Delta Air Lines (DAL) 8-KRaymond James Global Airline Conference

Filed: 3 Feb 11, 12:00am

| Non-GAAP Financial Measures | ||||||||||

| We sometimes use information that is derived from our Condensed Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Certain of this information is considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. The non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. | ||||||||||

| Delta is unable to reconcile certain forward-looking projections to GAAP as the nature or amount of special items cannot be estimated at this time. | ||||||||||

| Delta excludes special items because management believes the exclusion of these items is helpful to investors to evaluate the company’s recurring operational performance. | ||||||||||

| Delta presents net investing activities because management believes this metric is helpful to investors to evaluate the company’s investing activities. | ||||||||||

| Delta uses adjusted total debt, including aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated financial obligations. Delta reduces adjusted total debt by cash, cash equivalents and short-term investments, resulting in adjusted net debt, to present the amount of additional assets needed to satisfy the debt. | ||||||||||

| Delta presents return on invested capital (ROIC) as management believes it is helpful to investors in assessing the company's ability to generate returns using its invested capital. ROIC represents operating income excluding special items divided by the sum of average market value of equity and average adjusted net debt. | ||||||||||

Delta presents free cash flow because management believes this metric is helpful to investors to evaluate the company’s ability to generate cash. | ||||||||||

| Pre-Tax Income | ||||||||

| Full Year | Full Year | |||||||

| (in millions) | 2010 | 2009 | ||||||

| Pre-tax income (loss) | $ | 608 | $ | (1,581 | ) | |||

| Items excluded: | ||||||||

| Restructuring and merger-related items | 450 | 407 | ||||||

| Loss on extinguishment of debt | 391 | 83 | ||||||

| Other | 10 | - | ||||||

| Pre-tax income (loss) excluding special items | $ | 1,459 | $ | (1,091 | ) | |||

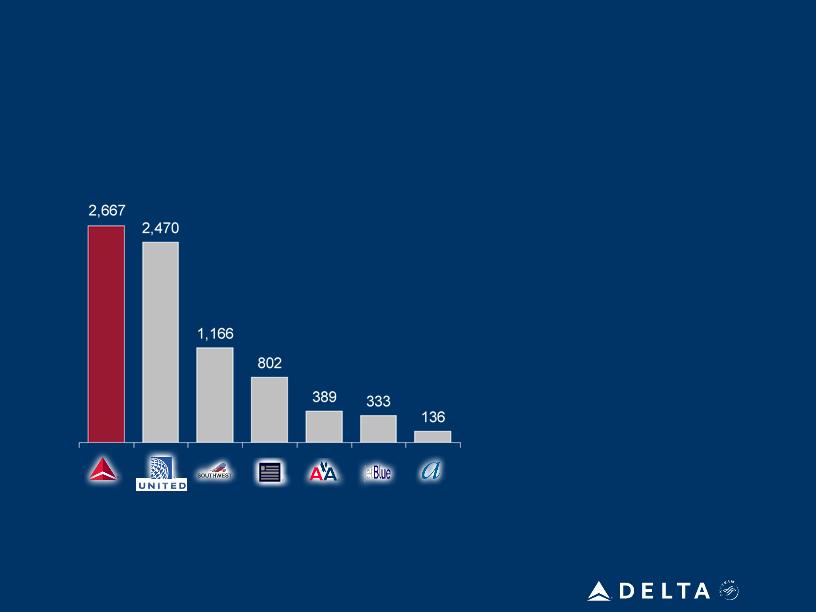

| Operating Income & Margin | ||||

| Full Year | ||||

| (in billions) | 2010 | |||

| Operating income | $ | 2,217 | ||

| Item excluded: | ||||

| Restructuring and merger-related items | 450 | |||

| Operating income excluding special items | $ | 2,667 | ||

| Total operating revenue | $ | 31,755 | ||

| Operating margin excluding special items | 8.4% | |||

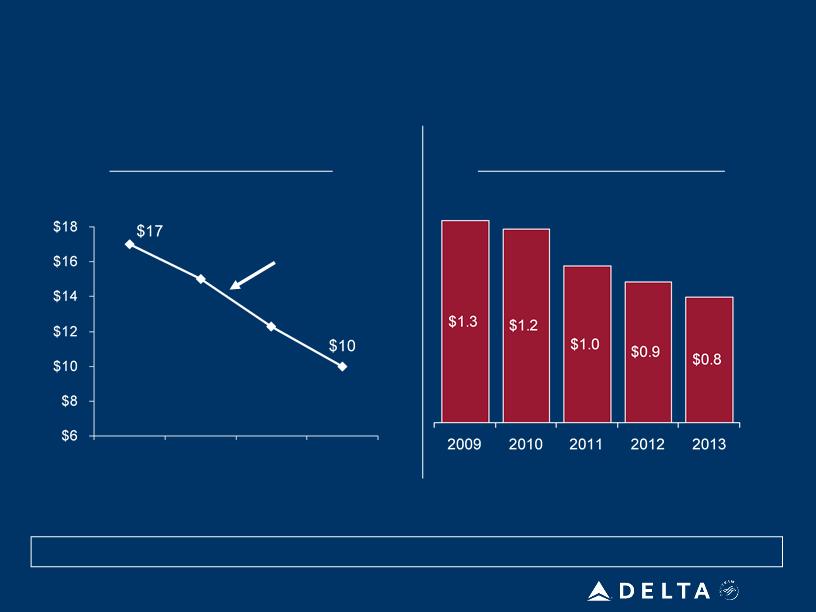

| Total capital expenditures | ||||||||

| Full Year | Full Year | |||||||

| (in billions) | 2009 | 2008 | ||||||

| Delta property and equipment additions (GAAP) | $ | 1.2 | $ | 1.5 | ||||

| Northwest property and equipment additions (GAAP) for the period from January 1 to October 29, 2008 | - | 1.1 | ||||||

| Other | 0.1 | (0.4 | ) | |||||

| Total capital expenditures | $ | 1.3 | $ | 2.2 | ||||

| Adjusted Net Debt & ROIC | ||||||||||||||||||||||||||||||||||||||||

| (in billions) | December 31, 2010 | September 30, 2010 | June 30, 2010 | March 31, 2010 | December 31, 2009 | |||||||||||||||||||||||||||||||||||

| Debt and capital lease obligations | $ | 15.3 | $ | 15.4 | $ | 15.8 | $ | 16.9 | $ | 17.2 | ||||||||||||||||||||||||||||||

| Plus: unamortized discount, net from purchase accounting and fresh start reporting | 0.6 | 0.7 | 1.0 | 1.1 | 1.1 | |||||||||||||||||||||||||||||||||||

| Adjusted debt and capital lease obligations | $ | 15.9 | $ | 16.1 | $ | 16.8 | $ | 18.0 | $ | 18.3 | ||||||||||||||||||||||||||||||

| Plus: 7x last twelve months' aircraft rent | 2.7 | 3.0 | 3.2 | 3.3 | 3.4 | |||||||||||||||||||||||||||||||||||

| Adjusted total debt | 18.6 | 19.1 | 20.0 | 21.3 | 21.7 | |||||||||||||||||||||||||||||||||||

| Less: cash, cash equivalents and short-term investments | (3.6 | ) | (3.9 | ) | (4.4 | ) | (4.9 | ) | (4.7 | ) | ||||||||||||||||||||||||||||||

| Adjusted net debt | $ | 15.0 | $ | 15.2 | $ | 15.6 | $ | 16.4 | $ | 17.0 | ||||||||||||||||||||||||||||||

| (in billions, except % return) | 2010 | |||||||||||||||||||||||||||||||||||||||

| Operating income | $ | 2.7 | ||||||||||||||||||||||||||||||||||||||

| Market value of equity (assuming $12.60/ share) | $ | 10.6 | ||||||||||||||||||||||||||||||||||||||

| Adjusted net debt | $ | 15.5 | ||||||||||||||||||||||||||||||||||||||

| Total invested capital | $ | 26.1 | ||||||||||||||||||||||||||||||||||||||

| Return on invested capital | 10 | % | ||||||||||||||||||||||||||||||||||||||