DTE Energy Analyst Day May 1, 2013 EXHIBIT 99.1

Safe Harbor Statement The information contained herein is as of the date of this presentation. Many factors may impact forward-looking statements including, but not limited to, the following: impact of regulation by the FERC, MPSC, NRC and other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation; impact of electric and natural gas utility restructuring in Michigan, including legislative amendments and Customer Choice programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, increased thefts of electricity and natural gas and high levels of uncollectible accounts receivable; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power and natural gas; volatility in the short-term natural gas storage markets impacting third-party storage revenues; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; the potential for increased costs or delays in completion of significant construction projects; the uncertainties of successful exploration of unconventional gas and oil resources and challenges in estimating gas and oil reserves with certainty; changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, terrorism or cyber attacks; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; binding arbitration, litigation and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements refer only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the “Forward-Looking Statements” sections in each of DTE Energy’s and DTE Electric’s 2012 Forms 10-K and 2013 Forms 10-Q (which sections are incorporated herein by reference), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. Cautionary Note – The Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this presentation such as "probable reserves" that the SEC's guidelines strictly prohibit us from including in filings with the SEC. You are urged to consider closely the disclosure in DTE Energy’s 2012 Form 10-K and 2013 Form 10-Q, File No. 1-11607, available from our offices or from our website at www.dteenergy.com. You can also obtain these Forms from the SEC by accessing its website at www.sec.gov or by calling 1-800-SEC-0330. A-2

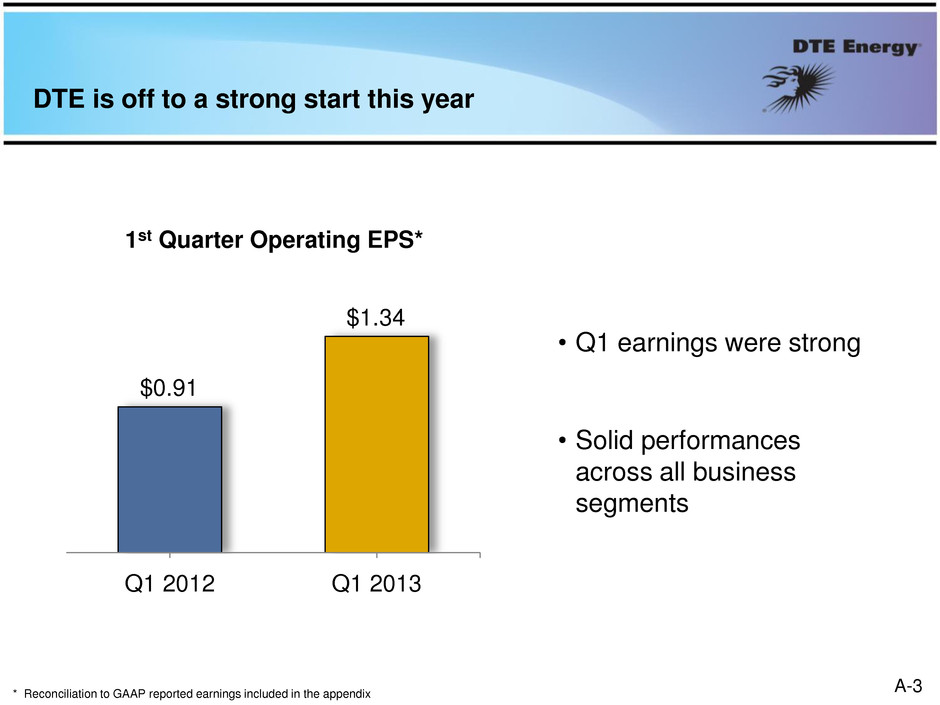

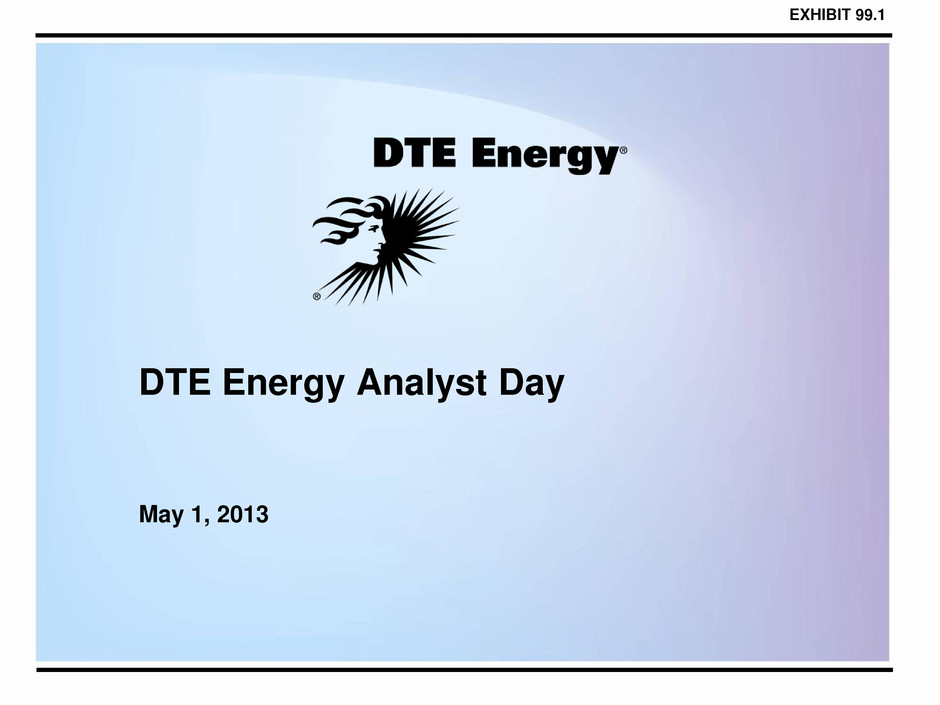

DTE is off to a strong start this year Q1 2012 Q1 2013 1st Quarter Operating EPS* • Q1 earnings were strong • Solid performances across all business segments $0.91 $1.34 * Reconciliation to GAAP reported earnings included in the appendix A-3

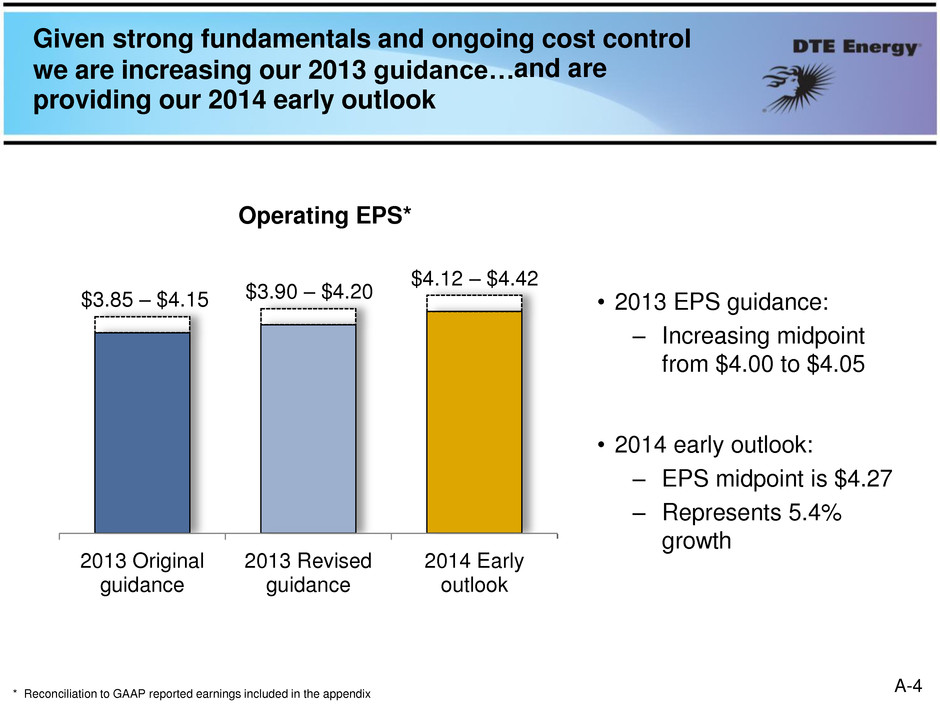

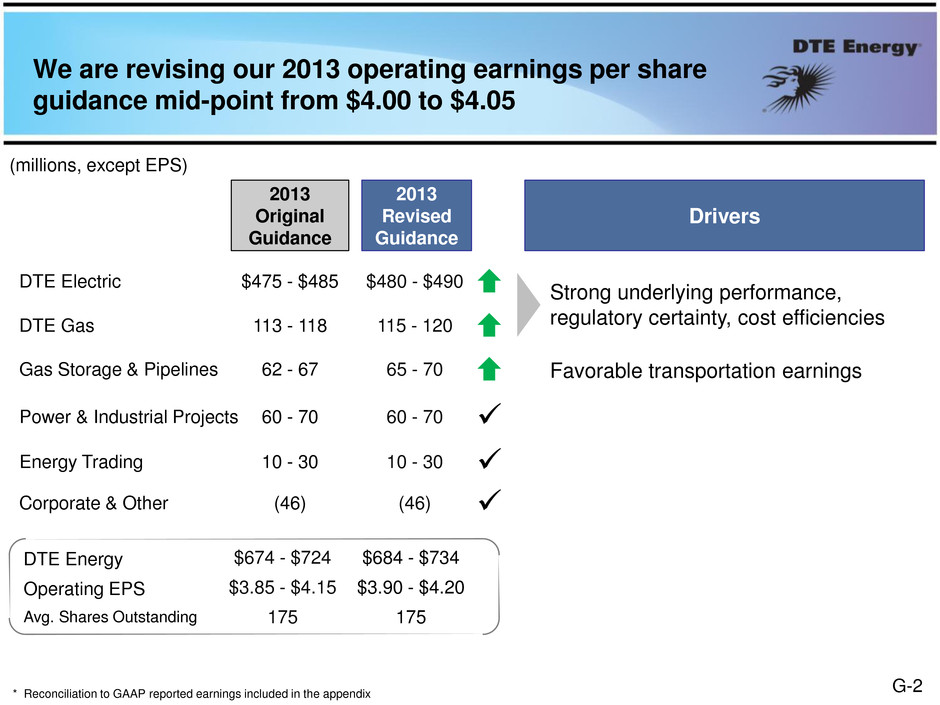

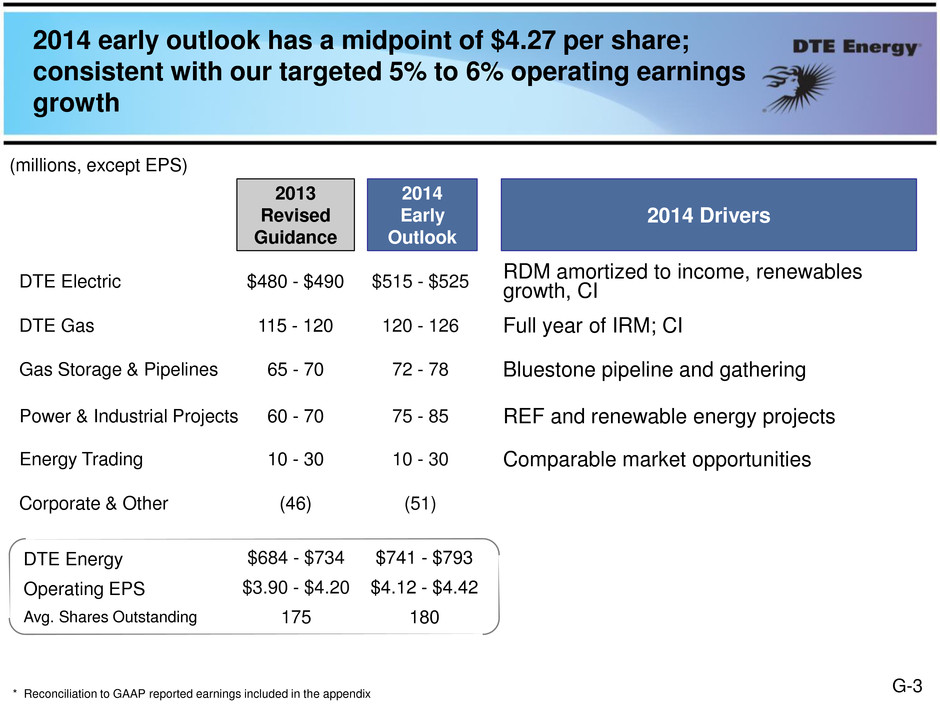

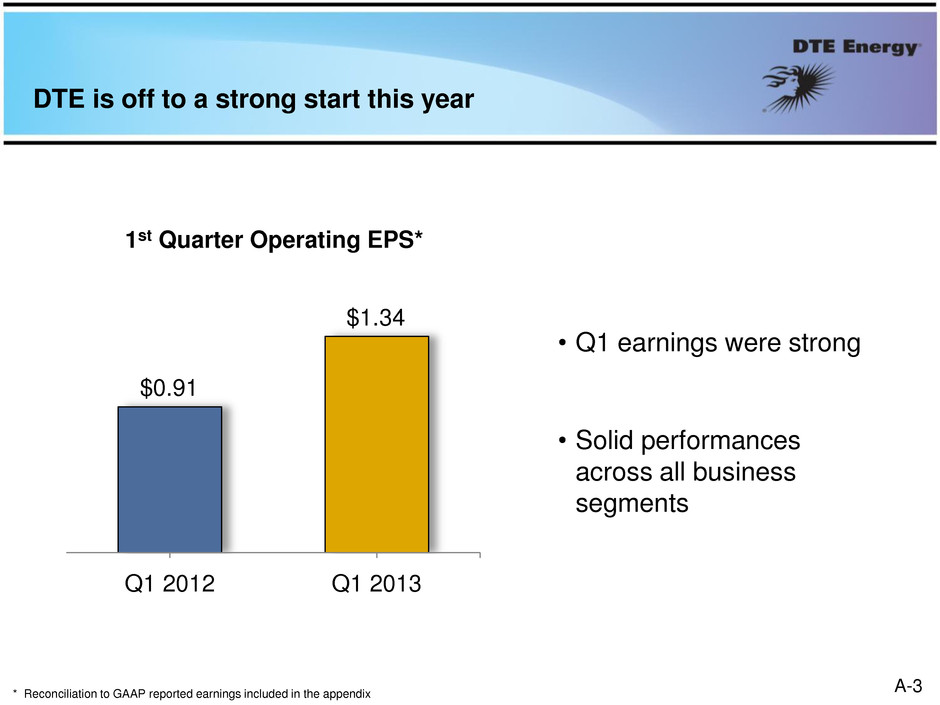

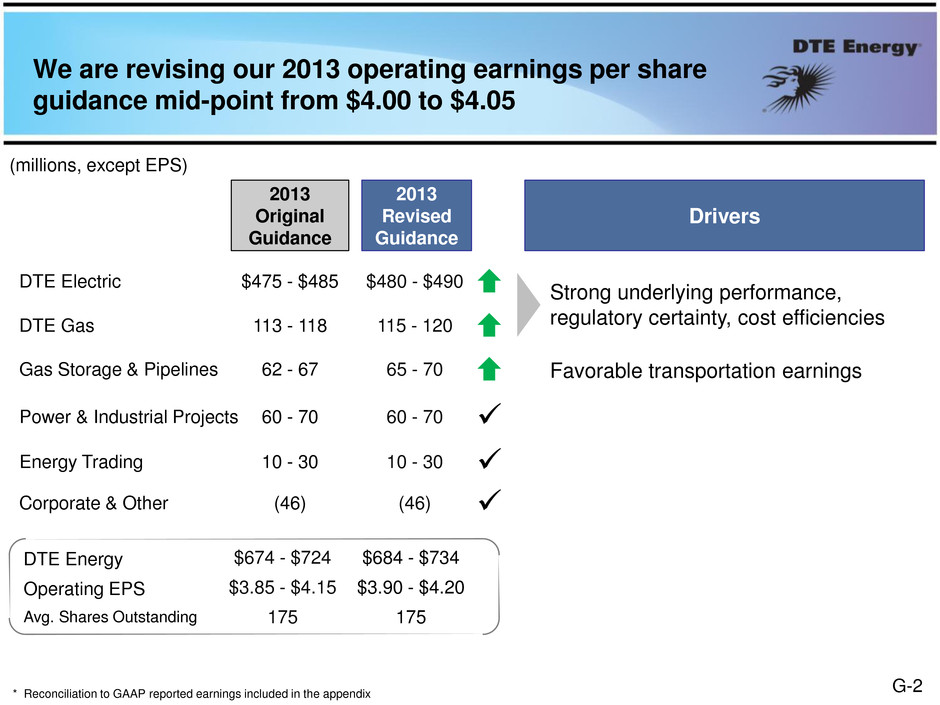

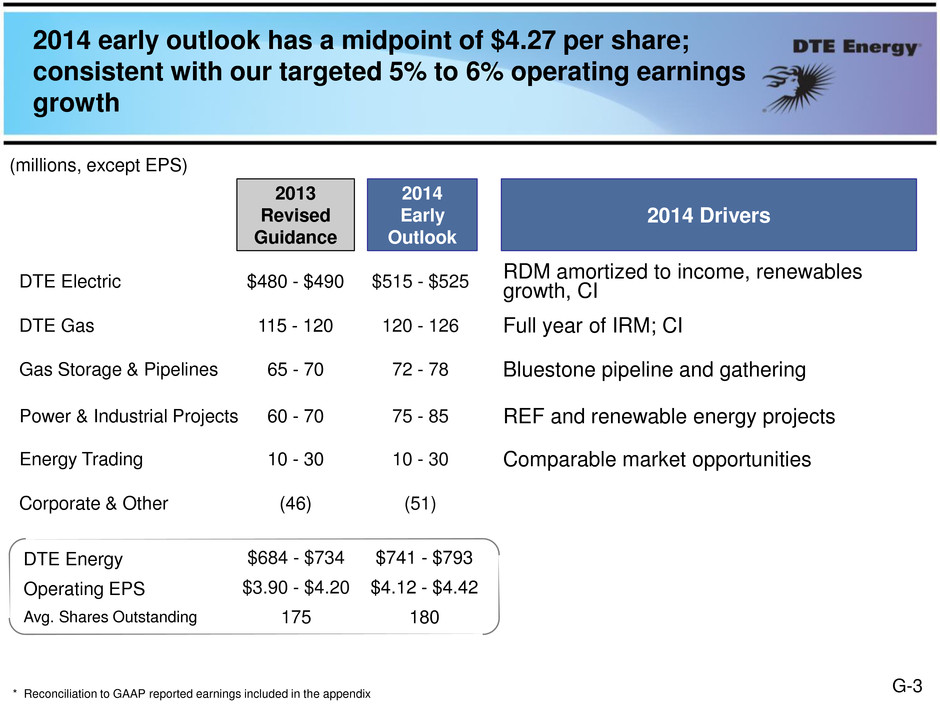

2013 Original guidance 2013 Revised guidance Given strong fundamentals and ongoing cost control we are increasing our 2013 guidance… $3.85 – $4.15 $3.90 – $4.20 • 2013 EPS guidance: ‒ Increasing midpoint from $4.00 to $4.05 • 2014 early outlook: ‒ EPS midpoint is $4.27 ‒ Represents 5.4% growth and are providing our 2014 early outlook $4.12 – $4.42 2014 Early outlook Operating EPS* * Reconciliation to GAAP reported earnings included in the appendix A-4

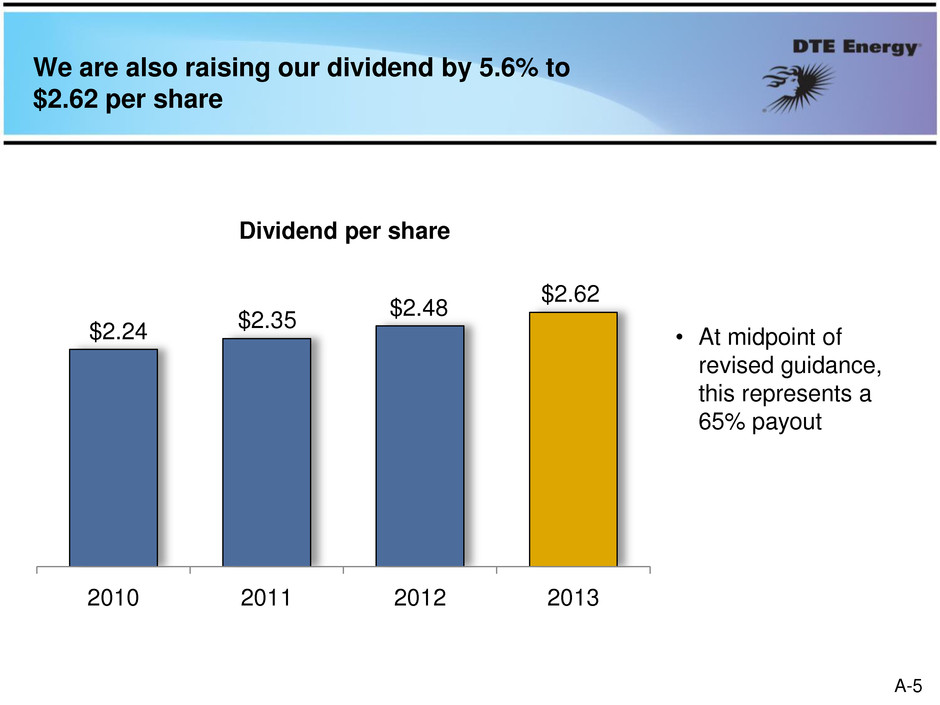

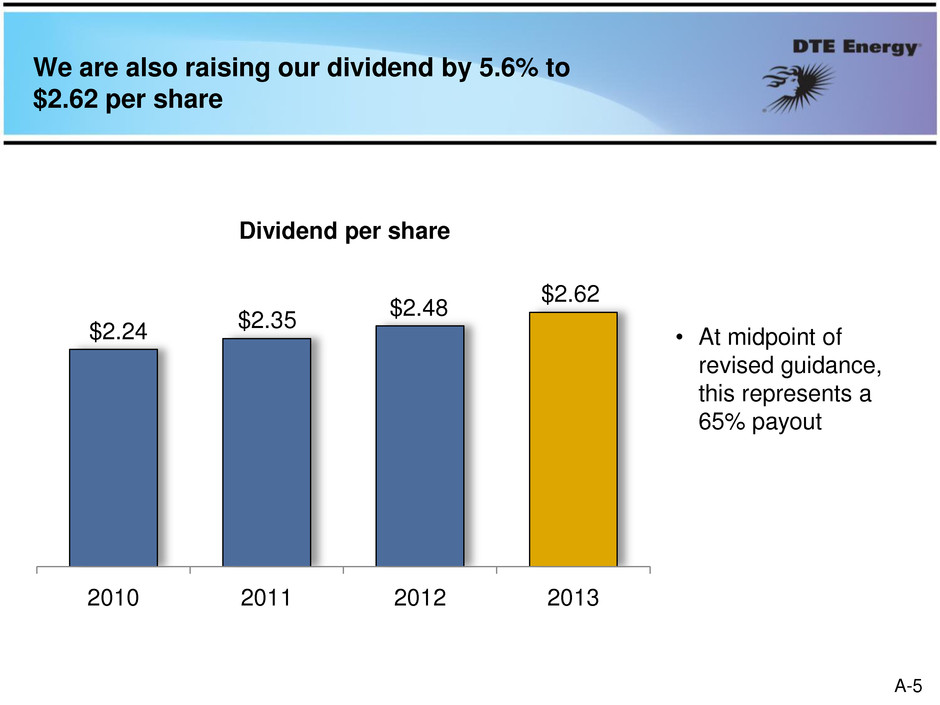

We are also raising our dividend by 5.6% to $2.62 per share 2010 2011 2012 2013 Dividend per share $2.35 $2.48 $2.62 • At midpoint of revised guidance, this represents a 65% payout $2.24 A-5

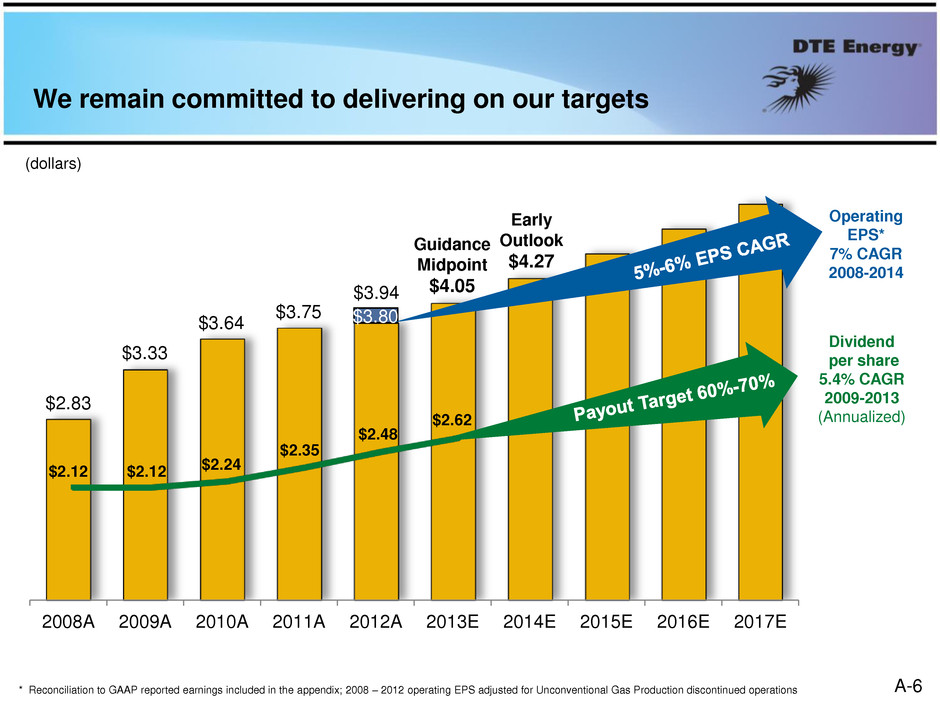

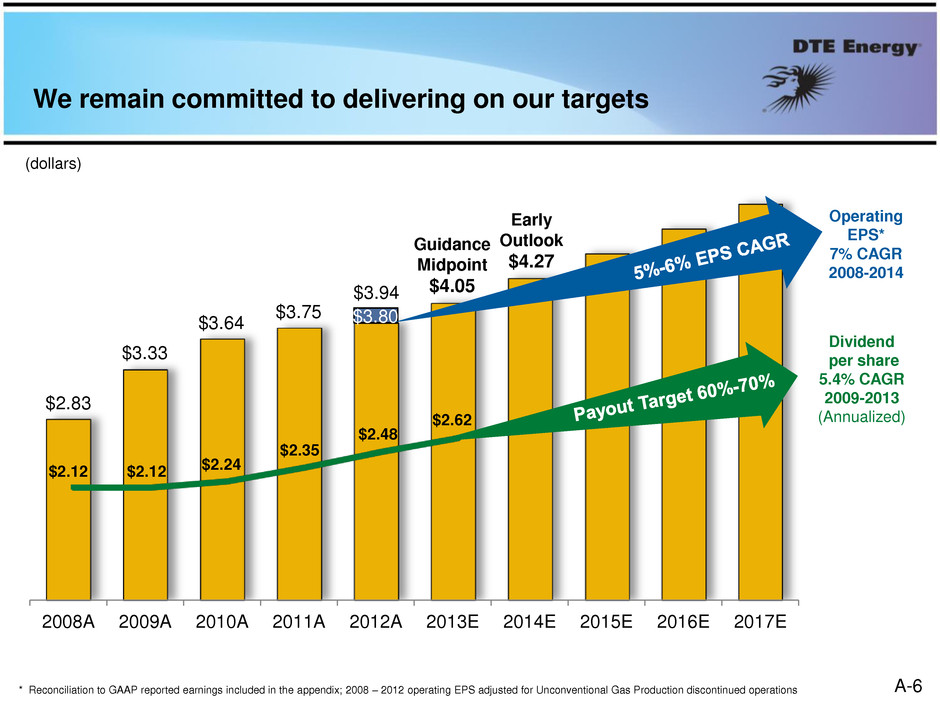

2008A 2009A 2010A 2011A 2012A 2013E 2014E 2015E 2016E 2017E $3.80 We remain committed to delivering on our targets * Reconciliation to GAAP reported earnings included in the appendix; 2008 – 2012 operating EPS adjusted for Unconventional Gas Production discontinued operations $3.33 $3.75 $3.64 Dividend per share 5.4% CAGR 2009-2013 (Annualized) Operating EPS* 7% CAGR 2008-2014 Guidance Midpoint $4.05 Early Outlook $4.27 $3.94 $2.12 $2.24 $2.35 $2.48 $2.12 $2.83 $2.62 (dollars) A-6

A-7 The best-operated energy company in North America and a force for growth and prosperity in the communities where we live and serve

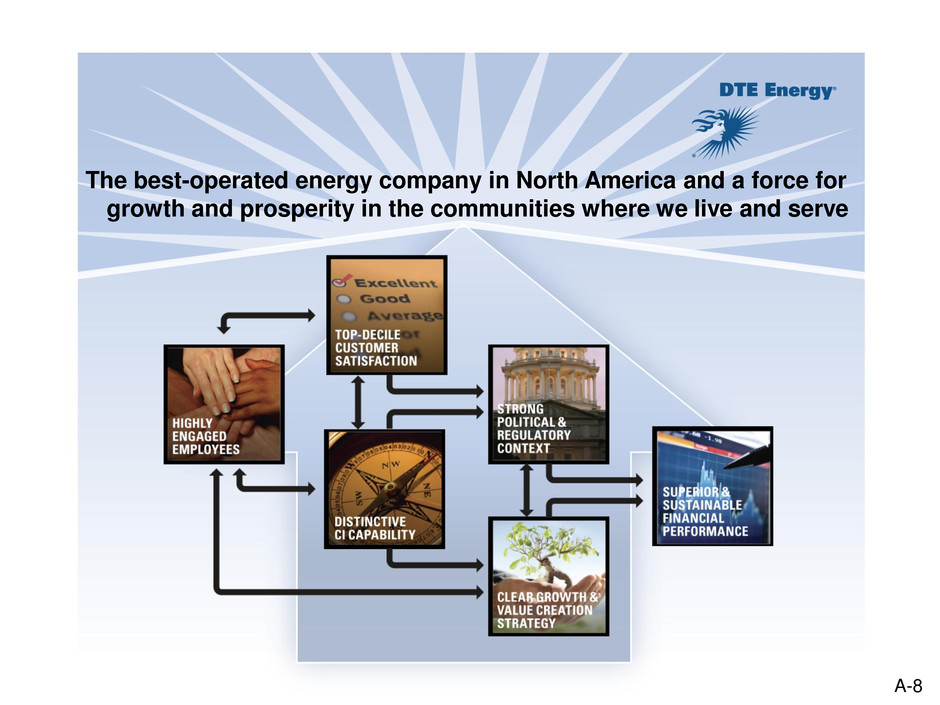

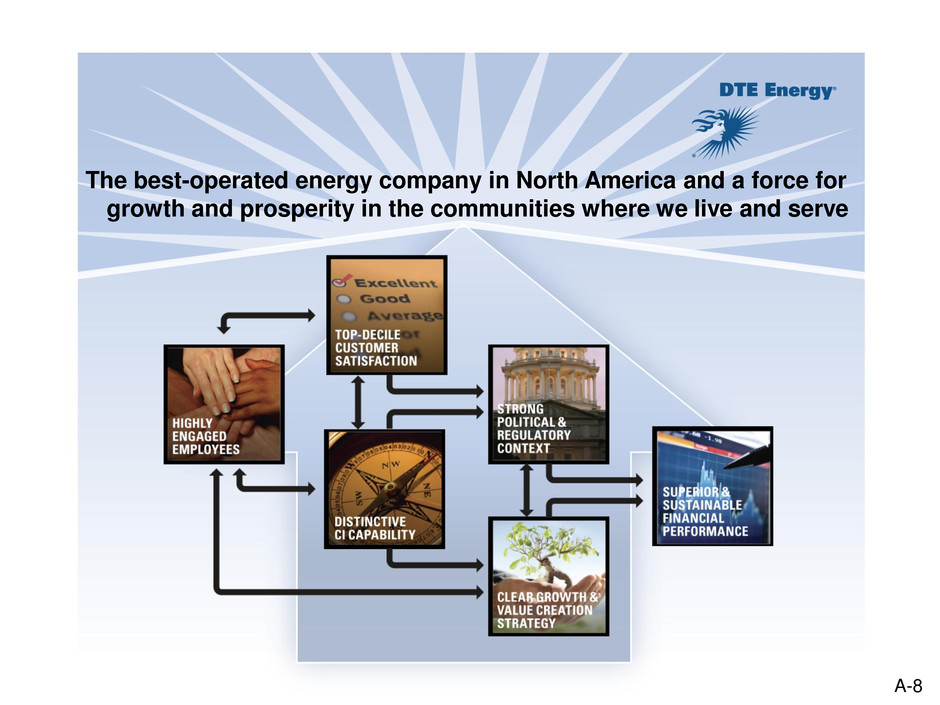

A-8 The best-operated energy company in North America and a force for growth and prosperity in the communities where we live and serve

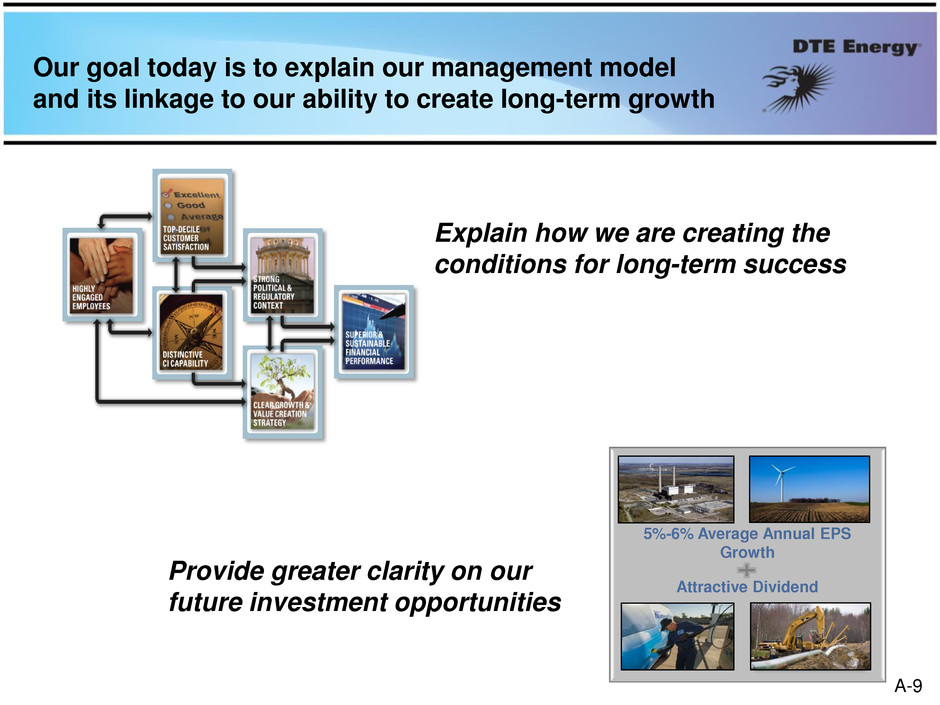

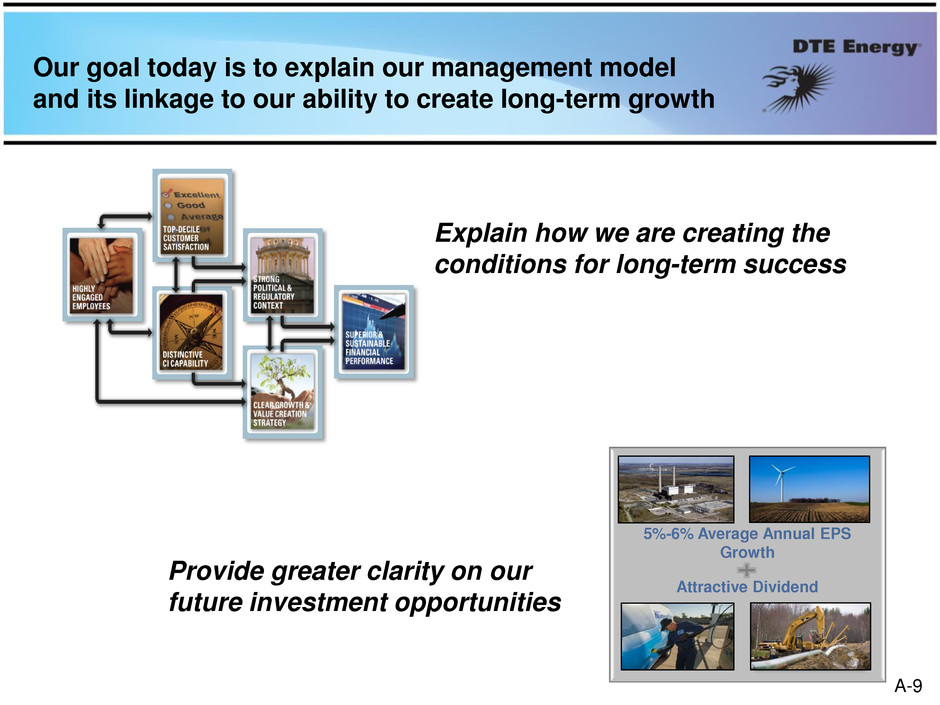

Our goal today is to explain our management model and its linkage to our ability to create long-term growth Explain how we are creating the conditions for long-term success Provide greater clarity on our future investment opportunities 5%-6% Average Annual EPS Growth Attractive Dividend A-9

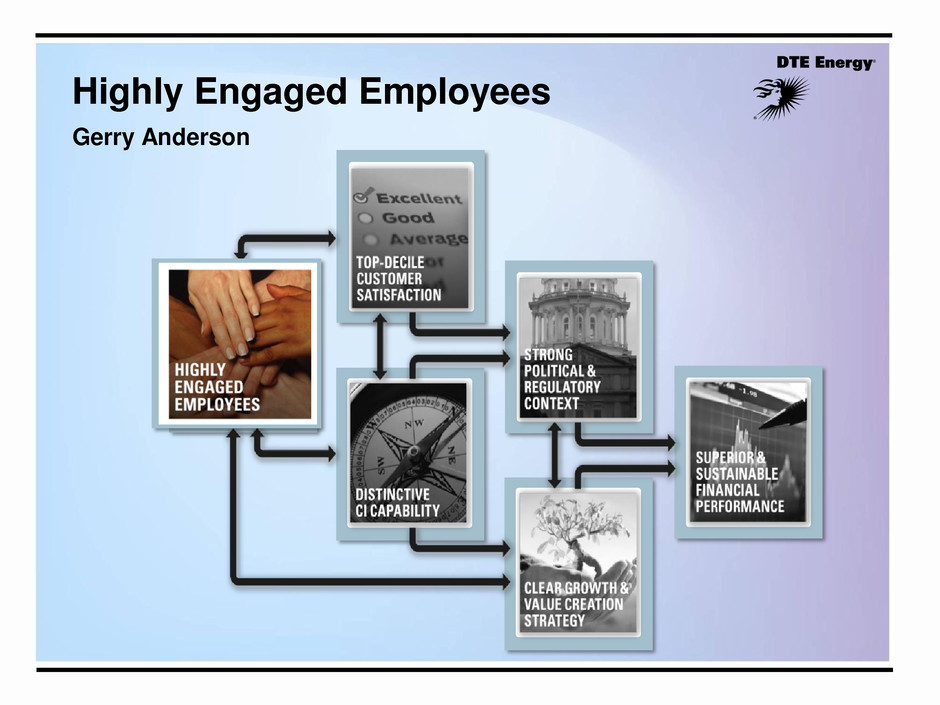

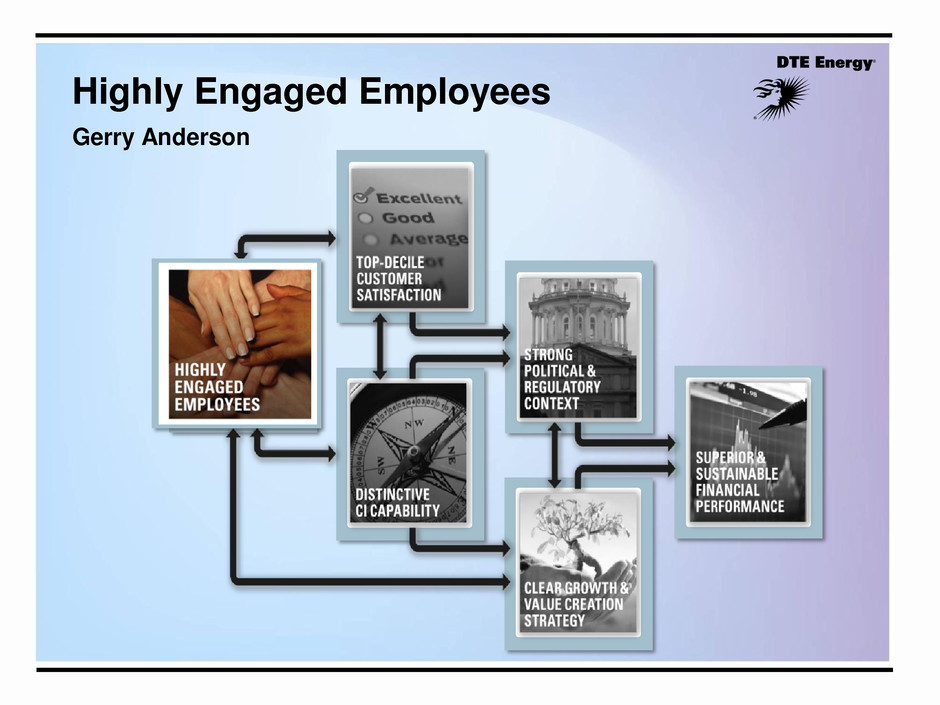

Highly Engaged Employees Gerry Anderson

The energy and engagement of our employees is driving the success of our company B-2

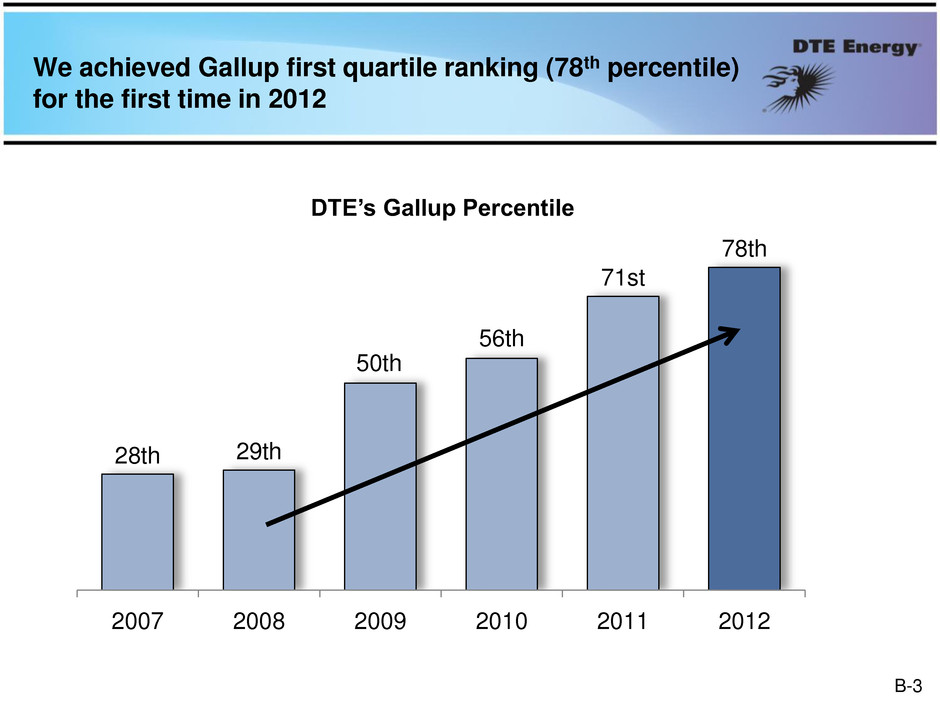

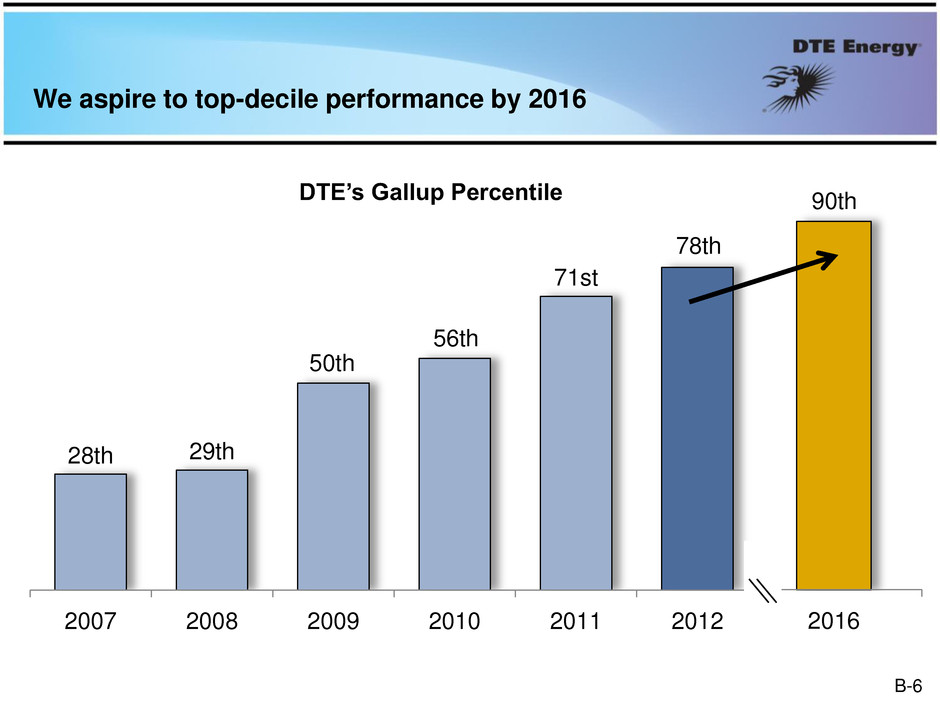

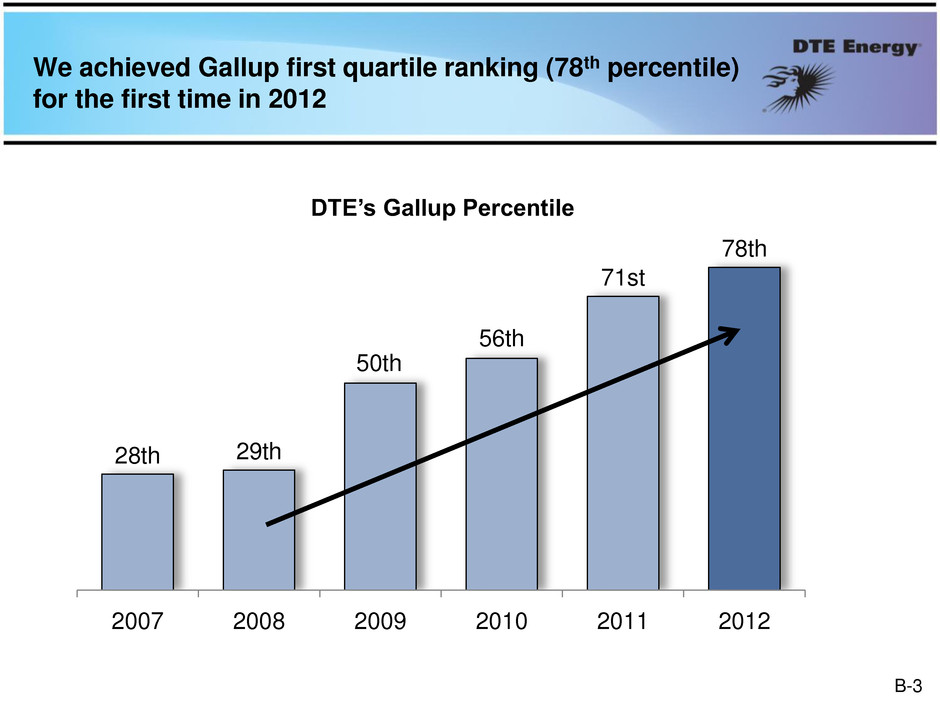

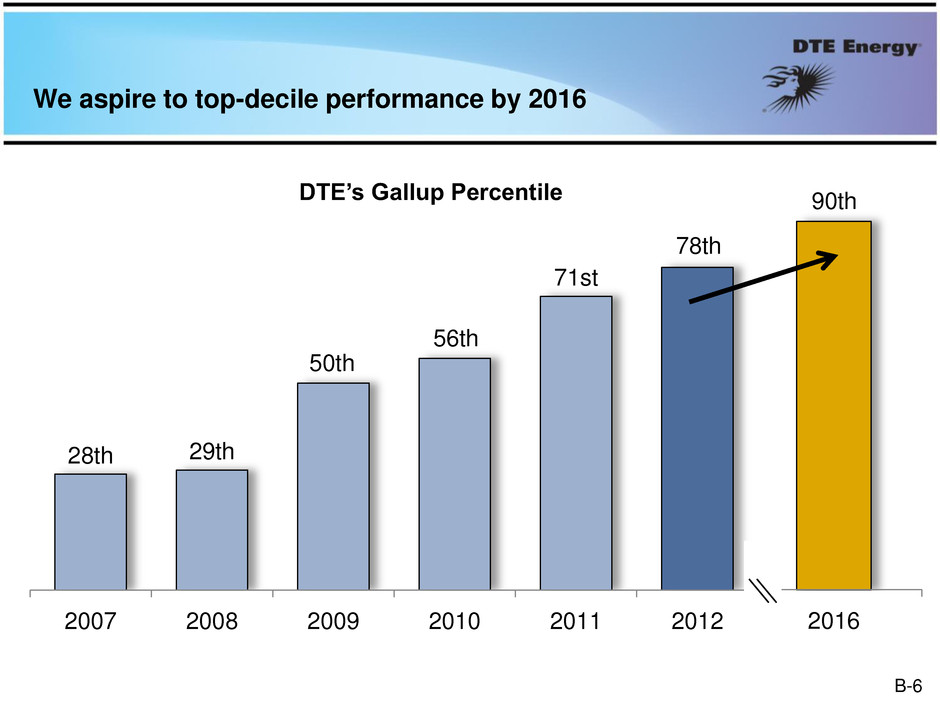

28th 29th 50th 56th 71st 78th 2007 2008 2009 2010 2011 2012 We achieved Gallup first quartile ranking (78th percentile) for the first time in 2012 DTE’s Gallup Percentile B-3

DTE received the 2013 Gallup Great Workplace Award • Winners are recognized for high employee engagement • DTE Energy is the only energy company that has ever received the award B-4

We have developed a formula for improving employee engagement Clear expectations and accountability Extensive training and development opportunities Employees actively engaged in driving daily improvements To rise in DTE’s leadership ranks, you MUST show the ability to engage people B-5

We aspire to top-decile performance by 2016 2016 28th 29th 50th 56th 71st 78th 2007 2008 2009 2010 2011 2012 90th DTE’s Gallup Percentile B-6

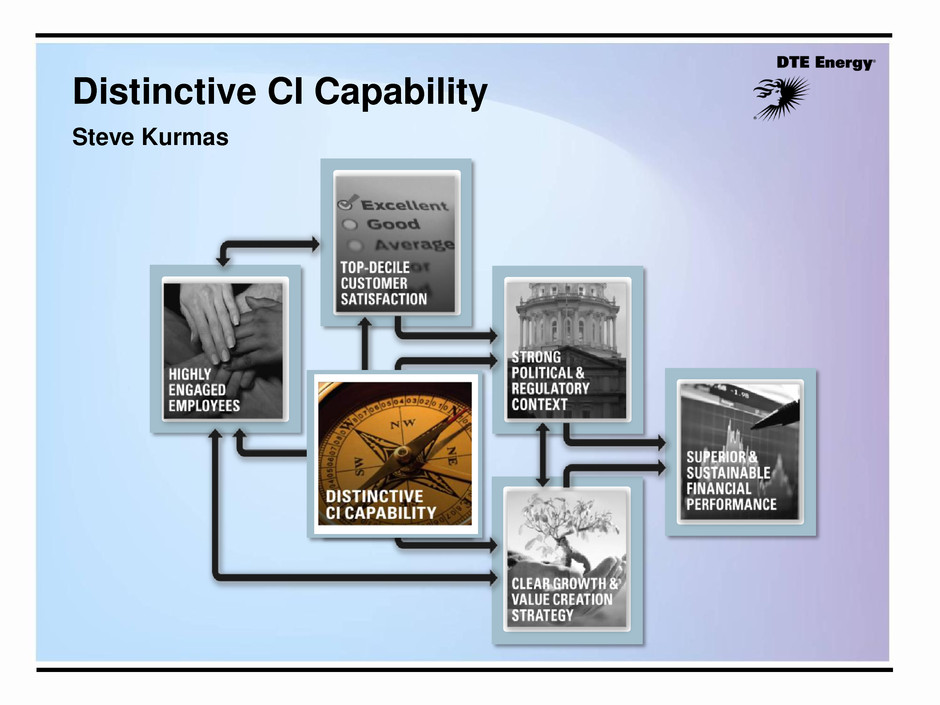

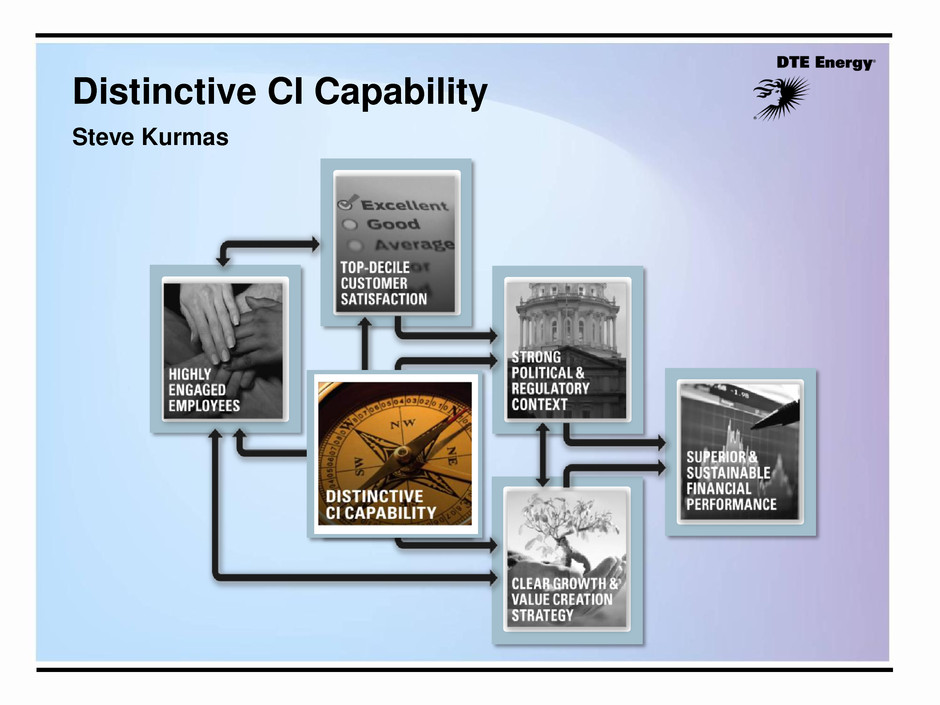

Distinctive CI Capability Steve Kurmas

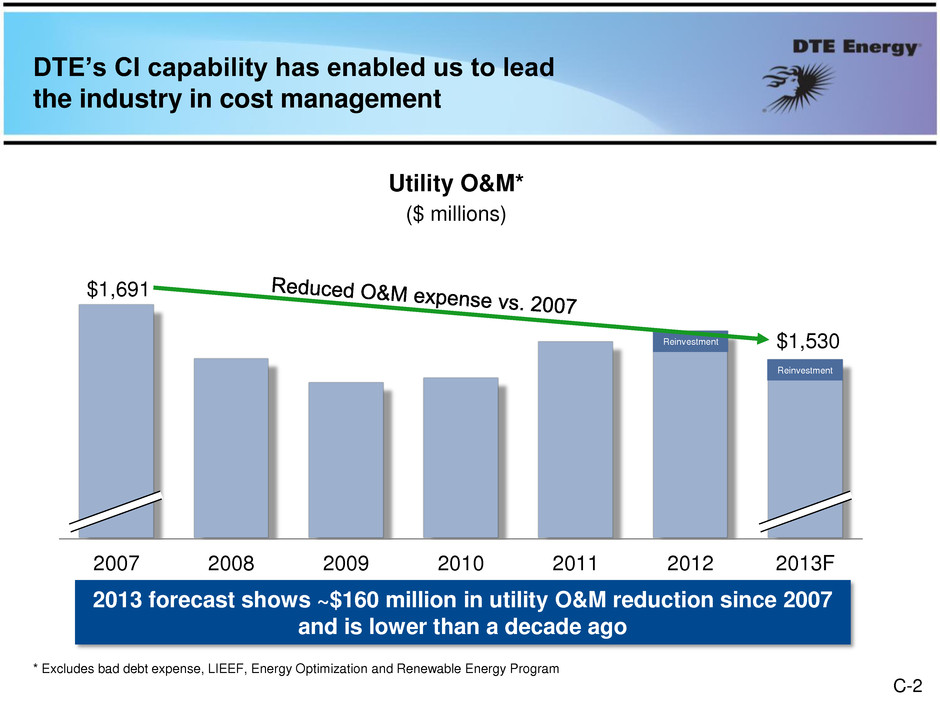

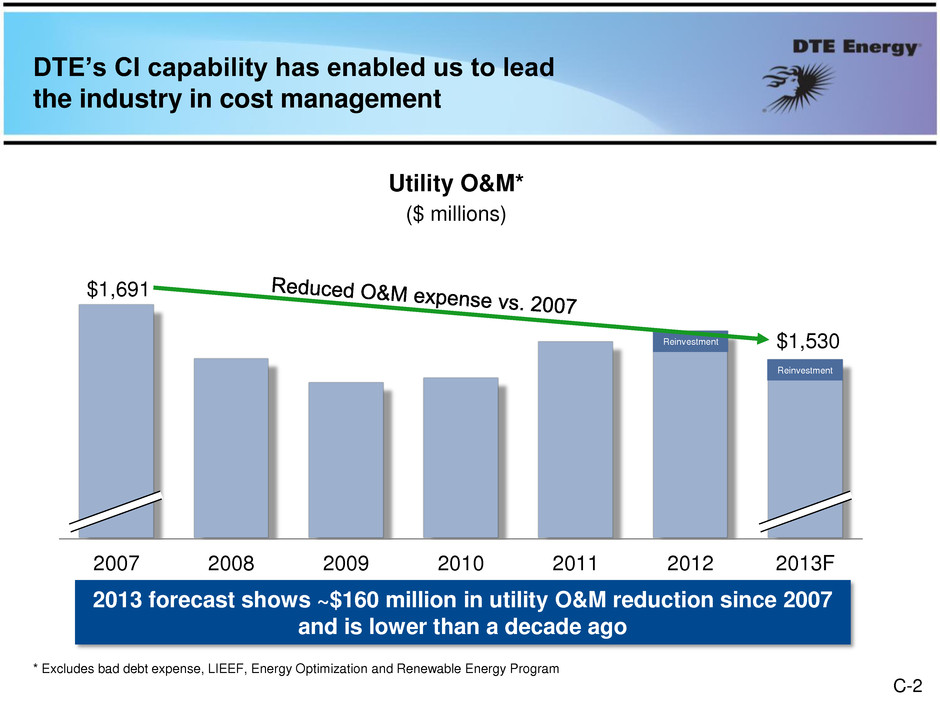

DTE’s CI capability has enabled us to lead the industry in cost management $1,691 $1,530 2007 2008 2009 2010 2011 2012 2013F Utility O&M* ($ millions) * Excludes bad debt expense, LIEEF, Energy Optimization and Renewable Energy Program 2013 forecast shows ~$160 million in utility O&M reduction since 2007 and is lower than a decade ago Reinvestment Reinvestment C-2

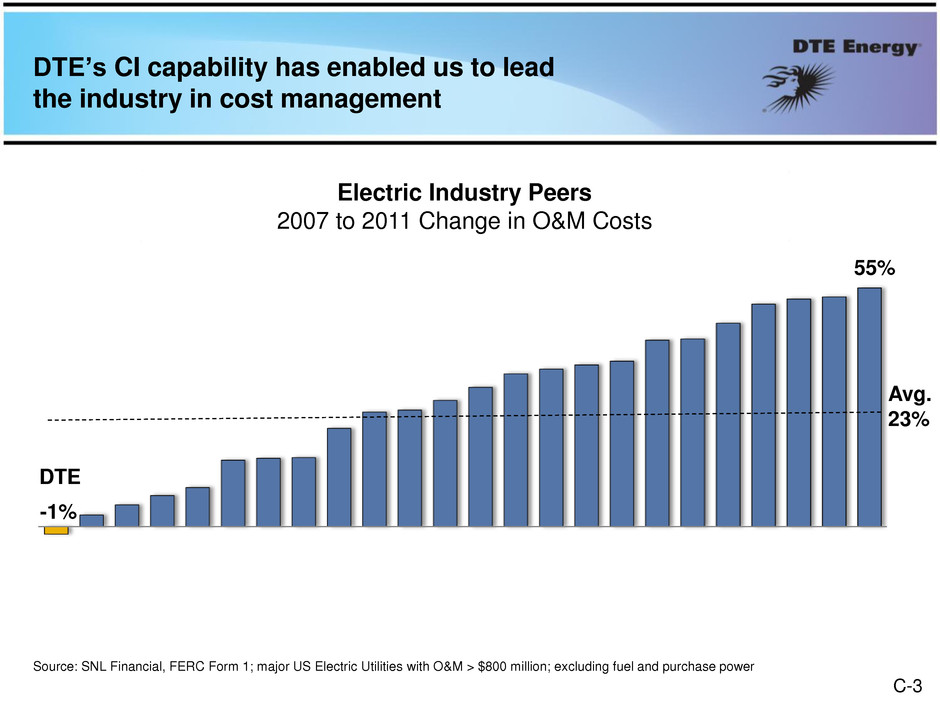

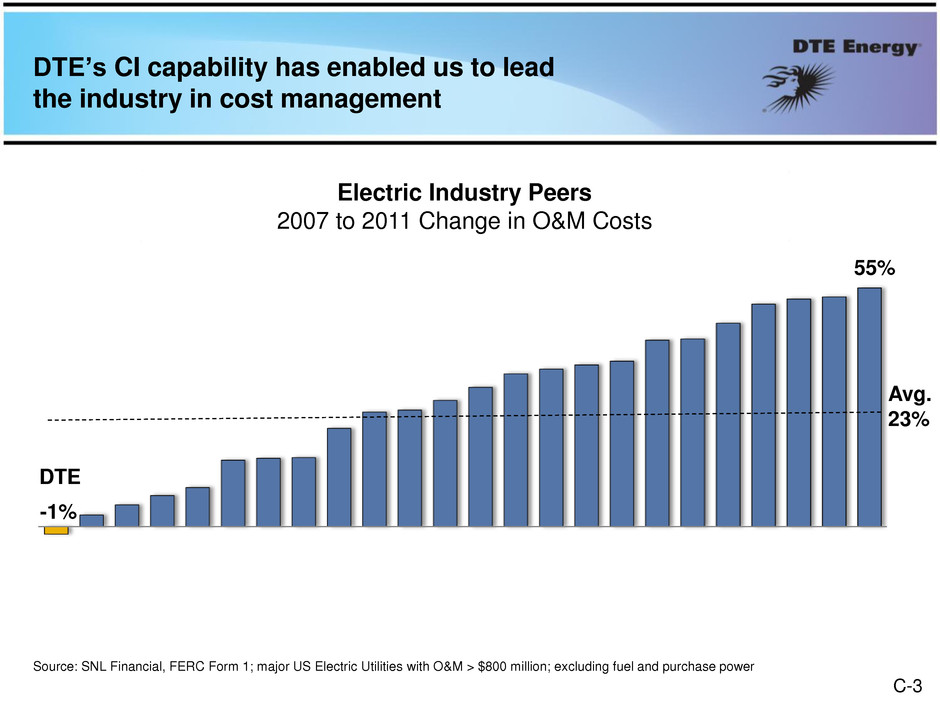

DTE Electric Industry Peers 2007 to 2011 Change in O&M Costs 55% -1% DTE’s CI capability has enabled us to lead the industry in cost management Source: SNL Financial, FERC Form 1; major US Electric Utilities with O&M > $800 million; excluding fuel and purchase power Avg. 23% C-3

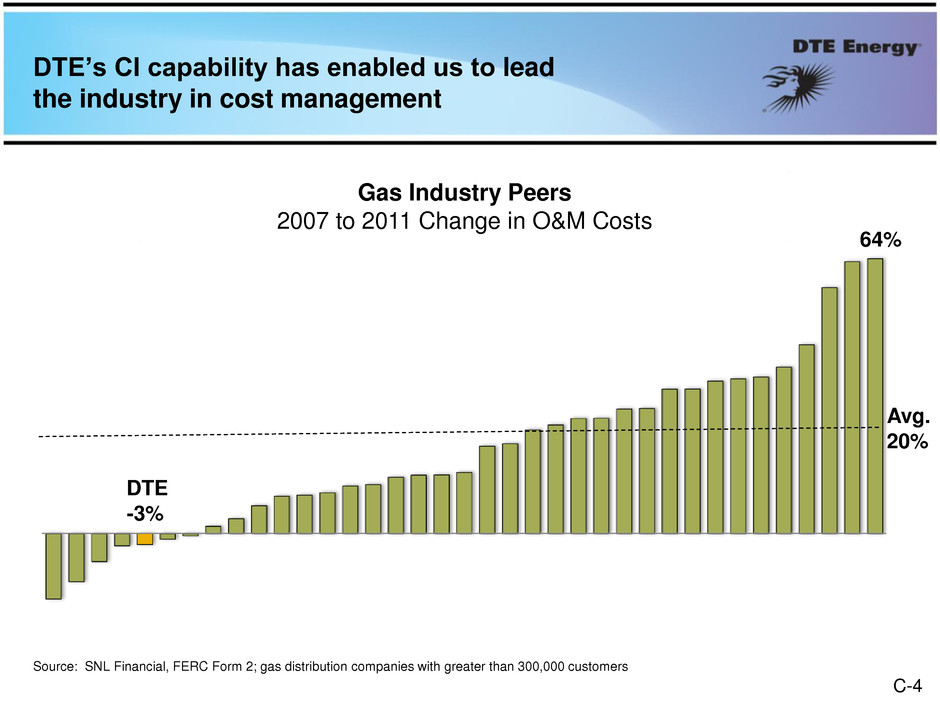

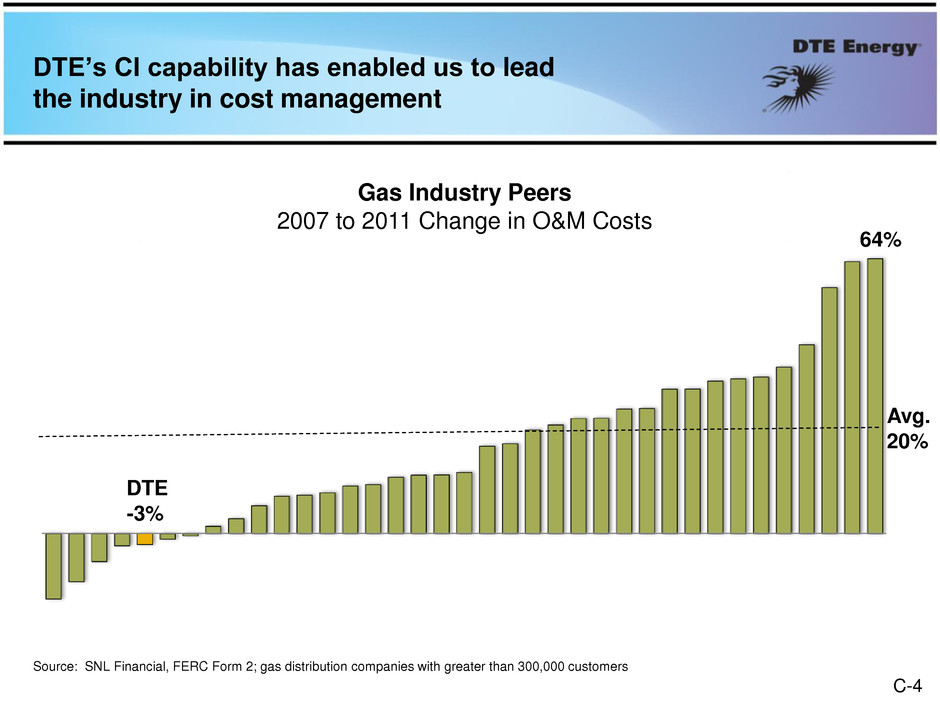

DTE 64% -3% DTE’s CI capability has enabled us to lead the industry in cost management Source: SNL Financial, FERC Form 2; gas distribution companies with greater than 300,000 customers Gas Industry Peers 2007 to 2011 Change in O&M Costs Avg. 20% C-4

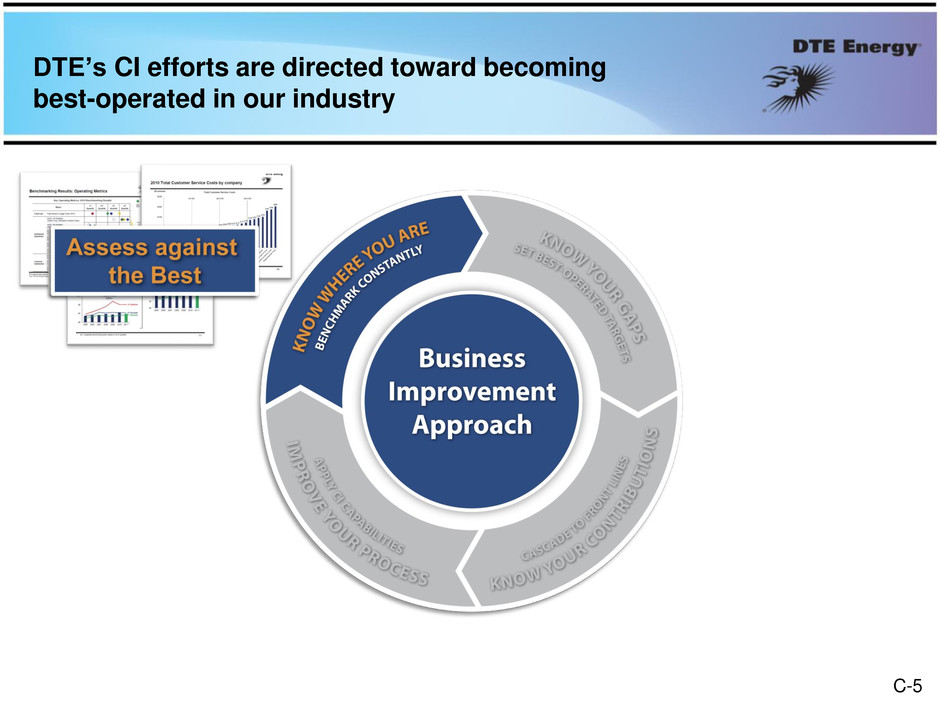

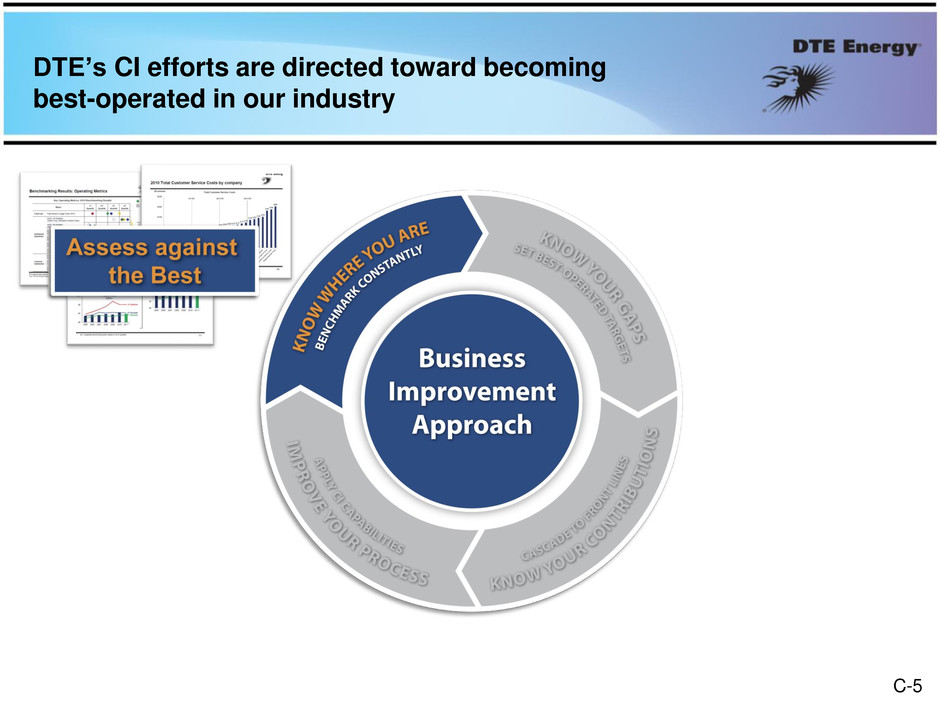

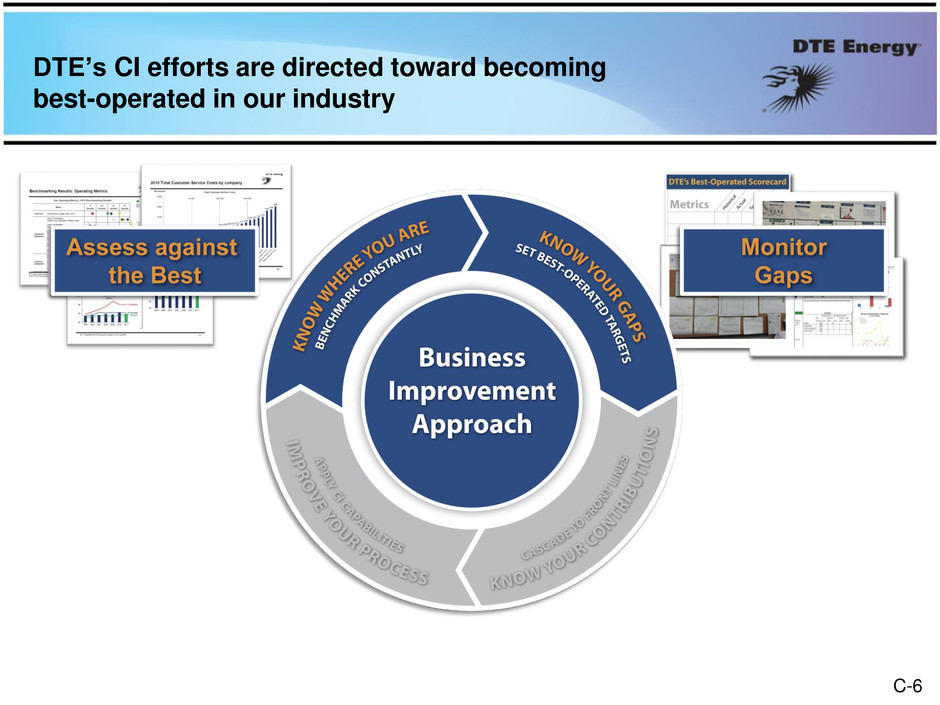

DTE’s CI efforts are directed toward becoming best-operated in our industry C-5

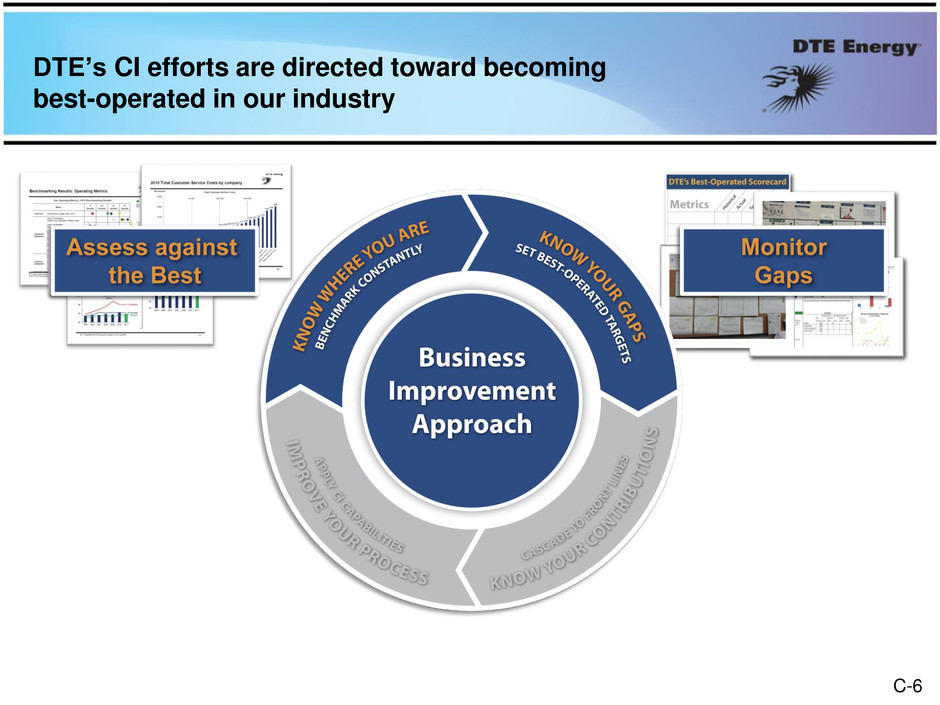

DTE’s CI efforts are directed toward becoming best-operated in our industry C-6

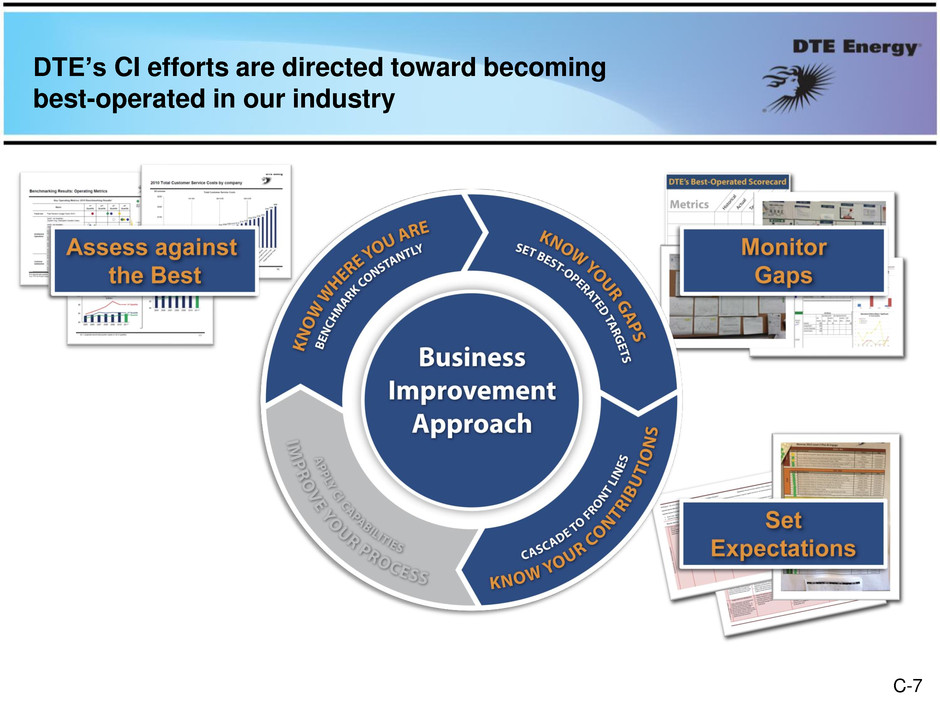

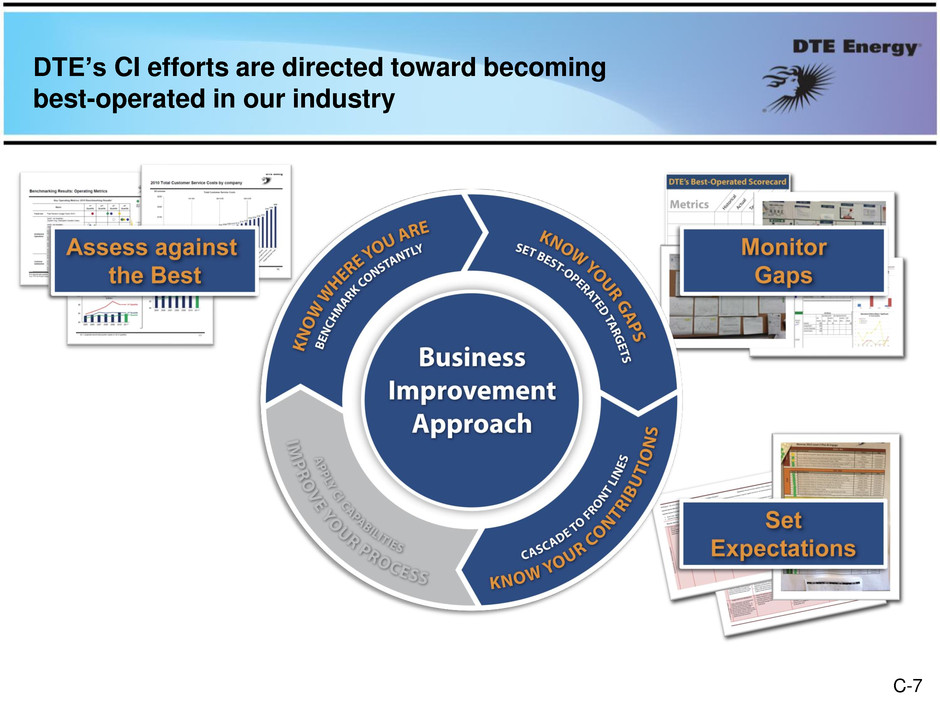

DTE’s CI efforts are directed toward becoming best-operated in our industry C-7

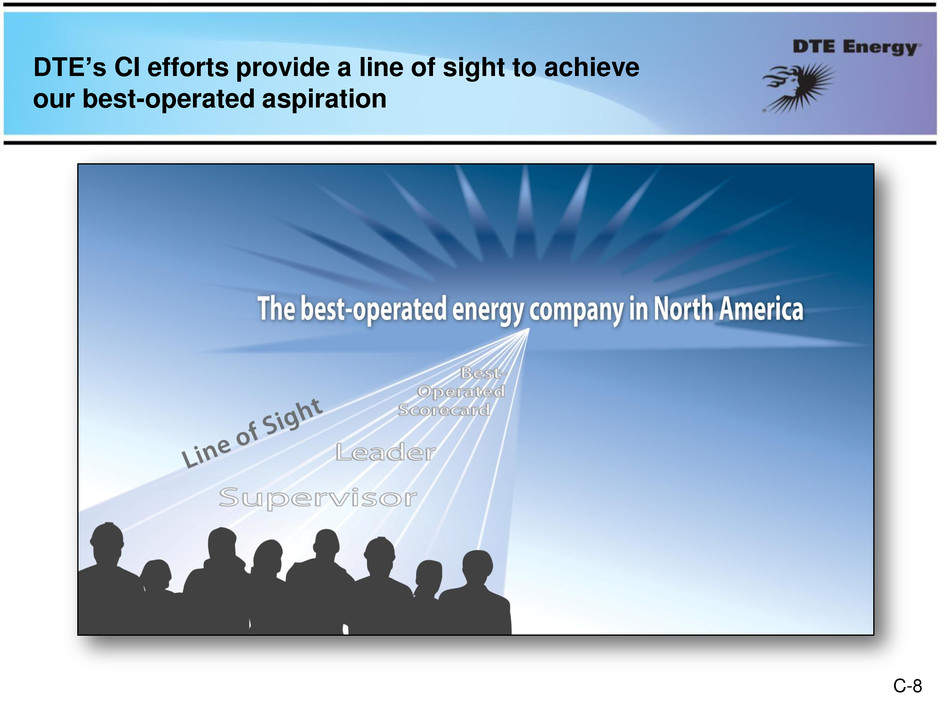

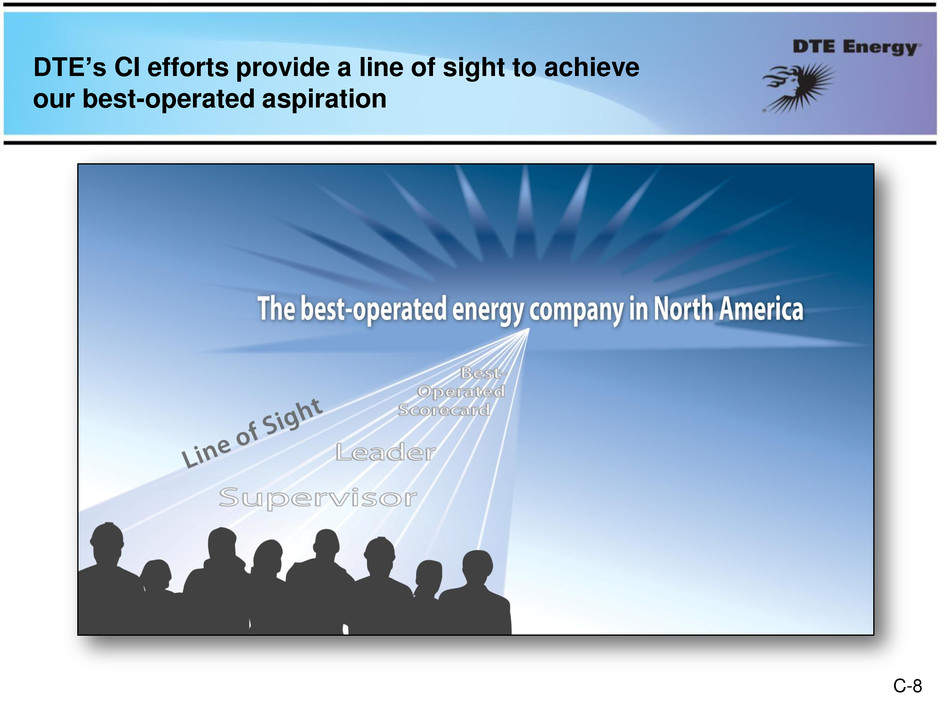

DTE’s CI efforts provide a line of sight to achieve our best-operated aspiration C-8

DTE’s CI efforts are directed toward becoming best-operated in our industry C-9

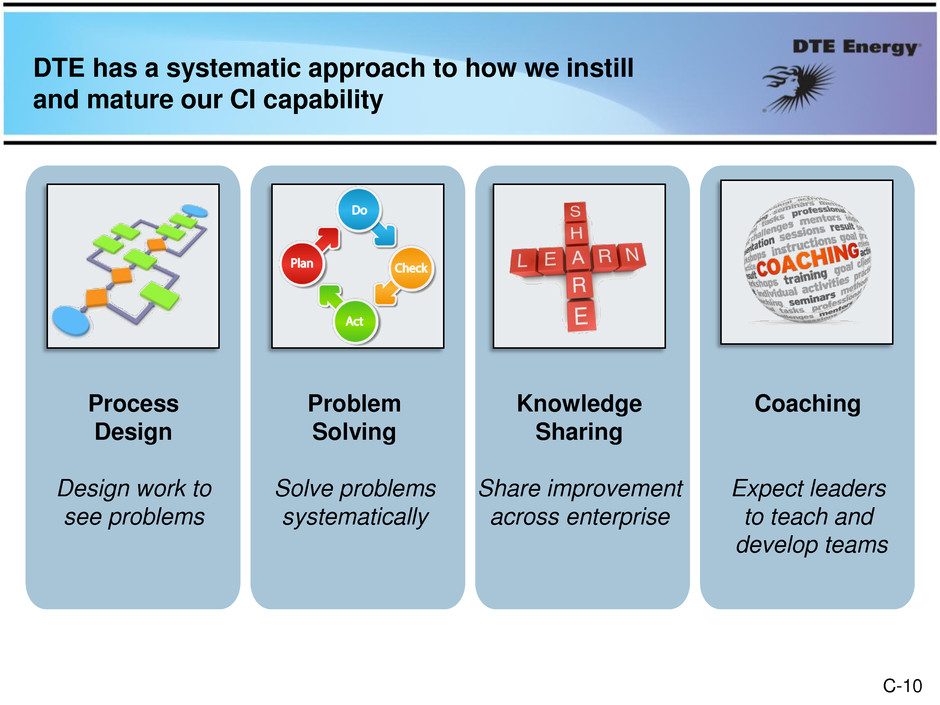

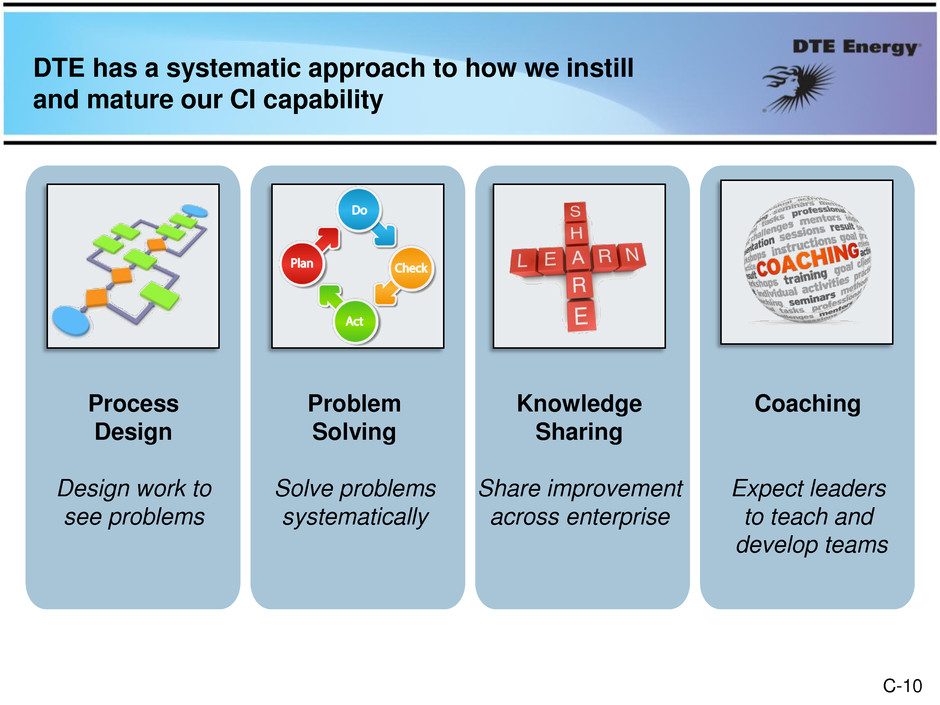

DTE has a systematic approach to how we instill and mature our CI capability Process Design Design work to see problems Problem Solving Solve problems systematically Knowledge Sharing Share improvement across enterprise Coaching Expect leaders to teach and develop teams C-10

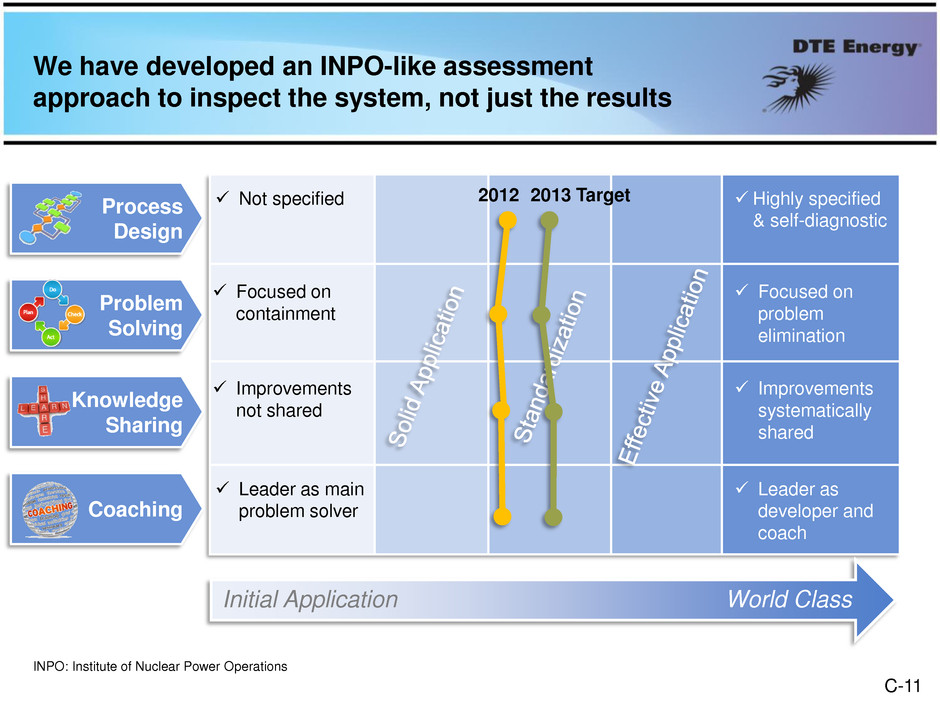

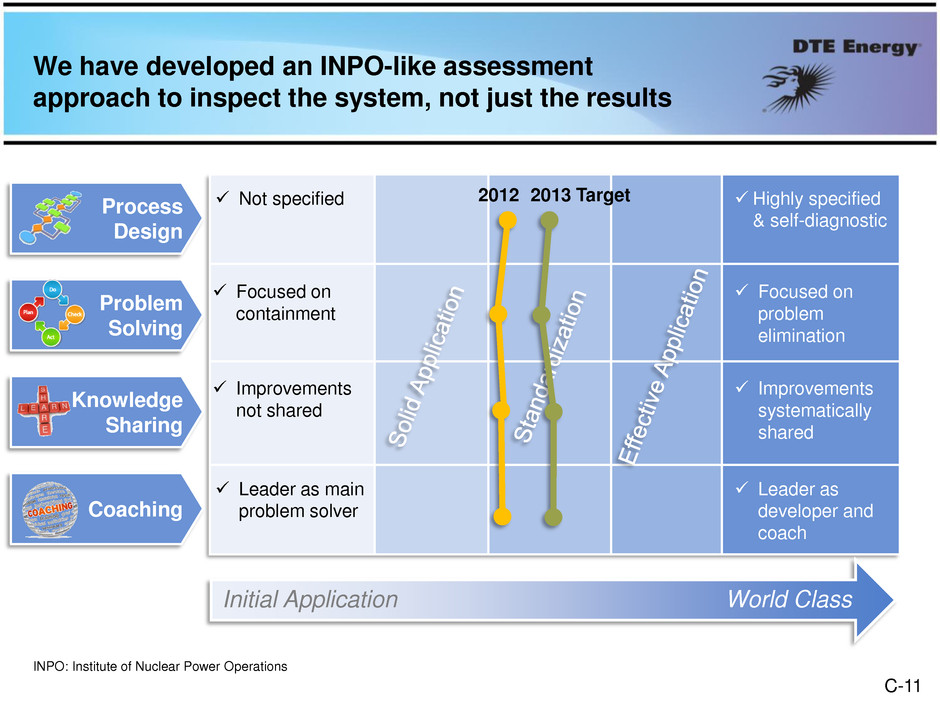

We have developed an INPO-like assessment approach to inspect the system, not just the results Initial Application World Class Not specified Highly specified & self-diagnostic Process Design Problem Solving Knowledge Sharing Coaching 2012 2013 Target Focused on containment Focused on problem elimination Improvements not shared Improvements systematically shared Leader as main problem solver Leader as developer and coach INPO: Institute of Nuclear Power Operations C-11

Our CI Journey DTE has been building a CI culture which will enable us to deliver results for years to come C-12

Our CI program was recently recognized by the London Process Excellence Network Best Process Improvement Program Process Excellence 2013 Global Awards C-13

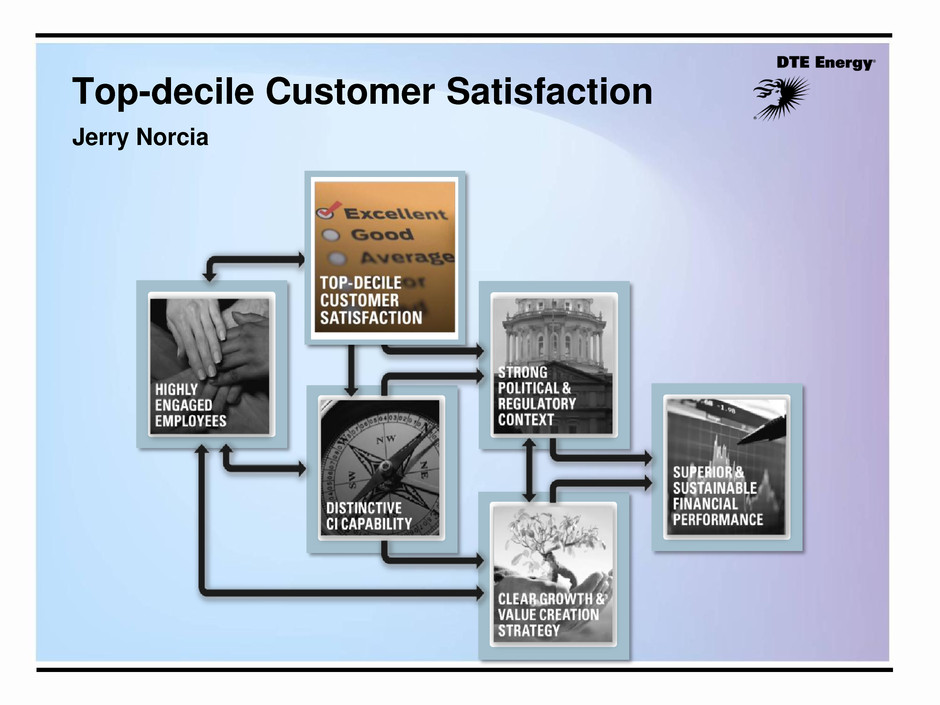

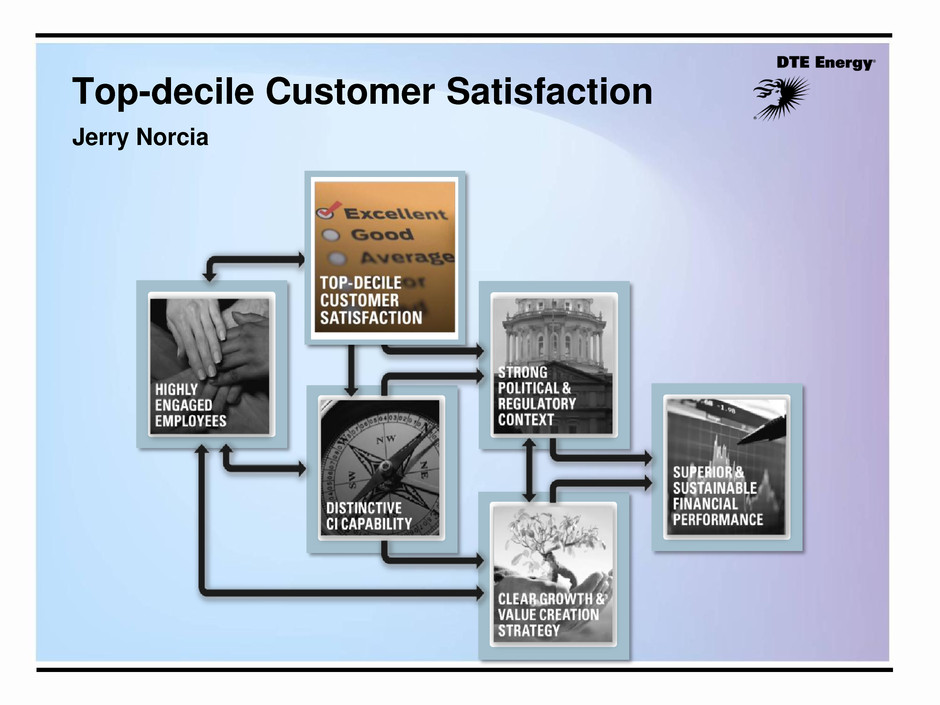

Top-decile Customer Satisfaction Jerry Norcia

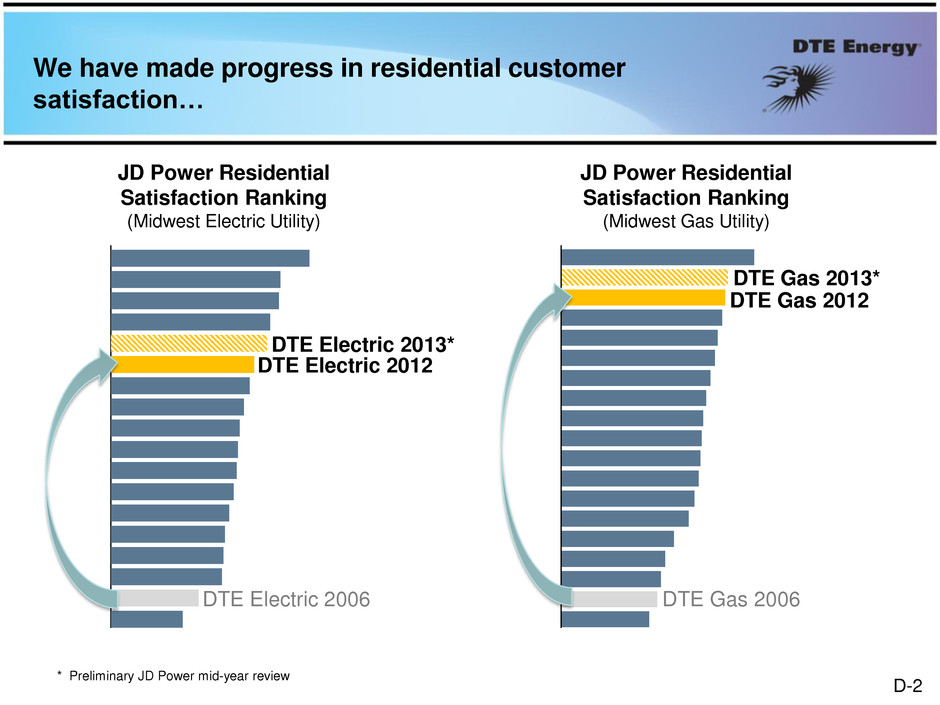

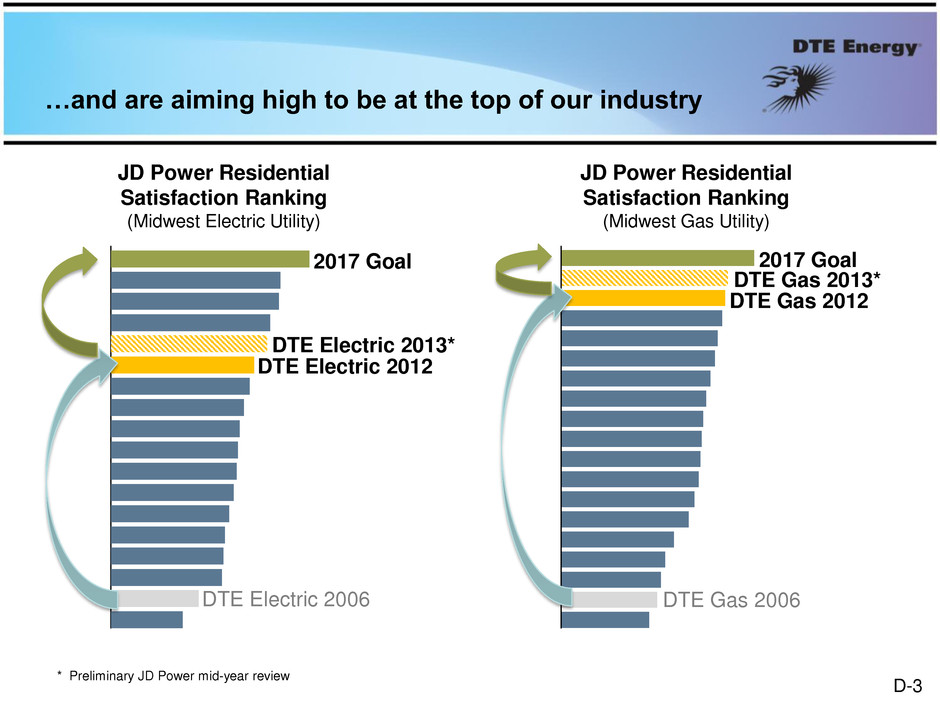

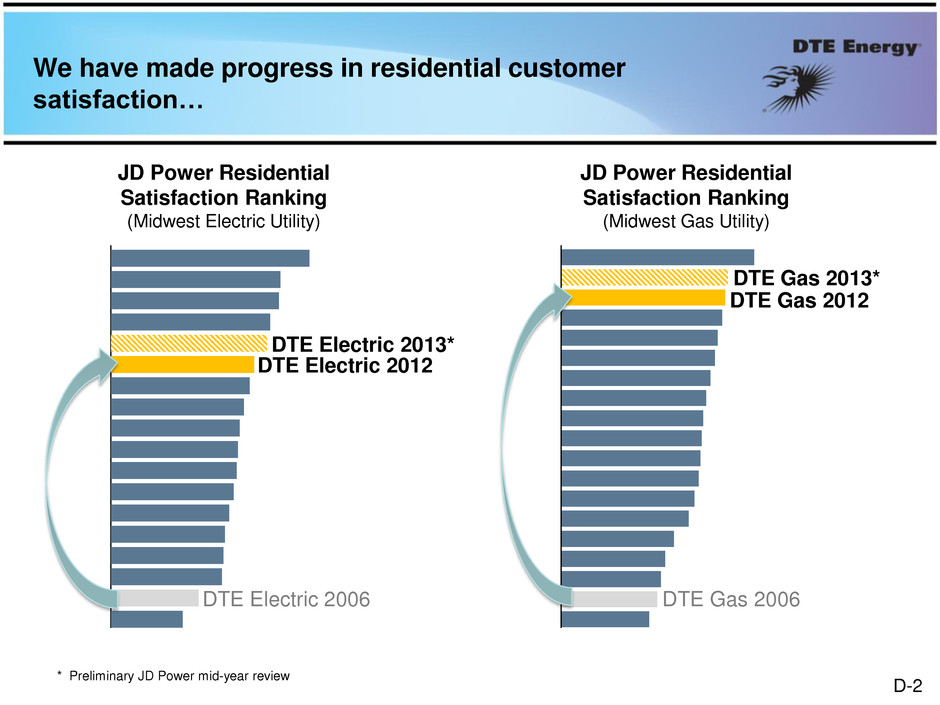

We have made progress in residential customer satisfaction… DTE Electric 2012 DTE Electric 2006 DTE Gas 2012 DTE Gas 2006 JD Power Residential Satisfaction Ranking (Midwest Electric Utility) DTE Electric 2013* DTE Gas 2013* * Preliminary JD Power mid-year review JD Power Residential Satisfaction Ranking (Midwest Gas Utility) D-2

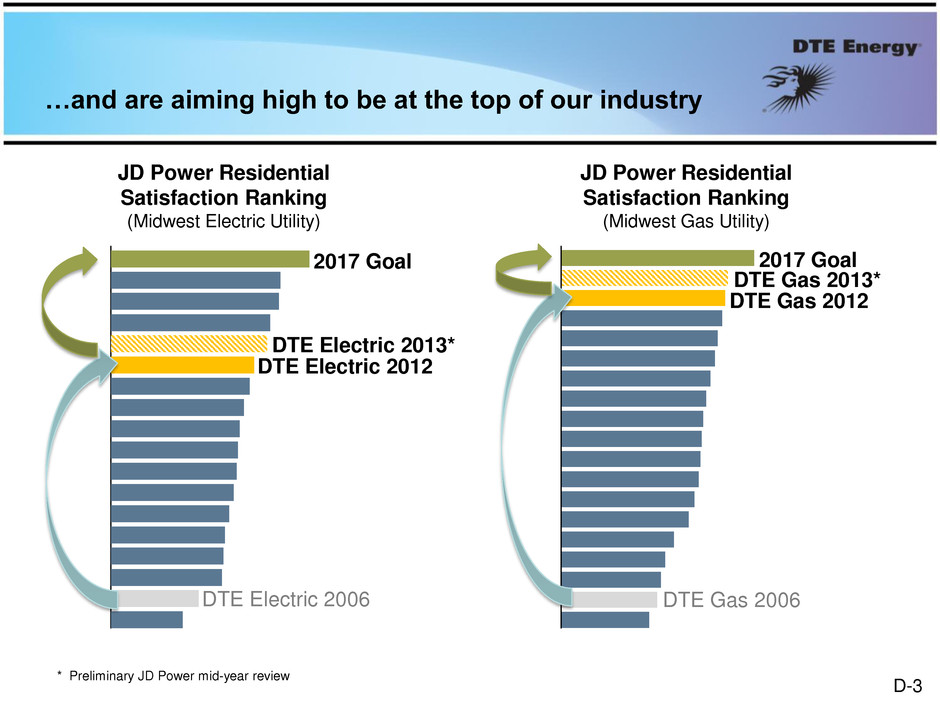

…and are aiming high to be at the top of our industry DTE Electric 2012 DTE Gas 2012 DTE Electric 2013* DTE Gas 2013* DTE Electric 2006 DTE Gas 2006 2017 Goal 2017 Goal JD Power Residential Satisfaction Ranking (Midwest Electric Utility) JD Power Residential Satisfaction Ranking (Midwest Gas Utility) * Preliminary JD Power mid-year review D-3

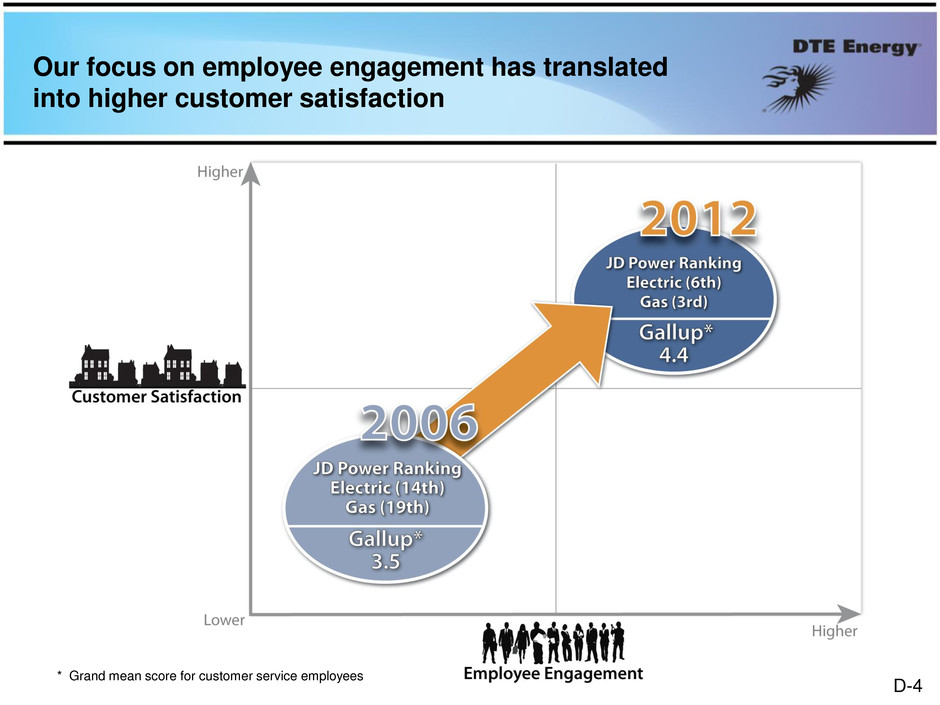

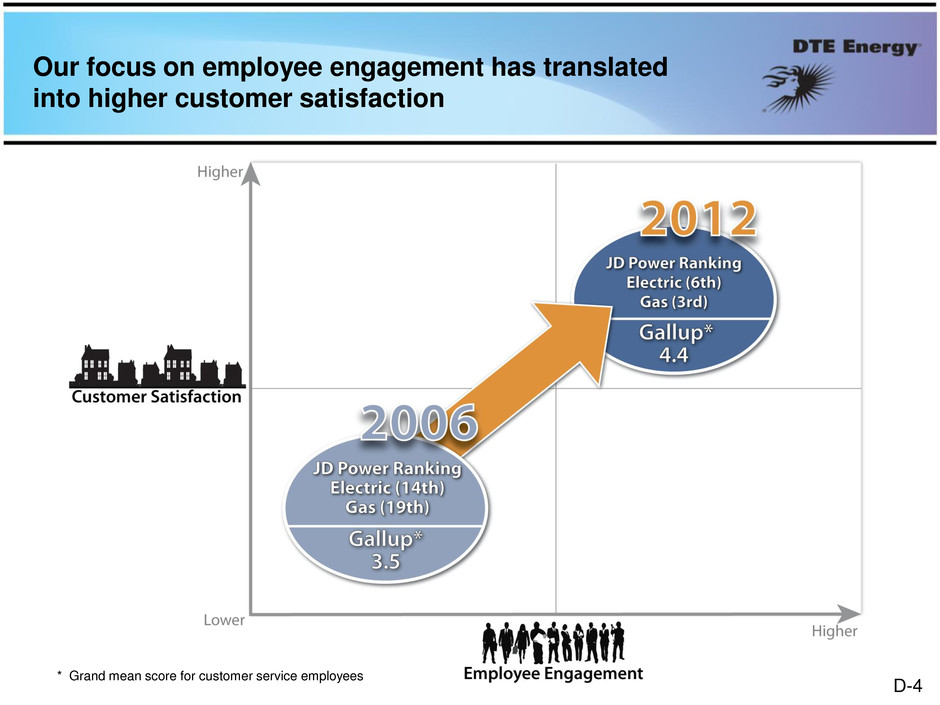

Our focus on employee engagement has translated into higher customer satisfaction * Grand mean score for customer service employees D-4

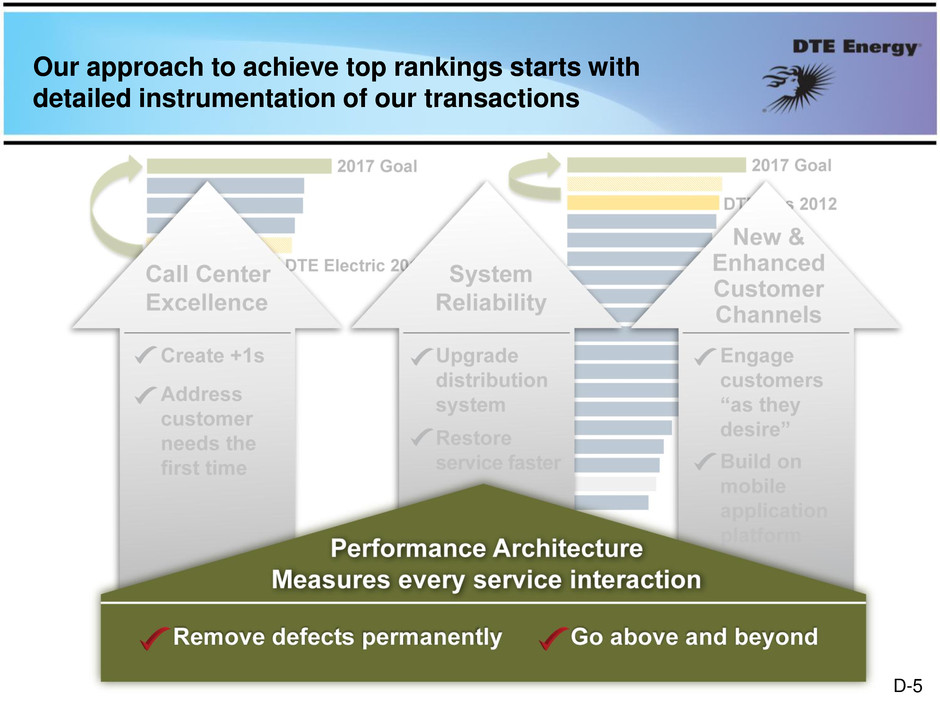

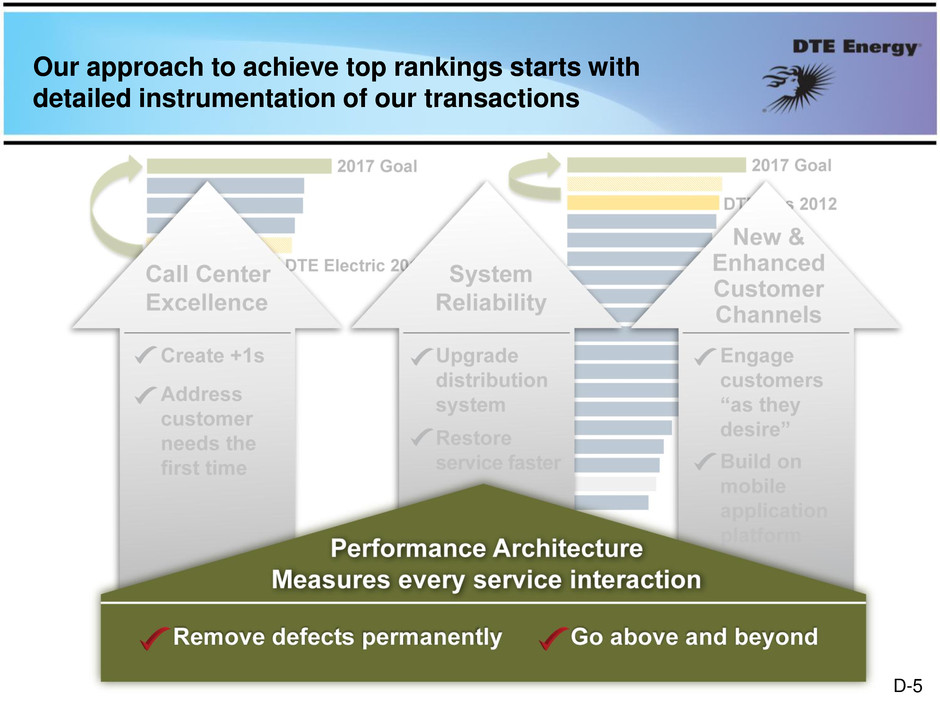

Our approach to achieve top rankings starts with detailed instrumentation of our transactions D-5

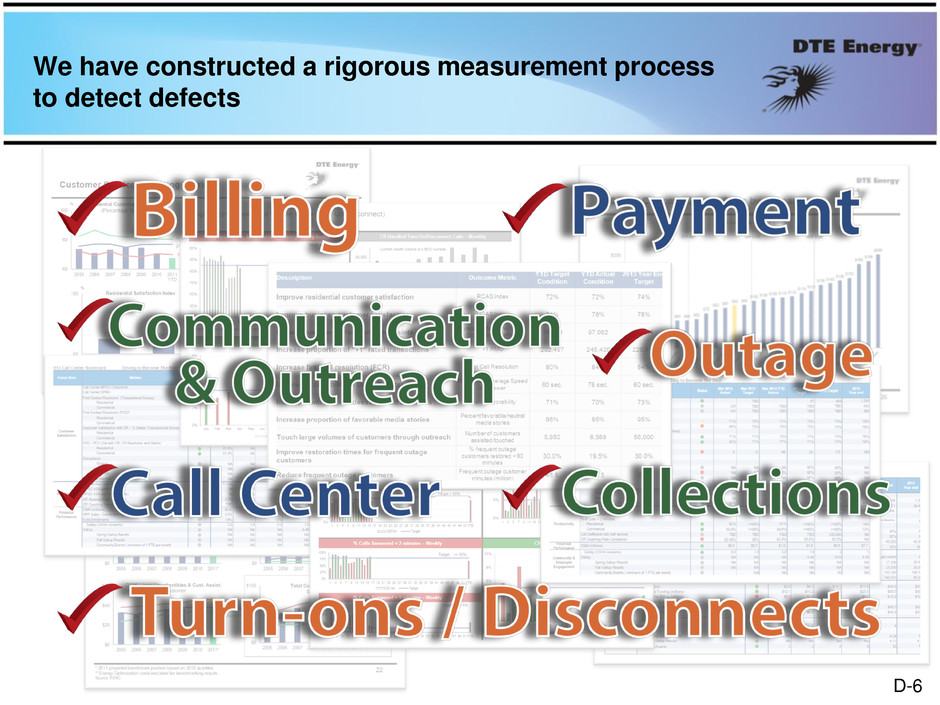

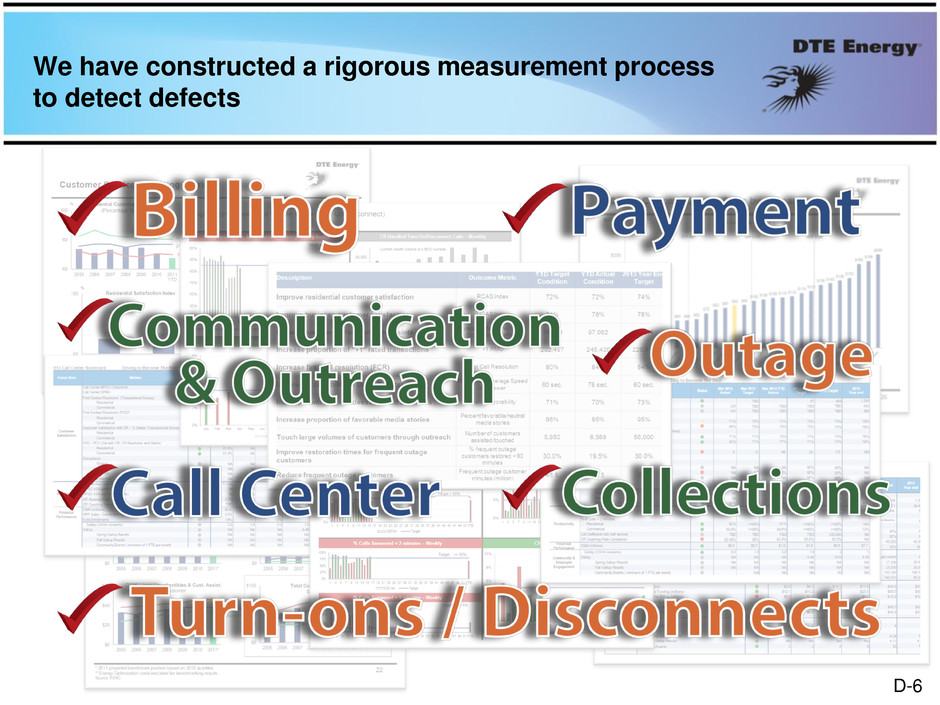

We have constructed a rigorous measurement process to detect defects D-6

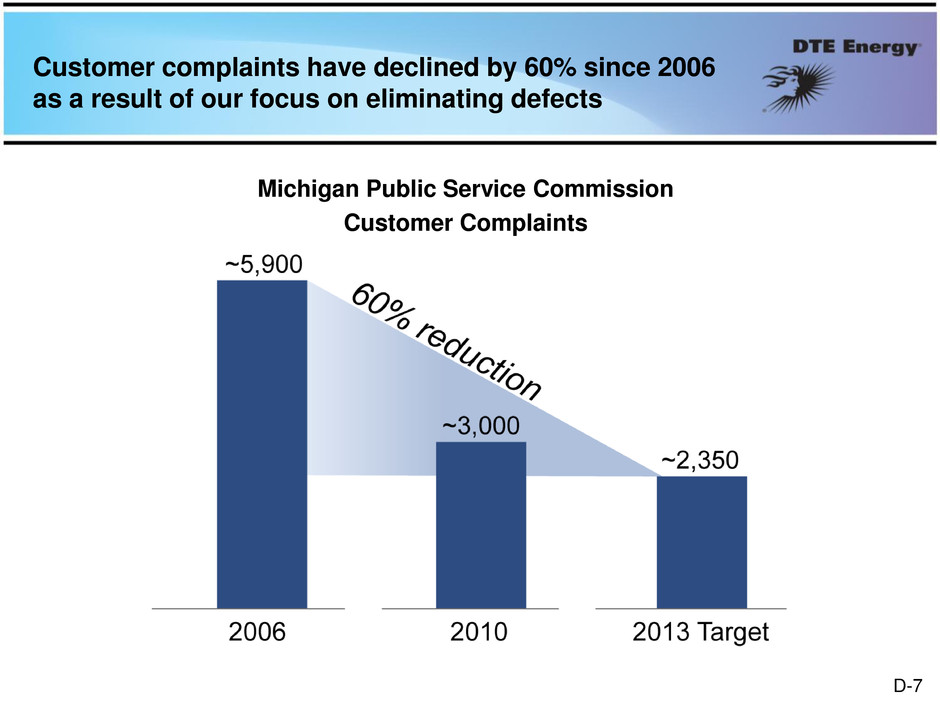

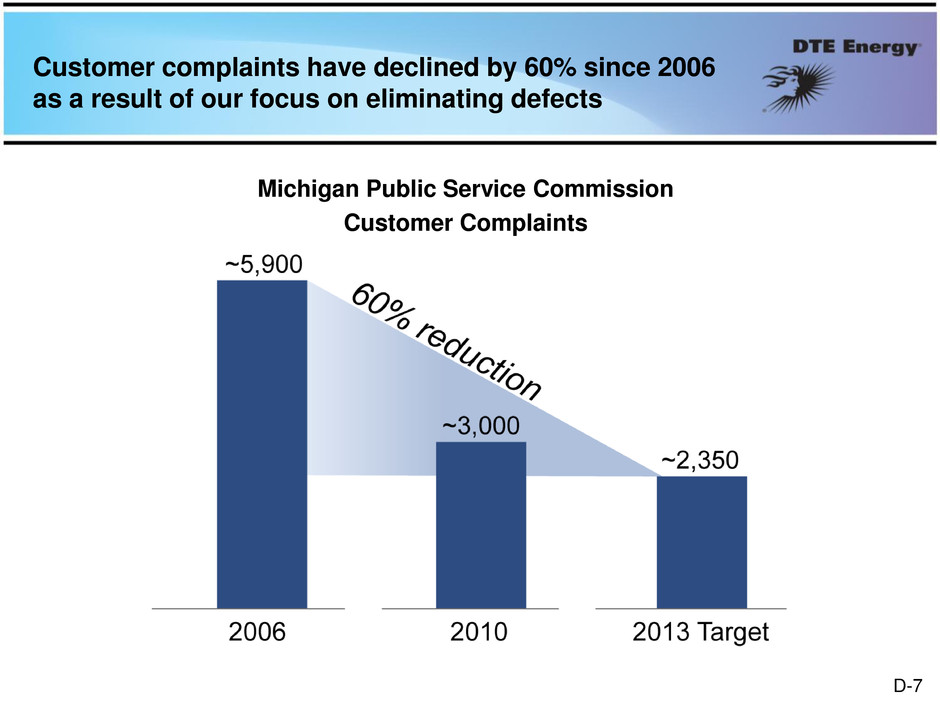

Customer complaints have declined by 60% since 2006 as a result of our focus on eliminating defects Michigan Public Service Commission Customer Complaints D-7

We have instilled a +1 mindset throughout our organization and into our customer processes… D-8

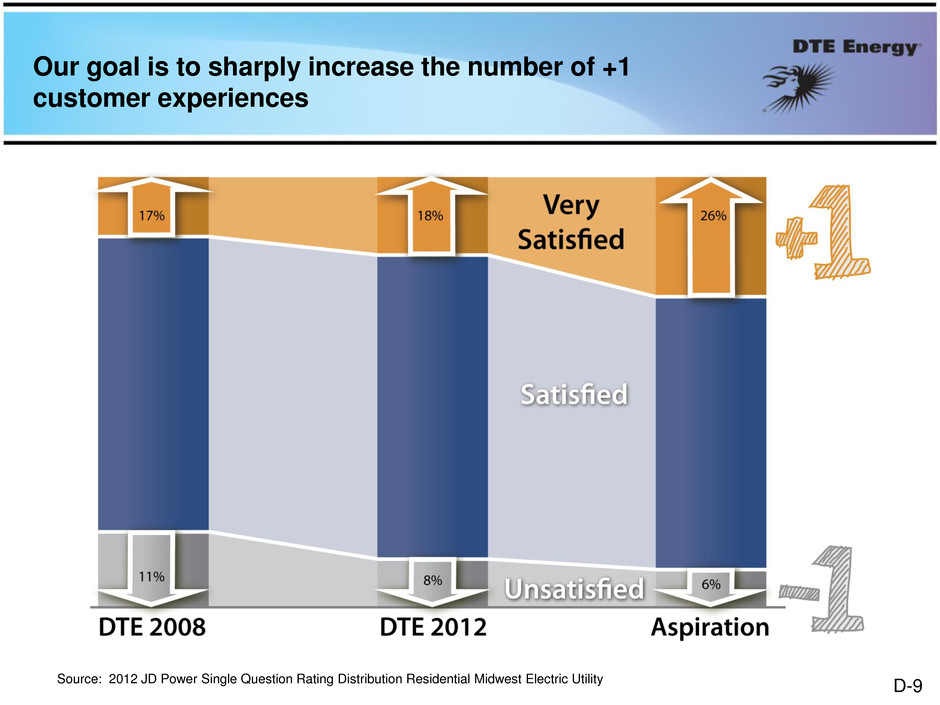

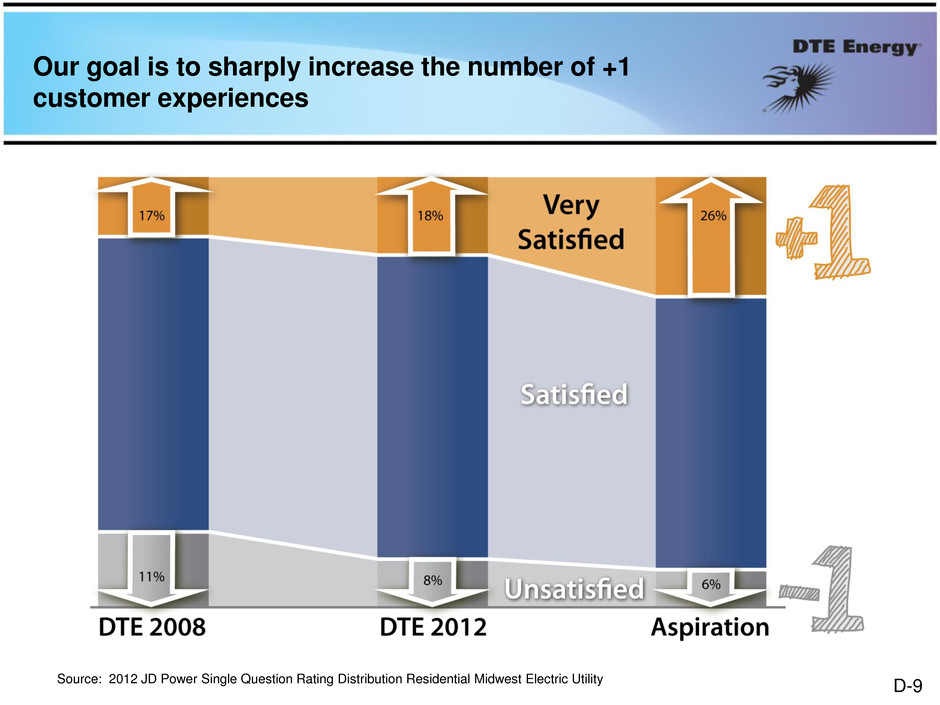

Our goal is to sharply increase the number of +1 customer experiences Source: 2012 JD Power Single Question Rating Distribution Residential Midwest Electric Utility D-9

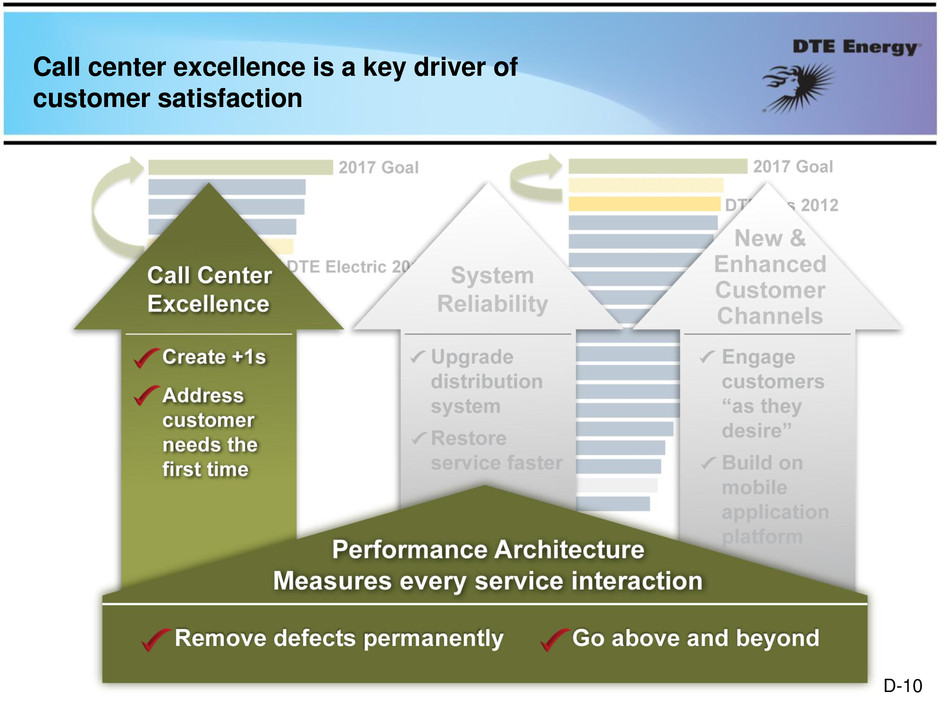

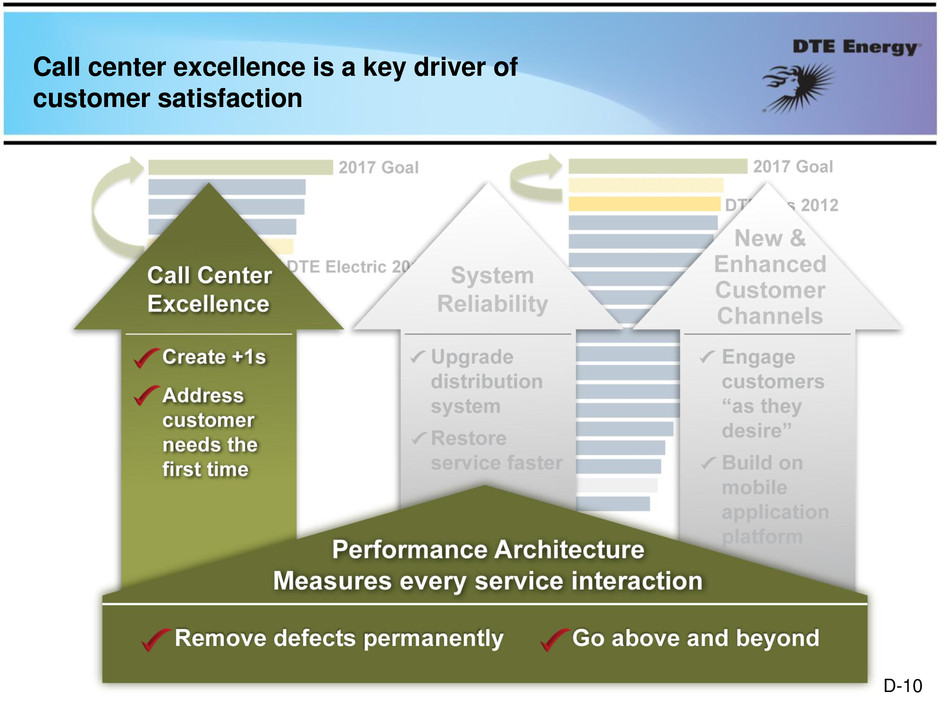

Call center excellence is a key driver of customer satisfaction D-10

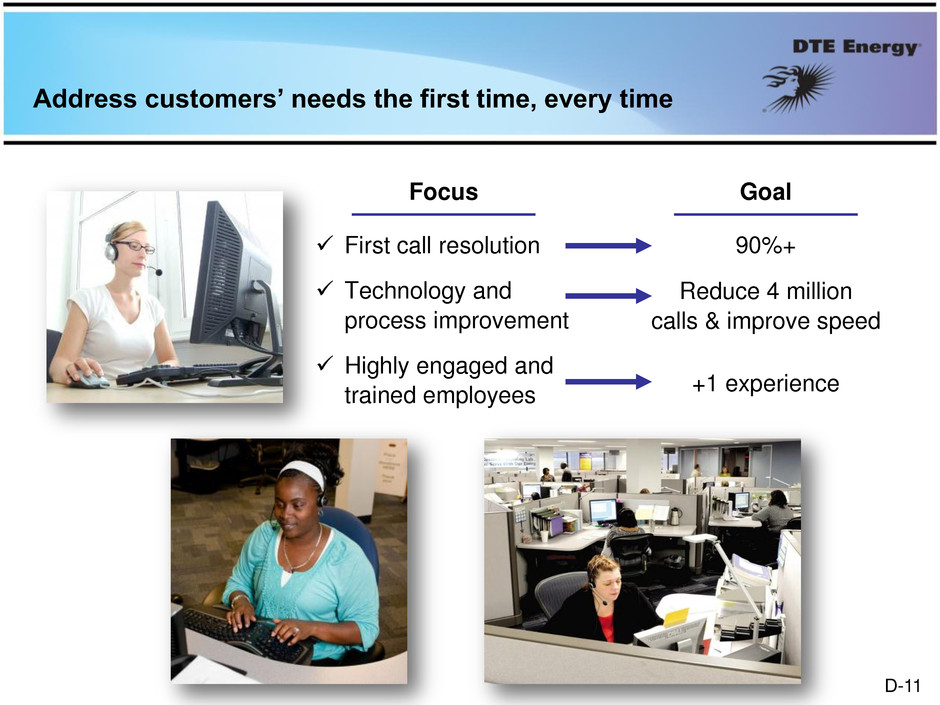

Address customers’ needs the first time, every time First call resolution Technology and process improvement Highly engaged and trained employees Focus Goal 90%+ Reduce 4 million calls & improve speed +1 experience D-11

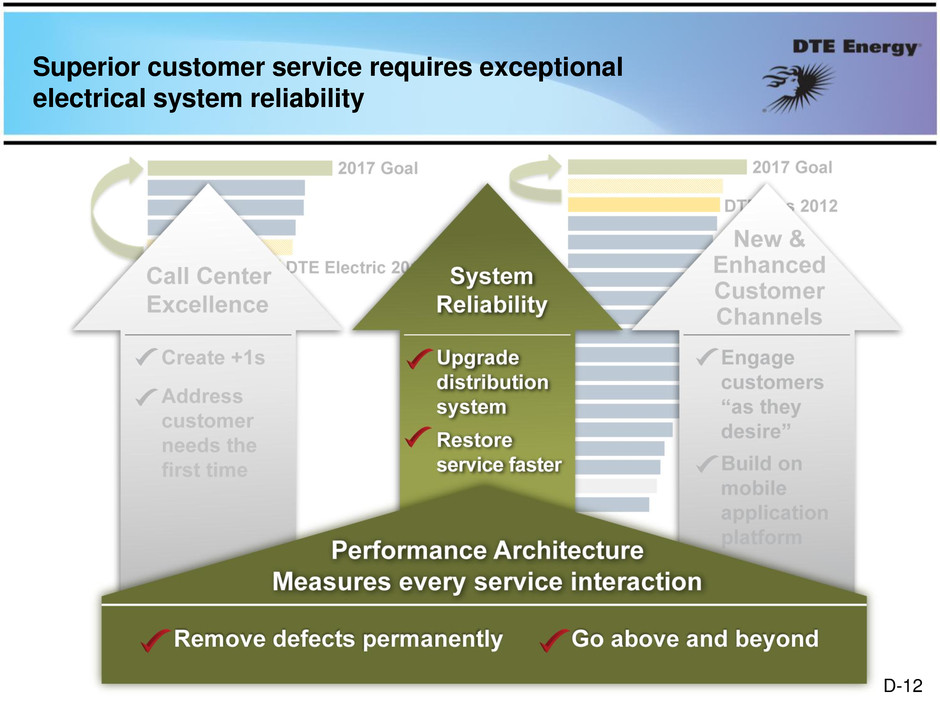

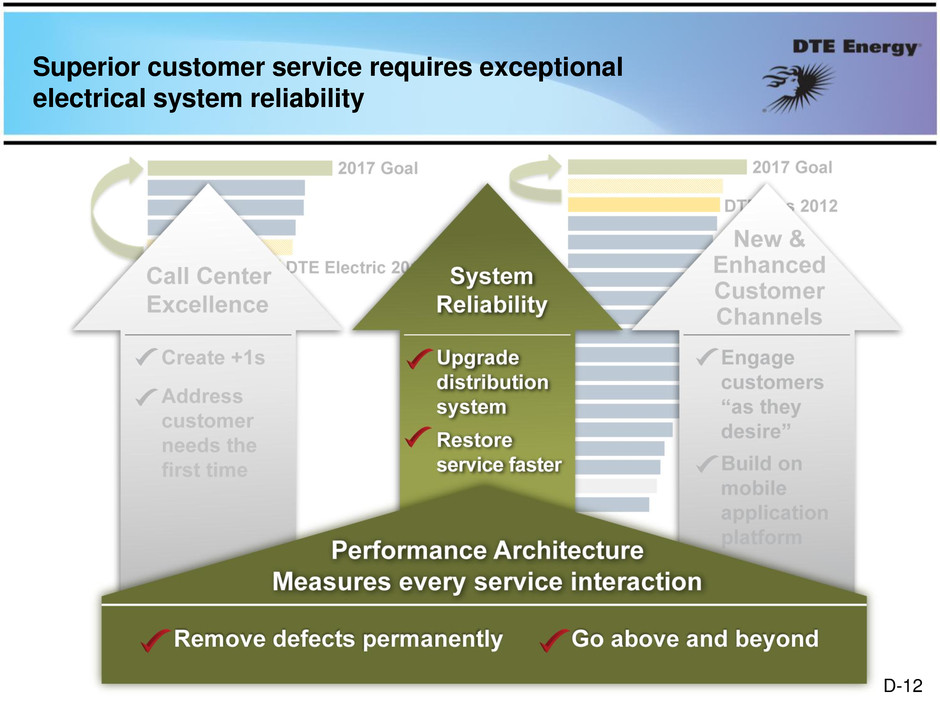

Superior customer service requires exceptional electrical system reliability D-12

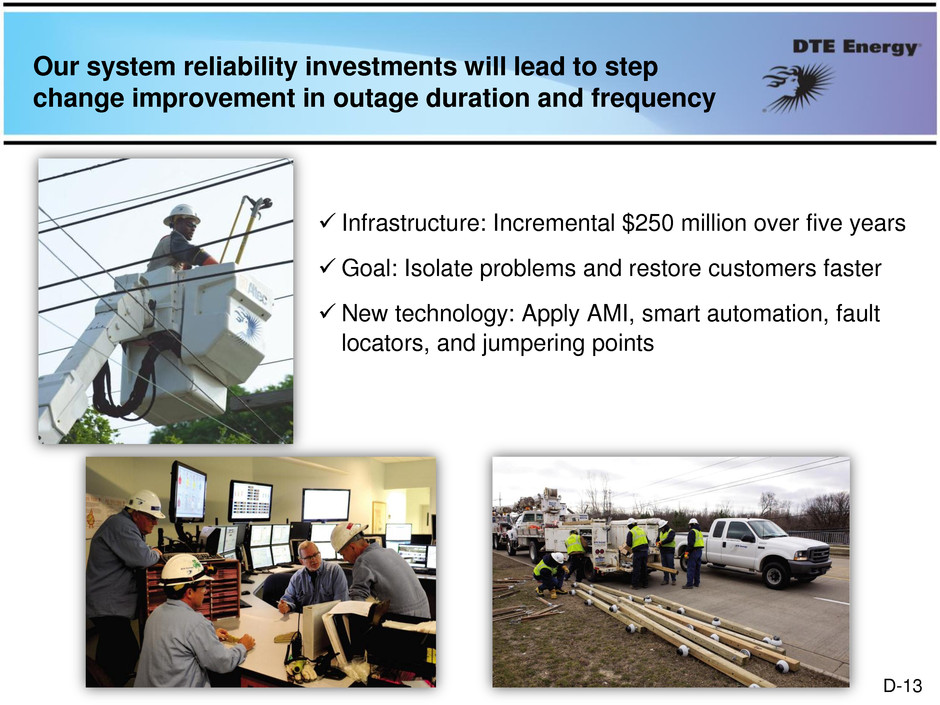

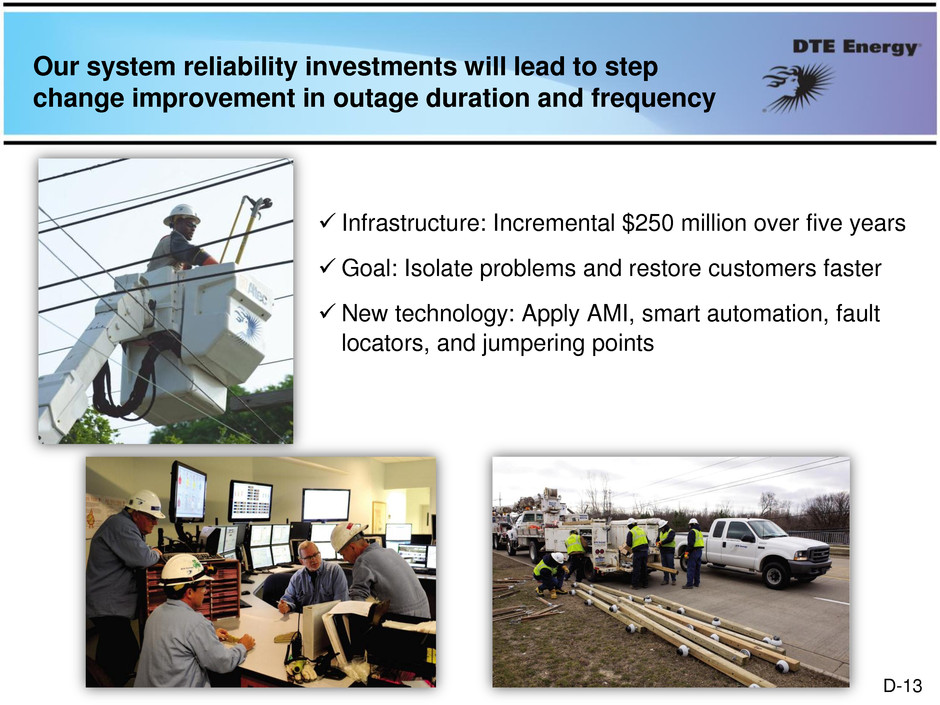

Our system reliability investments will lead to step change improvement in outage duration and frequency Infrastructure: Incremental $250 million over five years Goal: Isolate problems and restore customers faster New technology: Apply AMI, smart automation, fault locators, and jumpering points D-13

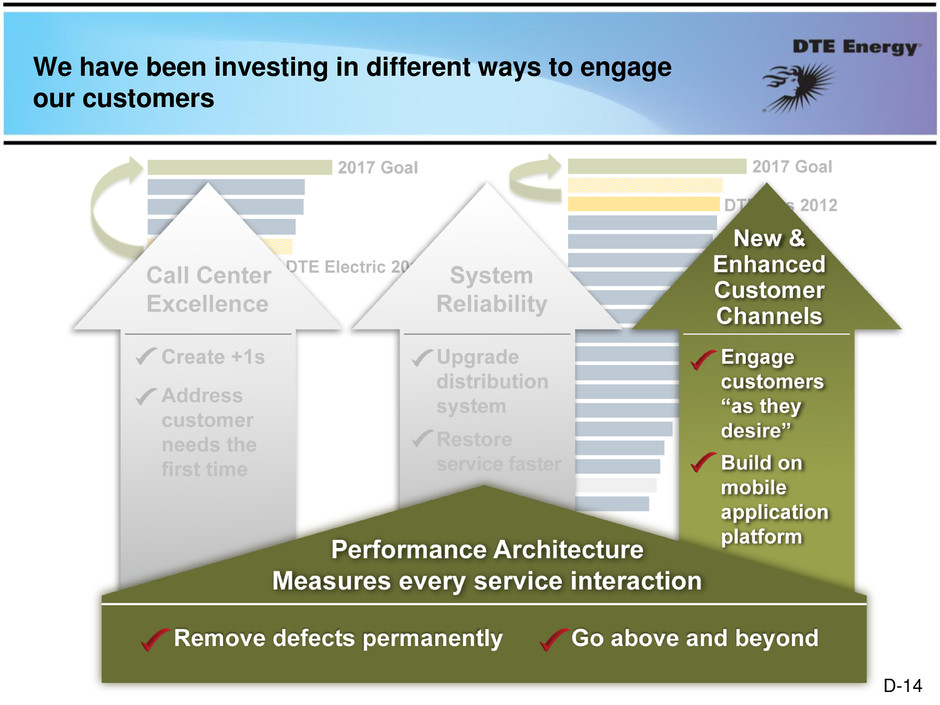

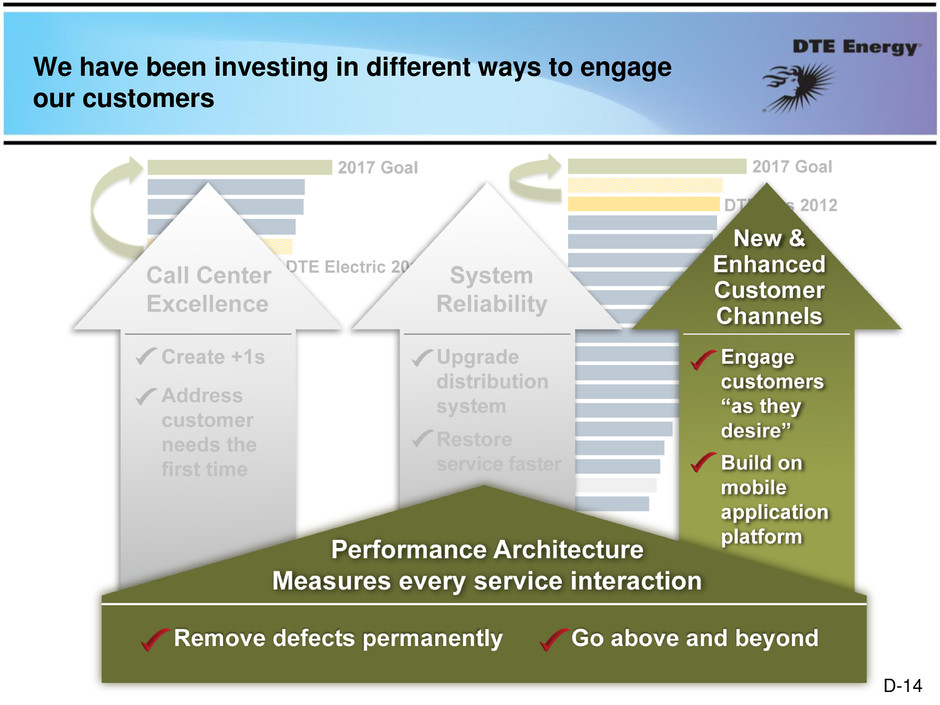

We have been investing in different ways to engage our customers D-14

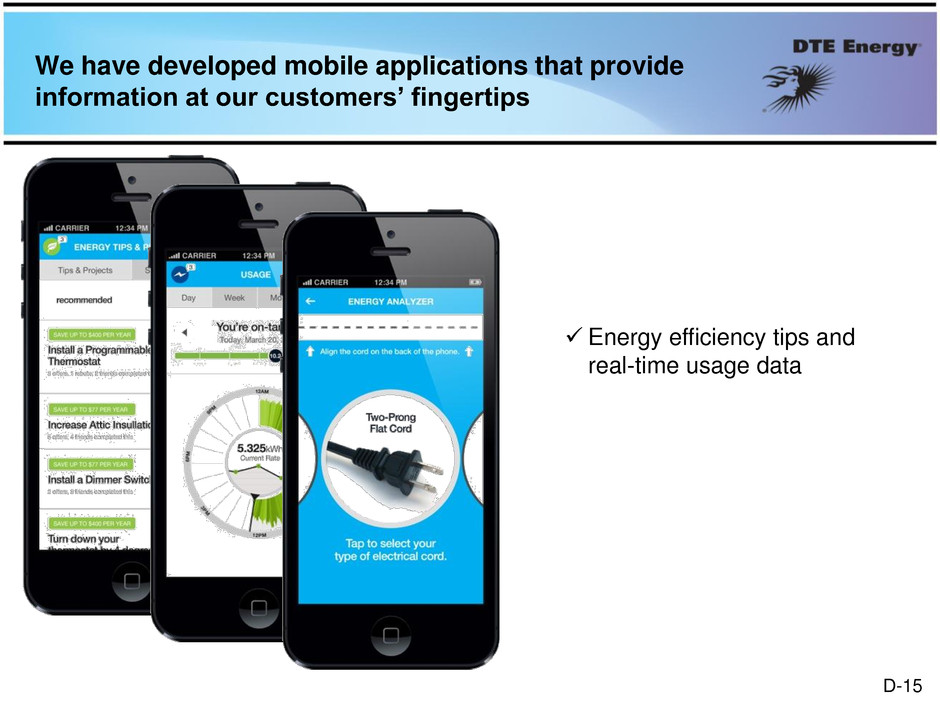

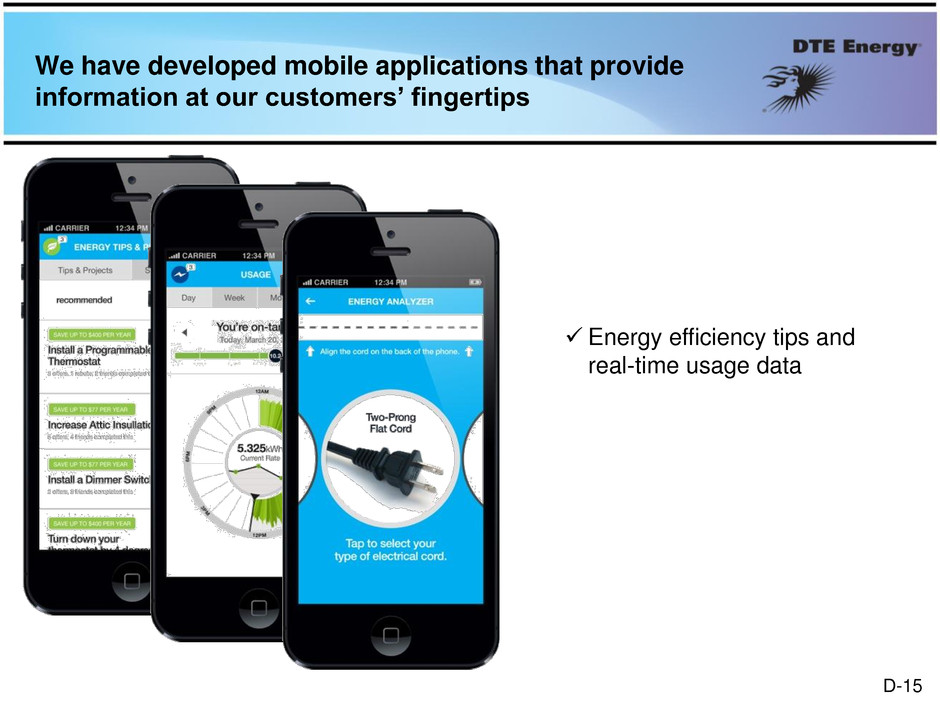

Energy efficiency tips and real-time usage data We have developed mobile applications that provide information at our customers’ fingertips D-15

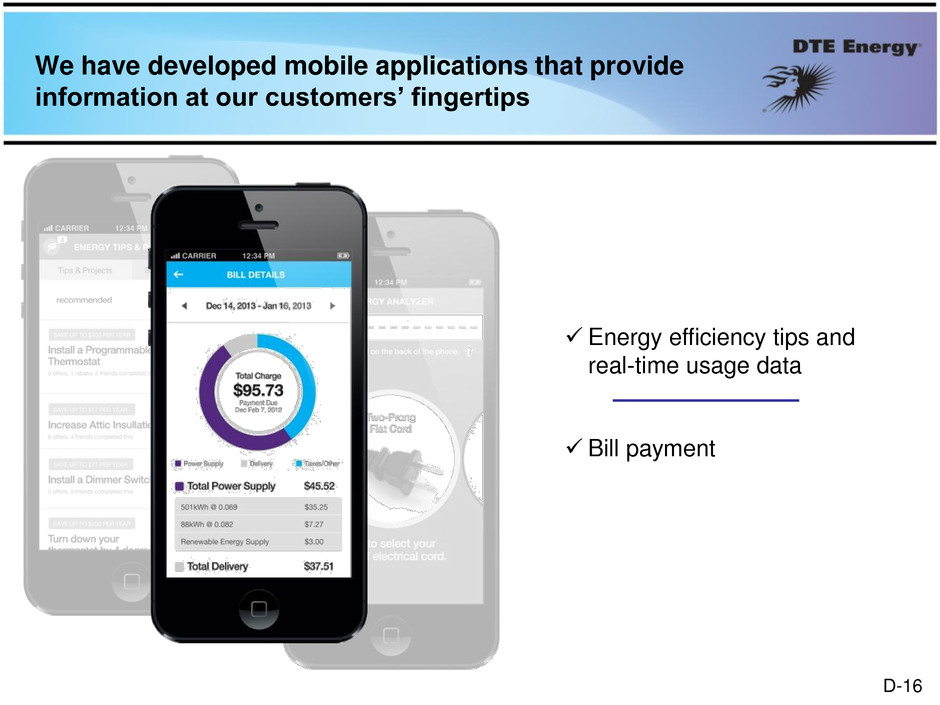

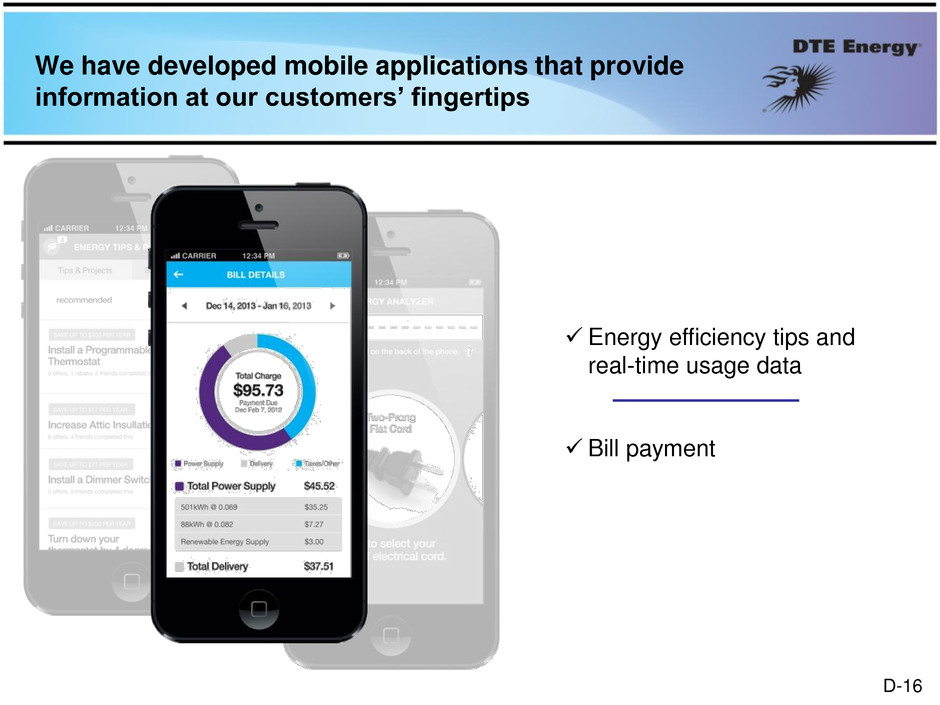

We have developed mobile applications that provide information at our customers’ fingertips Energy efficiency tips and real-time usage data Bill payment D-16

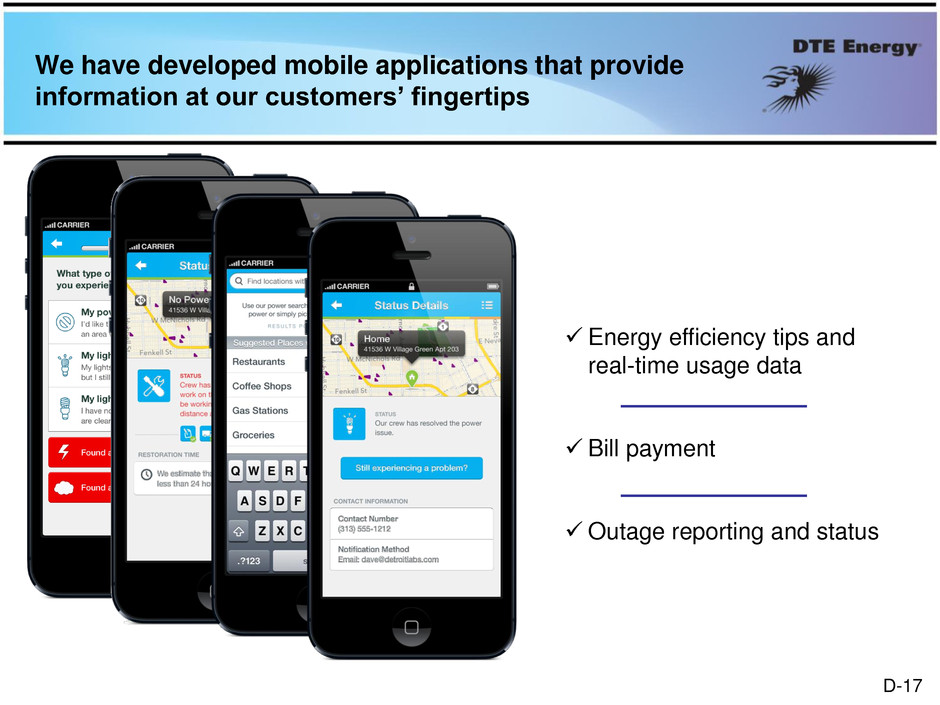

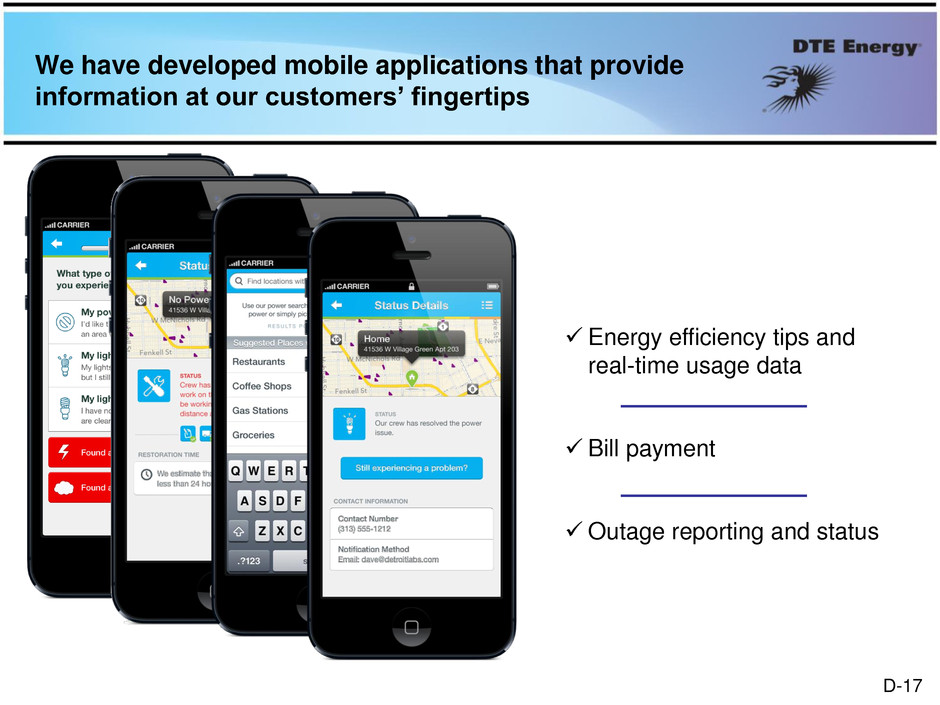

Energy efficiency tips and real-time usage data Bill payment Outage reporting and status We have developed mobile applications that provide information at our customers’ fingertips D-17

DTE is ranked #1 in mobile device customer satisfaction Source: JD Power & Associates 2013 Utility Website Evaluation Study D-18

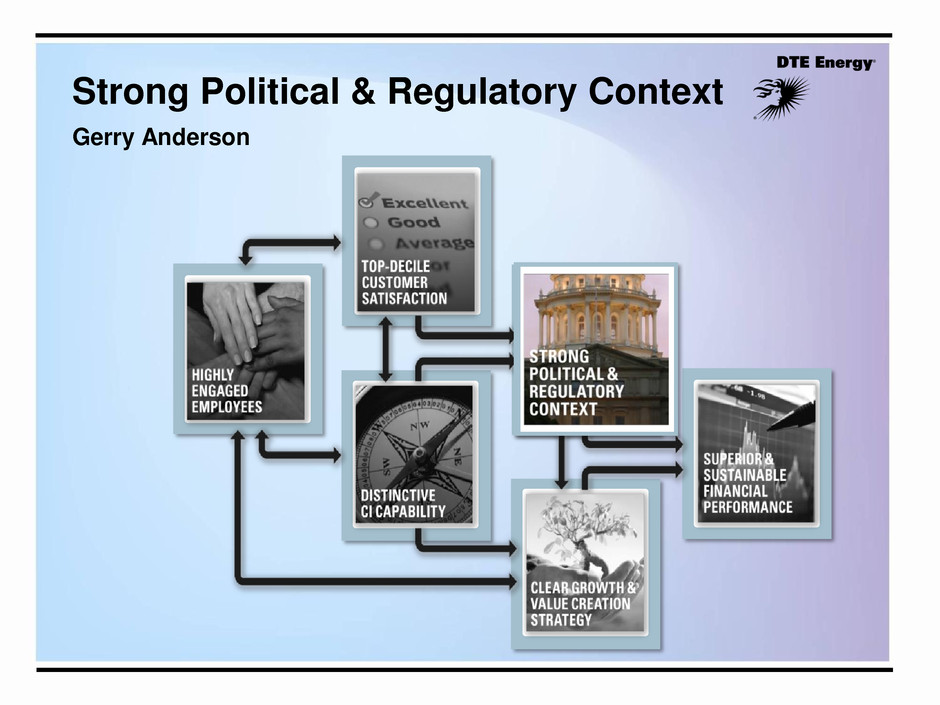

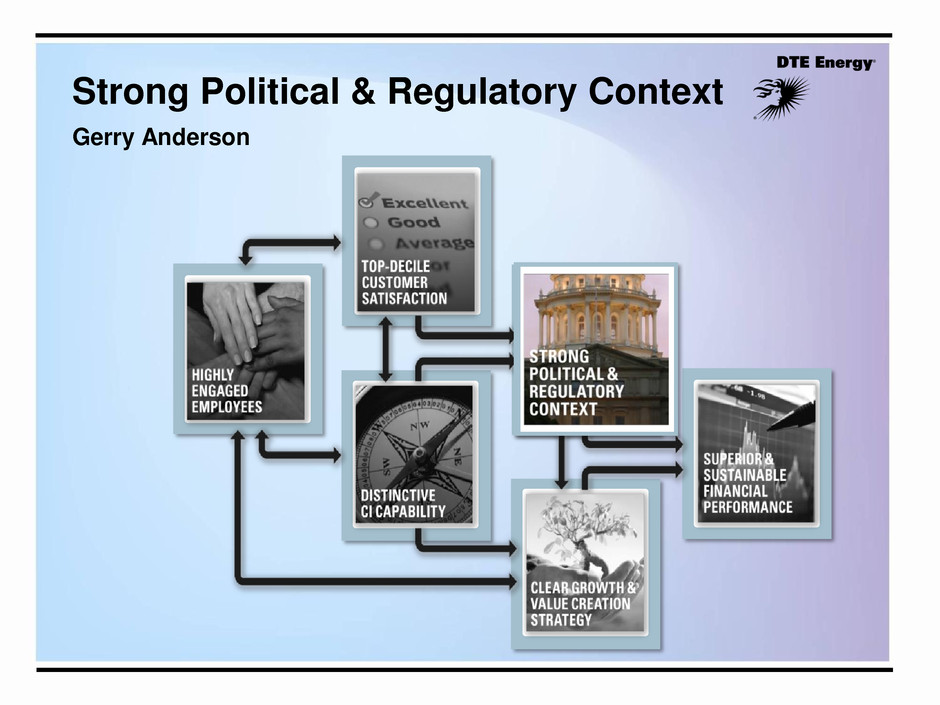

Strong Political & Regulatory Context Gerry Anderson

Maintaining a strong political and regulatory environment is fundamental to our strategy Transparency, open communication, trust and shared agendas E-2

We work hard to be a force for growth and prosperity in the communities where we live and serve Economic Development Michigan Procurement Detroit Public Lighting Neighborhood Revitalization DTE Campus Transformation DTE Energy Foundation E-3

Leaders in Michigan recognize DTE’s important role in building prosperity in Michigan Michigan Leaders E-4

Governor Snyder has played a strong role in rebuilding Michigan and its economy Dramatically improved business tax competitiveness (49th to 7th) Eliminated state’s $1.5 billion deficit Driving economic development Reshaping and creating a more efficient state government E-5

The Governor agreed to share his thoughts on Michigan, DTE Energy and energy policy Governor Snyder E-6

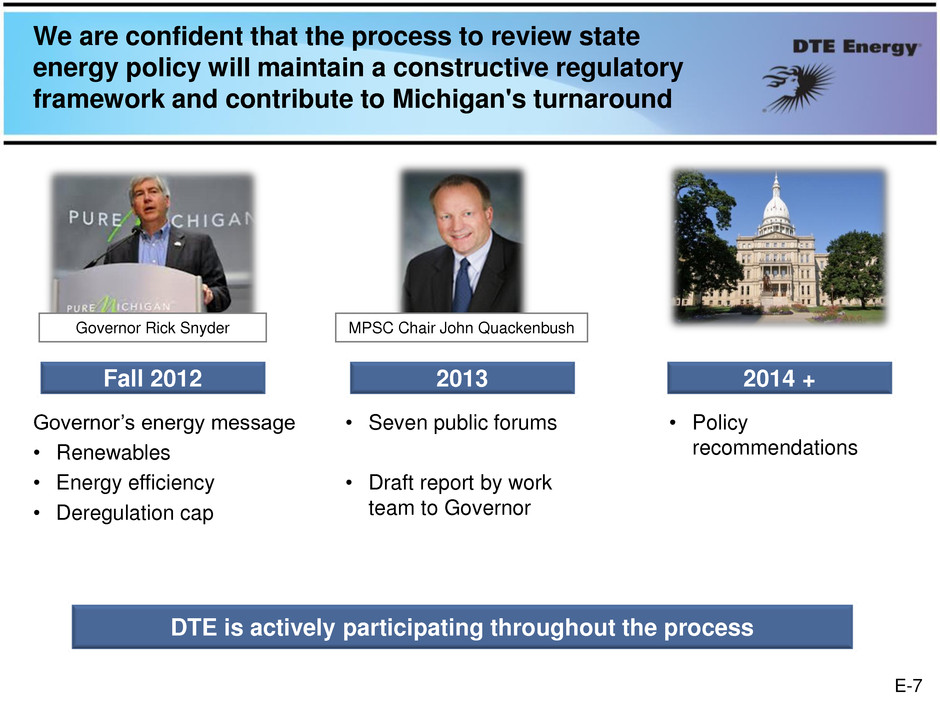

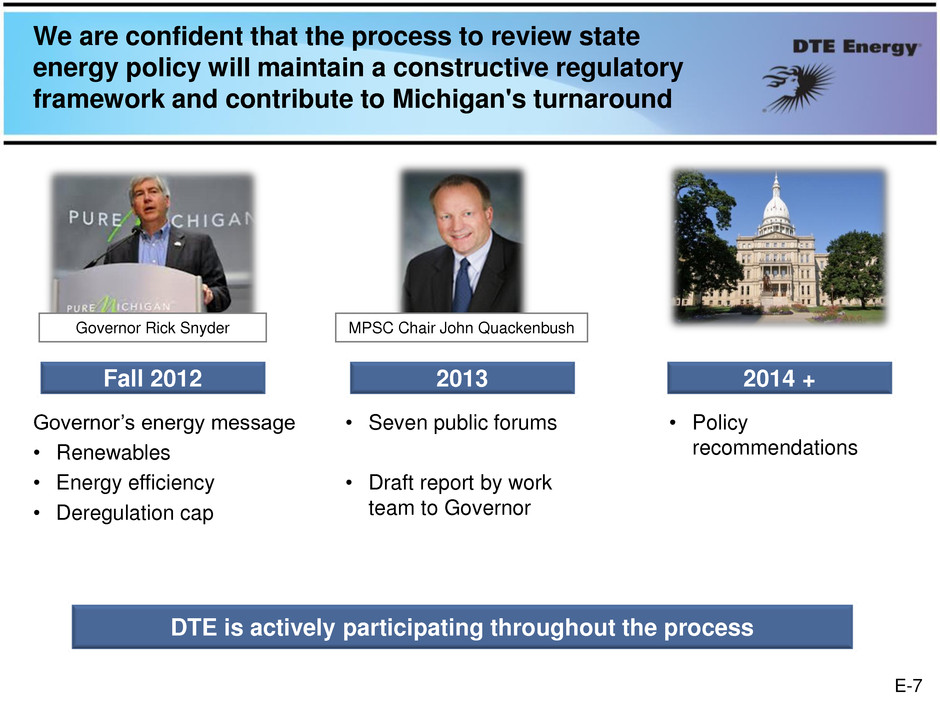

We are confident that the process to review state energy policy will maintain a constructive regulatory framework and contribute to Michigan's turnaround DTE is actively participating throughout the process Fall 2012 2013 2014 + Governor’s energy message • Renewables • Energy efficiency • Deregulation cap • Seven public forums • Draft report by work team to Governor • Policy recommendations Governor Rick Snyder MPSC Chair John Quackenbush E-7

There has been positive collaboration in the state regarding the future energy policy Business partners State and local agencies Community leaders Governor MPSC Senate House of Representatives Lansing Coalition Partners E-8

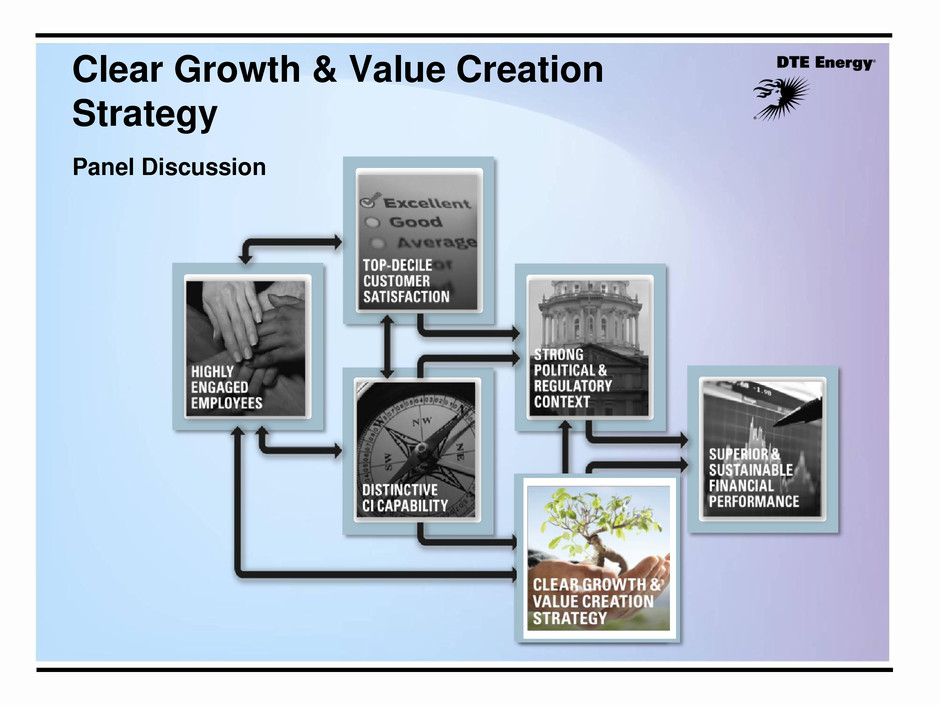

Clear Growth & Value Creation Strategy Panel Discussion

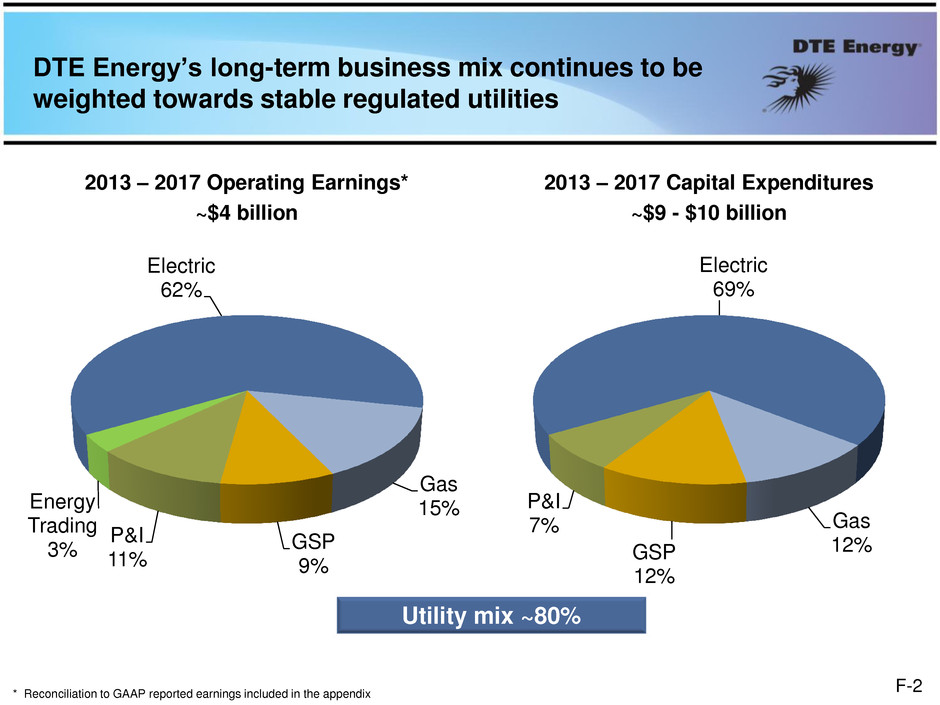

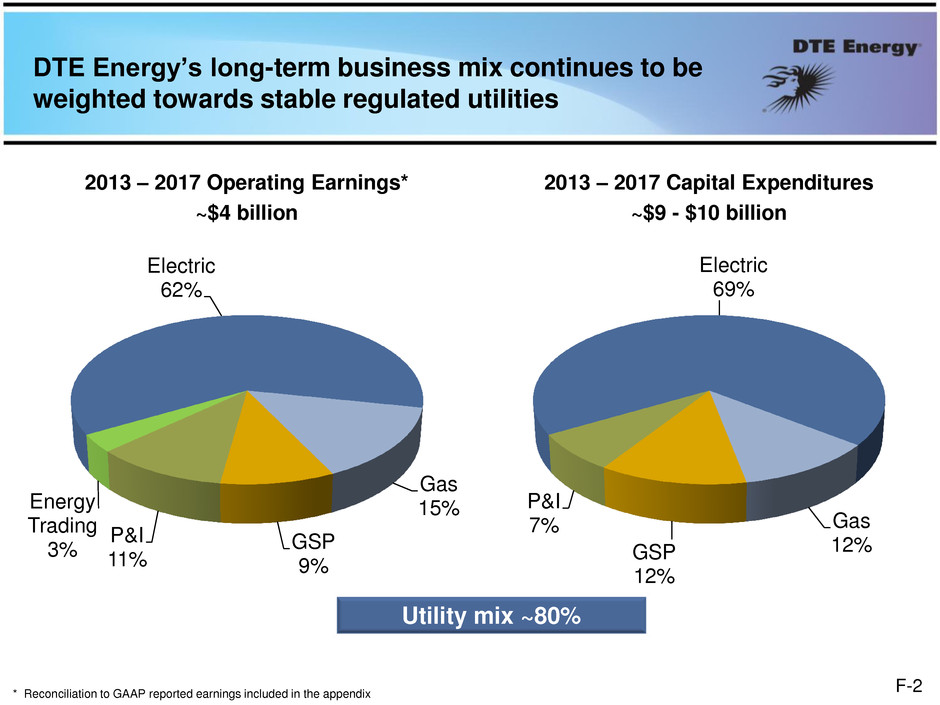

DTE Energy’s long-term business mix continues to be weighted towards stable regulated utilities Electric 62% Gas 15% GSP 9% P&I 11% Energy Trading 3% Electric 69% Gas 12% GSP 12% P&I 7% * Reconciliation to GAAP reported earnings included in the appendix 2013 – 2017 Operating Earnings* ~$4 billion 2013 – 2017 Capital Expenditures ~$9 - $10 billion Utility mix ~80% F-2

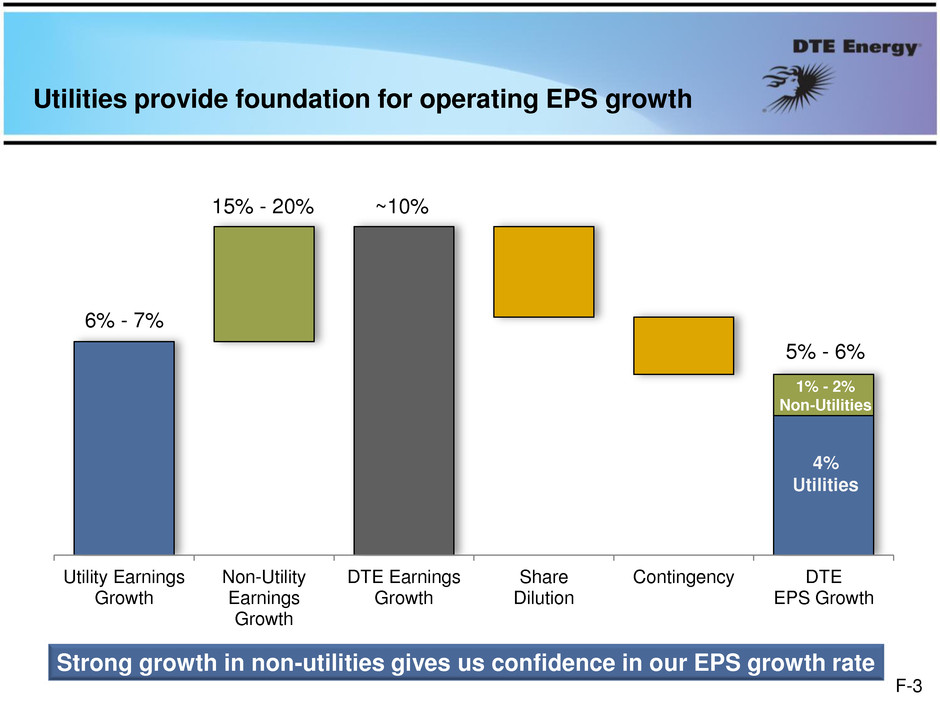

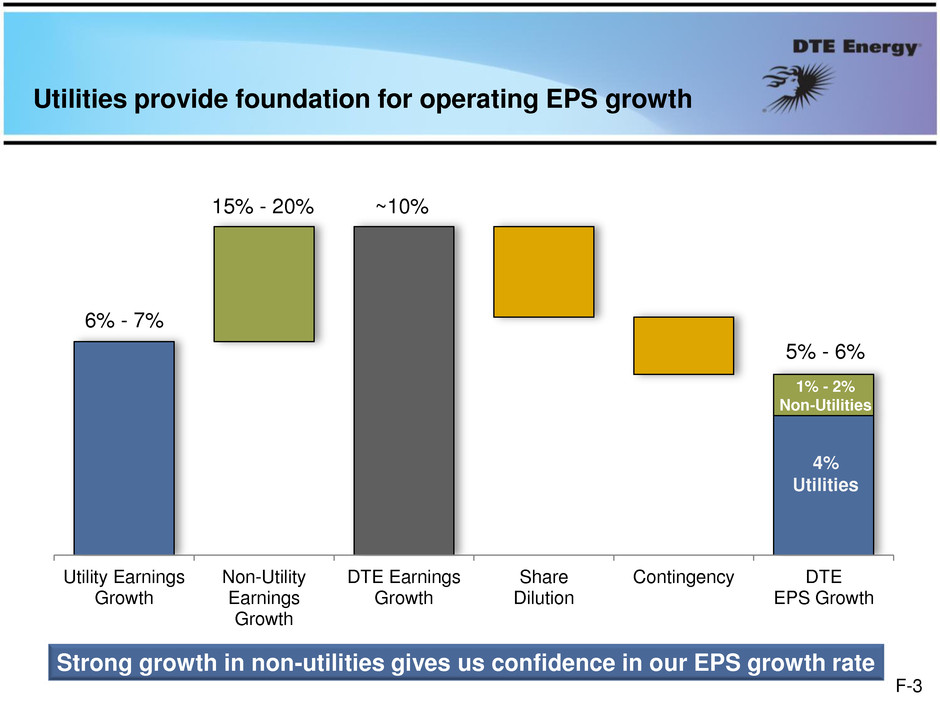

Utility Earnings Growth Non-Utility Earnings Growth DTE Earnings Growth Share Dilution Contingency DTE EPS Growth 1% - 2% Non-Utilities Utilities provide foundation for operating EPS growth 6% - 7% 15% - 20% ~10% 5% - 6% 4% Utilities Strong growth in non-utilities gives us confidence in our EPS growth rate F-3

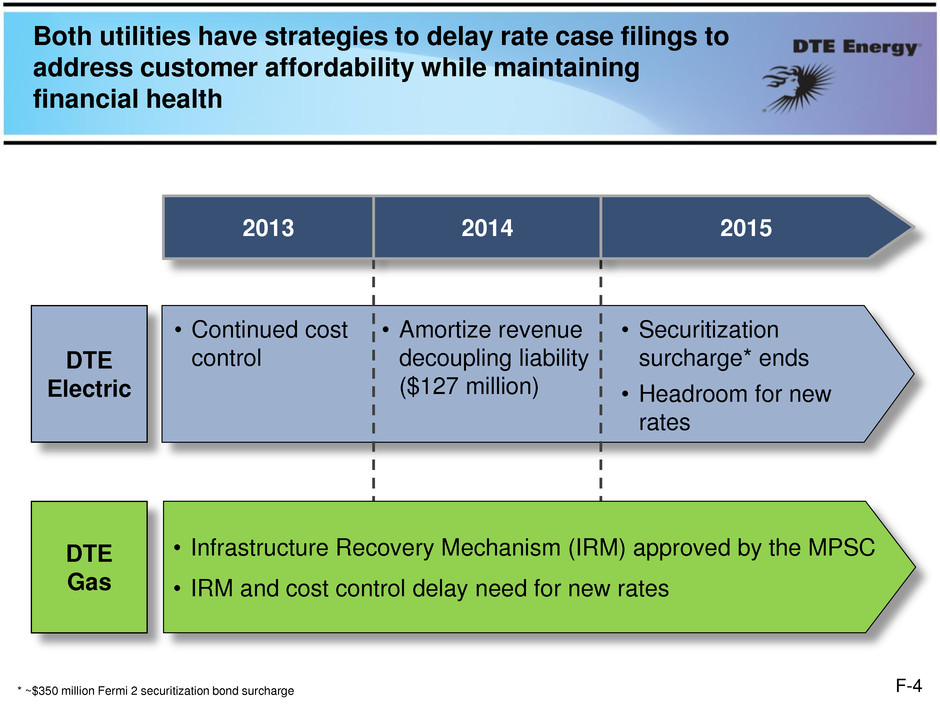

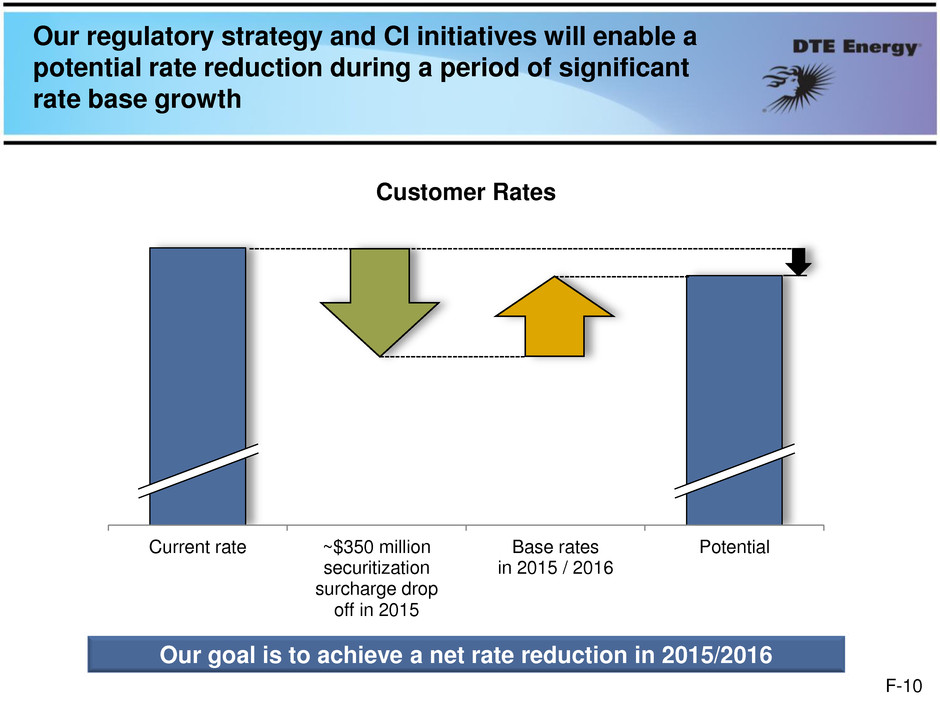

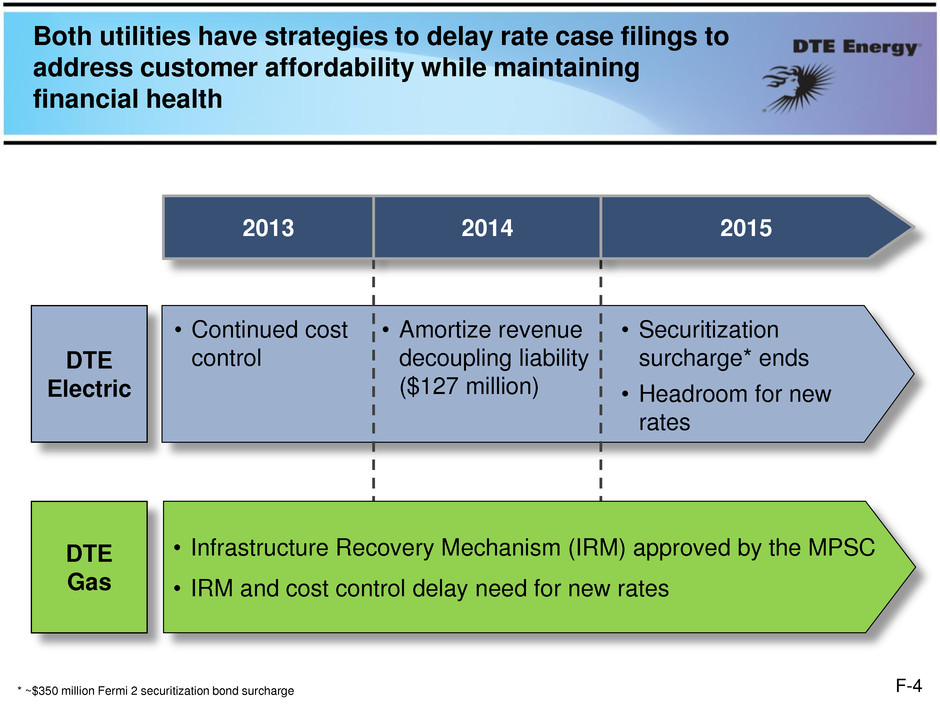

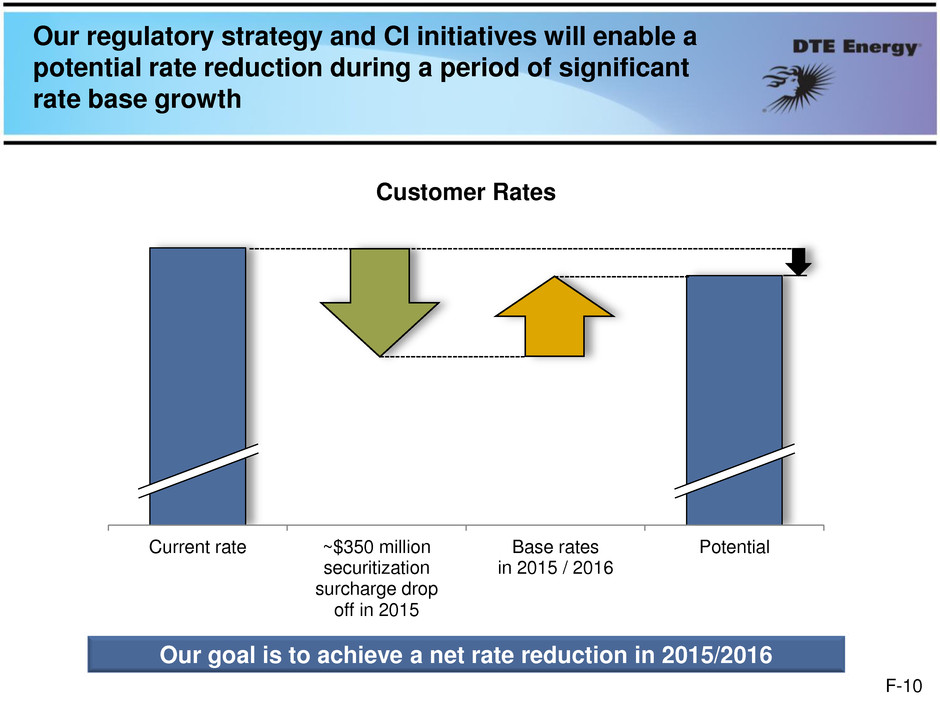

Both utilities have strategies to delay rate case filings to address customer affordability while maintaining financial health 2013 • Continued cost control • Amortize revenue decoupling liability ($127 million) • Securitization surcharge* ends • Headroom for new rates • Infrastructure Recovery Mechanism (IRM) approved by the MPSC • IRM and cost control delay need for new rates * ~$350 million Fermi 2 securitization bond surcharge DTE Electric DTE Gas 2014 2015 F-4

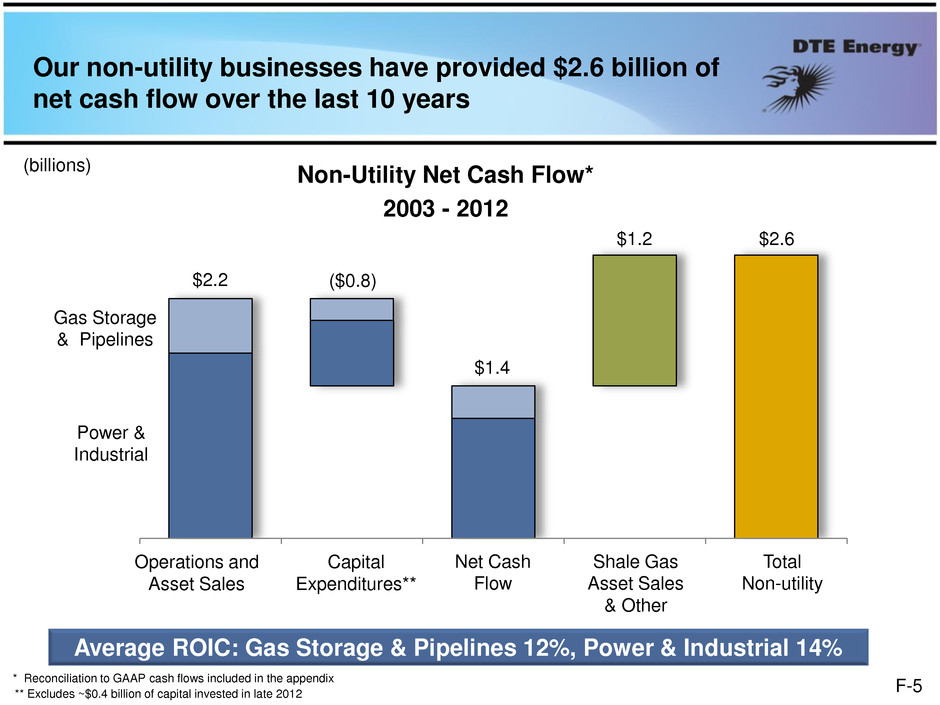

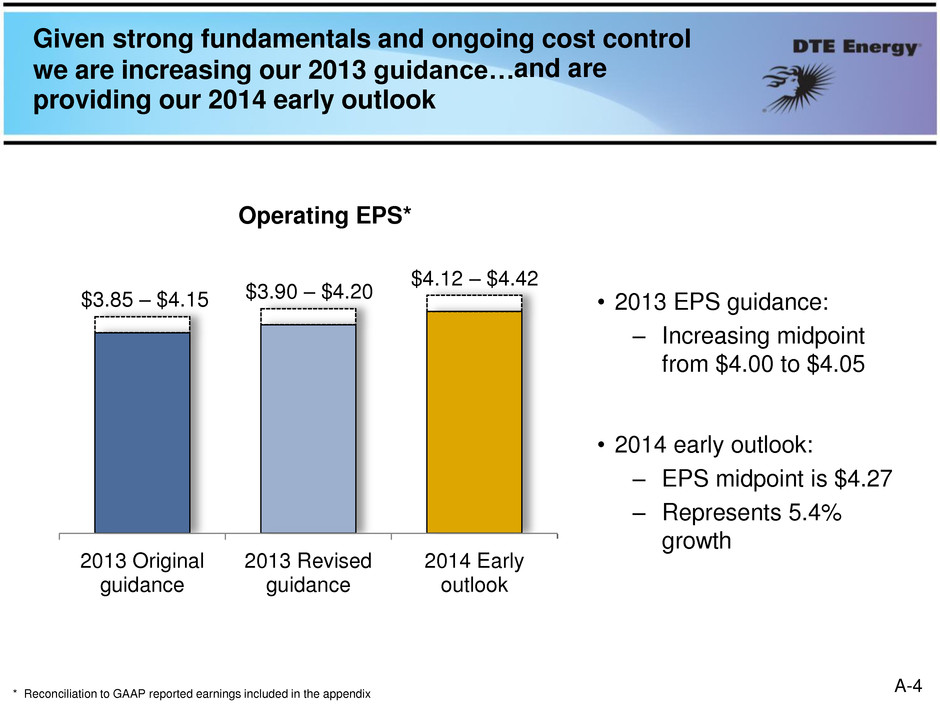

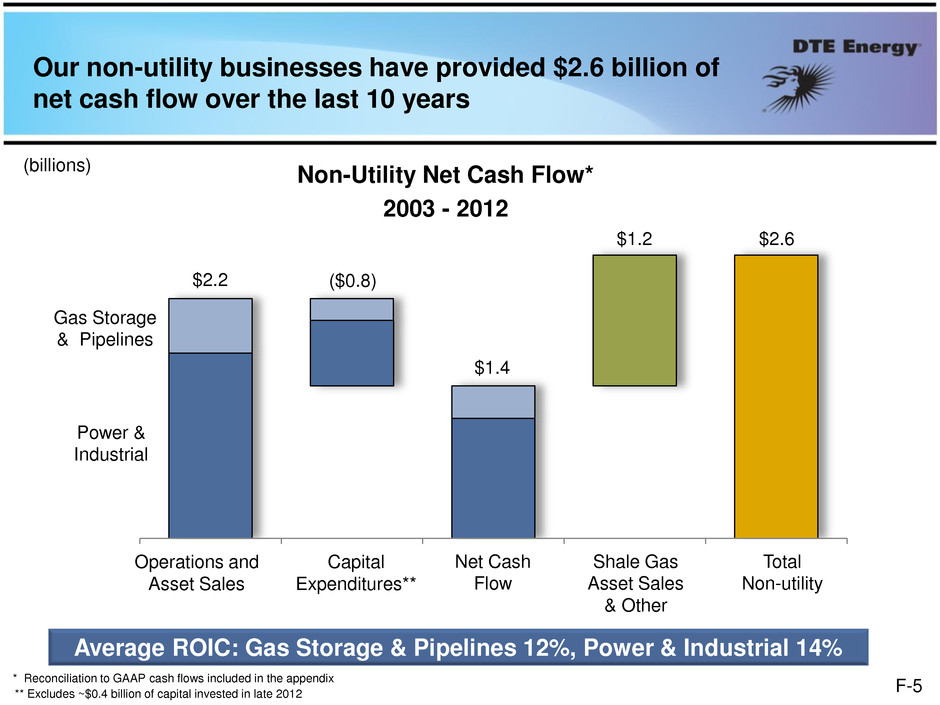

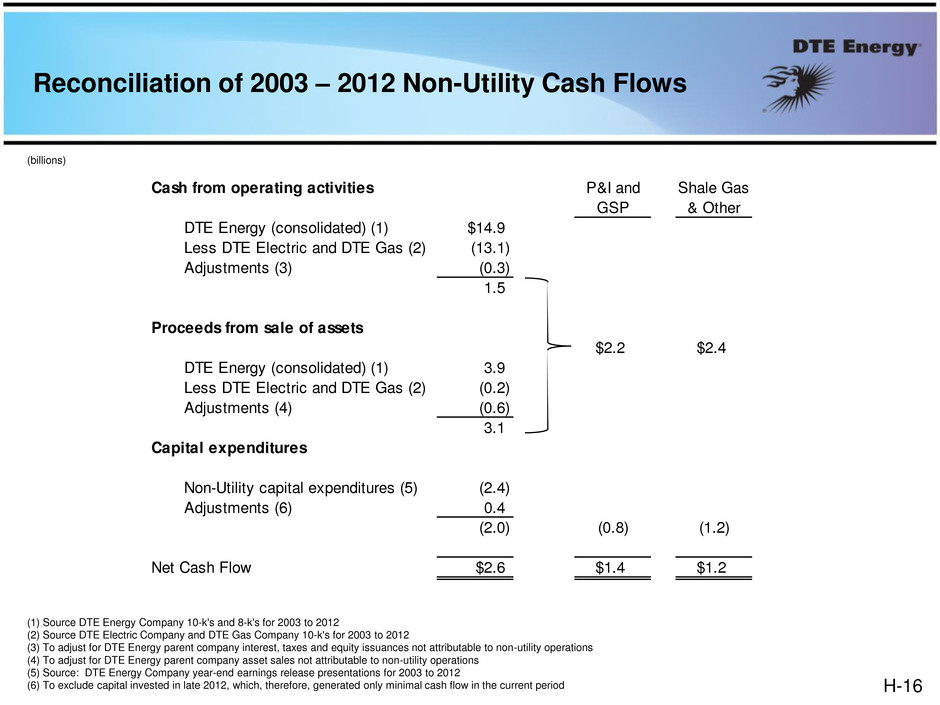

Our non-utility businesses have provided $2.6 billion of net cash flow over the last 10 years Non-Utility Net Cash Flow* 2003 - 2012 ** Excludes ~$0.4 billion of capital invested in late 2012 Operations and Asset Sales Capital Expenditures** Net Cash Flow Shale Gas Asset Sales & Other Total Non-utility Gas Storage & Pipelines Power & Industrial $2.2 $1.4 $1.2 $2.6 Average ROIC: Gas Storage & Pipelines 12%, Power & Industrial 14% ($0.8) (billions) * Reconciliation to GAAP cash flows included in the appendix F-5

Clear Growth & Value Creation Strategy • DTE Electric • DTE Gas • Gas Storage & Pipelines • Power & Industrial Projects F-6

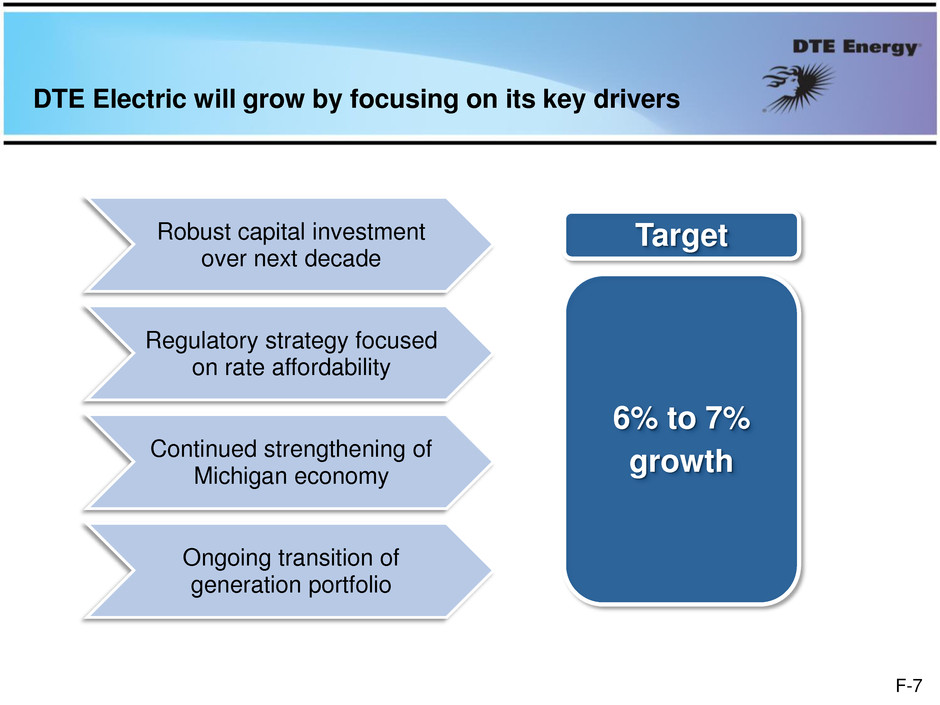

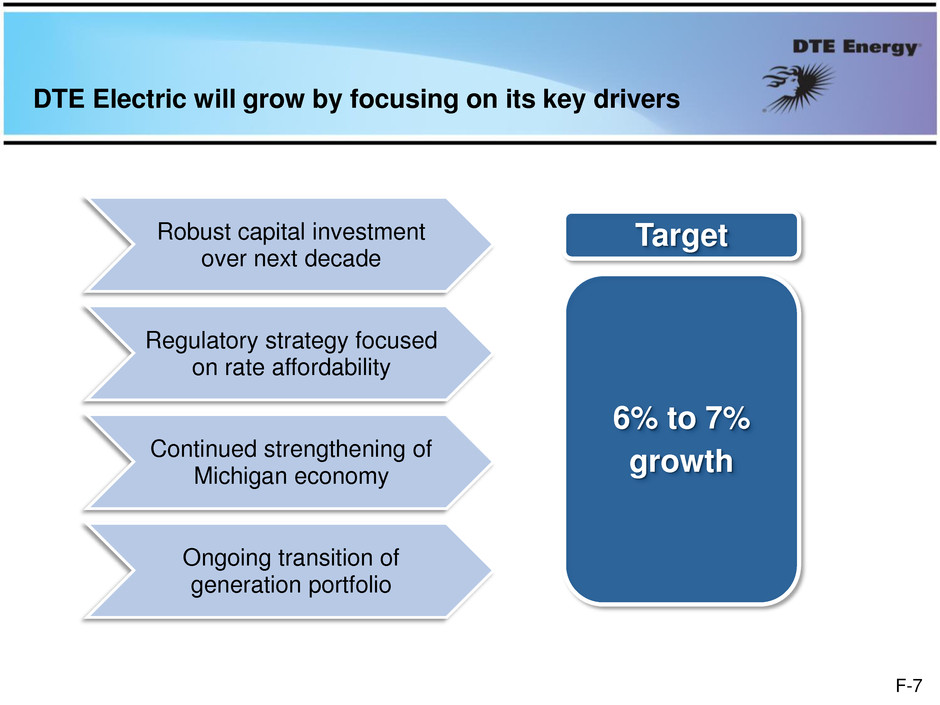

DTE Electric will grow by focusing on its key drivers Robust capital investment over next decade Regulatory strategy focused on rate affordability Continued strengthening of Michigan economy Ongoing transition of generation portfolio 6% to 7% growth Target F-7

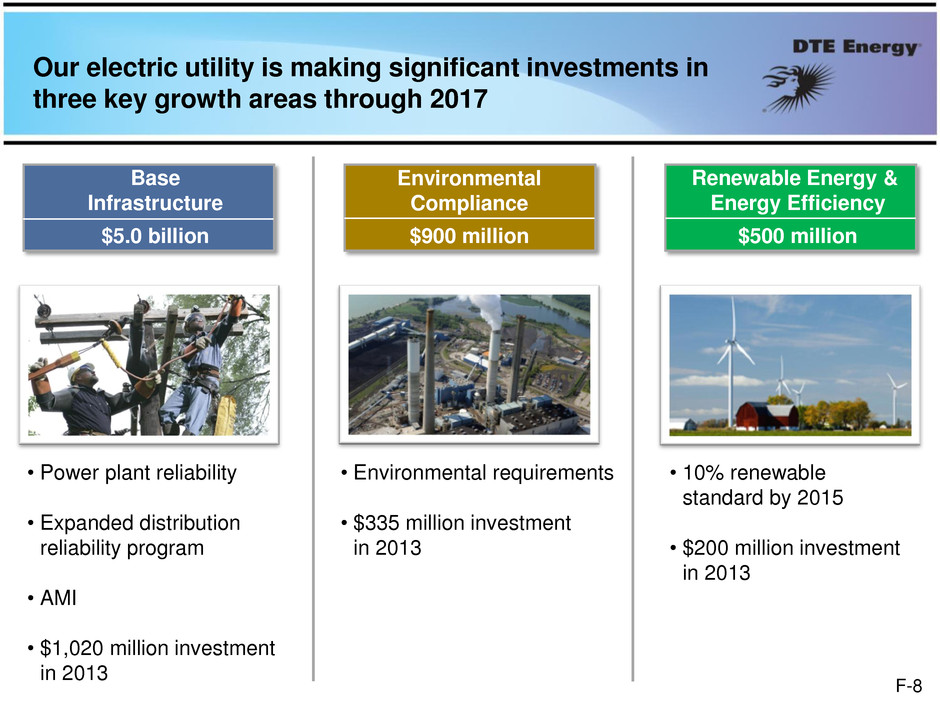

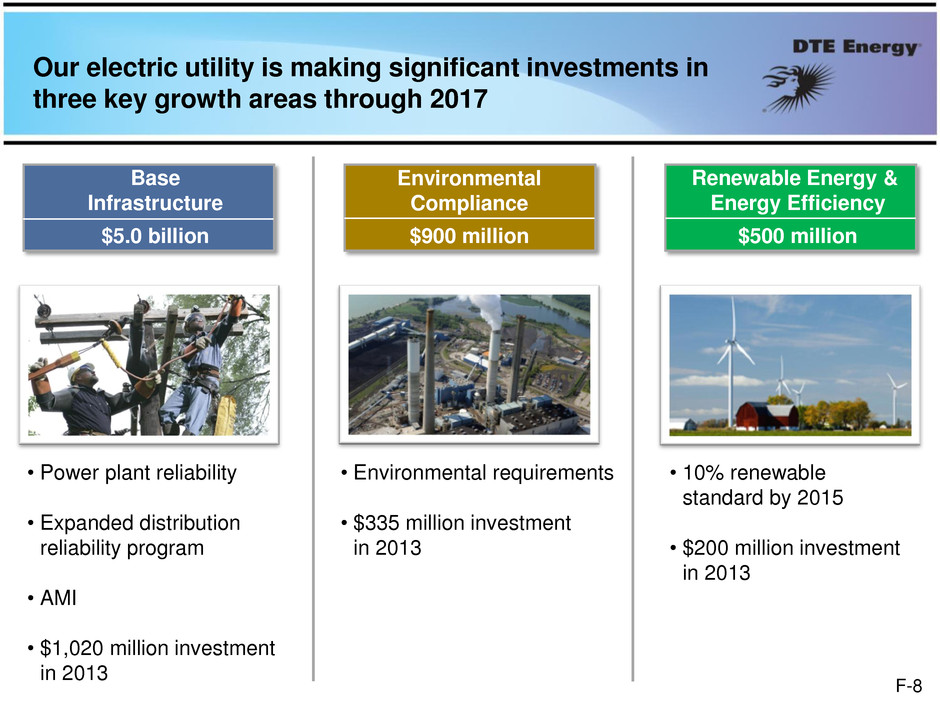

Our electric utility is making significant investments in three key growth areas through 2017 Base Infrastructure $5.0 billion Renewable Energy & Energy Efficiency $500 million Environmental Compliance $900 million • Environmental requirements • $335 million investment in 2013 • Power plant reliability • Expanded distribution reliability program • AMI • $1,020 million investment in 2013 • 10% renewable standard by 2015 • $200 million investment in 2013 F-8

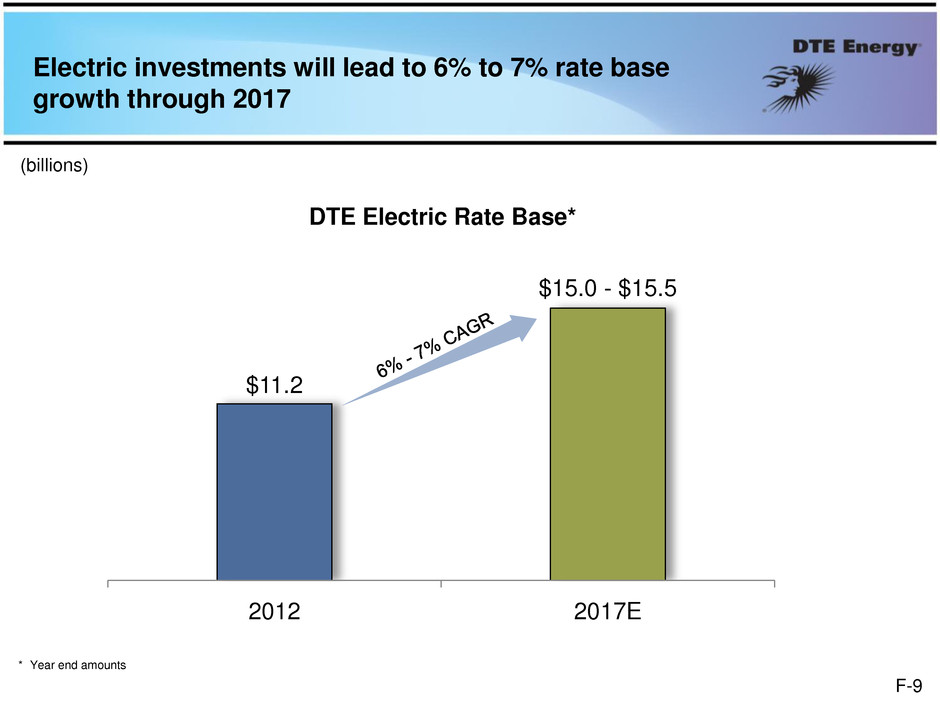

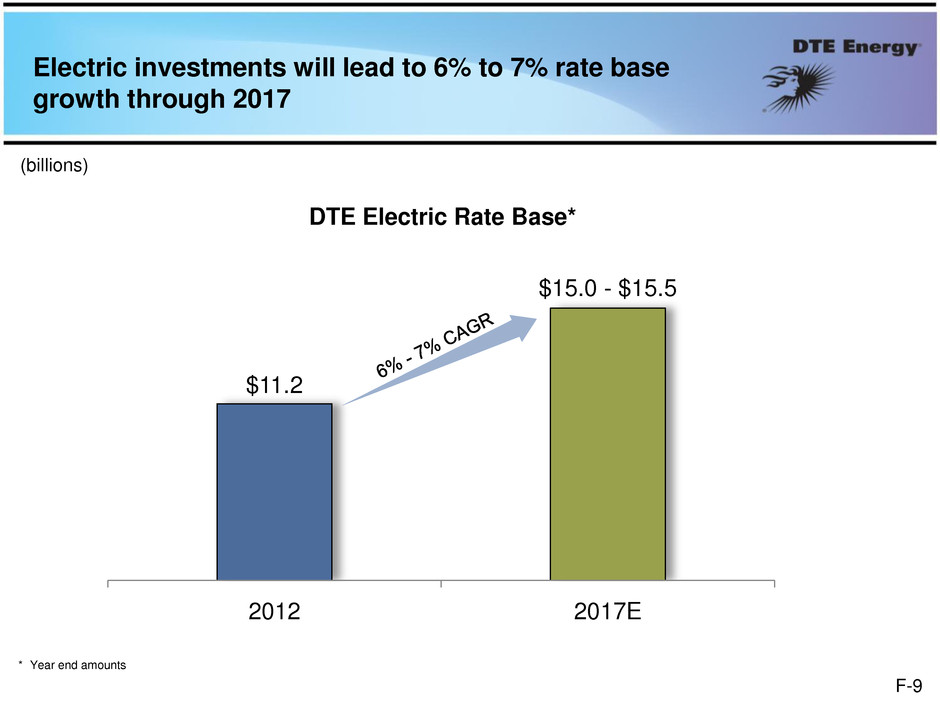

Electric investments will lead to 6% to 7% rate base growth through 2017 $11.2 2012 2017E * Year end amounts DTE Electric Rate Base* (billions) $15.0 - $15.5 F-9

Our regulatory strategy and CI initiatives will enable a potential rate reduction during a period of significant rate base growth Current rate ~$350 million securitization surcharge drop off in 2015 Base rates in 2015 / 2016 Potential Customer Rates Our goal is to achieve a net rate reduction in 2015/2016 F-10

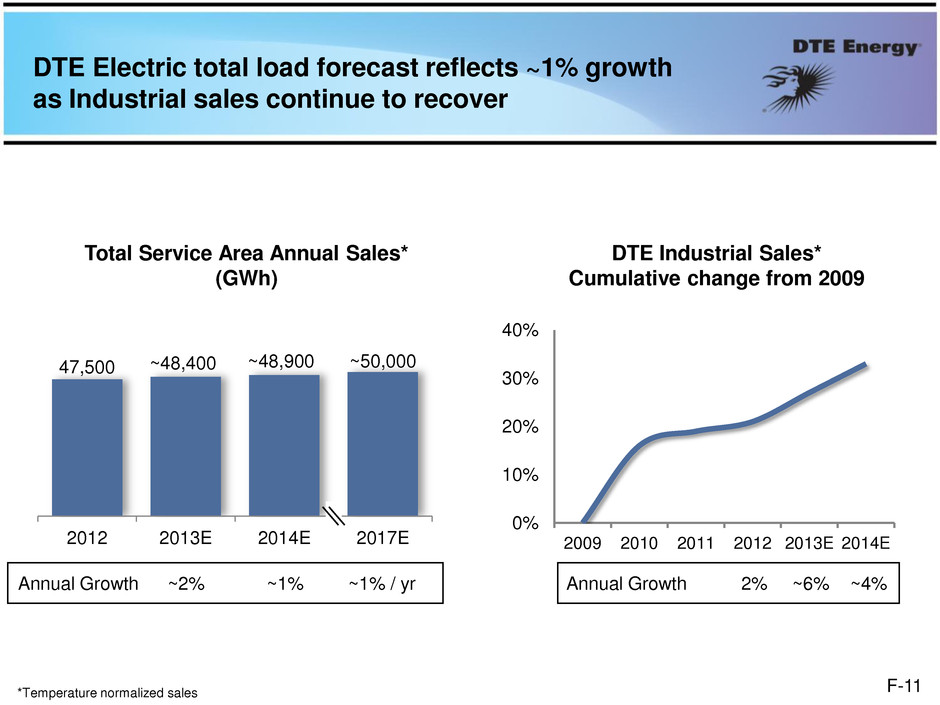

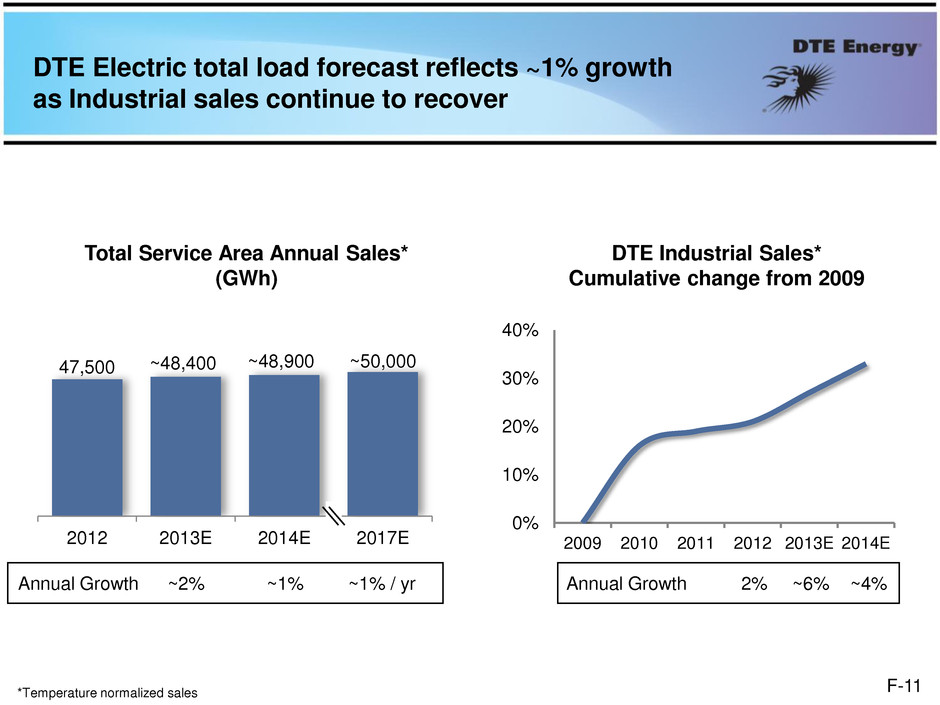

DTE Electric total load forecast reflects ~1% growth as Industrial sales continue to recover *Temperature normalized sales 0% 10% 20% 30% 40% 2009 2010 2011 2012 2013E 2014E DTE Industrial Sales* Cumulative change from 2009 2012 2013E 2014E 2017E Total Service Area Annual Sales* (GWh) ~2% ~1% / yr ~1% 47,500 ~48,400 ~48,900 ~50,000 Annual Growth 2% Annual Growth ~6% ~4% F-11

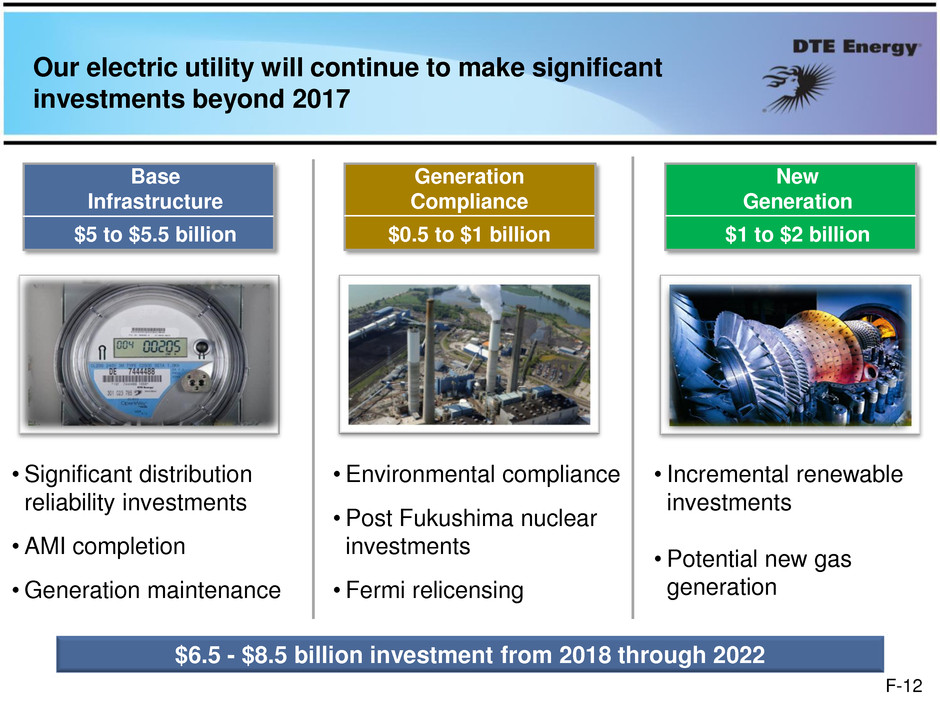

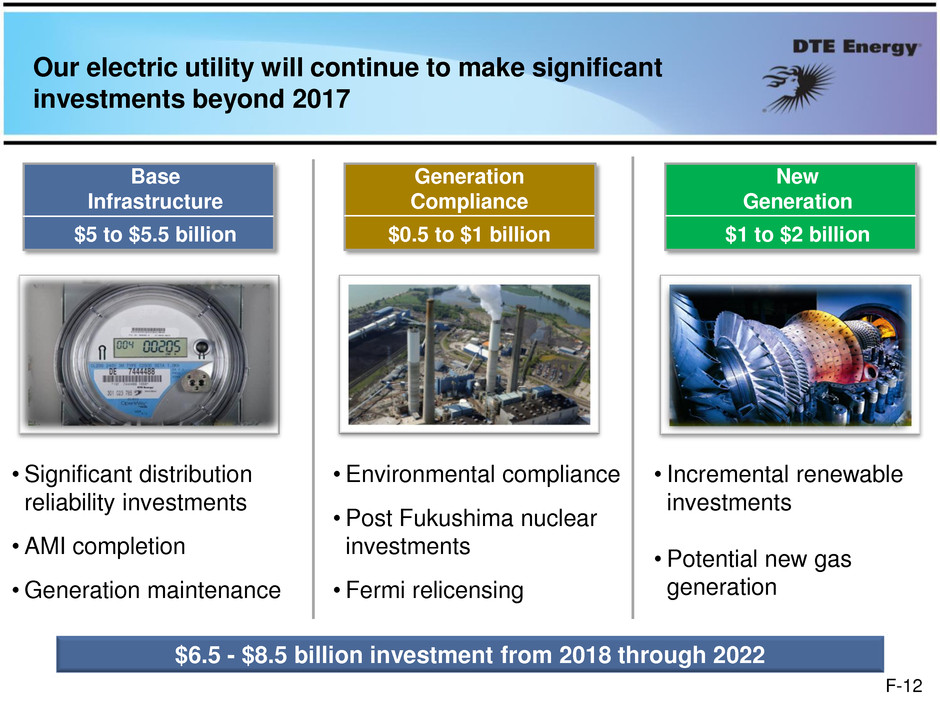

Our electric utility will continue to make significant investments beyond 2017 Base Infrastructure $5 to $5.5 billion New Generation $1 to $2 billion Generation Compliance $0.5 to $1 billion •Environmental compliance •Post Fukushima nuclear investments • Fermi relicensing • Significant distribution reliability investments • AMI completion •Generation maintenance • Incremental renewable investments •Potential new gas generation $6.5 - $8.5 billion investment from 2018 through 2022 F-12

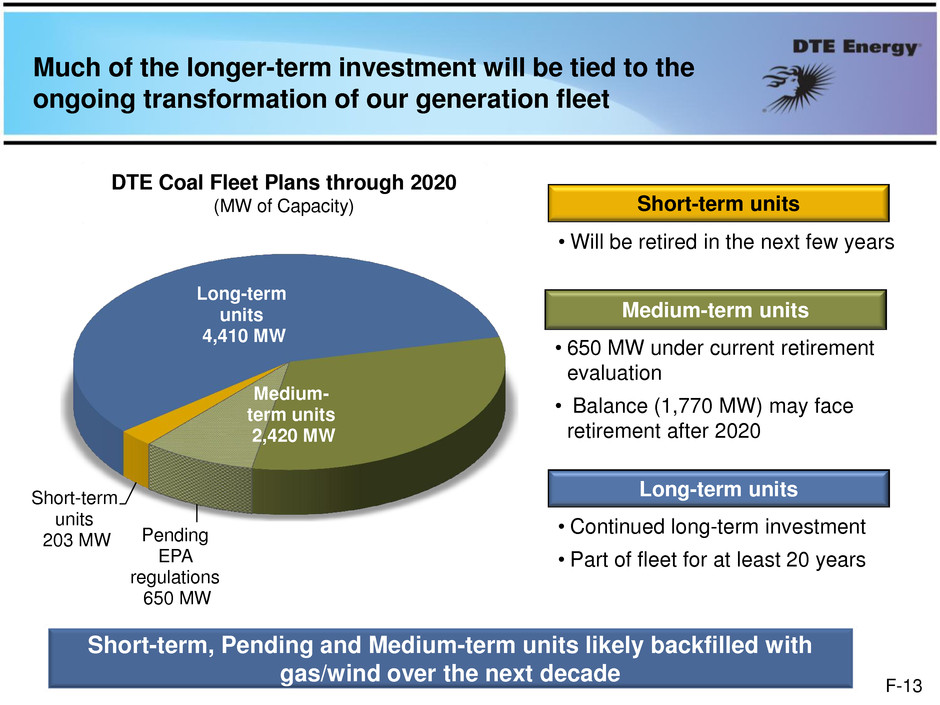

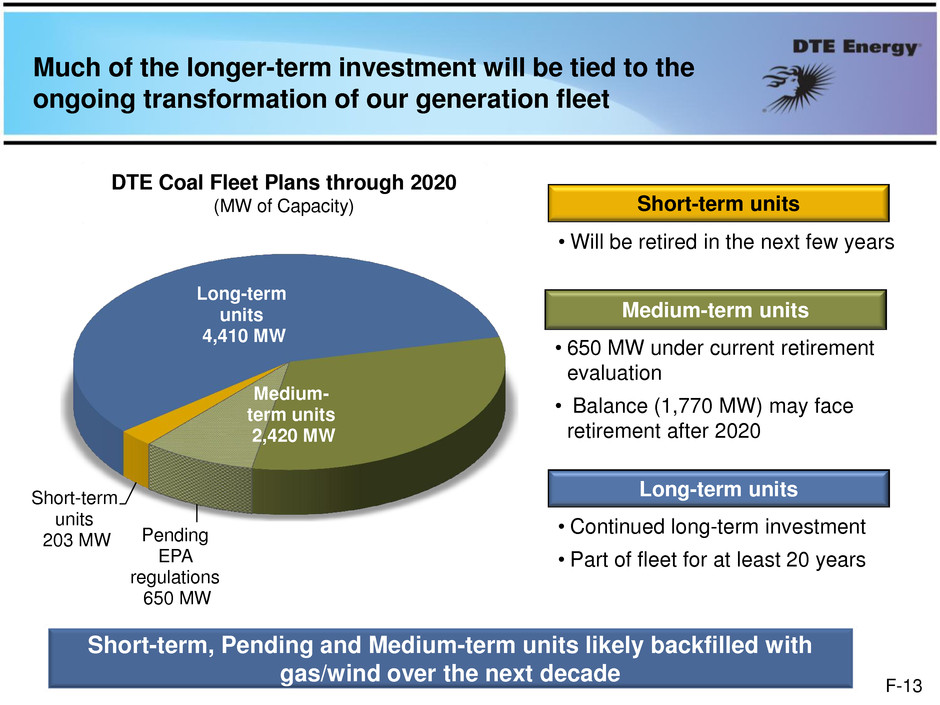

Long-term units 4,410 MW Medium- term units 2,420 MW Pending EPA regulations 650 MW Short-term units 203 MW DTE Coal Fleet Plans through 2020 (MW of Capacity) Much of the longer-term investment will be tied to the ongoing transformation of our generation fleet Long-term units • Continued long-term investment • Part of fleet for at least 20 years Medium-term units • 650 MW under current retirement evaluation • Balance (1,770 MW) may face retirement after 2020 Short-term units •Will be retired in the next few years Short-term, Pending and Medium-term units likely backfilled with gas/wind over the next decade F-13

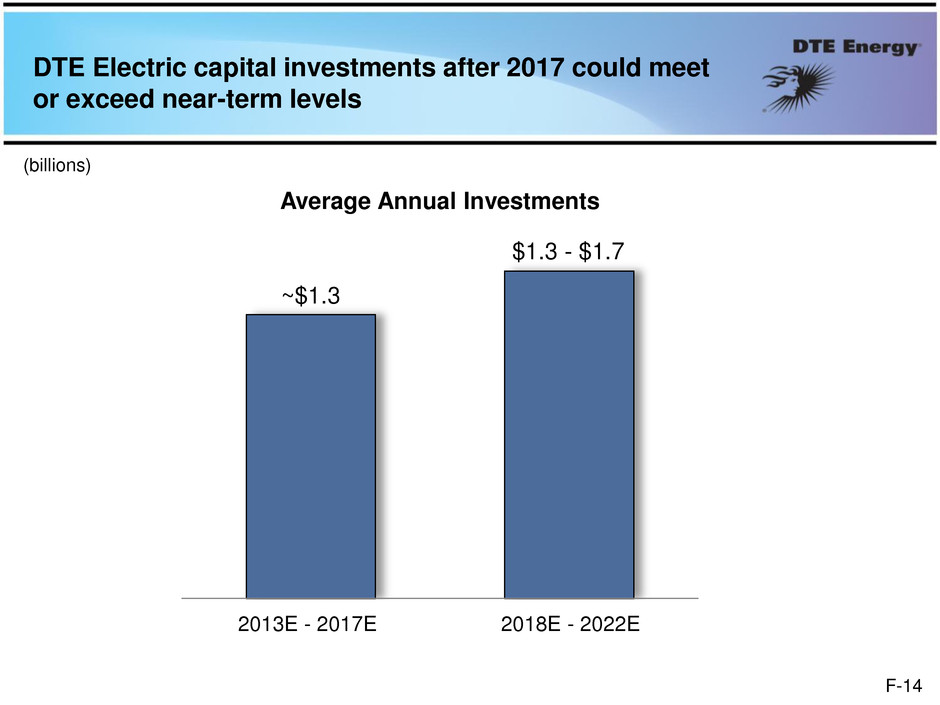

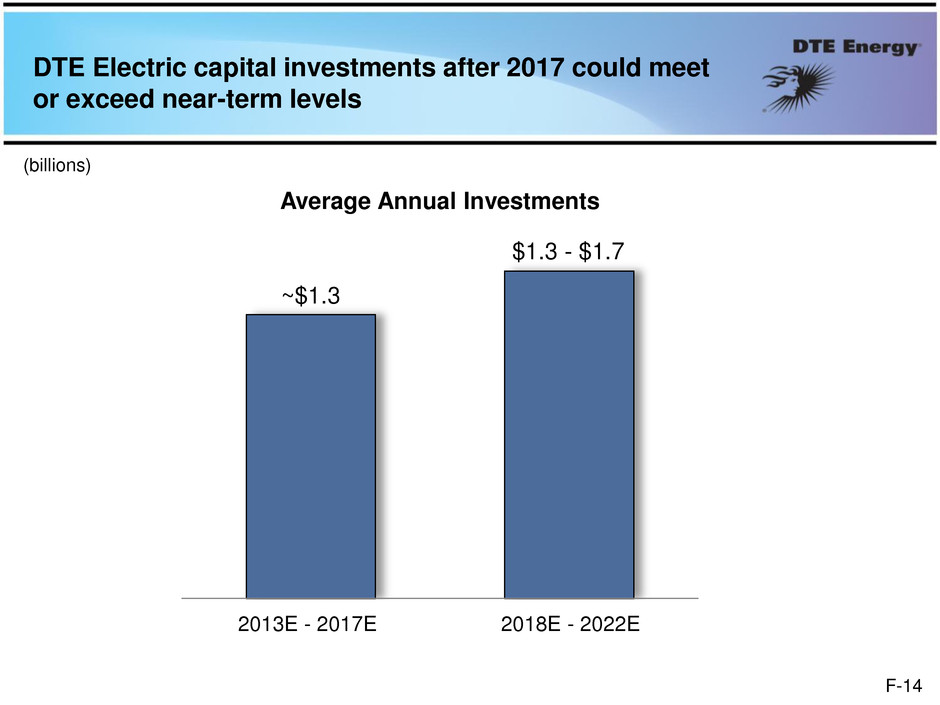

DTE Electric capital investments after 2017 could meet or exceed near-term levels (billions) Average Annual Investments $1.3 - $1.7 ~$1.3 2013E - 2017E 2018E - 2022E F-14

Clear Growth & Value Creation Strategy • DTE Electric • DTE Gas • Gas Storage & Pipelines • Power & Industrial Projects F-15

DTE Gas will grow by focusing on its key drivers Robust capital investment with dedicated recovery Cost control / customer affordability Continuing strengthening of Michigan economy 5% to 6% growth Target F-16

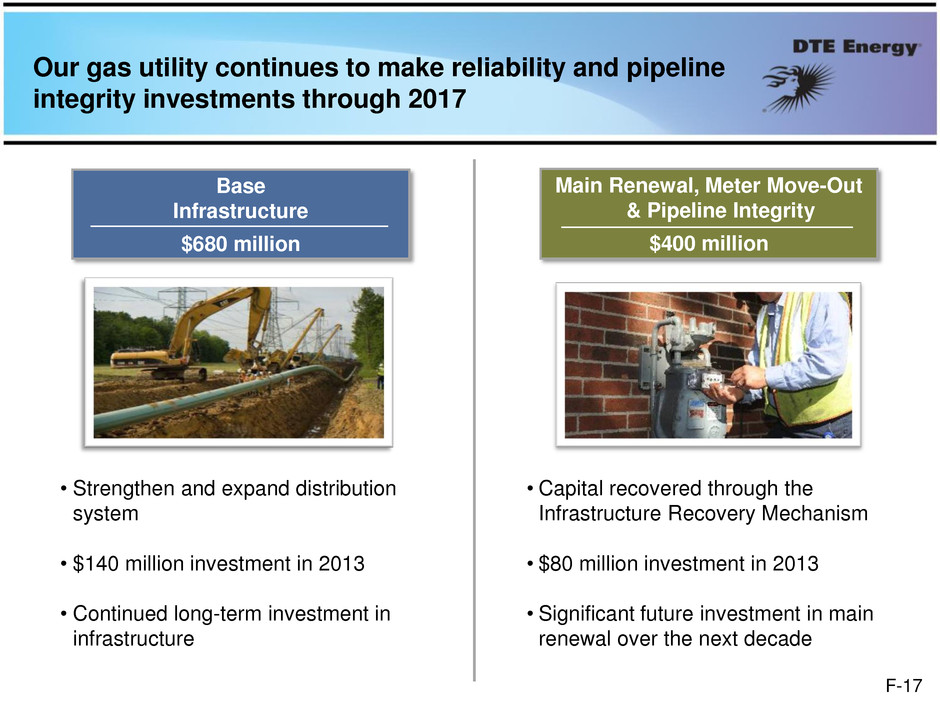

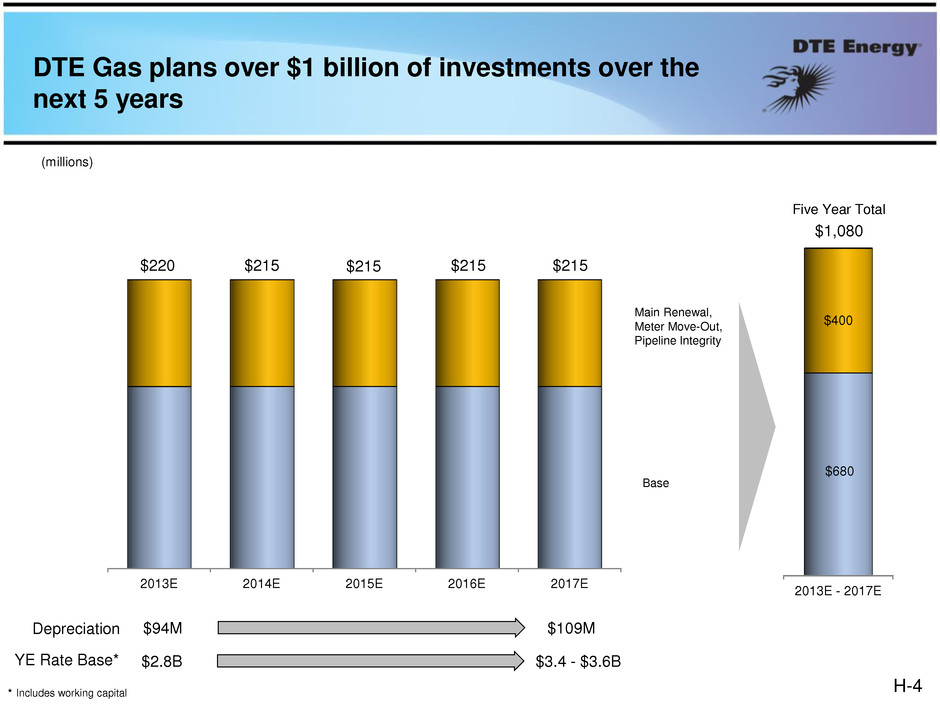

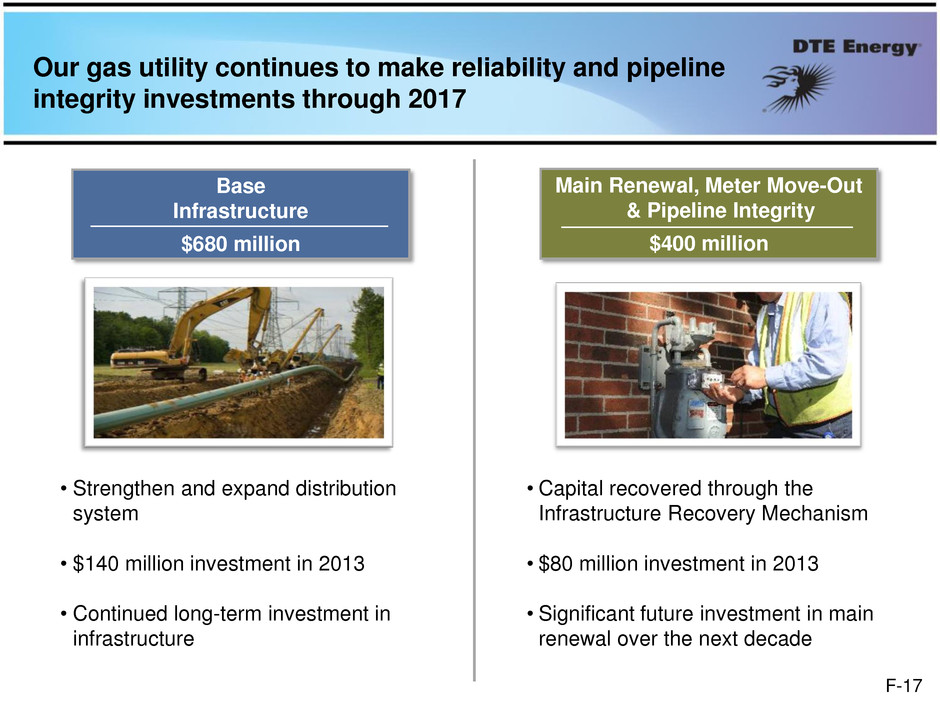

Main Renewal, Meter Move-Out & Pipeline Integrity $400 million Base Infrastructure $680 million Our gas utility continues to make reliability and pipeline integrity investments through 2017 • Capital recovered through the Infrastructure Recovery Mechanism • $80 million investment in 2013 • Significant future investment in main renewal over the next decade • Strengthen and expand distribution system • $140 million investment in 2013 • Continued long-term investment in infrastructure F-17

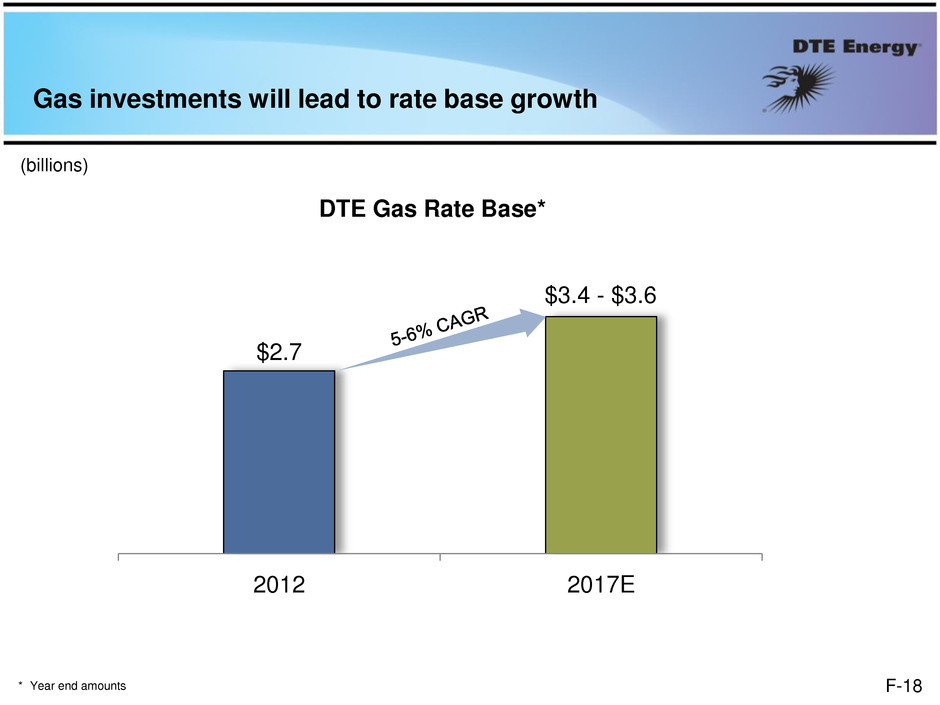

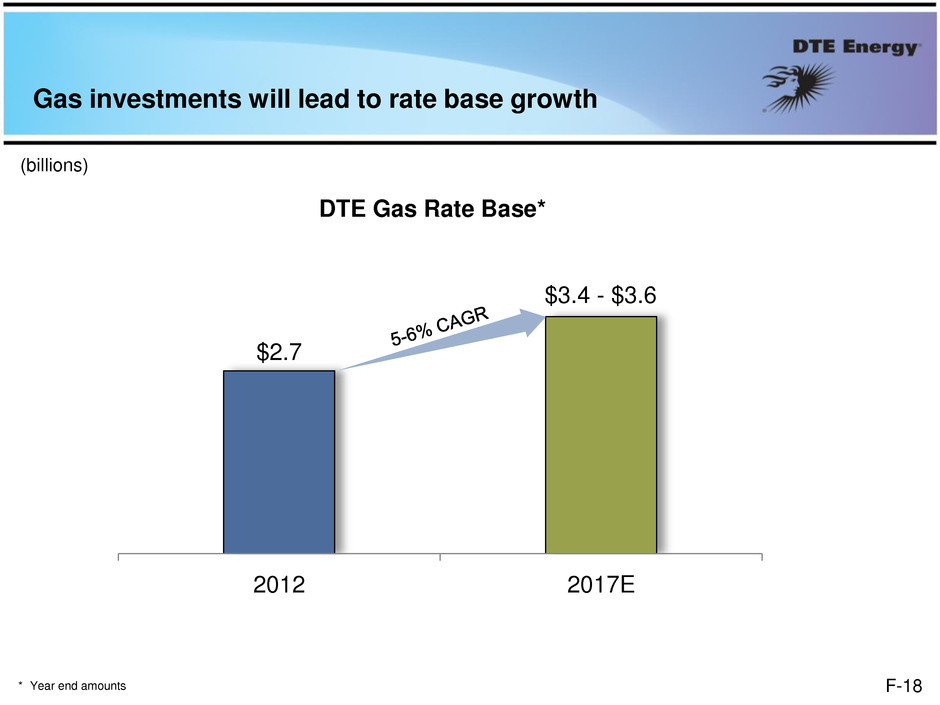

$2.7 2012 2017E Gas investments will lead to rate base growth * Year end amounts DTE Gas Rate Base* (billions) $3.4 - $3.6 F-18

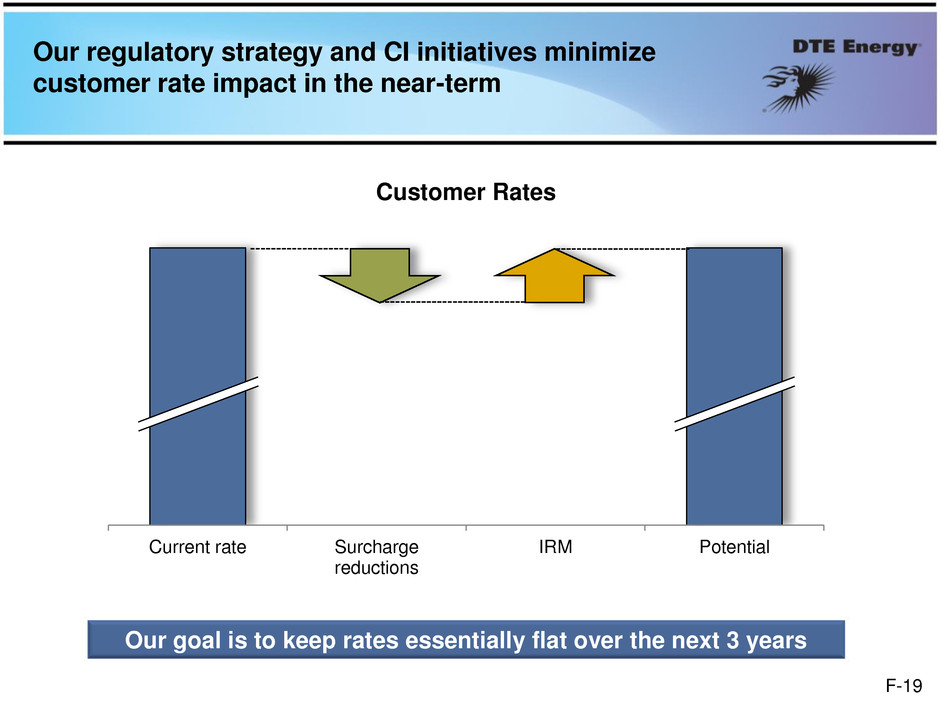

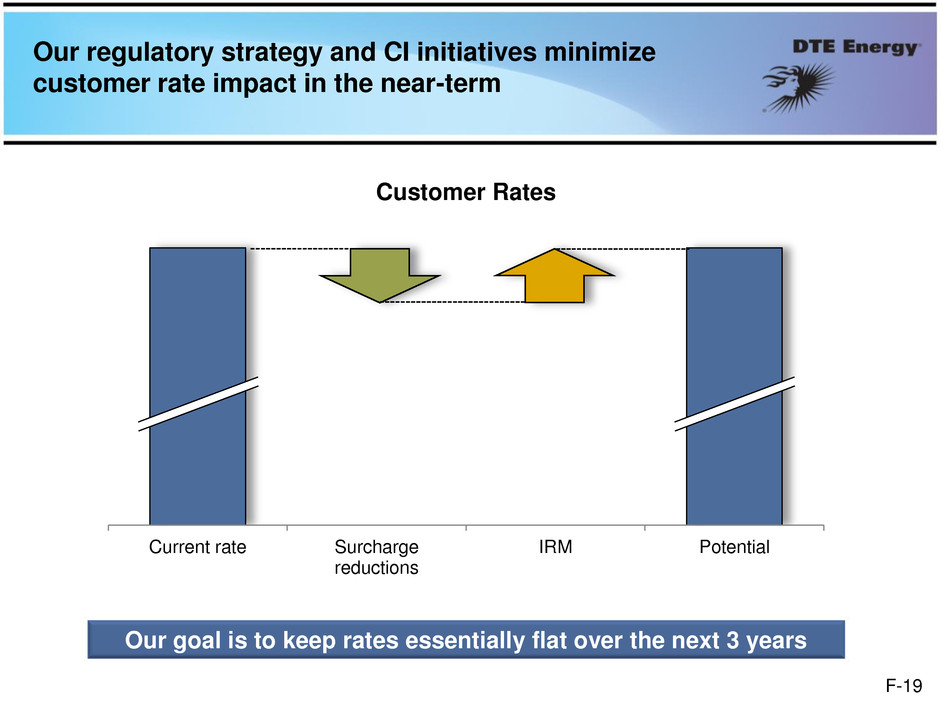

Our regulatory strategy and CI initiatives minimize customer rate impact in the near-term Current rate Surcharge reductions IRM Potential Customer Rates Our goal is to keep rates essentially flat over the next 3 years F-19

Clear Growth & Value Creation Strategy • DTE Electric • DTE Gas • Gas Storage & Pipelines • Power & Industrial Projects F-20

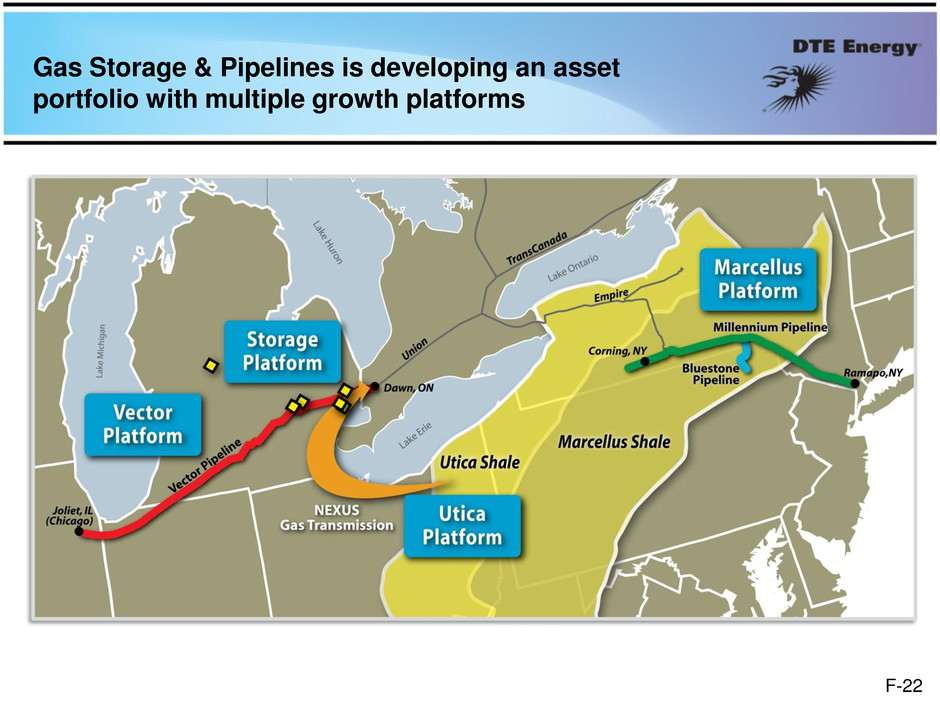

Gas Storage & Pipelines will grow by focusing on its key drivers Multiple asset platforms with expansion opportunities Partnerships with established pipeline/E&P players Manage risk exposure through long term contracts 10% to 15% growth 10% to 12% ROIC Targets F-21

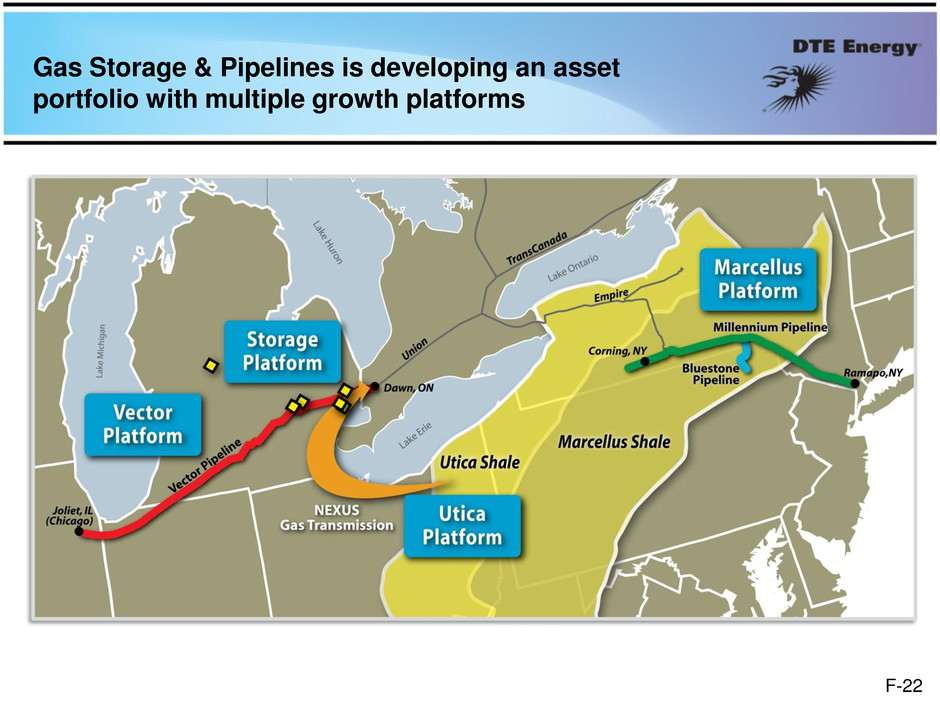

Gas Storage & Pipelines is developing an asset portfolio with multiple growth platforms F-22

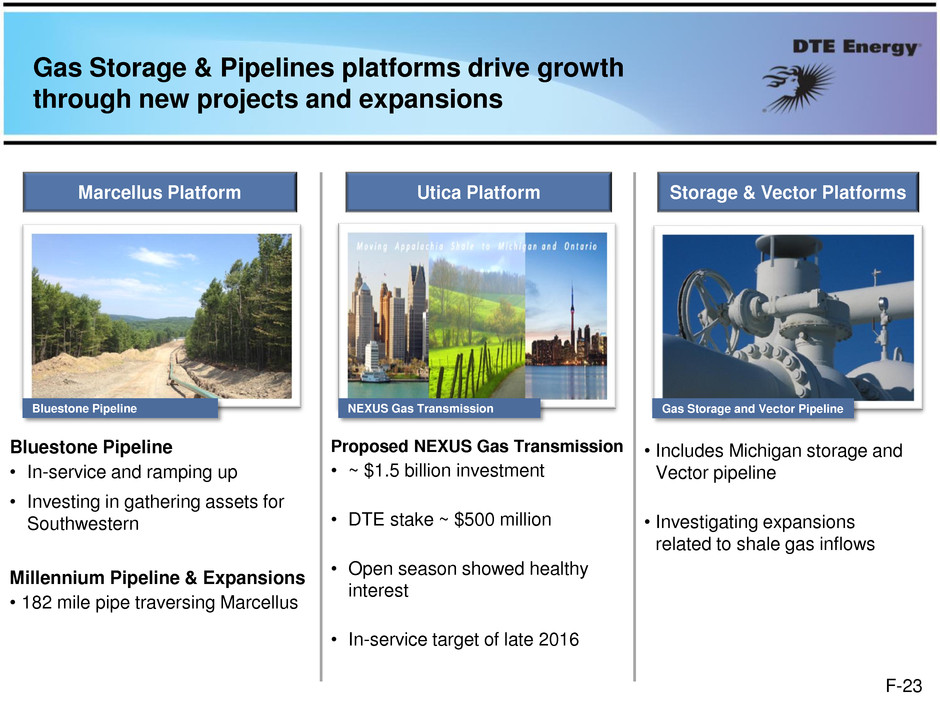

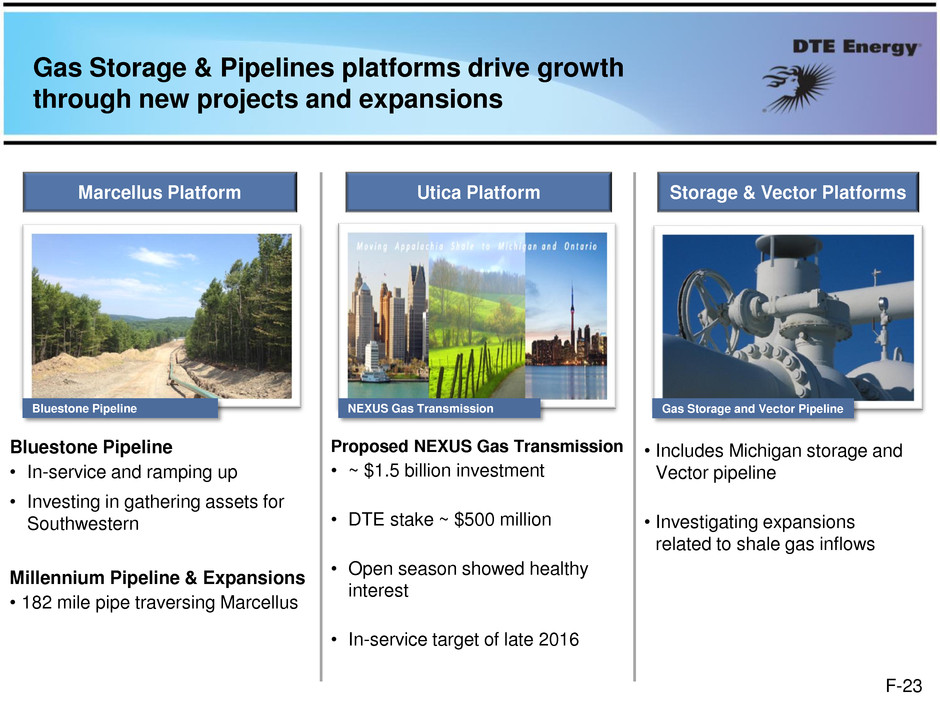

Gas Storage & Pipelines platforms drive growth through new projects and expansions Wood-fired Plant Cassville, WI Bluestone Pipeline • In-service and ramping up • Investing in gathering assets for Southwestern Millennium Pipeline & Expansions • 182 mile pipe traversing Marcellus Marcellus Platform Utica Platform NEXUS Gas Transmission Bluestone Pipeline Proposed NEXUS Gas Transmission • ~ $1.5 billion investment • DTE stake ~ $500 million • Open season showed healthy interest • In-service target of late 2016 Storage & Vector Platforms • Includes Michigan storage and Vector pipeline • Investigating expansions related to shale gas inflows Gas Storage and Vector Pipeline F-23

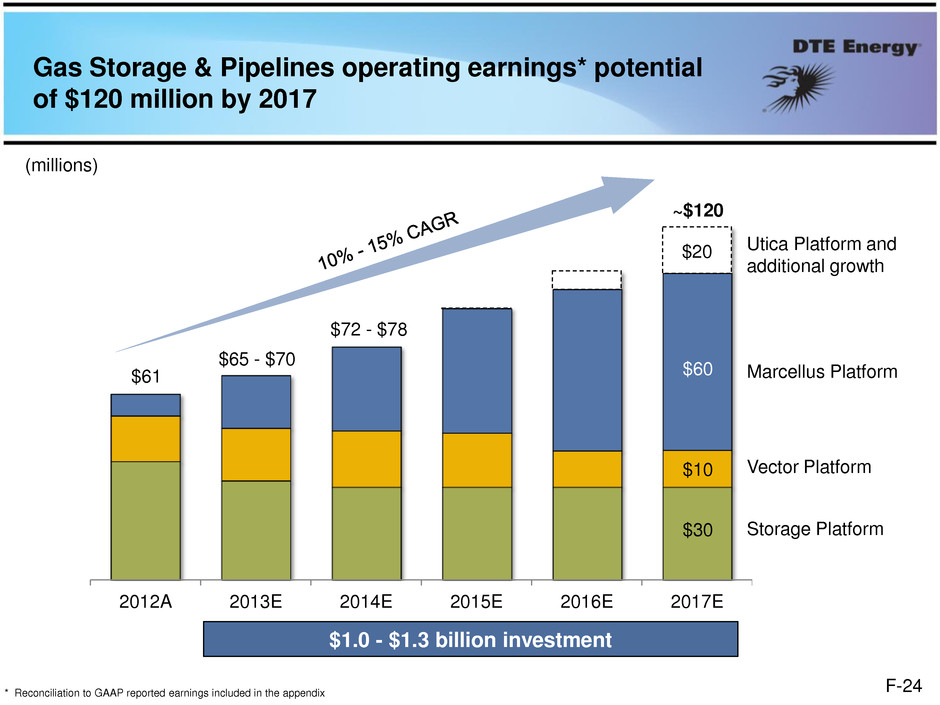

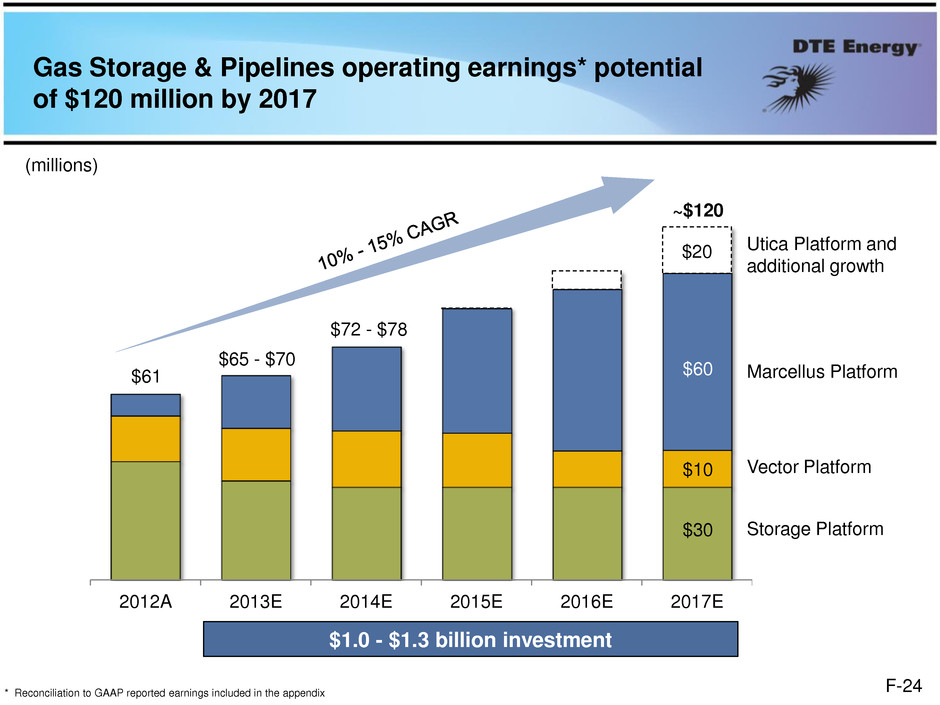

2012A 2013E 2014E 2015E 2016E 2017E Gas Storage & Pipelines operating earnings* potential of $120 million by 2017 ~$120 * Reconciliation to GAAP reported earnings included in the appendix (millions) Storage Platform Vector Platform Marcellus Platform Utica Platform and additional growth $30 $10 $60 $61 $65 - $70 $1.0 - $1.3 billion investment $20 $72 - $78 F-24

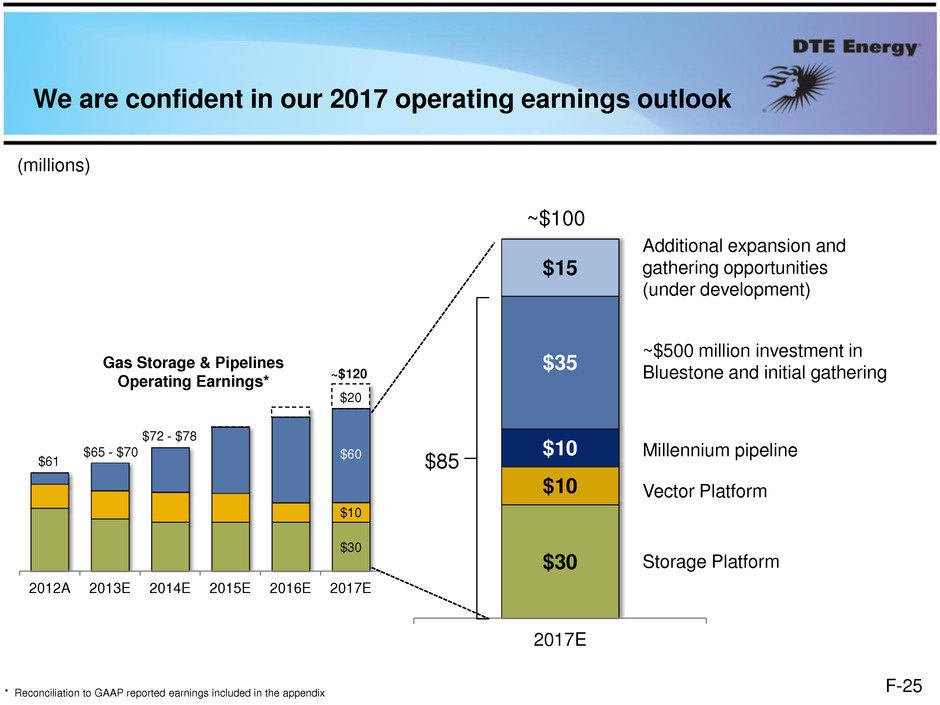

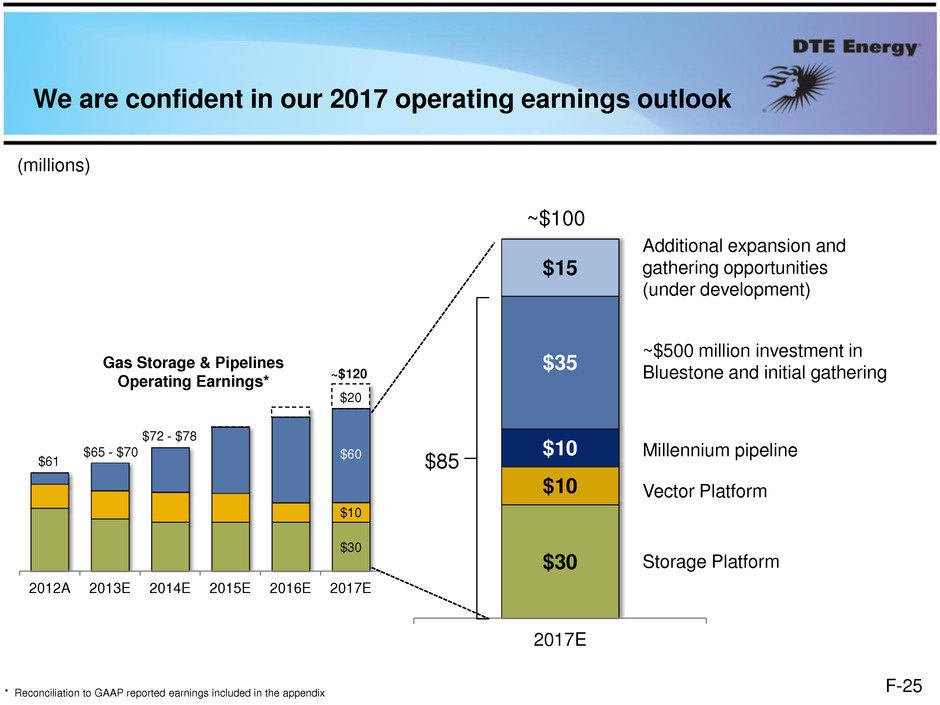

2012A 2013E 2014E 2015E 2016E 2017E $30 $10 $10 $35 $15 2017E ~$100 We are confident in our 2017 operating earnings outlook Millennium pipeline ~$500 million investment in Bluestone and initial gathering Additional expansion and gathering opportunities (under development) (millions) ~$120 $10 $60 $20 $61 $65 - $70 Gas Storage & Pipelines Operating Earnings* $30 $10 $60 $72 - $78 * Reconciliation to GAAP reported earnings included in the appendix Storage Platform Vector Platform $85 F-25

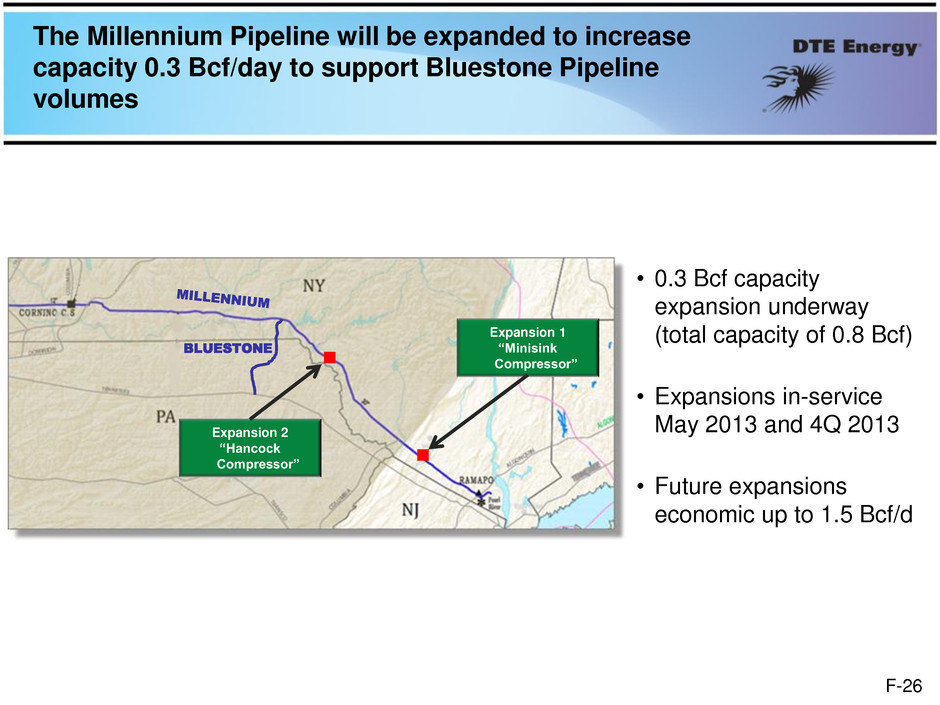

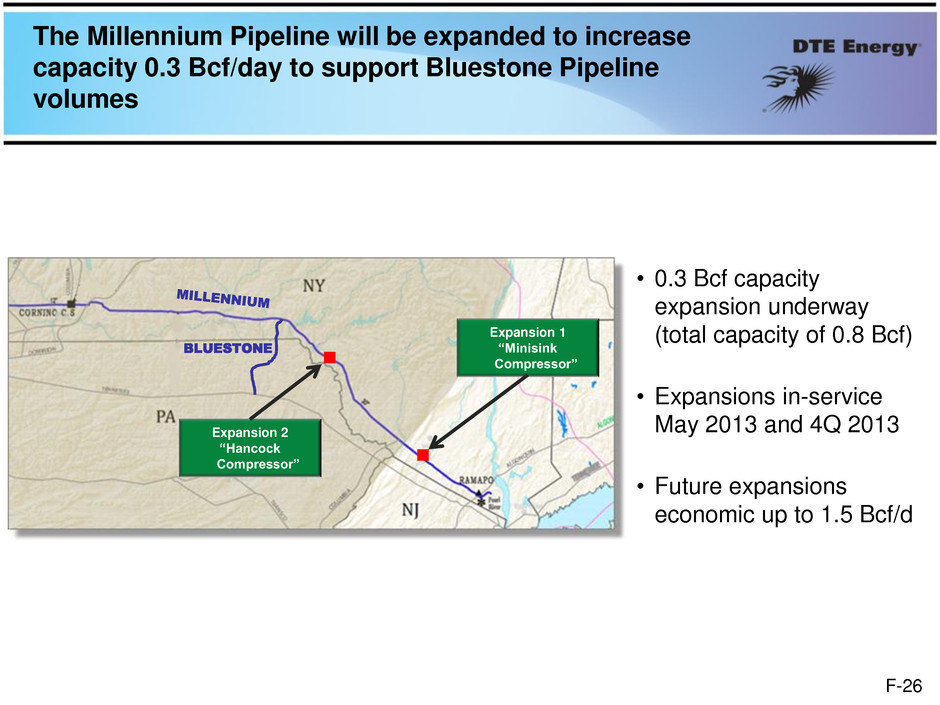

The Millennium Pipeline will be expanded to increase capacity 0.3 Bcf/day to support Bluestone Pipeline volumes • 0.3 Bcf capacity expansion underway (total capacity of 0.8 Bcf) • Expansions in-service May 2013 and 4Q 2013 • Future expansions economic up to 1.5 Bcf/d BLUESTONE Expansion 2 “Hancock Compressor” Expansion 1 “Minisink Compressor” F-26

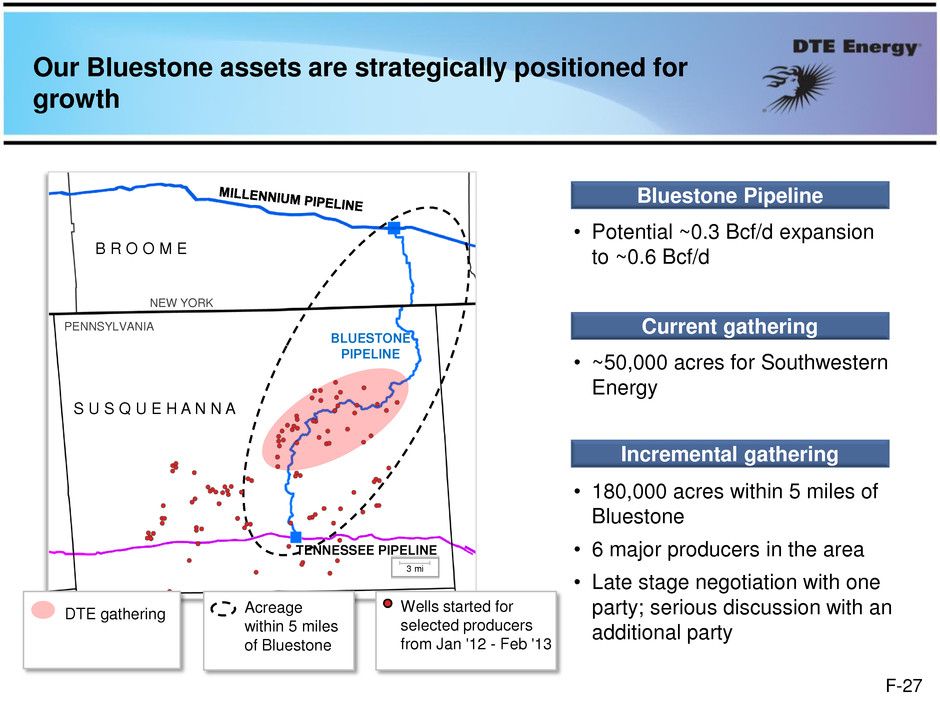

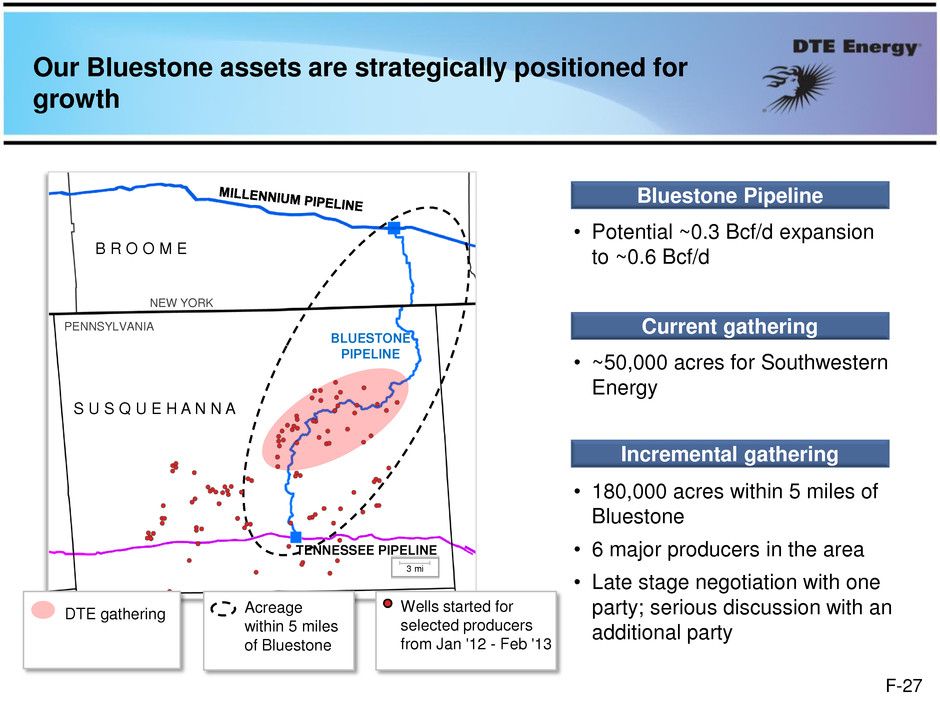

Our Bluestone assets are strategically positioned for growth • Potential ~0.3 Bcf/d expansion to ~0.6 Bcf/d S U S Q U E H A N N A NEW YORK PENNSYLVANIA BLUESTONE PIPELINE TENNESSEE PIPELINE B R O O M E • ~50,000 acres for Southwestern Energy Wells started for selected producers from Jan '12 - Feb '13 Acreage within 5 miles of Bluestone • 180,000 acres within 5 miles of Bluestone • 6 major producers in the area • Late stage negotiation with one party; serious discussion with an additional party DTE gathering Bluestone Pipeline Current gathering Incremental gathering 3 mi F-27

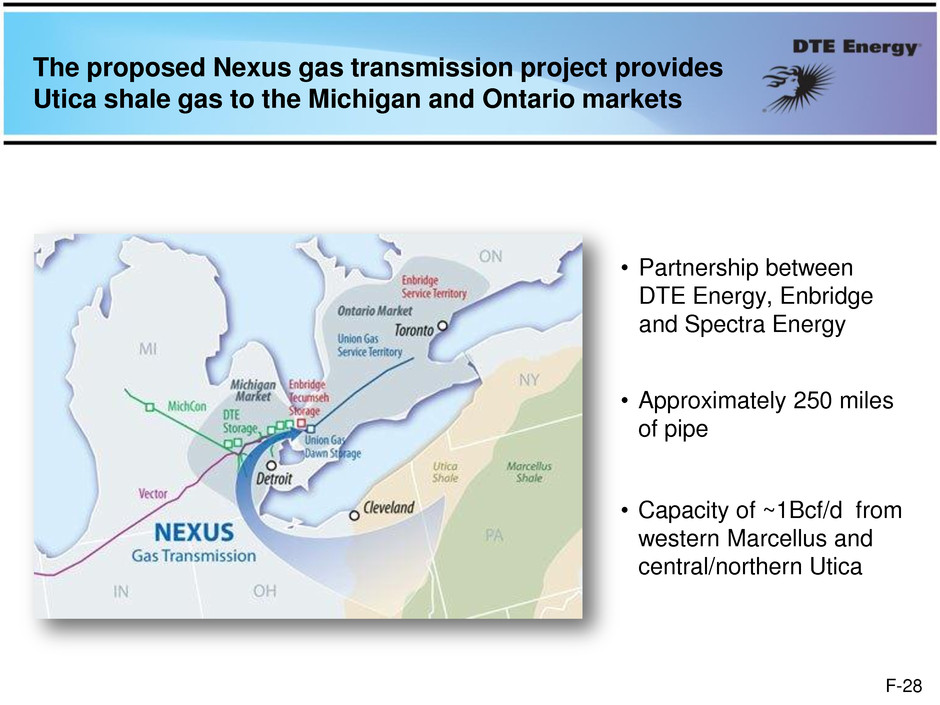

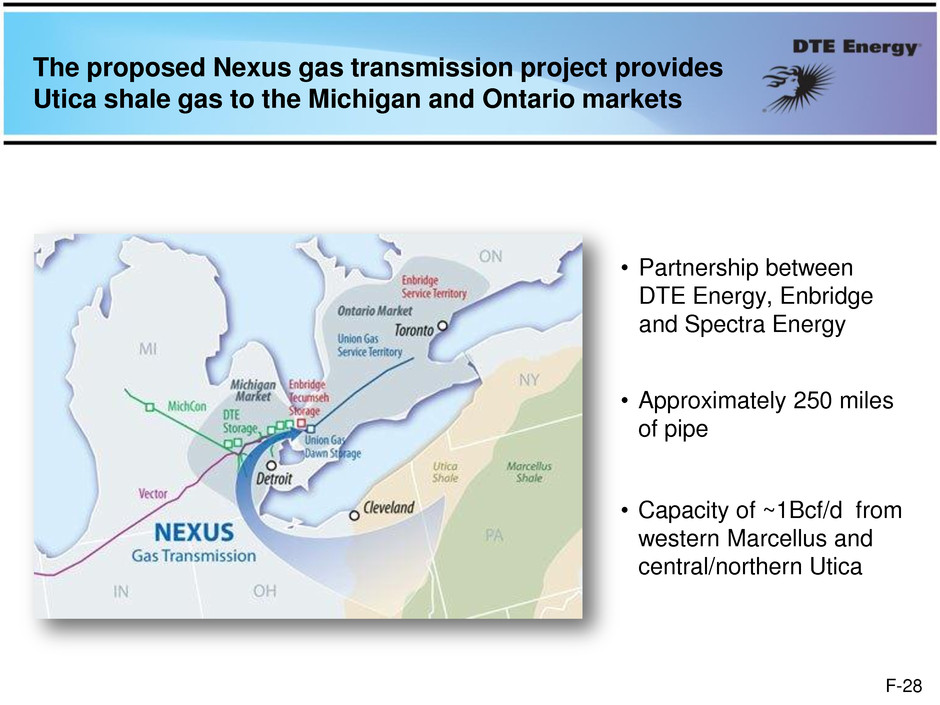

The proposed Nexus gas transmission project provides Utica shale gas to the Michigan and Ontario markets • Partnership between DTE Energy, Enbridge and Spectra Energy • Approximately 250 miles of pipe • Capacity of ~1Bcf/d from western Marcellus and central/northern Utica F-28

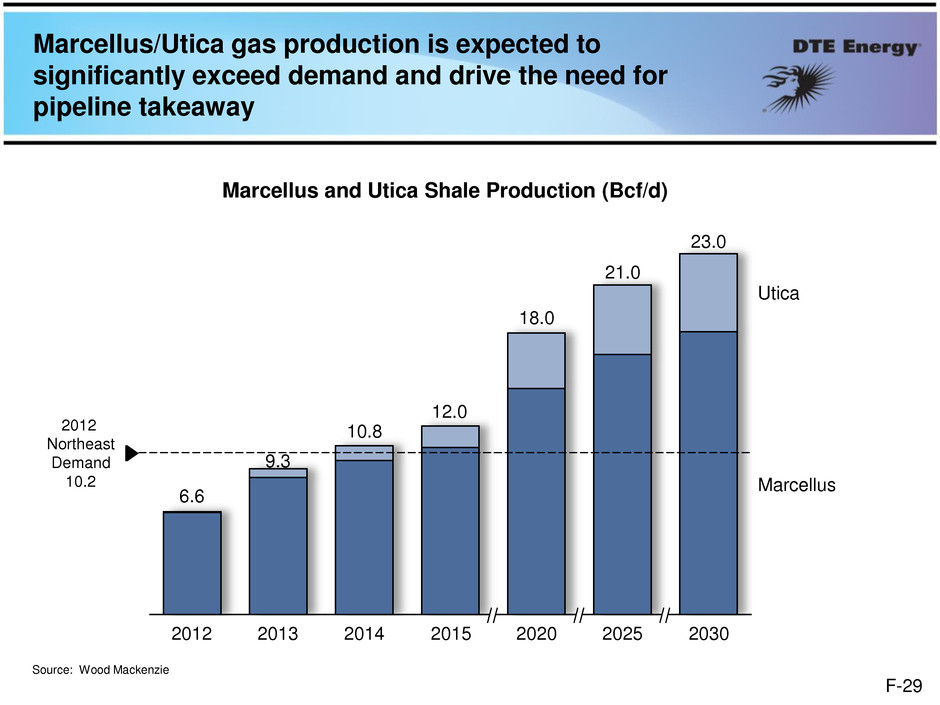

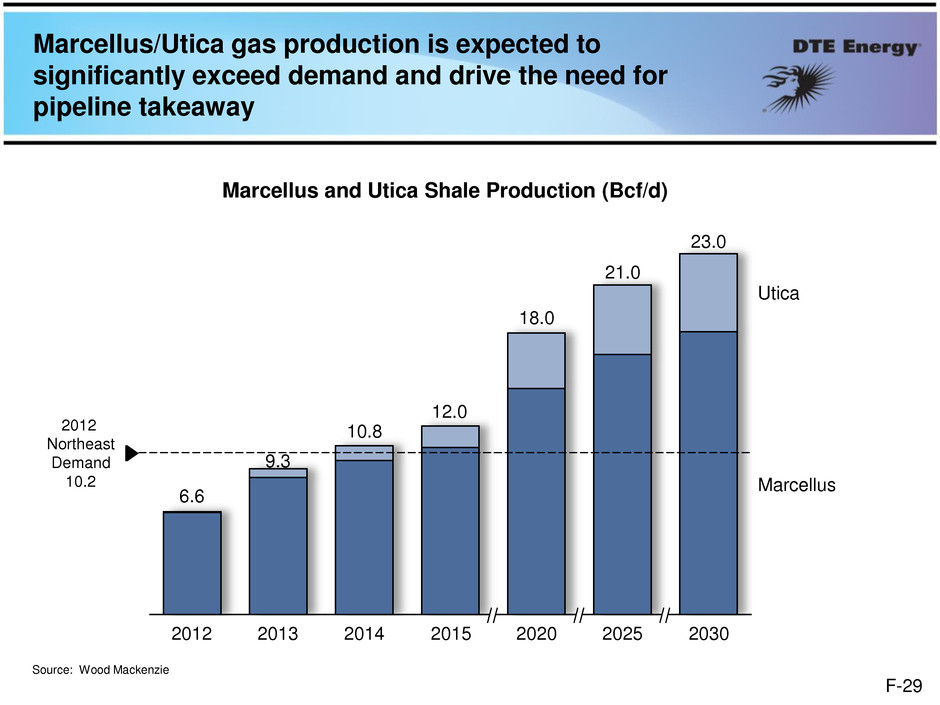

Marcellus/Utica gas production is expected to significantly exceed demand and drive the need for pipeline takeaway 10.8 2013 9.3 2015 12.0 2014 2012 6.6 2030 23.0 2025 21.0 2020 18.0 2012 Northeast Demand 10.2 Marcellus Utica Marcellus and Utica Shale Production (Bcf/d) Source: Wood Mackenzie F-29

Clear Growth & Value Creation Strategy • DTE Electric • DTE Gas • Gas Storage & Pipelines • Power & Industrial Projects F-30

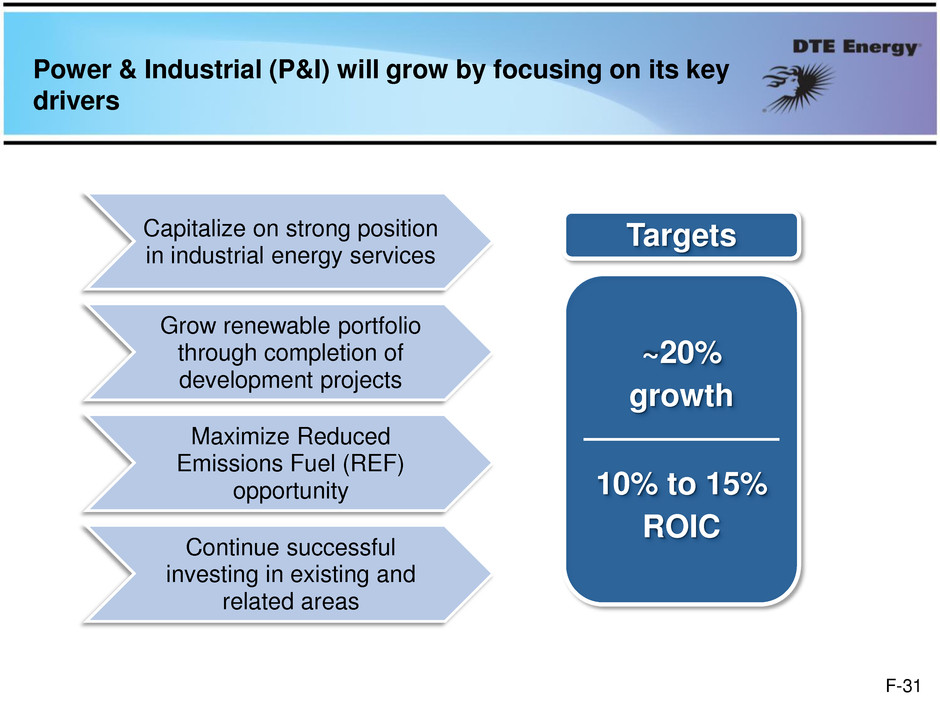

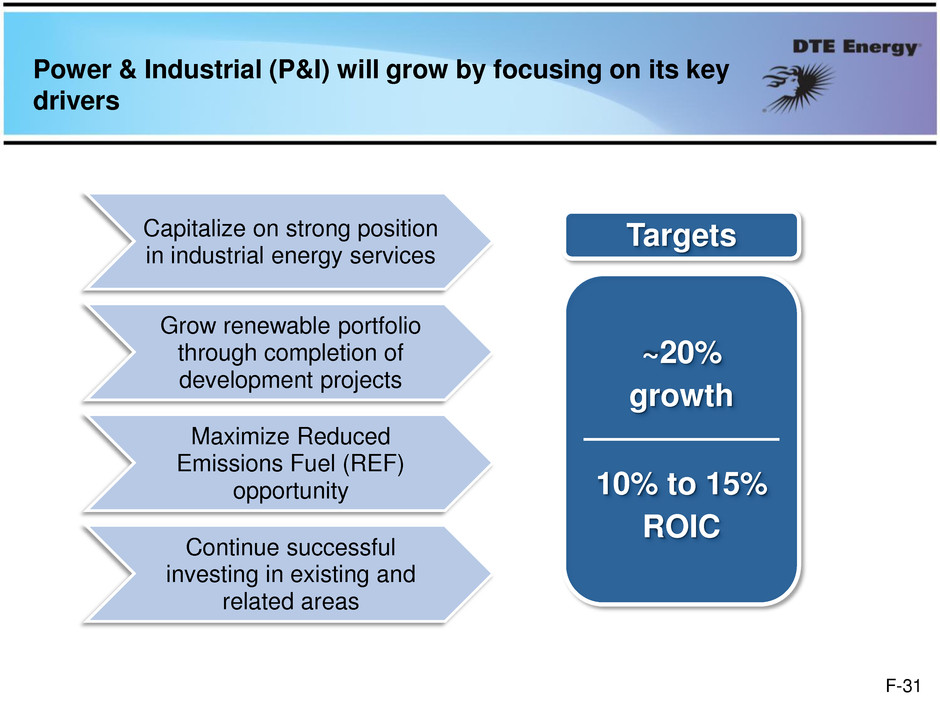

Power & Industrial (P&I) will grow by focusing on its key drivers Capitalize on strong position in industrial energy services Grow renewable portfolio through completion of development projects Maximize Reduced Emissions Fuel (REF) opportunity Continue successful investing in existing and related areas ~20% growth 10% to 15% ROIC Targets F-31

Power & Industrial is focused in three businesses Wood-fired Plant Cassville, WI • Produces fuel that reduces emissions from coal-fired plants • 9 REF units, 4 states Industrial Energy Services • Utility services at industrial sites • Coke and pulverized coal for steel customers • 42 projects, 11 states • Wood-fired power plants producing renewable power • Landfill gas to energy projects • 27 projects, 14 states Renewable Energy Reduced Emissions Fuel On-site Energy Project Wood-fired Plant Reduced Emissions Fuel Plant F-32

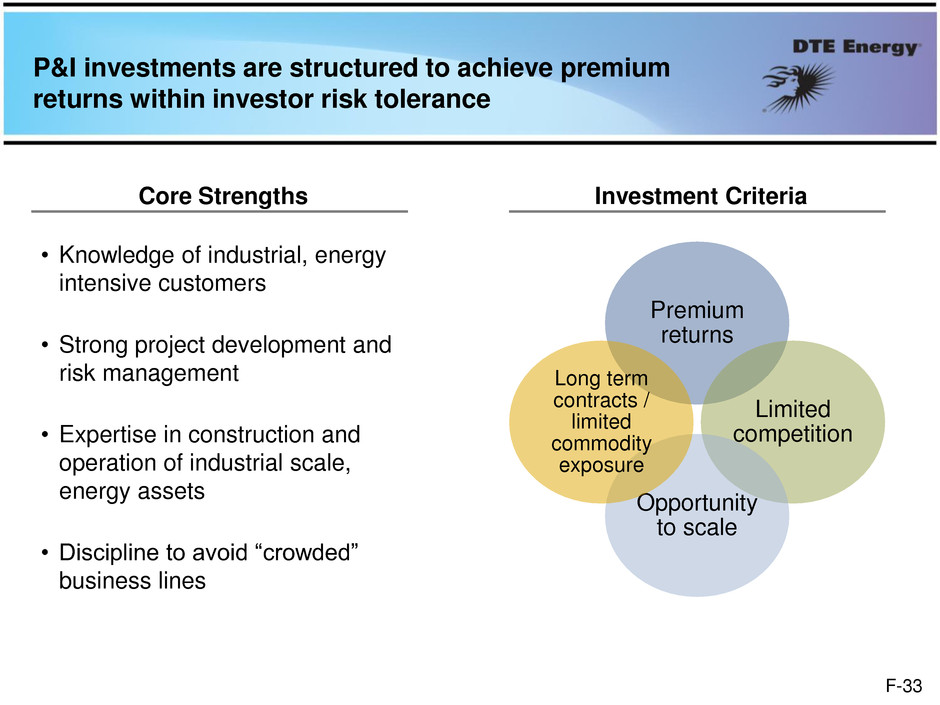

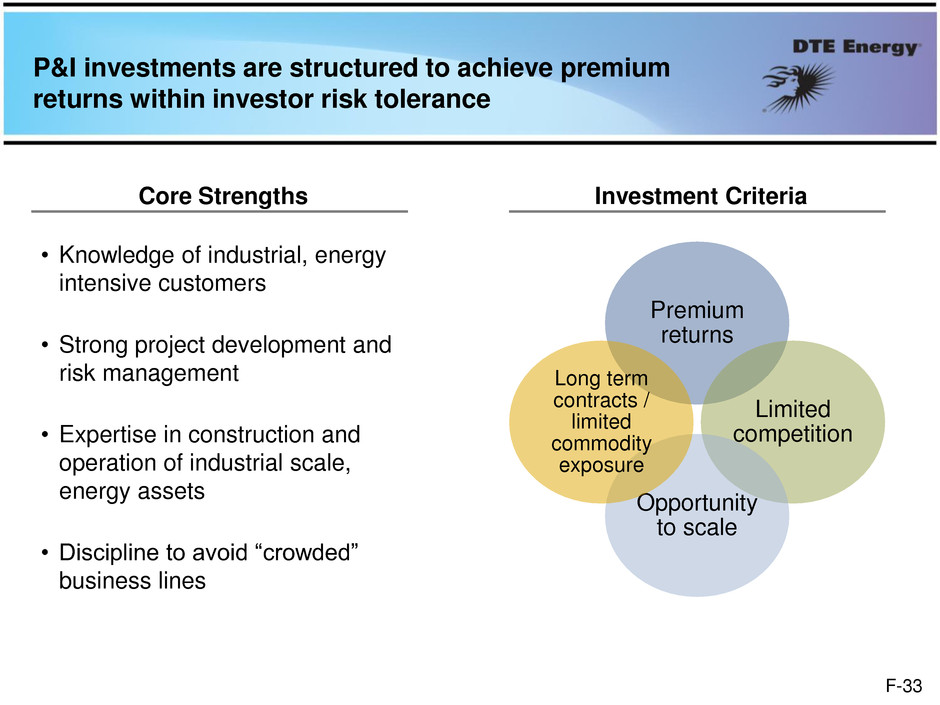

P&I investments are structured to achieve premium returns within investor risk tolerance Premium returns Limited competition Opportunity to scale Long term contracts / limited commodity exposure • Knowledge of industrial, energy intensive customers • Strong project development and risk management • Expertise in construction and operation of industrial scale, energy assets • Discipline to avoid “crowded” business lines Core Strengths Investment Criteria F-33

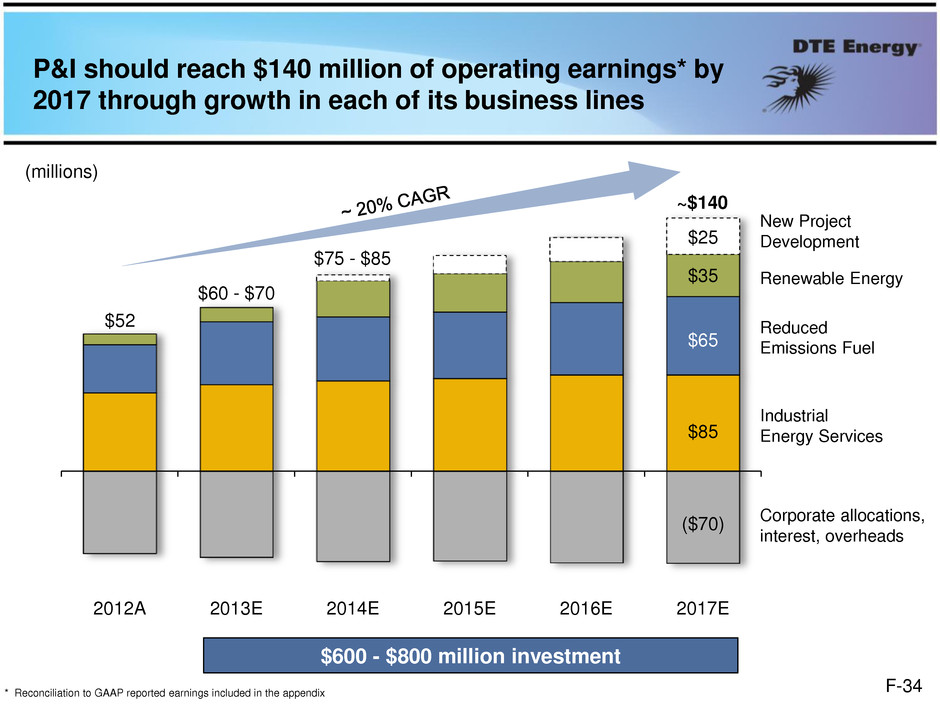

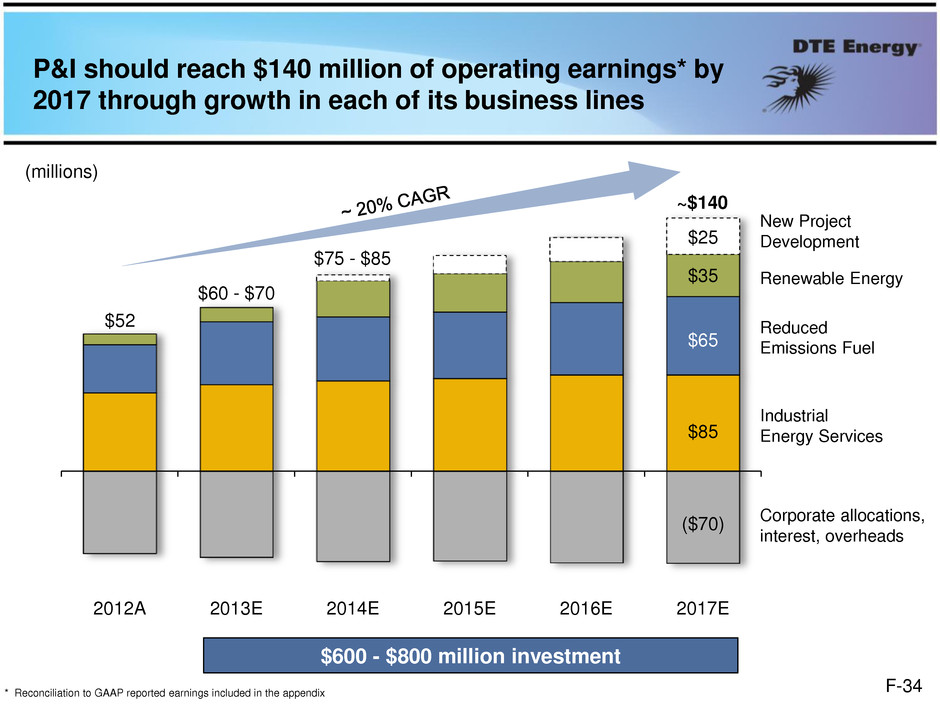

2012A 2013E 2014E 2015E 2016E 2017E P&I should reach $140 million of operating earnings* by 2017 through growth in each of its business lines ~$140 (millions) $52 $35 $65 $85 ($70) $25 $60 - $70 New Project Development Renewable Energy Reduced Emissions Fuel Industrial Energy Services Corporate allocations, interest, overheads * Reconciliation to GAAP reported earnings included in the appendix $75 - $85 $600 - $800 million investment F-34

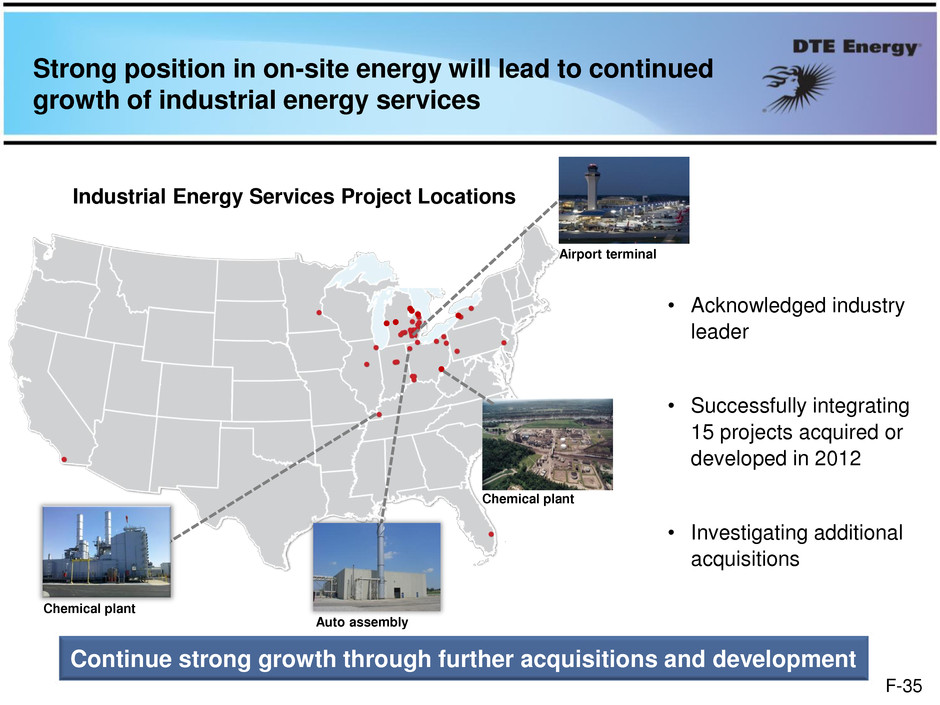

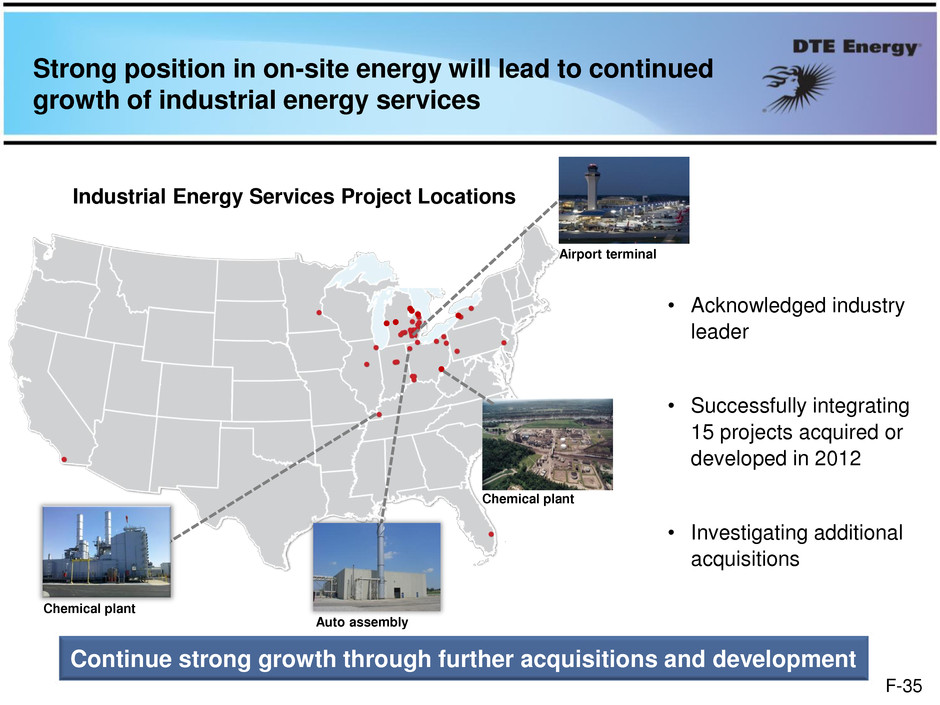

Strong position in on-site energy will lead to continued growth of industrial energy services • Acknowledged industry leader • Successfully integrating 15 projects acquired or developed in 2012 • Investigating additional acquisitions Industrial Energy Services Project Locations Continue strong growth through further acquisitions and development Chemical plant Auto assembly Chemical plant Airport terminal F-35

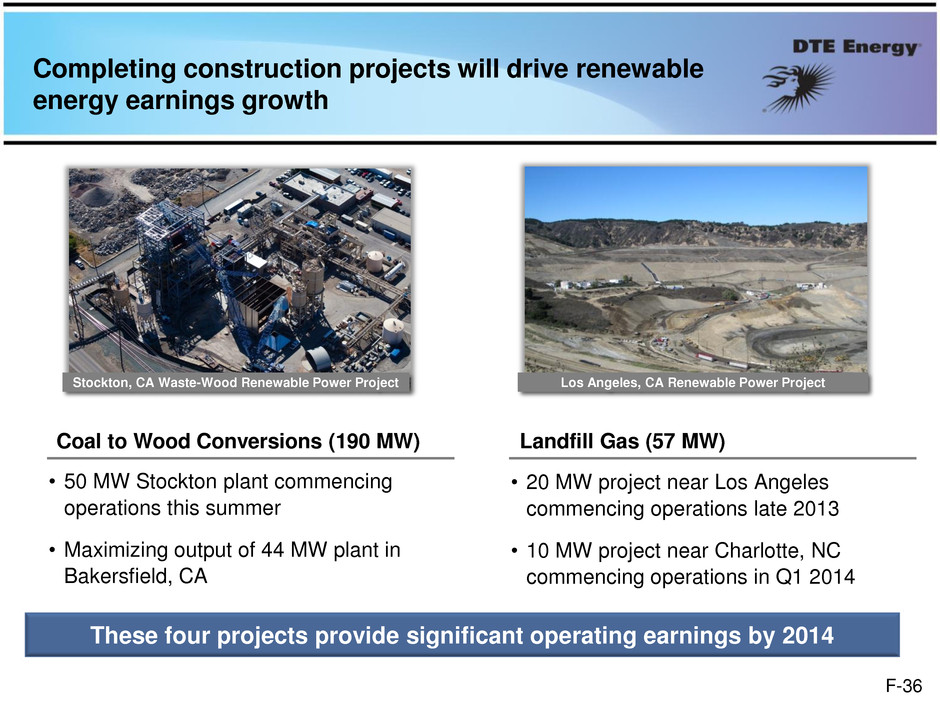

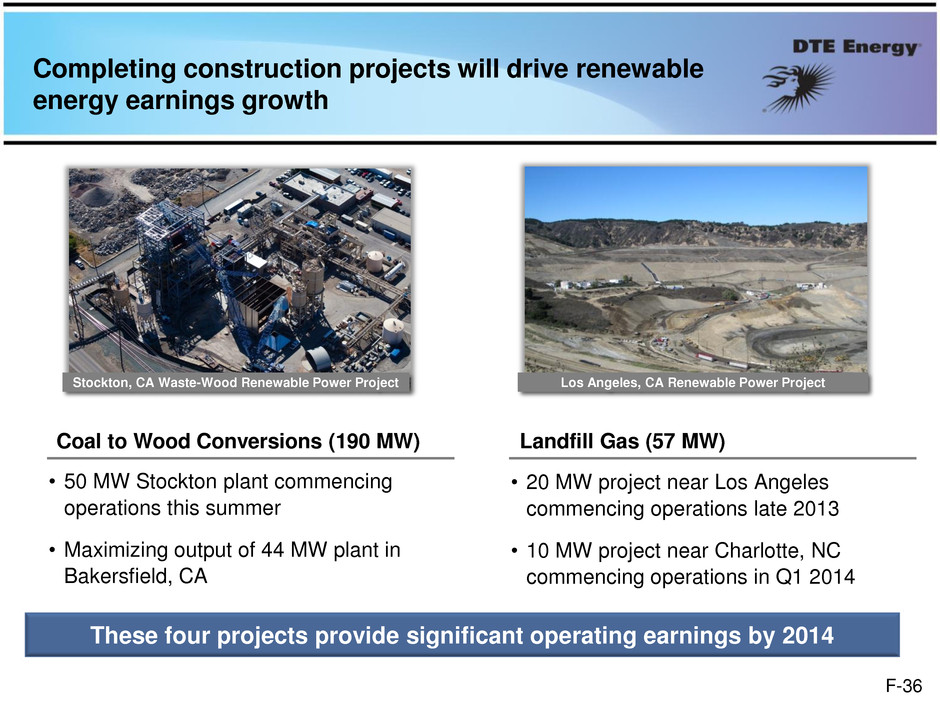

Completing construction projects will drive renewable energy earnings growth • 20 MW project near Los Angeles commencing operations late 2013 • 10 MW project near Charlotte, NC commencing operations in Q1 2014 • 50 MW Stockton plant commencing operations this summer • Maximizing output of 44 MW plant in Bakersfield, CA Stockton, CA Waste-Wood Renewable Power Project These four projects provide significant operating earnings by 2014 Coal to Wood Conversions (190 MW) Landfill Gas (57 MW) Los Angeles, CA Renewable Power Project F-36

P&I is continuing development of the Reduced Emissions Fuel business REF Projects: • Reduce NOx and mercury from coal-fired plants • Qualify for federal tax credit – 9 year remaining life • Reduce customer costs Reduced Emissions Fuel Projects F-37

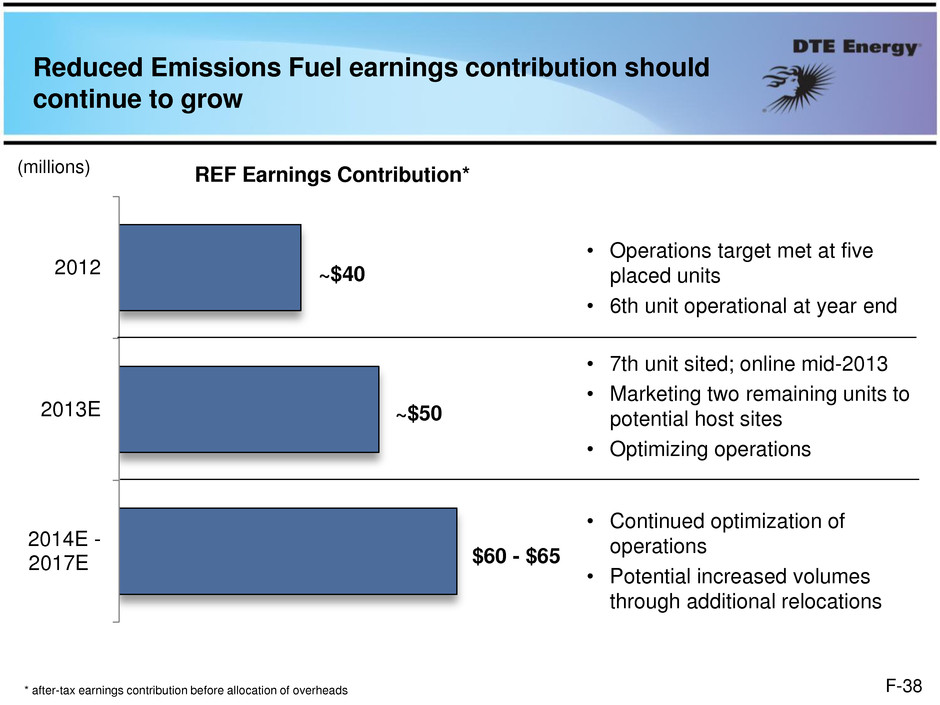

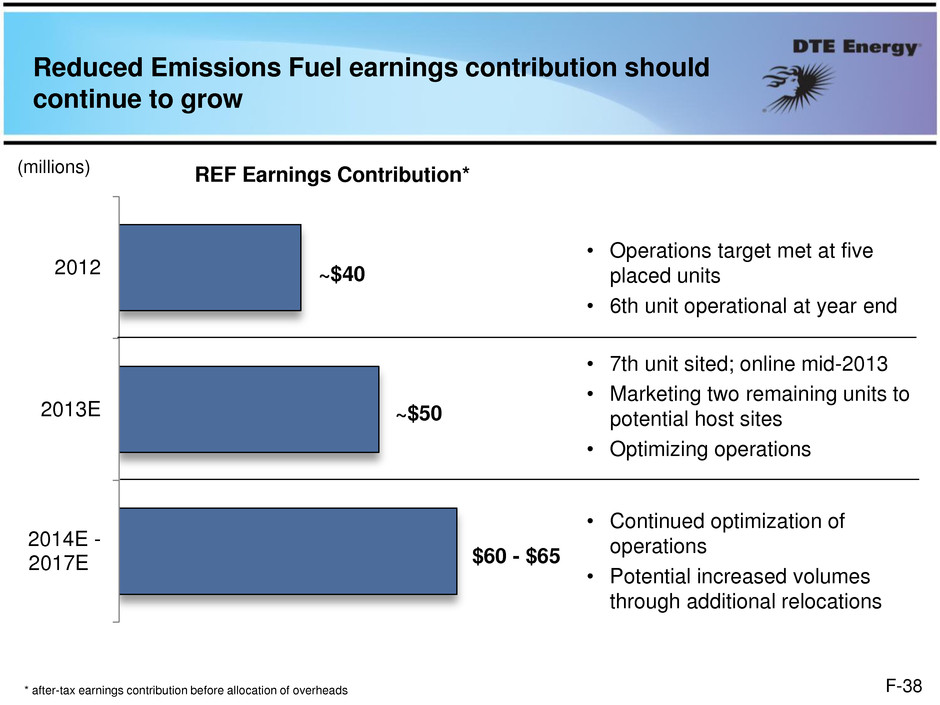

Reduced Emissions Fuel earnings contribution should continue to grow 2012 2013E 2014E - 2017E • Operations target met at five placed units • 6th unit operational at year end • 7th unit sited; online mid-2013 • Marketing two remaining units to potential host sites • Optimizing operations • Continued optimization of operations • Potential increased volumes through additional relocations ~$40 ~$50 $60 - $65 (millions) REF Earnings Contribution* * after-tax earnings contribution before allocation of overheads F-38

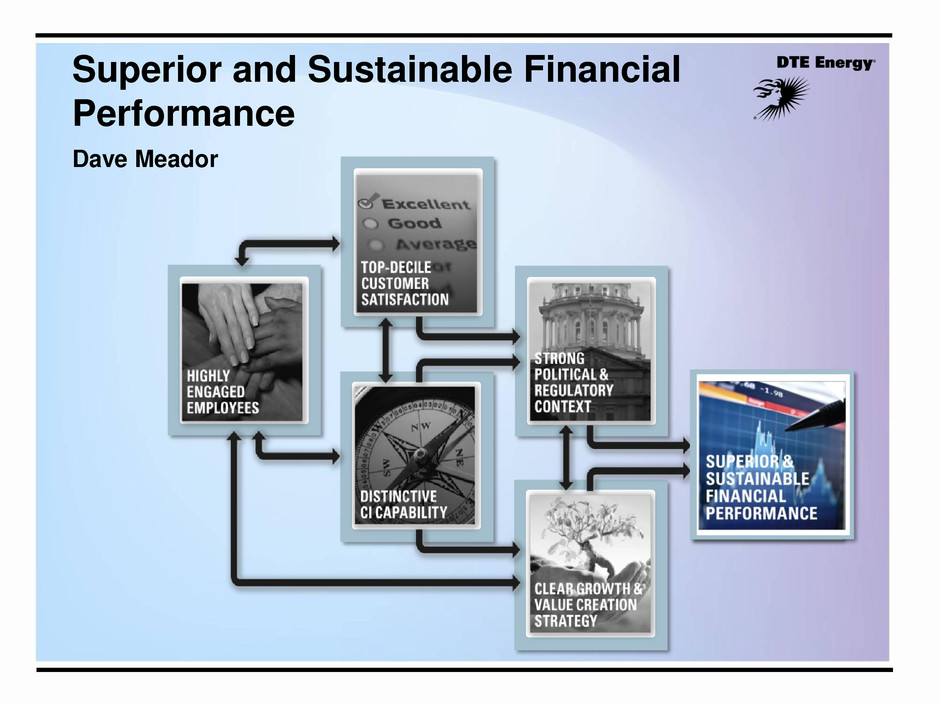

Superior and Sustainable Financial Performance Dave Meador

We are revising our 2013 operating earnings per share guidance mid-point from $4.00 to $4.05 Drivers 2013 Revised Guidance 2013 Original Guidance (millions, except EPS) DTE Electric Strong underlying performance, regulatory certainty, cost efficiencies $475 - $485 $480 - $490 DTE Gas 113 - 118 115 - 120 Gas Storage & Pipelines Favorable transportation earnings 62 - 67 65 - 70 Power & Industrial Projects 60 - 70 60 - 70 Energy Trading 10 - 30 10 - 30 Corporate & Other (46) (46) DTE Energy Operating EPS Avg. Shares Outstanding $674 - $724 $3.85 - $4.15 175 $684 - $734 $3.90 - $4.20 175 * Reconciliation to GAAP reported earnings included in the appendix G-2

2014 early outlook has a midpoint of $4.27 per share; consistent with our targeted 5% to 6% operating earnings growth 2014 Drivers 2014 Early Outlook 2013 Revised Guidance (millions, except EPS) DTE Electric $480 - $490 $515 - $525 DTE Gas Full year of IRM; CI 115 - 120 120 - 126 Gas Storage & Pipelines Bluestone pipeline and gathering 65 - 70 72 - 78 Power & Industrial Projects REF and renewable energy projects 60 - 70 75 - 85 Energy Trading Comparable market opportunities 10 - 30 10 - 30 Corporate & Other (46) (51) DTE Energy Operating EPS Avg. Shares Outstanding $684 - $734 $3.90 - $4.20 175 $741 - $793 $4.12 - $4.42 180 * Reconciliation to GAAP reported earnings included in the appendix RDM amortized to income, renewables growth, CI G-3

Equity $0.9 Debt* $1.5 2013 – 2015 cash from operations and equity issuances support utility capital spend and a strong balance sheet (billions) * Excludes securitization Sources of $7.4 billion Uses of $7.4 billion Cash from Operations* $5.0 Capital Spending $6.0 Dividends $1.4 G-4

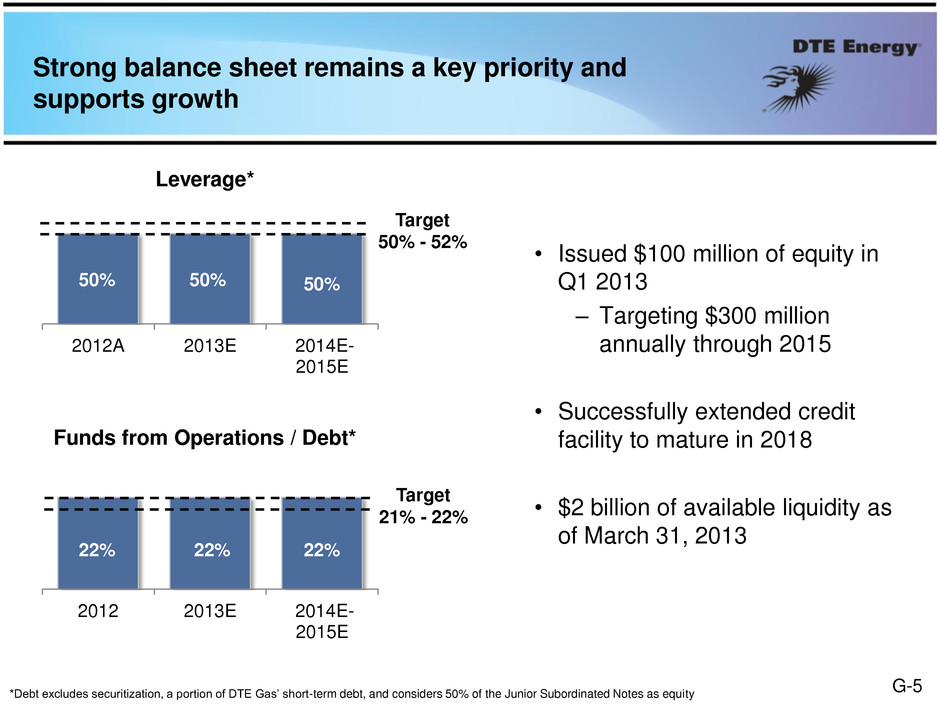

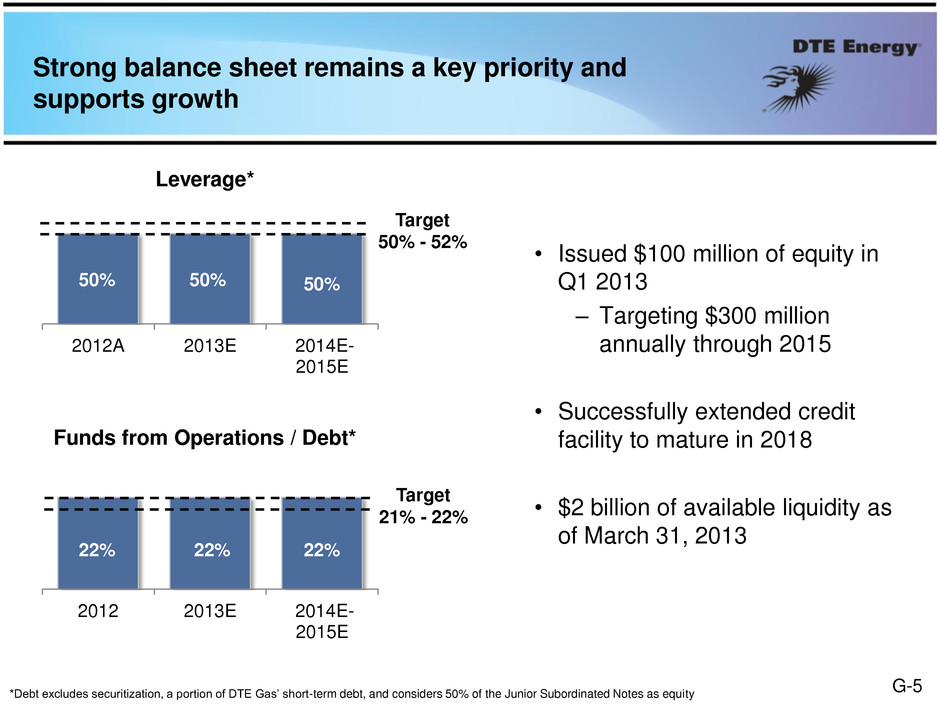

2012 2013E 2014E- 2015E *Debt excludes securitization, a portion of DTE Gas’ short-term debt, and considers 50% of the Junior Subordinated Notes as equity Leverage* Funds from Operations / Debt* 2012A 2013E 2014E- 2015E 50% 50% Target 50% - 52% 22% 22% Target 21% - 22% Strong balance sheet remains a key priority and supports growth 50% 22% • Issued $100 million of equity in Q1 2013 – Targeting $300 million annually through 2015 • Successfully extended credit facility to mature in 2018 • $2 billion of available liquidity as of March 31, 2013 G-5

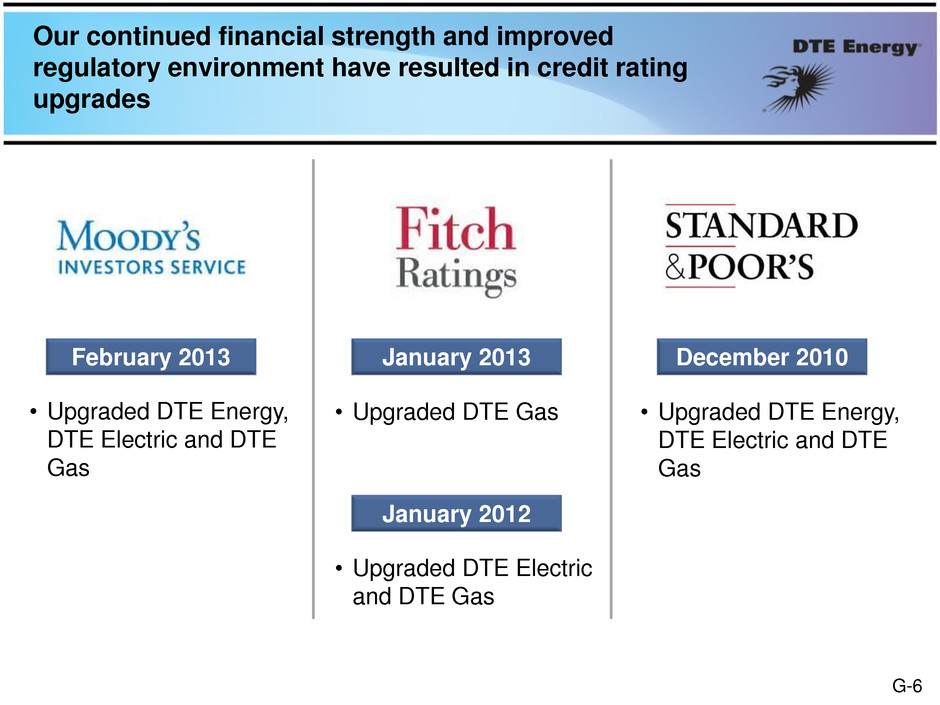

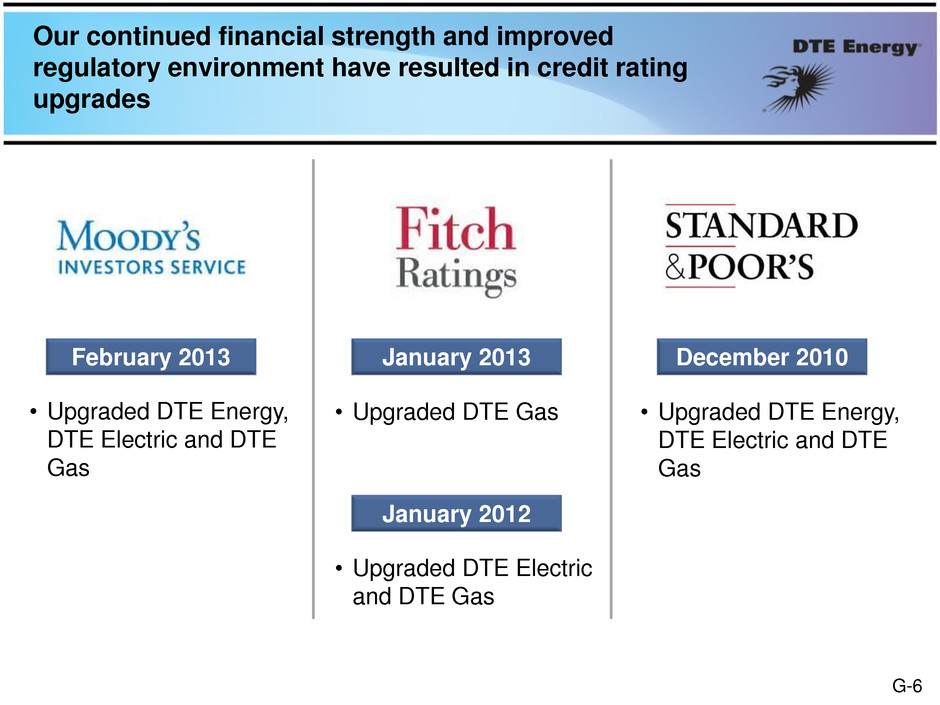

Our continued financial strength and improved regulatory environment have resulted in credit rating upgrades • Upgraded DTE Energy, DTE Electric and DTE Gas February 2013 January 2013 • Upgraded DTE Gas January 2012 • Upgraded DTE Electric and DTE Gas December 2010 • Upgraded DTE Energy, DTE Electric and DTE Gas G-6

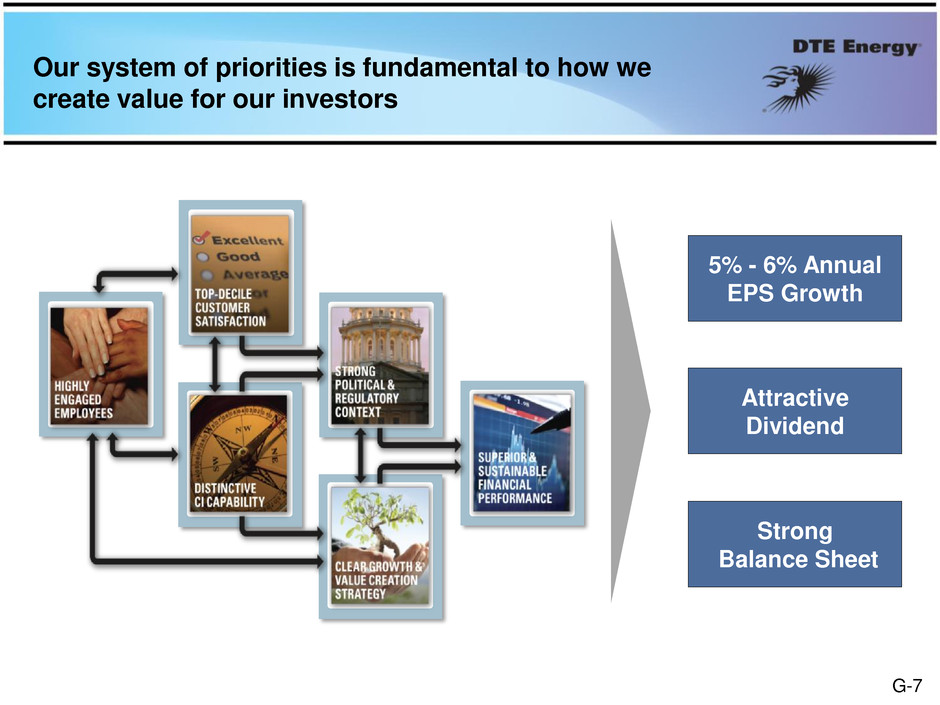

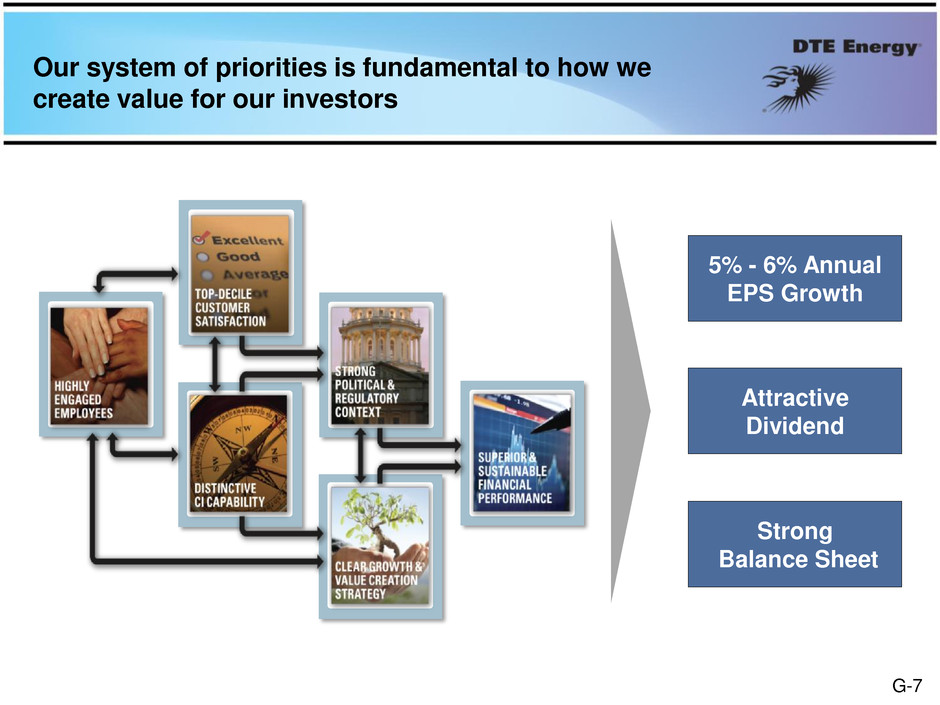

Our system of priorities is fundamental to how we create value for our investors 5% - 6% Annual EPS Growth Attractive Dividend Strong Balance Sheet G-7

Questions?

Appendix

Today’s speakers Highly Engaged Employees Gerry Anderson Distinctive CI Capability Steve Kurmas – DTE Electric President & COO Top-decile Customer Satisfaction Jerry Norcia – DTE Gas President & COO Strong Political & Regulatory Context Gerry Anderson Clear Growth & Value Creation Strategy Panel Discussion: Dave Meador – Executive VP & CFO Steve Kurmas Jerry Norcia David Ruud – DTE Power & Industrial President Superior & Sustainable Financial Performance Dave Meador Final Q&A and Closing Gerry Anderson H-2

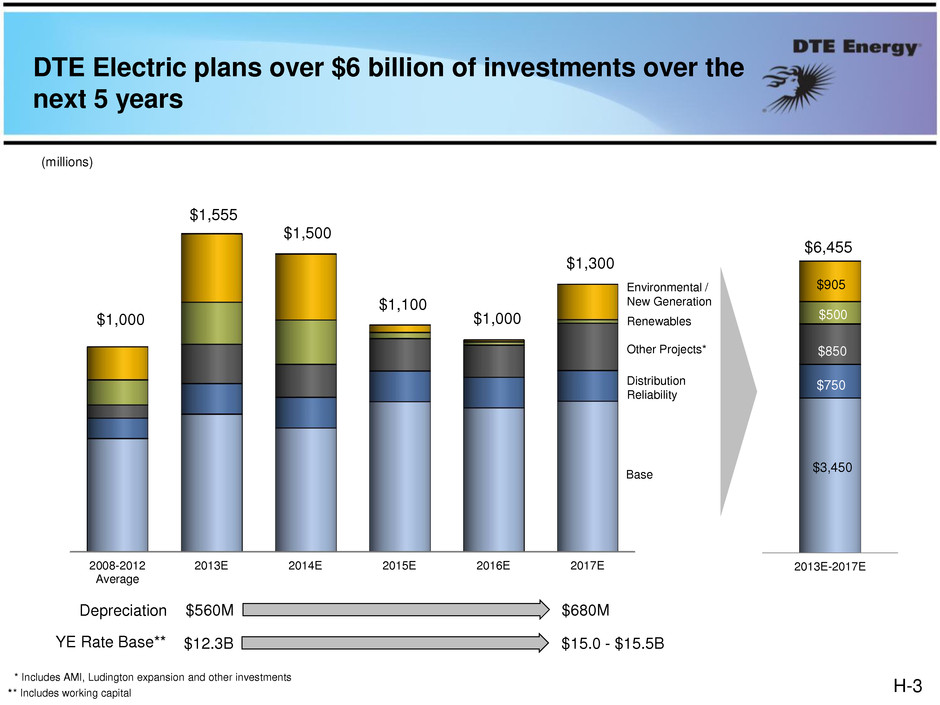

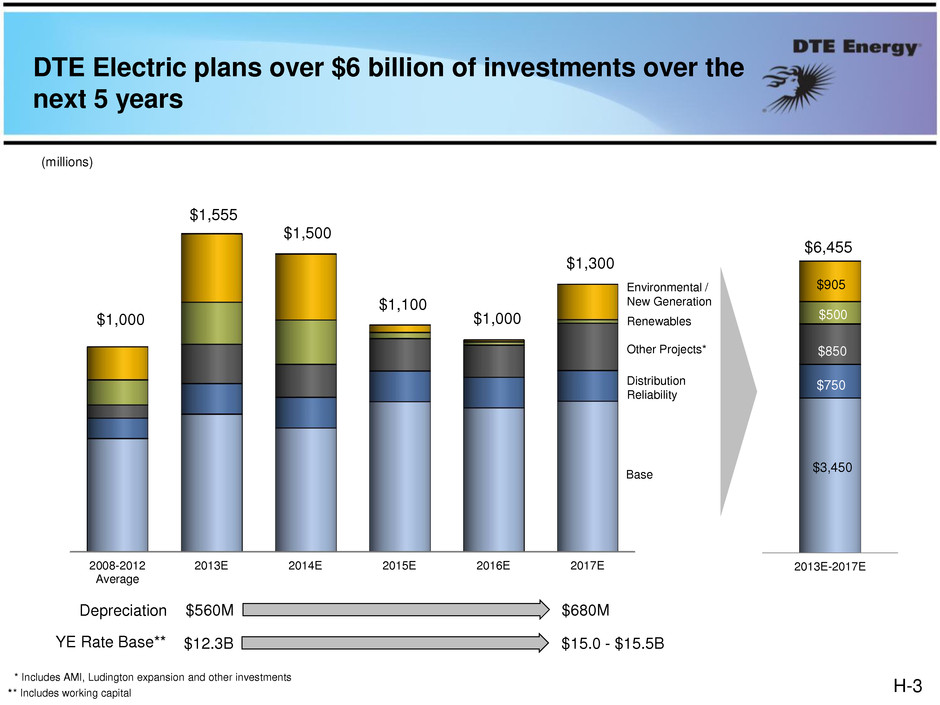

2008-2012 Average 2013E 2014E 2015E 2016E 2017E DTE Electric plans over $6 billion of investments over the next 5 years (millions) $1,555 $1,500 $1,000 $1,100 $1,300 $1,000 * Includes AMI, Ludington expansion and other investments Base Renewables Other Projects* Environmental / New Generation 2013E-2017E Distribution Reliability $905 $750 $500 $3,450 $6,455 $850 $12.3B $15.0 - $15.5B YE Rate Base** $560M $680M Depreciation * Includes working capital * H-3

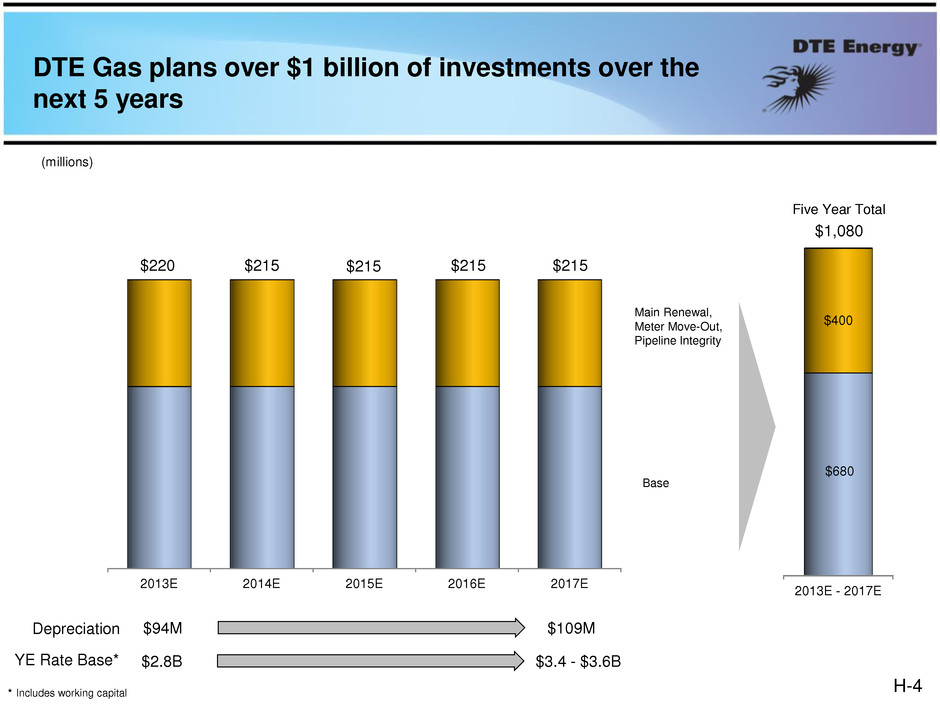

DTE Gas plans over $1 billion of investments over the next 5 years (millions) 2013E 2014E 2015E 2016E 2017E $220 $215 $215 $215 $215 2013E - 2017E $400 $680 $1,080 Five Year Total Base Main Renewal, Meter Move-Out, Pipeline Integrity $2.8B $3.4 - $3.6B YE Rate Base* $94M $109M Depreciation Includes working capital * H-4

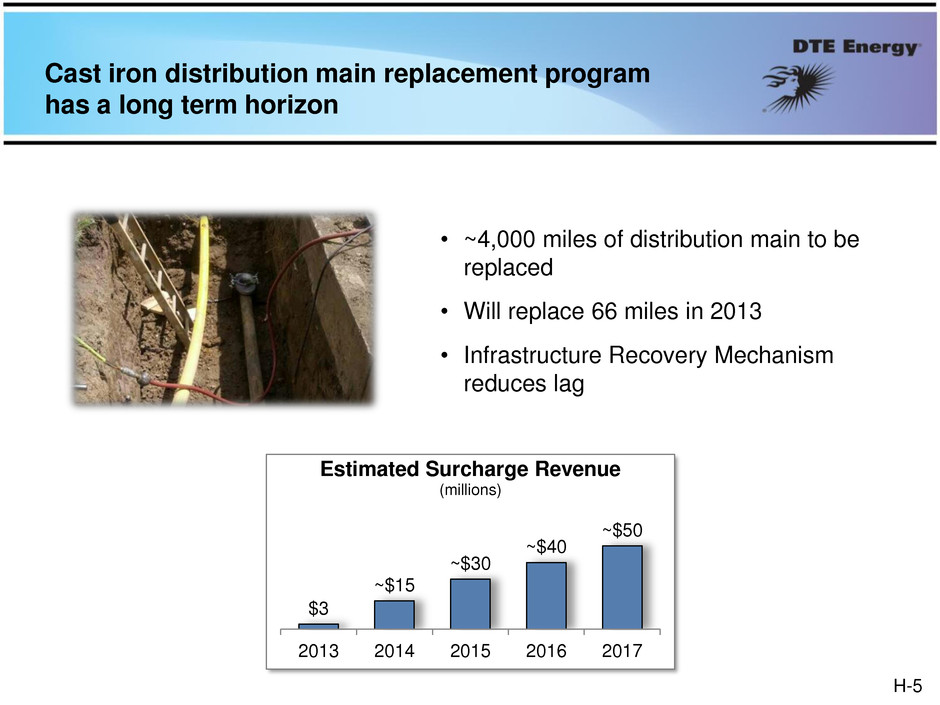

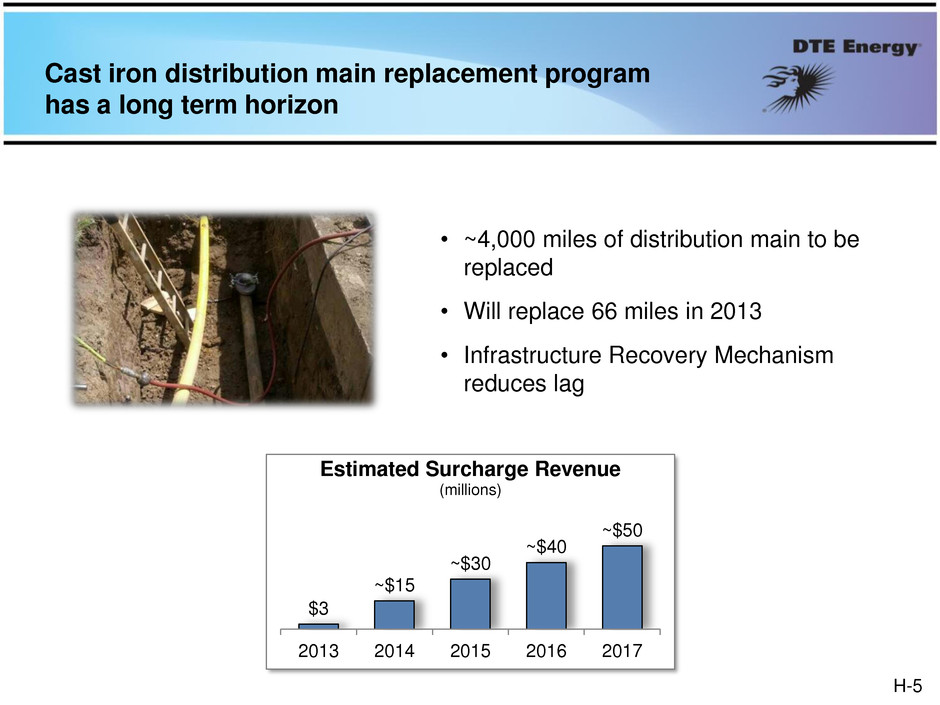

Cast iron distribution main replacement program has a long term horizon • ~4,000 miles of distribution main to be replaced • Will replace 66 miles in 2013 • Infrastructure Recovery Mechanism reduces lag $3 ~$15 ~$30 ~$40 ~$50 2013 2014 2015 2016 2017 Estimated Surcharge Revenue (millions) H-5

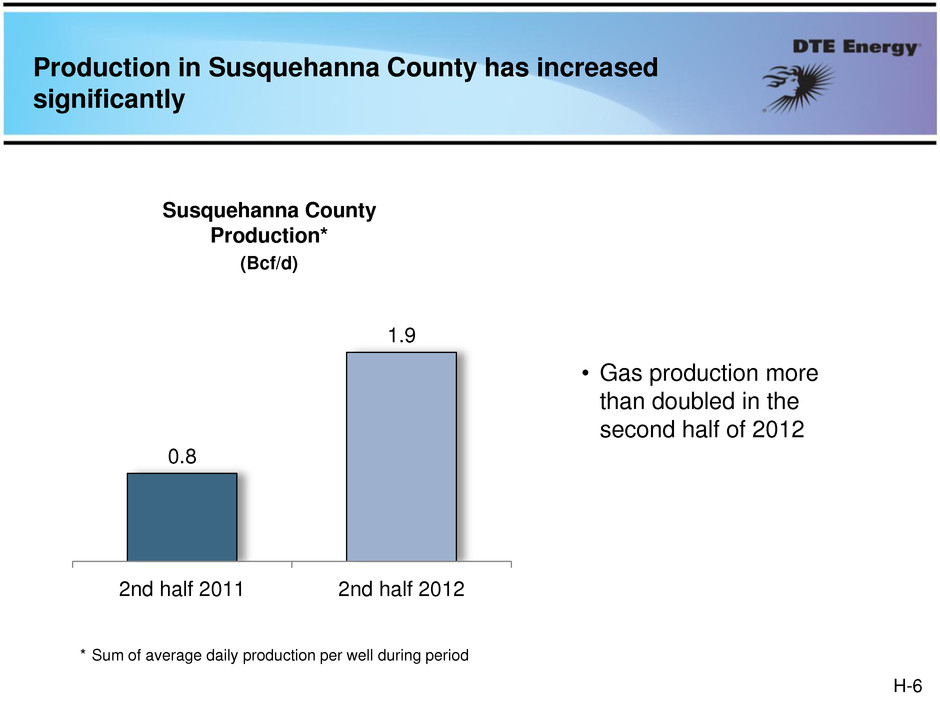

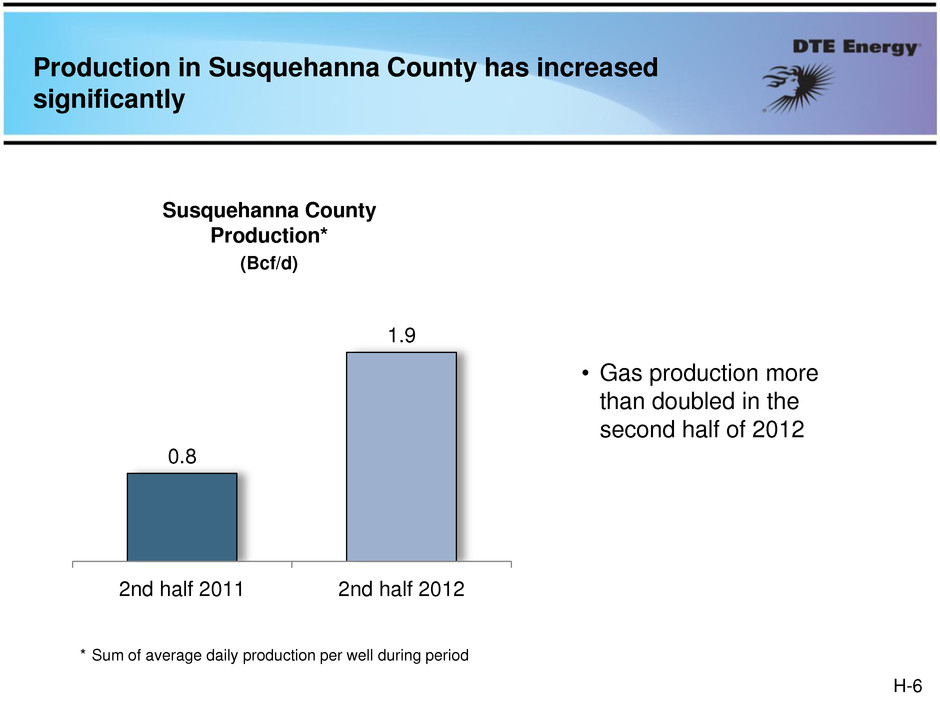

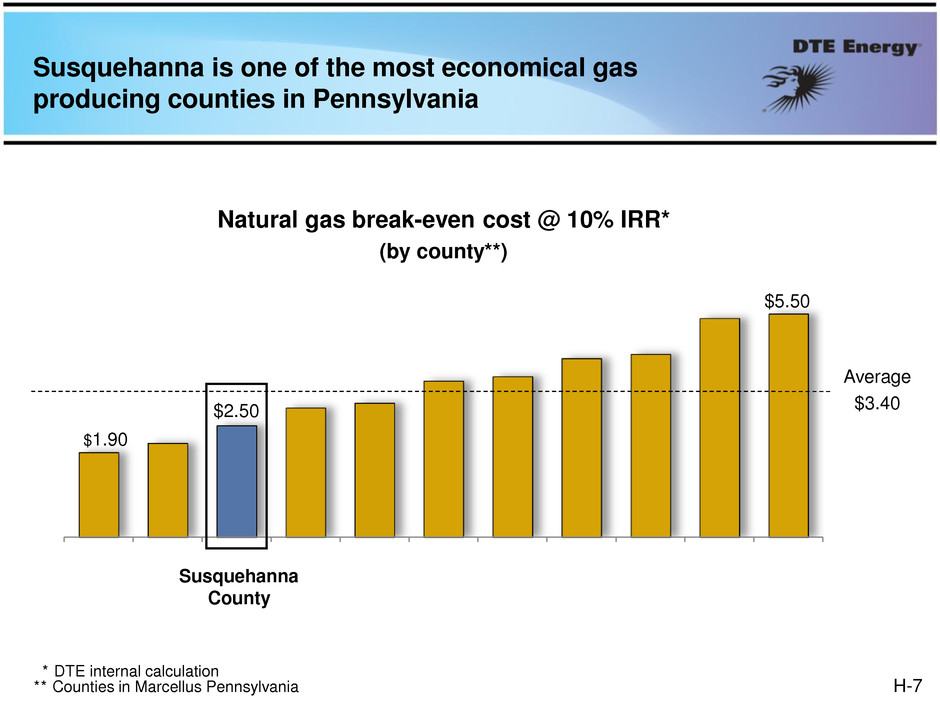

Production in Susquehanna County has increased significantly 0.8 1.9 2nd half 2011 2nd half 2012 Susquehanna County Production* (Bcf/d) * Sum of average daily production per well during period • Gas production more than doubled in the second half of 2012 H-6

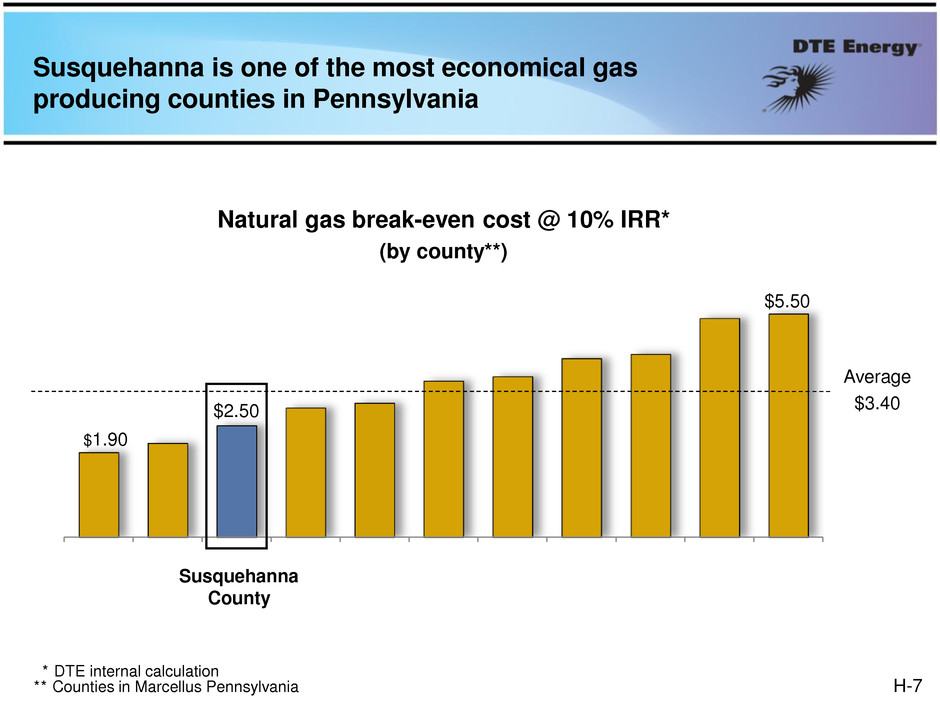

Susquehanna is one of the most economical gas producing counties in Pennsylvania Natural gas break-even cost @ 10% IRR* (by county**) Susquehanna County Average $3.40 * Counties in Marcellus Pennsylvania * DTE internal calculation * $1.90 $2.50 $5.50 H-7

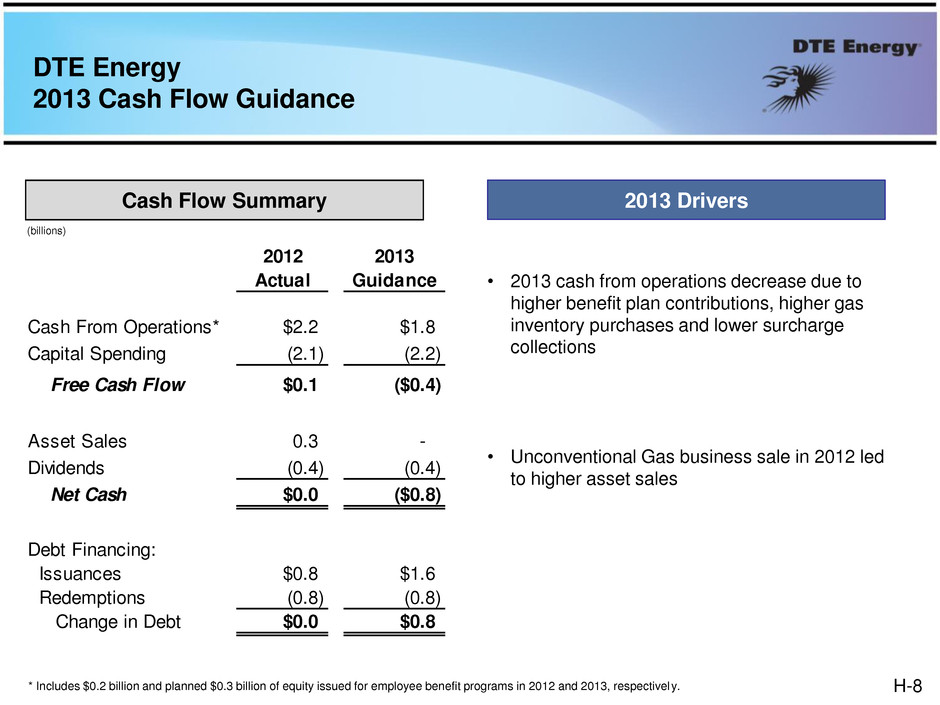

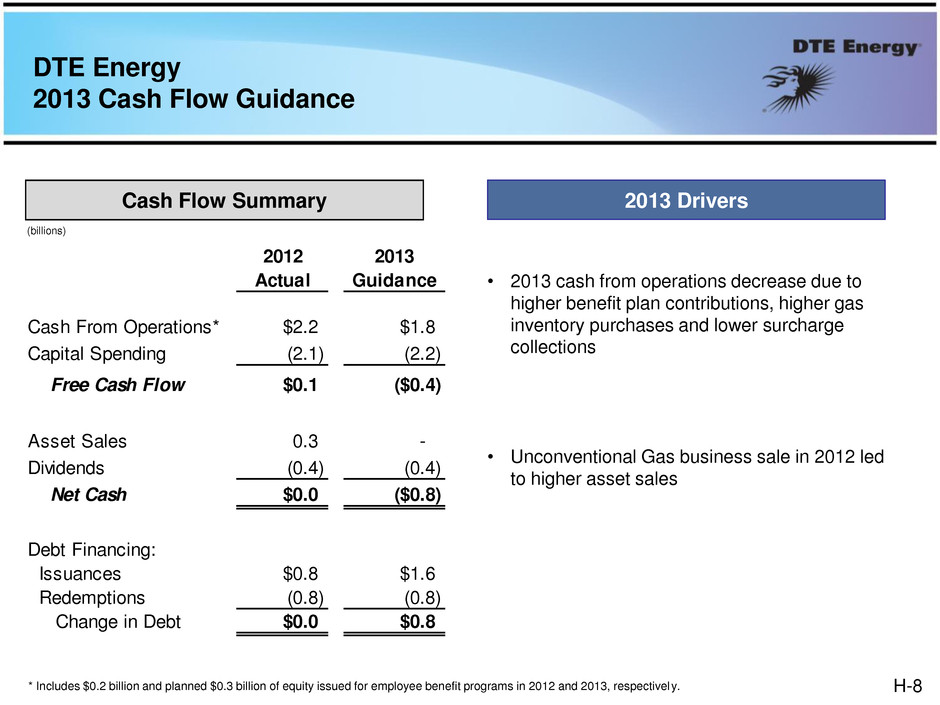

2012 2013 Actual Guidance Cash From Operations* $2.2 $1.8 Capital Spending (2.1) (2.2) Free Cash Flow $0.1 ($0.4) Asset Sales 0.3 - Dividends (0.4) (0.4) Net Cash $0.0 ($0.8) Debt Financing: Issuances $0.8 $1.6 Redemptions (0.8) (0.8) Change in Debt $0.0 $0.8 DTE Energy 2013 Cash Flow Guidance Cash Flow Summary (billions) • 2013 cash from operations decrease due to higher benefit plan contributions, higher gas inventory purchases and lower surcharge collections • Unconventional Gas business sale in 2012 led to higher asset sales 2013 Drivers * Includes $0.2 billion and planned $0.3 billion of equity issued for employee benefit programs in 2012 and 2013, respectively. H-8

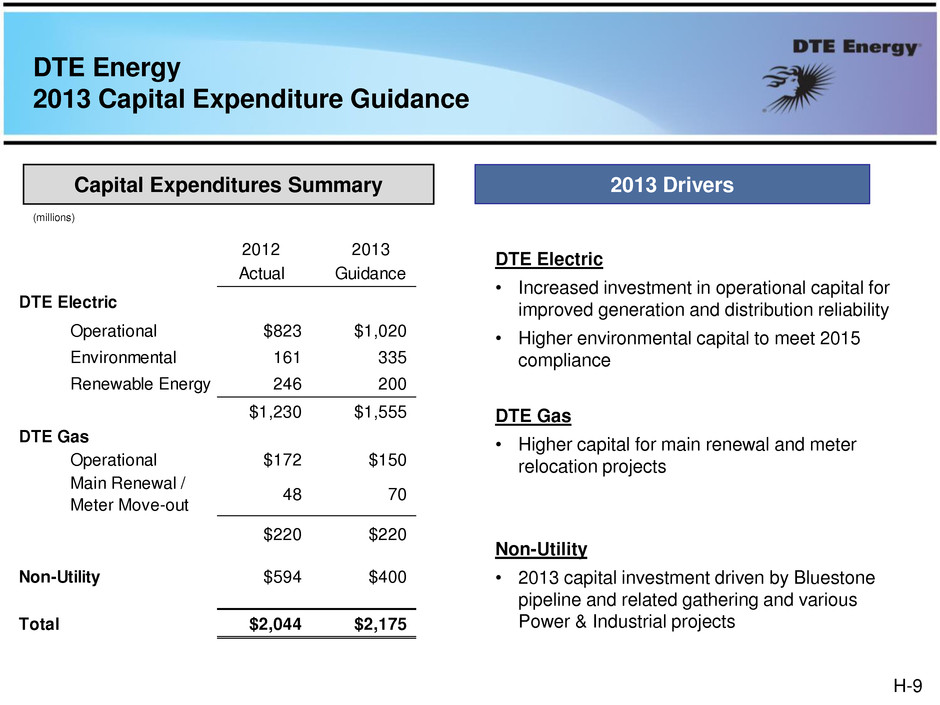

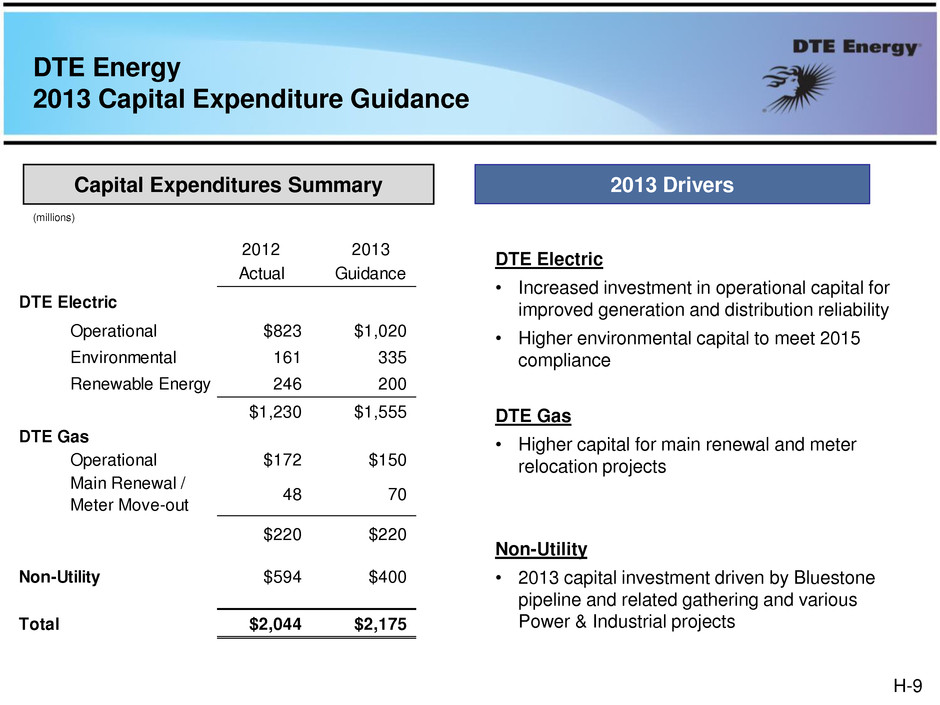

DTE Energy 2013 Capital Expenditure Guidance 2012 2013 Actual Guidance DTE Electric Operational $823 $1,020 Environmental 161 335 Renewable Energy 246 200 $1,230 $1,555 DTE Gas Operational $172 $150 Main Renewal / Meter Move-out 48 70 $220 $220 $594 $400 Total $2,044 $2,175 Non-Utility Capital Expenditures Summary (millions) DTE Electric • Increased investment in operational capital for improved generation and distribution reliability • Higher environmental capital to meet 2015 compliance DTE Gas • Higher capital for main renewal and meter relocation projects Non-Utility • 2013 capital investment driven by Bluestone pipeline and related gathering and various Power & Industrial projects 2013 Drivers H-9

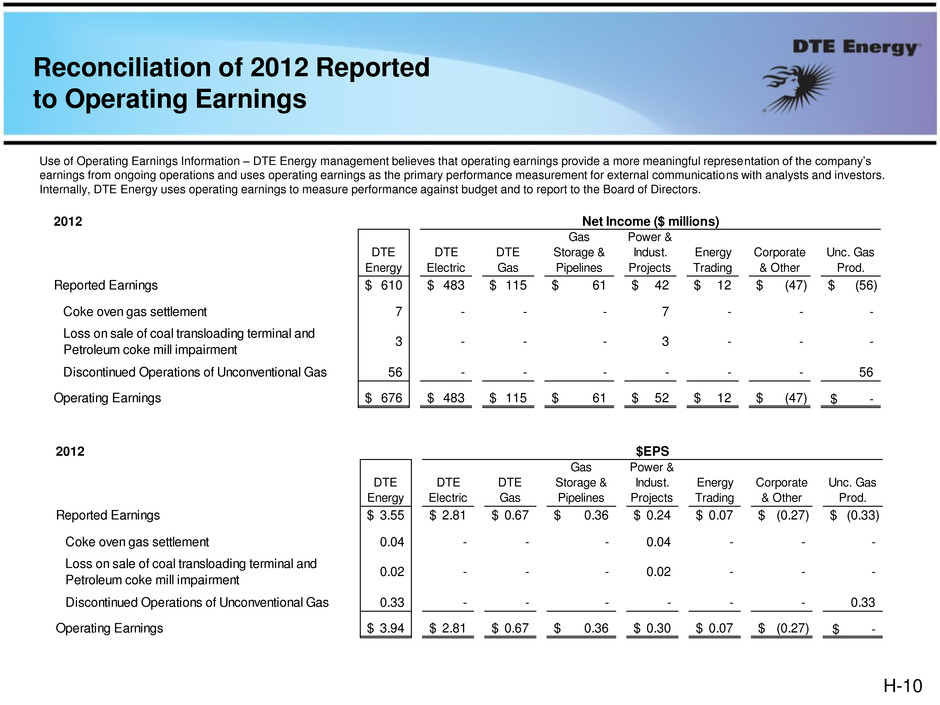

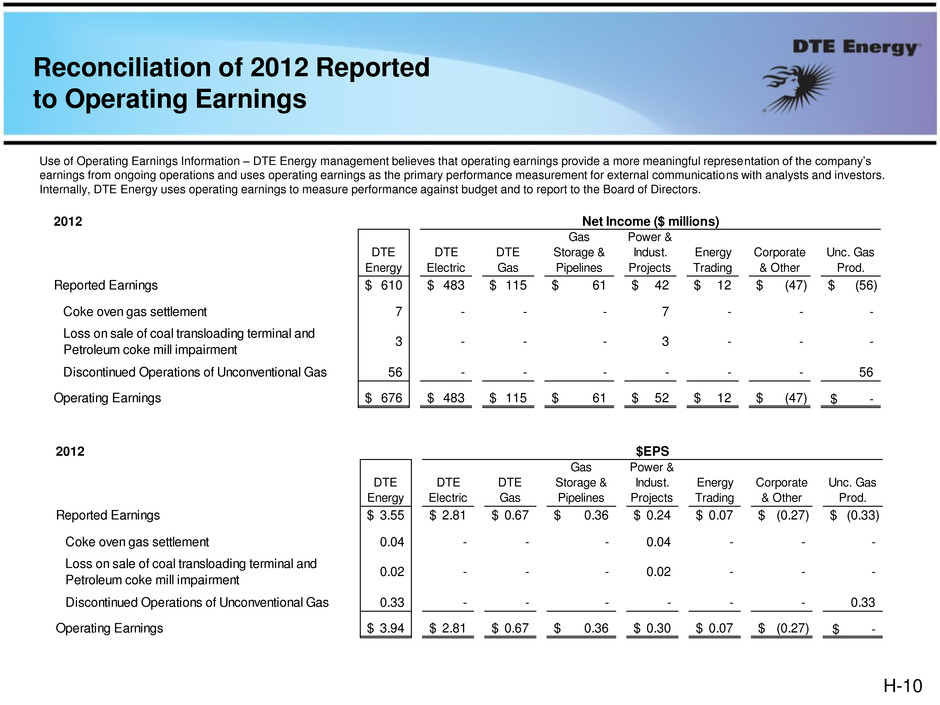

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Reconciliation of 2012 Reported to Operating Earnings 2012 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 610$ 483$ 115$ 61$ 42$ 12$ (47)$ (56)$ Coke oven gas settlement 7 - - - 7 - - - L s sal of coal transloading terminal and Petroleum coke mill impairment 3 - - - 3 - - - Discontinued Operations of Unconventional Gas 56 - - - - - - 56 Operating Earnings 676$ 483$ 115$ 61$ 52$ 12$ (47)$ -$ Net Income ($ millions) 2012 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 3. 5$ 2.81$ 0.67$ 0.36$ 0.24$ 0.07$ (0.27)$ (0.33)$ Coke oven gas settlement 0.04 - - - 0.04 - - Loss on sale of coal transloading terminal and Petroleum coke mill impairment 0.02 - - - 0.02 - - - Discontinued Operations of Unconventional Gas 0.33 - - - - - - 0.33 Operating Earnings 3.94$ 2.81$ 0.67$ 0.36$ 0.30$ 0.07$ (0.27)$ -$ $EPS H-10

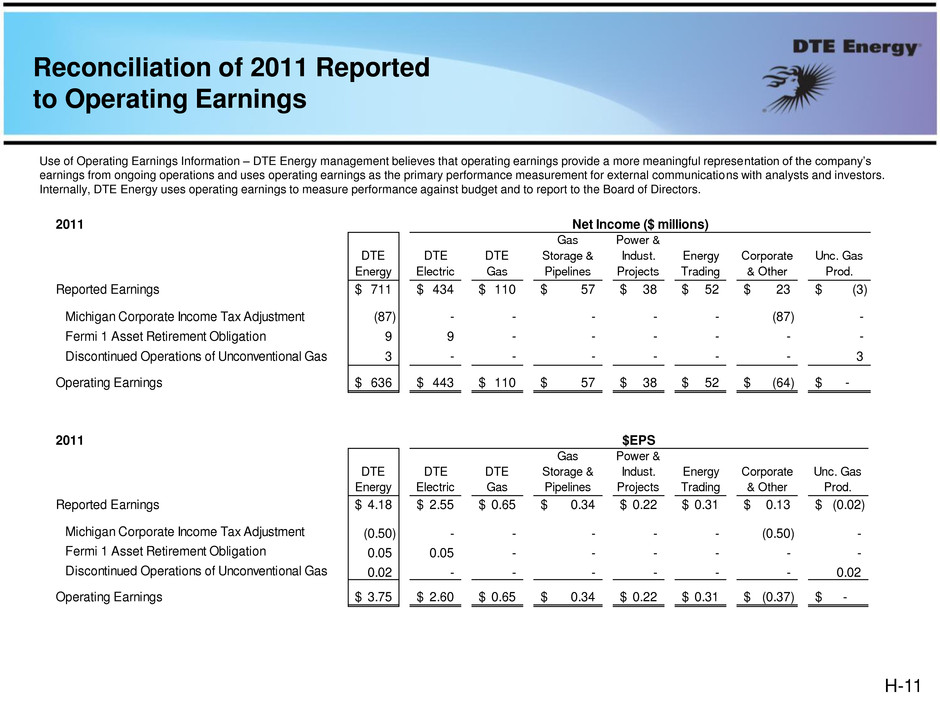

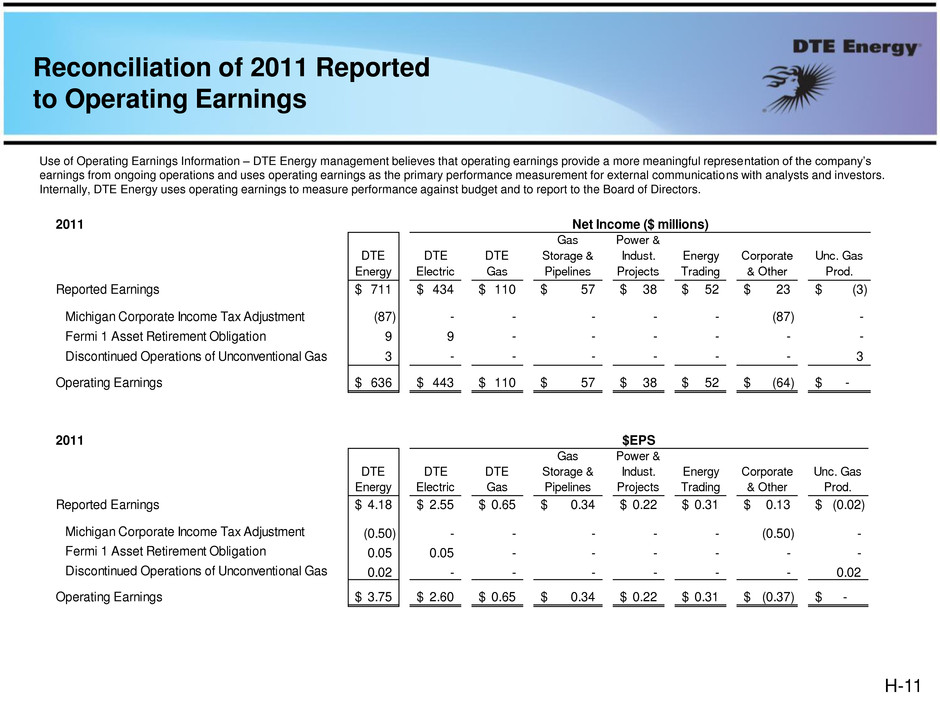

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Reconciliation of 2011 Reported to Operating Earnings 2011 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 711$ 434$ 110$ 57$ 38$ 52$ 23$ (3)$ Mic i a C rporate Income Tax Adjustment (87) - - - - - (87) - Fermi 1 Asset Retirement Obligation 9 9 - - - - - - Discontinued Operations of Unconventional Gas 3 - - - - - - 3 Operating Earnings 636$ 443$ 110$ 57$ 38$ 52$ (64)$ -$ Net Income ($ millions) 2011 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Repor ed Earnings 4.18 2.55 0.65 0.34 0.22 0.31 0.13 (0.02) Michigan Corporate Income Tax Adjustment (0.50) - - - - - (0.50) - Fermi 1 Asset Retirement Obligation 0.05 0.05 - - - - - - Discontinued Operations of Unconventional Gas 0.02 - - - - - - 0.02 Operating Earnings 3.75$ 2.60$ 0.65$ 0.34$ 0.22$ 0.31$ (0.37)$ -$ $EPS H-11

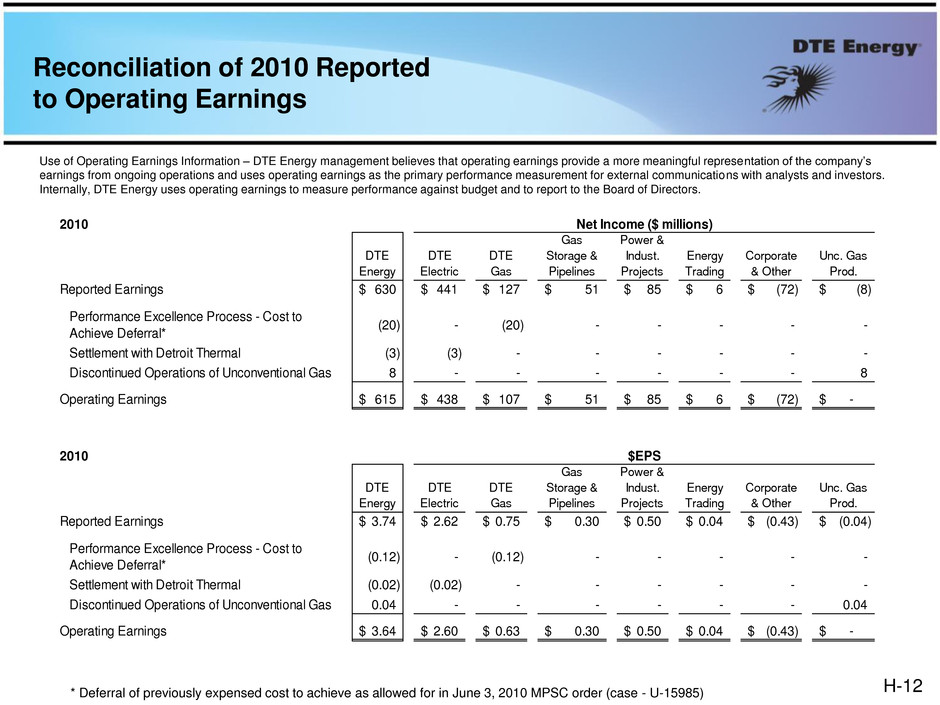

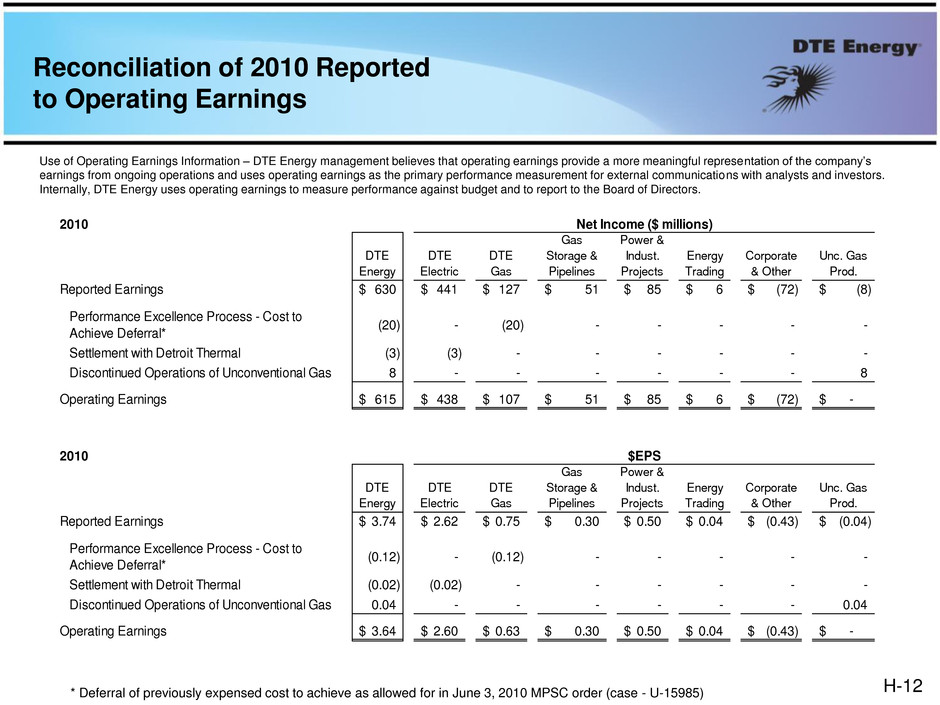

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Reconciliation of 2010 Reported to Operating Earnings * Deferral of previously expensed cost to achieve as allowed for in June 3, 2010 MPSC order (case - U-15985) 2010 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 630$ 441$ 127$ 51$ 85$ 6$ (72)$ (8)$ P rf ce Excellence Process - Cost to Achi v Deferral* (20) - (20) - - - - - Settlement with Detroit Thermal (3) (3) - - - - - - Discontinued Operations of Unconventional Gas 8 - - - - - - 8 Operating Earnings 615$ 438$ 107$ 51$ 85$ 6$ (72)$ -$ Net Income ($ millions) 2010 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 3.74$ 2.62$ 0.75$ 0.30$ 0.50$ 0.04$ (0.43)$ (0.04)$ P rformance Excellence Process - Cost to Achieve Deferral* (0.12) - (0.12) - - - - - Settlement with Detroit Thermal (0.02) (0.02) - - - - - - Discontinued Operations of Unconventional Gas 0.04 - - - - - - 0.04 Operating Earnings 3.64$ 2.60$ 0.63$ 0.30$ 0.50$ 0.04$ (0.43)$ -$ $EPS H-12

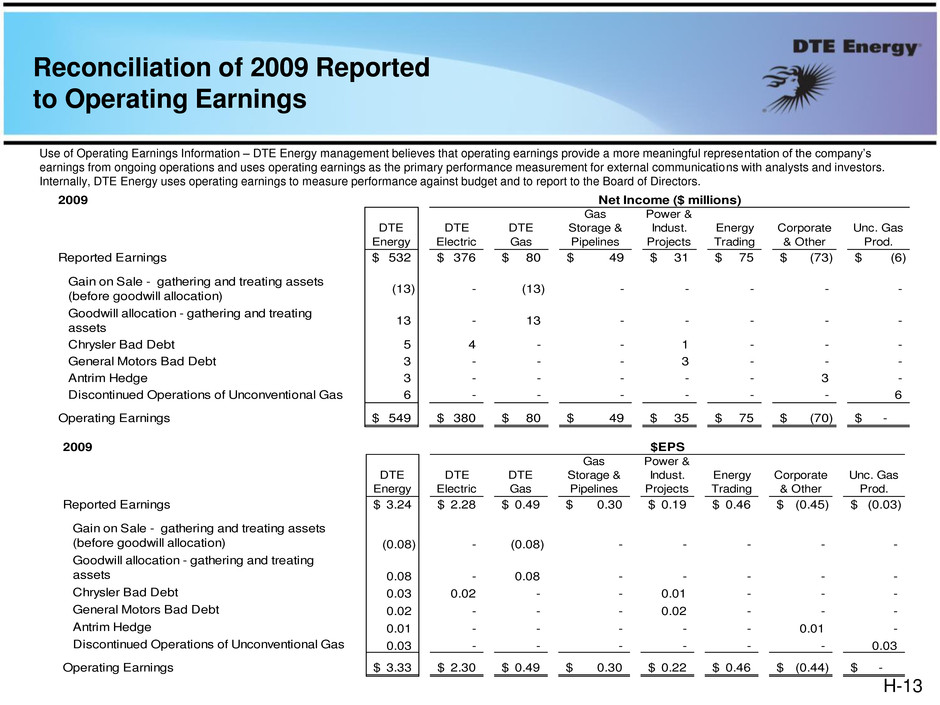

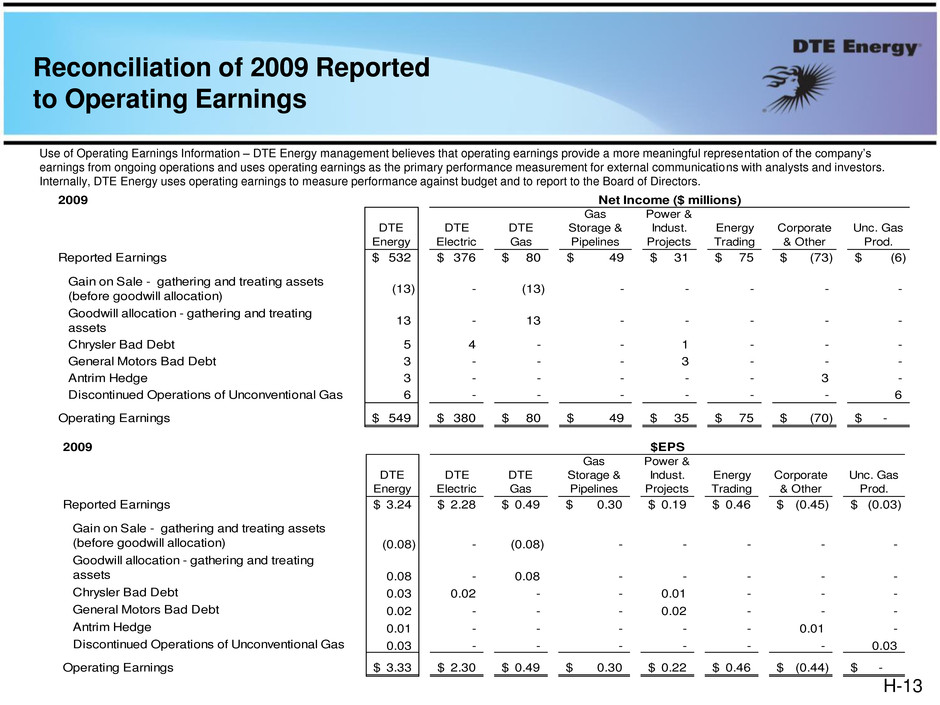

Reconciliation of 2009 Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2009 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 532$ 376$ 80$ 49$ 31$ 75$ (73)$ (6)$ Gain on Sale - gathering and treating assets (before goodwill allocation) (13) - (13) - - - - - Goodwill allocation - gathering and treating assets 13 - 13 - - - - - Chrysler Bad Debt 5 4 - - 1 - - - G l M tors Bad Debt 3 - - - 3 - - - Antrim Hedge 3 - - - - - 3 - Discontinued Operations of Unconventional Gas 6 - - - - - - 6 Operating Earnings 549$ 380$ 80$ 49$ 35$ 75$ (70)$ -$ Net Income ($ millions) 2009 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Reported Earnings 3.24$ 2.28$ 0.49$ 0.30$ 0.19$ 0.46$ (0.45)$ (0.03)$ Gain on Sale - ga hering and treating assets (b f r dwill allocation) (0.08) - (0.08) - - - - - Goodwill allocation - gathering and treating assets 0.08 - 0.08 - - - - - Chrysler B d Debt 0.03 0.02 - - 0.01 - - - General Motors Bad Debt 0.02 - - - 0.02 - - - Antrim Hedge 0.01 - - - - - 0.01 - Discontinued Operations of Unconventional Gas 0.03 - - - - - - 0.03 Operating Earnings 3.33$ 2.30$ 0.49$ 0.30$ 0.22$ 0.46$ (0.44)$ -$ $EPS H-13

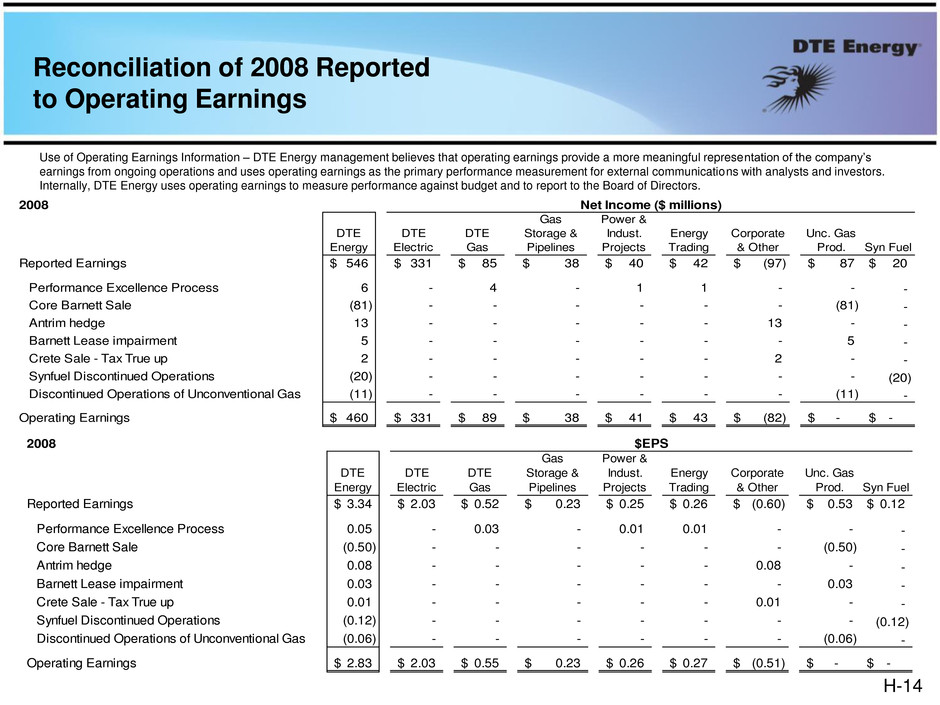

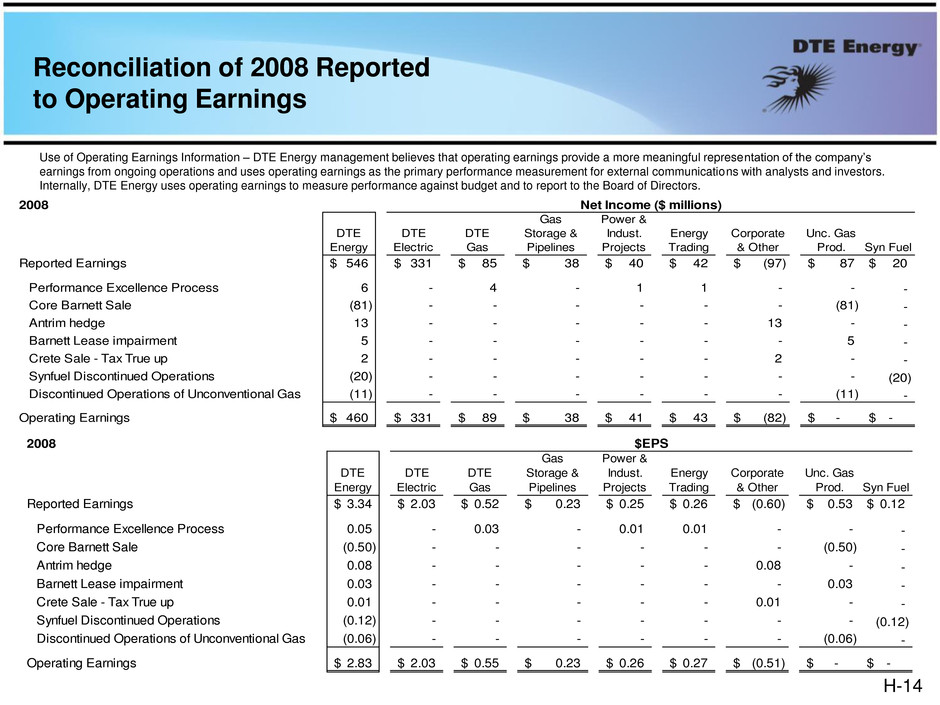

Reconciliation of 2008 Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2008 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Syn Fuel Reported Earnings 546$ 331$ 85$ 38$ 40$ 42$ (97)$ 87$ 20$ Performance Excellence Process 6 - 4 - 1 1 - - - Core Barnett Sale (81) - - - - - - (81) - Antrim hedge 13 - - - - - 13 - - Barnett Lease impairment 5 - - - - - - 5 - C t S l - Tax True up 2 - - - - - 2 - - Synfuel Discontinued Operations (20) - - - - - - - (20) Discontinued Operations of Unconventional Gas (11) - - - - - - (11) - Operating Earnings 460$ 331$ 89$ 38$ 41$ 43$ (82)$ -$ -$ Net Income ($ millions) 2008 DTE Energy DTE Electric DTE Gas Gas Storage & Pipelines Power & Indust. Projects Energy Trading Corporate & Other Unc. Gas Prod. Syn Fuel Reported Earnings 3.34$ 2.03$ 0.52$ 0.23$ 0.25$ 0.26$ (0.60)$ 0.53$ 0.12$ P rf ce E cellence Process 0.05 - 0.03 - 0.01 0.01 - - - Core Barnett Sale (0.50) - - - - - - (0.50) - Antrim hedge 0.08 - - - - - 0.08 - - Barnett Lease impairment 0.03 - - - - - - 0.03 - Crete Sale - Tax True up 0.01 - - - - - 0.01 - - Synfuel Discontinued Operations (0.12) - - - - - - - (0.12) Discontinued Operations of Unconventional Gas (0.06) - - - - - - (0.06) - Operating Earnings 2.83$ 2.03$ 0.55$ 0.23$ 0.26$ 0.27$ (0.51)$ -$ -$ $EPS H-14

Reconciliation of Other Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. There were no reported to operating earnings adjustments in 1Q 2013 or 1Q 2012. For comparative purposes, 2012 operating earnings excludes the Unconventional Gas Production segment that was classified as a discontinued operation on 12/31/2012. H-15

Reconciliation of 2003 – 2012 Non-Utility Cash Flows (billions) Cash from operating activities P&I and Shale Gas GSP & Other DTE Energy (consolidated) (1) $14.9 Less DTE Electric and DTE Gas (2) (13.1) Adjustments (3) (0.3) 1.5 Proceeds from sale of assets $2.2 $2.4 DTE Energy (consolidated) (1) 3.9 Less DTE Electric and DTE Gas (2) (0.2) Adjustments (4) (0.6) 3.1 Capital expenditures Non-Utility capital expenditures (5) (2.4) Adjustments (6) 0.4 (2.0) (0.8) (1.2) Net Cash Flow $2.6 $1.4 $1.2 (1) Source DTE Energy Company 10-k's and 8-k's for 2003 to 2012 (2) Source DTE Electric Company and DTE Gas Company 10-k's for 2003 to 2012 (3) To adjust for DTE Energy parent company interest, taxes and equity issuances not attributable to non-utility operations (4) To adjust for DTE Energy parent company asset sales not attributable to non-utility operations (5) Source: DTE Energy Company year-end earnings release presentations for 2003 to 2012 (6) To exclude capital invested in late 2012, which, therefore, generated only minimal cash flow in the current period H-16