UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

| | | | |

Commission File Number | | Exact Name of Registrant as Specified in its Charter,

State or Other Jurisdiction of Incorporation, Address of Principal Executive Offices, Zip Code and Telephone Number (Including Area Code) | | I.R.S. Employer

Identification Number |

| | |

| 001-31403 | | PEPCO HOLDINGS, INC. (Pepco Holdings or PHI), a Delaware corporation 701 Ninth Street, N.W. Washington, D.C. 20068 Telephone: (202)872-2000 | | 52-2297449 |

| | |

| 001-01072 | | POTOMAC ELECTRIC POWER COMPANY (Pepco), a District of Columbia and Virginia corporation 701 Ninth Street, N.W. Washington, D.C. 20068 Telephone: (202)872-2000 | | 53-0127880 |

| | |

| 001-01405 | | DELMARVA POWER & LIGHT COMPANY (DPL), a Delaware and Virginia corporation 500 North Wakefield Drive, 2nd Floor Newark, DE 19702 Telephone: (202)872-2000 | | 51-0084283 |

| | |

| 001-03559 | | ATLANTIC CITY ELECTRIC COMPANY (ACE), a New Jersey corporation 500 North Wakefield Drive, 2nd Floor Newark, DE 19702 Telephone: (202)872-2000 | | 21-0398280 |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Registrant | | Title of Each Class | | Name of Each Exchange on Which Registered |

Pepco Holdings | | Common Stock, $.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

| | | | |

Registrant | | Title of Each Class | | |

Pepco | | Common Stock, $.01 par value | | |

DPL | | Common Stock, $2.25 par value | | |

ACE | | Common Stock, $3.00 par value | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| | | | | | | | |

Pepco Holdings | | Yes x No ¨ | | | | Pepco | | Yes ¨ No x |

DPL | | Yes ¨ No x | | | | ACE | | Yes ¨ No x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| | | | | | | | |

Pepco Holdings | | Yes ¨ No x | | | | Pepco | | Yes ¨ No x |

DPL | | Yes ¨ No x | | | | ACE | | Yes ¨ No x |

Indicate by check mark whether each registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

| | | | | | | | |

Pepco Holdings | | Yes x No ¨ | | | | Pepco | | Yes x No ¨ |

DPL | | Yes x No ¨ | | | | ACE | | Yes x No ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| | | | | | | | |

Pepco Holdings | | Yes x No ¨ | | | | Pepco | | Yes x No ¨ |

DPL | | Yes x No ¨ | | | | ACE | | Yes x No ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K (applicable to Pepco Holdings only). x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

| | | Large Accelerated Filer | | Accelerated

Filer | | Non-

Accelerated

Filer | | Smaller

Reporting

Company |

| | | | |

Pepco Holdings | | x | | ¨ | | ¨ | | ¨ |

| | | | |

Pepco | | ¨ | | ¨ | | x | | ¨ |

| | | | |

DPL | | ¨ | | ¨ | | x | | ¨ |

| | | | |

ACE | | ¨ | | ¨ | | x | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| | | | | | | | |

Pepco Holdings | | Yes ¨ No x | | | | Pepco | | Yes ¨ No x |

DPL | | Yes ¨ No x | | | | ACE | | Yes ¨ No x |

Pepco, DPL, and ACE meet the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are therefore filing this Form 10-K with the reduced disclosure format specified in General Instruction I(2) of Form 10-K.

| | | | |

Registrant | | Aggregate Market Value of Voting and

Non-Voting Common Equity Held by

Non-Affiliates of the Registrant at June 30, 2011 | | Number of Shares of Common

Stock of the Registrant

Outstanding at February 15, 2012 |

Pepco Holdings | | $4,432,800,000 (a) | | 227,609,131

($.01 par value) |

Pepco | | None (b) | | 100

($.01 par value) |

DPL | | None (c) | | 1,000

($2.25 par value) |

ACE | | None (c) | | 8,546,017

($3.00 par value) |

| (a) | Solely for purposes of calculating this aggregate market value, PHI has defined its affiliates to include (i) those persons who were, as of June 30, 2011, its executive officers, directors and beneficial owners of more than 10% of its common stock, and (ii) such other persons who were, as of June 30, 2011, controlled by, or under common control with, the persons described in clause (i) above. |

| (b) | All voting and non-voting common equity is owned by Pepco Holdings. |

| (c) | All voting and non-voting common equity is owned by Conectiv, LLC, a wholly owned subsidiary of Pepco Holdings. |

THIS COMBINED FORM 10-K IS SEPARATELY FILED BY PEPCO HOLDINGS, PEPCO, DPL AND ACE. INFORMATION CONTAINED HEREIN RELATING TO ANY INDIVIDUAL REGISTRANT IS FILED BY SUCH REGISTRANT ON ITS OWN BEHALF. EACH REGISTRANT MAKES NO REPRESENTATION AS TO INFORMATION RELATING TO THE OTHER REGISTRANTS.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Pepco Holdings, Inc. definitive proxy statement for the 2012 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after December 31, 2011 are incorporated by reference into Part III of this report.

| | | | | | | | | | |

TABLE OF CONTENTS | |

| | | | | | | | Page | |

Glossary of Terms | | | | | | | | | i | |

Forward-Looking Statements | | | | | | | | | 1 | |

PART I | | | | | | | | | | |

Item 1. | | | - | | | Business | | | 3 | |

Item 1A. | | | - | | | Risk Factors | | | 23 | |

Item 1B. | | | - | | | Unresolved Staff Comments | | | 37 | |

Item 2. | | | - | | | Properties | | | 38 | |

Item 3. | | | - | | | Legal Proceedings | | | 39 | |

Item 4. | | | - | | | Mine Safety Disclosures | | | 39 | |

PART II | | | | | | | | | | |

Item 5. | | | - | | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 40 | |

Item 6. | | | - | | | Selected Financial Data | | | 43 | |

Item 7. | | | - | | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 44 | |

Item 7A. | | | - | | | Quantitative and Qualitative Disclosures About Market Risk | | | 125 | |

Item 8. | | | - | | | Financial Statements and Supplementary Data | | | 128 | |

Item 9. | | | - | | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | | 321 | |

Item 9A. | | | - | | | Controls and Procedures | | | 321 | |

Item 9B. | | | - | | | Other Information | | | 322 | |

PART III | | | | | | | | | | |

Item 10. | | | - | | | Directors, Executive Officers and Corporate Governance | | | 323 | |

Item 11. | | | - | | | Executive Compensation | | | 323 | |

Item 12. | | | - | | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 323 | |

Item 13. | | | - | | | Certain Relationships and Related Transactions, and Director Independence | | | 323 | |

Item 14. | | | - | | | Principal Accounting Fees and Services | | | 324 | |

PART IV | | | | | | | | | | |

Item 15. | | | - | | | Exhibits and Financial Statement Schedules | | | 324 | |

Schedule I | | | - | | | Condensed Financial Information of Parent Company | | | 326 | |

Schedule II | | | - | | | Valuation and Qualifying Accounts | | | 331 | |

Signatures | | | | | | | | | 349 | |

Exhibit 12 | | | - | | | Statements Re: Computation of Ratios | | | | |

Exhibit 21 | | | - | | | Subsidiaries of the Registrant | | | | |

Exhibit 23 | | | - | | | Consents of Independent Registered Public Accounting Firm | | | | |

Exhibits 31.1-31.8 | | | - | | | Rule 13a-14a/15d-14(a) Certifications | | | | |

Exhibits 32.1-32.4 | | | - | | | Section 1350 Certifications | | | | |

GLOSSARY OF TERMS

The following is a glossary of terms, abbreviations and acronyms that are used in the Reporting Companies’ SEC reports. The terms, abbreviations and acronyms used have the meanings set forth below, unless the context requires otherwise.

| | |

| Term | | Definition |

| ACE | | Atlantic City Electric Company |

| ACE Funding | | Atlantic City Electric Transition Funding LLC |

| ADITC | | Accumulated deferred investment tax credits |

| AFUDC | | Allowance for funds used during construction |

| AOCL | | Accumulated other comprehensive loss |

| AMI | | Advanced metering infrastructure |

| ASC | | Accounting Standards Codification |

| BART | | Best Available Retrofit Technology |

| BGS | | Basic Generation Service |

| BGS-CIEP | | BGS-Commercial and Industrial Energy Price |

| BGS-FP | | BGS-Fixed Price |

| Bondable Transition Property | | Principal and interest payments on the transition bonds and related taxes, expenses and fees |

| BSA | | Bill Stabilization Adjustment |

| Budget Support Act | | The Fiscal Year 2012 Budge Support Act of 2011, approved by the Council of the District of Columbia on June 14, 2011 |

| CAIR | | Clean Air Interstate Rule issued by EPA |

| Calpine | | Calpine Corporation, the purchaser of Conectiv Energy’s wholesale power generation business |

| CERCLA | | Comprehensive Environmental Response, Compensation, and Liability Act of 1980 |

| Conectiv | | Conectiv, LLC (formerly Conectiv), a wholly owned subsidiary of PHI and the parent of DPL and ACE |

| Conectiv Energy | | Conectiv Energy Holding Company and its subsidiaries |

| CSAPR | | Cross-State Air Pollution Rule |

| DCPSC | | District of Columbia Public Service Commission |

| DDOE | | District of Columbia Department of the Environment |

| Default Electricity Supply | | The supply of electricity by PHI’s electric utility subsidiaries at regulated rates to retail customers who do not elect to purchase electricity from a competitive supplier, and which, depending on the jurisdiction, is also known as SOS or BGS |

| DPL | | Delmarva Power & Light Company |

| DEDA | | Delaware Economic Development Authority |

| DOE | | U.S. Department of Energy |

| DPSC | | Delaware Public Service Commission |

| DRP | | Shareholder Dividend Reinvestment Plan |

| Dynamic Pricing | | A pricing mechanism that rewards SOS customers for lowering their energy use during those times when energy demand and, consequently, the cost of supplying electricity, are higher |

| EBITDA | | Earnings before interest, taxes, depreciation, and amortization |

| EDC | | Electricity Distribution Company |

| EDIT | | Excess Deferred Income Taxes |

| EmPower Maryland | | A DSM program for Pepco and DPL |

| EPA | | U.S. Environmental Protection Agency |

| Exchange Act | | Securities Exchange Act of 1934, as amended |

| FASB | | Financial Accounting Standards Board |

| FERC | | Federal Energy Regulatory Commission |

| FHACA | | Flood Hazard Area Control Act |

| FPA | | Federal Power Act |

| GAAP | | Accounting principles generally accepted in the United States of America |

i

| | |

| Term | | Definition |

| |

| GCR | | Gas Cost Rate |

| GWh | | Gigawatt hour |

| HPS | | Hourly Priced Service |

| IFRS | | International Financial Reporting Standards |

| IIP | | ACE’s Infrastructure Investment Program |

| IRS | | Internal Revenue Service |

| ISDA | | International Swaps and Derivatives Association |

| ISRA | | Industrial Site Recovery Act |

| Line Losses | | Estimates of electricity and gas expected to be lost in the process of its transmission and distribution to customers |

| LTIP | | The Pepco Holdings, Inc. Long-Term Incentive Plan |

| MAPP | | Mid-Atlantic Power Pathway |

| Market Transition Charge Tax | | Revenue ACE receives, and pays to ACE Funding to recover income taxes associated with Transition Bond Charge revenue |

| Mcf | | Thousand Cubic Feet |

| MDC | | MDC Industries, Inc. |

| Medicare Act | | Medicare Prescription Drug Improvement and Modernization Act of 2003 |

| Medicare Part D | | A prescription drug benefit under the Medicare Act |

| MFVRD | | Modified fixed variable rate design |

| Mirant | | Mirant Corporation |

| MMBtu | | One Million British Thermal Units |

| MPSC | | Maryland Public Service Commission |

| MSCG | | Morgan Stanley Capital Group, Inc. |

| MWh | | Megawatt hours |

| NAV | | Net Asset Value |

| NERC | | North American Electric Reliability Corporation |

| NYMEX | | New York Mercantile Exchange |

| NJBPU | | New Jersey Board of Public Utilities |

| NJDEP | | New Jersey Department of Environmental Protection |

| NOx | | Nitrogen oxide |

| NPCC | | Northeast Power Coordinating Council |

| NPDES | | National Pollutant Discharge Elimination System |

| NPL | | National Priorities List |

| NUGs | | Non-utility generators |

| OPEB | | Other postretirement benefit |

| PARS | | Performance accelerated restricted stock |

| PCBs | | Polychlorinated biphenyls |

| PCI | | Potomac Capital Investment Corporation and its subsidiaries |

| Pepco | | Potomac Electric Power Company |

| Pepco Energy Services | | Pepco Energy Services, Inc. and its subsidiaries |

| Pepco Holdings or PHI | | Pepco Holdings, Inc. |

| PJM | | PJM Interconnection, LLC |

| PJM RTO | | PJM regional transmission organization |

| Power Delivery | | The operations of Pepco, DPL and ACE, engaged primarily in the transmission, distribution and default supply of electricity and the distribution and supply of natural gas |

| PPA | | Power purchase agreement |

| PRP | | Potentially responsible party |

ii

| | |

| Term | | Definition |

| PUHCA 2005 | | Public Utility Holding Company Act of 2005 |

| RECs | | Renewable energy credits |

| Regulated T&D Electric Revenue | | Revenue from the transmission and the distribution of electricity to PHI’s customers within its service territories at regulated rates |

| Reporting Company | | Each of PHI, Pepco, DPL and ACE |

| Revenue Decoupling Adjustment | | An adjustment equal to the amount by which revenue from distribution sales differs from the revenue that Pepco and DPL are entitled to earn based on the approved distribution charge per customer |

| RFC | | ReliabilityFirst Corporation |

| RFP | | Request for proposals |

| RI/FS | | Remedial investigation and feasibility study |

| RIM | | Reliability investment recovery mechanism |

| ROE | | Return on equity |

| RPM | | Reliability Pricing Model |

| RPS | | Renewable Energy Portfolio Standards |

| SEC | | Securities and Exchange Commission |

| SO2 | | Sulfur dioxide |

| SOCA | | Standard Offer Capacity Agreement |

| SOS | | Standard Offer Service (the supply of electricity by Pepco in the District of Columbia, by Pepco and DPL in Maryland and by DPL in Delaware to retail customers who have not elected to purchase electricity from a competitive supplier) |

| SPCC | | Spill Prevention, Control, and Countermeasure plans, required pursuant to federal regulations requiring plans for facilities using oil-containing equipment in proximity to surface waters |

| T&D | | Transmission and distribution |

| Transition Bonds | | Transition Bonds issued by ACE Funding |

| VADEQ | | Virginia Department of Environmental Quality |

| VaR | | Value at Risk |

| VRDBs | | Variable Rate Demand Bonds |

| WACC | | Weighted average cost of capital |

iii

FORWARD-LOOKING STATEMENTS

Some of the statements contained in this Annual Report on Form 10-K with respect to Pepco Holdings, Inc. (PHI or Pepco Holdings), Potomac Electric Power Company (Pepco), Delmarva Power & Light Company (DPL) and Atlantic City Electric Company (ACE), including each of their respective subsidiaries, are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), and Section 27A of the Securities Act of 1933, as amended, and are subject to the safe harbor created thereby and by the Private Securities Litigation Reform Act of 1995. These statements include declarations regarding the intents, beliefs, estimates and current expectations of one or more Reporting Companies or their subsidiaries. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “anticipates,” “believes,” “projects,” “estimates,” “predicts,” “potential,” “future,” “goal,” “objective,” or “continue” or the negative of such terms or other variations thereof or comparable terminology, or by discussions of strategy that involve risks and uncertainties. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause one or more Reporting Company’s or their subsidiaries’ actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Therefore, forward-looking statements are not guarantees or assurances of future performance, and actual results could differ materially from those indicated by the forward-looking statements.

The forward-looking statements contained herein are qualified in their entirety by reference to the following important factors, which are difficult to predict, contain uncertainties, are beyond each Reporting Company’s or their subsidiaries’ control and may cause actual results to differ materially from those contained in forward-looking statements:

| | • | | Changes in governmental policies and regulatory actions affecting the energy industry, including allowed rates of return, industry and rate structure, acquisition and disposal of assets and facilities, operation and construction of transmission and distribution facilities and the recovery of purchased power expenses; |

| | • | | The outcome of pending and future rate cases, including the possible disallowance of costs and expenses; |

| | • | | The expenditures necessary to comply with regulatory requirements, including regulatory orders, and to implement reliability enhancement, emergency response and customer service improvement programs; |

| | • | | Possible fines, penalties or other sanctions assessed by regulatory authorities against PHI’s regulated utilities; |

| | • | | Weather conditions affecting usage and emergency restoration costs; |

| | • | | Population growth rates and changes in demographic patterns; |

| | • | | Changes in customer energy demand due to conservation measures and the use of more energy-efficient products; |

| | • | | General economic conditions, including the impact of an economic downturn or recession on energy usage; |

| | • | | Changes in and compliance with environmental and safety laws and policies; |

1

| | • | | Changes in tax rates or policies; |

| | • | | Changes in rates of inflation; |

| | • | | Changes in accounting standards or practices; |

| | • | | Unanticipated changes in operating expenses and capital expenditures; |

| | • | | Rules and regulations imposed by, and decisions of, federal and/or state regulatory commissions, PJM Interconnection, LLC (PJM), the North American Electric Reliability Corporation (NERC) and other applicable electric reliability organizations; |

| | • | | Legal and administrative proceedings (whether civil or criminal) and settlements that affect a Reporting Company’s or their subsidiaries’ business and profitability; |

| | • | | Pace of entry into new markets; |

| | • | | Interest rate fluctuations and the impact of credit and capital market conditions on the ability to obtain funding on favorable terms; and |

| | • | | Effects of geopolitical events, including the threat of domestic terrorism or cyber attacks. |

These forward-looking statements are also qualified by, and should be read together with, the risk factors included in Part I, Item 1A. “Risk Factors” in this Annual Report on Form 10-K, and investors should refer to such risk factors in evaluating the forward-looking statements contained in this Form 10-K.

Any forward-looking statements speak only as to the date of this Form 10-K for each Reporting Company and none of the Reporting Companies undertakes an obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for a Reporting Company to predict all such factors, nor can the impact of any such factor be assessed on such Reporting Company’s or its subsidiaries’ business (viewed independently or together with the business or businesses of some or all of the other Reporting Companies or their subsidiaries) or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

2

Part I

Overview

Pepco Holdings, a Delaware corporation incorporated in 2001, is a holding company that, through the following regulated public utility subsidiaries, is engaged primarily in the transmission, distribution and default supply of electricity and, to a lesser extent, the distribution and supply of natural gas:

| | • | | Potomac Electric Power Company, which was incorporated in Washington, D.C. in 1896 and became a domestic Virginia corporation in 1949, |

| | • | | Delmarva Power & Light Company, which was incorporated in Delaware in 1909 and became a domestic Virginia corporation in 1979, and |

| | • | | Atlantic City Electric Company, which was incorporated in New Jersey in 1924. |

Through Pepco Energy Services, Inc. and its subsidiaries (collectively, Pepco Energy Services), PHI also provides energy efficiency and renewable energy services primarily to government and institutional customers. Pepco Energy Services is in the process of winding down its competitive electricity and natural gas retail supply business and preparing for the retirement of its two oil-fired generating facilities.

In addition, through Potomac Capital Investment Corporation (PCI), PHI holds several cross-border energy lease investments as described below under the heading “Other Business Operations.”

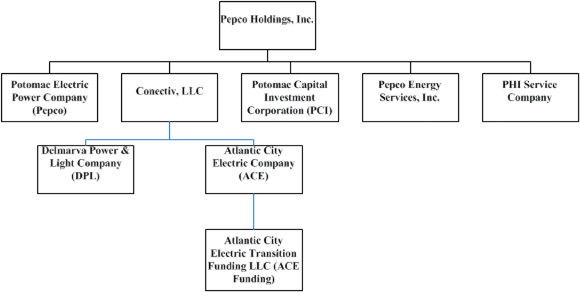

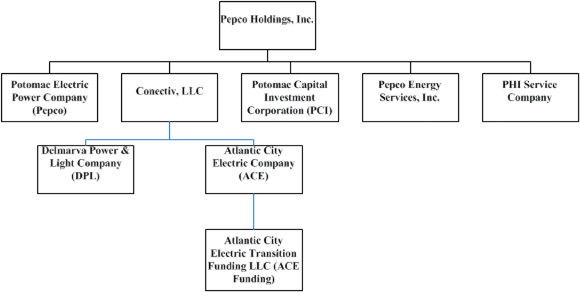

The following chart shows, in simplified form, the corporate structure of PHI and its principal subsidiaries:

3

PHI Service Company, a subsidiary service company of PHI, provides a variety of support services, including legal, accounting, treasury, tax, purchasing and information technology services, to PHI and its operating subsidiaries. These services are provided pursuant to a service agreement among PHI, PHI Service Company and the participating operating subsidiaries. The expenses of PHI Service Company are charged to PHI and the participating operating subsidiaries in accordance with cost allocation methods set forth in the service agreement.

Pepco Holdings’ management has identified its operating segments at December 31, 2011 as (i) Power Delivery, consisting of the operations of Pepco, DPL and ACE, engaged primarily in the transmission, distribution and default supply of electricity and the distribution and supply of natural gas, (ii) Pepco Energy Services and (iii) Other Non-Regulated, consisting primarily of the operations of PCI. For financial information relating to PHI’s segments, see Note (5), “Segment Information,” to the consolidated financial statements of PHI.

Discontinued Operations

In April 2010, the Board of Directors approved a plan for the disposition of PHI’s competitive wholesale power generation, marketing and supply business, which had been conducted through subsidiaries of Conectiv Energy Holding Company (Conectiv Energy). On July 1, 2010, PHI completed the sale of Conectiv Energy’s wholesale power generation business to Calpine Corporation (Calpine) for $1.64 billion. The disposition of Conectiv Energy’s remaining assets and businesses not included in the Calpine sale, including its load service supply contracts, energy hedging portfolio and certain tolling agreements, has been substantially completed. The operations of Conectiv Energy, which previously comprised a separate segment for financial reporting purposes, are being accounted for as a discontinued operation. For further information on the former Conectiv Energy segment and the disposition of its assets, operations and obligations, see Note (20), “Discontinued Operations,” to the consolidated financial statements of PHI.

Investor Information

Each Reporting Company maintains an Internet web site, at the Internet address listed below:

| | |

Reporting Company | | Internet Address |

| PHI | | http://www.pepcoholdings.com |

| Pepco | | http://www.pepco.com |

| DPL | | http://www.delmarva.com |

| ACE | | http://www.atlanticcityelectric.com |

Each of PHI, Pepco, DPL and ACE files reports with the Securities and Exchange Commission (SEC) under the Exchange Act. Copies of the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, of each Reporting Company are made available free of charge on PHI’s Internet Web site as soon as reasonably practicable after such documents are electronically filed with or furnished to the SEC. Copies of these reports may be found at http://www.pepcoholdings.com/investors. The information contained on the web sites listed above is not a part of this Form 10-K, and any web site references are not intended to be made through active hyperlinks.

Business Strategy

PHI’s business strategy is to become a top-performing, regulated power delivery company focused on:

| | • | | investing in transmission and distribution infrastructure to improve reliability of electric service; |

| | • | | building a smarter grid to automate certain functions on the electric system, restore power more efficiently and provide customers detailed energy information to help them control their energy costs; |

| | • | | investing in advanced technologies, new processes and personnel to enhance the customer experience during power restoration, including delivering enhanced customer communications; |

| | • | | pursuing a regulatory strategy that results in earning reasonable rates of return and timely cost recovery of PHI’s investments; |

4

| | • | | growing PHI’s energy services business by providing comprehensive energy management solutions and developing, installing and operating renewable energy solutions; and |

| | • | | demonstrating PHI’s core values of safety, diversity and environmental stewardship through PHI’s business approaches and tangible business practices and outcomes. |

To further its business strategy, PHI may examine transactions involving its existing businesses, including entering into joint ventures, disposing of businesses or making acquisitions. PHI also may refine components of its business strategy as it deems necessary or appropriate in response to business factors and conditions, including regulatory requirements.

Description of Business

Power Delivery

PHI’s primary business is Power Delivery. Power Delivery in 2011, 2010 and 2009, produced 79%, 73%, and 67%, respectively, of PHI’s consolidated operating revenues and 78%, 81%, and 78%, respectively, of PHI’s consolidated operating income.

Each utility comprising Power Delivery is regulated in the jurisdictions that encompass its electricity distribution service territory and is regulated by FERC for its electricity transmission facilities. DPL also is a regulated natural gas utility serving portions of Delaware. In the aggregate, Power Delivery distributes electricity to more than 1.8 million customers in the mid-Atlantic region and delivers natural gas to approximately 124,000 customers in Delaware. None of PHI’s three utilities owns any electric generation facilities.

Distribution and Default Supply of Electricity

Pepco, DPL and ACE each owns and operates a network of wires, substations and other equipment that are classified as transmission facilities, distribution facilities or common facilities (which are used for both transmission and distribution). Transmission facilities carry wholesale electricity into, or across, the utility’s service territory. Distribution facilities carry electricity from the transmission facilities to the end-use customers located in the utility’s service territory.

Each utility is responsible for the distribution of electricity in its service territory, for which it is paid tariff rates established by the applicable local public service commissions. Each utility also supplies electricity at regulated rates to retail customers in its service territory who do not elect to purchase electricity from a competitive retail supplier. The regulatory term for this default supply service is Standard Offer Service (SOS) in Delaware, the District of Columbia and Maryland, and Basic Generation Service (BGS) in New Jersey. In this Form 10-K, these supply services are referred to generally as Default Electricity Supply.

Transmission of Electricity and Relationship with PJM

The transmission facilities owned by Pepco, DPL and ACE are interconnected with the transmission facilities of contiguous utilities and are part of an interstate power transmission grid over which electricity is transmitted throughout the mid-Atlantic portion of the United States and parts of the Midwest. Pepco, DPL and ACE each is a member of the PJM Regional Transmission Organization (PJM RTO), the regional transmission organization designated by the Federal Energy Regulatory Commission (FERC) to coordinate the movement of wholesale electricity within a region consisting of all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

5

PJM, the FERC-approved independent grid operator, manages the transmission grid and the wholesale electricity market in the PJM RTO region. Any entity that wishes to have wholesale electricity delivered at any point within the PJM RTO region must obtain transmission services from PJM. In accordance with FERC-approved rules, Pepco, DPL, ACE and the other transmission-owning utilities in the region make their transmission facilities available to the PJM RTO, and PJM directs and controls the operation of these transmission facilities. For transmission services, transmission owners are paid rates proposed by the transmission owner and approved by FERC. PJM provides billing and settlement services, collects transmission service revenue from transmission service customers and distributes the revenue to the transmission owners. PJM also directs the regional transmission planning process within the PJM RTO region. The PJM Board of Managers reviews and approves each PJM regional transmission expansion plan, including whether to include new construction of transmission facilities proposed by PJM RTO members in the plan and, if so, the target in-service date for those facilities.

Seasonality

The operating results of Power Delivery historically have been directly related to the volume of electricity delivered to its customers, producing higher revenues and net income during periods when customers consumed higher amounts of electricity (usually during periods of extreme temperatures) and lower revenues and net income during periods when customers consumed lower amounts of electricity (usually during periods of mild temperatures). This has been due in part to the long standing practice by which the applicable public service commissions set distribution rates based on a fixed charge per kilowatt-hour of electricity used by the customer. Because most of the costs associated with the distribution of electricity do not vary with the volume of electricity delivered, this pricing mechanism also contributed to seasonal variations in net income. As a result of the implementation of a BSA for retail customers of Pepco and DPL in Maryland in June 2007 and for customers of Pepco in the District of Columbia in November 2009, distribution revenues have been decoupled from the amount of electricity delivered. Under the BSA, utility customers pay an approved distribution charge for their electric service which does not vary by electricity usage. This change has had the effect of aligning annual distribution revenues more closely with annual distribution costs. In addition, the change has had the effect of eliminating changes in customer electricity usage, whether due to weather conditions or for any other reason, as a factor having an impact on annual distribution revenue and net income in those jurisdictions. The BSA also eliminates what otherwise might be a disincentive for the utility to aggressively develop and promote efficiency programs. Distribution revenues are not decoupled for the distribution of electricity and natural gas by DPL in Delaware or for the distribution of electricity by ACE in New Jersey, and thus are subject to variability due to changes in customer consumption.

In contrast to electricity distribution costs, the cost of the electricity supplied, which is the largest component of a customer’s bill, does vary directly in relation to the volume of electricity used by a customer. Accordingly, whether or not a BSA is in effect for the jurisdiction, the revenues of Pepco, DPL and ACE from the supply of electricity and natural gas vary based on consumption and on this basis are seasonal. Because the revenues received by each of the utility subsidiaries for the default supply of electricity and natural gas closely approximate the supply costs, the impact on net income is immaterial, and therefore is not seasonal.

Regulated Utility Subsidiaries

The following is a more detailed description of the business of each of PHI’s three regulated utility subsidiaries:

6

Pepco

Pepco is engaged in the transmission, distribution and default supply of electricity in the District of Columbia and major portions of Prince George’s County and Montgomery County in Maryland. Pepco’s service territory covers approximately 640 square miles and has a population of approximately 2.2 million. As of December 31, 2011, Pepco distributed electricity to 788,000 customers (of which 257,000 were located in the District of Columbia and 531,000 were located in Maryland), as compared to 787,000 customers as of December 31, 2010 (of which 256,000 were located in the District of Columbia and 531,000 were located in Maryland). As of December 31, 2009, Pepco distributed electricity to 778,000 customers (of which 252,000 were located in the District of Columbia and 526,000 were located in Maryland).

In 2011, Pepco distributed a total of 26,895,000 megawatt hours of electricity, of which 57% was distributed within its Maryland territory and 43% within the District of Columbia. Of this amount, 30% of the total megawatt hours were delivered to residential customers, 50% to commercial customers, and 20% to United States and District of Columbia government customers. In 2010, Pepco distributed a total of 27,665,000 megawatt hours of electricity, of which 57% was distributed within its Maryland territory and 43% within the District of Columbia. Of this amount, 30% of the total megawatt hours were distributed to residential customers, 49% to commercial customers, and 21% to United States and District of Columbia government customers. In 2009, Pepco distributed a total of 26,549,000 megawatt hours of electricity, of which 57% was distributed within its Maryland territory and 43% within the District of Columbia. Of this amount, 29% of the total megawatt hours were distributed to residential customers, 50% to commercial customers, and 21% to United States and District of Columbia government customers.

Pepco has been providing SOS in Maryland since July 2004. Pursuant to orders issued by the Maryland Public Service Commission (MPSC), Pepco is obligated to provide SOS (i) to residential and small commercial customers until further action of the Maryland General Assembly and (ii) to medium-sized commercial customers through November 2012. Pepco purchases the electricity required to satisfy these SOS obligations from wholesale suppliers under contracts entered into in accordance with competitive bid procedures approved and supervised by the MPSC. Pepco also is obligated to provide Standard Offer Service, known as Hourly Priced Service (HPS), for large Maryland customers. Power to supply HPS customers is acquired in next-day and other short-term PJM RTO markets. Pepco is entitled to recover from its SOS customers the cost of acquiring the SOS supply, plus an administrative charge that is intended to allow Pepco to recover the administrative costs incurred to provide the SOS and a modest margin. Because the margin varies by customer class, the actual average margin over any given time period depends on the number of Maryland SOS customers in each customer class and the electricity used by such customers. Pepco is paid tariff rates for the distribution of electricity over its transmission and distribution facilities to all electricity customers in its Maryland service territory regardless of whether the customer receives SOS or purchases electricity from another supplier.

Pepco has been providing SOS in the District of Columbia since February 2005. Pursuant to orders issued by the District of Columbia Public Service Commission (DCPSC), Pepco is obligated to provide SOS to residential and small, medium-sized and large commercial customers indefinitely. Pepco purchases the electricity required to satisfy its SOS obligations from wholesale suppliers under contracts entered into in accordance with a competitive bid procedure approved and supervised by the DCPSC. Pepco is entitled to recover from its SOS customers the costs of acquiring the SOS supply, plus an administrative charge that is intended to allow Pepco to recover the administrative costs incurred to provide the SOS and a modest margin. Because the margin varies by customer class, the actual average margin over any given time period depends on the number of District of Columbia SOS customers in each customer class and the amount of electricity used by such customers. Pepco is paid tariff rates for the distribution of electricity over its transmission and distribution facilities to all electricity customers in its District of Columbia service territory regardless of whether the customer receives SOS or purchases electricity from another supplier.

7

For the year ended December 31, 2011, 43% of Pepco’s Maryland distribution sales (measured by megawatt hours) were to SOS customers, as compared to 46% and 49% in 2010 and 2009, respectively, and 27% of its District of Columbia distribution sales (measured by megawatt hours) were to SOS customers in 2011, as compared to 29% and 31% in 2010 and 2009, respectively.

DPL

DPL is engaged in the transmission, distribution and default supply of electricity in Delaware and portions of Maryland. In northern Delaware, DPL also supplies and delivers natural gas to retail customers and provides transportation-only services to retail customers that purchase natural gas from another supplier.

Distribution and Supply of Electricity

DPL’s electricity distribution service territory consists of the state of Delaware, and Caroline, Cecil, Dorchester, Harford, Kent, Queen Anne’s, Somerset, Talbot, Wicomico and Worcester counties in Maryland. This territory covers approximately 5,000 square miles and has a population of approximately 1.4 million. As of December 31, 2011, DPL delivered electricity to 501,000 customers (of which 301,000 were located in Delaware and 200,000 were located in Maryland), as compared to 500,000 customers as of December 31, 2010 (of which 301,000 were located in Delaware and 199,000 were located in Maryland). As of December 31, 2009, DPL delivered electricity to 498,000 customers (of which 299,000 were located in Delaware and 199,000 were located in Maryland).

In 2011, DPL distributed a total of 12,688,000 megawatt hours of electricity to its customers, of which 66% was distributed within its Delaware territory and 34% within Maryland. Of this amount, 41% of the total megawatt hours were distributed to residential customers, 42% to commercial customers and 17% to industrial customers. In 2010, DPL distributed a total of 12,853,000 megawatt hours of electricity, of which 66% was distributed within its Delaware territory and 34% within Maryland. Of this amount, 42% of the total megawatt hours were distributed to residential customers, 41% to commercial customers and 17% to industrial customers. In 2009, DPL distributed a total of 12,494,000 megawatt hours of electricity, of which 67% was distributed within its Delaware territory and 33% within Maryland. Of this amount, 39% of the total megawatt hours were distributed to residential customers, 41% to commercial customers and 20% to industrial customers.

DPL has been providing SOS in Delaware since May 2006. Pursuant to orders issued by the Delaware Public Service Commission (DPSC), DPL is obligated to provide SOS to residential, small commercial and industrial customers through May 2014, and to medium, large and general service commercial customers through May 2012. DPL purchases the electricity required to satisfy these SOS obligations from wholesale suppliers under contracts entered into in accordance with competitive bid procedures approved and supervised by the DPSC. DPL also has an obligation to provide SOS, known as HPS, for the largest Delaware customers. Power to supply the HPS customers is acquired in next-day and other short-term PJM RTO markets. DPL’s rates for supplying SOS and HPS reflect the associated capacity, energy (including satisfaction of renewable energy requirements), transmission and ancillary services costs and an amount referred to as a Reasonable Allowance for Retail Margin. Components of the Reasonable Allowance for Retail Margin include a fixed annual margin of approximately $2.75 million, plus estimated incremental expenses, a cash working capital allowance, and recovery, with a return over five years ending 2011, of the capitalized costs of the billing system used for billing HPS customers. DPL is paid tariff rates for the distribution of electricity over its transmission and distribution facilities to all electricity customers in its Delaware service territory regardless of whether the customer receives SOS or purchases electricity from another supplier.

8

DPL has been providing SOS in Maryland since June 2004. Pursuant to orders issued by the MPSC, DPL is obligated to provide SOS to residential and small commercial customers until further action of the Maryland General Assembly, and to medium-sized commercial customers through May 2014. DPL purchases the electricity required to satisfy these SOS obligations from wholesale suppliers under contracts entered into in accordance with a competitive bid procedure approved and supervised by the MPSC. DPL also is obligated to provide HPS for large Maryland customers. Power to supply the HPS customers is acquired in next-day and other short-term PJM RTO markets. DPL is entitled to recover from its SOS customers the costs of acquiring the SOS supply, plus an administrative charge that is intended to allow DPL to recover the administrative costs incurred to provide the SOS and a modest margin. Because the margin varies by customer class, the actual average margin over any given time period depends on the number of Maryland SOS customers in each customer class and the electricity used by such customers. DPL is paid tariff rates for the distribution of electricity over its transmission and distribution facilities to all electricity customers in its Maryland service territory regardless of whether the customer receives SOS or purchases electricity from another supplier.

For the year ended December 31, 2011, 51% of DPL’s Delaware distribution sales (measured by megawatt hours) were to SOS customers, as compared to 53% and 51% in 2010 and 2009, respectively, and 58% of its Maryland distribution sales (measured by megawatt hours) were to SOS customers in 2011, as compared to 63% in 2010 and 2009.

Supply and Distribution of Natural Gas

DPL provides regulated natural gas supply and distribution service to customers in a service territory consisting of a major portion of New Castle County in Delaware. This service territory covers approximately 275 square miles and has a population of approximately 500,000. Large volume commercial, institutional, and industrial natural gas customers may purchase natural gas either from DPL or from other suppliers. DPL uses its natural gas distribution facilities to deliver natural gas to customers that choose to purchase natural gas from another supplier. Intrastate transportation customers pay DPL distribution service rates approved by the DPSC. DPL purchases natural gas supplies for resale to its retail service customers from marketers and producers through a combination of long-term agreements and next-day distribution arrangements. For the year ended December 31, 2011, DPL supplied 64% of the natural gas that it delivered, compared to 65% in 2010 and 68% in 2009.

As of December 31, 2011, DPL delivered natural gas to 124,000 customers as compared to 123,000 customers as of December 31, 2010 and 2009. In 2011, DPL delivered 19,000,000 Mcf (thousand cubic feet) of natural gas to customers in its Delaware service territory, of which 40% were sales to residential customers, 23% to commercial customers, 1% to industrial customers and 36% to customers receiving a transportation-only service. In 2010, DPL delivered 19,000,000 Mcf of natural gas, of which 41% were sales to residential customers, 23% were sales to commercial customers, 1% were sales to industrial customers and 35% were sales to customers receiving a transportation-only service. In 2009, DPL delivered 19,000,000 Mcf of natural gas, of which 42% were sales to residential customers, 25% were sales to commercial customers, 1% were sales to industrial customers and 32% were sales to customers receiving a transportation-only service.

ACE

ACE is primarily engaged in the transmission, distribution and default supply of electricity in a service territory consisting of Gloucester, Camden, Burlington, Ocean, Atlantic, Cape May, Cumberland and Salem counties in southern New Jersey. ACE’s service territory covers approximately 2,700 square miles and has a population of approximately 1.1 million. As of December 31, 2011, ACE distributed electricity to 547,000 customers in its service territory, as compared to 548,000 and 547,000 customers as of December 31, 2010 and 2009, respectively.

9

In 2011, ACE distributed a total of 9,683,000 megawatt hours of electricity to its customers, of which 46% of the total was distributed to residential customers, 45% to commercial customers and 9% to industrial customers. In 2010, ACE distributed a total of 10,185,000 megawatt hours of electricity to its customers, of which 46% of the total was distributed to residential customers, 44% to commercial customers, and 10% to industrial customers. In 2009, ACE distributed a total of 9,659,000 megawatt hours of electricity to its customers, of which 45% was distributed to residential customers, 45% to commercial customers, and 10% to industrial customers.

Electric customers in New Jersey who do not choose another supplier receive BGS from their electric distribution company. New Jersey’s electric distribution companies, including ACE, jointly obtain the electricity to meet their BGS obligations from competitive suppliers selected through auctions authorized by the New Jersey Board of Public Utilities (NJBPU) for the supply of New Jersey’s total BGS requirements. Each winning bidder is required to supply its committed portion of the BGS customer load with full requirements service, consisting of power supply and transmission service.

ACE provides two types of BGS:

| | • | BGS-Fixed Price (BGS-FP), which is supplied to smaller commercial and residential customers at seasonally-adjusted fixed prices. BGS-FP rates change annually on June 1 and are based on the average BGS price obtained at auction in the current year and the two prior years. As of December 31, 2011, ACE’s BGS-FP peak load was approximately 1,500 megawatts, which represents approximately 98% of ACE’s total BGS load. |

| | • | BGS-Commercial and Industrial Energy Price (BGS-CIEP), which is supplied to large customers at hourly PJM RTO real-time market prices for a term of 12 months. As of December 31, 2011, ACE’s peak BGS-CIEP load was approximately 20 megawatts, which represents approximately 2% of ACE’s BGS load. |

ACE is paid tariff supply rates established by the NJBPU that compensate it for the cost of obtaining the BGS supply. These rates are set such that ACE does not make any profit or incur any loss on the supply component of the BGS it supplies to customers. ACE is paid tariff rates for the distribution of electricity over its transmission and distribution facilities to all electricity customers in its service territory regardless of whether the customer receives BGS or purchases electricity from another supplier.

For the year ended December 31, 2011, 56% of ACE’s total distribution sales (measured by megawatt hours) were to BGS customers, as compared to 65% and 73% in 2010 and 2009, respectively.

ACE has contracts with three unaffiliated non-utility generators (NUGs) under which ACE is obligated to purchase capacity and the entire generation output of the facilities. One of the contracts expires in 2016 and the other two expire in 2024. In 2011, ACE purchased 1.9 million megawatt hours of power from the NUGs. ACE sells this electricity into the wholesale market administered by PJM.

In 2001, ACE established Atlantic City Electric Transitional Funding LLC (ACE Funding) solely for the purpose of securitizing authorized portions of ACE’s recoverable stranded costs through the issuance and sale of bonds (Transition Bonds). The proceeds of the sale of each series of Transition Bonds were transferred to ACE in exchange for the transfer by ACE to ACE Funding of the right to collect a non-bypassable transition bond charge from ACE customers pursuant to bondable stranded costs rate orders issued by the NJBPU in an amount sufficient to fund the principal and interest payments on the Transition Bonds and related taxes, expenses and fees (Bondable Transition Property). The assets of ACE Funding, including the Bondable Transition Property, and the Transition Bond charges collected from ACE’s customers, are not available to creditors of ACE. The holders of Transition Bonds have recourse only to the assets of ACE Funding.

10

Other Power Delivery Initiatives and Activities

Reliability Enhancement and Emergency Restoration Improvement Plans

In 2010, PHI announced comprehensive reliability enhancement plans for Pepco in Maryland and the District of Columbia. These reliability enhancement plans include various initiatives such as enhanced vegetation management, the identification and upgrading of under-performing feeder lines, the addition of new facilities to support load, the installation of distribution automation systems on both the overhead and underground network system, the rejuvenation and replacement of underground residential cables, improvements to substation supply lines and selective undergrounding of portions of existing above ground primary feeder lines, where appropriate to improve reliability and enhance customer satisfaction. During 2011, Pepco continued to execute on its plans to improve reliability which it believes have contributed to its progress in reducing both the frequency and duration of power outages. During 2011, Pepco invested $120 million in capital expenditures on these reliability enhancement activities. Since initiating the reliability enhancement plans, Pepco trimmed trees along nearly 3,500 miles of power lines, completed 48 expansion projects to meet growth in customer demand for electricity, upgraded more than 340 miles of aging underground lines, and added 125 automated switches that will reroute power more effectively during outages. PHI has extended its reliability enhancement efforts to DPL and ACE.

In 2011 PHI initiated an accelerated emergency restoration improvement program prior to the start of the 2011 summer storm season. As part of this program, Pepco:

| | • | | more than doubled the number of telephone trunk lines to its Washington, D.C. regional call center; |

| | • | | developed mobile applications to report and track outages; |

| | • | | improved outage information on its Web site to enhance communications with its customers; |

| | • | | implemented regional storm centers for more efficient crew dispatch; |

| | • | | implemented better methodologies for estimating times for restoration of power; |

| | • | | employed technology, including smart meters, to obtain real-time information from the field on power outages and to assist restoration planning efforts by providing data needed to conduct real-time damage assessments; |

| | • | | augmented training of its emergency response personnel; and |

| | • | | installed a backup crisis call center. |

These and other emergency restoration improvements implemented as a part of this program were tested during Hurricane Irene in August 2011. Although nearly 500,000 customers across all three utilities were without power at the peak of the storm, nearly 98% of outages were restored within a little more than two days.

PHI’s capital expenditures for continuing reliability enhancement efforts are included in the table of projected capital expenditures, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations —Capital Resources and Liquidity – Capital Expenditures.”

Blueprint for the Future

Each of PHI’s utility subsidiaries is participating in a PHI initiative referred to as “Blueprint for the Future,” which is designed to meet the challenges of rising energy costs, respond to concerns about the environment, improve reliability and address government energy reduction goals. The initiative includes the implementation of various programs to help customers better manage their energy use, reduce the total cost of energy and provide other benefits. These programs also enhance the ability of PHI’s utilities to better manage and operate their electrical and natural gas distribution systems.

11

One of the primary initiatives of Blueprint for the Future is the installation of smart meters (also known as Advanced Metering Infrastructure (AMI)) for electric and natural gas customers, which are subject to the approval of applicable state regulators. These smart meters allow the utilities, among other capabilities, to remotely read meters, significantly reduce the number of customer bills that are based on usage estimates, improve outage management and detection, and provide customers with more detailed information about their energy consumption. In addition to the replacement of existing meters, the AMI system involves the construction of a wireless network across the service territories of PHI’s utility subsidiaries and the implementation and integration of new and existing information technology systems to collect and manage data made available by the advanced meters. The implementation of the AMI system involves a combination of technologies provided by multiple vendors. Meter installation is substantially complete for DPL electric customers in Delaware, with meter activation expected to be completed in the first quarter of 2012. Meter installation is progressing for Pepco customers in both the District of Columbia and Maryland, with installation expected to be complete in the second and fourth quarters of 2012, respectively. The respective public service commissions have approved the creation of a regulatory asset to defer AMI costs between rate cases, as well as the accrual of a return on the deferred costs. Thus, these costs will be recovered through base rates in the future.

Approval of AMI is still pending for electric customers in DPL’s Maryland service territory, and has been deferred for ACE in New Jersey.

On December 20, 2011, the Delaware Public Service Commission approved DPL’s request to implement dynamic pricing for its Delaware customers. Dynamic pricing will reward SOS customers for lowering their energy use during those times when energy demand and, consequently, the cost of supplying electricity, are higher. Implementation for residential customers will be phased in commencing in 2012 through 2013. Implementation of dynamic pricing for commercial and industrial SOS customers in Delaware will be phased in commencing in 2013 through 2014.

Dynamic pricing has been approved in concept for Pepco customers in Maryland, with phase-in for residential customers beginning in 2012. Pepco has dynamic pricing proposals pending in the District of Columbia jurisdiction with the proposed phase-in for residential customers anticipated to begin in 2012. Dynamic pricing has been approved in concept pending AMI deployment authorization for DPL’s Maryland customers and has been deferred for ACE’s customers in New Jersey.

For a discussion of the capital expenditures associated with Blueprint for the Future, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations —Capital Resources and Liquidity – Capital Requirements – Blueprint for the Future.”

MAPP Project

In October 2007, the PJM Board of Managers approved PHI’s proposal to construct a new 230-mile, 500-kilovolt interstate transmission line referred to as the Mid-Atlantic Power Pathway (MAPP), as part of PJM’s regional transmission expansion plan to address the reliability objectives of the PJM RTO system. Since that time, there have been various modifications to the proposal that have redefined the length and route of the MAPP project. PJM has approved the use of advanced direct current technology for segments of the project, including the portion of the line that will traverse under the Chesapeake Bay. The direct current portion of the line will be 640 kilovolts and the remainder of the line will be 500 kilovolts. As currently approved by the PJM Board of Managers, MAPP is approximately 152 miles in length originating at the Possum Point substation in Virginia and ending at the Indian River substation in Delaware. The cost of the MAPP project for Pepco and DPL is currently estimated to be $1.2 billion.

12

In connection with the MAPP project, FERC has authorized for each of Pepco and DPL a 150 basis point adder to its return on equity, resulting in a FERC-approved rate of return on the MAPP project of 12.8%, along with full recovery of construction work-in-progress and prudently incurred abandoned plant costs.

On August 18, 2011, PJM notified PHI that the scheduled in-service date for MAPP has been delayed from June 1, 2015 to the 2019 to 2021 time period, after taking into account changes in demand response, generation retirements and additions, and a revised load forecast for the PJM region that is lower than the load that was forecasted in prior PJM studies. A more recent load forecast continues to support this trend. PJM has retained the MAPP project in its 2011 Regional Transmission Expansion Plan. In light of the delayed in-service date for MAPP, substantially all of the anticipated capital expenditures associated with MAPP have been delayed until at least 2016 based on current projections.

The exact revised in-service date of MAPP will be evaluated as part of PJM’s 2012 Regional Transmission Expansion Plan review process. Until PJM’s evaluation is concluded, PJM has directed PHI to limit further development efforts with respect to the MAPP project and to proceed with only those development efforts reasonably necessary to allow the MAPP project to be quickly restarted if and when deemed necessary. Based on PJM’s direction, PHI intends to continue to complete the right-of-way acquisition for the proposed route, and some environmental and other preparatory activities.

For a discussion of the capital expenditures associated with the MAPP Project, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations —Capital Resources and Liquidity – Capital Requirements – MAPP Project.”

Pepco Energy Services

Pepco Energy Services is engaged in the following businesses:

| | • | | providing energy efficiency services principally to federal, state and local government customers, and designing, constructing, and operating combined heat and power and central energy plants. |

| | • | | providing high voltage electric construction and maintenance services to customers throughout the United States and low voltage electric construction and maintenance services and streetlight construction and asset management services to utilities, municipalities and other customers in the Washington, D.C. area. |

Most of Pepco Energy Services’ contracts with federal, state and local governments, as well as independent agencies such as housing and water authorities, contain provisions authorizing the governmental authority or independent agency to terminate the contract at any time. Those provisions contain explicit mechanisms that, if exercised, would require the other party to pay Pepco Energy Services for work performed through the date of termination and for additional costs incurred as a result of the termination.

From time to time, PHI is required to guarantee the obligations of Pepco Energy Services under certain of its construction contracts. At December 31, 2011, PHI’s guarantees of Pepco Energy Services’ projects totaled $65 million.

Pepco Energy Services has historically been engaged in the business of providing retail energy supply services, consisting of the sale of electricity, including electricity from renewable resources, primarily to commercial, industrial and government customers located primarily in the mid-Atlantic and northeastern regions of the United States, as well as Texas and Illinois, and the sale of natural gas to customers located primarily in the mid-Atlantic region. In December 2009, PHI announced that it would wind-down the retail energy supply business. Pepco Energy Services is implementing this wind-down by not entering into any new supply contracts, while continuing to perform under its existing supply contracts through their expiration dates. As of December 31, 2011, Pepco Energy Services’ estimated retail electricity backlog was approximately 3.9 million megawatts for distribution through 2014, a decrease of approximately 5.8 million megawatts and 16.2 million megawatts when compared to December 31, 2010 and 2009, respectively. For additional information on the Pepco Energy Services wind-down, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – General Overview – Pepco Energy Services.”

Pepco Energy Services’ retail natural gas sales volumes and revenues are seasonally dependent. Colder weather from November through March of each year generally translates into increased sales volumes, which, when coupled with higher natural gas prices during these months, allows Pepco Energy Services to recognize generally higher revenues as compared to other months of the year. Retail electricity sales volumes are also seasonally dependent, with sales in the summer and winter months being generally higher than other months of the year, which, when coupled with higher electricity prices during these periods, allows Pepco Energy Services to recognize generally higher revenues as compared to other periods during the year. However, as Pepco Energy Services is in the process of winding down its retail energy supply business, this effect of seasonality will likely decrease as such wind-down is completed. The energy services business is not seasonal.

Pepco Energy Services owns and operates two oil-fired generating facilities. The facilities are located in Washington, D.C. and have a combined generating capacity of approximately 790 megawatts. Pepco Energy Services sells the output of these facilities into the wholesale market administered by PJM. In February 2007, Pepco Energy Services provided notice to PJM of its intention to deactivate these facilities by the end of May 2012. PJM has informed Pepco

13

Energy Services that these facilities will not be needed for reliability after May 2012; therefore decommissioning plans are currently underway and on schedule. It is not expected that deactivation of these facilities will have a material impact on PHI’s financial condition, results of operations or cash flows.

Pepco Energy Services also owns three landfill gas-fired electricity facilities that have a total generating capacity rating of ten megawatts, the output of which is sold into the wholesale market administered by PJM. Pepco Energy Services also owns a solar photovoltaic facility that has a generating capacity rating of two megawatts, the output of which is sold to its host facility.

Pepco Energy Services’ continuing lines of business will not be significantly affected by the wind-down of the retail energy supply business.

PJM Capacity Markets

Historically, Pepco Energy Services has earned revenue from the sale of capacity associated with its generating facilities. PJM is responsible for ensuring that within its transmission control area there is sufficient generating capacity available to meet the load requirements plus a reserve margin and locates and prices electricity capacity by holding annual auctions covering capacity to be supplied over consecutive 12-month periods. Pepco Energy Services has been exposed to deficiency charges payable to PJM when their generation units failed to meet certain reliability levels.

Since Pepco Energy Services intends to deactivate its two oil-fired generating facilities by May 2012, Pepco Energy Services has not included the facilities’ capacity in any auctions for periods after May 2012.

Competition

Pepco Energy Services’ energy services business is highly competitive. Pepco Energy Services competes with other energy services companies primarily with respect to contracts with federal, state and local governments and independent agencies. Many of these energy services companies are subsidiaries of larger construction or utility holding companies (as is the case with Pepco Energy Services). Among the factors as to which the energy services business competes are the amount and duration of the guarantees provided in energy savings performance contracts and the quality and value of service provided to customers. The energy services business is impacted by new entrants into the market, energy prices, and general economic conditions.

Other Business Operations

Between 1994 and 2002, PCI, a subsidiary of PHI, entered into eight cross-border energy lease investments involving public utility assets (primarily consisting of hydroelectric generation and coal-fired electric generation facilities and natural gas distribution networks) located outside of the United States. Each of these investments is structured as a sale and leaseback transaction commonly referred to as a sale-in, lease-out, or SILO, transaction. During the second quarter of 2011, PHI entered into early termination agreements with two lessees involving all of the leases comprising one of the eight lease investments and a small portion of the leases comprising a second lease investment. The early termination of the leases were negotiated at the request of the lessees and were completed in June 2011. As of December 31, 2011, PHI’s equity investment in its cross-border energy leases was approximately $1.3 billion. For additional information concerning these cross-border energy lease investments, see Note (8), “Leasing Activities,” and Note (17), “Commitments and Contingencies,” to the consolidated financial statements of PHI.

14

Regulation

The operations of PHI’s utility subsidiaries, including the rates and tariffs they are permitted to charge customers for the distribution and transmission of electricity and, in the case of DPL, the distribution and transportation of natural gas, are subject to regulation by governmental agencies in the jurisdictions in which the subsidiaries provide utility service as follows:

| | • | | Pepco’s electricity distribution operations are regulated in Maryland by the MPSC and in the District of Columbia by the DCPSC. |

| | • | | DPL’s electricity distribution operations are regulated in Maryland by the MPSC and in Delaware by the DPSC. |

| | • | | DPL’s natural gas distribution and intrastate transportation operations in Delaware are regulated by the DPSC. |

| | • | | ACE’s electricity distribution operations are regulated by the NJBPU. |

| | • | | Each utility subsidiary’s transmission facilities are regulated by FERC. |

| | • | | DPL’s interstate transportation and wholesale sale of natural gas are regulated by FERC. |

| | • | | Each utility subsidiary’s and Pepco Energy Services’ bulk power system is subject to reliability standards established by NERC. |

Rates and tariffs are established by these regulatory commissions. PHI’s utility subsidiaries have filed rate cases which are pending in each of its jurisdictions as further described in Note (7), “Regulatory Matters – Regulatory Proceedings – Rate Proceedings,” to the consolidated financial statements of PHI.

The rates and tariffs established by these regulatory commissions are intended to balance the interests of the utilities’ customers and those of its investors by reflecting costs incurred during the period in which the rates are in effect, and giving each utility the opportunity to generate revenues sufficient to recover its costs, including a reasonable rate of return on investor supplied capital during such period. In establishing a utility’s rates, an important factor in the ability of each of Pepco, DPL and ACE to earn its authorized rate of return is the willingness of applicable public service commissions to adequately recognize forward-looking costs in the utility’s rate structure in order to minimize the shortfall in revenues due to the delay in time or “lag” between when costs are incurred and when they are reflected in rates. This delay is commonly known as “regulatory lag.” Each of Pepco, DPL and ACE is currently experiencing significant regulatory lag because their investment in the rate base and operating expenses is outpacing revenue growth.

Higher operating and construction costs, including labor, material, depreciation, taxes and financing costs, as well as costs associated with enhanced distribution system reliability and environmental compliance, are expected at each of PHI’s utility subsidiaries for several years into the future. At the same time, low usage growth and customer growth is expected to limit the growth in revenues. This mismatch between high expense growth and low revenue growth exacerbates regulatory lag for each of PHI’s utility subsidiaries, making it more difficult for each utility to earn equity returns that are allowed by regulators without higher rates or other regulatory relief. See “Risk Factors – The failure of PHI to obtain timely recognition of costs in its rates may have a negative effect on PHI’s results of operations and financial condition.”

Pepco, DPL and ACE anticipate that they will continue to face regulatory lag. In their most recent rate cases, Pepco (in the District of Columbia and Maryland) and DPL (in Delaware and Maryland) each has proposed mechanisms that would track reliability and other expenses and permit the utility between rate cases to make adjustments in its rates for prudent investments as made, thereby seeking to reduce the magnitude of regulatory lag. In New Jersey, the NJBPU has approved certain rate recovery mechanisms

15

in connection with ACE’s Infrastructure Investment Program (IIP), which ACE has proposed to extend and expand. There can be no assurance that these proposals or any other attempts by Pepco, DPL and ACE to mitigate regulatory lag will be approved, or that even if approved, the rate recovery mechanisms or any base rate cases will fully ameliorate the effects of regulatory lag. Until such time as these proposed mechanisms are approved, if necessary to address the problem of regulatory lag, the utilities plan to file rate cases at least annually in an effort to align more closely their revenue and related cash flow levels with other operation and maintenance spending and capital investments. In future rate cases, Pepco, DPL and ACE, as applicable, would also continue to seek cost recovery and tracking mechanisms from applicable regulatory commissions to reduce the effects of regulatory lag.

Maryland Reliability Investigation

In August 2010, following major storm events that occurred in July and August 2010, an investigation was initiated in Maryland into the reliability of Pepco’s distribution system and the quality of distribution service Pepco provided to its customers. As a result of that investigation, the MPSC imposed sanctions on Pepco in December 2011, including a fine of $1 million, which Pepco has paid. In accordance with the order, Pepco has filed a detailed work plan for the next five years, which provided a comprehensive description of Pepco’s reliability enhancement plan, its emergency response improvement project, and other communication and service restoration improvements. Pepco is also required to file quarterly updates and a year-end status report with the MPSC providing, among other things, detailed information about its reliability and emergency response improvement objectives, progress and spending (and explanations for any inability to meet such objectives), together with an analysis of trends concerning the measured duration and frequency of customer interruptions. In the required reports, Pepco will be required to demonstrate that its reliability enhancement plan costs were prudently spent and produced a significant improvement in reliability, and if it is unable to do so, the MPSC may deny Pepco reimbursement for future reliability enhancement investments or impose additional fines. In addition to the sanctions, the MPSC stated its intent to review the recovery of reliability costs in Pepco’s pending rate case and to disallow incremental costs it determines to be the result of imprudent management. Pepco believes its reliability costs have been prudently incurred. Furthermore, Pepco expects its reliability enhancement plan to enable Pepco to meet the MPSC’s requirements. For more information about the MPSC’s ruling in this proceeding, see Note (7), “Regulatory Matters – Regulatory Proceedings,” to the consolidated financial statements of PHI.

District of Columbia and Maryland Reliability and Customer Service Rulemakings

In December 2011, the MPSC approved proposed rules establishing reliability and customer service regulations, compliance with which is anticipated to be mandated as early as the second quarter of 2012. In addition, in July 2011, the DCPSC adopted regulations that establish specific maximum outage frequency and outage duration levels beginning in 2013 and continuing through 2020 and thereafter and are intended to require Pepco to achieve a reliability level in the first quartile of all utilities in the nation by 2020. Pepco and DPL each expect to incur significant operation and maintenance spending and capital investments to comply with these requirements. Pepco believes that the DCPSC’s standards are achievable in the short term, but continues to believe that the standards may not be realistically achievable at an acceptable cost over the longer term. The reliability standards permit Pepco to petition the DCPSC to reevaluate these standards for the period from 2016 to 2020 to address feasibility and cost issues.

Maryland New Generation RFP Issuance Requirement

In September 2009, the MPSC initiated an investigation into whether Maryland’s regulated electric distribution companies (EDCs) should be required to enter into long-term contracts with entities that construct, acquire or lease, and operate, new electric generation facilities in Maryland. In September 2011, the MPSC issued a notice in which it stated that it had not made a final determination at this time whether new generation in Maryland is needed, but directed each of the four Maryland EDCs, including Pepco and DPL, to issue a request for proposal (RFP) for new generation resources by October 7, 2011. On that date, Pepco and DPL issued the RFP and sought additional information from the MPSC on

16