1

Safe Harbor Statement

Statements in this presentation that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions,

projections or strategies for the future, may be “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. All

forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates,

expectations, beliefs, intentions, projections and strategies reflected in or suggested by the forward-looking statements. These risks and

uncertainties include, but are not limited to, the cost of aircraft fuel; the impact that our indebtedness will have on our financial and operating

activities and our ability to incur additional debt; the restrictions that financial covenants in our financing agreements will have on our financial and

business operations; labor issues; interruptions or disruptions in service at one of our hub airports; our increasing dependence on technology in

our operations; our ability to retain management and key employees; the ability of our credit card processors to take significant holdbacks in

certain circumstances; the effects of terrorist attacks; and competitive conditions in the airline industry.

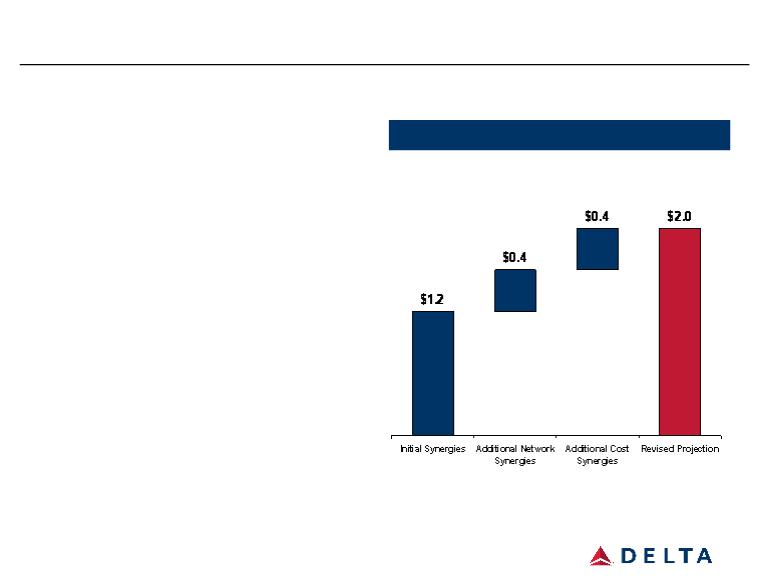

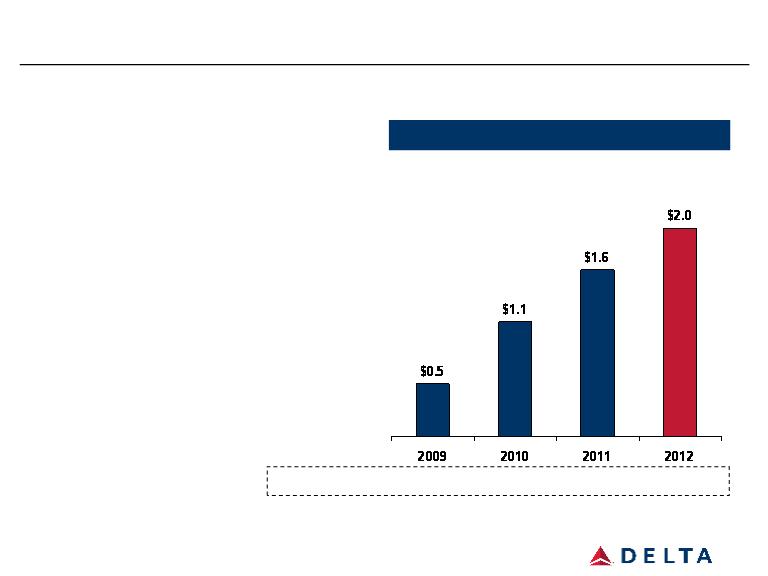

Forward-looking statements in this presentation that relate to our proposed merger transaction with Northwest Airlines Corporation include,

without limitation, our expectations with respect to the synergies, costs and charges, capitalization and anticipated financial impacts of the merger

transaction and related transactions; approval of the merger transaction and related transactions by shareholders; the satisfaction of the closing

conditions to the merger transaction and related transactions; and the timing of the completion of the merger transaction and related transactions.

Factors that may cause the actual results to differ materially from the expected results include, but are not limited to, the possibility that the

expected synergies will not be realized, or will not be realized within the expected time period, due to, among other things, (1) the airline pricing

environment; (2) competitive actions taken by other airlines; (3) general economic conditions; (4) changes in jet fuel prices; (5) actions taken or

conditions imposed by the United States and foreign governments; (6) the willingness of customers to travel; (7) difficulties in integrating the

operations of the two airlines; (8) the impact of labor relations; and (9) fluctuations in foreign currency exchange rates. Other factors include the

possibility that the merger does not close, including due to the failure to receive required stockholder or regulatory approvals, or the failure of

other closing conditions.

Additional information concerning risks and uncertainties that could cause differences between actual results and forward-looking statements is

contained in Delta’s Securities and Exchange Commission filings, including its Annual Report on Form 10-K for the fiscal year ended December

31, 2007. Caution should be taken not to place undue reliance on Delta’s forward-looking statements, which represent Delta’s views only as the

date of this presentation and which Delta has no current intention to update.

In connection with the proposed merger, Delta filed with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4

that includes a preliminary joint proxy statement of Delta and Northwest that also constitutes a prospectus of Delta. At the appropriate time, Delta

and Northwest will mail the final joint proxy statement/prospectus to their stockholders. Delta and Northwest urge investors and security holders

to read the final joint proxy statement/prospectus regarding the proposed merger when it becomes available because it will contain important

information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website

(www.sec.gov). You may also obtain these documents, free of charge, from Delta’s website (www.delta.com) under the tab “About Delta” and

then under the heading “Investor Relations” and then under the item “SEC Filings.” You may also obtain these documents, free of charge, from

Northwest’s website (www.nwa.com) under the tab “About Northwest” and then under the heading “Investor Relations” and then under the item

“SEC Filings and Section 16 Filings.”

Delta, Northwest and their respective directors, executive officers and certain other members of management and employees may be soliciting

proxies from Delta and Northwest stockholders in favor of the merger. Information regarding the persons who may, under the rules of the SEC, be

deemed participants in the solicitation of Delta and Northwest stockholders in connection with the proposed merger will be set forth in the proxy

statement/prospectus when it is filed with the SEC. You can find information about Delta’s executive officers and directors in its definitive proxy

statement filed with the SEC on April 25, 2008 related to Delta’s 2008 Annual Meeting of Stockholders. You can find information about

Northwest’s executive officers and directors in its Amendment to its Annual Report on Form 10-K filed with the SEC on April 29, 2008. You can

obtain free copies of these documents from Delta and Northwest using the contact information above.