Click to edit Master title style Business Update European Investor Meetings March 20-22, 2017 EXHIBIT 99.1

2 Safe Harbor Statement Many factors impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; impact of volatility of prices in the oil and gas markets on DTE Energy's gas storage and pipelines operations; impact of volatility in prices in the international steel markets on DTE Energy's power and industrial projects operations; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy's energy trading operations; changes in the financial condition of DTE Energy's significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, cyber crime and terrorism; employee relations and the impact of collective bargaining agreements; the risk of a major safety incident at an electric distribution or generation facility and, for DTE Energy, a gas storage, transmission, or distribution facility; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; implementation of new information systems; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2016 Form 10-K (which section is incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric.

3 • Overview • Long-Term Growth Update • Financial Update • Summary

4 DTE Energy is a Fortune 300 company with deep Michigan roots DTE Gas DTE Electric Headquarters • Market cap ~$18 billion • Two fully regulated utilities serving Michigan ‒ DTE Electric (founded 1886) ‒ DTE Gas (founded 1849) • Non-utility businesses with operations in 19 states • Top tier regulatory environment supports utility investment • Constructive energy legislation supports transition to cleaner energy • Strong state and local economy provides avenue for growth Our Business Michigan Strength

5 Growth is driven by strong, stable utilities and complementary non-utility businesses DTE Electric • Electric generation and distribution • 2.2 million customers • Fully regulated Growth driven by infrastructure investments aimed at improving customer reliability Growth driven by strategic opportunities 75%-80% Utility 20%-25% Non-Utility DTE Gas • Natural gas transmission, storage and distribution • 1.3 million customers • Fully regulated Gas Storage & Pipelines • Transport and store natural gas • 5 pipelines, 91 Bcf of storage Power & Industrial Projects • Own and operate energy related assets • 66 sites, 17 states Energy Trading • Active physical and financial gas and power marketing company

6 Our business strategy is fundamental to creating value for our investors 5% - 7% Annual EPS Growth Attractive Dividend Strong Balance Sheet Infrastructure investments drive regulated utility growth Strategic and transparent growth opportunities in non-utility businesses provide diversity in earnings and geography Constructive regulatory structure and continued cost savings enable utilities to earn their authorized returns Distinctive operational excellence and customer satisfaction deliver service integrity Strong BBB credit rating supports near-term dividends in line with high end of EPS growth target

7 We manage the business through established base, lean and invest plans • Along with our base plan, we enter each year with prepared “lean” and “invest” plans • Developing three plans allows us to be flexible and adapt to external forces such as weather Invest Base Lean FAVORABLE WEATHER UNFAVORABLE WEATHER

8 DTE is recognized by environmental, social and governance analysts for our sustainability efforts • Environmental Leadership ‒ Generation portfolio shift to gas and renewables (including building largest solar array east of the Mississippi) ‒ Greenhouse gas reduction program in place with targets and deadlines • Social / Corporate Citizenship ‒ Talent development, recruitment and retention programs ‒ Formal health and safety commitment ‒ Low-income customer programs ‒ Employee safety record continues positive momentum • Governance and Ethics ‒ 11 of 12 Board directors are independent ‒ Board includes separate Corporate Governance and Public Responsibility Committees ‒ Incentive plans are tied to safety and customer satisfaction targets Photo taken at Monroe power plant nature reserve

9 • Best employee safety record in company history • 4th consecutive Gallup Great Workplace award; only utility to be recognized Focus on employees and customers aided our success in 2016 and remains a priority * J.D. Power 2016 Electric Utility Residential and 2016 Gas Utility Residential Customer Satisfaction Study(sm)(large providers). Visit jdpower.com Employee Engagement • Top quartile customer satisfaction for both electric and gas residential customers in latest J.D. Power studies* • Best utility infrastructure reliability in over a decade; 70% reduction in customer outage duration Customer Satisfaction

10 • Constructive electric and gas rate orders • Michigan energy legislation signed into law Recent activities support growth plans for utilities and non-utilities Political & Regulatory Environment • Combined cycle gas plant build announced • Major acquisition at Gas Storage & Pipelines • Significant progress on NEXUS pipeline Growth / Value Capacity requirements 10% Retail Open Access cap 10-month rate case cycle 15% renewables by 2021

11 Continuous improvement has enabled us to be an industry leader in cost management * Source: SNL Financial, FERC Form 1; major US Electric Utilities with O&M greater than $800 million; excluding fuel and purchased power ** Source: SNL Financial, FERC Form 2; gas distribution companies with greater than 300,000 customers; excluding production expense Electric Peers* Gas Peers** 2008 to 2015 Change in O&M Costs 82% 92% Average 34% Daily focus on problem solving Metrics drive progress Scorecards monitor success DTE Gas -5% DTE Electric -3% Average 22%

12 Minimal regulatory lag Solid ROEs Unique recovery mechanisms Source: Barclays, February 2017 Top Tier Michigan’s regulatory environment is one of the best in the United States

13 Positive trends continue with Michigan’s economy Source: IHS 15.0 15.5 16.4 22.7 24.1 2013 2014 2015 2016 2017E Unemployment Rate Housing Start Ups (000s) Lowest unemployment in Michigan since 2000 7th top state for business* Michigan has the highest number of manufacturing jobs since 2007** $407 $414 $421 $429 $437 2013 2014 2015 2016 2017E Gross State Product (billions) 7th best state to make a living in 2016*** * Source: CNBC ** Source: U.S. Department of Labor 8.5% 7.1% 5.4% 4.9% 4.9% 2013 2014 2015 2016 2017E *** Source: Forbes

14 • Overview • Long-Term Growth Update • Financial Update • Summary

15 2017 – 2021 Plan 2012 – 2016 $12 billion $13.5 billion 2017 – 2021 Capital Plan Electric............... $8.4 billion Distribution infrastructure, maintenance, new generation Gas .................... $1.8 billion Base investments, infrastructure renewal, NEXUS related GSP .......... $2.2 to $2.8 billion Expansions, NEXUS P&I ........... $0.6 to $1.0 billion Cogeneration, on-site energy +12.5% Growth through 2021 fueled by investment in utility infrastructure and generation along with midstream opportunities

16 Generation and distribution infrastructure replacement will continue to improve service to customers over the next 10 years DTE Electric Investment New generation • Retire 60% of coal fleet; replacing with clean energy Distribution infrastructure • Move electric reliability to 1st quartile Maintenance and other projects • Productivity and efficiency improvements to reduce costs 2012 – 2016 2017 – 2021 2022 – 2026 $7.4 billion $8.4 billion $9.8 billion Nuclear/Other Gas Renewables Coal 2030 Scenario 2016 Electric Capacity Shift (GW) 15% 30%- 45% 15%- 30% 10% 22% 53% 25% 15%

17 Transformation of our generation fleet is driven by renewable energy standards and the age of our coal plants Belle River St. Clair River Rouge Retirements* Additions* Wind / Solar Trenton New gas plant * Timing and mix subject to change 2024 - 2030 New gas plant Wind / Solar 2017 - 2023 2017 - 2023 2024 - 2030 ~2,100 MW ~1,000 MW ~2,500 – 3,500 MW

18 We have already achieved significant emissions reductions and continue on the path to even cleaner energy 2005 2015 2030 CO2 Emissions 16% Reduction 2005 2015 2030 2005 2015 2030 NOX Emissions SO2 Emissions Emissions reductions are largely due to $2 billion in controls installed at Monroe Power Plant, new technology and reduced reliance on coal-fired generation In addition, mercury emissions have been reduced 42% since 2005 with over 75% reduction expected by 2030 67% Reduction 61% Reduction 40% Reduction 85% Reduction 95% Reduction

19 Infrastructure Resilience Infrastructure Redesign Technology Enhancements Upgraded nearly 20% of circuits since 2013; impact 33% of circuits by the end of 2020, improving reliability on impacted circuits by up to 70% Major investments planned at 20-25 substations by 2021 to address load growth and aging infrastructure Remote monitoring capability more than doubled from 2015 to 2016 with 100% capability planned by 2019 DTE Electric distribution investments continue to drive reliability and increase customer satisfaction Tree Trimming Enhanced program has resulted in a 70% reliability improvement on trimmed circuits

20 Infrastructure renewal and replacement improves service to customers over the next 10 years DTE Gas Investment NEXUS related compression Infrastructure renewal • Strengthen gas infrastructure by reducing planned main replacement cycle by half Base infrastructure • Transmission, compression, distribution, storage 2012 – 2016 2017 – 2021 $1.4 billion $1.8 billion 2022 – 2026 $1.7 billion

21 Main Replacement Pipeline Integrity Meter Move Out Systematically replaces poor performing unprotected main - minimizing leaks and improving customer satisfaction Drives productivity - reducing manual meter reading costs Strengthens the system - decreasing the potential for system failures Replacing aging infrastructure achieves a fundamental shift in performance, cost and productivity at DTE Gas i it l t

22 Gas Storage & Pipelines (GSP) has an asset portfolio with multiple growth platforms Growth Platforms Purposefully located in the best geology in North America ‒ Bluestone Pipeline & Gathering ‒ Millennium Pipeline ‒ NEXUS Pipeline ‒ Link* Lateral & Gathering Michigan Assets Strategically located between Chicago and Dawn trading hubs ‒ Vector Pipeline ‒ Storage ‒ Gathering Link Lateral & Gathering NEXUS Pipeline DTE Gas DTE Storage Bluestone Pipeline & Gathering Michigan Gathering Birdsboro Pipeline * Includes Appalachia Gathering System and 55% of Stonewall Gas Gathering

23 • FERC certificate of construction expected 1H17 • In-service 4Q17 • Ohio interconnect agreements provide 1.75 Bcf/d of market access • Mainline expandable up to 2.0 Bcf/d NEXUS • Initial shipper demand greater than anticipated ‒ Firming up near-term growth plans • Strong tie with existing markets; new market access to Gulf and Mid-Atlantic / LNG exports • Expansion potential over 1.0 Bcf/d Link* Lateral & Gathering Pipeline and gathering platforms provide unique opportunities and synergies for long-term growth * Includes Appalachia Gathering System and 55% of Stonewall Gas Gathering

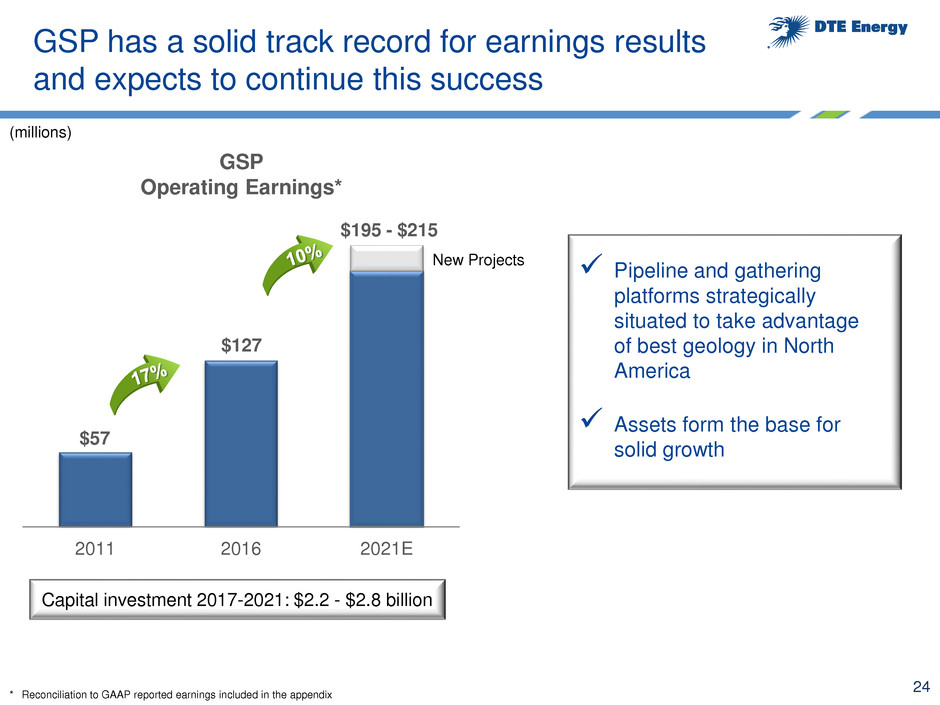

24 GSP has a solid track record for earnings results and expects to continue this success * Reconciliation to GAAP reported earnings included in the appendix GSP Operating Earnings* 2011 2016 2021E $127 $195 - $215 $57 (millions) Pipeline and gathering platforms strategically situated to take advantage of best geology in North America Assets form the base for solid growth Capital investment 2017-2021: $2.2 - $2.8 billion New Projects

25 Power & Industrial Projects (P&I) operates three distinct business lines across the United States Industrial Energy Services Renewable Energy Reduced Emissions Fuel (REF) • On-site utility services for industrial and commercial customers • Coke and pulverized coal for steel customers • Wood-fired power plants • Convert landfill gas to energy • Projects to reduce emissions from coal-fired plants • Utility contracted Typical contract 5-20 years Contract duration ~6 years Typical contract 10-25 years Contract duration ~15 years Contract duration ~5 years

26 Future growth focused on strategic utility-like projects and asset acquisitions Utility-Like Projects Asset Acquisition Distinct capabilities Experience with large industrial and commercial customers History of executing utility-like long-term contracts Expertise in operations and project management Proficiency in providing full suite of utility services

27 P&I’s new project growth will offset expiration of reduced emissions fuel earnings (millions) P&I Operating Earnings* Replace short-term REF earnings with long-term contracted value Development of cogeneration and utility-like services Asset acquisition Capital investment 2017-2021: $0.6 - $1.0 billion 2011 2016 2021E New Projects $100 - $110 $95 $38 * Reconciliation to GAAP reported earnings included in the appendix

28 • Overview • Long-Term Growth Update • Financial Update • Summary

29 Strong track record of exceeding original guidance; targeting 11th consecutive year in 2017 Increased operating EPS growth target to 5% - 7% from 5% - 6% Increased 2017 annualized dividend by 7.1%; targeting ~7% dividend increases in 2018 and 2019 * Reconciliation to GAAP reported earnings included in the appendix We increased our operating EPS* growth target to 5% - 7% from 5% - 6% (dollars per share) * Reconciliation to GAAP reported earnings included in the appendix ** Growth segments midpoint (excludes Energy Trading) 2017 Guidance $5.25 Growth Segment $4.93 ** $5.31 2016 Original Guidance 2016 Actual $3.08 $3.30 Operating EPS Annualized dividend per share $5.28 $5.14 Growth Segment

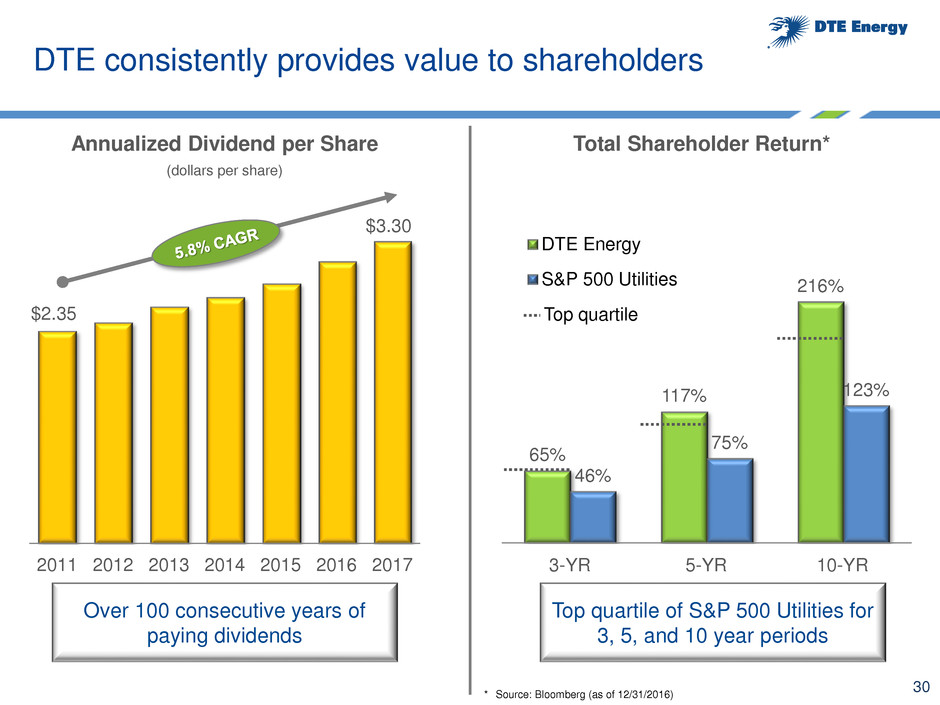

30 DTE consistently provides value to shareholders * Source: Bloomberg (as of 12/31/2016) 2011 2012 2013 2014 2015 2016 2017 Annualized Dividend per Share $2.35 $3.30 Total Shareholder Return* (dollars per share) Over 100 consecutive years of paying dividends 65% 117% 216% 46% 75% 123% DTE Energy S&P 500 Utilities 10-YR 5-YR Top quartile 3-YR Top quartile of S&P 500 Utilities for 3, 5, and 10 year periods

31 21% 2016 2017-2019E 51% 2016 2017-2019E Leverage* Funds from Operations** / Debt* Target 50% - 53% Target 20% + • No equity issuances planned for 2017 ‒ Acquisition related equity of $675 million in late 2019 (through convertible equity units) ‒ No additional equity planned through 2019 • Issued $2.7 billion of long-term debt to fund growth • $1.5 billion of available liquidity at December 31, 2016 Cash flow and balance sheet strength are a key priority * Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity ** Funds from Operations (FFO) is calculated using operating earnings

32 • Overview • Long-Term Growth Update • Financial Update • Summary

33 Engaged employees create a safe work environment and drive great operational results Value driven utility investments provide an excellent customer experience while ensuring affordable rates Constructive regulatory environment and continued cost savings enable utilities to earn authorized returns Strategic and transparent growth opportunities in non-utility businesses offer diversity in earnings and geography Strong EPS and dividend growth that deliver premium total shareholder returns Summary

34 Appendix

35 2017 Guidance DTE Electric DTE Gas Gas Storage & Pipelines Power & Industrial Projects Corporate & Other Growth segments** Growth segments operating EPS Energy Trading DTE Energy Operating EPS Avg. Shares Outstanding $610 - $624 143 - 151 140 - 150 90 - 100 (64) - (60) $919 - $965 $5.12 - $5.38 $5 - $15 $924 - $980 179.5 $5.15 - $5.46 2016 Actuals $622 138 127 95 (59) $923 $5.14 $25 $948 179.5 $5.28 2017 operating EPS* guidance supports 5% - 7% growth (millions, except EPS) * Reconciliation to GAAP reported earnings included in the appendix ** Total DTE Energy excluding Energy Trading • 2017 operating EPS growth segment guidance midpoint growing 6.5% from 2016 original guidance of $4.93 • 2017 guidance assumes return to normal weather – 2016 included significant weather favorability at DTE Electric

36 2016 Actual 2017 Guidance DTE Electric Distribution Infrastructure $567 $690 New Generation 131 45 Maintenance & Other 805 725 $1,503 $1,460 DTE Gas Base Infrastructure $177 $200 NEXUS Related 94 90 Main Replacement* 124 145 $395 $435 Non-Utility $1,533 $900 - $1,100 Total $3,431 $2,795 - $2,995 2016 Actual 2017 Guidance Cash From Operations $2.1 $1.9 Capital Expenditures (3.4) (3.0) Free Cash Flow ($1.3) ($1.1) Asset Sales & Other - - Dividends (0.5) (0.6) Net Cash ($1.8) ($1.7) Debt Financing: Issuances $2.7 $1.7 Redemptions (0.9) - Change in Debt $1.8 $1.7 Capital Expenditures Cash Flow 2017 cash flow and capital expenditures guidance support growth (billions) (millions) * Includes Main Renewal / Meter Move-out / Pipeline Integrity

37 With tax reform, DTE is uniquely situated to maximize customer and shareholder value = Consolidated DTE Impact Customer savings allow for potential additional reliability investment Increased earnings at non-utilities offset loss of interest deductions at holding company Operating EPS growth target remains at 5% - 7% • Reduces customers rates • Allows acceleration of customer centric reliability projects • Increases earnings • Reduces cash flow + Utilities + Non-utilities - Holding Company Assumptions • Increases earnings • Reduces earnings • Corporate tax rate reduction to 20% • 100% capital expensing • Loss of interest expense deductibility on all debt • Permanent loss of value for customers • Increases cash flow • Deferred benefit • Reduces earnings • Reduces earnings • No impact • Deferred benefit

38 The Michigan Public Service Commission (MPSC) is the state regulator for electric and gas utilities • The MPSC establishes fair and reasonable rates and administers terms and conditions of service for Michigan’s utility customers • The MPSC is composed of three members appointed by the Governor with the advice and confirmation of the State Senate • Commissioners are appointed to serve staggered six-year terms • One commissioner is designated as chairman by the Governor Sally Talberg Chair Term Ends: 7/2/19 Norm Saari Commissioner Term Ends: 7/2/21 Rachael Eubanks Commissioner Term Ends: 7/2/17

39 Over 10% of DTE Electric energy supply is from renewable energy sources Wind • Includes owned and contracted • Nearly 280 DTE owned turbines in- service with 65 more expected in 2018 Solar • 28 solar arrays with 3 more in development Landfill Gas • Converts methane gas from landfills to electricity Biomass • Generates electricity from material such as wood

40 DTE Electric plans $8.4 billion of investments over the next 5 years with a focus on increasing customer reliability * Includes power reliability, existing generation maintenance, AMI, Ludington expansion and other investments ** Includes working capital and rate base associated with surcharges Targeting 6% - 7% growth (millions) ~$15.6B ~$20.9B YE Rate Base** $704M ~$923M Depreciation 2016A 2017E 2018E 2019E 2020E 2021E Distribution infrastructure New generation Maintenance and other projects* 2017E - 2021E Total $2,000 $8,400 $3,200 $3,200 $1,503 $1,460 $1,700 $1,600 $1,800 $1,840

41 Customer reliability will be improved through $1.8 billion of planned investments over the next 5 years at DTE Gas 2016A 2017E 2018E 2019E 2020E 2021E 2017E - 2021E Total Base infrastructure Main Replacement* NEXUS related $1,800 $100 $700 $1,000 ~$3.6B ~$5.0B - $5.1B YE Rate Base** $104M ~$154M Depreciation ** Includes working capital $395 $435 $375 $330 $330 $330 * Includes main renewal, meter move-out and pipeline integrity (millions) Targeting 7% - 8% growth

42 NEXUS continues to move forward with expected in-service of 4Q 2017 Natural Gas LDC Industrial Customer Power Generation Marcellus / Utica Dry Gas Core DTE Gas Vector • Contractors secured • Procurement update – Compressors ordered – Compressor air permits secured • FERC approval – FEIS received – Certificate of construction expected 1H 2017 • Begin construction 1H 2017

43 Reconciliation of Other Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. 2016 Actual DTE Electric DTE Gas Gas Storage and Pipelines Power and Industrial Projects Corporate and Other Growth Segments Energy Trading DTE Energy R d rnings 622$ 138$ 119$ 95$ (61)$ 913$ (45)$ 868$ Pl t cl sure - - - - - - - - Link - - 8 - 2 10 - 10 Certain mark-to-market transactions - - - - - - 70 70 Operating Earnings 622$ 138$ 127$ 95$ (59)$ 923$ 25$ 948$ Net Income (millions) 2016 A u l DTE Electric DTE Gas Gas Storage and Pipelines Power and Industrial Projects Corporate and Other Growth Segments Energy Trading DTE Energy Repor ed Earnings 3.47$ 0.77$ 0.66$ 0. 3$ 0.35)$ 5.08$ (0.25)$ 4.83$ Plant closure - - - - - - - - Link 0.05 0.01 0.06 0.06 Certain mark-to-market transactions - - - - - - 0.39 0.39 Operating Earnings 3.47$ 0.77$ 0.71$ 0.53$ (0.34)$ 5.14$ 0.14$ 5.28$ EPS After-tax items: After-tax items: * ** * Total tax impact of adjustments to reported earnings: $51m ** Total tax impact of adjustments to reported EPS: $0.29

44 Reconciliation of 2011 Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2011 DTE Energy Electric Utility Gas Utility Gas Storage & Pipelines Unc. Gas Prod. Power & Indust. Projects Energy Trading Corporate & Other Reported Earnings $711 $434 $110 $57 ($6) $38 $52 $26 Michigan Corporate Income Tax Adjust t (87) - - - - - - (87) F rmi 1 Asset Retirement Obligation 9 9 - - - - - - Discontinued operations 3 - - - 3 - - - Operating Earnings $636 $443 $110 $57 ($3) $38 $52 ($61) Net Income (millions) 2011 DTE Energy Electric Utility Gas Utility Gas Storage & Pipelines Unc. Gas Prod. Power & Indust. Projects Energy Trading Corporate & Other Reported Earnings $4.18 $2.55 $0.65 $0.34 ($0.04) $0.22 $0.31 $0.15 Michigan Corporate Income Tax Adjustment (0.50) - - - - - - (0.50) Fermi 1 Asset Retirement Obligation 0.05 0.05 - - - - - - Discontinued operations 0.02 - - - 0.02 - - - Operating Earnings $3.75 $2.60 $0.65 $0.34 ($0.02) $0.22 $0.31 ($0.35) EPS * Total tax impact of adjustments to reported earnings: ($39)m After-tax items: After-tax items: * ** ** Total tax impact of adjustments to reported EPS: ($0.23)

45 Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to- market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to- market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. Reconciliation of Other Reported to Operating Earnings