EXHIBIT 99.1 EEI FINANCIAL CONFERENCE NOVEMBER 10 – 1 2 , 2 0 1 9 1

Safe Harbor Statement Certain information presented herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, and businesses of DTE Energy. Words such as “anticipate,” “believe,” “expect,” “projected,” “aspiration,” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated, or budgeted. Many factors impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility of prices in the oil and gas markets on DTE Energy's gas storage and pipelines operations; impact of volatility in prices in the international steel markets on DTE Energy's power and industrial projects operations; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy's energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power, or reduce power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in the Registrants' public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2018 Form 10-K and 2019 Forms 10-Q (which sections are incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. 2

• Overview • Strong track record of delivering value for shareholders • High-quality utilities with clear line of sight for growth • Disciplined approach for non-utility value creation • Appendix ― Financial and regulatory disclosures ― Recent acquisition 3

DTE ENERGY 70% – 75% Utility DTE Electric Electric generation and distribution DTE Gas Natural gas transmission, storage and distribution 25% – 30% Non-Utility Gas Storage & Pipelines (GSP) Transport, store and gather natural gas DTE Energy Power & Industrial Projects (P&I) Own and operate energy related assets 10,000+ employees 2,000 miles of GSP Energy Trading 2.2 million electric pipelines Gas, power and renewables marketing customers P&I projects in 15 1.3 million gas states customers 4

Accelerating and solidifying future growth with updated plan 7.5% operating EPS1 growth from 2019 original guidance to 2020 early outlook 5% – 7% operating EPS growth through 2024 from higher 2020 base 7% dividend growth extended through 20212 5-year utility investment $1 billion higher than prior plan Investing 80% of total 5-year capital in utilities Non-utilities delivering higher operating earnings with increased certainty from prior plan Continuing decade-long record of delivering premium shareholder returns 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 5 2. Subject to Board approval

Distinctive business portfolio delivers superior results Strong track record of delivering value for shareholders • Decade-long record of beating original guidance • Premium total shareholder returns vs. peers • Commitment to strong balance sheet • Underpinned by strong corporate culture High-quality utilities with clear line of sight for growth • Transformational investments in electric generation and distribution • Renewing and replacing aging gas infrastructure Disciplined approach for non-utility value creation • Producing growth at GSP from multiple well-positioned platforms • Achieving growth at P&I from high-quality platforms 6

• Overview • Strong track record of delivering value for shareholders • High-quality utilities with clear line of sight for growth • Disciplined approach for non-utility value creation • Appendix ― Financial and regulatory disclosures ― Recent acquisition 7

Distinctive business portfolio has delivered a strong track record of value and growth Total Shareholder Return1 10-Year Operating EPS2 CAGR vs. Peers 451% 8.1% 106% 56% 3-Year 5-Year 10-Year DTE S&P 500 Utilities DTE 2nd among peers for operating EPS growth from 2008 – 20183 Delivering shareholder value well above industry 1. Bloomberg as of 09/30/2019 2. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 8 3. Bloomberg

Accelerating operating EPS1 and dividend growth with updated plan Operating EPS Operating EPS grows 7.5% from 2019 original guidance to 2020 early outlook 5% – 7% operating EPS growth from 7.5% higher 2020 base Growth from $6.61 Extending 7% dividend growth through higher base $6.15 20212 2019 2020 2024E Original Early Guidance Outlook Midpoint Midpoint Accelerating near-term growth; sustaining growth from higher 2020 base 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 9 2. Subject to Board approval

Consistently deliver premium operating EPS1 results due to disciplined planning and management Decade of exceeding operating EPS guidance Robust Planning 8.1% CAGR Annually create detailed 5-year plan 9.0% CAGR $6.30 Includes earnings contingency across $4.09 the portfolio $2.90 Weekly detailed executive management review of first 2 years If contingency If contingency not consumed: 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 consumed: employ invest/ Original Guidance Actual employ lean increase guidance 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 10

Clear line of sight for growth supported by investment in utility infrastructure and disciplined non-utility opportunities (billions) 2020 – 2024 DTE Energy Investment $19 billion $15 Electric: Distribution infrastructure, $12 cleaner generation, maintenance Gas: Base infrastructure, main $3 80% renewal acceleration utility investment $1.2 - $1.7 GSP: Organic growth on existing platforms $1.0 - $1 GSP: Blue Union/LEAP contracted capital $1.4 $2.2 - $2.7 $1.0 – P&I: Industrial energy services, $1.4 renewable natural gas (RNG) Investing 80% of 5-year capital in utilities 11

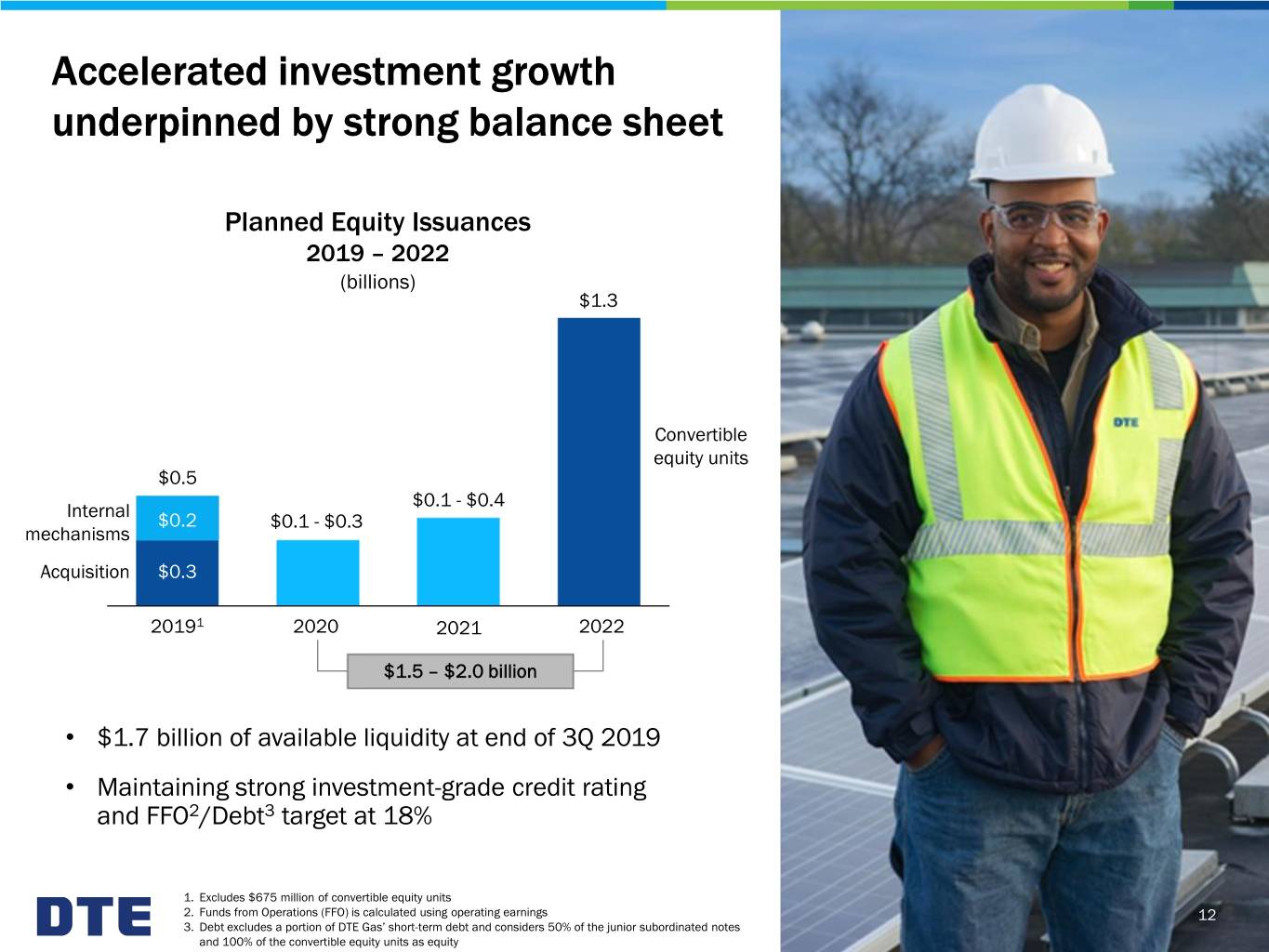

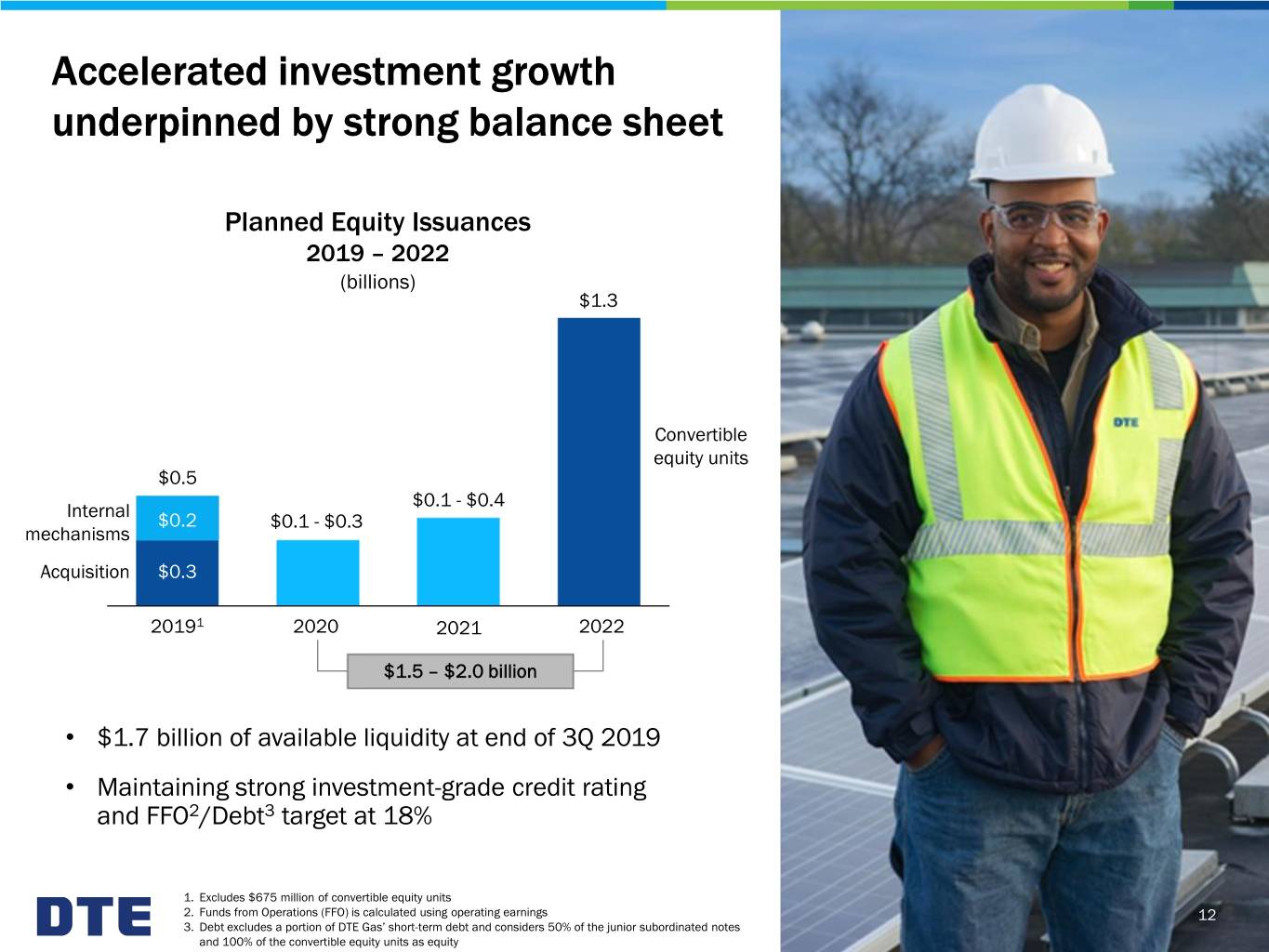

Accelerated investment growth underpinned by strong balance sheet Planned Equity Issuances 2019 – 2022 (billions) $1.3 Convertible equity units $0.5 $0.1 - $0.4 Internal $0.2 $0.1 - $0.3 mechanisms Acquisition $0.3 20191 2020 2021 2022 $1.5 – $2.0 billion • $1.7 billion of available liquidity at end of 3Q 2019 • Maintaining strong investment-grade credit rating and FFO2/Debt3 target at 18% 1. Excludes $675 million of convertible equity units 2. Funds from Operations (FFO) is calculated using operating earnings 12 3. Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity

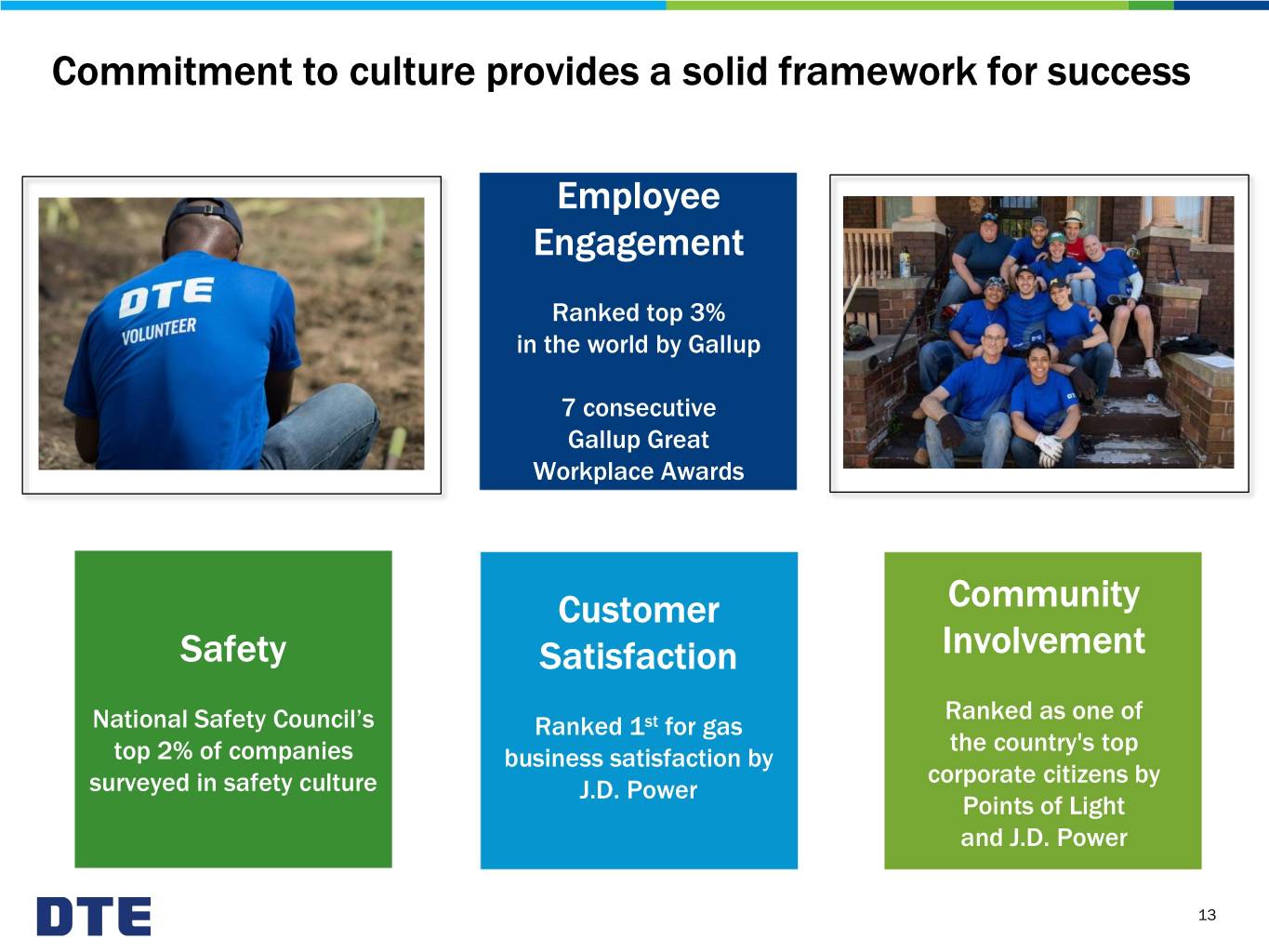

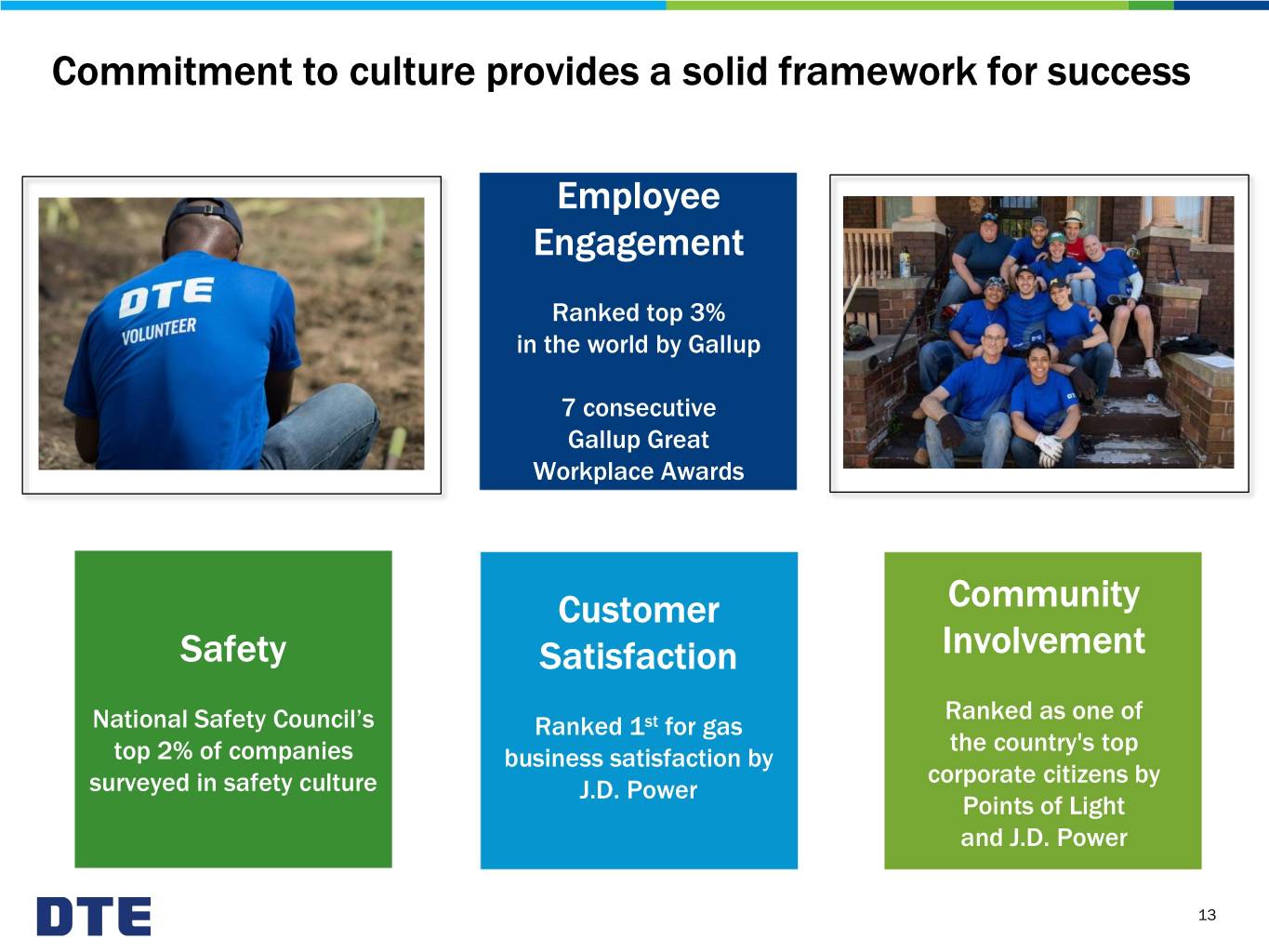

Commitment to culture provides a solid framework for success Employee Engagement Ranked top 3% in the world by Gallup 7 consecutive Gallup Great Workplace Awards Customer Community Safety Satisfaction Involvement Ranked as one of National Safety Council’s Ranked 1st for gas the country's top top 2% of companies business satisfaction by corporate citizens by surveyed in safety culture J.D. Power Points of Light and J.D. Power 13

Environmental, social and governance efforts are key priorities Environmental Social Governance • Net zero carbon emissions by • Advancing leadership in • 11 out of 13 Board 2050 diversity members are independent • 80% carbon emissions • Recognized by Diversity • Incentive plans tied to reduction by 2040 Inc as a top-five utility in safety and customer the nation satisfaction targets • Reducing methane emissions • 2019 Business Diversity • Providing renewable natural Innovation Award from the gas from agricultural waste Edison Electric Institute 14

• Overview • Strong track record of delivering value for shareholders • High-quality utilities with clear line of sight for growth • Disciplined approach for non-utility value creation • Appendix ― Financial and regulatory disclosures ― Recent acquisition 15

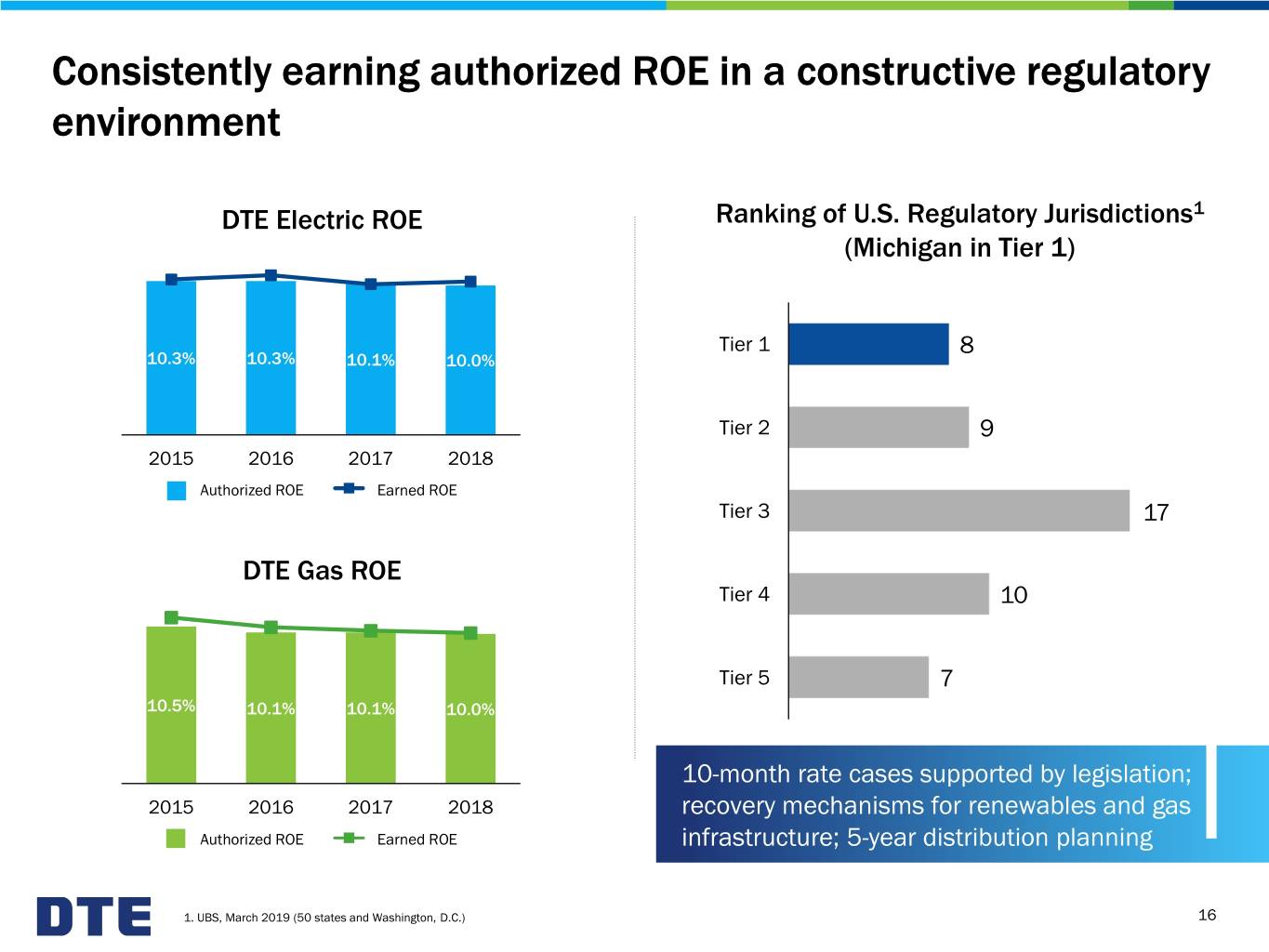

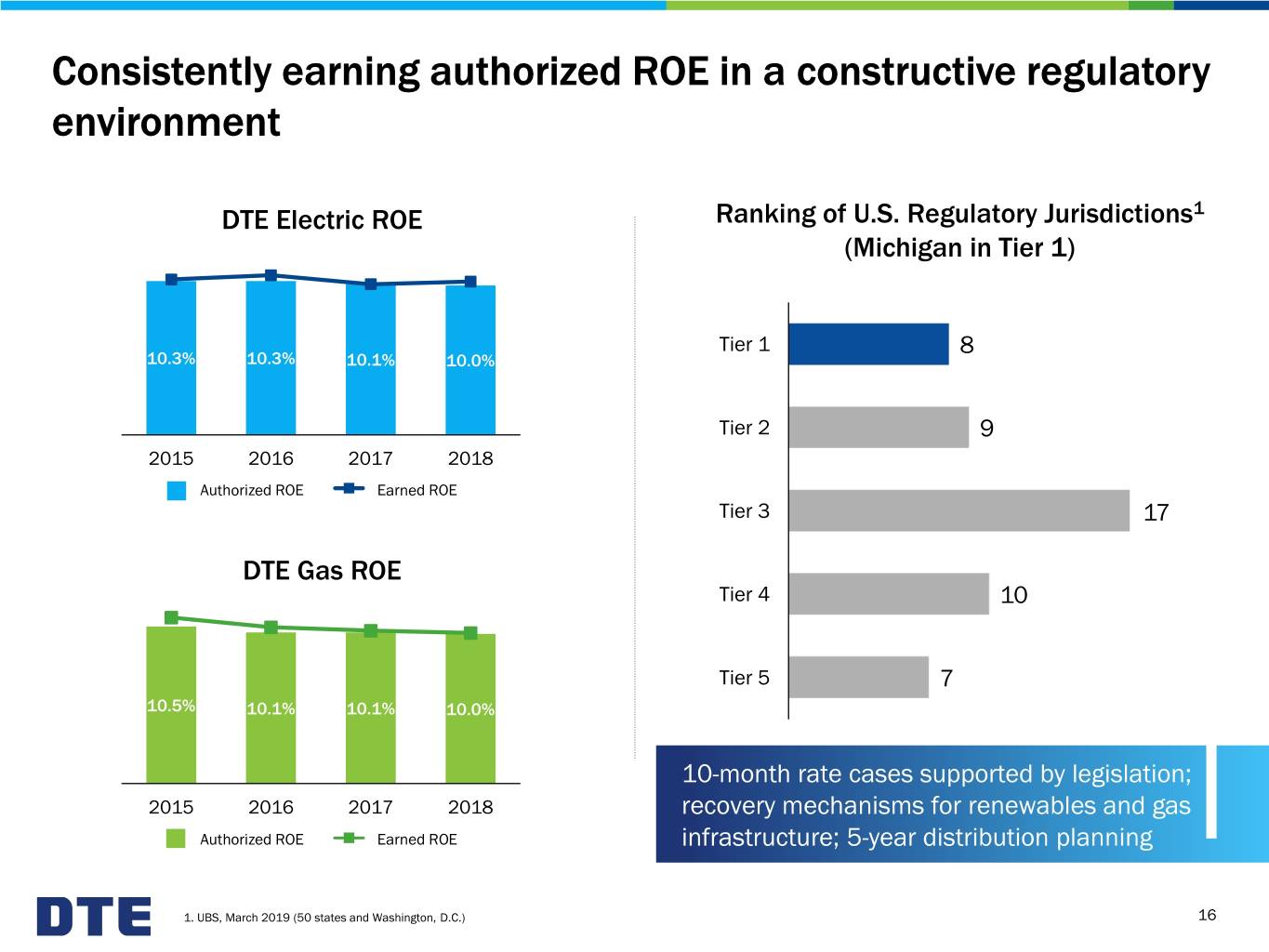

Consistently earning authorized ROE in a constructive regulatory environment DTE Electric ROE Ranking of U.S. Regulatory Jurisdictions1 (Michigan in Tier 1) Tier 1 8 10.3% 10.3% 10.1% 10.0% Tier 2 9 2015 2016 2017 2018 Authorized ROE Earned ROE Tier 3 17 DTE Gas ROE Tier 4 10 Tier 5 7 10.5% 10.1% 10.1% 10.0% 10-month rate cases supported by legislation; 2015 2016 2017 2018 recovery mechanisms for renewables and gas Authorized ROE Earned ROE infrastructure; 5-year distribution planning 1. UBS, March 2019 (50 states and Washington, D.C.) 16

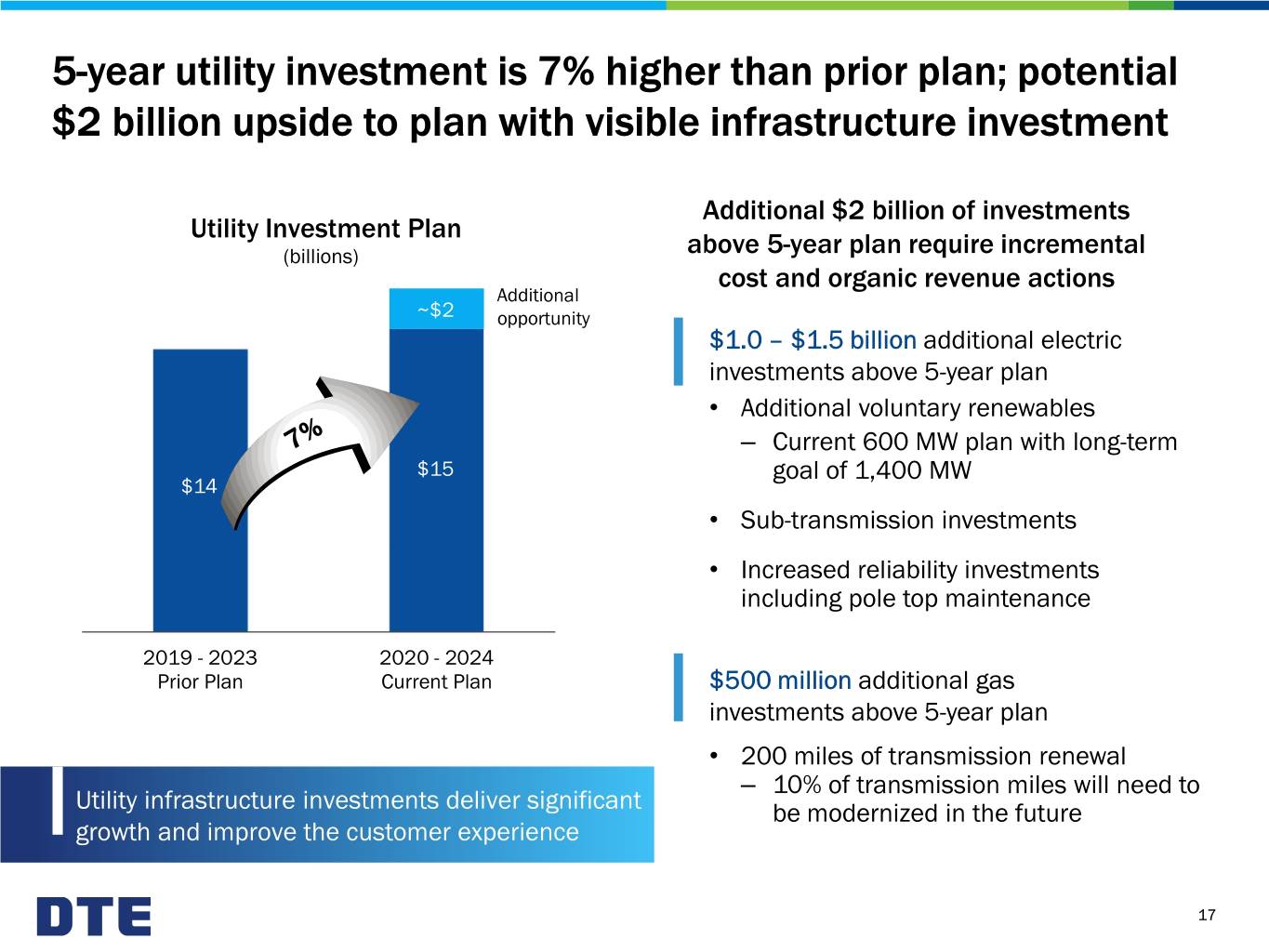

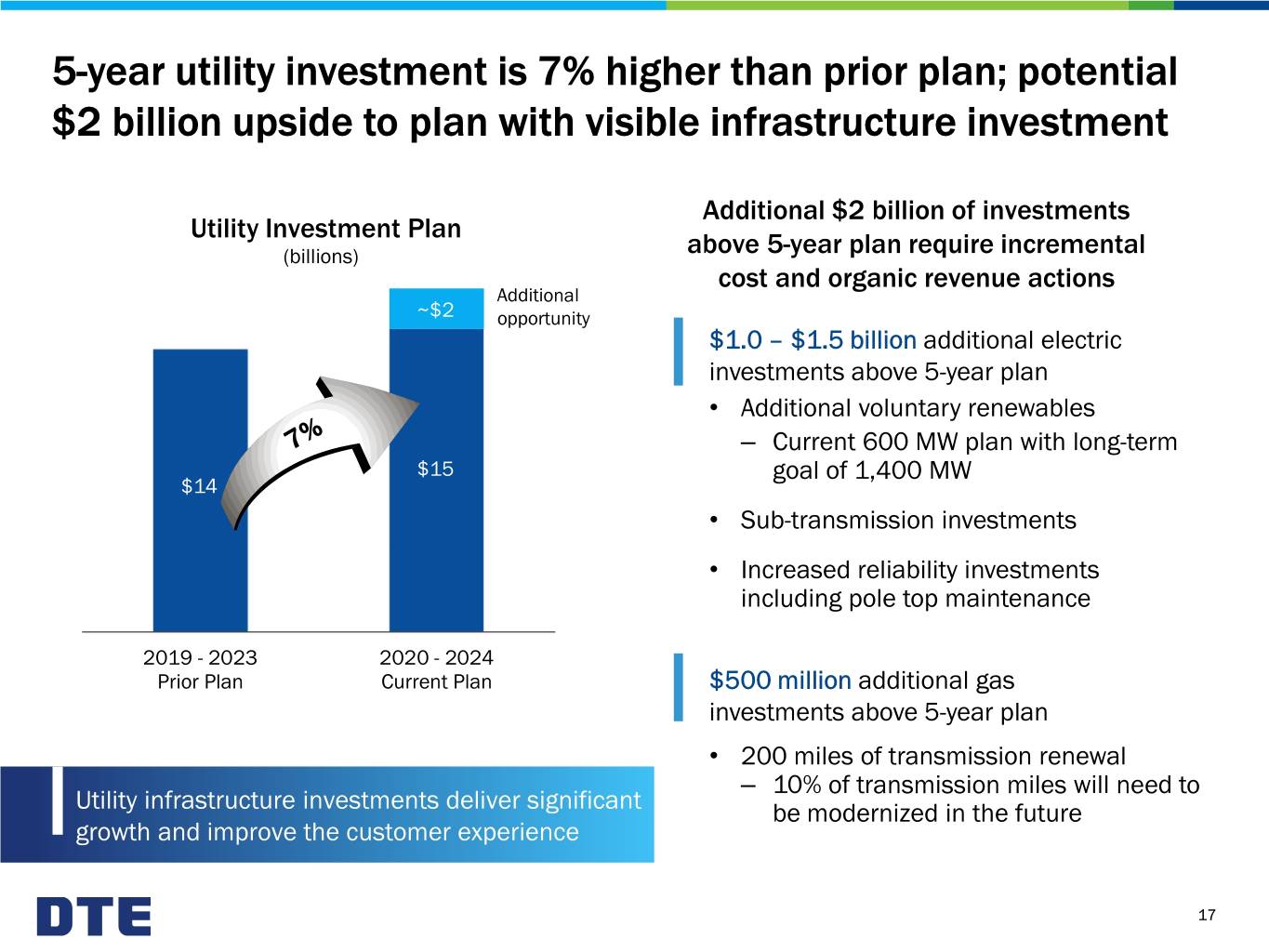

5-year utility investment is 7% higher than prior plan; potential $2 billion upside to plan with visible infrastructure investment Additional $2 billion of investments Utility Investment Plan (billions) above 5-year plan require incremental cost and organic revenue actions Additional ~$2 opportunity $1.0 – $1.5 billion additional electric investments above 5-year plan • Additional voluntary renewables ‒ Current 600 MW plan with long-term $15 goal of 1,400 MW $14 • Sub-transmission investments • Increased reliability investments including pole top maintenance 2019 - 2023 2020 - 2024 Prior Plan Current Plan $500 million additional gas investments above 5-year plan • 200 miles of transmission renewal ‒ 10% of transmission miles will need to Utility infrastructure investments deliver significant be modernized in the future growth and improve the customer experience 17

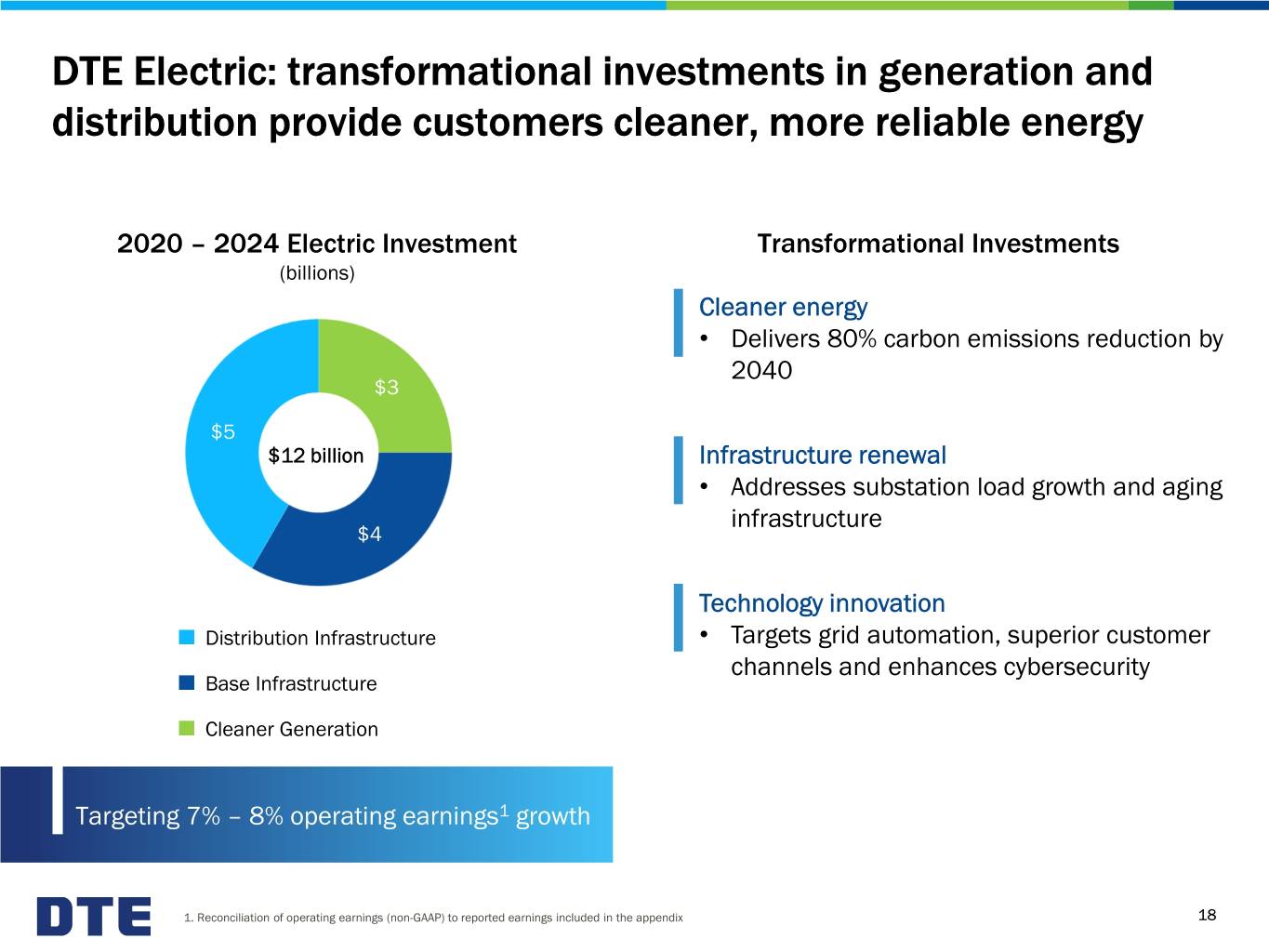

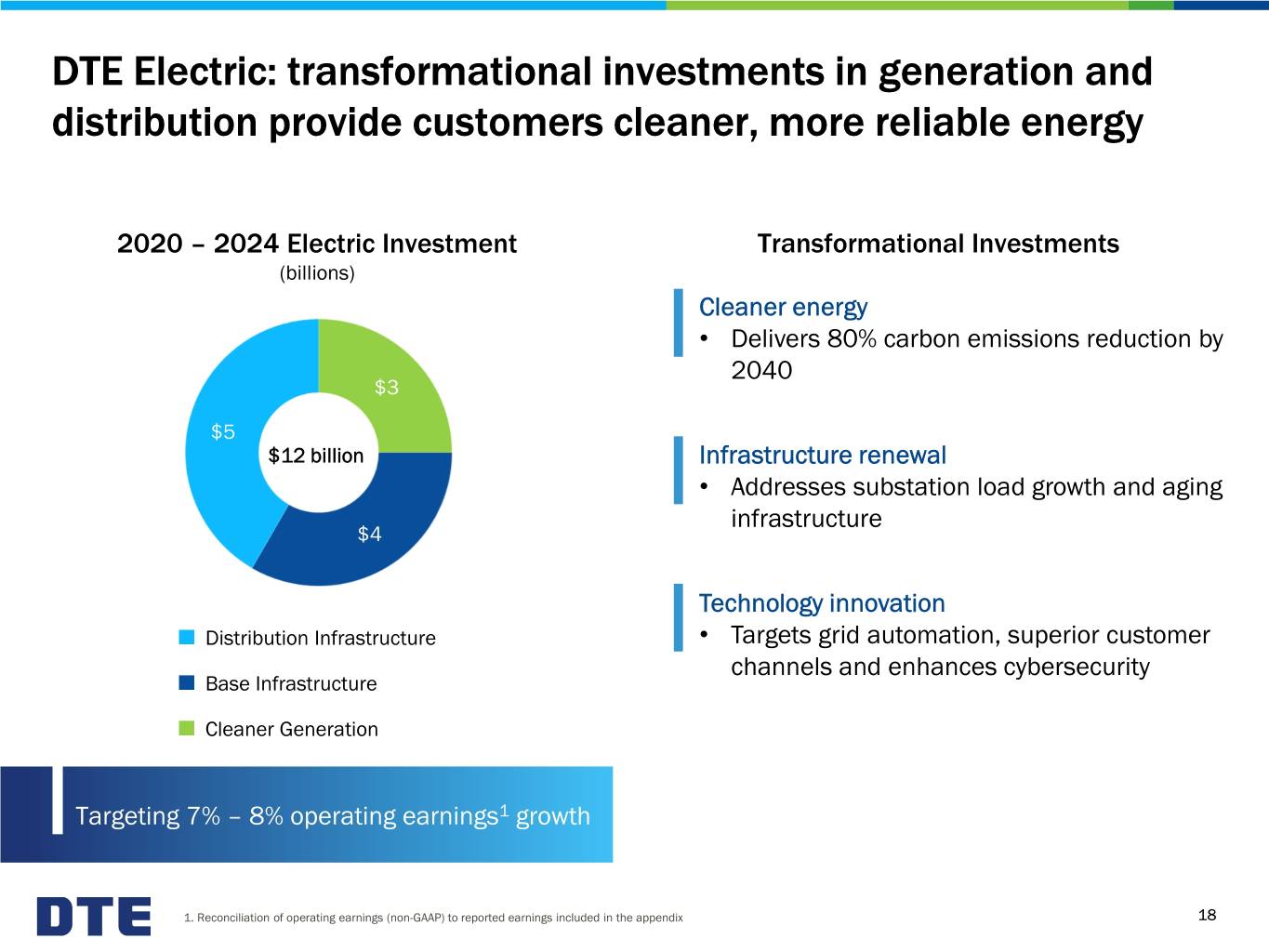

DTE Electric: transformational investments in generation and distribution provide customers cleaner, more reliable energy 2020 – 2024 Electric Investment Transformational Investments (billions) Cleaner energy • Delivers 80% carbon emissions reduction by 2040 $3 $5 $12 billion Infrastructure renewal • Addresses substation load growth and aging infrastructure $4 Technology innovation Distribution Infrastructure • Targets grid automation, superior customer channels and enhances cybersecurity Base Infrastructure Cleaner Generation Targeting 7% – 8% operating earnings1 growth 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 18

Steady march to creating clean, reliable, affordable, home-grown energy Cleaner Generation Mix 1% 2% 17% 20% 25-30% 18% 20-25% 20% 77% 20% 45% 30% 2005 2023E 2030E Coal Natural Gas Nuclear & Other Renewables Accelerating carbon emissions reduction • Doubling renewable investment from • 32% by 2023, 50% by 2030, 80% by 2040 1,000 MW to 2,000 MW by 2022 and net zero by 2050 • Expanding voluntary renewable program ‒ 600 MW by 2023 and 1,400 MW by 19 2030 19

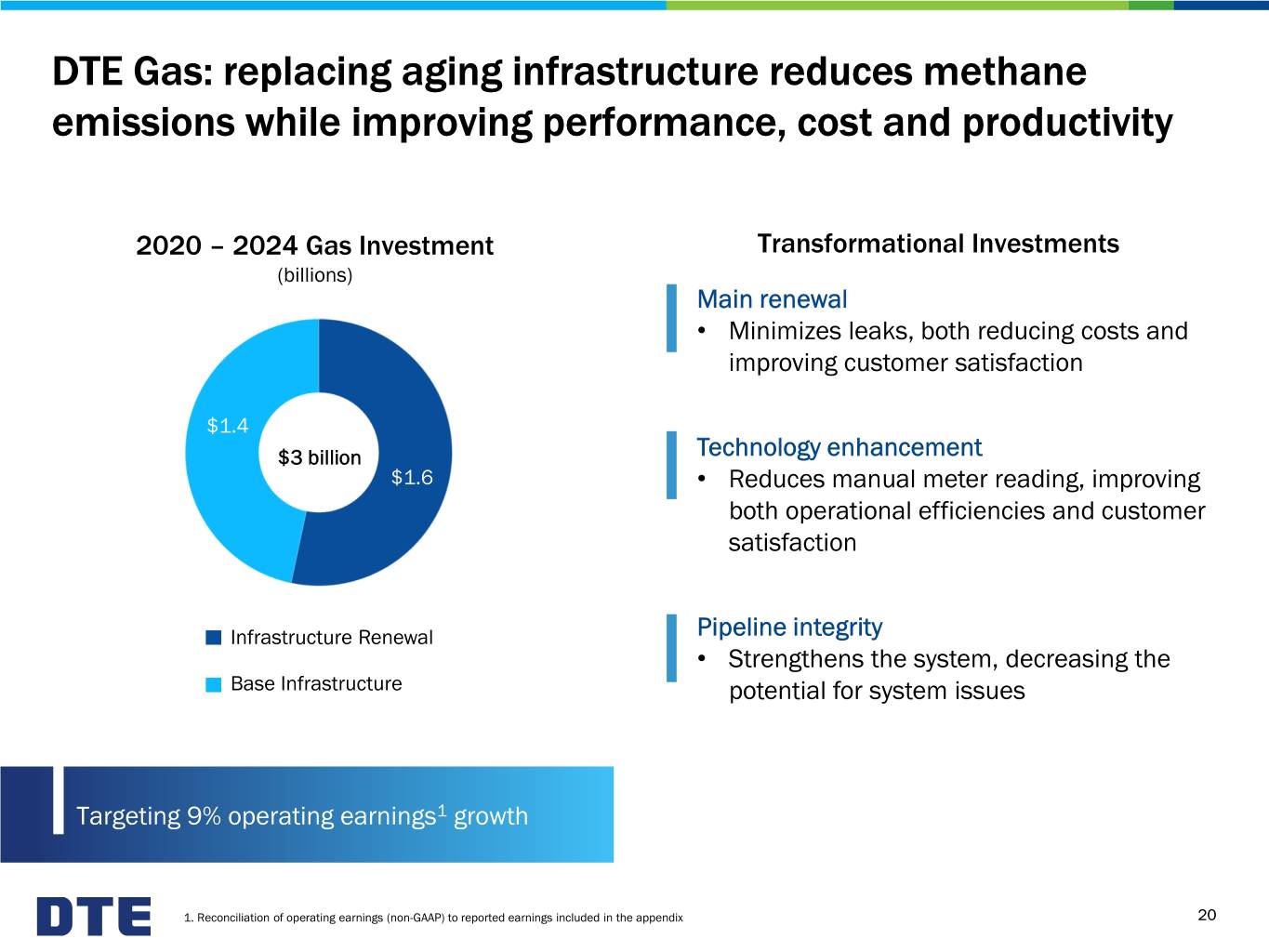

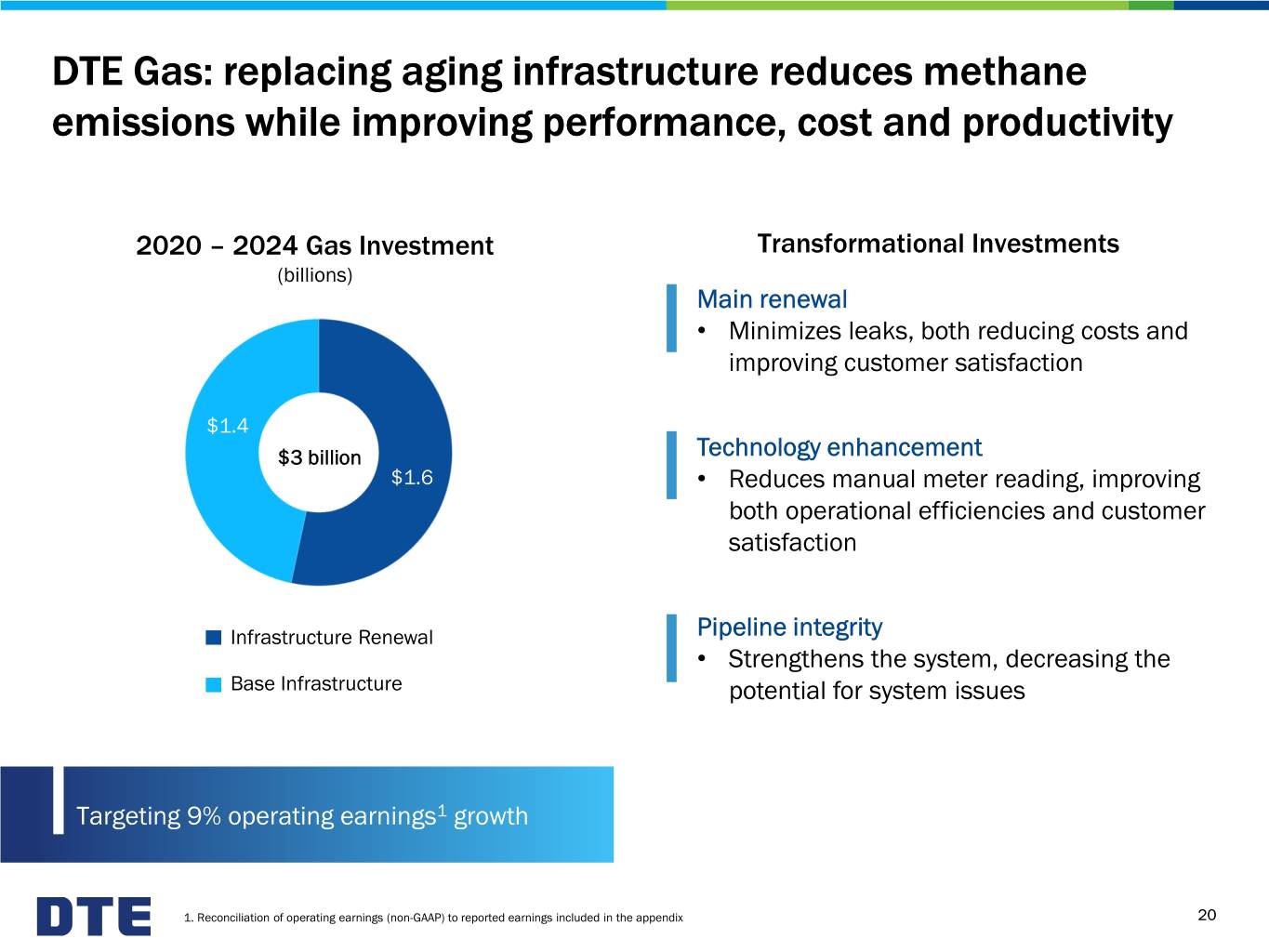

DTE Gas: replacing aging infrastructure reduces methane emissions while improving performance, cost and productivity 2020 – 2024 Gas Investment Transformational Investments (billions) Main renewal • Minimizes leaks, both reducing costs and improving customer satisfaction $1.4 $3 billion Technology enhancement $1.6 • Reduces manual meter reading, improving both operational efficiencies and customer satisfaction Infrastructure Renewal Pipeline integrity • Strengthens the system, decreasing the Base Infrastructure potential for system issues Targeting 9% operating earnings1 growth 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 20

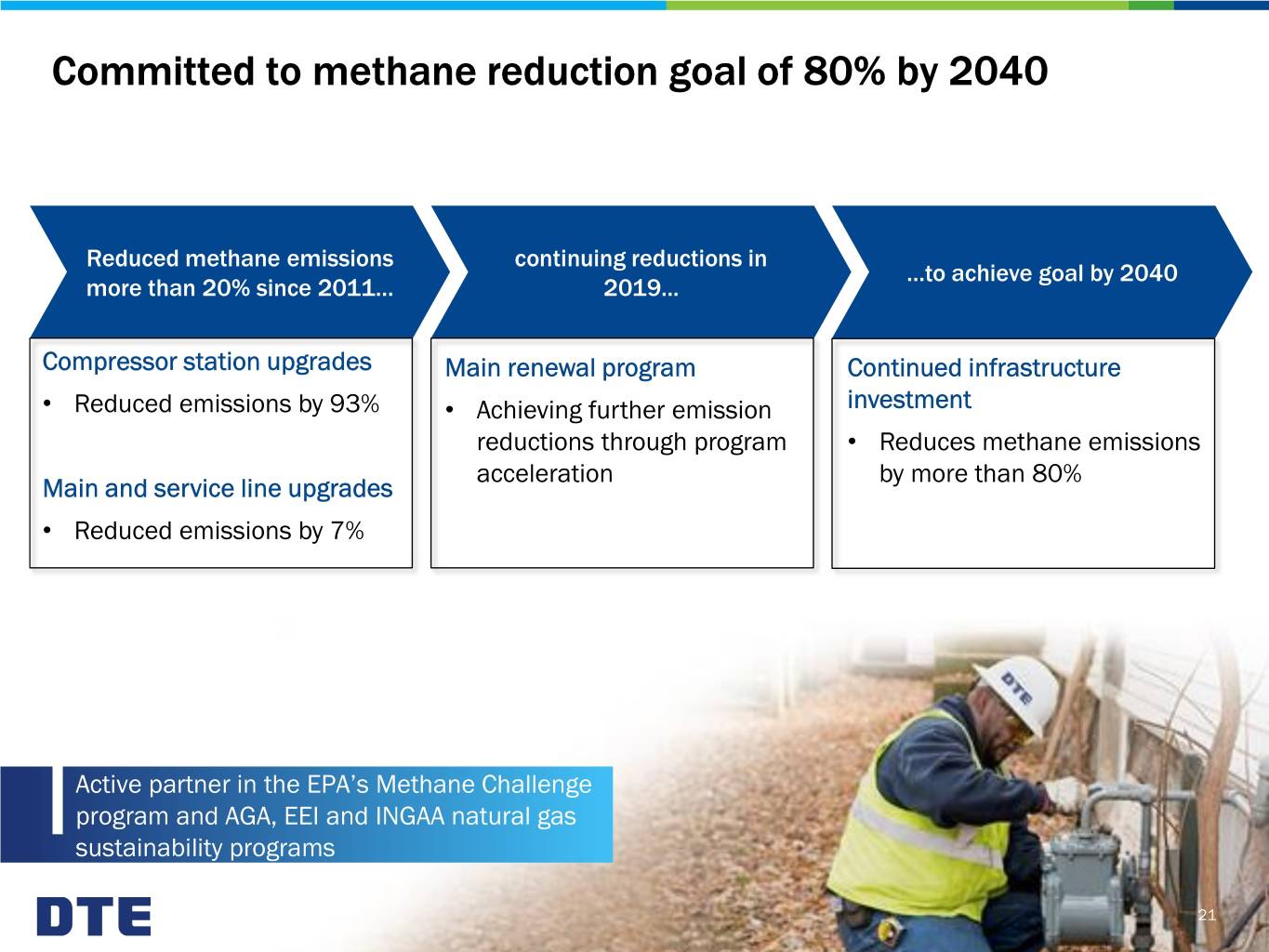

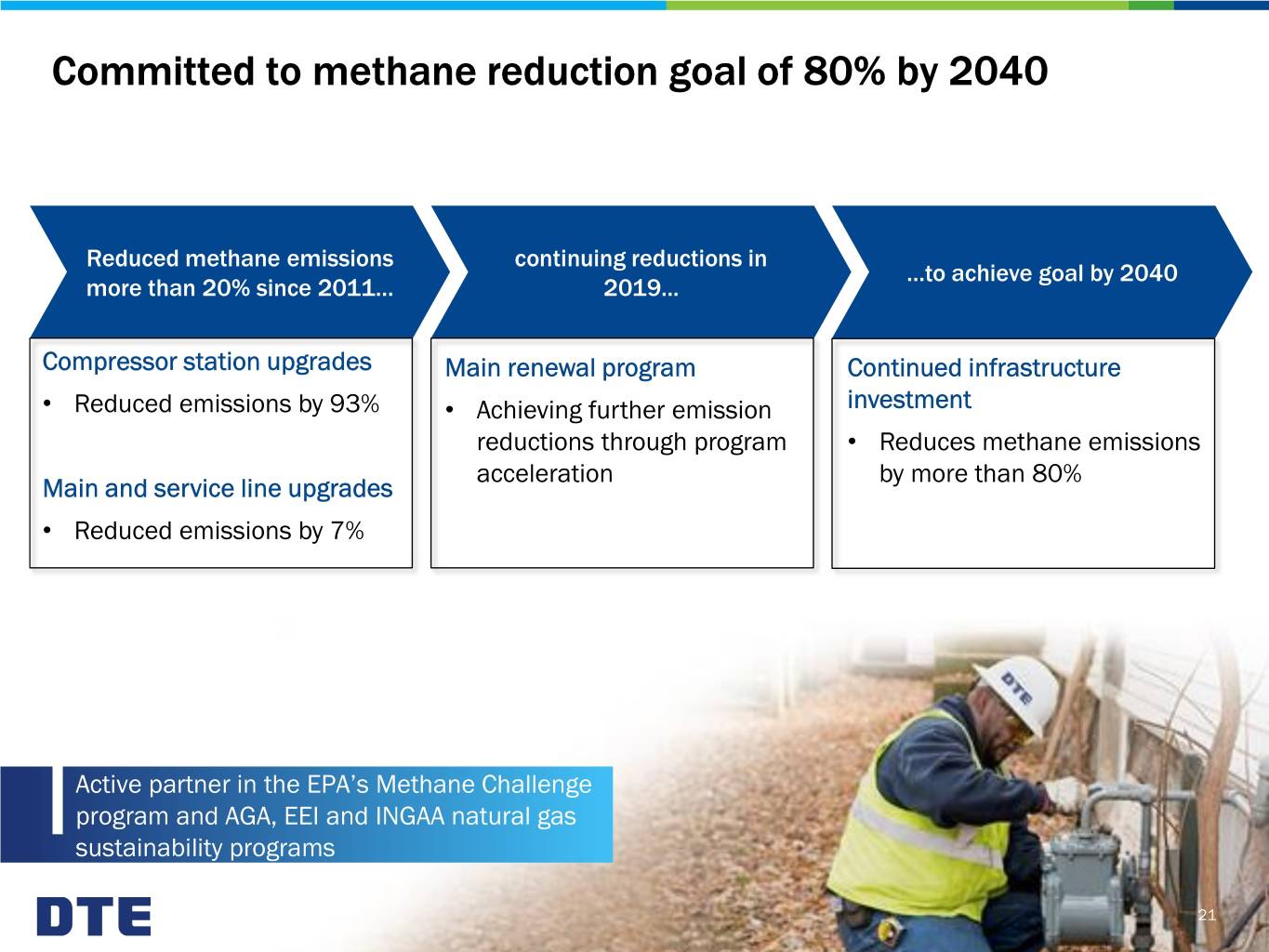

Committed to methane reduction goal of 80% by 2040 Reduced methane emissions continuing reductions in …to achieve goal by 2040 more than 20% since 2011… 2019... Compressor station upgrades Main renewal program Continued infrastructure • Reduced emissions by 93% • Achieving further emission investment reductions through program • Reduces methane emissions acceleration by more than 80% Main and service line upgrades • Reduced emissions by 7% Active partner in the EPA’s Methane Challenge program and AGA, EEI and INGAA natural gas sustainability programs 21

• Overview • Strong track record of delivering value for shareholders • High-quality utilities with clear line of sight for growth • Disciplined approach for non-utility value creation • Appendix ― Financial and regulatory disclosures ― Recent acquisition 22

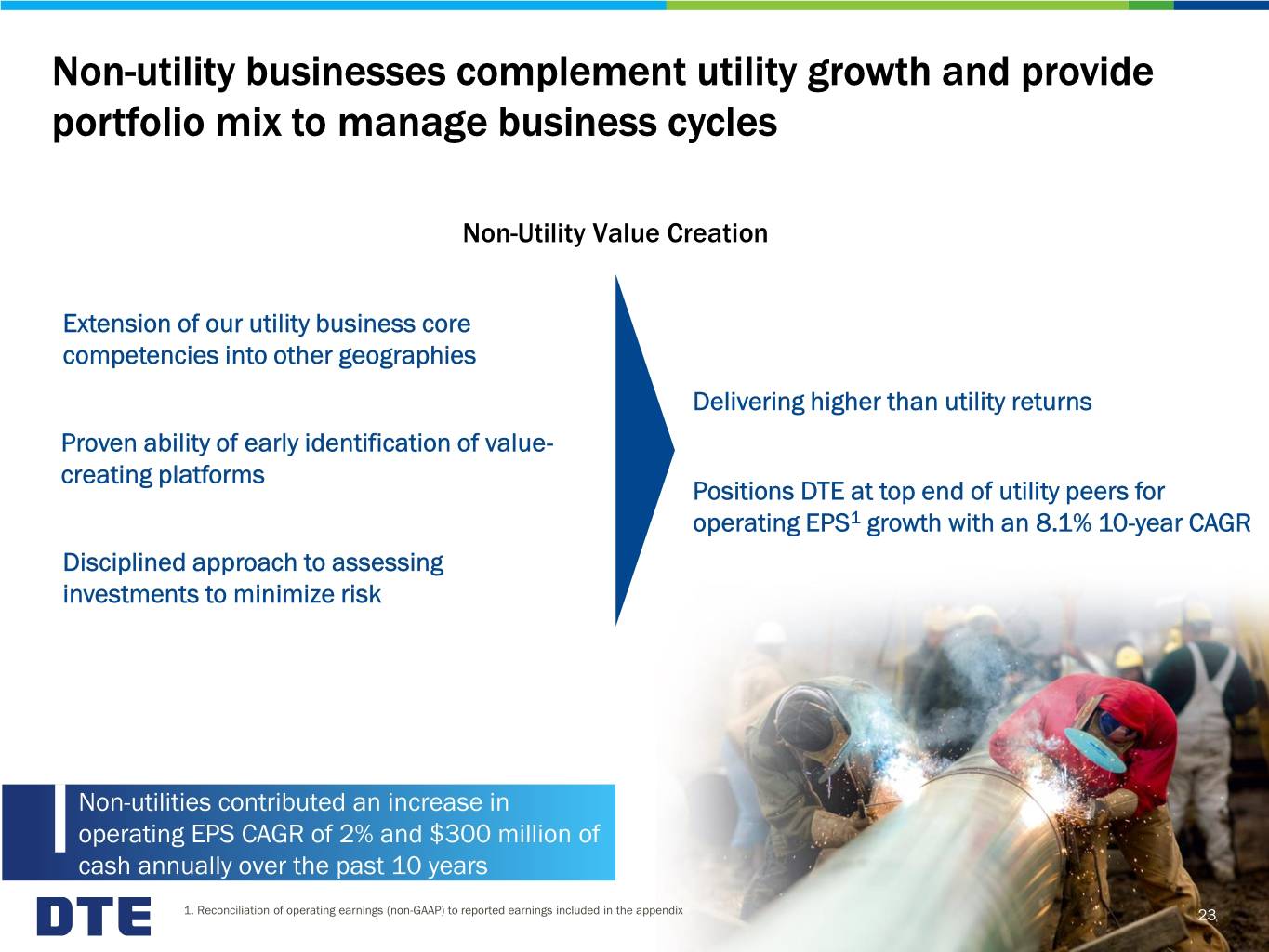

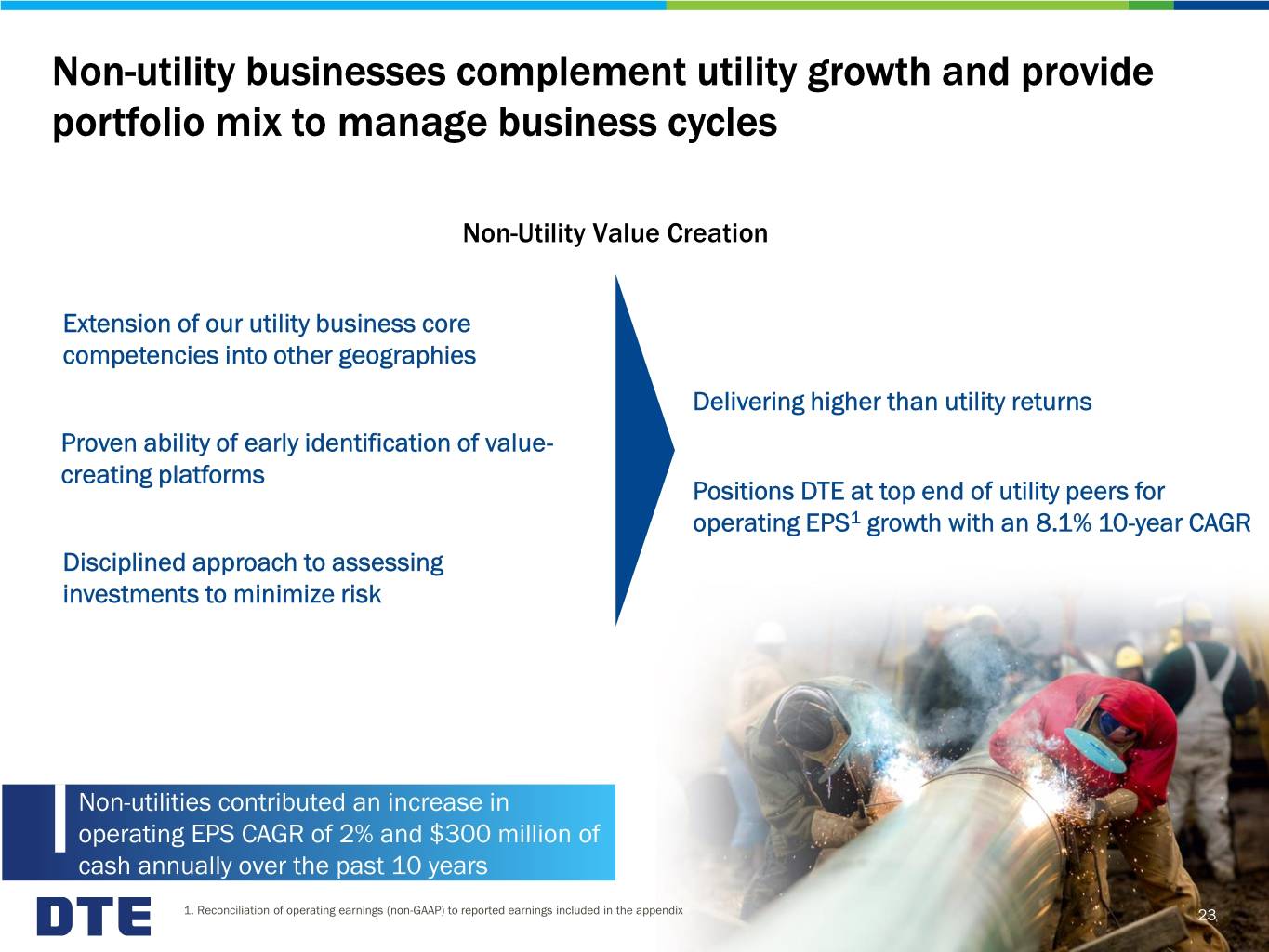

Non-utility businesses complement utility growth and provide portfolio mix to manage business cycles Non-Utility Value Creation Extension of our utility business core competencies into other geographies Delivering higher than utility returns Proven ability of early identification of value- creating platforms Positions DTE at top end of utility peers for operating EPS1 growth with an 8.1% 10-year CAGR Disciplined approach to assessing investments to minimize risk Non-utilities contributed an increase in operating EPS CAGR of 2% and $300 million of cash annually over the past 10 years 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 23

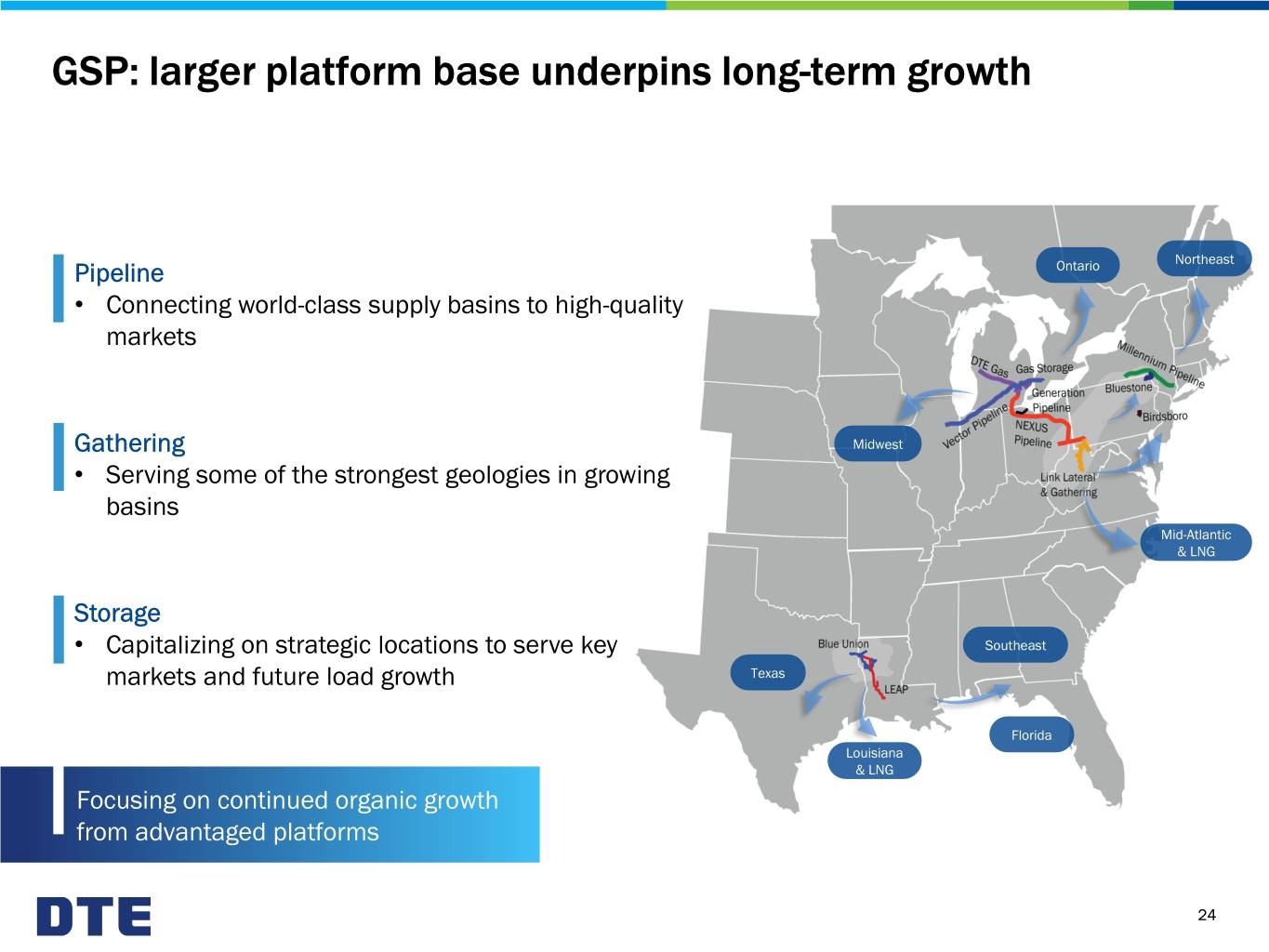

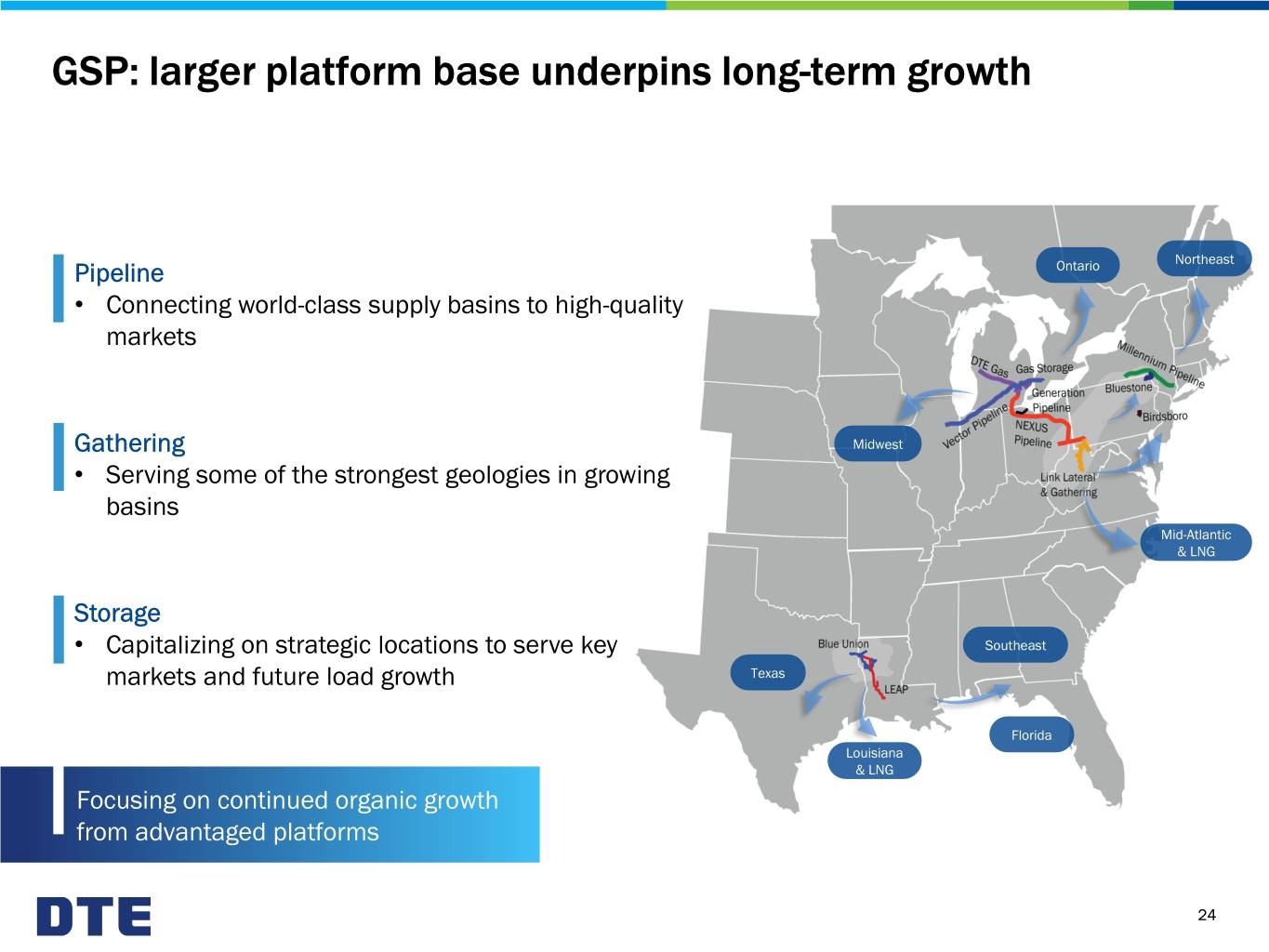

GSP: larger platform base underpins long-term growth Northeast Pipeline Ontario • Connecting world-class supply basins to high-quality markets Gathering Midwest • Serving some of the strongest geologies in growing basins Mid-Atlantic & LNG Storage • Capitalizing on strategic locations to serve key Southeast markets and future load growth Texas Florida Louisiana & LNG Focusing on continued organic growth from advantaged platforms 24

Majority of GSP growth secured; delivering higher operating earnings1 with increased certainty GSP Operating Earnings (millions) $400–$420 • $2.2 – $2.7 billion of investment in New project origination 2020 – 2024 $277–$293 ‒ $1.0 billion of growth contractually $208–$218 secured on Blue Union/LEAP assets ‒ $1.2 – $1.7 billion highly accretive organic growth from well-positioned platforms 2019 2020 2024E Original Early Guidance Outlook 2019 acquisition secured highly accretive and visible growth 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 25

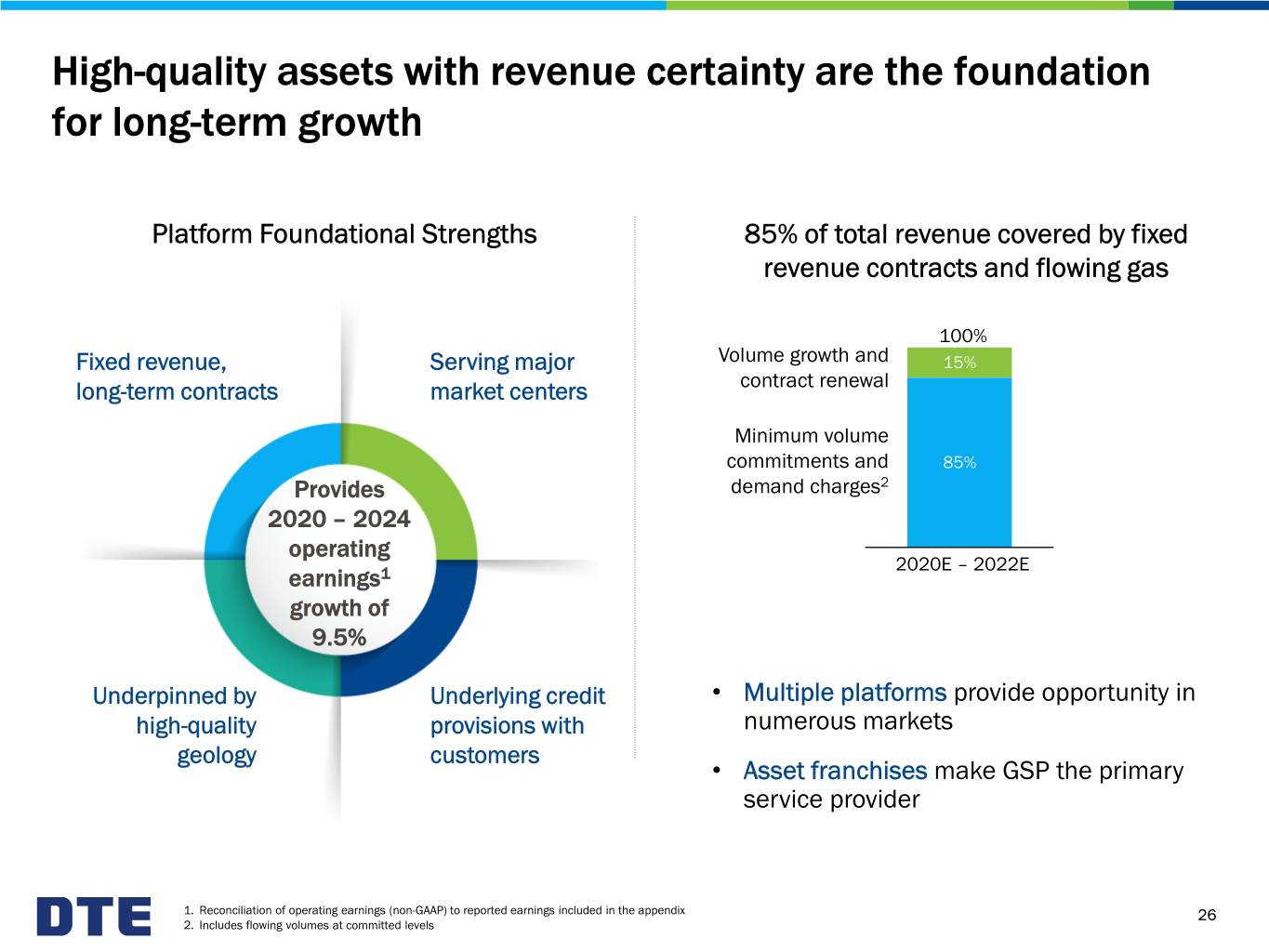

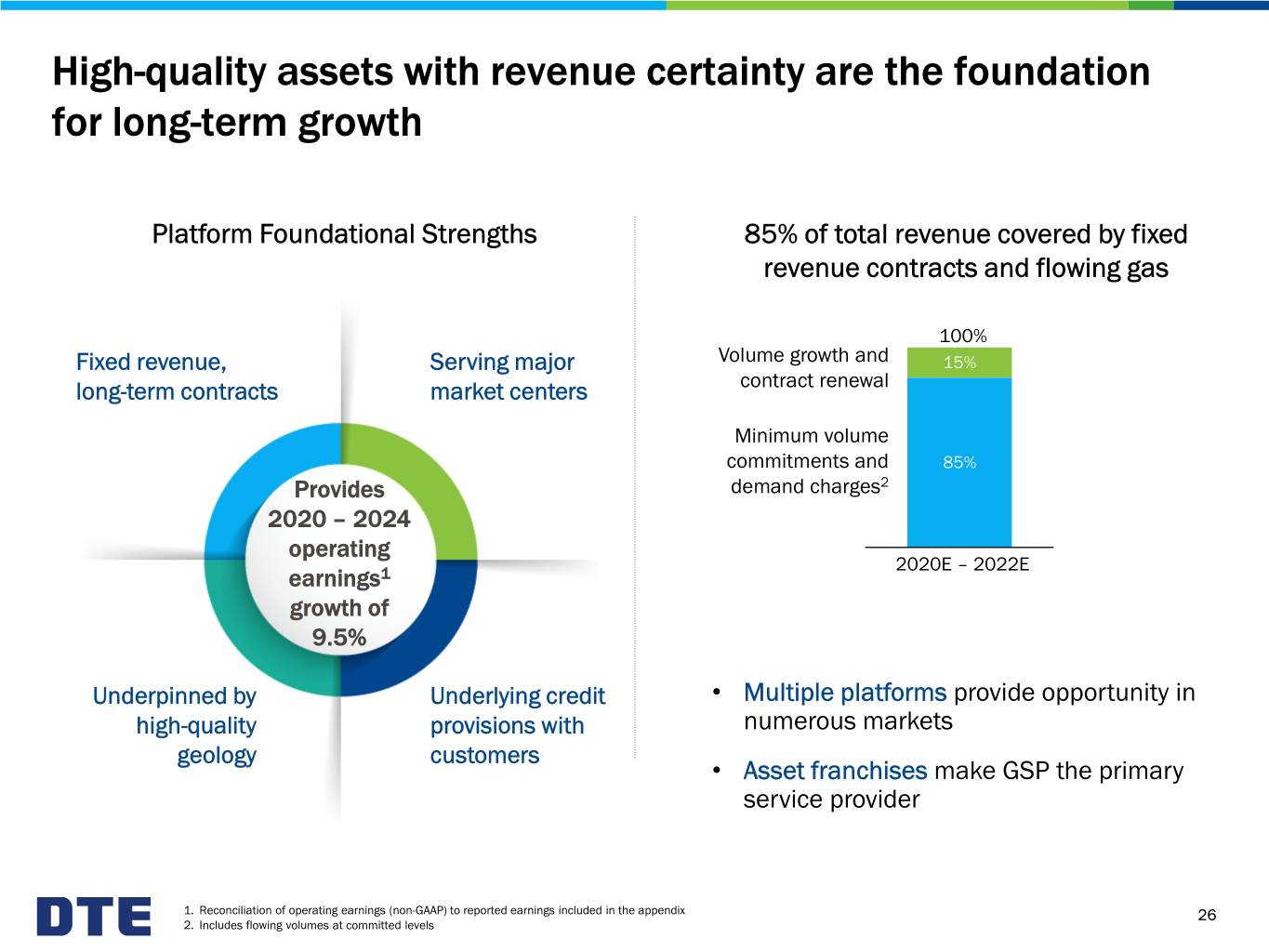

High-quality assets with revenue certainty are the foundation for long-term growth Platform Foundational Strengths 85% of total revenue covered by fixed revenue contracts and flowing gas 100% Fixed revenue, Serving major Volume growth and 15% long-term contracts market centers contract renewal Minimum volume commitments and 85% Provides demand charges2 2020 – 2024 operating 2020E – 2022E earnings1 growth of 9.5% Underpinned by Underlying credit • Multiple platforms provide opportunity in high-quality provisions with numerous markets geology customers • Asset franchises make GSP the primary service provider 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 26 2. Includes flowing volumes at committed levels

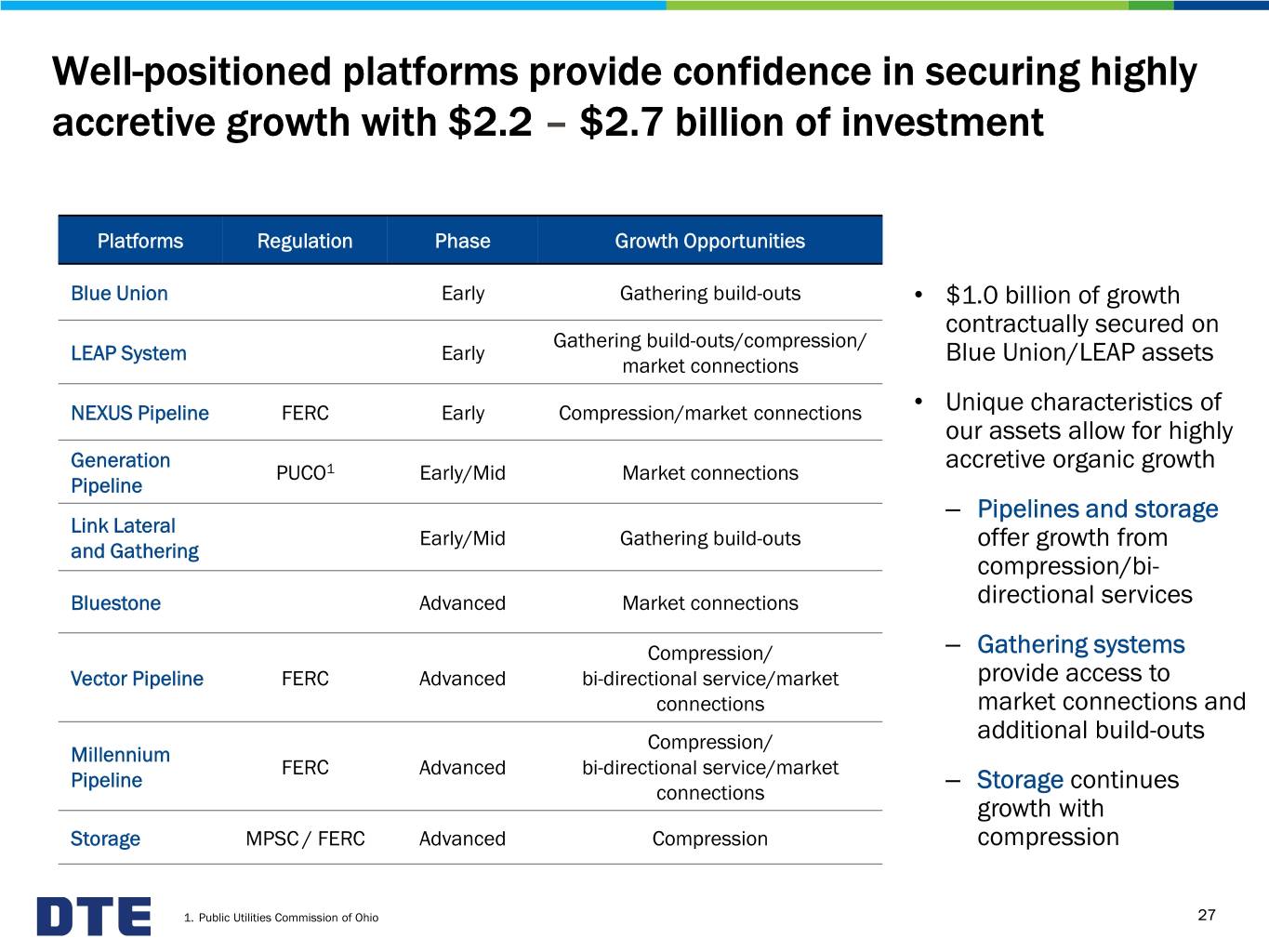

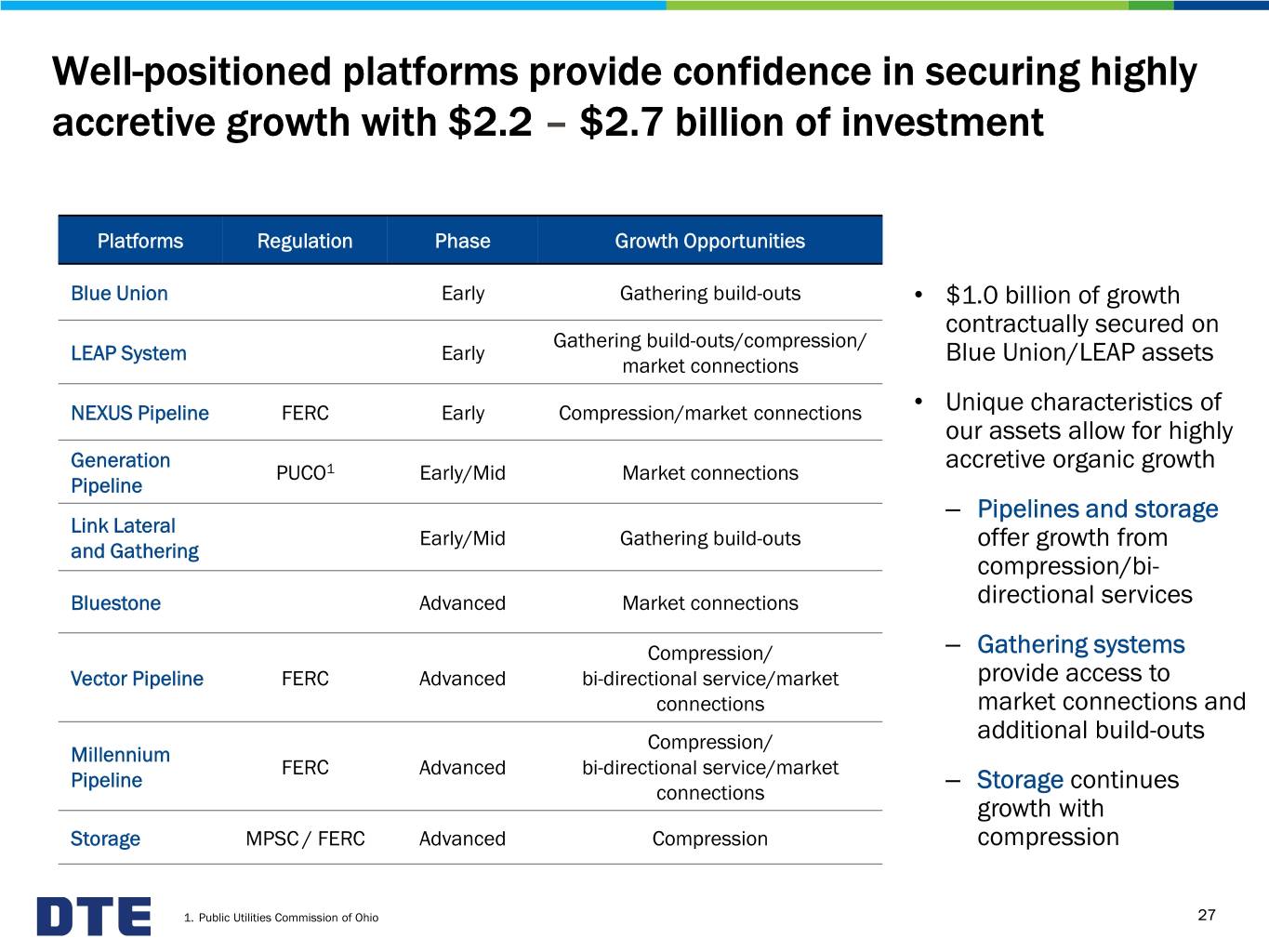

Well-positioned platforms provide confidence in securing highly accretive growth with $2.2 – $2.7 billion of investment Platforms Regulation Phase Growth Opportunities Blue Union Early Gathering build-outs • $1.0 billion of growth contractually secured on Gathering build-outs/compression/ LEAP System Early Blue Union/LEAP assets market connections NEXUS Pipeline FERC Early Compression/market connections • Unique characteristics of our assets allow for highly Generation accretive organic growth PUCO1 Early/Mid Market connections Pipeline ‒ Pipelines and storage Link Lateral Early/Mid Gathering build-outs offer growth from and Gathering compression/bi- Bluestone Advanced Market connections directional services Compression/ ‒ Gathering systems Vector Pipeline FERC Advanced bi-directional service/market provide access to connections market connections and Compression/ additional build-outs Millennium FERC Advanced bi-directional service/market Pipeline connections ‒ Storage continues growth with Storage MPSC / FERC Advanced Compression compression 1. Public Utilities Commission of Ohio 27

P&I: achieving growth from high-quality platforms Industrial Energy Services • Developing new cogeneration projects to improve customer environmental attributes and lower energy costs Renewable Energy • Expanding renewable natural gas (RNG) business at landfill and agricultural sites to meet growing demand for carbon reduction Reduced Emissions Fuel • Maximizing cash flows while reducing emissions from coal-fired plants P&I growth opportunities are robust and diversified 28

Operating earnings1 are underpinned by RNG and cogeneration growth opportunities P&I Operating Earnings (millions) • RNG and cogeneration projects drive long- $133 – $148 term earnings $125 – $135 ‒ Backfill sunsetting REF projects with new projects REF • Continuing an origination pace of ~$15 million per year ‒ Achieved origination targets in each of the past three years Longer-term ‒ Finalized three industrial energy contracts services projects and two RNG projects in 2019 2020 2024E Early • 2020 earnings increase from 2019 driven Outlook2 by new RNG and cogeneration projects Continuing origination success to reach 2024 ‒ REF earnings flat year-over-year target with $1.0 – $1.4 billion investment (2020 – 2024) 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 29 2. $90 million of earnings roll-off in 5-year plan (includes REF sunset net of $20 million of associated business unit cost reductions)

Leveraging expertise to grow our portfolio of RNG projects with focus on LCFS market • P&I has produced RNG from landfill gas for RNG is methane that is upgraded to natural gas over 15 years and has successfully entered pipeline quality standards the agricultural waste gas sector • Federal and state mandates are driving significant demand increases ‒ National renewable fuel standard (RFS) ‒ California low-carbon fuel standard (LCFS) ‒ International compliance standards ‒ Additional states RNG standards advancing • Volumes 100% contracted with a blend of fixed price contracts and open positions 30

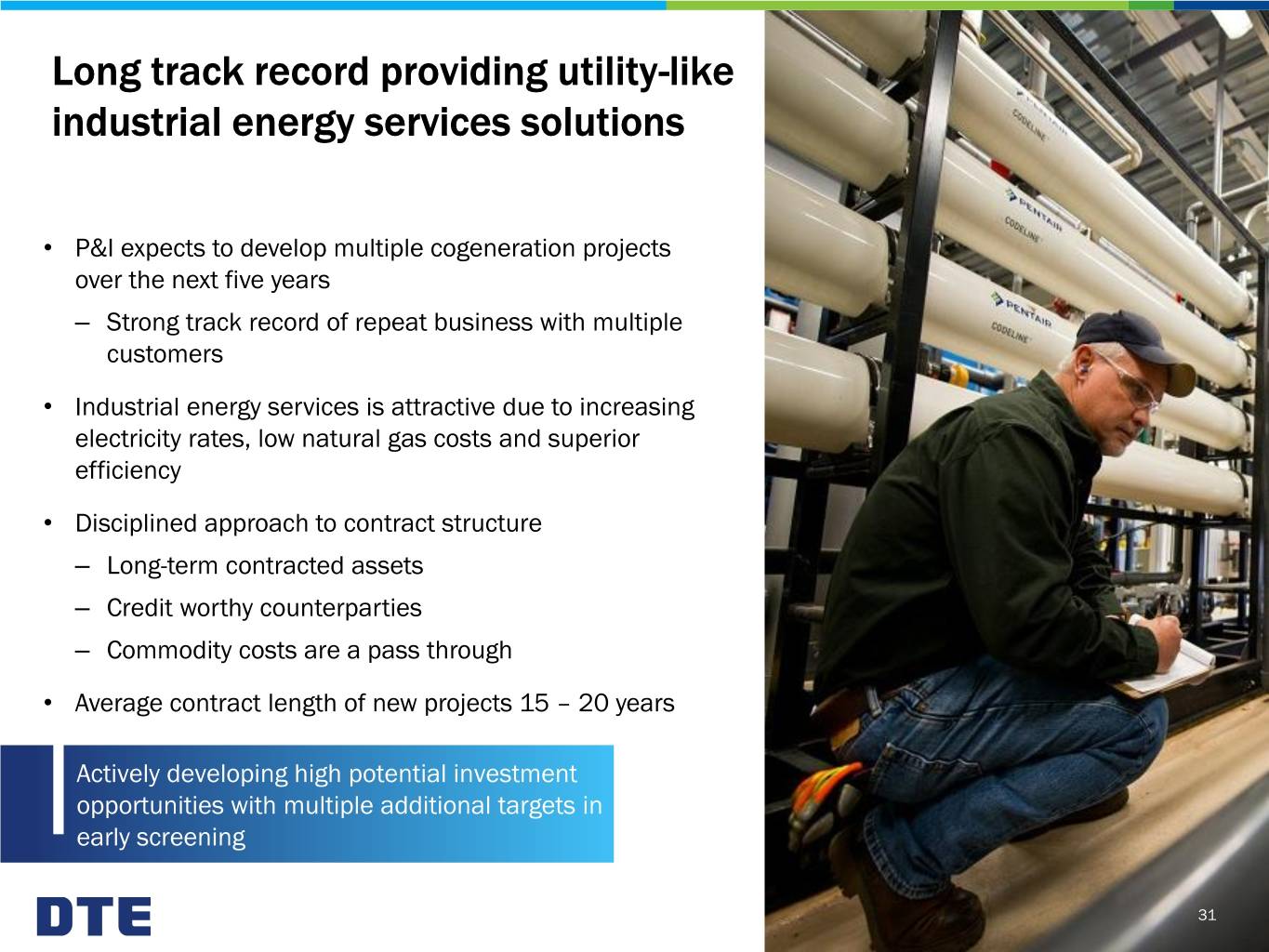

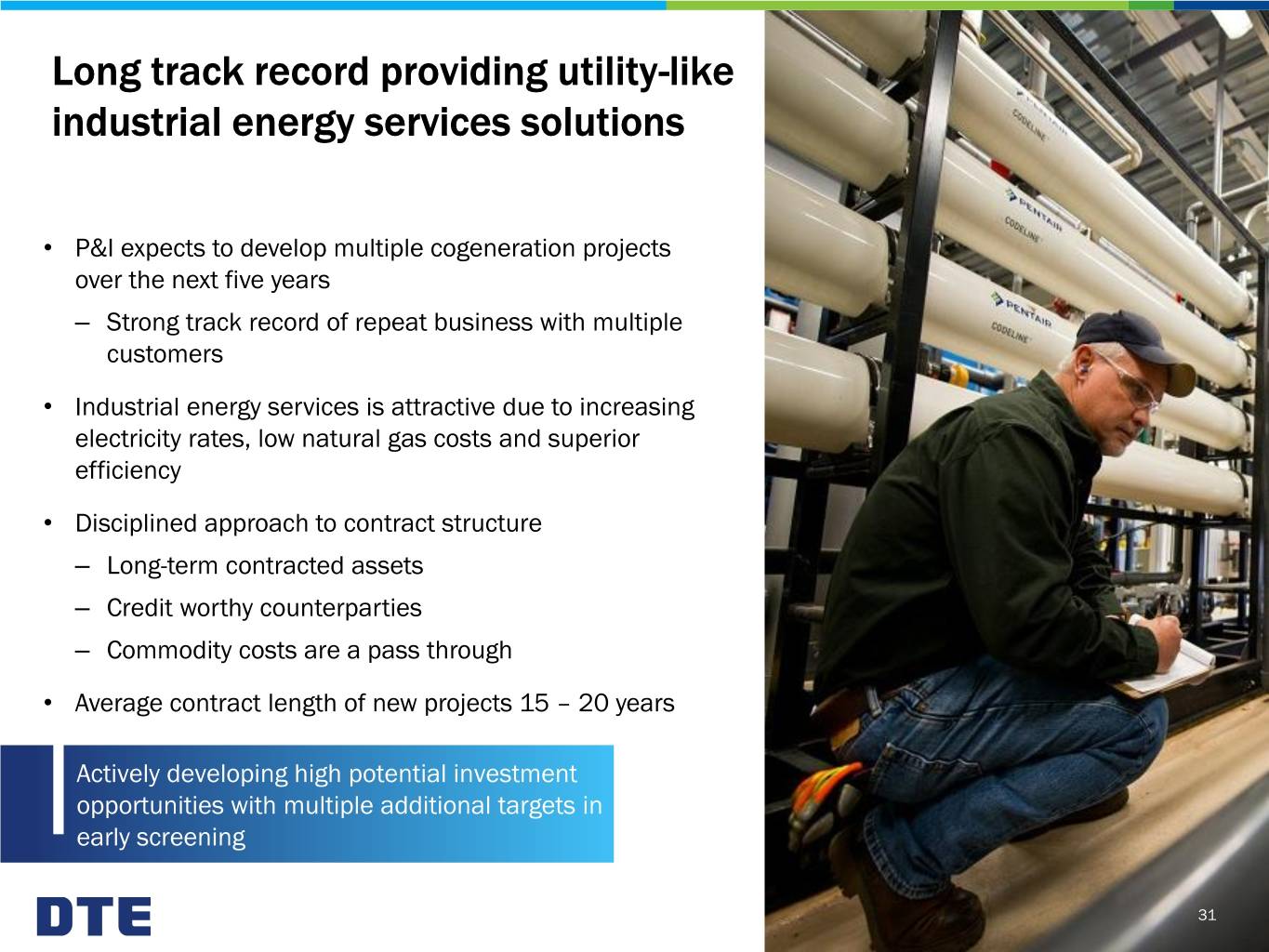

Long track record providing utility-like industrial energy services solutions • P&I expects to develop multiple cogeneration projects over the next five years ‒ Strong track record of repeat business with multiple customers • Industrial energy services is attractive due to increasing electricity rates, low natural gas costs and superior efficiency • Disciplined approach to contract structure ‒ Long-term contracted assets ‒ Credit worthy counterparties ‒ Commodity costs are a pass through • Average contract length of new projects 15 – 20 years Actively developing high potential investment opportunities with multiple additional targets in early screening 31

Continuing to deliver distinctive shareholder value Strong track record of delivering value for shareholders • Decade-long record of beating guidance • Premium total shareholder returns Top performing utilities with clear line of sight for growth • Sustained infrastructure investment • Constructive regulatory environment Disciplined approach for non-utility value creation • Proven track record of developing growth projects and managing risk • Targeting higher than utility returns Targeting 5% – 7% operating EPS1 growth through 2024 and annualized dividend growth of 7% through 20212 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 32 2. Subject to Board approval

• Overview • Strong track record of delivering value for shareholders • High-quality utilities with clear line of sight for growth • Disciplined approach for non-utility value creation • Appendix ― Financial and regulatory disclosures ― Recent acquisition 33

DTE Electric and DTE Gas regulatory update DTE Electric DTE Gas • General rate case - order received • General rate case - order received May 2019 (U-20162) September 2018 (U-18999) ‒ Effective: May 2019 ‒ Effective: October 2018 ‒ Rate recovery: $273 million ‒ Rate recovery: $47 million ‒ ROE: 10.0% ‒ ROE: 10.0% ‒ Capital structure: 50% debt, 50% equity ‒ Capital structure: 48% debt, 52% equity ‒ Rate base: $17 billion ‒ Rate base: $4.2 billion • General rate case – filed July 2019 • Anticipated rate case filing 4Q 2019 (U-20561) ‒ Effective: May 2020 ‒ Rate recovery: $351 million ‒ ROE: 10.5% ‒ Capital structure: 50% debt, 50% equity ‒ Rate base: $18.3 billion • Filed Integrated Resource Plan - March 2019 (U-20471) ‒ PFD expected late 2019 ‒ Order expected early 2020 34

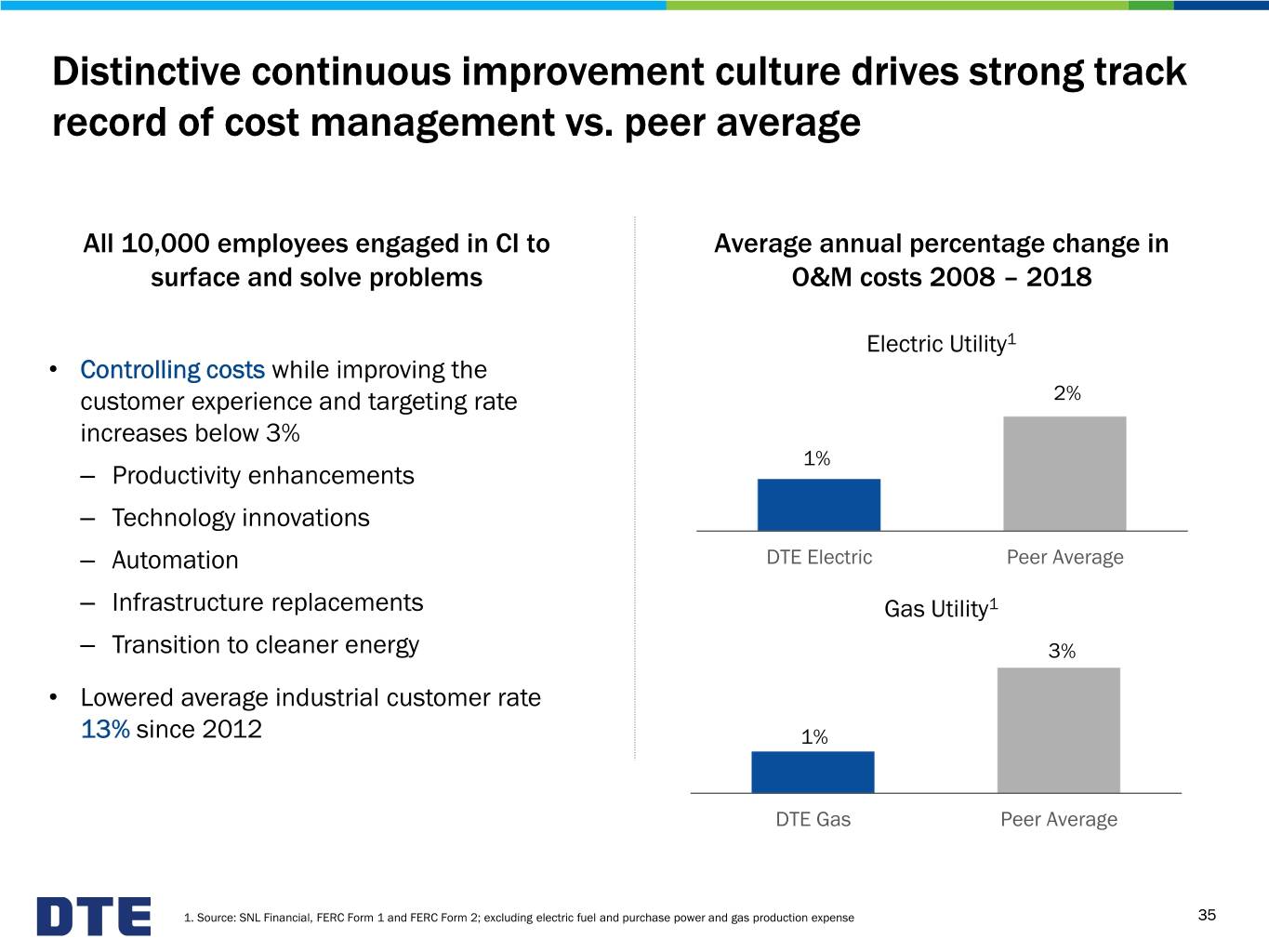

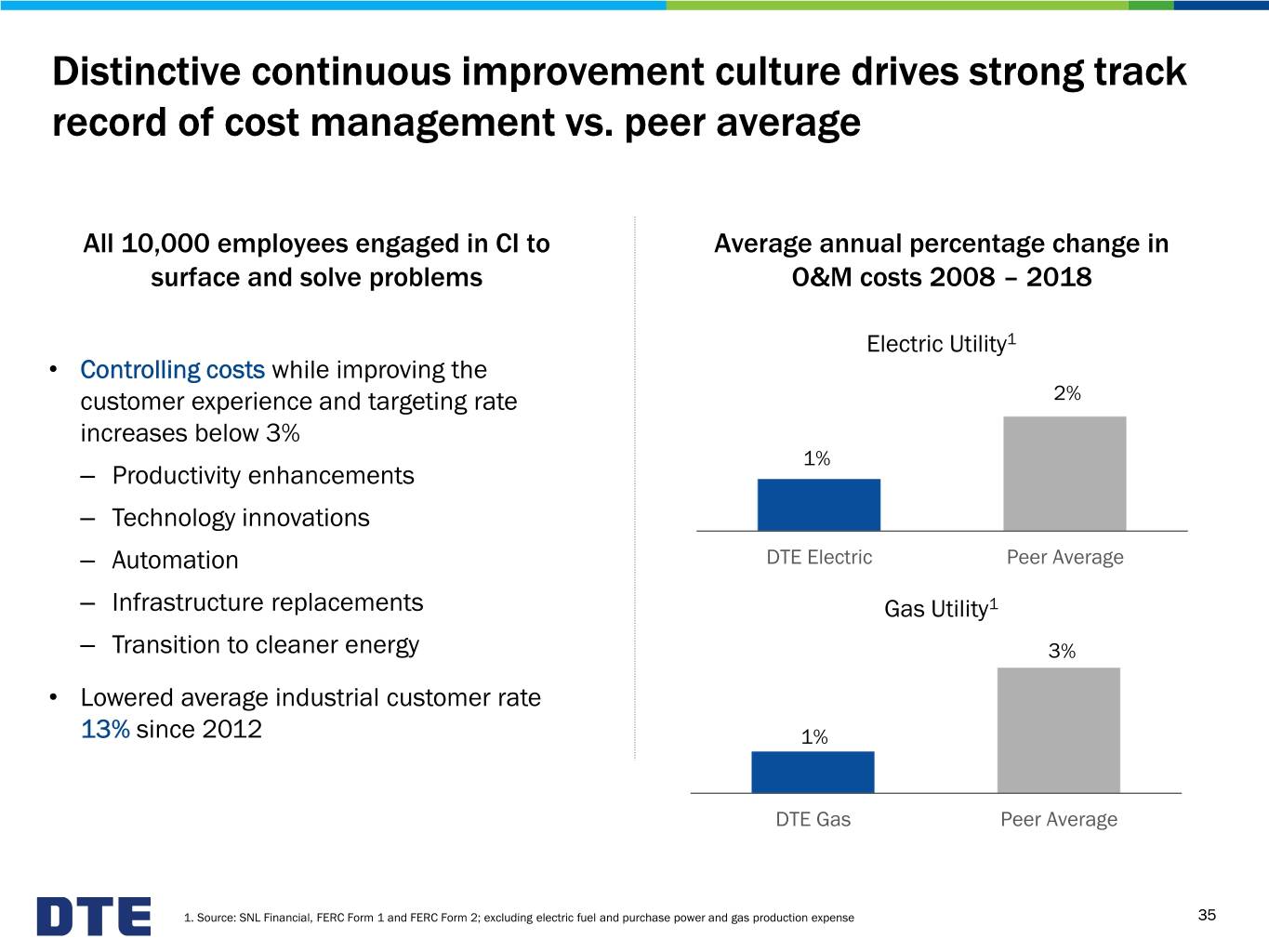

Distinctive continuous improvement culture drives strong track record of cost management vs. peer average All 10,000 employees engaged in CI to Average annual percentage change in surface and solve problems O&M costs 2008 – 2018 Electric Utility1 • Controlling costs while improving the customer experience and targeting rate 2% increases below 3% 1% ‒ Productivity enhancements ‒ Technology innovations ‒ Automation DTE Electric Peer Average ‒ Infrastructure replacements Gas Utility1 ‒ Transition to cleaner energy 3% • Lowered average industrial customer rate 13% since 2012 1% DTE Gas Peer Average 1. Source: SNL Financial, FERC Form 1 and FERC Form 2; excluding electric fuel and purchase power and gas production expense 35

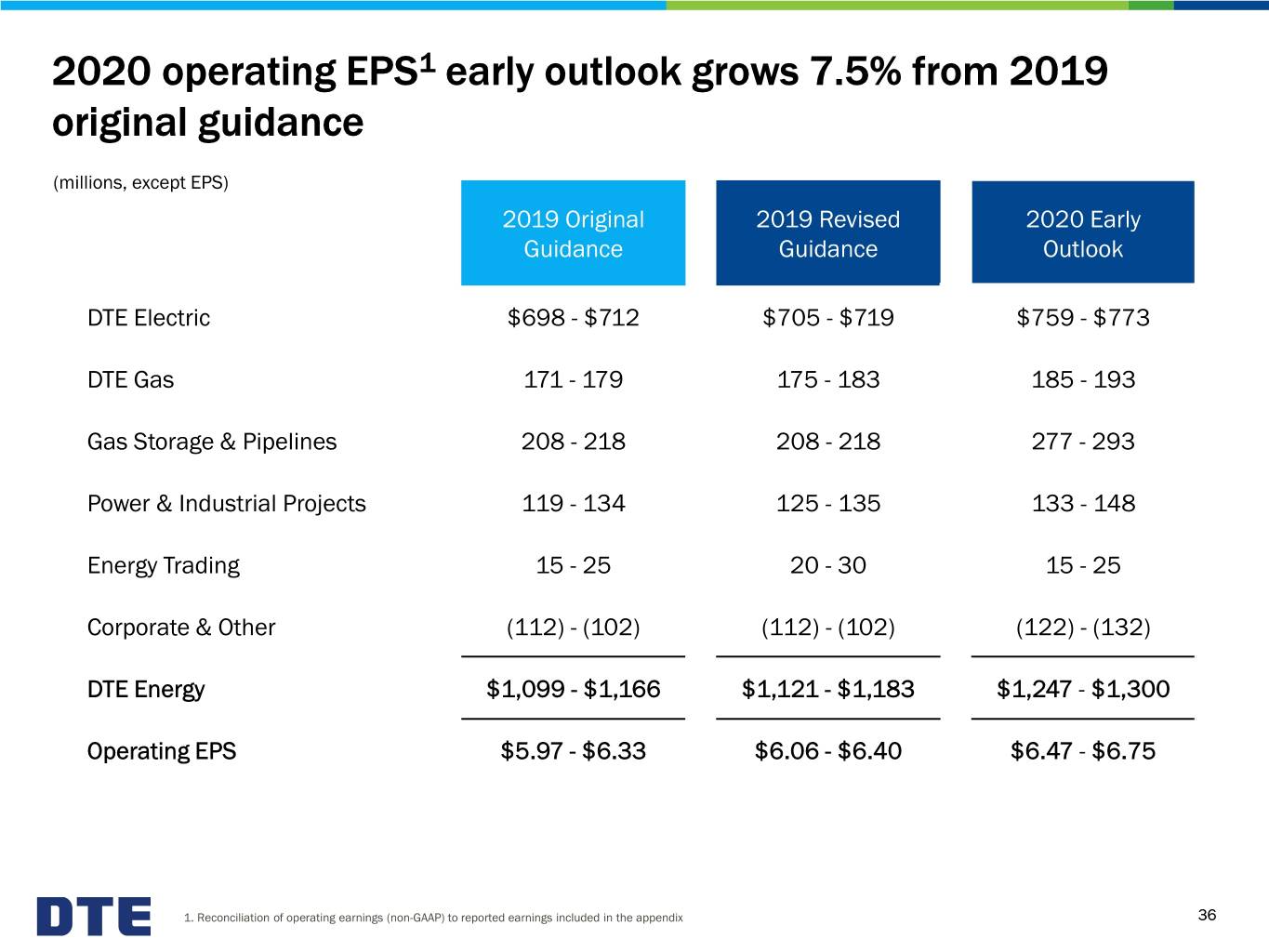

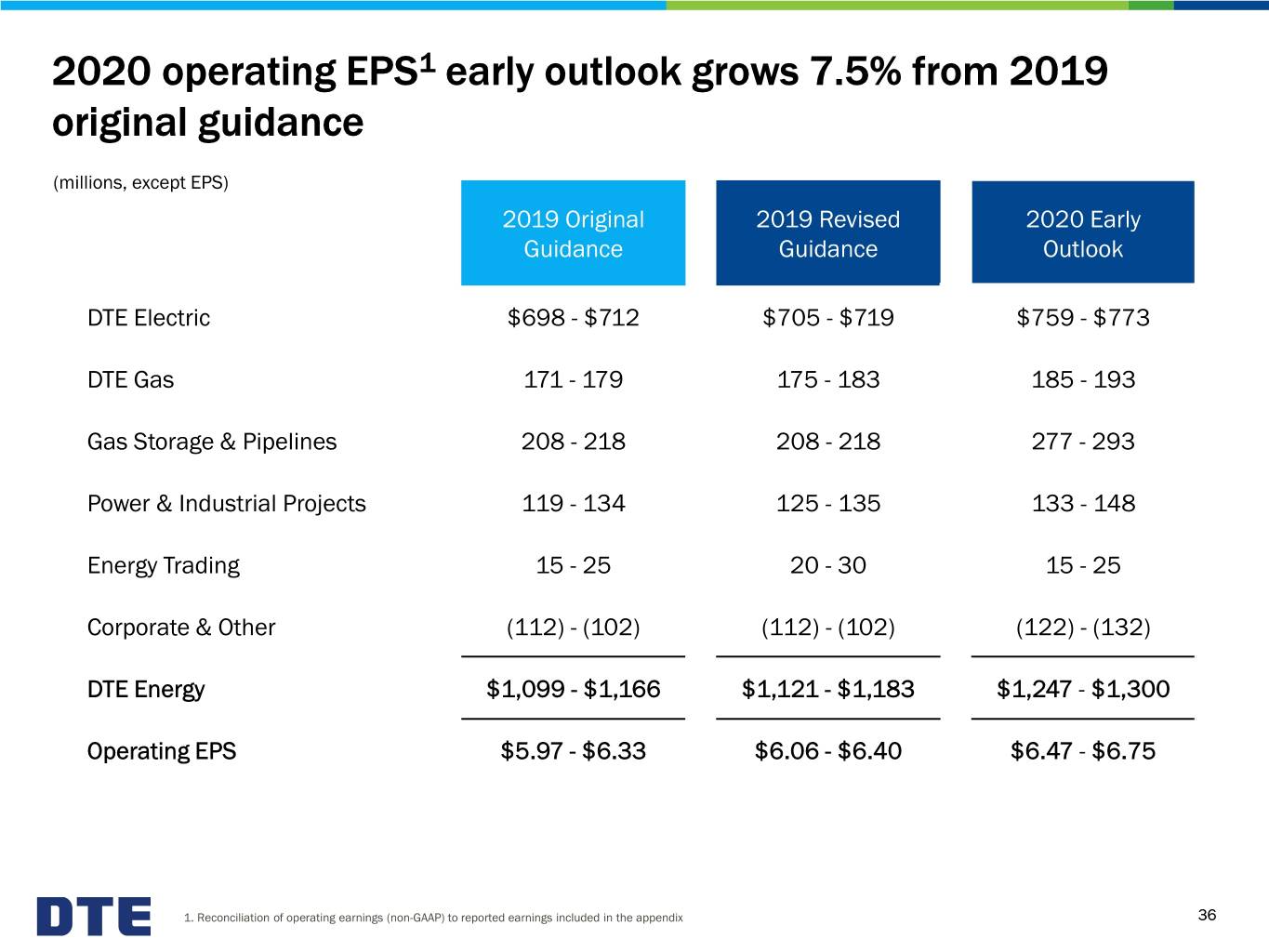

2020 operating EPS1 early outlook grows 7.5% from 2019 original guidance (millions, except EPS) 2019 Original 2019 Revised 2020 Early Guidance Guidance Outlook DTE Electric $698 - $712 $705 - $719 $759 - $773 DTE Gas 171 - 179 175 - 183 185 - 193 Gas Storage & Pipelines 208 - 218 208 - 218 277 - 293 Power & Industrial Projects 119 - 134 125 - 135 133 - 148 Energy Trading 15 - 25 20 - 30 15 - 25 Corporate & Other (112) - (102) (112) - (102) (122) - (132) DTE Energy $1,099 - $1,166 $1,121 - $1,183 $1,247 - $1,300 Operating EPS $5.97 - $6.33 $6.06 - $6.40 $6.47 - $6.75 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 36

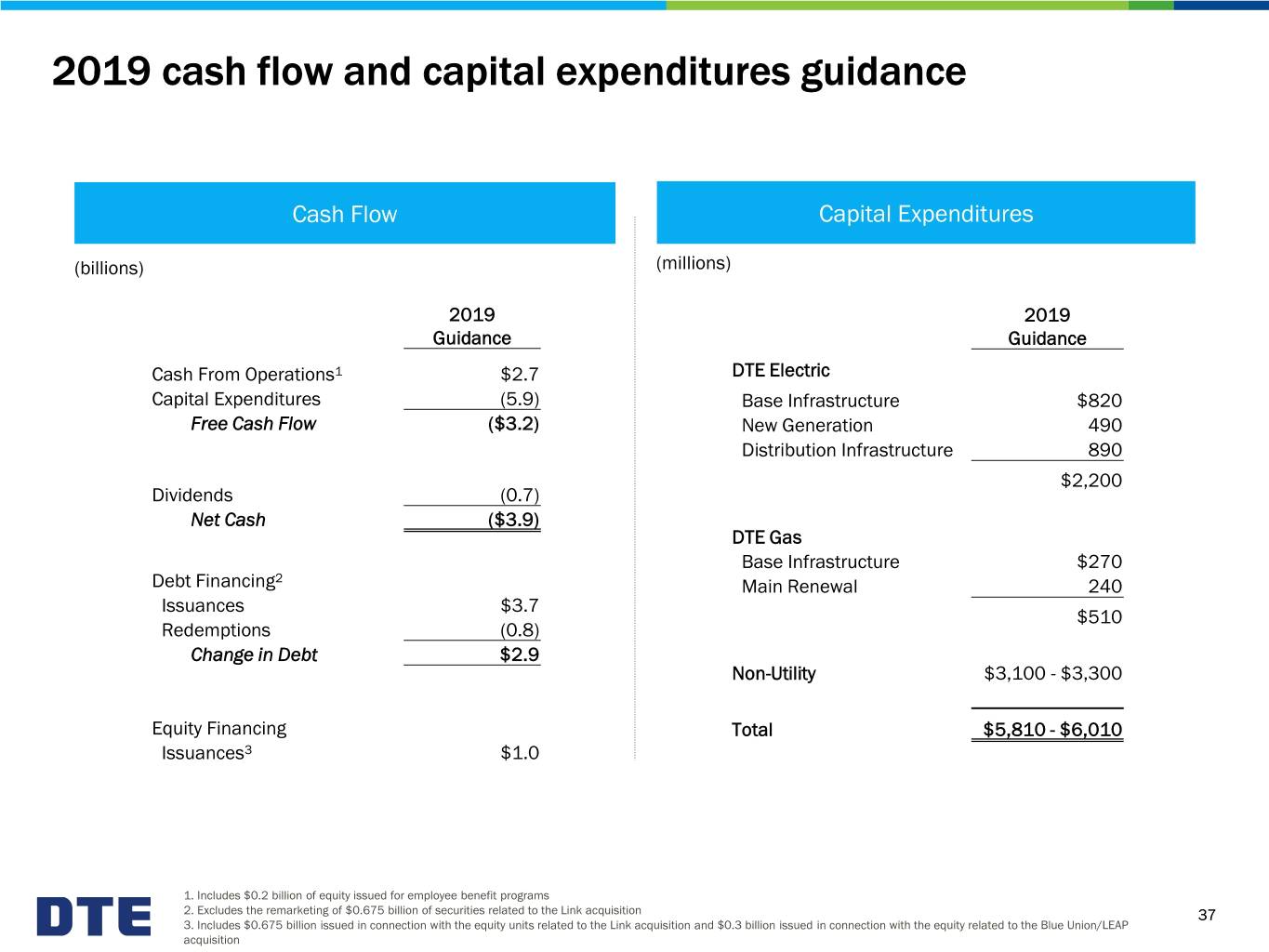

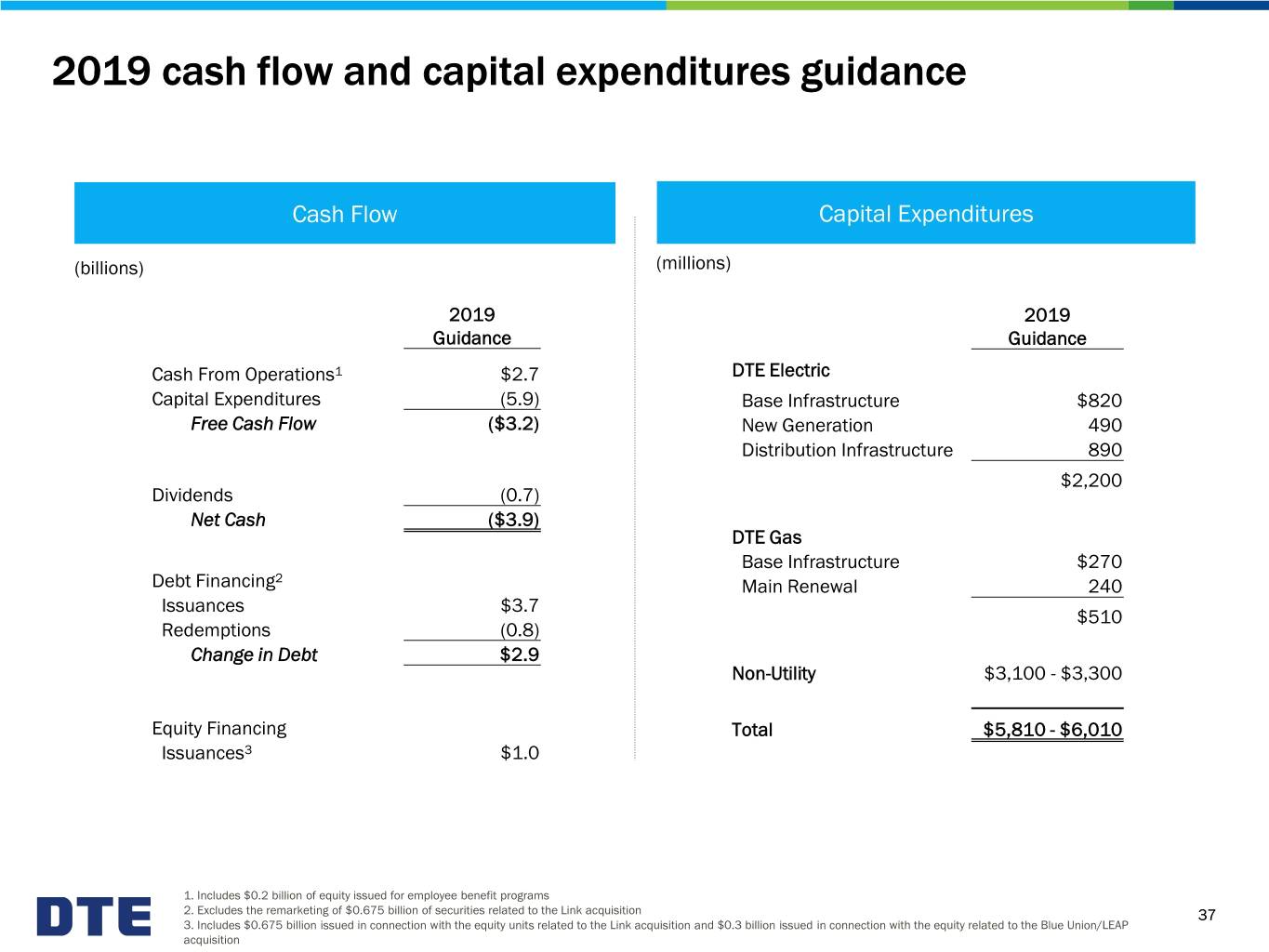

2019 cash flow and capital expenditures guidance Cash Flow Capital Expenditures (billions) (millions) 2019 2019 Guidance Guidance Cash From Operations1 $2.7 DTE Electric Capital Expenditures (5.9) Base Infrastructure $820 Free Cash Flow ($3.2) New Generation 490 Distribution Infrastructure 890 $2,200 Dividends (0.7) Net Cash ($3.9) DTE Gas Base Infrastructure $270 Debt Financing2 Main Renewal 240 Issuances $3.7 $510 Redemptions (0.8) Change in Debt $2.9 Non-Utility $3,100 - $3,300 Equity Financing Total $5,810 - $6,010 Issuances3 $1.0 1. Includes $0.2 billion of equity issued for employee benefit programs 2. Excludes the remarketing of $0.675 billion of securities related to the Link acquisition 37 3. Includes $0.675 billion issued in connection with the equity units related to the Link acquisition and $0.3 billion issued in connection with the equity related to the Blue Union/LEAP acquisition

• Overview • Strong track record of delivering value for shareholders • High-quality utilities with clear line of sight for growth • Disciplined approach for non-utility value creation • Appendix ― Financial and regulatory disclosures ― Recent acquisition 38

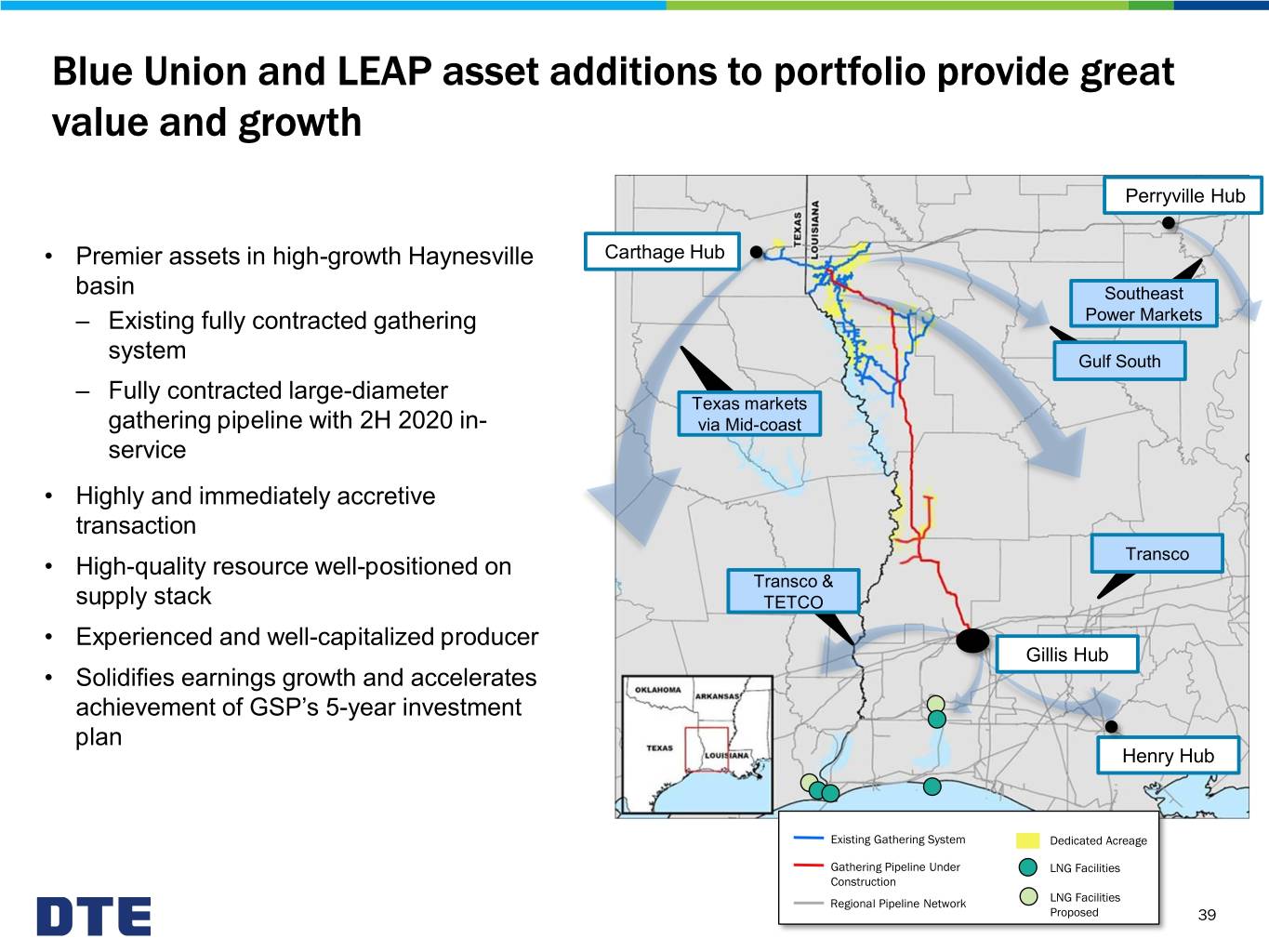

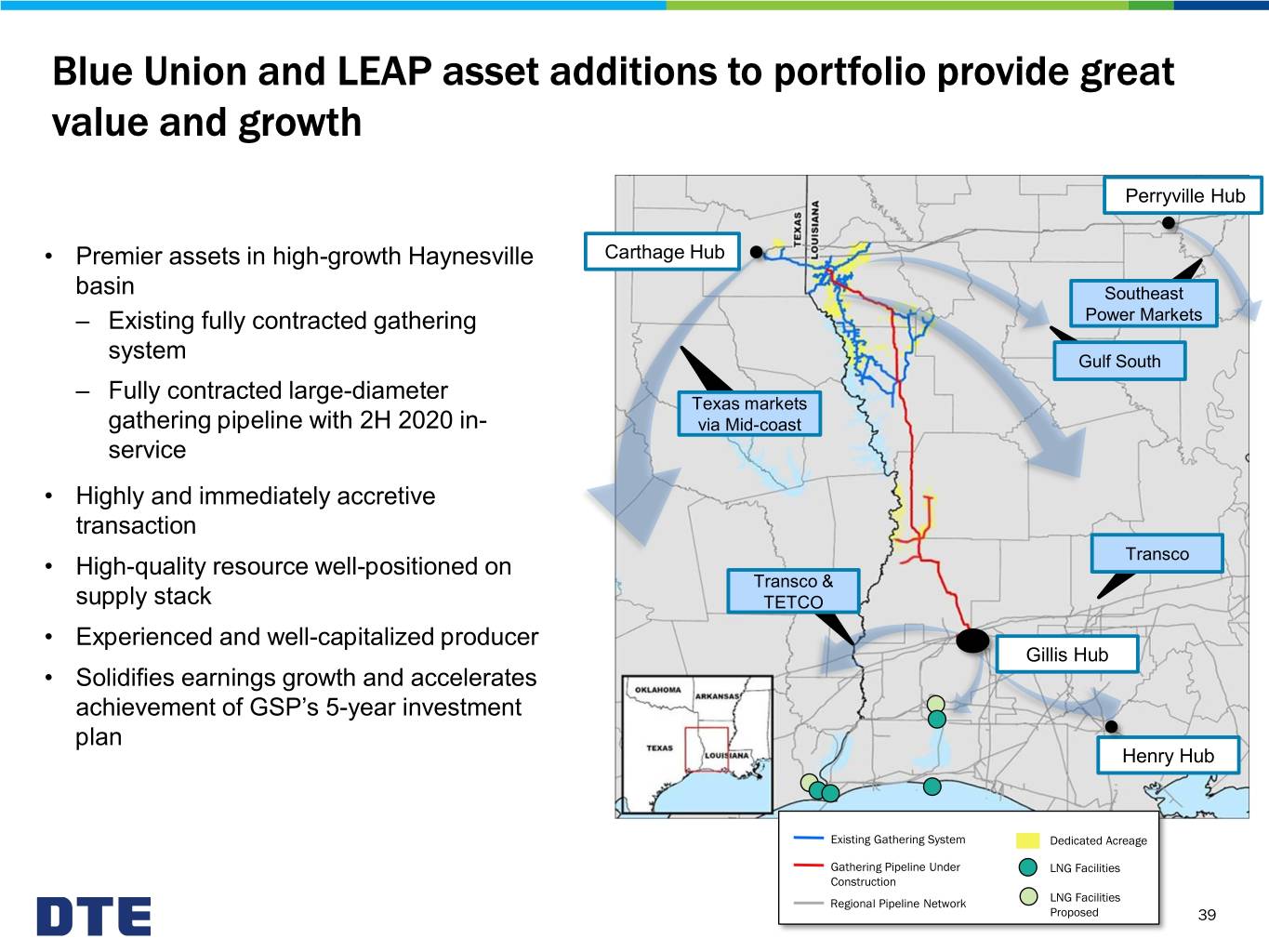

Blue Union and LEAP asset additions to portfolio provide great value and growth Perryville Hub • Premier assets in high-growth Haynesville Carthage Hub basin Southeast – Existing fully contracted gathering Power Markets system Gulf South – Fully contracted large-diameter Texas markets gathering pipeline with 2H 2020 in- via Mid-coast service • Highly and immediately accretive transaction Transco • High-quality resource well-positioned on Transco & supply stack TETCO • Experienced and well-capitalized producer Gillis Hub • Solidifies earnings growth and accelerates achievement of GSP’s 5-year investment plan Henry Hub Existing Gathering System Dedicated Acreage Gathering Pipeline Under LNG Facilities Construction Regional Pipeline Network LNG Facilities Proposed 39

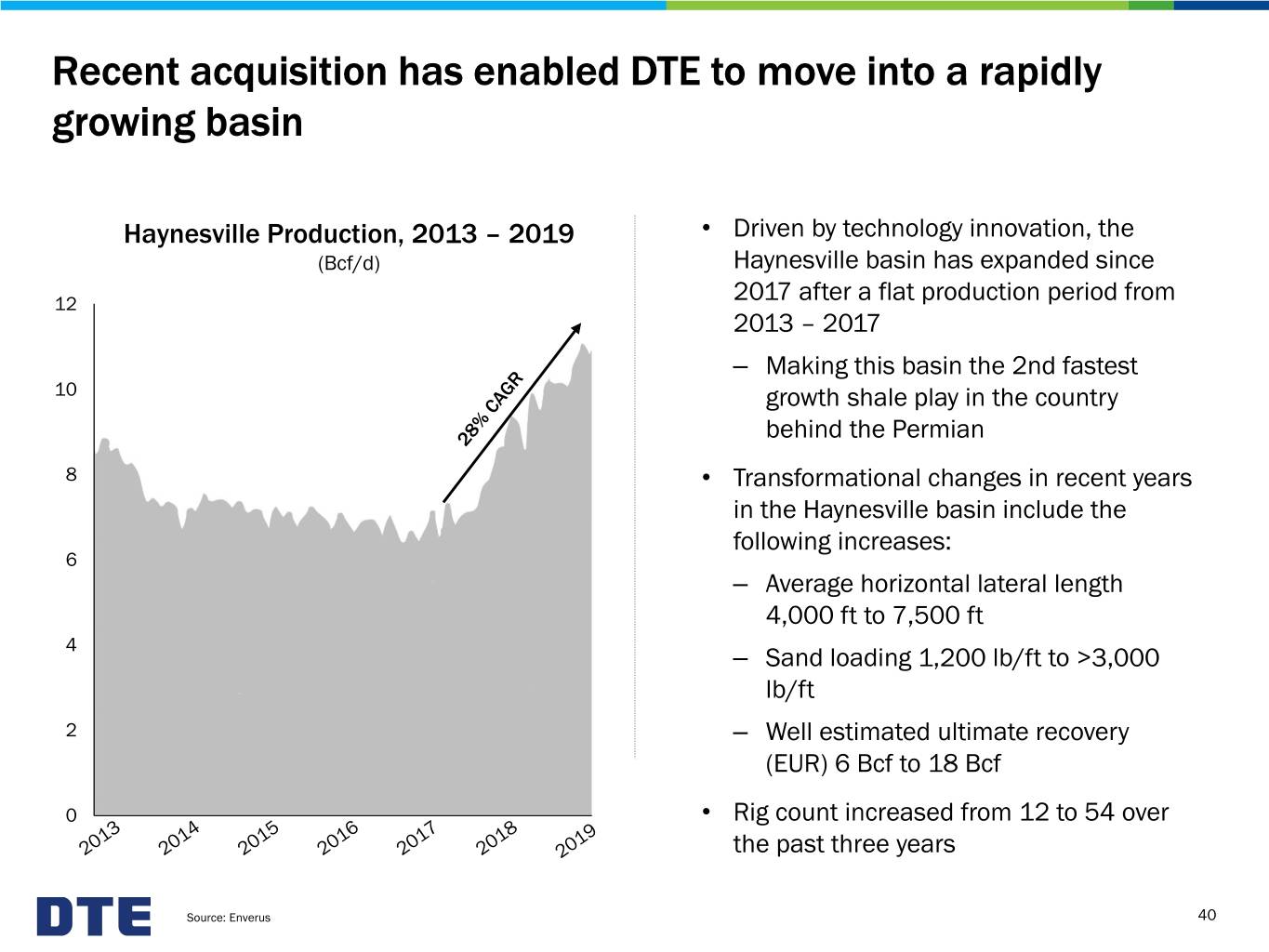

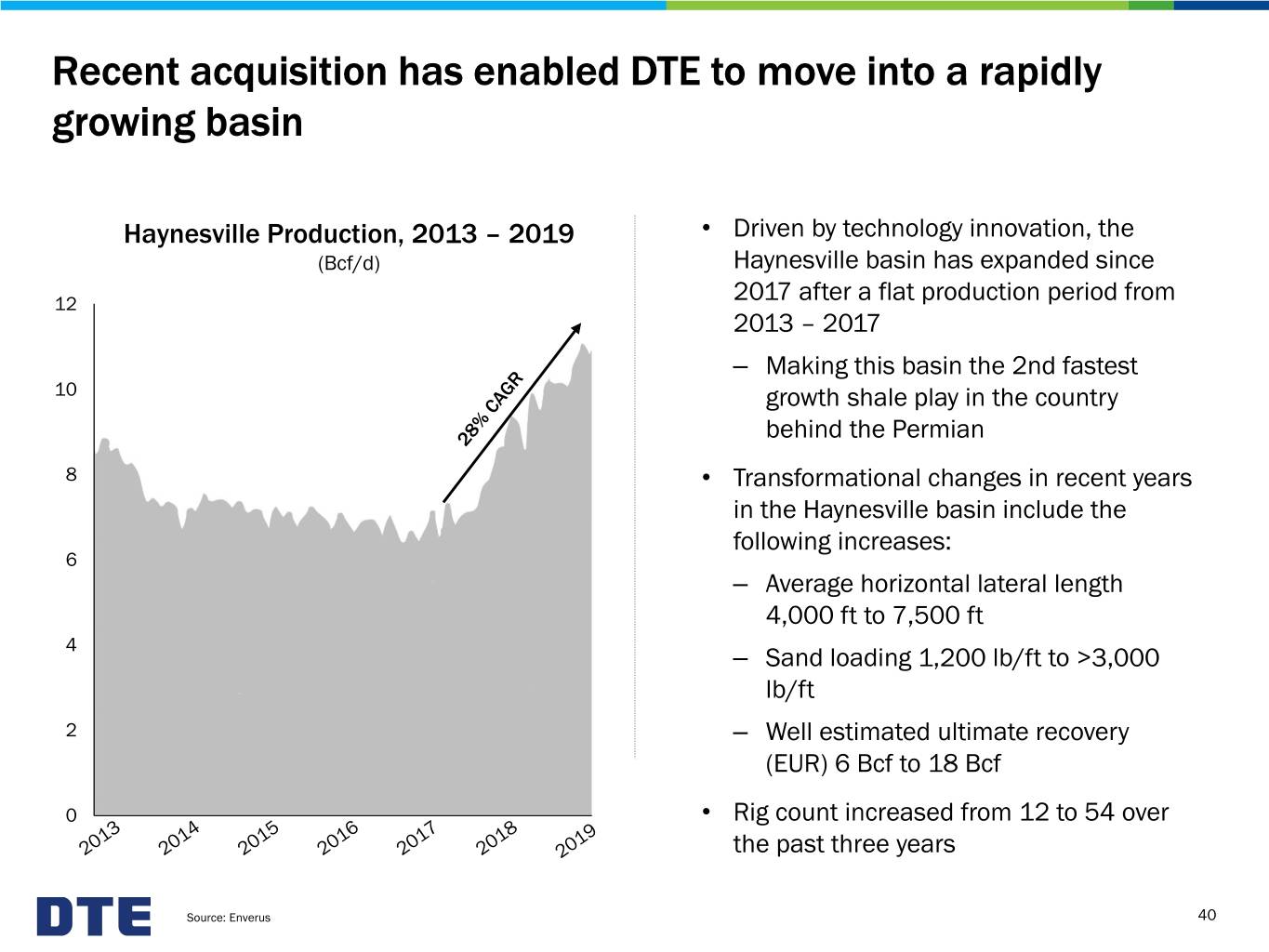

Recent acquisition has enabled DTE to move into a rapidly growing basin Haynesville Production, 2013 – 2019 • Driven by technology innovation, the (Bcf/d) Haynesville basin has expanded since 12 2017 after a flat production period from 2013 – 2017 – Making this basin the 2nd fastest 10 growth shale play in the country behind the Permian 8 • Transformational changes in recent years in the Haynesville basin include the following increases: 6 – Average horizontal lateral length 4,000 ft to 7,500 ft 4 – Sand loading 1,200 lb/ft to >3,000 lb/ft 2 – Well estimated ultimate recovery (EUR) 6 Bcf to 18 Bcf 0 • Rig count increased from 12 to 54 over the past three years Source: Enverus 40

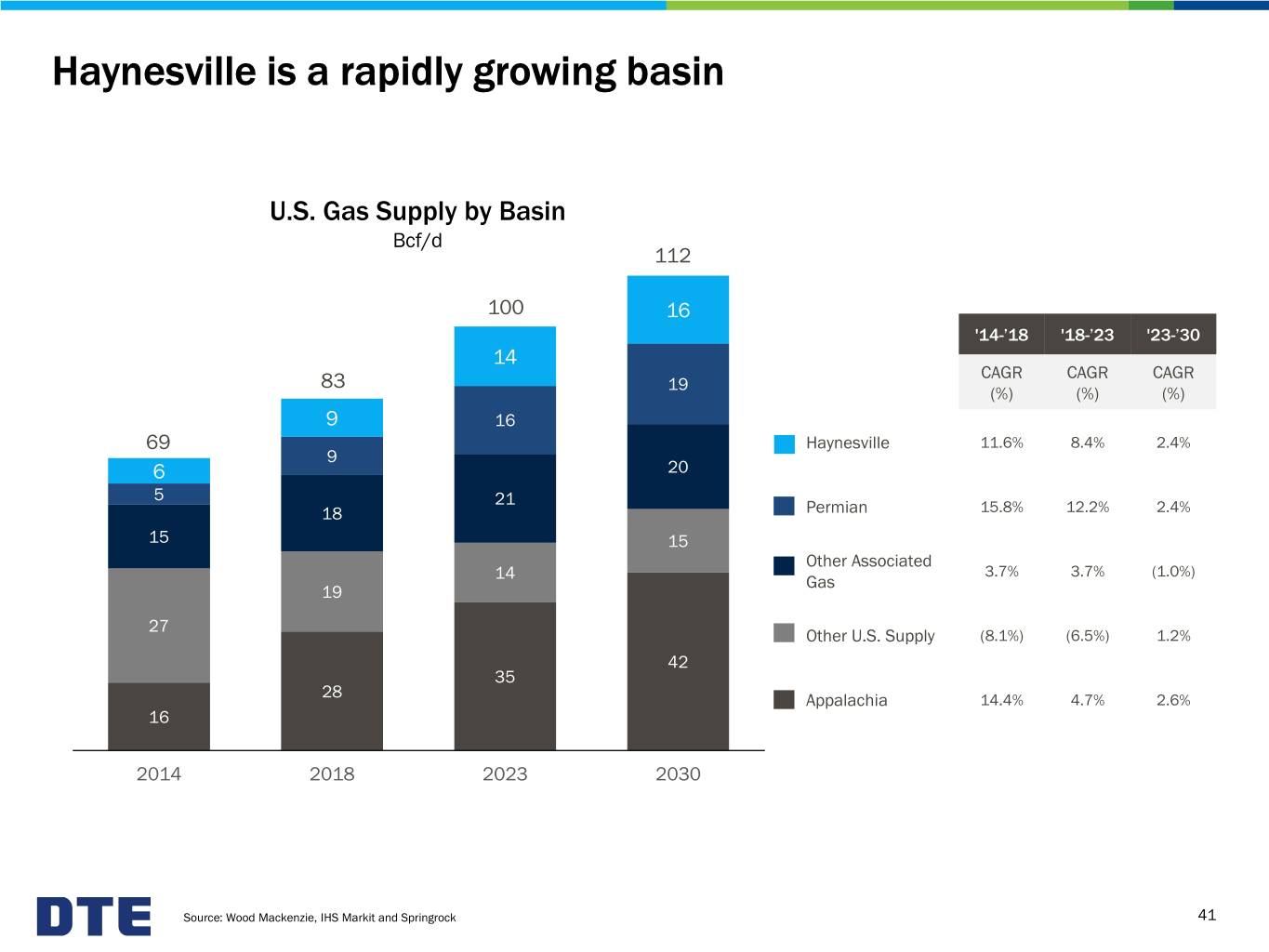

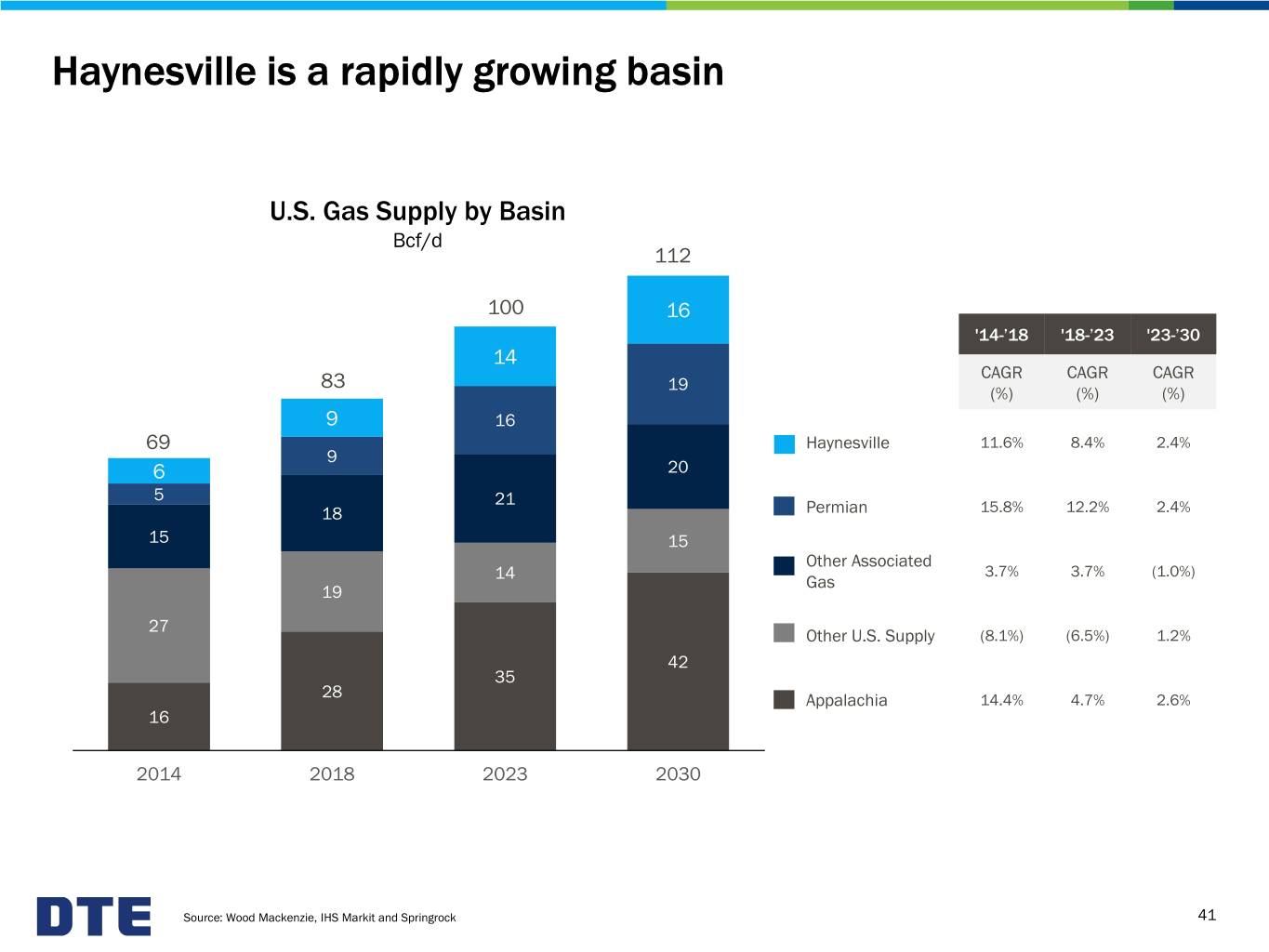

Haynesville is a rapidly growing basin U.S. Gas Supply by Basin Bcf/d 112 100 16 '14-’18 '18-’23 '23-’30 14 CAGR CAGR CAGR 83 19 (%) (%) (%) 9 16 69 Haynesville 11.6% 8.4% 2.4% 9 6 20 5 21 18 Permian 15.8% 12.2% 2.4% 15 15 Other Associated 14 3.7% 3.7% (1.0%) Gas 19 27 Other U.S. Supply (8.1%) (6.5%) 1.2% 42 35 28 Appalachia 14.4% 4.7% 2.6% 16 2014 2018 2023 2030 Source: Wood Mackenzie, IHS Markit and Springrock 41

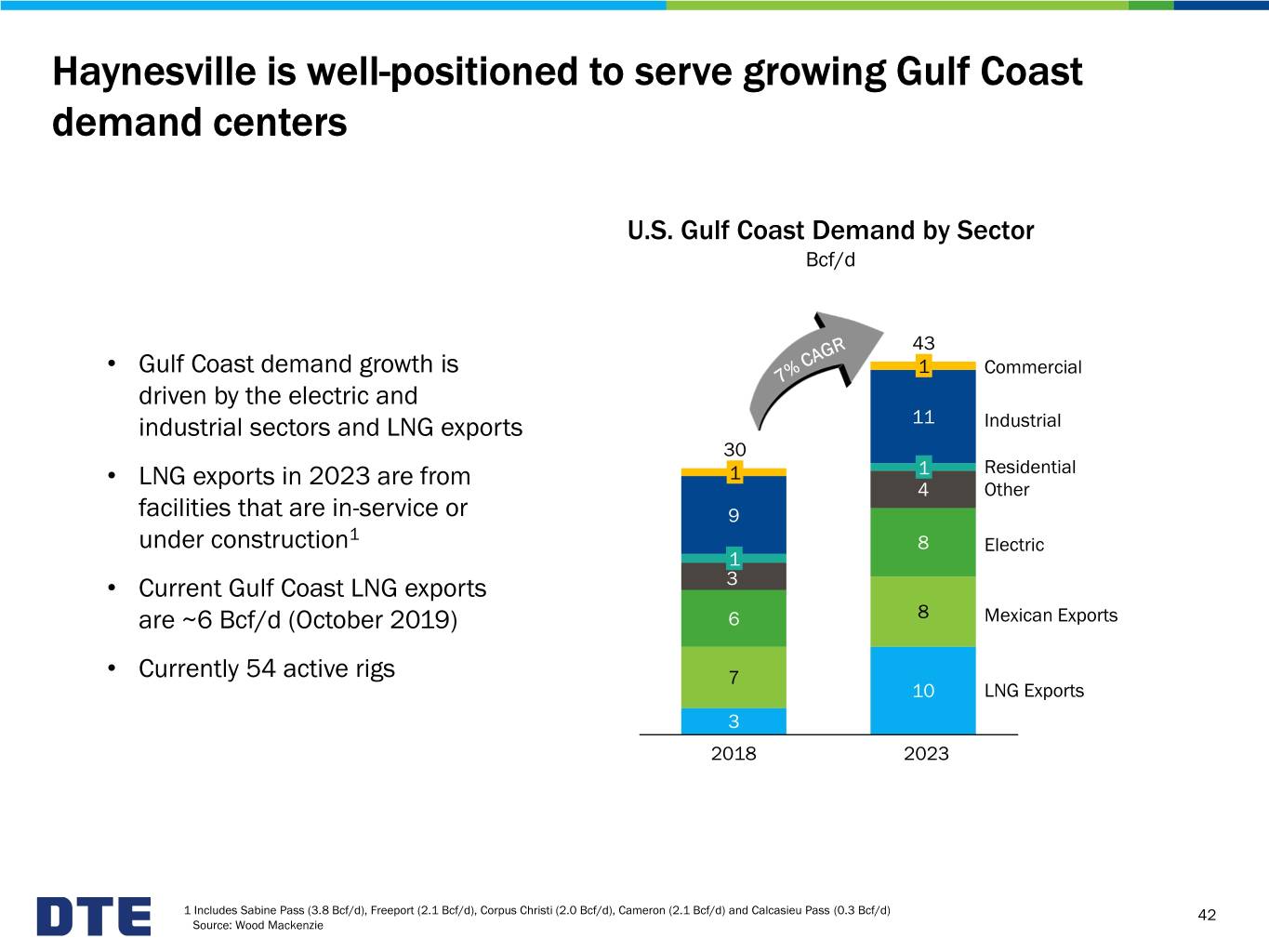

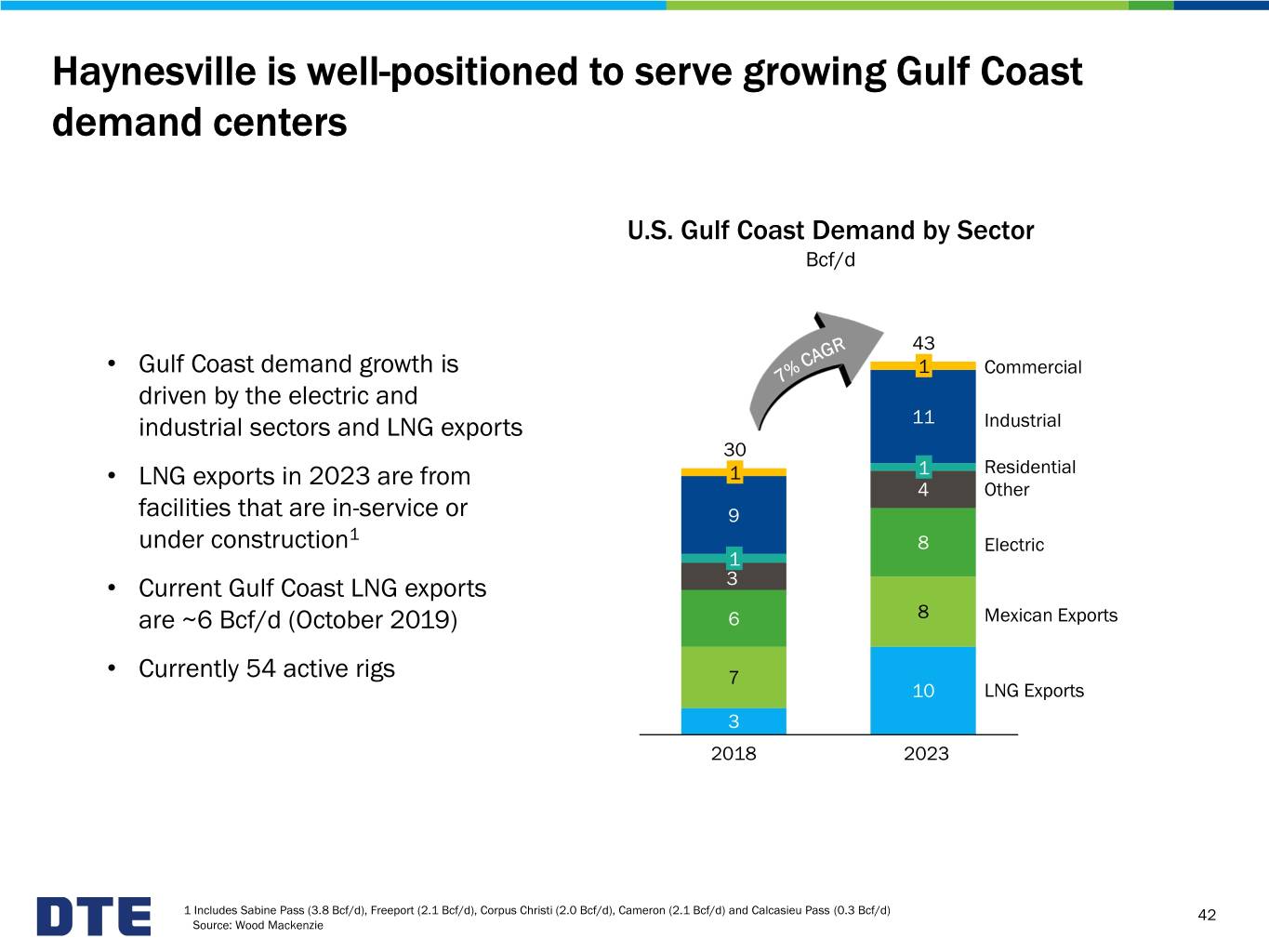

Haynesville is well-positioned to serve growing Gulf Coast demand centers U.S. Gulf Coast Demand by Sector Bcf/d 43 • Gulf Coast demand growth is 1 Commercial driven by the electric and industrial sectors and LNG exports 11 Industrial 30 • LNG exports in 2023 are from 1 1 Residential 4 Other facilities that are in-service or 9 1 under construction 8 Electric 1 • Current Gulf Coast LNG exports 3 are ~6 Bcf/d (October 2019) 6 8 Mexican Exports • Currently 54 active rigs 7 10 LNG Exports 3 2018 2023 1 Includes Sabine Pass (3.8 Bcf/d), Freeport (2.1 Bcf/d), Corpus Christi (2.0 Bcf/d), Cameron (2.1 Bcf/d) and Calcasieu Pass (0.3 Bcf/d) 42 Source: Wood Mackenzie

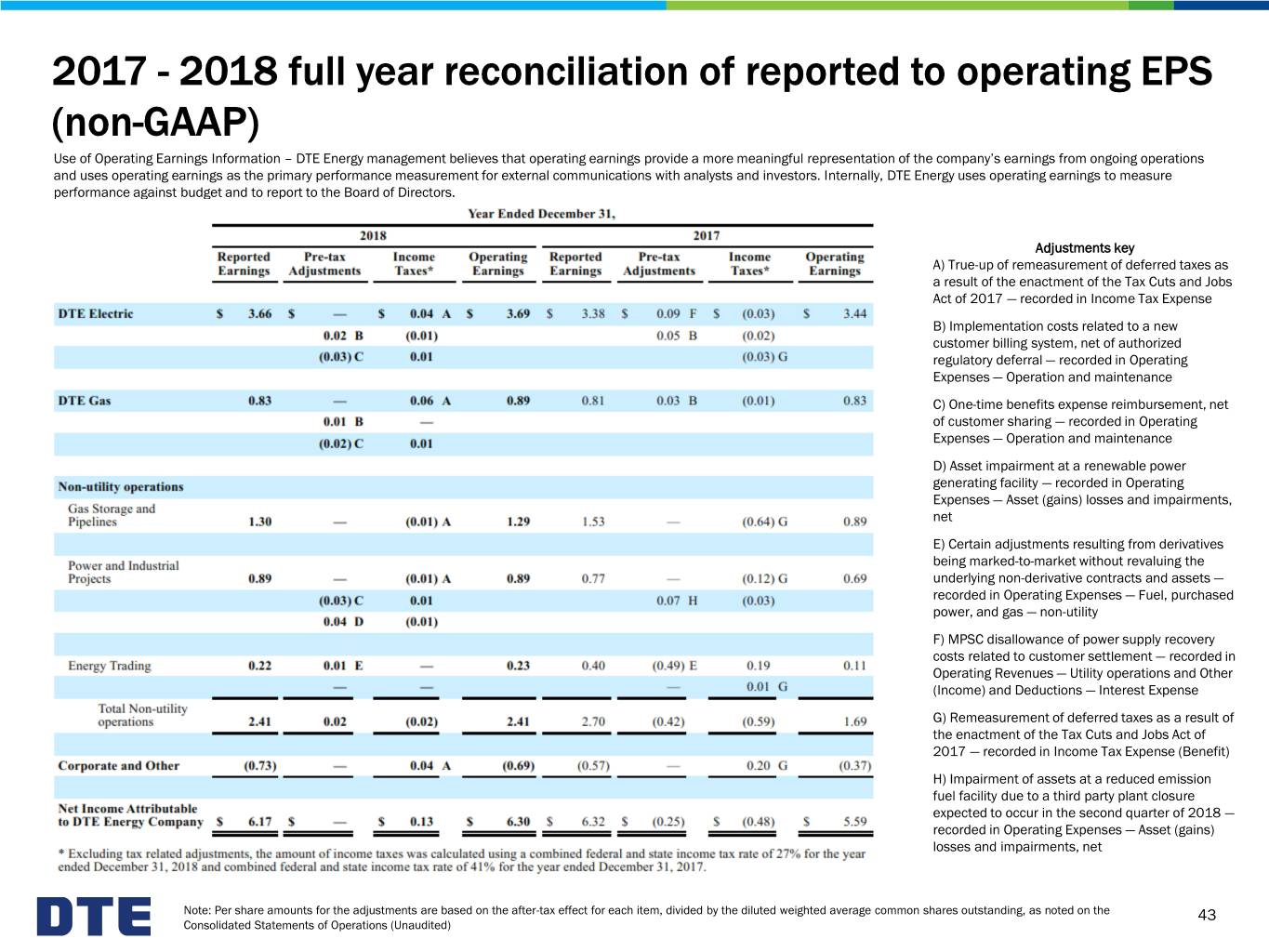

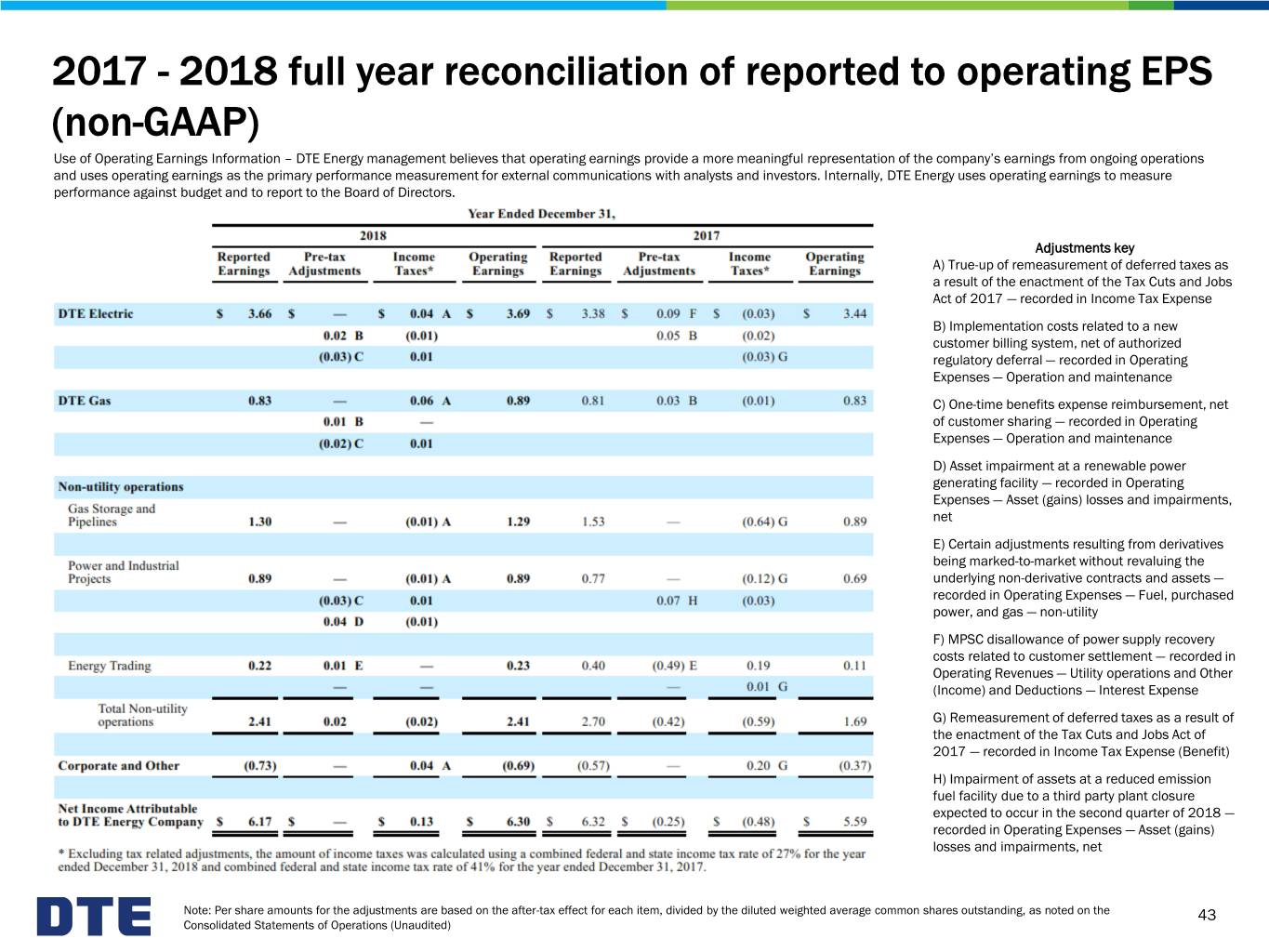

2017 - 2018 full year reconciliation of reported to operating EPS (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Adjustments key A) True-up of remeasurement of deferred taxes as a result of the enactment of the Tax Cuts and Jobs Act of 2017 — recorded in Income Tax Expense B) Implementation costs related to a new customer billing system, net of authorized regulatory deferral — recorded in Operating Expenses — Operation and maintenance C) One-time benefits expense reimbursement, net of customer sharing — recorded in Operating Expenses — Operation and maintenance D) Asset impairment at a renewable power generating facility — recorded in Operating Expenses — Asset (gains) losses and impairments, net E) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non-derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, and gas — non-utility F) MPSC disallowance of power supply recovery costs related to customer settlement — recorded in Operating Revenues — Utility operations and Other (Income) and Deductions — Interest Expense G) Remeasurement of deferred taxes as a result of the enactment of the Tax Cuts and Jobs Act of 2017 — recorded in Income Tax Expense (Benefit) H) Impairment of assets at a reduced emission fuel facility due to a third party plant closure expected to occur in the second quarter of 2018 — recorded in Operating Expenses — Asset (gains) losses and impairments, net Note: Per share amounts for the adjustments are based on the after-tax effect for each item, divided by the diluted weighted average common shares outstanding, as noted on the 43 Consolidated Statements of Operations (Unaudited)

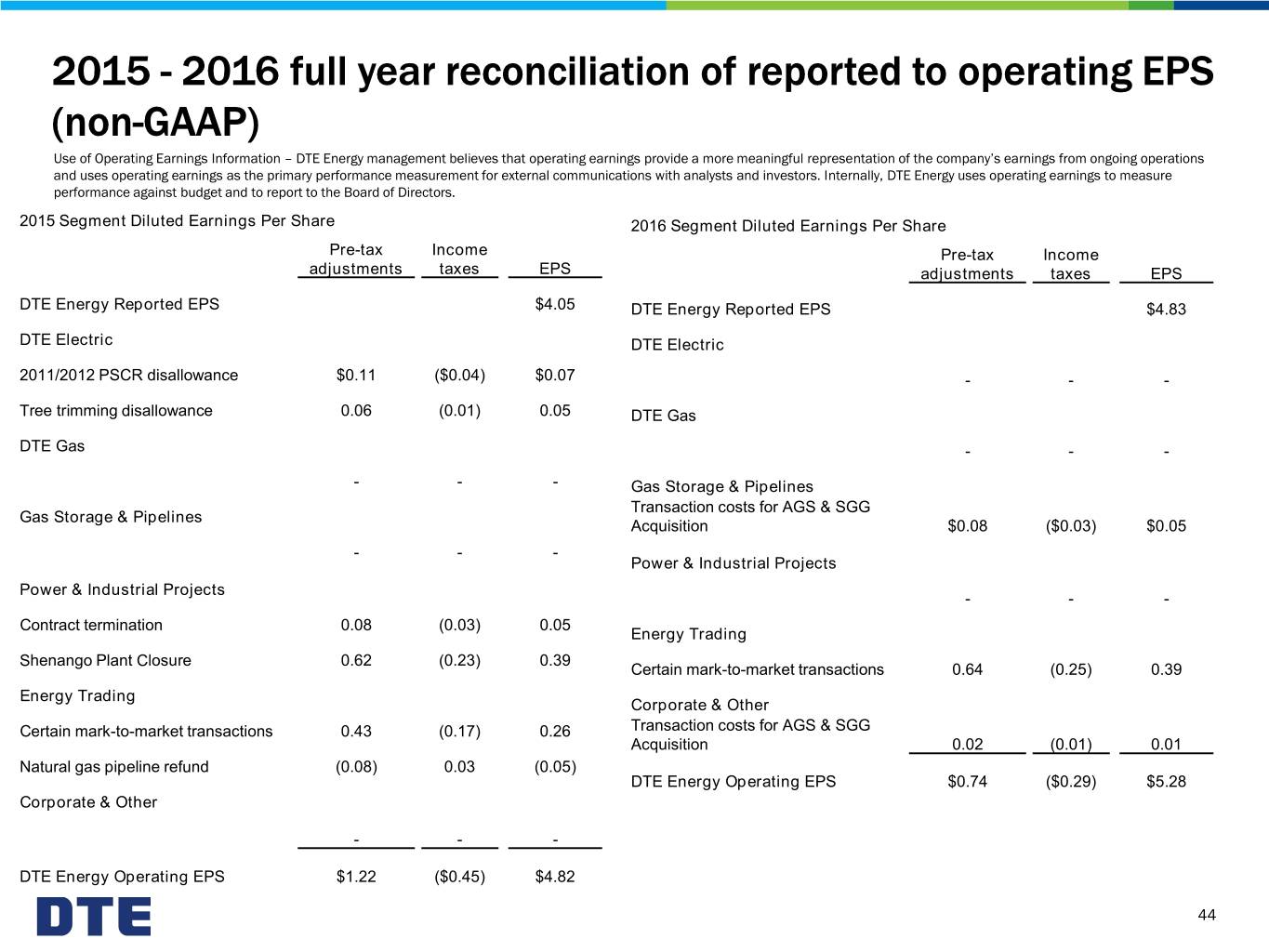

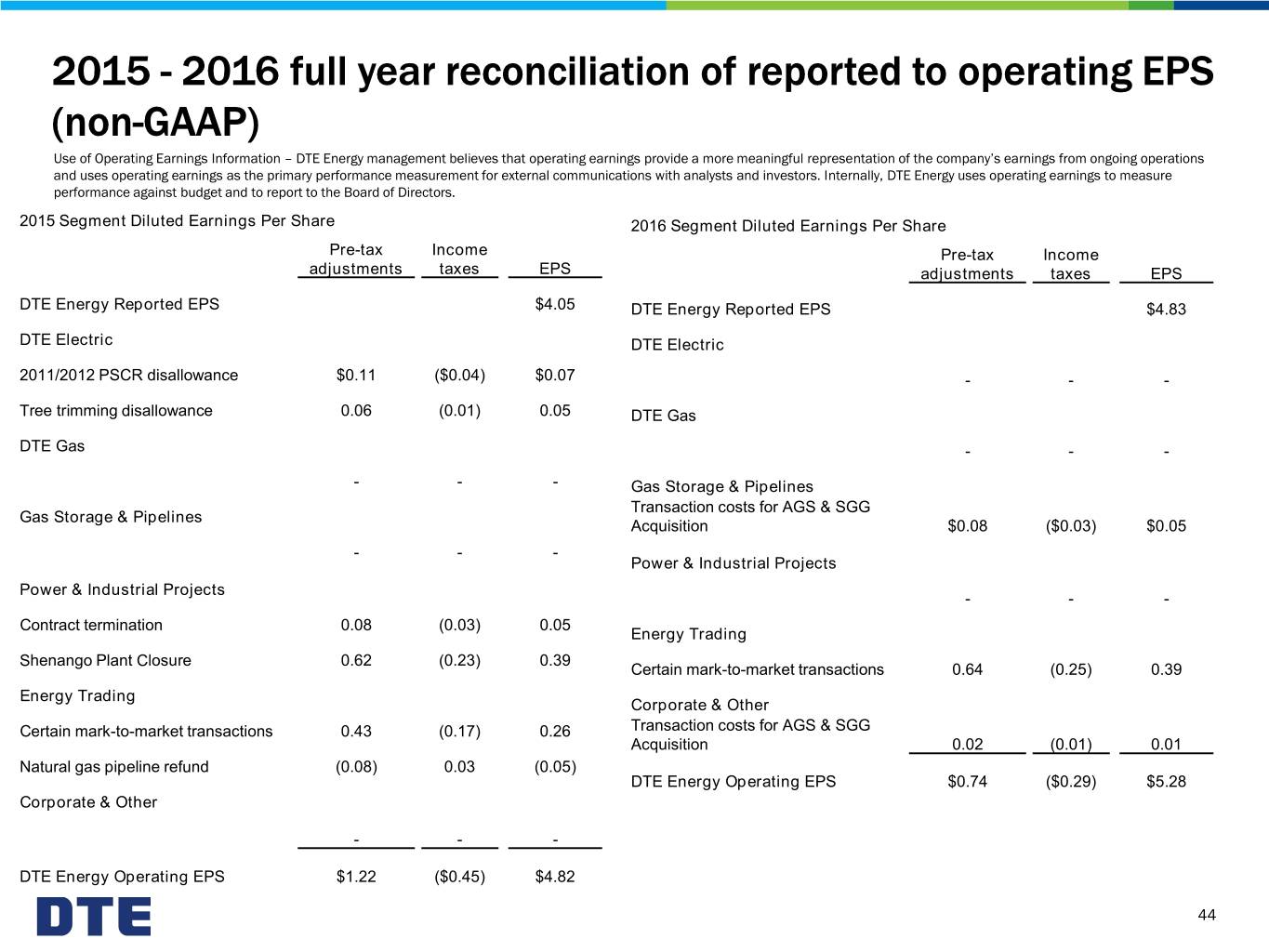

2015 - 2016 full year reconciliation of reported to operating EPS (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2015 Segment Diluted Earnings Per Share 2016 Segment Diluted Earnings Per Share Pre-tax Income Pre-tax Income adjustments taxes EPS adjustments taxes EPS DTE Energy Reported EPS $4.05 DTE Energy Reported EPS $4.83 DTE Electric DTE Electric 2011/2012 PSCR disallowance $0.11 ($0.04) $0.07 - - - Tree trimming disallowance 0.06 (0.01) 0.05 DTE Gas DTE Gas - - - - - - Gas Storage & Pipelines Transaction costs for AGS & SGG Gas Storage & Pipelines Acquisition $0.08 ($0.03) $0.05 - - - Power & Industrial Projects Power & Industrial Projects - - - Contract termination 0.08 (0.03) 0.05 Energy Trading Shenango Plant Closure 0.62 (0.23) 0.39 Certain mark-to-market transactions 0.64 (0.25) 0.39 Energy Trading Corporate & Other Certain mark-to-market transactions 0.43 (0.17) 0.26 Transaction costs for AGS & SGG Acquisition 0.02 (0.01) 0.01 Natural gas pipeline refund (0.08) 0.03 (0.05) DTE Energy Operating EPS $0.74 ($0.29) $5.28 Corporate & Other - - - DTE Energy Operating EPS $1.22 ($0.45) $4.82 44

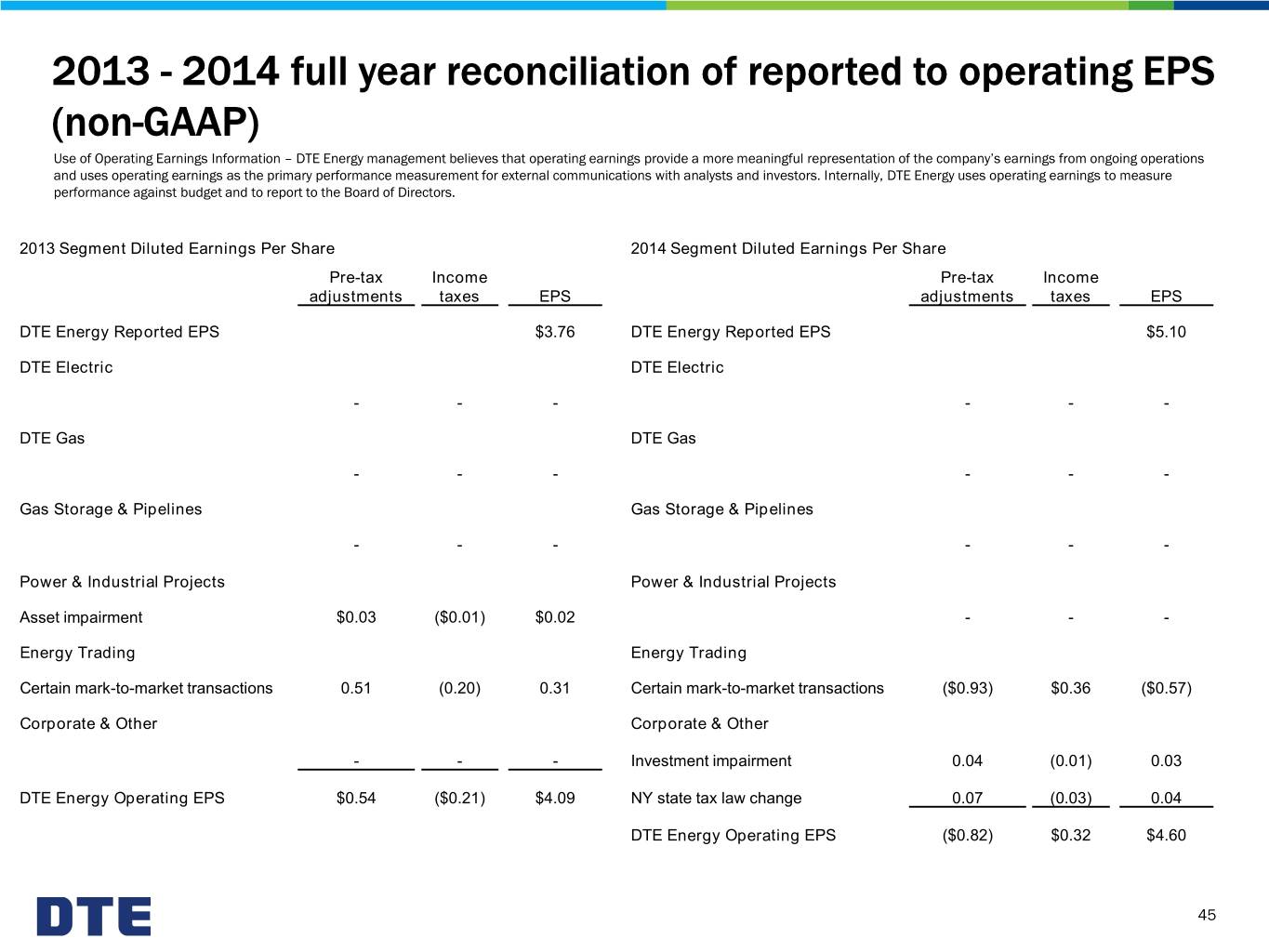

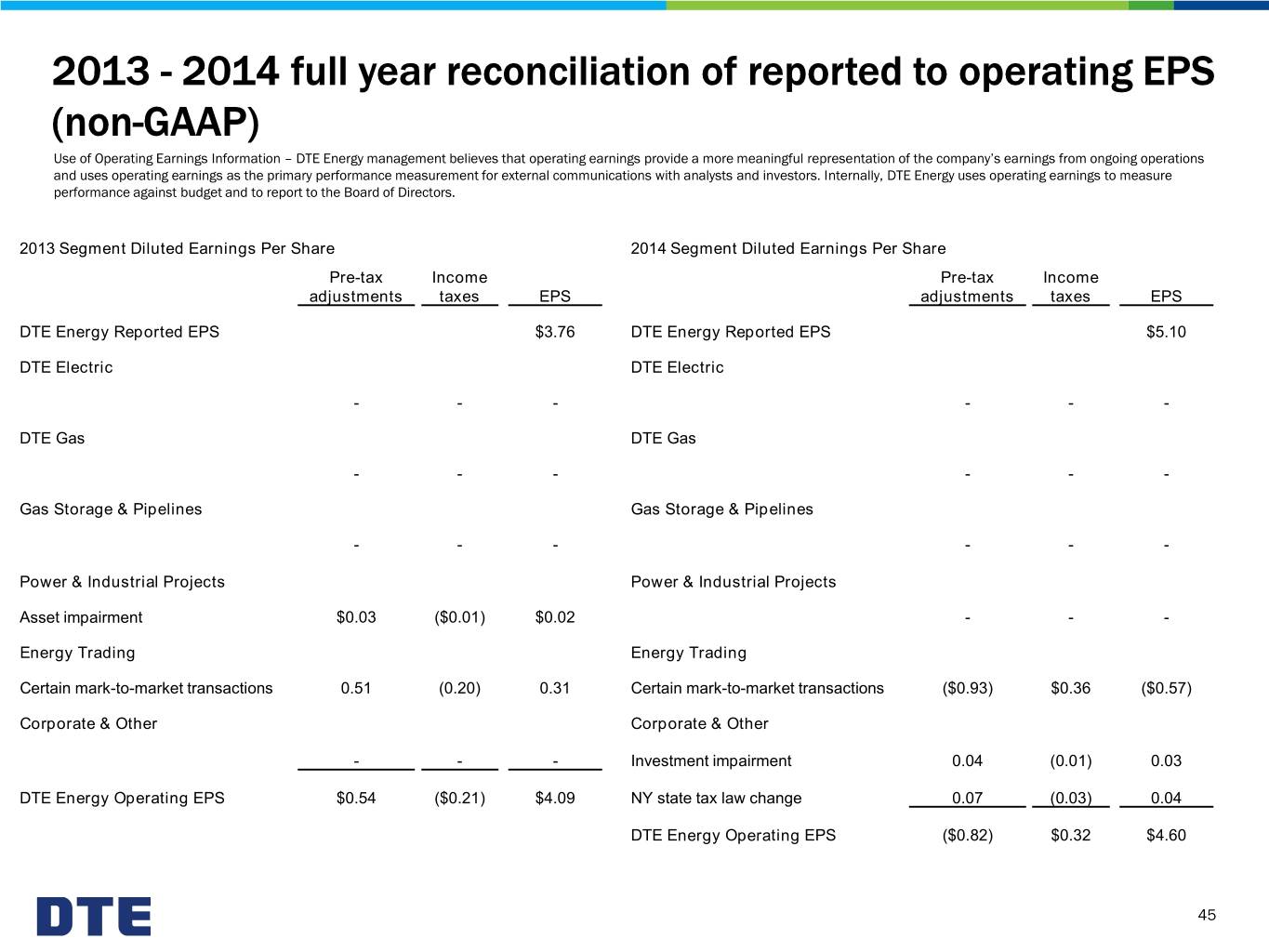

2013 - 2014 full year reconciliation of reported to operating EPS (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2013 Segment Diluted Earnings Per Share 2014 Segment Diluted Earnings Per Share Pre-tax Income Pre-tax Income adjustments taxes EPS adjustments taxes EPS DTE Energy Reported EPS $3.76 DTE Energy Reported EPS $5.10 DTE Electric DTE Electric - - - - - - DTE Gas DTE Gas - - - - - - Gas Storage & Pipelines Gas Storage & Pipelines - - - - - - Power & Industrial Projects Power & Industrial Projects Asset impairment $0.03 ($0.01) $0.02 - - - Energy Trading Energy Trading Certain mark-to-market transactions 0.51 (0.20) 0.31 Certain mark-to-market transactions ($0.93) $0.36 ($0.57) Corporate & Other Corporate & Other - - - Investment impairment 0.04 (0.01) 0.03 DTE Energy Operating EPS $0.54 ($0.21) $4.09 NY state tax law change 0.07 (0.03) 0.04 DTE Energy Operating EPS ($0.82) $0.32 $4.60 45

2011 - 2012 full year reconciliation of reported to operating EPS (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2011 Segment Diluted Earnings Per Share 2012 Segment Diluted Earnings Per Share Pre-tax Income Pre-tax Income adjustments taxes EPS adjustments taxes EPS DTE Energy Reported EPS $4.18 DTE Energy Reported EPS $3.55 DTE Electric DTE Electric Fermi asset retirement obligation $0.08 ($0.03) $0.05 - - - DTE Gas DTE Gas - - - - - - Gas Storage & Pipelines Gas Storage & Pipelines - - - - - - Power & Industrial Projects Power & Industrial Projects - - - Coke oven gas settlement $0.06 ($0.02) $0.04 Energy Trading Chicago Fuels Terminal sale 0.02 (0.01) 0.01 Pet coke mill impairment 0.01 - 0.01 Corporate & Other Energy Trading Income tax adjustment due to enactment of MCIT (0.50) - (0.50) - - - DTE Energy Operating EPS ($0.42) ($0.03) $3.73 Corporate & Other - - - Discontinued operations Unconventional gas production 0.48 (0.15) 0.33 DTE Energy Operating EPS $0.57 ($0.18) $3.94 46

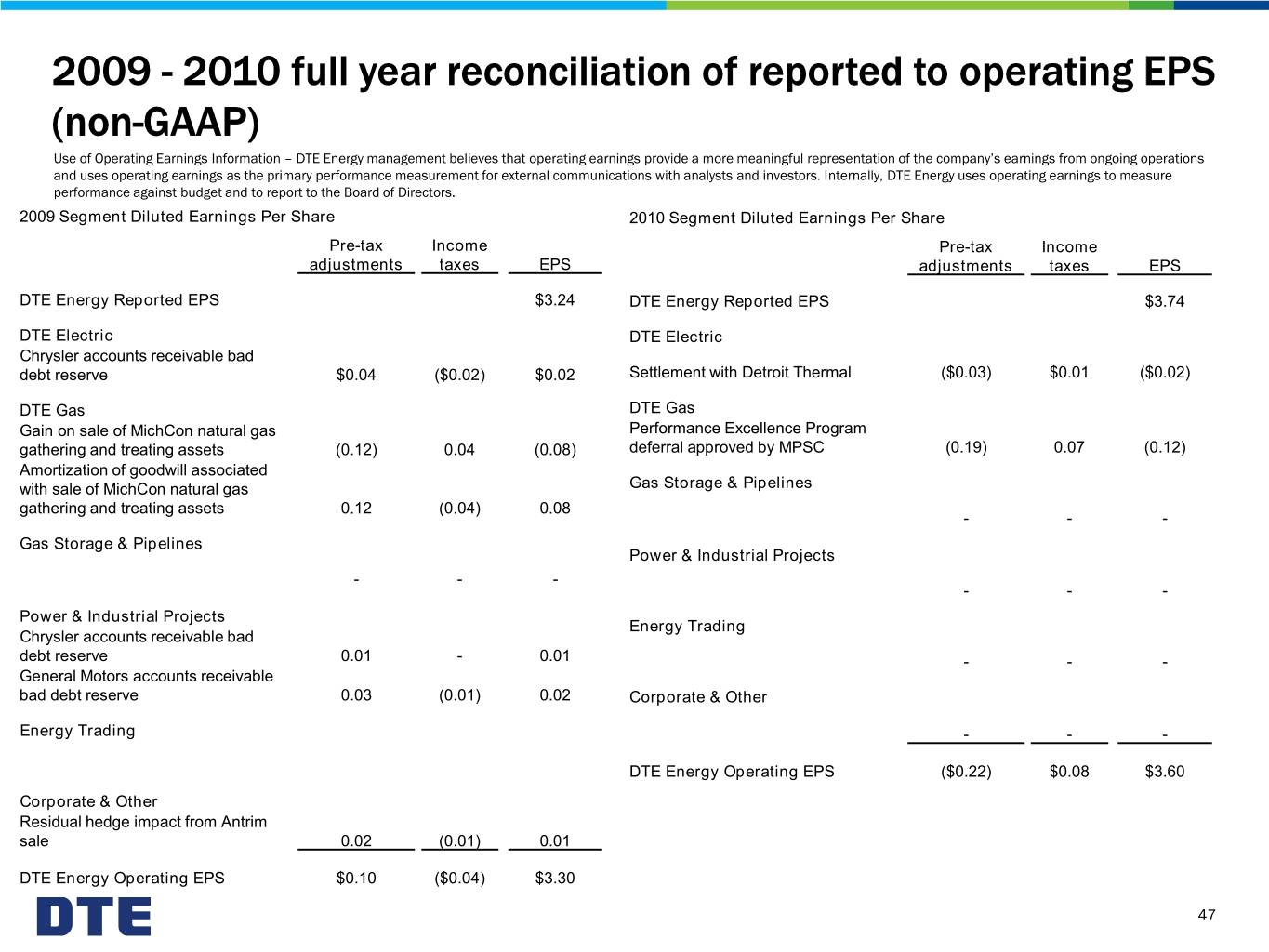

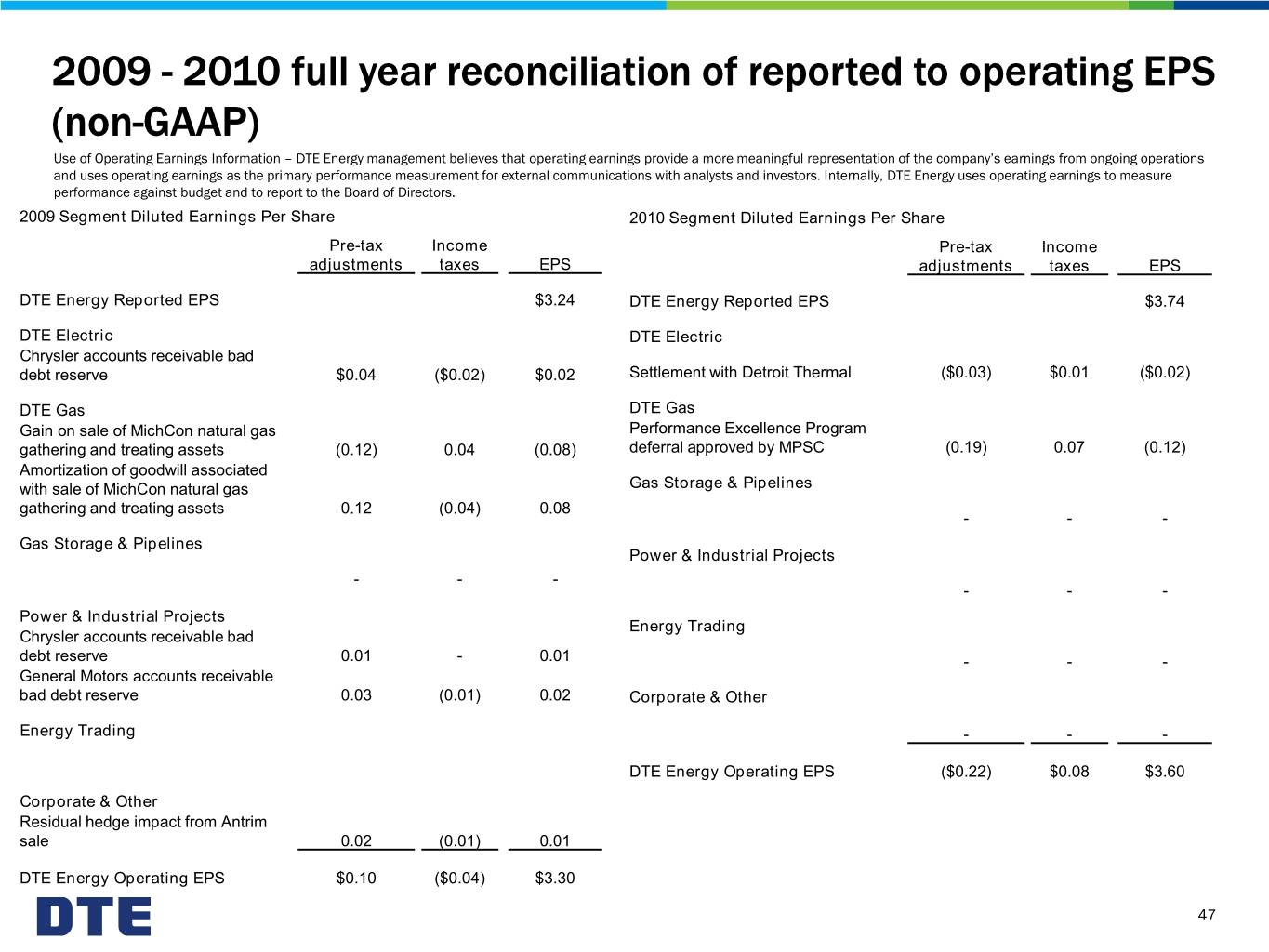

2009 - 2010 full year reconciliation of reported to operating EPS (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2009 Segment Diluted Earnings Per Share 2010 Segment Diluted Earnings Per Share Pre-tax Income Pre-tax Income adjustments taxes EPS adjustments taxes EPS DTE Energy Reported EPS $3.24 DTE Energy Reported EPS $3.74 DTE Electric DTE Electric Chrysler accounts receivable bad debt reserve $0.04 ($0.02) $0.02 Settlement with Detroit Thermal ($0.03) $0.01 ($0.02) DTE Gas DTE Gas Gain on sale of MichCon natural gas Performance Excellence Program gathering and treating assets (0.12) 0.04 (0.08) deferral approved by MPSC (0.19) 0.07 (0.12) Amortization of goodwill associated with sale of MichCon natural gas Gas Storage & Pipelines gathering and treating assets 0.12 (0.04) 0.08 - - - Gas Storage & Pipelines Power & Industrial Projects - - - - - - Power & Industrial Projects Energy Trading Chrysler accounts receivable bad debt reserve 0.01 - 0.01 - - - General Motors accounts receivable bad debt reserve 0.03 (0.01) 0.02 Corporate & Other Energy Trading - - - DTE Energy Operating EPS ($0.22) $0.08 $3.60 Corporate & Other Residual hedge impact from Antrim sale 0.02 (0.01) 0.01 DTE Energy Operating EPS $0.10 ($0.04) $3.30 47

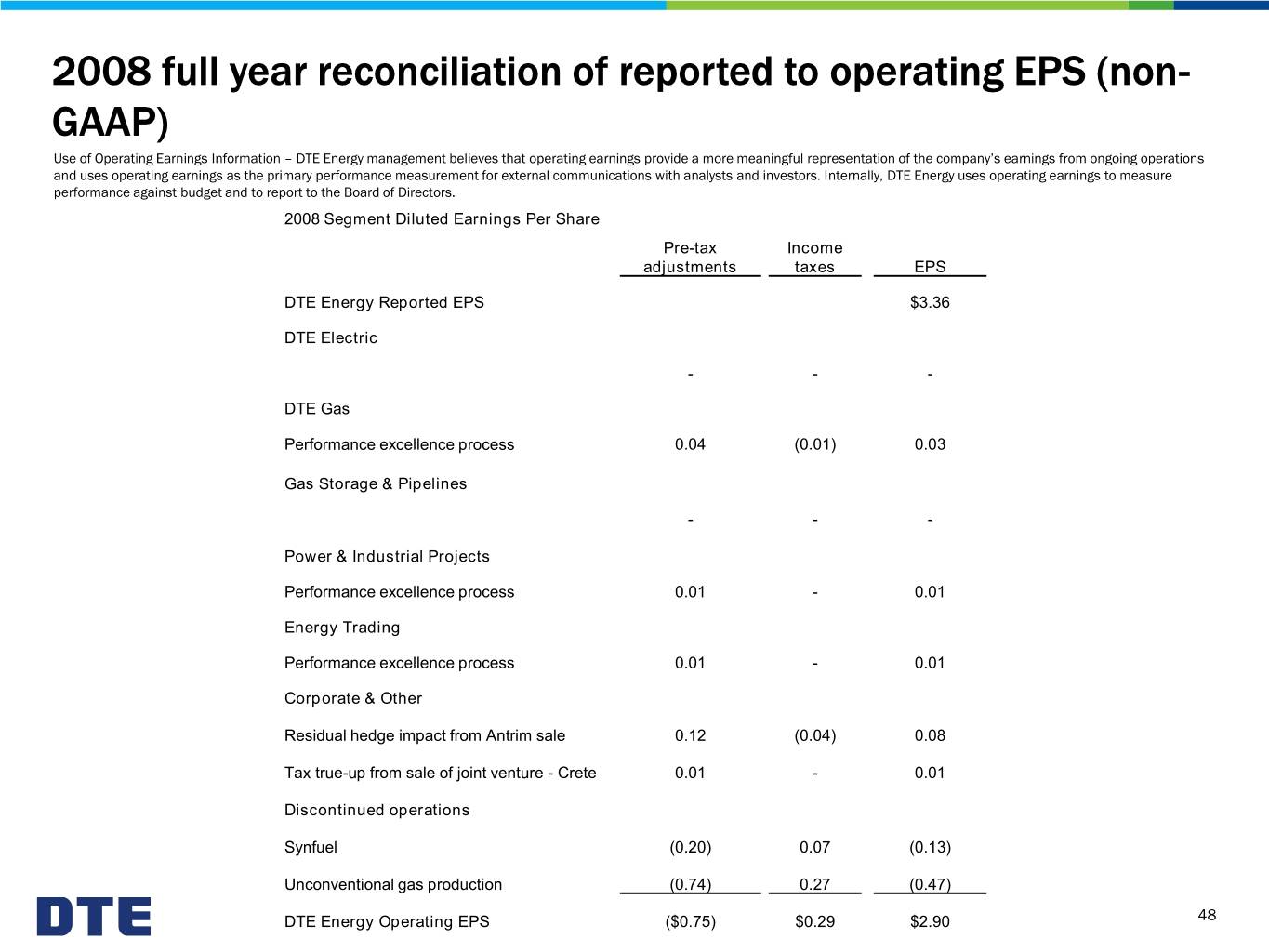

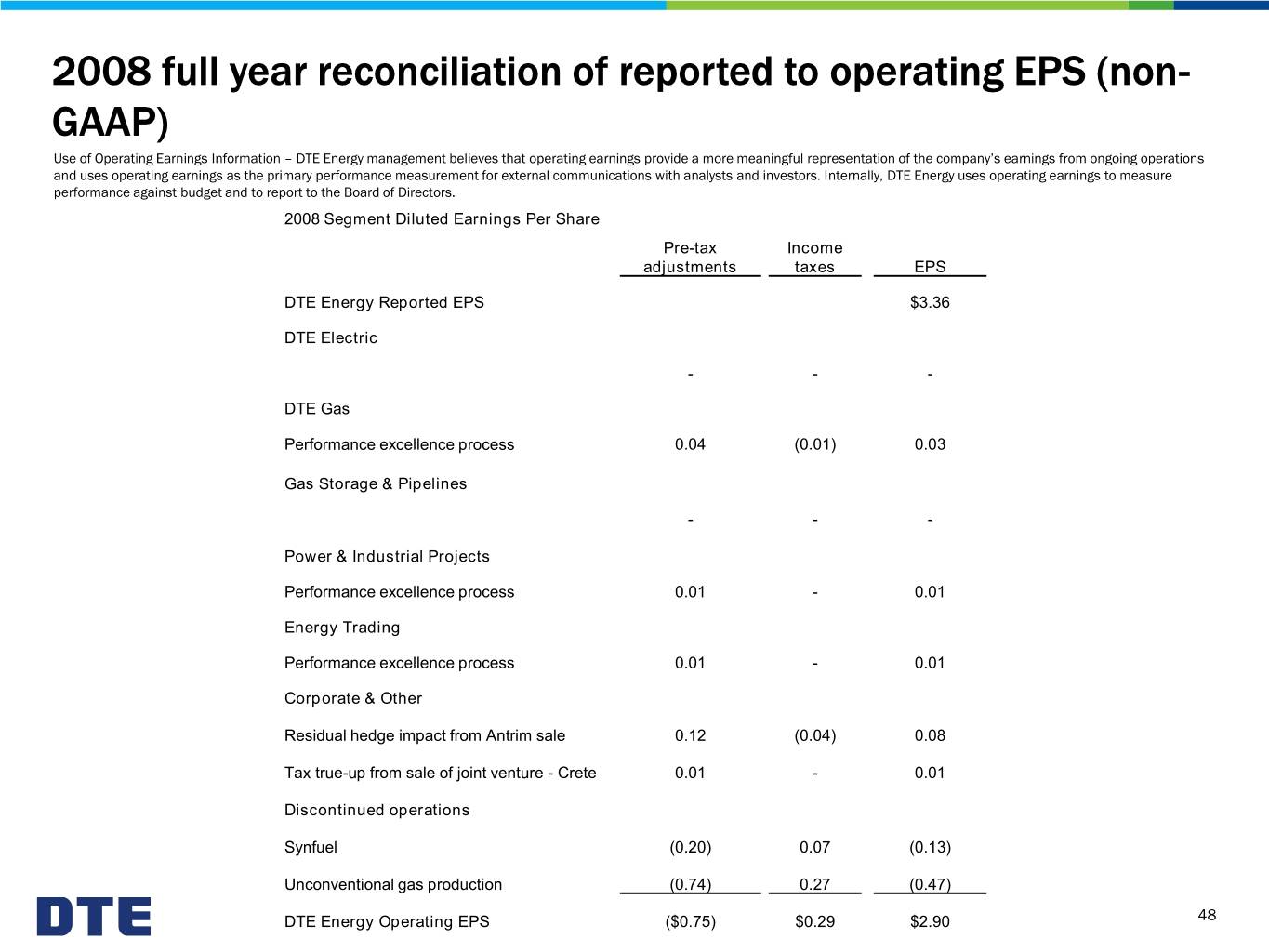

2008 full year reconciliation of reported to operating EPS (non- GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2008 Segment Diluted Earnings Per Share Pre-tax Income adjustments taxes EPS DTE Energy Reported EPS $3.36 DTE Electric - - - DTE Gas Performance excellence process 0.04 (0.01) 0.03 Gas Storage & Pipelines - - - Power & Industrial Projects Performance excellence process 0.01 - 0.01 Energy Trading Performance excellence process 0.01 - 0.01 Corporate & Other Residual hedge impact from Antrim sale 0.12 (0.04) 0.08 Tax true-up from sale of joint venture - Crete 0.01 - 0.01 Discontinued operations Synfuel (0.20) 0.07 (0.13) Unconventional gas production (0.74) 0.27 (0.47) DTE Energy Operating EPS ($0.75) $0.29 $2.90 48

Reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. 49