The Facts are…

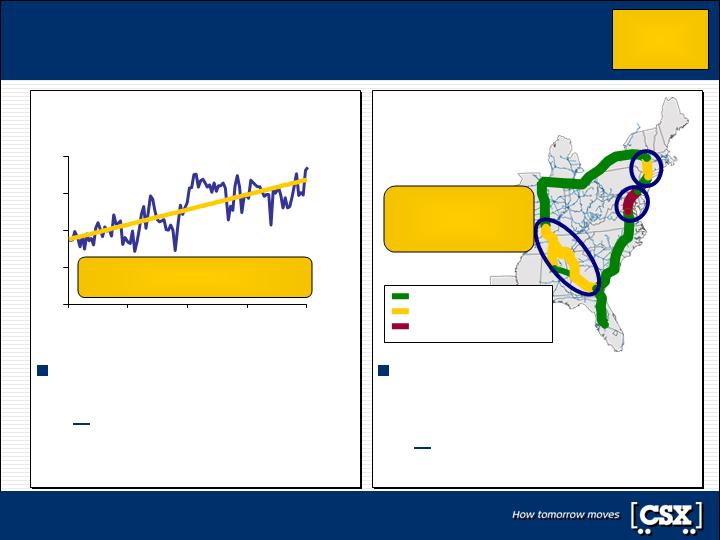

Board presided over the transformation of CSX into a highly focused rail entity, delivering

the most significant stock appreciation in the industry over the last 1, 2, 3, 4 and 5 years.

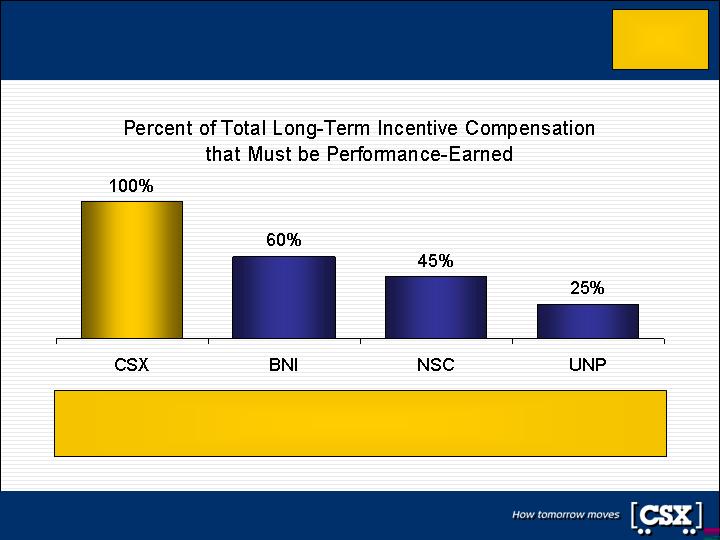

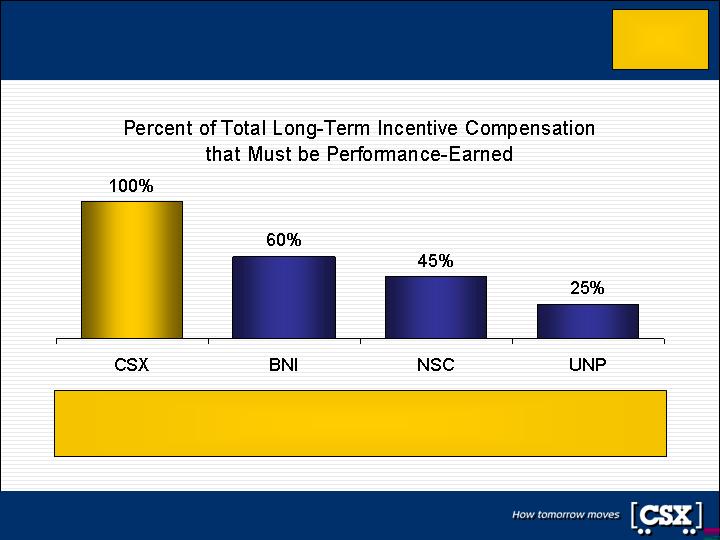

Board implemented a governance structure that ranks in the top 1% of all transportation

companies; CSX is the only rail with 100% performance-earned incentive compensation.

CSX Board delivers superior performance and leading governance

CSX’s Board has

transformed CSX into

an industry leader

CSX is on target

to become the best

railroad in N. America

TCI Group has flawed

ideas that could destroy

shareholder value

TCI Group’s

nominees raise

red flags

6

The facts are…

CSX Board delivers results; TCI Group delivers rhetoric

CSX is an industry leader with proven plans to continue delivering for shareholders.

Management has outlined the most aggressive long-term guidance in the industry, with

$400M+ of productivity savings and margins better than any U.S. railroad by 2010.

CSX Board drives unprecedented results and unmatched guidance

TCI Group’s demands to date include a leveraged buyout significantly below current stock

price, destroying CSX’s credit rating for a 20% annual buyback of CSX stock, raising

customer prices 7% annually for the next decade, and freezing expansion capital.

Now, the TCI Group is relying on misrepresentations and misleading analyses to promote

its nominees and its agenda.

TCI Group’s proposals would put CSX’s future at risk

Three of TCI Group’s nominees have no U.S. public board experience.

TCI Group’s nominees’ experience includes histories of bankruptcy, poor performance,

abysmal safety records, and conflicts of interest.

Two dissident, short-sighted shareholders are seeking a voting block of five and effective

control of CSX.

TCI Group has a poor track record, limited experience, and no coherent plan for CSX

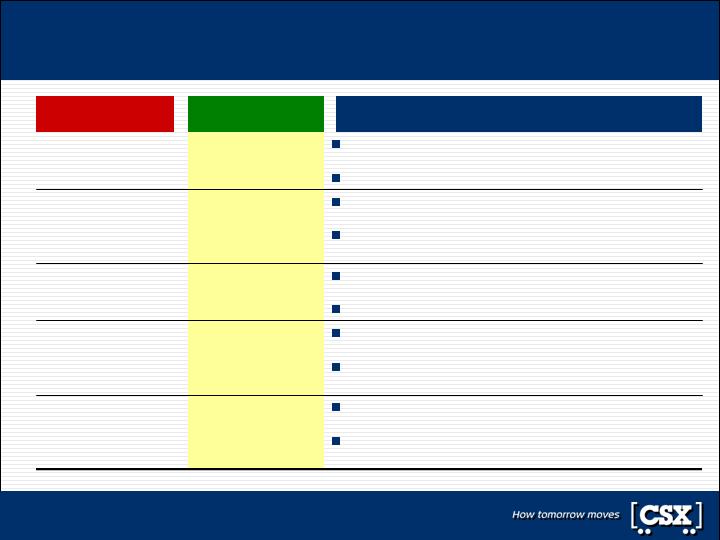

The facts are…

CSX has grown

operating income

faster than CN

Expense and

margin gaps with

CN are narrowing

Investment Grade

is in CSX’s

best interest

CSX public targets

are most

aggressive in

the industry

CSX performance

drove leading

stock appreciation

The Truth

More than a third of CN’s growth since 1998 was due

to acquisitions and inflation (not true operating gains).

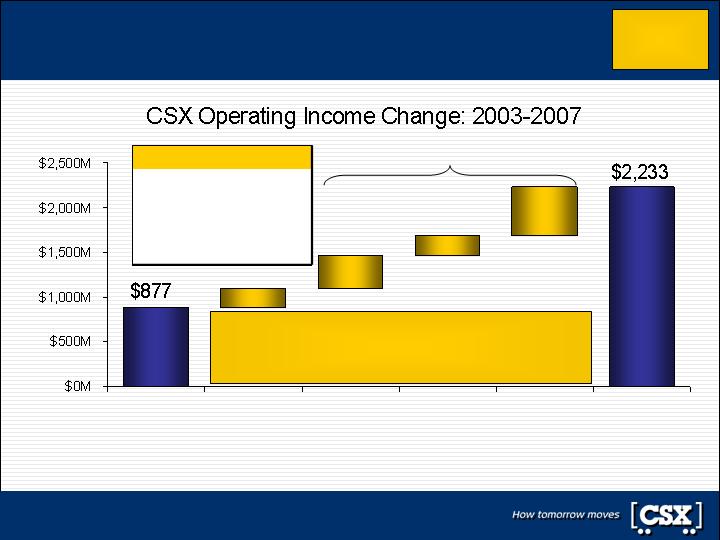

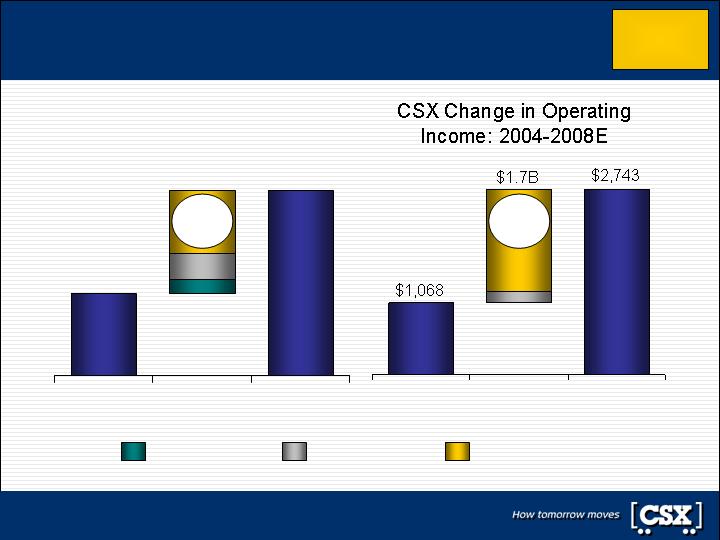

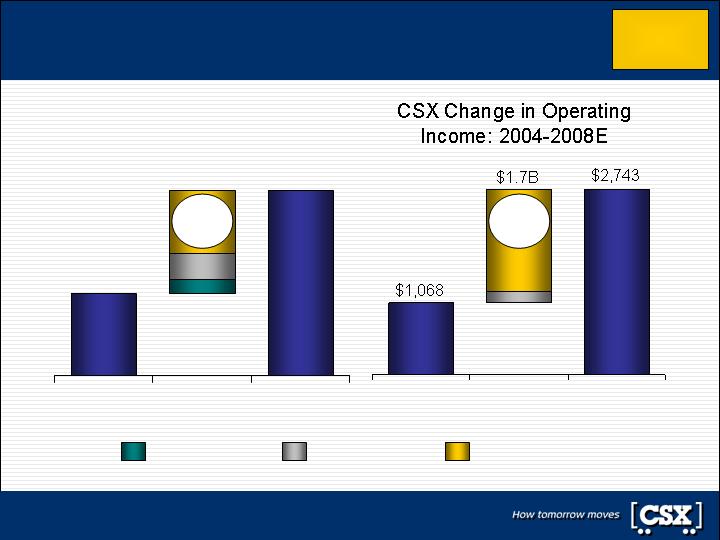

CSX on track to increase operating income by $1.7B

in just four years (outpacing CN’s C$1.6B over nine).

CN is a model of

income growth

CSX’s margin improved by 1,240 basis points since

2004, while CN margins have been essentially flat.

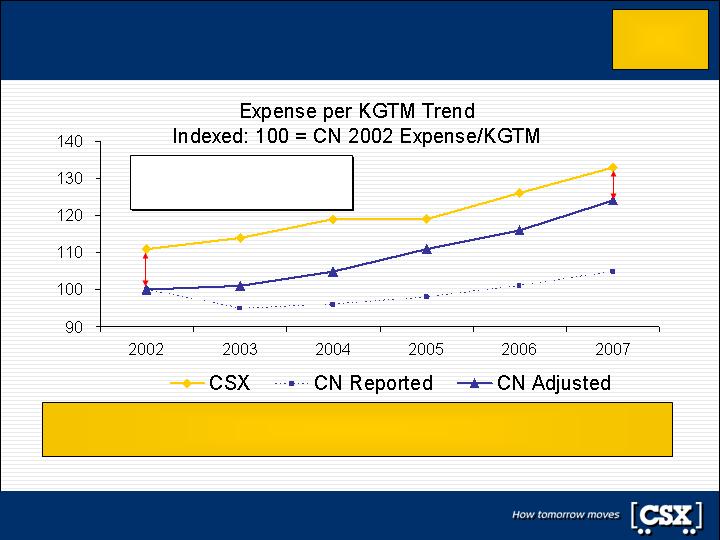

Expense gap has narrowed from 11% to 8% after

properly adjusting for the foreign currency translation.

The gap to CN

is widening

Extra $3B of debt today results in Junk Bond status,

increased cost of capital & only 2% EPS accretion.

CSX would lose financial flexibility, access to capital.

Junk Bond status

would create value

for CSX

CSX has targeted a low-70’s operating ratio by 2010,

with $400M+ of productivity savings from 2008-10.

Detailed plans to achieve targets have been

publicly communicated.

CSX has no public

targets to improve

operations

Price, productivity and yield management drive

unmatched margin expansion.

Industry-best shareholder returns over 1,2,3,4,5 years.

Industry-wide

factors drove

stock increase

TCI Group Claim

7

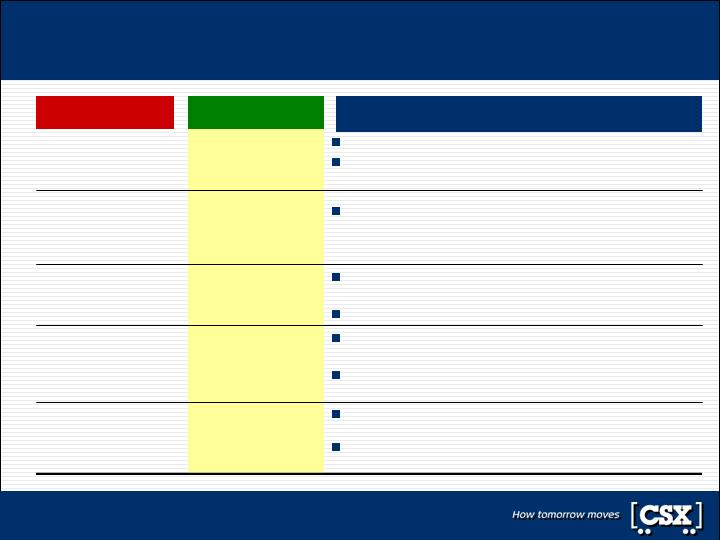

The facts are…

TCI Group uses bad math, flawed assumptions, half truths

The facts are…

CSX’s labor

efficiency per RTM

is better than NS

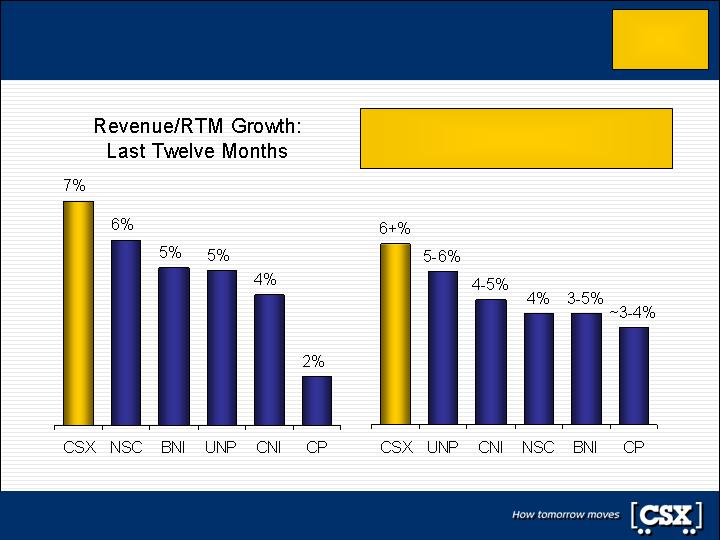

CSX pricing at

parity with NS and

increasing faster

CSX is top-tier in

customer service

Using meaningful

comparisons, CSX

is an industry

leader

Management

driving strong price

& productivity gains

The Truth

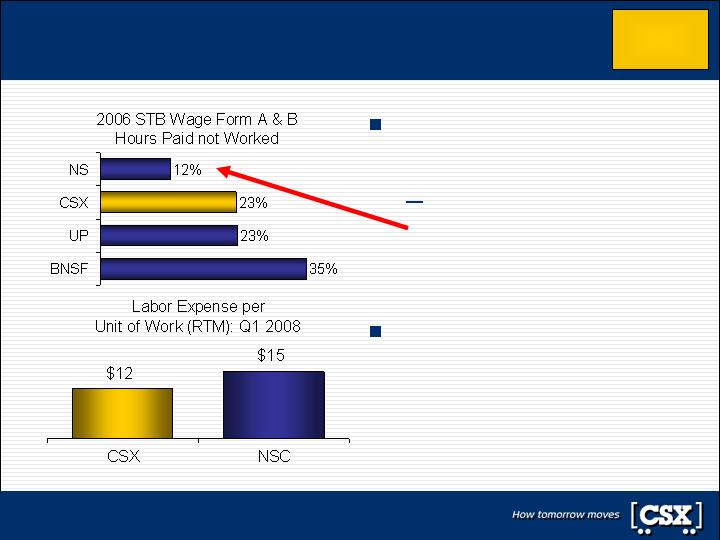

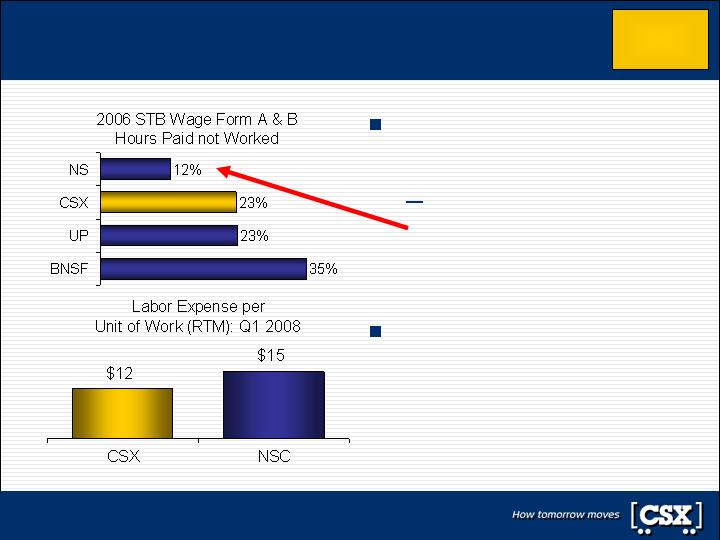

CSX does not count training as “hours worked,”

making comparison with NS invalid on this measure.

CSX labor cost per true unit of work is ~20% less than

NS, with further labor productivity initiatives in place.

CSX employees

are not as

efficient as NS

CSX’s longer average haul yields higher prices per

carload; adjusted price per RTM is at parity.

CSX pricing gains exceeded NS by over 300 bps in

‘07, with 6+% guidance in ‘08 versus only 4% at NS.

CSX prices at a

discount to NS

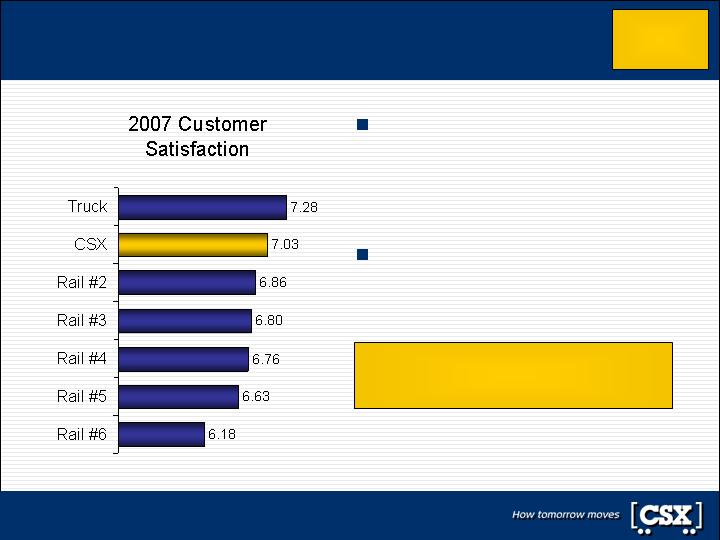

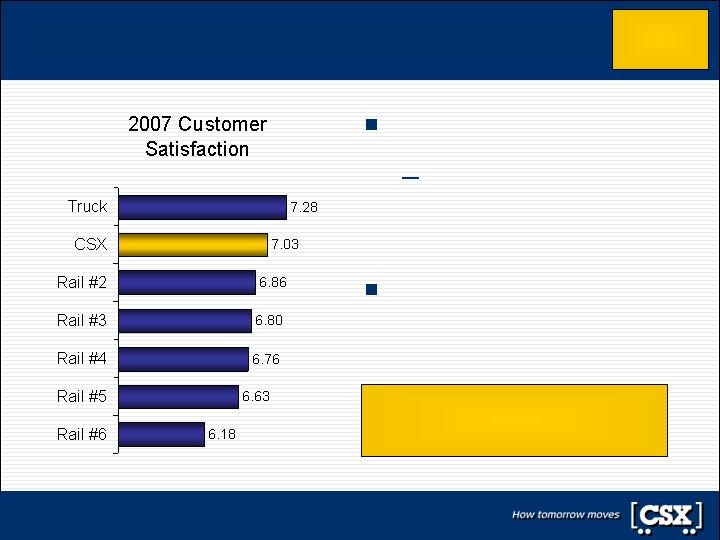

Third-party survey of 2,200 customers shows

CSX is #1 in total customer satisfaction.

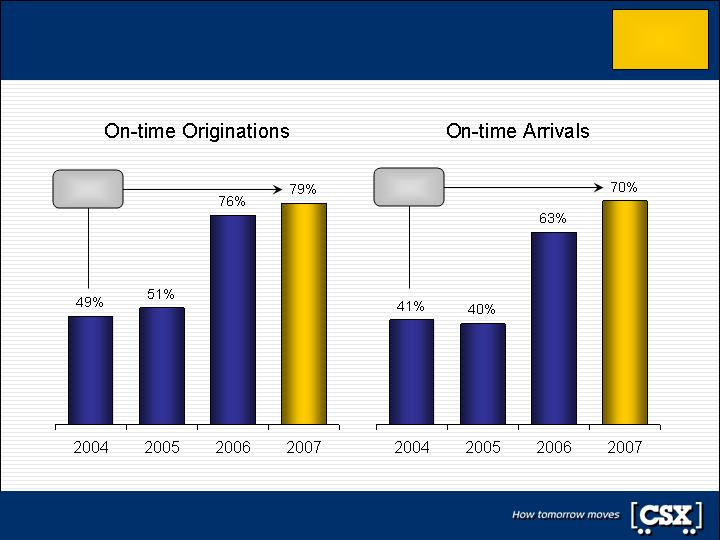

On-time performance approaching all-time highs.

CSX is a poor

performer in

customer service

CSX is an industry leader in cost control per revenue

ton mile, price gains, customer service and

employee safety.

CSX is an industry

laggard on key

operational metrics

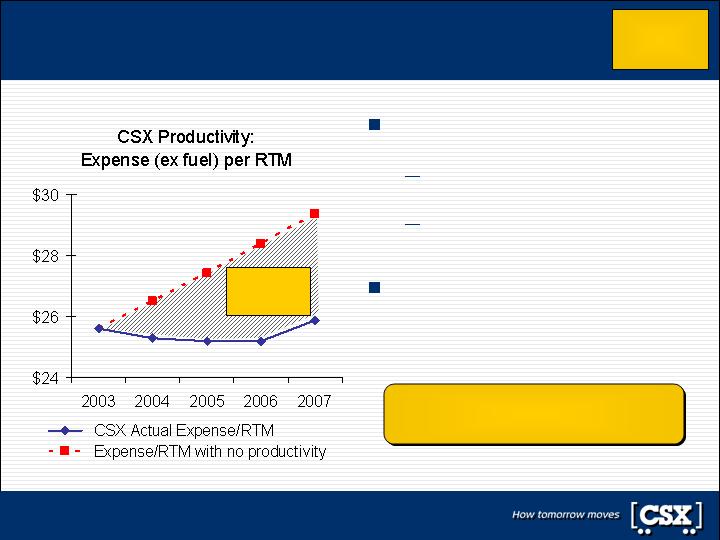

Productivity gains have exceeded $500M since 2003.

Price gains have been industry-leading due to strong

service and operational improvements.

CSX improvement

is from price with

no productivity

TCI Group Claim

8

The facts are…

TCI Group uses bad math, flawed assumptions, half truths

The facts are…

TCI Group Question

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

Corporate

Governance

9

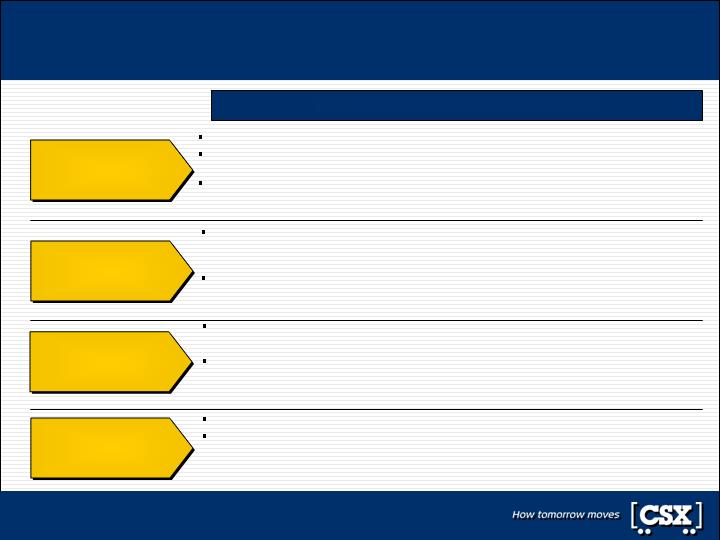

Is this board capable of holding

management accountable?

Is this board working for shareholders

or for management?

Why does CSX lag peers on nearly

every operational metric?

Why does CSX have barely half the

profitability of CN?

Why doesn’t management have public

targets to improve operations?

Why does CSX price at a deep

discount to competitor NS?

Is there a smarter way to price?

Is the capital expenditure budget

economically justifiable?

How can we be comfortable that

management will be disciplined?

What is the right capital structure for a

business as strong as CSX?

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry

leading shareholder value and continues to

raise the bar

Governance rating score of 99% is top tier

of industry

CSX is a leader in safety, service

and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent

and aggressive

CSX is an industry price leader, with the

most aggressive pricing guidance

Pricing process and discipline is

industry-leading

Disciplined capital spending in line with

peers and generating industry leading

shareholder returns

Aggressive, investment grade capital

structure

Corporate Governance

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

11

The facts are...

CSX Board delivering superior shareholder value

Proven record of delivering value to shareholders

Superior stock performance, investing for long-term growth, nearly tripled

dividends, targeting nearly $6 billion of buybacks between 2006 and 2009

Presiding over fastest growing company in an attractive industry

Leads industry in safety, service and financial improvement

Recognized among industry leaders in safety and service

Knowledge and expertise in place to continue strong improvement

Diverse background already in place for presiding over dynamic business

Corporate governance practices recognized among best-in-class

Constructive tension between Board and management in place to drive value

The CSX Board has a proven track record

and is a market leader in corporate governance

Corporate

Governance

12

The facts are...

CSX is the leader in shareholder value creation

Total Shareholder Return

219%

203%

97%

28%

6%

CP

23%

150%

158%

177%

219%

314%

4 Years

56%

157%

215%

264%

285%

323%

5 Years

20%

124%

88%

86%

110%

218%

3 Years

7%

52%

15%

17%

26%

88%

2 Years

(7%)

23%

10%

7%

13%

40%

1 Year

S&P

500

UP

NS

CN

BNSF

CSX

Current returns as of 4/25/08.

In sharp contrast to TCI Group’s claim, CSX significantly

leads the industry in current shareholder returns

Corporate

Governance

13

Economics policy expert and former president of Johns

Hopkins University. Former Chairman and President

of the W.K. Kellogg Foundation.

Board experience includes Fortune 500 companies

in the transportation, energy and banking industries.

“Philanthropist”

William

Richardson

Career spans private equity and CEO of a major

business services provider. Board experience

includes Fortune 500 companies in the transportation,

aerospace, financial services and banking industries.

Former Vice

Chairman,

Cendant

Robert

Kunisch

Key role in airline deregulation and is a transportation and

economic policy expert. Former chair of business and public

policy department at Wharton School of Business.

Board experience includes Fortune 500 companies

in the transportation, banking, technology,

agricultural and food products industries.

“Business School

Professor”

Elizabeth

Bailey

The whole truth…

TCI Group

says…

Board

Member

The facts are...

Incumbent directors have broad experience base

Corporate

Governance

14

The facts are...

Incumbent directors have broad experience base

CEO of a major commercial development firm—substantial

infrastructure expertise in the eastern U.S. building

for industries, including ethanol, real estate development,

and building products, which are critical to

CSX’s business strategies.

“Jacksonville

Contractor”

Steven

Halverson

Medical, healthcare and social policy expert as well as

former Chairman of the National Medical Association.

Board experience includes Fortune 500

companies in the transportation, energy,

banking, healthcare, and food products industries.

“Doctor”

Frank

Royal

The whole truth…

TCI Group

says…

Board

Member

CSX Board members have significant transportation experience,

blue chip business experience, and governance and policy expertise

Corporate

Governance

15

The facts are…

Qualifications of TCI Group nominees raise questions

Chaired a publicly traded company sold through a distressed sale,

and has a career characterized by buyouts and leverage.

Former Director CN

& Former Chairman

Illinois Central

Gil

Lamphere

Led Northwest Airlines into bankruptcy and

sold more than 75% of his shares in the months

immediately leading up to the bankruptcy filing.

Former Chairman

Northwest Airlines

Gary

Wilson

Transitional CEO as Conrail was converted to a switching operator.

As Managing Director of London Underground, performance is

down sharply and need for government funding is up 600%.

No U.S. public board experience.

Former CEO

Conrail

Tim

O’Toole

Led Brazilian railroad a fraction of CSX’s size with an abysmal

safety record. No U.S. public board experience.

Former CEO ALL

(Brazil)

Alex

Behring

Demands for CSX, if implemented, could have impaired

shareholder value. Made statements raising significant regulatory

concerns in Washington. No U.S. public board experience, and

resigned from a UK board amid allegations of conflict of interest.

Creates

shareholder value

Chris

Hohn

The whole truth…

TCI Group

says…

Board

Member

Corporate

Governance

The choice between director slates is clear

16

The facts are…

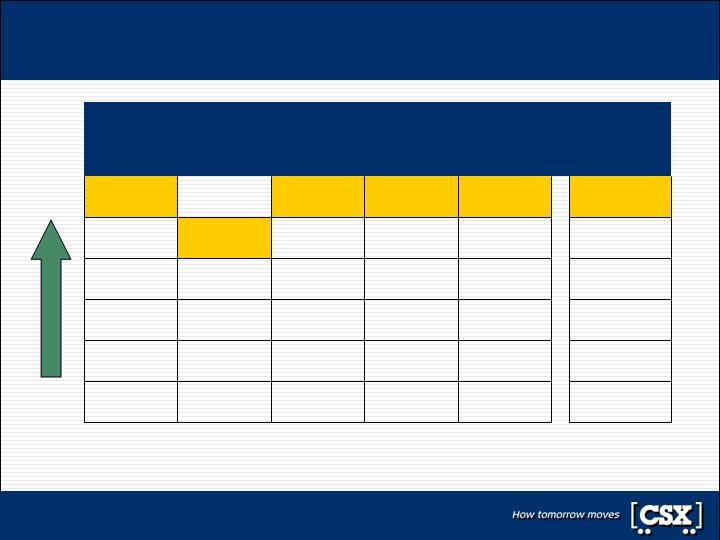

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

17

The facts are...

CSX’s Board is a leader in governance

CSX has a presiding independent director with delineated duties

Consistent with prevailing practice in the United States

CSX has a strong independent board

CEO is the only management director, with eleven outside directors

Best practices already in place at CSX

Key Board committees are comprised solely of independent directors

Election of entire Board is conducted annually

Majority election of Board in uncontested elections is required

No supermajority vote required

Ability of 15% of shareholders to call a special meeting

Executive severance payments capped at 2.99 times annual compensation

No poison pill

All incentive compensation is performance-earned

Corporate

Governance

CSX corporate governance ranks in top 1% of transportation companies

18

The facts are...

CSX incentive pay is entirely performance-earned

CSX is the only major railroad at which annual and

long-term incentive plans are both 100% performance-earned

Corporate

Governance

Source: 2008 Railroad Proxy Statements. Performance-earned excludes time-based stock options and restricted stock.

19

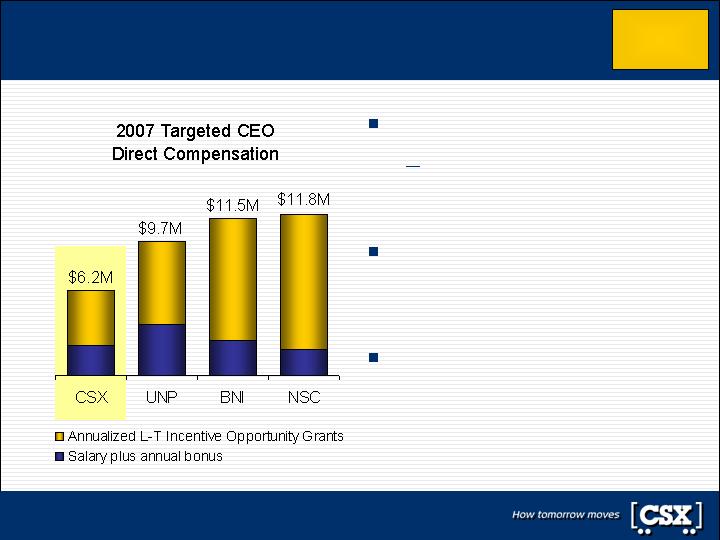

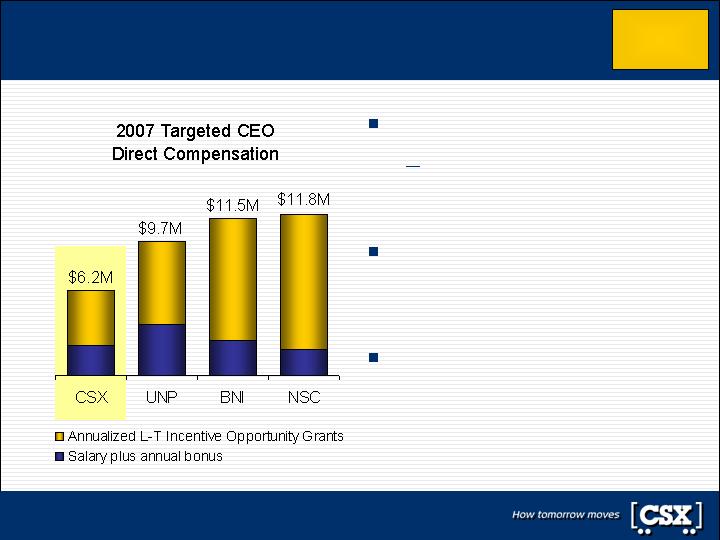

The facts are...

CSX targeted CEO pay is lowest of all U.S. rails

All of CSX’s CEO incentive pay is

performance-earned

Vesting of grants does not

occur unless performance

standards are met

CSX unmatched stock price

appreciation is a result of the most

impressive turnaround story of any

railroad since 2003

If other railroads had CSX’s stock

performance, CSX’s CEO would

have been the lowest paid U.S.

rail CEO from 2003-07

Source: 2004-2008 Railroad Proxy Statements.

CSX stock performance through 4/25/08.

Corporate

Governance

20

Productivity Opportunity

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

22

The facts are...

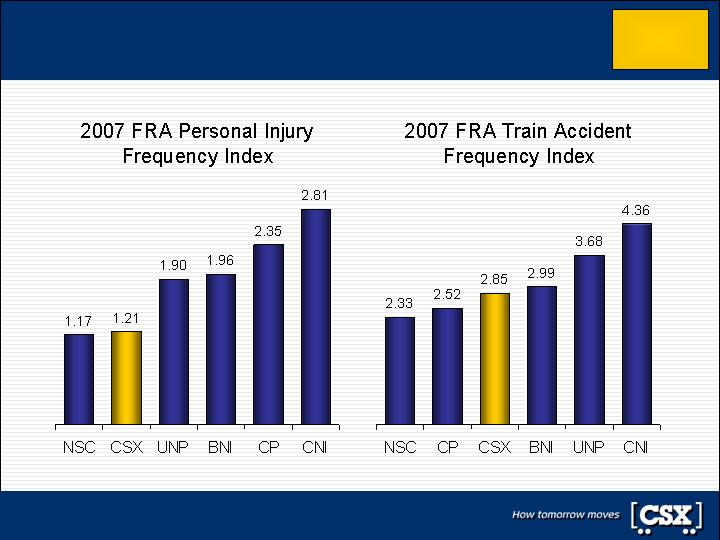

CSX is a leader in safety, service and productivity

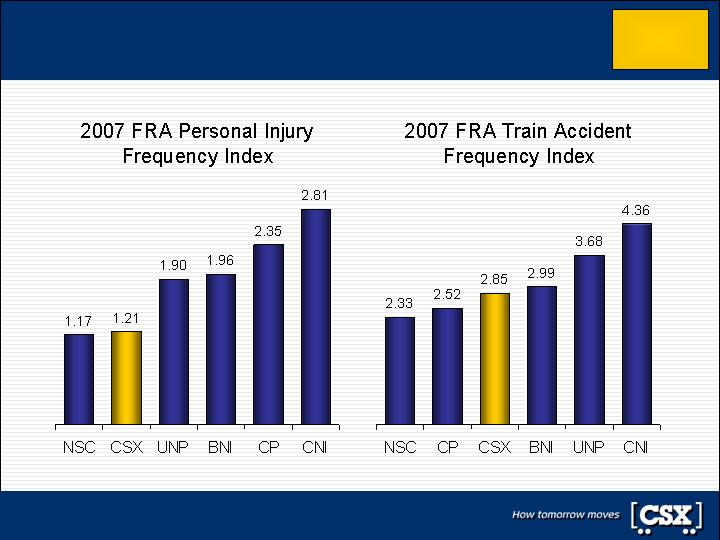

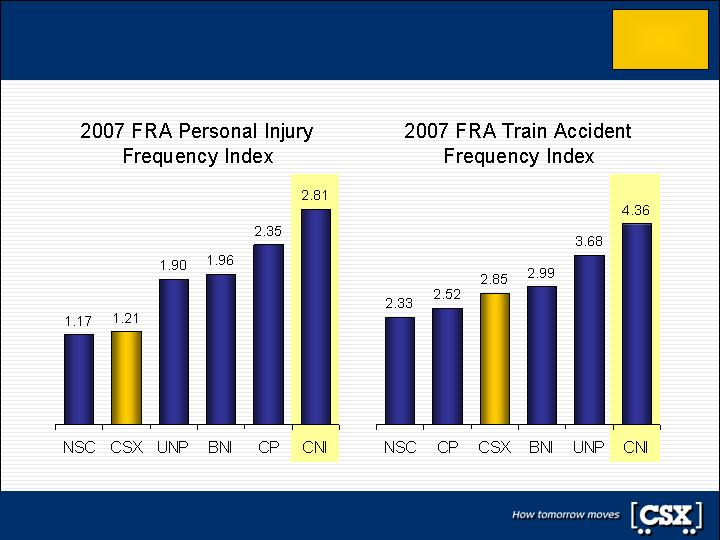

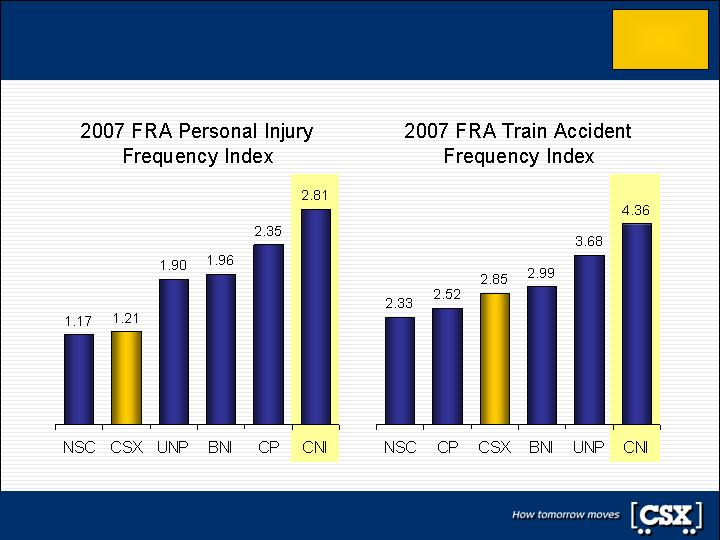

Safety: CSX is among industry leaders in safety and

train accident prevention

Service/Customer Satisfaction: CSX is now

top-tier in customer satisfaction measures as a

result of dramatic service improvements

Cost productivity: CSX has delivered $500M in

productivity savings since 2003, with at least an

additional $400M in productivity targeted through 2010

Productivity

Opportunity

23

The facts are...

CSX is among industry leaders in safety

Productivity

Opportunity

Source: 2007 Federal Railroad Administration data

24

Safety: CSX is among industry leaders in safety and

train accident prevention

Service/Customer Satisfaction: CSX is now

top-tier in customer satisfaction measures as a

result of dramatic service improvements

Cost productivity: CSX has delivered $500M in

productivity savings since 2003, with at least an

additional $400M in productivity targeted through 2010

The facts are...

CSX is a leader in safety, service and productivity

Productivity

Opportunity

25

The facts are...

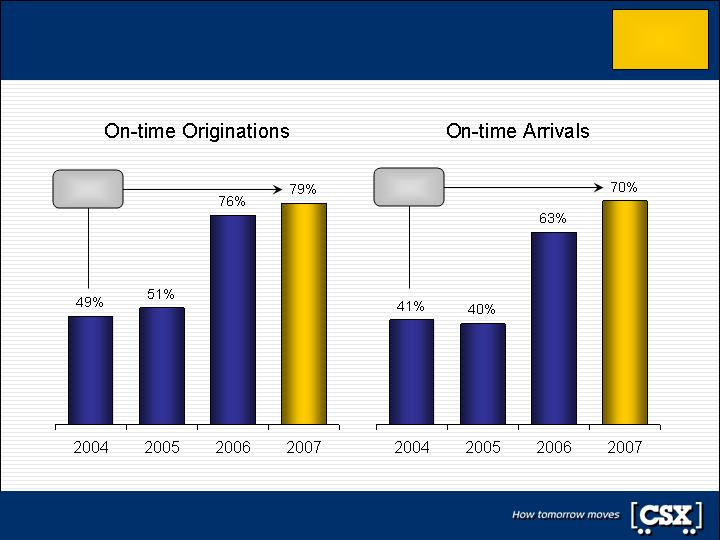

CSX’s service performance is dramatically improved

61%

Increase

71%

Increase

Productivity

Opportunity

26

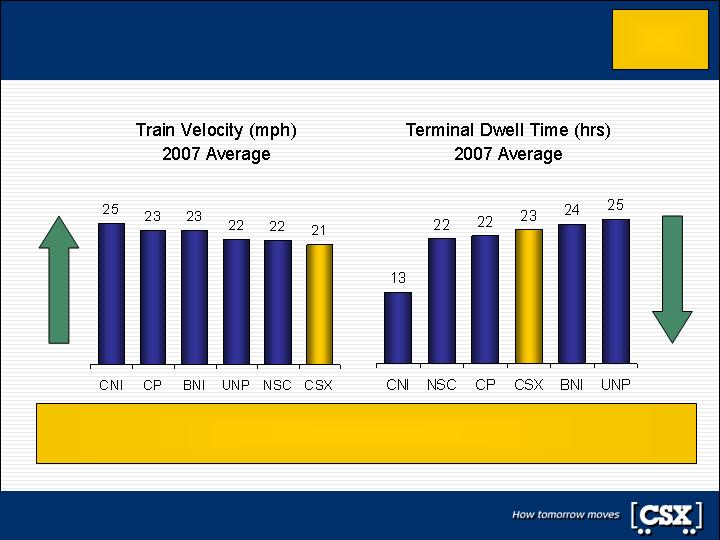

The facts are…

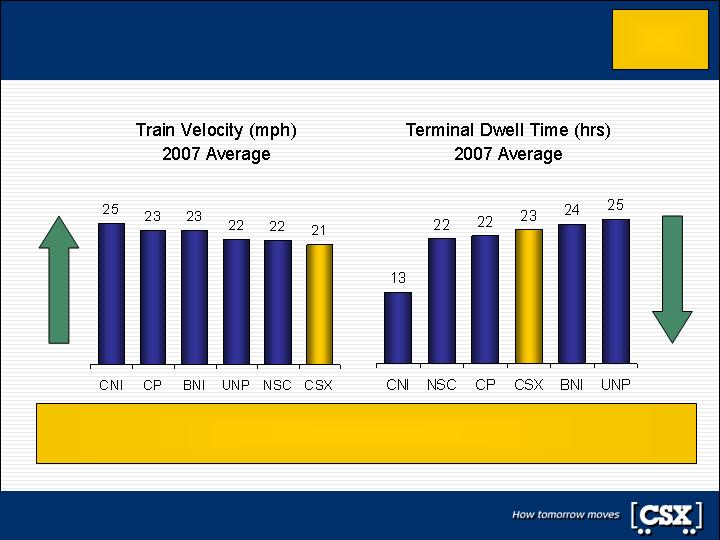

Velocity and dwell are not meaningfully comparable

Source: Original data published by American Association of Railroads (AAR) and CN website.

AAR states that velocity and dwell “cannot meaningfully be compared” due to

differences in mix, length of haul, methodology, etc. Yet, TCI Group did just that.

Better

Better

Productivity

Opportunity

27

The facts are...

CSX velocity by train type ahead of competitor NS

Source: Original data published by American Association of Railroads (AAR)

Productivity

Opportunity

Full Year 2007 AAR Velocity

(4%)

21.6

20.8

Total

(2%)

20.5

20.0

All Other

+ 7%

15.6

16.7

Coal

+ 4%

22.0

22.8

Auto

+ 5%

18.3

19.3

Grain

+ 6%

27.7

29.4

Intermodal

Difference

NS

CSX

28

Total velocity statistics are not

meaningfully comparable

across all railroads, primarily

due to train type mix

AAR publishes velocity by

train types to control for mix

—

CSX has higher velocity

than close competitor

NS in nearly all train types

—

NS total velocity is higher

than CSX only due to a

higher mix of faster

Intermodal traffic

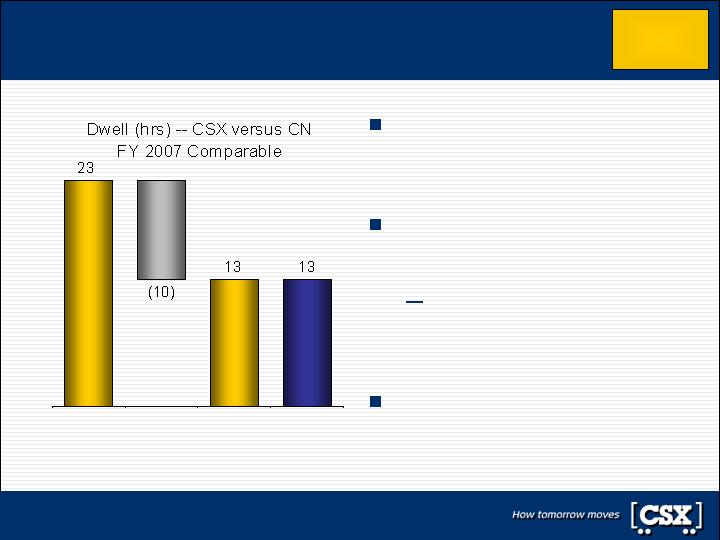

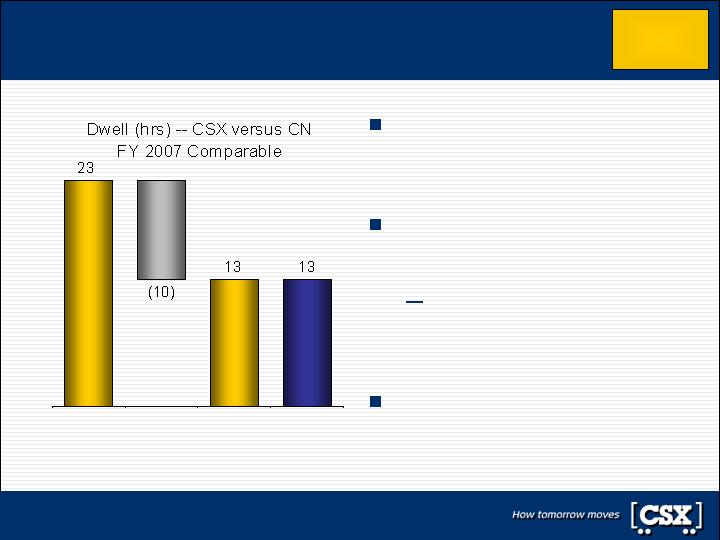

The facts are...

CSX dwell is on par with industry-leading CN

Dwell is the average time a

car resides at a terminal

location, expressed in hours

Cars that do not stop at

terminals (“through trains”)

are excluded from AAR dwell

However, CN includes

through trains in their

published dwell figure

On a comparable basis, CSX

dwell is on par with CN

CSX Dwell

(Reported)

Adj. for

through

trains

CSX

Adjusted

Dwell

CN

Dwell

Note: CSX analysis adjusts CSX’s AAR-reported Dwell to include through trains; CN Dwell from CN company website.

Productivity

Opportunity

29

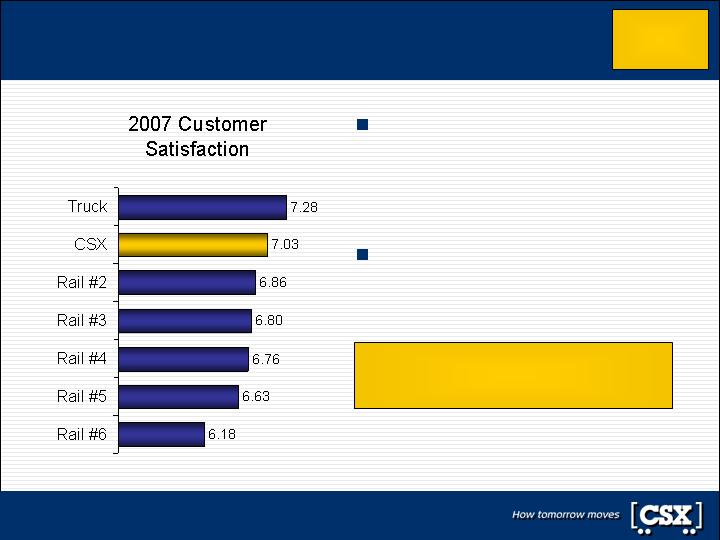

The facts are...

CSX is the industry leader in customer service

Customer satisfaction rankings

are based on independent

third-party survey with over

2,200 responses

Correlates to internal operating

measure gains

Source: Survey of CSX customers by a leading independent third-party surveyor

Productivity

Opportunity

Industry-leading service supports

industry-leading price gains

30

Safety: CSX is among industry leaders in safety and

train accident prevention

Service/Customer Satisfaction: CSX is now

top-tier in customer satisfaction measures as a

result of dramatic service improvements

Cost productivity: CSX has delivered $500M in

productivity savings since 2003, with at least an

additional $400M in productivity targeted through 2010

The facts are...

CSX is a leader in safety, service and productivity

Productivity

Opportunity

31

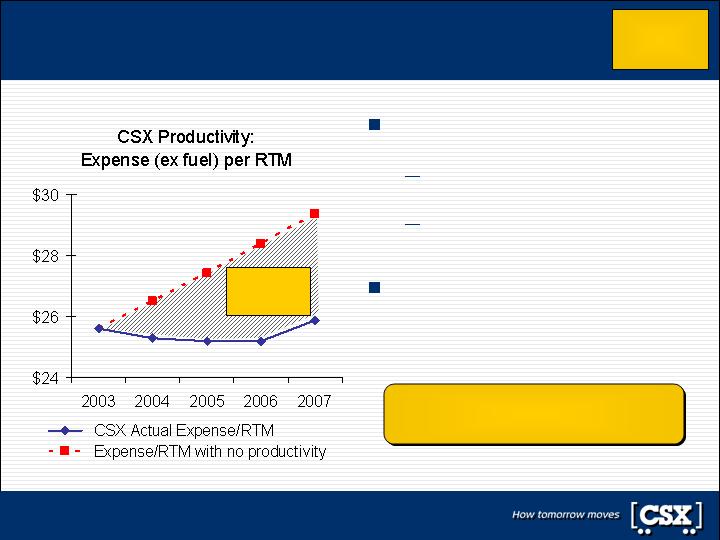

Productivity at CSX is defined as cost containment

CSX has achieved $500M+ of productivity since 2003

Disciplined approach will drive another $400M+ targeted through 2010

TCI Group claims CSX can achieve $2.2B of “productivity” over 5 years

The reality is, $1.8B of this “productivity” simply represents volume growth that is

economically dependant

The remaining $400M, or $80M annually, could be characterized as cost savings, but are

based on flawed and misleading assumptions and are not valid

The correct analysis targets $135M+ annually over the next three years,

but in very different areas than the TCI Group have identified

The facts are...

Discipline is key to aggressive productivity targets

CSX has clear and specific productivity initiatives

Network

Efficiency

Labor

Productivity

Locomotive

Fleet Mgmt.

Car Fleet

Utilization

Fuel

Efficiency

CSX’s plan targets $135M+ of real productivity annually

vs. the TCI Group’s foundationless lower targets

Productivity

Opportunity

32

The facts are...

TCI Group’s productivity analysis is flawed

Productivity is appropriately

measured on a workload basis

Revenue ton miles (RTM)–not

carloads—define workload

RTM’s include both tons

carried and length of haul

TCI Group inappropriately

measured productivity on a

per carload basis

Note: Dashed line assumes inflation growth of 3.5% (based on AAR’s ALL-LF index 2004-07) and no productivity.

$500M of productivity since 2003

$400M+ more planned through 2010

Productivity

Opportunity

CSX

Productivity

Gains

33

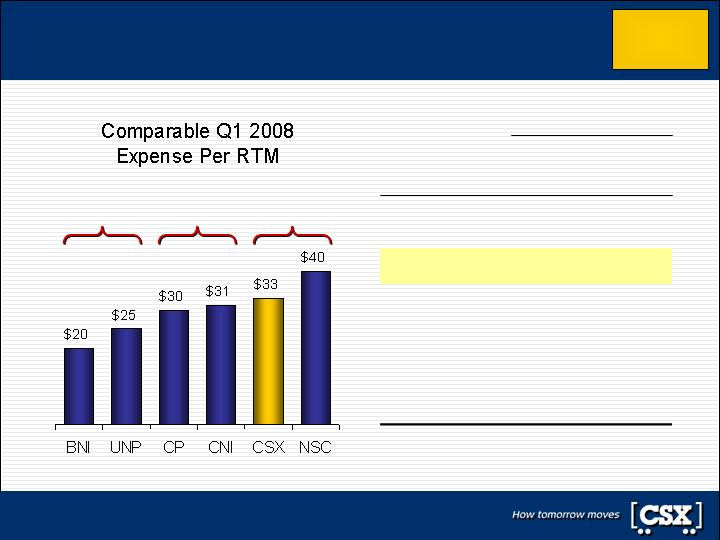

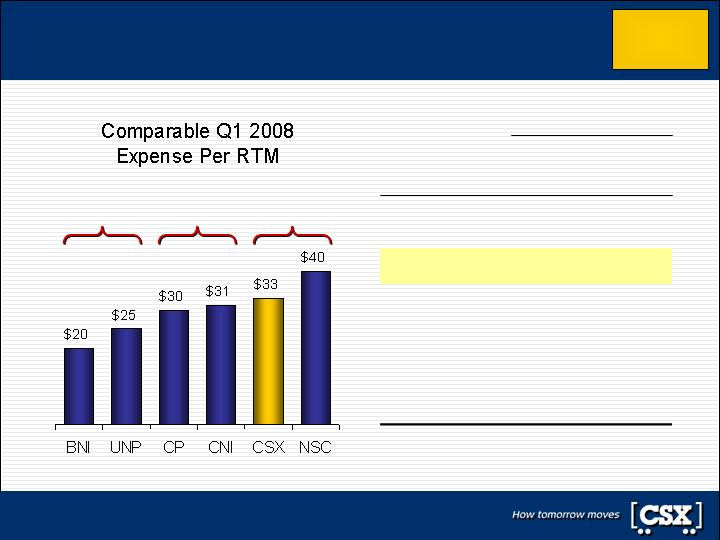

The facts are...

CSX among industry leaders in cost control

1Q04–1Q08 CAGR

4.9%

1.4%

2.3%

2.2%

0.5%

0.1%

Excluding

Fuel

8.7%

6

NSC

6.8%

5

BNI

6.6%

4

UNP

5.4%

3

CNI

3.9%

2

CSX

3.6%

1

CP

Expense

per RTM

Rank/Company

Note: See GAAP Reconciliation for CSX data; peer comparisons based on railroad financial reports and CSX Analysis.

Western

Rails

Eastern

Rails

Canadian

Rails

Productivity

Opportunity

34

The facts are...

CSX is number one after proper currency adjustment

Strengthening Canadian dollar

distorts comparability between

U.S. and Canadian rails

Using a fixed exchange rate to

U.S. dollars only compensates for

part of the issue

CN & CP translate U.S. dollar-

denominated expenses to

Canadian dollars

With a stronger Canadian

dollar, the translation of U.S.

dollar-denominated

expenses into Canadian

dollars understates expense

growth at CN & CP

Note: See GAAP Reconciliation for CSX data; peer comparisons based on railroad financial reports and CSX Analysis.

Adjusted CN & CP results sourced from CN/CP financial statements and CSX analysis.

1Q04–1Q08 CAGR

4.9%

5.5%

1.4%

2.3%

3.1%

0.5%

Adjusted,

Excluding

Fuel

8.7%

6

NSC

8.2%

5

CNI

6.8%

4

BNI

6.6%

3

UNP

6.0%

2

CP

3.9%

1

CSX

Adjusted

Expense

per RTM

Rank/Company

Productivity

Opportunity

35

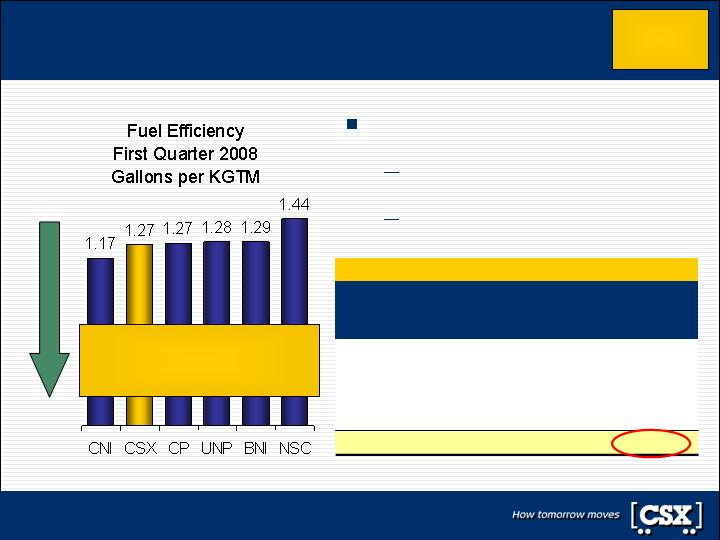

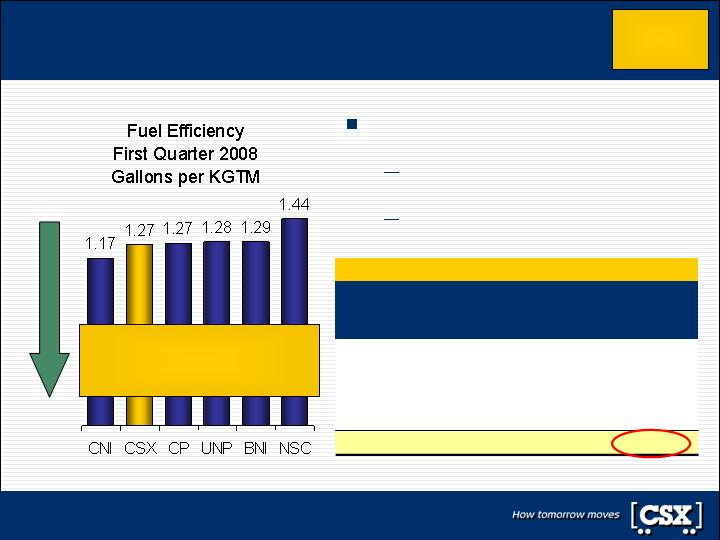

The facts are...

CSX is a leader in fuel efficiency

CN average length of haul is at least

800 miles – one-third longer than CSX

Math shows that TCI Group’s 600

mile average haul for CN is wrong

Longer hauls are more fuel

efficient

Better

Source: Railroad financial reports and CSX analysis. CN length of haul based on CN financial reports. KGTM is

thousand gross ton miles.

CSX’s fuel efficiency is 1.05

for 800-900 mile moves…

10% better than CN

CN Average Length of Haul Estimate

4,744k

1,324k

3,059k

361k

Units

850 miles

64

184.2

Total

1,640 miles

15

32.6

Intermodal

565 miles

80

137.8

Merchandise

/Auto

365 miles

Approx.

Average

Haul

13.8

KRTM

105

Est.

Tons/

Unit

Coal

Market

Productivity

Opportunity

36

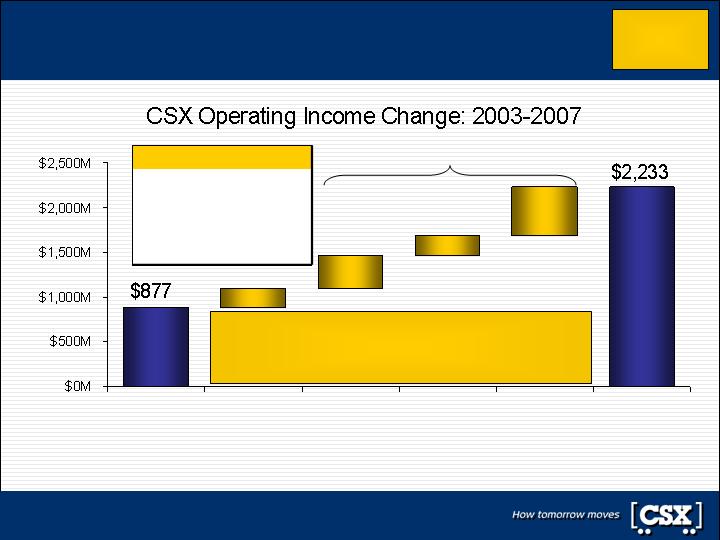

The facts are…

Management drives price, volume and productivity

2003

Comparable

Operating

Income

2007

Comparable

Operating

Income

Net

Inflation

Real

Pricing

Volume

Productivity

28%

Real Pricing

16%

Volume

40%

16%

Net Inflation

Productivity

Sources of Income Growth

Sustained, industry leading price above inflation.

Volume is up 7% on RTM basis with favorable mix.

Productivity has exceeded $500M.

Note: Inflation assumed at 3.5% based on AAR’s ALL-LF index. Real pricing based on “same store sales” price gains less

inflation and net impact from fuel price. See GAAP Reconciliation for CSX data.

Management Action

Productivity

Opportunity

37

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

38

The facts are...

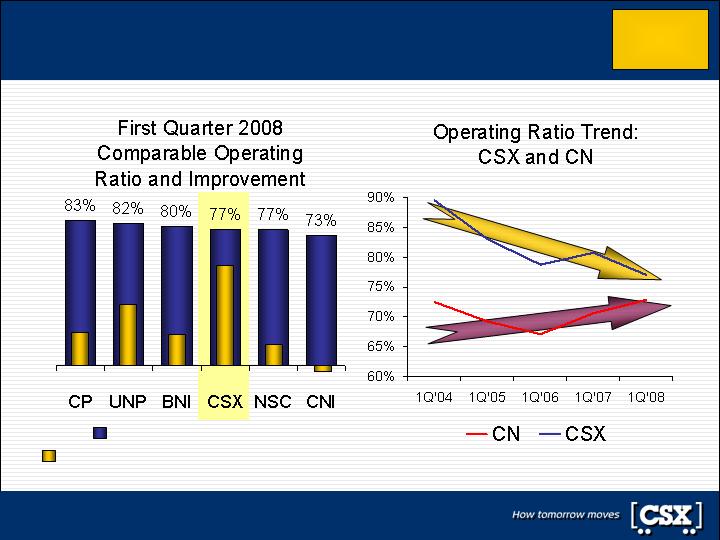

CSX safety, service, productivity gains outpacing CN

CSX margin difference to CN is closing rapidly

CN’s Q1 2008 margin is 30 bps below Q1 2004

CSX has improved by 1,240 bps over this period

CSX is closing the expense gap with CN

CN expense growth artificially low due to currency

translation impact

CN lags the industry in safety and customer service,

which are key CSX long-term strategies to create

shareholder value

Productivity

Opportunity

39

The facts are...

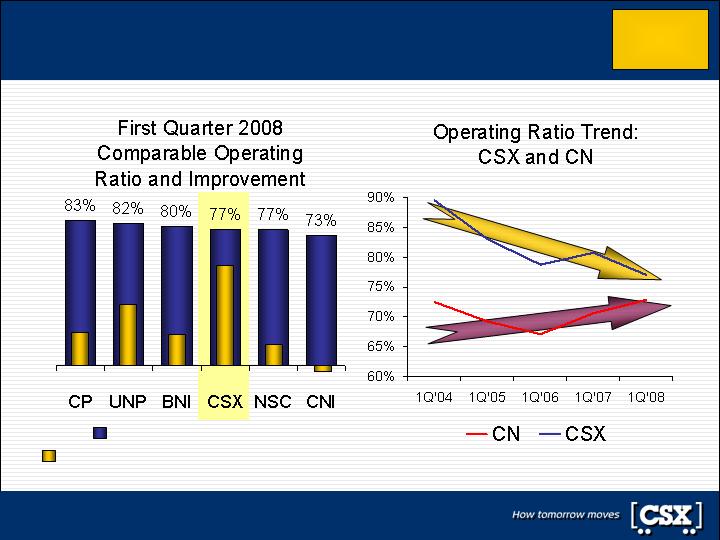

CSX is among industry leaders in operating ratio

420

760

410

1,240

270

(30)

Note: See GAAP Reconciliation for CSX data; peer comparisons based on First Call data

Q1 2008 Operating Ratio

Q1 2008 vs. Q1 2004 Improvement (bps)

Productivity

Opportunity

40

The facts are...

CSX safety, service, productivity gains outpacing CN

Productivity

Opportunity

CSX margin difference to CN is closing rapidly

CN’s Q1 2008 margin is 30 bps below Q1 2004

CSX has improved by 1,240 bps over this period

CSX is closing the expense gap with CN

CN expense growth artificially low due to currency

translation impact

CN lags the industry in safety and customer service,

which are key CSX long-term strategies to create

shareholder value

41

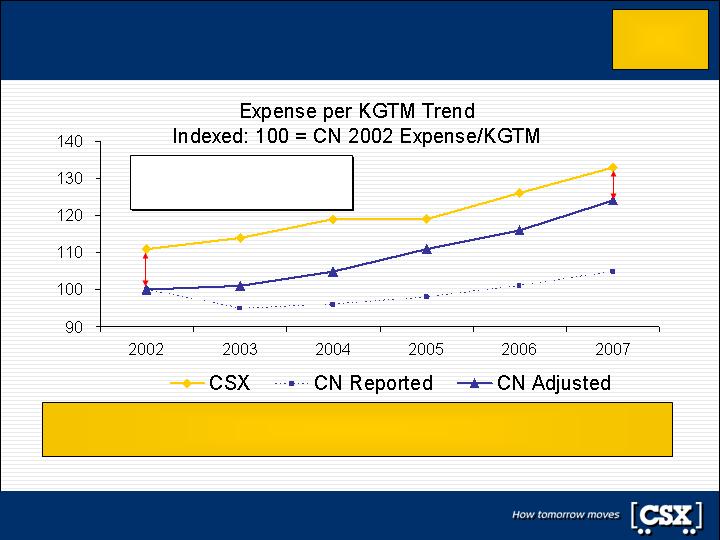

The facts are...

CSX is closing the cost gap with CN

CN’s results over time must be adjusted for the favorable impact from

translation of U.S. dollar-denominated expenses into Canadian dollars

11% Gap

8%

Gap

Note: Analysis assumes fixed 2007 exchange rate to USD. Adjusted CN results sourced from CN Financial

statements and CSX analysis. See Appendix for details.

Productivity

Opportunity

TCI Group analysis

ignores translation impact

42

The facts are...

CSX safety, service, productivity gains outpacing CN

Productivity

Opportunity

CSX margin difference to CN is closing rapidly

CN’s Q1 2008 margin is 30 bps below Q1 2004

CSX has improved by 1,240 bps over this period

CSX is closing the expense gap with CN

CN expense growth artificially low due to currency

translation impact

CN lags the industry in safety and customer service,

which are key CSX long-term strategies to create

shareholder value

43

The facts are...

CN ranks last in safety over the last 12 months

Productivity

Opportunity

Source: 2007 Federal Railroad Administration Data

44

The facts about CSX's performance…

CSX’s service is improving while CN declines

CSX’s customer satisfaction

ratings are industry-leading

On-time performance,

dwell and velocity all

show strong improvement

for CSX

According to a recent Morgan

Stanley survey, 37% of CN’s

customers report

deteriorating service

Productivity

Opportunity

Source: Customer Satisfaction survey is of CSX customers by a leading independent third-party surveyor. Morgan

Stanley Research by William Greene, 18 April 2008.

CSX’s long-term strategy is to

create price sustainability through

superior customer service

45

The facts are...

CSX’s superior service drives margin expansion

CSX is the leader in service, price and margin expansion

(30 bps)

31%

1240 bps

50%

Q1 ’08 vs.

Q1 ‘04

(180 bps)

4%

160 bps

8%

FY ‘07 vs.

FY ‘06

Margin

Expansion

Revenue per

Unit Growth

Margin

Expansion

Revenue per

Unit Growth

CN

CSX

CSX’s relentless pursuit of excellence in customer service

drives pricing power and margin expansion

Note: CN’s results over time have been adjusted for the currency translation impact of the stronger Canadian dollar on

U.S. dollar-denominated revenues. Operating Margin based on First Call data. See GAAP Reconciliation for CSX data.

Productivity

Opportunity

46

The facts are...

CSX gained more in four years than CN did in nine

2004

Operating

Income

2008E

Operating

Income

Four-Year

Improvement

Acquisitions

Net Inflation

True Gains

Note: CSX Analysis of CN reported financials uses 3.0% inflation rate for ‘98-’07 and 3.5% from 2004-08 (based on AAR’s

ALL-LF Index). CSX 2008E based on latest Analyst Consensus as of May 9, 2008. See GAAP Reconciliation for CSX data.

$1.5B

Productivity

Opportunity

1998

Operating

Income

2007

Operating

Income

Nine-Year

Improvement

CN Change in Operating

Income: 1998-2007

C$2,876

C$1.6B

C$1,281

C$1.0B

47

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

48

The facts are...

CSX has transparent and aggressive guidance

Exceed $1B

in 2010

Free Cash Flow

Before Dividends

Low 70’s

By 2010

Operating Ratio

18%–21%

CAGR

Earnings Per Share

13%–15%

CAGR

Operating Income

2008–2010

Targets

Note: Compound annual growth rates are off comparable 2007 results; EPS targets are stated before share buybacks

CSX has raised guidance three times since 2005—from “Mid-high 70’s”

Operating Ratio down to “Low 70’s” Operating Ratio target

Productivity

Opportunity

49

The facts are...

CSX targets an additional $400M+ through 2010

Total Service Integration (TSI) takes

operating performance to the next level

Utilizes capacity and efficiency to

support growth

Aligns customer needs with

operating capabilities

2008

2009-10

2011+

Process Improvement Teams

have developed a pipeline of

initiatives to meet $400M+

productivity target by 2010

Despite TCI Group claims, CSX has specific productivity targets

and is actively pursuing new opportunities

Productivity

Opportunity

50

The facts are...

Detailed initiatives to deliver the $400M+ of savings

Implementing on-board fuel saving systems

Effective deployment of new fuel efficient locomotives

Fuel Efficiency

Utilization gains through reduced dwell

Improved reclaim and settlement reduces cost

Car Fleet Utilization

Utilization gains with advanced planning tools,

distributed power and TSI

Driving maintenance efficiency and reliability

Locomotive Fleet

Management

Technology drives terminal and customer efficiency

Driving infrastructure maintenance productivity with

process and technology

Labor Productivity

Continuous focus on plan efficiency through design

TSI building reliable and productive service products

Network Efficiency/

Total Service Integration

Strategies for achieving targets

Key Focus Area

Process improvement teams have continuously delivered on

clear productivity targets and have a pipeline of specific initiatives

Productivity

Opportunity

51

The facts are...

Productivity targets include locomotives

TCI Group says CSX and NS

should have the same

locomotive maintenance cost

However, CSX has 25%

more KGTM’s; thus,

locomotive maintenance

costs are largely in line

CSX already has plans in

place to generate productivity

through improved locomotive

maintenance

Source: 2006 R1, excluding lease and depreciation expense. KGTM’s based on CSX and NS 2006 financial reports.

Equal costs per KGTM represent a $35M opportunity for CSX

The best measure of locomotive

productivity is Expense/KGTM

9%

$0.82

$0.89

Expense/KGTM

474

$424M

$0.83

CSX

35%

$315M

Loco Expense

23%

12%

%

384

$0.74

NS

KGTM’s

“TCI Group Math”

The “correct math”

yields a 9% cost gap

Productivity

Opportunity

52

The facts are...

TCI Group’s labor opportunities are overstated

CSX is in line with the

rail industry for hours paid

not worked

NS uniquely counts

training as “hours

worked,” making their

statistic not comparable

CSX remains focused on

labor productivity, but spends

20% less per unit of work

(RTM) on labor expense

than NS

Source: STB Wage Form A&B, Q1 2008 company financial reports.

Productivity

Opportunity

53

Pricing Performance

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

55

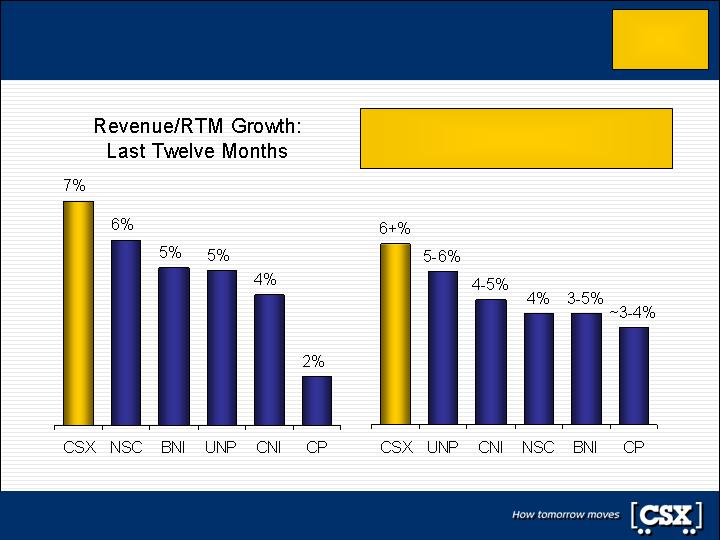

The facts are...

CSX is an industry leader in pricing for value

CSX “pure price” guidance for 2008

is the highest in the industry

Note: Peer comparisons based on First Call data. CN & CP adjusted for translation impact of Canadian dollar on U.S.

dollar-denominated revenues. Price guidance given by rail executives on analyst calls. LTM is Q207-Q108 vs. Q206-Q107.

Pricing

Performance

56

The facts are...

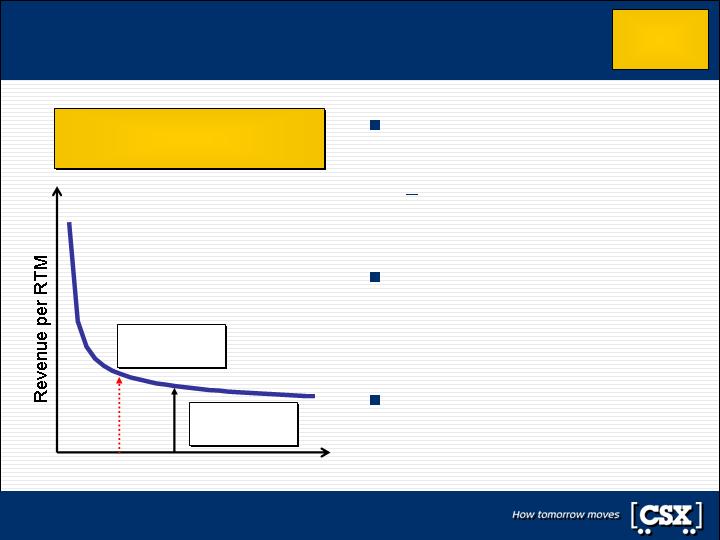

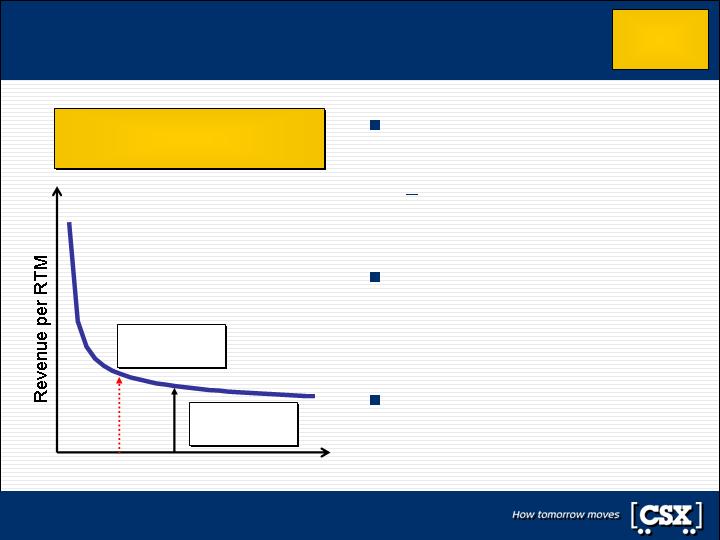

CSX pricing in line given longer hauls versus NS

Revenue per RTM is non-linear,

declines with longer hauls

Length of Haul (Miles)

NS

Average Haul

CSX

Average Haul

CSX’s average length of haul

is ~10% longer than NS with a

broader network reach

Recovery of pick-up and drop-off

costs results in declining revenue

per RTM for longer hauls

Adjusting for length of haul and

equipment privatization, CSX’s

revenue per RTM is

comparable to NS

Third-party analysis confirms

CSX’s pricing strategy is

focused and effective

Pricing

Performance

57

The facts are...

CSX pricing gains outpacing NS on any measure

3 pts

4%

7%

4 pts

4%

8%

Total

(2 pts)

8%

6%

(3 pts)

2%

(1%)

Intermodal

3 pts

5%

8%

4 pts

6%

10%

Merchandise/

Auto

6 pts

2%

8%

8 pts

3%

11%

Coal

CSX

vs. NS

NS

CSX

CSX

vs. NS

NS

CSX

2007 vs. 2006

Revenue per RTM

2007 vs. 2006

Revenue per Unit

Measuring on either a revenue per unit or per RTM basis,

CSX beat NS in 2007 and has more aggressive guidance in 2008.

Pricing

Performance

58

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

59

The facts are...

CSX uses capacity pricing to manage demand

Capacity-based pricing has been in place for years

Pricing in some markets is set on an ongoing basis to help optimize

network capacity, balance freight and enhance profits

For example, CSX Intermodal continuously modifies

prices across its entire market of owned equipment

CSX charges up to 50% more in periods of peak demand to help

optimize capacity and maximize profits

CSX uses an auction process when demand for

specific car types significantly exceeds supply

CSX’s pricing process and discipline is industry leading

Pricing

Performance

60

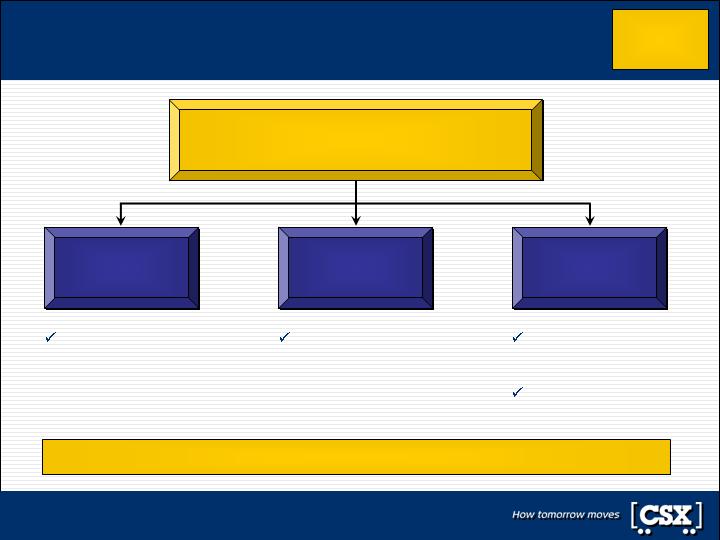

Capital Allocation & Structure

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

62

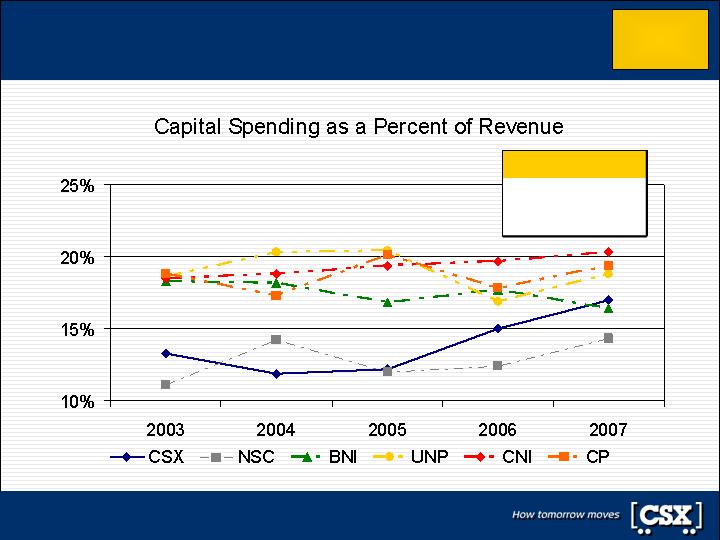

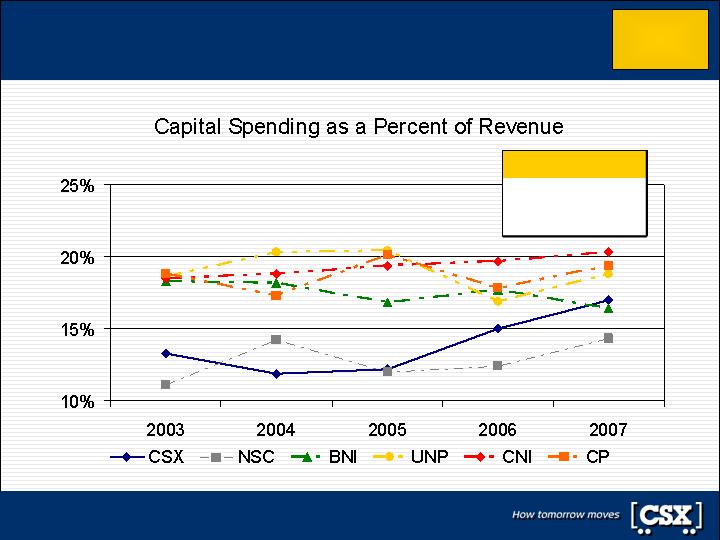

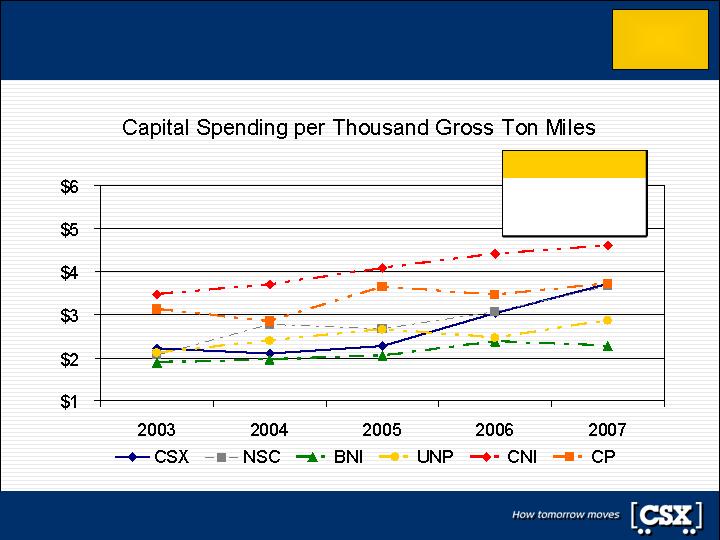

The facts are...

Disciplined capital spending is on par with peers

17%

14%

CSX

Industry

5-Year Average

Capital

Allocation &

Structure

Note: Capital spending based on CSX analysis.

63

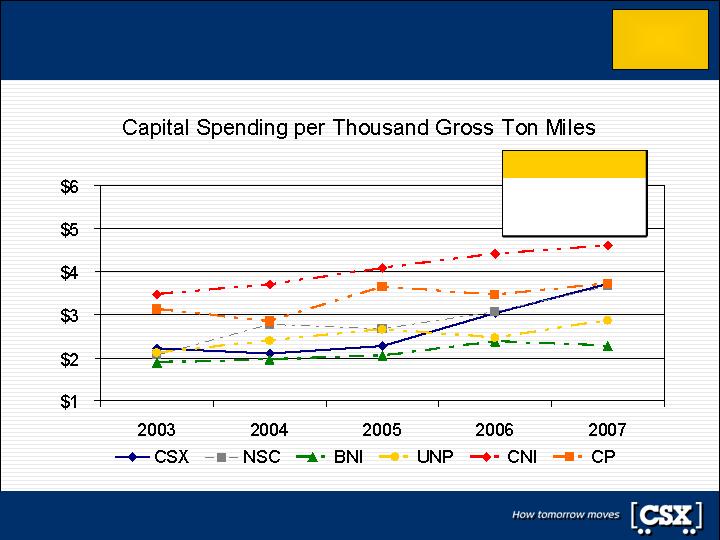

The facts are...

Disciplined capital spending is on par with peers

$2.97

$2.67

CSX

Industry

5-Year Average

Capital

Allocation &

Structure

Note: Capital spending based on CSX analysis.

64

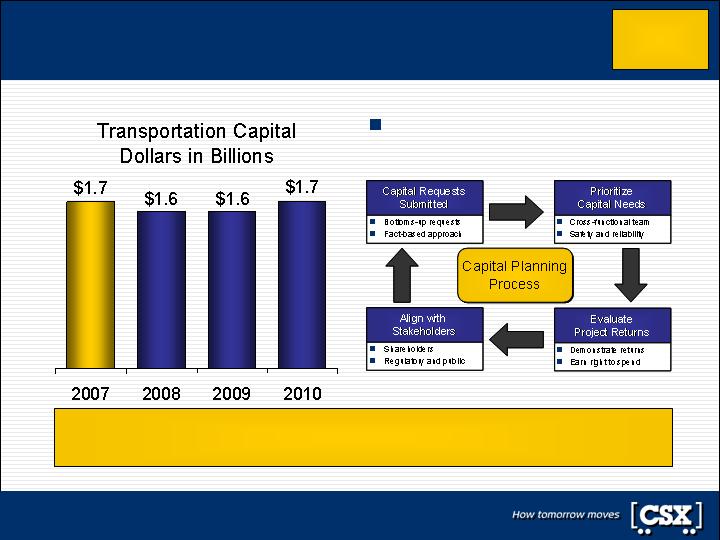

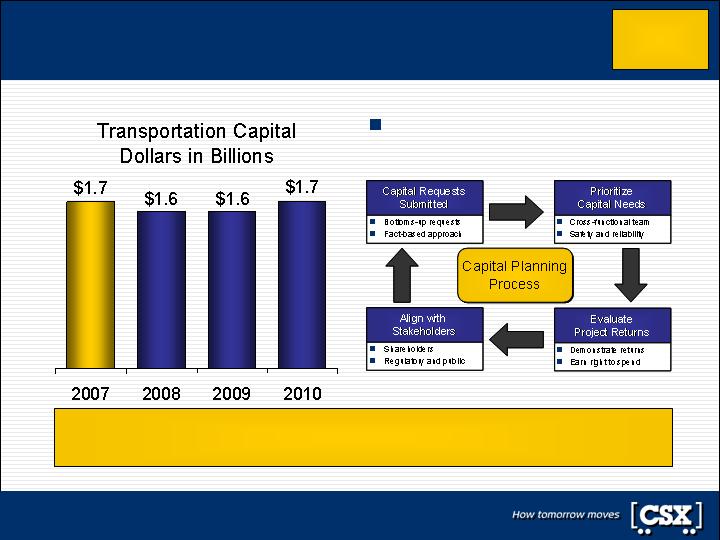

The facts are...

Transparent capital plan aims to maximize returns

Note: Excludes Katrina-related capital. 2007 includes $200M of locomotive refinancing.

Capital plans are consistent

with strategic objectives

Disciplined capital analysis aims to

maximize investment returns on replacement cost basis

Capital

Allocation &

Structure

65

The facts are...

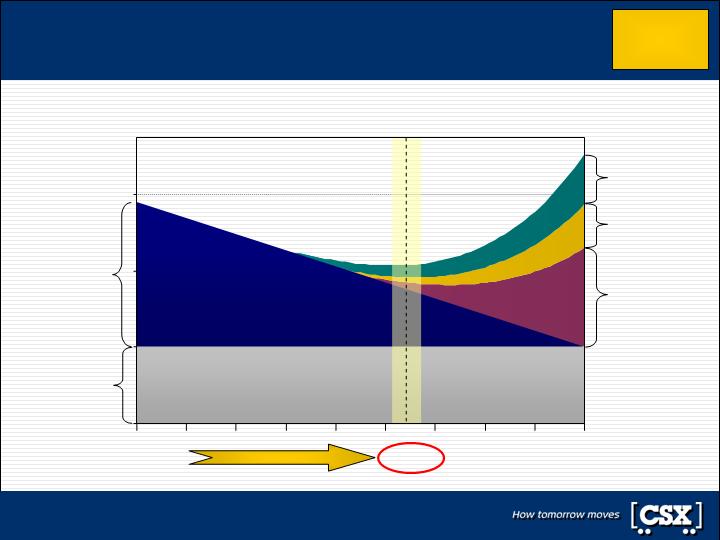

Capital plan based on economics, scientific modeling

Open-top Hoppers

Multilevels

Gondolas

Covered Hoppers

Other

Reinvestment

Hurdle Rate

Returns by Car Type

Investment decisions on equipment

are guided by economic analysis

Cars must meet reinvestment hurdle

rate to merit replacement

Locomotives must deliver

asset productivity

Freight Car Reinvestment Profile

Track Defect Rate by

Accumulated Tonnage

Accumulated Tonnage

Inflection point based on

industry research

Infrastructure investments are dictated

by proactive, scientific modeling

Track replacement technology

improves safety and service

Capital

Allocation &

Structure

66

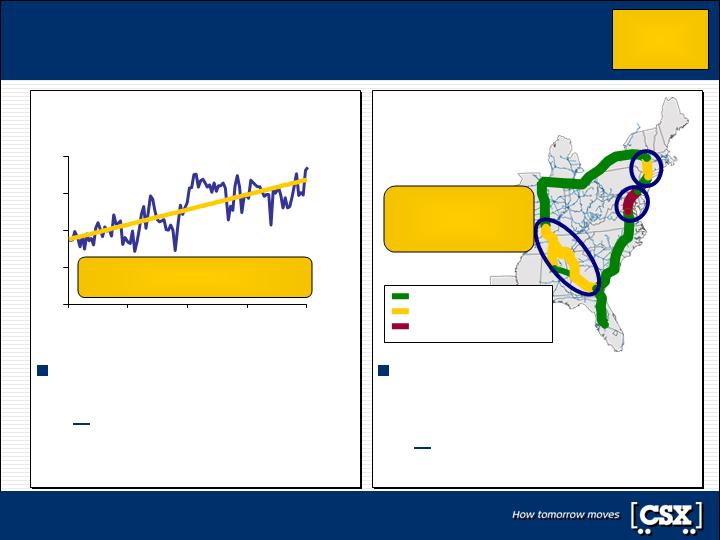

Strategic investments address

Intermodal needs, volume

shifts and bottlenecks

Detailed economic

modeling drives decisions

CSX strategic capital spending

helps drive operating results

Network velocity most

improved of all Class I rails

since 2004

The facts are...

Economics, operating gains drive capital investment

Average Velocity

Waycross to Atlanta: Key Growth Lane

Miles per Hour

10

15

20

25

30

Jan-06

Jul-06

Jan-07

Jul-07

Jan-08

Strategic investment made in 2006.

Velocity up 30% since that time.

Adequate Capacity

Approaching Capacity

Capacity Constrained

2010 Projected Capacity

Growth in

strategic lanes

requires investment

Capital

Allocation &

Structure

67

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

68

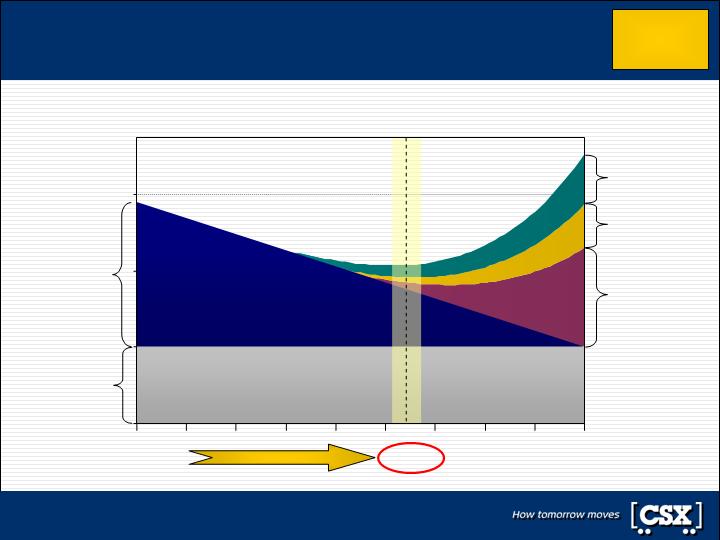

The facts are...

CSX is currently at lowest long-term cost of capital

Access

Costs

Distress

Costs

Equity

Risk

Risk-Free

Rate

AAA

High Yield

BBB-

Cost of Capital

Debt Tax

Shield

Capital

Allocation &

Structure

69

The facts are...

Investment banks agree with CSX analysis

BBB-

Investment Bank 4

BBB-

Investment Bank 5

BBB-

CSX Analysis

BBB-

Investment Bank 3

BBB/BBB-

Investment Bank 2

BBB

Investment Bank 1

CSX

Lowest Cost

of Capital

Every investment bank

advising CSX recommended

a target capital structure with

debt levels at Investment

Grade

Targets lowest cost of

capital

Balances cost of capital

with financial flexibility

and market access

Capital

Allocation &

Structure

70

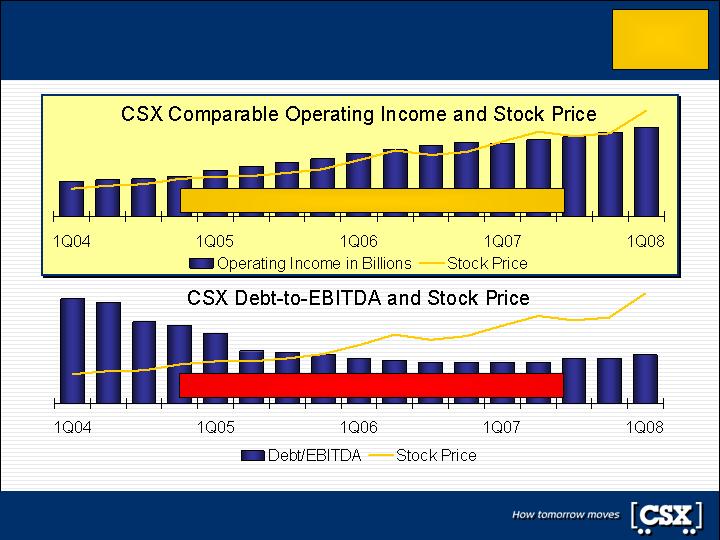

The facts are...

Lasting value comes from operations, not leverage

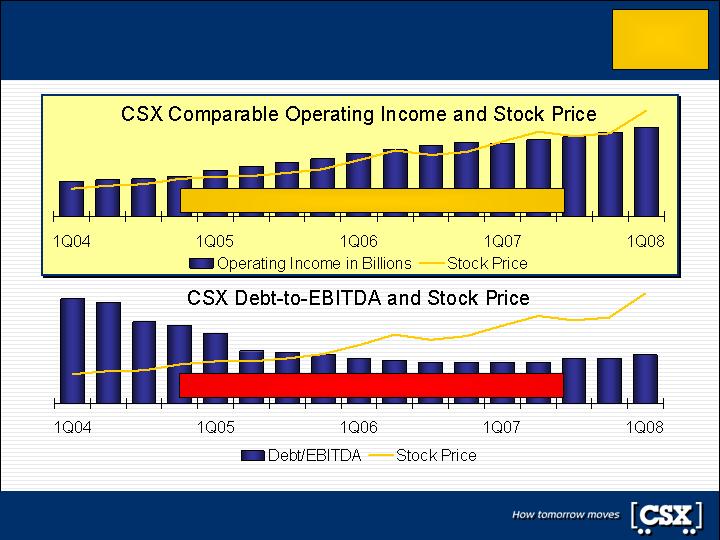

Note: Debt-to-EBITDA and Operating Income are expressed on a rolling twelve month basis

CSX leverage and stock price negatively correlated

Capital

Allocation &

Structure

CSX income and stock price 97% correlated

71

The facts are...

Driving value through balanced capital deployment

Capital

Investment

Investing $5B through

2010 to support

long-term growth

Share

Buybacks

Repurchased nearly

$3B since 2006

Targeting another $3B

by year-end 2009

Dividends

Nearly tripled the

quarterly dividend

since 2005

. . . While maintaining an investment grade profile

Growing Free Cash Flow and

Improving Return on Invested Capital . . .

Capital

Allocation &

Structure

72

The facts are...

TCI Group’s ideas restrict financial flexibility

Analysis shows EPS accretion of only 2% by bringing

CSX below Investment Grade to buy back shares1

TCI Group inaccurately suggests that taking CSX below

Investment Grade would create significant shareholder value

Additionally, incremental leverage to below Investment

Grade for CSX:

Increases the risk of distress

Destroys prudent financial flexibility and regular, uninterrupted

access to capital markets

Abandons long-term capital policy for short-term speculation

CSX drives value through balanced strategic capital deployment

Capital

Allocation &

Structure

1 See appendix for EPS accretion analysis.

73

The facts are...

CSX must maintain financial flexibility

The rail value proposition is strong even in the face of

an economic downturn, however…

Financial flexibility for major adverse events is critical,

especially in a weak economic environment

Natural disasters or acts of terrorism

Incidents with significant loss of life and property damage

Exploitative local litigation for minor incidents

CSX has an ongoing need for financial flexibility

and uninterrupted access to debt capital markets

Capital

Allocation &

Structure

74

The facts are…

TCI Group’s questions are answered by CSX’s performance

CSX Board of Directors is creating industry leading

shareholder value and continues to raise the bar

Governance rating score of 99% is top tier of industry

Corporate

Governance

Productivity

Opportunity

Pricing

Performance

Capital

Allocation &

Structure

CSX is a leader in safety, service and productivity

CSX margin tied for second; closing in on CN

Performance targets are transparent and aggressive

CSX is an industry price leader, with the most

aggressive pricing guidance

Pricing process and discipline is industry-leading

Disciplined capital spending in line with peers and

generating industry leading shareholder returns

Aggressive, investment grade capital structure

75

GAAP Reconciliation

GAAP Reconciliation Disclosure

CSX reports its financial results in accordance with generally accepted accounting principles

(“GAAP”). However, management believes that certain non-GAAP financial measures used to

manage the company’s business that fall within the meaning of Regulation G (Disclosure of Non-

GAAP Financial Measures) by the SEC may provide users of the financial information with additional

meaningful comparisons to prior reported results.

CSX has provided operating income, ratio and earnings per share adjusted for certain items, which

are non-GAAP financial measures. The company’s management evaluates its business and makes

certain operating decisions (e.g., budgeting, forecasting, employee compensation, asset

management and resource allocation) using these adjusted numbers

Likewise, this information facilitates comparisons to financial results that are directly associated with

ongoing business operations as well as provides comparable historical information. Lastly, earnings

forecasts prepared by stock analysts and other third parties generally exclude the effects of items

that are difficult to predict or measure in advance and are not directly related to CSX’s ongoing

operations. A reconciliation between GAAP and the non-GAAP measure is provided. These non-

GAAP measures should not be considered a substitute for GAAP measures.

77

GAAP Reconciliation to comparable results

77.0%

77.7%

79.3%

81.9%

86.7%

88.4%

87.2%

Comparable Operating Ratio

$ 624

$ 2,233

$ 1,981

$ 1,556

$ 1,068

$ 877

$ 1,010

Comparable Operating Income

-

-

-

-

-

108

-

Plus Additional Loss on Sale

-

-

-

-

-

232

-

Plus Provision for Casualty

Claims

-

-

-

-

71

22

-

Plus Restructuring Charge

(2)

(27)

(168)

-

-

-

-

Less Pretax Gain on

Insurance Recoveries

2,087

7,770

7,417

7,062

7,043

7,058

6,906

Operating Expense

$ 2,713

$ 10,030

$ 9,566

$ 8,618

$ 8,040

$ 7,573

$ 7,916

Operating Revenue

Q108

2007

2006

2005

2004

2003

2002

Dollars in millions

78

Appendix

Canadian National expenses adjusted for repatriation of

U.S.-Dollar denominated costs (page 41)

$5,483M

$5,244M

$4,841M

$4,477M

$4,065M

$3,946M

Adjusted

Expense

(USD)

$15.76

347.9

$5,891M

$870M

$5,021M

2007

$14.86

353.0

$5,634M

$735M

$4,899M

2006

$14.12

342.9

$5,201M

$585M

$4,616M

2005

$13.45

332.8

$4,810M

$430M

$4,380M

2004

$12.96

313.6

$4,367M

$260M

$4,107M

2003

$12.77

309.1

$4,240M

—

$4,240M

2002

Adjusted

Expense/

KGTM

KGTM

Adjusted

Expense

(C$)

Adjustment

(in C$)

Reported

Expense

(C$)

Year

Note: Reported expense from First Call. Exchange rate constant at $1.0744 C$/USD (FY 2007 average).

Repatriation impact from CN Financial Statements and CSX Analysis.

80

CN true gains in operating income were C$1.0 billion over

nine years (slide 46)

Calculated

$982M

True Gains

$2,876M

2007 Op

Income

CN press releases indicate C$478 million in

additional annual revenue from the acquisitions.

Actual operating margin in 2004 for these

companies post-acquisition was 35% per CN 2004

annual report

$167M

Great Lakes

& BC Rail

Represents 2 times the first half 2001 WC

operating income per the June 30, 2001 10Q,

translated to Canadian Dollars

$56M

Wisconsin

Central

Acquisitions:

Inflation of 3.0% is the industry's CAGR inflation

(1998-2007) as measured by the AAR's ALL-LF

Index (costs excluding fuel)

$390M

$1,175M

$1,556M

Inflation

Source: CN 2000 Annual Report, p. 12.

Includes consolidation of Illinois Central assuming

acquisition on 1/1/98.

Excludes 1998 Special Charge of C$590 million.

$1,281M

$3,856M

$5,137M

1998 Op

Income

Comments

Operating

Income

Expense

Revenue

81

CSX true gains in operating income are expected to be

$1.5 billion over four years (page 46)

Calculated

$1,517M

True Gains

Current Analyst Consensus

$2,743M

2008

Estimated

Op Income

Inflation of 3.5% is the industry's CAGR inflation

(2004-2007) as measured by the AAR's ALL-LF

Index (costs excluding fuel)

$158M

$1,029M

$1,186M

Inflation

Source: GAAP Reconciliation

$1,068M

$6,972M

$8,040M

2004

Comparable

Op Income

Comments

Operating

Income

Expense

Revenue

82

Additional $3 billion of debt (1x EBITDA) results in only

2% EPS accretion (page 72)

2%

Implied EPS Accretion (%)

$0.07

Implied EPS Accretion ($)

$3.05

Pro Forma Basic EPS

352.9

Adjusted Shares Outstanding after Share Repurchase

$1,078

Adjusted Earnings for Share Repurchases ($MM)

$2.98

Implied Basic EPS

404.7

Shares Outstanding on 4/25/08

$1,209

2007 Earnings ($MM)

13%

Percent of Shares Purchased

$61.94

Purchase Price (4/25/08)

$3,205

New Capital Raised for Share Repurchase = 1x EBITDA ($MM)

83

Proxy Statement Disclosure

84

Important Information

In connection with the 2008 annual meeting of shareholders, CSX Corporation ("CSX") has filed with the SEC and

mailed to shareholders a definitive Proxy Statement dated April 25, 2008. Security holders are strongly advised to read

the definitive Proxy Statement because it contains important information. Security holders may obtain a free copy of the

definitive Proxy Statement and any other documents filed by CSX with the SEC at the SEC’s website at www.sec.gov.

The definitive Proxy Statement and these other documents may also be obtained for free from CSX by directing a

request to CSX Corporation, Attn: Investor Relations, David Baggs, 500 Water Street C110, Jacksonville, FL 32202.

CSX, its directors, director nominee and certain named executive officers and employees may be deemed to be

participants in the solicitation of CSX’s security holders in connection with its 2008 Annual Meeting. Security holders

may obtain information regarding the names, affiliations and interests of such individuals in CSX’s definitive Proxy

Statement and its May 15, 2008 letter to shareholders filed with the SEC as definitive additional soliciting materials.

Forward-Looking Disclosure

This presentation and other statements by the company contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act with respect to, among other items: projections and estimates of earnings,

revenues, cost-savings, expenses, or other financial items; statements of management’s plans, strategies and

objectives for future operation, and management’s expectations as to future performance and operations and the time

by which objectives will be achieved; statements concerning proposed new products and services; and statements

regarding future economic, industry or market conditions or performance. Forward-looking statements are typically

identified by words or phrases such as “believe,” “expect,” “anticipate,” “project,” “estimate,” and similar expressions.

Forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to

update or revise any forward-looking statement. If the company does update any forward-looking statement, no

inference should be drawn that the company will make additional updates with respect to that statement or any other

forward-looking statements.

Forward-looking statements are subject to a number of risks and uncertainties, and actual performance or results could

differ materially from that anticipated by these forward-looking statements. Factors that may cause actual results to

differ materially from those contemplated by these forward-looking statements include, among others: (i) the company’s

success in implementing its financial and operational initiatives; (ii) changes in domestic or international economic or

business conditions, including those affecting the rail industry (such as the impact of industry competition, conditions,

performance and consolidation); (iii) legislative or regulatory changes; (iv) the inherent business risks associated with

safety and security; and (v) the outcome of claims and litigation involving or affecting the company. Other important

assumptions and factors that could cause actual results to differ materially from those in the forward-looking statements

are specified in the company’s SEC reports, accessible on the SEC’s website at www.sec.gov and the company’s

website at www.csx.com.

85