Investor Event September 28, 2015 EXHIBIT 99.1

Welcome 2

Safety Moment 3

Safe Harbor Statement The information contained herein is as of the date of this presentation. Many factors may impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, FERC, MPSC, NRC and CFTC as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation, including legislative amendments and Retail Access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation and increased thefts of electricity and, for DTE Energy, natural gas; environmental issues, laws, regulations, and the increased costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power and natural gas; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; volatility in commodity markets; deviations in weather and related risks impacting the results of DTE Energy’s energy trading operations; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant construction projects; changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, terrorism or cyber attacks; employee relations and the impact of collective bargaining agreements; the risk of a major safety incident at an electric distribution or generation facility and, for DTE Energy, a gas storage, transmission or generation facility; the availability, cost, coverage and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; contract disputes; binding arbitration, litigation and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the “Forward-Looking Statements” sections in each of DTE Energy’s and DTE Electric’s 2014 Forms 10-K and 2015 Forms 10-Q (which sections are incorporated herein by reference), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. 4

Management Overview 5 Gerry Anderson Chairman & CEO David Meador Vice Chairman & CAO Steven Kurmas President & COO Jerry Norcia President & COO Electric/GSP Peter Oleksiak Senior VP & CFO Mark Stiers President & COO DTE Gas David Ruud President Power & Industrial David Johnson VP Customer Service & Marketing Anastasia Minor Executive Director Investor Relations David Slater President - Gas Storage & Pipelines

Mayor Mike Duggan 6

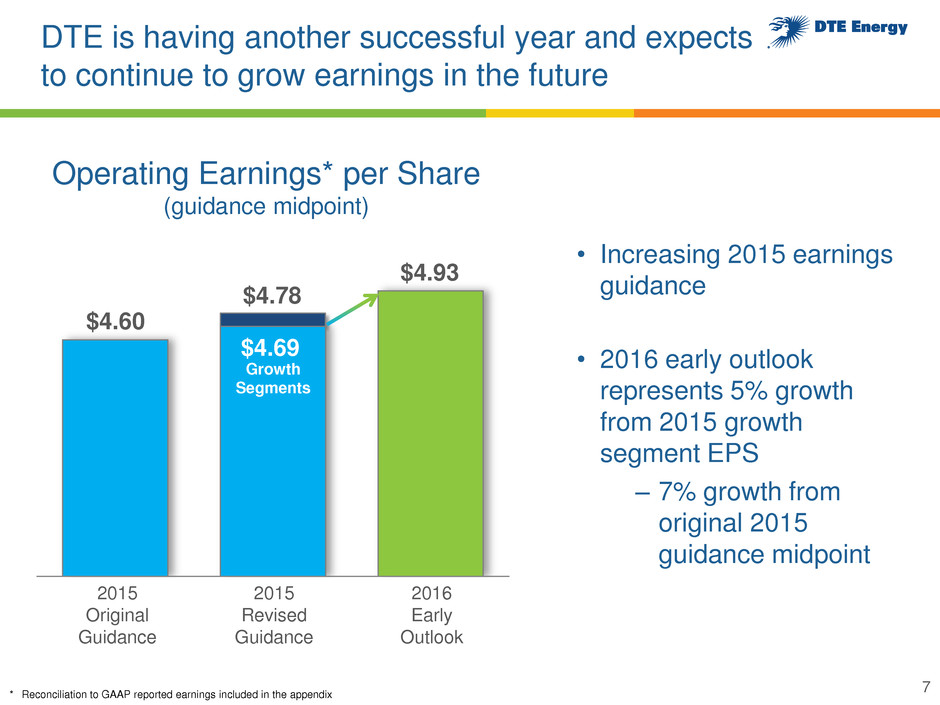

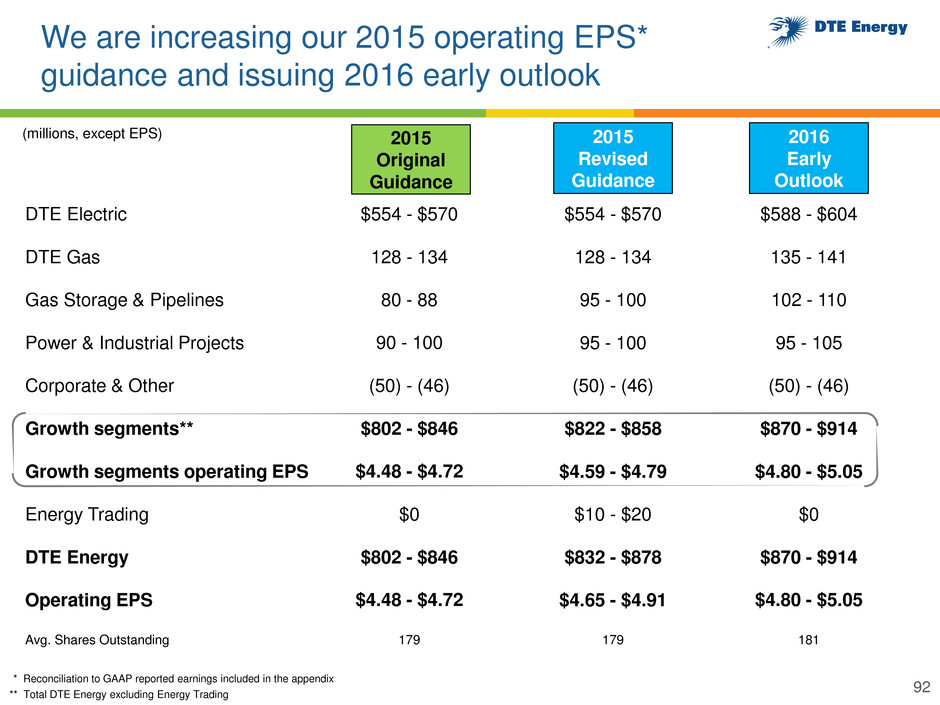

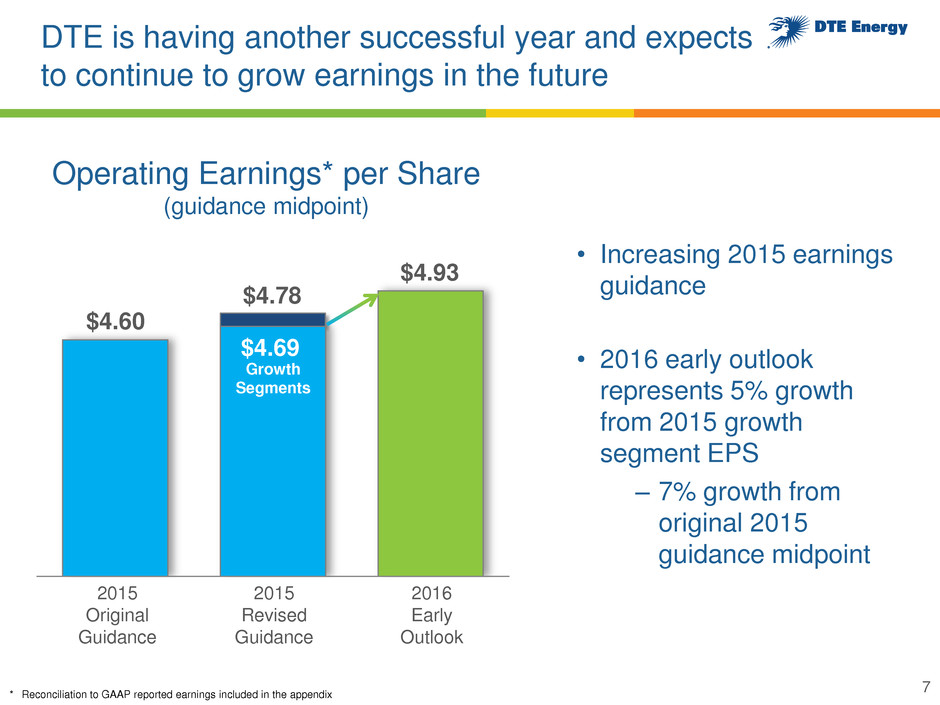

DTE is having another successful year and expects to continue to grow earnings in the future 2015 Original Guidance 2015 Revised Guidance 2016 Early Outlook $4.60 $4.78 $4.93 Operating Earnings* per Share (guidance midpoint) • Increasing 2015 earnings guidance • 2016 early outlook represents 5% growth from 2015 growth segment EPS * Reconciliation to GAAP reported earnings included in the appendix $4.69 Growth Segments 7 ‒ 7% growth from original 2015 guidance midpoint

We have delivered solid operating EPS* growth and expect to continue to grow at 5% to 6% * Reconciliation to GAAP reported earnings included in the appendix (dollars per share) 8 2015 Operating EPS Guidance Midpoint Growth segments $4.69 Total DTE Energy $4.78 2016 Operating EPS Early Outlook Midpoint $4.93 $3.33 $4.78 $4.93 $4.69 Operating Earnings per Share 2009 2015E 2016E 2020E

DTE increased its dividend again in 2015 2009 2010 2011 2012 2013 2014 2015 $2.12 $2.92 Annualized Dividend ($ per share) $2.76 • Increased dividend 5.8% in 2015 • Expect to continue to grow dividends as earnings grow 9

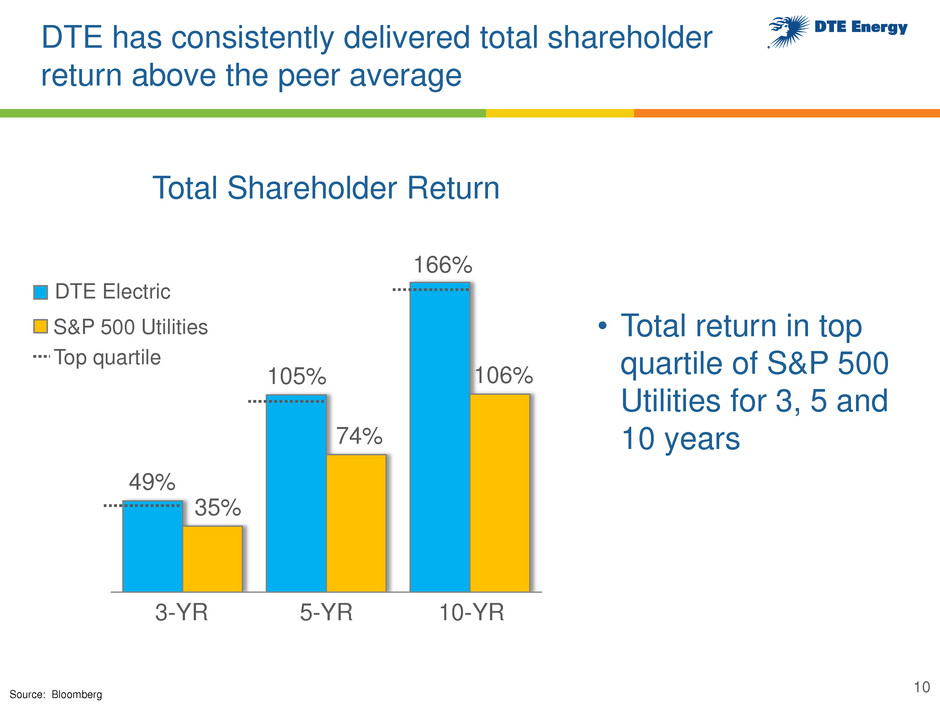

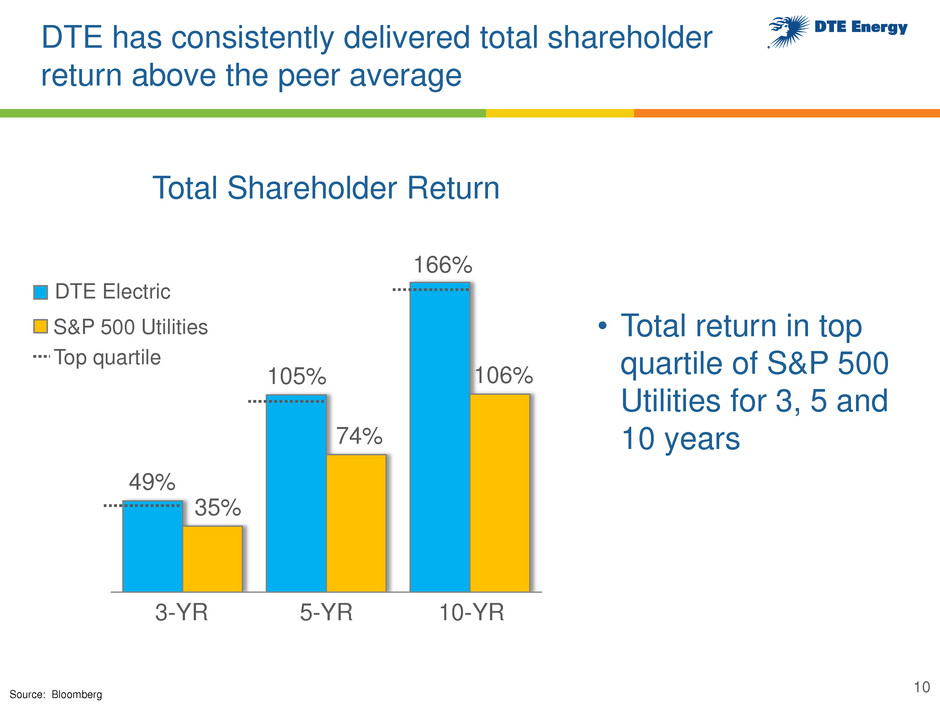

DTE has consistently delivered total shareholder return above the peer average Source: Bloomberg 10 Total Shareholder Return 49% • Total return in top quartile of S&P 500 Utilities for 3, 5 and 10 years 3-YR 105% 166% 10-YR 5-YR S&P 500 Utilities DTE Electric 35% 74% 106% Top quartile

Our performance over the past decade had a number of drivers 11 • Eight consecutive years of operating EPS growth... ...through the heart of the financial crisis • Large growth investment in our utilities... ...which averaged $1.4 billion annually over the last 5 years • The persistence of a healthy regulatory construct... ...which we know is a “two way street” • Operating cost reductions that led the industry... ...combined with J.D. Power scores at or near the top • The emergence of GSP as a major growth business... ...and $2 billion of non-utility cash flows across the decade

Our future success is tied to our Aspiration and a force for growth and prosperity in the communities where we live and serve To be the best-operated energy company in North America 12

We have implemented a Best Operated Scorecard to make this Aspiration real 13

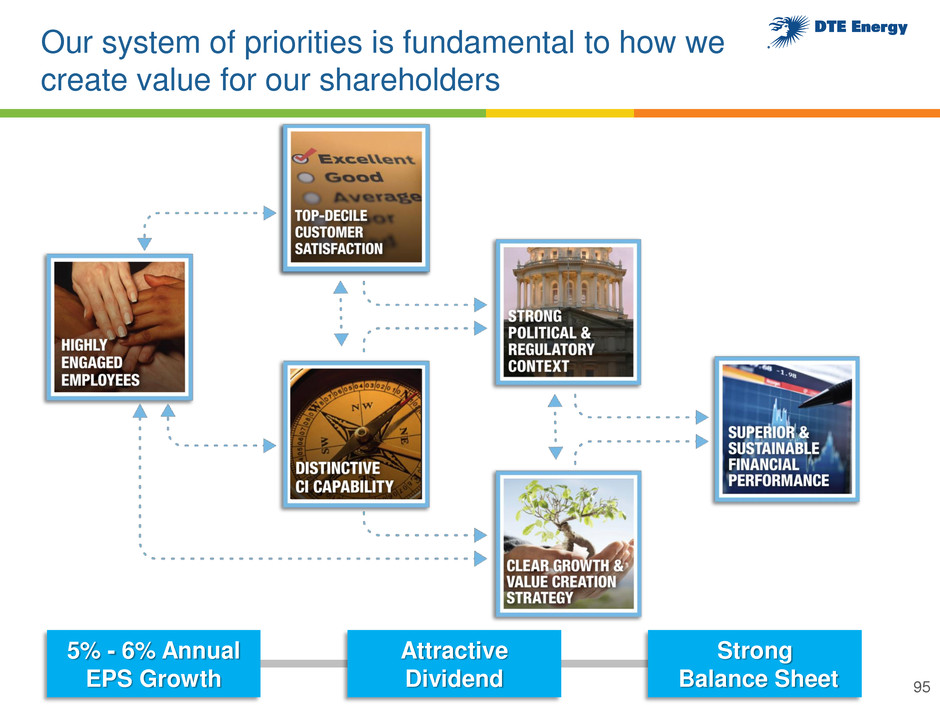

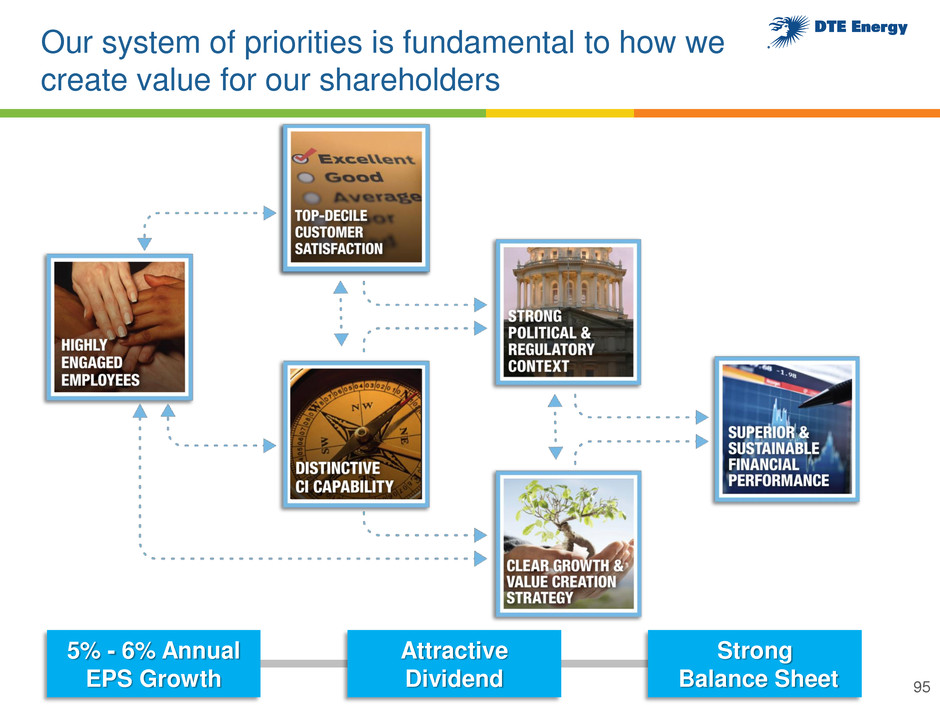

We achieve our Aspiration by continued focus on our system of priorities 14

Our goal today is to explain how commitment to our management model will provide consistent, superior results for our owners 15 5%-6% Operating EPS Growth Attractive Dividend

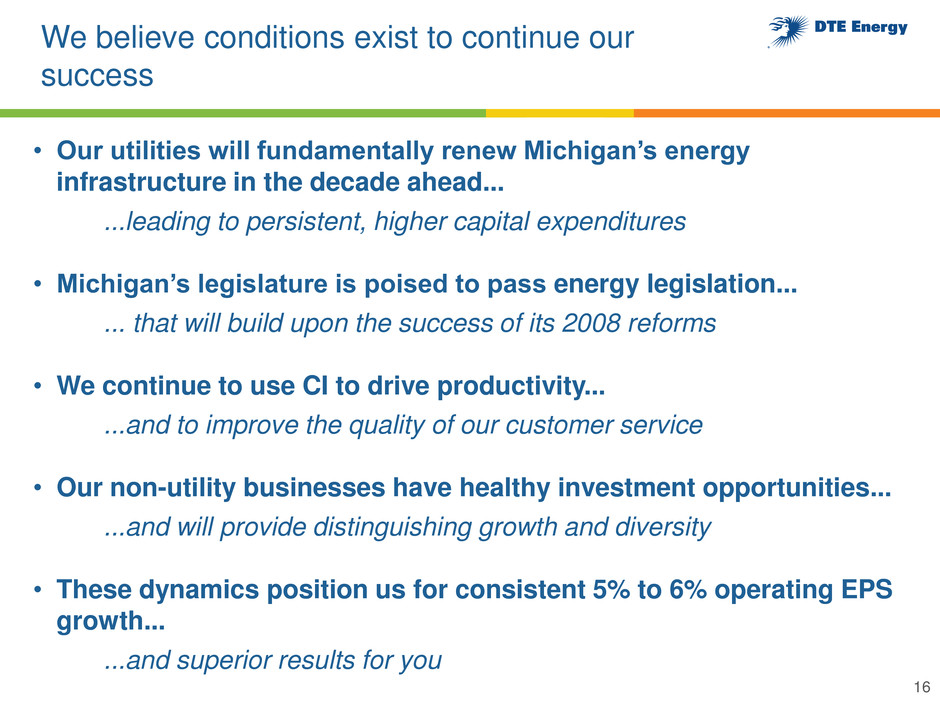

We believe conditions exist to continue our success 16 • Our utilities will fundamentally renew Michigan’s energy infrastructure in the decade ahead... ...leading to persistent, higher capital expenditures • Michigan’s legislature is poised to pass energy legislation... ... that will build upon the success of its 2008 reforms • We continue to use CI to drive productivity... ...and to improve the quality of our customer service • Our non-utility businesses have healthy investment opportunities... ...and will provide distinguishing growth and diversity • These dynamics position us for consistent 5% to 6% operating EPS growth... ...and superior results for you

Highly Engaged Employees Option Highly Engaged Employees

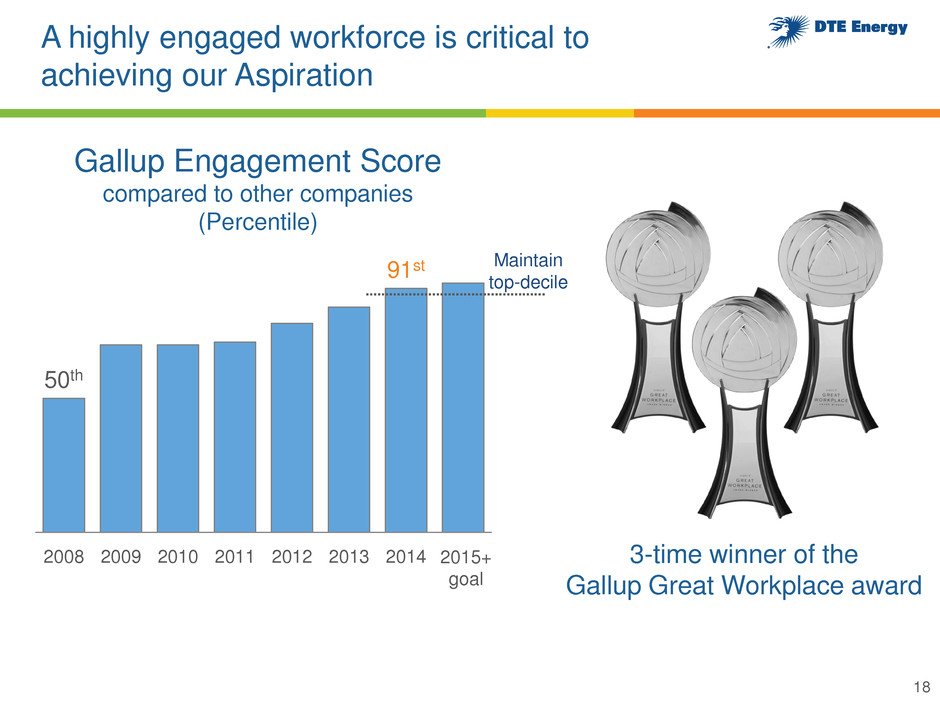

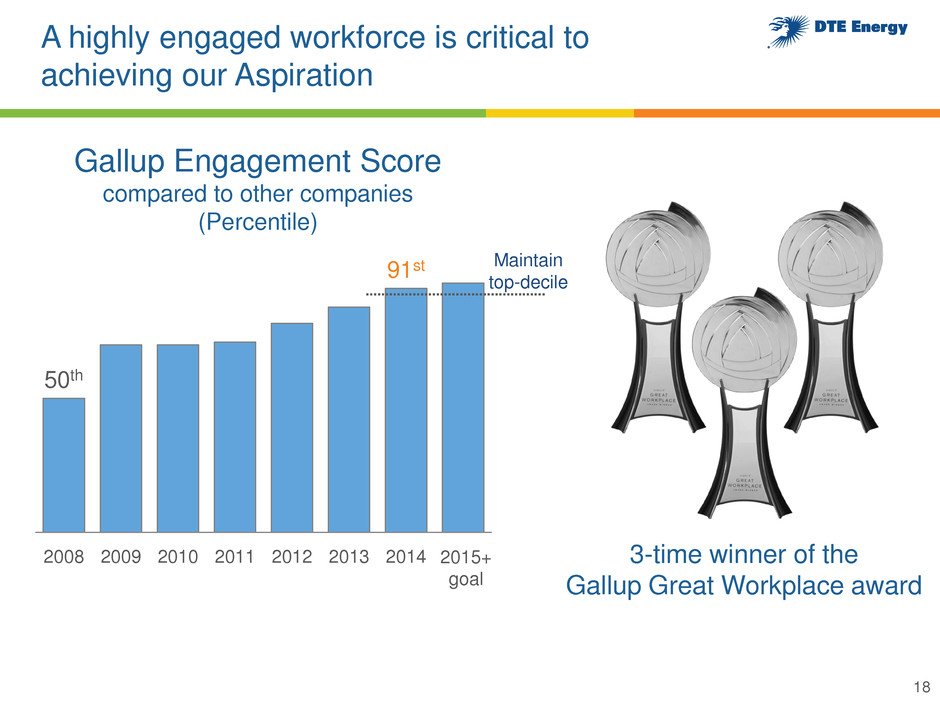

A highly engaged workforce is critical to achieving our Aspiration 3-time winner of the Gallup Great Workplace award Gallup Engagement Score compared to other companies (Percentile) 50th 91st 2008 2009 2010 2011 2012 2013 2014 Maintain top-decile 2015+ goal 18

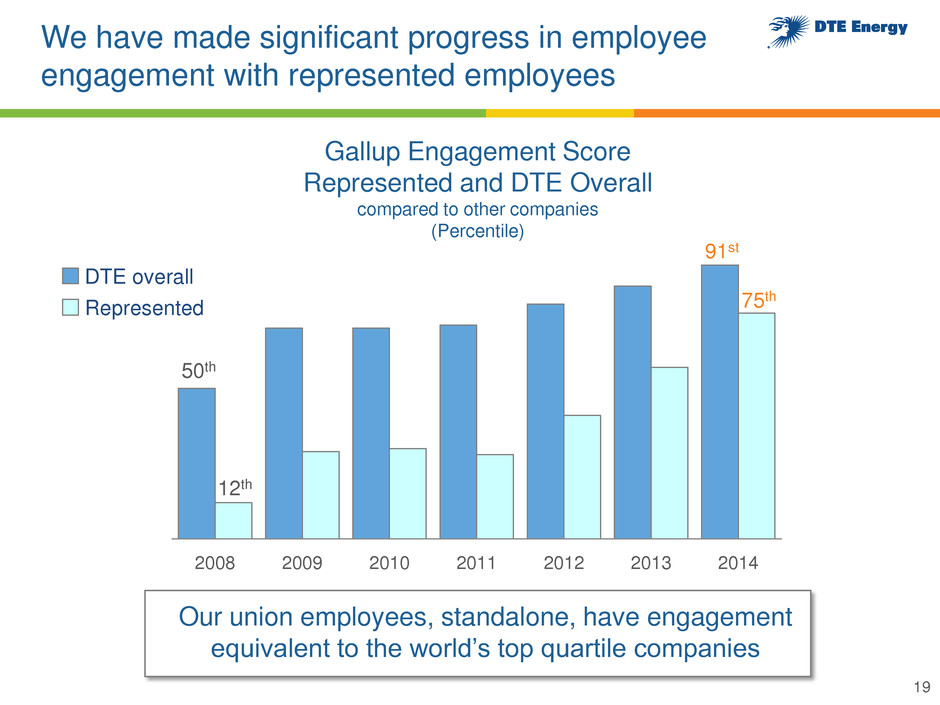

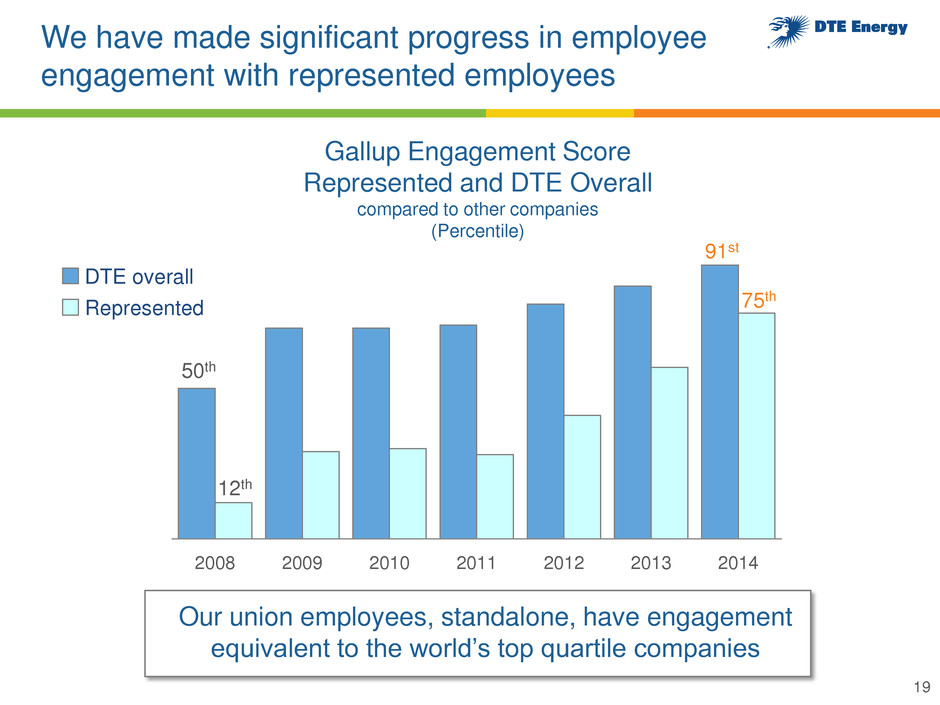

We have made significant progress in employee engagement with represented employees Gallup Engagement Score Represented and DTE Overall compared to other companies (Percentile) 2008 2009 2010 2011 2012 2013 2014 Our union employees, standalone, have engagement equivalent to the world’s top quartile companies 50th 12th 75th 91st DTE overall Represented 19

We have been recognized for our employee development program DTE received Gallup’s Development By Design Award DTE is taking an integrated approach to learning and development Our path to superior performance 20

Distinctive CI Capability Option Distinctive CI Capability

DTE’s continuous improvement capability has enabled us to lead the industry in cost management * Source: SNL Financial, FERC Form 1; major US Electric Utilities with O&M > $800 million; excluding fuel and purchased power ** Source: SNL Financial, FERC Form 2; gas distribution companies with > 300,000 customers; excluding production expense 2008 to 2014 Change in O&M Costs 83% DTE -3% Avg. 28% 80% DTE <1% Avg. 22% Electric Industry Peers* Gas Industry Peers** Successfully offset over $300 million of inflation from 2008 to 2014 22

To continue uncovering improvement opportunities we engage all 10,000 employees to see and solve problems 10,000 employees 1,060 huddles Every day INVOLVED IN Engaged in SOLVING PROBLEMS 23

Our CI problem solving allows us to get to root causes, prevent recurrence and achieve results CI video 24

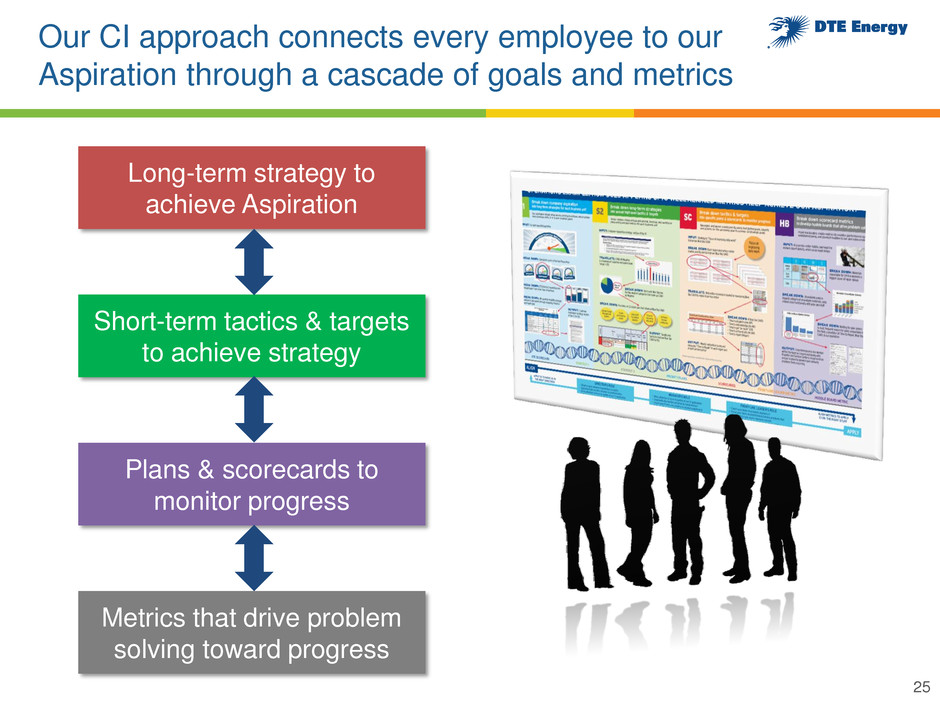

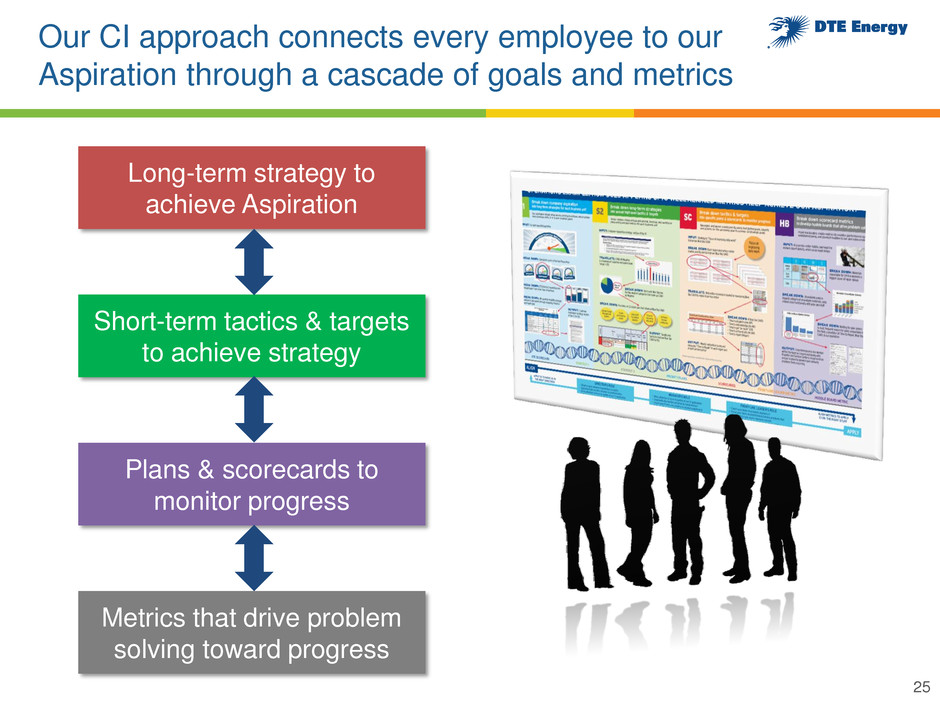

Our CI approach connects every employee to our Aspiration through a cascade of goals and metrics Long-term strategy to achieve Aspiration Short-term tactics & targets to achieve strategy Plans & scorecards to monitor progress Metrics that drive problem solving toward progress 25

Our CI program continues to be benchmarked by industry peers and outside organizations 26

Top-decile Customer Satisfaction PHOTO(S) Option Top-decile Customer Satisfaction

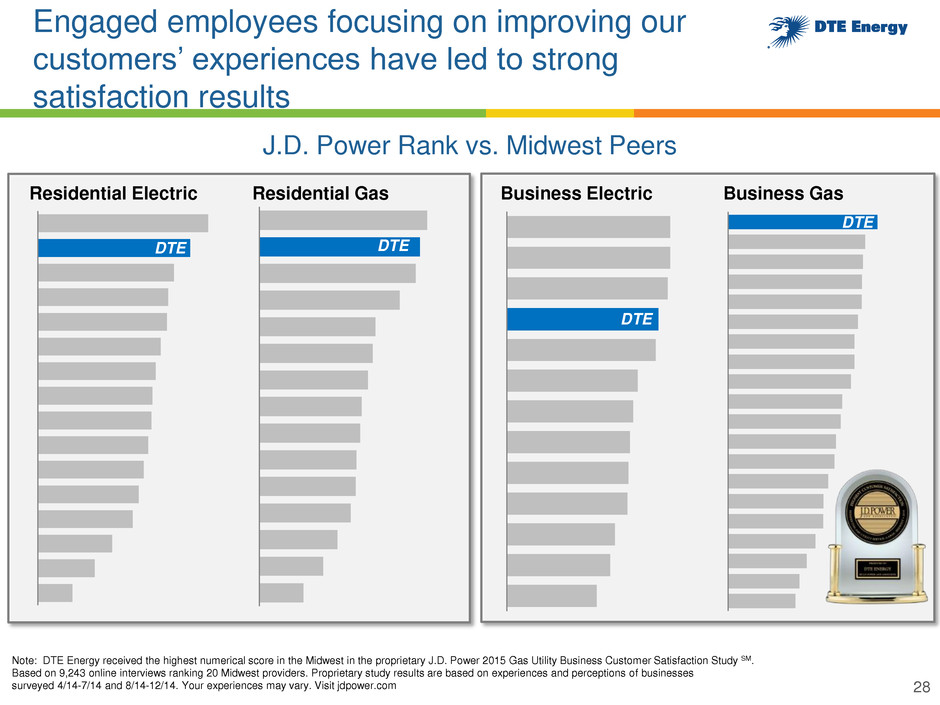

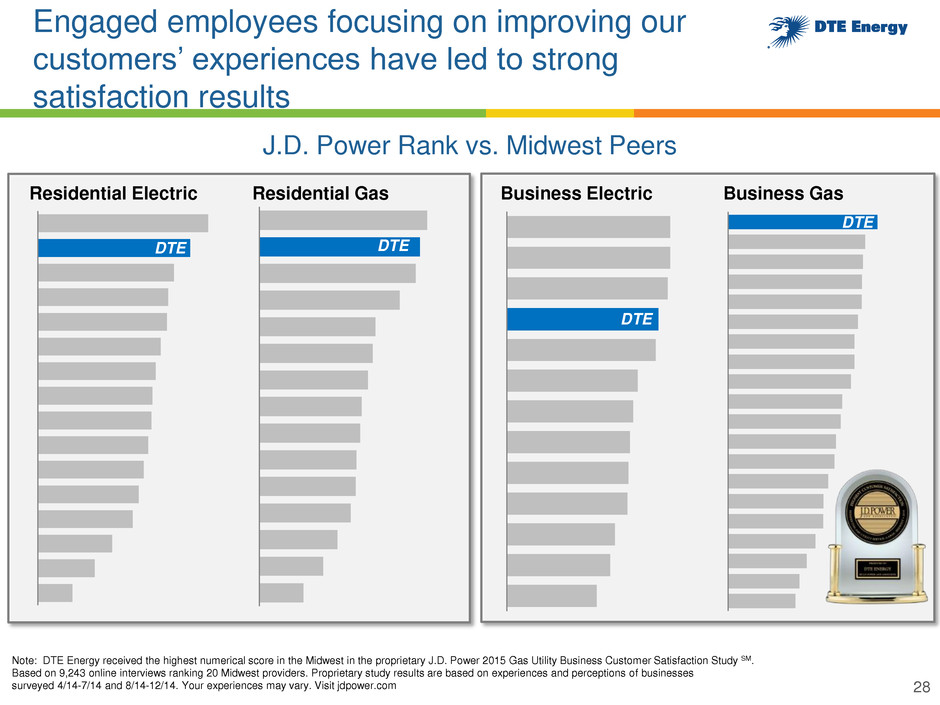

Engaged employees focusing on improving our customers’ experiences have led to strong satisfaction results J.D. Power Rank vs. Midwest Peers Note: DTE Energy received the highest numerical score in the Midwest in the proprietary J.D. Power 2015 Gas Utility Business Customer Satisfaction Study SM. Based on 9,243 online interviews ranking 20 Midwest providers. Proprietary study results are based on experiences and perceptions of businesses surveyed 4/14-7/14 and 8/14-12/14. Your experiences may vary. Visit jdpower.com Residential Electric Residential Gas DTE Business Electric Business Gas 28 DTE DTE DTE

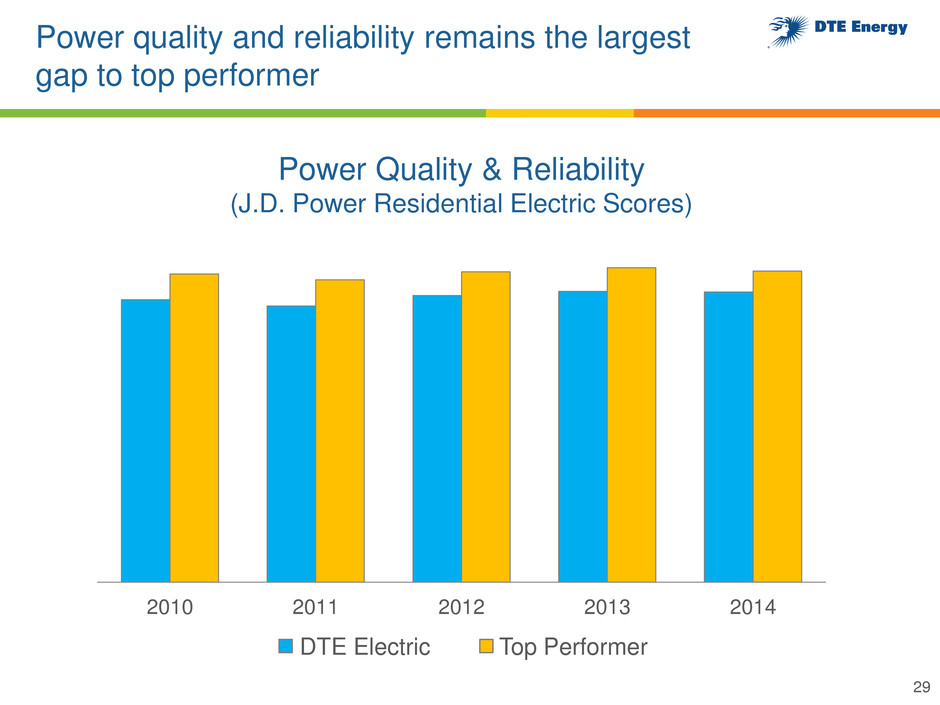

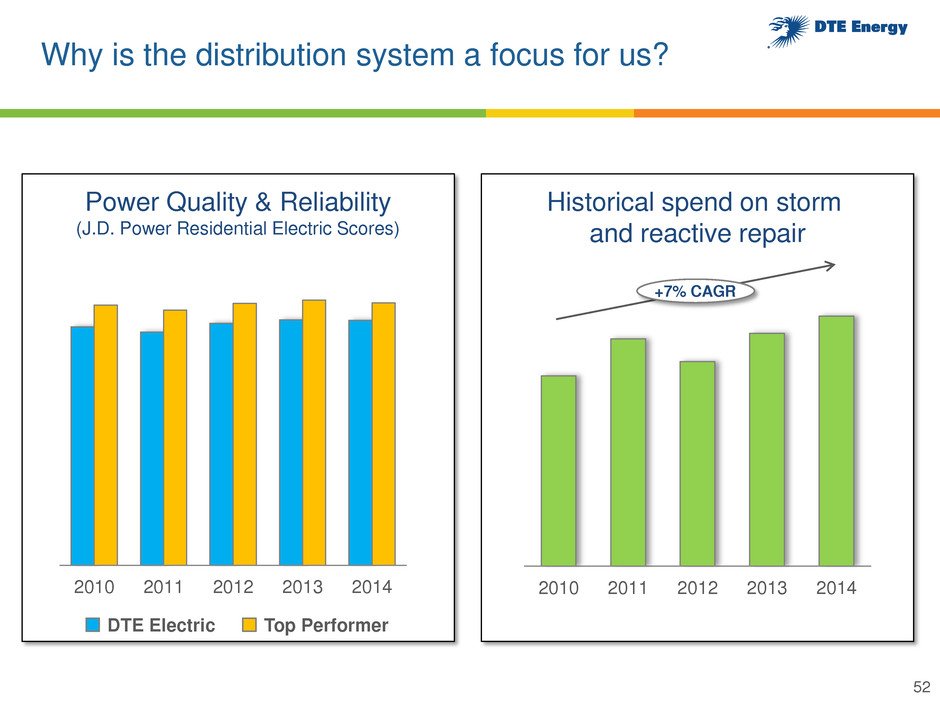

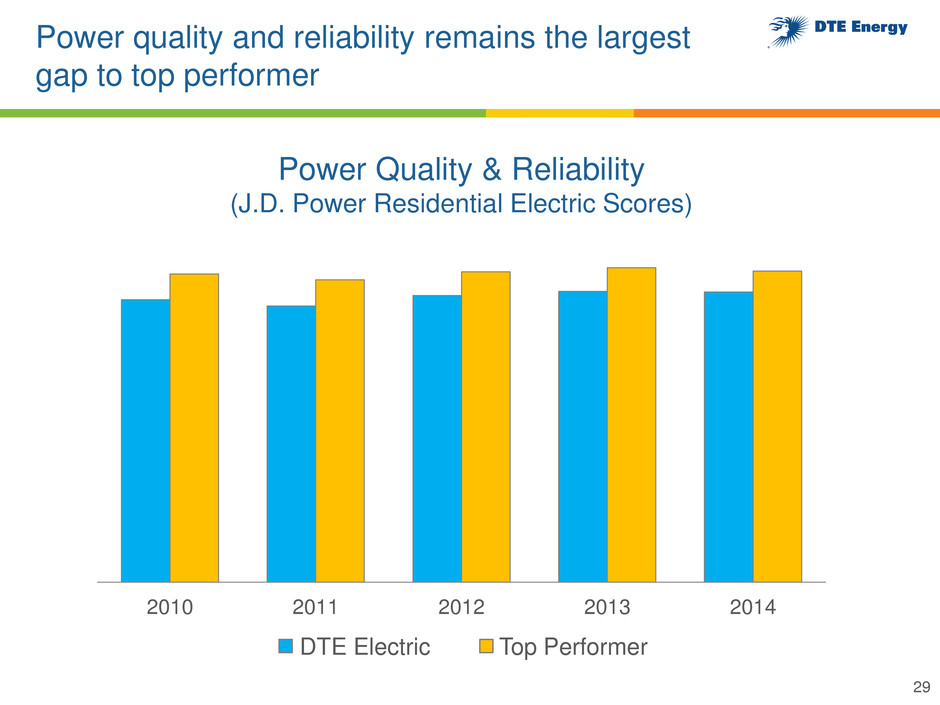

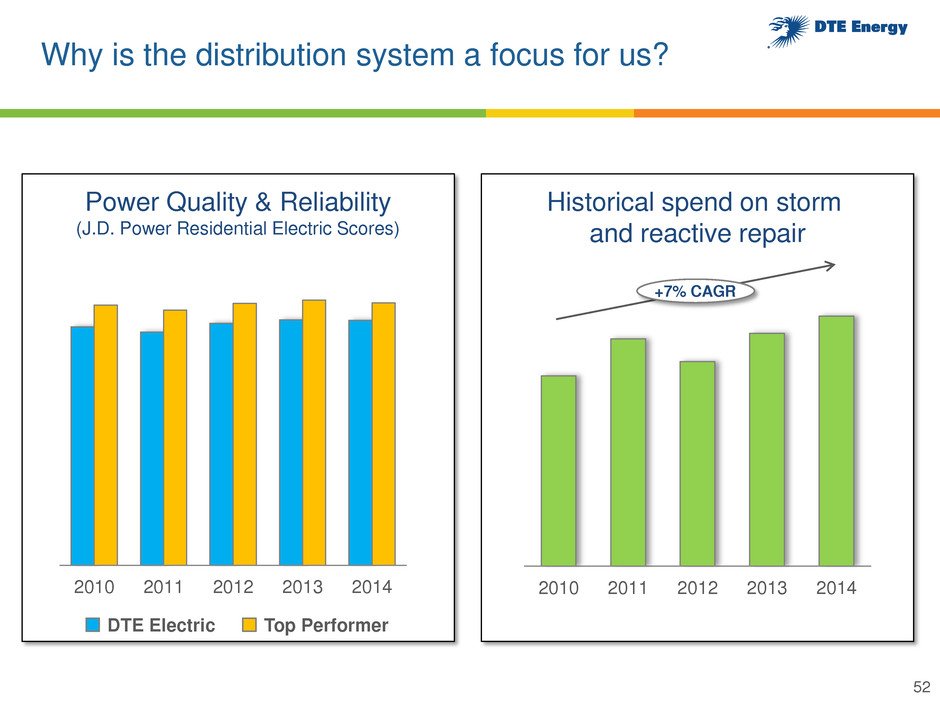

Power quality and reliability remains the largest gap to top performer 29 2010 2011 2012 2013 2014 Power Quality & Reliability (J.D. Power Residential Electric Scores) Top Performer DTE Electric

We have seen significant improvement in reducing defects and complaints 30 10.4% 8.6% 2011 2012 2013 2014 Customer Interaction Defect Rate 3,083 2,051 2011 2012 2013 2014 Public Service Commission Customer Complaints 17% reduction 33% reduction

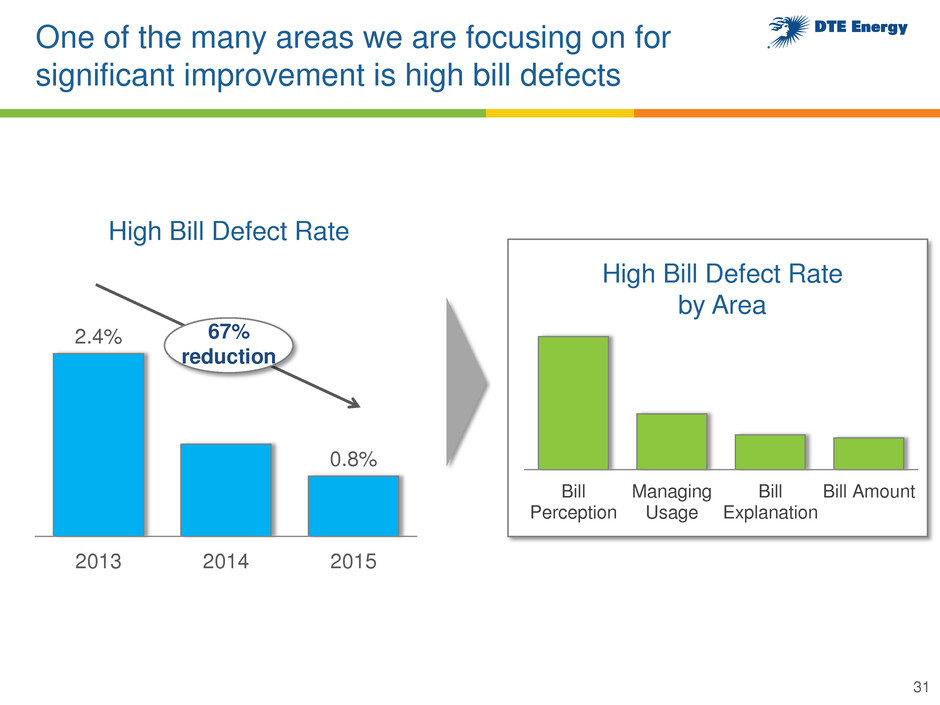

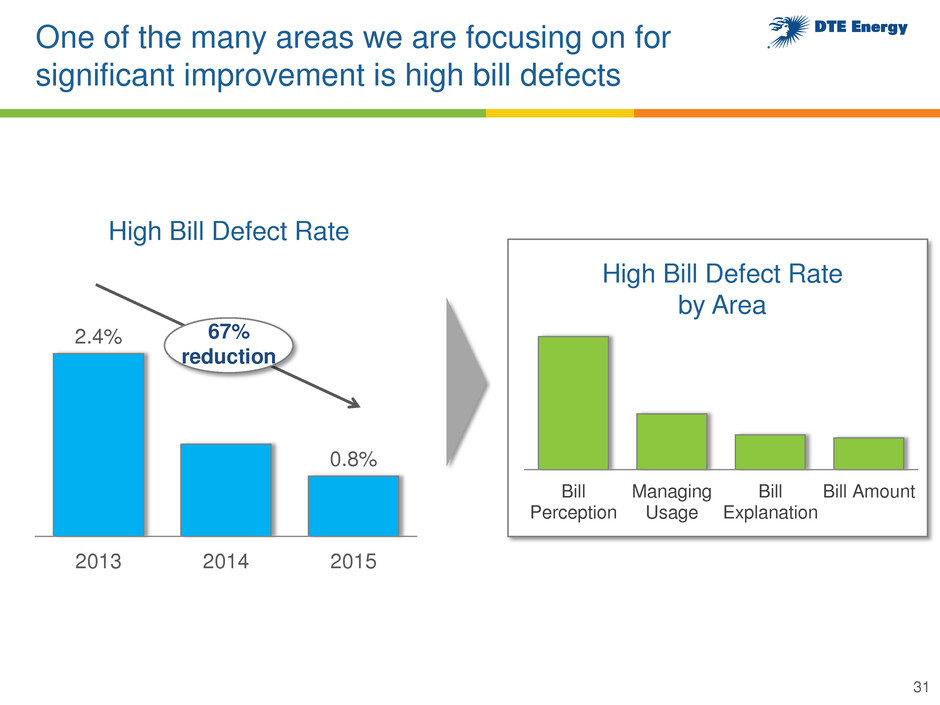

One of the many areas we are focusing on for significant improvement is high bill defects 31 2.4% 0.8% 2013 2014 2015 High Bill Defect Rate Bill Perception Managing Usage Bill Explanation Bill Amount High Bill Defect Rate by Area 67% reduction

We are creating highly satisfying experiences by offering customers new ways to interact with DTE Energy DTE Mobile App DTE Insight App Payment Kiosks Tracks real time usage – first to provide this app Promotes energy savings tools Serves urban customers in stores Seeking partnerships to expand the kiosk network Reports outages Makes payments Mobile App ranked #3 by J.D. Power amongst utilities* * 2015 Utility Website Evaluation Study 32

Option Strong Political and Regulatory Context

The EPA’s Clean Power Plan has set forth significant carbon reduction goals which will transform the electric industry The most transformational policy in the history of the electric industry Will cut CO2 emissions by 32% by 2030, compared to 2005 Initial compliance plans to be submitted by September 2016; final plans by September 2018 Initial compliance to begin 2022 with full compliance in 2030 34

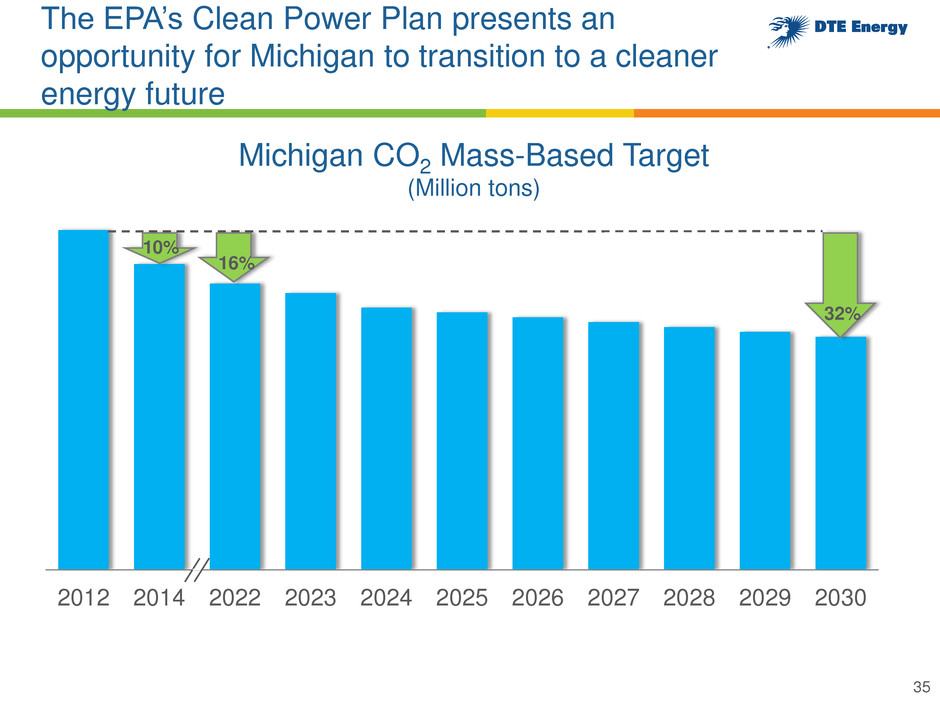

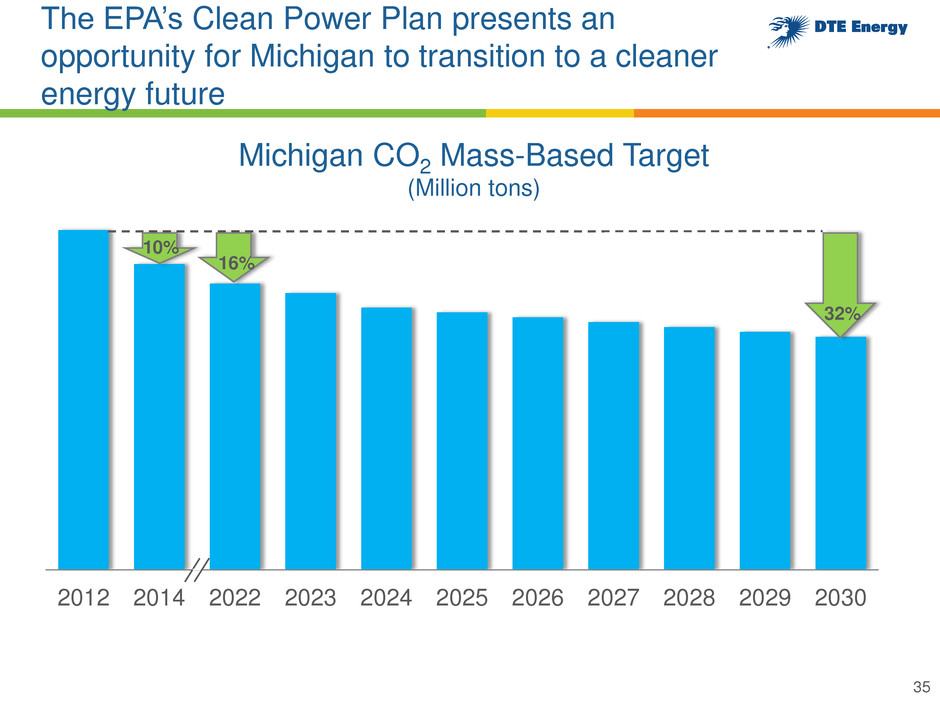

The EPA’s Clean Power Plan presents an opportunity for Michigan to transition to a cleaner energy future 2012 2014 2022 2023 2024 2025 2026 2027 2028 2029 2030 Michigan CO2 Mass-Based Target (Million tons) 16% 32% 10% 35

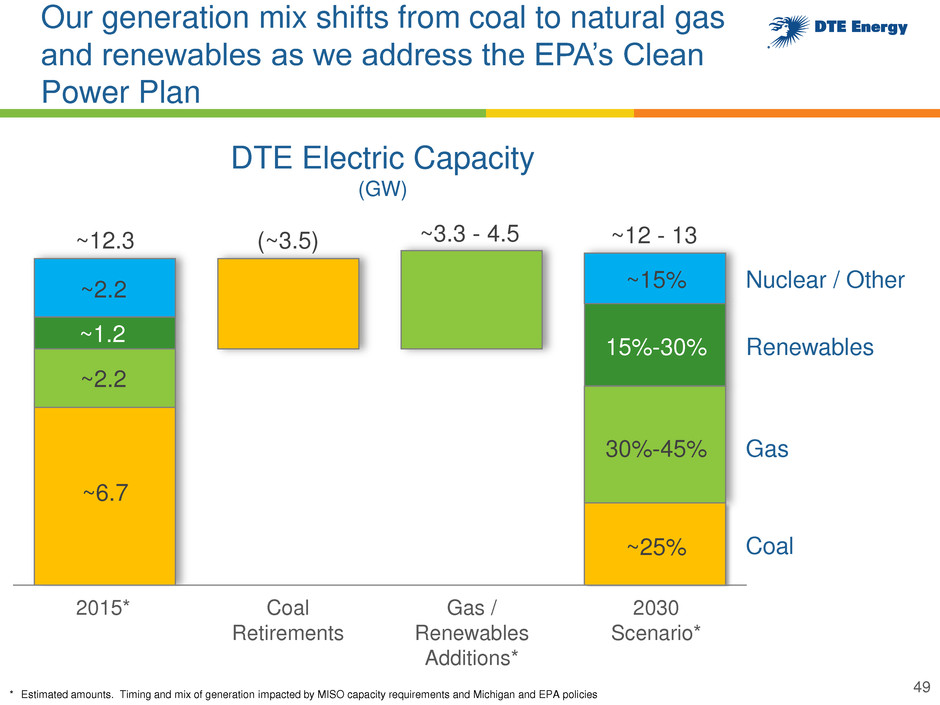

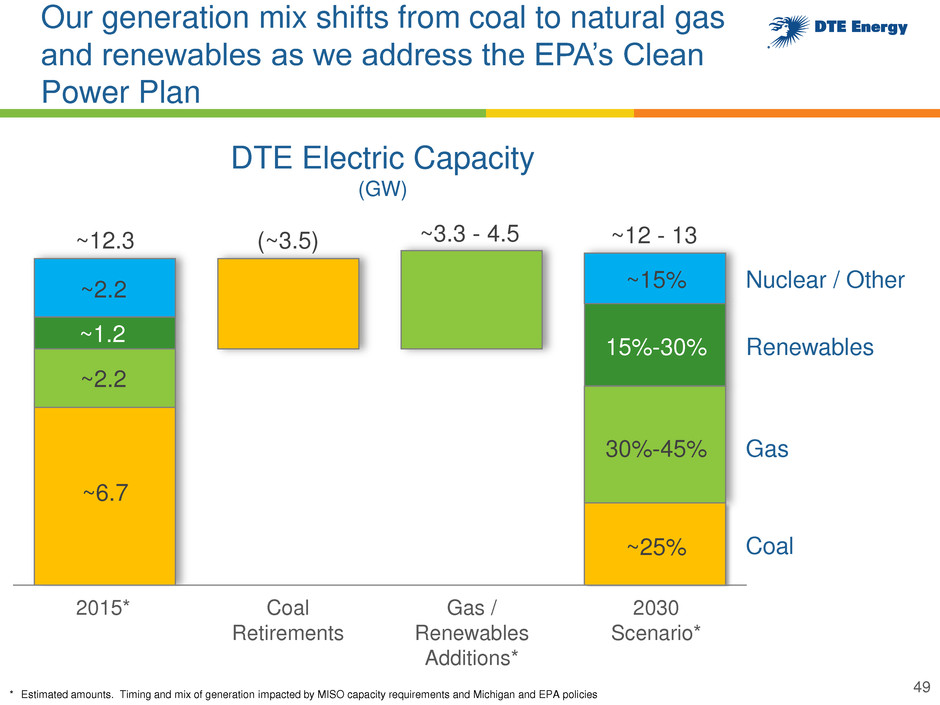

DTE’s transformation will meet both EPA and Michigan’s planning requirements 2012 2030 Scenario* Nuclear / Other Gas Renewables Coal ~60% ~15% ~5% ~20% ~25% 30% - 45% 15% - 30% ~15% DTE Electric Capacity Mix * Estimated amounts. Timing and mix of generation impacted by MISO capacity requirements and Michigan and EPA policies 36

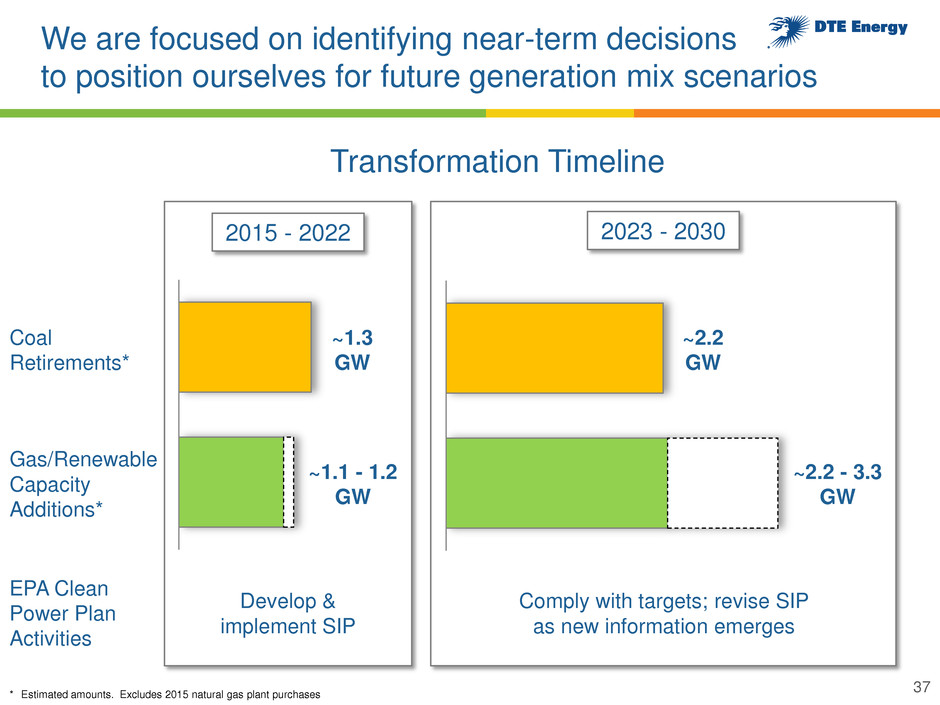

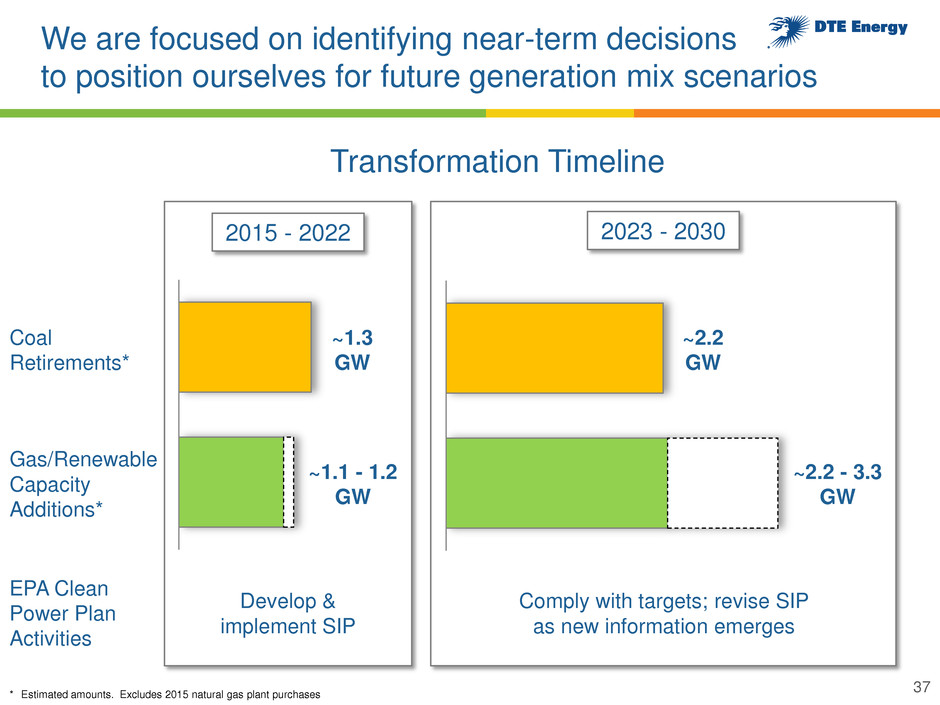

We are focused on identifying near-term decisions to position ourselves for future generation mix scenarios ~1.3 GW 2015 - 2022 Transformation Timeline Gas/Renewable Capacity Additions* Coal Retirements* ~1.1 - 1.2 GW ~2.2 GW ~2.2 - 3.3 GW 2023 - 2030 Develop & implement SIP EPA Clean Power Plan Activities Comply with targets; revise SIP as new information emerges * Estimated amounts. Excludes 2015 natural gas plant purchases 37

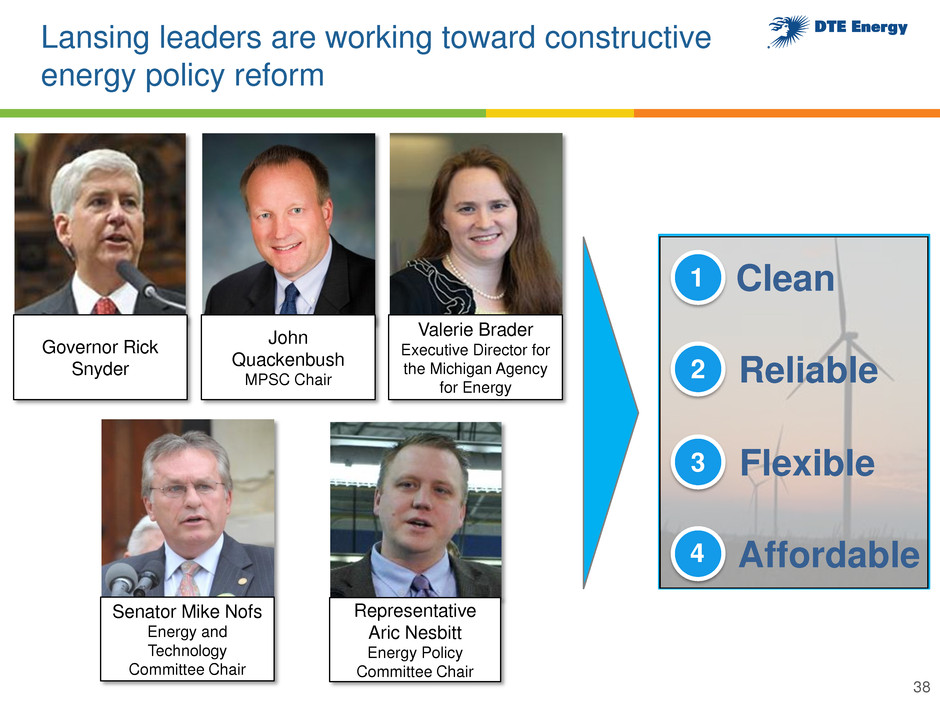

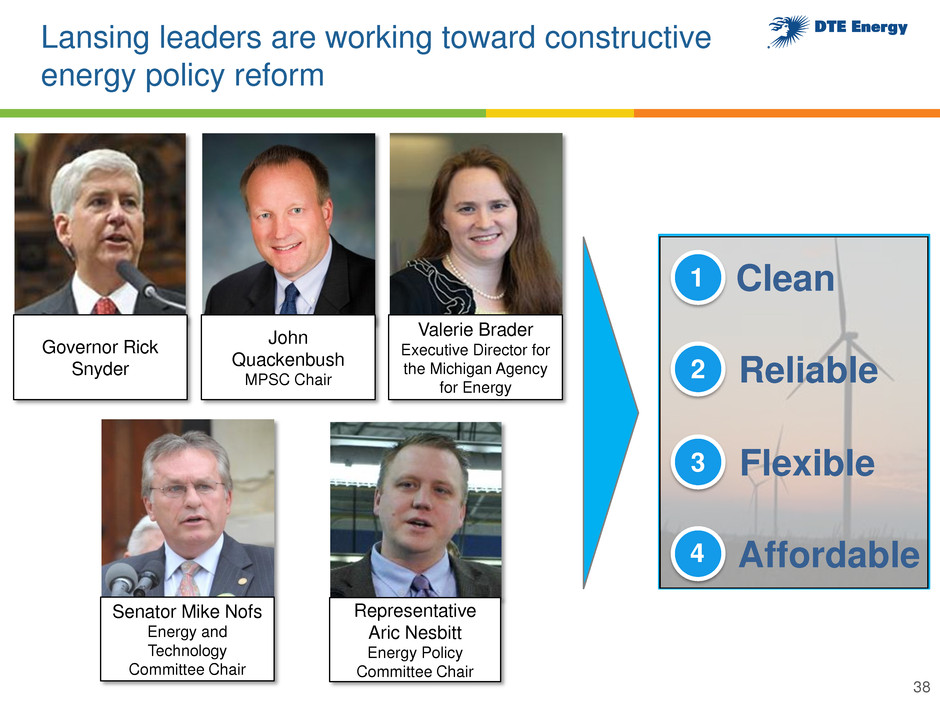

Lansing leaders are working toward constructive energy policy reform 38 Senator Mike Nofs Energy and Technology Committee Chair Valerie Brader Executive Director for the Michigan Agency for Energy Representative Aric Nesbitt Energy Policy Committee Chair Governor Rick Snyder Clean 1 2 Reliable 4 Affordable 3 Flexible John Quackenbush MPSC Chair

Michigan plans to control its energy future 39 • Michigan will develop its own state carbon implementation plan to ensure it retains control of its energy future • The plan will involve multi-agency collaboration ‒ Michigan Agency for Energy ‒ Michigan Public Service Commission ‒ Department of Environmental Quality ‒ Michigan Economic Development Corporation • Michigan’s initial plan will be submitted by September 6, 2016 “The best way to protect Michigan is to develop a state plan that reflects Michigan’s priorities of adaptability, affordability, reliability and protection of the environment.” – Governor Rick Snyder

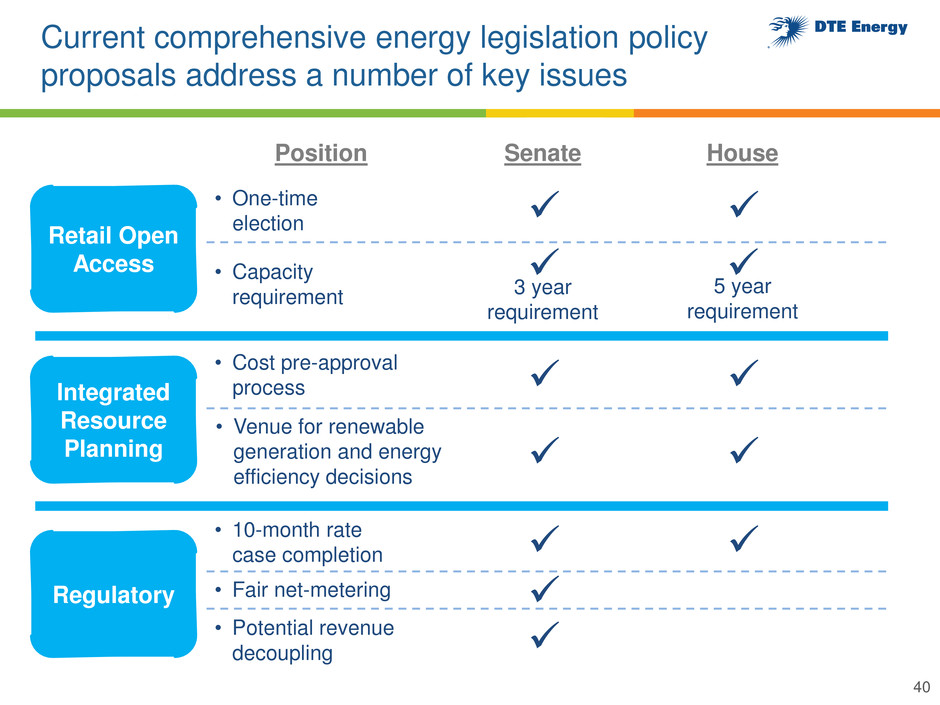

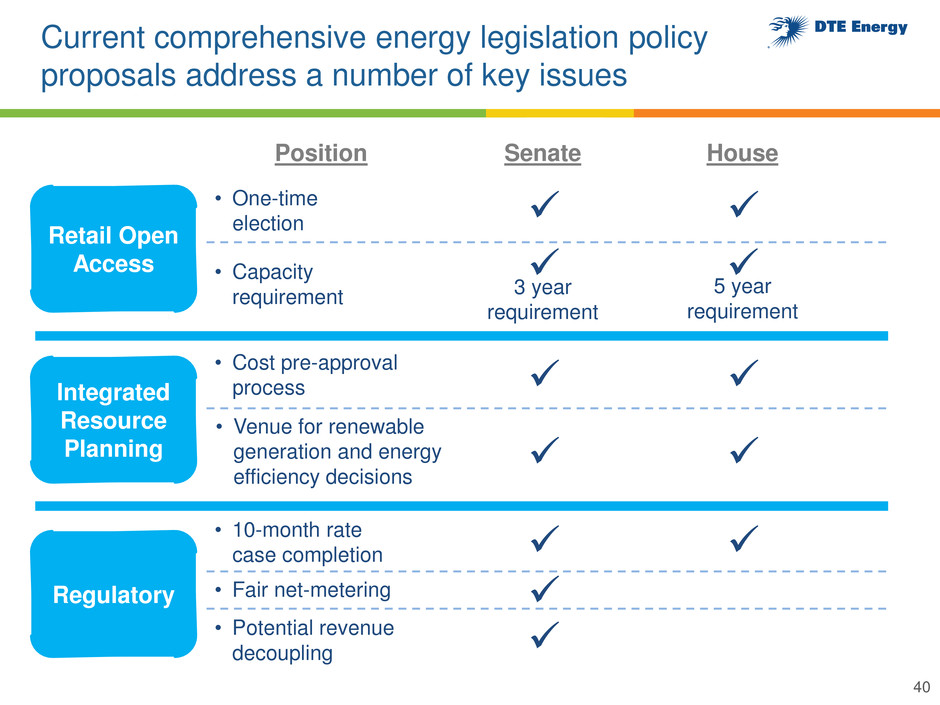

Current comprehensive energy legislation policy proposals address a number of key issues Retail Open Access Integrated Resource Planning Regulatory Senate 40 • One-time election • Cost pre-approval process • Fair net-metering 5 year requirement Position House 3 year requirement • Capacity requirement • Venue for renewable generation and energy efficiency decisions • 10-month rate case completion • Potential revenue decoupling

Activities to finalize energy legislation are underway 41 • Draft legislation developed in both House and Senate • Multiple House and Senate hearings have been held ‒ 12 hearings by the House Energy Policy Committee ‒ 8 hearings by the Senate Energy and Technology Committee • Valerie Brader, Executive Director for the Michigan Agency for Energy, testified before both Committees on the need to act on comprehensive energy legislation • We expect these discussions to continue through October “We look forward to the discussions and deliberations as we move through the process of enacting Michigan’s next energy policy.” – Chairman Mike Nofs

Michigan Public Service Commission MPSC Chair The Honorable John Quackenbush 42

Clear Growth & Value Creating Strategy DTE Gas Power & Industrial Projects (P&I) Gas Storage & Pipelines (GSP) DTE Electric

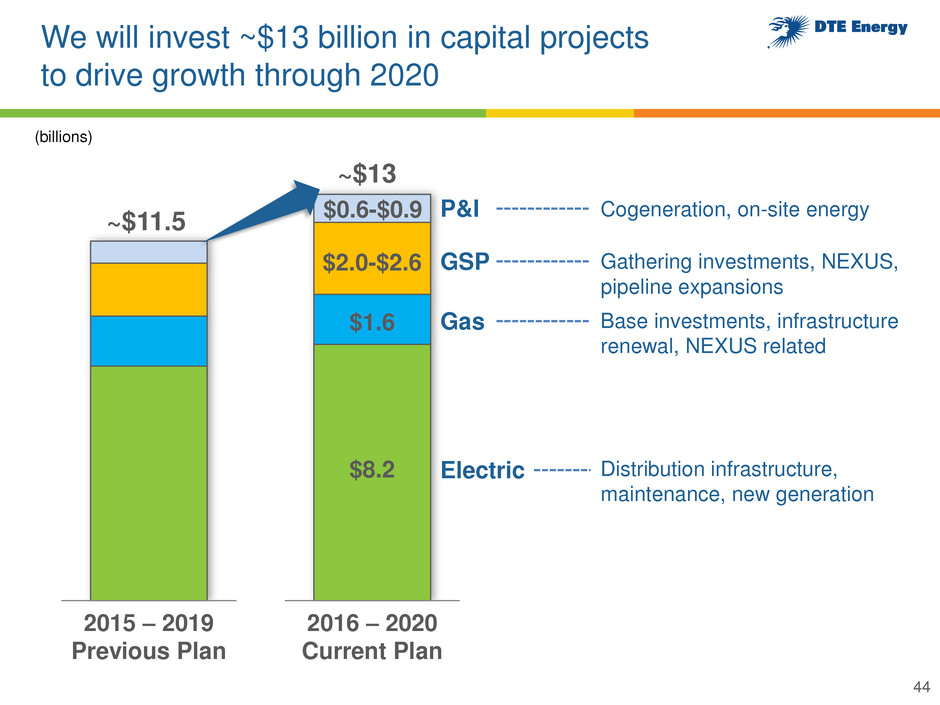

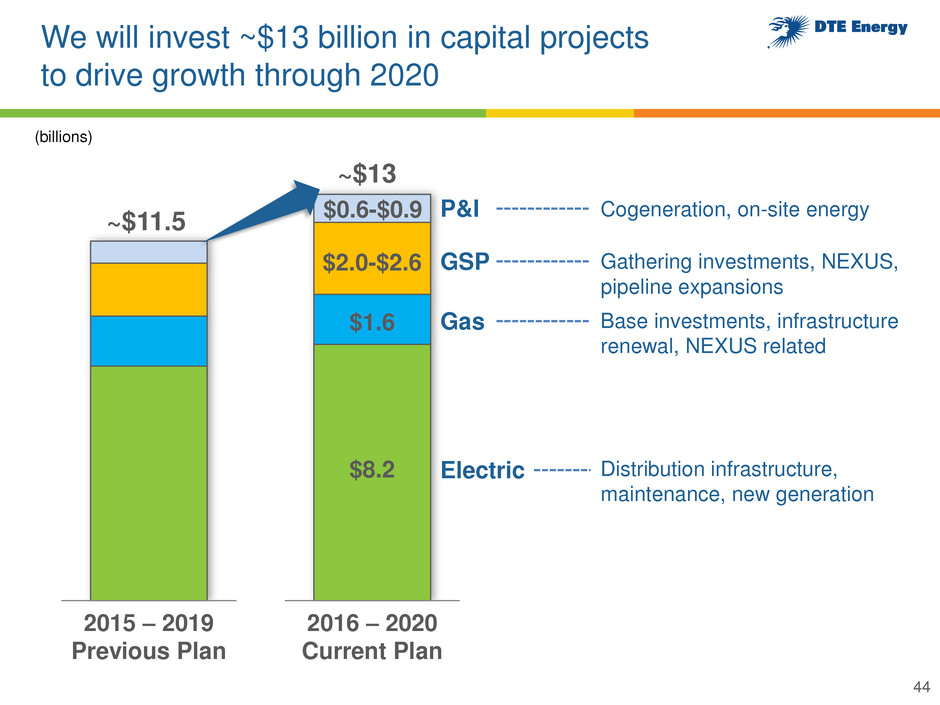

We will invest ~$13 billion in capital projects to drive growth through 2020 44 (billions) ~$13 $8.2 Distribution infrastructure, maintenance, new generation $1.6 Base investments, infrastructure renewal, NEXUS related $2.0-$2.6 Gathering investments, NEXUS, pipeline expansions $0.6-$0.9 Cogeneration, on-site energy 2016 – 2020 Current Plan 44 ~$11.5 2015 – 2019 Previous Plan P&I GSP Gas Electric

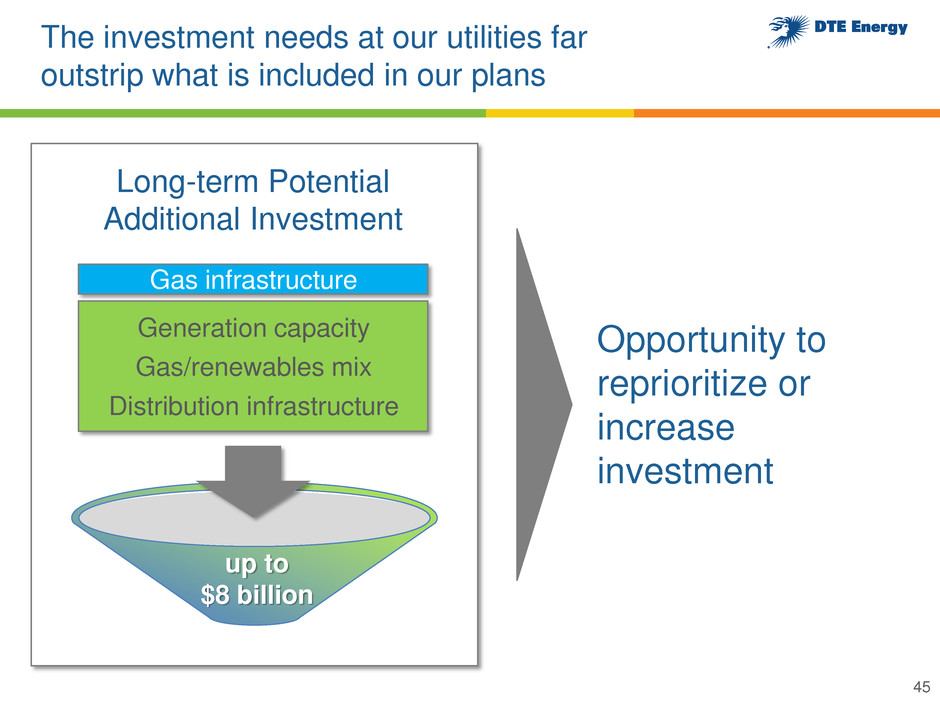

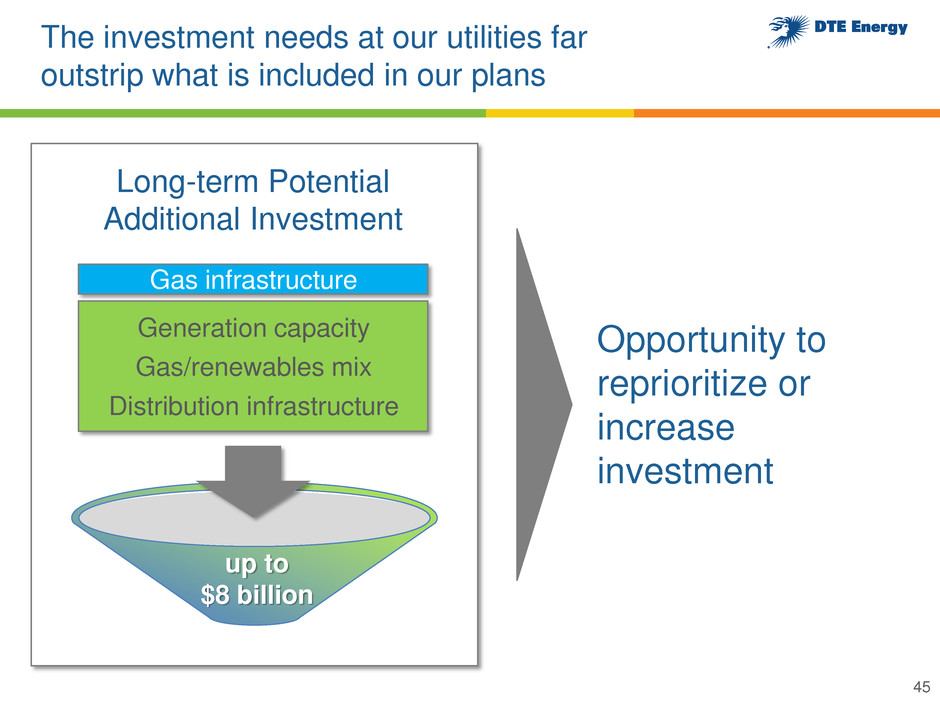

The investment needs at our utilities far outstrip what is included in our plans 45 Generation capacity Gas/renewables mix Distribution infrastructure up to $8 billion Long-term Potential Additional Investment Gas infrastructure Opportunity to reprioritize or increase investment

DTE Electric Targeting 6% - 7% growth

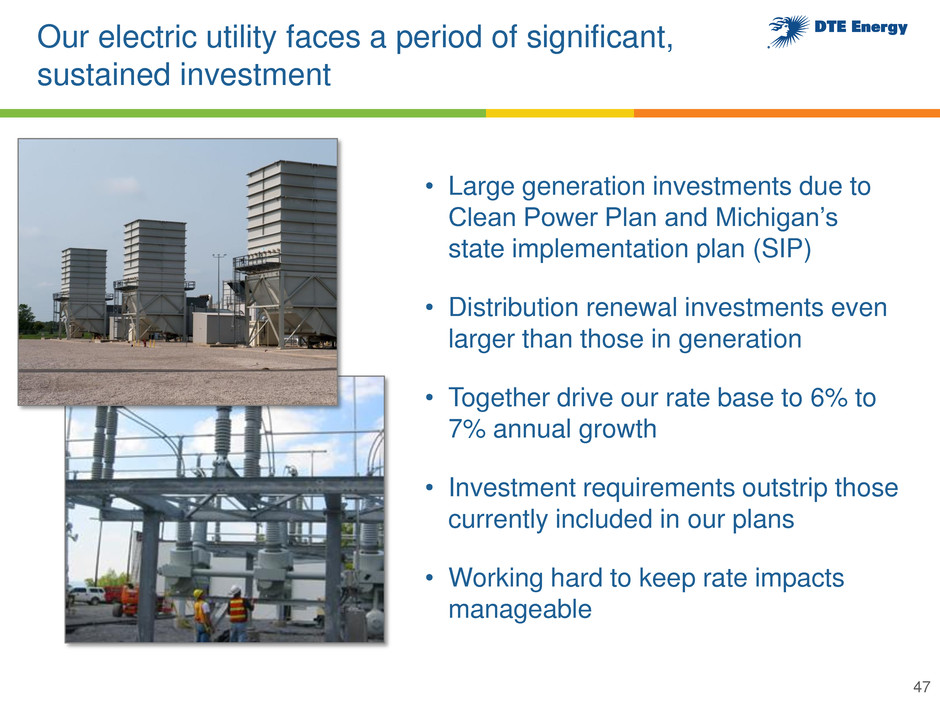

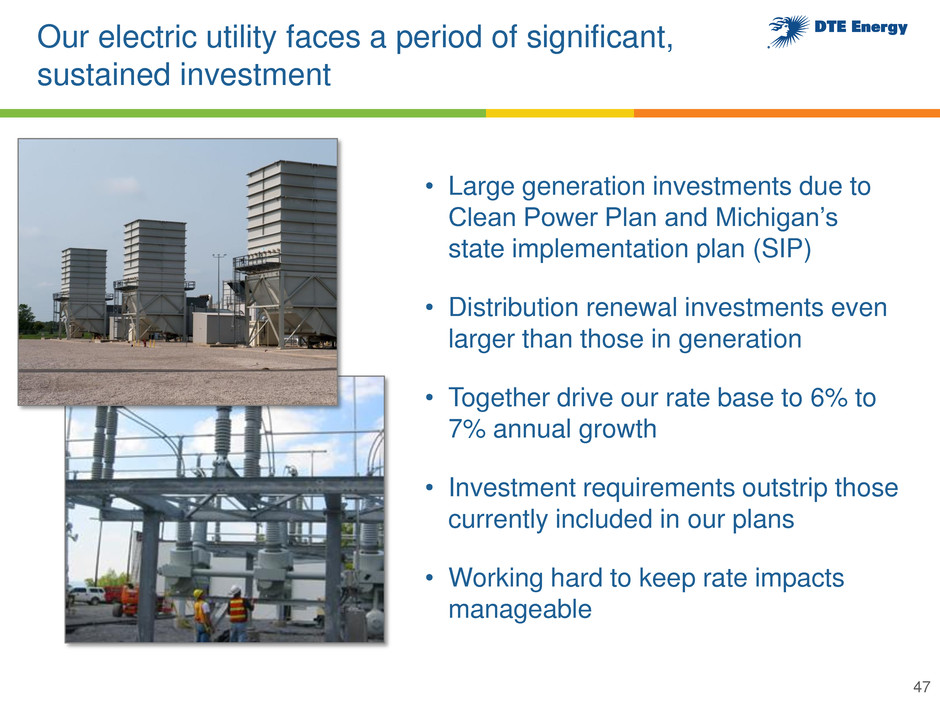

Our electric utility faces a period of significant, sustained investment 32% 47 • Large generation investments due to Clean Power Plan and Michigan’s state implementation plan (SIP) • Distribution renewal investments even larger than those in generation • Together drive our rate base to 6% to 7% annual growth • Investment requirements outstrip those currently included in our plans • Working hard to keep rate impacts manageable

Generation and infrastructure replacement will significantly increase investment over the next 10 years 32% DTE Electric Total Investment ~$8.2 ~$9.7 2016-2020 2021-2025 ~$7.1 2011-2015 New generation (billions) Distribution infrastructure 48 Maintenance and other projects

Our generation mix shifts from coal to natural gas and renewables as we address the EPA’s Clean Power Plan 32% Coal Retirements 2030 Scenario* ~6.7 2015* Gas / Renewables Additions* ~2.2 ~2.2 ~12.3 (~3.5) ~25% 15%-30% ~15% Nuclear / Other Gas Renewables Coal ~1.2 30%-45% DTE Electric Capacity (GW) * Estimated amounts. Timing and mix of generation impacted by MISO capacity requirements and Michigan and EPA policies ~12 - 13 49 ~3.3 - 4.5

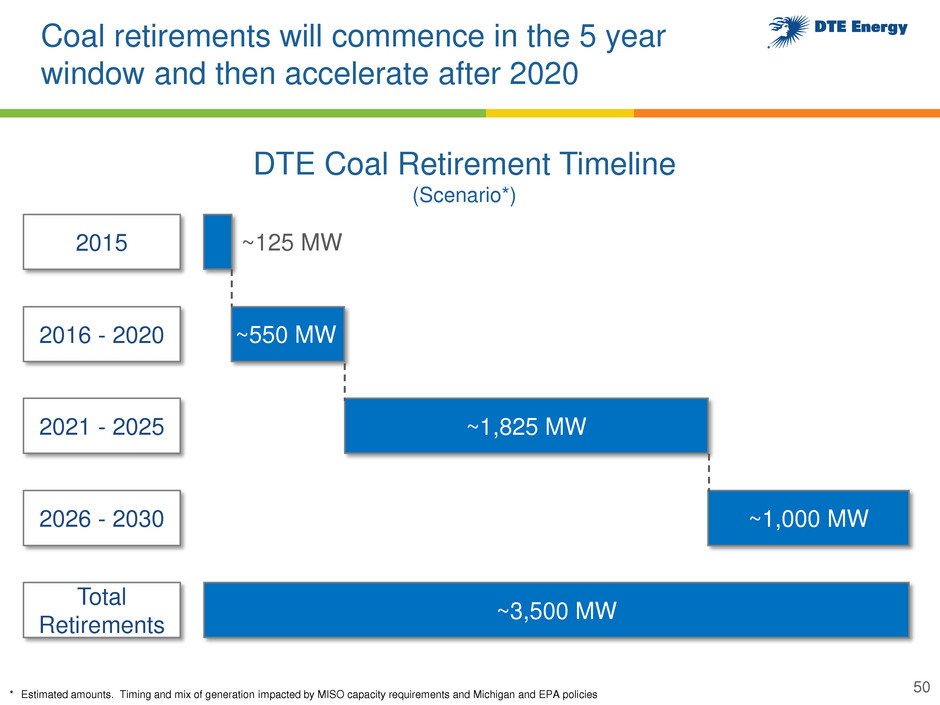

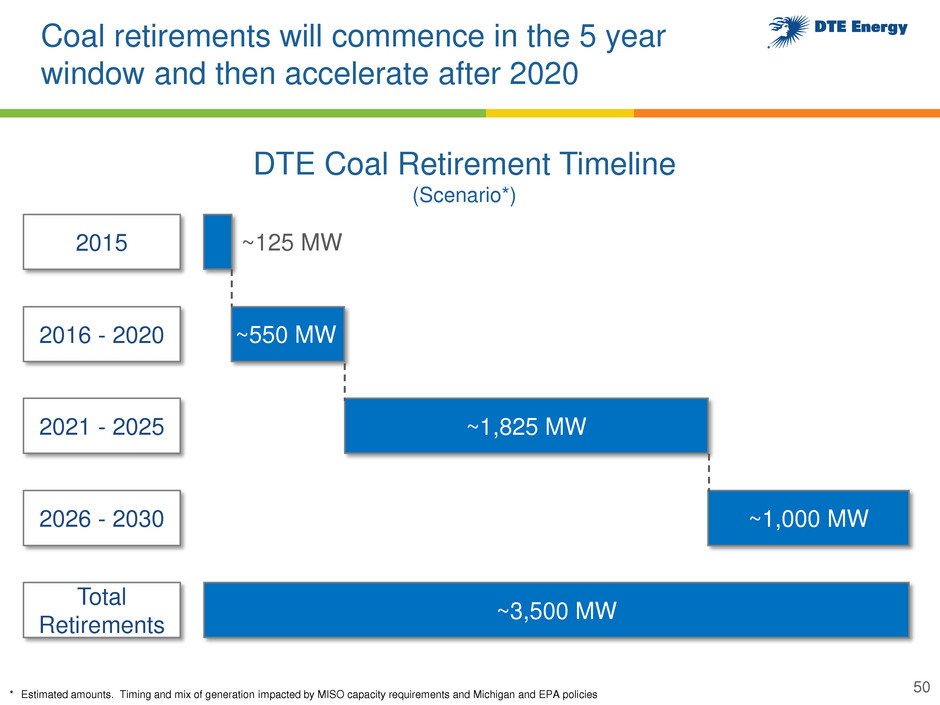

Coal retirements will commence in the 5 year window and then accelerate after 2020 32% 2015 2016 - 2020 2021 - 2025 ~1,825 MW ~125 MW ~550 MW 2026 - 2030 ~1,000 MW DTE Coal Retirement Timeline (Scenario*) * Estimated amounts. Timing and mix of generation impacted by MISO capacity requirements and Michigan and EPA policies 50 Total Retirements ~3,500 MW

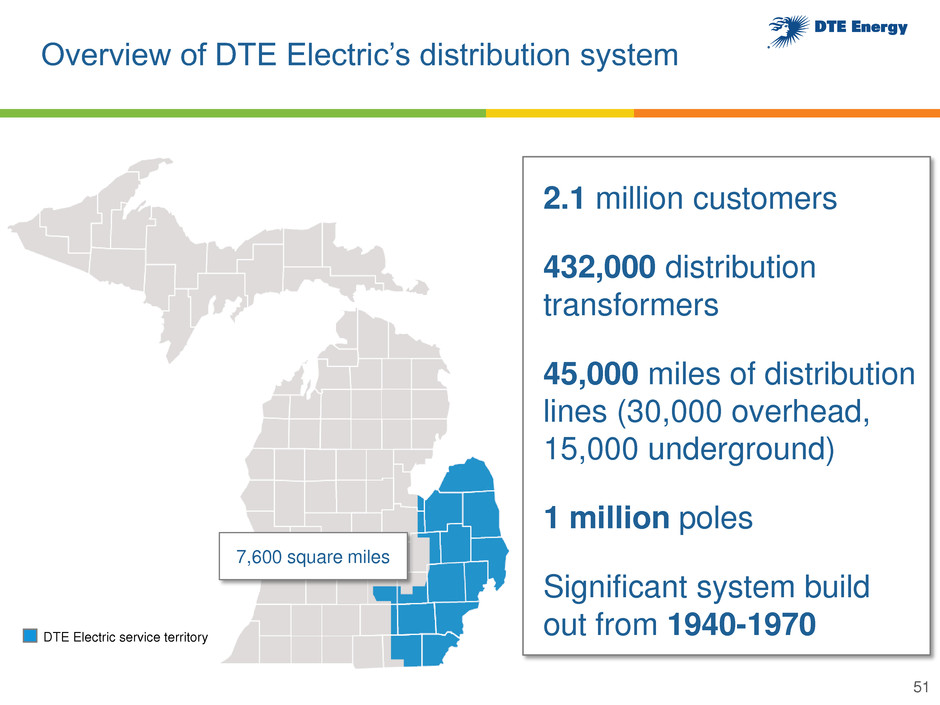

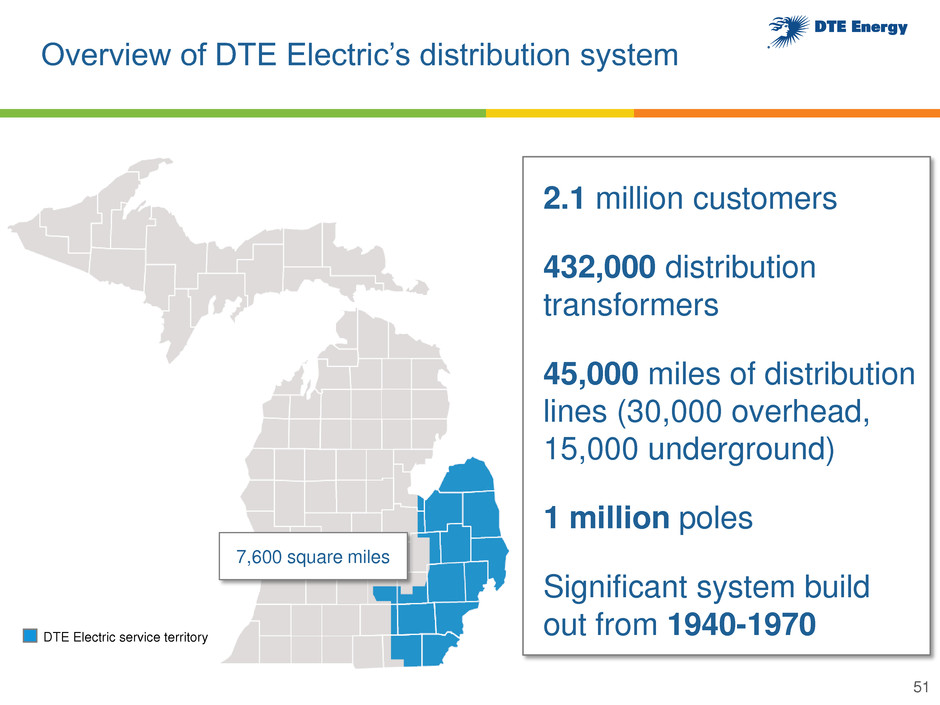

Overview of DTE Electric’s distribution system 32% DTE Electric service territory 7,600 square miles 51 2.1 million customers 432,000 distribution transformers 45,000 miles of distribution lines (30,000 overhead, 15,000 underground) 1 million poles Significant system build out from 1940-1970

Why is the distribution system a focus for us? 32% Historical spend on storm and reactive repair 2010 2011 2012 2013 2014 +7% CAGR 52 2010 2011 2012 2013 2014 Top Performer DTE Electric Power Quality & Reliability (J.D. Power Residential Electric Scores)

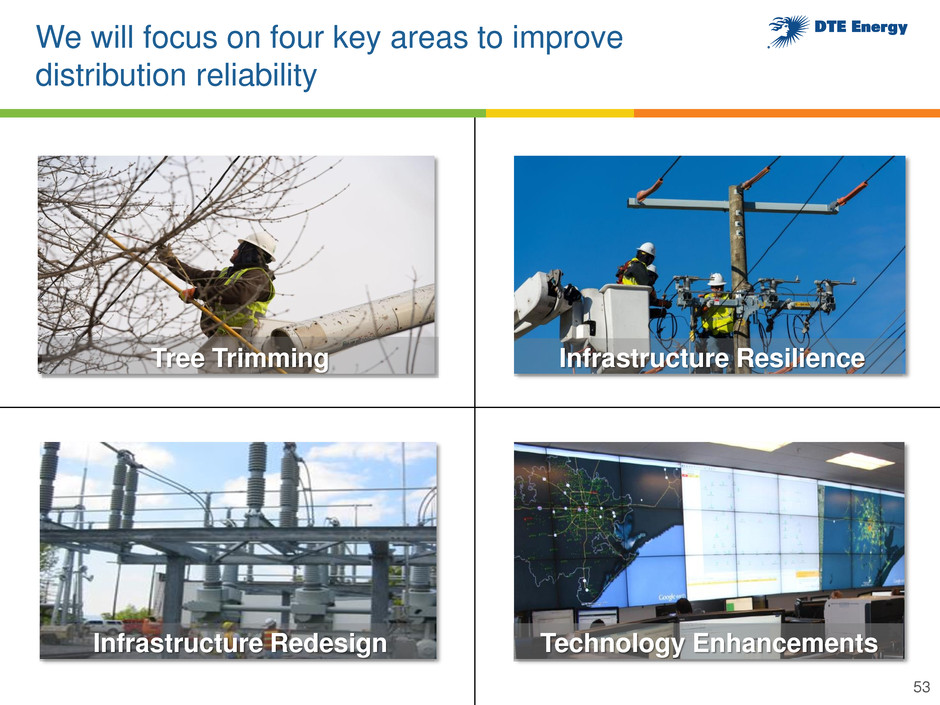

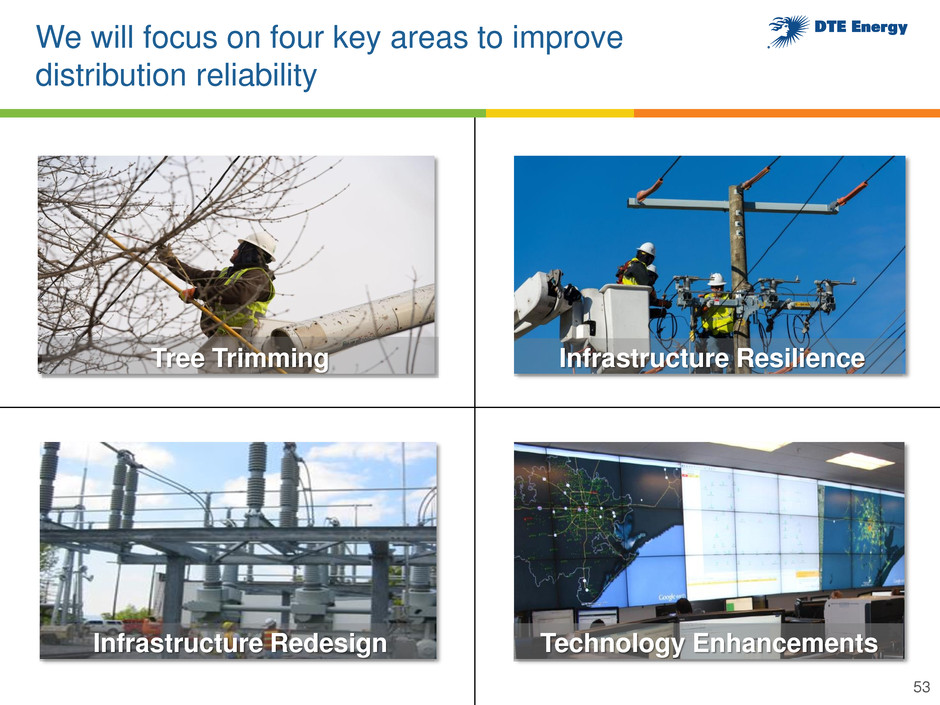

We will focus on four key areas to improve distribution reliability 53 Infrastructure Redesign Infrastructure Resilience Technology Enhancements Tree Trimming

Investing in an enhanced tree trimming program will provide the greatest near-term improvement in system reliability 32% Customer Minutes Interrupted (2011-2013) • Tree-related outages have driven the majority of customer interruptions in recent years Equipment 12% Tree Related 67% All Other 21% 54

We have identified areas of greatest need for capital investment 32% Infrastructure Resilience • Replace aging infrastructure • Focus on worst performing areas Technology Enhancements • Increase control capabilities • Provide greater visibility Infrastructure Redesign • Address overloaded substations • Reduce restoration time 55

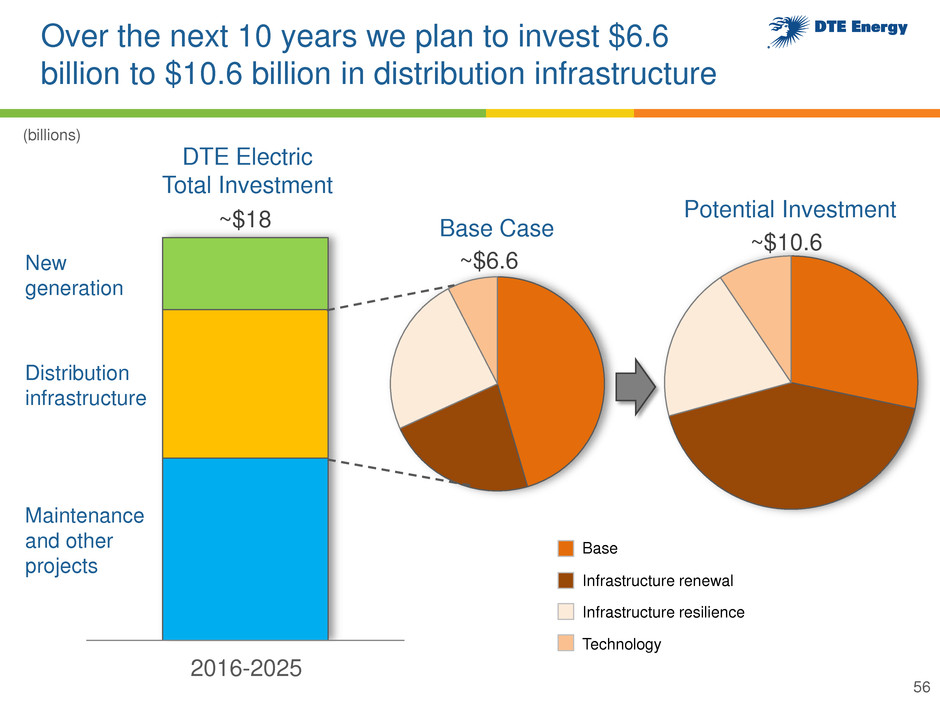

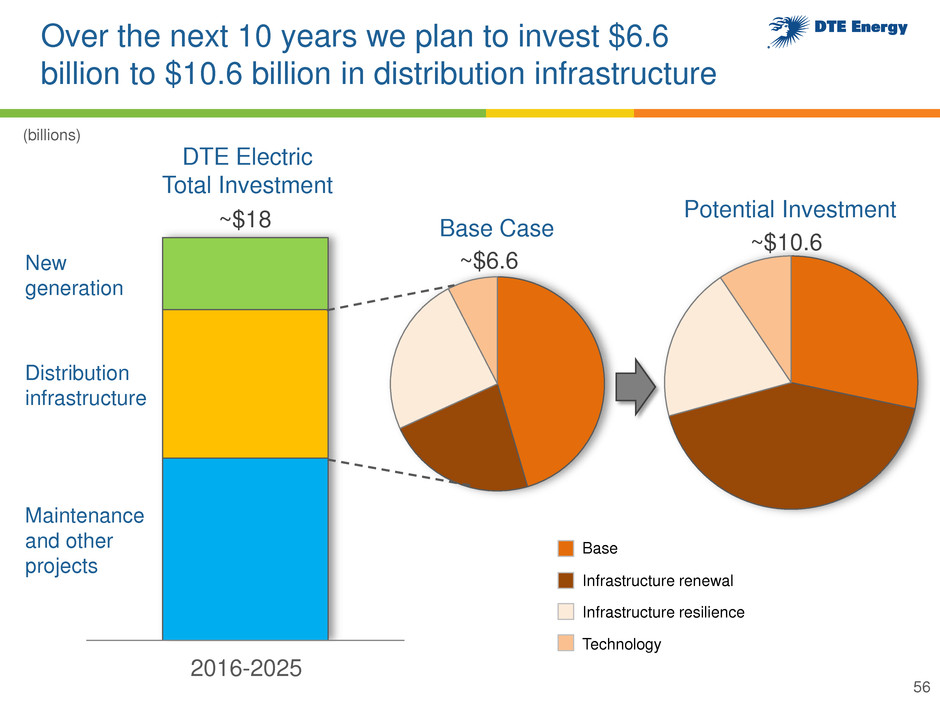

Over the next 10 years we plan to invest $6.6 billion to $10.6 billion in distribution infrastructure 32% 2016-2025 (billions) ~$18 Maintenance and other projects New generation Distribution infrastructure DTE Electric Total Investment Base Case Potential Investment Base Infrastructure renewal Infrastructure resilience Technology ~$6.6 ~$10.6 56

We enter this period of heavy investment on the heels of sharp declines in business rates 57 15%* Large Industrial Customers 9%* Commercial Customers • $600 million of surcharge reductions in 2014 and 2015 • Business cost of service rates implemented in 2015 • These reductions are after $230 million July self- implementation ‒ Final rate order expected December 2015 * Average rate reduction from 2013 through 2015 self-implementation

As we continue to grow, we are also focused on minimizing residential bill impact (dollars) 58 $1,215 $1,136 2013 2015E Average Annual Electric Residential Bill • Residential electric bills are down over 6% • Surcharge reductions offset by 2015 rate increase

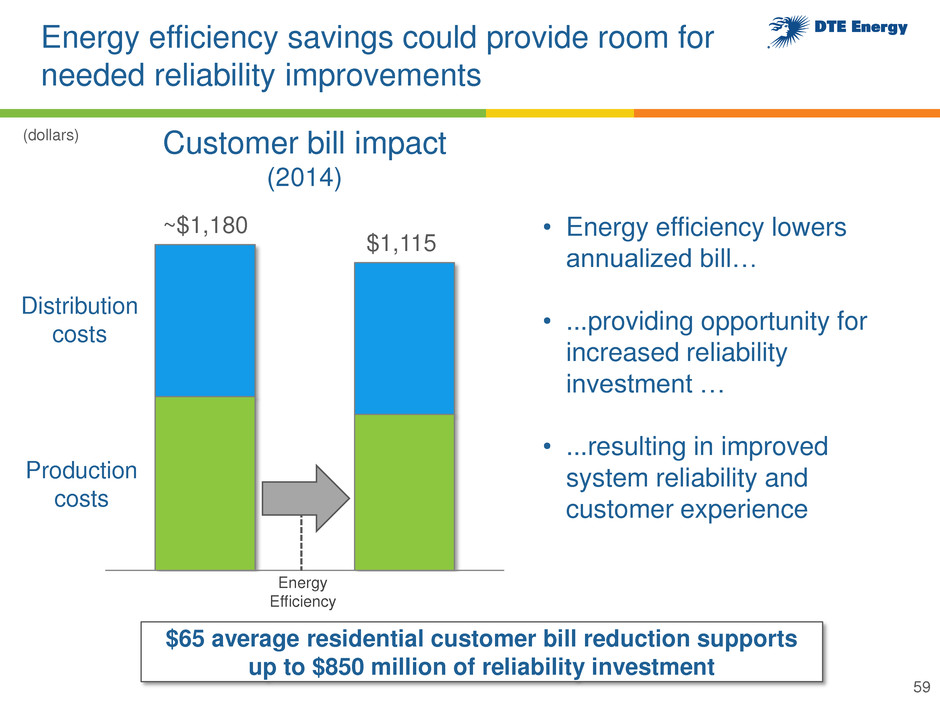

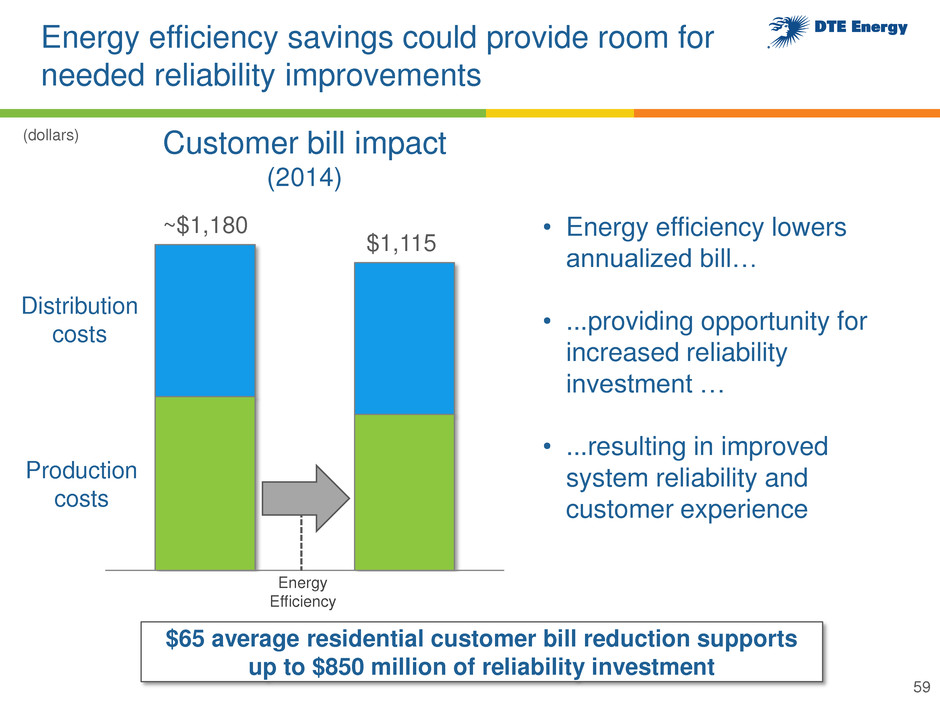

Energy efficiency savings could provide room for needed reliability improvements Customer bill impact (2014) 59 • Energy efficiency lowers annualized bill… • ...providing opportunity for increased reliability investment … • ...resulting in improved system reliability and customer experience Distribution costs Production costs Energy Efficiency ~$1,180 $1,115 $65 average residential customer bill reduction supports up to $850 million of reliability investment (dollars)

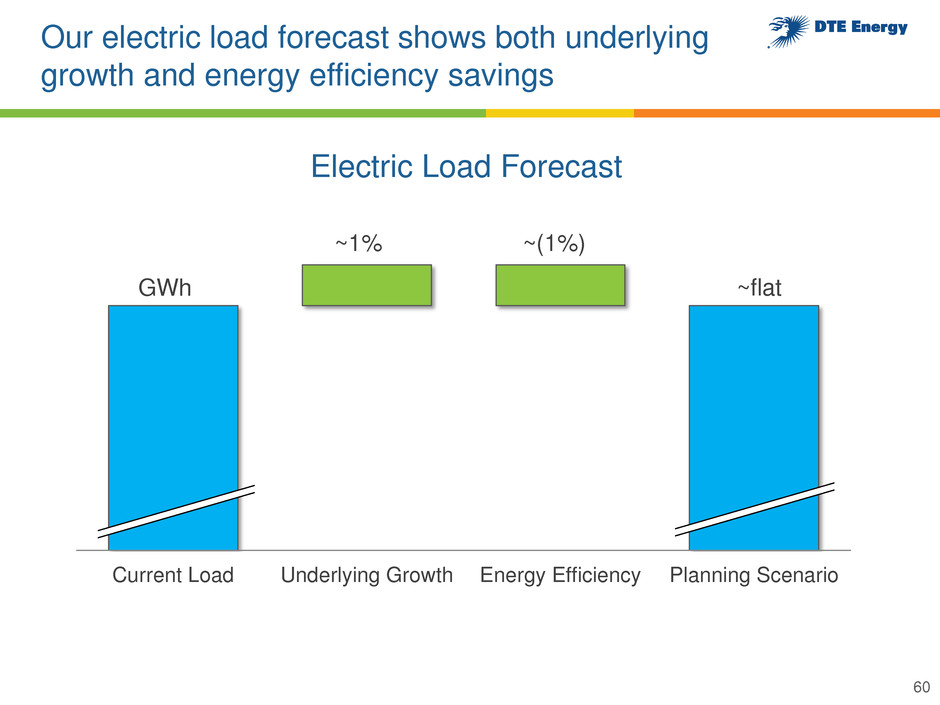

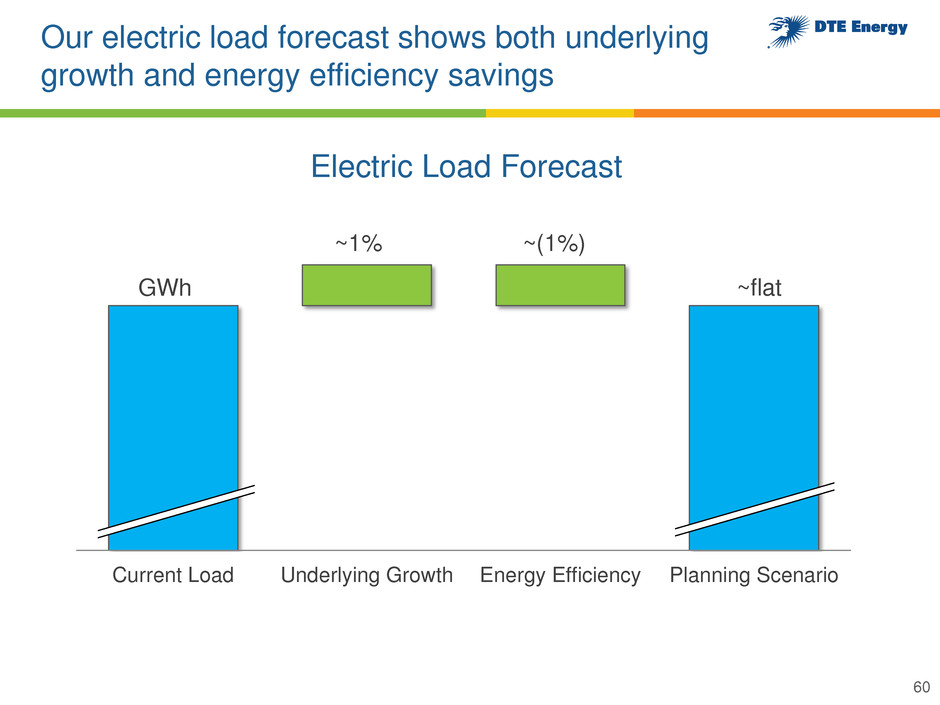

Our electric load forecast shows both underlying growth and energy efficiency savings Current Load Underlying Growth Energy Efficiency Planning Scenario Electric Load Forecast GWh ~1% ~(1%) ~flat 60

We are seeing incremental investment in our service territory driving additional load DTE Electric service territory 61 New business/expansions Prospective projects may add up to 0.5% of additional load

DTE Gas Targeting 7% - 8% growth

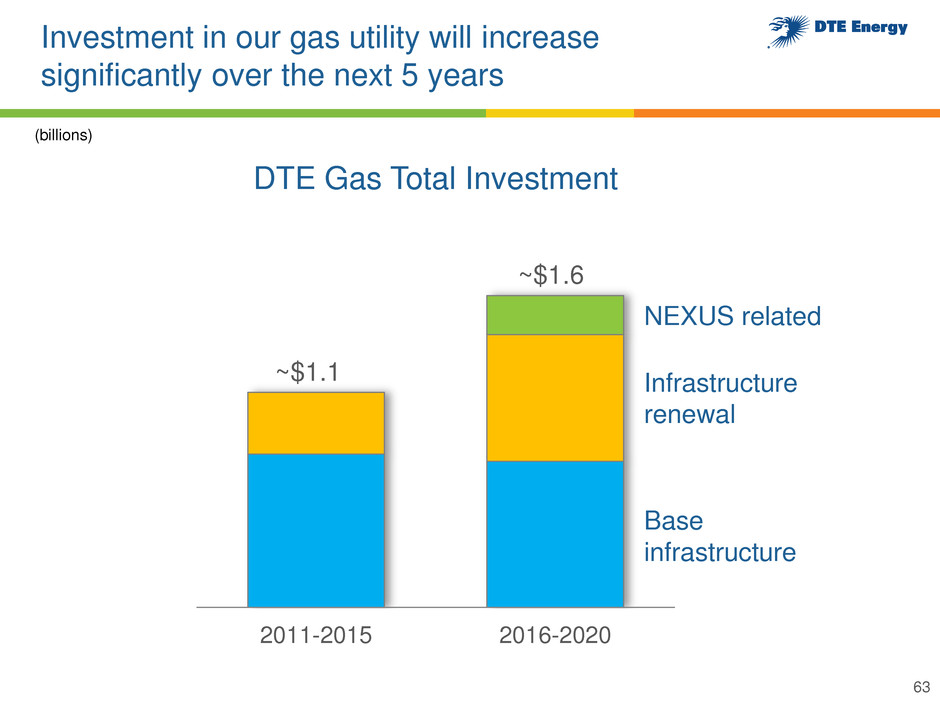

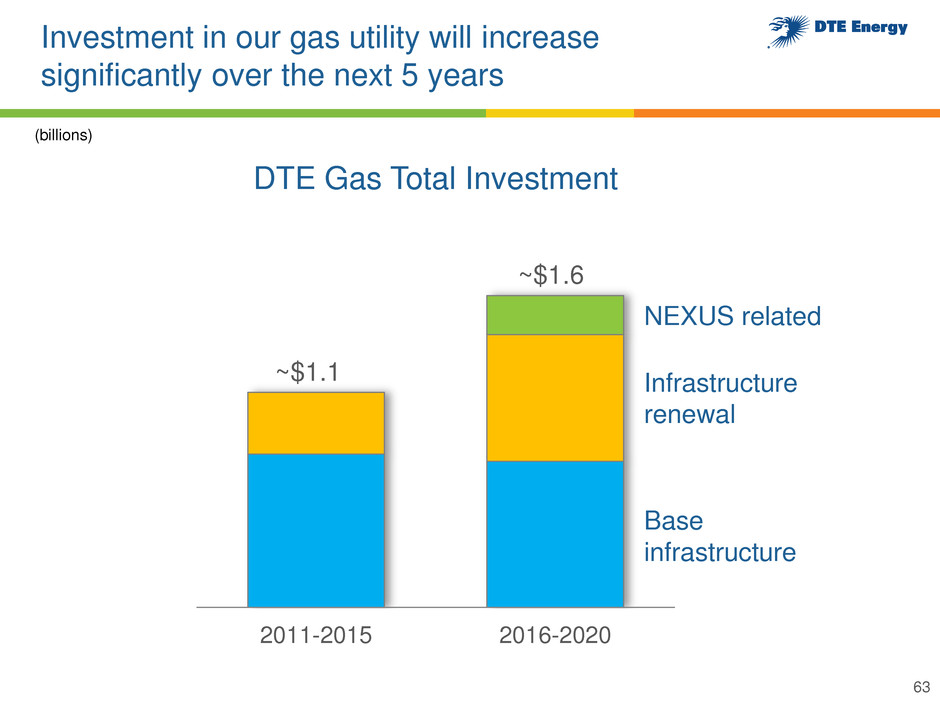

Investment in our gas utility will increase significantly over the next 5 years 63 2011-2015 2016-2020 ~$1.1 ~$1.6 DTE Gas Total Investment (billions) Base infrastructure Infrastructure renewal NEXUS related

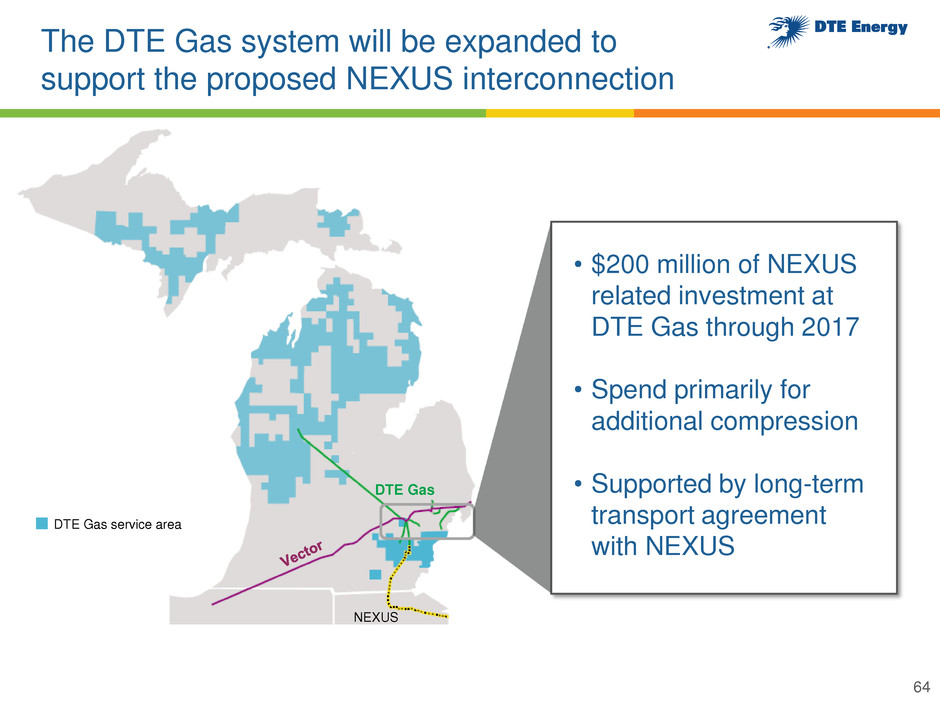

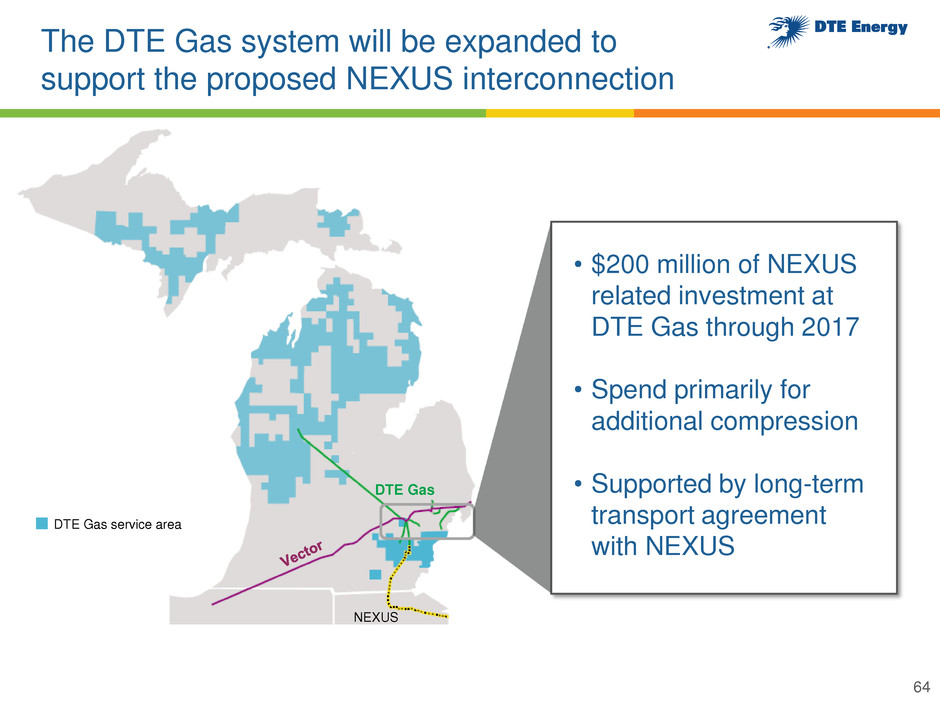

The DTE Gas system will be expanded to support the proposed NEXUS interconnection • $200 million of NEXUS related investment at DTE Gas through 2017 • Spend primarily for additional compression • Supported by long-term transport agreement with NEXUS DTE Gas service area NEXUS DTE Gas 64

Expanding to 160 miles per year would reduce planned main replacement cycle by half ~$80 Investment (millions) Miles ~80 miles ~$130 ~160 miles Current Gas Renewal Plan (50 years) Proposed Gas Renewal Plan (25 years) Investment* (millions) Miles * Consists of main replacement (~$99m), meter move-out (~$23m) and pipeline integrity (~$8m) 65 • Main replacement application filed with MPSC in November 2014 • Plan cuts renewal timeline in half, from 50 years to 25 years • Recent Proposal for Decision supports expanded plan • Order expected 4Q 2015

After 2020 we will still be investing heavily in our gas utility 66 Investment beyond 2020: Infrastructure renewal*: $2.0 - $2.2 billon Transmission and compression: $0.2 - $0.5 billion Distribution: TBD 2016-2020 ~$1.6 DTE Gas Total Investment ($ billions) * Includes main renewal and meter move out

Lower customer bills allow room for needed infrastructure investments Average customer bill is expected to decrease nearly 25% from 2010 $1,167 $1,027 $956 $904 $911 $878 2010 2011 2012 2013 2014 2015E Average Annual Gas Residential Bill* (dollars) 67 * Weather normalized

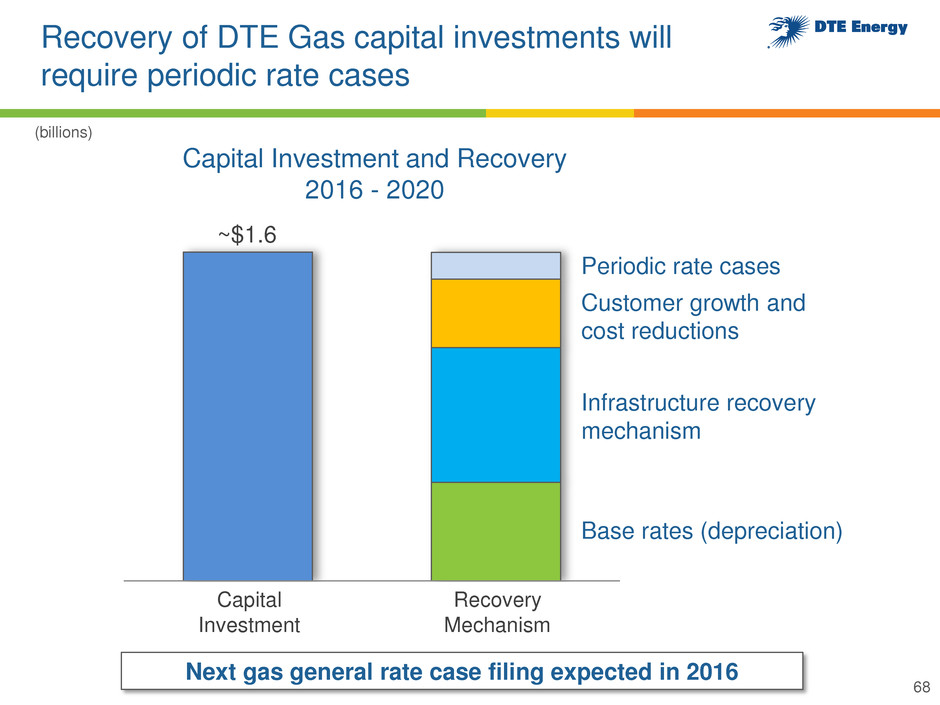

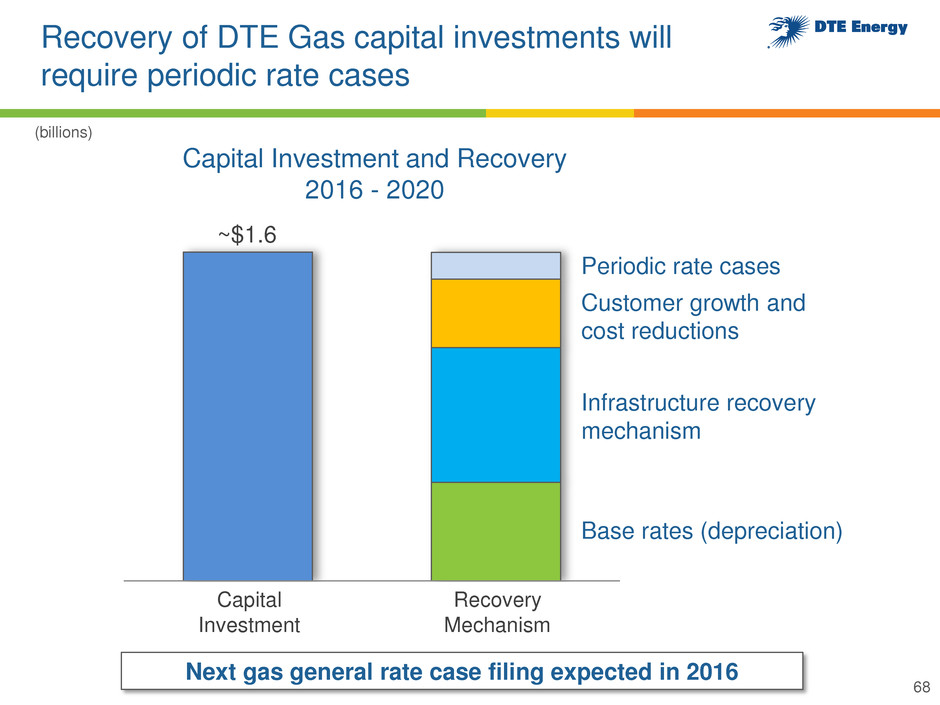

Recovery of DTE Gas capital investments will require periodic rate cases Capital Investment and Recovery 2016 - 2020 Infrastructure recovery mechanism Base rates (depreciation) Customer growth and cost reductions Periodic rate cases Capital Investment Recovery Mechanism (billions) ~$1.6 68 Next gas general rate case filing expected in 2016

Gas Storage & Pipelines

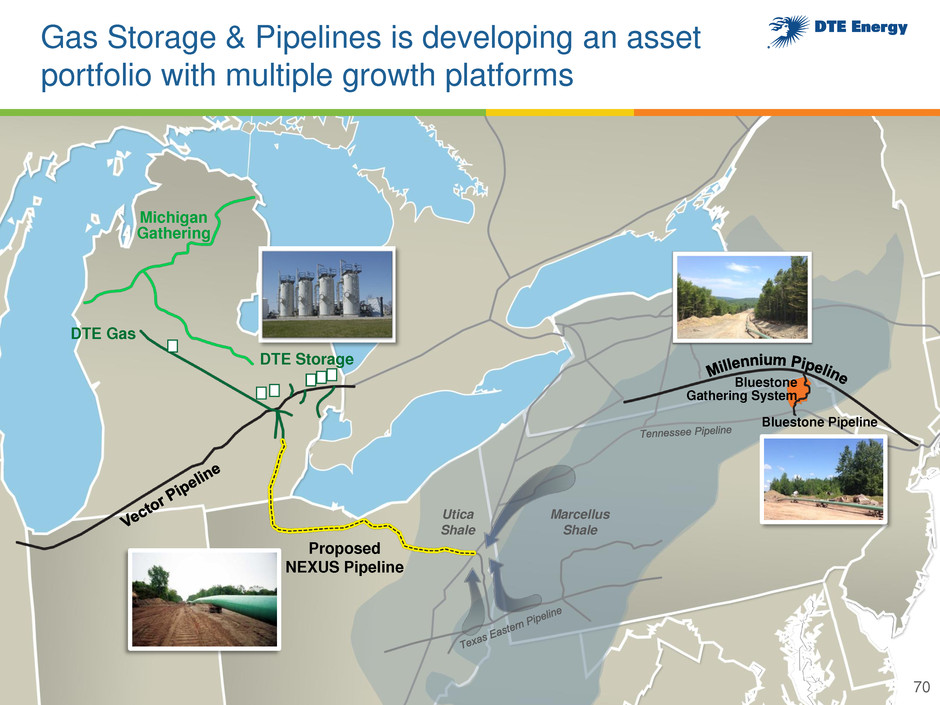

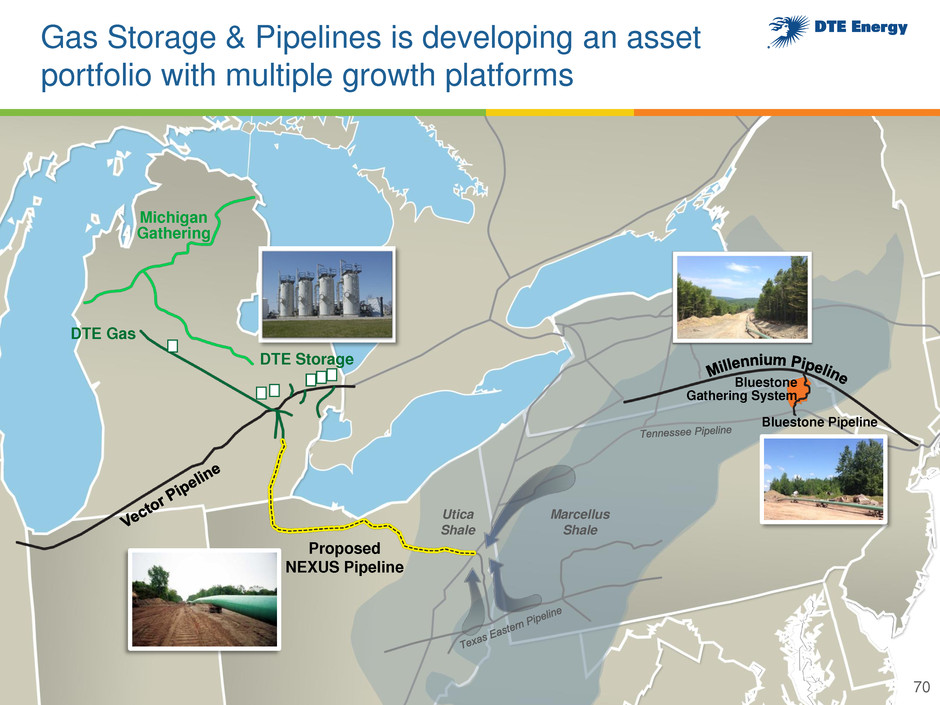

Gas Storage & Pipelines is developing an asset portfolio with multiple growth platforms 70 Proposed NEXUS Pipeline Michigan Gathering DTE Gas DTE Storage Marcellus Shale Utica Shale Bluestone Pipeline Bluestone Gathering System

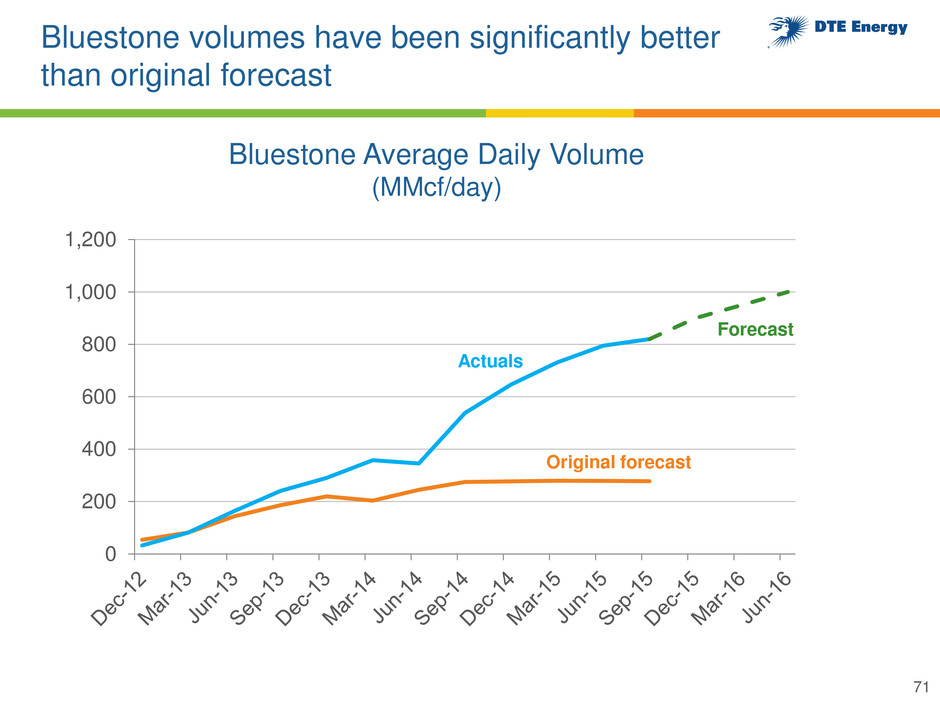

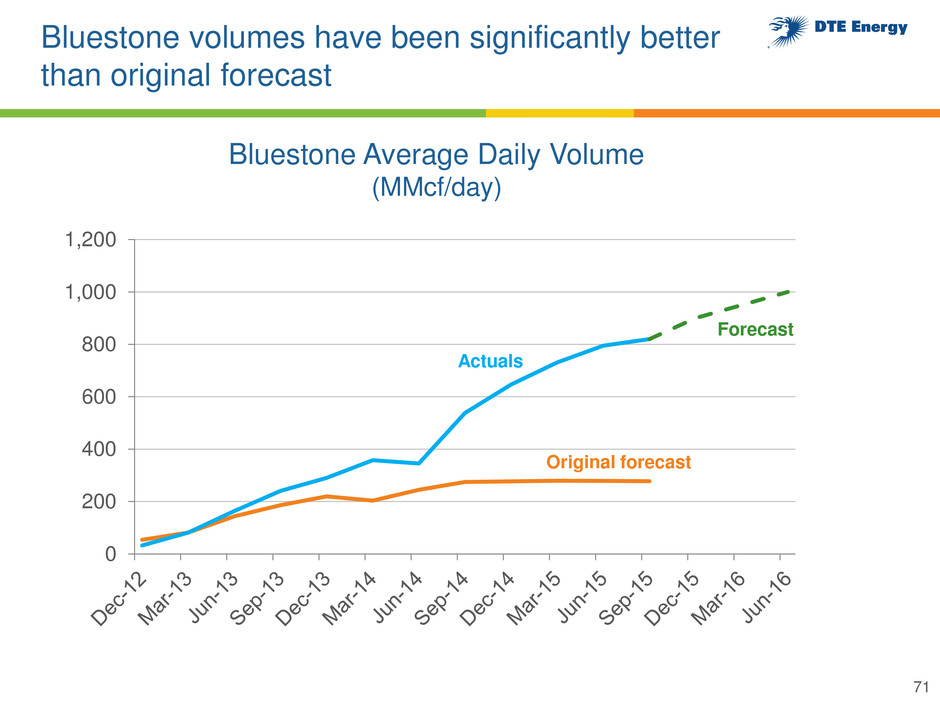

Bluestone volumes have been significantly better than original forecast 71 0 200 400 600 800 1,000 1,200 Bluestone Average Daily Volume (MMcf/day) Original forecast Actuals Forecast

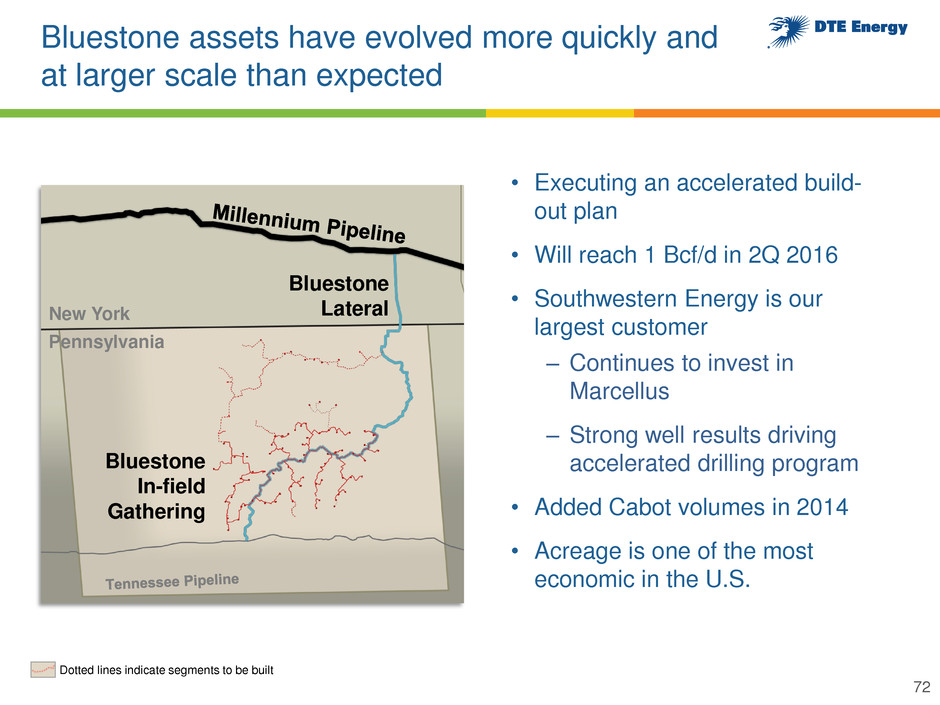

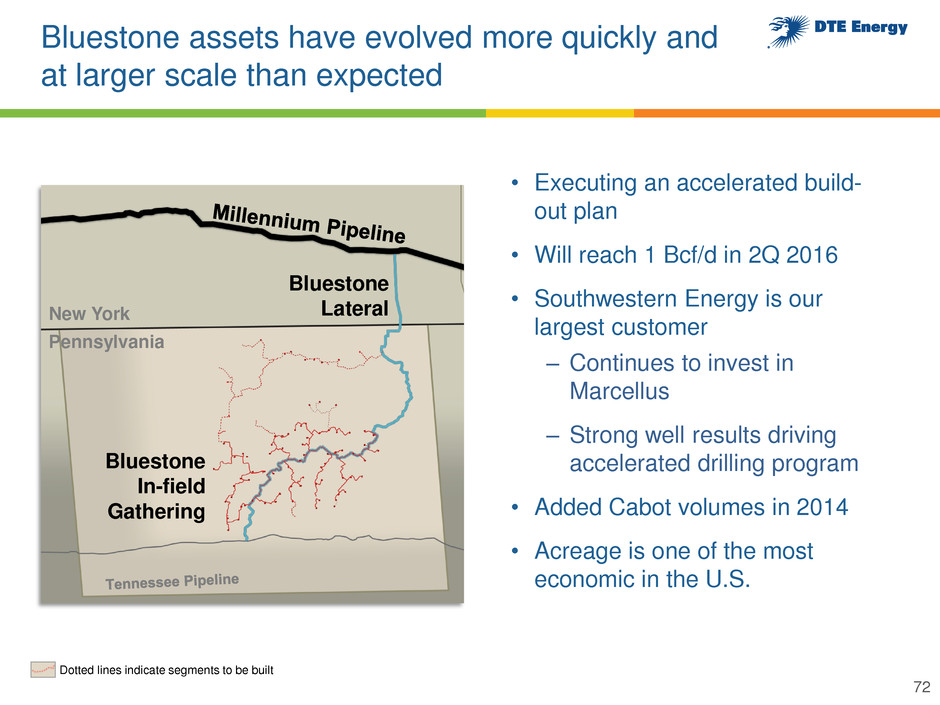

Bluestone assets have evolved more quickly and at larger scale than expected • Executing an accelerated build- out plan • Will reach 1 Bcf/d in 2Q 2016 • Southwestern Energy is our largest customer – Continues to invest in Marcellus – Strong well results driving accelerated drilling program • Added Cabot volumes in 2014 • Acreage is one of the most economic in the U.S. New York Pennsylvania Bluestone Lateral Bluestone In-field Gathering Dotted lines indicate segments to be built 72

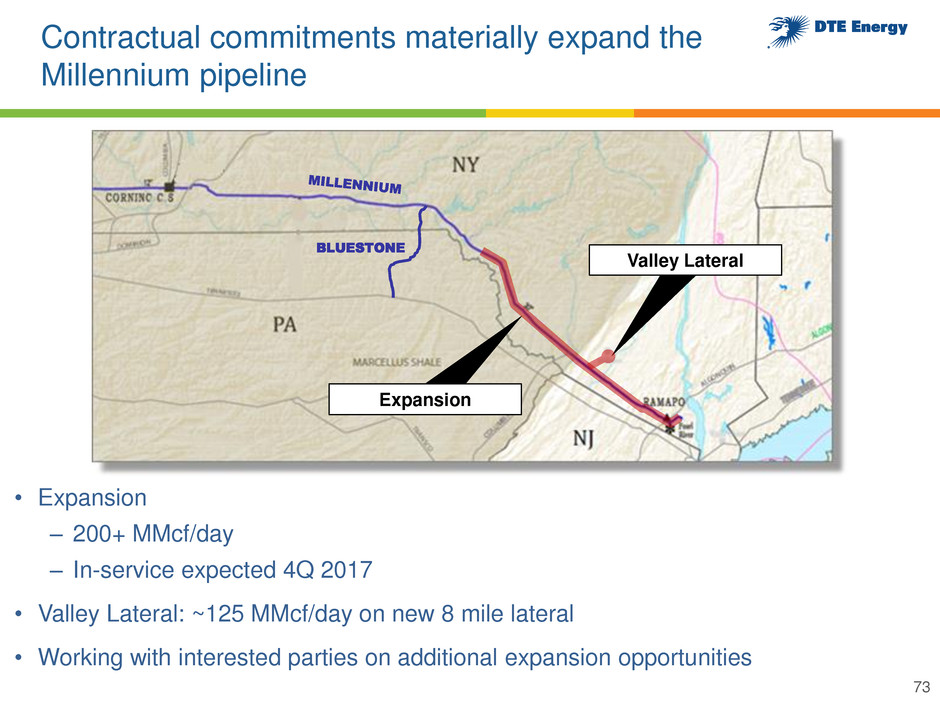

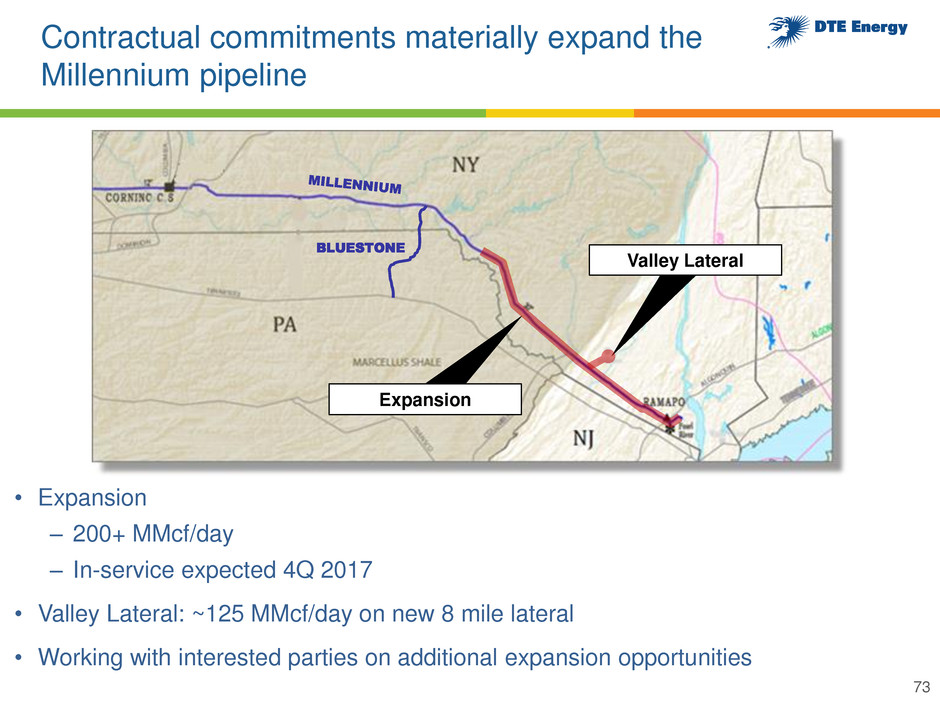

Contractual commitments materially expand the Millennium pipeline • Expansion – 200+ MMcf/day – In-service expected 4Q 2017 • Valley Lateral: ~125 MMcf/day on new 8 mile lateral • Working with interested parties on additional expansion opportunities BLUESTONE Valley Lateral Expansion 73

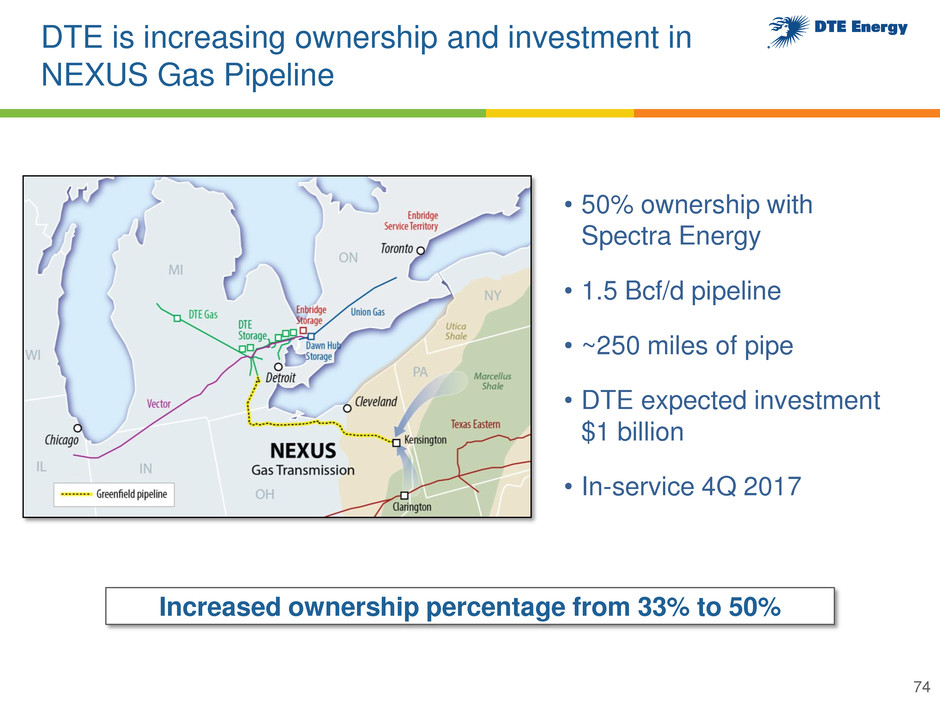

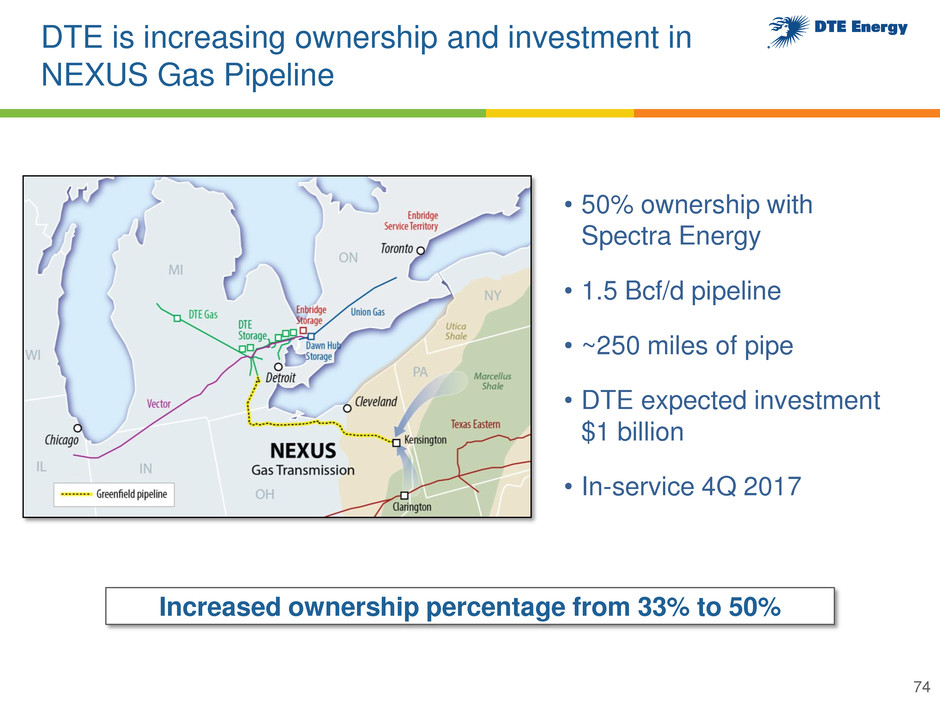

DTE is increasing ownership and investment in NEXUS Gas Pipeline • 50% ownership with Spectra Energy • 1.5 Bcf/d pipeline • ~250 miles of pipe • DTE expected investment $1 billion • In-service 4Q 2017 74 Increased ownership percentage from 33% to 50%

We continue to see strong supply in Utica and Southwest Marcellus 75 Source: Credit Suisse July 2015 report; Utica – Dry Gas estimate per DTE analysis; IHS CERA 0 5 10 15 20 25 2010 2015 2020 2025 Utica / SW Marcellus Supply Growth (Bcf/d) Actuals 2012 Forecast 2013 Forecast 2014 Forecast 2016 Forecast US Shale Basin Economics (NYMEX Gas Price Required for 15% After-Tax IRR) $ / MMBtu $2 $4 $6 $0 Marcellus – Super Rich Utica – Dry Gas Utica – Wet Gas Marcellus – SW Liquids

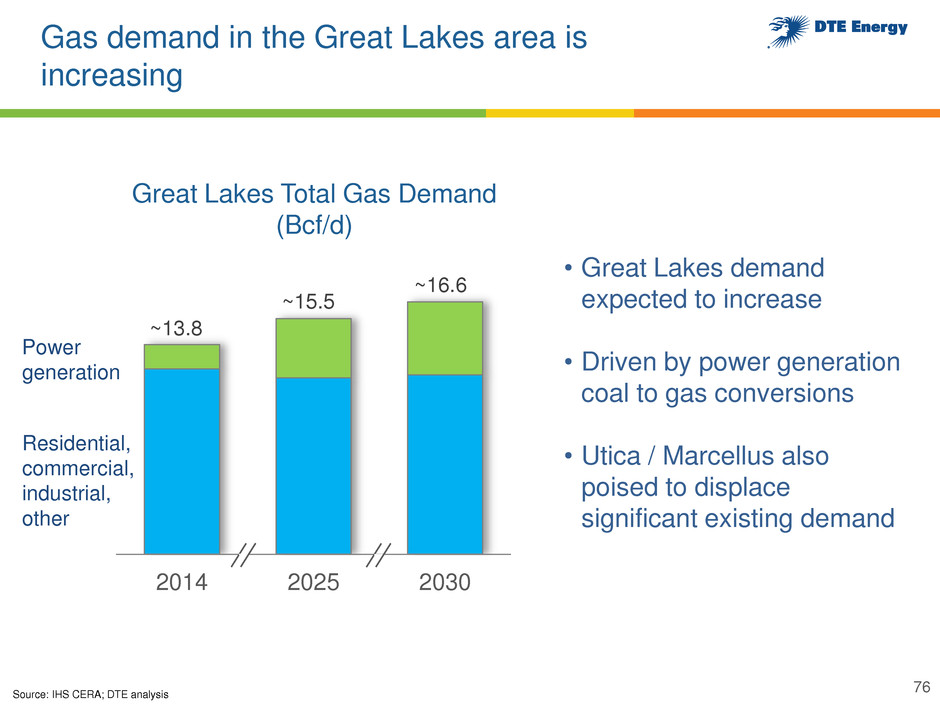

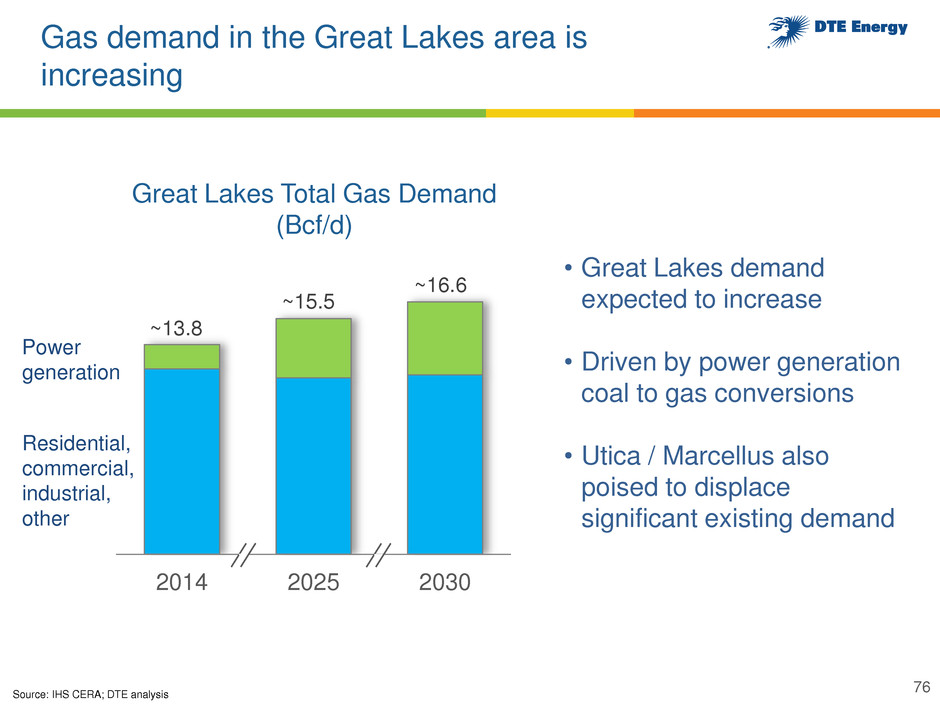

Gas demand in the Great Lakes area is increasing • Great Lakes demand expected to increase • Driven by power generation coal to gas conversions • Utica / Marcellus also poised to displace significant existing demand 76 Great Lakes Total Gas Demand (Bcf/d) 2014 2025 2030 ~13.8 ~15.5 ~16.6 Residential, commercial, industrial, other Power generation Source: IHS CERA; DTE analysis

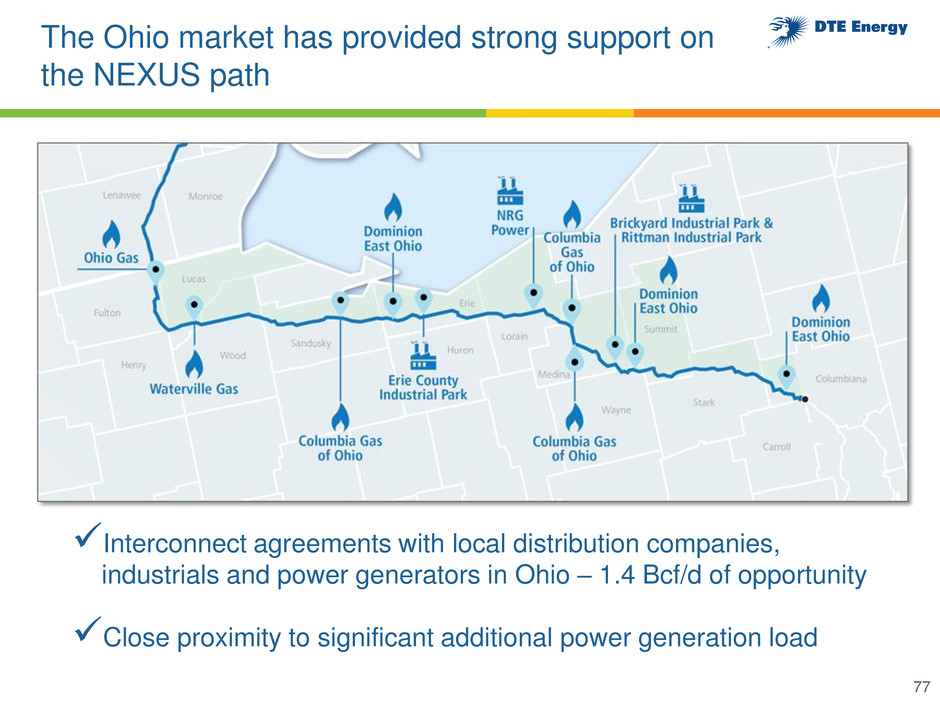

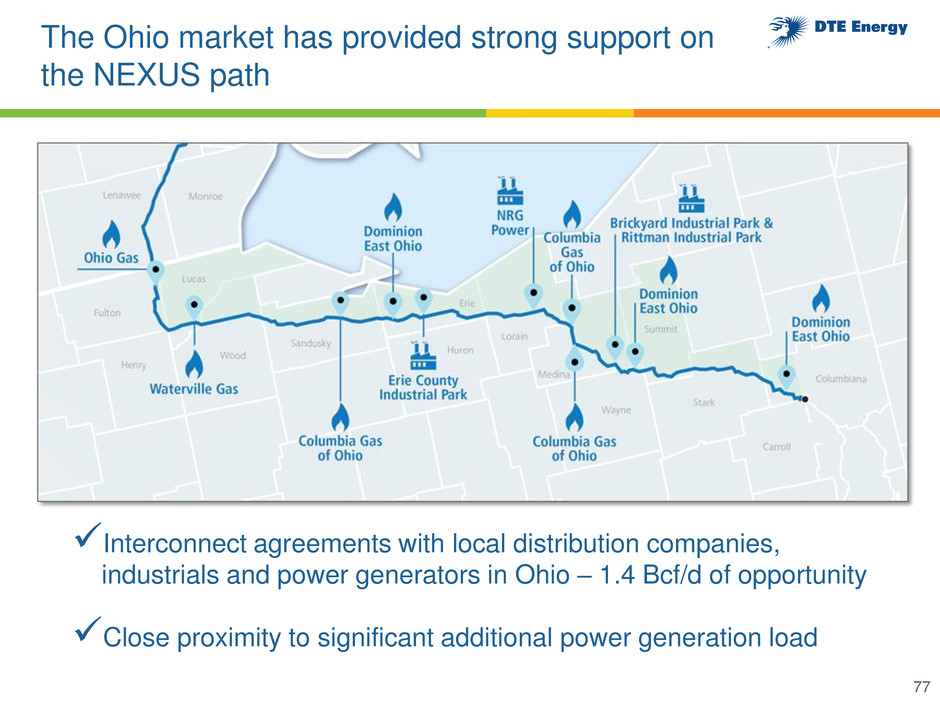

The Ohio market has provided strong support on the NEXUS path 77 Interconnect agreements with local distribution companies, industrials and power generators in Ohio – 1.4 Bcf/d of opportunity Close proximity to significant additional power generation load

We are actively developing several new investments 78 Proposed NEXUS Pipeline Marcellus Shale Utica Shale Bluestone Pipeline Bluestone Gathering System • Gathering opportunities in Appalachian Basin • Lateral opportunities with link to: ‒ End use markets ‒ Power plants • Bolt-on acquisition in advanced stages of negotiation

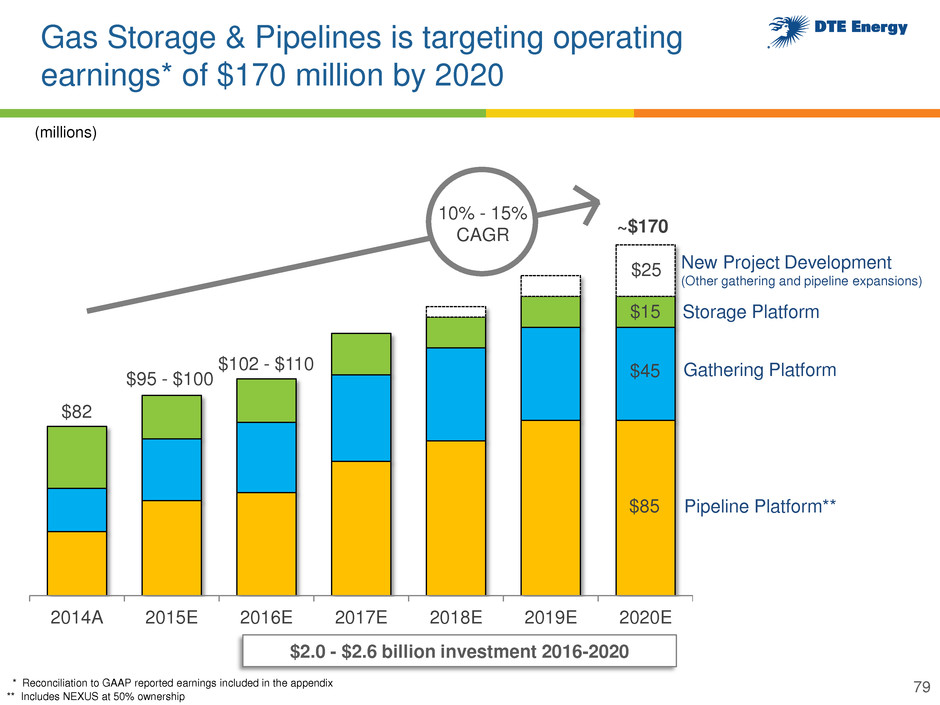

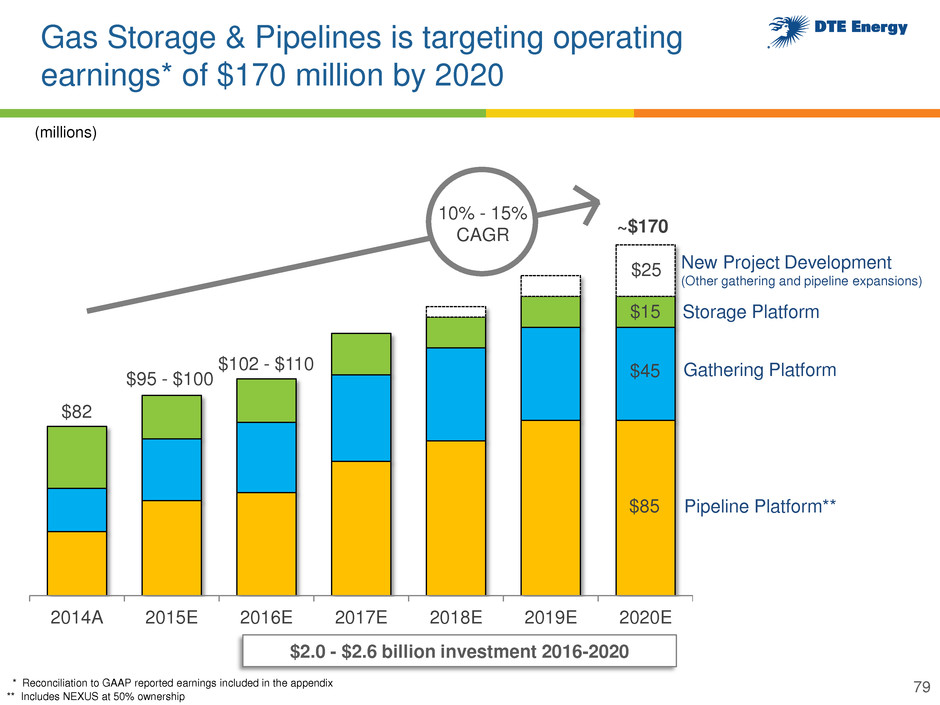

2014A 2015E 2016E 2017E 2018E 2019E 2020E * Reconciliation to GAAP reported earnings included in the appendix Pipeline Platform** Gathering Platform Storage Platform New Project Development (Other gathering and pipeline expansions) ~$170 $85 $45 $15 $25 ** Includes NEXUS at 50% ownership $82 $95 - $100 (millions) 10% - 15% CAGR $2.0 - $2.6 billion investment 2016-2020 79 Gas Storage & Pipelines is targeting operating earnings* of $170 million by 2020 $102 - $110

Power & Industrial Projects

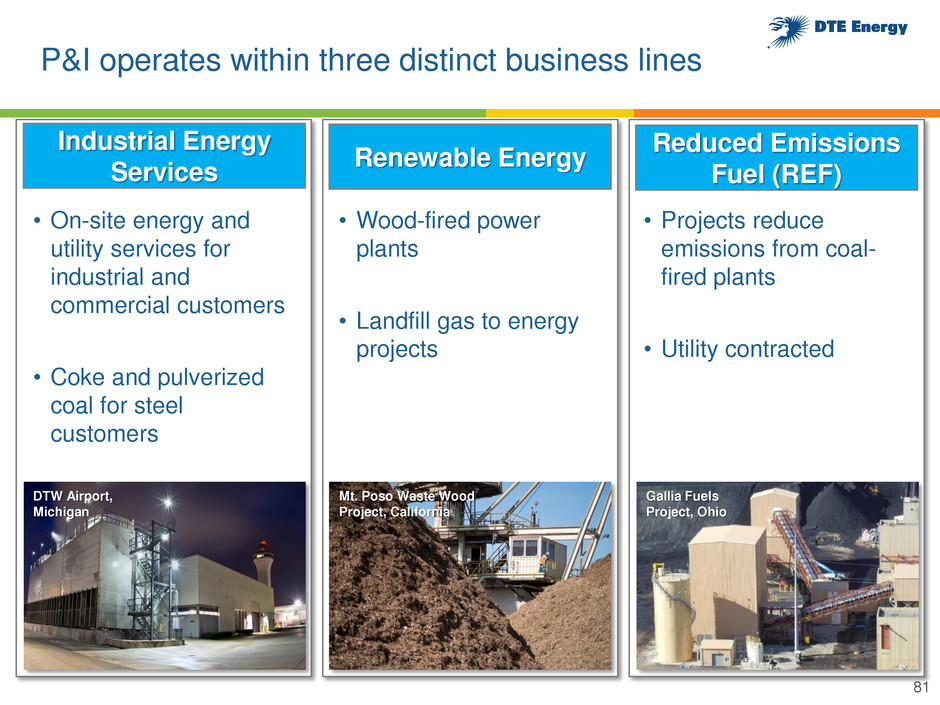

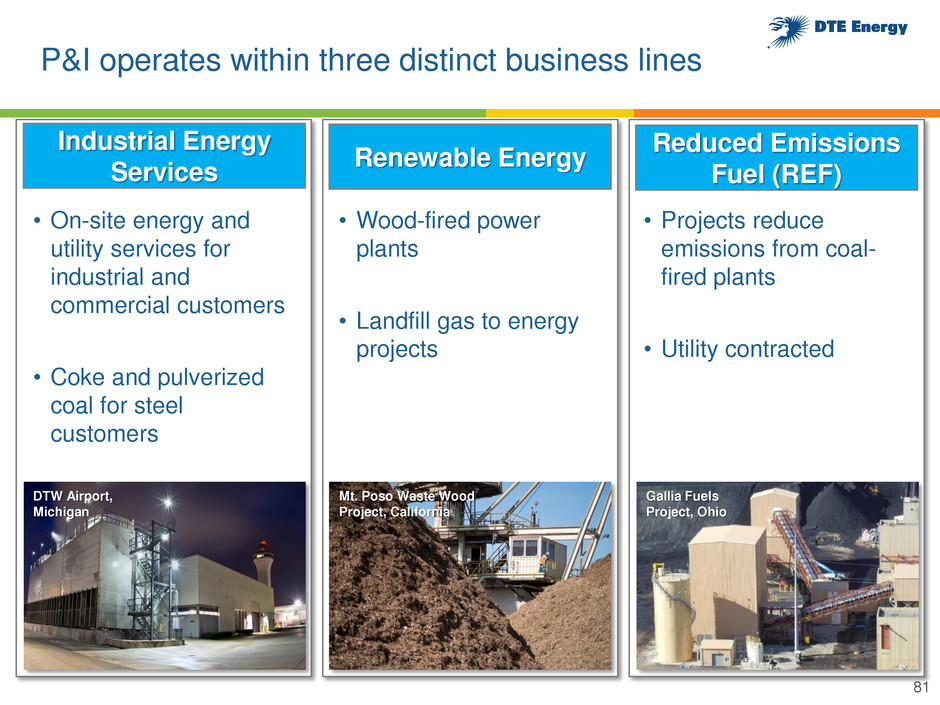

P&I operates within three distinct business lines DTW Airport, Michigan Gallia Fuels Project, Ohio Mt. Poso Waste Wood Project, California • On-site energy and utility services for industrial and commercial customers • Coke and pulverized coal for steel customers • Wood-fired power plants • Landfill gas to energy projects • Projects reduce emissions from coal- fired plants • Utility contracted Industrial Energy Services Renewable Energy Reduced Emissions Fuel (REF) 81

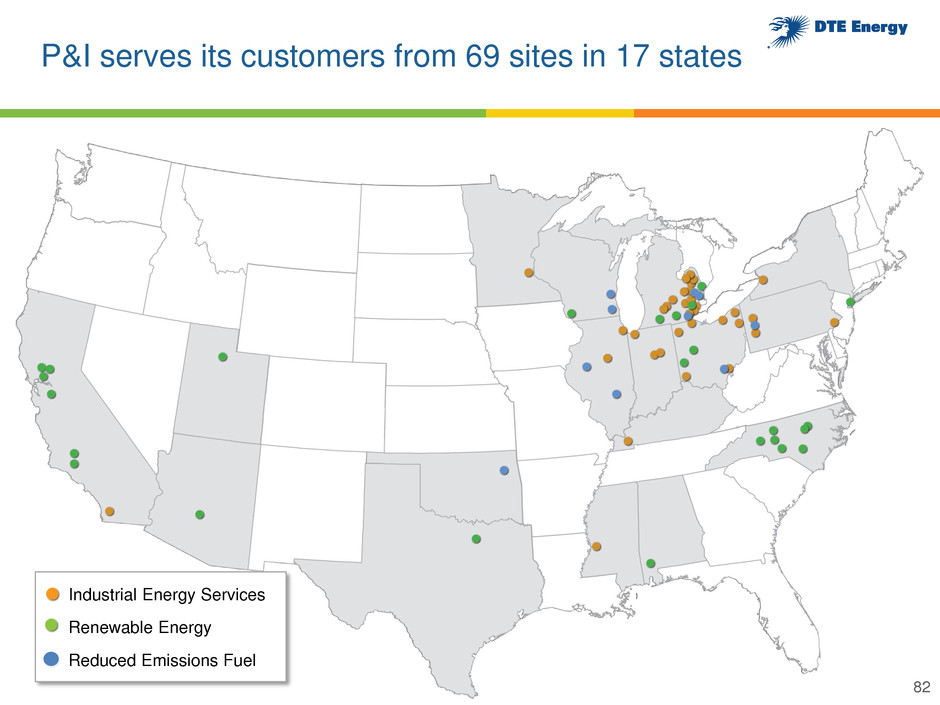

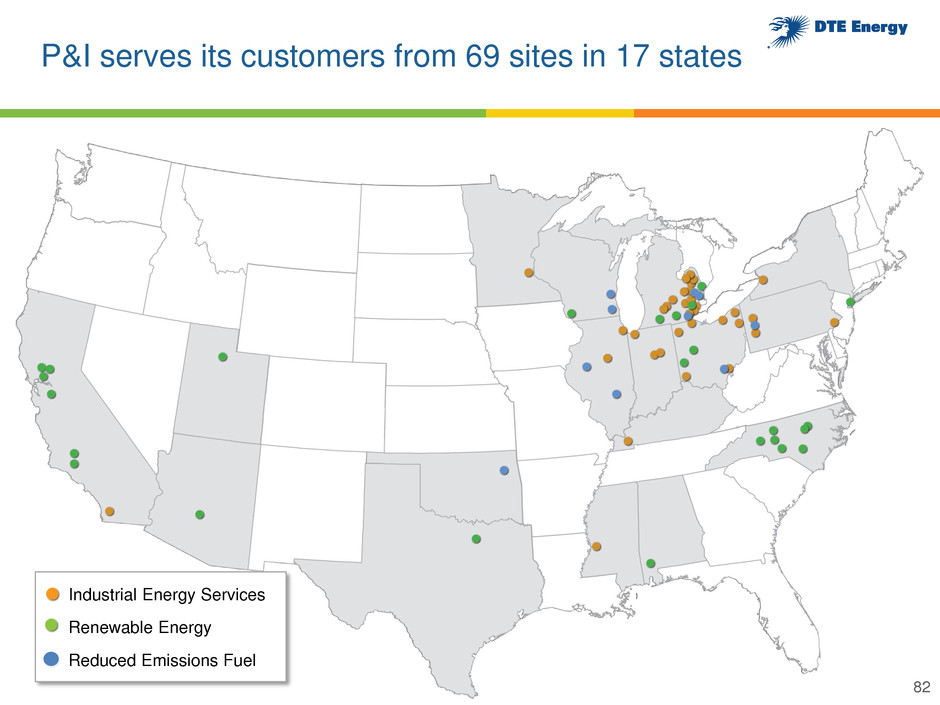

P&I serves its customers from 69 sites in 17 states 82 Industrial Energy Services Renewable Energy Reduced Emissions Fuel

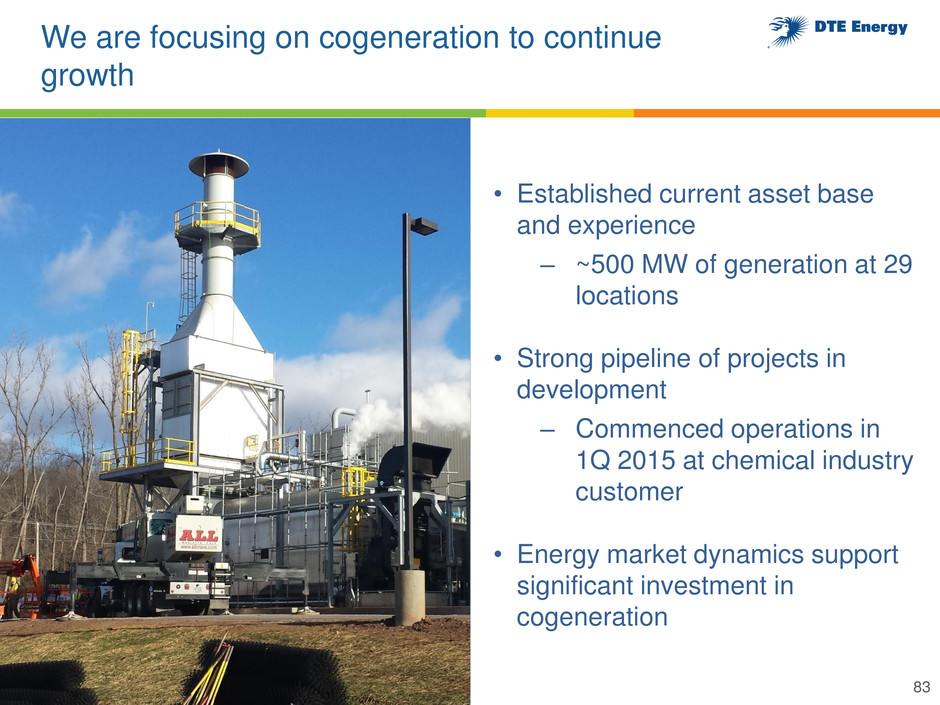

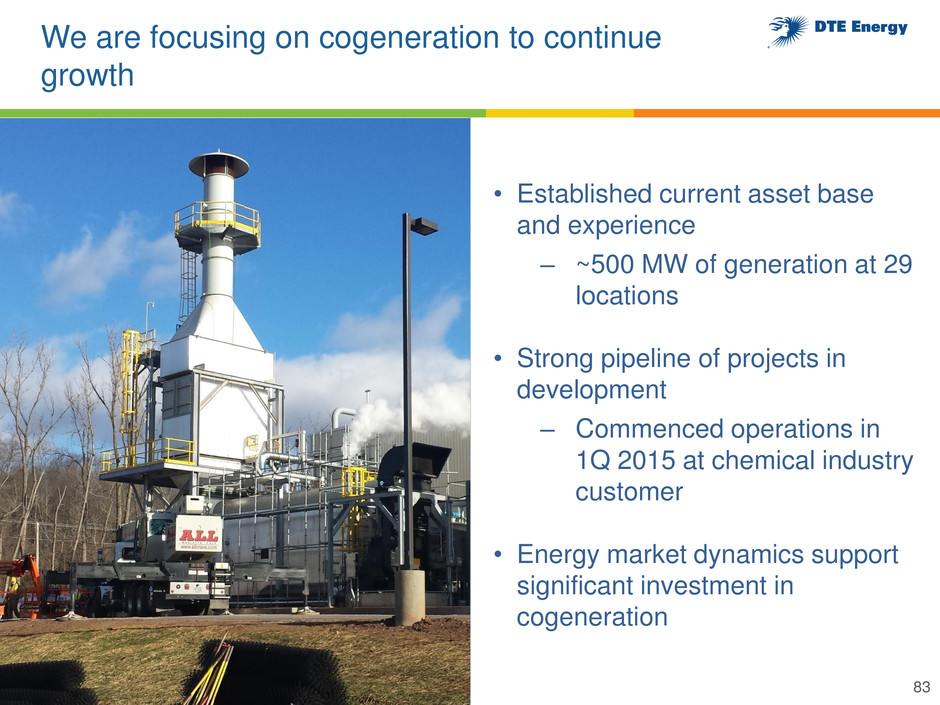

We are focusing on cogeneration to continue growth 83 • Established current asset base and experience ‒ ~500 MW of generation at 29 locations • Strong pipeline of projects in development ‒ Commenced operations in 1Q 2015 at chemical industry customer • Energy market dynamics support significant investment in cogeneration

We continue to optimize reduced emissions fuel business 84 Picture • Operations at 9th DTE owned project to begin 4Q 2015 • Initiated operations at 3rd party owned site in 2Q 2015 • Evaluating additional facility relocations to larger sites • Executing tax equity partnerships to optimize cash flows

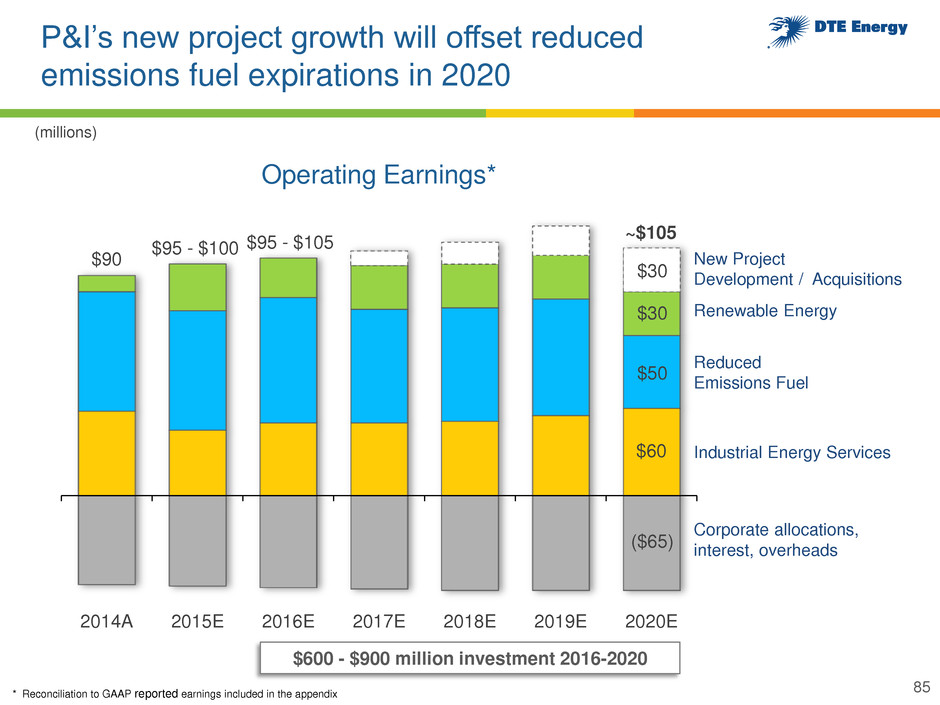

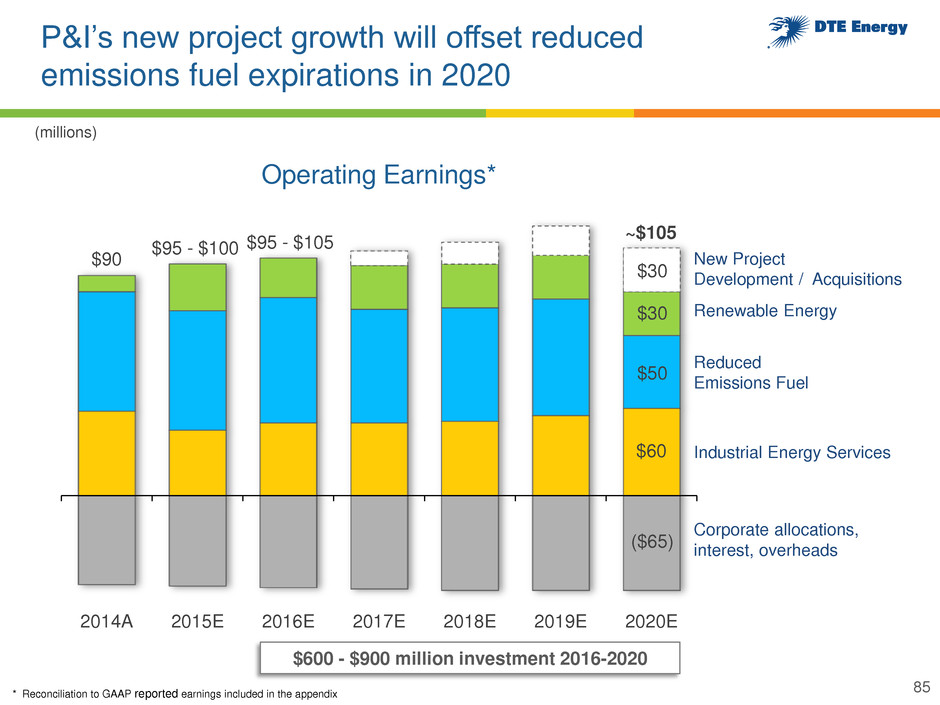

P&I’s new project growth will offset reduced emissions fuel expirations in 2020 2014A 2015E 2016E 2017E 2018E 2019E 2020E ~$105 $30 $50 $60 ($65) $30 New Project Development / Acquisitions Renewable Energy Reduced Emissions Fuel Industrial Energy Services Corporate allocations, interest, overheads $90 $600 - $900 million investment 2016-2020 * Reconciliation to GAAP reported earnings included in the appendix $95 - $100 (millions) 85 $95 - $105 Operating Earnings*

Superior Financial Performance

DTE has a strong investment thesis 87 Solid growth at our business segments DTE Electric... generation renewal and distribution reliability DTE Gas... infrastructure renewal program Non-utility... pipelines, laterals, gathering, cogeneration Constructive political and regulatory landscape Michigan Legislature strengthening foundation for energy investments in our state MPSC playing constructive role in energy policy Opportunity for additional growth Infrastructure investment needs exceed our current plan

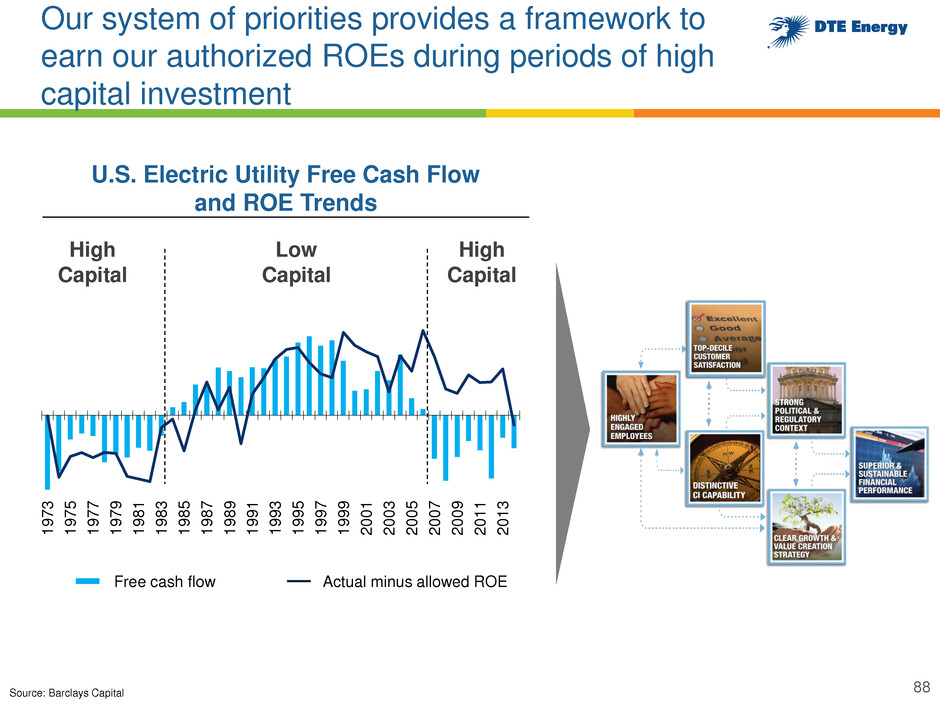

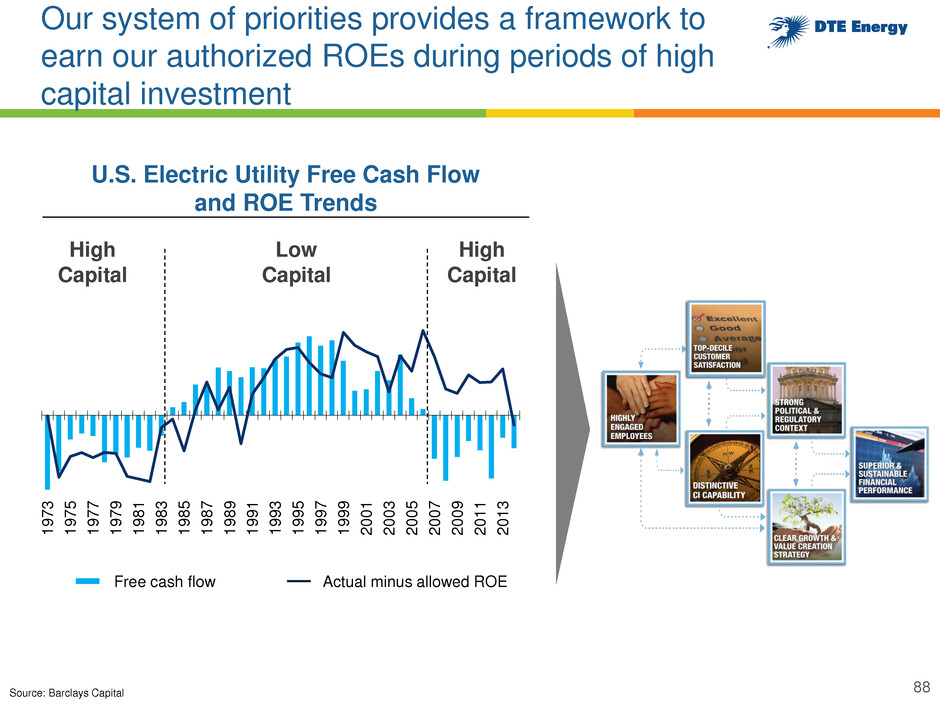

1 9 7 3 1 9 7 5 1 9 7 7 1 9 7 9 1 9 8 1 1 9 8 3 1 9 8 5 1 9 8 7 1 9 8 9 1 9 9 1 1 9 9 3 1 9 9 5 1 9 9 7 1 9 9 9 2 0 0 1 2 0 0 3 2 0 0 5 2 0 0 7 2 0 0 9 2 0 1 1 2 0 1 3 Our system of priorities provides a framework to earn our authorized ROEs during periods of high capital investment U.S. Electric Utility Free Cash Flow and ROE Trends High Capital Low Capital High Capital Source: Barclays Capital Free cash flow Actual minus allowed ROE 88

We are confident our growth plan will deliver value to our shareholders 89 ** Compared to S&P 500 utilities. Source: Bloomberg 2015 operating EPS Guidance midpoint $4.78 total DTE $4.69 growth segments 2016 operating EPS early outlook midpoint $4.93 Providing 5% - 6% growth Significant capital investment in the next 5 to 10 years... ...and investment need exceeds our plan * Reconciliation to GAAP reported earnings included in the appendix 87% 77% 80% 80% 87% 2010 2011 2012 2013 2014 History of growth DTE 3 YR total shareholder return percentile ranking** $3.64 $3.75 $3.94 $4.09 $4.60 Operating EPS* 6% CAGR Plan for success

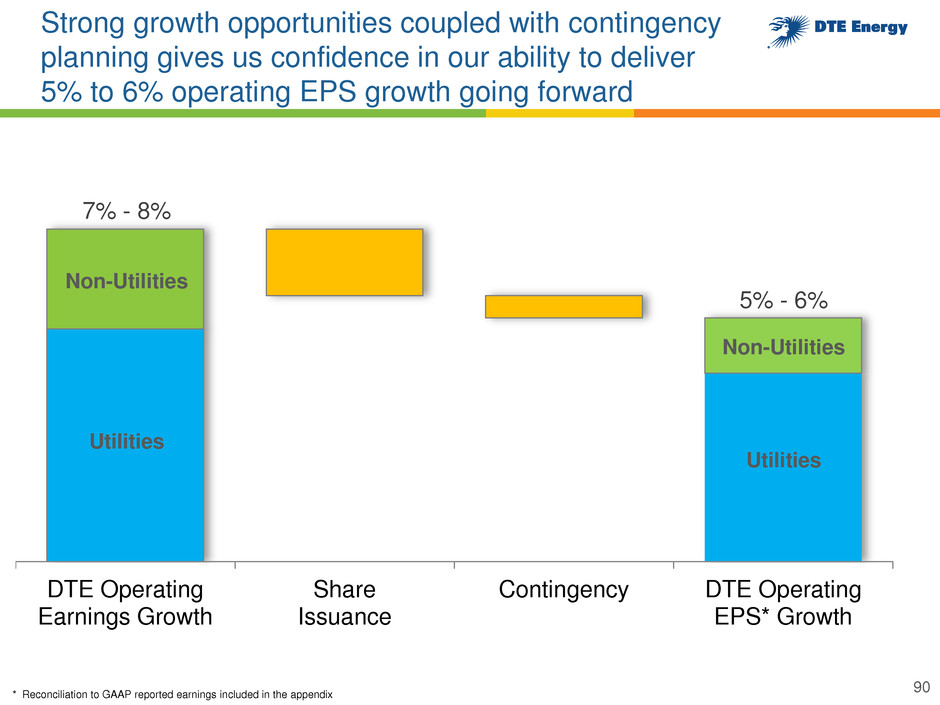

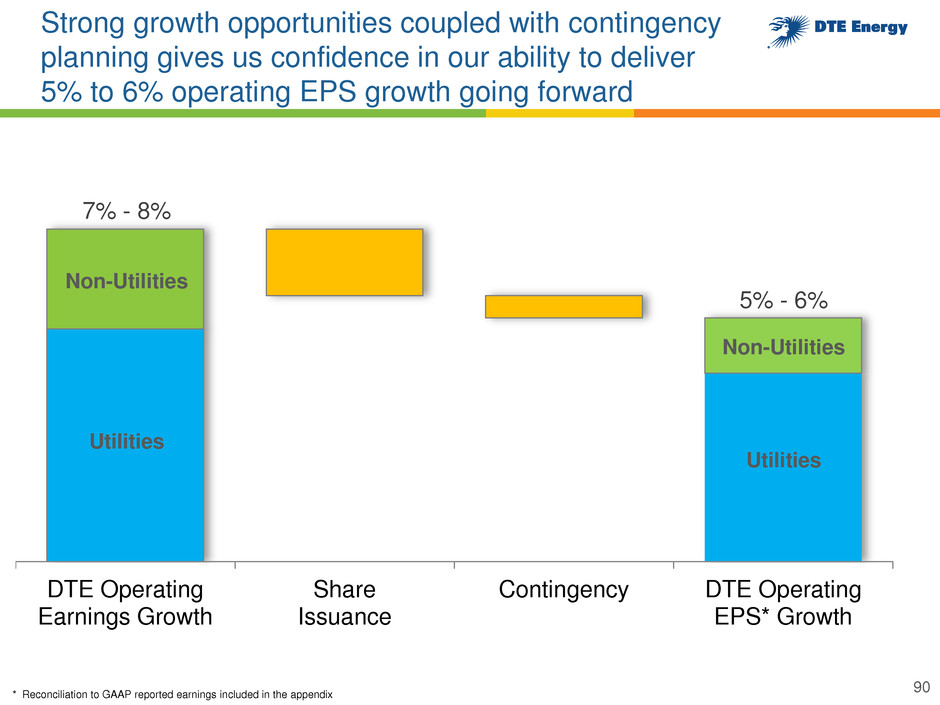

DTE Operating Earnings Growth Share Issuance Contingency DTE Operating EPS* Growth Non-Utilities 7% - 8% 5% - 6% * Reconciliation to GAAP reported earnings included in the appendix Strong growth opportunities coupled with contingency planning gives us confidence in our ability to deliver 5% to 6% operating EPS growth going forward 90 Non-Utilities Utilities Utilities

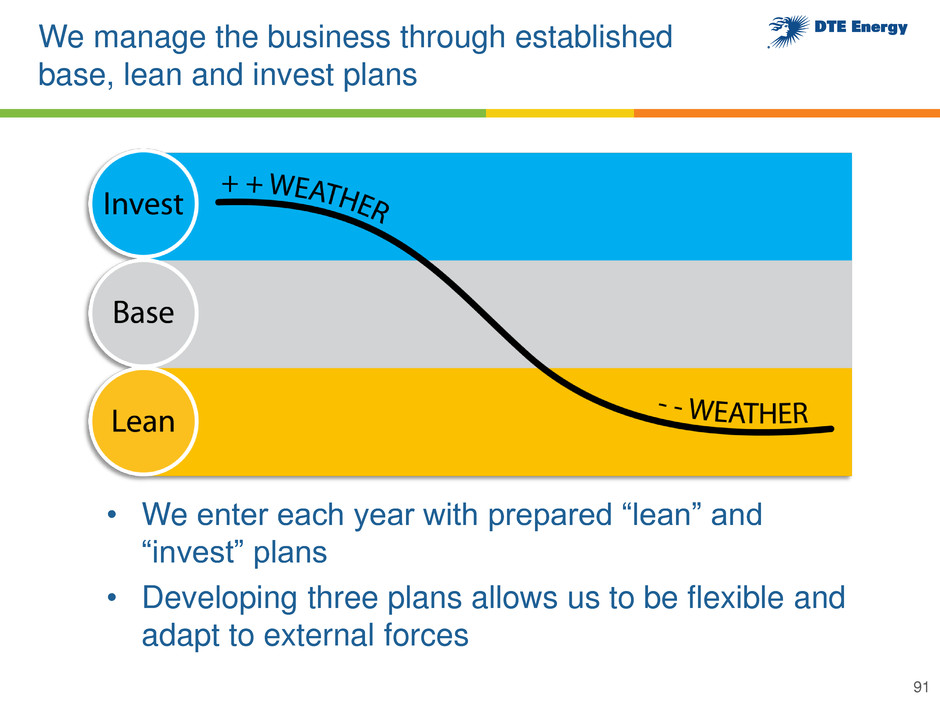

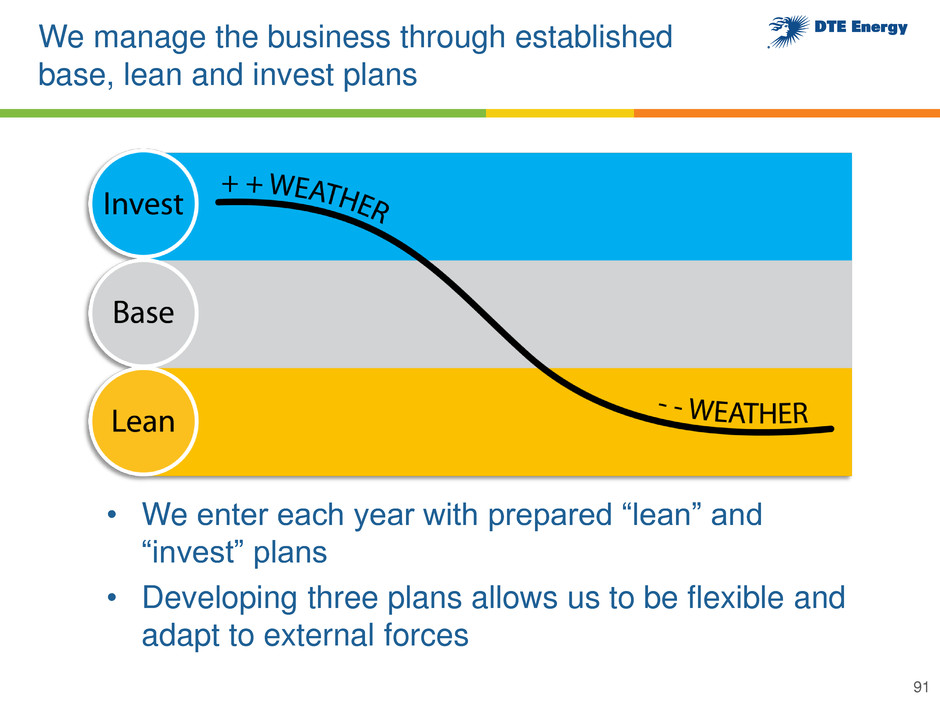

We manage the business through established base, lean and invest plans • We enter each year with prepared “lean” and “invest” plans • Developing three plans allows us to be flexible and adapt to external forces 91

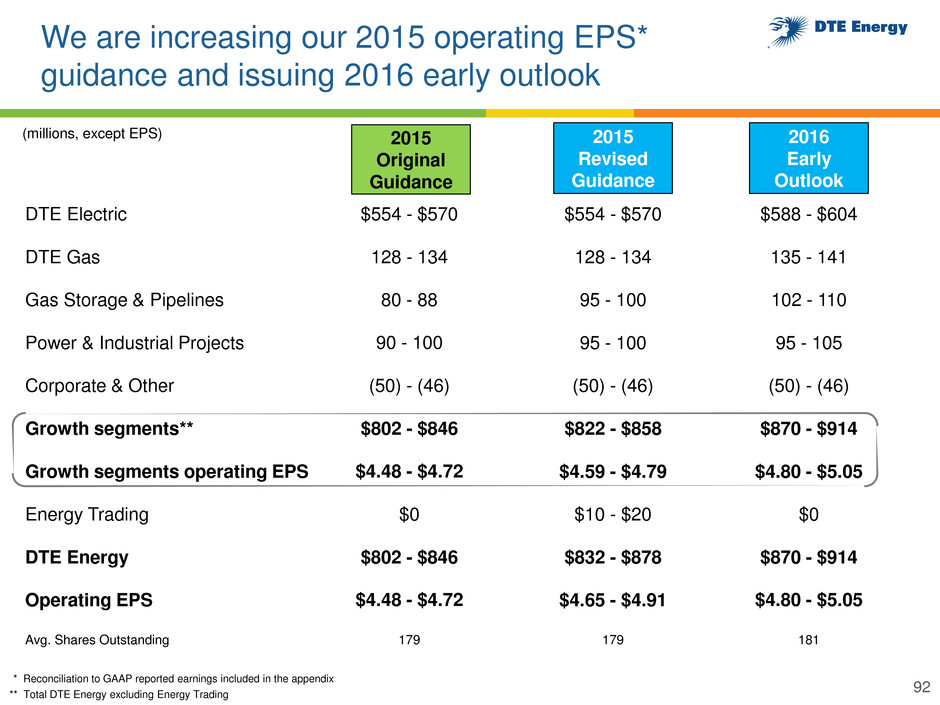

We are increasing our 2015 operating EPS* guidance and issuing 2016 early outlook (millions, except EPS) * Reconciliation to GAAP reported earnings included in the appendix ** Total DTE Energy excluding Energy Trading 2015 Revised Guidance 2016 Early Outlook 2015 Original Guidance DTE Electric DTE Gas Gas Storage & Pipelines Power & Industrial Projects Corporate & Other Growth segments** Growth segments operating EPS Energy Trading DTE Energy Operating EPS Avg. Shares Outstanding $554 - $570 128 - 134 95 - 100 95 - 100 (50) - (46) $822 - $858 $4.59 - $4.79 $10 - $20 $832 - $878 179 $4.65 - $4.91 $588 - $604 135 - 141 102 - 110 95 - 105 (50) - (46) $870 - $914 $4.80 - $5.05 $0 $870 - $914 181 $4.80 - $5.05 $554 - $570 128 - 134 80 - 88 90 - 100 (50) - (46) $802 - $846 $4.48 - $4.72 $0 $802 - $846 179 $4.48 - $4.72 92

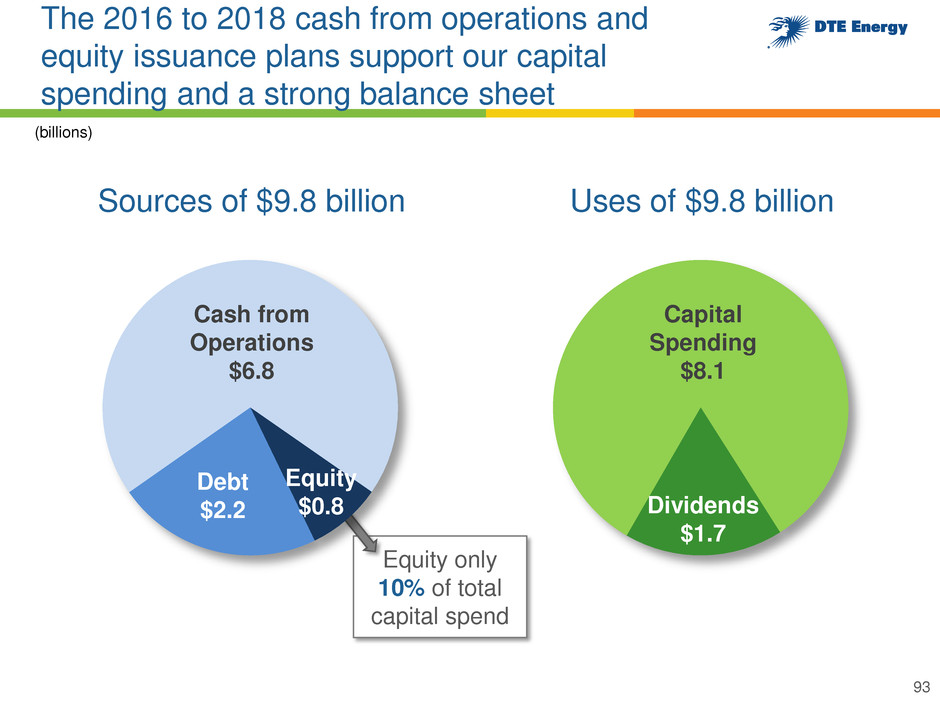

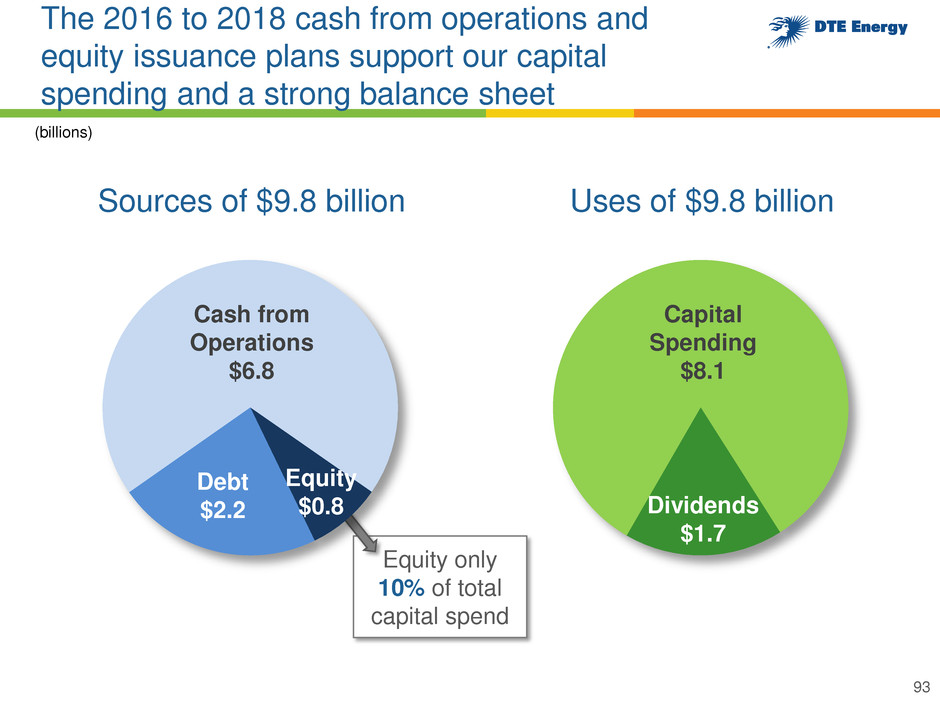

Equity only 10% of total capital spend The 2016 to 2018 cash from operations and equity issuance plans support our capital spending and a strong balance sheet Sources of $9.8 billion Uses of $9.8 billion (billions) Cash from Operations $6.8 Debt $2.2 Equity $0.8 Capital Spending $8.1 Dividends $1.7 93

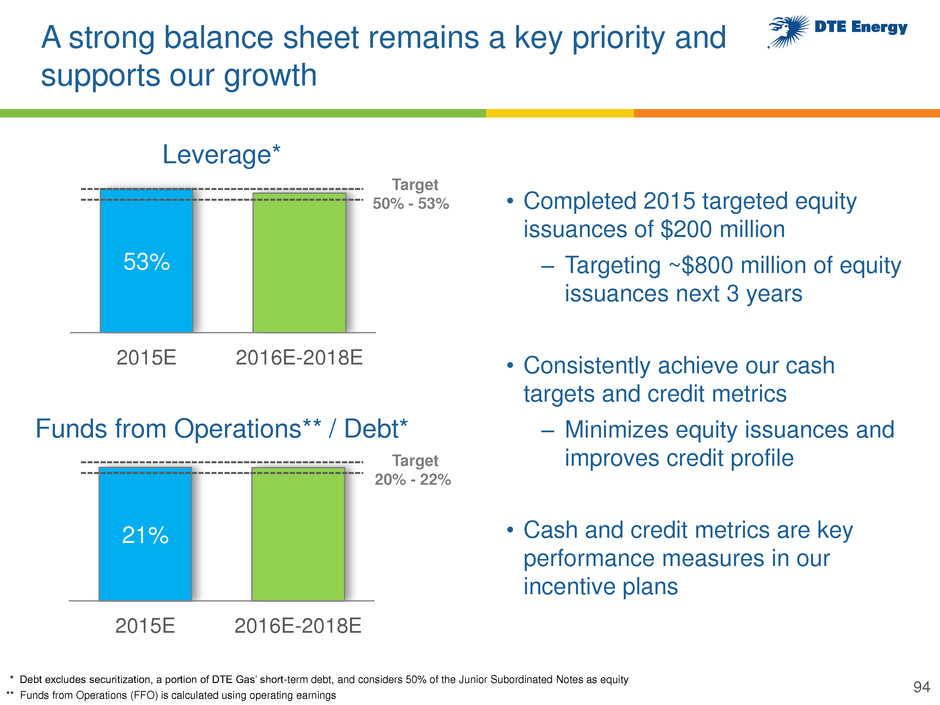

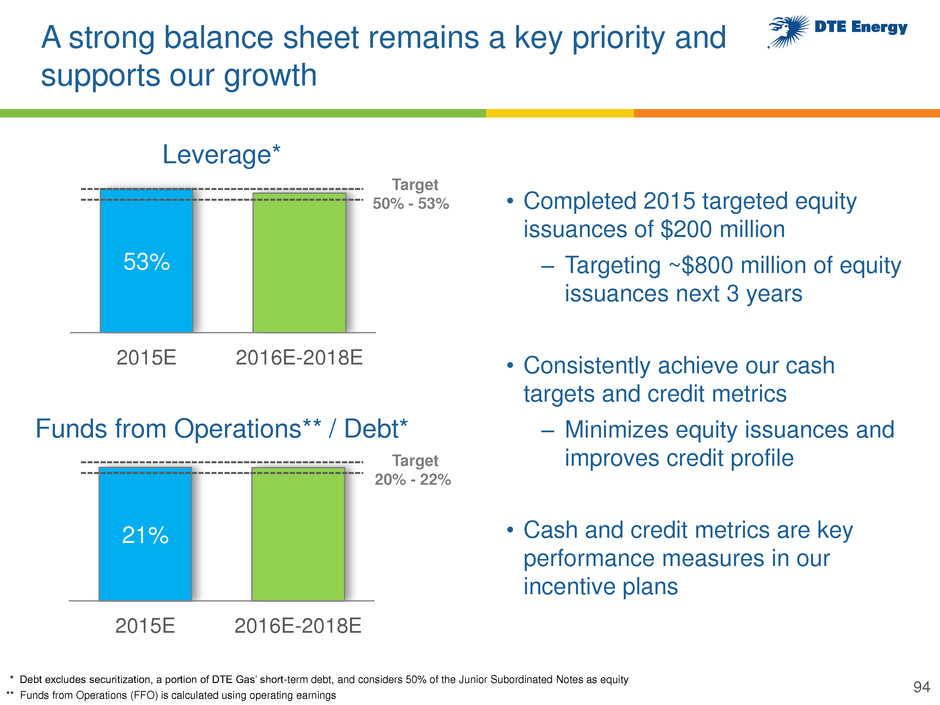

A strong balance sheet remains a key priority and supports our growth Leverage* 23% 25% * Debt excludes securitization, a portion of DTE Gas’ short-term debt, and considers 50% of the Junior Subordinated Notes as equity Target 50% - 53% Target 20% - 22% 5 ** Funds from Operations (FFO) is calculated using operating earnings 53% 2015E 2016E-2018E 21% 2015E 2016E-2018E • Completed 2015 targeted equity issuances of $200 million ‒ Targeting ~$800 million of equity issuances next 3 years • Consistently achieve our cash targets and credit metrics ‒ Minimizes equity issuances and improves credit profile • Cash and credit metrics are key performance measures in our incentive plans 94 Funds from Operations** / Debt*

Our system of priorities is fundamental to how we create value for our shareholders 95 5% - 6% Annual EPS Growth Attractive Dividend Strong Balance Sheet 95

Questions?

A force for growth in the communities where we live and serve

Our future success is tied to our Aspiration and a force for growth and prosperity in the communities where we live and serve To be the best-operated energy company in North America 98

$5 billion over the next 5 years We are a major investor in the State of Michigan and Detroit We are committed to buying from Michigan- based firms and encourage others to follow Our Michigan spend helps create and support ~7,500 jobs Michigan-Based Supplier Spend ($ millions) 2010 2011 2012 2013 2014 2015 Goal $475 $600 $825 $800 $925 $900-950 99

We are a major investor in the State of Michigan and Detroit Our spend with Detroit-based suppliers is helping to spur the city’s recovery $80 $100 $125 $140 $155 $160 2010 2011 2012 2013 2014 2015 Goal 100 Detroit-Based Supplier Spend ($ millions)

We are renewing Detroit’s lighting and electrical infrastructure 101 Lighting: Overseeing ~$180 million program to fully upgrade street lights Electrical: Investing ~$300 million to transition municipal customers to our grid

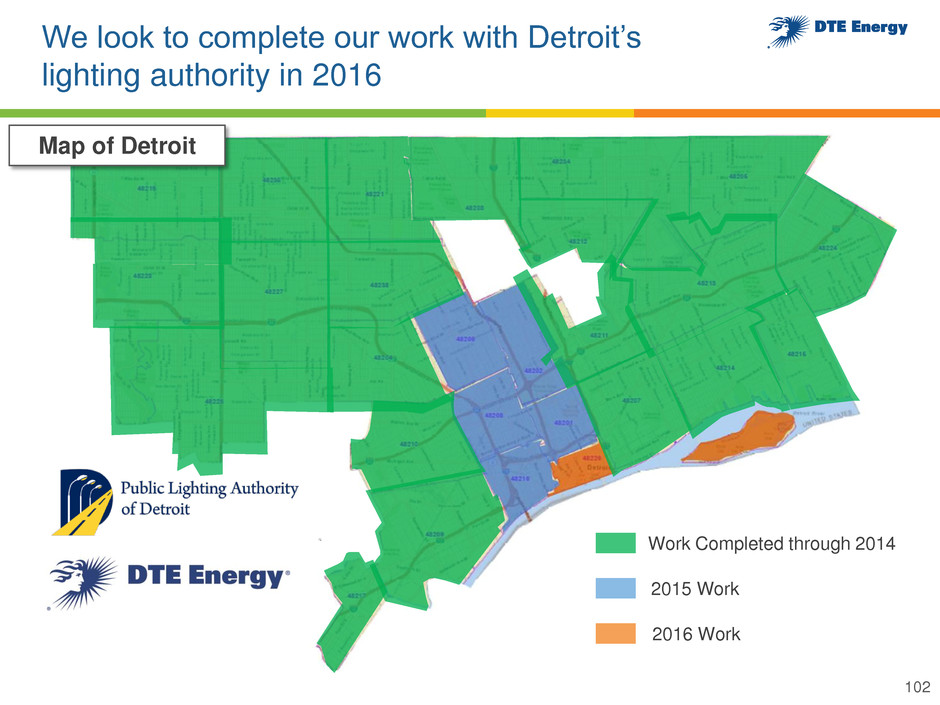

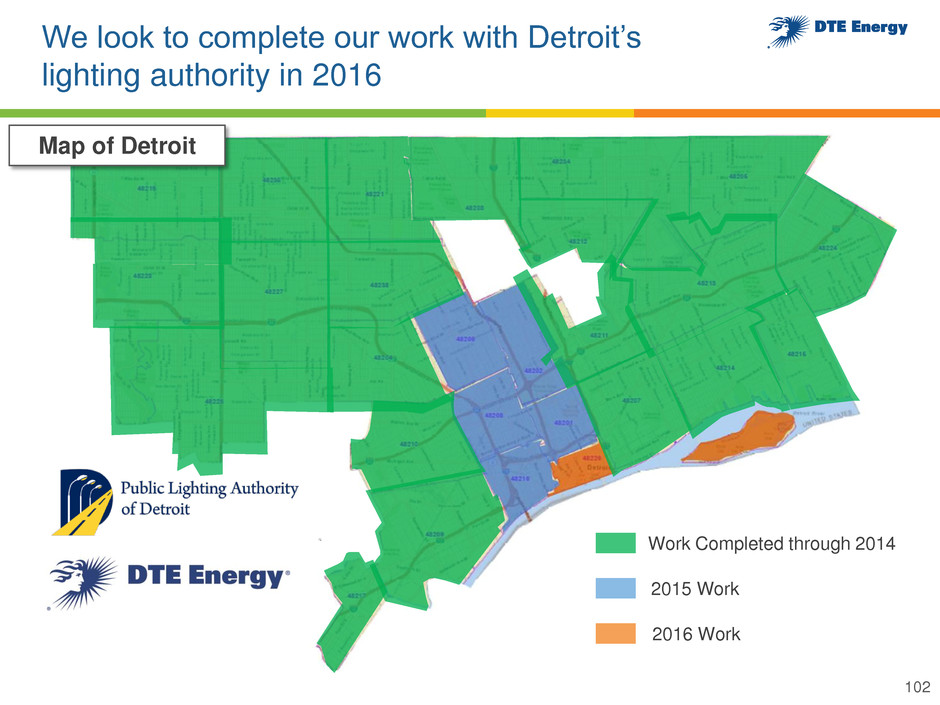

We look to complete our work with Detroit’s lighting authority in 2016 Map of Detroit Work Completed through 2014 2015 Work 2016 Work 102

We are revitalizing our downtown neighborhood and later this year we will break ground on the Grand River Public Space 103

We are serving our communities in a variety of other ways $10 million of additional funding in 2014 Low income assistance Impactful volunteer program Thousands of employees donate time to hundreds of organizations Youth development 550 youth summer jobs across Michigan; 300 interns and co-ops 104

Detroit is in the midst of a revitalization Detroit revitalization video 105

Detroit is in the midst of a revitalization Detroit revitalization video 106

Appendix 107

2015 operating EPS* guidance and 2016 early outlook 108 * Reconciliation to GAAP reported earnings included in the appendix (dollars per share) $3.33 $3.64 $3.75 $3.94 $4.09 $4.60 $2.12 $2.24 $2.35 $2.48 $2.62 $2.76 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Operating EPS Dividend Actuals Forecast $4.78 $4.69 5.8% increase $2.92 2015 Operating EPS Guidance Midpoint Growth segments $4.69 Total DTE Energy $4.78 2016 Operating EPS Early Outlook Midpoint $4.93 $4.93

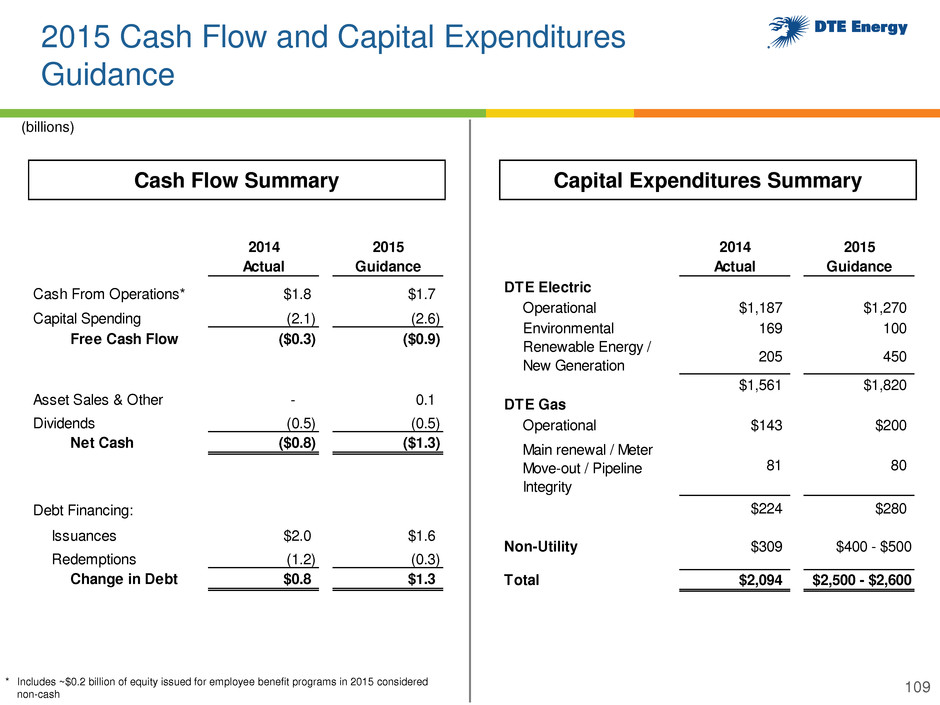

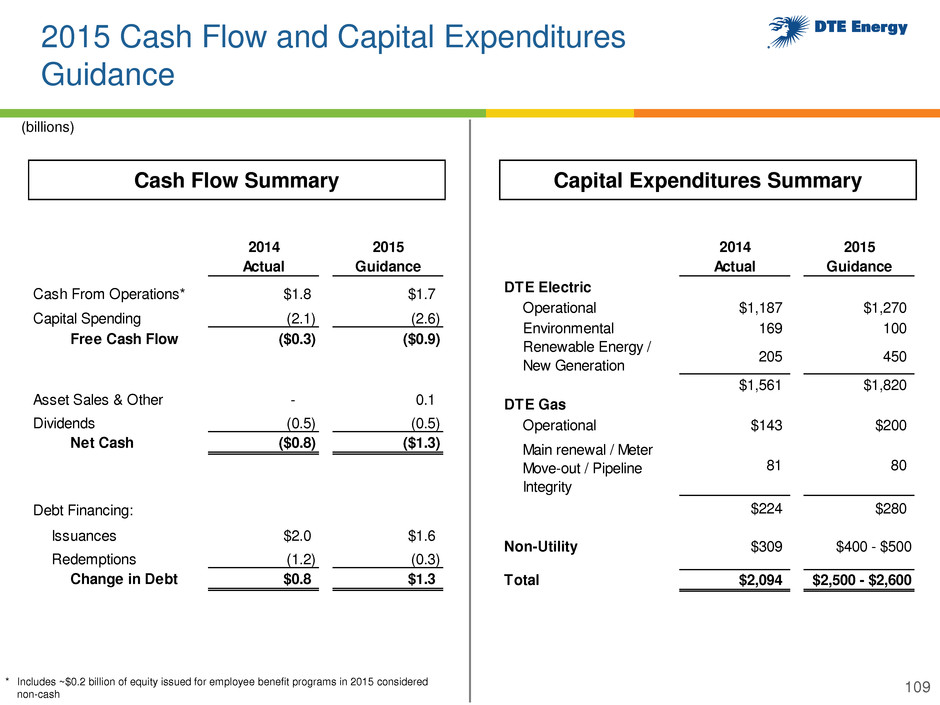

2015 Cash Flow and Capital Expenditures Guidance 109 (billions) Capital Expenditures Summary Cash Flow Summary 2014 2015 Actual Guidance Cash From Operations* $1.8 $1.7 Capital Spending (2.1) (2.6) Free Cash Flow ($0.3) ($0.9) Asset Sales & Other - 0.1 Dividends (0.5) (0.5) Net Cash ($0.8) ($1.3) Debt Financing: Issuances $2.0 $1.6 Redemptions (1.2) (0.3) Change in Debt $0.8 $1.3 2014 2015 Actual Guidance DTE Electric Operational $1,187 $1,270 Environmental 169 100 205 450 $1,561 $1,820 DTE Gas Operational $143 $200 81 80 $224 $280 Non-Utility $309 $400 - $500 Total $2,094 $2,500 - $2,600 Main renewal / Meter Move-out / Pipeline Integrity Renewable Energy / New Generation * Includes ~$0.2 billion of equity issued for employee benefit programs in 2015 considered non-cash

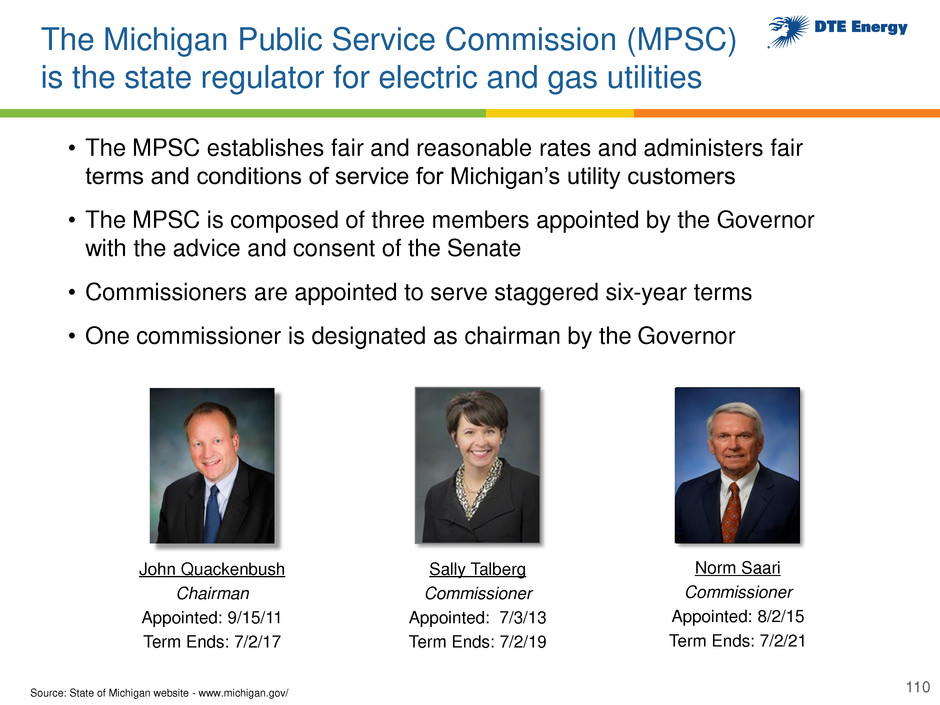

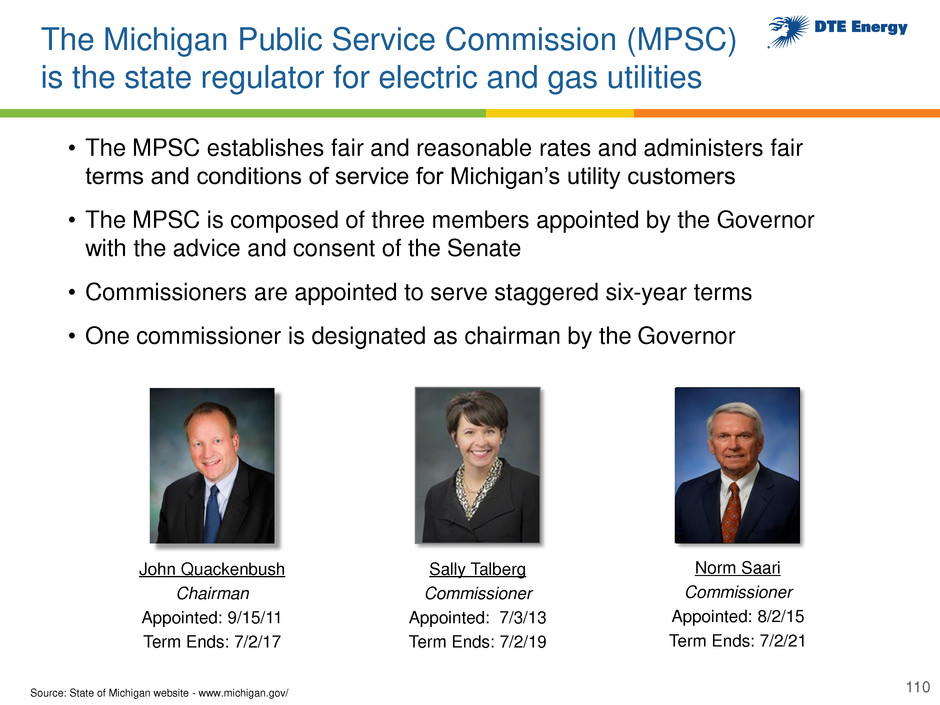

The Michigan Public Service Commission (MPSC) is the state regulator for electric and gas utilities Sally Talberg Commissioner Appointed: 7/3/13 Term Ends: 7/2/19 Norm Saari Commissioner Appointed: 8/2/15 Term Ends: 7/2/21 Source: State of Michigan website - www.michigan.gov/ • The MPSC establishes fair and reasonable rates and administers fair terms and conditions of service for Michigan’s utility customers • The MPSC is composed of three members appointed by the Governor with the advice and consent of the Senate • Commissioners are appointed to serve staggered six-year terms • One commissioner is designated as chairman by the Governor John Quackenbush Chairman Appointed: 9/15/11 Term Ends: 7/2/17 TBD 110

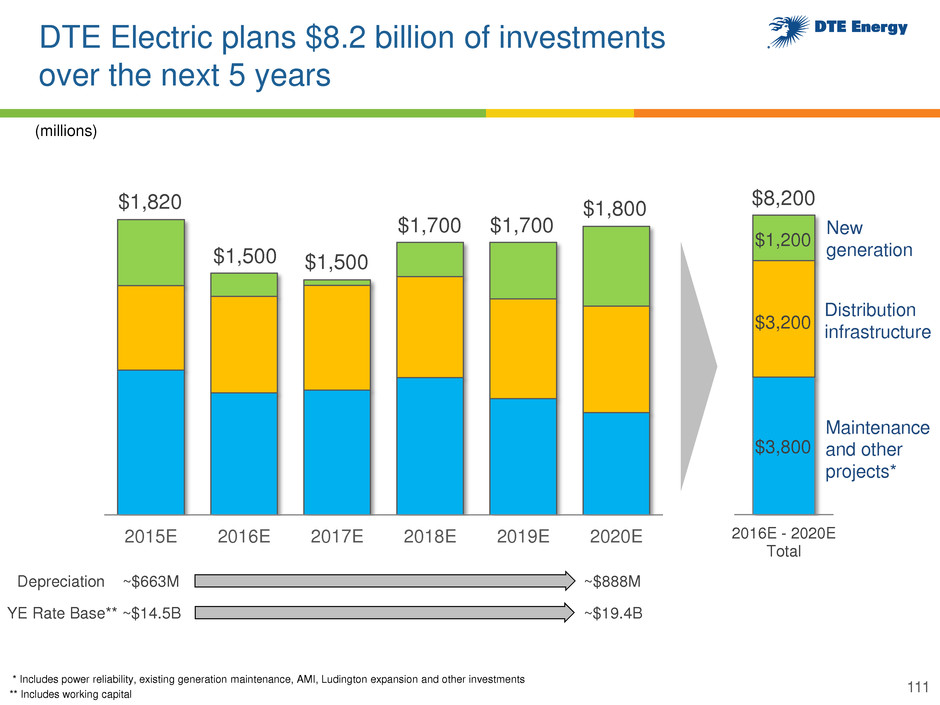

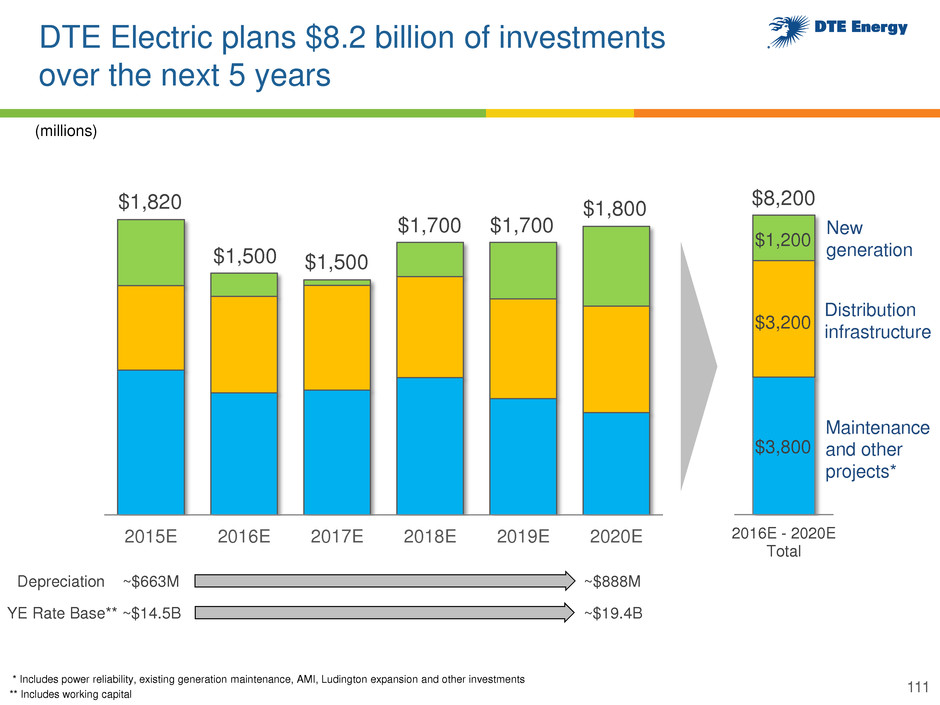

DTE Electric plans $8.2 billion of investments over the next 5 years 2015E 2016E 2017E 2018E 2019E 2020E Distribution infrastructure New generation Maintenance and other projects* 2016E - 2020E Total ~$14.5B ~$19.4B YE Rate Base** ~$663M ~$888M Depreciation * Includes power reliability, existing generation maintenance, AMI, Ludington expansion and other investments ** Includes working capital $1,200 $8,200 (millions) $3,800 $3,200 $1,820 $1,500 $1,500 $1,700 $1,700 $1,800 111

DTE Gas plans $1.6 billion of investments over the next 5 years 2015E 2016E 2017E 2018E 2019E 2020E 2016E - 2020E Total Base infrastructure Infrastructure renewal* NEXUS related $1,600 $200 $650 $750 ~$3.3B ~$4.5B - $4.6B YE Rate Base** ~$102M ~$136M Depreciation ** Includes working capital (millions) $280 $410 $380 $270 $270 $270 112 * Includes main renewal, meter move-out and pipeline integrity

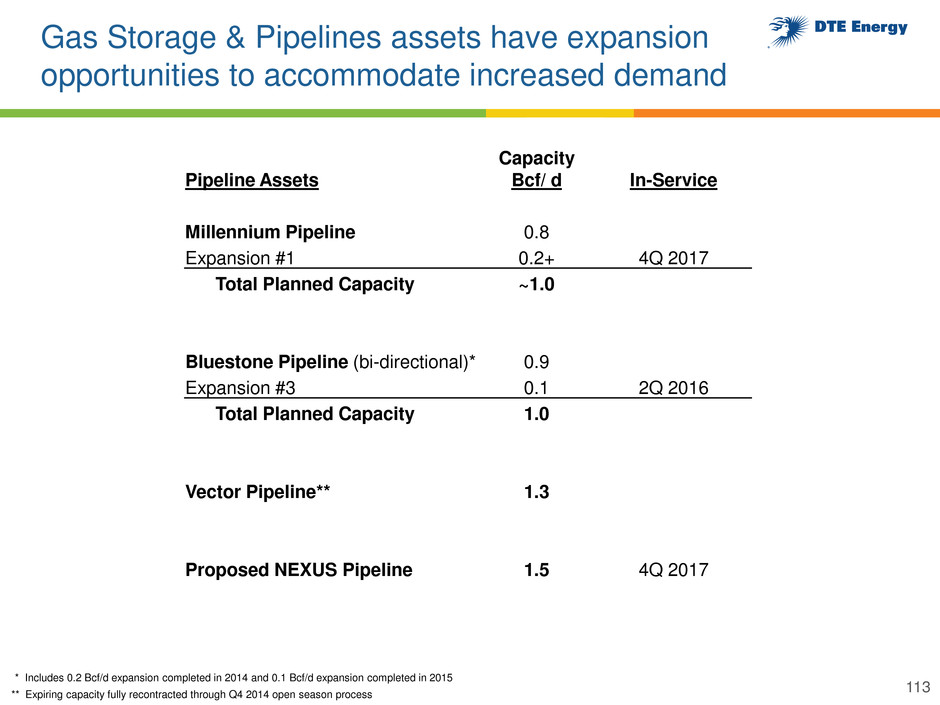

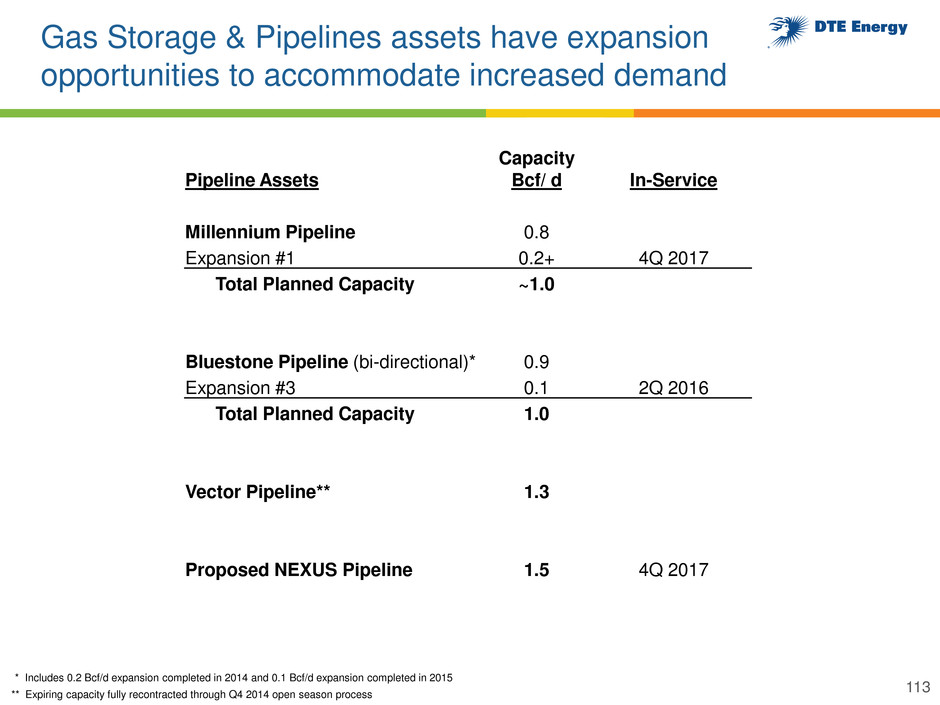

Gas Storage & Pipelines assets have expansion opportunities to accommodate increased demand Pipeline Assets Capacity Bcf/ d In-Service Millennium Pipeline 0.8 Expansion #1 0.2+ 4Q 2017 Total Planned Capacity ~1.0 Bluestone Pipeline (bi-directional)* 0.9 Expansion #3 0.1 2Q 2016 Total Planned Capacity 1.0 Vector Pipeline** 1.3 Proposed NEXUS Pipeline 1.5 4Q 2017 * Includes 0.2 Bcf/d expansion completed in 2014 and 0.1 Bcf/d expansion completed in 2015 ** Expiring capacity fully recontracted through Q4 2014 open season process 113

DTE regulatory filing timeline DTE Gas • Filed expanded Infrastructure Recovery Mechanism (IRM) 2015 • Filed cost of service rates and general rate case DTE Electric 2014 2016 • Business cost of service rates implemented 3Q • Self implement general rates 3Q • Final rate order 4Q • Expect rate case filing 1H • IRM review and ruling 4Q • Begin expanded IRM 1Q • Expect rate case filing 1H 114

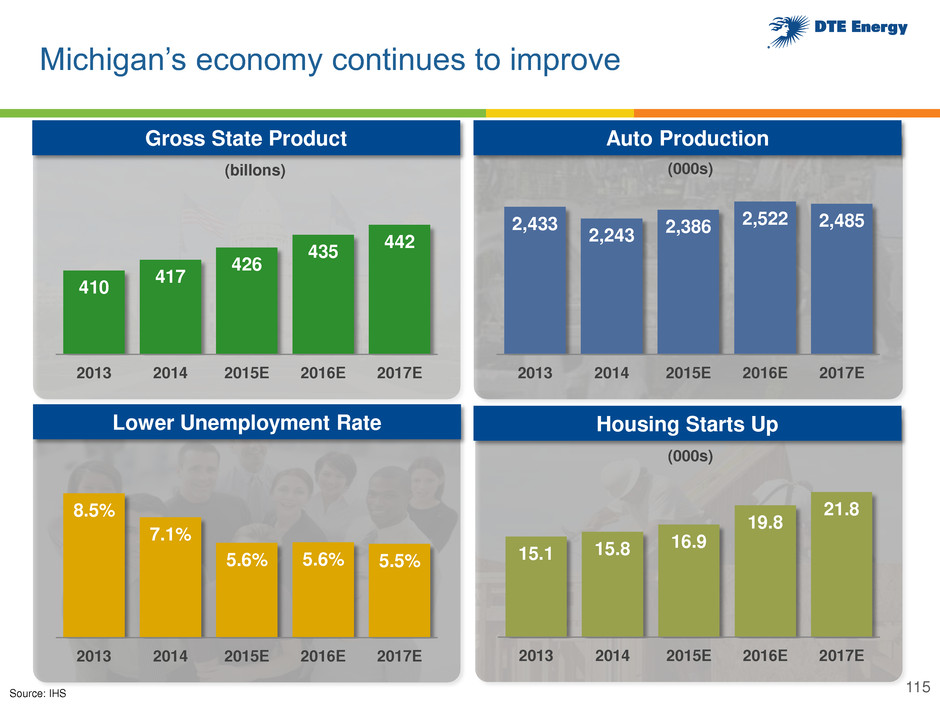

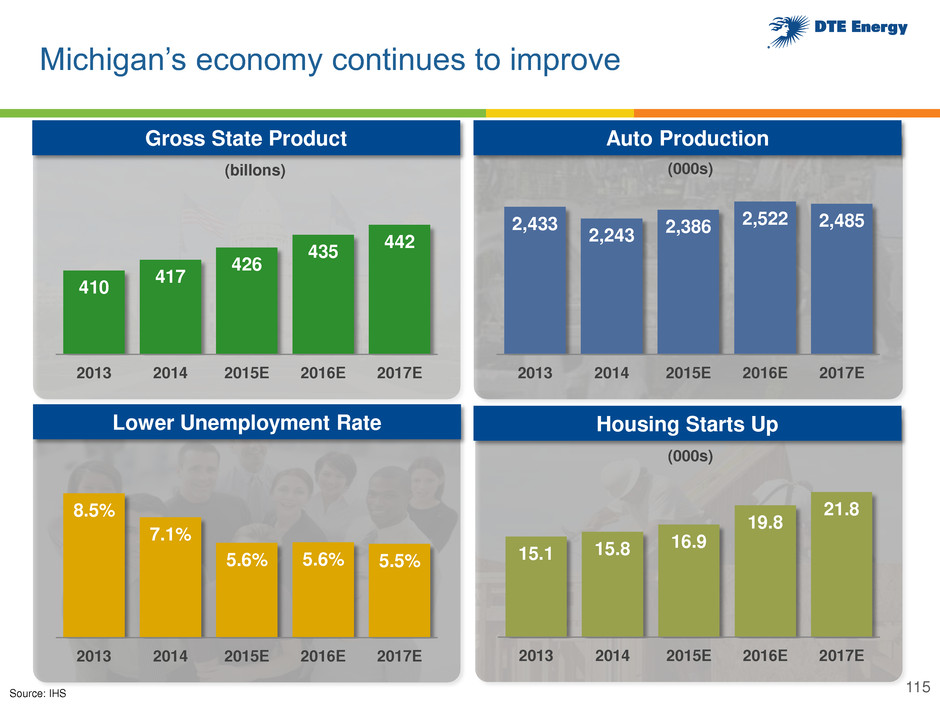

410 417 426 435 442 2013 2014 2015E 2016E 2017E (billons) Michigan’s economy continues to improve 8.5% 7.1% 5.6% 5.6% 5.5% 2013 2014 2015E 2016E 2017E 2,433 2,243 2,386 2,522 2,485 2013 2014 2015E 2016E 2017E (000s) 15.1 15.8 16.9 19.8 21.8 2013 2014 2015E 2016E 2017E (000s) Gross State Product Auto Production Lower Unemployment Rate Housing Starts Up Source: IHS 115

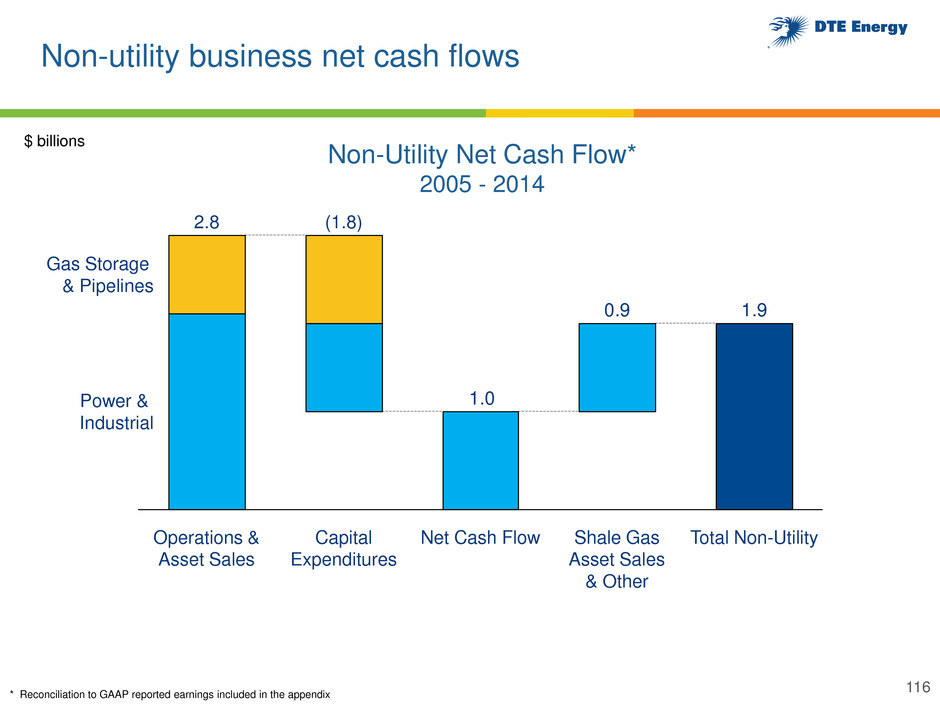

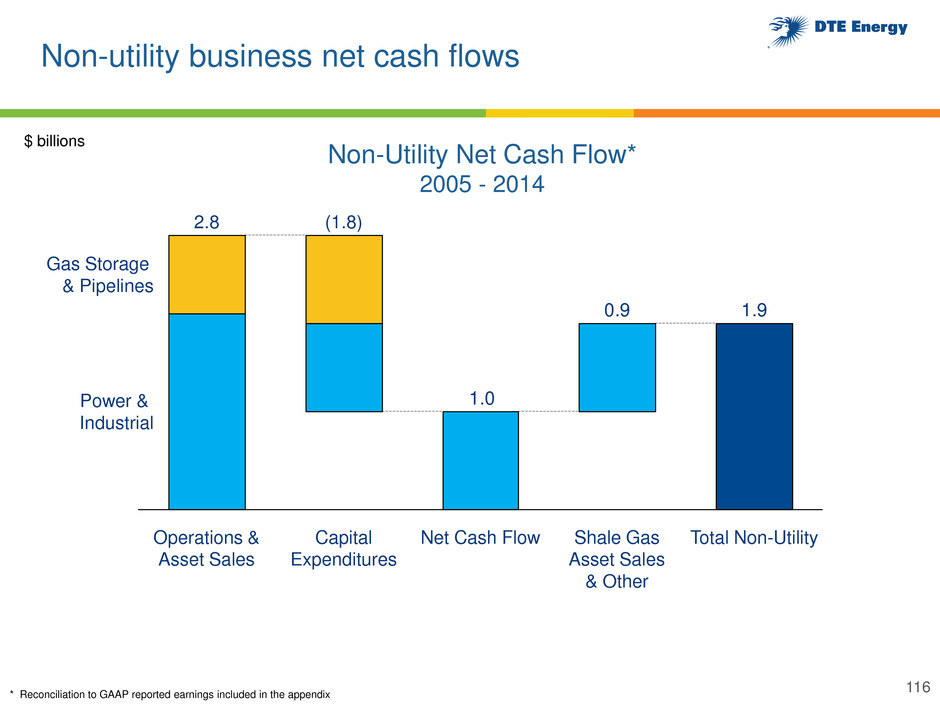

Non-utility business net cash flows * Reconciliation to GAAP reported earnings included in the appendix 1.90.9 1.0 Power & Industrial Total Non-Utility Gas Storage & Pipelines Shale Gas Asset Sales & Other Net Cash Flow Operations & Asset Sales Capital Expenditures (1.8) 2.8 Non-Utility Net Cash Flow* 2005 - 2014 $ billions 116

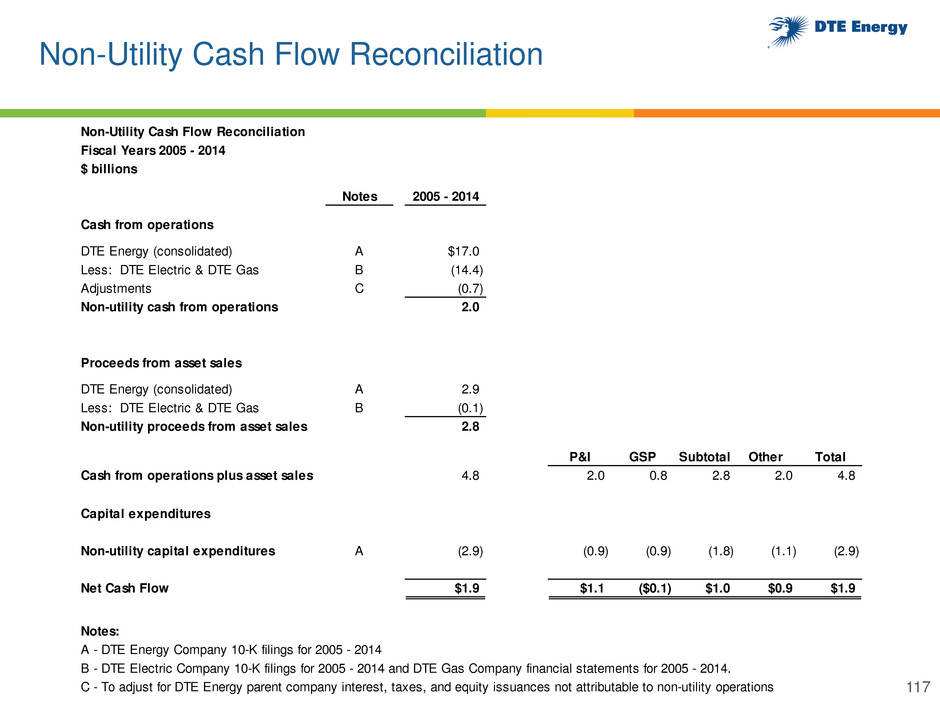

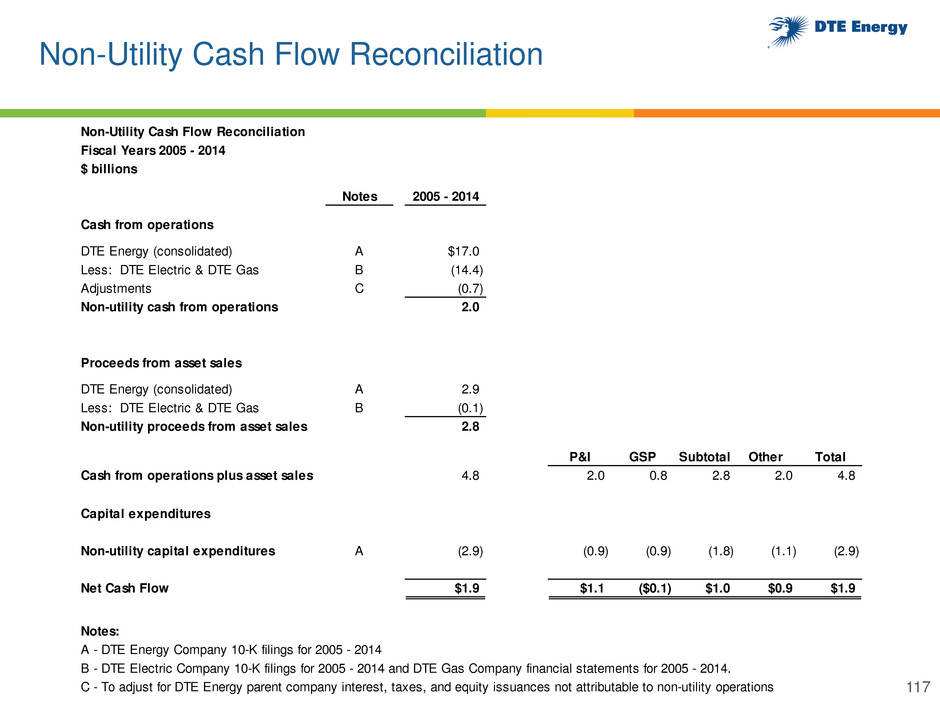

Non-Utility Cash Flow Reconciliation 117 Non-Utility Cash Flow Reconciliation Fiscal Years 2005 - 2014 $ billions Notes 2005 - 2014 Cash from operations DTE Energy (consolidated) A $17.0 Less: DTE Electric & DTE Gas B (14.4) Adjustments C (0.7) Non-utility cash from operations 2.0 Proceeds from asset sales DTE Energy (consolidated) A 2.9 Less: DTE Electric & DTE Gas B (0.1) Non-utility proceeds from asset sales 2.8 P&I GSP Subtotal Other Total Cash from operations plus asset sales 4.8 2.0 0.8 2.8 2.0 4.8 Capital expenditures Non-utility capital expenditures A (2.9) (0.9) (0.9) (1.8) (1.1) (2.9) Net Cash Flow $1.9 $1.1 ($0.1) $1.0 $0.9 $1.9 Notes: A - DTE Energy Company 10-K filings for 2005 - 2014 B - DTE Electric Company 10-K filings for 2005 - 2014 and DTE Gas Company financial statements for 2005 - 2014. C - To adjust for DTE Energy parent company interest, taxes, and equity issuances not attributable to non-utility operations

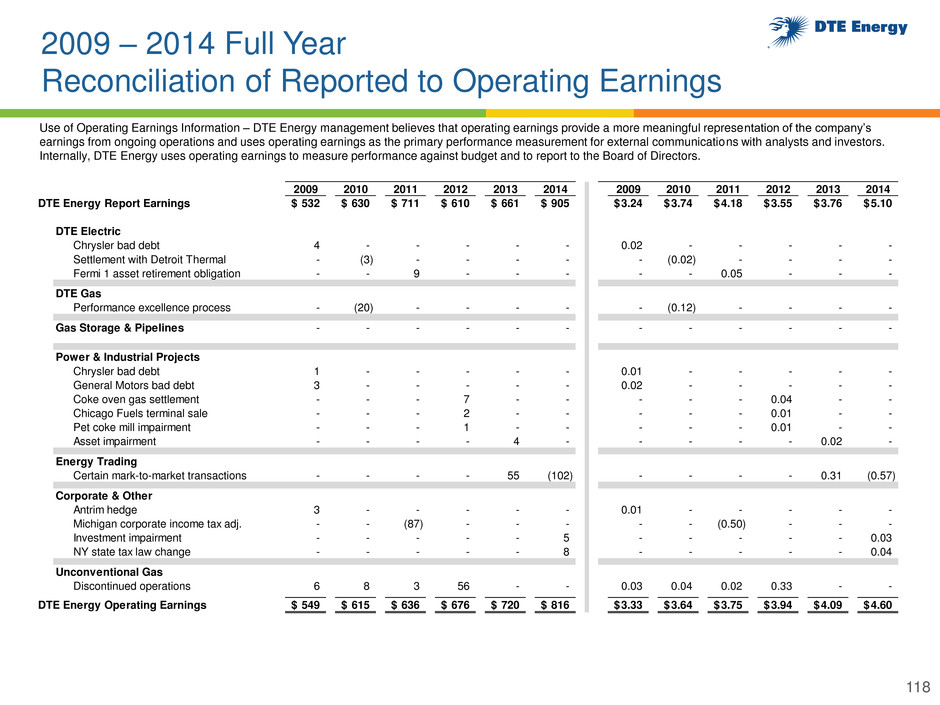

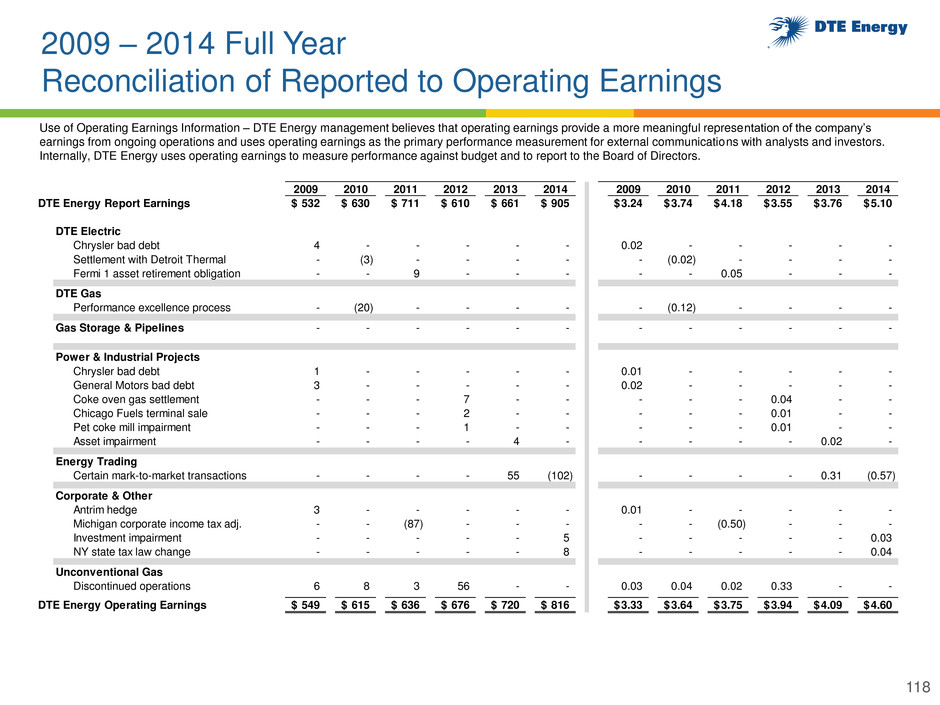

2009 – 2014 Full Year Reconciliation of Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 118 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 DTE Energy Report Earnings 532$ 630$ 711$ 610$ 661$ 905$ 3.24$ 3.74$ 4.18$ 3.55$ 3.76$ 5.10$ DTE Electric Chrysler bad debt 4 - - - - - 0.02 - - - - - Settlement with Detroit Thermal - (3) - - - - - (0.02) - - - - Fermi 1 asset retirement obligation - - 9 - - - - - 0.05 - - - DTE Gas Performance excellence process - (20) - - - - - (0.12) - - - - Gas Storage & Pipelines - - - - - - - - - - - - Power & Industrial Projects Chrysler bad debt 1 - - - - - 0.01 - - - - - General Motors bad debt 3 - - - - - 0.02 - - - - - Coke oven gas settlement - - - 7 - - - - - 0.04 - - Chicago Fuels terminal sale - - - 2 - - - - - 0.01 - - Pet coke mill impairment - - - 1 - - - - - 0.01 - - Asset impairment - - - - 4 - - - - - 0.02 - Energy Trading Certain mark-to-market transactions - - - - 55 (102) - - - - 0.31 (0.57) Corporate & Other Antrim hedge 3 - - - - - 0.01 - - - - - Michigan corporate income tax adj. - - (87) - - - - - (0.50) - - - Investment impairment - - - - - 5 - - - - - 0.03 NY state tax law change - - - - - 8 - - - - - 0.04 Unconventional Gas Discontinued operations 6 8 3 56 - - 0.03 0.04 0.02 0.33 - - DTE Energy Operating Earnings 549$ 615$ 636$ 676$ 720$ 816$ 3.33$ 3.64$ 3.75$ 3.94$ 4.09$ 4.60$

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. For comparative purposes, 2009 through 2012 operating earnings exclude the Unconventional Gas Production segment that was classified as a discontinued operation on 12/31/2012. Reconciliation of Other Reported to Operating Earnings 119