UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-02896 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios, Inc. 15 |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | | 655 Broad Street, 6th Floor |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 8/31/2023 |

| |

| Date of reporting period: | | 8/31/2023 |

Item 1 – Reports to Stockholders

PGIM SHORT DURATION HIGH YIELD INCOME FUND

ANNUAL REPORT

AUGUST 31, 2023

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2023 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Short Duration High Yield Income Fund informative and useful. The report covers performance for the 12-month period that ended August 31, 2023. Although central banks raised interest rates aggressively to tame surging inflation during the period, the global economy and financial markets demonstrated resilience. Employers continued to hire, consumers continued to spend, home prices rose, and recession fears receded. |

Stocks fell early in the period, bottomed in October, and then began a rally that eventually ended a bear market. Despite a banking industry crisis in March, stocks have continued to rise globally throughout 2023 as inflation cooled and the Federal Reserve slowed the pace of its rate hikes. Equities in both US and international markets posted gains during the period.

Bond market returns were mixed during the period as rising interest rates lifted yields to their highest level in two decades. US and global investment-grade bonds fell, while US high yield corporate bonds and emerging-market debt rose.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 14th-largest investment manager with more than $1.3 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Short Duration High Yield Income Fund

October 16, 2023

PGIM Short Duration High Yield Income Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| |

| | | Average Annual Total Returns as of 8/31/23 |

| | | | |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) | | Since Inception (%) |

| | | | |

Class A | | | | | | | | |

| | | | |

(with sales charges) | | 3.93 | | 3.19 | | 3.62 | | — |

| | | | |

(without sales charges) | | 6.33 | | 3.66 | | 3.85 | | — |

| | | | |

Class C | | | | | | | | |

| | | | |

(with sales charges) | | 4.54 | | 2.89 | | 3.08 | | — |

| | | | |

(without sales charges) | | 5.54 | | 2.89 | | 3.08 | | — |

| | | | |

Class Z | | | | | | | | |

| | | | |

(without sales charges) | | 6.60 | | 3.90 | | 4.11 | | — |

| | | | |

Class R6 | | | | | | | | |

| | | | |

(without sales charges) | | 6.78 | | 3.97 | | N/A | | 4.12 (10/27/2014) |

| | | | |

Bloomberg US High Yield Ba/B 1-5 Year 1% Capped Index | | | | | | | | |

| | | | |

| | | 7.63 | | 3.67 | | 3.97 | | — |

| | |

|

| Average Annual Total Returns as of 8/31/23 Since Inception (%) |

| |

| | | Class R6 (10/27/2014) |

| |

Bloomberg US High Yield Ba/B 1-5 Year 1% Capped Index | | 3.75 |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’s inception date.

4 Visit our website at pgim.com/investments

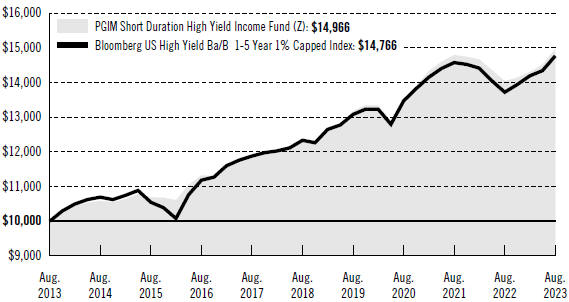

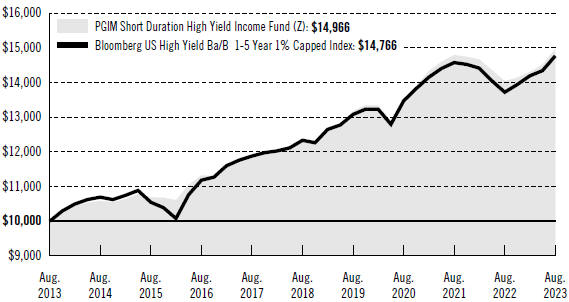

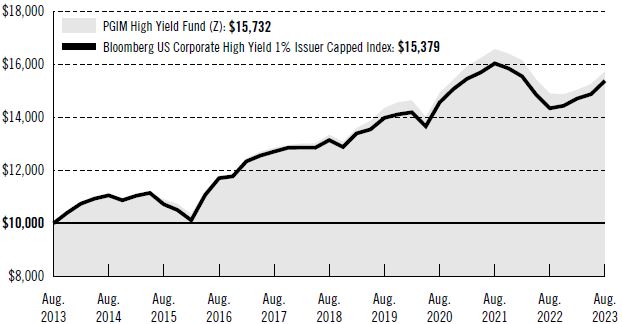

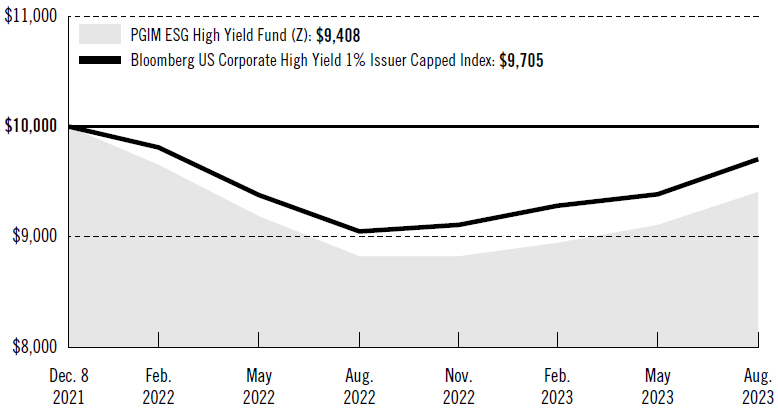

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Bloomberg US High Yield Ba/B 1-5 Year 1% Capped Index, by portraying the initial account values at the beginning of the 10-year period (August 31, 2013) and the account values at the end of the current fiscal year (August 31, 2023) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Short Duration High Yield Income Fund 5

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | |

| | | | | |

| | | Class A | | Class C | | Class Z | | Class R6 |

| | | | | |

Maximum initial sales charge | | 2.25% of the public offering price | | None | | None | | None |

| | | | | |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $500,000 or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None |

| | | | | |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.25% | | 1.00% | | None | | None |

Benchmark Definition

Bloomberg US High Yield Ba/B 1–5 Year 1% Capped Index—The Bloomberg US High Yield Ba/B 1–5 Year 1% Capped Index (the Index) represents the performance of US short duration, higher-rated high yield bonds.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

6 Visit our website at pgim.com/investments

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 8/31/23 (%) | |

| |

AAA | | | 6.8 | |

| |

BBB | | | 5.1 | |

| |

BB | | | 41.0 | |

| |

B | | | 34.6 | |

| |

CCC | | | 6.9 | |

| |

D | | | 0.5 | |

| |

Not Rated | | | 2.2 | |

| |

Cash/Cash Equivalents | | | 2.9 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | | | |

| | | |

| Distributions and Yields as of 8/31/23 | | | | | | |

| | | |

| | | Total Distributions Paid for One Year ($) | | SEC 30-Day Subsidized Yield* (%) | | SEC 30-Day Unsubsidized Yield** (%) |

| | | |

Class A | | 0.50 | | 7.26 | | 7.25 |

| | | |

Class C | | 0.44 | | 6.66 | | 6.66 |

| | | |

Class Z | | 0.52 | | 7.68 | | 7.61 |

| | | |

Class R6 | | 0.52 | | 7.72 | | 7.72 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

PGIM Short Duration High Yield Income Fund 7

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Short Duration High Yield Income Fund’s Class Z shares returned 6.60% in the 12-month reporting period that ended August 31, 2023, underperforming the 7.63% return of the Bloomberg US High Yield Ba/B 1-5 Year 1% Capped Index (the Index).

What were the market conditions?

| · | | US high yield bonds posted gains over the reporting period amid limited new issuance, resilient economic data, and an ongoing supply deficit fueled by a high volume of calls, tenders, maturities, and coupon payments. |

| · | | Spreads on the Bloomberg US Corporate High Yield Bond Index tightened 113 basis points (bps) to 372 bps as of the end of the reporting period. (One basis point equals 0.01%.) Spreads on the short-duration, higher-quality portion of the high yield market, as measured by the Bloomberg US High Yield Ba/B 1-5 year 1% Constrained Index, tightened 133 bps over the reporting period to 292 bps. |

| · | | Meanwhile, fundamentals remained solid, with leverage remaining low and coverage ratios remaining strong despite recession concerns and a series of rolling crises, including a string of regional bank failures, the debt ceiling debate, and still-high inflation. |

| · | | After posting outflows of $47 billion during 2022, high yield bond mutual funds saw $11.7 billion of outflows during the first eight months of 2023. However, technicals remained supportive as subdued primary activity helped to offset the headwinds from negative fund flows. After totaling just $106.5 billion in 2022, high yield gross issuance totaled $111.2 billion through the first eight months of 2023, or just $40.8 billion excluding refinancing activity. |

| · | | By quality, all credit tiers posted positive returns over the reporting period, with CCC-rated credits outperforming their B-rated and BB-rated peers. Meanwhile, the par-weighted US high yield default rate, including distressed exchanges, ended the reporting period at 2.40%, which was below its long-term historical average but 75 bps higher than the beginning of the year and 119 bps higher than a year earlier, according to J.P. Morgan. |

What worked?

| · | | Overall security selection contributed to the Fund’s performance over the reporting period, with selection in technology, healthcare & pharmaceuticals, and consumer non-cyclicals contributing the most. |

| · | | In individual security selection, positioning in Lumen Technologies Inc. (telecom), Bausch Health Americas Inc. (pharmaceuticals), and West Technology Group LLC (consumer non-cyclical) were among the largest contributors to performance. |

| · | | While overall sector allocation detracted from performance, an overweight relative to the Index to building materials & home construction, along with underweights relative to the Index to retailers & restaurants and real estate investment trusts (REITs), contributed. |

8 Visit our website at pgim.com/investments

What didn’t work?

| · | | While overall security selection contributed to the Fund’s performance during the reporting period, security selections in chemicals, upstream energy, and media & entertainment detracted. |

| · | | Overall sector allocation detracted from performance, with an underweight relative to the Index to gaming/lodging/leisure, along with overweights relative to the Index to telecom and cable & satellite, detracting the most. |

| · | | In individual security selection, positioning in Venator Materials LLC (chemicals), Digicel Group Holdings Ltd. (telecom), and CSC Holdings LLC (media) detracted from results. |

| · | | Having less beta, on average, in the Fund relative to the Index over the reporting period had a negative impact on returns. (Beta is a measure of the volatility or risk of a security or portfolio compared to the market or index.) |

Did the Fund use derivatives?

The Fund used credit index derivatives and interest rate futures to manage its overall risk profile during the reporting period, the aggregate impact of which was positive.

Current outlook

| · | | While PGIM Fixed Income expects to see some deterioration of fundamentals, some mitigating factors will likely keep US high yield spreads from widening sharply from current levels. The market is of a higher quality than prior cycles, with BB-rated credits comprising nearly 50% of the market, net leverage remaining near all-time lows, and interest coverage near all-time highs. Meanwhile, the technical backdrop remains supportive due to a variety of factors, including lower gross new issuance and sizeable rising stars leading to a meaningful supply deficit and an overall shrinking high yield market. |

| · | | PGIM Fixed Income does not expect defaults to be as severe as in previous downturns due to the strength of most issuers’ balance sheets and the absence of a near-term maturity wall, as many issuers have already termed out debt at low interest rates. Should the economy follow its base-case recession scenario, PGIM Fixed Income expects defaults to remain manageable, rising to 5% over the next 12 months. |

| · | | While the short-term outlook is somewhat positive, PGIM Fixed Income forecasts a flat excess return over the next 12 months. In terms of positioning, PGIM Fixed Income remains defensive but is looking to opportunistically add higher-quality and short-duration risk on pullbacks from here. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

PGIM Short Duration High Yield Income Fund 9

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended August 31, 2023. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 =8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

10 Visit our website at pgim.com/investments

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | | |

PGIM Short Duration High Yield Income Fund | | Beginning Account Value March 1, 2023 | | Ending Account Value August 31, 2023 | | Annualized Expense Ratio Based on the Six-Month Period | | Expenses Paid During the Six-Month Period* |

| | | | | |

Class A | | Actual | | $1,000.00 | | $1,045.00 | | 1.00% | | $5.15 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,020.16 | | 1.00% | | $5.09 |

| | | | | |

Class C | | Actual | | $1,000.00 | | $1,041.10 | | 1.75% | | $9.00 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,016.38 | | 1.75% | | $8.89 |

| | | | | |

Class Z | | Actual | | $1,000.00 | | $1,046.30 | | 0.75% | | $3.87 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,021.42 | | 0.75% | | $3.82 |

| | | | | |

Class R6 | | Actual | | $1,000.00 | | $1,047.90 | | 0.70% | | $3.61 |

| | | | | |

| | | Hypothetical | | $1,000.00 | | $1,021.68 | | 0.70% | | $3.57 |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended August 31, 2023, and divided by the 365 days in the Fund’s fiscal year ended August 31, 2023 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

PGIM Short Duration High Yield Income Fund 11

Schedule of Investments

as of August 31, 2023

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

LONG-TERM INVESTMENTS 95.4% | | | | | | | | | | | | |

| | | | |

ASSET-BACKED SECURITIES 3.2% | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations | | | | | | | | | | | | |

| | | | |

BlueMountain CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2016-02A, Class A1R2, 144A, 3 Month SOFR + 1.382% (Cap N/A, Floor 1.120%) | | 6.761%(c) | | 08/20/32 | | | 20,000 | | | $ | 19,850,778 | |

BlueMountain Fuji US CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2017-02A, Class A1AR, 144A, 3 Month SOFR + 1.262% (Cap N/A, Floor 0.000%) | | 6.588(c) | | 10/20/30 | | | 4,708 | | | | 4,698,606 | |

Carlyle Global Market Strategies CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2014-03RA, Class A1A, 144A, 3 Month SOFR + 1.312% (Cap N/A, Floor 0.000%) | | 6.669(c) | | 07/27/31 | | | 5,237 | | �� | | 5,208,128 | |

Series 2015-04A, Class A1R, 144A, 3 Month SOFR + 1.602% (Cap N/A, Floor 0.000%) | | 6.928(c) | | 07/20/32 | | | 7,000 | | | | 6,973,670 | |

Guggenheim CLO STAT Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2022-01A, Class A1A, 144A, 3 Month SOFR + 2.590% (Cap N/A, Floor 2.590%) | | 7.941(c) | | 10/25/31 | | | 22,772 | | | | 22,875,717 | |

KKR Static CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2022-02A, Class A1, 144A, 3 Month SOFR + 2.220% (Cap N/A, Floor 2.220%) | | 7.546(c) | | 10/20/31 | | | 35,395 | | | | 35,421,044 | |

Madison Park Funding Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2019-33A, Class AR, 144A, 3 Month SOFR + 1.290% (Cap N/A, Floor 1.290%) | | 6.598(c) | | 10/15/32 | | | 7,500 | | | | 7,434,398 | |

Signal Peak CLO Ltd., | | | | | | | | | | | | |

Series 2018-05A, Class A, 144A, 3 Month SOFR + 1.372% (Cap N/A, Floor 1.110%) | | 6.723(c) | | 04/25/31 | | | 8,913 | | | | 8,894,914 | |

TICP CLO Ltd. (Cayman Islands), | | | | | | | | | | | | |

Series 2017-09A, Class A, 144A, 3 Month SOFR + 1.402% (Cap N/A, Floor 1.140%) | | 6.728(c) | | 01/20/31 | | | 12,885 | | | | 12,843,833 | |

TSTAT Ltd. (Bermuda), | | | | | | | | | | | | |

Series 2022-02A, Class A1, 144A, 3 Month SOFR + 2.370% (Cap N/A, Floor 2.370%) | | 7.696(c) | | 01/20/31 | | | 22,809 | | | | 22,851,650 | |

| | | | | | | | | | | | |

| | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $146,057,394) | | | | | | | | | | | 147,052,738 | |

| | | | | | | | | | | | |

| | | | |

CONVERTIBLE BOND 0.0% | | | | | | | | | | | | |

| | | | |

Telecommunications | | | | | | | | | | | | |

| | | | |

Digicel Group Holdings Ltd. (Jamaica), | | | | | | | | | | | | |

Sub. Notes, 144A, Cash coupon 7.000% (original cost $56,425; purchased 03/21/23 - 04/03/23)(f)

(cost $56,425) | | 7.000 | | 09/18/23(oo) | | | 383 | | | | 36,380 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

PGIM Short Duration High Yield Income Fund 13

Schedule of Investments (continued)

as of August 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS 79.4% | | | | | | | | | | | | | | | | |

| | | | |

Aerospace & Defense 2.1% | | | | | | | | | | | | | | | | |

| | | | |

Bombardier, Inc. (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 6.000% | | | | 02/15/28 | | | | 15,150 | | | $ | 14,113,172 | |

Sr. Unsec’d. Notes, 144A | | | 7.125 | | | | 06/15/26 | | | | 23,375 | | | | 22,912,409 | |

Sr. Unsec’d. Notes, 144A | | | 7.500 | | | | 03/15/25 | | | | 3,828 | | | | 3,820,535 | |

Sr. Unsec’d. Notes, 144A(a) | | | 7.500 | | | | 02/01/29 | | | | 3,900 | | | | 3,826,875 | |

Sr. Unsec’d. Notes, 144A | | | 7.875 | | | | 04/15/27 | | | | 14,150 | | | | 14,114,625 | |

Spirit AeroSystems, Inc., | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A | | | 7.500 | | | | 04/15/25 | | | | 4,461 | | | | 4,405,203 | |

TransDigm UK Holdings PLC, | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.875 | | | | 05/15/26 | | | | 8,575 | | | | 8,714,344 | |

TransDigm, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.500 | | | | 11/15/27 | | | | 20,458 | | | | 19,419,030 | |

Gtd. Notes(a) | | | 7.500 | | | | 03/15/27 | | | | 6,788 | | | | 6,804,372 | |

Sr. Sec’d. Notes, 144A | | | 6.250 | | | | 03/15/26 | | | | 2,475 | | | | 2,458,989 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 100,589,554 | |

| | | | |

Airlines 1.3% | | | | | | | | | | | | | | | | |

| | | | |

American Airlines, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | | 7.250 | | | | 02/15/28 | | | | 2,925 | | | | 2,871,014 | |

Sr. Sec’d. Notes, 144A | | | 11.750 | | | | 07/15/25 | | | | 4,896 | | | | 5,361,960 | |

American Airlines, Inc./AAdvantage Loyalty IP Ltd., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 5.500 | | | | 04/20/26 | | | | 36,730 | | | | 36,046,006 | |

United Airlines, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.375 | | | | 04/15/26 | | | | 4,237 | | | | 3,995,299 | |

VistaJet Malta Finance PLC/Vista Management Holding, Inc. (Switzerland), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 7.875 | | | | 05/01/27 | | | | 7,933 | | | | 7,159,533 | |

Sr. Unsec’d. Notes, 144A(a) | | | 9.500 | | | | 06/01/28 | | | | 3,500 | | | | 3,228,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 58,662,562 | |

| | | | |

Apparel 0.2% | | | | | | | | | | | | | | | | |

| | | | |

Hanesbrands, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 4.875 | | | | 05/15/26 | | | | 1,475 | | | | 1,378,989 | |

William Carter Co. (The), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.625 | | | | 03/15/27 | | | | 7,240 | | | | 7,019,098 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 8,398,087 | |

| | | | |

Auto Manufacturers 1.5% | | | | | | | | | | | | | | | | |

| | | | |

Allison Transmission, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 4.750 | | | | 10/01/27 | | | | 3,824 | | | | 3,588,517 | |

See Notes to Financial Statements.

14

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Auto Manufacturers (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

Ford Motor Credit Co. LLC, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.300% | | | | 02/10/25 | | | | 4,000 | | | $ | 3,750,400 | |

Sr. Unsec’d. Notes | | | 2.700 | | | | 08/10/26 | | | | 1,750 | | | | 1,567,097 | |

Sr. Unsec’d. Notes(a) | | | 2.900 | | | | 02/16/28 | | | | 12,250 | | | | 10,440,618 | |

Sr. Unsec’d. Notes | | | 4.125 | | | | 08/17/27 | | | | 3,207 | | | | 2,910,869 | |

Sr. Unsec’d. Notes | | | 4.950 | | | | 05/28/27 | | | | 2,300 | | | | 2,155,077 | |

Sr. Unsec’d. Notes(a) | | | 5.584 | | | | 03/18/24 | | | | 1,525 | | | | 1,517,795 | |

Sr. Unsec’d. Notes(a) | | | 6.800 | | | | 05/12/28 | | | | 8,625 | | | | 8,619,121 | |

Sr. Unsec’d. Notes | | | 6.950 | | | | 03/06/26 | | | | 3,800 | | | | 3,808,517 | |

Sr. Unsec’d. Notes | | | 7.350 | | | | 11/04/27 | | | | 9,750 | | | | 9,931,751 | |

Jaguar Land Rover Automotive PLC (United Kingdom), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 7.750 | | | | 10/15/25 | | | | 6,625 | | | | 6,642,225 | |

Nissan Motor Acceptance Co. LLC, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 2.750 | | | | 03/09/28 | | | | 3,125 | | | | 2,632,365 | |

Sr. Unsec’d. Notes, 144A, MTN | | | 1.850 | | | | 09/16/26 | | | | 6,450 | | | | 5,591,946 | |

Nissan Motor Co. Ltd. (Japan), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 4.345 | | | | 09/17/27 | | | | 2,750 | | | | 2,517,064 | |

PM General Purchaser LLC, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 9.500 | | | | 10/01/28 | | | | 3,950 | | | | 3,794,244 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 69,467,606 | |

| | | | |

Auto Parts & Equipment 0.7% | | | | | | | | | | | | | | | | |

| | | | |

Adient Global Holdings Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 4.875 | | | | 08/15/26 | | | | 6,695 | | | | 6,410,462 | |

Sr. Sec’d. Notes, 144A | | | 7.000 | | | | 04/15/28 | | | | 3,300 | | | | 3,300,000 | |

American Axle & Manufacturing, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 6.250 | | | | 03/15/26 | | | | 1,341 | | | | 1,305,765 | |

Gtd. Notes(a) | | | 6.500 | | | | 04/01/27 | | | | 4,444 | | | | 4,215,634 | |

Dana Financing Luxembourg Sarl, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.750 | | | | 04/15/25 | | | | 4,737 | | | | 4,632,028 | |

Dana, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | | 5.375 | | | | 11/15/27 | | | | 2,400 | | | | 2,282,852 | |

Sr. Unsec’d. Notes(a) | | | 5.625 | | | | 06/15/28 | | | | 1,000 | | | | 940,934 | |

Tenneco, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 8.000 | | | | 11/17/28 | | | | 8,275 | | | | 6,814,716 | |

Titan International, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes(a) | | | 7.000 | | | | 04/30/28 | | | | 2,300 | | | | 2,189,923 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 32,092,314 | |

See Notes to Financial Statements.

PGIM Short Duration High Yield Income Fund 15

Schedule of Investments (continued)

as of August 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Banks 0.7% | | | | | | | | | | | | | | | | |

| | | | |

Credit Suisse AG (Switzerland), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | | 3.625% | | | | 09/09/24 | | | | 2,170 | | | $ | 2,111,368 | |

Freedom Mortgage Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 7.625 | | | | 05/01/26 | | | | 3,925 | | | | 3,610,762 | |

Sr. Unsec’d. Notes, 144A | | | 8.250 | | | | 04/15/25 | | | | 4,950 | | | | 4,883,369 | |

Intesa Sanpaolo SpA (Italy), | | | | | | | | | | | | | | | | |

Sub. Notes, 144A, MTN | | | 5.017 | | | | 06/26/24 | | | | 5,525 | | | | 5,372,510 | |

Popular, Inc. (Puerto Rico), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 7.250 | | | | 03/13/28 | | | | 14,600 | | | | 14,691,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 30,669,259 | |

| | | | |

Building Materials 1.2% | | | | | | | | | | | | | | | | |

| | | | |

Eco Material Technologies, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 7.875 | | | | 01/31/27 | | | | 5,175 | | | | 5,065,291 | |

JELD-WEN, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 4.625 | | | | 12/15/25 | | | | 4,570 | | | | 4,426,795 | |

Gtd. Notes, 144A(a) | | | 4.875 | | | | 12/15/27 | | | | 6,320 | | | | 5,635,867 | |

Masonite International Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.375 | | | | 02/01/28 | | | | 1,376 | | | | 1,296,880 | |

Standard Industries, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 4.750 | | | | 01/15/28 | | | | 5,600 | | | | 5,154,989 | |

Sr. Unsec’d. Notes, 144A(a) | | | 5.000 | | | | 02/15/27 | | | | 35,138 | | | | 33,376,821 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 54,956,643 | |

| | | | |

Chemicals 2.2% | | | | | | | | | | | | | | | | |

| | | | |

Avient Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 5.750 | | | | 05/15/25 | | | | 27,462 | | | | 27,100,553 | |

Cornerstone Chemical Co., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A, Cash coupon 8.250% and PIK 2.000% (original cost $5,913,003; purchased 04/05/19)(f) | | | 10.250 | | | | 09/01/27 | | | | 6,000 | | | | 5,197,722 | |

NOVA Chemicals Corp. (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 4.875 | | | | 06/01/24 | | | | 13,450 | | | | 13,197,947 | |

Olympus Water US Holding Corp., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.250 | | | | 10/01/28 | | | | 3,481 | | | | 2,877,862 | |

Sr. Sec’d. Notes, 144A | | | 9.750 | | | | 11/15/28 | | | | 7,775 | | | | 7,838,914 | |

Rain CII Carbon LLC/CII Carbon Corp., | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A | | | 7.250 | | | | 04/01/25 | | | | 363 | | | | 356,733 | |

SNF Group SACA (France), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 3.125 | | | | 03/15/27 | | | | 18,392 | | | | 16,236,274 | |

See Notes to Financial Statements.

16

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Chemicals (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

TPC Group, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 13.000% | | | | 12/16/27 | | | | 5,361 | | | $ | 5,420,101 | |

Venator Finance Sarl/Venator Materials LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.750 | | | | 07/15/25(d) | | | | 4,070 | | | | 122,100 | |

Sr. Sec’d. Notes, 144A | | | 9.500 | | | | 07/01/25(d) | | | | 25,261 | | | | 19,703,580 | |

WR Grace Holdings LLC, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.875 | | | | 06/15/27 | | | | 4,615 | | | | 4,306,457 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 102,358,243 | |

| | | | |

Coal 0.1% | | | | | | | | | | | | | | | | |

| | | | |

Conuma Resources Ltd. (Canada), | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 13.125 | | | | 05/01/28 | | | | 6,200 | | | | 5,727,250 | |

| | | | |

Commercial Services 4.3% | | | | | | | | | | | | | | | | |

| | | | |

Adtalem Global Education, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | | 5.500 | | | | 03/01/28 | | | | 4,953 | | | | 4,631,530 | |

Allied Universal Holdco LLC/Allied Universal Finance Corp., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 6.625 | | | | 07/15/26 | | | | 60,146 | | | | 57,256,731 | |

Sr. Unsec’d. Notes, 144A | | | 9.750 | | | | 07/15/27 | | | | 10,774 | | | | 9,895,646 | |

Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 Sarl, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.625 | | | | 06/01/28 | | | | 10,366 | | | | 8,811,100 | |

Sr. Sec’d. Notes, 144A | | | 4.625 | | | | 06/01/28 | | | | 3,625 | | | | 3,045,000 | |

Alta Equipment Group, Inc., | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A(a) | | | 5.625 | | | | 04/15/26 | | | | 19,350 | | | | 17,913,007 | |

AMN Healthcare, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.625 | | | | 10/01/27 | | | | 15,275 | | | | 14,081,265 | |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 4.750 | | | | 04/01/28 | | | | 1,020 | | | | 925,531 | |

Gtd. Notes, 144A(a) | | | 5.750 | | | | 07/15/27 | | | | 6,575 | | | | 6,316,032 | |

Gtd. Notes, 144A | | | 5.750 | | | | 07/15/27 | | | | 13,920 | | | | 13,296,845 | |

Avis Budget Finance PLC, | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.750 | | | | 01/30/26 | | | EUR | 1,825 | | | | 1,940,277 | |

Brink’s Co. (The), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.625 | | | | 10/15/27 | | | | 1,311 | | | | 1,219,703 | |

Herc Holdings, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 5.500 | | | | 07/15/27 | | | | 14,941 | | | | 14,359,136 | |

Hertz Corp. (The), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 4.625 | | | | 12/01/26 | | | | 3,625 | | | | 3,279,118 | |

See Notes to Financial Statements.

PGIM Short Duration High Yield Income Fund 17

Schedule of Investments (continued)

as of August 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Commercial Services (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

MPH Acquisition Holdings LLC, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 5.500% | | | | 09/01/28 | | | | 6,250 | | | $ | 5,317,802 | |

United Rentals North America, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.875 | | | | 01/15/28 | | | | 1,275 | | | | 1,212,594 | |

Verscend Escrow Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 9.750 | | | | 08/15/26 | | | | 36,573 | | | | 36,413,464 | |

VT Topco, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 8.500 | | | | 08/15/30 | | | | 2,175 | | | | 2,205,306 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 202,120,087 | |

| | | | |

Computers 0.8% | | | | | | | | | | | | | | | | |

| | | | |

CA Magnum Holdings (India), | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 5.375 | | | | 10/31/26 | | | | 2,100 | | | | 1,872,024 | |

NCR Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.750 | | | | 09/01/27 | | | | 18,220 | | | | 18,384,006 | |

Tempo Acquisition LLC/Tempo Acquisition Finance Corp., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 5.750 | | | | 06/01/25 | | | | 15,915 | | | | 15,658,755 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 35,914,785 | |

| | | | |

Distribution/Wholesale 0.4% | | | | | | | | | | | | | | | | |

| | | | |

H&E Equipment Services, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 3.875 | | | | 12/15/28 | | | | 18,099 | | | | 15,806,638 | |

Ritchie Bros Holdings, Inc. (Canada), | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 6.750 | | | | 03/15/28 | | | | 1,200 | | | | 1,210,200 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 17,016,838 | |

| | | | |

Diversified Financial Services 3.7% | | | | | | | | | | | | | | | | |

| | | | |

Bread Financial Holdings, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.750 | | | | 12/15/24 | | | | 26,515 | | | | 25,866,750 | |

goeasy Ltd. (Canada), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.375 | | | | 05/01/26 | | | | 950 | | | | 874,532 | |

Gtd. Notes, 144A(a) | | | 5.375 | | | | 12/01/24 | | | | 27,557 | | | | 27,074,753 | |

LD Holdings Group LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 6.125 | | | | 04/01/28 | | | | 13,275 | | | | 8,663,777 | |

LFS Topco LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 5.875 | | | | 10/15/26 | | | | 11,200 | | | | 9,718,625 | |

Macquarie Airfinance Holdings Ltd. (United Kingdom), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 8.375 | | | | 05/01/28 | | | | 1,175 | | | | 1,196,009 | |

See Notes to Financial Statements.

18

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Diversified Financial Services (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

Nationstar Mortgage Holdings, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.500% | | | | 08/15/28 | | | | 9,470 | | | $ | 8,618,037 | |

Gtd. Notes, 144A(a) | | | 6.000 | | | | 01/15/27 | | | | 6,775 | | | | 6,502,284 | |

Navient Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | | 5.875 | | | | 10/25/24 | | | | 500 | | | | 492,508 | |

Sr. Unsec’d. Notes | | | 6.750 | | | | 06/25/25 | | | | 5,150 | | | | 5,126,616 | |

Sr. Unsec’d. Notes, MTN | | | 6.125 | | | | 03/25/24 | | | | 14,883 | | | | 14,825,673 | |

OneMain Finance Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 3.500 | | | | 01/15/27 | | | | 3,400 | | | | 2,959,581 | |

Gtd. Notes | | | 3.875 | | | | 09/15/28 | | | | 2,525 | | | | 2,070,158 | |

Gtd. Notes | | | 6.125 | | | | 03/15/24 | | | | 1,000 | | | | 998,254 | |

Gtd. Notes | | | 6.875 | | | | 03/15/25 | | | | 17,747 | | | | 17,658,265 | |

Gtd. Notes | | | 7.125 | | | | 03/15/26 | | | | 17,838 | | | | 17,587,521 | |

Gtd. Notes | | | 8.250 | | | | 10/01/23 | | | | 4,775 | | | | 4,781,044 | |

PennyMac Financial Services, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.375 | | | | 10/15/25 | | | | 11,575 | | | | 11,196,763 | |

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 2.875 | | | | 10/15/26 | | | | 8,069 | | | | 7,179,996 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 173,391,146 | |

| | | | |

Electric 2.0% | | | | | | | | | | | | | | | | |

| | | | |

Calpine Corp., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.500 | | | | 02/15/28 | | | | 10,660 | | | | 9,873,316 | |

Sr. Sec’d. Notes, 144A(a) | | | 5.250 | | | | 06/01/26 | | | | 7,765 | | | | 7,627,256 | |

Sr. Unsec’d. Notes, 144A | | | 5.125 | | | | 03/15/28 | | | | 17,347 | | | | 15,807,413 | |

NRG Energy, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.750 | | | | 01/15/28 | | | | 13,524 | | | | 12,793,798 | |

Gtd. Notes, 144A | | | 5.250 | | | | 06/15/29 | | | | 10,250 | | | | 9,228,502 | |

Vistra Operations Co. LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.000 | | | | 07/31/27 | | | | 18,241 | | | | 17,173,067 | |

Gtd. Notes, 144A | | | 5.500 | | | | 09/01/26 | | | | 3,617 | | | | 3,487,933 | |

Gtd. Notes, 144A | | | 5.625 | | | | 02/15/27 | | | | 16,133 | | | | 15,524,651 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 91,515,936 | |

| | | | |

Electrical Components & Equipment 0.9% | | | | | | | | | | | | | | | | |

| | | | |

Energizer Holdings, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 6.500 | | | | 12/31/27 | | | | 16,843 | | | | 16,271,820 | |

See Notes to Financial Statements.

PGIM Short Duration High Yield Income Fund 19

Schedule of Investments (continued)

as of August 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Electrical Components & Equipment (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

WESCO Distribution, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 7.125% | | | | 06/15/25 | | | | 23,198 | | | $ | 23,365,161 | |

Gtd. Notes, 144A(a) | | | 7.250 | | | | 06/15/28 | | | | 2,802 | | | | 2,855,784 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 42,492,765 | |

| | | | |

Electronics 0.4% | | | | | | | | | | | | | | | | |

| | | | |

Likewize Corp., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A (original cost $16,666,646;

purchased 10/08/20 - 04/26/22)(f) | | | 9.750 | | | | 10/15/25 | | | | 16,109 | | | | 15,730,775 | |

Sensata Technologies BV, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.000 | | | | 10/01/25 | | | | 3,020 | | | | 2,929,400 | |

Gtd. Notes, 144A(a) | | | 5.625 | | | | 11/01/24 | | | | 1,050 | | | | 1,036,875 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 19,697,050 | |

| | | | |

Engineering & Construction 0.1% | | | | | | | | | | | | | | | | |

| | | | |

AECOM, | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.125 | | | | 03/15/27 | | | | 3,065 | | | | 2,944,303 | |

Brand Industrial Services, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 10.375 | | | | 08/01/30 | | | | 700 | | | | 722,803 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 3,667,106 | |

| | | | |

Entertainment 3.0% | | | | | | | | | | | | | | | | |

| | | | |

AMC Entertainment Holdings, Inc., | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A, Cash coupon 10.000% or PIK 12.000% or Cash coupon 5.000% and PIK 6.000% | | | 10.000 | | | | 06/15/26 | | | | 836 | | | | 579,890 | |

Caesars Entertainment, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 6.250 | | | | 07/01/25 | | | | 42,332 | | | | 42,032,024 | |

Sr. Sec’d. Notes, 144A | | | 7.000 | | | | 02/15/30 | | | | 14,275 | | | | 14,333,390 | |

CCM Merger, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 6.375 | | | | 05/01/26 | | | | 19,144 | | | | 18,575,657 | |

Golden Entertainment, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 7.625 | | | | 04/15/26 | | | | 13,666 | | | | 13,634,230 | |

International Game Technology PLC, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 4.125 | | | | 04/15/26 | | | | 2,700 | | | | 2,554,929 | |

Sr. Sec’d. Notes, 144A | | | 6.250 | | | | 01/15/27 | | | | 8,500 | | | | 8,372,500 | |

Jacobs Entertainment, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 6.750 | | | | 02/15/29 | | | | 4,775 | | | | 4,330,134 | |

Sr. Unsec’d. Notes, 144A | | | 6.750 | | | | 02/15/29 | | | | 5,075 | | | | 4,643,693 | |

See Notes to Financial Statements.

20

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Entertainment (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

Motion Bondco DAC (United Kingdom), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 6.625% | | | | 11/15/27 | | | | 6,350 | | | $ | 5,889,625 | |

Penn Entertainment, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 5.625 | | | | 01/15/27 | | | | 24,783 | | | | 23,514,329 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 138,460,401 | |

| | | | |

Environmental Control 0.0% | | | | | | | | | | | | | | | | |

| | | | |

GFL Environmental, Inc. (Canada), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.000 | | | | 08/01/28 | | | | 1,700 | | | | 1,511,521 | |

| | | | |

Foods 2.2% | | | | | | | | | | | | | | | | |

| | | | |

Albertson’s Cos., Inc./Safeway, Inc./New Albertson’s LP/Albertson’s LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 3.250 | | | | 03/15/26 | | | | 1,423 | | | | 1,324,102 | |

Gtd. Notes, 144A(a) | | | 4.625 | | | | 01/15/27 | | | | 13,775 | | | | 13,028,308 | |

Gtd. Notes, 144A | | | 6.500 | | | | 02/15/28 | | | | 750 | | | | 746,329 | |

B&G Foods, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 5.250 | | | | 04/01/25 | | | | 25,380 | | | | 24,784,320 | |

Gtd. Notes(a) | | | 5.250 | | | | 09/15/27 | | | | 22,026 | | | | 19,505,755 | |

Chobani LLC/Chobani Finance Corp., Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 7.500 | | | | 04/15/25 | | | | 15,986 | | | | 15,971,681 | |

Market Bidco Finco PLC (United Kingdom), | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 5.500 | | | | 11/04/27 | | | GBP | 1,000 | | | | 989,878 | |

Pilgrim’s Pride Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.875 | | | | 09/30/27 | | | | 17,510 | | | | 17,339,708 | |

Post Holdings, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 5.625 | | | | 01/15/28 | | | | 7,501 | | | | 7,194,762 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 100,884,843 | |

| | | | |

Gas 0.6% | | | | | | | | | | | | | | | | |

| | | | |

AmeriGas Partners LP/AmeriGas Finance Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.500 | | | | 05/20/25 | | | | 9,274 | | | | 9,098,830 | |

Sr. Unsec’d. Notes | | | 5.750 | | | | 05/20/27 | | | | 6,929 | | | | 6,409,444 | |

Sr. Unsec’d. Notes | | | 5.875 | | | | 08/20/26 | | | | 11,889 | | | | 11,272,946 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 26,781,220 | |

| | | | |

Healthcare-Services 2.2% | | | | | | | | | | | | | | | | |

| | | | |

HCA, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 7.050 | | | | 12/01/27 | | | | 15,705 | | | | 16,332,188 | |

See Notes to Financial Statements.

PGIM Short Duration High Yield Income Fund 21

Schedule of Investments (continued)

as of August 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Healthcare-Services (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

Legacy LifePoint Health LLC, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | | 4.375% | | | | 02/15/27 | | | | 24,830 | | | $ | 21,483,789 | |

Prime Healthcare Services, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 7.250 | | | | 11/01/25 | | | | 41,378 | | | | 38,826,879 | |

RegionalCare Hospital Partners Holdings, | | | | | | | | | | | | | | | | |

Inc./LifePoint Health, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 9.750 | | | | 12/01/26 | | | | 21,883 | | | | 20,469,578 | |

Tenet Healthcare Corp., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | | 4.625 | | | | 06/15/28 | | | | 5,744 | | | | 5,301,017 | |

Sr. Sec’d. Notes | | | 4.875 | | | | 01/01/26 | | | | 1,731 | | | | 1,678,177 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 104,091,628 | |

| | | | |

Home Builders 4.6% | | | | | | | | | | | | | | | | |

| | | | |

Ashton Woods USA LLC/Ashton Woods Finance Co., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 6.625 | | | | 01/15/28 | | | | 3,260 | | | | 3,118,059 | |

Beazer Homes USA, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.875 | | | | 10/15/27 | | | | 16,812 | | | | 15,860,622 | |

Gtd. Notes(a) | | | 6.750 | | | | 03/15/25 | | | | 12,045 | | | | 12,022,218 | |

Gtd. Notes | | | 7.250 | | | | 10/15/29 | | | | 6,417 | | | | 6,221,683 | |

Brookfield Residential Properties, Inc./Brookfield Residential US LLC (Canada), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 6.250 | | | | 09/15/27 | | | | 31,689 | | | | 29,035,046 | |

Century Communities, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.750 | | | | 06/01/27 | | | | 6,996 | | | | 6,976,837 | |

Empire Communities Corp. (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | | 7.000 | | | | 12/15/25 | | | | 29,712 | | | | 28,709,220 | |

Forestar Group, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 3.850 | | | | 05/15/26 | | | | 18,060 | | | | 16,842,877 | |

Gtd. Notes, 144A | | | 5.000 | | | | 03/01/28 | | | | 3,150 | | | | 2,923,291 | |

M/I Homes, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.950 | | | | 02/01/28 | | | | 8,649 | | | | 8,035,109 | |

Mattamy Group Corp. (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 5.250 | | | | 12/15/27 | | | | 33,644 | | | | 31,499,195 | |

Shea Homes LP/Shea Homes Funding Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 4.750 | | | | 02/15/28 | | | | 6,075 | | | | 5,590,221 | |

STL Holding Co. LLC, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 7.500 | | | | 02/15/26 | | | | 11,259 | | | | 10,538,843 | |

Taylor Morrison Communities, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.750 | | | | 01/15/28 | | | | 2,218 | | | | 2,149,350 | |

Gtd. Notes, 144A | | | 5.875 | | | | 06/15/27 | | | | 6,681 | | | | 6,565,095 | |

See Notes to Financial Statements.

22

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Home Builders (cont’d.) | | | | | | | | | | | | |

| | | | |

Taylor Morrison Communities, Inc./Taylor Morrison Holdings II, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.625% | | 03/01/24 | | | 6,397 | | | $ | 6,365,015 | |

Tri Pointe Homes, Inc., | | | | | | | | | | | | |

Gtd. Notes | | 5.250 | | 06/01/27 | | | 21,693 | | | | 20,712,489 | |

Gtd. Notes | | 5.700 | | 06/15/28 | | | 2,143 | | | | 2,030,991 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 215,196,161 | |

| | | | |

Household Products/Wares 0.1% | | | | | | | | | | | | |

| | | | |

Kronos Acquisition Holdings, Inc./KIK Custom Products, Inc. (Canada), | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 7.000 | | 12/31/27 | | | 4,500 | | | | 3,948,750 | |

Sr. Sec’d. Notes, 144A(a) | | 5.000 | | 12/31/26 | | | 2,736 | | | | 2,537,640 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 6,486,390 | |

| | | | |

Housewares 0.2% | | | | | | | | | | | | |

| | | | |

Scotts Miracle-Gro Co. (The), | | | | | | | | | | | | |

Gtd. Notes | | 4.375 | | 02/01/32 | | | 1,050 | | | | 828,537 | |

Gtd. Notes(a) | | 4.500 | | 10/15/29 | | | 7,975 | | | | 6,655,735 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 7,484,272 | |

| | | | |

Internet 1.8% | | | | | | | | | | | | |

| | | | |

Cablevision Lightpath LLC, | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 3.875 | | 09/15/27 | | | 11,805 | | | | 9,881,829 | |

Cogent Communications Group, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | 3.500 | | 05/01/26 | | | 1,150 | | | | 1,073,534 | |

Gen Digital, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | 5.000 | | 04/15/25 | | | 47,505 | | | | 46,587,853 | |

Go Daddy Operating Co. LLC/GD Finance Co., Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 5.250 | | 12/01/27 | | | 15,010 | | | | 14,367,147 | |

Northwest Fiber LLC/Northwest Fiber Finance Sub, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 4.750 | | 04/30/27 | | | 16,180 | | | | 14,163,371 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 86,073,734 | |

| | | | |

Iron/Steel 0.6% | | | | | | | | | | | | |

| | | | |

ATI, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 7.250 | | 08/15/30 | | | 1,775 | | | | 1,790,667 | |

See Notes to Financial Statements.

PGIM Short Duration High Yield Income Fund 23

Schedule of Investments (continued)

as of August 31, 2023

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Iron/Steel (cont’d.) | | | | | | | | | | | | |

| | | | |

Big River Steel LLC/BRS Finance Corp., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 6.625% | | 01/31/29 | | | 6,361 | | | $ | 6,334,753 | |

Cleveland-Cliffs, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 6.750 | | 04/15/30 | | | 3,750 | | | | 3,572,563 | |

Sr. Sec’d. Notes, 144A(a) | | 6.750 | | 03/15/26 | | | 18,100 | | | | 18,139,011 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 29,836,994 | |

| | | | |

Leisure Time 2.8% | | | | | | | | | | | | |

| | | | |

Carnival Corp., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.750 | | 03/01/27 | | | 10,050 | | | | 9,459,562 | |

Gtd. Notes, 144A | | 7.625 | | 03/01/26 | | | 15,025 | | | | 14,937,404 | |

Sr. Sec’d. Notes, 144A | | 7.000 | | 08/15/29 | | | 1,400 | | | | 1,415,750 | |

Lindblad Expeditions Holdings, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 9.000 | | 05/15/28 | | | 4,375 | | | | 4,487,800 | |

NCL Corp. Ltd., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.875 | | 03/15/26 | | | 21,356 | | | | 20,075,067 | |

Sr. Sec’d. Notes, 144A(a) | | 5.875 | | 02/15/27 | | | 7,575 | | | | 7,316,920 | |

Sr. Sec’d. Notes, 144A | | 8.375 | | 02/01/28 | | | 4,725 | | | | 4,843,125 | |

Royal Caribbean Cruises Ltd., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.250 | | 01/15/30 | | | 2,075 | | | | 2,100,336 | |

Sr. Unsec’d. Notes, 144A(a) | | 5.375 | | 07/15/27 | | | 11,244 | | | | 10,545,073 | |

Sr. Unsec’d. Notes, 144A(a) | | 5.500 | | 04/01/28 | | | 7,875 | | | | 7,358,873 | |

Sr. Unsec’d. Notes, 144A(a) | | 11.625 | | 08/15/27 | | | 26,700 | | | | 29,019,963 | |

Viking Cruises Ltd., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.875 | | 09/15/27 | | | 10,725 | | | | 9,974,250 | |

Gtd. Notes, 144A(a) | | 6.250 | | 05/15/25 | | | 3,000 | | | | 2,943,750 | |

Sr. Unsec’d. Notes, 144A(a) | | 7.000 | | 02/15/29 | | | 5,075 | | | | 4,795,875 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 129,273,748 | |

| | | | |

Lodging 2.7% | | | | | | | | | | | | |

| | | | |

Genting New York LLC/GENNY Capital, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | 3.300 | | 02/15/26 | | | 15,211 | | | | 13,594,228 | |

Las Vegas Sands Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | 2.900 | | 06/25/25 | | | 900 | | | | 849,682 | |

Sr. Unsec’d. Notes(a) | | 3.500 | | 08/18/26 | | | 700 | | | | 648,109 | |

MGM Resorts International, | | | | | | | | | | | | |

Gtd. Notes | | 4.625 | | 09/01/26 | | | 12,877 | | | | 12,130,214 | |

Gtd. Notes(a) | | 4.750 | | 10/15/28 | | | 15,964 | | | | 14,487,792 | |

Gtd. Notes(a) | | 5.500 | | 04/15/27 | | | 17,000 | | | | 16,256,598 | |

Gtd. Notes | | 5.750 | | 06/15/25 | | | 965 | | | | 953,033 | |

Gtd. Notes | | 6.750 | | 05/01/25 | | | 8,821 | | | | 8,835,038 | |

See Notes to Financial Statements.

24

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | |

Lodging (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp., | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 5.875% | | | 05/15/25 | | | | 23,495 | | | $ | 22,699,969 | |

Wynn Macau Ltd. (Macau), | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A(a) | | 5.500 | | | 01/15/26 | | | | 26,232 | | | | 24,530,593 | |

Sr. Unsec’d. Notes, 144A | | 5.500 | | | 10/01/27 | | | | 12,650 | | | | 11,358,878 | |

Sr. Unsec’d. Notes, 144A(a) | | 5.625 | | | 08/26/28 | | | | 2,337 | | | | 2,047,796 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 128,391,930 | |

| | | | |

Machinery-Diversified 1.5% | | | | | | | | | | | | | | |

| | | | |

Maxim Crane Works Holdings Capital LLC, | | | | | | | | | | | | | | |

Sec’d. Notes, 144A | | 10.125 | | | 08/01/24 | | | | 38,660 | | | | 38,730,511 | |

Sec’d. Notes, 144A | | 11.500 | | | 09/01/28 | | | | 8,100 | | | | 8,123,705 | |

TK Elevator US Newco, Inc. (Germany), | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | 5.250 | | | 07/15/27 | | | | 26,957 | | | | 25,154,251 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 72,008,467 | |

| | | | |

Media 9.4% | | | | | | | | | | | | | | |

| | | | |

AMC Networks, Inc., | | | | | | | | | | | | | | |

Gtd. Notes(a) | | 5.000 | | | 04/01/24 | | | | 12,485 | | | | 12,360,498 | |

CCO Holdings LLC/CCO Holdings Capital Corp., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 5.000 | | | 02/01/28 | | | | 25,695 | | | | 23,679,927 | |

Sr. Unsec’d. Notes, 144A(a) | | 5.125 | | | 05/01/27 | | | | 51,404 | | | | 48,333,254 | |

Sr. Unsec’d. Notes, 144A | | 5.500 | | | 05/01/26 | | | | 20,679 | | | | 20,148,126 | |

CSC Holdings LLC, | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.375 | | | 02/01/28 | | | | 21,500 | | | | 17,640,666 | |

Gtd. Notes, 144A(a) | | 5.500 | | | 04/15/27 | | | | 45,376 | | | | 39,167,747 | |

Sr. Unsec’d. Notes, 144A(a) | | 7.500 | | | 04/01/28 | | | | 12,585 | | | | 7,972,875 | |

Diamond Sports Group LLC/Diamond Sports Finance Co., | | | | | | | | | | | | | | |

Sec’d. Notes, 144A (original cost $15,609,994;

purchased 07/18/19 - 07/05/22)(f) | | 5.375 | | | 08/15/26 | (d) | | | 18,919 | | | | 551,854 | |

DISH DBS Corp., | | | | | | | | | | | | | | |

Gtd. Notes(a) | | 5.875 | | | 11/15/24 | | | | 17,902 | | | | 16,660,389 | |

Gtd. Notes | | 7.750 | | | 07/01/26 | | | | 44,200 | | | | 33,026,795 | |

DISH Network Corp., | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 11.750 | | | 11/15/27 | | | | 7,925 | | | | 8,046,755 | |

Gray Television, Inc., | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 5.875 | | | 07/15/26 | | | | 39,512 | | | | 36,033,688 | |

Gtd. Notes, 144A(a) | | 7.000 | | | 05/15/27 | | | | 2,000 | | | | 1,792,732 | |

See Notes to Financial Statements.

PGIM Short Duration High Yield Income Fund 25

Schedule of Investments (continued)

as of August 31, 2023

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | |

Media (cont’d.) | | | | | | | | | | | | | | |

| | | | |

iHeartCommunications, Inc., | | | | | | | | | | | | | | |

Sr. Sec’d. Notes(a) | | 6.375% | | | 05/01/26 | | | | 27,573 | | | $ | 24,056,065 | |

Midcontinent Communications/Midcontinent Finance Corp., | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.375 | | | 08/15/27 | | | | 23,983 | | | | 22,715,463 | |

Nexstar Media, Inc., | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.625 | | | 07/15/27 | | | | 40,350 | | | | 37,934,238 | |

Radiate Holdco LLC/Radiate Finance, Inc., | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | 4.500 | | | 09/15/26 | | | | 24,349 | | | | 18,966,217 | |

Sinclair Television Group, Inc., | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 5.125 | | | 02/15/27 | | | | 12,106 | | | | 9,936,686 | |

Univision Communications, Inc., | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 5.125 | | | 02/15/25 | | | | 39,388 | | | | 38,847,171 | |

Sr. Sec’d. Notes, 144A | | 6.625 | | | 06/01/27 | | | | 12,490 | | | | 12,092,459 | |

Videotron Ltd. (Canada), | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.375 | | | 06/15/24 | | | | 7,288 | | | | 7,244,345 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 437,207,950 | |

| | | | |

Mining 1.9% | | | | | | | | | | | | | | |

| | | | |

Arsenal AIC Parent LLC, | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | 8.000 | | | 10/01/30 | | | | 1,750 | | | | 1,786,770 | |

Constellium SE, | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.875 | | | 02/15/26 | | | | 3,212 | | | | 3,151,518 | |

First Quantum Minerals Ltd. (Zambia), | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 6.875 | | | 03/01/26 | | | | 800 | | | | 781,728 | |

Gtd. Notes, 144A | | 6.875 | | | 10/15/27 | | | | 2,400 | | | | 2,319,192 | |

Gtd. Notes, 144A | | 7.500 | | | 04/01/25 | | | | 16,731 | | | | 16,661,985 | |

Freeport-McMoRan, Inc., | | | | | | | | | | | | | | |

Gtd. Notes | | 4.375 | | | 08/01/28 | | | | 1,820 | | | | 1,690,616 | |

Hecla Mining Co., | | | | | | | | | | | | | | |

Gtd. Notes | | 7.250 | | | 02/15/28 | | | | 3,225 | | | | 3,161,750 | |

Hudbay Minerals, Inc. (Canada), | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 4.500 | | | 04/01/26 | | | | 20,485 | | | | 19,307,113 | |

New Gold, Inc. (Canada), | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.500 | | | 07/15/27 | | | | 6,650 | | | | 6,333,327 | |

Novelis Corp., | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 3.250 | | | 11/15/26 | | | | 25,674 | | | | 23,251,812 | |

Gtd. Notes, 144A(a) | | 4.750 | | | 01/30/30 | | | | 12,094 | | | | 10,823,737 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 89,269,548 | |

See Notes to Financial Statements.

26

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Miscellaneous Manufacturing 0.3% | | | | | | | | | | | | |

| | | | |

Amsted Industries, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.625% | | 07/01/27 | | | 8,461 | | | $ | 8,215,719 | |

Trinity Industries, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.750 | | 07/15/28 | | | 4,400 | | | | 4,489,490 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 12,705,209 | |

| | | | |

Oil & Gas 4.4% | | | | | | | | | | | | |

| | | | |

Aethon United BR LP/Aethon United Finance Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 8.250 | | 02/15/26 | | | 10,000 | | | | 10,047,256 | |

Alta Mesa Holdings LP/Alta Mesa Finance Services Corp., | | | | | | | | | | | | |

Gtd. Notes | | 7.875 | | 12/15/24(d) | | | 10,985 | | | | 1,099 | |

Ascent Resources Utica Holdings LLC/ARU Finance Corp., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.000 | | 11/01/26 | | | 1,750 | | | | 1,739,857 | |

Gtd. Notes, 144A | | 9.000 | | 11/01/27 | | | 7,789 | | | | 9,795,647 | |

Sr. Unsec’d. Notes, 144A | | 8.250 | | 12/31/28 | | | 19,888 | | | | 19,910,355 | |

Athabasca Oil Corp. (Canada), | | | | | | | | | | | | |

Sec’d. Notes, 144A | | 9.750 | | 11/01/26 | | | 18,230 | | | | 18,845,262 | |

Chesapeake Energy Corp., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.500 | | 02/01/26 | | | 2,425 | | | | 2,371,566 | |

CITGO Petroleum Corp., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | 6.375 | | 06/15/26 | | | 14,500 | | | | 14,204,871 | |

Sr. Sec’d. Notes, 144A | | 7.000 | | 06/15/25 | | | 9,285 | | | | 9,196,794 | |

Civitas Resources, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 8.375 | | 07/01/28 | | | 5,850 | | | | 6,024,952 | |

CNX Resources Corp., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.250 | | 03/14/27 | | | 6,675 | | | | 6,667,995 | |

Crescent Energy Finance LLC, | | | | | | | | | | | | |

Gtd. Notes, 144A | | 9.250 | | 02/15/28 | | | 3,675 | | | | 3,757,888 | |

Endeavor Energy Resources LP/EER Finance, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 5.750 | | 01/30/28 | | | 11,468 | | | | 11,221,511 | |

Hilcorp Energy I LP/Hilcorp Finance Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 5.750 | | 02/01/29 | | | 1,200 | | | | 1,123,713 | |

Sr. Unsec’d. Notes, 144A | | 6.250 | | 11/01/28 | | | 1,000 | | | | 961,245 | |

MEG Energy Corp. (Canada), | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 7.125 | | 02/01/27 | | | 10,907 | | | | 11,011,598 | |

Nabors Industries Ltd., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.250 | | 01/15/26 | | | 6,225 | | | | 5,968,219 | |

Nabors Industries, Inc., | | | | | | | | | | | | |

Gtd. Notes | | 5.750 | | 02/01/25 | | | 4,190 | | | | 4,109,993 | |

See Notes to Financial Statements.

PGIM Short Duration High Yield Income Fund 27

Schedule of Investments (continued)

as of August 31, 2023

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | |

Oil & Gas (cont’d.) | | | | | | | | | | | | |

| | | | |

Nabors Industries, Inc., (cont’d.) | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 7.375% | | 05/15/27 | | | 7,625 | | | $ | 7,438,162 | |

Noble Finance II LLC, | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 8.000 | | 04/15/30 | | | 1,325 | | | | 1,369,924 | |

Occidental Petroleum Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 7.150 | | 05/15/28 | | | 2,275 | | | | 2,360,095 | |

Parkland Corp. (Canada), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 5.875 | | 07/15/27 | | | 11,915 | | | | 11,468,188 | |

Precision Drilling Corp. (Canada), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.125 | | 01/15/26 | | | 4,646 | | | | 4,593,175 | |

Preem Holdings AB (Sweden), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 12.000 | | 06/30/27 | | EUR | 10,530 | | | | 12,246,025 | |

SilverBow Resources, Inc., | | | | | | | | | | | | |

Sec’d. Notes, 144A, 3 Month LIBOR + 0.750%^ | | 13.052(c) | | 12/15/28 | | | 6,500 | | | | 6,370,000 | |

Southwestern Energy Co., | | | | | | | | | | | | |

Gtd. Notes | | 5.375 | | 02/01/29 | | | 3,175 | | | | 3,010,036 | |

Gtd. Notes(a) | | 5.375 | | 03/15/30 | | | 5,600 | | | | 5,242,044 | |

Gtd. Notes(a) | | 8.375 | | 09/15/28 | | | 3,284 | | | | 3,410,305 | |

Sunoco LP/Sunoco Finance Corp., | | | | | | | | | | | | |

Gtd. Notes | | 5.875 | | 03/15/28 | | | 865 | | | | 842,187 | |

Gtd. Notes | | 6.000 | | 04/15/27 | | | 6,575 | | | | 6,505,289 | |

Valaris Ltd., | | | | | | | | | | | | |

Sec’d. Notes, 144A | | 8.375 | | 04/30/30 | | | 2,200 | | | | 2,240,810 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 204,056,061 | |

| | | | |

Packaging & Containers 1.7% | | | | | | | | | | | | |

| | | | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 4.125 | | 08/15/26 | | | 4,853 | | | | 4,524,500 | |

Sr. Unsec’d. Notes, 144A(a) | | 5.250 | | 08/15/27 | | | 3,150 | | | | 2,700,558 | |

Graham Packaging Co., Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.125 | | 08/15/28 | | | 11,950 | | | | 10,504,985 | |

Intelligent Packaging Ltd. Finco, Inc./Intelligent Packaging Ltd. Co-Issuer LLC (Canada), | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 6.000 | | 09/15/28 | | | 17,732 | | | | 15,958,800 | |

LABL, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | 5.875 | | 11/01/28 | | | 10,900 | | | | 9,925,663 | |

Sr. Sec’d. Notes, 144A | | 6.750 | | 07/15/26 | | | 7,075 | | | | 6,916,993 | |

Sr. Sec’d. Notes, 144A(a) | | 9.500 | | 11/01/28 | | | 2,075 | | | | 2,139,297 | |

Sr. Unsec’d. Notes, 144A(a) | | 10.500 | | 07/15/27 | | | 5,450 | | | | 5,203,425 | |

See Notes to Financial Statements.

28

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Packaging & Containers (cont’d.) | | | | | | | | | | | | | | | | |

| | | | |

Mauser Packaging Solutions Holding Co., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 7.875 | % | | | 08/15/26 | | | | 4,775 | | | $ | 4,704,544 | |

Owens-Brockway Glass Container, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 6.375 | | | | 08/15/25 | | | | 5,435 | | | | 5,434,863 | |

Pactiv Evergreen Group Issuer LLC/Pactiv Evergreen Group Issuer, Inc., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | | 4.375 | | | | 10/15/28 | | | | 3,205 | | | | 2,859,780 | |

Pactiv Evergreen Group Issuer, Inc./Pactiv Evergreen Group Issuer LLC, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A(a) | | | 4.000 | | | | 10/15/27 | | | | 1,625 | | | | 1,460,468 | |

Sealed Air Corp./Sealed Air Corp. US, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 6.125 | | | | 02/01/28 | | | | 1,275 | | | | 1,255,814 | |

Trident TPI Holdings, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 12.750 | | | | 12/31/28 | | | | 7,675 | | | | 8,002,925 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 81,592,615 | |

| | | | |

Pharmaceuticals 1.6% | | | | | | | | | | | | | | | | |

| | | | |

AdaptHealth LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 6.125 | | | | 08/01/28 | | | | 17,601 | | | | 15,927,400 | |

Bausch Health Americas, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | | 8.500 | | | | 01/31/27 | | | | 38,200 | | | | 21,248,750 | |

Bausch Health Cos., Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 5.000 | | | | 01/30/28 | | | | 4,150 | | | | 1,846,750 | |

Gtd. Notes, 144A | | | 7.000 | | | | 01/15/28 | | | | 3,468 | | | | 1,569,270 | |

Sr. Sec’d. Notes, 144A | | | 4.875 | | | | 06/01/28 | | | | 784 | | | | 464,520 | |