- DAL Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Delta Air Lines (DAL) DEF 14ADefinitive proxy

Filed: 28 Apr 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

DELTA AIR LINES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2017

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

Notice of Annual Meeting

Dear Stockholder:

On behalf of the Board of Directors, it is our pleasure to invite you to attend the 2017 Annual Meeting of Stockholders of Delta Air Lines, Inc. The meeting will be held at 7:30 a.m. Eastern Daylight Time on Friday, June 30, 2017, at the offices of Davis Polk & Wardwell, 450 Lexington Avenue, New York, New York. At the meeting, stockholders will vote on the following matters:

| – | the election of directors for the next year; |

| – | an advisory vote on executive compensation (also known as “say on pay”); |

| – | an advisory vote on the frequency of future advisory votes on executive compensation; |

| – | the ratification of the appointment of Ernst & Young LLP as Delta’s independent auditors for the year ending December 31, 2017; and |

| – | any other business that may properly come before the meeting. |

If you were a holder of record of Delta common stock at the close of business on May 3, 2017, you will be entitled to vote at the meeting. A list of stockholders entitled to vote at the meeting will be available for examination during normal business hours for ten days before the meeting at Delta’s Investor Relations Department, 1030 Delta Boulevard, Atlanta, Georgia 30354. The stockholder list will also be available at the meeting.

Because space at the meeting is limited, admission will be on a first-come, first-served basis. Stockholders without appropriate documentation may not be admitted to the meeting. If you plan to attend the meeting, please see the instructions on page 7 of the attached proxy statement. If you will need special assistance at the meeting because of a disability, contact Investor Relations at(866) 715-2170.

We encourage stockholders to sign up to receive future proxy materials electronically, including the Notice Regarding the Availability of Proxy Materials. To sign up, visithttp://enroll.icsdelivery.com/dal.

Please read our attached proxy statement carefully and submit your vote as soon as possible. Your vote is important. You can ensure that your shares are voted at the meeting by using our Internet or telephone voting system, or by completing, signing and returning a proxy card.

Sincerely,

|  | |

| Edward H. Bastian | Francis S. Blake | |

| Chief Executive Officer | Chairman of the Board |

Atlanta, Georgia

May 19, 2017

| 1 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

Voting Shares of Common Stock Registered in Your Name or Held under Plans | 5 | |||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

Annual Meeting of Stockholders

Date: | Friday, June 30, 2017 | |||

Time: | 7:30 a.m. Eastern Daylight Time | |||

Location: | Offices of Davis Polk & Wardwell, 450 Lexington Avenue, New York, New York (located in Midtown Manhattan between East 44th Street and East 45th Street) | |||

Record Date: | May 3, 2017 | |||

ITEM 1. Election of Directors — Board Recommendation: Vote FOR each nominee

We ask you to elect 11 directors. Each of the directors listed in the chart below is standing for election to hold office until the next annual meeting of stockholders or until his or her successor is elected and qualified. The following chart provides summary information about each director nominee. Additional information may be found beginning on page 14.

Director | Age | Director Since | Occupation | Other Public Boards | Current Delta Committees | |||||||||||

Independent Directors |

| |||||||||||||||

Francis S. Blake | 67 | 2014 | Former Chairman and CEO of The Home Depot, Inc. | 2 | Audit Corporate Governance* | |||||||||||

Daniel A. Carp | 69 | 2007 | Former Chairman and CEO of Eastman Kodak | 2 | Corporate Governance Personnel & Compensation* | |||||||||||

David G. DeWalt | 53 | 2011 | Former Executive Chairman and CEO of FireEye | 1 | Corporate Governance Safety and Security | |||||||||||

William H. Easter III | 67 | 2012 | Former Chairman, President and CEO of DCP Midstream | 3 | Audit* Corporate Governance | |||||||||||

Mickey P. Foret | 71 | 2008 | Former CFO of Northwest Airlines | 1 | Audit Safety and Security* | |||||||||||

Jeanne P. Jackson | 65 | 2017 | Senior Strategic Advisor to the CEO of NIKE, Inc. | 2 | Audit Personnel & Compensation | |||||||||||

George N. Mattson | 51 | 2012 | Former Partner of Goldman Sachs | 0 | Finance* Personnel & Compensation | |||||||||||

Sergio A.L. Rial | 56 | 2014 | CEO of Banco Santander Brazil | 0 | Audit Personnel & Compensation | |||||||||||

Kathy N. Waller | 59 | 2015 | Executive Vice President, CFO and President, Enabling Services of The Coca-Cola Company | 1 | Corporate Governance Finance | |||||||||||

Non-Independent Directors |

| |||||||||||||||

Edward H. Bastian | 59 | 2010 | CEO of Delta | 1 | n/a | |||||||||||

Douglas R. Ralph | 62 | 2015 | Captain, B767ER, Delta | 0 | Finance Safety and Security | |||||||||||

| * | Chair |

2017 PROXY STATEMENT 1

2017 PROXY STATEMENT 1

Proxy Statement Summary

Board Highlights

Upon election of the Board’s nominees at the annual meeting, the Board will have the following characteristics:

Director Independence

|

Board Tenure |

Diversity | ||||||

9 of 11 directors are independent. |

8 of 11 directors have served on the Board six years or less. |

4 of 11 directors are diverse from a racial, gender or ethnicity standpoint.

|

ITEM 2. Advisory on Executive Compensation — Board Recommendation: Vote FOR

We ask you to vote for approval on an advisory basis of compensation awarded to our executive officers. Additional information may be found beginning on page 54.

Executive Compensation Program

Our executive compensation program is based on the philosophy that we can best achieve our short-term and long-term business goals, which we refer to as our Flight Plan, by closely linking pay to performance and aligning the interest of all Delta employees, including executive officers, with our customers and stockholders. The following highlights reflect how our executive compensation program emphasizes pay for performance:

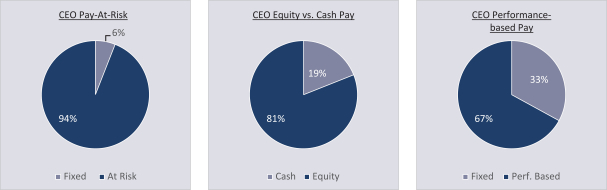

| • | A substantial portion of total compensation is placed at risk (i.e., value received is contingent upon our financial, operational, customer satisfaction and stock performance), emphasizing variable over fixed compensation. Ninety-four percent of our Chief Executive Officer’s target compensation opportunity for 2016 was at risk.Eighty-one percent of Mr. Bastian’s target compensation is delivered through equity-based opportunities and his cash-based compensation (base salary and annual incentive opportunity) is below the 25th percentile of our peer group. |

| • | Our annual and long-term incentive plans directly support our Flight Plan by utilizing challenging performance measures that provide incentives that deliver value to our stockholders and drive payouts to frontline employees under our broad-based profit sharing and shared rewards programs. |

| • | We continue to focus on long-term compensation opportunities. The Personnel & Compensation Committee of the Board of Directors continued to grant all awards under long-term incentive plans with vesting schedules of three years. |

ITEM 3. Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation — Board Recommendation: Vote FOR “One Year”

We ask you to vote for “ONE YEAR” for an advisory vote on the frequency of future advisory votes on executive compensation. This means a vote would occur on an annual basis (as opposed to voting every two or three years). Additional information may be found on page 55.

ITEM 4. Ratification of the Appointment of Independent Auditors — Board Recommendation: Vote FOR

We ask you to ratify the appointment of Ernst & Young LLP as independent auditors for the year ending December 31, 2017. Additional information may be found on page 56.

2 2017 PROXY STATEMENT

Proxy Statement Summary

2016 Performance Highlights*

Strong Financial Results

| ||||

Earnedpre-tax income of $6.6 billion, Delta’s seventh consecutive year of solid profitability.

| Excluding special items, earnedpre-tax income of $6.1 billion, a $206 million increase over 2015. | |||

|

| |||

Reduced debt and capital leases to $7.3 billion, a $997 million reduction from 2015.

| Reduced adjusted net debt to $6.1 billion, a $531 million reduction from 2015.

| |||

|

| |||

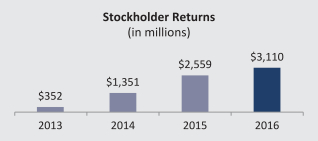

Returned $3.1 billion to stockholders through a combination of quarterly cash dividends and share repurchases.

| ||||

| ||||

Continued Revenue Premium

|

Excellent Operating Performance

| |||

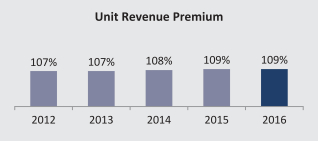

Generated a unit revenue premium relative to the industry for the sixth year in a row (based on our unit revenue compared to the average unit revenue of our domestic competitors).

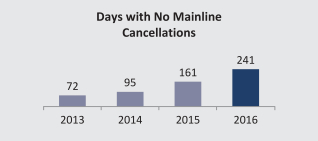

| Another year of strong operating performance, resulting in a mainlineon-time arrival rate of 86.3%, flight completion factor of 99.6% and a record of 241 days with zero cancellations in 2016.

| |||

|  | |||

| * | See “Supplemental Information about Financial Measures” on page 58 for reconciliations ofnon-GAAP measures and reasons we use them. |

2017 PROXY STATEMENT 3

2017 PROXY STATEMENT 3

Proxy Statement Summary

Governance Highlights

☑ Independent chairman |

☑ All directors elected annually; average tenure ofnon-management Board members is 4 years |

☑ Majority voting for directors in uncontested elections |

☑ Amended in 2016, Bylaws provide for proxy access |

☑ Also amended in 2016, our Corporate Governance Principles prohibit ownership of specific airline competitors’ stock by Board members and officers. The Corporate Governance Principles also provide no outside director will stand forre-election after age 72 |

☑ Robust annual self-assessment of Board and Board committees |

☑ Regular formal succession planning for management and the Board of Directors, evidenced by successful senior management and Board leadership transitions in 2016 |

☑ Ongoing Board refreshment efforts — five new directors from 2014 to the present |

☑ Anti-hedging and anti-pledging policy for all employees and Board members |

☑ Meaningful stock ownership and retention guidelines for Board members and executive officers |

☑ No stockholder rights plan (poison pill) or super-majority voting |

☑ No employment agreements or supplemental executive retirement plans for officers |

☑ Commitment to contributing 1% of net income to charitable groups |

Sustainability Efforts

☑ Improved fuel efficiency of aircraft and ground support equipment and reduced and recycled operational waste |

☑ The only North American airline in the Dow Jones North American Sustainability Index for the sixth consecutive year |

☑ Achieving carbon-neutral growth since 2012 through voluntary purchase of carbon offsets; among highest scoring North American airlines evaluated by the CDP (formerly Carbon Disclosure Project) for Climate Change; tracking fuel efficiency as part of the company-wide flight plan goals and managing carbon footprint ahead of airline industry goals |

☑ First legacy airline to report a verified annual greenhouse gas emissions inventory, with continued verification under The Climate Registry, anon-profit organization that verifies carbon footprints |

Active Investor Outreach

We have long-standing, active engagement with our investors. Our senior management meets with investors at our annual investor day and more than 10 industry conferences throughout the year. In 2016, management met with approximately 90% of our top 20 actively-managed investors to discuss governance and financial performance of the company. Annually we invite our largest 25 investors to discuss our executive compensation program, financial performance, say on pay proposal, Board succession planning and agenda items for the annual meeting. We regularly report our investors’ views to our Board of Directors, and its Personnel & Compensation Committee considers these views when developing our executive compensation program. In addition, we engage with analysts through quarterly conference calls, our annual Capital Markets day to discuss long-term targets, and meetings and calls. We have dedicated resources to engage with all shareholders through monitoring of investor relationse-mail, leveraging social media to convey key investment messages and utilizing infographics to improve communications with a broader audience.

In late 2015 and in 2016, the Board of Directors considered the adoption of a proxy access bylaw. After reviewing the specific terms of a bylaw proposed by an investor, proxy access bylaws adopted by other large companies and our own circumstances, we reached out to our large investors, including managers of index funds, to discuss the terms of a proposed bylaw for Delta. After taking into consideration our investors’ viewpoints, the Board of Directors adopted a proxy access bylaw in October 2016.

4 2017 PROXY STATEMENT

Internet Availability of Proxy Materials

Under rules adopted by the Securities and Exchange Commission (SEC), we are furnishing proxy materials (including our 2016Form 10-K) to our stockholders on the Internet, rather than mailing paper copies to each stockholder. If you received a Notice Regarding the Availability of Proxy Materials (the Notice) by U.S. or electronic mail, you will not receive a paper copy of these proxy materials unless you request one. Instead, the Notice tells you how to access and review the proxy materials and vote your shares on the Internet. If you would like to receive a paper copy of our proxy materials free of charge, follow the instructions in the Notice. The Notice will be distributed to our stockholders beginning on or about May 19, 2017.

The Board of Directors set May 3, 2017 as the record date for determining the stockholders entitled to notice of and to vote at the annual meeting. On April 15, 2017, 736,042,013 shares of Delta common stock, par value $0.0001 per share, were outstanding. We do not expect the number of shares will change materially as of the record date. The common stock is the only class of securities entitled to vote at the meeting. Each outstanding share entitles its holder to one vote.

Voting Shares of Common Stock Registered in Your Name or Held under Plans

The control number you receive in your Notice covers shares of common stock in any of the following forms:

| • | common stock registered in your name (registered shares); |

| • | common stock held in your account under the Delta Pilots Savings Plan (Pilot Plan); |

| • | common stock allocated to your account under the Delta Family-Care Savings Plan (Savings Plan); or |

| • | unvested restricted common stock granted under the Delta Air Lines, Inc. Performance Compensation Plan. |

Special Note to Delta Employees About the Employee Stock Purchase Plan. If you are a Delta employee participating in the Employee Stock Purchase Plan, the control number you receive in your Notice does not cover shares of common stock purchased pursuant to the plan. These shares are held for your benefit by Fidelity in street name. For information about voting these shares, see “Voting Shares Held in Street Name” on page 6.

If you hold shares in more than one of the ways listed above, you may receive more than one Notice with separate control numbers. You will need to submit voting instructions for shares associated with each control number in order to vote all of your shares.

Your submission of voting instructions for registered shares results in the appointment of a proxy to vote those shares. In contrast, your submission of voting instructions for common stock held in your Pilot Plan account or allocated to your Savings Plan account, or for unvested restricted common stock granted under the Delta Air Lines, Inc. Performance Compensation Plan, instructs the applicable plan trustee or administrator how to vote those shares, but does not result in the appointment of a proxy. You may submit your voting instructions regarding all shares covered by the same control number before the meeting by using our Internet or telephone system or by completing and returning a proxy card, as described below:

| • | Voting by the Internet or Telephone. You may vote using the Internet or telephone by following the instructions in the Notice to access the proxy materials and then following the instructions provided to allow you to record your vote. After accessing the proxy materials, to vote by telephone call1-800-690-6903, or to vote by the Internet, go towww.proxyvote.com and follow the instructions. The Internet and telephone voting procedures are designed to authenticate votes cast by using a personal identification number. These procedures enable stockholders to confirm their instructions have been properly recorded. |

| • | Voting by Proxy Card. If you obtained a paper copy of our proxy materials, you may also vote by signing, dating and returning your instructions on the proxy card in the enclosed postage-paid envelope. Please sign the proxy card exactly as your name appears on the card. If shares are owned jointly, each joint owner should sign the proxy card. If a stockholder is a corporation or partnership, the proxy card should be signed in the full corporate or partnership name by a duly authorized person. If the proxy card is signed pursuant to a power of attorney or by an executor, administrator, trustee or guardian, state the signer’s full title and provide a certificate or other proof of appointment. |

2017 PROXY STATEMENT 5

2017 PROXY STATEMENT 5

General Information

To be effective, instructions regarding shares held in your Pilot Plan account or allocated to your Savings Plan account must be received by 5:00 p.m. Eastern Daylight Time on June 28, 2017. Instructions regarding registered shares or unvested restricted common stock must be received by 11:59 p.m. Eastern Daylight Time on June 29, 2017.

You may also vote registered shares by attending the annual meeting and voting in person by ballot; this will revoke any proxy you previously submitted.

Note that you may not vote shares of unvested restricted common stock, shares held in your Pilot Plan account or shares allocated to your Savings Plan account in person at the meeting. If you do not submit voting instructions in a timely manner regarding shares of unvested restricted common stock, shares held in your Pilot Plan account or shares allocated to your Savings Plan account, they will not be voted. See “Voting Shares Held in Street Name” below for information about voting Employee Stock Purchase Plan shares.

All properly submitted voting instructions, whether submitted by the Internet, telephone or U.S. mail, will be voted at the annual meeting according to the instructions given, provided they are received prior to the applicable deadlines described above. All properly submitted proxy cards not containing specific instructions will be voted in accordance with the Board of Directors’ recommendations set forth on page 7. The members of Delta’s Board of Directors designated to vote the proxies returned pursuant to this solicitation are Edward H. Bastian, Francis S. Blake and Daniel A. Carp.

Revoking a Proxy or Voting Instructions

If you hold registered shares, unvested restricted common stock, shares in your Pilot Plan account or shares allocated to your Savings Plan account, you may revoke your proxy or voting instructions prior to the meeting by:

| • | providing written notice to Delta’s Law Department at Delta Air Lines, Inc., Dept. No. 981, 1030 Delta Boulevard, Atlanta, Georgia 30354, Attention: Corporate Secretary; or |

| • | submitting later-dated instructions by the Internet, telephone or U.S. mail. |

To be effective, revocation of instructions regarding shares held in your Pilot Plan account or allocated to your Savings Plan account must be received by 5:00 p.m. Eastern Daylight Time on June 28, 2017. Revocation of instructions regarding registered shares or unvested restricted common stock must be received by 11:59 p.m. Eastern Daylight Time on June 29, 2017.

You may also revoke your proxy covering registered shares by attending the annual meeting and voting in person by ballot. Attending the meeting will not, by itself, revoke a proxy.

Voting Shares Held in Street Name

If your shares are held in the name of a broker, bank or other record holder (that is, in street name), refer to the instructions provided by the record holder regarding how to vote your shares or to revoke your voting instructions. This includes any shares purchased through the Employee Stock Purchase Plan. You may also obtain a proxy from the record holder permitting you to vote in person at the annual meeting. Without a proxy from the record holder, you may not vote shares held in street name by returning a proxy card or by voting in person at the annual meeting.If you hold your shares in street name, it is critical that you provide instructions to, or obtain a proxy from, the record holder if you want your shares to count in the election of directors (Proposal 1), the advisory vote on executive compensation (Proposal 2), and the advisory vote on the frequency of future advisory votes on executive compensation (Proposal 3). As described in the next section of this proxy statement, regulations prohibit your bank or broker from voting your shares on these proposals.

Limitation on Brokers’ Authority to Vote Shares

Under New York Stock Exchange (NYSE) rules, brokerage firms may vote in their discretion on certain matters on behalf of clients who do not provide voting instructions at least 15 days before the date of the annual meeting. Generally, brokerage firms may vote to ratify the appointment of independent auditors and on other “discretionary” items. Because Proposals 1, 2 and 3 are not discretionary items, brokers are not permitted to vote your shares on these proposals unless you provide voting instructions. Accordingly, if your shares are held in a brokerage account and you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker on Proposal 4, but not the other proposals described in this proxy statement. Brokernon-votes will not be considered in connection with Proposals 1, 2 and 3.Therefore, we urge you to give voting instructions to your broker on all proposals.

6 2017 PROXY STATEMENT

General Information

The quorum at the annual meeting will consist of a majority of the votes entitled to be cast by the holders of all shares of common stock that are outstanding and entitled to vote. Abstentions from voting and brokernon-votes, if any, will be counted in determining whether a quorum is present. The meeting will not commence if a quorum is not present.

Votes Necessary to Act on Proposals

At an annual meeting at which a quorum is present, the following votes will be necessary on each of the proposals:

| • | Each director shall be elected by the vote of a majority of the votes cast with respect to the director. For purposes of this vote, a majority of the votes cast means that the number of shares voted “for” a director must exceed 50% of the votes with respect to that director (excluding abstentions). |

| • | The advisory vote to approve executive compensation (say on pay) requires the affirmative vote of the majority of shares present and entitled to vote at the meeting. Abstentions have the same effect as votes against the proposal. Although the outcome of the vote is advisory and therefore will not be binding on Delta, the Personnel & Compensation Committee of the Board of Directors will review and consider the voting results when making future decisions regarding executive compensation. |

| • | In the advisory vote on the frequency of future advisory votes on executive compensation, the choice that receives the highest number of votes cast will be the choice approved by stockholders. Abstentions will have no effect on the outcome of the vote. Although the outcome of the vote is advisory and therefore will not be binding on Delta, the Board of Directors will review and consider the voting results when making decisions regarding the frequency of future advisory votes on executive compensation. |

| • | Ratification of the appointment of Ernst & Young LLP as independent auditors for the year ending December 31, 2017 requires the affirmative vote of the majority of shares present and entitled to vote at the meeting. Abstentions have the same effect as votes against the proposal. |

Brokernon-votes, if any, will be handled as described under “Limitation on Brokers’ Authority to Vote Shares” page 6.

Recommendations of the Board of Directors

The Board of Directors recommends that you vote:

| • | FOR the election of the director nominees named in this proxy statement; |

| • | FOR the approval, on an advisory basis, of the compensation of Delta’s named executive officers; |

| • | FOR “one year” for an advisory vote on the frequency of future advisory votes on executive compensation; and |

| • | FOR the ratification of the appointment of Ernst & Young LLP as Delta’s independent auditors for the year ending December 31, 2017. |

All properly submitted proxy cards not containing specific instructions will be voted in accordance with the Board’s recommendations.

Presentation of Other Business at the Meeting

Delta is not aware of any business to be transacted at the annual meeting other than as described in this proxy statement. If any other item or proposal properly comes before the meeting (including, but not limited to, a proposal to adjourn the meeting in order to solicit votes in favor of any proposal contained in this proxy statement), the proxies received will be voted at the discretion of the directors designated to vote the proxies.

To attend the annual meeting, you will need to show you are either a Delta stockholder as of the record date, or hold a valid proxy from such a Delta stockholder.

| • | If your shares are registered in street name, or are held in your Pilot Plan account or your Savings Plan account, please bring evidence of your stock ownership, such as your most recent account statement. |

2017 PROXY STATEMENT 7

2017 PROXY STATEMENT 7

General Information

| • | If you own unvested restricted common stock, please bring your Delta-issued identification card; we will have a list of the holders of unvested restricted common stock at the meeting. |

All stockholders should also bring valid picture identification; employees may use their Delta-issued identification card. If you do not have valid picture identification and proof that you own Delta stock, you may not be admitted to the meeting.

As permitted by the Securities Exchange Act of 1934 (the 1934 Act), only one copy of this proxy statement is being delivered to stockholders residing at the same address, unless the stockholders have notified Delta of their desire to receive multiple copies of the proxy statement. This is known as householding.

Delta will promptly deliver, upon oral or written request, a separate copy of the proxy statement to any stockholder residing at an address to which only one copy was mailed. Requests for additional copies for the current year or future years should be directed to Delta’s Investor Relations toll free at (866)715-2170.

Stockholders of record residing at the same address and currently receiving multiple copies of the proxy statement may contact our registrar and transfer agent, Wells Fargo Shareowners Services, to request that only a single copy of the proxy statement be mailed in the future. Contact Wells Fargo by phone at (800)259-2345 or by mail at P.O. Box 64854, St. Paul, MN 55164-0854.

If you hold your shares in street name, you should contact Broadridge Investor Communication Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, NY 11717 or by calling1-866-540-7095 to request that only a single copy of the proxy statement be mailed in the future.

8 2017 PROXY STATEMENT

Delta believes that sound governance practices are essential to enhance long-term value for our stockholders. We operate under governance practices that are transparent and consistent with best practices.

You may view the charters of the Audit, Corporate Governance, Finance, Personnel & Compensation and Safety and Security Committees, the Certificate of Incorporation, the Bylaws, corporate governance principles, codes of ethics and business conduct, and director independence standards on our Corporate Governance website athttp://ir.delta.com/governance/governance-documents/default.aspx. You may obtain a copy of these materials by contacting Delta’s Corporate Secretary at the address below.

Independence of Audit, Corporate Governance and Personnel & Compensation Committee Members

For many years, Delta’s Board of Directors has been composed of a substantial majority of independent directors. Delta’s Board established the Audit Committee, the Corporate Governance Committee, the Finance Committee, the Personnel & Compensation Committee and the Safety and Security Committee to focus on particular Board responsibilities.

The Board of Directors has affirmatively determined that all current directors are independent under the New York Stock Exchange (NYSE) listing standards and Delta’s director independence standards, except Ed Bastian, who is not independent because he is our Chief Executive Officer, and Doug Ralph, who is not independent because he is a Delta pilot. In making these independence determinations, the Board of Directors considered information submitted by the directors in response to questionnaires, information obtained from Delta’s internal records and advice from counsel.

The Audit, Corporate Governance and Personnel & Compensation Committees consist entirely ofnon-employee directors who are independent, as defined in the NYSE listing standards and Delta’s director independence standards. The members of the Audit Committee also satisfy the additional independence requirements set forth in rules under the 1934 Act. In addition, each member of the Audit Committee has been designated an Audit Committee Financial Expert. The members of the Personnel & Compensation Committee also satisfy the additional independence requirements set forth in rules under the 1934 Act.

Directors Elected Annually; Majority Voting for Directors

Delta’s Certificate of Incorporation and Bylaws provide that all directors are elected annually. Under the Bylaws, a director in an uncontested election is elected by a majority of votes cast (excluding abstentions) at a stockholders’ meeting at which a quorum is present. In an election for directors where the number of nominees exceeds the number of directors to be elected — a contested election — the directors are elected by the vote of a plurality of the shares represented at the meeting and entitled to vote on the matter.

Identification and Selection of Nominees for Director

The Corporate Governance Committee recommends to the Board of Directors nominees for election to the Board. The Corporate Governance Committee seeks nominees who have the skills and experience to assist management in the operation of Delta’s business and to provide input on Delta’s strategy, among other matters. In accordance with Delta’s corporate governance principles, the Corporate Governance Committee and the Board of Directors assess potential nominees (including incumbent directors) based on factors such as the individual’s business experience, character, judgment, diversity of experience, international background and other matters relevant to the Board’s needs and objectives at the particular time. Independence, financial literacy and the ability to devote significant time to Board activities and to the enhancement of the nominee’s knowledge of Delta’s business are also factors considered for Board membership. The Corporate Governance Committee retains third-party search firms from time to time to assist in identifying and preliminarily screening potential Board members.

The Corporate Governance Committee evaluates potential nominees suggested by stockholders on the same basis as all other potential nominees. To recommend a potential nominee, you may:

| • | e-mailnonmgmt.directors@delta.comor |

| • | send a letter addressed to Delta’s Law Department at Delta Air Lines, Inc., Dept. No. 981, 1030 Delta Boulevard, Atlanta, Georgia 30354, Attention:Corporate Secretary. |

2017 PROXY STATEMENT 9

2017 PROXY STATEMENT 9

Governance Matters

Each potential nominee is reviewed and screened by the Corporate Governance Committee, which decides whether to recommend a candidate for consideration by the full Board.

Audit Committee Financial Experts

The Board of Directors has designated Mr. Easter, Mr. Blake, Mr. Foret, Ms. Franklin, Ms. Jackson and Mr. Rial as Audit Committee Financial Experts.

Compensation Committee Interlocks and Insider Participation

None of the members of the Personnel & Compensation Committee is a former or current officer or employee of Delta or has any interlocking relationships as set forth in applicable SEC rules.

Stockholders and other interested parties may communicate with ournon-management directors by sending ane-mail tononmgmt.directors@delta.com. We have established a link to this address on our Investor Relations website. Communications with directors may also be mailed to Delta’s Corporate Secretary at the address listed above. Communications will be sent directly to the Chairman of the Board, as representative of thenon-management directors, other than communications pertaining to customer service, human resources, accounting, auditing, internal control and financial reporting matters. Communications regarding customer service and human resources matters will be forwarded for handling by the appropriate Delta department. Communications regarding accounting, auditing, internal control and financial reporting matters will be brought to the attention of the Audit Committee Chair.

During 2016, the Board of Directors met 11 times. Each director who served on the Board during 2016 attended at least 75% of the meetings of the Board of Directors and the committees on which he or she served that were held during his or her tenure on the Board. It is the Board’s policy that directors are encouraged to attend the annual meeting. All of Delta’s directors, except one, attended the annual meeting in 2016.

In 2016, the Board routinely held executive sessions without the Chief Executive Officer or any other management director. Mr. Carp presided at executive sessions as Chairman of the Board until May 2, 2016. Thereafter, Mr. Blake, who was named lead director on May 2, 2016 and becamenon-executive Chairman of the Board on October 11, 2016, presided at the executive sessions.

Board of Directors Leadership Structure

Because we believe operating pursuant to sound governance practices benefits the long-term interests of our stockholders, since 2003 we have chosen to elect an independent,non-executive chairman separate from our Chief Executive Officer. Governance commentators, proxy voting advisory firms, and institutional stockholders generally conclude the separation of the two roles is a “best practice.” We believe thenon-executive Chairman of the Board plays an important governance leadership role that enhances long-term stockholder value. Responsibilities include:

| • | chairing meetings ofnon-management directors (executive sessions); |

| • | presiding at the Annual Stockholders Meeting; |

| • | briefing the Chief Executive Officer on issues raised in executive sessions; |

| • | in collaboration with the Corporate Governance Committee of the Board, committee chairs and the Chief Executive Officer, scheduling Board meetings, setting Board agendas and strategic discussions and providing a review ofpre-meeting materials delivered to directors; |

| • | overseeing Board, committee and senior management evaluations and succession planning; |

| • | managing the Board’s oversight of risks; |

| • | recommending appropriate governance policies and practices; |

| • | overseeing the avoidance of conflicts of interests; |

| • | recommending Board committee and committee chair assignments; |

10 2017 PROXY STATEMENT

Governance Matters

| • | facilitating director discussions inside and outside the boardroom, managing the relationship between the Chief Executive Officer and the Board, consulting with the Chief Executive Officer and serving as a counterweight as appropriate; |

| • | overseeing the process for selecting new Board members; |

| • | calling meetings of the Board and stockholders; |

| • | chairing the Corporate Governance Committee; |

| • | conducting/overseeing the annual evaluation of the committees and the Board; and |

| • | carrying out other duties requested by the Chief Executive Officer and the Board as a whole. |

The Board of Directors has established the following committees to assist it in discharging its responsibilities:

Audit Committee

The Audit Committee met 10 times in 2016. Among its other responsibilities, the Committee:

| • | appoints (subject to stockholder ratification) our independent auditors; |

| • | represents and assists the Board in its oversight of: |

| – | the integrity of our financial statements; |

| – | legal and regulatory matters, including compliance with applicable laws and regulations; |

| – | our independent auditors’ qualifications, independence and performance; |

| – | the performance of our internal audit department; |

| • | reviews audits and other work product of the independent auditors and internal audit department; |

| • | discusses the adequacy and effectiveness of our internal control over financial reporting; |

| • | oversees our compliance with procedures and processes pertaining to corporate ethics and standards of business conduct; |

| • | reviews and, if appropriate, approves or ratifies: |

| – | possible conflicts of interest involving members of the Board or executive officers; |

| – | transactions that would be subject to disclosure under Item 404 of SEC RegulationS-K; |

| • | considers complaints concerning accounting, auditing, internal control and financial reporting matters; |

| • | reviews the enterprise risk management process by which management identifies, assesses and manages Delta’s exposure to risk; discusses major risk exposures with management; apprises the Board of Directors of risk exposures and management’s actions to monitor and manage risk; and reviews Delta’s insurance programs; and |

| • | focuses on tone at the top and chooses key topics for detailed review. |

Corporate Governance Committee

The Corporate Governance Committee met four times in 2016. Among its other responsibilities, the Committee:

| • | leads the search and recruiting process for new outside directors; considers stockholder nominations of candidates for election as directors; and |

| • | considers, develops and makes recommendations, where appropriate, to the Board regarding: |

| – | governance standards; |

| – | qualifications and eligibility requirements for Board members, including director independence standards; |

| – | the Board’s size, composition, organization and processes; |

| – | the type, function, size, membership and chairs of Board committees; |

2017 PROXY STATEMENT 11

2017 PROXY STATEMENT 11

Governance Matters

| – | evaluation of the Board’s performance; |

| – | legal and regulatory changes in corporate governance; |

| – | political contributions reports; and |

| – | the compensation ofnon-employee directors. |

Finance Committee

The Finance Committee met 10 times in 2016. Among its other responsibilities, the Committee:

| • | reviews and makes recommendations, where appropriate, to the Board regarding: |

| – | financial planning and financial structure; |

| – | financings and guarantees; |

| – | capital expenditures, including fleet acquisition; |

| – | acquisitions and investments; |

| – | annual and longer-term operating plans; |

| – | capital structure, including issuances and repurchases of capital stock and other securities; |

| – | risk management practices and policies concerning investments and hedging, both financial andnon-financial, including swaps; |

| – | balance sheet strategies; |

| – | derivatives management, fuel hedging and oversight of Delta’s oil and fuel management; and |

| • | approves commitments, capital expenditures and debt financings andre-financings, subject to certain limits. |

Personnel & Compensation Committee

The Personnel & Compensation Committee met seven times in 2016. Among its other responsibilities, the Committee:

| • | establishes general compensation philosophy and oversees the development and implementation of compensation programs; |

| • | performs an annual performance evaluation of the Chief Executive Officer and determines and approves the Chief Executive Officer’s compensation; |

| • | reviews and approves compensation programs for executive officers; |

| • | reviews and regularly approves management succession plans; |

| • | makes recommendations to the Board regarding election of officers; and |

| • | selects, retains, terminates, and approves fees of compensation advisors to the Committee. |

Safety and Security Committee

The Safety and Security Committee met five times in 2016. Among its other responsibilities, the Committee:

| • | oversees and consults with management regarding customer, employee and aircraft operating safety and security, including related goals, performance and initiatives by: |

| – | reviewing current and proposed safety and security-related programs, policies and compliance matters; |

| – | reviewing matters with a material effect on Delta’s flight safety operations and security; |

| – | establishing and approving annual safety and security goals; |

| – | reviewing the safety and security programs and performance of the Delta Connection carriers; and |

| – | reviewing the security of Delta’s information technology systems and operations, including defenses against cyber threats to the airline and data of its customers and employees. |

12 2017 PROXY STATEMENT

Governance Matters

Board Oversight of Risk Management

The Board of Directors has ultimate responsibility to oversee Delta’s enterprise risk management program (ERM). The Board discusses risk throughout the year, particularly when reviewing operating and strategic plans and when considering specific actions for approval. Depending on the nature of the risk, the responsibility for oversight of selected risks may be delegated to appropriate committees of the Board of Directors, with material findings reported to the full Board. Delegations of risk oversight by the Board include:

| • | The Audit Committee reviews the ERM framework at the enterprise level; reviews management’s process for identifying, managing and assessing risk; oversees the management of risks related to the integrity of the consolidated financial statements, internal control over financial reporting, the internal audit function, legal and regulatory matters, and certain risks delegated for oversight from time to time by the Board; and related matters. |

| • | The Finance Committee oversees the management of risks related to aircraft fuel price and fuel hedging; foreign currency and interest rate hedging; Delta’s financial condition and capital structure; its financing, acquisition and investment transactions; and related matters. |

| • | The Personnel & Compensation Committee reviews risks related to management succession and Delta’s executive compensation program; and related matters. |

| • | The Corporate Governance Committee reviews risks related to Board of Directors’ succession and Delta’s corporate governance; and related matters. |

| • | The Safety and Security Committee oversees the management of risks related to customer, employee, aircraft and airport operating safety and security and information technology and cyber security; and related matters. |

Under Delta’s ERM process, a management level, cross-divisional council, the Delta Risk, Privacy and Compliance Council, is responsible for the following: setting risk tolerance levels; defining organizational responsibilities for risk management; determining the significant risks to Delta; developing risk mitigation and management strategies, based on Delta’s risk tolerance levels; and monitoring the business to determine that risk mitigation activities are in place and operating. The council periodically updates its assessment of risks to Delta as emerging risks are identified. When appropriate, the council requests approval by executive management for any additional resources needed to mitigate significant risks. An assessment of the ERM program effectiveness is evaluated by the cross-divisional council and reported to the Audit Committee.

The Board of Directors believes that Delta’s leadership structure, combined with the roles of the Board and its committees, provides the appropriate leadership for effective risk oversight.

The Board of Directors selects individuals with skills and experience to assist management in operating Delta’s business. It considers the needs of the Board and its committees on anon-going basis. The Corporate Governance Committee regularly reviews the mix of directors and skills on the Board. It seeks to establish a pipeline of potential Board members to refresh the Board from time to time and fill roles that will be open due to director retirements. It looks for directors with new and diverse perspectives and experiences in areas that are important to Delta, taking into account changes in our industry, the business environment, our operations and our strategy. The attributes and experience the Board believes to be important for potential Board members are listed beginning on page 14. From 2014 to present, we added five new Board members, and six Board members retired, not including two directors who will retire at the annual meeting.

Board and Committee Evaluation Process

For many years our Board of Directors and each of its committees have annually engaged in comprehensive self-assessments. The Corporate Governance Committee oversees the evaluation process, which differs from year to year. For the 2016 evaluation, the Chief Legal Officer met individually with each Board member to discuss specific topics and obtain his or her assessment of Board and committee performance. The responses to the self-assessments were compiled and discussed with the Board and committees. The Chairman of the Board and the chairs of the applicable committees address anyfollow-up matters with management or the members.

2017 PROXY STATEMENT 13

2017 PROXY STATEMENT 13

Proposal 1 — Election of Directors

General

All Delta directors are elected annually. At the annual meeting, each director will be elected by the vote of a majority of the votes cast. This means the number of votes cast “for” a director must exceed 50% of the votes cast with respect to that director (excluding abstentions). Each director elected will hold office until the next annual meeting of stockholders and the election of his or her successor.

Delta’s Bylaws provide that any director not elected by a majority of the votes cast at the annual meeting must offer to tender his or her resignation to the Board of Directors. The Corporate Governance Committee will make a recommendation to the Board of Directors whether to accept the resignation. The Board of Directors will consider the recommendation and publicly disclose its decision within 90 days after the certification of the election results.

Board Retirements

No outside director may stand forre-election after age 72, subject to a limited discretionary exception. As a result, directors Shirley C. Franklin and Kenneth B. Woodrow will retire at the annual meeting on June 30, 2017.

The Board of Directors recommends a vote FOR the following nominees:

(1) Edward H. Bastian | (7) Jeanne P. Jackson | |

(2) Francis S. Blake | (8) George N. Mattson | |

(3) Daniel A. Carp | (9) Douglas R. Ralph | |

(4) David G. DeWalt | (10) Sergio A. L. Rial | |

(5) William H. Easter III | (11) Kathy N. Waller | |

(6) Mickey P. Foret |

All of the nominees are currently serving on the Board of Directors. The Board of Directors believes each nominee for director will be able to stand for election. If any nominee becomes unable to stand for election, the Board may name a substitute nominee or reduce the number of directors. If a substitute nominee is chosen, the directors designated to vote the proxies will vote FOR the substitute nominee.

Delta, the Air Line Pilots Association, International, the collective bargaining representative for Delta pilots (ALPA), and the Delta Master Executive Council, the governing body of the Delta unit of ALPA (Delta MEC), have an agreement whereby Delta agrees (1) to cause the election to the Board of Directors of a Delta pilot designated by the Delta MEC who is not a member or officer of the Delta MEC or an officer of ALPA (Pilot Nominee); (2) at any meeting of stockholders at which the Pilot Nominee is subject to election, tore-nominate the Pilot Nominee or nominate another qualified Delta pilot designated by the Delta MEC to be elected to the Board of Directors and to use its reasonable best efforts to cause such person to be elected to the Board; and (3) in the event of the Pilot Nominee’s death, disability, resignation, removal or failure to be elected, to elect promptly to the Board a replacement Pilot Nominee designated by the Delta MEC to fill the resulting vacancy. Pursuant to this provision, the Delta MEC has designated Douglas R. Ralph to be nominated for election to the Board at the annual meeting.

The compensation of Mr. Ralph as a Delta pilot is determined under the collective bargaining agreement between Delta and ALPA. During 2016, Mr. Ralph received $400,190 in compensation (which includes: $309,133 in flight earnings, $56,057 in shared rewards/profit sharing payments and $35,000 in Delta contributions to a defined contribution plan). As a Delta pilot, Mr. Ralph is not separately compensated for his service as a director.

Delta believes each nominee for the Board of Directors has a reputation for integrity, honesty and adherence to high ethical standards; demonstrated business acumen and the exercise of sound judgment; and a track record of service as a leader in business or governmental settings. In addition to these traits, Delta believes it is important for directors and nominees for director to have experience in one or more of the following areas:

| • | As a chief executive or member of senior management of a large public or private company or in a leadership position in a governmental setting |

| • | Airline or other transportation industries |

14 2017 PROXY STATEMENT

Proposal 1 — Election of Directors

| • | Marketing |

| • | Finance and/or accounting |

| • | Risk management |

| • | Energy industry |

| • | International business |

| • | Information technology |

| • | Global security and government affairs |

| • | As a board member of a large public or private company |

The Board of Directors has fixed the size of the Board at eleven members effective at the annual meeting. We provide information below about each nominee for director, including the experience that led the Board of Directors to conclude the nominee should serve as a director of Delta.

Edward H. Bastian

Age: 59

Joined Delta’s Board: February 5, 2010 | Mr. Bastian is the Chief Executive Officer of Delta. Previously, he served as President of Delta from 2007 to May 2016 and President of Delta and Chief Executive Officer of Northwest Airlines, Inc. from 2008 to 2009. Mr. Bastian was also Chief Financial Officer of Delta from 2007 to 2008; Executive Vice President and Chief Financial Officer of Delta from 2005 to 2007; Chief Financial Officer of Acuity Brands from June 2005 to July 2005; Senior Vice President — Finance and Controller of Delta from 2000 to 2005 and Vice President and Controller of Delta from 1998 to 2000.

Mr. Bastian has over fifteen years of experience as a Delta officer, including serving as Delta’s Chief Executive Officer, President, Chief Financial Officer, Chief Restructuring Officer during its Chapter 11 bankruptcy proceeding and Northwest Airlines Inc.’s Chief Executive Officer after the merger. Mr. Bastian’s accounting and finance background provides financial and strategic expertise to the Board of Directors.

Directorships: Grupo Aeroméxico, S.A.B. de C.V.; GOL Linhas Aereas Inteligentes, S.A. (2012-2016)

Affiliations: Member, Board of Woodruff Arts Center

| |

| ||

Francis S. Blake

Age: 67

Joined Delta’s Board: July 25, 2014

Committees: Audit; Corporate Governance (Chair) | Mr. Blake is thenon-executive Chairman of Delta’s Board of Directors and previously served as the lead director of Delta’s Board from May 2016 to October 2016. He served as the Chairman of The Home Depot from 2007 until his retirement in February 2015. He was the Chief Executive Officer of The Home Depot from 2007 to November 2014 and previously served as Vice Chairman of the Board of Directors and its Executive Vice President. He joined The Home Depot in 2002 as Executive Vice President —Business Development and Corporate Operations. Mr. Blake was previously the deputy secretary for the U.S. Department of Energy and served in a variety of executive positions at General Electric Company, including as Senior Vice President, Corporate Business Development in charge of all worldwide mergers, acquisitions and dispositions.

Mr. Blake has extensive experience as the Chairman and Chief Executive Officer of a complex retail organization and prior leadership positions in business and government. He has also served on boards of directors of public companies in the energy industry. At other public companies, Mr. Blake has experience as a member of the audit and governance committees.

Directorships: Macy’s, Inc.; The Procter & Gamble Company

Affiliations: Member, Board of Georgia Aquarium; Member, Board of Grady Hospital; Member, Board of Agnes Scott College

| |

2017 PROXY STATEMENT 15

2017 PROXY STATEMENT 15

Proposal 1 — Election of Directors

Daniel A. Carp

Age: 69

Joined Delta’s Board: April 30, 2007

Committees:Corporate Governance; Personnel & Compensation (Chair) | Mr. Carp served asnon-executive Chairman of Delta’s Board of Directors from 2007 until May 2016. He was Chief Executive Officer and Chairman of the Board of Eastman Kodak Company from 2000 to 2005. Mr. Carp was President of Eastman Kodak Company from 1997 to 2003.

Mr. Carp has substantial business experience as Chairman and Chief Executive Officer of a multinational public company in the consumer goods and services sector, where he was employed for over 35 years. As a member of the boards of directors of large public companies other than Delta, Mr. Carp has experience on audit, compensation, finance and governance committees.

Directorships: Norfolk Southern Corporation; Texas Instruments Inc.

| |

David G. DeWalt

Age: 53

Joined Delta’s Board: November 22, 2011

Committees: Corporate Governance; Safety & Security (Vice Chair) | Mr. DeWalt most recently served as the Executive Chairman of FireEye, Inc., a global network cyber security company. Mr. DeWalt served as FireEye’s Chief Executive Officer from November 2012 to June 2016 and Chairman of the Board from June 2012 to January 2017. Mr. DeWalt was President and Chief Executive Officer of McAfee, Inc., a security technology company, from 2007 until 2011 when McAfee, Inc. was acquired by Intel Corporation. From 2003 to 2007, Mr. DeWalt held executive positions with EMC Corporation, a provider of information infrastructure technology and solutions, including serving as Executive Vice President and President-Customer Operations and Content Management Software.

Mr. DeWalt has substantial expertise in the information technology security industry and his strategic and operational experience as the former Chief Executive Officer of FireEye, Inc. and former Chief Executive Officer of McAfee, Inc. As a member of the boards of directors of public companies other than Delta, Mr. DeWalt has served on the audit and compensation committees.

Directorships: Five9, Inc.; FireEye, Inc. (2012-2017); Jive Software, Inc. (2011-2013); Polycom Inc. (2005-2013)

Affiliations: National Security & Technology Advisory Committee

| |

William H. Easter III

Age: 67

Joined Delta’s Board: December 3, 2012

Committees: Audit (Chair); Corporate Governance | Mr. Easter was Chairman, President and Chief Executive Officer of DCP Midstream, LLC (formerly Duke Energy Field Services, LLC) from 2004 until his retirement in 2008. Previously employed by ConocoPhillips for 32 years, Mr. Easter served as Vice President of State Government Affairs from 2002 to 2004 and as General Manager of the Gulf Coast Refining, Marketing and Transportation Business Unit from 1998 to 2002.

Mr. Easter has over 36 years of leadership and operational experience in natural gas, crude oil and refined product supply, transportation, refining and marketing with ConocoPhillips and DCP Midstream LLC. Additionally, Mr. Easter has experience as a member of the boards of directors of other public companies where he served on the audit, corporate governance, compensation and finance committees. Since his retirement from DCP Midstream, LLC, Mr. Easter has been involved in private investments.

Directorships: BakerHughes, Inc.; Concho Resources, Inc.; Grupo Aeroméxico, S.A.B. de C.V.; Sunoco, Inc. (2011-2012)

Affiliations: Member, Board of Memorial Hermann Health System, Houston, Texas

| |

16 2017 PROXY STATEMENT

Proposal 1 — Election of Directors

Mickey P. Foret

Age: 71

Joined Delta’s Board: October 29, 2008

Committees: Audit; Safety and Security (Chair) | Mr. Foret was Executive Vice President and Chief Financial Officer of Northwest Airlines, Inc. from 1998 to 2002, and also served as Chairman and Chief Executive Officer of Northwest Cargo from 1999 to 2002. Mr. Foret served as President and Chief Operating Officer of Atlas Air, Inc. from 1996 to 1997 and as Executive Vice President and Chief Financial Officer of Northwest Airlines, Inc. from 1993 to 1996.

Mr. Foret has significant experience in the airline industry, where he held numerous senior executive positions for over 35 years, particularly in the finance area. He served as Chief Financial Officer of Northwest Airlines, Inc. for seven years. Mr. Foret has also served on the audit, compensation, finance and governance committees of the boards of directors of other public companies.

Directorships: SpartanNash; URS Corporation (2003-2014); Nash Finch Company (2005-2013)

| |

Jeanne P. Jackson

Age:65

Joined Delta’s Board: January 25, 2017

Committees: Audit; Personnel & Compensation | Ms. Jackson is senior strategic advisor to the chief executive officer of NIKE, Inc. She served as NIKE’s President, Product and Merchandising from July 2013 until April 2016 and President, Direct to Consumer from 2009 until July 2013. Ms. Jackson joined the NIKE Executive team in 2009 after serving on its Board of Directors for eight years. She founded and served as the Chief Executive Officer of MSP Capital, a private investment company, from 2002 to 2009 and as Chief Executive Officer of Walmart.com, a privatee-commerce enterprise, from 2000 to 2002. Ms. Jackson previously served in various leadership positions at Gap Inc., Victoria’s Secret, Saks Fifth Avenue and Federated Department Stores, Inc., all clothing retailers, and Walt Disney Attractions, Inc., the theme parks and vacation resorts division of The Walt Disney Company.

Ms. Jackson has extensive experience as a senior executive for a major consumer retailer, with expertise in consumer product and direct to consumer marketing. She has also served on boards of directors of public companies in the consumer product industry. Ms. Jackson was recommended to the Board’s Corporate Governance Committee as a new director by an executive recruiting firm.

Directorships:McDonald’s Corporation; Kraft Heinz Company

Affiliations: United States Ski & Snowboard Association

| |

George N. Mattson

Age: 51

Joined Delta’s Board: October 1, 2012

Committees: Finance (Chair); Personnel & Compensation | Mr. Mattson served as a partner andco-head of the Global Industrials Group in Investment Banking at Goldman, Sachs & Co. from 2002 through August 2012, where he served in a variety of positions from 1994 to 2002. Mr. Mattson is a private investor focused on acquiring and building middle market businesses.

Mr. Mattson has experience in the areas of mergers and acquisitions, corporate finance and capital markets. In addition, Mr. Mattson has knowledge of the airline industry and other global industries acquired during his 18 years at Goldman, Sachs & Co., including asco-head of the Global Industrials Group in Investment Banking, which had responsibility for a diverse set of industry sectors, including companies in the transportation industry. Since his retirement from Goldman Sachs, Mr. Mattson has been involved in acquiring and growing middle market industrial businesses.

Affiliations:Vice Chair of the Board of Visitors of the Pratt School of Engineering at Duke University; Senior Advisor, Star Mountain Capital

| |

2017 PROXY STATEMENT 17

2017 PROXY STATEMENT 17

Proposal 1 — Election of Directors

Douglas R. Ralph

Age: 62

Joined Delta’s Board: June 25, 2015

Committees: Finance; Safety & Security | Mr. Ralph has been a Delta pilot since 1991 and is currently a Captain of a Boeing 767ER aircraft. He was an active duty pilot in the U.S. Marine Corps for six years prior to joining Delta. He was then a pilot in the U.S. Naval Reserves for 17 years, retiring with the rank of Captain in 2001. Mr. Ralph has been designated by the Delta MEC as the Pilot Nominee. Prior to joining the Board of Directors, Mr. Ralph was the Chair of the Investor Relations Committee of the Delta MEC and also served on a Government Affairs Committee for the Delta MEC.

As a pilot designated by the Delta MEC to serve on the Board of Directors, Mr. Ralph provides a unique perspective into the airline industry and related labor relations matters.

| |

Sergio A. L. Rial

Age: 56

Joined Delta’s Board: December 9, 2014

Committees: Audit; Personnel & Compensation | Mr. Rial has been Chief Executive Officer since January 2016 of Banco Santander Brazil, the third largest private bank in Brazil and a member of Santander Group, the largest bank in the Eurozone. Mr. Rial served as Chairman of Banco Santander Brazil from February 2015 until January 2016. From 2012 to February 2015, Mr. Rial was Chief Executive Officer of Marfrig Global Foods, one of the world’s largest meat companies with operations in Brazil and 15 other countries. Prior to joining Marfrig in 2012, Mr. Rial served in various leadership capacities with Cargill, Inc., a Minneapolis-based global provider of food, agriculture, financial and industrial products and services. At Cargill, Mr. Rial served as Chief Financial Officer from 2009 to 2011 and Executive Vice President from 2011 to 2012. He was also a member of Cargill’s board of directors from 2010 to 2012. From 2002 to 2004, Mr. Rial was a senior managing director andco-head of the Investment Banking Division at Bear Stearns & Co. in New York after serving at ABN AMRO Bank for 18 years.

Mr. Rial has experience as a chief executive officer in global business, particularly in the key market of Latin America, and has extensive financial experience as a chief financial officer of a global corporation. He has also served on boards of directors of public companies in the food and agricultural industry.

Directorships: Cyrela Brazil Realty S.A. (2010-2015); The Mosaic Company (2010-2011)

| |

Kathy N. Waller

Age: 59

Joined Delta’s Board: July 24, 2015

Committees:Corporate Governance; Finance | Ms. Waller has been the Executive Vice President and Chief Financial Officer of The Coca-Cola Company since 2014. Effective May 1, 2017, Ms. Waller assumed responsibility for Coca-Cola’s strategic governance area as Executive Vice President, Chief Financial Officer and President, Enabling Services. Ms. Waller joined Coca-Cola in 1987 as a senior accountant and has assumed roles of increasing responsibility during her career, including Vice President, Finance and Controller.

Ms. Waller has extensive financial experience with a global business enterprise, including her role as Chief Financial Officer. Ms. Waller’s accounting and finance background provides financial and strategic expertise to the Board of Directors.

Directorships: Monster Beverage Corporation; Coca-Cola FEMSA, S.A.B. de C.V. (2015 —2017)

| |

18 2017 PROXY STATEMENT

Beneficial Ownership of Securities

Directors, Nominees for Director and Executive Officers

The following table sets forth the number of shares of Delta common stock beneficially owned as of April 15, 2017, by each director and director nominee, each person named in the Summary Compensation Table in this proxy statement, and all directors and executive officers as a group. Unless otherwise indicated by footnote, the owner exercises sole voting and investment power over the shares.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | ||||

Directors: | |||||

Edward H. Bastian | 850,972 | (2)(3) | |||

Francis S. Blake | 21,875 | ||||

Daniel A. Carp | 63,343 | ||||

David G. DeWalt | 44,810 | ||||

William H. Easter III | 41,260 | ||||

Mickey P. Foret | 75,288 | ||||

Shirley C. Franklin | 36,760 | ||||

Jeanne P. Jackson | 3,190 | ||||

George N. Mattson | 59,750 | ||||

Douglas R. Ralph | 1,000 | ||||

Sergio A.L. Rial | 8,864 | ||||

Kathy N. Waller | 7,440 | ||||

Kenneth B. Woodrow | 76,983 | ||||

Named Executive Officers: | |||||

Richard H. Anderson | 196,083 | (2) | |||

Glen W. Hauenstein | 271,018 | (2) | |||

W. Gil West | 111,113 | ||||

Paul A. Jacobson | 514,870 | (2)(4) | |||

Peter W. Carter | 96,131 | ||||

Directors and Executive Officers as a Group (21 Persons) | 2,726,589 | (2) | |||

| (1) | Each of the individuals listed in the table and the directors and executive officers as a group beneficially owned less than 1% of the shares of common stock outstanding on April 15, 2017. |

| (2) | Includes the following number of shares of common stock which a director or named executive officer has the right to acquire upon the exercise of stock options that were exercisable as of April 15, 2017, or that will become exercisable within 60 days after that date: |

Name | Number of Shares | |||

Edward H. Bastian | 534,964 | |||

Glen W. Hauenstein | 98,600 | |||

Paul A. Jacobson | 123,900 | |||

Richard H. Anderson | 149,214 | |||

Directors & Executive Officers as a Group | 985,178 | |||

| (3) | Includes 2,000 shares held by a family foundation, of which Mr. Bastian and his wife are the directors. |

| (4) | Includes 25,000 shares held by a family foundation, of which Mr. Jacobson and his wife are the trustees. |

2017 PROXY STATEMENT 19

2017 PROXY STATEMENT 19

Beneficial Ownership of Securities

Beneficial Owners of More than 5% of Voting Stock

The following table provides information about the following entities known to Delta to be the beneficial owner of more than five percent of Delta’s outstanding common stock as of April 15, 2017.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Class | ||||||

Berkshire Hathaway Inc. 3555 Farnam Street Omaha, NE 68131 | 60,025,995 | (1) | 8.16 | % | ||||

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 50,560,615 | (2) | 6.87 | % | ||||

The Vanguard Group 100 Vanguard Blvd Malvern, PA 19355 | 45,971,900 | (3) | 6.25 | % | ||||

| (1) | Based on Schedule 13G filed February 14, 2017, in which Berskshire Hathway Inc. reported that, as of December 31, 2016, it had shared voting and dispositive power over all of these shares. |

| (2) | Based on Schedule 13G filed January 30, 2017, in which BlackRock, Inc. reported that, as of December 31, 2016, it had sole voting power over 43,024,381 of these shares and sole dispositive power over all of these shares. |

| (3) | Based on Schedule 13G/A filed February 9, 2017, in which The Vanguard Group reported that, as of December 31, 2016, it had sole voting power over 1,006,072 of these shares, sole dispositive power over 42,932,958 of these shares, and shared dispositive power over 1,038,942 of these shares. |

20 2017 PROXY STATEMENT

Compensation Discussion and Analysis

| 21 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 |

This section of the proxy statement provides an overview and analysis of our executive compensation program. It discusses our executive compensation philosophy and objectives, the administration of the executive compensation program and its material elements. It also reviews the actions taken by the Personnel & Compensation Committee of the Board of Directors (P&C Committee) in 2016 and the compensation of Delta’s named executive officers, who were:

| • | Edward H. Bastian — Chief Executive Officer |

| • | Glen W. Hauenstein — President |

| • | W. Gil West — Senior Executive Vice President & Chief Operating Officer |

| • | Paul A. Jacobson — Executive Vice President & Chief Financial Officer |

| • | Peter W. Carter — Executive Vice President & Chief Legal Officer and Corporate Secretary |

Effective May 2, 2016, Richard H. Anderson retired as Chief Executive Officer and assumed the role of Executive Chairman of the Board of Directors, until his retirement from the Board of Directors effective October 11, 2016. On May 2, 2016, Mr. Bastian succeeded Mr. Anderson as Chief Executive Officer and Mr. Hauenstein became President succeeding Mr. Bastian. Effective February 3, 2016, Mr. West was promoted to Senior Executive Vice President & Chief Operating Officer.

Our performance in 2016. In 2016, Delta continued to produce solid financial performance despite continued fuel price volatility and lower revenues, delivered industry-leading operational results and provided superior customer experience through investments in network, airports, fleet and technology. The following key accomplishments in 2016 helped make Delta the carrier of choice for passengers and position us for further success in 2017 and beyond:

| • | Strong financial results |

| – | Excluding special items, earnedpre-tax income of $6.1 billion or $206 million higher than the prior year, as lower fuel prices offset the impact of declining unit revenues. |

| – | Generated $7 billion in operating cash flow, including a contribution of over $1 billion to our defined benefit pension plans. We used operating cash flow to reinvest $3.4 billion in our business and reduce our adjusted debt levels by $500 million, while returning $3.1 billion to stockholders through dividends and share repurchases. |

| – | Continued to achieve over 20% return on invested capital, the seventh year in a row we had returns that met or exceeded our cost of capital. |

2017 PROXY STATEMENT 21

2017 PROXY STATEMENT 21

Executive Compensation

| – | Received investment-grade credit ratings from Moody’s Investors Service and Fitch Ratings, reflecting the company’s solid debt reduction, improved profitability, and its ability to generate meaningful free cash flow. |

| • | Industry-leading operating performance |

| – | Maintained strong operating performance with a mainlineon-time arrival rate of 86.3% and flight completion factor of 99.6% — achieving 241 days of zero mainline cancellations and 81 “brand perfect days,” with no cancellations of any Delta or Delta Connection flight. |

| – | Continued our 1st place performance among the major network carriers in fewest Department of Transportation (DOT) customer complaints and mishandled baggage. |

| • | Superior customer experience |

| – | Maintained Delta as a carrier of choice, evidenced by achieving a 40% domestic net promoter score for the year, a 25 point improvement since 2010. Net promoter score (or NPS) is a customer satisfaction score that measures the likelihood of referring others to Delta. |

| – | Continued our investment in products and amenities that customers value, including upgrading airport facilities in New York and Los Angeles, streamliningcheck-in, security and baggage claim and enhancing theon-board customer experience through, for example, the delivery of Delta’s first Airbus A321 aircraft and introducing the world’s firstall-suite business class in 2017. |

| • | Other company highlights |

| – | Received recognition from leading organizations and publications, including being named, for the sixth time in seven years, Fortune’s Most Admired Airline; won numerous airline industry awards including ranking No. 1 in Business Travel News Annual Airline Survey for an unprecedented six consecutive years. |

| – | Pledged to annually contribute one percent of net income from the previous year to key charitable organizations in the communities where Delta employees live, work and serve. In 2016, Delta and The Delta Air Lines Foundation contributed $37 million to charitable organizations worldwide. |

| – | Recognized as a national leader in our commitment to anti-human trafficking efforts and continued to provide training to customer-facing employees to help identify and report suspected instances of human trafficking. |

Our employee commitment. Delta’s employees are critical to our success. Our strong financial, operational and customer service results in 2016 would not have been possible without the dedication and determination of our employees. During 2016, we continued our commitment to promoting a culture of open, honest and direct communications, making Delta a great place to work, and building an environment that encourages diversity, integrity and respect. Key actions in 2016 include:

| • | Paying $1.1 billion in February 2017 under Delta’s broad-based profit sharing program for ground and flight attendant employees (Profit Sharing Program) in recognition of the achievements of our employees in meeting Delta’s financial targets in 2016 — the third consecutive year our employees received payouts exceeding $1 billion. |