Exhibit 99.2

Business and Financial Update

Gerry Anderson, Chairman, President and CEO Dave Meador, Executive Vice President and CFO

April 11-12, 2012

Safe Harbor Statement

The information contained herein is as of the date of this presentation. Many factors may impact forward-looking statements including, but not limited to, the following: impact of regulation by the FERC, MPSC, NRC and other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation; impact of electric and gas utility restructuring in Michigan, including legislative amendments and Customer Choice programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, increased thefts of electricity and gas and high levels of uncollectible accounts receivable; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power and natural gas; volatility in the short-term natural gas storage markets impacting third-party storage revenues; access to capital markets and the results of other financing efforts which can be affected by credit agenc y ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; the potential for increased costs or delays in completion of significant construction projects; the uncertainties of successful exploration of unconventional gas and oil resources and challenges in estimating gas and oil reserves with certainty; changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, terrorism or cyber attacks; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; binding arbitration, litigation and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements refer only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the “Forward-Looking Statements” sections in each of DTE Energy’s and Detroit Edison’s 2011 Forms 10-K and 2011 Forms 10-Q (which sections are incorporated herein by reference), and in conjunction with other SEC reports filed by DTE Energy and Detroit Edison.

Cautionary Note – The Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this presentation such as “probable reserves” that the SEC’s guidelines strictly prohibit us from including in filings with the SEC. You are urged to consider closely the disclosure in DTE Energy’s 2011 Form 10-K and 2011 Forms 10-Q, File No. 1-11607, available from our offices or from our website at www.dteenergy.com. You can also obtain these Forms from the SEC by accessing its website at www.sec.gov or by calling 1-800-SEC-0330.

Investment Thesis

DTE Energy has a plan it believes will provide 5%—6% long-term operating EPS growth, an attractive dividend yield and a strong balance sheet

– Utility growth plan driven by mandated investments

5%-6% Average Annual EPS Growth

– Constructive regulatory structure and continued cost savings enable utilities to earn their authorized returns

Attractive Dividend

– Plans in place to achieve operational excellence and customer satisfaction that are distinctive in our industry, with a focus on customer affordability

– Meaningful, low-risk growth opportunities in non-utility businesses continue to provide diversity in earnings and geography

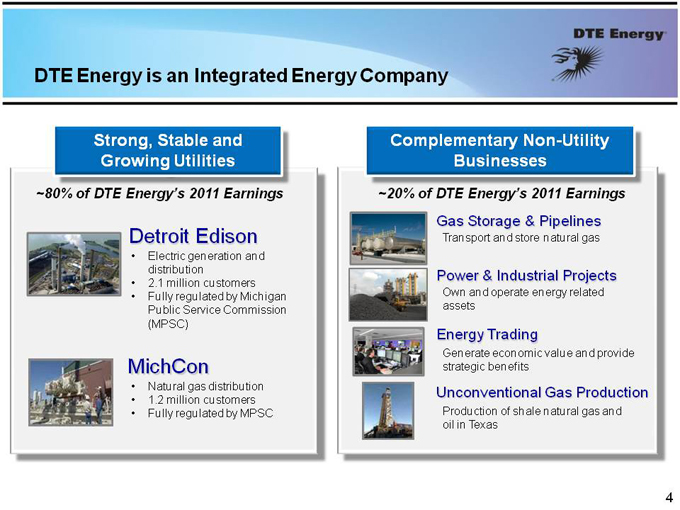

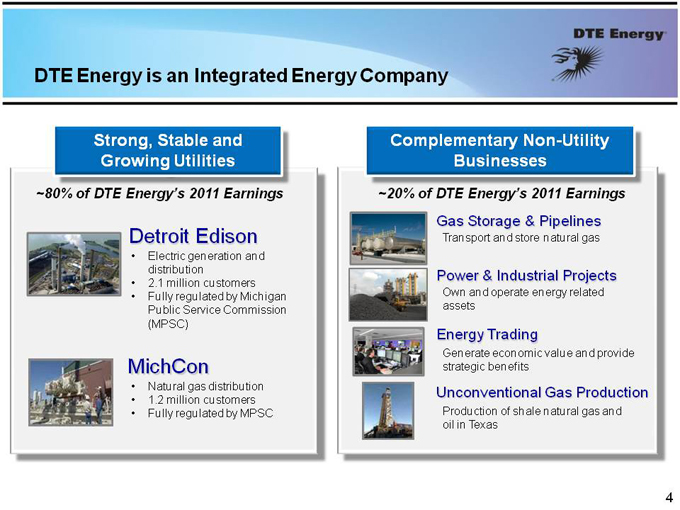

DTE Energy is an Integrated Energy Company

Strong, Stable and Complementary Non-Utility Growing Utilities Businesses

~80% of DTE Energy’s 2011 Earnings ~20% of DTE Energy’s 2011 Earnings

Gas Storage & Pipelines

Detroit Edison Transport and store natural gas

• Electric generation and

distribution Power & Industrial Projects

• 2.1 million customers

• Fully regulated by Michigan Own and operate energy related Public Service Commission assets (MPSC)

Energy Trading

Generate economic value and provide MichCon strategic benefits

• Natural gas distribution Unconventional Gas Production

• 1.2 million customers

• Fully regulated by MPSC Production of shale natural gas and oil in Texas

•

Long-Term Growth

Strategy

•

2012 Outlook

5

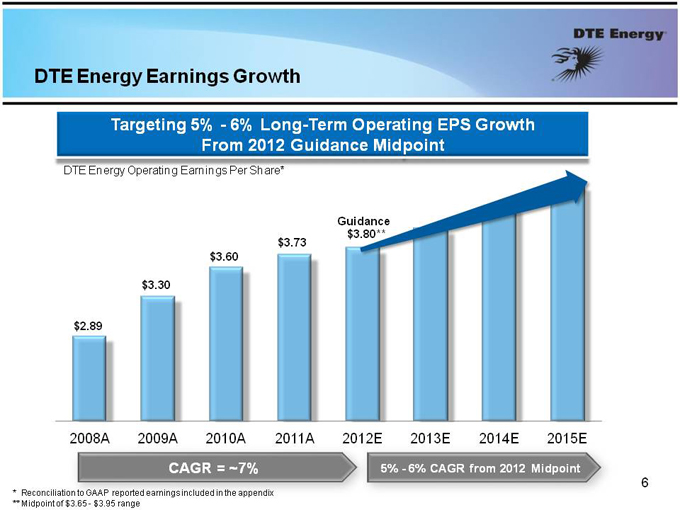

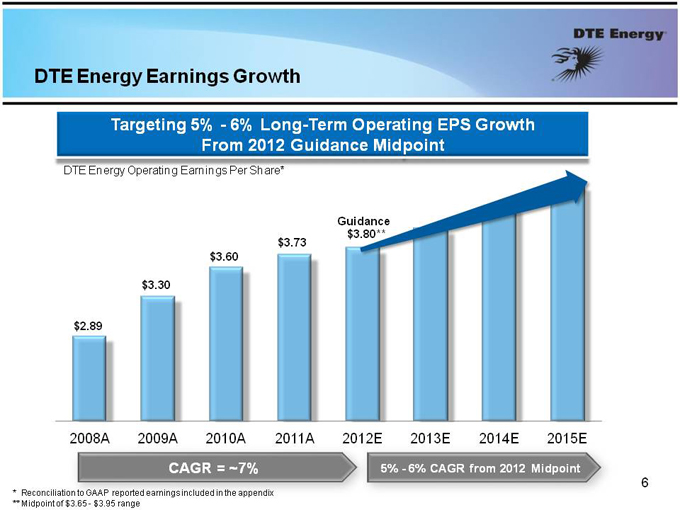

DTE Energy Earnings Growth

Targeting 5%—6% Long-Term Operating EPS Growth From 2012 Guidance Midpoint

DTE Energy Operating Earnings Per Share*

Guidance $3.80** $3.73 $3.60

$3.30

$2.89

2008A 2009A 2010A 2011A 2012E 2013E 2014E 2015E

CAGR = ~7% 5%—6% CAGR from 2012 Midpoint

* | | Reconciliation to GAAP reported earnings included in the appendix 6 |

** Midpoint of $3.65—$3.95 range

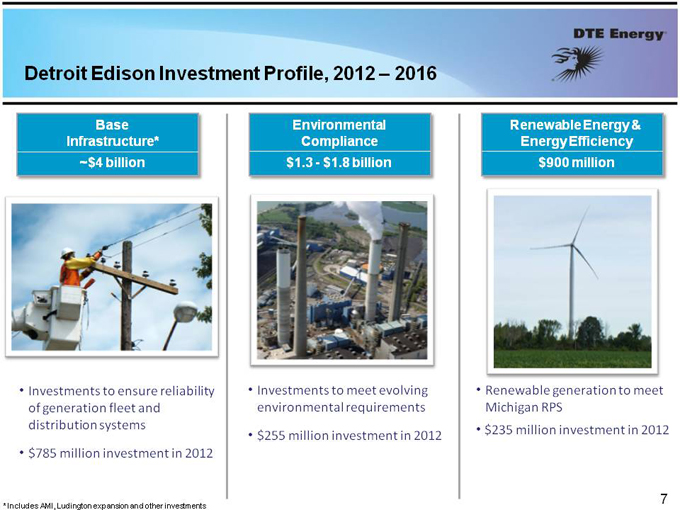

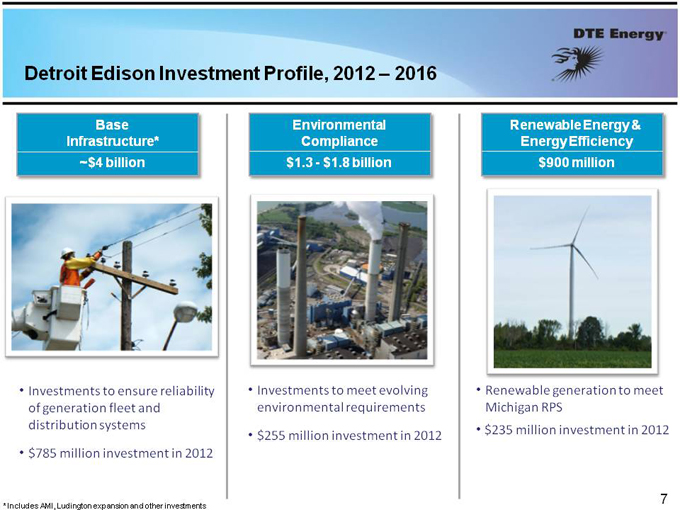

Detroit Edison Investment Profile, 2012 – 2016

Base Environmental Renewable Energy & Infrastructure* ast uctu e Com Co pliance a ce Ener e gy Efficienc c e cy

~$4 billion $1.3—$1.8 billion $900 million

• Investments to ensure reliability • Investments to meet evolving • Renewable generation to meet of generation fleet and environmental requirements Michigan RPS distribution systems $255 million investment in 2012 • $235 million investment in 2012

•

• $785 million investment in 2012

* | | Includes AMI, Ludington expansion and other investments |

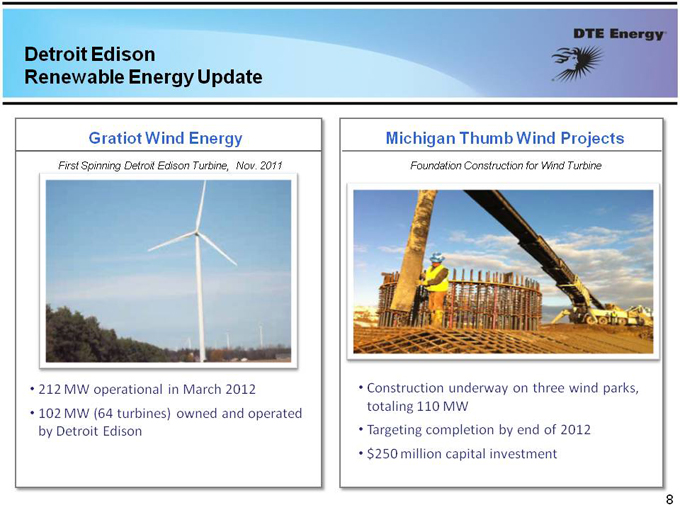

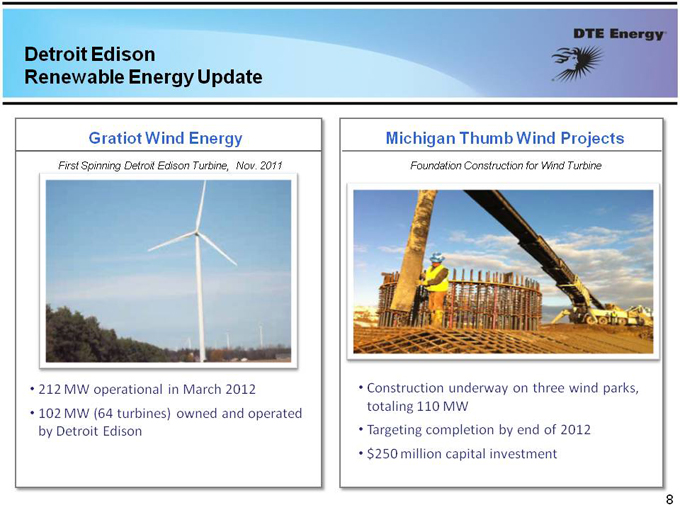

Detroit Edison

Renewable Energy Update

Gratiot Wind Energy Michigan Thumb Wind Projects

First Spinning Detroit Edison Turbine, Nov. 2011 Foundation Construction for Wind Turbine

• 212 MW operational in March 2012 • Construction underway on three wind parks, totaling 110 MW

• 102 MW (64 turbines) owned and operated by Detroit Edison • Targeting completion by end of 2012

• $250 million capital investment

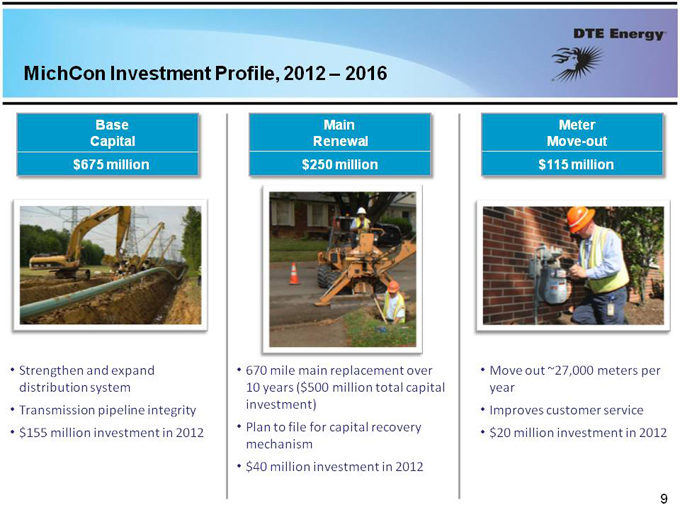

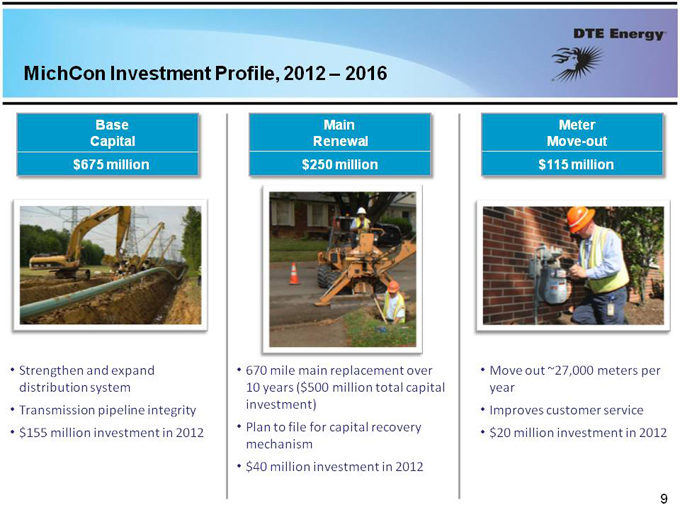

MichCon Investment Profile, 2012 – 2016

Base Main Meter Capital ta Renewal e e a Move o e-out $675 million $250 million $115 million

• Strengthen and expand • 670 mile main replacement over • Move out ~27,000 meters per distribution system 10 years ($500 million total capital year investment)

• Transmission pipeline integrity • Improves customer service

• • Plan to file for capital recovery • $155 million investment in 2012 $20 million investment in 2012 mechanism

• $40 million investment in 2012

9

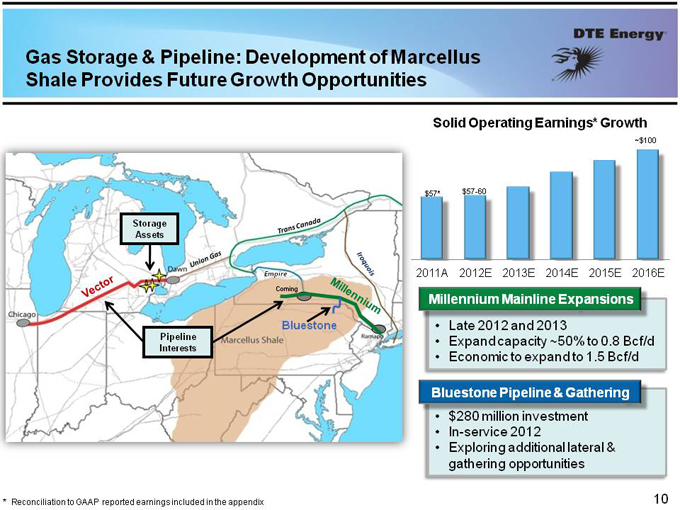

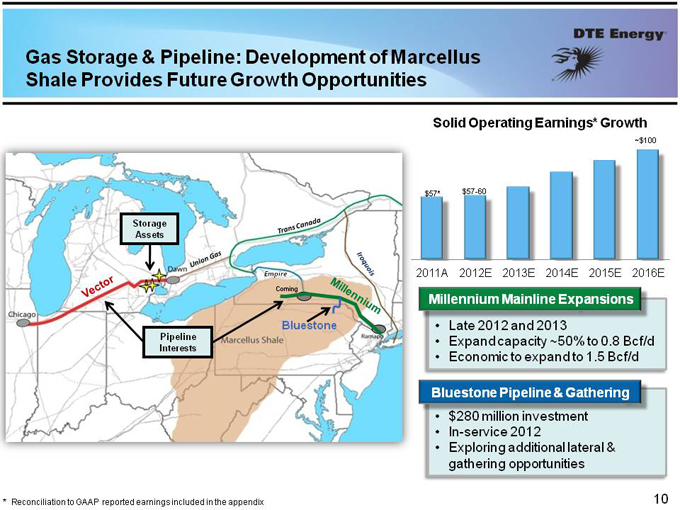

Gas Storage & Pipeline: Development of Marcellus Shale Provides Future Growth Opportunities

Solid Operating Earnings* Growth

~$100

$57* $57-60

Storage Assets

Empire 2011A 2012E 2013E 2014E 2015E 2016E

Corning

Millennium Mainline Expansions Bluestone • Late 2012 and 2013 Pipeline • Expand capacity ~50% to 0.8 Bcf/d

Interests

• Economic to expand to 1.5 Bcf/d

Bluestone Pipeline & Gathering

• $280 million investment

• In-service 2012

• Exploring additional lateral & gathering opportunities

* | | Reconciliation to GAAP reported earnings included in the appendix 10 |

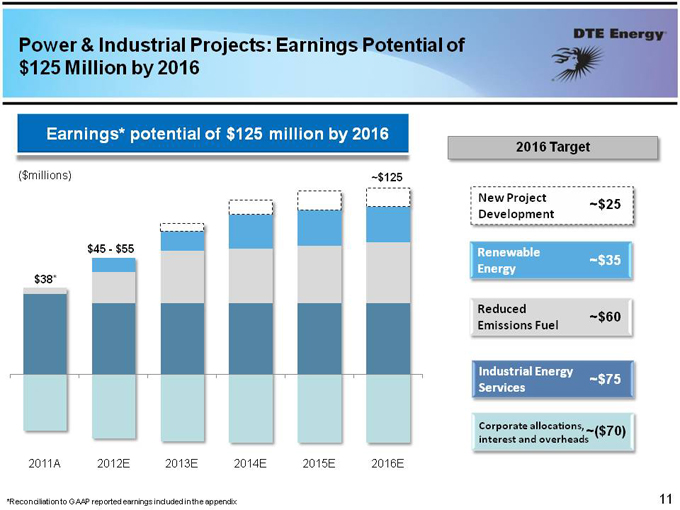

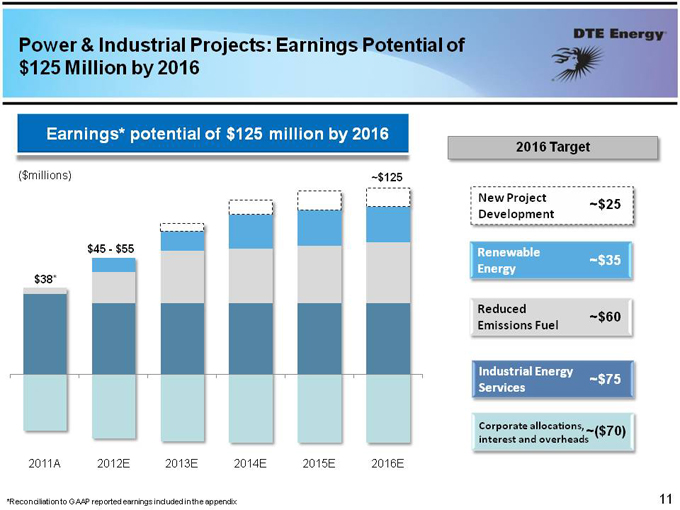

Power & Industrial Projects: Earnings Potential of $125 Million by 2016

Earnings* potential of $125 million by 2016

2016 Target

($millions) ~$125

New Project ~$25 Development

$45—$55 Renewable

~$35 $38* Energy Reduced

~$60

Emissions Fuel

Industrial Energy

~$75

Services

Corporate allocations, ~($70) interest and overheads

2011A 2012E 2013E 2014E 2015E 2016E

*Reconciliation to GAAP reported earnings included in the appendix 11

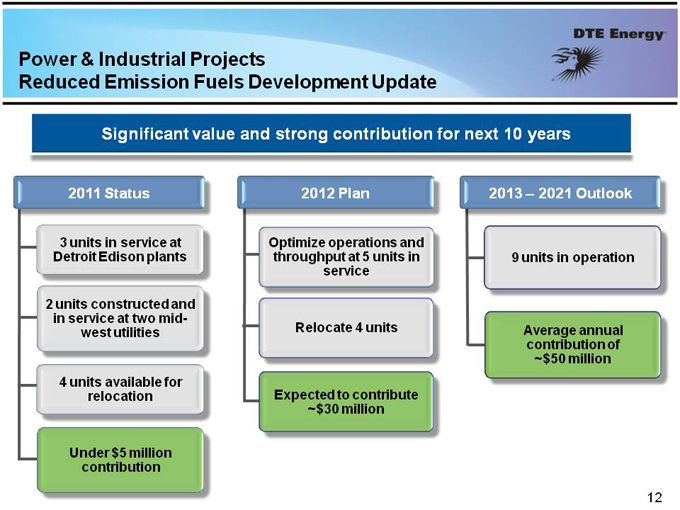

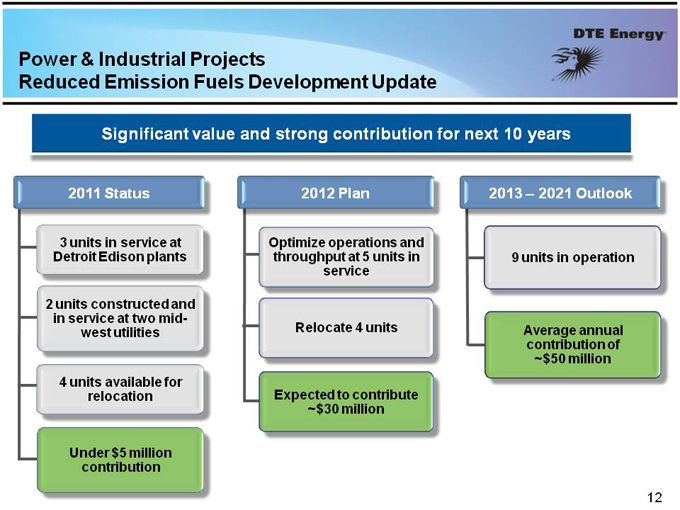

Power & Industrial Projects

Reduced Emission Fuels Development Update

Significant value and strong contribution for next 10 years

2011 Status 2012 Plan 2013 – 2021 Outlook

3 | | units in service at Optimize operations and |

Detroit Edison plants throughput at 5 units in 9 units in operation service

2 | | units constructed and in service at two midwest utilities Relocate 4 units Average annual contribution of |

~$50 million 4 units available for relocation Expected to contribute

~$30 million

Under $5 million contribution

12

• Long-Term Growth Strategy

• 2012 Outlook

13

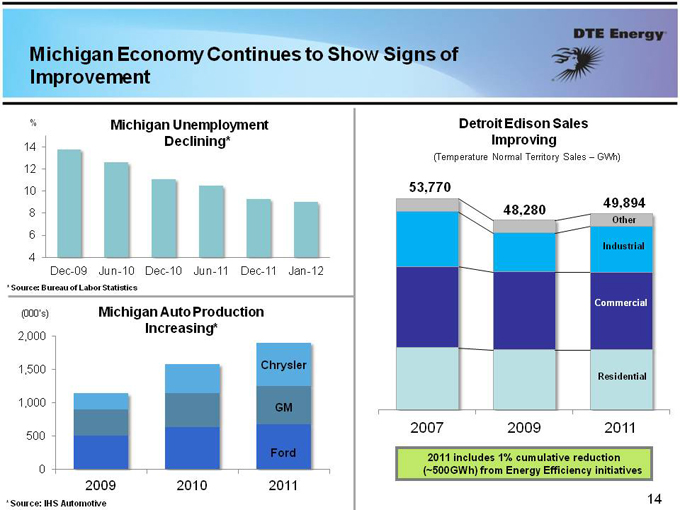

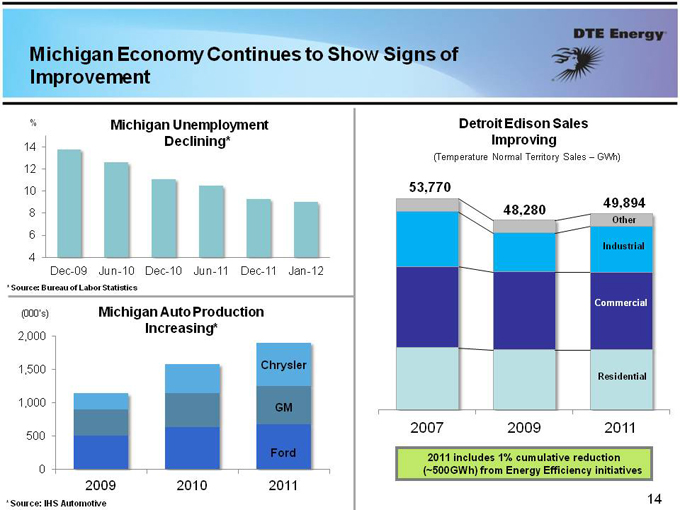

Michigan Economy Continues to Show Signs of Improvement

% Michigan Unemployment Detroit Edison Sales Declining* Improving

14

(Temperature Normal Territory Sales – GWh) 12

10 53,770

49,894

Industrial

Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 Jan-12

* | | Source: Bureau of Labor Statistics |

Commercial

(000’s) Michigan Auto Production Increasing*

2,000

1,500 Chrysler

Residential

1,000 GM

2007 2009 2011

500

Ford

2011 includes 1% cumulative reduction

0 (~500GWh) from Energy Efficiency initiatives

2009 2010 2011

* | | Source: IHS Automotive 14 |

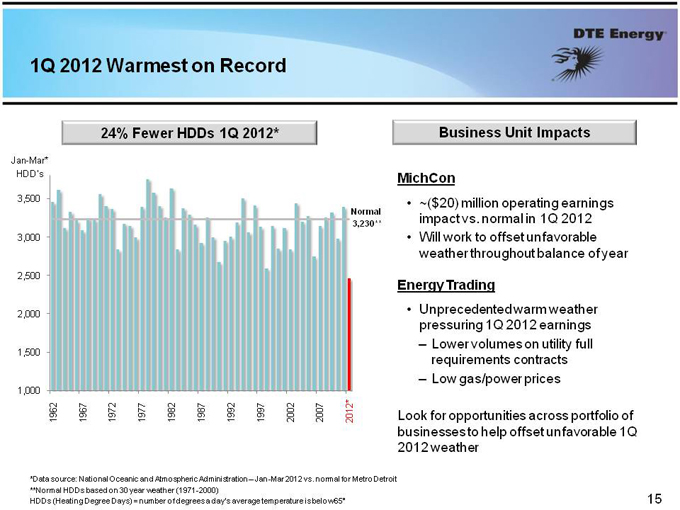

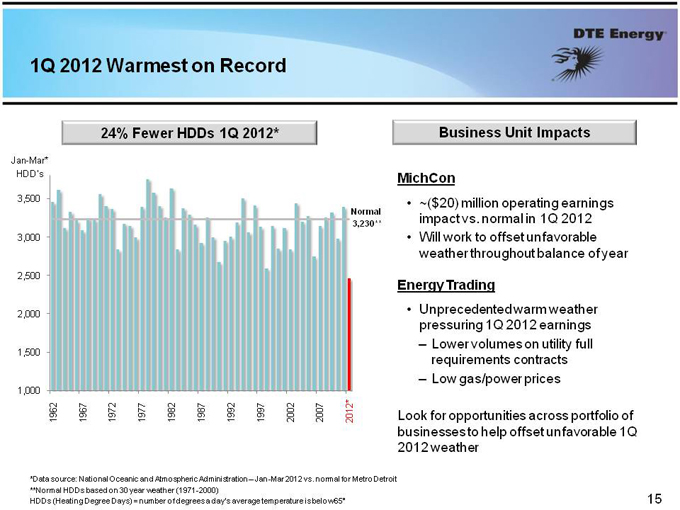

1Q 2012 Warmest on Record

24% Fewer HDDs 1Q 2012* Business Unit Impacts

Jan-Mar*

HDD’s MichCon

3,500 • ~($20) million operating earnings

Normal

3,230** impact vs. normal in 1Q 2012

3,000 • Will work to offset unfavorable weather throughout balance of year

2,500

Energy Trading

2,000 • Unprecedented warm weather pressuring 1Q 2012 earnings

– Lower volumes on utility full

1,500

requirements contracts

– Low gas/power prices

1,000

1962 1967 1972 1977 1982 1987 1992 1997 2002 2007 2012* Look for opportunities across portfolio of

businesses to help offset unfavorable 1Q 2012 weather

*Data source: National Oceanic and Atmospheric Administration – Jan-Mar 2012 vs. normal for Metro Detroit **Normal HDDs based on 30 year weather (1971-2000)

HDDs (Heating Degree Days) = number of degrees a day’s average temperature is below 65° 15

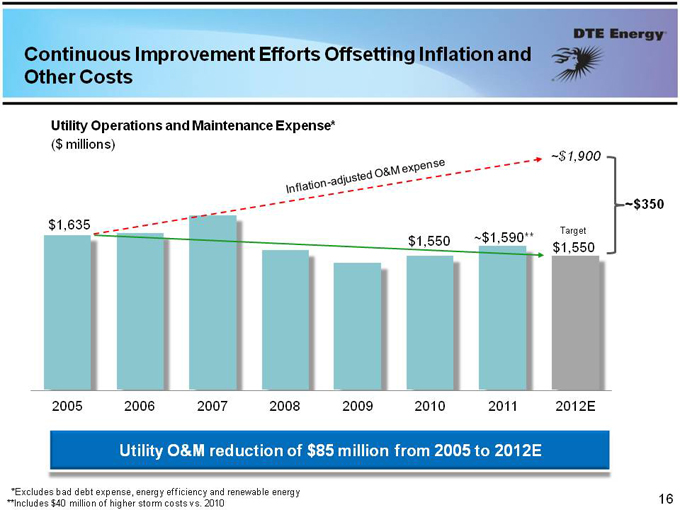

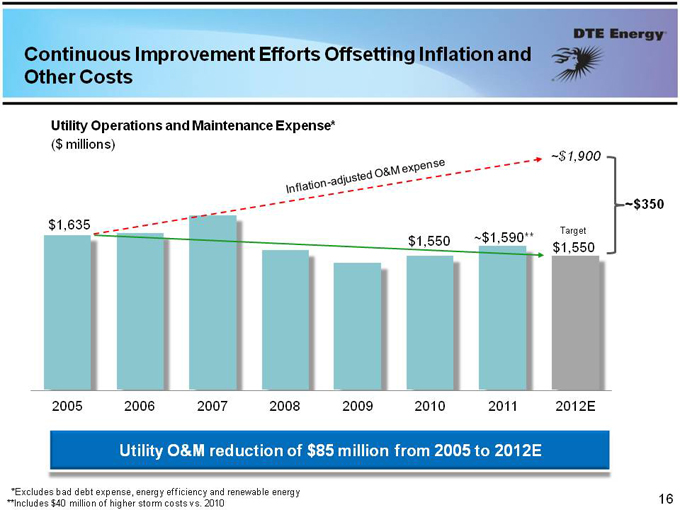

Continuous Improvement Efforts Offsetting Inflation and Other Costs

Utility Operations and Maintenance Expense*

($ millions) ~$1,900

~$350 $1,635

Target

$1,550 ~$1,590** $1,550

2005 2006 2007 2008 2009 2010 2011 2012E

Utility O&M reduction of $85 million from 2005 to 2012E

*Excludes bad debt expense, energy efficiency and renewable energy

**Includes $40 million of higher storm costs vs. 2010 16

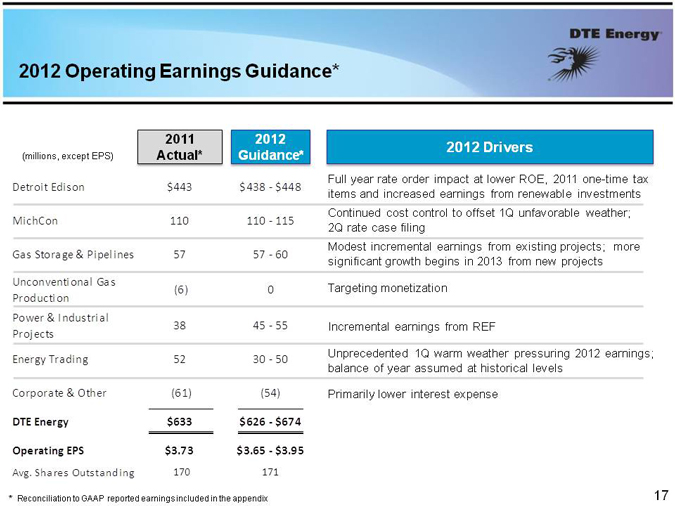

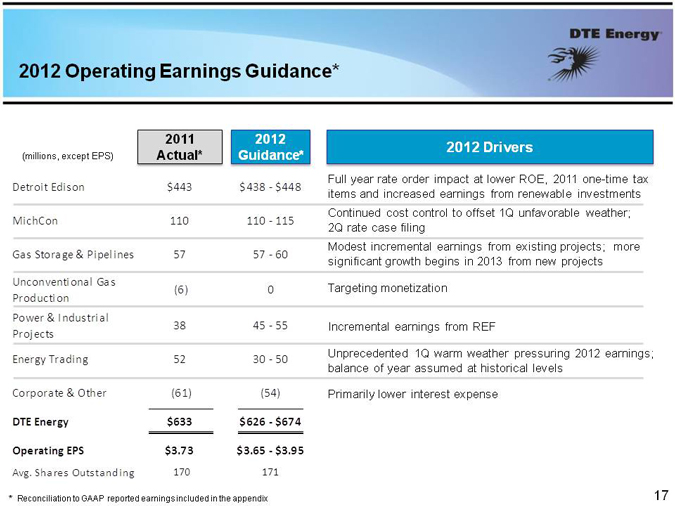

2012 Operating Earnings Guidance*

2011 2012

2012 Drivers

(millions, except EPS) Actual* Guidance*

Full year rate order impact at lower ROE, 2011 one-time tax

Detroit Edison $443 $438 $ ? 448 items and increased earnings from renewable investments Continued cost control to offset 1Q unfavorable weather;

MichCon 110 110 115 ?

2Q rate case filing

Modest incremental earnings from existing projects; more

Gas Storage & Pipelines 57 57 60 ? significant growth begins in 2013 from new projects

Unconventional Gas Targeting monetization

(6) | | 0 Production Power & Industrial |

38 45 55 ? Incremental earnings from REF

Projects

Unprecedented 1Q warm weather pressuring 2012 earnings;

Energy Trading 52 30 ?50 balance of year assumed at historical levels

Corporate & Other (61) (54) Primarily lower interest expense

DTE Energy $633 $626 $ ? 674

Operating EPS $3.73 $3.65 $ ? 3.95

Avg. Shares Outstanding 170 171

* | | Reconciliation to GAAP reported earnings included in the appendix 17 |

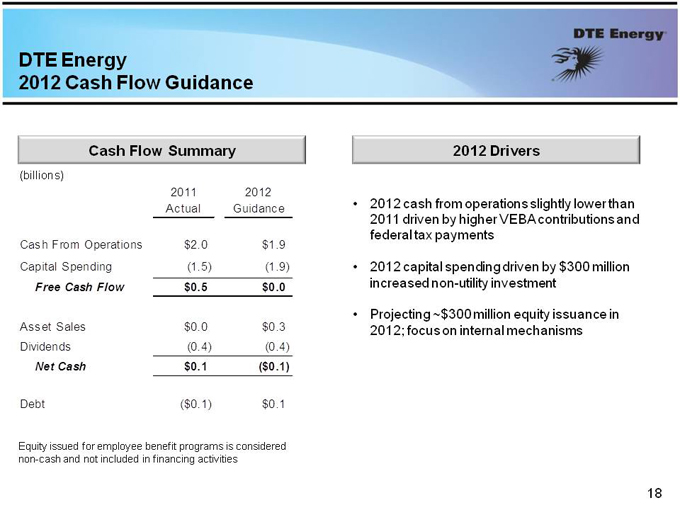

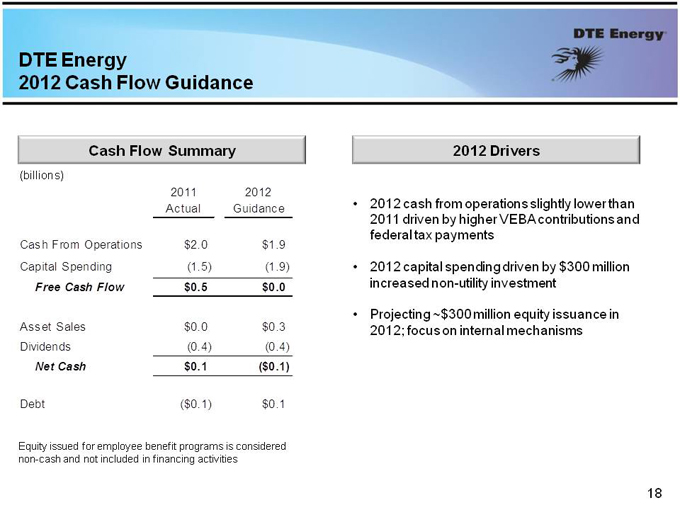

DTE Energy

2012 Cash Flow Guidance

Cash Flow Summary 2012 Drivers

(billions)

2011 2012

Actual Guidance • 2012 cash from operations slightly lower than

2011 driven by higher VEBA contributions and federal tax payments Cash From Operations $2.0 $1.9 Capital Spending (1.5) (1.9) • 2012 capital spending driven by $300 million Free Cash Flow $0.5 $0.0 increased non-utility investment

• Projecting ~$300 million equity issuance in Asset Sales $0.0 $0.3 2012; focus on internal mechanisms Dividends (0.4) (0.4)

Net Cash $0.1 ($0.1)

Debt ($0.1) $0.1

Equity issued for employee benefit programs is considered non-cash and not included in financing activities

18

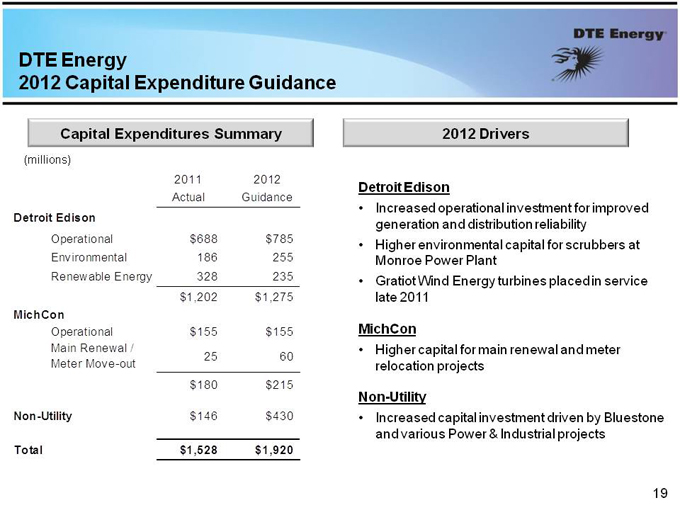

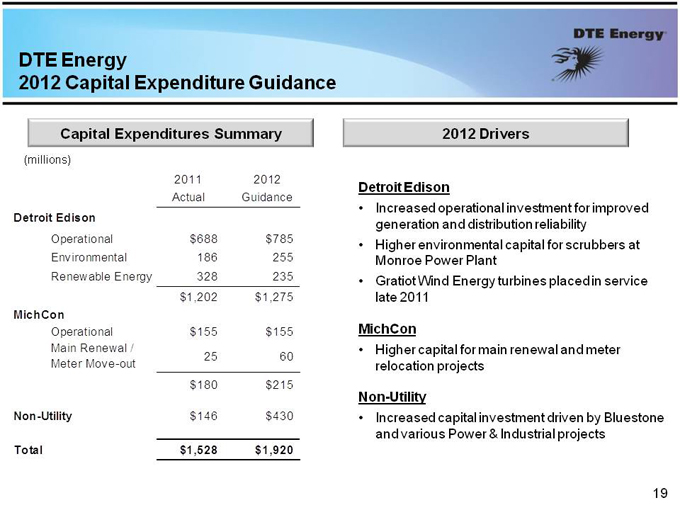

DTE Energy

2012 Capital Expenditure Guidance

Capital Expenditures Summary 2012 Drivers

(millions)

2011 2012

Detroit Edison

Actual Guidance

• Increased operational investment for improved Detroit Edison generation and distribution reliability Operational $688 $785 • Higher environmental capital for scrubbers at Environmental 186 255 Monroe Power Plant Renewable Energy 328 235 • Gratiot Wind Energy turbines placed in service $1,202 $1,275 late 2011

MichCon

Operational $155 $155 MichCon

Main Renewal / • Higher capital for main renewal and meter

25 60

Meter Move-out relocation projects $180 $215

Non-Utility

Non-Utility $146 $430 • Increased capital investment driven by Bluestone and various Power & Industrial projects

Total $1,528 $1,920

19

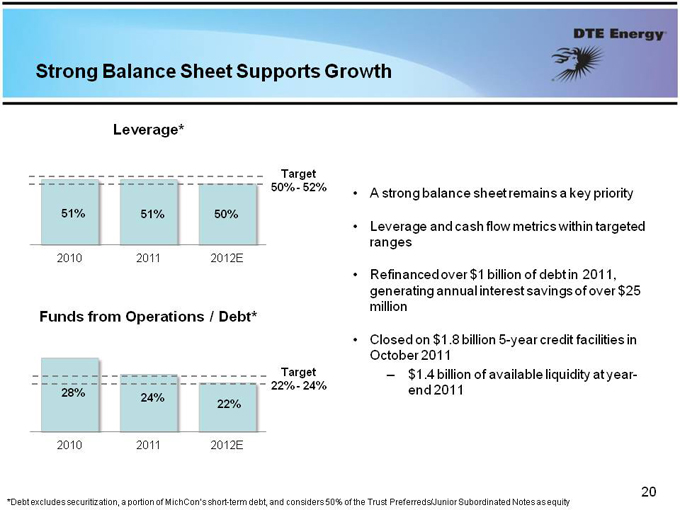

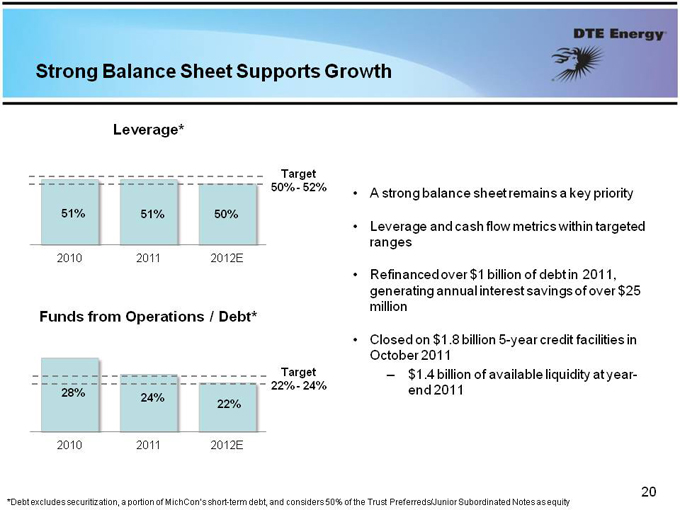

Strong Balance Sheet Supports Growth

Leverage*

Target

50%—52% • A strong balance sheet remains a key priority

51% 51% 50%

• Leverage and cash flow metrics within targeted ranges 2010 2011 2012E

• Refinanced over $1 billion of debt in 2011, generating annual interest savings of over $25 million

Funds from Operations / Debt*

• Closed on $1.8 billion 5-year credit facilities in October 2011 Target – $1.4 billion of available liquidity at year-

22%—24% end 2011 28% 24% 22%

2010 2011 2012E

*Debt excludes securitization, a portion of MichCon’s short-term debt, and considers 50% of the Trust Preferreds/Junior Subordinated Notes as equity 20

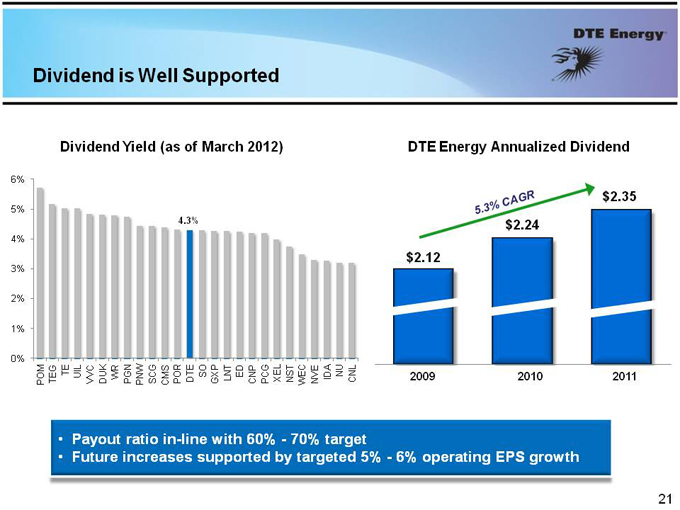

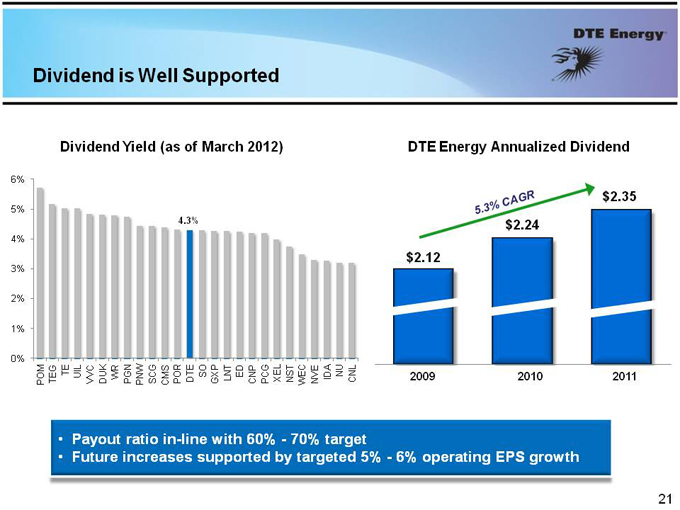

Dividend is Well Supported

Dividend Yield (as of March 2012) DTE Energy Annualized Dividend

6%

$2.35

5%

4.3% $2.24

4%

$2.12

3% 2% 1%

0%

TE UIL K WR W R SO ED A ID NU

POM TEG VVC DU PGN PN SCG CMS PO DTE GXP LNT CNP PCG XEL NST WEC NVE CNL 2009 2010 2011

• Payout ratio in-line with 60%—70% target

• Future increases supported by targeted 5%—6% operating EPS growth

21

Summary

h 1Q 2012 weather warmest on record (measured in HDDs). Will work to offset MichCon earnings impact through continued cost control

h Targeting midpoint of DTE guidance range; Look for opportunities to offset unfavorable 1Q 2012 weather

h Continue to drive to top quartile cost and operating performance across all business units

h MichCon planning 2Q 2012 rate case filing h Execute non-utility growth plans at Gas Storage & Pipelines (Bluestone) and Power & Industrial Projects (REF)

h Targeting 5%-6% long-term earnings per share growth

22

Contact Us

DTE Energy Investor Relations www.dteenergy.com/investors 313-235-8030

23

Appendix

Michigan Public Service Commission (MPSC)

• The Michigan Public Service Commission is composed of three members appointed by the Governor with the advice and consent of the Senate.

• Commissioners are appointed to serve staggered six-year terms.

• No more than two Commissioners may represent the same political party.

• One commissioner is designated as chairman by the Governor.

John Quackenbush Orjiakor Isiogu Greg White

Chairman Commissioner Commissioner

Appointed: 9/15/11 Appointed: 9/9/07 Appointed: 12/4/09

Term Ends: 7/2/17 Term Ends: 7/2/13 Term Ends: 7/2/15 (Republican) (Democrat) (Independent)

25

Source: MPSC website—www.michigan.gov/mpsc—Jan. 2010

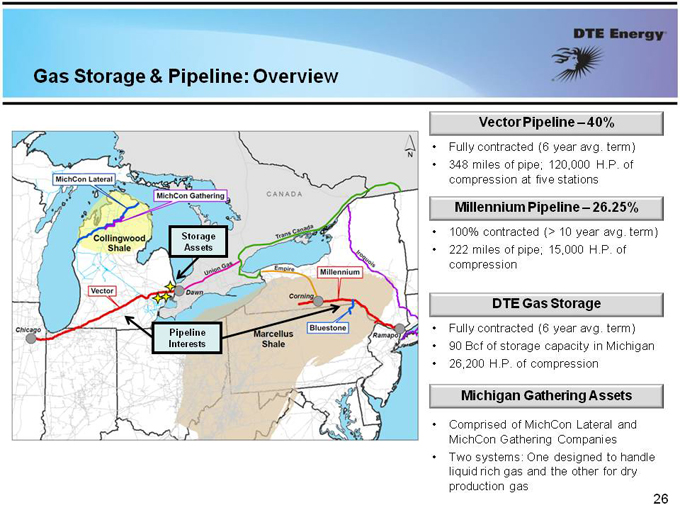

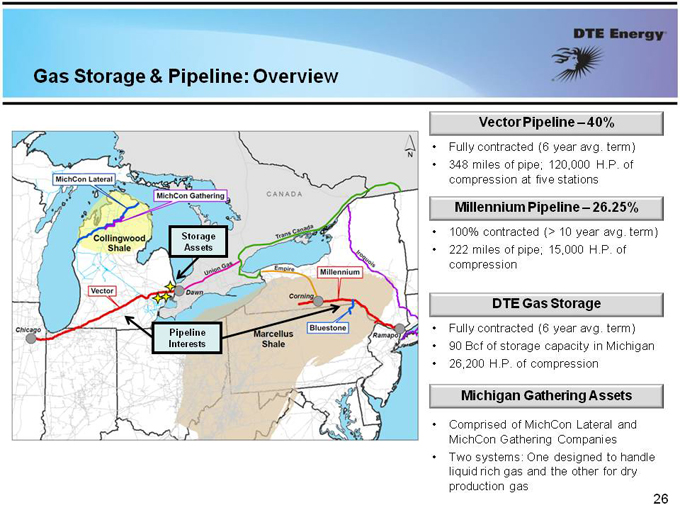

Gas Storage & Pipeline: Pipeline: Overview Overview

Vector Pipeline – 40%

• Fully contracted (6 year avg. term)

• 348 miles of pipe; 120,000 H.P. of compression at five stations

Millennium Pipeline – 26.25% Storage • 100% contracted (> 10 year avg. term) Assets • 222 miles of pipe; 15,000 H.P. of compression

DTE Gas Storage Pipeline • Fully contracted (6 year avg. term) Interests • 90 Bcf of storage capacity in Michigan

• 26,200 H.P. of compression

Michigan Gathering Assets

• Comprised of MichCon Lateral and

MichCon Gathering Companies

• Two systems: One designed to handle liquid rich gas and the other for dry production gas 26

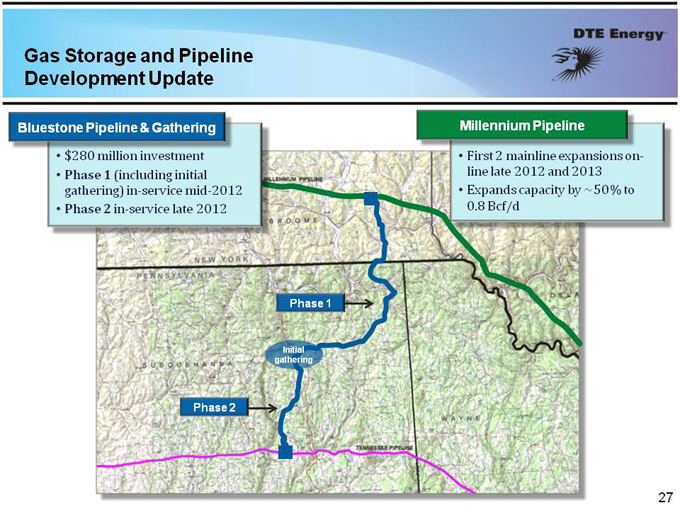

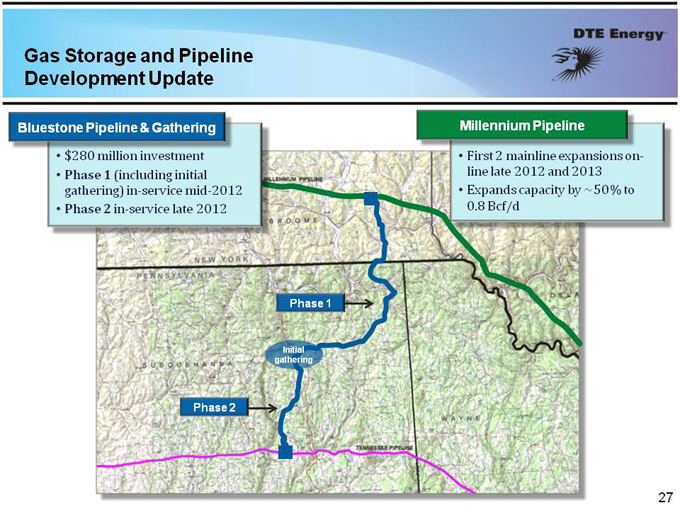

Gas Storage and Pipeline Development Update

Bluestone Pipeline & Gathering Millennium Pipeline

• $280 million investment • First 2 mainline

• Phase 1 (including initial line late 2012 and gathering) in?service mid?2012• Expands capacity

• Phase 2 in?service late 2012 0.8 Bcf/d

Phase 1

Initial gathering

Phase 2

27

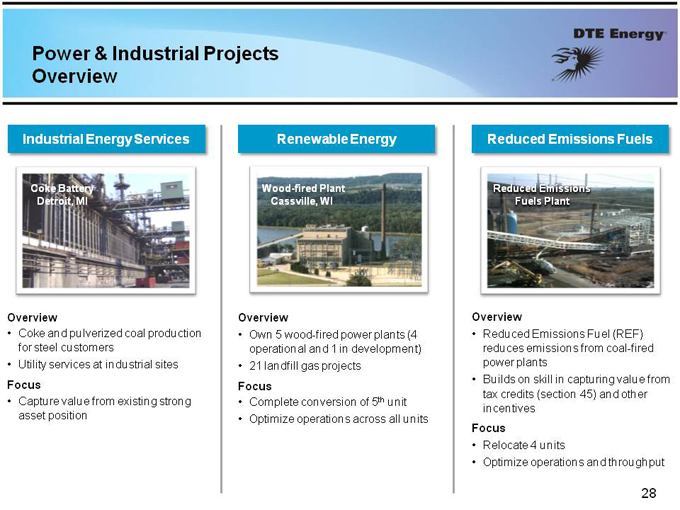

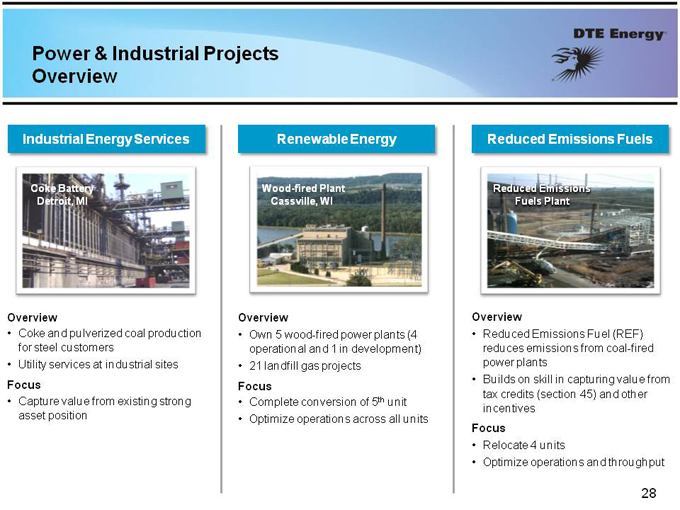

Power & Industrial Projects Overview

Industrial Energy Services Renewable Energy Reduced Emissions Fuels

Wood-fired Plant

Coke Battery Wood Cassville, -fired Plant WI Reduced Emissions Detroit, MI Cassville, WI Fuels Plant

Overview Overview Overview

• Coke and pulverized coal production • Own 5 wood-fired power plants (4 • Reduced Emissions Fuel (REF) for steel customers operational and 1 in development) reduces emissions from coal-fired

• Utility services at industrial sites • 21 landfill gas projects power plants

• Builds on skill in capturing value from

Focus Focus tax credits (section 45) and other

• Capture value from existing strong • Complete conversion of 5th unit incentives asset position • Optimize operations across all units

Focus

• Relocate 4 units

• Optimize operations and throughput 28

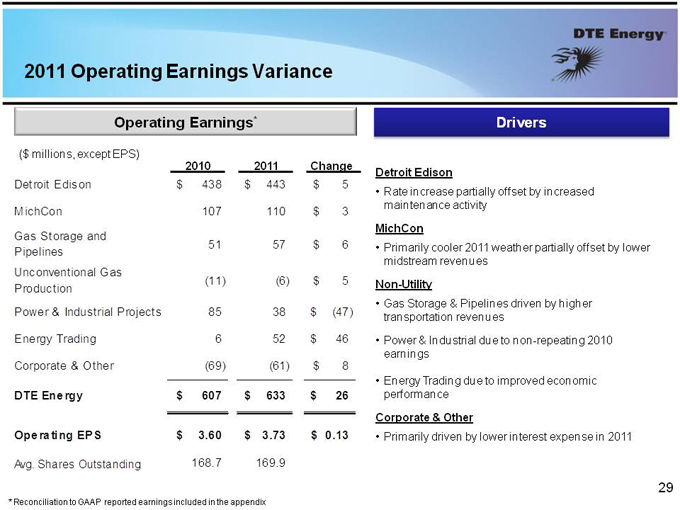

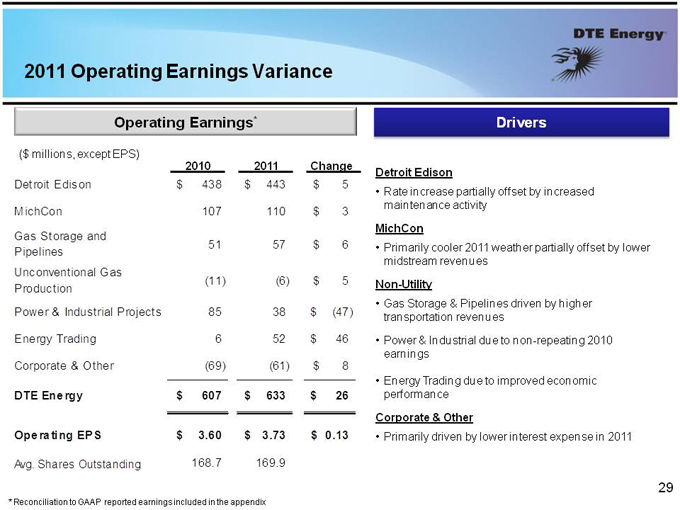

2011 Operating Earnings Variance

Operating Earnings* Drivers

($ millions, except EPS)

2010

2011

Change

Detroit Edison

$438

$443

$5

MichCon

107

110

$3

Gas Storage and

Pipelines

51

57

$6

Unconventional Gas

Production

(11)

(6)

$5

Power & Industrial Projects

85

38

$(47)

Energy Trading

6

52

$46

Corporate & Other

(69)

(61)

$8

DTE Energy

$607

$633

$26

Operating EPS

$3.60

$3.73

$0.13

Avg. Shares Outstanding

168.7

169.9

Detroit Edison

• Rate increase partially offset by increased maintenance activity

MichCon

• Primarily cooler 2011 weather partially offset by lower midstream revenues

Non-Utility

• Gas Storage & Pipelines driven by higher transportation revenues

• Power & Industrial due to non-repeating 2010 earnings

• Energy Trading due to improved economic performance

Corporate & Other

• Primarily driven by lower interest expense in 2011

29

* | | Reconciliation to GAAP reported earnings included in the appendix |

29

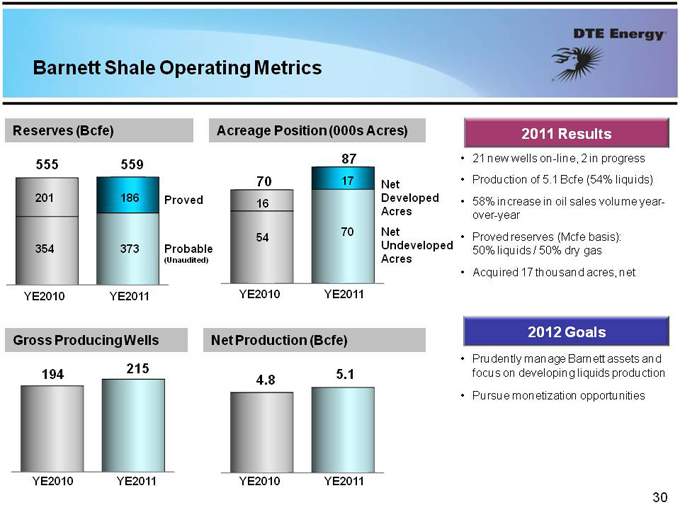

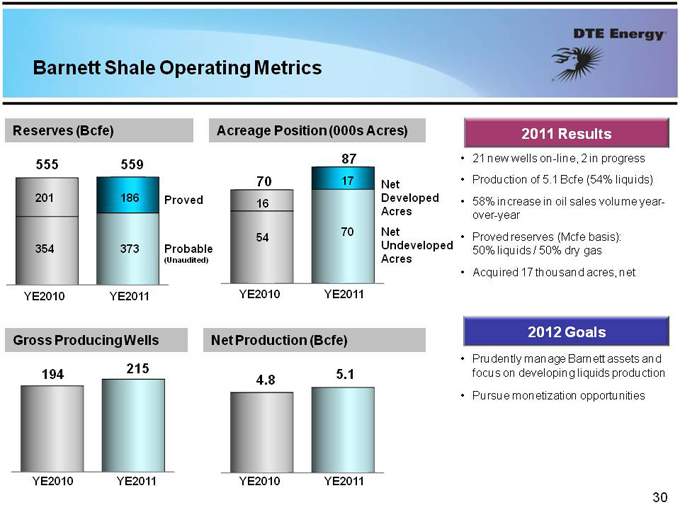

Barnett Shale Operating Metrics

Reserves (Bcfe) Acreage Position (000s Acres) 2011 Results

87 • 21 new wells on-line, 2 in progress

555 559

70 17 Net • Production of 5.1 Bcfe (54% liquids) 201 186 Proved Developed • 58% increase in oil sales volume year-

16

Acres over-year

70 Net

54 • Proved reserves (Mcfe basis):

354 373 Probable Undeveloped

50% liquids / 50% dry gas

(Unaudited) Acres

• Acquired 17 thousand acres, net

YE2010 YE2011 YE2010 YE2011

2012 Goals

Gross Producing Wells Net Production (Bcfe)

• Prudently manage Barnett assets and 194 215 5.1 focus on developing liquids production

4.8

• Pursue monetization opportunities

YE2010 YE2011 YE2010 YE2011

30

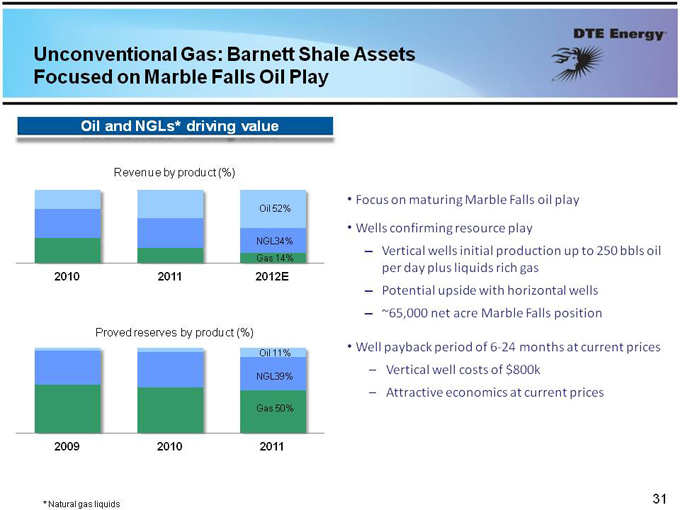

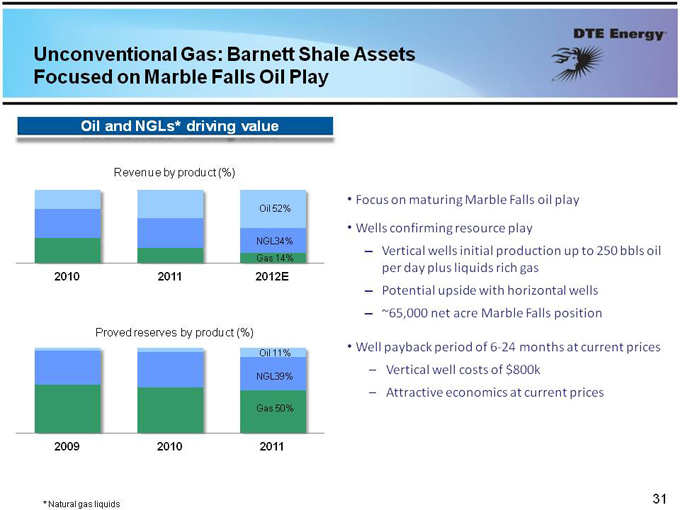

Unconventional Gas: Barnett Shale Assets Focused on Marble Falls Oil Play

Oil and NGLs* driving value

Revenue by product (%)

Oil 52% • Focus on maturing Marble Falls oil play

• Wells confirming resource play

NGL34%

– Vertical wells initial production up to 250 bbls oil

Gas 14%

per day plus liquids rich gas

2010 2011 2012E

– Potential upside with horizontal wells

– ~65,000 net acre Marble Falls position

Proved reserves by product (%)

• Well payback period of 6? 24 months at current prices

Oil 11%

– Vertical well costs of $800k

NGL39%

– Attractive economics at current prices

Gas 50%

2009 2010 2011

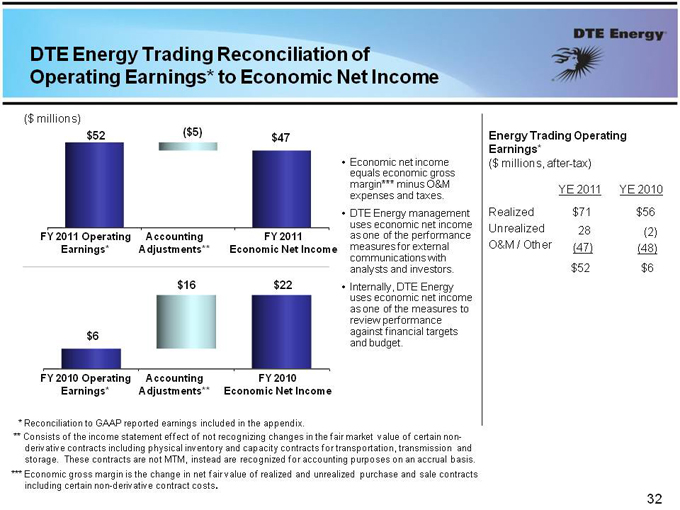

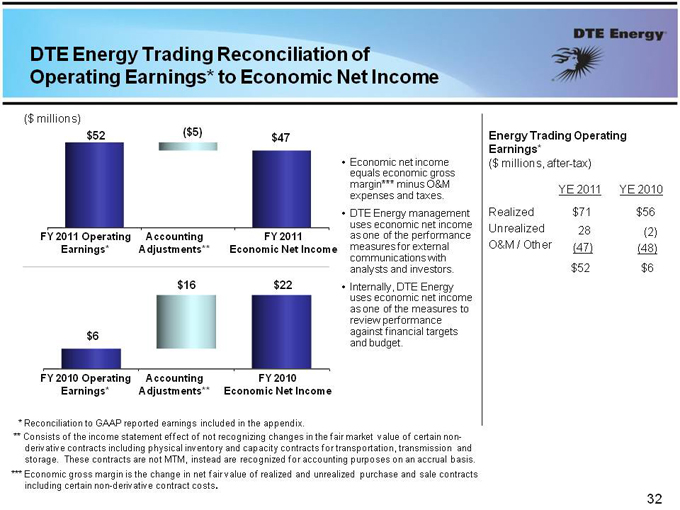

DTE Energy Trading Reconciliation of Operating Earnings* to Economic Net Income

($ millions)

$52 ($5) Energy Trading Operating $47 Earnings*

• Economic net income ($ millions, after-tax) equals economic gross margin*** minus O&M YE 2011 YE 2010 expenses and taxes.

• DTE Energy management Realized $71 $56 uses economic net income Unrealized

28 (2)

FY 2011 Operating Accounting FY 2011 as one of the performance

Earnings* Adjustments** Economic Net Income measures for external O&M / Other (47) (48) communications with $52 $6 analysts and investors.

$16 $22 • Internally, DTE Energy uses economic net income as one of the measures to review performance $6 against financial targets and budget.

FY 2010 Operating Accounting FY 2010 Earnings* Adjustments** Economic Net Income

* | | Reconciliation to GAAP reported earnings included in the appendix. |

** Consists of the income statement effect of not recognizing changes in the fair market value of certain non-derivative contracts including physical inventory and capacity contracts for transportation, transmission and storage. These contracts are not MTM, instead are recognized for accounting purposes on an accrual basis.

*** Economic gross margin is the change in net fair value of realized and unrealized purchase and sale contracts including certain non-derivative contract costs.

32

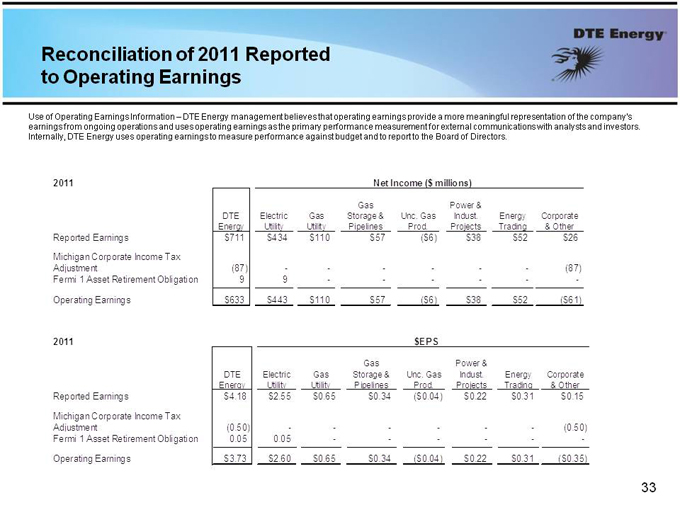

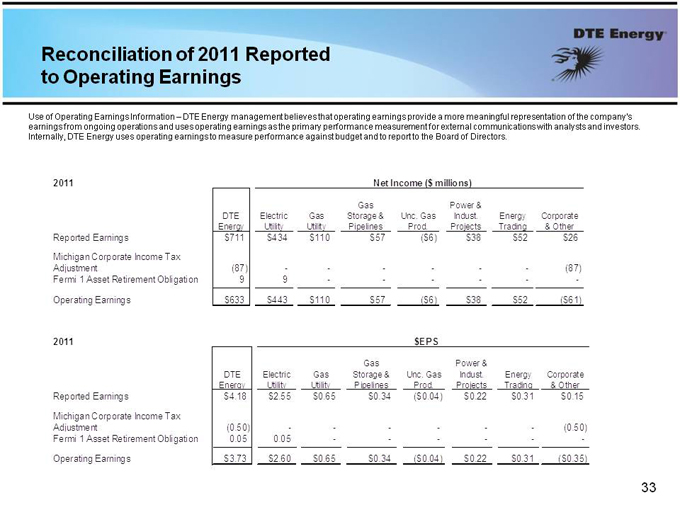

Reconciliation of 2011 Reported to Operating Earnings

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors.

2011

Net Income ($ millions)

Gas

Power &

DTE

Electric

Gas

Storage &

Unc. Gas

Indust.

Energy

Corporate

Energy

Utility

Utility

Pipelines

Prod.

Projects

Trading

& Other

Reported Earnings

$711

$434

$110

$57

($6)

$38

$52

$26

Michigan Corporate Income Tax

Adjustment

(87)

—

—

—

—

—

—

(87)

Fermi 1 Asset Retirement Obligation

9

9

—

—

—

—

—

—

Operating Earnings

$633

$443

$110

$57

($6)

$38

$52

($61)

2011

$EPS

Gas

Power &

DTE

Electric

Gas

Storage &

Unc. Gas

Indust.

Energy

Corporate

Energy

Utility

Utility

Pipelines

Prod.

Projects

Trading

& Other

Reported Earnings

$4.18

$2.55

$0.65

$0.34

($0.04)

$0.22

$0.31

$0.15

Michigan Corporate Income Tax

Adjustment

(0.50)

—

—

—

—

—

—

(0.50)

Fermi 1 Asset Retirement Obligation

0.05

0.05

—

—

—

—

—

— Operating Earnings

$3.73

$2.60 $0.65

$0.34 ($0.04) $0.22

$0.31 ($0.35)

33

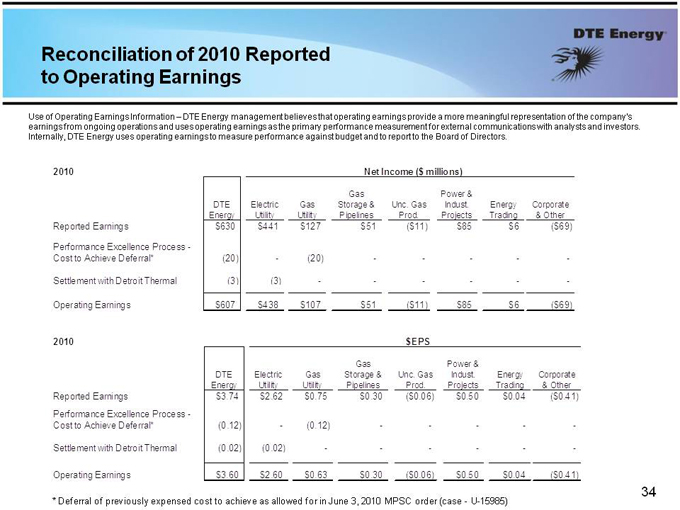

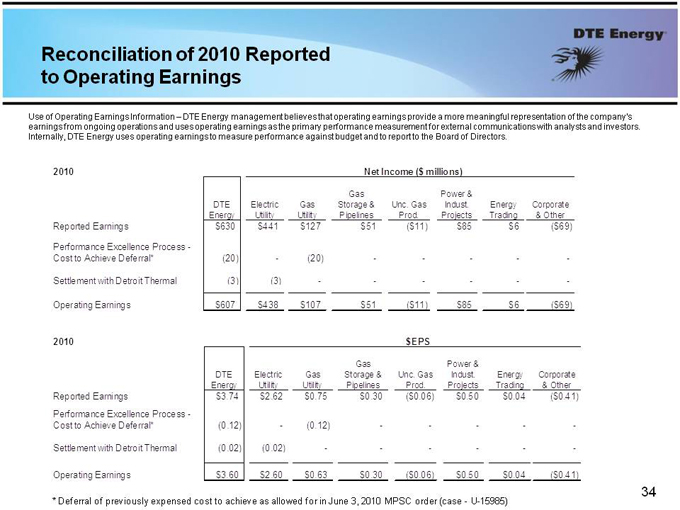

Reconciliation of 2010 Reported to Operating Earnings

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors.

2010

Net Income ($ millions

Gas

Power &

DTE

Electric

Gas

Storage &

Unc. Gas

Indust.

Energy

Corporate

Energy

Utility

Utility

Pipelines

Prod.

Projects

Trading

& Other

Reported Earnings

$630

$441

$127

$51

($11)

$85

$6

($69)

Performance Excellence Process -

Cost to Achieve Deferral*

(20)

—

(20)

—

—

—

—

—

Settlement with Detroit Thermal

(3)

(3)

—

—

—

—

—

—

Operating Earnings

$607

$438

$107

$51

($11)

$85

$6

($69)

2010

$EPS

Gas

Power &

DTE

Electric

Gas

Storage &

Unc. Gas

Indust.

Energy

Corporate

Energy

Utility

Utility

Pipelines

Prod.

Projects

Trading

& Other

Reported Earnings

$3.74

$2.62

$0.75

$0.30

($0.06)

$0.50

$0.04

($0.41)

Performance Excellence Process -

Cost to Achieve Deferral*

(0.12)

—

(0.12)

—

—

—

—

—

Settlement with Detroit Thermal

(0.02)

(0.02)

—

—

—

—

—

—

Operating Earnings

$3.60

$2.60

$0.63

$0.30

($0.06)

$0.50

$0.04

($0.41)

* Deferral of previously expensed cost to achieve as allowed for in June 3, 2010 MPSC order (case—U-15985)

34

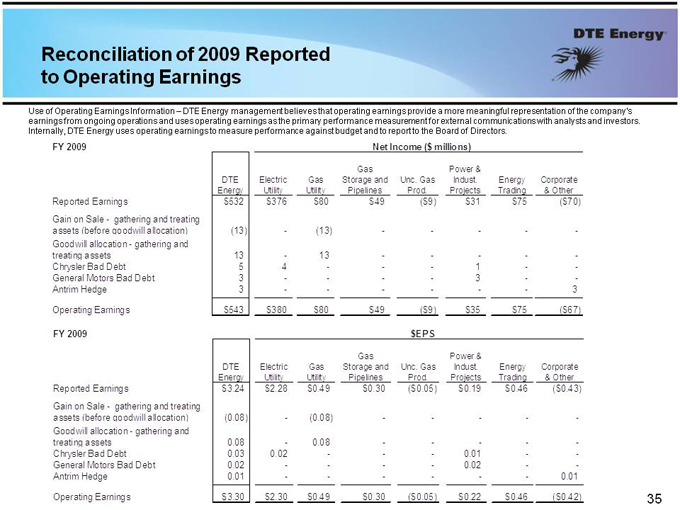

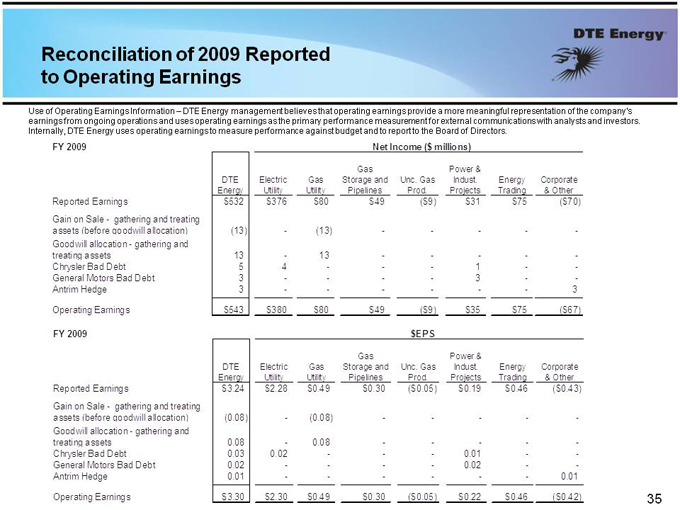

Reconciliation of 2009 Reported to Operating Earnings

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors.

FY 2009

Net Income ($ millions)

Gas

Power &

DTE

Electric

Gas

Storage and

Unc. Gas

Indust.

Energy

Corporate

Energy

Utility

Utility

Pipelines

Prod.

Projects

Trading

& Other

Reported Earnings

$532

$376

$80

$49

($9)

$31

$75

($70)

Gain on Sale—gathering and treatingassets (before goodwill allocation)

(13)

—

(13)

—

—

—

—

—

Goodwill allocation—gathering andtreating assets

13

—

13

—

—

—

—

—

Chrysler Bad Debt

5

4

—

—

—

1

—

—

General Motors Bad Debt

3

—

—

—

—

3

—

—

Antrim Hedge

3

—

—

—

—

—

—

3

Operating Earnings

$543

$380

$80

$49

($9)

$35

$75

($67)

FY 2009

$EPS

Gas

Power &

DTE

Electric

Gas

Storage and Unc. Gas

Indust.

Energy

Corporate

Energy

Utility

Utility

Pipelines

Prod.

Projects

Trading

& Other

Reported Earnings

$3.24

$2.28

$0.49

$0.30

($0.05)

$0.19

$0.46

($0.43)

Gain on Sale—gathering and treatingassets (before goodwill allocation)

(0.08)

—

(0.08)

—

—

—

—

—

Goodwill allocation—gathering andtreating assets

0.08

—

0.08

—

—

—

—

—

Chrysler Bad Debt

0.03

0.02

—

—

—

0.01

—

—

General Motors Bad Debt

0.02

—

—

—

—

0.02

—

—

Antrim Hedge

0.01

—

—

—

—

—

—

0.01

Operating Earnings

$3.30

$2.30

$0.49

$0.30

($0.05)

$0.22

$0.46

($0.42)

35

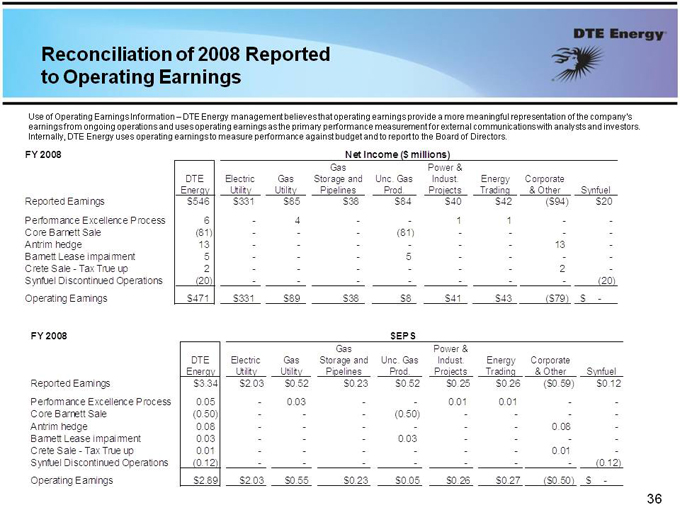

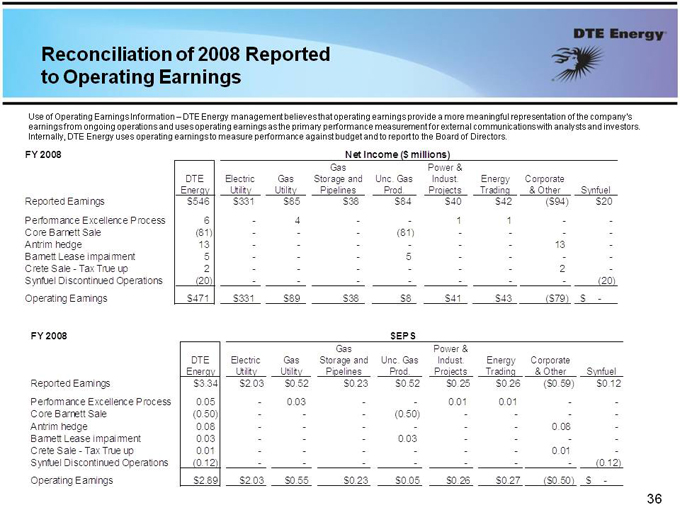

Reconciliation of 2008 Reported to Operating Earnings

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors.

FY 2008 Net Income ($ millions)

Gas Power &

DTE Electric Gas Storage and Unc. Gas Indust. Energy Corporate

Energy Utility Utility Pipelines Prod. Projects Trading & Other Synfuel Reported Earnings $546 $331 $85 $38 $84 $40 $42 ($94) $20 Performance Excellence Process 6 - 4 - - 1 1 - -Core Barnett Sale (81) - - - (81) - - - -Antrim hedge 13 - - - - - - 13 -Barnett Lease impairment 5 - - - 5 - - - -Crete Sale - Tax True up 2 - - - - - - 2 -Synfuel Discontinued Operations (20) - - - - - - - (20) Operating Earnings $471 $331 $89 $38 $8 $41 $43 ($79) $ -

FY 2008 $EPS

Gas Power &

DTE Electric Gas Storage and Unc. Gas Indust. Energy Corporate

Energy Utility Utility Pipelines Prod. Projects Trading & Other Synfuel Reported Earnings $3.34 $2.03 $0.52 $0.23 $0.52 $0.25 $0.26 ($0.59) $0.12 Performance Excellence Process 0.05 - 0.03 - - 0.01 0.01 - -Core Barnett Sale (0.50) - - - (0.50) - - - -Antrim hedge 0.08 - - - - - - 0.08 -Barnett Lease impairment 0.03 - - - 0.03 - - - -Crete Sale - Tax True up 0.01 - - - - - - 0.01 -Synfuel Discontinued Operations (0.12) - - - - - - - (0.12) Operating Earnings $2.89 $2.03 $0.55 $0.23 $0.05 $0.26 $0.27 ($0.50) $ -

36

Reconciliation of Other Reported to Operating Earnings

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors.

In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings.

37