Non-GAAP Financial Measures

Delta completed its merger with Northwest Airlines on October 29, 2008. Accordingly, Delta’s financial results prepared in accordance with accounting

principles generally accepted in the U.S. (GAAP) include the results of Northwest Airlines for 2009.Under GAAP, Delta does not include in its financial

results the results of Northwest Airlines prior to the completion of the merger. Accordingly, Delta’s financial results under GAAP for 2008 include the

results of Northwest Airlines for the period from October 30, 2008 through December 31, 2008. This impacts the comparability of Delta’s financial

statements under GAAP for 2009 and 2008.

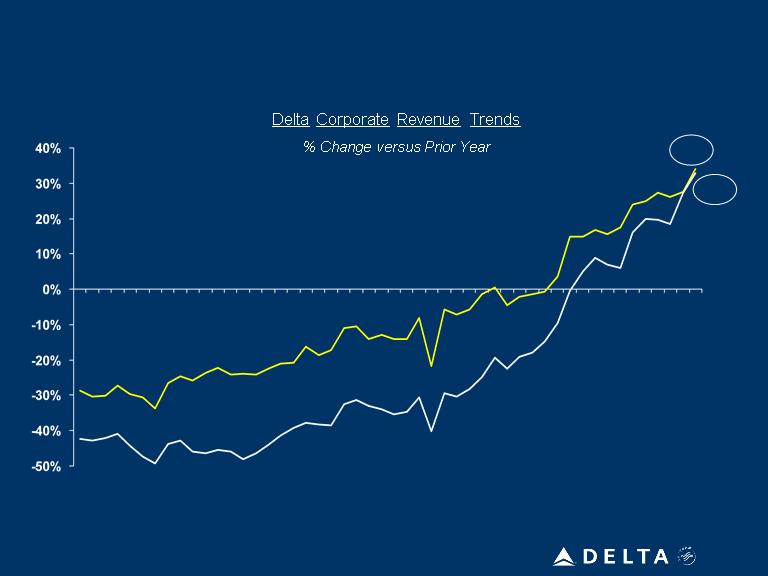

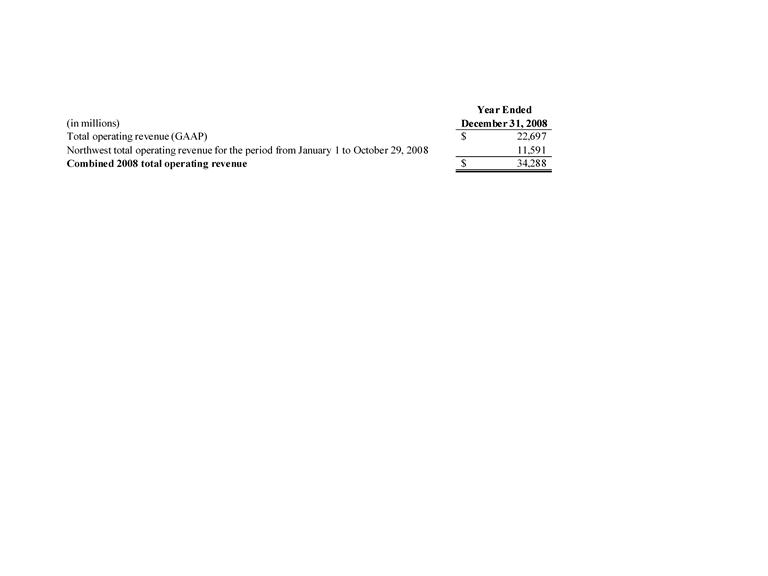

Year-over-year comparisons in certain presentations assume the 2008 financial statements were prepared on a combined basis, excluding special

items. “Combined basis” means the company combines the financial results of Delta and Northwest as if the merger had occurred prior to the beginning

of the applicable period. Delta believes presenting this financial information on a combined basis provides a more meaningful basis for comparing

Delta’s year-over-year financial performance than the GAAP financial information.

Delta is unable to reconcile certain forward-looking projections to GAAP as the nature or amount of special items cannot be estimated at this time.

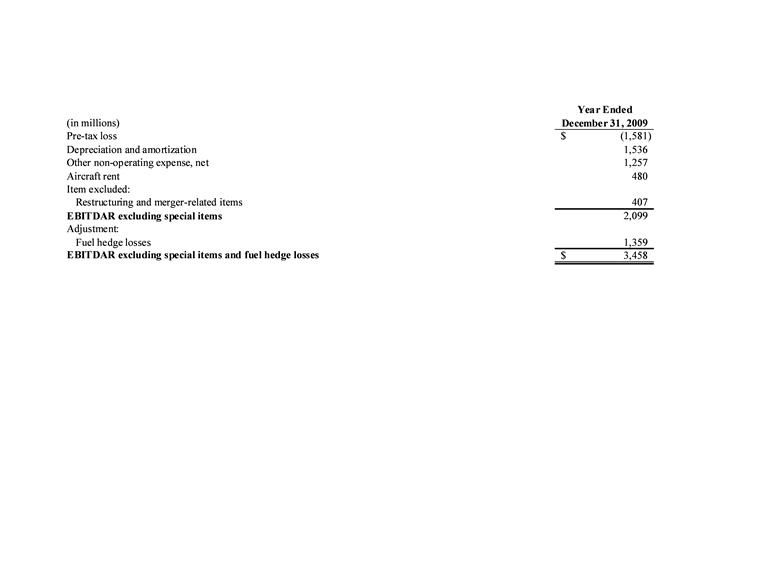

Delta excludes special items and fuel hedge losses because management believes the exclusion of these items is helpful to investors to evaluate the

company's recurring operational performance.

Earnings before interest, taxes, depreciation, amortization and aircraft rent (EBITDAR) has been presented as management believes it is helpful to

investors in utilizing EBITDAR as a proxy for operating cash flow on a period over period basis.

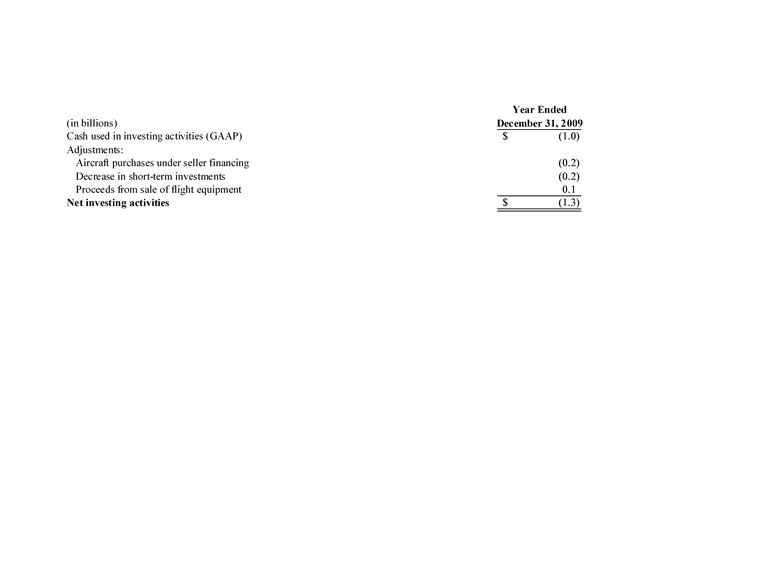

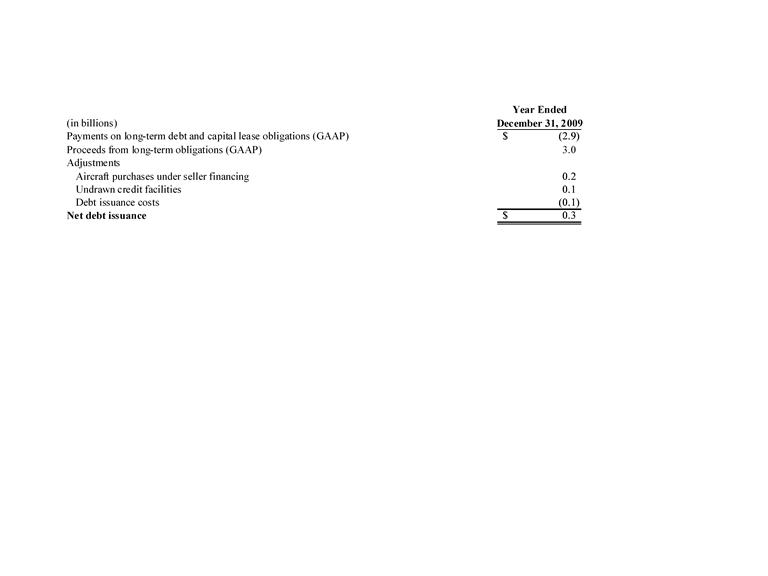

Delta presents net investing activities and net debt issuance because management believes this metric is helpful to investors to evaluate the company's

investing and financing activities.

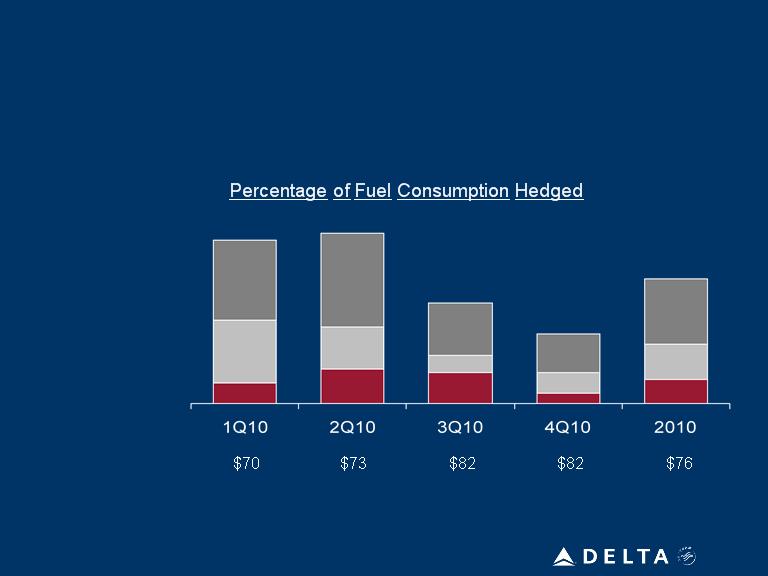

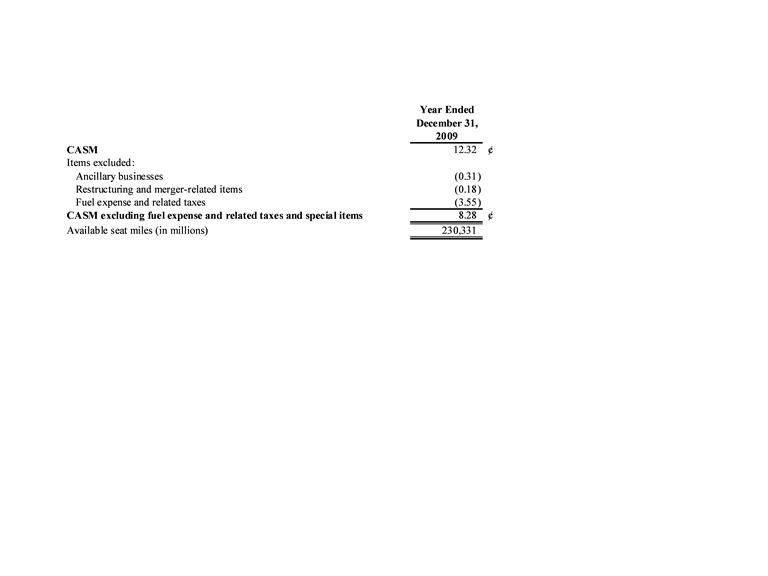

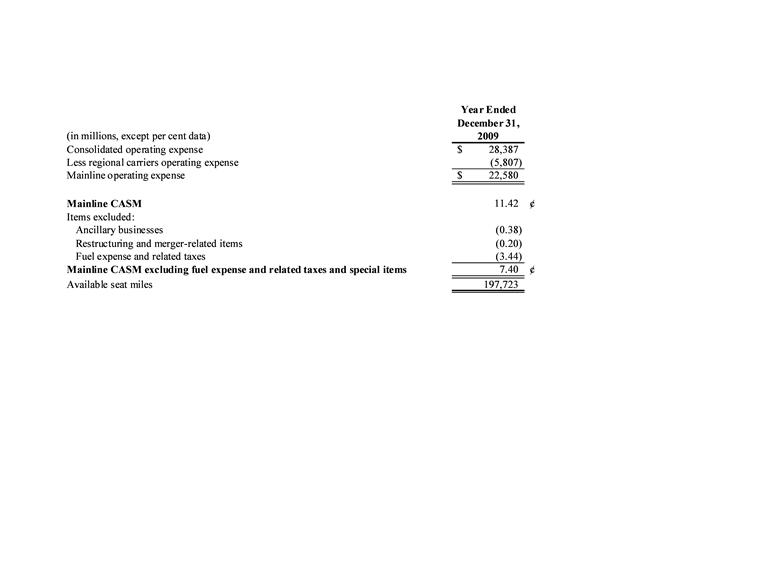

Delta presents consolidated and Mainline cost per available seat mile (CASM) excluding fuel expense and related taxes because management believes

the volatility in fuel prices impacts the comparability of year-over-year financial performance. Consolidated and Mainline CASM exclude ancillary

businesses not associated with the generation of a seat mile. These businesses include expenses related to Delta’s providing maintenance services

(MRO), staffing services and dedicated freight operations as well as Delta’s vacation wholesale operations.

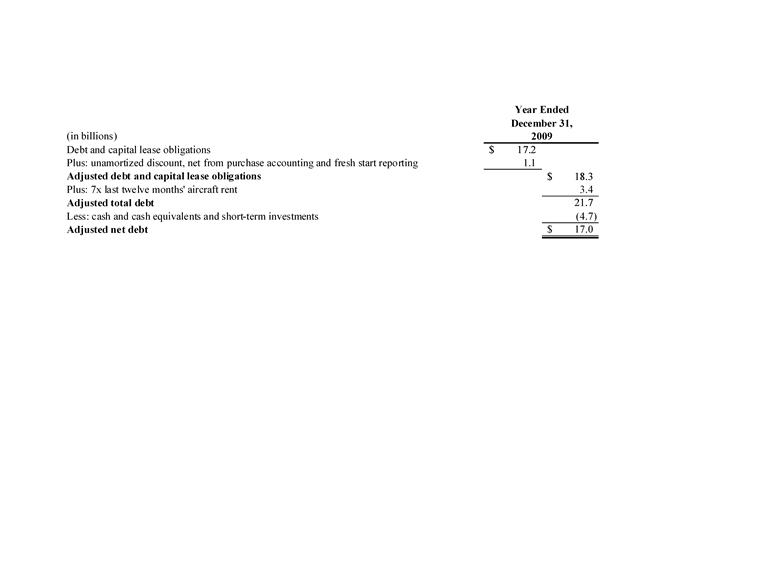

Delta uses adjusted total debt, including aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated financial obligations.

Delta reduces adjusted total debt by cash and cash equivalents and short-term investments, to present the amount of additional assets needed to satisfy

the debt.

The non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a

substitute for or superior to GAAP results.