Comerica Incorporated Fourth Quarter & Fiscal Year 2024 Financial Review January 22, 2025 This presentation, & other Comerica written & oral communications, include statements that are not historical facts but rather are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as achieve, anticipate, aspire, assume, believe, can, confident, continue, could, designed, enhances, estimate, expect, feel, forecast, forward, future, goal, grow, guidance, guide, initiative, intend, look forward, maintain, may, might, mission, model, objective, opportunity, outcome, on track, outlook, plan, position, potential, project, propose, remain, risk, seek, should, signs, strategy, strive, target, trajectory, trend, until, well-positioned, will, would or similar expressions, as they relate to Comerica or its management, or to economic, market or other environmental conditions, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs & assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation & do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans & objectives of Comerica's management for future or past operations, products or services, & forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments & subsidiaries as well as estimates of credit trends & global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events & are subject to risks & uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences include credit risks (changes in customer behavior; unfavorable developments concerning credit quality; & declines or other changes in the businesses or industries of Comerica's customers); market risks (changes in monetary & fiscal policies & fluctuations in interest rates & their impact on deposit pricing); liquidity risks (Comerica's ability to maintain adequate sources of funding & liquidity; reductions in Comerica's credit rating; & the interdependence of financial service companies & their soundness); technology risks (cybersecurity risks & heightened legislative & regulatory focus on cybersecurity & data privacy); operational risks (operational, systems or infrastructure failures; reliance on other companies to provide certain key components of business infrastructure; the impact of legal & regulatory proceedings or determinations; losses due to fraud; & controls & procedures failures); compliance risks (changes in regulation or oversight, or changes in Comerica’s status with respect to existing regulations or oversight; the effects of stringent capital requirements; & the impacts of future legislative, administrative or judicial changes to tax regulations); strategic risks (damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently & effectively develop, market & deliver new products & services; competitive product & pricing pressures among financial institutions within Comerica's markets; the implementation of Comerica's strategies & business initiatives; management's ability to maintain & expand customer relationships; management's ability to retain key officers & employees; & any future strategic acquisitions or divestitures); & other general risks (changes in general economic, political or industry conditions; negative effects from inflation; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events; physical or transition risks related to climate change; changes in accounting standards; the critical nature of Comerica's accounting policies, processes & management estimates; the volatility of Comerica’s stock price; & that an investment in Comerica’s equity securities is not insured or guaranteed by the FDIC). Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to Comerica’s filings with the Securities & Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 14 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2023. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Safe Harbor Statement 2©2025, Comerica Inc. All rights reserved.

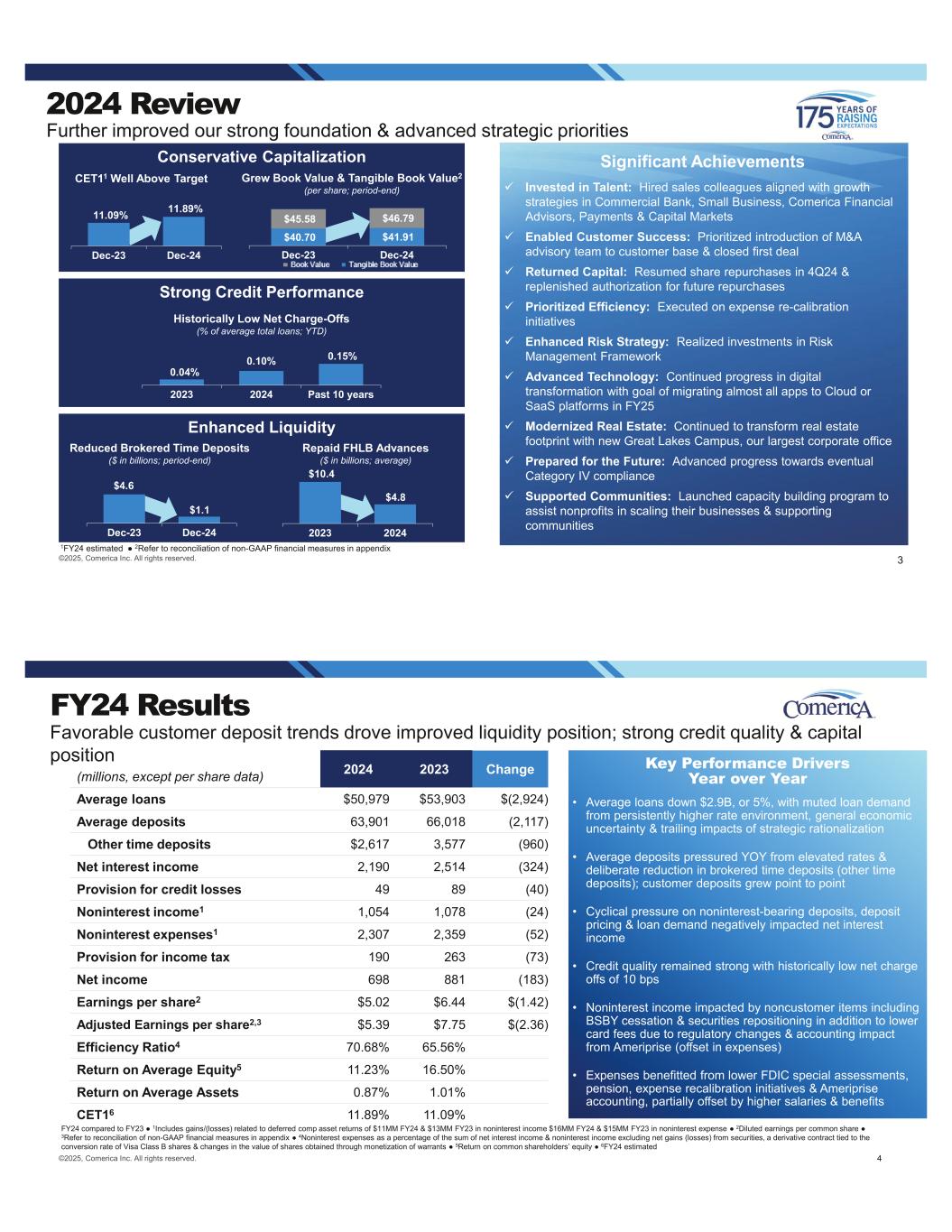

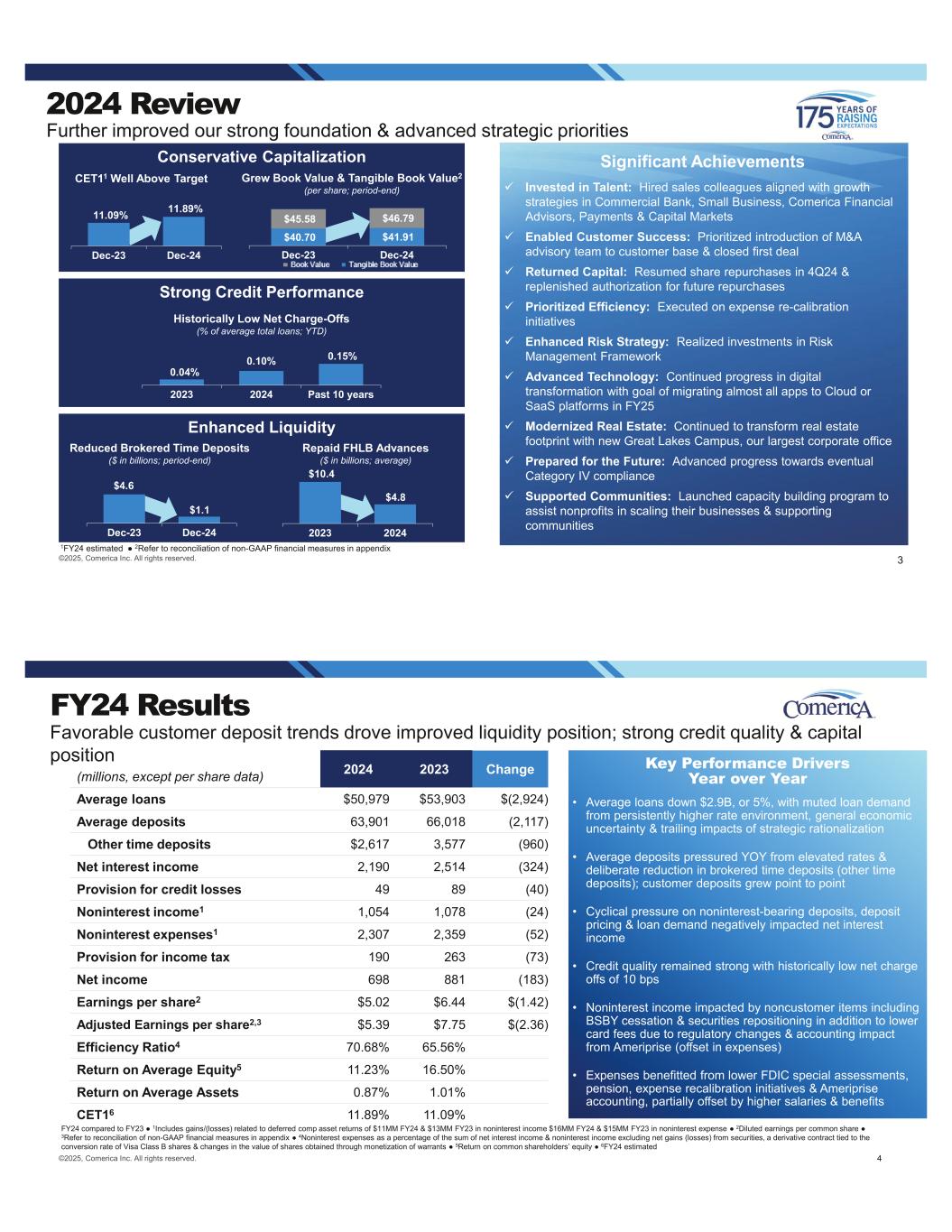

Enhanced Liquidity Significant Achievements Invested in Talent: Hired sales colleagues aligned with growth strategies in Commercial Bank, Small Business, Comerica Financial Advisors, Payments & Capital Markets Enabled Customer Success: Prioritized introduction of M&A advisory team to customer base & closed first deal Returned Capital: Resumed share repurchases in 4Q24 & replenished authorization for future repurchases Prioritized Efficiency: Executed on expense re-calibration initiatives Enhanced Risk Strategy: Realized investments in Risk Management Framework Advanced Technology: Continued progress in digital transformation with goal of migrating almost all apps to Cloud or SaaS platforms in FY25 Modernized Real Estate: Continued to transform real estate footprint with new Great Lakes Campus, our largest corporate office Prepared for the Future: Advanced progress towards eventual Category IV compliance Supported Communities: Launched capacity building program to assist nonprofits in scaling their businesses & supporting communities Strong Credit Performance Conservative Capitalization 2024 Review 3©2025, Comerica Inc. All rights reserved. Further improved our strong foundation & advanced strategic priorities Grew Book Value & Tangible Book Value2 (per share; period-end) Historically Low Net Charge-Offs (% of average total loans; YTD) CET11 Well Above Target Reduced Brokered Time Deposits ($ in billions; period-end) Repaid FHLB Advances ($ in billions; average) $4.6 $1.1 Dec-23 Dec-24 11.09% 11.89% Dec-23 Dec-24 0.04% 0.10% 0.15% 2023 2024 Past 10 years 1FY24 estimated 2Refer to reconciliation of non-GAAP financial measures in appendix $40.70 $41.91 $45.58 $46.79 Dec-23 Dec-24 Tangible Book Value Book Value $10.4 $4.8 2023 2024 4©2025, Comerica Inc. All rights reserved. FY24 compared to FY23 1Includes gains/(losses) related to deferred comp asset returns of $11MM FY24 & $13MM FY23 in noninterest income $16MM FY24 & $15MM FY23 in noninterest expense 2Diluted earnings per common share 3Refer to reconciliation of non-GAAP financial measures in appendix 4Noninterest expenses as a percentage of the sum of net interest income & noninterest income excluding net gains (losses) from securities, a derivative contract tied to the conversion rate of Visa Class B shares & changes in the value of shares obtained through monetization of warrants 5Return on common shareholders’ equity 6FY24 estimated Key Performance Drivers Year over Year • Average loans down $2.9B, or 5%, with muted loan demand from persistently higher rate environment, general economic uncertainty & trailing impacts of strategic rationalization • Average deposits pressured YOY from elevated rates & deliberate reduction in brokered time deposits (other time deposits); customer deposits grew point to point • Cyclical pressure on noninterest-bearing deposits, deposit pricing & loan demand negatively impacted net interest income • Credit quality remained strong with historically low net charge offs of 10 bps • Noninterest income impacted by noncustomer items including BSBY cessation & securities repositioning in addition to lower card fees due to regulatory changes & accounting impact from Ameriprise (offset in expenses) • Expenses benefitted from lower FDIC special assessments, pension, expense recalibration initiatives & Ameriprise accounting, partially offset by higher salaries & benefits FY24 Results Favorable customer deposit trends drove improved liquidity position; strong credit quality & capital position (millions, except per share data) 2024 2023 Change Average loans $50,979 $53,903 $(2,924) Average deposits 63,901 66,018 (2,117) Other time deposits $2,617 3,577 (960) Net interest income 2,190 2,514 (324) Provision for credit losses 49 89 (40) Noninterest income1 1,054 1,078 (24) Noninterest expenses1 2,307 2,359 (52) Provision for income tax 190 263 (73) Net income 698 881 (183) Earnings per share2 $5.02 $6.44 $(1.42) Adjusted Earnings per share2,3 $5.39 $7.75 $(2.36) Efficiency Ratio4 70.68% 65.56% Return on Average Equity5 11.23% 16.50% Return on Average Assets 0.87% 1.01% CET16 11.89% 11.09%

4Q24 Results Continued strong deposit, net interest income & credit results supported by conservative capital position 1Includes gains/(losses) related to deferred comp asset returns of $8MM 4Q23, $4MM 3Q24, $(0.2MM) 4Q24 in noninterest income & $8MM 4Q23, $6MM 3Q24, $1MM 4Q24 in noninterest expense 2Diluted earnings per common share 3Refer to reconciliation of non-GAAP financial measures in appendix 4Noninterest expenses as a percentage of the sum of net interest income & noninterest income excluding net gains (losses) from securities, a derivative contract tied to the conversion rate of Visa Class B shares & changes in the value of shares obtained through monetization of warrants 54Q24 estimated 6Reflects a $7MM benefit as a result of changes in the combined state income tax rate applicable to deferred tax assets (millions, except per share data) 4Q24 3Q24 4Q23 Change From 3Q24 4Q23 Average loans $50,617 $50,861 $52,796 $(244) $(2,179) Average deposits 63,347 63,896 66,045 (549) (2,698) Other time deposits 1,371 2,739 4,557 (1,368) (3,186) Net interest income 575 534 584 41 (9) Provision for credit losses 21 14 12 7 9 Noninterest income1 250 277 198 (27) 52 Noninterest expenses1 587 562 718 25 (131) Provision for income tax 47 51 19 (4) 28 Net income 170 184 33 (14) 137 Earnings per share2 $1.22 $1.33 $0.20 $(0.11) $1.02 Adjusted Earnings per share2,3 1.20 1.37 1.46 $(0.17) $(0.26) Efficiency Ratio4 69.51% 68.80% 91.86% CET15 11.89% 11.96% 11.09% Key Performance Drivers 4Q24 compared to 3Q24 • Slight decline in average loans driven primarily by expected Commercial Real Estate paydowns • Average deposits declined $0.5B or increased $0.9B excluding the deliberate $1.4B reduction in brokered time deposits (other time deposits) • Net interest income increased with favorable customer deposit trends, successful pricing strategy, lower headwind from swaps & BSBY cessation; net interest margin increased 26bps • Low net charge-offs of 13 bps with lower recoveries compared to 3Q; reserve ratio relatively flat at 1.44% reflecting expected normalization • Noninterest income negatively impacted by $19MM pre-tax loss related to modest 4Q24 securities repositioning, expect earn-back into net interest income in 2025 • Noninterest expenses increased as benefits from strategic sale of real estate were more than offset by higher legal related accruals & expenses, seasonally higher expenses & increased charitable contributions • Conservative approach to capital; maintained CET15 well above our 10% strategic target supporting resumption of share repurchases in 4Q • Taxes declined with lower pre-tax income partially & favorable discrete items6 5©2025, Comerica Inc. All rights reserved. Loans As expected, CRE paydowns pressured total loans; improved customer sentiment & activity supports optimism in 2025 4Q24 compared to 3Q24; Variance may not foot due to rounding 1See Quarterly Average Loans slide for more details 2See Commercial Real Estate slide for more details Loans ($ in billions) Average loans decreased $0.2B1, or ~0.5% - $225MM Commercial Real Estate2 - $132MM Corporate Banking + $116MM Energy • Period-end loans flat, inclusive of $0.5B decline in CRE • Pipeline supports growth outlook in 2025 6©2025, Comerica Inc. All rights reserved. Loan Yields % Average Balances Monthly Average Balances Loan Commitments Relatively Stable Following 2023 Strategic Rationalization Efforts (period-end; $ in billions) 53.7 50.9 50.0 49.5 49.5 48% 49% 50% 50% 49% 4Q23 1Q24 2Q24 3Q24 4Q24 Utilization 52.8 51.4 51.1 50.9 50.6 50.7 50.6 50.6 6.38 6.33 6.32 6.24 6.25 4Q23 1Q24 2Q24 3Q24 4Q24 Oct-24 Nov-24 Dec-24

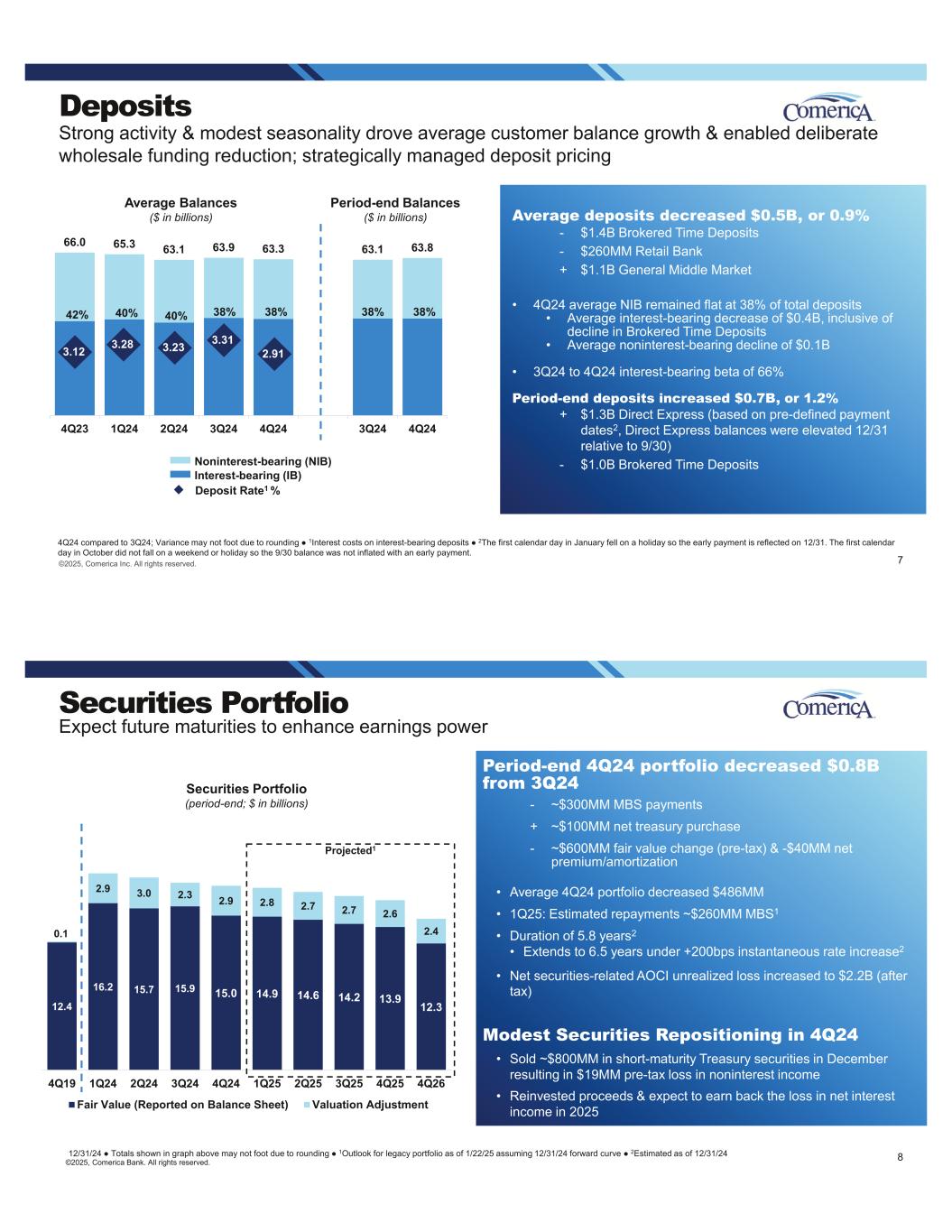

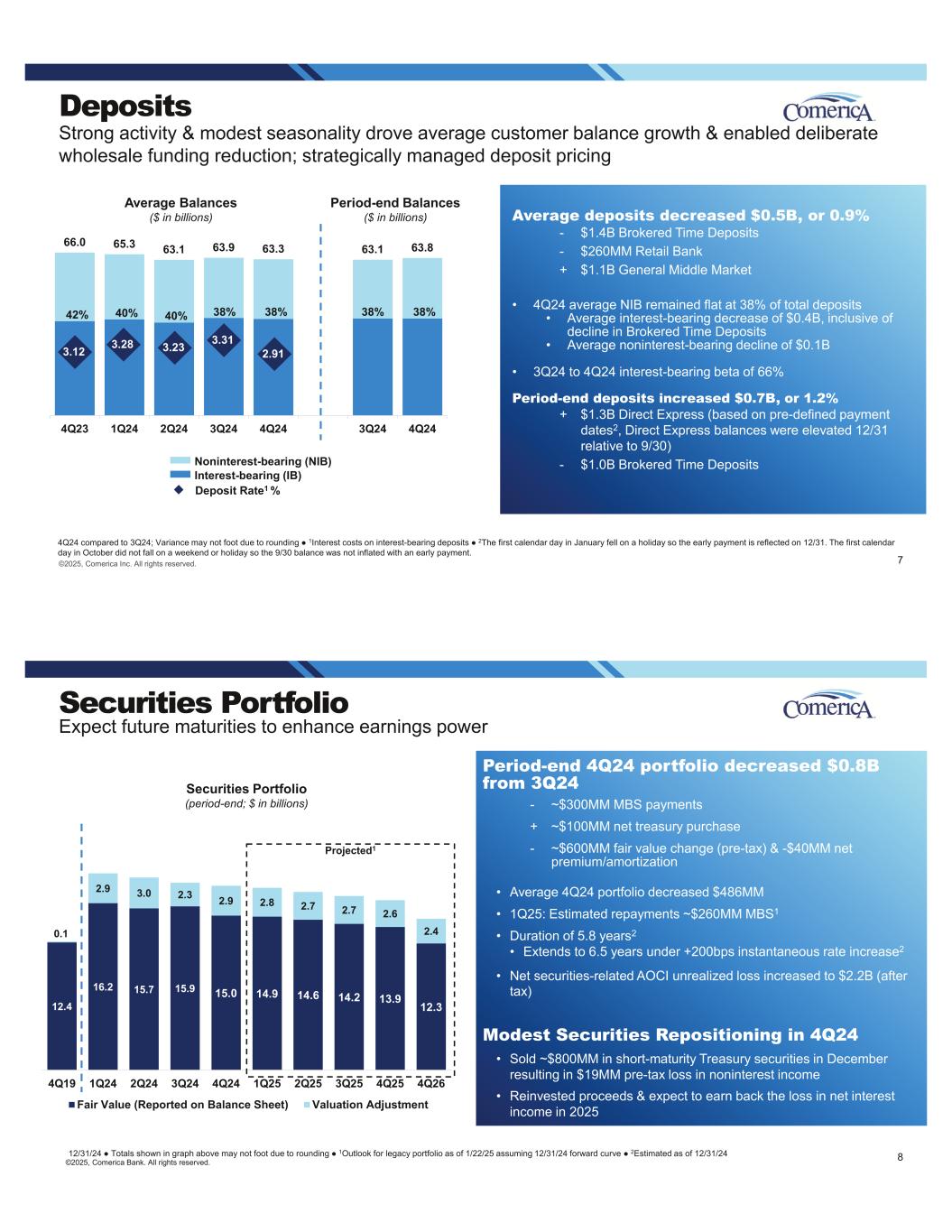

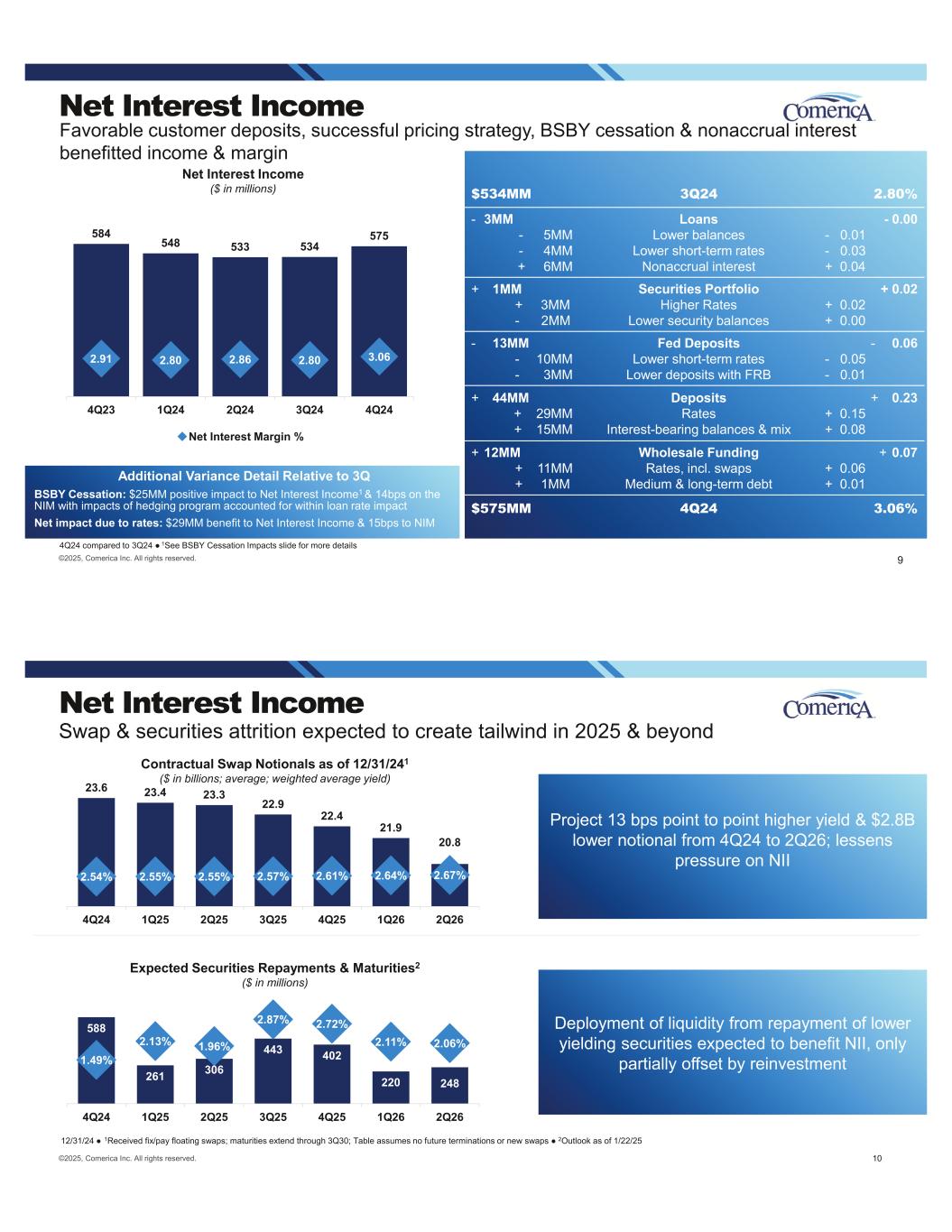

Deposits Strong activity & modest seasonality drove average customer balance growth & enabled deliberate wholesale funding reduction; strategically managed deposit pricing 4Q24 compared to 3Q24; Variance may not foot due to rounding 1Interest costs on interest-bearing deposits 2The first calendar day in January fell on a holiday so the early payment is reflected on 12/31. The first calendar day in October did not fall on a weekend or holiday so the 9/30 balance was not inflated with an early payment. Deposit Rate1 % Average Balances ($ in billions) Average deposits decreased $0.5B, or 0.9% - $1.4B Brokered Time Deposits - $260MM Retail Bank + $1.1B General Middle Market • 4Q24 average NIB remained flat at 38% of total deposits • Average interest-bearing decrease of $0.4B, inclusive of decline in Brokered Time Deposits • Average noninterest-bearing decline of $0.1B • 3Q24 to 4Q24 interest-bearing beta of 66% Period-end deposits increased $0.7B, or 1.2% + $1.3B Direct Express (based on pre-defined payment dates2, Direct Express balances were elevated 12/31 relative to 9/30) - $1.0B Brokered Time Deposits 7©2025, Comerica Inc. All rights reserved. Period-end Balances ($ in billions) Noninterest-bearing (NIB) Interest-bearing (IB) 66.0 65.3 63.1 63.9 63.3 63.1 63.8 4Q23 1Q24 2Q24 3Q24 4Q24 3Q24 4Q24 38% 38%38% 38%40% 40%42% 3.313.233.283.12 2.91 Securities Portfolio Expect future maturities to enhance earnings power 12/31/24 Totals shown in graph above may not foot due to rounding 1Outlook for legacy portfolio as of 1/22/25 assuming 12/31/24 forward curve 2Estimated as of 12/31/24 Period-end 4Q24 portfolio decreased $0.8B from 3Q24 - ~$300MM MBS payments + ~$100MM net treasury purchase - ~$600MM fair value change (pre-tax) & -$40MM net premium/amortization • Average 4Q24 portfolio decreased $486MM • 1Q25: Estimated repayments ~$260MM MBS1 • Duration of 5.8 years2 • Extends to 6.5 years under +200bps instantaneous rate increase2 • Net securities-related AOCI unrealized loss increased to $2.2B (after tax) Modest Securities Repositioning in 4Q24 • Sold ~$800MM in short-maturity Treasury securities in December resulting in $19MM pre-tax loss in noninterest income • Reinvested proceeds & expect to earn back the loss in net interest income in 2025 ©2025, Comerica Bank. All rights reserved. 8 Securities Portfolio (period-end; $ in billions) 12.4 16.2 15.7 15.9 15.0 14.9 14.6 14.2 13.9 12.3 0.1 2.9 3.0 2.3 2.9 2.8 2.7 2.7 2.6 2.4 4Q19 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 4Q26 Fair Value (Reported on Balance Sheet) Valuation Adjustment Projected1

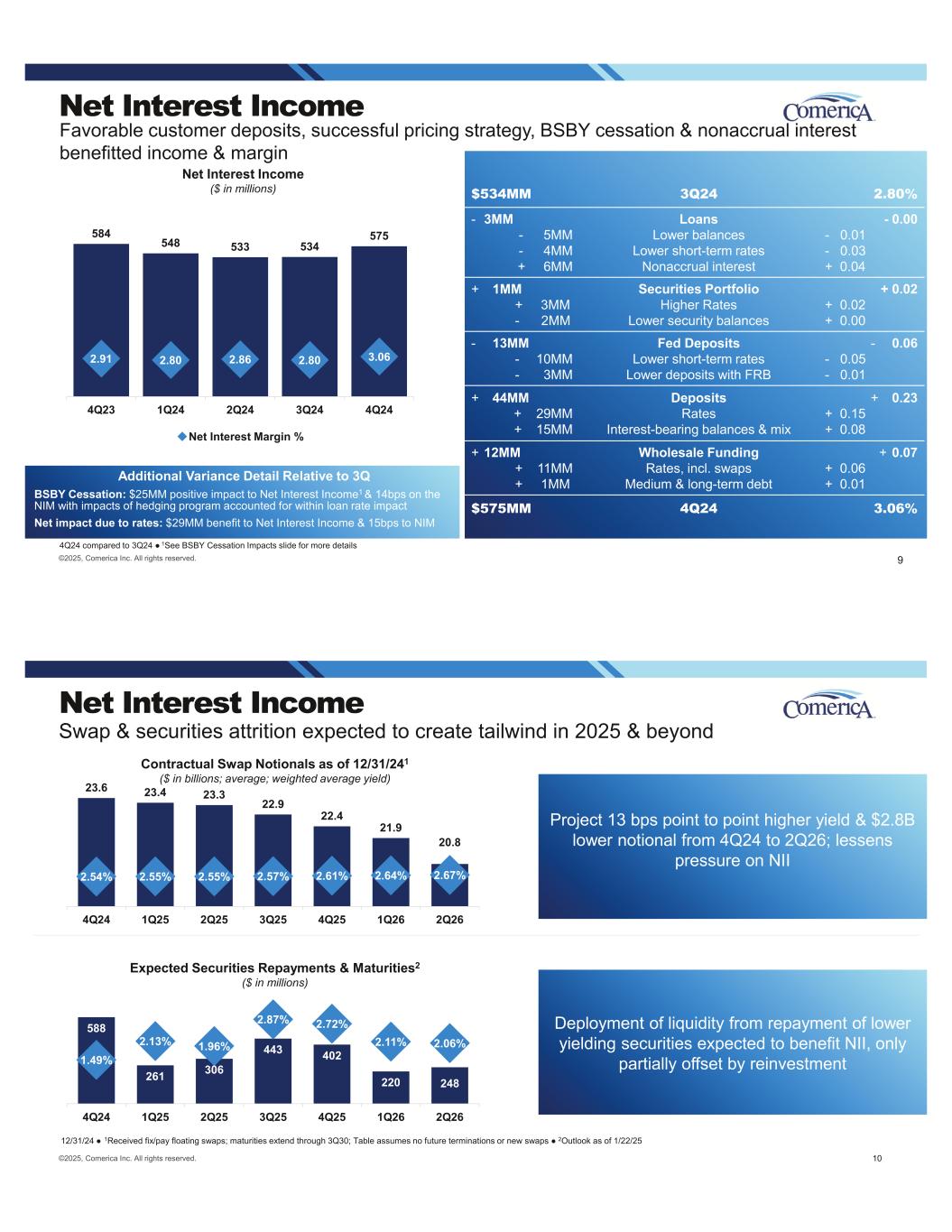

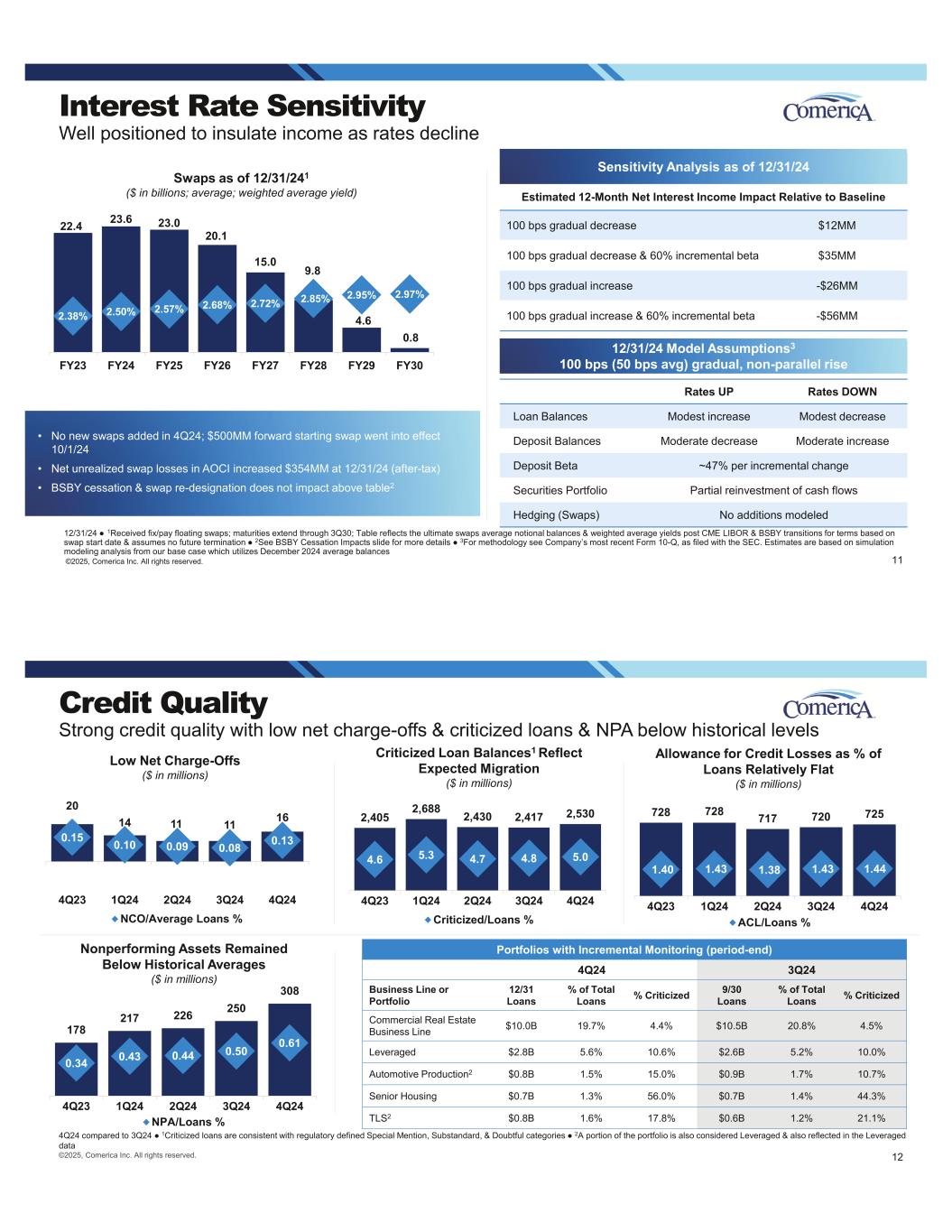

584 548 533 534 575 2.91 2.80 2.86 2.80 3.06 4Q23 1Q24 2Q24 3Q24 4Q24 Net Interest Income Favorable customer deposits, successful pricing strategy, BSBY cessation & nonaccrual interest benefitted income & margin 4Q24 compared to 3Q24 1See BSBY Cessation Impacts slide for more details Net Interest Income ($ in millions) $534MM 3Q24 2.80% - 3MM - 5MM - 4MM + 6MM Loans Lower balances Lower short-term rates Nonaccrual interest - 0.00 - 0.01 - 0.03 + 0.04 + 1MM + 3MM - 2MM Securities Portfolio Higher Rates Lower security balances + 0.02 + 0.02 + 0.00 - 13MM - 10MM - 3MM Fed Deposits Lower short-term rates Lower deposits with FRB - 0.06 - 0.05 - 0.01 + 44MM + 29MM + 15MM Deposits Rates Interest-bearing balances & mix + 0.23 + 0.15 + 0.08 + 12MM + 11MM + 1MM Wholesale Funding Rates, incl. swaps Medium & long-term debt + 0.07 + 0.06 + 0.01 $575MM 4Q24 3.06% 9©2025, Comerica Inc. All rights reserved. Additional Variance Detail Relative to 3Q BSBY Cessation: $25MM positive impact to Net Interest Income1 & 14bps on the NIM with impacts of hedging program accounted for within loan rate impact Net impact due to rates: $29MM benefit to Net Interest Income & 15bps to NIM Net Interest Margin % 10©2025, Comerica Inc. All rights reserved. Net Interest Income Expected Securities Repayments & Maturities2 ($ in millions) 588 261 306 443 402 220 248 1.49% 2.13% 1.96% 2.87% 2.72% 2.11% 2.06% 4Q24 1Q25 2Q25 3Q25 4Q25 1Q26 2Q26 Contractual Swap Notionals as of 12/31/241 ($ in billions; average; weighted average yield) Swap & securities attrition expected to create tailwind in 2025 & beyond Project 13 bps point to point higher yield & $2.8B lower notional from 4Q24 to 2Q26; lessens pressure on NII Deployment of liquidity from repayment of lower yielding securities expected to benefit NII, only partially offset by reinvestment 12/31/24 1Received fix/pay floating swaps; maturities extend through 3Q30; Table assumes no future terminations or new swaps 2Outlook as of 1/22/25 23.6 23.4 23.3 22.9 22.4 21.9 20.8 2.54% 2.55% 2.55% 2.57% 2.61% 2.64% 2.67% 4Q24 1Q25 2Q25 3Q25 4Q25 1Q26 2Q26

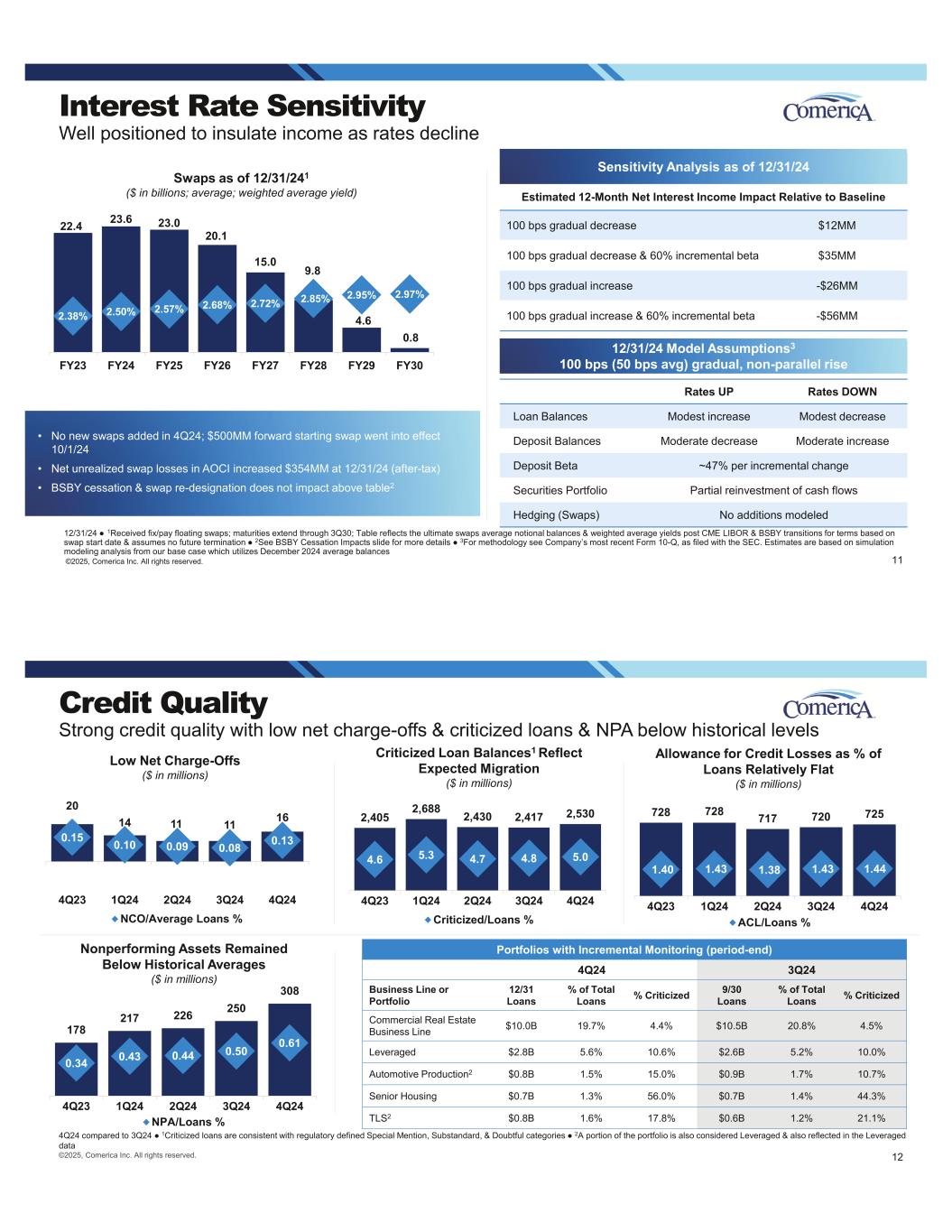

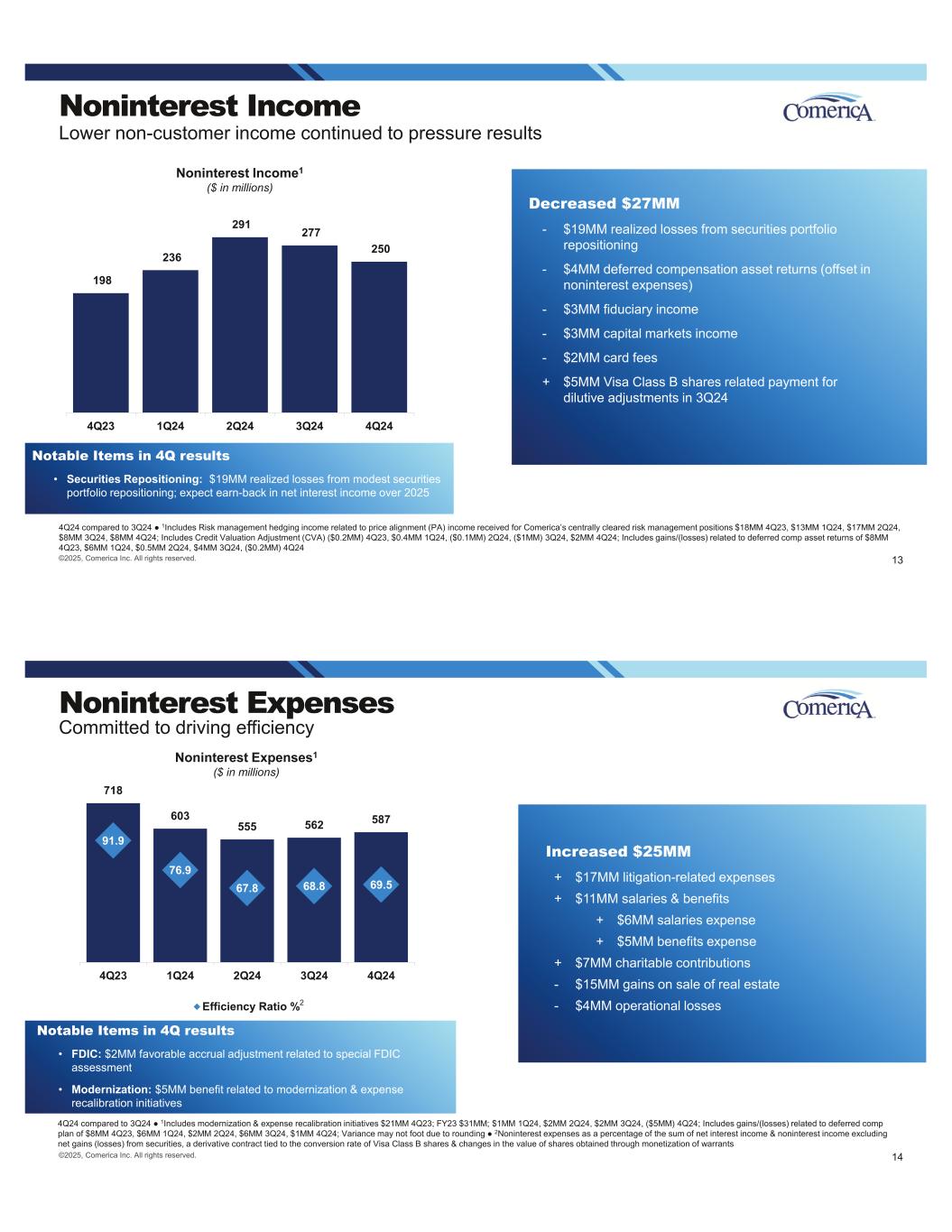

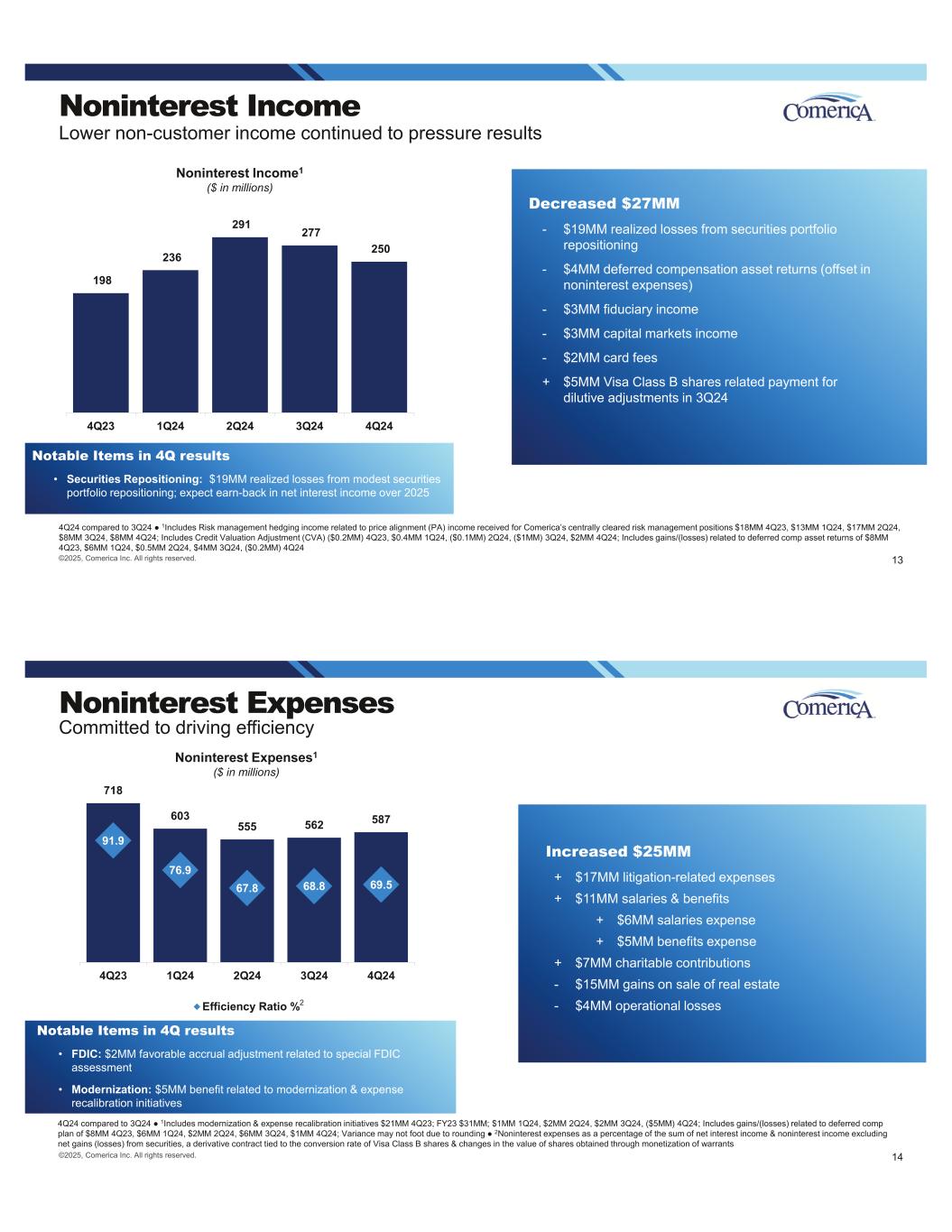

Interest Rate Sensitivity Well positioned to insulate income as rates decline 12/31/24 1Received fix/pay floating swaps; maturities extend through 3Q30; Table reflects the ultimate swaps average notional balances & weighted average yields post CME LIBOR & BSBY transitions for terms based on swap start date & assumes no future termination 2See BSBY Cessation Impacts slide for more details 3For methodology see Company’s most recent Form 10-Q, as filed with the SEC. Estimates are based on simulation modeling analysis from our base case which utilizes December 2024 average balances 11©2025, Comerica Inc. All rights reserved. Swaps as of 12/31/241 ($ in billions; average; weighted average yield) • No new swaps added in 4Q24; $500MM forward starting swap went into effect 10/1/24 • Net unrealized swap losses in AOCI increased $354MM at 12/31/24 (after-tax) • BSBY cessation & swap re-designation does not impact above table2 Estimated 12-Month Net Interest Income Impact Relative to Baseline 100 bps gradual decrease $12MM 100 bps gradual decrease & 60% incremental beta $35MM 100 bps gradual increase -$26MM 100 bps gradual increase & 60% incremental beta -$56MM Sensitivity Analysis as of 12/31/24 Rates UP Rates DOWN Loan Balances Modest increase Modest decrease Deposit Balances Moderate decrease Moderate increase Deposit Beta ~47% per incremental change Securities Portfolio Partial reinvestment of cash flows Hedging (Swaps) No additions modeled 12/31/24 Model Assumptions3 100 bps (50 bps avg) gradual, non-parallel rise 22.4 23.6 23.0 20.1 15.0 9.8 4.6 0.8 2.38% 2.50% 2.57% 2.68% 2.72% 2.85% 2.95% 2.97% FY23 FY24 FY25 FY26 FY27 FY28 FY29 FY30 Credit Quality Strong credit quality with low net charge-offs & criticized loans & NPA below historical levels 4Q24 compared to 3Q24 1Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories 2A portion of the portfolio is also considered Leveraged & also reflected in the Leveraged data Nonperforming Assets Remained Below Historical Averages ($ in millions) Criticized Loan Balances1 Reflect Expected Migration ($ in millions) 728 728 717 720 725 1.40 1.43 1.38 1.43 1.44 - 1.00 2.00 3.00 4.00 5.00 6.00 4Q23 1Q24 2Q24 3Q24 4Q24 ACL/Loans % Allowance for Credit Losses as % of Loans Relatively Flat ($ in millions) 2,405 2,688 2,430 2,417 2,530 4.6 5.3 4.7 4.8 5.0 - 2.00 4.00 6.00 8.00 10.00 12.00 4Q23 1Q24 2Q24 3Q24 4Q24 Criticized/Loans % 12©2025, Comerica Inc. All rights reserved. Low Net Charge-Offs ($ in millions) Portfolios with Incremental Monitoring (period-end) 4Q24 3Q24 Business Line or Portfolio 12/31 Loans % of Total Loans % Criticized 9/30 Loans % of Total Loans % Criticized Commercial Real Estate Business Line $10.0B 19.7% 4.4% $10.5B 20.8% 4.5% Leveraged $2.8B 5.6% 10.6% $2.6B 5.2% 10.0% Automotive Production2 $0.8B 1.5% 15.0% $0.9B 1.7% 10.7% Senior Housing $0.7B 1.3% 56.0% $0.7B 1.4% 44.3% TLS2 $0.8B 1.6% 17.8% $0.6B 1.2% 21.1% 20 14 11 11 16 0.15 0.10 0.09 0.08 0.13 (0.20) (0.15) (0.10) (0.05) - 0.05 0.10 0.15 0.20 0.25 0.30 4Q23 1Q24 2Q24 3Q24 4Q24 NCO/Average Loans % 178 217 226 250 308 0.34 0.43 0.44 0.50 0.61 (0.10) 0.10 0.30 0.50 0.70 0.90 1.10 1.30 1.50 4Q23 1Q24 2Q24 3Q24 4Q24 NPA/Loans %

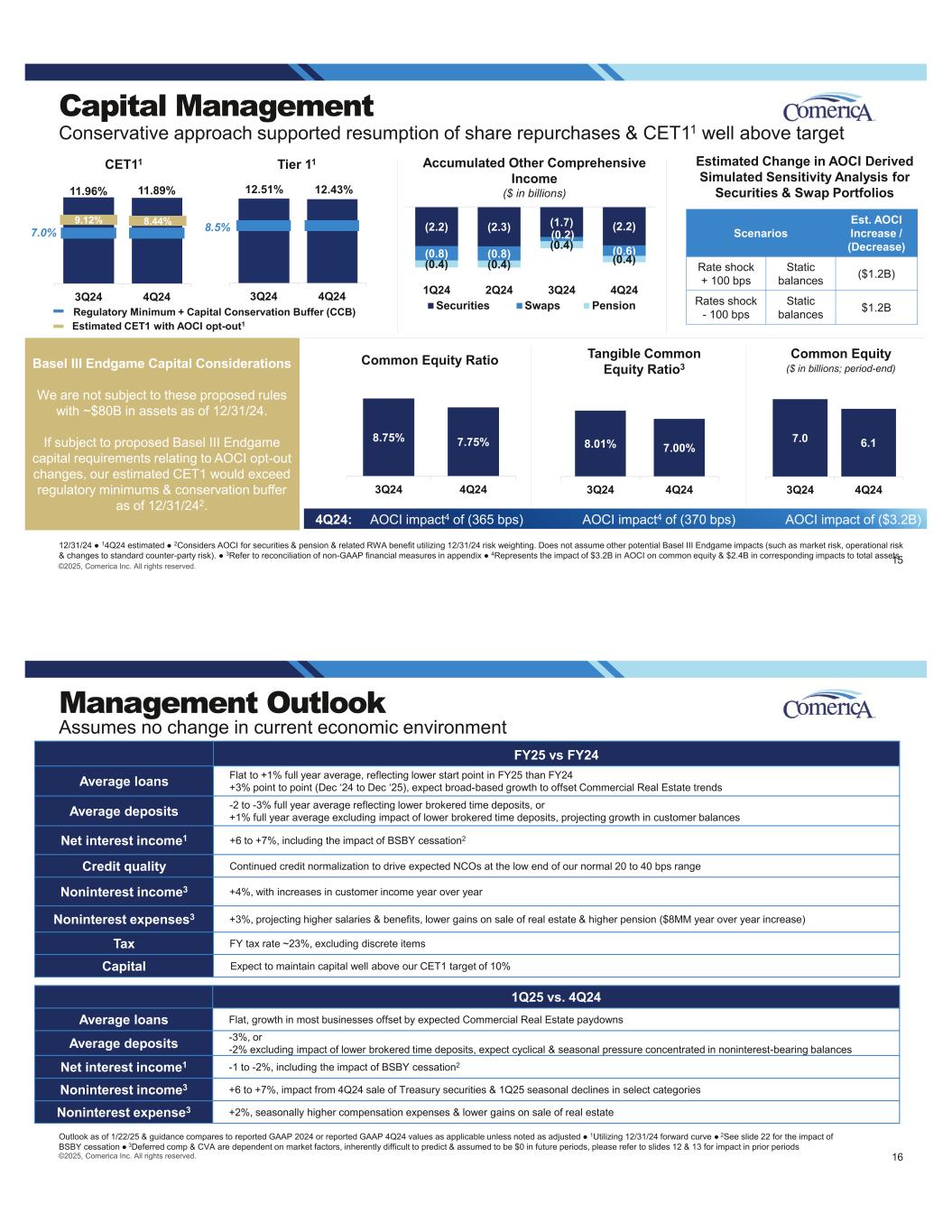

Noninterest Income Lower non-customer income continued to pressure results 4Q24 compared to 3Q24 1Includes Risk management hedging income related to price alignment (PA) income received for Comerica’s centrally cleared risk management positions $18MM 4Q23, $13MM 1Q24, $17MM 2Q24, $8MM 3Q24, $8MM 4Q24; Includes Credit Valuation Adjustment (CVA) ($0.2MM) 4Q23, $0.4MM 1Q24, ($0.1MM) 2Q24, ($1MM) 3Q24, $2MM 4Q24; Includes gains/(losses) related to deferred comp asset returns of $8MM 4Q23, $6MM 1Q24, $0.5MM 2Q24, $4MM 3Q24, ($0.2MM) 4Q24 Noninterest Income1 ($ in millions) 198 236 291 277 250 4Q23 1Q24 2Q24 3Q24 4Q24 Decreased $27MM - $19MM realized losses from securities portfolio repositioning - $4MM deferred compensation asset returns (offset in noninterest expenses) - $3MM fiduciary income - $3MM capital markets income - $2MM card fees + $5MM Visa Class B shares related payment for dilutive adjustments in 3Q24 13©2025, Comerica Inc. All rights reserved. Notable Items in 4Q results • Securities Repositioning: $19MM realized losses from modest securities portfolio repositioning; expect earn-back in net interest income over 2025 718 603 555 562 587 91.9 76.9 67.8 68.8 69.5 4Q23 1Q24 2Q24 3Q24 4Q24 Efficiency Ratio % Noninterest Expenses1 ($ in millions) Noninterest Expenses Committed to driving efficiency 4Q24 compared to 3Q24 1Includes modernization & expense recalibration initiatives $21MM 4Q23; FY23 $31MM; $1MM 1Q24, $2MM 2Q24, $2MM 3Q24, ($5MM) 4Q24; Includes gains/(losses) related to deferred comp plan of $8MM 4Q23, $6MM 1Q24, $2MM 2Q24, $6MM 3Q24, $1MM 4Q24; Variance may not foot due to rounding 2Noninterest expenses as a percentage of the sum of net interest income & noninterest income excluding net gains (losses) from securities, a derivative contract tied to the conversion rate of Visa Class B shares & changes in the value of shares obtained through monetization of warrants Increased $25MM + $17MM litigation-related expenses + $11MM salaries & benefits + $6MM salaries expense + $5MM benefits expense + $7MM charitable contributions - $15MM gains on sale of real estate - $4MM operational losses 14©2025, Comerica Inc. All rights reserved. Notable Items in 4Q results • FDIC: $2MM favorable accrual adjustment related to special FDIC assessment • Modernization: $5MM benefit related to modernization & expense recalibration initiatives 2

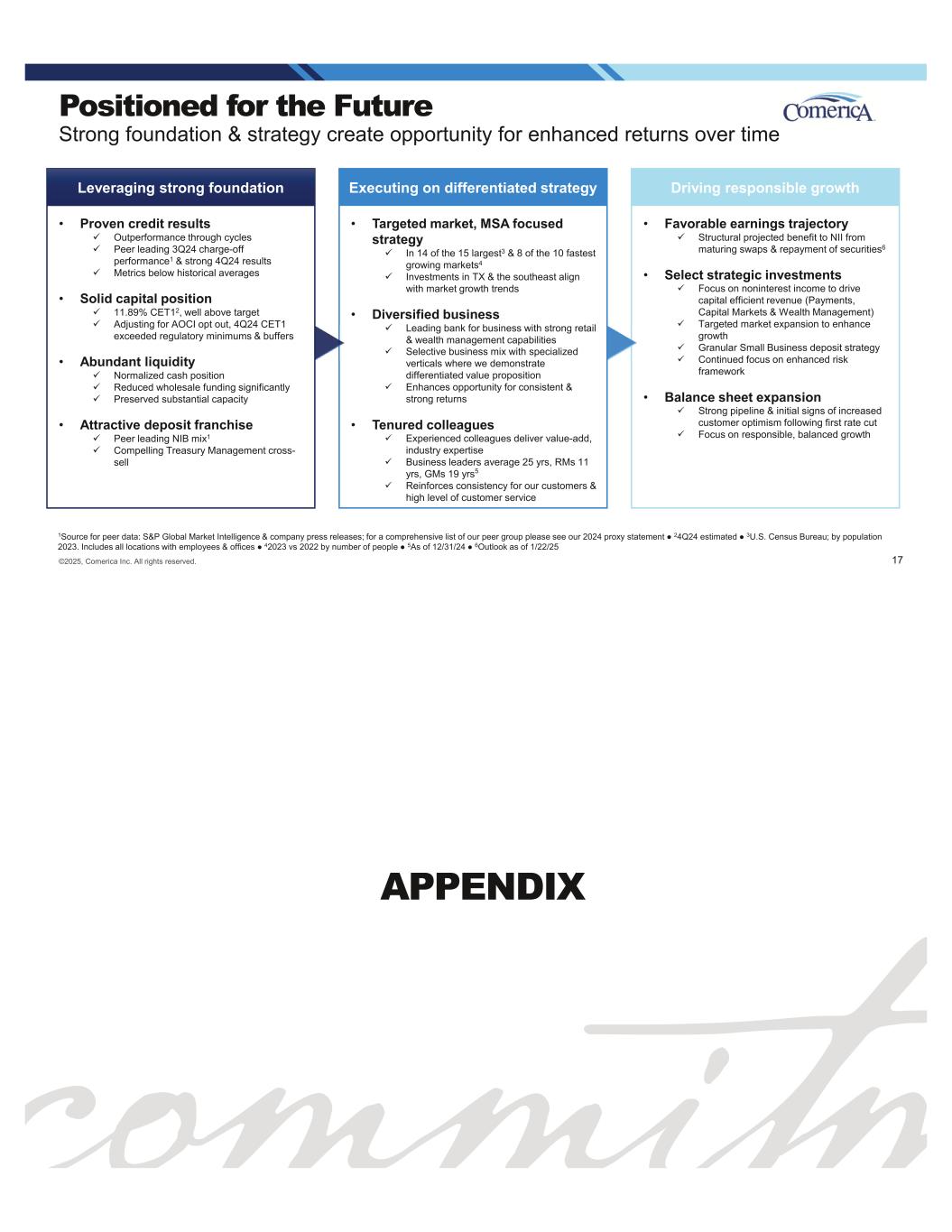

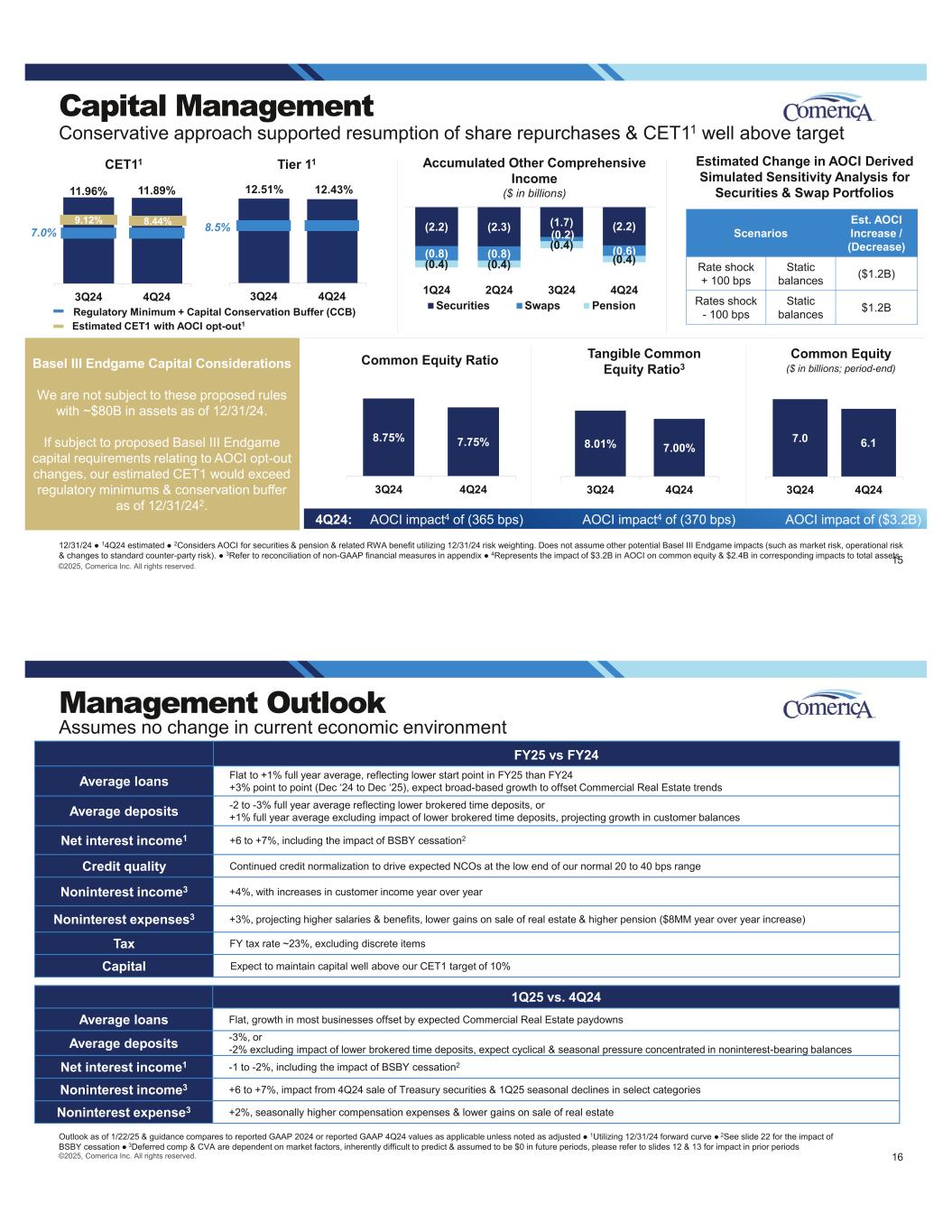

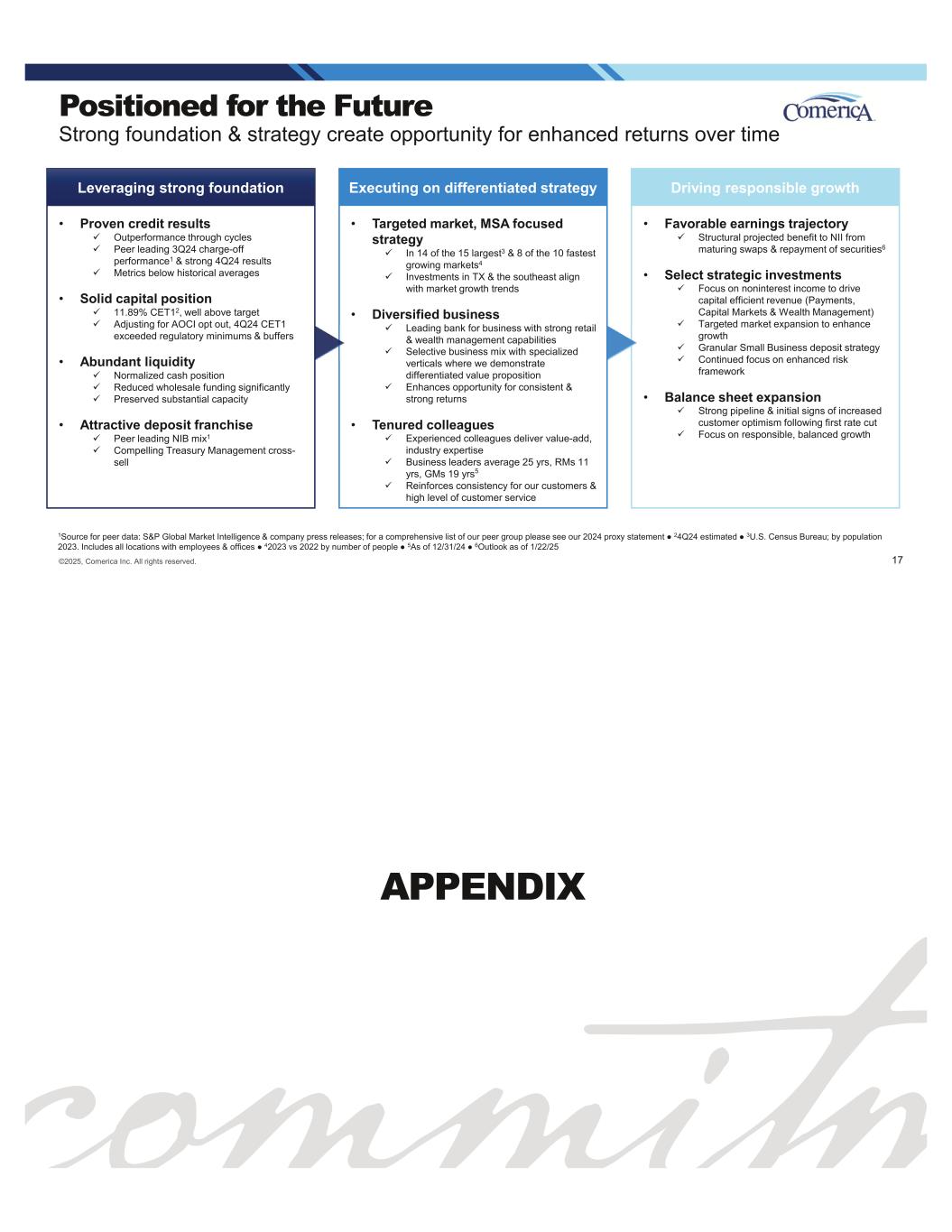

(2.2) (2.3) (1.7) (2.2) (0.8) (0.8) (0.2) (0.6) (0.4) (0.4) (0.4) (0.4) 1Q24 2Q24 3Q24 4Q24 Securities Swaps Pension 8.01% 7.00% 3Q24 4Q24 Capital Management Conservative approach supported resumption of share repurchases & CET11 well above target 12/31/24 14Q24 estimated 2Considers AOCI for securities & pension & related RWA benefit utilizing 12/31/24 risk weighting. Does not assume other potential Basel III Endgame impacts (such as market risk, operational risk & changes to standard counter-party risk). 3Refer to reconciliation of non-GAAP financial measures in appendix 4Represents the impact of $3.2B in AOCI on common equity & $2.4B in corresponding impacts to total assets 11.96% 11.89% 7.0% 3Q24 4Q24 CET11 Tier 11 12.51% 12.43% 8.5% 3Q24 4Q24 Regulatory Minimum + Capital Conservation Buffer (CCB) 15 ©2025, Comerica Inc. All rights reserved. 7.0 6.1 3Q24 4Q24 Common Equity ($ in billions; period-end) Tangible Common Equity Ratio3 8.75% 7.75% 3Q24 4Q24 Common Equity Ratio Accumulated Other Comprehensive Income ($ in billions) Scenarios Est. AOCI Increase / (Decrease) Rate shock + 100 bps Static balances ($1.2B) Rates shock - 100 bps Static balances $1.2B Estimated Change in AOCI Derived Simulated Sensitivity Analysis for Securities & Swap Portfolios 4Q24: AOCI impact4 of (365 bps) AOCI impact4 of (370 bps) AOCI impact of ($3.2B) Basel III Endgame Capital Considerations We are not subject to these proposed rules with ~$80B in assets as of 12/31/24. If subject to proposed Basel III Endgame capital requirements relating to AOCI opt-out changes, our estimated CET1 would exceed regulatory minimums & conservation buffer as of 12/31/242. 9.12% Estimated CET1 with AOCI opt-out1 8.44% FY25 vs FY24 Average loans Flat to +1% full year average, reflecting lower start point in FY25 than FY24 +3% point to point (Dec ‘24 to Dec ‘25), expect broad-based growth to offset Commercial Real Estate trends Average deposits -2 to -3% full year average reflecting lower brokered time deposits, or +1% full year average excluding impact of lower brokered time deposits, projecting growth in customer balances Net interest income1 +6 to +7%, including the impact of BSBY cessation2 Credit quality Continued credit normalization to drive expected NCOs at the low end of our normal 20 to 40 bps range Noninterest income3 +4%, with increases in customer income year over year Noninterest expenses3 +3%, projecting higher salaries & benefits, lower gains on sale of real estate & higher pension ($8MM year over year increase) Tax FY tax rate ~23%, excluding discrete items Capital Expect to maintain capital well above our CET1 target of 10% Management Outlook Assumes no change in current economic environment ©2025, Comerica Inc. All rights reserved. 16 1Q25 vs. 4Q24 Average loans Flat, growth in most businesses offset by expected Commercial Real Estate paydowns Average deposits -3%, or -2% excluding impact of lower brokered time deposits, expect cyclical & seasonal pressure concentrated in noninterest-bearing balances Net interest income1 -1 to -2%, including the impact of BSBY cessation2 Noninterest income3 +6 to +7%, impact from 4Q24 sale of Treasury securities & 1Q25 seasonal declines in select categories Noninterest expense3 +2%, seasonally higher compensation expenses & lower gains on sale of real estate Outlook as of 1/22/25 & guidance compares to reported GAAP 2024 or reported GAAP 4Q24 values as applicable unless noted as adjusted 1Utilizing 12/31/24 forward curve 2See slide 22 for the impact of BSBY cessation 3Deferred comp & CVA are dependent on market factors, inherently difficult to predict & assumed to be $0 in future periods, please refer to slides 12 & 13 for impact in prior periods

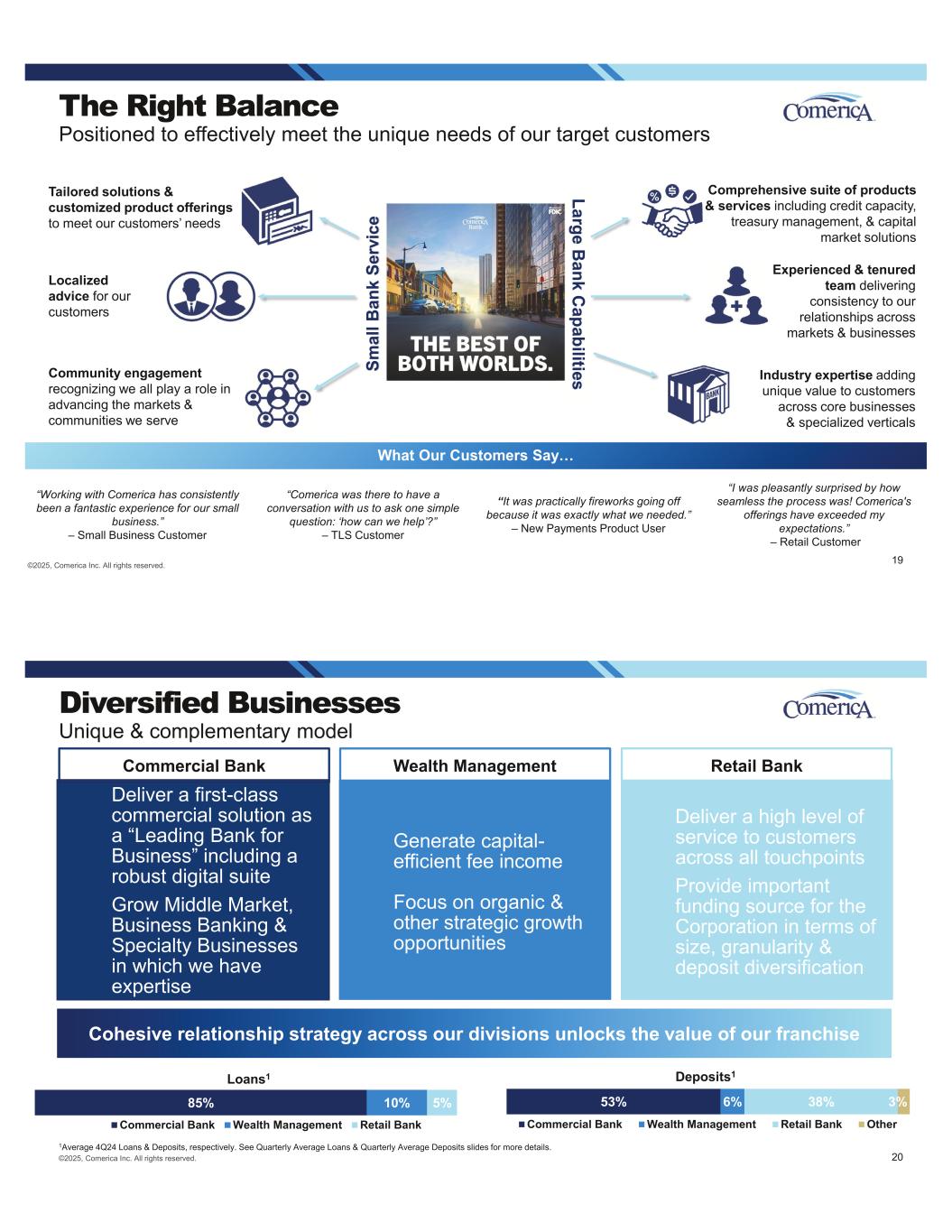

©2025, Comerica Inc. All rights reserved. Positioned for the Future Strong foundation & strategy create opportunity for enhanced returns over time • Proven credit results Outperformance through cycles Peer leading 3Q24 charge-off performance1 & strong 4Q24 results Metrics below historical averages • Solid capital position 11.89% CET12, well above target Adjusting for AOCI opt out, 4Q24 CET1 exceeded regulatory minimums & buffers • Abundant liquidity Normalized cash position Reduced wholesale funding significantly Preserved substantial capacity • Attractive deposit franchise Peer leading NIB mix1 Compelling Treasury Management cross- sell Leveraging strong foundation • Targeted market, MSA focused strategy In 14 of the 15 largest3 & 8 of the 10 fastest growing markets4 Investments in TX & the southeast align with market growth trends • Diversified business Leading bank for business with strong retail & wealth management capabilities Selective business mix with specialized verticals where we demonstrate differentiated value proposition Enhances opportunity for consistent & strong returns • Tenured colleagues Experienced colleagues deliver value-add, industry expertise Business leaders average 25 yrs, RMs 11 yrs, GMs 19 yrs5 Reinforces consistency for our customers & high level of customer service Executing on differentiated strategy • Favorable earnings trajectory Structural projected benefit to NII from maturing swaps & repayment of securities6 • Select strategic investments Focus on noninterest income to drive capital efficient revenue (Payments, Capital Markets & Wealth Management) Targeted market expansion to enhance growth Granular Small Business deposit strategy Continued focus on enhanced risk framework • Balance sheet expansion Strong pipeline & initial signs of increased customer optimism following first rate cut Focus on responsible, balanced growth Driving responsible growth 17 1Source for peer data: S&P Global Market Intelligence & company press releases; for a comprehensive list of our peer group please see our 2024 proxy statement 24Q24 estimated 3U.S. Census Bureau; by population 2023. Includes all locations with employees & offices 42023 vs 2022 by number of people 5As of 12/31/24 6Outlook as of 1/22/25 APPENDIX

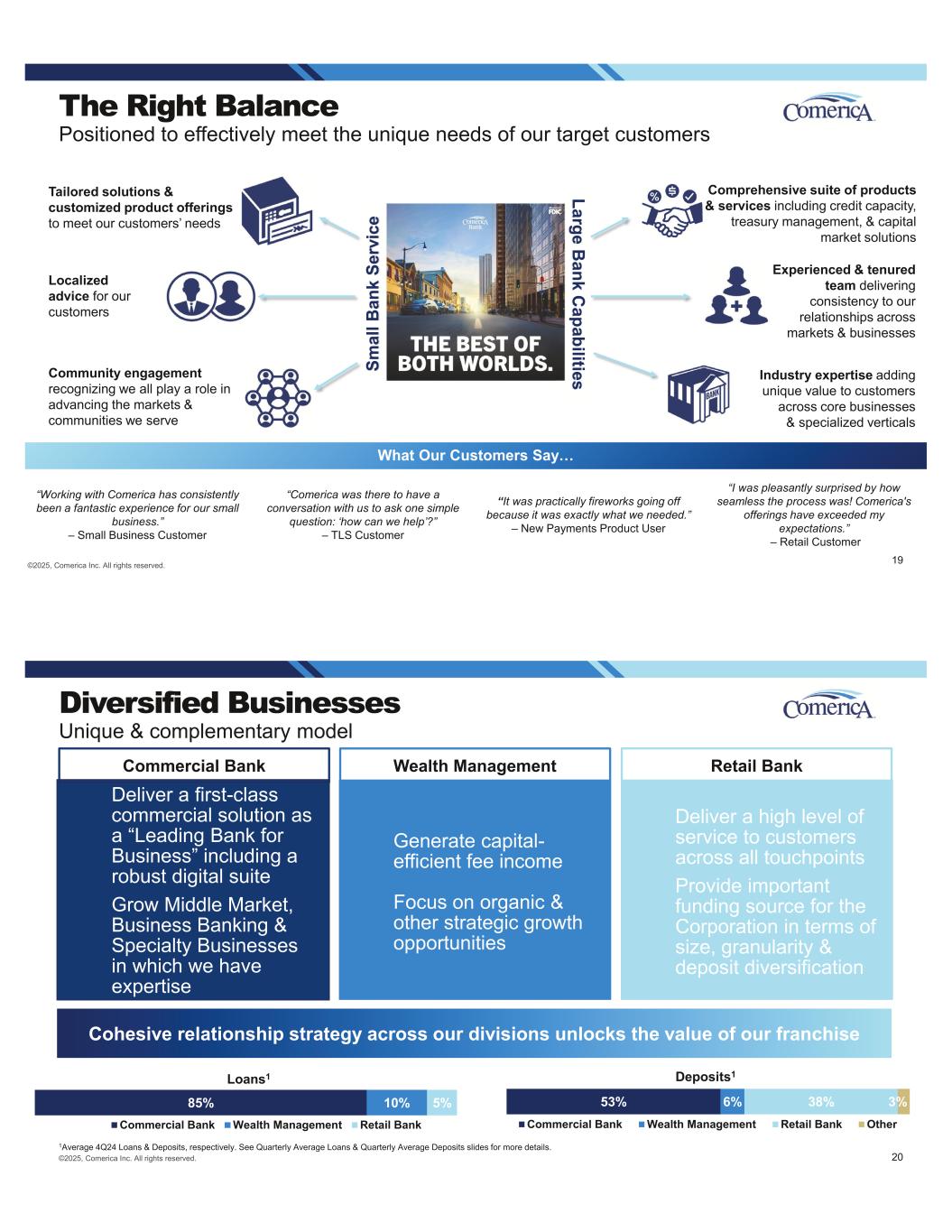

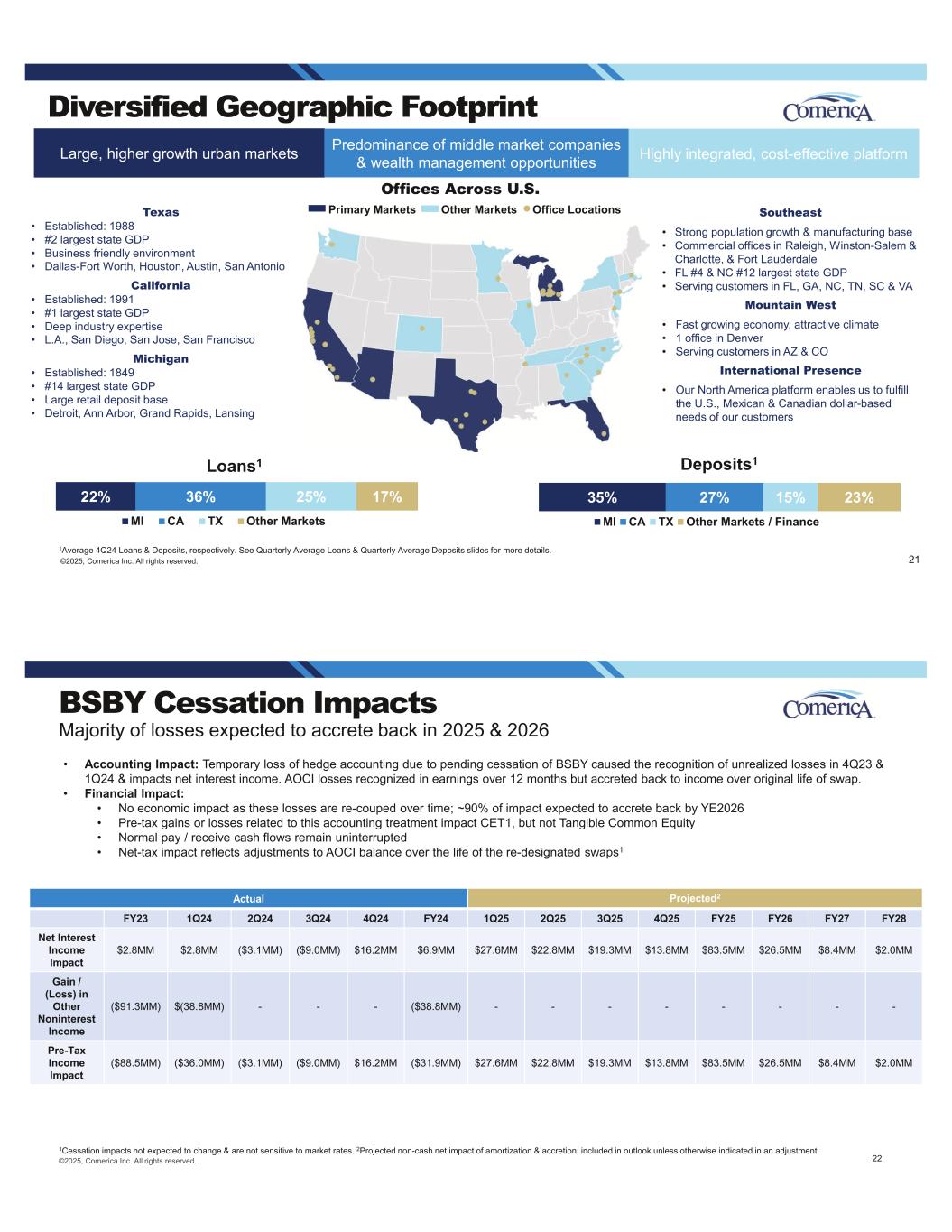

What Our Customers Say… “Working with Comerica has consistently been a fantastic experience for our small business.” – Small Business Customer “Comerica was there to have a conversation with us to ask one simple question: ‘how can we help’?” – TLS Customer “It was practically fireworks going off because it was exactly what we needed.” – New Payments Product User “I was pleasantly surprised by how seamless the process was! Comerica's offerings have exceeded my expectations.” – Retail Customer ©2025, Comerica Inc. All rights reserved. The Right Balance Positioned to effectively meet the unique needs of our target customers Experienced & tenured team delivering consistency to our relationships across markets & businesses Tailored solutions & customized product offerings to meet our customers’ needs Localized advice for our customers Industry expertise adding unique value to customers across core businesses & specialized verticals Comprehensive suite of products & services including credit capacity, treasury management, & capital market solutions Community engagement recognizing we all play a role in advancing the markets & communities we serve Large B ank C apabilitiesSm al l B an k Se rv ic e 19 Commercial Bank 85% 10% 5% Commercial Bank Wealth Management Retail Bank 53% 6% 38% 3% Commercial Bank Wealth Management Retail Bank Other ©2025, Comerica Inc. All rights reserved. Diversified Businesses Unique & complementary model Loans1 Deposits1 1Average 4Q24 Loans & Deposits, respectively. See Quarterly Average Loans & Quarterly Average Deposits slides for more details. 20 Wealth Management Deliver a first-class commercial solution as a “Leading Bank for Business” including a robust digital suite Grow Middle Market, Business Banking & Specialty Businesses in which we have expertise Generate capital- efficient fee income Focus on organic & other strategic growth opportunities Deliver a high level of service to customers across all touchpoints Provide important funding source for the Corporation in terms of size, granularity & deposit diversification Retail Bank Cohesive relationship strategy across our divisions unlocks the value of our franchise

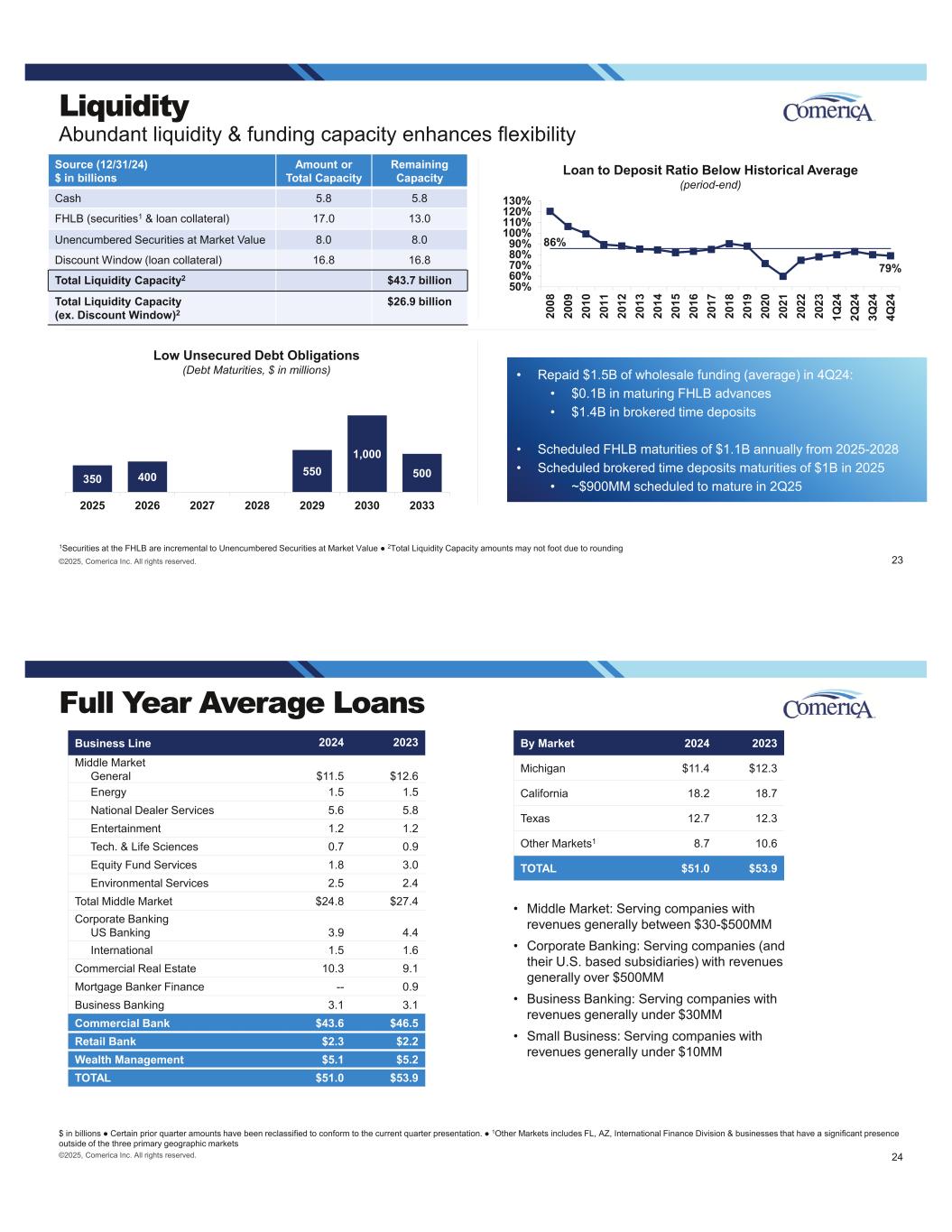

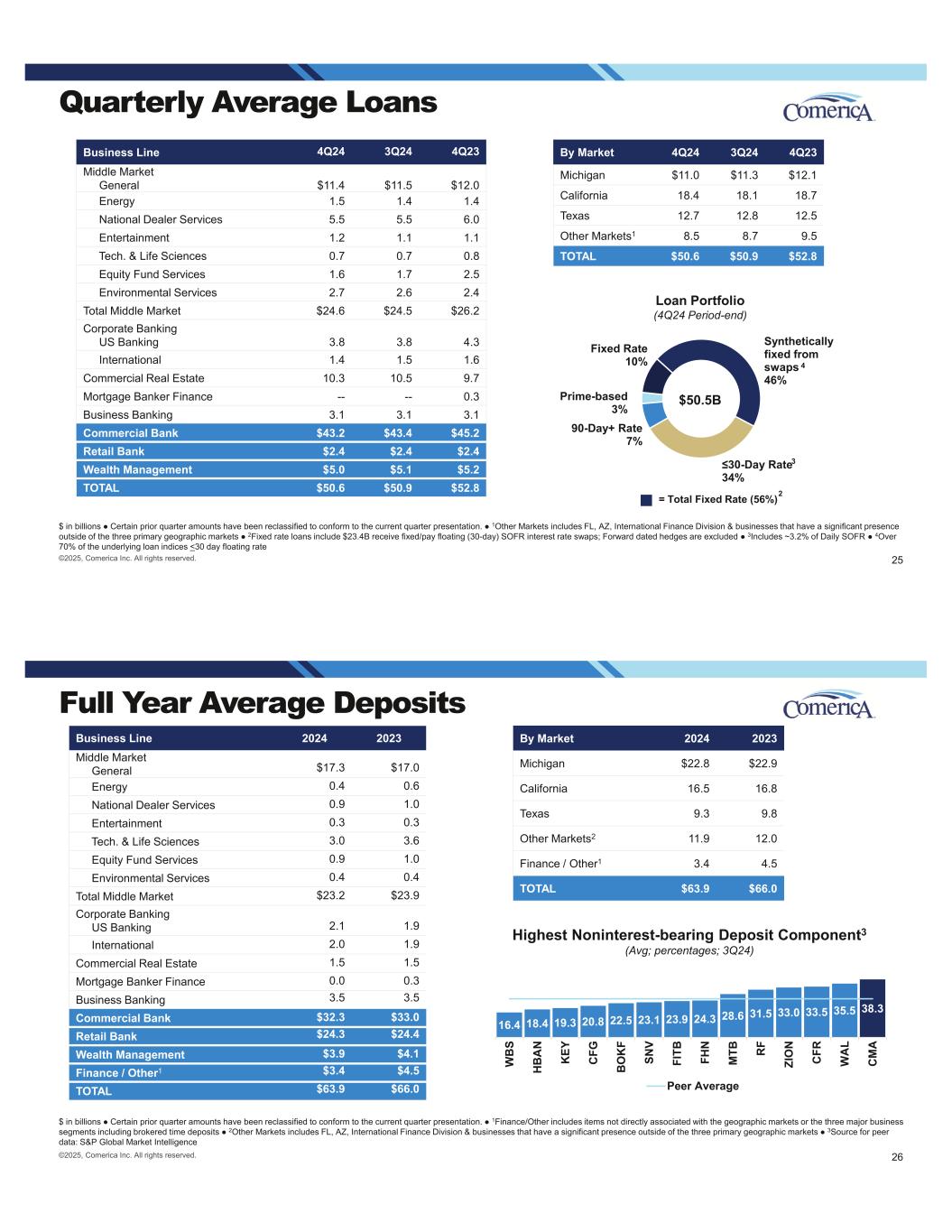

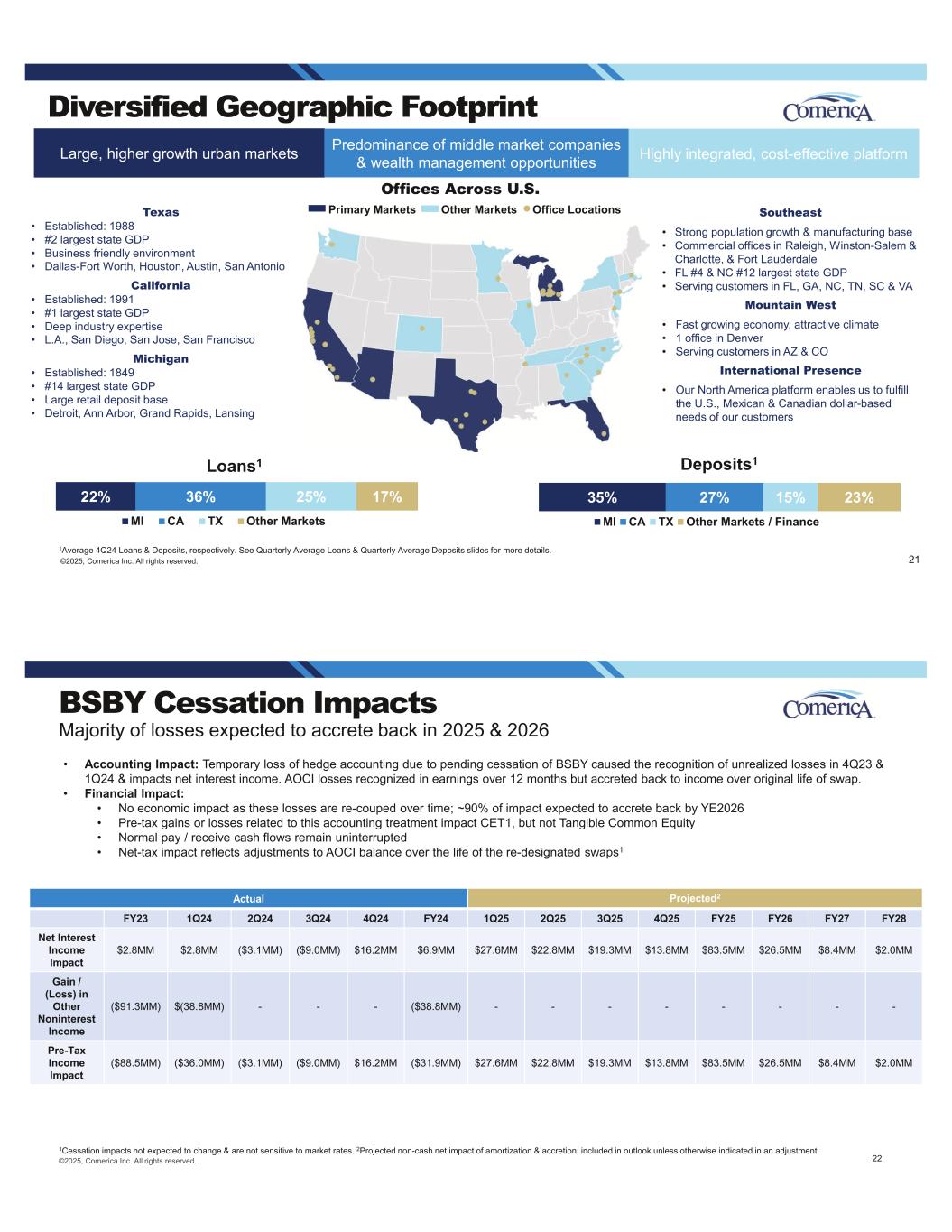

Primary Markets Other Markets Office Locations Diversified Geographic Footprint Texas • Established: 1988 • #2 largest state GDP • Business friendly environment • Dallas-Fort Worth, Houston, Austin, San Antonio California • Established: 1991 • #1 largest state GDP • Deep industry expertise • L.A., San Diego, San Jose, San Francisco Michigan • Established: 1849 • #14 largest state GDP • Large retail deposit base • Detroit, Ann Arbor, Grand Rapids, Lansing Offices Across U.S. Southeast • Strong population growth & manufacturing base • Commercial offices in Raleigh, Winston-Salem & Charlotte, & Fort Lauderdale • FL #4 & NC #12 largest state GDP • Serving customers in FL, GA, NC, TN, SC & VA Mountain West • Fast growing economy, attractive climate • 1 office in Denver • Serving customers in AZ & CO International Presence • Our North America platform enables us to fulfill the U.S., Mexican & Canadian dollar-based needs of our customers 21©2025, Comerica Inc. All rights reserved. Large, higher growth urban markets Highly integrated, cost-effective platformPredominance of middle market companies & wealth management opportunities 35% 27% 15% 23% MI CA TX Other Markets / Finance 22% 36% 25% 17% MI CA TX Other Markets Loans1 Deposits1 1Average 4Q24 Loans & Deposits, respectively. See Quarterly Average Loans & Quarterly Average Deposits slides for more details. 22©2025, Comerica Inc. All rights reserved. BSBY Cessation Impacts Actual Projected2 FY23 1Q24 2Q24 3Q24 4Q24 FY24 1Q25 2Q25 3Q25 4Q25 FY25 FY26 FY27 FY28 Net Interest Income Impact $2.8MM $2.8MM ($3.1MM) ($9.0MM) $16.2MM $6.9MM $27.6MM $22.8MM $19.3MM $13.8MM $83.5MM $26.5MM $8.4MM $2.0MM Gain / (Loss) in Other Noninterest Income ($91.3MM) $(38.8MM) - - - ($38.8MM) - - - - - - - - Pre-Tax Income Impact ($88.5MM) ($36.0MM) ($3.1MM) ($9.0MM) $16.2MM ($31.9MM) $27.6MM $22.8MM $19.3MM $13.8MM $83.5MM $26.5MM $8.4MM $2.0MM • Accounting Impact: Temporary loss of hedge accounting due to pending cessation of BSBY caused the recognition of unrealized losses in 4Q23 & 1Q24 & impacts net interest income. AOCI losses recognized in earnings over 12 months but accreted back to income over original life of swap. • Financial Impact: • No economic impact as these losses are re-couped over time; ~90% of impact expected to accrete back by YE2026 • Pre-tax gains or losses related to this accounting treatment impact CET1, but not Tangible Common Equity • Normal pay / receive cash flows remain uninterrupted • Net-tax impact reflects adjustments to AOCI balance over the life of the re-designated swaps1 Majority of losses expected to accrete back in 2025 & 2026 1Cessation impacts not expected to change & are not sensitive to market rates. 2Projected non-cash net impact of amortization & accretion; included in outlook unless otherwise indicated in an adjustment.

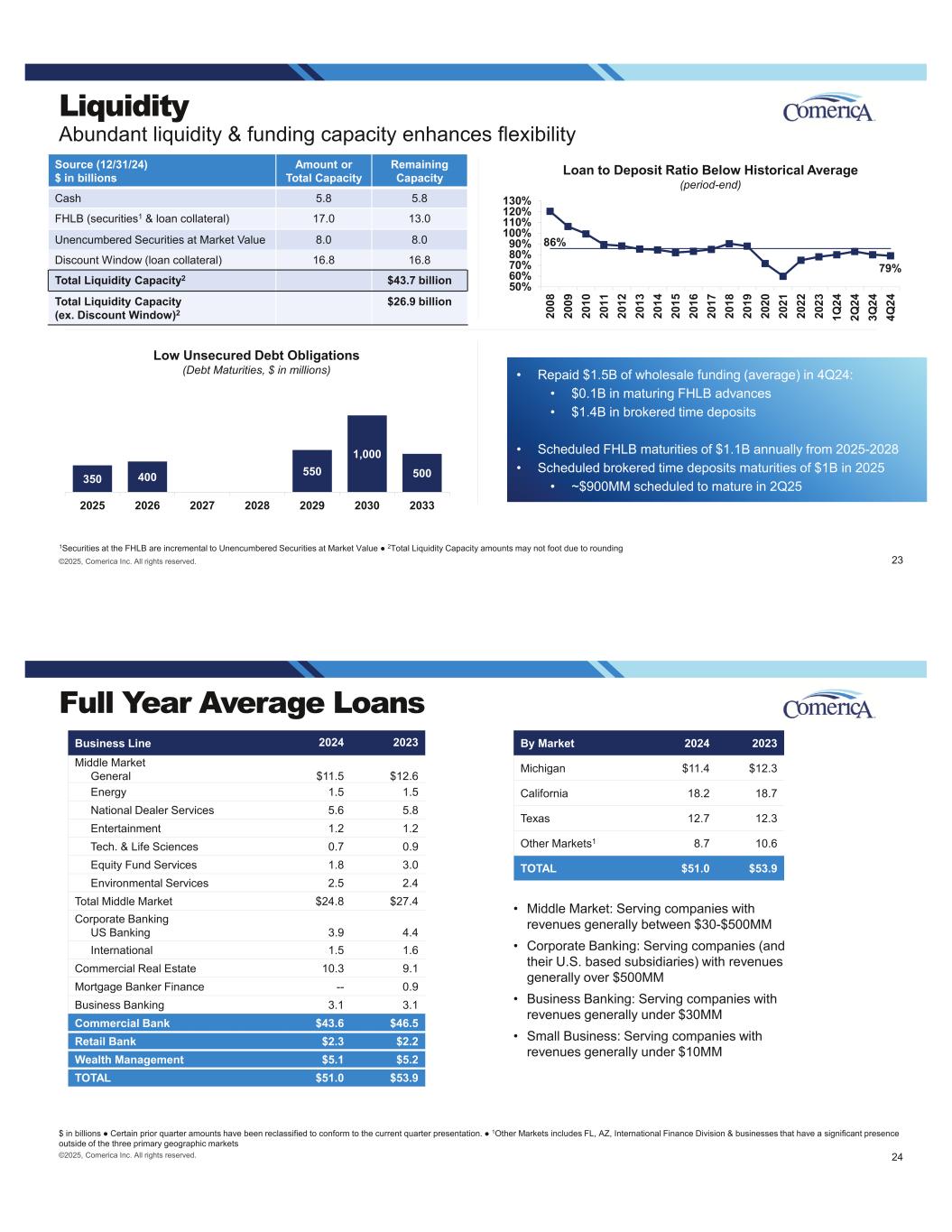

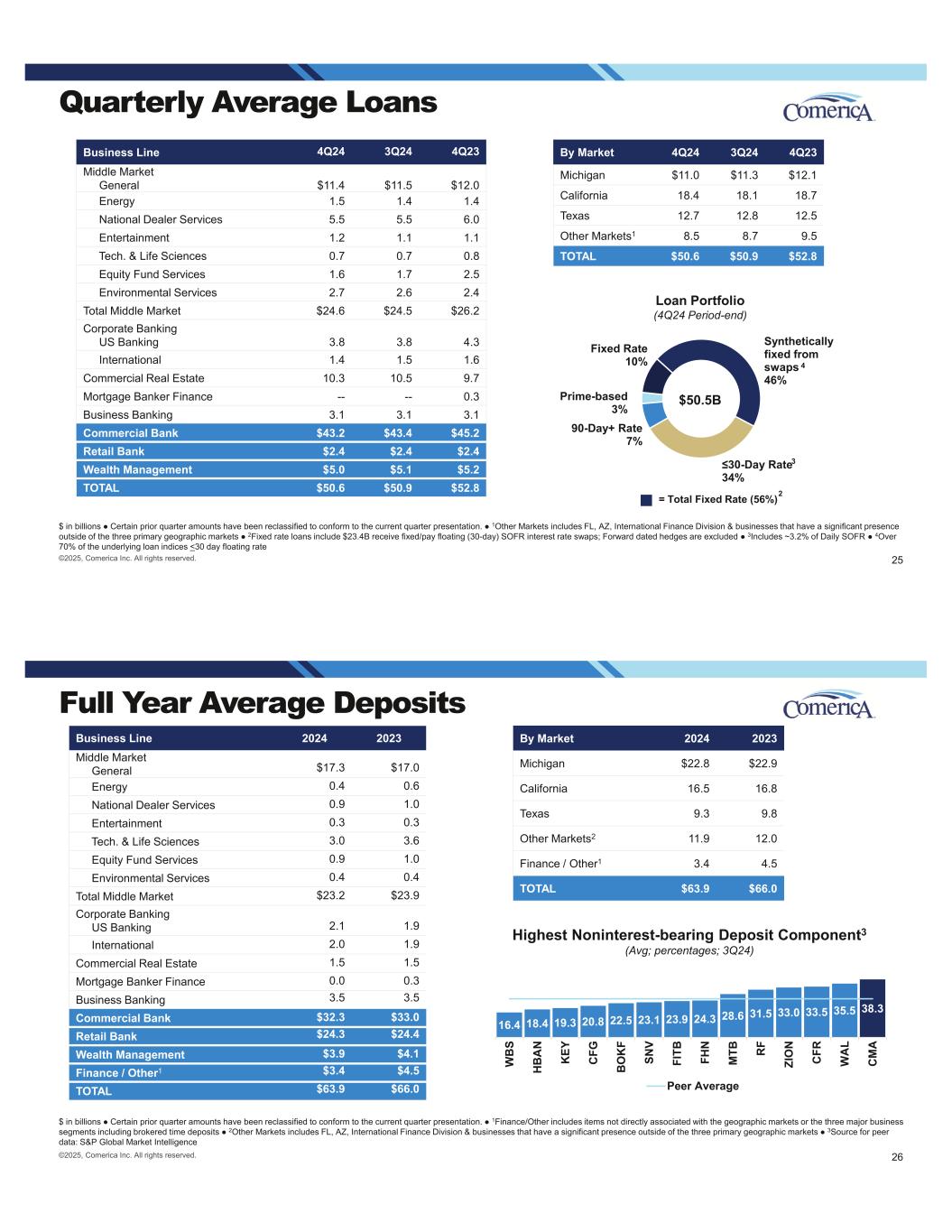

©2025, Comerica Inc. All rights reserved. Liquidity Abundant liquidity & funding capacity enhances flexibility 1Securities at the FHLB are incremental to Unencumbered Securities at Market Value 2Total Liquidity Capacity amounts may not foot due to rounding 23 • Repaid $1.5B of wholesale funding (average) in 4Q24: • $0.1B in maturing FHLB advances • $1.4B in brokered time deposits • Scheduled FHLB maturities of $1.1B annually from 2025-2028 • Scheduled brokered time deposits maturities of $1B in 2025 • ~$900MM scheduled to mature in 2Q25 Source (12/31/24) $ in billions Amount or Total Capacity Remaining Capacity Cash 5.8 5.8 FHLB (securities1 & loan collateral) 17.0 13.0 Unencumbered Securities at Market Value 8.0 8.0 Discount Window (loan collateral) 16.8 16.8 Total Liquidity Capacity2 $43.7 billion Total Liquidity Capacity (ex. Discount Window)2 $26.9 billion Low Unsecured Debt Obligations (Debt Maturities, $ in millions) 79% 86% 50% 60% 70% 80% 90% 100% 110% 120% 130% 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 1Q 24 2Q 24 3Q 24 4Q 24 Loan to Deposit Ratio Below Historical Average (period-end) 350 400 550 1,000 500 2025 2026 2027 2028 2029 2030 2033 Business Line 2024 2023 Middle Market General $11.5 $12.6 Energy 1.5 1.5 National Dealer Services 5.6 5.8 Entertainment 1.2 1.2 Tech. & Life Sciences 0.7 0.9 Equity Fund Services 1.8 3.0 Environmental Services 2.5 2.4 Total Middle Market $24.8 $27.4 Corporate Banking US Banking 3.9 4.4 International 1.5 1.6 Commercial Real Estate 10.3 9.1 Mortgage Banker Finance -- 0.9 Business Banking 3.1 3.1 Commercial Bank $43.6 $46.5 Retail Bank $2.3 $2.2 Wealth Management $5.1 $5.2 TOTAL $51.0 $53.9 Full Year Average Loans $ in billions Certain prior quarter amounts have been reclassified to conform to the current quarter presentation. 1Other Markets includes FL, AZ, International Finance Division & businesses that have a significant presence outside of the three primary geographic markets By Market 2024 2023 Michigan $11.4 $12.3 California 18.2 18.7 Texas 12.7 12.3 Other Markets1 8.7 10.6 TOTAL $51.0 $53.9 ©2025, Comerica Inc. All rights reserved. 24 • Middle Market: Serving companies with revenues generally between $30-$500MM • Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM • Business Banking: Serving companies with revenues generally under $30MM • Small Business: Serving companies with revenues generally under $10MM

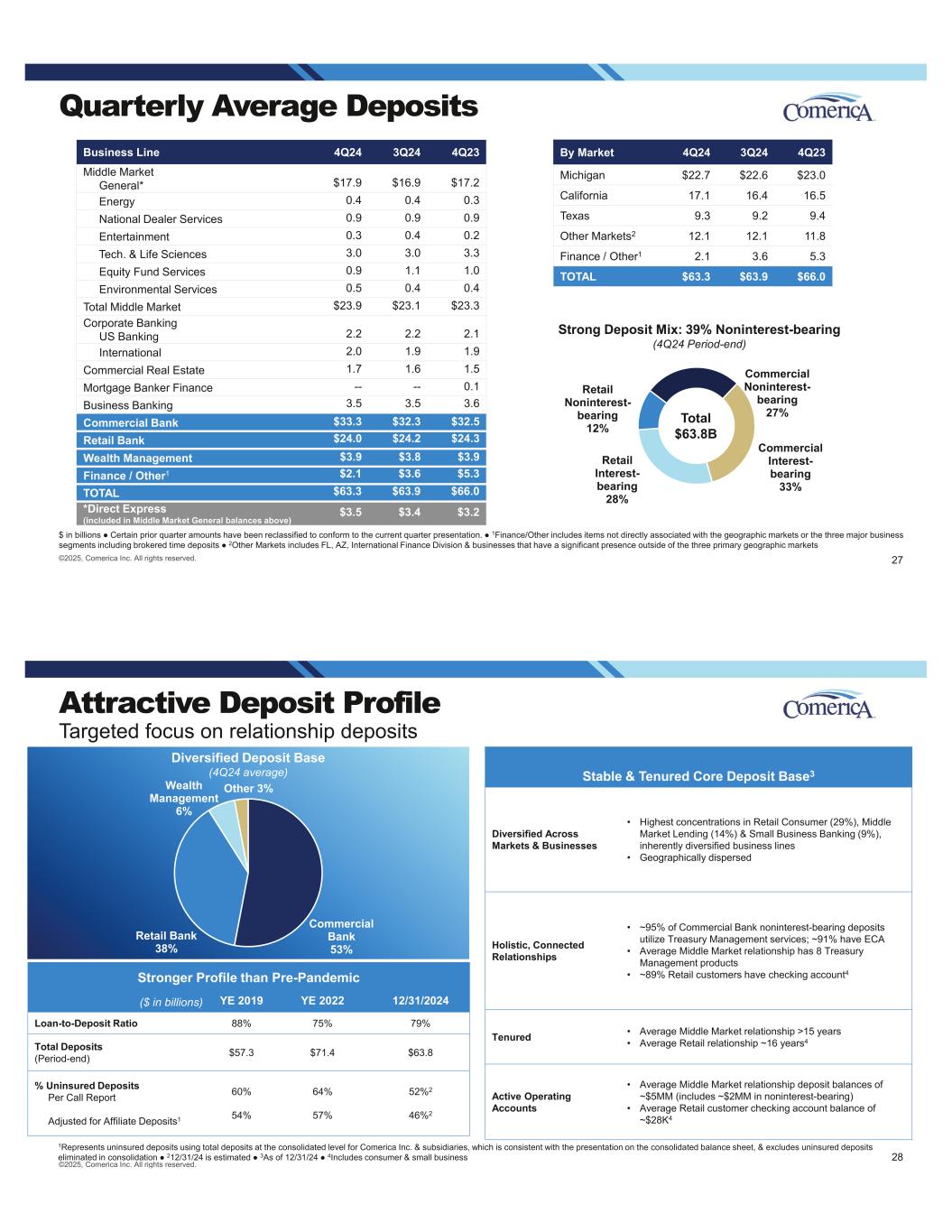

= Total Fixed Rate (56%) Business Line 4Q24 3Q24 4Q23 Middle Market General $11.4 $11.5 $12.0 Energy 1.5 1.4 1.4 National Dealer Services 5.5 5.5 6.0 Entertainment 1.2 1.1 1.1 Tech. & Life Sciences 0.7 0.7 0.8 Equity Fund Services 1.6 1.7 2.5 Environmental Services 2.7 2.6 2.4 Total Middle Market $24.6 $24.5 $26.2 Corporate Banking US Banking 3.8 3.8 4.3 International 1.4 1.5 1.6 Commercial Real Estate 10.3 10.5 9.7 Mortgage Banker Finance -- -- 0.3 Business Banking 3.1 3.1 3.1 Commercial Bank $43.2 $43.4 $45.2 Retail Bank $2.4 $2.4 $2.4 Wealth Management $5.0 $5.1 $5.2 TOTAL $50.6 $50.9 $52.8 Quarterly Average Loans $ in billions Certain prior quarter amounts have been reclassified to conform to the current quarter presentation. 1Other Markets includes FL, AZ, International Finance Division & businesses that have a significant presence outside of the three primary geographic markets 2Fixed rate loans include $23.4B receive fixed/pay floating (30-day) SOFR interest rate swaps; Forward dated hedges are excluded 3Includes ~3.2% of Daily SOFR 4Over 70% of the underlying loan indices <30 day floating rate By Market 4Q24 3Q24 4Q23 Michigan $11.0 $11.3 $12.1 California 18.4 18.1 18.7 Texas 12.7 12.8 12.5 Other Markets1 8.5 8.7 9.5 TOTAL $50.6 $50.9 $52.8 ©2025, Comerica Inc. All rights reserved. 25 Fixed Rate 10% Synthetically fixed from swaps 46% -Day Rate 34% 90-Day+ Rate 7% Prime-based 3% 2 Loan Portfolio (4Q24 Period-end) 3 $50.5B 4 Full Year Average Deposits $ in billions Certain prior quarter amounts have been reclassified to conform to the current quarter presentation. 1Finance/Other includes items not directly associated with the geographic markets or the three major business segments including brokered time deposits 2Other Markets includes FL, AZ, International Finance Division & businesses that have a significant presence outside of the three primary geographic markets 3Source for peer data: S&P Global Market Intelligence Business Line 2024 2023 Middle Market General $17.3 $17.0 Energy 0.4 0.6 National Dealer Services 0.9 1.0 Entertainment 0.3 0.3 Tech. & Life Sciences 3.0 3.6 Equity Fund Services 0.9 1.0 Environmental Services 0.4 0.4 Total Middle Market $23.2 $23.9 Corporate Banking US Banking 2.1 1.9 International 2.0 1.9 Commercial Real Estate 1.5 1.5 Mortgage Banker Finance 0.0 0.3 Business Banking 3.5 3.5 Commercial Bank $32.3 $33.0 Retail Bank $24.3 $24.4 Wealth Management $3.9 $4.1 Finance / Other1 $3.4 $4.5 TOTAL $63.9 $66.0 By Market 2024 2023 Michigan $22.8 $22.9 California 16.5 16.8 Texas 9.3 9.8 Other Markets2 11.9 12.0 Finance / Other1 3.4 4.5 TOTAL $63.9 $66.0 ©2025, Comerica Inc. All rights reserved. 26 16.4 18.4 19.3 20.8 22.5 23.1 23.9 24.3 28.6 31.5 33.0 33.5 35.5 38.3 W B S H B A N K EY C FG B O K F SN V FI TB FH N M TB R F ZI O N C FR W A L C M A Peer Average Highest Noninterest-bearing Deposit Component3 (Avg; percentages; 3Q24)

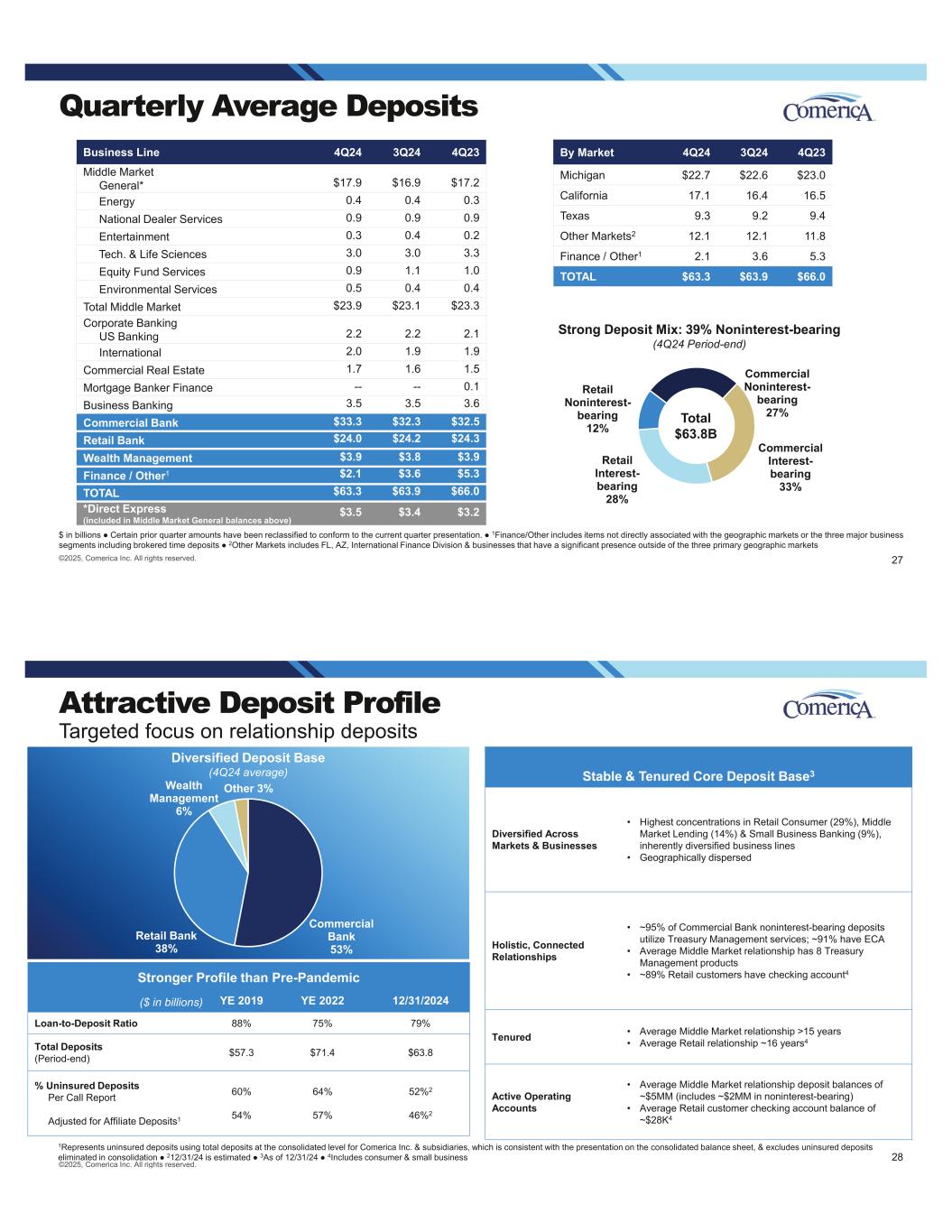

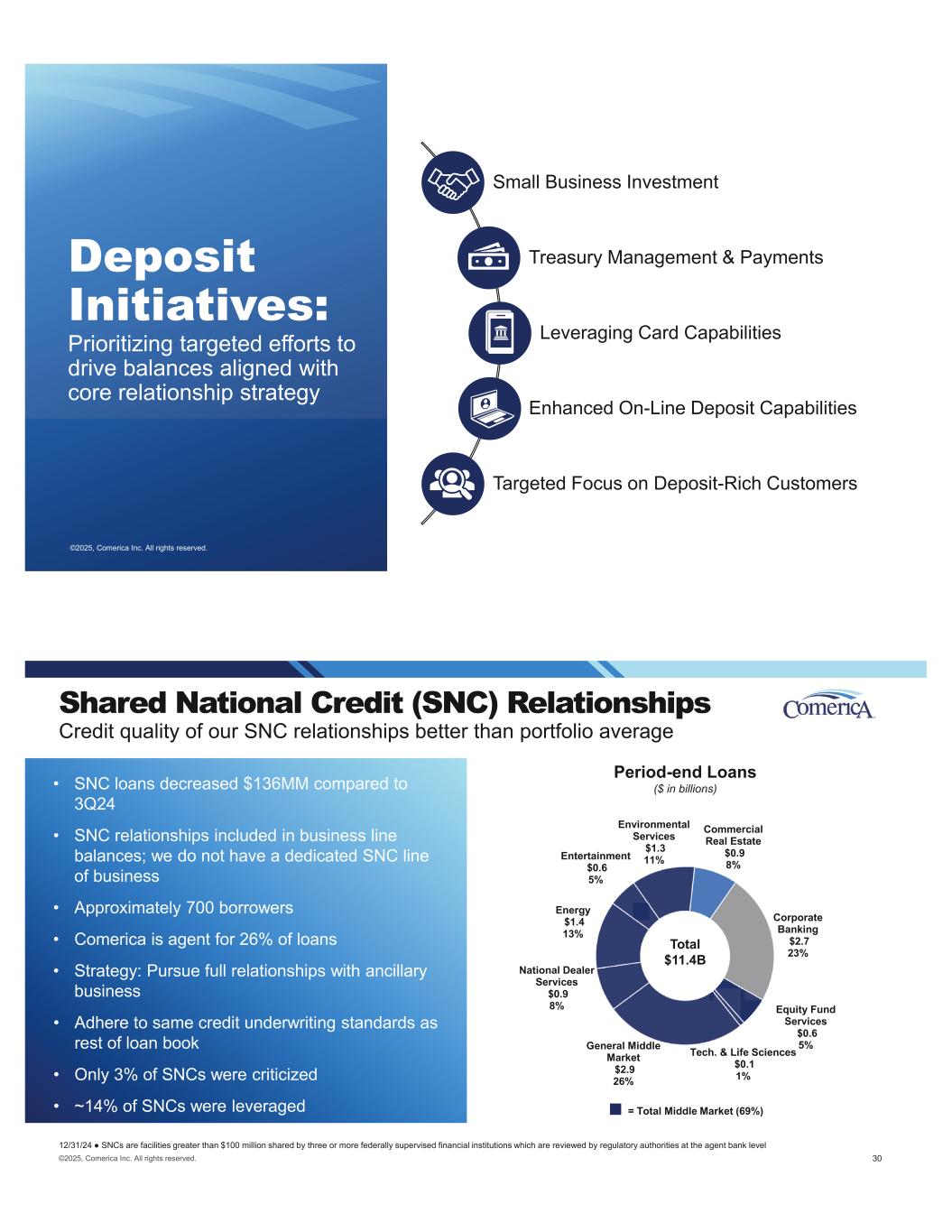

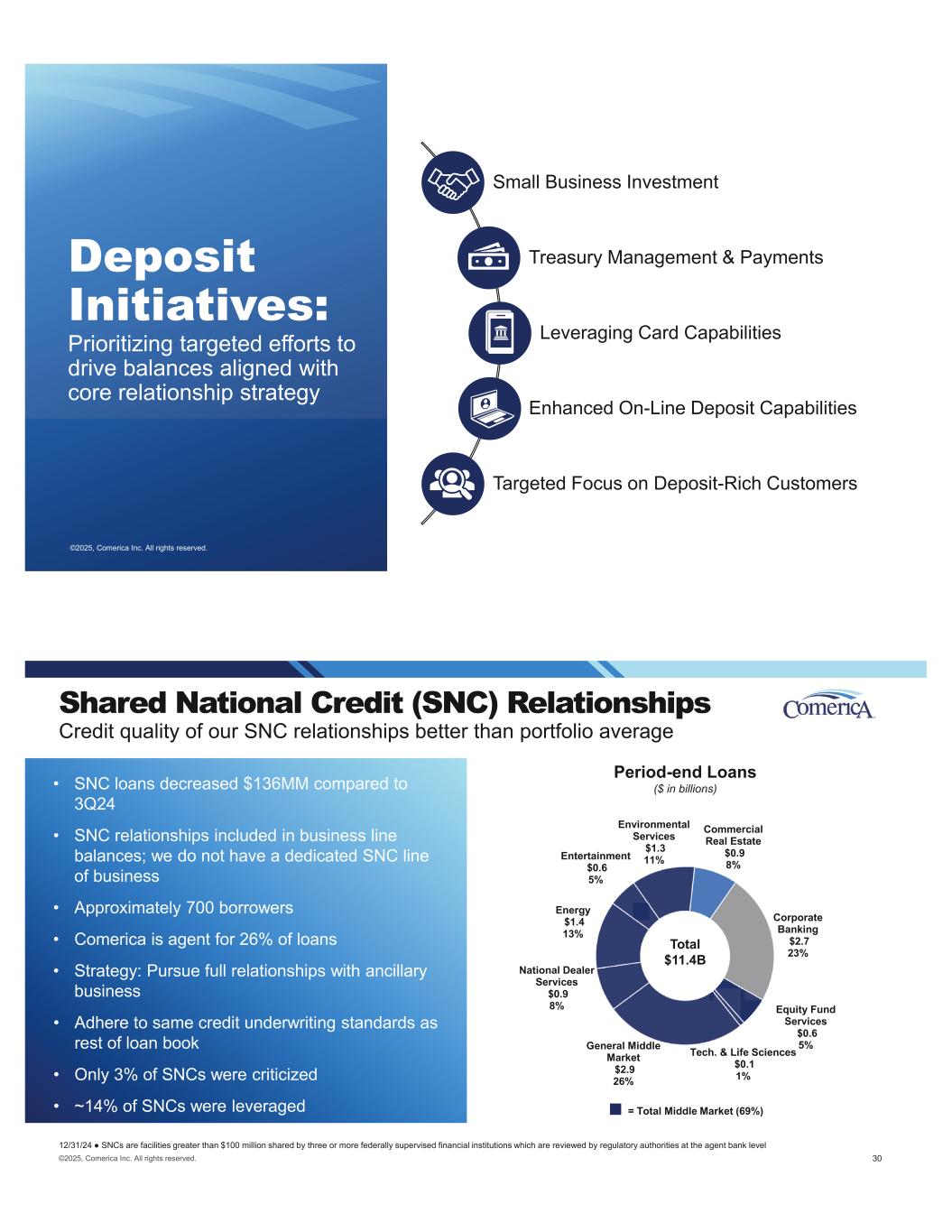

Quarterly Average Deposits $ in billions Certain prior quarter amounts have been reclassified to conform to the current quarter presentation. 1Finance/Other includes items not directly associated with the geographic markets or the three major business segments including brokered time deposits 2Other Markets includes FL, AZ, International Finance Division & businesses that have a significant presence outside of the three primary geographic markets Business Line 4Q24 3Q24 4Q23 Middle Market General* $17.9 $16.9 $17.2 Energy 0.4 0.4 0.3 National Dealer Services 0.9 0.9 0.9 Entertainment 0.3 0.4 0.2 Tech. & Life Sciences 3.0 3.0 3.3 Equity Fund Services 0.9 1.1 1.0 Environmental Services 0.5 0.4 0.4 Total Middle Market $23.9 $23.1 $23.3 Corporate Banking US Banking 2.2 2.2 2.1 International 2.0 1.9 1.9 Commercial Real Estate 1.7 1.6 1.5 Mortgage Banker Finance -- -- 0.1 Business Banking 3.5 3.5 3.6 Commercial Bank $33.3 $32.3 $32.5 Retail Bank $24.0 $24.2 $24.3 Wealth Management $3.9 $3.8 $3.9 Finance / Other1 $2.1 $3.6 $5.3 TOTAL $63.3 $63.9 $66.0 *Direct Express (included in Middle Market General balances above) $3.5 $3.4 $3.2 By Market 4Q24 3Q24 4Q23 Michigan $22.7 $22.6 $23.0 California 17.1 16.4 16.5 Texas 9.3 9.2 9.4 Other Markets2 12.1 12.1 11.8 Finance / Other1 2.1 3.6 5.3 TOTAL $63.3 $63.9 $66.0 ©2025, Comerica Inc. All rights reserved. 27 Commercial Noninterest- bearing 27% Commercial Interest- bearing 33% Retail Interest- bearing 28% Retail Noninterest- bearing 12% Strong Deposit Mix: 39% Noninterest-bearing (4Q24 Period-end) Total $63.8B Commercial Bank 53% Retail Bank 38% Wealth Management 6% Other 3% Diversified Deposit Base (4Q24 average) 1Represents uninsured deposits using total deposits at the consolidated level for Comerica Inc. & subsidiaries, which is consistent with the presentation on the consolidated balance sheet, & excludes uninsured deposits eliminated in consolidation 212/31/24 is estimated 3As of 12/31/24 4Includes consumer & small business ©2025, Comerica Inc. All rights reserved. Attractive Deposit Profile Targeted focus on relationship deposits Stronger Profile than Pre-Pandemic ($ in billions) YE 2019 YE 2022 12/31/2024 Loan-to-Deposit Ratio 88% 75% 79% Total Deposits (Period-end) $57.3 $71.4 $63.8 % Uninsured Deposits Per Call Report Adjusted for Affiliate Deposits1 60% 54% 64% 57% 52%2 46%2 Stable & Tenured Core Deposit Base3 Diversified Across Markets & Businesses • Highest concentrations in Retail Consumer (29%), Middle Market Lending (14%) & Small Business Banking (9%), inherently diversified business lines • Geographically dispersed Holistic, Connected Relationships • ~95% of Commercial Bank noninterest-bearing deposits utilize Treasury Management services; ~91% have ECA • Average Middle Market relationship has 8 Treasury Management products • ~89% Retail customers have checking account4 Tenured • Average Middle Market relationship >15 years • Average Retail relationship ~16 years4 Active Operating Accounts • Average Middle Market relationship deposit balances of ~$5MM (includes ~$2MM in noninterest-bearing) • Average Retail customer checking account balance of ~$28K4 28

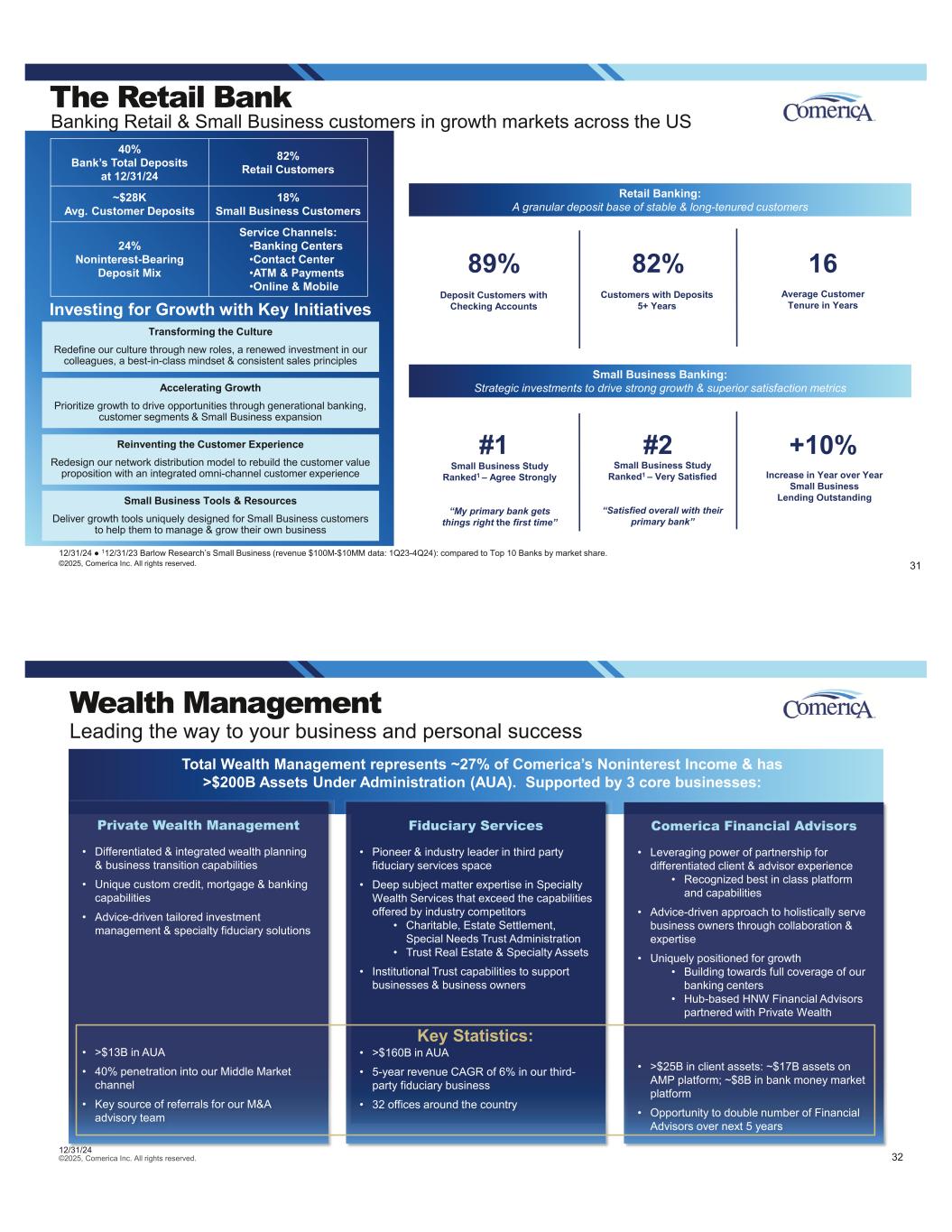

Deposit Initiatives: Prioritizing targeted efforts to drive balances aligned with core relationship strategy ©2025, Comerica Inc. All rights reserved. Small Business Investment Treasury Management & Payments Leveraging Card Capabilities Enhanced On-Line Deposit Capabilities Targeted Focus on Deposit-Rich Customers Shared National Credit (SNC) Relationships Credit quality of our SNC relationships better than portfolio average • SNC loans decreased $136MM compared to 3Q24 • SNC relationships included in business line balances; we do not have a dedicated SNC line of business • Approximately 700 borrowers • Comerica is agent for 26% of loans • Strategy: Pursue full relationships with ancillary business • Adhere to same credit underwriting standards as rest of loan book • Only 3% of SNCs were criticized • ~14% of SNCs were leveraged Period-end Loans ($ in billions) Commercial Real Estate $0.9 8% Corporate Banking $2.7 23% Equity Fund Services $0.6 5%Tech. & Life Sciences $0.1 1% General Middle Market $2.9 26% National Dealer Services $0.9 8% Energy $1.4 13% Entertainment $0.6 5% Environmental Services $1.3 11% = Total Middle Market (69%) Total $11.4B 30©2025, Comerica Inc. All rights reserved. 12/31/24 SNCs are facilities greater than $100 million shared by three or more federally supervised financial institutions which are reviewed by regulatory authorities at the agent bank level

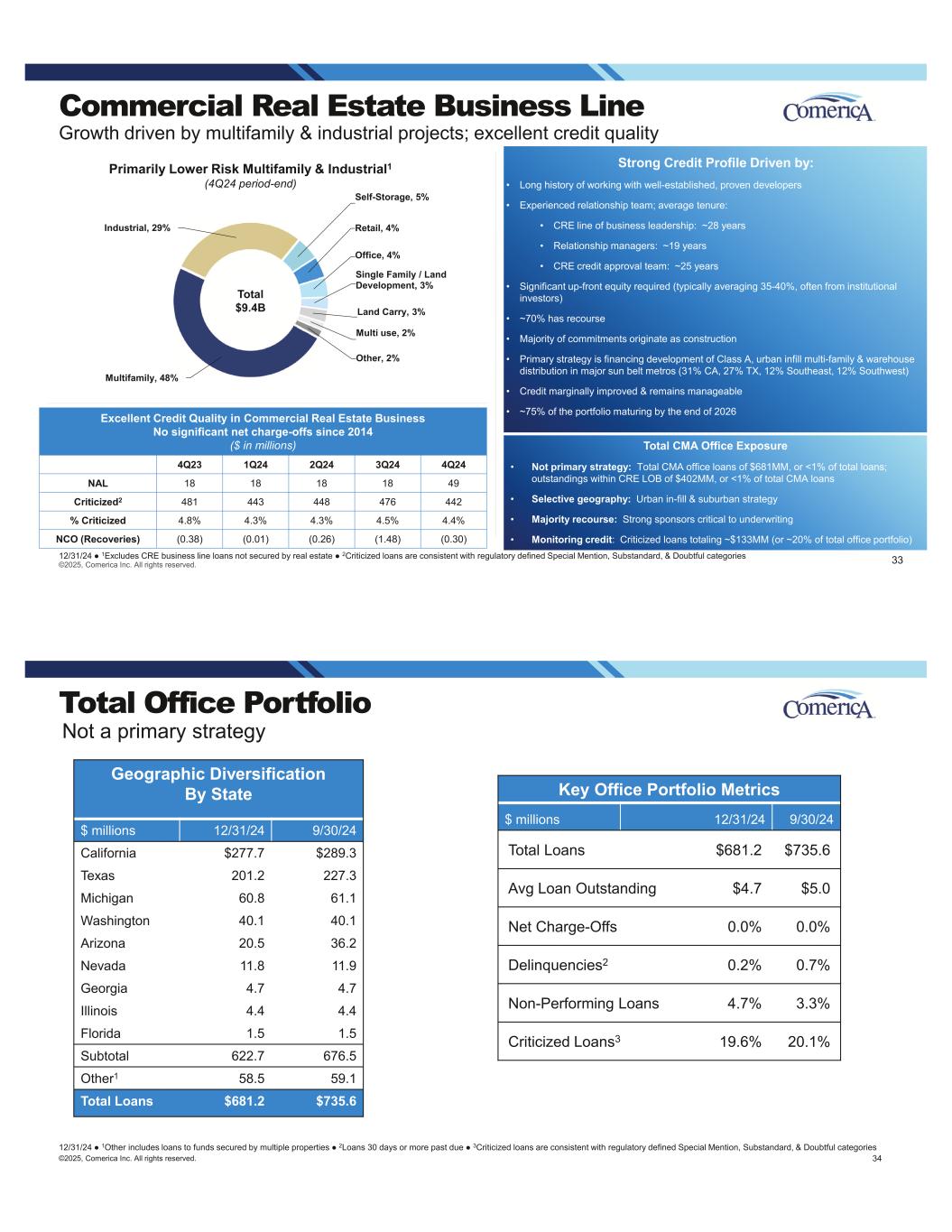

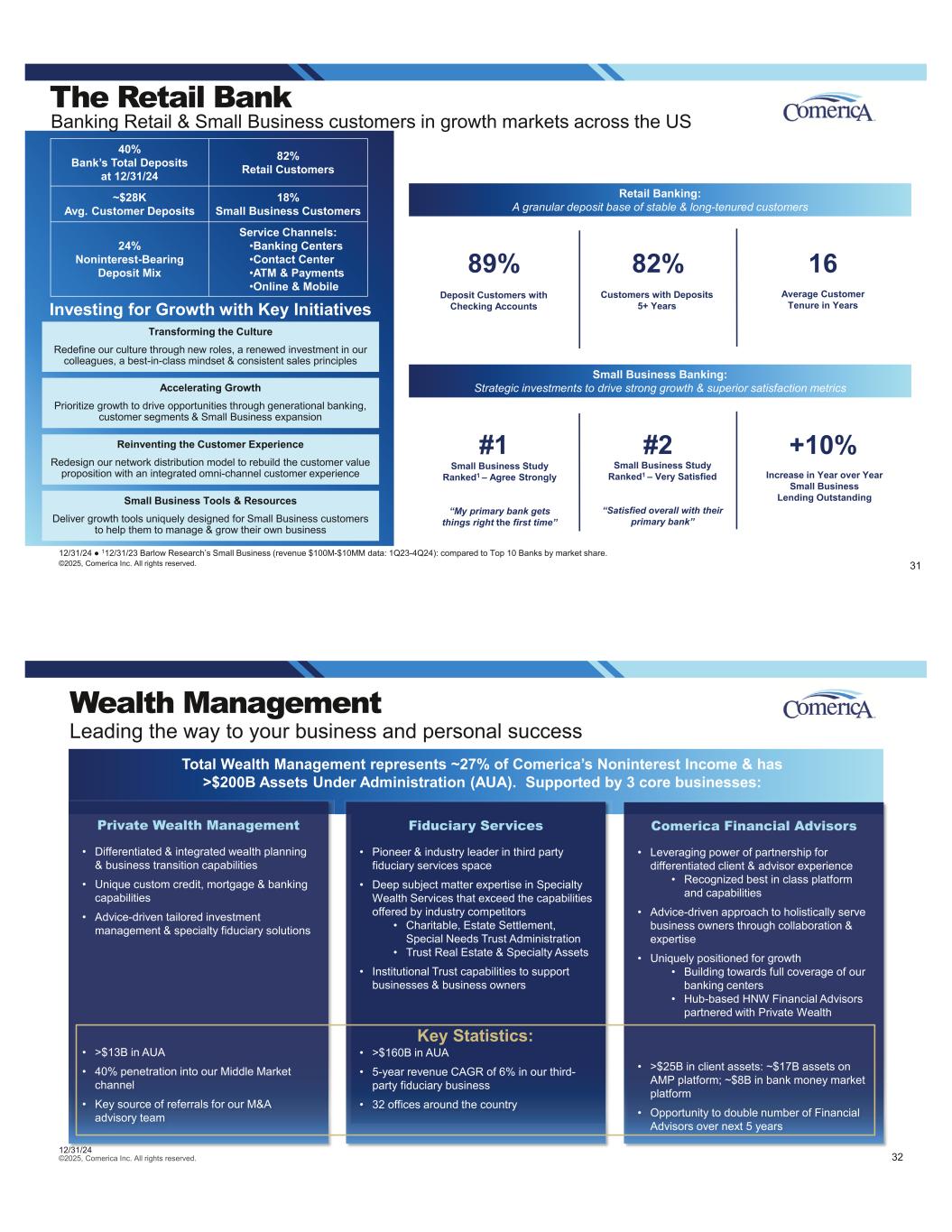

Investing for Growth with Key Initiatives Transforming the Culture Redefine our culture through new roles, a renewed investment in our colleagues, a best-in-class mindset & consistent sales principles Reinventing the Customer Experience Redesign our network distribution model to rebuild the customer value proposition with an integrated omni-channel customer experience Accelerating Growth Prioritize growth to drive opportunities through generational banking, customer segments & Small Business expansion 89% 82% 16 Average Customer Tenure in Years Deposit Customers with Checking Accounts ©2025, Comerica Inc. All rights reserved. 31 The Retail Bank Banking Retail & Small Business customers in growth markets across the US 12/31/24 112/31/23 Barlow Research’s Small Business (revenue $100M-$10MM data: 1Q23-4Q24): compared to Top 10 Banks by market share. Retail Banking: A granular deposit base of stable & long-tenured customers Small Business Banking: Customers with Deposits 5+ Years 40% at 12/31/24 ~$28K Avg. Customer Deposits Small Business Customers 24% Noninterest-Bearing Deposit Mix Service Channels: •Banking Centers •Contact Center •ATM & Payments •Online & Mobile #1 #2 +10% Increase in Year over Year Small Business Lending Outstanding Small Business Study Ranked1 – Very Satisfied “Satisfied overall with their primary bank” Small Business Tools & Resources Deliver growth tools uniquely designed for Small Business customers to help them to manage & grow their own business Small Business Study Ranked1 – Agree Strongly “My primary bank gets things right the first time” ©2025, Comerica Inc. All rights reserved. Wealth Management Leading the way to your business and personal success Fiduciary Services • Pioneer & industry leader in third party fiduciary services space • Deep subject matter expertise in Specialty Wealth Services that exceed the capabilities offered by industry competitors • Charitable, Estate Settlement, Special Needs Trust Administration • Trust Real Estate & Specialty Assets • Institutional Trust capabilities to support businesses & business owners • >$160B in AUA • 5-year revenue CAGR of 6% in our third- party fiduciary business • 32 offices around the country Private Wealth Management • Differentiated & integrated wealth planning & business transition capabilities • Unique custom credit, mortgage & banking capabilities • Advice-driven tailored investment management & specialty fiduciary solutions • >$13B in AUA • 40% penetration into our Middle Market channel • Key source of referrals for our M&A advisory team Comerica Financial Advisors • Leveraging power of partnership for differentiated client & advisor experience • Recognized best in class platform and capabilities • Advice-driven approach to holistically serve business owners through collaboration & expertise • Uniquely positioned for growth • Building towards full coverage of our banking centers • Hub-based HNW Financial Advisors partnered with Private Wealth • >$25B in client assets: ~$17B assets on AMP platform; ~$8B in bank money market platform • Opportunity to double number of Financial Advisors over next 5 years 32 Total Wealth Management represents ~27% of Comerica’s Noninterest Income & has >$200B Assets Under Administration (AUA). Supported by 3 core businesses: Key Statistics: 12/31/24

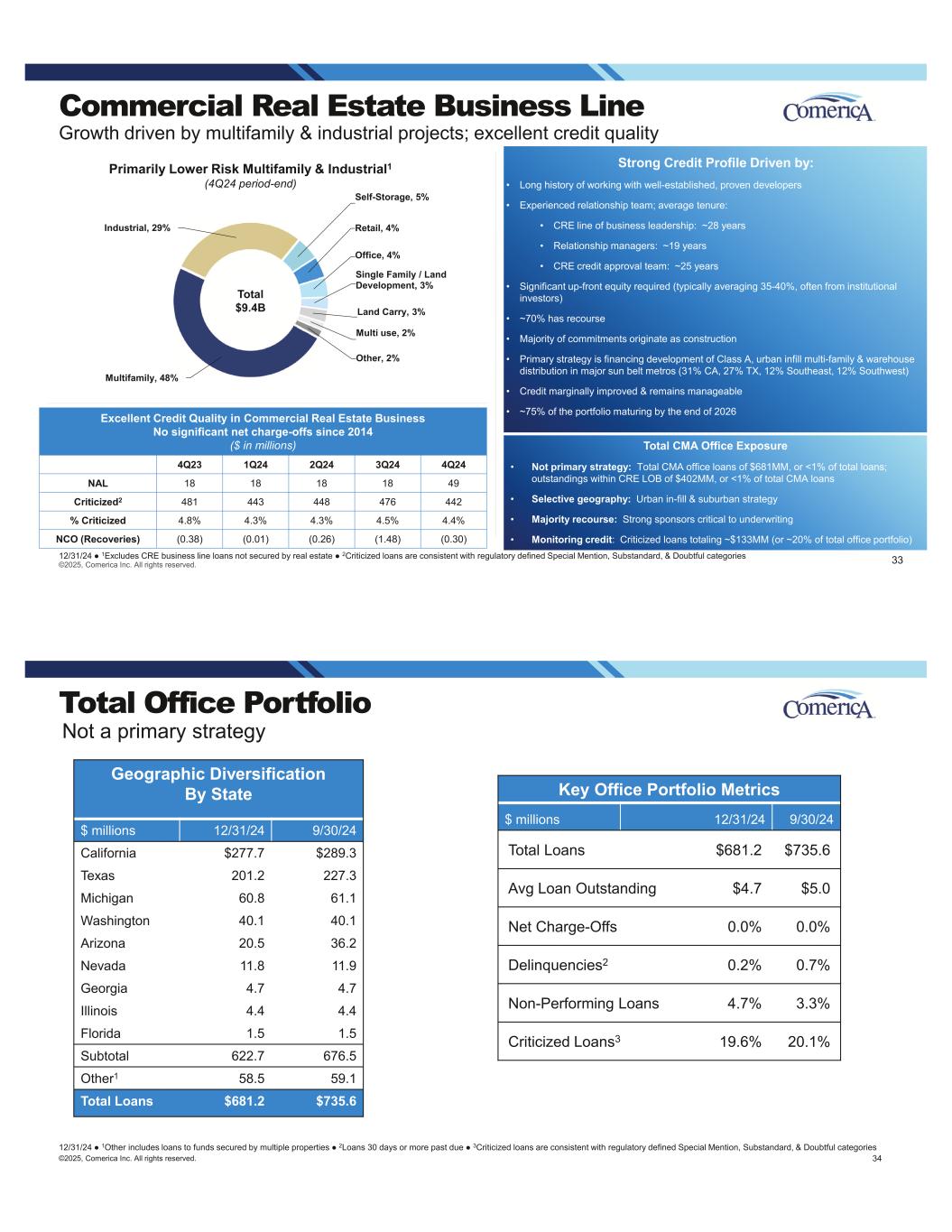

Total CMA Office Exposure • Not primary strategy: Total CMA office loans of $681MM, or <1% of total loans; outstandings within CRE LOB of $402MM, or <1% of total CMA loans • Selective geography: Urban in-fill & suburban strategy • Majority recourse: Strong sponsors critical to underwriting • Monitoring credit: Criticized loans totaling ~$133MM (or ~20% of total office portfolio) Multifamily, 48% Industrial, 29% Self-Storage, 5% Retail, 4% Office, 4% Single Family / Land Development, 3% Land Carry, 3% Multi use, 2% Other, 2% Commercial Real Estate Business Line Growth driven by multifamily & industrial projects; excellent credit quality 12/31/24 1Excludes CRE business line loans not secured by real estate 2Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories Primarily Lower Risk Multifamily & Industrial1 (4Q24 period-end) Total $9.4B Strong Credit Profile Driven by: • Long history of working with well-established, proven developers • Experienced relationship team; average tenure: • CRE line of business leadership: ~28 years • Relationship managers: ~19 years • CRE credit approval team: ~25 years • Significant up-front equity required (typically averaging 35-40%, often from institutional investors) • ~70% has recourse • Majority of commitments originate as construction • Primary strategy is financing development of Class A, urban infill multi-family & warehouse distribution in major sun belt metros (31% CA, 27% TX, 12% Southeast, 12% Southwest) • Credit marginally improved & remains manageable • ~75% of the portfolio maturing by the end of 2026 ©2025, Comerica Inc. All rights reserved. 33 Excellent Credit Quality in Commercial Real Estate Business No significant net charge-offs since 2014 ($ in millions) 4Q23 1Q24 2Q24 3Q24 4Q24 NAL 18 18 18 18 49 Criticized2 481 443 448 476 442 % Criticized 4.8% 4.3% 4.3% 4.5% 4.4% NCO (Recoveries) (0.38) (0.01) (0.26) (1.48) (0.30) 34©2025, Comerica Inc. All rights reserved. Total Office Portfolio Not a primary strategy Geographic Diversification By State $ millions 12/31/24 9/30/24 California $277.7 $289.3 Texas 201.2 227.3 Michigan 60.8 61.1 Washington 40.1 40.1 Arizona 20.5 36.2 Nevada 11.8 11.9 Georgia 4.7 4.7 Illinois 4.4 4.4 Florida 1.5 1.5 Subtotal 622.7 676.5 Other1 58.5 59.1 Total Loans $681.2 $735.6 Key Office Portfolio Metrics $ millions 12/31/24 9/30/24 Total Loans $681.2 $735.6 Avg Loan Outstanding $4.7 $5.0 Net Charge-Offs 0.0% 0.0% Delinquencies2 0.2% 0.7% Non-Performing Loans 4.7% 3.3% Criticized Loans3 19.6% 20.1% 12/31/24 1Other includes loans to funds secured by multiple properties 2Loans 30 days or more past due 3Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories

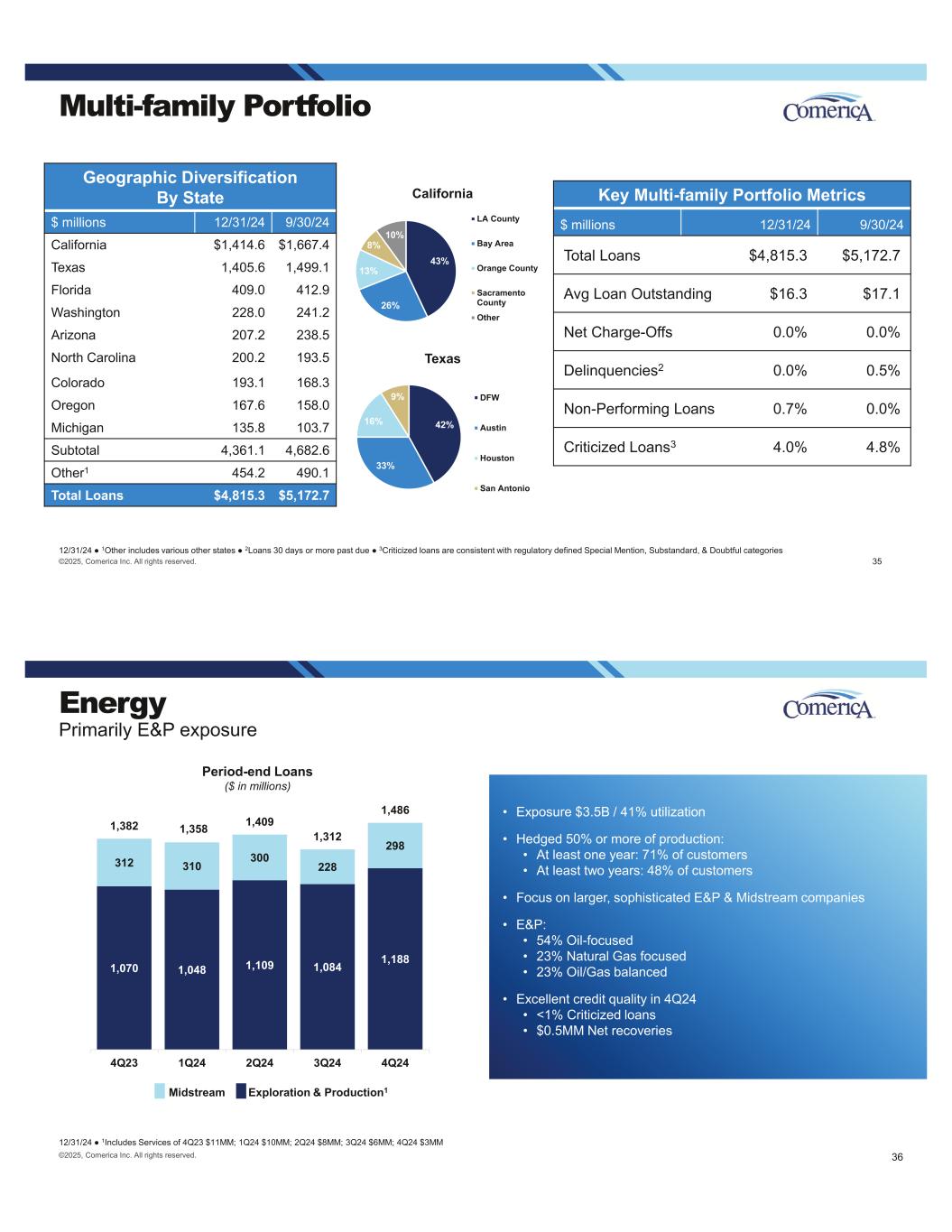

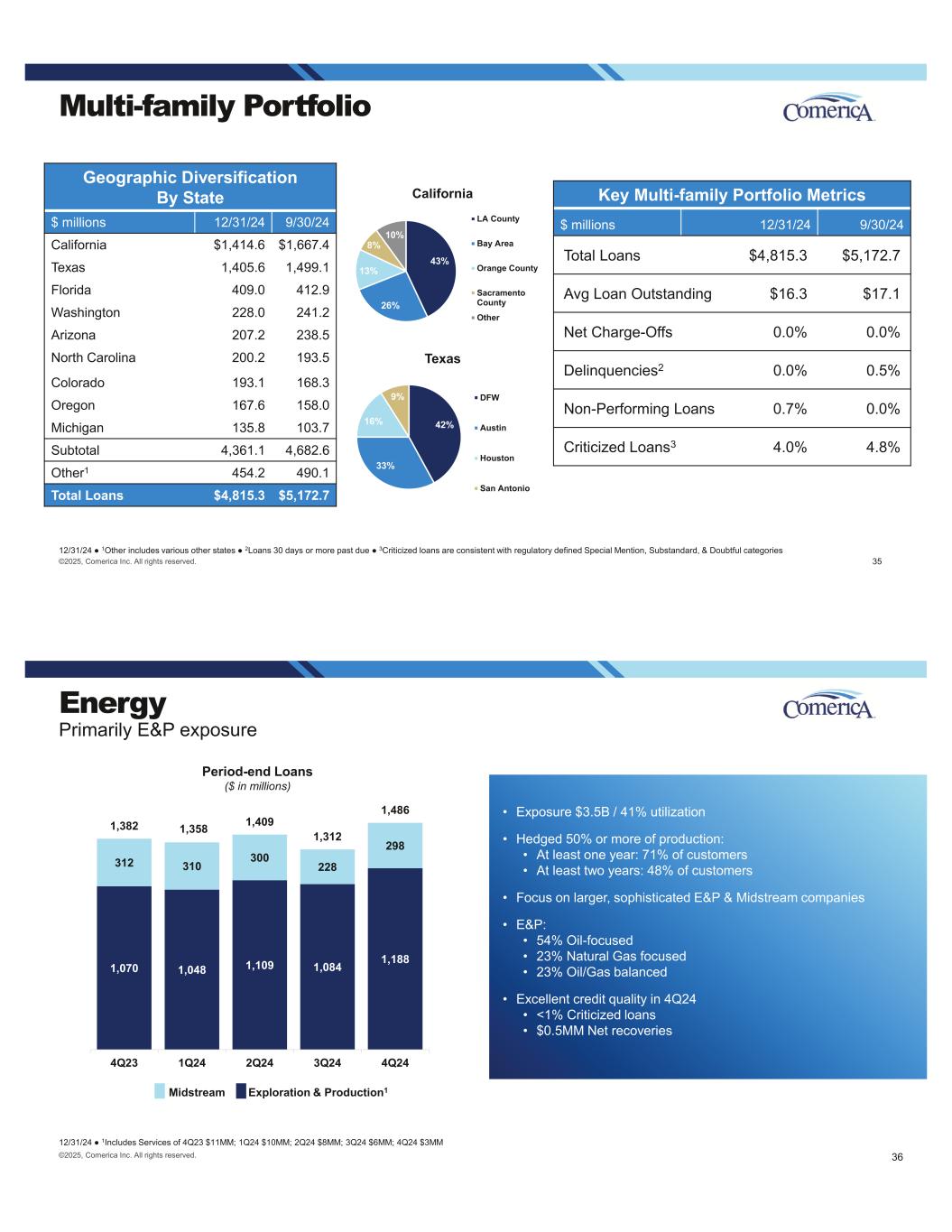

35©2025, Comerica Inc. All rights reserved. Multi-family Portfolio Key Multi-family Portfolio Metrics $ millions 12/31/24 9/30/24 Total Loans $4,815.3 $5,172.7 Avg Loan Outstanding $16.3 $17.1 Net Charge-Offs 0.0% 0.0% Delinquencies2 0.0% 0.5% Non-Performing Loans 0.7% 0.0% Criticized Loans3 4.0% 4.8% 12/31/24 1Other includes various other states 2Loans 30 days or more past due 3Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories 43% 26% 13% 8% 10% California LA County Bay Area Orange County Sacramento County Other 42% 33% 16% 9% Texas DFW Austin Houston San Antonio Geographic Diversification By State $ millions 12/31/24 9/30/24 California $1,414.6 $1,667.4 Texas 1,405.6 1,499.1 Florida 409.0 412.9 Washington 228.0 241.2 Arizona 207.2 238.5 North Carolina 200.2 193.5 Colorado 193.1 168.3 Oregon 167.6 158.0 Michigan 135.8 103.7 Subtotal 4,361.1 4,682.6 Other1 454.2 490.1 Total Loans $4,815.3 $5,172.7 Energy Primarily E&P exposure 12/31/24 1Includes Services of 4Q23 $11MM; 1Q24 $10MM; 2Q24 $8MM; 3Q24 $6MM; 4Q24 $3MM Period-end Loans ($ in millions) 1,070 1,048 1,109 1,084 1,188 312 310 300 228 298 1,382 1,358 1,409 1,312 1,486 4Q23 1Q24 2Q24 3Q24 4Q24 Midstream Exploration & Production1 ©2025, Comerica Inc. All rights reserved. 36 • Exposure $3.5B / 41% utilization • Hedged 50% or more of production: • At least one year: 71% of customers • At least two years: 48% of customers • Focus on larger, sophisticated E&P & Midstream companies • E&P: • 54% Oil-focused • 23% Natural Gas focused • 23% Oil/Gas balanced • Excellent credit quality in 4Q24 • <1% Criticized loans • $0.5MM Net recoveries

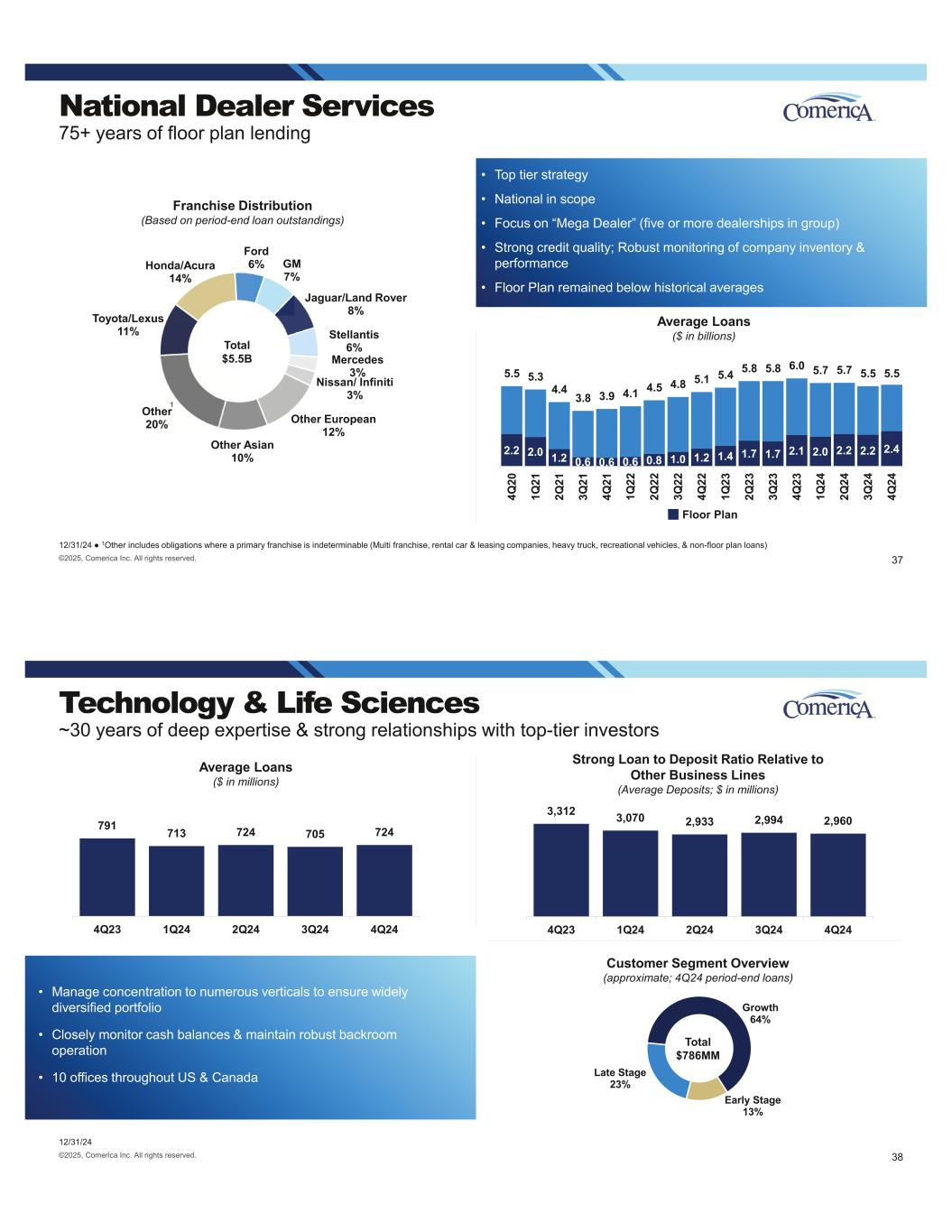

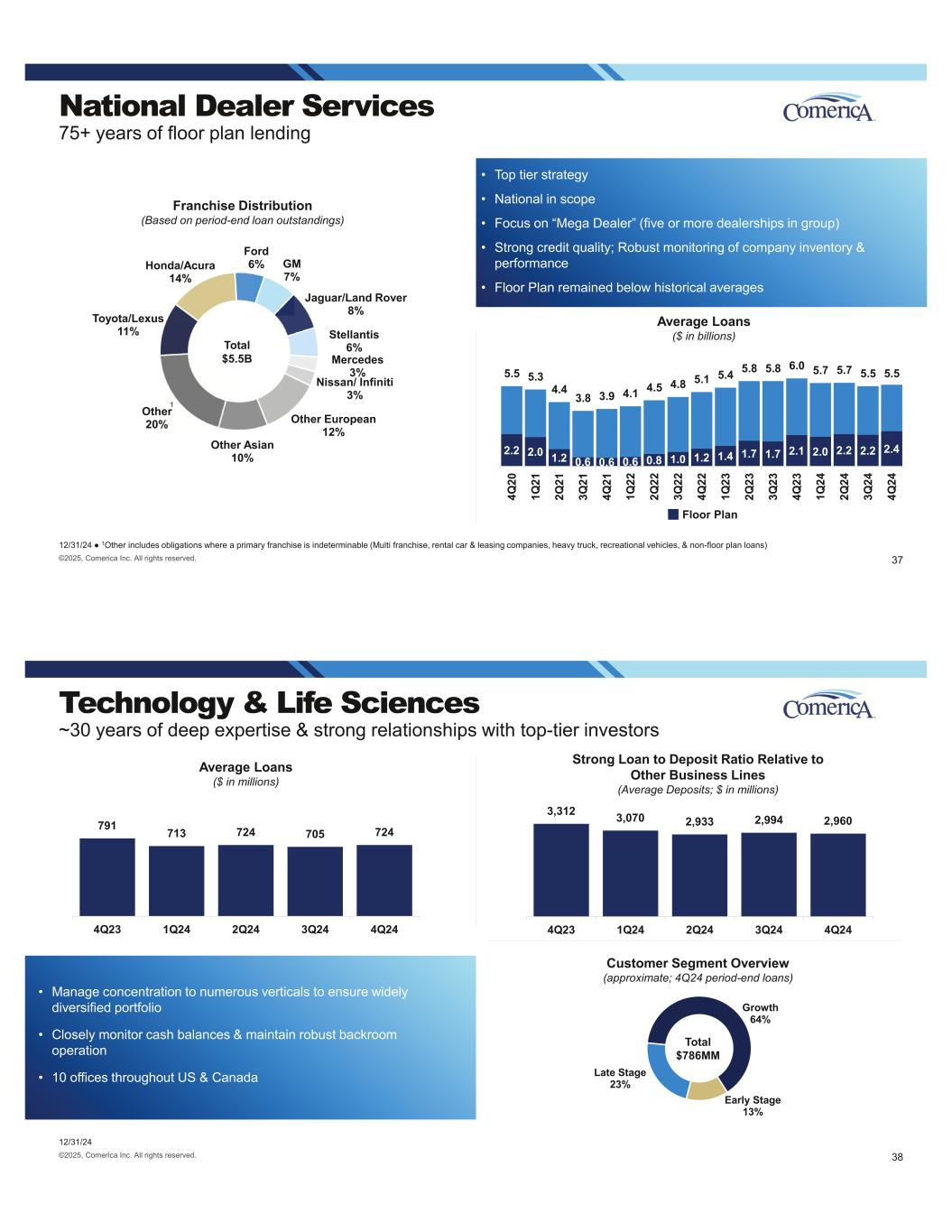

Toyota/Lexus 11% Honda/Acura 14% Ford 6% GM 7% Jaguar/Land Rover 8% Stellantis 6% Mercedes 3% Nissan/ Infiniti 3% Other European 12% Other Asian 10% Other 20% National Dealer Services 75+ years of floor plan lending 12/31/24 1Other includes obligations where a primary franchise is indeterminable (Multi franchise, rental car & leasing companies, heavy truck, recreational vehicles, & non-floor plan loans) Franchise Distribution (Based on period-end loan outstandings) • Top tier strategy • National in scope • Focus on “Mega Dealer” (five or more dealerships in group) • Strong credit quality; Robust monitoring of company inventory & performance • Floor Plan remained below historical averages 2.2 2.0 1.2 0.6 0.6 0.6 0.8 1.0 1.2 1.4 1.7 1.7 2.1 2.0 2.2 2.2 2.4 5.5 5.3 4.4 3.8 3.9 4.1 4.5 4.8 5.1 5.4 5.8 5.8 6.0 5.7 5.7 5.5 5.5 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 Floor Plan Average Loans ($ in billions) Total $5.5B 1 ©2025, Comerica Inc. All rights reserved. 37 3,312 3,070 2,933 2,994 2,960 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4Q23 1Q24 2Q24 3Q24 4Q24 791 713 724 705 724 4Q23 1Q24 2Q24 3Q24 4Q24 Technology & Life Sciences ~30 years of deep expertise & strong relationships with top-tier investors 12/31/24 Average Loans ($ in millions) • Manage concentration to numerous verticals to ensure widely diversified portfolio • Closely monitor cash balances & maintain robust backroom operation • 10 offices throughout US & Canada Strong Loan to Deposit Ratio Relative to Other Business Lines (Average Deposits; $ in millions) Growth 64% Early Stage 13% Late Stage 23% Customer Segment Overview (approximate; 4Q24 period-end loans) Total $786MM ©2025, Comerica Inc. All rights reserved. 38

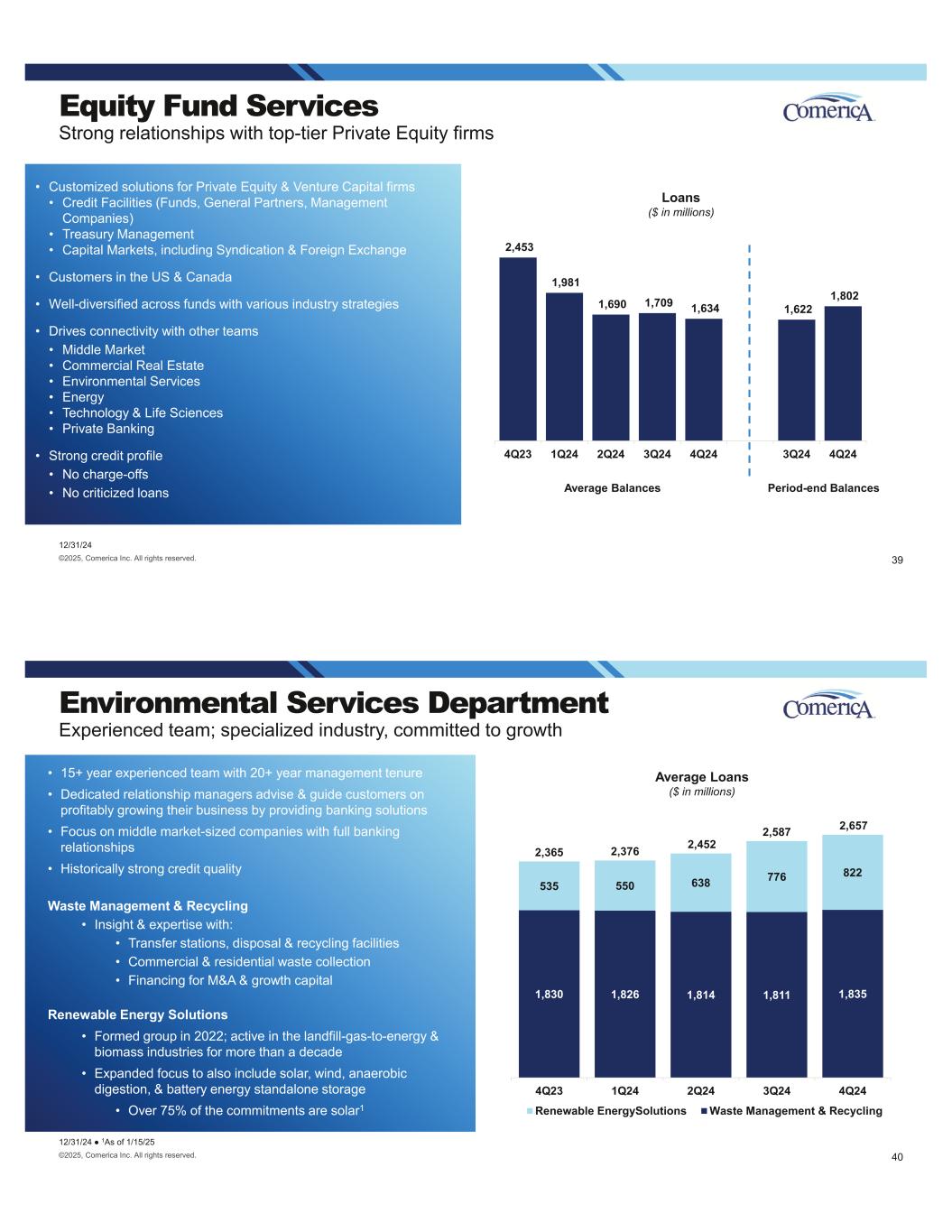

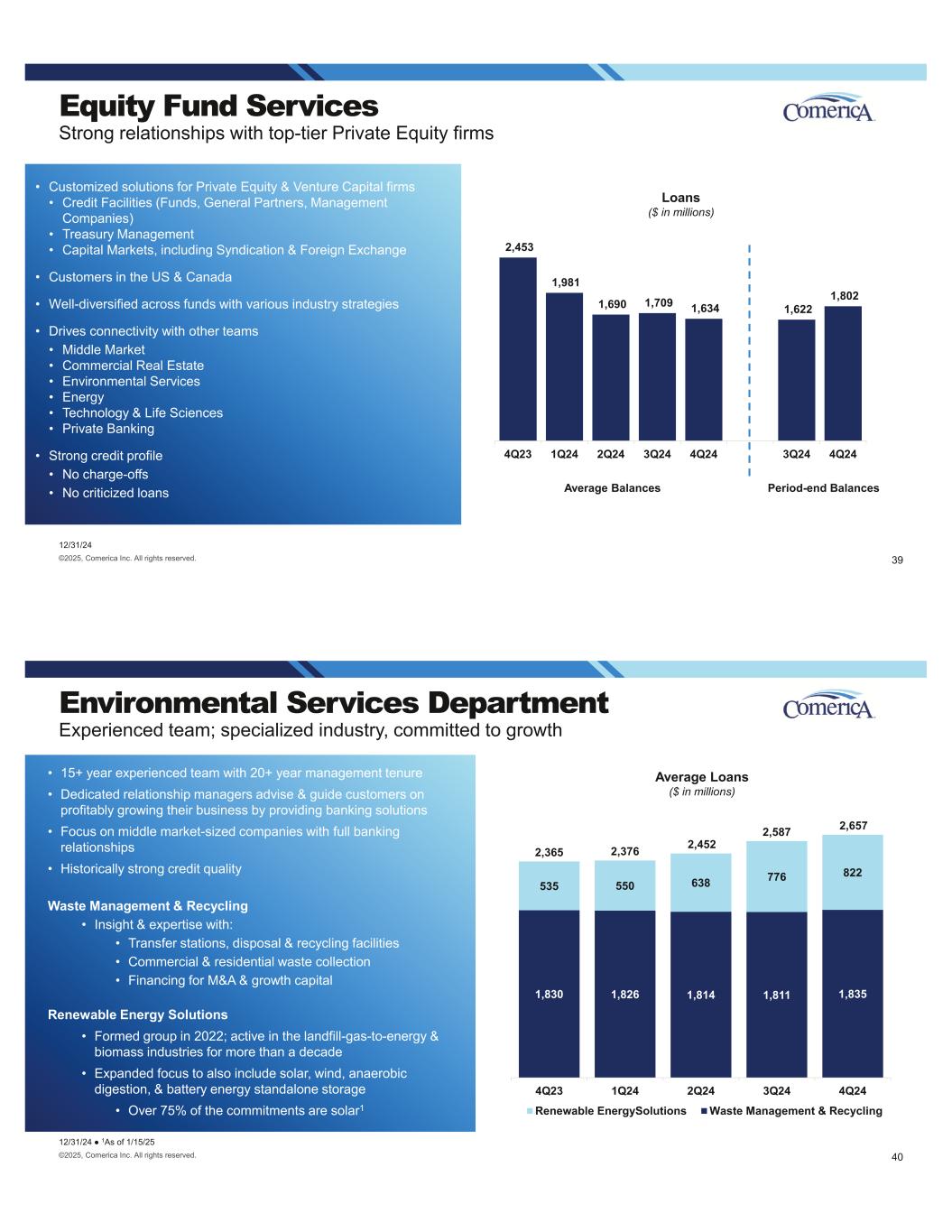

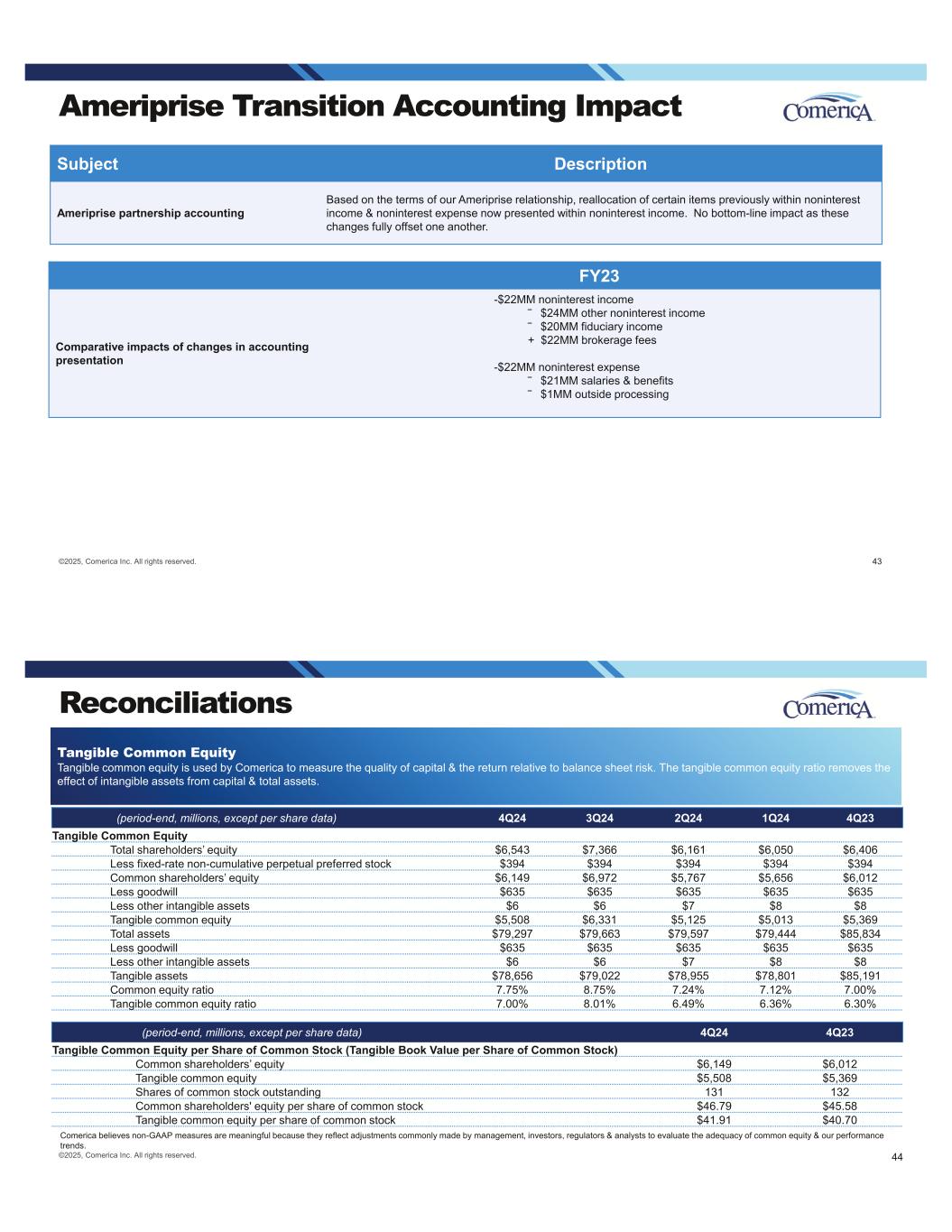

Equity Fund Services Strong relationships with top-tier Private Equity firms 12/31/24 • Customized solutions for Private Equity & Venture Capital firms • Credit Facilities (Funds, General Partners, Management Companies) • Treasury Management • Capital Markets, including Syndication & Foreign Exchange • Customers in the US & Canada • Well-diversified across funds with various industry strategies • Drives connectivity with other teams • Middle Market • Commercial Real Estate • Environmental Services • Energy • Technology & Life Sciences • Private Banking • Strong credit profile • No charge-offs • No criticized loans ©2025, Comerica Inc. All rights reserved. 39 Loans ($ in millions) 2,453 1,981 1,690 1,709 1,634 1,622 1,802 4Q23 1Q24 2Q24 3Q24 4Q24 3Q24 4Q24 Average Balances Period-end Balances Environmental Services Department Experienced team; specialized industry, committed to growth 12/31/24 1As of 1/15/25 • 15+ year experienced team with 20+ year management tenure • Dedicated relationship managers advise & guide customers on profitably growing their business by providing banking solutions • Focus on middle market-sized companies with full banking relationships • Historically strong credit quality Waste Management & Recycling • Insight & expertise with: • Transfer stations, disposal & recycling facilities • Commercial & residential waste collection • Financing for M&A & growth capital Renewable Energy Solutions • Formed group in 2022; active in the landfill-gas-to-energy & biomass industries for more than a decade • Expanded focus to also include solar, wind, anaerobic digestion, & battery energy standalone storage • Over 75% of the commitments are solar1 1,830 1,826 1,814 1,811 1,835 535 550 638 776 822 2,365 2,376 2,452 2,587 2,657 4Q23 1Q24 2Q24 3Q24 4Q24 Renewable EnergySolutions Waste Management & Recycling Average Loans ($ in millions) ©2025, Comerica Inc. All rights reserved. 40

©2025, Comerica Inc. All rights reserved. Comerica’s Core Values Trust OwnAct To raise expectations of what a bank can be for our colleagues, customers & communities 41 42©2025, Comerica Inc. All rights reserved. Descriptions of Notable Items Subject Description Securities repositioning • Securities repositioning relates to losses incurred on the sale of $827MM of Treasury securities that were replaced with higher-yielding Treasury securities with a duration of 1.9 years. Impact of BSBY cessation announcement • On November 15, 2023, Bloomberg Index Services Limited officially announced the future permanent cessation of Bloomberg Short-Term Bank Yield Index (“BSBY”) on November 15, 2024. • This announcement resulted in a temporary loss of hedge accounting for a portion of cash flow hedges, driving recognition of unrealized losses related to applicable swaps previously in AOCI in 4Q23 & 1Q24 & an impact to net interest income expected quarterly from 4Q23 through 2028. FDIC special assessment • CMA recorded an adjustment to lower the accrual related to the FDIC’s Deposit Insurance Fund (DIF) special assessment in 3Q24 & 4Q24 & an expense in 4Q23, 1Q24 & 2Q24. Modernization & expense recalibration initiatives • Actions taken to transform the retail banking delivery model, align corporate facilities, optimize technology platforms, enhance earnings power & create capacity for strategic & risk management investments resulted in severance charges.

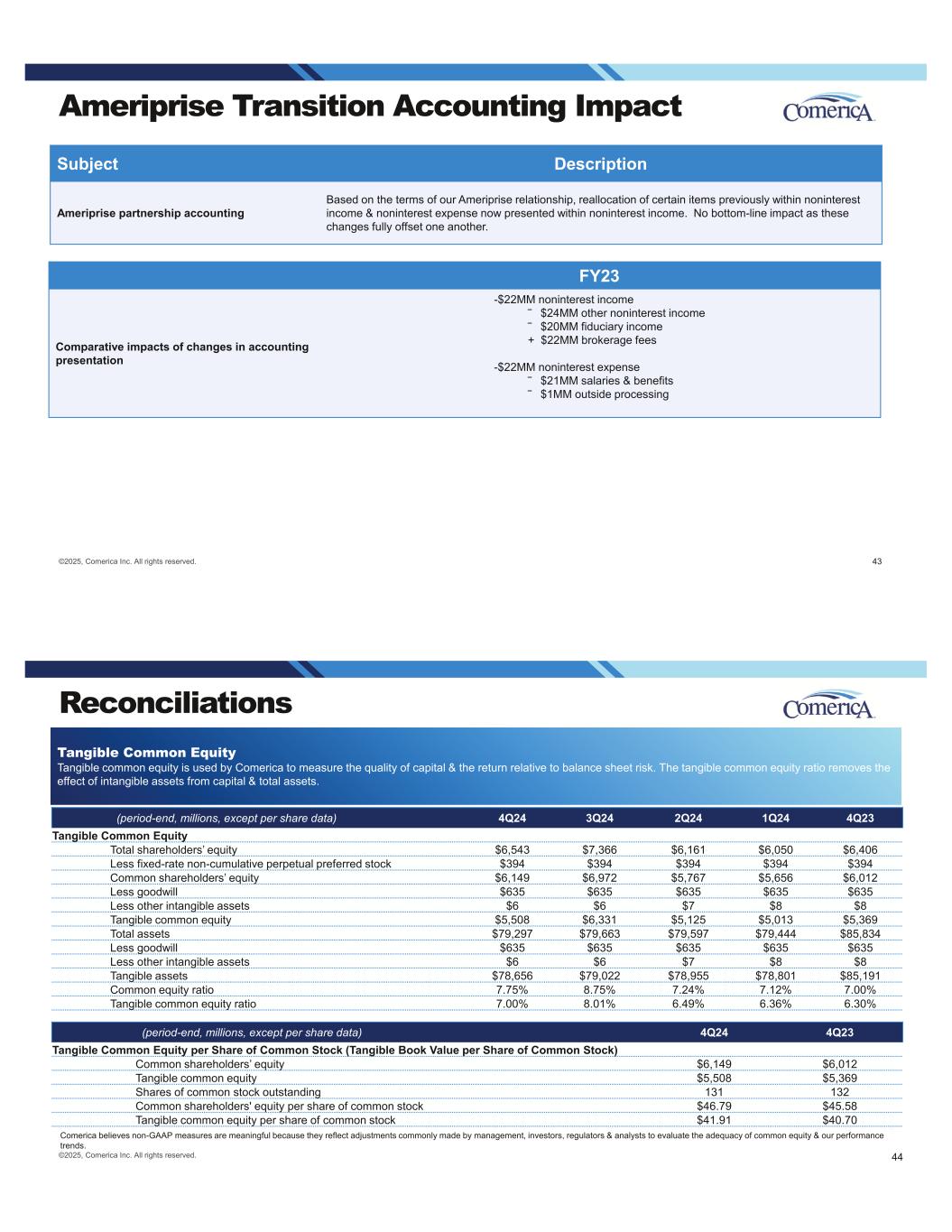

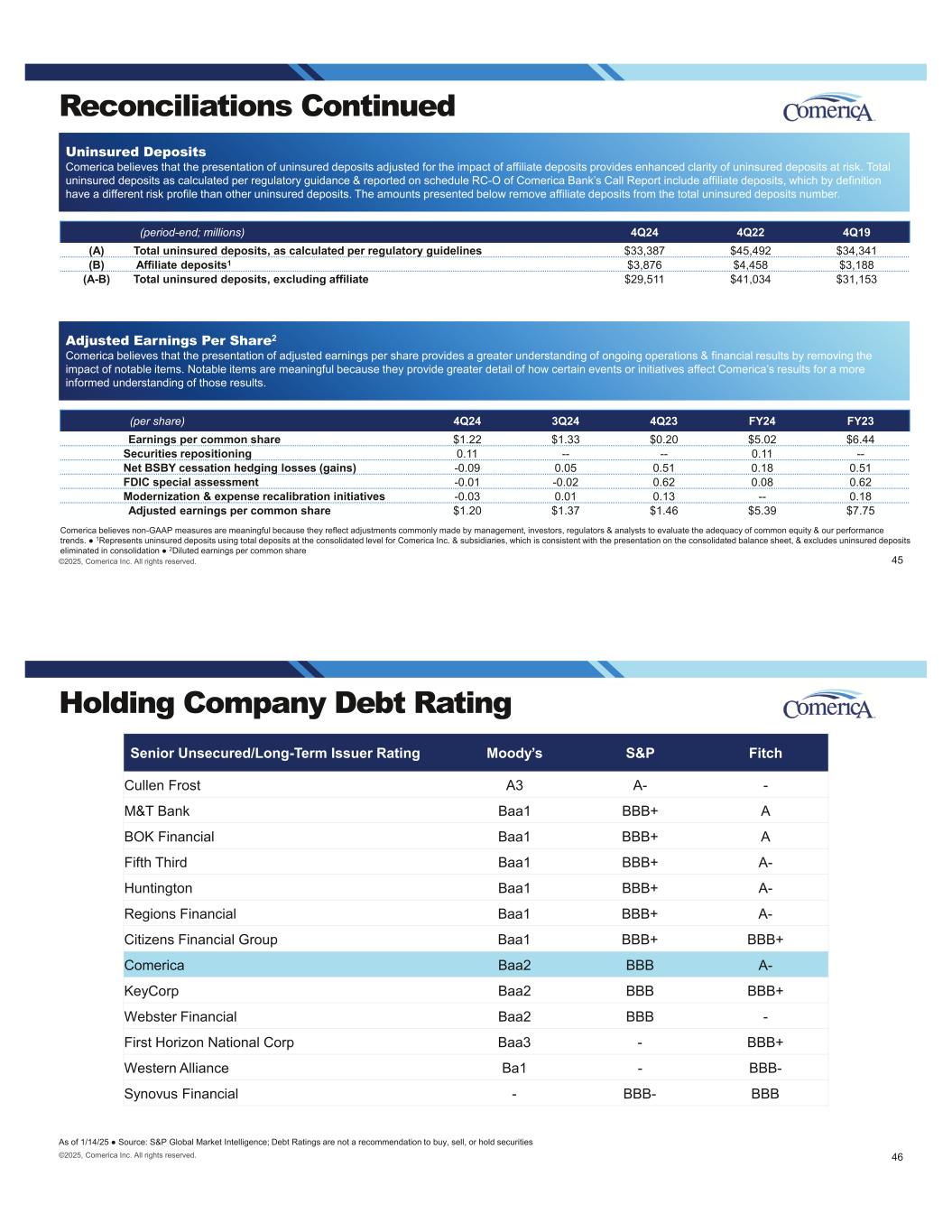

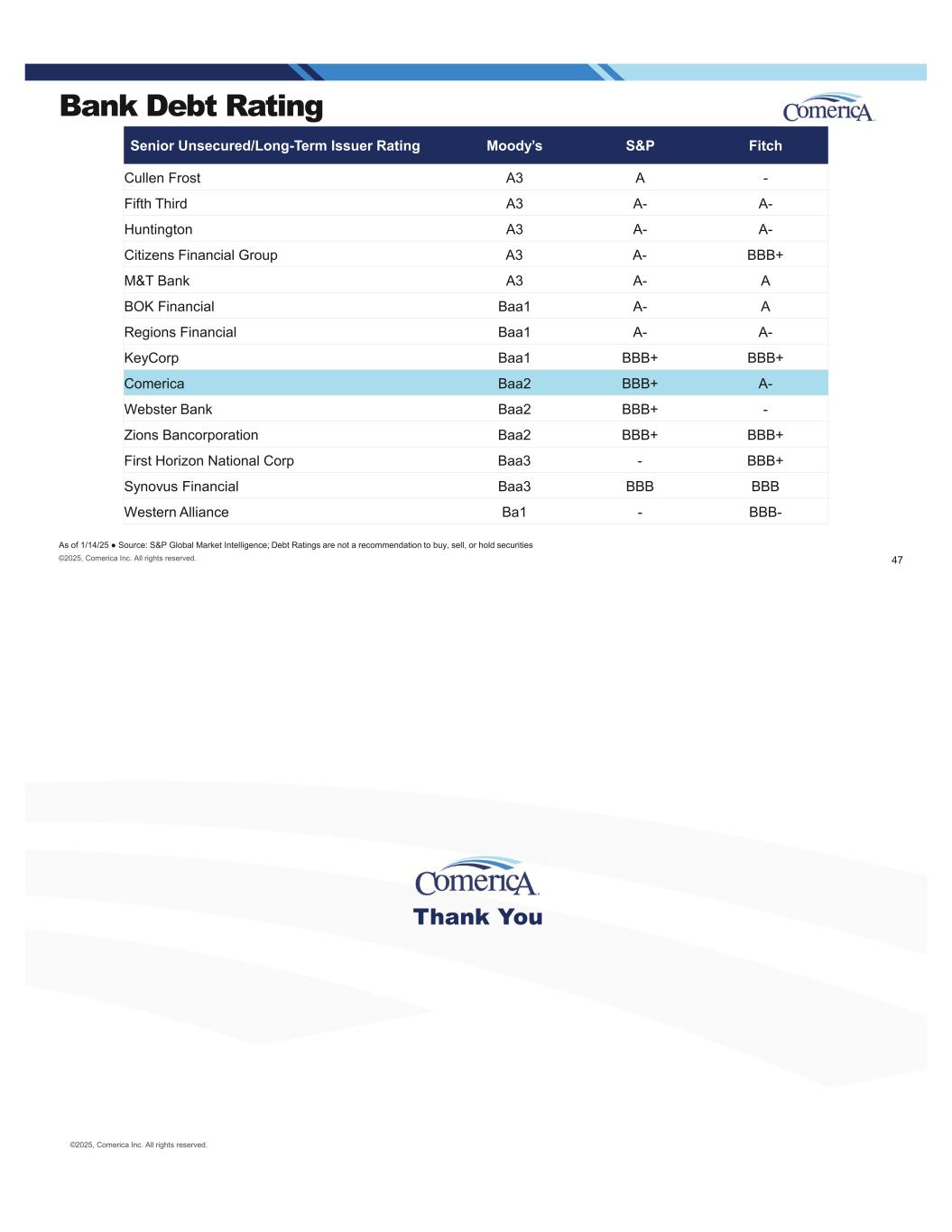

43©2025, Comerica Inc. All rights reserved. Ameriprise Transition Accounting Impact Subject Description Ameriprise partnership accounting Based on the terms of our Ameriprise relationship, reallocation of certain items previously within noninterest income & noninterest expense now presented within noninterest income. No bottom-line impact as these changes fully offset one another. FY23 Comparative impacts of changes in accounting presentation -$22MM noninterest income $24MM other noninterest income $20MM fiduciary income + $22MM brokerage fees -$22MM noninterest expense $21MM salaries & benefits $1MM outside processing Reconciliations ©2025, Comerica Inc. All rights reserved. 44 (period-end, millions, except per share data) 4Q24 3Q24 2Q24 1Q24 4Q23 Tangible Common Equity Total shareholders’ equity $6,543 $7,366 $6,161 $6,050 $6,406 Less fixed-rate non-cumulative perpetual preferred stock $394 $394 $394 $394 $394 Common shareholders’ equity $6,149 $6,972 $5,767 $5,656 $6,012 Less goodwill $635 $635 $635 $635 $635 Less other intangible assets $6 $6 $7 $8 $8 Tangible common equity $5,508 $6,331 $5,125 $5,013 $5,369 Total assets $79,297 $79,663 $79,597 $79,444 $85,834 Less goodwill $635 $635 $635 $635 $635 Less other intangible assets $6 $6 $7 $8 $8 Tangible assets $78,656 $79,022 $78,955 $78,801 $85,191 Common equity ratio 7.75% 8.75% 7.24% 7.12% 7.00% Tangible common equity ratio 7.00% 8.01% 6.49% 6.36% 6.30% Tangible Common Equity Tangible common equity is used by Comerica to measure the quality of capital & the return relative to balance sheet risk. The tangible common equity ratio removes the effect of intangible assets from capital & total assets. Comerica believes non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators & analysts to evaluate the adequacy of common equity & our performance trends. (period-end, millions, except per share data) 4Q24 4Q23 Tangible Common Equity per Share of Common Stock (Tangible Book Value per Share of Common Stock) Common shareholders’ equity $6,149 $6,012 Tangible common equity $5,508 $5,369 Shares of common stock outstanding 131 132 Common shareholders' equity per share of common stock $46.79 $45.58 Tangible common equity per share of common stock $41.91 $40.70

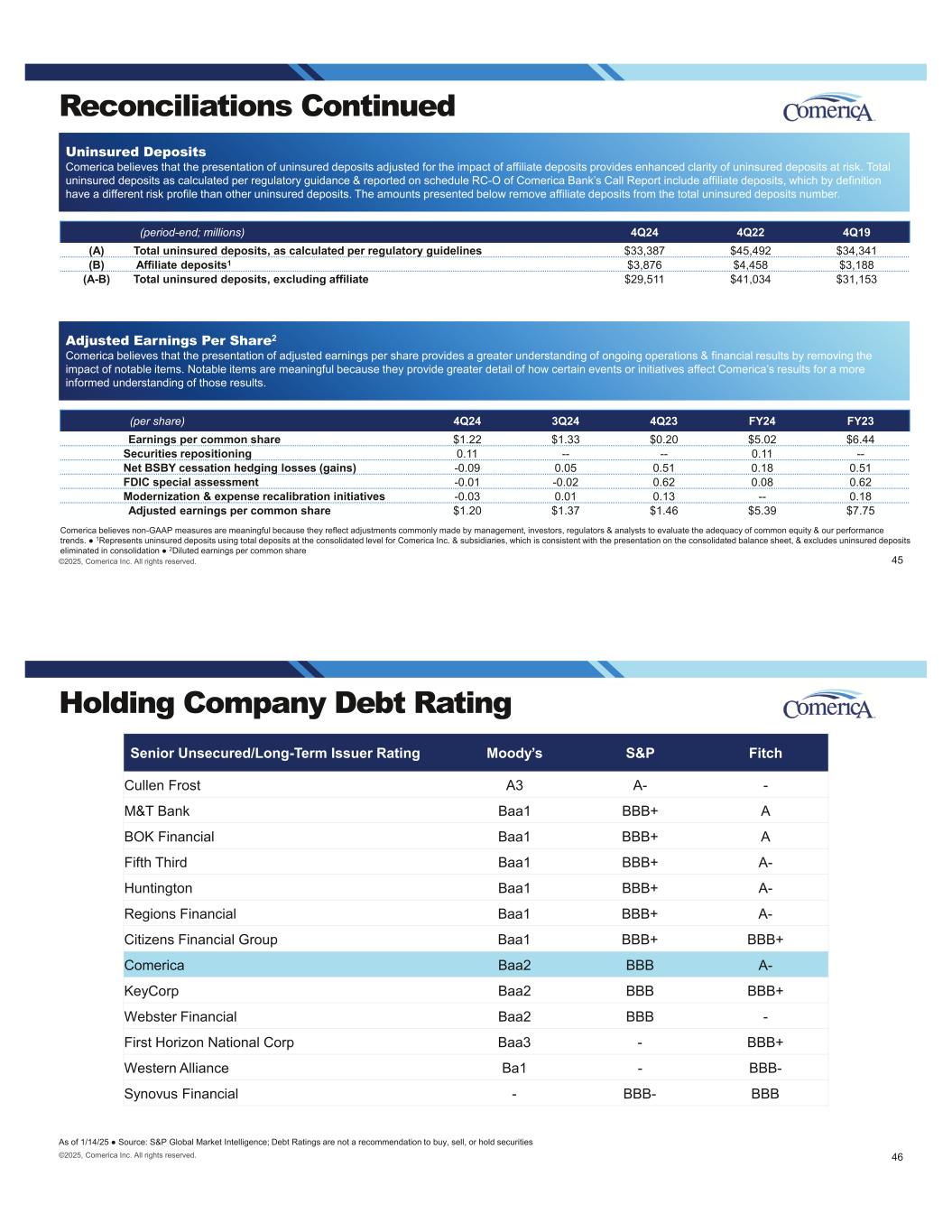

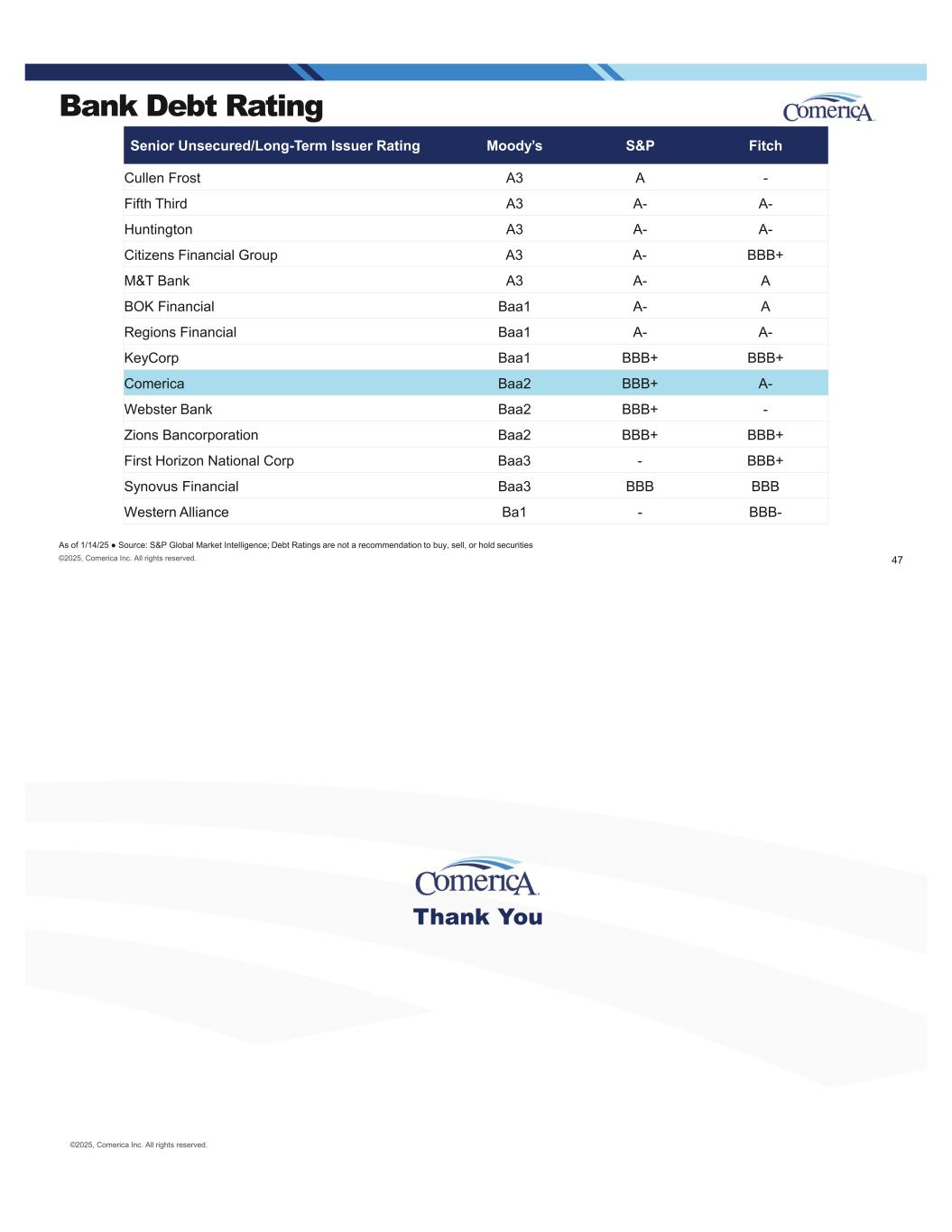

©2025, Comerica Inc. All rights reserved. Uninsured Deposits Comerica believes that the presentation of uninsured deposits adjusted for the impact of affiliate deposits provides enhanced clarity of uninsured deposits at risk. Total uninsured deposits as calculated per regulatory guidance & reported on schedule RC-O of Comerica Bank’s Call Report include affiliate deposits, which by definition have a different risk profile than other uninsured deposits. The amounts presented below remove affiliate deposits from the total uninsured deposits number. Reconciliations Continued Comerica believes non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators & analysts to evaluate the adequacy of common equity & our performance trends. 1Represents uninsured deposits using total deposits at the consolidated level for Comerica Inc. & subsidiaries, which is consistent with the presentation on the consolidated balance sheet, & excludes uninsured deposits eliminated in consolidation 2Diluted earnings per common share (period-end; millions) 4Q24 4Q22 4Q19 (A) Total uninsured deposits, as calculated per regulatory guidelines $33,387 $45,492 $34,341 (B) Affiliate deposits1 $3,876 $4,458 $3,188 (A-B) Total uninsured deposits, excluding affiliate $29,511 $41,034 $31,153 45 Adjusted Earnings Per Share2 Comerica believes that the presentation of adjusted earnings per share provides a greater understanding of ongoing operations & financial results by removing the impact of notable items. Notable items are meaningful because they provide greater detail of how certain events or initiatives affect Comerica’s results for a more informed understanding of those results. (per share) 4Q24 3Q24 4Q23 FY24 FY23 Earnings per common share $1.22 $1.33 $0.20 $5.02 $6.44 Securities repositioning 0.11 -- -- 0.11 -- Net BSBY cessation hedging losses (gains) -0.09 0.05 0.51 0.18 0.51 FDIC special assessment -0.01 -0.02 0.62 0.08 0.62 Modernization & expense recalibration initiatives -0.03 0.01 0.13 -- 0.18 Adjusted earnings per common share $1.20 $1.37 $1.46 $5.39 $7.75 Holding Company Debt Rating As of 1/14/25 Source: S&P Global Market Intelligence; Debt Ratings are not a recommendation to buy, sell, or hold securities Senior Unsecured/Long-Term Issuer Rating Moody’s S&P Fitch Cullen Frost A3 A- - M&T Bank Baa1 BBB+ A BOK Financial Baa1 BBB+ A Fifth Third Baa1 BBB+ A- Huntington Baa1 BBB+ A- Regions Financial Baa1 BBB+ A- Citizens Financial Group Baa1 BBB+ BBB+ Comerica Baa2 BBB A- KeyCorp Baa2 BBB BBB+ Webster Financial Baa2 BBB - First Horizon National Corp Baa3 - BBB+ Western Alliance Ba1 - BBB- Synovus Financial - BBB- BBB ©2025, Comerica Inc. All rights reserved. 46

Bank Debt Rating As of 1/14/25 Source: S&P Global Market Intelligence; Debt Ratings are not a recommendation to buy, sell, or hold securities Senior Unsecured/Long-Term Issuer Rating Moody’s S&P Fitch Cullen Frost A3 A - Fifth Third A3 A- A- Huntington A3 A- A- Citizens Financial Group A3 A- BBB+ M&T Bank A3 A- A BOK Financial Baa1 A- A Regions Financial Baa1 A- A- KeyCorp Baa1 BBB+ BBB+ Comerica Baa2 BBB+ A- Webster Bank Baa2 BBB+ - Zions Bancorporation Baa2 BBB+ BBB+ First Horizon National Corp Baa3 - BBB+ Synovus Financial Baa3 BBB BBB Western Alliance Ba1 - BBB- ©2025, Comerica Inc. All rights reserved. 47 Thank You ©2025, Comerica Inc. All rights reserved.