DTE 3Q 2021 EARNINGS CONFERENCE CALL OCTOBER 27, 2021 EXHIBIT 99.2

Safe harbor statement 2 The information contained herein is as of the date of this document. DTE Energy expressly disclaims any current intention to update any forward-looking statements contained in this document as a result of new information or future events or developments. Words such as “anticipate,” “believe,” “expect,” “may,” “could,” “would,” “projected,” “aspiration,” “plans” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various assumptions, risks and uncertainties. This document contains forward-looking statements about DTE Energy’s financial results and estimates of future prospects, and actual results may differ materially. Many factors impact forward-looking statements including, but not limited to, the following: risks related to the spin-off of DT Midstream, including that providing DT Midstream with the transition services previously negotiated could adversely affect our business, and that the transaction may not achieve some or all of the anticipated benefits; the duration and impact of the COVID-19 pandemic on DTE Energy and customers, impact of regulation by the EPA, the EGLE, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC and CARB, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility in prices in the international steel markets on DTE Vantage’s (formerly Power and Industrial Projects) operations; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets and customer data against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy’s energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power or reduce power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in DTE Energy’s public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2020 Form 10-K and 2021 Forms 10-Q (which sections are incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric.

Participants 3 Jerry Norcia – President and CEO Dave Ruud – Senior Vice President and CFO Barbara Tuckfield – Director Investor Relations

Focusing on our team, customers and communities while delivering for investors 4 Our Team Ensuring the health and safety of our employees Recognized as a Gallup Great Workplace for the ninth consecutive year Customers Addressing our customers’ most vital needs Investing an additional $70 million to combat extreme weather-related power outages with no impact to customer bills Communities Providing safe, reliable and cleaner energy Building first MIGreenPower community solar project in Washtenaw County Investors Delivering premium shareholder returns Strong 2021 results and well-positioned for future growth

Continuing strength in 2021; solidifying future growth with updated plan 5 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Bloomberg as of 9/30/2021 ✓ Delivering strong results in 2021 and raising 2021 operating EPS1 guidance midpoint ✓ Strong 2022 early outlook midpoint provides 6% operating EPS growth from 2021 original guidance ✓ 7% dividend growth extended to 2022, consistent with high end of operating EPS growth target ✓ Accelerating generation transition; ceasing coal use at Belle River two years earlier than planned and preparing to file updated Clean Vision Plan (IRP) one year earlier than planned ✓ Announcing strategic focus on decarbonization at DTE Vantage, formerly Power & Industrial Projects ✓ Continuing 5% - 7% operating EPS growth through 2026 18% 65% 281% DTE delivers premium total shareholder return2 1-year 5-year 10-year S&P 500 Utilities DTE

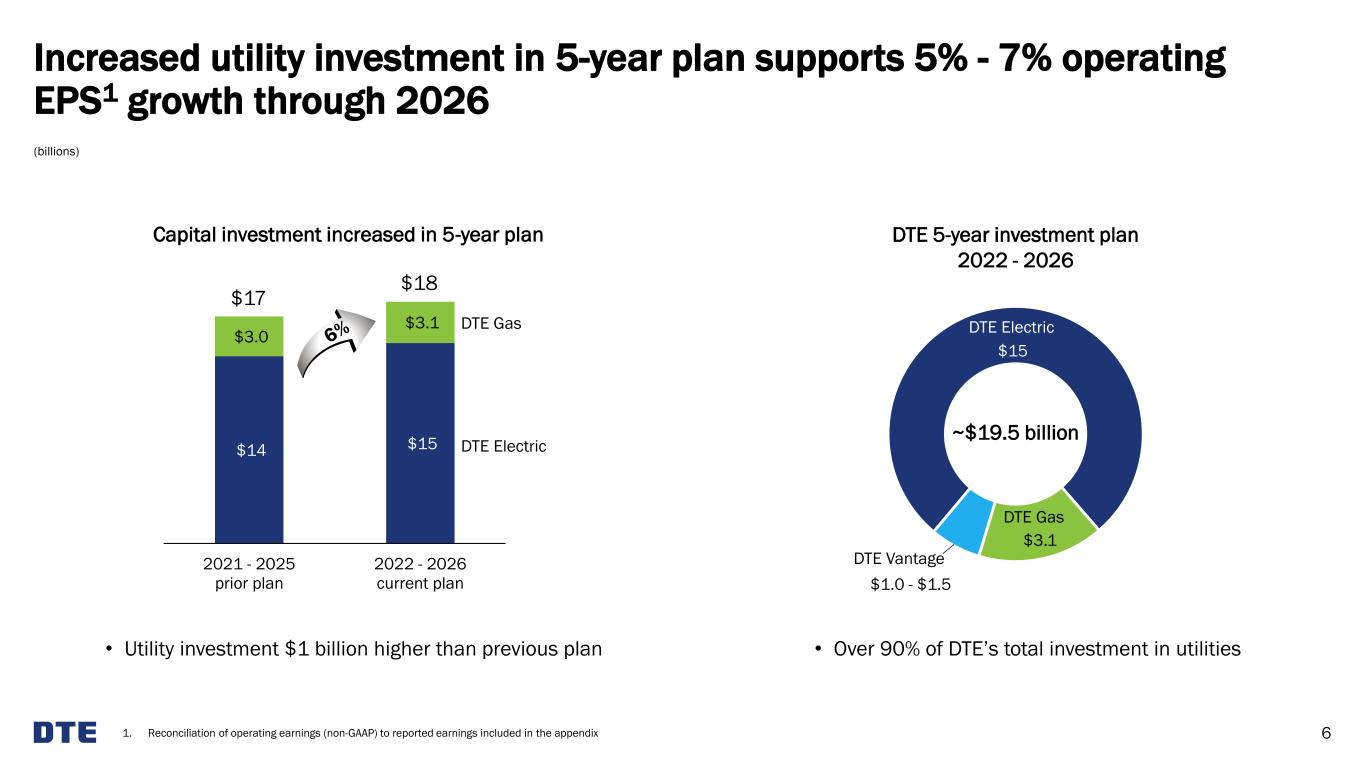

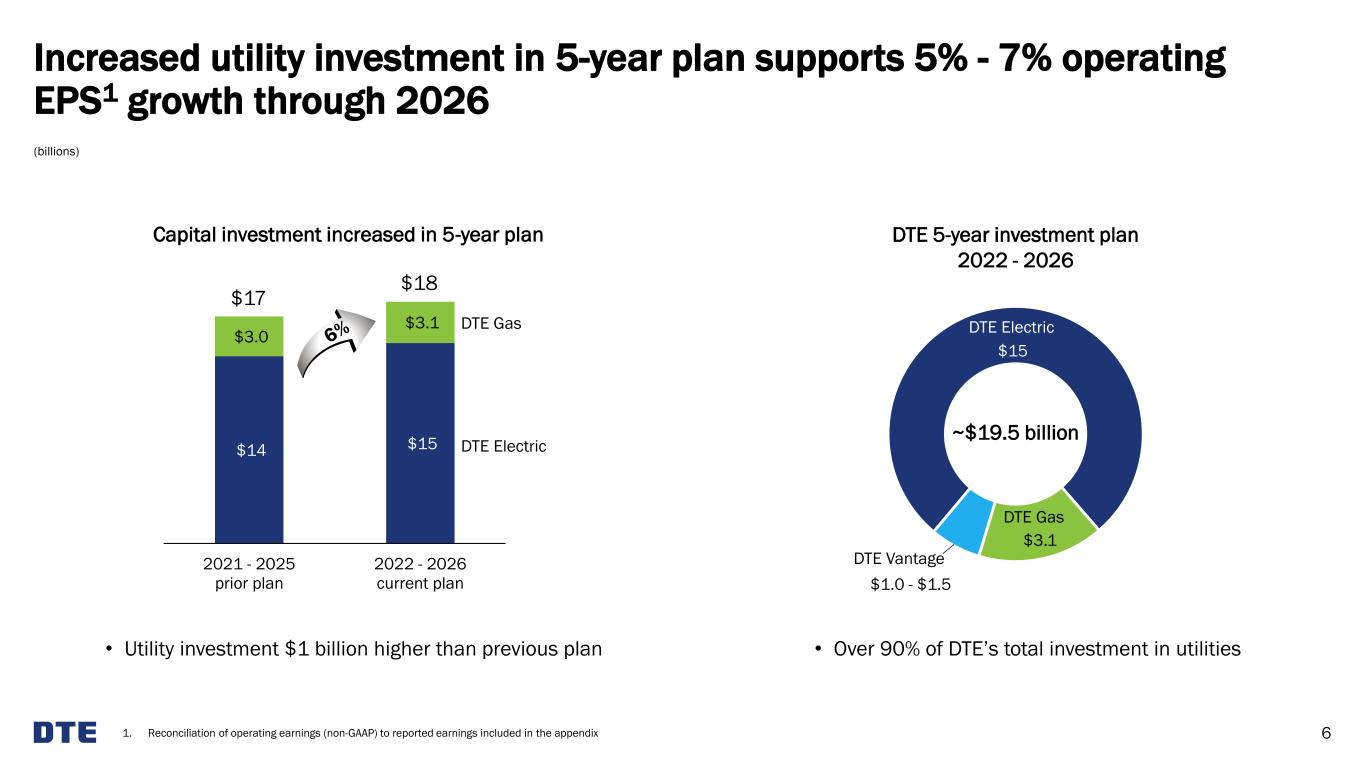

$14 $15 $3.0 $3.1 2021 - 2025 prior plan 2022 - 2026 current plan $17 Increased utility investment in 5-year plan supports 5% - 7% operating EPS1 growth through 2026 6 • Utility investment $1 billion higher than previous plan 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix DTE Gas DTE Electric ~$19.5 billion DTE Electric DTE Gas DTE Vantage $15 $3.1 $1.0 - $1.5 DTE 5-year investment plan 2022 - 2026 $18 (billions) Capital investment increased in 5-year plan • Over 90% of DTE’s total investment in utilities

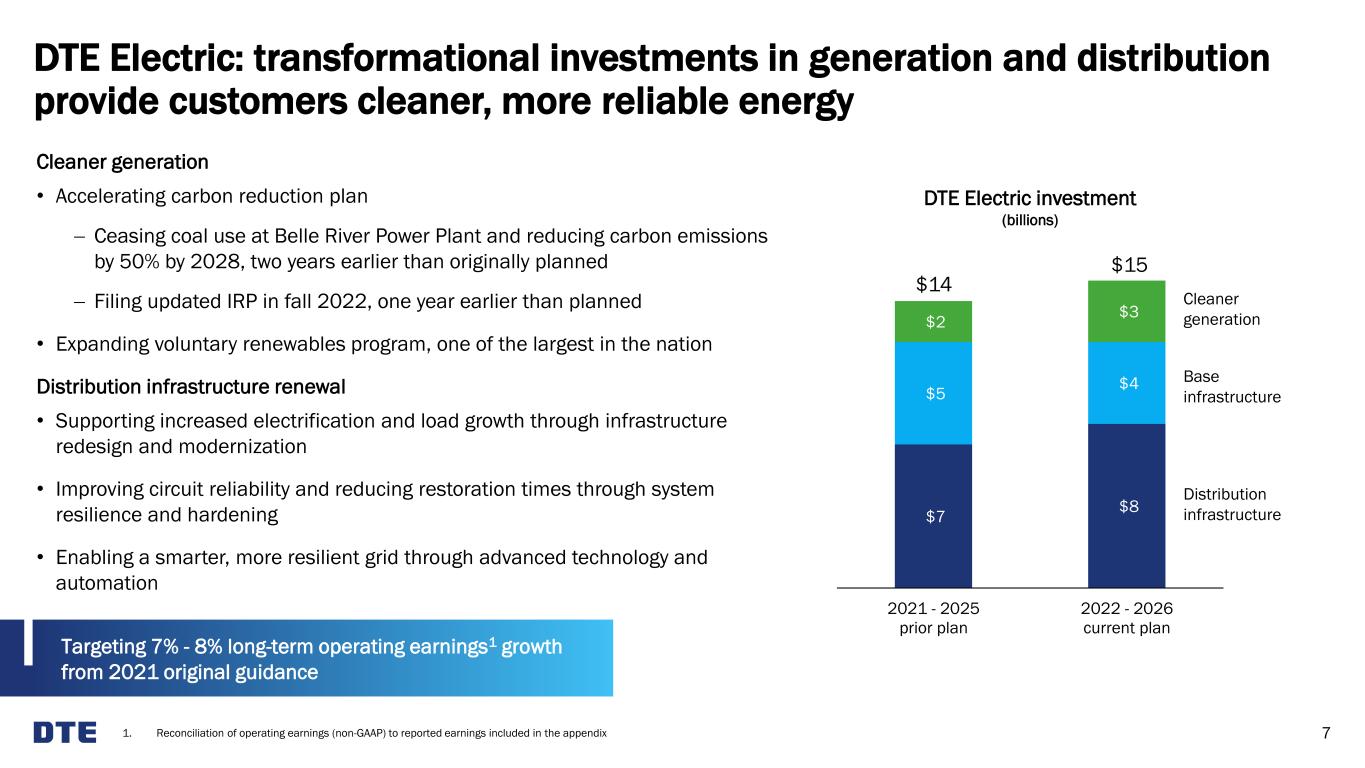

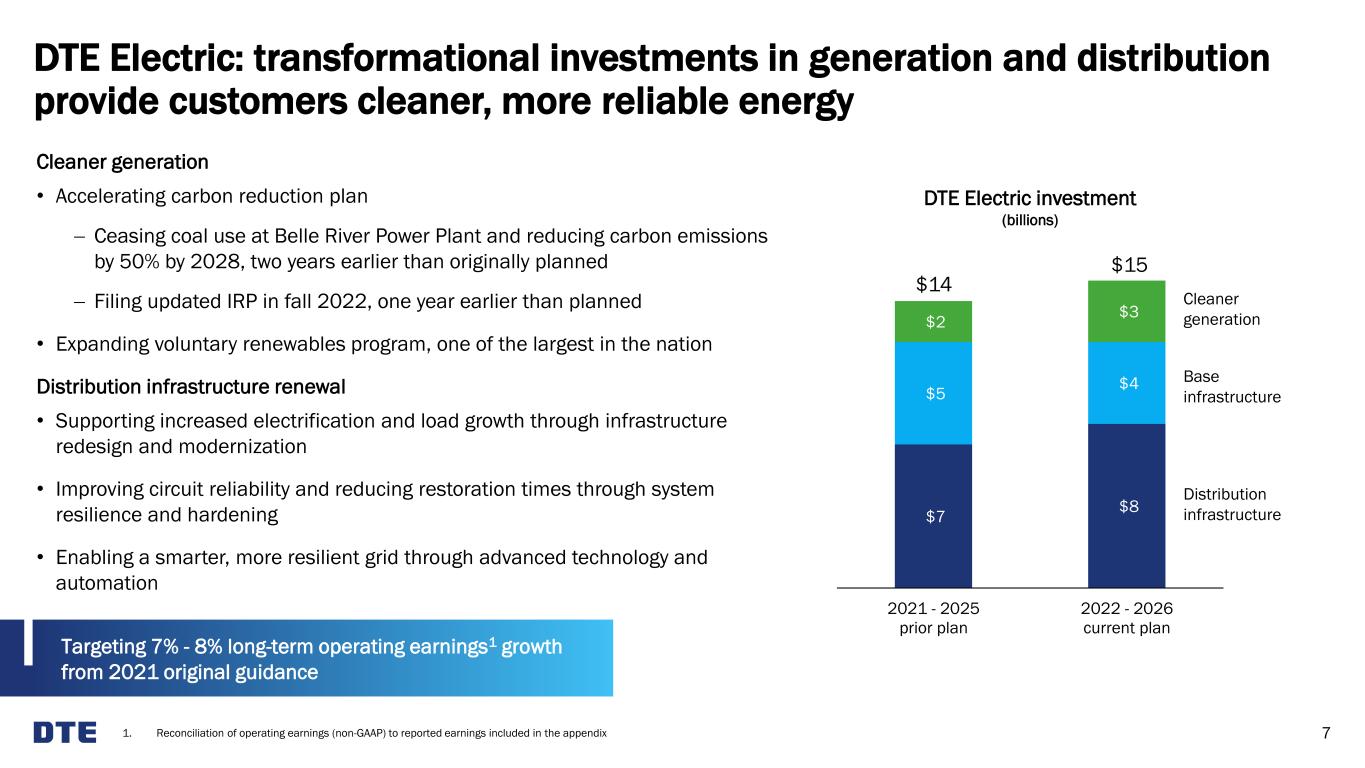

$7 $8 $5 $4 $2 $3 2021 - 2025 prior plan 2022 - 2026 current plan DTE Electric: transformational investments in generation and distribution provide customers cleaner, more reliable energy 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 7 Cleaner generation • Accelerating carbon reduction plan − Ceasing coal use at Belle River Power Plant and reducing carbon emissions by 50% by 2028, two years earlier than originally planned − Filing updated IRP in fall 2022, one year earlier than planned • Expanding voluntary renewables program, one of the largest in the nation Distribution infrastructure renewal • Supporting increased electrification and load growth through infrastructure redesign and modernization • Improving circuit reliability and reducing restoration times through system resilience and hardening • Enabling a smarter, more resilient grid through advanced technology and automation Distribution infrastructure Base infrastructure Cleaner generation Targeting 7% - 8% long-term operating earnings1 growth from 2021 original guidance $14 $15 DTE Electric investment (billions)

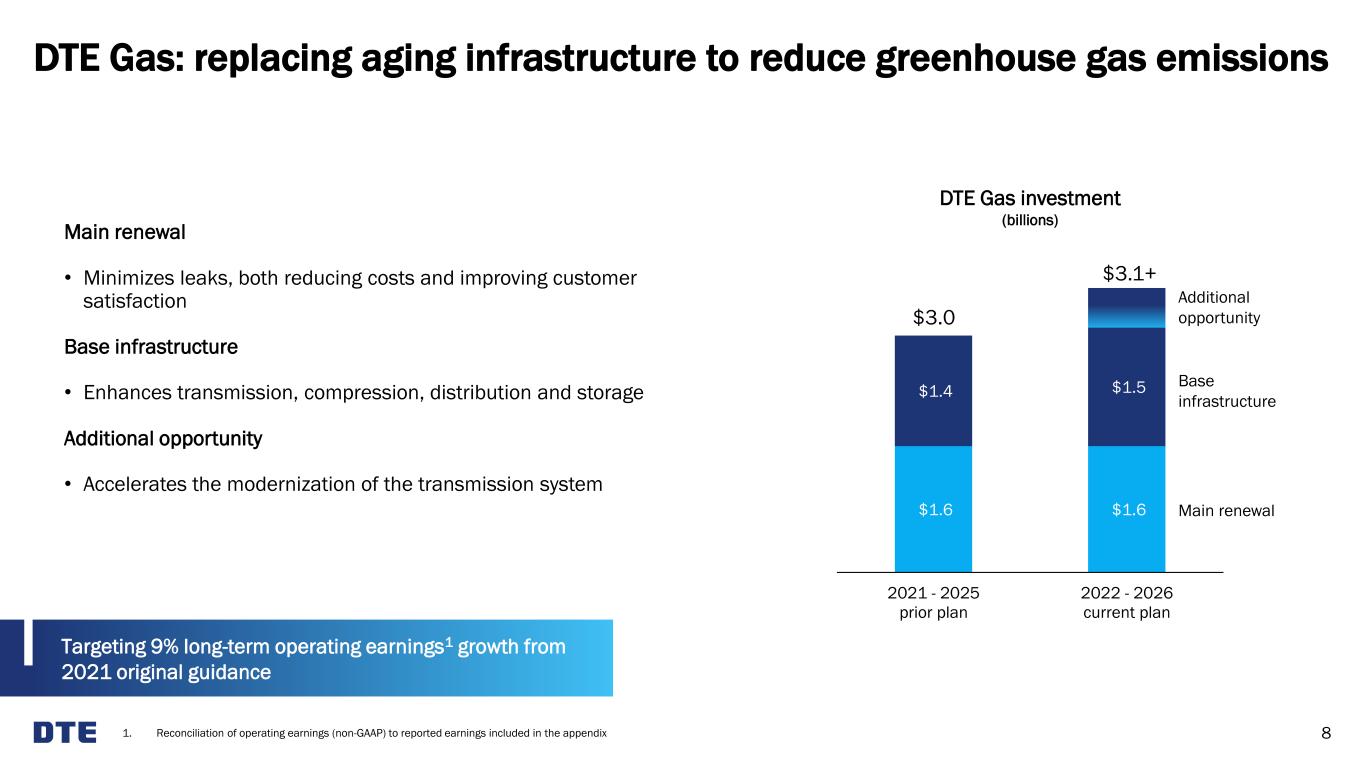

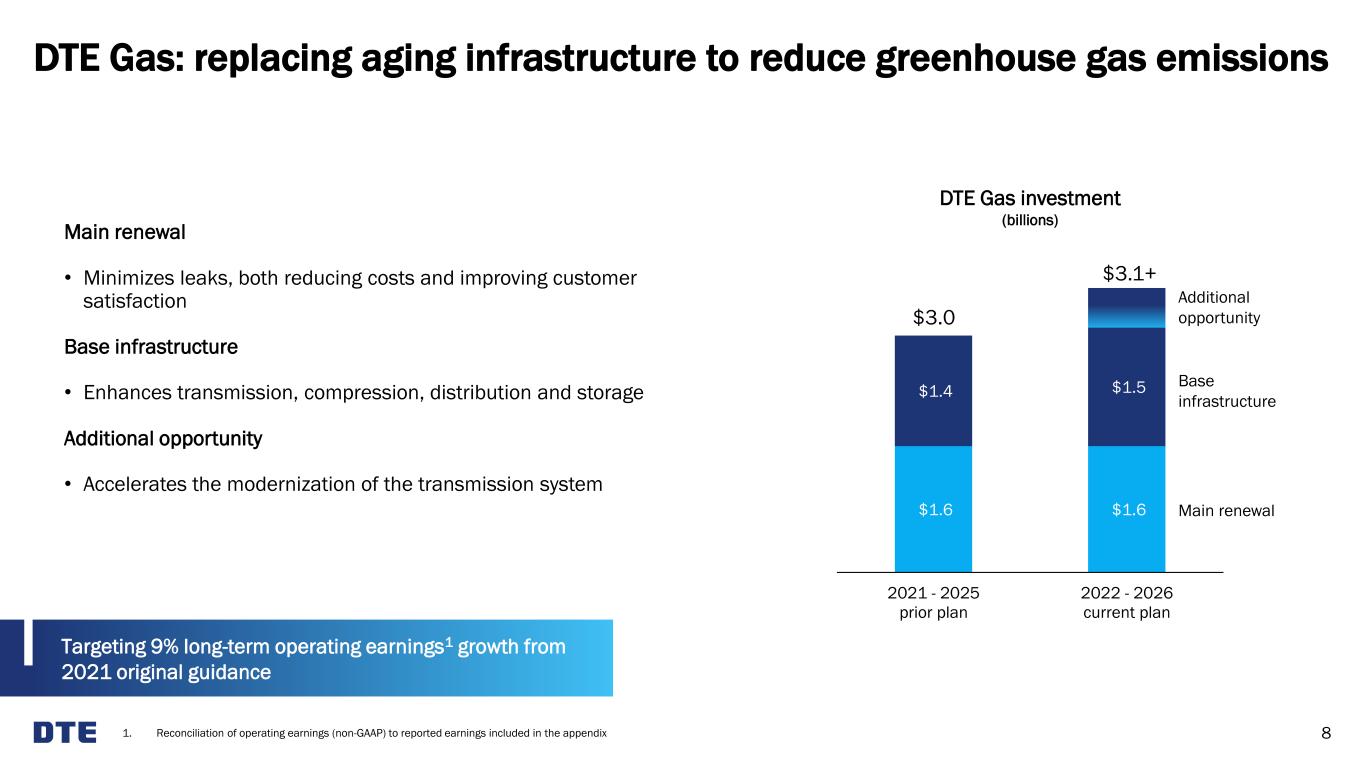

$1.6 $1.6 $1.4 $1.5 2021 - 2025 prior plan 2022 - 2026 current plan DTE Gas investment (billions) DTE Gas: replacing aging infrastructure to reduce greenhouse gas emissions 8 Main renewal Base infrastructure Main renewal • Minimizes leaks, both reducing costs and improving customer satisfaction Base infrastructure • Enhances transmission, compression, distribution and storage Additional opportunity • Accelerates the modernization of the transmission system Targeting 9% long-term operating earnings1 growth from 2021 original guidance 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix $3.0 $3.1+ Additional opportunity

DTE Vantage (formerly Power & Industrial Projects): strategic focus on decarbonization solutions for customers 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. ~$90 million of earnings roll-off (includes REF sunset net of $20 million of associated business unit cost reductions) 3. Renewables includes wood and landfill gas facilities and new decarbonization opportunities 9 Renewable natural gas (RNG) • Commenced construction on new Wisconsin RNG project and secured additional project in New York • One of the largest dairy RNG suppliers based on installed capacity • Strong market growth supported by the federal Renewable Fuel Standard and California’s Low Carbon Fuel Standard; future demand from additional states pursuing low carbon fuel standards Industrial energy services • Uniquely positioned to capitalize on a growing preference for efficient energy with opportunity to implement power and steam cogeneration systems Exploring additional decarbonization opportunities • Well-positioned to capitalize on future carbon capture and storage projects $1.0 - $1.5 billion capital investment 2022 - 2026; 80% of operating earnings is derived from decarbonization related projects 2021 original guidance 2022 early outlook 2026E Industrial energy services Other RNG/renewables3 REF2 $147 - $163 $85 - $95 $160 - $170 DTE Vantage operating earnings1 (millions)

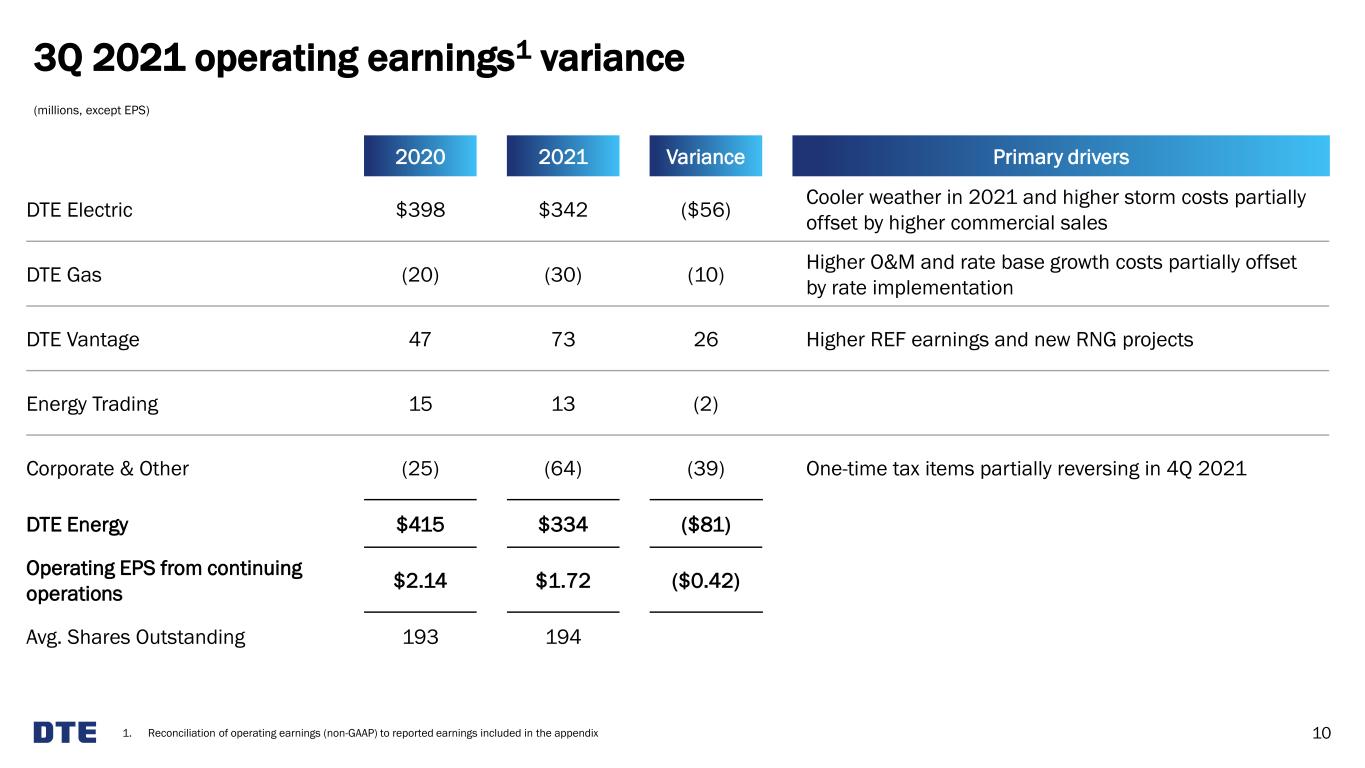

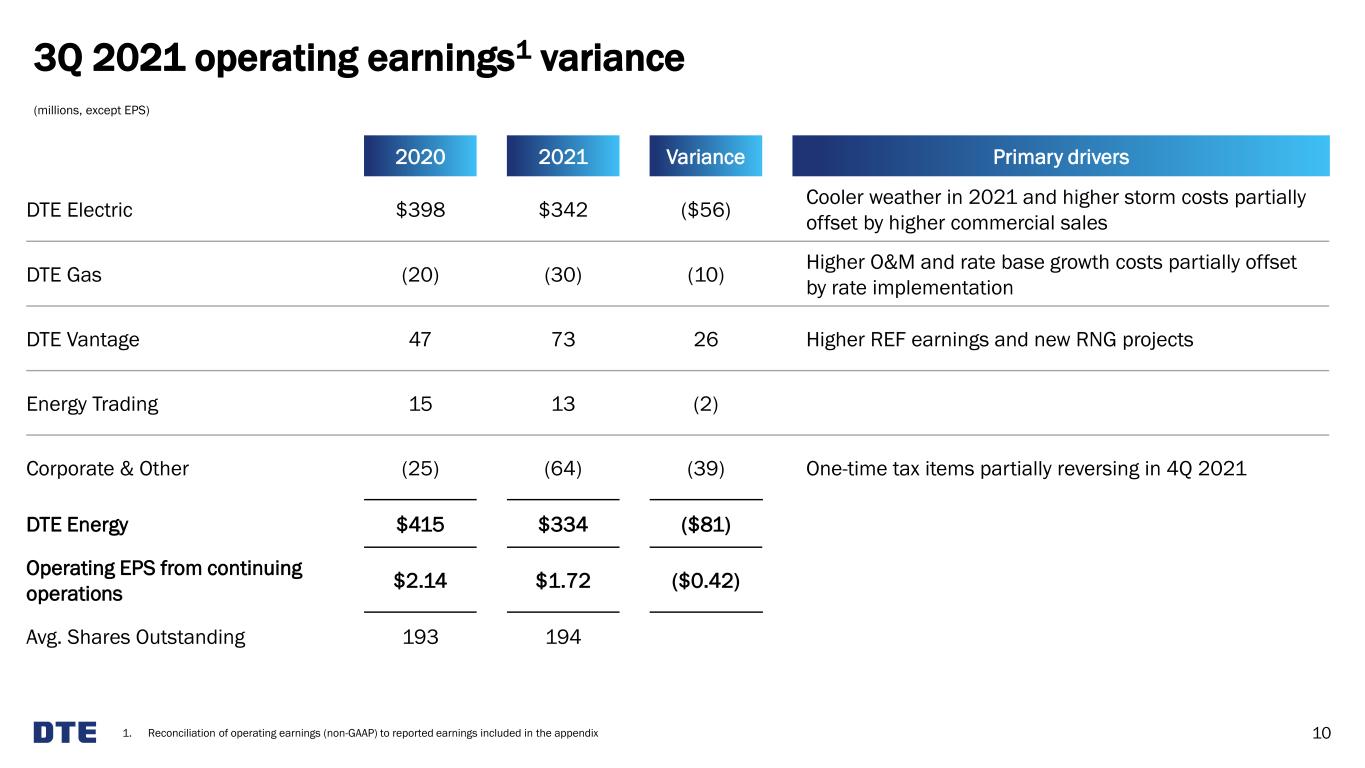

2020 2021 Variance Primary drivers DTE Electric $398 $342 ($56) Cooler weather in 2021 and higher storm costs partially offset by higher commercial sales DTE Gas (20) (30) (10) Higher O&M and rate base growth costs partially offset by rate implementation DTE Vantage 47 73 26 Higher REF earnings and new RNG projects Energy Trading 15 13 (2) Corporate & Other (25) (64) (39) One-time tax items partially reversing in 4Q 2021 DTE Energy $415 $334 ($81) Operating EPS from continuing operations $2.14 $1.72 ($0.42) Avg. Shares Outstanding 193 194 3Q 2021 operating earnings1 variance 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 10 (millions, except EPS)

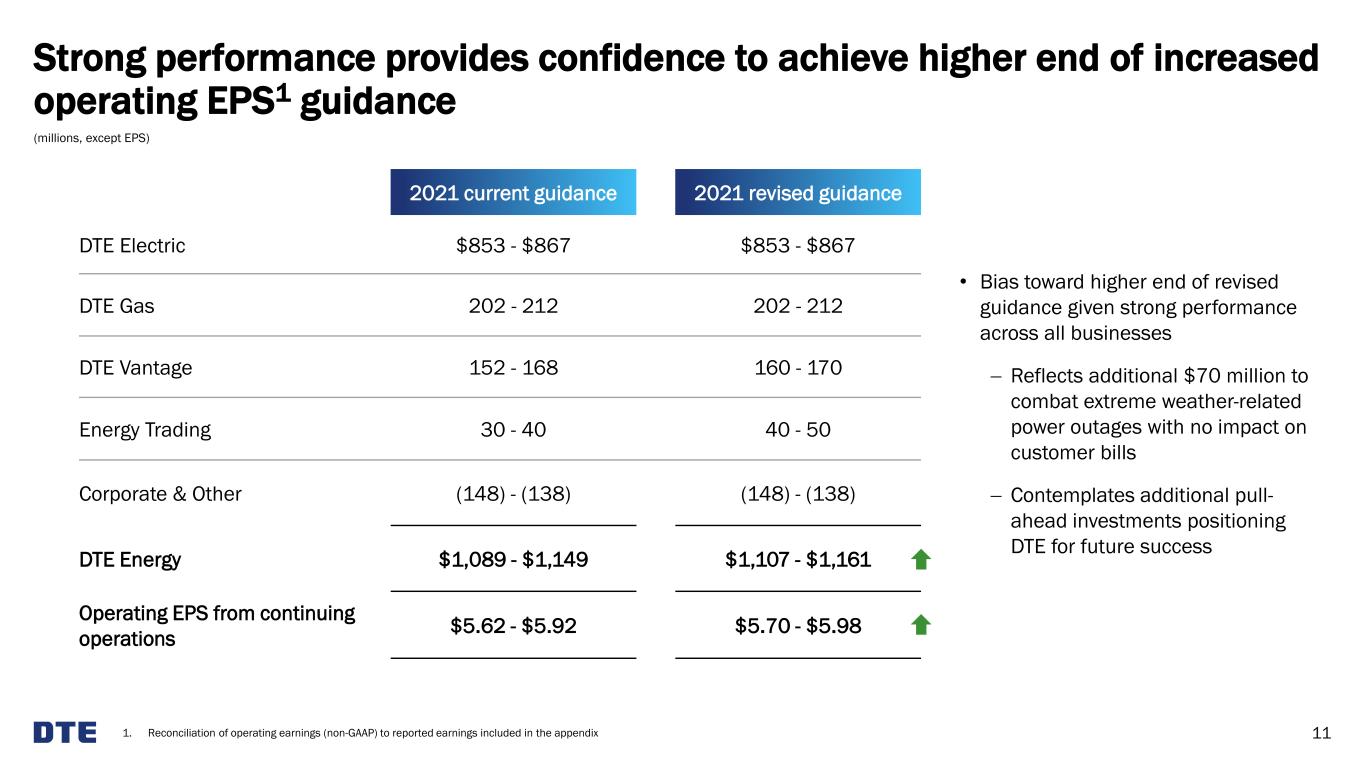

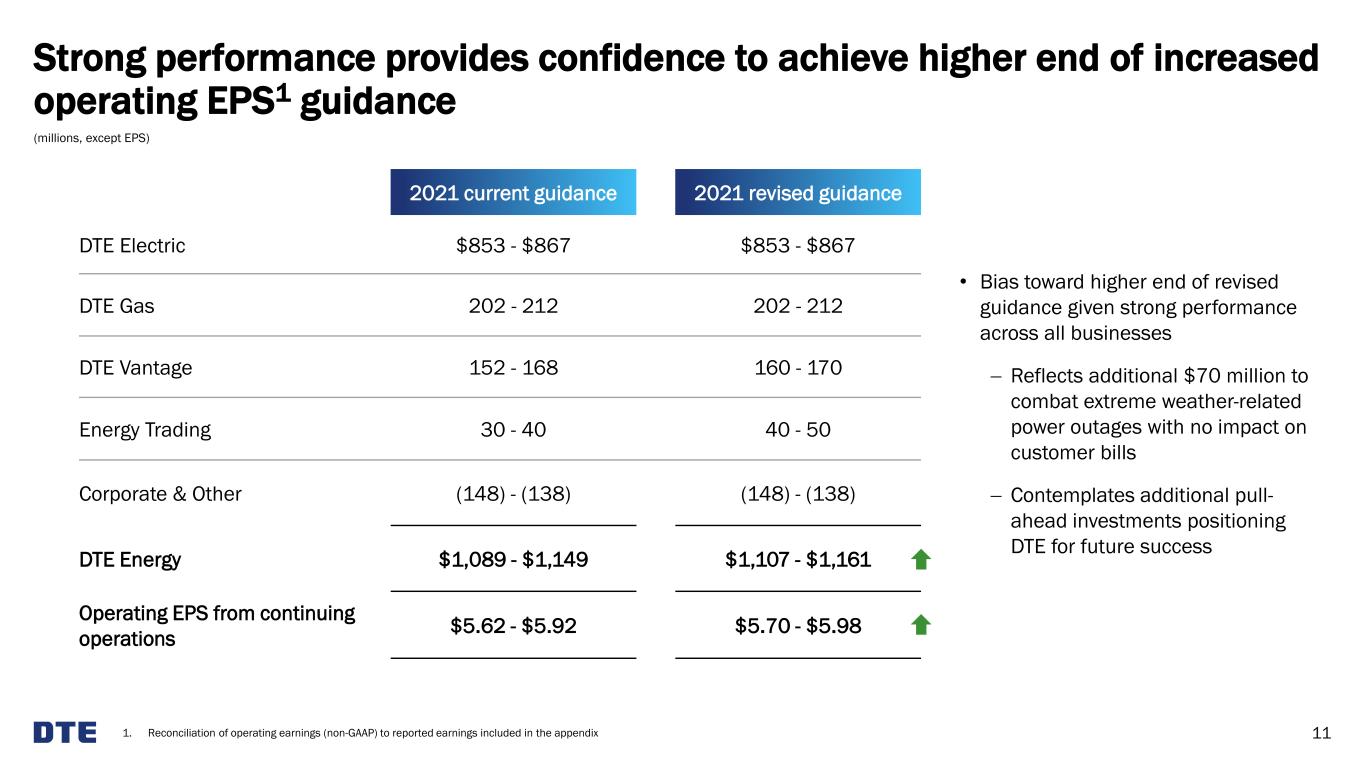

2021 current guidance 2021 revised guidance DTE Electric $853 - $867 $853 - $867 DTE Gas 202 - 212 202 - 212 DTE Vantage 152 - 168 160 - 170 Energy Trading 30 - 40 40 - 50 Corporate & Other (148) - (138) (148) - (138) DTE Energy $1,089 - $1,149 $1,107 - $1,161 Operating EPS from continuing operations $5.62 - $5.92 $5.70 - $5.98 Strong performance provides confidence to achieve higher end of increased operating EPS1 guidance 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix (millions, except EPS) 11 • Bias toward higher end of revised guidance given strong performance across all businesses − Reflects additional $70 million to combat extreme weather-related power outages with no impact on customer bills − Contemplates additional pull- ahead investments positioning DTE for future success

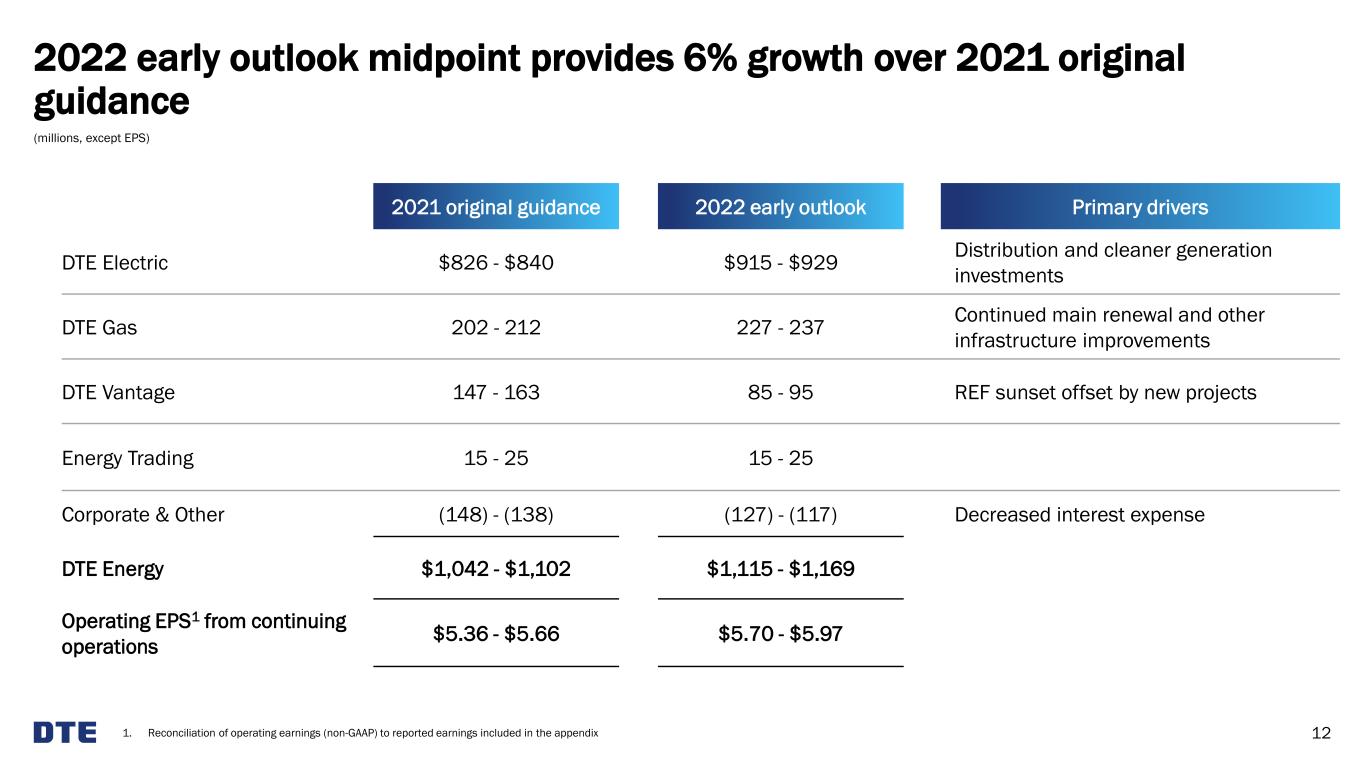

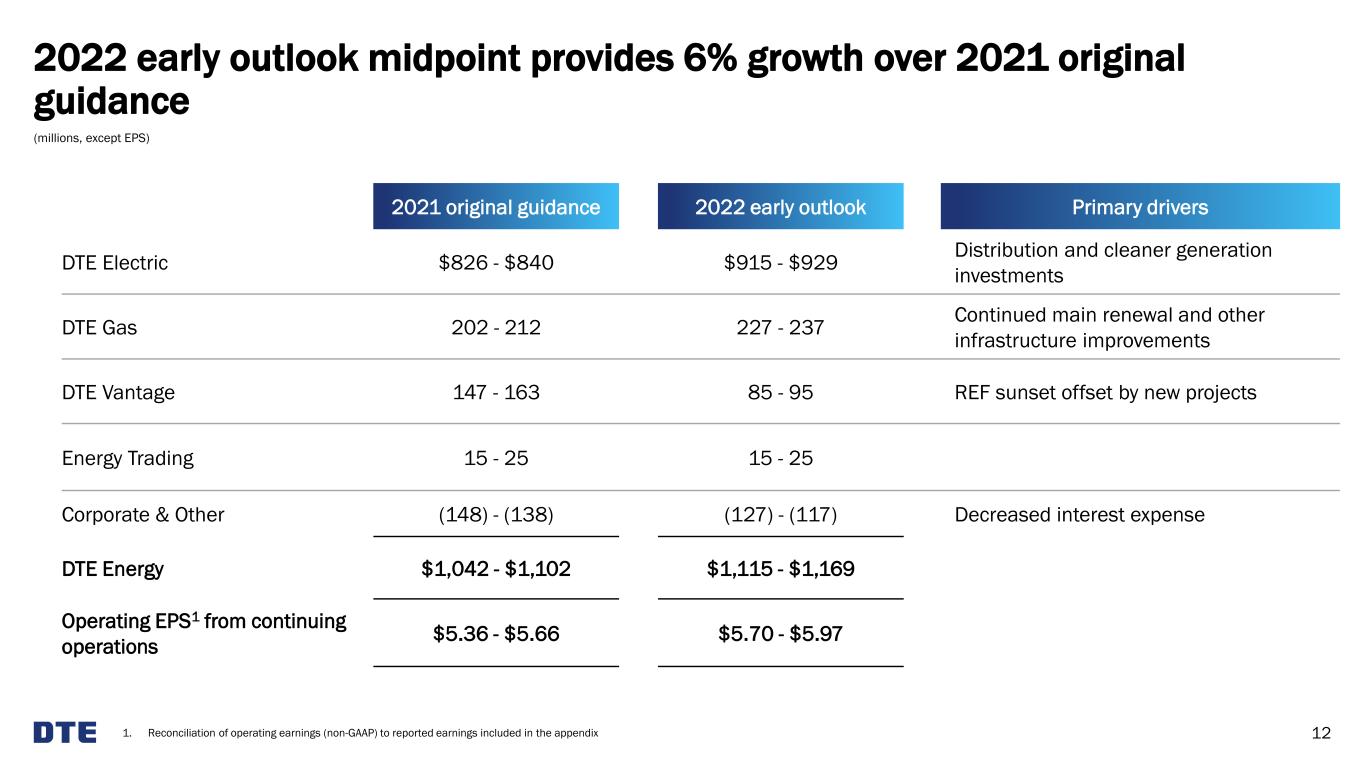

2021 original guidance 2022 early outlook Primary drivers DTE Electric $826 - $840 $915 - $929 Distribution and cleaner generation investments DTE Gas 202 - 212 227 - 237 Continued main renewal and other infrastructure improvements DTE Vantage 147 - 163 85 - 95 REF sunset offset by new projects Energy Trading 15 - 25 15 - 25 Corporate & Other (148) - (138) (127) - (117) Decreased interest expense DTE Energy $1,042 - $1,102 $1,115 - $1,169 Operating EPS1 from continuing operations $5.36 - $5.66 $5.70 - $5.97 2022 early outlook midpoint provides 6% growth over 2021 original guidance 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix (millions, except EPS) 12

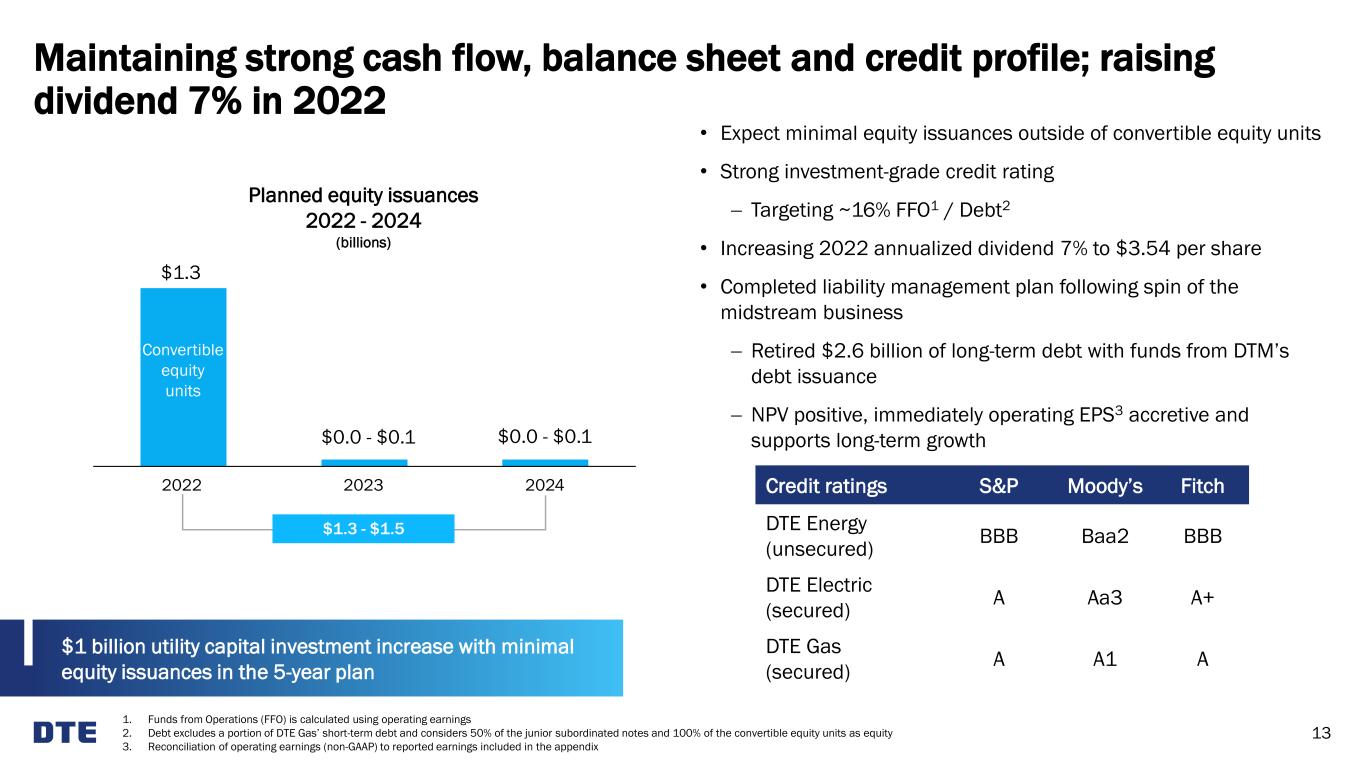

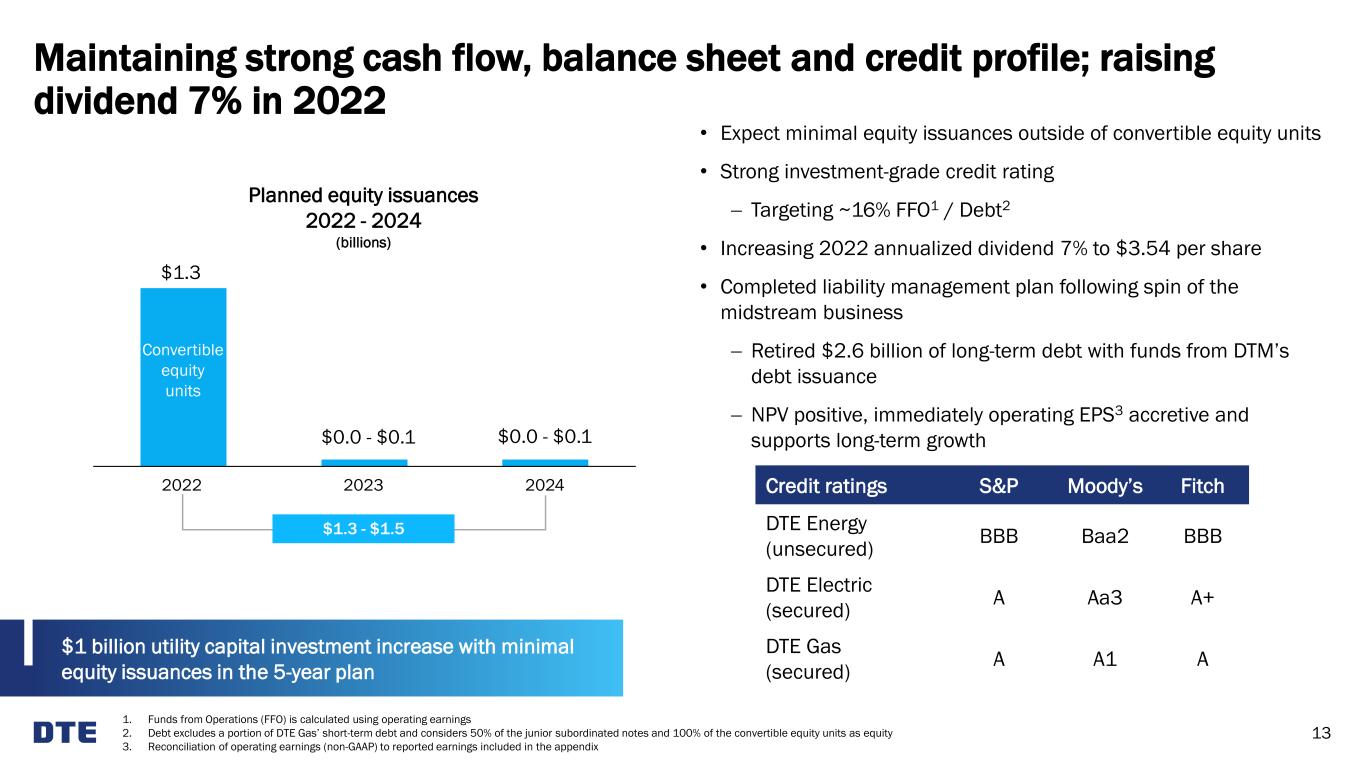

Maintaining strong cash flow, balance sheet and credit profile; raising dividend 7% in 2022 1. Funds from Operations (FFO) is calculated using operating earnings 2. Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity 3. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 13 $0.0 - $0.1 $1.3 Convertible equity units Planned equity issuances 2022 - 2024 (billions) 2022 2023 2024 $1.3 - $1.5 $1 billion utility capital investment increase with minimal equity issuances in the 5-year plan Credit ratings S&P Moody’s Fitch DTE Energy (unsecured) BBB Baa2 BBB DTE Electric (secured) A Aa3 A+ DTE Gas (secured) A A1 A $0.0 - $0.1 • Expect minimal equity issuances outside of convertible equity units • Strong investment-grade credit rating − Targeting ~16% FFO1 / Debt2 • Increasing 2022 annualized dividend 7% to $3.54 per share • Completed liability management plan following spin of the midstream business − Retired $2.6 billion of long-term debt with funds from DTM’s debt issuance − NPV positive, immediately operating EPS3 accretive and supports long-term growth

VISIT US: DTE INVESTOR RELATIONS 2021 ESG REPORT

15 Appendix

Weather impact on sales 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 16 3Q 2020 3Q 2021 % Change YTD 2020 YTD 2021 % Change Actuals 697 683 (2%) 956 991 4% Normal 635 635 0% 868 868 0% Deviation from normal 10% 8% 10% 14% (millions) (per share) 3Q YTD 3Q YTD 2020 $28 $27 $0.14 $0.14 2021 $16 $31 $0.08 $0.16 Cooling degree days Operating earnings1 impact of weather Weather normal sales (GWh) YTD 2020 YTD 2021 % Change Residential 12,367 12,435 1% Commercial 13,857 14,543 5% Industrial 7,179 7,586 6% Other 157 155 (1%) 33,560 34,719 3% DTE Electric 3Q 2020 3Q 2021 % Change YTD 2020 YTD 2021 % Change Actuals 135 71 (47%) 3,982 3,910 (2%) Normal 115 123 7% 4,184 4,132 (1%) Deviation from normal 17% (42%) (5%) (5%) (millions) (per share) 3Q YTD 3Q YTD 2020 $1 ($12) $0.01 ($0.06) 2021 ($1) ($11) ($0.01) ($0.06) Heating degree days Operating earnings impact of weather DTE Gas Note: As recommended by the MPSC in conjunction with the company’s previous IRP filing, beginning in 2021 DTE Electric moved from a 30-year weather strip to a 15-year rolling average weather strip to calculate normal weather patterns. 2020 numbers for DTE Electric have been restated to reflect the 15-year rolling average method. DTE Gas continues to use a 15-year rolling average method.

2021 cash flow and capital expenditures guidance 17 Current guidance Cash from operations1 $2.7 Capital expenditures (3.9) Free cash flow ($1.2) Dividends (0.8) Net cash ($2.0) Debt financing Impacts to continuing operations Issuances $2.3 Redemptions (0.7) Impacts due to spin of DTM DTM distribution 3.0 Spin-related redemptions2 (3.0) Total debt financing $1.6 Change in cash on hand ($0.4) Current guidance DTE Electric Base infrastructure $1,030 New generation 950 Distribution infrastructure 1,030 $3,010 DTE Gas Base infrastructure $325 Main renewal 295 $620 Non-utility $200 - $350 Total $3,830 - $3,980 (millions) Cash flow Capital expenditures (billions) 1. Includes equity issued for employee benefit programs 2. Includes $0.4 billion of debt breakage fees

Cash flow and capital expenditures actuals 18 YTD 2020 YTD 2021 DTE Electric Base infrastructure $676 $422 New generation 631 785 Distribution infrastructure 669 942 $1,976 $2,149 DTE Gas Base infrastructure $184 $209 Main renewal 202 233 $386 $442 Non-utility $1,126 $181 Total $3,488 $2,772 (millions) Cash flow Capital expenditures (billions) YTD 2020 YTD 2021 Cash from operations1 $2.8 $2.4 Capital expenditures (3.5) (2.8) Free cash flow ($0.7) ($0.4) Dividends (0.6) (0.6) Other - (0.2) Net cash ($1.3) ($1.2) Debt financing Impacts to continuing operations Issuances $2.9 $1.3 Redemptions (0.7) (0.6) Impacts due to spin of DTM DTM distribution - 3.0 Spin-related redemptions2 - (3.0) Total debt financing $2.2 $0.7 Change in cash on hand $0.9 ($0.5) 1. Includes equity issued for employee benefit programs 2. Includes $0.4 billion of debt breakage fees

Environmental, social and governance efforts are key priorities; aspiring to be the best in the industry 19 Environmental Transitioning towards net zero greenhouse gas emissions Delivering clean and reliable energy to customers Protecting our natural resources Social Focusing on the diversity, safety, well-being and success of our employees Committing to a strong culture provides a solid framework for success Revitalizing neighborhoods and investing in communities World-class volunteerism Governance Focusing on the oversight of environmental sustainability, social and governance Ensuring board diversity Providing incentive plans tied to safety and customer satisfaction targets

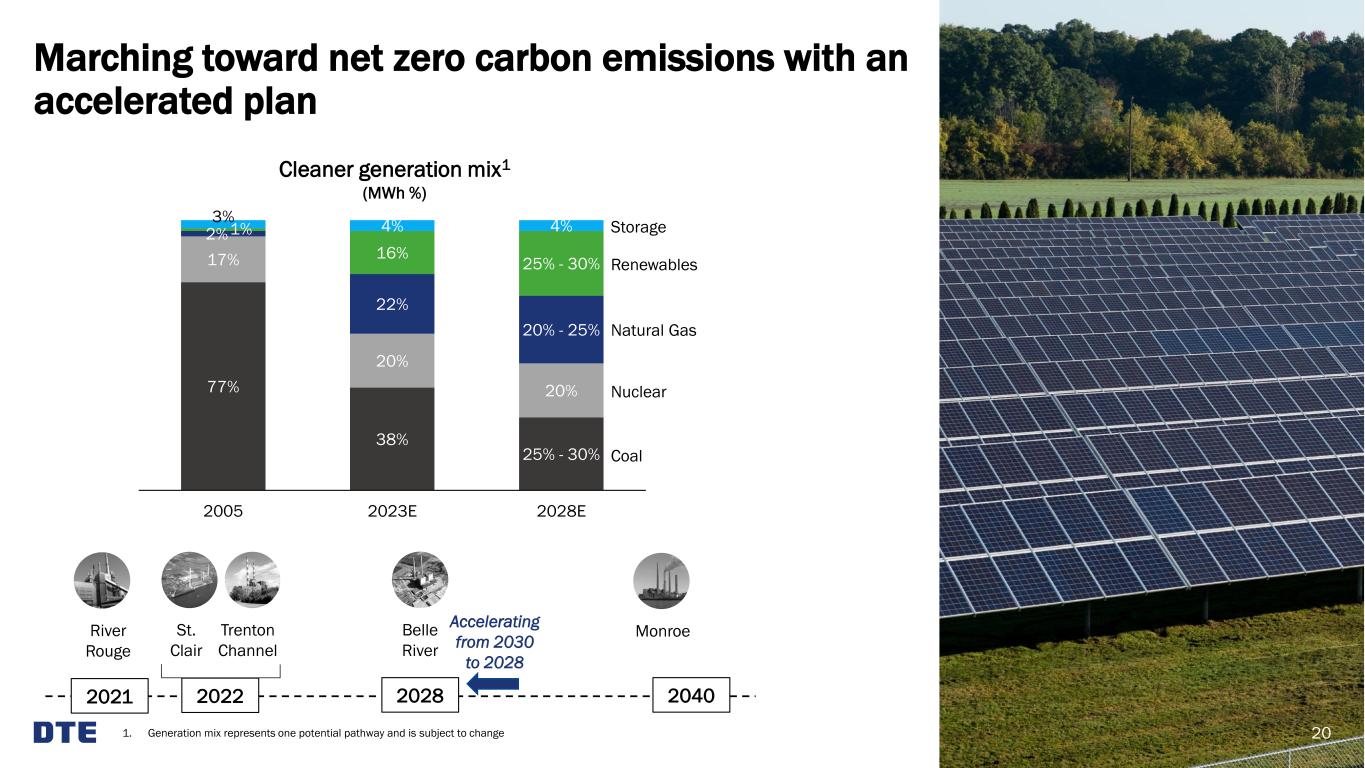

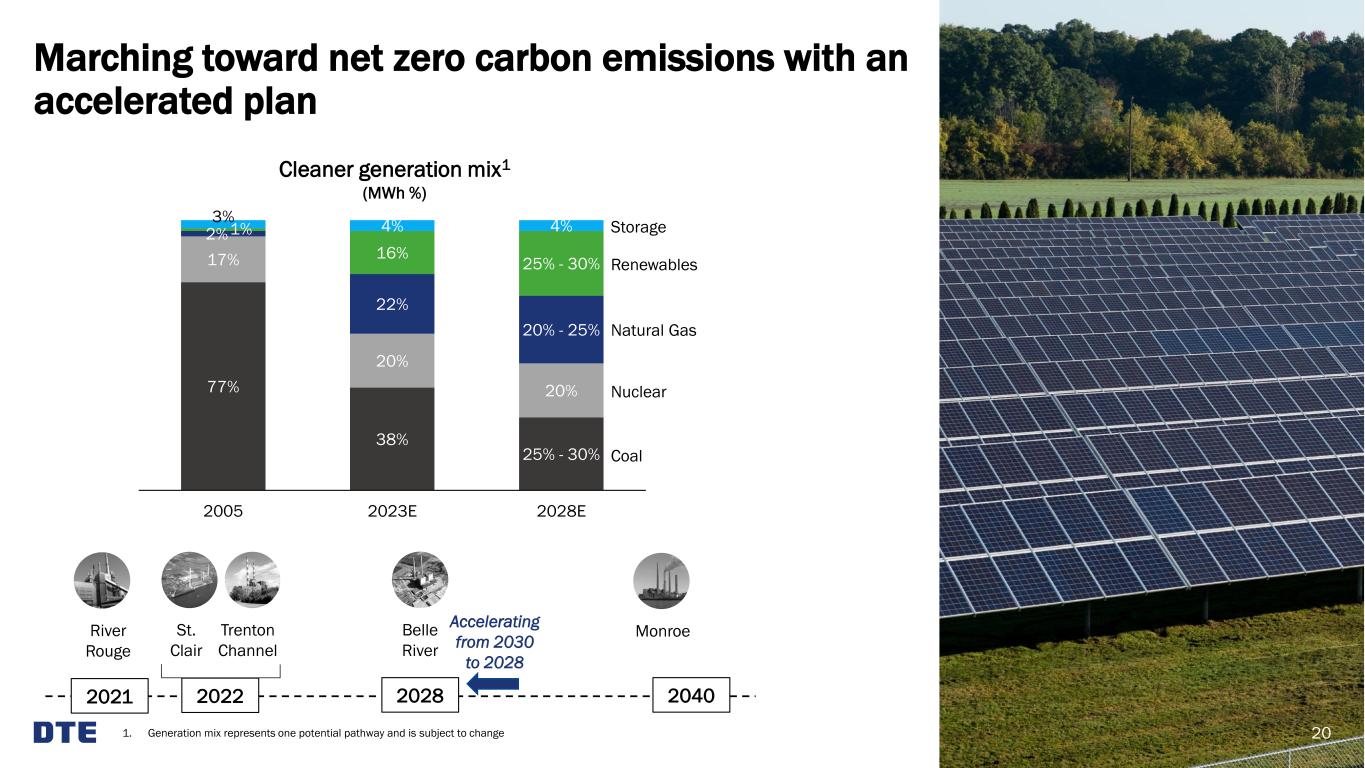

Marching toward net zero carbon emissions with an accelerated plan 1. Generation mix represents one potential pathway and is subject to change 20 Cleaner generation mix1 (MWh %) 77% 38% 25% - 30% 17% 20% 20% 2% 22% 20% - 25% 1% 16% 25% - 30% 3% 4% 4% 2005 2023E 2028E Coal Nuclear Natural Gas Renewables Storage River Rouge Trenton Channel Belle River Monroe 2022 2028 2040 St. Clair 2021 Accelerating from 2030 to 2028

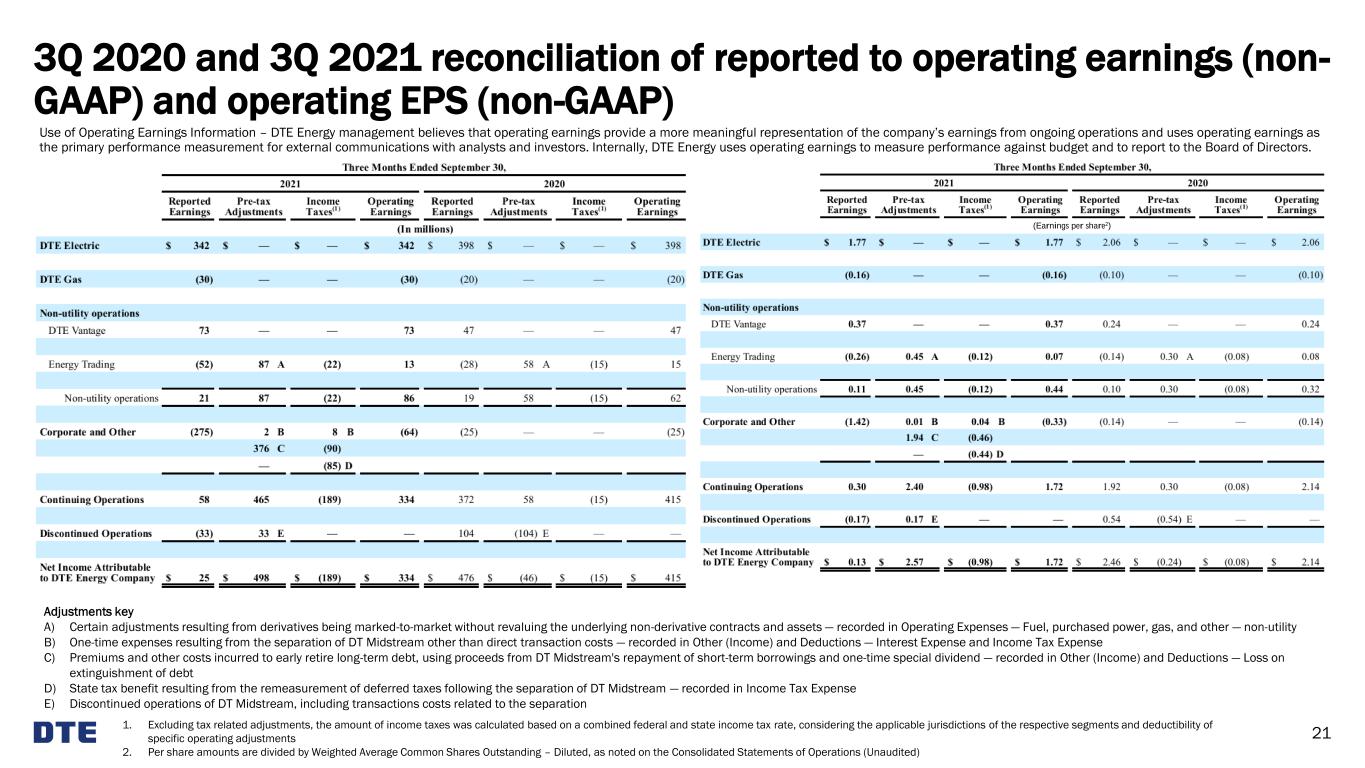

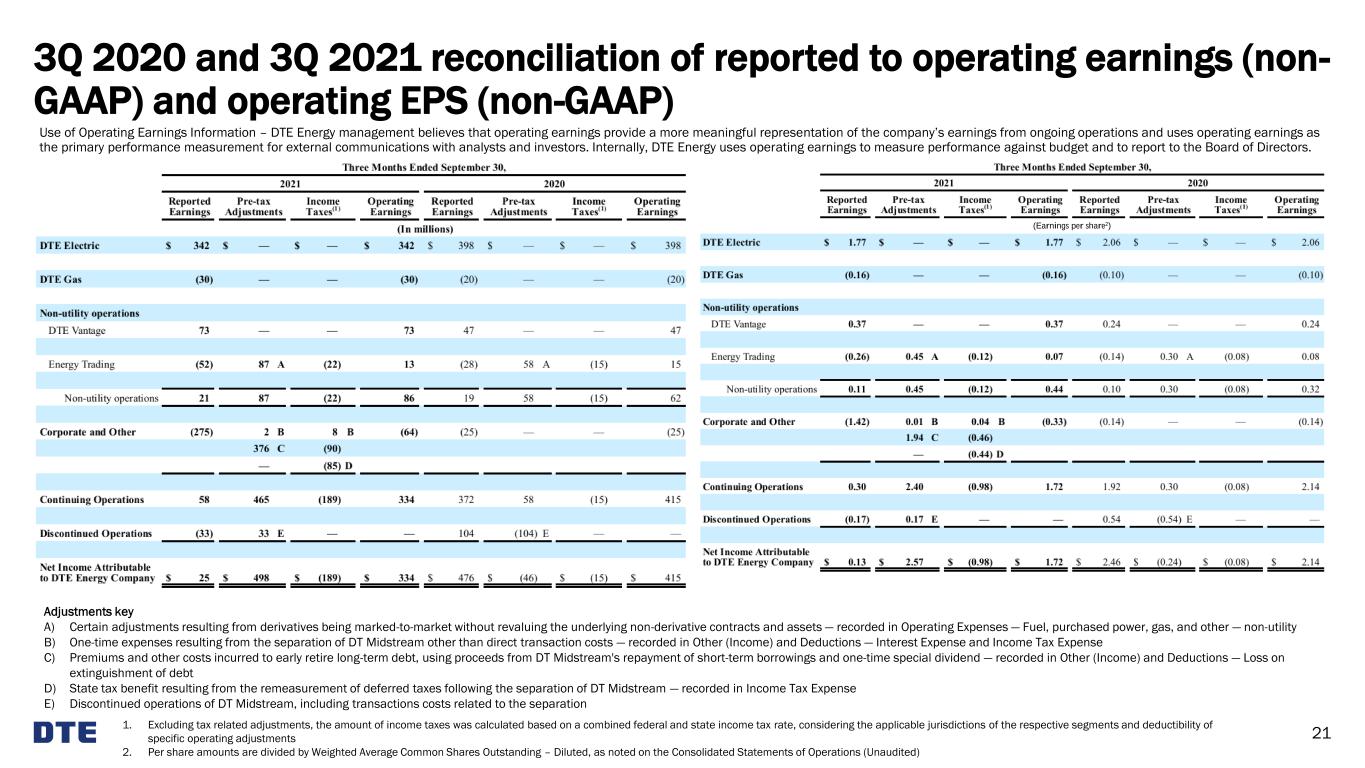

Adjustments key A) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non-derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, gas, and other — non-utility B) One-time expenses resulting from the separation of DT Midstream other than direct transaction costs — recorded in Other (Income) and Deductions — Interest Expense and Income Tax Expense C) Premiums and other costs incurred to early retire long-term debt, using proceeds from DT Midstream's repayment of short-term borrowings and one-time special dividend — recorded in Other (Income) and Deductions — Loss on extinguishment of debt D) State tax benefit resulting from the remeasurement of deferred taxes following the separation of DT Midstream — recorded in Income Tax Expense E) Discontinued operations of DT Midstream, including transactions costs related to the separation 3Q 2020 and 3Q 2021 reconciliation of reported to operating earnings (non- GAAP) and operating EPS (non-GAAP) 1. Excluding tax related adjustments, the amount of income taxes was calculated based on a combined federal and state income tax rate, considering the applicable jurisdictions of the respective segments and deductibility of specific operating adjustments 2. Per share amounts are divided by Weighted Average Common Shares Outstanding – Diluted, as noted on the Consolidated Statements of Operations (Unaudited) 21 Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. (Earnings per share2)

Reconciliation of reported to operating earnings (non-GAAP) 22 Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings.