The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund. Funds that invest in bonds can lose their value as interest rates rise, and an investor can lose principal.

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

An expense limitation was in effect for all classes during the periods shown in the Fund performance chart above and in the Performance of a $10,000 Investment chart on page 7. Performance would have been lower had the expense limitation not been in effect. The current expenses for each class are listed on the chart on the next page.

The Fund offers Class A, B, C, R, and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.30% of average daily net assets, but such a fee is currently subject to a contractual cap of 0.25% of average daily net assets through Nov. 30, 2008.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges, as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from

Performance summaries

Delaware Corporate Bond Fund

4.00% to zero depending on the period of time the shares are held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Please see the prospectus for additional information on Class B purchase and sales charges.

Lifetime performance figures for Class B shares reflect conversion to Class A shares after eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Please see the fee table in the prospectus and your financial professional for a more complete explanation of sales charges.

The average annual total returns for the 1-year, 3-year, 5-year, and lifetime (since June 2, 2003) periods ended July 31, 2008, for Delaware Corporate Bond Fund Class R shares were -0.21%, +2.06%, +4.34%, and +3.28%, respectively.

Class R shares were first made available June 2, 2003, and are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets, but such fee is currently subject to a contractual cap of 0.50% of average daily net assets through Nov. 30, 2008.

The average annual total returns for the 1-year, 3-year, 5-year, and lifetime periods ended July 31, 2008, for Delaware Corporate Bond Fund Institutional Class shares were +0.10%, +2.58%, +4.86%, and +6.03%, respectively.

Institutional Class shares were first made available Sept. 15, 1998, and are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The performance table on the previous page and the graph on the next page do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

The Fund may be affected by economic conditions that may hinder a company’s ability to make interest and principal payments on its debt.

High yielding noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds. Adverse conditions may affect the issuer’s ability to pay interest and principal on these securities.

This Fund will be affected primarily by declines in bond prices, which can be caused by an adverse change in interest rates, adverse economic conditions, or poor performance from specific industries or bond issuers.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the table below. Management has contracted to reimburse expenses and/or waive its management fees from Dec. 1, 2007, through Nov. 30, 2008. Please see the most recent prospectus for additional information on the fee waivers.

| Fund expense ratios | | | | | | | | | | | | | | | |

| | | Class A | | | Class B | | | Class C | | | Class R | | | Institutional Class |

| Total annual operating expenses | | | | | | | | | | | | | |

| (without fee waivers) | | 1.06 | % | | 1.76 | % | | 1.76 | % | | 1.36 | % | | 0.76 | % |

| Net expense ratio | | | | | | | | | | | | | | | |

| (including fee waivers, if any)* | | 0.90 | % | | 1.65 | % | | 1.65 | % | | 1.15 | % | | 0.65 | % |

| * | | The applicable fee waivers are discussed in the text on pages 5 and 6. |

6

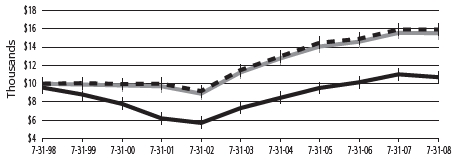

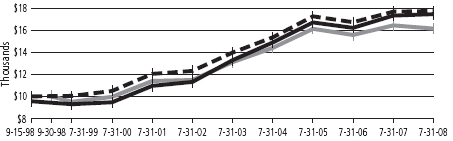

Performance of a $10,000 investment

Average annual total returns from Sept. 15, 1998, through July 31, 2008

| For period beginning Sept. 15, 1998, through July 31, 2008 | | Starting value | | Ending value |

| | Lehman Brothers U.S. Credit Index | | | $10,000 | | | $17,349 |

| | Lehman Brothers U.S. Corporate Investment Grade Index | | | $10,000 | | | $16,875 |

| | Delaware Corporate Bond Fund — Class A Shares | | | $9,550 | | | $16,620 |

The chart assumes $10,000 invested in the Fund on Sept. 15, 1998, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please see pages 5 and 6 for additional details on these fees.

Performance of other Fund classes will vary due to different charges and expenses.

The chart also assumes $10,000 invested in the Lehman Brothers U.S. Corporate Investment Grade Index and Lehman Brothers U.S. Credit Index as of Sept. 15, 1998. The Lehman Brothers U.S. Corporate Investment Grade Index is composed of U.S. dollar–denominated, investment grade, SEC-registered corporate bonds issued by industrial, utility, and financial companies. The Lehman Brothers U.S. Credit Index measures the total return performance of nonconvertible, investment grade domestic corporate bonds and SEC-registered foreign issues. All bonds have at least one year to maturity.

Effective June 1, 2008, the Fund changed its benchmark index from the Lehman Brothers U.S. Credit Index to the Lehman Brothers U.S. Corporate Investment Grade Index. The Fund´s portfolio managers believe that the Fund´s new benchmark is more consistent with how the Fund is managed and better tracks the Fund’s performance.

An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Past performance is not a guarantee of future results.

The chart does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

7

| Performance summaries | |

| Delaware Extended Duration Bond Fund | July 31, 2008 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments. com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Extended Duration Bond Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund. Funds that invest in bonds can lose their value as interest rates rise, and an investor can lose principal.

| Fund performance | | Average annual total returns through July 31, 2008 | |

| | 1 year | | 3 years | | 5 years | | Lifetime | |

| Class A (Est. Sept. 15, 1998) | | | | | | | | | |

| Excluding sales charge | | +0.83% | | +1.51% | | +5.61% | | +6.32% | |

| Including sales charge | | -3.75% | | -0.04% | | +4.65% | | +5.82% | |

| Class B (Est. Sept. 15, 1998) | | | | | | | | | |

| Excluding sales charge | | +0.08% | | +0.75% | | +4.79% | | +5.66% | |

| Including sales charge | | -3.74% | | +0.10% | | +4.56% | | +5.66% | |

| Class C (Est. Sept. 15, 1998) | | | | | | | | | |

| Excluding sales charge | | +0.08% | | +0.81% | | +4.83% | | +5.55% | |

| Including sales charge | | -0.88% | | +0.81% | | +4.83% | | +5.55% | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

An expense limitation was in effect for all classes during the periods shown in the Fund performance chart above and in the Performance of a $10,000 Investment chart on page 10. Performance would have been lower had the expense limitation not been in effect. The current expenses for each class are listed on the chart on the next page.

The Fund offers Class A, B, C, R, and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.30% of average daily net assets, but such a fee is currently subject to a contractual cap of 0.25% of average daily net assets through Nov. 30, 2008.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges, as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of

8

time the shares are held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Please see the prospectus for additional information on Class B purchase and sales charges.

Lifetime performance figures for Class B shares reflect conversion to Class A shares after eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Please see the fee table in the prospectus and your financial professional for a more complete explanation of sales charges.

The average annual total returns for the 1-year and lifetime (since Oct. 1, 2005) periods ended July 31, 2008, for Delaware Extended Duration Bond Fund Class R shares were +0.39% and +1.50%, respectively.

Class R shares were first made available Oct. 1, 2005, and are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets, but such fee is currently subject to a contractual cap of 0.50% of average daily net assets through Nov. 30, 2008.

The average annual total returns for the 1-year, 3-year, 5-year, and lifetime periods ended July 31, 2008, for Delaware Extended Duration Bond Fund Institutional Class shares were +1.09%, +1.76%, +5.85%, and +6.57%, respectively.

Institutional Class shares were first made available Sept. 15, 1998, and are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The performance table on the previous page and the graph on the next page do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

The Fund may be affected by economic conditions which may hinder a company’s ability to make interest and principal payments on its debt.

High yielding noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds. Adverse conditions may affect the issuer’s ability to pay interest and principal on these securities.

This Fund will be affected primarily by declines in bond prices, which can be caused by an adverse change in interest rates, adverse economic conditions, or poor performance from specific industries or bond issuers.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the table below. Management has contracted to reimburse expenses and/or waive its management fees from Dec. 1, 2007, through Nov. 30, 2008. Please see the most recent prospectus for additional information on the fee waivers.

| Fund expense ratios | | | | | | | | | | | | | | | |

| | | Class A | | | Class B | | | Class C | | | Class R | | | Institutional Class |

| Total annual operating expenses | | | | | | | | | | | | | | | |

| (without fee waivers) | | 1.20 | % | | 1.90 | % | | 1.90 | % | | 1.50 | % | | 0.90 | % |

| Net expense ratio | | | | | | | | | | | | | | | |

| (including fee waivers, if any)* | | 0.90 | % | | 1.65 | % | | 1.65 | % | | 1.15 | % | | 0.65 | % |

*The applicable fee waivers are discussed in the text on page 8 and 9. |

9

Performance summaries

Delaware Extended Duration Bond Fund

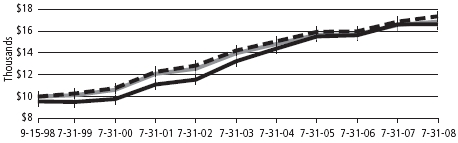

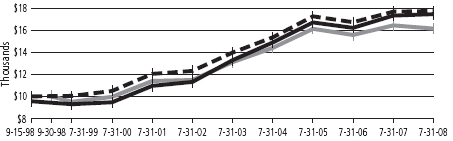

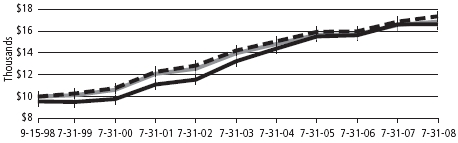

Performance of a $10,000 investment

Average annual total returns from Sept. 15, 1998, through July 31, 2008

| For period beginning Sept. 15, 1998, through July 31, 2008 | | Starting value | | Ending value |

| | Lehman Brothers U.S. Long Credit Index | | | $10,000 | | | $17,745 |

| | Delaware Extended Duration Bond Fund — Class A Shares | | | $9,550 | | | $17,468 |

| | Lehman Brothers Long U.S. Corporate Index | | | $10,000 | | | $16,150 |

The chart assumes $10,000 invested in the Fund on Sept. 15, 1998, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please see pages 8 and 9 for additional details on these fees.

Performance of other Fund classes will vary due to different charges and expenses.

The chart also assumes $10,000 invested in the Lehman Brothers Long U.S. Corporate Index as of Sept. 30, 1998, and the Lehman Brothers U.S. Long Credit Index as of Sept. 15, 1998. The Lehman Brothers Long U.S. Corporate Index is composed of U.S. dollar–denominated, investment grade, SEC-registered corporate bonds issued by industrial, utility, and financial companies. The Lehman Brothers U.S. Long Credit Index measures the total return performance of nonconvertible, investment grade domestic corporate bonds and SEC-registered foreign issues. All bonds have at least 10 years to maturity.

Effective June 1, 2008, the Fund changed its benchmark index from the Lehman Brothers U.S. Long Credit Index to the Lehman Brothers Long U.S. Corporate Index. The Fund´s portfolio managers believe that the Fund´s new benchmark is more consistent with how the Fund is managed and better tracks the Fund’s performance.

An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Past performance is not a guarantee of future results.

The chart does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

10

Disclosure of Fund expenses

For the period February 1, 2008 to July 31, 2008

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period February 1, 2008 to July 31, 2008.

Actual expenses

The first section of the tables shown, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% Return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

12

Delaware Corporate Bond Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | Expenses |

| | Account | | Account Value | | Annualized | | Paid During Period |

| | 2/1/08 | | 7/31/08 | | Expense Ratio | | 2/1/08 to 7/31/08* |

| Actual Fund return | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | $ | 970.10 | | 0.90 | % | | | $ | 4.41 | |

| Class B | | | 1,000.00 | | | 964.70 | | 1.65 | % | | | | 8.06 | |

| Class C | | | 1,000.00 | | | 966.50 | | 1.65 | % | | | | 8.07 | |

| Class R | | | 1,000.00 | | | 968.90 | | 1.15 | % | | | | 5.63 | |

| Institutional Class | | | 1,000.00 | | | 969.50 | | 0.65 | % | | | | 3.18 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | |

| Class A | | $ | 1,000.00 | | $ | 1,020.39 | | 0.90 | % | | | $ | 4.52 | |

| Class B | | | 1,000.00 | | | 1,016.66 | | 1.65 | % | | | | 8.27 | |

| Class C | | | 1,000.00 | | | 1,016.66 | | 1.65 | % | | | | 8.27 | |

| Class R | | | 1,000.00 | | | 1,019.14 | | 1.15 | % | | | | 5.77 | |

| Institutional Class | | | 1,000.00 | | | 1,021.63 | | 0.65 | % | | | | 3.27 | |

Delaware Extended Duration Bond Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | Expenses |

| | Account | | Account Value | | Annualized | | Paid During Period |

| | 2/1/08 | | 7/31/08 | | Expense Ratio | | 2/1/08 to 7/31/08* |

| Actual Fund return | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | $ | 963.00 | | 0.90 | % | | | $ | 4.39 | |

| Class B | | | 1,000.00 | | | 959.30 | | 1.65 | % | | | | 8.04 | |

| Class C | | | 1,000.00 | | | 961.10 | | 1.65 | % | | | | 8.05 | |

| Class R | | | 1,000.00 | | | 961.80 | | 1.15 | % | | | | 5.61 | |

| Institutional Class | | | 1,000.00 | | | 964.20 | | 0.65 | % | | | | 3.17 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | |

| Class A | | $ | 1,000.00 | | $ | 1,020.39 | | 0.90 | % | | | $ | 4.52 | |

| Class B | | | 1,000.00 | | | 1,016.66 | | 1.65 | % | | | | 8.27 | |

| Class C | | | 1,000.00 | | | 1,016.66 | | 1.65 | % | | | | 8.27 | |

| Class R | | | 1,000.00 | | | 1,019.14 | | 1.15 | % | | | | 5.77 | |

| Institutional Class | | | 1,000.00 | | | 1,021.63 | | 0.65 | % | | | | 3.27 | |

*“Expenses Paid During Period” are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period).

13

| Sector allocation and credit quality breakdown |

| Delaware Corporate Bond Fund | As of July 31, 2008 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may also represent the investment manager’s internal sector classifications, which may result in the sector designations for one Fund being different than another Fund’s sector designations.

| Sector | | Percentage of net assets |

| Agency Collateralized Mortgage Obligations | | | 0.20% | |

| Agency Mortgage-Backed Security | | | 0.19% | |

| Collateralized Debt Obligation | | | 0.02% | |

| Commercial Mortgage-Backed Securities | | | 2.80% | |

| Corporate Bonds | | | 82.22% | |

| Banking | | | 11.68% | |

| Basic Industry | | | 6.42% | |

| Brokerage | | | 3.59% | |

| Capital Goods | | | 2.43% | |

| Communications | | | 14.77% | |

| Consumer Cyclical | | | 4.57% | |

| Consumer Non-Cyclical | | | 10.97% | |

| Electric | | | 6.34% | |

| Energy | | | 6.13% | |

| Finance Companies | | | 3.33% | |

| Insurance | | | 6.35% | |

| Natural Gas | | | 2.13% | |

| Real Estate | | | 0.89% | |

| Technology | | | 0.99% | |

| Transportation | | | 1.63% | |

| Municipal Bonds | | | 1.11% | |

| Non-Agency Asset-Backed Securities | | | 2.16% | |

| Non-Agency Collateralized Mortgage Obligations | | | 1.09% | |

| Regional Agency | | | 0.28% | |

| Senior Secured Loans | | | 1.44% | |

| Sovereign Debt | | | 1.90% | |

| Supranational Banks | | | 0.75% | |

| U.S. Treasury Obligations | | | 0.95% | |

| Common Stock | | | 0.00% | |

| Preferred Stock | | | 2.02% | |

| Warrants | | | 0.00% | |

14

| Sector | | Percentage of net assets |

| Repurchase Agreements | | | 0.17 | % | |

| Securities Lending Collateral | | | 3.81 | % | |

| Total Value of Securities | | | 101.11 | % | |

| Obligation to Return Securities Lending Collateral | | | (3.81 | %) | |

| Receivables and Other Assets Net of Liabilities | | | 2.70 | % | |

| Total Net Assets | | | 100.00 | % | |

| | |

| Credit Quality Breakdown (as a % of fixed income investments) | | | | | |

| AAA | | | 12.27 | % | |

| AA | | | 11.01 | % | |

| A | | | 37.60 | % | |

| BBB | | | 31.21 | % | |

| BB | | | 4.93 | % | |

| B | | | 2.96 | % | |

| Not Rated | | | 0.02 | % | |

| Total | | | 100.00 | % | |

15

| Sector allocation and credit quality breakdown |

| Delaware Extended Duration Bond Fund | As of July 31, 2008 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may also represent the investment manager’s internal sector classifications, which may result in the sector designations for one Fund being different than another Fund’s sector designations.

| Sector | | Percentage of net assets |

| Agency Collateralized Mortgage Obligations | | | 1.83 | % | |

| Commercial Mortgage-Backed Securities | | | 2.30 | % | |

| Corporate Bonds | | | 84.10 | % | |

| Banking | | | 11.92 | % | |

| Basic Industry | | | 6.95 | % | |

| Brokerage | | | 3.53 | % | |

| Capital Goods | | | 0.22 | % | |

| Communications | | | 12.64 | % | |

| Consumer Cyclical | | | 6.19 | % | |

| Consumer Non-Cyclical | | | 10.22 | % | |

| Electric | | | 9.18 | % | |

| Energy | | | 7.74 | % | |

| Finance Companies | | | 2.88 | % | |

| Insurance | | | 8.02 | % | |

| Natural Gas | | | 1.85 | % | |

| Real Estate | | | 0.47 | % | |

| Technology | | | 0.75 | % | |

| Transportation | | | 1.54 | % | |

| Municipal Bonds | | | 1.10 | % | |

| Non-Agency Asset-Backed Securities | | | 1.76 | % | |

| Senior Secured Loans | | | 1.61 | % | |

| Sovereign Debt | | | 0.61 | % | |

| Supranational Bank | | | 0.20 | % | |

| U.S. Treasury Obligation | | | 0.65 | % | |

| Preferred Stock | | | 2.19 | % | |

| Warrants | | | 0.00 | % | |

| Securities Lending Collateral | | | 3.04 | % | |

| Total Value of Securities | | | 99.39 | % | |

| Obligation to Return Securities Lending Collateral | | | (3.04 | %) | |

| Receivables and Other Assets Net of Liabilities | | | 3.65 | % | |

| Total Net Assets | | | 100.00 | % | |

16

| Credit Quality Breakdown (as a % of fixed income investments) | | Percentage of net assets |

| AAA | | | 13.40 | % | |

| AA | | | 9.36 | % | |

| A | | | 40.71 | % | |

| BBB | | | 27.43 | % | |

| BB | | | 5.85 | % | |

| B | | | 3.25 | % | |

| Total | | | 100.00 | % | |

17

| Statements of net assets | |

| Delaware Corporate Bond Fund | July 31, 2008 |

| Principal amount° | | Value (U.S. $) |

| Agency Collateralized Mortgage Obligations – 0.20% | | | | | |

| ¥Fannie Mae REMIC | | | | | | |

| Series 2005-67 EY 5.50% 8/25/25 | USD | | 615,000 | | $ | 576,412 |

| ¥GNMA Series 2003-5 B 4.486% 10/16/25 | | 540,000 | | | 539,494 |

| Total Agency Collateralized Mortgage | | | | | | |

| Obligations (cost $1,149,330) | | | | | | 1,115,906 |

| |

| Agency Mortgage-Backed Security – 0.19% | | | | | | |

| ¥Fannie Mae S.F. 30 yr 5.50% 9/1/36 | | | 1,093,047 | | | 1,074,420 |

| Total Agency Mortgage-Backed Security | | | | | | |

| (cost $1,078,189) | | | | | | 1,074,420 |

| |

| @=#Collateralized Debt Obligation – 0.02% | | | | | | |

| Travelers Funding CBO | | | | | | |

| Series 1A A2 144A 6.35% 2/18/14 | | | 116,610 | | | 116,587 |

| Total Collateralized Debt Obligation | | | | | | |

| (cost $119,015) | | | | | | 116,587 |

| |

| Commercial Mortgage-Backed Securities – 2.80% | | | | | |

| ŸBank of America Commercial Mortgage | | | | | | |

| Series 2004-3 A5 5.316% 6/10/39 | | | 1,490,000 | | | 1,477,613 |

| Series 2005-6 AM 5.181% 9/10/47 | | | 675,000 | | | 619,299 |

| Series 2006-3 A4 5.889% 7/10/44 | | | 1,075,000 | | | 1,034,207 |

| Series 2007-3 A4 5.658% 5/10/17 | | | 1,230,000 | | | 1,136,290 |

| #Bear Stearns Commercial Mortgage | | | | | | |

| Securities Series 2004-ESA E 144A | | | | | | |

| 5.064% 5/14/16 | | | 1,105,000 | | | 1,119,627 |

| Ÿ#Credit Suisse First Boston Mortgage | | | | | | |

| Securities Series 2001-SPGA A2 144A | | | | | | |

| 6.515% 8/13/18 | | | 2,395,000 | | | 2,455,606 |

| JPMorgan Chase Commercial | | | | | | |

| Mortgage Securities | | | | | | |

| Series 2002-C2 A2 5.05% 12/12/34 | | | 800,000 | | | 778,595 |

| Series 2006-LDP9 A2 5.134% 5/15/47 | | | 2,400,000 | | | 2,195,981 |

| #Merrill Lynch Mortgage Investors | | | | | | |

| Series 1998-C3 G 144A 6.00% 12/15/30 | | 1,200,000 | | | 691,168 |

| #Merrill Lynch Mortgage Trust | | | | | | |

| Series 2002-MW1 J 144A | | | | | | |

| 5.695% 7/12/34 | | | 325,000 | | | 236,124 |

18

| | | Principal amount° | | Value (U.S. $) |

| Commercial Mortgage-Backed Securities (continued) | | | | | | |

| ŸMorgan Stanley Capital I | | | | | | |

| #Series 1999-FNV1 G 144A 6.12% 3/15/31 | USD | | 510,000 | | $ | 501,772 |

| Series 2007-T27 A4 5.65% 6/11/42 | | | 1,500,000 | | | 1,388,973 |

| #Tower 144A | | | | | | |

| Series 2004-2A A 4.232% 12/15/14 | | | 935,000 | | | 920,732 |

| Series 2006-1 B 5.588% 2/15/36 | | | 510,000 | | | 491,018 |

| Series 2006-1 C 5.707% 2/15/36 | | | 785,000 | | | 733,174 |

| Total Commercial Mortgage-Backed Securities | | | | | | |

| (cost $16,853,082) | | | | | | 15,780,179 |

| |

| Corporate Bonds – 82.22% | | | | | | |

| Banking – 11.68% | | | | | | |

| American Express Centurion Bank | | | | | | |

| 5.55% 10/17/12 | | | 3,155,000 | | | 3,073,393 |

| Bank of America | | | | | | |

| 4.90% 5/1/13 | | | 1,400,000 | | | 1,357,321 |

| 5.65% 5/1/18 | | | 7,205,000 | | | 6,737,806 |

| Bank of New York Mellon 4.50% 4/1/13 | | | 8,660,000 | | | 8,341,709 |

| *BB&T Capital Trust I 5.85% 8/18/35 | | | 4,981,000 | | | 3,619,479 |

| Branch Banking & Trust 5.625% 9/15/16 | | | 2,100,000 | | | 1,880,800 |

| #CoBank ACB 144A 7.875% 4/16/18 | | | 2,060,000 | | | 2,008,974 |

| JPMorgan Chase 6.40% 5/15/38 | | | 1,235,000 | | | 1,141,927 |

| JPMorgan Chase Capital XXV 6.80% 10/1/37 | | | 5,035,000 | | | 4,266,387 |

| Mellon Bank 5.45% 4/1/16 | | | 2,015,000 | | | 1,966,086 |

| #National Australia Bank 144A 5.35% 6/12/13 | | | 5,820,000 | | | 5,820,064 |

| PNC Bank 6.875% 4/1/18 | | | 4,385,000 | | | 4,330,841 |

| @ÕŸPopular North America 3.191% 4/6/09 | | | 845,000 | | | 828,722 |

| @ÕPopular North America Capital Trust I | | | | | | |

| 6.564% 9/15/34 | | | 1,500,000 | | | 973,484 |

| Silicon Valley Bank | | | | | | |

| 5.70% 6/1/12 | | | 2,320,000 | | | 2,140,483 |

| 6.05% 6/1/17 | | | 1,870,000 | | | 1,598,158 |

| Sovereign Bancorp 4.80% 9/1/10 | | | 1,670,000 | | | 1,469,324 |

| U.S. Bank | | | | | | |

| 4.80% 4/15/15 | | | 2,400,000 | | | 2,323,807 |

| 4.95% 10/30/14 | | | 1,520,000 | | | 1,503,294 |

| ŸUSB Capital IX 6.189% 4/15/49 | | | 2,120,000 | | | 1,484,833 |

19

Statements of net assets

Delaware Corporate Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Banking (continued) | | | | | |

| Washington Mutual | | | | | |

| *5.25% 9/15/17 | USD | | 1,215,000 | | $ 766,680 |

| 5.50% 8/24/11 | | | 2,627,000 | | 1,813,789 |

| Wells Fargo 5.625% 12/11/17 | | | 2,250,000 | | 2,148,219 |

| ·Wells Fargo Capital XIII 7.70% 12/29/49 | | | 4,450,000 | | 4,220,288 |

| | | | | | 65,815,868 |

| Basic Industry – 6.42% | | | | | |

| #ArcelorMittal 144A 6.125% 6/1/18 | | | 5,700,000 | | 5,483,645 |

| du Pont (EI) deNemours 6.00% 7/15/18 | | | 7,825,000 | | 7,933,258 |

| *#Evraz Group 144A 9.50% 4/24/18 | | | 1,491,000 | | 1,444,481 |

| Freeport McMoRan Copper & Gold | | | | | |

| 8.25% 4/1/15 | | | 1,375,000 | | 1,435,266 |

| 8.375% 4/1/17 | | | 1,800,000 | | 1,888,407 |

| *Georgia-Pacific 9.50% 12/1/11 | | | 45,000 | | 45,563 |

| #GTL Trade Finance 144A 7.25% 10/20/17 | | | 1,200,000 | | 1,196,950 |

| Lubrizol 4.625% 10/1/09 | | | 3,490,000 | | 3,471,639 |

| #Nine Dragons Paper Holdings 144A | | | | | |

| 7.875% 4/29/13 | | | 1,190,000 | | 1,168,118 |

| #Norske Skogindustrier 144A | | | | | |

| 7.125% 10/15/33 | | | 2,265,000 | | 1,347,675 |

| Rio Tinto Finance USA 6.50% 7/15/18 | | | 5,800,000 | | 5,826,663 |

| #Sappi Papier Holding 144A 6.75% 6/15/12 | | | 2,910,000 | | 2,626,534 |

| #Severstal 144A 9.75% 7/29/13 | | | 1,400,000 | | 1,407,700 |

| #Steel Dynamics 144A 7.75% 4/15/16 | | | 925,000 | | 915,750 |

| | | | | | 36,191,649 |

| Brokerage – 3.59% | | | | | |

| AMVESCAP 4.50% 12/15/09 | | | 1,435,000 | | 1,387,889 |

| Goldman Sachs Group | | | | | |

| 6.15% 4/1/18 | | | 7,514,000 | | 7,251,182 |

| 6.75% 10/1/37 | | | 2,167,000 | | 1,920,941 |

| Jefferies Group 6.45% 6/8/27 | | | 2,705,000 | | 2,097,195 |

| Lazard Group 6.85% 6/15/17 | | | 1,240,000 | | 1,082,451 |

| Lehman Brothers Holdings | | | | | |

| 5.625% 1/24/13 | | | 3,360,000 | | 3,144,211 |

| 6.875% 7/17/37 | | | 4,050,000 | | 3,365,631 |

| | | | | | 20,249,500 |

20

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Capital Goods – 2.43% | | | | | |

| *NXP BV Funding 9.50% 10/15/15 | USD | | 1,620,000 | | $ 1,125,900 |

| Textron 6.50% 6/1/12 | | | 3,085,000 | | 3,244,963 |

| Tyco Electronics Group | | | | | |

| 5.95% 1/15/14 | | | 6,205,000 | | 6,159,890 |

| 6.55% 10/1/17 | | | 3,180,000 | | 3,148,232 |

| | | | | | 13,678,985 |

| Communications – 14.77% | | | | | |

| AT&T 6.40% 5/15/38 | | | 3,260,000 | | 3,113,548 |

| AT&T Wireless 8.125% 5/1/12 | | | 7,750,000 | | 8,510,873 |

| #Charter Communications Operating 144A | | | | | |

| 10.875% 9/15/14 | | | 895,000 | | 935,275 |

| Comcast | | | | | |

| 5.875% 2/15/18 | | | 4,285,000 | | 4,133,350 |

| 6.30% 11/15/17 | | | 3,250,000 | | 3,232,505 |

| #DirecTV Holdings 144A 7.625% 5/15/16 | | | 1,200,000 | | 1,197,000 |

| France Telecom 7.75% 3/1/11 | | | 7,315,000 | | 7,794,872 |

| WInmarsat Finance 10.375% 11/15/12 | | | 1,550,000 | | 1,565,500 |

| Nortel Networks | | | | | |

| ·7.041% 7/15/11 | | | 720,000 | | 682,200 |

| *10.75% 7/15/16 | | | 620,000 | | 610,700 |

| Qwest 7.50% 10/1/14 | | | 1,490,000 | | 1,374,525 |

| Rogers Communications 7.50% 8/15/38 | | | 5,345,000 | | 5,382,468 |

| Sprint Capital 8.375% 3/15/12 | | | 1,550,000 | | 1,524,041 |

| Telecom Italia Capital | | | | | |

| 4.00% 1/15/10 | | | 2,325,000 | | 2,290,867 |

| 7.721% 6/4/38 | | | 3,430,000 | | 3,386,123 |

| Telefonica Emisiones 5.984% 6/20/11 | | | 1,450,000 | | 1,468,396 |

| Thomson Reuters | | | | | |

| 5.95% 7/15/13 | | | 3,010,000 | | 3,044,744 |

| *6.50% 7/15/18 | | | 4,045,000 | | 4,057,709 |

| Time Warner Cable 7.30% 7/1/38 | | | 2,900,000 | | 2,908,149 |

| Verizon Communications 5.55% 2/15/16 | | | 14,115,000 | 13,746,091 |

| Viacom | | | | | |

| ·3.126% 6/16/09 | | | 1,025,000 | | 1,018,376 |

| 5.75% 4/30/11 | | | 975,000 | | 966,462 |

| *#Vimpelcom 144A 9.125% 4/30/18 | | | 2,450,000 | | 2,399,996 |

| #Vivendi 144A 6.625% 4/4/18 | | | 4,360,000 | | 4,259,131 |

21

Statements of net assets

Delaware Corporate Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Communications (continued) | | | | | |

| Vodafone Group | | | | | |

| 5.375% 1/30/15 | USD | | 1,795,000 | | $ 1,730,209 |

| *5.625% 2/27/17 | | | 2,000,000 | | 1,923,628 |

| | | | | | 83,256,738 |

| Consumer Cyclical – 4.57% | | | | | |

| CVS Caremark | | | | | |

| 4.875% 9/15/14 | | | 1,519,000 | | 1,461,442 |

| 5.75% 6/1/17 | | | 4,341,000 | | 4,251,098 |

| ·DaimlerChrysler North America | | | | | |

| 3.234% 8/3/09 | | | 1,810,000 | | 1,796,041 |

| Disney (Walt) 7.55% 7/15/93 | | | 1,565,000 | | 1,737,416 |

| #Galaxy Entertainment Finance 144A | | | | | |

| 9.875% 12/15/12 | | | 800,000 | | 776,000 |

| General Motors | | | | | |

| 6.85% 10/15/08 | | | 2,170,000 | | 2,137,450 |

| *8.375% 7/15/33 | | | 635,000 | | 315,913 |

| GMAC 6.875% 8/28/12 | | | 1,795,000 | | 1,127,425 |

| John Deere Capital 4.95% 12/17/12 | | | 2,800,000 | | 2,816,447 |

| Johnson Controls 5.25% 1/15/11 | | | 3,000,000 | | 3,040,530 |

| Lear 8.75% 12/1/16 | | | 790,000 | | 628,050 |

| *Neiman Marcus Group 10.375% 10/15/15 | | | 690,000 | | 679,650 |

| *Tenneco 8.625% 11/15/14 | | | 450,000 | | 380,250 |

| VF 5.95% 11/1/17 | | | 2,054,000 | | 2,024,433 |

| Wal-Mart Stores 5.25% 9/1/35 | | | 3,000,000 | | 2,570,679 |

| | | | | | 25,742,824 |

| Consumer Non-Cyclical – 10.97% | | | | | |

| #AmBev International Finance 144A | | | | | |

| 9.50% 7/24/17 | BRL | | 3,200,000 | | 1,677,428 |

| Amgen 5.85% 6/1/17 | USD | | 3,785,000 | | 3,796,268 |

| AstraZeneca 5.90% 9/15/17 | | | 1,980,000 | | 2,039,459 |

| Covidien International Finance | | | | | |

| 5.45% 10/15/12 | | | 1,020,000 | | 1,016,216 |

| 6.00% 10/15/17 | | | 5,711,000 | | 5,723,993 |

| Delhaize America 9.00% 4/15/31 | | | 1,971,000 | | 2,270,424 |

| Diageo Capital 5.75% 10/23/17 | | | 5,385,000 | | 5,266,309 |

| #Dr Pepper Snapple Group 144A | | | | | |

| 6.82% 5/1/18 | | | 6,235,000 | | 6,280,360 |

| GlaxoSmithKline Capital 5.65% 5/15/18 | | | 6,200,000 | | 6,210,906 |

22

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Consumer Non-Cyclical (continued) | | | | | |

| HCA 9.25% 11/15/16 | USD | | 895,000 | | $ 924,088 |

| Kellogg 5.125% 12/3/12 | | | 1,523,000 | | 1,541,143 |

| Kraft Foods 6.125% 2/1/18 | | | 2,714,000 | | 2,656,789 |

| Kroger 6.75% 4/15/12 | | | 5,542,000 | | 5,806,437 |

| Quest Diagnostics 5.45% 11/1/15 | | | 4,644,000 | | 4,427,543 |

| Schering-Plough | | | | | |

| 5.55% 12/1/13 | | | 1,000,000 | | 1,006,866 |

| 6.00% 9/15/17 | | | 1,950,000 | | 1,928,872 |

| #Seminole Indian Tribe of Florida 144A | | | | | |

| 7.804% 10/1/20 | | | 1,000,000 | | 966,660 |

| Wyeth 5.50% 2/1/14 | | | 8,185,000 | | 8,291,019 |

| | | | | | 61,830,780 |

| Electric – 6.34% | | | | | |

| Baltimore Gas & Electric 6.125% 7/1/13 | | | 1,750,000 | | 1,774,015 |

| Columbus Southern Power 6.05% 5/1/18 | | | 3,710,000 | | 3,694,496 |

| Commonwealth Edison 6.15% 9/15/17 | | | 1,069,000 | | 1,068,472 |

| Connecticut Light & Power 5.65% 5/1/18 | | | 2,050,000 | | 2,020,275 |

| Detroit Edison 5.60% 6/15/18 | | | 2,075,000 | | 2,053,806 |

| Dominion Resources 6.40% 6/15/18 | | | 3,600,000 | | 3,663,864 |

| Florida Power 6.40% 6/15/38 | | | 3,685,000 | | 3,718,548 |

| Illinois Power 6.125% 11/15/17 | | | 2,454,000 | | 2,340,110 |

| #Ipalco Enterprises 144A 7.25% 4/1/16 | | | 300,000 | | 302,250 |

| #Korea Southern Power 144A 5.375% 4/18/13 | | 630,000 | | 617,084 |

| NRG Energy 7.375% 2/1/16 | | | 670,000 | | 651,575 |

| Pacific Gas & Electric 4.80% 3/1/14 | | | 2,600,000 | | 2,531,043 |

| PECO Energy 5.35% 3/1/18 | | | 4,170,000 | | 4,088,534 |

| #Power Contract Financing 144A | | | | | |

| 6.256% 2/1/10 | | | 991,883 | | 1,004,099 |

| @#Power Receivables Finance 144A | | | | | |

| 6.29% 1/1/12 | | | 124,058 | | 127,092 |

| #TAQA Abu Dhabi National Energy 144A | | | | | |

| 7.25% 8/1/18 | | | 560,000 | | 570,296 |

| #Texas Competitive Electric Holdings 144A | | | | | |

| 10.25% 11/1/15 | | | 1,145,000 | | 1,150,725 |

| *Union Electric 6.70% 2/1/19 | | | 1,480,000 | | 1,495,966 |

| Virginia Electric Power 5.95% 9/15/17 | | | 1,500,000 | | 1,512,896 |

| #West Penn Power 144A 5.95% 12/15/17 | | | 1,340,000 | | 1,329,844 |

| | | | | | 35,714,990 |

23

Statements of net assets

Delaware Corporate Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Energy – 6.13% | | | | | |

| Dynegy Holdings 7.75% 6/1/19 | USD | | 575,000 | | $ 531,875 |

| #Enbridge Energy Partners 144A | | | | | |

| 6.50% 4/15/18 | | | 6,380,000 | | 6,353,868 |

| 7.50% 4/15/38 | | | 2,280,000 | | 2,348,489 |

| #MarkWest Energy Partners 144A | | | | | |

| 8.75% 4/15/18 | | | 1,215,000 | | 1,215,000 |

| Petro-Canada 6.05% 5/15/18 | | | 5,135,000 | | 5,046,878 |

| #Plains All American Pipeline 144A | | | | | |

| 6.50% 5/1/18 | | | 4,395,000 | | 4,352,254 |

| #Ras Laffan Liquefied Natural Gas III 144A | | | | | |

| 5.832% 9/30/16 | | | 1,630,000 | | 1,591,299 |

| SEACOR SMIT Holdings 7.20% 9/15/09 | | | 2,115,000 | | 2,164,882 |

| Sibneft 10.75% 1/15/09 | | | 500,000 | | 512,500 |

| Suncor Energy 6.10% 6/1/18 | | | 2,795,000 | | 2,803,715 |

| #Transcontinental Gas Pipeline 144A | | | | | |

| 6.05% 6/15/18 | | | 2,935,000 | | 2,894,644 |

| Weatherford International | | | | | |

| 6.00% 3/15/18 | | | 3,685,000 | | 3,643,772 |

| 6.35% 6/15/17 | | | 1,060,000 | | 1,073,855 |

| | | | | | 34,533,031 |

| Finance Companies – 3.33% | | | | | |

| American Express 7.00% 3/19/18 | | | 1,600,000 | | 1,593,979 |

| Capmark Financial Group 6.30% 5/10/17 | | | 2,938,000 | | 1,727,714 |

| General Electric Capital 5.875% 1/14/38 | | | 1,355,000 | | 1,220,833 |

| ·#ILFC E-Capital Trust II 144A 6.25% 12/21/65 | | 2,335,000 | | 1,916,442 |

| International Lease Finance | | | | | |

| 5.35% 3/1/12 | | | 2,775,000 | | 2,419,670 |

| 5.875% 5/1/13 | | | 1,800,000 | | 1,532,630 |

| 6.375% 3/25/13 | | | 3,830,000 | | 3,314,033 |

| #Mantis Reef 144A 4.799% 11/3/09 | | | 2,140,000 | | 2,096,571 |

| #Nuveen Investments 144A 10.50% 11/15/15 | | 720,000 | | 651,600 |

| ·#Xstrata Finance 144A 3.035% 11/13/09 | | | 2,345,000 | | 2,293,619 |

| | | | | | 18,767,091 |

| Insurance – 6.35% | | | | | |

| *·#American International Group 144A | | | | | |

| 8.175% 5/15/58 | | | 1,647,000 | | 1,479,382 |

| #Berkshire Hathaway Finance 144A | | | | | |

| 5.40% 5/15/18 | | | 2,795,000 | | 2,753,360 |

24

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Insurance (continued) | | | | | |

| ·Hartford Financial Services Group | | | | | |

| 8.125% 6/15/38 | USD | | 6,540,000 | | $ 6,290,774 |

| @#Max USA Holdings 144A 7.20% 4/14/17 | | | 2,082,000 | | 2,110,494 |

| ·#MetLife Capital Trust X 144A 9.25% 4/8/38 | | | 5,400,000 | | 5,492,027 |

| @ÕMontpelier Re Holdings 6.125% 8/15/13 | | | 1,035,000 | | 1,012,733 |

| @·w#Stingray Pass Through Trust 144A | | | | | |

| 5.902% 1/12/15 | | | 2,300,000 | | 345,000 |

| @·w#Twin Reefs Pass Through Trust 144A | | | | | |

| 3.459% 12/31/49 | | | 3,100,000 | | 313,875 |

| UnitedHealth Group | | | | | |

| 5.50% 11/15/12 | | | 2,102,000 | | 2,066,138 |

| 5.80% 3/15/36 | | | 3,145,000 | | 2,490,308 |

| Unitrin 6.00% 5/15/17 | | | 3,774,000 | | 3,133,960 |

| WellPoint | | | | | |

| 5.00% 1/15/11 | | | 3,730,000 | | 3,692,148 |

| 5.00% 12/15/14 | | | 3,088,000 | | 2,879,279 |

| ·#White Mountains Re Group 144A | | | | | |

| 7.506% 5/29/49 | | | 2,220,000 | | 1,695,811 |

| | | | | | 35,755,289 |

| Natural Gas – 2.13% | | | | | |

| *CenterPoint Energy Resources | | | | | |

| 6.125% 11/1/17 | | | 3,043,000 | | 2,969,232 |

| Enterprise Products Operating | | | | | |

| 6.50% 1/31/19 | | | 2,286,000 | | 2,302,370 |

| *·8.375% 8/1/66 | | | 1,510,000 | | 1,477,399 |

| *Kinder Morgan Energy Partners | | | | | |

| 6.95% 1/15/38 | | | 4,020,000 | | 3,977,533 |

| Valero Energy 6.125% 6/15/17 | | | 1,332,000 | | 1,281,525 |

| | | | | | 12,008,059 |

| Real Estate – 0.89% | | | | | |

| iStar Financial | | | | | |

| 5.15% 3/1/12 | | | 900,000 | | 652,993 |

| 5.875% 3/15/16 | | | 1,274,000 | | 854,761 |

| Regency Centers 5.875% 6/15/17 | | | 2,569,000 | | 2,370,719 |

| ·#USB Realty 144A 6.091% 12/22/49 | | | 1,800,000 | | 1,170,902 |

| | | | | | 5,049,375 |

25

Statements of net assets

Delaware Corporate Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Technology – 0.99% | | | | | |

| Oracle 5.75% 4/15/18 | USD | | 3,880,000 | | $ 3,878,157 |

| Sungard Data Systems | | | | | |

| 9.125% 8/15/13 | | | 550,000 | | 565,125 |

| 10.25% 8/15/15 | | | 214,000 | | 218,280 |

| Xerox 5.50% 5/15/12 | | | 955,000 | | 939,039 |

| | | | | | 5,600,601 |

| Transportation – 1.63% | | | | | |

| Burlington North Santa Fe | | | | | |

| 5.65% 5/1/17 | | | 1,802,000 | | 1,752,845 |

| 5.75% 3/15/18 | | | 4,401,000 | | 4,303,937 |

| #DP World 144A 6.85% 7/2/37 | | | 1,490,000 | | 1,252,796 |

| Norfolk Southern 5.75% 4/1/18 | | | 1,800,000 | | 1,761,858 |

| =wUnited Air Lines 1992 Pass Through Trust | | | | | |

| 8.70% 10/7/08 | | | 374,608 | | 112,382 |

| | | | | | 9,183,818 |

| Total Corporate Bonds (cost $484,889,538) | | | | | 463,378,598 |

| |

| Municipal Bonds – 1.11% | | | | | |

| Massachusetts Bay Transportation Authority | | | | | |

| 5.00% 7/1/19 | | | 395,000 | | 426,019 |

| North Texas Tollway Authority Refunding | | | | | |

| (First Tier) Series A | | | | | |

| 5.50% 1/1/18 | | | 315,000 | | 335,711 |

| 6.00% 1/1/19 | | | 160,000 | | 174,782 |

| 6.00% 1/1/20 | | | 790,000 | | 853,650 |

| University of Texas Financing Authority | | | | | |

| Refunding Series A 5.25% 8/15/18 | | | 395,000 | | 437,245 |

| West Virginia Economic Development | | | | | |

| Authority Excess Lottery Revenue | | | | | |

| 5.37% 7/1/20 (MBIA) | | | 290,000 | | 274,375 |

| West Virginia Tobacco Settlement | | | | | |

| Finance Authority Asset-Backed | | | | | |

| Series A 7.467% 6/1/47 | | | 4,190,000 | | 3,728,724 |

| Total Municipal Bonds (cost $6,695,853) | | | | | 6,230,506 |

26

| | | | Principal amount° | | Value (U.S. $) |

| Non-Agency Asset-Backed Securities – 2.16% | | | | | |

| Capital One Multi-Asset Execution Trust | | | | | |

| Series 2007-A7 A7 5.75% 7/15/20 | USD | | 1,275,000 | | $ 1,214,161 |

| Caterpillar Financial Asset Trust | | | | | |

| Series 2007-A A3A 5.34% 6/25/12 | | | 480,000 | | 487,610 |

| Series 2008-A A3 4.94% 4/25/14 | | | 720,000 | | 723,709 |

| Citibank Credit Card Issuance Trust | | | | | |

| Series 2007-A3 A3 6.15% 6/15/39 | | | 3,155,000 | | 3,060,778 |

| CNH Equipment Trust Series 2008-A A3 | | | | | |

| 4.12% 5/15/12 | | | 445,000 | | 445,123 |

| Discover Card Master Trust Execution Note | | | | |

| Series 2007-A1 A1 5.65% 3/16/20 | | | 2,180,000 | | 2,034,326 |

| #Dunkin Securitization Series 2006-1 A2 | | | | | |

| 144A 5.779% 6/20/31 | | | 425,000 | | 346,153 |

| Hyundai Auto Receivables Trust | | | | | |

| Series 2007-A A3A 5.04% 1/17/12 | | | 480,000 | | 489,277 |

| @·#MASTR Specialized Loan Trust | | | | | |

| Series 2005-2 A2 144A 5.006% 7/25/35 | | 425,454 | | 376,527 |

| Mid-State Trust | | | | | |

| Series 11 A1 4.864% 7/15/38 | | | 191,074 | | 173,835 |

| Series 2004-1 A 6.005% 8/15/37 | | | 227,381 | | 221,986 |

| Series 2005-1 A 5.745% 1/15/40 | | | 265,954 | | 241,271 |

| RSB Bondco Series 2007-A A2 5.72% 4/1/18 | | 1,085,000 | | 1,095,147 |

| @ÕStructured Asset Securities | | | | | |

| Series 2001-SB1 A2 3.375% 8/25/31 | | | 535,144 | | 440,395 |

| World Omni Auto Receivables Trust | | | | | |

| Series 2008-A A3A 3.94% 10/15/2012 | | | 800,000 | | 799,311 |

| Total Non-Agency Asset-Backed Securities | | | | |

| (cost $12,649,969) | | | | | 12,149,609 |

| |

| Non-Agency Collateralized Mortgage Obligations – 1.09% | | |

| Countrywide Alternative Loan Trust | | | | | |

| Series 2006-2CB A3 5.50% 3/25/36 | | | 837,395 | | 780,727 |

| @Õ·First Horizon Alternative Mortgage Securities | | | | |

| Series 2006-FA2 B1 5.978% 5/25/36 | | | 1,913,884 | | 427,530 |

| @Õ·MASTR Adjustable Rate Mortgages Trust | | | | | |

| Series 2005-1 B1 5.565% 3/25/35 | | | 1,562,214 | | 1,066,677 |

27

Statements of net assets

Delaware Corporate Bond Fund

| | | Principal amount° | | Value (U.S. $) |

| Non-Agency Collateralized Mortgage Obligations (continued) | | |

| ·Wells Fargo Mortgage-Backed Securities Trust | | | | |

| Series 2006-AR6 7A1 5.111% 3/25/36 | USD | 3,053,232 | | $ 2,581,617 |

| Series 2006-AR12 1A2 6.025% 9/25/36 | | 787,646 | | 662,271 |

| Series 2006-AR14 2A4 6.085% 10/25/36 | | 899,040 | | 645,206 |

| Total Non-Agency Collateralized Mortgage | | | | |

| Obligations (cost $8,926,596) | | | | 6,164,028 |

| |

| Regional Agency – 0.28% | | | | |

| Australia | | | | |

| Queensland Treasury 6.00% 10/14/15 | AUD | 1,756,000 | | 1,580,614 |

| Total Regional Agency (cost $1,327,363) | | | | 1,580,614 |

| |

| «Senior Secured Loans – 1.44% | | | | |

| Bausch & Lomb | | | | |

| Parent Term Loan 6.051% 4/11/15 | USD | 1,110,884 | | 1,082,489 |

| Term DD 6.051% 4/11/15 | | 279,116 | | 271,982 |

| Ford Motor Term B 5.46% 11/29/13 | | 1,605,177 | | 1,269,655 |

| Lyondell Chemical Term U2 7.00% 12/30/15 | | 1,310,212 | | 1,094,027 |

| MetroPCS Wireless Term B 5.096% 2/20/14 | | 1,587,879 | | 1,516,433 |

| PTS Acquisition Term B 5.051% 4/10/14 | | 1,587,970 | | 1,399,398 |

| Texas Competitive Electric Holdings Term B2 | | | | |

| 6.199% 10/10/14 | | 1,595,980 | | 1,503,142 |

| Total Senior Secured Loans (cost $8,723,483) | | | | 8,137,126 |

| |

| Sovereign Debt – 1.90%D | | | | |

| Argentina – 0.09% | | | | |

| Republic of Argentina 8.28% 12/31/33 | | 629,998 | | 489,823 |

| | | | | 489,823 |

| Germany – 0.82% | | | | |

| Bundesobligation 4.25% 10/12/12 | EUR | 2,954,700 | | 4,601,237 |

| | | | | 4,601,237 |

| Indonesia – 0.29% | | | | |

| Republic of Indonesia | | | | |

| 8.50% 10/12/35 | USD | 310,000 | | 330,850 |

| 11.00% 12/15/12 | IDR | 11,748,000,000 | | 1,272,679 |

| | | | | 1,603,529 |

28

| | | | Principal amount° | | Value (U.S. $) |

| Sovereign Debt (continued) | | | | | |

| Mexico – 0.10% | | | | | |

| Mexican Bonos 8.00% 12/17/15 | MXN | | 6,109,000 | | $ 578,727 |

| | | | | | 578,727 |

| Philippines – 0.08% | | | | | |

| *Philippines Government 6.375% 1/15/32 | USD | | 490,000 | | 475,913 |

| | | | | | 475,913 |

| United Kingdom – 0.52% | | | | | |

| U.K. Treasury 8.00% 9/27/13 | GBP | | 1,296,000 | | 2,938,778 |

| | | | | | 2,938,778 |

| Total Sovereign Debt (cost $10,667,219) | | | | | 10,688,007 |

| |

| Supranational Banks – 0.75% | | | | | |

| European Investment Bank | | | | | |

| 11.25% 2/14/13 | BRL | | 1,600,000 | | 1,012,737 |

| Inter-American Development Bank | | | | | |

| 5.75% 6/15/11 | AUD | | 1,574,000 | | 1,433,449 |

| International Bank for Reconstruction & | | | | | |

| Development 7.50% 7/30/14 | NZD | | 2,390,000 | | 1,811,043 |

| Total Supranational Banks (cost $4,113,903) | | | | | 4,257,229 |

| |

| U.S. Treasury Obligation – 0.95% | | | | | |

| *U.S. Treasury Notes 3.875% 5/15/18 | USD | | 5,380,000 | | 5,335,448 |

| Total U.S. Treasury Obligation (cost $5,291,123) | | | | 5,335,448 |

| |

| | | | Number of shares | | |

| Common Stock – 0.00% | | | | | |

| *Masco | | | 281 | | 4,633 |

| *†UAL | | | 50 | | 416 |

| Total Common Stock (cost $2,229) | | | | | 5,049 |

| |

| ·Preferred Stock – 2.02% | | | | | |

| Bank of America 8.00% | | | 2,455,000 | | 2,268,368 |

| JPMorgan Chase 7.90% | | | 5,555,000 | | 5,153,573 |

| PNC Fiinancial Services Group 8.25% | | | 4,100,000 | | 3,956,500 |

| Total Preferred Stock (cost $12,007,314) | | | | | 11,378,441 |

29

Statements of net assets

Delaware Corporate Bond Fund

| | | | Number of shares | | Value (U.S. $) | |

| Warrants – 0.00% | | | | | | |

| †#Solutia144A, exercise price $7.59, | | | | | | |

| expiration date 7/15/09 | | | 1,590 | | $ 0 | |

| Total Warrant (cost $135,295) | | | | | 0 | |

| | |

| | | | Principal amount° | | |

| Repurchase Agreements** – 0.17% | | | | | | |

| Bank of America 2.04%, dated 7/31/08, | | | | | | |

| to be repurchased on 8/1/08, repurchase | | | | | |

| price $275,047 (collateralized by | | | | | | |

| U.S. Government obligations, | | | | | | |

| 4.00% 9/30/09; with market | | | | | | |

| value $280,909) | USD | | 275,000 | | 275,000 | |

| | |

| BNP Paribas 2.06%, dated 7/31/08, | | | | | | |

| to be repurchased on 8/1/08, repurchase | | | | | |

| price $694,119 (collateralized by U.S. | | | | | | |

| Government obligations, 4.00%; | | | | | | |

| 7/30/09 - 9/30/09; with market | | | | | | |

| value $708,744) | | | 694,000 | | 694,000 | |

| Total Repurchase Agreements (cost $969,000) | | | | 969,000 | |

| | |

| Total Value of Securities Before Securities | | | | | | |

| Lending Collateral – 97.30% (cost $575,598,501) | | | | 548,360,747 | |

| | |

| | | | Number of shares | | | |

| Securities Lending Collateral*** – 3.81% | | | | | | |

| Investment Companies | | | | | | |

| Mellon GSL DBT II Collateral Fund | | | 21,451,942 | | 21,451,942 | |

| Total Securities Lending Collateral (cost $21,451,942) | | | | 21,451,942 | |

| | |

| Total Value of Securities – 101.11% | | | | | | |

| (cost $597,050,443) | | | | 569,812,689 | © |

| Obligation to Return Securities | | | | | | |

| Lending Collateral*** – (3.81%) | | | | | (21,451,942 | ) |

| Receivables Net of Liabilities and | | | | | | |

| Other Assets – 2.70% | | | | | 15,204,462 | |

30

| |

| Net Assets Applicable to 107,595,835 | | |

| Shares Outstanding – 100.00% | $563,565,209 | |

| Net Asset Value – Delaware Corporate Bond Fund | | |

| Class A ($268,658,954 / 51,284,346 Shares) | | $5.24 | |

| Net Asset Value – Delaware Corporate Bond Fund | | |

| Class B ($15,524,910 / 2,965,737 Shares) | | $5.23 | |

| Net Asset Value – Delaware Corporate Bond Fund | | |

| Class C ($62,211,064 / 11,871,670 Shares) | | $5.24 | |

| Net Asset Value – Delaware Corporate Bond Fund | | |

| Class R ($11,972,858 / 2,284,357 Shares) | | $5.24 | |

| Net Asset Value – Delaware Corporate Bond Fund | | |

| Institutional Class ($205,197,423 / 39,189,725 Shares) | | $5.24 | |

| | |

| Components of Net Assets at July 31, 2008: | | |

| Shares of beneficial interest | | |

| (unlimited authorization - no par) | $612,027,121 | |

| Distribution in excess of net investment income | (2,034,617 | ) |

| Accumulated net realized loss on investments | (20,399,706 | ) |

| Net unrealized depreciation of investments | | |

| and foreign currencies | (26,027,589 | ) |

| Total net assets | $563,565,209 | |

° Principal amount shown is stated in the currency in which each security is denominated.

AUD – Australian Dollar

BRL – Brazilian Real

EUR – European Monetary Unit

GBP – British Pound Sterling

JPY– Japanese Yen

IDR – Indonesia Rupiah

MXN – Mexican Peso

NOK – Norwegian Kroner

NZD – New Zealand Dollar

RUB – Russian Ruble

USD – United States Dollar

31

Statements of net assets

Delaware Corporate Bond Fund

| | |

| ¥ | Fully or partially pledged as collateral for financial futures contracts. |

| |

| · | Variable rate security. The rate shown is the rate as of July 31, 2008. |

| |

| W | Step coupon bond. Indicates security that has a zero coupon that remains in effect until a predetermined date at which time the stated interest rate becomes effective. |

| |

| = | Security is being fair valued in accordance with the Fund’s fair valuation policy. At July 31, 2008, the aggregate amount of fair valued securities was $228,969, which represented 0.04% of the Fund’s net assets. See Note 1 in “Notes to financial statements.” |

| |

| @ | Illiquid security. At July 31, 2008, the aggregate amount of illiquid securities was $8,139,116 which represented 1.44% of the Fund’s net assets. See Note 13 in “Notes to financial statements.” |

| |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At July 31, 2008, the aggregate amount of Rule 144A securities was $97,329,052 which represented 17.27% of the Fund’s net assets. See Note 13 in “Notes to financial statements.” |

| |

| w | Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes. |

| |

| † | Non income producing security. |

| |

| « | Senior Secured Loans generally pay interest at rates which are periodically redetermined by reference to a base lending rate plus a premium. These base lending rates are generally: (i) the prime rate offered by one or more United States banks, (ii) the lending rate offered by one or more European banks such as the London Inter-Bank Offered Rate (LIBOR), and (iii) the certificate of deposit rate. Senior Secured Loans may be subject to restrictions on resale. |

| |

| D | Securities have been classified by country of origin. |

| |

| * | Fully or partially on loan. |

| |

| ** | See Note 1 in “Notes to financial statements.” |

| |

| *** | See Note 12 in “Notes to financial statements.” |

| |

| © | Includes $21,137,446 of securities loaned. |

32

| | |

| Õ | Restricted Security. These investments are in securities not registered under the Securities Act of 1933, as amended, and have certain restrictions on resale which may limit their liquidity. At July 31, 2008, the aggregate amount of the restricted securities was $4,749,541 or 0.84% of the Fund’s net assets. Further details on these holdings appear below and in Note 13 in “Notes to financial statements.” |

| | Date of | | | | |

| Investment | | Acquisition | | Cost | | Value |

| First Horizon Alternative Mortgage Securities | | | | | |

| Series 2006-FA2 B1 5.978% 5/25/36 | 8/2/06 | | $ 1,860,281 | | $ 427,530 |

| MASTR Adjustable Rate Mortgages Trust | | | | | |

| Series 2005-1 B1 5.565% 3/25/35 | 11/28/06 | | 1,548,117 | | 1,066,677 |

| Montpelier Re Holdings 6.125% 8/15/13 | 11/9/05 | | 979,119 | | 1,012,733 |

| Popular North America 3.191% 4/6/09 | 4/3/06 | | 845,000 | | 828,722 |

| Popular North America Capital Trust I 6.564% 9/15/34 | 9/19/04 | | 1,549,083 | | 973,484 |

| Structured Asset Securities Series 2001-SB1 A2 | | | | | |

| 3.375% 8/25/31 | 12/7/04 | | 504,707 | | 440,395 |

| Total | | | | | $ 4,749,541 |

Summary of Abbreviations:

CBO — Collateralized Bond Obligation

CDS — Credit Default Swap

GNMA — Government National Mortgage Association

MASTR — Mortgage Asset Securitization Transactions, Inc.

MBIA — Insured by the Municipal Bond Insurance Association

RSB — Rate Stabilization Bond

REMIC — Real Estate Mortgage Investment Conduit

yr — year

| Net Asset Value and Offering Price Per Share – | |

| Delaware Corporate Bond Fund | |

| Net asset value Class A (A) | $5.24 |

| Sales charge (4.50% of offering price) (B) | 0.25 |

| Offering price | $5.49 |

| (A) | | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. |

| |

| (B) | | See the current prospectus for purchases of $100,000 or more. |

33

Statements of net assets

Delaware Corporate Bond Fund

The following foreign currency exchange contracts, financial futures contracts, and swap contracts were outstanding at July 31, 2008:

Foreign Currency Exchange Contracts1

| | | | | | | | | | | Unrealized |

| Contracts to | | | | | | | | Appreciation |

| Receive (Deliver) | | | In Exchange For | | Settlement Date | | (Depreciation) |

| AUD | (2,349,147 | ) | | USD | 2,271,460 | | | 9/30/08 | | | $77,978 | |

| EUR | (2,952,049 | ) | | USD | 4,613,786 | | | 9/30/08 | | | 25,225 | |

| GBP | (1,371,635 | ) | | USD | 2,730,924 | | | 9/30/08 | | | 25,120 | |

| JPY | 554,509,834 | | | USD | (5,193,523 | ) | | 8/29/08 | | | (45,002 | ) |

| MXN | 274,800 | | | USD | (26,782 | ) | | 9/30/08 | | | 337 | |

| NOK | 3,624,717 | | | USD | (702,192 | ) | | 9/30/08 | | | 751 | |

| RUB | 18,603,144 | | | USD | (800,221 | ) | | 8/29/08 | | | (7,276 | ) |

| | | | | | | | | | | | $77,133 | |

Financial Futures Contracts2

| | | | | | | | | | | Unrealized |

| | | Notional Cost | | | | | | | Appreciation |

| Contracts to Buy (Sell) | | | (Proceeds) | | Notional Value | | Expiration Date | | (Depreciation) |

| 15 Long Gilt Bond | | $ 3,153,947 | | | $ 3,191,974 | | | 9/30/08 | | $ 38,027 | |

| 100 U.S. Treasury 5 yr Notes | | 11,092,421 | | | 11,133,594 | | | 9/30/08 | | 41,173 | |

| (363) U.S. Treasury 10 yr Notes | | (41,874,807 | ) | | (41,682,609 | ) | | 9/30/08 | | 192,198 | |

| 305 U.S. Treasury Long Bond | | 35,718,902 | | | 35,227,500 | | | 9/30/08 | | (491,402 | ) |

| | | | | | | | | | | $(220,004 | ) |

34

| |

| Swap Contracts3 |

| Credit Default Swap Contracts |

| | | | | Annual | | | | Unrealized |

| Swap Counterparty & | | | | Protection | | | | Appreciation |

| Referenced Obligation | | | Notional Value | | Payments | | Termination Date | | (Depreciation) |

| Protection Purchased: | | | | | | | | | |

| Citigroup Global Markets | | | | | | | | | |

| CenturyTel 5 yr CDS | | $1,615,000 | | 1.71% | | 9/20/13 | | $ (5,281 | ) |

| Goldman Sachs | | | | | | | | | |

| Kraft Foods 10 yr CDS | | 2,600,000 | | 0.77% | | 12/20/17 | | 26,445 | |

| JPMorgan Chase Bank | | | | | | | | | |

| Embarq 7 yr CDS | | 2,125,000 | | 0.77% | | 9/20/14 | | 185,814 | |

| Lehman Brothers | | | | | | | | | |

| Gannett 6 yr CDS | | 400,000 | | 3.15% | | 9/20/14 | | (115 | ) |

| Gannett 7 yr CDS | | 1,430,000 | | 0.88% | | 9/20/14 | | 153,942 | |

| Home Depot 5 yr CDS | | 2,114,500 | | 0.50% | | 9/20/12 | | 64,455 | |

| New York Times 7 yr CDS | | 1,430,000 | | 0.75% | | 9/20/14 | | 190,882 | |

| Sara Lee 7 yr CDS | | 1,430,000 | | 0.60% | | 9/20/14 | | 7,119 | |

| Target 5 yr CDS | | 1,970,000 | | 0.57% | | 12/20/12 | | 3,556 | |

| Washington Mutual | | | | | | | | | |

| 4 yr CDS | | 2,071,000 | | 0.85% | | 9/20/11 | | 515,285 | |

| 10 yr CDS | | 1,190,000 | | 3.15% | | 12/20/17 | | 252,469 | |

| | | | | | | | | $1,394,571 | |

| Protection Sold: | | | | | | | | | |

| Citigroup Global Markets | | | | | | | | | |

| Plains American CDS | | $1,395,000 | | 1.33% | | 9/20/13 | | $ 6,690 | |

| Total | | | | | | | | $1,401,261 | |

The use of foreign currency exchange contracts, financial futures contracts and swap contracts involves elements of market risk and risks in excess of the amounts recognized in the financial statements. The notional values presented above represent the Fund’s total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) is reflected in the Fund’s net assets.

1See Note 8 in “Notes to financial statements.”

2See Note 9 in “Notes to financial statements.”

3See Note 11 in “Notes to financial statements.”

See accompanying notes

35

| Statements of net assets | |

| Delaware Extended Duration Bond Fund | July 31, 2008 |

| | | | Principal amount° | | Value (U.S. $) |

| Agency Collateralized Mortgage Obligations – 1.83% | | | | |

| Freddie Mac Reference REMIC | | | | | |

| Series R002 ZA 5.50% 6/15/35 | USD | | 660,211 | | $ 590,417 |

| ¥Series R008 ZA 6.00% 7/15/36 | | | 3,082,782 | | 2,852,801 |

| Freddie Mac REMIC | | | | | |

| Series 3344 ME 5.50% 7/15/37 | | | 665,000 | | 628,973 |

| Total Agency Collateralized Mortgage | | | | | |

| Obligations (cost $4,166,118) | | | | | 4,072,191 |

| |

| Commercial Mortgage-Backed Securities – 2.30% | | | | |

| ·Bank of America Commercial Mortgage | | | | | |

| Series 2004-3 A5 5.316% 6/10/39 | | | 665,000 | | 659,472 |

| Series 2005-6 AM 5.181% 9/10/47 | | | 315,000 | | 289,006 |

| Series 2007-3 A4 5.658% 6/10/49 | | | 545,000 | | 503,478 |

| Bear Stearns Commercial Mortgage Securities | | | | |

| #Series 2004-ESA E 144A 5.064% 5/14/16 | | 260,000 | | 263,442 |

| ·Series 2007-T28 A4 5.742% 9/11/42 | | | 740,000 | | 682,893 |

| ·#Credit Suisse First Boston Mortgage Securities | | | | |

| Series 2001-SPGA A2 144A 6.515% 8/13/18 | | 610,000 | | 625,436 |

| JPMorgan Chase Commercial Mortgage Securities | | | | |

| Series 2006-LDP9 A2 5.134% 5/15/47 | | | 750,000 | | 686,244 |

| #Merrill Lynch Mortgage Investors | | | | | |

| Series 1998-C3 G 144A 6.00% 12/15/30 | | | 500,000 | | 287,987 |

| Merrill Lynch Mortgage Trust | | | | | |

| #Series 2002-MW1 J 144A 5.695% 7/12/34 | | 110,000 | | 79,919 |

| Series 2005-CIP1 A2 4.96% 7/12/38 | | | 50,000 | | 49,707 |

| ·Morgan Stanley Capital I | | | | | |

| #Series 1999-FNV1 G 144A 6.12% 3/15/31 | | 155,000 | | 152,499 |

| Series 2007-T27 A4 5.65% 6/11/42 | | | 715,000 | | 662,077 |

| #Tower Series 2004-2A A 144A | | | | | |

| 4.232% 12/15/14 | | | 195,000 | | 192,024 |

| Total Commercial Mortgage-Backed | | | | | |

| Securities (cost $5,540,553) | | | | | 5,134,184 |

| |

| Corporate Bonds – 84.10% | | | | | |

| Banking – 11.92% | | | | | |

| Bank of America | | | | | |

| 5.65% 5/1/18 | | | 3,105,000 | | 2,903,662 |

| BB&T Capital Trust I 5.85% 8/18/35 | | | 1,300,000 | | 944,654 |

36

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Banking (continued) | | | | | |

| BB&T Capital Trust II 6.75% 6/7/36 | USD | | 2,903,000 | | $ 2,355,724 |

| #CoBank ACB 144A 7.875% 4/16/18 | | | 935,000 | | 911,840 |

| JPMorgan Chase 6.40% 5/15/38 | | | 550,000 | | 508,550 |

| JPMorgan Chase Capital XXV 6.80% 10/1/37 | | | 3,855,000 | | 3,266,519 |

| Mellon Bank 5.45% 4/1/16 | | | 1,695,000 | | 1,653,854 |

| *PNC Bank 6.875% 4/1/18 | | | 4,065,000 | | 4,014,794 |

| Õ@Popular North America Capital Trust I | | | | | |

| 6.564% 9/15/34 | | | 708,000 | | 459,484 |

| Silicon Valley Bank | | | | | |

| 5.70% 6/1/12 | | | 1,150,000 | | 1,061,015 |

| 6.05% 6/1/17 | | | 805,000 | | 687,977 |

| ·USB Capital IX 6.189% 4/15/49 | | | 2,925,000 | | 2,048,650 |

| Washington Mutual 5.25% 9/15/17 | | | 530,000 | | 334,436 |

| Wells Fargo 5.625% 12/11/17 | | | 3,350,000 | | 3,198,459 |

| ·Wells Fargo Capital XIII 7.70% 12/29/49 | | | 2,335,000 | | 2,214,465 |

| | | | | | 26,564,083 |

| Basic Industry – 6.95% | | | | | |

| #ArcelorMittal 144A 6.125% 6/1/18 | | | 3,650,000 | | 3,511,457 |

| du Pont (EI) deNemours 6.00% 7/15/18 | | | 3,085,000 | | 3,127,681 |

| *#Evraz Group 144A 9.50% 4/24/18 | | | 667,000 | | 646,190 |

| Freeport McMoRan Copper & Gold | | | | | |

| 8.25% 4/1/15 | | | 625,000 | | 652,394 |

| 8.375% 4/1/17 | | | 800,000 | | 839,292 |

| Georgia-Pacific 9.50% 12/1/11 | | | 250,000 | | 253,125 |

| #GTL Trade Finance 144A 7.25% 10/20/17 | | | 540,000 | | 538,627 |

| #Nine Dragons Paper Holdings 144A | | | | | |

| 7.875% 4/29/13 | | | 530,000 | | 520,254 |

| #Norske Skogindustrier 144A 7.125% 10/15/33 | | | 1,055,000 | | 627,725 |

| Rio Tinto Finance USA 6.50% 7/15/18 | | | 2,600,000 | | 2,611,952 |

| #Sappi Papier Holding 144A 6.75% 6/15/12 | | | 1,320,000 | | 1,191,417 |

| #Severstal 144A 9.75% 7/29/13 | | | 553,000 | | 556,042 |

| #Steel Dynamics 144A 7.75% 4/15/16 | | | 420,000 | | 415,800 |

| | | | | | 15,491,956 |

| Brokerage – 3.53% | | | | | |

| Goldman Sachs Group | | | | | |

| 6.15% 4/1/18 | | | 1,540,000 | | 1,486,135 |

| 6.75% 10/1/37 | | | 3,284,000 | | 2,911,109 |

| Jefferies Group 6.45% 6/8/27 | | | 1,185,000 | | 918,734 |

37

Statements of net assets

Delaware Extended Duration Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Brokerage (continued) | | | | | |

| Lazard Group 6.85% 6/15/17 | USD | | 565,000 | | $ 493,213 |

| Lehman Brothers Holdings | | | | | |

| 6.50% 7/19/17 | | | 580,000 | | 524,381 |

| 6.875% 7/17/37 | | | 1,865,000 | | 1,549,853 |

| | | | | | 7,883,425 |

| Capital Goods – 0.22% | | | | | |

| *NXP BV Funding 9.50% 10/15/15 | | | 715,000 | | 496,925 |

| | | | | | 496,925 |

| Communications – 12.64% | | | | | |

| AT&T 6.40% 5/15/38 | | | 5,000,000 | | 4,775,379 |

| #Charter Communications Operating 144A | | | | | |

| 10.875% 9/15/14 | | | 405,000 | | 423,225 |

| Comcast | | | | | |

| 6.40% 5/15/38 | | | 1,815,000 | | 1,655,930 |

| 6.95% 8/15/37 | | | 1,767,000 | | 1,707,010 |

| #DirecTV Holdings 144A 7.625% 5/15/16 | | | 525,000 | | 523,688 |

| WInmarsat Finance 10.375% 11/15/12 | | | 700,000 | | 707,000 |

| News America 6.40% 12/15/35 | | | 850,000 | | 789,960 |

| Nortel Networks | | | | | |

| ·7.041% 7/15/11 | | | 320,000 | | 303,200 |

| 10.75% 7/15/16 | | | 290,000 | | 285,650 |

| Qwest 7.50% 10/1/14 | | | 625,000 | | 576,563 |

| Rogers Communications 7.50% 8/15/38 | | | 2,085,000 | | 2,099,616 |

| Sprint Capital 8.375% 3/15/12 | | | 675,000 | | 663,695 |

| Telecom Italia Capital 7.721% 6/4/38 | | | 2,970,000 | | 2,932,008 |

| Thomson Reuters 6.50% 7/15/18 | | | 1,765,000 | | 1,770,546 |

| Time Warner Cable 7.30% 7/1/38 | | | 1,310,000 | | 1,313,681 |

| Verizon Communications | | | | | |

| 5.55% 2/15/16 | | | 1,000,000 | | 973,864 |

| 6.90% 4/15/38 | | | 1,400,000 | | 1,392,625 |

| #Vimpelcom 144A 9.125% 4/30/18 | | | 1,120,000 | | 1,097,141 |

| #Vivendi 144A 6.625% 4/4/18 | | | 3,970,000 | | 3,878,154 |

| Windstream 8.125% 8/1/13 | | | 305,000 | | 309,575 |

| | | | | | 28,178,510 |

| Consumer Cyclical – 6.19% | | | | | |

| CVS Caremark | | | | | |

| 5.75% 6/1/17 | | | 1,000,000 | | 979,290 |

| 6.25% 6/1/27 | | | 1,800,000 | | 1,740,915 |

| Disney (Walt) 7.55% 7/15/93 | | | 1,920,000 | | 2,131,526 |

38

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Consumer Cyclical (continued) | | | | | |

| #Galaxy Entertainment Finance 144A | | | | | |

| 9.875% 12/15/12 | USD | | 325,000 | | $ 315,250 |

| General Motors | | | | | |

| 6.85% 10/15/08 | | | 945,000 | | 930,825 |

| *8.375% 7/15/33 | | | 290,000 | | 144,275 |

| GMAC 6.875% 8/28/12 | | | 805,000 | | 505,614 |

| Johnson Controls 6.00% 1/15/36 | | | 1,355,000 | | 1,192,886 |

| Lear 8.75% 12/1/16 | | | 300,000 | | 238,500 |

| McDonald’s 6.30% 3/1/38 | | | 2,400,000 | | 2,366,602 |

| *Neiman Marcus Group 10.375% 10/15/15 | | | 310,000 | | 305,350 |

| Tenneco 8.625% 11/15/14 | | | 200,000 | | 169,000 |

| VF 5.95% 11/1/17 | | | 925,000 | | 911,685 |

| Wal-Mart Stores 5.25% 9/1/35 | | | 2,175,000 | | 1,863,742 |

| | | | | | 13,795,460 |

| Consumer Non-Cyclical – 10.22% | | | | | |

| #AmBev International Finance 144A | | | | | |

| 9.50% 7/24/17 | BRL | | 1,500,000 | | 786,294 |

| AstraZeneca 6.45% 9/15/37 | USD | | 3,300,000 | | 3,387,265 |

| Covidien International Finance 6.55% 10/15/37 | | | 3,687,000 | | 3,592,550 |

| Delhaize America 9.00% 4/15/31 | | | 780,000 | | 898,494 |

| Diageo Capital 5.75% 10/23/17 | | | 1,410,000 | | 1,378,922 |

| #Dr Pepper Snapple Group 144A 6.82% 5/1/18 | | | 2,990,000 | | 3,011,752 |

| GlaxoSmithKline Capital 6.375% 5/15/38 | | | 3,230,000 | | 3,225,300 |

| HCA 9.25% 11/15/16 | | | 405,000 | | 418,163 |

| Kimberly-Clark 6.625% 8/1/37 | | | 1,250,000 | | 1,297,824 |

| Schering-Plough 6.55% 9/15/37 | | | 2,750,000 | | 2,619,364 |

| #Seminole Indian Tribe of Florida 144A | | | | | |

| 7.804% 10/1/20 | | | 425,000 | | 410,831 |

| Wyeth 5.95% 4/1/37 | | | 1,855,000 | | 1,760,955 |

| | | | | | 22,787,714 |

| Electric – 9.18% | | | | | |

| Columbus Southern Power 6.05% 5/1/18 | | | 3,260,000 | | 3,246,376 |

| Connecticut Light & Power | | | | | |

| 5.65% 5/1/18 | | | 915,000 | | 901,733 |

| 6.35% 6/1/36 | | | 2,320,000 | | 2,237,422 |

| Detroit Edison 5.60% 6/15/18 | | | 1,500,000 | | 1,484,679 |

| Dominion Resources 6.40% 6/15/18 | | | 1,595,000 | | 1,623,295 |

| Florida Power 6.40% 6/15/38 | | | 3,245,000 | | 3,274,541 |

| Illinois Power 6.125% 11/15/17 | | | 1,000,000 | | 953,590 |

39

Statements of net assets

Delaware Extended Duration Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Electric (continued) | | | | | |

| #Ipalco Enterprises 144A 7.25% 4/1/16 | USD | | 135,000 | | $ 136,013 |

| NRG Energy 7.375% 2/1/16 | | | 280,000 | | 272,300 |

| PacifiCorp 5.75% 4/1/37 | | | 3,250,000 | | 2,953,776 |

| PECO Energy 5.35% 3/1/18 | | | 1,920,000 | | 1,882,491 |

| PSI Energy 8.85% 1/15/22 | | | 230,000 | | 277,811 |

| #TAQA Abu Dhabi National Energy 144A | | | | | |

| 7.25% 8/1/18 | | | 221,000 | | 225,063 |

| #Texas Competitive Electric Holdings 144A | | | | | |

| 10.25% 11/1/15 | | | 500,000 | | 502,500 |

| #West Penn Power 144A 5.95% 12/15/17 | | | 490,000 | | 486,286 |

| | | | | | 20,457,876 |

| Energy – 7.74% | | | | | |

| CenterPoint Energy Resources 6.00% 5/15/18 | | 1,300,000 | | 1,239,263 |

| ConocoPhillips 5.90% 5/15/38 | | | 890,000 | | 870,960 |

| Dynegy Holdings 7.75% 6/1/19 | | | 230,000 | | 212,750 |

| #Enbridge Energy Partners 144A 7.50% 4/15/38 | | 2,215,000 | | 2,281,536 |

| #MarkWest Energy Partners 144A 8.75% 4/15/18 | | 555,000 | | 555,000 |

| Nexen 6.40% 5/15/37 | | | 2,515,000 | | 2,337,327 |

| Petro-Canada 5.35% 7/15/33 | | | 2,465,000 | | 2,017,884 |

| Plains All American Pipeline 6.65% 1/15/37 | | | 1,120,000 | | 1,025,099 |

| SEACOR SMIT Holdings 7.20% 9/15/09 | | | 240,000 | | 245,660 |

| Suncor Energy | | | | | |

| 6.50% 6/15/38 | | | 815,000 | | 783,737 |

| 6.85% 6/1/39 | | | 1,425,000 | | 1,450,472 |

| #Transcontinental Gas Pipeline 144A | | | | | |

| 6.05% 6/15/18 | | | 1,305,000 | | 1,287,056 |

| Weatherford International | | | | | |

| 6.00% 3/15/18 | | | 740,000 | | 731,721 |

| 6.80% 6/15/37 | | | 1,820,000 | | 1,823,231 |

| 7.00% 3/15/38 | | | 400,000 | | 402,211 |

| | | | | | 17,263,907 |

| Finance Companies – 2.88% | | | | | |

| Capmark Financial Group 6.30% 5/10/17 | | | 435,000 | | 255,805 |

| FTI Consulting 7.75% 10/1/16 | | | 270,000 | | 277,425 |

| General Electric Capital 6.75% 3/15/32 | | | 4,000,000 | | 4,025,536 |

| ·#ILFC E-Capital Trust II 144A 6.25% 12/21/65 | | 1,045,000 | | 857,680 |

| International Lease Finance 6.625% 11/15/13 | | 800,000 | | 717,048 |

| #Nuveen Investments 144A 10.50% 11/15/15 | | 315,000 | | 285,075 |

| | | | | | 6,418,569 |

40

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | |

| Insurance – 8.02% | | | | | |

| ·#American International Group 144A | | | | | |

| 8.175% 5/15/58 | USD | | 730,000 | | $ 655,706 |

| #Berkshire Hathaway Finance 144A | | | | | |

| 5.40% 5/15/18 | | | 3,835,000 | | 3,777,865 |

| ·Hartford Financial Services Group | | | | | |

| 8.125% 6/15/38 | | | 2,890,000 | | 2,779,868 |

| @#Max USA Holdings 144A 7.20% 4/14/17 | | | 870,000 | | 881,907 |

| ·#MetLife Capital Trust X 144A 9.25% 4/8/38 | | | 2,600,000 | | 2,644,309 |

| #Mutual of Omaha Insurance 144A | | | | | |

| 6.80% 6/15/36 | | | 1,290,000 | | 1,173,107 |

| Prudential Financial 6.625% 12/1/37 | | | 1,495,000 | | 1,392,986 |

| @w#Stingray Pass Through Trust 144A | | | | | |

| 5.902% 1/12/15 | | | 1,200,000 | | 180,000 |

| UnitedHealth Group 5.80% 3/15/36 | | | 1,800,000 | | 1,425,296 |

| Unitrin 6.00% 5/15/17 | | | 1,725,000 | | 1,432,454 |

| WellPoint 5.85% 1/15/36 | | | 845,000 | | 693,323 |

| ·#White Mountains Re Group 144A | | | | | |

| 7.506% 5/29/49 | | | 1,105,000 | | 844,086 |

| | | | | | 17,880,907 |

| Natural Gas – 1.85% | | | | | |