&RPHULFD�,QFRUSRUDWHG )RXUWK�4XDUWHU������DQG�)XOO�<HDU����� )LQDQFLDO�5HYLHZ -DQXDU\��������� 6DIH�+DUERU�6WDWHPHQW Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on track,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences are changes in general economic, political or industry conditions; changes in monetary and fiscal policies; operational, systems or infrastructure failures; reliance on other companies to provide certain key components of business infrastructure; cybersecurity risks; whether Comerica may achieve opportunities for revenue enhancements and efficiency improvements under the GEAR Up initiative, or changes in the scope or assumptions underlying the GEAR Up initiative; Comerica's ability to maintain adequate sources of funding and liquidity; the effects of more stringent capital requirements; declines or other changes in the businesses or industries of Comerica's customers; unfavorable developments concerning credit quality; changes in regulation or oversight; heightened legislative and regulatory focus on cybersecurity and data privacy; fluctuations in interest rates and their impact on deposit pricing; transitions away from LIBOR towards new interest rate benchmarks; reductions in Comerica's credit rating; damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; the interdependence of financial service companies; the implementation of Comerica's strategies and business initiatives; changes in customer behavior; management's ability to maintain and expand customer relationships; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes, fires, droughts and floods; the impacts of future legislative, administrative or judicial changes to tax regulations; any future strategic acquisitions or divestitures; management's ability to retain key officers and employees; the impact of legal and regulatory proceedings or determinations; losses due to fraud; the effects of terrorist activities and other hostilities; changes in accounting standards; the critical nature of Comerica's accounting policies; controls and procedures failures; and the volatility of Comerica’s stock price. Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2018. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

)LQDQFLDO�3HUIRUPDQFH Strong results position us well for the future 7RWDO�5HYHQXH (IILFLHQF\�5DWLR� 'LOXWHG�(DUQLQJV� ���LQ�PLOOLRQV 3HU�6KDUH $7.87 68% $7.20 3,168 3,328 3,349 2,848 59% 54% 52% $4.14 $2.68 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 5HWXUQ�RQ�$VVHWV 5HWXUQ�RQ�(TXLW\� %RRN�9DOXH� $51.57 15.82% 16.39% $46.07 $46.89 1.75% 1.68% $44.47 1.04% 9.34% 0.67% 6.22% 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 1Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & a derivative contract tied to the conversion rate of Visa Class B shares Ⴠ 2Return on average common shareholders’ equity Ⴠ �Average common shareholders’ equity per share 3 )<���5HVXOWV Strong loan growth, record revenue, cost control & capital management .H\�<R< 3HUIRUPDQFH�'ULYHUV �PLOOLRQV��H[FHSW�SHU�VKDUH�GDWD ���� ���� &KDQJH ƒ /RDQV�LQFUHDVHG��� $YHUDJH�ORDQV $50,511 $48,766 $1,745 ƒ 'HSRVLWV�UHODWLYHO\�VWDEOH $YHUDJH�GHSRVLWV 55,481 55,935 (454) ƒ 1HW�LQWHUHVW�LQFRPH�VWDEOH�ZLWK�� ORDQ�JURZWK� �KLJKHU�UDWHV�RIIVHW� 1HW�LQWHUHVW�LQFRPH $2,339 $2,352 $(13) E\�KLJKHU�IXQGLQJ�FRVWV 3URYLVLRQ�IRU�FUHGLW�ORVVHV 74 (1) 75 ƒ 3URYLVLRQ�LQFUHDVHG�IURP�YHU\�ORZ� 1RQLQWHUHVW�LQFRPH��� 1,010 976 34 OHYHO��UHIOHFWV�KLJKHU�(QHUJ\� UHVHUYHV� 1RQLQWHUHVW�H[SHQVHV� 1,743 1,794 (51) 3URYLVLRQ�IRU�LQFRPH�WD[ 334 300 34 ƒ 1RQLQWHUHVW�LQFRPH�JURZWK�OHG�E\� VWURQJ�FDUG�IHHV 1HW�LQFRPH 1,198 1,235 (37) ƒ � ([SHQVHV�ZHOO�FRQWUROOHG������� (DUQLQJV�SHU�VKDUH $7.87 $7.20 $0.67 LQFOXGHG����00�UHVWUXFWXULQJ� $YHUDJH�GLOXWHG�VKDUHV 151.3 170.5 (19.2) ƒ 7D[�LQFOXGHG�D����00�GHFUHDVH� 52(� 16.39% 15.82% LQ�GLVFUHWH�WD[�LWHPV 52$� 1.68 1.75 ƒ 5HSXUFKDVHG�����00�VKDUHV���� ����%�UHWXUQHG�WR�VKDUHKROGHUV� � (IILFLHQF\�5DWLR 51.82 53.56 �EX\EDFN� �GLYLGHQG FY19 compared to FY18 Ⴠ 1Includes loss related to repositioning of securities portfolio of $(20)MM FY18 & $(8)MM FY19 Ⴠ 2Includes gain/(loss) related to deferred comp plan of $9MM FY19 & $(2)MM FY18 (offset in noninterest expense) Ⴠ 3FY18 includes $53MM restructuring charge Ⴠ 4Diluted earnings per common share Ⴠ 5Return on average common shareholders’ equity Ⴠ 6Return on average assets Ⴠ 7Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & derivative contract tied to the conversion rate of Visa Class B shares Ⴠ 8Shares repurchased under share repurchase program 4

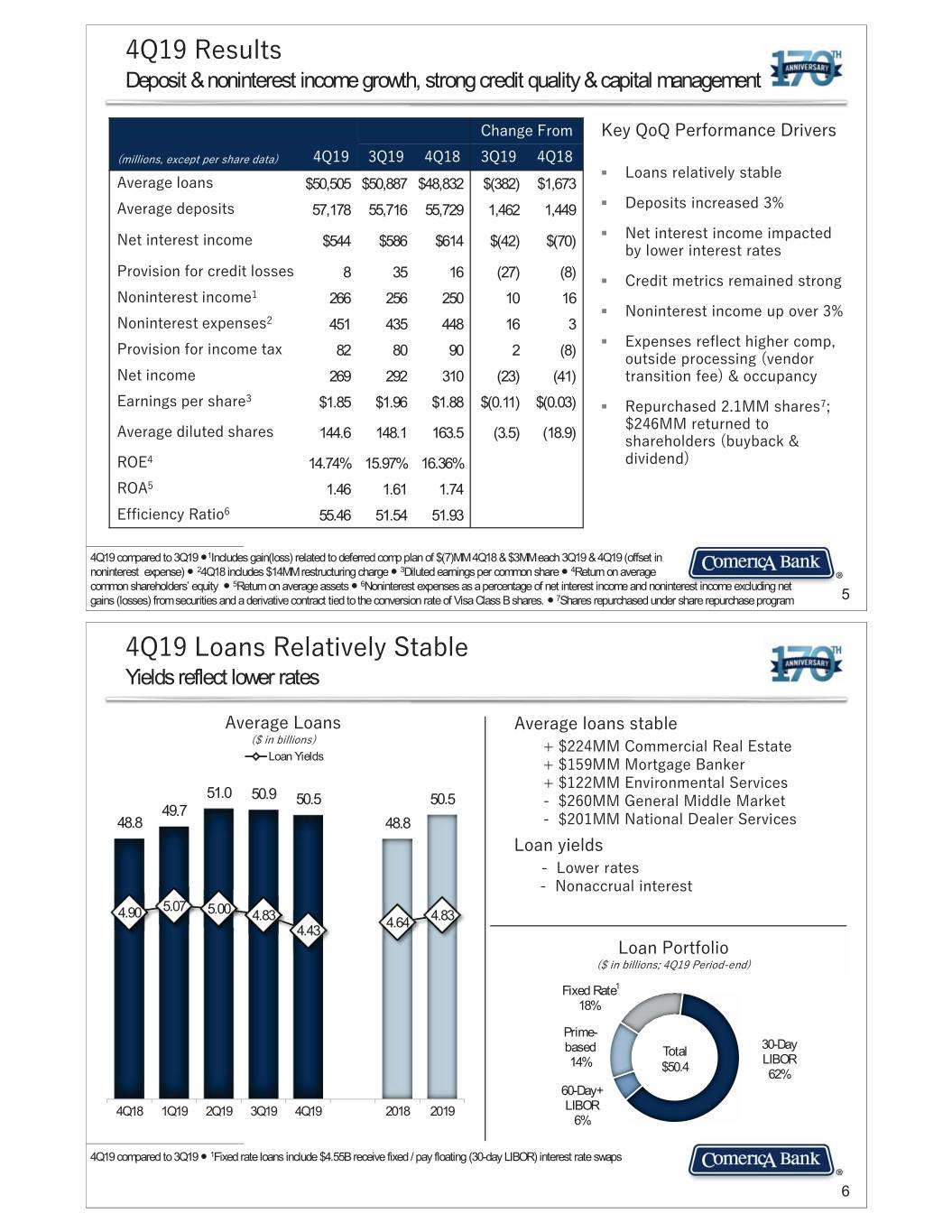

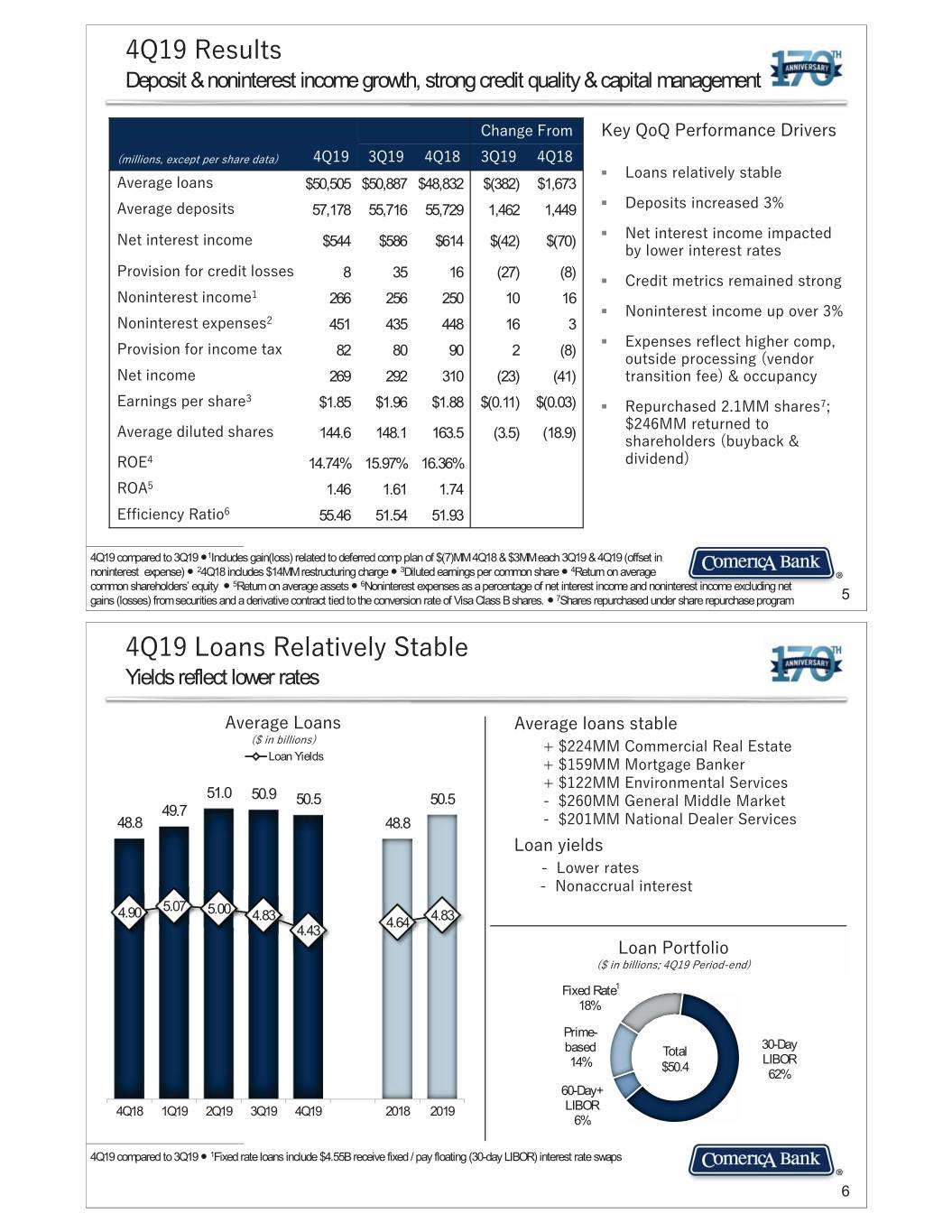

�4���5HVXOWV Deposit & noninterest income growth, strong credit quality & capital management &KDQJH�)URP .H\�4R4 3HUIRUPDQFH�'ULYHUV �PLOOLRQV��H[FHSW�SHU�VKDUH�GDWD �4�� �4�� �4�� �4�� �4�� ƒ /RDQV�UHODWLYHO\�VWDEOH $YHUDJH�ORDQV $50,505 $50,887 $48,832 $(382) $1,673 $YHUDJH�GHSRVLWV 57,178 55,716 55,729 1,462 1,449 ƒ 'HSRVLWV�LQFUHDVHG��� ƒ 1HW�LQWHUHVW�LQFRPH $544 $586 $614 $(42) $(70) 1HW�LQWHUHVW�LQFRPH�LPSDFWHG� E\�ORZHU�LQWHUHVW�UDWHV 3URYLVLRQ�IRU�FUHGLW�ORVVHV 8 35 16 (27) (8) ƒ &UHGLW�PHWULFV�UHPDLQHG�VWURQJ� 1RQLQWHUHVW�LQFRPH� 266 256 250 10 16 ƒ 1RQLQWHUHVW�LQFRPH�XS�RYHU �� 1RQLQWHUHVW�H[SHQVHV� 451 435 448 16 3 ƒ ([SHQVHV�UHIOHFW�KLJKHU�FRPS�� 3URYLVLRQ�IRU�LQFRPH�WD[ 82 80 90 2 (8) RXWVLGH�SURFHVVLQJ��YHQGRU� 1HW�LQFRPH 269 292 310 (23) (41) WUDQVLWLRQ�IHH � �RFFXSDQF\ � (DUQLQJV�SHU�VKDUH $1.85 $1.96 $1.88 $(0.11) $(0.03) ƒ 5HSXUFKDVHG����00�VKDUHV���� ����00�UHWXUQHG�WR� $YHUDJH�GLOXWHG�VKDUHV 144.6 148.1 163.5 (3.5) (18.9) VKDUHKROGHUV��EX\EDFN� � 52(� 14.74% 15.97% 16.36% GLYLGHQG 52$� 1.46 1.61 1.74 (IILFLHQF\�5DWLR� 55.46 51.54 51.93 4Q19 compared to 3Q19 Ⴠ1Includes gain(loss) related to deferred comp plan of $(7)MM 4Q18 & $3MM each 3Q19 & 4Q19 (offset in noninterest expense) Ⴠ 24Q18 includes $14MM restructuring charge Ⴠ 3Diluted earnings per common share Ⴠ 4Return on average common shareholders’ equity Ⴠ 5Return on average assets Ⴠ 6Noninterest expenses as a percentage of net interest income and noninterest income excluding net gains (losses) from securities and a derivative contract tied to the conversion rate of Visa Class B shares. Ⴠ 7Shares repurchased under share repurchase program 5 �4���/RDQV�5HODWLYHO\�6WDEOH Yields reflect lower rates $YHUDJH�/RDQV $YHUDJH�ORDQV�VWDEOH ���LQ�ELOOLRQV ������00�&RPPHUFLDO�5HDO�(VWDWH Loan Yields ������00�0RUWJDJH�%DQNHU ������00�(QYLURQPHQWDO�6HUYLFHV 51.0 50.9 50.5 50.5 � ����00�*HQHUDO�0LGGOH�0DUNHW 49.7 48.8 48.8 � ����00�1DWLRQDO�'HDOHU�6HUYLFHV /RDQ�\LHOGV � /RZHU�UDWHV� � 1RQDFFUXDO�LQWHUHVW� 5.07 4.90 5.00 4.83 4.83 4.64 4.43 /RDQ�3RUWIROLR ���LQ�ELOOLRQV���4���3HULRG�HQG Fixed Rate1 18% Prime- 30-Day based Total LIBOR 14% $50.4 62% 60-Day+ 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 LIBOR 6% 4Q19 compared to 3Q19 Ⴠ 1Fixed rate loans include $4.55B receive fixed / pay floating (30-day LIBOR) interest rate swaps 6

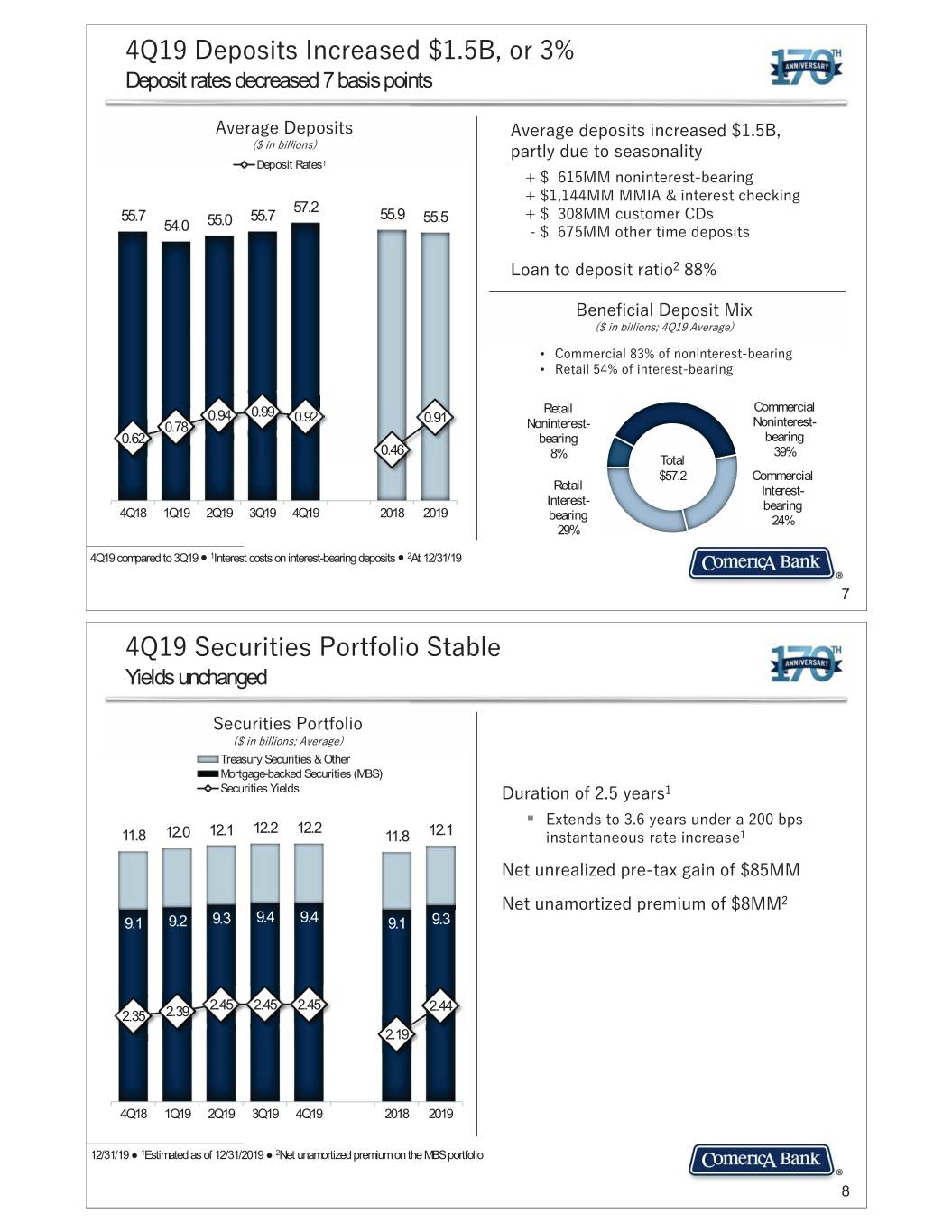

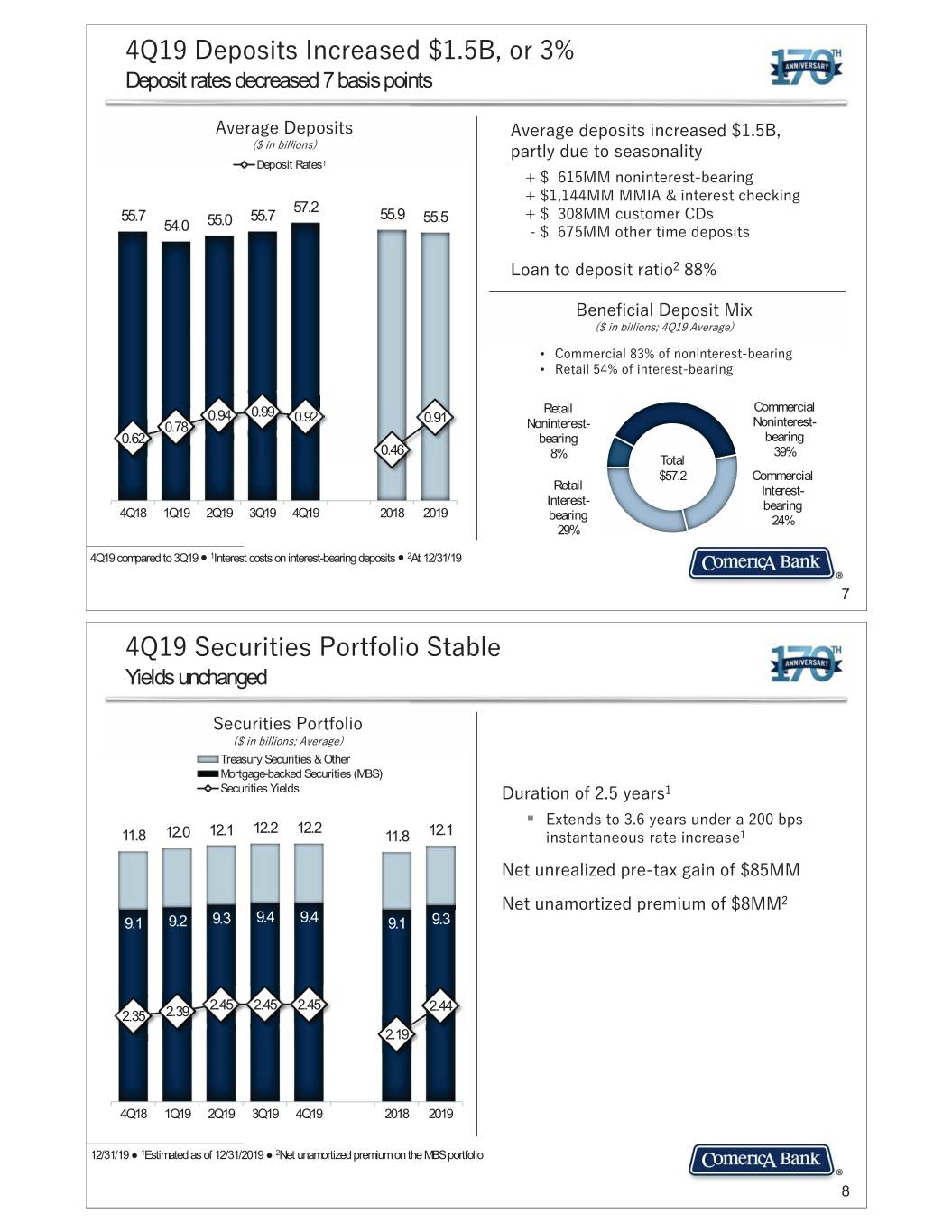

�4���'HSRVLWV�,QFUHDVHG�����%��RU��� Deposit rates decreased 7 basis points $YHUDJH�'HSRVLWV $YHUDJH�GHSRVLWV�LQFUHDVHG�����%�� ���LQ�ELOOLRQV SDUWO\�GXH�WR�VHDVRQDOLW\ Deposit Rates1 ��������00�QRQLQWHUHVW�EHDULQJ� ��������00�00,$� �LQWHUHVW�FKHFNLQJ 57.2 55.7 55.0 55.7 55.9 55.5 ��������00�FXVWRPHU�&'V 54.0 � ������00�RWKHU�WLPH�GHSRVLWV /RDQ�WR�GHSRVLW�UDWLR� ��� %HQHILFLDO�'HSRVLW�0L[� ���LQ�ELOOLRQV���4���$YHUDJH • &RPPHUFLDO�����RI�QRQLQWHUHVW�EHDULQJ • 5HWDLO�����RI�LQWHUHVW�EHDULQJ Retail Commercial 0.94 0.99 0.92 0.91 0.78 Noninterest- Noninterest- 0.62 bearing bearing 0.46 8% 39% Total $57.2 Commercial Retail Interest- Interest- bearing 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 bearing 24% 29% 4Q19 compared to 3Q19 Ⴠ 1Interest costs on interest-bearing deposits Ⴠ 2At 12/31/19 7 �4���6HFXULWLHV�3RUWIROLR�6WDEOH Yields unchanged 6HFXULWLHV�3RUWIROLR ���LQ�ELOOLRQV��$YHUDJH Treasury Securities & Other Mortgage-backed Securities (MBS) Securities Yields 'XUDWLRQ�RI�����\HDUV�� ƒ ([WHQGV�WR�����\HDUV�XQGHU�D�����ESV� 12.1 12.2 12.2 12.1 11.8 12.0 11.8 LQVWDQWDQHRXV�UDWH�LQFUHDVH� 1HW�XQUHDOL]HG�SUH�WD[�JDLQ�RI����00 1HW�XQDPRUWL]HG�SUHPLXP�RI���00� 9.1 9.2 9.3 9.4 9.4 9.1 9.3 2.45 2.45 2.45 2.44 2.35 2.39 2.19 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 12/31/19 Ɣ 1Estimated as of 12/31/2019 Ɣ 2Net unamortized premium on the MBS portfolio 8

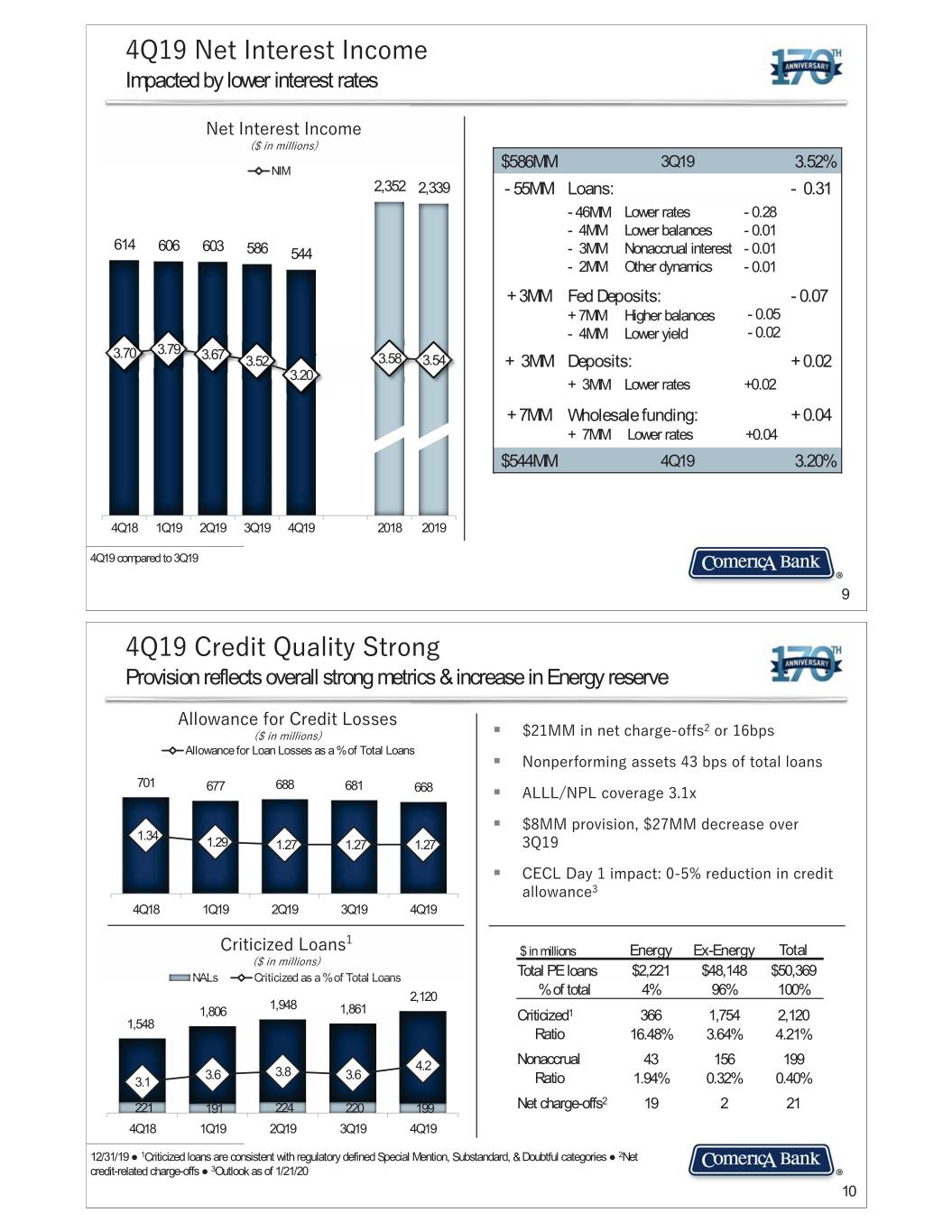

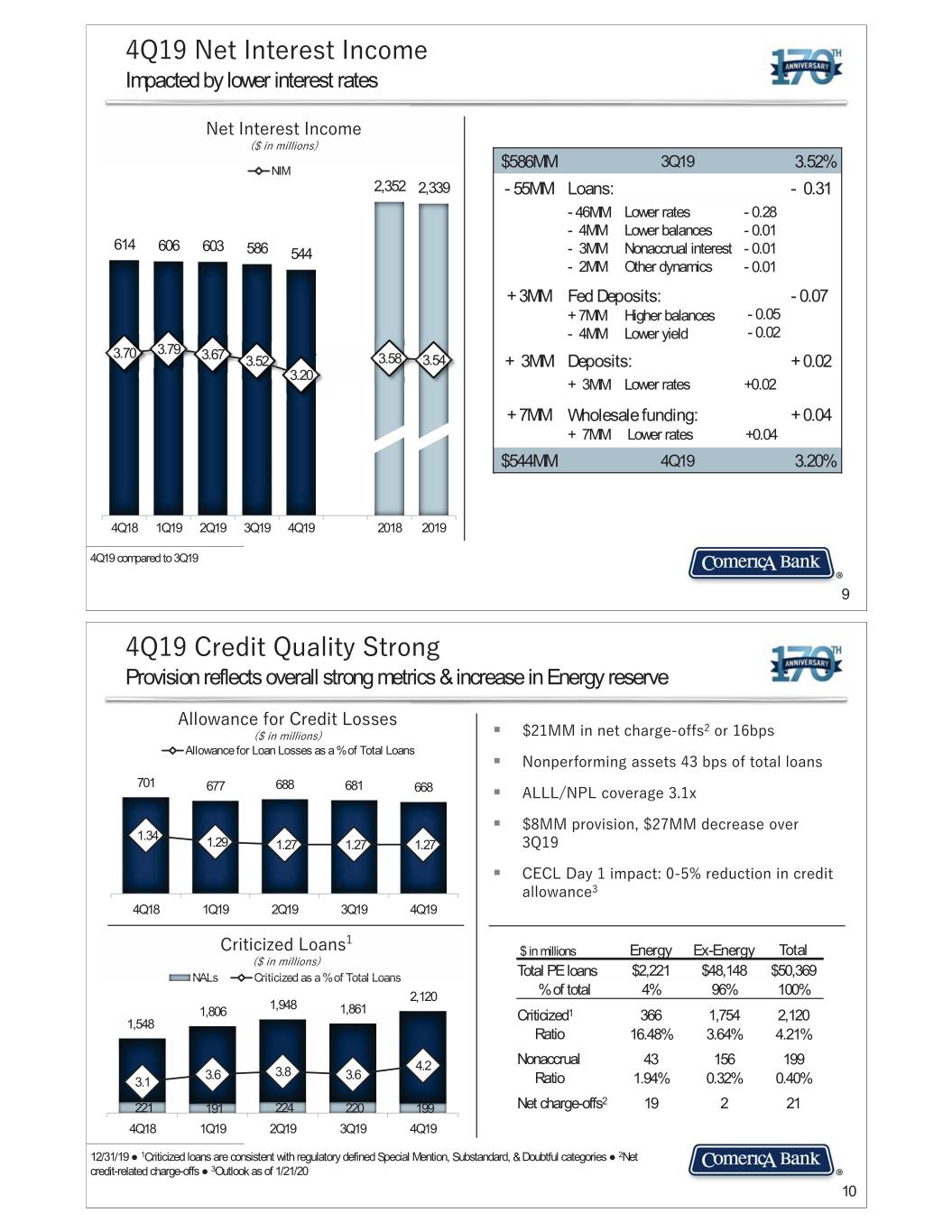

�4���1HW�,QWHUHVW�,QFRPH Impacted by lower interest rates 1HW�,QWHUHVW�,QFRPH ���LQ�PLOOLRQV $586MM 3Q19 3.52% NIM 2,352 2,339 - 55MM Loans: - 0.31 - 46MM Lower rates -0.28 - 4MM Lower balances -0.01 614 606 603 586 544 - 3MM Nonaccrual interest -0.01 - 2MM Other dynamics -0.01 + 3MM Fed Deposits: -0.07 + 7MM Higher balances -0.05 - 4MM Lower yield -0.02 3.70 3.79 3.67 3.52 3.58 3.54 + 3MM Deposits: + 0.02 3.20 + 3MM Lower rates +0.02 + 7MM Wholesale funding: + 0.04 + 7MM Lower rates +0.04 $544MM 4Q19 3.20% 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 4Q19 compared to 3Q19 9 �4���&UHGLW�4XDOLW\�6WURQJ Provision reflects overall strong metrics & increase in Energy reserve $OORZDQFH�IRU�&UHGLW�/RVVHV � ���LQ�PLOOLRQV ƒ ���00�LQ�QHW�FKDUJH�RIIV RU���ESV Allowance for Loan Losses as a % of Total Loans ƒ 1RQSHUIRUPLQJ�DVVHWV����ESV�RI�WRWDO�ORDQV 701 688 681 677 668 ƒ $///�13/�FRYHUDJH����[ ƒ ��00�SURYLVLRQ�����00�GHFUHDVH�RYHU� 1.34 1.29 1.27 1.27 1.27 �4�� ƒ &(&/�'D\���LPSDFW�������UHGXFWLRQ�LQ�FUHGLW� DOORZDQFH� 4Q18 1Q19 2Q19 3Q19 4Q19 � &ULWLFL]HG�/RDQV $ in millions Energy Ex-Energy Total ���LQ�PLOOLRQV NALsNALs CriticizedCriticizeda assa a % of TotalTotal LoaLoansns Total PE loans $2,221 $48,148 $50,369 2,120 % of total 4% 96% 100% 1,948 1,806 1,861 Criticized1 366 1,754 2,120 1,548 Ratio 16.48% 3.64% 4.21% 4.2 Nonaccrual 43 156 199 3.6 3.8 3.6 3.1 Ratio 1.94% 0.32% 0.40% 2 221 191 224 220 199 Net charge-offs 19 2 21 4Q18 1Q19 2Q19 3Q19 4Q19 12/31/19 Ɣ 1Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories Ɣ 2Net credit-related charge-offs Ɣ 3Outlook as of 1/21/20 10

�4���1RQLQWHUHVW�,QFRPH Increased $10MM, over 3% 1RQLQWHUHVW�,QFRPH� ���LQ�PLOOLRQV 1,010 976 ����00�&XVWRPHU�GHULYDWLYHV��RWKHU � 256 266 250 238 250 ����00�&RPPHUFLDO�OHQGLQJ�IHHV��V\QGLFDWLRQ � ��00�&DUG� ����00�*DLQ�RQ�VDOH�RI�+6$�EXVLQHVV��RWKHU 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 4Q19 compared to 3Q19 Ɣ 1Includes losses related to repositioning of securities portfolio as follows: $(20)MM in FY18; $(8)MM in 2Q19 11 �4���1RQLQWHUHVW�([SHQVH Controlling costs while investing for the future: 4Q19 efficiency ratio1 55% 1RQLQWHUHVW�([SHQVH� ���LQ�PLOOLRQV 1,794 1,743 ����00�6DODULHV� �EHQHILWV ��,QFHQWLYH�FRPS� �FRPPLVVLRQ 448 435 451 433 424 ��6WDII�LQVXUDQFH��VHDVRQDO � 7HFKQRORJ\�UHODWHG�FRQWLQJHQW�ODERU �����00�2XWVLGH�3URFHVVLQJ� �YHQGRU�WUDQVLWLRQ�IHH �����00�2FFXSDQF\��VHDVRQDO �����00�3URIHVVLRQDO�&RQVXOWLQJ��RWKHU 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 4Q19 compared to 3Q19 Ⴠ 1Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & a derivative contract tied to the conversion rate of Visa Class B sharesƔ 2FY18 included $53MM restructuring charge 12

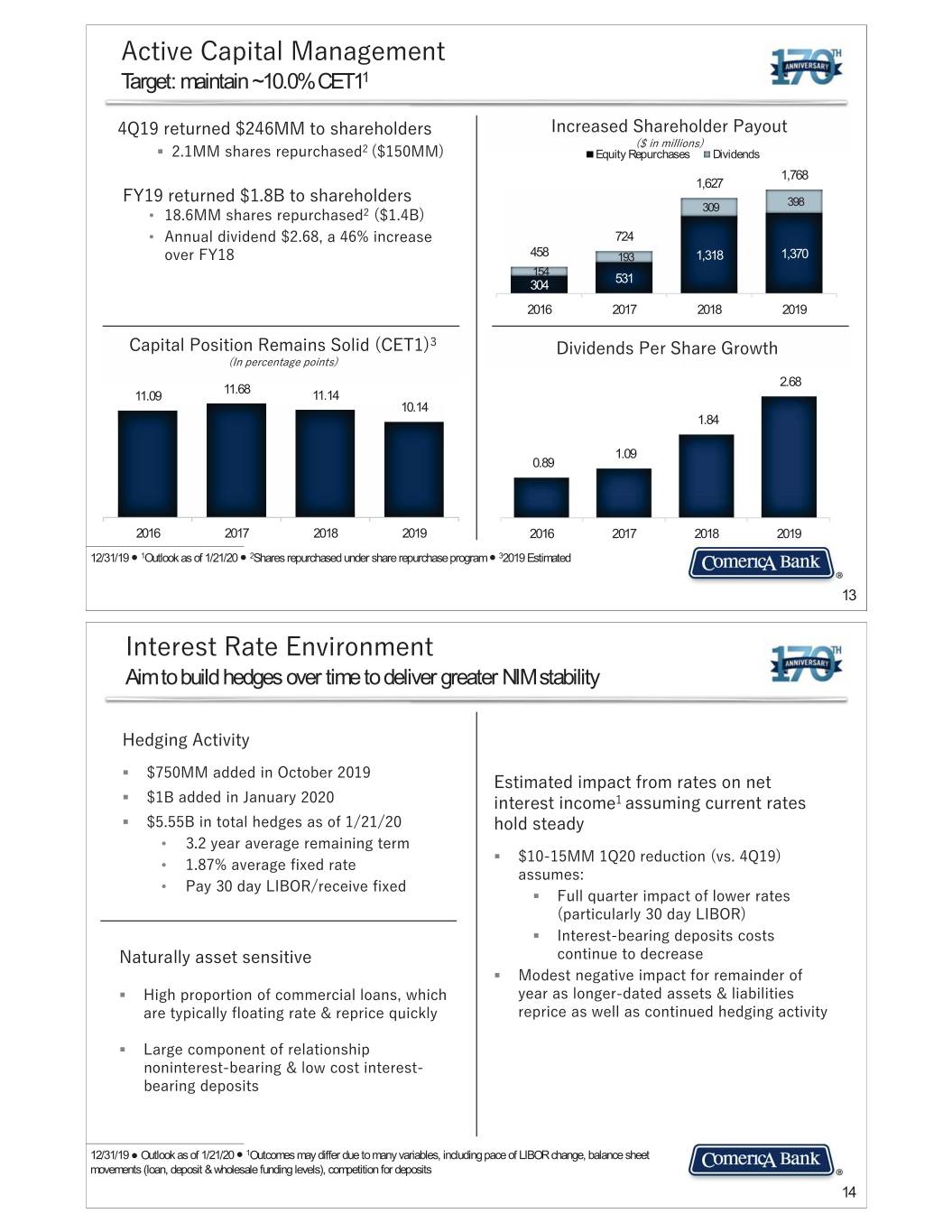

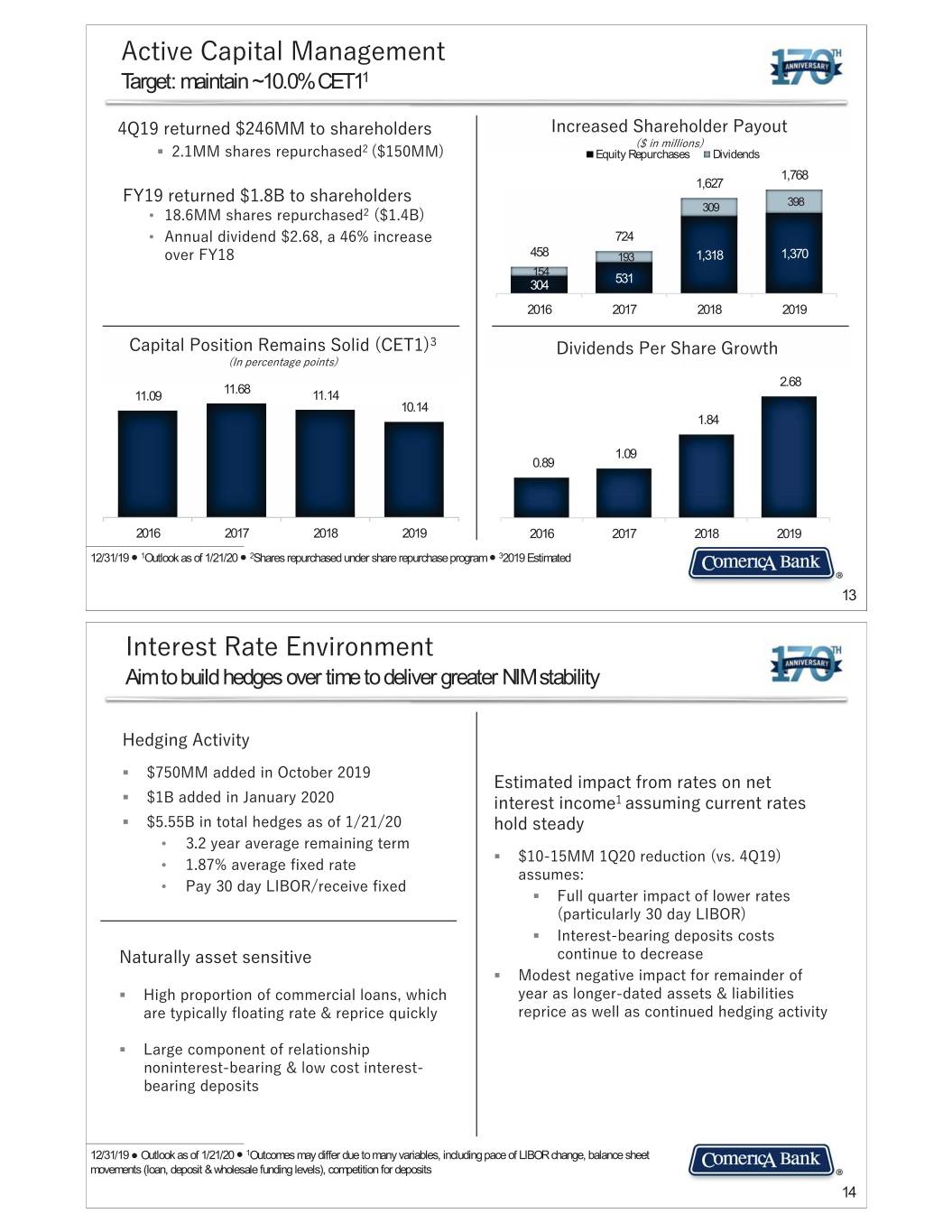

$FWLYH�&DSLWDO�0DQDJHPHQW Target: maintain ~10.0% CET11 �4���UHWXUQHG�����00�WR�VKDUHKROGHUV ,QFUHDVHG�6KDUHKROGHU�3D\RXW ���LQ�PLOOLRQV ƒ ���00�VKDUHV�UHSXUFKDVHG�������00 Equity Repurchases Dividends 1,768 1,627 )<���UHWXUQHG�����%�WR�VKDUHKROGHUV 309 398 • ����00�VKDUHV�UHSXUFKDVHG� �����% • $QQXDO�GLYLGHQG��������D�����LQFUHDVH� 724 RYHU�)<�� 458 193 1,318 1,370 154 531 304 2016 2017 2018 2019 &DSLWDO�3RVLWLRQ�5HPDLQV�6ROLG��&(7� � 'LYLGHQGV�3HU�6KDUH�*URZWK �,Q�SHUFHQWDJH�SRLQWV 2.68 11.68 11.09 11.14 10.14 1.84 1.09 0.89 2016 2017 2018 2019 2016 2017 2018 2019 12/31/19 Ⴠ 1Outlook as of 1/21/20 Ⴠ 2Shares repurchased under share repurchase program Ⴠ 32019 Estimated 13 ,QWHUHVW�5DWH�(QYLURQPHQW Aim to build hedges over time to deliver greater NIM stability +HGJLQJ�$FWLYLW\ ƒ ����00�DGGHG�LQ�2FWREHU����� (VWLPDWHG�LPSDFW�IURP�UDWHV�RQ�QHW� ƒ ��%�DGGHG�LQ�-DQXDU\������ LQWHUHVW�LQFRPH��DVVXPLQJ�FXUUHQW�UDWHV� ƒ �����%�LQ�WRWDO�KHGJHV�DV�RI�������� KROG�VWHDG\� • ����\HDU�DYHUDJH�UHPDLQLQJ�WHUP� ƒ ������00��4���UHGXFWLRQ��YV���4�� � • ������DYHUDJH�IL[HG�UDWH DVVXPHV� • 3D\����GD\�/,%25�UHFHLYH�IL[HG ƒ )XOO�TXDUWHU�LPSDFW�RI�ORZHU�UDWHV� �SDUWLFXODUO\����GD\�/,%25 ƒ ,QWHUHVW�EHDULQJ�GHSRVLWV�FRVWV� 1DWXUDOO\�DVVHW�VHQVLWLYH FRQWLQXH�WR�GHFUHDVH�� ƒ 0RGHVW�QHJDWLYH�LPSDFW�IRU�UHPDLQGHU�RI� ƒ +LJK�SURSRUWLRQ�RI�FRPPHUFLDO�ORDQV��ZKLFK� \HDU�DV�ORQJHU�GDWHG�DVVHWV� �OLDELOLWLHV�� DUH�W\SLFDOO\�IORDWLQJ�UDWH� �UHSULFH�TXLFNO\ UHSULFH�DV�ZHOO�DV�FRQWLQXHG�KHGJLQJ�DFWLYLW\� ƒ /DUJH�FRPSRQHQW�RI�UHODWLRQVKLS� QRQLQWHUHVW�EHDULQJ� �ORZ�FRVW�LQWHUHVW� EHDULQJ�GHSRVLWV� 12/31/19 Ɣ Outlook as of 1/21/20 Ⴠ 1Outcomes may differ due to many variables, including pace of LIBOR change, balance sheet movements (loan, deposit & wholesale funding levels), competition for deposits 14

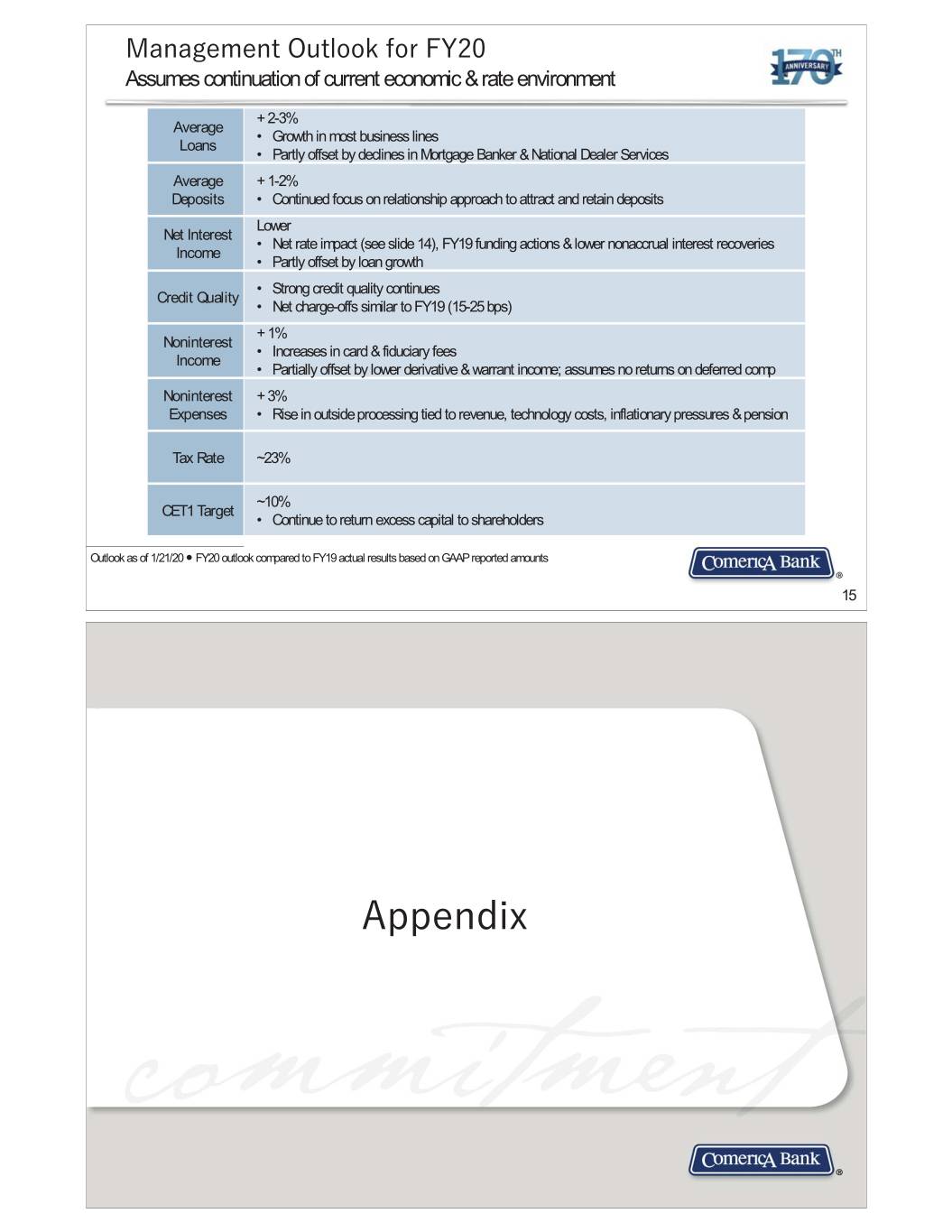

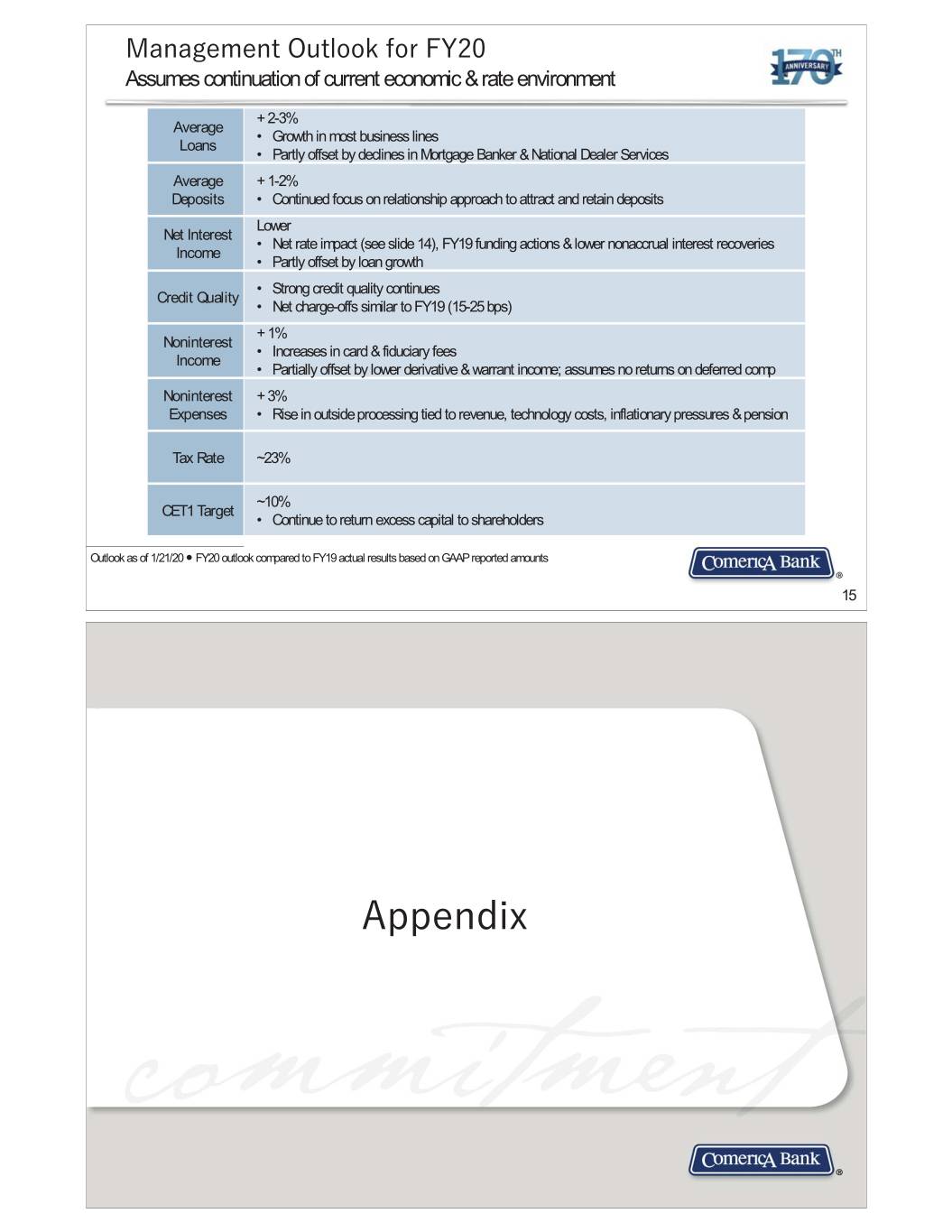

0DQDJHPHQW�2XWORRN�IRU�)<�� Assumes continuation of current economic & rate environment + 2-3% Average • Growth in most business lines Loans • Partly offset by declines in Mortgage Banker & National Dealer Services Average + 1-2% Deposits • Continued focus on relationship approach to attract and retain deposits Lower Net Interest • Net rate impact (see slide 14), FY19 funding actions & lower nonaccrual interest recoveries Income • Partly offset by loan growth • Strong credit quality continues Credit Quality • Net charge-offs similar to FY19 (15-25 bps) + 1% Noninterest • Increases in card & fiduciary fees Income • Partially offset by lower derivative & warrant income; assumes no returns on deferred comp Noninterest + 3% Expenses • Rise in outside processing tied to revenue, technology costs, inflationary pressures & pension Tax Rate ~23% ~10% CET1 Target • Continue to return excess capital to shareholders Outlook as of 1/21/20 Ⴠ FY20 outlook compared to FY19 actual results based on GAAP reported amounts 15 $SSHQGL[

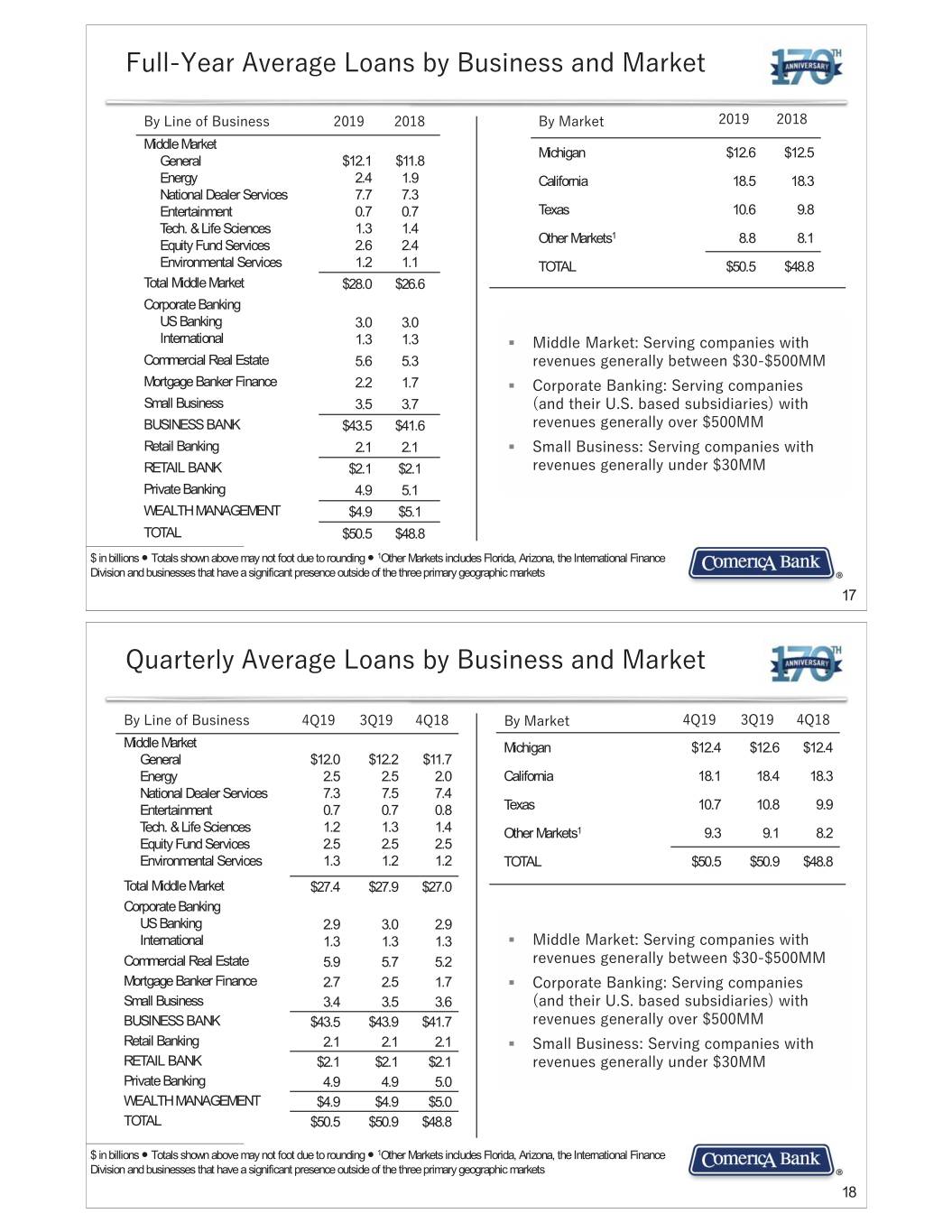

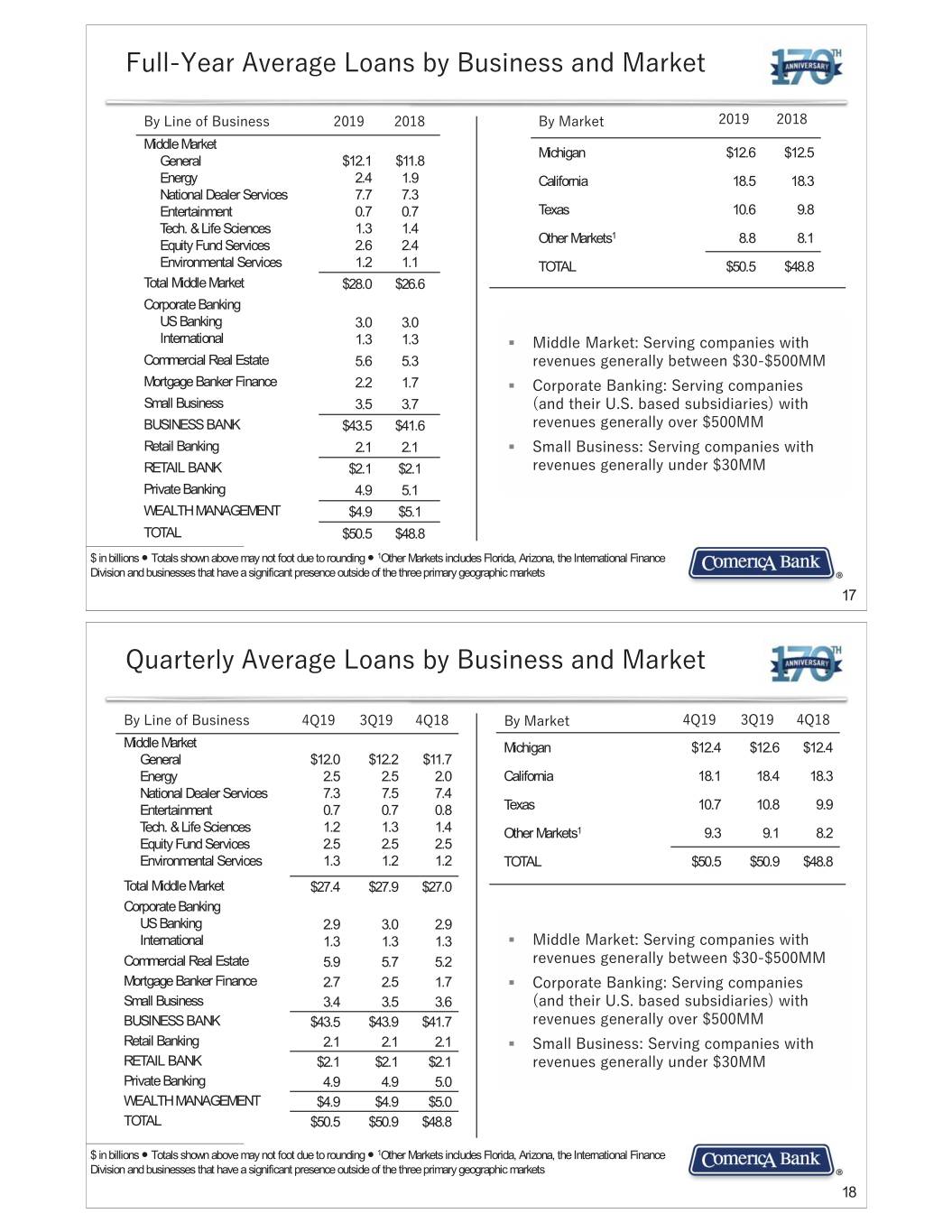

)XOO�<HDU�$YHUDJH�/RDQV�E\�%XVLQHVV�DQG�0DUNHW� %\�/LQH�RI�%XVLQHVV ���� ���� %\�0DUNHW ���� ���� Middle Market Michigan $12.6 $12.5 General $12.1 $11.8 Energy 2.4 1.9 California 18.5 18.3 National Dealer Services 7.7 7.3 Entertainment 0.7 0.7 Texas 10.6 9.8 Tech. & Life Sciences 1.3 1.4 Other Markets1 8.8 8.1 Equity Fund Services 2.6 2.4 Environmental Services 1.2 1.1 TOTAL $50.5 $48.8 Total Middle Market $28.0 $26.6 Corporate Banking US Banking 3.0 3.0 International 1.3 1.3 ƒ 0LGGOH�0DUNHW��6HUYLQJ�FRPSDQLHV�ZLWK� Commercial Real Estate 5.6 5.3 UHYHQXHV�JHQHUDOO\�EHWZHHQ���������00 Mortgage Banker Finance 2.2 1.7 ƒ &RUSRUDWH�%DQNLQJ��6HUYLQJ�FRPSDQLHV� Small Business 3.5 3.7 �DQG�WKHLU�8�6��EDVHG�VXEVLGLDULHV �ZLWK� BUSINESS BANK $43.5 $41.6 UHYHQXHV�JHQHUDOO\�RYHU�����00 Retail Banking 2.1 2.1 ƒ 6PDOO�%XVLQHVV��6HUYLQJ�FRPSDQLHV�ZLWK� RETAIL BANK $2.1 $2.1 UHYHQXHV�JHQHUDOO\�XQGHU����00 Private Banking 4.9 5.1 WEALTH MANAGEMENT $4.9 $5.1 TOTAL $50.5 $48.8 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets 17 4XDUWHUO\�$YHUDJH�/RDQV�E\�%XVLQHVV�DQG�0DUNHW� %\�/LQH�RI�%XVLQHVV �4�� �4�� �4�� %\�0DUNHW �4�� �4�� �4�� Middle Market Michigan $12.4 $12.6 $12.4 General $12.0 $12.2 $11.7 Energy 2.5 2.5 2.0 California 18.1 18.4 18.3 National Dealer Services 7.3 7.5 7.4 Entertainment 0.7 0.7 0.8 Texas 10.7 10.8 9.9 Tech. & Life Sciences 1.2 1.3 1.4 Other Markets1 9.3 9.1 8.2 Equity Fund Services 2.5 2.5 2.5 Environmental Services 1.3 1.2 1.2 TOTAL $50.5 $50.9 $48.8 Total Middle Market $27.4 $27.9 $27.0 Corporate Banking US Banking 2.9 3.0 2.9 International 1.3 1.3 1.3 ƒ 0LGGOH�0DUNHW��6HUYLQJ�FRPSDQLHV�ZLWK� Commercial Real Estate 5.9 5.7 5.2 UHYHQXHV�JHQHUDOO\�EHWZHHQ���������00 Mortgage Banker Finance 2.7 2.5 1.7 ƒ &RUSRUDWH�%DQNLQJ��6HUYLQJ�FRPSDQLHV� Small Business 3.4 3.5 3.6 �DQG�WKHLU�8�6��EDVHG�VXEVLGLDULHV �ZLWK� BUSINESS BANK $43.5 $43.9 $41.7 UHYHQXHV�JHQHUDOO\�RYHU�����00 Retail Banking 2.1 2.1 2.1 ƒ 6PDOO�%XVLQHVV��6HUYLQJ�FRPSDQLHV�ZLWK� RETAIL BANK $2.1 $2.1 $2.1 UHYHQXHV�JHQHUDOO\�XQGHU����00 Private Banking 4.9 4.9 5.0 WEALTH MANAGEMENT $4.9 $4.9 $5.0 TOTAL $50.5 $50.9 $48.8 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets 18

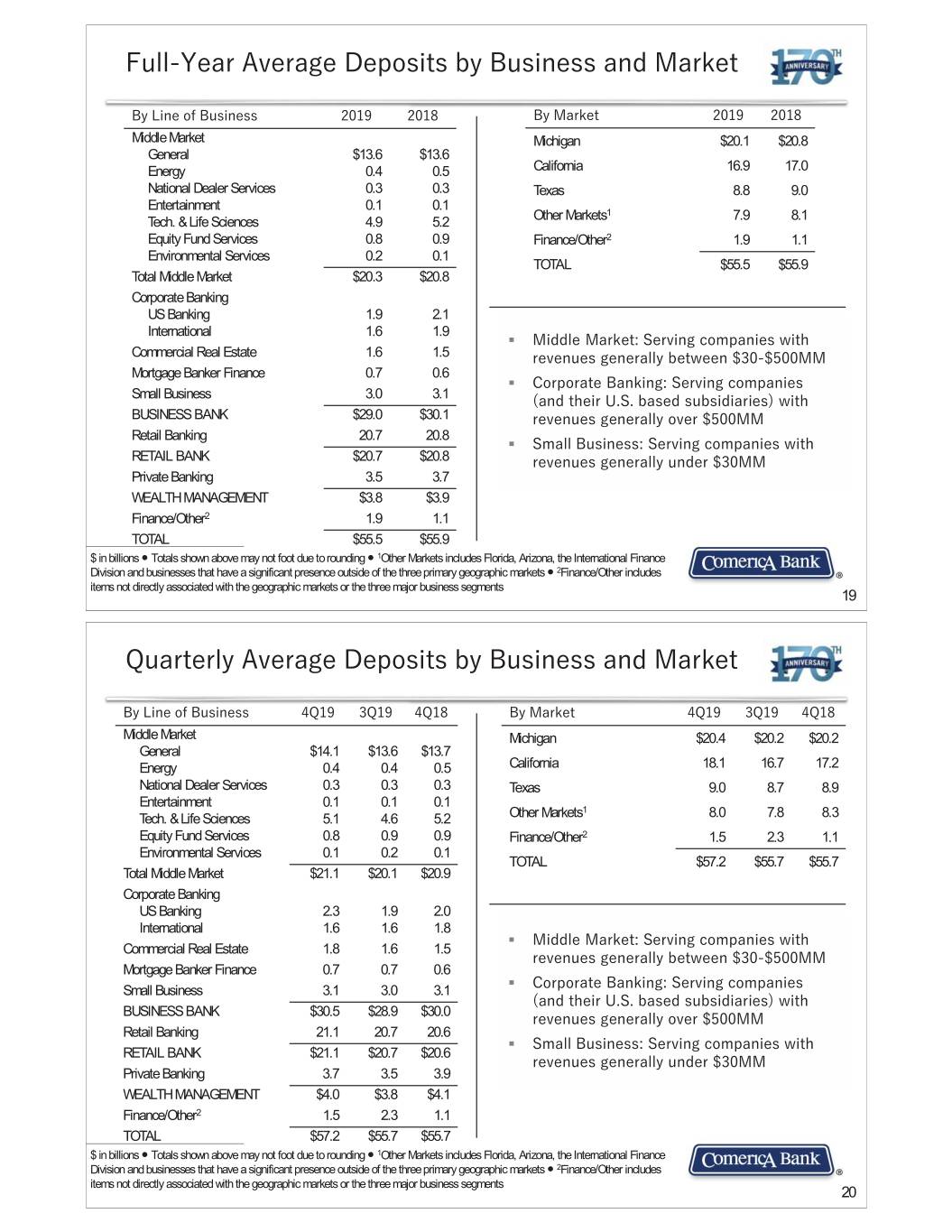

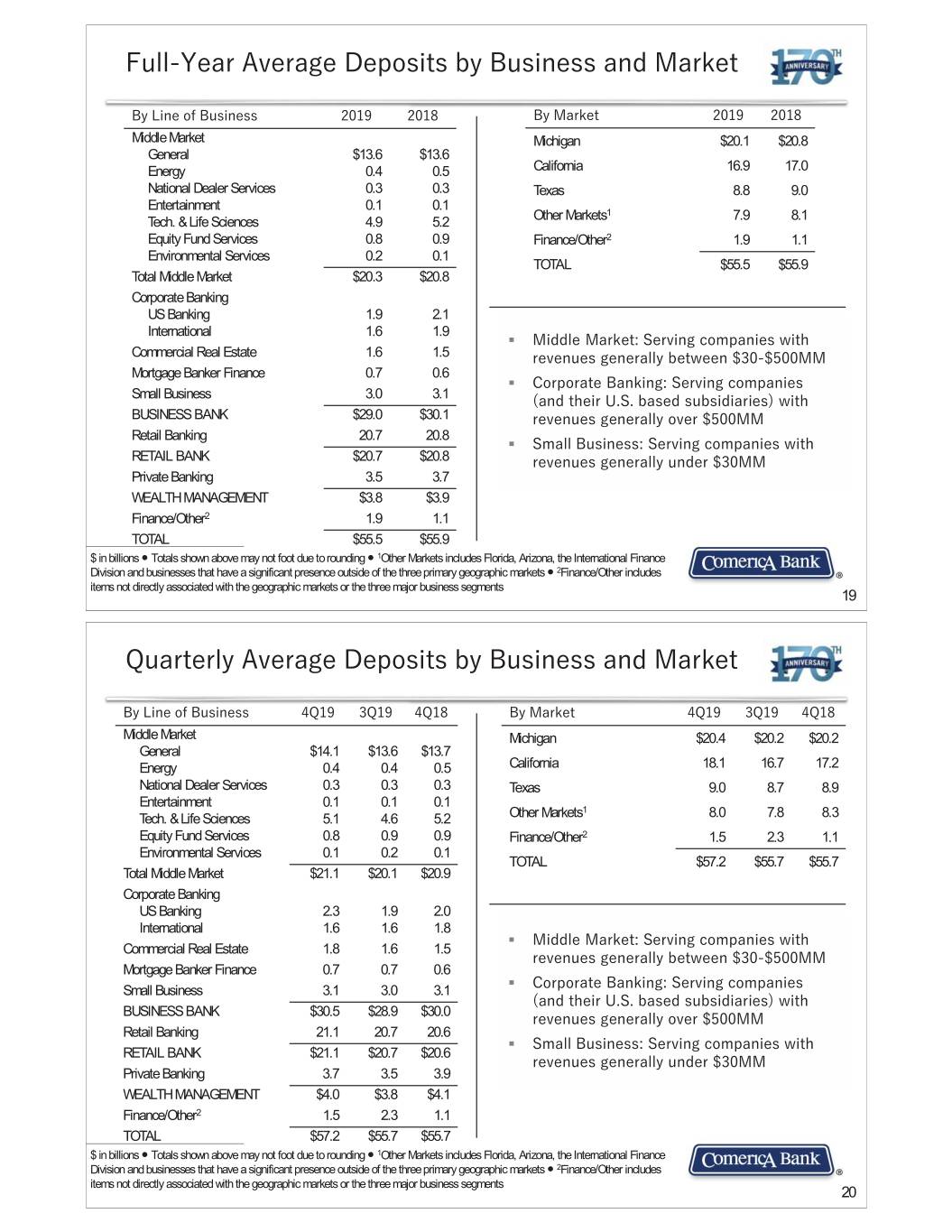

)XOO�<HDU�$YHUDJH�'HSRVLWV�E\�%XVLQHVV�DQG�0DUNHW %\�/LQH�RI�%XVLQHVV ���� ���� %\�0DUNHW ���� ���� Middle Market Michigan $20.1 $20.8 General $13.6 $13.6 Energy 0.4 0.5 California 16.9 17.0 National Dealer Services 0.3 0.3 Texas 8.8 9.0 Entertainment 0.1 0.1 1 Tech. & Life Sciences 4.9 5.2 Other Markets 7.9 8.1 Equity Fund Services 0.8 0.9 Finance/Other2 1.9 1.1 Environmental Services 0.2 0.1 TOTAL $55.5 $55.9 Total Middle Market $20.3 $20.8 Corporate Banking US Banking 1.9 2.1 International 1.6 1.9 ƒ 0LGGOH�0DUNHW��6HUYLQJ�FRPSDQLHV�ZLWK� Commercial Real Estate 1.6 1.5 UHYHQXHV�JHQHUDOO\�EHWZHHQ���������00 Mortgage Banker Finance 0.7 0.6 ƒ &RUSRUDWH�%DQNLQJ��6HUYLQJ�FRPSDQLHV� Small Business 3.0 3.1 �DQG�WKHLU�8�6��EDVHG�VXEVLGLDULHV �ZLWK� BUSINESS BANK $29.0 $30.1 UHYHQXHV�JHQHUDOO\�RYHU�����00 Retail Banking 20.7 20.8 ƒ 6PDOO�%XVLQHVV��6HUYLQJ�FRPSDQLHV�ZLWK� RETAIL BANK $20.7 $20.8 UHYHQXHV�JHQHUDOO\�XQGHU����00 Private Banking 3.5 3.7 WEALTH MANAGEMENT $3.8 $3.9 Finance/Other2 1.9 1.1 TOTAL $55.5 $55.9 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Ⴠ 2Finance/Other includes items not directly associated with the geographic markets or the three major business segments 19 4XDUWHUO\�$YHUDJH�'HSRVLWV�E\�%XVLQHVV�DQG�0DUNHW %\�/LQH�RI�%XVLQHVV �4�� �4�� �4�� %\�0DUNHW �4�� �4�� �4�� Middle Market Michigan $20.4 $20.2 $20.2 General $14.1 $13.6 $13.7 Energy 0.4 0.4 0.5 California 18.1 16.7 17.2 National Dealer Services 0.3 0.3 0.3 Texas 9.0 8.7 8.9 Entertainment 0.1 0.1 0.1 1 Tech. & Life Sciences 5.1 4.6 5.2 Other Markets 8.0 7.8 8.3 Equity Fund Services 0.8 0.9 0.9 Finance/Other2 1.5 2.3 1.1 Environmental Services 0.1 0.2 0.1 TOTAL $57.2 $55.7 $55.7 Total Middle Market $21.1 $20.1 $20.9 Corporate Banking US Banking 2.3 1.9 2.0 International 1.6 1.6 1.8 ƒ 0LGGOH�0DUNHW��6HUYLQJ�FRPSDQLHV�ZLWK� Commercial Real Estate 1.8 1.6 1.5 UHYHQXHV�JHQHUDOO\�EHWZHHQ���������00 Mortgage Banker Finance 0.7 0.7 0.6 Small Business 3.1 3.0 3.1 ƒ &RUSRUDWH�%DQNLQJ��6HUYLQJ�FRPSDQLHV� �DQG�WKHLU�8�6��EDVHG�VXEVLGLDULHV �ZLWK� BUSINESS BANK $30.5 $28.9 $30.0 UHYHQXHV�JHQHUDOO\�RYHU�����00 Retail Banking 21.1 20.7 20.6 ƒ 6PDOO�%XVLQHVV��6HUYLQJ�FRPSDQLHV�ZLWK� RETAIL BANK $21.1 $20.7 $20.6 UHYHQXHV�JHQHUDOO\�XQGHU����00 Private Banking 3.7 3.5 3.9 WEALTH MANAGEMENT $4.0 $3.8 $4.1 Finance/Other2 1.5 2.3 1.1 TOTAL $57.2 $55.7 $55.7 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Ⴠ 2Finance/Other includes items not directly associated with the geographic markets or the three major business segments 20

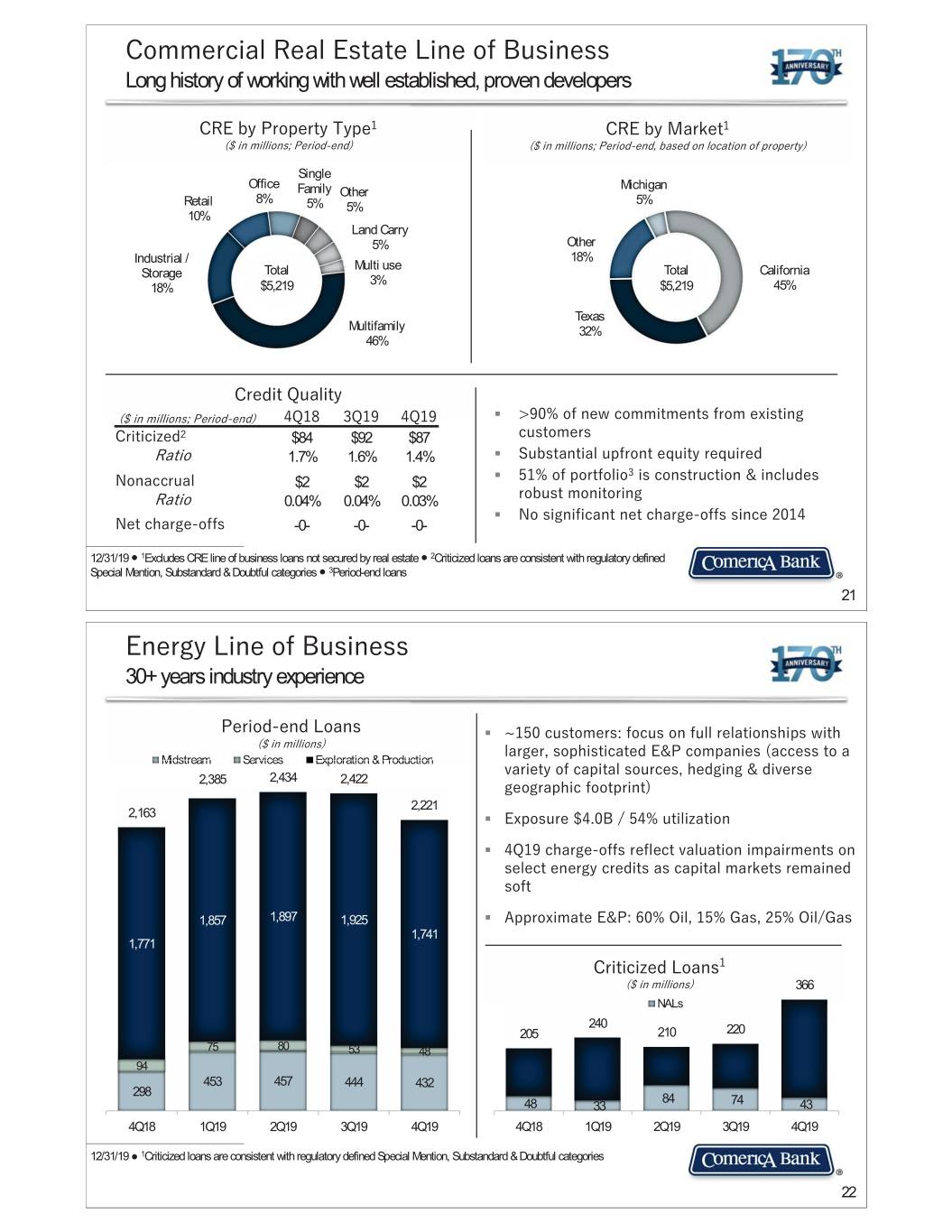

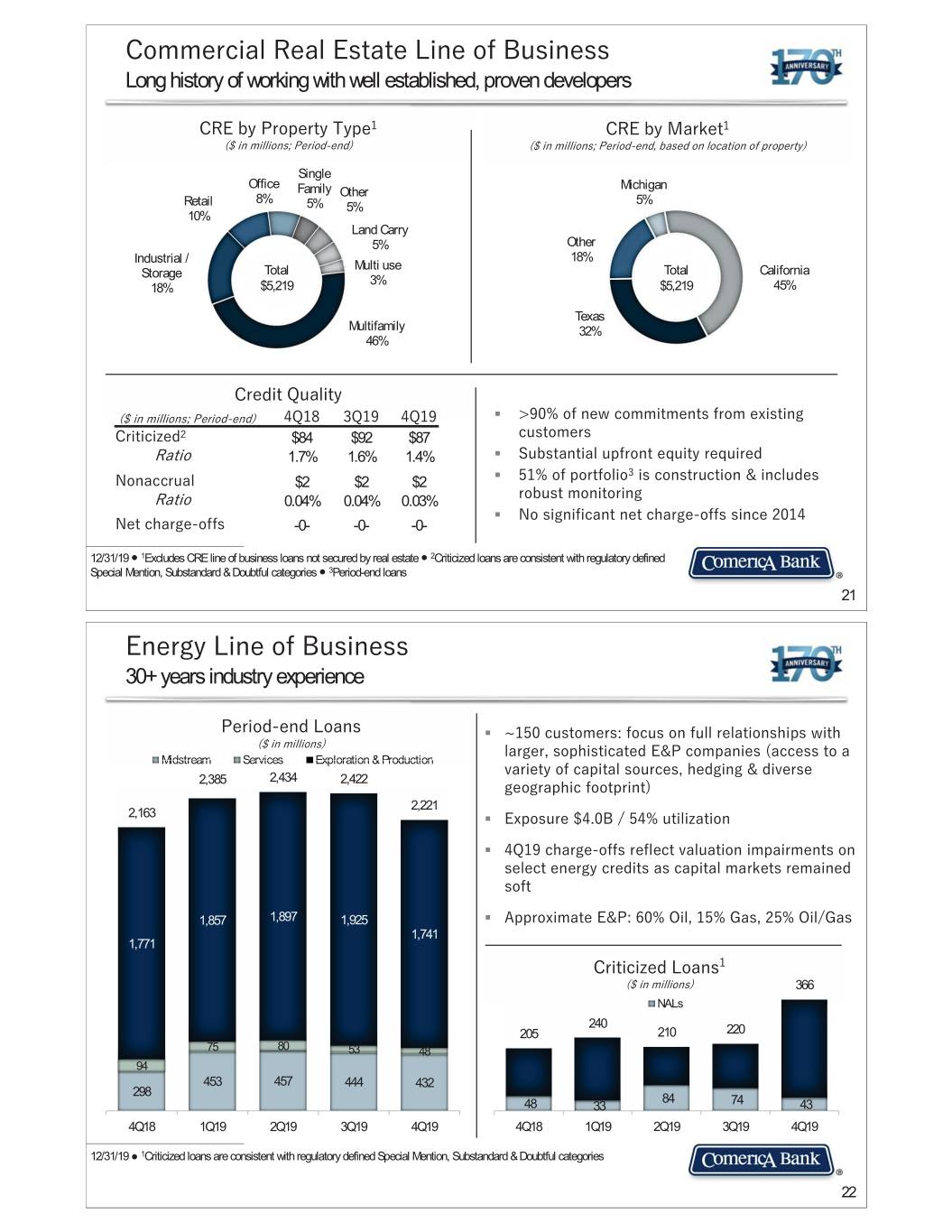

&RPPHUFLDO�5HDO�(VWDWH�/LQH�RI�%XVLQHVV Long history of working with well established, proven developers &5(�E\�3URSHUW\�7\SH� &5(�E\�0DUNHW� ���LQ�PLOOLRQV��3HULRG�HQG ���LQ�PLOOLRQV��3HULRG�HQG��EDVHG�RQ�ORFDWLRQ�RI�SURSHUW\ Single Office Michigan Family Other 8% 5% Retail 5% 5% 10% Land Carry 5% Other Industrial / 18% Multi use Storage Total Total California 3% 18% $5,219 $5,219 45% Texas Multifamily 32% 46% &UHGLW�4XDOLW\� ���LQ�PLOOLRQV��3HULRG�HQG �4�� �4�� �4�� ƒ !����RI�QHZ�FRPPLWPHQWV�IURP�H[LVWLQJ� &ULWLFL]HG� $84 $92 $87 FXVWRPHUV 5DWLR 1.7% 1.6% 1.4% ƒ 6XEVWDQWLDO�XSIURQW�HTXLW\�UHTXLUHG � 1RQDFFUXDO $2 $2 $2 ƒ ����RI�SRUWIROLR LV�FRQVWUXFWLRQ� �LQFOXGHV� 5DWLR 0.04% 0.04% 0.03% UREXVW�PRQLWRULQJ ƒ 1R�VLJQLILFDQW�QHW�FKDUJH�RIIV�VLQFH����� 1HW�FKDUJH�RIIV -0- -0- -0- 12/31/19 Ⴠ 1Excludes CRE line of business loans not secured by real estate Ⴠ 2Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories Ⴠ 3Period-end loans 21 (QHUJ\�/LQH�RI�%XVLQHVV 30+ years industry experience 3HULRG�HQG�/RDQV� ƒ f����FXVWRPHUV��IRFXV�RQ�IXOO�UHODWLRQVKLSV�ZLWK� ���LQ�PLOOLRQV ODUJHU��VRSKLVWLFDWHG�( 3�FRPSDQLHV��DFFHVV�WR�D� Midstream Services Exploration & Production YDULHW\�RI�FDSLWDO�VRXUFHV��KHGJLQJ� �GLYHUVH� 2,385 2,434 2,422 JHRJUDSKLF�IRRWSULQW 2,221 2,163 ƒ ([SRVXUH�����%�������XWLOL]DWLRQ� ƒ �4���FKDUJH�RIIV�UHIOHFW�YDOXDWLRQ�LPSDLUPHQWV�RQ� VHOHFW�HQHUJ\�FUHGLWV�DV�FDSLWDO�PDUNHWV�UHPDLQHGMixed � 18% VRIW 1,857 1,897 1,925 ƒ $SSUR[LPDWH�( 3������2LO������*DV������2LO�*DV 1,741 1,771 &ULWLFL]HG�/RDQV� ���LQ�PLOOLRQV 366 NALs 240 205 210 220 75 80 53 48 94 453 457 444 432 298 84 48 33 74 43 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 12/31/19 Ɣ 1Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories 22

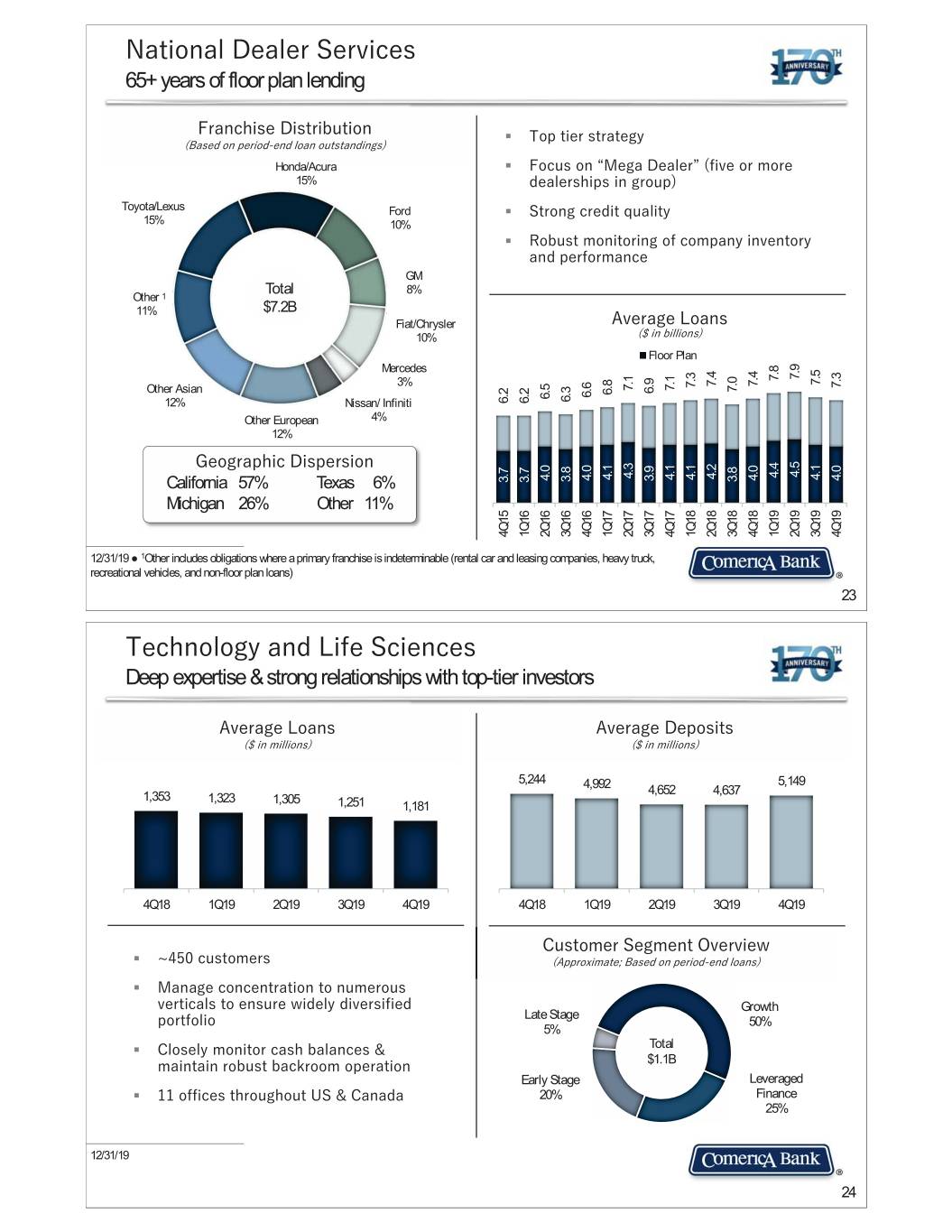

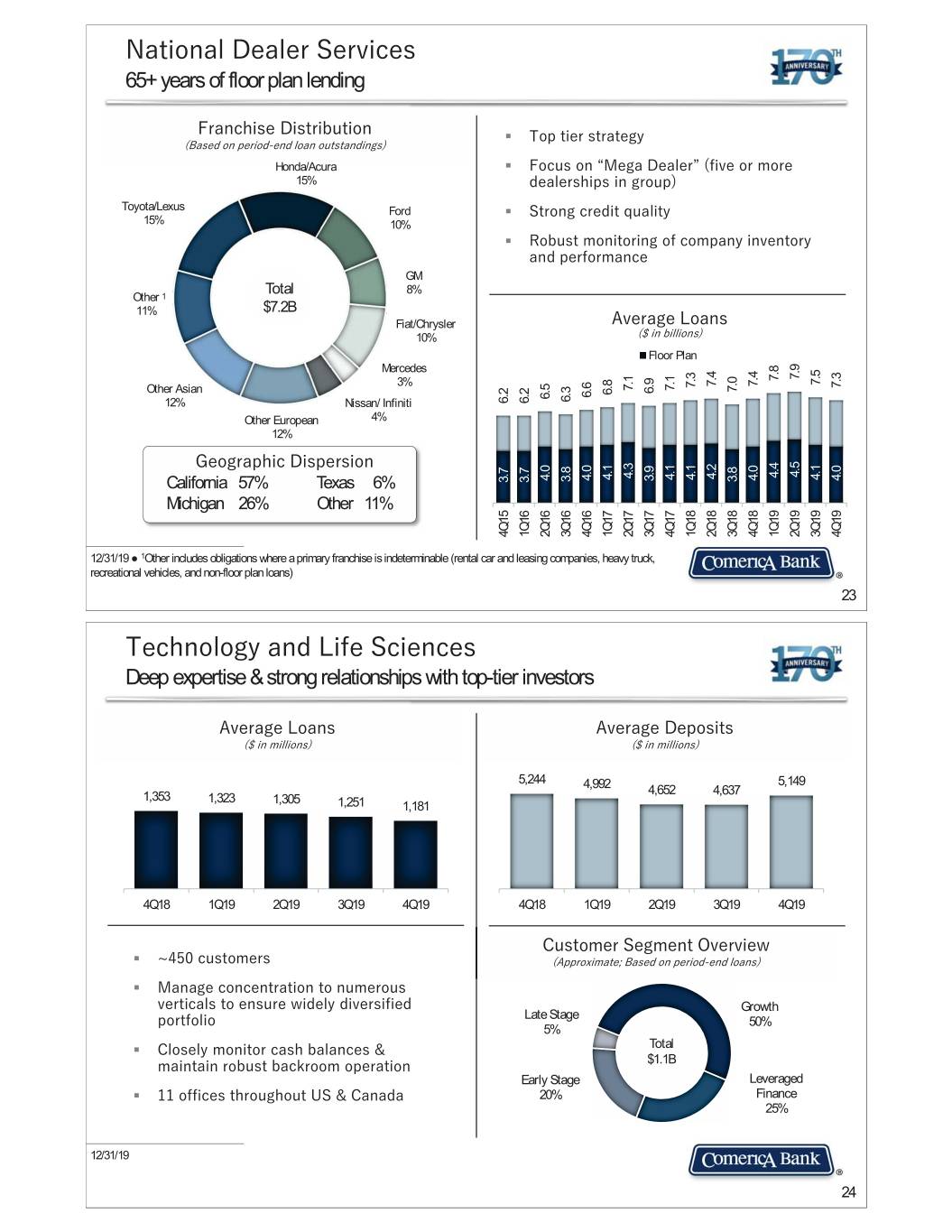

1DWLRQDO�'HDOHU�6HUYLFHV 65+ years of floor plan lending )UDQFKLVH�'LVWULEXWLRQ ƒ 7RS�WLHU�VWUDWHJ\ �%DVHG�RQ�SHULRG�HQG�ORDQ�RXWVWDQGLQJV Honda/Acura ƒ )RFXV�RQ�n0HJD�'HDOHU|��ILYH�RU�PRUH� 15% GHDOHUVKLSV�LQ�JURXS Toyota/Lexus Ford ƒ 6WURQJ�FUHGLW�TXDOLW\ 15% 10% ƒ 5REXVW�PRQLWRULQJ�RI�FRPSDQ\�LQYHQWRU\� DQG�SHUIRUPDQFH GM Total 8% Other 1 11% $7.2B Fiat/Chrysler $YHUDJH�/RDQV 10% ���LQ�ELOOLRQV Floor Plan Mercedes 7.9 7.8 7.5 7.4 7.4 7.3 3% 7.3 7.1 7.1 7.0 6.9 Other Asian 6.8 6.6 6.5 6.3 12% Nissan/ Infiniti 6.2 6.2 Other European 4% 12% *HRJUDSKLF�'LVSHUVLRQ 4.5 4.4 4.3 4.2 4.1 4.1 4.1 4.1 4.0 4.0 4.0 4.0 3.9 3.8 3.8 California 57% Texas 6% 3.7 3.7 Michigan 26% Other 11% 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 12/31/19 Ɣ 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans) 23 7HFKQRORJ\�DQG�/LIH�6FLHQFHV Deep expertise & strong relationships with top-tier investors $YHUDJH�/RDQV $YHUDJH�'HSRVLWV ���LQ�PLOOLRQV ���LQ�PLOOLRQV 5,244 5,149 4,992 4,652 4,637 1,353 1,323 1,305 1,251 1,181 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 &XVWRPHU�6HJPHQW�2YHUYLHZ ƒ f����FXVWRPHUV� �$SSUR[LPDWH��%DVHG�RQ�SHULRG�HQG�ORDQV ƒ 0DQDJH�FRQFHQWUDWLRQ�WR�QXPHURXV� YHUWLFDOV�WR�HQVXUH�ZLGHO\�GLYHUVLILHG� Growth Late Stage SRUWIROLR 50% 5% ƒ &ORVHO\�PRQLWRU�FDVK�EDODQFHV� � Total PDLQWDLQ�UREXVW�EDFNURRP�RSHUDWLRQ $1.1B Early Stage Leveraged ƒ ���RIILFHV�WKURXJKRXW�86� �&DQDGD 20% Finance 25% 12/31/19 24

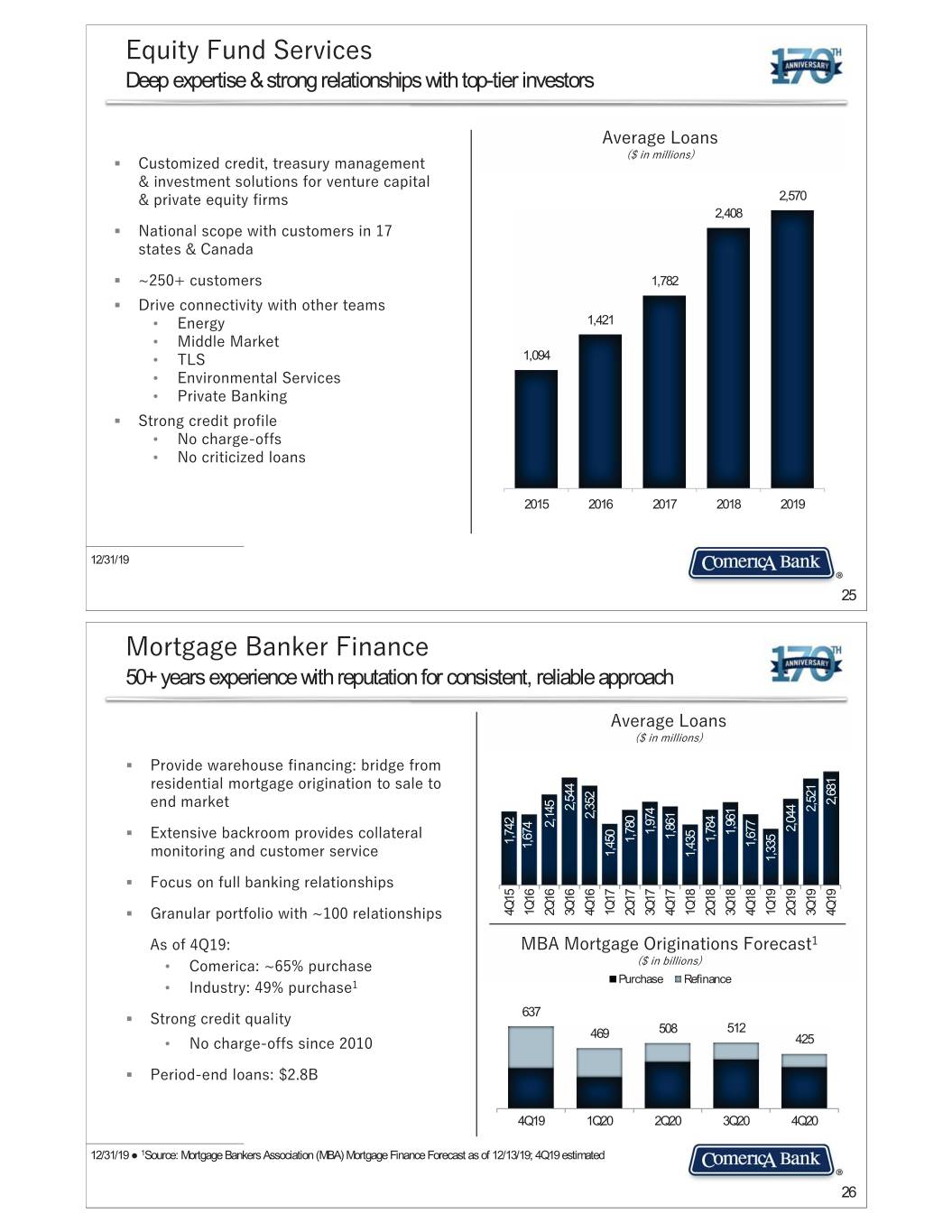

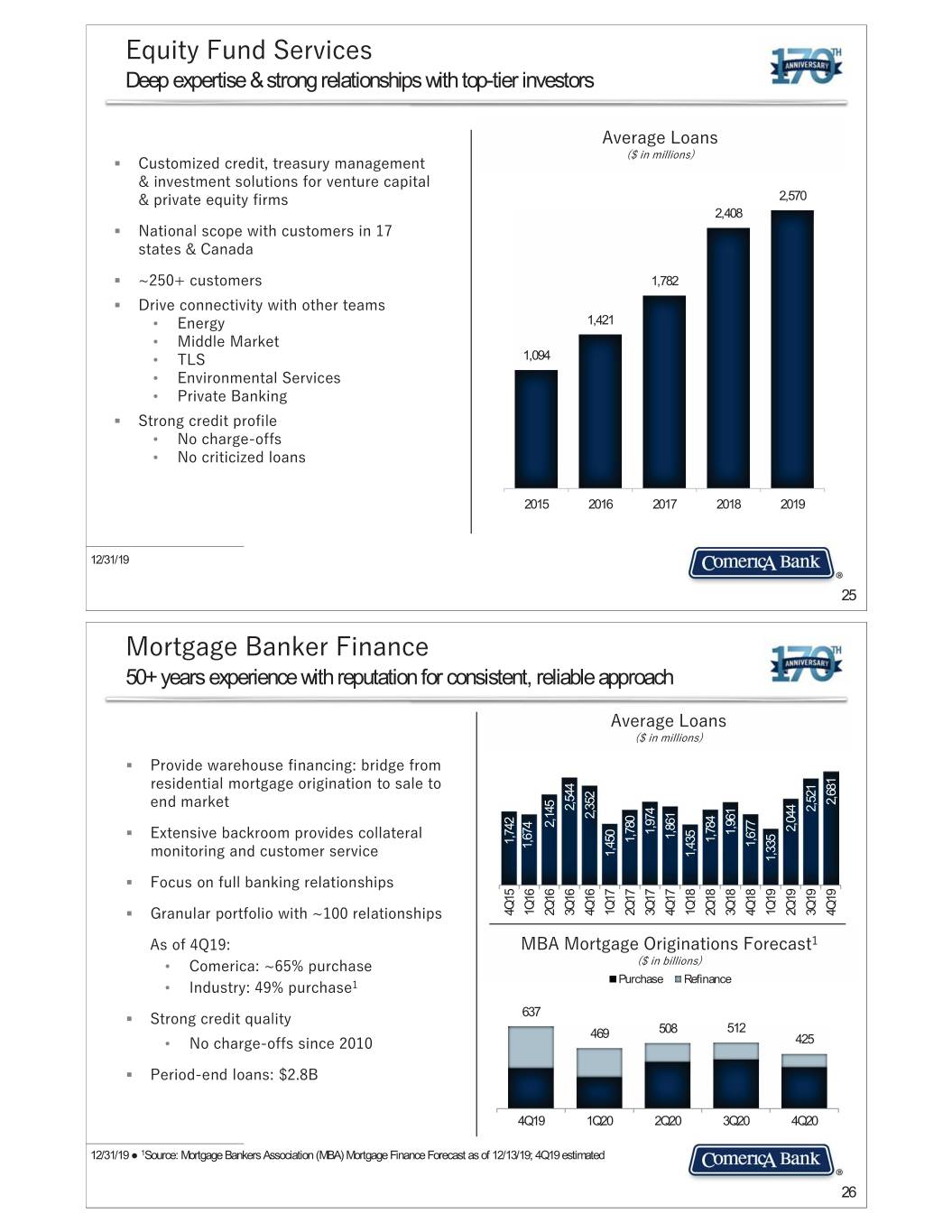

(TXLW\�)XQG�6HUYLFHV Deep expertise & strong relationships with top-tier investors $YHUDJH�/RDQV ���LQ�PLOOLRQV ƒ &XVWRPL]HG�FUHGLW��WUHDVXU\�PDQDJHPHQW� �LQYHVWPHQW�VROXWLRQV�IRU�YHQWXUH�FDSLWDO� �SULYDWH�HTXLW\�ILUPV 2,570 2,408 ƒ 1DWLRQDO�VFRSH�ZLWK�FXVWRPHUV�LQ���� VWDWHV� �&DQDGD ƒ f�����FXVWRPHUV� 1,782 ƒ 'ULYH�FRQQHFWLYLW\�ZLWK�RWKHU�WHDPV� • (QHUJ\ 1,421 • 0LGGOH�0DUNHW • 7/6 1,094 • (QYLURQPHQWDO�6HUYLFHV • 3ULYDWH�%DQNLQJ ƒ 6WURQJ�FUHGLW�SURILOH • 1R�FKDUJH�RIIV • 1R�FULWLFL]HG�ORDQV 2015 2016 2017 2018 2019 12/31/19 25 0RUWJDJH�%DQNHU�)LQDQFH 50+ years experience with reputation for consistent, reliable approach $YHUDJH�/RDQV ���LQ�PLOOLRQV ƒ 3URYLGH�ZDUHKRXVH�ILQDQFLQJ��EULGJH�IURP� UHVLGHQWLDO�PRUWJDJH�RULJLQDWLRQ�WR�VDOH�WR� HQG�PDUNHW 2,681 2,544 2,521 2,352 2,145 2,044 1,974 1,961 ƒ ([WHQVLYH�EDFNURRP�SURYLGHV�FROODWHUDO� 1,861 1,784 1,780 1,742 1,677 1,674 1,450 PRQLWRULQJ�DQG�FXVWRPHU�VHUYLFH 1,435 1,335 ƒ )RFXV�RQ�IXOO�EDQNLQJ�UHODWLRQVKLSV ƒ *UDQXODU�SRUWIROLR�ZLWK�f����UHODWLRQVKLSV 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 $V�RI��4���� 0%$�0RUWJDJH�2ULJLQDWLRQV�)RUHFDVW� • &RPHULFD��f����SXUFKDVH� ���LQ�ELOOLRQV Purchase Refinance • ,QGXVWU\������SXUFKDVH� ƒ 6WURQJ�FUHGLW�TXDOLW\ 637 469 508 512 • 1R�FKDUJH�RIIV�VLQFH����� 425 ƒ 3HULRG�HQG�ORDQV������% 4Q19 1Q20 2Q20 3Q20 4Q20 12/31/19 Ɣ 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 12/13/19; 4Q19 estimated 26

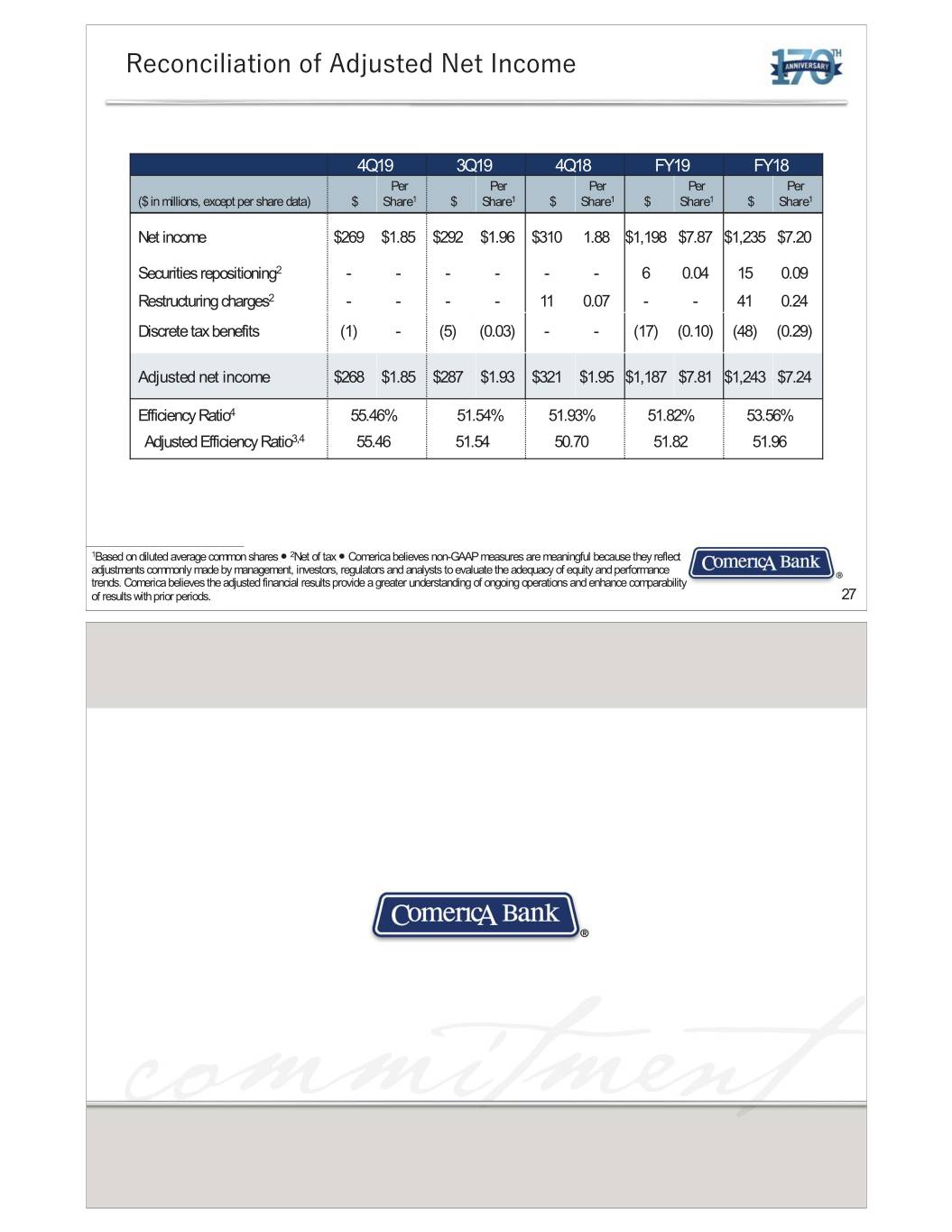

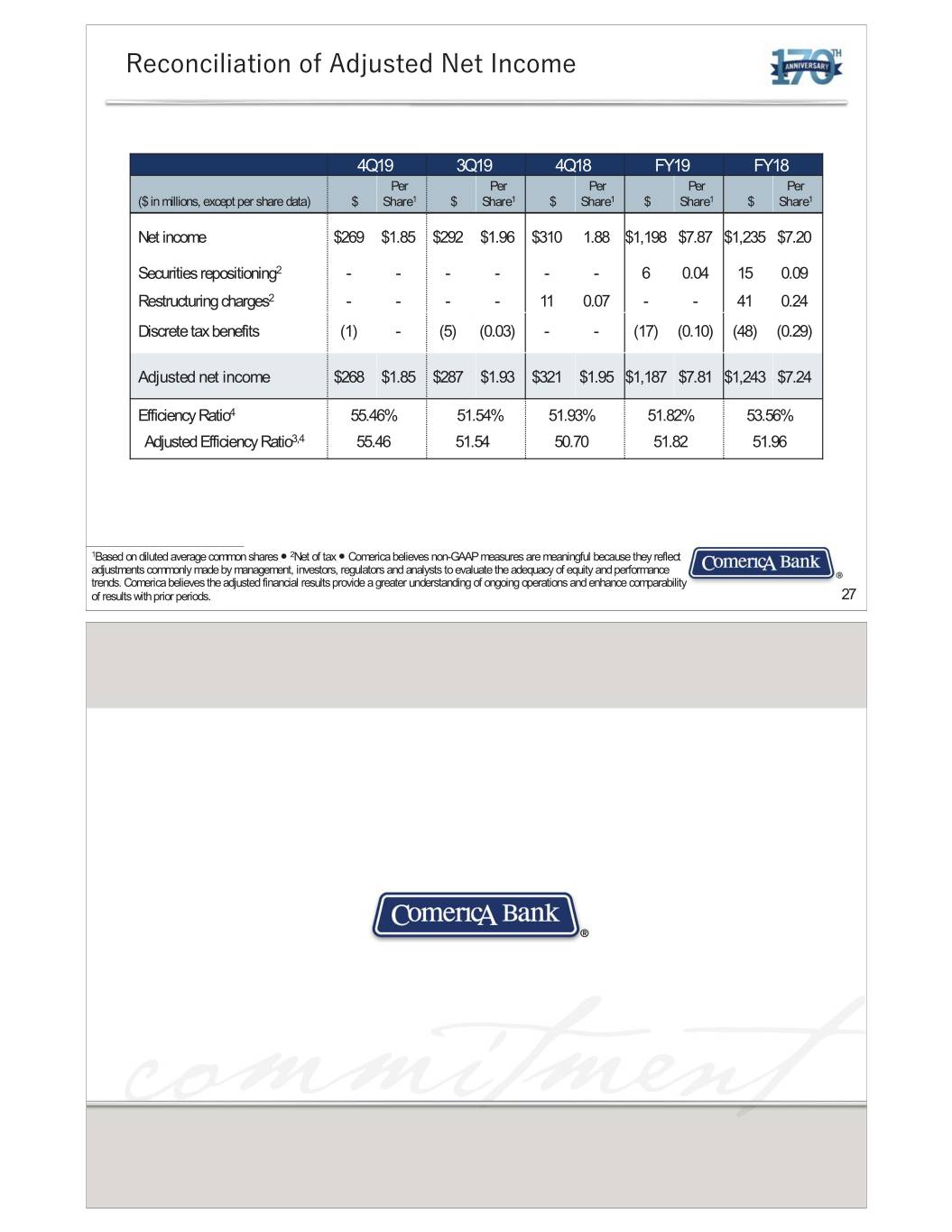

5HFRQFLOLDWLRQ�RI�$GMXVWHG�1HW�,QFRPH 4Q19 3Q19 4Q18 FY19 FY18 Per Per Per Per Per ($ in millions, except per share data) $ Share1 $ Share1 $ Share1 $ Share1 $ Share1 Net income $269 $1.85 $292 $1.96 $310 1.88 $1,198 $7.87 $1,235 $7.20 Securities repositioning2 ------60.04150.09 Restructuring charges2 - - - - 11 0.07 - - 41 0.24 Discrete tax benefits (1) - (5) (0.03) - - (17) (0.10) (48) (0.29) Adjusted net income $268 $1.85 $287 $1.93 $321 $1.95 $1,187 $7.81 $1,243 $7.24 Efficiency Ratio4 55.46% 51.54% 51.93% 51.82% 53.56% Adjusted Efficiency Ratio3,4 55.46 51.54 50.70 51.82 51.96 1Based on diluted average common shares Ⴠ 2Net of tax Ⴠ Comerica believes non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts to evaluate the adequacy of equity and performance trends. Comerica believes the adjusted financial results provide a greater understanding of ongoing operations and enhance comparability of results with prior periods. 27