[Janus Letterhead]

February 14, 2017

VIA EDGAR

Asen Parachkevov

Lauren Hamilton

Megan Miller

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549-0505

| Re: | Janus Investment Fund – Registration Statements on FormN-14 filed on December 30, 2016 |

Ladies and Gentlemen:

Thank you for your comments made by telephone on January 27, 2017 with respect to the registration statements on FormN-14 (each, a “Registration Statement”) filed by Janus Investment Fund (the “Trust” or the “Registrant”) with the Securities and Exchange Commission (“SEC”) on December 30, 2016 related to the reorganization of:

| | 1. | Janus Fund, a series of the Trust, with and into Janus Research Fund, a series of the Trust (FileNo. 333-215393) (the “ResearchN-14”); |

| | 2. | Janus Twenty Fund, a series of the Trust, with and into Janus Forty Fund, a series of the Trust (FileNo. 333-215394) (the “FortyN-14”); |

| | 3. | INTECH U.S. Core Fund, a series of the Trust, with and into INTECH U.S. Managed Volatility Fund, a series of the Trust (FileNo. 333-215396) (the “INTECHN-14”); |

| | 4. | Henderson Global Technology Fund, a series of Henderson Global Funds (the “Henderson Trust”), with and into Janus Global Technology Fund, a series of the Trust (FileNo. 333-215390) (the “Global TechnologyN-14”); |

| | 5. | Henderson Emerging Markets Fund, a series of the Henderson Trust, and Janus Emerging Markets Fund, a series of the Trust, with and into Janus Henderson Emerging Markets Fund, a newly formed series of the Trust (FileNo. 333-215392) (the “Emerging MarketsN-14”); and |

| | 6. | Henderson International Opportunities Fund, Henderson Global Equity Income Fund, Henderson European Focus Fund, Henderson Strategic Income Fund, Henderson All Asset Fund, Henderson International Long/Short Equity Fund and Henderson Dividend & Income Fund, each a series of the Henderson Trust, with and into Janus Henderson International Opportunities Fund, Janus Henderson Global Equity Income Fund, Janus Henderson European Focus Fund, Janus Henderson Strategic Income Fund, Janus Henderson All Asset Fund, Janus Henderson International Long/Short Equity Fund and Janus Henderson Dividend & Income Fund, respectively, each a newly created series of the Trust (FileNo. 333-215395) (the “Shell MergersN-14).1 We refer to such reorganizations as the “Shell Mergers” in this response letter. |

| 1 | As previously discussed with you,Pre-Effective Amendment No. 1 to the Shell MergersN-14 will also include the reorganization of Henderson U.S. Growth Opportunities Fund, a series of the Henderson Trust, with and into Janus Henderson U.S. Growth Opportunities Fund, a newly created series of the Trust. |

Securities and Exchange Commission

February 14, 2017

Page 2

On behalf of the Trust, we have summarized your comments to the best of our understanding and provided our responses to your comments below. Changes will be reflected inPre-Effective Amendment No. 1 to each Registration Statement, will be marked to show all changes made since the filing of such Registration Statement. The Trust intends to file the ResearchN-14, FortyN-14, INTECHN-14 and Global TechnologyN-14 on or about the date hereof and intends to file the Emerging MarketsN-14 and Shell MergersN-14 in the days thereafter. Capitalized terms used but not defined in this letter have the meanings set forth in each Registration Statement.

Generally Applicable Comments

| 1. | Staff Comment: To the extent a Fund’s operating expenses are increasing as a result of the Mergers, please provide disclosure explaining what expense category is increasing and what is causing such increase. |

Response: The requested disclosure has been added.

| 2. | Staff Comment: In any table or chart comparing the Target Fund and Acquiring Fund, please revise the headings to include the Fund’s name, with Target Fund or Acquiring Fund, as applicable, in parentheses. |

Response: The requested revision has been made.

| 3. | Staff Comment: With respect to Funds that have an investment strategy that involves a high portfolio turnover rate, provide additional disclosure to this effect in the comparison of the Funds’ investment strategies. |

Response: The requested disclosure has been added.

| 4. | Staff Comment: Please advise supplementally when the Trust intends to file validity of shares opinions. |

Response: Validity of shares opinions covering the shares to be issued in each reorganization have been filed as exhibits toPre-Effective Amendment No. 1 to eachN-14.

| 5. | Staff Comment: In the Synopsis, with respect to the Board’s recommendation for Proposal 1, provide more detail regarding the conclusions the Board made based on the factors they considered. |

Response: The summary of the board’s considerations set forth in the Synopsis has been revised as requested.

2

Securities and Exchange Commission

February 14, 2017

Page 3

| 6. | Staff Comment: To the extent capital loss carry forwards are discussed in the Proxy Statement/Prospectus, provide disclosure quantifying the impact expected and, if material, also include such disclosure in the Synopsis. |

Response: The requested disclosure has been added.

| 7. | Staff Comment: In the Fee Tables, revise the footnotes to remove footnotes that are not necessary to understanding the Fee Table. |

Response: The footnotes to the Fee Tables have been revised as requested.

| 8. | Staff Comment: Please advise supplementally when the Trust intends to file auditor consents for all of the financial statements incorporated by reference. |

Response: Auditor consents for all financial statements incorporated by reference in theN-14s have been filed as exhibits toPre-Effective Amendment No. 1 to eachN-14.

| 9. | Staff Comment: In the discussion of the expense structure of the Funds in the Synopsis, reference is made to Janus Capital Management LLC (“Janus Capital” or the “Adviser”) waiving its investment advisory fee and/or reimbursing fund expenses. Please disclose any recoupment terms, as applicable. |

Response: The requested disclosure has been added.

| 10. | Staff Comment: With respect to any fee waivers, disclose the period for which the expense reimbursement or fee waiver arrangement is expected to continue, including the expected termination date, and briefly describe who can terminate the arrangement and under what circumstances. |

Response: The requested disclosure has been added.

| 11. | Staff Comment:Confirm that all of the fees presented within the Fee Tables reflect current fees. |

Response: The Trust hereby confirms that the fees presented within the Fee Tables reflect current fees.

| 12. | Staff Comment: Review the Expense Examples to ensure that the expense calculation only applies the expense waiver for the time period in which such expense waiver is in effect and not after it expires. |

Response: Consistent with the manner in which Janus currently calculates the Expense Examples in each Fund’s prospectus, the Expense Examples in eachN-14 are calculated without giving effect to fee waivers. See lead in disclosure to the Expense Examples which states that “The following Examples are based on expenses without waivers.” Revisions have been made to eliminate any references to calculating Expense Examples after giving effect to waivers.

| 13. | Staff Comment: To the extent realized capital gains, transactional costs, and similar expenses incurred in connection with anticipated portfolio repositioning are discussed, keep the applicable disclosure close together in the Proxy Statement/Prospectus. Further, in the Synopsis, when discussing any realized gains or losses or portfolio repositioning, disclose the portfolio transaction costs that are expected to be generated as a result of those trades and the reasons for the portfolio repositioning. |

3

Securities and Exchange Commission

February 14, 2017

Page 4

Response: The requested disclosure has been added and the requested revisions made in the ResearchN-14, FortyN-14 and INTECHN-14. In the Emerging MarketsN-14 and Global TechnologyN-14, it has been noted that costs of any portfolio repositioning transactions are expected to bede minimis. No portfolio repositioning transactions are expected for the Shell Mergers.

| 14. | Staff Comment: With respect to any portfolio repositioning resulting from the Merger, either provide disclosure indicating that all of the securities held by the Target Fund would comply with the investment parameters and restrictions of the Acquiring Fund; or provide, in thepro formaschedules of investments, an estimate of the percentage of the securities of the Target Fund and/or Acquiring Fund that would not comply with the investment parameters and restrictions of the Acquiring Fund and therefore would need to be disposed of in connection with the merger; and, to the extent possible, identify within thepro formaschedules of investments which securities will be sold in order to comply with the Acquiring Fund’s investment parameters and restrictions. |

Response: With respect to eachN-14 other than the Emerging MarketsN-14, thepro formafinancial statements have been revised to indicate that all of the securities held by the Target Fund would comply with the investment parameters and restrictions of the Acquiring Fund. With respect to the Emerging MarketsN-14, thepro forma financial statements have been revised as requested.

| 15. | Staff Comment: Within the notes to thepro formafinancial statements, as it relates to any portfolio realignment, provide disclosure on the reason for the portfolio repositioning; the percentage of the Target Fund’s portfolio securities expected to be disposed of as a result of the portfolio repositioning and an estimate of the transaction costs and realized gains expected to result from such dispositions. Also include a statement that the total merger costs do not reflect commissions that would be incurred as a result of the portfolio repositioning. |

Response: Thepro forma financial statements have been revised as requested.

| 16. | Staff Comment: In thepro formastatement of operations, provide footnotes to explain the various adjustments that are being made within the statement. |

Response: Thepro forma financial statements have been revised as requested.

| 17. | Staff Comment: Within the notes to thepro formafinancial statements, please include thepro forma effects of the transactions, assuming that the reorganizations of all funds involved in the transactions had been consummated, on the significant accounting policies, including valuation policies, and net assets of the investment companies. |

Response: Thepro forma financial statements have been revised as requested.

| 18. | Staff Comment: For any Target Fund that has material capital loss carry forwards, please include disclosure in thepro formafinancial statements concerning the potential limitation of these capital loss carry forwards, including dollar amounts and expiration dates. |

Response: Thepro forma financial statements have been revised as requested.

4

Securities and Exchange Commission

February 14, 2017

Page 5

| 19. | Staff Comment: Explain why the information noted in Comment 18 was not provided in the prospectus orpro formafinancial statements for the Shell Mergers. |

Response: Because the Acquiring Fund in each Shell Merger is newly formed for the purpose of consummating the Shell Merger and has no assets or business history, each Shell Merger is intended to be treated as an “F” Reorganization for U.S. federal income tax purposes in which the beneficial ownership of the Acquiring Fund is the same as that of the Target Fund, and therefore does not trigger the applicable rules which limit the use of capital loss carry forwards.

| 20. | Staff Comment: In the lead in to the Capitalization Table, please add a statement that this is for informational purposes only and if the reorganization is consummated, the capitalization is likely to be different on the closing date as a result of daily share purchase and redemption activity in the Funds and changes to net asset values of the Funds. |

Response: The requested disclosure has been added.

| 21. | Staff Comment: In the notes to thepro forma financial statements, please confirm if any fees previously waived are subject to recoupment and if so, please include the amounts and terms as well as the impact of such amounts in connection with the reorganization. |

Response:No fees waived are subject to recoupment. Thepro forma financial statements have been revised as requested.

| 22. | Staff Comment: In thepro forma schedules of investments, when the Fund is invested in other investment companies, please include the share class in which the Fund is invested, as applicable. |

Response: Most of the other mutual funds in which the Funds invest are single class funds and therefore no share class is identified in the schedule of investments. Thepro forma financial statements of the Global Technology FundN-14 and Emerging Markets FundN-14 have been revised to identify the share classes of multi-class funds listed therein.

| 23. | Staff Comment: In the Fee Tables, please present fee waiver figures as negative numbers or in parenthesis. |

Response: The Fee Tables have been revised as requested.

| 24. | Staff Comment: Please include the estimated cost of proxy solicitation in the Synopsis. |

Response:The requested disclosure has been added to the Synopsis.

| 25. | Staff Comment: Under the heading “Current andPro Forma Fees and Expenses,” provide additional disclosure explicitly referencing the impact of redemptions. |

Response: The requested disclosure has been added.

| 26. | Staff Comment: The Capitalization Table should be dated within 30 days of the Registration Statement. |

Response: Item 4(b) of FormN-14 does not require that the Capitalization Table be presented as of a date within 30 days of the Registration Statement. Registrant respectfully submits that shareholders’ evaluation of the Merger is facilitated by dating the Capitalization Table as of the same date as thepro formaFinancial Statements.

5

Securities and Exchange Commission

February 14, 2017

Page 6

| | 27. | Staff Comment: Please confirm that when a Fund writes credit default swaps (“CDS”) or call options, it will maintain asset coverage equal to the full notional value of such CDS or option. |

Response: Registrant hereby confirms that when a combined Fund writes CDS or call options, such Fund will “cover” such positions or identify on its books liquid assets or cash in an amount equal to the full notional value of such swaps or options, as the case may be, while the positions are open.

ResearchN-14 Comments

| 28. | Staff Comment: In the Synopsis, under “How do the fee and expense structures of the Funds compare?”, please confirm that when calculating the performance fee adjustment the Funds are using the classes of shares with the same or similar expense structure. |

Response: Registrant hereby confirms that the class of shares used to calculate the performance fee adjustment for the Target Fund and the Acquiring Fund have the same or similar expense structure.

| 29. | Staff Comment: Under the heading “Expense Limitation” it states, “In addition, for two years after the completion of the Merger, the Adviser has agreed to waive its investment advisory fee to the lesser of the advisory fee rate payable by the Acquiring Fund, or the advisory fee rate that the Target Fund would have paid if the Merger did not occur.” Please explain what kind of assumptions are being made about the Target Fund (i.e., are you assuming the asset base will remain constant for the target fund?). |

Response: The fee waiver is implemented by calculating the performance adjustment two ways each month, as follows:

| | (i) | The actual 36 month historical performance of the Acquiring Fund; and |

| | (ii) | A blended 36 month historical performance that includes the historical track record of the Target Fund for periods prior to the closing of the Merger and the historical track record of the Acquiring Fund for periods after the closing of the Merger. |

The performance adjustment is calculated using the lesser of the two historical performance measurements above (i.e. the version that is more favorable to shareholders). Such performance adjustment is then multiplied by the 36 month average historical combined net assets of the funds, and divided by the current net assets of the Acquiring Fund to calculate the performance fee rate.

Disclosure has been modified to better reflect the nature of this calculation.

| 30. | Staff Comment: With respect to the Fee Table, please explain why the ratios for the Target Fund and Acquiring Fund don’t match the September 30, 2016 financial highlights for the Class C Shares. |

Response: The difference in the expense ratios results because the Target Fund and Acquiring Fund expenses for Class C Shares set forth in theN-14 reflect contractual12b-1 fee amounts. The financial highlights, however, reflect actual12b-1 fees incurred by the Class C Shares for the fiscal year ended September 30, 2016, net of refunds.

6

Securities and Exchange Commission

February 14, 2017

Page 7

| 31. | Staff Comment: Please explain why amounts are shown in the Expense Example for Class R Shares of the Acquiring Fund when the Fee Table shows N/A for such class of shares. |

Response: The Expense Example has been revised to show N/A for Class R Shares of the Acquiring Fund.

FortyN-14 Comments

| 32. | Staff Comment: In the Synopsis under the heading “Will the Merger result in a higher investment advisory fee rate for shareholders of Janus Twenty Fund?” it states, “For two years after the completion of the Merger, Janus Capital has agreed to waive its investment advisory fee rate to the lesser of the investment advisory fee rate payable by Janus Forty Fund, or the investment advisory fee rate that Janus Twenty Fund would have paid if the Merger did not occur, taking into account the differences in the performance fee adjustment described above and the historical performance of Janus Twenty Fund prior to the Merger.” Considering this fee waiver, please supplementally explain how the performance fee would be calculated considering that the performance of the Target Fund would be unknown after the Merger. |

Response:The calculation of the post-merger fee rate during the two years from the date of the Merger is described in further detail in Response #29. Disclosure has been modified to better reflect the nature of this calculation.

| 33. | Staff Comment: Under the heading “The Merger—Reasons for the Merger” it states that the Adviser agreed “for two years from the date of the Merger, to lower its advisory fee to the lesser of the advisory fee payable based on the Acquiring Fund’s performance prior to the Merger or the fee payable based on the Target Fund’s performance prior to the Merger.” Please explain the discrepancy between this disclosure and the disclosure noted in Comment 32. |

Response: The calculation of the post-merger fee rate during the two years from the date of the Merger is described in further detail in Responses 29 and 32. Disclosure has been modified to better reflect the nature of this calculation.

| 34. | Staff Comment: In the Synopsis under the heading “How do the fee and expense structures of the Funds compare?”, it states that performance fee adjustments were excluded from the fee waivers, please supplementally explain how this calculation is completed. |

Response: The Fund is subject to two waivers. The calculation of each such waiver is explained below:

| | ● | | The first is a continuation of the current waiver for the Acquiring Fund, pursuant to which the Adviser has agreed to waive its investment advisory fee and/or reimburse fund expenses to the extent necessary to limit the Acquiring Fund’s total annual fund operating expenses to 0.77% of the average daily net assets for the Acquiring Fund (excluding performance fee adjustments, distribution and shareholder servicing fees paid pursuant to a Rule12b-1 plan, administrative services fees payable pursuant to the transfer agency agreement, brokerage commissions, interest, dividends, taxes, acquired fund fees and expenses, and extraordinary expenses). Therefore, in calculating the fund’s total annual fund operating expenses for purposes of this waiver, the Fund’s base advisory fee is |

7

Securities and Exchange Commission

February 14, 2017

Page 8

| | included, but any performance adjustment (positive or negative) is not included. Thus, if the Fund’s total expense ratio based on the base advisory fee before any performance adjustment was 0.80%, Janus Capital would waive 0.03%, regardless of whether the Fund was subject to a positive or negative performance adjustment. |

| | ● | | The second waiver is a waiver for two years following the reorganization, pursuant to which the performance adjustment is calculated as described in further detail in response 29. |

| 35. | Staff Comment: With respect to the Fee Table, please explain how thepro formaTotal Annual Fund Operating Expenses After Fee Waiver was calculated. |

Response:See Responses #29 and #34 for further information regarding the calculation of the fee waiver reflected in the pro forma Total Annual Fund Operating Expenses After Fee Waiver.

INTECHN-14 Comments

| 36. | Staff Comment: Please confirm supplementally whether the benefits of the Merger considered by the Board were purely operational benefits and economies of scale or whether the change in the investment strategy was considered. |

Response: In considering the proposed Merger, the Board considered various factors and potential benefits of the Merger, including the Adviser’s belief that the Target Fund shareholders may benefit from the Merger (as shareholders of the Acquiring Fund following the Merger), as a result of having access to the technology and an investment process that targets outperformance with lower absolute volatility than the Russell 1000® Index.

| 37. | Staff Comment: In the Synopsis, under “Will the Merger result in higher Fund expenses?”, please discuss why most classes of the combined Fund are expected to have a higher total annual expense ratio when excluding the Performance Adjustment. |

Response: The Fund’s total annual expense ratio when excluding the Performance Adjustment is increasing because “Other Expenses” of the combined fund will be greater than those of the Target Fund. Because of differences in the shareholder base of the Acquiring Fund and the Target Fund, the Acquiring Fund incurs, and the combined fund will incur, higher shareholder reporting and registration expenses. Disclosure has been added similar to the disclosure referenced in Response #1.

| 38. | Staff Comment: In the Expense Examples, review and revise footnote 10 to ensure that the CDSC for Class C is reflected in the Expense Examples if the shares are redeemed. |

Response: The Expense Examples reflect the impact of the CDSC in Year 1. The footnotes to the Expense Examples have been revised accordingly.

| 39. | Staff Comment: Review and revise the Capitalization Table to ensure the labels are correct. |

Response: The Capitalization Table has been corrected.

8

Securities and Exchange Commission

February 14, 2017

Page 9

| 40. | Staff Comment: Under the heading “Additional Information about theSub-adviser” in Proposals 2 and 3, identify by name the registered investment company managed by the sameSub-Adviser. |

Response: Disclosure has been revised as requested.

| 41. | Staff Comment: Revise the fourth bullet point in the second bullet point list under the heading “Board Considerations” to be more specific to this Fund Merger. |

Response:The referenced bullet point has been revised to refer specifically to the Fund Merger addressed in theN-14.

Global TechnologyN-14 Comments

| 42. | Staff Comment: Since the Fund’s name includes “global,” please confirm its principal strategies reflect that a meaningful portion of assets are being invested outside of the United States. |

Response: Janus Global Technology Fund is an existing fund that has been in operations for nearly twenty years. The Fund implements its investment policy by investing primarily in equity securities of U.S. and foreign companies selected for their growth potential. The Fund normally invests in issuers from several different countries, which may include the United States. The Fund does not have a stated target or percentage for investments outside of the United States. Registrant respectfully submits that the Fund’s investment policies are consistent with formal SEC guidance regarding fund names.

| 43. | Staff Comment:Please supplementally explain why Target Fund shareholders who hold their funds through a third-party intermediary will not receive Class D Shares. |

Response: Class D Shares of Janus funds are available only to investors who hold accounts directly with Janus Therefore, each Henderson fund shareholder who holds shares through a third-party intermediary and is therefore eligible to hold the corresponding share class of the Janus fund will receive shares of such corresponding share class. However, in order to accommodate continued investment by Henderson fund shareholders who hold their shares directly, such shareholders will receive Class D Shares of the Janus fund.

| 44. | Staff Comment: In the Synopsis, under “What happens if the Merger is not approved?”, please add disclosure noting that the Henderson Target Fund could potentially be liquidated, if applicable. |

Response: Disclosure regarding the possibility of liquidation of the Henderson Target Fund if the Merger is not approved has been added.

| 45. | Staff Comment: Under the heading “Principal Investment Strategies,” if the Target Fund can only invest in equity and the Acquiring Fund can invest in equity and debt, please note this in the disclosure. |

Response: The comparison of principal investment strategies has been revised as requested.

9

Securities and Exchange Commission

February 14, 2017

Page 10

| 46. | Staff Comment: With regards to including derivatives for the purpose of meeting the 80% investment policy, please confirm that the market value of the derivatives will be used, as opposed to the notional exposure. |

Response:The Funds confirm that with regards to including derivatives for the purpose of meeting the 80% investment policy, the market value of the derivatives will be used.

Emerging MarketsN-14 Comments

| 47. | Staff Comment: Please relocate the discussion of the scenario in which only the Henderson Target is merged into Janus Henderson Emerging Markets Fund from Appendix M to the body of the Proxy Statement/Prospectus. |

Response: The requested revisions have been made.

| 48. | Staff Comment: Please explain the methodology used when classifying an issuer as belonging to a specific region. |

Response: The Fund invests in securities of issuers that (i) are primarily listed on the trading market of an emerging market country; (ii) are incorporated or have their principal business activities in an emerging market country; or (iii) derive 50% or more of their revenues from, or have 50% or more of their assets in, an emerging market country. An issuer’s jurisdiction of incorporation is one of three factors that the Fund may consider when determining whether a security is issued by an emerging market company. Registrant respectfully submits that the disclosure regarding making this determination is consistent with Rule35d-1 under the 1940 Act, which requires funds to disclose the “specific criteria” used to select investments that are tied to a particular country or geographic region.

| 49. | Staff Comment: In the Synopsis, under “How do the Funds’ investment objectives and principal investment strategies compare?”, in addition to discussing the differences between the Janus Target Fund and Henderson Target Fund, provide disclosure on how the Acquiring Fund compares. |

Response: The requested revisions have been made.

| 50. | Staff Comment: In the Synopsis, under “How do the investment advisory fee structures of the Funds compare?”, please disclose the actual management fee of the Henderson Target in addition to disclosing its breakpoints. |

Response: The requested revision has been made.

| 51. | Staff Comment: In the Synopsis, under “What happens if a Merger is not completed?”, please provide further detail about what may happen to the Target Funds in the event such Target Fund’s Merger is not completed. |

Response: The disclosure has been revised as requested.

10

Securities and Exchange Commission

February 14, 2017

Page 11

| 52. | Staff Comment: In Proposals 2 through 6, please insert a heading to indicate that these Proposals only apply to shareholders of the Janus Target Fund and that they do not apply to shareholders of the Henderson Target Fund. |

Response: The requested revisions have been made.

| 53. | Staff Comment: In Proposal 1, under the heading “Comparison of Investment Advisory Fees,” when stating the advisory fee applicable to a Fund, please clarify whether it is after the application of a fee waiver and, if so, indicate what the actual advisory fee would have been without the fee waiver. |

Response: The disclosure has been revised as requested.

| 54. | Staff Comment: In Proposal 1, under the heading “Expense Limitations,” please explain why the Acquiring Fund’s fee waiver is a“non-standard contractual waiver.” |

Response: The reference to a“non-standard contractual waiver” referred to the fact that in order to ensure all shareholders did not experience an expense ratio increase in the period following the Merger, the waiver agreed to in connection with this Merger utilizes a different methodology than the waivers generally agreed to by Janus with other Janus funds. However, the Fund agrees that the reference to a“non-standard” waiver does not provide shareholders with useful information. The disclosure has been revised to eliminate references to anon-standard waiver and to instead simply describe the terms of this fee waiver.

| 55. | Staff Comment: Please supplementally explain why the gross fees for some share classes are increasing even though the merging Funds are of similar size. Consider including additional disclosure regarding the benefits of economies of scale. |

Response:The combined fund will be managed in a manner similar to the Henderson Emerging Markets Fund. Currently, based on differences between the investment portfolios of the Janus Emerging Markets Fund and the Henderson Emerging Markets Fund, the Henderson fund incurs higher custodian fees and additional pricing service fees. Therefore, the combined fund is expected to incur such fees at a higher rate than the Janus fund resulting in the increased gross fees for some share classes. Additional disclosure to this effect has been added in response to Comment #1.

The Trust has reviewed disclosure throughout theN-14 and respectfully submits that the disclosure regarding the benefits of economies of scale is appropriate.

| 56. | Staff Comment: In Proposal 3, under the heading “Summary of Terms of HIMLSub-Advisory Agreement—Fees,” please explain why thesub-advisory fee rate paid to Janus Singaporepre-Merger was one third of the investment advisory fee paid to Janus Capital, but thesub-advisory fee rate paid to HIML post-Merger would be equal to fifty percent of the investment advisory fee paid to Janus Capital. |

Response: Thesub-advisory fee rate for Janus Emerging Markets Fund was established when the portfolio was managed by a combination of portfolio managers employed by Janus Singapore and portfolio managers employed by Janus Capital. The portfolio is currently managed solely by a portfolio manager employed by Janus Singapore. Therefore, in January 2017 the Fund’s Board of Trustees approved a modification to thesub-advisory fee, such that effective February 1, 2017 Janus Singapore receives 50% of the management fee, consistent with other funds in the fund

11

Securities and Exchange Commission

February 14, 2017

Page 12

complex for which Janus Capital serves as investment adviser and a Janus affiliatesub-adviser is responsible for day to day management. If HIML is approved assub-adviser, the Fund’s portfolio managers will be employed by HIML and thesub-advisory fee would be 50% of the management fee. Disclosure in theN-14 has been updated accordingly.

| 57. | Staff Comment: Please complete the “Comparable Funds” information in Appendix I. |

Response: The “Comparable Funds” information in Appendix I has been completed.

Shell MergersN-14 Comments

| 58. | Staff Comment: Please confirm thatPre-Effective Amendment No. 1 to the Shell MergersN-14 will include the class and series identifiers for each newly created series of the Trust. |

Response: Prior to filingPre-Effective Amendment No. 1 to the Shell MergerN-14, the Trust filed a Post-Effective Amendment to its Registration Statement on FormN-1A related to each newly created series of the Trust pursuant to which it obtained class and series identifiers for each such series. Such class and series identifiers have been reflected in the filing information forPre-Effective Amendment No. 1 to the Shell MergerN-14.

| 59. | Staff Comment: Please confirm that there will be no recoupment of expenses prior to the reorganization under the existing expense limitation agreement, other than in the ordinary course. |

Response: The Henderson Trust has confirmed that there will be no recoupment of expenses from any Henderson fund prior to the reorganization, other than in the ordinary course.

| 60. | Staff Comment: Where gross expenses are increasing for certain classes, fee waivers should be in effect for two years after the Mergers, pursuant to Section 15(f) of the Investment Company Act of 1940. Alternatively, please explain why Section 15(f) does not apply to the Shell Mergers. |

Response: Section 15(f) of the 1940 Act provides a safe harbor for the receipt of compensation or other benefit in connection with a sale of securities of, or a sale of any other interest in, an investment adviser which results in an assignment of an investment advisory contract with a registered investment company. Section 15(f) is not implicated when a transaction does not result in an assignment of an investment advisory contract.2

The 1940 Act defines “assignment” to include any direct or indirect transfer or hypothecation of an investment advisory contract by the assignor, or of a controlling block of the assignor’s outstanding voting securities by a security holder of the assignor. Although “controlling block” is not defined under the 1940 Act, “control” is defined in the 1940 Act as “the power to exercise a controlling influence over the management or policies of a company, unless such power is solely the result of an official position with such company.” In addition, the 1940 Act provides a rebuttable presumption of control when “any person . . . owns beneficially, either directly or through one or more controlled companies, more than 25 per centum of the voting securities of a company.”Conversely, a person who does not own more than 25% of the voting securities of a company is presumed not to control the company.

2 “The section contemplates the type of sale of interest and securities that results in assignment of an advisory contract. Sale of a noncontrolling block of securities or of nonvoting securities is not within the section.” Regulation of Money Managers: Mutual Funds and Advisers - Frankel, Laby, and Schwing,§12.04.

12

Securities and Exchange Commission

February 14, 2017

Page 13

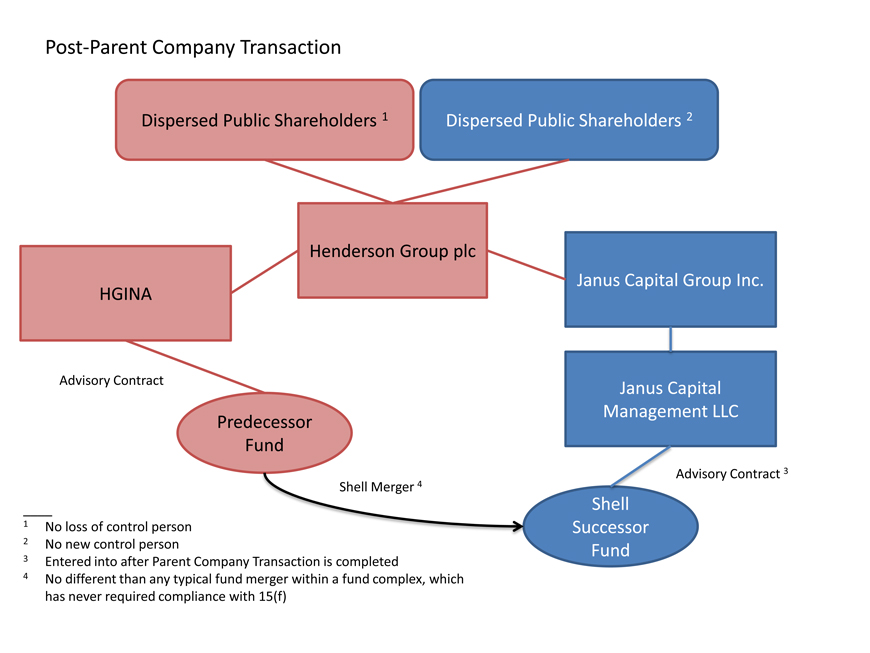

In the Parent Company Transaction, Janus Capital Group Inc. (“JCG”) will be merged with a subsidiary of Henderson Group plc (“Henderson”), with JCG surviving as a direct, wholly owned subsidiary of Henderson. Pursuant to the Parent Company Merger Agreement, each JCG share will be exchanged for Henderson shares. Existing Henderson and JCG shareholders are expected to own approximately 57% and 43%, respectively, of Henderson’s shares upon closing.

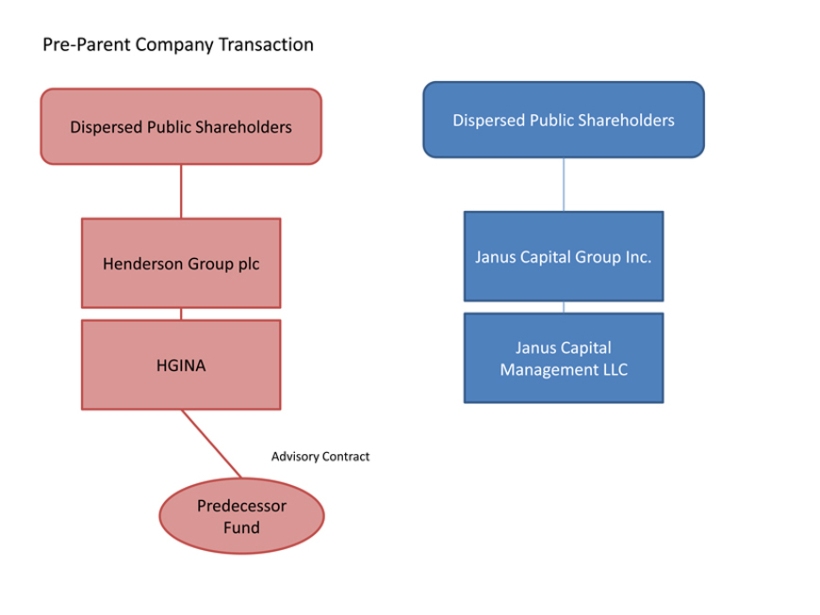

In each Shell Merger, a Henderson fund (the “Predecessor Fund”) is proposed to be merged into a newly created Janus Fund (the “Successor Fund”) after the Parent Company Transaction is completed.

Illustrative structure charts are attached hereto asAppendix A.

With respect to each Successor Fund, JCG is not relying on Section 15(f) because the Transaction will not result in the assignment of the advisory contract between the Successor Fund and its investment adviser, Janus Capital Management, LLC (“Janus Capital”). Each Successor Fund is a newly created entity and the advisory contract between each Successor Fund and Janus Capital will be entered after the closing of the Parent Company Transaction.

With respect to each Predecessor Fund, Henderson is not relying on Section 15(f) because the Parent Company Transaction will not result in an assignment of the advisory contract between the Predecessor Fund and its adviser, Henderson Global Investors (North America) Inc. (“HGINA”). Registrant understands that in concluding that the Parent Company Transaction would not result in assignment of the advisory contracts by HGINA, Henderson considered:

| | ● | | Henderson is a publicly-traded holding company, with a widely-dispersed group of public and institutional shareholders, whose advisory business is conducted through a number of indirect wholly-owned subsidiaries, including HGINA. No Henderson shareholder is presumed to control Henderson. |

| | ● | | JCG is a publicly-traded holding company, with a widely-dispersed group of public and institutional shareholders, whose advisory business is conducted through a number of indirect wholly-owned subsidiaries, including Janus Capital. No JCG shareholder is presumed to control JCG. |

| | ● | | Henderson has a dispersed group of public and institutional shareholders, with no shareholder presumptively controlling Henderson prior to the Parent Company Transaction. Therefore Henderson will not “lose” a controlling shareholder as a result of the Parent Company Transaction. |

| | ● | | Henderson will issue shares to JCG shareholders in exchange for JCG shares. JCG shares are held by a dispersed group of public and institutional shareholders, with no shareholder presumptively controlling JCG prior to the Parent Company Transaction, and a result no new shareholder will acquire a controlling block of Henderson shares as a result of the Parent Company Transaction. |

| | ● | | The advisory subsidiaries of Henderson, including HGINA, will not be merged out of existence in the Parent Company Transaction. |

13

Securities and Exchange Commission

February 14, 2017

Page 14

Registrant understands that Henderson consulted with outside counsel in reaching its conclusion that the Parent Company Transaction, when consummated, would not result in an assignment under the 1940 Act of advisory contracts entered into by HGINA.

Because the Parent Company Transaction will not result in an assignment of the advisory contract between a Predecessor Fund and HGINA or the advisory contract between a Successor Fund and Janus Capital, Section 15(f) is not implicated with respect to the Shell Mergers.

Each Shell Merger itself, when consummated after closing of the Parent Company Transaction, is no different than a typical fund merger within a fund complex, which has never been deemed to require compliance with Section 15(f).

| 61. | Staff Comment: Under the heading “Principal Risk Factors” for Janus Henderson International Opportunities Fund and Janus Henderson European Focus Fund, please revise the language within Concentration Risk to clarify that a Fund is either concentrated in a particular industry or group of industries or is not so concentrated. |

Response: In accordance with their fundamental investment restrictions, Henderson International Opportunities Fund and Henderson European Focus Fund do not and Janus Henderson International Opportunities Fund and Janus Henderson European Focus Fund will not concentrate their investments in any particular industry. Each Fund may, however, concentrate its investments in a single economic sector, a broader measure of the market made up of many industries. Disclosure under “Sector Concentration Risk” has been revised to avoid any inference that a fund may from time to time concentrate in a particular industry.

| 62. | Staff Comment: If a Fund includes the word “global,” “international,” “world” or a similar term in its title, please confirm its principal strategies reflect that a meaningful portion of assets are being invested outside of the United States. |

Response: Janus Henderson International Long/Short Equity Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in long and short positions of equity securities issued by, or equity-related derivative instruments providing exposure to,non-U.S. companies from at least three different countries.

Janus Henderson International Opportunities Fund invests at least 40% of its net assets in equity securities ofnon-U.S. companies and in at least three different countries.

Janus Henderson Global Equity Income Fund invests in U.S. andnon-U.S. issuers and has no specific policy on the number of different countries in which it will invest but intends to invest in at least three different countries. As of December 31, 2016, Henderson Global Equity Income Fund invested 87.5% of its assets outside of North America. The Fund does not have a stated target or percentage for investments outside of the United States. Registrant respectfully submits that the Fund’s investment policies are consistent with formal SEC guidance regarding fund names.

14

Securities and Exchange Commission

February 14, 2017

Page 15

| | 63. | Staff Comment: For Janus Henderson European Focus Fund, please explain the methodology used when classifying an issuer as belonging to a specific region. In explaining such methodology, please confirm that the jurisdiction of incorporation of the issuer is not the sole factor used when making such classification. |

Response: European companies are broadly defined to include any company that meets one or more of the following tests: (i) its country of organization, its primary business office and/or the principal trading market of its stock are located in Europe, (ii) 50% or more of its assets are located in Europe, or (iii) 50% or more of its revenues are derived from Europe. An issuer’s jurisdiction of incorporation is one of three factors that the Fund may consider when determining whether a security is issued by a European company. Registrant respectfully submits that the disclosure regarding making this determination is consistent with Rule35d-1 under the 1940 Act, which requires funds to disclose the “specific criteria” used to select investments that are tied to a particular country or geographic region.

| 64. | Staff Comment: For Janus Henderson Strategic Income Fund, please supplementally provide further disclosure regarding the kinds of mortgage-related and other asset-backed securities in which the Fund invests. To the extent investing in ABS is a principal strategy, provide more disclosure about the other types of ABS products in the prospectus. |

Response: The requested disclosure has been added. Registrant confirms that investing in ABS is not a principal strategy of Janus Henderson Strategic Income Fund.

| 65. | Staff Comment: For Janus Henderson Strategic Income Fund, Small- andMid-Sized Companies Risk is included as a Principal Risk Factor, but equivalent disclosure is not included in the ‘Principal Investment Strategies” section. If applicable, please provide disclosure regarding investments in small- andmid-sized companies in the “Principal Investment Strategies” section as well as information regarding any capitalization ranges that are targeted, if they are targeted. |

Response: Investing in small- andmid-sized companies is not a principal investment strategy of Janus Henderson Strategic Income Fund. Small- andMid-Sized Companies Risk has been deleted from the Principal Risk Factors.

| 66. | Staff Comment: For Janus Henderson Strategic Income Fund, Loan Risk is included in the “Principal Risk Factors” section, but equivalent disclosure is not included in the “Principal Investment Strategies” section. If applicable, please provide disclosure regarding investments indebtor-in-possession loans in the “Principal Investment Strategies” section. |

Response: The Fund has revised disclosure under Principal Investment Strategies to reference investments in loans.Debtor-in-possession loans are not a principal investment strategy and the reference to such loans has been deleted from the risk factors.

| 67. | Staff Comment:For Janus Henderson All Asset Fund and Janus Henderson International Long/Short Equity Fund, please confirm that investments in hedge funds, private equity funds, and similar private funds will not be greater than 15% of the Fund’s investments and will be counted as illiquid securities for purposes of the Fund’s limitation of investing no more than 15% of its assets in illiquid securities. |

Response: Registrant hereby confirms that investments by Janus Henderson All Asset Fund and Janus Henderson International Long/Short Equity Fund in hedge funds, private equity funds, and similar private funds will not be greater than 15% of the Fund’s investments and will be counted as illiquid securities for purposes of the Fund’s limitation of investing no more than 15% of its assets in illiquid securities.

15

Securities and Exchange Commission

February 14, 2017

Page 16

| 68. | Staff Comment: For Janus Henderson All Asset Fund, to the extent investing in a specific type of investment company structure (i.e., ETFs, hedge funds,closed-end funds, UITS, UCITS) is a principal investment strategy, please consider expanding the “Investment Company and Pooled Vehicles Risk.” |

Response: Investing in a specific type of investment company structure is not a principal investment strategy of Janus Henderson All Asset Fund. Rather, the Fund invests in underlying investment companies and other pooled investment vehicles to gain exposure to different areas of the market.

| 69. | Staff Comment: For Janus Henderson All Asset Fund, please supplementally explain how liquidity determinations are made for mortgage-backed and asset-backed securities. |

Response: Janus Henderson All Asset Fund may seek exposure to the asset classes in which it invests by investing in other investment companies or investment pools, by investing directly in securities and other investments or through the use of derivatives. Currently, Henderson All Asset Fund operates, and Janus Henderson All Asset Fund intends to operate, as afund-of-funds investing primarily in other investment companies or investment pools. The Fund has no present intention to invest directly in mortgage-backed securities and asset-backed securities. If the Fund were to invest directly in such instruments, Janus Capital would consider the following factors in making liquidity determinations: (i) the frequency of trades and quoted prices for the security; (ii) the number of dealers willing to purchase or sell the security and the number of other potential purchasers; (iii) the willingness of dealers to undertake to make a market in the security; and (iv) the nature of the security and the nature of the marketplace trades, including the time needed to dispose of the security, the method of soliciting offers, and the mechanics of the transfer.

| 70. | Staff Comment: For Janus Henderson All Asset Fund, to the extent the Fund invests in private equity funds that involve unfunded capital commitments, please supplementally confirm that the Fund will maintain sufficient unencumbered liquid assets to cover those commitments. |

Response:Registrant hereby confirms that to the extent the Fund invests in private equity funds that involve unfunded capital commitments, the Fund will maintain sufficient unencumbered liquid assets to cover those commitments.

| 71. | Staff Comment: In the Synopsis, please highlight which Funds will have higher total annual fund operating expenses post-Merger, including which will have higher gross expenses. |

Response: The requested information has been included in the Synopsis.

| 72. | Staff Comment: For Janus Henderson International Opportunities Fund, please supplementally explain why Class IF was not included in the Expense Example and revise accordingly. |

Response: The Expense Example for Class IF Shares of Henderson International Opportunities Fund was inadvertently omitted and has been added.

16

Securities and Exchange Commission

February 14, 2017

Page 17

| 73. | Staff Comment:For Janus Henderson International Opportunities Fund, please review and revise thepro forma amounts shown in the “If shares are not redeemed” item within the Expense Example. |

Response: The Expense Example has been reviewed and revised.

| 74. | Staff Comment: With respect to footnote 6 to the fee table for Janus Henderson International Opportunities Fund, please explain and confirm compliance with Item 3, Instruction 3(c)(i) of FormN-1A. |

Response: Registrant hereby confirms that the fee table for Janus Henderson International Opportunities Fund has been calculated in compliance with Item 3, Instruction 3(c)(i) of FormN-1A. Expenses of the Target Fund and thepro formaAcquiring Fund have been calculated without respect to expense offsets. The footnote has been revised.

| 75. | Staff Comment: Please supplementally explain footnote 6 to the fee table for Janus Henderson All Asset Fund. |

Response: Footnote 6 to the fee table for Janus Henderson All Asset Fund has been revised to eliminate references to“non-standard” waiver, as described in Response #54, and to eliminate the description of the effect of a “standard” waiver, as the Fund is not subject to such waiver.

| 76. | Staff Comment: With respect to footnote 7 to the fee table for Janus Henderson International Long/Short Equity Fund, please supplementally explain what is meant by“non-standard waiver.” |

Response: Footnote 7 to the fee table for Janus Henderson International Long/Short Equity Fund has been revised to eliminate references to“non-standard” waiver, as described in Response #54, and to eliminate the description of the effect of a “standard” waiver, as the Fund is not subject to such waiver.

| 77. | Staff Comment:Please supplementally explain why a fee waiver is being applied to Class C Shares and Class R Shares of Janus Henderson Dividend and Income Builder when it appears that they are below the fee waiver threshold. |

Response: The Fee Table for Janus Henderson Dividend and Income Builder has been revised.

| 78. | Staff Comment: In thepro forma fee table for Class D Shares of Janus Henderson Dividend and Income Builder Fund, please adjust parenthesis to show the Fee Waiver as a negative number, not the Total Annual Operating Expenses. |

Response: Thepro formafee table has been revised as requested.

| 79. | Staff Comment: With respect to the Capitalization table, please supplementally explain why most funds are showing a positive inflow in net assets. |

Response: The increase in net assets reflects the contribution by Janus of seed capital for each class of shares of the Acquiring Fund which will be established upon the commencement of operations of the Acquiring Fund, but for which shares would not be issued in the Shell Merger

| 80. | Staff Comment: With respect to the Capitalization table, the footnote notes, “Target Fund shareholders of any class who own their shares directly with the Target Fund and not through a |

17

Securities and Exchange Commission

February 14, 2017

Page 18

| | third-party intermediary may have their Acquiring Fund shares received in the Merger exchanged for Acquiring Fund Class D Shares after the Merger.” Accordingly, as applicable, please supplementally explain whether the amounts in the Capitalization Table related to this change are estimates and, if so, how these estimations were determined. |

Response: Amounts in the Capitalization Table related to this change are not estimates, but are based on actual shareholder information as of the date as of which the Capitalization Table is presented.

Comments to the Proxy Statements Applicable to ResearchN-14, FortyN-14, INTECHN-14 and Emerging MarketsN-14

| 81. | Staff Comment: In the Synopsis, include a statement indicating that Janus Capital is paying the cost of solicitation. |

Response: The Trust has added disclosure to the Synopsis noting that the Adviser is paying the cost of solicitation.

| 82. | Staff Comment: In the Synopsis, provide more detail regarding the proposed corporate transaction among Janus Capital Group Inc. (“Janus”) and Henderson Group plc (“Henderson”), and include more detail regarding Henderson’s investment advisory activities. |

Response: The Trust has copied disclosure regarding the proposed corporate transaction and Henderson’s investment advisory activities from the body of the Proxy Statement/Prospectus to the Synopsis.

| 83. | Staff Comment: Confirm supplementally that under the governing documents of the Trust, the chairperson of the special meeting has the authority to adjourn the meeting in the event that the necessary quorum is present but the vote required to approve a proposal is not obtained. |

Response: The Trust confirms that the officers of the Trust have the power to adjourn the meeting in the circumstances described above pursuant to the governing documents of the Trust. As described in each Proxy Statement/Prospectus, the officers of the Trust, who are also the persons designated as proxies, will exercise such authority if such proxy holders vote in favor of such adjournment or postponement, and such proxy holders will do so if they determine additional solicitation is warranted and in the interest of the Fund. In this regard, we have added additional clarifying disclosure to the proxy statement.

| 84. | Staff Comment: In the Synopsis, discuss the Janus and Henderson corporate transaction closing condition requiring approval by 67.5% of assets under management, and specifically indicate what percentage of the total assets under management are held by the Trust. |

Response: The Trust has copied disclosure to the Synopsis regarding the closing condition. The Trust respectfully submits that because shareholders will vote for new advisory agreements on a Fund by Fund basis the percentage of total assets under management held by the Trust would not provide shareholders with useful information and may result in confusion as to the impact of approval by any one Fund on satisfying the closing condition. This is exacerbated here because not all Funds within the Trust are contained within a single proxy statement. The Trust notes that eachPre-Effective Amendment No. 1 will include the net assets of the applicable Funds, which will allow shareholders to consider the assets of their Fund relative to the total assets under management of the Adviser.

18

Securities and Exchange Commission

February 14, 2017

Page 19

| 85. | Staff Comment: Under Proposal 2, provide more detail around Henderson’s investment advisory business, and include information required by Item 22(c)(3) of Schedule 14A. |

Response: The Trust has added the following disclosure under Proposal 1:

Additional Information About Henderson. Henderson is the holding company of the investment management group, Henderson Global Investors, an independent global asset management business with over 1,000 employees worldwide and approximately $131.2 billion in assets under management as of September 30, 2016. As a global money manager, Henderson provides a full spectrum of investment products and services to institutions and individuals around the world. Headquartered in London at 201 Bishopsgate, London, UK EC2M 3AE, Henderson has been managing assets for clients since 1934. Henderson is a multi-skill, multi-asset management business with a worldwide distribution network. Henderson’s U.S. subsidiary Henderson Global Investors (North America) Inc. serves as investment adviser to a family of 11 U.S. registered mutual funds with approximately $12.4 billion in assets as of September 30, 2016 (excluding liquidated funds), most of which are proposed to be integrated into the Janus fund complex upon the closing of the Parent Company Transaction.

| 86. | Staff Comment: Under Proposal 2, provide more detail around the termination rights of Janus and Henderson in connection with the corporate transaction. |

Response: The Trust has added disclosure to clarify the circumstances in which the corporate transaction may be terminated by Janus or Henderson, explaining that:

“The Parent Company Merger Agreement contains certain termination rights for each of Henderson and Janus, including in the event that (i) the Parent Company Transaction is not consummated on or before September 30, 2017, (ii) the approval of the Parent Company Transaction by the shareholders of Henderson or the stockholders of Janus is not obtained at the respective shareholder meetings or (iii) if any restraint that prevents, makes illegal or prohibits the consummation of the Parent Company Transaction shall have become final andnon-appealable. In addition, Henderson and Janus can each terminate the Parent Company Merger Agreement prior to the shareholder meeting of the other party if, among other things, the other party’s board of directors has changed its recommendation that its shareholders approve the Parent Company Transaction, and adopt the Parent Company Merger Agreement.”

| 87. | Staff Comment: Under Proposal 2, “Limitation on Liability”sub-section, confirm that the “as otherwise provided by law” carve out is accurate in the context of acts for which the Adviser will be liable. |

Response: The Trust has revised disclosure to clarify that the reference to “as otherwise provided by law” is not a carve out from the acts for which the Adviser will be liable but is a carve out from the limitation on liability. The limitation on liability will not apply to the extent otherwise provided by law.

| 88. | Staff Comment: Under the “Board Considerations” section following Proposal 2, provide additional detail regarding the Board’s consideration of comparable investment companies in determining the reasonableness of the approved fees. Consider adding a reference to disclosure regarding the factors considered by the Board of Trustees in connection with their most recent approval of the advisory agreements or the continuation thereof. |

19

Securities and Exchange Commission

February 14, 2017

Page 20

Response: The Trust has added a reference to the disclosure regarding the factors considered by the Board of Trustees in connection with their most recent approval of the advisory agreements or the continuation thereof.

| 89. | Staff Comment: Under the “Board Considerations” section, explain in a narrative form what will enable the Adviser to offer or provide increased distribution capabilities following the Janus and Henderson corporate transaction. |

Response: Under the “Board Considerations” heading, the Trust has included additional disclosure regarding anticipated distribution and marketing services following the corporate transaction as follows:

“In this regard, Janus Capital advised the Board that after the Parent Company Transaction, the extent of distribution and marketing services provided to the Funds are expected to increase based on the combined resources of Janus and Henderson. This is due primarily to the anticipated increase of sales related resources and expanded global presence of the combined Janus Henderson organization, which is expected to enhance visibility and brand recognition of the Janus Henderson Funds.”

| 90. | Staff Comment: Under the “Board Considerations” section, provide clarification regarding the Board’s consideration of expenses, specifically whether the Board anticipates expenses may increase, but not increase materially, as a result of the Janus and Henderson corporate transaction. |

Response: The Board considered that (i) the terms of the advisory contract, including the fee rate, would not change and (ii) the process for setting expense caps would not change. As disclosed in the “Board Considerations” section, the Board also considered the Adviser’s plans for the operation of the Funds, including the continued provision of all services currently provided to the Funds. The Trust believes that the disclosure accurately reflects the deliberations of the Board and that new disclosure is not warranted.

| 91. | Staff Comment: Under the “Board Considerations” section, explain in more detail what will enable economies of scale, specifically what services may be streamlined and any other specific support that will enable economies of scale. |

Response: In light of the factors noted in response to Comment 90 above, the Board for the Trust did not consider economies of scale a material factor in its deliberations. Accordingly, disclosure with respect to economies of scale has not been added.

| 92. | Staff Comment: Provide additional discussion in the trustee proposal section of the Proxy Statement/Prospectus regarding the impact of a plurality vote with one trustee nominee, specifically indicating that votes not cast or withheld will not affect the outcome, and because the trustee nominee is running unopposed, she is expected to be elected. |

Response: Disclosure has been added that (i) under a plurality voting standard the trustee nominee receiving the most votes will be elected, (ii) assuming the presence of a quorum, votes not cast or withheld will not affect the outcome of the vote, and (iii) because the trustee nominee is running unopposed, assuming the presence of a quorum, she is expected to be elected.

| 93. | Staff Comment: Under the Board Considerations section, provide a more detailed discussion or statement regarding the Board of Trustees’ consideration of whether the funds would experience diminution of services under the New Advisory and NewSub-Advisory Agreements, as applicable. |

20

Securities and Exchange Commission

February 14, 2017

Page 21

Response: The Trust has reviewed the disclosure in the Board Considerations section in light of the Staff’s comment. As disclosed in the Board Considerations section, the Board considered information provided by the Adviser with respect to the operation of the Funds following the Parent Company Transaction, including with respect to advisory services, and including information with respect to the personnel and resources proposed to support such services (see second bullet point in the first bullet point list under the heading “Board Considerations”). The Board also considered assurances provided by the Adviser with respect to the nature, extent and quality of advisory services to be provided post-Transaction (see third bullet in the second bullet point list under the heading “Board Considerations”). The Trust believes that these disclosures accurately reflect the Board’s considerations on this matter. Accordingly, the Trust has not modified the disclosure.

| 94. | Staff Comment: To the extent the term “hurdle” is used in relation to a Fund’s performance relative to its benchmark, revise the language to eliminate the use of the term “hurdle.” |

Response: Disclosure has been revised as requested.

| 95. | Staff Comment: In the trustee proposal section of the Proxy Statement/Prospectus, provide a more robust discussion of the trustee nominee’s background and experience. |

Response: The Trust respectfully submit that the disclosure in the Proxy Statement/Prospectus meets the requirements of Item 22(b) of Schedule 14A, including Item 22(b)(3)(i).

| 96. | Staff Comment: In the manager of managers proposal section of the Proxy Statement/Prospectus, under the “SEC Exemptive Order”sub-section, include disclosure addressing the Adviser’s representation to supervisesub-advisers as set forth in the Order. |

Response: Disclosure has been added to the manager of managers proposal to state that:

“In accordance with the SEC Exemptive Order, the Adviser will provide general management services, including overall supervisory responsibility for the general management and investment of the Fund’s assets. Subject to review and approval of the Board, the Adviser will (a) set a Fund’s overall investment strategies, (b) evaluate, select, and recommendsub-advisers to manage all or a portion of a Fund’s assets, and (c) implement procedures reasonably designed to ensure thatsub-advisers comply with a Fund’s investment objective, policies and restrictions. Subject to review by the Board, the Adviser will (a) when appropriate, allocate and reallocate a Fund’s assets among multiplesub-advisers; and (b) monitor and evaluate the performance ofsub-advisers.”

| 97. | Staff Comment: For Janus Henderson Emerging Markets Fund, under the Synopsis, provide additional detail regarding Henderson Investment Management Limited, as required by Item 22(c)(3) of Schedule 14A. |

Response: Disclosure regarding the Henderson Investment Management Limited, as required by Item 22(c)(3) of Schedule 14A, has been copied from the body of the Proxy Statement/Prospectus to the Synopsis.

21

Securities and Exchange Commission

February 14, 2017

Page 22

| 98. | Staff Comment: For Janus Henderson Emerging Markets Fund, under the Synopsis, include a statement that there will be no change in fees charged to the funds in connection with the approval of Henderson Investment Management Limited assub-adviser. |

Response: The requested statement has been added to the Synopsis.

| 99. | Staff Comment: For Janus Henderson Emerging Markets Fund, under Proposal 3, include at least five years of employment history for named portfolio managers. |

Response: The biographical information for each portfolio manager has been updated to include at least five years of employment history.

| 100. | Staff Comment: For Janus Henderson Emerging Markets Fund, confirm in correspondence that the Adviser is not aware of any issues under Section 15(f) with respect to the approval of a newsub-advisory agreement. |

Response: The Adviser supplementally confirms that it does not believe that the entry into a newsub-advisory agreement or the appointment of a newsub-adviser would preclude the Adviser from relying upon the safe harbor of Section 15(f). The approval of a newsub-advisory agreement would not impose an unfair burden on a Fund. The adviser notes thatsub-adviser fees are paid by the adviser out of the advisory fee received from the fund, which are payments for bona fide investment advisory services. In no event would the approval of a newsub-advisory agreement result in an increase in the advisory fees payable by a Fund.

* * *

Please call me at303-394-6459 with any questions or comments.

|

| Respectfully, |

|

| /s/ Kathryn L. Santoro |

| Kathryn L. Santoro |

| Vice President, Assistant General Counsel |

| cc: | Michelle Rosenberg, Janus Capital Management, LLC |

Bruce Rosenblum, Vedder Price P.C.

Kevin Hardy, Skadden, Arps, Slate, Meagher & Flom LLP

Michael Hoffman, Skadden, Arps, Slate, Meagher & Flom LLP

Kenneth Burdon, Skadden, Arps, Slate, Meagher & Flom LLP

22

Appendix A

Pre-Parent Company Transaction

Dispersed Public Shareholders

Dispersed Public Shareholders

Henderson Group plc

Janus Capital Group Inc.

HGINA

Janus Capital Management LLC

Advisory Contract

Predecessor Fund

Post-Parent Company Transaction

| 1 | No loss of control person |

| 3 | Entered into after Parent Company Transaction is completed |

| 4 | No different than any typical fund merger within a fund complex, which |

| | has never required compliance with 15(f) |

Dispersed Public Shareholders 1

Dispersed Public Shareholders 2

Henderson Group plc

HGINA

Janus Capital Group Inc.

Advisory Contract

Predecessor Fund

Janus Capital Management LLC

Advisory Contract 3

Shell Successor