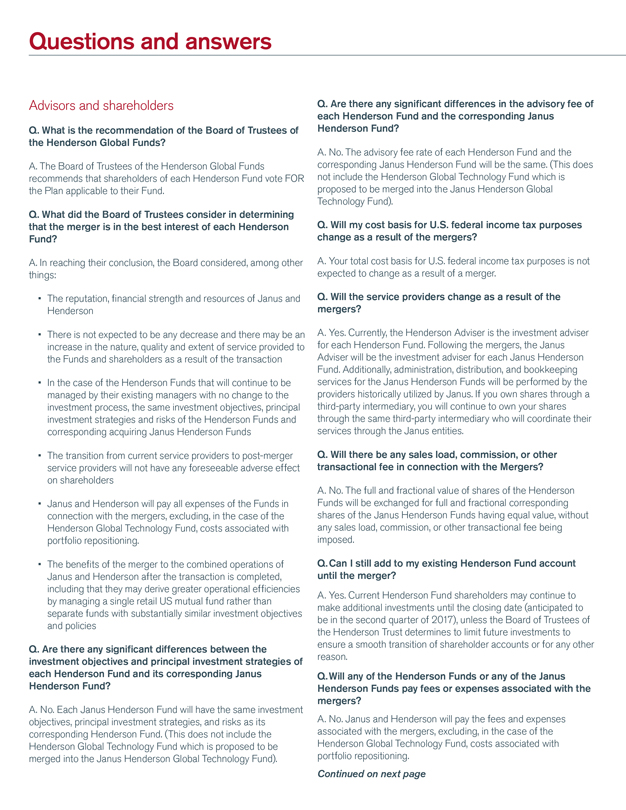

Questions and answers

Advisors and shareholders

Q. What is the recommendation of the Board of Trustees of the Henderson Global Funds?

A. The Board of Trustees of the Henderson Global Funds recommends that shareholders of each Henderson Fund vote FOR the Plan applicable to their Fund.

Q. What did the Board of Trustees consider in determining that the merger is in the best interest of each Henderson Fund?

A. In reaching their conclusion, the Board considered, among other things:

The reputation, financial strength and resources of Janus and Henderson

There is not expected to be any decrease and there may be an increase in the nature, quality and extent of service provided to the Funds and shareholders as a result of the transaction

In the case of the Henderson Funds that will continue to be managed by their existing managers with no change to the investment process, the same investment objectives, principal investment strategies and risks of the Henderson Funds and corresponding acquiring Janus Henderson Funds

The transition from current service providers to post-merger service providers will not have any foreseeable adverse effect on shareholders

Janus and Henderson will pay all expenses of the Funds in connection with the mergers, excluding, in the case of the Henderson Global Technology Fund, costs associated with portfolio repositioning.

The benefits of the merger to the combined operations of Janus and Henderson after the transaction is completed, including that they may derive greater operational efficiencies by managing a single retail US mutual fund rather than separate funds with substantially similar investment objectives and policies

Q. Are there any significant differences between the investment objectives and principal investment strategies of each Henderson Fund and its corresponding Janus Henderson Fund?

A. No. Each Janus Henderson Fund will have the same investment objectives, principal investment strategies, and risks as its corresponding Henderson Fund. (This does not include the Henderson Global Technology Fund which is proposed to be merged into the Janus Henderson Global Technology Fund).

Q. Are there any significant differences in the advisory fee of each Henderson Fund and the corresponding Janus Henderson Fund?

A. No. The advisory fee rate of each Henderson Fund and the corresponding Janus Henderson Fund will be the same. (This does not include the Henderson Global Technology Fund which is proposed to be merged into the Janus Henderson Global Technology Fund).

Q. Will my cost basis for U.S. federal income tax purposes change as a result of the mergers?

A. Your total cost basis for U.S. federal income tax purposes is not expected to change as a result of a merger.

Q. Will the service providers change as a result of the mergers?

A. Yes. Currently, the Henderson Adviser is the investment adviser for each Henderson Fund. Following the mergers, the Janus Adviser will be the investment adviser for each Janus Henderson Fund. Additionally, administration, distribution, and bookkeeping services for the Janus Henderson Funds will be performed by the providers historically utilized by Janus. If you own shares through a third-party intermediary, you will continue to own your shares through the same third-party intermediary who will coordinate their services through the Janus entities.

Q. Will there be any sales load, commission, or other transactional fee in connection with the Mergers?

A. No. The full and fractional value of shares of the Henderson Funds will be exchanged for full and fractional corresponding shares of the Janus Henderson Funds having equal value, without any sales load, commission, or other transactional fee being imposed.

Q. Can I still add to my existing Henderson Fund account until the merger?

A. Yes. Current Henderson Fund shareholders may continue to make additional investments until the closing date (anticipated to be in the second quarter of 2017), unless the Board of Trustees of the Henderson Trust determines to limit future investments to ensure a smooth transition of shareholder accounts or for any other reason.

Q. Will any of the Henderson Funds or any of the Janus Henderson Funds pay fees or expenses associated with the mergers?

A. No. Janus and Henderson will pay the fees and expenses associated with the mergers, excluding, in the case of the Henderson Global Technology Fund, costs associated with portfolio repositioning.

Continued on next page

Questions and answers

Q. If shareholders approve the mergers, when will the mergers take place?

A. If shareholders approve the merger for a Henderson Fund and any other conditions are satisfied or waived, the merger is expected to occur in the second quarter of 2017, or as soon as reasonably practicable after shareholder approval is obtained.

Q. What happens if a merger is not completed?

A. If a merger is not approved by shareholders or any other condition is not satisfied or waived, any shares held in a Henderson Fund would remain shares of the Henderson Fund. The Henderson Fund would continue to operate independently of the Janus Trust and the Board of Trustees of the Henderson Trust would determine what further action, if any, to take, including potential liquidation of the Henderson Fund.

Q. What if I want to exchange my shares into another Henderson fund prior to the mergers?

A. Shareholders of the Henderson Funds may exchange their shares into another Henderson fund before the closing date in accordance with their current exchange privileges by contacting their plan sponsor, broker-dealer, or financial intermediary, or by contacting a Henderson representative. If a shareholder chooses to exchange shares, the request will be treated as a normal exchange of shares and will be a taxable transaction unless the shares are held in a tax-deferred account, such as an individual retirement account (“IRA”). Exchanges may be subject to minimum investment requirements.

Investment teams

Q. How much integration of philosophy and process do you expect? Are Henderson and Janus’ approaches similar or different?

A. Henderson and Janus are well-aligned in terms of strategy, business mix and most importantly a culture of serving our clients by focusing on independent, active asset management. Investment teams will continue to invest using their established processes. The philosophy of both Henderson and Janus is to allow managers to invest in a way that best suits their asset classes and their clients’ needs while adhering to regulatory and risk frameworks – this will continue. The investment teams value collaboration and will interact as and where appropriate.

Q. How will the investment teams work together or will they remain independent? What will the structure look like for all teams (Equities / Fixed Income / Geneva)? Will they interact and share ideas or remain completely independent from one another?

A. Throughout our corporate histories, Henderson and Janus have fostered a climate where distinct investment styles and approaches can co-exist. The investment teams will remain independent in approach but interact and collaborate as appropriate.

Q. How will this impact the Henderson Europe and International equity teams?

A. This will not impact the Henderson Europe and International equity teams, they will remain intact and continue to follow their established investment processes.

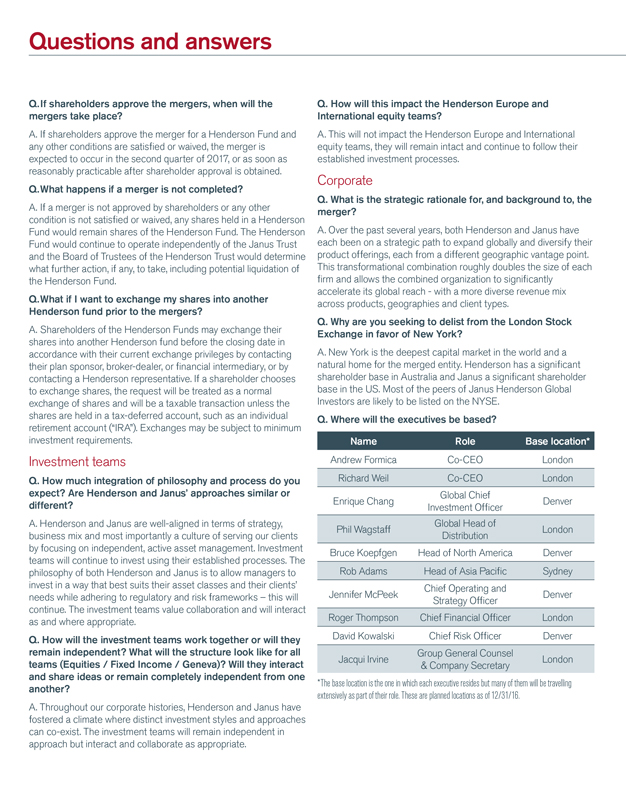

Corporate

Q. What is the strategic rationale for, and background to, the merger?

A. Over the past several years, both Henderson and Janus have each been on a strategic path to expand globally and diversify their product offerings, each from a different geographic vantage point. This transformational combination roughly doubles the size of each firm and allows the combined organization to significantly accelerate its global reach—with a more diverse revenue mix across products, geographies and client types.

Q. Why are you seeking to delist from the London Stock Exchange in favor of New York?

A. New York is the deepest capital market in the world and a natural home for the merged entity. Henderson has a significant shareholder base in Australia and Janus a significant shareholder base in the US. Most of the peers of Janus Henderson Global Investors are likely to be listed on the NYSE.

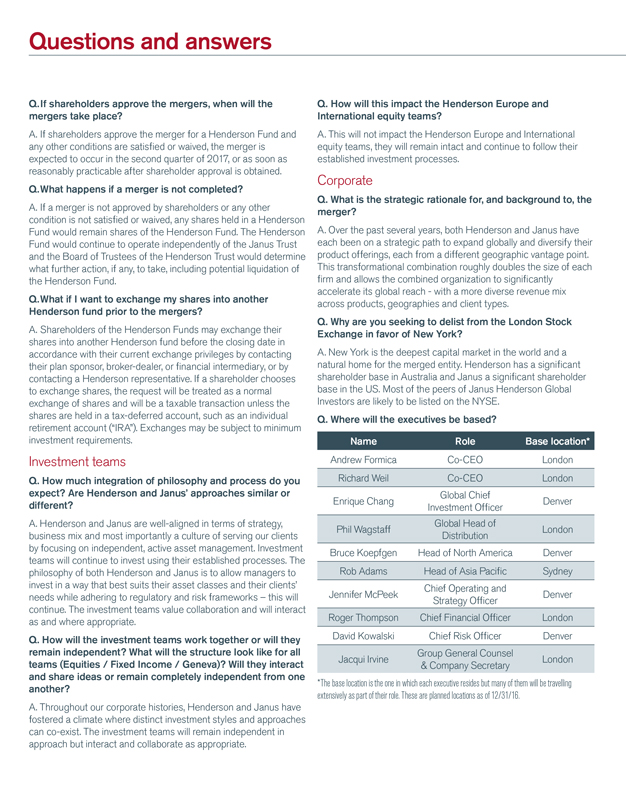

Q. Where will the executives be based?

Name

Role

Base location*

Andrew Formica

Co-CEO

London

Richard Weil

Co-CEO

London

Global Chief

Enrique Chang

Denver

Investment Officer

Global Head of

Phil Wagstaff

London

Distribution

Bruce Koepfgen

Head of North America

Denver

Rob Adams

Head of Asia Pacific

Sydney

Chief Operating and

Jennifer McPeek

Denver

Strategy Officer

Roger Thompson

Chief Financial Officer

London

David Kowalski

Chief Risk Officer

Denver

Group General Counsel

Jacqui Irvine

London

& Company Secretary

*The base location is the one in which each executive resides but many of them will be travelling extensively as part of their role. These are planned locations as of 12/31/16.

You | | can obtain free copies of the relevant Henderson Fund documents by contacting a Henderson representative at |

866-4HENDERSON | | (or 866-443-6337). The reports are also available, without charge, at henderson.com, or by sending a written request to the Secretary of Henderson Global Funds at P.O. Box 8391, Boston, MA 02266-8391. |

For | | additional information |

Please | | call 1 866 443 6337 Visit henderson.com |

In | | connection with the proposed transaction, the Acquiring Fund plans to file with the SEC and mail to its shareholders a registration statement on Form N-14 (the “Registration Statement”), which will contain a Proxy Statement/Prospectus (the “Proxy Statement/Prospectus”) that will be mailed to shareholders of the Target Fund. |

The | | Proxy Statement and the Registration Statement will each contain important information about the Target Fund and the Acquiring Fund (the “Funds”), the proposed transaction and related matters. Fund shareholders are urged to read the Proxy Statement and Proxy Statement/Prospectus and other documents filed with the SEC carefully and in their entirety when they become available because these documents will contain important information about the Funds, the transaction and the matters being submitted to shareholders. Shareholders should consider the investment objectives, risks, charges and expenses of the Funds carefully. The Proxy Statement/Prospectus will contain this and other important information. |

The | | Funds and their respective trustees, officers, other members of their management may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the Funds’ trustees and officers is available in their currently effective prospectuses and statements of additional information, as supplemented through the date hereof. Additional information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement and the Registration Statement when such documents become available. |

This | | letter is not intended to, and does not, constitute an offer to purchase or sell shares of the Funds; nor is this letter intended to solicit a proxy from any shareholder of the Funds. The solicitation of proxies will only be made pursuant to the final Proxy Statement or Proxy Statement/Prospectus. The Registration Statement has yet to be filed with the Securities and Exchange Commission (“SEC”). After the Registration Statement is filed with the SEC, it may be amended or withdrawn and the Joint Proxy Statement/Prospectus will not be distributed to shareholders unless and until the Registration Statement becomes effective. |

Shareholders | | may obtain free copies of the Registration Statement and Proxy Statement and other documents (when they become available) filed with the SEC at the SEC’s web site at www.sec.gov. |

International | | and emerging markets investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. |

The | | reorganization of the Henderson Global Funds is subject to approval by shareholders of the Funds. Past performance is no guarantee of future results. |

One | | should consider the investment objectives, risks, fees and expenses of any mutual fund carefully before investing. This and other important information is available in the Funds’ prospectus and summary prospectus available at henderson.com. Please read carefully before investing. |

The | | distributor of the Henderson Global Funds is Foreside Fund Services, LLC, which is not an affiliate of Henderson Global Investors. (12/16) |

Not FDIC Insured, Not Bank Guaranteed, and May Lose Money