UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

| Form 10-K |

(Mark One)

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

| or |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from . . . . . . . . . . . . to . . . . . . . . . . . . . . |

Commission File No. 001-10852 |

| International Shipholding Corporation |

| (Exact name of registrant as specified in its charter) |

Delaware | 36-2989662 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 11 North Water St. Suite 18290 Mobile, AL | 36602 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (251) 243-9100 |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Name of each exchange on which registered |

Common Stock, $1 Par Value | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer þ Non-accelerated filer ☐ Smaller reporting company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

State the aggregate market value of the voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Date Amount

June 30, 2012 $108,469,356

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

Common stock, $1 par value. . . . . . . . 7,210,643 shares outstanding as of March 1, 2013

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement to be furnished in connection with registrant’s 2013 annual meeting of stockholders are incorporated by reference into Part III of this Form 10-K.

INTERNATIONAL SHIPHOLDING CORPORATION

In this report, the terms “we,” “us,” “our” and the “Company” refer to International Shipholding Corporation and its subsidiaries. In addition, the term “COA” means a Contract of Affreightment, the term “MPS” means the maritime prepositioning ship program of the U.S. Navy, the term “MSC” means the U.S. Navy’s Military Sealift Command, the term “Notes” means the Notes to our Consolidated Financial Statements contained elsewhere in this report, the term “PCTC” means a Pure Car Truck Carrier vessel, the term “RO/RO” means a Roll-On/Roll-Off vessel, and the term “SEC” means the U.S. Securities and Exchange Commission.

Through our subsidiaries, we operate a diversified fleet of U.S. and International Flag vessels that provide international and domestic maritime transportation services to commercial and governmental customers primarily under medium to long-term time charters or contracts of affreightment. As of March 1, 2013 we owned or operated 50 ocean-going vessels.

Our operating fleet of 50 ocean-going vessels as of March 1, 2013 consisted of:

| · | One U.S. Flag Jones Act conveyor belt-equipped, self-unloading Coal Carrier, which carries coal in U.S. coastwise trade, |

| · | One U.S. Flag Jones Act Molten Sulphur Carrier, which transports molten sulphur from United States Gulf ports to a processing plant on the Florida Gulf Coast, |

| · | Two U.S. Flag Jones Act Handysize Bulk Carriers, two U.S. Flag Jones Act Tug-Barge units, one U.S. Flag Tug-Barge unit in drydock undergoing activation repairs, one U.S. Flag Tug-Barge unit which is currently inactive and one U.S. Flag Jones Act Harbor Tug, which transport coal, petcoke, unfinished phosphate rock and fertilizer in the U.S. Gulf/Florida coastwise market and PL480 cargos in international trade, |

| · | Six U.S. Flag and one International Flag Pure Car/Truck Carriers (“PCTC’s”) specifically designed to transport fully assembled automobiles, trucks and larger vehicles, |

| · | Three International Flag Double Hull Handysize Bulk Carriers and two time chartered International Flag Handysize Bulk Carriers, trading worldwide under a revenue sharing agreement with European partners, |

| · | One International Flag Capesize Bulk Carrier and one International Flag Handymax Bulk Carrier trading worldwide under a revenue sharing agreement with European partners, |

| · | Fourteen International Flag Mini-Bulk Carriers, in which we own a 25% shareholding interest, deployed either in spot market or under short-term or medium-term time charters, |

| · | Two International Flag Special Purpose Roll-On/Roll-Off (“RO/RO”) double deck vessels, which carry loaded rail cars between the U.S. Gulf Coast and Mexico, |

| · | Two U.S. Flag container vessels which began operating on time charters in 2008, |

| · | Two International Flag Multi-Purpose vessels, two International Flag Tankers, and three International Flag Container vessels, which service our long-term contract to transport supplies for an Indonesian mining company’s operations, |

| · | One International Flag 2000-built Multi-Purpose Ice Strengthened vessel which is currently employed in the spot market, and |

| · | One International Flag Multi-Purpose vessel time chartered under contract through April, 2013 |

As described further in Item 2 below, we own 100% of 20 of these 50 vessels.

On November 30, 2012, we acquired U.S. United Ocean Services, LLC (“UOS”), which substantially expanded our commercial domestic coastwise transportation operations. For additional information on the UOS acquisition, see Note B in this report. For additional information on the operations and vessels that we acquired from UOS, see the Current Report on Form 8-K that we filed with the SEC on December 6, 2012, as supplemented by a Current Report on Form 8-K/A that we filed with the SEC on February 8, 2013, as well as Items 1, 1A and 7 of this report.

Our fleet is operated by our principal subsidiaries, Central Gulf Lines, Inc. (“Central Gulf”), Waterman Steamship Corporation (“Waterman”), Enterprise Ship Company, Inc. (“ESC”), U.S. United Ocean Services, Inc. (“UOS”), CG Railway, Inc. (“CG Railway”), LCI Shipholdings, Inc. (“LCI”), East Gulf Shipholding, Inc. (“EGS”). Other of our subsidiaries provide ship charter brokerage, agency and other specialized services.

Additional information on our vessels appears on the Fleet Statistics Schedule located in the front of our combined 2012 Annual Report and 10-K report furnished to our stockholders.

Operating Segments

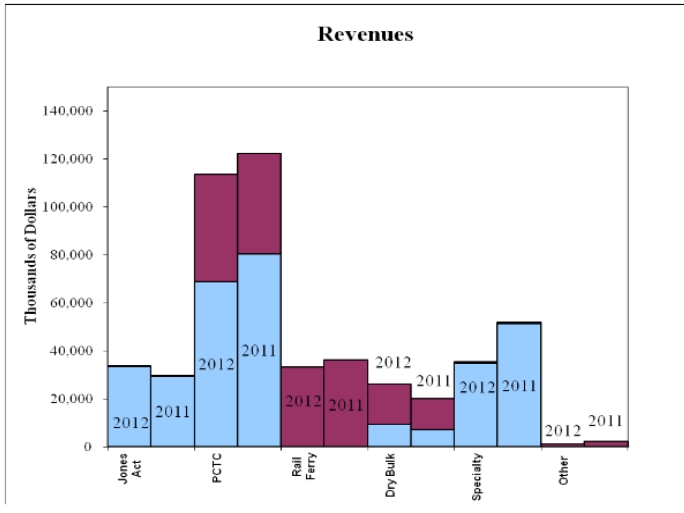

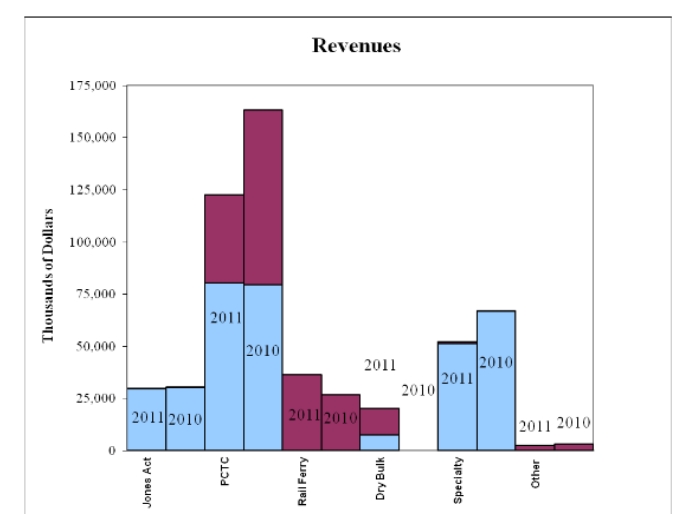

Following our acquisition of UOS in late 2012, we internally restructured the description of our diversified businesses to replace our prior operating segments (listed below) with the following new segments:

New Segments | Prior Segments |

· Jones Act | · Time Charter Contracts – U.S. Flag |

· Pure Car Truck Carriers | · Time Charter Contracts – International Flag |

· Dry Bulk Carriers | · Contracts of Affreightment |

· Rail-Ferry | · Rail-Ferry Service |

· Specialty Contracts | · Other |

· Other |

For further information on the rationale for this change and the amount of revenues and gross profits contributed by each segment, please see Item 7 of this report.

Jones Act: The Merchant Marine Act of 1920, or the MMA, regulates maritime commerce in U.S. waters between U.S. ports. Section 27 of the MMA, better known as the Jones Act, requires that all goods transported by water between U.S. ports be carried aboard U.S. Flag vessels, constructed in the U.S., owned by U.S. citizens and crewed by U.S. citizens with permanent U.S. residence.

With our acquisition of UOS, we now have the largest Jones Act dry bulk fleet capacity. Vessels deployed under our Jones Act segment serve both Eastern U.S. coasts and the Gulf of Mexico and operate as the primary marine transporter of coal for Tampa Electric and the primary marine transporter of unfinished phosphate rock for The Mosaic Company (“Mosaic”).

Under our Jones Act segment, we deploy (i) two Bulk Carriers, two Integrated Tug-Barge units, each consisting of one tug and one barge, and one Harbor Tug acquired in the UOS acquisition, (ii) one conveyor belt-equipped, self-unloading Coal Carrier to transport coal, under a time charter, which was previously part of our Time Charter Contracts – U.S. Flag segment, and (iii) one vessel that transports molten sulphur under a contract of affreightment through December 31, 2015, subject to the right of our customer to exercise renewal options through the end of 2024, which was previously part of our Contracts of Affreightment segment. Currently, the two bulk carriers in addition to transporting grain and other preference cargoes overseas on behalf of the United States government under Public Law 480, transport coal and phosphate for Tampa Electric and Mosaic, respectively. The two integrated tug-barge units and the harbor tug operate under contracts of affreightment with Tampa Electric and Mosaic. We also own two integrated tug-barge units acquired from UOS, one unit is in dry-dock under-going activation repair and the other unit is currently inactive. Trade for this segment is primarily driven by coal, petroleum coke, phosphate rock, sulphur and fertilizer.

We own all of the aforementioned vessels with the exception of the molten sulphur carrier, which we sold under a sale/leaseback arrangement in November 2012, with a buy back option in 2017. For more information on our Sale/Leasebacks see Note M and under Contractual Obligations and Other Commitments on page 51.

Pure Car Truck Carriers: Under our Pure Car Truck Carriers segment, we deploy seven Pure Car/Truck Carriers (“PCTC’s”), six of which are U.S. Flag vessels and one of which is an International Flag vessel. These vessels transport all types of vehicles, from fully assembled passenger cars to construction machinery and equipment, allowing for the efficient loading of large numbers of vehicles on multiple internal decks. This segment is an aggregation of the seven PCTC’s from our former Time Charter Contracts – U.S. Flag and Time Charter Contracts – International Flag segments.

All of our PCTC’s operate under time charters. Under these contracts, we fully equip the vessel and are responsible for normal operating expenses, repairs, crew wages, and insurance, while the charterer is responsible for voyage expenses, such as fuel, port and stevedoring expenses. In addition to contractually fixed time charter hire income, we also earn from time to time supplemental voyage income as a result of chartering our U.S. Flag PCTC’s for the carriage of supplemental cargo when available.

We have operated PCTC’s since 1986 when we entered into contracts with Toyota and Honda. We own the one International Flag PCTC, which was delivered from the shipyard in 2010, and is employed on a long-term time charter contract. We own three of the six U.S. Flag PCTC’s and lease the other three U.S Flag PCTC’s, with buy back options in 2015, 2018 and 2019.

Dry Bulk Carriers: Our modern, diversified bulk carrier fleet ranges in size, design and classification from an 8,028 metric deadweight ton Mini-Bulk Carrier to a 170,578 metric deadweight ton Capesize Bulk Carrier. Our Dry Bulk vessels carry a wide variety of cargoes, including iron ore, coal, agricultural, steel, chemical and forest products.

2

The vessels which we deploy in this segment include one Capesize Bulk Carrier and one Handymax Bulk Carrier, which we own, that are part of revenue-sharing agreements with European partners, and five Handysize Bulk Carriers, three of which we own and two of which we time charter, that are part of another revenue-sharing agreement. Under these revenue-sharing agreements, we and the other participating vessel owners receive monthly distributions of net cash flow from voyage profits based on a participating vessel’s performance capability compared with other participating vessels in the revenue-sharing agreement.

Our Dry Bulk Carriers segment also includes 14 Mini-Bulk carriers in which we own a 25% shareholding interest through two unconsolidated entities. In 2009, we acquired a 25% shareholding interest in eight of these Mini-Bulk carriers for $6.25 million. In 2010, we acquired a 25% shareholding interest in two more of these Mini-Bulk carriers for $3.9. In January 2013, we acquired a 25% shareholding interest in four more of these Mini-Bulk carriers, giving us a 25% investment in a total of fourteen Mini-Bulk carriers. These Mini-Bulkers are deployed in the spot market or on short to medium term time charters. We believe these arrangements expand our global commercial and operational network.

Rail-Ferry: Our Rail-Ferry segment uses our two Roll-on/Roll-off Special Purpose double-deck vessels, which carry loaded rail cars between the U.S. Gulf Coast and Mexico in regularly scheduled waterborne rail service. The service provides departures every four days from Mexico and the U.S. Gulf Coast, respectively, for a three-day transit between ports. Since 2007, we have conducted these operations out of our new terminal in Mobile, Alabama and a terminal in Coatzacoalcos, Mexico, which we upgraded in 2007 to accommodate the vessels’ newly-installed second decks that doubled their carrying capacity. We own a 49% interest in Terminales Transgolfo, S.A. de C.V., which owns and operates the rail terminal in Coatzacoalcos, Mexico.

We believe this unique service provides a cost effective alternative route for shippers between Mexico and the Eastern United States providing more efficient direct service and the option of not crossing the Texas-Mexican border. Trade for this segment is primarily driven by commodities such as forest products, sugar, metals, minerals, plastics and chemicals.

In August 2012, we acquired two related businesses that own and operate a certified rail-car repair facility near the port of Mobile, Alabama. For further information on this acquisition, see Note B of this report. We plan to continue to use these businesses to service and repair third party customers as well as rail-cars that are transported via our Rail-Ferry vessels. We believe this acquisition allows us to integrate two established services and retain revenue and profits related to the cleaning and repairs of rail-cars that were previously contracted to a third party.

Specialty Contracts: Our Specialty Contracts segment is comprised of vessels not otherwise described above, operating under unique contracts and constitutes the remainder of our former Time Charter Contracts – U.S. Flag and Time Charter Contracts – International Flag segments. This segment includes (i) two Container vessels which are on time charter to another shipping company, (ii) two Multi-Purpose vessels, two Tankers, and three Container vessels which service our long-term contract since 1995 to transport fuel and supplies for an Indonesian mining company, (iii) one time chartered Multi-Purpose vessel which is time chartered to a large industrial customer, and (iv) one Multi-Purpose Ice Strengthened vessel deployed in the spot market. For several years prior to February 2012, we operated three Roll-on/Roll-off vessels under contract to the U.S. Navy’s Military Sealift Command that was not renewed.

Other: This segment consists of operations that include ship and cargo charter brokerage and agency services provided to unaffiliated companies and our operating companies, and other specialized services provided to our operating subsidiaries. These services facilitate our operations by allowing us to avoid reliance on third parties to provide these essential services. Also reported within this segment are corporate-related items, and income and expense items not allocated to our other reportable segments.

Business Strategy

We operate a diversified fleet of U.S. and International Flag vessels that provide international and domestic maritime transportation services to commercial and governmental customers. We seek to deploy our fleet primarily under medium to long-term time charter contracts or contracts of affreightment. Our current fleet enables us to serve niche markets with diverse cargo needs. Our business strategy focuses on identifying growth opportunities as market needs change, utilizing our extensive experience to meet those needs, maintaining a diverse portfolio of medium to long-term contracts, and maintaining strong relations with our long-standing customer base by providing quality transportation services. From time to time, we deploy our vessels under short-term arrangements, particularly when we believe that more attractive opportunities could arise in the future.

History

Our Company was originally founded as Central Gulf Steamship Corporation (“Central Gulf”) in 1947 by the late Niels F. Johnsen and his sons, Niels W. Johnsen and Erik F. Johnsen, both of whom served as past CEOs and former directors prior to their retirements. Central Gulf was privately held until 1971 when it merged with Trans Union Corporation. In 1978, International Shipholding Corporation was formed to act as a holding company for Central Gulf, LCI, and certain other affiliated companies in connection with the 1979 spin-off by Trans Union of our common stock to Trans Union’s stockholders. In 1986 we acquired the assets of Forest Lines, in 1989 we acquired Waterman and in late 2012 we acquired UOS. Since our spin-off from Trans Union, we have continued to act solely as a holding company, and our only significant assets are the capital stock of our subsidiaries.

Competitive Strengths

Diversification. Our strategy for many years has been to seek and obtain contracts that provide predictable cash flows and contribute to a diversification of operations. These diverse operations vary from chartering vessels to the United States government, to chartering vessels to a wide range of commercial customers for the transport of a broad range of products, including automobiles, coal, minerals, paper, steel, wood products, mining supplies, molten sulphur and standard size railroad cars.

Predictable Operating Cash Flows. Our operations have historically generated cash flows sufficient to cover our debt service requirements and operating expenses, including the recurring drydocking requirements of our fleet. For the years ending December 31, 2012 and December 31, 2011, approximately 60% and 63%, respectively, of our revenues were generated from fixed contracts. The length and structure of our contracts, the creditworthiness of our customers, and our diversified customer and cargo bases all contribute to our ability to consistently meet such requirements in an industry that tends to be cyclical in nature. Our medium to long-term time charters provide for a daily charter hire rate that is payable whether or not the charterer utilizes the vessel. These time charters require the charterer to pay certain voyage operating costs, including fuel, port, and stevedoring expenses, and in some cases include cost escalation features covering certain of our expenses. In addition, our contracts of affreightment guarantee a minimum amount of cargo for transportation. Our cash flow from operations was approximately $9.7 million, $46.3 million, and $64.4 million for the years ended December 31, 2012, 2011 and 2010, respectively, after deducting cash used for drydocking payments of $11.3 million, $6.8 million and $2.5 million for each of these years, respectively.

Longstanding Customer Relationships. Historically, we have maintained strong relationships with a variety of creditworthy customers for many years. Substantially all of our current cargo contracts and time charter agreements are renewals or extensions of previous agreements. In recent years, we have been successful in winning extensions or renewals of a substantial majority of all of our contracts. We believe that our longstanding customer relationships are in part due to our excellent reputation for providing quality specialized maritime service in terms of on-time performance, minimal cargo damage claims and reasonable time charter and freight rates.

Experienced Management Team. Our management team has substantial experience in the shipping industry. Our Chief Executive Officer, President, and Chief Financial Officer have over 111 years of collective experience with our Company. We believe that the experience of our management team is important to maintaining long-term relationships with our customers.

Marketing

We maintain marketing staffs in New York, Mobile, Tampa, Singapore, and Shanghai and a network of marketing agents in major cities around the world who market our time charter and contracts of affreightment services. We market our Rail-Ferry Service under the name “CG Railway.” We market our remaining transportation services under the brand names Central Gulf Lines, Waterman Steamship, East Gulf Shipholding, and U.S. United Ocean Services. We advertise our services in trade publications in the United States and abroad.

3

Insurance

We maintain protection and indemnity (“P&I”) insurance to cover liabilities arising out of our ownership and operation of vessels with the Standard Club Europe Ltd., which is a mutual shipowners’ insurance organization commonly referred to as a P&I club. The club is a participant in and subject to the rules of its respective international group of P&I associations. The premium terms and conditions of the P&I coverage provided to us are governed by the rules of the club.

We maintain hull and machinery insurance policies on each of our vessels in amounts related to the value of each vessel. This insurance coverage, which includes increased value, is maintained with a syndicate of hull underwriters from the U.S., British, Dutch, Japanese and French insurance markets. We maintain war risk insurance on each of our vessels in an amount equal to each vessel’s total insured hull value. War risk insurance is placed through U.K. insurance markets and covers physical damage to the vessels and P&I risks for which coverage would be excluded by reason of war exclusions under either the hull policies or the rules of the P&I club. Our war risk insurance also covers liability to third parties caused by war or terrorism, but does not cover damages to our land-based assets caused by war or terrorism. (See Item 1a., Risk Factors, for a description of material risks relating to terrorism).

The P&I insurance also covers our vessels against liabilities arising from the discharge of oil or hazardous substances in U.S., international, and foreign waters, subject to various exclusions.

We also maintain loss of hire insurance with U.S., British, Dutch and French insurance markets to cover our loss of revenue in the event that a vessel is unable to operate for a certain period of time due to loss or damage arising from the perils covered by the hull and machinery policy and war risk policy.

Insurance coverage for shoreside property, shipboard consumables and inventory, spare parts, workers’ compensation, office contents, and general liability risks is maintained with underwriters in U.S. and British markets.

Insurance premiums for the coverage described above vary from year to year depending upon our loss record and market conditions. In order to reduce premiums, we maintain certain deductible and co-insurance provisions that we believe are prudent and generally consistent with those maintained by other shipping companies. Certain exclusions under our insurance policies could limit our ability to receive payment for our losses. (See Note H – Self-Retention Insurance).

Tax Matters

The American Jobs Creation Act of 2004 (“Jobs Creation Act”), under which we made an election effective January 1, 2005, changed the United States tax treatment of operations for both our U.S. and International Flag vessels. As a result of the election made in accordance with the provisions of the Jobs Creation Act, our U.S. subsidiaries owning and/or operating qualifying vessels are taxed under a “tonnage tax” regime as opposed to the traditional corporate income tax regime. Income for U.S. income tax purposes with respect to qualifying shipping activities of U.S. Flag vessels excludes (1) income from qualifying shipping activities in U.S. foreign trade, (2) income from bank deposits and temporary investments that are reasonably necessary to meet the working capital requirements of qualifying shipping activities and (3) income from cash or other intangible assets accumulated pursuant to a plan to purchase qualifying shipping assets. Qualifying U.S. Flag vessels are assessed a tax based on “daily notional shipping income”, derived from the net tonnage of the qualifying vessel(s). The daily notional shipping income is 40 cents per 100 tons of the net tonnage of the vessel up to 25,000 net tons, and 20 cents per 100 tons of the net tonnage of the vessel in excess of 25,000 net tons. This daily notional shipping income is taxed at the highest corporate income tax rate (currently 35%) with no allowances for offsetting deductions or credits. All of our other U.S. operations are taxed under the regular U.S. corporate income tax regime and at the statutory tax rate.

The Jobs Creation Act also provided for the deferred recognition of taxable income from shipping operations of Controlled Foreign Corporations until that income is repatriated. Our plan is to indefinitely re-invest our foreign earnings, and accordingly we have not provided deferred taxes against those earnings. The principal reasons for this position are as follows: maintenance of foreign flag fleet, future expansion of foreign flag fleet and U.S. Flag fleet’s operating cash flow needs are adequately met by its operations.

The American Taxpayer Relief Act of 2012, enacted on January 2, 2013, extended the active financing exception from Subpart F income. The extension was retroactive from January 1, 2012 through December 31, 2013. For 2012, the Company has reflected its active financing income as a reduction to its current year U.S. net operating loss. During the first quarter of 2013, we will increase our U.S. net operating loss carryforward $1,971,000 to reflect the retroactive application of the new law. (See Note J – Income Taxes).

During 2010 the deferred tax assets created by the continued losses of the U.S. filing group resulting in the Company moving to an overall net deferred tax asset position. Based on the below factors, it was determined that the establishment of a valuation allowance was warranted. The valuation allowance was recorded, with the net deferred tax asset being reduced to zero as of December 31, 2010. The Company’s position has not changed during 2012 and the valuation allowance remains in effect as of December 31, 2012, with the net deferred tax asset remaining at a zero balance. The establishment of the valuation allowance results in a higher effective tax rate for 2012, 2011, and 2010.

In considering the need both for establishment and continuation of a valuation allowance, the Company gave consideration to the following factors:

| · | The Company files a consolidated U. S. corporate income tax return for its eligible domestic members. |

| · | Exclusive of the tonnage tax companies, this group has experienced book losses for the three year period. |

| · | The book losses have translated into net operating losses for U.S. tax reporting. |

Notwithstanding the above information, the recent acquisition of UOS will result in the Company changing its assessment of the realization of its deferred tax assets to a more likely than not position. If such a change were to happen, it would result in the Company’s recognition of these tax benefits.

Regulation

Our operations between the United States and foreign countries are subject to the Shipping Act of 1984 (the “Shipping Act”), which is administered by the Federal Maritime Commission, and certain provisions of the Federal Water Pollution Control Act, the Oil Pollution Act of 1990, the Act to Prevent Pollution from Ships, and the Comprehensive Environmental Response Compensation and Liability Act, all of which are administered by the U.S. Coast Guard and other federal agencies, and certain other international, federal, state, and local laws and regulations, including international conventions and laws and regulations of the flag nations of our vessels. On October 16, 1998, the Ocean Shipping Reform Act of 1998 was enacted, which amended the Shipping Act to promote the growth and development of United States exports through certain reforms in the regulation of ocean transportation. This legislation, in part, repealed the requirement that a common carrier or conference file tariffs with the Federal Maritime Commission, replacing it with a requirement that tariffs be open to public inspection in an electronically available, automated tariff system. Furthermore, the legislation required that only the essential terms of service contracts be published and made available to the public.

4

On October 8, 1996, Congress adopted the Maritime Security Act of 1996, which created the Maritime Security Program (MSP) and authorized the payment of $2.1 million per year, per ship for 47 U.S. Flag ships through the fiscal year ending September 30, 2005. This program eliminated the trade route restrictions imposed by the previous federal program and provides flexibility to operate freely in the competitive market. On December 20, 1996, Waterman entered into four MSP operating agreements with the United States Maritime Administration (“MarAd”), and Central Gulf entered into three MSP operating agreements with MarAd. We also participate in the Voluntary Intermodal Sealift Agreement (“VISA”) program administered by MarAd. Under this VISA program, and as a condition of participating in the MSP, we have committed to providing vessel capacity for the movement of military cargoes in times of war or national emergency. By law, the MSP is subject to annual appropriations from Congress. In the event that sufficient appropriations are not made for the MSP by Congress in any fiscal year, the Maritime Security Act of 1996 permits MSP participants, such as Waterman and Central Gulf, to re-flag their vessels under foreign registry expeditiously. In 2003, Congress authorized an extension of the MSP through 2015, increased the number of ships eligible to participate in the program from 47 to 60, and increased MSP payments to companies in the program, all made effective on October 1, 2005. Authorized annual payments per fiscal year for each vessel for the current MSP program were $2.9 million for years 2009 to 2011, and $3.1 million for years 2012 to 2015, subject to annual appropriation by the Congress, which is not assured. On October 15, 2004, Waterman and Central Gulf each filed applications to extend their MSP operating agreements for another ten years through September 30, 2015, all seven of which were effectively grandfathered in the MSP reauthorization. Simultaneously, we offered an additional ship for participation in the MSP. On January 12, 2005, MarAd awarded Central Gulf four MSP operating agreements and Waterman four MSP operating agreements, effective October 1, 2005, for a net increase of one MSP operating agreement. On January 7, 2011, the President signed into law legislation that extended the MSP under its current terms and conditions through September 30, 2025. The terms of the MSP contracts of Waterman and Central Gulf currently run though September 30, 2015. On January 2, 2013, the President signed into law the National Defense Authorization Act for any Fiscal Year 2013 which included a comprehensive reauthorization of the Maritime Security Program. Under the new law, all current MSP contractors, including Waterman and Central Gulf, will be offered the opportunity by MarAd to extend their current contracts through September 30, 2025. Authorized annual payments per fiscal year for each vessel under this new law, commencing October 1, 2015, will be $3.1 million for years 2015 to 2018, $3.5 million for years 2019 to 2021, and $3.7 million for years 2022 to 2025.

Under the Merchant Marine Act, U.S. Flag vessels are subject to requisition or charter to the U.S. Government’s MSC whenever the President declares that national security requires such action. The owners of any such vessels must receive just compensation as provided in the Merchant Marine Act, but there is no assurance that lost profits, if any, will be fully recovered. In addition, during any extension period under each MSC charter or contract, the MSC has the right to terminate the charter or contract on 30 days’ notice.

Certain laws governing our operations, as well as our U.S. coastwise transportation contracts, require us to be at least 75% owned by U.S. citizens. We monitor our stock ownership to verify our continuing compliance with these requirements. Our certificate of incorporation allows our board of directors to restrict the acquisition of our capital stock by non-U.S. citizens. Under our certificate of incorporation, our board of directors may, in the event of a transfer of our capital stock that would result in non-U.S. citizens owning more than 23% (the “permitted amount”) of our total voting power, declare such transfer to be void and ineffective. In addition, our board of directors may, in its sole discretion, deny voting rights and withhold dividends with respect to any shares of our capital stock owned by non-U.S. citizens in excess of the permitted amount. Furthermore, our board of directors is entitled under our certificate of incorporation to redeem shares owned by non-U.S. citizens in excess of the permitted amount in order to reduce the ownership of our capital stock by non-U.S. citizens to the permitted amount.

We are required by various governmental and quasi-governmental agencies to obtain permits, licenses, and certificates with respect to our vessels. The kinds of permits, licenses, and certificates required depend upon such factors as the country of registry, the commodity transported, the waters in which the vessel operates, the nationality of the vessel’s crew, the age of the vessel, and our status as a vessel owner or charterer. We believe that we have, or can readily obtain, all permits, licenses, and certificates necessary to permit our vessels to operate.

The International Maritime Organization (“IMO”) amended the International Convention for the Safety of Life at Sea (“SOLAS”), to which the United States is a party, to require nations that are parties to SOLAS to implement the International Safety Management (“ISM”) Code. The ISM Code requires that responsible companies, including owners or operators of vessels engaged on foreign voyages, develop and implement a safety management system to address safety and environmental protection in the management and operation of vessels. Companies and vessels to which the ISM Code applies are required to receive certification and documentation of compliance. Vessels operating without such certification and documentation in the U.S. and ports of other nations that are parties to SOLAS may be denied entry into ports, detained in ports or fined. We implemented a comprehensive safety management system and obtained timely IMO certification and documentation for our companies and all of our vessels. In addition, our ship management subsidiary, LMS Shipmanagement, Inc., is certified under the ISO 9001-2008 Quality Standard. We believe that we are in compliance in all material respects with applicable ISM regulations.

In 2003, SOLAS was again amended to require parties to the convention to implement the International Ship and Port Facility Security (“ISPS”) Code. The ISPS Code requires owners and operators of vessels engaged on foreign voyages to conduct vulnerability assessments and to develop and implement company and vessel security plans, as well as other measures, to protect vessels, ports and waterways from terrorist and criminal acts. In the U.S., these provisions were implemented through the Maritime Transportation Security Act of 2002 (“MTSA”). These provisions became effective on July 1, 2004. As with the ISM Code, companies and vessels to which the ISPS Code applies must be certificated and documented. Vessels operating without such certification and documentation in the U.S. and ports of other nations that are parties to SOLAS may be denied entry into ports, detained in ports or fined. Vessels subject to fines in the U.S. are liable in rem, which means vessels may be subject to arrest by the U.S. government. For U.S. Flag vessels, company and vessel security plans must be reviewed and approved by the U.S. Coast Guard. We have conducted the required security assessments and submitted plans for review and approval as required, and we believe that we are in compliance in all material respects with applicable ISPS Code and MTSA security requirements.

The Coast Guard and Maritime Transportation Act of 2004 amended the Oil Pollution Act of 1990 (“OPA”) to require owners or operators of all non-tanker vessels of 400 gross tons or greater to develop and submit plans for responding, to the maximum extent practicable, to worst case discharges and substantial threats of discharges of oil from these vessels. This statute extends to all types of vessels of 400 gross tons or greater. The vessel response planning requirements of the OPA had previously only applied to tanker vessels. We have submitted response plans timely for our vessels, and have received Coast Guard approval for all of our vessels.

Also, under the OPA, vessel owners, operators and bareboat charterers are jointly, severally and strictly liable for all response costs and other damages arising from oil spills from their vessels in waters subject to U.S. jurisdiction, with certain limited exceptions. Other damages include, but are not limited to, natural resource damages, real and personal property damages, and other economic damages such as net loss of taxes, royalties, rents, profits or earning capacity, and loss of subsistence use of natural resources. For non-tanker vessels, the OPA limits the liability of responsible parties to the greater of $1,000 per gross ton or $854,400. The limits of liability do not apply if it is shown that the discharge was proximately caused by the gross negligence or willful misconduct of, or a violation of a federal safety, construction or operating regulation by, the responsible party, an agent of the responsible party or a person acting pursuant to a contractual relationship with the responsible party. Further, the limits do not apply if the responsible party fails or refuses to report the incident, or to cooperate and assist in oil spill removal activities. Additionally, the OPA specifically permits individual states to impose their own liability regimes with regard to oil discharges occurring within state waters, and some states have implemented such regimes.

The Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) also applies to owners and operators of vessels, and contains a similar liability regime for cleanup and removal of hazardous substances and natural resource damages. Liability under CERCLA is limited to the greater of $300 per gross ton or $5 million per vessel.

Under the OPA, vessels are required to establish and maintain with the U.S. Coast Guard evidence of financial responsibility sufficient to meet the highest limit of their potential liability under the act. Under U.S. Coast Guard regulations, evidence of financial responsibility may be demonstrated by insurance, surety bond, self-insurance or guaranty. An owner or operator of more than one vessel must demonstrate financial responsibility for the entire fleet in an amount equal to the financial responsibility of the vessel having greatest maximum liability under the OPA and CERCLA. We insure each of our vessels with pollution liability insurance in the amounts required by law. A catastrophic spill could exceed the insurance coverage available, in which event our financial condition and results of operations could be adversely affected.

Many countries have ratified and follow the liability plan adopted by the IMO as set out in the International Convention on Civil Liability for Oil Pollution Damage of 1969 (the “1969 Convention”) and the Convention for the Establishment of an International Fund for Oil Pollution of 1971. Under these conventions, the registered owner of a vessel is strictly liable for pollution damage caused in the territorial seas of a state party by the discharge of persistent oil, subject to certain defenses. Liability is limited to approximately $183 per gross registered ton (a unit of measurement of the total enclosed spaces in a vessel) or approximately $19.3 million, whichever is less. If a country is a party to the 1992 Protocol to the International Convention on Civil Liability for Oil Pollution Damage (the “1992 Protocol”), the maximum liability limit is $82.7 million. The limit of liability is tied to a unit of account that varies according to a basket of currencies. The right to limit liability is forfeited under the 1969 Convention when the discharge is caused by the owner's actual fault, and under the 1992 Protocol when the discharge is caused by the owner's intentional or reckless misconduct. Vessels operating in waters of states that are parties to these conventions must provide evidence of insurance covering the liability of the owner. In jurisdictions that are not parties to these conventions, various legislative schemes or common law govern. We believe that our pollution insurance policy covers the liability under the IMO regimes.

5

Competition

The shipping industry is intensely competitive and is influenced by economic and political events largely outside the control of shipping companies. Varying economic factors can cause wide swings in freight rates and sudden shifts in traffic patterns. Vessel redeployments and new vessel construction can lead to an overcapacity of vessels offering the same service or operating in the same market. Changes in the political or regulatory environment can also create competition that is not necessarily based on normal considerations of profit and loss. Several of our competitors have greater resources than we do. Our strategy is to reduce the effects of cyclical market conditions by operating specialized vessels in niche market segments and deploying a substantial number of our vessels under medium to long-term time contracts with creditworthy customers and on trade routes where we have established market share. We also seek to compete effectively in the traditional areas of price, reliability, and timeliness of service.

Our Jones Act and PCTC segments primarily include medium and long-term contracts with long standing customers. With the acquisition of UOS, we believe we have attained a competitive advantage by strengthening our position in the domestic coastal trade and by having the largest Jones Act dry bulk carriers by capacity. While our U.S. Flag PCTC’s operate worldwide in markets where International Flag vessels with foreign crews predominate, we believe that our U.S. Flag PCTC’s can compete effectively in obtaining renewals of existing contracts if we are able to continue to participate in the MSP and continue to receive cooperation from our seamen’s unions in controlling costs.

Our Rail-Ferry segment faces competition principally from companies who transport cargo over land rather than water, including railroads and trucking companies that cross land borders.

In our Dry Bulk Carriers segment we are part of two revenue-sharing agreements with two separate European partners. The vessels in the revenue sharing agreements are employed under short term and spot market basis. In addition, to augmenting our worldwide offices, we believe these partnerships expand our global commercial and operational network.

Contracts

We derive a substantial portion of our revenue under medium to long-term contracts, including time charters and contracts of affreightment.

Time charters are marine transportation contracts under which we retain operating control over the vessel, but our charterer obtains the right for a specified period to direct the movements and utilization of the vessel in exchange for payment of a specified daily rate. Under these contracts, we typically fully equip the vessel and are responsible for normal operating expenses, repairs, crew wages, and insurance, while the charterer is responsible for voyage expenses, such as fuel, port and stevedoring expenses.

Contracts of affreightment are marine transportation contracts by which we undertake to provide space on our vessels for the carriage of specified goods or a specified quantity of goods on a single voyage or series of voyages over a given period of time, generally at our cost, between named ports or within certain geographical areas in return for the payment of an agreed amount per unit of cargo carried.

Employees

As of December 31, 2012, we employed approximately 403 shipboard personnel and 158 shoreside personnel. We consider relations with our employees to be excellent.

All of Central Gulf, Waterman, and our other U.S. shipping companies’ shipboard personnel are covered by collective bargaining agreements. Some of these agreements relate to particular vessels and have terms corresponding with the terms of their respective vessel’s charter. We have experienced no strikes or other significant labor problems during the last ten years.

Available Information

Our internet address is www.intship.com. We make available free of charge through our website our annual report on Form 10-K, proxy statement for our annual meeting of stockholders, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information found on our website is not part of this or any other report.

Unless otherwise indicated, information contained in this annual report and other documents filed by us under the federal securities laws concerning our views and expectations regarding the marine transportation industry are based on estimates made by us using data from industry sources, and on assumptions made by us based on our management’s knowledge and experience in the markets in which we operate and the marine transportation industry. We believe these estimates and assumptions are accurate on the date made. However, this information may prove to be inaccurate because it cannot always be verified with certainty. You should be aware that we have not independently verified data from industry or other third-party sources and cannot guarantee its accuracy or completeness. Our estimates and assumptions involve risks and uncertainties and are subject to change based on various factors, including those discussed immediately below in Item 1A of this annual report.

Investors may also read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

The following are a list of factors that could materially and adversely affect our business, financial condition, results of operations, liquidity or prospects. These risk factors discuss all known material risks.

Risks Related To Our Business

Our industry is cyclical and has experienced a recent decline in the demand for certain of the services we offer, which could negatively impact our revenues and earnings.

Historically, the shipping industry has been cyclical. The nature, timing and degree of changes to industry conditions are generally unpredictable and are impacted by factors beyond our control. Various factors influence the demand for our transportation services, including worldwide demand for the products we carry and changes in the supply and demand of vessels. The worldwide supply of vessels generally increases with deliveries of new, refurbished or converted vessels and decreases with the scrapping of older vessels. If the available supply of vessels exceeds the number of vessels being scrapped, vessel capacity and competition in the markets where we operate may increase. In the absence of a corresponding increase in the demand for these vessels, the charter hire and cargo rates for our vessels could fluctuate significantly and result in, among other things, lower operating revenues, earnings and asset values.

Beginning in 2008, our revenues and gross voyage profits benefited from significant increases in the volume of supplemental cargoes carried by our vessels. These supplemental cargoes peaked during the fourth quarter of 2009, and decreased substantially thereafter until recently stabilizing at levels comparable to pre-2008. If our supplemental cargo volumes continue to decrease, the revenues and gross voyage profits from our incumbent operations will be negatively impacted.

6

We may not be able to renew our time charters and contracts when they expire at favorable rates or at all.

During the year ended December 31, 2012, we received approximately 60% of our revenue from time charters and fixed contracts. However, there can be no assurance that any of these charters or contracts, which are generally for periods of one year or more, will be renewed.

Moreover, you should be aware that shipping rates are based on several factors that are unpredictable and beyond our control. Accordingly, even if we are able to renew our charters or other contracts when they lapse, we may not be able to earn rates comparable to those received under the expired charters or contracts, which would adversely affect our revenues and earnings. In the event we cannot deploy a vessel at economically viable rates, we may opt to lay up the vessel until such time that spot or charter rates become attractive again. During the period of lay-up, the vessel will continue to incur expenditures such as insurance and maintenance costs.

From time to time, we enter into charter agreements with various agencies or departments of the U.S. government that allow the customer to terminate the agreement at any time without cause, subject to the payment of certain early termination fees.

If our exposure to the spot market increases, our revenues could suffer and our expenses could increase.

Currently we deploy over 40% of our vessels in the spot market, where rates are typically volatile and subject to short-term market fluctuations. The spot market for marine transportation services is highly competitive, and charter rates for most dry cargo vessels in the spot market are currently low in relation to historical rates over the past couple of decades. If we deploy a greater percentage of our vessels in the spot market, we may experience a lower overall utilization of our fleet through waiting time or ballast voyages, leading to a decline in our operating revenue and gross profit. Moreover, to the extent our vessels are employed in the spot market voyage contracts, both our revenue from vessels and our operating costs will likely be more significantly impacted by increases in fuel costs.

We operate in a highly competitive industry.

The shipping industry is intensely competitive and can be influenced by economic and political events that are largely outside the control of shipping companies. Many of our current and potential competitors:

| · | may have greater resources or stronger brands than we have; |

| · | own larger and more diverse fleets of vessels; |

| · | conduct operations or raise capital at lower costs than us; or |

| · | may be better positioned to adapt to changes in market or economic conditions. |

Changes in the political or regulatory environment can also create competition that is not necessarily based on normal considerations of profit and loss. Consequently, there can be no assurance that we will be able to deploy our vessels on economically attractive terms, maintain attractive freight rates, pass cost increases through to our customers or otherwise successfully compete against our competitors. Any failure to remain competitive in the shipping industry could have an adverse effect on our results of operations and financial condition.

Competition could adversely impact us in several ways, including (i) the loss of customers and market share, (ii) the possibility of customers reducing their usage of our vessels or services, (iii) our need to expend substantial time or money on vessel acquisitions or capital improvement projects, (iv) our need to lower prices or increase marketing expenses to remain competitive and (v) our inability to diversify by successfully offering new marine transportation services.

A significant amount of our and UOS’ recent revenues were derived from two customers, and our or their revenues could decrease significantly if these customers were lost.

For the years ended December 31, 2011 and 2012, we derived 34% and 41% of our revenues, respectively, from contracts with various agencies or departments of the U.S. government. Likewise, we derived 15% and 15.3% of our revenues for the same periods, respectively, from contracts with one company which time charters our PCTC’s. Similarly, in 2011 and for the eleven months prior to our acquisition of UOS on November 30, 2012, UOS derived over half of its revenues for each respective period from contracts with Tampa Electric and Mosaic (which percentage has increased since October 2012 due to the settlement of litigation that for the prior two years had halted the shipment of a portion of the cargoes carried for on of these key customers.). Our inability or failure to continue to employ our newly-acquired and incumbent vessels at rates comparable to those historically earned from these customers, the loss of any of these customers or the failure to charter these vessels otherwise in a reasonable period of time or at all could adversely affect our operations and performance.

Although our customers generally include leading international companies and governmental agencies such as the customers referenced above, we are unable to assure you that these customers will continue to contract with us on similar terms, or will not decide to contract with our competitors, or will decide to perform their shipping functions themselves.

Economic conditions, a prolonged economic downturn, economic uncertainty, an increase in trade protectionism or a change in trade patterns in the markets where we operate may have a material adverse effect on our business, financial condition and results of operations.

The demand for our transportation services has been and will continue to be affected by domestic and global economic conditions. Worldwide economic growth has been sluggish since 2008, which has contributed to lower charter rates for marine transportation services since then. Many experts believe that a confluence of factors in the United States, Europe, Asia and developing economies could result in a prolonged period of economic downturn, slow growth or economic uncertainty. If these conditions persist, our customers and potential customers may experience deterioration in their business, which may result in a lower demand for our transportation services or impair the ability of our customers or other third parties to pay amounts owed to us. Moreover, our business, financial condition, results of operations, ability to pay dividends and our future prospects will likely be materially and adversely affected by a prolonged economic downturn in any of these countries or regions.

The demand for our transportation services is also exposed to the risk that increases in trade protectionism or changes in trade patterns will adversely affect our business. If global economic conditions remain slack and uncertain, governments may turn to trade barriers to protect their domestic industries against foreign imports, thereby depressing the demand for shipping. Similarly, if changes in production costs or other factors cause manufacturing companies to continue to locate a greater share of their production facilities nearer to their consumers demand for our shipping services could be further depressed. Either of these could have a material adverse effect on our financial condition, results of operations, ability to pay dividends and future prospects.

7

If Congress does not make sufficient appropriations under the National Defense Authorization Act for any Fiscal Year, we may not continue to receive certain payments.

If Congress does not make sufficient appropriations under the National Defense Authorization Act for Fiscal Year 2013 in any fiscal year, we may not continue to receive annual payments with respect to certain of our U.S. Flag vessels that we have committed to the federal government under the U.S. Maritime Security Program. Under this program, which is currently in effect through 2025, each participating vessel received annual payments of $2.9 million in 2011 and $3.1 million in 2012, and is scheduled to receive our annual payment of $3.1 million in 2013. As of December 31, 2012, eight of our vessels operated under contracts issued under this program. Since payments under this program are subject to annual appropriations by Congress and are not guaranteed, we cannot assure that we will continue to receive these annual payments, in full or in part.

We cannot assure that we will be able to comply with all of our loan covenants.

All of our credit agreements impose restrictions on our business and require us to comply with various loan covenants. The restrictions these covenants place on us include limitations on our ability to: (i) consolidate or merge; (ii) incur new debt; (iii) engage in transactions with affiliates; (iv) create liens or permit them to exist on our assets; and (v) directly invest in assets other than vessels. These agreements also require us to comply with various financial covenants, including covenants that stipulate minimum levels of net worth, working capital and earnings, and maximum levels of debt and debt leverage. Our ability to satisfy these and other covenants depends on our results of operations and ability to respond to changes in business and economic conditions. Several of these matters are beyond our control or may be significantly restricted, and, as a result, we may be prevented from engaging in transactions that otherwise might be considered beneficial to us and our stockholders.

While we currently believe that we have available options to prevent or mitigate any covenant breaches, we cannot assure that we will be able to implement them timely or at all, or that they will enable us to meet all of our current covenants. In the unanticipated event that our cash flow and capital resources are not sufficient to fund our debt service obligations, we could be forced to reduce or delay capital expenditures, sell assets, obtain additional capital, enter into financings of our unencumbered vessels or restructure debt. Based on current circumstances, we believe we can continue to fund our working capital and routine capital expenditure needs through cash flow from operations or accessing available lines of credit. For further detailed information on our compliance with our financial covenants as of December 31, 2012, see below in this report “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Debt Covenants.”

Because our debt obligations are represented by separate agreements with different lenders, in some cases the breach of any of these covenants or other default under one agreement may create an event of default under other agreements, resulting in the acceleration of our obligation to pay principal, interest and potential penalties under such other agreements (even though we may otherwise be in compliance with all of our obligations under those agreements). Thus, an event of default under a single agreement, including one that is technical in nature or otherwise not material, could result in the acceleration of significant indebtedness under multiple lending agreements. If amounts outstanding under such agreements were to be accelerated, there can be no assurance that our assets would generate sufficient cash flow to repay the accelerated indebtedness, or that our lenders would not proceed against the collateral securing that indebtedness.

Our business would be adversely affected if we failed to comply with the Jones Act, or if this law was modified or repealed.

A portion of our shipping operations and substantially all of the shipping operations we acquired from UOS are conducted in the U.S. coastwise trade. Under U.S. federal laws known as the “Jones Act,” this trade is restricted to vessels built in the United States, owned and manned by U.S. citizens and registered under U.S. Flag. Our failure to comply with these restrictions could subject us to severe penalties, including the permanent loss of the right to engage in U.S. coastwise trade. If the Jones Act were repealed, substantially amended or waived, it could potentially result in additional competition from vessels built in generally lower-cost foreign shipyards and owned and manned by foreign nationals, which could have an adverse effect on our business, results of operations and financial condition. We cannot assure you that the Jones Act will not be repealed or modified in a way that would be detrimental to our business.

Terrorist attacks, piracy and international hostilities can affect the transportation industry, which could adversely affect our business.

Terrorist attacks or piracy attacks against merchant ships, the outbreak of war, or the existence of international hostilities could adversely affect us in several ways, including:

| · | damaging the world economy; |

| · | adversely affecting the availability of and demand for transportation services generally, or our vessels in particular; |

| · | increasing the cost of insurance; |

| · | disrupting our vessel usage or deployment; and |

| · | adversely affecting the value of our vessels or our ability to profitably operate our vessels and serve our customers. |

Over the past several years, piracy attacks on merchant ships have remained high, particularly in the Gulf of Aden and off the East Coast of Africa. Our industry is a sector of the economy that we believe is particularly likely to be adversely impacted by the effects of political instability, terrorist attacks, war, international hostilities or piracy. In addition, we conduct operations in Indonesia, Southern Mexico, West Africa, Arabian Gulf, and other areas that are particularly likely to be exposed to the risk of these potential adverse effects.

8

The market value of vessels fluctuates significantly, which could adversely affect our liquidity, result in breaches of our financing agreements or otherwise adversely affect our financial condition.

The market values of vessels fluctuate over time. The fluctuation in market value of vessels over time is based upon various factors, including:

| · | the age of the vessel; |

| · | general economic and market conditions affecting the ocean transportation industry, including the demand for cargoes and the availability of vessel financing; |

| · | the number of vessels in the world fleet; |

| · | the types and sizes of vessels available; |

| · | changes in trading patterns or trading routes that affect demand for particular sizes and types of vessels; |

| · | the cost of vessels under construction and scrap prices; |

| · | prevailing levels of time charter and voyage rates; |

| · | changes in regulation or competition from other shipping companies and other modes of transportation; and |

| · | technological advances in vessel design and propulsion. |

Declining values of our vessels could adversely affect us in several respects, including reducing our liquidity by limiting our ability to raise cash by refinancing vessels. Declining vessel values could also result in a breach of loan covenants or trigger events of default under relevant financing agreements that require us to maintain certain loan-to-value ratios. In such instances, if we are unable or unwilling to pledge additional collateral to offset the decline in vessel values, our lenders could accelerate our debt and foreclose on our vessels pledged as collateral for the loans.

In addition, accounting pronouncements require that we periodically review our long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. Measurement of the impairment charge is based on the fair value of the asset as provided by third parties as compared to its carrying value. In this respect, management regularly reviews the carrying amount of our vessels in connection with the estimated recoverable amount for each vessel. Such reviews may from time to time result in asset write-downs that could adversely affect our financial condition and results of operations. For information on the impairment charge we recognized in 2010 in connection with our Rail-Ferry segment, see “– Our Rail-Ferry segment has a history of losses, and we can give no assurances as to its future profitability.”

As a holding company with no operations of our own, we rely on payments from our operating companies to meet our obligations.

As a holding company without any material assets or operations, substantially all of our income and operating cash flow is dependent upon the earnings of our subsidiaries and the distribution of those earnings to us or upon loans or other payments of funds by those subsidiaries to us. As a result, we rely upon our subsidiaries to generate the funds necessary to meet our obligations, including the payment of amounts owed under our long-term debt, or to declare and make dividend payments to the holders of our securities. The ability of our subsidiaries to generate sufficient cash flow from operations to allow us and them to make scheduled payments on our respective obligations will depend on their future financial performance, which will be affected by a range of economic, competitive and business factors, many of which are outside of our control. Additionally, our subsidiaries are separate and distinct legal entities and have no obligation to pay any amounts owed by us, or, subject to limited exceptions for tax-sharing purposes, to make any funds available to us to pay dividends or to repay our debt or other obligations. Our rights to receive assets of any subsidiary upon its liquidation or reorganization will also be effectively subordinated to the claims of creditors of that subsidiary, including trade creditors.

Our business and financial alternatives could be constrained by our current obligations and any future borrowings.

As a result of additional borrowings or operating leases we incurred to finance the UOS acquisition, we have become more leveraged. See our Consolidated Balance Sheets on page F-5. In addition to the liabilities recorded on our consolidated balance sheets as of December 31, 2012, we owe substantial amounts under our long-term operating leases.

Our leverage could have material adverse consequences for us, including:

| · | hindering our ability to adjust to changing market, industry or economic conditions; |

| · | limiting our ability to access the capital markets to refinance maturing debt or to fund acquisitions of vessels or businesses; |

| · | requiring us to dedicate a substantial portion of our cash flow from operations to the payment of debt, thereby limiting the amount of free cash flow available for other purposes, including capital expenditures, dividends, stock repurchases or growth opportunities; |

| · | making us more vulnerable to economic or industry downturns, including interest rate increases; and |

| · | placing us at a competitive disadvantage to those of our competitors who have less indebtedness. |

We expect to periodically require financing to meet our debt obligations as they come due. Due to the unstable economy and the current credit market environment, we may not be able to refinance maturing debt at terms that are as favorable as those from which we previously benefited, at terms that are acceptable to us or at all. In connection with executing our business strategies, from time to time we evaluate the possibility of acquiring additional vessels or businesses, and we may elect to finance such acquisitions by incurring additional indebtedness. Moreover, if we were to suffer uninsured material losses or liabilities, we could be required to borrow to fund liabilities that we could not pay with our operating cash flow. Our ability to arrange additional financing will depend on, among other factors, our financial position and performance, as well as prevailing market conditions and other factors beyond our control. We cannot assure you that we will be able to obtain additional financing on terms acceptable to us or at all. If we are able to obtain additional financing, our credit may be adversely affected and our ability to satisfy our obligations under our current indebtedness could be adversely affected.

We cannot assure you that our access to the public debt and equity markets will remain free of disruptions.

In the future, we may consider selling debt and/or equity securities to raise additional funds, including to refinance a portion of our maturing debt. Our ability to arrange any such financing will depend on, among other factors, our financial position and performance, as well as prevailing market conditions and other factors beyond our control. Prevailing market conditions could be adversely affected by the ongoing sovereign debt crises in Europe, the failure of the United States to reduce its deficit in amounts deemed to be sufficient, downgrades in the credit ratings of the U.S. debt, contractions or limited growth in the economy or other similar adverse economic developments in the U.S. or abroad. As a result, we cannot assure that we will be able to obtain additional financing on terms acceptable to us or at all. Any such failure to obtain additional financing could jeopardize our ability to repay, refinance or reduce our debt obligations.

We are subject to certain risks with respect to our counterparties on contracts, and failure of such counterparties to meet their obligations could cause us to suffer losses or otherwise adversely affect our business.

The ability of our counterparties to perform their obligations under their contracts with us will depend upon a number of factors that are beyond our control and may include, among other things, general economic conditions and the overall financial condition of these counterparties, especially in light of the current global financial weakness. If our counterparties fail to honor their obligations under their agreements with us, we could sustain significant losses or a reduction in our vessel usage, both of which could have an adverse effect on our financial condition, results of operations and cash flows.

9

Older vessels have higher operating costs and are potentially less desirable to charterers.

The average age of the vessels in our fleet that we own or lease, excluding our UOS vessels, is approximately 12 years (nine years if our partially-owned Mini Bulk Carriers built in 2010 and 2011 are included in the average). The average age of our UOS vessels actively providing services is approximately 32 years (which reflects the longer vessel lives typically associated with vessels deployed in U.S. coastwise trade). See below in this report “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Executive Summary– Overview of Fleet.” In general, capital expenditures and other costs necessary for maintaining a vessel in good operating condition increase and become more difficult to estimate with accuracy as the age of the vessel increases. Moreover, customers generally prefer modern vessels over older vessels, which places the older vessels at a competitive disadvantage, especially in weak markets. In addition, changes in governmental regulations, compliance with classification society standards and customer requirements or competition may require us to make additional expenditures for alterations or the addition of new equipment. In order to make such alterations or add such equipment, we may be required to take our vessels out of service, thereby reducing our revenues. Expenditures such as these may also require us to incur additional debt or raise additional capital. There can be no assurance that market or general economic conditions will enable us to replace our existing vessels with new vessels, justify the expenditures necessary to maintain our older vessels in good operating condition or enable us to operate our older vessels profitably during the remainder of their estimated useful lives.

Our Rail-Ferry Segment has a history of losses, and we can give no assurances as to its future gross voyage profitability.

This service began operating in February of 2001 and in the past has been unprofitable every year with the exception of 2008, 2011, and 2012. In 2009, the worldwide economic downturn negatively impacted the volumes and cargo rates for this service, especially on its northbound route to the U.S. As a result of a reduction in future anticipated cash flows generated by this service, we recognized a non-cash impairment charge of $25.4 million in the third quarter of 2010 to reduce the carrying value of these assets to their estimated fair value. With the reduced capital cost and an increase in cargoes, this segment was profitable for the last two years. We cannot assure that this service will be operated profitably in the future.

We are subject to the risk of continuing high prices, and increasing prices, of the fuel we consume in our Rail-Ferry segment, Jones Act segment and Revenue Sharing Agreements

We are exposed to commodity price risks with respect to fuel consumption under our contracts of affreightment, our rail-ferry service and our revenue-sharing agreements based on the number of voyage contracts concluded by the participating vessels. We can give no assurance that we will be able to offset higher fuel costs due to the competitive nature of these operations. Although we currently have some fuel surcharges in place, a material increase in current fuel prices that are not covered by fuel surcharges or that we cannot recover through fuel cost surcharges could adversely affect our results of operations and financial condition.

Our business and operations are highly regulated, which can adversely affect our operations.

Our business and the shipping industry in general are subject to increasingly stringent laws and regulations governing our vessels, including workers’ health and safety, and the staffing, construction, operation, insurance and transfer of our vessels. Compliance with or the enforcement of these laws and regulations could have an adverse effect on our business, results of operations or financial condition. For example, in the event of war or national emergency, our U.S. Flag vessels are subject to requisition by the U.S. government. Although we would be entitled to compensation in the event of a requisition of our vessels, the amount and timing of such payments would be uncertain and there would be no guarantee that such amounts would be paid, or if paid, would fully satisfy lost profits associated with the requisition.

In addition, we are required by various governmental and quasi-governmental agencies to obtain and maintain certain permits, licenses and certificates with respect to our operations. In certain instances, the failure to obtain or maintain these authorizations could have an adverse effect on our business. We may also be required to periodically modify operating procedures or alter or introduce new equipment for our existing vessels to appropriately respond to changes in governmental regulation.